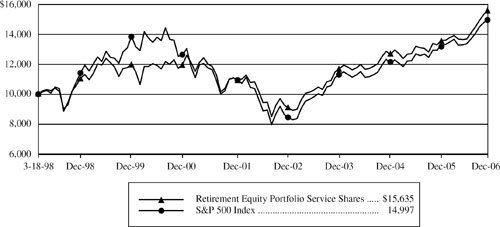

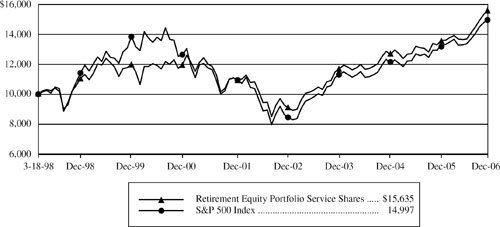

For the year ended December 31, 2006, Lazard Retirement Equity Portfolio Service Shares posted a total return of 17.48%, as compared with the 15.79% return of the S&P 500 Index.

Stock selection in technology was beneficial for performance, as some of the Portfolio’s larger-cap industry leaders, in areas such as software and networking, performed well after a period of extended weakness. Investors have begun to appreciate the strong competitive positions of these companies and the resilience of their diversified business models. Cisco reported better-than-expected year-on-year revenue growth, due to broad-based strength across all geographies, customer segments, and products. Shares of Oracle rose, as investors gained confidence in the company’s acquisition strategy, which was supported by better-than-expected recent earnings. Shares of Avaya also posted strong gains. The company reported solid sales growth, due to continued robust demand for its IP (Internet Protocol) products, and better-than-expected earnings were driven by improved margins, resulting from aggressive cost cutting by new management. Stock selection in the financials sector also helped performance, as shares of MasterCard rose sharply during the period. MasterCard’s third-quarter earnings results exceeded analysts’ expectations, as the company benefited from a secular shift from paper to plastic transactions, coupled with improving margins and a heightened focus on profitability. MasterCard was sold from the Portfolio after it reached our target valuation. An underweight position and stock selection in health care also boosted returns, as shares of Sepracor rose sharply. This pharmaceutical company released better-than-expected third-quarter earnings, and it continues to gain market share in the sleep-aid market, due to accelerating prescription growth for Lunesta. This was followed by a recent favorable decision from the Centers for Medicare and Medicaid Services, regarding reimbursement for the company’s asthma drug, Xopenex. Stock selection in telecom services detracted from performance, as Sprint shares declined in the third quarter after the company reported disappointing earnings. The product of a merger between Sprint and Nextel, the combined company has been hurt by slowing subscriber growth, due to the defection of a sizable number of Nextel’s lower-spending retail customers to other service providers.

Overall, the valuation of the broader stock market is reasonable, in the context of historic valuations. However, looking forward, our concern is that the historically high margins and returns in many cyclical stocks and sectors are not sustainable, especially given the beginning of an economic slowdown. The focus of the Portfolio will continue to be on those companies with valuations that are attractive and earnings that are more sustainable. We will seek to avoid those areas of the market where we believe earnings to be unsustainably high. As ever, good stock selection will be the key factor to a successful year ahead. Our investment process is focused on individual stock selection, which is based on company fundamentals, not on macroeconomic considerations. A complicating factor, from a fundamental perspective, is the continuation of a strong equity market and abundant liquidity, which is fuelling an extraordinary merger and acquisition cycle.

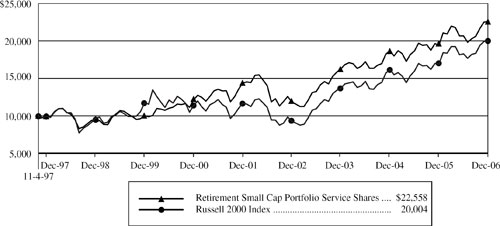

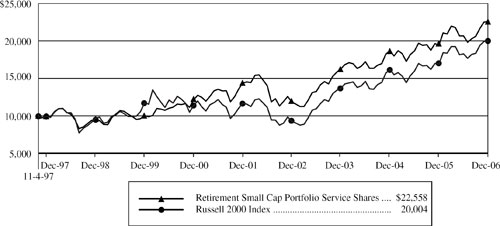

For the year ended December 31, 2006, Lazard Retirement Small Cap Portfolio Service Shares posted a total return of 16.07%, as compared with the 18.37% return of the Russell 2000 Index.

Stock selection in industrials helped performance, as shares of American Commercial Lines, a provider of inland waterway transportation, as well as a manufacturer of barges, rose significantly. The company was aided by tight conditions in both of its businesses, which helped to increase utilization and raise pricing. Stock selection in materials also helped returns, as shares of Oregon Steel, a manufacturer of oil-country tubular goods and other steel-related products, also rose sharply over the year. Oregon Steel benefited from strong demand for its products from its energy customers and, in November, it received a takeover bid from a Russian steel company, Evraz, at a substantial premium. We sold Oregon Steel into this strength, as it has exceeded our target valuation. An overweight position was beneficial to performance, as this was one of the best-performing sectors during the period. Finally, stock selection in technology also boosted returns, as shares of C-COR rose strongly. The company’s cable and telecom services customers continue to require C-COR’s equipment for building out their next generation networks to provide additional voice, data, and video

|

|

Lazard Retirement Series, Inc. |

|

Investment Overviews (continued) |

|

|

services to their customers. Stock selection in telecom services and financials detracted from performance over the period. Within telecom services, performance was hurt by lack of exposure to stocks of Regional Local Exchange Carriers (RLEC). RLEC shares posted solid gains over the period, as business conditions stabilized, and investors became more attracted to and confident in their high yields. Additionally, the Portfolio owned Wireless Facilities, a provider of design and engineering services to the telecom services industry, which declined substantially over the year, as customer activity slowed dramatically. Wireless Facilities was sold from the Portfolio, as we believed this slowdown was likely to persist. Within financials, bank holdings faced a difficult environment owing to a yield curve that is pressuring margins across a wide spectrum of companies. We expect the negative environment for banks to subside, in time, preferably as the Federal Reserve decides to lower short-term funding rates. Therefore, we maintain a reasonable exposure to banks in growing geographies with proven management teams.

The primary risk for small caps continues to be a slowdown in the economy, which would slow the earnings-growth differential relative to large caps, as well as raise the risk premium for investing in the small-cap market. As always, we continue to seek out small-cap companies with above-average prospects that can prosper over the long term, even if the market environment should turn more difficult.

Lazard Retirement International Equity Portfolio

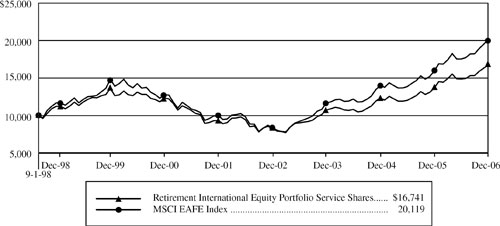

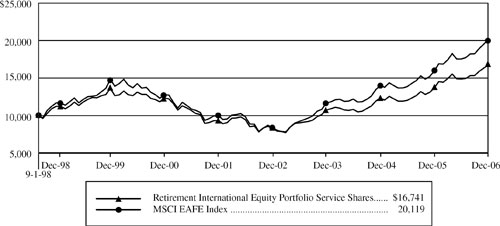

For the year ended December 31, 2006, Lazard Retirement International Equity Portfolio Service Shares posted a total return of 22.53%, as compared with the 26.34% return of the MSCI EAFE Index.

Helping performance was stock selection in consumer staples, as Gallaher shares posted solid gains. This U.K. tobacco company received a takeover bid from Japan Tobacco in December. Shares of InBev also continued to perform well, after the Belgian-based brewer announced profits that far exceeded analysts’ estimates. Shares of U.K. supermarket retailer, Tesco, also performed well. In addition, stock selection in materials boosted returns, as shares of Lafarge, the world’s largest cement maker, posted solid gains. Due to higher cement prices, the company’s third-quarter earnings increased by 32% and exceeded analysts’ expectations. Shares of building-materials supplier, CRH, also rose, after the company announced solid progress in integrating its largest acquisition to date. And, exposure to emerging-markets stocks also added value in the period. Conversely, stock selection in industrials detracted from performance, as shares of Yamato Holdings fell, due to disappointing quarterly-earnings results. Factors that negatively impacted the company’s results included rising personnel expenses, weakness in non-core businesses, and pricing declines in door-to-door delivery services. This stock was sold from the Portfolio, as we believed that our investment thesis for Yamato Holdings was no longer valid. THK Co., Ltd. shares also declined, as slowing momentum in the company’s monthly order data, in addition to general macroeconomic concerns, resulted in significant multiple contraction, despite better-than-expected results in the latest quarter. Stock selection in financials detracted from performance, as Japanese holdings, such as Mitsubishi UFJ, Sumitomo Mitsui, and Nomura, underperformed along with the overall Japanese market. An overweight position and stock selection in health care was detrimental to performance, as the shares of Sanofi-Aventis declined. The company reported lower-than-expected sales, due, in part, to cuts in government health spending in France and Germany and the late delivery of U.S. flu vaccines. We believe that the stock’s attractive valuation already reflects much of this bad news, but does not adequately recognize the positive impact that the company’s pipeline of new drug therapies could have on future earnings. Shares of Swiss pharmaceutical maker Novartis AG also fell. The company reported that the FDA required three more months to determine whether problems encountered by animals taking its oral diabetes drug, Galvus, may pose risks to humans.

