UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number : 811-08231

SPIRIT OF AMERICA INVESTMENT FUND, INC.

(Exact name of registrant as specified in charter)

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Address of principal executive offices) (Zip code)

Mr. David Lerner

David Lerner Associates

477 Jericho Turnpike

P.O. Box 9006

Syosset, NY 11791-9006

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-516-390-5565

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

December 31, 2020

| Spirit of America Real Estate Income and Growth Fund | |

| Spirit of America Large Cap Value Fund | |

| Spirit of America Municipal Tax Free Bond Fund | |

| Spirit of America Income Fund | |

| Spirit of America Income & Opportunity Fund | |

| SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND MANAGEMENT DISCUSSION (UNAUDITED) |

Dear Shareholder,

We are happy to have this opportunity to share with you, our shareholders, the Annual Report for the Spirit of America Real Estate Income and Growth Fund. This includes a review of our performance in 2020, in addition to a discussion of the economy, and our thoughts on the securities markets.

At Spirit of America Investment Funds, our team takes a comprehensive approach to investing. We analyze economic trends, and evaluate industries that could benefit from those trends. Based upon this analysis, we select investments we believe are positioned to provide the best potential returns. Our portfolio managers and analysts utilize their extensive backgrounds in their respective fields to carefully scrutinize each security in the portfolio on an ongoing basis.

The Spirit of America Real Estate Income and Growth Fund’s investment philosophy continues to be to seek enduring value in the physical structures of America by investing in real estate companies which own office buildings, shopping malls, hotels, apartments, and other income producing assets. Our goal is to maximize total return to shareholders by benefitting from the income generated through the rental of these properties, while also participating in potential long term appreciation of asset values.

We thank you for your support, and look forward to your future investment in the Spirit of America Real Estate Income and Growth Fund.

Sincerely,

|  David Lerner President Spirit of America Investment Fund, Inc. |  |  Doug Revello Portfolio Manager |

| 1 |

| SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its third and final reading of the third quarter 2020 gross domestic product (GDP) to show an increase in the annual growth rate of a record 33.4%, fueled by more than $3 trillion in pandemic relief. That was revised slightly up from the 33.1% pace reported last month. Gross domestic product, the broadest measure of economic health, decreased by 31.4% for the second quarter 2020, the deepest since the government started keeping records in 1947. Consumer spending, which accounts for more than two-thirds of U.S. activity, steered the extensive recovery last quarter. Consumption appears to have since cooled, with retail sales declining in October and November as household incomes felt the pressure amid the government-funded weekly unemployment subsidy expiring. First-time applications for weekly unemployment benefits are at a three-month high. The GDP growth rate estimates for the fourth quarter hover around 5% due to labor market stress and depleted household income. Most economists expect modest growth or even a contraction in the first three months of 2021.

Nonfarm payrolls increased by just 245,000 in November. This number was well below Wall Street estimates as rising coronavirus cases coincided with a considerable slowdown in hiring. Economists had been looking for the nonfarm payrolls number to be 440,000 and the jobless rate to decrease to 6.7% from 6.9% in October. The unemployment rate met expectations, though it fell along with a drop in the labor force participation to 61.5%. A more encompassing measure of joblessness edged lower to 12% while the number of Americans outside the labor force remains just above 100 million. The November gain represented a noticeable slowdown from the 610,000 positions added in October. The economy has brought back 12.3 million of the 22 million jobs lost in the beginning of the crisis. However, there are still 10.7 million Americans considered unemployed, compared with 5.8 million in February. Professional and business services added 66,000 jobs while health care was able to add 46,000 jobs. The battered hospitality industry, which has taken the worst of the job losses during the pandemic, increased just 31,000, while retail lost 35,000 jobs, a potential troubling sign heading into the holiday season. Retail is down 550,000 employees from February, which was the month before the pandemic effects began to hit. Though the U.S. is coming off its fastest growth quarter ever, economists worry that the next quarter or two could see flat or even negative growth before rebounding strongly in the latter part of 2021.

As expected during its December meeting, the Federal Open Market Committee (FOMC), voted to hold their benchmark short-term borrowing rate in a range of 0% to 0.25% to support the wounded U.S. economy as it recovers from the deep impact of the Covid-19 lockdowns. After its two-day meeting, the FOMC committed to continue buying bonds until the economy reaches full employment and inflation stays at 2%. The Fed pledged it would continue to purchase at least $120 billion of bonds each month until substantial progress has been made to the Fed’s employment and price stability goals. Fed officials also raised their outlook on the economy since the last forecast in September. The median expectation for gross domestic product in 2020 is now a decline of 2.4%, compared with the negative 3.7% in September. The outlook for 2021 is now 4.2% compared with 4% previously and 3.2% in 2022 against 3%. The Fed still sees economic activity recovering but still below the pre-pandemic level. Overall, the committee expects the pandemic will “continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Market Commentary

In 2020 the FTSE Nareit All Equity REITs Index delivered a total return of (5.12)%. The leading REIT industry for the year was the Data Centers Sector which finished 2020 with a strong 21.00% total return. Three other sectors of the FTSE Nareit all Equity REITs index also saw positive returns in 2019 of over 10%; which were the Self-Storage 12.91%, Industrial 12.17%, & Timber 10.33% .. Retail was the worst performing sector finishing 2020 with a positive total return of (25.18)%.

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

| 2 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Fund Summary

The Spirit of America Real Estate Income and Growth Fund (the “Fund”), aims to provide high total return through a combination of capital appreciation and dividend income.

As of December 31, 2020 the Fund was invested over 98% in REITs. A REIT, or Real Estate Investment Trust, is a company that owns or finances income-producing real estate. REITs provide investors regular income streams, diversification and long-term capital appreciation. REITs typically pay out all of their taxable income as dividends to shareholders. REITs are tied to almost all aspects of the economy, including apartments, hospitals, hotels, industrial facilities, infrastructure, nursing homes, offices, shopping malls, storage centers, and student housing.

Return Summary

The Fund had a total one year return of (3.65)% (no load, gross of fees). This compares to the (7.57)% returned by its benchmark, the MSCI US REIT Index, for the same period. That result does not take the sales charge and expense ratio into account.

The material factors that affected the Fund were market direction and security selection. The value of the Fund and the securities in which the Fund invests may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

The Fund’s outperformance was primarily due to its highest weighted sectors, the Industrial and Specialized subsets of the REIT market. The Specialized Reit sector constitutes mainly of Data Centers. The Fund was overweight in those two sectors as compared to its MSCI US REIT benchmark. They were also the highest performing sectors in the Fund. With Specialized having a total return of 16.64% for the Fund and Industrial returning 26.03% for the period ending December 31, 2020. The Fund was also over 5% below its benchmark in the Retail REITS sector which had the lowest total return of all the REIT sectors in 2020. The Fund did not rely on derivatives or leverage strategies. While not having a material impact on the Fund’s portfolio, the Fund does employ derivatives in a limited fashion utilizing a covered call writing strategy.

