Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

Evergreen Investment Management Company, LLC (“EIMC”), a subsidiary of Wells Fargo & Company (“Wells Fargo”), is the investment advisor to the Fund and is paid an annual fee starting at 0.51% and declining to 0.26% as average daily net assets increase. For the year ended September 30, 2009, the advisory fee was equivalent to an annual rate of 0.51% of the Fund’s average daily net assets.

On October 3, 2008, Wells Fargo and Wachovia Corporation (“Wachovia”) announced that Wells Fargo agreed to acquire Wachovia in a whole company transaction that would include all of Wachovia’s banking and other businesses. In connection with this transaction, Wachovia issued preferred shares to Wells Fargo representing approximately a 40% voting interest in Wachovia. Due to its ownership of preferred shares, Wells Fargo may have been deemed to control EIMC. If Wells Fargo was deemed to control EIMC, then the existing advisory agreement between the Fund and EIMC would have terminated automatically in connection with the issuance of preferred shares. To address this possibility, on October 20, 2008 the Board of Trustees approved an interim advisory agreement with EIMC with the same terms and conditions as the existing agreement which became effective upon the issuance of the preferred shares. EIMC’s receipt of the advisory fees under the interim advisory agreement was subject to the approval by shareholders of the Fund of a new advisory agreement with EIMC.

On December 31, 2008, Wachovia merged with and into Wells Fargo and as a result of the merger, EIMC, Evergreen Investment Services, Inc. (“EIS”) and Evergreen Service Company, LLC (“ESC”) became subsidiaries of Wells Fargo. After the merger, a new interim advisory agreement with the same terms and conditions between the Fund and EIMC went into effect.

Shareholders approved the new advisory agreement between the Fund and EIMC on February 12, 2009.

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. During the year ended September 30, 2009, EIMC voluntarily waived its advisory fee in the amount of $112.

The Fund may invest in money market funds which are advised by EIMC. Income earned on these investments is included in income from affiliated issuers on the Statement of Operations.

NOTES TO FINANCIAL STATEMENTS continued

EIMC also serves as the administrator to the Fund providing the Fund with facilities, equipment and personnel. EIMC is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds) starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds) increase. For the year ended September 30, 2009, the administrative services fee was equivalent to an annual rate of 0.10% of the Fund’s average daily net assets.

ESC, an affiliate of EIMC and a subsidiary of Wells Fargo, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund. For the year ended September 30, 2009, the transfer agent fees were equivalent to an annual rate of 0.18% of the Fund’s average daily net assets.

Wachovia Bank NA, a subsidiary of Wells Fargo and an affiliate of EIMC, through its securities lending division, Wachovia Global Securities Lending, acts as the securities lending agent for the Fund (see Note 5).

The Fund has placed a portion of its portfolio transactions with brokerage firms that are affiliates of Wells Fargo. During the year ended September 30, 2009, the Fund paid brokerage commissions of $4,939 to broker-dealers affiliated with Wells Fargo.

4. DISTRIBUTION PLANS

EIS, an affiliate of EIMC and a subsidiary of Wells Fargo, serves as distributor of the Fund’s shares. The Fund has adopted Distribution Plans, as allowed by Rule 12b-1 of the 1940 Act, for each class of shares, except Class I. Under the Distribution Plans, the Fund is permitted to pay distribution fees at an annual rate of up to 0.75% of the average daily net assets for Class A shares and up to 1.00% of the average daily net assets for each of Class B and Class C shares. However, currently the distribution fees for Class A shares are limited to 0.25% of the average daily net assets of the class.

For the year ended September 30, 2009, EIS received $14,089 from the sale of Class A shares and $34, $19,216 and $2,043 in contingent deferred sales charges from redemptions of Class A, Class B and Class C shares, respectively.

5. INVESTMENT TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were $60,176,850 and $62,118,153, respectively, for the year ended September 30, 2009.

27

NOTES TO FINANCIAL STATEMENTS continued

Fair value measurements are determined within a framework that has established a fair value hierarchy based upon the various data inputs utilized in determining the value of the Fund’s investments. These inputs are summarized into three broad levels as follows:

Level 1 – quoted prices in active markets for identical securities Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of September 30, 2009, the inputs used in valuing the Fund’s assets, which are carried at fair value, were as follows:

| | | | | Significant | | | | | | |

| | | | | Other | | Significant | | | | |

| | | | | Observable | | Unobservable | | | | |

| | Quoted Prices | | Inputs | | Inputs | | | | |

Investments in Securities | | (Level 1) | | (Level 2) | | (Level 3) | | | Total | |

|

|

|

|

|

|

|

|

|

|

| |

Equity securities | | | | | | | | | | | |

Common stocks | | $ | 298,313,067 | | $ | 0 | | $ | 0 | | $ | 298,313,067 | |

Short-term investments | | | 38,358,950 | | | 0 | | | 0 | | | 38,358,950 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | $ | 336,672,017 | | $ | 0 | | $ | 0 | | $ | 336,672,017 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Further details on the major security types listed above can be found in the Schedule of Investments.

During the year ended September 30, 2009, the Fund loaned securities to certain brokers and earned $350,926, net of $39,075 paid to Wachovia Global Securities Lending as the securities lending agent. At September 30, 2009, the value of securities on loan and the total value of collateral received for securities loaned (including segregated cash) amounted to $34,858,555 and $36,110,473, respectively.

On September 30, 2009, the aggregate cost of securities for federal income tax purposes was $316,183,158. The gross unrealized appreciation and depreciation on securities based on tax cost was $41,234,703 and $20,745,844, respectively, with a net unrealized appreciation of $20,488,859.

As of September 30, 2009, the Fund had $63,677,014 in capital loss carryovers for federal income tax purposes with $24,379,268 expiring in 2010, $37,876,227 expiring in 2011 and $1,421,519 expiring in 2017.

For income tax purposes, capital losses incurred after October 31 within the Fund’s fiscal year are deemed to arise on the first business day of the following fiscal year. As of September 30, 2009, the Fund incurred and will elect to defer post-October losses of $12,388,598.

28

NOTES TO FINANCIAL STATEMENTS continued

6. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an interfund lending program with certain funds in the Evergreen fund family. This program allows the Fund to borrow from, or lend money to, other participating funds. During the year ended September 30, 2009, the Fund did not participate in the interfund lending program.

7. DISTRIBUTIONS TO SHAREHOLDERS

As of September 30, 2009, the components of distributable earnings on a tax basis were as follows:

Undistributed | | Capital Loss

Carryovers and | Temporary |

Ordinary | Unrealized | Post-October | Book/Tax |

Income | Appreciation | Losses | Differences |

|

|

|

|

$2,019,505 | $20,488,859 | $76,065,612 | $(32,851) |

|

|

|

|

The differences between the components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales. The temporary book/tax differences are a result of timing differences between book and tax recognition of income and/or expenses.

The tax character of distributions paid were $1,374,060 and $233,744 of ordinary income for the years ended September 30, 2009 and September 30, 2008, respectively.

8. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund’s custodian, a portion of fund expenses has been reduced.

