UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-08231

Spirit of America Investment Fund, Inc.

(Exact name of registrant as specified in charter)

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Address of principal executive offices) (Zip code)

Mr. David Lerner

David Lerner Associates

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Name and address of agent for service)

Registrant’s telephone number, including area code: (516) 390-5565

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

MESSAGETOOURSHAREHOLDERS

Dear Shareholder,

We are very pleased to provide you with the 2010 annual report for The Spirit of America High Yield Tax Free Bond Fund, (“the Fund”). We look forward to the continued inflows and further development of the Fund in this New Year.

Utilizing our many years of experience in the municipal bond market has allowed us to effectively pursue a balance between yield and risk. Our goal is to continue seeking high current income that is exempt from federal income tax, while employing a relatively conservative approach to investing in the high yield sector of the municipal market. Although the mandate of the Fund allows it to invest in lower rated securities, at this time, the focus will continue to be investing in bonds which are investment grade.

We have been proud to watch the number of investors grow. We appreciate your support of our fund and look forward to your future investment in the Spirit of America High Yield TaxFree Bond Fund.

Thank you for being a part of the Spirit of America Family of Funds.

Any investment in debt securities is subject to risk and market values may fluctuate with economic conditions, interest rates, civil unrest and other factors, which will affect its market value. As with any mutual fund, an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results.

Prospective investors should consider the investment objective, risks and charges and expenses of the Fund carefully before investing. The maximum sales charge on share purchases is 4.75% of the offering price. The Fund’s prospectus contains this and other information about the Fund and may be obtained through your broker or by calling 1-800-452-4892. The prospectus should be read carefully before investing.

|

| HIGH YIELD TAX FREE BOND FUND

|

|

| 1

|

|

MANAGEMENTDISCUSSION

Introduction The Spirit of America High Yield Tax Free Bond Fund’s (SOAMX), (“the Fund”), objective is to maintain current income that is exempt from federal income tax, including the alternative minimum tax (“AMT”). The emphasis of the Fund is in the High Yield section of the municipal market.

As a High Yield Bond Fund, the mandate allows the Fund to invest in lower rated securities; however we have kept our focus on investing in bonds in the “Baa3”/“BBB-” range and higher. Our plan is to continue with this relatively conservative approach to investing in the high yield municipal market.

In keeping with this philosophy, the Fund has been able to maintain attractive yields without venturing into the speculative, below investment grade, segment of the high yield municipal market. Currently, as of December 31, 2010, 98.41% of the portfolio is investment grade or above, with over 71% rated “A” or better. The average rating of holdings in the Fund is “A/A2”.

Overview

High yield municipal bonds are typically issued by government entities to finance economic or industrial development projects, as well as, housing, healthcare and environmental projects. Other high yield municipals are issued to finance such things as airport terminals, charter schools, and projects related to utilities. In addition, a large number of bonds have been issued by local governments in anticipation of revenues owed by the tobacco industry.

The interest payments are usually covered by a special tax or revenue from the project, and the bonds are often backed by hard assets or mortgage income associated with the project. High yield municipals may also be issued to finance private projects that | benefit the community, such as waste remediation or public utilities. In those cases the debt is usually backed and paid for by a corporation. As with the broader municipal market, high yield municipal bonds provide income that is exempt from federal, and sometimes state, income taxes.

One of the Fund’s goals has been to diversify with respect to location and sector. As of December, 31 2010, the Fund consists of 274 different issues varied across 44 states, 2 territories and the District of Columbia. The holdings range throughout 24 sectors of the market, including areas such as healthcare, higher education, industrial development and transportation. Also, while it certainly has not been a primary goal of the Fund, we have been able to maintain a percentage of our bonds in states and territories which have a state tax exemption in New York, New Jersey and Connecticut, where most of our clients reside.

Market Commentary

Municipal bonds performed well in the first half of 2010, the 30-Year “AAA” Municipal Market Data (MMD) yield rallied from 4.16% to 4.02%. However, in the second half of the year the 30-Year “AAA” MMD went from 4.02% to 4.68%. The Fund’s Net Asset Value (NAV) went from 9.31 to 9.04 during the year. The performance of the Fund corresponded to unstable market conditions in the second half of 2010. Addressing these market conditions and recent press, we would like to share some thoughts on the municipal market in light of some recent press.

“Millions of people swim at U.S. beaches every year, most of them without incident. However, with a single shark attack, suddenly there are a series of news stories.

We see parallels to today’s bond market. In recent years, a series of payment problems |

2

|

SPIRIT OF AMERICA

|

MANAGEMENTDISCUSSION (CONT.)

(Vallejo California, Jefferson County Alabama, and Harrisburg Pennsylvania) combined with budget problems in California and Illinois have helped to create some negative press. In our opinion, some “publicity hounds” have taken these concerns to the next level.

While it is important to acknowledge the budgetary problems that some issuers are having we believe it is equally important to recognize the imperative of municipal bond issuers to maintain market access. Municipal bonds have historically been relatively conservative, enduring investments. After all, much of this country’s infrastructure was built with Municipal Bonds.

It is clear that municipal bonds will continue to play an integral role for both issuers and investors alike. We feel there is tremendous value in the municipal bond market; however, it is important to know the municipal market. Here at Spirit of America each and every credit goes through vigorous credit analysis, in addition, our trading department is staffed by traders with a wealth of knowledge and experience.

We believe that some states and localities across the country need to confront current challenges seriously and re-examine the role they play and the services they provide. Many state and local governments are beginning to address this. They are making difficult budgetary choices and have begun the debate of reforming pensions and other benefits for their workforce.

We believe that fiscal responsibility on the federal, the state and local government level is moving to the forefront of American politics. The recent elections have shown that officials will be held accountable. Here is a silver lining; these very stories which paint a negative picture of municipals could also be a catalyst for making the industry even stronger than it is. | This country was built on Municipal Bonds. When you see our highways, our roads, our tunnels and bridges – many of these things were built with municipal bonds.

What a great way to invest in America!!!”

Investment grade municipal bonds historically have a long record of safety and consistency of making timely interest payments. As of December 31, 2010, 98.41% of the Spirit of America High Yield Tax Free Bond Fund was investment grade.

Summary

Spirit of America High Yield Tax Free Bond Fund continues to grow at a steady and healthy pace. The Fund saw inflows over $41 million, while outflows were approximately $15 million in 2010. Since inception in March of 2008, the Fund has grown to over $90 million in net assets. We expect continued growth in assets under management in the future.

Our plan is to proceed with the same strategy that we have utilized since the Fund’s inception. We will continue to seek out municipal bonds that provide a balance between credit risk and the potential to offer high current income and consistently attractive yields. |

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

3

|

|

MANAGEMENTDISCUSSION (CONT.)

Ratings are provided by Moody’s Investor Services (“Moody’s”) and Standard & Poor’s (“S&P”). The Moody’s ratings in the following ratings explanations are in parentheses. AAA (Aaa) - The highest rating assigned by (“Moody’s”) and (“S&P”). Capacity to pay interest and repay principal is extremely strong. AA (Aa) - Debt has a very strong capacity to pay interest and repay principal and differs from the highest rated issues only in a small degree. A - Debt rated “A” has a strong capacity to pay interest and repay principal, although it is somewhat more susceptible to the adverse affects of changes in circumstances and economic conditions than debt in higher-rated categories. BBB (Baa) - Debt is regarded as having an adequate capacity to pay interest and repay principal. These ratings by Moody’s and S&P are the “cut-off” for a bond to be considered investment grade. Whereas debt normally exhibits adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal in this category than in higher-rated categories. BB (Bb), B, CCC (Ccc), CC (Cc), C - Debt rated in these categories is regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. “BB” indicates the least degree of speculation and “C” the highest. While such debt will likely have some quality and protective characteristics, these are outweighed by large uncertainties or market exposure to adverse conditions and are not considered to be investment grade. D - Debt rated “D” is in payment default. This rating category is used when interest payments or principal payments are not made on the date due, even if the applicable grace period has not expired, unless S&P believes that such payments will be made during such grace period. Ratings are subject to change. Ratings apply to the bonds in the portfolio. They do not remove market risk associated with the fund. Ratings are based on Moody’s, S&P as applicable. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. If securities are rated differently by the rating agencies, the higher of the two rating is applied thus improving the overall evaluation of the portfolio. |

4

|

SPIRIT OF AMERICA

|

MANAGEMENTDISCUSSION (CONT.)

