UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08189

J.P. Morgan Fleming Mutual Fund Group, Inc.

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: June 30

Date of reporting period: July 1, 2022 through December 31, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

Semi-Annual Report

J.P. Morgan Mid Cap/Multi-Cap Funds

December 31, 2022 (Unaudited)

JPMorgan Growth Advantage Fund |

JPMorgan Mid Cap Equity Fund |

JPMorgan Mid Cap Growth Fund |

JPMorgan Mid Cap Value Fund |

JPMorgan Value Advantage Fund |

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

Letter to Shareholders

February 13, 2023 (Unaudited)

Dear Shareholder,

Financial markets have rebounded somewhat as the U.S. and other developed market economies have shown notable resilience in the face of higher inflation, rising interest rates and the ongoing war in Ukraine. While the factors that weighed on equity and bond markets in 2022 largely remain, there are signals that inflationary pressures may have peaked and the long-term economic outlook appears positive.

|

“Investors may face continued economic and geopolitical challenges in the year ahead. However, some of the acute risks encountered in 2022 appear to have receded and last year’s reset in asset prices may provide attractive investment opportunities.” — Brian S. Shlissel

|

While U.S. economic growth was surprisingly strong in the closing months of 2022, with broad gains in employment and consumer spending in the final months of the year, the U.S. Federal Reserve’s efforts to counter inflationary pressure through sharply higher interest rates could slow economic momentum in the months ahead.

Corporate earnings have been squeezed by higher costs for materials and labor, while the strong U.S. dollar has hindered export revenues. However, the impact of higher prices and interest rates has not landed on all sectors of the economy evenly. Energy sector profits have soared over the past year, while earnings in housing and construction sectors have declined.

Across Europe, the war in Ukraine has driven up prices for energy, food and a range of other goods and has fueled negative consumer sentiment. The prolonged nature of the conflict and its potential to spread remain key concerns among policymakers, diplomats, military planners, economists and investors. It is worth noting that Europe’s largest industrialized nations in concert with the European Union have moved swiftly to secure alternatives to Russian sources of natural gas and petroleum, which has eased an energy crisis that began last year.

Investors may face continued economic and geopolitical challenges in the year ahead. However, some of the acute risks encountered in 2022 appear to have receded and last year’s reset in asset prices may provide attractive investment opportunities. A long-term view and a properly diversified portfolio, in our opinion, remain key elements to a successful investment approach.

Our broad array of investment solutions seeks to provide investors with ability to build durable portfolios that can help them meet their financial goals.

Sincerely,

Brian S. Shlissel

President - J.P. Morgan Funds

J.P. Morgan Asset Management

1-800-480-4111 or www.jpmorganfunds.com for more information

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

J.P. Morgan Mid Cap/Multi-Cap Funds

MARKET OVERVIEW

SIX MONTHS ENDED December 31, 2022 (Unaudited)

Overall, leading U.S. equity indexes ended the period with positive returns, rebounding from a broad sell-off in August and September. Investors were largely focused on the pace and size of interest rate increases by the U.S. Federal Reserve (the “Fed”), while the highest inflation rate in 40 years, the war in Ukraine and pandemic-related disruptions in China weighed on global financial markets.

During the second half of 2022, the Fed raised interest rates in July, September, November and December, following three increases in the first half of the year. Meanwhile, corporate earnings for the second and third quarters of 2022, generally were better than expected given a cooling economy and slower consumer spending. The U.S. unemployment rate remained historically low, hovering between 3.5% and 3.7% for the six-month period.

Within U.S. equity markets, the energy sector outperformed amid constrained supply from Russia and Europe’s efforts to find alternative sources of petroleum and natural gas. The utilities sector also performed well as investors sought attractive dividend yields and companies less exposed to economic cycles. The real estate sector largely underperformed amid rising interest rates, while changing consumer habits and investor concerns over increased competition weighed on the communication services sector.

Overall, mid cap growth stocks generated the highest U.S. equity returns, while large cap and mid cap value stocks outperformed small cap stocks and large cap growth stocks. For the six month period, the Russell Mid Cap Index returned 5.43%, the Russell Mid Cap Growth Index returned 6.20% and the Russell Mid Cap Value Index returned 5.01%.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Growth Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited)

| |

Fund (Class A Shares, without a sales charge) * | |

Russell 3000 Growth Index | |

Net Assets as of 12/31/2022 (In Thousands) | |

INVESTMENT OBJECTIVE **

The JPMorgan Growth Advantage Fund (the “Fund”) seeks to provide long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class A Shares, without a sales charge, underperformed the Russell 3000 Growth Index (the “Benchmark”) for the six months ended December 31, 2022.

The Fund’s security selection in the information technology and consumer discretionary sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection and overweight positions in the health care and industrials sectors were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight position in Catalent Inc., Zoom Video Communications Inc. and Tesla Inc. Shares of Catalent, a pharmaceuticals maker, fell after the company reported lower-than-expected earnings and revenue for the third quarter of 2022 and lowered its forecast for the full year. Shares of Zoom Video Communications, a video conferencing service provider, fell after the company reported lower-than-expected revenue for the second quarter of 2022 and issued a weaker-than-expected forecast. Shares of Tesla, an electric vehicle manufacturer, fell amid investor concerns about both weaker delivery volumes and Chief Executive Elon Musk’s controversial decisions as majority owner and chief executive of Twitter Inc.

Leading individual contributors to relative performance included the Fund’s overweight positions in Horizon Therapeutics PLC, Burlington Stores Inc. and Alnylam Pharmaceuticals Inc. Shares of Horizon Therapeutics PLC, a pharmaceuticals developer based in Ireland, rose after the company agreed to be acquired by Amgen Inc. for about $28 billion. Shares of Burlington Stores, an apparel retail chain, rose after the company reported weak but better-than-expected results for the third quarter of 2022. Shares of Alnylam Pharmaceuticals, a drug development company, rose amid strong product revenue for the second quarter of 2022 and after the company reported positive Phase 3 clinical trial results for its amyloidosis treatment.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies across market capitalizations in an effort to construct portfolios of stocks that have strong fundamentals. The Fund’s portfolio managers sought to invest in high quality companies with durable franchises that, in their view, possessed the ability to

generate strong future earnings growth.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| | |

| | |

| Mastercard, Inc., Class A | |

| | |

| | |

| Regeneron Pharmaceuticals, Inc. | |

| | |

| | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Growth Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF December 31, 2022

