attractive when compared to their historical norms. Inflation seems to be under control despite the high cost of raw materials and energy. In order to preempt inflation, central banks have responded to strong global growth with rate hikes (including the European Central Bank). Increases in U.S. short-term rates have been well-digested by the markets. Increases in interest rates outside the United States may raise the level of uncertainty about the earnings potential of smaller, more volatile companies. Thus, going forward, we would expect a market rotation away from smaller, more volatile companies towards larger, more consistently profitable companies, as the economic recovery matures and corporate-earnings growth slows from the current robust rate. In the United States, large-cap stocks have begun to outperform small-cap stocks.

At the end of 2005, emerging markets equity logged in four consecutive years of dramatic outperformance. Although emerging markets equities still trade at a valuation discount to developed markets, their relative valuation is at the high end of its historical range. In our opinion, investors have become most enthusiastic about this asset class. Evidence of this optimism is the large number of recent initial public offerings and the heightened coverage of the asset class in the popular press. The excitement over the bull market in commodities, many of which are sourced from emerging markets, is also a sign of investor optimism. Historically, emerging markets equities have often performed poorly during periods of tightening monetary policy in the United States. Thus, we have reservations concerning the immediate term for this asset class. However, we remain constructive over the medium-and long-term, as there are powerful drivers that appear to be leading to a secular re-rating of emerging markets valuations to the levels of the developed markets. Among these drivers are improvements in corporate governance, rule of law, exchange-rate policies, and debt management.

We maintain our view that this is a stock picker’s market rather than one that favors sector rotation or other short-term timing strategies. We do not see excessive over or under valuations between sectors or industries. Valuation levels between domestic and international stocks have narrowed, but stock selection overseas remains a critical prerequisite to success. We believe that market leadership is likely to be narrower than in previous cycles, with only the highest quality and most attractively valued companies delivering outperformance.

In the first half of 2005, global stocks were unable to sustain a strong advance and finished with a small negative return. Signs of positive economic growth and improving company earnings were generally not reflected in stock prices, a result of macro-economic concerns that weighed on the markets. Persistent worries that high oil prices would slow economic growth continued to unnerve investors as oil prices topped $60 a barrel, driven by increased demand from China and fears over supply disruptions. The sustainability of European integration and the euro itself came under scrutiny after the rejection of the proposed E.U. Constitution by Dutch and French voters. Anxiety about the prospects for the euro contributed to a rally in the U.S. dollar, which strengthened considerably, based on positive U.S. economic data and encouraging signals from the U.S. Federal Reserve regarding the interest rate hikes.

During the third quarter, global equity markets witnessed solid gains, as investors became more confident regarding the prospects for global growth. Energy stocks outpaced the market during the quarter, as the price of oil briefly topped $70 per barrel after hurricanes Katrina and Rita devastated the Gulf shores, crippling U.S. oil production and refining in the area. Consumer confidence fell in September, as higher gasoline prices in the United States threatened to curtail consumer spending. However, European economies showed positive signs of growth, benefiting from a weak euro that made their goods more attractive abroad. In Germany, business confidence rose to a new high in September. Unemployment in Italy reached a new low, and consumer spending in France was improved. Japanese markets rallied sharply during the quarter, as this country’s economy began to show signs of improvement.

World markets moved higher in the fourth quarter, as the outlook for most global economies continued to be robust, and inflation appeared to be under control, despite high energy and raw-materials costs. The U.S. dollar was strong versus most major currencies, continuing the trend that started at the beginning of the

Lazard Retirement Series, Inc.

Investment Overviews (continued)

year. Central banks responded to stronger global growth with rate hikes in an effort to preempt inflation. The U.S. Federal Reserve raised rates twice during the fourth quarter for a total of thirteen rate increases over the last eighteen months. The European Central Bank raised interest rates in December for the first time in many years. While Japan has yet to tighten its monetary policy, continued signs of economic recovery led to speculation that Japan would end its zero interest-rate policy fairly soon. Smaller-cap stocks continued to outperform large-cap stocks for the quarter and for the year, on a global basis. However, this long-term trend waned in the United States, as large and small caps performed roughly in line for the year.

From a sector perspective, energy, industrials, financials, and materials all outperformed for the year. The only sector that witnessed a negative return was tele-com services, as the industry has become increasingly competitive. The highest performing regions of the MSCI World® Index, for the first half of 2005, were Japan, Australasia, and the Far East. Trailing were Europe, the United Kingdom and, lastly, North America.

For the second half of 2005, Japan was again the top-performer. Quite a bit behind, from a performance perspective, but in second place, was Europe, followed by Australasia, North America, the United Kingdom, and the Far East.

Emerging market equities had a solid, but volatile, first quarter of 2005. After solid gains over the first two months of the year, March witnessed a pullback due to concerns over the pace of interest-rate increases in the United States and their future impact on the global economy. In April, emerging markets equities fell modestly, but rebounded in both May and June. Notable events over the quarter included a continued increase in the price of oil, which climbed above $60 a barrel, and considerable strength in the U.S. dollar against many world currencies. Emerging markets shares experienced a powerful third quarter, as investor excitement over commodity prices generated a return for the MSCI EM Index in excess of 18%. The quarter included newsworthy events such as terrorist attacks in the London Underground and the Sharm El Sheikh Resort in Egypt, the death of King Fahd of Saudi Ara-bia, and record high crude oil prices. Emerging markets equities also experienced a robust fourth

quarter, as the Index rose by more than 7%, to finish the year with a 34% return. Regionally, all countries ended the year higher, except for Venezuela. Latin American and Eastern European equities posted the largest returns, with Asian emerging markets also performing well. All sectors finished the year significantly higher. However, energy, consumer staples, health care, and utilities outperformed the Index. Lagging sectors included telecom services, information technology, materials, financials, and consumer discretionary.

Lazard Retirement Equity Portfolio

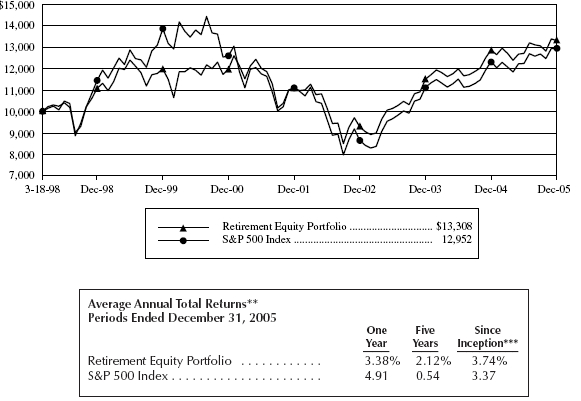

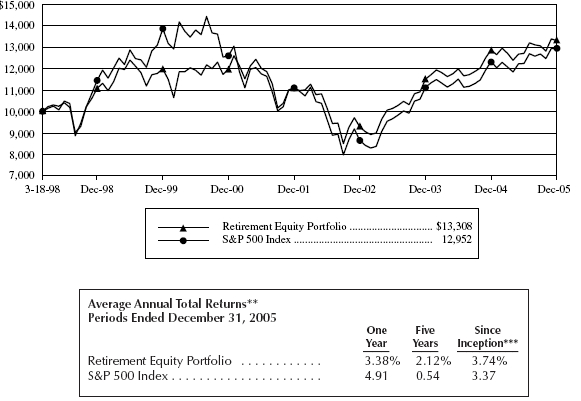

For the year ended December 31, 2005, Lazard Retirement Equity Portfolio posted a total return of 3.38%, as compared with the 4.91% return of the S&P 500 Index.

Despite a robust domestic economy and solid corporate-profit growth, the U.S. stock market was among the few that did not enjoy a year-end rally. Instead, U.S. equities had a lackluster year, posting rather modest positive returns. The U.S. economy proved remarkably resilient in 2005, overcoming progressive monetary tightening, waning fiscal stimulus, hurricanes, and a brutal run-up in oil prices. As a result of higher energy costs, there was also considerable worry about an overall decline in consumer spending and a dismal holiday shopping season. However, economic growth re-accelerated in the third quarter, due to gains in consumer spending, business investment, and residential construction. Fortunately, consumers were not as affected by higher energy costs as had been expected, in part because gasoline prices declined after September.

Despite high energy and raw-material costs, the economy continued to be robust through December, and inflation appeared to be under control. Mergers and acquisitions activity boomed, and the value of announced transactions for 2005 was the largest in the last five years. Larger-cap stocks performed roughly in-line with small caps for the year, breaking the multi-year trend of smaller-cap outperformance. Weakness in energy and utility companies during the last few months of the year was in sharp contrast to the earlier part of the year, when these companies dominated market returns. Still, the energy sector contributed almost 50% of the total annual return of the S&P 500 Index in 2005, although the price of oil declined to

4

Lazard Retirement Series, Inc.

Investment Overviews (continued)

approximately $60 from its peak. From a sector perspective, energy, utilities and financials outperformed, while consumer discretionary and technology witnessed negative returns for the year.

An overweight position in energy benefited the Portfolio, as this was the best-performing sector for the year due to rising oil prices. Stock selection in energy also boosted returns, as the Portfolio’s holdings in Global-SantaFe Corp. and BJ Services performed well. The Portfolio also benefited from stock selection in health care, as holdings such as Allergan and Medimmune performed well. An overweight position in consumer discretionary, particularly media, detracted from returns, as this was the worst performing sector for the year. Holdings such as News Corp., Tribune, and Westwood One declined during the year. Shares of Westwood One steadily declined during the year, due to negative sentiment regarding the radio-advertising market. More recently, in December, CEO Shane Coppola resigned. At the same time, the company announced that it would not meet fourth-quarter guidance, as revenues would be weaker than expected. Despite lower guidance, we believe that Westwood One is undervalued given the negative sentiment. We also believe that investors may be rewarded as the advertising market begins to turn around. Stock selection in financials detracted from performance, as the Portfolio’s insurance holdings declined on losses they experienced from the Gulf Coast hurricanes.

