Filing under Rule 425 under the U.S. Securities Act of 1933

Filing by: The Sumitomo Trust and Banking Co., Ltd.

Subject Company: The Sumitomo Trust and Banking Co., Ltd.

Commission File Number: 132-02705

Dated November 24, 2010

The Sumitomo Trust and Banking Co, Ltd .

Information Meeting on Financial Results for 1HFY2010

November 24, 2010

Global Markets

Fiduciary Services

Real Estate

Wholesale

Financial Services

Retail Financial Services

This presentation material contains information that constitutes forward- looking statements. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in the forward-looking statements as a result of various factors including changes in managerial circumstances. This presentation does not constitute an offer to sell or a solicitation of an offer to subscribe for or purchase any securities.

Meeting agenda

1HFY2010 financial results and financial condition 3 Basel III and status of capital 16 Forecast for FY2010 19

Strengthen group strategy and prioritized businesses 21

(For reference) Credit portfolio 28

(For reference) Division performance 34

1

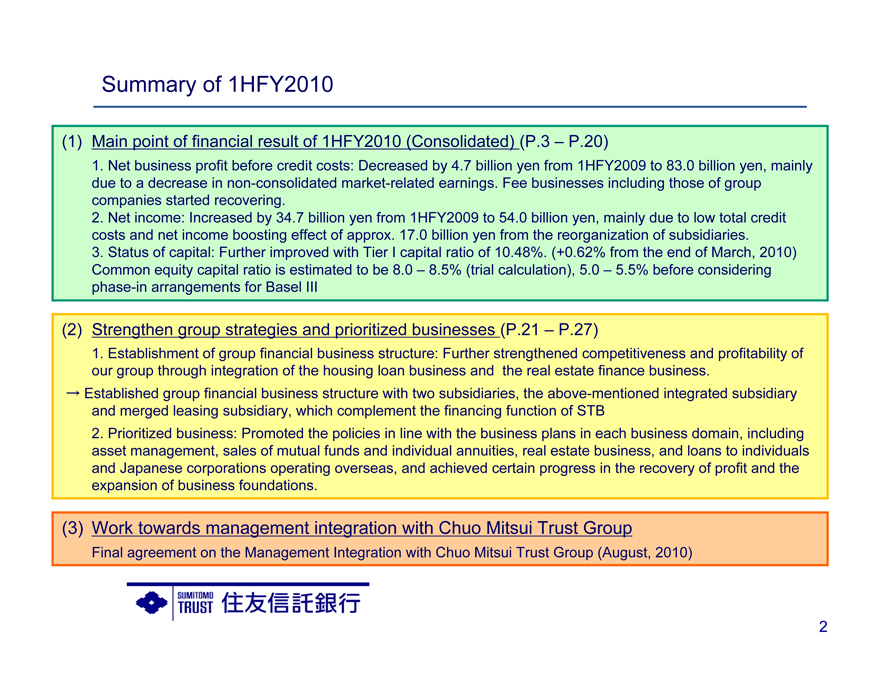

Summary of 1HFY2010

(1) Main point of financial result of 1HFY2010 (Consolidated) (P.3 – P.20)

1. Net business profit before credit costs: Decreased by 4.7 billion yen from 1HFY2009 to 83.0 billion yen, mainly due to a decrease in non-consolidated market-related earnings. Fee businesses including those of group companies started recovering.

2. Net income: Increased by 34.7 billion yen from 1HFY2009 to 54.0 billion yen, mainly due to low total credit costs and net income boosting effect of approx. 17.0 billion yen from the reorganization of subsidiaries.

3. Status of capital: Further improved with Tier I capital ratio of 10.48%. (+0.62% from the end of March, 2010) Common equity capital ratio is estimated to be 8.0 – 8.5% (trial calculation), 5.0 – 5.5% before considering phase-in arrangements for Basel III

(2) Strengthen group strategies and prioritized businesses (P.21 – P.27)

1. Establishment of group financial business structure: Further strengthened competitiveness and profitability of our group through integration of the housing loan business and the real estate finance business.

Established group financial business structure with two subsidiaries, the above-mentioned integrated subsidiary and merged leasing subsidiary, which complement the financing function of STB

2. Prioritized business: Promoted the policies in line with the business plans in each business domain, including asset management, sales of mutual funds and individual annuities, real estate business, and loans to individuals and Japanese corporations operating overseas, and achieved certain progress in the recovery of profit and the expansion of business foundations.

(3) Work towards management integration with Chuo Mitsui Trust Group

Final agreement on the Management Integration with Chuo Mitsui Trust Group (August, 2010)

2

1HFY2010 financial results and financial condition

3

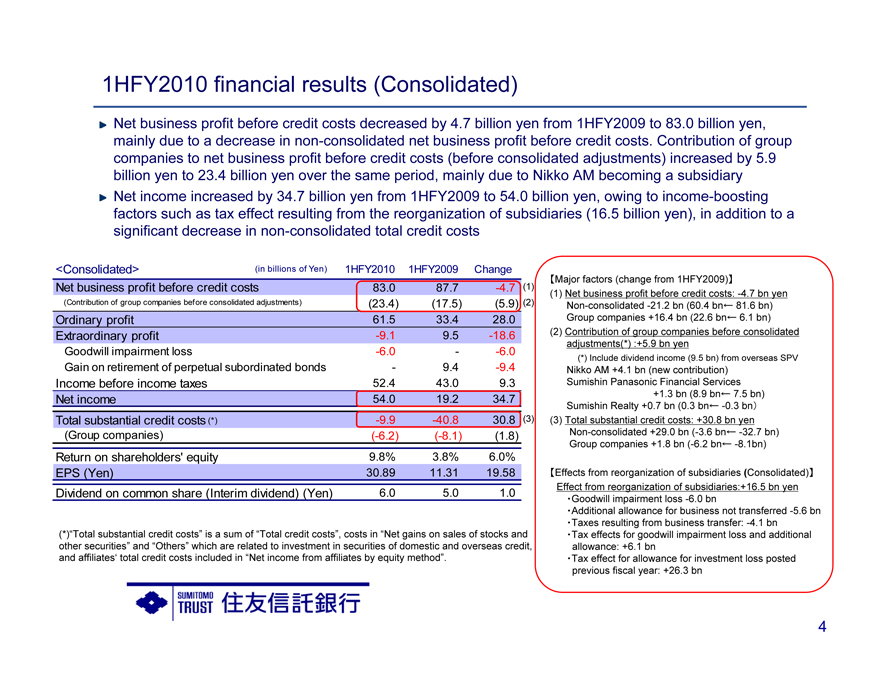

1HFY2010 financial results (Consolidated)

Net business profit before credit costs decreased by 4.7 billion yen from 1HFY2009 to 83.0 billion yen, mainly due to a decrease in non-consolidated net business profit before credit costs. Contribution of group companies to net business profit before credit costs (before consolidated adjustments) increased by 5.9 billion yen to 23.4 billion yen over the same period, mainly due to Nikko AM becoming a subsidiary Net income increased by 34.7 billion yen from 1HFY2009 to 54.0 billion yen, owing to income-boosting factors such as tax effect resulting from the reorganization of subsidiaries (16.5 billion yen), in addition to a significant decrease in non-consolidated total credit costs

<Consolidated> (in billions of Yen) 1HFY2010 1HFY2009 Change

Net business profit before credit costs 83.0 87.7 -4.7 (1)

(Contribution of group companies before consolidated adjustments) (23.4) (17.5) (5.9) (2)

Ordinary profit 61.5 33.4 28.0

Extraordinary profit -9.1 9.5 -18.6

Goodwill impairment loss -6.0 — -6.0

Gain on retirement of perpetual subordinated bonds — 9.4 -9.4

Income before income taxes 52.4 43.0 9.3

Net income 54.0 19.2 34.7

Total substantial credit costs (*) -9.9 -40.8 30.8 (3)

(Group companies) (-6.2) (-8.1) (1.8)

Return on shareholders’ equity 9.8% 3.8% 6.0%

EPS (Yen) 30.89 11.31 19.58

Dividend on common share (Interim dividend) (Yen) 6.0 5.0 1.0

(*)Total substantial credit costs” is a sum of “Total credit costs”, costs in “Net gains on sales of stocks and other securities” and “Others” which are related to investment in securities of domestic and overseas credit, and affiliates’ total credit costs included in “Net income from affiliates by equity method”.

[Major factors (change from 1HFY2009)]

(1) Net business profit before credit costs: -4.7 bn yen Non-consolidated -21.2 bn (60.4 bn 81.6 bn) Group companies +16.4 bn (22.6 bn 6.1 bn) (2) Contribution of group companies before consolidated adjustments(*) :+5.9 bn yen (*) Include dividend income (9.5 bn) from overseas SPV

Nikko AM +4.1 bn (new contribution) Sumishin Panasonic Financial Services +1.3 bn (8.9 bn 7.5 bn) Sumishin Realty +0.7 bn (0.3 bn -0.3 bn) (3) Total substantial credit costs: +30.8 bn yen Non-consolidated +29.0 bn (-3.6 bn -32.7 bn) Group companies +1.8 bn (-6.2 bn -8.1bn)

[Effects from reorganization of subsidiaries (Consolidated)] Effect from reorganization of subsidiaries:+16.5 bn yen

Goodwill impairment loss -6.0 bn

Additional allowance for business not transferred -5.6 bn

Taxes resulting from business transfer: -4.1 bn

Tax effects for goodwill impairment loss and additional allowance: +6.1 bn

Tax effect for allowance for investment loss posted previous fiscal year: +26.3 bn

4

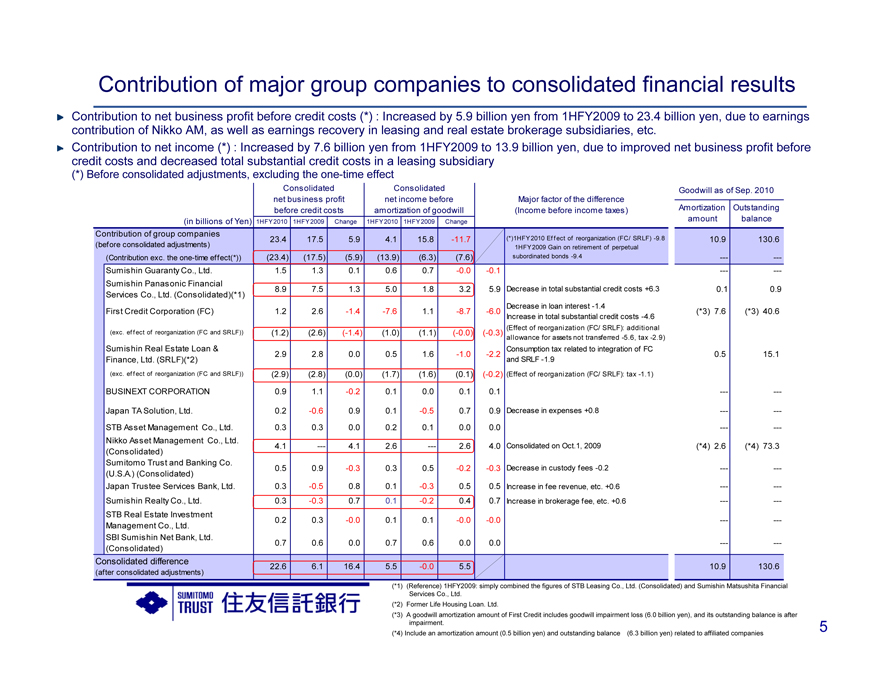

Contribution of major group companies to consolidated financial results

Contribution to net business profit before credit costs (*) : Increased by 5.9 billion yen from 1HFY2009 to 23.4 billion yen, due to earnings contribution of Nikko AM, as well as earnings recovery in leasing and real estate brokerage subsidiaries, etc.

Contribution to net income (*) : Increased by 7.6 billion yen from 1HFY2009 to 13.9 billion yen, due to improved net business profit before credit costs and decreased total substantial credit costs in a leasing subsidiary (*) Before consolidated adjustments, excluding the one-time effect

Consolidated Consolidated net business profit net income before before credit costs amortization of goodwill (in billions of Yen) 1HFY2010 1HFY2009 Change 1HFY2010 1HFY2009 Change

Contribution of group companies 23.4 17.5 5.9 4.1 15.8 -11.7

(before consolidated adjustments)

(Contribution exc. the one-time effect(*)) (23.4) (17.5) (5.9) (13.9) (6.3) (7.6)

Sumishin Guaranty Co., Ltd. 1.5 1.3 0.1 0.6 0.7 -0.0 -0.1

Sumishin Panasonic Financial

Services Co., Ltd. (Consolidated)(*1) 8.9 7.5 1.3 5.0 1.8 3.2 5.9

First Credit Corporation (FC) 1.2 2.6 -1.4 -7.6 1.1 -8.7 -6.0

(exc. ef f ect of reorganization (FC and SRLF)) (1.2) (2.6) (-1.4) (1.0) (1.1) (-0.0) (-0.3)

Sumishin Real Estate Loan &

Finance, Ltd. (SRLF)(*2) 2.9 2.8 0.0 0.5 1.6 -1.0 -2.2

(exc. ef f ect of reorganization (FC and SRLF)) (2.9) (2.8) (0.0) (1.7) (1.6) (0.1) (-0.2)

BUSINEXT CORPORATION 0.9 1.1 -0.2 0.1 0.0 0.1 0.1

Japan TA Solution, Ltd. 0.2 -0.6 0.9 0.1 -0.5 0.7 0.9

STB Asset Management Co., Ltd. 0.3 0.3 0.0 0.2 0.1 0.0 0.0

Nikko Asset Management Co., Ltd.

(Consolidated) 4.1 -— 4.1 2.6 -— 2.6 4.0

Sumitomo Trust and Banking Co.

(U.S.A.) (Consolidated) 0.5 0.9 -0.3 0.3 0.5 -0.2 -0.3

Japan Trustee Services Bank, Ltd. 0.3 -0.5 0.8 0.1 -0.3 0.5 0.5

Sumishin Realty Co., Ltd. 0.3 -0.3 0.7 0.1 -0.2 0.4 0.7

STB Real Estate Investment

Management Co., Ltd. 0.2 0.3 -0.0 0.1 0.1 -0.0 -0.0

SBI Sumishin Net Bank, Ltd.

(Consolidated) 0.7 0.6 0.0 0.7 0.6 0.0 0.0

Consolidated difference 22.6 6.1 16.4 5.5 -0.0 5.5

(after consolidated adjustments)

(*1) (Reference) 1HFY2009: simply

Goodwill as of Sep. 2010

Major factor of the difference

(Income before income taxes) Amortization Outstanding amount balance

(*)1HFY2010 Ef f ect of reorganization (FC/ SRLF) -9.8 10.9 130.6

1HFY2009 Gain on retirement of perpetual subordinated bonds -9.4

Decrease in total substantial credit costs +6.3 0.1 0.9

Decrease in loan interest -1.4 (*3) 7.6 (*3) 40.6

Increase in total substantial credit costs -4.6

(Effect of reorganization (FC/ SRLF): additional allowance for assets not transferred -5.6, tax -2.9)

Consumption tax related to integration of FC 0.5 15.1 and SRLF -1.9

(Effect of reorganization (FC/ SRLF): tax -1.1)

Decrease in expenses +0.8

Consolidated on Oct.1, 2009 (*4) 2.6 (*4) 73.3

Decrease in custody fees -0.2

Increase in fee revenue, etc. +0.6

Increase in brokerage fee, etc. +0.6

10.9 130.6

(*1) (Reference) 1HFY2009: simply combined the figures of STB Leasing Co., Ltd. (Consolidated) and Sumishin Matsushita Financial Services Co., Ltd.

(*2) Former Life Housing Loan. Ltd.

(*3) A goodwill amortization amount of First Credit includes goodwill impairment loss (6.0 billion yen), and its outstanding balance is after impairment. 5 (*4) Include an amortization amount (0.5 billion yen) and outstanding balance (6.3 billion yen) relate d to affiliated companies

5

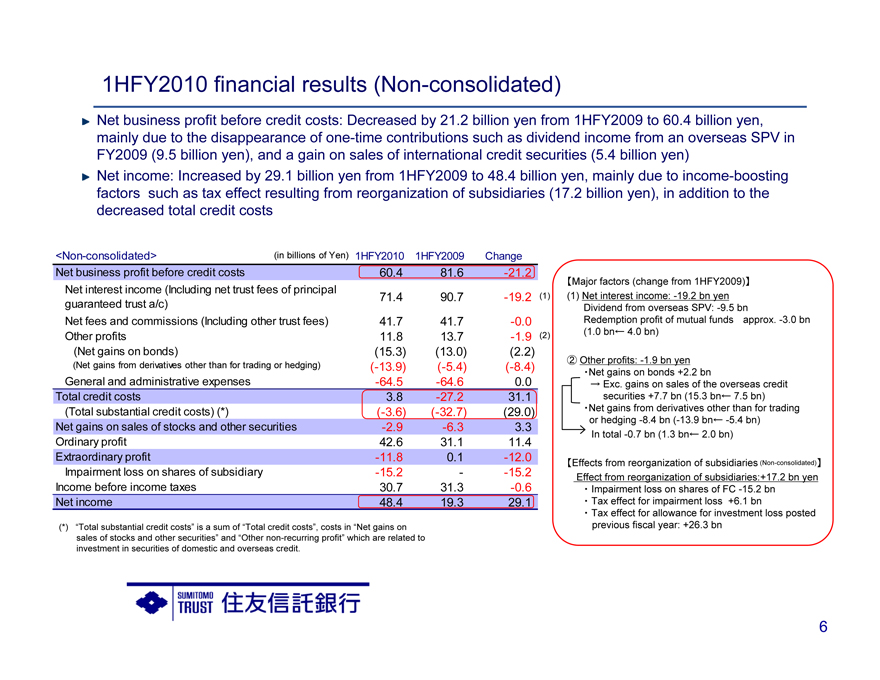

1HFY2010 financial results (Non-consolidated)

Net business profit before credit costs: Decreased by 21.2 billion yen from 1HFY2009 to 60.4 billion yen, mainly due to the disappearance of one-time contributions such as dividend income from an overseas SPV in FY2009 (9.5 billion yen), and a gain on sales of international credit securities (5.4 billion yen) Net income: Increased by 29.1 billion yen from 1HFY2009 to 48.4 billion yen, mainly due to income-boosting factors such as tax effect resulting from reorganization of subsidiaries (17.2 billion yen), in addition to the decreased total credit costs

<Non-consolidated> (in billions of Yen) 1HFY2010 1HFY2009 Change

Net business profit before credit costs 60.4 81.6 -21.2

Net interest income (Including net trust fees of principal

guaranteed trust a/c) 71.4 90.7 -19.2 (1)

Net fees and commissions (Including other trust fees) 41.7 41.7 -0.0

Other profits 11.8 13.7 -1.9 (2)

(Net gains on bonds) (15.3) (13.0) (2.2)

(Net gains from derivatives other than for trading or hedging) (-13.9) (-5.4) (-8.4)

General and administrative expenses -64.5 -64.6 0.0

Total credit costs 3.8 -27.2 31.1

(Total substantial credit costs) (*) (-3.6) (-32.7) (29.0)

Net gains on sales of stocks and other securities -2.9 -6.3 3.3

Ordinary profit 42.6 31.1 11.4

Extraordinary profit -11.8 0.1 -12.0

Impairment loss on shares of subsidiary -15.2 - -15.2

Income before income taxes 30.7 31.3 -0.6

Net income 48.4 19.3 29.1

(*) “Total substantial credit costs” is a sum of “Total credit costs”, costs in “Net gains on sales of stocks and other securities” and “Other non-recurring profit” which are related to investment in securities of domestic and overseas credit.

