BULLFINCH FUND, INC.

3909 Rush Mendon Road

Mendon, New York 14506

(585) 624-3150

1-888-BULLFINCH

(1-888-285-5346)

Annual Report

October 31, 2017

Management’s Discussion of Fund Performance

December 27, 2017

Dear Fellow Shareholders:

We are very proud to present the October 2017 Annual Report of Bullfinch Fund, Inc. This report contains the audited financial statements for both the Unrestricted Series and the Greater Western New York Series.

This year produced excellent results for the Bullfinch Fund, Inc. The Greater Western New York Series finished the year at a new all-time high in net assets and both the Unrestricted Series and the Greater Western New York Series ended with all-time highs in accumulated performance. While past performance can never guarantee future results, it should be noted these records occurred at a time when our value style of management has been out of favor. You can see this in the one-year benchmark comparison in the performance summary on the next page.

In the Unrestricted Series, the top performing stocks included stocks we recently purchased – RetailMeNot (which was bought out shortly after we bought it) and Meritage Homes. In addition, both Adobe Systems and Toll Brothers also ranked high in terms of performance during the fiscal year. Among the laggards were Fred’s, Mattel, and Xperi Corporation. A total of 22 out of the 34 stocks we held during the year were up double digits, compared to a total of 8 that were down for the year.

During the fiscal year, in the Greater Western New York Series, a total of 24 (out of 38) individual stocks experienced greater than double digit returns. Of these, 3 returned more than 80% (Columbus McKinnon Co, Integer Holdings Corporation, and Ultralife Corp) with an additional 3 reaping more than 50% for the year (Harris Corporation, Moog, Inc, and Southwest Airlines). A total of 9 stocks had a negative return for the year, led by Frontier Communications, Manning & Napier, Inc, and Mattel.

Most of this year’s performance in both portfolios occurred in the last several months of the fiscal year as value stocks appeared to have returned to favor. To give you a sense for the disparity in the markets, in mid-August the difference in returns between large cap growth and small cap value was an unprecedented 15% year-to-date. Across the board, growth beat value and large cap beat small cap. What makes this so unusual is that we had not seen this extreme difference for many years.

Some say the market may be overvalued, and that may be true for the indexes in general. But, with the economy showing signs that, after nearly ten years of stagnation, it wants to take off, we might be headed towards a situation where a rising tide floats all boats. As we have come to expect, in many cases it is the stocks that have experienced the highest near-term downside that often have the highest long-term upside. Right now, our research efforts have been directed towards finding those stocks.

We wish to thank our shareholders for expressing their confidence in us and wish you continued good fortune.

Best Regards,

Bullfinch Fund, Inc.

Christopher Carosa, CTFA

President

BULLFINCH FUND INC.

PERFORMANCE SUMMARY

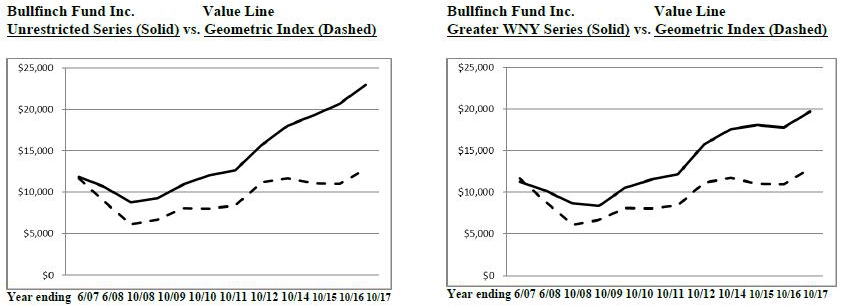

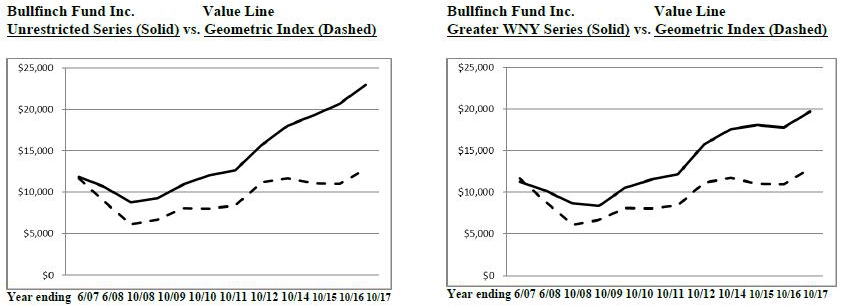

The graph below represents the changes in value for an initial $10,000 investment in the BULLFINCH Fund from 7/1/07 to 10/31/17. These changes are then compared to a $10,000 investment in the Value Line Geometric Index. The Value LINE Geometric Index (VLG) is an unmanaged index of between 1,600 and 1,700 stocks. Value Line states “The VLG was intended to provide a rough approximation of how the median stock in the Value Line Universe performed. The VLG also has appeal to institutional investors as a proxy for the so-called ‘multi-cap’ market because it includes large cap, mid cap and small cap stocks alike.” The Fund feels it is an appropriate benchmark because the Fund’s portfolios are multi-cap portfolios. The Fund’s returns include the reinvestment of all dividends, but do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemptions of fund shares. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

| Annualized | | | | | | | | Annualized | | | | | | |

| Returns Ending | | Bullfinch Fund Inc. | | | Value Line | | | Returns Ending | | Bullfinch Fund Inc. | | | Value Line | |

| 10/31/2017 | | Unrestricted Series | | | Geometric Index | | | 10/31/2017 | | Greater WNY Series | | | Geometric Index | |

| | | | | | | | | | | | | | | |

| One – Year | | | +10.92 | % | | | +16.80 | % | | One – Year | | | +10.89 | % | | | +16.80 | % |

| Five – Year | | | +12.75 | % | | | +8.91 | % | | Five – Year | | | +10.15 | % | | | +8.91 | % |

| Ten – Year | | | +6.82 | % | | | +1.34 | % | | Ten – Year | | | +5.26 | % | | | +1.34 | % |

UNRESTRICTED SERIES

(A Series Within Bullfinch Fund, Inc.)

FINANCIAL STATEMENTS AS OF OCTOBER 31, 2017

TOGETHER WITH INDEPENDENT AUDITORS’ REPORT

DeJoy, Knauf & Blood, LLP

Certified Public Accountants

280 East Broad Street, Suite 300

Rochester, NY 14604

Tel 585-546-1840

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Shareholders of

Bullfinch Fund, Inc. - Unrestricted Series:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments in securities, of Bullfinch Fund, Inc. - Unrestricted Series (one of the series constituting the Bullfinch Fund, Inc. [the “Company”]) as of October 31, 2017, the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for each of the two years in the period then ended. These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for each of the three years in the period ended October 31, 2015, were audited by other auditors whose report dated December 21, 2015, expressed an unqualified opinion on those statements.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2017, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Bullfinch Fund Inc. - Unrestricted Series as of October 31, 2017, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

| /s/ DeJoy, Knauf & Blood, LLP | |

| Rochester, New York | |

| December 27, 2017. | |

UNRESTRICTED SERIES

(A SERIES WITHIN THE BULLFINCH FUND, INC.)

STATEMENT OF ASSETS AND LIABILITIES

OCTOBER 31, 2017

| ASSETS | | | | |

| | | | | |

| Investments in Securities, at Fair Value, Identified Cost of $5,207,263 | �� | $ | 7,841,295 | |

| | | | | |

| Cash & Cash Equivalents | | | 1,023,242 | |

| | | | | |

| Accrued Interest and Dividends | | | 12,433 | |

| | | | | |

| Prepaid Expenses | | | 500 | |

| | | | | |

| Total Assets | | $ | 8,877,470 | |

| | | | | |

| LIABILITIES AND NET ASSETS | | | | |

| | | | | |

| LIABILITIES | | | | |

| | | | | |

| Accrued Expenses | | $ | 11,835 | |

| | | | | |

| Due to Investment Adviser | | | 7,696 | |

| | | | | |

| NET ASSETS | | | | |

| | | | | |

| Net Assets (Equivalent to $20.78 per share based on 426,297.315 shares of stock outstanding) | | | 8,857,939 | |

| | | | | |

| Total Liabilities and Net Assets | | $ | 8,877,740 | |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

| | | | | |

| Shares of Common Stock - Par Value $.01; 426,297.315 Shares Outstanding | | $ | 6,066,105 | |

| | | | | |

| Accumulated Net Investment Gain & Realized Gain from Security Transactions | | | 157,802 | |

| | | | | |

| Net Unrealized Appreciation on Investments | | | 2,634,032 | |

| | | | | |

| Net Assets at October 31, 2017 | | $ | 8,857,939 | |

The accompanying notes are an integral part of these financial statements.

