UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08243

Direxion Funds

(Exact name of registrant as specified in charter)

33 Whitehall Street, 10th Floor

New York, NY 10004

(Address of principal executive offices) (Zip code)

Daniel D. O’Neill

33 Whitehall Street, 10th floor

New York, NY 10004

(Name and address of agent for service)

646-572-3390

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2011

Date of reporting period: October 31, 2011

Item 1. Report to Stockholders.

ANNUAL REPORT OCTOBER 31, 2011

33 Whitehall Street, 10th Floor New York, New York 10004 (800) 851-0511

Commodity Trends Strategy Fund (Consolidated)

Currency Trends Strategy Fund

(formerly Financial Trends Strategy Fund)

Direxion/Wilshire Dynamic Fund

Direxion Long/Short Global IPO Fund

Help Preserve the Environment – Go Green!

Go paperless with Direxion e-Delivery – a service allowing shareholders to reduce clutter with full online access to regulatory documents. Begin the preservation process with e-delivery.

With Direxion e-Delivery you can:

| | • | | Receive email notifications when your most recent shareholder communications are available for review. |

| | • | | Access prospectuses, annual reports and semiannual reports online. |

It’s easy to enroll:

| 1. | | Visit www.direxionfunds.com/edelivery |

| 2. | | Follow the simple enrollment instructions |

If you have questions about Direxion e-Delivery services, contact one of our shareholder representatives at 800-851-0511.

Table of Contents

LETTERTO SHAREHOLDERS

Dear Shareholders,

This Annual Report covers the Direxion/Wilshire Dynamic Fund (the “Dynamic Fund”), the Commodity Trends Strategy Fund, the Currency Trends Strategy Fund and the Direxion Long/Short Global IPO Fund (“Global IPO Fund”) for the period of November 1, 2010 to October 31, 2011 (the “Annual Period”). During the Annual Period, the DJ Industrial Average Index returned 10.33%, the S&P 500 Index returned 7.98% the Barclay Capital Aggregate Bond Index returned 5.00% and the NASDAQ-100 Index returned 12.08%.

As we continue to endure a slow and painful recovery, it is evident Western economies will not emerge from the global financial crisis in the same fashion as past recessions. Through global collaboration, governments are seeking innovative ways to stimulate economic growth; although, with global interest rates at all time lows, options are limited for the debt-laden West. Growth in the United States continues at a very sluggish pace and unemployment remains high, 9.0% at period end. Manufacturing levels are unfortunately low, as the Western consumer continues the personal deleveraging process.

Since last fiscal year, the European economic situation has deteriorated dramatically. As we know, much of the same credit related concerns facing the U.S. are shared by our European counterparts. It has become evident the less industrious nations in the European Union (Greece, Spain, Portugal, Italy, etc.) will struggle to stay within the European Union given current levels of debt. That said, it has been up to their stronger-funded partners like France and Germany to dictate the terms of their economic future. The discussion surrounding a breakup of the Euro has become a very real possibility, as it would afford these debt strapped countries increased flexibility in order to stave off default.

China’s growth has continued to outpace the rest of the developed global economies. While the Chinese have produced significant economic growth, their developing economic counterparts like India, Russia and Brazil also continue to post strong growth numbers. Despite the Western economic outlook, United States government bond yields are breaking record lows, signaling there is still significant interest in U.S. debt.

The Dynamic Fund uses built-in tactical strategies to attempt to capitalize on short-term market inefficiencies, designed for investors seeking to outperform a traditional strategic (long-term only) asset allocation approach. The Dynamic Fund seeks capital appreciation. To achieve its investment objective, the Dynamic Fund combines a strategic asset allocation with a “tactical overlay” to position the Dynamic Fund defensively or aggressively, depending upon the outlook of the Wilshire Associates Incorporated (the “Sub-Adviser”). Under normal circumstances, the Dynamic Fund is managed by the Rafferty Asset Management, LLC (“Rafferty” or the “Adviser”) pursuant to the Sub-Adviser’s traditional asset allocation model. This model allocates approximately 60% of the Dynamic Fund’s total assets to equity securities and 40% to fixed income securities, with a tactical overlay to increase or decrease the Dynamic Fund’s risk exposure based on the Sub-adviser’s outlook for the market. The Sub-Adviser’s tactical model evaluates asset class allocations on a monthly basis. In response to market conditions, the Sub-Adviser may recommend that the Adviser rebalance the Dynamic Fund’s portfolio, use short positions and/or employ leverage in its tactical allocations.

The Dynamic Fund Investor Class returned 3.17% as compared to a total net return of 1.76% from the MSCI World Index, 5.00% for the Barclays Capital Aggregate Bond Index and 3.06% for a composite of the two.

Equity and fixed income markets both domestically and abroad were extremely choppy over the one year period ending November 2011. Macro themes dominated during the period as conflict in the Middle East, the nuclear situation in Japan, a downgrade of U.S. Treasury securities and more led investors to make frequent shifts between risk-on and risk-off modes. Broadly speaking, the Dynamic Fund was modestly underweight both U.S. and international equities during the Annual Period due to a noticeable rise in market volatility in the U.S. and the continued compression of future growth prospects in the European region. The Fund was modestly overweight U.S. investment grade debt, TIPS and high yield for much of the Annual Period which proved beneficial as fixed income offered downside protection as markets sold-off. Towards the end of the Annual Period, the Fund shifted towards a modestly overweight position in commodities after having a neutral weight in this asset class for most of the period. Correlations across asset classes tend to increase during higher volatility market environments, thus limiting the effectiveness of risk diversification.

The Commodity Trends Strategy Fund, the Currency Trends Strategy Fund and the Direxion Long/Short Global IPO Fund incorporate long/short, tactical strategies with exposure to alternative asset classes.

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate and an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. To obtain performance data current to the most recent month-end, please call, toll-free, 1-800-851-0511 or visit www.direxionfunds.com.

The Commodity Trends Strategy Fund seeks investment results comparable to the performance of the AFT Commodity Trends Indicator (“AFT CTI”). The Commodity Trends Strategy Fund Investor Class returned -16.52% The AFT CTI itself declined -14.04%.

The Annual Period proved to be a challenging time for long/short commodity strategies. Lack of sustainable trends in commodity prices has adversely impacted performance of the Commodity Trend Strategies Fund as the Fund sought to benefit from directional price trends. The Fund was positioned overweight long through the majority of the first half of the Annual Period, which helped performance as most commodities traded higher. Most notably, the Fund was long crude oil, which was up 32.52% over the first six months of the Annual Period. Despite the strong performance over the first half of the Annual Period, the Fund struggled to retain those gains. This was due to long positions in grains like wheat and corn, which sold off precipitously in September and October based on a perceived slowdown in demand from the developing world. These types of whipsawing markets make it difficult for a trend-following approach such as the Fund follows.

The Currency Trends Strategy Fund seeks investment results comparable to the performance of the AFT FX Trends Indicator (“AFT FXTI”). Prior to September 1, 2011, the Currency Trends Strategy Fund was named the Financial Trends Strategy Fund and it sought investment results comparable to the AFT Financial Trends Indicator (“AFT FTI”). The Currency Trends Strategy Fund Investor Class returned -7.02%, the AFT FXTI returned -3.49% and the AFT FTI itself returned -3.33%.

The Annual Period proved difficult for currency trend following strategies. Volatility in the currency markets was the major global theme of the year with the risk on/risk off trader mentality hurting trend followers. Tensions in Europe, and general concerns about global economic growth potential caused wild fluctuations in currency prices. Most notably, investors sent the U.S. Dollar on a rollercoaster ride, trading much lower as compared to the major G10 countries through the first half of the Annual Period, and subsequently rallying into the end of the period. September and October were notably tough months for the Currency Trends Strategy Fund, erasing all accumulated gains on the year finishing -6.53% over the two month period. Emerging Market currencies fared best over the Annual Period with the South African Rand and the Mexican Peso finishing positive 13.73% and 8.15%, respectively. Developed Market currencies like the Yen and Swiss Franc fared the worst, closing the period down -2.77% and -10.73%, respectively against the dollar. The U.S. Dollar strengthened in the month of September, largely due to the flight to safety as a result of the continued Euro zone crisis. The Fund was predominantly positioned to benefit if the U.S. Dollar weakened, negatively impacting the Fund’s performance during that period.

The Global IPO Fund seeks capital appreciation through a risk-controlled portfolio. To achieve its investment objective, the Fund utilizes three components to implement its global long/short initial public offering (“IPO”) investment strategy. The first component is a long position in the IPOX Global Sequential Portfolio, which is an index of securities that recently went public (the “Long Component”). The second component is a short position in board based market indexes (the “Short Component”). The IPO Fund is currently invested in three broad based market indexes and gains this exposure by investing in other ETFs. The three broad based market indexes are the MSCI Emerging Markets Index, the MSCI US Board Market Index and the FTSE China 25 Index. The final component is participation in IPOs. For every one dollar that is invested in the Long Component, the IPO Fund invests 35% to 100% of that amount in the Short Component.