[Major factors (change from 1HFY2009)] (1) Net interest income: -19.2 bn yen Dividend from overseas SPV: -9.5 bn

Redemption profit of mutual funds approx. -3.0 bn (1.0 bn 4.0 bn)

2 Other profits: -1.9 bn yen Net gains on bonds +2.2 bn

Exc. gains on sales of the overseas credit securities +7.7 bn (15.3 bn 7.5 bn) Net gains from derivatives other than for trading or hedging -8.4 bn (-13.9 bn -5.4 bn) In total -0.7 bn (1.3 bn 2.0 bn)

[Effects from reorganization of subsidiaries (Non-consolidated)] Effect from reorganization of subsidiaries:+17.2 bn yen Impairment loss on shares of FC -15.2 bn Tax effect for impairment loss +6.1 bn Tax effect for allowance for investment loss posted previous fiscal year: +26.3 bn

6

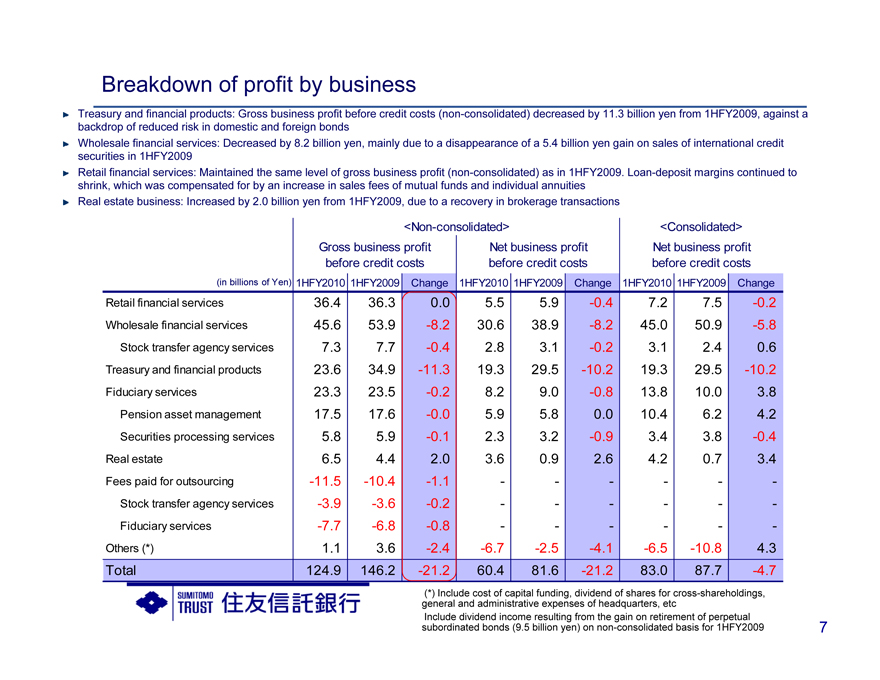

Breakdown of profit by business

Treasury and financial products: Gross business profit before credit costs (non-consolidated) decreased by 11.3 billion yen from 1HFY2009, against a backdrop of reduced risk in domestic and foreign bonds Wholesale financial services: Decreased by 8.2 billion yen, mainly due to a disappearance of a 5.4 billion yen gain on sales of international credit securities in 1HFY2009 Retail financial services: Maintained the same level of gross business profit (non-consolidated) as in 1HFY2009. Loan-deposit margins continued to shrink, which was compensated for by an increase in sales fees of mutual funds and individual annuities Real estate business: Increased by 2.0 billion yen from 1HFY2009, due to a recovery in brokerage transactions

<Non-consolidated> <Consolidated>

Gross business profit Net business profit Net business profit

before credit costs before credit costs before credit costs

(in billions of Yen) 1HFY2010 1HFY2009 Change 1HFY2010 1HFY2009 Change 1HFY2010 1HFY2009 Change

Retail financial services 36.4 36.3 0.0 5.5 5.9 -0.4 7.2 7.5 -0.2

Wholesale financial services 45.6 53.9 -8.2 30.6 38.9 -8.2 45.0 50.9 -5.8

Stock transfer agency services 7.3 7.7 -0.4 2.8 3.1 -0.2 3.1 2.4 0.6

Treasury and financial products 23.6 34.9 -11.3 19.3 29.5 -10.2 19.3 29.5 -10.2

Fiduciary services 23.3 23.5 -0.2 8.2 9.0 -0.8 13.8 10.0 3.8

Pension asset management 17.5 17.6 -0.0 5.9 5.8 0.0 10.4 6.2 4.2

Securities processing services 5.8 5.9 -0.1 2.3 3.2 -0.9 3.4 3.8 -0.4

Real estate 6.5 4.4 2.0 3.6 0.9 2.6 4.2 0.7 3.4

Fees paid for outsourcing -11.5 -10.4 -1.1 - - - - - -

Stock transfer agency services -3.9 -3.6 -0.2 - - - - - -

Fiduciary services -7.7 -6.8 -0.8 - - - - - -

Others (*) 1.1 3.6 -2.4 -6.7 -2.5 -4.1 -6.5 -10.8 4.3

Total 124.9 146.2 -21.2 60.4 81.6 -21.2 83.0 87.7 -4.7

(*) Include cost of capital funding, dividend of shares for cross-shareholdings, general and administrative expenses of headquarters, etc Include dividend income resulting from the gain on retirement of perpetual subordinated bonds (9.5 billion yen) on non-consolidated basis for 1HFY2009

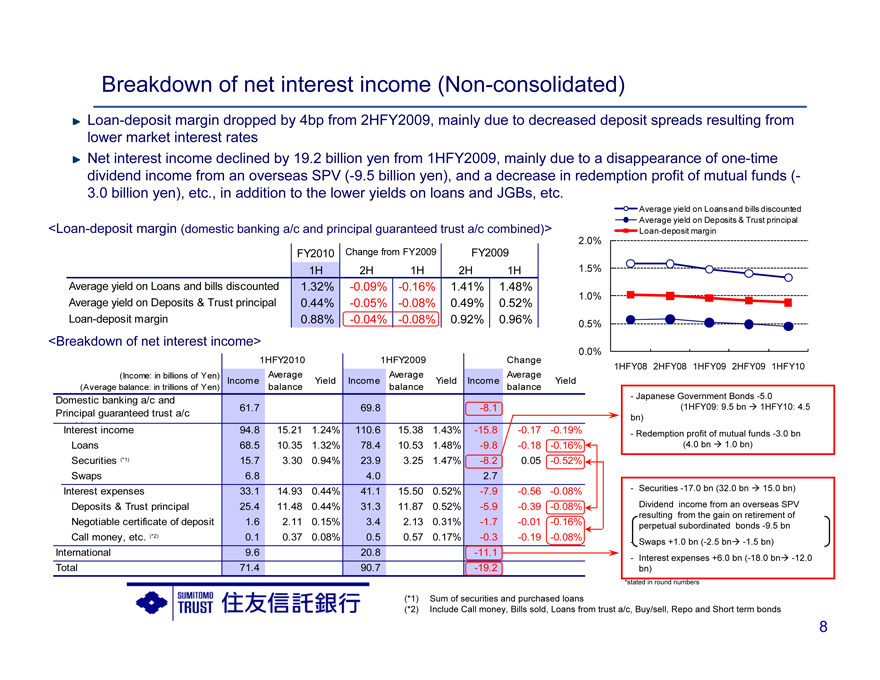

Breakdown of net interest income (Non-consolidated)

Loan-deposit margin dropped by 4bp from 2HFY2009, mainly due to decreased deposit spreads resulting from lower market interest rates Net interest income declined by 19.2 billion yen from 1HFY2009, mainly due to a disappearance of one-time dividend income from an overseas SPV (-9.5 billion yen), and a decrease in redemption profit of mutual funds (- 3.0 billion yen), etc., in addition to the lower yields on loans and JGBs, etc.

<Loan-deposit margin (domestic banking a/c and principal guaranteed trust a/c combined)>

FY2010 Change from FY2009 FY2009

1H 2H 1H 2H 1H

Average yield on Loans and bills discounted 1.32% -0.09% -0.16% 1.41% 1.48%

Average yield on Deposits & Trust principal 0.44% -0.05% -0.08% 0.49% 0.52%

Loan-deposit margin 0.88% -0.04% -0.08% 0.92% 0.96%

<Breakdown of net interest income>

(Income: in billions of Yen) Average Average Average

Income Yield Income Yield Income Yield

(Average balance: in trillions of Yen) balance balance balance

Domestic banking a/c and

Principal guaranteed trust a/c 61.7 69.8 -8.1

Interest bi d income 94.8 15.21 1.24% 110.6 15.38 1.43% -15.8 -0.17 -0.19%

Loans 68.5 10.35 1.32% 78.4 10.53 1.48% -9.8 -0.18 -0.16%

Securities (*1) 15.7 3.30 0.94% 23.9 3.25 1.47% -8.2 0.05 -0.52%

Swaps 6.8 4.0 2.7

Interest expenses 33.1 14.93 0.44% 41.1 15.50 0.52% -7.9 -0.56 -0.08%

Deposits & Trust principal 25.4 11.48 0.44% 31.3 11.87 0.52% - -5.9 -0.39 -0.08%

Negotiable certificate of deposit 1.6 2.11 0.15% 3.4 2.13 0.31% -1.7 -0.01 -0.16%

Call money, etc. (*2) 0.1 0.37 0.08% 0.5 0.57 0.17% -0.3 -0.19 -0.08%

International 9.6 20.8 -11.1

Total 71.4 90.7 -19.2

Average yield on Loans and bills discounted Average yield on Deposits & Trust principal Loan-deposit margin

2.0%

1.5%

1.0%

0.5%

0.0%

1HFY08 2HFY08 1HFY09 2HFY09 1HFY10

- Japanese Government Bonds -5.0

(1HFY09: 9.5 bn 1HFY10: 4.5 bn)

- Redemption profit of mutual funds -3.0 bn (4.0 bn 1.0 bn)

- Securities -17.0 bn (32.0 bn 15.0 bn) Dividend income from an overseas SPV resulting from the gain on retirement of perpetual subordinated bonds -9.5 bn

- Swaps +1.0 bn (-2.5 bn-1.5 bn)

- Interest expenses +6.0 bn (-18.0 bn -12.0 bn) *stated in round numbers

(*1) Sum of securities and purchased loans

(*2) Include Call money, Bills sold, Loans from trust a/c, Buy/sell, Repo and Short term bonds

8

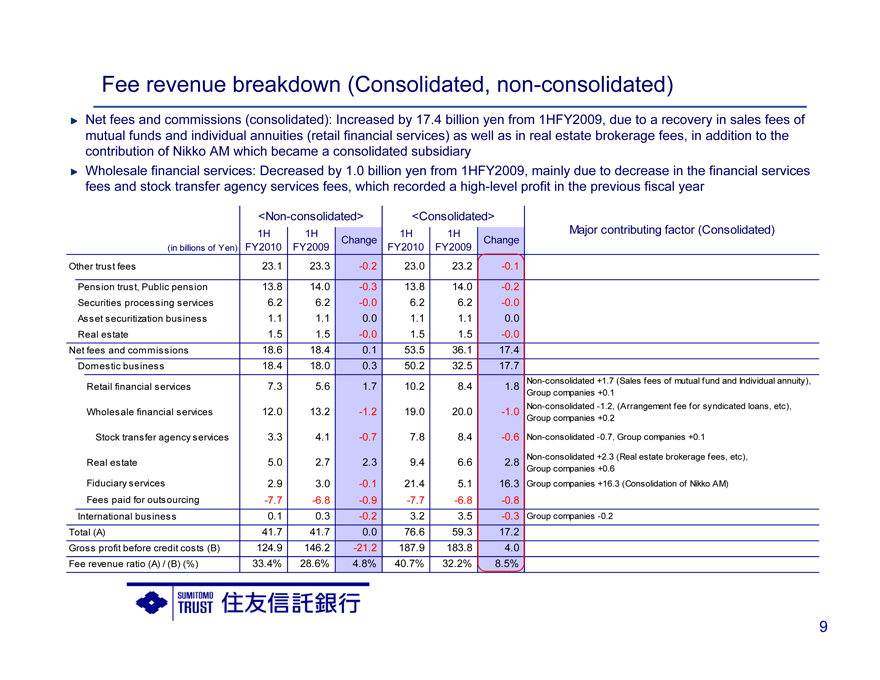

Fee revenue breakdown (Consolidated, non-consolidated)

Net fees and commissions (consolidated): Increased by 17.4 billion yen from 1HFY2009, due to a recovery in sales fees of mutual funds and individual annuities (retail financial services) as well as in real estate brokerage fees, in addition to the contribution of Nikko AM which became a consolidated subsidiary Wholesale financial services: Decreased by 1.0 billion yen from 1HFY2009, mainly due to decrease in the financial services fees and stock transfer agency services fees, which recorded a high-level profit in the previous fiscal year

<Non-consolidated> <Consolidated>

1H 1H 1H 1H

Change Change

(in billions of Yen) FY2010 FY2009 FY2010 FY2009

Other trust fees 23.1 23.3 -0.2 23.0 23.2 -0.1

Pension trust, Public pension 13.8 14.0 -0.3 13.8 14.0 -0.2

Securities processing services 6.2 6.2 -0.0 6.2 6.2 -0.0

Asset securitization business 1.1 1.1 0.0 1.1 1.1 0.0

Real estate 1.5 1.5 -0.0 1.5 1.5 -0.0

Net fees and commissions 18.6 18.4 0.1 53.5 36.1 17.4

Domestic business 18.4 18.0 0.3 50.2 32.5 17.7

Retail financial services 7.3 5.6 1.7 10.2 8.4 1.8

Wholesale financial services 12.0 13.2 -1.2 19.0 20.0 -1.0

Stock transfer agency services 3.3 4.1 -0.7 7.8 8.4 -0.6

Real estate 5.0 2.7 2.3 9.4 6.6 2.8

Fiduciary services 2.9 3.0 -0.1 21.4 5.1 16.3

Fees paid for outsourcing -7.7 -6.8 -0.9 -7.7 -6.8 -0.8

International business 0.1 0.3 -0.2 3.2 3.5 -0.3

Total (A) 41.7 41.7 0.0 76.6 59.3 17.2

Gross profit before credit costs (B) 124.9 146.2 -21.2 187.9 183.8 4.0

Fee revenue ratio (A) / (B) (%) 33.4% 28.6% 4.8% 40.7% 32.2% 8.5%

Major contributing factor (Consolidated)

Non-consolidated +1.7 (Sales fees of mutual fund and Individual annuity), Group companies +0.1 Non-consolidated -1.2, (Arrangement fee for syndicated loans, etc), Group companies +0.2

Non-consolidated -0.7, Group companies +0.1

Non-consolidated +2.3 (Real estate brokerage fees, etc), Group companies +0.6 Group companies +16.3 (Consolidation of Nikko AM)

Group companies -0.2

9

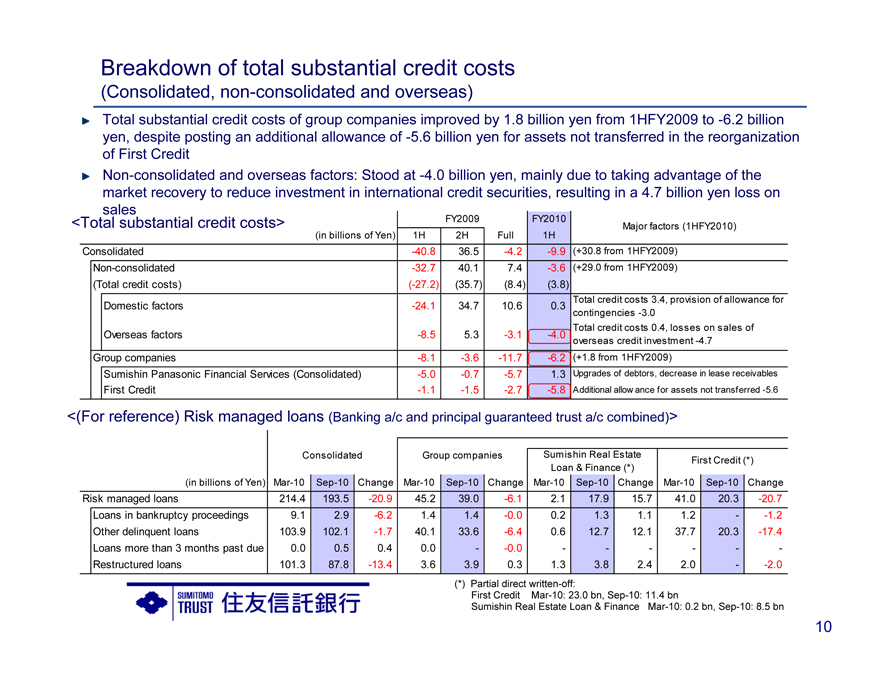

Breakdown of total substantial credit costs

(Consolidated, non-consolidated and overseas)

Total substantial credit costs of group companies improved by 1.8 billion yen from 1HFY2009 to -6.2 billion yen, despite posting an additional allowance of -5.6 billion yen for assets not transferred in the reorganization of First Credit Non-consolidated and overseas factors: Stood at -4.0 billion yen, mainly due to taking advantage of the market recovery to reduce investment in international credit securities, resulting in a 4.7 billion yen loss on

sales

<Total substantial credit costs> FY2009 FY2010

Major factors (1HFY2010)

(in billions of Yen) 1H 2H Full 1H

Consolidated - -40.8 36.5 -4.2 -9.9 (+30.8 from 1HFY2009)

Non-consolidated -32.7 40.1 7.4 -3.6 (+29.0 from 1HFY2009)

(Total credit costs) (-27.2) (35.7) (8.4) (3.8)

Domestic factors -24.1 34.7 10.6 0.3 Total credit costs 3.4, provision of allowance for

contingencies -3.0

Total credit costs 0.4, losses on sales of

Overseas factors -8.5 5.3 -3.1 -4.0 overseas credit investment -4.7

Group companies -8.1 -3.6 -11.7 -6.2 (+1.8 from 1HFY2009)

