through the early part of 2004 before stocks lost ground in the first quarter. The slow rate of job creation in the U.S. (and its implications for the sustainability of consumer spending) weighed on stocks, as did heightened terrorism concerns in the wake of the Madrid train bombing. Global stocks fell during the early part of the second quarter of 2004, based on concerns regarding rising inflation and tightening monetary policy in the U.S. Stronger economic data and signs of a resurgence in inflation led investors to expect that the U.S. Federal Reserve would raise interest rates sooner than anticipated, which weighed on stocks. Moreover, Chinese authorities announced measures aimed at curbing excessive investment, which had the effect of increasing investors’ perception of risk. This was felt particularly strongly in the emerging markets.

Global stocks reached their lows for the year in August, based on concerns that sharply rising oil prices would hurt corporate earnings and, potentially, reverse the global economic recovery. Concerns over potential terrorist attacks at the Olympics and the U.S. political conventions also weighed on stocks. Even as oil prices stayed stubbornly high, stocks began to rally in mid-August and, in a November post-election rally, finally broke out of the trading range they had been mired in throughout 2004. The definitive outcome of the U.S. election cheered investors who feared a disputed result, as in 2000, and a decline in oil prices further fueled the rally.

Global stocks ended the year with a return of nearly 15%, although a significant portion of the advance resulted from the dollar’s decline against currencies such as the euro and the Japanese yen. Energy stocks were strong during the year, as oil prices rose sharply. In contrast, technology stocks lagged, as corporate spending on IT products hasn’t significantly rebounded. Utilities benefited from investor demand for dividend yield, since most fixed income securities offered yields that were very low relative to historical norms. However, yield support did not help health care stocks, which were hurt due to concerns over drug safety following Merck’s high profile recall of Vioxx. In addition, several major pharmaceutical companies face uncertainty in the wake of pending legal suits from increasingly aggressive generic drug manufacturers. These lawsuits threaten to overturn highly profitable patents for some of their most important drugs. On a regional basis, European markets generally outperformed, helped by the rising euro, while the Japanese market lagged on concerns over the sustainability of the economic rebound.

For the year, emerging markets rose by over 25%, and the vast majority of countries recorded an increase. The asset class has now sustained its first two-year period of consecutive positive returns since 1993 and 1994, which is attracting further interest from global investors. Although the discounted valuations and positive outlook encourage us to remain constructive over the medium- and long-term, it is worth noting that the emerging markets asset class is no longer extraordinarily inexpensive. Small caps stocks also continued to outperform large caps in 2004, as they have for nearly five years. As with the emerging markets, valuations are no longer as compelling as they were before the period of outperformance, but calling turning points in the cap cycle is notoriously difficult.

For the year ended December 31, 2004, Lazard Retirement Equity Portfolio posted a total return of 11.79%, as compared with the 10.88% return of the S&P 500 Index.

U.S. stocks spent most of 2004 in a trading range, as strong earnings growth was offset by concerns over rising interest rates and the sustainability of a global economic rebound. However, a rally following the outcome of the U.S. presidential election drove equities to modest gains for the year. Energy stocks were strong, as oil prices rose sharply, and technology stocks lagged, as corporate spending on IT products has yet to significantly rebound.

During 2004, the Portfolio benefited from stock selection in health care by avoiding some of the many large stocks in the sector that experienced weakness due to drug safety issues and patent expirations. The Portfolio also benefited from stock selection and an overweight position in energy. Conversely, stock selection in materials hurt performance as more economically-sensitive stocks outperformed during the year.

While small and mid cap stocks continued to outperform in 2004, we are confident that the relative performance of large caps will improve.

Lazard Retirement Series, Inc.

Investment Overviews (continued)

|

Lazard Retirement Small Cap Portfolio

For the year ended December 31, 2004, Lazard Retirement Small Cap Portfolio posted a total return of 14.89%, as compared with the 18.33% return of Russell 2000 Index.

The Portfolio underperformed the Index by more than 300 basis points, with sector attribution acting as a small positive. The Portfolio benefited from stock selection in health care and technology. In health care, Neighborcare Inc., a distributor of drugs to alternative care settings and Inveresk Research, a provider of clinical research services to the pharmaceutical industry, both received takeover offers at substantial premiums from industry competitors. In the technology sector, DRS Technologies, a provider of electronics to the defense industry, continued to post strong earnings gains, and received an indication of acquisition interest from industry competitor, L3 Communications.

In financial services, results were negatively impacted by our holdings in eSpeed, Inc. and Knight Trading Group. Both companies offer trade execution services for the fixed income and equity marketplace, and were adversely affected by declining trading volumes following the strong market rally of 2003 and early 2004. Additionally, eSpeed faced increased pricing pressure from one of its competitors.

Materials/processing results were hurt by our focus away from the commodity producers of chemicals, metals, and precious metals. Producers of commodity goods continued to benefit from strong global demand, especially from China, and years of under-investment in production infrastructure. We continue our underweight position in this sector, although we have found select names, such as Chicago Bridge & Iron, which we believe may continue to benefit from infrastructure-related builds.

In consumer discretionary, our holding in Leapfrog Enterprises, a leading supplier of educational toys to the K–6th grade marketplace, declined due to disappointing sales of its products and continued logistical missteps. Additionally, Alliance Gaming, a manufacturer of gaming systems for casinos, also declined as sales of existing products slowed and the company increased investment spending on its next generation products.

While the small cap market has currently outperformed the large cap market for the past six years, relative valuations are still only near average historical levels and, thus, we believe that we may continue to see small caps perform admirably over the course of 2005. Despite the quick market rally of the second half of 2004, earnings growth expectations for 2005 look reasonable as the domestic economy continues to expand and absolute valuations, while not at the significant discount of a few years past, are well within historical norms. We believe that the pickup in merger and acquisitions activity that was seen in 2004 should continue to be a positive backdrop for small cap performance in 2005.

Lazard Retirement International Equity Portfolio

For the year ended December 31, 2004, Lazard Retirement International Equity Portfolio posted a total return of 14.98%, as compared with the 20.25% return of the MSCI EAFE Index.

International stocks spent most of 2004 in a trading range, as strong earnings growth was offset by concerns over rising interest rates, rising oil prices, and the sustainability of the global economic rebound. However, stocks ended 2004 with their best quarterly performance of the year as oil prices crested, easing concerns that higher energy costs would restrain earnings and economic growth. The rally started right after the U.S. presidential election, as uncertainty over the election’s outcome was lifted. Energy stocks were strong during the year, since oil prices rose sharply and utilities also performed well as investors sought out yield in a low interest rate environment. In contrast, technology stocks lagged as corporate spending on IT products has yet to significantly rebound. Health care stocks were hurt by the concerns over drug safety following Merck’s high profile recall of Vioxx. On a regional basis, European markets generally outperformed, helped by the rising euro, while the Japanese market lagged the broad index on concerns over the sustainability of the economic rebound.

During 2004, stock selection in health care helped the Portfolio by avoiding problem stocks like AstraZeneca, as well as from gains in Schering, which rose due to ongoing restructuring and the recent approval of its birth control pill. Also, Aventis gained based on expectations of revenue and cost synergies from the since

4

Lazard Retirement Series, Inc.

Investment Overviews (continued)

|

completed acquisition by Sanofi-Synthelabo. Conversely, stock selection in financials hurt performance when reinsurers Swiss Re and Munich Re were hurt by the rash of hurricanes hitting Florida. However, while the hurricanes cause near-term costs as payments are made to their reinsurance clients, the longer-term outlook for these companies’ earnings is positive, since the upfront costs to the industry remove capacity and improve pricing discipline going forward. Stock selection in consumer discretionary also detracted from returns, as Nissan declined due to concerns regarding the steel shortage caused by the increased demand for the metal in China. However, the company stated that the shortage should have a relatively small impact on sales in the U.S., its biggest market.

For 2004 overall, the Portfolio was hurt by its overweight position in large cap stocks, while small and mid cap stocks continued to outperform. However, we are confident that the performance of large caps may improve, since their relative valuation versus small caps is very attractive, based on historical norms.

Lazard Retirement Emerging Markets Portfolio

For the year ended December 31, 2004, Lazard Retirement Emerging Markets Portfolio posted a total return of 30.59%, as compared with the 25.55% return of the MSCI EM Index.

Over the past twelve months, the emerging markets asset class has witnessed a wide swing in investor sentiment and returns. The asset class rose despite government elections in Taiwan (which included an assassination attempt), India, Indonesia and the Philip-pines, a new Prime Minister and cabinet in Russia, election protests in the Ukraine, a new government in Egypt, and impeachment proceedings in South Korea. In addition, the market had to overcome fears of a Chi-nese hard landing, the death of Yasser Arafat, and the devastating Tsunami in Southeast Asia. Yet with all of these events, the Index finished the year up by more than 25%.

The Portfolio benefited from good stock selection in energy, consumer discretionary, industrials, materials, and Brazil. Our underweight position in information technology and overweight positions in Hungary, Indonesia, Egypt, Brazil, and telecommunications also added value. Strong share performance was exhibited in Caemi and CVRD (both Brazilian) based on increased iron demand as well as future price hikes; ABSA Group (South Africa), after Barclay’s Bank made an offer for the company; and Steinhoff International and Edgars (both South African) as domestic demand for retail products has increased as interest rates decline.