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

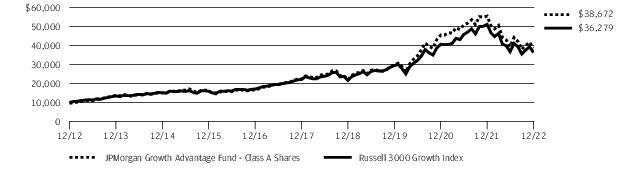

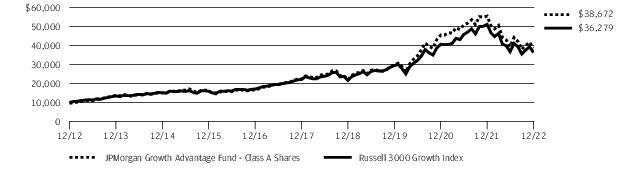

TEN YEAR FUND PERFORMANCE (12/31/12 TO 12/31/22)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2 and Class R3 Shares prior to their inception dates are based on the performance of Class A Shares. The actual returns for Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A Shares. The actual returns for Class R3 Shares would have been similar to those shown because Class R3 Shares have similar expenses to Class A Shares.

Returns for Class R4 Shares prior to their inception dates are based on the performance of Class I Shares. The actual returns of Class R4 Shares would have been different than those shown because Class R4 Shares have different expenses to Class I Shares.

Returns for Class R6 Shares prior to their inception date are based on the performance of Class R5 Shares. The actual returns of Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses than Class R5 and Class I Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Growth Advantage Fund and the Russell 3000 Growth Index from December 31, 2012 to December 31, 2022. The performance of the

Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the Russell 3000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell 3000 Growth Index is an unmanaged index which measures the performance of those Russell 3000 companies (largest 3000 U.S. companies) with higher price-to-book ratios and higher forecasted growth values. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited)

| |

| |

| |

Net Assets as of 12/31/2022 (In Thousands) | |

INVESTMENT OBJECTIVE **

The JPMorgan Mid Cap Equity Fund (the “Fund”) seeks long-term capital growth.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Russell Midcap Index (the “Benchmark”) for the six months ended December 31, 2022.

The Fund’s security selection in the information technology and energy sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the health care and industrials sectors was a contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in IAC Inc., Newell Brands Inc. and Catalent Inc. Shares of IAC, a media and internet content provider, fell after the company reported lower-than-expected results for the second and third quarters of 2022. Shares of Newell Brands, a manufacturer of housewares and specialty products, fell after the company issued weaker-than-expected earnings forecasts. Shares of Catalent, a pharmaceuticals maker, fell after the company reported lower-than-expected earnings and revenue for the third quarter of 2022 and lowered its forecast for the full year 2022.

Leading individual contributors to relative performance included the Fund’s overweight positions in Hubbell Inc., Horizon Therapeutics PLC and Ametek Inc. Shares of Hubbell, a manufacturer of electrical components and equipment, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2022 and amid investor expectations the company will benefit from planned infrastructural upgrades to U.S. electricity grids. Shares of Horizon Therapeutics PLC, a pharmaceuticals developer based in Ireland, rose after the company agreed to be acquired by Amgen Inc. for about $28 billion. Shares of Ametek, a manufacturer of electrical components and equipment, rose after the company reported better-than-expected earnings and revenue for the second and third quarters of 2022 and raised its earnings forecast for the full year 2022.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers employed a bottom-up approach to stock selection, constructing a portfolio based on company fundamentals, quantitative screening and proprietary fundamental analysis. The Fund’s portfolio managers sought to identify dominant franchises with predictable business models they deemed capable of achieving, in their view, sustained growth, as well as undervalued companies with the potential to

grow their intrinsic value per share.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| | |

| | |

| | |

| Ameriprise Financial, Inc. | |

| Laboratory Corp. of America Holdings | |

| | |

| Huntington Bancshares, Inc. | |

| | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Equity Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF December 31, 2022

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

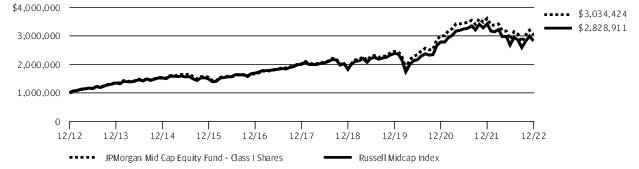

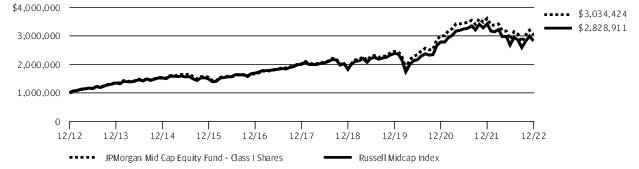

TEN YEAR FUND PERFORMANCE (12/31/12 TO 12/31/22)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns of Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A Shares.

Returns for Class R5 and Class R6 Shares prior to their inception date are based on the performance of Class I Shares. The actual returns of Class R5 and Class R6 Shares would have been different than those shown because Class R5 and Class R6 Shares have different expenses than Class I Shares.

The graph illustrates comparative performance for $1,000,000 invested in the Class I Shares of JPMorgan Mid Cap Equity Fund and the Russell Midcap Index from December 31, 2012 to December 31, 2022. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Index

does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the bench mark, if applicable. The Russell Midcap Index is an unmanaged index which measures the performance of the 800 smallest companies in the Russell 1000 Index. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited)

| |

| |

Russell Midcap Growth Index | |

Net Assets as of 12/31/2022 (In Thousands) | |

INVESTMENT OBJECTIVE **

The JPMorgan Mid Cap Growth Fund (the “Fund”) seeks growth of capital.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Russell Midcap Growth Index (the “Benchmark”) for the six months ended December 31, 2022.

The Fund’s security selection in the information technology and financials sectors

was a leading detractor from performance relative to the Benchmark, while the Fund’s

security selection in the industrials and health care sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s overweight positions in Catalent Inc. and Zoom Video Communications Inc., and its out-of-Benchmark position in Palo Alto Networks Inc. Shares of Catalent, a pharmaceuticals maker, fell after the company reported lower-than-expected earnings and revenue for the third quarter of 2022 and lowered its forecast for the full year. Shares of Zoom Video Communications, a video conferencing service provider, fell after the company reported lower-than-expected revenue for the second quarter of 2022 and issued a weaker-than-expected forecast. Shares of Palo Alto Networks, a cybersecurity systems provider, fell in late December 2022 amid a broad sell-off in cybersecurity stocks due to investor concerns about slower near-term growth.