We view the outlook for equities to be positive, as earnings growth and cash generation remain strong, and valuations appear relatively attractive compared to historical norms. However, we would expect a market rotation away from more highly leveraged, volatile companies toward more consistently profitable companies, as the economic recovery matures and corporate-earnings growth slows from the current robust rate.

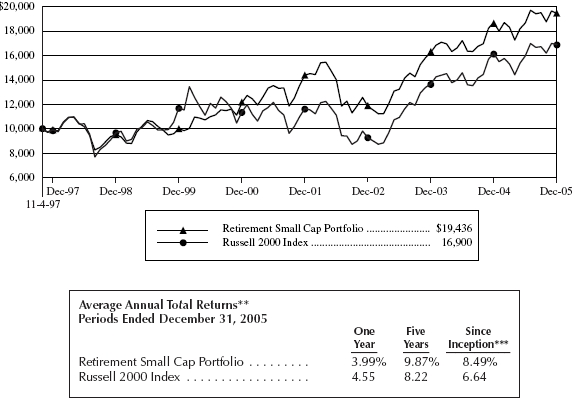

Lazard Retirement Small Cap Portfolio

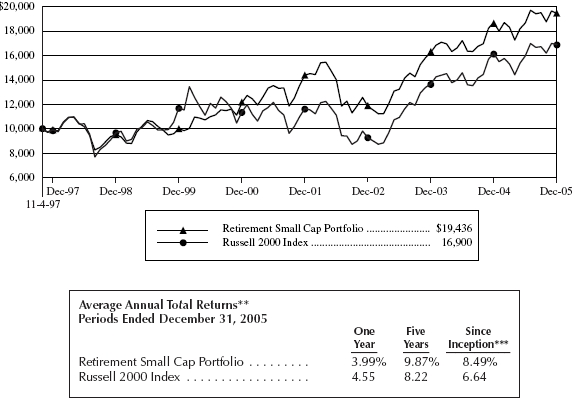

For the year ended December 31, 2005, Lazard Retirement Small Cap Portfolio posted a total return of 3.99%, as compared with the 4.55% return of the Russell 2000 Index. 2005 brought investors a seesaw pattern of peaks and troughs through most of the year with equity markets producing choppy returns. Small cap stocks were no exception.

For the year, mid-cap stocks led the way, with the Rus-sell Midcap® Index up 12.5%, followed by large-cap stocks, up 4.9% (as measured by the S&P 500 Index), and small cap stocks (as measured by the Russell 2000 Index) slightly lower than that, up 4.5% .

The Portfolio benefited from its overweight positions in both the energy and industrial sectors. Climbing commodity prices buoyed the energy sector, as both exploration and production companies and oil-services companies witnessed solid earnings and cash flow growth. We continue to overweight the energy sector, as we believe that global economic growth will continue to be robust, which should help maintain commodity prices at record high levels. The industrial sector also continues to benefit from solid economic growth and multiple years of restructuring, which have helped many companies profit from an upturn in sales activity. We continue to overweight the industrial sector.

Stock selection in several sectors also boosted the Portfolio’s performance during the year. The shares of RTI International Metals, a fabricator of titanium parts primarily serving the aerospace industry, rose, as the company continues to benefit from increased volumes shipped to Boeing and Airbus. Veritas DGC, a provider of seismic services to the oil and gas industry, was another solid contributor to performance. Due to surging commodity prices, many exploration and production companies are trying to find new energy deposits or seeking to enlarge existing fields. Veritas’ data helps its customers see underground deposits more clearly. Despite all the negative news regarding the airline industry, the shares of AirTran, a domestic airline carrier, posted solid gains for the year. AirTran is a low-cost carrier that is gaining market share at the expense of rivals, particularly as Delta cuts back its schedule out of its Atlanta hub. The Portfolio continues to hold positions in all three of these companies.

An overweight position in technology hardware detracted from performance, as the technology sector

5

Lazard Retirement Series, Inc.

Investment Overviews (continued)

continued to face slowing growth and increasing competitive issues. We continue to believe that broader technology shares can rally in 2006, as valuations are reasonable and economic growth should boost capital expenditures in this sector after four years of weak demand. Stock selection in health care hurt returns, as the shares of generic drug manufacturers, Taro Pharmaceuticals and Able Labs, declined. The shares of Amerigroup, a provider of managed-care services to Medicaid populations, also fell, due to deteriorating cost trends in its business. We exited all three positions over the course of 2005.

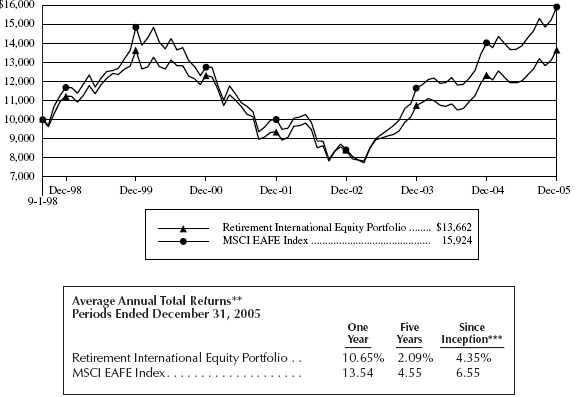

Lazard Retirement International Equity Portfolio

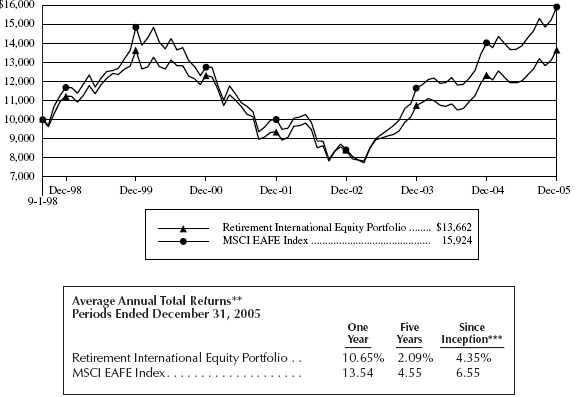

For the year ended December 31, 2005, Lazard Retirement International Equity Portfolio posted a total return of 10.65%, as compared with the 13.54% return of the MSCI EAFE Index.

2005 saw another strong performance from international stocks, which posted their third consecutive year of gains. Japanese stocks led the way, as the Nikkei 225 Index rose 40% in the year. Japan’s outperformance has coincided with the re-election of Prime Minister Koizumi and the reshuffling of his cabinet. Investors feel that Koizumi’s strong showing in the polls has given him a clear mandate to continue the restructuring of the Japanese economy and further reinforces the belief that corporate profitability may be about to improve. European markets also posted solid gains, driven by corporate restructuring, low interest rates, favorable profit-growth, and a boom in mergers and acquisitions (M&A) activity. Globally, the value of announced M&A transactions for 2005 was the largest in the last five years. Based on these signs of improving economic conditions, the European Central Bank raised interest rates in December, for the first time in five years, in an effort to curb inflation. While Japan has yet to tighten its monetary policy, continued signs of economic recovery have led to speculation that Japan will end its zero interest-rate policy fairly soon. From a sector perspective, materials, industrials, financials, and energy all outperformed for the year, as the outlook for global growth looks positive. The only sector that witnessed a negative return was telecom services, as the industry has become increasingly competitive. Regionally, Japan was the top-performing country, while the United Kingdom lagged. In Europe, Switzerland, Denmark, and Norway posted solid gains, while Ireland and Spain were the only countries that witnessed negative returns.

Stock selection in technology benefited the Portfolio, as one of its holdings (Hoya Corp.) continued to post solid earnings results throughout the year, in addition to doubling its dividend payout and announcing a share buy back. The demand for the company’s glass templates, which are used to make liquid crystal displays, remains robust. The shares of Nidec, a Japanese manufacturer of motors for IT products, also rose, after the company announced solid second-quarter results. We believe that the company should continue to benefit from the strength of its HDD (hard disk drive) motors business, as demand for digital music players continues to be strong. Stock selection in consumer discretionary also helped performance: the shares of a large Japanese automobile company, Toyota, were purchased in a timely fashion prior to Japan’s recent strong rally and the shares of Marks and Spencer, a large U.K. clothing retailer, also rose sharply, due to the company reporting better-than-expected earnings. The CEO’s restructuring efforts have begun to bear fruit, and the company is benefiting from a rebound in U.K. consumer confidence. Shares of Richemont, a Swiss luxury goods holding, also rose, as the company benefits from heavy demand from affluent consumers. Stock selection in telecom services detracted from performance, as this group has been weakened by an increasingly competitive landscape in European wireless services and continued declines in wire-line telephony. However, we believe that the Portfolio’s holdings in this sector are undervalued, particularly in relation to their robust free-cash generation, and that investors’ outlook for the group is overly pessimistic. An underweight position in materials also hurt returns, as this was one of the top-performing sectors.

The international economy demonstrated tremendous resiliency in 2005, as growth remained strong even as energy prices soared and central banks around the world continued to tighten monetary policy. Our outlook on international stocks remains positive, as earnings growth and cash generation remain healthy, and valuations appear relatively attractive compared to historical norms. However, increases in interest rates outside the United States may raise the level of uncertainty about the earnings potential of smaller, more

6

Lazard Retirement Series, Inc.

Investment Overviews (concluded)

volatile companies. Thus, we would expect a market rotation away from such companies and toward larger, more consistently profitable companies, as the economic recovery matures and corporate earnings growth slows from its current hardy rate.

Lazard Retirement Emerging Markets Portfolio

For the year ended December 31, 2005, Lazard Retirement Emerging Markets Portfolio posted a total return of 40.78%, as compared with the 34.00% return of the MSCI EM Index.

