UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number :811-08231

SPIRIT OF AMERICA INVESTMENT FUND, INC.

(Exact name of registrant as specified in charter)

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Address of principal executive offices) (Zip code)

Mr. David Lerner

David Lerner Associates

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-516-390-5565

Date of fiscal year end:December 31

Date of reporting period:December 31, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

DECEMBER 31, 2018

Spirit of America Real Estate Income and Growth Fund

Spirit of America Large Cap Value Fund

Spirit of America Municipal Tax Free Bond Fund

Spirit of America Income Fund

Spirit of America Income and Opportunity Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds' shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, David Lerner Associates Inc. or from your respective Fund(s). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from your Fund(s) electronically by contacting your investment counselor at David Lerner Associates Inc. or, if you hold your shares directly through the Fund(s), by calling Shareholder Services at (800) 452-4892.

You may elect to receive all future reports in paper free of charge. You can inform your respective Fund(s) that you wish to continue receiving paper copies of your shareholder reports by following the instructions included with this document or by contacting your investment counselor at David Lerner Associates Inc. If you hold your shares directly through the Fund(s), you may call Shareholder Services at (800) 452-4892. Your election to receive reports in paper will apply to all funds held within the fund family.

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We are happy to have this opportunity to share with you, our shareholders, the Annual Report for the Spirit of America Real Estate Income and Growth Fund. This includes a review of our performance in 2018, in addition to a discussion of the economy, and our thoughts on the securities markets.

At Spirit of America Investment Funds, our team takes a comprehensive approach to investing. We analyze economic trends, and evaluate industries that could benefit from those trends. Based upon this analysis, we select investments we believe are positioned to provide the best potential returns. Our portfolio managers utilize their extensive backgrounds in their respective fields to carefully scrutinize each security in the portfolio on an ongoing basis.

The Spirit of America Real Estate Income and Growth Fund’s investment philosophy continues to be to seek enduring value in the physical structures of America by investing in real estate companies which own office buildings, shopping malls, hotels, apartments, and other income producing assets. Our goal is to maximize total return to shareholders by benefitting from the income generated through the rental of these properties, while also participating in potential long term appreciation of asset values.

We thank you for your support, and look forward to your future investment in the Spirit of America Real Estate Income and Growth Fund.

Sincerely,

|

David Lerner |

|

Doug Revello |

1 |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final revision of the third quarter 2018 gross domestic product (GDP) slightly decreasing the estimate to an annual growth rate to 3.4%, from the previous 3.5% reading. This growth rate is down from the 4.2% recorded in the second quarter of 2018, but up from the 2.2% in the first quarter of 2018. The pace is likely strong enough to keep growth on track to hit the President’s 3% growth target for this year following the $1.5 trillion tax cut stimulus package. However, the economy does appear to be slowing in the fourth quarter amid a widening trade deficit, sluggish business spending on equipment and a weak housing market.

The December data released from the U.S. Bureau of Labor Statistics revealed nonfarm payrolls rose by 312,000, exceeding the expectations. This growth far surpassed the November pace of 176,000, and is also an increase over the 274,000 added in October. Growth in jobs totaled 2.6 million in 2018, the highest since 2015 and coming in well above the 2.2 million in 2017. The unemployment rate rose to 3.9% as new workers entered the workforce and the labor force participation increased to 63.1%. In addition to the big job gains, wages jumped 3.2% from a year ago. This positive report comes amid concern over whether the U.S. economy is part of a global deceleration.

At the December meeting of the policymaking Federal Open Market Committee (FOMC), Fed officials voted to increase its benchmark interest rate a quarter of a point to a range of 2.25% to 2.50%. This was the Fed’s ninth rate hike since policy normalization began in December 2015. There was reluctance from a few members who noted the lack of inflationary pressures and argued against this increase. Officials have acknowledged that the policy path ahead is “less clear,” indicating that future increases to the fed funds rate may be more gradual. The indecision was reflected in rate forecasts among individual members who cut their expected moves in 2019 from four to two, citing a range of concerns about growth and volatility in the financial markets.

Market Commentary

In 2018, the FTSE Nareit All Equity REITs Index delivered a total return of (4.04)%. The decline was in part due to a (7.89)% loss in the final month of the 4th quarter. The S&P 500’s total return was (4.38)% for the year. The leading REIT industry was the Health Care Sector which was one of the few REIT sectors to post a positive total return in 2018 with a total return of 7.58%. Only three other sectors of the FTSE Nareit all Equity REITs index saw positive returns in 2018 which were the Infrastructure Sector 6.99%, Residential Sector 3.09%, and the Self-Storage Sector 2.94%. Office was the worst sector finishing 2018 with a total return of (14.55)%. Followed by Data Centers which ended a disappointing 2018 with a total return of (14.11)%.

Fund Summary

The Spirit of America Real Estate Income and Growth Fund (the “Fund”) aims to provide high total return through a combination of capital appreciation and dividend income.

As of December 31, 2018 the Fund was invested over 95% in REITs. A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate. REITs provide investors regular income streams, diversification and long-term capital appreciation. REITs typically pay out all of their taxable income as dividends to shareholders. REITs are tied to almost all aspects of the economy, including apartments, hospitals, hotels, industrial facilities, infrastructure, nursing homes, offices, shopping malls, storage centers, and student housing.

Return Summary

The Fund had a total one year return of (5.46)% (no load, gross of fees). This compares to the (4.57)% returned by its benchmark, the MSCI US REIT Index, for the same period. That result does not take the sales charge and expense ratio into account.

The material factors that affected the Fund were market direction and security selection. The Funds underperformance was primarily due to being overweight in the Data Center subset of the Specialty REITS sector which saw a total return loss of (14.11)% in 2018. The Fund was also about 8% below its benchmark in the Health Care REITS which saw a positive 7.56% return in 2018.

2 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Including sales charge and expenses, as of December 31, 2018 the Fund’s Class A Shares one year return was (11.77)%. The annualized five year return was 4.83% per year, while the average annual return over the past ten years was 10.29%.

Summary of Portfolio Holdings(Unaudited) As of December 31, 2018 | ||||||||

Residential (REITs) | 24.19 | % | $ | 19,556,926 | ||||

Specialized (REITs) | 24.12 | % | 19,491,479 | |||||

Office (REITs) | 9.82 | % | 7,937,476 | |||||

Hotel & Resort (REITs) | 9.46 | % | 7,644,852 | |||||

Retail (REITs) | 9.36 | % | 7,561,975 | |||||

Industrial (REITs) | 9.08 | % | 7,338,879 | |||||

Energy | 4.03 | % | 3,255,780 | |||||

Health Care (REITs) | 3.82 | % | 3,085,473 | |||||

Diversified (REITs) | 2.99 | % | 2,420,438 | |||||

Mortgage (REITs) | 2.51 | % | 2,025,309 | |||||

Municipal Bonds | 0.22 | % | 181,594 | |||||

Real Estate Operating Companies | 0.19 | % | 153,962 | |||||

Financials | 0.15 | % | 121,140 | |||||

Utilities | 0.06 | % | 46,120 | |||||

Total Investments | 100.00 | % | $ | 80,821,403 | ||||

3 |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Average Annual Total Returns(Unaudited) For the periods ended December 31, 2018 | ||||

1 Year | 5 Year | 10 Year | Expense Ratios3 | |

Class A Shares - with load | (11.77)% | 4.83% | 10.29% | 1.48% |

Class A Shares - no load | (6.85)% | 5.97% | 10.89% | 1.48% |

Class C Shares - with load1 | (8.29)% | 5.23% | 10.12% | 2.18% |

Class C Shares - no load1 | (7.44)% | 5.23% | 10.12% | 2.18% |

MSCI US REIT Index2 | (4.57)% | 7.80% | 12.17% | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 5.25% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

2 | The Morgan Stanley Capital International (“MSCI”) US REIT Index is an unmanaged index. The MSCI US REIT Index is a free float- adjusted market capitalization weighted index that is comprised of equity Real Estate Investment Trusts (“REITs”) that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

3 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2018. Additional information pertaining to the Fund’s expense ratios as of December 31, 2018, can be found in the financial highlights. |

Fixed Distribution Policy(Unaudited)

The Board of Directors of the Fund has set a fixed distribution policy whereby the Fund will declare semi-annual distributions comprised of income earned, if any, realized long-term capital gains, if any, and to the extent necessary, return of capital, payable as of June 30 and December 31 of each year in the annual aggregate minimum amount of $0.85 per share. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions. The Fund’s total return based on net asset value is presented on the prior page as well as in the Financial Highlights tables.