Leading individual contributors to relative performance included the Fund’s overweight positions in Horizon Therapeutics PLC, Toro Co. and Trane Technologies PLC. Shares of Horizon Therapeutics PLC, a pharmaceuticals developer based in Ireland, rose after the company agreed to be acquired by Amgen Inc. for about $28 billion. Shares of Toro, a manufacturer of tractors, mowers and related landscaping equipment, rose after the company reported consecutive quarters of better-than-expected earnings and increased its quarterly dividend. Shares of Trane Technologies, a provider of heating, ventilation and air conditioning

systems and services based in Ireland, rose after the company

reported better-than-expected earnings and revenue for the third quarter of 2022 and raised its earnings forecast.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection, researching individual companies in an effort to construct a portfolio of stocks that have strong fundamentals. The Fund’s portfolio managers sought to invest in high quality companies with durable franchises that, in their view, possessed the ability to generate strong future earnings

growth.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| | |

| | |

| | |

| Agilent Technologies, Inc. | |

| | |

| | |

| | |

| Hilton Worldwide Holdings, Inc. | |

| Cadence Design Systems, Inc. | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Growth Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF December 31, 2022

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

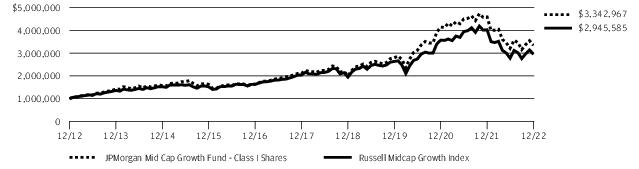

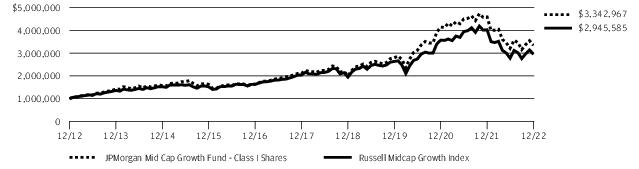

TEN YEAR FUND PERFORMANCE (12/31/12 TO 12/31/22)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for the Class R3 and Class R4 Shares prior to their inception dates are based on the performance of Class I Shares. Prior performance for Class R3 and Class R4 Shares has been adjusted to reflect the differences in expenses between classes.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Mid Cap Growth Fund and the Russell Midcap Growth Index from December 31, 2012 to December 31, 2022. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Midcap Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities

included in the benchmark, if applicable. The Russell Midcap Growth Index is an unmanaged index which measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. Investors cannot invest directly in an index.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Value Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited)

| |

| |

Russell Midcap Value Index | |

Net Assets as of 12/31/2022 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan Mid Cap Value Fund (the “Fund”) seeks growth from capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class L Shares outperformed the Russell Midcap Value Index (the “Benchmark”) for the six months ended December 31, 2022.

The Fund’s security selection in the information technology and health care sectors was a leading contributor to performance relative to the Benchmark, while the Fund’s security selection in the communication services and utilities sectors was a leading detractor from relative performance.

Leading individual contributors to relative performance included the Fund’s overweight positions in Ameriprise Financial Inc., Hubbell Inc. and Arch Capital Group Ltd. Shares of Ameriprise Financial, a financial services provider, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2022. Shares of Hubbell, an electronic components and equipment manufacturer, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2022 and raised its earnings in anticipation of increased federal government spending on electrical grid upgrades. Shares of Arch Capital Group, a property and casualty insurer, rose after the company reported better-than-expected earnings and revenue for the third quarter of 2022 and after the company became a component of the S&P 500 Index.

Leading individual detractors from relative performance included the Fund’s overweight positions in IAC Inc., Newell Brands Inc. and Liberty Broadband Corp. Shares of IAC, a media and internet content provider, fell after the company reported lower-than-expected results for the second and third quarters of 2022. Shares of Newell Brands, a manufacturer of housewares and specialty products, fell after the company issued weaker-than-expected earnings forecasts. Shares of Liberty Broadband, a cable and satellite TV provider, fell amid broad weakness in communications sector stocks.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection and sought to identify durable franchises possessing the ability to generate, in their view, sustainable

levels of free cash flow.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| Ameriprise Financial, Inc. | |

| Laboratory Corp. of America Holdings | |

| | |

| Huntington Bancshares, Inc. | |

| | |

| | |

| | |

| | |

| | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Value Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

AVERAGE ANNUAL TOTAL RETURNS AS OF December 31, 2022

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

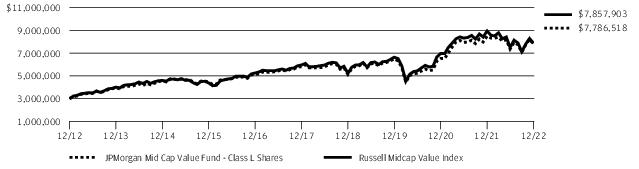

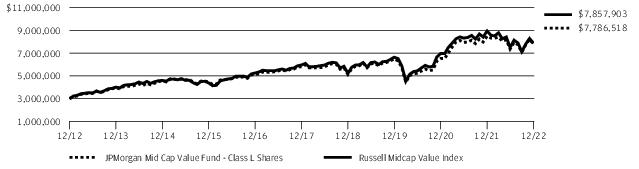

TEN YEAR FUND PERFORMANCE (12/31/12 TO 12/31/22)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R3 Shares prior to their inception dates are based on the performance of Class A Shares. The actual returns of Class R3 Shares would have been lower than those shown because Class R3 Shares have higher expenses than Class A Shares.

Returns for the Class R4 Shares prior to their inception date are based on the performance of Class I Shares. The actual returns of Class R4 Shares would have been lower because Class R4 Shares have higher expenses than Class I Shares.

Returns for the Class R5 and R6 Shares prior to their inception date are based on the performance of Class L Shares. The actual returns of Class R5 Shares would have been lower than those shown because Class R5 Shares have higher expenses than Class L Shares. The actual returns for Class R6 Shares would have been different than those shown because Class R6 Shares have different expenses to Class L Shares.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan Mid Cap Value Fund and the Russell Midcap

Value Index from December 31, 2012 to December 31, 2022. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell Mid-cap Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell Midcap Value Index is an unmanaged index which measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. Investors cannot invest directly in an index.

Class L Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Value Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited)

| |

| |

| |

Net Assets as of 12/31/2022 (In Thousands) | |

INVESTMENT OBJECTIVE**

The JPMorgan Value Advantage Fund (the “Fund”) seeks to provide long-term total return from a combination of income and capital gains.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class L Shares underperformed the Russell 3000 Value Index (the “Benchmark”) for the six months ended December 31, 2022.