During the year, the Portfolio benefited from significant appreciation in several individual holdings. The shares of Orascom Telecom (Egypt) rose, based on the positive trends for subscriber growth in its cellular concessions. Shares of Petrobras (Brazil), Petrokazakhstan (Kazakhstan), and LUKOIL (Russia) rose sharply, based on higher crude-oil prices. Shares in iron ore companies Vale do Rio Doce and Caemi (both in Brazil), and Kumba (South Africa) increased due to buoyant iron ore prices, as well as optimism concerning upcoming negotiations. Satyam (India) shares benefited from positive and improving business conditions in the software industry. Shares of LG Household & Health (South Korea) climbed higher, based on investors’ optimism regarding a business turnaround under a new CEO. Delta Electronics (Taiwan) shares rose markedly, based on news concerning new orders. The Portfolio’s overweight positions in Brazil and Egypt, and underweight positions in China, Malaysia, and Taiwan, also added value. Good stock selection in Brazil, South Africa, and Taiwan, as well as in consumer staples, financials, industrials, materials, information technology, and telecom services also helped performance.

Weak stock selection in Russia, China, and the consumer discretionary sector detracted from performance in 2005. An overweight position in Venezuela and an underweight position in energy also subtracted value. Poor stock performance was registered in the shares of Anonima Nacional Telefonos (Venezuela), after the company faced Venezuela Supreme Court legal challenges concerning its pension fund. Shares in Taiwanese financial companies Fubon Financial Group and Chinatrust fell, based on investor concerns regarding worsening credit card asset quality. Shares of Grendene (Brazil) and People’s Food (China) performed poorly, as investors became concerned over both companies’ guidance. PT Bank Mandiri (Indone-sia) shares fell, after its CEO was removed and its asset quality was markedly downgraded. Sappi (South Africa) shares dropped in expectation of a poor earnings announcement.

Notes to Investment Overviews:

All returns are for the year ended December 31, 2005 and reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolios have been waived or reimbursed by the Fund’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. Past performance is not indicative, nor a guarantee, of future results.

The performance data of the indices and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. These indices are unmanaged, have no fees or costs and are not available for investment.

The views of the Fund’s management and the portfolio holdings described in this report are as of December 31, 2005; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in each Portfolio at the time you receive this report, or that securities sold will have not been repurchased. The specific portfolio securities may in aggregate represent only a small percentage of each Portfolio’s holdings. It should not be assumed that investments in the securities identified and discussed were, or will be, profitable, or that the investment decisions we make in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of the outlooks for markets, sectors and securities as discussed herein. You should read the Fund’s prospectus for a more detailed discussion of each Portfolio’s investment objective, strategies, risks and fees.

7

Lazard Retirement Series, Inc.

Performance Overviews

Lazard Retirement Equity Portfolio*

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement Equity Portfolio

and S&P 500® Index**

| * | See Note 8 under Notes to Financial Statements. |

| |

| ** | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reim- bursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer peri- ods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The S&P 500 Index is a market capitalization-weighted index of 500 common stocks, designed to measure performance of the broad domestic econo- my through changes in the aggregate market value of these stocks, which represent all major industries. |

| |

| *** | The Portfolio’s inception date was March 18, 1998. |

| |

8

Lazard Retirement Series, Inc.

Performance Overviews (continued)

Lazard Retirement Small Cap Portfolio*

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement Small Cap Portfolio

and Russell 2000® Index**

| * | See Note 8 under Notes to Financial Statements. |

| |

| ** | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reim- bursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer peri- ods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The Russell 2000 Index is comprised of the 2,000 smallest U.S. companies included in the Russell 3000® Index (which consists of the 3,000 largest U.S. companies by capitalization). |

| |

| *** | The Portfolio’s inception date was November 4, 1997. |

| |

9

Lazard Retirement Series, Inc.

Performance Overviews (continued)

Lazard Retirement International Equity Portfolio*

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement International Equity Portfolio

and Morgan Stanley Capital International (MSCI®) Europe, Australasia and Far East (EAFE®) Index**

| * | See Note 8 under Notes to Financial Statements. |

| |

| ** | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reim- bursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluc- tuate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The MSCI EAFE Index is a broadly diversified international index comprised of equity securities of approximately 1,000 companies located outside the United States. |

| |

| *** | The Portfolio’s inception date was September 1, 1998. |

| |

10

Lazard Retirement Series, Inc.

Performance Overviews (concluded)

Lazard Retirement Emerging Markets Portfolio*

Comparison of Changes in Value of $10,000 Investment in Lazard Retirement Emerging Markets Portfolio

and MSCI Emerging Markets (EM®) Index**

| * | See Note 8 under Notes to Financial Statements. |

| |

| ** | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| | Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that an investor’s shares in the Portfolio, when redeemed, may be worth more or less than their original cost. Within the longer peri- ods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| | The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The index is unmanaged, has no fees or costs and is not available for investment. The MSCI EM Index is comprised of emerging market securities in countries open to non-local investors. |

| |

| *** | The Portfolio’s inception date was November 4, 1997. |

| |

11

Lazard Retirement Series, Inc.

Information About Your Fund’s Expenses

Expense Example

As a shareholder in a Portfolio of the Fund, you incur ongoing costs, include management fees, distribution and service (12b-1) fees, and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from July 1, 2005 through December 31, 2005 and held for the entire period.

Actual Expenses

For each Portfolio of the Fund, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Portfolio of the Fund, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that you also bear fees and charges imposed by participating insurance companies at the separate account level, which are described in the separate prospectuses issued by the insurance companies. Such charges will have the effect of reducing Account Value.

| | | | | | | | Annualized |

| | Beginning | | Ending | | Expenses Paid | | Expense Ratio |

| | Account Value | | Account Value | | During Period* | | During Period |

|

|

| | 7/1/05 | | 12/31/05 | | 7/1/05-12/31/05 | | 7/1/05-12/31/05 |

|

|

| Retirement Equity Portfolio** | | | | | | | |

| Actual | $1,000.00 | | $1,042.50 | | $6.44 | | 1.25% |

| Hypothetical (5% Return Before Expenses) | $1,000.00 | | $1,018.90 | | $6.36 | | 1.25% |

| |

| Retirement Small Cap Portfolio** | | | | | | | |

| Actual | $1,000.00 | | $1,034.40 | | $6.12 | | 1.19% |

| Hypothetical (5% Return Before Expenses) | $1,000.00 | | $1,019.19 | | $6.07 | | 1.19% |

| |

| Retirement International Equity Portfolio** | | | | | | | |

| Actual | $1,000.00 | | $1,140.10 | | $6.37 | | 1.18% |

| Hypothetical (5% Return Before Expenses) | $1,000.00 | | $1,019.25 | | $6.01 | | 1.18% |

| |

| Retirement Emerging Markets Portfolio** | | | | | | | |

| Actual | $1,000.00 | | $1,280.70 | | $9.20 | | 1.60% |

| Hypothetical (5% Return Before Expenses) | $1,000.00 | | $1,017.14 | | $8.13 | | 1.60% |

| * | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

| |

| ** | See Note 8 under Notes to Financial Statements. |

| |

12

Lazard Retirement Series, Inc.

Portfolio Holdings Presented by Sector

December 31, 2005

| | | | | | | | Lazard | | Lazard |

| | Lazard | | Lazard | | Retirement | | Retirement |

| | Retirement | | Retirement | | International | | Emerging |

| | Equity | | Small Cap | | Equity | | Markets |

| Sector* | Portfolio | | Portfolio | | Portfolio | | Portfolio |

|

| Commercial Services | 4.2 | % | | 10.7 | % | | — | % | | 2.0 | % |

| Consumer Discretionary | 14.9 | | | 11.2 | | | 9.4 | | | 10.3 | |

| Consumer Durables | 1.1 | | | 1.5 | | | 7.3 | | | 2.5 | |

| Consumer Staples | 4.4 | | | 1.1 | | | 7.9 | | | 10.1 | |

| Energy | 12.6 | | | 8.2 | | | 9.6 | | | 9.2 | |

| Financials | 21.5 | | | 17.7 | | | 29.7 | | | 16.6 | |

| Health Care | 8.5 | | | 10.4 | | | 7.0 | | | 0.9 | |

| Process Industry | 3.7 | | | 6.3 | | | 0.6 | | | 10.4 | |

| Producer Manufacturing | 8.4 | | | 9.5 | | | 5.3 | | | 0.9 | |

| Technology | 16.3 | | | 14.2 | | | 6.3 | | | 13.5 | |

| Telecommunications | 4.4 | | | — | | | 7.2 | | | 15.9 | |

| Transportation | — | | | 5.0 | | | 3.7 | | | 1.8 | |

| Utilities | — | | | 1.5 | | | 3.7 | | | — | |

| Short-Term Investments | — | | | 2.7 | | | 2.3 | | | 5.9 | |

|

|

| Total Investments | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

|

|

* Represents percentage of total investments.13

Lazard Retirement Series, Inc.

