UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2008

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission file number 001-33192

www.bmhc.com

Building Materials Holding Corporation

Delaware | | 91-1834269 |

| (State of incorporation) | | (I.R.S. Employer Identification No.) |

Four Embarcadero Center, Suite 3200, San Francisco, CA 94111

(415) 627-9100

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

The number of shares outstanding of the registrant’s common stock as of November 5, 2008 was 29,691,028.

BUILDING MATERIALS HOLDING CORPORATION

FORM 10-Q

For the Period Ended September 30, 2008

INDEX

| | | Page Number |

| | | |

PART I - FINANCIAL INFORMATION | | 2 |

| | | |

Item 1 - Financial Statements (unaudited) | | |

| | | |

Consolidated Statements of Operations for the Three and Nine Months Ended September 30, 2008 and 2007 | | 2 |

| | | |

| Consolidated Balance Sheets as of September 30, 2008 and December 31, 2007 | | 3 |

| | | |

Consolidated Statements of Shareholders’ Equity for the Nine Months Ended September 30, 2008 and 2007 | | 4 |

| | | |

Consolidated Statements of Comprehensive (Loss) Income for Nine Months Ended September 30, 2008 and 2007 | | 5 |

| | | |

Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2008 and 2007 | | 6 |

| | | |

| Notes to Consolidated Financial Statements | | 7 |

| | | |

Item 2 - Management's Discussion and Analysis of Financial Condition and Results of Operations | | 42 |

| | | |

Item 3 - Quantitative and Qualitative Disclosures about Market Risk | | 61 |

| | | |

Item 4 - Controls and Procedures | | 62 |

| | | |

| | | |

PART II - OTHER INFORMATION | | 63 |

| | | |

Item 1 - Legal Proceedings | | 63 |

| | | |

Item 1A - Risk Factors | | 64 |

| | | |

Item 2 - Unregistered Sales of Equity Securities and Use of Proceeds | | 69 |

| | | |

Item 3 - Defaults Upon Senior Securities | | 70 |

| | | |

Item 4 - Submission of Matters to a Vote of Security Holders | | 71 |

| | | |

Item 5 - Other Information | | 72 |

| | | |

Item 6 - Exhibits | | 73 |

| | | |

SIGNATURES | | 74 |

Item 1. Financial Statements

Building Materials Holding Corporation

Consolidated Statements of Operations

(thousands, except per share data)

(unaudited)

| | | Three Months Ended September 30 | | Nine Months Ended September 30 | | Year Ended

December 31 | |

| | | 2008 | | 2007 | | 2008 | | 2007 | | 2007 | |

Sales | | | | | | | | | | | |

| Building products | | $ | 184,568 | | $ | 265,652 | | $ | 563,116 | | $ | 785,378 | | $ | 997,035 | |

| Construction services | | | 179,862 | | | 328,387 | | | 528,882 | | | 990,835 | | | 1,182,038 | |

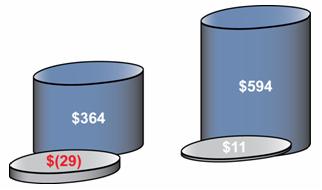

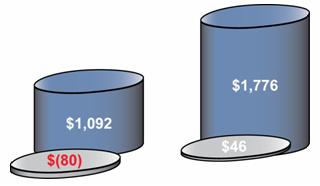

Total sales | | | 364,430 | | | 594,039 | | | 1,091,998 | | | 1,776,213 | | | 2,179,073 | |

| | | | | | | | | | | | | | | | | |

Costs and operating expenses | | | | | | | | | | | | | | | | |

| Cost of goods sold | | | | | | | | | | | | | | | | |

| Building products | | | 139,569 | | | 192,879 | | | 416,837 | | | 569,681 | | | 722,786 | |

| Construction services | | | 162,439 | | | 285,739 | | | 478,954 | | | 853,730 | | | 1,027,796 | |

| Impairment of assets | | | 3,856 | | | — | | | 12,325 | | | — | | | 272,152 | |

Selling, general and administrative expenses | | | 86,850 | | | 106,227 | | | 269,799 | | | 321,021 | | | 422,694 | |

| Other expense (income), net | | | 763 | | | (1,797 | ) | | (5,953 | ) | | (13,839 | ) | | (9,971 | ) |

| Total costs and operating expenses | | | 393,477 | | | 583,048 | | | 1,171,962 | | | 1,730,593 | | | 2,435,457 | |

| | | | | | | | | | | | | | | | | |

(Loss) income from operations | | | (29,047 | ) | | 10,991 | | | (79,964 | ) | | 45,620 | | | (256,384 | ) |

| | | | | | | | | | | | | | | | | |

| Interest expense | | | 16,085 | | | 8,751 | | | 36,969 | | | 26,470 | | | 33,800 | |

| | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before income taxes and minority interests | | | (45,132 | ) | | 2,240 | | | (116,933 | ) | | 19,150 | | | (290,184 | ) |

| | | | | | | | | | | | | | | | | |

| Income tax (expense) benefit | | | (971 | ) | | (121 | ) | | (4,363 | ) | | (4,904 | ) | | 25,670 | |

| Minority interests (income) loss | | | — | | | (548 | ) | | 63 | | | (1,189 | ) | | (1,253 | ) |

(Loss) income from continuing operations | | | (46,103 | ) | | 1,571 | | | (121,233 | ) | | 13,057 | | | (265,767 | ) |

| | | | | | | | | | | | | | | | | |

(Loss) income from discontinued operations prior to sale | | | (4,582 | ) | | 457 | | | (10,290 | ) | | 5,235 | | | 2,937 | |

| Impairment of assets | | | 873 | | | — | | | 7,085 | | | — | | | 64,922 | |

| Gain on sale of discontinued operations | | | — | | | 3,722 | | | — | | | 3,722 | | | 20,029 | |

| Income tax benefit (expense) | | | 6,352 | | | (1,582 | ) | | 27,600 | | | (3,395 | ) | | (4,990 | ) |

Income (loss) from discontinued operations | | | 897 | | | 2,597 | | | 10,225 | | | 5,562 | | | (46,946 | ) |

| | | | | | | | | | | | | | | | | |

Net (loss) income | | $ | (45,206 | ) | $ | 4,168 | | $ | (111,008 | ) | $ | 18,619 | | $ | (312,713 | ) |

| | | | | | | | | | | | | | | | | |

Net (loss) income per share: | | | | | | | | | | | | | | | | |

| Continuing operations | | | $(1.58 | ) | | $0.05 | | | $(4.17 | ) | | $0.46 | | | $(9.23 | ) |

| Discontinued operations | | | 0.03 | | | 0.09 | | | 0.35 | | | 0.19 | | | (1.63 | ) |

| Basic | | | $(1.55 | ) | | $0.14 | | | $(3.82 | ) | | $0.65 | | | $(10.86 | ) |

| | | | | | | | | | | | | | | | | |

| Continuing operations | | | $(1.58 | ) | | $0.05 | | | $(4.17 | ) | | $0.44 | | | $(9.23 | ) |

| Discontinued operations | | | 0.03 | | | 0.09 | | | 0.35 | | | 0.19 | | | (1.63 | ) |

| Diluted | | | $(1.55 | ) | | $0.14 | | | $(3.82 | ) | | $0.63 | | | $(10.86 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

Building Materials Holding Corporation

Consolidated Balance Sheets

(thousands)

(unaudited)

| | | | | | | | | |

Assets | | | | | | | Liabilities, Minority Interests and Shareholders’ Equity | | | | | |

| Cash and cash equivalents | $ | 55,644 | | $ | 60,587 | | | | | | | |

| Marketable securities | | — | | | 1,872 | | | | | | | |

| Receivables, net of allowances | | | | | | | Accounts payable | $ | 50,271 | | $ | 74,025 |

| of $12,630 and $4,656 | | 177,634 | | | 200,995 | | Accrued compensation | | 32,330 | | | 31,537 |

| Inventory | | 90,054 | | | 115,524 | | Insurance deductible reserves | | 21,603 | | | 27,189 |

| Unbilled receivables | | 26,903 | | | 39,189 | | Other accrued liabilities | | 34,503 | | | 28,989 |

| Income tax receivable | | 58,942 | | | 9,812 | | Billings in excess of costs and estimated | | | | | |

| Deferred income taxes | | — | | | 11,470 | | earnings | | 27,640 | | | 20,977 |

| Prepaid expenses and other | | 5,174 | | | 8,973 | | Current portion of long-term debt | | 68,807 | | | 4,923 |

| Assets of discontinued operations | | 12,322 | | | 10,492 | | Liabilities of discontinued operations | | 4,272 | | | 8,533 |

