SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

KEYNOTE SYSTEMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

Keynote Systems, Inc.

777 Mariners Island Boulevard

San Mateo, California 94404

January 28, 2005

To our Stockholders:

You are cordially invited to attend the 2005 Annual Meeting of Stockholders of Keynote Systems, Inc. to be held at our executive offices, located at 777 Mariners Island Boulevard in San Mateo, California, on Thursday, March 24, 2005 at 10:00 a.m., Pacific Time.

The matters expected to be acted upon at the meeting are described in detail in the following notice of the 2005 Annual Meeting of Stockholders and proxy statement.

It is important that you use this opportunity to take part in the affairs of Keynote Systems, Inc. by voting on the business to come before this meeting. Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting. Returning the proxy does not deprive you of your right to attend the meeting and to vote your shares in person.

We look forward to seeing you at the meeting.

Sincerely,

Umang Gupta

Chairman of the Board and Chief Executive Officer

Keynote Systems, Inc.

777 Mariners Island Boulevard

San Mateo, California 94404

NOTICE OF THE 2005 ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

NOTICE IS HEREBY GIVEN that the 2005 Annual Meeting of Stockholders of Keynote Systems, Inc. will be held at our executive offices, located at 777 Mariners Island Boulevard in San Mateo, California, on Thursday, March 24, 2005 at 10:00 a.m., Pacific Time, for the following purposes:

1. To elect directors, each to serve until his or her successor has been elected and qualified or until his or her earlier resignation or removal;

2. To ratify the selection of KPMG LLP as independent auditors for the fiscal year ending September 30, 2005; and

3. To transact such other business as may properly come before the meeting or any adjournment.

The foregoing items of business are more fully described in the proxy statement accompanying this notice.

Only stockholders of record at the close of business on January 26, 2005 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors,

Peter J. Maloney

Secretary

San Mateo, California

January 28, 2005

Whether or not you expect to attend the Annual Meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting.

TABLE OF CONTENTS

The Report of the Audit Committee, the Report of the Compensation Committee and the Stock Price Performance Graph contained in this proxy statement are required by the Securities and Exchange Commission. The information in these sections shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference into such filings. In addition, this information shall not otherwise be deemed to be “soliciting material” or to be filed under those Acts.

Keynote Systems, Inc.

777 Mariners Island Boulevard

San Mateo, California 94404

PROXY STATEMENT

FOR THE 2005 ANNUAL MEETING OF STOCKHOLDERS

January 28, 2005

The accompanying proxy is solicited on behalf of the board of directors of Keynote Systems, Inc., a Delaware corporation, for use at the 2005 Annual Meeting of Stockholders to be held at our executive offices, located at 777 Mariners Island Boulevard in San Mateo, California, on Thursday, March 24, 2005 at 10:00 a.m., Pacific Time. Only holders of record of our common stock at the close of business on January 26, 2005, which is the record date, will be entitled to vote at the Annual Meeting. At the close of business on the record date, we had 20,040,751 shares of common stock outstanding and entitled to vote. All proxies will be voted in accordance with the instructions contained therein and, if no choice is specified, the proxies will be voted in favor of the nominees for director and the proposal presented in the accompanying notice of the Annual Meeting and this proxy statement. This proxy statement and the accompanying form of proxy were first mailed to stockholders on or about February 14, 2005. Our annual report and Form 10-K for the fiscal year ended September 30, 2004 are enclosed with this proxy statement.

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the record date.

Vote Needed for a Quorum

A quorum is required for our stockholders to conduct business at the Annual Meeting. The holders of a majority of the shares of our common stock entitled to vote on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business.

Vote Required to Approve the Proposals

With respect to Proposal No. 1, directors will be elected by a plurality of the votes of the shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. The effectiveness of any of the proposals is not conditioned upon the approval by our stockholders of any other proposal by the stockholders.

Effect of Abstentions

If stockholders abstain from voting, including brokers holding their customers’ shares of record who cause abstentions to be recorded, these shares are considered present and entitled to vote at the Annual Meeting. These shares will count toward determining whether or not a quorum is present. However, these shares will not be taken into account in determining the outcome of any of the proposals.

Effect of “Broker Non-Votes”

If a stockholder does not give a proxy to its broker with instructions as to how to vote the shares, the broker has authority under New York Stock Exchange rules to vote those shares for or against certain “routine” matters,

1

such as all of the proposals to be voted on at the Annual Meeting. If a broker votes shares that are unvoted by its customers for or against a proposal, these shares are considered present and entitled to vote at the Annual Meeting. These shares will count toward determining whether or not a quorum is present. These shares will also be taken into account in determining the outcome of all of the proposals.

Although all of the proposals to be voted on at the Annual Meeting are considered “routine,” where a matter is not “routine,” a broker generally would not be entitled to vote its customers’ unvoted shares. These so-called “broker non-votes” would count toward determining whether or not a quorum is present. However, these shares would not be taken into account in determining the outcome of any of the proposals.

Adjournment of Meeting

In the event that sufficient votes in favor of the proposals are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitations of proxies. Any such adjournment would require the affirmative vote of the majority of the shares of common stock present in person or represented by proxy at the Annual Meeting.

Expenses of Soliciting Proxies

We will pay the expenses of soliciting proxies to be voted at the Annual Meeting. Following the original mailing of the proxies and other soliciting materials, we and/or our agents may also solicit proxies by mail, telephone, telegraph or in person. Following the original mailing of the proxies and other soliciting materials, we will request that brokers, custodians, nominees and other record holders of our common stock forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and request authority for the exercise of proxies. In these cases, we will reimburse the record holders for their reasonable expenses if they ask us to do so.

Revocability of Proxies

Any person signing a proxy in the form accompanying this proxy statement has the power to revoke it prior to the Annual Meeting or at the Annual Meeting prior to the vote. A proxy may be revoked by any of the following methods:

| | • | | a written instrument delivered to us stating that the proxy is revoked; |

| | • | | a subsequent proxy that is signed by the person who signed the earlier proxy and is presented at the Annual Meeting; or |

| | • | | attendance at the Annual Meeting and voting in person. |

Please note, however, that if a stockholder’s shares are held of record by a broker, bank or other nominee and that stockholder wishes to vote at the Annual Meeting, the stockholder must bring to the Annual Meeting a letter from the broker, bank or other nominee confirming the stockholder’s beneficial ownership of the shares.

2

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, stockholders will elect each director to hold office until the next Annual Meeting of Stockholders and until his or her successor has been elected and qualified or until such director’s earlier resignation or removal. The size of our board of directors is currently set at seven members. Accordingly, seven nominees will be elected at the Annual Meeting to be our directors. If any nominee for any reason is unable to serve, or for good cause will not serve, as a director, the proxies may be voted for a substitute nominee as the proxy holder may determine. We are not aware of any nominee who will be unable to or, for good cause, will not serve as a director.