9. DEFERRED TRUSTEES’ FEES

Each Trustee of the Fund may defer any or all compensation related to performance of his or her duties as a Trustee. The Trustees’ deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts is based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported in the Fund’s Trustees’ fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

10. FINANCING AGREEMENT

The Fund and certain other Evergreen funds share in a $100 million unsecured revolving credit commitment for temporary and emergency purposes, including the funding of redemptions, as permitted by each participating fund’s borrowing restrictions. Borrowings under this facility bear interest at the higher of the Federal Funds rate plus 1.25% or

29

NOTES TO FINANCIAL STATEMENTS continued

LIBOR plus 1.25%. Prior to June 26, 2009, the interest rate was 0.50% per annum above the Federal Funds rate. All of the participating funds are charged an annual commitment fee of 0.145% on the unused balance, which is allocated pro rata. Prior to June 26, 2009, the annual commitment fee was 0.09%. During the year ended September 30, 2009, the Fund had no borrowings.

11. REGULATORY MATTERS AND LEGAL PROCEEDINGS

The Evergreen funds, EIMC and certain of EIMC’s affiliates are involved in various legal actions, including private litigation and class action lawsuits, and are and may in the future be subject to regulatory inquiries and investigations.

EIMC and EIS have reached final settlements with the Securities and Exchange Commission (“SEC”) and the Securities Division of the Secretary of the Commonwealth of Massachusetts (“Commonwealth”) primarily relating to the liquidation of Evergreen Ultra Short Opportunities Fund (“Ultra Short Fund”). The claims settled include the following: first, that during the period February 2007 through Ultra Short Fund’s liquidation on June 18, 2008, Ultra Short Fund’s former portfolio management team failed to properly take into account readily-available information in valuing certain non-agency residential mortgage-backed securities held by the Ultra Short Fund, resulting in the Ultra Short Fund’s net asset value (“NAV”) being overstated during the period; second, that EIMC and EIS acted inappropriately when, in an effort to explain the decline in Ultra Short Fund’s NAV, certain information regarding the decline was communicated to some, but not all, shareholders and financial intermediaries; third, that the Ultra Short Fund portfolio management team did not adhere to regulatory requirements for affiliated cross trades in executing trades with other Evergreen funds; and finally, that from at least September 2007 to August 2008, EIS did not preserve certain text and instant messages transmitted via personal digital assistant devices. In settling these matters, EIMC and EIS have agreed to payments totaling $41,125,000, up to $40,125,000 of which will be distributed to eligible shareholders of Ultra Short Fund pursuant to a methodology and plan approved by the regulators. EIMC and EIS neither admitted nor denied the regulators’ conclusions.

Three purported class actions have also been filed in the U.S. District Court for the District of Massachusetts relating to the same events; defendants include various Evergreen entities, including EIMC and EIS, and Evergreen Fixed Income Trust and its Trustees. The cases generally allege that investors in the Ultra Short Fund suffered losses as a result of (i) misleading statements in Ultra Short Fund’s registration statement and prospectus, (ii) the failure to accurately price securities in the Ultra Short Fund at different points in time and (iii) the failure of the Ultra Short Fund’s risk disclosures and description of its investment strategy to inform investors adequately of the actual risks of the fund.

30

NOTES TO FINANCIAL STATEMENTS continued

EIMC does not expect that any of the legal actions, inquiries or settlement of regulatory matters will have a material adverse impact on the financial position or operations of the Fund to which these financial statements relate. Any publicity surrounding or resulting from any legal actions or regulatory inquiries involving EIMC or its affiliates or any of the Evergreen Funds could result in reduced sales or increased redemptions of Evergreen fund shares, which could increase Evergreen fund transaction costs or operating expenses or have other adverse consequences on the Evergreen funds, including the Fund.

31

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Trustees and Shareholders

Evergreen Equity Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Evergreen Large Company Growth Fund, a series of the Evergreen Equity Trust, as of September 30, 2009 and the related statement of operations for the year then ended, statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2009 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Evergreen Large Company Growth Fund as of September 30, 2009, the results of its operations, changes in its net assets and financial highlights for each of the years described above, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

November 24, 2009

32

ADDITIONAL INFORMATION (unaudited)

FEDERAL TAX DISTRIBUTIONS

For corporate shareholders, 100% of ordinary income dividends paid during the fiscal year ended September 30, 2009 qualified for the dividends received deduction.

With respect to dividends paid from investment company taxable income during the fiscal year ended September 30, 2009, the Fund designates 100% of ordinary income and any short-term capital gain distributions as Qualified Dividend Income in accordance with the Internal Revenue Code. Complete 2009 year-end tax information will be reported on your 2009 Form 1099-DIV, which shall be provided to you in early 2010.

33

ADDITIONAL INFORMATION (unaudited) continued

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S INVESTMENT ADVISORY AGREEMENT

Each year, as required by law, the Fund’s Board of Trustees determines whether to approve the continuation of the Fund’s investment advisory agreements. At an in person meeting on September 23-24, 2009, the Trustees, including a majority of the Trustees who are not “interested persons” (as that term is defined in the 1940 Act) of the Fund or EIMC (the “independent Trustees”), approved the continuation of the Fund’s investment advisory agreements. (References below to the “Fund” are to Evergreen Large Company Growth Fund; references to the “funds” are to the Evergreen funds generally.)

At the same time, the Trustees considered the continuation of the investment advisory agreements for all of the Evergreen funds. The description below refers in many cases to the Trustees’ process for considering, and conclusions regarding, all of the funds’ agreements. In all of their deliberations, the Board of Trustees and the independent Trustees were advised by independent counsel to the independent Trustees and counsel to the funds.

The review process. In connection with its review of the funds’ investment advisory agreements, the Board of Trustees requests and evaluates, and EIMC and any sub-advisors are required to furnish, such information as the Trustees consider to be reasonably necessary in the circumstances. Over the course of the year preceding their September 2009 meeting, the Trustees regularly reviewed information regarding the investment performance of all of the funds. As part of their ongoing review of investment performance, the Trustees monitored for changes in performance and for the results of any changes in a fund’s investment process or investment team. The Trustees paid particular attention to funds whose performance since September 2008 (when the Trustees completed their 2008 review of the funds’ investment advisory agreements) indicated short-term or longer-term performance issues and to funds that they had identified during their 2008 review process as having short- or longer-term performance issues.

In spring 2009, a committee of the Board of Trustees (the “Committee”), working with EIMC management, determined generally the types of information the Trustees would review as part of the 2009 review process and set a timeline detailing the information required and the dates for its delivery to the Trustees. The Board engaged the independent data provider Keil Fiduciary Strategies LLC (“Keil”) to provide fund-specific and industry-wide data containing information of a nature and in a format generally prescribed by the Committee, and the Committee worked with Keil and EIMC to develop appropriate groups of peer funds for each fund. The Committee also identified a number of expense, performance, and other areas of review and requested specific information as to those areas of review.