Conversely, poor stock selection in health care and consumer staples, and in Hungary, subtracted value. Additional detractors included: share price declines in Delta Electronics (Thailand), as a previous acquisition has continued to have problems integrating; Harmony Gold (South Africa), which declined after making a hostile bid for Gold Fields; and Pliva (Croatia), which has witnessed increased competition and eroding profits in its core pharmaceutical generics business.

In the first quarter of 2004, the Index rose by more than 9.5% . By region, Eastern European stocks generated a particularly robust return, with especially impressive performance from Russian, Hungarian, and Czech stocks. In both Asia and Latin America, the results were decent, although less dramatic. Positive individual country performances were generated in South Korea, as well as in Malaysia, Colombia, Venezuela, and Mexico. In Taiwan, the market rose despite the bizarre assassination attempt. Only a few countries, including Brazil, India, Thailand, and China, exhibited profit taking.

In response to warnings by U.S. Federal Reserve Chairman, Alan Greenspan, over the likelihood of a new, somewhat inflationary environment, and the probability of interest rates rises, emerging markets equities experienced significant profit taking in the second quarter. Moreover, Chinese authorities announced measures aimed at curbing excessive investment, which had the effect of increasing investors’ perception of risk. After having risen almost 10% in the first quarter, the Index fell by over 10% in the second quarter. All regional markets experienced sizeable corrections, the largest ones occurring in Eastern Europe and Asia. Economically sensitive sectors, such as energy, materials, consumer discretionary, and information technology, fared poorly. Defensive sectors, such as health care and consumer staples, performed relatively well. The U.S. dollar also rallied strongly after a sustained period of weakness.

5

Lazard Retirement Series, Inc.

Investment Overviews (concluded)

|

Emerging markets experienced a strong third quarter after a turbulent second quarter. Eastern European and, especially, Latin American equities led the way with significantly better performance than Asian shares. The quarter began with weak share price performance and investor caution based on several issues, including higher crude oil prices, threats of terrorism, uncertainty over the outcome of the U.S. election, and the risk of a prolonged slowdown in China. However, emerging markets equities continued to generate gains as investors re-entered commodity stocks, as concern over slowing Chinese growth moderated. The most notable feature of the quarter was record high crude oil prices.

Emerging markets equities rallied strongly during the fourth quarter of 2004, especially in the aftermath of the U.S. presidential election and lower crude oil prices. The Index rose by almost 17%, with especially good performance in Latin America. Asian markets recovered, aided by generally strong currencies and good performance in India and Indonesia. Markets in Eastern Europe lagged, although several countries finished with strong gains. South African equities moved sharply higher, aided by the strong rand. All sectors rose, with the most pronounced increases in financial services and telecommunications services. For the year, the vast majority of emerging market countries recorded an increase. The emerging markets asset class has currently sustained its first two-year period of consecutive positive returns since 1993 and 1994, which may be attracting further interest from global investors.

By sector, energy, consumer discretionary, industrials, materials, telecommunications, information technology, and financials outperformed. Conversely, health care and consumer staples underperformed.

Notes to Investment Overviews:All returns are for the year ended December 31, 2004 and reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolios have been waived or reimbursed by the Fund’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance.

The performance data of the indices and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. These indices are unmanaged, have no fees or costs and are not available for investment.

Past performance is not indicative, nor a guarantee, of future results.

6

Lazard Retirement Series, Inc.

Performance Overviews

|

Lazard Retirement Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement Equity Portfolio

and S&P 500® Index*

|

| Average Annual Total Returns* |

| Periods Ended December 31, 2004 |

| | | One | | Five | | Since |

| | | Year | | Years | | Inception** |

| |

|

| |

|

| |

|

|

| Retirement Equity Portfolio | | 11.79 | % | | 1.43 | % | | 3.79 | % |

| S&P 500 Index | | 10.88 | | | (2.30 | ) | | 3.15 | |

|

|

| * | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctu- ate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The S&P 500 Index is a market capitalization-weighted index of 500 common stocks, designed to measure performance of the broad domestic econo- my through changes in the aggregate market value of these stocks, which represent all major industries. |

| |

| ** | The Portfolio’s inception date was March 18, 1998. |

| |

7

Lazard Retirement Series, Inc.

Performance Overviews (continued)

|

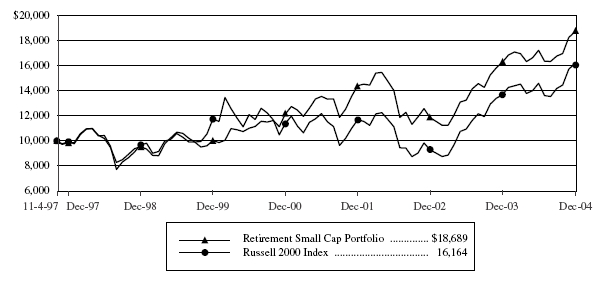

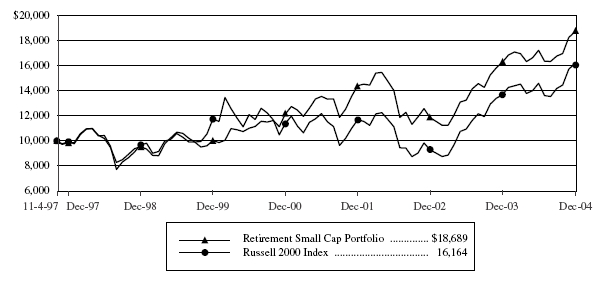

Lazard Retirement Small Cap Portfolio

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement Small Cap Portfolio

and Russell 2000® Index*

|

| Average Annual Total Returns* |

| Periods Ended December 31, 2004 |

| | | One | | Five | | Since |

| | | Year | | Years | | Inception** |

| |

| |

|

| |

|

|

| Retirement Small Cap Portfolio | | 14.89 | % | | 13.26 | % | | 9.13 | % |

| Russell 2000 Index | | 18.33 | | | 6.61 | | | 6.93 | |

|

|

| * | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The Russell 2000 Index is comprised of the 2,000 smallest U.S. companies included in the Russell 3000® Index (which consists of the 3,000 largest U.S. companies by capitalization). |

| |

| ** | The Portfolio’s inception date was November 4, 1997. |

| |

8

Lazard Retirement Series, Inc.

Performance Overviews (continued)

|

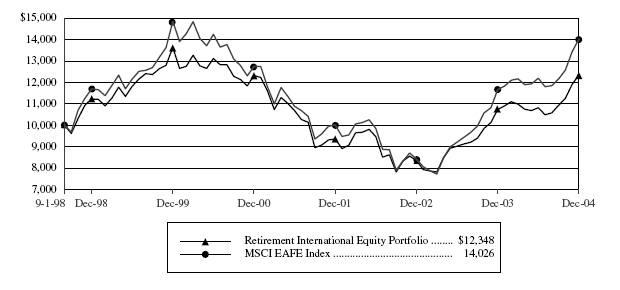

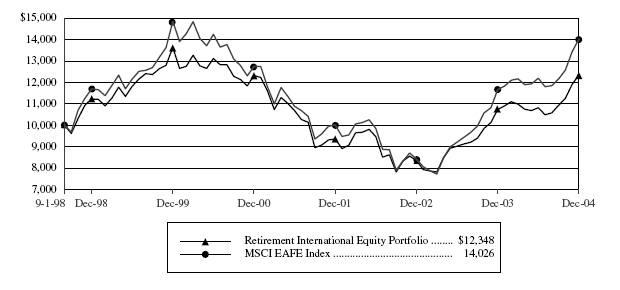

Lazard Retirement International Equity Portfolio

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement International Equity Portfolio

and Morgan Stanley Capital International (MSCI®) Europe, Australasia and Far East (EAFE®) Index*

|

| Average Annual Total Returns* |

| Periods Ended December 31, 2004 |

| | | One | | Five | | Since |

| | | Year | | Years | | Inception** |

| |

|

| |

|

| |

|

|

| Retirement International Equity Portfolio | | 14.98 | % | | (1.96 | )% | | 3.39 | % |

| MSCI EAFE Index. | | 20.25 | | | (1.13 | ) | | 5.48 | |

|

|

| * | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no sin- gle period of any length may be taken as typical of what may be expected in future periods. |

| |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The MSCI EAFE Index is a broadly diversified international index comprised of equity securities of approximately 1,000 companies located outside the United States. |

| |

| ** | The Portfolio’s inception date was September 1, 1998. |

| |

9

Lazard Retirement Series, Inc.

Performance Overviews (concluded)

|

Lazard Retirement Emerging Markets Portfolio

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement Emerging Markets Portfolio

and MSCI Emerging Markets (EM®) Index*

|

| Average Annual Total Returns* |

| Periods Ended December 31, 2004 |

| | | One | | Five | | Since |

| | | Year | | Years | | Inception** |

| |

|

| |

|

| |

|

|

| Retirement Emerging Markets Portfolio | | 30.59 | % | | 6.08 | % | | 5.85 | % |

| MSCI EM Index | | 25.55 | | | 4.34 | | | 5.27 | |

|

|

| * | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The MSCI EM Index is comprised of emerging market securities in countries open to non-local investors. |

| |

| ** | The Portfolio’s inception date was November 4, 1997. |

| |

10

Lazard Retirement Series, Inc.

Information About Your Fund’s Expenses

|

Expense Example

As a shareholder of the Fund, you incur ongoing costs including management fees; distribution and service (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2004 through December 31, 2004.

