Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

Evergreen Investment Management Company, LLC (“EIMC”), a subsidiary of Wells Fargo & Company (“Wells Fargo”), is the investment advisor to the Fund and is paid an annual fee starting at 0.52% and declining to 0.41% as the aggregate average daily net assets of the Fund and its variable annuity counterpart, Evergreen VA Omega Fund, increase. For the six months ended March 31, 2009, the advisory fee was equivalent to an annual rate of 0.52% of the Fund’s average daily net assets.

On October 3, 2008, Wells Fargo and Wachovia Corporation (“Wachovia”) announced that Wells Fargo agreed to acquire Wachovia in a whole company transaction that would include all of Wachovia’s banking and other businesses. In connection with this transaction, Wachovia issued preferred shares to Wells Fargo representing approximately a 40% voting interest in Wachovia. Due to its ownership of preferred shares, Wells Fargo may have been deemed to control EIMC. If Wells Fargo was deemed to control EIMC, then the existing advisory agreement between the Fund and EIMC would have terminated automatically in connection with the issuance of preferred shares. To address this possibility, on October 20, 2008 the Board of Trustees approved an interim advisory agreement with EIMC with the same terms and conditions as the existing agreement which became effective upon the issuance of the preferred shares. EIMC’s receipt of the advisory fees under the interim advisory agreement was subject to the approval by shareholders of the Fund of a new advisory agreement with EIMC.

On December 31, 2008, Wachovia merged with and into Wells Fargo and as a result of the merger, EIMC, Evergreen Investment Services, Inc. (“EIS”) and Evergreen Service Company, LLC (“ESC”) became subsidiaries of Wells Fargo. After the merger, a new interim advisory agreement with the same terms and conditions between the Fund and EIMC went into effect.

Shareholders approved the new advisory agreement between the Fund and EIMC on March 12, 2009.

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. During the six months ended March 31, 2009, EIMC voluntarily waived its advisory fee in the amount of $430,949.

The Fund may invest in money market funds which are advised by EIMC. Income earned on these investments is included in income from affiliated issuers on the Statement of Operations.

EIMC also serves as the administrator to the Fund providing the Fund with facilities, equipment and personnel. EIMC is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds) starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds) increase. For the six months ended March 31, 2009, the administrative services fee was equivalent to an annual rate of 0.10% of the Fund’s average daily net assets.

ESC, an affiliate of EIMC and a subsidiary of Wells Fargo, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund. For the six months ended March 31, 2009, the transfer agent fees were equivalent to an annual rate of 0.59% of the Fund’s average daily net assets.

Wachovia Bank NA, a subsidiary of Wells Fargo and an affiliate of EIMC, through its securities lending division, Wachovia Global Securities Lending, acts as the securities lending agent for the Fund (see Note 5).

The Fund has placed a portion of its portfolio transactions with brokerage firms that are affiliates of Wells Fargo. During the six months ended March 31, 2009, the Fund paid brokerage commissions of $10,256 to Wachovia Securities, LLC, a broker-dealer affiliated with Wells Fargo.

4. DISTRIBUTION PLANS

EIS, an affiliate of EIMC and a subsidiary of Wells Fargo, serves as distributor of the Fund’s shares. The Fund has adopted Distribution Plans, as allowed by Rule 12b-1 of the 1940 Act, for each class of shares, except Class I. Under the Distribution Plans, the Fund is permitted to pay distribution fees at an annual rate of up to 0.75% of the average daily net assets for Class A shares and up to 1.00% of the average daily net assets for each of Class B, Class C and Class R shares. However, currently the distribution fees for Class A shares are limited to 0.25% of the average daily net assets of the class and the distribution fees for Class R shares are limited to 0.50% of the average daily net assets of Class R shares.

For the six months ended March 31, 2009, EIS received $5,520 from the sale of Class A shares and $108, $82,661and $743 in contingent deferred sales charges from redemptions of Class A, Class B and Class C shares, respectively.

21

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

5. INVESTMENT TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were $50,287,030 and $83,940,864, respectively, for the six months ended March 31, 2009.

On October 1, 2008, the Fund implemented Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”). FAS 157 establishes a single authoritative definition of fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. FAS 157 establishes a fair value hierarchy based upon the various inputs used in determining the value of the Fund’s investments. These inputs are summarized into three broad levels as follows:

Level 1 – quoted prices in active markets for identical securities Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of March 31, 2009, the inputs used in valuing the Fund’s assets, which are carried at fair value, were as follows:

Valuation Inputs | | Investments in

Securities | |

|

|

|

|

Level 1 – Quoted Prices | | $ | 546,751,448 | |

Level 2 – Other Significant Observable Inputs | | | 0 | |

Level 3 – Significant Unobservable Inputs | | | 0 | |

|

|

|

|

|

Total | | $ | 546,751,448 | |

|

|

|

|

|

During the six months ended March 31, 2009, the Fund loaned securities to certain brokers and earned $1,843,492, net of $204,541 paid to Wachovia Global Securities Lending as the securities lending agent. At March 31, 2009, the value of securities on loan and the total value of collateral received for securities loaned (including segregated cash) amounted to $90,991,947 and $91,789,729, respectively.

On March 31, 2009, the aggregate cost of securities for federal income tax purposes was $653,969,207. The gross unrealized appreciation and depreciation on securities based on tax cost was $28,152,877 and $135,370,636, respectively, with a net unrealized depreciation of $107,217,759.

As of September 30, 2008, the Fund had $404,285,192 in capital loss carryovers for federal income tax purposes with $7,956,060 expiring in 2009, $196,908,105 expiring in 2010 and $199,421,027 expiring in 2011.

22

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

Certain portions of the capital loss carryovers of the Fund were assumed as a result of acquisitions. These losses are subject to certain limitations prescribed by the Internal Revenue Code.

6. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an interfund lending program with certain funds in the Evergreen fund family. This program allows the Fund to borrow from, or lend money to, other participating funds. During the six months ended March 31, 2009, the Fund did not participate in the interfund lending program.

7. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund’s custodian, a portion of fund expenses has been reduced.

8. DEFERRED TRUSTEES’ FEES

Each Trustee of the Fund may defer any or all compensation related to performance of his or her duties as a Trustee. The Trustees’ deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts is based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported in the Fund’s Trustees’ fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

9. FINANCING AGREEMENT

The Fund and certain other Evergreen funds share in a $100 million unsecured revolving credit commitment for temporary and emergency purposes, including the funding of redemptions, as permitted by each participating fund’s borrowing restrictions. Borrowings under this facility bear interest at 0.50% per annum above the Federal Funds rate. All of the participating funds are charged an annual commitment fee of 0.09% on the unused balance, which is allocated pro rata. During the six months ended March 31, 2009, the Fund had no borrowings.

10. REGULATORY MATTERS AND LEGAL PROCEEDINGS

The Evergreen funds, EIMC and certain of EIMC’s affiliates are involved in various legal actions, including private litigation and class action lawsuits, and are and may in the future be subject to regulatory inquiries and investigations.

The SEC and the Secretary of the Commonwealth, Securities Division, of the Commonwealth of Massachusetts are conducting separate investigations of EIMC, EIS and Evergreen Ultra Short Opportunities Fund (the “Ultra Short Fund”) concerning

23

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

alleged issues surrounding the drop in net asset value of the Ultra Short Fund in May and June 2008. In addition, three purported class actions have been filed in the U.S. District Court for the District of Massachusetts relating to the same events; defendants include various Evergreen entities, including EIMC and EIS, and Evergreen Fixed Income Trust and its Trustees. The cases generally allege that investors in the Ultra Short Fund suffered losses as a result of (i) misleading statements in Ultra Short Fund’s registration statement and prospectus, (ii) the failure to accurately price securities in the Ultra Short Fund at different points in time and (iii) the failure of the Ultra Short Fund’s risk disclosures and description of its investment strategy to inform investors adequately of the actual risks of the fund.