The Trustees formed small groups to review individual funds in greater detail. They reviewed, with the assistance of an independent industry consultant that they retained, the

34

ADDITIONAL INFORMATION (unaudited) continued

information that EIMC and Keil provided. In addition, the Trustees considered information regarding, among other things, the funds’ brokerage practices, the funds’ use of derivatives, analyst and research support available to the portfolio management teams, risk management practices, and certain fall-out benefits received directly and indirectly by EIMC and its affiliates from the funds. The Trustees requested and received additional information following that review.

In December 2008 Wells Fargo & Company (“Wells Fargo”) acquired Wachovia Corporation (“Wachovia”), EIMC’s parent company. Wells Fargo and EIMC have taken steps to combine the operations of Wells Fargo’s investment management affiliates and EIMC during the past year and have proposed to the Trustees the combination of the mutual fund families managed by them. During the course of the year, and during their review, the Trustees requested and received information about Wells Fargo and its advisory and broker-dealer operations, the status of efforts to combine the Wells Fargo and Evergreen investment management operations, and the effects on the funds and on the services provided by EIMC and its affiliates to the funds. In their deliberations, the Trustees were mindful that it was possible that the proposed combination of the two fund families might be effected during the coming 12-month period.

The Committee met several times by telephone during the 2009 review process to consider the information provided to it. The Committee then met with representatives of EIMC and its affiliates, including Wells Fargo. In addition, during the course of their review, the Trustees discussed the continuation of the funds’ advisory agreements with representatives of EIMC, and in meetings with independent legal counsel in multiple private sessions at which no personnel of EIMC were present. At a meeting of the full Board of Trustees held on September 23-24, 2009, the Committee reported the results of its discussions with EIMC. The full Board met with representatives of EIMC and its affiliates and engaged in further review of the materials provided to it, after which the independent Trustees and the full Board approved the continuation of each of the advisory and sub-advisory agreements.

The Trustees’ determination to approve the continuation of the advisory and sub-advisory agreements was based on a comprehensive evaluation of all of the information provided to them. In considering the continuation of the agreements, the Trustees did not identify any particular information or consideration that was all-important or controlling, and each Trustee attributed different weights to various factors. The Trustees evaluated information provided to them both in terms of the funds generally and with respect to each fund, including the Fund, specifically as they considered appropriate. Although the Trustees considered the continuation of the agreements for each of the funds as part of the larger process of considering the continuation of the advisory contracts for all of the funds, their determination to continue the advisory agreements for each of the funds was ultimately made on a fund-by-fund basis.

35

ADDITIONAL INFORMATION (unaudited) continued

This summary describes a number of the most important, but not necessarily all, of the factors considered by the Board and the independent Trustees.

Information reviewed. The Board of Trustees and committees of the Board of Trustees met periodically during the course of the year. EIMC presented a wide variety of information at those meetings regarding the services it provides for the funds, the investment performance of the funds, and other aspects of the business and operations of the funds. At those meetings, and in the process of considering the continuation of the agreements, the Trustees considered information regarding, for example, the funds’ investment results; the portfolio management teams for the funds and the experience of the members of the teams, and any recent changes in the membership of the teams; portfolio trading practices; compliance by the funds and EIMC with applicable laws and regulations and with the funds’ and EIMC’s compliance policies and procedures; risk evaluation and oversight procedures at EIMC; services provided by affiliates of EIMC to the funds and shareholders of the funds; and other information relating to the nature, extent, and quality of services provided by EIMC. The Trustees considered a number of changes in portfolio management personnel at EIMC and its advisory affiliates in the year since September 2008. The Trustees also considered changes in personnel at the funds and EIMC, including the appointment of a new President of the funds, who also serves as President and Chief Operating Officer of EIMC, and a new Chief Investment Officer of EIMC in August of 2008.

The Trustees considered the rates at which the funds pay investment advisory fees, and the efforts generally by EIMC and its affiliates as sponsors of the funds. The data provided by Keil showed the management fees paid by each fund in comparison to the management fees of other peer mutual funds, in addition to data regarding the investment performance of the funds in comparison to other peer mutual funds. The Trustees were assisted by an independent industry consultant in reviewing the information presented to them.

The Trustees noted that, in certain cases, EIMC and/or its affiliates provide advisory services to other clients that are comparable to the advisory services they provide to certain funds. The Trustees considered the information EIMC provided regarding the rates at which those other clients pay advisory fees to EIMC. Fees charged to those other clients were generally lower than those charged to the respective funds. In respect of these other accounts, EIMC noted that the compliance, reporting, and other legal burdens of providing investment advice to mutual funds generally exceed those required to provide advisory services to non-mutual fund clients such as retirement or pension plans.

The Trustees considered the transfer agency fees paid by the funds to an affiliate of EIMC. They reviewed information presented to them showing that the transfer agency fees charged to the funds were generally consistent with industry norms.

36

ADDITIONAL INFORMATION (unaudited) continued

The Trustees also considered that EIMC serves as administrator to the funds and receives a fee for its services as administrator. In their comparison of fees paid by the funds with those paid by other mutual funds, the Trustees considered administrative fees paid by the funds and those other mutual funds. They considered that EIS, an affiliate of EIMC, would serve as distributor to the funds until January 3, 2010, and that Wells Fargo Funds Distributor, LLC, also an affiliate of EIMC, would serve as distributor to the funds beginning on January 4, 2010, and noted that the distributor receives fees from the funds for those services. The Trustees also considered other so-called “fall-out” benefits to EIMC and its affiliates due to their other relationships with the funds, including, for example, soft-dollar services received by EIMC attributable to transactions entered into by EIMC on behalf of the funds and brokerage commissions received by Wells Fargo Advisors, LLC (“Wells Fargo Advisors”) (formerly Wachovia Securities, LLC), an affiliate of EIMC, from transactions effected by it for the funds. The Trustees noted that the funds pay sub-transfer agency fees to various financial institutions, including Wells Fargo Advisors and its affiliates, that hold fund shares in omnibus accounts, and that an affiliate of EIMC receives fees for administering the sub-transfer agency payment program. In reviewing the services provided by an affiliate of EIMC, the Trustees noted that the affiliate of EIMC that provides transfer agency services to the funds had won recognition from Dalbar customer service each year since 1998, and also won recognition from National Quality Review for customer service and for accuracy in processing transactions in 2008. They also considered that Wells Fargo Advisors and its affiliates receive distribution-related fees and shareholder servicing payments (including amounts derived from payments under the funds’ Rule 12b-1 plans) in respect of shares sold or held through them and that an affiliate of EIMC receives compensation for serving as a securities lending agent for a number of the funds.

The Trustees considered regulatory actions taken against EIMC or its affiliates in the past year, and on-going reviews of the operations of EIMC and its affiliates as they might affect the funds. They considered the findings of the regulators, the cooperation of EIMC and its affiliates with those regulators and with the Trustees in respect of those actions and reviews, and the remedial steps EIMC and its affiliates have taken in response. They also considered the scope and nature of on-going reviews being conducted by EIMC and its affiliates, and communications to the Trustees relating to those reviews.