Including sales charge and expenses, as of December 31, 2020 the Fund’s Class A Shares one year return was (10.09)%. The annualized five year return was 3.89% per year, while the average annual return over the past ten years was 6.33%.

| 3 |

| SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Summary of Portfolio Holdings (Unaudited)

As of December 31, 2020

| Industrial REITs | 24.75 | % | $ | 20,641,146 | ||||

| Data Center (REITs) | 24.06 | % | 20,071,097 | |||||

| Residential REITs | 20.65 | % | 17,221,628 | |||||

| Office REITs | 6.26 | % | 5,218,169 | |||||

| Retail REITs | 5.99 | % | 4,998,095 | |||||

| Self-Storage REITs | 4.26 | % | 3,550,813 | |||||

| Health Care REITs | 3.27 | % | 2,726,215 | |||||

| Infrastructure REITs | 2.60 | % | 2,172,157 | |||||

| Multi Asset Class REITs | 2.20 | % | 1,830,842 | |||||

| Hotel REITs | 2.04 | % | 1,703,891 | |||||

| Specialty REITs | 1.48 | % | 1,237,963 | |||||

| Gaming REITs | 1.15 | % | 959,423 | |||||

| Mortage REITs | 0.74 | % | 619,976 | |||||

| Municipal Bonds | 0.25 | % | 205,871 | |||||

| P&C Insurance | 0.13 | % | 104,920 | |||||

| Energy | 0.09 | % | 72,032 | |||||

| Electric Transmission & Distribution | 0.06 | % | 53,760 | |||||

| Timber REITs | 0.02 | % | 16,765 | |||||

| Total Investments | 100.00 | % | $ | 83,404,763 |

| 4 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Average Annual Returns (Unaudited)

For the periods ended December 31, 2020

| 1 Year | 5 Year | 10 Year | Expense Ratios(4) | |||||||||||||

| Class A Shares - with load | (10.09 | )% | 3.89 | % | 6.33 | % | 1.54 | % | ||||||||

| Class A Shares - no load | (5.13 | )% | 5.01 | % | 6.91 | % | 1.54 | % | ||||||||

| Class C Shares - with load1 | (6.72 | )% | 4.27 | % | 6.16 | % | 2.24 | % | ||||||||

| Class C Shares - no load1 | (5.85 | )% | 4.27 | % | 6.16 | % | 2.24 | % | ||||||||

| Institutional Class Shares2 | (4.77 | )% | 5.34 | % | 7.24 | % | 1.24 | % | ||||||||

| MSCI US REIT Index3 | (7.57 | )% | 4.84 | % | 8.30 | % | ||||||||||

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 5.25% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | The Morgan Stanley Capital International (“MSCI”) US REIT Index is an unmanaged index. The MSCI US REIT Index is a free float- adjusted market capitalization weighted index that is comprised of equity Real Estate Investment Trusts (“REITs”) that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2020. Additional information pertaining to the Fund’s expense ratios as of December 31, 2020, can be found in the financial highlights. |

| Fixed Distribution Policy (Unaudited) |

The Board of Directors of the Fund has set a fixed distribution policy whereby the Fund will declare semi-annual distributions comprised of income earned, if any, realized long-term capital gains, if any, and to the extent necessary, return of capital, payable as of June 30 and December 31 of each year in the annual aggregate minimum amount of $0.85 per share. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions. The Fund’s total return based on net asset value is presented on the prior page as well as in the Financial Highlights tables.

| 5 |

| SPIRIT OF AMERICA REAL ESTATE INCOME AND GROWTH FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

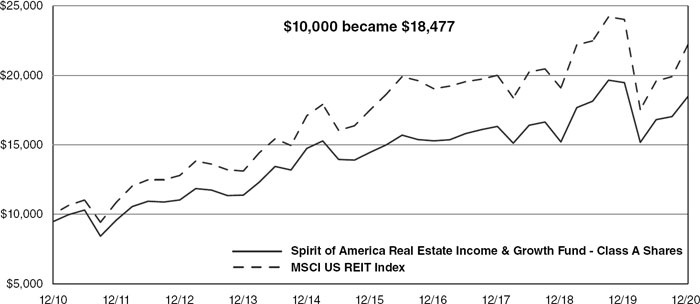

| Growth of $10,000 (Unaudited) |

| (includes one-time 5.25% maximum sales charge and reinvestment of all distributions) |

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

| 6 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA LARGE CAP VALUE FUND MANAGEMENT DISCUSSION (UNAUDITED) |

Dear Shareholder,

We welcome this opportunity to share with you, our investors, the Annual Report for the Spirit of America Large Cap Value Fund, (the “Fund”) along with our thoughts on the market and recent events.

At Spirit of America, we take a comprehensive approach to investing. Our portfolio managers and analysts use their extensive backgrounds in their respective fields to carefully scrutinize each security in the portfolio on an ongoing basis. We evaluate economic trends, we analyze sectors that could benefit from those trends, and finally, invest in companies that we believe possess strong fundamentals.

We believe that investing in sound companies with attractive valuations will help enhance the long-term returns of the Fund.

The Spirit of America Large Cap Value Fund’s investment philosophy continues to be to focus on the large cap value segment of the U.S. equity market. Among the valuation factors used to evaluate these stocks are companies with lower debt ratios than their peer group and companies that are undervalued vs. the company’s intrinsic worth and future income potential.

We appreciate your continued support and look forward to your future investment in the Spirit of America Large Cap Value Fund.

Sincerely,

|  David Lerner President Spirit of America Investment Fund, Inc. |  |  Doug Revello Portfolio Manager |

| 7 |

| SPIRIT OF AMERICA LARGE CAP VALUE FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its third and final reading of the third quarter 2020 gross domestic product (GDP) to show an increase in the annual growth rate of a record 33.4%, fueled by more than $3 trillion in pandemic relief. That was revised slightly up from the 33.1% pace reported last month. Gross domestic product, the broadest measure of economic health, decreased by 31.4% for the second quarter 2020, the deepest since the government started keeping records in 1947. Consumer spending, which accounts for more than two-thirds of U.S. activity, steered the extensive recovery last quarter. Consumption appears to have since cooled, with retail sales declining in October and November as household incomes felt the pressure amid the government-funded weekly unemployment subsidy expiring. First-time applications for weekly unemployment benefits are at a three-month high. The GDP growth rate estimates for the fourth quarter hover around 5% due to labor market stress and depleted household income. Most economists expect modest growth or even a contraction in the first three months of 2021.

Nonfarm payrolls increased by just 245,000 in November. This number was well below Wall Street estimates as rising coronavirus cases coincided with a considerable slowdown in hiring. Economists had been looking for the nonfarm payrolls number to be 440,000 and the jobless rate to decrease to 6.7% from 6.9% in October. The unemployment rate met expectations, though it fell along with a drop in the labor force participation to 61.5%. A more encompassing measure of joblessness edged lower to 12% while the number of Americans outside the labor force remains just above 100 million. The November gain represented a noticeable slowdown from the 610,000 positions added in October. The economy has brought back 12.3 million of the 22 million jobs lost in the beginning of the crisis. However, there are still 10.7 million Americans considered unemployed, compared with 5.8 million in February. Professional and business services added 66,000 jobs while health care was able to add 46,000 jobs. The battered hospitality industry, which has taken the worst of the job losses during the pandemic, increased just 31,000, while retail lost 35,000 jobs, a potential troubling sign heading into the holiday season. Retail is down 550,000 employees from February, which was the month before the pandemic effects began to hit. Though the U.S. is coming off its fastest growth quarter ever, economists worry that the next quarter or two could see flat or even negative growth before rebounding strongly in the latter part of 2021.