Portfolios of Investments

December 31, 2005

| Description | Shares | | | Value |

|

| Lazard Retirement Equity Portfolio | | | | |

| Common Stocks—98.7% | | | | |

| Alcohol & Tobacco—1.0% | | | | |

| Altria Group, Inc. | 550 | | $ | 41,096 |

| |

|

| Banking—6.5% | | | | |

| Bank of America Corp. | 3,005 | | | 138,680 |

| Golden West Financial Corp. | 1,105 | | | 72,930 |

| The Bank of New York Co., Inc. | 2,155 | | | 68,637 |

| |

|

| | | | | 280,247 |

| |

|

| Building & Construction—1.1% | | | | |

| Masco Corp. | 1,510 | | | 45,587 |

| |

|

| Chemicals—1.3% | | | | |

| Cabot Corp. | 675 | | | 24,165 |

| Du Pont (E.I.) de Nemours & Co. | 735 | | | 31,238 |

| |

|

| | | | | 55,403 |

| |

|

| Commercial Services—3.8% | | | | |

| ARAMARK Corp., Class B | 2,190 | | | 60,838 |

| Automatic Data Processing, Inc. | 1,400 | | | 64,246 |

| Republic Services, Inc. | 1,035 | | | 38,864 |

| |

|

| | | | | 163,948 |

| |

|

| Computer Software—7.7% | | | | |

| Computer Associates International, Inc. | 1,145 | | | 32,278 |

| Microsoft Corp. | 7,425 | | | 194,164 |

| Oracle Corp. (a) | 6,835 | | | 83,455 |

| Symantec Corp. (a) | 1,300 | | | 22,750 |

| |

|

| | | | | 332,647 |

| |

|

| Consumer Products—1.7% | | | | |

| The Procter & Gamble Co. | 1,280 | | | 74,086 |

| |

|

| Drugs—4.1% | | | | |

| Abbott Laboratories | 500 | | | 19,715 |

| Bristol-Myers Squibb Co. | 1,200 | | | 27,576 |

| Merck & Co., Inc. | 1,000 | | | 31,810 |

| Pfizer, Inc. | 4,175 | | | 97,361 |

| |

|

| | | | | 176,462 |

| |

|

| Energy Integrated—7.7% | | | | |

| Chevron Corp. | 1,190 | | | 67,556 |

| ConocoPhillips | 1,485 | | | 86,398 |

| Exxon Mobil Corp. | 2,565 | | | 144,076 |

| Marathon Oil Corp. | 565 | | | 34,448 |

| |

|

| | | | | 332,478 |

| |

|

| Energy Services—4.7% | | | | |

| BJ Services Co. | 1,325 | | | 48,588 |

| GlobalSantaFe Corp. | 920 | | | 44,298 |

| Halliburton Co. | 770 | | | 47,709 |

| The Williams Cos., Inc. | 2,765 | | | 64,065 |

| |

|

| | | | | 204,660 |

| |

|

| Financial Services—10.1% | | | | |

| Ameriprise Financial, Inc. | 760 | | | 31,160 |

| Citigroup, Inc. | 2,465 | | | 119,627 |

| JPMorgan Chase & Co. | 2,454 | | | 97,399 |

| MBNA Corp. | 2,080 | | | 56,472 |

| Mellon Financial Corp. | 1,325 | | | 45,381 |

| Merrill Lynch & Co., Inc. | 330 | | | 22,351 |

| The Bear Stearns Cos., Inc. | 540 | | | 62,386 |

| |

|

| | | | | 434,776 |

| |

|

| Food & Beverages—0.6% | | | | |

| The Pepsi Bottling Group, Inc. | 915 | | | 26,178 |

| |

|

| Forest & Paper Products—3.4% | | | | |

| Ball Corp. | 1,100 | | | 43,692 |

| International Paper Co. | 1,735 | | | 58,313 |

| Kimberly-Clark Corp. | 750 | | | 44,738 |

| |

|

| | | | | 146,743 |

| |

|

| Health Services—1.0% | | | | |

| Laboratory Corp. of America | | | | |

| Holdings (a) | 840 | | | 45,234 |

| |

|

| Insurance—4.6% | | | | |

| American International Group, Inc. | 1,430 | | | 97,569 |

| The Allstate Corp. | 800 | | | 43,256 |

| The St. Paul Travelers Cos., Inc. | 600 | | | 26,802 |

| XL Capital, Ltd., Class A | 450 | | | 30,321 |

| |

|

| | | | | 197,948 |

| |

|

| Leisure & Entertainment—8.4% | | | | |

| Clear Channel Communications, Inc. | 2,090 | | | 65,730 |

| Expedia, Inc. (a) | 1,585 | | | 37,977 |

| McDonald’s Corp. | 1,260 | | | 42,487 |

| News Corp., Class A | 6,295 | | | 97,887 |

| Tribune Co. | 1,145 | | | 34,648 |

| Viacom, Inc., Class B (a) | 1,075 | | | 35,045 |

| Westwood One, Inc. | 2,900 | | | 47,270 |

| |

|

| | | | | 361,044 |

| |

|

The accompanying notes are an integral part of these financial statements.

14

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2005

| Description | Shares | | | Value |

|

| Lazard Retirement Equity Portfolio (concluded) | | | |

| Manufacturing—8.2% | | | | |

| Dover Corp. | 1,030 | | $ | 41,705 |

| General Electric Co. | 2,665 | | | 93,408 |

| Honeywell International, Inc. | 1,475 | | | 54,944 |

| Ingersoll-Rand Co., Ltd., Class A | 1,165 | | | 47,031 |

| Tyco International, Ltd. | 1,865 | | | 53,824 |

| United Technologies Corp. | 1,160 | | | 64,855 |

| |

|

| | | | | 355,767 |

| |

|

| Medical Products—3.3% | | | | |

| Becton, Dickinson & Co. | 730 | | | 43,858 |

| Johnson & Johnson | 1,605 | | | 96,461 |

| |

|

| | | | | 140,319 |

| |

|

| Printing & Publishing—0.4% | | | | |

| Dex Media, Inc. | 610 | | | 16,525 |

| |

|

| Retail—6.4% | | | | |

| Dollar Tree Stores, Inc. (a) | 2,095 | | | 50,154 |

| Liz Claiborne, Inc. | 825 | | | 29,552 |

| Sears Holdings Corp. (a) | 185 | | | 21,373 |

| The Home Depot, Inc. | 2,680 | | | 108,486 |

| Wal-Mart Stores, Inc. | 1,405 | | | 65,754 |

| |

|

| | | | | 275,319 |

| |

|

Semiconductors & Components—1.5% | | | | |

| Intel Corp. | 2,590 | | | 64,646 |

| |

|

| Technology—2.0% | | | | |

| International Business Machines Corp. | 1,050 | | | 86,310 |

| |

|

| Technology Hardware—4.9% | | | | |

| Avaya, Inc. (a) | 7,380 | | | 78,745 |

| Cisco Systems, Inc. (a) | 4,330 | | | 74,130 |

| Hewlett-Packard Co. | 1,980 | | | 56,687 |

| |

|

| | | | | 209,562 |

| |

|

| Telecommunications—4.3% | | | | |

| ALLTEL Corp. | 755 | | | 47,641 |

| Sprint Nextel Corp. | 3,439 | | | 80,335 |

| Verizon Communications, Inc. | 1,960 | | | 59,035 |

| |

|

| | | | | 187,011 |

| |

|

| Total Common Stocks | | | | |

| (Identified cost $3,918,030) | | | | 4,253,996 |

| | | |

|

|

| Total Investments—98.7% | | | | |

| (Identified cost $3,918,030) (b) | | | $ | 4,253,996 |

| Cash and Other Assets in Excess | | | | |

| of Liabilities—1.3% | | | | 57,434 |

| |

|

| Net Assets—100.0% | | | $ | 4,311,430 |

| |

|

The accompanying notes are an integral part of these financial statements.