In the context of historic valuations, the current valuation of the broader stock market is reasonable. Yet, we are concerned that the historically high margins and returns in many cyclical stocks and sectors are not sustainable, especially given the beginning of an economic slowdown. However, the Portfolio’s performance continues to be driven by stock selection, and we continue to look for an attractive balance of valuation and financial productivity. In a period when many companies are generating record returns, we are also very focused on the sustainability of returns,

5

|

|

Lazard Retirement Series, Inc. |

|

Investment Overviews (concluded) |

|

|

which we believe will be key to performance, going forward. Although we were disappointed by the Portfolio’s relative performance in 2006, we believe that the Portfolio enters 2007 well positioned to achieve its investment objective.

Lazard Retirement Emerging Markets Portfolio

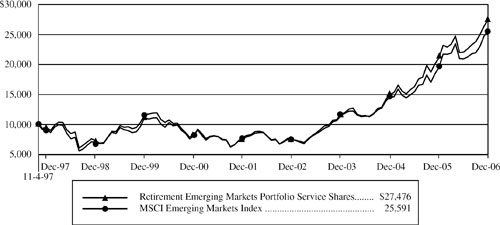

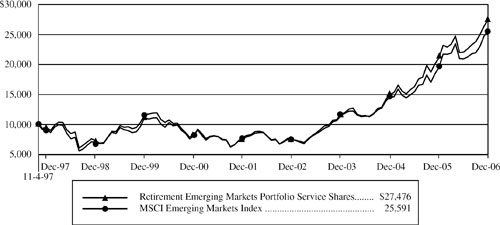

For the year ended December 31, 2006, Lazard Retirement Emerging Markets Portfolio’s Service Shares posted a total return of 29.95%, as compared with the 32.17% return of the MSCI Emerging Markets Index. The Portfolio’s Investor Shares (first offered on May 1, 2006) posted a total return of 10.64%, as compared with the 8.17% return of the Index during that period.

The Portfolio benefited from strong stock selection within the industrials and materials sectors. From a regional perspective, performance was enhanced by good stock selection within South Africa and Israel, and from a higher-than-index weight in Brazil. Petro-Bras, a Brazilian energy company, performed well, based on strong oil prices and a favorable outlook for reserve growth. Shares of Telekom Indonesia also rose sharply, due to robust cellular demand. Shares of Caemi, a Brazilian iron ore mining company, performed well, due to continued strong pricing for the metal. During the period, Caemi was acquired by CVRD, which was also held by the Portfolio. Conversely, performance was hurt by poor stock selection within the financials and consumer discretionary sectors and within South Korea and India. A lower-than-index weight to China was also a detractor. We saw poor stock performance in some of our South Korean holdings, such as Lotte Shopping, which declined on slow consumption levels within South Korea; LG Electronics, which declined due to concerns about handset prices; and Hyundai, which fell due to investors’ concerns about the strong won and increased competition.

2006 was very robust for emerging-markets equities. We remain positive over the medium- and long-term, based upon reasonable valuations and continuing high financial productivity.

Notes to Investment Overviews:1 “European Shares Set New Record,” October 13, 2006, “European Stocks Drop Sharply,” November 24, 2006, “Stocks Get Lift from Oil’s Slide,” August 28, 2006, “Stocks Decline as Oil Slides,” October 27, 2006, “NASDAQ Reaches New Five-Year High,” October 26, 2006, “Stocks Weaken as Dollar’s Fall Chills Investors,” November 25, 2006, “Japan Hits Fresh Seven-Month High,” December 26, 2006, “Foreigners Sell Japan Shares,” June 13, 2006, http://www.online.wsj.com/home/us/.

All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolios have been waived or reimbursed by the Fund’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolios’ returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. Past performance is not indicative, nor a guarantee, of future results.

The performance data of the indices and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. These indices are unmanaged, have no fees or costs and are not available for investment.

The views of the Fund’s management and the portfolio holdings described in this report are as of December 31, 2006; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in each Portfolio at the time you receive this report, or that securities sold will have not been repurchased. The specific portfolio securities may in aggregate represent only a small percentage of each Portfolio’s holdings. It should not be assumed that investments in the securities identified and discussed were, or will be, profitable, or that the investment decisions we make in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of the outlooks for markets, sectors and securities as discussed herein. You should read the Fund’s prospectus for a more detailed discussion of each Portfolio’s investment objective, strategies, risks and fees.

6

|

|

Lazard Retirement Series, Inc. |

|

Performance Overviews |

|

|

|

Lazard Retirement Equity Portfolio |

Comparison of Changes in Value of $10,000 Investment in the Service Shares of

Lazard Retirement Equity Portfolio and S&P 500® Index*

| | | | | | | | | |

Average Annual Total Returns*

Periods Ended December 31, 2006 | |

| | One

Year | | Five

Years | | Since

Inception** | |

| |

| |

| |

| |

Retirement Equity Portfolio Service Shares | | 17.48 | % | 7.12 | % | | 5.21 | % | |

S&P 500 Index | | 15.79 | | 6.19 | | | 4.72 | | |

| |

|

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The S&P 500 Index is a market capitalization-weighted index of 500 common stocks, designed to measure performance of the broad domestic economy through changes in the aggregate market value of these stocks, which represent all major industries. The index is unmanaged, has no fees or costs and is not available for investment. |

| |

** | The Portfolio’s inception date was March 18, 1998. |

7

|

|

Lazard Retirement Series, Inc. |

|

Performance Overviews (continued) |

|

|

|

Lazard Retirement Small Cap Portfolio |

Comparison of Changes in Value of $10,000 Investment in the Service Shares of

Lazard Retirement Small Cap Portfolio and Russell 2000® Index*

| | | | | | | | | |

Average Annual Total Returns*

Periods Ended December 31, 2006 | |

| | One

Year | | Five

Years | | Since

Inception** | |

| |

| |

| |

| |

Retirement Small Cap Portfolio Service Shares | | 16.07 | % | 9.39 | % | | 9.29 | % | |

Russell 2000 Index | | 18.37 | | 11.39 | | | 7.86 | | |

| |

|

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The Russell 2000 Index is comprised of the 2,000 smallest U.S. companies included in the Russell 3000® Index (which consists of the 3,000 largest U.S. companies by capitalization). The index is unmanaged, has no fees or costs and is not available for investment. |

| |

** | The Portfolio’s inception date was November 4, 1997. |

8

|

|

Lazard Retirement Series, Inc. |

|

Performance Overviews (continued) |

|

|

|

Lazard Retirement International Equity Portfolio |

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement

International Equity Portfolio and Morgan Stanley Capital International (MSCI®) Europe,

Australasia and Far East (EAFE®) Index*

| | | | | | | | | |

Average Annual Total Returns*

Periods Ended December 31, 2006 | |

| | One

Year | | Five

Years | | Since

Inception** | |

| |

| |

| |

| |

Retirement International Equity Portfolio Service Shares | | 22.53 | % | 12.34 | % | | 6.38 | % | |

MSCI EAFE Index | | 26.34 | | 14.98 | | | 8.75 | | |

| |

|

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The MSCI EAFE Index is a broadly diversified international index comprised of equity securities of approximately 1,000 companies located outside the United States. The index is unmanaged, has no fees or costs and is not available for investment. |

| |

** | The Portfolio’s inception date was September 1, 1998. |

9

|

|

Lazard Retirement Series, Inc. |

|

Performance Overviews (concluded) |

|

|

|

Lazard Retirement Emerging Markets Portfolio |

Comparison of Changes in Value of $10,000 Investment in the Service Shares of Lazard Retirement

Emerging Markets Portfolio and MSCI Emerging Markets Index*

| | | | | | | | | |

Average Annual Total Returns*

Periods Ended December 31, 2006 | | | | | |

| | Service Shares | | Investor Shares | |

| |

| |

| |

| | One

Year | | Five

Years | | Since

Inception† | | Since

Inception† | |

| |

| |

| |

| |

| |

Retirement Emerging Markets Portfolio** | | 29.95 | % | 29.19 | % | 11.67 | % | | 10.64 | % | |

MSCI Emerging Markets Index | | 32.17 | | 26.59 | | 10.80 | | | 8.17 | | |

| |

|

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or Administrator; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, nor a guarantee, of future results; the investment return and principle value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The MSCI Emerging Markets Index is comprised of emerging market securities in countries open to non-local investors. The index is unmanaged, has no fees or costs and is not available for investment. |

| |

** | The performance of Service Shares may be greater than or less than the performance of Investor Shares, based on the differences in fees borne by shareholders investing in different classes. |

| |

† | The inception date for Service Shares was November 4, 1997 and for Investor Shares was May 1, 2006. |

10

|

|

Lazard Retirement Series, Inc. |

|

Information About Your Portfolio’s Expenses |

|

|

Expense Example

As a shareholder in a Portfolio of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees (Service Shares only), and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from July 1, 2006 through December 31, 2006 and held for the entire period.

Actual Expenses

For each Share class of the Portfolios, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Share class of the Portfolios, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of the other funds.