UNRESTRICTED SERIES

(A SERIES WITHIN BULLFINCH FUND, INC.)

SCHEDULE OF INVESTMENTS IN SECURITIES OCTOBER 31, 2017

| | | | | | Historical | | | | |

| | | Shares | | | Cost | | | Value | |

| | | | | | | | | | |

| Level 1 - Common Stocks – 88.46% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| *ASTERISK DENOTES A NON INCOME PRODUCING SECURITY | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Computers - Software – 16.61% | | | | | | | | | | �� | | |

| Adobe Systems Inc.* | | | 1,100 | | | | 28,660 | | | | 192,676 | |

| Microsoft Corp. | | | 6,200 | | | | 151,626 | | | | 515,716 | |

| Oracle Corp. | | | 5,500 | | | | 56,122 | | | | 279,950 | |

| Synopsis, Inc.* | | | 5,600 | | | | 115,460 | | | | 484,512 | |

| | | | | | | | 351,868 | | | | 1,472,854 | |

| | | | | | | | | | | | | |

| Medical Products and Supplies - 11.01% | | | | | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 5,450 | | | | 266,295 | | | | 336,047 | |

| Edwards Lifesciences* | | | 2,750 | | | | 108,269 | | | | 281,132 | |

| Johnson & Johnson | | | 2,400 | | | | 136,714 | | | | 334,584 | |

| Medtronic Inc. | | | 300 | | | | 22,701 | | | | 24,156 | |

| | | | | | | | 533,979 | | | | 975,919 | |

| | | | | | | | | | | | | |

| Building & Related – 7.42% | | | | | | | | | | | | |

| Meritage Homes Corp.* | | | 5,850 | | | | 246,488 | | | | 284,895 | |

| Toll Brothers Inc. | | | 8,100 | | | | 274,638 | | | | 372,924 | |

| | | | | | | | 521,126 | | | | 657,819 | |

| | | | | | | | | | | | | |

| Semiconductors - 4.78% | | | | | | | | | | | | |

| Intel Corp. | | | 5,000 | | | | 85,564 | | | | 227,450 | |

| Xperi Corporation | | | 8,550 | | | | 198,390 | | | | 196,650 | |

| | | | | | | | 283,954 | | | | 424,100 | |

| | | | | | | | | | | | | |

| Electrical Equipment - 4.69% | | | | | | | | | | | | |

| Corning Inc. | | | 7,300 | | | | 66,773 | | | | 228,563 | |

| General Electric Co. | | | 9,300 | | | | 223,523 | | | | 187,488 | |

| | | | | | | | 290,296 | | | | 416,051 | |

| | | | | | | | | | | | | |

| Retail – Specialty – 4.32% | | | | | | | | | | | | |

| Fastenal Co. | | | 4,800 | | | | 83,684 | | | | 225,456 | |

| Zumiez Inc.* | | | 8,900 | | | | 193,235 | | | | 157,085 | |

| | | | | | | | 276,919 | | | | 382,541 | |

| | | | | | | | | | | | | |

| Computers - Networking - 4.12% | | | | | | | | | | | | |

| Cisco Systems, Inc. | | | 10,700 | | | | 160,238 | | | | 365,405 | |

| | | | | | | | | | | | | |

| Insurance – 4.07% | | | | | | | | | | | | |

| Arthur J Gallagher & Co | | | 5,700 | | | | 138,298 | | | | 360,981 | |

| | | | | | | | | | | | | |

| Telecommunications – 3.67% | | | | | | | | | | | | |

| AT&T Corporation | | | 4,400 | | | | 158,437 | | | | 148,060 | |

| Verizon Communications | | | 3,700 | | | | 180,520 | | | | 177,119 | |

| | | | | | | | 338,957 | | | | 325,179 | |

| | | | | | | | | | | | | |

| Level 1 - Common Stocks – 88.46% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Commercial Services - 3.42% | | | | | | | | | | | | |

| Paychex, Inc. | | | 4,750 | | | | 130,496 | | | | 303,003 | |

| | | | | | | | | | | | | |

| Utilities – Natural Resources – 3.26% | | | | | | | | | | | | |

| Consolidated Water Co. | | | 23,500 | | | | 276,520 | | | | 289,050 | |

| | | | | | | | | | | | | |

| Consumer – Electronics – 3.26% | | | | | | | | | | | | |

| Canon Inc. | | | 7,650 | | | | 260,879 | | | | 288,788 | |

| | | | | | | | | | | | | |

| Oil & Related – 2.77% | | | | | | | | | | | | |

| Total SA ADR | | | 4,400 | | | | 227,558 | | | | 245,168 | |

| | | | | | | | | | | | | |

| Pharmaceuticals -2.72% | | | | | | | | | | | | |

| Mylan Inc.* | | | 6,750 | | | | 381,117 | | | | 241,043 | |

| | | | | | | | | | | | | |

| Biotech – 2.33% | | | | | | | | | | | | |

| Meridian Bioscience Inc. | | | 13,800 | | | | 249,015 | | | | 206,310 | |

| | | | | | | | | | | | | |

| Tobacco Products – 2.07% | | | | | | | | | | | | |

| Universal Corp. VA | | | 3,200 | | | | 120,756 | | | | 183,520 | |

| | | | | | | | | | | | | |

| Leisure & Recreational – 1.95% | | | | | | | | | | | | |

| Mattel Inc.* | | | 12,250 | | | | 287,489 | | | | 172,970 | |

| | | | | | | | | | | | | |

| Aerospace – 1.93% | | | | | | | | | | | | |

| AAR Corporation | | | 4,400 | | | | 83,191 | | | | 171,116 | |

| | | | | | | | | | | | | |

| Electronics Components – 1.90% | | | | | | | | | | | | |

| TE Connectivity Ltd. | | | 1,850 | | | | 50,371 | | | | 168,294 | |

| | | | | | | | | | | | | |

| Industrial Services – 1.25% | | | | | | | | | | | | |

| Expeditors Int’l Washington | | | 1,900 | | | | 61,567 | | | | 110,922 | |

| | | | | | | | | | | | | |

| Retail - General - 0.91% | | | | | | | | | | | | |

| Fred’s Inc. Class A | | | 18,200 | | | | 182,669 | | | | 80,262 | |

| | | | | | | | | | | | | |

| Total Investments in Securities | | | | | | | 5,207,263 | | | | 7,841,295 | |

| | | | | | | | | | | | | |

| Level 1 – Cash & Equivalents – 11.54% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Schwab Gov’t Money Fund - 11.54% | | | | | | | 1,023,242 | | | | 1,023,242 | |

| Sweep Shares 7 day Yield .47% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Invested Assets | | | | | | $ | 6,230,505 | | | $ | 8,864,537 | |

The accompanying notes are an integral part of these financial statements.

UNRESTRICTED SERIES

(A SERIES WITHIN BULLFINCH FUND, INC.)

