UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08397

THE MARSICO INVESTMENT FUND

(Exact name of registrant as specified in charter)

1200 17th Street, Suite 1600

Denver, CO 80202

(Address of principal executive offices)(Zip code)

Christopher J. Marsico

The Marsico Investment Fund

1200 17th Street, Suite 1600

Denver, CO 80202

(Name and address of agent for service)

Copies to:

Anthony H. Zacharski

Dechert LLP

90 State House Square

Hartford, CT 06103

Registrant's telephone number, including area code: (303)454-5600

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

Item 1 – Reports to Stockholders.

DEAR SHAREHOLDER:

Enclosed is your annual report for The Marsico Investment Fund, encompassing the fiscal year from October 1, 2014 to September 30, 2015.

The purpose of this report is to provide a review of the Marsico Funds’ one-year investment results by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector and industry positioning, and individual stock selection – as compared to the Funds’ performance benchmark indexes. For updated information regarding the market environment and the Funds’ overall investment postures and performance, please refer to the Funds’ most recent monthly fact sheets and quarterly investment updates, which are available in the Investor Resources section of the Funds’ website at www.marsicofunds.com.(1)

NOTE REGARDING CHANGE TO THE MARSICO GROWTH FUND TEAM

The Marsico Growth Fund is co-managed by a team of managers. Effective October 6, 2015, Kevin Boone is no longer a member of the team that co-manages the Marsico Growth Fund. Thomas F. Marsico and Coralie T. Witter, CFA, continue to be jointly and primarily responsible for day-to-day management of the Fund.

(1) | The references to the Marsico Funds website (www.marsicofunds.com) included throughout this annual report do not incorporate the website’s contents into this report. |

| | KEY FUND STATISTICS | 2 | |

| | MARKET ENVIRONMENT | 5 | |

| | | | |

| | MARSICO FOCUS FUND |

| | Investment Review | 6 | |

| | Fund Overview | 9 | |

| | Schedule of Investments | 10 | |

| | | | |

| | MARSICO GROWTH FUND |

| | Investment Review | 11 | |

| | Fund Overview | 13 | |

| | Schedule of Investments | 14 | |

| | | | |

| | MARSICO 21st CENTURY FUND |

| | Investment Review | 16 | |

| | Fund Overview | 18 | |

| | Schedule of Investments | 19 | |

| | | | |

| | MARSICO INTERNATIONAL OPPORTUNITIES FUND |

| | Investment Review | 21 | |

| | Fund Overview | 23 | |

| | Schedule of Investments | 24 | |

| | | | |

| | MARSICO FLEXIBLE CAPITAL FUND |

| | Investment Review | 26 | |

| | Fund Overview | 28 | |

| | Schedule of Investments | 29 | |

| | | | |

| | MARSICO GLOBAL FUND |

| | Investment Review | 31 | |

| | Fund Overview | 33 | |

| | Schedule of Investments | 34 | |

| | | | |

| | FINANCIAL STATEMENTS | 36 | |

| | NOTES TO FINANCIAL STATEMENTS | 46 | |

| | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 55 | |

| | EXPENSE EXAMPLE | 56 | |

| | OTHER INFORMATION | 57 | |

| | TRUSTEE AND OFFICER INFORMATION | 58 | |

| | | | |

1

KEY FUND STATISTICS (UNAUDITED) |

Marsico Focus Fund | Marsico Growth Fund | Marsico 21st Century

Fund |

| | MFOCX | | | MGRIX | | | MXXIX | |

For additional disclosures, please see page 9. | For additional disclosures, please see page 13. | For additional disclosures, please see page 18. |

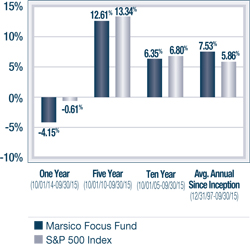

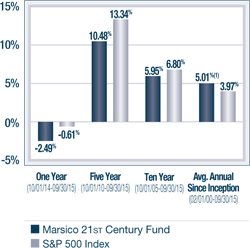

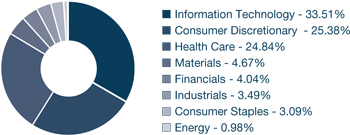

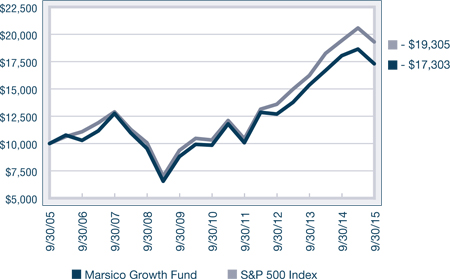

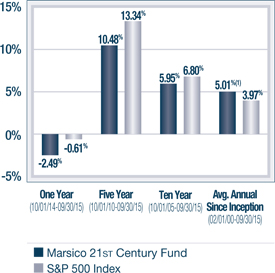

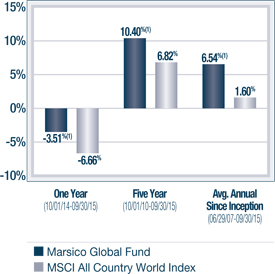

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

| | |

TOTAL ANNUAL OPERATING EXPENSES* 1.34% | TOTAL ANNUAL OPERATING EXPENSES* 1.37% | TOTAL ANNUAL OPERATING EXPENSES* 1.43% |

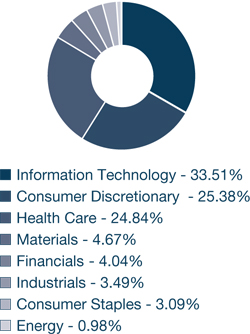

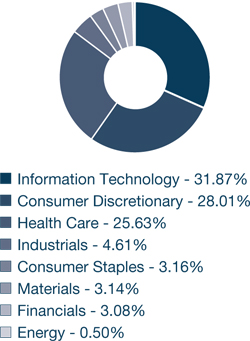

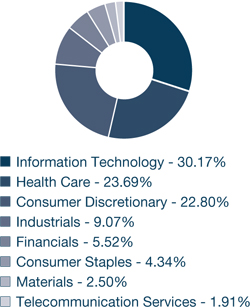

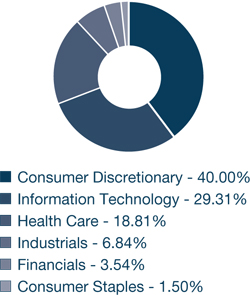

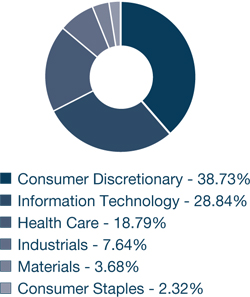

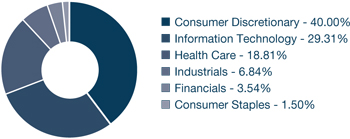

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

| | |

TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

Facebook, Inc. - Cl. A | 8.15% | Facebook, Inc. - Cl. A | 6.12% | Facebook, Inc. - Cl. A | 5.91% |

NIKE, Inc. - Cl. B | 5.76% | Google, Inc. - Cl. A | 5.07% | MasterCard, Inc. - Cl. A | 3.96% |

Visa, Inc. - Cl. A | 5.74% | NIKE, Inc. - Cl. B | 4.39% | Constellation Brands, Inc. - Cl. A | 3.63% |

Google, Inc. - Cl. A | 5.20% | The Walt Disney Company | 4.24% | Norwegian Cruise Line Holdings Ltd. | 3.63% |

The Walt Disney Company | 5.00% | Starbucks Corporation | 3.98% | Electronic Arts, Inc. | 3.16% |

For additional disclosures about the Marsico Funds, please see page 4. The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

2

KEY FUND STATISTICS (UNAUDITED) |

Marsico International

Opportunities Fund | Marsico Flexible Capital

Fund | Marsico Global Fund |

| | MIOFX | | | MFCFX | | | MGLBX | |

For additional disclosures, please see page 23. | For additional disclosures, please see page 28. | For additional disclosures, please see page 33. |