Summary of Portfolio Holdings

(Unaudited)

The Securities and Exchange Commission (“SEC”) has adopted a requirement that all funds present their categories of portfolio holdings in a table, chart or graph format in their annual and semi-annual shareholder reports, whether or not a schedule of investments is utilized. The following table, which presents portfolio holdings as a percentage of total market value, is provided in compliance with such requirement.

Spirit of America High Yield Tax Free Bond Fund

December 31, 2010

New York | 17.39 | % | $15,305,117 | |||||

Puerto Rico | 14.98 | 13,185,421 | ||||||

Texas | 6.37 | 5,609,597 | ||||||

New Jersey | 6.28 | 5,526,348 | ||||||

California | 5.77 | 5,078,386 | ||||||

Ohio | 5.37 | 4,727,931 | ||||||

Florida | 5.14 | 4,521,671 | ||||||

Michigan | 3.48 | 3,059,463 | ||||||

Wisconsin | 3.47 | 3,058,332 | ||||||

Louisiana | 3.05 | 2,680,354 | ||||||

Maryland | 2.69 | 2,370,827 | ||||||

Illinois | 2.65 | 2,328,201 | ||||||

Pennsylvania | 2.03 | 1,788,851 | ||||||

Washington | 1.68 | 1,478,788 | ||||||

Georgia | 1.61 | 1,414,496 | ||||||

Oregon | 1.49 | 1,310,271 | ||||||

Rhode Island | 1.40 | 1,235,712 | ||||||

North Dakota | 1.39 | 1,225,488 | ||||||

Colorado | 1.27 | 1,119,742 | ||||||

Kentucky | 1.16 | 1,024,043 | ||||||

Connecticut | 1.11 | 975,105 | ||||||

Arizona | 0.90 | 795,817 | ||||||

Massachusetts | 0.90 | 795,758 | ||||||

New Mexico | 0.81 | 711,463 | ||||||

Indiana | 0.69 | 611,281 | ||||||

Alaska | 0.68 | 597,655 | ||||||

North Carolina | 0.63 | 553,854 | ||||||

District of Columbia | 0.58 | 511,243 | ||||||

Missouri | 0.56 | 493,561 | ||||||

West Virginia | 0.52 | 461,005 | ||||||

New Hampshire | 0.39 | 346,485 | ||||||

Iowa | 0.34 | 301,521 | ||||||

South Carolina | 0.33 | 286,112 | ||||||

Nebraska | 0.29 | 251,520 | ||||||

Kansas | 0.28 | 242,523 | ||||||

Montana | 0.27 | 241,197 | ||||||

Mississippi | 0.26 | 229,767 | ||||||

Virginia | 0.24 | 214,263 | ||||||

Wyoming | 0.24 | 206,522 | ||||||

Minnesota | 0.23 | 198,774 | ||||||

Tennessee | 0.22 | 196,614 | ||||||

Alabama | 0.22 | 196,466 | ||||||

Maine | 0.22 | 192,882 | ||||||

Nevada | 0.16 | 140,700 | ||||||

South Dakota | 0.11 | 97,654 | ||||||

Virgin Islands | 0.11 | 96,652 | ||||||

Hawaii | 0.04 | 37,938 | ||||||

| Total Investments | 100.00 | % | $ | 88,033,371 |

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

5

|

|

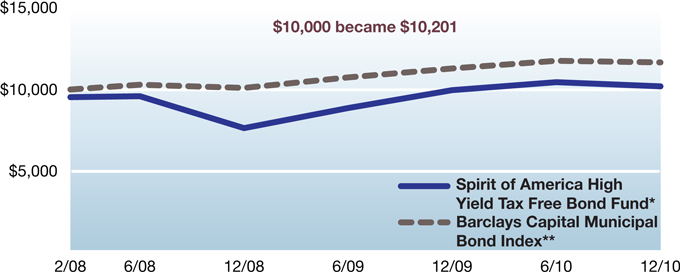

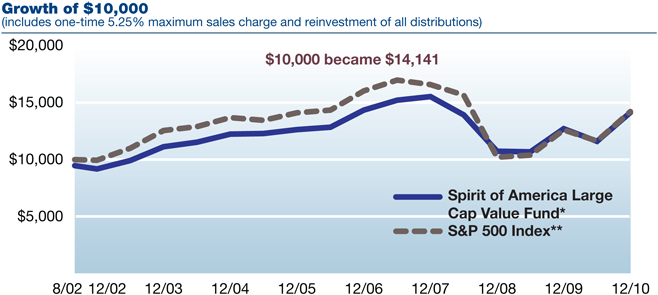

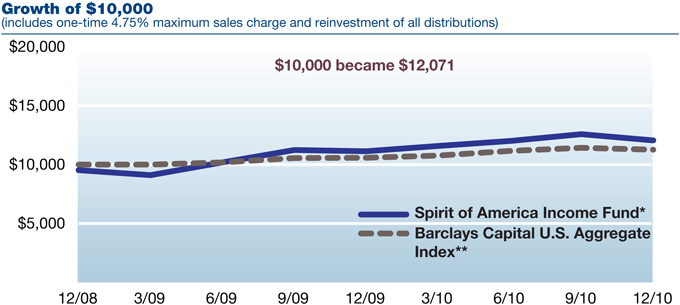

ILLUSTRATIONOFINVESTMENT (UNAUDITED)

The graph below compares the increase in value of a $10,000 investment in the Fund with the performance of the Barclays Capital Municipal Bond Index. The values and returns for the Fund include reinvested distributions, and the impact of the maximum sales charge of 4.75% placed on purchases. The returns shown do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

Aggregate Total Returns

For the Periods Ended December 31, 2010

| Shares | ||||

1 Year (with sales charge) | (2.38) | %a | ||

1 Year (without sales charge) | 2.44 | % | ||

Since Inception | 0.70 | %a | ||

(with sales charge)b | ||||

Since Inception (without sales charge)b

|

| 2.45

| %

| |

Past performance is not indicative of future results.

a Reflects a 4.75% front-end sales charge.

b Inception date: February 29, 2008.

Growth of $10,000

(includes one-time 4.75% maximum sales charge and reinvestment of all distributions)

| * | Fund commenced operations February 29, 2008. |

| ** | The Barclays Capital Municpal Bond Index benchmark is based on a start date of February 29, 2008. |

The Barclays Capital Municipal Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible.

6

|

SPIRIT OF AMERICA

|

DISCLOSUREOFFUNDEXPENSES (UNAUDITED)

FORTHEPERIODJULY 1, 2010TODECEMBER 31, 2010

| We believe it is important for you to understand the impact of fees regarding your investment. All mutual funds have operating expenses. As a shareholder of the Fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from the Fund’s gross income, directly reduce the investment return of the Fund. | The Fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period. |

| Spirit of America High Yield Tax Free Bond Fund | ||||||||

| Beginning Account Value 7/1/10 | Ending Account Value 12/31/10 | Expense Ratio(1) | Expenses Paid During Period(2) | |||||

Actual Fund Return | $1,000.00 | $ 976.30 | 0.90% | $4.48 | ||||

Hypothetical 5% Return | $1,000.00 | $1,020.67 | 0.90% | $4.58 | ||||

This table illustrates your Fund’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, the third column shows the period’s annualized expense ratio, and the last column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund at the beginning of the period. You may use the information here, together with your account value, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period.” | Hypothetical 5% Return: This section is intended to help you compare your Fund’s costs with those of other mutual funds. It assumes that the Fund had a return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. You can assess your Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), or redemption fees.

(1) Annualized, based on the Fund’s most recent halfyear expenses.