4 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Growth of $10,000(Unaudited)

(includes one-time 5.25% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800- 452-4892.

5 |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We welcome this opportunity to share with you, our investors, the Annual Report for the Spirit of America Large Cap Value Fund, (the “Fund”) along with our thoughts on the market and recent events.

At Spirit of America, we take a comprehensive approach to investing. Our portfolio managers use their extensive backgrounds in their respective fields to carefully scrutinize each security in the portfolio on an ongoing basis. We evaluate economic trends, we analyze sectors that could benefit from those trends, and finally, invest in companies that we believe possess strong fundamentals.

We believe that investing in sound companies with attractive valuations will help enhance the long-term returns of the Fund.

The Spirit of America Large Cap Value Fund’s investment philosophy continues to be to focus on the large cap value segment of the U.S. equity market. Among the valuation factors used to evaluate these stocks are companies with lower debt ratios than their peer group and companies that are undervalued vs. the company’s intrinsic worth and future income potential.

We appreciate your continued support and look forward to your future investment in the Spirit of America Large Cap Value Fund.

Sincerely,

|

David Lerner |

|

Doug Revello |

6 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final revision of the third quarter 2018 gross domestic product (GDP) slightly decreasing the estimate to an annual growth rate to 3.4%, from the previous 3.5% reading. This growth rate is down from the 4.2% recorded in the second quarter of 2018, but up from the 2.2% in the first quarter of 2018. The pace is likely strong enough to keep growth on track to hit the President’s 3% growth target for this year following the $1.5 trillion tax cut stimulus package. However, the economy does appear to be slowing in the fourth quarter amid a widening trade deficit, sluggish business spending on equipment and a weak housing market.

The December data released from the U.S. Bureau of Labor Statistics revealed nonfarm payrolls rose by 312,000, exceeding the expectations. This growth far surpassed the November pace of 176,000, and is also an increase over the 274,000 added in October. Growth in jobs totaled 2.6 million in 2018, the highest since 2015 and coming in well above the 2.2 million in 2017. The unemployment rate rose to 3.9% as new workers entered the workforce and the labor force participation increased to 63.1%. In addition to the big job gains, wages jumped 3.2% from a year ago. This positive report comes amid concern over whether the U.S. economy is part of a global deceleration.

At the December meeting of the policymaking Federal Open Market Committee (FOMC), Fed officials voted to increase its benchmark interest rate a quarter of a point to a range of 2.25% to 2.50%. This was the Fed’s ninth rate hike since policy normalization began in December 2015. There was reluctance from a few members who noted the lack of inflationary pressures and argued against this increase. Officials have acknowledged that the policy path ahead is “less clear,” indicating that future increases to the fed funds rate may be more gradual. The indecision was reflected in rate forecasts among individual members who cut their expected moves in 2019 from four to two, citing a range of concerns about growth and volatility in the financial markets.

Market Commentary

The U.S. markets had a tumultuous year in 2018. The S&P 500 and Dow fell for the first time in three years, and the NASDAQ broke a six-year positive streak. 2018 was a year fraught with volatility, characterized by record highs and sharp reversals. For the first time, the S&P 500 rose in the first three quarters of the year, only to decline and lose the gains in the fourth. December accounted for a sizable chunk of the quarter’s losses with all three of the aforementioned indexes dropping over 8%. The Dow and S&P 500 recorded their worst December performance since 1931, and their biggest monthly loss since February 2009. The drops in December came amid concerns of an economic slowdown and fears the Federal Reserve may be making a monetary policy mistake. Concerns over ongoing trade negotiations between China and the U.S. also added pressure to the stock market. For the year, the S&P 500 had a return of (4.38)%, the Dow returned (3.48)%, and the NASDAQ ended the year down (2.81)% for the year.

Fund Summary

The Spirit of America Large Cap Value Fund (the "Fund") seeks to provide capital appreciation with a secondary objective of current income. The emphasis of the Fund is focused on investing in a diversified portfolio. We are invested in all 11 sectors on the S&P 500 Index.

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model. We invest the old fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on the experience of our dedicated team of professionals.

Return Summary

The Fund had a total return of (6.50)% (no load, gross of fees) in 2018. This compares to its benchmark, the S&P 500 Index ("S&P 500"), which was down (4.38)% for the year 2018.

The material factors that affected the Fund’s underperformance compared to its benchmark were market direction and security selection. Unlike the previous year which saw ten sectors finish with positive returns, the S&P 500 ended 2018 with only four sectors in the positive. The top performing sector of the year was Health Care which was up 5.04%. The Utilities sector was the second leading segment of the S&P 500 with a total return of 5.00%. The Fund was underweight both of those sectors verses the S&P 500. Materials, Energy, Financials, Consumer Staples, Communication Services, Real

7 |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Estate, and Industrials all ended the year with negative total return numbers. As part of the security selection process the Fund takes a “value” approach, seeking to invest in securities considered to be conservatively valued relative to comparable companies. This philosophy of investing also contributed to the Fund’s underperformance of the S&P 500 as the positions that are considered growth stocks outperformed those labeled as value stocks. The Russell 1000 Value Index finished 2018 with a total return of (8.81)% underperforming the Russell 1000 Growth Index by 6.27% which ended the year with a net return of (2.54)%.

Including sales charge and expenses, as of December 31, 2018 the Fund’s Class A Shares one year return was (12.72)%. The annualized five year return was 4.51%, while the average annual return over the past ten years was 8.71%.

Summary of Portfolio Holdings(Unaudited) As of December 31, 2018 | ||||||||

Information Technology | 29.31 | % | $ | 26,217,552 | ||||

Financials | 15.28 | % | 13,663,133 | |||||

Health Care | 13.82 | % | 12,354,431 | |||||

Industrials | 11.45 | % | 10,236,527 | |||||

Consumer Discretionary | 6.49 | % | 5,801,723 | |||||

Consumer Staples | 5.36 | % | 4,783,260 | |||||

Communication Services | 5.03 | % | 4,494,002 | |||||

Energy | 4.88 | % | 4,366,878 | |||||

Real Estate Investment Trusts | 4.12 | % | 3,683,432 | |||||

Materials | 1.91 | % | 1,703,578 | |||||

Utilities | 2.07 | % | 1,850,246 | |||||

Telecommunication Services | 0.28 | % | 251,085 | |||||

Total Investments | 100.00 | % | $ | 89,405,847 | ||||

8 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Average Annual Total Returns(Unaudited) For the periods ended December 31, 2018 | ||||

1 Year | 5 Year | 10 Year | Expense Ratios3 | |

Class A Shares - with load | (12.72)% | 4.51% | 8.71% | 1.47% |

Class A Shares - no load | (7.87)% | 5.64% | 9.29% | 1.47% |

Class C Shares - with load1 | (9.35)% | 4.87% | 8.51% | 2.17% |

Class C Shares - no load1 | (8.50)% | 4.87% | 8.51% | 2.17% |

S&P 500 Index2 | (4.38)% | 8.49% | 13.12% | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 5.25% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

2 | S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

3 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2018. Additional information pertaining to the Fund’s expense ratios as of December 31, 2018, can be found in the financial highlights. |

Fixed Distribution Policy(Unaudited)

The Board of Directors of the Fund has set a fixed distribution policy whereby the Fund will declare semi-annual distributions comprised of income earned, if any, realized long-term capital gains, if any, and to the extent necessary, return of capital, payable as of June 30 and December 31 of each year in the annual aggregate minimum amount of $1.40 per share. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions. The Fund’s total return based on net asset value is presented in the table above as well as in the Financial Highlights tables.