EIMC does not expect that any of the legal actions, inquiries or investigations currently pending or threatened will have a material adverse impact on the financial position or operations of the Fund to which these financial statements relate. Any publicity surrounding or resulting from any legal actions or regulatory inquiries involving EIMC or its affiliates or any of the Evergreen Funds could result in reduced sales or increased redemptions of Evergreen fund shares, which could increase Evergreen fund transaction costs or operating expenses or have other adverse consequences on the Evergreen funds, including the Fund.

11. NEW ACCOUNTING PRONOUNCEMENT

In April 2009, FASB issued FASB Staff Position No. FAS 157-4, Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly (“FAS 157-4”). FAS 157-4 provides additional guidance for determining fair value when the volume and level of activity for an asset or a liability have significantly decreased and identifying transactions that are not orderly. FAS 157-4 requires enhanced disclosures about the inputs and valuation technique(s) used to measure fair value and a discussion of changes in valuation techniques and related inputs, if any, during the period. In addition, the three-level hierarchy disclosure and the level three roll-forward disclosure will be expanded for each major category of assets. Management of the Fund does not believe the adoption of FAS 157-4 will materially impact the financial statement amounts, but will require additional disclosures. FAS 157-4 is effective for interim and annual reporting periods ending after June 15, 2009.

24

ADDITIONAL INFORMATION (unaudited)

SPECIAL MEETING OF SHAREHOLDERS

On March 12, 2009, a Special Meeting of Shareholders for the Fund was held to consider a number of proposals. On December 1, 2008, the record date for the meeting, the Fund had $418,812,028 of net assets outstanding of which $228,845,861 (54.64%) of net assets were represented at the meeting.

Proposal 1 — To consider and act upon a new investment advisory agreement with Evergreen Investment Management Company, LLC:

| | | |

|

|

|

|

Net assets voted “For” | | $ | 201,106,304 |

Net assets voted “Against” | | $ | 7,718,277 |

Net assets voted “Abstain” | | $ | 20,021,280 |

|

|

|

|

25

This page left intentionally blank

26

This page left intentionally blank

27

TRUSTEES AND OFFICERS

TRUSTEES1 | |

Charles A. Austin III

Trustee

DOB: 10/23/1934

Term of office since: 1991

Other directorships: None | Investment Counselor, Anchor Capital Advisors, LLC. (investment advice); Director, The Andover Companies (insurance); Trustee, Arthritis Foundation of New England; Former Director, The Francis Ouimet Society (scholarship program); Former Director, Executive Vice President and Treasurer, State Street Research & Management Company (investment advice) |

|

|

K. Dun Gifford

Trustee

DOB: 10/23/1938

Term of office since: 1974

Other directorships: None | Chairman and President, Oldways Preservation and Exchange Trust (education); Trustee, Member of the Executive Committee, Former Chairman of the Finance Committee, and Former Treasurer, Cambridge College |

|

|

Dr. Leroy Keith, Jr.

Trustee

DOB: 2/14/1939

Term of office since: 1983

Other directorships: Trustee,

Phoenix Fund Complex

(consisting of 50 portfolios

as of 12/31/2008) | Managing Director, Almanac Capital Management (commodities firm); Trustee, Phoenix Fund Complex; Director, Diversapack Co. (packaging company); Former Partner, Stonington Partners, Inc. (private equity fund); Former Director, Obagi Medical Products Co.; Former Director, Lincoln Educational Services |

|

|

Carol A. Kosel

Trustee

DOB: 12/25/1963

Term of office since: 2008

Other directorships: None | Former Consultant to the Evergreen Boards of Trustees; Former Vice President and Senior Vice President, Evergreen Investments, Inc.; Former Treasurer, Evergreen Funds; Former Treasurer, Vestaur Securities Fund |

|

|

Gerald M. McDonnell

Trustee

DOB: 7/14/1939

Term of office since: 1988

Other directorships: None | Former Manager of Commercial Operations, CMC Steel (steel producer) |

|

|

Patricia B. Norris

Trustee

DOB: 4/9/1948

Term of office since: 2006

Other directorships: None | President and Director of Buckleys of Kezar Lake, Inc. (real estate company); Former President and Director of Phillips Pond Homes Association (home community); Former Partner, PricewaterhouseCoopers, LLP (independent registered public accounting firm) |

|

|

William Walt Pettit2

Trustee

DOB: 8/26/1955

Term of office since: 1988

Other directorships: None | Partner and Vice President, Kellam & Pettit, P.A. (law firm); Director, Superior Packaging Corp. (packaging company); Member, Superior Land, LLC (real estate holding company), Member, K&P Development, LLC (real estate development); Former Director, National Kidney Foundation of North Carolina, Inc. (non-profit organization) |

|

|

David M. Richardson

Trustee

DOB: 9/19/1941

Term of office since: 1982

Other directorships: None | President, Richardson, Runden LLC (executive recruitment advisory services); Director, J&M Cumming Paper Co. (paper merchandising); Former Trustee, NDI Technologies, LLP (communications); Former Consultant, AESC (The Association of Executive Search Consultants) |

|

|

Russell A. Salton III, MD

Trustee

DOB: 6/2/1947

Term of office since: 1984

Other directorships: None | President/CEO, AccessOne MedCard, Inc. |

|

|

28

TRUSTEES AND OFFICERS continued

Michael S. Scofield

Trustee

DOB: 2/20/1943

Term of office since: 1984

Other directorships: None | Retired Attorney, Law Offices of Michael S. Scofield; Former Director and Chairman, Branded Media Corporation (multi-media branding company) |

|

|

Richard J. Shima

Trustee

DOB: 8/11/1939

Term of office since: 1993

Other directorships: None | Independent Consultant; Director, Hartford Hospital; Trustee, Greater Hartford YMCA; Former Director, Trust Company of CT; Former Trustee, Saint Joseph College (CT) |

|

|

Richard K. Wagoner, CFA3

Trustee

DOB: 12/12/1937

Term of office since: 1999

Other directorships: None | Member and Former President, North Carolina Securities Traders Association; Member, Financial Analysts Society |

|

|

| |

OFFICERS | |

W. Douglas Munn4

President

DOB: 4/21/1963

Term of office since: 2009 | Principal occupations: Chief Operating Officer, Wells Fargo Funds Management, LLC; former Chief Operating Officer, Evergreen Investment Company, Inc. |

|

|

Jeremy DePalma4

Treasurer

DOB: 2/5/1974

Term of office since: 2005 | Principal occupations: Senior Vice President, Evergreen Investment Management Company, LLC; Former Vice President, Evergreen Investment Services, Inc.; Former Assistant Vice President, Evergreen Investment Services, Inc. |

|

|

Michael H. Koonce4

Secretary

DOB: 4/20/1960

Term of office since: 2000 | Principal occupations: Senior Vice President and General Counsel, Evergreen Investment Services, Inc.; Secretary, Senior Vice President and General Counsel, Evergreen Investment Management Company, LLC and Evergreen Service Company, LLC |

|

|

Robert Guerin4

Chief Compliance Officer

DOB: 9/20/1965

Term of office since: 2007 | Principal occupations: Chief Compliance Officer, Evergreen Funds and Senior Vice President of Evergreen Investment Company, Inc.; Former Managing Director and Senior Compliance Officer, Babson Capital Management LLC; Former Principal and Director, Compliance and Risk Management, State Street Global Advisors; Former Vice President and Manager, Sales Practice Compliance, Deutsche Asset Management |

|

|

1 | Each Trustee serves until a successor is duly elected or qualified or until his or her death, resignation, retirement or removal from office. Each Trustee oversaw 77 Evergreen funds as of December 31, 2008. Correspondence for each Trustee may be sent to Evergreen Board of Trustees, P.O. Box 20083, Charlotte, NC 28202. |

