(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

The number of shares outstanding of the registrant’s common stock as of May 14, 2009 was 29,856,508.

The accompanying notes are an integral part of these consolidated financial statements.

The accompanying notes are an integral part of these consolidated financial statements.

The accompanying notes are an integral part of these consolidated financial statements.

The accompanying notes are an integral part of these consolidated financial statements.

Notes to Unaudited Consolidated Financial Statements

1. Summary of Significant Accounting Policies

Nature of Operations

Building Materials Holding Corporation (BMHC) provides building products and construction services to professional homebuilders and contractors in western and southern regions of the United States. We distribute building products, manufacture building components (millwork, floor and roof trusses and wall panels) and provide construction services to professional builders and contractors through a network of 31 distribution facilities, 43 manufacturing facilities and 5 regional construction services facilities. Based on National Association of Home Builders building permit activity, we provide building products and construction services in 9 of the top 25 single-family construction markets.

Principles of Consolidation

The consolidated financial statements include the accounts of BMHC and its subsidiaries. All significant intercompany balances and transactions are eliminated.

Basis of Presentation

| | · | Interim consolidated financial statements |

These consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted pursuant to those rules and regulations. These consolidated financial statements should be read in conjunction with the consolidated financial statements and the accompanying notes included in our most recent Annual Report on Form 10-K.

These consolidated financial statements have not been audited by independent registered public accountants. However, in the opinion of management, all adjustments, including those of a normal and recurring nature, necessary to present fairly the results for the periods have been included. The preparation of these consolidated financial statements required estimates and assumptions. Actual results may differ from those estimates.

| | · | Uncertainty regarding Liquidity and Going Concern |

Our consolidated financial statements were prepared assuming we will continue as a going concern which contemplates the realization of assets and the liquidation of liabilities in the normal course of business.

Beginning with the fourth quarter of 2007 and continuing through the first quarter of 2009, we have incurred losses from operations and, during 2008 and the first quarter of 2009, restructuring costs as we downsized our business to match the current environment. We have managed our liquidity during this time with closure and consolidation of underperforming business units and cost reduction initiatives as well as sales of assets. However, the downturn in the housing industry has been deepened by an increase in home foreclosures and reduced consumer confidence from tightened lending standards and rising unemployment, which have created a difficult business environment for homebuilders generally. Our operating performance and liquidity were negatively affected by these economic and industry conditions, which are beyond our control.

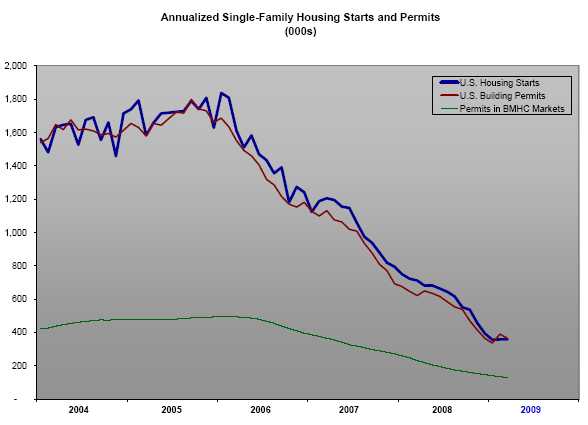

These business conditions have not improved during 2009. As of March 2009, single-family housing starts for the U.S. as a whole fell to an annualized rate below 0.4 million and single-family permits in our markets remained at a depressed annualized rate of 0.1 million. We do not believe these business conditions will improve significantly during 2009.

Our actions to align our cost structure with anticipated sales may not be sufficient to fund our operating costs, restructuring costs and debt service requirements. When funds from operations are insufficient, our primary source of funding has been the revolver component of our credit facility. Our amended credit facility provides a $200 million revolver and a $340 million term note maturing in November 2011. Our revolver is subject to borrowing base limitations based on certain accounts receivable, inventory, property and equipment and real estate and may not provide adequate liquidity. As of March 31, 2009, there were $2.3 million borrowings outstanding under the revolver and $313.8 million was outstanding under the term note.

Our credit agreement requires monthly compliance with financial covenants, including minimum liquidity and adjusted earnings before interest, taxes, depreciation and amortization (monthly Adjusted EBITDA). Operating results, particularly income from continuing operations, are a primary factor for these covenants, and our ability to comply with these covenants depends on our operating performance. Lack of compliance with these covenants would constitute an event of default under the credit agreement which, absent any waiver, forbearance or modification, would enable the lenders under our credit agreement to cause all amounts borrowed to become due and payable immediately and to prohibit further borrowings by us under the revolver.

Based on financial information for February 2009, we were not in compliance with the monthly Adjusted EBITDA requirement of our credit agreement. In March 2009, we obtained a limited waiver through April 15, 2009 for lack of compliance with the monthly Adjusted EBITDA requirement and we preserved access to limited liquidity permitting us to borrow up to $20 million under the revolver. Previously, we had obtained waivers for financial covenants due to lower than planned operating performance as of both June 2008 and December 2007.

Due to the difficulty of reliably projecting our operating results within the depressed business conditions of the homebuilding industry, we believe that it is likely that we will not be able to meet the financial covenants of our credit agreement during 2009. Also, our independent registered public accounting firm included a going concern explanatory paragraph in their report on our financial statements for 2008, citing among other things, the uncertainty that we would remain in compliance with these financial covenants. The going concern explanatory paragraph constitutes a default under our credit agreement. In April 2009, we obtained a waiver for the going concern explanatory paragraph.

In April 2009, our lenders also agreed to extend the limited waiver through June 1, 2009. In May 2009, the limited waiver was extended through June 29, 2009. This limited waiver continues to waive compliance with the monthly Adjusted EBITDA, forecast and projection requirements of our credit agreement. The limited waiver limits borrowings under the revolver to $20 million and limits capital expenditures to $0.1 million from the date of the extended limited waiver. Lenders approving each of the March, April and May 2009 limited waivers were paid a fee of 0.10% of their revolver commitment and their portion of the outstanding principal amount of the term note.

For March 2009, we were not in compliance with the monthly Adjusted EBITDA requirement of our credit agreement. Additionally, as the limited waiver for these financial covenants is less than a year, it is probable we will not be in compliance with these financial covenants within the next year and given there is no amendment or other financing agreement currently in place, the revolver and term note are classified as a current liability in the consolidated balance sheet.

We are anticipating tax refunds of $56 million as a result of net operating losses for 2008. These refunds will be applied to reduce the amount outstanding under our term loan facility to approximately $275 million. The remaining portion of the tax refund will be available for working capital needs after payment of any borrowings under the revolver. We filed for our federal tax refund in April 2009 and our professional advisors have advised us that receipt of the refund is anticipated in mid- to late May 2009.

We are currently negotiating with our lenders to develop debt and capital structures to support our long-term strategic plan and business objectives. We expect that these negotiations may lead to a bankruptcy filing which we anticipate would reflect the agreement of our lenders and would provide for the payment in full of all amounts owing to key vendors and the uninterrupted supply of goods and services to our customers. Equity holders may be substantially diluted or be eliminated in a bankruptcy filing.

There can be no assurance these negotiations will result in debt and capital structures acceptable to us and the lenders or an agreement that would achieve our goals. If these negotiations fail, we would not be able to continue as a going concern and would be forced to seek relief through bankruptcy filing without an agreement of our lenders. We also continue to pursue alternative financing arrangements as well as evaluate other financing options.

We may not be able to meet near-term working capital and scheduled interest and debt payment requirements if cash flows are inadequate from our reduced operating activities or if our access to the revolver portion of our credit facility is restricted because we are unable to reach an agreement with our lenders. Absent any waiver, forbearance or modification to our current credit agreement, we believe our recurring losses from operations, interest and debt burden amid declining sales and potential inability to generate sufficient cash flow to meet our obligations and sustain our operations raise substantial doubt about our ability to continue as a going concern.

