UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

J.P. Morgan Fleming Mutual Fund Group, Inc.

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class A Shares/Ticker: JAMCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class A Shares) | $59 | 1.12% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

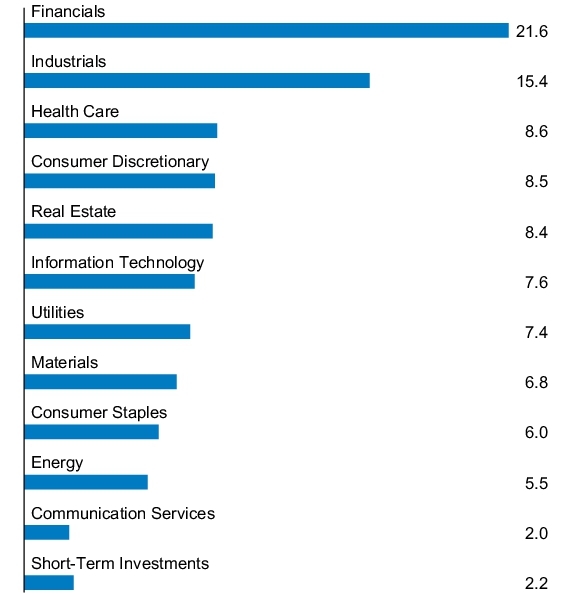

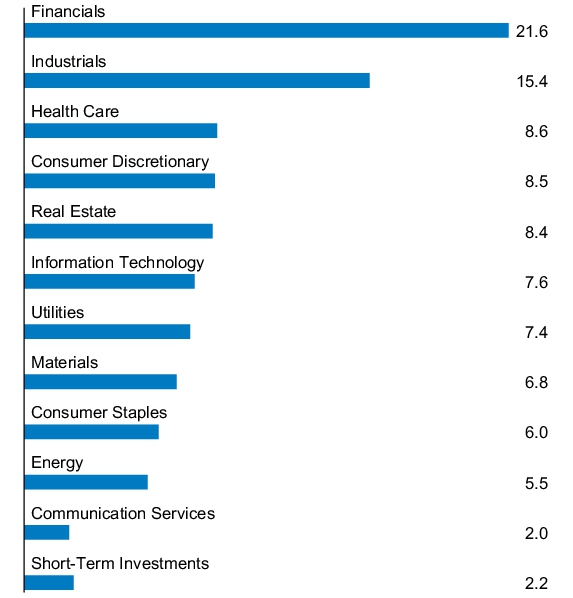

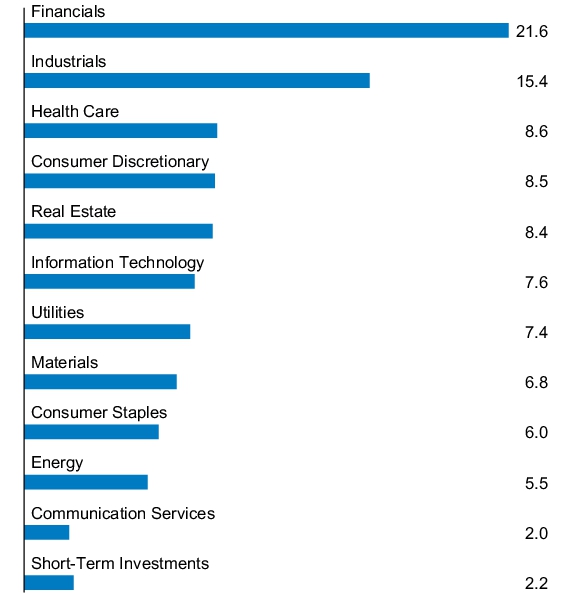

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class C Shares/Ticker: JCMVX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class C Shares) | $85 | 1.62% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

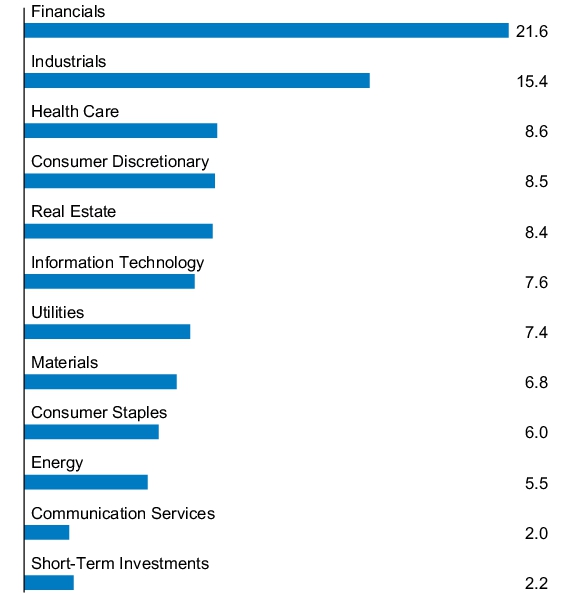

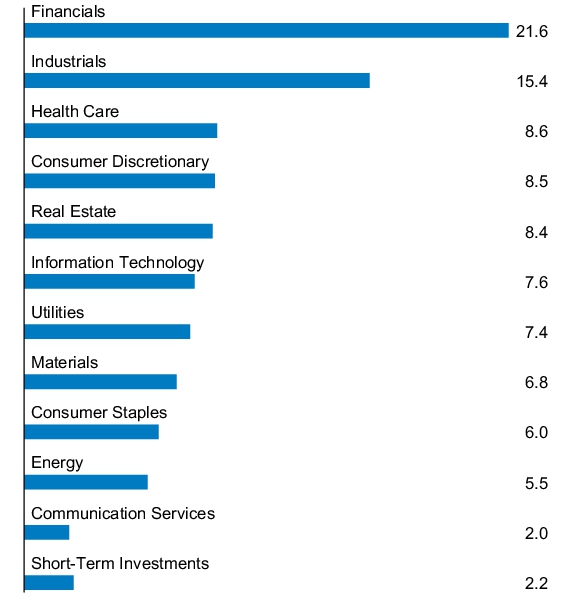

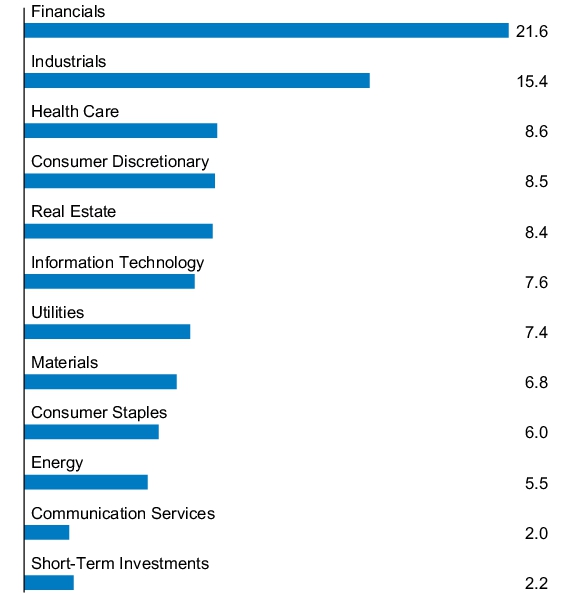

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class I Shares/Ticker: JMVSX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class I Shares) | $46 | 0.87% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