(2) Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the period (184), then divided by 365. |

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

7

|

|

SCHEDULEOFINVESTMENTS | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Municipal Bonds 97.54% | ||||||||

Alabama 0.22% | ||||||||

Cullman County Health Care Authority, Refunding Revenue | $ | 100,000 | $ | 97,603 | ||||

Cullman County Health Care Authority, Refunding Revenue | 100,000 | 98,863 | ||||||

| 196,466 | ||||||||

Alaska 0.66% | ||||||||

Alaska Housing Finance Corp., State Single-Family Housing | 240,000 | 236,170 | ||||||

Northern TOB Securitization Corp., Refunding Revenue | 500,000 | 361,485 | ||||||

| 597,655 | ||||||||

Arizona 0.88% | ||||||||

Arizona Health Facilities Authority, Refunding Revenue | 100,000 | 93,575 | ||||||

Pima County Industrial Development Authority, Refunding | 750,000 | 602,243 | ||||||

State of Arizona, Public Improvements Revenue Bonds, Series A, | 100,000 | 99,999 | ||||||

| 795,817 | ||||||||

California 5.63% | ||||||||

Bay Area Toll Authority, Highway Improvements Revenue | 250,000 | 245,533 | ||||||

California Health Facilities Financing Authority, Hospital | 1,000,000 | 1,009,990 | ||||||

City of Turlock, Hospital Improvements, Certificate of | 250,000 | 219,715 | ||||||

City of Turlock, Hospital Improvements, Certificate of | 250,000 | 217,880 | ||||||

County of San Bernardino, Refunding Bonds, Certificate of | 250,000 | 254,777 | ||||||

See accompanying notes to financial statements.

8

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

California (cont.) | ||||||||

County of San Bernardino, Refunding Bonds, Certificate of | $ | 50,000 | $ | 47,399 | ||||

Golden State Tobacco Securitization Corp., Refunding Revenue | 55,000 | 37,100 | ||||||

Hesperia Public Financing Authority, Miscellaneous Purposes | 350,000 | 248,455 | ||||||

State of California, Port, Airport & Marina Improvements, | 250,000 | 246,637 | ||||||

State of California, Port, Airport & Marina Improvements, | 250,000 | 241,907 | ||||||

State of California, Public Improvements, General Obligation | 500,000 | 512,010 | ||||||

State of California, Public Improvements, General Obligation | 100,000 | 102,006 | ||||||

State of California, Refunding Bonds, General Obligation | 250,000 | 236,593 | ||||||

State of California, Refunding Notes, General Obligation | 500,000 | 455,780 | ||||||

State of California, Refunding Notes, General Obligation | 500,000 | 450,620 | ||||||

University of California, University & College Improvements | 475,000 | 391,889 | ||||||

Washington Township Health Care District, Hospital | 20,000 | 21,053 | ||||||

Washington Township Health Care District, Hospital | 140,000 | 139,042 | ||||||

| 5,078,386 | ||||||||

HIGH YIELD TAX FREE BOND FUND

|

9

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Colorado 1.24% | ||||||||

Colorado Educational & Cultural Facilities Authority, School | $ | 250,000 | $ | 285,140 | ||||

Colorado Educational & Cultural Facilities Authority, School | 250,000 | 277,555 | ||||||

Colorado Health Facilities Authority, Refunding Revenue | 100,000 | 100,497 | ||||||

Montrose Memorial Hospital, Hospital Improvements Revenue | 500,000 | 456,550 | ||||||

| 1,119,742 | ||||||||

Connecticut 1.08% | ||||||||

Connecticut Housing Finance Authority, Refunding Revenue | 100,000 | 89,996 | ||||||

Connecticut Housing Finance Authority, Refunding Revenue | 100,000 | 94,426 | ||||||

Connecticut State Development Authority, Refunding Revenue | 250,000 | 201,775 | ||||||

Connecticut State Health & Educational Facility Authority, | 100,000 | 97,720 | ||||||

Connecticut State Health & Educational Facility Authority, | 250,000 | 238,363 | ||||||

Connecticut State Health & Educational Facility Authority, | 100,000 | 91,981 | ||||||

State of Connecticut, Refunding Revenue Bonds, Callable | 100,000 | 108,729 | ||||||

University of Connecticut, University & College Improvements | 50,000 | 52,115 | ||||||

| 975,105 | ||||||||

10

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

District of Columbia 0.57% | ||||||||

District of Columbia, Hospital Improvements Revenue Bonds, | $ | 530,000 | $ 511,243 | |||||

Florida 5.01% | ||||||||

City of Jacksonville, Public Improvements Revenue Bonds, | 200,000 | 189,884 | ||||||

City of Miami, Parking Facility Improvements Revenue Bonds, | 100,000 | 94,729 | ||||||

City of Miami, Parking Facility Improvements Revenue Bonds, Series A, Callable 07/01/20 @ 100, (AGM) (OID), 5.25%, 07/01/39 | 125,000 | 116,623 | ||||||

City of Miami, Public Improvements Revenue Bonds, Callable | 500,000 | 459,255 | ||||||

City of Miami, Refunding Revenue Bonds, Callable 10/01/19 @ | 500,000 | 480,130 | ||||||

County of Miami-Dade, Hospital Improvements Revenue | 100,000 | 99,994 | ||||||

County of Miami-Dade, Port, Airport & Marina Improvements Revenue Bonds, Series A, Callable 10/01/20 @ 100 (OID), 5.25%, 10/01/30 | 150,000 | 144,456 | ||||||

County of Miami-Dade, Port, Airport & Marina Improvements | 500,000 | 474,140 | ||||||

County of Miami-Dade, Public Improvements, General | 250,000 | 259,027 | ||||||

County of Miami-Dade, Recreational Facility Improvements | 250,000 | 251,450 | ||||||

Escambia County Health Facilities Authority, Hospital | 100,000 | 105,774 | ||||||

Escambia County Health Facilities Authority, Hospital | 230,000 | 230,324 | ||||||

Escambia County Health Facilities Authority, Hospital | 125,000 | 122,890 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

11

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Florida (cont.) | ||||||||

Florida Housing Finance Corp., State Single-Family Housing | $125,000 | $ | 118,814 | |||||

Florida State Board of Education, School Improvements | 380,000 | 412,786 | ||||||

Greater Orlando Aviation Authority, Port, Airport & Marina | 200,000 | 204,946 | ||||||

Hillsborough County Industrial Development Authority, School | 250,000 | 192,217 | ||||||

Miami-Dade County Expressway Authority, Refunding Revenue | 500,000 | 460,625 | ||||||

Orange County Health Facilities Authority, Hospital | 100,000 | 103,607 | ||||||

| 4,521,671 | ||||||||

Georgia 1.57% | ||||||||

Albany-Dougherty Inner City Authority, University & College | 250,000 | 228,500 | ||||||

City of Atlanta, Refunding Revenue Bonds, Series B, Callable | 250,000 | 249,073 | ||||||

Coffee County Hospital Authority, Refunding Revenue Bonds, | 250,000 | 250,163 | ||||||

Gainesville & Hall County Hospital Authority, Hospital | 750,000 | 686,760 | ||||||

| 1,414,496 | ||||||||

Hawaii 0.04% | ||||||||

Hawaii Pacific Health, Hospital Improvements Revenue Bonds, | 40,000 | 37,938 | ||||||

Illinois 2.58% | ||||||||

City of Chicago, Local Multi-Family Housing Revenue Bonds, | 250,000 | 238,473 | ||||||

Illinois Finance Authority, Hospital Improvements Revenue | 250,000 | 227,123 | ||||||

12

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Illinois (cont.) | ||||||||

Illinois Finance Authority, Hospital Improvements Revenue | $250,000 | $ 267,467 | ||||||

Illinois Finance Authority, Hospital Improvements Revenue | 250,000 | 229,200 | ||||||

Illinois Finance Authority, Refunding Revenue Bonds, Series A, | 215,000 | 211,551 | ||||||

Illinois Finance Authority, Refunding Revenue Bonds, Series A, | 175,000 | 168,376 | ||||||

Illinois Finance Authority, Refunding Revenue Bonds, | 520,000 | 489,081 | ||||||

Railsplitter Tobacco Settlement Authority, Public Improvements | 250,000 | 250,920 | ||||||

Railsplitter Tobacco Settlement Authority, Public Improvements | 250,000 | 246,010 | ||||||

| 2,328,201 | ||||||||

Indiana 0.68% | ||||||||

Indiana Finance Authority, Hospital Improvements Revenue | 250,000 | 246,690 | ||||||

Indiana Finance Authority, Refunding Revenue Bonds, Series A, | 100,000 | 99,991 | ||||||

Indiana Finance Authority, Refunding Revenue Bonds, Series A, | 265,000 | 264,600 | ||||||

| 611,281 | ||||||||

Iowa 0.33% | ||||||||

Iowa Finance Authority, Hospital Improvements Revenue | 300,000 | 301,521 | ||||||

Kansas 0.27% | ||||||||

Kansas Development Finance Authority, Refunding Revenue | 250,000 | 242,523 | ||||||

Kentucky 1.13% | ||||||||

Kentucky Economic Development Finance Authority, | 750,000 | 764,753 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