SCHEDULE OF INVESTMENTS IN SECURITIES OCTOBER 31, 2017

Table of Industries

| Industry | | Market Value | | | Percent | |

| | | | | | | |

| Aerospace | | $ | 171,116 | | | | 1.93 | % |

| Biotech | | $ | 206,310 | | | | 2.33 | % |

| Building & Related | | $ | 657,819 | | | | 7.42 | % |

| Commercial Services | | $ | 303,003 | | | | 3.42 | % |

| Computers – Networking | | $ | 365,405 | | | | 4.12 | % |

| Computers – Software | | $ | 1,472,854 | | | | 16.61 | % |

| Consumer – Electronics | | $ | 288,788 | | | | 3.26 | % |

| Electrical Equipment | | $ | 416,051 | | | | 4.69 | % |

| Electronics Components | | $ | 168,294 | | | | 1.90 | % |

| Industrial Services | | $ | 110,922 | | | | 1.25 | % |

| Insurance | | $ | 360,981 | | | | 4.07 | % |

| Leisure & Recreational | | $ | 172,970 | | | | 1.95 | % |

| Medical Products & Supplies | | $ | 975,919 | | | | 11.01 | % |

| Oil & Related | | $ | 245,168 | | | | 2.77 | % |

| Pharmaceuticals | | $ | 241,043 | | | | 2.72 | % |

| Retail – General | | $ | 80,262 | | | | 0.91 | % |

| Retail – Specialty | | $ | 382,541 | | | | 4.32 | % |

| Semiconductors | | $ | 424,100 | | | | 4.78 | % |

| Telecommunications | | $ | 325,179 | | | | 3.67 | % |

| Tobacco Products | | $ | 183,520 | | | | 2.07 | % |

| Utilities – Natural Resources | | $ | 289,050 | | | | 3.26 | % |

| Total Equities | | $ | 7,841,295 | | | | 88.46 | % |

| | | | | | | | | |

| Cash & Equivalents (7 day yield .47%) | | $ | 1,023,242 | | | | 11.54 | % |

| | | | | | | | | |

| Total Invested Assets | | $ | 8,864,537 | | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

UNRESTRICTED SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

STATEMENT OF OPERATIONS FOR THE YEAR ENDED OCTOBER 31, 2017

| INVESTMENT INCOME: | | | | |

| Dividend and Interest Income | | $ | 154,089 | |

| EXPENSES: | | | | |

| Adviser Fees | | | 90,508 | |

| Legal and Professional | | | 17,006 | |

| Director’s Fees | | | 1,250 | |

| D&O/E&O | | | 8,493 | |

| Fidelity Bond | | | 939 | |

| State Income Taxes | | | 304 | |

| Foreign Taxes | | | 4,587 | |

| Telephone | | | 40 | |

| Registration Fees | | | 3,485 | |

| Custodian Fees | | | 4,592 | |

| Dues & Subscriptions | | | 2,148 | |

| Total expense | | | 133,352 | |

| Net investment income | | | 20,737 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

| Realized gain from securities transactions | | | 557,090 | |

| Unrealized appreciation during the period | | | 348,458 | |

| Net gain on investments | | | 905,548 | |

| CHANGE IN NET ASSETS FROM OPERATIONS | | $ | 926,285 | |

UNRESTRICTED SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE YEARS ENDED OCTOBER 31, 2017 AND 2016

| | October 2017 | | | October 2016 | |

| CHANGE IN NET ASSETS FROM OPERATIONS: | | | | | | |

| Net investment income | | $ | 20,737 | | | $ | 13,894 | |

| Net realized gain from security transactions | | | 557,090 | | | | 625,476 | |

| Net change in unrealized appreciation (depreciation) of investments | | | 348,458 | | | | (33,427 | ) |

| Increase in net assets from operations | | | 926,285 | | | | 605,943 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distribution of capital gains | | | (676,498 | ) | | | (707,089 | ) |

| Distribution of ordinary income | | | (13,862 | ) | | | (14,067 | ) |

| Decrease in net assets from distributions to shareholders | | | (690,360 | ) | | | (721,156 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Shares Sold | | | 163,697 | | | | 670,510 | |

| Reinvestment of distributions to shareholders | | | 690,360 | | | | 721,156 | |

| Shares Redeemed | | | (810,180 | ) | | | (331,114 | ) |

| Increase in net assets from capital share transactions | | | 43,877 | | | | 1,060,552 | |

| TOTAL INCREASE IN NET ASSETS | | | 279,802 | | | | 945,339 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 8,578,137 | | | | 7,632,798 | |

| End of period | | $ | 8,857,939 | | | $ | 8,578,137 | |

The accompanying notes are an integral part of these financial statements.

UNRESTRICTED SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

FINANCIAL HIGHLIGHTS (PER SHARE DATA FOR A SHARE OUTSTANDING)

FOR THE YEARS ENDED OCTOBER 31, 2017, 2016, 2015, 2014 AND 2013

| | | October | | | October | | | October | | | October | | | October | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| NET ASSET VALUE, beginning of period | | $ | 20.29 | | | $ | 20.75 | | | $ | 20.42 | | | $ | 18.46 | | | $ | 15.35 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.05 | | | | 0.03 | | | | 0.04 | | | | (0.01 | ) | | | 0.05 | |

| Net gain on securities both realized and unrealized | | | 2.07 | | | | 1.47 | | | | 1.34 | | | | 2.74 | | | | 3.57 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total from investment operations | | | 2.12 | | | | 1.50 | | | | 1.38 | | | | 2.73 | | | | 3.62 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | | | | | |

| Distribution of capital gains | | | (1.60 | ) | | | (1.92 | ) | | | (1.05 | ) | | | (0.72 | ) | | | (0.45 | ) |

| Distribution of ordinary income | | | (0.03 | ) | | | (0.04 | ) | | | 0.00 | | | | (0.05 | ) | | | (0.06 | ) |

| Total stock dividend distributions | | | (1.63 | ) | | | (1.96 | ) | | | (1.05 | ) | | | (0.77 | ) | | | (0.51 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, end of period | | $ | 20.78 | | | $ | 20.29 | | | $ | 20.75 | | | $ | 20.42 | | | $ | 18.46 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS, end of period | | $ | 8,857,939 | | | $ | 8,578,137 | | | $ | 7,632,798 | | | $ | 7,127,458 | | | $ | 6,287,193 | |

UNRESTRICTED SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

FINANCIAL HIGHLIGHTS (RATIOS AND SUPPLEMENTAL DATA)

FOR THE YEARS ENDED OCTOBER 31, 2017, 2016, 2015, 2014 AND 2013

| | | October | | | October | | | October | | | October | | | October | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| RATIO OF EXPENSES | | | | | | | | | | | | | | | | | | | | |

| TO AVERAGE NET ASSETS* | | | 1.51 | % | | | 1.50 | % | | | 1.48 | % | | | 1.51 | % | | | 1.63 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME | | | | | | | | | | | | | | | | | | | | |

| TO AVERAGE NET ASSETS* | | | 0.24 | % | | | 0.17 | % | | | 0.19 | % | | | (0.05 | )% | | | 0.29 | % |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE* | | | 10.72 | % | | | 1.95 | % | | | 10.55 | % | | | 11.74 | % | | | 6.54 | % |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 10.92 | % | | | 7.62 | % | | | 6.83 | % | | | 15.02 | % | | | 24.20 | % |

* Per share amounts calculated using the average shares method

The accompanying notes are an integral part of these financial highlights.

UNRESTRICTED SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

NOTES TO FINANCIAL STATEMENTS OCTOBER 31, 2017

NOTE A - SCOPE OF BUSINESS

The Unrestricted Series (the “Series”) is a series within the Bullfinch Fund, Inc. (the “Fund”), which was organized as a Maryland corporation registered under the Investment Company Act of 1940 as an open-ended non-diversified management investment company. The Fund offers two series of common stock. In addition to the Unrestricted Series, the Fund also offers the Greater Western New York Series.

The investment objective of the Series is to seek conservative long-term growth in capital. The Adviser seeks to achieve this objective by using an asset mix consisting primarily of exchange listed securities and over-the-counter common stocks as well as U.S. Government securities maturing within five years.

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Series in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States (“GAAP”). The Series follows the investment company accounting and reporting guidance of the Financial Accounting Standard Board Accounting Standard Codification 946, Financial Services – Investment Companies.

Fair Value Measurements – ASC 820-10 establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

Level 1: Quoted prices (unadjusted) for identical assets or liabilities in active markets that the entity has the ability to access as of the measurement date.

Level 2: Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3: Significant unobservable inputs that reflect a reporting entity’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

The following is a description of the valuation methodologies used for assets measured at fair value:

Cash & Equivalents- Cash consists of amounts deposited in money market accounts or treasury bills and is not federally insured. The Series has not experienced any losses on such amounts and believes it is not exposed to any significant credit risk on cash.

Security Valuation - The Series records its investments at fair value and is in compliance with FASB ASC 820-10-50. Securities traded on national securities exchanges or the NASDAQ National Market System are valued daily at the closing prices of the securities on those exchanges and securities traded on over-the-counter markets are valued daily at the closing bid prices. Short-term and money market securities are valued at amortized cost, which approximates market value.