Current assets | | 426,673 | | | 458,914 | | Current liabilities | | 239,426 | | | 196,173 |

| | | | | | | | | | | | | |

| Property and equipment | | | | | | | Insurance deductible reserves | | 25,144 | | | 27,898 |

| Land | | 35,989 | | | 60,052 | | Long-term debt | | 290,120 | | | 343,937 |

| Buildings and improvements | | 134,749 | | | 135,009 | | Other long-term liabilities | | 34,162 | | | 44,503 |

| Equipment | | 165,859 | | | 185,958 | | | | | | | |

| Construction in progress | | 6,411 | | | 16,134 | | Minority interests | | — | | | 8,591 |

| Accumulated depreciation | | (155,493) | | | (155,083) | | | | | | | |

| Assets held for sale | | 33,861 | | | — | | Commitments and contingent liabilities | | — | | | — |

| Marketable securities | | — | | | 40,039 | | | | | | | |

Deferred income taxes | | — | | | 11,269 | | Shareholders’ equity | | | | | |

| Deferred loan costs | | 4,871 | | | 4,358 | | Common shares, $0.001 par value: | | | | | |

| Other long-term assets | | 25,274 | | | 30,956 | | authorized 50 million shares; issued and | | | | | |

| Other intangibles, net | | 44,552 | | | 58,310 | | outstanding 29.5 and 29.2 million shares | | 29 | | | 29 |

| Goodwill | | 13,750 | | | 14,196 | | Additional paid-in capital | | 167,849 | | | 164,043 |

| Assets of discontinued operations | | — | | | 14,732 | | Deferred compensation common shares obligation | | 1,308 | | | 1,427 |

| | $ | 736,496 | | $ | 874,844 | | Deferred compensation common shares | | (1,308) | | | (1,427) |

| | | | | | | | (Accumulated deficit) retained earnings | | (16,526) | | | 94,482 |

| | | | | | | | Accumulated other comprehensive loss, net | | (3,708) | | | (4,812) |

| | | | | | | | Shareholders’ equity | | 147,644 | | | 253,742 |

| | | | | | | | | $ | 736,496 | | $ | 874,844 |

The accompanying notes are an integral part of these consolidated financial statements.

Building Materials Holding Corporation

Consolidated Statements of Shareholders’ Equity

(thousands)

(unaudited)

| | | Nine Months Ended September 30 | | Year Ended December 31 | |

| | | 2008 | | 2007 | | 2007 | |

| Common shares - beginning balance | | $ | 29 | | $ | 29 | | $ | 29 | |

| Shares issued from Incentive and Performance Plans | | | — | | | — | | | — | |

| Shares issued upon exercise of warrants | | | — | | | — | | | — | |

Common Shares | | $ | 29 | | $ | 29 | | $ | 29 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Additional paid-in capital - beginning balance | | $ | 164,043 | | $ | 154,405 | | $ | 154,405 | |

| Shares issued from Incentive and Performance Plans | | | | | | | | | | |

| Options exercised - Management | | | 9 | | | 167 | | | 203 | |

| (Taxes) tax benefit for share options exercised | | | (529 | ) | | 82 | | | 29 | |

| Restricted shares - Management | | | 1,123 | | | 2,643 | | | 2,614 | |

| Unearned compensation | | | (1,123 | ) | | (2,643 | ) | | (2,614 | ) |

| Tax benefit for dividends on restricted shares | | | — | | | — | | | 63 | |

| Shares - Directors | | | 402 | | | 405 | | | 405 | |

| Earned compensation | | | | | | | | | | |

| Options - Management | | | 2,548 | | | 3,928 | | | 5,177 | |

| Restricted shares - Management | | | 1,287 | | | 2,445 | | | 3,317 | |

| (Taxes) tax benefit for vested restricted shares | | | (723 | ) | | 167 | | | 167 | |

| Shares issued from Employee Stock Purchase Plan | | | 30 | | | 277 | | | 277 | |

| Warrants | | | | | | | | | | |

| Fair value of warrants issued | | | 782 | | | — | | | — | |

| Warrants exercised | | | — | | | — | | | — | |

Additional paid-in capital | | $ | 167,849 | | $ | 161,876 | | $ | 164,043 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Deferred compensation common shares obligation - beginning balance | | $ | 1,427 | | $ | 1,200 | | $ | 1,200 | |

| Shares purchased with deferred compensation | | | 279 | | | 350 | | | 364 | |

| Shares purchased with dividends | | | 11 | | | 28 | | | 38 | |

| Distributions | | | (409 | ) | | (174 | ) | | (175 | ) |

Deferred compensation common shares obligation | | $ | 1,308 | | $ | 1,404 | | $ | 1,427 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Deferred compensation common shares - beginning balance | | $ | (1,427 | ) | $ | (1,200 | ) | $ | (1,200 | ) |

Shares purchased with deferred compensation and dividends | | | (290 | ) | | (378 | ) | | (402 | ) |

| Distributions | | | 409 | | | 174 | | | 175 | |

Deferred compensation common shares | | $ | (1,308 | ) | $ | (1,404 | ) | $ | (1,427 | ) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Retained earnings - beginning balance | | $ | 94,482 | | $ | 418,927 | | $ | 418,927 | |

| Net (loss) income | | | (111,008 | ) | | 18,619 | | | (312,713 | ) |

| Cash dividends on common shares | | | — | | | (8,794 | ) | | (11,732 | ) |

(Accumulated deficit) retained earnings | | $ | (16,526 | ) | $ | 428,752 | | $ | 94,482 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Accumulated other comprehensive (loss) income, net - beginning balance | | $ | (4,812 | ) | $ | (732 | ) | $ | (732 | ) |

| Interest rate swap contracts - active: | | | | | | | | | | |

| Unrealized gain (loss) | | | 1,836 | | | (1,797 | ) | | (7,673 | ) |

| Notional reduction settlement payments | | | 2,591 | | | — | | | — | |

| (Taxes) tax benefit for unrealized gain (loss) | | | (1,696 | ) | | 678 | | | 2,933 | |

| Interest rate swap contracts - terminated: | | | | | | | | | | |

| Notional reduction settlement payments | | | (2,591 | ) | | — | | | — | |

| Amortization of notional reduction settlement payments | | | 734 | | | — | | | — | |

| Tax benefit (taxes) for unrealized (loss) gain | | | 706 | | | — | | | — | |

| Marketable securities: | | | | | | | | | | |

| Unrealized (loss) gain | | | (721 | ) | | 639 | | | 1,000 | |

| Tax benefit (taxes) for unrealized (loss) gain | | | 245 | | | (217 | ) | | (340 | ) |

Accumulated other comprehensive (loss) income, net | | $ | (3,708 | ) | $ | (1,429 | ) | $ | (4,812 | ) |

| | | | | | | | | | | |

Shareholders’ Equity | | $ | 147,644 | | $ | 589,228 | | $ | 253,742 | |

The accompanying notes are an integral part of these consolidated financial statements.

Building Materials Holding Corporation

Consolidated Statements of Comprehensive (Loss) Income

(thousands)

(unaudited)

| | | | Nine Months Ended September 30 | | | Year Ended

December 31 | |

| | | | 2008 | | | 2007 | | | 2007 | |

| | | | | | | | | | | |

| Net (loss) income | | $ | (111,008 | ) | $ | 18,619 | | $ | (312,713 | ) |

| | | | | | | | | | | |

| Unrealized gain (loss) on interest rate swap contracts: | | | | | | | | | | |

| Interest rate swap contracts - active: | | | | | | | | | | |

| Unrealized gain (loss) | | $ | 1,836 | | $ | (1,797 | ) | $ | (7,673 | ) |

| Notional reduction settlement payments | | | 2,591 | | | — | | | — | |

| (Taxes) tax benefit for unrealized gain (loss) | | | (1,696 | ) | | 678 | | | 2,933 | |

| Interest rate swap contracts - terminated: | | | | | | | | | | |

| Notional reduction settlement payments | | | (2,591 | ) | | — | | | — | |

| Amortization of notional reduction settlement payments | | | 734 | | | — | | | — | |

| Tax benefit (taxes) for unrealized (loss) gain | | | 706 | | | — | | | — | |

| | | $ | 1,580 | | $ | (1,119 | ) | $ | (4,740 | ) |

| Unrealized (loss) gain on marketable securities: | | | | | | | | | | |

| Unrealized (loss) gain | | $ | (721 | ) | $ | 639 | | $ | 1,000 | |

| Tax benefit (taxes) for unrealized (loss) gain | | | 245 | | | (217 | ) | | (340 | ) |

| | | $ | (476 | ) | $ | 422 | | $ | 660 | |

| | | | | | | | | | | |

Comprehensive (loss) income | | $ | (109,904 | ) | $ | 17,922 | | $ | (316,793 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