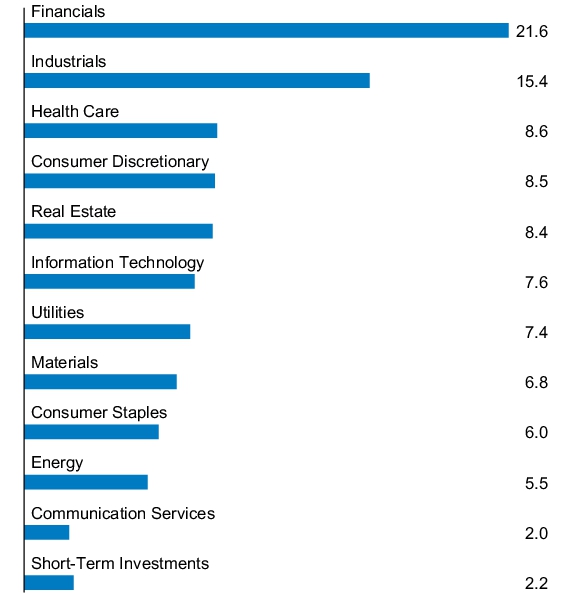

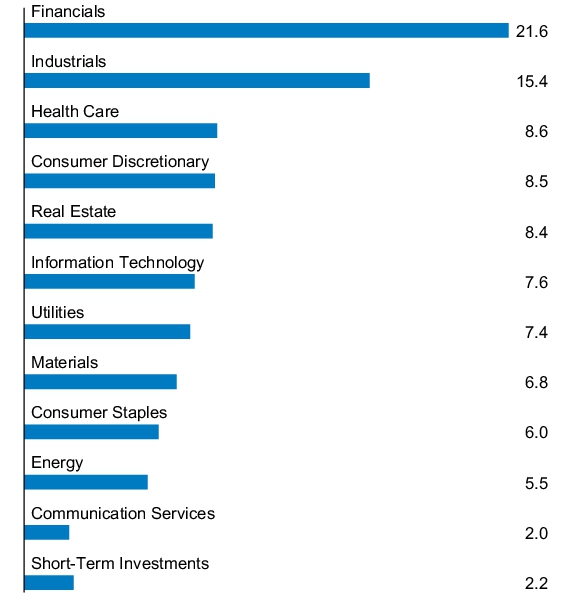

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class L Shares/Ticker: FLMVX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class L Shares) | $39 | 0.73% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

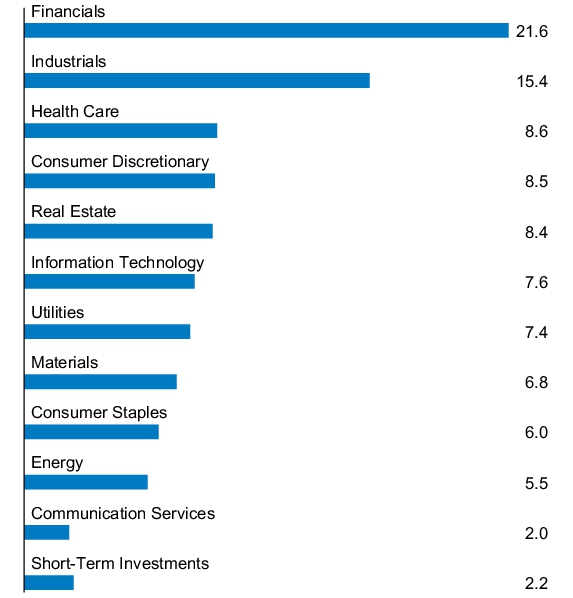

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class R2 Shares/Ticker: JMVZX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class R2 Shares) | $73 | 1.38% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class R3 Shares/Ticker: JMVPX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class R3 Shares) | $60 | 1.13% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class R4 Shares/Ticker: JMVQX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class R4 Shares) | $46 | 0.88% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class R5 Shares/Ticker: JMVRX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class R5 Shares) | $39 | 0.73% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | December 31, 2024 (Unaudited)

JPMorgan Mid Cap Value Fund

Class R6 Shares/Ticker: JMVYX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Mid Cap Value Fund (the "Fund") for the period July 1, 2024 to December 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment* |

JPMorgan Mid Cap Value Fund

(Class R6 Shares) | $33 | 0.63% |

| * | This charge is annualized. |

| Fund net assets (000's) | $13,096,933 | |

| Total number of portfolio holdings | 99 | |

| Portfolio turnover rate | 18 | % |

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ITEM 2. CODE OF ETHICS.

Not applicable to a semi-annual report.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to a semi-annual report.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to a semi-annual report.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to a semi-annual report.

ITEM 6. INVESTMENTS.

File Schedule I – Investments in securities of unaffiliated issuers as of the close of the reporting period as set forth in Section 210.12-12 of Regulation S-X, unless the schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Included in Item 1.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT

COMPANIES.