13

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Kentucky (cont.) | ||||||||

Kentucky Municipal Power Agency, Revenue Bonds, Series A, | $ 250,000 | $ 259,290 | ||||||

| 1,024,043 | ||||||||

Louisiana 2.97% | ||||||||

Louisiana Public Facilities Authority, Refunding Revenue | 250,000 | 255,665 | ||||||

Parish of St. John Baptist, Industrial Improvements Revenue | 2,685,000 | 2,424,689 | ||||||

| 2,680,354 | ||||||||

Maine 0.21% | ||||||||

Maine State Housing Authority, Local Single-Family Housing | 100,000 | 98,947 | ||||||

Maine State Housing Authority, State Single-Family Housing | 100,000 | 93,935 | ||||||

| 192,882 | ||||||||

Maryland 2.63% | ||||||||

Maryland Community Development Administration, Refunding | 350,000 | 338,405 | ||||||

Maryland Community Development Administration, State | 250,000 | 233,317 | ||||||

Maryland Community Development Administration, State | 500,000 | 450,570 | ||||||

Maryland Economic Development Corp., Port, Airport & | 500,000 | 475,665 | ||||||

Maryland Economic Development Corp., Port, Airport & | 445,000 | 419,951 | ||||||

Maryland Health & Higher Educational Facilities Authority, | 60,000 | 54,002 | ||||||

14

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Maryland (cont.) | ||||||||

Maryland Health & Higher Educational Facilities Authority, | $165,000 | $ 155,174 | ||||||

Montgomery County Housing Opportunites Commission, | 250,000 | 243,743 | ||||||

| 2,370,827 | ||||||||

Massachusetts 0.88% | ||||||||

Massachusetts Educational Financing Authority, Refunding | 100,000 | 96,918 | ||||||

Massachusetts Educational Financing Authority, Refunding | 100,000 | 96,085 | ||||||

Massachusetts Health & Educational Facilities Authority, | 150,000 | 149,238 | ||||||

Massachusetts Health & Educational Facilities Authority, | 100,000 | 91,605 | ||||||

Massachusetts Housing Finance Agency, State Mulit-Family | 175,000 | 169,327 | ||||||

Massachusetts Housing Finance Agency, State Multi-Family | 100,000 | 95,710 | ||||||

Massachusetts Housing Finance Agency, State Multi-Family | 100,000 | 96,875 | ||||||

| 795,758 | ||||||||

Michigan 3.39% | ||||||||

Cesar Chavez Academy, Inc., School Improvements, Certificate | 185,000 | 183,490 | ||||||

Crossroads Charter Academy, Refunding Revenue Bonds, | 250,000 | 181,305 | ||||||

Michigan Public Educational Facilities Authority, School | 500,000 | 453,370 | ||||||

Michigan State Hospital Finance Authority, Refunding Revenue | 100,000 | 95,682 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

15

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Michigan (cont.) | ||||||||

Michigan State Hospital Finance Authority, Refunding Revenue | $ | 250,000 | $ | 240,130 | ||||

Michigan Tobacco Settlement Finance Authority, Miscellaneous | 1,700,000 | 1,158,091 | ||||||

Michigan Tobacco Settlement Finance Authority, Refunding | 250,000 | 236,953 | ||||||

Royal Oak Hospital Finance Authority, Refunding Revenue | 250,000 | 257,417 | ||||||

Royal Oak Hospital Finance Authority, Refunding Revenue | 250,000 | 253,025 | ||||||

| 3,059,463 | ||||||||

Minnesota 0.22% | ||||||||

City of St. Cloud, Refunding Revenue Bonds, Series A, Callable | 200,000 | 198,774 | ||||||

Mississippi 0.25% | ||||||||

Mississippi Hospital Equipment & Facilities Authority, | 250,000 | 229,767 | ||||||

Missouri 0.55% | ||||||||

Hanley Road Corridor Transportation Development District, | 250,000 | 262,100 | ||||||

Missouri Housing Development Commission, State | 245,000 | 231,461 | ||||||

| 493,561 | ||||||||

Montana 0.27% | ||||||||

Montana Facility Finance Authority, Refunding Revenue Bonds, | 250,000 | 241,197 | ||||||

Nebraska 0.28% | ||||||||

Nebraska Investment Finance Authority, State Single-Family | 250,000 | 251,520 | ||||||

16

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Nevada 0.15% | ||||||||

City of Reno, Hospital Improvements Revenue Bonds, Callable | $ | 50,000 | $ 48,473 | |||||

Nevada Housing Division, State Single-Family Housing | 100,000 | 92,227 | ||||||

| 140,700 | ||||||||

New Hampshire 0.38% | ||||||||

New Hampshire Health & Education Facilities Authority, | 250,000 | 235,717 | ||||||

New Hampshire Health & Education Facilities Authority, | 100,000 | 110,768 | ||||||

| 346,485 | ||||||||

New Jersey 6.12% | ||||||||

Essex County Improvement Authority, Public Improvements | 250,000 | 247,355 | ||||||

Hudson County Improvement Authority, Refunding Revenue | 150,000 | 150,897 | ||||||

New Jersey Economic Development Authority, Economic | 1,050,000 | 1,049,612 | ||||||

New Jersey Economic Development Authority, Economic | 400,000 | 375,236 | ||||||

New Jersey Economic Development Authority, Economic | 450,000 | 416,592 | ||||||

New Jersey Economic Development Authority, School | 100,000 | 99,997 | ||||||

New Jersey Health Care Facilities Financing Authority, Hospital | 500,000 | 505,970 | ||||||

New Jersey Health Care Facilities Financing Authority, Hospital | 520,000 | 540,946 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

17

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

New Jersey (cont.) | ||||||||

New Jersey Health Care Facilities Financing Authority, | $ | 250,000 | $ 245,320 | |||||

New Jersey Higher Education Assistance Authority, Refunding | 100,000 | 97,206 | ||||||

New Jersey Higher Education Assistance Authority, | 250,000 | 244,875 | ||||||

New Jersey Higher Education Assistance Authority, Revenue | 65,000 | 60,962 | ||||||

New Jersey Housing & Mortgage Finance Agency, State | 185,000 | 180,220 | ||||||

Newark Housing Authority, Public Improvements Revenue | 750,000 | 834,240 | ||||||

Tobacco Settlement Financing Corp., Refunding Revenue | 800,000 | 476,920 | ||||||

| 5,526,348 | ||||||||

New Mexico 0.79% | ||||||||

New Mexico Hospital Equipment Loan Council, Hospital | 445,000 | 434,947 | ||||||

New Mexico Hospital Equipment Loan Council, Hospital | 225,000 | 213,842 | ||||||

Village of Los Ranchos de Albuquerque, Refunding Revenue | 75,000 | 62,674 | ||||||

| 711,463 | ||||||||

New York 16.96% | ||||||||

Hudson Yards Infrastructure Corp., Transit Improvements | 1,500,000 | 1,358,925 | ||||||

Long Island Power Authority, Refunding Revenue Bonds, Series | 250,000 | 255,567 | ||||||

Metropolitan Transportation Authority, Refunding Revenue | 250,000 | 252,127 | ||||||

18

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

New York (cont.) | ||||||||

Metropolitan Transportation Authority, Refunding Revenue | $500,000 | $493,270 | ||||||

Metropolitan Transportation Authority, Refunding Revenue | 500,000 | 501,900 | ||||||

Monroe County Industrial Development Corp., Hospital | 250,000 | 267,800 | ||||||

New York City Housing Development Corp, Local | 100,000 | 94,042 | ||||||

New York City Housing Development Corp., Local | 200,000 | 197,448 | ||||||

New York City Housing Development Corp., Local | 500,000 | 468,830 | ||||||

New York City Housing Development Corp., Local | 250,000 | 237,193 | ||||||

New York City Housing Development Corp., Local | 100,000 | 93,507 | ||||||

New York City Housing Development Corp., Local | 250,000 | 227,685 | ||||||

New York City Housing Development Corp., Local | 250,000 | 227,383 | ||||||

New York City Housing Development Corp., Local | 150,000 | 161,448 | ||||||

New York City Housing Development Corp., Local | 250,000 | 231,907 | ||||||

New York City Housing Development Corp., Local | 250,000 | 232,050 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

19

|

| SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010 |

| Principal Amount | Market Value | |||||||

New Jersey (cont.) | ||||||||

New York City Housing Development Corp., Refunding | $ | 250,000 | $ | 236,330 | ||||