The Global IPO Fund Investor Class returned -11.76%. The portion of the portfolio that invests in the IPOX Global Long/Short Index returned -6.73% for the Annual Period. The Annual Period was a tale of two IPO markets. The first half of the year was very active, with the IPO calendar seeing record issuances, as the fears of a sputtering economy began to abate. Issuances came to a screeching halt in early August as the capital markets were presenting less favorable outlooks for companies looking to go public and capital became scarce. It is worth noting that the Fund participated in 128 initial public offerings over the Annual Period. Top performers in IPOs that the Fund participated in included: The Fresh Market (TFM), GNC Holdings (GNC), SodaStream (SODA) and Linkedin (LNKD). The fund was able to participate in the majority of IPOs that came to market over the period. The Fund’s hedge (shorting component) provided some protection during the significant downdrafts in the equity markets of Q3. However, this was not enough to offset the difficult performance period of the global IPO markets, led by the broader equity market selloff. Towards the end of the Annual Period, the Fund changed its hedging techniques to provide a more comprehensive hedge of the global equity markets. This hedge has proven to be more effective since initiation.

Looking ahead to 2012, in the spirit of our continued commitment to our shareholders, we have reassessed the Funds in order to provide an improved risk/return profiles to our shareholders. Effective February 1, 2012, the Commodity Trends Strategy Fund will change its underlying index to the Auspice Broad Commodity Index, a rules-based, long/flat commodity

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate and an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. To obtain performance data current to the most recent month-end, please call, toll-free, 1-800-851-0511 or visit www.direxionfunds.com.

index. Our focus is to provide shareholders access to commodities while mitigating downside risk. A long/flat approach will allow the Fund to take advantage of higher commodity prices and at the same time shift into a cash position of an individual commodity that shows a downward trend in price. The Fund will be renamed the Direxion Commodity Indexed Strategy Fund.

Effective February 1, 2012, the Currency Trends Strategy Fund will begin to seek 150% of the calendar month performance of the AFT FXTI, while implementing a strategic overlay to maintain the Fund’s exposure to the AFT FXTI between 145% and 155%. This change will provide our shareholders with the potential for an improved return profile while keeping the overall risk characteristics within our expectation for the currency asset class. Currencies, as an asset class, generally exhibit low levels of volatility providing the opportunity to employ leverage. Finally, the Global IPO Fund will change the index used as the Long Component of its investment strategy. Effective February 1, 2012, the index used as the Long Component will be the FTSE Renaissance Global IPO Index. Though the Fund’s investment objective remains to provide a long/short approach to IPO investing, this change in index will help to provide better access to IPOs in a timely fashion and broader diversification of global IPO stocks.

As further testament to our commitment to our shareholders, we are lowering the annual expenses incurred in each Fund effective February 1, 2012. By reducing the costs incurred, we believe our shareholders will be better positioned to achieve long-tern success in our strategies.

Also please note that effective February 1, 2012, each Fund will start selling Class A shares and the existing Investor Class shareholders will have their shares converted to Class A shares (load waived).

As always, we thank you for using the Direxion Funds and we look forward to our mutual success.

Best Regards,

| | |

| |  |

Daniel O’Neill Chief Investment Officer | | Patrick Rudnick Principal Financial Officer |

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate and an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. To obtain performance data current to the most recent month-end, please call, toll-free, 1-800-851-0511 or visit www.direxionfunds.com.

The total annual fund operating expense ratios of the Direxion/Wilshire Dynamic Fund Investor Class, Commodity Trends Strategy Fund Investor Class, Currency Trends Strategy Fund Investor Class and the Direxion Long/Short Global IPO Fund Investor Class is 1.58%, 1.75%, 1.77% and 1.90%, respectively, net of any fee, waivers or expense reimbursements.*

An investment in any of the Direxion Funds is subject to a number of risks that could affect the value of its shares. It is important that investors closely review and understand these risks before making an investment. An investor should consider the investment objectives, risks, charges and expenses of the Direxion Funds carefully before investing. The prospectus contains this and other information about the Direxion Funds. To obtain a prospectus, please call the Direxion Funds at 1-800-851-0511 or visit www.direxionfunds.com. The prospectus should be read carefully before investing.

Distributed by: Rafferty Capital Markets, LLC.

Date of First Use: December 22, 2011

* The total annual fund operating expense ratios include Acquired Fund Fees and Expenses, indirect fees and expenses that the Funds incur that are required to be disclosed. Without Acquired Fund Fees and Expenses, total annual operating expense ratios of the Direxion/Wilshire Dynamic Fund Investor Class, Commodity Trends Strategy Fund Investor Class, Currency Trends Strategy Fund Investor Class and the Direxion Long/Short Global IPO Fund Investor Class is 1.40%, 1.74%, 1.75% and 1.79%, respectively.

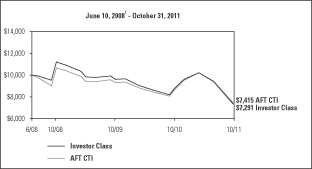

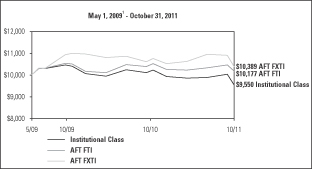

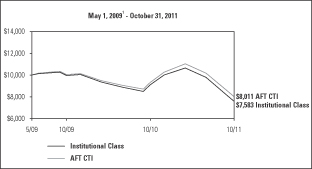

Commodity Trends Strategy Fund (Consolidated)

Performance Summary (Unaudited)

Investor Class

Institutional Class

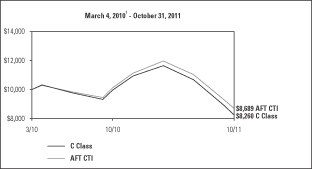

C Class

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions of the redemption of fund shares. The performance of the Alpha Financial Technologies Commodity Trends Indicator (“AFT CTI”), the Fund’s benchmark, does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Fund may impose a 1.00% redemption fee on Investor Class and Institutional Class shares redeemed (through sales or exchanges) within 90 days of the date of purchase. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Fund imposes a 1.00% contingent deferred sales charge of the net amount of the redemption of C Class shares if redeemed within 12 months of purchase.

The performance data shown represents past performance and does not guarantee future results.

| | | | | | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | 3 Year | | | Since Inception | |

Investor Class | | | (16.52 | )% | | | (13.38 | )% | | | (8.89 | )% |

AFT CTI | | | (14.04 | )% | | | (11.37 | )% | | | (8.44 | )% |

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

Institutional Class | | | (16.38 | )% | | | (10.46 | )% |

AFT CTI | | | (14.04 | )% | | | (8.48 | )% |

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

C Class3 | | | (17.04 | )% | | | (10.88 | )% |

AFT CTI | | | (14.04 | )% | | | (8.12 | )% |

Market Exposure

| | | | |

Investment Type | | %

Net Assets | |

Common Stocks | | | 0.0% | |

Swap Contracts | | | 100.9% | |

| | | | |

Total Exposure | | | 100.9% | |

| | | | |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

| 1 | Commencement of operations. |

| 2 | As of October 31, 2011. |

| 3 | These returns do not include the contingent deferred sales charge. Had this sales charge been included the 1 year total return would be (17.87)%. |

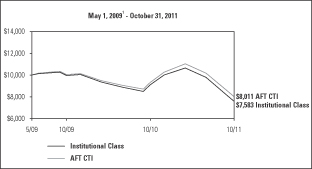

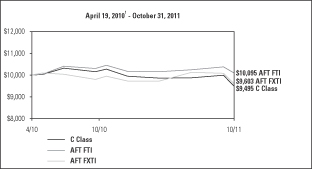

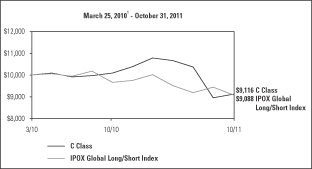

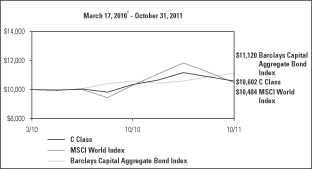

Currency Trends Strategy Fund

Performance Summary (Unaudited)

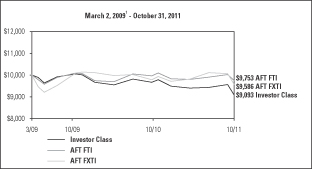

Investor Class

Institutional Class

C Class

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions of the redemption of fund shares. The performance of the Alpha Financial Technologies Financial Trends Indicator (“AFT FTI”) and the Alpha Financial Technologies FX Trends Indicator (“AFT FXTI”), the Fund’s benchmark, does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Fund may impose a 1.00% redemption fee on Investor Class and Institutional Class shares redeemed (through sales or exchanges) within 90 days of the date of purchase. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Fund imposes a 1.00% contingent deferred sales charge of the net amount of the redemption of C Class shares if redeemed within 12 months of purchase.

The performance data shown represents past performance and does not guarantee future results.