Actual Expenses

For each Portfolio of the Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Portfolio of the Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that you also bear fees and charges imposed by insurance companies at the separate account level, which are described in the separate prospectuses issued by the insurance companies. Such charges will have the effect of reducing Account Value.

| | | | | | | | | | | | Annualized |

| | | Beginning | | Ending | | Expenses Paid | | Expense Ratio |

| | | Account Value | | Account Value | | During Period* | | During Period |

| |

|

| |

|

| |

|

| |

|

|

| | | 7/1/04 | | 12/31/04 | | 7/1/04–12/31/04 | | 7/1/04–12/31/04 |

| |

|

| |

|

| |

|

| |

|

|

| Retirement Equity Portfolio | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | $ | 1,073.50 | | $ | 6.52 | | 1.25 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | $ | 1,018.85 | | $ | 6.34 | | 1.25 | % |

| |

| Retirement Small Cap Portfolio | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | $ | 1,085.40 | | $ | 6.55 | | 1.25 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | $ | 1,018.85 | | $ | 6.34 | | 1.25 | % |

| |

| Retirement International Equity Portfolio | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | $ | 1,141.00 | | $ | 6.73 | | 1.25 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | $ | 1,018.85 | | $ | 6.34 | | 1.25 | % |

| |

| Retirement Emerging Markets Portfolio | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | $ | 1,318.20 | | $ | 9.32 | | 1.60 | % |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | $ | 1,017.09 | | $ | 8.11 | | 1.60 | % |

|

| * | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect one-half year period). |

| |

11

Lazard Retirement Series, Inc.

Portfolio Holdings Presented by Sector

December 31, 2004

|

| | | | | | | | | Lazard | | Lazard |

| | | Lazard | | Lazard | | Retirement | | Retirement |

| | | Retirement | | Retirement | | International | | Emerging |

| | | Equity | | Small Cap | | Equity | | Markets |

| Sector* | | Portfolio | | Portfolio | | Portfolio | | Portfolio |

| |

|

| |

|

| |

|

| |

|

|

| Commercial Services | | 3.4 | % | | 10.9 | % | | 1.0 | % | | 2.4 | % |

| Consumer Discretionary | | 11.8 | | | 12.8 | | | 7.2 | | | 7.0 | |

| Consumer Durables | | — | | | — | | | 5.4 | | | 2.8 | |

| Consumer Staples | | 8.5 | | | 0.6 | | | 8.9 | | | 10.2 | |

| Energy | | 10.4 | | | 7.5 | | | 11.5 | | | 6.0 | |

| Financials | | 27.2 | | | 18.9 | | | 25.7 | | | 16.4 | |

| Health Care | | 6.5 | | | 10.0 | | | 8.6 | | | 1.8 | |

| Process Industry | | 5.2 | | | 6.4 | | | 3.8 | | | 16.1 | |

| Producer Manufacturing | | 7.7 | | | 5.1 | | | 5.6 | | | 0.9 | |

| Technology | | 7.4 | | | 12.8 | | | 3.8 | | | 12.4 | |

| Telecommunications | | 4.1 | | | 2.8 | | | 10.1 | | | 15.8 | |

| Transportation | | 1.0 | | | 4.2 | | | 0.9 | | | 1.6 | |

| Utilities | | 3.8 | | | 1.9 | | | 5.4 | | | 1.1 | |

| Short-Term Investments | | 3.0 | | | 6.1 | | | 2.1 | | | 5.5 | |

| |

|

| |

|

| |

|

| |

|

|

| Total Investments | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| |

|

| |

|

| |

|

| |

|

|

|

| * | Represents percentage of total investments. |

| |

12

Lazard Retirement Series, Inc.

Portfolios of Investments

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement Equity Portfolio | | | | |

| Common Stocks—97.0% | | | | |

| Aerospace & Defense—2.2% | | | | |

| Goodrich Corp. | 700 | | $ | 22,848 |

| Lockheed Martin Corp. | 650 | | | 36,108 |

| United Technologies Corp. | 450 | | | 46,507 |

| | |

|

|

| | | | | 105,463 |

| | |

|

|

| Airlines—0.5% | | | | |

| Southwest Airlines Co. | 1,500 | | | 24,420 |

| | |

|

|

| Apparel & Textiles—0.4% | | | | |

| Reebok International, Ltd. | 400 | | | 17,600 |

| | |

|

|

| Banking—10.0% | | | | |

| Bank of America Corp. | 2,400 | | | 112,776 |

| Golden West Financial Corp. | 1,000 | | | 61,420 |

| M&T Bank Corp. | 250 | | | 26,960 |

| North Fork Bancorporation, Inc. | 2,100 | | | 60,585 |

| Northern Trust Corp. | 1,450 | | | 70,441 |

| SunTrust Banks, Inc. | 850 | | | 62,798 |

| U.S. Bancorp | 800 | | | 25,056 |

| Wells Fargo & Co. | 1,100 | | | 68,365 |

| | |

|

|

| | | | | 488,401 |

| | |

|

|

| Business Services & Supplies—4.2% | | | | |

| ARAMARK Corp., Class B | 2,000 | | | 53,020 |

| Automatic Data Processing, Inc. | 1,100 | | | 48,785 |

| First Data Corp. | 800 | | | 34,032 |

| IAC/InterActiveCorp. (a) | 1,000 | | | 27,620 |

| Iron Mountain, Inc. (a) | 600 | | | 18,294 |

| Pitney Bowes, Inc. | 500 | | | 23,140 |

| | |

|

|

| | | | | 204,891 |

| | |

|

|

| Cable & Broadcasting—1.1% | | | | |

| Comcast Corp., Class A (a) | 1,600 | | | 52,544 |

| | |

|

|

| Chemicals—1.7% | | | | |

| Du Pont (E.I.) de Nemours & Co. | 950 | | | 46,598 |

| Praxair, Inc. | 800 | | | 35,320 |

| | |

|

|

| | | | | 81,918 |

| | |

|

|

| Computer Software—2.3% | | | | |

| Microsoft Corp. | 3,100 | | | 82,801 |

| Oracle Corp. (a) | 2,150 | | | 29,498 |

| | |

|

|

| | | | | 112,299 |

| | |

|

|

| Computers & Business Equipment—3.1% | | | |

| Cisco Systems, Inc. (a) | 1,800 | | | 34,740 |

| Hewlett-Packard Co. | 1,900 | | | 39,843 |

| International Business Machines Corp. . | 775 | | | 76,399 |

| | |

|

|

| | | | | 150,982 |

| | |

|

|

| Consumer Products—0.9% | | | | |

| Altria Group, Inc. | 750 | | | 45,825 |

| | |

|

|

| Containers—1.3% | | | | |

| Pactiv Corp. (a) | 1,000 | | | 25,290 |

| Sealed Air Corp. (a) | 750 | | | 39,953 |

| | |

|

|

| | | | | 65,243 |

| | |

|

|

| Cosmetics & Toiletries—1.5% | | | | |

| Avon Products, Inc. | 1,400 | | | 54,180 |

| Colgate-Palmolive Co. | 400 | | | 20,464 |

| | |

|

|

| | | | | 74,644 |

| | |

|

|

| Diversified—4.5% | | | | |

| Emerson Electric Co. | 500 | | | 35,050 |

| General Electric Co. | 2,950 | | | 107,675 |

| Honeywell International, Inc. | 600 | | | 21,246 |

| Tyco International, Ltd. | 1,600 | | | 57,184 |

| | |

|

|

| | | | | 221,155 |

| | |

|

|

| Drugs & Health Care—3.3% | | | | |

| GlaxoSmithKline PLC ADR | 700 | | | 33,173 |

| Medco Health Solutions, Inc. (a) | 1,200 | | | 49,920 |

| Novartis AG ADR | 600 | | | 30,324 |

| Pfizer, Inc. | 1,750 | | | 47,057 |

| | |

|

|

| | | | | 160,474 |

| | |

|

|

| Environmental—1.3% | | | | |

| Republic Services, Inc. | 1,900 | | | 63,726 |

| | |

|

|

| Financial Services—12.0% | | | | |

| American Express Co. | 1,500 | | | 84,555 |

| Citigroup, Inc. | 2,600 | | | 125,268 |

| Fifth Third Bancorp | 2,000 | | | 94,560 |

| JPMorgan Chase & Co. | 2,854 | | | 111,335 |

| MBNA Corp. | 1,700 | | | 47,923 |

| Merrill Lynch & Co., Inc. | 800 | | | 47,816 |

| Morgan Stanley | 1,350 | | | 74,952 |

| | |

|

|

| | | | | 586,409 |

| | |

|

|

| Food & Beverages—5.0% | | | | |

| General Mills, Inc. | 1,300 | | | 64,623 |

| H.J. Heinz Co. | 950 | | | 37,040 |

| PepsiCo, Inc. | 525 | | | 27,405 |

| Sara Lee Corp. | 1,000 | | | 24,140 |

| Sysco Corp. | 600 | | | 22,902 |

| The Coca-Cola Co. | 1,300 | | | 54,119 |

| The Pepsi Bottling Group, Inc. | 500 | | | 13,520 |

| | |

|

|

| | | | | 243,749 |

| | |

|

|

| Forest & Paper Products—1.1% | | | | |

| International Paper Co. | 1,300 | | | 54,600 |

| | |

|

|

The accompanying notes are an integral part of these financial statements.

