UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08397

THE MARSICO INVESTMENT FUND

(Exact name of registrant as specified in charter)

1200 17th Street, Suite 1600

(Address of principal executive offices)(Zip code)

Christopher J. Marsico

The Marsico Investment Fund

1200 17th Street, Suite 1600

(Name and address of agent for service)

Copies to:

Sander M. Bieber, Esq.

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant's telephone number, including area code: (303)454-5600

Date of fiscal year end: September 30

Date of reporting period: September 30, 2014

Item 1 – Reports to Stockholders.

DEAR SHAREHOLDER:

Enclosed is your annual report for The Marsico Investment Fund, encompassing the fiscal year from October 1, 2013 to September 30, 2014.

The purpose of this report is to provide a review of the Marsico Funds’ one-year investment results by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector and industry positioning, and individual stock selection – as compared to the Funds’ performance benchmark indexes. For updated information regarding the market environment and the Funds’ overall investment postures and performance, please refer to the Funds’ most recent monthly fact sheets and quarterly investment updates, which are available in the Investor Resources section of the Funds’ website at www.marsicofunds.com.(1)

NOTE REGARDING CHANGES TO THE MARSICO INVESTMENT TEAM

Effective August 22, 2014, Thomas F. Marsico, previously co-manager of the Marsico Global Fund, assumed sole portfolio manager responsibility for the Marsico Global Fund. Effective on the same date, Munish Malhotra, CFA, previously co-manager of the Marsico International Opportunities Fund, assumed sole portfolio manager responsibility for the Marsico International Opportunities Fund. On and after that date, James G. Gendelman no longer served as co-manager of either Fund.

| (1) | The references to the Marsico Funds website (www.marsicofunds.com) included throughout this annual report do not incorporate the website’s contents into this report. |

| | KEY FUND STATISTICS | 2 | |

| | MARKET ENVIRONMENT | 5 | |

| | | | |

| | |

| | Investment Review | 6 | |

| | Fund Overview | 9 | |

| | Schedule of Investments | 10 | |

| | | | |

| | |

| | Investment Review | 6 | |

| | Fund Overview | 11 | |

| | Schedule of Investments | 12 | |

| | | | |

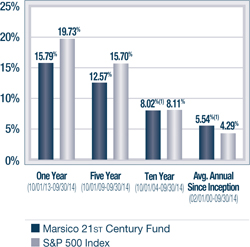

| | MARSICO 21st CENTURY FUND |

| | Investment Review | 14 | |

| | Fund Overview | 16 | |

| | Schedule of Investments | 17 | |

| | | | |

| | MARSICO INTERNATIONAL OPPORTUNITIES FUND |

| | Investment Review | 19 | |

| | Fund Overview | 21 | |

| | Schedule of Investments | 22 | |

| | | | |

| | MARSICO FLEXIBLE CAPITAL FUND |

| | Investment Review | 24 | |

| | Fund Overview | 26 | |

| | Schedule of Investments | 27 | |

| | | | |

| | |

| | Investment Review | 29 | |

| | Fund Overview | 31 | |

| | Schedule of Investments | 32 | |

| | | | |

| | FINANCIAL STATEMENTS | 34 | |

| | NOTES TO FINANCIAL STATEMENTS | 44 | |

| | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 52 | |

| | EXPENSE EXAMPLE | 53 | |

| | OTHER INFORMATION | 54 | |

| | TRUSTEE AND OFFICER INFORMATION | 55 | |

KEY FUND STATISTICS (UNAUDITED) |

Marsico Focus Fund | Marsico Growth Fund | Marsico 21st Century Fund |

| | MFOCX | | | MGRIX | | | MXXIX | |

| For additional disclosures, please see page 9. | For additional disclosures, please see page 11. | For additional disclosures, please see page 16. |