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

Investor Class | | | (7.02 | )% | | | (3.50 | )% |

AFT FTI3 | | | (3.33 | )% | | | (0.93 | )% |

AFT FXTI3 | | | (3.49 | )% | | | (1.57 | )% |

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

Institutional Class | | | (6.63 | )% | | | (1.82 | )% |

AFT FTI3 | | | (3.33 | )% | | | 0.71 | % |

AFT FXTI3 | | | (3.49 | )% | | | 1.54 | % |

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

C Class4 | | | (7.52 | )% | | | (3.32 | )% |

AFT FTI3 | | | (3.33 | )% | | | 0.62 | % |

AFT FXTI3 | | | (3.49 | )% | | | (2.60 | )% |

Market Exposure

| | | | |

Investment Type | | %

Net Assets | |

Swap Contracts | | | 99.6% | |

| | | | |

Total Exposure | | | 99.6% | |

| | | | |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

| 1 | Commencement of operations. |

| 2 | As of October 31, 2011. |

| 3 | On September 1, 2011, the AFT FXTI replaced the AFT FTI as benchmark. |

| 4 | These returns do not include the contingent deferred sales charge. Had this sales charge been included the 1 year total return would be (8.44)%. |

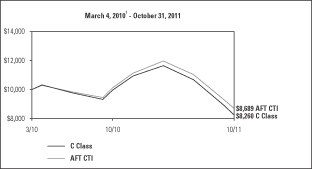

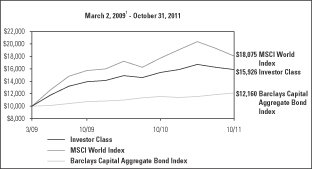

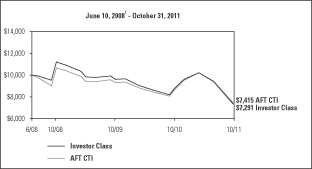

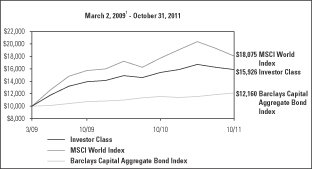

Direxion/Wilshire Dynamic Fund

Performance Summary (Unaudited)

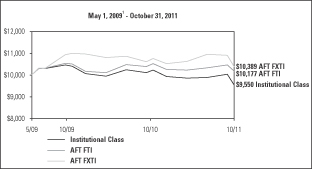

Investor Class

C Class

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions of the redemption of fund shares. The performance of the MSCI World Index and Barclays Capital Aggregate Bond Index do not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Fund may impose a 1.00% redemption fee on Investor Class shares redeemed (through sales or exchanges) within 90 days of the date of purchase. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Fund imposes a 1.00% contingent deferred sales charge of the net amount of the redemption of C Class shares if redeemed within 12 months of purchase.

The performance data shown represents past performance and does not guarantee future results.

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

Investor Class | | | 3.17 | % | | | 19.07 | % |

MSCI World Index | | | 1.76 | % | | | 24.86 | % |

Barclays Capital Aggregate Bond Index | | | 5.00 | % | | | 7.61 | % |

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

C Class3 | | | 2.40 | % | | | 3.66 | % |

MSCI World Index | | | 1.76 | % | | | 2.95 | % |

Barclays Capital Aggregate Bond Index | | | 5.00 | % | | | 6.75 | % |

Market Exposure

| | | | |

Investment Type | | %

Net Assets | |

Investment Companies | | | 31.3% | |

Swap Contracts | | | 68.7% | |

| | | | |

Total Exposure | | | 100.0% | |

| | | | |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

| 1 | Commencement of operations. |

| 2 | As of October 31, 2011. |

| 3 | These returns do not include the contingent deferred sales charge. Had this sales charge been included the 1 year total return would be 1.38%. |

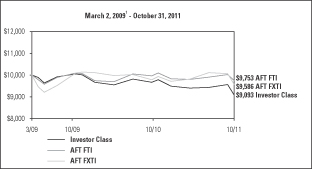

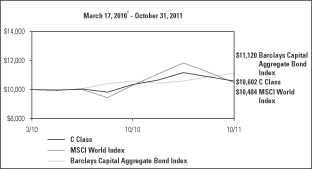

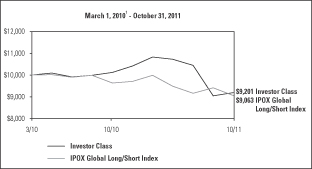

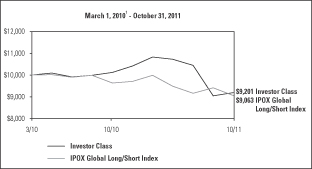

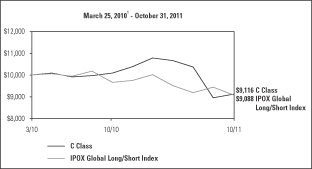

Direxion Long/Short Global IPO Fund

Performance Summary (Unaudited)

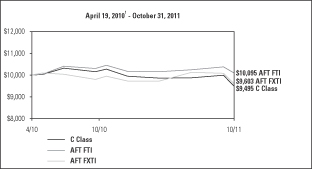

Investor Class

C Class

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund’s inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions of the redemption of fund shares. The performance of the IPOX Global Long/Short Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The Fund may impose a 1.00% redemption fee on Investor Class shares redeemed (through sales or exchanges) within 90 days of the date of purchase. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Fund imposes a 1.00% contingent deferred sales charge of the net amount of the redemption of C Class shares if redeemed within 12 months of purchase.

The performance data shown represents past performance and does not guarantee future results.

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

Investor Class | | | (11.76 | )% | | | (4.87 | )% |

IPOX Global Long/Short Index | | | (6.73 | )% | | | (5.73 | )% |

| | | | | | | | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | | Since Inception | |

C Class3 | | | (12.29 | )% | | | (5.61 | )% |

IPOX Global Long/Short Index | | | (6.73 | )% | | | (5.79 | )% |

Market Exposure

| | | | |

Investment Type | | %

Net Assets | |

Common Stocks | | | 51.8% | |

Swap Contracts | | | (10.5)% | |

| | | | |

Total Exposure | | | 41.3% | |

| | | | |

“Market Exposure” includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

| 1 | Commencement of operations. |

| 3 | These returns do not include the contingent deferred sales charge. Had this sales charge been included the 1 year total return would be (13.17)%. |

| | |

| | |

| 10 | | DIREXION ANNUAL REPORT |

Expense Example

October 31, 2011 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2011 — October 31, 2011).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem Investor Class or Institutional Class shares of the Fund that have been held for less than 90 days. You may be charged a contingent deferred sales charge of 1.00% of the net amount of the redemption if you redeem Class C shares of the Fund within 12 months of purchase. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your count during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as wire transfers, redemption fees, sales charges (loads), returned checks or stop payment orders. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | |

| |

| DIREXION ANNUAL REPORT | | 11 |

Expense Example Tables

October 31, 2011 (Unaudited)

| | | | | | | | | | | | | | | | |

| | | Expense

Ratio1 | | | Beginning

Account Value

May 1, 2011 | | | Ending

Account Value

October 31, 2011 | | | Expenses

Paid During

Period2 | |

Commodity Trends Strategy Fund Investor Class | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 1.74 | % | | $ | 1,000.00 | | | $ | 693.30 | | | $ | 7.43 | |

Based on hypothetical 5% return | | | 1.74 | % | | | 1,000.00 | | | | 1,016.43 | | | | 8.84 | |

Commodity Trends Strategy Fund Institutional Class | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 1.24 | % | | | 1,000.00 | | | | 693.70 | | | | 5.29 | |

Based on hypothetical 5% return | | | 1.24 | % | | | 1,000.00 | | | | 1,018.95 | | | | 6.31 | |

Commodity Trends Strategy Fund Class C | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 2.24 | % | | | 1,000.00 | | | | 691.10 | | | | 9.55 | |

Based on hypothetical 5% return | | | 2.24 | % | | | 1,000.00 | | | | 1,013.91 | | | | 11.37 | |

Currency Trends Strategy Fund Investor Class | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 1.75 | % | | | 1,000.00 | | | | 959.20 | | | | 8.64 | |

Based on hypothetical 5% return | | | 1.75 | % | | | 1,000.00 | | | | 1,016.38 | | | | 8.89 | |

Currency Trends Strategy Fund Institutional Class | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 1.25 | % | | | 1,000.00 | | | | 961.00 | | | | 6.18 | |

Based on hypothetical 5% return | | | 1.25 | % | | | 1,000.00 | | | | 1,018.90 | | | | 6.36 | |

Currency Trends Strategy Fund Class C | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 2.25 | % | | | 1,000.00 | | | | 956.20 | | | | 11.09 | |

Based on hypothetical 5% return | | | 2.25 | % | | | 1,000.00 | | | | 1,013.86 | | | | 11.42 | |

Direxion/Wilshire Dynamic Fund Investor Class | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 1.40 | % | | | 1,000.00 | | | | 953.20 | | | | 6.89 | |

Based on hypothetical 5% return | | | 1.40 | % | | | 1,000.00 | | | | 1,018.15 | | | | 7.12 | |

Direxion/Wilshire Dynamic Fund Class C | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 2.05 | % | | | 1,000.00 | | | | 949.40 | | | | 10.07 | |

Based on hypothetical 5% return | | | 2.05 | % | | | 1,000.00 | | | | 1,014.87 | | | | 10.41 | |

Direxion Long/Short Global IPO Fund Investor Class | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 1.79 | % | | | 1,000.00 | | | | 847.10 | | | | 8.33 | |

Based on hypothetical 5% return | | | 1.79 | % | | | 1,000.00 | | | | 1,016.18 | | | | 9.10 | |

Direxion Long/Short Global IPO Fund Class C | | | | | | | | | | | | | | | | |

Based on actual fund return | | | 2.29 | % | | | 1,000.00 | | | | 844.30 | | | | 10.65 | |