Building Materials Holding Corporation

Consolidated Statements of Cash Flows

(thousands)

(unaudited)

| | | Nine Months Ended September 30 | | Year Ended

December 31 | |

| | | 2008 | | 2007 | | 2007 | |

Operating Activities | | | | | | | |

| Net (loss) income | | $ | (111,008 | ) | $ | 18,619 | | $ | (312,713 | ) |

| Items in net (loss) income not using (providing) cash: | | | | | | | | | | |

| Minority interests (loss) income, net | | | (63 | ) | | 790 | | | 853 | |

| Depreciation and amortization | | | 29,393 | | | 36,509 | | | 48,781 | |

| Deferred loan cost amortization | | | 1,235 | | | 842 | | | 1,123 | |

| Deferred loan cost write off | | | 6,969 | | | — | | | — | |

| Amortization of interest rate swap contracts notional reduction settlement payments | | | 734 | | | — | | | — | |

| Impairment of assets | | | 19,410 | | | — | | | 337,074 | |

| Share-based compensation | | | 4,178 | | | 6,722 | | | 8,944 | |

| Gain on sale of discontinued operations | | | — | | | (3,722 | ) | | (20,029 | ) |

| Gain on sale of assets, net | | | (2,865 | ) | | (8,738 | ) | | (8,789 | ) |

| Realized (gain) loss on marketable securities | | | (542 | ) | | 15 | | | (408 | ) |

| Deferred income taxes | | | 21,994 | | | 3,649 | | | (19,452 | ) |

| Accrued loss for acquisition purchase obligation | | | — | | | — | | | 5,500 | |

Changes in assets and liabilities, net of effects of acquisitions and divestitures of business units: | | | | | | | | | | |

| Receivables, net | | | 20,791 | | | (14,498 | ) | | 68,385 | |

| Inventory | | | 26,417 | | | 5,482 | | | 24,599 | |

| Unbilled receivables | | | 12,007 | | | (11,058 | ) | | 3,610 | |

| Income tax receivable | | | (49,130 | ) | | (1,404 | ) | | (7,304 | ) |

| Prepaid expenses and other current assets | | | 3,971 | | | (2,542 | ) | | (454 | ) |

| Accounts payable | | | (9,409 | ) | | 9,543 | | | (22,621 | ) |

| Accrued compensation | | | (3,262 | ) | | (6,173 | ) | | (16,536 | ) |

| Insurance deductible reserves | | | (6,577 | ) | | 3,893 | | | 3,557 | |

| Other accrued liabilities | | | 3,285 | | | (10,294 | ) | | (13,033 | ) |

| Billings in excess of costs and estimated earnings | | | 5,327 | | | 2,790 | | | (3,843 | ) |

| Other long-term assets and liabilities | | | 4,023 | | | (10,595 | ) | | (12,560 | ) |

| Other, net | | | (745 | ) | | 461 | | | 2,595 | |

Cash flows (used) provided by operating activities | | | (23,867 | ) | | 20,291 | | | 67,279 | |

| | | | | | | | | | | |

Investing Activities | | | | | | | | | | |

| Purchases of property and equipment | | | (14,342 | ) | | (21,771 | ) | | (32,995 | ) |

| Acquisitions and investments in businesses, net of cash acquired | | | (8,475 | ) | | (76,440 | ) | | (80,961 | ) |

| Proceeds from dispositions of property and equipment | | | 12,424 | | | 16,325 | | | 16,905 | |

| Proceeds from sale of discontinued operations | | | — | | | 9,592 | | | 27,176 | |

| Purchase of marketable securities | | | (28,589 | ) | | (26,447 | ) | | (35,239 | ) |

| Proceeds from sales of marketable securities | | | 70,221 | | | 26,161 | | | 52,650 | |

| Other, net | | | (2,340 | ) | | (290 | ) | | (628 | ) |

Cash flows provided (used) by investing activities | | | 28,899 | | | (72,870 | ) | | (53,092 | ) |

| | | | | | | | | | | |

Financing Activities | | | | | | | | | | |

| Net borrowings under revolver | | | 29,200 | | | 28,700 | | | — | |

| Principal payments on term notes | | | (16,681 | ) | | (2,625 | ) | | (3,500 | ) |

| Interest rate swap contracts notional reduction settlement payments | | | (2,591 | ) | | — | | | — | |

| Net payments on other notes | | | (2,109 | ) | | (4,523 | ) | | (4,505 | ) |

| Decrease in book overdrafts | | | (5,008 | ) | | (275 | ) | | (7,609 | ) |

| Proceeds from share options exercised | | | 9 | | | 167 | | | 203 | |

| (Taxes) tax benefit for share-based compensation | | | (1,252 | ) | | 249 | | | 259 | |

| Dividends paid | | | (2,938 | ) | | (8,771 | ) | | (11,709 | ) |

| Deferred financing costs | | | (8,717 | ) | | — | | | — | |

| Distributions to minority interests | | | — | | | (1,223 | ) | | (1,223 | ) |

| Other, net | | | 112 | | | 212 | | | 212 | |

Cash flows (used) provided by financing activities | | | (9,975 | ) | | 11,911 | | | (27,872 | ) |

| | | | | | | | | | | |

Decrease in Cash and Cash Equivalents | | | (4,943 | ) | | (40,668 | ) | | (13,685 | ) |

| | | | | | | | | | | |

| Cash and cash equivalents, beginning of period | | | 60,587 | | | 74,272 | | | 74,272 | |

| Cash and cash equivalents, end of period | | $ | 55,644 | | $ | 33,604 | | $ | 60,587 | |

| | | | | | | | | | | |

Supplemental Disclosure of Cash Flow Information | | | | | | | | | | |

| Accrued but unpaid dividends | | $ | — | | $ | 2,938 | | $ | 2,938 | |

| Cash paid for interest | | $ | 28,743 | | $ | 25,595 | | $ | 32,827 | |

| Cash paid for income taxes | | $ | 3,181 | | $ | 7,569 | | $ | 7,233 | |

| | | | | | | | | | | |

Supplemental Schedule of Investing Activities | | | | | | | | | | |

| Fair value of assets acquired | | $ | — | | $ | 12,999 | | $ | 12,999 | |

| Liabilities of acquisitions (extinguished) | | $ | (8,475 | ) | $ | 840 | | $ | (3,680 | ) |

| Cash paid for acquisitions made this period | | $ | 8,475 | | $ | 12,159 | | $ | 16,679 | |

| Cash paid for acquisitions made in prior period | | $ | — | | $ | 64,281 | | $ | 64,282 | |

| | | | | | | | | | | |

Supplemental Schedule of Financing Activities | | | | | | | | | | |

| Fair value of warrants issued | | $ | 782 | | $ | — | | $ | — | |

| Discount on warrants issued | | $ | (782 | ) | $ | — | | $ | — | |

The accompanying notes are an integral part of these consolidated financial statements.

Notes to Consolidated Financial Statements

1. Summary of Significant Accounting Policies

Basis of Presentation

These consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to those rules and regulations. These consolidated financial statements should be read in conjunction with the consolidated financial statements and the accompanying notes included in our most recent Annual Report on Form 10-K.

These consolidated financial statements present separately the financial information for discontinued operations as follows:

| · | concrete block masonry, concrete services and truss manufacturing in Florida (June 2008), |

| · | framing services in Virginia (March 2008) and |

| · | three building materials distribution businesses in Western Colorado (September 2007). |

As a result of these transactions:

| · | the operating results of these operations are presented separately from continuing operations within the caption of discontinued operations and |

| · | related assets and liabilities are separately classified in the consolidated balance sheet. |

These consolidated financial statements refer to three months as a quarter and nine months as a period.

These consolidated financial statements have not been audited by independent registered public accountants. However, in the opinion of management, all adjustments, including those of a normal and recurring nature, necessary to present fairly the results for the periods have been included. The preparation of these consolidated financial statements required estimates and assumptions. Actual results may differ from those estimates.

Nature of Operations

Building Materials Holding Corporation (BMHC) provides building products and construction services to professional homebuilders and contractors in western and southern regions of the United States. We distribute building products, manufacture building components (millwork, floor and roof trusses and wall panels) and provide construction services to professional builders and contractors through a network of 35 distribution facilities, 53 manufacturing facilities and 5 regional construction services facilities. Based on National Association of Home Builders building permit activity, we provide building products and construction services in 10 of the top 25 single-family construction markets.