The Fund’s security selection in the financials and industrials sectors was a leading detractor from performance relative to the Benchmark, while the Fund’s security selection in the information technology and consumer discretionary sectors was a leading contributor to relative performance.

Leading individual detractors from relative performance included the Fund’s underweight position in Exxon Mobil Corp. and its overweight positions in Liberty Broadband Corp. and IAC Inc. Shares of Exxon Mobil, an integrated petroleum and natural gas company, rose after reporting strong earnings and revenue growth as global energy prices remained elevated during the period. Shares of Liberty Broadband, a cable and satellite TV provider, fell amid broad weakness in communications sector stocks. Shares of IAC, a media and internet content provider, fell amid declining revenues and consecutive quarters of lower-than-expected earnings.

Leading individual contributors to relative performance included the Fund’s overweight position in Dick’s Sporting Goods Inc. and its underweight positions in Meta Platforms Inc. and Intel Corp. Shares of Dick’s Sporting Goods, a recreational products and apparel retail chain, rose after the company reported better-than-expected earnings, revenue and store sales for the third quarter of 2022. Shares of Meta Platforms, parent company of social media platform Facebook, fell after the company issued a lower-than-expected revenue forecast and amid investor concerns about the company’s push into virtual reality entertainment. Shares of Intel, a semiconductor manufacturer not held in the Fund, fell with the broader

semiconductor sub-sector amid lower industry growth forecasts and changes in global technology supply chains.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers utilized a bottom-up approach to stock selection and sought to identify durable franchises possessing the ability to generate, in the portfolio managers’

view, significant levels of free cash flow.

TOP TEN HOLDINGS OF THE

PORTFOLIO AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| | |

| Berkshire Hathaway, Inc., Class B | |

| | |

| | |

| | |

| | |

| | |

| | |

| Capital One Financial Corp. | |

| | |

PORTFOLIO COMPOSITION BY SECTOR

AS OF December 31, 2022 | PERCENT OF

TOTAL

INVESTMENTS |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

*

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Value Advantage Fund

FUND COMMENTARY

SIX MONTHS ENDED December 31, 2022 (Unaudited) (continued)

the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

**

The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

AVERAGE ANNUAL TOTAL RETURNS AS OF December 31, 2022

|

| |

| Sales Charge for Class A Shares is 5.25%. |

| Assumes a 1% CDSC (contingent deferred sales charge) for the 6 month and one year periods and 0% CDSC thereafter. |

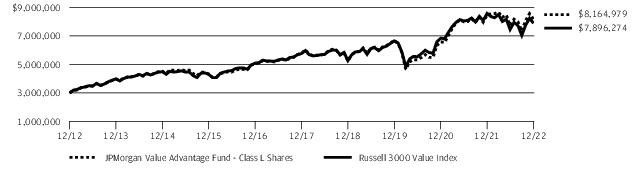

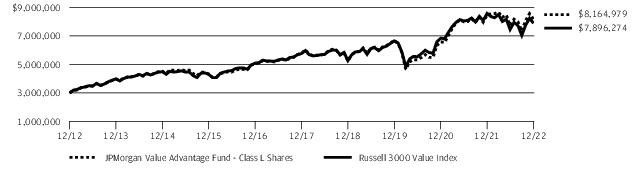

TEN YEAR FUND PERFORMANCE (12/31/12 TO 12/31/22)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class R2 and Class R3 Shares prior to their inception date are based on the performance of Class A Shares. The actual returns of Class R2 Shares would have been lower than those shown because Class R2 Shares have higher expenses than Class A Shares. Returns for Class R3 Shares would have been similar to those shown because Class R3 Shares have similar expenses to Class A Shares.

Returns for the Class R4 Shares prior to their inception date are based on the performance of Class I Shares. The actual returns of Class R4 Shares would have been similar to those shown because Class R4 Shares have similar expenses to Class I Shares.

Returns for the Class R5 and Class R6 Shares prior to their inception date are based on the performance of Class L Shares. The actual returns for Class R5 and Class R6 Shares would have been different than those shown because Class R5 and Class R6 Shares have different expenses to Class L Shares.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan Value Advantage Fund and the Russell 3000

Value Index from December 31, 2012 to December 31, 2022. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Russell 3000 Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Russell 3000 Value Index is an unmanaged index which measures the performance of those Russell 3000 companies (largest 3000 U.S. companies) with lower price-to-book ratios and lower forecasted growth values. Investors cannot invest directly in an index.

Class L Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C reflects Class A performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Growth Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited)

| | |

|

|

| | |

|

| | |

| | |

| | |

|

Constellation Brands, Inc., Class A | | |

|

Alnylam Pharmaceuticals, Inc. * | | |

| | |

| | |

| | |

Horizon Therapeutics plc * | | |

| | |

Regeneron Pharmaceuticals, Inc. * | | |

| | |

|

| | |

|

| | |

Charles Schwab Corp. (The) | | |

| | |

| | |

| | |

Commercial Services & Supplies — 1.3% |

| | |

Communications Equipment — 0.4% |

| | |

Construction & Engineering — 2.0% |

| | |

Electrical Equipment — 2.0% |

| | |

| | |

| | |

Electronic Equipment, Instruments & Components — 1.2% |

Keysight Technologies, Inc. * | | |

Zebra Technologies Corp., Class A * | | |

| | |

| | |

|

Energy Equipment & Services — 0.4% |

| | |

Health Care Equipment & Supplies — 4.2% |

| | |

| | |

| | |

Intuitive Surgical, Inc. * | | |

| | |

Health Care Providers & Services — 4.6% |

| | |

| | |

| | |

| | |

Hotels, Restaurants & Leisure — 3.2% |

| | |

| | |

Hilton Worldwide Holdings, Inc. | | |

Royal Caribbean Cruises Ltd. * (a) | | |

| | |

Household Durables — 0.5% |

| | |

|

| | |

Interactive Media & Services — 4.5% |

Alphabet, Inc., Class C * | | |

| | |

| | |

Internet & Direct Marketing Retail — 4.0% |

| | |

|

| | |

| | |

Mastercard, Inc., Class A | | |

| | |

| | |

Life Sciences Tools & Services — 2.1% |

Mettler-Toledo International, Inc. * | | |

Thermo Fisher Scientific, Inc. | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

