Exhibit (c)(4)

Project Ryan PRELIMINARY DISCUSSION MATERIAL SFOR THE SPECIAL COMMITTEE OF THE BOARD OF DIRECTORS OF REALNET WORKS,INC. MARCH 24,2022 | CONFIDENTIAL PRELIMINARY DRAFT SUBJECT TO FURTHER REVIEW

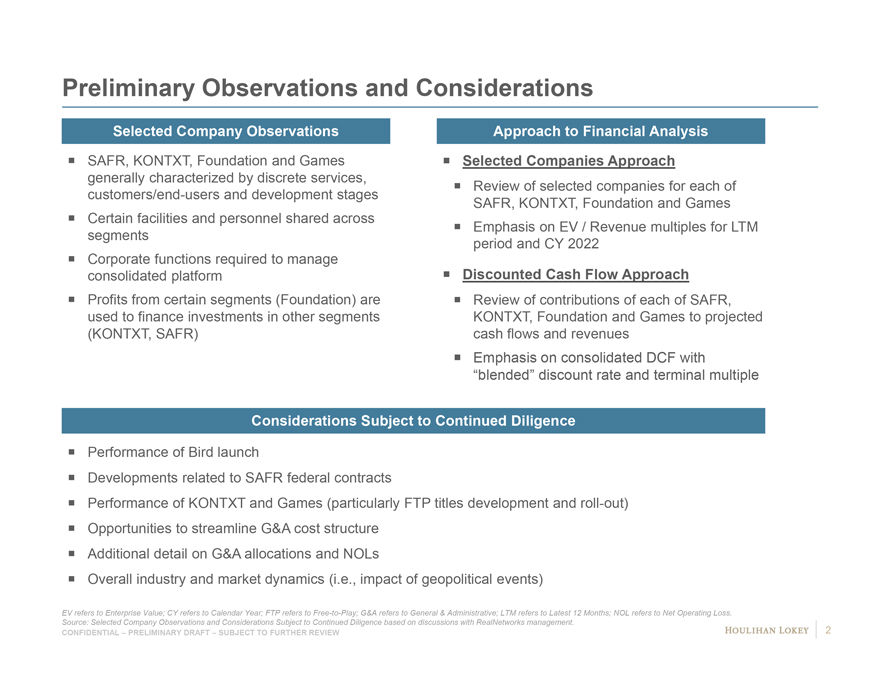

Preliminary Observations and Considerations Selected Company Observations ? SAFR, KONTXT, Foundation and Games generally characterized by discrete services, customers/end-users and development stages? Certain facilities and personnel shared across segments ? Corporate functions required to manage consolidated platform ? Profits from certain segments (Foundation) are used to finance investments in other segments (KONTXT, SAFR) Approach to Financial Analysis ? Selected Companies Approach ? Review of selected companies for each of SAFR, KONTXT, Foundation and Games? Emphasis on EV / Revenue multiples for LTM period and CY 2022 ? Discounted Cash Flow Approach ? Review of contributions of each of SAFR, KONTXT, Foundation and Games to projected cash flows and revenues ? Emphasis on consolidated DCF with “blended” discount rate and terminal multiple Considerations Subject to Continued Diligence ? Performance of Bird launch ? Developments related to SAFR federal contracts ? Performance of KONTXT and Games (particularly FTP titles development and roll-out) ? Opportunities to streamline G&A cost structure ? Additional detail on G&A allocations and NOLs ? Overall industry and market dynamics (i.e., impact of geopolitical events) EV refers to Enterprise Value; CY refers to Calendar Year; FTP refers to Free-to-Play; G&A refers to General & Administrative; LTM refers to Latest 12 Months; NOL refers to Net Operating Loss. Source: Selected Company Observations and Considerations Subject to Continued Diligence based on discussions with RealNetworks management. CONFIDENTIAL – PRELIMINARY DRAFT – SUBJECT TO FURTHER REVIEW

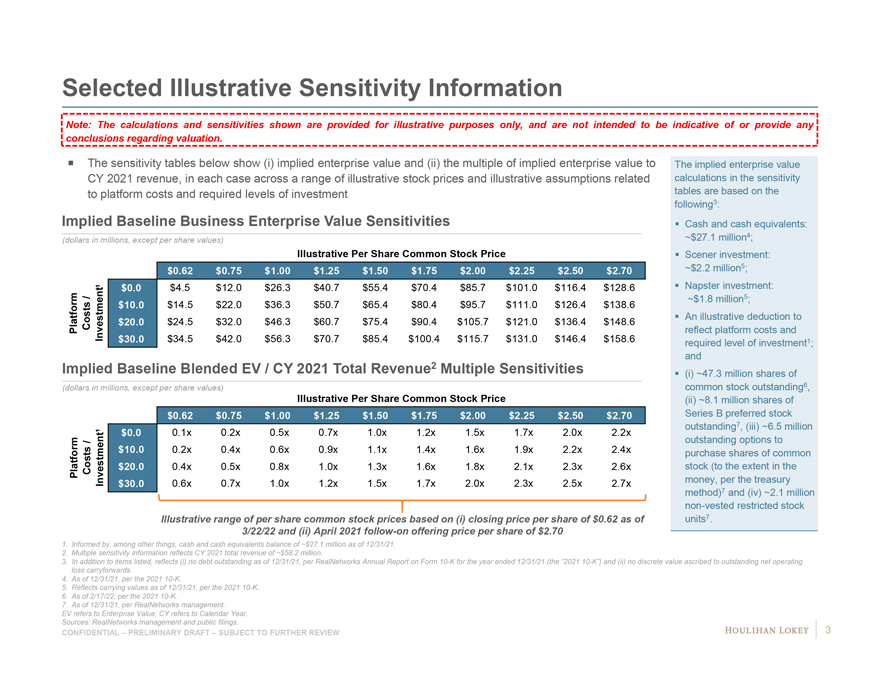

Selected Illustrative Sensitivity Information Note: The calculations and sensitivities shown are provided for illustrative purposes only, and are not intended to be indicative of or provide any conclusions regarding valuation. ? The sensitivity tables below show (i) implied enterprise value and (ii) the multiple of implied enterprise value to CY 2021 revenue, in each case across a range of illustrative stock prices and illustrative assumptions related to platform costs and required levels of investment Implied Baseline Business Enterprise Value Sensitivities (dollars in millions, except per share values) Illustrative Per Share Common Stock Price $51.3 $0.62 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.70 ¹ $0.0 $4.5 $12.0 $26.3 $40.7 $55.4 $70.4 $85.7 $101.0 $116.4 $128.6 / $10.0 $14.5 $22.0 $36.3 $50.7 $65.4 $80.4 $95.7 $111.0 $126.4 $138.6 Platform Costs Investment $20.0 $24.5 $32.0 $46.3 $60.7 $75.4 $90.4 $105.7 $121.0 $136.4 $148.6 $30.0 $34.5 $42.0 $56.3 $70.7 $85.4 $100.4 $115.7 $131.0 $146.4 $158.6 Implied Baseline Blended EV / CY 2021 Total Revenue2 Multiple Sensitivities (dollars in millions, except per share values) Illustrative Per Share Common Stock Price $0.62 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.70 $0.0 0.1x 0.2x 0.5x 0.7x 1.0x 1.2x 1.5x 1.7x 2.0x 2.2x / $10.0 0.2x 0.4x 0.6x 0.9x 1.1x 1.4x 1.6x 1.9x 2.2x 2.4x Platform Costs Investment¹ $20.0 0.4x 0.5x 0.8x 1.0x 1.3x 1.6x 1.8x 2.1x 2.3x 2.6x $30.0 0.6x 0.7x 1.0x 1.2x 1.5x 1.7x 2.0x 2.3x 