Semi-Annual Financial Statements

J.P. Morgan Mid Cap/Multi-Cap Funds

December 31, 2024 (Unaudited)

JPMorgan Growth Advantage Fund |

JPMorgan Mid Cap Equity Fund |

JPMorgan Mid Cap Growth Fund |

JPMorgan Mid Cap Value Fund |

JPMorgan Value Advantage Fund |

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

JPMorgan Growth Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited)

| | |

|

|

| | |

|

Constellation Brands, Inc., Class A | | |

|

Alnylam Pharmaceuticals, Inc. * | | |

| | |

| | |

Regeneron Pharmaceuticals, Inc. * | | |

| | |

|

| | |

|

| | |

|

| | |

Goldman Sachs Group, Inc. (The) | | |

Interactive Brokers Group, Inc., Class A | | |

| | |

| | |

Robinhood Markets, Inc., Class A * | | |

| | |

Commercial Services & Supplies — 0.9% |

| | |

Communications Equipment — 0.7% |

| | |

Construction & Engineering — 1.2% |

| | |

Construction Materials — 0.4% |

| | |

|

| | |

Electrical Equipment — 2.3% |

| | |

| | |

| | |

Vertiv Holdings Co., Class A | | |

| | |

Energy Equipment & Services — 0.8% |

TechnipFMC plc (United Kingdom) | | |

| | |

|

|

| | |

Take-Two Interactive Software, Inc. * | | |

| | |

Financial Services — 2.8% |

Mastercard, Inc., Class A | | |

Ground Transportation — 1.8% |

JB Hunt Transport Services, Inc. | | |

| | |

Uber Technologies, Inc. * | | |

| | |

Health Care Equipment & Supplies — 2.1% |

Cooper Cos., Inc. (The) * | | |

Intuitive Surgical, Inc. * | | |

| | |

Health Care Providers & Services — 0.5% |

| | |

Hotels, Restaurants & Leisure — 3.7% |

| | |

DoorDash, Inc., Class A * | | |

Flutter Entertainment plc (United Kingdom) * | | |

Hilton Worldwide Holdings, Inc. | | |

| | |

| | |

Household Durables — 0.7% |

| | |

Industrial Conglomerates — 0.6% |

| | |

|

| | |

Interactive Media & Services — 9.5% |

| | |

Meta Platforms, Inc., Class A | | |

| | |

|

| | |

Shopify, Inc., Class A (Canada) * | | |

Snowflake, Inc., Class A * | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Growth Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited) (continued)

| | |

Common Stocks — continued |

Life Sciences Tools & Services — 1.3% |

| | |

Mettler-Toledo International, Inc. * | | |

Thermo Fisher Scientific, Inc. | | |

| | |

|

| | |

| | |

| | |

|

Trade Desk, Inc. (The), Class A * | | |

Oil, Gas & Consumable Fuels — 0.7% |

| | |

Personal Care Products — 0.5% |

| | |

|

| | |

Intra-Cellular Therapies, Inc. * | | |

| | |

Professional Services — 0.6% |

Booz Allen Hamilton Holding Corp. | | |

Semiconductors & Semiconductor Equipment — 15.7% |

| | |

| | |

| | |

| | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) | | |

| | |

| | |

|

AppLovin Corp., Class A * | | |

Atlassian Corp., Class A * | | |

| | |

Crowdstrike Holdings, Inc., Class A * | | |

| | |

| | |

| | |

| | |

| | |

|

|

Palo Alto Networks, Inc. * | | |

| | |

| | |

|

| | |

| | |

| | |

Technology Hardware, Storage & Peripherals — 6.5% |

| | |

Trading Companies & Distributors — 0.3% |

| | |

Total Common Stocks

(Cost $9,304,685) | | |

Short-Term Investments — 1.3% |

Investment Companies — 1.1% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.54% (c) (d)

(Cost $227,128) | | |

Investment of Cash Collateral from Securities Loaned — 0.2% |

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.47% (c) (d)

(Cost $48,146) | | |

Total Short-Term Investments

(Cost $275,274) | | |

Total Investments — 100.5%

(Cost $9,579,959) | | |

Liabilities in Excess of Other Assets — (0.5)% | | |

| | |

Percentages indicated are based on net assets. |

| |

| American Depositary Receipt |

| Value determined using significant unobservable inputs. |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2024. The total value of securities on loan at December 31, 2024 is $46,604. |

| Fund is subject to legal or contractual restrictions on the resale of the security. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2024. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited)

| | |

|

Aerospace & Defense — 1.2% |

| | |

| | |

| | |

| | |

| | |

|

| | |

|

| | |

First Citizens BancShares, Inc., Class A | | |

| | |

NU Holdings Ltd., Class A (Brazil) * | | |

| | |

| | |

|

Constellation Brands, Inc., Class A | | |

| | |

| | |

|

Alnylam Pharmaceuticals, Inc. * | | |

| | |

| | |

| | |

| | |

REVOLUTION Medicines, Inc. * | | |

| | |

Viking Therapeutics, Inc. * | | |

| | |

|

| | |

| | |

Fortune Brands Innovations, Inc. | | |

Simpson Manufacturing Co., Inc. | | |

| | |

| | |

|

Ameriprise Financial, Inc. | | |

| | |

| | |

Coinbase Global, Inc., Class A * | | |

FactSet Research Systems, Inc. | | |

| | |

|

Capital Markets — continued |

Interactive Brokers Group, Inc., Class A | | |

Jefferies Financial Group, Inc. | | |

LPL Financial Holdings, Inc. | | |

| | |

| | |

| | |

Raymond James Financial, Inc. | | |

Robinhood Markets, Inc., Class A * | | |

| | |

| | |

Tradeweb Markets, Inc., Class A | | |

| | |

|

| | |

| | |

| | |

Commercial Services & Supplies — 1.2% |

| | |

| | |

| | |

| | |

| | |

Communications Equipment — 0.3% |

| | |

| | |

| | |

Construction & Engineering — 0.7% |

Comfort Systems USA, Inc. | | |

| | |

| | |

Construction Materials — 1.0% |

| | |

Martin Marietta Materials, Inc. | | |

| | |

|

Discover Financial Services | | |

Consumer Staples Distribution & Retail — 1.7% |

Casey's General Stores, Inc. | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Consumer Staples Distribution & Retail — continued |

| | |

| | |

| | |

Containers & Packaging — 2.4% |

| | |

Graphic Packaging Holding Co. | | |

| | |

Packaging Corp. of America | | |

| | |

| | |

|

| | |

| | |

| | |

Diversified Consumer Services — 0.3% |

Bright Horizons Family Solutions, Inc. * | | |

Electric Utilities — 1.8% |

| | |

| | |

| | |

Electrical Equipment — 3.9% |

| | |

| | |

| | |

| | |

Vertiv Holdings Co., Class A | | |

| | |

Electronic Equipment, Instruments & Components — 3.8% |

| | |

| | |

| | |

| | |

Teledyne Technologies, Inc. * | | |

Zebra Technologies Corp., Class A * | | |

| | |

Energy Equipment & Services — 1.0% |

| | |

TechnipFMC plc (United Kingdom) | | |

| | |

| | |

|

|

Take-Two Interactive Software, Inc. * | | |

Warner Music Group Corp., Class A | | |

| | |

Financial Services — 2.4% |

| | |

Fidelity National Information Services, Inc. | | |

| | |

Rocket Cos., Inc., Class A * | | |

| | |

|

| | |

| | |

| | |

| | |

Ground Transportation — 1.4% |

JB Hunt Transport Services, Inc. | | |

| | |

| | |

Health Care Equipment & Supplies — 1.8% |

Cooper Cos., Inc. (The) * | | |

| | |

GE HealthCare Technologies, Inc. | | |

Globus Medical, Inc., Class A * | | |

IDEXX Laboratories, Inc. * | | |

Inspire Medical Systems, Inc. * | | |

| | |

Health Care Providers & Services — 4.3% |

| | |

| | |

| | |

| | |

| | |

| | |

Universal Health Services, Inc., Class B | | |

| | |

|

| | |

Health Care Technology — 0.4% |

Veeva Systems, Inc., Class A * | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited) (continued)