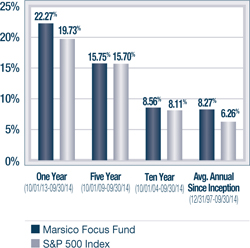

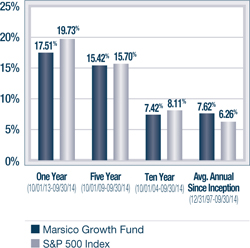

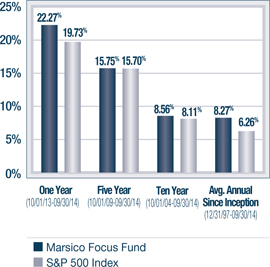

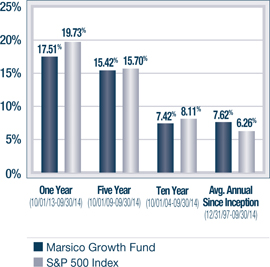

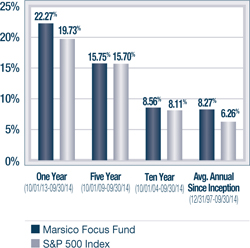

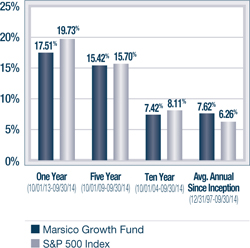

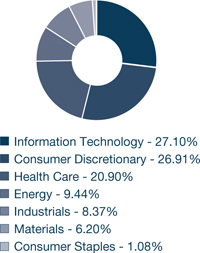

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

|  |  |

TOTAL ANNUAL OPERATING EXPENSES* 1.36% | TOTAL ANNUAL OPERATING EXPENSES* 1.37% | TOTAL ANNUAL OPERATING EXPENSES* 1.46% |