2 | It is possible that Mr. Pettit may be viewed as an “interested person” of the Evergreen funds, as defined in the 1940 Act, because of his law firm’s previous representation of affiliates of Wells Fargo & Company (“Wells Fargo”), the parent to the Evergreen funds’ investment advisor, EIMC. The Trustees are treating Mr. Pettit as an interested trustee for the time being. |

3 | Mr. Wagoner is an “interested person” of the Evergreen funds because of his ownership of shares in Wells Fargo & Company, the parent to the Evergreen funds’ investment advisor. |

4 | The address of the Officer is 200 Berkeley Street, Boston, MA 02116. |

Additional information about the Fund’s Board of Trustees and Officers can be found in the Statement of Additional Information (SAI) and is available upon request without charge by calling 800.343.2898.

29

566382 rv6 05/2009

Evergreen Small-Mid Growth Fund

| | table of contents |

1 | | LETTER TO SHAREHOLDERS |

4 | | FUND AT A GLANCE |

6 | | ABOUT YOUR FUND’S EXPENSES |

7 | | FINANCIAL HIGHLIGHTS |

9 | | SCHEDULE OF INVESTMENTS |

13 | | STATEMENT OF ASSETS AND LIABILITIES |

14 | | STATEMENT OF OPERATIONS |

15 | | STATEMENTS OF CHANGES IN NET ASSETS |

16 | | NOTES TO FINANCIAL STATEMENTS |

23 | | ADDITIONAL INFORMATION |

24 | | TRUSTEES AND OFFICERS |

This semiannual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of the fund’s proxy voting policies and procedures, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. The fund’s proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

Mutual Funds:

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Copyright 2009, Evergreen Investment Management Company, LLC.

Evergreen Investment Management Company, LLC is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s other Broker Dealer subsidiaries.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. 200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

May 2009

W. Douglas Munn

President and Chief Executive Officer

Dear Shareholder:

We are pleased to provide the Semiannual Report for Evergreen Small-Mid Growth Fund for the six-month period ended March 31, 2009 (the “period”).

Volatility continued to dominate trading patterns through the end of 2008, as losses mounted within the equity markets. Weak economic data, falling profit forecasts, and uncertainty about the auto industry compounded worries about the credit crisis. The selling spared few equity categories. In early 2009, layoff announcements accelerated, further pressuring personal consumption and business investment. The equity markets were affected by weakness in economic data and corporate profits. International markets were hit hard as economies in both developed and emerging countries remained weak. The fixed income markets continued to worry about deflation, as evidenced by investor willingness to accept virtually nothing for short-term loans to the government. Concerns about federal spending have also increased, with yields climbing for longer-term U.S. Treasuries during the first quarter of 2009.

The unprecedented economic and financial turmoil has been met with an unprecedented policy response, as the Federal Reserve, Treasury, Federal Deposit Insurance Corp. and Federal Housing Administration have allocated more than $11 trillion to combat this crisis. Perhaps most important, the Public-Private Investment Program (“PPIP”) has been designed to help rid banks of toxic assets from their balance sheets. The measures taken to address this crisis have merely treated the symptoms, but the announcement of this program gets to the root cause: the distressed assets on (and off) bank balance sheets. The PPIP is designed to use government subsidies to attract private purchases of currently illiquid mortgage related loans and securities held by banks. As a market returns for these assets, banks will be positioned to improve capital ratios, increase lending activity, and potentially buy their way out of the increasingly restrictive Troubled Asset Relief Program. We believe that the successful implementation of this program is critical for a sustainable expansion to ensue. As the lagged effects of the massive policy response take hold, we look for pent-up consumer demand to combine with government spending to help push Gross Domestic Product back into positive territory by the fourth quarter of 2009.

During the period, the management teams of Evergreen’s growth-oriented equity funds maintained their pursuit of capital appreciation, focusing on bottom-up, fundamental analysis in making individual stock selections consistent with the investment discipline and style of each fund. The manager of Evergreen Large Company Growth Fund and

1

LETTER TO SHAREHOLDERS continued

Evergreen Omega Fund pursued a small number of companies with the potential to sustain above-average growth for long-term cash flows. The management of Evergreen Strategic Growth Fund sought large cap companies offering superior long-term growth potential. The portfolio managers of Evergreen Mid Cap Growth Fund and Evergreen Small-Mid Growth Fund aimed to balance each portfolio with exposure both to consistent growth companies and to companies offering attractive intrinsic value. At the same time, managers of Evergreen Growth Fund concentrated on opportunities among small cap growth companies with above-average earnings prospects and reasonable stock valuations.

As we look back over the extraordinary series of events during the period, we believe it is important for all investors to keep perspective and remain focused on their long-term goals. We continue to urge investors to work with their financial advisors to pursue fully diversified strategies in order to participate in future market gains and limit the risks of potential losses. Investors should keep in mind that the economy and the financial markets have had long and successful histories of adaptability, recovery, innovation and growth. Proper asset allocation decisions can have significant impacts on the returns of long-term portfolios.

Please visit us at EvergreenInvestments.com for more information about our funds and other investment products available to you. Thank you for doing business with Evergreen Investments.

Sincerely,

W. Douglas Munn

President and Chief Executive Officer

Evergreen Funds

2

LETTER TO SHAREHOLDERS continued

Notices to Shareholders:

| • | On December 31, 2008, Wachovia Corporation merged with and into Wells Fargo & Company (“Wells Fargo”). As a result of the merger, Evergreen Investment Management Company, LLC (“EIMC”), Tattersall Advisory Group, Inc., First International Advisors, LLC, Metropolitan West Capital Management, LLC, Evergreen Investment Services, Inc. and Evergreen Service Company, LLC, are subsidiaries of Wells Fargo. |

| • | Effective January 1, 2009, W. Douglas Munn became President and Chief Executive Officer of the Evergreen Funds. |

3

FUND AT A GLANCE

as of March 31, 2009

MANAGEMENT TEAM

Investment Advisor:

Evergreen Investment Management Company, LLC

Portfolio Managers:

Kenneth J. Doerr; Robert C. Junkin, CPA; Lori S. Evans; Julian J. Johnson

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 3/31/2009.

The Equity style box placement is based on 10 growth and valuation measures for each fund holding and the median size of the companies in which the fund invests.

PERFORMANCE AND RETURNS

Portfolio inception date: 10/11/2005

Class inception date | Class A

10/11/2005 | Class I

10/11/2005 |

|

|

|

Nasdaq symbol | ESMGX | ESMIX |

|

|

|

6-month return with sales charge | -29.14% | N/A |

|

|

|

6-month return w/o sales charge | -24.81% | -24.84% |

|

|

|

Average annual return* | | |

|

|

|

1-year with sales charge | -34.59% | N/A |

|

|

|

1-year w/o sales charge | -30.62% | -30.48% |

|

|

|

Since portfolio inception | -5.07% | -3.24% |

|

|

|

Maximum sales charge | 5.75%

Front-end | N/A |

|

|

|

* | Adjusted for maximum applicable sales charge, unless noted. |

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Classes A or I, please go to EvergreenInvestments.com/fundperformance. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund incurs a 12b-1 fee of 0.25% for Class A. Class I does not pay a 12b-1 fee.