Principles of Consolidation

The consolidated financial statements include the accounts of BMHC and its subsidiaries. All significant intercompany balances and transactions are eliminated.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and contingent assets and liabilities at the date of the financial statements as well as the reported amounts of sales and expenses during the reporting period. Actual amounts may differ materially from those estimates. The following critical accounting estimates often require our subjective and complex judgment as a result of the need to estimate matters that are inherently uncertain:

| · | Revenue Recognition for Construction Services |

The percentage-of-completion method is used to recognize revenue for construction services. Periodic estimates of our progress towards completion are made based on a comparison of labor costs incurred to date with total estimated contract costs for labor. The percentage-of-completion method requires the use of various estimates, including among others, the extent of progress towards completion, contract revenues and contract completion costs. Contract revenues and contract costs to be recognized are dependent on the accuracy of estimates, including quantities of materials, labor productivity and other cost estimates. We have a history of making reasonable estimates of the extent of progress towards completion, contract revenues and contract completion costs. However, due to uncertainties inherent in the estimation process, it is possible that actual contract revenues and completion costs may vary from estimates. Revisions of contract revenues and cost estimates as well as provisions for estimated losses on uncompleted contracts are recognized in the period such revisions are known.

| · | Estimated Losses on Uncompleted Contracts and Changes in Contract Estimates |

Estimated losses on uncompleted contracts and changes in contract estimates are established by assessing estimated costs to complete, change orders and claims for uncompleted contracts. Revisions of estimated losses are recognized in the period such revisions are known.

Goodwill represents the excess of purchase price over the fair values of net tangible and identifiable intangible assets of acquired businesses. An annual assessment for impairment is completed in the fourth quarter and whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment is recognized if the carrying amount is more than the estimated future operating cash flows as measured by fair value techniques.

| · | Insurance Deductible Reserves |

The estimated cost of automobile, general liability and workers’ compensation claims is determined by actuarial methods. Claims in excess of insurance deductibles are insured with third-party insurance carriers. Insurance deductible reserves for claims are recognized based on the estimated costs of these claims as limited by the deductibles of the applicable insurance policies. Revisions to insurance deductible reserves for estimated claims are recognized in the period such revisions are known.

The estimated cost of warranties for certain construction services is based on the nature and frequency of claims, anticipated claims and cost per claim. Claims in excess of insurance deductibles are insured with third-party insurance carriers. Estimated costs for warranties are recognized when the revenue associated with the service is recognized. Revisions of estimated warranties are recognized in the period such revisions are known.

| · | Share-based Compensation |

Our estimates of the fair values of our share-based payment transactions are based on the modified Black-Scholes-Merton model. In order to meet the fair value measurement objective, we are required to develop estimates regarding expected exercise patterns, share price volatility, forfeiture rates, risk-free interest rate and dividend yield. These assumptions are based principally on historical experience. When circumstances indicate the availability of new or different information that would be useful in estimating these assumptions, revisions are recognized in the period such revisions are known. Due to uncertainties inherent in these assumptions, it is possible that actual share-based compensation may vary from this estimate.

Cash and Cash Equivalents

Cash and cash equivalents consist of short-term investments that have a maturity of three months or less at the date of purchase.

Receivables

Receivables consist primarily of amounts due from customers and are net of an allowance for doubtful accounts. The allowance for doubtful accounts reflects our best estimate of probable losses inherent in the accounts receivable balance. We determine the allowance based on known troubled accounts, historical experience and other available evidence.

Inventory Valuation

Inventory consists principally of building materials purchased for resale and is valued at the lower of average cost or market. We participate in vendor rebate programs under which rebates are earned by attaining certain purchase volumes. Volume rebates are accrued as earned. These volume rebates are recorded as a reduction in inventory and recognized in cost of goods sold when the related product is sold.

Unbilled Receivables and Billings in Excess of Costs and Estimated Earnings

The percentage-of-completion method results in recognizing costs incurred and estimated revenues on uncompleted contracts. Unbilled receivables represent revenues recognized for construction services performed, however not yet billed. Billings in excess of costs and estimated earnings represent billings made in excess of estimated revenues recognized. These billings are deferred until the actual progress towards completion indicates recognition is appropriate. Costs include direct labor and materials as well as equipment costs related to contract performance.

Property and Equipment

Property and equipment are recorded at cost. Cost includes expenditures for major improvements and replacements that extend useful life. Certain costs of software are capitalized provided those costs are not research and development and certain other criteria are met. Capitalized interest was $0.8 million for the period ended September 30, 2008, $0.2 million for the period ended September 30, 2007 and $0.3 million for 2007. Expenditures for other maintenance and repairs are expensed as incurred. Gains and losses from sales and retirements are included in Other expense (income), net as they occur. Depreciation is calculated using the straight-line method over the economic useful lives of the assets. The estimated useful lives of depreciable assets are generally:

· ten to thirty years for buildings and improvements,

· seven to ten years for machinery and fixtures,

· three to ten years for handling and delivery equipment and

· three to ten years for software development costs.

To improve financial returns, we periodically evaluate our investments in property and equipment. As a result, property and equipment may be consolidated, leased or sold. For continuing operations, we recognized a gain of $3.7 million for the period ended September 30, 2008, a gain of $8.4 million for the period ended September 30, 2007 and a gain of $8.4 million for 2007 from the sales of property and equipment.

Assets Held for Sale

Assets held for sale are measured at the lower of carrying amount or fair value less costs to sell and are no longer depreciated. These assets are being actively marketed for sale at a price that is reasonable in relation to their carrying amounts. Any gain or loss arising from the sale of these assets is included in Other expense (income), net. Assets held for sale are as follows (thousands):

| | | September 30 | |

| Property and equipment | | | |

| Land | | $ | 21,600 | |

| Buildings and improvements | | | — | |

| Equipment | | | 12,261 | |

| | | $ | 33,861 | |

Long-lived Assets

Long-lived assets such as property, equipment and intangibles with useful lives are evaluated for impairment whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment is recognized if the carrying amount exceeds its fair value and when the carrying amount is not recoverable based on the estimated future operating cash flows on an undiscounted basis.

Derivative Instruments and Hedging Activities

We are exposed to certain risks related to business operations, some of which we may seek to manage with derivative instruments and hedging activities. The primary risk managed with derivative instruments is interest rate risk. Interest rate swap contracts are entered into to manage interest rate risk associated with variable-rate borrowings. These interest rate swap contracts are accounted for as cash flow hedges.

The fair value of derivative instruments is based on pricing models using current market rates. The fair value of interest rate swap contracts is recorded as an asset or liability and the effective portion of the gain or loss is recorded as a component of Accumulated other comprehensive (loss) income, net, a separate component of shareholders’ equity, and is subsequently reclassified into Interest expense as interest expense is recognized on the term note. The ineffective portion, if any, of the change in the value of the interest rate swap contracts is immediately recognized as a component of interest expense.

Derivative financial instruments are not utilized to hedge other risks or for speculative or trading purposes.

Revenue Recognition

Revenues for building products are recognized when title to the goods and risk of loss pass to the buyer, which is at the time of delivery. The percentage-of-completion method is used to recognize revenue for construction services. Taxes assessed by governmental authorities that are directly imposed on our revenue-producing transactions are excluded from sales.

Shipping and Handling

Shipping and handling costs for manufactured building components and construction services are included as a component of cost of goods sold. Shipping and handling costs for building products are included as a component of selling, general and administrative expenses and were $45.0 million for the period ended September 30, 2008, $53.0 million for the period ended September 30, 2007 and $69.7 million for 2007.

Reclassifications

Certain reclassifications, none of which affected previously reported consolidated results of operations, cash flows or shareholders’ equity, have been made to amounts reported in prior periods to conform to the current period presentation.

Recent Accounting Principles

In May 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 162, The Hierarchy of Generally Accepted Accounting Principles. This accounting principle identifies a consistent framework, or hierarchy, for selecting accounting principles to be used in preparing financial statements that are presented in conformity with U.S. generally accepted accounting principles (GAAP) for nongovernmental entities. This accounting principle is effective November 2008 and is not expected to have any impact on our consolidated financial position, results of operations or cash flows.

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities. This accounting principle enhances disclosure for derivative instruments and hedging activities and their effects on consolidated financial position, results of operations and cash flows. Specifically, enhanced disclosures will include objectives and strategies for using derivatives, including underlying risk and accounting designation, as well as fair values, gains and losses. This accounting principle was adopted June 2008 and had no impact on our consolidated financial position, results of operations or cash flows.

In December 2007, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 160, Noncontrolling Interests in Consolidated Financial Statements. This accounting principle eliminates noncomparable accounting for minority interests. Specifically, minority interests are presented as a component of shareholders’ equity; consolidated net income includes amounts attributable to both the parent and minority interest and is disclosed on the face of the income statement; changes in the ownership interest are accounted for as equity transactions if ownership remains controlling; purchase accounting for acquisitions of noncontrolling interests and acquisitions of additional interests is eliminated; and deconsolidated controlling interests are recognized based on fair value consistent with Statement of Financial Accounting Standards No. 141 (revised 2007), Business Combinations. This accounting principle will be adopted January 2009. The accounting requirements will be adopted prospectively, however presentation and disclosure will be adopted retrospectively for all periods presented. Earlier adoption is prohibited. Adoption is not expected to have an impact on our consolidated financial position, results of operations or cash flows.