ASSETS AT FAIR VALUE AS OF:

| | | 10/31/17 | |

| | | LEVEL 1 | |

| COMMON STOCKS | | $ | 7,841,295 | |

| CASH & EQUIVALENTS | | $ | 1,023,242 | |

| TOTAL INVESTED ASSETS | | $ | 8,864,537 | |

In cases where market prices are unreliable or not readily available, for example, when trading on securities are halted as permitted by the SEC or when there is no trading volume on an Over-the-Counter security held by the Fund, the Fund relies on fair value pricing provided by the Adviser. In performing its fair value pricing, the Adviser acts under the ultimate supervision of, and follows, the policies of the Board of Directors. The Board of Directors retains the right to determine its own fair value price should it have reason to believe the price provided by the Adviser does not reflect fair value. Valuing securities at fair value involves greater reliance on judgment than securities that have readily available market quotations. There can be no assurance the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines their net asset value per share.

Series Allocations - Common expenses of the Fund are evenly split between the two series of the Fund unless the Board of Directors approves an alternative allocation of expenses based on management’s estimate.

Income Taxes - It is the policy of the Fund to comply with the requirements of Subchapter M of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. In addition, the Fund intends to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code. Therefore, no provision for federal income taxes or excise taxes has been made.

Management has reviewed all open tax years and major tax jurisdictions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed or expected to be taken on a tax return. The tax returns of the Series for the prior three years are open for examination.

Distributions to Shareholders - Distributions to shareholders are recorded on the ex-dividend date. The Series made a distribution of its ordinary income of $14,067 to its shareholders on December 29, 2015, in the form of stock dividends equal to 722.839 shares of stock. The Series made a distribution of its capital gains of $707,089 to its shareholders on December 29, 2015, in the form of stock dividends equal to 36,335.515 shares of stock. The Series made a distribution of its ordinary income of $13,862 to its shareholders on December 29, 2016, in the form of stock dividends equal to 707.261 shares of stock. The Series made a distribution of its capital gains of $676,498 to its shareholders on December 29, 2016, in the form of stock dividends equal to 34,515.213 shares of stock.

Other - The Series follows industry practice and records security transactions on the trade date. The specific identification method is used for determining gains and losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date.

Use of Estimates - The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results can differ from those estimates.

Subsequent Events - In accordance with GAAP, the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through December 27, 2017, the date of issuance of these financial statements.

During December 2017, the Adviser of the Fund received notification of findings by the United States Securities and Exchange Commission of certain deficiencies and weaknesses in controls as a result of a limited scope field examination of the Fund for the period January 1, 2016 through August 31, 2017. The Adviser is reviewing its policies and procedures as part of its remediation efforts to maintain compliance with federal securities laws.

NOTE C – INVESTMENTS

For the year ended October 31, 2017, the Series purchased $1,729,116 of common stock. During the same period, the Series sold $944,462 of common stock.

At October 31, 2017, the gross unrealized appreciation for all securities totaled $3,165,928 and the gross unrealized depreciation for all securities totaled $531,896 or a net unrealized appreciation of $2,634,032. The aggregate cost of securities for federal income tax purposes at October 31, 2017 was $5,207,263.

NOTE D – RELATED PARTY TRANSACTIONS

Carosa Stanton Asset Management, LLC serves as investment adviser to the Fund pursuant to an investment adviser agreement which was approved by the Fund’s board of directors. Carosa Stanton Asset Management, LLC is a Registered Investment Adviser under the Investment Advisers Act of 1940. The Investment adviser agreement provides that Carosa Stanton Asset Management, LLC, subject to the supervision and approval of the Fund’s board of directors, is responsible for the day-to-day management of the Fund’s portfolio, which includes selecting investments and handling its business affairs.

As compensation for its services to the Fund, the investment adviser receives monthly compensation at an annual rate of 1.25% on the first $1 million of daily average net assets and 1% on that portion of the daily average net assets in excess of $1 million. These fees are reduced by any sub-transfer agent fees incurred by the Fund.

Carosa Stanton Asset Management, LLC has agreed as part of its contract to forego sufficient investment adviser fees to limit total expenses of the Fund to 2% of the first $10 million in average assets and 1.5% of the next $20 million in average assets.

During the year ended October 31, 2017, the Fund paid investment adviser fees of $90,508.

As of October 31, 2017, the Fund had $7,696 included in accrued expenses, as owed to Carosa Stanton Asset Management, LLC.

Certain officers of the Fund are also officers of Carosa Stanton Asset Management.

NOTE E – REMUNERATION OF DIRECTORS

The Directors are paid a fee of $50 per meeting. They may be reimbursed for travel expenses.

NOTE F – COMMITMENTS AND CONTINGENCIES

The Series indemnifies the Fund’s officers and the Board of Directors for certain liabilities that might arise from their performance of their duties to the Series. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on its experience, the Fund expects the risk of loss to be remote.

NOTE G - CAPITAL SHARE TRANSACTIONS

The Fund has authorized 10,000,000 shares of common stock at $0.01 par value per share. These shares are issued under either of the two series of the Fund. Each share has equal dividend, distribution and liquidation rights. Transactions in capital stock of the Series were as follows:

| | | Shares | | | Amount | |

| | | | | | | |

| Balance at October 31, 2015 | | | 367,912.112 | | | $ | 4,961,676 | |

| | | | | | | | | |

| Shares sold during 2016 | | | 34,807.058 | | | | 670,510 | |

| Shares redeemed during 2016 | | | (16,934.829 | ) | | | (331,114 | ) |

| Reinvestment of Distributions, December 29, 2015 | | | 37,058.354 | | | | 721,156 | |

| Balance at October 31, 2016 | | | 422,842.695 | | | $ | 6,022,228 | |

| | | | | | | | | |

| Shares sold during 2017 | | | 8,172.333 | | | | 163,697 | |

| Shares redeemed during 2017 | | | (39,940.187 | ) | | | (810,180 | ) |

| Reinvestment of Distributions, December 29, 2016 | | | 35,222.474 | | | | 690,360 | |

| Balance at October 31, 2017 | | | 426,297.315 | | | $ | 6,066,105 | |

GREATER WESTERN NEW YORK SERIES (A Series Within Bullfinch Fund, Inc.)

FINANCIAL STATEMENTS AS OF OCTOBER 31, 2017

TOGETHER WITH INDEPENDENT AUDITORS’ REPORT

DeJoy, Knauf & Blood, LLP

Certified Public Accountants

280 East Broad Street, Suite 300

Rochester, NY 14604

Tel 585-546-1840

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Shareholders of

Bullfinch Fund, Inc. - Greater Western New York Series:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments in securities, of Bullfinch Fund, Inc. - Greater Western New York Series (one of the series constituting the Bullfinch Fund, Inc. [the “Company”]) as of October 31, 2017, the related statement of operations for the year then ended, and the statements of changes in net assets and the financial highlights for each of the two years in the period then ended. These financial statements and financial highlights are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for each of the three years in the period ended October 31, 2015, were audited by other auditors whose report dated December 21, 2015, expressed an unqualified opinion on those statements.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2017, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Bullfinch Fund Inc. - Greater Western New York Series as of October 31, 2017, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/ DeJoy, Knauf & Blood, LLP

Rochester, New York

December 27, 2017.

GREATER WESTERN NEW YORK SERIES

(A SERIES WITHIN BULLFINCH FUND, INC.)