Nature and quality of the services provided. The Trustees considered that EIMC and its affiliates generally provide a comprehensive investment management service to the funds. They noted that EIMC formulates and implements an investment program for the Fund. They noted that EIMC makes its personnel available to serve as officers of the funds, and concluded that the reporting and management functions provided by EIMC with respect to the funds were generally satisfactory. The Trustees considered the investment philosophy of the Fund’s portfolio management team and the in-house research

37

ADDITIONAL INFORMATION (unaudited) continued

capabilities of EIMC and its affiliates, as well as other resources available to EIMC, including research services available to it from third parties.

The Trustees considered the managerial and financial resources available to EIMC and its affiliates and the commitment that the Evergreen/Wells Fargo organization has made to the funds generally. They considered assurances from representatives of Wells Fargo that the merger of Wells Fargo and Wachovia and the integration of those firms’ advisory and broker-dealer operations was not expected to result in any adverse effect on the funds, on the quality and level of services that EIMC provides to the funds, or on the resources available to the funds and to EIMC, and that Wells Fargo is committed to continue providing the funds with high-quality services.

The Trustees noted the resources EIMC and its affiliates have committed to the regulatory, compliance, accounting, tax and oversight of tax reporting, and shareholder servicing functions, and the number and quality of staff committed to those functions, which they concluded were appropriate and generally in line with EIMC’s responsibilities to the Fund and to the funds generally. The Board and the independent Trustees concluded, within the context of their overall conclusions regarding the funds’ advisory agreements, that they were generally satisfied with the nature, extent, and quality of the services provided by EIMC, including services provided by EIMC under its administrative services agreements with the funds. They determined that the nature and scope of the services provided by EIMC were consistent with EIMC’s duties under the investment advisory agreements and appropriate and consistent with the investment programs and best interests of the funds.

Investment performance. The Trustees considered the investment performance of each fund, both by comparison to other comparable mutual funds and to broad market indices. Although the Trustees considered the performance of all share classes, the Trustees noted that for the one-, three-, five-, and ten-year periods ended December 31, 2008, the Fund’s Class A shares had outperformed the Fund’s benchmark index, the Russell 1000 Growth Index. The Trustees also noted that the Fund’s Class A shares’ performance was in the first quintile for the one-, three-, and five-year periods ended December 31, 2008, and in the second quintile for the ten-year period ended December 31, 2008, of the mutual funds against which the Trustees compared the Fund’s performance.

The Trustees discussed each fund’s performance with representatives of EIMC. In each instance where a fund experienced a substantial period of underperformance relative to its benchmark index and/or the non-Evergreen fund peers against which the Trustees compared the fund’s performance, the Trustees considered EIMC’s explanation of the reasons for the relative underperformance and the steps being taken to address the relative underperformance. The Trustees emphasized that the continuation of the investment advisory agreement for a fund should not be taken as any indication that the Trustees did not believe investment performance for any specific fund might not be improved, and

38

ADDITIONAL INFORMATION (unaudited) continued

they noted that they would continue to monitor closely the investment performance of the funds going forward.

Advisory and administrative fees. The Trustees recognized that EIMC does not seek to provide the lowest cost investment advisory service, but to provide a high quality, full-service investment management product at a reasonable price. They also noted that EIMC has in many cases sought to set its investment advisory fees at levels consistent with industry norms. The Trustees noted that, in certain cases, a fund’s management fees were higher than many or most other mutual funds in the same Keil peer group. However, in each case, the Trustees determined on the basis of the information presented that the level of management fees was not excessive. The Trustees noted that the management fee paid by the Fund was lower than the management fees paid by a majority of the mutual funds against which the Trustees compared the Fund’s management fee, and that the level of profitability realized by EIMC in respect of the fee did not appear excessive.

Economies of scale. The Trustees noted the possibility that economies of scale would be achieved by EIMC in managing the funds as the funds grow. They reviewed the breakpoints in the Fund’s advisory fee structure, which operate generally to reduce the effective management fee rate of the Fund (as a percentage of Fund assets) as the Fund grows in size. They considered that, as a fund shrinks in size, breakpoints result in increasing fee levels. The Trustees noted that they would continue to review the appropriate levels of breakpoints in the future, and concluded that the breakpoints as implemented appeared to be a reasonable step toward the realization of economies of scale by the Fund.

Profitability. The Trustees considered information provided to them regarding the profitability to the EIMC organization of the investment advisory, administration, and transfer agency (with respect to the open-end funds only) fees paid to EIMC and its affiliates by each of the funds. They considered that the information provided to them was necessarily estimated, and that the profitability information provided to them, especially on a fund-by-fund basis, did not necessarily provide a definitive tool for evaluating the appropriateness of each fund’s advisory fee. They noted that the levels of profitability of the funds to EIMC varied widely, depending on, among other things, the size and type of fund. They considered the profitability of the funds in light of such factors as, for example, the information they had received regarding the relation of the fees paid by the funds to those paid by other mutual funds, the investment performance of the funds, and the amount of revenues involved. In light of these factors, the Trustees concluded that the profitability to EIMC of the services provided to any of the funds, individually or in the aggregate, should not prevent the Trustees from approving the continuation of the agreements.

39

TRUSTEES AND OFFICERS

TRUSTEES1 | | |

Charles A. Austin III

Trustee

DOB: 10/23/1934

Term of office since: 1991

Other directorships: None | | Investment Counselor, Anchor Capital Advisors, LLC. (investment advice); Director, The Andover Companies (insurance); Trustee, Arthritis Foundation of New England; Former Director, The Francis Ouimet Society (scholarship program); Former Director, Executive Vice President and Treasurer, State Street Research & Management Company (investment advice) |

|

|

|

K. Dun Gifford

Trustee

DOB: 10/23/1938

Term of office since: 1974

Other directorships: None | | Chairman and President, Oldways Preservation and Exchange Trust (education); Trustee, Member of the Executive Committee, Former Chairman of the Finance Committee, and Former Treasurer, Cambridge College |

|

|

|

Dr. Leroy Keith, Jr.

Trustee

DOB: 2/14/1939

Term of office since: 1983

Other directorships: Trustee,

Phoenix Fund Complex

(consisting of 50 portfolios

as of 12/31/2008) | | Managing Director, Almanac Capital Management (commodities firm); Trustee, Phoenix Fund Complex; Director, Diversapack Co. (packaging company); Former Partner, Stonington Partners, Inc. (private equity fund); Former Director, Obagi Medical Products Co.; Former Director, Lincoln Educational Services |

|

|

|

Carol A. Kosel

Trustee

DOB: 12/25/1963

Term of office since: 2008

Other directorships: None | | Former Consultant to the Evergreen Boards of Trustees; Former Vice President and Senior Vice President, Evergreen Investments, Inc.; Former Treasurer, Evergreen Funds; Former Treasurer, Vestaur Securities Fund |

|

|

|

Gerald M. McDonnell

Trustee

DOB: 7/14/1939

Term of office since: 1988

Other directorships: None | | Former Manager of Commercial Operations, CMC Steel (steel producer) |

|

|

|

Patricia B. Norris

Trustee

DOB: 4/9/1948

Term of office since: 2006

Other directorships: None | | President and Director of Buckleys of Kezar Lake, Inc. (real estate company); Former President and Director of Phillips Pond Homes Association (home community); Former Partner, PricewaterhouseCoopers, LLP (independent registered public accounting firm) |