As expected during its December meeting, the Federal Open Market Committee (FOMC), voted to hold their benchmark short-term borrowing rate in a range of 0% to 0.25% to support the wounded U.S. economy as it recovers from the deep impact of the Covid-19 lockdowns. After its two-day meeting, the FOMC committed to continue buying bonds until the economy reaches full employment and inflation stays at 2%. The Fed pledged it would continue to purchase at least $120 billion of bonds each month until substantial progress has been made to the Fed’s employment and price stability goals. Fed officials also raised their outlook on the economy since the last forecast in September. The median expectation for gross domestic product in 2020 is now a decline of 2.4%, compared with the negative 3.7% in September. The outlook for 2021 is now 4.2% compared with 4% previously and 3.2% in 2022 against 3%. The Fed still sees economic activity recovering but still below the pre-pandemic level. Overall, the committee expects the pandemic will “continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Market Commentary

The U.S. markets finished one of the most volatile years in history with record closings for all the major indices. The S&P 500 finished the year, including dividends, with a total return over 18%. The NASDAQ, led by the technology sector, ended the year with a total return of 43.6% which was its best number since 2009. The Dow Jones Industrial Average concluded the year by posting a return of 7.2%. The Covid-19 virus sent shockwaves around the world and throughout the markets during the first quarter of 2020. Government lockdowns and businesses being forced to shut down in order to better deal with the virus led the S&P 500 to plunge 8.4% in February and 12.5% in March. Trading became extremely volatile as the S&P 500 rose or fell by at least 1% twice as many days during the year than it had, on average, since 1950. The markets were able to roar back thanks in large part to unprecedented help from the Federal Reserve and Congress as they pushed through multiple, massive stimulus bills. By August the S&P 500 index had recovered all of its early losses and climbed to new highs all the way till the end of 2020. With vaccine hopes along with more stimulus plans the S&P 500 set 33 record highs throughout the year, a truly incredible feat given the dire circumstances early on.

| 8 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA LARGE CAP VALUE FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Fund Summary

The Spirit of America Large Cap Value Fund (the “Fund”) seeks to provide capital appreciation with a secondary objective of current income. The emphasis of the Fund is focused on investing in a diversified portfolio. We are invested in all 11 sectors on the S&P 500 Index.

The material factors that affected the Fund were market direction, stock selection, and the ongoing Covid-19 pandemic. The value of the Fund and the securities in which the Fund invests may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model. We invest the old fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on the experience of our dedicated team of professionals. While not having a material impact on the Fund’s portfolio, the Fund does employ derivatives in a limited fashion utilizing a covered call writing strategy.

Return Summary

The Fund had a total return of 17.26% (no load, gross of fees) in 2020. This compares to its benchmark, the S&P 500 Index, which was up 18.40% for the year 2020. That result does not take the Fund’s sales charge and expense ratio into account.

The material factors that affected the Fund’s underperformance of its benchmark, the S&P 500, were market direction and security selection. The Fund continues to invest with a value approach as opposed to growth. The S&P 500 outweighed the Fund by 5.01% in the consumer discretionary sector which was the second highest returning sector, mostly due to a few growth names, for the period ending December 31, 2020. The consumer discretionary had a total return of 34.38% for the benchmark as opposed to 23.08% for the Fund. The Fund was also less weighted than its benchmark in the materials sector of the S&P 500. This sector was the smallest weighted sector in both the Fund and its benchmark but provided a higher total return for the benchmark S&P 500.

Including sales charge and expenses, as of December 31, 2020 the Fund’s Class A Shares one year return was 9.42%. The annualized five year return was 11.24% per year, while the average annual return over the past ten years was 10.12%.

| 9 |

| SPIRIT OF AMERICA LARGE CAP VALUE FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

| Summary of Portfolio Holdings (Unaudited) | ||||||||

| As of December 31, 2020 | ||||||||

| Technology | 36.32 | % | $ | 47,059,631 | ||||

| Health Care | 12.68 | % | 16,428,945 | |||||

| Industrials | 8.93 | % | 11,574,804 | |||||

| Communications | 8.59 | % | 11,139,744 | |||||

| Financials | 8.34 | % | 10,815,552 | |||||

| Consumer Staples | 8.19 | % | 10,620,064 | |||||

| Consumer Discretionary | 6.55 | % | 8,482,955 | |||||

| Real Estate | 5.18 | % | 6,716,882 | |||||

| Utilities | 2.37 | % | 3,074,890 | |||||

| Energy | 1.73 | % | 2,241,609 | |||||

| Materials | 1.12 | % | 1,452,593 | |||||

| Total Investments | 100.00 | % | $ | 129,607,669 | ||||

| 10 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA LARGE CAP VALUE FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

| Average Annual Returns (Unaudited) | ||||||||||||||||

| For the periods ended December 31, 2020 | ||||||||||||||||

| 1 Year | 5 Year | 10 Year | Expense Ratios(4) | |||||||||||||

| Class A Shares - with load | 9.42 | % | 11.24 | % | 10.12 | % | 1.52 | % | ||||||||

| Class A Shares - no load | 15.49 | % | 12.44 | % | 10.72 | % | 1.52 | % | ||||||||

| Class C Shares - with load1 | 13.70 | % | 11.62 | % | 9.93 | % | 2.22 | % | ||||||||

| Class C Shares - no load1 | 14.70 | % | 11.62 | % | 9.93 | % | 2.22 | % | ||||||||

| Institutional Class Shares2 | 15.89 | % | 12.79 | % | 11.05 | % | 1.22 | % | ||||||||

| S&P 500 Index3 | 18.40 | % | 15.22 | % | 13.88 | % | ||||||||||

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 5.25% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | S&P 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2020. Additional information pertaining to the Fund’s expense ratios as of December 31, 2020, can be found in the financial highlights. |

| Fixed Distribution Policy (Unaudited) |

The Board of Directors of the Fund has set a fixed distribution policy whereby the Fund will declare semi-annual distributions comprised of income earned, if any, realized long-term capital gains, if any, and to the extent necessary, return of capital, payable as of June 30 and December 31 of each year in the annual aggregate minimum amount of $1.40 per share. Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions. The Fund’s total return based on net asset value is presented in the table above as well as in the Financial Highlights tables.

| 11 |

| SPIRIT OF AMERICA LARGE CAP VALUE FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

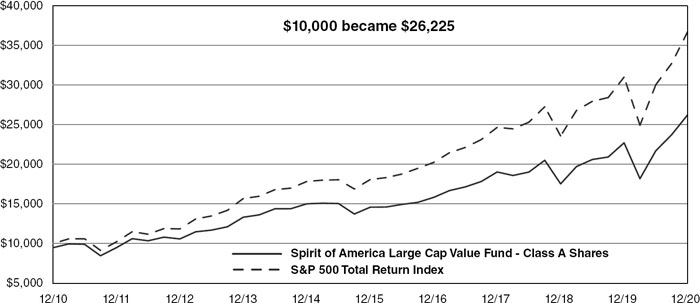

| Growth of $10,000 (Unaudited) |

| (includes one-time 5.25% maximum sales charge and reinvestment of all distributions) |

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

| 12 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND MANAGEMENT DISCUSSION (UNAUDITED) |

Dear Shareholder,

We are very pleased to provide the 2020 Annual report for the Spirit of America Municipal Tax Free Bond Fund, (“the Fund”). We look forward to continued inflows and further development of the Fund.