Nominees for Board of Directors

The names of the nominees for election to our board of directors at the Annual Meeting, and information about each of them, are included below.

| | | | | | |

Name

| | Age

| | Principal Occupation

| | Director Since

|

Umang Gupta | | 55 | | Chairman of the Board and Chief Executive Officer of Keynote | | 1997 |

| | | |

David Cowan | | 39 | | General Partner of Bessemer Venture Partners | | 1998 |

| | | |

Deborah Rieman | | 55 | | Retired President and Chief Executive Officer of Check Point Software Technologies Inc. | | 2002 |

| | | |

Mohan Gyani | | 53 | | Retired President and Chief Executive Officer of AT&T Wireless Mobility Services | | 2002 |

| | | |

Geoffrey Penney | | 59 | | Retired Executive Vice President and Chief Information Officer, Charles Schwab Corporation | | 2002 |

| | | |

Raymond L. Ocampo Jr. | | 51 | | President and Chief Executive Officer, Samurai Surfer LLC | | 2004 |

| | | |

Jennifer J. Bolt | | 40 | | Senior Vice President and Chief Information Officer of Franklin Resources, Inc. | | 2004 |

Umang Gupta has served as one of our directors since September 1997 and as our Chief Executive Officer and Chairman of the board of directors since December 1997. Previously, he was a private investor and an advisor to high-technology companies and the founder and chairman of the board and chief executive officer of Centura Software Corporation. He previously held various positions with Oracle Corporation and IBM. Mr. Gupta holds a B.S. degree in chemical engineering from the Indian Institute of Technology, Kanpur, India, and an M.B.A. degree from Kent State University.

David Cowan has served as one of our directors since March 1998. Since August 1996, Mr. Cowan has served as a General Partner of Bessemer Venture Partners, a venture capital investment firm. Mr. Cowan is also a director of several private companies. Mr. Cowan holds an A.B. degree in mathematics and computer science and a M.B.A. degree from Harvard University.

Deborah Rieman has served as one of our directors since January 2002. Since June 1999, Dr. Rieman has managed a private investment fund. From July 1995 to June 1999, Dr. Rieman was the President and Chief Executive Officer of Check Point Software Technologies Inc., an Internet security software company. Dr. Rieman also serves as a director of Arbinet Inc., Corning Inc., Kintera, Inc., and Tumbleweed Communications Inc. Dr. Rieman holds a Ph.D. degree in mathematics from Columbia University and a B.A. degree in mathematics from Sarah Lawrence College.

3

Mohan Gyani has served as one of our directors since January 2002. From January 2003 to December 2004, Mr. Gyani served as Senior Advisor, Office of the Chairman and Chief Executive Officer, of AT&T Wireless Mobility Services, a telecommunications company. From March 2000 to January 2003. he served as President and Chief Executive Officer and, from January 2000 to March 2000, as Chief Financial Officer of AT&T Wireless Mobility Services. From October 1999 to December 1999, Mr. Gyani served as President and Chief Financial Officer of PeoplePC, Inc., a computer company. From June 1999 to September 1999, he served as the Head of Strategy and Corporate Development and a member of the board of directors of Vodafone AirTouch Plc, a mobile telecommunications network company. He served as Executive Vice President and Chief Financial Officer of AirTouch, a telecommunications company, from September 1995 to June 1999, prior to its merger with Vodafone. Mr. Gyani is a member of the boards of directors of Safeway Inc., Epiphany Inc. and a private company. Mr. Gyani holds an M.B.A. degree and a B.A. degree in business administration from San Francisco State University.

Geoffrey Penney has served as one of our directors since July 2002. From December 1998 to his retirement in June 2004, Mr. Penney served as Executive Vice President, and since November 2001, as Chief Information Officer, of the Charles Schwab Corporation, a financial services company. Mr. Penney holds a Ph.D. degree and B.A. degree in inorganic chemistry from St. John’s College, Cambridge (U.K.).

Raymond L. Ocampo Jr. has served as one of our directors since March 2004. Since April 2004, Mr. Ocampo has served as President and Chief Executive Officer of Samurai Surfer LLC, a consulting and investment company. In November 1996, Mr. Ocampo retired from Oracle Corporation, where he had served in various senior and executive positions since 1986, most recently as Senior Vice President, General Counsel and Secretary since September 1990. Mr. Ocampo is a member of the boards of directors of CytoGenix, Inc., Intraware, Inc., PMI Group, Inc. and VitalStream Holdings, Inc. Since January 2000, Mr. Ocampo has also served as a member of the board of directors of the Berkeley Center for Law & Technology, which he co-founded in 1996. Mr. Ocampo holds a J.D. degree from Boalt Hall School of Law at the University of California at Berkeley and an A.B. degree in Political Science from the University of California, Los Angeles.

Jennifer Bolt has served as one of our directors since April, 2004. Ms. Bolt has served as senior vice president and chief information officer of Franklin Resources, Inc., a financial services company since May 2003. Prior to that time, she served in various other capacities for Franklin Resources, Inc. or its subsidiaries. She also serves as chairman of Franklin Capital Corporation and Franklin Templeton Bank & Trust, and is a member of Franklin Resources, Inc.’s Executive Committee. Ms. Bolt holds a B.A. degree in economics and physical education from the University of California at Davis.

The Board Recommends a Vote FOR the Election of

Each of the Nominated Directors.

Corporate Governance and Board Matters

Corporate Governance

Keynote maintains a corporate governance page on its website which includes key information about its corporate governance initiatives, including Keynote’s Code of Business Conduct and Ethics, Code of Ethics for Chief Executive Officer and Senior Financial Department Personnel, and charters for the committees of the Board of Directors. The corporate governance page can be found at www.keynote.com, by clicking on “About Us,” and then on “Corporate Governance.”

Keynote’s policies and practices reflect corporate governance initiatives that are compliant with the listing requirements of NASDAQ and the corporate governance requirements of the Sarbanes-Oxley Act of 2002, including:

| | • | | A majority of the board members are independent of Keynote and its management; |

| | • | | All members of the key board committees—the audit committee, the compensation committee, and the nominating and governance committee—are independent; |

4

| | • | | Keynote has appointed a lead independent director; |

| | • | | The independent members of the board of directors meet regularly without the presence of management. The lead independent director presides at these executive sessions; |

| | • | | Keynote has a clear code of business conduct; |

| | • | | The charters of the board committees clearly establish their respective roles and responsibilities; |

| | • | | Keynote’s audit committee has procedures in place for the anonymous submission of employee complaints on accounting, internal accounting controls, or auditing matters; and |

| | • | | Keynote has adopted a code of ethics that applies to its chief executive officer and all senior members of its finance department, including our chief financial officer. |

Director Independence

The board has determined that each of our directors is an independent director as defined by the rules of the NASDAQ Stock Market, other than Mr. Gupta, who serves as an employee of Keynote as our chief executive officer. In addition, the Board has determined that each member of the audit committee meets the additional independence criteria of the SEC required for audit committee membership.