|

|

|

William Walt Pettit2

Trustee

DOB: 8/26/1955

Term of office since: 1988

Other directorships: None | | Partner and Vice President, Kellam & Pettit, P.A. (law firm); Director, Superior Packaging Corp. (packaging company); Member, Superior Land, LLC (real estate holding company), Member, K&P Development, LLC (real estate development); Former Director, National Kidney Foundation of North Carolina, Inc. (non-profit organization) |

|

|

|

David M. Richardson

Trustee

DOB: 9/19/1941

Term of office since: 1982

Other directorships: None | | President, Richardson, Runden LLC (executive recruitment advisory services); Director, J&M Cumming Paper Co. (paper merchandising); Former Trustee, NDI Technologies, LLP (communications); Former Consultant, AESC (The Association of Executive Search Consultants) |

|

|

|

Russell A. Salton III, MD

Trustee

DOB: 6/2/1947

Term of office since: 1984

Other directorships: None | | President/CEO, AccessOne MedCard, Inc. |

|

|

|

40

TRUSTEES AND OFFICERS continued

Michael S. Scofield

Trustee

DOB: 2/20/1943

Term of office since: 1984

Other directorships: None | | Retired Attorney, Law Offices of Michael S. Scofield; Former Director and Chairman, Branded Media Corporation (multi-media branding company) |

|

|

|

Richard J. Shima

Trustee

DOB: 8/11/1939

Term of office since: 1993

Other directorships: None | | Independent Consultant; Director, Hartford Hospital; Trustee, Greater Hartford YMCA; Former Director,Trust Company of CT; Former Trustee, Saint Joseph College (CT) |

|

|

|

Richard K. Wagoner, CFA3

Trustee

DOB: 12/12/1937

Term of office since: 1999

Other directorships: None | | Member and Former President, North Carolina Securities Traders Association; Member, Financial Analysts Society |

|

|

|

OFFICERS | | |

W. Douglas Munn4

President

DOB: 4/21/1963

Term of office since: 2009 | | Principal occupations: Chief Operating Officer, Wells Fargo Funds Management, LLC; President and Chief Operating Officer, Evergreen Investment Company, Inc. |

|

|

|

Jeremy DePalma4

Treasurer

DOB: 2/5/1974

Term of office since: 2005 | | Principal occupations: Senior Vice President, Evergreen Investment Management Company, LLC; Former Vice President, Evergreen Investment Services, Inc.; Former Assistant Vice President, Evergreen Investment Services, Inc. |

|

|

|

Michael H. Koonce4

Secretary

DOB: 4/20/1960

Term of office since: 2000 | | Principal occupations: Senior Vice President and General Counsel, Evergreen Investment Services, Inc.; Secretary, Senior Vice President and General Counsel, Evergreen Investment Management Company, LLC and Evergreen Service Company, LLC |

|

|

|

Robert Guerin4

Chief Compliance Officer

DOB: 9/20/1965

Term of office since: 2007 | | Principal occupations: Chief Compliance Officer, Evergreen Funds and Senior Vice President of Evergreen Investment Company, Inc.; Former Managing Director and Senior Compliance Officer, Babson Capital Management LLC; Former Principal and Director, Compliance and Risk Management, State Street Global Advisors; Former Vice President and Manager, Sales Practice Compliance, Deutsche Asset Management |

|

|

|

1 | Each Trustee serves until a successor is duly elected or qualified or until his or her death, resignation, retirement or removal from office. Each Trustee oversaw 77 Evergreen funds as of December 31, 2008. Correspondence for each Trustee may be sent to Evergreen Board of Trustees, P.O. Box 20083, Charlotte, NC 28202. |

2 | It is possible that Mr. Pettit may be viewed as an “interested person” of the Evergreen funds, as defined in the 1940 Act, because of his law firm’s previous representation of affiliates of Wells Fargo & Company (“Wells Fargo”), the parent to the Evergreen funds’ investment advisor, EIMC. The Trustees are treating Mr. Pettit as an interested trustee for the time being. |

3 | Mr. Wagoner is an “interested person” of the Evergreen funds because of his ownership of shares in Wells Fargo & Company, the parent to the Evergreen funds’ investment advisor. |

4 | The address of the Officer is 200 Berkeley Street, Boston, MA 02116. |

Additional information about the Fund’s Board of Trustees and Officers can be found in the Statement of Additional Information (SAI) and is available upon request without charge by calling 800.343.2898.

41

563828 rv7 11/2009

Evergreen Mid Cap Growth Fund

| | table of contents |

1 | | LETTER TO SHAREHOLDERS |

4 | | FUND AT A GLANCE |

6 | | PORTFOLIO MANAGER COMMENTARY |

10 | | ABOUT YOUR FUND’S EXPENSES |

11 | | FINANCIAL HIGHLIGHTS |

15 | | SCHEDULE OF INVESTMENTS |

20 | | STATEMENT OF ASSETS AND LIABILITIES |

21 | | STATEMENT OF OPERATIONS |

22 | | STATEMENTS OF CHANGES IN NET ASSETS |

23 | | NOTES TO FINANCIAL STATEMENTS |

31 | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

32 | | ADDITIONAL INFORMATION |

40 | | TRUSTEES AND OFFICERS |

This annual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of the fund’s proxy voting policies and procedures, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. The fund’s proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

Mutual Funds:

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Copyright 2009, Evergreen Investment Management Company, LLC.

Evergreen Investment Management Company, LLC is a subsidiary of Wells Fargo & Company and is an affiliate of Wells Fargo & Company’s other Broker Dealer subsidiaries.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. 200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

November 2009

W. Douglas Munn

President and Chief Executive Officer

Dear Shareholder:

We are pleased to provide the Annual Report for Evergreen Mid Cap Growth Fund for the twelve-month period ended September 30, 2009 (the “period”).

Capital markets throughout the globe continued to experience extreme pressure during the period. Home prices fell and job losses persisted. The collapse of Lehman Brothers in September 2008 led to collateral damage in the ensuing weeks as venerable financial institutions both in the United States and Europe fell like dominos. Distrust prevailed, and counter-party risk, whether real or imagined, escalated. Inter-bank lending ceased to exist, and the credit markets froze. In response, the Federal Reserve Board (the “Fed”), the U.S. Treasury, the Federal Deposit Insurance Corporation, and the Securities and Exchange Commission took a series of dramatic and innovative steps to help the economy and the financial markets emerge from this crisis. In October 2008, Congress rushed through a $700 billion rescue plan designed to address the capital inadequacy of banks. Meanwhile, in a further effort to re-stimulate lending activity, the Fed twice slashed the key fed funds rate in October 2008, bringing the influential overnight lending rate to just 1.00%. The Fed slashed rates again in December to near zero, where it stayed during the remainder of the period. Overseas, other major central banks also cut short-term rates to inject liquidity into the financial markets. At the same time, foreign governments took other measures to buttress financial institutions and forestall the possibility of a global recession.