Based on hypothetical 5% return | | | 2.29 | % | | | 1,000.00 | | | | 1,013.66 | | | | 11.62 | |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year/period, then divided by 365. |

Allocation of Portfolio Holdings

October 31, 2011 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | Cash* | | | Common Stock | | | Investment

Companies | | | Swaps | | | Total | |

Commodity Trends Strategy Fund (Consolidated) | | | 129 | % | | | — | | | | — | | | | (29 | %) | | | 100 | % |

Currency Trends Strategy Fund | | | 107 | % | | | — | | | | — | | | | (7 | %) | | | 100 | % |

Direxion/Wilshire Dynamic Fund | | | 67 | % | | | — | | | | 31 | % | | | 2 | % | | | 100 | % |

Direxion Long/Short Global IPO Fund | | | 64 | % | | | 52 | % | | | — | | | | (16 | %) | | | 100 | % |

| * | Cash, cash equivalents and other assets less liabilities. |

| | |

| | |

| 12 | | DIREXION ANNUAL REPORT |

Commodity Trends Strategy Fund (Consolidated)

Schedule of Investments

October 31, 2011

No reportable investments.

| | | | | | |

| | TOTAL INVESTMENTS

(Cost $—) - 0.0% | | $ | — | |

| | Other Assets in Excess of

Liabilities - 100.0%(a) | | | 92,354,402 | |

| | | | | | |

| | TOTAL NET ASSETS - 100.0% | | $ | 92,354,402 | |

| | | | | | |

Percentages are stated as a percent of net assets.

| (a) | $50,181,637 of cash is pledged as collateral for swap contracts. |

Commodity Trends Strategy Fund (Consolidated)

Long Equity Swap Contracts

October 31, 2011

| | | | | | | | | | | | | | | | | | | | | | |

Counterparty | | Reference Index | | Number of

Contracts | | | Notional

Amount | | | Interest Rate

Paid | | | Termination

Date | | | Unrealized

Depreciation | |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 40,805 | | | $ | 78,767,524 | | | | (1.23 | %) | | | 1/23/2012 | | | $ | (16,353,058 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 1,895 | | | | 3,999,701 | | | | (1.23 | %) | | | 4/2/2012 | | | | (1,095,235 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 1,188 | | | | 2,500,455 | | | | (1.23 | %) | | | 4/26/2012 | | | | (677,723 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 1,174 | | | | 2,499,387 | | | | (1.23 | %) | | | 5/7/2012 | | | | (697,379 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 515 | | | | 1,098,083 | | | | (1.23 | %) | | | 5/8/2012 | | | | (307,414 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 2,107 | | | | 4,498,487 | | | | (1.23 | %) | | | 5/14/2012 | | | | (1,262,927 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 7,179 | | | | 14,999,802 | | | | (1.23 | %) | | | 6/11/2012 | | | | (3,961,396 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 1,980 | | | | 3,999,422 | | | | (1.23 | %) | | | 7/27/2012 | | | | (947,720 | ) |

Bank of America Merrill Lynch | | AFT Commodity Trends Indicator | | | 2,615 | | | | 4,998,259 | | | | (1.23 | %) | | | 8/13/2012 | | | | (964,398 | ) |

Credit Suisse International | | AFT Commodity Trends Indicator | | | 1,387 | | | | 2,999,457 | | | | (0.99 | %) | | | 5/17/2012 | | | | (865,827 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | 60,845 | | | $ | 120,360,577 | | | | | | | | | | | $ | (27,133,077 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| |

| DIREXION ANNUAL REPORT | | 13 |

Currency Trends Strategy Fund

Schedule of Investments

October 31, 2011

No reportable investments.

| | | | | | |

| | TOTAL INVESTMENTS

(Cost $—) - 0.0% | | $ | — | |

| | Other Assets in Excess of

Liabilities - 100.0%(a) | | | 17,849,246 | |

| | | | | | |

| | TOTAL NET ASSETS - 100.0% | | $ | 17,849,246 | |

| | | | | | |

Percentages are stated as a percent of net assets.

| (a) | $3,784,000 of cash is pledged as collateral for swap contracts. |

Currency Trends Strategy Fund

Long Equity Swap Contracts

October 31, 2011

| | | | | | | | | | | | | | | | | | | | | | |

Counterparty | | Reference Index | | Number of

Contracts | | | Notional

Amount | | | Interest Rate

Paid | | | Termination

Date | | | Unrealized

Depreciation | |

Bank of America Merrill Lynch | | AFT FX Trends Index | | | 6,872 | | | $ | 18,000,000 | | | | (1.23 | %) | | | 10/1/2012 | | | $ | (1,129,778 | ) |

Bank of America Merrill Lynch | | AFT FX Trends Index | | | 368 | | | | 950,548 | | | | (1.23 | %) | | | 11/5/2012 | | | | (46,039 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | 7,240 | | | $ | 18,950,548 | | | | | | | | | | | $ | (1,175,817 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| | |

| 14 | | DIREXION ANNUAL REPORT |

Direxion/Wilshire Dynamic Fund

Schedule of Investments

October 31, 2011

| | | | | | | | |

Shares | | | | | Value | |

| INVESTMENT COMPANIES - 31.3% | | | | |

| | 5,957 | | | iShares Barclays TIPS Bond Fund | | $ | 693,931 | |

| | 11,411 | | | iShares MSCI Emerging Markets Index Fund | | | 465,569 | |

| | 82,266 | | | iShares MSCI Japan Index Fund | | | 772,478 | |

| | 8,040 | | | iShares MSCI Pacific ex-Japan Index Fund | | | 343,147 | |

| | 61,904 | | | iShares MSCI United Kingdom Index Fund | | | 1,032,559 | |

| | 5,510 | | | iShares Russell 2000 Growth Index Fund | | | 468,405 | |

| | 5,410 | | | iShares Russell 2000 Value Index Fund | | | 353,165 | |

| | 34,887 | | | iShares S&P Europe 350 Index Fund | | | 1,249,652 | |

| | 13,807 | | | iShares S&P GSCI Commodity Indexed Trust | | | 459,635 | |

| | 18,027 | | | SPDR Barclays Capital High Yield Bond ETF | | | 702,512 | |

| | 7,403 | | | SPDR Barclays Capital International Treasury Bond ETF | | | 452,397 | |

| | 3,828 | | | SPDR Dow Jones REIT ETF | | | 247,633 | |

| | | | | | | | |

| | | | TOTAL INVESTMENT COMPANIES

(Cost $6,237,222) | | $ | 7,241,083 | |

| | | | | | | | |

| | | | TOTAL INVESTMENTS

(Cost $6,237,222) - 31.3% | | $ | 7,241,083 | |

| | | | Other Assets in Excess of

Liabilities - 68.7%(a) | | | 15,923,678 | |

| | | | | | | | |

| | | | TOTAL NET ASSETS - 100.0% | | $ | 23,164,761 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| (a) | $2,360,000 of cash is pledged as collateral for swap contracts. |

Direxion/Wilshire Dynamic Fund

Long Equity Swap Contracts

October 31, 2011

| | | | | | | | | | | | | | | | | | | | | | |

Counterparty | | Reference Entity | | Number of

Contracts | | | Notional

Amount | | | Interest Rate

Paid | | | Termination

Date | | | Unrealized

Appreciation/

(Depreciation) | |

Credit Suisse Capital, LLC | | iShares Barclays Aggregate Bond Fund | | | 76,717 | | | $ | 8,185,758 | | | | (0.49 | %) | | | 3/13/2012 | | | $ | 368,879 | |

Credit Suisse Capital, LLC | | iShares Russell 1000 Growth Index Fund | | | 62,865 | | | | 3,631,508 | | | | (0.49 | %) | | | 3/13/2012 | | | | 53,368 | |

Credit Suisse Capital, LLC | | iShares Russell 1000 Value Index Fund | | | 57,518 | | | | 3,728,507 | | | | (0.49 | %) | | | 3/13/2012 | | | | (64,519 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | 197,100 | | | $ | 15,545,773 | | | | | | | | | | | $ | 357,728 | |

| | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| |

| DIREXION ANNUAL REPORT | | 15 |

Direxion Long/Short Global IPO Fund

Schedule of Investments

October 31, 2011

| | | | | | | | |

Shares | | | | | Value | |

| COMMON STOCKS - 51.8% | |

| Administrative and Support Services - 0.9% | |

| | 3,000 | | | HomeAway, Inc.(a) | | $ | 99,150 | |

| | | | | | | | |

| Air Transportation - 1.5% | |

| | 100,000 | | | Grupo Aeromexico SAB de CV (Mexico)(a) | | | 173,707 | |

| | | | | | | | |

| Amusement, Gambling and Recreation Industries - 2.7% | |

| | 110,000 | | | MGM China Holdings Ltd. (China)(a) (Restricted Security, acquired on 5/27/11 & 7/19/11, cost $222,879) | | | 172,742 | |

| | 20,000 | | | T4F Entretenimento SA (Brazil)(a) | | | 134,549 | |

| | | | | | | | |

| | | | | | | 307,291 | |

| | | | | | | | |

| Apparel Manufacturing - 1.4% | |

| | 800,000 | | | Milan Station Holdings Ltd. (China) | | | 159,613 | |

| | | | | | | | |

| Chemical Manufacturing - 3.9% | |

| | 852,500 | | | China NT Pharma Group Co. Ltd. (China)(a) (Restricted Security, acquired on 4/14/11, cost $502,738) | | | 126,194 | |