Board Meetings

The board met four times during the fiscal year ended September 30, 2004. No director attended fewer than 75% of the total number of meetings held by the board and by all committees of the board on which such director served, during the period that such director served.

Board Committees

Our board of directors has a compensation committee, an audit committee and a nominating and governance committee. Each committee operates pursuant to a written charter; copies of these written charters are available on our website at www.keynote.com.

Compensation Committee. The current members of our compensation committee are Mr. Cowan and Dr. Rieman. The board of directors has determined that each member of the compensation committee is an independent director as defined by the rules of the NASDAQ Stock Market, a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, and an outside director within the meaning of Section 162(m) of the Internal Revenue Code. The compensation committee reviews and makes recommendations to our board concerning salaries and incentive compensation for our officers and employees. The compensation committee also administers our 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan. The compensation committee met three times during the fiscal year ended September 30, 2004.

Audit Committee. The current members of our audit committee are Mr. Gyani, Mr. Penney and Mr. Ocampo. The board of directors has determined that each member of the audit committee is an independent director as defined by the rules of the Securities and Exchange Commission and the NASDAQ Stock Market, and that each of them is able to read and understand fundamental financial statements. The board of directors has also determined that Mr. Gyani is an “audit committee financial expert” within the meaning of the rules of the Securities and Exchange Commission and is “financially sophisticated” within the meaning of the rules of the NASDAQ Stock Market. Our audit committee reviews our financial statements, monitors our accounting policies and practices, makes recommendations to our board regarding the selection of independent auditors and reviews the results and scope of audits and other services provided by our independent auditors. The audit committee met six times during the fiscal year ended September 30, 2004.

5

Nominating and Governance Committee. The current members of our nominating and governance committee are Mr. Cowan and Mr. Penney. The board of directors has determined that each member of the nominating and governance committee is an independent director as defined by the rules of the NASDAQ Stock Market. Our nominating and governance committee identifies, considers and recommends candidates to serve as members of the board and makes recommendations regarding the structure and composition of the board and board committees. During the fiscal year ended September 30, 2004, the independent directors as a group, including the members of the nominating and governance committee, performed these functions.

Consideration of Director Nominees

Our nominating and governance committee generally identifies nominees for our board based upon recommendations by our directors and management. The nominating and governance committee will also consider recommendations properly submitted by our stockholders in accordance with the procedure set forth in our bylaws. Stockholders can recommend qualified candidates for our board by writing to our corporate secretary at Keynote Systems, Inc., 777 Mariners Island Boulevard, San Mateo, CA 94404. Submissions that are received that meet the criteria outlined below will be forwarded to the nominating and governance committee for review and consideration. We request that any such recommendations be made at least three months prior to the end of the fiscal year ending September 30, 2005 to ensure adequate time for meaningful consideration by the nominating and governance committee. The nominating and governance committee intends to review periodically whether a more formal policy regarding stockholder nominations should be adopted.

The goal of the nominating and governance committee is to ensure that our board possesses a variety of perspectives and skills derived from high-quality business and professional experience. The nominating and governance committee seeks to achieve a balance of knowledge, experience and capability on our board. To this end, the nominating and governance committee seeks nominees with the highest professional and personal ethics and values, an understanding of our business and industry, diversity of business experience and expertise, a high level of education, broad-based business acumen, and the ability to think strategically. Although the nominating and governance committee uses these and other criteria to evaluate potential nominees, we have no stated minimum criteria for nominees. The nominating and governance committee does not use different standards to evaluates nominees depending on whether they are proposed by our directors and management or by our stockholders. To date, we have not paid any third parties to assist us in this process.

Stockholder Communication with Our Board

Our stockholders may communicate with our board or any of our individual directors by writing to them c/o Keynote Systems, Inc., 777 Mariners Island Boulevard, San Mateo, CA 94404. In addition, all communications that are received by our chief executive officer or chief financial officer that are directed to the attention of our board are forwarded to our board. The nominating and governance committee intends to consider whether it is appropriate to adopt a more formal process for our stockholders to communicate with our board. Our directors are strongly encouraged to attend our Annual Meeting. Mr. Gupta, chairman of our board and our chief executive officer, has attended all of our Annual Meetings.

Director Compensation

Cash Compensation. Each member of the board of directors who is not employed by Keynote is paid an annual retainer of $20,000, provided that each such non-employee director must attend at least three of the four regularly scheduled board meetings during the fiscal year and at least 75% of the total number of board meetings held during such year. Directors who are employees do not receive cash compensation from Keynote for the services they provide as directors. All directors are reimbursed for their reasonable expenses in attending board and board committee meetings.

Option Grants. Under our 1999 Equity Incentive Plan, each new non-employee director is automatically granted an option to purchase 50,000 shares of common stock on the date he or she becomes a director. In

6

addition, each new member of the audit committee or of the compensation committee is generally granted an option to purchase 10,000 shares of common stock on the date he or she is elected or appointed to serve on such committee. The chair of the audit committee generally is granted an option to purchase an additional 5,000 shares of common stock on the date of his or her appointment as chair. The options have an exercise price equal to the fair market value of our common stock on the date of grant, have ten-year terms and vest over three years. One-third of the shares subject to these options vest on the earlier of one year following the director’s appointment to the board of directors or committee, as applicable, or the first annual meeting of our stockholders following the grant of the option. The remaining shares subject to these options vest ratably monthly over the two years from the date on which shares first vest.

In April 2004, Raymond L. Ocampo Jr., was granted an option to purchase 50,000 shares of our common stock in his capacity as a new director, as well as an option to purchase 10,000 shares of our common stock in his capacity as a member of our audit committee. In April 2004, Ms. Bolt was granted an option to purchase 50,000 shares of our common stock in her capacity as a new director. These options were granted according to the terms set forth above.

Compensation Committee Interlocks and Insider Participation

None of the members of the compensation committee has at any time since our formation been one of our officers or employees. None of our executive officers currently serves or in the past has served as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our board or compensation committee.

Code of Ethics

We have adopted a code of ethics that applies to our Chief Executive Officer and senior financial officers, including our chief financial officer and controller. This code of ethics is posted on our website at http://www.keynote.com.

7

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The audit committee of our board of directors has selected KPMG LLP as the independent auditors to perform the audit of our financial statements for the fiscal year ending September 30, 2005, and our stockholders are being asked to ratify such selection. Representatives of KPMG are expected to be present at the Annual Meeting, will have the opportunity to make a statement at the Annual Meeting if they desire to do so and are expected to be available to respond to appropriate questions.