Additionally, our long-term future is dependent on more normal levels of single-family housing starts and our ability to implement and maintain cost structures, including reduced interest and debt that align with single-family housing trends. If this fails to transpire or if we cannot obtain a waiver, forbearance or modification to our current credit agreement or other financing options, we may not be able to continue as a going concern and may be forced to seek relief through a bankruptcy filing.

These consolidated financial statements present separately the financial information for discontinued operations as follows:

| | · | concrete block masonry, concrete services and truss manufacturing in Florida (June 2008) and |

| | · | framing services in Virginia (March 2008). |

As a result of these transactions:

| | · | these operations are presented separately from continuing operations within the caption of discontinued operations and |

| | · | related assets and liabilities are separately classified in the consolidated balance sheet. |

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and contingent assets and liabilities as of the date of the financial statements as well as the reported amounts of sales and expenses during the reporting period. Actual amounts may differ materially from those estimates. The following critical accounting estimates often require our subjective and complex judgment as a result of the need to estimate matters that are inherently uncertain:

| | · | Revenue Recognition for Construction Services |

The percentage-of-completion method is used to recognize revenue for construction services. Periodic estimates of our progress towards completion are made based on a comparison of labor costs incurred to date with total estimated contract costs for labor. The percentage-of-completion method requires the use of various estimates, including among others, the extent of progress towards completion, contract revenues and contract completion costs. Contract revenues and contract costs to be recognized are dependent on the accuracy of estimates, including quantities of materials, labor productivity and other cost estimates. We have a history of making reasonable estimates of the extent of progress towards completion, contract revenues and contract completion costs. However, due to uncertainties inherent in the estimation process, it is possible that actual contract revenues and completion costs may vary from estimates. Revisions of contract revenues and cost estimates as well as provisions for estimated losses on uncompleted contracts are recognized in the period such revisions are known.

| | · | Estimated Losses on Uncompleted Contracts and Changes in Contract Estimates |

Estimated losses on uncompleted contracts and changes in contract estimates are established by assessing estimated costs to complete, change orders and claims for uncompleted contracts. Revisions of estimated losses are recognized in the period such revisions are known.

| | · | Realizability of Net Deferred Tax Asset |

Deferred tax assets and liabilities are recognized for tax credits and for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. A valuation allowance is recognized to reduce the carrying amount of deferred tax assets to the amount that is more likely than not to be realized. If it is later determined it is more likely than not that deferred tax assets will be realized, the valuation allowance will be adjusted. Revisions of the valuation allowance are recognized in the period such revisions are known.

Goodwill represents the excess of purchase price over the fair values of net tangible and identifiable intangible assets of acquired businesses. An annual assessment for impairment is completed in the fourth quarter and whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment is recognized if the carrying amount is more than the estimated future operating cash flows as measured by fair value techniques.

| | · | Insurance Deductible Reserves |

The estimated cost of automobile, general liability and workers’ compensation claims is determined by actuarial methods. Claims in excess of insurance deductibles are insured with third-party insurance carriers. Insurance deductible reserves for claims are recognized based on the estimated costs of these claims as limited by the deductibles of the applicable insurance policies. Revisions to insurance deductible reserves for estimated claims are recognized in the period such revisions are known.

The estimated cost of warranties for certain construction services is based on the nature and frequency of claims, anticipated claims and cost per claim. Claims in excess of insurance deductibles are insured with third-party insurance carriers. Estimated costs for warranties are recognized when the revenue associated with the service is recognized. Revisions of estimated warranties are recognized in the period such revisions are known.

| | · | Share-based Compensation |

Our estimates of the fair values of our share-based payment transactions are based on the modified Black-Scholes-Merton model. To meet the fair value measurement objective, we are required to develop estimates regarding expected exercise patterns, share price volatility, forfeiture rates, risk-free interest rate and dividend yield. These assumptions are based principally on historical experience. When circumstances indicate changes in forfeiture rates, revisions to forfeiture rates are recognized in the period such revisions are known. Due to uncertainties inherent in these assumptions, it is possible that actual share-based compensation may vary from these estimates.

Cash and Cash Equivalents

Cash and cash equivalents consist of short-term investments that have a maturity of three months or less at the date of purchase.

Receivables

Receivables consist primarily of amounts due from customers and are net of an allowance for doubtful accounts. The allowance for doubtful accounts reflects our best estimate of probable losses of accounts receivable. We determine the allowance based on known troubled accounts, historical experience and other available evidence.

Inventory Valuation

Inventory consists principally of building materials purchased for resale and is valued at the lower of average cost or market. We participate in vendor rebate programs under which rebates are earned by attaining certain purchase volumes. Volume rebates are accrued as earned. These volume rebates are recorded as a reduction in inventory and recognized in cost of goods sold when the related product is sold.

Unbilled Receivables and Billings in Excess of Costs and Estimated Earnings

The percentage-of-completion method results in recognizing costs incurred and estimated revenues on uncompleted contracts. Unbilled receivables represent revenues recognized for construction services performed, however not yet billed. Billings in excess of costs and estimated earnings represent billings made in excess of estimated revenues recognized. These billings are deferred until the actual progress towards completion indicates recognition is appropriate. Costs include labor and materials as well as equipment costs related to contract performance.

Property and Equipment

Property and equipment are recorded at cost. Cost includes expenditures for major improvements and replacements that extend useful life. Certain costs of software are capitalized provided those costs are not research and development and certain other criteria are met. Capitalized interest was not significant for the period ended March 31, 2009, $0.3 million for the period ended March 31, 2008 and $0.9 million for 2008. Expenditures for other maintenance and repairs are expensed as incurred. Gains and losses from sales and retirements are included in Other expense (income), net as they occur. Depreciation is calculated using the straight-line method over the economic useful lives of the assets. The estimated useful lives of depreciable assets are generally:

| · | ten to thirty years for buildings and improvements, |

| · | seven to ten years for machinery and fixtures, |

| · | three to ten years for handling and delivery equipment and |

| · | three to ten years for software development costs. |

To improve financial returns, we periodically evaluate our investments in property and equipment. As a result, property and equipment may be consolidated, leased or sold. For continuing operations, we recognized a gain of $5.3 million for the period ended March 31, 2009, $3.4 million for the period ended March 31, 2008 and $3.2 million for 2008 from the sales of property and equipment.

Assets Held for Sale

Assets held for sale are measured at the lower of carrying amount or fair value less costs to sell and are no longer depreciated. These assets are being actively marketed for sale at a price that is reasonable in relation to their carrying amounts. Any gain or loss arising from the sale of these assets is included in Other expense (income), net. Assets held for sale are as follows (thousands):

| | | | | | | |

| Property and equipment | | | | | | |

| Land | | $ | 23,611 | | | $ | 26,211 | |

| Buildings and improvements | | | 17,840 | | | | 20,089 | |

| | | $ | 41,451 | | | $ | 46,300 | |

Long-lived Assets

Long-lived assets such as property, equipment and intangibles with useful lives are evaluated for impairment whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment is recognized if the carrying amount exceeds its fair value and when the carrying amount is not recoverable based on the estimated future operating cash flows on an undiscounted basis.

Derivative Instruments and Hedging Activities

We are exposed to certain risks related to business operations, some of which we may seek to manage with derivative instruments and hedging activities. The primary risk managed with derivative instruments is interest rate risk. Interest rate swap contracts are entered into to manage interest rate risk associated with variable-rate borrowings. These interest rate swap contracts are accounted for as cash flow hedges unless effectiveness is not probable.

The fair value of derivative instruments is based on pricing models using current market rates. The fair value of interest rate swap contracts is recorded as an asset or liability and the effective portion of the gain or loss is recorded as a component of Accumulated other comprehensive (loss) income, net, a separate component of equity, and is subsequently reclassified into Interest expense as interest expense is recognized on the term note. The ineffective portion, if any, of the change in the value of the interest rate swap contracts is immediately recognized as a component of interest expense.