STATEMENT OF ASSETS AND LIABILITIES

OCTOBER 31, 2017

| ASSETS | | | | |

| Investments in Securities, at Fair Value, Identified Cost of $829,878 | | $ | 1,655,890 | |

| Cash and Cash Equivalents | | | 297,274 | |

| Accrued Interest and Dividends | | | 2,455 | |

| Prepaid Expenses | | | 300 | |

| Total Assets | | $ | 1,955,919 | |

| | | | | |

| LIABILITIES AND NET ASSETS | | | | |

| LIABILITIES | | | | |

| Accrued Expenses | | $ | 1,315 | |

| Due to Investment Adviser | | | 1,884 | |

| | | | | |

| NET ASSETS | | | | |

| Net Assets (Equivalent to $22.23 per share based on 87,836.534 shares of stock outstanding) | | | 1,952,720 | |

| Total Liabilities and Net Assets | | $ | 1,955,919 | |

| | | | | |

| COMPOSITION OF NET ASSETS | | | | |

Shares of Common Stock - Par Value $.01;

87,836.534 Shares Outstanding | | $ | 1,179,348 | |

| Accumulated Net Investment Loss & Realized Loss from Security Transactions | | | (52,640 | ) |

| Net Unrealized Appreciation on Investments | | | 826,012 | |

| Net Assets at October 31, 2017 | | $ | 1,952,720 | |

The accompanying notes are an integral part of these financial statements.

GREATER WESTERN NEW YORK SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

SCHEDULE OF INVESTMENTS IN SECURITIES OCTOBER 31, 2017

| | | | | | Historical | | | | |

| | | Shares | | | Cost | | | Value | |

| | | | | | | | | | |

| Level 1 Common Stocks – 84.78% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| *ASTERISK DENOTES A NON INCOME PRODUCING SECURITY | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Electrical Equipment - 12.27% | | | | | | | | | | | | |

| Corning, Inc. | | | 2,200 | | | | 26,502 | | | | 68,882 | |

| General Electric Co. | | | 2,000 | | | | 50,686 | | | | 40,320 | |

| Ultralife Corp.* | | | 17,400 | | | | 65,037 | | | | 130,500 | |

| | | | | | | | 142,225 | | | | 239,702 | |

| | | | | | | | | | | | | |

| Aerospace - 9.45% | | | | | | | | | | | | |

| Harris Corporation | | | 500 | | | | 24,989 | | | | 69,660 | |

| Moog, Inc. Class A* | | | 637 | | | | 15,976 | | | | 55,903 | |

| Northrop Grumman | | | 200 | | | | 2,294 | | | | 59,106 | |

| | | | | | | | 43,259 | | | | 184,669 | |

| | | | | | | | | | | | | |

| Medical Products & Supplies – 8.60% | | | | | | | | | | | | |

| Bristol-Myers Squibb Co. | | | 1,150 | | | | 29,276 | | | | 70,909 | |

| Integer Holdings Corp* | | | 850 | | | | 17,417 | | | | 41,310 | |

| Johnson & Johnson | | | 400 | | | | 22,617 | | | | 55,764 | |

| | | | | | | | 69,310 | | | | 167,983 | |

| | | | | | | | | | | | | |

| Banking & Finance – 6.86% | | | | | | | | | | | | |

| Community Bank System | | | 1,200 | | | | 23,452 | | | | 66,348 | |

| M&T Bank Corp. | | | 300 | | | | 29,839 | | | | 50,031 | |

| Manning & Napier Inc. | | | 4,800 | | | | 31,165 | | | | 17,520 | |

| | | | | | | | 84,456 | | | | 133,899 | |

| | | | | | | | | | | | | |

| Electronics Components – 5.53% | | | | | | | | | | | | |

| Astronics Corp. Class A* | | | 1,491 | | | | 3,025 | | | | 51,290 | |

| IEC Electronics Corp.* | | | 4,518 | | | | 6,983 | | | | 20,354 | |

| TE Connectivity Ltd. | | | 400 | | | | 10,904 | | | | 36,388 | |

| | | | | | | | 20,912 | | | | 108,032 | |

| | | | | | | | | | | | | |

| Foods & Beverages – 4.49% | | | | | | | | | | | | |

| Constellation Brands, Inc. | | | 400 | | | | 2,509 | | | | 87,636 | |

| | | | | | | | | | | | | |

| Telecommunications - 3.78% | | | | | | | | | | | | |

| AT&T Corporation | | | 950 | | | | 33,705 | | | | 31,968 | |

| Frontier Communications | | | 693 | | | | 44,445 | | | | 8,392 | |

| Verizon Communications | | | 700 | | | | 34,210 | | | | 33,509 | |

| | | | | | | | 112,360 | | | | 73,869 | |

| | | | | | | | | | | | | |

| Utilities - Natural Resources - 3.72% | | | | | | | | | | | | |

| National Fuel Gas Co. | | | 1,250 | | | | 50,833 | | | | 72,562 | |

| | | | | | | | | | | | | |

| Commercial Services - 3.41% | | | | | | | | | | | | |

| Conduent* | | | 280 | | | | 5,074 | | | | 4,335 | |

| Paychex, Inc. | | | 975 | | | | 25,852 | | | | 62,195 | |

| | | | | | | | 30,926 | | | | 66,530 | |

| | | | | | | | | | | | | |

| Steel – 3.40% | | | | | | | | | | | | |

| Gilbraltar Industries Inc.* | | | 2,000 | | | | 25,111 | | | | 66,500 | |

| | | | | | | | | | | | | |

| Railroads - 3.31% | | | | | | | | | | | | |

| Genesee & Wyoming Class A* | | | 900 | | | | 2,522 | | | | 64,602 | |

| | | | | | | | | | | | | |

| Airlines - 2.90% | | | | | | | | | | | | |

| Southwest Airlines Co. | | | 1,050 | | | | 19,813 | | | | 56,553 | |

| | | | | | | | | | | | | |

| Automotive - 2.65% | | | | | | | | | | | | |

| Monro Inc. | | | 1,050 | | | | 12,443 | | | | 51,818 | |

| | | | | | | | | | | | | |

| Real Estate & Related - 2.48% | | | | | | | | | | | | |

| Life Storage Inc. | | | 600 | | | | 22,199 | | | | 48,492 | |

| | | | | | | | | | | | | |

| Computers - Software – 2.35% | | | | | | | | | | | | |

| Oracle Corp. | | | 900 | | | | 12,070 | | | | 45,810 | |

| | | | | | | | | | | | | |

| Leisure & Recreational – 2.17% | | | | | | | | | | | | |

| Mattel Inc.* | | | 3,000 | | | | 70,144 | | | | 42,360 | |

| | | | | | | | | | | | | |

| Retail - Specialty – 1.92% | | | | | | | | | | | | |

| Fastenal Co. | | | 800 | | | | 13,954 | | | | 37,576 | |

| | | | | | | | | | | | | |

| Computers - Services – 1.55% | | | | | | | | | | | | |

| Computer Task Group, Inc. | | | 6,000 | | | | 33,877 | | | | 30,240 | |

| | | | | | | | | | | | | |

| Metal Fabrication & Hardware – 1.38% | | | | | | | | | | | | |

| Graham Corp. | | | 1,400 | | | | 15,140 | | | | 26,978 | |

| | | | | | | | | | | | | |

| Environmental Services – 1.20% | | | | | | | | | | | | |

| Ecology & Environment Inc. | | | 2,000 | | | | 25,398 | | | | 23,500 | |

| | | | | | | | | | | | | |

| Instruments – 0.57% | | | | | | | | | | | | |

| Taylor Devices* | | | 877 | | | | 4,394 | | | | 11,138 | |

| | | | | | | | | | | | | |

| Office Equipment – 0.54% | | | | | | | | | | | | |

| Xerox Corp. | | | 350 | | | | 12,742 | | | | 10,608 | |

| | | | | | | | | | | | | |

| Machinery – 0.20% | | | | | | | | | | | | |

| Columbus McKinnon Corp. | | | 100 | | | | 2,344 | | | | 3,956 | |

| | | | | | | | | | | | | |

| Industrial Materials - 0.05% | | | | | | | | | | | | |

| Servotronics, Inc. | | | 100 | | | | 937 | | | | 877 | |

| | | | | | | | | | | | | |

| Total Investments in Securities | | | | | | | 829,878 | | | | 1,655,890 | |

| | | | | | | | | | | | | |

| Level 1 – Cash & Equivalents – 15.22% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Schwab Gov’t Money Fund – 15.22% | | | | | | | 297,274 | | | | 297,274 | |

| Sweep Shares 7 day Yield .47% | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total Invested Assets | | | | | | $ | 1,127,152 | | | $ | 1,953,164 | |

The accompanying notes are an integral part of these financial statements.