Please note that you also bear fees and charges imposed by participating insurance companies at the separate account level, which are described in the separate prospectuses issued by the insurance companies. Such charges will have the effect of reducing Account Value.

| | | | | | | | | | | | | | | |

| | Beginning

Account Value | | Ending

Account Value | | Expenses Paid

During Period* | | Annualized

Expense Ratio

During Period |

| |

| |

| |

| |

|

| | 7/1/06 | | 12/31/06 | | 7/1/06-12/31/06 | | 7/1/06-12/31/06 |

| |

| |

| |

| |

|

Retirement Equity Portfolio Service Shares | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,144.70 | | | $ | 6.76 | | | 1.25 | % |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 6.37 | | | 1.25 | % |

| | | | | | | | | | | | | | | |

Retirement Small Cap Portfolio Service Shares | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,091.70 | | | $ | 6.30 | | | 1.19 | % |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.19 | | | $ | 6.08 | | | 1.19 | % |

| | | | | | | | | | | | | | | |

Retirement International Equity Portfolio

Service Shares | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,126.10 | | | $ | 6.71 | | | 1.25 | % |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.90 | | | $ | 6.37 | | | 1.25 | % |

| | | | | | | | | | | | | | | |

Retirement Emerging Markets Portfolio

Service Shares | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,245.20 | | | $ | 9.06 | | | 1.60 | % |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,017.14 | | | $ | 8.14 | | | 1.60 | % |

Investor Shares | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,247.30 | | | $ | 7.64 | | | 1.35 | % |

Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.41 | | | $ | 6.86 | | | 1.35 | % |

| |

|

* | Expenses are equal to the Portfolio’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