Our many years of experience in the municipal bond market have helped us to pursue a balance between yield and quality. Our goal is to continue seeking current income that is exempt from federal income tax, while employing a relatively conservative approach to investing in the municipal market. Although the mandate of the Fund allows it to invest in lower rated securities, at this time, the focus will continue to be investing in bonds which are investment grade.

We appreciate your support of our fund and look forward to your future investment in the Spirit of America Municipal Tax Free Bond Fund.

Thank you for being a part of the Spirit of America Family of Funds.

Sincerely,

|  David Lerner President Spirit of America Investment Fund, Inc. |  |  Mark Reilly Portfolio Manager |

| * | Effective January 16, 2020, Mark Reilly has replaced William Mason as Portfolio Manager for the Spirit of America Income & Opportunity Fund. |

| 13 |

| SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its third and final reading of the third quarter 2020 gross domestic product (GDP) to show an increase in the annual growth rate of a record 33.4%, fueled by more than $3 trillion in pandemic relief. That was revised slightly up from the 33.1% pace reported last month. Gross domestic product, the broadest measure of economic health, decreased by 31.4% for the second quarter 2020, the deepest since the government started keeping records in 1947. Consumer spending, which accounts for more than two-thirds of U.S. activity, steered the extensive recovery last quarter. Consumption appears to have since cooled, with retail sales declining in October and November as household incomes felt the pressure amid the government-funded weekly unemployment subsidy expiring. First-time applications for weekly unemployment benefits are at a three-month high. The GDP growth rate estimates for the fourth quarter hover around 5% due to labor market stress and depleted household income. Most economists expect modest growth or even a contraction in the first three months of 2021.

Nonfarm payrolls increased by just 245,000 in November. This number was well below Wall Street estimates as rising coronavirus cases coincided with a considerable slowdown in hiring. Economists had been looking for the nonfarm payrolls number to be 440,000 and the jobless rate to decrease to 6.7% from 6.9% in October. The unemployment rate met expectations, though it fell along with a drop in the labor force participation to 61.5%. A more encompassing measure of joblessness edged lower to 12% while the number of Americans outside the labor force remains just above 100 million. The November gain represented a noticeable slowdown from the 610,000 positions added in October. The economy has brought back 12.3 million of the 22 million jobs lost in the beginning of the crisis. However, there are still 10.7 million Americans considered unemployed, compared with 5.8 million in February. Professional and business services added 66,000 jobs while health care was able to add 46,000 jobs. The battered hospitality industry, which has taken the worst of the job losses during the pandemic, increased just 31,000, while retail lost 35,000 jobs, a potential troubling sign heading into the holiday season. Retail is down 550,000 employees from February, which was the month before the pandemic effects began to hit. Though the U.S. is coming off its fastest growth quarter ever, economists worry that the next quarter or two could see flat or even negative growth before rebounding strongly in the latter part of 2021.

As expected during its December meeting, the Federal Open Market Committee (FOMC), voted to hold their benchmark short-term borrowing rate in a range of 0% to 0.25% to support the wounded U.S. economy as it recovers from the deep impact of the Covid-19 lockdowns. After its two-day meeting, the FOMC committed to continue buying bonds until the economy reaches full employment and inflation stays at 2%. The Fed pledged it would continue to purchase at least $120 billion of bonds each month until substantial progress has been made to the Fed’s employment and price stability goals. Fed officials also raised their outlook on the economy since the last forecast in September. The median expectation for gross domestic product in 2020 is now a decline of 2.4%, compared with the negative 3.7% in September. The outlook for 2021 is now 4.2% compared with 4% previously and 3.2% in 2022 against 3%. The Fed still sees economic activity recovering but still below the pre-pandemic level. Overall, the committee expects the pandemic will “continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Market Commentary

Municipal bond issuance eclipsed a record $474 billion mark in 2020, beating 2017’s record $448 billion of issuance. After initially postponing issuances following the COVID-19 outbreak in March, municipal issuers came back in a big way to take advantage of low interest rates and strong investor demand. Taxable municipal bonds were mostly responsible for the issuance surge, with a large portion of them being refunding’s. While the total $144.3 billion of taxable municipal bonds issued is less than 2010’s $151.87 billion, it is the largest on record when 2010 is stripped of direct-pay Build America Bonds. For the year, volume jumped 11% to $474.05 billion from $426.35 billion in 2019.

The 30 Year US Treasury yield moved from a 2.33% on 1/2/20 to a 1.65% on 12/31/20. The MMD Tax-Free 30 Year AAA yield began the year at a 2.07% on 1/2/20 and ended the year at a 1.39% on 12/31/20. After a tumultuous year, the municipal market ended 2020 with strength, stability, and better-than expected returns. From historically low yields amid a global pandemic and a controversial U.S. presidential election, the municipal market was punctuated with much uncertainty and volatility that still resulted in one of the better-performing asset classes across fixed-income markets. Treasuries with two, five and seven year maturities all posted gains for the year and the Bloomberg Barclays U.S. Treasury index had a firmly positive year-to-date total return.

| 14 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Fund Summary

The Spirit of America Municipal Tax Free Bond Fund (“the Fund”) seeks to provide high current income that is exempt from federal income tax, including alternative minimum tax. The Fund focuses on quality credits in the municipal market. We are targeting a balance between attractive yield and quality investments.

The Fund can invest in lower rated securities; however we have kept our focus on investing in bonds that are investment grade. Our plan is to continue with this relatively conservative approach to investing in the municipal market.

In keeping with this philosophy, the Fund has been able to maintain attractive yields without venturing into the speculative, below investment grade, segment of the municipal market. As of December 31, 2020, approximately 95.91% of the portfolio was above investment grade, with 91.63% rated “A” or better. The average rating of holdings in the Fund is Aa3/AA-.

One of the Fund’s goals has been to diversify with respect to geographic location and sector. As of the end of December 2020, the Fund consists of 234 different positions varied across 36 states, 2 territories and the District of Columbia. The holdings range throughout various sectors, including areas such as: general obligations, healthcare, education, industrial development and other public improvement bonds.

While it certainly has not been a primary goal of the Fund, we have been able to maintain a percentage of bonds in states and territories which have a state tax exemption in New York, New Jersey and Connecticut, where a majority of our clients reside. Additionally, Puerto Rico bonds are exempt from state tax. Due to the struggles Puerto Rico has been facing, the Fund has actively managed its Puerto Rico holdings. As of December 31, 2020, Puerto Rico holdings represent 0.83% of the portfolio, down slightly from 0.84% at the end of 2019.

Return Summary

The Fund’s Class A Shares Net Asset Value (NAV) went from $9.45 to $9.54 during 2020. The Fund had $71,290,106 in net assets with 1,742 shareholder accounts as of December 31, 2020.

The Fund had a total one year return of 4.51% (no load, gross of fees) for 2020. This compares to the 5.21% return of its benchmark, the Bloomberg Barclays Municipal Bond Index, for the same period. That result does not take the Fund’s sales charge and expense ratio into account. The Fund’s lower performance relative to the benchmark was largely due to its shorter duration compared to the benchmark at a time of declining interest rates.

The material factors that affected the Fund were the decline in interest rates in 2020 and the selection of high quality securities. As a result of the Fund’s focus on quality, it had very little exposure to Puerto Rico whose challenges have been well documented. The Fund does not rely on derivatives or leverage strategies. The value of the Fund and the securities may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

Including the sales charge and expenses, as of December 31, 2020, the Fund’s Class A Shares one year return was (1.35)%. The annualized five year return was 1.98% and annualized ten year return was 3.65%.