13

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement Equity Portfolio (concluded) | | | |

| Insurance—6.0% | | | | |

| American International Group, Inc. | 1,100 | | $ | 72,237 |

| Berkshire Hathaway, Inc., Class B (a) | 23 | | | 67,528 |

| Jefferson-Pilot Corp. | 700 | | | 36,372 |

| RenaissanceRe Holdings, Ltd. | 1,000 | | | 52,080 |

| The St. Paul Travelers Cos., Inc. | 700 | | | 25,949 |

| WellPoint, Inc. (a) | 325 | | | 37,375 |

| | |

|

|

| | | | | 291,541 |

| | |

|

|

| Leisure & Entertainment—0.5% | | | | |

| Mattel, Inc. | 1,300 | | | 25,337 |

| | |

|

|

| Machinery—0.5% | | | | |

| Deere & Co. | 350 | | | 26,040 |

| | |

|

|

| Medical Products & Services—2.5% | | | | |

| Baxter International, Inc. | 1,000 | | | 34,540 |

| Johnson & Johnson | 1,000 | | | 63,420 |

| MedImmune, Inc. (a) | 800 | | | 21,688 |

| | |

|

|

| | | | | 119,648 |

| | |

|

|

| Metals & Mining—1.1% | | | | |

| Alcoa, Inc. | 1,700 | | | 53,414 |

| | |

|

|

| Multimedia—6.1% | | | | |

| Clear Channel Communications, Inc. | 600 | | | 20,094 |

| News Corp., Class A | 7,400 | | | 138,084 |

| Time Warner, Inc. (a) | 2,800 | | | 54,432 |

| Tribune Co. | 900 | | | 37,926 |

| Viacom, Inc., Class B | 1,300 | | | 47,307 |

| | |

|

|

| | | | | 297,843 |

| | |

|

|

| Oil & Gas—10.3% | | | | |

| Burlington Resources, Inc. | 1,300 | | | 56,550 |

| ChevronTexaco Corp. | 1,300 | | | 68,263 |

| ConocoPhillips | 750 | | | 65,122 |

| Exxon Mobil Corp. | 3,000 | | | 153,780 |

| GlobalSantaFe Corp. | 1,950 | | | 64,565 |

| Marathon Oil Corp. | 300 | | | 11,283 |

| Occidental Petroleum Corp. | 300 | | | 17,508 |

| Schlumberger, Ltd. | 400 | | | 26,780 |

| Unocal Corp. | 950 | | | 41,078 |

| | |

|

|

| | | | | 504,929 |

| | |

|

|

| Restaurants—1.1% | | | | |

| Brinker International, Inc. (a) | 700 | | | 24,549 |

| Darden Restaurants, Inc. | 1,000 | | | 27,740 |

| | |

|

|

| | | | | 52,289 |

| | |

|

|

| Retail—3.1% | | | | |

| Sears, Roebuck & Co. | 500 | | | 25,515 |

| Target Corp. | 500 | | | 25,965 |

| The Home Depot, Inc. | 1,300 | | | 55,562 |

| Wal-Mart Stores, Inc. | 850 | | | 44,897 |

| | |

|

|

| | | | | 151,939 |

| | |

|

|

| Semiconductors & Components—2.0% | | | |

| Intel Corp. | 1,500 | | | 35,085 |

| Novellus Systems, Inc. (a) | 1,400 | | | 39,046 |

| Texas Instruments, Inc. | 1,000 | | | 24,620 |

| | |

|

|

| | | | | 98,751 |

| | |

|

|

| Telecommunications—3.0% | | | | |

| BellSouth Corp. | 1,200 | | | 33,348 |

| Nextel Communications, Inc., Class A (a) | 400 | | | 12,000 |

| Sprint Corp. | 1,100 | | | 27,335 |

| Verizon Communications, Inc. | 1,850 | | | 74,944 |

| | |

|

|

| | | | | 147,627 |

| | |

|

|

| Transportation—0.6% | | | | |

| Union Pacific Corp. | 400 | | | 26,900 |

| | |

|

|

| Utilities—3.8% | | | | |

| Ameren Corp. | 500 | | | 25,070 |

| Duke Energy Corp. | 600 | | | 15,198 |

| Entergy Corp. | 500 | | | 33,795 |

| KeySpan Corp. | 1,400 | | | 55,230 |

| The Southern Co. | 1,650 | | | 55,308 |

| | |

|

|

| | | | | 184,601 |

| | |

|

|

| Total Common Stocks | | | | |

| (Identified cost $3,980,667) | | | | 4,735,202 |

| | | |

|

|

| Warrant—0.0% | | | | |

| Computers & Business Equipment—0.0% | | | |

| Lucent Technologies, Inc., | | | | |

| 12/10/07 | | | | |

| (Identified cost $0) (a), (d) | 267 | | | 422 |

| | |

|

|

| | Principal | | |

| | Amount | | |

| | (000) | | |

|

|

| | |

| Repurchase Agreement—3.0% | | | | |

| State Street Bank and Trust Co., | | | | |

| 1.40%, 01/03/05 | | | | |

| (Dated 12/31/04, collateralized by | | | | |

| $140,000 United States Treasury | | | | |

| Note, 6.625%, 05/15/07, with a | | | | |

| value of $152,160) | | | | |

| Proceeds of $146,017 | | | | |

| (Identified cost $146,000) | $146 | | | 146,000 |

| | |

|

|

| Total Investments | | | | |

| (Identified cost $4,126,667) (b) | 100.0 | % | $ | 4,881,624 |

| Cash and Other Assets in Excess | | | | |

| of Liabilities | — | | | 1,131 |

|

|

|

|

|

| Net Assets | 100.0 | % | $ | 4,882,755 |

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

14

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement Small Cap Portfolio | | | | |