New York City Industrial Development Agency, Recreational | 650,000 | 689,839 | ||||||

New York City Industrial Development Agency, Recreational | 145,000 | 138,777 | ||||||

New York City Industrial Development Agency, Recreational | 200,000 | 183,898 | ||||||

New York City Industrial Development Agency, Recreational | 3,000,000 | 2,686,590 | ||||||

New York City Industrial Development Agency, Recreational | 100,000 | 83,756 | ||||||

New York City Transitional Finance Authority, School | 250,000 | 255,800 | ||||||

New York City Trust For Cultural Resources, Refunding | 100,000 | 95,016 | ||||||

New York Convention Center Development Corp., Recreational | 250,000 | 230,875 | ||||||

New York Mortgage Agency, Refunding Revenue Bonds, | 50,000 | 55,513 | ||||||

New York State Dormitory Authority, Hospital Improvements | 650,000 | 660,517 | ||||||

New York State Dormitory Authority, Hospital Improvements | 500,000 | 501,615 | ||||||

New York State Dormitory Authority, Hospital Improvements | 350,000 | 348,523 | ||||||

New York State Dormitory Authority, Hospital Improvements | 750,000 | 694,860 | ||||||

20

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

New York (cont.) | ||||||||

New York State Dormitory Authority, Refunding Revenue | $500,000 | $ 462,405 | ||||||

New York State Dormitory Authority, Refunding Revenue | 300,000 | 298,080 | ||||||

New York State Dormitory Authority, School Improvements | 165,000 | 146,553 | ||||||

New York State Dormitory Authority, University & College | 200,000 | 193,090 | ||||||

New York State Dormitory Authority, University & College | 250,000 | 235,217 | ||||||

New York State Dormitory Authority, University & College | 750,000 | 755,535 | ||||||

New York State Housing Finance Agency, State Multi-Family | 100,000 | 92,799 | ||||||

New York State Housing Finance Agency, State Multi-Family | 250,000 | 242,153 | ||||||

New York State Housing Finance Agency, State Multi-Family | 205,000 | 192,231 | ||||||

New York State Housing Finance Agency, State Multi-Family | 150,000 | 142,575 | ||||||

New York State Urban Development Corp., Public | 100,000 | 112,875 | ||||||

Tobacco Settlement Financing Corp., Housing Revenue Bonds, | 250,000 | 268,613 | ||||||

| 15,305,117 | ||||||||

North Carolina 0.61% | ||||||||

Charlotte-Mecklenburg Hospital Authority, Refunding Revenue | 100,000 | 100,453 | ||||||

North Carolina Eastern Municipal Power Agency, Refunding | 250,000 | 252,003 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

21

|

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

North Carolina (cont.) | ||||||||

North Carolina Turnpike Authority, Highway Improvements | $ | 200,000 | $201,398 | |||||

| 553,854 | ||||||||

North Dakota 1.36% | ||||||||

City of Grand Forks, Hospital Improvements Revenue Bonds, | 1,250,000 | 1,225,488 | ||||||

Ohio 5.24% | ||||||||

Buckeye Tobacco Settlement Financing Authority, | 410,000 | 280,354 | ||||||

Buckeye Tobacco Settlement Financing Authority, | 5,160,000 | 3,742,909 | ||||||

Buckeye Tobacco Settlement Financing Authority, | 315,000 | 207,708 | ||||||

Ohio Higher Educational Facility Commission, Hospital | 250,000 | 261,635 | ||||||

Ohio Higher Educational Facility Commission, Refunding | 250,000 | 235,325 | ||||||

| 4,727,931 | ||||||||

Oregon 1.45% | ||||||||

Medford Hospital Facilities Authority, Refunding Revenue | 100,000 | 106,106 | ||||||

Medford Hospital Facilities Authority, Refunding Revenue | 250,000 | 257,700 | ||||||

Medford Hospital Facilities Authority, Refunding Revenue | 250,000 | 237,407 | ||||||

Oregon Health & Science University, Cash Flow Management | 500,000 | 521,530 | ||||||

Oregon State Facilities Authority, Refunding Revenue Bonds, | 200,000 | 187,528 | ||||||

| 1,310,271 | ||||||||

22

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Pennsylvania 1.98% | ||||||||

City of Philadelphia, Public Improvements, General Obligation | $ | 750,000 | $834,158 | |||||

Montgomery County Industrial Development Authority, | 500,000 | 494,660 | ||||||

Pennsylvania Higher Educational Facilities Authority, University | 100,000 | 97,807 | ||||||

Philadelphia Municipal Authority, Public Improvements | 250,000 | 259,613 | ||||||

Philadelphia Municipal Authority, Public Improvements | 100,000 | 102,613 | ||||||

| 1,788,851 | ||||||||

Puerto Rico 14.61% | ||||||||

Commonwealth of Puerto Rico, Public Improvements, General | 350,000 | 358,047 | ||||||

Commonwealth of Puerto Rico, Public Improvements, General | 500,000 | 497,090 | ||||||

Commonwealth of Puerto Rico, Public Improvements, General | 200,000 | 184,310 | ||||||

Commonwealth of Puerto Rico, Public Improvements, General | 250,000 | 249,735 | ||||||

Commonwealth of Puerto Rico, Public Improvements, General | 250,000 | 237,043 | ||||||

Commonwealth of Puerto Rico, Refunding Bonds, General | 250,000 | 256,140 | ||||||

Commonwealth of Puerto Rico, Refunding Bonds, General | 500,000 | 518,870 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

23

|

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Puerto Rico (cont.) | ||||||||

Commonwealth of Puerto Rico, Refunding Bonds, General | $ | 250,000 | $ 246,137 | |||||

Commonwealth of Puerto Rico, Refunding Bonds, General | 200,000 | 190,156 | ||||||

Commonwealth of Puerto Rico, Refunding Bonds, General | 100,000 | 100,891 | ||||||

Commonwealth of Puerto Rico, Refunding Bonds, General | 1,525,000 | 1,552,359 | ||||||

Puerto Rico Commonwealth Aqueduct & Sewer Authority, | 355,000 | 357,549 | ||||||

Puerto Rico Commonwealth Aqueduct & Sewer Authority, | 500,000 | 475,130 | ||||||

Puerto Rico Commonwealth Aqueduct & Sewer Authority, | 250,000 | 252,697 | ||||||

Puerto Rico Electric Power Authority, Electric Light & Power | 500,000 | 521,610 | ||||||

Puerto Rico Electric Power Authority, Electric Light & Power | 250,000 | 230,385 | ||||||

Puerto Rico Electric Power Authority, Electric Light & Power | 250,000 | 237,457 | ||||||

Puerto Rico Electric Power Authority, Refunding Revenue | 250,000 | 236,353 | ||||||

Puerto Rico Highway & Transportation Authority, Highway | 250,000 | 250,495 | ||||||

Puerto Rico Highway & Transportation Authority, Refunding | 200,000 | 196,392 | ||||||

24

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Puerto Rico (cont.) | ||||||||

Puerto Rico Highway & Transportation Authority, Refunding | $ | 100,000 | $ 94,455 | |||||

Puerto Rico Public Buildings Authority, Economic | 210,000 | 217,757 | ||||||

Puerto Rico Public Buildings Authority, Public Improvements | 645,000 | 612,376 | ||||||

Puerto Rico Public Buildings Authority, Refunding Revenue | 375,000 | 382,406 | ||||||

Puerto Rico Public Buildings Authority, Refunding Revenue | 250,000 | 267,237 | ||||||

Puerto Rico Public Buildings Authority, Refunding Revenue | 350,000 | 370,776 | ||||||

Puerto Rico Public Buildings Authority, Refunding Revenue | 240,000 | 256,440 | ||||||

Puerto Rico Public Buildings Authority, Refunding Revenue | 100,000 | 101,630 | ||||||

Puerto Rico Public Buildings Authority, Refunding Revenue | 220,000 | 213,173 | ||||||

Puerto Rico Sales Tax Financing Corp., Public Improvements | 175,000 | 174,116 | ||||||

Puerto Rico Sales Tax Financing Corp., Public Improvements | 250,000 | 247,910 | ||||||

Puerto Rico Sales Tax Financing Corp., Public Improvements | 1,700,000 | 1,660,492 | ||||||