11

|

|

Lazard Retirement Series, Inc. |

|

Portfolio Holdings Presented by Sector |

December 31, 2006 |

| | | | | | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

Sector* | | Lazard

Retirement

Equity

Portfolio | | Lazard

Retirement

Small Cap

Portfolio | | Lazard

Retirement

International

Equity

Portfolio | | Lazard

Retirement

Emerging

Markets

Portfolio |

|

|

|

|

|

|

|

|

|

Commercial Services | | | 5.8 | % | | | 10.4 | % | | | — | % | | | 4.0 | % |

Consumer Discretionary | | | 10.1 | | | | 14.5 | | | | 11.1 | | | | 11.4 | |

Consumer Durables | | | 0.9 | | | | 1.9 | | | | 6.5 | | | | 5.0 | |

Consumer Staples | | | 6.2 | | | | — | | | | 11.0 | | | | 2.8 | |

Energy | | | 8.6 | | | | 4.4 | | | | 8.9 | | | | 9.1 | |

Financials | | | 20.6 | | | | 20.6 | | | | 25.8 | | | | 17.3 | |

Health Care | | | 10.4 | | | | 6.6 | | | | 8.3 | | | | 1.0 | |

Process Industry | | | 5.7 | | | | 2.5 | | | | — | | | | 11.7 | |

Producer Manufacturing | | | 9.9 | | | | 8.0 | | | | 5.0 | | | | 1.4 | |

Technology | | | 17.0 | | | | 23.0 | | | | 2.1 | | | | 10.2 | |

Telecommunications | | | 4.8 | | | | 0.6 | | | | 10.2 | | | | 14.2 | |

Transportation | | | — | | | | 2.3 | | | | 2.5 | | | | 2.5 | |

Utilities | | | — | | | | 0.2 | | | | 5.6 | | | | 0.9 | |

Short-Term Investments | | | — | | | | 5.0 | | | | 3.0 | | | | 8.5 | |

| | |

| | | |

| | | |

| | | |

| |

Total Investments | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | |

| | | |

| | | |

| | | |

| |

| |

|

* | Represents percentage of total investments. |

12

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments |

December 31, 2006 |

|

| | | | | | | |

Description | | Shares | | Value | |

|

|

|

|

|

|

Lazard Retirement Equity Portfolio | | | | | | | |

Common Stocks—99.5% | | | | | | | |

Alcohol & Tobacco—1.7% | | | | | | | |

Altria Group, Inc. | | | 1,000 | | $ | 85,820 | |

| | | | |

|

| |

Banking—5.5% | | | | | | | |

Bank of America Corp. | | | 2,906 | | | 155,151 | |

The Bank of New York Co., Inc. | | | 2,275 | | | 89,567 | |

Washington Mutual, Inc. | | | 800 | | | 36,392 | |

| | | | |

|

| |

| | | | | | 281,110 | |

| | | | |

|

| |

Building & Construction—0.9% | | | | | | | |

Masco Corp. | | | 1,590 | | | 47,493 | |

| | | | |

|

| |

Chemicals—3.3% | | | | | | | |

Cabot Corp. | | | 715 | | | 31,153 | |

Du Pont (E.I.) de Nemours & Co. | | | 775 | | | 37,750 | |

Sigma-Aldrich Corp. | | | 650 | | | 50,518 | |

The Dow Chemical Co. | | | 1,170 | | | 46,730 | |

| | | | |

|

| |

| | | | | | 166,151 | |

| | | | |

|

| |

Commercial Services—4.7% | | | | | | | |

Automatic Data Processing, Inc. | | | 2,050 | | | 100,962 | |

DST Systems, Inc. (a) | | | 400 | | | 25,052 | |

First Data Corp. | | | 2,200 | | | 56,144 | |

Idearc, Inc. (a) | | | 1,900 | | | 54,435 | |

| | | | |

|

| |

| | | | | | 236,593 | |

| | | | |

|

| |

Computer Software—7.2% | | | | | | | |

Microsoft Corp. | | | 8,855 | | | 264,410 | |

Oracle Corp. (a) | | | 5,915 | | | 101,383 | |

| | | | |

|

| |

| | | | | | 365,793 | |

| | | | |

|

| |

Consumer Products—1.8% | | | | | | | |

Fortune Brands, Inc. | | | 640 | | | 54,650 | |

The Stanley Works | | | 690 | | | 34,700 | |

| | | | |

|

| |

| | | | | | 89,350 | |

| | | | |

|

| |

Drugs—6.1% | | | | | | | |

Biogen Idec, Inc. (a) | | | 850 | | | 41,812 | |

Bristol-Myers Squibb Co. | | | 1,710 | | | 45,007 | |

Pfizer, Inc. | | | 2,335 | | | 60,476 | |

Sepracor, Inc. (a) | | | 960 | | | 59,117 | |

Wyeth | | | 2,000 | | | 101,840 | |

| | | | |

|

| |

| | | | | | 308,252 | |

| | | | |

|

| |

Energy Integrated—5.7% | | | | | | | |

Chevron Corp. | | | 1,460 | | | 107,354 | |

ConocoPhillips | | | 1,405 | | | 101,090 | |

Hess Corp. | | | 700 | | | 34,699 | |

Massey Energy Co. | | | 2,040 | | | 47,389 | |

| | | | |

|

| |

| | | | | | 290,532 | |

| | | | |

|

| |

| | | | | | | |

Description | | Shares | | Value | |

|

|

|

|

|

|

Energy Services—2.8% | | | | | | | |

BJ Services Co. | | | 1,415 | | $ | 41,488 | |

Halliburton Co. | | | 850 | | | 26,393 | |

The Williams Cos., Inc. | | | 2,895 | | | 75,617 | |

| | | | |

|

| |

| | | | | | 143,498 | |

| | | | |

|

| |

Financial Services—9.7% | | | | | | | |

A.G. Edwards, Inc. | | | 1,050 | | | 66,454 | |

American Express Co. | | | 900 | | | 54,603 | |

Citigroup, Inc. | | | 1,915 | | | 106,665 | |

JPMorgan Chase & Co. | | | 1,304 | | | 62,983 | |

Legg Mason, Inc. | | | 250 | | | 23,763 | |

Mellon Financial Corp. | | | 2,865 | | | 120,760 | |

The Bear Stearns Cos., Inc. | | | 345 | | | 56,159 | |

| | | | |

|

| |

| | | | | | 491,387 | |

| | | | |

|

| |

Food & Beverages—3.0% | | | | | | | |

Coca-Cola Enterprises, Inc. | | | 4,700 | | | 95,974 | |

The Coca-Cola Co. | | | 1,140 | | | 55,005 | |

| | | | |

|

| |

| | | | | | 150,979 | |

| | | | |

|

| |

Forest & Paper Products—3.8% | | | | | | | |

Ball Corp. | | | 1,160 | | | 50,576 | |

Kimberly-Clark Corp. | | | 1,110 | | | 75,425 | |

Louisiana-Pacific Corp. | | | 3,210 | | | 69,111 | |

| | | | |

|

| |

| | | | | | 195,112 | |

| | | | |

|

| |

Health Services—2.3% | | | | | | | |

Laboratory Corp. of America Holdings (a) | | | 880 | | | 64,654 | |

Service Corp. International | | | 2,600 | | | 26,650 | |

WellPoint, Inc. (a) | | | 350 | | | 27,541 | |

| | | | |

|

| |

| | | | | | 118,845 | |

| | | | |

|

| |

Insurance—5.3% | | | | | | | |

American International Group, Inc. | | | 700 | | | 50,162 | |

Aon Corp. | | | 1,150 | | | 40,641 | |

Lincoln National Corp. | | | 570 | | | 37,848 | |

PartnerRe, Ltd. | | | 413 | | | 29,335 | |

The Allstate Corp. | | | 960 | | | 62,506 | |

The St. Paul Travelers Cos., Inc. | | | 880 | | | 47,247 | |

| | | | |

|

| |

| | | | | | 267,739 | |

| | | | |

|

| |

Leisure & Entertainment—4.1% | | | | | | | |

Gannett Co., Inc. | | | 1,010 | | | 61,065 | |

News Corp., Class A | | | 3,965 | | | 85,168 | |

Time Warner, Inc. | | | 2,810 | | | 61,202 | |

| | | | |

|

| |

| | | | | | 207,435 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

13

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments (continued) |

December 31, 2006 |

|

| | | | | | | |

Description | | | Shares | | | Value | |

|

|

|

|

|

|

|

|

Lazard Retirement Equity Portfolio (concluded) | | | | | | | |

Manufacturing—9.8% | | | | | | | |

General Electric Co. | | | 4,345 | | $ | 161,678 | |

Honeywell International, Inc. | | | 1,555 | | | 70,348 | |

Ingersoll-Rand Co., Ltd., Class A | | | 1,470 | | | 57,521 | |

Pitney Bowes, Inc. | | | 1,600 | | | 73,904 | |

Tyco International, Ltd. | | | 1,965 | | | 59,736 | |

United Technologies Corp. | | | 1,210 | | | 75,649 | |

| | | | |

|

| |

| | | | | | 498,836 | |

| | | | |

|

| |

Medical Products—2.0% | | | | | | | |

Johnson & Johnson | | | 1,515 | | | 100,020 | |

| | | | |

|

| |

Printing & Publishing—1.1% | | | | | | | |

R.H. Donnelley Corp. (a) | | | 872 | | | 54,701 | |

| | | | |

|

| |

Retail—4.2% | | | | | | | |

CVS Corp. | | | 2,050 | | | 63,365 | |

Dollar Tree Stores, Inc. (a) | | | 1,605 | | | 48,311 | |

Liz Claiborne, Inc. | | | 1,175 | | | 51,065 | |

The Kroger Co. | | | 2,300 | | | 53,061 | |

| | | | |

|

| |

| | | | | | 215,802 | |

| | | | |

|

| |

Semiconductors & Components—1.8% | | | | | | | |

Flextronics International, Ltd. (a) | | | 2,280 | | | 26,174 | |

Intel Corp. | | | 2,030 | | | 41,108 | |

Solectron Corp. (a) | | | 7,270 | | | 23,409 | |

| | | | |

|

| |

| | | | | | 90,691 | |

| | | | |

|

| |

| | | | | | | |

Description | | Shares | | Value | |

|

|

|

|

|

|

Technology—2.2% | | | | | | | |

International Business Machines Corp. | | | 1,160 | | $ | 112,694 | |

| | | | |

|

| |

Technology Hardware—5.7% | | | | | | | |

Avaya, Inc. (a) | | | 4,800 | | | 67,104 | |

Cisco Systems, Inc. (a) | | | 3,210 | | | 87,730 | |

Dell, Inc. (a) | | | 1,970 | | | 49,427 | |

EMC Corp. (a) | | | 4,600 | | | 60,720 | |

Sun Microsystems, Inc. (a) | | | 4,850 | | | 26,287 | |

| | | | |

|

| |

| | | | | | 291,268 | |

| | | | |

|

| |

Telecommunications—4.8% | | | | | | | |

ALLTEL Corp. | | | 1,485 | | | 89,813 | |

Sprint Nextel Corp. | | | 4,699 | | | 88,764 | |

Verizon Communications, Inc. | | | 1,750 | | | 65,170 | |

| | | | |

|

| |

| | | | | | 243,747 | |

| | | | |

|

| |

Total Common Stocks

(Identified cost $4,551,245) | | | | | | 5,053,848 | |

| | | | |

|

| |

Total Investments—99.5%

(Identified cost $4,551,245) (b) | | | | | $ | 5,053,848 | |

Cash and Other Assets in Excess of Liabilities—0.5% | | | | | | 24,465 | |

| | | | |

|

| |

Net Assets—100.0% | | | | | $ | 5,078,313 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