Early in 2009, the fixed-income markets worried about deflation, as evidenced by investor willingness to accept virtually nothing for short-term loans to the government. Concerns about federal spending also increased with the $787 billion American Recovery and Reinvestment Act of 2009, signed into law in February. Yields climbed for longer-term U.S. Treasuries during the first quarter of 2009. International markets were hit hard, as economies in both developed and emerging countries struggled. Equity markets were affected by the weakness in economic data and corporate profits, although stocks rallied off their March 9th lows, with international and small cap stocks leading the gains. Signs of stability emerged in the corporate credit markets, as both issuance and performance improved. The price of oil surged in the second quarter of 2009, pulling most commodities higher, as the dollar weakened and gold gave back earlier gains. However, gold surged at the end of the fiscal year, and stocks finished a banner third quarter 2009, with all major market indexes climbing by approximately 15%, as investor sentiment was buoyed by signs of improvement in the economy and corporate

1

LETTER TO SHAREHOLDERS continued

earnings. In international markets, most major equity indexes doubled in the developing world from their lows of last year, while the market gains in developed economies have been somewhat more muted.

While recent data reflect an economy that is managing to climb from the depths reached in March, we question whether the fundamentals are in place for sustainable growth, given that economic reports continue to display data that is simply “less bad” than it was earlier in the fiscal year. Until we see stabilization in home prices and employment, it is unlikely that activity will exceed anything beyond what is considered to be “below potential” for any period of time.

During a volatile and challenging period in the capital markets, the investment managers of Evergreen’s growth-oriented equity funds focused on managing risk and finding potential opportunities while maintaining the goal of seeking long-term capital appreciation. Managers of Evergreen Large Company Growth Fund and Evergreen Omega Fund focused on bottom-up, fundamental analysis in making individual stock selections. The management teams supervising Evergreen Mid Cap Growth Fund and Evergreen Small-Mid Growth Fund, meanwhile, sought out growing companies with strong fundamentals and reasonable valuations. At the same time, managers of Evergreen Growth Fund concentrated on opportunities among small cap growth companies with above-average earnings prospects and reasonable stock prices. The team supervising Evergreen Strategic Growth Fund, meanwhile, focused on large cap companies offering superior long-term growth potential.

We believe the changing conditions in the investment environment over the period have underscored the value of a well-diversified, long-term investment strategy that seeks to help soften the effects of volatility in any one market or asset class. As always, we encourage investors to maintain diversified investment portfolios in pursuit of their long-term investment goals.

Please visit us at EvergreenInvestments.com for more information about our funds and other investment products available to you. Thank you for your continued support of Evergreen Investments.

Sincerely,

W. Douglas Munn

President and Chief Executive Officer

Evergreen Funds

2

LETTER TO SHAREHOLDERS continued

Notice to Shareholders:

Effective after the close of business on June 30, 2009, Class B shares of the Fund were closed to new accounts and additional purchases by existing shareholders. Existing shareholders of Class B shares of the Fund may continue to exchange their Class B shares for Class B shares of other Evergreen Funds subject to the limitations described in each fund’s prospectus and may also continue to add to their accounts through dividend reinvestment. All other Class B share features and attributes, including, but not limited to, the 12b-1 fee, contingent deferred sales charge and conversion after a number of years to Class A shares, remain unchanged. Shareholders of the Fund may continue to redeem Fund shares in the manner described in the Fund’s prospectus.

3

FUND AT A GLANCE

as of September 30, 2009

MANAGEMENT TEAM

Investment Advisor:

Evergreen Investment Management Company, LLC

Portfolio Managers:

Robert C. Junkin, CPA; Lori S. Evans; Julian J. Johnson

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 9/30/2009.

The Equity style box placement is based on 10 growth and valuation measures for each fund holding and the median size of the companies in which the fund invests.

PERFORMANCE AND RETURNS

Portfolio inception date: 9/11/1935

| Class A | Class B | Class C | Class I |

Class inception date | 1/20/1998 | 9/11/1935 | 1/26/1998 | 1/26/1998 |

|

|

|

|

|

Nasdaq symbol | EKAAX | EKABX | EKACX | EKAYX |

|

|

|

|

|

Average annual return* | | | | |

|

|

|

|

|

1-year with sales charge | -13.32% | -13.21% | -9.59% | N/A |

|

|

|

|

|

1-year w/o sales charge | -8.05% | -8.68% | -8.68% | -7.92% |

|

|

|

|

|

5-year | -0.86% | -0.82% | -0.40% | 0.55% |

|

|

|

|

|

10-year | 1.15% | 1.00% | 1.02% | 1.99% |

|

|

|

|

|

Maximum sales charge | 5.75% | 5.00% | 1.00% | N/A |

| Front-end | CDSC | CDSC | |

|

|

|

|

|

* | Adjusted for maximum applicable sales charge, unless noted. |

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Classes A, B, C or I, please go to EvergreenInvestments.com/fundperformance. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund incurs a 12b-1 fee of 0.25% for Class A and 1.00% for Classes B and C. Class I does not pay a 12b-1 fee.

The returns shown for Class B shares do not reflect the conversion of Class B shares to Class A shares after eight years.

Class B shares are closed to new investments by new and existing shareholders.

Returns reflect expense limits previously in effect, without which returns would have been lower.

4

FUND AT A GLANCE continued

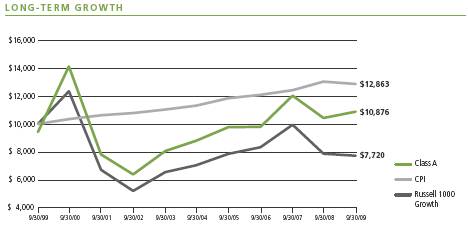

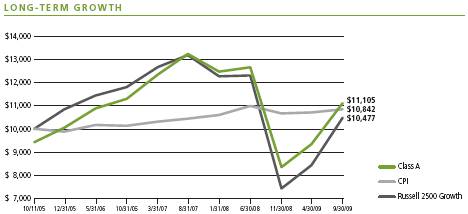

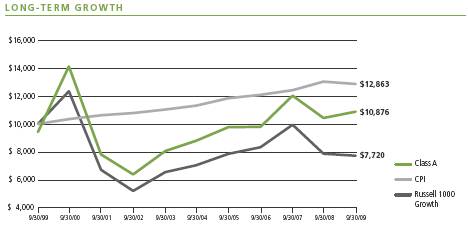

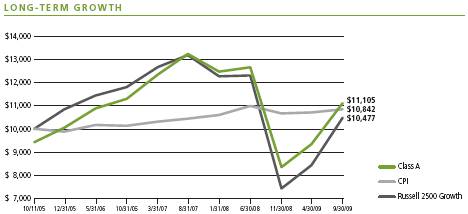

Comparison of a $10,000 investment in the Evergreen Mid Cap Growth Fund Class A shares versus a similar investment in the Russell Midcap Growth Index (Russell Midcap Growth) and the Consumer Price Index (CPI).