| | 25,000 | | | Phosagro OAO GDR (Russia)(a) | | | 310,000 | |

| | | | | | | | |

| | | | | | | 436,194 | |

| | | | | | | | |

| Clothing and Clothing Accessories Stores - 3.3% | |

| | 1,500,000 | | | Hongguo International Holdings Ltd. (China)(a) (Restricted Security, acquired on 9/19/11, cost $447,202) | | | 366,852 | |

| | | | | | | | |

| Computer and Electronic Product Manufacturing - 2.3% | |

| | 10,000 | | | Skullcandy, Inc.(a) | | | 157,500 | |

| | 5,000 | | | Ubiquiti Networks, Inc.(a) | | | 104,950 | |

| | | | | | | | |

| | | | | | | 262,450 | |

| | | | | | | | |

| Credit Intermediation and Related Activities - 3.0% | |

| | 10,000 | | | Bank Gospodarki Zywnosciowej SA (Poland)(a) | | | 140,694 | |

| | 100,000 | | | CITIC Securities Co. Ltd. (China)(a) (Restricted Security, acquired on 9/28/11, cost $172,288) | | | 199,258 | |

| | | | | | | | |

| | | | | | | 339,952 | |

| | | | | | | | |

| Crop Production - 0.9% | |

| | 10,000 | | | Adecoagro SA ADR (Brazil)(a) | | | 97,200 | |

| | | | | | | | |

| Educational Services - 2.6% | |

| | 25,000 | | | Abril Educacao SA (Brazil)(a) | | | 290,940 | |

| | | | | | | | |

| Food and Beverage Stores - 1.2% | |

| | 2,500 | | | Teavana Holdings, Inc.(a) | | | 57,150 | |

| | 100,000 | | | Tenfu Cayman Holdings Co. Ltd. (China)(a) (Restricted Security, acquired on 9/21/11, cost $77,777) | | | 73,242 | |

| | | | | | | | |

| | | | | | | 130,392 | |

| | | | | | | | |

| Food Manufacturing - 1.6% | |

| | 25,000 | | | International Meal Co. Holdings (Brazil)(a) | | | 165,274 | |

| | 15,000 | | | Norway Royal Salmon AS (Norway) | | | 20,120 | |

| | | | | | | | |

| | | | | | | 185,394 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Value | |

| Heavy and Civil Engineering Construction - 0.7% | |

| | 5,000 | | | KiOR, Inc.(a) | | $ | 82,650 | |

| | | | | | | | |

| Hospitals - 0.4% | |

| | 4,900 | | | Vanguard Health Systems, Inc.(a) | | | 47,628 | |

| | | | | | | | |

| Insurance Carriers and Related Activities - 0.3% | |

| | 3,000 | | | Gjensidige Forsikring ASA (Norway) | | | 32,968 | |

| | | | | | | | |

| Merchant Wholesalers, Durable Goods - 1.0% | |

| | 10,000 | | | Wesco Aircraft Holdings, Inc.(a) | | | 112,900 | |

| | | | | | | | |

| Mining (Except Oil and Gas) - 3.1% | |

| | 248,000 | | | China Hanking Holdings Ltd. (China)(a) Restricted Security, acquired on 9/27/11, cost $80,637) | | | 75,018 | |

| | 500,000 | | | IRC Limited (China)(a) (Restricted Security, acquired on 10/15/10,

cost $117,196) | | | 77,232 | |

| | 75,000 | | | Nickel Asia Corp. (Philippines) | | | 33,916 | |

| | 5,000 | | | Royal Bafokeng Platinum Ltd. (South Africa)(a) | | | 35,284 | |

| | 10,000 | | | SunCoke Energy, Inc.(a) | | | 126,200 | |

| | | | | | | | |

| | | | | | | 347,650 | |

| | | | | | | | |

| Miscellaneous Store Retailers - 0.7% | |

| | 40,000 | | | Parkson Retail Asia Ltd. (Singapore)(a) | | | 29,965 | |

| | 150,000 | | | Puregold Price Club, Inc. (Phillipines)(a) | | | 43,556 | |

| | | | | | | | |

| | | | | | | 73,521 | |

| | | | | | | | |

| Oil and Gas Extraction - 4.9% | |

| | 75,000 | | | Bumi Armada Berhad (Malaysia)(a) (Restricted Security, acquired on 7/8/11, cost $76,266) | | | 91,428 | |

| | 350,000 | | | Hilong Holdings Ltd. (China) (Restricted Security, acquired on 4/21/11,

cost $117,347) | | | 71,633 | |

| | 25,000 | | | Lone Pine Resources, Inc. (Canada)(a) | | | 188,250 | |

| | 9,300 | | | VOC Energy Trust | | | 207,111 | |

| | | | | | | | |

| | | | | | | 558,422 | |

| | | | | | | | |

| Other Information Services - 2.1% | |

| | 1,500 | | | LinkedIn Corp.(a) | | | 134,850 | |

| | 14,300 | | | Taomee Holdings Ltd. ADR (China)(a) | | | 90,519 | |

| | 1,000 | | | Tudou Holdings Ltd. ADR (China)(a) | | | 16,400 | |

| | | | | | | | |

| | | | | | | 241,769 | |

| | | | | | | | |

| Primary Metal Manufacturing - 3.8% | | | | |

| | 14,237 | | | AMAG Austria Metall AG (Austria)(a) | | | 307,316 | |

| | 690,000 | | | China Kingstone Mining Holdings Ltd. (China)(a) (Restricted Security, acquired on 3/11/11, cost $201,344) | | | 124,343 | |

| | | | | | | | |

| | | | | | | 431,659 | |

| | | | | | | | |

| Rail Transportation - 1.0% | | | | |

| | 13,000 | | | TransContainer OAO ADR (Russia) | | | 117,000 | |

| | | | | | | | |

| Real Estate - 1.6% | | | | |

| | 15,000 | | | STAG Industrial, Inc. | | | 161,100 | |

| | 500 | | | Zillow, Inc.(a) | | | 14,845 | |

| | | | | | | | |

| | | | | | | 175,945 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| | |

| 16 | | DIREXION ANNUAL REPORT |

Direxion Long/Short Global IPO Fund

Schedule of Investments

October 31, 2011

| | | | | | | | |

Shares | | �� | | | Value | |

| Rental & Leasing Services - 0.3% | | | | |

| | 1,500 | | | Air Lease Corp.(a) | | $ | 33,495 | |

| | | | | | | | |

| Sporting Goods, Hobby, Book, and Music Stores - 2.3% | |

| | 60,000 | | | Holdsport Ltd. (South Africa)(a) | | | 257,073 | |

| | | | | | | | |

| Support Activities for Transportation - 0.3% | | | | |

| | 50,000 | | | Hutchison Port Holdings Trust ADR (Singapore) | | | 33,500 | |

| | | | | | | | |

| Transportation Equipment Manufacturing - 3.4% | |

| | 17,500 | | | Autometal SA (Brazil) | | | 137,607 | |

| | 10,000 | | | Williams F1 (United Kingdom)(a) | | | 242,147 | |

| | | | | | | | |

| | | | | | | 379,754 | |

| | | | | | | | |

| Utilities - 0.6% | | | | |

| | 250,000 | | | Huaneng Renewables Corp. Ltd.

(China)(a) (Restricted Security, acquired on 6/3/11, cost $81,160) | | | 68,221 | |

| | | | | | | | |

| | | | TOTAL COMMON STOCKS

(Cost $7,371,962) | | $ | 5,843,290 | |

| | | | | | | | |

| | | | TOTAL INVESTMENTS

(Cost $7,371,962) - 51.8% | | $ | 5,843,290 | |

| | | | Other Assets in Excess of

Liabilities - 48.2%(b) | | | 5,437,345 | |

| | | | | | | | |

| | | | TOTAL NET ASSETS - 100.0% | | $ | 11,280,635 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| (b) | $5,500,000 of cash is pledged as collateral for swap contracts. |

Concentration By Country

| | | | |

Country | | %

of Investments | |

China | | | 27.8 | |

United States of America | | | 22.9 | |

Brazil | | | 14.1 | |

Russia | | | 7.3 | |

Austria | | | 5.3 | |

South Africa | | | 5.0 | |

United Kingdom | | | 4.1 | |

Canada | | | 3.2 | |

Mexico | | | 3.0 | |

Poland | | | 2.4 | |

Malaysia | | | 1.6 | |

Philippines | | | 1.3 | |

Singapore | | | 1.1 | |

Norway | | | 0.9 | |

The accompanying notes are an integral part of these financial statements.

| | |

| |

| DIREXION ANNUAL REPORT | | 17 |

Direxion Long/Short Global IPO Fund

Long Equity Swap Contracts

October 31, 2011

| | | | | | | | | | | | | | | | | | | | | | |

Counterparty | | Reference Index | | Number of

Contracts | | | Notional

Amount | | | Interest Rate

Paid | | | Termination

Date | | | Unrealized

Depreciation | |

Credit Suisse Capital, LLC | | IPOX Global L/S (USD/TR) | | | 12,650 | | | $ | 7,394,931 | | | | (0.64 | %) | | | 10/29/2012 | | | $ | (1,229,869 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