In December 2007, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 141 (revised 2007), Business Combinations. This accounting principle requires acquisition accounting (purchase accounting) be applied to all business combinations in which control is obtained regardless of consideration and for an acquirer to be identified for each business combination. Additionally, this accounting principle requires acquisition-related costs and restructuring costs at the date of acquisition to be expensed rather than allocated to the assets acquired and the liabilities assumed; minority interests, including goodwill, to be recorded at fair value at the acquisition date; recognition of the fair value of assets and liabilities arising from contractual contingencies and contingent consideration (payments conditioned on the outcome of future events) at the acquisition date; recognition of bargain purchase (acquisition-date fair value exceeds consideration plus any noncontrolling interest) as a gain; and recognition of changes in deferred taxes. This accounting principle will be adopted January 2009. The accounting requirements will be adopted prospectively. Earlier adoption is prohibited. Adoption is not expected to have an impact on our consolidated financial position, results of operations or cash flows.

2. Liquidity

Liquidity is essential to our business. We fund working capital requirements and necessary capital expenditures with cash flow from operations and seasonal borrowings under our credit facility. Should we experience a substantial deterioration in operating performance, our ability to obtain funding from operations or our credit facility could be impacted.

We obtained waivers for financial covenants related to our credit facility due to lower than planned operating performance as of both June 2008 and December 2007. On September 30, 2008, we entered into an amendment to our credit facility with our lenders. The amended credit facility continues to provide a $200 million revolver subject to borrowing base limitations and a $340 million term note maturing in November 2011. As of September 30, 2008, $29.2 million was outstanding under the revolver and $328.9 million was outstanding under the term note.

Our amended credit facility requires monthly compliance with financial covenants including minimum liquidity and adjusted earnings before interest, taxes, depreciation and amortization (monthly Adjusted EBITDA) at least through 2010. If our leverage ratio is at a certain maximum as of September 30, 2010, the monthly Adjusted EBITDA may be replaced with quarterly compliance with a leverage ratio and interest coverage ratio. Operating results, particularly income from continuing operations, are a primary factor for these covenants and our ability to comply with these covenants depends on our operating performance. The significant and ongoing correction in single-family housing starts has negatively impacted and may continue to negatively impact our operating performance.

The continued challenges in the homebuilding industry may impact our ability to comply with these covenants in the future. If we fail to comply with covenants, we may be in default and the lenders may have the right to cause all amounts borrowed to become due and payable immediately. Reduced operating cash flow and revolver borrowing base limitations may adversely affect our ability to finance operations or capital needs.

3. Restructuring

In May 2008, we initiated a comprehensive analysis of our businesses operations to improve cash flow and profitability as well as rationalize our operations for the current conditions of the homebuilding industry. The plan places a priority on efficient use of capital and higher returns and focuses on closing and consolidating underperforming business units as well as improving business processes. As a result, by the end of the fourth quarter of 2008 we expect to:

| · | close 34 underperforming units, |

| · | consolidate 12 underperforming units with other business units and |

| · | consolidate administrative functions of information systems, reporting, accounts payable and human resources. |

Our restructuring plans do not include formal severance plans for employees affected by the closures and consolidations of underperforming business units or enhancements to administrative functions.

As of September 30, 2008, the estimated charges expected to be incurred and recognized in (loss) from continuing operations were as follows (thousands):

| | | | Estimated Charges | | | Recognized Nine Months Ended September 30 2008 | | | Total Remaining | |

| Impairment of assets | | $ | 4,980 | | $ | 4,980 | | $ | — | |

| Operating lease obligations | | | 4,744 | | | 4,744 | | | — | |

| | | $ | 9,724 | | $ | 9,724 | | $ | — | |

Impairments of assets were determined based on available market data and are recognized in Impairment of assets. Operating lease obligations represent the present value of contractual rental payments offset by estimated sublease income and are recognized in Selling, general and administrative expenses.

Activity related to restructuring plans for the period ended September 30, 2008 was as follows (thousands):

| | | Recognized Nine Months Ended September 30 2008 | | Cash Payments | | Non-cash Charges | | Liability Balance at September 30 2008 | |

| Impairment of assets | | $ | 4,980 | | $ | — | | $ | 4,980 | | $ | — | |

| Operating lease obligations | | | 4,744 | | | 390 | | | 700 | | | 3,654 | |

| | | $ | 9,724 | | $ | 390 | | $ | 5,680 | | $ | 3,654 | |

Due to uncertainties in the markets of certain business units and inherent in the estimation process, it is possible the actual costs of restructuring may vary from estimates. Revisions of these costs are recognized in the period such revisions are known.

Long-lived assets such as property, equipment and intangibles are evaluated for impairment whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment for these assets is recognized if the carrying amount exceeds its fair value and when the carrying amount is not recoverable based on the estimated future operating cash flows on an undiscounted basis.

Similarly, goodwill is evaluated for impairment in the fourth quarter and whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment for goodwill is recognized if the carrying amount is more than the estimated future operating cash flows as measured by fair value techniques.

As a result of our ongoing evaluations of underperforming business units, property and equipment, intangibles and goodwill specific to these business units were identified as impaired. The following impairments were recognized in (loss) from continuing operations for the third quarter of 2008:

| · | $0.7 million for covenants not to compete, |

| · | $3.0 million for certain property and equipment held for sale and |

| · | $0.2 million for goodwill. |

The following impairments were recognized in (loss) from continuing operations for the second quarter of 2008:

| · | $6.2 million for certain customer relationships and covenants not to compete, |

| · | $1.3 million for leasehold improvements, |

| · | $0.7 million for certain property and equipment held for sale and |

| · | $0.3 million for goodwill. |

During the later portion of the fourth quarter of 2007, the leading sources of economic and housing data forecasted sharper reductions in housing starts. The rapid deterioration in housing forecasts and our operating performance resulted in significant revisions of our operating expectations underpinning the assumptions of recoverability of the carrying amount of customer relationships and goodwill. Additionally, our enterprise value reflected a significant reduction as investors considered negative perceptions of the future of the housing market and depressed the share values of housing related companies. For impairment testing, the fair values were determined based on estimates of enterprise value as well as the present value of estimated future operating cash flows. As a result, we determined the carrying amount of certain customer relationships and goodwill exceeded their respective estimated fair values and recognized the following impairments in (loss) from continuing operations for the fourth quarter of 2007:

| · | $30.0 million for certain customer relationships, |

| · | $242.0 million for goodwill and |

| · | $0.2 million for certain equipment. |

Continued deterioration in our markets could result in additional impairments of the carrying amount of intangibles and goodwill.

5. Discontinued Operations

The results of operations and financial position of discontinued operations are separately reported for all periods presented as a result of the following transactions:

| · | In June 2008, we discontinued concrete block masonry, concrete services and truss manufacturing in Florida. These business units represented approximately 6% of sales. |

| · | In March 2008, we discontinued framing services in Virginia. This business unit represented less than 1% of sales. |

| · | In September 2007, we sold three building materials distribution businesses in Western Colorado. The businesses were sold for $11.4 million, consisting of $9.6 million cash and a $1.8 million note receivable and resulted in recognition of an initial gain of $3.7 million. In December 2007, the remaining real estate for one of these operations was sold for $17.6 million cash and resulted in recognition of a gain of $16.3 million. These business units represented approximately 1% of sales. |

Assets, liabilities, sales and income (loss) after related income taxes (benefit) for these operations are separately reported from continuing operations and were as follows (thousands):

| | | | | | | | |

| Assets | | $ | 12,322 | | $ | 25,224 | |

| Liabilities | | $ | 4,272 | | $ | 8,533 | |

| | | Three Months Ended September 30 | | Nine Months Ended September 30 | | Year Ended

December 31 | |

| | | 2008 | | 2007 | | 2008 | | 2007 | | 2007 | |

| Sales | | | | | | | | | | | |

| Building products | | $ | 743 | | $ | 11,893 | | $ | 2,021 | | $ | 33,391 | | $ | 33,955 | |

| Construction services | | $ | 11,235 | | $ | 23,351 | | $ | 36,509 | | $ | 85,900 | | $ | 101,649 | |

| | | | | | | | | | | | | | | | | |

Income (loss) from discontinued operations | | $ | 897 | | $ | 2,597 | | $ | 10,225 | | $ | 5,562 | | $ | (46,946 | ) |

6. Net (Loss) Income Per Share

Net (loss) income per share was determined using the following information (thousands, except per share data):

| | | Three Months Ended September 30 | | Nine Months Ended September 30 | | Year Ended