The advisor is waiving a portion of its advisory fee. Had the fee not been waived, returns would have been lower. Returns reflect expense limits previously in effect for Class A, without which returns for Class A would have been lower.

4

FUND AT A GLANCE continued

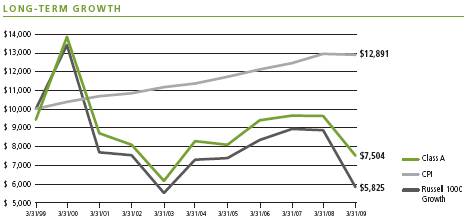

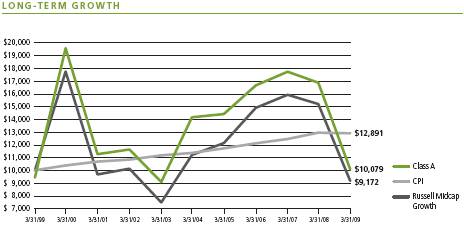

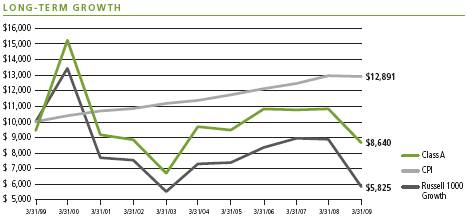

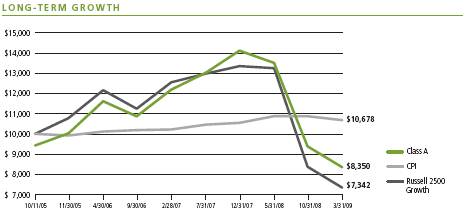

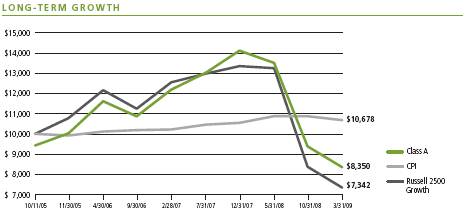

Comparison of a $10,000 investment in the Evergreen Small-Mid Growth Fund Class A shares versus a similar investment in the Russell 2500 Growth Index (Russell 2500 Growth) and the Consumer Price Index (CPI).

The Russell 2500 Growth is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

Class I shares are only offered, subject to the minimum initial purchase requirements, in the following manner: (1) to investment advisory clients of EIMC (or its advisory affiliates), (2) to employer- or state-sponsored benefit plans, including but not limited to, retirement plans, defined benefit plans, deferred compensation plans, or savings plans, (3) to fee-based mutual fund wrap accounts, (4) through arrangements entered into on behalf of the Evergreen funds with certain financial services firms, (5) to certain institutional investors, and (6) to persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994 or who owned shares of any SouthTrust fund in registered name as of March 18, 2005 or who owned shares of Vestaur Securities Fund as of May 20, 2005.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

The fund’s investment objective may be changed without a vote of the fund’s shareholders.

Small and mid cap securities may be subject to special risks associated with narrower product lines and limited financial resources compared to their large cap counterparts, and, as a result, small and mid cap securities may decline significantly in market downturns and may be more volatile than those of larger companies due to the higher risk of failure.

All data is as of March 31, 2009, and subject to change.

5

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2008 to March 31, 2009.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value

10/1/2008 | | Ending

Account Value

3/31/2009 | | Expenses Paid

During Period* |

|

|

|

|

|

|

|

Actual | | | | | | | | |

Class A | | $1,000.00 | | $ | 751.88 | | | $5.33 |

Class I | | $1,000.00 | | $ | 751.63 | | | $4.24 |

Hypothetical

(5% return before expenses) | | | | | | | | |

Class A | | $1,000.00 | | $ | 1,018.85 | | | $6.14 |

Class I | | $1,000.00 | | $ | 1,020.09 | | | $4.89 |

|

|

|

|

|

|

|

|

|

* | For each class of the fund, expenses are equal to the annualized expense ratio of each class (1.22% for Class A and 0.97% for Class I), multiplied by the average account value over the period, multiplied by 182 / 365 days. |

6

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

CLASS A | | Six Months Ended

March 31, 2009

(unaudited) | | Year Ended September 30, | |

| |

2008 | | 2007 | | 20061 | |

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 10.64 | | $ | 14.73 | | $ | 11.53 | | $ | 10.00 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.02 | ) | | (0.08 | ) | | (0.11 | )2 | | (0.05 | ) |

Net realized and unrealized gains or losses on investments | | | (2.62 | ) | | (2.59 | ) | | 3.31 | | | 1.58 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (2.64 | ) | | (2.67 | ) | | 3.20 | | | 1.53 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | |

Net realized gains | | | 0 | | | (1.36 | ) | | 0 | | | 0 | |

Tax basis return of capital | | | 0 | | | (0.06 | ) | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | 0 | | | (1.42 | ) | | 0 | | | 0 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 8.00 | | $ | 10.64 | | $ | 14.73 | | $ | 11.53 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return3 | | | (24.81 | )% | | (20.01 | )% | | 27.75 | % | | 15.30 | % |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 17,661 | | $ | 26,497 | | $ | 45,706 | | $ | 3 | |

Ratios to average net assets | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 1.22 | %4 | | 1.18 | % | | 1.17 | % | | 1.18 | %4,5 |

Expenses excluding waivers/reimbursements and expense reductions | | | 1.82 | %4 | | 1.33 | % | | 1.28 | % | | 1.99 | %4 |

Net investment income (loss) | | | (0.08 | )%4 | | (0.48 | )% | | (0.79 | )% | | (0.66 | )%4 |

Portfolio turnover rate | | | 34 | % | | 129 | % | | 192 | % | | 132 | % |

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | For the period from October 11, 2005 (commencement of class operations), to September 30, 2006. |

2 | Net investment income (loss) per share is based on average shares outstanding during the period. |

3 | Excluding applicable sales charges |

5 | Including the expense reductions, the ratio would be 1.17%. |

See Notes to Financial Statements

7

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

CLASS I | | Six Months Ended

March 31, 2009

(unaudited) | | Year Ended September 30, | |

| |

2008 | | 2007 | | 20061 | |

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 10.71 | | $ | 14.77 | | $ | 11.54 | | $ | 10.00 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.01 | ) | | (0.03 | )2 | | (0.06 | )2 | | (0.02 | ) |

Net realized and unrealized gains or losses on investments | | | (2.65 | ) | | (2.61 | ) | | 3.30 | | | 1.56 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (2.66 | ) | | (2.64 | ) | | 3.24 | | | 1.54 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | |

Net investment income | | | 0 | | | 0 | | | (0.01 | ) | | 0 | |

Net realized gains | | | 0 | | | (1.36 | ) | | 0 | | | 0 | |

Tax basis return of capital | | | 0 | | | (0.06 | ) | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | 0 | | | (1.42 | ) | | (0.01 | ) | | 0 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 8.05 | | $ | 10.71 | | $ | 14.77 | | $ | 11.54 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return | | | (24.84 | )% | | (19.72 | )% | | 28.11 | % | | 15.40 | % |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 14,334 | | $ | 17,489 | | $ | 140,931 | | $ | 22,429 | |

Ratios to average net assets | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 0.97 | %3 | | 0.92 | % | | 0.92 | % | | 0.93 | %3,4 |

Expenses excluding waivers/reimbursements and expense reductions | | | 1.57 | %3 | | 1.04 | % | | 0.98 | % | | 1.74 | %3 |