Direxion Long/Short Global IPO Fund

Short Equity Swap Contracts

October 31, 2011

| | | | | | | | | | | | | | | | | | | | | | |

Counterparty | | Reference Entity | | Number of

Contracts | | | Notional

Amount | | | Interest Rate

(Paid) Received | | | Termination

Date | | | Unrealized

Depreciation | |

Credit Suisse Capital, LLC | | iShares FTSE/Xinhua China 25 Index Fund | | | 10,000 | | | $ | 321,236 | | | | (1.26 | %) | | | 10/26/2012 | | | $ | (39,859) | |

Credit Suisse Capital, LLC | | Vanguard MSCI Emerging Markets ETF | | | 80,500 | | | | 2,989,977 | | | | 0.14 | % | | | 10/26/2012 | | | | (349,570) | |

Credit Suisse Capital, LLC | | Vanguard Total Stock Market ETF | | | 56,500 | | | | 3,489,987 | | | | (0.21 | %) | | | 10/2/2012 | | | | (160,334) | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | 147,000 | | | $ | 6,801,200 | | | | | | | | | | | $ | (549,763) | |

| | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| | |

| 18 | | DIREXION ANNUAL REPORT |

Statements of Assets and Liabilities

October 31, 2011

| | | | | | | | | | | | | | | | |

| | | Commodity Trends

Strategy Fund

(Consolidated) | | | Currency Trends

Strategy Fund | | | Direxion/Wilshire

Dynamic Fund | | | Direxion

Long/Short

Global IPO

Fund | |

Assets: | | | | | | | | | | | | | | | | |

Investments, at fair value (Note 2) | | $ | — | | | $ | — | | | $ | 7,241,083 | | | $ | 5,843,290 | |

Cash | | | 70,248,858 | | | | 15,577,201 | | | | 13,361,658 | | | | 1,755,624 | |

Receivables: | | | | | | | | | | | | | | | | |

Fund shares sold | | | 136,621 | | | | 2,957 | | | | 240,004 | | | | 4,602 | |

Investment securities sold | | | — | | | | — | | | | 807 | | | | — | |

Deposits at brokers for swaps | | | 50,181,637 | | | | 3,784,000 | | | | 2,360,000 | | | | 5,500,000 | |

Unrealized appreciation on swaps | | | — | | | | — | | | | 422,247 | | | | — | |

Dividends and interest | | | 1,420 | | | | — | | | | — | | | | 5,310 | |

Other assets | | | 28 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total assets | | | 120,568,564 | | | | 19,364,158 | | | | 23,625,799 | | | | 13,108,826 | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Payables: | | | | | | | | | | | | | | | | |

Fund shares redeemed | | | 208,100 | | | | 32,730 | | | | 11,134 | | | | — | |

Investment securities purchased | | | — | | | | — | | | | 57,518 | | | | 30,264 | |

Deposits from brokers for swaps | | | — | | | | 280,000 | | | | 300,000 | | | | | |

Due to brokers for swaps | | | 729,788 | | | | — | | | | — | | | | — | |

Unrealized depreciation on swaps | | | 27,133,077 | | | | 1,175,817 | | | | 64,519 | | | | 1,779,632 | |

Accrued investment advisory fees | | | 75,140 | | | | 13,047 | | | | 14,135 | | | | 7,520 | |

Accrued operating services fees | | | 34,326 | | | | 6,147 | | | | 5,654 | | | | 5,415 | |

Accrued distribution expense | | | 17,857 | | | | 3,642 | | | | 5,712 | | | | 2,853 | |

Accrued shareholder servicing fees | | | 15,874 | | | | 3,482 | | | | 2,366 | | | | 2,507 | |

Other liabilities | | | — | | | | 47 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total liabilities | | | 28,214,162 | | | | 1,514,912 | | | | 461,038 | | | | 1,828,191 | |

| | | | | | | | | | | | | | | | |

Net Assets | | $ | 92,354,402 | | | $ | 17,849,246 | | | $ | 23,164,761 | | | $ | 11,280,635 | |

| | | | | | | | | | | | | | | | |

Net Assets Consist Of: | | | | | | | | | | | | | | | | |

Capital stock | | $ | 119,487,479 | | | $ | 19,025,063 | | | $ | 21,439,567 | | | $ | 14,427,230 | |

Undistributed net investment income | | | — | | | | — | | | | — | | | | — | |

Undistributed net realized gain | | | — | | | | — | | | | 363,605 | | | | 162,088 | |

Net unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | |

Investments | | | — | | | | — | | | | 1,003,861 | | | | (1,528,672 | ) |

Foreign Currency | | | — | | | | — | | | | — | | | | (379 | ) |

Swaps | | | (27,133,077 | ) | | | (1,175,817 | ) | | | 357,728 | | | | (1,779,632 | ) |

| | | | | | | | | | | | | | | | |

Total Net Assets | | $ | 92,354,402 | | | $ | 17,849,246 | | | $ | 23,164,761 | | | $ | 11,280,635 | |

| | | | | | | | | | | | | | | | |

Investor Class: | | | | | | | | | | | | | | | | |

Net assets | | $ | 60,639,227 | | | $ | 15,660,200 | | | $ | 19,183,887 | | | $ | 9,492,304 | |

Shares outstanding (unlimited shares of beneficial interest authorized, no par value) | | | 2,856,904 | | | | 574,094 | | | | 436,362 | | | | 356,127 | |

Net asset value, redemption and offering price per share | | $ | 21.23 | | | $ | 27.28 | | | $ | 43.96 | | | $ | 26.65 | |

| | | | | | | | | | | | | | | | |

Institutional Class: | | | | | | | | | | | | | | | | |

Net assets | | $ | 26,772,448 | | | $ | 1,613,049 | | | | | | | | | |

Shares outstanding (unlimited shares of beneficial interest authorized, no par value) | | | 1,257,256 | | | | 58,472 | | | | | | | | | |

Net asset value, redemption and offering price per share | | $ | 21.29 | | | $ | 27.59 | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Class C: | | | | | | | | | | | | | | | | |

Net assets | | $ | 4,942,727 | | | $ | 575,997 | | | $ | 3,980,874 | | | $ | 1,788,331 | |

Shares outstanding (unlimited shares of beneficial interest authorized, no par value) | | | 235,029 | | | | 21,295 | | | | 91,523 | | | | 67,718 | |

Net asset value, redemption and offering price per share | | $ | 21.03 | | | $ | 27.05 | | | $ | 43.50 | | | $ | 26.41 | |

| | | | | | | | | | | | | | | | |

Cost of Investments | | $ | — | | | $ | — | | | $ | 6,237,222 | | | $ | 7,371,962 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| |

| DIREXION ANNUAL REPORT | | 19 |

Statements of Operations

For the Year Ended October 31, 2011

| | | | | | | | | | | | | | | | |

| | | Commodity

Trends Strategy

Fund

(Consolidated) | | | Currency

Trends Strategy

Fund | | | Direxion/Wilshire

Dynamic Fund | | | Direxion

Long/Short

Global IPO

Fund | |

Investment income: | | | | | | | | | | | | | | | | |

Dividend income (net of foreign withholding tax of $-, $-, $-, $1,417, respectively) | | $ | — | | | $ | — | | | $ | 243,887 | | | $ | 42,826 | |

Interest income | | | 73,742 | | | | 8,636 | | | | 6,114 | | | | 2,837 | |

| | | | | | | | | | | | | | | | |

Total investment income | | | 73,742 | | | | 8,636 | | | | 250,001 | | | | 45,663 | |

| | | | | | | | | | | | | | | | |

Expenses: | | | | | | | | | | | | | | | | |

Investment advisory fees | | | 1,243,936 | | | | 149,538 | | | | 167,232 | | | | 140,505 | |

Operating services fees | | | 570,597 | | | | 70,371 | | | | 66,893 | | | | 105,608 | |

Distribution expenses - Investor Class | | | 277,806 | | | | 37,292 | | | | 48,394 | | | | 39,223 | |

Distribution expenses - Class C | | | 25,012 | | | | 3,623 | | | | 22,051 | | | | 22,836 | |

Shareholder servicing fees - Investor Class | | | 277,806 | | | | 37,292 | | | | 21,315 | | | | 39,223 | |

Shareholder servicing fees - Class C | | | 8,339 | | | | 1,208 | | | | 7,351 | | | | 7,612 | |

| | | | | | | | | | | | | | | | |

Total expenses | | | 2,403,496 | | | | 299,324 | | | | 333,236 | | | | 355,007 | |

| | | | | | | | | | | | | | | | |

Net investment loss | | | (2,329,754 | ) | | | (290,688 | ) | | | (83,235 | ) | | | (309,344 | ) |

| | | | | | | | | | | | | | | | |

Realized and unrealized gain (loss) on investments: | | | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | |

Investments | | | 13,474 | | | | — | | | | 69,173 | | | | 2,117,920 | |

Foreign Currency | | | — | | | | — | | | | — | | | | (5,453 | ) |

Futures | | | (111,535 | ) | | | — | | | | — | | | | (16,059 | ) |

Swaps | | | (11,294,217 | ) | | | 536,089 | | | | 759,925 | | | | (1,806,839 | ) |

| | | | | | | | | | | | | | | | |

| | | (11,392,278 | ) | | | 536,089 | | | | 829,098 | | | | 289,569 | |

| | | | | | | | | | | | | | | | |

Capital gain distributions from regulated investment companies | | | — | | | | — | | | | 12,770 | | | | — | |

| | | | | | | | | | | | | | | | |

Change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | |

Investments | | | — | | | | — | | | | (279,118 | ) | | | (1,728,582 | ) |

Foreign Currency | | | — | | | | — | | | | — | | | | (65 | ) |

Futures | | | — | | | | — | | | | — | | | | 3,263 | |

Swaps | | | (13,735,465 | ) | | | (1,646,665 | ) | | | (64,755 | ) | | | (1,504,080 | ) |

| | | | | | | | | | | | | | | | |

| | | (13,735,465 | ) | | | (1,646,665 | ) | | | (343,873 | ) | | | (3,229,464 | ) |

| | | | | | | | | | | | | | | | |

Net realized and unrealized gain (loss) on investments | | | (25,127,743 | ) | | | (1,110,576 | ) | | | 497,995 | | | | (2,939,895 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | (27,457,497 | ) | | $ | (1,401,264 | ) | | $ | 414,760 | | | $ | (3,249,239 | ) |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| | |

| 20 | | DIREXION ANNUAL REPORT |

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | Commodity Trends Strategy Fund

(Consolidated) | | | Currency Trends Strategy Fund | |

| | | Year Ended

October 31, 2011 | | | Year Ended

October 31, 2010 | | | Year Ended

October 31, 2011 | | | Year Ended

October 31, 2010 | |

Increase (Decrease) in net assets from: | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment loss | | $ | (2,329,754 | ) | | $ | (3,692,980 | ) | | $ | (290,688 | ) | | $ | (504,593 | ) |

Net realized gain (loss) on investments | | | (11,392,278 | ) | | | (40,266,560 | ) | | | 536,089 | | | | (363,809 | ) |

Change in net unrealized appreciation (depreciation) on investments | | | (13,735,465 | ) | | | 8,553,537 | | | | (1,646,665 | ) | | | (313,697 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | (27,457,497 | ) | | | (35,406,003 | ) | | | (1,401,264 | ) | | | (1,182,099 | ) |

| | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Investor Class Shares | | | — | | | | (7,144,922 | ) | | | — | | | | — | |

Institutional Class Shares | | | — | | | | (1,200,358 | ) | | | — | | | | — | |

C Class Shares | | | — | | | | — | | | | — | | | | — | |

Return of capital | | | | | | | | | | | | | | | | |

Investor Class Shares | | | — | | | | (63 | ) | | | — | | | | — | |

Institutional Class Shares | | | — | | | | — | | | | — | | | | — | |

C Class Shares | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | — | | | | (8,345,343 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Capital share transactions: | | | | | | | | | | | | | | | | |

Total increase (decrease) in net assets from net change in capital share transactions(a) | | | (28,843,527 | ) | | | (152,108,839 | ) | | | 158,644 | | | | (24,608,660 | ) |

| | | | | | | | | | | | | | | | |

Total decrease in net assets | | | (56,301,024 | ) | | | (195,860,185 | ) | | | (1,242,620 | ) | | | (25,790,759 | ) |

| | | | | | | | | | | | | | | | |

Net assets: | | | | | | | | | | | | | | | | |

Beginning of year | | | 148,655,426 | | | | 344,515,611 | | | | 19,091,866 | | | | 44,882,625 | |

| | | | | | | | | | | | | | | | |

End of year | | $ | 92,354,402 | | | $ | 148,655,426 | | | $ | 17,849,246 | | | $ | 19,091,866 | |

| | | | | | | | | | | | | | | | |

Undistributed net investment income, end of year | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| (a) | Summary of capital share transactions is as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Commodity Trends Strategy Fund (Consolidated) | | | Currency Trends Strategy Fund | |

| | | Year Ended

October 31, 2011 | | | Year Ended

October 31, 2010 | | | Year Ended

October 31, 2011 | | | Year Ended

October 31, 2010 | |

| | | Shares | | | Value | | | Shares | | | Value | | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | 2,349,211 | | | $ | 65,443,177 | | | | 3,844,292 | | | $ | 101,129,983 | | | | 394,645 | | | $ | 11,305,671 | | | | 864,429 | | | $ | 25,258,477 | |

Institutional Class Shares | | | 1,040,233 | | | | 29,858,469 | | | | 1,248,893 | | | | 32,715,850 | | | | 4,658 | | | | 133,710 | | | | 181,938 | | | | 5,399,506 | |

C Class Shares | | | 276,389 | | | | 7,684,245 | | | | 14,688 | | | | 362,965 | | | | 10,051 | | | | 285,130 | | | | 12,789 | | | | 373,186 | |

Shares issued in reinvestment of distributions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | — | | | | — | | | | 254,406 | | | | 6,937,656 | | | | — | | | | — | | | | — | | | | — | |

Institutional Class Shares | | | — | | | | — | | | | 6,835 | | | | 185,908 | | | | — | | | | — | | | | — | | | | — | |

C Class Shares | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Shares redeemed | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | (4,484,411 | ) | | | (115,304,011 | ) | | | (9,814,027 | ) | | | (251,084,512 | ) | | | (336,582 | ) | | | (9,591,301 | ) | | | (1,226,315 | ) | | | (35,920,012 | ) |

Institutional Class Shares | | | (620,205 | ) | | | (15,217,088 | ) | | | (1,666,841 | ) | | | (42,356,689 | ) | | | (67,248 | ) | | | (1,932,317 | ) | | | (677,251 | ) | | | (19,718,549 | ) |

C Class Shares | | | (56,048 | ) | | | (1,308,319 | ) | | | — | | | | — | | | | (1,502 | ) | | | (42,249 | ) | | | (43 | ) | | | (1,268 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) | | | (1,494,831 | ) | | $ | (28,843,527 | ) | | | (6,111,754 | ) | | $ | (152,108,839 | ) | | | 4,022 | | | $ | 158,644 | | | | (844,453 | ) | | $ | (24,608,660 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| |

| DIREXION ANNUAL REPORT | | 21 |

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | Direxion/Wilshire Dynamic Fund | | | Direxion Long/Short Global IPO Fund | |

| | | Year Ended

October 31, 2011 | | | Year Ended

October 31, 2010 | | | Year Ended

October 31, 2011 | | | March 1, 20101 to

October 31, 2010 | |

Increase (Decrease) in net assets from: | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | |

Net investment loss | | $ | (83,235 | ) | | $ | (53,025 | ) | | $ | (309,344 | ) | | $ | (55,257 | ) |

Net realized gain on investments | | | 829,098 | | | | 1,254,698 | | | | 289,569 | | | | 423,985 | |

Capital gain distributions from regulated investment companies | | | 12,770 | | | | 4,187 | | | | — | | | | — | |

Change in net unrealized appreciation (depreciation) on investments | | | (343,873 | ) | | | 288,995 | | | | (3,229,464 | ) | | | (79,219 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 414,760 | | | | 1,494,855 | | | | (3,249,239 | ) | | | 289,509 | |

| | | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | | | | | | | |

Net investment income | | | | | | | | | | | | | | | | |

Investor Class Shares | | | — | | | | (33,999 | ) | | | — | | | | — | |

C Class Shares | | | — | | | | — | | | | — | | | | — | |

Net realized gain | | | | | | | | | | | | | | | | |

Investor Class Shares | | | (986,952 | ) | | | (366,106 | ) | | | (306,675 | ) | | | — | |

C Class Shares | | | (115,303 | ) | | | — | | | | (99,048 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Total distributions to shareholders | | | (1,102,255 | ) | | | (400,105 | ) | | | (405,723 | ) | | | — | |

| | | | | | | | | | | | | | | | |

Capital share transactions: | | | | | | | | | | | | | | | | |

Total increase in net assets from net change in capital share transactions(a) | | | 6,410,410 | | | | 3,040,336 | | | | 7,654,306 | | | | 6,991,782 | |

| | | | | | | | | | | | | | | | |

Total increase in net assets | | | 5,722,915 | | | | 4,135,086 | | | | 3,999,344 | | | | 7,281,291 | |

| | | | | | | | | | | | | | | | |

Net assets: | | | | | | | | | | | | | | | | |

Beginning of year/period | | | 17,441,846 | | | | 13,306,760 | | | | 7,281,291 | | | | — | |

| | | | | | | | | | | | | | | | |

End of year/period | | $ | 23,164,761 | | | $ | 17,441,846 | | | $ | 11,280,635 | | | $ | 7,281,291 | |

| | | | | | | | | | | | | | | | |

Undistributed (Accumulated) net investment income (loss), end of year/period | | $ | — | | | $ | — | | | $ | — | | | $ | (13,799 | ) |

| | | | | | | | | | | | | | | | |

| (a) | Summary of capital share transactions is as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Direxion/Wilshire Dynamic Fund | | | Direxion Long/Short Global IPO Fund | |

| | | Year Ended

October 31, 2011 | | | Year Ended

October 31, 2010 | | | Year Ended

October 31, 2011 | | | March 1, 20101 to

October 31, 2010 | |

| | | Shares | | | Value | | | Shares | | | Value | | | Shares | | | Value | | | Shares | | | Value | |

