| OMB APPROVAL |

OMB Number: 3235-0570 Expires: September 30, 2007 Estimated average burden hours per response: 19.4 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08413

Evergreen Equity Trust

_____________________________________________________________

(Exact name of registrant as specified in charter)

200 Berkeley Street Boston, Massachusetts 02116

_____________________________________________________________

(Address of principal executive offices) (Zip code)

Michael H. Koonce, Esq. 200 Berkeley Street Boston, Massachusetts 02116

____________________________________________________________

(Name and address of agent for service)

Registrant's telephone number, including area code: (617) 210-3200

Date of fiscal year end: Registrant is making a semi-annual filing for eleven of its series, Evergreen Disciplined Small-Mid Value Fund, Evergreen Disciplined Value Fund, Evergreen Equity Income Fund, Evergreen Fundamental Large Cap Fund, Evergreen Fundamental Mid Cap Fund, Evergreen Golden Core Opportunities Fund, Evergreen Golden Large Cap Core Fund, Evergreen Golden Mid Cap Core Fund, Evergreen Intrinsic Value Fund, Evergreen Small Cap Value Fund and Evergreen Special Values Fund, for the six months ended January 31, 2008. These eleven series have a July 31 fiscal year end.

Date of reporting period: January 31, 2008

Item 1 - Reports to Stockholders.

Evergreen Disciplined Small-Mid Value Fund

| table of contents |

| 1 | | LETTER TO SHAREHOLDERS |

| 4 | | FUND AT A GLANCE |

| 6 | | ABOUT YOUR FUND’S EXPENSES |

| 7 | | FINANCIAL HIGHLIGHTS |

| 9 | | SCHEDULE OF INVESTMENTS |

| 17 | | STATEMENT OF ASSETS AND LIABILITIES |

| 18 | | STATEMENT OF OPERATIONS |

| 19 | | STATEMENTS OF CHANGES IN NET ASSETS |

| 20 | | NOTES TO FINANCIAL STATEMENTS |

| 26 | | ADDITIONAL INFORMATION |

| 32 | | TRUSTEES AND OFFICERS |

This semiannual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of the fund’s proxy voting policies and procedures, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. The fund’s proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

| Mutual Funds: | | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC.

Copyright 2008, Evergreen Investment Management Company, LLC.

Evergreen Investment Management Company, LLC is a subsidiary of Wachovia Corporation

and is an affiliate of Wachovia Corporation’s other Broker Dealer subsidiaries.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc.

200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

March 2008

Dennis H. Ferro

President and Chief Executive Officer

Dear Shareholder:

We are pleased to provide the Semiannual Report for Evergreen Disciplined Small-Mid Value Fund, covering the six-month period ended January 31, 2008.

Investors in the domestic equity market faced challenging and increasingly stormy conditions over the six-month period ended January 31, 2008. Problems in the housing and subprime mortgage markets led to a tightening of credit, which in turn contributed to widening fears of a dramatic deceleration in the economy’s expansion. As the economy weakened, equity prices generally declined across companies of all sizes. Large cap stocks held up somewhat better than mid cap and small cap shares, while growth stocks outperformed more economically sensitive value stocks. Fixed income investors, meanwhile, sought out the highest-quality securities and attempted to avoid credit risk. Longer-maturity Treasuries outperformed other sectors, while the prices of corporate bonds and many asset-backed securities fell as the yield spreads between Treasuries and lower-rated securities widened. In this environment, the price of gold surged while the dollar remained weak.

The U.S. economy exhibited increasing signs of weakness in the latter half of 2007 and the first month of 2008 after experiencing solid growth early in 2007. Although housing and credit-related concerns began weighing on investor sentiment early in the year, the economy’s growth trajectory continued to be supported early in 2007 by the combination of solid trends in employment, income, investment and export trends. That began to change in the latter months of 2007, however, as each of these pillars of support began to weaken. Growth in Gross Domestic Product

1

LETTER TO SHAREHOLDERS continued

rose by just 0.6% during the final quarter of 2007 as economic output slowed because of a sharp reduction in business inventories. The rate of corporate earnings growth, meanwhile, declined over the second half of 2007. Payrolls dropped by 17,000 in January 2008, contributing to growing concerns about the outlook for consumer spending, which accounts for up to 70% of economic output. Faced with growing evidence of the economy’s deceleration, the Federal Reserve Board (the “Fed”) began to focus more on stimulating growth and less on watching inflation. The Fed cut the target fed funds rate from 5.25% to 4.25% during the last four months of 2007 and then slashed the rate by an additional 1.25% in two separate actions within just eight days of each other in January 2008. Also in early 2008, Congress passed, and President Bush signed, a $168 billion fiscal stimulus bill that contained rebates for taxpayers, tax breaks for businesses and additional assistance for Social Security recipients and disabled veterans.

Over the six-month period ended January 31, 2008, the management teams of Evergreen’s value-oriented equity funds tended to emphasize investments in attractively priced, fundamentally sound corporations. The portfolio manager of both Evergreen Disciplined Value Fund and Evergreen Disciplined Small-Mid Value Fund, for example, used a combination of quantitative tools and traditional fundamental analysis in reviewing opportunities among larger and smaller companies, respectively. The manager of Evergreen Equity Index Fund maintained a portfolio reflecting the composition of the Standard & Poor’s 500® Index, using a proprietary process to control trading and operational costs. Managers of Evergreen Equity Income Fund emphasized companies they believe have the ability to maintain and increase their dividends to shareholders. The managers of Evergreen Fundamental Large Cap Fund focused on larger corporations with stable earnings growth records while the managers of Evergreen Fundamental Mid Cap Value Fund, which was launched on September 28, 2007, emphasized mid-sized companies selling at what the managers believed to be reasonable valuations. The team managing Evergreen Intrinsic Value Fund sought out investments in

2

LETTER TO SHAREHOLDERS continued

established companies selling at stock prices below the managers’ estimate of the company’s intrinsic value. Meanwhile, the managers of Evergreen Small Cap Value Fund and Evergreen Special Values Fund each focused on higher-quality small companies that the managers believed to have reasonable prices and strong balance sheets.

We believe the experiences in the investment markets during the past six months have underscored the value of a well-diversified, long-term investment strategy to help soften the effects of volatility in any one market or asset class. As always, we encourage investors to maintain diversified investment portfolios in pursuit of their long-term investment goals.

Please visit us at EvergreenInvestments.com for more information about our funds and other investment products available to you. Thank you for your continued support of Evergreen Investments.

Sincerely,

Dennis H. Ferro

President and Chief Executive Officer

Evergreen Investment Company, Inc.

Special Notice to Shareholders:

Please visit our Web site at EvergreenInvestments.com for statements from President and Chief Executive Officer, Dennis Ferro, regarding the firm’s recent settlement with the Securities and Exchange Commission (SEC) and prior settlement with the Financial Industry Regulatory Authority (FINRA).

3

FUND AT A GLANCE

as of January 31, 2008

MANAGEMENT TEAM

Investment Advisor:

• Evergreen Investment Management Company, LLC

Portfolio Manager:

• William E. Zieff

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 12/31/2007.

The Equity style box placement is based on 10 growth and valuation measures for each fund holding and the median size of the companies in which the fund invests.

PERFORMANCE AND RETURNS

Portfolio inception date: 12/14/2005

| | | Class A | | Class I |

| Class inception date | | 12/14/2005 | | 12/14/2005 |

|

| Nasdaq symbol | | EDASX | | EDISX |

|

| 6-month return with sales charge | | -15.11% | | N/A |

|

| 6-month return w/o sales charge | | -9.90% | | -9.75% |

|

| Average annual return* | | | | |

|

| 1-year with sales charge | | -21.15% | | N/A |

|

| 1-year w/o sales charge | | -16.32% | | -16.02% |

|

| Since portfolio inception | | -2.19% | | 0.84% |

|

| Maximum sales charge | | 5.75% | | N/A |

| | | Front-end | | |

|

* Adjusted for maximum applicable sales charge, unless noted.

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Class I, please go to EvergreenInvestments.com/fundperformance. Class A shares are not available for sale to the public. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The fund incurs a 12b-1 fee of 0.30% for Class A. Class I does not pay a 12b-1 fee.

The advisor is waiving a portion of its advisory fee and reimbursing a portion of the 12b-1 fee for Class A. Had the fees not been waived or reimbursed, returns would have been lower.

4

FUND AT A GLANCE continued

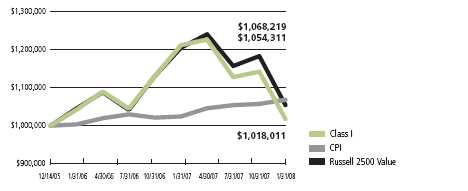

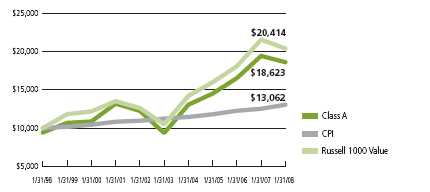

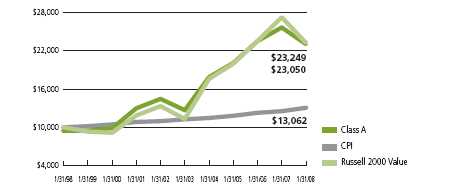

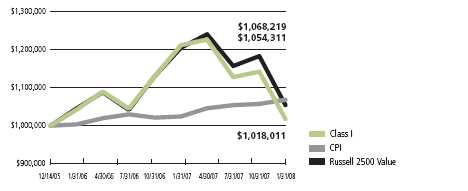

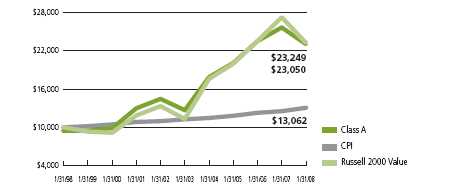

LONG-TERM GROWTH

Comparison of a $1,000,000 investment in the Evergreen Disciplined Small-Mid Value Fund Class I shares versus a similar investment in the Russell 2500 Value Index (Russell 2500 Value) and the Consumer Price Index (CPI).

The Russell 2500 Value is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

Class I shares are only offered in the following manner: (1) to investment advisory clients of Evergreen Investment Management Company, LLC (or its advisory affiliates) when purchased by such advisor(s) on behalf of its clients, (2) to certain mutual fund wrap program clients of Wachovia Securities and of third-party broker/dealers when purchased through a clearing relationship with Wachovia Securities or an affiliate providing mutual fund clearing services, (3) through arrangements entered into on behalf of the Evergreen funds with certain financial services firms, (4) to certain institutional investors, and (5) to persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994 or who owned shares of any SouthTrust fund in registered name as of March 18, 2005 or who owned shares of Vestaur Securities Fund as of May 20, 2005.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

The fund’s investment objective may be changed without a vote of the fund’s shareholders.

Mid cap securities may be subject to special risks associated with narrower product lines and limited financial resources compared to their large cap counterparts, and, as a result, mid cap securities may decline significantly in market downturns.

The stocks of smaller companies may be more volatile than those of larger companies due to the higher risk of failure.

Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

All data is as of January 31, 2008, and subject to change.

5

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from August 1, 2007 to January 31, 2008.

The example illustrates your fund’s costs in two ways:

- Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. - Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning | | Ending | | |

| | | Account | | Account | | Expenses |

| | | Value | | Value | | Paid During |

| | | 8/1/2007 | | 1/31/2008 | | Period* |

|

| Actual | | | | | | |

| Class A | | $ 1,000.00 | | $ 901.05 | | $ 5.64 |

| Class I | | $ 1,000.00 | | $ 902.53 | | $ 4.40 |

| Hypothetical | | | | | | |

| (5% return | | | | | | |

| before expenses) | | | | | | |

| Class A | | $ 1,000.00 | | $ 1,019.20 | | $ 5.99 |

| Class I | | $ 1,000.00 | | $ 1,020.51 | | $ 4.67 |

|

* For each class of the Fund, expenses are equal to the annualized expense ratio of each class (1.18% for Class A and 0.92% for Class I), multiplied by the average account value over the period, multiplied by 184 / 366 days.

6

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | | | | | |

| | | Six Months Ended | | Year Ended July 31, |

| | January 31, 2008 | |

|

| CLASS A | | (unaudited) | | 2007 | | 20061 |

|

| Net asset value, beginning of period | | $11.07 | | $10.44 | | $10.00 |

|

| Income from investment operations | | | | | | |

| Net investment income (loss) | | 0.07 | | 0.08 | | 0.06 |

| Net realized and unrealized gains or losses on investments | | (1.15) | | 0.722 | | 0.38 |

| |

|

| Total from investment operations | | (1.08) | | 0.80 | | 0.44 |

|

| Distributions to shareholders from | | | | | | |

| Net investment income | | (0.09) | | (0.12) | | 0 |

| Net realized gains | | (0.25) | | (0.05) | | 0 |

| |

|

| Total distributions to shareholders | | (0.34) | | (0.17) | | 0 |

|

| Net asset value, end of period | | $ 9.65 | | $11.07 | | $10.44 |

|

| Total return3 | | (9.90%) | | 7.59% | | 4.40% |

|

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (thousands) | | $ 27 | | $ 32 | | $ 1 |

| Ratios to average net assets | | | | | | |

| Expenses including waivers/reimbursements but excluding expense reductions | | 1.18%4 | | 1.16% | | 1.11%4 |

| Expenses excluding waivers/reimbursements and expense reductions | | 1.44%4 | | 1.90% | | 3.38%4 |

| Net investment income (loss) | | 1.14%4 | | 1.45% | | 0.97%4 |

| Portfolio turnover rate | | 35% | | 73% | | 63% |

|

1 For the period from December 14, 2005 (commencement of class operations), to July 31, 2006.

2 The per share net realized and unrealized gains or losses is not in accord with the net realized and unrealized gains or losses for the period due to the timing of sales and redemptions of fund shares in relation to fluctuating market values of the portfolio.

3 Excluding applicable sales charges

4 Annualized

See Notes to Financial Statements

7

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | | | | | | |

| | | Six Months Ended | | Year Ended July 31, |

| | January 31, 2008 | |

|

| CLASS I | | (unaudited) | | 2007 | | 20061 |

|

| Net asset value, beginning of period | | $ 11.11 | | $ 10.45 | | $10.00 |

|

| Income from investment operations | | | | | | |

| Net investment income (loss) | | 0.08 | | 0.12 | | 0.07 |

| Net realized and unrealized gains or losses on investments | | (1.14) | | 0.722 | | 0.38 |

| |

|

| Total from investment operations | | (1.06) | | 0.84 | | 0.45 |

|

| Distributions to shareholders from | | | | | | |

| Net investment income | | (0.11) | | (0.13) | | 0 |

| Net realized gains | | (0.25) | | (0.05) | | 0 |

| |

|

| Total distributions to shareholders | | (0.36) | | (0.18) | | 0 |

|

| Net asset value, end of period | | $ 9.69 | | $ 11.11 | | $10.45 |

|

| Total return | | (9.75%) | | 7.94% | | 4.50% |

|

| Ratios and supplemental data | | | | | | |

| Net assets, end of period (thousands) | | $23,424 | | $27,816 | | $6,665 |

| Ratios to average net assets | | | | | | |

| Expenses including waivers/reimbursements but excluding expense reductions | | 0.92%3 | | 0.92% | | 0.93%3 |

| Expenses excluding waivers/reimbursements and expense reductions | | 1.13%3 | | 1.61% | | 3.20%3 |

| Net investment income (loss) | | 1.39%3 | | 1.76% | | 1.20%3 |

| Portfolio turnover rate | | 35% | | 73% | | 63% |

|

1 For the period from December 14, 2005 (commencement of class operations), to July 31, 2006.

2 The per share net realized and unrealized gains or losses is not in accord with the net realized and unrealized gains or losses for the period due to the timing of sales and redemptions of fund shares in relation to fluctuating market values of the portfolio.

3 Annualized

See Notes to Financial Statements

8

SCHEDULE OF INVESTMENTS

January 31, 2008 (unaudited)

| | | | | Shares | | Value |

|

| |

| COMMON STOCKS 97.3% | | | | | | |

| CONSUMER DISCRETIONARY 10.6% | | | | |

| Auto Components 1.2% | | | | | | |

| BorgWarner, Inc. | | | | 2,748 | | $ 139,076 |

| Lear Corp. | | | | 4,850 | | 142,396 |

| |

|

| | | | | | | 281,472 |

| |

|

| Diversified Consumer Services 0.5% | | | | |

| Stewart Enterprises, Inc., Class A | | | | 15,676 | | 111,613 |

| |

|

| Hotels, Restaurants & Leisure 1.6% | | | | |

| Bob Evans Farms, Inc. | | | | 4,289 | | 127,555 |

| IHOP Corp. (p) | | | | 2,506 | | 133,420 |

| O’Charley’s, Inc. * | | | | 7,921 | | 109,864 |

| |

|

| | | | | | | 370,839 |

| |

|

| Household Durables 2.2% | | | | | | |

| American Greetings Corp., Class A | | | | 5,914 | | 121,356 |

| BLYTH, Inc. | | | | 6,499 | | 141,613 |

| NVR, Inc. * | | | | 182 | | 114,933 |

| Tupperware Brands Corp. | | | | 3,595 | | 133,015 |

| |

|

| | | | | | | 510,917 |

| |

|

| Leisure Equipment & Products 0.8% | | | | |

| Hasbro, Inc. | | | | 7,473 | | 194,074 |

| |

|

| Media 2.5% | | | | | | |

| DreamWorks Animation SKG, Inc., Class A * | | 6,019 | | 147,164 |

| Marvel Entertainment, Inc. | | | | 5,888 | | 166,042 |

| Media General, Inc., Class A | | | | 3,956 | | 75,096 |

| R.H. Donnelley Corp. | | | | 2,602 | | 78,242 |

| Scholastic Corp. * | | | | 3,323 | | 113,879 |

| |

|

| | | | | | | 580,423 |

| |

|

| Specialty Retail 1.2% | | | | | | |

| Asbury Automotive Group, Inc. | | | | 1,671 | | 23,695 |

| Barnes & Noble, Inc. | | | | 4,451 | | 151,111 |

| RadioShack Corp. | | | | 6,391 | | 110,884 |

| |

|

| | | | | | | 285,690 |

| |

|

| Textiles, Apparel & Luxury Goods 0.6% | | | | |

| Jones Apparel Group, Inc. | | | | 8,858 | | 148,814 |

| |

|

| CONSUMER STAPLES 5.7% | | | | | | |

| Beverages 0.9% | | | | | | |

| Molson Coors Brewing Co., Class B | | | | 4,885 | | 218,213 |

| |

|

| Food & Staples Retailing 1.4% | | | | |

| Casey’s General Stores, Inc. | | | | 4,536 | | 117,936 |

| Longs Drug Stores Corp. | | | | 2,875 | | 132,279 |

| Spartan Stores, Inc. | | | | 4,338 | | 76,262 |

| |

|

| | | | | | | 326,477 |

| |

|

See Notes to Financial Statements

9

SCHEDULE OF INVESTMENTS continued

January 31, 2008 (unaudited)

| | | | | | | Shares | | Value |

|

| |

| COMMON STOCKS continued | | | | | | |

| CONSUMER STAPLES continued | | | | |

| Food Products 1.3% | | | | | | |

| Corn Products International, Inc. | | | | 3,925 | | $ 133,270 |

| Del Monte Foods Co. | | | | | | 5,649 | | 180,994 |

| |

|

| | | | | | | | | 314,264 |

| |

|

| Household Products 0.5% | | | | | | |

| Church & Dwight Co. | | | | | | 2,011 | | 107,025 |

| |

|

| Personal Products 0.8% | | | | | | |

| Alberto-Culver Co. | | | | | | 7,366 | | 197,335 |

| |

|

| Tobacco 0.8% | | | | | | | | |

| Universal Corp. | | | | | | 3,537 | | 176,178 |

| |

|

| ENERGY 6.0% | | | | | | | | |

| Energy Equipment & Services 2.9% | | | | |

| Grey Wolf, Inc. * | | | | | | 21,162 | | 126,126 |

| Patterson-UTI Energy, Inc. | | | | 4,795 | | 93,792 |

| SEACOR Holdings, Inc. | | | | | | 2,031 | | 179,134 |

| Tidewater, Inc. | | | | | | 2,396 | | 126,892 |

| Trico Marine Services, Inc. | | | | 4,894 | | 157,048 |

| |

|

| | | | | | | | | 682,992 |

| |

|

| Oil, Gas & Consumable Fuels 3.1% | | | | |

| Continental Resources, Inc. | | | | 5,011 | | 124,824 |

| Frontier Oil Corp. | | | | | | 4,423 | | 155,999 |

| Helix Energy Solutions, Inc. * | | | | 3,134 | | 115,864 |

| Mariner Energy, Inc. * | | | | | | 6,650 | | 166,649 |

| Swift Energy Co. * | | | | | | 2,169 | | 93,593 |

| Tesoro Corp. | | | | | | 1,844 | | 72,008 |

| |

|

| | | | | | | | | 728,937 |

| |

|

| FINANCIALS 25.7% | | | | | | |

| Capital Markets 2.4% | | | | | | |

| Jefferies Group, Inc. | | | | | | 2,906 | | 58,759 |

| Knight Capital Group, Inc., Class A * | | 8,529 | | 142,861 |

| MCG Capital Corp. | | | | | | 6,675 | | 88,470 |

| Raymond James Financial, Inc. | | | | 4,486 | | 126,012 |

| Waddell & Reed Financial, Inc., Class A | | 4,676 | | 155,150 |

| |

|

| | | | | | | | | 571,252 |

| |

|

| Commercial Banks 6.5% | | | | | | |

| Banco Latinoamericano de Exportaciones SA | | 6,759 | | 104,291 |

| BOK Financial Corp. | | | | | | 1,481 | | 80,685 |

| Center Financial Corp. | | | | | | 4,137 | | 47,906 |

| Central Pacific Financial Corp. | | | | 3,614 | | 68,666 |

| Colonial BancGroup, Inc. (p) | | | | 5,171 | | 81,185 |

| East West Bancorp, Inc. | | | | | | 3,545 | | 85,293 |

| Hanmi Financial Corp. | | | | | | 5,029 | | 43,650 |

See Notes to Financial Statements

10

SCHEDULE OF INVESTMENTS continued

January 31, 2008 (unaudited)

| | | Shares | | Value |

|

| |

| COMMON STOCKS continued | | | | |

| FINANCIALS continued | | | | |

| Commercial Banks continued | | | | |

| Irwin Financial Corp. | | 8,198 | | $ 94,195 |

| Oriental Financial Group, Inc. | | 9,705 | | 154,989 |

| Pacific Capital Bancorp | | 4,074 | | 87,591 |

| Peoples Bancorp, Inc. | | 4,967 | | 117,321 |

| Popular, Inc. (p) | | 15,254 | | 206,234 |

| Simmons First National Corp., Class A | | 2,116 | | 59,989 |

| South Financial Group, Inc. | | 5,808 | | 100,362 |

| Southwest Bancorp, Inc. | | 5,668 | | 99,700 |

| Taylor Capital Group, Inc. | | 4,608 | | 90,271 |

| |

|

| | | | | 1,522,328 |

| |

|

| Consumer Finance 0.4% | | | | |

| Cash America International, Inc. | | 2,867 | | 93,206 |

| |

|

| Diversified Financial Services 0.6% | | | | |

| Nasdaq Stock Market, Inc. * | | 2,896 | | 133,998 |

| |

|

| Insurance 10.5% | | | | |

| Allied World Assurance Co. Holdings, Ltd. | | 2,647 | | 125,060 |

| American Physicians Capital, Inc. | | 1,762 | | 72,806 |

| Arch Capital Group, Ltd. | | 2,939 | | 207,082 |

| Aspen Insurance Holdings, Ltd. | | 6,728 | | 189,864 |

| Axis Capital Holdings, Ltd. | | 6,456 | | 258,498 |

| Cathay Financial Holding Co., Ltd. | | 3,190 | | 82,545 |

| HCC Insurance Holdings, Inc. | | 5,690 | | 158,523 |

| IPC Holdings, Ltd. | | 6,671 | | 171,645 |

| National Financial Partners Corp. | | 1,726 | | 62,309 |

| PartnerRe, Ltd. | | 2,253 | | 178,618 |

| Reinsurance Group of America, Inc. | | 2,983 | | 172,924 |

| RenaissanceRe Holdings, Ltd. | | 3,996 | | 227,732 |

| Safety Insurance Group, Inc. | | 2,998 | | 116,982 |

| TransAtlantic Holdings, Inc. | | 1,433 | | 97,731 |

| Universal American Financial Corp. | | 6,725 | | 186,484 |

| Zenith National Insurance Corp. | | 3,844 | | 153,068 |

| |

|

| | | | | 2,461,871 |

| |

|

| Real Estate Investment Trusts 4.5% | | | | |

| Agree Realty Corp. | | 4,376 | | 129,180 |

| Arbor Realty Trust, Inc. | | 4,895 | | 86,984 |

| Capital Trust, Inc., Class A (p) | | 1,946 | | 55,831 |

| Deerfield Capital Corp. (p) | | 8,200 | | 65,518 |

| First Industrial Realty Trust, Inc. | | 2,837 | | 98,813 |

| Gramercy Capital Corp. (p) | | 2,927 | | 67,760 |

| Hospitality Properties Trust | | 4,671 | | 158,580 |

| HRPT Properties Trust | | 12,954 | | 102,984 |

| LaSalle Hotel Properties | | 3,564 | | 97,689 |

See Notes to Financial Statements

11

SCHEDULE OF INVESTMENTS continued

January 31, 2008 (unaudited)

| | | | | | | | | Shares | | Value |

|

| |

| COMMON STOCKS continued | | | | | | |

| FINANCIALS continued | | | | | | | | |

| Real Estate Investment Trusts continued | | | | |

| LTC Properties, Inc. | | | | | | | | 2,098 | | $ 54,653 |

| Newcastle Investment Corp. | | | | | | | | 3,538 | | 44,225 |

| Potlatch Corp. | | | | | | | | 2,387 | | 102,474 |

| |

|

| | | | | | | | | | | 1,064,691 |

| |

|

| Thrifts & Mortgage Finance 0.8% | | | | | | |

| Corus Bankshares, Inc. (p) | | | | | | | | 5,122 | | 65,152 |

| FirstFed Financial Corp. * (p) | | | | | | | | 1,620 | | 67,959 |

| PMI Group, Inc. | | | | | | | | 4,827 | | 45,856 |

| |

|

| | | | | | | | | | | 178,967 |

| |

|

| HEALTH CARE 6.5% | | | | | | | | | | |

| Biotechnology 0.5% | | | | | | | | | | |

| Applera Corp. - Celera Genomics Group * | | 8,328 | | 127,585 |

| |

|

| Health Care Equipment & Supplies 0.3% | | | | |

| Varian Medical Systems, Inc. | | | | | | 1,228 | | 66,619 |

| |

|

| Health Care Providers & Services 3.0% | | | | |

| AMERIGROUP Corp. * | | | | | | | | 4,791 | | 179,758 |

| Centene Corp. * | | | | | | | | 5,771 | | 138,158 |

| Health Net, Inc. * | | | | | | | | 2,343 | | 108,926 |

| HealthSpring, Inc. * | | | | | | | | 6,498 | | 134,444 |

| Molina Healthcare, Inc. * | | | | | | | | 3,919 | | 133,677 |

| |

|

| | | | | | | | | | | 694,963 |

| |

|

| Life Sciences Tools & Services 1.5% | | | | |

| Charles River Laboratories International, Inc. * | | 2,740 | | 170,154 |

| Invitrogen Corp. * | | | | | | | | 1,986 | | 170,140 |

| |

|

| | | | | | | | | | | 340,294 |

| |

|

| Pharmaceuticals 1.2% | | | | | | | | |

| King Pharmaceuticals, Inc. * | | | | | | 13,183 | | 138,290 |

| Watson Pharmaceuticals, Inc. * | | | | | | 5,727 | | 149,532 |

| |

|

| | | | | | | | | | | 287,822 |

| |

|

| INDUSTRIALS 11.3% | | | | | | | | | | |

| Aerospace & Defense 0.2% | | | | | | | | |

| Curtiss-Wright Corp. | | | | | | | | 1,369 | | 57,087 |

| |

|

| Air Freight & Logistics 0.4% | | | | | | | | |

| Pacer International, Inc. | | | | | | | | 5,719 | | 97,966 |

| |

|

| Airlines 0.5% | | | | | | | | | | |

| UAL Corp. | | | | | | | | 3,122 | | 118,480 |

| |

|

See Notes to Financial Statements

12

SCHEDULE OF INVESTMENTS continued

January 31, 2008 (unaudited)

| | | | | Shares | | Value |

|

| |

| COMMON STOCKS continued | | | | |

| INDUSTRIALS continued | | | | | | |

| Commercial Services & Supplies 2.2% | | | | |

| Bowne & Co. | | | | 6,580 | | $ 80,934 |

| Deluxe Corp. | | | | 3,559 | | 86,555 |

| RSC Holdings, Inc. | | | | 7,239 | | 79,629 |

| Spherion Corp. * | | | | 20,240 | | 135,203 |

| United Stationers, Inc. * | | | | 2,242 | | 123,893 |

| |

|

| | | | | | | 506,214 |

| |

|

| Construction & Engineering 1.0% | | | | |

| EMCOR Group, Inc. | | | | 6,512 | | 142,808 |

| Perini Corp. * | | | | 2,572 | | 89,892 |

| |

|

| | | | | | | 232,700 |

| |

|

| Electrical Equipment 1.1% | | | | | | |

| Acuity Brands, Inc. | | | | 2,837 | | 129,456 |

| Hubbell, Inc., Class B | | | | 2,542 | | 121,203 |

| |

|

| | | | | | | 250,659 |

| |

|

| Industrial Conglomerates 1.2% | | | | |

| Teleflex, Inc. | | | | 2,511 | | 148,450 |

| Tredegar Corp. | | | | 9,715 | | 134,650 |

| |

|

| | | | | | | 283,100 |

| |

|

| Machinery 3.7% | | | | | | |

| AGCO Corp. * | | | | 2,946 | | 177,408 |

| Gardner Denver, Inc. * | | | | 5,225 | | 169,499 |

| Mueller Industries, Inc. | | | | 5,397 | | 151,116 |

| SPX Corp. | | | | 2,101 | | 211,361 |

| Timken Co. | | | | 5,518 | | 166,809 |

| |

|

| | | | | | | 876,193 |

| |

|

| Road & Rail 0.4% | | | | | | |

| Hertz Global Holdings, Inc. | | | | 6,990 | | 104,291 |

| |

|

| Trading Companies & Distributors 0.6% | | | | |

| GATX Corp. | | | | 3,533 | | 132,841 |

| |

|

| INFORMATION TECHNOLOGY 10.6% | | | | |

| Communications Equipment 2.6% | | | | |

| ADC Telecommunications, Inc. * | | | | 6,414 | | 94,863 |

| Adtran, Inc. | | | | 5,038 | | 104,841 |

| CommScope, Inc. * | | | | 2,130 | | 94,130 |

| Extreme Networks, Inc. * | | | | 32,630 | | 112,573 |

| Plantronics, Inc. | | | | 4,687 | | 89,522 |

| Tekelec * | | | | 9,923 | | 118,977 |

| |

|

| | | | | | | 614,906 |

| |

|

See Notes to Financial Statements

13

SCHEDULE OF INVESTMENTS continued

January 31, 2008 (unaudited)

| | | | | Shares | | Value |

|

| |

| COMMON STOCKS continued | | | | | | |

| INFORMATION TECHNOLOGY continued | | | | | | |

| Computers & Peripherals 1.0% | | | | | | |

| Lexmark International, Inc., Class A * | | | | 3,385 | | $ 122,571 |

| QLogic Corp. * | | | | 7,153 | | 102,288 |

| |

|

| | | | | | | 224,859 |

| |

|

| Electronic Equipment & Instruments 1.6% | | | | | | |

| Avnet, Inc. * | | | | 4,028 | | 143,437 |

| AVX Corp. | | | | 2,668 | | 34,764 |

| Littelfuse, Inc. * | | | | 2,868 | | 87,158 |

| Tech Data Corp. * | | | | 3,052 | | 104,928 |

| |

|

| | | | | | | 370,287 |

| |

|

| IT Services 2.1% | | | | | | |

| CACI International, Inc., Class A * | | | | 3,224 | | 140,534 |

| CIBER, Inc. | | | | 16,403 | | 79,063 |

| Hewitt Associates, Inc., Class A * | | | | 3,881 | | 144,257 |

| ManTech International Corp., Class A * | | | | 2,938 | | 120,164 |

| |

|

| | | | | | | 484,018 |

| |

|

| Semiconductors & Semiconductor Equipment 2.0% | | | | |

| Amkor Technology, Inc. * | | | | 8,266 | | 63,152 |

| Entegris, Inc. * | | | | 12,323 | | 94,887 |

| Integrated Device Technology, Inc. | | | | 10,536 | | 78,493 |

| RF Micro Devices Inc. | | | | 14,759 | | 47,672 |

| Teradyne, Inc. * | | | | 10,098 | | 110,775 |

| Zoran Corp. * | | | | 6,706 | | 79,131 |

| |

|

| | | | | | | 474,110 |

| |

|

| Software 1.3% | | | | | | |

| Compuware Corp. * | | | | 13,460 | | 114,410 |

| Lawson Software, Inc. | | | | 10,452 | | 90,828 |

| Parametric Technology Corp. | | | | 6,718 | | 110,511 |

| |

|

| | | | | | | 315,749 |

| |

|

| MATERIALS 8.0% | | | | | | |

| Chemicals 5.3% | | | | | | |

| Celanese Corp., Ser. A | | | | 5,607 | | 208,468 |

| Cytec Industries, Inc. | | | | 2,413 | | 136,600 |

| Eastman Chemical Co. | | | | 1,386 | | 91,573 |

| H.B. Fuller Co. | | | | 6,049 | | 125,577 |

| International Flavors & Fragrances, Inc. | | | | 2,626 | | 111,894 |

| Lubrizol Corp. | | | | 3,953 | | 207,967 |

| OM Group, Inc. | | | | 2,896 | | 166,173 |

| PolyOne Corp. * | | | | 13,571 | | 83,598 |

| Spartech Corp. | | | | 8,081 | | 119,033 |

| |

|

| | | | | | | 1,250,883 |

| |

|

See Notes to Financial Statements

14

SCHEDULE OF INVESTMENTS continued

January 31, 2008 (unaudited)

| | | | | Shares | | Value |

|

| |

| COMMON STOCKS continued | | | | | | |

| MATERIALS continued | | | | | | |

| Metals & Mining 1.6% | | | | | | |

| Carpenter Technology Corp. | | | | 2,824 | | $ 174,071 |

| Quanex Corp. | | | | 3,798 | | 199,053 |

| |

|

| | | | | | | 373,124 |

| |

|

| Paper & Forest Products 1.1% | | | | | | |

| Buckeye Technologies, Inc. | | | | 8,862 | | 116,535 |

| Schweitzer-Mauduit International, Inc. | | | | 6,045 | | 144,113 |

| |

|

| | | | | | | 260,648 |

| |

|

| TELECOMMUNICATION SERVICES 2.1% | | | | |

| Diversified Telecommunication Services 1.4% | | | | |

| CenturyTel, Inc. | | | | 4,563 | | 168,420 |

| IDT Corp., Class B * | | | | 11,658 | | 80,907 |

| Premiere Global Services, Inc. * | | | | 7,496 | | 91,376 |

| |

|

| | | | | | | 340,703 |

| |

|

| Wireless Telecommunication Services 0.7% | | | | |

| Telephone & Data Systems, Inc. | | | | 2,973 | | 156,796 |

| |

|

| UTILITIES 10.8% | | | | | | |

| Electric Utilities 3.4% | | | | | | |

| CMS Energy Corp. | | | | 11,904 | | 186,536 |

| Northeast Utilities | | | | 7,251 | | 200,998 |

| Pepco Holdings, Inc. | | | | 9,848 | | 250,730 |

| UIL Holdings Corp. | | | | 4,571 | | 156,099 |

| |

|

| | | | | | | 794,363 |

| |

|

| Gas Utilities 4.3% | | | | | | |

| AGL Resources, Inc. | | | | 3,338 | | 126,343 |

| Energen Corp. | | | | 2,896 | | 182,159 |

| Northwest Natural Gas Co. | | | | 1,910 | | 90,991 |

| ONEOK, Inc. | | | | 5,033 | | 236,551 |

| Southern Union Co. | | | | 3,692 | | 100,349 |

| UGI Corp. | | | | 3,857 | | 102,926 |

| WGL Holdings, Inc. | | | | 5,146 | | 165,907 |

| |

|

| | | | | | | 1,005,226 |

| |

|

| Multi-Utilities 3.1% | | | | | | |

| Alliant Energy Corp. | | | | 4,914 | | 181,327 |

| CenterPoint Energy, Inc. | | | | 8,374 | | 134,068 |

| NSTAR | | | | 6,214 | | 201,520 |

| OGE Energy Corp. | | | | 6,258 | | 204,824 |

| |

|

| | | | | | | 721,739 |

| |

|

| Total Common Stocks (cost $26,036,196) | | | | 22,825,801 |

| |

|

See Notes to Financial Statements

15

SCHEDULE OF INVESTMENTS continued

January 31, 2008 (unaudited)

| | | | | Principal | | |

| | | | | Amount | | Value |

|

| SHORT-TERM INVESTMENTS 6.4% | | | | |

| U.S. TREASURY OBLIGATIONS 0.4% | | | | |

| U.S. Treasury Bill, 2.70%, 03/20/2008 ß ƒ | | $ 100,000 | | $ 99,640 |

| | |

|

|

| | | | | Shares | | Value |

|

| |

| MUTUAL FUND SHARES 6.0% | | | | |

| AIM Short-Term Investments Trust Government & Agency Portfolio, | | | | |

| Class I, 3.72% q (pp) | | | | 736,701 | | 736,701 |

| Evergreen Institutional Money Market Fund, Class I, 4.31% q ø | | 656,308 | | 656,308 |

| |

|

| | | | | | | 1,393,009 |

| |

|

| Total Short-Term Investments (cost $1,492,649) | | | | 1,492,649 |

| |

|

| Total Investments (cost $27,528,845) 103.7% | | | | 24,318,450 |

| Other Assets and Liabilities (3.7%) | | | | (867,080) |

| |

|

| Net Assets 100.0% | | | | | | $ 23,451,370 |

| |

|

| (p) | | All or a portion of this security is on loan. |

| * | | Non-income producing security |

| q | | Rate shown is the 7-day annualized yield at period end. |

| (pp) | | All or a portion of this security represents investment of cash collateral received from securities on loan. |

| ø | | Evergreen Investment Management Company, LLC is the investment advisor to both the Fund and the money market |

| | | fund. |

| ß | | Rate shown represents the yield to maturity at date of purchase. |

| ƒ | | All or a portion of this security was pledged to cover initial margin requirements for open futures contracts. |

| The following table shows the percent of total long-term investments by sector as of January 31, 2008: |

| |

| Financials | | 26.4% | |

| Industrials | | 11.6% | |

| Utilities | | 11.0% | |

| Information Technology | | 10.9% | |

| Consumer Discretionary | | 10.9% | |

| Materials | | 8.3% | |

| Health Care | | 6.6% | |

| Energy | | 6.2% | |

| Consumer Staples | | 5.9% | |

| Telecommunication Services | | 2.2% | |

| |

| |

| | | 100.0% | |

| | |

| |

See Notes to Financial Statements

16

STATEMENT OF ASSETS AND LIABILITIES

January 31, 2008 (unaudited)

| Assets | | |

| Investments in securities, at value (cost $26,872,537) including $730,579 | | |

| of securities loaned | | $ 23,662,142 |

| Investments in affiliated money market fund, at value (cost $656,308) | | 656,308 |

|

| Total investments | | 24,318,450 |

| Receivable for securities sold | | 991,005 |

| Dividends receivable | | 32,378 |

| Receivable for daily variation margin on open futures contracts | | 15,620 |

| Receivable for securities lending income | | 2,491 |

| Prepaid expenses and other assets | | 5,480 |

|

| Total assets | | 25,365,424 |

|

| Liabilities | | |

| Payable for securities purchased | | 1,140,825 |

| Payable for Fund shares redeemed | | 20,960 |

| Payable for securities on loan | | 736,701 |

| Advisory fee payable | | 319 |

| Due to other related parties | | 213 |

| Accrued expenses and other liabilities | | 15,036 |

|

| Total liabilities | | 1,914,054 |

|

| Net assets | | $ 23,451,370 |

|

| Net assets represented by | | |

| Paid-in capital | | $ 28,057,673 |

| Undistributed net investment income | | 66,887 |

| Accumulated net realized losses on investments | | (1,422,676) |

| Net unrealized losses on investments | | (3,250,514) |

|

| Total net assets | | $ 23,451,370 |

|

| Net assets consists of | | |

| Class A | | $ 27,453 |

| Class I | | 23,423,917 |

|

| Total net assets | | $ 23,451,370 |

|

| Shares outstanding (unlimited number of shares authorized) | | |

| Class A | | 2,846 |

| Class I | | 2,417,228 |

|

| Net asset value per share | | |

| Class A | | $ 9.65 |

| Class A—Offering price (based on sales charge of 5.75%) | | $ 10.24 |

| Class I | | $ 9.69 |

|

See Notes to Financial Statements

17

STATEMENT OF OPERATIONS

Six Months Ended January 31, 2008 (unaudited)

| Investment income | | |

| Dividends (net of foreign withholding taxes of $725) | | $ 264,747 |

| Income from affiliate | | 20,874 |

| Securities lending | | 12,128 |

| Interest | | 4,443 |

|

| Total investment income | | 302,192 |

|

| Expenses | | |

| Advisory fee | | 91,558 |

| Distribution Plan expenses | | 46 |

| Administrative services fee | | 13,029 |

| Transfer agent fees | | 40 |

| Trustees’ fees and expenses | | 421 |

| Printing and postage expenses | | 9,031 |

| Custodian and accounting fees | | 9,993 |

| Registration and filing fees | | 14,405 |

| Professional fees | | 9,680 |

| Other | | 326 |

|

| Total expenses | | 148,529 |

| Less: Expense reductions | | (403) |

| Fee waivers and expense reimbursements | | (27,946) |

|

| Net expenses | | 120,180 |

|

| Net investment income | | 182,012 |

|

| Net realized and unrealized gains or losses on investments | | |

| Net realized losses on: | | |

| Securities | | (1,279,798) |

| Futures contracts | | (177,249) |

|

| Net realized losses on investments | | (1,457,047) |

| Net change in unrealized gains or losses on investments | | (1,433,862) |

|

| Net realized and unrealized gains or losses on investments | | (2,890,909) |

|

| Net decrease in net assets resulting from operations | | $ (2,708,897) |

|

See Notes to Financial Statements

18

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | | | |

| | | January 31, 2008 | | Year Ended |

| | | (unaudited) | | July 31, 2007 |

|

| Operations | | | | | | | | |

| Net investment income | | $ 182,012 | | $ 213,560 |

| Net realized gains or losses on investments | | | | (1,457,047) | | | | 659,695 |

| Net change in unrealized gains or losses | | | | | | | | |

| on investments | | | | (1,433,862) | | | | (1,977,985) |

|

| Net decrease in net assets resulting from | | | | | | | | |

| operations | | | | (2,708,897) | | | | (1,104,730) |

|

| Distributions to shareholders from | | | | | | | | |

| Net investment income | | | | | | | | |

| Class A | | | | (228) | | | | (337) |

| Class I | | | | (270,849) | | | | (92,917) |

| Net realized gains | | | | | | | | |

| Class A | | | | (731) | | | | (144) |

| Class I | | | | (596,084) | | | | (36,420) |

|

| Total distributions to shareholders | | | | (867,892) | | | | (129,818) |

|

| | | Shares | | | | Shares | | |

| Capital share transactions | | | | | | | | |

| Proceeds from shares sold | | | | | | | | |

| Class A | | 0 | | 0 | | 2,727 | | 29,688 |

| Class I | | 392,784 | | 4,191,843 | | 2,084,856 | | 25,040,612 |

|

| | | | | 4,191,843 | | | | 25,070,300 |

|

| Net asset value of shares issued in | | | | | | | | |

| reinvestment of distributions | | | | | | | | |

| Class A | | 90 | | 926 | | 40 | | 464 |

| Class I | | 21,056 | | 217,549 | | 93 | | 1,084 |

|

| | | | | 218,475 | | | | 1,548 |

|

| Payment for shares redeemed | | | | | | | | |

| Class A | | (111) | | (1,115) | | 0 | | 0 |

| Class I | | (500,074) | | (5,229,008) | | (219,189) | | (2,655,406) |

|

| | | | | (5,230,123) | | | | (2,655,406) |

|

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from capital share transactions | | | | (819,805) | | | | 22,416,442 |

|

| Total increase (decrease) in net assets | | | | (4,396,594) | | | | 21,181,894 |

| Net assets | | | | | | | | |

| Beginning of period | | | | 27,847,964 | | | | 6,666,070 |

|

| End of period | | $ 23,451,370 | | $ 27,847,964 |

|

| Undistributed net investment income | | $ 66,887 | | $ 155,952 |

|

See Notes to Financial Statements

19

NOTES TO FINANCIAL STATEMENTS (unaudited)

1. ORGANIZATION

Evergreen Disciplined Small-Mid Value Fund (the “Fund”) is a diversified series of Evergreen Equity Trust (the “Trust”), a Delaware statutory trust organized on September 18, 1997. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund offers Class A and Class I shares. Class A shares are sold with a front-end sales charge. However, Class A share investments of $1 million or more are not subject to a front-end sales charge but are subject to a contingent deferred sales charge of 1.00% upon redemption within 18 months. Class A shares are currently not available for sale to the public. Class I shares are sold without a front-end sales charge or contingent deferred sales charge. Class A shares pay an ongoing distribution fee.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America, which require management to make estimates and assumptions that affect amounts reported herein. Actual results could differ from these estimates.

a. Valuation of investments

Listed equity securities are usually valued at the last sales price or official closing price on the national securities exchange where the securities are principally traded.

Short-term securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates market value.

Investments in open-end mutual funds are valued at net asset value. Securities for which market quotations are not readily available or not reflective of current market value are valued at fair value as determined by the investment advisor in good faith, according to procedures approved by the Board of Trustees.

b. Repurchase agreements

Securities pledged as collateral for repurchase agreements are held by the custodian bank or in a segregated account in the Fund’s name until the agreements mature. Collateral for certain tri-party repurchase agreements is held at the counterparty’s custodian in a segregated account for the benefit of the Fund and the counterparty. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. However, in the event of default or bankruptcy by the other party to the agreement, retention of the collateral may be subject to legal proceedings. The Fund will enter into repurchase agreements with banks and other financial institutions, which are deemed by the investment advisor to be creditworthy pursuant to guidelines established by the Board of Trustees. In certain instances, the Fund’s securities lending agent may provide collateral in the form of repurchase agreements.

20

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

c. Futures contracts

In order to gain exposure to, or protect against changes in, security values, the Fund may buy and sell futures contracts. The primary risks associated with the use of futures contracts are the imperfect correlation between changes in market values of securities held by the Fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued based upon their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the financial statements. Fluctuations in the value of the contracts are recorded in the Statement of Assets and Liabilities as an asset or liability and in the Statement of Operations as unrealized gains or losses until the contracts are closed, at which point they are recorded as net realized gains or losses on futures contracts.

d. Securities lending

The Fund may lend its securities to certain qualified brokers in order to earn additional income. The Fund receives compensation in the form of fees or interest earned on the investment of any cash collateral received. The Fund also continues to receive interest and dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a market value at least equal to the market value of the securities on loan. In the event of default or bankruptcy by the borrower, the Fund could experience delays and costs in recovering the loaned securities or in gaining access to the collateral. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

e. Security transactions and investment income

Security transactions are recorded on trade date. Realized gains and losses are computed using the specific cost of the security sold. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Dividend income is recorded on the ex-dividend date. Foreign income and capital gains realized on some securities may be subject to foreign taxes, which are accrued as applicable.

f. Federal taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income, including any net capital gains (which have already been offset by available capital loss carryovers). Accordingly, no provision for federal taxes is required.

g. Distributions

Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

h. Class allocations

Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

21

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

3. ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Evergreen Investment Management Company, LLC (“EIMC”), an indirect, wholly-owned subsidiary of Wachovia Corporation (“Wachovia”), is the investment advisor to the Fund and is paid an annual fee starting at 0.70% and declining to 0.65% as average daily net assets increase. For the six months ended January 31, 2008, the advisory fee was equivalent to 0.70% of the Fund’s average daily net assets (on an annualized basis).

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. During the six months ended January 31, 2008, EIMC contractually and voluntarily waived its advisory fee in the amounts of $22,099 and $5,840, respectively, and voluntarily reimbursed Distribution Plan expenses (see Note 4) relating to Class A shares in the amount of $7.

The Fund may invest in money market funds which are advised by EIMC. Income earned on these investments is included in income from affiliate on the Statement of Operations.

Effective January 1, 2008, EIMC replaced Evergreen Investment Services, Inc. (“EIS”), an indirect, wholly-owned subsidiary of Wachovia, as the administrator to the Fund upon the assignment of the Fund’s Administrative Services Agreement from EIS to EIMC. There were no changes to the services being provided or fees being paid by the Fund. The administrator provides the Fund with facilities, equipment and personnel and is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds and Evergreen Institutional Enhanced Income Fund), starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds and Evergreen Institutional Enhanced Income Fund) increase.

Evergreen Service Company, LLC (“ESC”), an indirect, wholly-owned subsidiary of Wachovia, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund.

Wachovia Bank NA, through its securities lending division of Wachovia Global Securities Lending, acts as the securities lending agent for the Fund.

4. DISTRIBUTION PLAN

EIS serves as distributor of the Fund’s shares. The Fund has adopted a Distribution Plan, as allowed by Rule 12b-1 of the 1940 Act, for Class A shares. Under the Distribution Plan, distribution fees are paid at an annual rate of 0.30% of the average daily net assets for Class A shares.

5. INVESTMENT TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were $8,907,610 and $9,329,848, respectively, for the six months ended January 31, 2008.

During the six months ended January 31, 2008, the Fund loaned securities to certain brokers. At January 31, 2008, the value of securities on loan and the total value of collateral received for securities loaned amounted to $730,579 and $736,701, respectively.

22

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

At January 31, 2008, the Fund had open long futures contracts outstanding as follows:

| | | | | Initial | | Value at | | |

| | | | | Contract | | January 31, | | Unrealized |

| Expiration | | Contracts | | Amount | | 2008 | | Loss |

|

| March 2008 | | 3 Russell 2000 | | $ 229,418 | | $ 214,500 | | $14,918 |

| | | Mini Futures | | | | | | |

| |

| March 2008 | | 4 S&P MidCap | | 347,761 | | 322,560 | | 25,201 |

| | | 400 Futures | | | | | | |

|

On January 31, 2008 the aggregate cost of securities for federal income tax purposes was $27,537,286. The gross unrealized appreciation and depreciation on securities based on tax cost was $594,819 and $3,813,655, respectively, with a net unrealized depreciation of $3,218,836.

6. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an interfund lending program with certain funds in the Evergreen fund family. This program allows the Fund to borrow from, or lend money to, other participating funds. During the six months ended January 31, 2008, the Fund did not participate in the interfund lending program.

7. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund’s custodian, a portion of fund expenses has been reduced.

8. DEFERRED TRUSTEES’ FEES

Each Trustee of the Fund may defer any or all compensation related to performance of his or her duties as a Trustee. The Trustees’ deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts is based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported in the Fund’s Trustees’ fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

9. FINANCING AGREEMENT

The Fund and certain other Evergreen funds share in an unsecured revolving credit commitment for temporary and emergency purposes, including the funding of redemptions, as permitted by each participating fund’s borrowing restrictions. Borrowings under this facility bear interest at 0.50% per annum above the Federal Funds rate. All of the participating funds are charged an annual commitment fee on the unused balance, which is allocated pro rata. The credit facility is for $100 million with an annual commitment fee of 0.08%. During the six months ended January 31, 2008, the Fund had no borrowings.

23

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

10. REGULATORY MATTERS AND LEGAL PROCEEDINGS

Pursuant to an administrative order issued by the SEC on September 19, 2007, EIMC, EIS, ESC (collectively, the “Evergreen Entities”), Wachovia Securities, LLC and the SEC have entered into an agreement settling allegations of (i) improper short-term trading arrangements in effect prior to May 2003 involving former officers and employees of EIMC and certain broker-dealers, (ii) insufficient systems for monitoring exchanges and enforcing exchange limitations as stated in certain funds’ prospectuses, and (iii) inadequate e-mail retention practices. Under the settlement, the Evergreen Entities were censured and paid approximately $32 million in disgorgement and penalties. This amount, along with a fine assessed by the SEC against Wachovia Securities, LLC will be distributed pursuant to a plan to be developed by an independent distribution consultant and approved by the SEC. The Evergreen Entities neither admitted nor denied the allegations and findings set forth in its settlement with the SEC.

In addition, the Evergreen funds and EIMC and certain of its affiliates are involved in various legal actions, including private litigation and class action lawsuits. EIMC does not expect that any of such legal actions currently pending or threatened will have a material adverse impact on the financial position or operations of any of the Evergreen funds or on EIMC’s ability to provide services to the Evergreen funds.

Although EIMC believes that none of the matters discussed above will have a material adverse impact on the Evergreen funds, there can be no assurance that these matters and any publicity surrounding or resulting from them will not result in reduced sales or increased redemptions of Evergreen fund shares, which could increase Evergreen fund transaction costs or operating expenses, or that they will not have other adverse consequences on the Evergreen funds.

11. NEW ACCOUNTING PRONOUNCEMENTS

In June 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes — an interpretation of FASB statement 109 (“FIN 48”). FIN 48 supplements FASB 109 by prescribing a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The Fund’s financial statements have not been impacted by the adoption of FIN 48. However, the conclusions regarding FIN 48 may be subject to review and adjustment at a later date based on factors including, but not limited to, further implementation guidance expected from FASB, and on-going analysis of tax laws, regulations, and interpretations thereof.

In September 2006, FASB issued Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”). FAS 157 establishes a single authoritative definition of fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. FAS 157 applies to fair value measurements already required or permitted by existing standards. The change to current generally accepted accounting principles from the application of FAS 157 relates to the definition of fair value, the methods used to measure fair

24

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

value, and the expanded disclosures about fair value measurements. Management of the Fund does not believe the adoption of FAS 157 will materially impact the financial statement amounts, however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements on changes in net assets for the period. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years.

25

ADDITIONAL INFORMATION (unaudited)

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S INVESTMENT ADVISORY AGREEMENT

Each year, the Fund’s Board of Trustees is required to consider whether to continue in place the Fund’s investment advisory agreement. In September 2007, the Trustees, including a majority of the Trustees who are not interested persons (as that term is defined in the 1940 Act) of the Fund or of EIMC, approved the continuation of the Fund’s investment advisory agreement. (References below to the “Fund” are to Evergreen Disciplined Small-Mid Value Fund; references to the “funds” are to the Evergreen funds generally.)

At the same time, the Trustees considered the continuation of the investment advisory agreements for all of the funds, and the description below refers in many cases to the Trustees’ process and conclusions in connection with their consideration of this matter for all of the funds. (See “Certain Fund-Specific Considerations” below for a discussion regarding certain factors considered by the Trustees relating specifically to the Fund.) In all of its deliberations, the Board of Trustees and the disinterested Trustees were advised by independent counsel to the disinterested Trustees and counsel to the funds.

The review process. The 1940 Act requires that the Board of Trustees request and evaluate, and that EIMC and any sub-advisors furnish, such information as may reasonably be necessary to evaluate the terms of a fund’s advisory agreement. The review process began at the time of the last advisory contract-renewal process in September 2006. In the course of that process, the Trustees identified a number of funds that had experienced either short-term or longer-term performance issues. During the following months, the Trustees reviewed information relating to any changes in the performance of those funds and/or any changes in the investment process or the investment teams responsible for the management of the funds. In addition, during the course of the year, the Trustees reviewed information regarding the investment performance of all of the funds and identified additional funds that they believed warranted further attention based on performance since September 2006.

In spring 2007, a committee of the Board of Trustees (the “Committee”), working with EIMC management, determined generally the types of information the Board would review and set a timeline detailing the information required and the dates for its delivery to the Trustees. The independent data provider Keil Fiduciary Strategies LLC (“Keil”) was engaged to provide fund-specific and industry-wide data to the Board containing information of a nature and in a format generally prescribed by the Committee, and the Committee worked with Keil and EIMC to develop appropriate groups of peer funds for each fund. The Committee also identified a number of expense, performance, and other issues and requested specific information as to those issues.