Sumishin Panasonic Financial Services (Consolidated) -5.0 -0.7 -5.7 1.3 Upgrades of debtors, decrease in lease receivables

First Credit -1.1 -1.5 -2.7 -5.8 Additional allow ance for assets not transferred -5.6

<(For reference) Risk managed loans (Banking a/c and principal guaranteed trust a/c combined)>

Consolidated Group companies Sumishin Real Estate First Credit (*)

Loan & Finance (*)

(in billions of Yen) Mar-10 Sep-10 Change Mar-10 Sep-10 Change Mar-10 Sep-10 Change Mar-10 Sep-10 Change

Risk managed loans 214.4 193.5 -20.9 45.2 39.0 -6.1 2.1 17.9 15.7 41.0 20.3 -20.7

Loans in bankruptcy proceedings 9.1 2.9 -6.2 1.4 1.4 -0.0 0.2 1.3 1.1 1.2 - -1.2

Other delinquent loans 103.9 102.1 -1.7 40.1 33.6 -6.4 0.6 12.7 12.1 37.7 20.3 - 17.4

Loans more than 3 months past due 0.0 0.5 0.4 0.0 - -0.0- - - - - -

Restructured loans 101.3 87.8 -13.4 3.6 3.9 0.3 1.3 3.8 2.4 2.0 — -2.0

(*) Partial direct written-off:

First Credit Mar-10: 23.0 bn, Sep-10: 11.4 bn

Sumishin Real Estate Loan & Finance Mar-10: 0.2 bn, Sep-10: 8.5 bn

10

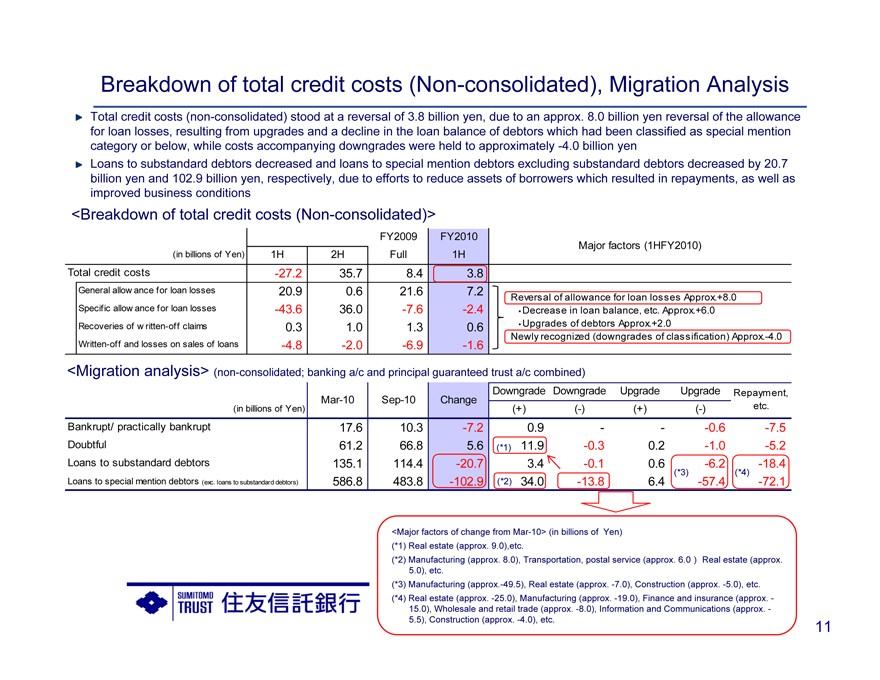

Breakdown of total credit costs (Non-consolidated), Migration Analysis

Total credit costs (non-consolidated) stood at a reversal of 3.8 billion yen, due to an approx. 8.0 billion yen reversal of the allowance for loan losses, resulting from upgrades and a decline in the loan balance of debtors which had been classified as special mention category or below, while costs accompanying downgrades were held to approximately -4.0 billion yen

Loans to substandard debtors decreased and loans to special mention debtors excluding substandard debtors decreased by 20.7 billion yen and 102.9 billion yen, respectively, due to efforts to reduce assets of borrowers which resulted in repayments, as well as improved business conditions

<Breakdown of total credit costs (Non-consolidated)>

FY2009 FY2010

Major factors (1HFY2010)

(in billions of Yen) 1H 2H Full 1H

Total credit costs -27.2 35.7 8.4 3.8

General allowance for loan losses 20.9 0.6 21.6 7.2 Reversal of allowance for loan losses Approx.+8.0

Specific allowance for loan losses -43.6 36.0 -7.6 -2.4 Decrease in loan balance, etc. Approx.+6.0

Recoveries of written-off claims 0.3 1.0 1.3 0.6 Upgrades of debtors Approx.+2.0

Newly recognized (downgrades of classification) Approx.-4.0

Written-off and losses on sales of loans -4.8 -2.0 -6.9 -1.6

<Migration analysis> (non-consolidated; banking a/c and principal guaranteed trust a/c combined)

Downgrade Downgrade Upgrade Upgrade Repayment,

Mar-10 Sep-10 Change

(in billions of Yen) (+) (-) (+) (-) etc.

Bankrupt/ practically bankrupt 17.6 10.3 -7.2 0.9 - - -0.6 -7.5

Doubtful 61.2 66.8 5.6 (*1) 11.9 -0.3 0.2 -1.0 -5.2

Loans to substandard debtors 135.1 114.4 -20.7 3.4 -0.1 0.6 -6.2 -18.4

Loans to special mention debtors (exc. loans to substandard debtors) 586.8 483.8 -102.9 (*2) 34.0 -13.8 6.4 (*3) -57.4 (*4) -72.1

<Major factors of change from Mar-10> (in billions of Yen)

(*1) Real estate (approx. 9.0),etc.

(*2) Manufacturing (approx. 8.0), Transportation, postal service (approx. 6.0 Real estate (approx. 5.0), etc.

(*3) Manufacturing (approx.-49.5), Real estate (approx. -7.0), Construction (approx. -5.0), etc.

(*4) Real estate (approx. -25.0), Manufacturing (approx. -19.0), Finance and insurance (approx. -15.0), Wholesale and retail trade (approx. -8.0), Information and Communications (approx. - -5.5), Construction (approx. -4.0), etc.

11

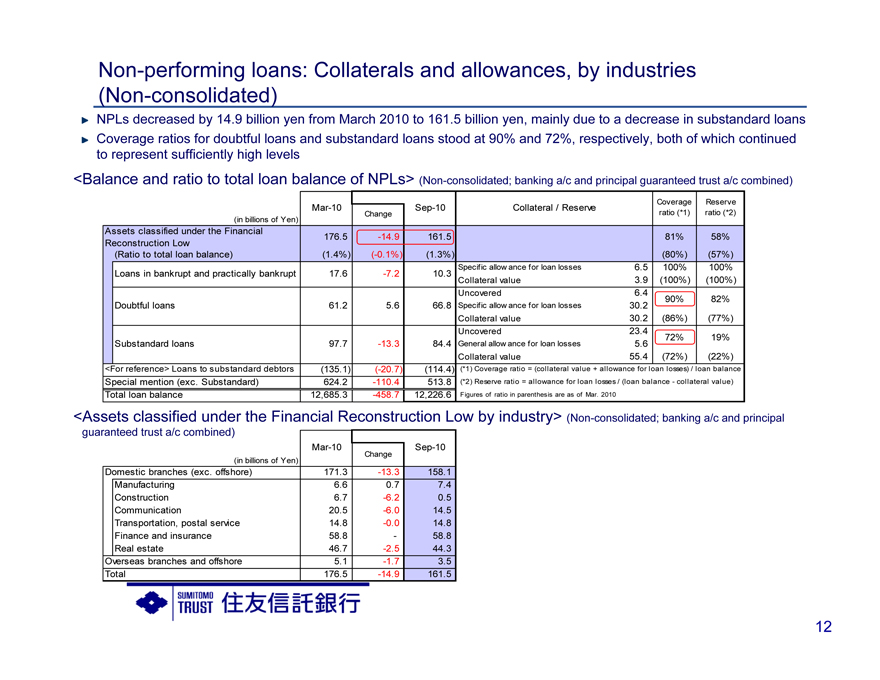

Non-performing loans: Collaterals and allowances, by industries (Non-consolidated)

NPLs decreased by 14.9 billion yen from March 2010 to 161.5 billion yen, mainly due to a decrease in substandard loans

Coverage ratios for doubtful loans and substandard loans stood at 90% and 72%, respectively, both of which continued to represent sufficiently high levels

<Balance and ratio to total loan balance of NPLs> (Non-consolidated; banking a/c and principal guaranteed trust a/c combined)

Mar-10 Sep-10 Collateral / Reserve Coverage Reserve

Change ratio (*1) ratio (*2)

(in billions of Yen)

Assets classified under the Financial 176.5 -14.9 161.5 81% 58%

Reconstruction Low

(Ratio to total loan balance) (1.4%) (-0.1%) (1.3%) (80%) (57%)

Specific allowance for loan losses 6.5 100% 100%

Loans in bankrupt and practically bankrupt 17.6 -7.2 10.3

Collateral value 3.9 (100%) (100%)

Uncovered 6.4

90% 82%

Doubtful loans 61.2 5.6 66.8 Specific allowance for loan losses 30.2

Collateral value 30.2 (86%) (77%)

Uncovered 23.4

72% 19%

Substandard loans 97.7 -13.3 84.4 General allowance for loan losses 5.6

Collateral value 55.4 (72%) (22%)

<For reference> Loans to substandard debtors (135.1) (-20.7) (114.4) (*1) Coverage ratio = (collateral value + allowance for loan losses) / loan balance

Special mention (exc. Substandard) 624.2 -110.4 513.8 (*2) Reserve ratio = allowance for loan losses / (loan balance - collateral value)

Total loan balance 12,685.3 -458.7 12,226.6 Figures of ratio in parenthesis are as of Mar. 2010

<Assets classified under the Financial Reconstruction Low by industry> (Non-consolidated; banking a/c and principal guaranteed trust a/c combined)

Mar-10 Sep-10

Change

(in billions of Yen)

Domestic branches (exc. offshore) 171.3 -13.3 158.1

Manufacturing 6.6 0.7 7.4

Construction 6.7 -6.2 0.5

Communication 20.5 -6.0 14.5

Transportation, postal service 14.8 -0.0 14.8

Finance and insurance 58.8 - 58.8

Real estate 46.7 -2.5 44.3

Overseas branches and offshore 5.1 -1.7 3.5

Total 176.5 -14.9 161.5

12

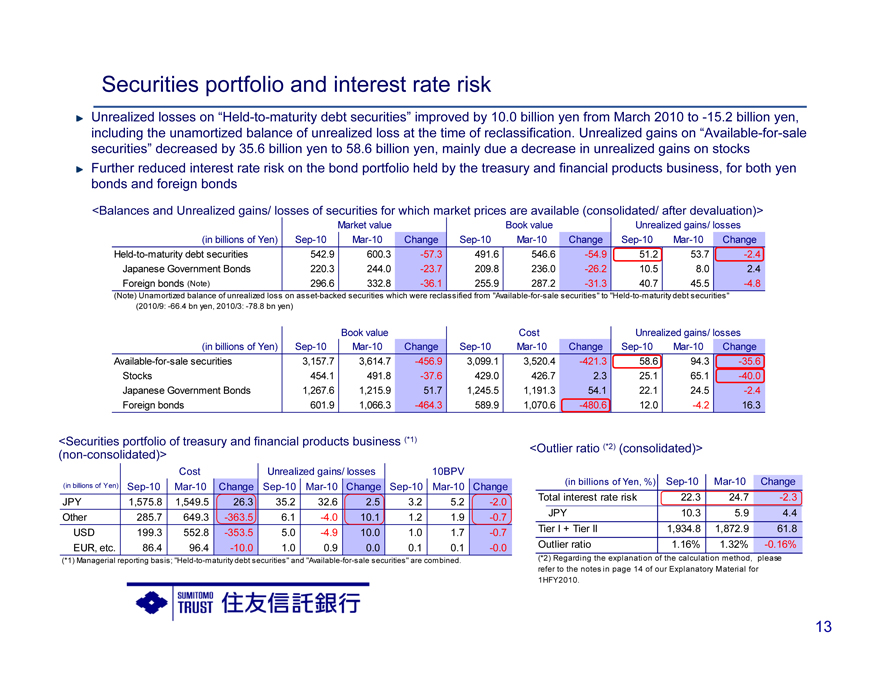

Securities portfolio and interest rate risk

Unrealized losses on “Held-to-maturity debt securities” improved by 10.0 billion yen from March 2010 to -15.2 billion yen, including the unamortized balance of unrealized loss at the time of reclassification. Unrealized gains on “Available-for-sale securities” decreased by 35.6 billion yen to 58.6 billion yen, mainly due a decrease in unrealized gains on stocks

Further reduced interest rate risk on the bond portfolio held by the treasury and financial products business, for both yen bonds and foreign bonds

<Balances and Unrealized gains/ losses of securities for which market prices are available (consolidated/ after devaluation)>

Market value Book value Unrealized gains/ losses

(in billions of Yen) Sep-10 Mar-10 Change Sep-10 Mar-10 Change Sep-10 Mar-10 Change

Held-to-maturity debt securities 542.9 600.3 -57.3 491.6 546.6 -54.9 51.2 53.7 -2.4

Japanese Government Bonds 220.3 244.0 -23.7 209.8 236.0 -26.2 10.5 8.0 2.4

Foreign bonds (Note) 296.6 332.8 -36.1 255.9 287.2 -31.3 40.7 45.5 -4.8

(Note) Unamortized balance of unrealized loss on asset-backed securities which were reclassified from “Available-for-sale securities” to “Held-to-maturity debt securities” (2010/9: -66.4 bn yen, 2010/3: -78.8 bn yen)

Book value Cost Unrealized gains/ losses

(in billions of Yen) Sep-10 Mar-10 Change Sep-10 Mar-10 Change Sep-10 Mar-10 Change

Available-for-sale securities 3,157.7 3,614.7 -456.9 3,099.1 3,520.4 -421.3 58.6 94.3 -35.6

Stocks 454.1 491.8 -37.6 429.0 426.7 2.3 25.1 65.1 -40.0

Japanese Government Bonds 1,267.6 1,215.9 51.7 1,245.5 1,191.3 54.1 22.1 24.5 -2.4

Foreign bonds 601.9 1,066.3 -464.3 589.9 1,070.6 -480.6 12.0 -4.2 16.3

<Securities portfolio of treasury and financial products business (*1)

(non-consolidated)> <Outlier ratio (*2) (consolidated)>

Cost Unrealized gains/ losses 10BPV

(in billions of Yen) Sep-10 Mar-10 Change Sep-10 Mar-10 Change Sep-10 Mar-10 Change (in billions of Yen, %) Sep-10 Mar-10 Change

JPY 1,575.8 1,549.5 26.3 35.2 32.6 2.5 3.2 5.2 -2.0 Total interest rate risk 22.3 24.7 -2.3

Other 285.7 649.3 -363.5 6.1 -4.0 10.1 1.2 1.9 -0.7 JPY 10.3 5.9 4.4

USD 199.3 552.8 -353.5 5.0 -4.9 10.0 1.0 1.7 -0.7 Tier I + Tier II 1,934.8 1,872.9 61.8

EUR, etc. 86.4 96.4 -10.0 1.0 0.9 0.0 0.1 0.1 -0.0 Outlier ratio 1.16% 1.32% -0.16%

(*1) Managerial reporting basis; “Held-to-maturity debt securities” and “Available-for-sale securities” are combined. (*2) Regarding the explanation of the calculation method, please refer to the notes in page 14 of our Explanatory Material for

1HFY2010.

13

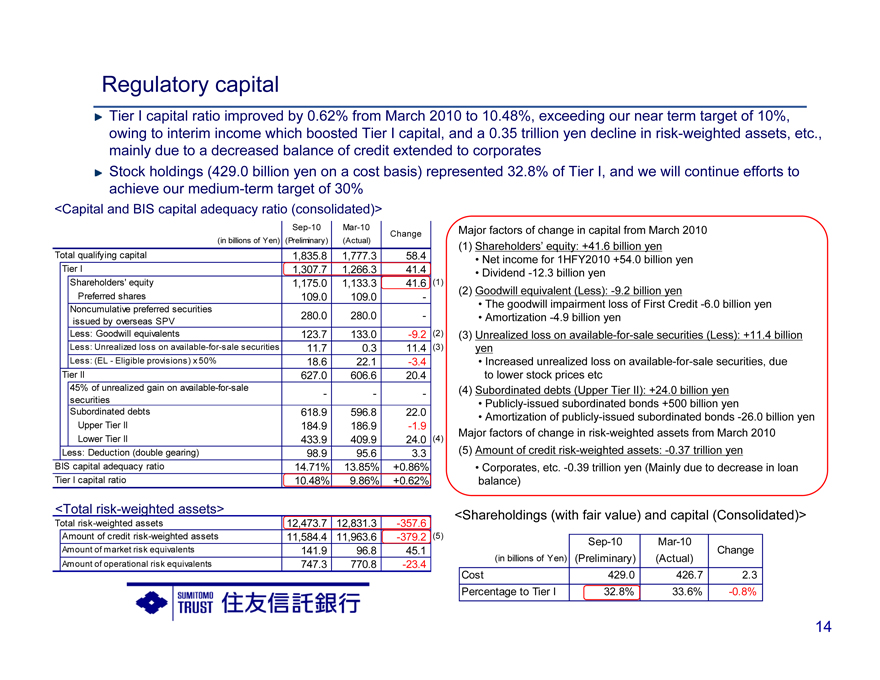

Regulatory capital

Tier I capital ratio improved by 0.62% from March 2010 to 10.48%, exceeding our near term target of 10%, owing to interim income which boosted Tier I capital, and a 0.35 trillion yen decline in risk-weighted assets, etc., mainly due to a decreased balance of credit extended to corporates

Stock holdings (429.0 billion yen on a cost basis) represented 32.8% of Tier I, and we will continue efforts to achieve our medium-term target of 30%

<Capital and BIS capital adequacy ratio (consolidated)>

Sep-10 Mar-10 Major factors of change in capital from March 2010

Change

(in billions of Yen) (Preliminary) (Actual) (1) Shareholders’ equity: +41.6 billion yen

Total qualifying capital 1,835.8 1,777.3 58.4 • Net income for 1HFY2010 +54.0 billion yen

Tier I 1,307.7 1,266.3 41.4 • Dividend -12.3 billion yen

Shareholders’ equity 1,175.0 1,133.3 41.6 (1)