December 31 | |

| | | | | 2007 | | 2008 | | 2007 | | 2007 | |

| (Loss) income from continuing operations | | $ | (46,103 | ) | $ | 1,571 | | $ | (121,233 | ) | $ | 13,057 | | $ | (265,767 | ) |

| Income (loss) from discontinued operations | | | 897 | | | 2,597 | | | 10,225 | | | 5,562 | | | (46,946 | ) |

| Net (loss) income | | $ | (45,206 | ) | $ | 4,168 | | $ | (111,008 | ) | $ | 18,619 | | $ | (312,713 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average shares - basic | | | 29,196 | | | 28,945 | | | 29,027 | | | 28,800 | | | 28,807 | |

| Effect of dilutive: | | | | | | | | | | | | | | | | |

| Share options | | | — | | | 512 | | | — | | | 598 | | | — | |

| Restricted shares | | | — | | | 99 | | | — | | | 142 | | | — | |

| Warrants | | | — | | | — | | | — | | | — | | | — | |

Weighted average shares - assuming dilution | | | 29,196 | | | 29,556 | | | 29,027 | | | 29,540 | | | 28,807 | |

| | | | | | | | | | | | | | | | | |

| Net (loss) income per share: | | | | | | | | | | | | | | | | |

| Continuing operations | | | $(1.58 | ) | | $0.05 | | | $(4.17 | ) | | $0.46 | | | $(9.23 | ) |

| Discontinued operations | | | 0.03 | | | 0.09 | | | 0.35 | | | 0.19 | | | (1.63 | ) |

| Basic | | | $(1.55 | ) | | $0.14 | | | $(3.82 | ) | | $0.65 | | | $(10.86 | ) |

| | | | | | | | | | | | | | | | | |

| Continuing operations | | | $(1.58 | ) | | $0.05 | | | $(4.17 | ) | | $0.44 | | | $(9.23 | ) |

| Discontinued operations | | | 0.03 | | | 0.09 | | | 0.35 | | | 0.19 | | | (1.63 | ) |

| Diluted | | | $(1.55 | ) | | $0.14 | | | $(3.82 | ) | | $0.63 | | | $(10.86 | ) |

| | | | | | | | | | | | | | | | | |

| Cash dividends declared per share | | | $— | | | $0.10 | | | $— | | | $0.30 | | | $0.40 | |

Certain share options, restricted shares and warrants are excluded from the computation of diluted net (loss) income per share:

| · | options and warrants with exercise prices greater than the average market value of the common shares (out-of-the-money) and |

| · | unrecognized compensation expense for restricted shares with after-tax proceeds greater than the average market value of the common shares. |

Options, restricted shares and warrants excluded from the computation of diluted net (loss) income per share will change based on additional grants as well as the average market value of the common shares for the period. These options, restricted shares and warrants that are not dilutive and therefore excluded from the computation of diluted net (loss) income per share were as follows (thousands, except share price data):

| | | Three Months Ended September 30 | | Nine Months Ended September 30 | | Year Ended

December 31 | |

| | | 2008 | | 2007 | | 2008 | | 2007 | | 2007 | |

| Average market value of shares | | | $2 | | | $13 | | | $3 | | | $17 | | | $14 | |

| Share options: | | | | | | | | | | | | | | | | |

| Exercise price range | | | $5 to $38 | | | $15 to $38 | | | $5 to $38 | | | $15 to $38 | | | $5 to $38 | |

| Not dilutive | | | 2,698 | | | 1,328 | | | 2,698 | | | 1,328 | | | 2,978 | |

| Restricted shares: | | | | | | | | | | | | | | | | |

| Grant price range | | | $15 to $42 | | | $17 to $42 | | | $15 to $42 | | | $34 | | | $15 to $42 | |

| Not dilutive | | | 255 | | | 299 | | | 255 | | | 2 | | | 410 | |

| Warrants: | | | | | | | | | | | | | | | | |

| Exercise price | | | $0.47 | | | $— | | | $0.47 | | | $— | | | $— | |

| Not dilutive | | | 2,825 | | | — | | | 2,825 | | | — | | | — | |

7. Acquisitions and Minority Interests

Acquisitions are accounted for under the purchase method of accounting. The purchase price is allocated to the assets acquired, including intangible assets, and liabilities assumed based on their estimated fair values at the date of acquisition. Subsequent to the initial allocation of purchase price, adjustments may be made to reflect the fair value of working capital and tangible assets. Any excess of the purchase price over the estimated fair value of the identifiable assets and liabilities acquired is recorded as goodwill. Operating results of acquired businesses are included in the consolidated statements of operations from the date of acquisition.

| · | In March 2007, we acquired a concrete services business in Fresno, California for approximately $0.7 million in cash. |

Minority interests reflects the other owners’ proportionate share in the assets and liabilities of business ventures as of the date of purchase, adjusted by the proportionate share of post-acquisition income or loss. As the operating results of entities with minority interests are consolidated, minority interests income represents the income or loss attributable to the other owners.

| · | In June 2008, we acquired the remaining 40% interest in SelectBuild Mechanical for $0.2 million in cash. In October 2004, we formed this venture for an initial 60% interest for $0.3 million in cash. SelectBuild Mechanical provides heating, ventilation and air conditioning services in Las Vegas, Nevada. |

| · | In January 2008, we were required to purchase the remaining 49% interest in SelectBuild Illinois (RCI Construction) for $8.3 million in cash of which $2.4 million was paid in January 2008 and $5.9 million was paid in July 2008. The fair value of SelectBuild Illinois did not exceed its net book value. As a result, the $5.5 million excess of the purchase price for the minority interest over the recorded amount for the minority interest in SelectBuild Illinois was recognized as an expense in Other income, net in December 2007. In January 2005, we acquired an initial 51% interest for $4.9 million in cash. SelectBuild Illinois provides framing services to production homebuilders in the greater Chicago area. |

| · | In September 2007, we acquired the remaining 49% interest in SelectBuild Trim for $0.5 million in cash. In January 2007, we formed this venture for an initial 51% interest for $0.5 million in cash. SelectBuild Trim provides door and molding installation services in Las Vegas, Nevada. |

| · | In September 2007, we acquired the remaining 49% interest in A-1 Building Components, LLC (A-1 Truss) for $5.0 million in cash. In September 2004, we acquired an initial 51% interest for $2.3 million in cash. A-1 Truss manufactures trusses in Fort Pierce, Florida. |

| · | In May 2007, we acquired the remaining 33% interest in SelectBuild Mid-Atlantic (WBC Mid-Atlantic) for no consideration pursuant to the operating agreement. In October 2003, we acquired an initial 67% interest for $5.1 million in cash and $0.2 million of our common shares. SelectBuild Mid-Atlantic provided framing services to production homebuilders in Delaware, Maryland and Virginia. |

| · | In April 2007, we acquired the remaining 27% interest in Riggs Plumbing for $10.5 million in cash. In July 2005, we acquired an additional 13% interest for $1.4 million in cash and in April 2005, acquired an initial 60% interest for $17.8 million in cash. Riggs Plumbing provides plumbing services to production homebuilders in the Phoenix and Tucson markets. |

Assets and liabilities acquired in acquisitions made in 2008 and 2007, including payments of amounts retained for settlement periods, were as follows (thousands):

| | | | | | | | | |

| Receivables | $ | — | | $ | (21) | | Other accrued liabilities | $ | 53 | | $ | (60,787) |

| Prepaid expenses and other | | — | | | 18 | | | | | | | |

Current assets | | — | | | (3) | | Current liabilities | | 53 | | | (60,787) |

| | | | | | | | | | | | | |

| Property and equipment | | — | | | 216 | | Deferred income taxes | | — | | | (917) |

| Other intangibles, net | | — | | | 2,287 | | Minority interests | | (8,528) | | | (3,680) |

| Goodwill | | — | | | 13,077 | | | | | | | |

| | $ | — | | $ | 15,577 | | | $ | (8,475) | | $ | (65,384) |

Had the SelectBuild Mechanical acquisition in June 2008 and the SelectBuild Illinois acquisition in January 2008 taken place as of the beginning of 2007, pro forma results of operations would not have been significantly different from reported amounts.

8. Marketable Securities

Investments in marketable securities consist of debt securities held by our captive insurance subsidiary and are considered available-for-sale and recorded at fair value. Fair value is based on market quotes. Realized gains and losses are recognized in Other income, net based on specific identification. Unrealized gains and losses, net of deferred taxes, are recorded as a component of Accumulated other comprehensive loss, net, a component of shareholders’ equity. There were no significant unrealized losses.

The fair values of these marketable securities were as follows (thousands):

| | | | | | |

| U.S. government and agencies | | $ | — | | $ | 18,380 | |

| Asset backed securities | | | — | | | 9,798 | |

| Corporate securities | | | — | | | 13,733 | |

| | | $ | — | | $ | 41,911 | |

Contractual maturities were as follows (thousands):

| | | | | | |

| Less than 1 year | | $ | — | | $ | 1,872 | |

| Due in 1 to 2 years | | | — | | | 12,683 | |

| Due in 2 to 5 years | | | — | | | 27,356 | |

| | | $ | — | | $ | 41,911 | |

Pursuant to our plans to terminate our captive insurance subsidiary, the marketable securities were sold and invested in money market funds as of September 30, 2008.

9. Intangible Assets and Goodwill

Intangible assets represent the values assigned to customer relationships, covenants not to compete, trade names and favorable leases. Intangible assets are amortized on a straight-line basis over their expected useful lives. Customer relationships are amortized over 3 to 10 years, covenants not to compete over 3 to 5 years and favorable leases over 2 to 5 years. Amortization expense for intangible assets was $6.9 million for the period ended September 30, 2008, $11.4 million for the period ended September 30, 2007 and $15.1 million for 2007. Intangible assets consist of the following (thousands):

| | | | September 30, 2008 | |

| | | | Gross Carrying Amount | | | Accumulated Amortization | | | Net Carrying Amount | |

| Customer relationships | | $ | 70,481 | | $ | (28,482 | ) | $ | 41,999 | |

| Covenants not to compete | | | 8,602 | | | (6,049 | ) | | 2,553 | |

| Favorable leases | | | 382 | | | (382 | ) | | — | |

| | | $ | 79,465 | | $ | (34,913 | ) | $ | 44,552 | |

| | | | December 31, 2007 | |

| | | | Gross Carrying Amount | | | Accumulated Amortization | | | Net Carrying Amount | |

| Customer relationships | | $ | 80,495 | | $ | (27,271 | ) | $ | 53,224 | |

| Covenants not to compete | | | 10,611 | | | (6,057 | ) | | 4,554 | |

| Trade names | | | 204 | | | (204 | ) | | — | |

| Favorable leases | | | 780 | | | (248 | ) | | 532 | |

| | | $ | 92,090 | | $ | (33,780 | ) | $ | 58,310 | |

Estimated amortization expense for intangible assets is $2.0 million for the remainder of 2008, $7.9 million for 2009, $7.4 million for 2010, $6.6 million for 2011, $6.4 million for 2012 and $14.3 million thereafter.

Goodwill represents the excess of the purchase price over the fair value of net tangible and identifiable intangible assets of acquired businesses. Adjustments to amounts previously reported as goodwill may occur as a result of completing the purchase price allocation to the assets acquired, including intangible assets, and liabilities assumed based on their estimated fair values at the date of acquisition.

An annual assessment for impairment is completed in the fourth quarter and whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment is recognized at the reporting unit if the carrying amount is more than the estimated future operating cash flows as measured by fair value techniques.

Changes in the carrying amount of goodwill were as follows:

| | | | | | | | |

| Balance at beginning of period | | $ | 14,196 | | $ | 308,000 | |

| Purchase price adjustment | | | — | | | (182 | ) |

| Goodwill acquired | | | — | | | 13,259 | |

| Impairment | | | (446 | ) | | (306,881 | ) |

| Balance at end of period | | $ | 13,750 | | $ | 14,196 | |

While goodwill is tested for impairment annually and not amortized for financial statement purposes, goodwill may be deductible for income tax purposes. Certain goodwill is non-deductible. Changes to non-deductible goodwill were as follows (thousands):

| | | | | | | | |

| Balance at beginning of period | | $ | 3,460 | | $ | 41,362 | |

| Goodwill acquired | | | — | | | (4,656 | ) |

| Impairment | | | — | | | (33,246 | ) |

| Balance at end of period | | $ | 3,460 | | $ | 3,460 | |

10. Debt

Long-term debt consists of the following (thousands):

| | | | | | | Notional

Amount of Interest

Rate Swaps | | |

| | | | | | | | | | | |

| Revolver | $ | 29,200 | | LIBOR plus 5.25% or Prime plus 3.25% and 0.50% commitment fee | | $ | — | | 8.6% | | 8.6% |

| | | | | | | | | | | | |

| Term note | | 328,944 | | LIBOR plus 5.25% or Prime plus 3.25% | | | 150,000 | | 8.5% | | 11.75% |

| | | | | | | | | | | | |

| Other | | 1,565 | | Various | | | — | | — | | — |

| | | 359,709 | | | | $ | 150,000 | | | | |

| | | | | | | | | | | | |

| Less: Current portion | | 68,807 | | | | | | | | | |

Less: Unamortized discount | | 782 | | | | | | | | | |

| | $ | 290,120 | | | | | | | | | |

As of December 31, 2007 | | | | | | | Notional Amount of Interest Rate Swaps | | Effective Interest Rate |

| | | Balance | | Stated Interest Rate | | | | Average

for Year | | As of December 31 |

| Revolver | $ | — | | LIBOR plus 1.50% or Prime plus 0.25% and 0.25% commitment fee | | $ | — | | 8.8% | | n/a |

| | | | | | | | | | | | |

| Term note | | 345,625 | | LIBOR plus 2.50% or Prime plus 1.25% | | | 200,000 | | 7.7% | | 7.5% |

| | | | | | | | | | | | |

| Other | | 3,235 | | Various | | | — | | — | | — |

| | | 348,860 | | | | $ | 200,000 | | | | |

| | | | | | | | | | | | |

| Less: Current portion | | 4,923 | | | | | | | | | |

| | $ | 343,937 | | | | | | | | | |

On September 30, 2008, we entered into an amendment to our credit facility with our lenders. The amended credit facility continues to provide a $200 million revolver subject to borrowing base limitations and a $340 million term note maturing in November 2011.

The $200 million revolver is subject to borrowing base limitations and matures in November 2011. The revolver may consist of both LIBOR and Prime based borrowings. The variable interest rate for the revolver was increased to LIBOR plus 5.25% or Prime plus 3.25%. Minimum LIBOR interest is 3.0%. Additionally, a commitment fee for the unused portion is 0.50%. LIBOR interest is paid quarterly and Prime interest is paid monthly. As of September 30, 2008, $29.2 million of Prime based borrowings were outstanding under the revolver.

The effective interest rate is based on interest rates for the period as well as the commitment fee for the unused portion of the revolver.

Letters of credit outstanding that guaranteed performance or payment to third parties were $99.4 million as of September 30, 2008 and $106.7 million as of December 31, 2007. These letters of credit reduce the $200 million revolver commitment.

Total availability under the revolver is subject to a monthly borrowing base calculation that includes:

| · | 70% of certain accounts receivable, |

| · | 50% of certain inventory, |

| · | 25% of certain other inventory, |

| · | approximately 75% of the appraised value of certain property and equipment and |

| · | 50% of the appraised value of real estate. |

As of September 30, 2008, the unused borrowing base available under the revolver was $71.4 million.

The term note matures in November 2011 and is payable in quarterly installments of $0.9 million with the remaining principal of $282.7 million payable in November 2011. The variable interest rate for the term note was increased to LIBOR plus 5.25% or Prime plus 3.25%. LIBOR interest is paid quarterly and Prime interest is paid monthly. In addition to the LIBOR and Prime interest rates, the term note includes an additional payment-in-kind interest or fee of 2.75% that is payable on the earlier of payoff or maturity. As of September 30, 2008, $328.9 million was outstanding under this term note.

Other long-term debt consists of term notes, equipment notes and capital leases for equipment. Interest rates vary and dates of maturity are through March 2021. As of September 30, 2008, other long-term debt was $1.6 million.

Covenants and Maturities

Our amended credit facility requires monthly compliance with financial covenants including minimum liquidity and adjusted earnings before interest, taxes, depreciation and amortization (monthly Adjusted EBITDA) at least through 2010. If our leverage ratio is at a certain maximum as of September 30, 2010, the monthly Adjusted EBITDA may be replaced with quarterly compliance with a leverage ratio and interest coverage ratio. Operating results, particularly income from continuing operations, are a primary factor for these covenants and our ability to comply with these covenants depends on our operating performance. The significant and ongoing correction in single-family housing starts has negatively impacted and may continue to negatively impact our operating performance.

The amended credit facility requires certain proceeds and cash flows be applied to the credit facility as follows:

| § | Proceeds from the liquidation of statutory funding requirements of our captive insurance subsidiary, |

| § | cash in excess of $25 million. |

| § | Proceeds from certain dispositions, |

| § | 75% of excess cash flow as defined beginning in 2010. |

Due to requirements to apply proceeds from the liquidation of our captive insurance subsidiary and tax refunds to the credit facility, the revolver balance of $29.2 million and 70% of an expected 2009 tax refund of $35.7 million have been classified as a current portion of long-term debt. The remaining $3.9 million of the current portion of long-term debt represents scheduled payments on the term note and other debt.