14

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments (continued) |

December 31, 2006 |

|

| | | | | | | |

Description | | Shares | | Value | |

|

|

|

|

|

|

Lazard Retirement Small Cap Portfolio | | | | | | | |

Common Stocks—94.8% | | | | | | | |

Banking—10.0% | | | | | | | |

Bank of the Ozarks, Inc. | | | 37,800 | | $ | 1,249,668 | |

BankUnited Financial Corp., Class A | | | 33,200 | | | 928,272 | |

First Community Bancorp | | | 21,400 | | | 1,118,578 | |

Franklin Bank Corp. (a) | | | 35,300 | | | 725,062 | |

Prosperity Bancshares, Inc. | | | 20,300 | | | 700,553 | |

Provident Bankshares Corp. | | | 20,500 | | | 729,800 | |

Sterling Bancshares, Inc. | | | 84,300 | | | 1,097,586 | |

United Bankshares, Inc. | | | 14,350 | | | 554,627 | |

Wintrust Financial Corp. | | | 23,100 | | | 1,109,262 | |

| | | | |

|

| |

| | | | | | 8,213,408 | |

| | | | |

|

| |

Building & Construction—2.7% | | | | | | | |

AMCOL International Corp. | | | 25,900 | | | 718,466 | |

Builders FirstSource, Inc. (a) | | | 12,400 | | | 221,092 | |

Perini Corp. (a) | | | 21,500 | | | 661,770 | |

Watsco, Inc. | | | 13,500 | | | 636,660 | |

| | | | |

|

| |

| | | | | | 2,237,988 | |

| | | | |

|

| |

Commercial Services—9.6% | | | | | | | |

Arbitron, Inc. | | | 13,800 | | | 599,472 | |

G & K Services, Inc. | | | 28,300 | | | 1,100,587 | |

John H. Harland Co. | | | 21,400 | | | 1,074,280 | |

Navigant Consulting, Inc. (a) | | | 41,700 | | | 823,992 | |

Rollins, Inc. | | | 41,200 | | | 910,932 | |

Tetra Tech, Inc. (a) | | | 28,400 | | | 513,756 | |

United Rentals, Inc. (a) | | | 19,700 | | | 500,971 | |

Waste Connections, Inc. (a) | | | 21,200 | | | 880,860 | |

Watson Wyatt Worldwide, Inc. | | | 9,200 | | | 415,380 | |

Wright Express Corp. (a) | | | 34,100 | | | 1,062,897 | |

| | | | |

|

| |

| | | | | | 7,883,127 | |

| | | | |

|

| |

Computer Software—1.7% | | | | | | | |

Agile Software Corp. (a) | | | 100,400 | | | 617,460 | |

Secure Computing Corp. (a) | | | 125,000 | | | 820,000 | |

| | | | |

|

| |

| | | | | | 1,437,460 | |

| | | | |

|

| |

Consumer Products—7.2% | | | | | | | |

Central Garden & Pet Co. (a) | | | 23,800 | | | 1,152,396 | |

Ethan Allen Interiors, Inc. | | | 9,800 | | | 353,878 | |

Fossil, Inc. (a) | | | 30,100 | | | 679,658 | |

Matthews International Corp., Class A | | | 18,900 | | | 743,715 | |

Physicians Formula Holdings, Inc. | | | 46,500 | | | 869,085 | |

Polaris Industries, Inc. | | | 17,200 | | | 805,476 | |

Sealy Corp. | | | 48,800 | | | 719,800 | |

WMS Industries, Inc. (a) | | | 18,600 | | | 648,396 | |

| | | | |

|

| |

| | | | | | 5,972,404 | |

| | | | |

|

| |

Electric—0.2% | | | | | | | |

Cleco Corp. | | | 5,100 | | | 128,673 | |

| | | | |

|

| |

| | | | | | | |

Description | | Shares | | Value | |

|

|

|

|

|

|

Energy Exploration & Production—1.8% | | | | | | | |

Brigham Exploration Co. (a) | | | 76,600 | | $ | 559,946 | |

The Exploration Co. of Delaware (a) | | | 70,347 | | | 938,429 | |

| | | | |

|

| |

| | | | | | 1,498,375 | |

| | | | |

|

| |

Energy Integrated—0.4% | | | | | | | |

Foundation Coal Holdings, Inc. | | | 11,700 | | | 371,592 | |

| | | | |

|

| |

Energy Services—2.1% | | | | | | | |

Complete Production Services, Inc. | | | 32,400 | | | 686,880 | |

Hercules Offshore, Inc. (a) | | | 12,300 | | | 355,470 | |

W-H Energy Services, Inc. (a) | | | 14,500 | | | 706,005 | |

| | | | |

|

| |

| | | | | | 1,748,355 | |

| | | | |

|

| |

Financial Services—1.9% | | | | | | | |

Waddell & Reed Financial, Inc. | | | 57,800 | | | 1,581,408 | |

| | | | |

|

| |

Forest & Paper Products—0.5% | | | | | | | |

Silgan Holdings, Inc. | | | 8,500 | | | 373,320 | |

| | | | |

|

| |

Gas Utilities—0.0% | | | | | | | |

South Jersey Industries, Inc. | | | 700 | | | 23,387 | |

| | | | |

|

| |

Health Services—3.9% | | | | | | | |

BioScrip, Inc. (a) | | | 66,000 | | | 228,360 | |

Centene Corp. (a) | | | 28,600 | | | 702,702 | |

Five Star Quality Care, Inc. (a) | | | 77,500 | | | 864,125 | |

Hanger Orthopedic Group, Inc. (a) | | | 67,900 | | | 511,287 | |

inVentiv Health, Inc. (a) | | | 3,800 | | | 134,330 | |

LifePoint Hospitals, Inc. (a) | | | 24,200 | | | 815,540 | |

| | | | |

|

| |

| | | | | | 3,256,344 | |

| | | | |

|

| |

Insurance—3.3% | | | | | | | |

Arch Capital Group, Ltd. (a) | | | 12,600 | | | 851,886 | |

Aspen Insurance Holdings, Ltd. | | | 29,000 | | | 764,440 | |

Max Re Capital, Ltd. | | | 28,100 | | | 697,442 | |

RLI Corp. | | | 7,900 | | | 445,718 | |

| | | | |

|

| |

| | | | | | 2,759,486 | |

| | | | |

|

| |

Leisure & Entertainment—2.2% | | | | | | | |

Bally Technologies, Inc. (a) | | | 26,000 | | | 485,680 | |

CBRL Group, Inc. | | | 15,500 | | | 693,780 | |

RARE Hospitality International, Inc. (a) | | | 18,100 | | | 596,033 | |

| | | | |

|

| |

| | | | | | 1,775,493 | |

| | | | |

|

| |

Manufacturing—8.0% | �� | | | | | | |

Altra Holdings, Inc. | | | 34,600 | | | 486,130 | |

Applied Signal Technology, Inc. | | | 50,800 | | | 714,248 | |

Columbus McKinnon Corp. (a) | | | 27,100 | | | 569,642 | |

DRS Technologies, Inc. | | | 12,750 | | | 671,670 | |

Esterline Technologies Corp. (a) | | | 13,500 | | | 543,105 | |

Insteel Industries, Inc. | | | 39,700 | | | 706,263 | |

Kennametal, Inc. | | | 9,600 | | | 564,960 | |

Knoll, Inc. | | | 41,800 | | | 919,600 | |

Ladish Co., Inc. (a) | | | 26,100 | | | 967,788 | |

RBC Bearings, Inc. (a) | | | 14,700 | | | 421,302 | |

| | | | |

|

| |

| | | | | | 6,564,708 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

15

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments (continued) |

December 31, 2006 |

|

| | | | | | | |

Description | | | Shares | | Value | |

|

|

|

|

| |

Lazard Retirement Small Cap Portfolio (concluded) | | | | | | | |

Medical Products—2.7% | | | | | | | |

American Medical Systems Holdings, Inc. (a) | | | 20,000 | | $ | 370,400 | |

Pharmanet Development Group, Inc. (a) | | | 27,100 | | | 598,097 | |

Symmetry Medical, Inc. (a) | | | 49,500 | | | 684,585 | |

Wright Medical Group, Inc. (a) | | | 23,400 | | | 544,752 | |

| | | | |

|

| |

| | | | | | 2,197,834 | |

| | | | |

|

| |

Metals & Mining—2.0% | | | | | | | |

Cleveland-Cliffs, Inc. | | | 9,200 | | | 445,648 | |

Coeur d’Alene Mines Corp. (a) | | | 116,200 | | | 575,190 | |

Quanex Corp. | | | 18,400 | | | 636,456 | |

| | | | |

|

| |

| | | | | | 1,657,294 | |

| | | | |

|

| |

Real Estate—5.4% | | | | | | | |

Ashford Hospitality Trust | | | 86,300 | | | 1,074,435 | |

Brandywine Realty Trust | | | 22,000 | | | 731,500 | |

Cousins Properties, Inc. | | | 23,000 | | | 811,210 | |

Healthcare Realty Trust, Inc. | | | 21,300 | | | 842,202 | |

MFA Mortgage Investments, Inc. | | | 127,200 | | | 978,168 | |

| | | | |

|

| |

| | | | | | 4,437,515 | |

| | | | |

|

| |

Retail—5.1% | | | | | | | |

Guitar Center, Inc. (a) | | | 27,200 | | | 1,236,512 | |

Pacific Sunwear of California, Inc. (a) | | | 43,100 | | | 843,898 | |

Stein Mart, Inc. | | | 16,100 | | | 213,486 | |

The Finish Line, Inc. | | | 43,000 | | | 614,040 | |

The Timberland Co. (a) | | | 22,500 | | | 710,550 | |

Tractor Supply Co. (a) | | | 12,800 | | | 572,288 | |

| | | | |

|

| |

| | | | | | 4,190,774 | |

| | | | |

|

| |

Semiconductors & Components—10.2% | | | | | | | |

Actel Corp. (a) | | | 32,500 | | | 590,200 | |

Benchmark Electronics, Inc. (a) | | | 29,850 | | | 727,146 | |

Coherent, Inc. (a) | | | 31,000 | | | 978,670 | |

CPI International, Inc. | | | 57,900 | | | 868,500 | |

Exar Corp. (a) | | | 65,300 | | | 848,900 | |

FARO Technologies, Inc. (a) | | | 30,800 | | | 740,432 | |

Integrated Device Technology, Inc. (a) | | | 49,300 | | | 763,164 | |

Microsemi Corp. (a) | | | 38,000 | | | 746,700 | |

Plexus Corp. (a) | | | 26,600 | | | 635,208 | |

Semtech Corp. (a) | | | 66,400 | | | 867,848 | |

TTM Technologies, Inc. (a) | | | 58,000 | | | 657,140 | |

| | | | |

|

| |

| | | | | | 8,423,908 | |

| | | | |

|

| |

Services—1.0% | | | | | | | |

Perot Systems Corp., Class A (a) | | | 51,500 | | | 844,085 | |

| | | | |

|

| |

| | | | | | | |

Description | | | Shares | | Value | |

|

|

|

|

| |

Technology Hardware—10.0% | | | | | | | |

Avid Technology, Inc. (a) | | | 14,700 | | $ | 547,722 | |

Avocent Corp. (a) | | | 29,500 | | | 998,575 | |

Brightpoint, Inc. (a) | | | 50,100 | | | 673,845 | |

C-COR, Inc. (a) | | | 42,900 | | | 477,906 | |

Emulex Corp. (a) | | | 9,700 | | | 189,247 | |

FEI Electronics Corp. (a) | | | 34,600 | | | 912,402 | |

Houston Wire & Cable Co. | | | 27,300 | | | 570,570 | |

Ixia (a) | | | 54,000 | | | 518,400 | |

Komag, Inc. (a) | | | 22,200 | | | 840,936 | |

LTX Corp. (a) | | | 70,300 | | | 393,680 | |

Powerwave Technologies, Inc. (a) | | | 104,900 | | | 676,605 | |

Rogers Corp. (a) | | | 9,700 | | | 573,755 | |

SafeNet, Inc. (a) | | | 35,500 | | | 849,870 | |

| | | | |

|

| |

| | | | | | 8,223,513 | |

| | | | |

|

| |

Telecommunications—0.6% | | | | | | | |

Alaska Communications Systems Group, Inc. | | | 35,300 | | | 536,207 | |

| | | | |

|

| |

Transportation—2.3% | | | | | | | |

AirTran Holdings, Inc. (a) | | | 91,500 | | | 1,074,210 | |

American Commercial Lines, Inc. (a) | | | 6,000 | | | 393,060 | |

Hub Group, Inc., Class A (a) | | | 15,100 | | | 416,005 | |

| | | | |

|

| |

| | | | | | 1,883,275 | |

| | | | |

|

| |

Total Common Stocks

(Identified cost $72,874,188) | | | | | | 78,219,933 | |

| | | | |

|

| |

| | | | | | | |

| | Principal

Amount

(000) | | | | |

| |

|

| | | | |

Repurchase Agreement—5.0% | | | | | | | |

State Street Bank and Trust Co.,

4.30%, 01/02/07 (Dated 12/29/06, collateralized by $3,450,000 United States Treasury Bond, 7.50%, 11/15/16, with a value of $4,220,506) Proceeds of $4,136,976 (Identified cost $4,135,000) | | $ | 4,135 | | | 4,135,000 | |

| | | | |

|

| |

Total Investments—99.8%

(Identified cost $77,009,188) (b) | | | | | $ | 82,354,933 | |

Cash and Other Assets in Excess of Liabilities—0.2% | | | | | | 159,040 | |

| | | | |

|

| |

Net Assets—100.0% | | | | | $ | 82,513,973 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