Our plan is to proceed with the same strategy that we have utilized since the Fund’s inception. We will continue to seek out municipal bonds that provide a balance between credit risk and the potential to offer high current income and consistently attractive yields.

| 15 |

| SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Ratings are provided by Moody’s Investor Services and Standard & Poor’s.

The Moody’s ratings in the following ratings explanations are in parenthesis.

AAA (Aaa) - The highest rating assigned by Moody’s and S&P. Capacity to pay interest and repay principal is extremely strong.

AA (Aa) - Debt has a very strong capacity to pay interest and repay principal and differs from the highest rated issues only in a small degree.

A - Debt rated “A” has a strong capacity to pay interest and repay principal, although it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher-rated categories.

BBB (Baa) - Debt is regarded as having an adequate capacity to pay interest and repay principal. These ratings by Moody’s and S&P are the “cut-off” for a bond to be considered investment grade. Whereas debt normally exhibits adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal in this category than in higher-rated categories.

BB (Bb), B, CCC (Ccc), CC (Cc), C - Debt rated in these categories is regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. “BB” indicates the least degree of speculation and “C” the highest. While such debt will likely have some quality and protective characteristics, these are outweighed by large uncertainties or market exposure to adverse conditions and are not considered to be investment grade.

D - Debt rated “D” is in payment default. This rating category is used when interest payments or principal payments are not made on the date due, even if the applicable grace period has not expired, unless S&P believes that such payments will be made during such grace period.

Ratings are subject to change.

Ratings apply to the bonds in the portfolio. They do not remove market risk associated with the fund.

Ratings are based on Moody’s and S&P, as applicable. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. If securities are rated differently by the rating agencies, the higher of the two rating is applied thus improving the overall evaluation of the portfolio.

| 16 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

| Summary of Portfolio Holdings (Unaudited) |

| As of December 31, 2020 |

| New York | 20.07 | % | $ | 14,165,172 | ||||

| Connecticut | 9.87 | % | 6,965,563 | |||||

| Texas | 8.94 | % | 6,309,152 | |||||

| Florida | 8.07 | % | 5,701,163 | |||||

| Pennsylvania | 6.18 | % | 4,365,215 | |||||

| New Jersey | 5.67 | % | 4,005,191 | |||||

| Indiana | 4.83 | % | 3,408,567 | |||||

| California | 4.48 | % | 3,162,155 | |||||

| Massachusetts | 3.96 | % | 2,794,025 | |||||

| Michigan | 3.01 | % | 2,122,822 | |||||

| Money Market | 2.35 | % | 1,662,626 | |||||

| Maine | 1.91 | % | 1,347,362 | |||||

| Georgia | 1.84 | % | 1,296,508 | |||||

| District of Columbia | 1.58 | % | 1,116,258 | |||||

| Washington | 1.48 | % | 1,047,770 | |||||

| Utah | 1.34 | % | 947,628 | |||||

| Missouri | 1.17 | % | 823,642 | |||||

| Nevada | 1.17 | % | 827,701 | |||||

| New Mexico | 1.08 | % | 765,627 | |||||

| Rhode Island | 0.96 | % | 681,288 | |||||

| Minnesota | 0.95 | % | 668,124 |

| Louisiana | 0.92 | % | $ | 649,846 | ||||

| Arizona | 0.88 | % | 624,630 | |||||

| Ohio | 0.83 | % | 587,640 | |||||

| Puerto Rico | 0.80 | % | 565,740 | |||||

| Alaska | 0.72 | % | 507,390 | |||||

| Illinois | 0.65 | % | 459,778 | |||||

| South Dakota | 0.60 | % | 426,027 | |||||

| Tennessee | 0.59 | % | 416,775 | |||||

| Iowa | 0.44 | % | 311,198 | |||||

| Virginia | 0.41 | % | 292,486 | |||||

| Wyoming | 0.40 | % | 279,485 | |||||

| Nebraska | 0.37 | % | 261,725 | |||||

| Oklahoma | 0.37 | % | 261,045 | |||||

| Vermont | 0.36 | % | 251,880 | |||||

| North Carolina | 0.33 | % | 230,652 | |||||

| North Dakota | 0.15 | % | 109,081 | |||||

| Virgin Islands | 0.11 | % | 75,011 | |||||

| Wisconsin | 0.11 | % | 80,214 | |||||

| Oregon | 0.05 | % | 37,529 | |||||

| Total Investments | 100.00 | % | $ | 70,611,691 |

| 17 |

| SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Average Annual Returns (Unaudited)

For the periods ended December 31, 2020

| Expense Ratios(4) | |||||

| With Applicable | |||||

| 1 Year | 5 Year | 10 Year | Gross | Waivers | |

| Class A Shares - with load | (1.35)% | 1.98% | 3.65% | 1.13% | 0.92% |

| Class A Shares - no load | 3.56% | 2.98% | 4.16% | 1.13% | 0.92% |

| Class C Shares - with load1 | 1.70% | 2.05% | 3.25% | 1.98% | 1.77% |

| Class C Shares - no load1 | 2.70% | 2.05% | 3.25% | 1.98% | 1.77% |

| Institutional Class Shares2 | 3.73% | 3.14% | 4.32% | 0.98% | 0.77% |

| Bloomberg Barclays Municipal Bond Index3 | 5.21% | 3.91% | 4.63% | ||

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 4.75% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2020. Spirit of America Management Corp. (the “Adviser”) has contractually agreed to waive advisory fees and/or reimburse expenses under an Operating Expenses Agreement so that the total operating expenses will not exceed 0.90%, 1.75% and 0.75% of the Class A Shares, Class C Shares and Institutional Shares average daily net assets, respectively, through April 30, 2021. The waiver does not include front end or contingent deferred loads, taxes, interest, dividend expenses, brokerage commissions or expenses incurred in connection with any merger, reorganization, or extraordinary expenses such as litigation. Any amounts waived or reimbursed by the Adviser are subject to reimbursement by the Fund within the following three years, provided the Fund is able to make such reimbursement and remain in compliance with the expense limitations stated above. The Operating Expense Agreement may be terminated at any time, by the Board of Directors, on behalf of the Fund, upon sixty days written notice to the Adviser. Additional information pertaining to the Fund’s expense ratios as of December 31, 2020, can be found in the financial highlights. |

| 18 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA MUNICIPAL TAX FREE BOND FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

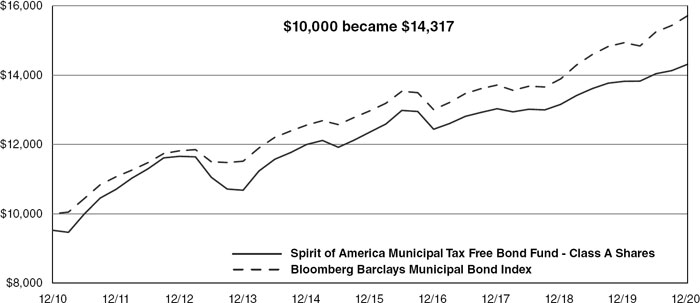

| Growth of $10,000 (Unaudited) |

| (includes one-time 4.75% maximum sales charge and reinvestment of all distributions) |

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

| 19 |

| SPIRIT OF AMERICA INCOME FUND MANAGEMENT DISCUSSION (UNAUDITED) |

Dear Shareholder,

We are pleased to send you the 2020 Annual Report for the Spirit of America Income Fund, (the “Fund”). The Fund began operations on December 31, 2008.