Ratification by our stockholders of the selection of KPMG LLP as our independent accountants is not required by our bylaws or otherwise. However, the board is submitting the selection of KPMG LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify this selection, the audit committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the audit committee in its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of Keynote and our stockholders.

The Board Recommends a Vote FOR the Ratification of the Selection of KPMG LLP

Principal Accountant Fees and Services

During the fiscal years ended September 30, 2003 and 2004, the aggregate fees billed by Keynote’s independent auditors, KPMG LLP, for professional services were as follows:

| | • | | Audit Fees. The aggregate fees billed by KPMG LLP for professional services rendered for the audit of Keynote’s annual consolidated financial statements, review of the consolidated financial statements included in Keynote’s quarterly reports on Form 10-Q and services that are normally provided by the independent auditors in connection with statutory and regulatory filings or engagements were $659,320, including auditing services related to acquisitions, for the fiscal year ended September 30, 2004 and $291,500 for the fiscal year ended September 30, 2003; |

| | • | | Audit-Related Fees. The aggregate fees billed by KPMG LLP for assurance and related services that are reasonably related to the performance of Keynote’s consolidated financial statements that are not reported above under “Audit Fees” were $18,400 for the fiscal year ended September 30, 2004. The services for the fees disclosed under this category primarily include accounting consultations in connection with acquisitions. No fees for assurance and related services were billed by KPMG for the fiscal year ended September 30, 2003; |

| | • | | Tax Fees. The aggregate fees billed by KPMG LLP for professional services rendered for tax compliance and tax advice planning were $149,427 for the fiscal year ended September 30, 2004 and $110,850 for the fiscal year ended September 30, 2003. The services for the fees disclosed under this category include tax consultation and the preparation of tax returns; and |

| | • | | All Other Fees. For the fiscal year ended September 30, 2004, KPMG LLP billed aggregate fees of $1,500 for services other than those described above. No other fees were billed by KPMG LLP for the fiscal year ended September 30, 2003 for services other than those described above. |

The Audit Committee has determined that the provision of these services is compatible with maintaining KPMG LLP’s independence.

8

REPORT OF THE AUDIT COMMITTEE

The audit committee of the board of directors consists of three members. Each member of the committee is “independent” as defined by the rules of the Securities and Exchange Commission and meets each of the other requirements for audit committee members under applicable NASDAQ listing standards.

The current members of the committee are Mr. Gyani, Mr. Penney and Mr. Ocampo, each of whom is “financially literate” as required by NASDAQ rules. The board of directors has also determined that Mr. Gyani is an “audit committee financial expert” within the meaning of the rules of the Securities and Exchange Commission. Stockholders should understand that these designations related to our audit committee members’ experience and understanding with respect to certain accounting and auditing matters do not impose upon any of them any duties, obligations or liabilities that are greater than those generally imposed on a member of the audit committee or of the board.

Keynote’s financial and senior management supervise the systems of internal controls and the financial reporting process. KPMG LLP, Keynote’s independent auditor, is responsible for performing an independent audit of Keynote’s consolidated financial statements in accordance with generally accepted auditing standards and issuing a report on these consolidated financial statements. The audit committee’s responsibility is to monitor and oversee these processes and the independence of Keynote’s independent auditors.

The audit committee has reviewed Keynote’s audited consolidated financial statements for the fiscal year ended September 30, 2004 and has met with the management of Keynote and its independent accountants to discuss the consolidated financial statements. Keynote’s management has represented to the audit committee that Keynote’s audited consolidated financial statements were prepared in accordance with generally accepted accounting principles.

The audit committee has discussed with Keynote’s independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Codification of Statements on Auditing Standards, AU Section 380. The audit committee has received from Keynote’s independent auditors the written disclosures and letter required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, and has discussed with them their independence. The audit committee has also considered whether the provision of non-audit services by Keynote’s independent auditors is compatible with maintaining the independence of the independent auditors.

Based on the review and discussions noted above, the audit committee recommended to Keynote’s board of directors that the audited consolidated financial statements be included in Keynote’s annual report on Form 10-K for the fiscal year ended September 30, 2004, and be filed with the Securities and Exchange Commission.

The Audit Committee selected KPMG LLP to be Keynote’s independent auditor for fiscal 2004 and, pursuant to the requirements of law and the charter of the audit committee, pre-approved all audit and non-audit services provided to us by the independent auditors during fiscal 2004.

Audit Committee

Mohan Gyani

Geoffrey Penney

Raymond L. Ocampo Jr.

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information as to the beneficial ownership of our common stock as of December 31, 2004 by:

| | • | | each stockholder known by us to be the beneficial owner of more than 5% of our common stock; |

| | • | | our Chief Executive Officer and four other most highly compensated executive officers who were serving as executive officers as of September 30, 2004; and |

| | • | | all of our directors and executive officers as a group. |

The percentage ownership is based on 19,975,257 shares of common stock outstanding as of December 31, 2004. Shares of common stock that are subject to options currently exercisable or exercisable within 60 days of December 31, 2004, are deemed outstanding for the purposes of computing the percentage ownership of the person holding these options but are not deemed outstanding for computing the percentage ownership of any other person. Beneficial ownership is determined under the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Unless indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. Unless otherwise noted, the address for each stockholder listed below is c/o Keynote Systems, Inc., 777 Mariners Island Boulevard, San Mateo, CA 94404.

| | | | | |

| | | Shares Beneficially Owned

| |

Name of Beneficial Owner

| | Number of Shares

| | Percent

| |

Umang Gupta(1) | | 3,522,576 | | 18 | % |

FMR Corp.(2) One Federal Street Boston, MA 02110-2003 | | 2,184,808 | | 11 | % |

Donald Aoki(3) | | 323,039 | | 2 | % |

Lloyd Taylor(4) | | 241,616 | | 1 | % |

David Cowan(5) | | 139,761 | | * | |

Peter Maloney(6) | | 123,059 | | * | |

Raymond L. Ocampo Jr.(7) | | 57,444 | | * | |

Richard Rudolph(8) | | 62,479 | | * | |

Mohan Gyani(9) | | 61,388 | | * | |

Deborah Rieman(10) | | 56,388 | | * | |

Geoffrey Penney(11) | | 54,999 | | * | |

Jennifer Bolt(12) | | — | | * | |

All 11 directors and executive officers as a group(12) | | 4,469,331 | | 22 | % |

| * | | Indicates beneficial ownership of less than 1%. |

| (1) | | Includes 70,000 shares held by the Gupta Family 1999 Irrevocable Trust. Mr. Gupta disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the shares. Includes 1,391,666 shares subject to options exercisable within 60 days of December 31, 2004. |

| (2) | | Based solely on information provided by FMR Corp. and various Fidelity Funds in their amended Schedule 13F or N-30D filed with the Securities and Exchange Commission on or prior to September 30, 2004. According to this Schedule 13F, FMR Corp. may be deemed to share voting and/or investment power with respect to these shares with certain affiliated companies and persons listed in the Schedule 13F. |