| | |

Common Stocks — continued |

Hotel & Resort REITs — 0.5% |

Host Hotels & Resorts, Inc. | | |

Hotels, Restaurants & Leisure — 3.7% |

| | |

| | |

DoorDash, Inc., Class A * | | |

| | |

Flutter Entertainment plc (United Kingdom) * | | |

Hilton Worldwide Holdings, Inc. | | |

| | |

Planet Fitness, Inc., Class A * | | |

| | |

Household Durables — 0.8% |

| | |

Mohawk Industries, Inc. * | | |

| | |

Independent Power and Renewable Electricity Producers — 0.3% |

| | |

|

| | |

| | |

Hartford Financial Services Group, Inc. (The) | | |

| | |

| | |

| | |

Interactive Media & Services — 0.4% |

| | |

|

| | |

| | |

| | |

| | |

Snowflake, Inc., Class A * | | |

| | |

Life Sciences Tools & Services — 0.9% |

Agilent Technologies, Inc. | | |

| | |

Mettler-Toledo International, Inc. * | | |

West Pharmaceutical Services, Inc. | | |

| | |

| | |

|

|

| | |

| | |

| | |

| | |

Lincoln Electric Holdings, Inc. | | |

| | |

Westinghouse Air Brake Technologies Corp. | | |

| | |

|

Trade Desk, Inc. (The), Class A * | | |

|

| | |

|

| | |

| | |

Public Service Enterprise Group, Inc. | | |

| | |

| | |

Oil, Gas & Consumable Fuels — 3.7% |

| | |

| | |

| | |

| | |

Williams Cos., Inc. (The) | | |

| | |

Personal Care Products — 0.3% |

| | |

|

Intra-Cellular Therapies, Inc. * | | |

Jazz Pharmaceuticals plc * | | |

| | |

Professional Services — 1.4% |

Booz Allen Hamilton Holding Corp. | | |

| | |

UL Solutions, Inc., Class A | | |

| | |

Real Estate Management & Development — 0.7% |

CBRE Group, Inc., Class A * | | |

|

American Homes 4 Rent, Class A | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Residential REITs — continued |

AvalonBay Communities, Inc. | | |

Mid-America Apartment Communities, Inc. | | |

| | |

|

| | |

Semiconductors & Semiconductor Equipment — 2.4% |

| | |

| | |

Microchip Technology, Inc. | | |

Monolithic Power Systems, Inc. | | |

| | |

| | |

| | |

| | |

| | |

|

AppLovin Corp., Class A * | | |

Atlassian Corp., Class A * | | |

Confluent, Inc., Class A * | | |

Crowdstrike Holdings, Inc., Class A * | | |

| | |

| | |

| | |

| | |

| | |

| | |

Palantir Technologies, Inc., Class A * | | |

Palo Alto Networks, Inc. * | | |

| | |

Tyler Technologies, Inc. * | | |

| | |

|

| | |

| | |

| | |

| | |

|

| | |

| | |

|

Specialty Retail — continued |

| | |

| | |

Burlington Stores, Inc. * | | |

Floor & Decor Holdings, Inc., Class A * | | |

| | |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 1.4% |

| | |

On Holding AG, Class A (Switzerland) * | | |

| | |

| | |

Trading Companies & Distributors — 0.2% |

| | |

Total Common Stocks

(Cost $3,721,840) | | |

Short-Term Investments — 2.7% |

Investment Companies — 2.7% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.54% (a) (b)

(Cost $140,828) | | |

Total Investments — 99.9%

(Cost $3,862,668) | | |

Other Assets in Excess of Liabilities — 0.1% | | |

| | |

Percentages indicated are based on net assets. |

| |

| Real Estate Investment Trust |

| Non-income producing security. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2024. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Growth Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited)

| | |

|

Aerospace & Defense — 2.7% |

| | |

| | |

| | |

| | |

|

| | |

|

NU Holdings Ltd., Class A (Brazil) * | | |

|

Constellation Brands, Inc., Class A | | |

|

Alnylam Pharmaceuticals, Inc. * | | |

| | |

| | |

| | |

| | |

REVOLUTION Medicines, Inc. * | | |

| | |

Viking Therapeutics, Inc. * (a) | | |

| | |

|

| | |

Simpson Manufacturing Co., Inc. | | |

| | |

| | |

|

| | |

Coinbase Global, Inc., Class A * | | |

FactSet Research Systems, Inc. | | |

Interactive Brokers Group, Inc., Class A | | |

Jefferies Financial Group, Inc. | | |

LPL Financial Holdings, Inc. | | |

| | |

| | |

Raymond James Financial, Inc. | | |

Robinhood Markets, Inc., Class A * | | |

| | |

Tradeweb Markets, Inc., Class A | | |

| | |

Commercial Services & Supplies — 1.9% |

| | |

| | |

|

Commercial Services & Supplies — continued |

| | |

| | |

| | |

Communications Equipment — 0.4% |

| | |

Construction & Engineering — 2.1% |

Comfort Systems USA, Inc. | | |

| | |

| | |

Construction Materials — 0.8% |

| | |

Consumer Staples Distribution & Retail — 1.0% |

Casey's General Stores, Inc. | | |

|

| | |

Diversified Consumer Services — 1.0% |

Bright Horizons Family Solutions, Inc. * | | |

Electrical Equipment — 3.7% |

| | |

| | |

| | |

Vertiv Holdings Co., Class A | | |

| | |

Electronic Equipment, Instruments & Components — 1.2% |

| | |

Teledyne Technologies, Inc. * | | |

| | |

Energy Equipment & Services — 0.9% |

TechnipFMC plc (United Kingdom) | | |

|

Take-Two Interactive Software, Inc. * | | |

Financial Services — 0.9% |

| | |

Rocket Cos., Inc., Class A * (a) | | |

| | |

Ground Transportation — 2.0% |

JB Hunt Transport Services, Inc. | | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Health Care Equipment & Supplies — 2.1% |