As 2020 has come to an end, we could not be more proud and excited about the progress of this fund. Our goal is to continue seeking current income while investing in quality fixed income securities.

We firmly maintain our philosophy that striving for the optimal balance between yield and quality will continue to position us to achieve long term success. Our dedication to providing our investors with a fund that will merit their long term commitment and satisfaction has never been stronger. Now is an excellent time to team up with your Investment Counselor to evaluate your portfolio and make sure you are properly positioned to achieve your investment goals.

Your support is sincerely appreciated and we look forward to your continued confidence in the Spirit of America Income Fund.

Sincerely,

|  David Lerner President Spirit of America Investment Fund, Inc. |  |  Mark Reilly Portfolio Manager |

| 20 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA INCOME FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its third and final reading of the third quarter 2020 gross domestic product (GDP) to show an increase in the annual growth rate of a record 33.4%, fueled by more than $3 trillion in pandemic relief. That was revised slightly up from the 33.1% pace reported last month. Gross domestic product, the broadest measure of economic health, decreased by 31.4% for the second quarter 2020, the deepest since the government started keeping records in 1947. Consumer spending, which accounts for more than two-thirds of U.S. activity, steered the extensive recovery last quarter. Consumption appears to have since cooled, with retail sales declining in October and November as household incomes felt the pressure amid the government-funded weekly unemployment subsidy expiring. First-time applications for weekly unemployment benefits are at a three-month high. The GDP growth rate estimates for the fourth quarter hover around 5% due to labor market stress and depleted household income. Most economists expect modest growth or even a contraction in the first three months of 2021.

Nonfarm payrolls increased by just 245,000 in November. This number was well below Wall Street estimates as rising coronavirus cases coincided with a considerable slowdown in hiring. Economists had been looking for the nonfarm payrolls number to be 440,000 and the jobless rate to decrease to 6.7% from 6.9% in October. The unemployment rate met expectations, though it fell along with a drop in the labor force participation to 61.5%. A more encompassing measure of joblessness edged lower to 12% while the number of Americans outside the labor force remains just above 100 million. The November gain represented a noticeable slowdown from the 610,000 positions added in October. The economy has brought back 12.3 million of the 22 million jobs lost in the beginning of the crisis. However, there are still 10.7 million Americans considered unemployed, compared with 5.8 million in February. Professional and business services added 66,000 jobs while health care was able to add 46,000 jobs. The battered hospitality industry, which has taken the worst of the job losses during the pandemic, increased just 31,000, while retail lost 35,000 jobs, a potential troubling sign heading into the holiday season. Retail is down 550,000 employees from February, which was the month before the pandemic effects began to hit. Though the U.S. is coming off its fastest growth quarter ever, economists worry that the next quarter or two could see flat or even negative growth before rebounding strongly in the latter part of 2021.

As expected during its December meeting, the Federal Open Market Committee (FOMC), voted to hold their benchmark short-term borrowing rate in a range of 0% to 0.25% to support the wounded U.S. economy as it recovers from the deep impact of the Covid-19 lockdowns. After its two-day meeting, the FOMC committed to continue buying bonds until the economy reaches full employment and inflation stays at 2%. The Fed pledged it would continue to purchase at least $120 billion of bonds each month until substantial progress has been made to the Fed’s employment and price stability goals. Fed officials also raised their outlook on the economy since the last forecast in September. The median expectation for gross domestic product in 2020 is now a decline of 2.4%, compared with the negative 3.7% in September. The outlook for 2021 is now 4.2% compared with 4% previously and 3.2% in 2022 against 3%. The Fed still sees economic activity recovering but still below the pre-pandemic level. Overall, the committee expects the pandemic will “continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Market Commentary

The U.S. markets finished one of the most volatile years in history with record closings for all the major indices. The S&P 500 finished the year, including dividends, with a total return over 18%. The NASDAQ, led by the technology sector, ended the year with a total return of 43.6% which was its best number since 2009. The Dow Jones Industrial Average concluded the year by posting a return of 7.2%. The Covid-19 virus sent shockwaves around the world and throughout the markets during the first quarter of 2020. Government lockdowns and businesses being forced to shut down in order to better deal with the virus led the S&P 500 to plunge 8.4% in February and 12.5% in March. Trading became extremely volatile as the S&P 500 rose or fell by at least 1% twice as many days during the year than it had, on average, since 1950. The markets were able to roar back thanks in large part to unprecedented help from the Federal Reserve and Congress as they pushed through multiple, massive stimulus bills. By August the S&P 500 index had recovered all of its early losses and climbed to new highs all the way till the end of 2020. With vaccine hopes along with more stimulus plans the S&P 500 set 33 record highs throughout the year, a truly incredible feat given the dire circumstances early on.

| 21 |

| SPIRIT OF AMERICA INCOME FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Municipal bond issuance eclipsed a record $474 billion mark in 2020, beating 2017’s record $448 billion of issuance. After initially postponing issuances following the COVID-19 outbreak in March, municipal issuers came back in a big way to take advantage of low interest rates and strong investor demand. Taxable municipal bonds were mostly responsible for the issuance surge, with a large portion of them being refunding’s. While the total $144.3 billion of taxable municipal bonds issued is less than 2010’s $151.87 billion, it is the largest on record when 2010 is stripped of direct-pay Build America Bonds. For the year, volume jumped 11% to $474.05 from $426.35 billion in 2019.

The 30 Year US Treasury yield moved from a 2.33% on 1/2/20 to a 1.65% on 12/31/20. At the same time, the MMD Tax-Free 30 Year AAA yield began the year at a 2.07% on 1/2/20 and ended the year at a 1.39% on 12/31/20. After a tumultuous year, the municipal market ended 2020 with strength, stability, and better-than expected returns. From historically low yields, to a global pandemic, mixed with a controversial U.S. presidential election, the municipal market was peppered with much uncertainty and volatility that still resulted in one of the better-performing asset classes across fixed-income markets. Treasuries with two, five and seven year maturities all posted gains for the year and the Bloomberg Barclays U.S. Treasury index had a firmly positive year-to-date total return.

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

Fund Summary

The Spirit of America Income Fund (the “Fund”) is the second largest fund in the Spirit of America Family of Funds based on assets under management. The Fund’s objective is to seek high current income. The emphasis of the Fund is focused on investing in a diversified portfolio of taxable municipal bonds, income producing convertible securities, preferred stocks, collateralized mortgage obligations, and master limited partnerships (MLPs).

At the end of 2020, the Fund had over 55% of its assets in taxable municipal bonds, more than 17% in preferred stock, over 8% in corporate bonds, and over 1% in MLPs. We remain diligent in our approach to the market. Here at Spirit of America each and every credit goes through rigorous credit analysis.

The Fund does not make decisions based on complicated algorithms. We are not a hedge fund. At Spirit of America, technology works for us; we do not work for technology. We do not receive buy signals from a computer generated model.

We invest the old fashioned way – utilizing hard work, intensive research, and intuitive decisions. Our decisions are based on the experience of our dedicated team of professionals. When we began the Fund, we felt the environment was favorable to start an income fund and while past performance is no guarantee of future results; our results continue to validate that belief.