10

| (3) | | Includes 74,172 shares held by the Aoki family trust, 5,042 shares held by Mr. Aoki as trustee for his minor children and 950 shares held by the Frank and Jeanne Aoki Revocable Trust, over which Mr. Aoki exercises investment power. Mr. Aoki disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the shares. Includes 230,416 shares subject to options exercisable within 60 days of December 31, 2004. |

| (4) | | Includes 113,949 shares held by the Taylor Family Trust and 167,667 shares subject to options exercisable within 60 days of December 31, 2004. Mr. Taylor resigned as our Vice President of Operations in November 2004. |

| (5) | | Includes 56,388 shares subject to options exercisable within 60 days of December 31, 2004. |

| (6) | | Includes 121,456 shares subject to options exercisable within 60 days of December 31, 2004. |

| (7) | | Includes 34,716 shares held by Raymond L. Ocampo Jr. and Sandra O. Ocampo, Trustees of Ocampo Revocable Trust UTA May 30, 1996. |

| (8) | | Includes 52,775 shares subject to options exercisable within 60 days of December 31, 2004. |

| (9) | | Represents 61,388 shares subject to options exercisable within 60 days of December 31, 2004. |

| (10) | | Represents 56,388 shares subject to options exercisable within 60 days of December 31, 2004. |

| (11) | | Represents 54,999 shares subject to options exercisable within 60 days of December 31, 2004. |

| (12) | | Includes 2,087,170 shares subject to options exercisable within 60 days of December 31, 2004. |

11

EXECUTIVE COMPENSATION

The following table presents compensation information for the fiscal years ending September 30, 2002, 2003 and 2004 paid or accrued to our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2004.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

| | | Fiscal

Year

| | Annual Compensation

| | | Long Term

Compensation

Awards

| | All Other

Compensation(1)

|

Name and Principal Position

| | | Salary

| | | Bonus

| | Other

Compensation

| | | Securities

Underlying

Options

| |

Umang Gupta Chief Executive Officer | | 2004

2003

2002 | | $

| 225,000

237,500

237,500 | (2)

| | $

| 150,000

127,500

100,000 | | $

| —

—

— |

| | —

—

1,300,000 | | $

| 2,000

—

— |

| | | | | | |

Richard Rudolph Vice President of Worldwide Sales | | 2004

2003

2002 | |

| 157,697

166,250

131,250 |

| |

| 55,401

109,513

69,640 | |

| —

—

25,216 |

(3) | | 15,000

40,000

150,000 | |

| 2,000

— |

| | | | | | |

Lloyd Taylor(4) Former Vice President of Operations | | 2004

2003

2002 | |

| 168,884

176,939

186,251 |

| |

| 26,917

26,075

20,953 | |

| —

—

— |

| | 25,000

30,000

60,000 | |

| —

—

— |

| | | | | | |

Donald Aoki Senior Vice President of Products, Engineering and Operations | | 2004

2003

2002 | |

| 169,305

176,504

185,794 |

| |

| 29,334

25,970

19,111 | |

| —

—

— |

| | 25,000

40,000

50,000 | |

| 2,000

—

— |

| | | | | | |

Peter Maloney Vice President of Finance and Chief Financial Officer | | 2004

2003

2002 | |

| 163,500

156,375

165,000 |

| |

| 37,247

28,194

30,625 | |

| —

—

— |

| | 25,000

50,000

125,000 | |

| 2,000

—

— |

| (1) | | The amounts disclosed in the All Other Compensation column consist of Keynote’s matching contributions under our 401(k) plan. |

| (2) | | In fiscal 2004, Mr. Gupta voluntarily took a 10% cut to his annual base salary of $250,000. |

| (3) | | Represents an allowance for certain travel expenses. |

| (4) | | Mr. Taylor resigned as our Vice President of Operations in November 2004. |

12

Option Grants in Fiscal 2004

The following table presents the grants of stock options under our 1999 Equity Incentive Plan during the fiscal year ended September 30, 2004 to our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2004.

| | | | | | | | | | | | | | | | |

Name

| | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term

|

| | Number of Securities Underlying Options

Granted

| | Percent of Total Options Granted to Employees In

Fiscal 2004

| | | Exercise Price

Per Share

| | Expiration

Date

| |

| | | | | | 5%

| | 10%

|

Umang Gupta | | — | | — | % | | $ | — | | — | | $ | — | | $ | — |

| | | | | | |

Richard Rudolph | | 15,000 | | 1.12 | % | | | 13.01 | | 07/15/2014 | | | 122,729 | | | 311,019 |

| | | | | | |

Lloyd Taylor | | 25,000 | | 1.87 | % | | | 13.01 | | 07/15/2014 | | | 204,548 | | | 518,365 |

| | | | | | |

Donald Aoki | | 25,000 | | 1.87 | % | | | 13.01 | | 07/15/2014 | | | 204,548 | | | 518,365 |

| | | | | | |

Peter Maloney | | 25,000 | | 1.87 | % | | | 13.01 | | 07/15/2014 | | | 204,548 | | | 518,365 |

All options granted under our 1999 Equity Incentive Plan are either incentive stock options or nonstatutory stock options. Options granted under our 1999 Equity Incentive Plan generally vest and become exercisable over a four-year period as to 25% of the shares subject to the option one year from the date of grant and as to 2.083% of the shares each succeeding month. Options expire 10 years from the date of grant. Options were granted at an exercise price equal to the fair market value of our common stock on the date of grant. In the year ending September 30, 2004, we granted to our employees options to purchase a total of 1,335,555 shares of our common stock.

Potential realizable values are computed by:

| | • | | multiplying the number of shares of common stock subject to a given option by the market price per share of our common stock on the date of grant; |

| | • | | assuming that the aggregate option exercise price derived from that calculation compounds at the annual 5% or 10% rates shown in the table for the entire 10-year term of the option; and |

| | • | | subtracting from that result the aggregate option exercise price. |

The 5% and 10% assumed annual rates of stock price appreciation are required by the rules of the Securities and Exchange Commission and do not represent our estimate or projection of future common stock prices. The closing price per share of our common stock as reported on the NASDAQ National Market on September 30, 2004, was $14.16.