9 |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Growth of $10,000(Unaudited)

(includes one-time 5.25% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800- 452-4892.

10 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We are very pleased to provide the 2018 Annual report for the Spirit of America Municipal Tax Free Bond Fund, (“the Fund”). We look forward to continued inflows and further development of the Fund.

Our many years of experience in the municipal bond market have helped us to pursue a balance between yield and quality. Our goal is to continue seeking current income that is exempt from federal income tax, while employing a relatively conservative approach to investing in the municipal market. Although the mandate of the Fund allows it to invest in lower rated securities, at this time, the focus will continue to be investing in bonds which are investment grade.

We appreciate your support of our fund and look forward to your future investment in the Spirit of America Municipal Tax Free Bond Fund.

Thank you for being a part of the Spirit of America Family of Funds.

Sincerely,

|

David Lerner |

|

Mark Reilly |

11 |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final revision of the third quarter 2018 gross domestic product (GDP) slightly decreasing the estimate to an annual growth rate to 3.4%, from the previous 3.5% reading. This growth rate is down from the 4.2% recorded in the second quarter of 2018, but up from the 2.2% in the first quarter of 2018. The pace is likely strong enough to keep growth on track to hit the President’s 3% growth target for this year following the $1.5 trillion tax cut stimulus package. However, the economy appeared slower in the fourth quarter amid a widening trade deficit, sluggish business spending on equipment and a weaker housing market.

The December data released from the U.S. Bureau of Labor Statistics revealed nonfarm payrolls rose by 312,000, exceeding expectations. This growth far surpassed the November pace of 176,000, and is also an increase over the 274,000 added in October. Growth in jobs totaled 2.6 million in 2018, the highest since 2015 and coming in well above the 2.2 million in 2017. The unemployment rate rose to 3.9% as new workers entered the workforce and the labor force participation increased to 63.1%. In addition to the big job gains, wages jumped 3.2% from a year ago. This positive report comes amid concern over whether the U.S. economy is part of a global deceleration.

At the December meeting of the policymaking Federal Open Market Committee (FOMC), Fed officials voted to increase its benchmark interest rate a quarter of a point to a range of 2.25% to 2.50%. This was the Fed’s ninth rate hike since policy normalization began in December 2015. There was reluctance from a few members who noted the lack of inflationary pressures and argued against this increase. Officials have acknowledged that the policy path ahead is “less clear,” indicating that future increases to the fed funds rate may be more gradual. The indecision was reflected in rate forecasts among individual members who cut their expected moves in 2019 from four to two, citing a range of concerns about growth and volatility in the financial markets.

Market Commentary

Municipal bond issuance was down two-thirds this December from a year earlier, putting 2018 total volume at $338 billion, nearly a quarter less than the $448 billion the market produced in 2017. The comparison the past two years highlights the impact of the new tax legislation, which banned advanced refundings and reduced state and local tax deductions. For the year, refundings declined 61.2% to $59.42 billion from $153.26 billion. New money on the other hand was up 16% on the year to $235.3 billion from $202.8 billion. For the year, tax exempt issuance was down by 25.9% to $291.47 billion from $393.21 billion and taxable bond volume dipped 23% to $29.95 billion from $38.92 billion.

The 30 Year US Treasury yield moved from a 2.81 on 1/2/18 to a 3.01 on 12/31/18. At the same time, the MMD Tax-Free 30 Year AAA yield began the year at 2.55 on 1/2/18 and ended the year at 3.02 on 12/31/18. Amid increased volatility and flailing equity markets, municipal bonds stood their ground in 2018. Despite the Federal Reserve raising short-term interest rates four times, Treasuries with two, five and seven year maturities all posted gains for the year and the Bloomberg Barclays U.S. Treasury index had a firmly positive year-to-date total return.

Fund Summary

The Spirit of America Municipal Tax Free Bond Fund (“the Fund”) seeks to provide high current income that is exempt from federal income tax, including alternative minimum tax. The Fund focuses on quality credits in the municipal market. We are targeting a balance between attractive yield and quality investments.

The Fund can invest in lower rated securities; however we have kept our focus on investing in bonds that are investment grade. Our plan is to continue with this relatively conservative approach to investing in the municipal market.

In keeping with this philosophy, the Fund has been able to maintain attractive yields without venturing into the speculative, below investment grade, segment of the municipal market. As of December 31, 2018, approximately 95.07% of the portfolio was above investment grade, with 88.35% rated “A” or better. The average rating of holdings in the Fund is Aa3/AA-.

One of the Fund’s goals has been to diversify with respect to geographic location and sector. As of the end of December 2018, the Fund consists of 303 different positions varied across 45 states, 2 territories and the District of Columbia. The holdings range throughout various sectors, including areas such as: general obligations, healthcare, education, industrial development and other public improvement bonds.

12 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

While it certainly has not been a primary goal of the Fund, we have been able to maintain a percentage of bonds in states and territories which have a state tax exemption in New York, New Jersey and Connecticut, where a majority of our clients reside. Additionally, Puerto Rico bonds are exempt from state tax. Due to the struggles Puerto Rico has been facing, the Fund has actively managed its Puerto Rico holdings. As of December 31, 2018, Puerto Rico holdings represent 1.44% of the portfolio, up slightly from 0.99% at the end of 2017.

Return Summary

The Fund’s Class A Shares Net Asset Value (NAV) went from $9.47 to $9.26 during 2018. The Fund is currently at $72.97 million in net assets with 2,330 shareholder accounts as of December 31, 2018.

The Fund had a one year return of 1.88% (no load, gross of fees) for 2018. This compares to the 1.28% return of its benchmark, the Bloomberg Barclays Municipal Bond Index, for the same period. That result does not take the Fund’s sales charge and expense ratio into account. The Fund’s slightly higher performance relative to the benchmark was largely due to its continued investment in undervalued tax-free municipal securities.

The material factors that affected the Fund were the modest rise in interest rates in 2018 and the selection of high quality securities. As a result of the Fund’s focus on quality, it had very little exposure to Puerto Rico whose challenges have been well documented. The Fund does not rely on derivatives or leverage strategies.

Including the sales charge and expenses, as of December 31, 2018, the Fund’s Class A Shares one year return was (3.81)%. The Fund's Class A Shares had an annualized five year return of 3.26% and an annualized ten year return of 5.83%.

Our plan is to proceed with the same strategy that we have utilized since the Fund’s inception. We will continue to seek out municipal bonds that provide a balance between credit risk and the potential to offer high current income and consistently attractive yields.

Ratings are provided by Moody’s Investor Services and Standard & Poor’s.

The Moody’s ratings in the following ratings explanations are in parenthesis.

AAA (Aaa) - The highest rating assigned by Moody’s and S&P. Capacity to pay interest and repay principal is extremely strong.

AA (Aa) - Debt has a very strong capacity to pay interest and repay principal and differs from the highest rated issues only in a small degree.

A - Debt rated “A” has a strong capacity to pay interest and repay principal, although it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher-rated categories.

BBB (Baa) - Debt is regarded as having an adequate capacity to pay interest and repay principal. These ratings by Moody’s and S&P are the “cut-off” for a bond to be considered investment grade. Whereas debt normally exhibits adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal in this category than in higher-rated categories.

BB (Bb), B, CCC (Ccc), CC (Cc), C - Debt rated in these categories is regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. “BB” indicates the least degree of speculation and “C” the highest. While such debt will likely have some quality and protective characteristics, these are outweighed by large uncertainties or market exposure to adverse conditions and are not considered to be investment grade.

D - Debt rated “D” is in payment default. This rating category is used when interest payments or principal payments are not made on the date due, even if the applicable grace period has not expired, unless S&P believes that such payments will be made during such grace period.

Ratings are subject to change.

Ratings apply to the bonds in the portfolio. They do not remove market risk associated with the fund.

Ratings are based on Moody’s and S&P, as applicable. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. If securities are rated differently by the rating agencies, the higher of the two rating is applied thus improving the overall evaluation of the portfolio.