| Common Stocks—95.0% | | | | |

| Aerospace & Defense—2.2% | | | | |

| DRS Technologies, Inc. (a) | 27,600 | | $ | 1,178,796 |

| Esterline Technologies Corp. (a) | 12,400 | | | 404,860 |

| The Titan Corp. (a) | 55,100 | | | 892,620 |

| | |

|

|

| | | | | 2,476,276 |

| | |

|

|

| Agriculture—0.8% | | | | |

| Delta & Pine Land Co. | 33,900 | | | 924,792 |

| | |

|

|

| Apparel & Textiles—4.8% | | | | |

| AnnTaylor Stores Corp. (a) | 28,200 | | | 607,146 |

| Hot Topic, Inc. (a) | 51,900 | | | 892,161 |

| K-Swiss, Inc., Class A | 19,400 | | | 564,928 |

| The Gymboree Corp. (a) | 59,000 | | | 756,380 |

| The Sports Authority, Inc. (a) | 34,600 | | | 890,950 |

| The Timberland Co., Class A (a) | 13,000 | | | 814,710 |

| The Warnaco Group, Inc. (a) | 39,500 | | | 853,200 |

| | |

|

|

| | | | | 5,379,475 |

| | |

|

|

| Automotive—2.2% | | | | |

| CSK Auto Corp. (a) | 43,500 | | | 728,190 |

| Rush Enterprises, Inc., Class A (a) | 26,600 | | | 431,718 |

| TBC Corp. (a) | 27,300 | | | 758,940 |

| Winnebago Industries, Inc. | 13,600 | | | 531,216 |

| | |

|

|

| | | | | 2,450,064 |

| | |

|

|

| Banking—7.3% | | | | |

| Bank of the Ozarks, Inc. | 2,200 | | | 74,866 |

| First Community Bancorp | 13,200 | | | 563,640 |

| First Midwest Bancorp, Inc. | 20,600 | | | 747,574 |

| First Republic Bank | 11,700 | | | 620,100 |

| Hudson United Bancorp | 7,800 | | | 307,164 |

| MB Financial, Inc. | 13,500 | | | 569,025 |

| Provident Bankshares Corp. | 18,900 | | | 687,393 |

| Sterling Bancshares, Inc. | 69,200 | | | 987,484 |

| Texas Regional Bancshares, Inc., | | | | |

| Class A | 17,400 | | | 568,632 |

| Umpqua Holdings Corp. | 18,800 | | | 473,948 |

| United Bankshares, Inc. | 25,700 | | | 980,455 |

| W Holding Co., Inc. | 26,068 | | | 598,003 |

| Westamerica Bancorporation | 16,100 | | | 938,791 |

| | |

|

|

| | | | | 8,117,075 |

| | |

|

|

| Building & Construction—1.5% | | | | |

| Chicago Bridge & Iron Co. NV, | | | | |

| NY Shares | 19,800 | | | 792,000 |

| The Shaw Group, Inc. (a) | 48,500 | | | 865,725 |

| | |

|

|

| | | | | 1,657,725 |

| | |

|

|

| Business Services & Supplies—8.4% | | | | |

| ADVO, Inc. | 38,900 | | | 1,386,785 |

| Arbitron, Inc. (a) | 30,700 | | | 1,202,826 |

| BearingPoint, Inc. (a) | 72,400 | | | 581,372 |

| Herman Miller, Inc. | 38,000 | | | 1,049,940 |

| MPS Group, Inc. (a) | 76,000 | | | 931,760 |

| ProQuest Co. (a) | 22,100 | | | 656,370 |

| Tetra Tech, Inc. (a) | 64,300 | | | 1,076,382 |

| The BISYS Group, Inc. (a) | 49,000 | | | 806,050 |

| Veritas DGC, Inc. (a) | 35,400 | | | 793,314 |

| Watson Wyatt & Co. Holdings | 32,000 | | | 862,400 |

| | |

|

|

| | | | | 9,347,199 |

| | |

|

|

| Chemicals—2.5% | | | | |

| Ferro Corp. | 19,300 | | | 447,567 |

| Olin Corp. | 41,900 | | | 922,638 |

| PolyOne Corp. (a) | 67,500 | | | 611,550 |

| Spartech Corp. | 30,500 | | | 826,245 |

| | |

|

|

| | | | | 2,808,000 |

| | |

|

|

| Coal—0.7% | | | | |

| Foundation Coal Holdings, Inc. | 31,500 | | | 726,390 |

| | |

|

|

| Computer Software—2.5% | | | | |

| Avocent Corp. (a) | 13,800 | | | 559,176 |

| Catapult Communications Corp. (a) | 6,200 | | | 149,792 |

| JDA Software Group, Inc. (a) | 32,000 | | | 435,840 |

| SERENA Software, Inc. (a) | 41,500 | | | 898,060 |

| Verity, Inc. (a) | 52,200 | | | 684,864 |

| | |

|

|

| | | | | 2,727,732 |

| | |

|

|

| Computers & Business Equipment—2.5% | | | |

| Advanced Digital Information | | | | |

| Corp. (a) | 54,300 | | | 544,086 |

| Black Box Corp. | 1,600 | | | 76,832 |

| Foundry Networks, Inc. (a) | 50,700 | | | 667,212 |

| Komag, Inc. (a) | 46,300 | | | 869,514 |

| Photon Dynamics, Inc. (a) | 27,500 | | | 667,700 |

| | |

|

|

| | | | | 2,825,344 |

| | |

|

|

| Consumer Products—1.1% | | | | |

| Jarden Corp. (a) | 8,300 | | | 360,552 |

| The Scotts Co., Class A (a) | 12,200 | | | 896,944 |

| | |

|

|

| | | | | 1,257,496 |

| | |

|

|

| Diversified—0.9% | | | | |

| The Liberty Corp. | 21,800 | | | 958,328 |

| | |

|

|

The accompanying notes are an integral part of these financial statements.

15

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement Small Cap Portfolio (continued) |

| Drugs & Health Care—6.6% | | | | |

| Able Laboratories, Inc. (a) | 28,000 | | $ | 637,000 |

| Andrx Corp. (a) | 43,200 | | | 943,056 |

| Beverly Enterprises, Inc. (a) | 115,700 | | | 1,058,655 |

| Kindred Healthcare, Inc. (a) | 34,000 | | | 1,018,300 |

| LifePoint Hospitals, Inc. (a) | 39,300 | | | 1,368,426 |

| MIM Corp. (a) | 85,800 | | | 544,830 |

| Select Medical Corp. | 63,600 | | | 1,119,360 |

| Taro Pharmaceutical Industries, Ltd. (a) | 17,100 | | | 581,913 |

| | |

|

|

| | | | | 7,271,540 |

| | |

|

|

| Education—2.0% | | | | |

| Corinthian Colleges, Inc. (a) | 40,700 | | | 766,992 |

| DeVry, Inc. (a) | 31,400 | | | 545,104 |

| Leapfrog Enterprises, Inc. (a) | 1,500 | | | 20,400 |

| Learning Tree International, Inc. (a) | 67,900 | | | 909,860 |

| | |

|

|

| | | | | 2,242,356 |

| | |

|

|

| Electrical Equipment—2.8% | | | | |

| Coherent, Inc. (a) | 26,000 | | | 791,440 |

| General Cable Corp. (a) | 12,300 | | | 170,355 |

| GrafTech International, Ltd. (a) | 56,800 | | | 537,328 |

| Plexus Corp. (a) | 52,700 | | | 685,627 |

| Rogers Corp. (a) | 20,700 | | | 892,170 |

| | |

|

|

| | | | | 3,076,920 |

| | |

|

|

| Electronics—1.8% | | | | |

| Metrologic Instruments, Inc. (a) | 33,700 | | | 716,125 |

| TTM Technologies, Inc. (a) | 104,400 | | | 1,231,920 |

| | |

|

|

| | | | | 1,948,045 |

| | |

|

|

| Environmental—0.5% | | | | |

| Waste Connections, Inc. (a) | 15,950 | | | 546,288 |

| | |

|

|

| Equipment Rental—0.4% | | | | |

| United Rentals, Inc. (a) | 25,200 | | | 476,280 |

| | |

|

|

| Financial Services—5.0% | | | | |

| Calamos Asset Management, Inc., | | | | |

| Class A | 23,300 | | | 629,100 |

| eSpeed, Inc., Class A (a) | 67,300 | | | 832,501 |

| Financial Federal Corp. (a) | 17,000 | | | 666,400 |

| IndyMac Bancorp, Inc. | 13,200 | | | 454,740 |

| Knight Trading Group, Inc., Class A (a) | 103,700 | | | 1,135,515 |

| MAF Bancorp, Inc. | 20,100 | | | 900,882 |

| The South Financial Group, Inc. | 28,200 | | | 917,346 |

| | |

|

|

| | | | | 5,536,484 |

| | |

|

|

| Food & Beverages—0.6% | | | | |

| Performance Food Group Co. (a) | 25,400 | | | 683,514 |

| | |

|

|

| Forest & Paper Products—0.5% | | | | |

| Packaging Corp. of America | 22,400 | | | 527,520 |

| | |

|

|

| Household Products & Home | | | | |

| Furnishings—0.4% | | | | |

| Cost Plus, Inc. (a) | 14,100 | | | 453,033 |

| | |

|

|

| Industrial & Machinery—1.9% | | | | |

| Roper Industries, Inc. | 18,100 | | | 1,099,937 |

| Tecumseh Products Co., Class A | 21,300 | | | 1,018,140 |

| | |

|

|

| | | | | 2,118,077 |

| | |

|

|

| Insurance—3.3% | | | | |

| Arch Capital Group, Ltd. (a) | 28,800 | | | 1,114,560 |

| Assured Guaranty, Ltd. | 49,200 | | | 967,764 |

| Bristol West Holdings, Inc. | 7,800 | | | 156,000 |

| Max Re Capital, Ltd. | 30,700 | | | 654,831 |

| Reinsurance Group of America, Inc. | 15,900 | | | 770,355 |

| | |

|

|

| | | | | 3,663,510 |

| | |

|

|

| Leisure & Entertainment—1.1% | | | | |

| Alliance Gaming Corp. (a) | 57,400 | | | 792,694 |

| WMS Industries, Inc. (a) | 13,200 | | | 442,728 |

| | |

|

|

| | | | | 1,235,422 |

| | |

|

|

| Medical Products & Services—3.5% | | | | |

| Bio-Rad Laboratories, Inc., Class A (a) | 800 | | | 45,896 |

| Charles River Laboratories | | | | |

| International, Inc. (a) | 6,288 | | | 289,311 |

| Cutera, Inc. | 7,900 | | | 98,592 |

| DJ Orthopedics, Inc. (a) | 42,000 | | | 899,640 |

| Hanger Orthopedic Group, Inc. (a) | 12,900 | | | 104,490 |

| INAMED Corp. (a) | 15,950 | | | 1,008,837 |

| Martek Biosciences Corp. (a) | 8,600 | | | 440,320 |

| PSS World Medical, Inc. (a) | 72,400 | | | 906,086 |

| Respironics, Inc. (a) | 800 | | | 43,488 |

| Viasys Healthcare, Inc. (a) | 4,000 | | | 76,000 |

| | |

|

|

| | | | | 3,912,660 |

| | |

|

|

| Oil & Gas—6.9% | | | | |

| Bill Barrett Corp. | 7,300 | | | 233,527 |

| Denbury Resources, Inc. (a) | 20,500 | | | 562,725 |

| Energy Partners, Ltd. (a) | 21,200 | | | 429,724 |

| Forest Oil Corp. (a) | 20,900 | | | 662,948 |

| Grey Wolf, Inc. (a) | 104,300 | | | 549,661 |

| Hanover Compressor Co. (a) | 51,400 | | | 726,282 |

| Key Energy Services, Inc. (a) | 108,800 | | | 1,283,840 |

| Kinder Morgan Management, LLC (a) | 21,484 | | | 874,399 |

| Maverick Tube Corp. (a) | 13,800 | | | 418,140 |

| Range Resources Corp. | 28,500 | | | 583,110 |

| The Houston Exploration Co. (a) | 12,000 | | | 675,720 |

| Whiting Petroleum Corp. (a) | 22,700 | | | 686,675 |

| | |

|

|

| | | | | 7,686,751 |

| | |

|

|

The accompanying notes are an integral part of these financial statements.