13

Aggregated Option Exercises in Fiscal 2004 and Option Values at September 30, 2004

The following table presents the number of shares of common stock subject to vested and unvested stock options held as of September 30, 2004 by our Chief Executive Officer and our four other most highly compensated executive officers who were serving as executive officers as of September 30, 2004. Also reported is the value of in-the-money stock options as of September 30, 2004, which represents the positive difference between the aggregate exercise price of the outstanding options and the aggregate fair market value of the options based on $14.16, the closing price per share of our common stock on September 30, 2004, as reported on the NASDAQ National Market. The value of the unexercised in-the-money options has not been, and may never be, realized.

| | | | | | | | | | | | | | | |

| | | Number of Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at September 30, 2004

| | Value of Unexercised In-the-Money Options at September 30, 2004

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Umang Gupta | | — | | $ | — | | 1,287,499 | | 312,501 | | $ | 6,556,993 | | $ | 2,075,007 |

| | | | | | |

Richard Rudolph | | 57,850 | | | 250,695 | | 54,025 | | 93,125 | | | 279,478 | | | 382,719 |

| | | | | | |

Lloyd Taylor | | — | | | — | | 160,792 | | 78,438 | | | 743,935 | | | 315,209 |

| | | | | | |

Donald Aoki | | — | | | — | | 207,499 | | 101,251 | | | 984,416 | | | 412,334 |

| | | | | | |

Peter Maloney | | — | | | — | | 102,915 | | 97,085 | | | 640,179 | | | 396,021 |

Equity Compensation Plans

As of September 30, 2004, we maintained our 1999 Equity Incentive Plan and 1999 Employee Stock Purchase Plan, both of which were approved by our stockholders. The following table gives information about equity awards under those plans as of September 30, 2004:

| | | | | | | | |

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of Shares to be Issued Upon Exercise of Outstanding Options

| | Weighted-Average Exercise Price of Outstanding Options

| | Number of Shares Remaining Available for Equity Compensation Plans (Excluding Shares Reflected in Column (a))

| |

Equity compensation plans approved by stockholders | | 5,890,794 | | $ | 13.39 | | 4,915,569 | (1) |

| | | |

Equity compensation plans not approved by stockholders(2) | | — | | | — | | — | |

| | | |

Total | | 5,890,794 | | $ | 13.39 | | 4,915,569 | |

| (1) | | Of these, 4,042,624 shares remained available for grant under the 1999 Equity Incentive Plan and 872,945 shares remained available for grant under the 1999 Employee Stock Purchase Agreement. All of the shares available for grant under the 1999 Equity Incentive Plan may be issued as restricted stock, although we do not currently intend to do so. |

| (2) | | In connection with our acquisition of Velogic, Inc. in June 2002, we assumed the options to purchase stock initially granted under Velogic’s 1998 Stock Option/Stock Issuance Plan. The options have been converted into options to purchase our common stock on the terms specified in the agreement and plan of reorganization with Velogic but are otherwise administered in accordance with the terms of the Velogic’s 1998 Stock Option/Stock Issuance Plan. No further awards will be made under Velogic’s 1998 Stock Option/Stock Issuance Plan. The options generally vest over four years and expire ten years from the date of grant. As of September 30, 2004, there were outstanding options to purchase a total of 1,047 shares with a weighted average exercise price of $2.053 per share. Information regarding these assumed options is not included in the table above. |

14

Employment Agreement with Chief Executive Officer

We entered into an employment agreement with Umang Gupta, our Chief Executive Officer, in December 1997 and amended this agreement in November 2001. This agreement, as amended, establishes Mr. Gupta’s annual base salary and eligibility for benefits and bonuses. This agreement continues until it is terminated upon written notice by Mr. Gupta or us. We must pay Mr. Gupta his salary and other benefits through the date of any termination of his employment. If his employment is terminated by us without cause or through his constructive termination due to a material reduction in his salary or benefits, a material change in his responsibilities or a sale of us if he is not the Chief Executive Officer of the resulting combined company, we must also pay his salary for six additional months after that date.

In connection with the November 2001 amendment of this agreement, Mr. Gupta was granted an option to purchase 1,300,000 shares of common stock at an exercise price of $7.52 per share. This option is immediately exercisable, subject to our right to repurchase the shares of common stock upon termination of his employment. This option vested as to 20,833 shares on January 7, 2002, vested as to 33,333 shares each month thereafter for 24 months, and is vesting as to 20,833 shares each month thereafter.

Under the agreement, as amended, all shares subject to Mr. Gupta’s options will vest in full 90 days following a sale of us if Mr. Gupta is not the Chief Executive Officer of the resulting combined company. If his employment is terminated by us without cause or through his voluntary termination, and if he assists in the transition to a successor Chief Executive Officer, vesting of the shares subject to his options will continue for an additional 12 months. If his employment is terminated by us without cause or due to his death or through his constructive termination due to a material reduction in his salary or benefits or a material change in his responsibilities, the shares subject to his options will vest in an amount equal to the number that would vest during the six months following this termination. If his employment is terminated by us for cause or due to his disability or through his voluntarily termination, the vesting of any shares subject to his options will cease on the date of termination.

Other Change-of-Control Arrangements

The options that we grant to our executive officers other than our Chief Executive Officer, as described above, under our 1999 Equity Incentive Plan generally provide for acceleration of the vesting of such options upon the occurrence of specified events. If the executive officer is terminated without cause following a sale of our company that occurs 12 or more months after the date of grant of the option, that option vests immediately with respect to all of the shares subject to that option. For the purposes of this provision, a sale of our company includes any sale of all or substantially all of our assets, or any merger or consolidation of us with or into any other corporation, corporations, or other entity in which more than 50% of our voting power is transferred. For purposes of this provision, cause means (i) willfully engaging in gross misconduct that is materially and demonstrably injurious to us; (ii) willful and continued failure to substantially perform the executive officer’s duties (other than incapacity due to physical or mental illness), provided that this failure continues after our Board of Directors has provided the executive officer with a written demand for substantial performance, setting forth in detail the specific respects in which it believes the executive officer has willfully and not substantially performed his or her duties and a reasonable opportunity (to be not less than 30 days) to cure the failure. A termination without cause includes a termination of employment by the executive officer within 30 days following any one of the following events: (x) a 10% or more reduction in the executive officer’s salary that is not part of a general salary reduction plan applicable to all officers of the successor company; (y) a change in the executive officer’s position or status to a position that is not at the level of Vice President or above with the successor; or (z) relocating the executive officer’s principal place of business, in excess of fifty (50) miles from the current location of such principal place of business. In addition, if any of these executive officers is terminated without cause, he or she is entitled to receive a payment equal to three months of his or her base salary.

The options that we grant to our non-employee directors under the automatic option grant provision of our 1999 Equity Incentive Plan provide that any unvested shares subject to these options will become immediately exercisable upon a transaction that results in a change of control.