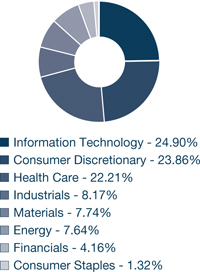

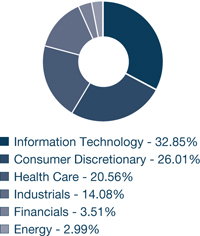

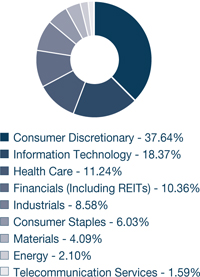

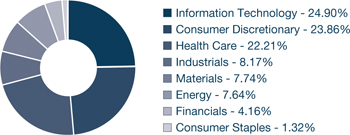

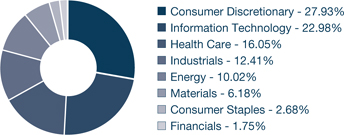

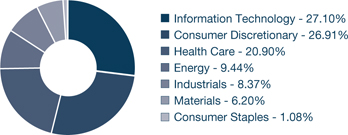

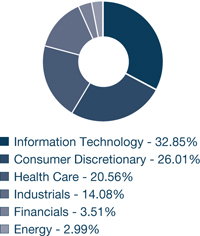

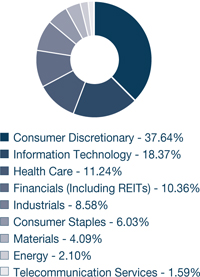

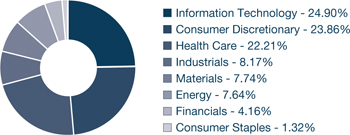

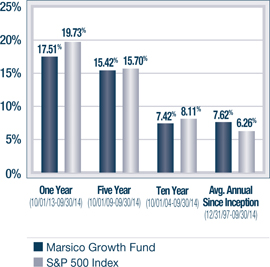

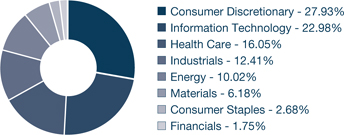

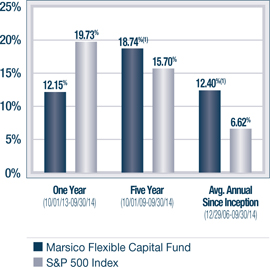

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

|  |  |

| TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

| 8.50% | | 6.63% | | 5.21% |

| 6.15% | FACEBOOK, INC. - CL. A | 5.15% | | 4.89% |

| 5.42% | CANADIAN PACIFIC RAILWAY LTD. | 4.75% | | 3.59% |

CANADIAN PACIFIC RAILWAY LTD. | 5.25% | UNION PACIFIC CORPORATION | 4.06% | SCHLUMBERGER LTD. | 3.58% |

ALIBABA GROUP HOLDING LTD. SPON. ADR | 4.15% | STARWOOD HOTELS & RESORTS WORLDWIDE, INC. | 3.88% | | 3.29% |

For additional disclosures about the Marsico Funds, please see page 4. The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

KEY FUND STATISTICS (UNAUDITED) |

Marsico International Opportunities Fund | Marsico Flexible Capital Fund | Marsico Global Fund |

| | MIOFX | | | MFCFX | | | MGLBX | |

| For additional disclosures, please see page 21. | For additional disclosures, please see page 26. | For additional disclosures, please see page 31. |

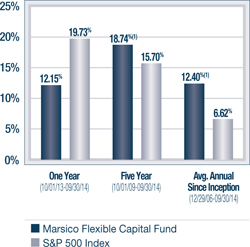

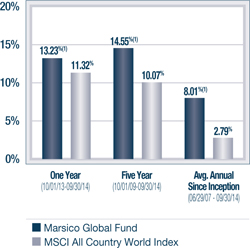

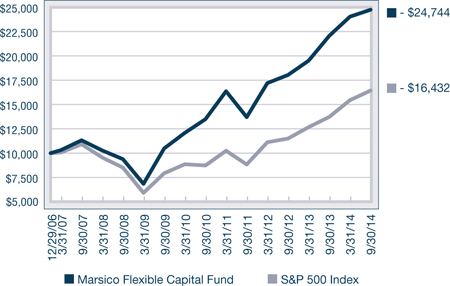

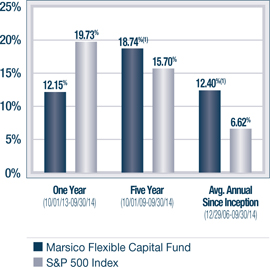

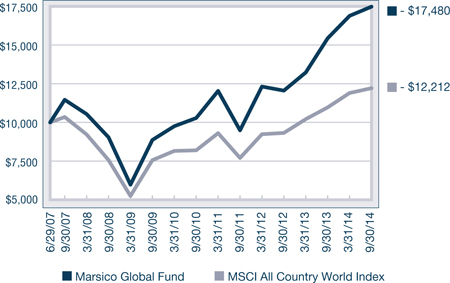

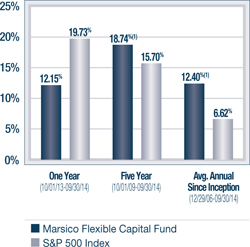

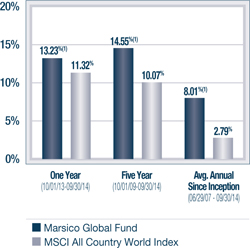

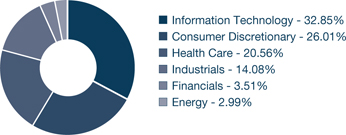

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

|  |  |

TOTAL ANNUAL OPERATING EXPENSES* 1.74% NET EXPENSES*† 1.60% | TOTAL ANNUAL OPERATING EXPENSES* 1.47% | TOTAL ANNUAL OPERATING EXPENSES* 1.86% NET EXPENSES*† 1.60% |