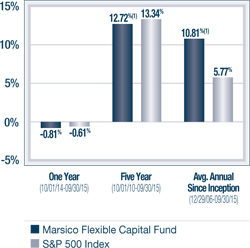

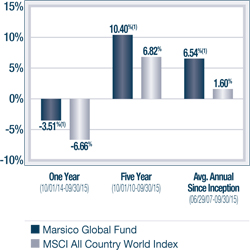

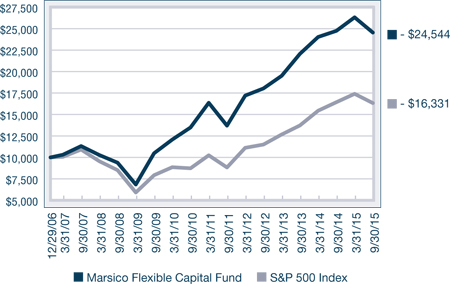

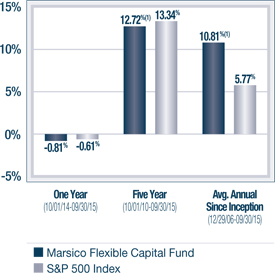

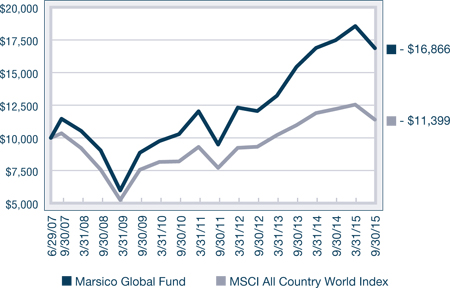

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

| | |

TOTAL ANNUAL OPERATING EXPENSES* 1.69% NET EXPENSES*†1.60% | TOTAL ANNUAL OPERATING EXPENSES* 1.39% | TOTAL ANNUAL OPERATING EXPENSES* 1.66% NET EXPENSES*†1.60% |

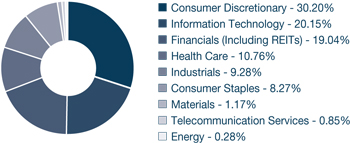

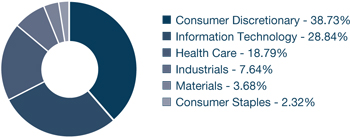

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

| | |

TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

Liberty Global PLC -

Series C | 4.84% | Constellation Brands, Inc. - Cl. A | 5.22% | Facebook, Inc. - Cl. A | 5.15% |

Endo International PLC | 4.21% | The Home Depot, Inc. | 5.20% | Novartis AG | 4.91% |

MasterCard, Inc. - Cl. A | 4.18% | Facebook, Inc. - Cl. A | 4.89% | Domino's Pizza Group PLC | 4.21% |

The Priceline Group, Inc. | 4.06% | Visa, Inc. - Cl. A | 4.85% | Ryanair Holdings PLC Spon. ADR | 4.17% |

Facebook, Inc. - Cl. A | 3.96% | The Walt Disney Company | 4.45% | NIKE, Inc. - Cl. B | 4.06% |

Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

3

KEY FUND STATISTICS (UNAUDITED) |

ADDITIONAL DISCLOSURES ABOUT THE MARSICO FUNDS

* | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 30, 2015. The information may differ from the expense ratios disclosed in this report. |

† | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of each of the International Opportunities Fund and the Global Fund (excluding interest, taxes, acquired fund fees and expenses, litigation, brokerage and extraordinary expenses) to an annual rate of 1.60% of each Fund’s average net assets until January 31, 2016. This expense limitation and fee waiver agreement may be terminated by the Adviser at any time after January 31, 2016, upon 15 days prior notice to the Fund and its administrator. The Adviser may recoup from a Fund fees previously waived or expenses previously reimbursed by the Adviser with respect to that Fund pursuant to this agreement (or a previous expenses limitation agreement) if: (1) such recoupment by the Adviser does not cause the Fund, at the time of recoupment, to exceed the lesser of (a) the expense limitation in effect at the time the relevant amount was waived and/or reimbursed, or (b) the expense limitation in effect at the time of the proposed recoupment, and (2) the recoupment is made within three fiscal years after the end of the fiscal year in which the amount was waived or reimbursed. |

(1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. |

The performance included in the chart does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

Periodically, certain fees and expenses have been waived or reimbursed by the Adviser for the 21st Century Fund, the International Opportunities Fund, the Flexible Capital Fund and the Global Fund. In the absence of such a waiver, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses from the 21st Century Fund, the International Opportunities Fund, and the Global Fund resulting in a lower performance return.

(2) | Sector weightings represent the percentage of the respective Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

4

MARKET ENVIRONMENT: OCTOBER 2014 – SEPTEMBER 2015 (UNAUDITED)

Global equity markets registered varying results for the one-year fiscal period ended September 30, 2015, ranging from modest losses overall in the US to substantial losses in emerging markets. US markets treaded water for much of the period as foreign stocks weakened, but both domestic and international stocks swooned late in the period on fears that global economic growth would falter. In August, a sharp downturn in Chinese equity market performance and an unexpected devaluation of China’s currency stoked fears of a prolonged slow-down in the Chinese economy. In addition, market participants focused on the effects of potential US interest rate hikes. Increased anxieties about geopolitical conflicts also contributed to the sell-off in the equity markets.

The center of concern during much of the reporting period was China. In the immediate aftermath of the 2007-09 “Great Recession,” China embarked upon massive government-supported infrastructure and real estate investment. China’s economic rebound was officially declared “strong” by the Chinese government, and a sharp rebound for globally priced industrial commodities and trade with China gave apparent legitimacy to claims of a solid recovery. As China pulled back from stimulus programs and an export-focused economy, however, raw industrial commodity prices retreated and shipments to Asia began to slow. While China has been slowing for some time, the recent sharp retrenchment in global risk assets reflected concerns about potential acceleration of the slowdown, despite upbeat official Chinese GDP reports.

The slowdown in China and US dollar strength led to weakness in the US manufacturing industry and created a headwind for multi-national businesses. Commodity prices fell and the equity returns of many commodity-oriented economies such as Brazil, Russia and China were hard hit, as evidenced by the dismal performance of the MSCI BRIC Index.

As illustrated in the table below, US equities posted returns that were better than the returns of many international equity markets. In the US, oil price weakness and falling prices of imported goods combined to keep the US inflation rate at essentially zero. Zero inflation and faltering activity abroad seemed to trump Federal Reserve Board insistence that rates would be raised this year. US consumer confidence perked up during the period, aided by lower prices at the gas pump and relatively strong housing markets. The US also saw improvement in the labor market as unemployment rates reached their lowest level in seven years. Given the strong US economic backdrop as compared to foreign economies, small, domestically-focused US companies were in favor. As depicted in the table below, small-capitalization US equities outperformed large capitalization stocks for the one-year fiscal period ended September 30, 2015.

Index Name(1) | Universe of

Equities Represented | One-Year Total Return |

US | | |

S&P 500 | US large-capitalization equities | -0.61% |

Russell 3000 | US publicly-traded equities of all sizes | -0.49% |

Russell 2000 | US small-capitalization equities | +1.25% |

Russell Mid-Cap | US medium-capitalization equities | -0.25% |

Index Name(1) | Universe of

Equities Represented | One-Year Total Return |

INTERNATIONAL | |

MSCI EAFE (US$) | Equities in developed international equity markets, including Japan, Western Europe, and Australasia | -8.66% |

MSCI Emerging Markets (US$) | Equities in developing international equity markets, including China, India, Eastern Europe, and Latin America | -19.28% |

MSCI ACWI (US$) | Equities in the global developed and emerging markets | -6.66% |

During the one-year fiscal period ended September 30, 2015, the US dollar generally appreciated against other currencies, reflecting the relative strength of the US economy. The US dollar’s rise dampened US inflationary pressures by making US exports less competitive overseas and lowering the cost of imported goods. Most emerging market currencies sold off sharply due to economic instability, the potential effects of further slowing in China, and higher interest rates that may come in the US. The devaluation of the Chinese yuan brought China’s currency to a four-year low versus the US dollar. Developed market currencies also trended lower. The Japanese yen weakened as Japanese policymakers continued initiatives to end Japan’s deflation, and the euro sank to a 12-year low versus the dollar before recovering a portion of its losses. The Australian dollar and Canadian dollar also weakened versus the US dollar as the price of commodities and crude oil declined.