Return Summary

The Fund had a total return of 7.12% (no load, gross of fees) for fiscal year ended December 31, 2020. This compares to the 7.51% returned by its benchmark, the Bloomberg Barclays U.S. Aggregate Index, for the same period. That result does not take the Fund’s sales charge and expense ratio into account.

The material factors that affected the Fund were market direction and security selection. The Fund’s underperformance relative to its benchmark was principally due to a slight underperformance of 20-30 year municipal bonds versus comparable treasuries and government related securities, which are prevalent in the benchmark. The Fund does not rely on derivatives or leverage strategies. The value of the Fund and the securities may be adversely affected by impacts caused by COVID-19 and other epidemics and pandemics that may arise in the future.

Including the sales charge and expenses, as of December 31, 2020, the Fund’s Class A Shares one year return was 0.90%. The annualized five year return was 4.74% and annualized ten year return was 5.93%.

We plan to proceed with the same game plan we have employed since the Fund began: pursuing a balance between yield and risk with a focus on quality.

| 22 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA INCOME FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Ratings are provided by Moody’s Investor Services and Standard & Poor’s.

The Moody’s ratings in the following ratings explanations are in parenthesis.

AAA (Aaa) - The highest rating assigned by Moody’s and S&P. Capacity to pay interest and repay principal is extremely strong.

AA (Aa) - Debt has a very strong capacity to pay interest and repay principal and differs from the highest rated issues only in a small degree.

A - Debt rated “A” has a strong capacity to pay interest and repay principal, although it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher-rated categories.

BBB (Baa) - Debt is regarded as having an adequate capacity to pay interest and repay principal. These ratings by Moody’s and S&P are the “cut-off” for a bond to be considered investment grade. Whereas debt normally exhibits adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal in this category than in higher-rated categories.

BB (Bb), B, CCC (Ccc), CC (Cc), C - Debt rated in these categories is regarded as having predominantly speculative characteristics with respect to capacity to pay interest and repay principal. “BB” indicates the least degree of speculation and “C” the highest. While such debt will likely have some quality and protective characteristics, these are outweighed by large uncertainties or market exposure to adverse conditions and are not considered to be investment grade.

D - Debt rated “D” is in payment default. This rating category is used when interest payments or principal payments are not made on the date due, even if the applicable grace period has not expired, unless S&P believes that such payments will be made during such grace period.

Ratings are subject to change.

Ratings apply to the bonds in the portfolio. They do not remove market risk associated with the fund.

Ratings are based on Moody’s and S&P, as applicable. Credit ratings are based largely on the rating agency’s investment analysis at the time of rating and the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security by a rating agency does not necessarily reflect its assessment of the volatility of a security’s market value or of the liquidity of an investment in the security. If securities are rated differently by the rating agencies, the higher of the two rating is applied thus improving the overall evaluation of the portfolio.

| 23 |

| SPIRIT OF AMERICA INCOME FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Summary of Portfolio Holdings (Unaudited)

As of December 31, 2020

| Municipal Bonds | 55.83 | % | $ | 74,866,386 | ||||

| Preferred Stocks | 17.69 | % | 23,719,876 | |||||

| Common Stocks | 15.41 | % | 20,666,358 | |||||

| Corporate Bonds | 8.67 | % | 11,623,603 | |||||

| Money Market | 2.30 | % | 3,077,947 | |||||

| Collateralized Mortgage Obligations | 0.10 | % | 130,031 | |||||

| Total Investments | 100.00 | % | $ | 134,084,201 |

Average Annual Returns (Unaudited)

For the periods ended December 31, 2020

| Expense Ratios(4) | |||||

| With Applicable | |||||

| 1 Year | 5 Year | 10 Year | Gross | Waivers | |

| Class A Shares - with load | 0.90% | 4.74% | 5.93% | 1.14% | 1.11% |

| Class A Shares - no load | 5.95% | 5.77% | 6.45% | 1.14% | 1.11% |

| Class C Shares - with load1 | 4.18% | 4.96% | 5.65% | 1.89% | 1.86% |

| Class C Shares - no load1 | 5.18% | 4.96% | 5.65% | 1.89% | 1.86% |

| Institutional Class Shares2 | 6.15% | 6.02% | 6.71% | 0.89% | 0.86% |

| Bloomberg Barclays U.S. Aggregate Bond Index3 | 7.51% | 4.44% | 3.84% | ||

The Fund’s past performance does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns, with load, include the 4.75% maximum sales charge for the Class A Shares or the 1.00% maximum deferred sales charge for the Class C Shares.

| 1 | Class C Shares commenced operations on March 15, 2016. Prior to March 15, 2016, performance is based on the performance of Class A Shares adjusted for the Class C Shares’ 12b-1 fees and contingent deferred sales charge. |

| 2 | Institutional Shares commenced operations on May 1, 2020. Prior to May 1, 2020, performance is based on the performance of Class A Shares. |

| 3 | The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index. The performance of an index assumes no transaction costs, taxes, management fees or other expenses. A direct investment in an index is not possible. |

| 4 | Reflects the expense ratio as disclosed in the Fund’s prospectus dated May 1, 2020. Spirit of America Management Corp. (the “Adviser”) has contractually agreed to waive advisory fees and/or reimburse expenses under an Operating Expenses Agreement so that the total operating expenses will not exceed 1.10%, 1.85% and 0.85% of the Class A Shares, Class C Shares and Institutional Shares average daily net assets, respectively, through April 30, 2021. The waiver does not include front end or contingent deferred loads, taxes, interest, dividend expenses, brokerage commissions or expenses incurred in connection with any merger, reorganization, or extraordinary expenses such as litigation. Any amounts waived or reimbursed by the Adviser are subject to reimbursement by the Fund within the following three years, provided the Fund is able to make such reimbursement and remain in compliance with the expense limitations stated above. The Operating Expense Agreement may be terminated at any time, by the Board of Directors, on behalf of the Fund, upon sixty days written notice to the Adviser. Additional information pertaining to the Fund’s expense ratios as of December 31, 2020, can be found in the financial highlights. |

| 24 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA INCOME FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

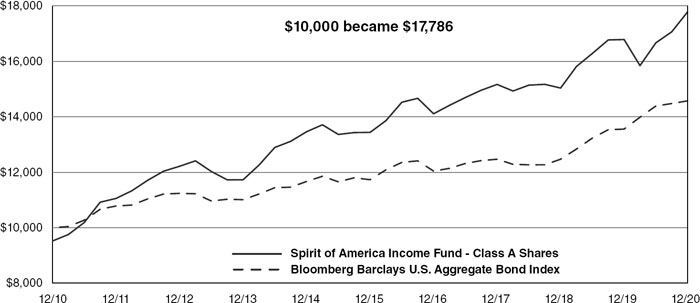

| Growth of $10,000 (Unaudited) |

| (includes one-time 4.75% maximum sales charge and reinvestment of all distributions) |

The chart represents historical performance of a hypothetical investment of $10,000 in the Fund over the past 10 years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call (800) 452-4892.

| 25 |

| SPIRIT OF AMERICA INCOME & OPPORTUNITY FUND MANAGEMENT DISCUSSION (UNAUDITED) |

Dear Shareholder,

We are pleased to send you the 2020 Annual Report for The Spirit of America Income and Opportunity Fund, (the “Fund”). The Fund began operations on July 8, 2013.