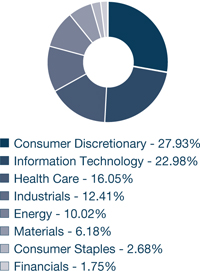

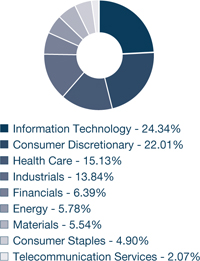

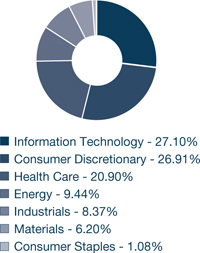

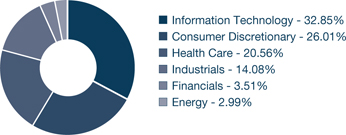

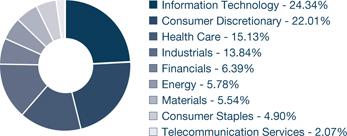

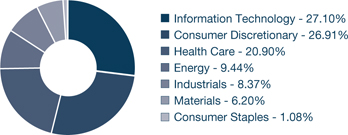

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

|  |  |

| TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

LIBERTY GLOBAL PLC - SERIES C | 4.62% | | 4.46% | | 6.86% |

CANADIAN PACIFIC RAILWAY LTD. | 4.49% | | 4.23% | CANADIAN PACIFIC RAILWAY LTD. | 5.50% |

| 4.32% | | 4.04% | | 5.20% |

| 4.00% | UNION PACIFIC CORPORATION | 4.04% | | 4.40% |

| 3.56% | | 3.77% | | 4.20% |

Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

KEY FUND STATISTICS (UNAUDITED) |

ADDITIONAL DISCLOSURES ABOUT THE MARSICO FUNDS

| * | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2014. The information may differ from the expense ratios disclosed in this report. |

| † | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of each of the International Opportunities Fund and the Global Fund (excluding interest, taxes, acquired fund fees and expenses, litigation, brokerage and extraordinary expenses) to an annual rate of 1.60% of each Fund’s average net assets until January 31, 2015. This expense limitation and fee waiver agreement may be terminated by the Adviser at any time after January 31, 2015, upon 15 days prior notice to the Fund and its administrator. The Adviser may recoup from a Fund fees previously waived or expenses previously reimbursed by the Adviser with respect to that Fund pursuant to this agreement (or a previous expense limitation agreement) if such reimbursement does not cause the Fund to exceed the expense limitation currently in effect and the reimbursement is made within three years after the year in which the Adviser waived the fee or reimbursed the expense. |

| (1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com. |

The performance included in the chart does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

The performance returns for the 21st Century Fund (for the period prior to March 31, 2004), the International Opportunities Fund (for the period prior to September 30, 2004 and from October 2011 through December 2013), the Flexible Capital Fund (for the period prior to February 1, 2011), and the Global Fund (for the period prior to January 1, 2009, from April 2009 through May 2009 and from January 2012 through September 2014) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. The performance returns for the 21st Century Fund (for the period from April 2004 through January 2005), the International Opportunities Fund (for the period from October 2004 through December 2005 and from January 2014 through September 2014), and the Global Fund (for the one-month period June 2009) would have been higher but for the reimbursement of fees waived previously.

| (2) | Sector weightings represent the percentage of the respective Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARKET ENVIRONMENT: OCTOBER 2013 – SEPTEMBER 2014 (UNAUDITED)

Global equity markets advanced to post positive returns for the one-year fiscal period that ended September 30, 2014. The rise in stock prices occurred even as investors grappled with concerns about US Federal Reserve (“Fed”) policy, slower growth in emerging markets and many developed markets, rising equity valuations, mixed US economic data and geopolitical tensions in Ukraine, sectarian violence in Iraq, and protests in Hong Kong.

Despite a string of weak job gains at the end of 2013 and a difficult winter, which were temporarily reflected in weak retail sales, construction activity and the housing market, the US economy expanded at a slow, but respectable pace during the year overall. Large capitalization US equities, as measured by the S&P 500 Index, significantly outperformed small capitalization stocks, as measured by the Russell 2000 Index. Equities of smaller capitalization stocks were under pressure during the period on concerns that valuations were stretched and that smaller companies, due to borrowing needs, may be more vulnerable to a rising interest rate environment.