15

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2005

| Description | Shares | | | Value |

|

| Lazard Retirement Small Cap Portfolio | | | |

| Common Stocks—97.3% | | | | |

| Agriculture—0.6% | | | | |

| Delta & Pine Land Co. | 35,950 | | $ | 827,210 |

| |

|

| Banking—8.3% | | | | |

| Bank of the Ozarks, Inc. | 25,800 | | | 952,020 |

| BankUnited Financial Corp., Class A . | 59,800 | | | 1,588,886 |

| Boston Private Financial Holdings, Inc. | 30,400 | | | 924,768 |

| First Community Bancorp | 15,200 | | | 826,424 |

| First Midwest Bancorp, Inc. | 23,000 | | | 806,380 |

| MB Financial, Inc. | 39,400 | | | 1,394,760 |

| Provident Bankshares Corp. | 19,800 | | | 668,646 |

| Sterling Bancshares, Inc. | 63,000 | | | 972,720 |

| Texas Regional Bancshares, Inc., | | | | |

| Class A | 46,850 | | | 1,325,855 |

| The South Financial Group, Inc. | 48,500 | | | 1,335,690 |

| United Bankshares, Inc. | 17,850 | | | 629,034 |

| |

|

| | | | | 11,425,183 |

| Building & Construction—2.0% | | | | |

| Levitt Corp., Class A | 42,300 | | | 961,902 |

| Perini Corp. (a) | 27,800 | | | 671,370 |

| Texas Industries, Inc. | 21,900 | | | 1,091,496 |

| |

|

| | | | | 2,724,768 |

| |

|

| Chemicals—2.1% | | | | |

| PolyOne Corp. (a) | 118,700 | | | 763,241 |

| Rogers Corp. (a) | 30,700 | | | 1,202,826 |

| Westlake Chemical Corp. | 33,300 | | | 959,373 |

| |

|

| | | | | 2,925,440 |

| |

|

| Commercial Services—9.3% | | | | |

| ADVO, Inc. | 54,775 | | | 1,543,559 |

| Arbitron, Inc. | 29,400 | | | 1,116,612 |

| Learning Tree International, Inc. (a) | 80,700 | | | 1,035,381 |

| MPS Group, Inc. (a) | 65,300 | | | 892,651 |

| Rush Enterprises, Inc., Class A (a) | 3,100 | | | 46,128 |

| Tetra Tech, Inc. (a) | 57,800 | | | 905,726 |

| The BISYS Group, Inc. (a) | 67,700 | | | 948,477 |

| United Rentals, Inc. (a) | 55,300 | | | 1,293,467 |

| Waste Connections, Inc. (a) | 18,100 | | | 623,726 |

| Watson Wyatt Worldwide, Inc. | 48,700 | | | 1,358,730 |

| WESCO International, Inc. (a) | 23,600 | | | 1,008,428 |

| Wireless Facilities, Inc. (a) | 227,000 | | | 1,157,700 |

| Wright Express Corp. | 39,500 | | | 869,000 |

| |

|

| | | | | 12,799,585 |

| | | |

|

|

| Computer Software—1.8% | | | | |

| Agile Software Corp. (a) | 164,300 | | | 982,514 |

| Openwave Systems, Inc. (a) | 27,100 | | | 473,437 |

| WebEx Communications, Inc. (a) | 45,050 | | | 974,431 |

| |

|

| | | | | 2,430,382 |

| |

|

| Consumer Products—3.9% | | | | |

| Elizabeth Arden, Inc. (a) | 42,100 | | | 844,526 |

| Fossil, Inc. (a) | 57,000 | | | 1,226,070 |

| Matthews International Corp., Class A | 17,600 | | | 640,816 |

| Take-Two Interactive Software, Inc. (a) | 53,800 | | | 952,260 |

| Tempur-Pedic International, Inc. (a) | 47,000 | | | 540,500 |

| WMS Industries, Inc. (a) | 45,200 | | | 1,134,068 |

| |

|

| | | | | 5,338,240 |

| |

|

| Drugs—2.0% | | | | |

| First Horizon Pharmaceutical Corp. (a) | 98,600 | | | 1,700,850 |

| K-V Pharmaceutical Co., Class A (a) | 47,700 | | | 982,620 |

| |

|

| | | | | 2,683,470 |

| |

|

| | | | | |

| Energy Exploration & Production—2.9% | | | | |

| Brigham Exploration Co. (a) | 64,200 | | | 761,412 |

| Denbury Resources, Inc. (a) | 29,200 | | | 665,176 |

| Energy Partners, Ltd. (a) | 29,400 | | | 640,626 |

| Forest Oil Corp. (a) | 16,000 | | | 729,120 |

| Penn Virginia Corp. | 8,500 | | | 487,900 |

| Range Resources Corp. | 27,450 | | | 723,033 |

| |

|

| | | | | 4,007,267 |

| |

|

| Energy Services—5.3% | | | | |

| Dresser-Rand Group, Inc. | 58,600 | | | 1,416,948 |

| Grey Wolf, Inc. (a) | 105,700 | | | 817,061 |

| Hercules Offshore, Inc. | 14,500 | | | 411,945 |

| Key Energy Services, Inc. (a) | 65,850 | | | 886,999 |

| Kinder Morgan Management, LLC (a) | 23,469 | | | 1,066,901 |

| Oil States International, Inc. (a) | 20,200 | | | 639,936 |

| Todco, Class A | 33,800 | | | 1,286,428 |

| Veritas DGC, Inc. (a) | 19,800 | | | 702,702 |

| |

|

| | | | | 7,228,920 |

| |

|

| Financial Services—1.7% | | | | |

| Financial Federal Corp. | 20,150 | | | 895,668 |

| Waddell & Reed Financial, Inc. | 67,300 | | | 1,411,281 |

| |

|

| | | | | 2,306,949 |

| |

|

| Food & Beverages—0.5% | | | | |

| Performance Food Group Co. (a) | 22,400 | | | 635,488 |

| |

|

The accompanying notes are an integral part of these financial statements.

16

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2005

| Description | Shares | | | Value |

|

| Lazard Retirement Small Cap Portfolio (continued) |

| Health Services—5.0% | | | | |

| Alderwoods Group, Inc. (a) | 58,900 | | $ | 934,743 |

| BioScrip, Inc. (a) | 94,700 | | | 714,038 |

| Gentiva Health Services, Inc. (a) | 23,500 | | | 346,390 |

| Hanger Orthopedic Group, Inc. (a) | 128,300 | | | 732,593 |

| Kindred Healthcare, Inc. (a) | 47,600 | | | 1,226,176 |

| LifePoint Hospitals, Inc. (a) | 46,500 | | | 1,743,750 |

| Ventiv Health, Inc. (a) | 49,900 | | | 1,178,638 |

| |

|

| | | | | 6,876,328 |

| |

|

| Insurance—4.4% | | | | |

| Arch Capital Group, Ltd. (a) | 18,300 | | | 1,001,925 |

| Aspen Insurance Holdings, Ltd. | 49,700 | | | 1,176,399 |

| Assured Guaranty, Ltd. | 46,300 | | | 1,175,557 |

| Bristol West Holdings, Inc. | 61,400 | | | 1,168,442 |

| Scottish Re Group, Ltd. | 59,600 | | | 1,463,180 |

| |

|

| | | | | 5,985,503 |

| |

|

| Leisure & Entertainment—3.4% | | | | |

| Alliance Gaming Corp. (a) | 109,100 | | | 1,420,482 |

| Carmike Cinemas, Inc. | 2,500 | | | 63,400 |

| CBRL Group, Inc. | 26,500 | | | 931,475 |

| Journal Register Co. | 14,868 | | | 222,277 |

| RARE Hospitality International, Inc. (a) | 33,500 | | | 1,018,065 |

| Ruby Tuesday, Inc. | 40,500 | | | 1,048,545 |

| |

|

| | | | | 4,704,244 |

| |

|

| Manufacturing—9.5% | | | | |

| Acuity Brands, Inc. | 25,100 | | | 798,180 |

| Applied Signal Technology, Inc. | 52,900 | | | 1,200,830 |

| Columbus McKinnon Corp. (a) | 41,000 | | | 901,180 |

| DRS Technologies, Inc. | 18,950 | | | 974,409 |

| Esterline Technologies Corp. (a) | 33,300 | | | 1,238,427 |

| Kennametal, Inc. | 18,100 | | | 923,824 |

| Knoll, Inc. | 71,700 | | | 1,226,787 |

| Ladish Co., Inc. (a) | 32,700 | | | 730,845 |

| RBC Bearings, Inc. | 53,000 | | | 861,250 |

| Regal-Beloit Corp. | 31,100 | | | 1,100,940 |

| RTI International Metals, Inc. (a) | 54,700 | | | 2,075,865 |

| Wabash National Corp. | 50,000 | | | 952,500 |

| |

|

| | | | | 12,985,037 |

| |

|

| Medical Products—4.1% | | | | |

| Advanced Medical Optics, Inc. (a) | 32,900 | | | 1,375,220 |

| Candela Corp. (a) | 54,400 | | | 785,536 |

| Encore Medical Corp. (a) | 74,600 | | | 369,270 |

| PSS World Medical, Inc. (a) | 81,000 | | | 1,202,040 |

| Symmetry Medical, Inc. (a) | 59,800 | | | 1,159,522 |

| Wright Medical Group, Inc. (a) | 36,200 | | | 738,480 |

| |

|

| | | | | 5,630,068 |

| |

|

| Metals & Mining—3.6% | | | | |

| Cleveland-Cliffs, Inc. | 8,300 | | | 735,131 |

| NS Group, Inc. (a) | 30,500 | | | 1,275,205 |

| Olin Corp. | 46,750 | | | 920,040 |

| Oregon Steel Mills, Inc. (a) | 25,800 | | | 759,036 |

| Quanex Corp. | 8,600 | | | 429,742 |

| Steel Dynamics, Inc. | 21,600 | | | 767,016 |

| |

|

| | | | | 4,886,170 |

| |

|

| Printing & Publishing—0.9% | | | | |

| R.H. Donnelley Corp. (a) | 19,600 | | | 1,207,752 |

| |

|

| Real Estate—3.3% | | | | |

| Alexandria Real Estate Equities, Inc. | 14,000 | | | 1,127,000 |

| BioMed Realty Trust, Inc. | 24,500 | | | 597,800 |

| Brandywine Realty Trust | 34,200 | | | 954,522 |

| Cousins Properties, Inc. | 22,600 | | | 639,580 |

| Lexington Corporate Properties Trust | 33,800 | | | 719,940 |

| The Mills Corp. | 10,750 | | | 450,855 |

| |

|

| | | | | 4,489,697 |

| |

|

| Retail—3.8% | | | | |

| CSK Auto Corp. (a) | 53,300 | | | 803,764 |

| Dick’s Sporting Goods, Inc. (a) | 21,800 | | | 724,632 |

| Hot Topic, Inc. (a) | 59,000 | | | 840,750 |

| PETCO Animal Supplies, Inc. (a) | 46,900 | | | 1,029,455 |

| The Finish Line, Inc. | 55,500 | | | 966,810 |

| The Talbots, Inc. | 29,400 | | | 817,908 |

| |

|

| | | | | 5,183,319 |

| |

|

| Semiconductors & Components—7.5% | | | | |

| Actel Corp. (a) | 77,800 | | | 990,394 |

| Benchmark Electronics, Inc. (a) | 47,000 | | | 1,580,610 |

| Coherent, Inc. (a) | 39,900 | | | 1,184,232 |

| Exar Corp. (a) | 89,000 | | | 1,114,280 |

| FARO Technologies, Inc. (a) | 21,700 | | | 434,000 |

| Integrated Device Technology, Inc. (a) . | 153,100 | | | 2,017,858 |

| Microsemi Corp. (a) | 28,700 | | | 793,842 |

| TTM Technologies, Inc. (a) | 121,600 | | | 1,143,040 |

| Zoran Corp. (a) | 59,100 | | | 958,011 |

| |

|

| | | | | 10,216,267 |

| | | |

|

|

| Technology Hardware—4.9% | | | | |

| ADE Corp. (a) | 32,400 | | | 779,544 |

| Avocent Corp. (a) | 45,000 | | | 1,223,550 |

| Brooks Automation, Inc. (a) | 54,100 | | | 677,873 |

| C-COR, Inc. (a) | 145,000 | | | 704,700 |

| Dot Hill Systems Corp. (a) | 163,100 | | | 1,130,283 |

| Photon Dynamics, Inc. (a) | 42,900 | | | 784,212 |

| SafeNet, Inc. (a) | 45,800 | | | 1,475,676 |

| |

|

| | | | | 6,775,838 |

| |

|

The accompanying notes are an integral part of these financial statements.