Cooper Cos., Inc. (The) * | | |

| | |

IDEXX Laboratories, Inc. * | | |

Inspire Medical Systems, Inc. * | | |

| | |

Health Care Providers & Services — 0.9% |

| | |

Health Care Technology — 1.1% |

Veeva Systems, Inc., Class A * | | |

Hotels, Restaurants & Leisure — 6.9% |

| | |

DoorDash, Inc., Class A * | | |

Flutter Entertainment plc (United Kingdom) * | | |

Hilton Worldwide Holdings, Inc. | | |

| | |

Planet Fitness, Inc., Class A * | | |

| | |

Household Durables — 0.7% |

| | |

Independent Power and Renewable Electricity Producers — 0.9% |

| | |

|

| | |

|

| | |

| | |

| | |

Snowflake, Inc., Class A * | | |

| | |

Life Sciences Tools & Services — 2.7% |

Agilent Technologies, Inc. | | |

| | |

Mettler-Toledo International, Inc. * | | |

West Pharmaceutical Services, Inc. | | |

| | |

|

| | |

| | |

| | |

|

|

| | |

Westinghouse Air Brake Technologies Corp. | | |

| | |

|

Trade Desk, Inc. (The), Class A * | | |

Oil, Gas & Consumable Fuels — 2.2% |

| | |

| | |

| | |

Personal Care Products — 0.7% |

| | |

|

Intra-Cellular Therapies, Inc. * | | |

Professional Services — 1.1% |

Booz Allen Hamilton Holding Corp. | | |

Semiconductors & Semiconductor Equipment — 5.3% |

| | |

| | |

Monolithic Power Systems, Inc. | | |

| | |

| | |

| | |

| | |

| | |

|

AppLovin Corp., Class A * | | |

Atlassian Corp., Class A * | | |

Confluent, Inc., Class A * | | |

| | |

Crowdstrike Holdings, Inc., Class A * | | |

| | |

| | |

| | |

| | |

| | |

| | |

Palantir Technologies, Inc., Class A * | | |

Palo Alto Networks, Inc. * | | |

| | |

Tyler Technologies, Inc. * | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Growth Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited) (continued)

| | |

Common Stocks — continued |

|

| | |

Burlington Stores, Inc. * | | |

Floor & Decor Holdings, Inc., Class A * | | |

| | |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 0.7% |

On Holding AG, Class A (Switzerland) * | | |

Trading Companies & Distributors — 0.5% |

| | |

Total Common Stocks

(Cost $8,386,150) | | |

Short-Term Investments — 1.7% |

Investment Companies — 1.6% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.54% (c) (d)

(Cost $190,756) | | |

Investment of Cash Collateral from Securities Loaned — 0.1% |

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.47% (c) (d)

(Cost $9,270) | | |

Total Short-Term Investments

(Cost $200,026) | | |

Total Investments — 100.3%

(Cost $8,586,176) | | |

Liabilities in Excess of Other Assets — (0.3)% | | |

| | |

Percentages indicated are based on net assets. |

| Value determined using significant unobservable inputs. |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2024. The total value of securities on loan at December 31, 2024 is $9,156. |

| Fund is subject to legal or contractual restrictions on the resale of the security. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2024. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Value Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited)

| | |

|

Aerospace & Defense — 0.4% |

| | |

|

| | |

First Citizens BancShares, Inc., Class A | | |

| | |

| | |

| | |

|

Constellation Brands, Inc., Class A | | |

| | |

| | |

|

| | |

Fortune Brands Innovations, Inc. | | |

| | |

|

Ameriprise Financial, Inc. | | |

| | |

| | |

Raymond James Financial, Inc. | | |

| | |

| | |

|

| | |

| | |

| | |

Commercial Services & Supplies — 0.8% |

| | |

Communications Equipment — 0.3% |

| | |

Construction Materials — 1.1% |

Martin Marietta Materials, Inc. | | |

|

Discover Financial Services | | |

Consumer Staples Distribution & Retail — 2.0% |

| | |

| | |

| | |

| | |

|

Containers & Packaging — 3.7% |

| | |

Graphic Packaging Holding Co. | | |

| | |

Packaging Corp. of America | | |

| | |

| | |

|

| | |

Electric Utilities — 2.9% |

| | |

| | |

| | |

Electrical Equipment — 4.0% |

| | |

| | |

| | |

| | |

Electronic Equipment, Instruments & Components — 5.2% |

| | |

| | |

| | |

Teledyne Technologies, Inc. * | | |

Zebra Technologies Corp., Class A * | | |

| | |

Energy Equipment & Services — 1.0% |

| | |

|

Take-Two Interactive Software, Inc. * | | |

Warner Music Group Corp., Class A | | |

| | |

Financial Services — 3.2% |

| | |

Fidelity National Information Services, Inc. | | |

| | |

| | |

|

| | |

| | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Value Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited) (continued)

| | |

Common Stocks — continued |

Ground Transportation — 1.1% |

JB Hunt Transport Services, Inc. | | |

Health Care Equipment & Supplies — 1.7% |

GE HealthCare Technologies, Inc. | | |

Globus Medical, Inc., Class A * | | |

| | |

Health Care Providers & Services — 6.1% |

| | |

| | |

| | |

| | |

| | |

Universal Health Services, Inc., Class B | | |

| | |

|

| | |

Hotel & Resort REITs — 0.7% |

Host Hotels & Resorts, Inc. | | |

Hotels, Restaurants & Leisure — 2.0% |

| | |

| | |

| | |

Household Durables — 0.9% |

Mohawk Industries, Inc. * | | |

|

| | |

Hartford Financial Services Group, Inc. (The) | | |

| | |

| | |

| | |

Interactive Media & Services — 0.6% |

| | |

|

| | |

|

| | |

| | |

| | |

Lincoln Electric Holdings, Inc. | | |

| | |

| | |

| | |

|

|

| | |

|

| | |

| | |

Public Service Enterprise Group, Inc. | | |

| | |

| | |

Oil, Gas & Consumable Fuels — 4.5% |

| | |

| | |

Williams Cos., Inc. (The) | | |

| | |

|

Jazz Pharmaceuticals plc * | | |

Professional Services — 1.6% |

| | |

UL Solutions, Inc., Class A | | |

| | |

Real Estate Management & Development — 1.0% |

CBRE Group, Inc., Class A * | | |

|

American Homes 4 Rent, Class A | | |

AvalonBay Communities, Inc. | | |

Mid-America Apartment Communities, Inc. | | |

| | |

|

| | |

Semiconductors & Semiconductor Equipment — 1.0% |

Microchip Technology, Inc. | | |

| | |

| | |

|

| | |

| | |

| | |

| | |

|

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Specialty Retail — continued |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 1.8% |

| | |

| | |

| | |

Total Common Stocks

(Cost $7,534,020) | | |

Short-Term Investments — 2.2% |

Investment Companies — 2.2% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.54% (a) (b)