Preferred shares 109.0 109.0 - (2) Goodwill equivalent (Less): -9.2 billion yen

Noncumulative preferred securities • The goodwill impairment loss of First Credit -6.0 billion yen

issued by overseas SPV 280.0 280.0 - • Amortization -4.9 billion yen

Less: Goodwill equivalents 123.7 133.0 -9.2 (2) (3) Unrealized loss on available-for-sale securities (Less): +11.4 billion

Less: Unrealized loss on available-for-sale securities 11.7 0.3 11.4 (3) yen

Less: (EL - Eligible provisions) x 50% 18.6 22.1 -3.4 • Increased unrealized loss on available-for-sale securities, due

Tier II 627.0 606.6 20.4 to lower stock prices etc

45% of unrealized gain on available-for-sale - - - (4) Subordinated debts (Upper Tier II): +24.0 billion yen

securities • Publicly-issued subordinated bonds +500 billion yen

Subordinated debts 618.9 596.8 22.0 • Amortization of publicly-issued subordinated bonds -26.0 billion yen

Upper Tier II 184.9 186.9 -1.9 Major factors of change in risk-weighted assets from March 2010

Lower Tier II 433.9 409.9 24.0 (4)

Less: Deduction (double gearing) 98.9 95.6 3.3 (5) Amount of credit risk-weighted assets: -0.37 trillion yen

BIS capital adequacy ratio 14.71% 13.85% +0.86% • Corporates, etc. -0.39 trillion yen (Mainly due to decrease in loan

Tier I capital ratio 10.48% 9.86% +0.62% balance)

<Total risk-weighted assets> <Shareholdings (with fair value) and capital (Consolidated)>

Total risk-weighted assets 12,473.7 12,831.3 -357.6

Amount of credit risk-weighted assets 11,584.4 11,963.6 -379.2 (5) Sep-10 Mar-10

Amount of market risk equivalents 141.9 96.8 45.1 Change

Amount of operational risk equivalents 747.3 770.8 -23.4 (in billions of Yen) (Preliminary) (Actual)

Cost 429.0 426.7 2.3

Percentage to Tier I 32.8% 33.6% -0.8%

14

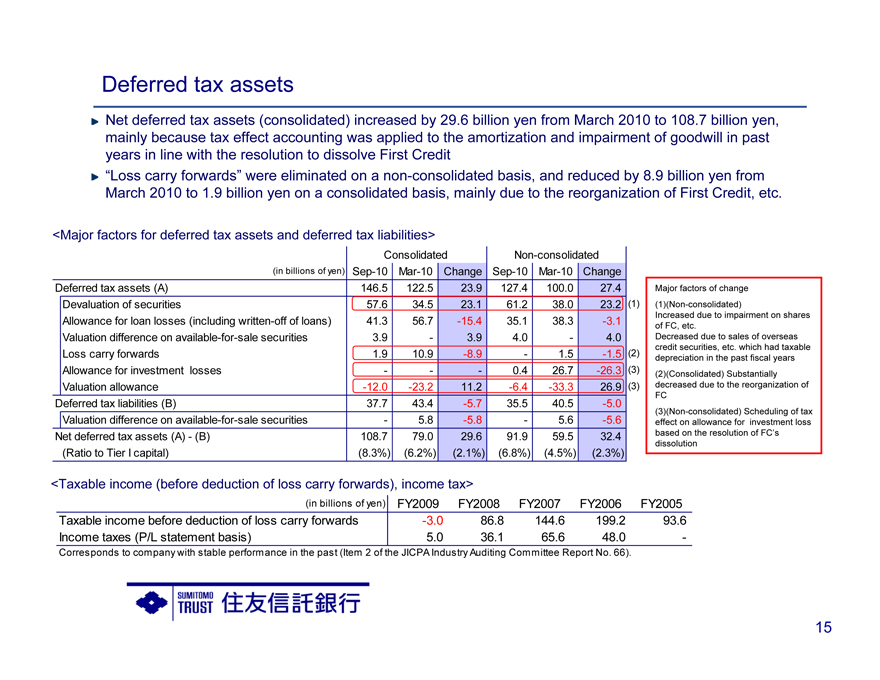

Deferred tax assets

Net deferred tax assets (consolidated) increased by 29.6 billion yen from March 2010 to 108.7 billion yen, mainly because tax effect accounting was applied to the amortization and impairment of goodwill in past years in line with the resolution to dissolve First Credit

“Loss carry forwards” were eliminated on a non-consolidated basis, and reduced by 8.9 billion yen from March 2010 to 1.9 billion yen on a consolidated basis, mainly due to the reorganization of First Credit, etc.

<Major factors for deferred tax assets and deferred tax liabilities>

Consolidated Non-consolidated

(in billions of yen) Sep-10 Mar-10 Change Sep-10 Mar-10 Change

Deferred tax assets (A) 146.5 122.5 23.9 127.4 100.0 27.4 Major factors of change

Devaluation of securities 57.6 34.5 23.1 61.2 38.0 23.2 (1) (1)(Non-consolidated)

Increased due to impairment on shares

Allowance for loan losses (including written-off of loans) 41.3 56.7 -15.4 35.1 38.3 -3.1 of FC, etc.

Valuation difference on available-for-sale securities 3.9 - 3.9 4.0 - 4.0 Decreased due to sales of overseas

credit securities, etc. which had taxable

Loss carry forwards 1.9 10.9 -8.9 - 1.5 -1.5 (2) depreciation in the past fiscal years

Allowance for investment losses - - - 0.4 26.7 -26.3 (3) (2)(Consolidated) Substantially

Valuation allowance -12.0 -23.2 11.2 -6.4 -33.3 26.9 (3) decreased due to the reorganization of

FC

Deferred tax liabilities (B) 37.7 43.4 -5.7 35.5 40.5 -5.0

(3)(Non-consolidated) Scheduling of tax

Valuation difference on available-for-sale securities - 5.8 -5.8 - 5.6 -5.6 effect on allowance for investment loss

Net deferred tax assets (A) - (B) 108.7 79.0 29.6 91.9 59.5 32.4 based on the resolution of FC’s

dissolution

(Ratio to Tier I capital) (8.3%) (6.2%) (2.1%) (6.8%) (4.5%) (2.3%)

<Taxable income (before deduction of loss carry forwards), income tax>

(in billions of yen) FY2009 FY2008 FY2007 FY2006 FY2005

Taxable income before deduction of loss carry forwards -3.0 86.8 144.6 199.2 93.6

Income taxes (P/L statement basis) 5.0 36.1 65.6 48.0 -

Corresponds to company with stable performance in the past (Item 2 of the JICPA Industry Auditing Committee Report No. 66).

15

Basel III and status of capital

16

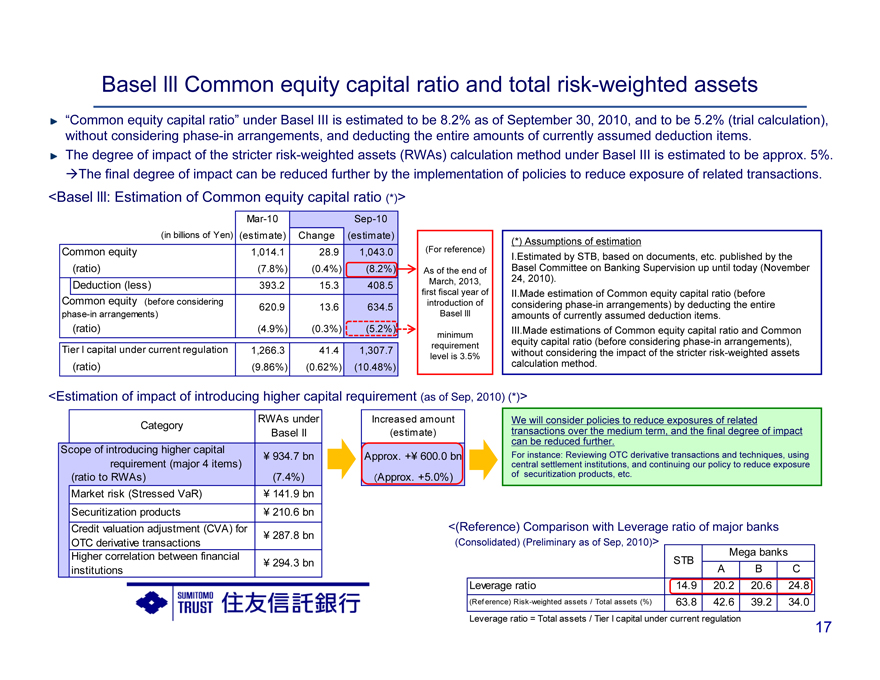

Basel lll Common equity capital ratio and total risk-weighted assets

“Common equity capital ratio” under Basel III is estimated to be 8.2% as of September 30, 2010, and to be 5.2% (trial calculation), without considering phase-in arrangements, and deducting the entire amounts of currently assumed deduction items.

The degree of impact of the stricter risk-weighted assets (RWAs) calculation method under Basel III is estimated to be approx. 5%. AThe final degree of impact can be reduced further by the implementation of policies to reduce exposure of related transactions.

<Basel lll: Estimation of Common equity capital ratio (*)>

Mar-10 Sep-10 (in billions of Yen) (estimate) Change (estimate) Common equity 1,014.1 28.9 1,043.0 (ratio) (7.8%) (0.4%) (8.2%) Deduction (less) 393.2 15.3 408.5 Common equity (before considering 620.9 13.6 634.5 phase-in arrangements) (ratio) (4.9%) (0.3%) (5.2%) Tier l capital under current regulation 1,266.3 41.4 1,307.7 (ratio) (9.86%) (0.62%) (10.48%)

(For reference)

As of the end of March, 2013, first fiscal year of introduction of Basel lll

minimum requirement level is 3.5%

(*) Assumptions of estimation

I.Estimated by STB, based on documents, etc. published by the Basel Committee on Banking Supervision up until today (November 24, 2010).

II.Made estimation of Common equity capital ratio (before considering phase-in arrangements) by deducting the entire amounts of currently assumed deduction items.

III.Made estimations of Common equity capital ratio and Common equity capital ratio (before considering phase-in arrangements), without considering the impact of the stricter risk-weighted assets calculation method.

<Estimation of impact of introducing higher capital requirement (as of Sep, 2010) (*)>

RWAs under Category Basel II

Scope of introducing higher capital

¥ 934.7 bn requirement (major 4 items) (ratio to RWAs) (7.4%) Market risk (Stressed VaR) ¥ 141.9 bn Securitization products ¥ 210.6 bn Credit valuation adjustment (CVA) for

¥ 287.8 bn OTC derivative transactions Higher correlation between financial

¥ 294.3 bn institutions

Increased amount (estimate)

Approx. +¥ 600.0 bn (Approx. +5.0%)

We will consider policies to reduce exposures of related transactions over the medium term, and the final degree of impact can be reduced further.

For instance: Reviewing OTC derivative transactions and techniques, using central settlement institutions, and continuing our policy to reduce exposure of securitization products, etc.

<(Reference) Comparison with Leverage ratio of major banks (Consolidated) (Preliminary as of Sep, 2010)>

Mega banks STB

A B C Leverage ratio 14.9 20.2 20.6 24.8

(Reference) Risk-weighted assets / Total assets (%) 63.8 42.6 39.2 34.0 Leverage ratio = Total assets / Tier l capital under current regulation

17

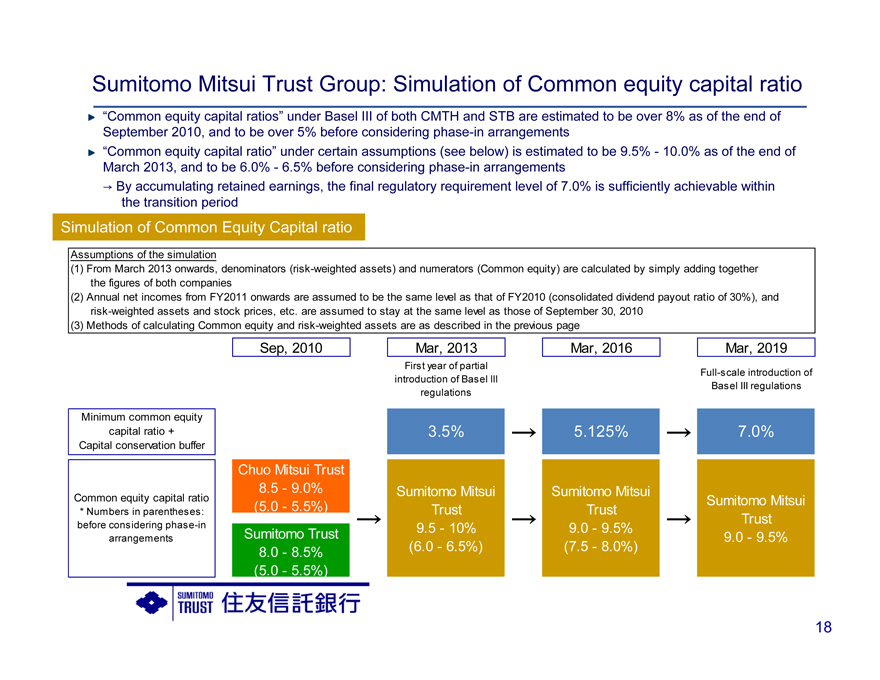

Sumitomo Mitsui Trust Group: Simulation of Common equity capital ratio

“Common equity capital ratios” under Basel III of both CMTH and STB are estimated to be over 8% as of the end of September 2010, and to be over 5% before considering phase-in arrangements “Common equity capital ratio” under certain assumptions (see below) is estimated to be 9.5% - 10.0% as of the end of March 2013, and to be 6.0% - 6.5% before considering phase-in arrangements

By accumulating retained earnings, the final regulatory requirement level of 7.0% is sufficiently achievable within the transition period

Simulation of Common Equity Capital ratio

Assumptions of the simulation

(1) From March 2013 onwards, denominators (risk-weighted assets) and numerators (Common equity) are calculated by simply adding together the figures of both companies (2) Annual net incomes from FY2011 onwards are assumed to be the same level as that of FY2010 (consolidated dividend payout ratio of 30%), and risk-weighted assets and stock prices, etc. are assumed to stay at the same level as those of September 30, 2010 (3) Methods of calculating Common equity and risk-weighted assets are as described in the previous page

Sep, 2010 Mar, 2013 Mar, 2016 Mar, 2019

First year of partial

Full-scale introduction of introduction of Basel lll Basel III regulations

Minimum common equity capital ratio + Capital conservation buffer

Common equity capital ratio

* Numbers in parentheses: before considering phase-in arrangements

Chuo Mitsui Trust 8.5 - 9.0% (5.0 - 5.5%) Sumitomo Trust 8.0 - 8.5% (5.0 - 5.5%)

3.5%

Sumitomo Mitsui Trust 9.5 - 10% (6.0 - 6.5%)

5.125%

Sumitomo Mitsui Trust 9.0 - 9.5% (7.5 - 8.0%)

7.0%

Sumitomo Mitsui Trust 9.0 - 9.5%

18

Forecast for FY2010

19

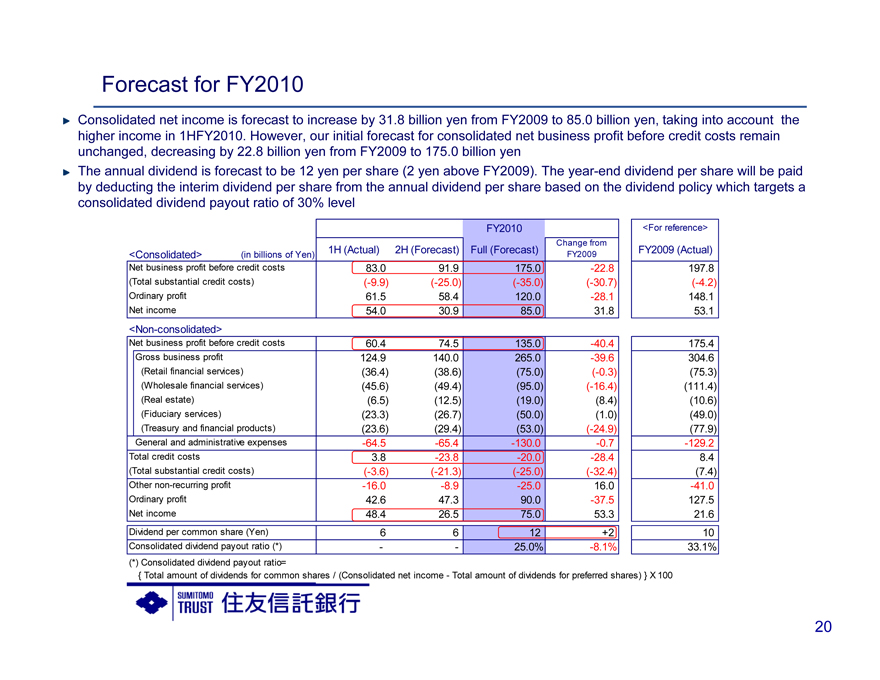

Forecast for FY2010

Consolidated net income is forecast to increase by 31.8 billion yen from FY2009 to 85.0 billion yen, taking into account the higher income in 1HFY2010. However, our initial forecast for consolidated net business profit before credit costs remain unchanged, decreasing by 22.8 billion yen from FY2009 to 175.0 billion yen

The annual dividend is forecast to be 12 yen per share (2 yen above FY2009). The year-end dividend per share will be paid by deducting the interim dividend per share from the annual dividend per share based on the dividend policy which targets a consolidated dividend payout ratio of 30% level

FY2010 <For reference>

Change from

1H (Actual) 2H (Forecast) Full (Forecast) FY2009 (Actual)

<Consolidated> (in billions of Yen) FY2009

Net business profit before credit costs 83.0 91.9 175.0 -22.8 197.8

(Total substantial credit costs) (-9.9) (-25.0) (-35.0) (-30.7) (-4.2)

Ordinary profit 61.5 58.4 120.0 -28.1 148.1

Net income 54.0 30.9 85.0 31.8 53.1

<Non-consolidated>

Net business profit before credit costs 60.4 74.5 135.0 -40.4 175.4

Gross business profit 124.9 140.0 265.0 -39.6 304.6

(Retail financial services) (36.4) (38.6) (75.0) (-0.3) (75.3)

(Wholesale financial services) (45.6) (49.4) (95.0) (-16.4) (111.4)

(Real estate) (6.5) (12.5) (19.0) (8.4) (10.6)

(Fiduciary services) (23.3) (26.7) (50.0) (1.0) (49.0)

(Treasury and financial products) (23.6) (29.4) (53.0) (-24.9) (77.9)

General and administrative expenses -64.5 -65.4 -130.0 -0.7 -129.2

Total credit costs 3.8 -23.8 -20.0 -28.4 8.4

(Total substantial credit costs) (-3.6) (-21.3) (-25.0) (-32.4) (7.4)