17

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2005

| Description | Shares | | | Value | |

|

| Lazard Retirement Small Cap Portfolio (concluded) |

| Transportation—5.0% | | | | | |

| AirTran Holdings, Inc. (a) | 83,200 | | $ | 1,333,696 | |

| American Commercial Lines, Inc. (a) | 39,600 | | | 1,199,484 | |

| Genco Shipping & Trading, Ltd. | 27,000 | | | 470,880 | |

| Hub Group, Inc., Class A (a) | 15,000 | | | 530,250 | |

| OMI Corp. | 99,500 | | | 1,805,925 | |

| Pacer International, Inc. | 35,900 | | | 935,554 | |

| Swift Transportation Co., Inc. (a) | 29,250 | | | 593,775 | |

| |

|

| | | | | 6,869,564 | |

| |

|

| Utilities—1.5% | | | | | |

| Cleco Corp. | 67,100 | | | 1,399,035 | |

| New Jersey Resources Corp. | 16,500 | | | 691,185 | |

| |

|

| | | | | 2,090,220 | |

| |

|

| Total Common Stocks | | | | | |

| (Identified cost $123,873,689) | | | | 133,232,909 | |

| | | |

|

| |

| | | | | | |

| | Principal | | | | |

| | Amount | | | | |

| | (000) | | | | |

| |

| | | | |

Repurchase Agreement—2.7% | | | | | |

| State Street Bank and Trust Co., | | | | | |

| 3.25%, 01/03/06 | | | | | |

| (Dated 12/30/05, collateralized by | | | | | |

| $3,875,000 United States Treasury | | | | | |

| Note, 4.00%, 11/15/12, with a | | | | | |

| value of $3,821,719) | | | | | |

| Proceeds of $3,743,351 | | | | | |

| (Identified cost $3,742,000) | $3,742 | | $ | 3,742,000 | |

|

|

Total Investments—100.0% | | | | | |

| (Identified cost $127,615,689) (b) | | | $ | 136,974,909 | |

Liabilities in Excess of Cash and | | | | | |

| Other Assets | | | | (4,846 | ) |

|

|

| Net Assets—100.0% | | | $ | 136,970,063 | |

|

|

The accompanying notes are an integral part of these financial statements.

18

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2005

| Description | Shares | | | Value |

|

| Lazard Retirement International Equity Portfolio | |

| Common Stocks—97.7% | | | | |

| Belgium—1.7% | | | | |

| Belgacom SA | 69,200 | | $ | 2,248,765 |

| InBev NV | 52,600 | | | 2,281,370 |

| |

|

| Total Belgium | | | | 4,530,135 |

| |

|

| France—15.3% | | | | |

| Axa | 97,300 | | | 3,128,636 |

| BNP Paribas SA | 64,800 | | | 5,224,321 |

| France Telecom SA | 157,800 | | | 3,906,931 |

| Lafarge SA | 42,800 | | | 3,836,840 |

| Lagardere SCA | 50,930 | | | 3,904,841 |

| Sanofi-Aventis | 38,708 | | | 3,378,693 |

| Schneider Electric SA | 39,500 | | | 3,510,724 |

| Total SA | 36,593 | | | 9,159,246 |

| Vivendi Universal SA | 153,100 | | | 4,778,387 |

| |

|

| Total France | | | 40,828,619 |

| |

|

| Germany—5.3% | | | | |

| Deutsche Bank AG | 27,100 | | | 2,617,999 |

| Siemens AG | 79,900 | | | 6,823,413 |

| Volkswagen AG | 90,800 | | | 4,777,871 |

| |

|

| Total Germany | | | 14,219,283 |

| |

|

| Ireland—2.0% | | | | |

| Bank of Ireland | 146,700 | | | 2,303,162 |

| CRH PLC | 99,547 | | | 2,917,903 |

| |

|

| Total Ireland | | | | 5,221,065 |

| |

|

| Italy—8.6% | | | | |

| Assicurazioni Generali SpA | 80,900 | | | 2,816,963 |

| Banco Popolare di Verona e Novara Scrl | 136,077 | | | 2,743,109 |

| Enel SpA | 328,100 | | | 2,567,814 |

| Eni SpA | 189,775 | | | 5,244,784 |

| Mediolanum SpA | 49,700 | | | 326,534 |

| Telecom Italia SpA | 1,590,500 | | | 4,615,142 |

| UniCredito Italiano SpA | 658,475 | | | 4,520,418 |

| |

|

| Total Italy | | | 22,834,764 |

| |

|

| Japan—25.9% | | | | |

| East Japan Railway Co. | 611 | | | 4,198,263 |

| Fujitsu, Ltd. | 449,800 | | | 3,422,184 |

| Hoya Corp. | 133,600 | | | 4,799,322 |

| Mitsubishi UFJ Financial Group, Inc. | . 678 | | | 9,190,884 |

| Murata Manufacturing Co., Ltd. | 70,300 | | | 4,502,821 |

| Nidec Corp. | 44,200 | | | 3,756,045 |

| Nomura Holdings, Inc. | 273,100 | | | 5,229,230 |

| NTT DoCoMo, Inc. | 1,520 | | | 2,318,055 |

| Shin-Etsu Chemical Co., Ltd. | 30,300 | | | 1,609,599 |

| Shinsei Bank, Ltd. | 389,000 | | | 2,247,717 |

| Sony Corp. | 95,800 | | | 3,912,192 |

| Takeda Pharmaceutical Co., Ltd. | 83,500 | | | 4,513,514 |

| The Sumitomo Trust and Banking | | | | |

| Co., Ltd. | 332,000 | | | 3,389,477 |

| Tokyo Gas Co., Ltd. | 882,000 | | | 3,915,682 |

| Toyota Motor Corp. | 151,400 | | | 7,850,275 |

| Yokogawa Electric Corp. | 244,200 | | | 4,158,621 |

| |

|

| | | | | |

| Total Japan | | | | 69,013,881 |

| Netherlands—3.3% | | |

|

|

| Royal Dutch Shell PLC, A Shares | 104,100 | | | 3,165,556 |

| TNT NV | 182,600 | | | 5,686,185 |

| |

|

| Total Netherlands | | | | 8,851,741 |

| |

|

| Norway—2.7% | | | | |

| DNB NOR ASA | 354,700 | | | 3,771,593 |

| Statoil ASA | 146,800 | | | 3,360,384 |

| |

|

| Total Norway | | | | 7,131,977 |

| |

|

| Singapore—1.3% | | | | |

| Oversea-Chinese Banking Corp., Ltd. | 852,920 | | | 3,436,712 |

| |

|

| Switzerland—10.5% | | | | |

| Compagnie Financiere Richemont AG, | | | | |

| A Shares | 75,300 | | | 3,268,075 |

| Credit Suisse Group | 143,070 | | | 7,273,182 |

| Nestle SA | 18,840 | | | 5,617,907 |

| Novartis AG | 142,200 | | | 7,450,139 |

| Zurich Financial Services AG (a) | 20,800 | | | 4,418,984 |

| |

|

| Total Switzerland | | | | 28,028,287 |

| |

|

| United Kingdom—21.1% | | | | |

| Barclays PLC | 600,400 | | | 6,297,801 |

| BP PLC | 445,020 | | | 4,729,086 |

| Cadbury Schweppes PLC | 341,040 | | | 3,217,215 |

| Diageo PLC | 438,975 | | | 6,349,167 |

| GlaxoSmithKline PLC | 127,100 | | | 3,205,342 |

| Imperial Tobacco Group PLC | 118,380 | | | 3,530,085 |

| Marks & Spencer Group PLC | 567,400 | | | 4,919,124 |

| National Grid PLC | 355,324 | | | 3,467,869 |

| Prudential PLC | 319,083 | | | 3,012,822 |

| Royal Bank of Scotland Group PLC | 233,200 | | | 7,026,074 |

| Tesco PLC | 729,200 | | | 4,149,896 |

| Vodafone Group PLC | 2,873,190 | | | 6,190,349 |

| |

|

| Total United Kingdom | | | | 56,094,830 |

| |

|

| Total Common Stocks | | | | |

| (Identified cost $219,192,322) | | | | 260,191,294 |

| |

|

The accompanying notes are an integral part of these financial statements.

19

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2005

| | | Principal | | | |

| | | Amount | | | |

| Description | | (000) | | | Value |

|

| Lazard Retirement International Equity Portfolio | | | |

| (concluded) | | | | | |

Repurchase Agreement—2.3% | | | | | |

| State Street Bank and Trust Co., | | | | | |

| 3.25%, 01/03/06 | | | | | |

| (Dated 12/30/05, collateralized by | | | | | |

| $6,420,000 United States Treasury | | | | | |

| Note, 4.00%, 11/15/12, with a | | | | | |

| value of $6,331,725) | | | | | |

| Proceeds of $6,208,241 | | | | | |

| (Identified cost $6,206,000) | $ | 6,206 | | $ | 6,206,000 |

| | | | |

|

| Total Investments—100.0% | | | | | |

| (Identified cost $225,398,322) (b) | | | | $ | 266,397,294 |

| Cash and Other Assets in Excess | | | | | |

| of Liabilities | | | | | 39,505 |

| | | |

|

| Net Assets—100.0% | | | | $ | 266,436,799 |

| | | |

|

The accompanying notes are an integral part of these financial statements.