Puerto Rico Sales Tax Financing Corp., Public Improvements | 100,000 | 97,725 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

25

|

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Puerto Rico (cont.) | ||||||||

Puerto Rico Sales Tax Financing Corp., Public Improvements | $ | 250,000 | $237,067 | |||||

Puerto Rico Sales Tax Financing Corp., Public Improvements | 295,000 | 296,569 | ||||||

Puerto Rico Sales Tax Financing Corp., Public Improvements | 850,000 | 806,446 | ||||||

| 13,185,421 | ||||||||

Rhode Island 1.37% | ||||||||

Rhode Island Housing & Mortgage Finance Corp., State | 215,000 | 208,546 | ||||||

Rhode Island Housing & Mortgage Finance Corp., State | 250,000 | 241,547 | ||||||

Rhode Island Student Loan Authority, Student Loans Revenue | 500,000 | 513,635 | ||||||

Rhode Island Turnpike & Bridge Authority, Highway | 250,000 | 239,313 | ||||||

Rhode Island Turnpike & Bridge Authority, Highway | 35,000 | 32,671 | ||||||

| 1,235,712 | ||||||||

South Carolina 0.32% | ||||||||

South Carolina Jobs-Economic Development Authority, | 250,000 | 238,727 | ||||||

South Carolina Jobs-Economic Development Authority, | 50,000 | 47,385 | ||||||

| 286,112 | ||||||||

South Dakota 0.11% | ||||||||

South Dakota Housing Development Authority, State | 100,000 | 97,654 | ||||||

26

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

Principal Amount | Market Value | |||||||

Tennessee 0.22% | ||||||||

Metropolitan Government of Nashville & Davidson County | $ | 200,000 | $196,614 | |||||

Texas 6.21% | ||||||||

Garza County Public Facility Corp., Public Improvements | 250,000 | 252,697 | ||||||

Harris County Cultural Education Facilities Finance Corp., | 100,000 | 105,197 | ||||||

Harris County Cultural Education Facilities Finance Corp., | 175,000 | 169,575 | ||||||

North Texas Tollway Authority, Refunding Revenue Bonds, | 100,000 | 99,999 | ||||||

North Texas Tollway Authority, Refunding Revenue Bonds, | 250,000 | 253,917 | ||||||

North Texas Tollway Authority, Refunding Revenue Bonds, | 210,000 | 202,824 | ||||||

North Texas Tollway Authority, Refunding Revenue Bonds, | 1,250,000 | 1,269,525 | ||||||

North Texas Tollway Authority, Refunding Revenue Bonds, | 555,000 | 523,964 | ||||||

Schertz-Seguin Local Government Corp., Water Utility | 100,000 | 89,139 | ||||||

Schertz-Seguin Local Government Corp., Water Utility | 100,000 | 88,382 | ||||||

Tarrant County Cultural Education Facilities Finance Corp., | 100,000 | 99,569 | ||||||

Tarrant County Cultural Education Facilities Finance Corp., | 1,000,000 | 979,140 | ||||||

Tarrant County Cultural Education Facilities Finance Corp., | 100,000 | 97,826 | ||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

27

|

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

Texas (cont.) | ||||||||

Tarrant County Health Facilities Development Corp., Hospital | $ | 50,000 | $55,775 | |||||

Tarrant County Health Facilities Development Corp., Hospital | 100,000 | 103,261 | ||||||

Texas A&M University, Refunding Revenue Bonds, Series B, | 100,000 | 100,068 | ||||||

Texas State Public Finance Authority Charter School Finance | 900,000 | 719,829 | ||||||

Tyler Health Facilities Development Corp., Hospital | 500,000 | 398,910 | ||||||

| 5,609,597 | ||||||||

Virgin Islands 0.11% | ||||||||

Virgin Islands Public Finance Authority, Refunding Revenue | 100,000 | 96,652 | ||||||

Virginia 0.24% | ||||||||

Virginia Housing Development Authority, State Multi-Family | 250,000 | 214,263 | ||||||

Washington 1.64% | ||||||||

Grays Harbor County Public Utility District No. 1, Electric | 250,000 | 254,135 | ||||||

Washington Health Care Facilities Authority, Hospital | 500,000 | 509,130 | ||||||

Washington Health Care Facilities Authority, Refunding | 250,000 | 241,123 | ||||||

Washington State Housing Finance Commission, State | 500,000 | 474,400 | ||||||

| 1,478,788 | ||||||||

West Virginia 0.51% | ||||||||

West Virginia Hospital Finance Authority, Hospital | 250,000 | 265,307 | ||||||

28

|

SPIRIT OF AMERICA

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

| Principal Amount | Market Value | |||||||

West Virginia (cont.) | ||||||||

West Virginia Hospital Finance Authority, Hospital | $ | 200,000 | $ 195,698 | |||||

| 461,005 | ||||||||

Wisconsin 3.39% | ||||||||

Wisconsin Health & Educational Facilities Authority, Hospital | 400,000 | 409,928 | ||||||

Wisconsin Health & Educational Facilities Authority, Hospital | 100,000 | 89,237 | ||||||

Wisconsin Health & Educational Facilities Authority, Hospital | 100,000 | 96,365 | ||||||

Wisconsin Health & Educational Facilities Authority, Hospital | 100,000 | 99,143 | ||||||

Wisconsin Health & Educational Facilities Authority, | 2,115,000 | 1,821,967 | ||||||

Wisconsin Health & Educational Facilities Authority, | 500,000 | 442,560 | ||||||

Wisconsin Housing & Economic Development Authority, State | 100,000 | 99,132 | ||||||

| 3,058,332 | ||||||||

Wyoming 0.23% | ||||||||

County of Campbell, Resource Recovery Improvements | 200,000 | 206,522 | ||||||

Total Investments — 97.54% (Cost $89,274,127*) | 88,033,371 | |||||||

Cash and Other Assets Net of Liabilities — 2.46% | 2,220,698 | |||||||

NET ASSETS — 100.00% | $90,254,069 | |||||||

ACA - Insured by ACA Financial Guaranty Corp. | ||||||||

| AGM - Assured Guaranty Municipal. | $ | |||||||

| AMBAC - Insured by AMBAC Indemnity Corp. | ||||||||

BHAC-CR - Berkshire Hathaway Assurance Corp. Custodial Receipts | ||||||||

| CIFG - Insured by CDC IXIS Financial Guaranty. | ||||||||

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

29

|

|

SCHEDULEOFINVESTMENTS (CONT.) | DECEMBER 31, 2010

FGIC - Insured by Financial Guaranty Insurance Corp. FHA - Insured by Federal Housing Administration. FSA - Financial Security Assurance. GO - General Obligation LOC - Letter of Credit MBIA - Insured by MBIA. NATL-RE - Insured by National Public Finance Guarantee Corp. OID - Original Issue Discount TCRS - Transferable Custodial Receipts. XLCA - Insured by XL Capital Assurance.

* The aggregate cost for federal income tax purposes is $89,276,071, and net unrealized depreciation consists of:

|

| |||

Gross unrealized appreciation | $ | 1,636,318 | ||

Gross unrealized depreciation | (2,879,018 | ) | ||

Net unrealized depreciation | $ | (1,242,700 | ) | |

30

|

SPIRIT OF AMERICA

|

STATEMENTOFASSETSANDLIABILITIES | DECEMBER 31, 2010

ASSETS | ||||

Investments in securities at value (cost $89,274,127) (Note 1) | $ | 88,033,371 | ||

Cash | 441,615 | |||

Receivable for Fund shares sold | 215,301 | |||

Receivable for investments sold | 249,805 | |||

Dividends and interest receivable | 1,502,978 | |||

Prepaid expenses | 17,468 | |||

TOTAL ASSETS | 90,460,538 | |||

LIABILITIES | ||||

Payable for Fund shares redeemed | 25,570 | |||

Payable for investment advisory fees | 19,197 | |||

Payable for accounting and administration fees | 28,884 | |||

Payable for distributions to shareholders | 76,168 | |||

Payable for audit fees | 16,300 | |||

Payable for distribution fees (Note 3) | 11,585 | |||

Payable for printing fees | 14,982 | |||

Other accrued expenses | 13,783 | |||

TOTAL LIABILITIES | 206,469 | |||

NET ASSETS | $ | 90,254,069 | ||

Net assets applicable to 9,988,038 shares outstanding, $0.001 par value | $ | 90,254,069 | ||