Derivative financial instruments are not utilized to hedge other risks or for speculative or trading purposes.

Revenue Recognition

Revenues for building products are recognized when title to the goods and risk of loss pass to the buyer, which is at the time of delivery. The percentage-of-completion method is used to recognize revenue for construction services. Taxes assessed by governmental authorities that are directly imposed on our revenue-producing transactions are excluded from sales.

Shipping and Handling

Shipping and handling costs for manufactured building components and construction services are included as a component of cost of goods sold. Shipping and handling costs for building products are included as a component of selling, general and administrative expenses and were $10.2 million for the period ended March 31, 2009, $14.6 million for the period ended March 31, 2008 and $57.9 million for 2008.

Reclassifications

Certain reclassifications, none of which affected previously reported consolidated results of operations, cash flows or shareholders’ equity, have been made to amounts reported in prior periods to conform to the current period presentation.

Recent Accounting Principles

In May 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 162, The Hierarchy of Generally Accepted Accounting Principles. This accounting principle identifies a consistent framework, or hierarchy, for selecting accounting principles to be used in preparing financial statements that are presented in conformity with U.S. generally accepted accounting principles (GAAP) for nongovernmental entities. This accounting principle was adopted November 2008 and had no impact on our consolidated financial position, results of operations or cash flows.

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities. This accounting principle enhances disclosure for derivative instruments and hedging activities and their effects on consolidated financial position, results of operations and cash flows. Specifically, enhanced disclosures include objectives and strategies for using derivatives, including underlying risk and accounting designation, as well as fair values, gains and losses. This accounting principle was adopted June 2008 and had no impact on our consolidated financial position, results of operations or cash flows.

In December 2007, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 160, Noncontrolling Interests in Consolidated Financial Statements. This accounting principle eliminates noncomparable accounting for noncontrolling interests. Specifically, noncontrolling interests are presented as a component of equity; consolidated net income includes amounts attributable to both the parent and noncontrolling interest and is disclosed on the face of the income statement; changes in the ownership interest are accounted for as equity transactions if ownership remains controlling; purchase accounting for acquisitions of noncontrolling interests and acquisitions of additional interests is eliminated; and deconsolidated controlling interests are recognized based on fair value consistent with Statement of Financial Accounting Standards No. 141 (revised 2007), Business Combinations. The accounting requirements were adopted January 2009 and had no impact on our consolidated financial position, results of operations or cash flows.

In December 2007, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 141 (revised 2007), Business Combinations. This accounting principle requires acquisition accounting (purchase accounting) be applied to all business combinations in which control is obtained regardless of consideration and for an acquirer to be identified for each business combination. Additionally, this accounting principle requires acquisition-related costs and restructuring costs at the date of acquisition to be expensed rather than allocated to the assets acquired and the liabilities assumed; noncontrolling interests, including goodwill, to be recorded at fair value at the acquisition date; recognition of the fair value of assets and liabilities arising from contingent consideration (payments conditioned on the outcome of future events) at the acquisition date; recognition of bargain purchase (acquisition-date fair value exceeds consideration plus any noncontrolling interest) as a gain; and recognition of changes in deferred taxes. This accounting principle was adopted January 2009 and had no impact on our consolidated financial position, results of operations or cash flows.

2. Restructuring

In May 2008, we initiated a comprehensive analysis of our businesses operations to improve cash flow and profitability as well as rationalize our operations for the current conditions of the homebuilding industry. The plan places a priority on positive cash flow, efficient use of capital and higher returns and focuses on closing or consolidating business units in underperforming markets as well as improving business processes. The results of the plan were as follows:

| | · | for the period ended March 31, 2009: |

| | § | closed 6 business units and |

| | § | consolidated 1 business unit with other business units. |

| | · | for the period ended March 31, 2008: |

| | § | no restructuring activity as the plan was not initiated until May 2008. |

| | § | closed 42 business units, |

| | § | consolidated 15 business units with other business units and |

| | § | consolidated administrative functions of information systems, reporting, accounts payable and human resources. |

Our restructuring plans do not include formal severance plans for employees affected by the closures and consolidations of business units or enhancements to administrative functions.

As of March 31, 2009, the estimated cumulative charges expected to be incurred and recognized in (loss) from continuing operations and resulting liability were as follows (thousands):

| | | Impairment of assets | | | Operating lease obligations | | | Total | |

| Estimated charges | | $ | 8,967 | | | $ | 11,387 | | | $ | 20,354 | |

| Changes in estimates, net | | | — | | | | (753 | ) | | | (753 | ) |

| Cash payments | | | — | | | | (535 | ) | | | (535 | ) |

| Non-cash charges | | | (8,967 | ) | | | (3,051 | ) | | | (12,018 | ) |

| | | $ | — | | | $ | 7,048 | | | $ | 7,048 | |

Impairments of assets were determined based on available market data and are recognized in Impairment of assets. Operating lease obligations represent the present value of contractual rental payments offset by estimated sublease income and are recognized in Selling, general and administrative expenses. The liability for restructuring is recorded in the consolidated balance sheet as follows:

| | · | $4.1 million in Other accrued liabilities and $2.9 million in Other long-term liabilities as of March 31, 2009 and |

| | · | $5.6 million in Other accrued liabilities and $4.0 million in Other long-term liabilities as of December 31, 2008. |

Activity related to restructuring plans and the resulting liability were as follows (thousands):

| | | Three Months Ended March 31, 2009 | | | | |

| | | Impairment of assets | | | Operating lease obligations | | | Total | |

| Balance at beginning of period | | $ | — | | | $ | 9,644 | | | $ | 9,644 | |

| Estimated charges | | | 365 | | | | — | | | | 365 | |

| Change in estimates, net | | | — | | | | (753 | ) | | | (753 | ) |

| Cash payments | | | — | | | | (145 | ) | | | (145 | ) |

| Non-cash charges | | | (365 | ) | | | (1,698 | ) | | | (2,063 | ) |

| | | $ | — | | | $ | 7,048 | | | $ | 7,048 | |

| | | Year Ended December 31, 2008 | | | | |

| | | Impairment of assets | | | Operating lease obligations | | | Total | |

| Balance at beginning of period | | $ | — | | | $ | — | | | $ | — | |

| Estimated charges | | | 8,602 | | | | 11,387 | | | | 19,989 | |

| Change in estimates, net | | | — | | | | — | | | | — | |

| Cash payments | | | — | | | | (390 | ) | | | (390 | ) |

| Non-cash charges | | | (8,602 | ) | | | (1,353 | ) | | | (9,955 | ) |

| | | $ | — | | | $ | 9,644 | | | $ | 9,644 | |

Due to uncertainties in the markets of certain business units and inherent in the estimation process, it is possible the actual costs of restructuring may vary from estimates. Revisions of these costs are recognized in the period such revisions are known.

3. Impairment of Assets

Long-lived assets such as property, equipment and intangibles are evaluated for impairment whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment for these assets is recognized if the carrying amount exceeds their fair value and when the carrying amount is not recoverable based on the estimated future operating cash flows on an undiscounted basis.

Similarly, goodwill is evaluated for impairment in the fourth quarter and whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment for goodwill is recognized if the carrying amount is more than the estimated future operating cash flows as measured by fair value techniques.

As a result of our ongoing evaluations of underperforming business units, certain property and equipment specific to these business units were identified as impaired. Impairments recognized in loss from continuing operations were as follows:

| | · | for the period ended March 31, 2009: |

| | § | $0.4 million for certain property and equipment held for sale. |

During the later portion of the fourth quarter of 2008, the leading sources of economic and housing data forecasted deeper reductions in estimated housing starts. Market factors as well as developing regulatory efforts to revive historically low housing starts have been further complicated by the weakening economic conditions of rising unemployment and pessimistic consumer confidence stemming from tightened lending standards and losses in home values and investments. Similarly, tightened lending conditions have impacted the liquidity of our customers.