The Russell Midcap Growth is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

Class I shares are only offered, subject to the minimum initial purchase requirements, in the following manner: (1) to investment advisory clients of EIMC (or its advisory affiliates), (2) to employer- or state-sponsored benefit plans, including but not limited to, retirement plans, defined benefit plans, deferred compensation plans, or savings plans, (3) to fee-based mutual fund wrap accounts, (4) through arrangements entered into on behalf of the Evergreen funds with certain financial services firms, (5) to certain institutional investors, and (6) to persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994 or who owned shares of any SouthTrust fund in registered name as of March 18, 2005 or who owned shares of Vestaur Securities Fund as of May 20, 2005.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

The fund’s investment objective may be changed without a vote of the fund’s shareholders.

Foreign investments may contain more risk due to the inherent risks associated with changing political climates, foreign market instability and foreign currency fluctuations.

Small and mid cap securities may be subject to special risks associated with narrower product lines and limited financial resources compared to their large cap counterparts, and, as a result, small and mid cap securities may decline significantly in market downturns and may be more volatile than those of larger companies due to the higher risk of failure.

All data is as of September 30, 2009, and subject to change.

5

PORTFOLIO MANAGER COMMENTARY

The fund’s Class A shares returned -8.05% for the twelve-month period ended September 30, 2009, excluding any applicable sales charges. During the same period, the Russell Midcap Growth returned -0.40%.

The fund’s objective is to seek long-term capital growth.

Investment process

The U.S. equity markets and international indexes have rebounded significantly since March, as economic conditions and profitability have shown signs of improvement. The best-performing sectors were the higher-beta, more cyclical sectors, which are most sensitive to changes in the economy. Since the upturn, Energy has been the top performer. Over the fiscal year, expectations for the economic recovery have increased considerably. As the credit crisis receded and capital became available, the market continued to rotate into lower-quality distressed companies with weak balance sheets and poor profits.

We kept to our long-term discipline during the fiscal year while positioning the portfolio for the period ahead. At the end of the period, the fund was overweight in sectors linked to U.S. exports and manufacturing, reflecting our belief that exports will continue to gain share and contribute positively to the growth of the domestic economy. The weak U.S. dollar, combined with the sheer size of emerging markets and their secular growth trends, should provide great potential for continued gains in exports. Strong balance sheets for manufacturing companies, many of which restrained their capital investments, also encourage an optimistic view. At the same time, in view of the financial backstops put into place by government and monetary authorities, we would expect to add to Financials, as empirical evidence continues to emerge that the worst of the credit crisis has passed.

In times of market tumult, we believe it is important to remain focused and to adhere to a disciplined long-term investment process. Under severe stress, opportunities are typically created, and we see them occurring as credit losses faced by financial institutions enter the later stages of a cycle, and offsetting developments have begun to emerge. We believe that the preconditions for a sustainable economic recovery are also apparent in the advent of lower mortgage rates, which, in combination with lower house prices, have dramatically improved housing affordability. Various government initiatives have also supported the housing market and shored up financial institutions. In addition, oil and commodity prices have retreated.

Contributors to performance

By sector, our overweighting of Energy and Materials tended to support performance. The underweighting of Health Care also contributed positively. Stock selection was best in the Energy and Telecommunication Services sectors. The strongest individual stock performers included: Priceline.com, Inc., a Consumer Discretionary position; Cognizant

6

PORTFOLIO MANAGER COMMENTARY continued

Technology Solutions Corp., an Information Technology holding; and Flowserve Corp., from the Industrials sector.

Priceline provides e-commerce Internet services at a price that enable consumers to purchase a wide range of products over the Internet and save money. Priceline is still in its early-growth stage. It is gaining market share from offline sources and from suppliers. Priceline will likely benefit from its high customer retention and high international hotel exposure. We believe it is well positioned to maintain a pipeline of high international gross bookings growth through the early entry into emerging markets.

Cognizant provides IT design development, integration, and maintenance services for companies primarily in financial services, health care, manufacturing/retail, and telecommunication/media. Cognizant is an outsourcing company based in India that supplies labor. Cognizant is facing a positive demand environment as an increasing portion of IT spending is moving offshore to save costs.

Flowserve manufactures flow control equipment for critical service applications in the water treatment, power generations, chemical, and petroleum industries. The end markets are stable, orders are picking up, and costs have been reduced due to optimization of the operating platform. Flowserve has a strong balance sheet which may be levered to create long-term shareowner value. We believe there may be buybacks and some M&A.

Detractors from performance

The fund’s underweight in Consumer Discretionary and Information Technology detracted from results, as did the overweight in Telecommunication Services. Stock selection in Information Technology, Health Care, and Financials also held back performance. As the liquidity squeeze receded in March, the fund’s exposure to profitable companies with strong balance sheets lagged. Many of the more significant detractors for the full twelve-month period had performed relatively well the first half of the period. The largest performance detractors since the market upturn in March included Qwest Communications, Granite Construction, and Alliant Techsystems.

Qwest provides broadband Internet-based data, voice, and image communications in the United States. Qwest is the fourth-largest Regional Bell Operating Company in the United States and serves regional customers in 14 Northern and Midwestern states. It also provides long distance and wireless services within its territory. Last quarter, Qwest reported a decline in revenues, attributed to weakness in the wholesale and mass market segments and flat revenues in the business market segment. We continue to hold Qwest for its strong free cash flow generation, attractive valuation, and costs reduction. Qwest announced an agreement to extend the partnership with Direct TV for bundling broadband and voice services and entered an agreement with IBM to offer managed services to mid-size businesses.

7

PORTFOLIO MANAGER COMMENTARY continued

Granite Construction provides heavy civil construction services for both public and private sectors. Construction projects include major highways, large dams, mass transit facilities, bridges, pipelines, canals, tunnels, and airport infrastructure. Revenues are negatively affected by the competitive environment for low-bid public construction projects from the California state transportation department. However the long-term thesis is still intact of increased spending in domestic infrastructure. The slow pickup in funding and project award for the remainder of 2009 is reflected in expectations. Near-and long-term catalysts include funding for the highway trust fund, Build America bond funding, stimulus funding, and reauthorization of highway bill.

Alliant Techsystems manufactures and supplies advanced defense and aerospace systems. Products include missile systems, military ammunition, satellite components and sub-systems. Given the pending administration decision on NASA Constellation, we expect stock price volatility over the next few months. We believe that most of the risk is already reflected in the shares. We believe the potential upside to earnings at the current Constellation program, or something close to it, significantly outweighs the worst-case NASA scenario, including a decline in ammunition revenues from war withdrawal.

Portfolio management outlook

Economic recoveries are typically self-sustaining. As the recovery gains momentum, confidence and credit are restored, enabling the private sector to grow. However, there is always much uncertainty and skepticism during the early stages of a recovery, which make it fragile. Today’s uncertainties include unemployment, federal spending, home prices, and bank balance sheets. It is important for policy stimulus to remain intact in order to support the recovery. Prematurely trying to reduce budget deficits by raising taxes and cutting spending may undermine the recovery.