16

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments (continued) |

December 31, 2006 |

|

| | | | | | | |

Description | | | Shares | | Value | |

|

|

|

|

| |

Lazard Retirement International Equity Portfolio | | | | | | | |

Common Stocks—95.6% | | | | | | | |

Belgium—1.8% | | | | | | | |

InBev NV | | | 82,200 | | $ | 5,413,150 | |

| | | | |

|

| |

Brazil—0.6% | | | | | | | |

Petroleo Brasileiro SA ADR | | | 17,200 | | | 1,771,428 | |

| | | | |

|

| |

Egypt—0.7% | | | | | | | |

Orascom Telecom Holding SAE GDR | | | 30,600 | | | 2,019,600 | |

| | | | |

|

| |

Finland—0.9% | | | | | | | |

Fortum Oyj | | | 99,200 | | | 2,820,267 | |

| | | | |

|

| |

France—13.7% | | | | | | | |

Axa | | | 72,623 | | | 2,937,093 | |

BNP Paribas | | | 56,800 | | | 6,190,432 | |

France Telecom SA | | | 222,000 | | | 6,132,912 | |

Lafarge SA | | | 20,769 | | | 3,086,521 | |

Sanofi-Aventis | | | 77,480 | | | 7,146,725 | |

Total SA | | | 131,872 | | | 9,503,257 | |

Vivendi | | | 185,700 | | | 7,250,702 | |

| | | | |

|

| |

Total France | | | | | | 42,247,642 | |

| | | | |

|

| |

Germany—4.1% | | | | | | | |

Adidas AG | | | 57,500 | | | 2,860,780 | |

Allianz AG | | | 14,500 | | | 2,959,078 | |

DaimlerChrysler AG | | | 70,400 | | | 4,344,584 | |

KarstadtQuelle AG (a) | | | 86,373 | | | 2,501,152 | |

| | | | |

|

| |

Total Germany | | | | | | 12,665,594 | |

| | | | |

|

| |

Ireland—2.2% | | | | | | | |

Bank of Ireland | | | 137,058 | | | 3,162,803 | |

CRH PLC | | | 87,147 | | | 3,624,465 | |

| | | | |

|

| |

Total Ireland | | | | | | 6,787,268 | |

| | | | |

|

| |

Italy—7.3% | | | | | | | |

Banco Popolare di Verona e Novara Scrl | | | 114,477 | | | 3,283,275 | |

Capitalia SpA | | | 319,696 | | | 3,022,638 | |

Enel SpA | | | 521,150 | | | 5,370,583 | |

Eni SpA | | | 151,675 | | | 5,096,161 | |

UniCredito Italiano SpA | | | 657,372 | | | 5,755,844 | |

| | | | |

|

| |

Total Italy | | | | | | 22,528,501 | |

| | | | |

|

| |

| | | | | | | |

Description | | | Shares | | Value | |

|

|

|

|

| |

Japan—17.9% | | | | | | | |

Daito Trust Construction Co., Ltd. | | | 52,100 | | $ | 2,387,361 | |

East Japan Railway Co. | | | 358 | | | 2,388,570 | |

Hoya Corp. | | | 89,400 | | | 3,481,314 | |

Keyence Corp. | | | 13,100 | | | 3,242,155 | |

Mitsubishi UFJ Financial Group, Inc. | | | 315 | | | 3,886,115 | |

Nidec Corp. | | | 53,900 | | | 4,161,638 | |

Nissan Motor Co., Ltd. | | | 457,600 | | | 5,503,259 | |

Nomura Holdings, Inc. | | | 240,800 | | | 4,536,914 | |

Sega Sammy Holdings, Inc. | | | 112,700 | | | 3,036,104 | |

Sumitomo Mitsui Financial Group, Inc. | | | 618 | | | 6,327,557 | |

Takeda Pharmaceutical Co., Ltd. | | | 43,700 | | | 2,996,341 | |

The Sumitomo Trust and Banking Co., Ltd. | | | 470,000 | | | 4,922,664 | |

THK Co., Ltd. | | | 81,400 | | | 2,097,251 | |

Tokyo Gas Co., Ltd. | | | 770,000 | | | 4,090,554 | |

Yamada Denki Co., Ltd. | | | 27,400 | | | 2,322,521 | |

| | | | |

|

| |

Total Japan | | | | | | 55,380,318 | |

| | | | |

|

| |

Netherlands—1.7% | | | | | | | |

TNT NV | | | 122,600 | | | 5,267,097 | |

| | | | |

|

| |

New Zealand—1.1% | | | | | | | |

Telecom Corp. of New Zealand, Ltd. | | | 958,300 | | | 3,283,888 | |

| | | | |

|

| |

Norway—0.9% | | | | | | | |

Statoil ASA | | | 108,650 | | | 2,883,618 | |

| | | | |

|

| |

Russia—0.5% | | | | | | | |

Mobile TeleSystems Sponsored ADR | | | 32,700 | | | 1,641,213 | |

| | | | |

|

| |

Singapore—1.2% | | | | | | | |

Singapore Telecommunications, Ltd. | | | 1,809,000 | | | 3,867,249 | |

| | | | |

|

| |

South Korea—1.3% | | | | | | | |

Hyundai Motor Co., Ltd. GDR (a) | | | 50,600 | | | 1,033,758 | |

Kookmin Bank Sponsored ADR | | | 36,200 | | | 2,919,168 | |

| | | | |

|

| |

Total South Korea | | | | | | 3,952,926 | |

| | | | |

|

| |

Spain—2.0% | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA | | | 255,904 | | | 6,155,051 | |

| | | | |

|

| |

Sweden—1.0% | | | | | | | |

Telefonaktiebolaget LM Ericsson, B Shares | | | 749,000 | | | 3,026,428 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

17

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments (continued) |

December 31, 2006 |

|

| | | | | | | |

Description | | | Shares | | Value | |

|

|

|

|

| |

Lazard Retirement International Equity Portfolio (concluded) | | | | | | | |

Switzerland—9.7% | | | | | | | |

Compagnie Financiere Richemont AG, A Shares | | | 65,800 | | $ | 3,827,148 | |

Credit Suisse Group | | | 109,612 | | | 7,654,971 | |

Nestle SA | | | 19,844 | | | 7,038,955 | |

Novartis AG | | | 151,700 | | | 8,730,175 | |

Zurich Financial Services AG | | | 9,800 | | | 2,633,243 | |

| | | | |

|

| |

Total Switzerland | | | | | | 29,884,492 | |

| | | | |

|

| |

Turkey—0.9% | | | | | | | |

Turkcell Iletisim Hizmetleri AS ADR | | | 216,036 | | | 2,890,562 | |

| | | | |

|

| |

United Kingdom—26.1% | | | | | | | |

BAE Systems PLC | | | 716,500 | | | 5,970,284 | |

BP PLC | | | 487,920 | | | 5,419,243 | |

Diageo PLC | | | 300,375 | | | 5,893,487 | |

Friends Provident PLC | | | 693,500 | | | 2,945,305 | |

Gallaher Group PLC | | | 195,041 | | | 4,376,472 | |

GlaxoSmithKline PLC | | | 252,700 | | | 6,647,045 | |

Imperial Tobacco Group PLC | | | 147,780 | | | 5,813,476 | |

ITV PLC | | | 1,169,000 | | | 2,436,623 | |

Kingfisher PLC | | | 417,400 | | | 1,948,341 | |

Lloyds TSB Group PLC | | | 268,900 | | | 3,007,677 | |

Marks & Spencer Group PLC | | | 231,519 | | | 3,248,852 | |

National Grid PLC | | | 528,523 | | | 7,623,520 | |

Northern Rock PLC | | | 121,800 | | | 2,808,127 | |

Old Mutual PLC | | | 1,286,357 | | | 4,386,907 | |

Reckitt Benckiser PLC | | | 101,200 | | | 4,622,804 | |

Tesco PLC | | | 656,900 | | | 5,200,462 | |

Vodafone Group PLC | | | 2,993,866 | | | 8,291,115 | |

| | | | |

|

| |

Total United Kingdom | | | | | | 80,639,740 | |

| | | | |

|

| |

Total Common Stocks

(Identified cost $239,306,851) | | | | | | 295,126,032 | |

| | | | |

|

| |

| | | | | | | |

Description | | | Shares | | Value | |

|

|

|

|

| |

Preferred Stock—1.0% | | | | | | | |

Brazil—1.0% | | | | | | | |

Tele Norte Leste Participacoes SA ADR (Identified cost $3,105,388) | | | 214,100 | | $ | 3,194,372 | |

| | | | |

|

| |

| | | | | | |

| | Principal

Amount

(000) | | | | |

| |

| | | | |

Repurchase Agreement—3.0% | | | | | | | |

State Street Bank and Trust Co.,4.30%, 01/02/07 (Dated 12/29/06, collateralized by $7,675,000 United States Treasury Bond, 7.50%, 11/15/16, with a value of $9,389,096) Proceeds of $9,207,397 (Identified cost $9,203,000) | | $ | 9,203 | | | 9,203,000 | |

| | | | |

|

| |

Total Investments—99.6%

(Identified cost $251,615,239) (b) | | | | | $ | 307,523,404 | |

Cash and Other Assets in Excess of Liabilities—0.4% | | | | | | 1,169,457 | |

| | | | |

|

| |

Net Assets—100.0% | | | | | $ | 308,692,861 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

18

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments (continued) |

December 31, 2006 |

|

| | | | | | | |

Description | | Shares | | Value | |

|

Lazard Retirement Emerging Markets Portfolio | | | | | | | |

Common Stocks—81.7% | | | | | | | |

Argentina—0.7% | | | | | | | |

Banco Macro SA ADR | | | 39,900 | | $ | 1,245,279 | |

| | | | |

|

| |

Bahrain—0.6% | | | | | | | |

Investcorp Bank BSC GDR (a) | | | 3,904 | | | 103,456 | |

Investcorp Bank BSC GDR (a), (c) | | | 35,584 | | | 942,976 | |

| | | | |

|

| |

Total Bahrain | | | | | | 1,046,432 | |

| | | | |

|

| |

Brazil—6.8% | | | | | | | |

Brasil Telecom Participacoes SA ADR | | | 56,400 | | | 2,407,716 | |

Companhia de Concessoes Rodoviarias | | | 135,800 | | | 1,835,049 | |

Petroleo Brasileiro SA ADR | | | 42,500 | | | 4,377,075 | |

Souza Cruz SA | | | 94,034 | | | 1,675,875 | |

Ultrapar Participacoes SA Sponsored ADR | | | 56,200 | | | 1,292,600 | |

| | | | |

|

| |

Total Brazil | | | | | | 11,588,315 | |

| | | | |

|

| |

Chile—0.1% | | | | | | | |

Administradora de Fondos de Pensiones Provida SA Sponsored ADR | | | 3,660 | | | 94,099 | |