GREATER WESTERN NEW YORK SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

SCHEDULE OF INVESTMENTS IN SECURITIES OCTOBER 31, 2017

Table of Industries

| Industry | | Market Value | | | Percent | |

| | | | | | | |

| Aerospace | | $ | 184,669 | | | | 9.45 | % |

| Airlines | | $ | 56,553 | | | | 2.90 | % |

| Automotive | | $ | 51,818 | | | | 2.65 | % |

| Banking & Finance | | $ | 133,899 | | | | 6.86 | % |

| Commercial Services | | $ | 66,530 | | | | 3.41 | % |

| Computers – Services | | $ | 30,240 | | | | 1.55 | % |

| Computers – Software | | $ | 45,810 | | | | 2.35 | % |

| Electrical Equipment | | $ | 239,702 | | | | 12.27 | % |

| Electronics Components | | $ | 108,032 | | | | 5.53 | % |

| Environmental Services | | $ | 23,500 | | | | 1.20 | % |

| Foods & Beverages | | $ | 87,636 | | | | 4.49 | % |

| Industrial Materials | | $ | 877 | | | | 0.05 | % |

| Instruments | | $ | 11,138 | | | | 0.57 | % |

| Leisure & Recreational | | $ | 42,360 | | | | 2.17 | % |

| Machinery | | $ | 3,956 | | | | 0.20 | % |

| Medical Products & Supplies | | $ | 167,983 | | | | 8.60 | % |

| Metal Fabrication & Hardware | | $ | 26,978 | | | | 1.38 | % |

| Office Equipment | | $ | 10,608 | | | | 0.54 | % |

| Railroads | | $ | 64,602 | | | | 3.31 | % |

| Real Estate & Related | | $ | 48,492 | | | | 2.48 | % |

| Retail – Specialty | | $ | 37,576 | | | | 1.92 | % |

| Steel | | $ | 66,500 | | | | 3.40 | % |

| Telecommunications | | $ | 73,869 | | | | 3.78 | % |

| Utilities – Natural Resources | | $ | 72,562 | | | | 3.72 | % |

| Total Equities | | $ | 1,655,890 | | | | 84.78 | % |

| | | | | | | | | |

| Cash & Equivalents (7 day yield .47%) | | $ | 297,274 | | | | 15.22 | % |

| | | | | | | | | |

| Total Invested Assets | | $ | 1,953,164 | | | | 100.00 | % |

The accompanying notes are an integral part of these financial statements.

GREATER WESTERN NEW YORK SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

STATEMENT OF OPERATIONS FOR THE YEAR ENDED OCTOBER 31, 2017

| INVESTMENT INCOME: | | | |

| Dividend and Interest Income | | $ | 25,782 | |

| EXPENSES: | | | | |

| Adviser Fees | | | 21,292 | |

| Legal and Professional | | | 1,890 | |

| Director’s Fees | | | 1,250 | |

| D&O/E&O | | | 944 | |

| Fidelity Bond | | | 104 | |

| State Income Taxes Refunded | | | (2,421 | ) |

| Telephone | | | 40 | |

| Custodian Fees | | | 1,375 | |

| Dues and Subscriptions | | | 1,348 | |

| Total expense | | | 25,822 | |

| Net investment loss | | | (40 | ) |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

| Realized gain from securities transactions | | | 81,817 | |

| Unrealized appreciation during the period | | | 109,870 | |

| Net gain on investments | | | 191,687 | |

| CHANGE IN NET ASSETS FROM OPERATIONS | | $ | 191,647 | |

GREATER WESTERN NEW YORK SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE YEARS ENDED OCTOBER 31, 2017 AND 2016

| | | October 2017 | | | October 2016 | |

| CHANGE IN NET ASSETS FROM OPERATIONS: | | | | | | | | |

| Net investment loss | | $ | (40 | ) | | $ | (809 | ) |

| Net realized gain (loss) from security transactions | | | 81,817 | | | | (1,629 | ) |

| Net change in unrealized appreciation (depreciation) of investments | | | 109,870 | | | | (21,724 | ) |

| Change in net assets from operations | | | 191,647 | | | | (24,162 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distribution of capital gains | | | (28,776 | ) | | | (6,100 | ) |

| Distribution of ordinary income | | | 0 | | | | (5,115 | ) |

| Decrease in net assets from distributions to shareholders | | | (28,776 | ) | | | (11,215 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Shares Sold | | | 73,642 | | | | 61,728 | |

| Reinvestment of distributions to shareholders | | | 28,776 | | | | 11,215 | |

| Shares Redeemed | | | (49,110 | ) | | | (79,828 | ) |

| Increase (decrease) in net assets from capital share transactions | | | 53,308 | | | | (6,885 | ) |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 216,179 | | | | (42,262 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 1,736,541 | | | | 1,778,803 | |

| End of period | | $ | 1,952,720 | | | $ | 1,736,541 | |

The accompanying notes are an integral part of these financial statements.

GREATER WESTERN NEW YORK SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

FINANCIAL HIGHLIGHTS (PER SHARE DATA FOR A SHARE OUTSTANDING)

FOR THE YEARS ENDED OCTOBER 31, 2017, 2016, 2015, 2014 AND 2013

| | | October | | | October | | | October | | | October | | | October | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| NET ASSET VALUE, beginning of period | | $ | 20.36 | | | $ | 20.79 | | | $ | 22.41 | | | $ | 20.16 | | | $ | 15.53 | |

| | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.00 | | | | (0.01 | ) | | | 0.00 | | | | (0.08 | ) | | | (0.08 | ) |

| Net gain (loss) on securities both realized and unrealized | | | 2.21 | | | | (0.29 | ) | | | 0.65 | | | | 2.33 | | | | 4.71 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total from investment operations | | | 2.21 | | | | (0.30 | ) | | | 0.65 | | | | 2.25 | | | | 4.63 | |

| | | | | | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | | | | | | | | | | | | |

| Distribution of capital gains | | | (0.34 | ) | | | (0.07 | ) | | | (2.27 | ) | | | 0.00 | | | | 0.00 | |

| Distribution of ordinary income | | | 0.00 | | | | (0.06 | ) | | | 0.00 | | | | 0.00 | | | | 0.00 | |

| Total stock dividend distributions | | | (0.34 | ) | | | (0.13 | ) | | | (2.27 | ) | | | 0.00 | | | | 0.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, end of period | | $ | 22.23 | | | $ | 20.36 | | | $ | 20.79 | | | $ | 22.41 | | | $ | 20.16 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS, end of period | | $ | 1,952,720 | | | $ | 1,736,541 | | | $ | 1,778,803 | | | $ | 1,774,261 | | | $ | 1,554,267 | |

GREATER WESTERN NEW YORK SERIES (A SERIES WITHIN BULLFINCH FUND, INC.)

FINANCIAL HIGHLIGHTS (RATIOS AND SUPPLEMENTAL DATA)

FOR THE YEARS ENDED OCTOBER 31, 2017, 2016, 2015, 2014 AND 2013

| | | October | | | October | | | October | | | October | | | October | |

| | | 2017 | | | 2016 | | | 2015 | | | 2014 | | | 2013 | |

| RATIO OF EXPENSES | | | | | | | | | | | | | | | | | | | | |

| TO AVERAGE NET ASSETS* | | | 1.37 | % | | | 1.56 | % | | | 1.54 | % | | | 1.68 | % | | | 1.74 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIO OF NET INVESTMENT INCOME | | | | | | | | | | | | | | | | | | | | |

| TO AVERAGE NET ASSETS* | | | 0.00 | % | | | (0.05 | )% | | | (0.02 | )% | | | (0.38 | )% | | | (0.45 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE* | | | 2.87 | % | | | 0.16 | % | | | 4.34 | % | | | 13.65 | % | | | 0.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 10.89 | % | | | (1.45 | )% | | | 2.85 | % | | | 11.16 | % | | | 29.81 | % |

* Per share amounts calculated using the average shares method

The accompanying notes are an integral part of these financial highlights.

GREATER WESTERN NEW YORK SERIES (A SERIES WITHIN BULLFINCH FUND, INC.) NOTES TO FINANCIAL STATEMENTS OCTOBER 31, 2017

NOTE A - SCOPE OF BUSINESS

The Greater Western New York Series (the “Series”) is a series within the Bullfinch Fund, Inc. (the “Fund”), which was organized as a Maryland corporation registered under the Investment Company Act of 1940 as an open-ended non-diversified management investment company. The Fund offers two series of common stock. In addition to the Greater Western New York Series, the Fund also offers the Unrestricted Series.