13 |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Summary of Portfolio Holdings(Unaudited)

As of December 31, 2018

New York | 20.95 | % | $ | 15,490,932 | ||||

Connecticut | 12.68 | % | 9,377,915 | |||||

Florida | 8.40 | % | 6,210,895 | |||||

New Jersey | 7.53 | % | 5,566,024 | |||||

Texas | 6.00 | % | 4,434,354 | |||||

Michigan | 4.04 | % | 2,984,772 | |||||

California | 3.98 | % | 2,938,724 | |||||

Pennsylvania | 3.59 | % | 2,653,664 | |||||

Massachusetts | 3.17 | % | 2,345,389 | |||||

Indiana | 3.04 | % | 2,249,618 | |||||

Georgia | 1.96 | % | 1,445,358 | |||||

Rhode Island | 1.86 | % | 1,377,277 | |||||

Washington | 1.81 | % | 1,340,445 | |||||

District of Columbia | 1.47 | % | 1,084,020 | |||||

Puerto Rico | 1.42 | % | 1,052,114 | |||||

Maine | 1.30 | % | 962,991 | |||||

Missouri | 1.29 | % | 951,063 | |||||

Louisiana | 1.18 | % | 870,603 | |||||

New Mexico | 1.15 | % | 850,240 | |||||

Arizona | 1.08 | % | 798,750 | |||||

Nevada | 1.06 | % | 786,498 | |||||

Ohio | 1.01 | % | 748,569 | |||||

Illinois | 1.00 | % | 741,805 | |||||

Alaska | 0.90 | % | 663,595 | |||||

Virginia | 0.66 | % | 486,798 | |||||

Wyoming | 0.65 | % | $ | 480,868 | ||||

West Virginia | 0.62 | % | 458,445 | |||||

Tennessee | 0.56 | % | 415,701 | |||||

Maryland | 0.55 | % | 408,768 | |||||

South Dakota | 0.52 | % | 381,286 | |||||

Oregon | 0.47 | % | 347,818 | |||||

Kentucky | 0.46 | % | 340,191 | |||||

North Carolina | 0.43 | % | 317,537 | |||||

Utah | 0.43 | % | 318,557 | |||||

Iowa | 0.40 | % | 294,630 | |||||

Nebraska | 0.37 | % | 271,163 | |||||

Mississippi | 0.35 | % | 256,213 | |||||

Oklahoma | 0.34 | % | 252,760 | |||||

Vermont | 0.33 | % | 245,568 | |||||

Alabama | 0.14 | % | 100,376 | |||||

Colorado | 0.14 | % | 103,134 | |||||

New Hampshire | 0.14 | % | 103,257 | |||||

North Dakota | 0.14 | % | 100,112 | |||||

Virgin Islands | 0.14 | % | 101,303 | |||||

Wisconsin | 0.11 | % | 82,225 | |||||

South Carolina | 0.07 | % | 51,135 | |||||

Hawaii | 0.06 | % | 42,301 | |||||

Kansas | 0.05 | % | 35,962 | |||||

Total Investments | 100.00 | % | $ | 73,921,723 |

14 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Average Annual Total Returns(Unaudited) For the periods ended December 31, 2018 | |||||

Expense Ratios3 | |||||

1 Year | 5 Year | 10 Year | Gross | With Applicable | |

Class A Shares - with load | (3.81)% | 3.26% | 5.83% | 1.02% | 0.91% |

Class A Shares - no load | 0.96% | 4.26% | 6.35% | 1.02% | 0.91% |

Class C Shares - with load1 | (0.98)% | 3.30% | 5.41% | 1.87% | 1.76% |

Class C Shares - no load1 | 0.00% | 3.30% | 5.41% | 1.87% | 1.76% |

Bloomberg Barclays Municipal Bond Index2 | 1.28% | 3.82% | 4.85% | ||

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 4.75% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

2 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

3 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2018. Spirit of America Management Corp. (the “Adviser”), the Fund’s adviser, has contractually agreed to waive advisory fees and/or reimburse expenses under an Operating Expenses Agreement so that the total operating expenses will not exceed 0.90% and 1.75% of the Class A Shares and Class C Shares average daily net assets, respectively, through April 30, 2019. Additional information pertaining to the Fund’s expense ratios as of December 31, 2018, can be found in the financial highlights. |

15 |

SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

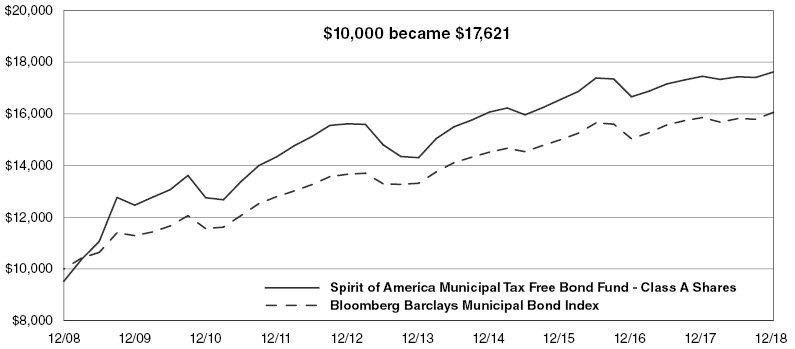

Growth of $10,000(Unaudited)

(includes one-time 4.75% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800- 452-4892.

16 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA INCOME FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We are pleased to send you the 2018 Annual Report for the Spirit of America Income Fund, (the “Fund”). The Fund began operations on December 31, 2008.

As 2018 has come to an end, we could not be more proud and excited about the progress of this fund. Our goal is to continue seeking current income while investing in quality fixed income securities.

We firmly maintain our philosophy that striving for the optimal balance between yield and quality will continue to position us to achieve long term success. Our dedication to providing our investors with a fund that will merit their long term commitment and satisfaction has never been stronger. Now is an excellent time to team up with your Investment Counselor to evaluate your portfolio and make sure you are properly positioned to achieve your investment goals.

Your support is sincerely appreciated and we look forward to your continued confidence in the Spirit of America Income Fund.

Sincerely,

|

David Lerner |

|

Mark Reilly |

17 |

SPIRIT OF AMERICA INCOME FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final revision of the third quarter 2018 gross domestic product (GDP) slightly decreasing the estimate to an annual growth rate to 3.4%, from the previous 3.5% reading. This growth rate is down from the 4.2% recorded in the second quarter of 2018, but up from the 2.2% in the first quarter of 2018. The pace is likely strong enough to keep growth on track to hit the President’s 3% growth target for this year following the $1.5 trillion tax cut stimulus package. However, the economy does appear to be slowing in the fourth quarter amid a widening trade deficit, sluggish business spending on equipment and a weak housing market.

The December data released from the U.S. Bureau of Labor Statistics revealed nonfarm payrolls rose by 312,000, exceeding expectations. This growth far surpassed the November pace of 176,000, and is also an increase over the 274,000 added in October. Growth in jobs totaled 2.6 million in 2018, the highest since 2015 and coming in well above the 2.2 million in 2017. The unemployment rate rose to 3.9% as new workers entered the workforce and the labor force participation increased to 63.1%. In addition to the big job gains, wages jumped 3.2% from a year ago. This positive report comes amid concern over whether the U.S. economy is part of a global deceleration.

At the December meeting of the policymaking Federal Open Market Committee (FOMC), Fed officials voted to increase its benchmark interest rate a quarter of a point to a range of 2.25% to 2.50%. This was the Fed’s ninth rate hike since policy normalization began in December 2015. There was reluctance from a few members who noted the lack of inflationary pressures and argued against this increase. Officials have acknowledged that the policy path ahead is “less clear,” indicating that future increases to the fed funds rate may be more gradual. The indecision was reflected in rate forecasts among individual members who cut their expected moves in 2019 from four to two, citing a range of concerns about growth and volatility in the financial markets.

Market Commentary

U.S. stocks had their worst year in 2018 since 2008. The Dow fell 5.6%. The S&P was down 6.2% and the NASDAQ fell 4%. A sizable chunk of the losses came during a violent December. The indexes all dropped at least 8.7% for the month amid concerns of an economic slowdown and fears the Federal Reserve might be making a monetary policy mistake as well as concerns over ongoing trade negotiations between the China and the U.S.