Other non-recurring profit -16.0 -8.9 -25.0 16.0 -41.0

Ordinary profit 42.6 47.3 90.0 -37.5 127.5

Net income 48.4 26.5 75.0 53.3 21.6

Dividend per common share (Yen) 6 6 12 +2 10

Consolidated dividend payout ratio (*) - - 25.0% -8.1% 33.1%

(*) Consolidated dividend payout ratio=

{Total amount of dividends for common shares / (Consolidated net income - Total amount of dividends for preferred shares) } X 100

20

Strengthen group strategy and prioritized businesses

21

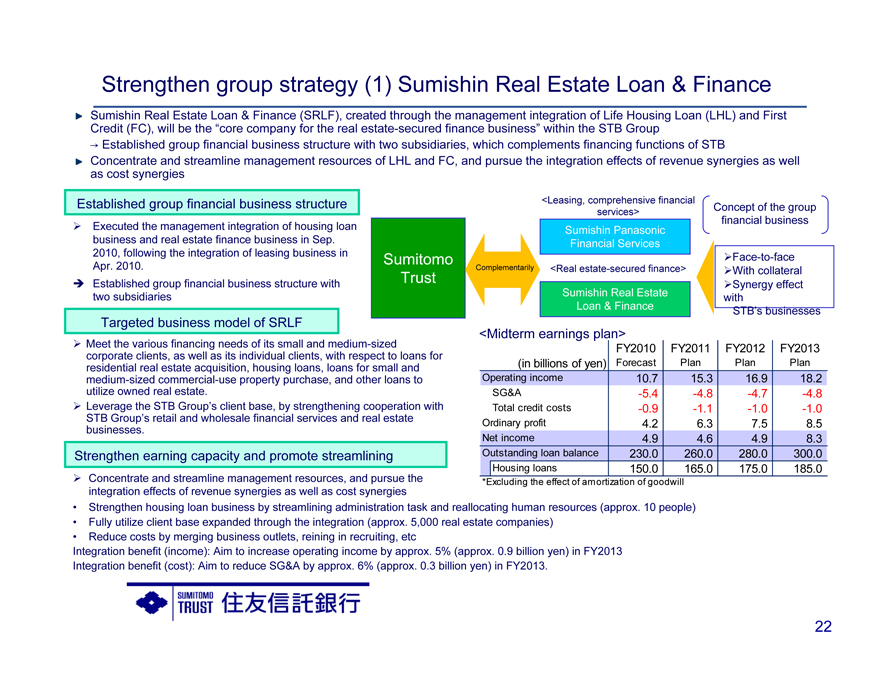

Strengthen group strategy (1) Sumishin Real Estate Loan & Finance

Sumishin Real Estate Loan & Finance (SRLF), created through the management integration of Life Housing Loan (LHL) and First Credit (FC), will be the “core company for the real estate-secured finance business” within the STB Group

Established group financial business structure with two subsidiaries, which complements financing functions of STB

Concentrate and streamline management resources of LHL and FC, and pursue the integration effects of revenue synergies as well as cost synergies

Established group financial business structure

Executed the management integration of housing loan business and real estate finance business in Sep. 2010, following the integration of leasing business in Apr. 2010.

Established group financial business structure with two subsidiaries

Targeted business model of SRLF

Meet the various financing needs of its small and medium-sized corporate clients, as well as its individual clients, with respect to loans for residential real estate acquisition, housing loans, loans for small and medium-sized commercial-use property purchase, and other loans to utilize owned real estate.

Leverage the STB Group’s client base, by strengthening cooperation with STB Group’s retail and wholesale financial services and real estate businesses.

Strengthen earning capacity and promote streamlining

Concentrate and streamline management resources, and pursue the integration effects of revenue synergies as well as cost synergies

• Strengthen housing loan business by streamlining administration task and reallocating human resources (approx. 10 people)

• Fully utilize client base expanded through the integration (approx. 5,000 real estate companies)

• Reduce costs by merging business outlets, reining in recruiting, etc

Integration benefit (income): Aim to increase operating income by approx. 5% (approx. 0.9 billion yen) in FY2013 Integration benefit (cost): Aim to reduce SG&A by approx. 6% (approx. 0.3 billion yen) in FY2013.

<Leasing, comprehensive financial services>

Concept of the group financial business

Sumitomo Trust

Sumishin Panasonic Financial Services

Complementarily

<Real estate-secured finance>

Sumishin Real Estate Loan & Finance

Face-to-face

With collateral

Synergy effect with STB’s businesses

<Midterm earnings plan>

(in billions of yen) FY2010 Forecast FY2011 Plan FY2012 Plan FY2013 Plan

Operating income 10.7 15.3 16.9 18.2

SG&A - -5.4 -4.8 -4.7 -4.8

Total credit costs -0.9 -1.1 -1.0 -1.0

Ordinary profit 4.2 6.3 7.5 8.5

Net income 4.9 4.6 4.9 8.3

Outstanding loan balance 230.0 260.0 280.0 300.0

Housing loans 150.0 165.0 175.0 185.0

*Excluding the effect of amortization of goodwill

22

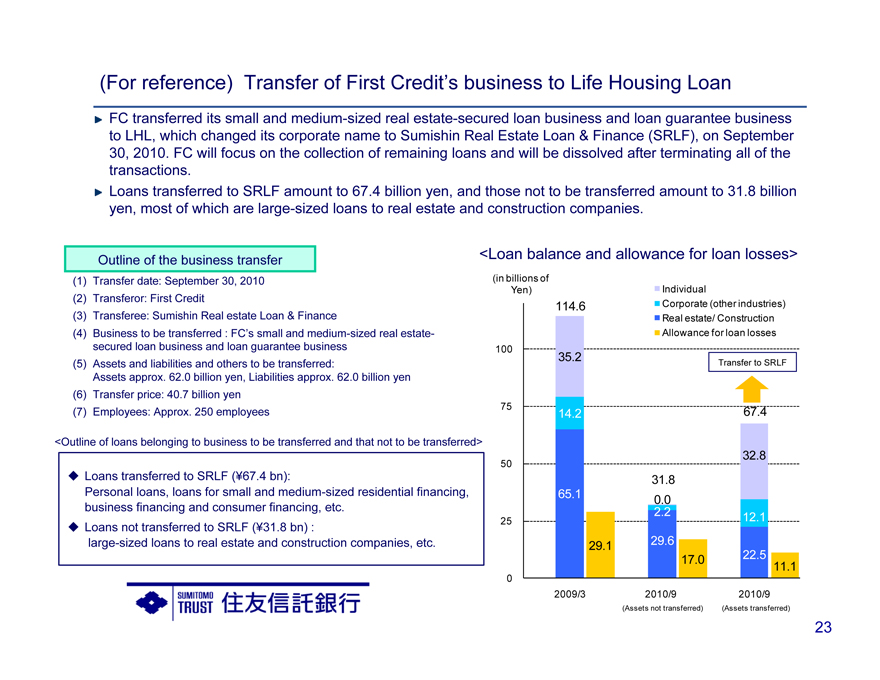

(For reference) Transfer of First Credit’s business to Life Housing Loan

FC transferred its small and medium-sized real estate-secured loan business and loan guarantee business to LHL, which changed its corporate name to Sumishin Real Estate Loan & Finance (SRLF), on September 30, 2010. FC will focus on the collection of remaining loans and will be dissolved after terminating all of the transactions.

Loans transferred to SRLF amount to 67.4 billion yen, and those not to be transferred amount to 31.8 billion yen, most of which are large-sized loans to real estate and construction companies.

Outline of the business transfer (1) Transfer date: September 30, 2010 (2) Transferor: First Credit

(3) Transferee: Sumishin Real estate Loan & Finance

(4) Business to be transferred : FC’s small and medium-sized real estate- secured loan business and loan guarantee business (5) Assets and liabilities and others to be transferred: Assets approx. 62.0 billion yen, Liabilities approx. 62.0 billion yen (6) Transfer price: 40.7 billion yen (7) Employees: Approx. 250 employees

<Outline of loans belonging to business to be transferred and that not to be transferred>

Loans transferred to SRLF (¥67.4 bn):

Personal loans, loans for small and medium-sized residential financing, business financing and consumer financing, etc.

Loans not transferred to SRLF (¥31.8 bn) : large-sized loans to real estate and construction companies, etc.

<Loan balance and allowance for loan losses>

(in billions of Yen)

Individual

Corporate (other industries) Real estate/ Construction Allowance for loan losses

100 75 50 25 0

114.6

35.2

14.2

65.1

29.1

31.8 0.0 2.2

29.6 17.0

Transfer to SRLF

67.4

32.8

12.1

22.5 11.1

Transfer to SRLF

2009/3 2010/9 2010/9

(Assets not transferred) (Assets transferred)

23

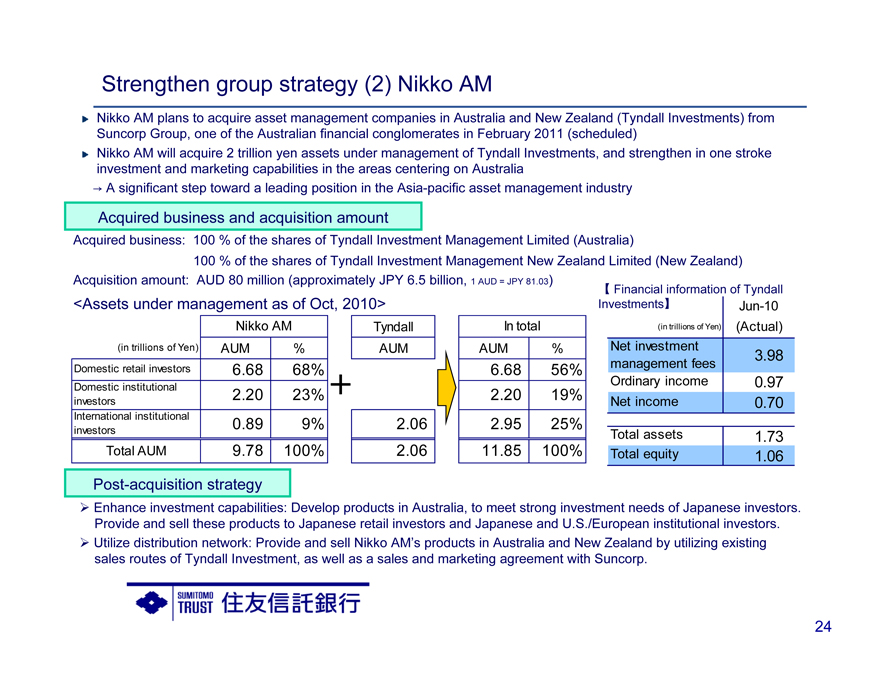

Strengthen group strategy (2) Nikko AM

Nikko AM plans to acquire asset management companies in Australia and New Zealand (Tyndall Investments) from Suncorp Group, one of the Australian financial conglomerates in February 2011 (scheduled) Nikko AM will acquire 2 trillion yen assets under management of Tyndall Investments, and strengthen in one stroke investment and marketing capabilities in the areas centering on Australia

A significant step toward a leading position in the Asia-pacific asset management industry

Acquired business and acquisition amount

Acquired business: 100 % of the shares of Tyndall Investment Management Limited (Australia)

100 % of the shares of Tyndall Investment Management New Zealand Limited (New Zealand) Acquisition amount: AUD 80 million (approximately JPY 6.5 billion, 1 AUD = JPY 81.03)

<Assets under management as of Oct, 2010>

Nikko AM Tyndall In total

(in trillions of Yen) AUM % AUM AUM %

Domestic retail investors 6.68 68% 6.68 56%

Domestic institutional

investors 2.20 23% 2.20 19%

International institutional

investors 0.89 9% 2.06 2.95 25%

Total AUM 9.78 100% 2.06 11.85 100%

[ Financial information of Tyndall Investments]

Jun-10

(in trillions of Yen) (Actual)

Net investment

management fees 3.98

Ordinary income 0.97

Net income 0.70

Total assets 1.73

Total equity 1.06

Post-acquisition strategy

Enhance investment capabilities: Develop products in Australia, to meet strong investment needs of Japanese investors. Provide and sell these products to Japanese retail investors and Japanese and U.S./European institutional investors.

Utilize distribution network: Provide and sell Nikko AM’s products in Australia and New Zealand by utilizing existing sales routes of Tyndall Investment, as well as a sales and marketing agreement with Suncorp.

24

Strengthen prioritized business 1. Investment sales (Retail, wholesale)

Retail investment marketing: Achieved solid progress in coordination with STB AM and Nikko AM, and sales of fund wrap and SMAs

Reinforce sales support structure of headquarters, to solidify consulting sales model at bank networks

Wholesale investment marketing: Sales volume of investment products in 1HFY2010 reached approx. 450.0 billion yen, and their balance as of September 2010 amounted to approx. 1.1 trillion yen.

Strengthen capability to provide custom-made investment products by investor segment

Retail investment marketing

Strengthened cooperation with STB AM and Nikko AM contributed to expanded sales volume of mutual funds managed by both companies STB AM: 2HFY2009 38.4 billion yen 1HFY2010 42.7 billion yen Nikko AM: 2HFY2009 12.3 billion yen 1HFY2010 36.0 billion yen Plan to utilize both companies’ product capabilities and to develop and launch new products which benefit from growth of Asian economies.

Fund wrap and SMA sales in 1HFY2010 steadily increased by 2.7 billion yen from 2HFY2009 to 14.8 billion yen.

Expand fund wrap sales further via seminar programs. promote SMA sales by coordinating with wealth management cervices and expanding the client base of high net-worth individuals.

Established consulting sales model corresponding to clients’ needs and risk tolerance, and “core + satellite” portfolio strategy.

Increased support staff at headquarters (+5 people in October 2010), and strengthened sales support for proposal activities at branch networks.

Wholesale investment marketing

Sales volume of investment products in 1HFY2010 increased by 51.2 billion yen from 2HFY2009 to 450.1 billion yen, mainly because sales volume of derivative embedded deposits in 1HFY2010 increased by 48.4 billion yen from 2HFY2009 to 246.0 billion yen.

Expand client base of wholesale investors by providing custom-made investment products by investor segment (financial institutions, non-profit organizations, etc.) and developing new products

Outstanding balance of investment products sales as of September 2010 increased by 103.1 billion yen from March 2010 to 1,098.1 billion yen

<Sales volume of mutual funds/ individual annuity>

(in billions of

Yen) 228.7 222.5 Mutual funds Fund wrap / SMA

200

Annuity 82.7

77.3 150 144.8 131.1 12.0 14.8 33.0 50.0 100 79.4 3.8 7.5 36.3 133.9 130.3

50 94.2 87.2 2.4 40.5 0

1HFY2008 2HFY2008 1HFY2009 2HFY2009 1HFY2010

<Sales balance of mutual fund in defined contribution (DC) area>

(in billions of Yen)

75

50

89.5 92.0 57.8 61.7 63.4 25

0

2007/3 2008/3 2009/3 2010/3 2010/9

25

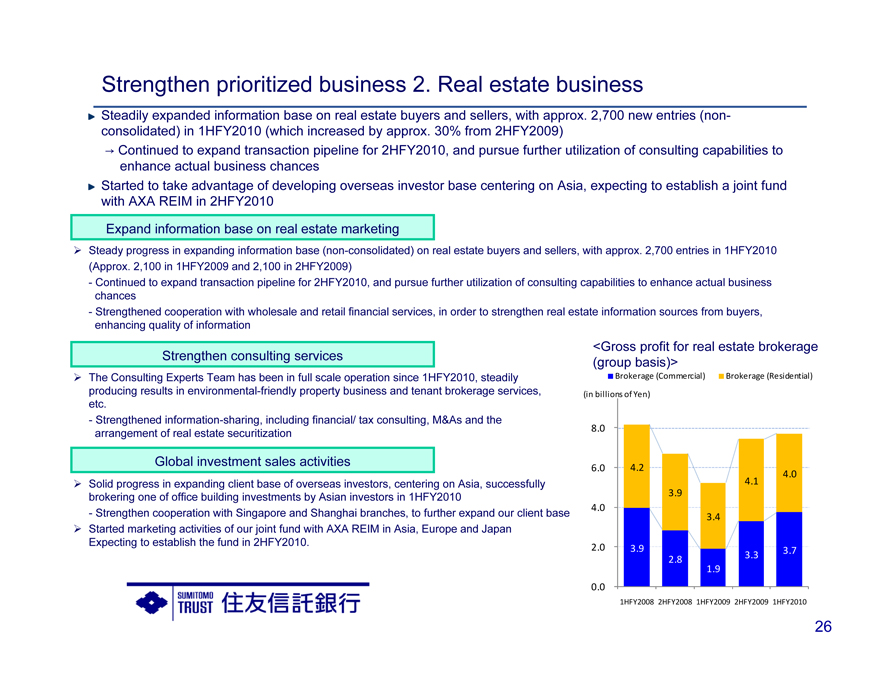

Strengthen prioritized business 2. Real estate business

Steadily expanded information base on real estate buyers and sellers, with approx. 2,700 new entries (non- consolidated) in 1HFY2010 (which increased by approx. 30% from 2HFY2009)

Continued to expand transaction pipeline for 2HFY2010, and pursue further utilization of consulting capabilities to enhance actual business chances Started to take advantage of developing overseas investor base centering on Asia, expecting to establish a joint fund with AXA REIM in 2HFY2010

Expand information base on real estate marketing

Steady progress in expanding information base (non-consolidated) on real estate buyers and sellers, with approx. 2,700 entries in 1HFY2010 (Approx. 2,100 in 1HFY2009 and 2,100 in 2HFY2009)

- Continued to expand transaction pipeline for 2HFY2010, and pursue further utilization of consulting capabilities to enhance actual business chances

- Strengthened cooperation with wholesale and retail financial services, in order to strengthen real estate information sources from buyers, enhancing quality of information

Strengthen consulting services

The Consulting Experts Team has been in full scale operation since 1HFY2010, steadily producing results in environmental-friendly property business and tenant brokerage services, etc.

- Strengthened information-sharing, including financial/ tax consulting, M&As and the arrangement of real estate securitization

Global investment sales activities

Solid progress in expanding client base of overseas investors, centering on Asia, successfully brokering one of office building investments by Asian investors in 1HFY2010

- Strengthen cooperation with Singapore and Shanghai branches, to further expand our client base

Started marketing activities of our joint fund with AXA REIM in Asia, Europe and Japan Expecting to establish the fund in 2HFY2010.