Net asset value and redemption price per share | $ | 9.04 | ||

Maximum offering price per share ($9.04 ÷ 0.9525) | $ | 9.49 | ||

SOURCE OF NET ASSETS | ||||

As of December 31, 2010, net assets consisted of: | ||||

Paid-in capital | $ | 92,294,005 | ||

Accumulated net realized loss on investments | (799,180 | ) | ||

Net unrealized depreciation on investments | (1,240,756 | ) | ||

NET ASSETS | $ | 90,254,069 | ||

See accompanying notes to financial statements.

|

HIGH YIELD TAX FREE BOND FUND

|

|

31

|

STATEMENTOFOPERATIONS

For the Year Ended | ||||

INVESTMENT INCOME | ||||

Interest | $ 5,214,519 | |||

TOTAL INVESTMENT INCOME | 5,214,519 | |||

EXPENSES | ||||

Investment Advisory fees (Note 3) | 502,756 | |||

Distribution fees (Note 3) | 125,689 | |||

Accounting and Administration fees | 153,796 | |||

Auditing fees | 16,300 | |||

Chief Compliance Officer salary (Note 3) | 5,326 | |||

Custodian fees | 21,433 | |||

Directors’ fees | 9,671 | |||

Insurance expense | 26,339 | |||

Legal fees | 20,649 | |||

Printing expense | 37,074 | |||

Registration fees | 22,507 | |||

Transfer Agent fees | 77,953 | |||

Other expenses | 2,572 | |||

TOTAL EXPENSES | 1,022,065 | |||

Fees waived and reimbursed by Adviser (Note 3) | (267,931) | |||

NET EXPENSES | 754,134 | |||

NET INVESTMENT INCOME | 4,460,385 | |||

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

Net realized loss from investment transactions | (59,259) | |||

Net change in unrealized appreciation/depreciation of investments | (3,307,963) | |||

Net realized and unrealized loss on investments | (3,367,222) | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ 1,093,163 | |||

See accompanying notes to financial statements.

32

|

SPIRIT OF AMERICA

|

STATEMENTOFCHANGESINNETASSETS

For the Year Ended | For the Year Ended | |||||||

OPERATIONS | ||||||||

Net investment income | $ | 4,460,385 | $ 2,726,138 | |||||

Net realized (loss) from investment transactions | (59,259) | (556,635) | ||||||

Net change in unrealized appreciation/depreciation | (3,307,963) | 7,893,041 | ||||||

Net increase in net assets resulting from operations | 1,093,163 | 10,062,544 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

Distributions from net investment income | (4,460,385) | (2,726,138) | ||||||

Total distributions to shareholders | (4,460,385) | (2,726,138) | ||||||

CAPITAL SHARE TRANSACTIONS (Dollar Activity) | ||||||||

Shares sold | 38,416,153 | 42,307,972 | ||||||

Shares issued from reinvestment of distributions | 2,2859,028 | 1,743,546 | ||||||

Shares redeemed | (15,582,869) | (6,433,008) | ||||||

Increase in net assets derived from capital share | 25,692,312 | 37,618,510 | ||||||

Total increase in net assets | 22,325,090 | 44,954,916 | ||||||

NET ASSETS | ||||||||

Beginning of period | 67,928,979 | 22,974,063 | ||||||

End of period | $ 90,254,069 | $ 67,928,979 | ||||||

(a) Transactions in capital stock were: | ||||||||

Shares sold | 4,036,428 | 4,786,414 | ||||||

Shares issued from reinvestment of distributions | 302,002 | 197,087 | ||||||

Shares redeemed | (1,62,926) | (717,346) | ||||||

Increase in shares outstanding | 2,695,504 | 4,266,155 | ||||||

See accompanying notes to financial statements.

|

HIGH YIELD TAX FREE BOND FUND

|

|

33

|

FINANCIALHIGHLIGHTS

The table below sets forth financial data for one share of beneficial interest outstanding throughout the period presented.

For the Year Ended | For the Year Ended | For the Period Ended December 31, 2008* | ||||||||||

Net Asset Value, Beginning of Period | $ 9.31 | $ 7.59 | $ 10.00 | |||||||||

Income from Investment Operations: | ||||||||||||

Net investment income | 0.511 | 0.551 | 0.471 | |||||||||

Net realized and unrealized gain (loss) on investments | (0.27) | 1.73 | (2.41) | |||||||||

Total from investment operations | 0.24 | 2.28 | (1.94) | |||||||||

Less Distributions: | ||||||||||||

Distributions from net investment income | (0.51) | (0.56) | (0.47) | |||||||||

Total distributions | (0.51) | (0.56) | (0.47) | |||||||||

Net Asset Value, End of Period | $ 9.04 | $ 9.31 | $ 7.59 | |||||||||

Total Return2 | 2.44% | 30.78% | (20.05%) | |||||||||

Ratios/Supplemental Data | ||||||||||||

Net assets, end of period (000) | $90,254 | $67,929 | $22,974 | |||||||||

Ratio of expenses to average net assets: | ||||||||||||

Before expense reimbursement or recapture | 1.22% | 1.41% | 1.84%3 | |||||||||

After expense reimbursement or recapture | 0.90% | 0.90% | 0.30%3 | |||||||||

Ratio of net investment income to average net assets | 5.32% | 6.22% | 6.42%3 | |||||||||

Portfolio turnover | 8.66% | 5.87% | 6.63%4 | |||||||||

| 1 | Calculated based on the average number of shares outstanding during the period. |

| 2 | Calculation does not reflect sales load. |

| 3 | Calculation is annualized. |

| 4 | Calculation is not annualized. |

| * | The Fund commenced operations on February 29, 2008. |

See accompanying notes to financial statements.

34

|

SPIRIT OF AMERICA

|

NOTESTOFINANCIALSTATEMENTS | DECEMBER 31, 2010

Note 1 - Significant Accounting Policies Spirit of America High Yield Tax Free Bond Fund (the “Fund”), a series of Spirit of America Investment Fund, Inc. (the “Company”), is an open-end non-diversified mutual fund registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company was incorporated under the laws of Maryland on May 15, 1997. The Fund commenced operations on February 29, 2008. The Fund seeks high current income that is exempt from federal income tax, investing at least 80% of its assets in municipal bonds. The Fund offers one class of shares.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America for investment companies.

A. Security Valuation: The offering price and net asset value (“NAV”) per share for the Fund are calculated as of the close of regular trading on the New York Stock Exchange (“NYSE”), currently 4:00 p.m., Eastern Time on each day the NYSE is open for trading. The Fund’s securities are valued at the official close or the last reported sales price on the principal exchange on which the security trades, or if no sales price is reported, the mean of the latest bid and asked prices is used. Securities traded over-the-counter are priced at the mean of the latest bid and asked prices. Short-term investments having a maturity of 60 days or | less are valued at amortized cost, which the Board of Directors (the “Board”) believes represents fair value. Fund securities for which market quotations are not readily available are valued at fair value as determined in good faith under procedures established by and under the supervision of the Board.

B. Fair Value Measurements: Various inputs are used in determining the fair value of investments which are as follows:

• Level 1 – Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access at the measurement date

• Level 2 – Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

• Level 3 – Unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund’s own assumptions used in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. |

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

35

|

|

NOTESTOFINANCIALSTATEMENTS (CONT.) | DECEMBER 31, 2010

The summary of inputs used to value the Fund’s net assets as of December 31, 2010 is as follows:

|

| |||||||||

| High Yield Tax Free Bond Fund | ||||||||||

| Valuation Inputs | ||||||||||

Level 1 | - Quoted Prices | $ | — | |||||||

Level 2 | - Other Significant Observable Inputs * | 88,033,371 | ||||||||

Level 3 | - Significant Unobservable Inputs | — | ||||||||

Total Market Value of Investments | $ | 88,033,371 | ||||||||

* Security Types as defined in the Schedule of Investments | ||||||||||

During the year ended December 31, 2010, the Fund recognized no significant transfers to/from Level 1 or Level 2. Additional disclosure surrounding the activity in Level 3 fair value measurement will also be effective for fiscal years beginning after December 15, 2010. Management is currently evaluating the impact on the Funds’ financial statements.

C. Investment Income and Securities Transactions: Security transactions are accounted for on the date the securities are purchased or sold (trade date). Cost is determined and gains and losses are based on the identified cost basis for both financial statement and federal income tax purposes. Dividend income and distributions to shareholders are reported on the ex-dividend date. Interest income and expenses are accrued daily.