|

| | |

| | |

| | |

| | |

|

Trade Desk, Inc. (The), Class A * | | |

|

| | |

Oil, Gas & Consumable Fuels — 2.7% |

| | |

| | |

| | |

|

Estee Lauder Cos., Inc. (The), Class A | | |

|

| | |

Jazz Pharmaceuticals plc * | | |

Royalty Pharma plc, Class A | | |

| | |

Professional Services — 0.6% |

| | |

|

Old Dominion Freight Line, Inc. | | |

Semiconductors & Semiconductor Equipment — 7.0% |

Advanced Micro Devices, Inc. * | | |

| | |

| | |

| | |

| | |

| | |

SolarEdge Technologies, Inc. * | | |

| | |

| | |

|

Confluent, Inc., Class A * (a) | | |

Crowdstrike Holdings, Inc., Class A * | | |

| | |

| | |

| | |

Palo Alto Networks, Inc. * | | |

| | |

|

|

| | |

| | |

Zoom Video Communications, Inc., Class A * | | |

| | |

| | |

|

Burlington Stores, Inc. * | | |

National Vision Holdings, Inc. * | | |

| | |

| | |

| | |

Technology Hardware, Storage & Peripherals — 7.4% |

| | |

Textiles, Apparel & Luxury Goods — 0.7% |

| | |

Total Common Stocks

(Cost $8,482,397) | | |

Short-Term Investments — 1.0% |

Investment Companies — 0.5% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c)

(Cost $62,872) | | |

Investment of Cash Collateral from Securities Loaned — 0.5% |

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.56% (b) (c) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Growth Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited) (continued)

| | |

Short-Term Investments — continued |

Investment of Cash Collateral from Securities Loaned — continued |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c) | | |

Total Investment of Cash Collateral from Securities Loaned

(Cost $52,609) | | |

Total Short-Term Investments

(Cost $115,481) | | |

Total Investments — 100.1%

(Cost $8,597,878) | | |

Liabilities in Excess of Other Assets — (0.1)% | | |

| | |

Percentages indicated are based on net assets. |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $51,399. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2022. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited)

| | |

|

Aerospace & Defense — 0.3% |

| | |

|

| | |

| | |

| | |

|

Citizens Financial Group, Inc. | | |

| | |

| | |

First Citizens BancShares, Inc., Class A | | |

| | |

Huntington Bancshares, Inc. (a) | | |

| | |

| | |

| | |

| | |

| | |

|

Constellation Brands, Inc., Class A | | |

| | |

| | |

|

Alnylam Pharmaceuticals, Inc. * | | |

| | |

| | |

Horizon Therapeutics plc * | | |

| | |

Neurocrine Biosciences, Inc. * | | |

| | |

| | |

|

| | |

Fortune Brands Innovations, Inc. | | |

| | |

| | |

|

Ameriprise Financial, Inc. | | |

| | |

FactSet Research Systems, Inc. | | |

LPL Financial Holdings, Inc. | | |

| | |

| | |

|

Capital Markets — continued |

| | |

| | |

Raymond James Financial, Inc. | | |

| | |

| | |

T. Rowe Price Group, Inc. (a) | | |

Tradeweb Markets, Inc., Class A | | |

| | |

|

| | |

| | |

| | |

Commercial Services & Supplies — 1.0% |

| | |

| | |

| | |

Communications Equipment — 1.4% |

| | |

| | |

| | |

| | |

Construction & Engineering — 1.4% |

| | |

| | |

| | |

| | |

Construction Materials — 0.6% |

Martin Marietta Materials, Inc. | | |

|

Discover Financial Services | | |

Containers & Packaging — 1.5% |

| | |

Packaging Corp. of America | | |

| | |

| | |

|

| | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited) (continued)

| | |

Common Stocks — continued |

Diversified Consumer Services — 0.2% |

Bright Horizons Family Solutions, Inc. * (a) | | |

Diversified Financial Services — 0.4% |

| | |

Electric Utilities — 2.5% |

| | |

| | |

| | |

| | |

Electrical Equipment — 3.0% |

| | |

| | |

| | |

| | |

Electronic Equipment, Instruments & Components — 3.4% |

| | |

| | |

| | |

Keysight Technologies, Inc. * | | |

Teledyne Technologies, Inc. * | | |

Zebra Technologies Corp., Class A * | | |

| | |

Energy Equipment & Services — 0.2% |

| | |

|

Take-Two Interactive Software, Inc. * | | |

Equity Real Estate Investment Trusts (REITs) — 5.7% |

American Homes 4 Rent, Class A | | |

AvalonBay Communities, Inc. | | |

Boston Properties, Inc. (a) | | |

Brixmor Property Group, Inc. | | |

Essex Property Trust, Inc. | | |

Federal Realty Investment Trust (a) | | |

Host Hotels & Resorts, Inc. | | |

| | |

| | |

Mid-America Apartment Communities, Inc. | | |

| | |

| | |

Rexford Industrial Realty, Inc. | | |

| | |

| | |

| | |

|

Equity Real Estate Investment Trusts (REITs) — continued |

| | |

| | |

| | |

Food & Staples Retailing — 0.9% |

| | |

| | |

| | |

|

| | |

|

| | |

Health Care Equipment & Supplies — 4.2% |

| | |

| | |

Globus Medical, Inc., Class A * (a) | | |

| | |

IDEXX Laboratories, Inc. * | | |

| | |

| | |

| | |

Zimmer Biomet Holdings, Inc. | | |

| | |

Health Care Providers & Services — 5.2% |

Acadia Healthcare Co., Inc. * | | |

| | |

| | |

| | |

| | |

Laboratory Corp. of America Holdings | | |

| | |

Universal Health Services, Inc., Class B | | |

| | |

Hotels, Restaurants & Leisure — 3.0% |

| | |

| | |

Chipotle Mexican Grill, Inc. * | | |

| | |

| | |

Hilton Worldwide Holdings, Inc. | | |

Royal Caribbean Cruises Ltd. * | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Household Durables — 1.2% |