Shares sold | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | 424,404 | | | $ | 18,943,076 | | | | 180,436 | | | $ | 7,739,497 | | | | 811,514 | | | $ | 25,261,889 | | | | 194,639 | | | $ | 5,834,271 | |

C Class Shares | | | 52,092 | | | | 2,292,961 | | | | 42,585 | | | | 1,835,884 | | | | 74,862 | | | | 2,335,944 | | | | 67,553 | | | | 2,017,519 | |

Shares issued in reinvestment of distributions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | 21,826 | | | | 943,974 | | | | 9,428 | | | | 395,619 | | | | 9,256 | | | | 289,056 | | | | — | | | | — | |

C Class Shares | | | 2,637 | | | | 113,575 | | | | — | | | | — | | | | 3,114 | | | | 96,878 | | | | — | | | | — | |

Shares redeemed | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | (354,742 | ) | | | (15,629,685 | ) | | | (163,691 | ) | | | (6,929,286 | ) | | | (630,674 | ) | | | (18,096,808 | ) | | | (28,608 | ) | | | (841,794 | ) |

C Class Shares | | | (5,759 | ) | | | (253,491 | ) | | | (32 | ) | | | (1,378 | ) | | | (77,200 | ) | | | (2,232,653 | ) | | | (611 | ) | | | (18,214 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net increase | | | 140,458 | | | $ | 6,410,410 | | | | 68,726 | | | $ | 3,040,336 | | | | 190,872 | | | $ | 7,654,306 | | | | 232,973 | | | $ | 6,991,782 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 | Commencement of operations. |

The accompanying notes are an integral part of these financial statements.

| | |

| | |

| 22 | | DIREXION ANNUAL REPORT |

Financial Highlights

October 31, 2011

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | RATIOS TO AVERAGE NET ASSETS | |

| Year/Period | | Net Asset

Value,

Beginning

of Year/

Period | | | Net

Investment

Income

(Loss)3 | | | Net

Realized

and

Unrealized

Gain

(Loss) on

Investments | | | Net

Increase

(Decrease) in

Net Asset

Value

Resulting

from

Operations | | | Dividends

from Net

Investment

Income | | | Distributions

from

Realized

Capital

Gains | | | Return of

Capital

Distribution | | | Total

Distributions | | | Redemption

Fees Paid to Fund | | | Net

Asset

Value, End of

Year/

Period | | | Total

Return4 | | | Net

Assets,

End of

Year/

Period

(,000) | | | Total

Expenses1 | | | Net

Expenses1 | | | Net Investment

Income

(Loss) After

Expense

Reimbursement/

Recoupment1 | | | Portfolio

Turnover

Rate5 | |

Commodity Trends Strategy Fund (Consolidated) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended October 31, 2011 | | $ | 25.43 | | | $ | (0.46 | ) | | $ | (3.77 | ) | | $ | (4.23 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 0.03 | | | $ | 21.23 | | | | (16.52% | ) | | $ | 60,639 | | | | 1.74% | | | | 1.74% | | | | (1.69% | ) | | | 0% | |

Year ended October 31, 2010 | | | 28.81 | | | | (0.43 | ) | | | (2.19 | ) | | | (2.62 | ) | | | (0.77 | ) | | | — | | | | — | 6 | | | (0.77 | ) | | | 0.01 | | | | 25.43 | | | | (9.24% | ) | | | 126,967 | | | | 1.78% | | | | 1.78% | | | | (1.66% | ) | | | 0% | |

May 1, 2009 to October 31, 2009 | | | 29.42 | | | | (0.25 | ) | | | (0.37 | ) | | | (0.62 | ) | | | — | | | | — | | | | — | | | | — | | | | 0.01 | | | | 28.81 | | | | (2.07% | )2 | | | 308,482 | | | | 2.01% | | | | 1.93% | | | | (1.68% | ) | | | 0% | 2 |

June 10, 20088 to

April 30, 2009 | | | 30.00 | | | | (0.34 | ) | | | (0.21 | ) | | | (0.55 | ) | | | — | | | | — | | | | (0.08 | ) | | | (0.08 | ) | | | 0.05 | | | | 29.42 | | | | (1.73% | )2 | | | 363,818 | | | | 2.02% | | | | 2.00% | | | | (1.22% | ) | | | 0% | 2 |

Institutional Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended October 31, 2011 | | | 25.46 | | | | (0.32 | ) | | | (3.85 | ) | | | (4.17 | ) | | | — | | | | — | | | | — | | | | — | | | | — | 6 | | | 21.29 | | | | (16.38% | ) | | | 26,772 | | | | 1.24% | | | | 1.24% | | | | (1.19% | ) | | | 0% | |

Year ended October 31, 2010 | | | 28.87 | | | | (0.30 | ) | | | (2.24 | ) | | | (2.54 | ) | | | (0.87 | ) | | | — | | | | — | | | | (0.87 | ) | | | — | 6 | | | 25.46 | | | | (8.98% | ) | | | 21,317 | | | | 1.27% | | | | 1.27% | | | | (1.16% | ) | | | 0% | |

May 1, 20098

to October 31, 2009 | | | 28.98 | | | | (0.18 | ) | | | 0.07 | | | | (0.11 | ) | | | — | | | | — | | | | — | | | | — | | | | — | 6 | | | 28.87 | | | | (0.38% | )2 | | | 36,034 | | | | 1.48% | | | | 1.44% | | | | (1.21% | ) | | | 0% | 2 |

Class C Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended October 31, 2011 | | | 25.35 | | | | (0.57 | ) | | | (3.75 | ) | | | (4.32 | ) | | | — | | | | — | | | | — | | | | — | | | | — | 6 | | | 21.03 | | | | (17.04% | )7 | | | 4,943 | | | | 2.24% | | | | 2.24% | | | | (2.20% | ) | | | 0% | |

March 4, 20108 to October 31, 2010 | | | 25.46 | | | | (0.33 | ) | | | 0.22 | | | | (0.11 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 25.35 | | | | (0.43% | )2 | | | 372 | | | | 2.24% | | | | 2.24% | | | | (2.10% | ) | | | 0% | 2 |

Currency Trends Strategy Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended October 31, 2011 | | | 29.34 | | | | (0.48 | ) | | | (1.60 | ) | | | (2.08 | ) | | | — | | | | — | | | | — | | | | — | | | | 0.02 | | | | 27.28 | | | | (7.02% | ) | | | 15,660 | | | | 1.75% | | | | 1.75% | | | | (1.70% | ) | | | 0% | |

Year ended October 31, 2010 | | | 30.01 | | | | (0.49 | ) | | | (0.20 | ) | | | (0.69 | ) | | | — | | | | — | | | | — | | | | — | | | | 0.02 | | | | 29.34 | | | | (2.23% | ) | | | 15,142 | | | | 1.78% | | | | 1.78% | | | | (1.69% | ) | | | 0% | |

March 2, 20098 to October 31, 2009 | | | 30.00 | | | | (0.33 | ) | | | 0.30 | | | | (0.03 | ) | | | — | | | | — | | | | — | | | | — | | | | 0.04 | | | | 30.01 | | | | 0.03% | 2 | | | 26,343 | | | | 2.23% | | | | 1.90% | | | | (1.69% | ) | | | 0% | 2 |

Institutional Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended October 31, 2011 | | | 29.55 | | | | (0.34 | ) | | | (1.62 | ) | | | (1.96 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 27.59 | | | | (6.63% | ) | | | 1,613 | | | | 1.25% | | | | 1.25% | | | | (1.19% | ) | | | 0% | |

Year ended October 31, 2010 | | | 30.08 | | | | (0.36 | ) | | | (0.17 | ) | | | (0.53 | ) | | | — | | | | — | | | | — | | | | — | | | | — | 6 | | | 29.55 | | | | (1.76% | ) | | | 3,577 | | | | 1.29% | | | | 1.29% | | | | (1.21% | ) | | | 0% | |

May 1, 20098 to October 31, 2009 | | | 28.89 | | | | (0.18 | ) | | | 1.37 | | | | 1.19 | | | | — | | | | — | | | | — | | | | — | | | | — | 6 | | | 30.08 | | | | 4.12% | 2 | | | 18,539 | | | | 1.58% | | | | 1.40% | | | | (1.23% | ) | | | 0% | 2 |

Class C Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended October 31, 2011 | | | 29.25 | | | | (0.62 | ) | | | (1.58 | ) | | | (2.20 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | 27.05 | | | | (7.52% | )7 | | | 576 | | | | 2.25% | | | | 2.25% | | | | (2.21% | ) | | | 0% | |

April 19, 20108 to October 31, 2010 | | | 28.49 | | | | (0.33 | ) | | | 1.09 | | | | 0.76 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 29.25 | | | | 2.67% | 2 | | | 373 | | | | 2.25% | | | | 2.25% | | | | (2.13% | ) | | | 0% | 2 |

Direxion/Wilshire Dynamic Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class Shares | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended October 31, 2011 | | | 45.03 | | | | (0.13 | ) | | | 1.46 | | | | 1.33 | | | | — | | | | (2.46 | ) | | | — | | | | (2.46 | ) | | | 0.06 | | | | 43.96 | | | | 3.17% | | | | 19,184 | | | | 1.41% | | | | 1.41% | | | | (0.28% | ) | | | 151% | |