| | | | |

|

| |

China—1.3% | | | | | | | |

CNOOC, Ltd. ADR | | | 23,500 | | | 2,223,805 | |

| | | | |

|

| |

Egypt—4.0% | | | | | | | |

Eastern Tobacco | | | 29,534 | | | 1,603,071 | |

Orascom Construction Industries | | | 55,949 | | | 2,702,794 | |

Orascom Telecom Holding SAE | | | 38,800 | | | 2,564,791 | |

| | | | |

|

| |

Total Egypt | | | | | | 6,870,656 | |

| | | | |

|

| |

Hong Kong—1.0% | | | | | | | |

China Netcom Group Corp. (Hong Kong), Ltd. | | | 478,000 | | | 1,281,468 | |

Pacific Basin Shipping, Ltd. | | | 760,000 | | | 478,833 | |

| | | | |

|

| |

Total Hong Kong | | | | | | 1,760,301 | |

| | | | |

|

| |

Hungary—2.0% | | | | | | | |

Gedeon Richter Nyrt. | | | 7,285 | | | 1,659,939 | |

MOL Hungarian Oil and Gas Nyrt. | | | 15,237 | | | 1,726,339 | |

| | | | |

|

| |

Total Hungary | | | | | | 3,386,278 | |

| | | | |

|

| |

| | | | | | | |

Description | | Shares | | Value | |

|

India—6.6% | | | | | | | |

Hero Honda Motors, Ltd. | | | 77,721 | | $ | 1,332,811 | |

Hindustan Lever, Ltd. | | | 205,332 | | | 1,005,320 | |

Oil and Natural Gas Corp., Ltd. | | | 125,853 | | | 2,459,621 | |

Punjab National Bank, Ltd. | | | 6,700 | | | 76,749 | |

Satyam Computer Services, Ltd. | | | 252,164 | | | 2,762,352 | |

State Bank of India | | | 128,863 | | | 3,624,818 | |

| | | | |

|

| |

Total India | | | | | | 11,261,671 | |

| | | | |

|

| |

Indonesia—3.2% | | | | | | | |

PT Bank Mandiri Tbk | | | 7,148,000 | | | 2,304,909 | |

PT Telekomunikasi Indonesia Tbk Sponsored ADR | | | 38,700 | | | 1,764,720 | |

PT United Tractors Tbk | | | 2,023,400 | | | 1,473,650 | |

| | | | |

|

| |

Total Indonesia | | | | | | 5,543,279 | |

| | | | |

|

| |

Israel—2.8% | | | | | | | |

Bank Hapoalim BM | | | 688,436 | | | 3,241,332 | |

Israel Chemicals, Ltd. | | | 238,969 | | | 1,494,123 | |

| | | | |

|

| |

Total Israel | | | | | | 4,735,455 | |

| | | | |

|

| |

Kazakhstan—1.1% | | | | | | | |

KazMunaiGas Exploration | | | | | | | |

Production GDR | | | 51,700 | | | 1,264,582 | |

KazMunaiGas Exploration Production GDR (c) | | | 24,200 | | | 591,932 | |

| | | | |

|

| |

Total Kazakhstan | | | | | | 1,856,514 | |

| | | | |

|

| |

Mexico—6.0% | | | | | | | |

Cemex SAB de CV Sponsored ADR (a) | | | 113,734 | | | 3,853,308 | |

Desarrolladora Homex SA de CV ADR (a) | | | 23,390 | | | 1,381,648 | |

Grupo Mexico SAB de CV, Series B | | | 316,700 | | | 1,158,348 | |

Grupo Televisa SA Sponsored ADR | | | 79,300 | | | 2,141,893 | |

Kimberly-Clark de Mexico SAB de CV, Series A | | | 389,300 | | | 1,794,241 | |

| | | | |

|

| |

Total Mexico | | | | | | 10,329,438 | |

| | | | |

|

| |

Morocco—0.0% | | | | | | | |

Maroc Telecom | | | 4,900 | | | 75,095 | |

| | | | |

|

| |

Peru—0.7% | | | | | | | |

Credicorp, Ltd. | | | 30,400 | | | 1,244,576 | |

| | | | |

|

| |

Philippines—1.5% | | | | | | | |

Philippine Long Distance Telephone Co. Sponsored ADR | | | 50,300 | | | 2,571,839 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

19

|

|

Lazard Retirement Series, Inc. |

|

Portfolios of Investments (concluded) |

December 31, 2006 |

|

| | | | | | | |

Description | | Shares | | Value | |

|

Lazard Retirement Emerging Markets Portfolio (concluded) | | | | | | | |

Russia—3.0% | | | | | | | |

Evraz Group SA GDR | | | 53,900 | | $ | 1,384,691 | |

Mobile TeleSystems Sponsored ADR | | | 73,000 | | | 3,663,870 | |

| | | | |

|

| |

Total Russia | | | | | | 5,048,561 | |

| | | | |

|

| |

South Africa—9.6% | | | | | | | |

Aquarius Platinum, Ltd. | | | 122,334 | | | 2,655,234 | |

Edgars Consolidated Stores, Ltd. | | | 598,755 | | | 3,312,759 | |

Exxaro Resources, Ltd. | | | 42,085 | | | 334,257 | |

Imperial Holdings, Ltd. (a) | | | 80,400 | | | 1,869,985 | |

Kumba Iron Ore, Ltd. (a) | | | 140,934 | | | 2,223,722 | |

Murray & Roberts Holdings, Ltd. | | | 240,467 | | | 1,367,617 | |

Sanlam, Ltd. | | | 248,530 | | | 645,052 | |

Steinhoff International Holdings, Ltd. | | | 721,853 | | | 2,544,133 | |

Truworths International, Ltd. | | | 319,656 | | | 1,452,580 | |

| | | | |

|

| |

Total South Africa | | | | | | 16,405,339 | |

| | | | |

|

| |

South Korea—15.8% | | | | | | | |

Hite Brewery Co., Ltd. | | | 7,500 | | | 963,710 | |

Hyundai Motor Co., Ltd. | | | 30,740 | | | 2,227,824 | |

Kangwon Land, Inc. | | | 102,010 | | | 2,215,701 | |

Kookmin Bank | | | 61,558 | | | 4,957,736 | |

KT Corp. Sponsored ADR | | | 48,790 | | | 1,236,826 | |

LG Electronics, Inc. | | | 23,070 | | | 1,364,355 | |

Lotte Shopping Co., Ltd. GDR (a), (c) | | | 101,900 | | | 2,068,570 | |

Samsung Electronics Co., Ltd. GDR | | | 5,700 | | | 1,875,300 | |

Samsung Electronics Co., Ltd. GDR (c) | | | 13,126 | | | 4,318,454 | |

Shinhan Financial Group Co., Ltd. | | | 83,070 | | | 4,242,822 | |

SK Corp. | | | 20,800 | | | 1,632,688 | |

| | | | |

|

| |

Total South Korea | | | | | | 27,103,986 | |

| | | | |

|

| |

Sweden—2.0% | | | | | | | |

Oriflame Cosmetics SA SDR | | | 81,200 | | | 3,346,252 | |

| | | | |

|

| |

Taiwan—8.5% | | | | | | | |

Advantech Co., Ltd. | | | 453,388 | | | 1,627,939 | |

Chinatrust Financial Holding Co., Ltd. | | | 4,009,493 | | | 3,353,036 | |

Chunghwa Telecom Co., Ltd. ADR | | | 16,116 | | | 317,969 | |

Fubon Financial Holding Co., Ltd. | | | 2,713,000 | | | 2,539,405 | |

Hon Hai Precision Industry Co., Ltd. | | | 481,506 | | | 3,435,634 | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 1,359,848 | | | 2,816,932 | |

Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR | | | 49,027 | | | 535,865 | |

| | | | |

|

| |

Total Taiwan | | | | | | 14,626,780 | |

| | | | |

|

| |

| | | | | | | |

Description | | Shares | | Value | |

|

Thailand—0.8% | | | | | | | |

Kasikornbank PCL | | | 514,500 | | $ | 889,523 | |

Thai Union Frozen Products PCL | | | 709,800 | | | 490,871 | |

| | | | |

|

| |

Total Thailand | | | | | | 1,380,394 | |

| | | | |

|

| |

Turkey—3.6% | | | | | | | |

Enka Insaat ve Sanayi AS | | | 122,662 | | | 1,307,586 | |

Turkcell Iletisim Hizmetleri AS | | | 529,401 | | | 2,672,232 | |

Turkcell Iletisim Hizmetleri AS ADR | | | 161,578 | | | 2,161,914 | |

| | | | |

|

| |

Total Turkey | | | | | | 6,141,732 | |

| | | | |

|

| |

Total Common Stocks

(Identified cost $109,093,654) | | | | | | 139,886,076 | |

| | | | |

|

| |

Preferred Stocks—9.2% | | | | | | | |

Brazil—8.6% | | | | | | | |

AES Tiete SA | | | 50,269,689 | | | 1,466,886 | |

Bradespar SA | | | 38,005 | | | 1,797,895 | |

Companhia Vale do Rio Doce, A Shares | | | 203,700 | | | 5,198,882 | |

Iochpe Maxion SA | | | 98,200 | | | 834,815 | |

Klabin SA | | | 774,400 | | | 1,940,534 | |

Tele Norte Leste Participacoes SA ADR | | | 91,700 | | | 1,368,164 | |

Telemar Norte Leste SA | | | 94,742 | | | 2,156,656 | |

| | | | |

|

| |

Total Brazil | | | | | | 14,763,832 | |

| | | | |

|

| |

South Korea—0.6% | | | | | | | |

Hyundai Motor Co., Ltd. | | | 25,450 | | | 1,086,414 | |

| | | | |

|

| |

Total Preferred Stocks

(Identified cost $13,830,124) | | | | | | 15,850,246 | |

| | | | |

|

| |

| | | | | | | |

| | Principal

Amount

(000) | | | | |

| |

| | | | |

Repurchase Agreement—8.4% | | | | | | | |

State Street Bank and Trust Co., 4.30%, 01/02/07 (Dated 12/29/06, collateralized by $12,055,000 United States Treasury Bond, 7.50%, 11/15/16, with a value of $14,747,303) Proceeds of $14,459,905 (Identified cost $14,453,000) | | $ | 14,453 | | | 14,453,000 | |

| | | | |

|

| |

Total Investments—99.3%

(Identified cost $137,376,778) (b) | | | | | $ | 170,189,322 | |

Cash and Other Assets in Excess of Liabilities—0.7% | | | | | | 1,125,682 | |

| | | | |

|

| |

Net Assets—100.0% | | | | | $ | 171,315,004 | |

| | | | |

|

| |

The accompanying notes are an integral part of these financial statements.