(Cost $288,108) | | |

Total Investments — 100.1%

(Cost $7,822,128) | | |

Liabilities in Excess of Other Assets — (0.1)% | | |

| | |

Percentages indicated are based on net assets. |

| |

| Real Estate Investment Trust |

| Non-income producing security. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2024. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Value Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited)

| | |

|

Aerospace & Defense — 1.9% |

| | |

| | |

| | |

| | |

Air Freight & Logistics — 1.8% |

| | |

United Parcel Service, Inc., Class B | | |

| | |

Automobile Components — 0.2% |

| | |

|

| | |

Columbia Banking System, Inc. | | |

| | |

First Citizens BancShares, Inc., Class A | | |

| | |

PNC Financial Services Group, Inc. (The) | | |

| | |

| | |

| | |

|

| | |

|

| | |

Regeneron Pharmaceuticals, Inc. * | | |

Vertex Pharmaceuticals, Inc. * | | |

| | |

|

| | |

|

| | |

Fortune Brands Innovations, Inc. | | |

| | |

|

Charles Schwab Corp. (The) | | |

| | |

| | |

Raymond James Financial, Inc. | | |

| | |

| | |

| | |

|

|

Axalta Coating Systems Ltd. * | | |

Communications Equipment — 0.5% |

| | |

Construction & Engineering — 0.7% |

WillScot Holdings Corp. * | | |

Construction Materials — 0.7% |

Martin Marietta Materials, Inc. | | |

|

| | |

Capital One Financial Corp. | | |

Discover Financial Services | | |

| | |

Containers & Packaging — 3.1% |

Graphic Packaging Holding Co. | | |

| | |

Packaging Corp. of America | | |

| | |

| | |

| | |

Diversified Telecommunication Services — 0.5% |

Verizon Communications, Inc. | | |

Electric Utilities — 3.0% |

| | |

| | |

| | |

| | |

| | |

| | |

Electrical Equipment — 0.4% |

| | |

Electronic Equipment, Instruments & Components — 1.1% |

| | |

|

| | |

Financial Services — 4.4% |

Berkshire Hathaway, Inc., Class B * | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Financial Services — continued |

| | |

| | |

| | |

|

| | |

Ground Transportation — 0.8% |

| | |

Health Care Equipment & Supplies — 0.7% |

| | |

| | |

| | |

Health Care Providers & Services — 6.4% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Hotel & Resort REITs — 0.8% |

Apple Hospitality REIT, Inc. | | |

Host Hotels & Resorts, Inc. | | |

| | |

Hotels, Restaurants & Leisure — 2.5% |

| | |

| | |

| | |

| | |

| | |

Household Durables — 0.6% |

Mohawk Industries, Inc. * | | |

Household Products — 1.1% |

Procter & Gamble Co. (The) | | |

Industrial Conglomerates — 0.5% |

Honeywell International, Inc. | | |

|

EastGroup Properties, Inc. | | |

| | |

|

|

| | |

| | |

| | |

Oscar Health, Inc., Class A * | | |

| | |

Travelers Cos., Inc. (The) | | |

| | |

| | |

Interactive Media & Services — 0.7% |

| | |

Meta Platforms, Inc., Class A | | |

| | |

|

Cognizant Technology Solutions Corp., Class A | | |

International Business Machines Corp. | | |

| | |

|

| | |

| | |

| | |

| | |

|

Nexstar Media Group, Inc. | | |

Sirius XM Holdings, Inc. (a) | | |

| | |

|

| | |

Public Service Enterprise Group, Inc. | | |

| | |

Oil, Gas & Consumable Fuels — 7.2% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Williams Cos., Inc. (The) | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Value Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF December 31, 2024 (Unaudited) (continued)

| | |

Common Stocks — continued |

Passenger Airlines — 0.4% |

| | |

|

| | |

| | |

| | |

| | |

Professional Services — 0.4% |

Paylocity Holding Corp. * | | |

Real Estate Management & Development — 0.5% |

CBRE Group, Inc., Class A * | | |

|

American Homes 4 Rent, Class A | | |

Mid-America Apartment Communities, Inc. | | |

| | |

|

Federal Realty Investment Trust | | |

| | |

| | |

| | |

Semiconductors & Semiconductor Equipment — 2.5% |

| | |

ASML Holding NV (Registered), NYRS (Netherlands) | | |

Microchip Technology, Inc. | | |

| | |

| | |

|

Lamar Advertising Co., Class A | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

Dick's Sporting Goods, Inc. | | |

| | |

| | |

|

Specialty Retail — continued |

| | |

| | |

| | |

Technology Hardware, Storage & Peripherals — 1.4% |

Hewlett Packard Enterprise Co. | | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 0.3% |

| | |

|

Philip Morris International, Inc. | | |

Wireless Telecommunication Services — 0.4% |

| | |

Total Common Stocks

(Cost $5,366,665) | | |

Short-Term Investments — 2.4% |

Investment Companies — 2.2% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.54% (b) (c)

(Cost $198,067) | | |

Investment of Cash Collateral from Securities Loaned — 0.2% |

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.47% (b) (c)

(Cost $19,729) | | |

Total Short-Term Investments

(Cost $217,796) | | |

Total Investments — 99.5%

(Cost $5,584,461) | | |

Other Assets in Excess of Liabilities — 0.5% | | |

| | |

Percentages indicated are based on net assets. |

| |

| |

| Real Estate Investment Trust |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2024. The total value of securities on loan at December 31, 2024 is $19,162. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2024. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF ASSETS AND LIABILITIESAS OF December 31, 2024 (Unaudited)