For impairment testing of customer relationships and covenants not to compete, the carrying amounts exceeded the estimated future operating cash flows on an undiscounted basis. The impairment testing for goodwill indicated the carrying amount exceeded our estimate of enterprise value. Impairments recognized in loss from continuing operations were as follows:

| | · | for the period ended March 31, 2008: |

| | § | no impairments were recognized. |

| | § | $30.2 million for certain customer relationships and covenants not to compete, |

| | § | $14.2 million for goodwill, |

| | § | $6.3 million for certain property and equipment held for sale and |

| | § | $2.3 million for leasehold improvements. |

4. Discontinued Operations

The results of operations and financial position of discontinued operations are separately reported for all periods presented as a result of the following transactions:

| | · | In June 2008, we discontinued concrete block masonry, concrete services and truss manufacturing in Florida. These business units represented approximately 6% of sales. |

| | · | In March 2008, we discontinued framing services in Virginia. This business unit represented less than 1% of sales. |

Assets, liabilities, sales and loss after related income tax expense (benefit) for these operations are separately reported from continuing operations and were as follows (thousands):

| | | March 31 | | | December 31 | |

| | | 2009 | | | 2008 | |

| Assets | | $ | 5,073 | | | $ | 5,659 | |

| Liabilities | | $ | 502 | | | $ | 773 | |

| | | Three Months Ended March 31 | | | Year Ended December 31 | |

| | | 2009 | | | 2008 | | | 2008 | |

| Sales | | | | | | | | | |

| Building products | | $ | — | | | $ | 485 | | | $ | 2,021 | |

| Construction services | | $ | 17 | | | $ | 12,206 | | | $ | 38,624 | |

| | | | | | | | | | | | | |

| Loss from discontinued operations | | $ | (152 | ) | | $ | (57 | ) | | $ | (22,353 | ) |

5. Net Loss Per Share

Net loss per share was determined using the following information (thousands, except per share data):

| | | Three Months Ended March 31 | | | Year Ended December 31 | |

| | | 2009 | | | 2008 | | | 2008 | |

| Loss from continuing operations | | $ | (45,068 | ) | | $ | (33,804 | ) | | $ | (192,456 | ) |

| Loss from discontinued operations | | | (152 | ) | | | (57 | ) | | | (22,353 | ) |

Net loss attributable to common shareholders | | $ | (45,220 | ) | | $ | (33,861 | ) | | $ | (214,809 | ) |

| | | | | | | | | | | | | |

| Weighted average shares - basic | | | 29,508 | | | | 28,972 | | | | 29,081 | |

| Effect of dilutive: | | | | | | | | | | | | |

| Share options | | | — | | | | — | | | | — | |

| Restricted shares | | | — | | | | — | | | | — | |

| Warrants | | | — | | | | — | | | | — | |

Weighted average shares - assuming dilution | | | 29,508 | | | | 28,972 | | | | 29,081 | |

| | | | | | | | | | | | | |

| Net loss per share: | | | | | | | | | | | | |

| Continuing operations | | $ | (1.53 | ) | | $ | (1.17 | ) | | $ | (6.62 | ) |

| Discontinued operations | | | — | | | | — | | | | (0.77 | ) |

| Basic | | $ | (1.53 | ) | | $ | (1.17 | ) | | $ | (7.39 | ) |

| | | | | | | | | | | | | |

| Continuing operations | | $ | (1.53 | ) | | $ | (1.17 | ) | | $ | (6.62 | ) |

| Discontinued operations | | | — | | | | — | | | | (0.77 | ) |

| Diluted | | $ | (1.53 | ) | | $ | (1.17 | ) | | $ | (7.39 | ) |

| | | | | | | | | | | | | |

| Cash dividends declared per share | | $ | — | | | $ | — | | | $ | — | |

Potential common shares for options, restricted shares and warrants are generally excluded from the computation of diluted net loss per share if there is a loss from continuing operations for the period. Additionally, certain share options, restricted shares and warrants are excluded from the computation of diluted net loss per share:

| | · | options and warrants with exercise prices greater than the average market value of the common shares (out-of-the-money) and |

| | · | unrecognized compensation expense for restricted shares with after-tax proceeds greater than the average market value of the common shares. |

Options, restricted shares and warrants excluded from the computation of diluted net loss per share will change based on additional grants as well as the average market value of the common shares for the period. These options, restricted shares and warrants that are not dilutive and therefore excluded from the computation of diluted net loss per share were as follows (thousands, except share price data):

| | | Three Months Ended March 31 | | | Year Ended December 31 | |

| | | 2009 | | | 2008 | | | 2008 | |

| Average market value of shares | | | $0.38 | | | | $5 | | | | $3 | |

| Share options: | | | | | | | | | | | | |

| Exercise price range | | | $5 to $38 | | | | $5 to $38 | | | | $5 to $38 | |

| Not dilutive | | | 2,472 | | | | 2,964 | | | | 2,627 | |

| Restricted shares: | | | | | | | | | | | | |

| Grant price range | | | $15 to $18 | | | | $14 to $42 | | | | $15 to $38 | |

| Not dilutive | | | 103 | | | | 297 | | | | 214 | |

| Warrants: | | | | | | | | | | | | |

| Exercise price | | | $0.47 | | | | — | | | | $0.47 | |

| Not dilutive | | | 2,825 | | | | — | | | | 2,825 | |

6. Noncontrolling Interests

Noncontrolling interests reflects the other owners’ proportionate share in the assets and liabilities of business ventures as of the date of purchase, adjusted by the proportionate share of post-acquisition income or loss. As the operating results of entities with noncontrolling interests are consolidated, noncontrolling interests loss represents the loss attributable to the other owners.

| | · | In June 2008, we acquired the remaining 40% interest in SelectBuild Mechanical for $0.2 million in cash. In October 2004, we formed this venture for an initial 60% interest for $0.3 million in cash. SelectBuild Mechanical provides heating, ventilation and air conditioning services in Las Vegas, Nevada. |

| | · | In January 2008, we were required to purchase the remaining 49% interest in SelectBuild Illinois (RCI Construction) for $8.3 million in cash of which $2.4 million was paid in January 2008 and $5.9 million was paid in July 2008. The fair value of SelectBuild Illinois did not exceed its net book value. As a result, the $5.5 million excess of the purchase price for the noncontrolling interest over the recorded amount for the noncontrolling interest in SelectBuild Illinois was recognized as an expense in Other income, net in December 2007. In January 2005, we acquired an initial 51% interest for $4.9 million in cash. SelectBuild Illinois provides framing services to production homebuilders in the greater Chicago area. |

Assets and liabilities acquired in acquisitions, including payments of amounts retained for settlement periods, were as follows (thousands):

| | | March 31 | December 31 | | | | March 31 | December 31 | |

| | | 2009 | | 2008 | | | | 2009 | | 2008 | |

| Receivables | | $ | — | | | $ | — | | Other accrued liabilities | | $ | — | | | $ | (47 | ) |

| Prepaid expenses and other | | | — | | | | — | | | | | | | | | | |

| Current assets | | | — | | | | — | | Current liabilities | | | — | | | | (47 | ) |

| | | | | | | | | | | | | | | | | | |

| Property and equipment | | | — | | | | — | | Deferred income taxes | | | — | | | | — | |

| Other intangibles, net | | | — | | | | — | | Noncontrolling interests | | | — | | | | (8,528 | ) |

| Goodwill | | | — | | | | — | | | | | | | | | | |

| | | $ | — | | | $ | — | | | | $ | — | | | $ | (8,575 | ) |

7. Intangible Assets and Goodwill

Intangible assets represent the values assigned to customer relationships, covenants not to compete, trade names and favorable leases. Intangible assets are amortized on a straight-line basis over their expected useful lives. Customer relationships are amortized over 7 years and covenants not to compete over 3 years. Amortization expense for intangible assets was $0.8 million for the period ended March 31, 2009, $2.4 million for the period ended March 31, 2008 and $8.9 million for 2008. Intangible assets consist of the following (thousands):