16

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement Small Cap Portfolio (concluded) |

| Printing & Publishing—1.9% | | | | |

| Journal Register Co. (a) | 56,668 | | $ | 1,095,392 |

| R. H. Donnelley Corp. (a) | 17,700 | | | 1,045,185 |

| | |

|

|

| | | | | 2,140,577 |

| | |

|

|

| Real Estate—3.1% | | | | |

| Alexandria Real Estate Equities, Inc. | 5,500 | | | 409,310 |

| Capital Automotive REIT | 10,400 | | | 369,460 |

| CarrAmerica Realty Corp. | 15,100 | | | 498,300 |

| Inland Real Estate Corp. | 21,800 | | | 347,710 |

| Lexington Corporate Properties Trust | 25,300 | | | 571,274 |

| Prentiss Properties Trust | 8,200 | | | 313,240 |

| The Mills Corp. | 14,500 | | | 924,520 |

| | |

|

|

| | | | | 3,433,814 |

| | |

|

|

| Restaurants—0.6% | | | | |

| CBRL Group, Inc. | 15,900 | | | 665,415 |

| | |

|

|

| Retail—1.5% | | | | |

| 99 Cents Only Stores (a) | 50,500 | | | 816,080 |

| Tractor Supply Co. (a) | 22,300 | | | 829,783 |

| | |

|

|

| | | | | 1,645,863 |

| | |

|

|

| Semiconductors & Components—3.5% | | | |

| AMIS Holdings, Inc. (a) | 53,300 | | | 880,516 |

| Benchmark Electronics, Inc. (a) | 20,700 | | | 705,870 |

| Brooks Automation, Inc. (a) | 41,400 | | | 712,908 |

| Exar Corp. (a) | 81,000 | | | 1,149,390 |

| Ultratech, Inc. (a) | 22,600 | | | 426,010 |

| | |

|

|

| | | | | 3,874,694 |

| | |

|

|

| Steel—0.6% | | | | |

| Schnitzer Steel Industries, Inc., | | | | |

| Class A | 9,400 | | | 318,942 |

| Steel Dynamics, Inc. | 8,400 | | | 318,192 |

| | |

|

|

| | | | | 637,134 |

| | |

|

|

| Telecommunications—2.9% | | | | |

| C-COR, Inc. (a) | 109,500 | | | 1,018,350 |

| CommScope, Inc. (a) | 52,900 | | | 999,810 |

| Ditech Communications Corp. (a) | 28,700 | | | 429,065 |

| Oplink Communications, Inc. (a) | 104,000 | | | 204,880 |

| Wireless Facilities, Inc. (a) | 56,800 | | | 536,192 |

| | |

|

|

| | | | | 3,188,297 |

| | |

|

|

| Transportation—4.2% | | | | | | |

| AirTran Holdings, Inc. (a) | 72,500 | | | | 775,750 | |

| Forward Air Corp. (a) | 17,100 | | | | 764,370 | |

| OMI Corp. | 40,900 | | | | 689,165 | |

| Overnite Corp. | 18,500 | | | | 688,940 | |

| Pacer International, Inc. (a) | 55,800 | | | | 1,186,308 | |

| Swift Transportation Co., Inc. (a) | 26,200 | | | | 562,776 | |

| | | |

|

| |

| | | | | | 4,667,309 | |

| | | |

|

| |

| Utilities—2.0% | | | | | | |

| AGL Resources, Inc. | 22,000 | | | | 731,280 | |

| Cleco Corp. | 39,400 | | | | 798,244 | |

| New Jersey Resources Corp. | 15,100 | | | | 654,434 | |

| | | |

|

| |

| | | | | | 2,183,958 | |

| | | |

|

| |

| Total Common Stocks | | | | | | |

| (Identified cost $91,811,517) | | | | | 105,471,357 | |

| | | | |

|

| |

| | Principal | | | | |

| | Amount | | | | |

| | (000) | | | | |

|

|

| | | | |

| Repurchase Agreement—6.2% | | | | | | |

| State Street Bank and Trust Co., | | | | | | |

| 1.40%, 01/03/05 | | | | | | |

| (Dated 12/31/04, collateralized by | | | | | | |

| $6,995,000 United States Treasury | | | | | | |

| Note, 2.50%, 09/30/06, with a | | | | | | |

| value of $6,976,897) | | | | | | |

| Proceeds of $6,840,798 | | | | | | |

| (Identified cost $6,840,000) | $6,840 | | | | 6,840,000 | |

| | | |

|

| |

| Total Investments | | | | | | |

| (Identified cost $98,651,517) (b) | 101.2 | % | | $ | 112,311,357 | |

| Liabilities in Excess of Cash and | | | | | | |

| Other Assets | (1.2 | ) | | | (1,329,486 | ) |

|

| | |

|

| |

| Net Assets | 100.0 | % | | $ | 110,981,871 | |

|

| | |

|

| |

The accompanying notes are an integral part of these financial statements.

17

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement International Equity Portfolio |

| Common Stocks—97.4% | | | | |

| Finland—4.4% | | | | |

| Nokia Oyj | 409,300 | | $ | 6,464,681 |

| Stora Enso Oyj, R Shares | 174,700 | | | 2,676,185 |

| | |

|

|

| Total Finland | | | | 9,140,866 |

| | |

|

|

| France—11.6% | | | | |

| Carrefour SA | 66,900 | | | 3,186,321 |

| Credit Agricole SA | 126,900 | | | 3,829,251 |

| Lagardere SCA | 27,930 | | | 2,015,880 |

| Sanofi-Aventis | 60,308 | | | 4,820,050 |

| Schneider Electric SA | 16,800 | | | 1,169,172 |

| Total SA | 25,993 | | | 5,677,688 |

| Vivendi Universal SA (a) | 102,900 | | | 3,285,471 |

| | |

|

|

| Total France | | | | 23,983,833 |

| | |

|

|

| Germany—10.9% | | | | |

| Deutsche Telekom AG (a) | 253,500 | | | 5,737,087 |

| E.ON AG | 52,100 | | | 4,748,982 |

| Schering AG | 61,200 | | | 4,576,066 |

| Siemens AG | 41,400 | | | 3,510,306 |

| Volkswagen AG | 87,000 | | | 3,943,795 |

| | |

|

|

| Total Germany | | | | 22,516,236 |

| | |

|

|

| Ireland—2.8% | | | | |

| Bank of Ireland | 224,900 | | | 3,744,767 |

| CRH PLC | 80,847 | | | 2,164,858 |

| | |

|

|

| Total Ireland | | | | 5,909,625 |

| | |

|

|

| Italy—4.2% | | | | |

| Enel SpA | 217,600 | | | 2,138,437 |

| Eni SpA | 203,375 | | | 5,091,977 |

| Terna SpA | 476,400 | | | 1,366,323 |

| | |

|

|

| Total Italy | | | | 8,596,737 |

| | |

|

|

| Japan—19.4% | | | | |

| ACOM Co., Ltd. | 24,360 | | | 1,823,375 |

| Aiful Corp. | 8,800 | | | 967,854 |

| East Japan Railway Co. | 347 | | | 1,930,223 |

| Fanuc, Ltd. | 50,300 | | | 3,288,865 |

| Fujitsu, Ltd. | 434,800 | | | 2,830,210 |

| Mitsubishi Estate Co., Ltd. | 260,000 | | | 3,044,793 |

| Murata Manufacturing Co., Ltd. | 63,100 | | | 3,528,477 |

| NEC Electronics Corp. | 29,000 | | | 1,415,048 |

| Nissan Motor Co., Ltd. | 360,900 | | | 3,923,515 |

| Nomura Holdings, Inc. | 300,000 | | | 4,373,963 |

| NTT DoCoMo, Inc. | 1,370 | | | 2,526,886 |

| Shin-Etsu Chemical Co., Ltd. | 75,500 | | | 3,094,564 |

| Takeda Pharmaceutical Co., Ltd. | 42,700 | | | 2,150,210 |

| The Sumitomo Trust and | | | | |

| Banking Co., Ltd. | 280,000 | | | 2,024,788 |

| Tokyo Gas Co., Ltd. | 753,000 | | | 3,086,367 |

| | |

|

|

| Total Japan | | | | 40,009,138 |

| | |

|

|

| Netherlands—6.3% | | | | |

| Heineken NV | 55,463 | | | 1,849,269 |

| Koninklijke (Royal) Philips | | | | |

| Electronics NV | 133,650 | | | 3,544,259 |

| Royal Dutch Petroleum Co. | 133,200 | | | 7,667,555 |

| | |

|

|

| Total Netherlands | | | | 13,061,083 |

| | |

|

|

| Norway—1.9% | | | | |

| DnB NOR ASA | 145,300 | | | 1,433,412 |

| Statoil ASA | 157,500 | | | 2,470,425 |

| | |

|

|

| Total Norway | | | | 3,903,837 |

| | |

|

|

| Singapore—1.2% | | | | |

| Oversea-Chinese Banking Corp., Ltd. | 294,050 | | | 2,431,803 |

| | |

|

|

| Switzerland—6.8% | | | | |

| Compagnie Financiere Richemont AG, | | | | |

| A Shares | 66,000 | | | 2,196,904 |

| Credit Suisse Group (a) | 127,170 | | | 5,345,815 |

| Nestle SA | 11,000 | | | 2,877,935 |

| Swiss Re | 51,300 | | | 3,658,808 |

| | |

|

|

| Total Switzerland | | | | 14,079,462 |

| | |

|

|

| United Kingdom—27.9% | | | | |

| Barclays PLC | 434,900 | | | 4,892,896 |

| BP PLC | 292,420 | | | 2,852,002 |

| Cadbury Schweppes PLC | 218,740 | | | 2,036,802 |

| Diageo PLC | 311,975 | | | 4,450,283 |

| EMAP PLC | 81,500 | | | 1,276,029 |

| GlaxoSmithKline PLC | 271,000 | | | 6,357,985 |

| HSBC Holdings PLC | 361,186 | | | 6,095,352 |

| Imperial Tobacco Group PLC | 105,080 | | | 2,878,876 |

| Kesa Electricals PLC | 197,420 | | | 1,070,751 |

| Marks & Spencer Group PLC | 271,500 | | | 1,787,899 |

| Prudential PLC | 396,783 | | | 3,450,883 |

| Rentokil Initial PLC | 715,700 | | | 2,030,194 |

| Rio Tinto PLC | 67,800 | | | 1,995,496 |

| Royal Bank of Scotland Group PLC | 176,400 | | | 5,933,510 |

| Unilever PLC | 440,700 | | | 4,327,805 |

| Vodafone Group PLC | 2,311,900 | | | 6,269,552 |

| | |

|

|

| Total United Kingdom | | | | 57,706,315 |

| | |

|

|

| Total Common Stocks | | | | |

| (Identified cost $170,534,249) | | | | 201,338,935 |

| | | |

|

|

| Preferred Stock—0.5% | | | | |

| Germany—0.5% | | | | |

| Porsche AG | | | | |

| (Identified cost $873,939) | 1,680 | | | 1,072,122 |

| | |

|

|

The accompanying notes are an integral part of these financial statements.