(Amounts in thousands, except per share amounts)

| JPMorgan

Growth

Advantage Fund | JPMorgan

Mid Cap

Equity Fund | |

| | | |

Investments in non-affiliates, at value | | | |

Investments in affiliates, at value | | | |

Investments of cash collateral received from securities loaned, at value (See Note 2.C.) | | | |

| | | |

| | | |

| | | |

Interest from non-affiliates | | | |

Dividends from non-affiliates | | | |

Dividends from affiliates | | | |

Securities lending income (See Note 2.C.) | | | |

| | | |

| | | |

| | | |

| | | |

Collateral received on securities loaned (See Note 2.C.) | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Custodian and accounting fees | | | |

Trustees’ and Chief Compliance Officer’s fees | | | |

| | | |

| | | |

| | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Growth Advantage Fund | JPMorgan Mid Cap Equity Fund | |

| | | |

| | | |

Total distributable earnings (loss) | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Outstanding units of beneficial interest (shares)

($0.0001 par value; unlimited number of shares authorized): | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Class A — Redemption price per share | | | |

Class C — Offering price per share (b) | | | |

Class I — Offering and redemption price per share | | | |

Class R2 — Offering and redemption price per share | | | |

Class R3 — Offering and redemption price per share | | | |

Class R4 — Offering and redemption price per share | | | |

Class R5 — Offering and redemption price per share | | | |

Class R6 — Offering and redemption price per share | | | |

Class A maximum sales charge | | | |

Class A maximum public offering price per share

[net asset value per share/(100% – maximum sales charge)] | | | |

Cost of investments in non-affiliates | | | |

Cost of investments in affiliates | | | |

Investment securities on loan, at value (See Note 2.C.) | | | |

Cost of investment of cash collateral (See Note 2.C.) | | | |

(a)

Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding.

(b)

Redemption price for Class C Shares varies based upon length of time the shares are held.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF ASSETS AND LIABILITIESAS OF December 31, 2024 (Unaudited) (continued)

(Amounts in thousands, except per share amounts)

| JPMorgan

Mid Cap

Value Fund | |

| | |

Investments in non-affiliates, at value | | |

Investments in affiliates, at value | | |

Investments of cash collateral received from securities loaned, at value (See Note 2.C.) | | |

| | |

| | |

| | |

Interest from non-affiliates | | |

Dividends from non-affiliates | | |

Dividends from affiliates | | |

Securities lending income (See Note 2.C.) | | |

| | |

| | |

| | |

Collateral received on securities loaned (See Note 2.C.) | | |

| | |

| | |

| | |

| | |

| | |

| | |

Custodian and accounting fees | | |

Trustees’ and Chief Compliance Officer’s fees | | |

| | |

| | |

| | |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Mid Cap Value Fund | |

| | |

| | |

Total distributable earnings (loss) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Outstanding units of beneficial interest (shares)

($0.0001 par value; unlimited number of shares authorized): | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Class A — Redemption price per share | | |

Class C — Offering price per share (b) | | |

Class I — Offering and redemption price per share | | |

Class L — Offering and redemption price per share | | |

Class R2 — Offering and redemption price per share | | |

Class R3 — Offering and redemption price per share | | |

Class R4 — Offering and redemption price per share | | |

Class R5 — Offering and redemption price per share | | |

Class R6 — Offering and redemption price per share | | |

Class A maximum sales charge | | |

Class A maximum public offering price per share

[net asset value per share/(100% – maximum sales charge)] | | |

Cost of investments in non-affiliates | | |

Cost of investments in affiliates | | |

Investment securities on loan, at value (See Note 2.C.) | | |

Cost of investment of cash collateral (See Note 2.C.) | | |

(a)

Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding.

(b)

Redemption price for Class C Shares varies based upon length of time the shares are held.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF OPERATIONSFOR THE SIX MONTHS ENDED December 31, 2024 (Unaudited)

(Amounts in thousands)

| JPMorgan

Growth

Advantage Fund | JPMorgan

Mid Cap

Equity Fund | |

| | | |

Dividend income from non-affiliates | | | |

Dividend income from affiliates | | | |

Income from securities lending (net) (See Note 2.C.) | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Custodian and accounting fees | | | |

Interest expense to affiliates | | | |

| | | |

Trustees’ and Chief Compliance Officer’s fees | | | |

Printing and mailing costs | | | |

Registration and filing fees | | | |

Transfer agency fees (See Note 2.G.) | | | |

| | | |

| | | |

| | | |

Less expense reimbursements | | | |

| | | |

Net investment income (loss) | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Growth Advantage Fund | JPMorgan Mid Cap Equity Fund | |

REALIZED/UNREALIZED GAINS (LOSSES): | | | |

Net realized gain (loss) on transactions from: | | | |

Investments in non-affiliates | | | |

Investments in affiliates | | | |

| | | |

Change in net unrealized appreciation/depreciation on: | | | |

Investments in non-affiliates | | | |

Investments in affiliates | | | |

Change in net unrealized appreciation/depreciation | | | |

Net realized/unrealized gains (losses) | | | |

Change in net assets resulting from operations | | | |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF OPERATIONSFOR THE SIX MONTHS ENDED December 31, 2024 (Unaudited) (continued)

(Amounts in thousands)

| JPMorgan

Mid Cap

Value Fund | JPMorgan

Value

Advantage Fund |

| | |

Dividend income from non-affiliates | | |

Dividend income from affiliates | | |

Income from securities lending (net) (See Note 2.C.) | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Custodian and accounting fees | | |

| | |

Trustees’ and Chief Compliance Officer’s fees | | |

Printing and mailing costs | | |

Registration and filing fees | | |

Transfer agency fees (See Note 2.G.) | | |

| | |

| | |

| | |

Less expense reimbursements | | |

| | |

Net investment income (loss) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Mid Cap Value Fund | JPMorgan Value Advantage Fund |

REALIZED/UNREALIZED GAINS (LOSSES): | | |

Net realized gain (loss) on transactions from: | | |

Investments in non-affiliates | | |

Investments in affiliates | | |

| | |

Change in net unrealized appreciation/depreciation on: | | |

Investments in non-affiliates | | |

Investments in affiliates | | |

Change in net unrealized appreciation/depreciation | | |

Net realized/unrealized gains (losses) | | |

Change in net assets resulting from operations | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED

(Amounts in thousands)

| JPMorgan Growth Advantage Fund | JPMorgan Mid Cap Equity Fund |

| Six Months Ended

December 31, 2024

(Unaudited) | | Six Months Ended

December 31, 2024

(Unaudited) | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | |

Net investment income (loss) | | | | |

| | | | |

Change in net unrealized appreciation/depreciation | | | | |

Change in net assets resulting from operations | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Total distributions to shareholders | | | | |

| | | | |

Change in net assets resulting from capital transactions | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Mid Cap Growth Fund | JPMorgan Mid Cap Value Fund |

| Six Months Ended

December 31, 2024

(Unaudited) | | Six Months Ended

December 31, 2024

(Unaudited) | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | |

Net investment income (loss) | | | | |

| | | | |

Change in net unrealized appreciation/depreciation | | | | |

Change in net assets resulting from operations | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Total distributions to shareholders | | | | |

| | | | |

Change in net assets resulting from capital transactions | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED (continued)