D. Federal Income Taxes: The Fund intends to comply with all requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

E. Use of Estimates: In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the | reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

F. Distributions to Shareholders: The Fund intends to distribute substantially all of its net investment income and capital gains to shareholders each year. Normally, income distributions will be declared daily and paid monthly. Capital gains, if any, will be distributed annually in December, but may be distributed more frequently if deemed advisable by the Board. All such distributions are taxable to the shareholders whether received in cash or reinvested in shares.

Note 2 - Purchases and Sales of Securities Purchases and proceeds from the sales of securities for the year ended December 31, 2010, excluding short-term investments, were $32,018,761 and $7,140,018, respectively.

Note 3 - Investment Management Fee and Other Transactions with Affiliates Spirit of America Management Corp. (the “Adviser”) has been retained to act as the Company’s investment adviser pursuant to an Investment Advisory Agreement (the “Advisory Agreement”). The Adviser was incorporated in 1997 and is a registered investment adviser under the Investment Advisers Act of 1940, as amended. Under the Advisory Agreement, the Fund pays the Adviser a monthly fee of 1/12 of 0.60% of the |

| ||||||||

36

|

SPIRIT OF AMERICA

|

NOTESTOFINANCIALSTATEMENTS (CONT.) | DECEMBER 31, 2010

Fund’s average daily net assets. Investment advisory fees for the year ended December 31, 2010 were $502,756.

The Adviser has contractually agreed to waive advisory fees and/or reimburse expenses so that the total operating expenses will not exceed 0.90% of the average daily net assets of the Fund through April 30, 2011. For the year ended December 31, 2010, the Adviser reimbursed the Fund $267,931.

Any amounts waived or reimbursed by the Adviser are subject to reimbursement by the Fund within the following three years, provided the Fund is able to make such reimbursement and remain in compliance with the expense limitation as stated above. The balance of recoverable expenses to the Adviser as of December 31, 2010 was $606,296. Of this balance, $116,140 will expire in 2011, $222,225 will expire in 2012, and $267,931 will expire in 2013.

The Fund has adopted a plan of distribution pursuant to Rule 12b-1 (the “Plan”). The Plan permits the Fund to pay David Lerner Associates, Inc. (the “Distributor”) a monthly fee of 1/12 of 0.15% of the Funds average daily net assets for the Distributor’s services and expenses in distributing shares of the Fund and providing personal services and/or maintaining shareholder accounts. For the year ended December 31, 2010, fees paid to the Distributor under the Plan were $125,689.

The Fund’s shares are subject to an initial sales charge imposed at the time of purchase, in accordance with the Fund’s current prospectus. For the year ended December 31, 2010, sales charges received by the Distributor were $1,808,463. A contingent deferred sales charge(“CDSC”) of 1.00% may be imposed on redemptions of $1 million or more made within one year of purchase. Certain redemptions made within seven years of purchase are subject to a CDSC, in accordance | with the Fund’s current prospectus. For the year ended December 31, 2010, CDSC fees paid to the Distributor were $7,104.

Certain Officers and Directors of the Company are “affiliated persons”, as that term is defined in the 1940 Act, of the Adviser or the Distributor. Each Director of the Company, who is not an affiliated person of the Adviser or Distributor, receives a quarterly retainer of $1,500, $1,000 for each Board meeting attended, and $500 for each committee meeting attended plus reimbursement for certain travel and other out-of-pocket expenses incurred in connection with attending Board meetings. The Company does not compensate the Officers for the services they provide. There are no Directors’ fees paid to affiliated Directors of the Company. For the year ended December 31, 2010, the Fund was allocated $5,326 of the Chief Compliance Officer’s salary.

Note 4 - Concentration and Other Risks The Fund is non-diversified such that the Fund may invest a larger percentage of its assets in a given security than a diversified fund.

The Fund’s performance could be adversely affected by interest rate risk, which is the possibility that overall bond prices will decline because of rising interest rates. Interest rate risk is expected to be high for the Fund because it invests mainly in long-term bonds, whose prices are much more sensitive to interest fluctuations than are the prices of short-term bonds.

The Fund may be affected by credit risk, which is the possibility that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. This risk may be greater to the extent that the Fund may invest in junk bonds. |

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

37

|

|

NOTESTOFINANCIALSTATEMENTS (CONT.) | DECEMBER 31, 2010

The Fund may be affected by credit risk of lower grade securities, which is the possibility that municipal securities rated below investment grade, or unrated of similar quality, (frequently called “junk bonds”), may be subject to greater price fluctuations and risks of loss of income and principal than investment-grade municipal securities. Securities that are (or that have fallen) below investment-grade have a greater risk that the issuers may not meet their debt obligations. These types of securities are generally considered speculative in relation to the issuer’s ongoing ability to make principal and interest payments. During periods of rising interest | rates or economic downturn, the trading market for these securities may not be active and may reduce the Fund’s ability to sell these securities at an acceptable price. If the issuer of securities is in default in payment of interest or principal, the Fund may lose its entire investment in those securities.

Other risks include income risk, liquidity risk, municipal project specific risk, municipal lease obligation risk, zero coupon securities risk, market risk, manager risk, taxability risk, state-specific risk and exchange traded funds risk. |

Note 5 – Federal Income Taxes

The tax character of distributions paid during the years ended December 31, 2010 and 2009 were as follows:

| ||||||||

| Tax Basis Distributions | ||||||||

Ordinary Income | Tax Exempt Income | Net Long-Term Capital Gains | Total Distributions | |||||

12/31/2010 | $549,814 | $3,910,571 | $0 | $4,460,385 | ||||

12/31/2009 | $414,275 | $2,311,863 | $0 | $2,726,138 | ||||

Distribution classifications may differ from the Statement of Changes in Net Assets as a result of the treatment of short-term capital gains as ordinary income for tax purposes.

At December 31, 2010, the components of accumulated distributable earnings for the Fund on a tax basis were as follows:

|

| required distributions of net capital gains to shareholders through the years of 2016 and 2017, respectively.

For the year ended December 31, 2010, the Fund utilized Capital Loss Carryforwards of $80,996.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for the four year period ended December 31, 2010, and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue. | ||||||

Capital Loss Carryforward | $ | (610,766 | ) | |||||

Deferred Post-October Losses | (186,470 | ) | ||||||

Unrealized depreciation | (1,242,700 | ) | ||||||

Total Distributable Earnings | $ | (2,039,936 | ) | |||||

At December 31, 2010, the Fund had net capital loss carryforwards for federal income tax purposes of $610,766, of which $40,049 and $570,717 are available to reduce future |

| |||||||

38

|

SPIRIT OF AMERICA

|

NOTESTOFINANCIALSTATEMENTS (CONT.) | DECEMBER 31, 2010

Note 6 – Subsequent Events

Management has evaluated the impact of all subsequent events on the Fund and has determined that there were no events that require recognition or disclosure in the financial statements.

Tax Information (Unaudited)

All designations are based on financial information available as of the date of this annual report and, accordingly, are subject to change. For each item, it is the intention of the Fund to designate the maximum amount permitted under the Internal Revenue Code and the regulations thereunder.

Exempt Interest Dividends

For the period ended December 31, 2010, in accordance with the Internal Revenue Code 852 (b)(5), the Fund qualifies to designate $3,910,571 as exempt-interest dividends. Shareholders may treat these distributions as excludable from gross income per Internal Revenue Code 103(a).

|

HIGH YIELD TAX FREE BOND FUND

|

|

|

39

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Spirit of America Income Fund and Board of Directors Spirit of America Investment Fund, Inc. Syosset, New York

| ||||

We have audited the accompanying statements of assets and liabilities of Spirit of America High Yield Tax Free Bond Fund (the “Fund”), a series of shares of beneficial interest in Spirit of America Investment Fund, Inc., including the schedule of investments as of December 31, 2010, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the two years in the period then ended and the period February 29, 2008 (commencement of operations) to December 31, 2008. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on those financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit | procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2010 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Spirit of America High Yield Tax Free Bond Fund as of December 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the two years in the period then ended and the period February 29, 2008 to December 31, 2008, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania February 18, 2011 | |||

40

|

SPIRIT OF AMERICA

|

APPROVALOFTHEINVESTMENTADVISORYAGREEMENT | DECEMBER 31, 2010

| Approval of the Investment Advisory Agreement (Unaudited) | ||||