18

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2004

|

| | Principal | | | |

| | Amount | | | |

| Description | (000) | | | Value |

|

|

|

|

|

| Lazard Retirement International Equity Portfolio | | |

| (concluded) | | | | |

Repurchase Agreement—2.1% | | | | |

| State Street Bank and Trust Co., | | | | |

| 1.40%, 01/03/05 | | | | |

| (Dated 12/31/04, collateralized by | | | | |

| $4,375,000 United States Treasury | | | | |

| Note, 2.50%, 09/30/06, with a | | | | |

| value of $4,363,678) | | | | |

| Proceeds of $4,276,499 | | | | |

| (Identified cost $4,276,000) | $ | 4,276 | | $ | 4,276,000 |

|

| |

|

|

| Description | | | | | Value | |

|

|

|

|

|

|

|

| Total Investments | | | | | | |

| (Identified cost $175,684,188) (b) | 100.0 | % | | $ | 206,687,057 | |

| Liabilities in Excess of Cash and | | | | | | |

| Other Assets | — | | | | (62,185 | ) |

|

|

| |

|

| |

| Net Assets | 100.0 | % | | $ | 206,624,872 | |

|

|

| |

|

| |

The accompanying notes are an integral part of these financial statements.

19

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement Emerging Markets Portfolio | | | |

| Common Stocks—86.4% | | | | |

| Brazil—8.2% | | | | |

| Brasil Telecom Participacoes SA ADR | 5,400 | | $ | 206,010 |

| Companhia de Concessoes | | | | |

| Rodoviarias | 11,400 | | | 249,375 |

| Companhia Vale do Rio Doce ADR | 31,200 | | | 905,112 |

| Empresa Brasileira de Aeronautica SA | | | | |

| ADR | 8,200 | | | 274,208 |

| Grendene SA (a) | 15,000 | | | 177,899 |

| Petroleo Brasileiro SA ADR | 10,900 | | | 433,602 |

| Souza Cruz SA | 27,700 | | | 371,489 |

| | |

|

|

| Total Brazil | | | | 2,617,695 |

| | |

|

|

| Chile—1.0% | | | | |

| Administradora de Fondos de Pensiones | | | | |

| Provida SA Sponsored ADR | 11,360 | | | 323,760 |

| | |

|

|

| China—0.8% | | | | |

| People’s Food Holdings, Ltd. | 278,000 | | | 255,452 |

| | |

|

|

| Croatia—0.7% | | | | |

| Pliva d.d. GDR (c) | 17,400 | | | 224,860 |

| | |

|

|

| Czech Republic—0.8% | | | | |

| Cesky Telecom AS | 14,900 | | | 247,552 |

| | |

|

|

| Egypt—4.1% | | | | |

| Commercial International Bank | 88,400 | | | 565,789 |

| Orascom Construction Industries | 33,000 | | | 394,043 |

| Orascom Telecom Holding SAE (a) | 8,200 | | | 344,413 |

| | |

|

|

| Total Egypt | | | | 1,304,245 |

| | |

|

|

| Hong Kong—4.3% | | | | |

| China Mobile (Hong Kong), Ltd. | | | | |

| Sponsored ADR | 21,820 | | | 374,431 |

| China Netcom Group Corp. | | | | |

| (Hong Kong), Ltd. | 40,000 | | | 54,293 |

| CNOOC, Ltd. ADR | 4,700 | | | 254,693 |

| Hutchison Telecommunications | | | | |

| International, Ltd. (a) | 243,000 | | | 220,406 |

| Pacific Basin Shipping, Ltd. | 586,000 | | | 252,563 |

| Texwinca Holdings, Ltd. | 222,000 | | | 209,927 |

| | |

|

|

| Total Hong Kong | | | | 1,366,313 |

| | |

|

|

| Hungary—2.0% | | | | |

| Gedeon Richter Rt. | 2,700 | | | 339,135 |

| MOL Magyar Olaj-es Gazipari Rt. | 4,000 | | | 281,312 |

| | |

|

|

| Total Hungary | | �� | | 620,447 |

| | |

|

|

| India—8.1% | | | | |

| Hero Honda Motors, Ltd. | 22,650 | | | 297,571 |

| Hindalco Industries, Ltd. GDR (c) | 12,800 | | | 421,504 |

| Hindustan Lever, Ltd. | 75,600 | | | 249,565 |

| Reliance Industries, Ltd. | 38,500 | | | 472,770 |

| Satyam Computer Services, Ltd. | 48,900 | | | 461,102 |

| State Bank of India | 45,300 | | | 679,917 |

| | |

|

|

| Total India | | | | 2,582,429 |

| | |

|

|

| Indonesia—3.7% | | | | |

| PT Hanjaya Mandala Sampoerna Tbk | 923,900 | | | 661,884 |

| PT Telekomunikasi Indonesia Tbk | | | | |

| Sponsored ADR | 24,500 | | | 514,990 |

| | |

|

|

| Total Indonesia | | | | 1,176,874 |

| | |

|

|

| Israel—1.0% | | | | |

| Bank Hapoalim, Ltd. | 90,300 | | | 304,553 |

| | |

|

|

| Mexico—6.5% | | | | |

| America Telecom SA de CV, | | | | |

| Series A1 Shares (a) | 80,200 | | | 230,304 |

| Fomento Economico Mexicano SA | | | | |

| de CV Sponsored ADR | 4,810 | | | 253,054 |

| Grupo Televisa SA Sponsored ADR | 5,600 | | | 338,800 |

| Kimberly-Clark de Mexico SA de CV, | | | | |

| Series A Shares | 68,800 | | | 237,624 |

| Telefonos de Mexico SA de CV, | | | | |

| Series L Shares Sponsored ADR | 19,000 | | | 728,080 |

| Urbi, Desarrollos Urbanos, SA de CV | 63,400 | | | 276,988 |

| | |

|

|

| Total Mexico | | | | 2,064,850 |

| | |

|

|

| Morocco—0.1% | | | | |

| Maroc Telecom | 2,500 | | | 26,306 |

| | |

|

|

| Netherlands—0.2% | | | | |

| Efes Breweries International | | | | |

| Sponsored GDR (a), (c) | 2,100 | | | 63,000 |

| | |

|

|

| Peru—0.8% | | | | |

| Credicorp, Ltd. | 15,600 | | | 246,636 |

| | |

|

|

| Philippines—0.7% | | | | |

| Philippine Long Distance Telephone Co. | | | | |

| Sponsored ADR (a) | 9,000 | | | 224,370 |

| | |

|

|

| Russia—2.1% | | | | |

| LUKOIL Sponsored ADR | 3,720 | | | 455,700 |

| Mobile TeleSystems Sponsored ADR | 400 | | | 55,404 |

| Wimm-Bill-Dann Foods OJSC ADR (a) | 10,300 | | | 147,393 |

| | |

|

|

| Total Russia | | | | 658,497 |

| | |

|

|

The accompanying notes are an integral part of these financial statements.

20

Lazard Retirement Series, Inc.

Portfolios of Investments (concluded)