THE MARSICO INVESTMENT TEAM

(1) | All indices are unmanaged and investors cannot invest directly in an index. |

5

INVESTMENT REVIEW BY TOM MARSICO AND CORALIE WITTER (UNAUDITED)

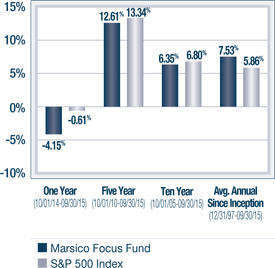

The Marsico Focus Fund posted a total return of -4.15% for the one-year fiscal period ended September 30, 2015. For comparative purposes, the S&P 500 Index, which is the Fund’s benchmark index, had a total return of -0.61% over that same time period. Please see the Fund Overview immediately following this commentary for more detailed information about the Fund’s longer-term performance for various periods ended September 30, 2015.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedules of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Focus Fund is non-diversified and may hold fewer securities than a diversified fund because it is permitted to invest a greater percentage of its assets in a smaller number of securities. Holding fewer securities increases the risk that the value of the Fund could go down because of the poor performance of a single investment. The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which they invest may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

The Focus Fund and the Growth Fund often invest in similar growth companies. Their performance may differ, however, because of a variety of factors. Among other factors, the Focus Fund is a non-diversified mutual fund that may hold the securities of fewer issuers than the Growth Fund, which is a diversified Fund. As a result, the Focus Fund may hold some securities that are different from those held by the Growth Fund, and the Focus Fund may be more exposed to individual stock volatility than the Growth Fund or other mutual funds that invest in a relatively larger number of securities.

The Marsico Focus Fund’s performance shortfall versus the S&P 500 Index for the one-year fiscal period ended September 30, 2015 was primarily attributable to investments in certain stocks in the Health Care and Industrials sectors, as defined in the Global Industry Classification Standard (“GICS”)(2).

A few stocks in the Pharmaceuticals Biotechnology & Life Sciences industry group detracted from performance. Pacira Pharmaceuticals, Inc. a manufacturer of non-opioid post-surgical pain anesthetics, declined -56% after the company suspended its previous 2015 revenue guidance for its Exparel product. As of the end of the fiscal year, we continued to maintain a position in Pacira, as we believe the company’s therapies to be best-in-class with long-term growth opportunities. Gilead Sciences, Inc. was a long-time holding in the Fund and added significant value to the Fund’s performance over the full period it was held. During the fiscal period of this report, Gilead Sciences experienced growing competitive pricing pressures for hepatitis C treatments, and its stock price dipped -2% prior to being sold from the Fund. Another long-time biotechnology holding, Biogen Idec Inc., slid -5% during the period. The company significantly cut its 2015 guidance on slower sales of its blockbuster multiple sclerosis drug, Tecfidera. We chose to sell Gilead Sciences and Biogen in favor of other investments with better growth visibility.

Canadian Pacific Railway Ltd. (-34% prior to being sold), like other railroad companies, faced headwinds of lower oil prices and lower volumes as fewer carloads of commodities such as coal are being transported. Though we believe Canadian Pacific to be among the best managed and operated railroad companies with significant pricing power, we chose to sell the position, as we believe low energy prices will remain a headwind for the company for some time.

6

Certain Consumer Discretionary positions struggled. Casino operator Wynn Resorts Ltd., a position that had contributed positively to the Fund’s performance for more than 10 years, posted a return of -31% during the reporting period, and was sold from the Fund. The Fund benefitted from the timing of the sale as Wynn Resorts continued to decline substantially after the Fund’s final sale through the end of the fiscal period. Wynn Resorts’ stock price weakened during a period of weaker Chinese economic data and the Chinese government’s anti-corruption campaign, which tended to restrain gaming activity in Macau. The Chinese government’s policies may hamper growth in Macau for some time, and it is difficult – if not impossible – to predict the timing of government policy changes. Accordingly, we chose to exit the position in favor of other investments with better growth visibility. Electric vehicle manufacturer Tesla Motors, Inc. fell in conjunction with the decline in crude oil prices, as concerns rose that lower gas prices may reduce demand for fuel efficient cars. Tesla Motors posted a return of -20% prior to being sold from the Fund.

Chinese ecommerce company Alibaba Group Holding Ltd. Spon. ADR (-43%) was a detractor within the Information Technology sector. The marketplace has been closely monitoring Alibaba’s ability to monetize sales made on mobile devices, as the company currently makes less on mobile device-based sales than on PC-based sales. Recent data suggests improvement in monetization trends, and we continue to have confidence in the long-term growth opportunities for Alibaba. Online social networking platform LinkedIn Corporation – Cl. A (-10% prior to being sold) and Internet services company Google, Inc. – Cl. A (-17%) were other weak performing holdings within the Information Technology sector.

Within the Financials sector, American Express Company’s stock price dropped -10% after the company announced that its exclusivity and co-branded card agreement with Costco Wholesale will end. We sold the position from the Fund.

The Fund sold most of its Energy-related positions prior to period-end. The Fund’s Energy holdings held earlier in the period, such as Continental Resources Corp. (-17% prior to being sold) and Halliburton Company (-19% prior to being sold) posted negative returns and detracted from performance.

There were several areas of strength for the Fund’s performance. From a sector allocation standpoint, the Fund benefitted relative to the benchmark index from selling most of its Energy holdings during the period, and from having significant overweight allocations to the Consumer Discretionary and Health Care sectors, as both were strong performing sectors of the benchmark index.

Although several Fund holdings within the Consumer Discretionary and Health Care sectors posted negative returns, other holdings within the sectors generated superior performance results relative to the Fund’s benchmark. Coffee purveyor Starbucks Corporation soared +53% as the company reported strong sales and continued its roll-out of a mobile order and pay platform in its stores. Athletic apparel company NIKE, Inc. – Cl. B gained +39% after the company reported continued acceleration of sales in a number of its markets. We believe Nike’s future product sales growth may be further bolstered by the 2016 Brazil Olympics, as Nike will be the official footwear and apparel supplier for US Olympic athletes. Media holding The Walt Disney Company (+17%) experienced strong revenue growth in its studio and consumer products businesses, driven in part by the continued success of its animated film, “Frozen.” Health care services provider United Health Group, Inc. (+24%) demonstrated strength in its business following the passage of the Affordable Care Act.

Leading individual holdings included financial transaction processor Visa, Inc. – Cl. A (+31%) and Facebook, Inc. – Cl. A (+14%). Visa managed to deliver solid performance despite a tumultuous global macroeconomic environment. Facebook’s business grew as more advertising continued to shift to online venues from traditional media such as print advertisements.

The Fund also benefitted relative to its benchmark from effective stock selection in the Materials sector. Agricultural materials provider Monsanto Company (+6% prior to being sold) and paint manufacturer The Sherwin-Williams Company (+3%) each generated positive returns.

During the reporting period, the Fund reduced its exposure to the Energy, Industrials and Materials sectors while increasing its allocations to the Information Technology, Health Care, Consumer Discretionary and Consumer Staples sectors.

7

Fiscal Period-End Investment Posture

As of September 30, 2015, the Fund’s largest sector allocations included Information Technology, Consumer Discretionary, Health Care and Materials. The Fund had no exposure to the Utilities or Telecommunication Services sectors.

Sincerely,

THOMAS F. MARSICO

CORALIE T. WITTER, CFA

PORTFOLIO MANAGERS

(1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Please see the Prospectus for more information. |

(2) | Regarding GICS data cited throughout this report, the Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by Marsico Capital Management, LLC (the “Adviser”). Neither MSCI, S&P, nor the Adviser or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, the Adviser, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

8

September 30, 2015 (Unaudited)

The Focus Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Fund will normally hold a core position of between 20 and 35 common stocks.

TOTAL ANNUAL OPERATING EXPENSES* 1.34% | NET ASSETS $788,850,513 | NET ASSET VALUE PER SHARE $18.83 |

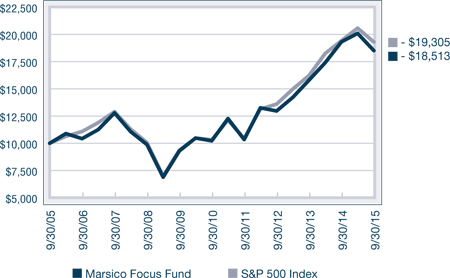

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

| |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | | | |

| | Facebook, Inc. - Cl. A | 8.15% | |

| | NIKE, Inc. - Cl. B | 5.76% | |

| | Visa, Inc. - Cl. A | 5.74% | |

| | Google, Inc. - Cl. A | 5.20% | |

| | The Walt Disney Company | 5.00% | |

| | | | |

* | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 30, 2015 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

(1) | This chart assumes an initial investment of $10,000 made on September 30, 2005. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

(2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

9

MARSICO FOCUS FUND

SCHEDULE OF INVESTMENTS

September 30, 2015

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS | | | | | | | | | |

Aerospace & Defense | | | | | | | | | |

The Boeing Company | | | 206,731 | | | $ | 27,071,424 | | | | 3.43 | % |

| | | | | �� | | | | | | | | |

Application Software | | | | | | | | | | | | |

salesforce.com, inc.* | | | 427,341 | | | | 29,670,286 | | | | 3.76 | |

| | | | | | | | | | | | | |

Biotechnology | | | | | | | | | | | | |

Celgene Corporation* | | | 164,783 | | | | 17,824,577 | | | | 2.26 | |

Regeneron Pharmaceuticals, Inc.* | | | 17,402 | | | | 8,094,366 | | | | 1.03 | |

Vertex Pharmaceuticals, Inc.* | | | 193,460 | | | | 20,146,925 | | | | 2.55 | |

| | | | | | | | 46,065,868 | | | | 5.84 | |

Data Processing & Outsourced Services | | | | | |

Visa, Inc. - Cl. A | | | 649,746 | | | | 45,261,306 | | | | 5.74 | |

| | | | | | | | | | | | | |

Drug Retail | | | | | | | | | | | | |

CVS Health Corporation | | | 248,115 | | | | 23,938,135 | | | | 3.03 | |

| | | | | | | | | | | | | |

Footwear | | | | | | | | | | | | |

NIKE, Inc. - Cl. B | | | 369,313 | | | | 45,414,420 | | | | 5.76 | |

| | | | | | | | | | | | | |

General Merchandise Stores | | | | | | | | | |

Dollar Tree, Inc.* | | | 412,301 | | | | 27,483,985 | | | | 3.48 | |

| | | | | | | | | | | | | |

Health Care Facilities | | | | | | | | | | | | |

HCA Holdings, Inc.* | | | 420,666 | | | | 32,542,722 | | | | 4.13 | |

| | | | | | | | | | | | | |

Home Entertainment Software | | | | | | | | | |

Electronic Arts, Inc.* | | | 417,726 | | | | 28,300,936 | | | | 3.59 | |

| | | | | | | | | | | | | |

Internet Retail | | | | | | | | | | | | |

Amazon.com, Inc.* | | | 32,652 | | | | 16,714,232 | | | | 2.12 | |

| | | | | | | | | | | | | |

Internet Software & Services | | | | | |

Alibaba Group Holding Ltd. Spon. ADR* | | | 335,568 | | | | 19,788,445 | | | | 2.51 | |

Facebook, Inc. - Cl. A* | | | 715,727 | | | | 64,343,857 | | | | 8.15 | |

Google, Inc. - Cl. A* | | | 64,255 | | | | 41,018,465 | | | | 5.20 | |

| | | | | | | | 125,150,767 | | | | 15.86 | |

Investment Banking & Brokerage | | | | | |

The Charles Schwab Corporation | | | 1,096,477 | | | | 31,315,383 | | | | 3.97 | |

| | | | | | | | | | | | | |

Life Sciences Tools & Services | | | | | |

Illumina, Inc.* | | | 110,647 | | | | 19,453,956 | | | | 2.47 | |

| | | | | | | | | | | | | |

Managed Health Care | | | | | | | | | | | | |

UnitedHealth Group, Inc. | | | 293,621 | | | | 34,062,972 | | | | 4.32 | |

| | | | | | | | | | | | | |

Movies & Entertainment | | | | | | | | | | | | |

The Walt Disney Company | | | 386,349 | | | | 39,484,868 | | | | 5.00 | |

| | | | | | | | | | | | | |

Oil & Gas Equipment & Services | | | | | |

Schlumberger Ltd. | | | 110,667 | | | | 7,632,703 | | | | 0.97 | |

COMMON STOCKS (continued) | | | | | |

Pharmaceuticals | | | | | | | | | | | | |

Allergan PLC* | | | 85,694 | | | $ | 23,292,486 | | | | 2.96 | % |

Novartis AG | | | 280,877 | | | | 25,815,922 | | | | 3.27 | |

Pacira Pharmaceuticals, Inc.* | | | 278,768 | | | | 11,457,365 | | | | 1.45 | |

| | | | | | | | 60,565,773 | | | | 7.68 | |

Restaurants | | | | | | | | | | | | |

Chipotle Mexican Grill, Inc.* | | | 42,069 | | | | 30,300,197 | | | | 3.84 | |

Starbucks Corporation | | | 658,092 | | | | 37,405,949 | | | | 4.74 | |

| | | | | | | | 67,706,146 | | | | 8.58 | |

Specialty Chemicals | | | | | | | | | | | | |

The Sherwin-Williams Company | | | 162,647 | | | | 36,234,499 | | | | 4.59 | |

| | | | | | | | | | | | | |

Technology Hardware, Storage & Peripherals | | | | | |

Apple, Inc. | | | 285,441 | | | | 31,484,142 | | | | 3.99 | |

| | | | | | | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | | |

(Cost $675,268,791) | | | | | | | 775,554,523 | | | | 98.31 | |

| | | | | | | | | | | | | |

SHORT-TERM INVESTMENTS | | | | | |

State Street Institutional U.S. Government Money Market Fund, 0.000% | | | 9,931,496 | | | | 9,931,496 | | | | 1.26 | |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | |

(Cost $9,931,496) | | | | | | | 9,931,496 | | | | 1.26 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | | |

(Cost $685,200,287) | | | | | | | 785,486,019 | | | | 99.57 | |

| | | | | | | | | | | | | |

Cash and Other Assets, Less Liabilities | | | | 3,364,494 | | | | 0.43 | |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | $ | 788,850,513 | | | | 100.00 | % |

| See notes to financial statements. |

10

INVESTMENT REVIEW BY TOM MARSICO AND CORALIE WITTER (UNAUDITED)

For the one-year fiscal period ended September 30, 2015, the Marsico Growth Fund posted a total return of -4.10%. For comparative purposes, the S&P 500 Index, which is the Fund’s benchmark index, had a total return of -0.61% over the same period. Please see the Fund Overview for more detailed information about the Fund’s longer-term performance for various periods ended September 30, 2015.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedules of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

The Focus Fund and the Growth Fund often invest in similar growth companies. Their performance may differ, however, because of a variety of factors. Among other factors, the Focus Fund is a non-diversified mutual fund that may hold the securities of fewer issuers than the Growth Fund, which is a diversified Fund. As a result, the Focus Fund may hold some securities that are different from those held by the Growth Fund, and the Focus Fund may be more exposed to individual stock volatility than the Growth Fund or other mutual funds that invest in a relatively larger number of securities.

A number of the Growth Fund’s Health Care holdings, particularly in the Pharmaceuticals, Biotechnology & Life Sciences industry group, detracted from its performance relative to the S&P 500 Index during the one-year fiscal period. Pacira Pharmaceuticals, Inc., a manufacturer of non-opioid post-surgical pain anesthetics, declined -57% after the company suspended its previous 2015 revenue guidance for its Exparel product. As of the end of the fiscal year, we continued to maintain a position in Pacira, as we believe the company’s therapies to be best-in-class with long-term growth opportunities. Gilead Sciences, Inc., was a long-time holding in the Fund and added significant value to the Fund’s performance over the full period it was held. During the fiscal period of this report, Gilead Sciences experienced growing competitive pricing pressures for the hepatitis C treatment market, and its stock price dipped -2% prior to being sold from the Fund. Vertex Pharmaceuticals, Inc., a manufacturer of therapies for the treatment of cystic fibrosis patients, posted a return of -17% during the period.

In the Industrials sector, the Fund’s positions in railroad operators Canadian Pacific Railway, Ltd. (-34% prior to being sold) and Union Pacific Corporation (-9% prior to being sold) faced headwinds of lower oil prices and lower volumes as fewer carloads of commodities such as coal are being transported. We chose to sell both positions, as we believe low energy prices will remain a headwind for the companies for some time.

Casino operator Wynn Resorts Ltd., a Consumer Discretionary position that had contributed positively to the Fund’s performance for more than 10 years, posted a return of -30% during the reporting period and was sold from the Fund. The Fund benefitted from the timing of the sale as Wynn Resorts continued to decline substantially after the Fund’s final sale through the end of the fiscal period. Wynn Resorts’ stock price weakened during a period of weaker Chinese economic data and the Chinese government’s anti-corruption campaign, which tended to restrain gaming activity in Macau. The Chinese government’s policies may hamper growth in Macau for some time, and it is difficult – if not impossible – to predict the timing of government policy changes. Accordingly, we chose to exit the position in favor of other investments with better growth visibility.

11

Chinese ecommerce company Alibaba Group Holding Ltd. Spon. ADR (-44%) was a detractor within the Information Technology sector. Alibaba’s stock struggled on worries that slower macroeconomic growth in China could lead to fewer online retail sales. Some market participants question Alibaba’s ability to transition from focusing on sales made via desktop computers to monetizing sales made on mobile devices. We believe Alibaba will be successful in capitalizing on monetization trends, and we continue to have confidence in the company’s long-term growth opportunities. Online social networking platform LinkedIn Corporation – Cl. A (-9% prior to being sold) and Internet services company Google, Inc. – Cl. A (-18%) were other weak performing holdings within the Information Technology sector.

The Fund sold most of its Energy-related positions prior to period-end. A few of the Fund’s Energy holdings held earlier in the period, such as Antero Resources Corporation (-33% prior to being sold) and Halliburton Company (-19% prior to being sold) posted negative returns and detracted from performance. The Fund benefitted from the timing of the sale of Antero Resources Corp. as Antero continued to decline substantially after the Fund’s final sale through the end of the fiscal period.

There were several areas of strength for the Fund’s performance. From a sector allocation standpoint, the Fund benefitted relative to the benchmark index from selling most of its Energy holdings during the period and by having a significant overweight allocation to the Health Care sector, which was among the stronger-performing areas of the benchmark index.

Although several Fund holdings within the Consumer Discretionary and Health Care sectors posted negative returns, other holdings within the sectors generated superior performance results relative to the Fund’s benchmark. Coffee purveyor Starbucks Corporation soared +53% as the company reported strong sales and continued its roll-out of a mobile order and pay platform in its stores. Athletic apparel company NIKE, Inc. – Cl. B gained +39% after the company reported continued acceleration of sales in a number of its markets. We believe Nike’s future product sales growth may be further bolstered by the 2016 Brazil Olympics, as Nike will be the official footwear and apparel supplier for US Olympic athletes. Media holding The Walt Disney Company (+17%) experienced strong revenue growth in its studio and consumer products businesses, driven in part by the continued success of its animated film, “Frozen.” Health care services provider United Health Group, Inc. (+24%) demonstrated strength in its business following the passage of the Affordable Care Act.

Like the Focus Fund, leading individual holdings for the Growth Fund included financial transaction processor Visa, Inc. – Cl. A (+31%) and Facebook, Inc. – Cl. A (+14%). Financial transaction processor, Visa, managed to deliver solid performance despite a tumultuous global macroeconomic environment. Facebook’s business grew as more advertising continued to shift to online venues from traditional media such as print advertisements. Electronic game developer and distributor Electronic Arts, Inc. rose +20% after reporting strong revenue growth from sales and downloads of its video games.

The Fund also benefitted relative to its benchmark from effective stock selection in the Materials sector. Agricultural materials provider Monsanto Company (+6% prior to being sold) and paint manufacturer The Sherwin-Williams Company (+3%) each generated positive returns.

During the reporting period, the Fund increased its allocations to the Health Care and Information Technology sectors. The Fund reduced its holdings in the Energy, Industrials and Materials sectors.

Fiscal Period-End Investment Posture

As of September 30, 2015, the Fund’s largest sector allocations included Information Technology, Consumer Discretionary, Health Care and Industrials. The Fund had no exposure to the Utilities or Telecommunication Services sectors.

As noted earlier in this report, effective October 6, 2015, Kevin Boone is no longer a member of the team that co-manages the Marsico Growth Fund. We continue to be jointly and primarily responsible for day-to-day management of the Fund.

Sincerely,

THOMAS F. MARSICO

CORALIE T. WITTER, CFA

PORTFOLIO MANAGERS

(1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Please see the Prospectus for more information. |

12

September 30, 2015 (Unaudited)

The Growth Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Growth Fund will normally hold a core position of between 35 and 50 common stocks.

TOTAL ANNUAL OPERATING EXPENSES* 1.37% | NET ASSETS $410,441,505 | NET ASSET VALUE PER SHARE $20.11 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

| |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | | | |

| | Facebook, Inc. - Cl. A | 6.12% | |

| | Google, Inc. - Cl. A | 5.07% | |

| | NIKE, Inc. - Cl. B | 4.39% | |

| | The Walt Disney Company | 4.24% | |

| | Starbucks Corporation | 3.98% | |

| | | | |

* | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 30, 2015 and may differ from the expense ratio disclosed in this report. |

| The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. |

| The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| All indices are unmanaged and investors cannot invest directly in an index. |

(1) | This chart assumes an initial investment of $10,000 made on September 30, 2005. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

(2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

13

MARSICO GROWTH FUND

SCHEDULE OF INVESTMENTS

September 30, 2015

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS | | | | | | | | | |

Aerospace & Defense | | | | | | | | | |

The Boeing Company | | | 100,382 | | | $ | 13,145,023 | | | | 3.20 | % |

| | | | | | | | | | | | | |

Airlines | | | | | | | | | | | | |

Delta Air Lines, Inc. | | | 114,551 | | | | 5,139,903 | | | | 1.25 | |

| | | | | | | | | | | | | |

Application Software | | | | | | | | | | | | |

salesforce.com, inc.* | | | 195,821 | | | | 13,595,852 | | | | 3.31 | |

| | | | | | | | | | | | | |

Automobile Manufacturers | | | | | |

Tesla Motors, Inc.* | | | 25,160 | | | | 6,249,744 | | | | 1.52 | |

| | | | | | | | | | | | | |

Biotechnology | | | | | | | | | | | | |

Celgene Corporation* | | | 99,318 | | | | 10,743,228 | | | | 2.62 | |

Incyte Corporation* | | | 49,576 | | | | 5,469,720 | | | | 1.33 | |

Regeneron Pharmaceuticals, Inc.* | | | 12,002 | | | | 5,582,610 | | | | 1.36 | |

Vertex Pharmaceuticals, Inc.* | | | 112,907 | | | | 11,758,135 | | | | 2.87 | |

| | | | | | | | 33,553,693 | | | | 8.18 | |

Communications Equipment | | | | | |

Palo Alto Networks, Inc.* | | | 39,969 | | | | 6,874,668 | | | | 1.68 | |

| | | | | | | | | | | | | |

Data Processing & Outsourced Services | | | | | |

FleetCor Technologies, Inc.* | | | 43,674 | | | | 6,010,416 | | | | 1.47 | |

Visa, Inc. - Cl. A | | | 203,363 | | | | 14,166,266 | | | | 3.45 | |

| | | | | | | | 20,176,682 | | | | 4.92 | |

Drug Retail | | | | | | | | | | | | |

CVS Health Corporation | | | 129,983 | | | | 12,540,760 | | | | 3.06 | |

| | | | | | | | | | | | | |

Footwear | | | | | | | | | | | | |

NIKE, Inc. - Cl. B | | | 146,599 | | | | 18,027,279 | | | | 4.39 | |

| | | | | | | | | | | | | |

General Merchandise Stores | | | | | |

Dollar Tree, Inc.* | | | 178,160 | | | | 11,876,146 | | | | 2.89 | |

| | | | | | | | | | | | | |

Health Care Facilities | | | | | | | | | | | | |

HCA Holdings, Inc.* | | | 153,462 | | | | 11,871,820 | | | | 2.89 | |

| | | | | | | | | | | | | |

Home Entertainment Software | | | | | |

Electronic Arts, Inc.* | | | 186,843 | | | | 12,658,613 | | | | 3.08 | |

| | | | | | | | | | | | | |

Hotels, Resorts & Cruise Lines | | | | | |

Royal Caribbean Cruises Ltd. | | | 68,279 | | | | 6,082,976 | | | | 1.48 | |

| | | | | | | | | | | | | |

Internet Retail | | | | | | | | | | | | |

Amazon.com, Inc.* | | | 17,126 | | | | 8,766,628 | | | | 2.14 | |

The Priceline Group, Inc.* | | | 7,447 | | | | 9,210,897 | | | | 2.24 | |

| | | | | | | | 17,977,525 | | | | 4.38 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | |

Internet Software & Services | | | | | |

Alibaba Group Holding Ltd. Spon. ADR* | | | 139,686 | | | $ | 8,237,284 | | | | 2.00 | % |

Facebook, Inc. - Cl. A* | | | 279,299 | | | | 25,108,980 | | | | 6.12 | |

Google, Inc. - Cl. A* | | | 32,593 | | | | 20,806,393 | | | | 5.07 | |

| | | | | | | | 54,152,657 | | | | 13.19 | |

Investment Banking & Brokerage | | | | | |

The Charles Schwab Corporation | | | 428,116 | | | | 12,226,993 | | | | 2.98 | |

| | | | | | | | | | | | | |

Life Sciences Tools & Services | | | | | |

Illumina, Inc.* | | | 57,539 | | | | 10,116,507 | | | | 2.47 | |

| | | | | | | | | | | | | |

Managed Health Care | | | | | | | | | | | | |

UnitedHealth Group, Inc. | | | 128,895 | | | | 14,953,109 | | | | 3.64 | |

| | | | | | | | | | | | | |

Movies & Entertainment | | | | | | | | | | | | |

The Walt Disney Company | | | 170,314 | | | | 17,406,091 | | | | 4.24 | |

| | | | | | | | | | | | | |

Oil & Gas Equipment & Services | | | | | |

Schlumberger Ltd. | | | 28,964 | | | | 1,997,647 | | | | 0.49 | |

| | | | | | | | | | | | | |

Pharmaceuticals | | | | | | | | | | | | |

Allergan PLC* | | | 47,116 | | | | 12,806,600 | | | | 3.12 | |

Eli Lilly & Company | | | 71,928 | | | | 6,019,654 | | | | 1.47 | |

Pacira Pharmaceuticals, Inc.* | | | 112,802 | | | | 4,636,162 | | | | 1.13 | |

Zoetis, Inc. | | | 188,169 | | | | 7,748,800 | | | | 1.89 | |

| | | | | | | | 31,211,216 | | | | 7.61 | |

Restaurants | | | | | | | | | | | | |

Chipotle Mexican Grill, Inc.* | | | 16,828 | | | | 12,120,367 | | | | 2.95 | |

Starbucks Corporation | | | 287,371 | | | | 16,334,168 | | | | 3.98 | |

| | | | | | | | 28,454,535 | | | | 6.93 | |

Semiconductors | | | | | | | | | | | | |

NXP Semiconductors N.V.* | | | 52,950 | | | | 4,610,356 | | | | 1.12 | |

| | | | | | | | | | | | | |

Specialty Chemicals | | | | | | | | | | | | |

The Sherwin-Williams Company | | | 55,906 | | | | 12,454,739 | | | | 3.04 | |

| | | | | | | | | | | | | |

Specialty Stores | | | | | | | | | | | | |

Signet Jewelers Ltd. | | | 37,181 | | | | 5,061,450 | | | | 1.23 | |

| | | | | | | | | | | | | |

Technology Hardware, Storage & Peripherals | | | | | |

Apple, Inc. | | | 130,598 | | | | 14,404,959 | | | | 3.51 | |

| | | | | | | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | | | | | |

(Cost $355,509,257) | | | | | | | 396,820,943 | | | | 96.68 | |

See notes to financial statements.

14

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

SHORT-TERM INVESTMENTS | | | | |

State Street Institutional Treasury Money Market Fund, 0.000% | | | 13,528,740 | | | $ | 13,528,740 | | | | 3.30 | % |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | |

(Cost $13,528,740) | | | | | | | 13,528,740 | | | | 3.30 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | | | | | |

(Cost $369,037,997) | | | | | | | 410,349,683 | | | | 99.98 | |

| | | | | | | | | | | | | |

Cash and Other Assets, Less Liabilities | | | | | | | 91,822 | | | | 0.02 | |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | $ | 410,441,505 | | | | 100.00 | % |

| See notes to financial statements. |

15

INVESTMENT REVIEW BY BRANDON GEISLER (UNAUDITED)

The Marsico 21st Century Fund posted a total return of -2.49% for the one-year fiscal period ended September 30, 2015. For comparative purposes, the S&P 500 Index, which is the Fund’s primary benchmark index, had a total return of -0.61% over the same time period. The Russell 3000 Index, a proxy for the performance of all publicly-traded US equity securities including smaller capitalization companies (which may be a useful comparison in light of the Fund’s ability to invest across the entire market capitalization spectrum), had a total return of -0.49% for the fiscal period. Please see the Fund Overview immediately following this commentary for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2015.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

Several weak-performing stocks in the Consumer Discretionary, Health Care and Industrials sectors were the primary detractors from the 21st Century Fund’s performance compared to its benchmark during the period. One of the larger positive contributors to the Fund’s performance over the past 10 years, casino operator Wynn Resorts Ltd., declined -30% during the reporting period prior to being sold. The Fund benefitted from the timing of the sale as Wynn Resorts continued to decline substantially after the Fund’s final sale through the end of the fiscal period. Wynn Resorts’ stock price struggled during a period of weaker Chinese economic data and the Chinese government’s anti-corruption campaign, which tended to restrain gaming activity in Macau. Online travel reservations company TripAdvisor, Inc. also posted a negative return (-23% during the period) and was sold. TripAdvisor’s stock price struggled after the company reported weaker than expected click-based ad revenue.

Health Care holdings Salix Pharmaceuticals Ltd. (-43% prior to being sold), Concordia Healthcare Corporation (-47%) and Gilead Sciences, Inc. (-7% prior to being sold) each posted negative returns during the period. The Fund sold Salix after the company announced inventory issues for several of its key products. Gilead Sciences was a long-time holding in the Fund, and added significant value to the Fund’s performance over the full period it was held. During the past year, Gilead Sciences experienced growing competitive pricing pressures for the hepatitis C treatment market, and was sold from the Fund. In the final weeks of the reporting period, comments by US presidential candidates led to greater concerns that legislative changes could lead to drug price controls and hamper profitability for drug manufacturers, and related attention to drug pricing contributed to a sell-off in many pharmaceutical and biotechnology company stocks. Concordia Healthcare, a biopharmaceutical company with headquarters in Canada, was among the stocks impacted.

Sharply lower energy prices negatively affected several of the Fund’s Industrials holdings such as railroad operators Genesee & Wyoming, Inc. – Cl. A (-38%) and Canadian Pacific Railway, Ltd. (-27%). BE Aerospace, Inc. (-28%), a manufacturer of interior cabin products for aircraft, also experienced challenges as weaker global oil prices temporarily slowed demand for new aircraft and aircraft components despite beneficial energy cost reductions.

The Fund also sold all of its holdings in the Energy sector prior to period-end given the lower energy prices. The Fund’s Energy holdings held early in the period posted negative returns and detracted from performance.

16

Chinese ecommerce company Alibaba Group Holding Ltd. Spon. ADR returned -16% prior to being sold from the Fund. Alibaba’s stock struggled on worries that slower macroeconomic growth in China could lead to fewer online retail sales.

Superior stock selection in the Information Technology sector and favorable sector allocation effects were primary factors contributing positively to the Fund’s performance. Video game company Electronic Arts, Inc. (+54%), social media company Facebook, Inc. – Cl. A (+13%) and cloud computing company salesforce.com, inc. (+21%) each had a material, positive impact on performance.

Select holdings in the Consumer Staples, Materials and Financials sectors also generated strong returns. Constellation Brands, Inc. – Cl. A soared +44% after the company reported strong beer sales that exceeded market expectations. Agricultural materials provider Monsanto Company (+5% prior to being sold) and paint manufacturer The Sherwin-Williams Company (+2%) each generated positive returns. First Republic Bank (+29%) performed well as the company reported strong loan and deposit growth.

While several Fund holdings within the Consumer Discretionary and Health Care sectors posted negative returns, other holdings within the sectors performed well. Leading Consumer Discretionary holdings included Norwegian Cruise Line Holdings Ltd. (+23%), Domino’s Pizza, Inc. (+43%) and The Walt Disney Company (+17%). Health Care holding, DexCom, Inc., a manufacturer of systems for diabetes management, rose +99%.

The Fund’s overall sector allocation effect was positive relative to the benchmark index. The Fund did well by having an underweight allocation to the Energy sector and by selling its few Energy holdings prior to period-end. The Fund also benefitted relative to the benchmark index from having an overweight allocation to the Consumer Discretionary sector, which was the strongest-performing sector of the benchmark index during the period.

During the reporting period, the Fund sold its Energy holdings, as noted earlier, and reduced its allocations to the Industrials and Materials sectors. The Fund increased its allocation to the Health Care and Information Technology sectors.

Fiscal Period-End Investment Posture

As of September 30, 2015, the Fund’s primary economic sector allocations included Information Technology, Health Care, Consumer Discretionary and Industrials. The Fund had no investments in the Energy and Utilities sectors.

Sincerely,

BRANDON A. GEISLER

PORTFOLIO MANAGER

(1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Periodically, certain fees and expenses have been waived or reimbursed by the Adviser for the 21st Century Fund. In the absence of such a waiver, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses from the 21st Century Fund resulting in a lower performance return. Please see the Prospectus for more information. |

17

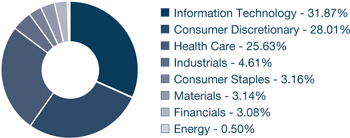

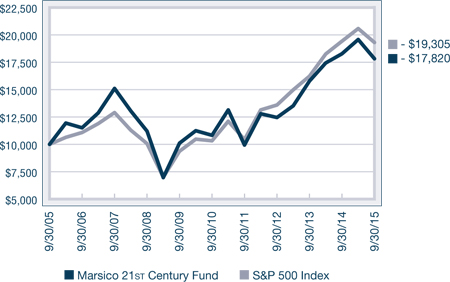

21st CENTURY FUND OVERVIEW |

September 30, 2015 (Unaudited)

The 21st Century Fund invests primarily in common stocks that are selected for their long-term growth potential. The Fund may invest in companies of any size, and will normally hold a core position of between 35 and 60 common stocks.

TOTAL ANNUAL OPERATING EXPENSES* 1.43% | NET ASSETS $268,383,830 | NET ASSET VALUE PER SHARE $20.38 |

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

| |

SECTOR ALLOCATION(3) | TOP FIVE HOLDINGS |

| | | | |

| | Facebook, Inc. - Cl. A | 5.91% | |

| | MasterCard, Inc. - Cl. A | 3.96% | |

| | Constellation Brands, Inc. - Cl. A | 3.63% | |

| | Norwegian Cruise Line Holdings Ltd. | 3.63% | |

| | Electronic Arts, Inc. | 3.16% | |

| | | | |

* | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 30, 2015 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

(1) | Periodically, certain fees and expenses have been waived or reimbursed by the Adviser for the 21st Century Fund. In the absence of such a waiver, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses from the 21st Century Fund resulting in a lower performance return. |

(2) | This chart assumes an initial investment of $10,000 made on September 30, 2005. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

(3) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

19

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS

September 30, 2015

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS | | | | | | | | | |

Aerospace & Defense | | | | | | | | | |

BE Aerospace, Inc. | | | 91,649 | | | $ | 4,023,391 | | | | 1.50 | % |

The Boeing Company | | | 58,402 | | | | 7,647,742 | | | | 2.85 | |

| | | | | | | | 11,671,133 | | | | 4.35 | |

Airlines | | | | | | | | | | | | |

Delta Air Lines, Inc. | | | 59,247 | | | | 2,658,413 | | | | 0.99 | |

| | | | | | | | | | | | | |

Application Software | | | | | | | | | | | | |

Mobileye N.V.* | | | 45,593 | | | | 2,073,569 | | | | 0.77 | |

salesforce.com, inc.* | | | 114,104 | | | | 7,922,241 | | | | 2.95 | |

| | | | | | | | 9,995,810 | | | | 3.72 | |

Automobile Manufacturers | | | | | | | | | | | | |

Tesla Motors, Inc.* | | | 19,767 | | | | 4,910,123 | | | | 1.83 | |

| | | | | | | | | | | | | |

Automotive Retail | | | | | | | | | | | | |

O'Reilly Automotive, Inc.* | | | 17,779 | | | | 4,444,750 | | | | 1.66 | |

| | | | | | | | | | | | | |

Biotechnology | | | | | | | | | | | | |

Alexion Pharmaceuticals, Inc.* | | | 20,350 | | | | 3,182,536 | | | | 1.19 | |

Alkermes PLC* | | | 99,739 | | | | 5,851,687 | | | | 2.18 | |

Isis Pharmaceuticals, Inc.* | | | 27,865 | | | | 1,126,303 | | | | 0.42 | |

Juno Therapeutics, Inc.* | | | 28,456 | | | | 1,157,875 | | | | 0.43 | |

NATERA, Inc.* | | | 65,936 | | | | 715,406 | | | | 0.27 | |

Regeneron Pharmaceuticals, Inc.* | | | 11,561 | | | | 5,377,484 | | | | 2.00 | |

| | | | | | | | 17,411,291 | | | | 6.49 | |

Communications Equipment | | | | | |

Palo Alto Networks, Inc.* | | | 25,333 | | | | 4,357,276 | | | | 1.62 | |

| | | | | | | | | | | | | |

Construction Materials | | | | | | | | | | | | |

Vulcan Materials Company | | | 22,640 | | | | 2,019,488 | | | | 0.75 | |

| | | | | | | | | | | | | |

Data Processing & Outsourced Services | | | | | |

FleetCor Technologies, Inc.* | | | 40,009 | | | | 5,506,039 | | | | 2.05 | |

MasterCard, Inc. - Cl. A | | | 117,852 | | | | 10,620,822 | | | | 3.96 | |

| | | | | | | | 16,126,861 | | | | 6.01 | |

Distillers & Vintners | | | | | | | | | | | | |

Constellation Brands, Inc. - Cl. A | | | 77,746 | | | | 9,734,577 | | | | 3.63 | |

| | | | | | | | | | | | | |

Diversified Support Services | | | | | |

Healthcare Services Group, Inc. | | | 85,588 | | | | 2,884,315 | | | | 1.07 | |

| | | | | | | | | | | | | |

General Merchandise Stores | | | | | |

Burlington Stores, Inc.* | | | 93,211 | | | | 4,757,489 | | | | 1.77 | |

| | | | | | | | | | | | | |

Health Care Equipment | | | | | | | | | | | | |

ConforMIS, Inc.* | | | 55,348 | | | | 999,585 | | | | 0.37 | |

DexCom, Inc.* | | | 70,014 | | | | 6,011,402 | | | | 2.24 | |

Intuitive Surgical, Inc.* | | | 7,215 | | | | 3,315,870 | | | | 1.24 | |

| | | | | | | | 10,326,857 | | | | 3.85 | |

Health Care Facilities | | | | | | | | | | | | |

Acadia Healthcare Company, Inc.* | | | 65,496 | | | | 4,340,420 | | | | 1.62 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | |

Health Care Services | | | | | | | | | | | | |

Envision Healthcare Holdings, Inc.* | | | 97,968 | | | $ | 3,604,243 | | | | 1.34 | % |

| | | | | | | | | | | | | |

Home Entertainment Software | | | | | |

Electronic Arts, Inc.* | | | 125,066 | | | | 8,473,221 | | | | 3.16 | |

| | | | | | | | | | | | | |

Hotels, Resorts & Cruise Lines | | | | | |

Norwegian Cruise Line Holdings Ltd.* | | | 169,843 | | | | 9,732,004 | | | | 3.63 | |

| | | | | | | | | | | | | |

Internet Retail | | | | | | | | | | | | |

Amazon.com, Inc.* | | | 14,372 | | | | 7,356,883 | | | | 2.74 | |

Ctrip.com International, Ltd. ADR* | | | 42,284 | | | | 2,671,503 | | | | 1.00 | |