2.5x 2.7x Illustrative range of per share common stock prices based on (i) closing price per share of $0.62 as of 3/22/22 and (ii) April 2021 follow-on offering price per share of $2.70 The implied enterprise value calculations in the sensitivity tables are based on the following3:? Cash and cash equivalents: ~$27.1 million4;? Scener investment: ~$2.2 million5;? Napster investment: ~$1.8 million5; ? An illustrative deduction to reflect platform costs and required level of investment1; and? (i) ~47.3 million shares of common stock outstanding6, (ii) ~8.1 million shares of Series B preferred stock outstanding7, (iii) ~6.5 million outstanding options to purchase shares of common stock (to the extent in the money, per the treasury method)7 and (iv) ~2.1 million non-vested restricted stock units7. 1. Informed by, among other things, cash and cash equivalents balance of ~$27.1 million as of 12/31/21. 2. Multiple sensitivity information reflects CY 2021 total revenue of ~$58.2 million. 3. In addition to items listed, reflects (i) no debt outstanding as of 12/31/21, per RealNetworks Annual Report on Form 10-K for the year ended 12/31/21 (the “2021 10-K”) and (ii) no discrete value ascribed to outstanding net operating loss carryforwards. 4. As of 12/31/21, per the 2021 10-K. 5. Reflects carrying values as of 12/31/21, per the 2021 10-K. 6. As of 2/17/22, per the 2021 10-K. 7. As of 12/31/21, per RealNetworks management. EV refers to Enterprise Value; CY refers to Calendar Year. Sources: RealNetworks management and public filings. CONFIDENTIAL – PRELIMINARY DRAFT – SUBJECT TO FURTHER REVIEW

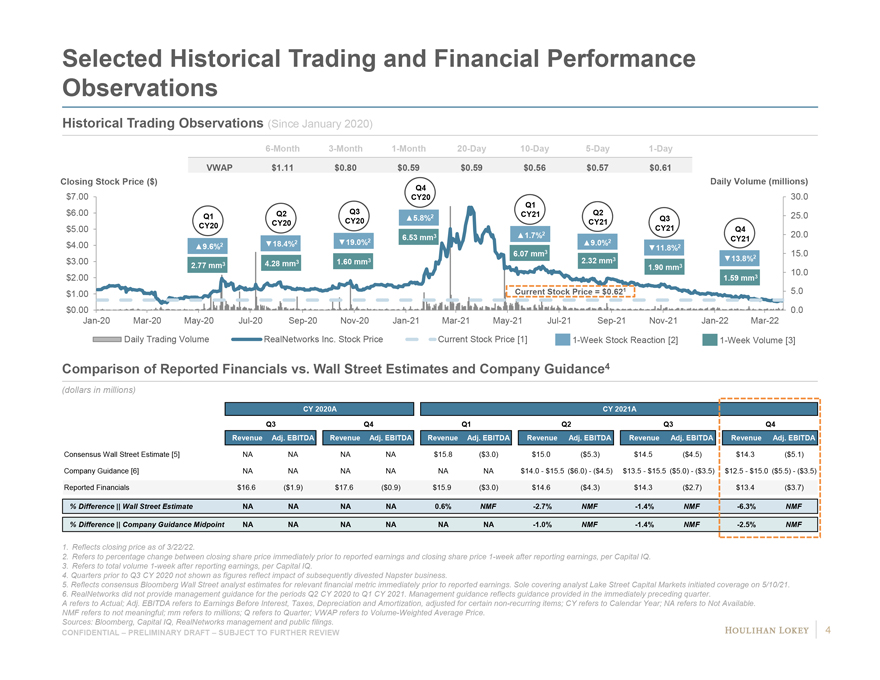

Selected Historical Trading and Financial Performance Observations Historical Trading Observations (Since January 2020) 6-Month 3-Month 1-Month 20-Day 10-Day 5-Day 1-Day VWAP $1.11 $0.80 $0.59 $0.59 $0.56 $0.57 $0.61 Closing Stock Price ($) Daily Volume (millions) Q4 $7.00 CY20 30.0 Q3 Q1 $6.00 Q2 CY21 Q2 Q1 ?5.8%2 Q3 25.0 CY20 CY20 CY21 CY20 CY21 $5.00 Q4 6.53 mm3 ?1.7%2 20.0 2 2 CY21 ?18.4%2 ?19.0% ?9.0% $4.00 ?9.6%2 ?11.8%2 6.07 mm3 2 15.0 3 2.32 mm3 ?13.8% $3.00 3 4.28 mm3 1.60 mm 2.77 mm 1.90 mm3 10.0 $2.00 1.59 mm3 $1.00 Current Stock Price = $0.621 5.0 $0.00 0.0 Jan-20 Mar-20 May-20 Jul-20 Sep-20 Nov-20 Jan-21 Mar-21 May-21 Jul-21 Sep-21 Nov-21 Jan-22 Mar-22 Daily Trading Volume RealNetworks Inc. Stock Price Current Stock Price [1] 1-Week Stock Reaction [2] 1-Week Volume [3] Comparison of Reported Financials vs. Wall Street Estimates and Company Guidance4 (dollars in millions) CY 2020A CY 2021A Q3 Q4 Q1 Q2 Q3 Q4 Revenue Adj. EBITDA Revenue Adj. EBITDA Revenue Adj. EBITDA Revenue Adj. EBITDA Revenue Adj. EBITDA Revenue Adj. EBITDA Consensus Wall Street Estimate [5] NA NA NA NA $15.8 ($3.0) $15.0 ($5.3) $14.5 ($4.5) $14.3 ($5.1) Company Guidance [6] NA NA NA NA NA NA $14.0—$15.5 ($6.0)—($4.5) $13.5—$15.5 ($5.0)—($3.5) $12.5—$15.0 ($5.5)—($3.5) Reported Financials $16.6 ($1.9) $17.6 ($0.9) $15.9 ($3.0) $14.6 ($4.3) $14.3 ($2.7) $13.4 ($3.7) % Difference || Wall Street Estimate NA NA NA NA 0.6% NMF -2.7% NMF -1.4% NMF -6.3% NMF % Difference || Company Guidance Midpoint NA NA NA NA NA NA -1.0% NMF -1.4% NMF -2.5% NMF 1. Reflects closing price as of 3/22/22. 2. Refers to percentage change between closing share price immediately prior to reported earnings and closing share price 1-week after reporting earnings, per Capital IQ. 3. Refers to total volume 1-week after reporting earnings, per Capital IQ. 4. Quarters prior to Q3 CY 2020 not shown as figures reflect impact of subsequently divested Napster business. 5. Reflects consensus Bloomberg Wall Street analyst estimates for relevant financial metric immediately prior to reported earnings. Sole covering analyst Lake Street Capital Markets initiated coverage on 5/10/21. 6. RealNetworks did not provide management guidance for the periods Q2 CY 2020 to Q1 CY 2021. Management guidance reflects guidance provided in the immediately preceding quarter. A refers to Actual; Adj. EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; NA refers to Not Available. NMF refers to not meaningful; mm refers to millions; Q refers to Quarter; VWAP refers to Volume-Weighted Average Price. Sources: Bloomberg, Capital IQ, RealNetworks management and public filings. 4 CONFIDENTIAL – PRELIMINARY DRAFT – SUBJECT TO FURTHER REVIEW

Disclaimer This presentation, and any supplemental information (written or oral) or other documents provided in connection therewith (collectively, the “materials”), are provided solely for the information of the Special Committee (the “Committee”) of the Board of Directors (the “Board”) of RealNetworks, Inc. (“RealNetworks” or the “Company”) by Houlihan Lokey in connection with the Committee’s consideration of a potential transaction (the “Transaction”) involving the Company. This presentation is incomplete without reference to, and should be considered in conjunction with, any supplemental information provided by and discussions with Houlihan Lokey in connection therewith. Any defined terms used herein shall have the meanings set forth herein, even if such defined terms have been given different meanings elsewhere in the materials. ? The materials are for discussion purposes only. Houlihan Lokey expressly disclaims any and all liability, whether direct or indirect, in contract or tort or otherwise, to any person in connection with the materials. The materials were prepared for specific persons familiar with the business and affairs of the Company for use in a specific context and were not prepared with a view to public disclosure or to conform with any disclosure standards under any state, federal or international securities laws or other laws, rules or regulations, and none of the Committee, the Company or Houlihan Lokey takes any responsibility for the use of the materials by persons other than the Committee. The materials are provided on a confidential basis solely for the information of the Committee and may not be disclosed, summarized, reproduced, disseminated or quoted or otherwise referred to, in whole or in part, without Houlihan Lokey’s express prior written consent. ? Notwithstanding any other provision herein, the Company (and each employee, representative or other agent of the Company) may disclose to any and all persons without limitation of any kind, the tax treatment and tax structure of any transaction and all materials of any kind (including opinions or other tax analyses, if any) that are provided to the Company relating to such tax treatment and structure. However, any information relating to the tax treatment and tax structure shall remain confidential (and the foregoing sentence shall not apply) to the extent necessary to enable any person to comply with securities laws. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. income or franchise tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. income or franchise tax treatment of the transaction. If the Company plans to disclose information pursuant to the first sentence of this paragraph, the Company shall inform those to whom it discloses any such information that they may not rely upon such information for any purpose without Houlihan Lokey’s prior written consent. Houlihan Lokey is not an expert on, and nothing contained in the materials should be construed as advice with regard to, legal, accounting, regulatory, insurance, tax or other specialist matters. Houlihan Lokey’s role in reviewing any information was limited solely to performing such a review as it deemed necessary to support its own advice and analysis and was not on behalf of the Committee. ? The materials necessarily are based on financial, economic, market and other conditions as in effect on, and the information available to Houlihan Lokey as of, the date of the materials. Although subsequent developments may affect the contents of the materials, Houlihan Lokey has not undertaken, and is under no obligation, to update, revise or reaffirm the materials, except as may be expressly contemplated by Houlihan Lokey’s engagement letter. The materials are not intended to provide the sole basis for evaluation of the Transaction and do not purport to contain all information that may be required. The materials do not address the underlying business decision of the Company or any other party to proceed with or effect the Transaction, or the relative merits of the Transaction as compared to any alternative business strategies or transactions that might be available for the Company or any other party. The materials do not constitute any opinion, nor do the materials constitute a recommendation to the Board, the Committee, the Company, any security holder of the Company or any other party as to how to vote or act with respect to any matter relating to the Transaction or otherwise or whether to buy or sell any assets or securities of any company. Houlihan Lokey’s only opinion is the opinion, if any, that is actually delivered to the Committee. In preparing the materials Houlihan Lokey has acted as an independent contractor and nothing in the materials is intended to create or shall be construed as creating a fiduciary or other relationship between Houlihan Lokey and any party. The materials may not reflect information known to other professionals in other business areas of Houlihan Lokey and its affiliates. ? The preparation of the materials was a complex process involving quantitative and qualitative judgments and determinations with respect to the financial, comparative and other analytic methods employed and the adaption and application of these methods to the unique facts and circumstances presented and, therefore, is not readily susceptible to partial analysis or summary description. Furthermore, Houlihan Lokey did not attribute any particular weight to any analysis or factor considered by it, but rather made qualitative judgments as to the significance and relevance of each analysis and factor. Each analytical technique has inherent strengths and weaknesses, and the nature of the available information may further affect the value of particular techniques. Accordingly, the analyses contained in the materials must be considered as a whole. Selecting portions of the analyses, analytic