<Gross profit for real estate brokerage (group basis)>

Brokerage (Commercial) Brokerage (Residential)

(in billions of Yen)

8.0

6.0 4.2

4.0 4.1 3.9 4.0 3.4

2.0 3.9 3.3 3.7 2.8 1.9 0.0

1HFY2008 2HFY2008 1HFY2009 2HFY2009 1HFY2010

26

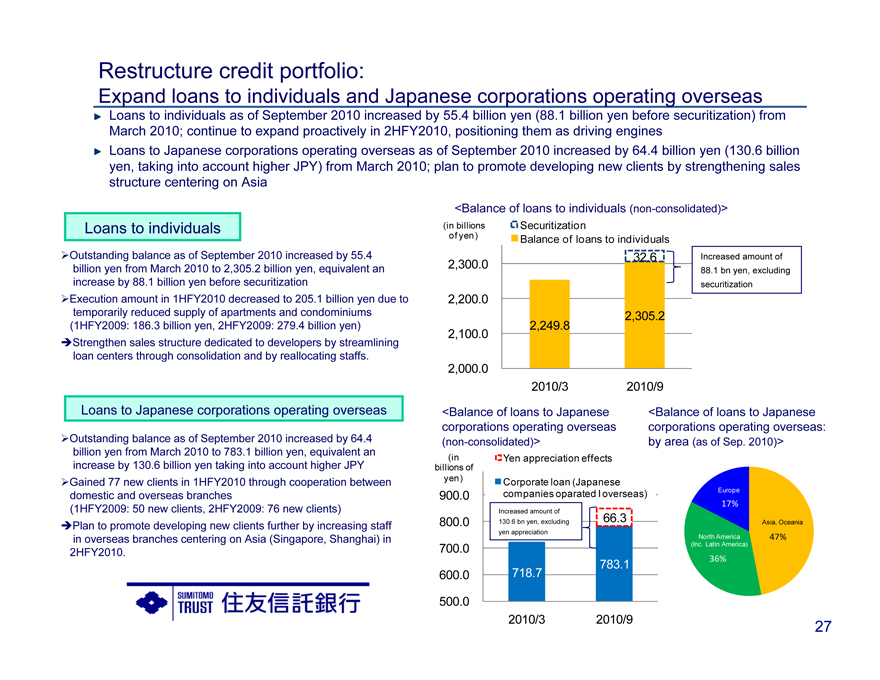

Restructure credit portfolio:

Expand loans to individuals and Japanese corporations operating overseas

Loans to individuals as of September 2010 increased by 55.4 billion yen (88.1 billion yen before securitization) from March 2010; continue to expand proactively in 2HFY2010, positioning them as driving engines Loans to Japanese corporations operating overseas as of September 2010 increased by 64.4 billion yen (130.6 billion yen, taking into account higher JPY) from March 2010; plan to promote developing new clients by strengthening sales structure centering on Asia

Loans to individuals

Outstanding balance as of September 2010 increased by 55.4 billion yen from March 2010 to 2,305.2 billion yen, equivalent an increase by 88.1 billion yen before securitization

Execution amount in 1HFY2010 decreased to 205.1 billion yen due to temporarily reduced supply of apartments and condominiums (1HFY2009: 186.3 billion yen, 2HFY2009: 279.4 billion yen) Strengthen sales structure dedicated to developers by streamlining loan centers through consolidation and by reallocating staffs.

Loans to Japanese corporations operating overseas

Outstanding balance as of September 2010 increased by 64.4 billion yen from March 2010 to 783.1 billion yen, equivalent an increase by 130.6 billion yen taking into account higher JPY

Gained 77 new clients in 1HFY2010 through cooperation between domestic and overseas branches (1HFY2009: 50 new clients, 2HFY2009: 76 new clients) Plan to promote developing new clients further by increasing staff in overseas branches centering on Asia (Singapore, Shanghai) in 2HFY2010.

<Balance of loans to individuals (non-consolidated)> (in billions Securitization of yen) Balance of loans to individuals

32.6 Increased amount of

2,300.0

88.1 bn yen, excluding securitization

2,200.0

2,305.2 2,249.8 2,100.0

2,000.0

2010/3 2010/9

<Balance of loans to Japanese corporations operating overseas (non-consolidated)> ( Yen appreciation effects in billions of yen) Corporate loan (Japanese 900.0 companies oparated I overseas)

Increased amount of

800.0 130.6 bn yen, excluding 66.3 yen appreciation

700.0

783.1 600.0 718.7 500.0 2010/3 2010/9

<Balance of loans to Japanese corporations operating overseas: by area (as of Sep. 2010)>

Europe

17%

Asia, Oceania

North America 47% (Inc. Latin America)

36%

27

Credit portfolio

28

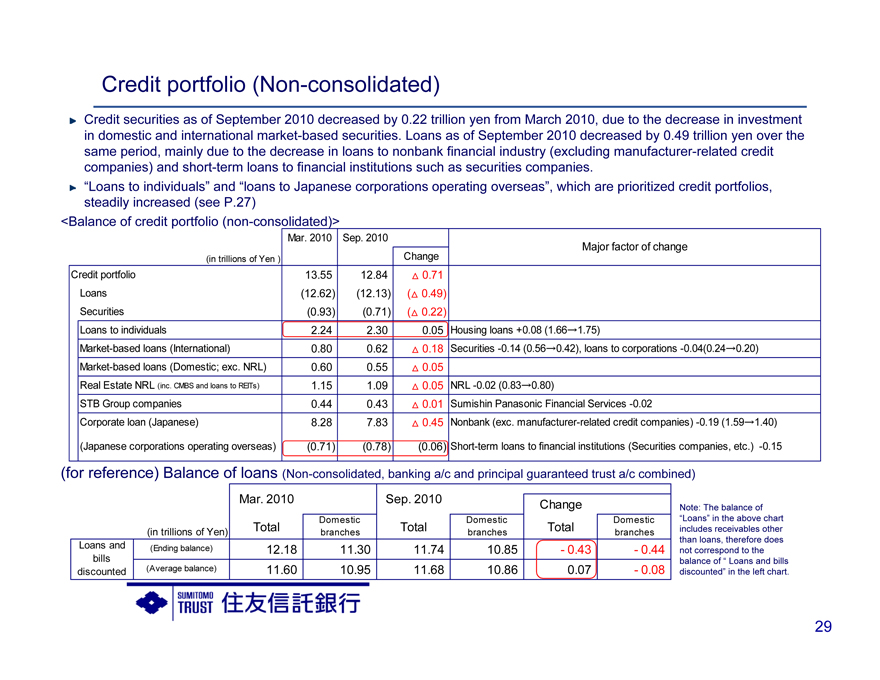

C\]redit portfolio (Non-consolidated)

Credit securities as of September 2010 decreased by 0.22 trillion yen from March 2010, due to the decrease in investment in domestic and international market-based securities. Loans as of September 2010 decreased by 0.49 trillion yen over the same period, mainly due to the decrease in loans to nonbank financial industry (excluding manufacturer-related credit companies) and short-term loans to financial institutions such as securities companies.

“Loans to individuals” and “loans to Japanese corporations operating overseas”, which are prioritized credit portfolios, steadily increased (see P.27)

<Balance of credit portfolio (non-consolidated)>

(in trillions of Yen ) Change Mar. 2010 Sep. 2010 Major factor of change

Credit portfolio 13.55 12.84 0.71

Loans (12.62) (12.13) ( 0.49)

Securities (0.93) (0.71) ( 0.22)

Loans to individuals 2.24 2.30 0.05 Housing loans +0.08 (1.66?1.75)

Market-based loans (International) 0.80 0.62 0.18 Securities -0.14 (0.56 0.42), loans to corporations -0.04(0.24 0.20)

Market-based loans (Domestic; exc. NRL) 0.60 0.55 0.05

Real Estate NRL (inc. CMBS and loans to REITs) 1.15 1.09 0.05 NRL -0.02 (0.83 0.80)

STB Group companies 0.44 0.43 0.01 Sumishin Panasonic Financial Services -0.02

Corporate loan (Japanese) 8.28 7.83 0.45 Nonbank (exc. manufacturer-related credit companies) -0.19 (1.59?1.40)

(Japanese corporations operating overseas) (0.71) (0.78) (0.06) Short-term loans to financial institutions (Securities companies, etc.) -0.15

(for reference) Balance of loans (Non-consolidated, banking a/c and principal guaranteed trust a/c combined)

Mar. 2010 Sep. 2010 Change

Domestic branches Domestic branches Domestic branches

(in trillions of Yen) Total Total Total

Loans and bills discounted (Ending balance) 12.18 11.30 11.74 10.85 —0.43 —0.44

(Average balance) 11.60 10.95 11.68 10.86 0.07 — 0.08

Note: The balance of “Loans” in the above chart includes receivables other than loans, therefore does not correspond to the balance of “ Loans and bills discounted” in the left chart.

29

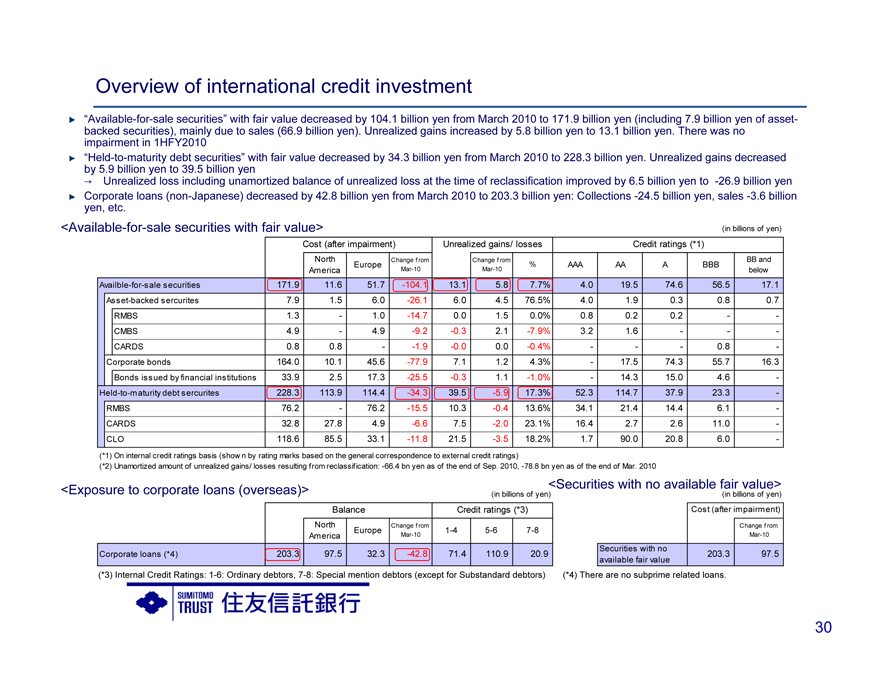

Overview of international credit investment

“Available-for-sale securities” with fair value decreased by 104.1 billion yen from March 2010 to 171.9 billion yen (including 7.9 billion yen of asset-backed securities), mainly due to sales (66.9 billion yen). Unrealized gains increased by 5.8 billion yen to 13.1 billion yen. There was no impairment in 1HFY2010 “Held-to-maturity debt securities” with fair value decreased by 34.3 billion yen from March 2010 to 228.3 billion yen. Unrealized gains decreased by 5.9 billion yen to 39.5 billion yen

Unrealized loss including unamortized balance of unrealized loss at the time of reclassification improved by 6.5 billion yen to -26.9 billion yen Corporate loans (non-Japanese) decreased by 42.8 billion yen from March 2010 to 203.3 billion yen: Collections -24.5 billion yen, sales -3.6 billion yen, etc.

<Available-for-sale securities with fair value> (in billions of yen)

Cost (after impairment) Unrealized gains/ losses Credit ratings (*1)

North America Europe Change from Mar-10 Change from Mar-10 BB and below % AAA AA A BBB

Availble-for-sale securities 171.9 11.6 51.7 -104.1 13.1 5.8 7.7% 4.0 19.5 74.6 56.5 17.1

Asset-backed sercurites 7.9 1.5 6.0 -26.1 6.0 4.5 76.5% 4.0 1.9 0.3 0.8 0.7

RMBS 1.3 — 1.0 -14.7 0.0 1.5 0.0% 0.8 0.2 0.2 — -

CMBS 4.9 — 4.9 -9.2 -0.3 2.1 -7.9% 3.2 1.6 —— -

CARDS 0.8 0.8 — -1.9 -0.0 0.0 -0.4% ——— 0.8 -

Corporate bonds 164.0 10.1 45.6 -77.9 7.1 1.2 4.3% — 17.5 74.3 55.7 16.3

Bonds issued by financial institutions 33.9 2.5 17.3 -25.5 -0.3 1.1 -1.0% — 14.3 15.0 4.6 -

Held-to-maturity debt sercurites 228.3 113.9 114.4 -34.3 39.5 -5.9 17.3% 52.3 114.7 37.9 23.3 -

RMBS 76.2 — 76.2 -15.5 10.3 -0.4 13.6% 34.1 21.4 14.4 6.1 -

CARDS 32.8 27.8 4.9 -6.6 7.5 -2.0 23.1% 16.4 2.7 2.6 11.0 -

CLO 118.6 85.5 33.1 -11.8 21.5 -3.5 18.2% 1.7 90.0 20.8 6.0 -

(*1) On internal credit ratings basis (show n by rating marks based on the general correspondence to external credit ratings)

(*2) Unamortized amount of unrealized gains/ losses resulting from reclassification: -66.4 bn yen as of the end of Sep. 2010, -78.8 bn yen as of the end of Mar. 2010

<Exposure to corporate loans (overseas)>

<Securities with no available fair value>

Balance Credit ratings (*3)

North America Europe Change f rom Mar-10 1-4 5-6 7-8

Corporate loans (*4) 203.3 97.5 32.3 -42.8 71.4 110.9 20.9

Cost (after impairment)

Change from Mar-10

Securities with no available fair value

203.3 97.5

(*3) Internal Credit Ratings: 1-6: Ordinary debtors, 7-8: Special mention debtors (except for Substandard debtors)

(*4) There are no subprime related loans.

30

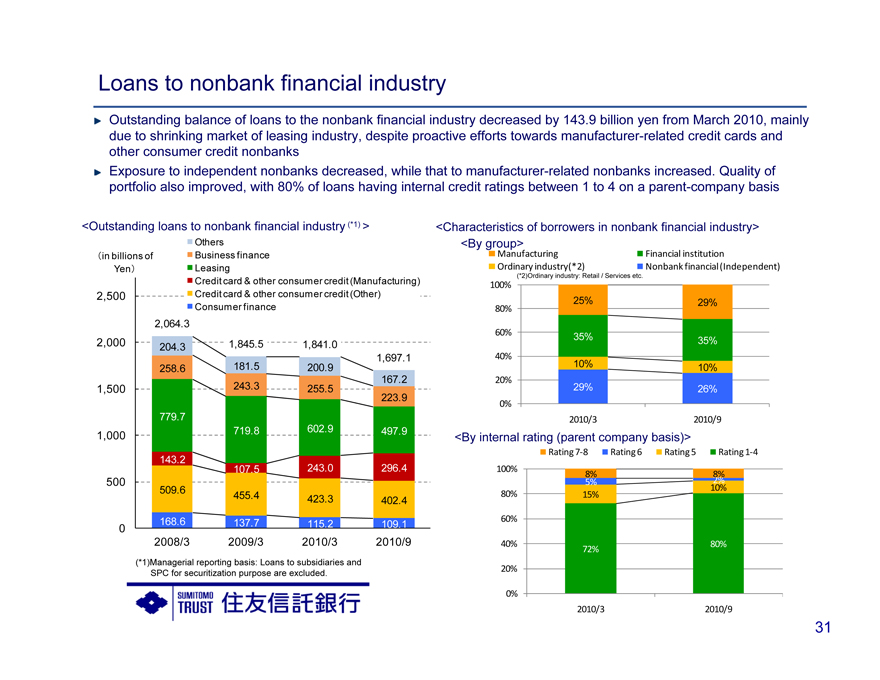

Loans to nonbank financial industry

Outstanding balance of loans to the nonbank financial industry decreased by 143.9 billion yen from March 2010, mainly due to shrinking market of leasing industry, despite proactive efforts towards manufacturer-related credit cards and other consumer credit nonbanks Exposure to independent nonbanks decreased, while that to manufacturer-related nonbanks increased. Quality of portfolio also improved, with 80% of loans having internal credit ratings between 1 to 4 on a parent-company basis

<Outstanding loans to nonbank financial industry (*1) > <Characteristics of borrowers in nonbank financial industry>

in billions of Business finance Yen

Others

Leasing

Credit card & other consumer credit (Manufacturing)

Credit card & other consumer credit (Other)

Consumer finance

Business finance

2,500 2,000 1,500 1,000 500 0

2,064.3 204.3 258.6

779.7

143.2

509.6

168.6 2008/3

1,845.5 1,841.0

1,697.1 181.5 200.9 167.2 243.3 255.5 223.9

719.8 602.9 497.9

107.5 243.0 296.4

455.4 423.3

402.4

137.7 115.2 109.1 2009/3 2010/3 2010/9

<Characteristics of borrowers in nonbank financial industry> <By group>

Manufacturing Financial institution

Ordinary industry(*2) Nonbank financial(Independent)

(*2)Ordinary industry: Retail / Services etc.

100%

80% 25% 29%

60% 35%

35%

40%

10% 10%

20%

29% 26%

0%

2010/3 2010/9

<By internal rating (parent company basis)>

Rating 7 8 Rating 6 Rating 5 Rating 1 4 100%

8% 8%

5% 10% 2% 80% 15%

60%

40% 80% 72%

20%

0%

2010/3 2010/9

(*1)Managerial reporting basis: Loans to subsidiaries and SPC for securitization purpose are excluded.

31

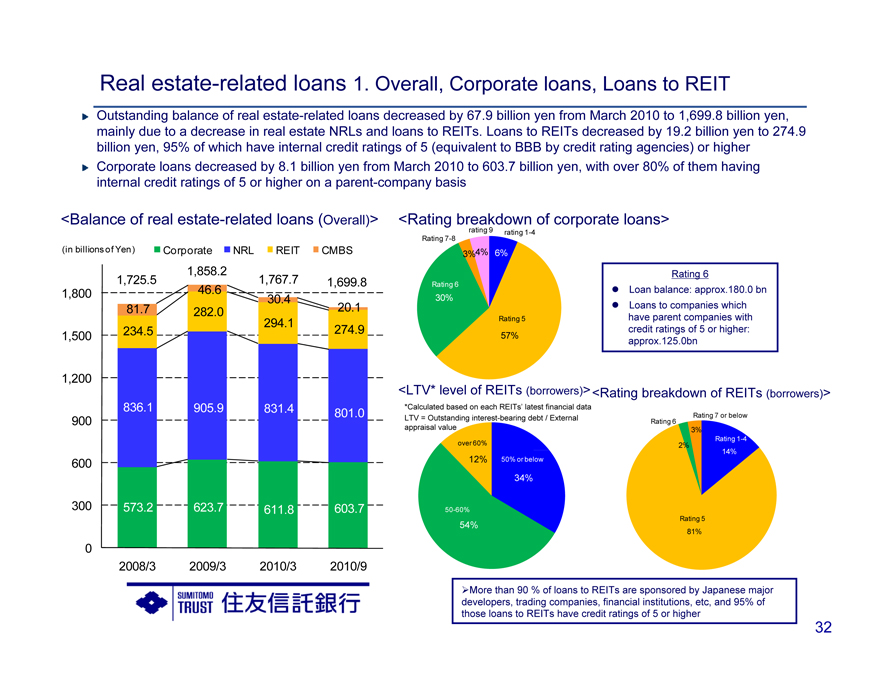

Real estate-related loans 1. Overall, Corporate loans, Loans to REIT

Outstanding balance of real estate-related loans decreased by 67.9 billion yen from March 2010 to 1,699.8 billion yen, mainly due to a decrease in real estate NRLs and loans to REITs. Loans to REITs decreased by 19.2 billion yen to 274.9 billion yen, 95% of which have internal credit ratings of 5 (equivalent to BBB by credit rating agencies) or higher Corporate loans decreased by 8.1 billion yen from March 2010 to 603.7 billion yen, with over 80% of them having internal credit ratings of 5 or higher on a parent-company basis

<Balance of real estate-related loans (Overall)>

(in billions of Yen) Corporate NRL REIT CMBS

1,858.2

1,725.5 1,767.7 1,699.8 1,800 46.6

30.4

81.7 282.0 20.1 294.1 234.5 274.9 1,500

1,200

836.1 905.9 831.4

801.0 900

600

300 573.2 623.7 611.8 603.7

0

2008/3 2009/3 2010/3 2010/9

<Rating breakdown of corporate loans>

rating 9 rating 1-4 Rating 7-8

3%4% 6%

Rating 6 30%

Rating 5

57%

Rating 6 z Loan balance: approx.180.0 bn z Loans to companies which have parent companies with credit ratings of 5 or higher: approx.125.0bn

<LTV* level of REITs (borrowers)><Rating breakdown of REITs (borrowers)>

*Calculated based on each REITs’ latest financial data LTV = Outstanding interest-bearing debt / External appraisal value

Rating 6 Rating 7 or below

3%

2% Rating 1-4 14%

Rating 5 81%

over 60%

12% 50% or below

34%

50-60%

54%

More than 90 % of loans to REITs are sponsored by Japanese major developers, trading companies, financial institutions, etc, and 95% of those loans to REITs have credit ratings of 5 or higher

32

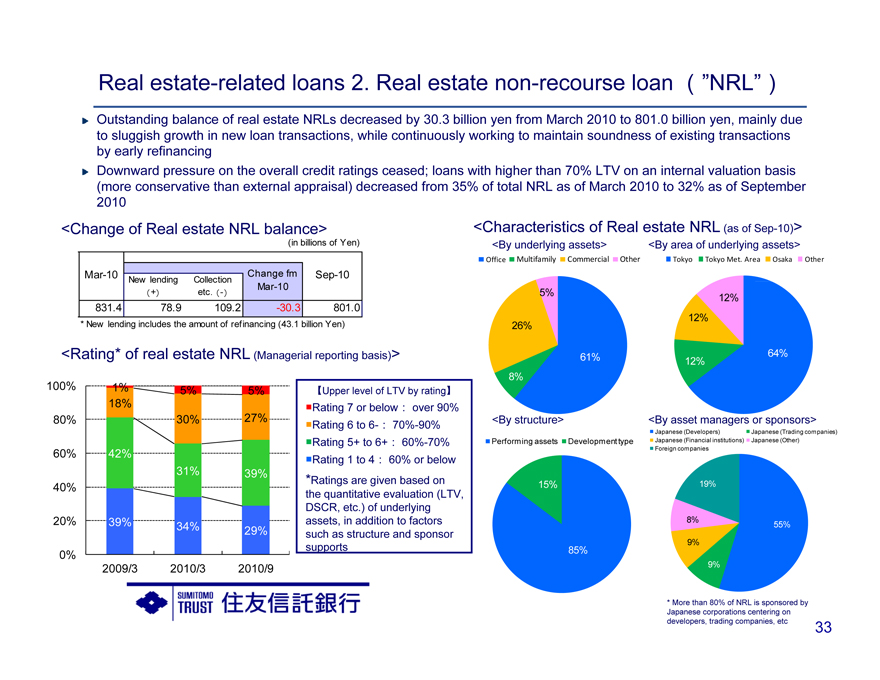

Real estate-related loans 2. Real estate non-recourse loan ”NRL”

Outstanding balance of real estate NRLs decreased by 30.3 billion yen from March 2010 to 801.0 billion yen, mainly due to sluggish growth in new loan transactions, while continuously working to maintain soundness of existing transactions by early refinancing

Downward pressure on the overall credit ratings ceased; loans with higher than 70% LTV on an internal valuation basis (more conservative than external appraisal) decreased from 35% of total NRL as of March 2010 to 32% as of September

<Change of Real estate NRL balance>

(in billions of Yen)

Mar-10 Change fm Sep-10

New lending Collection

+ etc. - Mar-10

831.4 78.9 109.2 -30.3 801.0

* New lending includes the amount of refinancing (43.1 billion Yen)

<Rating* of real estate NRL (Managerial reporting basis)>

100% 1% 5% 5%

18%

80% 30% 27%

60% 42%

31% 39% 40%

20% 39%

34% 29%

0%

2009/3 2010/3 2010/9

Upper level of LTV by rating

Rating 7 or below over 90%

Rating 6 to 6- 70%-90%

Rating 5+ to 6+ 60%-70%

Rating 1 to 4 60% or below

*Ratings are given based on the quantitative evaluation (LTV, DSCR, etc.) of underlying assets, in addition to factors such as structure and sponsor supports

<Characteristics of Real estate NRL (as of Sep-10)>

<By underlying assets>

Office Multifamily Commercial Other

<By area of underlying assets>

Tokyo Tokyo Met. Area Osaka Other

<By structure>

Performing assets Development type

15%

85%

<By asset managers or sponsors>

Japanese (Developers) Japanese (Trading companies) Japanese (Financial institutions) Japanese (Other) Foreign companies

19%

8%

55% 9% 9%

More than 80% of NRL is sponsored by Japanese corporations centering on developers, trading companies, etc

33

Division performance

34

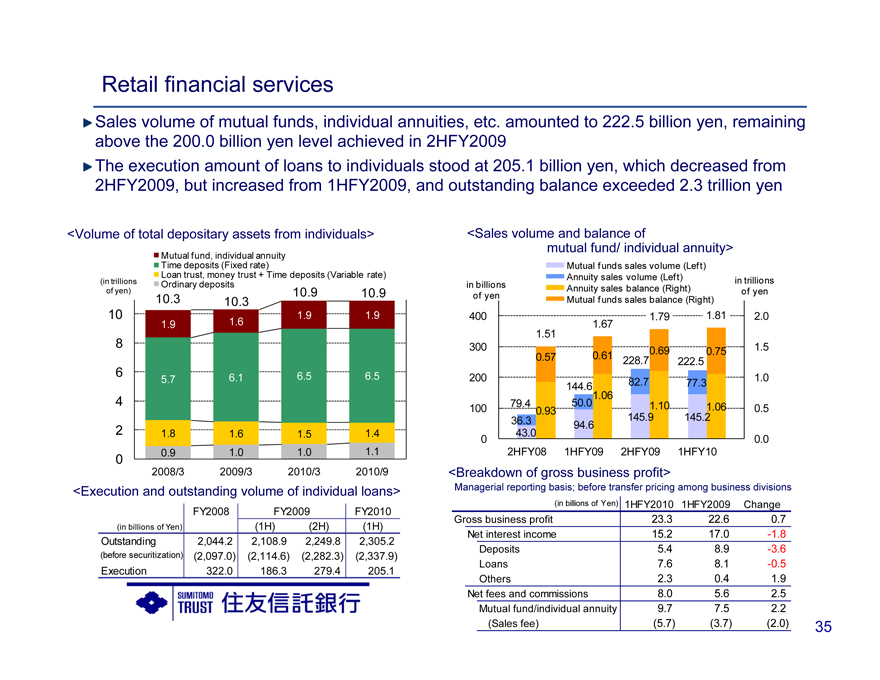

Retail financial services

Sales volume of mutual funds, individual annuities, etc. amounted to 222.5 billion yen, remaining above the 200.0 billion yen level achieved in 2HFY2009

The execution amount of loans to individuals stood at 205.1 billion yen, which decreased from 2HFY2009, but increased from 1HFY2009, and outstanding balance exceeded 2.3 trillion yen

<Volume of total depositary assets from individuals>

Mutual fund, individual annuity

Time deposits (Fixed rate)

Loan trust, money trust + Time deposits (Variable rate)

Ordinary deposits

(in trillions of yen)

10 8 6 4 2 0

10.3

10.3

10.9

10.9

1.9

5.7

1.8

0.9

1.6

6.1

1.6

1.0

1.9

6.5

1.5

1.0

1.9

6.5

1.4

1.1

2008/3

2009/3

2010/3

2010/9

<Execution and outstanding volume of individual loans>

(in billions of Yen)

Outstanding (before securitization) Execution

FY2008

2,044.2 (2,097.0) 322.0

FY2009 (1H) (2H) 2,108.9 2,249.8 (2,114.6) (2,282.3) 186.3 279.4

FY2010 (1H) 2,305.2 (2,337.9) 205.1

<Sales volume and balance of mutual fund/ individual annuity>

Mutual funds sales volume (Left) Annuity sales volume (Left) Annuity sales balance (Right) Mutual funds sales balance (Right)

in trillions of yen

in billions of yen

400 300 200 100 0

2.0

1.5

1.0

0.5

0.0

2HFY08 1HFY09 2HFY09 1HFY10

79.4 36.3 43.0

1.51

0.57

0.93

144.6 50.0

94.6

1.67 0.61 1.06

228.7 82.7

145.9

0.69

1.10

222.5 0 77.3

145.2 1

.75

.06

<Breakdown of gross business profit>

Managerial reporting basis; before transfer pricing among business divisions (in billions of Yen) 1HFY2010 1HFY2009 Change Gross business profit 23.3 22.6 0.7 Net interest income 15.2 17.0 - -1.8 Deposits 5.4 8.9 -3.6 Loans 7.6 8.1 -0.5 Others 2.3 0.4 1.9 Net fees and commissions 8.0 5.6 2.5 Mutual fund/individual annuity 9.7 7.5 2.2 (Sales fee) (5.7) (3.7) (2.0)

35

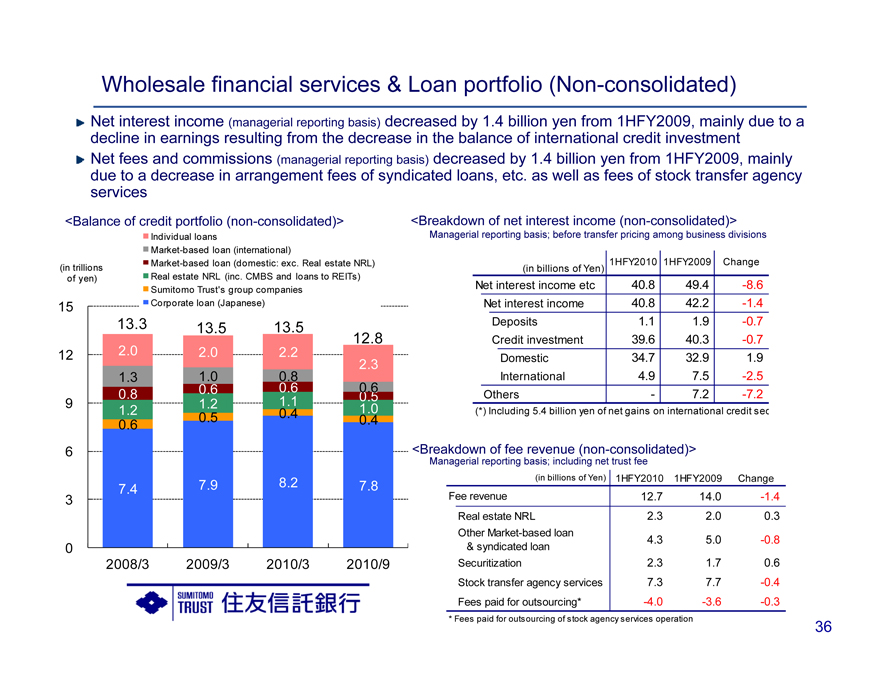

Wholesale financial services & Loan portfolio (Non-consolidated)

Net interest income (managerial reporting basis) decreased by 1.4 billion yen from 1HFY2009, mainly due to a decline in earnings resulting from the decrease in the balance of international credit investment Net fees and commissions (managerial reporting basis) decreased by 1.4 billion yen from 1HFY2009, mainly due to a decrease in arrangement fees of syndicated loans, etc. as well as fees of stock transfer agency services <Balance of credit portfolio (non-consolidated)> <Breakdown of net interest income (non-consolidated)>

Individual loans Managerial reporting basis; before transfer pricing among business divisions Market-based loan (international) Market-based loan (domestic: exc. Real estate NRL) 1HFY2010 1HFY2009 Change (in trillions Real estate NRL (inc. CMBS and loans to REITs) (in billions of Yen) of yen) Sumitomo Trust’s group companies Net interest income etc 40.8 49.4 -8.6

15 Corporate loan (Japanese) Net interest income 40.8 42.2 -1.4

13.3 13.5 13.5 Deposits 1.1 1.9 -0.7 2.0 12.8 Credit investment 39.6 40.3 -0.7

12 2.0 2.2 2.3 Domestic 34.7 32.9 1.9 1.3 1.0 0.6 0.8 0.6 International 4.9 7.5 -2.5 0.8 0.6 Others—7.2 -7.2 1.1 0.5

9 1.2 1.0

1.2 0.5 0.4 (*) Including 5.4 billion yen of net gains on international credit sec

0.6 0.4

6 | | <Breakdown of fee revenue (non-consolidated)> |

Managerial reporting basis; including net trust fee

8.2 (in billions of Yen) 1HFY2010 1HFY2009 Change 7.4 7.9 7.8 Fee revenue 12.7 14.0 -1.4

Real estate NRL 2.3 2.0 0.3 Other Market-based loan 4.3 5.0 -0.8

0 & syndicated loan

2008/3 2009/3 2010/3 2010/9 Securitization 2.3 1.7 0.6

Stock transfer agency services 7.3 7.7 -0.4 Fees paid for outsourcing* -4.0 - -3.6 -0.3

* | | Fees paid for outsourcing of stock agency services operation |

36

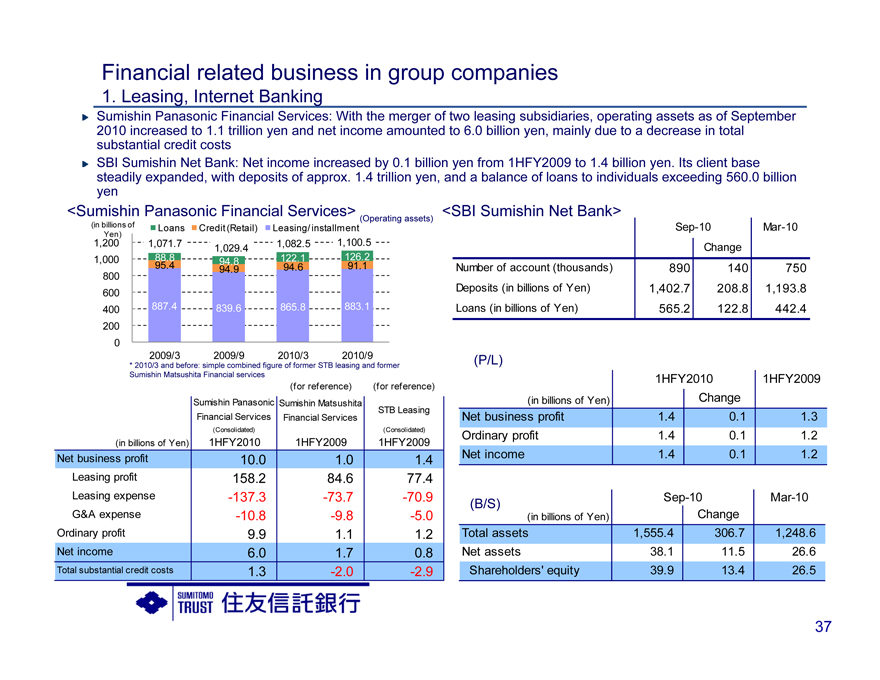

Financial related business in group companies

1. Leasing, Internet Banking

Sumishin Panasonic Financial Services: With the merger of two leasing subsidiaries, operating assets as of September 2010 increased to 1.1 trillion yen and net income amounted to 6.0 billion yen, mainly due to a decrease in total substantial credit costs SBI Sumishin Net Bank: Net income increased by 0.1 billion yen from 1HFY2009 to 1.4 billion yen. Its client base steadily expanded, with deposits of approx. 1.4 trillion yen, and a balance of loans to individuals exceeding 560.0 billion yen <Sumishin Panasonic Financial Services> <SBI Sumishin Net Bank>

(Operating assets)

(in billions of Loans Credit (Retail) Leasing/ installment Sep-10 Mar-10 1,200 Yen) 1,100.5 1,071.7 1,082.5 Change 1,029.4 1,000 88.8 94.8 122.1 126.2 95.4 94.9 94.6 91.1 Number of account (thousands) 890 140 750 800 Deposits (in billions of Yen) 1,402.7 208.8 1,193.8 600 400 887.4 839.6 865.8 883.1 Loans (in billions of Yen) 565.2 122.8 442.4 200 0 2009/3 2009/9 2010/3 2010/9 (P/L)

* | | 2010/3 and before: simple combined figure of former STB leasing and former |

Sumishin Matsushita Financial services 1HFY2010 1HFY2009 (for reference) (for reference) Sumishin Panasonic (in billions of Yen) Change Sumishin Matsushita STB Leasing Financial Services Financial Services Net business profit 1.4 0.1 1.3

(Consolidated) (Consolidated) Ordinary profit 1.4 0.1 1.2

(in billions of Yen) 1HFY2010 1HFY2009 1HFY2009

Net business profit 10.0 1.0 1.4 Net income 1.4 0.1 1.2

Leasing profit 158.2 84.6 77.4

Leasing expense -137.3 -73.7 -70.9 Sep-10 Mar-10

G&A expense (B/S)

-10.8 -9.8 -5.0 (in billions of Yen) Change

Ordinary profit 9.9 1.1 1.2 Total assets 1,555.4 306.7 1,248.6 Net income 6.0 1.7 0.8 Net assets 38.1 11.5 26.6 Total substantial credit costs 1.3 -2.0 -2.9 Shareholders’ equity 39.9 13.4 26.5