| | March 31, 2009 | |

| | Gross Carrying Amount | | Accumulated Amortization | | Net Carrying Amount | |

| Customer relationships | | $ | 25,300 | | | $ | (7,730 | ) | | $ | 17,570 | |

| Covenants not to compete | | | 1,900 | | | | (1,045 | ) | | | 855 | |

| | | $ | 27,200 | | | $ | (8,775 | ) | | $ | 18,425 | |

| | | December 31, 2008 | |

| | | Gross Carrying Amount | | | Accumulated Amortization | | | Net Carrying Amount | |

| Customer relationships | | $ | 29,074 | | | $ | (10,802 | ) | | $ | 18,272 | |

| Covenants not to compete | | | 4,089 | | | | (3,139 | ) | | | 950 | |

| Favorable leases | | | 382 | | | | (382 | ) | | | — | |

| | | $ | 33,545 | | | $ | (14,323 | ) | | $ | 19,222 | |

Estimated amortization expense for intangible assets is $2.4 million for the remainder of 2009, $3.2 million for 2010, $3.0 million for 2011, $2.8 million for 2012, $2.8 million for 2013 and $4.2 million thereafter.

Goodwill represents the excess of the purchase price over the fair value of net tangible and identifiable intangible assets of acquired businesses. Adjustments to amounts previously reported as goodwill may occur as a result of completing the purchase price allocation to the assets acquired, including intangible assets, and liabilities assumed based on their estimated fair values at the date of acquisition.

An annual assessment for impairment is completed in the fourth quarter and whenever events and circumstances indicate the carrying amount may not be recoverable. An impairment is recognized at the reporting unit if the carrying amount is more than the estimated future operating cash flows as measured by fair value techniques.

Changes in the carrying amount of goodwill were as follows:

| | | Three Months Ended | | | Year Ended | |

| | | March 31 | | | December 31 | |

| | | 2009 | | 2008 | | | 2008 | |

| Balance at beginning of period | | $ | — | | | $ | 14,196 | | | $ | 14,196 | |

| Impairment | | | — | | | | — | | | | (14,196 | ) |

| | | $ | — | | | $ | 14,196 | | | $ | — | |

While goodwill is tested for impairment annually and not amortized for financial statement purposes, goodwill may be deductible for income tax purposes. Certain goodwill is non-deductible. Changes to non-deductible goodwill were as follows (thousands):

| | | Three Months Ended | | | Year Ended | |

| | | March 31 | | | December 31 | |

| | | 2009 | | 2008 | | | 2008 | |

| Balance at beginning of period | | $ | — | | | $ | 3,460 | | | $ | 3,460 | |

| Impairment | | | — | | | | — | | | | (3,460 | ) |

| | | $ | — | | | $ | 3,460 | | | $ | — | |

8. Debt

Long-term debt consists of the following (thousands):

As of March 31, 2009 | | | | | | Notional | | | Effective Interest Rate | |

| | | Balance | | Stated Interest Rate | | Amount of Interest Rate Swaps | | | Average for Quarter | | | As of March 31 | |

| Revolver | | $ | 2,300 | | LIBOR (minimum of 3%) plus 5.25% OR Prime plus 3.25% and 0.50% commitment fee | | $ | — | | | | 7.0 | % | | | 7.0 | % |

| Term note | | | 313,773 | | LIBOR (minimum of 3%) plus 5.25% OR Prime plus 3.25% | | | 123,019 | | | | 11.5 | % | | | 11.5 | % |

| Other | | | 1,275 | | Various | | | — | | | | — | | | | — | |

| | | | 317,348 | | | | $ | 123,019 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Less: Current portion | | | 316,309 | | | | | | | | | | | | | | |

Less: Unamortized discount | | | 658 | | | | | | | | | | | | | | |

| | | $ | 381 | | | | | | | | | | | | | | |

| As of December 31, 2008 | | | | | | Notional | | | Effective Interest Rate | |

| | | Balance | | Stated Interest Rate | | Amount of Interest Rate Swaps | | | Average for Year | | | As of December 31 | |

| Revolver | | $ | — | | LIBOR (minimum of 3%) plus 5.25% OR Prime plus 3.25% and 0.50% commitment fee | | $ | — | | | | 12.9 | % | | | n/a | |

| Term note | | | 325,759 | | LIBOR (minimum of 3%) plus 5.25% OR Prime plus 3.25% | | | 135,124 | | | | 9.6 | % | | | 11.5 | % |

| Other | | | 1,412 | | Various | | | — | | | | — | | | | — | |

| | | | 327,171 | | | | $ | 135,124 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Less: Current portion | | | 39,443 | | | | | | | | | | | | | | |

Less: Unamortized discount | | | 719 | | | | | | | | | | | | | | |

| | | $ | 287,009 | | | | | | | | | | | | | | |

In September 2008, we entered into an amendment to our credit agreement with our lenders. The amended credit facility continues to provide a $200 million revolver subject to borrowing base limitations and a $340 million term note maturing in November 2011. However, the April 2009 limited waiver limits borrowings under the revolver to $20 million and may not provide adequate liquidity.

The $200 million revolver is subject to borrowing base limitations and matures in November 2011. The revolver may consist of both LIBOR and Prime based borrowings. In the September 2008 amendment, the variable interest rate for the revolver was increased to LIBOR plus 5.25% or Prime plus 3.25%. Minimum LIBOR interest is 3.0%. Additionally, a commitment fee for the unused portion is 0.50%. LIBOR interest is paid quarterly and Prime interest is paid monthly. As of March 31, 2009, $2.3 million was outstanding under the revolver.

The effective interest rate is based on interest rates for the period as well as the commitment fee for the unused portion of the revolver.

Letters of credit outstanding that guaranteed performance or payment to third parties were $109.0 million as of March 31, 2009. These letters of credit reduce the $200 million revolver commitment.

Total availability under the revolver is subject to a monthly borrowing base calculation that includes:

| | · | 70% of certain accounts receivable, |

| | · | 50% of certain inventory, |

| | · | 25% of certain other inventory, |

| | · | approximately 75% of the appraised value of certain property and equipment and |

| | · | 50% of the appraised value of real estate. |

As of March 31, 2009, the unused borrowing base under the revolver was $49.2 million, however the April 2009 limited waiver limits borrowings under the revolver to $20 million.

The term note matures in November 2011 and is payable in quarterly installments of $0.9 million with the remaining principal of $270.0 million payable in November 2011. In the September 2008 amendment, the variable interest rate for the term note was increased to LIBOR plus 5.25% or Prime plus 3.25%. Minimum LIBOR interest is 3.0%. LIBOR interest is paid quarterly and Prime interest is paid monthly. In addition to the LIBOR and Prime interest rates, the term note includes an additional annual payment-in-kind interest or fee of 2.75% that is payable on the earlier of payoff or maturity. As of March 31, 2009, $313.8 million was outstanding under this term note.

Other long-term debt consists of term notes, equipment notes and capital leases for equipment. Interest rates vary and dates of maturity are through March 2021. As of March 31, 2009, other long-term debt was $1.3 million.

Covenants and Maturities

Our credit agreement requires monthly compliance with financial covenants, including minimum liquidity and adjusted earnings before interest, taxes, depreciation and amortization (monthly Adjusted EBITDA). Operating results, particularly income from continuing operations, are a primary factor for these covenants, and our ability to comply with these covenants depends on our operating performance. Lack of compliance with these covenants would constitute an event of default under the credit agreement which, absent any waiver, forbearance or modification, would enable the lenders under our credit agreement to cause all amounts borrowed to become due and payable immediately and to prohibit further borrowings by us under the revolver.