The Trustees reviewed, with the assistance of an independent industry consultant retained by the disinterested Trustees, the information provided by EIMC in response to the Committee’s requests and the information provided by Keil. The Trustees formed small committees to review individual funds in greater detail. In addition, the Trustees requested information regarding,

26

ADDITIONAL INFORMATION (unaudited) continued

among other things, brokerage practices of the funds, the use of derivatives by the funds, strategic planning for the funds, analyst and research support available to the portfolio management teams, and information regarding the various fall-out benefits received directly and indirectly by EIMC and its affiliates from the funds. The Trustees requested and received additional information following that review.

The Committee met several times by telephone to consider the information provided by EIMC. The Committee met with representatives of EIMC in early September. At a meeting of the full Board of Trustees later in September, the Committee reported the results of its discussions with EIMC, and the full Board met with representatives of EIMC, engaged in further review of the materials provided to them, and approved the continuation of each of the advisory and sub-advisory agreements.

The disinterested Trustees discussed the continuation of the funds’ advisory agreements with representatives of EIMC and in multiple private sessions with legal counsel at which no personnel of EIMC were present. In considering the continuation of the agreement, the Trustees did not identify any particular information or consideration that was all-important or controlling, and each Trustee attributed different weights to various factors. The Trustees evaluated information provided to them both in terms of the Evergreen mutual funds generally and with respect to each fund, including the Fund, specifically as they considered appropriate; although the Trustees considered the continuation of the agreement as part of the larger process of considering the continuation of the advisory contracts for all of the funds, their determination to continue the advisory agreement for each of the funds was ultimately made on a fund-by-fund basis.

This summary describes a number of the most important, but not necessarily all, of the factors considered by the Board and the disinterested Trustees.

Information reviewed. The Board of Trustees and committees of the Board of Trustees meet periodically during the course of the year. At those meetings, the Board receives a wide variety of information regarding the services performed by EIMC, the investment performance of the funds, and other aspects of the business and operations of the funds. At those meetings, and in the process of considering the continuation of the agreements, the Trustees considered information regarding, for example, the funds’ investment results; the portfolio management teams for the funds and the experience of the members of those teams, and any recent changes in the membership of the teams; portfolio trading practices; compliance by the funds and EIMC with applicable laws and regulations and with the funds’ and EIMC’s compliance policies and procedures; risk evaluation and oversight procedures at EIMC; services provided by affiliates of EIMC to the funds and shareholders of the funds; and other information relating to the nature, extent, and quality of services provided by EIMC. The Trustees considered a number of changes in portfolio management personnel at EIMC and its advisory affiliates in the year since September 2006, and recent changes in compliance personnel at EIMC, including the appointment of a new Chief Compliance Officer for the funds.

27

ADDITIONAL INFORMATION (unaudited) continued

The Trustees considered the rates at which the funds pay investment advisory fees, and the efforts generally by EIMC and its affiliates as sponsors of the funds. The data provided by Keil showed the management fees paid by each fund in comparison to the management fees of other peer mutual funds, in addition to data regarding the investment performance of the funds in comparison to other peer mutual funds. The Trustees were assisted by the independent industry consultant in reviewing the information presented to them.

The Trustees considered the transfer agency fees paid by the funds to an affiliate of EIMC. They reviewed information presented to them showing that the transfer agency fees charged to the funds were generally consistent with industry norms.

The Trustees also considered that EIS, an affiliate of EIMC, serves as administrator to the funds and receives a fee for its services as administrator. In their comparison of the advisory fee paid by the funds with those paid by other mutual funds, the Trustees took into account administrative fees paid by the funds and those other mutual funds. The Board considered that EIS serves as distributor to the funds generally and receives fees from the funds for those services. They considered other so-called “fall-out” benefits to EIMC and its affiliates due to their other relationships with the funds, including, for example, soft-dollar services received by EIMC attributable to transactions entered into by EIMC for the benefit of the funds and brokerage commissions received by Wachovia Securities, LLC, an affiliate of EIMC, from transactions effected by it for the funds. The Trustees also noted that the funds pay sub-transfer agency fees to various financial institutions who hold fund shares in omnibus accounts, and that Wachovia Securities, LLC and its affiliates receive such payments from the funds in respect of client accounts they hold in omnibus arrangements, and that an affiliate of EIMC receives fees for administering the sub-transfer agency payment program. They also considered that Wachovia Securities, LLC and its affiliates receive distribution-related fees and shareholder servicing payments (including amounts derived from payments under the funds’ Rule 12b-1 plans) in respect of shares sold or held through it. The Trustees also noted that an affiliate of EIMC receives compensation for serving as a securities lending agent for the funds.

Nature and quality of the services provided. The Trustees considered that EIMC and its affiliates generally provide a comprehensive investment management service to the funds. They noted that EIMC makes its personnel available to serve as officers of the funds, and concluded that the reporting and management functions provided by EIMC with respect to the funds were generally satisfactory. The Trustees considered the investment philosophy of the Fund’s portfolio management team, and considered the in-house research capabilities of EIMC and its affiliates, as well as other resources available to EIMC, including research services available to it from third parties. The Board considered the managerial and financial resources available to EIMC and its affiliates, and the commitment that the Wachovia organization has made to the funds generally. On the basis of these factors, they determined that the nature and scope of the services provided by EIMC were consistent with its duties under the investment advisory agreements and appropriate and consistent with the investment programs and best interests of the funds.

28

ADDITIONAL INFORMATION (unaudited) continued

The Trustees noted the resources EIMC and its affiliates have committed to the regulatory, compliance, accounting, tax and oversight of tax reporting, and shareholder servicing functions, and the number and quality of staff committed to those functions, which they concluded were appropriate and generally in line with EIMC’s responsibilities to the Fund and to the funds generally. The Board and the disinterested Trustees concluded, within the context of their overall conclusions regarding the funds’ advisory agreements, that they were generally satisfied with the nature, extent, and quality of the services provided by EIMC, including services provided by EIS under its administrative services agreements with the funds.

Investment performance. The Trustees considered the investment performance of each fund, both by comparison to other comparable mutual funds and to broad market indices. The Trustees emphasized that the continuation of the investment advisory agreement for a fund should not be taken as any indication that the Trustees did not believe investment performance for any specific fund might not be improved, and they noted that they would continue to monitor closely the investment performance of the funds going forward.

Advisory and administrative fees. The Trustees recognized that EIMC does not seek to provide the lowest cost investment advisory service, but to provide a high quality, full-service investment management product at a reasonable price. They also noted that EIMC has in many cases sought to set its investment advisory fees at levels consistent with industry norms. The Trustees noted that, in certain cases, a fund’s management fees were higher than many or most other mutual funds in the same Keil peer group. However, in each case, the Trustees determined on the basis of the information presented that the level of management fees was not excessive.

Certain Fund-specific considerations. The Trustees noted that, for the one-year period ended December 31, 2006, the Fund’s Class A shares had outperformed the Fund’s benchmark index, the Russell 2500 Value Index, and a majority of the mutual funds against which the Trustees compared the Fund’s performance. The Trustees also noted that the Fund’s management fee was lower than the management fees of the mutual funds against which the Trustees compared the Fund’s management fee and that the level of profitability realized by EIMC in respect of the fee did not appear excessive.

Economies of scale. The Trustees noted that economies of scale would likely be achieved by EIMC in managing the funds as the funds grow. The Trustees noted that the Fund had implemented breakpoints in its advisory fee structure. The Trustees noted that they would continue to review the appropriate levels of breakpoints in the future, but concluded that the breakpoints as implemented appeared to be a reasonable step toward the realization of economies of scale by the Fund.

Profitability. The Trustees considered information provided to them regarding the profitability to the EIMC organization of the investment advisory, administration, and transfer agency (with respect to the open-end funds only) fees paid to EIMC and its affiliates by each of the funds. They considered that the information provided to them was necessarily estimated, and that the profitability information provided to them, especially on a fund-by-fund basis, did not necessarily

29

ADDITIONAL INFORMATION (unaudited) continued

provide a definitive tool for evaluating the appropriateness of each fund’s advisory fee. They noted that the levels of profitability of the funds to EIMC varied widely, depending on among other things the size and type of fund. They considered the profitability of the funds in light of such factors as, for example, the information they had received regarding the relation of the fees paid by the funds to those paid by other mutual funds, the investment performance of the funds, and the amount of revenues involved. In light of these factors, the Trustees concluded that the profitability of any of the funds, individually or in the aggregate, should not prevent the Trustees from approving the continuation of the agreements.

30

This page left intentionally blank

31

TRUSTEES AND OFFICERS

TRUSTEES1