NetFlix, Inc.* | | | 27,135 | | | | 2,801,960 | | | | 1.04 | |

Yoox SpA* | | | 68,680 | | | | 2,067,806 | | | | 0.77 | |

| | | | | | | | 14,898,152 | | | | 5.55 | |

Internet Software & Services | | | | | |

CoStar Group, Inc.* | | | 23,846 | | | | 4,126,789 | | | | 1.54 | |

Envestnet, Inc.* | | | 18,464 | | | | 553,366 | | | | 0.21 | |

Facebook, Inc. - Cl. A* | | | 176,535 | | | | 15,870,497 | | | | 5.91 | |

LinkedIn Corporation - Cl. A* | | | 16,226 | | | | 3,085,049 | | | | 1.15 | |

| | | | | | | | 23,635,701 | | | | 8.81 | |

Investment Banking & Brokerage | | | | | |

The Charles Schwab Corporation | | | 230,969 | | | | 6,596,475 | | | | 2.46 | |

| | | | | | | | | | | | | |

Life Sciences Tools & Services | | | | | |

Illumina, Inc.* | | | 30,456 | | | | 5,354,774 | | | | 2.00 | |

| | | | | | | | | | | | | |

Movies & Entertainment | | | | | | | | | | | | |

Imax Corporation* | | | 88,002 | | | | 2,973,587 | | | | 1.11 | |

The Walt Disney Company | | | 79,218 | | | | 8,096,080 | | | | 3.01 | |

| | | | | | | | 11,069,667 | | | | 4.12 | |

Packaged Foods & Meats | | | | | | | | | | | | |

Blue Buffalo Pet Products, Inc.* | | | 55,386 | | | | 991,963 | | | | 0.37 | |

| | | | | | | | | | | | | |

Pharmaceuticals | | | | | | | | | | | | |

Allergan PLC* | | | 27,841 | | | | 7,567,462 | | | | 2.82 | |

Concordia Healthcare Corporation | | | 54,565 | | | | 2,328,161 | | | | 0.87 | |

Endo International PLC* | | | 110,634 | | | | 7,664,724 | | | | 2.85 | |

| | | | | | | | 17,560,347 | | | | 6.54 | |

Railroads | | | | | | | | | | | | |

Canadian Pacific Railway Ltd. | | | 26,875 | | | | 3,858,444 | | | | 1.44 | |

Genesee & Wyoming, Inc. - Cl. A* | | | 22,906 | | | | 1,353,286 | | | | 0.50 | |

| | | | | | | | 5,211,730 | | | | 1.94 | |

Regional Banks | | | | | | | | | | | | |

First Republic Bank | | | 112,291 | | | | 7,048,506 | | | | 2.63 | |

| | | | | | | | | | | | | |

Restaurants | | | | | | | | | | | | |

Domino's Pizza, Inc. | | | 60,997 | | | | 6,582,186 | | | | 2.45 | |

| | | | | | | | | | | | | |

Semiconductors | | | | | | | | | | | | |

ARM Holdings PLC | | | 190,851 | | | | 2,741,997 | | | | 1.02 | |

NXP Semiconductors N.V.* | | | 89,383 | | | | 7,782,578 | | | | 2.90 | |

| | | | | | | | 10,524,575 | | | | 3.92 | |

See notes to financial statements.

19

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS (continued)

September 30, 2015

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS (continued) | |

Specialty Chemicals | | | | | | | | | |

The Sherwin-Williams Company | | | 18,748 | | | $ | 4,176,679 | | | | 1.56 | % |

| | | | | | | | | | | | | |

Systems Software | | | | | | | | | | | | |

Tableau Software, Inc. - Cl. A* | | | 19,121 | | | | 1,525,473 | | | | 0.57 | |

| | | | | | | | | | | | | |

Wireless Telecommunication Services | | | | | |

SBA Communications Corporation - Cl. A* | | | 45,185 | | | | 4,732,677 | | | | 1.76 | |

| | | | | | | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | | |

(Cost $211,741,171) | | | | | | | 247,357,176 | | | | 92.17 | |

| | | | | | | | | | | | | |

SHORT-TERM INVESTMENTS | | | | | |

State Street Institutional Treasury Money Market Fund, 0.000% | | | 21,204,689 | | | | 21,204,689 | | | | 7.90 | |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | | | | | |

(Cost $21,204,689) | | | | | | | 21,204,689 | | | | 7.90 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | | | | | |

(Cost $232,945,860) | | | | | | | 268,561,865 | | | | 100.07 | |

| | | | | | | | | | | | | |

Liabilities, Less Cash and Other Assets | | | | | | | (178,035 | ) | | | (0.07 | ) |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | $ | 268,383,830 | | | | 100.00 | % |

See notes to financial statements.

20

INTERNATIONAL OPPORTUNITIES FUND |

INVESTMENT REVIEW BY MUNISH MALHOTRA (UNAUDITED)

The Marsico International Opportunities Fund posted a total return of (US$) -1.43% for the one-year fiscal period ended September 30, 2015. For comparative purposes, the MSCI EAFE Index, which is the Fund’s benchmark index, had a total return of (US$) -8.66%. Please see the Fund Overview immediately following this commentary for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2015.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, differences in securities regulations and accounting standards, possible changes in taxation, limited public information, and other factors. In addition, the Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

Superior stock selection and an overweight allocation to the Information Technology sector were significant contributors to the International Opportunities Fund’s substantial outperformance compared to its benchmark during the period. Leading Information Technology holdings in the Fund included financial transaction processor MasterCard Inc. – Cl. A (+22%), Chinese Internet services company Tencent Holdings Ltd. (+12%), United Kingdom’s online auto classified advertising service Auto Trader Group PLC (+47%), social media platform Facebook, Inc. – Cl. A (+10%) and global financial technology services company Wirecard A.G. (+24% prior to being sold). Information Technology was a relatively strong performing area of the benchmark index, and the Fund was aided by having a significant portion of its net assets invested in the sector.

Similarly, the Fund benefitted relative to the benchmark index from good stock selection and an overweight to the Consumer Discretionary sector. United Kingdom-based pizza master-franchise company Domino’s Pizza Group PLC soared +50% on strong system sales growth in the UK market. The Fund also held a position in related company Domino’s Pizza Enterprises Ltd., which holds master franchise rights for the pizza brand in markets including Australia, New Zealand, France, Belgium, the Netherlands and Japan. Domino’s Pizza Enterprises gained +15% during the period it was held in the Fund, buoyed by strong results in its European market. Norwegian Cruise Line Holdings Ltd. (+30%), Japanese retailer Start Today Company Ltd. (+42%) and media company Liberty Global PLC – Series C (+3%) were other positive contributors in the sector.

Other individual Fund holdings having a material, positive impact on performance included Ryanair Holdings PLC Spon. ADR (+27%) and Hargreaves Lansdown PLC (+23%). European discount airline Ryanair Holdings reported strong profits and operating performance during the period. Hargreaves Lansdown’s platform, Vantage, is the United Kingdom’s largest investment and fund supermarket.

The Fund sold its sole holding in the Energy sector during the period. This aided Fund performance relative to the benchmark index, as Energy was the weakest-performing sector of the MSCI EAFE Index.

21

INTERNATIONAL OPPORTUNITIES FUND |

Although active currency management is not a central facet of the Fund’s investment process, fluctuations in major world currencies can at times affect the Fund’s performance. During the period, the net effect of currency moves was positive for the Fund. The Fund did well as compared to the benchmark index by having greater exposure to securities denominated in the US dollar, which strengthened versus most major world currencies. Additionally, the Fund’s results were positively affected by having an underweight allocation to the euro and the Australian dollar, which weakened during the period. A portion of this positive effect was offset by the Fund’s holdings in securities denominated in the Canadian dollar. The Canadian dollar, like currencies of many commodity-rich countries, weakened during the period. Canadian securities are not constituents of the benchmark index.

A number of weaker stocks in the Health Care sector were the primary detractors from Fund performance relative to its benchmark during the period. In the final weeks of the reporting period, comments by US presidential candidates led to greater concerns that legislative changes could lead to drug price controls and hamper profitability for drug manufacturers, and related attention to drug pricing contributed to a sell-off in many pharmaceutical and biotechnology company stocks. Concordia Healthcare Corporation (-44%), a biopharmaceutical company with headquarters in Canada, was among the stocks impacted. UCB S.A., a Belgium headquartered manufacturer of treatment for central nervous system disorders, declined -16% and was sold from the Fund. Novadaq Technologies, Inc., a developer of imaging technologies for surgical procedures, posted a return of -30% prior to being sold from the Fund.

From a sector allocation perspective, the Fund’s performance was held back by having very few investments in the strongest-performing sector of the benchmark index, Consumer Staples.

During the period, the Fund significantly increased its allocation to the Consumer Discretionary sector. The Fund reduced its allocations to the Industrials and Energy sectors.

The International Opportunities Fund experienced elevated portfolio turnover during the period, which primarily related to the Fund’s changing its portfolio composition to reinvest in other positions that we believe may have more upside potential and to take advantage of new opportunities. Portfolio turnover increases transaction-related expenses and could reduce Fund returns.

Fiscal Period-End Investment Posture

As of September 30, 2015, the Fund’s primary economic sector allocations included Consumer Discretionary, Information Technology, Health Care and Industrials. The Fund had no exposure to the Utilities, Telecommunication Services, Energy and Materials sectors at period-end.

In terms of country allocations, the Fund’s most significant weightings at period-end, excluding short-term investments, were the United States, the United Kingdom, China/Hong Kong, Canada, France and Australia. The Fund’s United States holdings primarily comprised multi-national companies. Country-level weightings generally should be considered a residual of the Fund’s stock selection process rather than a major, proactive facet of its investment strategy.