37

Financial related business in group companies

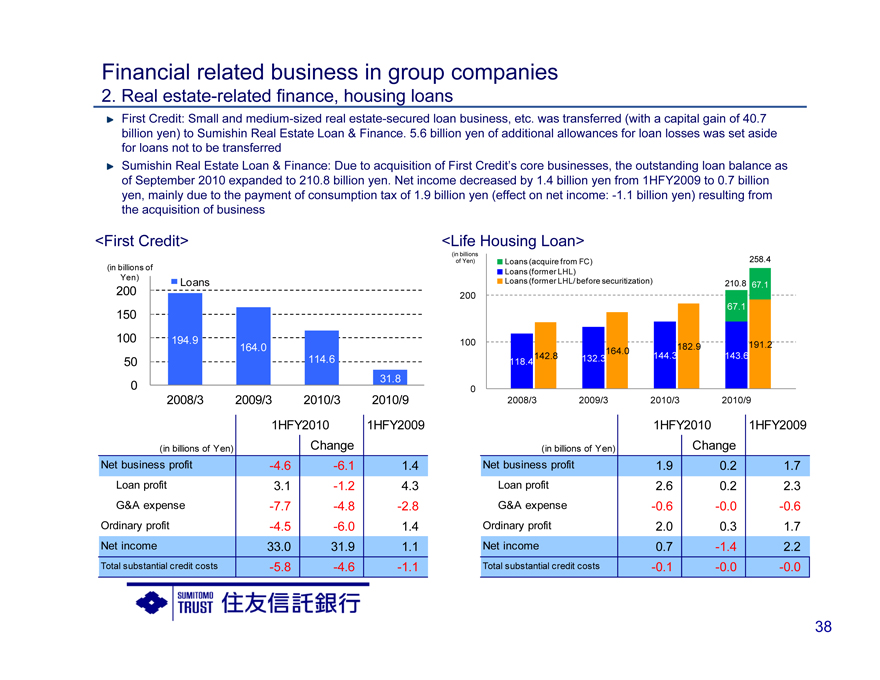

2. Real estate-related finance, housing loans

First Credit: Small and medium-sized real estate-secured loan business, etc. was transferred (with a capital gain of 40.7 billion yen) to Sumishin Real Estate Loan & Finance. 5.6 billion yen of additional allowances for loan losses was set aside for loans not to be transferred

Sumishin Real Estate Loan & Finance: Due to acquisition of First Credit’s core businesses, the outstanding loan balance as of September 2010 expanded to 210.8 billion yen. Net income decreased by 1.4 billion yen from 1HFY2009 to 0.7 billion yen, mainly due to the payment of consumption tax of 1.9 billion yen (effect on net income: -1.1 billion yen) resulting from the acquisition of business

<First Credit>

(in billions of

Yen) Loans 200 150 100 194.9

164.0

50 114.6

31.8 0 2008/3 2009/3 2010/3 2010/9

<Life Housing Loan>

(in billions of Yen) ?Loans (acquire from FC) 258.4

?Loans (former LHL)

?Loans (former LHL/ before securitization) 210.8 67.1 200 67.1

100 191.2 182.9 164.0 142.8 132.3 144.3 143.6 118.4

0

2008/3 2009/3 2010/3 2010/9

1HFY2010 1HFY2009

(in billions of Yen) Change

Net business profit -4.6 -6.1 1.4 Loan profit 3.1 -1.2 4.3 G&A expense -7.7 -4.8 -2.8 Ordinary profit -4.5 -6.0 1.4 Net income 33.0 31.9 1.1

Total substantial credit costs -5.8 -4.6 -1.1

1HFY2010 1HFY2009

(in billions of Yen) Change

Net business profit 1.9 0.2 1.7 Loan profit 2.6 0.2 2.3 G&A expense -0.6 -0.0 -0.6 Ordinary profit 2.0 0.3 1.7 Net income 0.7 -1.4 2.2 Total substantial credit costs -0.1 -0.0 -0.0

38

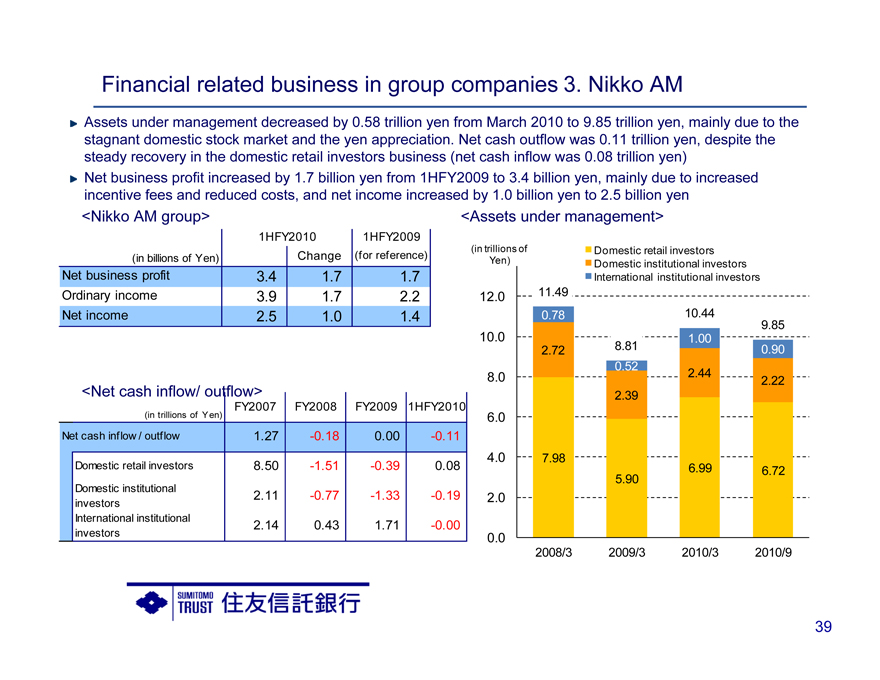

Financial related business in group companies 3. Nikko AM

Assets under management decreased by 0.58 trillion yen from March 2010 to 9.85 trillion yen, mainly due to the stagnant domestic stock market and the yen appreciation. Net cash outflow was 0.11 trillion yen, despite the steady recovery in the domestic retail investors business (net cash inflow was 0.08 trillion yen)

Net business profit increased by 1.7 billion yen from 1HFY2009 to 3.4 billion yen, mainly due to increased incentive fees and reduced costs, and net income increased by 1.0 billion yen to 2.5 billion yen

<Nikko AM group>

1HFY2010 1HFY2009 (in billions of Yen) Change (for reference) Net business profit 3.4 1.7 1.7 Ordinary income 3.9 1.7 2.2 Net income 2.5 1.0 1.4

<Net cash inflow/ outflow>

FY2007 FY2008 FY2009 1HFY2010

(in trillions of Yen)

Net cash inflow / outflow 1.27 -0.18 0.00 -0.11

Domestic retail investors 8.50 -1.51 -0.39 0.08 Domestic institutional 2.11 -0.77 -1.33 - -0.19 investors International institutional 2.14 0.43 1.71 -0.00 investors

<Assets under management>

(in trillions of Domestic retail investors Yen) Domestic institutional investors International institutional investors

12.0 11.49

0.78 10.44 9.85

10.0 1.00

2.72 8.81 0.90

0.52

8.0 2.44

2.22

2.39

6.0

4.0 7.98

5.90 6.99 6.72

2.0

0.0

2008/3 2009/3 2010/3 2010/9

39

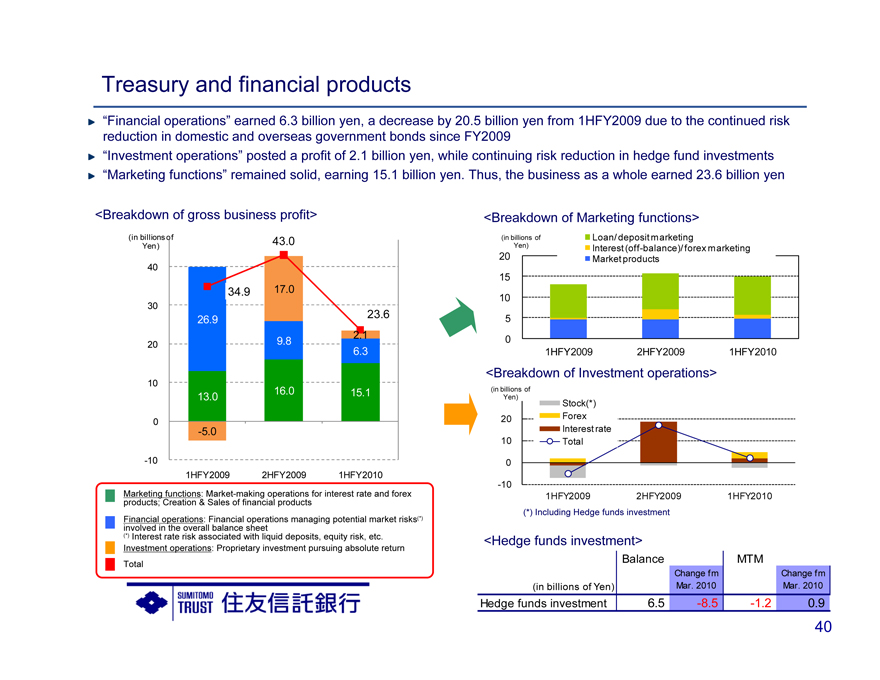

Treasury and financial products

“Financial operations” earned 6.3 billion yen, a decrease by 20.5 billion yen from 1HFY2009 due to the continued risk reduction in domestic and overseas government bonds since FY2009

“Investment operations” posted a profit of 2.1 billion yen, while continuing risk reduction in hedge fund investments

“Marketing functions” remained solid, earning 15.1 billion yen. Thus, the business as a whole earned 23.6 billion yen

<Breakdown of gross business profit>

(in billions of 43.0 Yen)

40

34.9 17.0 30

23.6

26.9

2.1

20 9.8 6.3 10

16.0 15.1

13.0

0 -5.0 -10

1HFY2009 2HFY2009 1HFY2010

Marketing functions: Market-making operations for interest rate and forex products; Creation & Sales of financial products Financial operations:

Financial operations managing potential market risks(*) involved in the overall balance sheet (*) Interest rate risk associated with liquid deposits, equity risk, etc.

Investment operations: Proprietary investment pursuing absolute return

Total

<Breakdown of Marketing functions>

(in billions of Loan/ deposit marketing

Yen) Interest (off-balance)/ forex marketing

20 Market products 15

10

5

0

1HFY2009 2HFY2009 1HFY2010

<Breakdown of Investment operations>

(in billions of Yen)

Stock(*)

20 Forex Interest rate

10 Total 0

-10

1HFY2009 2HFY2009 1HFY2010 (*) Including Hedge funds investment

<Hedge funds investment>

Balance MTM

Change fm Change fm (in billions of Yen) Mar. 2010 Mar. 2010 Hedge funds investment 6.5 -8.5 -1.2 0.9

40

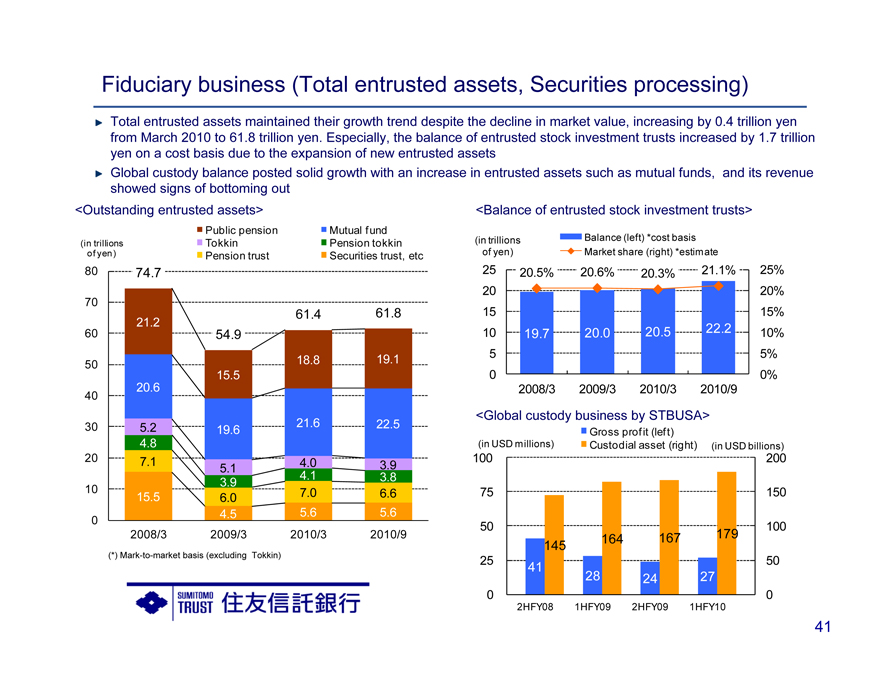

Fiduciary business (Total entrusted assets, Securities processing)

Total entrusted assets maintained their growth trend despite the decline in market value, increasing by 0.4 trillion yen from March 2010 to 61.8 trillion yen. Especially, the balance of entrusted stock investment trusts increased by 1.7 trillion yen on a cost basis due to the expansion of new entrusted assets

Global custody balance posted solid growth with an increase in entrusted assets such as mutual funds, and its revenue showed signs of bottoming out

<Outstanding entrusted assets>

Public pension Mutual fund (in trillions Tokkin Pension tokkin of yen) Pension trust Securities trust, etc

80 74.7

70

61.4 61.8

60 21.2 54.9

50 18.8 19.1 15.5 20.6 40

30 5.2 21.6 22.5 19.6 4.8

20 7.1 4.0

5.1 3.9 4.1 3.8 3.9

10 7.0 6.6 15.5 6.0 4.5 5.6 5.6 0 2008/3 2009/3 2010/3 2010/9

(*) Mark-to-market basis (excluding Tokkin)

<Balance of entrusted stock investment trusts>

(in trillions Balance (left) *cost basis of yen) Market share (right) *estimate

25 20.5% 20.6% 20.3% 21.1% 25%

20 20%

15 15%

10 19.7 20.0 20.5 22.2 10%

5 5%

0 0% 2008/3 2009/3 2010/3 2010/9

<Global custody business by STBUSA>

Gross profit (left)

(in USD millions) Custodial asset (right) (in USD billions)

100 200

75 150

50 100 145 164 167 179

25 50 41

28 24 27

0 0

2HFY08 1HFY09 2HFY09 1HFY10

41

Fiduciary business (Pension, Investment management)

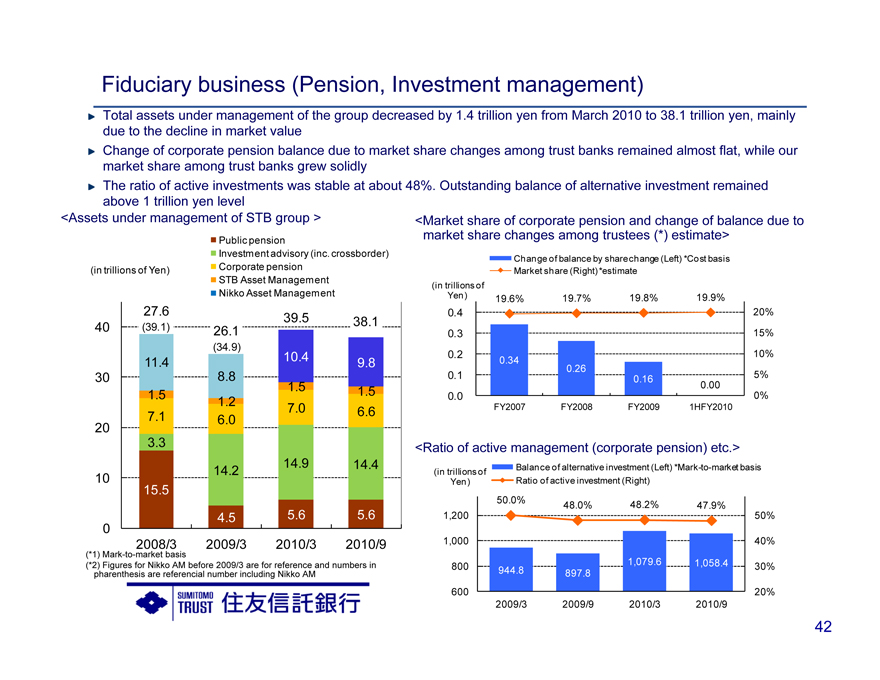

Total assets under management of the group decreased by 1.4 trillion yen from March 2010 to 38.1 trillion yen, mainly due to the decline in market value

Change of corporate pension balance due to market share changes among trust banks remained almost flat, while our market share among trust banks grew solidly

The ratio of active investments was stable at about 48%. Outstanding balance of alternative investment remained above 1 trillion yen level

<Assets under management of STB group >

Public pension

Investment advisory (inc. crossborder) (in trillions of Yen) Corporate pension STB Asset Management Nikko Asset Management

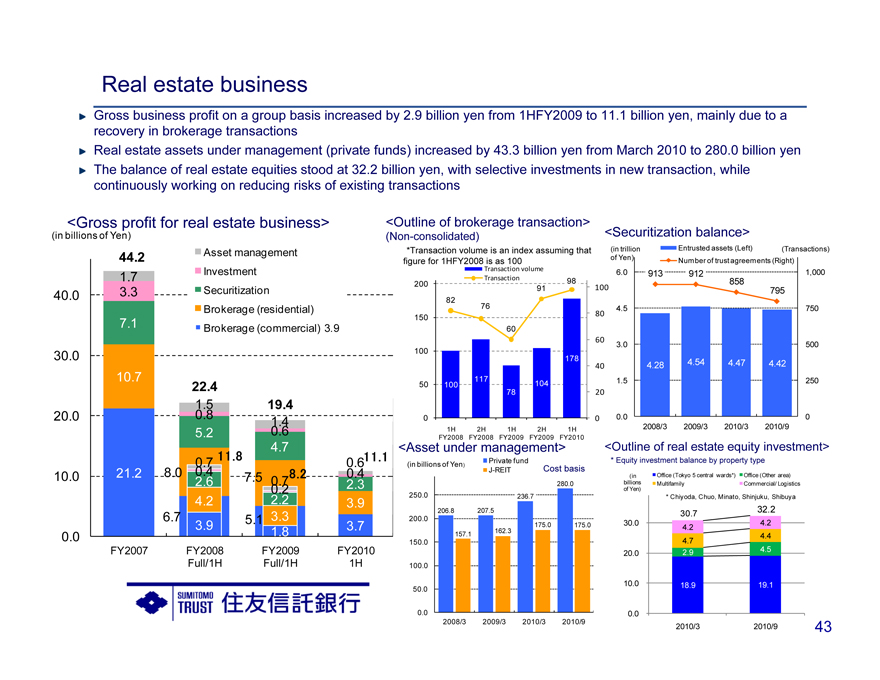

27.6