The key question is whether the recovery is sustainable long-term or, conversely, whether the United States is entering a period of prolonged multi-year stagnation, as occurred in Japan. To avoid stagnation, it is crucial that the imbalances that created the recession are alleviated. Some of the progress we see on several of the economy’s imbalances include the reduction of overcapacity in banking, housing, commercial real estate, and retailing. However, the most important factor is the U.S. consumer, upon whom the sustainability of the worldwide recovery ultimately depends. Some positive signs of improvement include the strengthening consumer balance sheet, the stabilization of the negative wealth effect from falling house prices, and the stabilization of equity markets. In addition, housing has become more affordable, oil prices have fallen, and the consumer is de-leveraging.

The self-sustaining nature of a recovery can create the perception, as is the case today, of markets getting ahead of fundamentals. We believe that high unemployment and delinquencies on consumer loans are valid concerns. The economy is not out of the woods. However, while a short-term pull-back would not surprise us, we believe that

8

PORTFOLIO MANAGER COMMENTARY continued

fundamentals are improving overall, and we expect the economic issues to be resolved during the recovery process. In our view, a market pull-back is an opportunity to incrementally add market exposure.

This commentary reflects the views and opinions of the fund’s portfolio manager(s) on the date indicated and may include statements that constitute “forward-looking statements” under the U.S. Securities laws. Forward-looking statements include, among other things, projections, estimates and information about possible or future results related to the fund, markets, or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed above are subject to change at any time based upon economic, market, or other conditions and Evergreen undertakes no obligation to update the views expressed herein. Any discussions of specific securities should not be considered a recommendation to buy or sell those securities. The views expressed herein (including any forward-looking statements) may not be relied upon as investment advice or as an indication of the fund’s trading intent.

9

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2009 to September 30, 2009.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning | Ending | |

| Account Value | Account Value | Expenses Paid |

| 4/1/2009 | 9/30/2009 | During Period* |

|

|

|

|

Actual | | | |

Class A | $1,000.00 | $1,325.37 | $ 6.76 |

Class B | $1,000.00 | $1,318.33 | $11.10 |

Class C | $1,000.00 | $1,318.33 | $11.10 |

Class I | $1,000.00 | $1,324.64 | $ 5.30 |

Hypothetical | | | |

(5% return before expenses) | | | |

Class A | $1,000.00 | $1,019.25 | $ 5.87 |

Class B | $1,000.00 | $1,015.49 | $ 9.65 |

Class C | $1,000.00 | $1,015.49 | $ 9.65 |

Class I | $1,000.00 | $1,020.51 | $ 4.61 |

|

|

|

|

* | For each class of the fund, expenses are equal to the annualized expense ratio of each class (1.16% for Class A, 1.91% for Class B, 1.91% for Class C and 0.91% for Class I), multiplied by the average account value over the period, multiplied by 183 / 365 days. |

10

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | Year Ended September 30, | |

| |

| |

CLASS A | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 4.94 | | $ | 7.01 | | $ | 5.55 | | $ | 5.44 | | $ | 4.65 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.01 | | | (0.01 | )1 | | (0.01 | ) | | (0.02 | ) | | (0.03 | ) |

Net realized and unrealized gains or losses on investments | | | (0.43 | ) | | (1.80 | ) | | 1.47 | | | 0.13 | | | 0.82 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (0.42 | ) | | (1.81 | ) | | 1.46 | | | 0.11 | | | 0.79 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | (0.05 | ) | | (0.09 | ) | | 0 | | | 0 | | | 0 | |

Net realized gains | | | (0.03 | ) | | (0.17 | ) | | 0 | | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | (0.08 | ) | | (0.26 | ) | | 0 | | | 0 | | | 0 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 4.44 | | $ | 4.94 | | $ | 7.01 | | $ | 5.55 | | $ | 5.44 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return2 | | | (8.05 | )% | | (26.74 | )% | | 26.31 | % | | 2.02 | % | | 16.99 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (millions) | | $ | 296 | | $ | 354 | | $ | 540 | | $ | 506 | | $ | 564 | |

Ratios to average net assets | | | | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 1.09 | % | | 0.93 | % | | 1.06 | % | | 1.09 | % | | 1.13 | % |

Expenses excluding waivers/reimbursements and expense reductions | | | 1.19 | % | | 1.05 | % | | 1.07 | % | | 1.09 | % | | 1.13 | % |

Net investment income (loss) | | | 0.05 | % | | (0.14 | )% | | (0.36 | )% | | (0.34 | )% | | (0.68 | )% |

Portfolio turnover rate | | | 41 | % | | 114 | % | | 89 | % | | 110 | % | | 141 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | Per share amount is based on average shares outstanding during the period. |

2 | Excluding applicable sales charges |

See Notes to Financial Statements

11

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | Year Ended September 30, | |

| |

| |

CLASS B | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 4.53 | | $ | 6.45 | | $ | 5.15 | | $ | 5.08 | | $ | 4.37 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.02 | )1 | | (0.05 | )1 | | (0.06 | )1 | | (0.05 | )1 | | (0.07 | )1 |

Net realized and unrealized gains or losses on investments | | | (0.38 | ) | | (1.67 | ) | | 1.36 | | | 0.12 | | | 0.78 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (0.40 | ) | | (1.72 | ) | | 1.30 | | | 0.07 | | | 0.71 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | 0 | | | (0.03 | ) | | 0 | | | 0 | | | 0 | |

Net realized gains | | | (0.03 | ) | | (0.17 | ) | | 0 | | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | (0.03 | ) | | (0.20 | ) | | 0 | | | 0 | | | 0 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 4.10 | | $ | 4.53 | | $ | 6.45 | | $ | 5.15 | | $ | 5.08 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return2 | | | (8.68 | )% | | (27.41 | )% | | 25.24 | % | | 1.38 | % | | 16.25 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (millions) | | $ | 7 | | $ | 11 | | $ | 21 | | $ | 21 | | $ | 27 | |

Ratios to average net assets | | | | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 1.83 | % | | 1.68 | % | | 1.78 | % | | 1.79 | % | | 1.83 | % |

Expenses excluding waivers/reimbursements and expense reductions | | | 1.93 | % | | 1.78 | % | | 1.78 | % | | 1.79 | % | | 1.83 | % |

Net investment loss | | | (0.68 | )% | | (0.89 | )% | | (1.08 | )% | | (1.04 | )% | | (1.38 | )% |

Portfolio turnover rate | | | 41 | % | | 114 | % | | 89 | % | | 110 | % | | 141 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | Per share amount is based on average shares outstanding during the period. |

2 | Excluding applicable sales charges |

See Notes to Financial Statements

12

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | Year Ended September 30, | |

| |

| |

CLASS C | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 4.53 | | $ | 6.45 | | $ | 5.15 | | $ | 5.08 | | $ | 4.37 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.02 | )1 | | (0.05 | )1 | | (0.06 | )1 | | (0.05 | )1 | | (0.07 | )1 |

Net realized and unrealized gains or losses on investments | | | (0.38 | ) | | (1.66 | ) | | 1.36 | | | 0.12 | | | 0.78 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (0.40 | ) | | (1.71 | ) | | 1.30 | | | 0.07 | | | 0.71 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | |