UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08397

The Marsico Investment Fund

(Exact name of Registrant as specified in charter)

1200 17th Street, Suite 1600

Denver, Colorado 80202

(Address of principal executive offices) (Zip code)

Christopher J. Marsico

The Marsico Investment Fund

1200 17th Street, Suite 1600

Denver, Colorado 80202

(Name and address of agent for service)

Copies to:

Sander M. Bieber, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant's telephone number, including area code: (303) 454-5600

| Date of fiscal year end: September 30 |

| Date of reporting period: March 31, 2007 |

Item 1. Reports to Stockholders

DEAR SHAREHOLDER:

Enclosed is your semi-annual report for The Marsico Investment Fund encompassing the six-month fiscal period from October 1, 2006 to March 31, 2007. |

The purpose of this report is to provide a retrospective for the Marsico Funds’ six-month investment results by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector positioning, industry allocations, and stock selection – as compared to the Funds’ performance benchmark indexes. Certain sector or industry classifications used in the discussion and review portions of the semi-annual report may be broader or narrower than those used in Fund Overviews, Schedules of Investments, or elsewhere in this report. For our updated commentary regarding the market environment and the Funds’ overall investment posture, please refer to the Funds’ most recent quarterly shareholder update available on the Funds’ website at www.marsicofunds.com. |

Market Enviroment | 4 | |

Investment Review for Focus Fund and Growth Fund | 6 | |

| | |

MARSICO FOCUS FUND | | |

| | |

Fund Overview | 8 | |

Schedule of Investments | 9 | |

Statement of Assets and Liabilities | 11 | |

Statement of Operations | 11 | |

Statements of Changes in Net Assets | 12 | |

Financial Highlights | 13 | |

| | |

MARSICO GROWTH FUND | | |

| | |

Fund Overview | 14 | |

Schedule of Investments | 15 | |

Statement of Assets and Liabilities | 17 | |

Statement of Operations | 17 | |

Statements of Changes in Net Assets | 18 | |

Financial Highlights | 19 | |

| | |

MARSICO 21ST CENTURY FUND | | |

| | |

Investment Review for 21st Century Fund | 20 | |

Fund Overview | 22 | |

Schedule of Investments | 23 | |

Statement of Assets and Liabilities | 25 | |

Statement of Operations | 25 | |

Statements of Changes in Net Assets | 26 | |

Financial Highlights | 27 | |

| | |

MARSICO INTERNATIONAL OPPORTUNITES FUND | | |

| | |

Investment Review for International Opportunities Fund | 28 | |

Fund Overview | 30 | |

Schedule of Investments | 31 | |

Statement of Assets and Liabilities | 34 | |

Statement of Operations | 34 | |

Statements of Changes in Net Assets | 35 | |

Financial Highlights | 36 | |

| | |

MARSICO FLEXIBLE CAPITAL FUND | | |

| | |

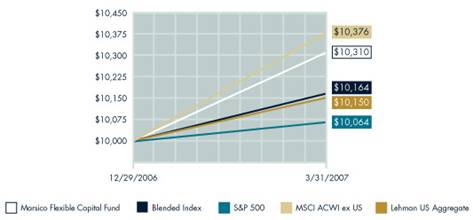

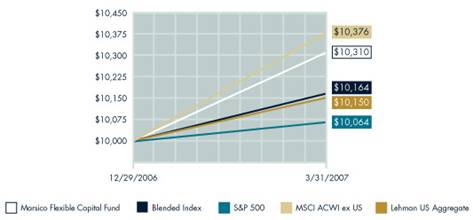

Investment Review for Flexible Capital Fund | 37 | |

Fund Overview | 39 | |

Schedule of Investments | 40 | |

Statement of Assets and Liabilities | 42 | |

Statement of Operations | 42 | |

Statements of Changes in Net Assets | 43 | |

Financial Highlights | 44 | |

| | |

NOTES TO FINANCIAL STATEMENTS | 45 | |

| | |

EXPENSE EXAMPLE | 51 | |

| | |

CONSIDERATION OF | | |

INVESTMENT ADVISORY AGREEMENTS | 53 | |

| | |

OTHER INFORMATION | 56 | |

MARKET ENVIRONMENT: OCTOBER 2006-MARCH 2007 (UNAUDITED)

In assessing the Funds’ performance over the six-month period ended March 31, 2007, it may be helpful to review the performance of broader equity markets during this period. Equities around the world posted solid gains in the six-month period. A recap of global stock market performance using several well-known benchmark indexes is provided below:

Index Name | Universe of | Six Month |

| Equities Represented | Total Return |

US | | | |

| | | |

S&P 500 | US large | | |

| capitalization equities | 7.38 | % |

| | | |

Russell 3000 | US publicly-traded | | |

| equities of all sizes | 8.49 | % |

| | | |

Russell 2000 | US small | | |

| capitalization equities | 11.02 | % |

| | | |

Russell Mid-Cap | US medium | | |

| capitalization equities | 12.38 | % |

| | | |

International | | | |

| | | |

MSCI EAFE | Companies in developed | | |

| international equity markets, | | |

| including Japan, Western | | |

| Europe, and Australasia | 14.85 | % |

As shown above, US small- and medium-capitalization and international equities were strong performers during the reporting period, substantially outperforming US large capitalization companies.

US LARGE CAPITALIZATION EQUITIES

US large-cap stocks moved higher during the six-month period ended March 31, 2007, weathering a variety of challenges including interest rate and inflation concerns, rising energy prices, housing market weakness, and geopolitical tensions in the process. Nearly all of the S&P 500 Index’s six-month gain was achieved in the fourth quarter of 2006; the Index rose 6.70% over that time. During the first quarter of 2007, large-cap returns were considerably more tepid amid resurfacing inflation-related concerns and mounting worries regarding a substantial economic slowdown.

Regarding sector performance, larger US stocks in economic sectors defined under the Global Industry Classification Standard (“GICS”) (using the S&P 500 Index as a reference) exhibited strength and breadth during the reporting period, although there was somewhat of a defensive orientation (i.e., higher dividend yield, lower risk) in terms of market leadership. All ten GICS sectors in the S&P 500 Index were in positive territory, with leading performance provided by certain sectors such as Materials (+21%), Utilities (+19%), Telecommunications Services (+17%), and Energy (+14%). Other major sectors in the S&P 500 Index – including Financials, Information Technology, and Health Care – also had gains, but those increases were considerably more modest in nature – 5% or less. Industry-level results also demonstrated widespread strength. The top-performing GICS industry groups represented a diverse mix, including Real Estate, Consumer Durables & Apparel, Consumer Services, and Media. Only two industries were in negative territory during the reporting period: Semiconductors & Semi-equipment and Pharmaceuticals, Biotechnology & Life Sciences.

US ALL-CAPITALIZATION EQUITIES

The performance of the broad US equity market, which encompasses companies of all sizes, was modestly better than results in the large-cap arena alone for the six-month period ended March 31, 2007. That was primarily attributable to the strength of medium- and small-capitalization companies, as noted above. To a significant extent, we think that the outperformance of these market segments, as compared to larger capitalization companies, was a result of escalated merger and acquisition activity that took place in these areas, with the latter fueled largely by capital provided or borrowed by private equity funds.

INTERNATIONAL EQUITIES

International equities in both “developed” and so-called “emerging” markets posted strong gains for the six-month period ended March 31, 2007, substantially outperforming their US equity counterparts. Within the EAFE Index, every individual constituent country had a positive return. Performance was particularly strong in countries such as Australia, Germany, United Kingdom, and France, which comprise a significant portion of the Index. Japan, which has been saddled for some time with concerns regarding its economy and growth potential, managed to rise 9%.

From a GICS economic sector perspective, international equity market strength was widespread during the reporting period. All ten GICS sectors in the EAFE Index had gains, led by robust increases in Materials (+26%), Industrials (+24%), Utilities (+20%), and Telecommunications Services (+19%).

At an industry level, international equity performance results were similarly strong. Every GICS industry group in the EAFE Index had a positive return. The top-performing areas included Real Estate (+27%), Capital Goods (+26%), Consumer Services (+24%), Automobiles & Components (+22%), Transportation (+21%), and Food & Staples Retailing (+20%). Many other industry groups, however, also had impressive gains, particularly those residing within the Consumer Staples, Consumer Discretionary, and Financials sectors.

THE MARSICO INVESTMENT TEAM

MARSICO FOCUS FUND & MARSICO GROWTH FUND |

INVESTMENT REVIEW BY TOM MARSICO (UNAUDITED)

The Focus Fund and Growth Fund had total returns of 7.99% and 8.44%, respectively, for the six-month period ended March 31, 2007, modestly outperforming their primary benchmark index. For comparative purposes, the S&P 500 Index – which we consider to be the Funds’ primary benchmark index – had a total six-month return of 7.38%. Please see the Funds’ Overviews for more detailed information about each Fund’s longer-term performance for various time periods ended March 31, 2007.

The performance data for the Funds quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a single six-month period. Shareholders should keep in mind that the Funds are intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Funds may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of each Fund's portfolio represented by the securities mentioned in this report.

FOCUS FUND

There were several primary factors that contributed to the Focus Fund’s outperformance for the semi-annual period ended March 31, 2007 (as compared with the S&P 500 Index):

| • | Consumer Discretionary Positions: Various Focus Fund holdings within this sector, which together comprised on average the Fund’s largest position within a single sector during the reporting period, were decisively the most important positive contributors to the Fund’s performance. The Fund’s positions in this sector generated a collective return of 21% - which was more than double the S&P 500 Index’s return of 10% within the same sector. In particular, hotel/casino operators had strong results, including MGM Mirage (+77%), Wynn Resorts, Ltd. (+40%), and Las Vegas Sands Corp. (+27%). In addition, Toyota Motor Corp. (+18%), Lowe’s Cos. (+12%), and Four Seasons Hotels (+26%) were material positive contributors to performance. |

| • | Financials: The Focus Fund had significant investments in this sector during the reporting period, averaging nearly a 22% allocation. Although the sector was among the S&P 500 Index’s lowest-performing areas with a benchmark return of 4%, the Fund’s positions in this sector substantially outperformed the Index’s sector return, gaining nearly 9% in aggregate, led by Banking and Diversified Financials holdings. Specifically, Goldman Sachs Group, Inc. (+22%), Industrial and Commercial Bank of China Ltd. (+23%), and Prologis (+14%), a REIT-structured operator of industrial distribution facilities in North America, Europe and Asia, helped buoy performance. |

The primary negative performance factors for the Focus Fund over the six-month period were stock selection in the Information Technology and Health Care sectors, and underweighted postures in Energy, Utilities, and Telecommunications Services, which were among the benchmark index’s best-performing constituents. Regarding the technology-related holdings, the Fund was hampered mainly by positions in Texas Instruments, Inc. and Motorola, Inc. which fell -15% and -14%, respectively, prior to being sold. With respect to Health Care, the Fund’s performance was negatively impacted by a position in biotechnology company Genzyme Corp. (-11% prior to being sold).

GROWTH FUND

The Growth Fund shared quite a few of the Focus Fund’s performance characteristics. On the positive side:

| • | Consumer Discretionary: Similar to the Focus Fund, the Growth Fund’s Consumer Discretionary positions, which were a significant area of emphasis, performed well during the reporting period, posting a collective gain of 21%. Hotel/casino operator positions were the main contributors, including MGM Mirage (+76%), Wynn Resorts, Ltd. (+40%), Las Vegas Sands Corp. (+27%), and Station Casinos, Inc. (+50%). Other individual holdings within the sector that performed well were Toyota Motor Corp. (+18%) and Lowe’s Cos. (+12%). |

| • | Financials: The Fund’s holdings in the Financials sector had a collective return of 8% during the reporting period, which doubled the S&P 500 Index’s benchmark return in this sector. A major underlying source of this gain was provided by the Fund’s positions in Goldman Sachs Group, Inc. and Industrial and Commercial Bank of China Ltd., which surged 22% and 35%, respectively. |

There were several areas of weakness for the Fund during the reporting period. Stock selection in the Health Care and Information Technology sectors detracted from performance, as did underweighted postures in the Utilities and Energy sectors which were among the equity markets’ top-performing areas. In Health Care, performance was hampered by positions in Amylin Pharmaceuticals (-15%) and Genzyme Corp. (-11%). With regard to Information Technology, three holdings had significant sub-par returns: Texas Instruments (-15% prior to being sold), Intel Corp. (-11%), and Motorola, Inc. (-14% prior to being sold).

In terms of economic sector positioning, as of March 31, 2007 the Focus Fund’s and Growth Fund’s primary sector allocations were in Consumer Discretionary, Health Care, Financials, and Industrials. The Funds had little or no investments in areas such as Telecommunications Services, Energy, and Utilities and were substantially underweighted (compared to the S&P 500 Index) in Information Technology.

As you know, the Focus Fund and Growth Fund often invest in similar growth companies. Their performance may differ at times, however, because of a variety of factors. Among other factors, the Focus Fund is a non-diversified mutual fund that may invest in a more concentrated portfolio and may hold the securities of fewer issuers than the Growth Fund. As a result, the Focus Fund may hold some securities that are different from those held by the Growth Fund, and may be more exposed to individual stock volatility than the Growth Fund or other mutual funds that invest in a larger number of securities.

With regard to the modest differential in performance between the two Funds during the reporting period (the Growth Fund outperformed the Focus Fund by 0.45%), the lion’s share of that was attributable to the Focus Fund’s having a larger average weighting in certain technology-related positions that did not perform well (e.g., Texas Instruments, Motorola). In addition, the Focus Fund had no positions in the Telecommunications Services sector, which was – as mentioned earlier – one of the top-performing areas of the equity markets. The Growth Fund also had a below-benchmark index allocation in the Telecommunications Services sector, but did own positions in America Movil and China Mobile Ltd. Each of these holdings performed well, which mitigated the opportunity cost of being underweighted in the sector.

Sincerely,

THOMAS F. MARSICO

PORTFOLIO MANAGER

| (1) | Total returns are based on net change in NAV assuming reinvestment of distributions. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the prospectus for more information. |

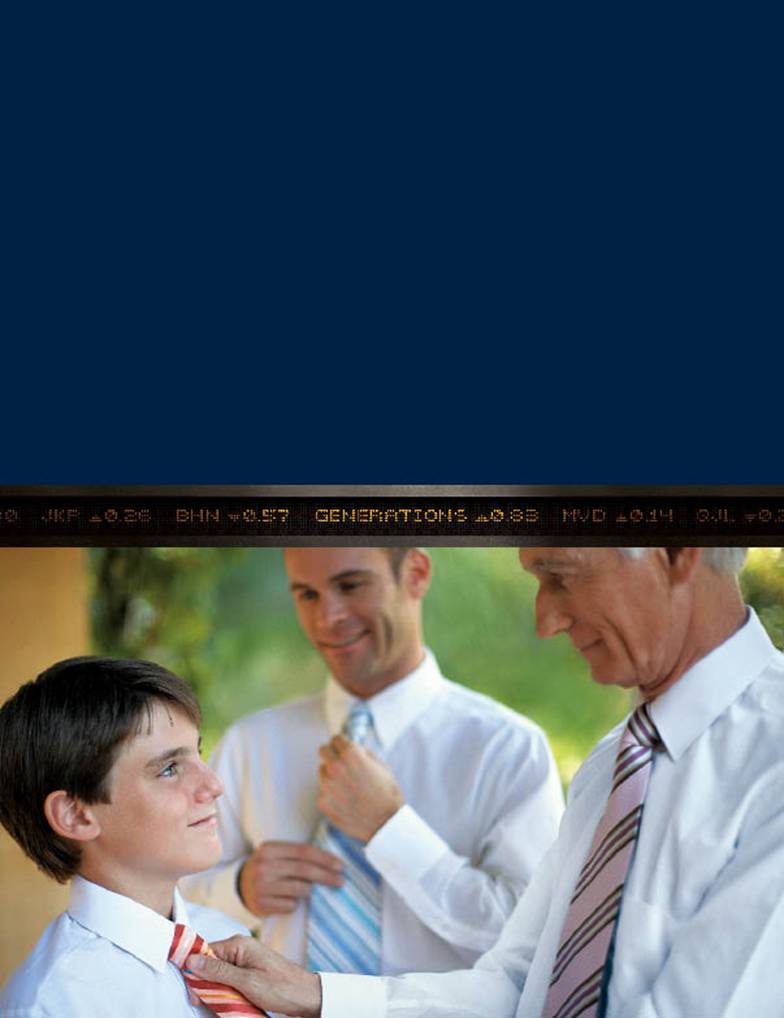

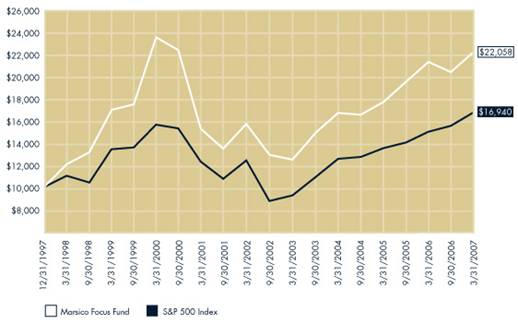

FUND OVERVIEW MARCH 31, 2007 (UNAUDITED)

The Focus Fund invests primarily in the common stocks of large companies, normally a core position of 20–30 common stocks that are selected for their long-term growth potential. |

| One Year | Five Year Average Annual | Average Annual Since Inception | Total Annual |

| (4/1/06 – 3/31/07) | (4/1/02 – 3/31/07) | (12/31/97 – 3/31/07) | Operating Expenses* |

| | | | |

Marsico Focus Fund | 3.39% | 6.69% | 8.93% | 1.26% |

S&P 500 Index | 11.83% | 6.26% | 5.87% | N/A |

| | | | | |

NET ASSETS | | |

| | |

3/31/07 | $4,863,331,974 | |

NET ASSET value | | |

| | |

Net Asset Value Per Share | $19.15 | |

| | |

TOP FIVE HOLDINGS | | |

| | |

UnitedHealth Group, Inc. | 8.09 | % |

Genentech, Inc. | 5.17 | |

Toyota Motor | | |

Corporation Spon. ADR | 4.94 | |

The Goldman Sachs | | |

Group, Inc. | 4.47 | |

Comcast Corporation - Cl. A | 4.25 | |

| | |

SECTOR ALLOCATION(2) | | |

| | |

Consumer Cyclical | 24.44 | % |

Financials (includes REITs) | 22.27 | |

Consumer Non-Cyclical | 21.02 | |

Industrials | 15.95 | |

Communications | 10.15 | |

Basic Materials | 3.76 | |

Energy | 2.41 | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ prospectus dated February 1, 2007 and may differ from the expense ratios disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares held for 30 days or less.

The performance included in the table and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

| (1) | This chart assumes an initial investment of $10,000 made on December 31, 1997 (inception). Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

SCHEDULE OF INVESTMENTS MARCH 31, 2007 (UNAUDITED)

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS | | | | | |

| | | | | |

Aerospace/Defense | | | | | |

General Dynamics Corporation | 1,097,113 | $83,819,433 | | 1.72 | % |

Lockheed Martin Corporation | 1,603,360 | 155,557,987 | | 3.20 | |

| | 239,377,420 | | 4.92 | |

| | | | | |

Aerospace/Defense - Equipment | | | | | |

United Technologies | | | | | |

Corporation | 426,743 | 27,738,295 | | 0.57 | |

| | | | | |

Agricultural Chemicals | | | | | |

Monsanto Company | 3,181,045 | 174,830,233 | | 3.59 | |

| | | | | |

Automotive - Cars/Light Trucks | | | | | |

Toyota Motor | | | | | |

Corporation Spon. ADR | 1,874,233 | 240,201,701 | | 4.94 | |

| | | | | |

Beverages - Non-Alcoholic | | | | | |

PepsiCo, Inc. | 2,105,853 | 133,848,017 | | 2.75 | |

| | | | | |

Cable TV | | | | | |

Comcast Corporation - Cl. A* | 7,965,249 | 206,698,211 | | 4.25 | |

| | | | | |

Casino Hotels | | | | | |

Las Vegas Sands Corp.* | 1,748,724 | 151,456,986 | | 3.11 | |

MGM MIRAGE* | 2,363,622 | 164,319,001 | | 3.38 | |

Wynn Resorts Ltd. | 1,633,932 | 154,994,789 | | 3.19 | |

| | 470,770,776 | | 9.68 | |

| | | | | |

Commercial Banks - Non-U.S. | | | | | |

Industrial and Commercial | | | | | |

Bank of China - Cl. H* | 325,509,000 | 182,470,010 | | 3.75 | |

| | | | | |

Cosmetics & Toiletries | | | | | |

The Procter & | | | | | |

Gamble Company | 3,156,641 | 199,373,446 | | 4.10 | |

| | | | | |

Diversified | | | | | |

Manufacturing Operations | | | | | |

General Electric Company | 2,278,678 | 80,574,054 | | 1.66 | |

| | | | | |

Finance - Investment | | | | | |

Banker/Broker | | | | | |

Citigroup, Inc. | 2,438,667 | 125,201,164 | | 2.57 | |

The Goldman Sachs | | | | | |

Group, Inc. | 1,050,993 | 217,166,684 | | 4.47 | |

Lehman Brothers | | | | | |

Holdings, Inc. | 2,081,690 | 145,864,018 | | 3.00 | |

UBS AG | 2,440,974 | 145,067,085 | | 2.98 | |

| | 633,298,951 | | 13.02 | |

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS continued | | | | | |

| | | | | |

Hotels & Motels | | | | | |

Four Seasons Hotels, Inc. | 825,883 | $66,318,405 | | 1.36 | % |

| | | | | |

Medical - Biomedical/Genetic | | | | | |

Genentech, Inc.* | 3,063,682 | 251,589,566 | | 5.17 | |

| | | | | |

Medical - HMO | | | | | |

UnitedHealth Group, Inc. | 7,426,413 | 393,377,097 | | 8.09 | |

| | | | | |

Networking Products | | | | | |

Cisco Systems, Inc.* | 7,511,827 | 191,776,943 | | 3.94 | |

| | | | | |

Oil - Field Services | | | | | |

Schlumberger Ltd. | 1,625,497 | 112,321,843 | | 2.31 | |

| | | | | |

REITs - Warehouse/Industrial | | | | | |

ProLogis | 1,377,301 | 89,428,154 | | 1.84 | |

| | | | | |

Retail - Building Products | | | | | |

Lowe’s Companies, Inc. | 5,125,498 | 161,401,932 | | 3.32 | |

| | | | | |

Retail - Discount | | | | | |

Target Corporation | 1,540,220 | 91,273,437 | | 1.88 | |

| | | | | |

Retail - Restaurants | | | | | |

Starbucks Corporation* | 3,422,513 | 107,330,008 | | 2.21 | |

| | | | | |

Super-Regional Banks - U.S. | | | | | |

Wells Fargo & Company | 3,806,954 | 131,073,426 | | 2.70 | |

| | | | | |

Transportation - Rail | | | | | |

Burlington Northern | | | | | |

Santa Fe Corporation | 2,564,229 | 206,240,939 | | 4.24 | |

| | | | | |

Transportation - Services | | | | | |

FedEx Corporation | 1,753,268 | 188,353,581 | | 3.87 | |

| | | | | |

Web Portals/Internet | | | | | |

Service Providers | | | | | |

Google, Inc. - Cl. A* | 161,878 | 74,166,024 | | 1.53 | |

| | | | | |

Total Common Stocks | | | | | |

(cost $3,471,768,089) | | 4,653,832,469 | | 95.69 | |

| | | | | |

See notes to financial statements.

SCHEDULE OF INVESTMENTS MARCH 31, 2007 (UNAUDITED)

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

| | | | | |

| | | | | |

SHORT-TERM INVESTMENTS | | | | | |

| | | | | |

SSgA Money | | | | | |

Market Fund, 5.00% | 1 | $1 | | 0.00 | % |

SSgA Prime Money | | | | | |

Market Funds, 5.19% | 203,070,581 | 203,070,581 | | 4.18 | |

| | | | | |

Total Short-Term Investments | | | | | |

(cost $203,070,582) | | 203,070,582 | | 4.18 | |

| | | | | |

Total Investments | | | | | |

(cost $3,674,838,671) | | 4,856,903,051 | | 99.87 | |

| | | | | |

Cash and Other Assets | | | | | |

Less Liabilities | | 6,428,923 | | 0.13 | |

| | | | | |

NET ASSETS | | $4,863,331,974 | | 100.00 | % |

See notes to financial statements.

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2007 (UNAUDITED)

(Amounts in thousands)

ASSETS | | |

| | |

Investments, at value (cost $3,674,839) | $4,856,903 | |

Receivable for investments sold | 4,968 | |

Receivable for capital stock sold | 8,622 | |

Interest and dividends receivable | 1,923 | |

Prepaid expenses and other assets | 700 | |

Total Assets | 4,873,116 | |

| | |

LIABILITIES | | |

| | |

Payable for capital stock redeemed | 3,840 | |

Accrued investment advisory fee | 3,340 | |

Accrued distribution fee | 720 | |

Accrued trustees’ fees | 799 | |

Accrued transfer agent fees and expenses | 783 | |

Accrued expenses and other liabilities | 302 | |

Total Liabilities | 9,784 | |

| | |

NET ASSETS | $4,863,332 | |

| | |

NET ASSETS CONSIST OF | | |

| | |

Paid-in-capital | $3,675,151 | |

Accumulated net investment loss | (3,507 | ) |

Accumulated net realized gain on investments | | |

and foreign currency transactions | 9,477 | |

Net unrealized appreciation on investments | 1,182,211 | |

| | |

NET ASSETS | $4,863,332 | |

| | |

SHARES OUTSTANDING, $0.001 par value | | |

(Unlimited shares authorized) | 253,969 | |

| | |

NET ASSET VALUE, REDEMPTION PRICE, | | |

AND OFFERING PRICE PER SHARE | | |

(NET ASSETS/SHARES OUTSTANDING)* | $19.15 | |

| | |

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED MARCH 31, 2007

(UNAUDITED)

(Amounts in thousands)

INVESTMENT INCOME | | |

| | |

Interest | $4,909 | |

Dividends (net of $0 of non-reclaimable | | |

foreign withholding taxes) | 27,281 | |

Miscellaneous income | 12 | |

Total Investment Income | 32,202 | |

| | |

EXPENSES | | |

| | |

Investment advisory fees | 19,851 | |

Distribution fees | 6,111 | |

Transfer agent fees and expenses | 2,703 | |

Printing and postage expenses | 342 | |

Custody and fund accounting fees | 289 | |

Fund administration fees | 196 | |

Miscellaneous | 121 | |

Trustees’ fees and expenses(1) | 120 | |

Professional fees | 114 | |

Federal and state registration fees | 71 | |

Total expenses | 29,918 | |

Less expenses paid indirectly | (121 | ) |

Net Expenses | 29,797 | |

| | |

NET INVESTMENT INCOME | 2,405 | |

| | |

REALIZED AND UNREALIZED GAIN | | |

| | |

Net realized gain on investments | 67,483 | |

Net realized gain on foreign | | |

currency transactions | 71 | |

Change in unrealized appreciation/ | | |

depreciation on investments and | | |

foreign currency translations | 297,528 | |

Net Gain on Investments | 365,082 | |

| | |

NET INCREASE IN NET ASSETS | | |

RESULTING FROM OPERATIONS | $367,487 | |

| (1) | Includes $77,661 for Trustees’ fees and expenses and $42,386 for the unrealized appreciation related to the mark to market of the shares in the Deferred Fee Plan during the period ended March 31, 2007. |

See notes to financial statements.

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months | | Year |

| Ended 3/31/07 | | Ended |

(Amounts in thousands) | (Unaudited) | | 9/30/06 |

Net investment income (loss) | $2,405 | | $(5,610 | ) |

Net realized gain on investments | 67,483 | | 241,639 | |

Net realized gain on foreign currency transactions | 71 | | — | (1) |

Change in unrealized appreciation/depreciation | | | | |

on investments and foreign currency translations | 297,528 | | (83,235 | ) |

| | | | |

Net increase in net assets resulting from operations | 367,487 | | 152,794 | |

Net investment income | (5,110 | ) | — | |

Net realized gains | (118,228 | ) | — | |

| | | | |

Total distributions | (123,338 | ) | — | |

CAPITAL SHARE TRANSACTIONS | | |

Proceeds from sale of shares | 654,072 | | 1,548,292 | |

Proceeds from reinvestment of distributions | 120,582 | | — | |

Redemption fees | 23 | | 64 | |

Redemption of shares | (771,949 | ) | (824,886 | ) |

| | | | |

Net increase from capital share transactions | 2,728 | | 723,470 | |

| | | | |

TOTAL INCREASE IN NET ASSETS | 246,877 | | 876,264 | |

Beginning of period | 4,616,455 | | 3,740,191 | |

| | | | |

End of period | $4,863,332 | | $4,616,455 | |

| | | | |

Accumulated net investment loss | (3,507 | ) | (802 | ) |

Shares sold | 33,747 | | 85,019 | |

Shares issued in reinvestment of distributions | 6,311 | | — | |

Shares redeemed | (39,876 | ) | (45,617 | ) |

| | | | |

Net increase | 182 | | 39,402 | |

See notes to financial statements.

FINANCIAL HIGHLIGHTS

| Six Months | Year | Year | Year | Year | Year |

For a Fund Share Outstanding | Ended 3/31/07 | Ended | Ended | Ended | Ended | Ended |

Throughout the Period. | (Unaudited) | 9/30/06 | 9/30/05 | 9/30/04 | 9/30/03 | 9/30/02 |

NET ASSET VALUE, BEGINNING OF PERIOD | $18.19 | | $17.45 | | $14.83 | | $13.49 | | $11.68 | | $12.27 | |

INCOME FROM INVESTMENT OPERATIONS | | |

Net investment income (loss) | 0.01 | | (0.02 | ) | (0.03 | ) | (0.05 | ) | (0.03 | ) | (0.08 | ) |

Net realized and unrealized | | | | | | | | | | | | |

gains (losses) on investments | 1.44 | | 0.76 | | 2.65 | | 1.39 | | 1.84 | | (0.47 | ) |

Total from investment operations | 1.45 | | 0.74 | | 2.62 | | 1.34 | | 1.81 | | (0.55 | ) |

Net investment income | (0.02 | ) | — | | — | | — | | — | | — | |

Net realized gains | (0.47 | ) | — | | — | | — | | — | | — | |

Tax return of capital | — | | — | | — | | — | | — | | (0.04 | ) |

Redemption fees [See Note 2(i)] | — | (1) | — | (1) | — | (1) | — | (1) | — | | — | |

Total distributions & other | (0.49 | ) | — | | — | | — | | — | | (0.04 | ) |

| | | | | | | | | | | | |

NET ASSET VALUE, END OF PERIOD | $19.15 | | $18.19 | | $17.45 | | $14.83 | | $13.49 | | $11.68 | |

| | | | | | | | | | | | |

TOTAL RETURN | 7.99% | (3) | 4.24% | | 17.67% | | 9.93% | | 15.50% | | (4.50)% | |

SUPPLEMENTAL DATA AND RATIOS | | |

Net assets, end of period (000s) | $4,863,332 | | $4,616,455 | | $3,740,191 | | $2,895,322 | | $2,282,113 | | $1,274,068 | |

| | | | | | | | | | | | |

Ratio of expenses to average net assets, | | | | | | | | | | | | |

before expenses paid indirectly | 1.22% | (2) | 1.24% | | 1.25% | | 1.30% | | 1.34% | | 1.35% | |

| | | | | | | | | | | | |

Ratio of net investment income (loss) to | | | | | | | | | | | | |

average net assets, net of waivers and | | | | | | | | | | | | |

expenses paid indirectly | 0.10% | (2) | (0.13)% | | (0.18)% | | (0.36)% | | (0.54)% | | (0.64)% | |

| | | | | | | | | | | | |

Ratio of net investment income (loss) to | | | | | | | | | | | | |

average net assets, before waivers and | | | | | | | | | | | | |

expenses paid indirectly | 0.09% | (2) | (0.15)% | | (0.21)% | | (0.40)% | | (0.59)% | | (0.68)% | |

| | | | | | | | | | | | |

Portfolio turnover rate | 20% | (3) | 80% | | 84% | | 84% | | 90% | | 117% | |

| (3) | Not annualized for the six months ended March 31, 2007. |

See notes to financial statements.

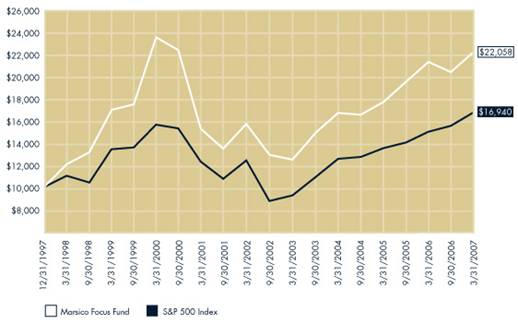

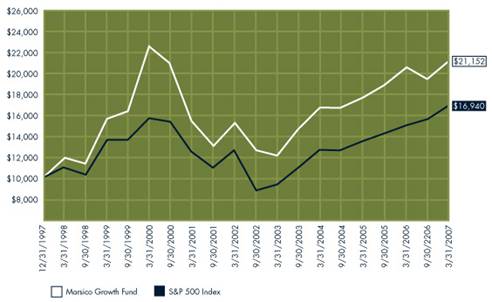

FUND OVERVIEW MARCH 31, 2007 (UNAUDITED)

The Growth Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Growth Fund will normally hold a core position of between 35 and 50 common stocks. |

| One Year | Five Year Average Annual | Average Annual Since Inception | Total Annual |

| (4/1/06 – 3/31/07) | (4/1/02 – 3/31/07) | (12/31/97 – 3/31/07) | Operating Expenses* |

Marsico Growth Fund | 3.59% | 6.69% | 8.44% | 1.27% |

S&P 500 Index | 11.83% | 6.26% | 5.87% | N/A |

NET ASSETS | | |

| | |

3/31/07 | $2,777,548,298 | |

NET ASSET VALUE | | |

| | |

Net Asset Value Per Share | $20.18 | |

| | |

TOP FIVE HOLDINGS | | |

| | |

UnitedHealth Group, Inc. | 7.30 | % |

Genentech, Inc. | 4.61 | |

Comcast Corporation - Cl. A | 3.97 | |

The Procter & Gamble | | |

Company | 3.93 | |

Burlington Northern | | |

Santa Fe Corporation | 3.77 | |

| | |

SECTOR ALLOCATION(2) | | |

| | |

Consumer Cyclical | 23.30 | % |

Consumer Non-Cyclical | 20.26 | |

Industrials | 18.53 | |

Financials (includes REITs) | 17.10 | |

Communications | 11.25 | |

Basic Materials | 3.71 | |

Technology | 3.23 | |

Energy | 1.99 | |

Utilities | 0.63 | |

| | | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ prospectus dated February 1, 2007 and may differ from the expense ratios disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less.

The performance included in the table and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

| (1) | This chart assumes an initial investment of $10,000 made on December 31, 1997 (inception). Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

SCHEDULE OF INVESTMENTS MARCH 31, 2007 (UNAUDITED)

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS | | | | |

| | | | |

Aerospace/Defense | | | | |

The Boeing Company | 591,242 | $52,567,326 | 1.89 | % |

General Dynamics Corporation | 1,095,705 | 83,711,862 | 3.01 | |

Lockheed Martin Corporation | 896,229 | 86,952,138 | 3.14 | |

| | 223,231,326 | 8.04 | |

| | | | |

Aerospace/Defense - Equipment | | | | |

United Technologies | | | | |

Corporation | 451,182 | 29,326,830 | 1.06 | |

| | | | |

Agricultural Chemicals | | | | |

Monsanto Company | 1,348,604 | 74,119,276 | 2.67 | |

| | | | |

Automotive - Cars/Light Trucks | | | | |

Toyota Motor | | | | |

Corporation Spon. ADR | 675,979 | 86,633,469 | 3.12 | |

| | | | |

Brewery | | | | |

Heineken N.V. ADR | 1,648,573 | 43,110,184 | 1.55 | |

| | | | |

Cable TV | | | | |

Comcast Corporation - Cl. A* | 4,251,421 | 110,324,375 | 3.97 | |

| | | | |

Casino Hotels | | | | |

Las Vegas Sands Corp.* | 851,582 | 73,755,517 | 2.65 | |

MGM MIRAGE* | 1,228,909 | 85,433,754 | 3.08 | |

Station Casinos, Inc. | 202,324 | 17,515,189 | 0.63 | |

Wynn Resorts Ltd. | 791,390 | 75,071,255 | 2.70 | |

| | 251,775,715 | 9.06 | |

| | | | |

Cellular Telecommunications | | | | |

America Movil S.A.B. | | | | |

de C.V. ADR Ser. L | 941,379 | 44,988,502 | 1.62 | |

China Mobile Ltd. | 4,495,500 | 40,907,410 | 1.47 | |

| | 85,895,912 | 3.09 | |

| | | | |

Commercial Banks - Non-U.S. | | | | |

China Merchants | | | | |

Bank Co., Ltd. - Cl. H* | 2,676,500 | 5,405,410 | 0.19 | |

Industrial and Commercial | | | | |

Bank of China - Cl. H* | 115,923,000 | 64,982,753 | 2.34 | |

| | 70,388,163 | 2.53 | |

| | | | |

Cosmetics & Toiletries | | | | |

The Procter & | | | | |

Gamble Company | 1,728,916 | 109,198,335 | 3.93 | |

| | | | |

Data Processing/Management | | | | |

MasterCard, Inc. - Cl. A | 482,768 | 51,289,272 | 1.85 | |

| | | | |

Electronic Components - | | | | |

Semiconductors | | | | |

Intel Corporation | 1,927,717 | 36,877,226 | 1.33 | |

| | | | |

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS continued | | | | |

| | | | |

Finance - Investment | | | | |

Banker/Broker | | | | |

Citigroup, Inc. | 510,083 | $26,187,661 | 0.94 | % |

The Goldman Sachs | | | | |

Group, Inc. | 479,426 | 99,063,794 | 3.57 | |

Lehman Brothers | | | | |

Holdings, Inc. | 1,152,532 | 80,757,917 | 2.91 | |

UBS AG | 1,341,498 | 79,725,226 | 2.87 | |

| | 285,734,598 | 10.29 | |

| | | | |

Hotels & Motels | | | | |

Four Seasons Hotels, Inc. | 336,417 | 27,014,285 | 0.97 | |

| | | | |

Independent Power Producer | | | | |

NRG Energy, Inc.* | 237,905 | 17,138,676 | 0.62 | |

| | | | |

Industrial Gases | | | | |

Praxair, Inc. | 428,503 | 26,978,549 | 0.97 | |

| | | | |

Medical - Biomedical/Genetic | | | | |

Genentech, Inc.* | 1,561,111 | 128,198,435 | 4.61 | |

Genzyme Corporation* | 609,489 | 36,581,530 | 1.32 | |

| | 164,779,965 | 5.93 | |

| | | | |

Medical - HMO | | | | |

UnitedHealth Group, Inc. | 3,829,424 | 202,844,589 | 7.30 | |

| | | | |

Networking Products | | | | |

Cisco Systems, Inc.* | 2,394,869 | 61,141,006 | 2.20 | |

| | | | |

Oil - Field Services | | | | |

Schlumberger Ltd. | 785,481 | 54,276,737 | 1.95 | |

| | | | |

Real Estate | | | | |

Management/Services | | | | |

CB Richard | | | | |

Ellis Group, Inc. - Cl. A* | 242,588 | 8,291,658 | 0.30 | |

| | | | |

Real Estate | | | | |

Operating/Development | | | | |

The St. Joe Company | 317,602 | 16,613,761 | 0.60 | |

| | | | |

REITs - Mortgage | | | | |

KKR Financial Corporation | 436,404 | 11,970,562 | 0.43 | |

| | | | |

Retail - Building Products | | | | |

Lowe’s Companies, Inc. | 2,237,315 | 70,453,049 | 2.54 | |

| | | | |

Retail - Discount | | | | |

Target Corporation | 895,709 | 53,079,715 | 1.91 | |

| | | | |

Retail - Regional | | | | |

Department Stores | | | | |

Federated Department | | | | |

Stores, Inc. | 1,234,245 | 55,602,737 | 2.00 | |

| | | | |

See notes to financial statements.

SCHEDULE OF INVESTMENTS MARCH 31, 2007 (UNAUDITED)

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS continued | | | | |

| | | | |

Retail - Restaurants | | | | |

Starbucks Corporation* | 1,176,747 | $36,902,786 | 1.33 | % |

Yum! Brands, Inc. | 930,820 | 53,764,163 | 1.93 | |

| | 90,666,949 | 3.26 | |

| | | | |

Super-Regional Banks - U.S. | | | | |

Wells Fargo & Company | 2,118,888 | 72,953,314 | 2.63 | |

| | | | |

Telephone - Integrated | | | | |

AT&T, Inc. | 592,513 | 23,362,788 | 0.84 | |

| | | | |

Therapeutics | | | | |

Amylin Pharmaceuticals, Inc.* | 866,156 | 32,359,588 | 1.17 | |

| | | | |

Transportation - Rail | | | | |

Burlington Northern | | | | |

Santa Fe Corporation | 1,301,365 | 104,668,787 | 3.77 | |

Union Pacific Corporation | 639,856 | 64,977,377 | 2.34 | |

| | 169,646,164 | 6.11 | |

| | | | |

Transportation - Services | | | | |

FedEx Corporation | 771,300 | 82,860,759 | 2.98 | |

| | | | |

Web Portals/Internet | | | | |

Service Providers | | | | |

Google, Inc. - Cl. A* | 56,269 | 25,780,205 | 0.93 | |

| | | | |

Total Common Stocks | | | | |

(cost $2,096,817,803) | | 2,725,719,737 | 98.13 | |

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

SHORT-TERM INVESTMENTS | | | | |

| | | | |

SSgA Money | | | | |

Market Fund, 5.00% | 1 | $1 | 0.00 | % |

SSgA Prime Money | | | | |

Market Funds, 5.19% | 27,154,840 | 27,154,840 | 0.98 | |

| | | | |

Total Short-Term Investments | | | | |

(cost $27,154,841) | | 27,154,841 | 0.98 | |

| | | | |

Total Investments | | | | |

(cost $2,123,972,644) | | 2,752,874,578 | 99.11 | |

| | | | |

Cash and Other | | | | |

Assets Less Liabilities | | 24,673,720 | 0.89 | |

| | | | |

NET ASSETS | | $2,777,548,298 | 100.00 | % |

See notes to financial statements.

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2007 (UNAUDITED)

(Amounts in thousands)

ASSETS | | |

| | |

Investments, at value (cost $2,123,973) | $2,752,875 | |

Receivable for investments sold | 24,213 | |

Receivable for capital stock sold | 4,224 | |

Interest and dividends receivable | 1,119 | |

Prepaid expenses and other assets | 364 | |

Total Assets | 2,782,795 | |

| | |

LIABILITIES | | |

| | |

Payable for capital stock redeemed | 1,602 | |

Accrued investment advisory fee | 1,992 | |

Accrued distribution fee | 651 | |

Accrued trustees’ fees | 429 | |

Accrued transfer agent fees and expenses | 351 | |

Accrued expenses and other liabilities | 222 | |

Total Liabilities | 5,247 | |

| | |

NET ASSETS | $2,777,548 | |

| | |

NET ASSETS CONSIST OF | | |

| | |

Paid-in-capital | $2,154,806 | |

Accumulated net investment loss | (503 | ) |

Accumulated net realized loss on investments and | | |

foreign currency transactions | (5,734 | ) |

Net unrealized appreciation on investments | | |

and foreign currency translations | 628,979 | |

| | |

NET ASSETS | $2,777,548 | |

| | |

SHARES OUTSTANDING, $0.001 par value | | |

(Unlimited shares authorized) | 137,658 | |

| | |

NET ASSET VALUE, REDEMPTION PRICE, | | |

AND OFFERING PRICE PER SHARE | | |

(NET ASSETS/SHARES OUTSTANDING)* | $20.18 | |

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED MARCH 31, 2007

(UNAUDITED)

(Amounts in thousands)

Investment income | | |

| | |

Interest | $1,236 | |

Dividends (net of $0 of non-reclaimable | | |

foreign withholding taxes) | 15,559 | |

Total Investment Income | 16,795 | |

| | |

EXPENSES | | |

| | |

Investment advisory fees | 11,606 | |

Distribution fees | 3,414 | |

Transfer agent fees and expenses | 1,130 | |

Printing and postage expenses | 186 | |

Custody and fund accounting fees | 183 | |

Fund administration fees | 142 | |

Trustees’ fees and expenses(1) | 76 | |

Miscellaneous | 67 | |

Federal and state registration fees | 62 | |

Professional fees | 59 | |

Total expenses | 16,925 | |

Less expenses paid indirectly | (43 | ) |

Net Expenses | 16,882 | |

| | |

NET INVESTMENT LOSS | (87 | ) |

| | |

REALIZED AND UNREALIZED GAIN | | |

| | |

Net realized gain on investments | 20,880 | |

Net realized gain on foreign | | |

currency transactions | 20 | |

Change in unrealized appreciation/ | | |

depreciation on investments and | | |

foreign currency translations | 193,392 | |

Net Gain on Investments | 214,292 | |

| | |

NET INCREASE IN NET ASSETS | | |

RESULTING FROM OPERATIONS | $214,205 | |

| (1) | Includes $48,494 for Trustees’ fees and expenses and $27,236 for the unrealized appreciation related to the mark to market of the shares in the Deferred Fee Plan during the period ended March 31, 2007. |

See notes to financial statements.

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months | | Year |

| Ended 3/31/07 | | Ended |

(Amounts in thousands) | (Unaudited) | | 9/30/06 |

Net investment loss | $(87 | ) | $(6,150 | ) |

Net realized gain on investments | 20,880 | | 93,450 | |

Net realized gain on foreign currency transactions | 20 | | — | (1) |

Change in unrealized appreciation/depreciation | | | | |

on investments and foreign currency translations | 193,392 | | (30,092 | ) |

| | | | |

Net increase in net assets resulting from operations | 214,205 | | 57,208 | |

| | | | |

CAPITAL SHARE TRANSACTIONS | | | | |

| | | | |

Proceeds from sale of shares | 389,104 | | 959,936 | |

Redemption fees | 18 | | 71 | |

Redemption of shares | (376,420 | ) | (592,242 | ) |

| | | | |

Net increase from capital share transactions | 12,702 | | 367,765 | |

| | | | |

TOTAL INCREASE IN NET ASSETS | 226,907 | | 424,973 | |

| | | | |

NET ASSETS | | | | |

| | | | |

Beginning of period | 2,550,641 | | 2,125,668 | |

| | | | |

End of period | $2,777,548 | | $2,550,641 | |

| | | | |

Accumulated net investment loss | (503 | ) | (416 | ) |

| | | | |

TRANSACTIONS IN SHARES | | | | |

| | | | |

Shares sold | 19,403 | | 51,358 | |

Shares redeemed | (18,802 | ) | (31,795 | ) |

| | | | |

Net increase | 601 | | 19,563 | |

| | | | |

See notes to financial statements.

FINANCIAL HIGHLIGHTS

| Six Months | Year | Year | Year | Year | Year |

For a Fund Share Outstanding | Ended 3/31/07 | Ended | Ended | Ended | Ended | Ended |

Throughout the Period. | (Unaudited) | 9/30/06 | 9/30/05 | 9/30/04 | 9/30/03 | 9/30/02 |

NET ASSET VALUE, BEGINNING OF PERIOD | $18.61 | | $18.09 | | $15.95 | | $14.09 | | $11.88 | | $12.71 | |

INCOME FROM INVESTMENT OPERATIONS | | |

Net investment income (loss) | — | (1) | (0.04 | ) | (0.02 | ) | (0.04 | ) | (0.07 | ) | (0.04 | ) |

Net realized and unrealized | | | | | | | | | | | | |

gains (losses) on investments | 1.57 | | 0.56 | | 2.16 | | 1.90 | | 2.28 | | (0.77 | ) |

Total from investment operations | 1.57 | | 0.52 | | 2.14 | | 1.86 | | 2.21 | | (0.81 | ) |

| | | | | | | | | | | | |

Net realized gains | — | | — | | — | | — | | — | | — | |

Tax return of capital | — | | — | | — | | — | | — | | (0.02 | ) |

Redemption fees [See Note 2(i)] | — | (1) | — | (1) | — | (1) | — | (1) | — | | — | |

Total distributions & other | — | | — | | — | | — | | — | | (0.02 | ) |

| | | | | | | | | | | | |

NET ASSET VALUE, END OF PERIOD | $20.18 | | $18.61 | | $18.09 | | $15.95 | | $14.09 | | $11.88 | |

| | | | | | | | | | | | |

TOTAL RETURN | 8.44% | (3) | 2.87% | | 13.42% | | 13.20% | | 18.60% | | (6.42)% | |

SUPPLEMENTAL DATA AND RATIOS | | |

| | | | | | | | | | | | |

Net assets, end of period (000s) | $2,777,548 | | $2,550,641 | | $2,125,668 | | $1,363,425 | | $789,220 | | $641,974 | |

| | | | | | | | | | | | |

Ratio of expenses to average net assets, | | | | | | | | | | | | |

before expenses paid indirectly | 1.24% | (2) | 1.26% | | 1.26% | | 1.30% | | 1.38% | | 1.37% | |

| | | | | | | | | | | | |

Ratio of net investment income (loss) to | | | | | | | | | | | | |

average net assets, net of expenses | | | | | | | | | | | | |

paid indirectly | (0.01)% | (2) | (0.26)% | | (0.14)% | | (0.34)% | | (0.62)% | | (0.49)% | |

| | | | | | | | | | | | |

Ratio of net investment income (loss) to | | | | | | | | | | | | |

average net assets, before expenses | | | | | | | | | | | | |

paid indirectly | (0.01)% | (2) | (0.27)% | | (0.16)% | | (0.38)% | | (0.67)% | | (0.52)% | |

| | | | | | | | | | | | |

Portfolio turnover rate | 18% | (3) | 59% | | 73% | | 73% | | 91% | | 111% | |

| (3) | Not annualized for the six months ended March 31, 2007. |

See notes to financial statements.

MARSICO 21ST CENTURY FUND |

INVESTMENT REVIEW BY CORY GILCHRIST (UNAUDITED)

I am pleased to report that the 21st Century Fund posted a total return of 11.85% for the six-month period ended March 31, 2007, substantially outperforming the S&P 500 Index, the Fund’s primary benchmark index, which had a total return of 7.38%. For comparative purposes, the Russell 3000 Index, a proxy for the performance of all publicly-traded US equity securities including smaller capitalization companies, had a total return of 8.49%. Please see the Fund Overview for more detailed information about the Fund’s longer-term performance for various time periods ended March 31, 2007.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent

month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a single six-month period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Funds may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of each Fund's portfolio represented by the securities mentioned in this report.

During the reporting period, the Fund’s results were buoyed primarily by the following specific factors:

| • | Consumer Discretionary: Stock selection within this sector was a major “plus” for performance, as the Fund’s aggregate holdings in this sector had a collective return of 31%. In fact, six out of the Fund’s top seven individual contributors were Consumer Discretionary holdings. Holdings in two industry groups within the sector – Consumer Services and Retailing – were particularly strong. With regard to Consumer Services, the Fund’s positions in hotel/casino operators performed well, including Station Casinos, Inc. (+50%), Wynn Resorts, Ltd. (+39%), and Las Vegas Sands Corp. (+28%). In the Retailing industry, Saks, Inc. (+10%) and Nordstrom, Inc. (+19% prior to being sold) had solid gains. Another stock that performed well was Cablevision Systems Corp., which rose 27%. The Fund also benefited, relative to its benchmark index, by maintaining on average nearly twice the weighting in this sector compared to the sector’s weighting in the benchmark, resulting in a strong absolute return for the Fund. |

| • | Stock Selection in the Financials Sector: The Fund’s aggregate holdings in the Financials sector rose 12% during the reporting period, propelled primarily by CB Richard Ellis Group (+39%), a real estate holding and development company, Goldman Sachs Group, Inc. (+22%), and several foreign banking companies including Industrial and Commercial Bank of China Ltd. (+34%), China Merchants Bank Co. Ltd. (+36%), and Austria-based Erste Bank der Oesterreichischen Sparkassen (+25%). In addition, KKR Financial Corp., a multiple asset class investor that is currently structured as a real estate investment trust but is proposed to be reorganized as a limited liability company, gained 12%. |

The main areas that detracted materially from the Fund’s performance over the past six-months were our stock selections in the Consumer Durables & Apparel (namely, homebuilding-related holdings) and Pharmaceuticals, Biotechnology & Life Sciences industry groups. More specifically, Ryland Group, a California-based home construction company, sank -19% prior to being sold. Amylin Pharmaceuticals, Inc. (-15%) and Genzyme Corp.

(-11% prior to being sold) were also among the Fund’s weakest-performing individual holdings. Our decision to underweight the Energy and Telecommunications Services sectors also imposed a modest “opportunity” cost on the Fund, as these sectors were among the best-performing areas of the US equity market for the six-month period.

The 21st Century Fund has tended to have a relatively high portfolio turnover level because of its investment style. Although the Fund may hold core positions for some time, it may change its portfolio composition quickly to take advantage of new opportunities, or to address issues affecting particular holdings.

As of March 31, 2007 the Fund’s primary economic sector allocations were in the following areas: Financials, Consumer Discretionary, and Information Technology. The Fund had little or no exposure to Telecommunications Services or Energy.

Sincerely,

CORYDON J. GILCHRIST, CFA

PORTFOLIO MANAGER

| (1) | Total returns are based on net change in NAV assuming reinvestment of distributions. For the period prior to March 31, 2004, the performance returns for the 21st Century Fund reflect a fee waiver in effect; in the absence of such a waiver, the returns would have been reduced. For the period beginning April 1, 2004 through January 2005, performance returns for the Fund would have been higher but for the reimbursement of fees waived previously. A redemption fee of 2% may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less. Please see the prospectus for more information. |

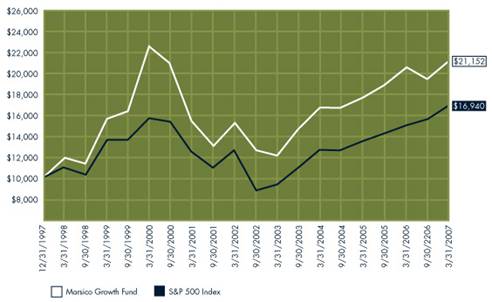

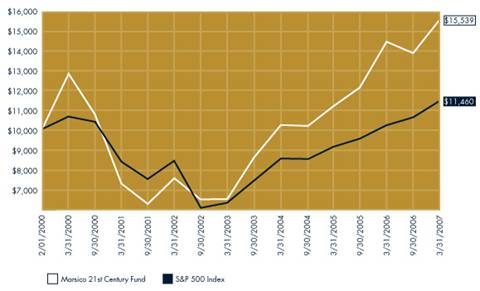

MARSICO 21ST CENTURY FUND |

FUND OVERVIEW MARCH 31, 2007 (UNAUDITED)

The 21st Century Fund invests primarily in common stocks that are selected for their long-term growth potential. The Fund may invest in companies of any size, and will normally hold a core position of between 35 and 50 common stocks. |

| One Year | Five Year Average Annual | Average Annual Since Inception | Total Annual |

| (4/1/06 – 3/31/07) | (4/1/02 – 3/31/07) | (2/1/00 – 3/31/07) | Operating Expenses* |

| | | | |

Marsico 21st Century Fund | 7.82% | 15.62%(1) | 6.35%(1) | 1.35% |

S&P 500 Index | 11.83% | 6.26% | 1.92% | N/A |

| | | | | |

NET ASSETS | | |

| | |

3/31/07 | $1,756,104,660 | |

NET ASSET VALUE | | |

| | |

Net Asset Value Per Share | $15.40 | |

| | |

TOP FIVE HOLDINGS | | |

| | |

MasterCard, Inc. - Cl. A | 5.15 | % |

Las Vegas Sands Corp. | 4.64 | |

Saks, Inc. | 3.89 | |

Moody’s Corporation | 3.74 | |

Heineken Holding N.V. | 3.69 | |

| | |

SECTOR ALLOCATION(3) | | |

| | |

Financials (includes REITs) | 28.17 | % |

Consumer Cyclical | 19.60 | |

Consumer Non-Cyclical | 18.22 | |

Communications | 9.18 | |

Industrials | 8.82 | |

Technology | 5.76 | |

Basic Materials | 5.03 | |

Utilities | 2.83 | |

Energy | 2.39 | |

| | | |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ prospectus dated February 1, 2007 and may differ from the expense ratios disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. A redemption fee may be imposed on redemptions or exchanges of Fund shares owned for 30 days or less.

The performance included in the table and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

| (1) | The performance returns for the 21st Century Fund (for the period prior to March 31, 2004) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. For the period beginning April 2004 through January 2005, performance returns for the 21st Century Fund would be higher but for the reimbursement of fees waived previously. |

| (2) | This chart assumes an initial investment of $10,000 made on February 1, 2000 (inception). Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (3) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

SCHEDULE OF INVESTMENTS MARCH 31, 2007 (UNAUDITED)

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS | | | | | |

| | | | | |

Aerospace/Defense - Equipment | | | | | |

DRS Technologies, Inc. | 905,791 | $47,255,116 | | 2.69 | % |

| | | | | |

Agricultural Chemicals | | | | | |

Monsanto Company | 872,107 | 47,931,001 | | 2.73 | |

| | | | | |

Brewery | | | | | |

Heineken Holding N.V. | 1,464,680 | 64,841,488 | | 3.69 | |

| | | | | |

Building Products - | | | | | |

Cement/Aggregates | | | | | |

Holcim Ltd. | 220,104 | 22,043,910 | | 1.25 | |

| | | | | |

Cable TV | | | | | |

Comcast Corporation - Cl. A* | 1,685,286 | 43,733,172 | | 2.49 | |

| | | | | |

Casino Hotels | | | | | |

Las Vegas Sands Corp.* | 940,524 | 81,458,784 | | 4.64 | |

MGM MIRAGE* | 606,671 | 42,175,768 | | 2.40 | |

Station Casinos, Inc. | 298,211 | 25,816,126 | | 1.47 | |

Wynn Resorts Ltd. | 434,256 | 41,193,524 | | 2.35 | |

| | 190,644,202 | | 10.86 | |

| | | | | |

Commercial Banks - Non-U.S. | | | | | |

Banco Itau Holding | | | | | |

Financeria S.A. ADR | 1,221,088 | 42,518,284 | | 2.42 | |

China Merchants Bank Co., | | | | | |

Ltd. - Cl. H* | 12,048,500 | 24,332,928 | | 1.39 | |

Erste Bank der oesterreichischen | | | | | |

Sparkassen AG | 458,028 | 35,671,248 | | 2.03 | |

Industrial and Commercial | | | | | |

Bank of China - Cl. H* | 45,642,000 | 25,585,456 | | 1.46 | |

| | 128,107,916 | | 7.30 | |

| | | | | |

Commercial Services/Finance | | | | | |

Moody’s Corporation | 1,057,912 | 65,654,019 | | 3.74 | |

| | | | | |

Data Processing/Management | | | | | |

MasterCard, Inc. - Cl. A | 851,553 | 90,468,991 | | 5.15 | |

| | | | | |

Finance - Investment | | | | | |

Banker/Broker | | | | | |

Evercore Partners, Inc. | 87,743 | 2,736,704 | | 0.16 | |

The Goldman Sachs Group, Inc. | 209,538 | 43,296,837 | | 2.47 | |

Jefferies Group, Inc. | 1,117,099 | 32,340,016 | | 1.84 | |

UBS AG | 754,213 | 44,812,722 | | 2.55 | |

| | 123,186,279 | | 7.02 | |

| | | | | |

Independent Power Producer | | | | | |

NRG Energy, Inc.* | 617,302 | 44,470,436 | | 2.53 | |

| | | | | |

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS continued | | | | | |

| | | | | |

Medical - Biomedical/Genetic | | | | | |

Arena Pharmaceuticals, Inc.* | 583,944 | $6,341,632 | | 0.36 | % |

Diversa Corporation* | 894,371 | 6,985,038 | | 0.40 | |

Genentech, Inc.* | 205,063 | 16,839,773 | | 0.96 | |

| | 30,166,443 | | 1.72 | |

| | | | | |

Medical - HMO | | | | | |

UnitedHealth Group, Inc. | 1,088,356 | 57,650,217 | | 3.28 | |

| | | | | |

Medical - Products | | | | | |

Accuray, Inc.* | 356,848 | 7,936,300 | | 0.45 | |

| | | | | |

Metal Processors & Fabricators | | | | | |

Precision Castparts Corp. | 419,395 | 43,638,050 | | 2.48 | |

| | | | | |

Miscellaneous Manufacturing | | | | | |

American Railcar | | | | | |

Industries, Inc. | 392,258 | 11,693,211 | | 0.67 | |

| | | | | |

Networking Products | | | | | |

Cisco Systems, Inc.* | 2,217,449 | 56,611,473 | | 3.22 | |

| | | | | |

Oil - Field Services | | | | | |

Schlumberger Ltd. | 415,894 | 28,738,275 | | 1.64 | |

| | | | | |

Oil Companies - Integrated | | | | | |

Petroleo Brasileiro S.A. ADR | 88,583 | 8,814,894 | | 0.50 | |

| | | | | |

Paper & Related Products | | | | | |

Weyerhaeuser Company | 415,453 | 31,050,957 | | 1.77 | |

| | | | | |

Printing - Commercial | | | | | |

Consolidated Graphics, Inc.* | 136,104 | 10,078,501 | | 0.57 | |

| | | | | |

Real Estate | | | | | |

Management/Services | | | | | |

CB Richard Ellis | | | | | |

Group, Inc. - Cl. A* | 1,420,794 | 48,562,739 | | 2.77 | |

| | | | | |

Real Estate | | | | | |

Operating/Development | | | | | |

The St. Joe Company | 624,159 | 32,649,757 | | 1.86 | |

| | | | | |

REITs - Mortgage | | | | | |

Crystal River | | | | | |

Capital, Inc. 144A | 163,717 | 4,394,164 | | 0.25 | |

KKR Financial Corporation | 1,191,658 | 32,687,179 | | 1.86 | |

Redwood Trust, Inc. | 149,650 | 7,808,737 | | 0.44 | |

| | 44,890,080 | | 2.55 | |

See notes to financial statements.

MARSICO 21ST CENTURY FUND |

SCHEDULE OF INVESTMENTS MARCH 31, 2007 (UNAUDITED)

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

COMMON STOCKS continued | | | | | |

| | | | | |

REITs - Warehouse/Industrial | | | | | |

ProLogis | 158,837 | $10,313,286 | | 0.59 | % |

| | | | | |

Resorts/Theme Parks | | | | | |

Vail Resorts, Inc.* | 600,436 | 32,621,688 | | 1.86 | |

| | | | | |

Retail - Gardening Products | | | | | |

Tractor Supply Company* | 316,393 | 16,294,240 | | 0.93 | |

| | | | | |

Retail - Major | | | | | |

Department Store | | | | | |

Saks, Inc. | 3,277,793 | 68,309,206 | | 3.89 | |

| | | | | |

Super-Regional Banks - U.S. | | | | | |

Wells Fargo & Company | 1,588,896 | 54,705,689 | | 3.11 | |

| | | | | |

Therapeutics | | | | | |

Amylin Pharmaceuticals, Inc.* | 1,333,130 | 49,805,737 | | 2.84 | |

| | | | | |

Transportation - Rail | | | | | |

Genesee & | | | | | |

Wyoming, Inc. - Cl. A* | 520,795 | 13,858,355 | | 0.79 | |

| | | | | |

Web Portals/Internet | | | | | |

Service Providers | | | | | |

Google, Inc. - Cl. A* | 95,724 | 43,856,908 | | 2.50 | |

| | | | | |

Total Common Stocks | | | | | |

(cost $1,429,763,786) | | 1,570,582,536 | | 89.44 | |

| Number | | Percent |

| of | | of Net |

| Shares | Value | Assets |

SHORT-TERM INVESTMENTS | | | | | |

| | | | | |

Federal Home Loan | | | | | |

Mortgage Discount | | | | | |

Notes, 4.97%, 4/2/07 | 16,200,000 | $16,197,764 | | 0.92 | % |

SSgA Money | | | | | |

Market Fund, 5.00% | 79,076,835 | 79,076,835 | | 4.50 | |

SSgA Prime Money | | | | | |

Market Funds, 5.19% | 79,117,148 | 79,117,148 | | 4.51 | |

| | | | | |

Total Short-Term Investments | | | | | |

(cost $174,391,747) | | 174,391,747 | | 9.93 | |

| | | | | |

Total Investments | | | | | |

(cost $1,604,155,533) | | 1,744,974,283 | | 99.37 | |

| | | | | |

Cash and Other | | | | | |

Assets Less Liabilities | | 11,130,377 | | 0.63 | |

| | | | | |

NET ASSETS | | $1,756,104,660 | | 100.00 | % |

See notes to financial statements.

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2007 (UNAUDITED)

(Amounts in thousands)

ASSETS | | |

| | |

Investments, at value (cost $1,604,156) | $1,744,974 | |

Receivable for investments sold | 18,491 | |

Receivable for capital stock sold | 3,234 | |

Interest and dividends receivable | 1,278 | |

Prepaid expenses and other assets | 350 | |

Total Assets | 1,768,327 | |

| | |

LIABILITIES | | |

| | |

Payable for investments purchased | 8,891 | |

Payable for capital stock redeemed | 730 | |

Accrued investment advisory fee | 1,242 | |

Accrued distribution fee | 748 | |

Accrued trustees’ fees | 321 | |

Accrued expenses and other liabilities | 290 | |

Total Liabilities | 12,222 | |

| | |

NET ASSETS | $1,756,105 | |

| | |

NET ASSETS CONSIST OF | | |

| | |

Paid-in-capital | $1,578,499 | |

Accumulated net investment income | 241 | |

Accumulated net realized gain on investments and | | |

foreign currency transactions | 36,475 | |

Net unrealized appreciation on investments | 140,890 | |

| | |

NET ASSETS | $1,756,105 | |

| | |

SHARES OUTSTANDING, $0.001 par value | | |

(Unlimited shares authorized) | 114,030 | |

| | |

NET ASSET VALUE, REDEMPTION PRICE, | | |

AND OFFERING PRICE PER SHARE | | |

(NET ASSETS/SHARES OUTSTANDING)* | $15.40 | |

| | |

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED MARCH 31, 2007

(UNAUDITED)

(Amounts in thousands)

INVESTMENT INCOME | | |

| | |

Interest | $3,419 | |

Dividends (net of $3 of non-reclaimable | | |

foreign withholding taxes) | 15,907 | |

Total Investment Income | 19,326 | |

| | |

EXPENSES | | |

| | |

Investment advisory fees | 5,707 | |

Distribution fees | 1,679 | |

Transfer agent fees and expenses | 826 | |

Custody and fund accounting fees | 170 | |

Fund administration fees | 107 | |

Printing and postage expenses | 76 | |

Federal and state registration fees | 61 | |

Trustees’ fees and expenses(1) | 43 | |

Professional fees | 29 | |

Miscellaneous | 17 | |

Total expenses | 8,715 | |

Less expenses paid indirectly | (3 | ) |

Net Expenses | 8,712 | |

| | |

NET INVESTMENT INCOME | 10,614 | |

| | |

REALIZED AND UNREALIZED GAIN | | |

| | |

Net realized gain on investments | 39,448 | |

Net realized gain on foreign | | |

currency transactions | 888 | |

Change in unrealized appreciation/ | | |

depreciation on investments and | | |

foreign currency translations | 59,076 | |

Net Gain on Investments | 99,412 | |

| | |

NET INCREASE IN NET ASSETS | | |

RESULTING FROM OPERATIONS | $110,026 | |

| (1) | Includes $18,906 for Trustees’ fees and expenses and $23,998 for the unrealized appreciation related to the mark to market of the shares in the Deferred Fee Plan during the period ended March 31, 2007. |

See notes to financial statements.

MARSICO 21ST CENTURY FUND |

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months | | Year |

| Ended 3/31/07 | | Ended |

(Amounts in thousands) | (Unaudited) | | 9/30/06 |

Net investment income | $10,614 | | $1,131 | |

Net realized gain on investments | 39,448 | | 32,726 | |

Net realized gain (loss) on foreign currency transactions | 888 | | (215 | ) |

Change in unrealized appreciation/depreciation | | | | |

on investments and foreign currency translations | 59,076 | | 26,623 | |

| | | | |

Net increase in net assets resulting from operations | 110,026 | | 60,265 | |

Net investment income | (10,725 | ) | (67 | ) |

| | | | |

Total distributions | (10,725 | ) | (67 | ) |

CAPITAL SHARE TRANSACTIONS | | | | |

Proceeds from sale of shares | 897,709 | | 586,063 | |

Proceeds from reinvestment of distributions | 10,081 | | 64 | |

Redemption fees | 72 | | 138 | |

Redemption of shares | (122,517 | ) | (154,332 | ) |

| | | | |

Net increase from capital share transactions | 785,345 | | 431,933 | |

| | | | |

TOTAL INCREASE IN NET ASSETS | 884,646 | | 492,131 | |

Beginning of period | 871,459 | | 379,328 | |

| | | | |

End of period | $1,756,105 | | $871,459 | |

| | | | |

Accumulated net investment income | 241 | | 352 | |

Shares sold | 58,683 | | 42,721 | |

Shares issued in reinvestment of distributions | 663 | | 5 | |

Shares redeemed | (8,046 | ) | (11,411 | ) |

| | | | |

Net increase | 51,300 | | 31,315 | |

See notes to financial statements.

FINANCIAL HIGHLIGHTS

| Six Months | Year | Year | Year | Year | Year |

For a Fund Share Outstanding | Ended 3/31/07 | Ended | Ended | Ended | Ended | Ended |

Throughout the Period. | (Unaudited) | 9/30/06 | 9/30/05 | 9/30/04 | 9/30/03 | 9/30/02 |

NET ASSET VALUE, BEGINNING OF PERIOD | $13.89 | | $12.07 | | $10.20 | | $8.74 | | $6.54 | | $6.26 | |

INCOME FROM INVESTMENT OPERATIONS | | |

Net investment income (loss) | 0.09 | | 0.02 | | (0.01 | ) | (0.04 | ) | (0.04 | ) | (0.08 | ) |

Net realized and unrealized | | | | | | | | | | | | |

gains on investments | 1.55 | | 1.80 | | 1.88 | | 1.50 | | 2.23 | | 0.36 | |

Total from investment operations | 1.64 | | 1.82 | | 1.87 | | 1.46 | | 2.19 | | 0.28 | |

Net investment income | (0.13 | ) | — | (1) | — | | — | | — | | — | |

Increase from payment by service provider | — | | — | | — | | — | | 0.01 | | — | |

Redemption fees [See Note 2(i)] | — | (1) | — | (1) | — | (1) | — | (1) | — | | — | |

Total distributions & other | (0.13 | ) | — | | — | | — | | 0.01 | | — | |

| | | | | | | | | | | | |

NET ASSET VALUE, END OF PERIOD | $15.40 | | $13.89 | | $12.07 | | $10.20 | | $8.74 | | $6.54 | |

| | | | | | | | | | | | |

TOTAL RETURN | 11.85% | (4) | 15.10% | | 18.33% | | 16.70% | | 33.64% | | 4.47% | |

SUPPLEMENTAL DATA AND RATIOS | | |

Net assets, end of period (000s) | $1,756,105 | | $871,459 | | $379,328 | | $216,228 | | $104,038 | | $56,021 | |

| | | | | | | | | | | | |

Ratio of expenses to average net assets, | | | | | | | | | | | | |

less waivers and before expenses | | | | | | | | | | | | |

paid indirectly, plus reimbursements of | | | | | | | | | | | | |

previously waived expenses | 1.30% | (3) | 1.33% | | 1.39% | | 1.50% | | 1.55% | (5) | 1.50% | |

| | | | | | | | | | | | |

Ratio of net investment income (loss) to | | | | | | | | | | | | |

average net assets, net of waivers, | | | | | | | | | | | | |

reimbursements of previously waived | | | | | | | | | | | | |

expenses and expenses paid indirectly | 1.56% | (3) | 0.20% | | (0.19)% | | (0.48)% | | (1.05)% | | (0.89)% | |

| | | | | | | | | | | | |

Ratio of expenses to average net assets, | | | | | | | | | | | | |

before waivers, reimbursements of | | | | | | | | | | | | |

previously waived expenses and | | | | | | | | | | | | |

expenses paid indirectly | 1.30% | (3) | 1.33% | | 1.36% | | 1.44% | | 1.65% | | 1.60% | |

| | | | | | | | | | | | |

Ratio of net investment income (loss) to | | | | | | | | | | | | |

average net assets, before waivers, | | | | | | | | | | | | |

reimbursements of previously waived | | | | | | | | | | | | |

expenses and expenses paid indirectly | 1.56% | (3) | 0.20% | | (0.22)% | | (0.42)% | | (1.15)% | | (0.99)% | |

| | | | | | | | | | | | |

Portfolio turnover rate(2) | 39% | (4) | 136% | | 175% | | 191% | | 236% | | 388% | |

| (2) | Portfolio turnover is greater than most funds due to the investment style of the Fund. |

| (4) | Not annualized for the six months ended March 31, 2007. |

| (5) | See Note 3 for information regarding the voluntary fee waiver. |

See notes to financial statements.

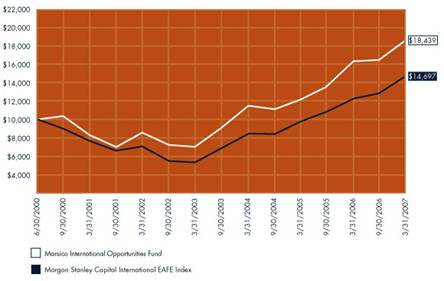

MARSICO INTERNATIONAL OPPORTURNITIES FUND |

INVESTMENT REVIEW BY JIM GENDELMAN (UNAUDITED)

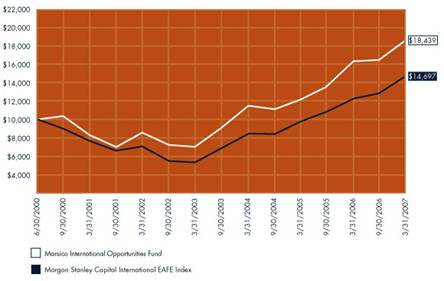

The six-month period ended March 31, 2007 was another healthy period for international equities. The International Opportunities Fund had a total return of (US$) 11.87%. That was a solid absolute gain, but unfortunately it did not keep pace with the Fund’s primary benchmark index, the MSCI EAFE Index (“EAFE Index”), which had a stellar total return of 14.85% during the period. Please see the Fund Overview for more detailed information about the Fund’s longer-term performance for various periods ended March 31, 2007.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a single six-month period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Funds may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of each Fund's portfolio represented by the securities mentioned in this report.

The Fund’s performance shortfall during the reporting period, as compared to the EAFE Index, occurred entirely in the first calendar quarter of 2007, when the Fund had a total return of 0.41% and the EAFE Index had a total return of 4.08%. In fact, during the fourth calendar quarter of 2006, the Fund (which gained 11.41% over that period) outperformed the EAFE Index (which gained 10.35% in that quarter). There were three primary factors that contributed to the Fund’s underperformance as compared to its benchmark index during the latter part of the six-month period ended March 31, 2007:

| • | Stock Selection in the Consumer Discretionary Sector: The Fund’s holdings in the Consumer Discretionary sector had a collective return of 7% during the reporting period. That was a strong absolute return, but it lagged well behind the EAFE Index’s sector return of 17%. The Fund’s performance in this area was singed by disappointing performance in several positions, including amusement game manufacturer Sega Sammy Holdings, Inc. |

(-30% prior to being sold), hotel/casino operator Melco PBL Entertainment (Macau) Ltd.

(-17%), and computer and electronics retailer Yamada Denki Co., Ltd. (-7%).

| • | Stock Selection in the Information Technology Sector: The Fund’s holdings in this area fell -6% in aggregate, performing well below the EAFE Index’s return of +7% for this sector. The major “culprits” that contributed to the Fund’s performance shortfall in this sector were semiconductor-related companies, including positions in Samsung Electronics Co. Ltd. |

(-12% prior to being sold) and Tokyo-headquartered Advantest Corp. (-11%), which provides automated test equipment and services to the semiconductor industry. SAP AG, a Germany-based enterprise application software company, skidded -9% prior to being sold.

| • | Currency: Especially in the fourth calendar quarter of 2006, the US dollar weakened in relation to certain other major currencies, particularly the Euro. The Fund in general was underweighted (as compared to the EAFE Index) in securities priced in Euros and traded in countries that utilize the Euro, including France and Germany, meaning that a smaller portion of the Fund benefited from the Euro’s valuation increase. This had a modestly negative impact on the Fund’s performance compared to the EAFE Index. As a reminder, active currency management is not a central facet of the Fund’s investment process. |

The Fund did have a number of bright spots in terms of its six-month performance. Chief among them were holdings in the Health Care, Financials, and Materials sectors, as noted below:

| • | Health Care: The Fund’s holdings in this sector generated a collective return of 18%, far surpassing the EAFE Index’s sector return of 4%. A major contributor to this outperformance was a position in Australia-based pharmaceutical company CSL Ltd., which gained 64%. |

| • | Financials: Since this sector is a major constituent of the EAFE Index (30% of the Index as of March 31, 2007), its performance can be highly influential on the Index’s overall return and, therefore, is commonly a significant factor – either “plus” or “minus” -- in explaining the Fund’s relative return. The six-month period was no exception, as the Fund’s total holdings in this sector had a gain of 14%, which compared favorably to the EAFE Index’s sector return of 12%. Man Group PLC, the world’s largest publicly-traded hedge fund company, surged 30%. Several of the Fund’s banking companies performed well, including Macquarie Bank Ltd. (+30%), Industrial and Commercial Bank of China Ltd. (+34%), Erste Bank der Oesterreichischen Sparkassen (+25%), and Unibanco-Uniao de Bancos Brasileiros SA (+18%). Another position that produced a robust gain for the Fund was CapitaLand Ltd., a Singapore-based real estate holding and development company, which soared 65%. |