20

Lazard Retirement Series, Inc.

Portfolios of Investments (continued)

December 31, 2005

| Description | Shares | | | Value |

|

| Lazard Retirement Emerging Markets Portfolio | | | |

| Common Stocks—82.2% | | | | |

| Brazil—8.4% | | | | |

| Brasil Telecom Participacoes SA ADR | 29,700 | | $ | 1,109,295 |

| Companhia de Bebidas das Americas ADR | 2,754 | | | 90,056 |

| Companhia de Concessoes Rodoviarias | 29,200 | | | 925,198 |

| Companhia Vale do Rio Doce ADR | 36,000 | | | 1,481,040 |

| Grendene SA | 45,800 | | | 440,448 |

| Petroleo Brasileiro SA ADR | 30,200 | | | 2,152,354 |

| Souza Cruz SA | 61,600 | | | 764,890 |

| |

|

| Total Brazil | | | | 6,963,281 |

| |

|

| Chile—0.5% | | | | |

| Administradora de Fondos de | | | | |

| Pensiones Provida SA Sponsored ADR | 13,560 | | | 385,104 |

| |

|

| China—1.8% | | | | |

| People’s Food Holdings, Ltd. | 1,181,000 | | | 759,965 |

| Yanzhou Coal Mining Co., Ltd | 1,118,900 | | | 717,933 |

| |

|

| Total China | | | | 1,477,898 |

| |

|

| Egypt—4.2% | | | | |

| Commercial International Bank | 111,900 | | | 1,145,567 |

| Eastern Tobacco | 19,544 | | | 1,123,855 |

| Orascom Telecom Holding SAE | 11,700 | | | 1,213,069 |

| |

|

| Total Egypt | | | | 3,482,491 |

| |

|

| Hong Kong—3.3% | | | | |

| China Netcom Group Corp. | | | | |

| (Hong Kong), Ltd. | 301,000 | | | 479,438 |

| CNOOC, Ltd. ADR | 11,700 | | | 795,249 |

| Hutchison Telecommunications | | | | |

| International, Ltd. (a) | 590,000 | | | 852,255 |

| Texwinca Holdings, Ltd. | 884,000 | | | 638,469 |

| |

|

| Total Hong Kong | | | | 2,765,411 |

| |

|

| Hungary—1.6% | | | | |

| Gedeon Richter Rt. | 4,100 | | | 733,996 |

| MOL Magyar Olaj-es Gazipari Rt. | 6,600 | | | 615,216 |

| |

|

| Total Hungary | | | | 1,349,212 |

| |

|

| India—7.1% | | | | |

| Hero Honda Motors, Ltd. | 41,710 | | | 789,626 |

| Hindalco Industries, Ltd. GDR (c) | 281,800 | | | 876,398 |

| Hindustan Lever, Ltd. | 120,900 | | | 527,813 |

| Oil and Natural Gas Corp., Ltd. | 34,782 | | | 907,995 |

| Satyam Computer Services, Ltd. | 80,082 | | | 1,318,391 |

| State Bank of India | 71,200 | | | 1,432,226 |

| |

|

| Total India | | | | 5,852,449 |

| |

|

| Indonesia—4.8% | | | | |

| PT Bank Mandiri | 4,798,500 | | | 799,750 |

| PT Bumi Resources | 8,339,000 | | | 644,069 |

| PT Telekomunikasi Indonesia Sponsored ADR | 76,600 | | | 1,827,676 |

| PT United Tractors | 1,944,400 | | | 726,186 |

| |

|

| Total Indonesia | | | | 3,997,681 |

| |

|

| Israel—1.7% | | | | |

| Bank Hapoalim BM | 297,000 | | | 1,379,280 |

| |

|

| Mexico—5.2% | | | | |

| America Telecom SA de CV, Series A1 Shares (a) | 139,700 | | | 678,956 |

| Desarrolladora Homex SA de CV ADR (a) | 24,790 | | | 760,557 |

| Fomento Economico Mexicano SA de | | | | |

| CV Sponsored ADR | 14,335 | | | 1,039,431 |

| Grupo Mexico SA de CV | 153,300 | | | 357,395 |

| Grupo Televisa SA Sponsored ADR | 13,800 | | | 1,110,900 |

| Kimberly-Clark de Mexico SA de CV | 97,100 | | | 346,862 |

| Urbi, Desarrollos Urbanos, SA de CV (a) | 6,600 | | | 45,602 |

| |

|

| Total Mexico | | | | 4,339,703 |

| |

|

| Morocco—0.8% | | | | |

| Maroc Telecom | 64,500 | | | 695,800 |

| |

|

| Peru—0.5% | | | | |

| Credicorp, Ltd. | 19,400 | | | 442,126 |

| |

|

| Philippines—1.3% | | | | |

| Philippine Long Distance Telephone | | | | |

| Co. Sponsored ADR | 31,200 | | | 1,046,448 |

| |

|

| Russia—3.3% | | | | |

| Evraz Group SA GDR | 40,700 | | | 736,670 |

| LUKOIL Sponsored ADR | 16,380 | | | 966,420 |

| Mobile TeleSystems Sponsored ADR | 30,000 | | | 1,050,000 |

| |

|

| Total Russia | | | | 2,753,090 |

| |

|

| South Africa—7.2% | | | | |

| Edgars Consolidated Stores, Ltd. | 203,100 | | | 1,125,896 |

| Kumba Resources, Ltd. | 40,100 | | | 644,887 |

| Murray & Roberts Holdings, Ltd. | 294,190 | | | 909,125 |

| Old Mutual PLC | 462,500 | | | 1,308,110 |

| Sanlam, Ltd. | 164,330 | | | 393,563 |

| Steinhoff International Holdings, Ltd. | 531,903 | | | 1,572,437 |

| |

|

| Total South Africa | | | | 5,954,018 |

| |

|

The accompanying notes are an integral part of these financial statements.

21

Lazard Retirement Series, Inc.

Portfolios of Investments (concluded)

December 31, 2005

| Description | Shares | | | Value |

|

| Lazard Retirement Emerging Markets Portfolio | | | |

| (concluded) | | | | |

| South Korea—18.0% | | | | |

| Hite Brewery Co., Ltd. | 5,000 | | $ | 712,272 |

| Hyundai Motor Co. | 6,150 | | | 591,972 |

| Kangwon Land, Inc. | 54,240 | | | 1,102,668 |

| Kookmin Bank | 40,790 | | | 3,086,942 |

| KT Corp. Sponsored ADR | 33,190 | | | 715,244 |

| LG Electronics, Inc. | 17,100 | | | 1,510,640 |

| LG Household & Health Care, Ltd. | 21,900 | | | 1,191,571 |

| LG.Philips LCD Co., Ltd. ADR (a) | 40,300 | | | 864,838 |

| Samsung Electronics Co., Ltd. GDR | 700 | | | 230,650 |

| Samsung Electronics Co., Ltd. GDR (c) | 10,326 | | | 3,402,417 |

| Samsung SDI Co., Ltd. | 6,960 | | | 802,137 |

| SK Corp. | 14,000 | | | 721,571 |

| |

|

| Total South Korea | | | | 14,932,922 |

| |

|

| Taiwan—7.8% | | | | |

| Advantech Co., Ltd. | 245,502 | | | 695,177 |

| Chinatrust Financial Holding Co., Ltd. | 934,369 | | | 739,689 |

| Chunghwa Telecom Co., Ltd. | | | | |

| Sponsored ADR | 29,200 | | | 535,820 |

| Delta Electronics, Inc. | 247,000 | | | 506,138 |

| Delta Electronics, Inc. Sponsored GDR | 31,551 | | | 313,932 |

| Fubon Financial Holding Co., Ltd. | 840,000 | | | 721,250 |

| Hon Hai Precision Industry Co., Ltd. | 215,922 | | | 1,183,386 |

| Taiwan Semiconductor Manufacturing | | | | |

| Co., Ltd. | 703,299 | | | 1,338,373 |

| Taiwan Semiconductor Manufacturing | | | | |

| Co., Ltd. Sponsored ADR | 39,900 | | | 395,409 |

| |

|

| Total Taiwan | | | | 6,429,174 |

| |

|

| Thailand—0.6% | | | | |

| Thai Union Frozen Products PCL | 670,800 | | | 499,010 |

| |

|

| Turkey—3.7% | | | | |

| Akbank TAS | 221,300 | | | 1,801,184 |

| Turkcell Iletisim Hizmetleri AS ADR | 81,132 | | | 1,246,187 |

| |

|

| Total Turkey | | | | 3,047,371 |

| |

|

| Venezuela—0.4% | | | | |

| Compania Anonima Nacional Telefonos | | | | |

| de Venezuela ADR | 22,485 | | | 321,536 |

| |

|

| Total Common Stocks | | | | |

| (Identified cost $53,120,680) | | | | 68,114,005 |

| |

|

| Preferred Stocks—10.8% | | | | |

| Brazil—10.0% | | | | |

| All America Latina Logistica SA Units | 11,900 | | | 508,253 |

| Caemi Mineracao e Metalurgia SA | 1,852,350 | | | 2,704,566 |

| Companhia Brasileira de Distribuicao | | | | |

| Grupo Pao de Acucar Sponsored ADR | 27,700 | | | 911,330 |

| Companhia de Bebidas das Americas ADR | 31,470 | | | 1,197,433 |

| Gerdau SA Sponsored ADR | 63,800 | | | 1,064,184 |

| Telemar Norte Leste SA | 48,042 | | | 1,306,216 |

| Usinas Siderurgicas de Minas Gerais SA | 25,100 | | | 597,542 |

|

|

| Total Brazil | | | | 8,289,524 |

|

|

| South Korea—0.8% | | | | |

| Hyundai Motor Co. | 10,380 | | | 667,458 |

|

|

| Total Preferred Stocks | | | | |

| (Identified cost $6,067,207) | | | | 8,956,982 |

|

|

| Warrant—0.1% | | | | |

| India—0.1% | | | | |

| Hindalco Industries, Ltd. Right, | | | | |

| 01/05/06 | | | | |

| (Identified cost $0) (a), (d) | 70,450 | | | 54,951 |

|

|

| |

| | Principal | | | |

| | Amount | | | |

| | (000) | | | |

| |

| | | |

| Repurchase Agreement—5.9% | | | | |

| State Street Bank and Trust Co., | | | | |

| 3.25%, 01/03/06 | | | | |

| (Dated 12/30/05, collateralized by | | | | |

| $5,045,000 United States Treasury | | | | |

| Note, 4.00%, 11/15/12, with a | | | | |

| value of $4,975,631) | | | | |

| Proceeds of $4,876,760 | | | | |

| (Identified cost $4,875,000) | $4,875 | | | 4,875,000 |

|

|

| Total Investments—99.0% | | | | |

| (Identified cost $64,062,887) (b) | | | $ | 82,000,938 |

| Cash and Other Assets in Excess | | | | |

| of Liabilities—1.0% | | | | 811,272 |

|

|

| Net Assets—100.0% | | | $ | 82,812,210 |

|

|

The accompanying notes are an integral part of these financial statements.