Municipal bond issuance was down two-thirds this December from a year earlier, putting 2018 total volume at $338 billion, nearly a quarter less than the $448 billion the market produced in 2017. The comparison the past two years highlights the impact of the new tax legislation, which banned advanced refundings and reduced state and local tax deductions. For the year, refundings declined 61.2% to $59.42 billion from $153.26 billion.

The 30 Year Treasury yield moved from a 2.81 on 1/2/18 to a 3.01 on 12/31/18. At the same time, the MMD Taxable 30 Year AAA yield began the year at 3.48 on 1/2/18 and ended the year at 3.96 on 12/31/18. Notably, the Federal Reserve raised short-term interest rates 4 times over the course of the year and the unemployment rate hit its lowest since 1969, yet inflation remained tame.

Fund Summary

The Spirit of America Income Fund (the “Fund”) is the second largest fund in the Spirit of America Family of Funds based on assets under management. The Fund’s objective is to seek high current income. The emphasis of the Fund is focused on investing in a diversified portfolio of taxable municipal bonds, income producing convertible securities, preferred stocks, collateralized mortgage obligations, and master limited partnerships (MLPs).

At the end of 2018, the Fund had approximately 72% of its assets in taxable municipal bonds, more than 10% in preferred stock, over 9% in corporate bonds, and over 4% in MLPs. We remain diligent in our approach to the market. Here at Spirit of America each and every credit goes through rigorous credit analysis.

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model.

18 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA INCOME FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

We invest the old fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on the experience of our dedicated team of professionals. When we began the Fund, we felt the environment was favorable to start an income fund and while past performance is no guarantee of future results; our results continue to validate that belief.

Return Summary

The Fund had a total return of 0.23% (no load, gross of fees) for fiscal year ended December 31, 2018. This compares to the 0.01% returned by its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, for the same period.

The material factors that affected the Fund were market direction and security selection. The Fund’s outperformance relative to its benchmark was principally due to its continued investment in a broad range of Investment grade fixed-income products that outperformed lower rated securities. The Fund does not rely on derivatives or leverage strategies.

Including the sales charge and expenses, as of December 31, 2018, the Fund’s Class A Shares one year return was (5.56)%. The annualized five year return was 4.08% and the annualized ten year return was 6.66%.

We plan to proceed with the same game plan we have employed since the Fund began: pursuing a balance between yield and risk with a focus on quality.

Summary of Portfolio Holdings(Unaudited) As of December 31, 2018 | ||||||||

Municipal Bonds | 71.91 | % | $ | 99,099,557 | ||||

Preferred Stocks | 10.35 | % | 14,262,884 | |||||

Corporate Bonds | 9.57 | % | 13,184,425 | |||||

Common Stocks | 8.04 | % | 11,078,306 | |||||

Collateralized Mortgage Obligations | 0.13 | % | 185,317 | |||||

Total Investments | 100.00 | % | $ | 137,810,489 | ||||

19 |

SPIRIT OF AMERICA INCOME FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Average Annual Total Returns(Unaudited) For the periods ended December 31, 2018 | ||||

1 Year | 5 Year | 10 Year | Expense Ratios3 | |

Class A Shares - with load | (5.56)% | 4.08% | 6.66% | 1.10% |

Class A Shares - no load | (0.87)% | 5.10% | 7.18% | 1.10% |

Class C Shares - with load1 | (2.64)% | 4.29% | 6.38% | 1.85% |

Class C Shares - no load1 | (1.69)% | 4.29% | 6.38% | 1.85% |

Bloomberg Barclays U.S. Aggregate Bond Index2 | 0.01% | 2.52% | 3.48% | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 4.75% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

2 | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

3 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2018. Spirit of America Management Corp. (the “Adviser”), the Fund’s adviser, has contractually agreed to waive advisory fees and/or reimburse expenses of the Fund under an Operating Expenses Agreement so that the total operating expenses will not exceed 1.10% and 1.85% of the Class A and Class C average daily net assets of the Fund, respectively, through April 30, 2019. Additional information pertaining to the Fund’s expense ratios as of December 31, 2018, can be found in the financial highlights. |

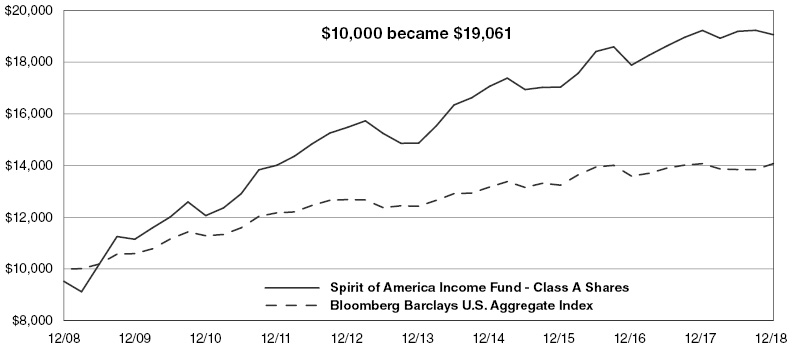

Growth of $10,000(Unaudited)

(includes one-time 4.75% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800- 452-4892.

20 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA INCOME AND OPPORTUNITY FUND

MANAGEMENT DISCUSSION (UNAUDITED)

Dear Shareholder,

We are pleased to send you the Annual Report for the Spirit of America Income and Opportunity Fund, (the “Fund”). The Fund began operations on July 8, 2013.

We hope you are as excited as we are to be a part of our fund. The Fund is a comprehensive portfolio of fixed income and equity securities. This fund gives our clients a solid base in high quality fixed income securities and at the same time a diverse portfolio of equity securities.

The Fund is designed to deliver attractive returns and achieve long term success for our investors. Our dedication to providing you with a fund that will merit your long term commitment and satisfaction has never been stronger. Now is an excellent time to team up with your Investment Counselor to evaluate your portfolio and make sure you are properly positioned to achieve your investment goals for the upcoming year.

We appreciate your support of our fund and look forward to your continued investment in The Spirit of America Income and Opportunity Fund.

Sincerely,

|

David Lerner |

|

William Mason |

21 |

SPIRIT OF AMERICA INCOME AND OPPORTUNITY FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its final revision of the third quarter 2018 gross domestic product (GDP) slightly decreasing the estimate to an annual growth rate to 3.4%, from the previous 3.5% reading. This growth rate is down from the 4.2% recorded in the second quarter of 2018, but up from the 2.2% in the first quarter of 2018. The pace is likely strong enough to keep growth on track to hit the President’s 3% growth target for this year following the $1.5 trillion tax cut stimulus package. However, the economy does appear to be slowing in the fourth quarter amid a widening trade deficit, sluggish business spending on equipment and a weak housing market.

The December data released from the U.S. Bureau of Labor Statistics revealed nonfarm payrolls rose by 312,000, exceeding expectations. This growth far surpassed the November pace of 176,000, and is also an increase over the 274,000 added in October. Growth in jobs totaled 2.6 million in 2018, the highest since 2015 and coming in well above the 2.2 million in 2017. The unemployment rate rose to 3.9% as new workers entered the workforce and the labor force participation increased to 63.1%. In addition to the big job gains, wages jumped 3.2% from a year ago. This positive report comes amid concern over whether the U.S. economy is part of a global deceleration.

At the December meeting of the policymaking Federal Open Market Committee (FOMC), Fed officials voted to increase its benchmark interest rate a quarter of a point to a range of 2.25% to 2.50%. This was the Fed’s ninth rate hike since policy normalization began in December 2015. There was reluctance from a few members who noted the lack of inflationary pressures and argued against this increase. Officials have acknowledged that the policy path ahead is “less clear,” indicating that future increases to the fed funds rate may be more gradual. The indecision was reflected in rate forecasts among individual members who cut their expected moves in 2019 from four to two, citing a range of concerns about growth and volatility in the financial markets.