| | |

| | |

Mohawk Industries, Inc. * | | |

| | |

| | |

Household Products — 0.3% |

| | |

|

Arch Capital Group Ltd. * | | |

| | |

Hartford Financial Services Group, Inc. (The) | | |

| | |

| | |

| | |

RenaissanceRe Holdings Ltd. (Bermuda) | | |

| | |

| | |

Interactive Media & Services — 0.7% |

| | |

| | |

| | |

Internet & Direct Marketing Retail — 0.2% |

Chewy, Inc., Class A * (a) | | |

|

FleetCor Technologies, Inc. * | | |

| | |

| | |

| | |

| | |

| | |

| | |

Life Sciences Tools & Services — 1.9% |

10X Genomics, Inc., Class A * | | |

Agilent Technologies, Inc. | | |

Maravai LifeSciences Holdings, Inc., Class A * | | |

Mettler-Toledo International, Inc. * | | |

West Pharmaceutical Services, Inc. | | |

| | |

|

| | |

| | |

|

|

| | |

| | |

Lincoln Electric Holdings, Inc. | | |

Middleby Corp. (The) * (a) | | |

| | |

| | |

| | |

| | |

|

Liberty Broadband Corp., Class C * | | |

Liberty Media Corp.-Liberty SiriusXM, Class C * | | |

Trade Desk, Inc. (The), Class A * | | |

| | |

|

| | |

|

| | |

|

| | |

| | |

| | |

| | |

Oil, Gas & Consumable Fuels — 3.1% |

| | |

| | |

| | |

| | |

| | |

Williams Cos., Inc. (The) | | |

| | |

|

| | |

|

Jazz Pharmaceuticals plc * | | |

Royalty Pharma plc, Class A | | |

| | |

Professional Services — 0.3% |

| | |

Real Estate Management & Development — 0.5% |

CBRE Group, Inc., Class A * (a) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Equity Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited) (continued)

| | |

Common Stocks — continued |

|

Old Dominion Freight Line, Inc. | | |

Semiconductors & Semiconductor Equipment — 1.7% |

Advanced Micro Devices, Inc. * | | |

Enphase Energy, Inc. * (a) | | |

| | |

| | |

SolarEdge Technologies, Inc. * | | |

| | |

| | |

| | |

|

Cadence Design Systems, Inc. * | | |

Clear Secure, Inc., Class A (a) | | |

Confluent, Inc., Class A * | | |

Crowdstrike Holdings, Inc., Class A * | | |

| | |

| | |

HashiCorp, Inc., Class A * | | |

| | |

Palo Alto Networks, Inc. * | | |

Procore Technologies, Inc. * | | |

| | |

Zoom Video Communications, Inc., Class A * | | |

| | |

| | |

|

| | |

| | |

| | |

Burlington Stores, Inc. * | | |

| | |

| | |

National Vision Holdings, Inc. * | | |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 1.8% |

| | |

Lululemon Athletica, Inc. * | | |

| | |

|

Textiles, Apparel & Luxury Goods — continued |

| | |

| | |

| | |

Thrifts & Mortgage Finance — 0.4% |

| | |

Trading Companies & Distributors — 0.3% |

| | |

Total Common Stocks

(Cost $2,438,130) | | |

Short-Term Investments — 5.6% |

Investment Companies — 2.8% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c)

(Cost $85,568) | | |

Investment of Cash Collateral from Securities Loaned — 2.8% |

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.56% (b) (c) | | |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c) | | |

Total Investment of Cash Collateral from Securities Loaned

(Cost $88,139) | | |

Total Short-Term Investments

(Cost $173,707) | | |

Total Investments — 103.3%

(Cost $2,611,837) | | |

Liabilities in Excess of Other Assets — (3.3)% | | |

| | |

Percentages indicated are based on net assets. |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $85,712. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2022. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Growth Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited)

| | |

|

Aerospace & Defense — 0.7% |

| | |

|

| | |

|

| | |

| | |

| | |

| | |

|

Constellation Brands, Inc., Class A | | |

|

Alnylam Pharmaceuticals, Inc. * | | |

| | |

| | |

Horizon Therapeutics plc * | | |

| | |

Neurocrine Biosciences, Inc. * | | |

| | |

| | |

|

| | |

|

| | |

FactSet Research Systems, Inc. | | |

LPL Financial Holdings, Inc. | | |

| | |

| | |

| | |

Tradeweb Markets, Inc., Class A | | |

| | |

Commercial Services & Supplies — 2.3% |

| | |

| | |

| | |

Communications Equipment — 1.7% |

| | |

| | |

| | |

Construction & Engineering — 3.5% |

| | |

| | |

|

Construction & Engineering — continued |

| | |

| | |

| | |

Diversified Consumer Services — 0.5% |

Bright Horizons Family Solutions, Inc. * | | |

Electrical Equipment — 2.2% |

| | |

| | |

| | |

Electronic Equipment, Instruments & Components — 2.8% |

| | |

Keysight Technologies, Inc. * | | |

Teledyne Technologies, Inc. * | | |

Zebra Technologies Corp., Class A * | | |

| | |

Energy Equipment & Services — 0.5% |

| | |

|

Take-Two Interactive Software, Inc. * (a) | | |

Health Care Equipment & Supplies — 7.7% |

| | |

| | |

| | |

IDEXX Laboratories, Inc. * | | |

| | |

| | |

| | |

| | |

Health Care Providers & Services — 4.3% |

Acadia Healthcare Co., Inc. * | | |

| | |

| | |

| | |

| | |

Hotels, Restaurants & Leisure — 5.6% |

| | |

| | |

Chipotle Mexican Grill, Inc. * | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Growth Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited) (continued)

| | |

Common Stocks — continued |

Hotels, Restaurants & Leisure — continued |

Hilton Worldwide Holdings, Inc. | | |

Royal Caribbean Cruises Ltd. * (a) | | |

| | |

Household Durables — 1.0% |

| | |

| | |

| | |

|

| | |

Interactive Media & Services — 0.5% |

| | |

Internet & Direct Marketing Retail — 0.5% |

Chewy, Inc., Class A * (a) | | |

|

| | |

| | |

| | |

| | |

| | |

Life Sciences Tools & Services — 4.6% |

10X Genomics, Inc., Class A * (a) | | |

Agilent Technologies, Inc. | | |

Maravai LifeSciences Holdings, Inc., Class A * | | |

Mettler-Toledo International, Inc. * | | |

West Pharmaceutical Services, Inc. | | |

| | |

|

| | |

| | |

| | |

| | |

|

Trade Desk, Inc. (The), Class A * | | |

|

| | |

Oil, Gas & Consumable Fuels — 3.7% |

| | |

| | |

|

Oil, Gas & Consumable Fuels — continued |

| | |

| | |

| | |

|

Jazz Pharmaceuticals plc * | | |

Royalty Pharma plc, Class A | | |

| | |

Professional Services — 0.8% |

| | |

|

Old Dominion Freight Line, Inc. | | |

Semiconductors & Semiconductor Equipment — 4.2% |

Advanced Micro Devices, Inc. * | | |

Enphase Energy, Inc. * (a) | | |

| | |

| | |

SolarEdge Technologies, Inc. * | | |

| | |

| | |

| | |

|

Cadence Design Systems, Inc. * | | |

Clear Secure, Inc., Class A (a) | | |

Confluent, Inc., Class A * | | |

Crowdstrike Holdings, Inc., Class A * | | |

| | |

HashiCorp, Inc., Class A * | | |

| | |

Palo Alto Networks, Inc. * | | |

Procore Technologies, Inc. * | | |

| | |

Zoom Video Communications, Inc., Class A * | | |

| | |

| | |

|

| | |

Burlington Stores, Inc. * | | |

| | |

National Vision Holdings, Inc. * (a) | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Specialty Retail — continued |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 0.5% |