Based on financial information for February 2009, we were not in compliance with the monthly Adjusted EBITDA requirement of our credit agreement. In March 2009, we obtained a limited waiver through April 15, 2009 for lack of compliance with the monthly Adjusted EBITDA requirement and we preserved access to limited liquidity permitting us to borrow up to $20 million under the revolver. Previously, we had obtained waivers for financial covenants due to lower than planned operating performance as of both June 2008 and December 2007.

Due to the difficulty of reliably projecting our operating results within the depressed business conditions of the homebuilding industry, we believe that it is likely that we will not be able to meet the financial covenants of our credit agreement during 2009. Also, our independent registered public accounting firm included a going concern explanatory paragraph in their report on our financial statements for 2008, citing among other things, the uncertainty that we would remain in compliance with these financial covenants. The going concern explanatory paragraph constitutes a default under our credit agreement. In April 2009, we obtained a waiver for the going concern explanatory paragraph.

In April 2009, our lenders also agreed to extend the limited waiver through June 1, 2009. In May 2009, the limited waiver was extended through June 29, 2009. This limited waiver continues to waive compliance with the monthly Adjusted EBITDA, forecast and projection requirements of our credit agreement. The limited waiver limits borrowings under the revolver to $20 million and limits capital expenditures to $0.1 millionfrom the date of the extended limited waiver. Lenders approving each of the March, April and May 2009 limited waivers were paid a fee of 0.10% of their revolver commitment and their portion of the outstanding principal amount of the term note.

For March 2009, we were not in compliance with the monthly Adjusted EBITDA requirement of our credit agreement. Additionally, as the limited waiver for these financial covenants is less than a year, it is probable we will not be in compliance with these financial covenants within the next year and given there is no amendment or other financing agreement currently in place, the revolver and term note are classified as a current liability in the consolidated balance sheet.

We are anticipating tax refunds of $56 million as a result of net operating losses for 2008. These refunds will be applied to reduce the amount outstanding under our term loan facility to approximately $275 million. The remaining portion of the tax refund will be available for working capital needs after payment of any borrowings under the revolver. We filed for our federal tax refund in April 2009 and our professional advisors have advised us that receipt of the refund is anticipated in mid- to late May 2009.

We are currently negotiating with our lenders to develop debt and capital structures to support our long-term strategic plan and business objectives. We expect that these negotiations may lead to a bankruptcy filing which we anticipate would reflect the agreement of our lenders and would provide for the payment in full of all amounts owing to key vendors and the uninterrupted supply of goods and services to our customers. Equity holders may be substantially diluted or be eliminated in a bankruptcy filing.

There can be no assurance these negotiations will result in debt and capital structures acceptable to us and the lenders or an agreement that would achieve our goals. If these negotiations fail, we would not be able to continue as a going concern and would be forced to seek relief through bankruptcy filing without an agreement of our lenders. We also continue to pursue alternative financing arrangements as well as evaluate other financing options.

If our leverage ratio is at or above a certain maximum as of September 30, 2010, the monthly Adjusted EBITDA may be replaced with quarterly compliance with a leverage ratio and interest coverage ratio. Operating results, particularly income from continuing operations, are a primary factor for these covenants and our ability to comply with these covenants depends on our operating performance. The significant downturn in single-family housing starts has negatively impacted and may continue to negatively impact our operating performance.

The credit agreement requires certain proceeds and cash flows be applied to the credit facility as follows:

| | § | cash in excess of $25 million. |

| | § | proceeds from certain dispositions, |

| | § | 75% of excess cash flow as defined beginning in 2010. |

Proceeds from tax refunds and certain dispositions are retained in a separate cash account. Cash in excess of $25 million in this separate cash account is to be applied to the revolver or term note. There was no amount in this separate cash account as of March 31, 2009. In the event of default, this cash is restricted and not available for our operating needs.

The amended credit facility continues to restrict our ability to incur additional indebtedness, pay dividends, repurchase shares, enter into mergers or acquisitions, use proceeds from equity offerings, make capital expenditures and sell assets. The amended credit facility is secured by all assets of our wholly-owned subsidiaries.

In connection with the September 2008 amendment, 100% or $2.8 million of unamortized deferred loan costs related to the term note were recognized as interest expense in the third quarter of 2008. We also incurred $3.8 million of costs in connection with the amendment and $2.0 million of these costs will be amortized over the remaining term of the credit facility whereas $1.8 million of these costs were recognized as interest expense in the third quarter of 2008.

In connection with the February 2008 amendment, 60% or $2.4 million of unamortized deferred loan costs related to the previous revolver were recognized as interest expense in the first quarter of 2008. We also incurred $4.9 million of fees in connection with the amendment and these costs were to be amortized over the remaining term of our credit facility. However, in connection with the September 2008 amendment, the remaining $2.6 million of these unamortized costs were recognized as interest expense in the third quarter of 2008.

Scheduled maturities of long-term debt are as follows (thousands):

| 2009 | | $ | 316,246 | |

| 2010 | | | 223 | |

| 2011 | | | 66 | |

| 2012 | | | 65 | |

| 2013 | | | 70 | |

| Thereafter | | | 678 | |

| | | $ | 317,348 | |

Warrants

In connection with the amendment of our credit facility in September 2008, we issued warrants that entitle the lenders to purchase approximately 8.75% or 2.8 million of our common shares at a purchase price of $0.47 per common share, the closing price on the NYSE on September 30, 2008. These warrants may be exercised through September 2015.

The fair value of the warrants of $0.8 million was recorded as a discount on the term note. Amortization of the discount will be recognized ratably through November 2011, the remaining term of our credit facility.

Hedging Activities

In addition to the amendment to our credit facility in September 2008, we amended our interest rate swap contracts to lower amounts and a maturity matching the credit facility. As of March 2009, the interest rate swap contracts effectively converted $123.0 million of variable rate borrowings to a fixed interest rate of 10.6% plus any difference between minimum LIBOR interest of 3.0% and LIBOR, thus reducing the impact of increases in interest rates on future interest expense. Additionally, the notional amount of the interest rate swap contracts will be ratably reduced to zero through the maturity of November 2011.

As of March 2009, approximately 39% of the outstanding variable rate borrowings have been hedged with these interest rate swap contracts. After giving effect to the interest rate swap contracts, total borrowings were 61% variable and 39% fixed. The fair value of the interest rate swap contracts was a liability of $6.4 million as of March 31, 2009. Management may choose not to swap variable rates to fixed rates or may terminate a previously executed swap if the variable rate positions are more beneficial.

Hedge accounting was discontinued in January 2009, as it is not probable future LIBOR interest rates for the remaining term of the interest rate swap contracts will be at or above the minimum LIBOR interest of 3.0% of the term note. In September 2008, we amended our interest rate swap contracts. Monthly settlements are made to ratably reduce the notional amount of the interest rate swap contracts through November 2011. As a result, the following amounts were recognized as Interest expense:

| | · | $0.1 million for the period ended March 31, 2009 for an increase in the fair value of the interest rate swap contracts rather than recorded in Accumulated other comprehensive loss, net, a component of equity. This increase in the fair value was after $1.2 million of notional reduction settlement payments for the period ended March 31, 2009. There were no notional reduction settlement payments for the period ended March 31, 2008. |

| | · | $0.4 million for the period ended March 31, 2009 for amortization of unrealized loss due to increases in fair value of interest rate swap contracts previously accounted for as a cash flow hedge and recorded in Accumulated other comprehensive loss, net. The remaining unrealized loss of $4.1 million in Accumulated other comprehensive loss, net as of March 31, 2009 will be subsequently amortized to Interest expense over the remaining term of our term note. |

| | · | $0.2 million for the period ended March 31, 2009 and $0.9 million for 2008 for amortization of the notional reduction settlement payments previously accounted for as a cash flow hedge and recorded in Accumulated other comprehensive loss, net. The remaining unrealized loss of $2.7 million for notional reduction settlement payments previously accounting for cash flow hedged for 2008 recorded in Accumulated other comprehensive loss, net as of March 31, 2009 will be subsequently amortized to Interest expense over the remaining term of our term note. |

In December 2008, we determined the interest rate swap contracts were not an effective hedge of variable interest due to the recent significant reductions in LIBOR interest rates. As a result of the estimated difference between the LIBOR interest of the interest rate swap contracts and the minimum LIBOR interest of 3.0% of the term note, we recognized $3.0 million of interest expense for the ineffective portion of these interest rate swap contracts for 2008. The effective portion of the interest rate swap contracts of $4.5 million was recorded as an unrealized loss and an unrealized tax benefit of $1.7 million in Accumulated other comprehensive loss, net, a component of equity. A corresponding deferred tax asset for the unrealized tax benefit was eliminated with a valuation allowance as there may be an inability to utilize this deferred tax asset. The remaining unrealized loss of $4.1 million in Accumulated other comprehensive loss, net as of March 31, 2009 will be subsequently amortized to Interest expense over the remaining term of our term note.