Market Commentary

The U.S. markets had a tumultuous year in 2018. The S&P 500 and Dow fell for the first time in three years, and the NASDAQ broke a six-year positive streak. 2018 was a year fraught with volatility, characterized by record highs and sharp reversals. For the first time, the S&P 500 rose in the first three quarters of the year, only to decline and lose the gains in the fourth. December accounted for a sizable chunk of the quarter’s losses with all three of the aforementioned indexes dropping over 8%. The Dow and S&P 500 recorded their worst December performance since 1931, and their biggest monthly loss since February 2009. The drops in December came amid concerns of an economic slowdown and fears the Federal Reserve may be making a monetary policy mistake. Concerns over ongoing trade negotiations between China and the U.S. also added pressure to the stock market. For the year, the S&P 500 had a return of (4.38)%, the Dow returned (3.48)%, and the NASDAQ ended the year down (2.81)% for the year.

The Fund invests a portion of its assets in Master Limited Partnerships (MLPs). The Alerian MLP Index (AMZ), a leading gauge of energy MLPs, had a total return of (12.33)% for the period of December 31, 2017 through December 31, 2018. At the same time oil prices dropped 24.84% with U.S. crude oil closing at $45.41, down from $60.42 at the end of 2017.

The 30 Year US Treasury yield moved from a 2.81 on 1/2/18 to a 3.02 on 12/31/18. At the same time, the MMD Taxable 30 Year AAA yield began the year at a 3.48 on 1/2/18 and ended the year at a 3.96 on 12/31/18.

Fund Summary

The Spirit of America Income and Opportunity Fund’s (the “Fund”) objective is to provide shareholders with current income and the potential for capital appreciation. The emphasis of the Fund is focused on investing in a diversified portfolio of equity securities, fixed income securities, and MLPs.

At the end of 2018, the Fund had more than 60% of its assets invested in taxable municipal bonds, over 16% in preferred stock, over 8% in master limited partnerships (MLPs), over 3% in corporate bonds, and over 9% in non-MLP common stock positions.

22 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA INCOME AND OPPORTUNITY FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model. We invest the old fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on years of experience being involved with the markets.

Return Summary

The Fund had a total one year return of (2.49)% (no load, gross of fees) as of December 31, 2018. This compares to the 0.01% return of its benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, for the same period. That result does not take the Fund’s sales charge and expense ratio into account.

As we mentioned earlier, yields rose on both the long US Treasury Bond and the taxable municipal market over the year. Moreover, both MLPs and the overall the stock market showed were down for the year. The downward trajectory of the stock market in addition to the bond market contributed to the Fund’s underperformance of the benchmark which is solely a measure of the bond market.

The material factors that affected the Fund were market direction and security selection. The holdings of the Fund were chosen based on consideration of several factors including credit ratings, market capitalization, and securities that provide income. The Fund did not rely on derivatives or leverage strategies.

Including the sales charge and expenses, as of December 31, 2018, the Fund’s Class A Shares one year return was (8.25)%. The annualized five year return was 2.47% and the annualized return since inception was 1.95% as December 31, 2018.

Summary of Portfolio Holdings(Unaudited) As of December 31, 2018 | ||||||||

Municipal Bonds | 60.72 | % | $ | 15,476,382 | ||||

Common Stocks | 18.20 | % | 4,638,306 | |||||

Preferred Stocks | 16.63 | % | 4,239,702 | |||||

Corporate Bonds | 3.63 | % | 924,213 | |||||

Money Market Funds | 0.82 | % | 209,291 | |||||

Total Investments | 100.00 | % | $ | 25,487,894 | ||||

23 |

SPIRIT OF AMERICA INCOME AND OPPORTUNITY FUND

MANAGEMENT DISCUSSION (UNAUDITED) (CONT.)

Average Annual Total Returns(Unaudited) For the periods ended December 31, 2018 | ||||

1 Year | 5 Year | Since Inception (July 8, 2013) | Expense Ratios3 | |

Class A Shares - with load | (8.25)% | 2.47% | 1.95% | 1.25% |

Class A Shares - no load | (3.70)% | 3.48% | 2.86% | 1.25% |

Class C Shares - with load1 | (5.35)% | 2.60% | 2.00% | 2.00% |

Class C Shares - no load1 | (4.43)% | 2.60% | 2.00% | 2.00% |

Bloomberg Barclays U.S. Aggregate Bond Index2 | 0.01% | 2.52% | 2.49% | |

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 4.75% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares' 12b-1 fees and contingent deferred sales charge. |

2 | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

3 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2018. Spirit of America Management Corp. (the “Adviser”), the Fund’s adviser, has contractually agreed to waive advisory fees and/or reimburse expenses of the Opportunity Fund under an Operating Expenses Agreement so that the total operating expenses will not exceed 1.25% and 2.00% of the Class A and Class C average daily net assets of the Fund, respectively, through April 30, 2019. Additional information pertaining to the Fund’s expense ratios as of December 31, 2018, can be found in the financial highlights. |

Fixed Distribution Policy(Unaudited)

The Board of Directors of the Fund has set a fixed distribution policy whereby the Fund will declare semi-annual distributions comprised of income earned, if any, realized long-term capital gains, if any, and to the extent necessary, return of capital, payable as of June 30 and December 31 of each year in the annual aggregate minimum amount of $0.60 per share. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions. The Fund’s total return based on net asset value is presented in the table above as well as in the Financial Highlights tables.

24 | SPIRIT OF AMERICA |

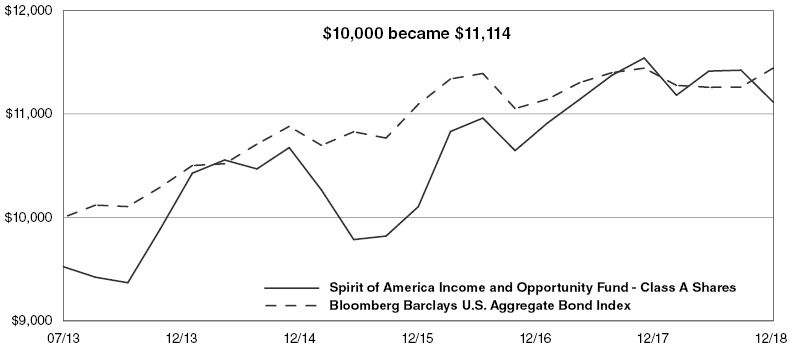

Growth of $10,000(Unaudited)

(includes one-time 4.75% maximum sales charge and reinvestment of all distributions)

The chart represents historical performance of a hypothetical investment of $10,000 in the Fundsince inception.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-800- 452-4892.

See accompanying notes which are an integral part of these financial statements.