Net investment income (loss) | | | (0.02 | )%3 | | (0.27 | )% | | (0.42 | )% | | (0.37 | )%3 |

Portfolio turnover rate | | | 34 | % | | 129 | % | | 192 | % | | 132 | % |

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | For the period from October 11, 2005 (commencement of class operations), to September 30, 2006. |

2 | Net investment income (loss) per share is based on average shares outstanding during the period. |

4 | Including the expense reductions, the ratio would be 0.92%. |

See Notes to Financial Statements

8

SCHEDULE OF INVESTMENTS

March 31, 2009 (unaudited)

| | Shares | | Value | |

|

|

|

|

| |

COMMON STOCKS 86.4% | | | | | | | |

CONSUMER DISCRETIONARY 15.7% | | | | | | | |

Diversified Consumer Services 4.8% | | | | | | | |

Capella Education Co. * | | | 13,157 | | $ | 697,321 | |

Strayer Education, Inc. | | | 4,600 | | | 827,402 | |

| | | | |

|

| |

| | | | | | 1,524,723 | |

| | | | |

|

| |

Hotels, Restaurants & Leisure 3.7% | | | | | | | |

Buffalo Wild Wings, Inc. * ρ | | | 19,548 | | | 715,066 | |

Penn National Gaming, Inc. * | | | 19,700 | | | 475,755 | |

| | | | |

|

| |

| | | | | | 1,190,821 | |

| | | | |

|

| |

Internet & Catalog Retail 1.0% | | | | | | | |

priceline.com, Inc. * | | | 4,200 | | | 330,876 | |

| | | | |

|

| |

Specialty Retail 4.9% | | | | | | | |

Aeropostale, Inc. * | | | 18,700 | | | 496,672 | |

GameStop Corp., Class A * | | | 15,000 | | | 420,300 | |

O’Reilly Automotive, Inc. * | | | 10,000 | | | 350,100 | |

PetSmart, Inc. | | | 14,800 | | | 310,208 | |

| | | | |

|

| |

| | | | | | 1,577,280 | |

| | | | |

|

| |

Textiles, Apparel & Luxury Goods 1.3% | | | | | | | |

Hanesbrands, Inc. * | | | 43,200 | | | 413,424 | |

| | | | |

|

| |

CONSUMER STAPLES 4.9% | | | | | | | |

Food Products 2.8% | | | | | | | |

Hain Celestial Group, Inc. * | | | 17,700 | | | 252,048 | |

Ralcorp Holdings, Inc. * | | | 11,600 | | | 625,008 | |

| | | | |

|

| |

| | | | | | 877,056 | |

| | | | |

|

| |

Personal Products 2.1% | | | | | | | |

Alberto-Culver Co. | | | 29,800 | | | 673,778 | |

| | | | |

|

| |

ENERGY 5.3% | | | | | | | |

Oil, Gas & Consumable Fuels 5.3% | | | | | | | |

Cabot Oil & Gas Corp. | | | 11,500 | | | 271,055 | |

Continental Resources, Inc. * | | | 19,700 | | | 417,837 | |

Denbury Resources, Inc. * | | | 25,677 | | | 381,560 | |

Southwestern Energy Co. * | | | 21,156 | | | 628,122 | |

| | | | |

|

| |

| | | | | | 1,698,574 | |

| | | | |

|

| |

FINANCIALS 3.0% | | | | | | | |

Commercial Banks 1.4% | | | | | | | |

Associated Banc-Corp. | | | 17,400 | | | 268,656 | |

PrivateBancorp, Inc. | | | 11,800 | | | 170,628 | |

| | | | |

|

| |

| | | | | | 439,284 | |

| | | | |

|

| |

Thrifts & Mortgage Finance 1.6% | | | | | | | |

NewAlliance Bancshares, Inc. | | | 45,000 | | | 528,300 | |

| | | | |

|

| |

See Notes to Financial Statements

9

SCHEDULE OF INVESTMENTS continued

March 31, 2009 (unaudited)

| | Shares | | Value | |

|

|

|

|

| |

COMMON STOCKS continued | | | | | | | |

HEALTH CARE 15.7% | | | | | | | |

Biotechnology 3.3% | | | | | | | |

Cephalon, Inc. * ρ | | | 9,940 | | $ | 676,914 | |

OSI Pharmaceuticals, Inc. * | | | 10,000 | | | 382,600 | |

| | | | |

|

| |

| | | | | | 1,059,514 | |

| | | | |

|

| |

Health Care Equipment & Supplies 3.1% | | | | | | | |

Hologic, Inc. * | | | 34,500 | | | 451,605 | |

ResMed, Inc. * | | | 15,300 | | | 540,702 | |

| | | | |

|

| |

| | | | | | 992,307 | |

| | | | |

|

| |

Health Care Providers & Services 0.8% | | | | | | | |

Psychiatric Solutions, Inc. * | | | 15,594 | | | 245,293 | |

| | | | |

|

| |

Life Sciences Tools & Services 7.4% | | | | | | | |

AMAG Pharmaceuticals, Inc. * | | | 15,300 | | | 562,581 | |

Covance, Inc. * | | | 6,600 | | | 235,158 | |

Life Technologies Corp. * | | | 19,000 | | | 617,120 | |

Pharmaceutical Product Development, Inc. | | | 15,700 | | | 372,404 | |

Qiagen NV * ρ | | | 37,100 | | | 592,116 | |

| | | | |

|

| |

| | | | | | 2,379,379 | |

| | | | |

|

| |

Pharmaceuticals 1.1% | | | | | | | |

Shire, Ltd., ADS | | | 10,000 | | | 359,400 | |

| | | | |

|

| |

INDUSTRIALS 16.0% | | | | | | | |

Commercial Services & Supplies 1.2% | | | | | | | |

Corrections Corporation of America * | | | 29,900 | | | 383,019 | |

| | | | |

|

| |

Electrical Equipment 5.6% | | | | | | | |

EnerSys, Inc. * | | | 49,400 | | | 598,728 | |

General Cable Corp. * | | | 29,800 | | | 590,636 | |

Roper Industries, Inc. | | | 14,240 | | | 604,488 | |

| | | | |

|

| |

| | | | | | 1,793,852 | |

| | | | |

|

| |

Machinery 2.6% | | | | | | | |

SPX Corp. | | | 13,300 | | | 625,233 | |

Wabtec | | | 8,400 | | | 221,592 | |

| | | | |

|

| |

| | | | | | 846,825 | |

| | | | |

|

| |

Professional Services 2.0% | | | | | | | |

FTI Consulting, Inc. * | | | 12,838 | | | 635,224 | |

| | | | |

|

| |

Road & Rail 1.7% | | | | | | | |

Landstar System, Inc. | | | 16,200 | | | 542,214 | |

| | | | |

|

| |

Trading Companies & Distributors 1.5% | | | | | | | |

MSC Industrial Direct Co., Class A | | | 15,825 | | | 491,683 | |

| | | | |

|

| |

Transportation Infrastructure 1.4% | | | | | | | |

Aegean Marine Petroleum Network, Inc. | | | 25,900 | | | 433,825 | |

| | | | |

|

| |

See Notes to Financial Statements

10

SCHEDULE OF INVESTMENTS continued

March 31, 2009 (unaudited)