The fair value and gains and losses on interest rate swap contracts are as follows (thousands):

| | March 31 | | December 31 | |

| | 2009 | | 2008 | |

| | Balance Sheet | Fair | | Balance Sheet | Fair | |

| | Classification | Value | | Classification | Value | |

| Interest rate swap contracts – | | | | | | | | |

| not designated as cash flow hedge | Other long-term | | | | | | | |

| | liabilities | | $ | 6,411 | | | | $ | — | |

Interest rate swap contracts – designated as cash flow hedge | | | | | | Other long-term | | | | |

| | | | $ | — | | liabilities | | $ | 7,514 | |

The effect of interest rate swap contracts on the consolidated statement of operations is as follows (thousands):

| | Gain (Loss) Recognized in Accumulated Other Comprehensive Loss, Net | |

| | Three Months Ended March 31 | | Year Ended December 31 | |

| | | 2009 | | | 2008 | | | 2008 | |

| Unrealized (loss) gain | | $ | — | | | $ | (8,419 | ) | | $ | 226 | |

| | | Loss Reclassified from Accumulated Other Comprehensive Loss, Net to Interest Expense | |

| | | Three Months Ended March 31 | | | Year Ended December 31 | |

| | | 2009 | | | 2008 | | | 2008 | |

| Effective cash flow hedge | | | | | | | | | | | | |

| Interest rate swap contracts – active | | | | | | | | | | | | |

| Amortization of unrealized loss | | $ | 384 | | | $ | — | | | $ | — | |

| Interest rate swap contracts – terminated | | | | | | | | | | | | |

| Notional reduction settlement payments | | | | | | | | | | | | |

| Amortization of payments | | | 250 | | | | — | | | | 926 | |

| | | | | | | | | | | | | |

| Ineffective cash flow hedge | | | | | | | | | | | | |

Interest rate swap contracts – active Ineffective portion | | | — | | | | — | | | | 3,022 | |

| | | $ | 634 | | | $ | — | | | $ | 3,948 | |

9. Shareholders’ (Deficit) Equity

Preferred Shares

We are authorized to issue 2 million preferred shares, however none of these shares are issued. Under the terms of our Restated Certificate of Incorporation, the Board of Directors is authorized to determine or alter the rights, preferences, privileges and restrictions of the preferred shares.

Common Shares

Our common shares have a par value of $0.001. We have 50 million shares authorized, of which 29.7 million are issued and outstanding as of March 31, 2009.

Of the unissued shares, 6.0 million shares were reserved for the following:

| Employee Stock Purchase Plan | 1.3 million |

| 2008 Stock Incentive Plan | 1.9 million |

| Warrants | 2.8 million |

Warrants

In connection with the amendment of our credit facility in September 2008, we issued warrants that entitle the lenders to purchase approximately 8.75% or 2.8 million of our common shares at a purchase price of $0.47 per common share, the closing price on the NYSE on September 30, 2008. These warrants may be exercised through September 2015.

The fair value of these warrants was estimated on the date of grant using the modified Black-Scholes-Merton model. The following table presents the assumptions used in the valuation and the resulting fair value as of the date of grant:

| Expected term (years) | | | 5.5 | |

| Expected volatility | | | 64.6 | % |

| Expected dividend yield | | | 0.0 | % |

| Risk-free interest rate | | | 3.0 | % |

| Exercise price | | | $0.47 | |

| Weighted average fair value | | | $0.28 | |

These assumptions to determine fair value are based principally on historical experience. Due to uncertainties inherent in these assumptions, it is possible that actual value received by the warrant holders may vary from the estimate of the fair value of these warrants.

The fair value of the warrants of $0.8 million was recorded as a discount on our term note. Amortization of the discount will be recognized ratably through November 2011, the remaining term of our credit facility.

No warrants have been exercised and all 2.8 million warrants are outstanding and exercisable as of March 31, 2009. Warrants exercised are settled with newly issued common shares. The common shares for warrants are not included in the calculation of basic income per share until exercised, however the common shares for warrants may be included in the calculation of diluted income per share.

Dividends

Cash dividends per common share were as follows:

| | | 2009 | | | 2008 | |

| First quarter | | $ | — | | | $ | — | |

| Second quarter | | | — | | | | — | |

| Third quarter | | | — | | | | — | |

| Fourth quarter | | | — | | | | — | |

| | | $ | — | | | $ | — | |

Our credit facility, amended in September 2008, prohibits the payment of cash dividends on our common shares. The determination of future dividend payments (cash or shares) will depend on many factors, including credit facility restrictions, financial position, results of operations and cash flows.

Our credit facility, amended in September 2008, prohibits the repurchase of our common shares. The determination of future share repurchases will depend on many factors, including credit facility restrictions, financial position, results of operations and cash flows.

10. Employee Benefit Plans

Retirement Plans

· Savings and Retirement Plan

We provide a savings and retirement plan for salaried and certain hourly employees whereby eligible employees may contribute a percentage of their earnings to a trust. Participants may defer up to 75% of their eligible compensation (base salary, annual incentive and long-term incentives) subject to the limitations imposed under the Internal Revenue Code.

Prior to 2009, our matching contributions ranged from 25% of the first 4% to 50% of the first 6% of the participant’s contribution. Matching contributions are established at the discretion of the Compensation Committee of our Board of Directors in the first quarter. Vesting in matching contributions occurs at the rate of 20% per year of service, upon reaching normal or early retirement date, or upon death, disability or certain other circumstances. Matching contributions were temporarily suspended for 2009 and matching contributions of $1.0 million for the period ended March 31, 2008 and $2.9 million for 2008 were made to the trusts based on a percentage of the contributions made by participants.

Participants may direct their contributions and matching contributions through any of the investment options offered, including self-directed brokerage accounts. Investment options are reviewed and may be revised quarterly by an Investment Committee comprised of management and advised by consultants.

· Executive Deferred Compensation

We previously provided a deferred compensation plan for directors, executives and key employees. The objective of the plan was to provide executives and key employees with an additional opportunity to save for their retirement. Executive and key employee participants could defer up to 80% of their eligible compensation (base salary, annual incentive and medium term incentives). Director participants could defer 100% of their compensation. Effective January 2009, the plan was suspended and no participant contributions or matching contributions will be made.

There are no minimum or guaranteed returns. Participants may elect distribution upon reaching a specific age, number of years or separation of service. Distributions may be a lump sum payment or monthly installments over 5 to 10 years.

Matching contributions were the same as the savings and retirement plan matching contribution percentage. Matching contributions were established at the discretion of the Compensation Committee of our Board of Directors in the first quarter. There were no matching contributions for the period ended March 31, 2009 and matching contributions of less than $0.1 million for the period ended March 31, 2008 and $0.1 million for 2008 were made to the trust based on a percentage of the contributions made by participants.