(Amounts in thousands)

| JPMorgan Value Advantage Fund |

| Six Months Ended

December 31, 2024

(Unaudited) | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | |

Net investment income (loss) | | |

| | |

Change in net unrealized appreciation/depreciation | | |

Change in net assets resulting from operations | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Total distributions to shareholders | | |

| | |

Change in net assets resulting from capital transactions | | |

| | |

| | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Growth Advantage Fund | JPMorgan Mid Cap Equity Fund |

| Six Months Ended December 31, 2024

(Unaudited) | | Six Months Ended December 31, 2024

(Unaudited) | |

| | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class A capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class C capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class I capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R2 capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R3 capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R4 capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R5 capital transactions | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED (continued)

(Amounts in thousands)

| JPMorgan Growth Advantage Fund | JPMorgan Mid Cap Equity Fund |

| Six Months Ended December 31, 2024 (Unaudited) | | Six Months Ended December 31, 2024 (Unaudited) | |

CAPITAL TRANSACTIONS: (continued) | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R6 capital transactions | | | | |

Total change in net assets resulting from capital transactions | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R2 Shares | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R3 Shares | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R4 Shares | | | | |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Growth Advantage Fund | JPMorgan Mid Cap Equity Fund |

| Six Months Ended December 31, 2024 (Unaudited) | | Six Months Ended December 31, 2024 (Unaudited) | |

SHARE TRANSACTIONS: (continued) | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R5 Shares | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R6 Shares | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED (continued)

(Amounts in thousands)

| JPMorgan Mid Cap Growth Fund | JPMorgan Mid Cap Value Fund |

| Six Months Ended December 31, 2024

(Unaudited) | | Six Months Ended December 31, 2024

(Unaudited) | |

| | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class A capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class C capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class I capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class L capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R2 capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R3 capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R4 capital transactions | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Mid Cap Growth Fund | JPMorgan Mid Cap Value Fund |

| Six Months Ended December 31, 2024 (Unaudited) | | Six Months Ended December 31, 2024 (Unaudited) | |

CAPITAL TRANSACTIONS: (continued) | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R5 capital transactions | | | | |

| | | | |

Proceeds from shares issued | | | | |

| | | | |

| | | | |

Change in net assets resulting from Class R6 capital transactions | | | | |

Total change in net assets resulting from capital transactions | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R2 Shares | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED (continued)

(Amounts in thousands)

| JPMorgan Mid Cap Growth Fund | JPMorgan Mid Cap Value Fund |

| Six Months Ended December 31, 2024 (Unaudited) | | Six Months Ended December 31, 2024 (Unaudited) | |

SHARE TRANSACTIONS: (continued) | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R3 Shares | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R4 Shares | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R5 Shares | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Change in Class R6 Shares | | | | |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Value Advantage Fund |

| Six Months Ended December 31, 2024

(Unaudited) | |

| | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class A capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class C capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class I capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class L capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class R2 capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class R3 capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class R4 capital transactions | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED (continued)

(Amounts in thousands)

| JPMorgan Value Advantage Fund |

| Six Months Ended December 31, 2024 (Unaudited) | |

CAPITAL TRANSACTIONS: (continued) | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class R5 capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class R6 capital transactions | | |

Total change in net assets resulting from capital transactions | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Change in Class R2 Shares | | |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Value Advantage Fund |

| Six Months Ended December 31, 2024 (Unaudited) | |

SHARE TRANSACTIONS: (continued) | | |

| | |

| | |

| | |

| | |

Change in Class R3 Shares | | |

| | |

| | |

| | |

| | |

Change in Class R4 Shares | | |

| | |

| | |

| | |

| | |

Change in Class R5 Shares | | |

| | |

| | |

| | |

| | |

Change in Class R6 Shares | | |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

FINANCIAL HIGHLIGHTSFOR THE PERIODS INDICATED

| Per share operating performance |

| | | |

| Net asset

value,

beginning

of period | Net

investment

income

(loss)(b) | Net realized

and unrealized

gains (losses)

on investments | Total from

investment

operations | | | |

JPMorgan Growth Advantage Fund | | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| |

| | | Ratios to average net assets(a) |

Net asset

value,

end of

period | Total return

(excludes

sales charge)(c)(d) | Net assets,

end of

period

(000's) | | Net

investment

income

(loss) | Expenses without

waivers and

reimbursements | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

FINANCIAL HIGHLIGHTSFOR THE PERIODS INDICATED (continued)

| Per share operating performance |

| | | |

| Net asset

value,

beginning

of period | Net

investment

income

(loss)(b) | Net realized

and unrealized

gains (losses)

on investments | Total from

investment

operations | | | |

JPMorgan Growth Advantage Fund (continued) | | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

|

| Annualized for periods less than one year, unless otherwise noted. |

| Calculated based upon average shares outstanding. |

| Not annualized for periods less than one year. |

| Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| Includes interest expense, if applicable, which is less than 0.005% unless otherwise noted. |

| Certain non-recurring expenses incurred by the Fund were not annualized for the period indicated. |

| Amount rounds to less than $0.005. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| |

| | | Ratios to average net assets(a) |

Net asset

value,

end of

period | Total return

(excludes

sales charge)(c)(d) | Net assets,

end of

period

(000's) | | Net

investment

income

(loss) | Expenses without

waivers and

reimbursements | |

|

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

FINANCIAL HIGHLIGHTSFOR THE PERIODS INDICATED

| Per share operating performance |

| | | |

| Net asset

value,

beginning

of period | Net

investment

income

(loss)(b) | Net realized

and unrealized

gains (losses)

on investments | Total from

investment

operations | | | |

JPMorgan Mid Cap Equity Fund | | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Six Months Ended December 31, 2024 (Unaudited) | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| |

| | | Ratios to average net assets(a) |

Net asset

value,

end of

period | Total return

(excludes

sales charge)(c)(d) | Net assets,

end of

period

(000's) | | Net

investment

income

(loss) | Expenses without

waivers and

reimbursements | |

| | | | | | |

| | | | | | |