The investment objective of the Series is to seek capital appreciation through the investment in common stock of companies with an important economic presence in the Greater Western New York Region. The Adviser seeks to achieve this objective by using an asset mix consisting primarily of exchange listed securities and over -the-counter common stocks as well as U.S. Government securities maturing within five years.

NOTE B - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Series in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States (“GAAP”). The Series follows the investment company accounting and reporting guidance of the Financial Accounting Standard Board Accounting Standard Codification 946, Financial Services – Investment Companies.

Fair Value Measurements – ASC 820-10 establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

Level 1: Quoted prices (unadjusted) for identical assets or liabilities in active markets that the entity has the ability to access as of the measurement date.

Level 2: Significant other observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data.

Level 3: Significant unobservable inputs that reflect a reporting entity’s own assumptions about the assumptions that market participants would use in pricing an asset or liability.

The following is a description of the valuation methodologies used for assets measured at fair value:

Cash & Equivalents- Cash consists of amounts deposited in money market accounts or treasury bills and is not federally insured. The Series has not experienced any losses on such amounts and believes it is not exposed to any significant credit risk on cash.

Security Valuation - The Series records its investments at fair value and is in compliance with FASB ASC 820-10-50. Securities traded on national securities exchanges or the NASDAQ National Market System are valued daily at the closing prices of the securities on those exchanges and securities traded on over-the-counter markets are valued daily at the closing bid prices. Short-term and money market securities are valued at amortized cost, which approximates market value.

ASSETS AT FAIR VALUE AS OF:

| | | 10/31/17 | |

| | | LEVEL 1 | |

| COMMON STOCKS | | $ | 1,655,890 | |

| CASH & EQUIVALENTS | | $ | 297,274 | |

| TOTAL INVESTED ASSETS | | $ | 1,953,164 | |

In cases where market prices are unreliable or not readily available, for example, when trading on securities are halted as permitted by the SEC or when there is no trading volume on an Over-the-Counter security held by the Fund, the Fund relies on fair value pricing provided by the Adviser. In performing its fair value pricing, the Adviser acts under the ultimate supervision of, and follows, the policies of the Board of Directors. The Board of Directors retains the right to determine its own fair value price should it have reason to believe the price provided by the Adviser does not reflect fair value. Valuing securities at fair value involves greater reliance on judgment than securities that have readily available market quotations. There can be no assurance the Fund could obtain the fair value assigned to a security if they were to sell the security at approximately the time at which the Fund determines their net asset value per share.

Series Allocations - Common expenses of the Fund are evenly split between the two series of the Fund unless the Board of Directors approves an alternative allocation of expenses based on management’s estimate.

Income Taxes - It is the policy of the Fund to comply with the requirements of Subchapter M of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. In addition, the Fund intends to distribute an amount sufficient to avoid imposition of any excise tax under Section 4982 of the Code. Therefore, no provision for federal income taxes or excise taxes has been made.

Management has reviewed all open tax years and major tax jurisdictions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed or expected to be taken on a tax return. The tax returns of the Series for the prior three years are open for examination.

Distributions to Shareholders - Distributions to shareholders are recorded on the ex-dividend date. The Series made a distribution of its ordinary income of $5,115 to its shareholders on December 29, 2015 in the form of stock dividends equal to 246.371 shares of stock. The Series made a distribution of its capital gains of $6,100 to its shareholders on December 29, 2015 in the form of stock dividends equal to 293.831 shares of stock. The Series made a distribution of its capital gains of $28,776 to its shareholders on December 29, 2016 in the form of stock dividends equal to1,336.559 shares of stock.

Other - The Series follows industry practice and records security transactions on the trade date. The specific identification method is used for determining gains and losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date.

Use of Estimates - The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results can differ from those estimates.

Subsequent Events - In accordance with GAAP, the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through December 27, 2017, the date of issuance of these financial statements.

During December 2017, the Adviser of the Fund received notification of findings by the United States Securities and Exchange Commission of certain deficiencies and weaknesses in controls as a result of a limited scope field examination of the Fund for the period January 1, 2016 through August 31, 2017. The Adviser is reviewing its policies and procedures as part of its remediation efforts to maintain compliance with federal securities laws.

NOTE C – INVESTMENTS

For the year ended October 31, 2017, the Series purchased $53,940 of common stock. During the same period, the Series sold $154,348 of common stock.

At October 31, 2017, the gross unrealized appreciation for all securities totaled $935,756 and the gross unrealized depreciation for all securities totaled $109,744, or a net unrealized appreciation of $826,012. The aggregate cost of securities for federal income tax purposes at October 31, 2017 was $829,878.

NOTE D – RELATED PARTY TRANSACTIONS

Carosa Stanton Asset Management, LLC serves as investment adviser to the Fund pursuant to an investment adviser agreement which was approved by the Fund’s board of directors. Carosa Stanton Asset Management, LLC is a Registered Investment Adviser under the Investment Advisers Act of 1940. The Investment adviser agreement provides that Carosa Stanton Asset Management, LLC, subject to the supervision and approval of the Fund’s board of directors, is responsible for the day -to-day management of the Fund’s portfolio, which includes selecting investments and handling its business affairs.

As compensation for its services to the Fund, the investment adviser receives monthly compensation at an annual rate of 1.25% on the first $1 million of daily average net assets and 1% on that portion of the daily average net assets in excess of $1 million. These fees are reduced by any sub-transfer agent fees incurred by the Fund.

Carosa Stanton Asset Management, LLC has agreed as part of its contract to forego sufficient investment adviser fees to limit total expenses of the Fund to 2% of the first $10 million in average assets and 1.5% of the next $20 million in average assets.

During the year ended October 31, 2017, the Fund paid investment adviser fees of $21,292,

As of October 31, 2017, the Fund had $1,884 included in accrued expenses, as owed to Carosa Stanton Asset Management, LLC.

Certain officers of the Fund are also officers of Carosa Stanton Asset Management.

NOTE E – REMUNERATION OF DIRECTORS

The Directors are paid a fee of $50 per meeting. They may be reimbursed for travel expenses.

NOTE F – COMMITMENTS AND CONTINGENCIES

The Series indemnifies the Fund’s officers and the Board of Directors for certain liabilities that might arise from their performance of their duties to the Series. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on its experience, the Fund expects the risk of loss to be remote.

NOTE G - CAPITAL SHARE TRANSACTIONS

The Fund has authorized 10,000,000 shares of common stock at $0.01 par value per share. These shares are issued under either of the two series of the Fund. Each share has equal dividend, distribution and liquidation rights. Transactions in capital stock of the Series were as follows:

| | | Shares | | | Amount | |

| | | | | | | | | |

| Balance at October 31, 2015 | | | 85,564.891 | | | $ | 1,132,925 | |

| | | | | | | | | |

| Shares sold during 2016 | | | 2,995.918 | | | | 61,728 | |

| Shares redeemed during 2016 | | | (3,811.697 | ) | | | (79,828 | ) |

| Reinvestment of Distributions, December 29, 2015 | | | 540.202 | | | | 11,215 | |

| | | | | | | | | |

| Balance at October 31, 2016 | | | 85,289.314 | | | $ | 1,126,040 | |

| | | | | | | | | |

| Shares sold during 2017 | | | 3,436.881 | | | | 73,642 | |

| Shares redeemed during 2017 | | | (2,226.220 | ) | | | (49,110 | ) |

| Reinvestment of Distributions, December 29, 2016 | | | 1,336.559 | | | | 28,776 | |

| | | | | | | | | |

| Balance at October 31, 2017 | | | 87,836.534 | | | $ | 1,179,348 | |

ADDITIONAL INFORMATION

| EXPENSE TABLE | | Beginning | | | Ending | | | | | | | |

| | | Account Value | | | Account Value | | | Annualized | | | Expenses Paid | |

| ACTUAL | | 5/1/17 | | | 10/31/17 | | | Expense Ratio | | | During Period+ | |

| Unrestricted Series | | $ | 1,000.00 | | | $ | 1,021.10 | | | | 1.51 | % | | $ | 7.57 | |

| Greater Western New York Series | | | 1,000.00 | | | | 1,033.00 | | | | 1.37 | % | | $ | 6.91 | |

| HYPOTHETICAL++ | | | | | | | | | | | | | | | | |

| Unrestricted Series | | | 1,000.00 | | | | 1,025.00 | | | | 1.51 | % | | $ | 7.58 | |

| Greater Western New York Series | | | 1,000.00 | | | | 1,025.00 | | | | 1.37 | % | | $ | 6.88 | |

+ Expenses are equal to each Series’ annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days (181) in the most recent fiscal half-year, then divided by 365.