methods and factors without considering all analyses and factors could create a misleading or incomplete view. The materials reflect judgments and assumptions with regard to industry performance, general business, economic, regulatory, market and financial conditions and other matters, many of which are beyond the control of the participants in the Transaction. Any estimates of value contained in the materials are not necessarily indicative of actual value or predictive of future results or values, which may be significantly more or less favorable. Any analyses relating to the value of assets, businesses or securities do not purport to be appraisals or to reflect the prices at which any assets, businesses or securities may actually be sold. The materials do not constitute a valuation opinion or credit rating. The materials do not address the consideration to be paid or received in, the terms of any arrangements, understandings, agreements or documents related to, or the form, structure or any other portion or aspect of, the Transaction or otherwise. Furthermore, the materials do not address the fairness of any portion or aspect of the Transaction to any party. In preparing the materials, Houlihan Lokey has not conducted any physical inspection or independent appraisal or evaluation of any of the assets, properties or liabilities (contingent or otherwise) of the Company or any other party and has no obligation to evaluate the solvency of the Company or any other party under any law. CONFIDENTIAL – PRELIMINARY DRAFT – SUBJECT TO FURTHER REVIEW 5

Disclaimer (cont.) All budgets, projections, estimates, financial analyses, reports and other information with respect to operations (including, without limitation, estimates of potential cost savings and synergies) reflected in the materials have been prepared by management of the relevant party or are derived from such budgets, projections, estimates, financial analyses, reports and other information or from other sources, which involve numerous and significant subjective determinations made by management of the relevant party and/or which such management has reviewed and found reasonable. The budgets, projections and estimates (including, without limitation, estimates of potential cost savings and synergies) contained in the materials may or may not be achieved and differences between projected results and those actually achieved may be material. Houlihan Lokey has relied upon representations made by management of the Company and other participants in the Transaction that such budgets, projections and estimates have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of such management (or, with respect to information obtained from public sources, represent reasonable estimates), and Houlihan Lokey expresses no opinion with respect to such budgets, projections or estimates or the assumptions on which they are based. The scope of the financial analysis contained herein is based on discussions with the Company (including, without limitation, regarding the methodologies to be utilized), and Houlihan Lokey does not make any representation, express or implied, as to the sufficiency or adequacy of such financial analysis or the scope thereof for any particular purpose. ? Houlihan Lokey has assumed and relied upon the accuracy and completeness of the financial and other information provided to, discussed with or reviewed by it