Lululemon Athletica, Inc. * | | |

Trading Companies & Distributors — 0.7% |

| | |

Total Common Stocks

(Cost $6,460,566) | | |

Short-Term Investments — 4.2% |

Investment Companies — 2.5% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c)

(Cost $188,878) | | |

Investment of Cash Collateral from Securities Loaned — 1.7% |

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.56% (b) (c) | | |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c) | | |

Total Investment of Cash Collateral from Securities Loaned

(Cost $128,332) | | |

Total Short-Term Investments

(Cost $317,210) | | |

Total Investments — 101.9%

(Cost $6,777,776) | | |

Liabilities in Excess of Other Assets — (1.9)% | | |

| | |

Percentages indicated are based on net assets. |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $124,682. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2022. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Value Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited)

| | |

|

|

| | |

|

Citizens Financial Group, Inc. | | |

| | |

First Citizens BancShares, Inc., Class A | | |

Huntington Bancshares, Inc. | | |

| | |

| | |

| | |

| | |

|

Constellation Brands, Inc., Class A | | |

| | |

| | |

|

| | |

Fortune Brands Innovations, Inc. | | |

| | |

|

Ameriprise Financial, Inc. | | |

| | |

Raymond James Financial, Inc. | | |

| | |

T. Rowe Price Group, Inc. | | |

| | |

|

| | |

| | |

| | |

Communications Equipment — 1.3% |

| | |

Construction Materials — 1.1% |

Martin Marietta Materials, Inc. | | |

|

Discover Financial Services | | |

Containers & Packaging — 2.6% |

| | |

Packaging Corp. of America | | |

| | |

| | |

| | |

|

|

| | |

| | |

| | |

Diversified Financial Services — 0.6% |

| | |

Electric Utilities — 4.2% |

| | |

| | |

| | |

| | |

Electrical Equipment — 3.7% |

| | |

| | |

| | |

| | |

Electronic Equipment, Instruments & Components — 3.8% |

| | |

| | |

| | |

Teledyne Technologies, Inc. * | | |

| | |

|

Take-Two Interactive Software, Inc. * | | |

Equity Real Estate Investment Trusts (REITs) — 9.7% |

American Homes 4 Rent, Class A | | |

AvalonBay Communities, Inc. | | |

| | |

Brixmor Property Group, Inc. | | |

Essex Property Trust, Inc. | | |

Federal Realty Investment Trust | | |

Host Hotels & Resorts, Inc. (a) | | |

| | |

| | |

Mid-America Apartment Communities, Inc. | | |

| | |

| | |

Rexford Industrial Realty, Inc. | | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Equity Real Estate Investment Trusts (REITs) — continued |

| | |

| | |

| | |

Food & Staples Retailing — 1.5% |

| | |

| | |

| | |

|

| | |

|

| | |

Health Care Equipment & Supplies — 1.7% |

Globus Medical, Inc., Class A * | | |

Zimmer Biomet Holdings, Inc. | | |

| | |

Health Care Providers & Services — 5.8% |

| | |

| | |

Laboratory Corp. of America Holdings | | |

Universal Health Services, Inc., Class B | | |

| | |

Hotels, Restaurants & Leisure — 1.2% |

| | |

| | |

| | |

Household Durables — 1.4% |

Mohawk Industries, Inc. * | | |

| | |

| | |

Household Products — 0.5% |

| | |

|

Arch Capital Group Ltd. * | | |

| | |

Hartford Financial Services Group, Inc. (The) | | |

| | |

| | |

| | |

|

|

RenaissanceRe Holdings Ltd. (Bermuda) | | |

| | |

| | |

Interactive Media & Services — 0.8% |

| | |

|

FleetCor Technologies, Inc. * | | |

| | |

| | |

|

| | |

| | |

Lincoln Electric Holdings, Inc. | | |

| | |

| | |

| | |

| | |

|

Liberty Broadband Corp., Class C * | | |

Liberty Media Corp.-Liberty SiriusXM, Class C * | | |

| | |

|

| | |

|

| | |

|

| | |

| | |

| | |

| | |

Oil, Gas & Consumable Fuels — 2.6% |

| | |

| | |

Williams Cos., Inc. (The) | | |

| | |

|

| | |

|

Jazz Pharmaceuticals plc * | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Mid Cap Value Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited) (continued)

| | |

Common Stocks — continued |

Real Estate Management & Development — 0.9% |

CBRE Group, Inc., Class A * | | |

|

| | |

|

| | |

| | |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 2.7% |

| | |

| | |

| | |

| | |

Thrifts & Mortgage Finance — 0.6% |

| | |

Total Common Stocks

(Cost $9,015,107) | | |

Short-Term Investments — 0.5% |

Investment Companies — 0.1% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c)

(Cost $13,430) | | |

| | |

|

Investment of Cash Collateral from Securities Loaned — 0.4% |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c)