++ Assumes annual return of 5% before expenses.

All mutual funds have operating expenses. As a shareholder of the Fund, you incur operating expenses including investment advisory fees, regulatory fees and other Fund expenses. Such expenses, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund. The Fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The Expense Table is intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period (May 1, 2017 to October 31, 2017).

The Expense Table illustrates your Fund’s costs in two ways.

| | ● | ACTUAL EXPENSES. This section helps you to estimate the actual expenses after fee waivers that would have been paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. |

| | | |

| | ● | HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES. This section is intended to help you compare your Fund’s costs with those of other mutual funds. It is based on your Fund’s actual expense ratio and assumes that your Fund had an annual return of 5% before expenses during the period shown. In this case - because the return used is not your Fund’s actual return – the results may not be used to estimate your actual ending account value or expenses you paid during this period. The example is useful in making comparisons between your Fund and other funds because the Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on an annual 5% return. You can assess your Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds. |

BOARD OF DIRECTORS INFORMATION

The business and affairs of the Fund are managed under the direction of the Fund’s Board of Directors. Information pertaining to the Directors of the Fund are set forth below. The Fund’s SAI includes additional information about the Fund’s Directors, and is available without charge, by calling (585) 624-3150 or 1-888-BULLFINCH. Each director may be contacted by writing to the director c/o Bullfinch Fund, Inc. 3909 Rush Mendon Road, Mendon, New York 14506.

The directors and officers of the Fund are:

NAME, AGE

ADDRESS | | POSITON(S)

HELD

WITH FUND | | TERM OF OFFICE AND LENGTH OF TIME SERVED IN FUND | | PRINCIPLE OCCUPATION(S) DURING PAST

5 YEARS | | NUMBER OF PORTFOLIOS IN COMPLEX OVERSEEN BY DIRECTOR | | OTHER DIR- RECTORSHIPS HELD BY DIRECTOR |

| | | | | | | | | | | |

| INTERESTED PERSONS | | | | | | | | |

| | | | | | | | | | | |

| Christopher Carosa, 57 | | President; | | Term of Office: N/A | | President, Founder | | 2 | | N/A |

| 2 Lantern Lane | | Director; | | Length of Time | | Carosa Stanton Asset | | | | |

| Honeoye Falls, New York 14472 | | Chairman of Board; Chief Compliance Officer | | Served: Since 1997 | | Management, LLC President, Director and Chairman of the Board, Bullfinch Fund, Inc. | | | | |

| | | | | | | | | | | |

| Betsy Kay Carosa, 57 | | Corporate | | Term of Office: N/A | | Office Manager | | 2 | | N/A |

| 2 Lantern Lane | | Secretary | | Length of Time | | Carosa Stanton Asset | | | | |

| Honeoye Falls, NY 14472 | | | | Served: Since 1997 | | Management, LLC Corporate Secretary, Bullfinch Fund, Inc. | | | | |

| | | | | | | | | | | |

| INDEPENDENT DIRECTORS | | | | | | | | |

| | | | | | | | | |

| Thomas M. Doeblin, 58 | | Director; Audit | | Term of Office: N/A | | Teacher | | 2 | | N/A |

| 73 San Gabriel Drive | | Committee | | Length of Time | | Pittsford Mendon High | | | | |

| Rochester, NY 14610 | | | | Served: Since 2006 | | School | | | | |

| | | | | | | | | | | |

| Bryan D. Hickman, 72 | | Director; Audit | | Term of Office: N/A | | Co Founder, Vice Chairman | | 2 | | N/A |

| 6288 Bopple Hill Road | | Committee | | Length of Time | | E3 Rochester | | | | |

| Naples, NY 14512 | | | | Served: Since 2008 | | | | | | |

| | | | | | | | | | | |

| Lois Irwin, 65 | | Director | | Term of Office: N/A | | Director of Provider Services | | 2 | | N/A |

| 33 Oak Meadow Trail | | | | Length of Time | | ULTRAMOBILE IMAGING | | | | |

| Pittsford, NY 14534 | | | | Served: Since 2006 | | | | | | |

| | | | | | | | | | | |

| John P. Lamberton, 57 | | Director | | Term of Office: N/A | | Founder, General Partner | | 2 | | N/A |

| 110 East Center Street #2057 | | | | Length of Time | | Cape Bojador Capital Management | | | | |

| Madison, SD 57042 | | | | Served: Since 2003 | | | | | | |

| | | | | | | | | | | |

| Jerome C Lojacono 58 | | Director | | Term of Office: N/A | | President | | 2 | | N/A |

| 6499 Poplar Court | | | | Length of Time | | Jerome C Lojacono | | | | |

| East Amherst, NY 14051 | | | | Served: Since 2016 | | Enterprises | | | | |

| | | | | | | | | | | |

| William E.J. Martin, 57 | | Director | | Term of Office: N/A | | Managing Member, | | 2 | | N/A |

| 4410 Woodlawn Ave. N | | | | Length of Time | | Chipman & Martin, LLC | | | | |

| Seattle, WA 98103 | | | | Served: Since 1997 | | | | | | |

| | | | | | | | | | | |

| Michael W. Reynolds, 56 | | Director; Audit | | Term of Office: N/A | | Marketing Consultant | | 2 | | N/A |

| 203 Randwood Drive | | Committee | | Length of Time | | Sole Proprietor | | | | |

| Getzville, NY 14068 | | | | Served: Since 2000 | | | | | | |

PROXY VOTING GUIDELINES

Carosa Stanton Asset Management, LLC, the Fund’s Investment Adviser, is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Adviser in fulfilling this responsibility and the voting record during the most recent 12 month period ending June 30th is available without charge, upon request, by calling (585) 624-3150 or 1-888-BULLFINCH. The Fund’s Forms N-PX is available on the SEC’s website at http://www.sec.gov. The Fund’s Forms N-PX may also be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

QUARTERLY FILING OF PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N -Q are available on the SEC’s website at http://www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

DISCLOSURE REGARDING THE BOARD OF DIRECTORS’ APPROVAL OF THE INVESTMENT ADVISORY CONTRACT

At the Board’s Annual Meeting, the Independent Directors of the Board met separately to discuss the Adviser and reported the conclusions to the Board. In determining whether to renew the Management and Investment Advisory Agreements between the Fund and Carosa Stanton Asset Management, LLC, (the Adviser), the Board of Directors requested, and the Adviser provided information relevant to the Board’s consideration. Among the factors the Board considered were:

| | 1) | Nature, extent and quality of service provided by the Adviser – the Independent Directors noted the unprecedented access they have to the Adviser, the quick responsiveness to requests . |

| | | |

| | 2) | The overall performance of the Funds relative to the performance of other funds in the Funds’ peer group. |

| | | |

| | 3) | In addition, the Board compared expenses of each Fund to the expenses of its peers. However, the board did not compare advisory fees of each fund to the advisory fees of its peers. |

| | | |

| | 4) | The Board also considered the fact that Adviser has implemented breakpoints in the Funds’ advisory fee schedule and the Board agreed that this type of fee structure remained reasonable and fair to shareholders. |

| | | |

| | 5) | They noted the range of investment advisory and administrative services provided by the Adviser to the Fund. |

| | | |

| | 6) | They also took note of the fact that the Fund is not subject to sales charges or Rule 12b-1 fees. |

| | | |

| | 7) | The Board also reviewed financial information concerning the Adviser’s brokerage practices, including soft dollar arrangements, and noted that these were reasonable. |

Based upon their review and consideration of these factors and other matters deemed relevant, the Board concluded that the terms of the Investment Management Agreements are fair and reasonable and the Board voted to renew the Agreements.