22

Lazard Retirement Series, Inc.

Notes to Portfolios of Investments

December 31, 2005

| (a) | Non-income producing security. |

| |

| (b) | For federal income tax purposes, the aggregate cost, aggregate gross unrealized appreciation, aggregate gross unrealized depreciation and the net unrealized appreciation is as follows: |

| |

| | | | | Aggregate | | Aggregate | | | |

| | | | | Gross | | Gross | | Net |

| | Aggregate | | Unrealized | | Unrealized | | Unrealized |

| Portfolio | Cost | | Appreciation | | Depreciation | | Appreciation |

|

| Retirement Equity | $ | 3,967,821 | | $ | 383,249 | | $ | 97,074 | | $ | 286,175 |

| Retirement Small Cap | | 128,530,630 | | | 13,924,566 | | | 5,480,287 | | | 8,444,279 |

| Retirement International Equity | | 225,609,429 | | | 44,615,704 | | | 3,827,839 | | | 40,787,865 |

| Retirement Emerging Markets | | 64,236,055 | | | 18,234,645 | | | 469,762 | | | 17,764,883 |

| (c) | Pursuant to Rule 144A under the Securities Act of 1933, these securities may only be traded among “qualified institutional buyers.” |

| |

| (d) | Date shown is the expiration date. |

| |

Security Abbreviations:

ADR — American Depositary Receipt

GDR — Global Depositary Receipt

The accompanying notes are an integral part of these financial statements.

23

Lazard Retirement Series, Inc.

Notes to Portfolios of Investments (concluded)

December 31, 2005

Portfolio holdings by industry (as percentage of net assets), for those Portfolios previously presented by country:| | | | | | |

| | Lazard | | Lazard |

| | Retirement | | Retirement |

| | International | | Emerging |

| | Equity | | Markets |

| | Portfolio | | Portfolio |

| |

| |

|

| Industry | | | | | |

| Alcohol & Tobacco | 4.6 | % | | 4.7 | % |

| Apparel & Textiles | — | | | 0.8 | |

| Automotive | 4.7 | | | 2.4 | |

| Banking | 21.1 | | | 13.1 | |

| Building & Construction | 2.6 | | | 2.1 | |

| Chemicals | 0.6 | | | — | |

| Consumer Products | — | | | 5.8 | |

| Drugs | 7.0 | | | 0.9 | |

| Energy Exploration & Production | — | | | 2.1 | |

| Energy Integrated. | 9.6 | | | 7.0 | |

| Financial Services | 3.4 | | | 3.4 | |

| Food & Beverages | 3.3 | | | 2.8 | |

| Forest & Paper Products | — | | | 0.4 | |

| Insurance. | 5.1 | | | — | |

| Leisure & Entertainment | 3.3 | | | 2.6 | |

| Manufacturing | 3.9 | | | 0.9 | |

| Metals & Mining | — | | | 10.3 | |

| Retail | 4.6 | | | 3.0 | |

| Semiconductors & Components. | 5.1 | | | 9.3 | |

| Technology | 2.9 | | | 1.6 | |

| Technology Hardware | 1.3 | | | 2.4 | |

| Telecommunications | 7.2 | | | 15.8 | |

| Transportation | 3.7 | | | 1.7 | |

| Utilities | 3.7 | | | — | |

| |

| |

|

| Subtotal | 97.7 | | | 93.1 | |

| Repurchase Agreements | 2.3 | | | 5.9 | |

| |

| |

|

| Total Investments | 100.0 | % | | 99.0 | % |

|

| |

|

The accompanying notes are an integral part of these financial statements.

24

Lazard Retirement Series, Inc.

Statements of Assets and Liabilities

December 31, 2005

| | | | | | | | | | Lazard | | | | Lazard |

| | | Lazard | | | | Lazard | | | Retirement | | | | Retirement |

| | | Retirement | | | | Retirement | | | International | | | | Emerging |

| | | Equity | | | | Small Cap | | | Equity | | | | Markets |

| | | Portfolio | | | | Portfolio | | | Portfolio | | | | Portfolio |

|

| |

| ASSETS | | | | | | | | | | | | | |

| Investments in securities, at value | $ | 4,253,996 | | | $ | 136,974,909 | | $ | 266,397,294 | | | $ | 82,000,938 |

| Cash | | 65,004 | | | | 660 | | | 711 | | | | 105 |

| Foreign currency | | — | | | | — | | | 50,131 | | | | 1,025,913 |

| Receivables for: | | | | | | | | | | | | | |

| Investments sold | | — | | | | 417,629 | | | — | | | | 1,312,875 |

| Dividends and interest | | 4,716 | | | | 90,674 | | | 353,422 | | | | 218,105 |

| Capital stock sold | | 7 | | | | 14,911 | | | 110,266 | | | | 7,928 |

| Amount due from Investment Manager | | 3,152 | | | | — | | | — | | | | — |

|

|

| Total assets | | 4,326,875 | | | | 137,498,783 | | | 266,911,824 | | | | 84,565,864 |

|

|

| LIABILITIES | | | | | | | | | | | | | |

| Payables for: | | | | | | | | | | | | | |

| Management fees | | — | | | | 88,528 | | | 168,368 | | | | 53,610 |

| Accrued distribution fees | | 956 | | | | 29,509 | | | 56,123 | | | | 16,917 |

| Accrued directors’ fees | | 18 | | | | 525 | | | 995 | | | | 272 |

| Investments purchased | | — | | | | 282,324 | | | 174,845 | | | | 1,437,223 |

| Capital stock repurchased | | 238 | | | | 79,561 | | | 222 | | | | 131,226 |

| Other accrued expenses and payables | | 14,233 | | | | 48,273 | | | 74,472 | | | | 114,406 |

|

|

| Total liabilities | | 15,445 | | | | 528,720 | | | 475,025 | | | | 1,753,654 |

|

|

| Net assets | $ | 4,311,430 | | | $ | 136,970,063 | | $ | 266,436,799 | | | $ | 82,812,210 |

|

|

| NET ASSETS | | | | | | | | | | | | | |

| Paid in capital | $ | 4,120,747 | | | $ | 116,445,486 | | $ | 210,535,407 | | | $ | 57,260,765 |

| Undistributed net investment income | | 27,495 | | | | 21,746 | | | 2,929,782 | | | | 585,559 |

| Accumulated undistributed net realized gain (loss) | | (172,778 | ) | | | 11,143,611 | | | 11,980,550 | | | | 7,029,268 |

| Net unrealized appreciation (depreciation) on: | | | | | | | | | | | | | |

| Investments | | 335,966 | | | | 9,359,220 | | | 40,998,972 | | | | 17,931,699 |

| Foreign currency | | — | | | | — | | | (7,912 | ) | | | 4,919 |

|

|

| Net assets | $ | 4,311,430 | | | $ | 136,970,063 | | $ | 266,436,799 | | | $ | 82,812,210 |

|

|

| |

| Shares of capital stock outstanding* | | 391,371 | | | | 8,395,800 | | | 20,774,060 | | | | 4,403,558 |

| Net asset value, offering and redemption price per share | $ | 11.02 | | | $ | 16.31 | | $ | 12.83 | | | $ | 18.81 |

| |

| Cost of investments in securities | $ | 3,918,030 | | | $ | 127,615,689 | | $ | 225,398,322 | | | $ | 64,062,887 |

| Cost of foreign currency | $ | — | | | $ | — | | $ | 50,146 | | | $ | 1,023,923 |

| |

| *$0.001 par value, 500,000,000 shares authorized for the Portfolios in total. | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

25

Lazard Retirement Series, Inc.

Statements of Operations

For the year ended December 31, 2005

| | | | | | | | | | | Lazard | | | | Lazard | |

| | | Lazard | | | | Lazard | | | | Retirement | | | | Retirement | |

| | | Retirement | | | | Retirement | | | | International | | | | Emerging | |

| | | Equity | | | | Small Cap | | | | Equity | | | | Markets | |

| | | Portfolio | | | | Portfolio | | | | Portfolio | | | | Portfolio | |

|

| |

| INVESTMENT INCOME (LOSS) | | | | | | | | | | | | | | | |

| Income: | | | | | | | | | | | | | | | |

| Dividends | $ | 82,600 | | | $ | 1,046,895 | | | $ | 5,981,506 | | | $ | 1,413,458 | |

| Interest | | 3,101 | | | | 138,686 | | | | 213,768 | | | | 73,822 | |

|

|