(Cost $62,314) | | |

Total Short-Term Investments

(Cost $75,744) | | |

Total Investments — 98.8%

(Cost $9,090,851) | | |

Other Assets Less Liabilities — 1.2% | | |

| | |

Percentages indicated are based on net assets. |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $61,634. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2022. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Value Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited)

| | |

|

Aerospace & Defense — 2.8% |

| | |

| | |

Raytheon Technologies Corp. | | |

| | |

Air Freight & Logistics — 0.6% |

| | |

|

| | |

| | |

Citizens Financial Group, Inc. | | |

| | |

PNC Financial Services Group, Inc. (The) | | |

| | |

| | |

| | |

| | |

|

| | |

|

| | |

Regeneron Pharmaceuticals, Inc. * | | |

Vertex Pharmaceuticals, Inc. * | | |

| | |

|

| | |

Fortune Brands Innovations, Inc. | | |

| | |

|

Charles Schwab Corp. (The) | | |

| | |

| | |

| | |

T. Rowe Price Group, Inc. (a) | | |

| | |

|

Axalta Coating Systems Ltd. * | | |

Communications Equipment — 0.6% |

| | |

CommScope Holding Co., Inc. * | | |

| | |

| | |

|

Construction Materials — 1.5% |

Martin Marietta Materials, Inc. | | |

| | |

| | |

|

| | |

Capital One Financial Corp. | | |

| | |

Containers & Packaging — 1.4% |

Packaging Corp. of America | | |

| | |

| | |

Diversified Financial Services — 2.5% |

Berkshire Hathaway, Inc., Class B * | | |

Diversified Telecommunication Services — 1.2% |

Verizon Communications, Inc. | | |

Electric Utilities — 3.9% |

American Electric Power Co., Inc. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Electrical Equipment — 0.6% |

| | |

Electronic Equipment, Instruments & Components — 0.5% |

| | |

Equity Real Estate Investment Trusts (REITs) — 7.7% |

American Homes 4 Rent, Class A | | |

Apple Hospitality REIT, Inc. | | |

Brixmor Property Group, Inc. | | |

EastGroup Properties, Inc. | | |

Federal Realty Investment Trust (a) | | |

| | |

| | |

Lamar Advertising Co., Class A | | |

Mid-America Apartment Communities, Inc. | | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

JPMorgan Value Advantage Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF December 31, 2022 (Unaudited) (continued)

| | |

Common Stocks — continued |

Equity Real Estate Investment Trusts (REITs) — continued |

| | |

| | |

| | |

Food & Staples Retailing — 0.7% |

Albertsons Cos., Inc., Class A | | |

| | |

| | |

|

| | |

| | |

| | |

Health Care Equipment & Supplies — 0.9% |

| | |

Zimmer Biomet Holdings, Inc. | | |

| | |

Health Care Providers & Services — 5.7% |

| | |

| | |

| | |

| | |

Laboratory Corp. of America Holdings | | |

| | |

| | |

Hotels, Restaurants & Leisure — 1.1% |

| | |

| | |

| | |

Household Durables — 1.2% |

Mohawk Industries, Inc. * | | |

| | |

| | |

Household Products — 1.5% |

| | |

Procter & Gamble Co. (The) | | |

| | |

Industrial Conglomerates — 0.8% |

Honeywell International, Inc. | | |

|

American International Group, Inc. | | |

| | |

|

|

| | |

| | |

Fairfax Financial Holdings Ltd. (Canada) | | |

Hartford Financial Services Group, Inc. (The) | | |

| | |

Marsh & McLennan Cos., Inc. | | |

| | |

Travelers Cos., Inc. (The) | | |

| | |

Interactive Media & Services — 1.8% |

Alphabet, Inc., Class C * | | |

| | |

Meta Platforms, Inc., Class A * | | |

| | |

|

FleetCor Technologies, Inc. * | | |

International Business Machines Corp. | | |

| | |

|

| | |

| | |

| | |

| | |

| | |

|

Liberty Broadband Corp., Class C * | | |

Liberty Media Corp.-Liberty SiriusXM, Class C * | | |

Nexstar Media Group, Inc., Class A (a) | | |

| | |

|

| | |

| | |

| | |

|

Public Service Enterprise Group, Inc. | | |

Oil, Gas & Consumable Fuels — 8.2% |

| | |

| | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| | |

Common Stocks — continued |

Oil, Gas & Consumable Fuels — continued |

| | |

| | |

Williams Cos., Inc. (The) | | |

| | |

|

| | |

|

| | |

| | |

| | |

| | |

Professional Services — 0.5% |

| | |

Real Estate Management & Development — 0.7% |

CBRE Group, Inc., Class A * | | |

|

| | |

| | |

| | |

Semiconductors & Semiconductor Equipment — 2.1% |

| | |

NXP Semiconductors NV (China) | | |

| | |

| | |

|

| | |

| | |

| | |

Dick's Sporting Goods, Inc. (a) | | |

| | |

| | |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods — 1.0% |

Columbia Sportswear Co. (a) | | |

| | |

| | |

| | |

|

Thrifts & Mortgage Finance — 0.4% |

| | |

|

Philip Morris International, Inc. | | |

Wireless Telecommunication Services — 0.5% |

| | |

Total Common Stocks

(Cost $6,180,662) | | |

Short-Term Investments — 2.7% |

Investment Companies — 1.3% |

JPMorgan Prime Money Market Fund Class IM Shares, 4.49% (b) (c)

(Cost $117,681) | | |

Investment of Cash Collateral from Securities Loaned — 1.4% |

JPMorgan Securities Lending Money Market Fund Agency SL Class Shares, 4.56% (b) (c) | | |

JPMorgan U.S. Government Money Market Fund Class IM Shares, 4.12% (b) (c) | | |

Total Investment of Cash Collateral from Securities Loaned

(Cost $131,669) | | |

Total Short-Term Investments

(Cost $249,350) | | |

Total Investments — 101.0%

(Cost $6,430,012) | | |

Liabilities in Excess of Other Assets — (1.0)% | | |

| | |

Percentages indicated are based on net assets. |

| Non-income producing security. |

| The security or a portion of this security is on loan at December 31, 2022. The total value of securities on loan at December 31, 2022 is $128,755. |

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of December 31, 2022. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

STATEMENTS OF ASSETS AND LIABILITIES

AS OF December 31, 2022 (Unaudited)

(Amounts in thousands, except per share amounts)

| JPMorgan

Growth

Advantage Fund | JPMorgan

Mid Cap

Equity Fund | |

| | | |

Investments in non-affiliates, at value | | | |

Investments in affiliates, at value | | | |

Investments of cash collateral received from securities loaned, at value (See Note 2.B.) | | | |

| | | |

| | | |

| | | |

Dividends from non-affiliates | | | |

Dividends from affiliates | | | |

Securities lending income (See Note 2.B.) | | | |

| | | |

| | | |

| | | |

| | | |

Investment securities purchased | | | |

Collateral received on securities loaned (See Note 2.B.) | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Custodian and accounting fees | | | |

| | | |

| | | |

| | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Mid Cap/Multi-Cap Funds | |

| JPMorgan Growth Advantage Fund | JPMorgan Mid Cap Equity Fund | |

| | | |

| | | |

Total distributable earnings (loss) | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Outstanding units of beneficial interest (shares)

($0.0001 par value; unlimited number of shares authorized): | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Class A — Redemption price per share | | | |

Class C — Offering price per share (b) | | | |