December 31, 2004

|

| Description | Shares | | | Value |

|

|

|

|

|

| Lazard Retirement Emerging Markets Portfolio (concluded) |

| South Africa—12.0% | | | | |

| Edgars Consolidated Stores, Ltd. | 9,100 | | $ | 488,214 |

| Harmony Gold Mining Co., Ltd. | | | | |

| Sponsored ADR | 6,800 | | | 63,036 |

| Impala Platinum Holdings, Ltd. | 6,400 | | | 544,149 |

| Kumba Resources, Ltd. | 53,500 | | | 417,839 |

| Old Mutual PLC | 213,600 | | | 543,371 |

| Sanlam, Ltd. | 107,100 | | | 247,136 |

| Sappi, Ltd. | 32,300 | | | 475,864 |

| Sasol, Ltd. | 20,800 | | | 446,736 |

| Steinhoff International Holdings, Ltd. | 258,603 | | | 578,371 |

| | |

|

|

| Total South Africa | | | | 3,804,716 |

| | |

|

|

| South Korea—18.9% | | | | |

| Daewoo Shipbuilding & Marine | | | | |

| Engineering Co., Ltd. GDR (c) | 13,600 | | | 357,000 |

| Hite Brewery Co., Ltd. | 2,900 | | | 239,519 |

| Hyundai Motor Co. | 6,050 | | | 324,358 |

| Kookmin Bank (a) | 22,090 | | | 864,224 |

| KT Corp. Sponsored ADR | 14,090 | | | 307,303 |

| LG Chem, Ltd. | 6,900 | | | 274,947 |

| LG Electronics, Inc. | 3,600 | | | 222,913 |

| LG Household & Health Care, Ltd. | 10,000 | | | 265,166 |

| LG Philips LCD Co., Ltd. ADR | 12,500 | | | 224,875 |

| POSCO ADR | 8,190 | | | 364,701 |

| Samsung Electronics Co., Ltd. GDR (c) | 5,826 | | | 1,275,894 |

| Samsung Fire & Marine | | | | |

| Insurance Co., Ltd. | 4,542 | | | 357,586 |

| Samsung SDI Co., Ltd. | 2,360 | | | 257,612 |

| SK Telecom Co., Ltd. | 1,800 | | | 342,543 |

| SK Telecom Co., Ltd. ADR | 13,945 | | | 310,276 |

| | |

|

|

| Total South Korea | | | | 5,988,917 |

| | |

|

|

| Taiwan—7.2% | | | | |

| Advantech Co., Ltd. | 149,645 | | | 363,606 |

| Chinatrust Financial Holding Co., Ltd. | 223,080 | | | 266,795 |

| Compal Electronics, Inc. | 94,783 | | | 94,813 |

| Compal Electronics, Inc. GDR | 17,683 | | | 87,884 |

| Fubon Financial Holding Co., Ltd. | 311,000 | | | 318,949 |

| Hon Hai Precision Industry Co., Ltd. | 113,249 | | | 525,327 |

| Taiwan Semiconductor Manufacturing | | | | |

| Co., Ltd. | 403,000 | | | 642,206 |

| | |

|

|

| Total Taiwan | | | | 2,299,580 |

| | |

|

|

| Thailand—0.5% | | | | |

| Thai Union Frozen Products PCL | 262,900 | | | 167,823 |

| | |

|

|

| Turkey—1.5% | | | | | |

| Akbank TAS | 77,400,850 | | | | 479,271 |

| | | |

|

|

| Venezuela—1.2% | | | | | |

| Compania Anonima Nacional | | | | | |

| Telefonos de Venezuela ADR | 16,485 | | | | 369,099 |

| | | |

|

|

| Total Common Stocks | | | | | |

| (Identified cost $21,068,664) | | | | | 27,417,245 |

| | | | |

|

|

| Preferred Stocks—7.9% | | | | | |

| Brazil—7.9% | | | | | |

| Caemi Mineracao | | | | | |

| e Metalurgia SA (a) | 1,031,050 | | | | 885,088 |

| Companhia Brasileira de | | | | | |

| Distribuicao Grupo Pao de | | | | | |

| Acucar Sponsored ADR | 8,400 | | | | 215,040 |

| Companhia de Bebidas das | | | | | |

| Americas ADR | 11,270 | | | | 319,279 |

| Companhia Paranaense de | | | | | |

| Energia-Copel Sponsored ADR | 77,000 | | | | 344,190 |

| Telemar Norte Leste SA | 17,142 | | | | 435,972 |

| Usinas Siderurgicas de Minas | | | | | |

| Gerais SA | 15,000 | | | | 304,688 |

| | | |

|

|

| Total Brazil | | | | | 2,504,257 |

| | | |

|

|

| Total Preferred Stocks | | | | | |

| (Identified cost $1,509,519) | | | | | 2,504,257 |

| | | |

|

|

| |

| | Principal | | | |

| | Amount | | | |

| | (000) | | | |

|

|

| | | |

| Repurchase Agreement—5.5% | | | | | |

| State Street Bank and Trust Co., | | | | | |

| 1.40%, 01/03/05 | | | | | |

| (Dated 12/31/04, collateralized by | | | | | |

| $1,775,000 United States Treasury | | | | | |

| Note, 2.50%, 09/30/06, with a | | | | | |

| value of $1,770,406) | | | | | |

| Proceeds of $1,735,202 | | | | | |

| (Identified cost $1,735,000) | $1,735 | | | | 1,735,000 |

| | | |

|

|

| Total Investments | | | | | |

| (Identified cost $24,313,183) (b) | 99.8 | % | | $ | 31,656,502 |

| Cash and Other Assets in Excess | | | | | |

| of Liabilities | 0.2 | | | | 53,479 |

|

| | |

|

|

| Net Assets | 100.0 | % | | $ | 31,709,981 |

|

| | |

|

|

The accompanying notes are an integral part of these financial statements.

21

Lazard Retirement Series, Inc.

Notes to Portfolios of Investments

December 31, 2004

|

| (a) | Non-income producing security. |

| |

| (b) | For federal income tax purposes, the aggregate cost, aggregate gross unrealized appreciation, aggregate gross unrealized depreciation and the net unrealized appreciation is as follows: |

| |

| | | | | | Aggregate | | Aggregate | | | |

| | | | | | Gross | | Gross | | Net |

| | | Aggregate | | Unrealized | | Unrealized | | Unrealized |

| Portfolio | | Cost | | Appreciation | | Depreciation | | Appreciation |

| |

|

| |

|

| |

|

| |

|

|

| Retirement Equity | | $ | 4,192,403 | | $ | 729,521 | | $ | 40,300 | | $ | 689,221 |

| Retirement Small Cap | | | 98,857,945 | | | 15,407,233 | | | 1,953,821 | | | 13,453,412 |

| Retirement International Equity | | | 176,783,171 | | | 31,168,558 | | | 1,264,672 | | | 29,903,886 |

| Retirement Emerging Markets | | | 24,744,863 | | | 7,025,003 | | | 113,364 | | | 6,911,639 |

| (c) | Pursuant to Rule 144A under the Securities Act of 1933, these securities may only be traded among “qualified institutional buyers.” |

| |

| (d) | Date shown is the expiration date. |

| |

Security Abbreviations:

ADR —American Depositary Receipt

GDR—Global Depositary Receipt

REIT—Real Estate Investment Trust

|

The accompanying notes are an integral part of these financial statements.

22

Lazard Retirement Series, Inc.

Notes to Portfolios of Investments (concluded)

December 31, 2004

|

Portfolio holdings by industry, for those Portfolios previously presented by country:

| | | Lazard | | Lazard |

| | | Retirement | | Retirement |

| | | International | | Emerging |

| | | Equity | | Markets |

| | | Portfolio | | Portfolio |

| |

|

| |

|

|

| Industry | | | | | | |

| Aerospace & Defense | | — | % | | 0.9 | % |

| Apparel & Textiles | | — | | | 2.8 | |

| Automotive | | 4.3 | | | 2.0 | |

| Banking | | 16.1 | | | 10.0 | |

| Brewery | | 0.9 | | | 2.8 | |

| Broadcasting | | — | | | 1.1 | |

| Building & Construction | | 1.0 | | | 2.1 | |

| Chemicals | | 1.5 | | | 2.4 | |

| Computers & Business Equipment | | 1.4 | | | 4.8 | |

| Diversified | | 5.7 | | | — | |

| Drugs & Health Care | | 8.7 | | | 1.8 | |

| Electrical Equipment | | 0.6 | | | — | |

| Electronics | | 3.3 | | | 6.2 | |

| Financial Services | | 4.6 | | | 2.8 | |

| Food & Beverages | | 4.5 | | | 1.8 | |

| Forest & Paper Products | | 1.3 | | | 2.2 | |

| Household Products & Home Furnishings | | — | | | 3.4 | |

| Insurance | | 3.4 | | | 3.6 | |

| Metals & Mining | | 1.0 | | | 10.2 | |

| Multimedia | | 1.6 | | | — | |

| Oil & Gas | | 11.5 | | | 5.9 | |

| Printing & Publishing | | 0.6 | | | — | |

| Real Estate | | 1.5 | | | — | |

| Retail | | 4.0 | | | 0.7 | |

| Semiconductors & Components | | 2.4 | | | 2.0 | |

| Shipbuilding | | — | | | 1.1 | |

| Steel | | — | | | 2.1 | |

| Telecommunications | | 10.2 | | | 15.7 | |

| Tobacco | | 1.4 | | | 3.2 | |

| Transportation | | 0.9 | | | 1.6 | |

| Utilities | | 5.5 | | | 1.1 | |

| |

|

| |

|

|

| Subtotal | | 97.9 | | | 94.3 | |

| Repurchase Agreements | | 2.1 | | | 5.5 | |

| |

|

| |

|

|

| Total Investments | | 100.0 | % | | 99.8 | % |

| |

|

| |

|

|

The accompanying notes are an integral part of these financial statements.

23

Lazard Retirement Series, Inc.

Statements of Assets and Liabilities

December 31, 2004

|

| | | | | | | | | Lazard | | | Lazard | |

| | | Lazard | | | Lazard | | | Retirement | | | Retirement | |

| | | Retirement | | | Retirement | | | International | | | Emerging | |

| | | Equity | | | Small Cap | | | Equity | | | Markets | |

| | | Portfolio | | | Portfolio | | | Portfolio | | | Portfolio | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS | | | | | | | | | | | | |

| Investments in securities, at value | $ | 4,881,624 | | $ | 112,311,357 | | $ | 206,687,057 | | $ | 31,656,502 | |

| Cash | | 1,119 | | | 752 | | | — | | | 1,203 | |

| Foreign currency | | — | | | — | | | 242,959 | | | 112,333 | |

| Receivables for: | | | | | | | | | | | | |

| Investments sold | | — | | | 570,618 | | | — | | | 131,661 | |

| Dividends and interest | | 6,027 | | | 56,374 | | | 322,298 | | | 62,269 | |