20

|

|

Lazard Retirement Series, Inc. |

|

Notes to Portfolios of Investments |

December 31, 2006 |

|

| |

(a) | Non-income producing security. |

| |

(b) | For federal income tax purposes, the aggregate cost, aggregate gross unrealized appreciation, aggregate gross unrealized depreciation and the net unrealized appreciation are as follows: |

| | | | | | | | | | | | | | |

| Portfolio | | Aggregate

Cost | | Aggregate

Gross

Unrealized

Appreciation | | Aggregate

Gross

Unrealized

Depreciation | | Net

Unrealized

Appreciation | |

|

| |

| |

| |

| |

| |

| Retirement Equity | | $ | 4,580,937 | | $ | 502,857 | | $ | 29,946 | | $ | 472,911 | |

| Retirement Small Cap | | | 77,729,064 | | | 7,215,231 | | | 2,589,362 | | | 4,625,869 | |

| Retirement International Equity | | | 251,806,030 | | | 58,709,146 | | | 2,991,772 | | | 55,717,374 | |

| Retirement Emerging Markets | | | 137,597,679 | | | 33,576,156 | | | 984,513 | | | 32,591,643 | |

| |

(c) | Pursuant to Rule 144A under the Securities Act of 1933, these securities may only be traded among “qualified institutional buyers.” At December 31, 2006, these securities amounted to 4.6% of net assets and are considered to be liquid for Lazard Retirement Emerging Markets Portfolio. |

Security Abbreviations:

ADR — American Depositary Receipt

GDR — Global Depositary Receipt

SDR — Swedish Depositary Receipt

The accompanying notes are an integral part of these financial statements.

21

|

|

Lazard Retirement Series, Inc. |

|

Notes to Portfolios of Investments (concluded) |

December 31, 2006 |

|

|

Portfolio holdings by industry (as percentage of net assets), for those Portfolios previously presented by country: |

| | | | | | | |

| | Lazard

Retirement

International

Equity

Portfolio | | Lazard

Retirement

Emerging

Markets

Portfolio | |

| |

| |

| |

Industry | | | | | | | |

Agriculture | | — | % | | 0.9 | % | |

Alcohol & Tobacco | | 7.0 | | | 2.5 | | |

Automotive | | 3.5 | | | 2.7 | | |

Banking | | 18.2 | | | 12.2 | | |

Building & Construction | | 2.9 | | | 6.2 | | |

Consumer Products | | 3.7 | | | 4.8 | | |

Drugs | | 8.3 | | | 1.0 | | |

Electric | | 4.2 | | | 0.9 | | |

Energy Exploration & Production | | — | | | 2.7 | | |

Energy Integrated | | 8.9 | | | 6.4 | | |

Financial Services | | 3.9 | | | 5.0 | | |

Food & Beverages | | 2.3 | | | 0.3 | | |

Forest & Paper Products | | — | | | 2.2 | | |

Gas Utilities | | 1.3 | | | — | | |

Insurance | | 3.7 | | | — | | |

Leisure & Entertainment | | 3.1 | | | 2.5 | | |

Manufacturing | | 3.7 | | | 1.3 | | |

Metals & Mining | | — | | | 8.6 | | |

Retail | | 5.9 | | | 4.0 | | |

Semiconductors & Components | | 1.1 | | | 6.5 | | |

Technology | | 1.3 | | | 1.6 | | |

Technology Hardware | | 1.0 | | | 2.0 | | |

Telecommunications | | 10.1 | | | 14.2 | | |

Transportation | | 2.5 | | | 2.4 | | |

| |

|

| |

|

| |

Subtotal | | 96.6 | | | 90.9 | | |

Repurchase Agreements | | 3.0 | | | 8.4 | | |

| |

|

| |

|

| |

Total Investments | | 99.6 | % | | 99.3 | % | |

| |

|

| |

|

| |

The accompanying notes are an integral part of these financial statements.

22

|

|

Lazard Retirement Series, Inc. |

|

Statements of Assets and Liabilities |

December 31, 2006 |

| | | | | | | | | | | | | |

|

|

| | Lazard

Retirement

Equity

Portfolio | | Lazard

Retirement

Small Cap

Portfolio | | Lazard

Retirement

International

Equity

Portfolio | | Lazard

Retirement

Emerging

Markets

Portfolio | |

|

ASSETS | | | | | | | | | | | | | |

Investments in securities, at value | | $ | 5,053,848 | | $ | 82,354,933 | | $ | 307,523,404 | | $ | 170,189,322 | |

Cash | | | 23,598 | | | 349 | | | 744 | | | 257 | |

Foreign currency | | | — | | | — | | | 4,393 | | | 208 | |

Receivables for: | | | | | | | | | | | | | |

Investments sold | | | — | | | 475,546 | | | 1,904,723 | | | 566,964 | |

Dividends and interest | | | 5,677 | | | 51,141 | | | 699,768 | | | 423,402 | |

Capital stock sold | | | — | | | 24 | | | 55,539 | | | 502,982 | |

Amount due from Investment Manager (Note 3) | | | 13,128 | | | — | | | — | | | — | |

| |

|

| |

|

| |

|

| |

|

| |

Total assets | | | 5,096,251 | | | 82,881,993 | | | 310,188,571 | | | 171,683,135 | |

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | | |

Payables for: | | | | | | | | | | | | | |

Management fees | | | — | | | 52,764 | | | 194,282 | | | 111,691 | |

Accrued distribution fees | | | 1,125 | | | 17,588 | | | 64,761 | | | 26,158 | |

Accrued directors’ fees | | | 12 | | | 274 | | | 665 | | | 307 | |

Investments purchased | | | — | | | 224,008 | | | 1,154,352 | | | 79,505 | |

Capital stock redeemed | | | 36 | | | 43,367 | | | 183 | | | 11,280 | |

Other accrued expenses and payables | | | 16,765 | | | 30,019 | | | 81,467 | | | 139,190 | |

| |

|

| |

|

| |

|

| |

|

| |

Total liabilities | | | 17,938 | | | 368,020 | | | 1,495,710 | | | 368,131 | |

| |

|

| |

|

| |

|

| |

|

| |

Net assets | | $ | 5,078,313 | | $ | 82,513,973 | | $ | 308,692,861 | | $ | 171,315,004 | |

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | | |

Paid in capital | | $ | 4,183,652 | | $ | 53,528,081 | | $ | 210,067,669 | | $ | 122,870,904 | |

Undistributed net investment income | | | 31,239 | | | 3 | | | 4,086,576 | | | 1,276,939 | |

Accumulated undistributed net realized gain | | | 360,819 | | | 23,640,144 | | | 38,618,924 | | | 14,407,021 | |

Net unrealized appreciation on: | | | | | | | | | | | | | |

Investments | | | 502,603 | | | 5,345,745 | | | 55,908,165 | | | 32,759,060 | |

Foreign currency | | | — | | | — | | | 11,527 | | | 1,080 | |

| |

|

| |

|

| |

|

| |

|

| |

Net assets | | $ | 5,078,313 | | $ | 82,513,973 | | $ | 308,692,861 | | $ | 171,315,004 | |

| |

|

| |

|

| |

|

| |

|

| |

| | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | |

Net assets | | $ | 5,078,313 | | $ | 82,513,973 | | $ | 308,692,861 | | $ | 129,305,604 | |

Shares of capital stock outstanding* | | | 394,810 | | | 4,767,452 | | | 20,736,302 | | | 5,698,332 | |

Net asset value, offering and redemption price per share | | $ | 12.86 | | $ | 17.31 | | $ | 14.89 | | $ | 22.69 | |

| | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | |

Net assets | | | — | | | — | | | — | | $ | 42,009,400 | |

Shares of capital stock outstanding* | | | — | | | — | | | — | | | 1,849,829 | |

Net asset value, offering and redemption price per share | | | — | | | — | | | — | | $ | 22.71 | |

| | | | | | | | | | | | | |

Cost of investments in securities | | $ | 4,551,245 | | $ | 77,009,188 | | $ | 251,615,239 | | $ | 137,376,778 | |

Cost of foreign currency | | $ | — | | $ | — | | $ | 4,296 | | $ | 205 | |

* $0.001 par value, 500,000,000 shares authorized for the Portfolios in total.

The accompanying notes are an integral part of these financial statements.