| | Shares | | Value | |

|

|

|

|

| |

COMMON STOCKS continued | | | | | | | |

INFORMATION TECHNOLOGY 19.6% | | | | | | | |

Communications Equipment 3.8% | | | | | | | |

F5 Networks, Inc. * | | | 23,757 | | $ | 497,709 | |

NICE-Systems, Ltd., ADS * | | | 28,708 | | | 713,681 | |

| | | | |

|

| |

| | | | | | 1,211,390 | |

| | | | |

|

| |

Computers & Peripherals 1.4% | | | | | | | |

Synaptics, Inc. * ρ | | | 17,000 | | | 454,920 | |

| | | | |

|

| |

Electronic Equipment, Instruments & Components 1.6% | | | | | | | |

Flir Systems, Inc. * | | | 25,500 | | | 522,241 | |

| | | | |

|

| |

Internet Software & Services 1.1% | | | | | | | |

VistaPrint, Ltd. * | | | 12,700 | | | 349,123 | |

| | | | |

|

| |

IT Services 1.8% | | | | | | | |

Syntel, Inc. | | | 27,869 | | | 573,544 | |

| | | | |

|

| |

Semiconductors & Semiconductor Equipment 5.9% | | | | | | | |

Monolithic Power Systems, Inc. * | | | 40,594 | | | 629,207 | |

NetLogic Microsystems, Inc. ρ * | | | 27,500 | | | 755,700 | |

Power Integrations, Inc. * | | | 29,500 | | | 507,400 | |

| | | | |

|

| |

| | | | | | 1,892,307 | |

| | | | |

|

| |

Software 4.0% | | | | | | | |

Ansys, Inc. * | | | 23,100 | | | 579,810 | |

Quality Systems, Inc. ρ | | | 15,036 | | | 680,379 | |

| | | | |

|

| |

| | | | | | 1,260,189 | |

| | | | |

|

| |

MATERIALS 3.6% | | | | | | | |

Chemicals 3.6% | | | | | | | |

CF Industries Holdings, Inc. | | | 8,000 | | | 569,040 | |

Scotts Miracle-Gro Co., Class A | | | 16,500 | | | 572,550 | |

| | | | |

|

| |

| | | | | | 1,141,590 | |

| | | | |

|

| |

TELECOMMUNICATION SERVICES 2.6% | | | | | | | |

Wireless Telecommunication Services 2.6% | | | | | | | |

NII Holdings, Inc. * | | | 23,900 | | | 358,500 | |

Syniverse Holdings, Inc. * | | | 28,900 | | | 455,464 | |

| | | | |

|

| |

| | | | | | 813,964 | |

| | | | |

|

| |

Total Common Stocks (cost $33,635,277) | | | | | | 27,635,919 | |

| | | | |

|

| |

SHORT-TERM INVESTMENTS 14.5% | | | | | | | |

MUTUAL FUND SHARES 14.5% | | | | | | | |

Evergreen Institutional Money Market Fund, Class I, 0.76% q ρρ ø (cost $4,640,387) | | | 4,640,387 | | | 4,640,387 | |

| | | | |

|

| |

Total Investments (cost $38,275,664) 100.9% | | | | | | 32,276,306 | |

Other Assets and Liabilities (0.9%) | | | | | | (280,692 | ) |

| | | | |

|

| |

Net Assets 100.0% | | | | | $ | 31,995,614 | |

| | | | |

|

| |

See Notes to Financial Statements

11

SCHEDULE OF INVESTMENTS continued

March 31, 2009 (unaudited)

* | Non-income producing security |

ρ | All or a portion of this security is on loan. |

q | Rate shown is the 7-day annualized yield at period end. |

ρρ | All or a portion of this security represents investment of cash collateral received from securities on loan. |

ø | Evergreen Investment Management Company, LLC is the investment advisor to both the Fund and the money market fund. |

| |

Summary of Abbreviations |

ADS | American Depository Shares |

The following table shows the percent of total long-term investments by sector as of March 31, 2009:

Information Technology | 22.7 | % |

Industrials | 18.6 | % |

Consumer Discretionary | 18.3 | % |

Health Care | 18.2 | % |

Energy | 6.1 | % |

Consumer Staples | 5.6 | % |

Materials | 4.1 | % |

Financials | 3.5 | % |

Telecommunication Services | 2.9 | % |

|

| |

| 100.0 | % |

|

| |

See Notes to Financial Statements

12

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2009 (unaudited)

Assets | | | | |

Investments in unaffiliated issuers, at value (cost $33,635,277) including $3,455,523 of securities loaned | | $ | 27,635,919 | |

Investments in affiliated issuers, at value (cost $4,640,387) | | | 4,640,387 | |

|

|

|

| |

Total investments | | | 32,276,306 | |

Receivable for Fund shares sold | | | 3,208,276 | |

Dividends receivable | | | 13,085 | |

Receivable for securities lending income | | | 4,587 | |

Prepaid expenses and other assets | | | 21,644 | |

|

|

|

| |

Total assets | | | 35,523,898 | |

|

|

|

| |

Liabilities | | | | |

Payable for Fund shares redeemed | | | 34,929 | |

Payable for securities on loan | | | 3,479,272 | |

Advisory fee payable | | | 16 | |

Distribution Plan expenses payable | | | 120 | |

Due to other related parties | | | 96 | |

Printing and postage expenses payable | | | 8,742 | |

Accrued expenses and other liabilities | | | 5,109 | |

|

|

|

| |

Total liabilities | | | 3,528,284 | |

|

|

|

| |

Net assets | | $ | 31,995,614 | |

|

|

|

| |

Net assets represented by | | | | |

Paid-in capital | | $ | 46,579,809 | |

Undistributed net investment loss | | | (34,246 | ) |

Accumulated net realized losses on investments | | | (8,550,591 | ) |

Net unrealized losses on investments | | | (5,999,358 | ) |

|

|

|

| |

Total net assets | | $ | 31,995,614 | |

|

|

|

| |

Net assets consists of | | | | |

Class A | | $ | 17,661,207 | |

Class I | | | 14,334,407 | |

|

|

|

| |

Total net assets | | $ | 31,995,614 | |

|

|

|

| |

Shares outstanding (unlimited number of shares authorized) | | | | |

Class A | | | 2,208,895 | |

Class I | | | 1,780,207 | |

|

|

|

| |

Net asset value per share | | | | |

Class A | | $ | 8.00 | |

Class A — Offering price (based on sales charge of 5.75%) | | $ | 8.49 | |

Class I | | $ | 8.05 | |

|

|

|

| |

See Notes to Financial Statements

13

STATEMENT OF OPERATIONS

Six Months Ended March 31, 2009 (unaudited)

Investment income | | | | |

Dividends | | $ | 91,945 | |

Securities lending | | | 34,250 | |

Income from affiliated issuers | | | 13,161 | |

|

|

|

| |

Total investment income | | | 139,356 | |

|

|

|

| |

Expenses | | | | |

Advisory fee | | | 108,329 | |

Distribution Plan expenses | | | 23,062 | |

Administrative services fee | | | 15,476 | |

Transfer agent fees | | | 66,959 | |

Trustees’ fees and expenses | | | 644 | |

Printing and postage expenses | | | 12,765 | |

Custodian and accounting fees | | | 7,823 | |

Registration and filing fees | | | 16,971 | |

Professional fees | | | 12,416 | |

Other | | | 1,097 | |

|

|

|

| |

Total expenses | | | 265,542 | |

Less: Expense reductions | | | (37 | ) |

Fee waivers | | | (92,330 | ) |

|

|

|

| |

Net expenses | | | 173,175 | |

|

|

|

| |

Net investment loss | | | (33,819 | ) |

|

|

|

| |

Net realized and unrealized gains or losses on investments | | | | |

Net realized losses on securities in unaffiliated issuers | | | (7,545,380 | ) |

Net change in unrealized gains or losses on securities in unaffiliated issuers | | | (3,251,326 | ) |

|

|

|

| |

Net realized and unrealized gains or losses on investments | | | (10,796,706 | ) |

|

|

|

| |

Net decrease in net assets resulting from operations | | $ | (10,830,525 | ) |

|

|

|

| |

See Notes to Financial Statements

14

STATEMENTS OF CHANGES IN NET ASSETS

| | Six Months Ended

March 31, 2009

(unaudited) | | Year Ended

September 30, 2008 | |

|

|

|

|

|

|

|

|

|

|

| |

Operations | | | | | | | | | | | |

Net investment loss | | | | $ | (33,819 | ) | | | $ | (431,682 | ) |

Net realized gains or losses on investments | | | | | (7,545,380 | ) | | | | 1,925,332 | |