25 |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

SCHEDULE OF INVESTMENTS | December 31, 2018

Shares | Market Value | |||||||

Common Stocks 96.35% | ||||||||

Diversified REITs 2.99% | ||||||||

American Assets Trust, Inc. | 10,400 | $ | 417,768 | |||||

Liberty Property Trust | 8,600 | 360,168 | ||||||

STORE Capital Corporation | 3,780 | 107,012 | ||||||

WP Carey, Inc. | 23,500 | 1,535,490 | ||||||

| 2,420,438 | ||||||||

Energy 4.03% | ||||||||

Cheniere Energy Partners LP | 7,100 | 256,310 | ||||||

Enterprise Products Partners LP | 48,677 | 1,196,967 | ||||||

Exxon Mobil Corporation | 750 | 51,143 | ||||||

Kinder Morgan, Inc. | 3,500 | 53,830 | ||||||

Magellan Midstream Partners LP | 8,200 | 467,892 | ||||||

Marathon Petroleum Corporation | 3,009 | 177,561 | ||||||

MPLX LP | 12,886 | 390,446 | ||||||

Parsley Energy, Inc., Class A(a) | 500 | 7,990 | ||||||

Phillips 66 | 1,750 | 150,763 | ||||||

Valero Energy Corporation | 2,100 | 157,437 | ||||||

Western Gas Partners LP | 8,180 | 345,441 | ||||||

| 3,255,780 | ||||||||

Health Care REITs 3.82% | ||||||||

Global Medical REIT, Inc. | 15,000 | 133,350 | ||||||

HCP, Inc. | 14,018 | 391,523 | ||||||

Healthcare Trust of America, Inc., Class A | 5,000 | 126,550 | ||||||

Senior Housing Properties Trust | 2,900 | 33,988 | ||||||

Ventas, Inc. | 12,650 | 741,163 | ||||||

Welltower, Inc. | 23,900 | 1,658,899 | ||||||

| 3,085,473 | ||||||||

Hotel & Resort REITs 8.75% | ||||||||

Apple Hospitality REIT, Inc. | 76,710 | 1,093,885 | ||||||

Ashford Hospitality Trust, Inc. | 69,950 | 279,800 | ||||||

Braemar Hotels & Resorts, Inc. | 23,400 | 208,962 | ||||||

DiamondRock Hospitality Company | 205,147 | 1,862,735 | ||||||

Hersha Hospitality Trust | 45,500 | 798,070 | ||||||

Pebblebrook Hotel Trust | 50,031 | 1,416,378 | ||||||

RLJ Lodging Trust | 68,634 | 1,125,597 | ||||||

Sotherly Hotels, Inc. | 52,000 | 291,720 | ||||||

| 7,077,147 | ||||||||

Industrial REITs 9.07% | ||||||||

Prologis, Inc.(b) | 99,738 | 5,856,615 | ||||||

STAG Industrial, Inc. | 23,000 | 572,240 | ||||||

Terreno Realty Corporation | 25,875 | 910,024 | ||||||

| 7,338,879 | ||||||||

Mortgage REITs 2.50% | ||||||||

Blackstone Mortgage Trust, Inc. | 28,200 | 898,452 | ||||||

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 19,267 | 367,036 | ||||||

Starwood Property Trust, Inc. | 38,550 | 759,821 | ||||||

| 2,025,309 | ||||||||

See accompanying notes which are an integral part of these financial statements.

26 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

SCHEDULE OF INVESTMENTS (CONT.) | December 31, 2018

Shares | Market Value | |||||||

Office REITs 9.75% | ||||||||

Alexandria Real Estate Equities, Inc. | 5,300 | $ | 610,772 | |||||

Boston Properties, Inc.(b) | 13,850 | 1,558,818 | ||||||

City Office REIT, Inc. | 117,258 | 1,201,895 | ||||||

Hudson Pacific Properties, Inc. | 50,100 | 1,455,906 | ||||||

JBG SMITH Properties | 5,000 | 174,050 | ||||||

Kilroy Realty Corporation | 18,515 | 1,164,223 | ||||||

SL Green Realty Corporation | 14,500 | 1,146,660 | ||||||

Vornado Realty Trust | 9,250 | 573,777 | ||||||

| 7,886,101 | ||||||||

Real Estate Operating Companies 0.19% | ||||||||

Brookfield Property Partners, L.P. | 9,551 | 153,962 | ||||||

Residential REITs 24.05% | ||||||||

American Campus Communities, Inc. | 3,650 | 151,074 | ||||||

Apartment Investment & Management Company, Class A | 43,280 | 1,899,126 | ||||||

AvalonBay Communities, Inc. | 13,640 | 2,374,042 | ||||||

Camden Property Trust | 16,150 | 1,422,007 | ||||||

Equity LifeStyle Properties, Inc. | 22,600 | 2,195,138 | ||||||

Equity Residential | 34,815 | 2,298,138 | ||||||

Essex Property Trust, Inc. | 9,836 | 2,411,886 | ||||||

Mid-America Apartment Communities, Inc. | 16,922 | 1,619,435 | ||||||

Sun Communities, Inc. | 26,100 | 2,654,631 | ||||||

UDR, Inc. | 61,306 | 2,428,944 | ||||||

| 19,454,421 | ||||||||

Retail REITs 8.04% | ||||||||

Brixmor Property Group, Inc. | 8,475 | 124,498 | ||||||

Federal Realty Investment Trust | 15,975 | 1,885,689 | ||||||

Kimco Realty Corporation | 42,319 | 619,973 | ||||||

Realty Income Corporation | 9,880 | 622,835 | ||||||

Regency Centers Corporation | 18,600 | 1,091,448 | ||||||

Simon Property Group, Inc. | 12,300 | 2,066,277 | ||||||

Spirit MTA REIT(a) | 1,140 | 8,128 | ||||||

Spirit Realty Capital, Inc. | 2,280 | 80,370 | ||||||

| 6,499,218 | ||||||||

Specialized REITs 23.16% | ||||||||

American Tower Corporation | 3,400 | 537,846 | ||||||

CoreSite Realty Corporation | 39,750 | 3,467,393 | ||||||

Crown Castle International Corporation | 3,650 | 396,500 | ||||||

CubeSmart | 18,000 | 516,420 | ||||||

CyrusOne, Inc. | 39,450 | 2,086,116 | ||||||

Digital Realty Trust, Inc. | 49,131 | 5,234,908 | ||||||

Equinix, Inc. | 4,875 | 1,718,730 | ||||||

Extra Space Storage, Inc. | 13,395 | 1,211,980 | ||||||

Gaming and Leisure Properties, Inc. | 1,000 | 32,310 | ||||||

Life Storage, Inc. | 13,850 | 1,287,911 | ||||||

QTS Realty Trust, Inc., Class A | 60,550 | 2,243,377 | ||||||

| 18,733,491 | ||||||||

Total Common Stocks | ||||||||

(Cost $58,836,258) | 77,930,219 | |||||||

See accompanying notes which are an integral part of these financial statements.

27 |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

SCHEDULE OF INVESTMENTS (CONT.) | December 31, 2018

Shares | Market Value | |||||||

Preferred Stocks 3.35% | ||||||||

Financial Exchanges & Data 0.15% | ||||||||

Arch Capital Group Ltd., Series E, 5.25% | 2,000 | $ | 39,740 | |||||

Arch Capital Group Ltd., Series F, 5.45% | 2,000 | 40,660 | ||||||

Carlyle Group LP (The), Series A, 5.88% | 2,000 | 40,740 | ||||||

| 121,140 | ||||||||

Hotel & Resort REITs 0.70% | ||||||||

Ashford Hospitality Trust, Inc., Series F, 7.38% | 6,000 | 111,420 | ||||||

Hersha Hospitality Trust, Series D, 6.50% | 5,000 | 101,000 | ||||||

Hersha Hospitality Trust, Series E, 6.50% | 5,000 | 103,800 | ||||||

Pebblebrook Hotel Trust, Series F, 6.30% | 2,500 | 58,925 | ||||||

Sotherly Hotels, Inc., Series B, 8.00% | 6,000 | 148,560 | ||||||

Sotherly Hotels, Inc., Series C, 7.88% | 2,000 | 44,000 | ||||||

| 567,705 | ||||||||

Office REITs 0.06% | ||||||||

Vornado Realty Trust, Series M, 5.25% | 2,500 | 51,375 | ||||||

Residential REITs 0.13% | ||||||||

American Homes 4 Rent, Series G, 5.88% | 2,000 | 41,020 | ||||||

Bluerock Residential Growth REIT, Inc., Series A, 7.13% | 3,000 | 61,485 | ||||||

| 102,505 | ||||||||

Retail REITs 1.31% | ||||||||

Federal Realty Investment Trust, Series C, 5.00% | 6,500 | 135,525 | ||||||

Monmouth Real Estate Investment Corporation, Series C, 6.13% | 4,000 | 90,960 | ||||||

National Retail Properties, Inc., Series E, 5.70% | 26,364 | 606,372 | ||||||

National Retail Properties, Inc., Series F, 5.20% | 11,000 | 229,900 | ||||||

| 1,062,757 | ||||||||

Specialized REITs 0.94% | ||||||||

Digital Realty Trust, Inc., Series H, 7.38% | 6,000 | 151,260 | ||||||

Digital Realty Trust, Inc., Series I, 6.35% | 11,018 | 280,628 | ||||||

Digital Realty Trust, Inc., Series J, 5.25% | 4,000 | 83,800 | ||||||

Public Storage, Series Z, 6.00% | 6,000 | 150,300 | ||||||

QTS Realty Trust, Inc., 7.13% | 4,000 | $ | 92,000 | |||||

| 757,988 | ||||||||

Water Utilities 0.06% | ||||||||

Entergy Louisiana LLC, 4.88% | 2,000 | 46,120 | ||||||

Total Preferred Stocks | ||||||||

(Cost $3,004,944) | 2,709,590 | |||||||

See accompanying notes which are an integral part of these financial statements.