15

REPORT OF THE COMPENSATION COMMITTEE

The compensation committee of the board of directors administers Keynote’s executive compensation program. The current members of the compensation committee are Mr. Cowan and Dr. Rieman. Each is a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended, and an outside director within the meaning of Section 162(m) of the Internal Revenue Code. Neither Mr. Cowan nor Dr. Rieman has any interlocking relationships as defined by the Securities and Exchange Commission.

General Compensation Philosophy

The role of the compensation committee is to set the salaries and other compensation of Keynote’s executive officers and other key employees, and to make grants of stock options and to administer the stock option and other employee equity and bonus plans. Keynote’s compensation philosophy for executive officers is to relate compensation to corporate performance and increases in stockholder value, while providing a total compensation package that is competitive and enables Keynote to attract, motivate, reward and retain key executive officers and employees. Accordingly, each executive officer’s compensation package may, in one or more years, be comprised of the following three elements:

| | • | | base salary that is designed primarily to be competitive with base salary levels in effect at high technology companies in the San Francisco Bay Area that are of comparable size to Keynote and with which Keynote competes for executive personnel; |

| | • | | annual variable performance awards, such as bonuses, payable in cash and/or stock-based incentive awards, tied to the achievement of goals based on Keynote’s performance either generally, or in the given area under the individual’s management, and using financial or other appropriate measures for determining achievement that are established by the compensation committee; and |

| | • | | long-term stock-based incentive awards that strengthen the mutuality of interests between Keynote’s executive officers and Keynote’s stockholders. |

In preparing the Stock Price Performance Graph for this proxy statement, Keynote used The Street.com Internet Sector Index as its published line of business index. The compensation practices of most of the companies in that index were not reviewed by Keynote when the compensation committee reviewed the compensation information described above because such companies were determined not to be competitive with Keynote for executive talent. Instead, the compensation committee reviewed the compensation practices of a number of high technology companies in the San Francisco Bay Area for which adequate information was available for analysis.

Executive Compensation

Base Salary. Salaries for executive officers for the fiscal year ended September 30, 2004 were generally determined on an individual basis by evaluating each executive officer’s scope of responsibility, performance, prior experience and salary history, as well as the salaries for similar positions at comparable companies. We believe our executive’s salaries are generally in the mid-range of those companies that figured in our analysis.

Annual Incentive Awards. In the past, Keynote has included performance-based bonuses, payable in cash and/or stock-based incentive awards, as part of each executive officer’s annual compensation plan. Annual performance-based bonuses are based on mutually agreed upon goals and objectives. This practice is expected to continue and each executive officer’s annual performance will be measured by the achievement of established goals and objectives using quantitative and qualitative measures.

Long-Term Incentive Awards. The compensation committee believes that equity-based compensation in the form of stock options links the interests of executive officers with the long-term interests of Keynote’s stockholders and encourages executive officers to remain employed with Keynote. Stock options generally have value for executive officers only if the price of our stock increases above the fair market value on the grant date and the officer remains employed with Keynote for the period required for the shares to vest.

16

Keynote grants stock options in accordance with its 1999 Equity Incentive Plan. In the fiscal year ended September 30, 2004, stock options were granted to certain executive officers to aid in the retention of those executive officers and to align their interests with those of Keynote’s stockholders. Stock options typically are granted to an executive officer when he or she first joins us. The compensation committee may, however, grant additional stock options to executive officers for other reasons such as for retention or to attempt to ensure that a given executive officer’s actual and potential stockholdings (meaning shares held plus vested and unvested options) will align his or her interests with those of Keynote’s other stockholders. The number of shares subject to each stock option granted is within the discretion of the compensation committee and is based on anticipated future contribution and ability to impact Keynote’s results, past performance or consistency within the officer’s peer group, and the number of unvested options. In the fiscal year ended September 30, 2004, the compensation committee considered these factors and other factors as well. Stock options generally vest and become exercisable over a four-year period, remain exercisable for as long as nine years after vesting (so long as the executive remains in our employ), and are granted at a price that is equal to the fair market value of Keynote’s common stock on the date of grant.

Chief Executive Officer Compensation

The compensation committee reviewed Mr. Gupta’s performance and compensation package in October 2003. At that time it determined not to make any adjustment for fiscal 2004 to Mr. Gupta’s base salary of $250,000 per year or his target bonus of $150,000. The compensation committee believes that the target bonus of the CEO should be paid primarily in relation to improving Keynote’s financial and operating performance. For fiscal 2004, the compensation committee therefore determined that Mr. Gupta’s target bonus should be entirely based on Keynote achieving profit and revenue objectives contained in the operating plan approved by the Board of Directors. The compensation committee believes that revenue growth is an important element in the long-term success of Keynote, and established fourth quarter revenues, rather than annual revenues, as the revenue objective for Mr. Gupta’s performance bonus on the basis that fourth quarter revenues are a better indicator of revenues for the following fiscal year. Based on Keynote’s fiscal 2004 performance against these profit and revenue objectives, the compensation committee determined that Mr. Gupta had earned his full target bonus of $150,000. The Board, with Mr. Gupta not present, reviewed and ratified this determination. With respect to long term incentive compensation, Mr. Gupta requested that he not be granted any stock options in fiscal 2004 to moderate the potential dilution from stock options to our stockholders. The compensation committee took account of this request, of the option grant awarded in fiscal 2002, and of the level of his existing shareholdings in concluding that Mr. Gupta’s interest in the long-term success of Keynote remains aligned with that of Keynote’s other stockholders.

Internal Revenue Code Section 162(m) Limitation

Section 162(m) of the Internal Revenue Code limits the tax deduction in any taxable year of a publicly held company to one million dollars for compensation paid to the Chief Executive Officer and its four other most highly compensated executive officers. Having considered the requirements of Section 162(m), the compensation committee believes that grants made pursuant to Keynote’s 1999 Equity Incentive Plan meet the requirements that such grants be “performance based” and are, therefore, exempt from the limitations of Section 162(m) on deductibility. Historically, and for fiscal year 2004 as well, the combined salary and bonus of each executive officer covered by Section 162(m) has been below one million dollars. The compensation committee’s present intention is to structure compensation arrangements to maximize Keynote’s available deductions consistent with Section 162(m) unless the occasion should arise that the compensation committee reasonably believes that the best interests of Keynote and its stockholders will be served by structuring compensation for a given executive officer, or executive officers, differently.