We hope you are as excited as we are to be a part of our fund. The Fund is a comprehensive portfolio of fixed income and equity securities. This fund gives our clients a solid base in high quality fixed income securities and at the same time a diverse portfolio of equity securities.

The Fund is designed to deliver attractive returns and achieve long term success for our investors. Our dedication to providing you with a fund that will merit your long term commitment and satisfaction has never been stronger. Now is an excellent time to team up with your Investment Counselor to evaluate your portfolio and make sure you are properly positioned to achieve your investment goals for the upcoming year.

We appreciate your support of our fund and look forward to your continued investment in The Spirit of America Income and Opportunity Fund.

Sincerely,

|  David Lerner President Spirit of America Investment Fund, Inc. |  |  Mark Reilly Portfolio Manager |

| 26 | SPIRIT OF AMERICA |

| SPIRIT OF AMERICA INCOME & OPPORTUNITY FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Economic Summary

At the end of December, the U.S. Bureau of Economic Analysis released its third and final reading of the third quarter 2020 gross domestic product (GDP) to show an increase in the annual growth rate of a record 33.4%, fueled by more than $3 trillion in pandemic relief. That was revised slightly up from the 33.1% pace reported last month. Gross domestic product, the broadest measure of economic health, decreased by 31.4% for the second quarter 2020, the deepest since the government started keeping records in 1947. Consumer spending, which accounts for more than two-thirds of U.S. activity, steered the extensive recovery last quarter. Consumption appears to have since cooled, with retail sales declining in October and November as household incomes felt the pressure amid the government-funded weekly unemployment subsidy expiring. First-time applications for weekly unemployment benefits are at a three-month high. The GDP growth rate estimates for the fourth quarter hover around 5% due to labor market stress and depleted household income. Most economists expect modest growth or even a contraction in the first three months of 2021.

Nonfarm payrolls increased by just 245,000 in November. This number was well below Wall Street estimates as rising coronavirus cases coincided with a considerable slowdown in hiring. Economists had been looking for the nonfarm payrolls number to be 440,000 and the jobless rate to decrease to 6.7% from 6.9% in October. The unemployment rate met expectations, though it fell along with a drop in the labor force participation to 61.5%. A more encompassing measure of joblessness edged lower to 12% while the number of Americans outside the labor force remains just above 100 million. The November gain represented a noticeable slowdown from the 610,000 positions added in October. The economy has brought back 12.3 million of the 22 million jobs lost in the beginning of the crisis. However, there are still 10.7 million Americans considered unemployed, compared with 5.8 million in February. Professional and business services added 66,000 jobs while health care was able to add 46,000 jobs. The battered hospitality industry, which has taken the worst of the job losses during the pandemic, increased just 31,000, while retail lost 35,000 jobs, a potential troubling sign heading into the holiday season. Retail is down 550,000 employees from February, which was the month before the pandemic effects began to hit. Though the U.S. is coming off its fastest growth quarter ever, economists worry that the next quarter or two could see flat or even negative growth before rebounding strongly in the latter part of 2021.

As expected during its December meeting, the Federal Open Market Committee (FOMC), voted to hold their benchmark short-term borrowing rate in a range of 0% to 0.25% to support the wounded U.S. economy as it recovers from the deep impact of the Covid-19 lockdowns. After its two-day meeting, the FOMC committed to continue buying bonds until the economy reaches full employment and inflation stays at 2%. The Fed pledged it would continue to purchase at least $120 billion of bonds each month until substantial progress has been made to the Fed’s employment and price stability goals. Fed officials also raised their outlook on the economy since the last forecast in September. The median expectation for gross domestic product in 2020 is now a decline of 2.4%, compared with the negative 3.7% in September. The outlook for 2021 is now 4.2% compared with 4% previously and 3.2% in 2022 against 3%. The Fed still sees economic activity recovering but still below the pre-pandemic level. Overall, the committee expects the pandemic will “continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.”

Market Commentary

The U.S. markets finished one of the most volatile years in history with record closings for all the major indices. The S&P 500 finished the year, including dividends, with a total return over 18%. The NASDAQ, led by the technology sector, ended the year with a total return of 45.06% which was its best number since 2009. The Dow Jones Industrial Average concluded the year by posting a return of 7.2%. The Covid-19 virus sent shockwaves around the world and throughout the markets during the first quarter of 2020. Government lockdowns and businesses being forced to shut down in order to better deal with the virus led the S&P 500 to plunge 8.4% in February and 12.5% in March. Trading became extremely volatile as the S&P 500 rose or fell by at least 1% twice as many days during the year than it had, on average, since 1950. The markets were able to roar back thanks in large part to unprecedented help from the Federal Reserve and Congress as they pushed through multiple, massive stimulus bills. By August the S&P 500 index had recovered all of its early losses and climbed to new highs all the way till the end of 2020. With vaccine hopes along with more stimulus plans the S&P 500 set 33 record highs throughout the year, a truly incredible feat given the dire circumstances early on.

| 27 |

SPIRIT OF AMERICA INCOME & OPPORTUNITY FUND MANAGEMENT DISCUSSION (UNAUDITED) (CONT.) |

Municipal bond issuance eclipsed a record $474 billion mark in 2020, beating 2017’s record $448 billion of issuance. After initially postponing issuances following the COVID-19 outbreak in March, municipal issuers came back in a big way to take advantage of low interest rates and strong investor demand. Taxable municipal bonds were mostly responsible for the issuance surge, with a large portion of them being refunding’s. While the total $144.3 billion of taxable municipal bonds issued is less than 2010’s $151.87 billion, it is the largest on record when 2010 is stripped of direct-pay Build America Bonds. For the year, volume jumped 11% to $474.05 from $426.35 billion in 2019.

The 30 Year US Treasury yield moved from a 2.33% on 1/2/20 to a 1.65% on 12/31/20. At the same time, the MMD Tax-Free 30 Year AAA yield began the year at a 2.07% on 1/2/20 and ended the year at a 1.39% on 12/31/20. After a tumultuous year, the municipal market ended 2020 with strength, stability, and better-than expected returns. From historically low yields amid a global pandemic and a controversial U.S. presidential election, the municipal market was punctuated with much uncertainty and volatility that still resulted in one of the better-performing asset classes across fixed-income markets. Treasuries with two, five and seven year maturities all posted gains for the year and the Bloomberg Barclays U.S. Treasury index had a firmly positive year-to-date total return.

On March 11, 2020, the World Health Organization announced that it had made the assessment that COVID-19 can be characterized as a pandemic. The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. Public health crises caused by the COVID-19 outbreak may exacerbate other pre-existing political, social and economic risks in certain countries or globally. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.

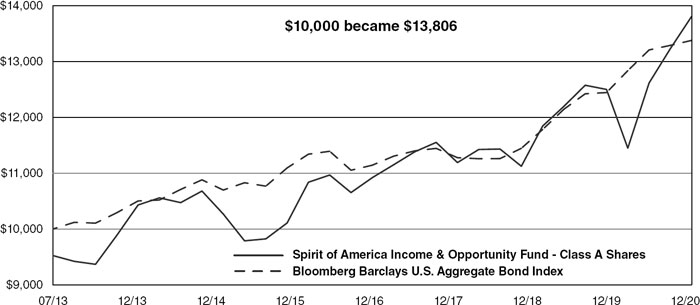

Fund Summary