28 | SPIRIT OF AMERICA |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

SCHEDULE OF WRITTEN OPTIONS | December 31, 2018

Principal | Market Value | |||||||

Municipal Bonds 0.23% | ||||||||

Franklin County Convention Facilities Authority, Revenue Bonds,6.54%, 12/1/2036 | $ | 140,000 | $ | 181,594 | ||||

Total Municipal Bonds | ||||||||

(Cost $164,755) | 181,594 | |||||||

Total Investments — 99.93% | ||||||||

(Cost $62,005,957) | 80,821,403 | |||||||

Other Assets in Excess of Liabilities — 0.07% | 57,660 | |||||||

NET ASSETS — 100.00% | $ | 80,879,063 | ||||||

(a) | Non-income producing security. |

(b) | All or a portion of the security is held as collateral for written call options. |

SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND

SCHEDULE OF WRITTEN OPTIONS | December 31, 2018

Number of | Notional | Exercise | Expiration | Value | ||||||||||||||||

Written Call Options — (0.00)% | ||||||||||||||||||||

Boston Properties, Inc.(a) | (10) | $ | (112,550 | ) | $ | 135.00 | January 2019 | $ | (300) | |||||||||||

Prologis, Inc.(a) | (20) | (117,440 | ) | 70.00 | February 2019 | (300 | ) | |||||||||||||

Total Written Call Options— (0.00)% | ||||||||||||||||||||

(Premiums Received $2,719) | $ | (600) | ||||||||||||||||||

(a) | Non-income producing security. |

See accompanying notes which are an integral part of these financial statements.

29 |

SPIRIT OF AMERICA LARGE CAP VALUE FUND

SCHEDULE OF INVESTMENTS | December 31, 2018

Shares | Market Value | |||||||

Common Stocks 97.68% | ||||||||

Communication Services 5.05% | ||||||||

AT&T, Inc. | 24,350 | $ | 694,949 | |||||

CBS Corporation, Class B | 7,600 | 332,272 | ||||||

Comcast Corporation, Class A | 30,000 | 1,021,500 | ||||||

Verizon Communications, Inc. | 18,140 | 1,019,831 | ||||||

Walt Disney Company (The) | 13,000 | 1,425,450 | ||||||

| 4,494,002 | ||||||||

Consumer Discretionary 6.52% | ||||||||

D.R. Horton, Inc. | 7,800 | 270,348 | ||||||

Home Depot, Inc. (The) | 14,450 | 2,482,799 | ||||||

Lennar Corporation, Class A | 5,000 | 195,750 | ||||||

McDonald’s Corporation | 7,930 | 1,408,130 | ||||||

MGM Resorts International | 7,100 | 172,246 | ||||||

Ross Stores, Inc. | 6,000 | 499,200 | ||||||

Royal Caribbean Cruises Ltd. | 1,600 | 156,464 | ||||||

Target Corporation | 5,000 | 330,450 | ||||||

TJX Companies, Inc. (The) | 6,400 | 286,336 | ||||||

| 5,801,723 | ||||||||

Consumer Staples 5.37% | ||||||||

Altria Group, Inc. | 13,350 | 659,356 | ||||||

Coca-Cola Company (The) | 14,600 | 691,310 | ||||||

Colgate-Palmolive Company | 2,500 | 148,800 | ||||||

Conagra Brands, Inc. | 7,100 | 151,656 | ||||||

Constellation Brands, Inc., Class A | 150 | 24,123 | ||||||

Costco Wholesale Corporation | 2,701 | 550,221 | ||||||

Kraft Heinz Company (The) | 2,999 | 129,077 | ||||||

Lamb Weston Holdings, Inc. | 4,800 | 353,088 | ||||||

PepsiCo, Inc. | 2,650 | 292,772 | ||||||

Philip Morris International, Inc. | 7,350 | 490,686 | ||||||

Procter & Gamble Company (The) | 4,700 | 432,024 | ||||||

Walmart, Inc. | 9,234 | 860,147 | ||||||

| 4,783,260 | ||||||||

Energy 4.62% | ||||||||

Chevron Corporation | 8,260 | 898,605 | ||||||

ConocoPhillips | 8,550 | 533,093 | ||||||

Devon Energy Corporation | 3,000 | 67,620 | ||||||

EOG Resources, Inc. | 8,700 | 758,727 | ||||||

Exxon Mobil Corporation(b) | 10,500 | 715,995 | ||||||

Kinder Morgan, Inc. | 1,000 | 15,380 | ||||||

Marathon Petroleum Corporation | 3,416 | 201,578 | ||||||

Valero Energy Corporation | 12,350 | 925,880 | ||||||

| 4,116,878 | ||||||||

Financials 13.65% | ||||||||

American Express Company | 10,000 | 953,200 | ||||||

Bank of America Corporation | 46,300 | 1,140,832 | ||||||

BankUnited, Inc. | 15,350 | 459,579 | ||||||

Blackstone Group, LP (The) | 16,700 | 497,827 | ||||||

Carlyle Group LP (The) | 20,950 | 329,963 | ||||||

Citigroup, Inc. | 14,550 | 757,473 | ||||||

CME Group, Inc. | 5,100 | 959,412 | ||||||

Fifth Third Bancorp | 15,400 | 362,362 | ||||||

See accompanying notes which are an integral part of these financial statements.

30 | SPIRIT OF AMERICA

|

SPIRIT OF AMERICA LARGE CAP VALUE FUND

SCHEDULE OF INVESTMENTS (CONT.) | December 31, 2018

Shares | Market Value | |||||||

Financials (cont.) | ||||||||

Goldman Sachs Group, Inc. (The) | 4,215 | $ | 704,116 | |||||

Hartford Financial Services Group, Inc. (The) | 15,000 | 666,750 | ||||||

Huntington Bancshares, Inc. | 34,750 | 414,220 | ||||||

JPMorgan Chase & Company | 16,442 | 1,605,068 | ||||||

KeyCorp | 34,575 | 511,018 | ||||||

Lazard Ltd., Class A | 11,875 | 438,306 | ||||||

M&T Bank Corporation | 2,200 | 314,886 | ||||||

Prudential Financial, Inc. | 4,500 | 366,975 | ||||||

SVB Financial Group(a) | 5,003 | 950,170 | ||||||

Travelers Companies, Inc. (The) | 1,400 | 167,650 | ||||||

U.S. Bancorp | 12,000 | 548,400 | ||||||

| 12,148,207 | ||||||||

Health Care 13.88% | ||||||||

AbbVie, Inc. | 5,300 | 488,607 | ||||||

Allergan plc | 3,300 | 441,078 | ||||||

Amgen, Inc. | 3,250 | 632,678 | ||||||

Bristol-Myers Squibb Company | 14,000 | 727,720 | ||||||

Centene Corporation(a) | 3,800 | 438,140 | ||||||

CVS Health Corporation | 2,961 | 194,005 | ||||||

Edwards LifeSciences Corporation(a) | 1,000 | 153,170 | ||||||

Gilead Sciences, Inc. | 5,300 | 331,515 | ||||||

Humana, Inc. | 3,000 | 859,440 | ||||||

Johnson & Johnson | 11,110 | 1,433,745 | ||||||

McKesson Corporation | 2,850 | 314,839 | ||||||

Medtronic plc | 7,469 | 679,380 | ||||||

Merck & Company, Inc. | 13,100 | 1,000,971 | ||||||

Pfizer, Inc. | 16,900 | 737,685 | ||||||

Quest Diagnostics, Inc. | 4,500 | 374,715 | ||||||

Thermo Fisher Scientific, Inc. | 2,700 | 604,233 | ||||||

UnitedHealth Group, Inc. | 9,550 | 2,379,096 | ||||||

Vertex Pharmaceuticals, Inc.(a) | 3,400 | 563,414 | ||||||

| 12,354,431 | ||||||||