Net change in unrealized gains or losses on investments | | | | | (3,251,326 | ) | | | | (23,866,131 | ) |

|

|

|

|

|

|

|

|

|

|

| |

Net decrease in net assets resulting from operations | | | | | (10,830,525 | ) | | | | (22,372,481 | ) |

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | |

Net realized gains | | | | | | | | | | | |

Class A | | | | | 0 | | | | | (4,210,289 | ) |

Class I | | | | | 0 | | | | | (14,249,012 | ) |

Tax basis return of capital | | | | | | | | | | | |

Class A | | | | | 0 | | | | | (68,740 | ) |

Class I | | | | | 0 | | | | | (174,955 | ) |

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | | | 0 | | | | | (18,702,996 | ) |

|

|

|

|

|

|

|

|

|

|

| |

| | Shares | | | | | Shares | | | | |

|

|

|

|

|

|

|

|

|

|

| |

Capital share transactions | | | | | | | | | | | |

Proceeds from shares sold | | | | | | | | | | | |

Class A | | 84,113 | | | 671,849 | | 159,103 | | | 2,085,642 | |

Class I | | 610,840 | | | 4,840,704 | | 3,137,908 | | | 41,105,310 | |

|

|

|

|

|

|

|

|

|

|

| |

| | | | | 5,512,553 | | | | | 43,190,952 | |

|

|

|

|

|

|

|

|

|

|

| |

Net asset value of shares issued in reinvestment of distributions | | | | | | | | | | | |

Class A | | 0 | | | 0 | | 320,456 | | | 4,246,043 | |

Class I | | 0 | | | 0 | | 974,366 | | | 12,949,320 | |

|

|

|

|

|

|

|

|

|

|

| |

| | | | | 0 | | | | | 17,195,363 | |

|

|

|

|

|

|

|

|

|

|

| |

Payment for shares redeemed | | | | | | | | | | | |

Class A | | (364,950 | ) | | (2,940,943 | ) | (1,092,637 | ) | | (13,550,494 | ) |

Class I | | (464,194 | ) | | (3,731,345 | ) | (12,020,039 | ) | | (148,410,747 | ) |

|

|

|

|

|

|

|

|

|

|

| |

| | | | | (6,672,288 | ) | | | | (161,961,241 | ) |

|

|

|

|

|

|

|

|

|

|

| |

Net decrease in net assets resulting from capital share transactions | | | | | (1,159,735 | ) | | | | (101,574,926 | ) |

|

|

|

|

|

|

|

|

|

|

| |

Total decrease in net assets | | | | | (11,990,260 | ) | | | | (142,650,403 | ) |

Net assets | | | | | | | | | | | |

Beginning of period | | | | | 43,985,874 | | | | | 186,636,277 | |

|

|

|

|

|

|

|

|

|

|

| |

End of period | | | | $ | 31,995,614 | | | | $ | 43,985,874 | |

|

|

|

|

|

|

|

|

|

|

| |

Undistributed net investment loss | | | | $ | (34,246 | ) | | | $ | (427 | ) |

|

|

|

|

|

|

|

|

|

|

| |

See Notes to Financial Statements

15

NOTES TO FINANCIAL STATEMENTS (unaudited)

1. ORGANIZATION

Evergreen Small-Mid Growth Fund (the “Fund”) is a diversified series of Evergreen Equity Trust (the “Trust”), a Delaware statutory trust organized on September 18, 1997. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund offers Class A and Class I shares. Class A shares are sold with a front-end sales charge. However, Class A share investments of $1 million or more are not subject to a front-end sales charge but are subject to a contingent deferred sales charge of 1.00% upon redemption within 18 months. Class I shares are sold without a front-end sales charge or contingent deferred sales charge. Class A shares pay an ongoing distribution fee.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America, which require management to make estimates and assumptions that affect amounts reported herein. Actual results could differ from these estimates.

a. Valuation of investments

Listed equity securities are usually valued at the last sales price or official closing price on the national securities exchange where the securities are principally traded.

Short-term securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates fair value.

Investments in open-end mutual funds are valued at net asset value. Securities for which market quotations are not readily available or not reflective of current fair value are valued at fair value as determined by the investment advisor in good faith, according to procedures approved by the Board of Trustees.

b. Repurchase agreements

Securities pledged as collateral for repurchase agreements are held by the custodian bank or in a segregated account in the Fund’s name until the agreements mature. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the Fund and the counterparty. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. However, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings. The Fund will only enter into repurchase agreements with banks and other financial institutions, which are deemed by the investment advisor to be creditworthy pursuant to guidelines established by the Board of Trustees. In certain instances, the Fund’s securities lending agent may provide collateral in the form of repurchase agreements.

16

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

c. Securities lending

The Fund may lend its securities to certain qualified brokers in order to earn additional income. The Fund receives compensation in the form of fees or interest earned on the investment of any cash collateral received. The Fund also continues to receive interest and dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a market value at least equal to the market value of the securities on loan. In the event of default or bankruptcy by the borrower, the Fund could experience delays and costs in recovering the loaned securities or in gaining access to the collateral. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

d. Security transactions and investment income

Security transactions are recorded on trade date. Realized gains and losses are computed using the specific cost of the security sold. Dividend income is recorded on the ex-dividend date.

e. Federal and other taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income, including any net capital gains (which have already been offset by available capital loss carryovers). Accordingly, no provision for federal taxes is required. The Fund’s income and excise tax returns and all financial records supporting those returns for the prior three fiscal years are subject to examination by the federal, Massachusetts and Delaware revenue authorities.

f. Distributions

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

g. Class allocations

Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

3. ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Evergreen Investment Management Company, LLC (“EIMC”), a subsidiary of Wells Fargo & Company (“Wells Fargo”), is the investment advisor to the Fund and is paid an annual fee starting at 0.70% and declining to 0.65% as average daily net assets increase. For the six months ended March 31, 2009, the advisory fee was equivalent to an annual rate of 0.70% of the Fund’s average daily net assets.

17

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

On October 3, 2008, Wells Fargo and Wachovia Corporation (“Wachovia”) announced that Wells Fargo agreed to acquire Wachovia in a whole company transaction that would include all of Wachovia’s banking and other businesses. In connection with this transaction, Wachovia issued preferred shares to Wells Fargo representing approximately a 40% voting interest in Wachovia. Due to its ownership of preferred shares, Wells Fargo may have been deemed to control EIMC. If Wells Fargo was deemed to control EIMC, then the existing advisory agreement between the Fund and EIMC would have terminated automatically in connection with the issuance of preferred shares. To address this possibility, on October 20, 2008 the Board of Trustees approved an interim advisory agreement with EIMC with the same terms and conditions as the existing agreement which became effective upon the issuance of the preferred shares. EIMC’s receipt of the advisory fees under the interim advisory agreement was subject to the approval by shareholders of the Fund of a new advisory agreement with EIMC.