without (and without assuming responsibility for) independent verification of such information, makes no representation or warranty (express or implied) in respect of the accuracy or completeness of such information and has further relied upon the assurances of the Company and other participants in the Transaction that they are not aware of any facts or circumstances that would make such information inaccurate or misleading. In addition, Houlihan Lokey has relied upon and assumed, without independent verification, that there has been no change in the business, assets, liabilities, financial condition, results of operations, cash flows or prospects of the Company or any other participant in the Transaction since the respective dates of the most recent financial statements and other information, financial or otherwise, provided to, discussed with or reviewed by Houlihan Lokey that would be material to its analyses, and that the final forms of any draft documents reviewed by Houlihan Lokey will not differ in any material respect from such draft documents. ? The materials are not an offer to sell or a solicitation of an indication of interest to purchase any security, option, commodity, future, loan or currency. The materials do not constitute a commitment by Houlihan Lokey or any of its affiliates to underwrite, subscribe for or place any securities, to extend or arrange credit, or to provide any other services. In the ordinary course of business, certain of Houlihan Lokey’s affiliates and employees, as well as investment funds in which they may have financial interests or with which they may co-invest, may acquire, hold or sell, long or short positions, or trade or otherwise effect transactions, in debt, equity, and other securities and financial instruments (including loans and other obligations) of, or investments in, the Company, any Transaction counterparty, any other Transaction participant, any other financially interested party with respect to any transaction, other entities or parties that are mentioned in the materials, or any of the foregoing entities’ or parties’ respective affiliates, subsidiaries, investment funds, portfolio companies and representatives (collectively, the “Interested Parties”), or any currency or commodity that may be involved in the Transaction. Houlihan Lokey provides mergers and acquisitions, restructuring and other advisory and consulting services to clients, which may have in the past included, or may currently or in the future include, one or more Interested Parties, for which services Houlihan Lokey has received, and may receive, compensation. Although Houlihan Lokey in the course of such activities and relationships or otherwise may have acquired, or may in the future acquire, information about one or more Interested Parties or the Transaction, or that otherwise may be of interest to the Board, the Committee, or the Company, Houlihan Lokey shall have no obligation to, and may not be contractually permitted to, disclose such information, or the fact that Houlihan Lokey is in possession of such information, to the Board, the Committee, or the Company or to use such information on behalf of the Board, the Committee, or the Company. Houlihan Lokey’s personnel may make statements or provide advice that is contrary to information contained in the materials.

CORPORATE FINANCE FINANCIAL RESTRUCTURING FINANCIAL AND VALUATION ADVISORY HL.com