Investments of the deferred compensation plan are held in a custodial account and the assets are subject to the claims of general creditors. Participants may elect to invest their deferred compensation through any of the investment options offered, including our common shares. Investment options are reviewed and may be revised quarterly by an Investment Committee comprised of management and advised by consultants.

| | · | Compensation deferred and invested in third-party investment options is recorded in Other long-term assets and Other long-term liabilities. As the obligation is settled for the value of the underlying investments, changes in the fair value of the investments are recognized in Other income and changes in the fair value of the liability are recognized in Selling, general and administrative expenses. Fair value is based on market quotes. The fair value of these investments was $1.3 million at March 31, 2009 and $4.0 million at December 31, 2008. |

| | · | Compensation deferred and invested in our common shares is recorded as a component of shareholders’ equity. As the obligation is settled for the fixed number of common shares purchased, changes in fair value are not recognized. Rather, purchases and distributions of the common shares are recorded at historical cost. The historical cost of these common shares was $0.1 million or 15,116 common shares at March 31, 2009 and $0.9 million or 107,757 common shares at December 31, 2008. |

· Supplemental Retirement

Additionally, there is a supplemental retirement plan for executives and key employees. The objective of the plan is to provide a supplemental retirement benefit that enables participants to retire at age 65 with 30 years of service at an income level of at least 60% of pre-retirement base salary after considering deferred compensation, predecessor retirement and social security benefits. Effective January 2009, the plan was suspended as no contributions or return will be made to participants except the contribution and return required for the employment agreements of certain executives and no new participants will be added to the plan.

Contributions have typically been 5.5% of net income. Contributions are allocated proportionately to participants based on their base salaries and limited to 30% of a participant’s base salary.

| | · | 65% of the contributions are invested in company-owned life insurance polices for certain participants. |

| | · | 35% of the contributions are made in our common shares and distributed to the savings and retirement plans of certain participants. |

Active participants invested in company-owned life insurance policies receive a return based on long-term corporate bond yields. This return has been approximately 6% and may vary based on changes to this yield. Inactive participants receive a return of 0% to 9% based on their years of service and payment elections. Participants receiving our common shares receive a return of any related dividend.

Contributions and the return are established at the discretion of the Compensation Committee of our Board of Directors in the first quarter. Participants are immediately vested in the contribution.

The Compensation Committee decided to make:

| | · | no contribution or return to participants and no contribution or return was required for the employment agreements of certain executives for the period ended March 31, 2009. |

| | · | no contribution or return to participants and no contribution or return was required for the employment agreements of certain executives for the period ended March 31, 2008. |

| | · | no contributions or return to participants and no contribution or return was required for the employment agreements of certain executives for 2008. |

The cash surrender value of the company-owned life insurance policies approximates the obligation, however the returns, if any, are not fully funded as these returns are dependent upon years of service and payment elections. These life insurance policies fund the obligation to the participants or their beneficiaries over a 5, 10 or 15-year period.

· Management Retention Compensation

In February 2008, the Compensation Committee of our Board of Directors approved management retention agreements for certain executives and key employees. Participants receive common share equivalent units which may be exchanged for the market value of those shares upon vesting two years from the date of grant. Compensation expense recognized for these agreements was not significant for the period ended March 31, 2009, for the period ended March 31, 2008 and for 2008.

Employee Stock Purchase Plan

In February 2008, our Board of Directors adopted the Employee Stock Purchase Plan, as approved by our shareholders in May 2008. The plan amended an employee share purchase plan originally effective October 2000. The plan permits eligible employees to purchase common shares through payroll deductions of up to 10% of an employee’s compensation limited to $25,000 each year. The purchase price of the shares may be 85% or more of the lowest market price on either the first or last day of each three month period ending January, April, July and October. A total of 2 million shares were authorized for issuance, however 0.4 million shares were issued under the previous employee share purchase plan resulting in 1.6 million shares remaining available for this plan. Unissued shares were 1.3 million for the period ended March 31, 2009 and 1.4 million as of December 31, 2008. Compensation expense recognized was not significant for the period ended March 31, 2009, for the period ended March 31, 2008 and for 2008.

Incentive and Performance Plans

In February 2008, our Board of Directors adopted the 2008 Stock Incentive Plan, as approved by our shareholders in May 2008. A total of 2 million common shares were reserved for issuance under the plan.

In addition to the payment of an annual retainer, non-employee directors receive annual share grants with an approximate value of $50,000, based on the closing price of our common shares on the day of grant. There were no grants of equity for the period ended March 31, 2009 and shares of 0.1 million that were restricted from trading for six months were granted to directors for 2008.

There were no grants of equity awards to employees, including all executives, for the period ended March 31, 2009 or 2008. Grants of equity awards are approved by our Compensation Committee at regularly scheduled meetings. Unissued shares were 1.9 million as of March 31, 2009 and December 31, 2008.

Employees and non-employee directors are eligible to receive awards at the discretion of the Compensation Committee. Options, appreciation rights, restricted shares, other share-based awards and non-discretionary awards may be granted under these plans.

Options

| | · | Grants of options under the 2008 Stock Incentive Plan vest ratably over a maximum of 5 years from the date of grant and expire after 10 years if unexercised. Under certain circumstances, some or all of the options may vest earlier. Options are to be awarded with exercise prices equal to the closing share price of our common shares on the date of grant. |

| | · | Grants of options under the 2004 Incentive and Performance Plan vest ratably over 3 to 4 years from the date of grant and expire after 7 years if unexercised. Under certain circumstances, some or all of the options may vest earlier. Options were awarded with exercise prices equal to the closing share price of our common shares on the date of grant. No further grants will be made under this plan. |

| | · | Grants of options under the 2000 Stock Incentive Plan vest ratably through the end of the fourth year from the date of grant and expire after 10 years if unexercised. Under certain circumstances, some or all of the options may vest earlier. Options were awarded with exercise prices equal to the closing share price of our common shares on the date of grant. No further grants will be made under this plan. |

Share-based compensation expense includes the fair value of share options, restricted shares and other share awards and is recognized over the requisite service period. Additionally, tax benefits for share-based compensation payments are reported as a financing activity for the statement of cash flows.

The fair value of each option is estimated on the date of grant using the modified Black-Scholes-Merton model. These assumptions are based principally on historical experience. Due to uncertainties inherent in these assumptions, it is possible that actual share-based compensation may vary from the estimate of the fair value of these options. There were no grants of share options, restricted shared or other awards for the period ended March 31, 2009, for the period ended March 31, 2008 and for 2008.

Activity for option awards was as follows (thousands, except per share data):

| | | Three Months Ended March 31 | | | Three Months Ended March 31 | | | Year Ended December 31 | |

| | | 2009 | | | 2008 | | | 2008 | |

| | | Shares | | | Weighted Average Exercise Price | | | Weighted Average Remaining Contractual Term (years) | | | Shares | | | Weighted Average Exercise Price | | | Shares | | | Weighted Average Exercise Price | |

Outstanding at beginning of the period | | | 2,627 | | | | $14 | | | | 3.2 | | | | 2,978 | | | | $15 | | | | 2,978 | | | | $15 | |

| Granted | | | — | | | | $— | | | | | | | | — | | | | $— | | | | — | | | | $— | |

| Exercised | | | — | | | | $— | | | | | | | | (1 | ) | | | $6 | | | | (1 | ) | | | $6 | |

| Forfeited | | | (155 | ) | | | $21 | | | | | | | | (6 | ) | | | $26 | | | | (350 | ) | | | $20 | |

Outstanding at end of the period | | | 2,472 | | | | $14 | | | | 2.8 | | | | 2,971 | | | | $15 | | | | 2,627 | | | | $14 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exercisable at end of the period | | | 2,305 | | | | $13 | | | | 2.6 | | | | 2,414 | | | | $13 | | | | 2,245 | | | | $13 | |

| | | March 31 | | | Year Ended December 31 | |

| | | 2009 | | | 2008 | | | 2008 | |

| Weighted average grant-date fair value | | | — | | | | — | | | | — | |