On December 31, 2008, Wachovia merged with and into Wells Fargo and as a result of the merger, EIMC, Evergreen Investment Services, Inc. (“EIS”) and Evergreen Service Company, LLC (“ESC”) became subsidiaries of Wells Fargo. After the merger, a new interim advisory agreement with the same terms and conditions between the Fund and EIMC went into effect.

Shareholders approved the new advisory agreement between the Fund and EIMC on February 12, 2009.

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. During the six months ended March 31, 2009, EIMC voluntarily waived its advisory fee in the amount of $92,330.

The Fund may invest in money market funds which are advised by EIMC. Income earned on these investments is included in income from affiliated issuers on the Statement of Operations.

EIMC also serves as the administrator to the Fund providing the Fund with facilities, equipment and personnel. EIMC is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds) starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds) increase. For the six months ended March 31, 2009, the administrative services fee was equivalent to an annual rate of 0.10% of the Fund’s average daily net assets.

ESC, an affiliate of EIMC and a subsidiary of Wells Fargo, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund. For the six months ended March 31, 2009, the transfer agent fees were equivalent to an annual rate of 0.43% of the Fund’s average daily net assets.

18

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

Wachovia Bank NA, a subsidiary of Wells Fargo and an affiliate of EIMC, through its securities lending division, Wachovia Global Securities Lending, acts as the securities lending agent for the Fund (see Note 5).

The Fund has placed a portion of its portfolio transactions with brokerage firms that are affiliates of Wells Fargo. During the six months ended March 31, 2009, the Fund paid brokerage commissions of $2,770 to Wachovia Securities, LLC, a broker-dealer affiliated with Wells Fargo.

4. DISTRIBUTION PLAN

EIS, an affiliate of EIMC and a subsidiary of Wells Fargo, serves as distributor of the Fund’s shares. The Fund has adopted a Distribution Plan, as allowed by Rule 12b-1 of the 1940 Act, for Class A shares. Under the Distribution Plan, the Fund is permitted to pay distribution fees at an annual rate of up to 0.75% of the average daily net assets for Class A shares. However, currently the distribution fees for Class A shares are limited to 0.25% of the average daily net assets of the class.

For the six months ended March 31, 2009, EIS received $403 from the sale of Class A shares.

5. INVESTMENT TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were $10,465,200 and $13,201,611, respectively, for the six months ended March 31, 2009.

On October 1, 2008, the Fund implemented Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”). FAS 157 establishes a single authoritative definition of fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. FAS 157 establishes a fair value hierarchy based upon the various inputs used in determining the value of the Fund’s investments. These inputs are summarized into three broad levels as follows:

Level 1 – quoted prices in active markets for identical securities Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

19

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

As of March 31, 2009, the inputs used in valuing the Fund’s assets, which are carried at fair value, were as follows:

Valuation Inputs | | Investments in

Securities | |

|

|

|

|

Level 1 – Quoted Prices | | $ | 32,276,306 | |

Level 2 – Other Significant Observable Inputs | | | 0 | |

Level 3 – Significant Unobservable Inputs | | | 0 | |

|

|

|

|

|

Total | | $ | 32,276,306 | |

|

|

|

|

|

During the six months ended March 31, 2009, the Fund loaned securities to certain brokers and earned $34,250, net of $3,238 paid to Wachovia Global Securities Lending as the securities lending agent. At March 31, 2009, the value of securities on loan and the total value of collateral received for securities loaned amounted to $3,455,523 and $3,479,272, respectively.

On March 31, 2009, the aggregate cost of securities for federal income tax purposes was $39,464,143. The gross unrealized appreciation and depreciation on securities based on tax cost was $185,976 and $7,373,813, respectively, with a net unrealized depreciation of $7,187,837.

For income tax purposes, capital losses incurred after October 31 within the Fund’s fiscal year are deemed to arise on the first business day of the following fiscal year. As of September 30, 2008, the Fund incurred and elected to defer post-October losses of $174,637.

6. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an interfund lending program with certain funds in the Evergreen fund family. This program allows the Fund to borrow from, or lend money to, other participating funds. During the six months ended March 31, 2009, the Fund did not participate in the interfund lending program.

7. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund’s custodian, a portion of fund expenses has been reduced.

8. DEFERRED TRUSTEES’ FEES

Each Trustee of the Fund may defer any or all compensation related to performance of his or her duties as a Trustee. The Trustees’ deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts is based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported

20

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

in the Fund’s Trustees’ fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

9. FINANCING AGREEMENT

The Fund and certain other Evergreen funds share in a $100 million unsecured revolving credit commitment for temporary and emergency purposes, including the funding of redemptions, as permitted by each participating fund’s borrowing restrictions. Borrowings under this facility bear interest at 0.50% per annum above the Federal Funds rate. All of the participating funds are charged an annual commitment fee of 0.09% on the unused balance, which is allocated pro rata. During the six months ended March 31, 2009, the Fund had no borrowings.

10. REGULATORY MATTERS AND LEGAL PROCEEDINGS

The Evergreen funds, EIMC and certain of EIMC’s affiliates are involved in various legal actions, including private litigation and class action lawsuits, and are and may in the future be subject to regulatory inquiries and investigations.

The SEC and the Secretary of the Commonwealth, Securities Division, of the Commonwealth of Massachusetts are conducting separate investigations of EIMC, EIS and Evergreen Ultra Short Opportunities Fund (the “Ultra Short Fund”) concerning alleged issues surrounding the drop in net asset value of the Ultra Short Fund in May and June 2008. In addition, three purported class actions have been filed in the U.S. District Court for the District of Massachusetts relating to the same events; defendants include various Evergreen entities, including EIMC and EIS, and Evergreen Fixed Income Trust and its Trustees. The cases generally allege that investors in the Ultra Short Fund suffered losses as a result of (i) misleading statements in Ultra Short Fund’s registration statement and prospectus, (ii) the failure to accurately price securities in the Ultra Short Fund at different points in time and (iii) the failure of the Ultra Short Fund’s risk disclosures and description of its investment strategy to inform investors adequately of the actual risks of the fund.

EIMC does not expect that any of the legal actions, inquiries or investigations currently pending or threatened will have a material adverse impact on the financial position or operations of the Fund to which these financial statements relate. Any publicity surrounding or resulting from any legal actions or regulatory inquiries involving EIMC or its affiliates or any of the Evergreen Funds could result in reduced sales or increased redemptions of Evergreen fund shares, which could increase Evergreen fund transaction costs or operating expenses or have other adverse consequences on the Evergreen funds, including the Fund.

21

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

11. NEW ACCOUNTING PRONOUNCEMENT

In April 2009, FASB issued FASB Staff Position No. FAS 157-4, Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly (“FAS 157-4”). FAS 157-4 provides additional guidance for determining fair value when the volume and level of activity for an asset or a liability have significantly decreased and identifying transactions that are not orderly. FAS 157-4 requires enhanced disclosures about the inputs and valuation technique(s) used to measure fair value and a discussion of changes in valuation techniques and related inputs, if any, during the period. In addition, the three-level hierarchy disclosure and the level three roll-forward disclosure will be expanded for each major category of assets. Management of the Fund does not believe the adoption of FAS 157-4 will materially impact the financial statement amounts, but will require additional disclosures. FAS 157-4 is effective for interim and annual reporting periods ending after June 15, 2009.

22

ADDITIONAL INFORMATION (unaudited)

SPECIAL MEETING OF SHAREHOLDERS

On February 12, 2009, a Special Meeting of Shareholders for the Fund was held to consider a number of proposals. On December 1, 2008, the record date for the meeting, the Fund had $28,939,615 of net assets outstanding of which $17,883,966 (61.80%) of net assets were represented at the meeting.