Compensation Committee

David Cowan

Deborah Rieman

17

STOCK PRICE PERFORMANCE GRAPH

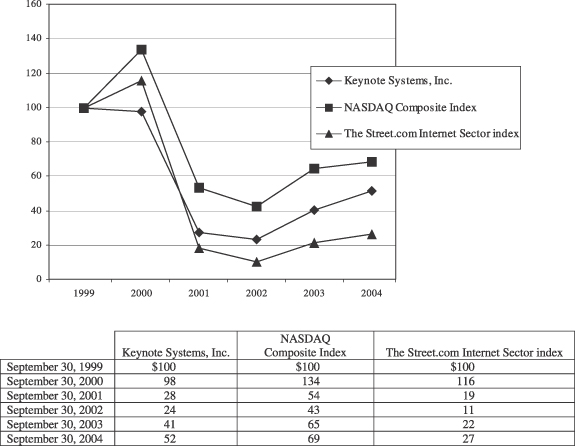

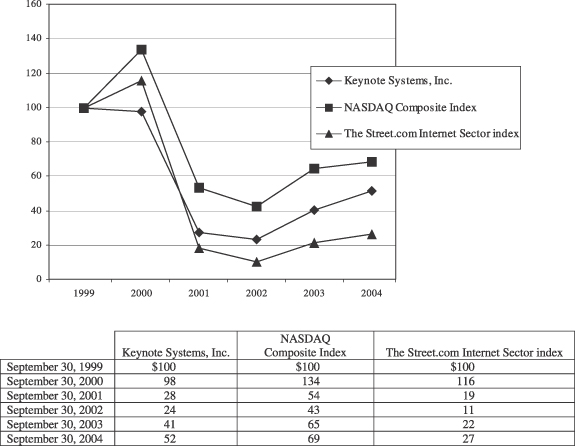

The following graph and table compare the cumulative total stockholder return on our common stock, the NASDAQ Composite Index and The Street.com Internet Sector Index. The graph and table assume that $100 was invested in our common stock, the NASDAQ Composite Index and The Street.com Internet Sector Index on September 30, 1999, and calculates the annual return through September 30, 2004. The stock price performance on the following graph and table is not necessarily indicative of future stock price performance.

18

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Other than the compensation arrangements that are described above in “Director Compensation” and “Employment Agreement with Chief Executive Officer,” since October 1, 2003, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or will be a party in which the amount involved exceeds $60,000 and in which any director, executive officer, holder of more than 5% of our common stock or any member of their immediate family had or will have a direct or indirect material interest.

STOCKHOLDER PROPOSALS FOR THE 2006 ANNUAL MEETING OF STOCKHOLDERS

Proposals of stockholders intended to be presented at our 2006 Annual Meeting of Stockholders and included in our proxy statement and form of proxy relating to the meeting, pursuant to Rule 14a-8 under the Exchange Act, must be received by us at our principal executive offices no later than 120 calendar days before the one-year anniversary of the date of this proxy statement, or September 30, 2005. In accordance with our bylaws, written notice of any proposals of stockholders intended to be presented at the meeting but not included in our proxy materials must be received by us at our principal executive offices not less than 60 days nor more than 90 days before the one-year anniversary of the date of the annual meeting to which this proxy statement relates. For the 2006 Annual Meeting, such notice must be received between December 24, 2005 and January 23, 2006. Such notice must include information on the nominees for election and the business to be brought before the meeting. Such notice must also contain information concerning the stockholder submitting the proposal, including its name and address, the number and class of shares of our capital stock beneficially owned by such stockholder and any material interest that such stockholder has in the business proposed to be brought before the meeting. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements, including conditions established by the Securities and Exchange Commission.

COMPLIANCE UNDER SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16 of the Securities Exchange Act of 1934, as amended, requires our directors and officers, and persons who own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the Securities and Exchange Commission and the NASDAQ National Market. Such persons are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms that they file.

Based solely on our review of the copies of such forms furnished to us and written representations from our executive officers and directors, we believe that all Section 16(a) filing requirements for the year ended September 30, 2004 were met.

OTHER BUSINESS

The board of directors does not presently intend to bring any other business before the Annual Meeting, and, so far as is known to the board, no matters are to be brought before the Annual Meeting except as specified in the notice of the Annual Meeting. As to any business that may properly come before the Annual Meeting, however, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

Whether or not you expect to attend the meeting, please complete, date, sign and promptly return the accompanying proxy in the enclosed postage-paid envelope so that your shares may be represented at the meeting.

19

KEYNOTE SYSTEMS, INC.

PROXY FOR ANNUAL MEETING OF STOCKHOLDERS

This proxy is solicited on behalf of the board of directors of Keynote Systems, Inc.

The undersigned hereby appoints Umang Gupta and Peter J. Maloney, or either of them, as proxies, each with full power of substitution, and hereby authorizes them to represent and to vote, as designated on the reverse side, all shares of common stock, $0.001 par value per share, of Keynote Systems, Inc. held of record by the undersigned on January 26, 2005, at the Annual Meeting of Stockholders to be held at the executive offices of Keynote Systems, Inc. in San Mateo, California, on Thursday, March 24, 2005 at 10:00 a.m., Pacific Time, and at any adjournments or postponements thereof.

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE)

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THE SEVEN NOMINEES LISTED IN PROPOSAL NO. 1 AND FOR PROPOSAL NO. 2. PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x

| | | | | | |

| ¨ | | FOR ALL NOMINEES | | Nominees: | | m Umang Gupta m David Cowan m Deborah Rieman m Mohan Gyani m Geoffrey Penney m Raymond L. Ocampo Jr. m Jennifer Bolt |

| |

| ¨ | | WITHHOLD AUTHORITY FOR ALL NOMINEES |

| | | |

| ¨ | | FOR ALL EXCEPT (SEE INSTRUCTION BELOW) | | | | |

| | |

| |

| Instruction: | | To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee for which you wish to withhold authority to vote, as shown here: l |

| 2. | | RATIFICATION OF THE SELECTION OF KPMG LLP AS KEYNOTE SYSTEMS, INC.’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2005. |

| | | | |

| ¨ FOR | | ¨ AGAINST | | ¨ ABSTAIN |

THIS PROXY WILL BE VOTED AS DIRECTED ABOVE. WHEN NO CHOICE IS INDICATED, THIS PROXY WILL BE VOTED FOR THE ELECTION OF ALL NOMINEES LISTED IN PROPOSAL NO. 1 AND FOR PROPOSAL NO. 2. In their discretion, the proxy holders are authorized to vote upon such other business as may properly come before the meeting or any adjournments or postponements thereof to the extent authorized by Rule 14a-4(c) promulgated under the Securities Exchange Act of 1934, as amended.

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE URGED TO COMPLETE, DATE, SIGN AND PROMPTLY MAIL THIS PROXY IN THE ENCLOSED ENVELOPE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE ANNUAL MEETING

To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. ¨

Signature of Stockholder: Date: Signature of Stockholder: Date:

Note: This proxy must be signed exactly as the name appears hereon. If shares are held jointly, each holder should sign. If signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If the signer is a partnership, please sign full partnership name by authorized person, giving full title as such.