The amended credit facility continues to restrict our ability to incur additional indebtedness, pay dividends, repurchase shares, enter into mergers or acquisitions, use proceeds from equity offerings, make capital expenditures and sell assets. The amended credit facility is secured by all assets of our wholly-owned subsidiaries, except the assets of our captive insurance subsidiary.

In connection with the September 2008 amendment, 100% or $2.8 million of unamortized deferred loan costs related to the term note were recognized as interest expense in the third quarter of 2008. We also incurred approximately $3.8 million of costs in connection with the amendment and $2.0 million of these costs will be amortized over the remaining term of the credit facility whereas $1.8 million of these costs were recognized as interest expense in the third quarter of 2008.

In connection with the February 2008 amendment, 60% or $2.4 million of unamortized deferred loan costs related to the previous revolver were recognized as interest expense in the first quarter of 2008. We also incurred $4.9 million of fees in connection with the February 2008 amendment and these costs were to be amortized over the remaining term of our credit facility, however in connection with the September 2008 amendment, $2.8 million of these unamortized costs were recognized as interest expense in the third quarter of 2008.

Scheduled maturities of long-term debt are as follows (thousands):

| 2008 | | $ | 1,018 | |

| 2009 | | | 68,730 | |

| 2010 | | | 3,727 | |

| 2011 | | | 285,421 | |

| 2012 | | | 65 | |

| Thereafter | | | 748 | |

| | | $ | 359,709 | |

Discount for Warrants

In connection with the amendment of our credit facility in September 2008, we issued warrants that entitle the lenders to purchase approximately 8.75% or 2.8 million of our common shares at a purchase price of $0.47 per common share, the closing price on the NYSE on September 30, 2008. These warrants may be exercised through September 2015.

The fair value of the warrants of $0.8 million was recorded as a discount on the term note. Amortization of the discount will be recognized ratably through November 2011, the remaining term of our credit facility.

Hedging Activities

In addition to the amendment to our credit facility in September 2008, we amended our interest rate swap contracts to lower amounts and a maturity matching the credit facility. The interest rate swap contracts effectively convert $150 million of variable rate borrowings to a fixed interest rate of 9.6% through November 2011, thus reducing the impact of increases in interest rates on future interest expense. Additionally, the notional amount of the interest rate swap contracts will be ratably reduced to zero through the maturity of November 2011.

Approximately 46% of the outstanding variable rate borrowings have been hedged through the designation of interest rate swap contracts accounted for as cash flow hedges. After giving effect to the interest rate swap contracts, total borrowings were 42% fixed and 58% variable. Management may choose not to swap variable rates to fixed rates or may terminate a previously executed swap if the variable rate positions are more beneficial.

The fair value of the interest rate swap contracts was a liability of $4.2 million and a corresponding unrealized tax benefit of $1.6 million as of September 30, 2008. The corresponding unrealized loss for the interest rate swap contracts and unrealized tax benefit were recorded in accumulated other comprehensive (loss) income, net a separate component of shareholders’ equity. A corresponding deferred tax asset for the unrealized tax benefit was not recognized as there may be an inability to utilize this deferred tax asset.

To amend our interest rate swap contracts in September 2008, payments of $2.6 million were made to settle a portion of the interest rate swap contracts liability and reduce the notional amount of the interest rate swap contracts. The corresponding unrealized loss of $2.6 million and unrealized tax benefit of $0.7 million remained in accumulated other comprehensive (loss) income, net a separate component of shareholders’ equity. A corresponding deferred tax asset for the unrealized tax benefit was not recognized as there may be an inability to utilize this deferred tax asset. The unrealized loss will be subsequently amortized to interest expense over the remaining term of our term note. Amortization to interest expense for this unrealized loss was $0.7 million for the period ended September 30, 2008.

The fair value and gains and losses on interest rate swap contracts are as follows (thousands):

| | | | September 30, 2008 | | | December 31, 2007 | |

| | | | Balance Sheet Classification | | | Fair Value | | | Balance Sheet Classification | | | Fair Value | |

Interest rate swap contracts | | | Other long-term liabilities | | $ | 4,209 | | | Other long-term liabilities | | $ | 8,553 | |

The effect of interest rate swap contracts on the consolidated statement of operations is as follows (thousands):

| | | Gain (Loss) Recognized in Accumulated Other Comprehensive (Loss) Income, Net | |

| | | Three Months Ended September 30 | | Nine Months Ended September 30 | | Year Ended

December 31 | |

| | | 2008 | | 2007 | | 2008 | | 2007 | | 2007 | |

| Cash Flow Hedging Relationships: | | | | | | | | | | | |

| Interest rate swap contracts | | $ | 1,389 | | $ | (5,488 | ) | $ | 1,836 | | $ | (1,797 | ) | $ | (7,673 | ) |

| | | Loss (Gain) Reclassified from Accumulated Other

Comprehensive (Loss) Income, Net | |

| | | Three Months Ended September 30 | | Nine Months Ended September 30 | | Year Ended

December 31 | |

| | | 2008 | | 2007 | | 2008 | | 2007 | | 2007 | |

| Statement of Operations Location: | | | | | | | | | | | |

| Interest expense | | $ | 1,624 | | $ | (137 | ) | $ | 2,970 | | $ | (410 | ) | $ | (465 | ) |

11. Shareholders’ Equity

Preferred Shares

We are authorized to issue 2 million preferred shares, however none of these shares are issued. Under the terms of our Restated Certificate of Incorporation, the Board of Directors is authorized to determine or alter the rights, preferences, privileges and restrictions of the preferred shares.

Common Shares

Our common shares have a par value of $0.001. We have 50 million shares authorized of which 29.5 million are issued and outstanding as of September 30, 2008.

Of the unissued shares, 6.3 million shares were reserved for the following:

| Employee Stock Purchase Plan | | | 1.6 million | |

| 2008 Stock Incentive Plan | | | 1.9 million | |

| Warrants | | | 2.8 million | |

Warrants

In connection with the amendment of our credit facility in September 2008, we issued warrants that entitle the lenders to purchase approximately 8.75% or 2.8 million of our common shares at a purchase price of $0.47 per common share, the closing price on the NYSE on September 30, 2008. These warrants may be exercised through September 2015.

The fair value of these warrants was estimated on the date of grant using the modified Black-Scholes-Merton model. The following table presents the assumptions used in the valuation and the resulting fair value:

| | | Nine Months Ended |

| Expected term (years) | | 5.5 |

| Expected volatility | | 64.6% |

| Expected dividend yield | | 0.0% |

| Risk-free interest rate | | 3.0% |

| Exercise price | | $0.47 |

| Weighted average fair value | | $0.28 |

These assumptions are based principally on historical experience. Due to uncertainties inherent in these assumptions, it is possible that actual value received may vary from the estimate of the fair value of these warrants.

The fair value of the warrants of $0.8 million was recorded as a discount on our term note. Amortization of the discount will be recognized ratably through November 2011, the remaining term of our credit facility.

No warrants have been exercised and all 2.8 million warrants are outstanding and exercisable as of September 30, 2008. Warrants exercised are settled with newly issued common shares. These warrants are not included in the calculation of basic income per share until exercised, however the common shares for these warrants are included in the calculation of diluted income per share.

Dividends

Cash dividends per common share were as follows:

| | | | 2008 | | | 2007 | |

| First quarter | | | $— | | | $0.10 | |

| Second quarter | | | — | | | 0.10 | |

| Third quarter | | | — | | | 0.10 | |

| Fourth quarter | | | — | | | 0.10 | |

| | | | $— | | | $0.40 | |

Our credit facility, amended in September 2008, prohibits the payment of cash dividends on our common shares. The determination of future dividend payments (cash or shares) will depend on many factors, including credit facility restrictions, financial position, results of operations and cash flows.

Repurchase Program

In March 2007, our Board of Directors authorized the repurchase of up to $25 million of our common shares through March 2008. The repurchase program expired in March 2008 with no shares repurchased.

Our credit facility, amended in September 2008, prohibits the repurchase of our common shares. The determination of future share repurchases will depend on many factors, including credit facility restrictions, financial position, results of operations and cash flows.

12. Employee Benefit Plans

Retirement Plans

· Savings and Retirement Plan

We provide a savings and retirement plan for salaried and certain hourly employees whereby eligible employees may contribute a percentage of their earnings to a trust. Participants may defer up to 75% of their eligible compensation (base salary, annual incentive and long-term incentives) subject to the limitations imposed under the Internal Revenue Code.