International developed equity markets, as measured by the MSCI EAFE Index, posted a return that, while positive, lagged many US equity indices. Economic data in Europe and Japan was generally weak. European growth numbers remained soft as the region continued to struggle with high unemployment levels and near zero inflation. Japan’s economy, meanwhile, slowed after a large sales tax took effect in spring. China and Brazil, major players in the emerging markets, also exhibited evidence of slowdowns. Brazil showed signs of strain as inflation and consumer debt levels increased. China’s economic slowdown continued as industrial output declined and property markets slumped.

Index Name(1) | Universe of Equities Represented | One-Year Total Return |

| US | | |

| S&P 500 | US large-capitalization equities | +19.73% |

| Russell 3000 | US publicly-traded equities of all sizes | +17.76% |

| Russell 2000 | US small-capitalization equities | +3.93% |

| Russell Mid-Cap | US medium-capitalization equities | +15.83% |

Index Name(1) | Universe of Equities Represented | One-Year Total Return |

| INTERNATIONAL | |

| MSCI EAFE (US$) | Equities in developed international equity markets, including Japan, Western Europe, and Australasia | +4.25% |

| MSCI Emerging Markets (US$) | Equities in developing international equity markets, including China, India, Eastern Europe, and Latin America | +4.30% |

| MSCI ACWI (US$) | Equities in the global developed and emerging markets | +11.32% |

The one-year fiscal period ended September 30, 2014 was a volatile period for many currencies. During the period, the US dollar appreciated, reflecting better than expected news in the US, and dimming prospects in Europe and the developing world as well as other geopolitical concerns. Emerging market currencies generally sold off due to economic instability and the potential effect of the Fed’s tapering of monetary stimulus to limit flows available to emerging economies. The Japanese yen weakened as Japanese policymakers continued initiatives to end Japan’s deflation. The stronger US dollar was a mixed blessing that generally pushed oil and other commodity prices down, benefitted US consumers and manufacturers, and penalized resource producers, US exporters, and US investors in foreign markets.

THE MARSICO INVESTMENT TEAM

| (1) | All indices are unmanaged and investors cannot invest directly in an index. |

INVESTMENT REVIEW BY TOM MARSICO AND CORALIE WITTER (UNAUDITED)

The Marsico Focus Fund and the Marsico Growth Fund posted total returns of +22.27% and +17.51%, respectively, for the one-year fiscal period ended September 30, 2014. For comparative purposes, the S&P 500 Index had a total return of +19.73% over that same time period. Please see the Funds’ Overviews immediately following this commentary for more detailed information about each Fund’s longer-term performance for various periods ended September 30, 2014.

The performance data for the Funds quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Funds are intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Funds may not necessarily hold these securities or investments today. Please see the accompanying Schedules of Investments for the percentage of each Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Focus Fund is non-diversified and may hold fewer securities than a diversified fund because it is permitted to invest a greater percentage of its assets in a smaller number of securities. Holding fewer securities increases the risk that the value of the Fund could go down because of the poor performance of a single investment. The Funds are subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which they invest may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

The Focus Fund and the Growth Fund often invest in similar growth companies. Their performance may differ, however, because of a variety of factors. Among other factors, the Focus Fund is a non-diversified mutual fund that may invest in a more concentrated portfolio and may hold the securities of fewer issuers than the Growth Fund, which is a diversified Fund. As a result, the Focus Fund may hold some securities that are different from those held by the Growth Fund, and the Focus Fund may be more exposed to individual stock volatility than the Growth Fund or other mutual funds that invest in a relatively larger number of securities.

FOCUS FUND

The Marsico Focus Fund’s outperformance versus the S&P 500 Index for the one-year fiscal period ended September 30, 2014 was primarily attributable to stock selection and an overweight allocation to the Health Care sector, as defined in the Global Industry Classification Standard (“GICS”)(2). The Fund maintained significant investments in the Health Care sector given the paradigm shift that we saw taking place within the biotechnology industry. Positions in the Pharmaceuticals, Biotechnology & Life Sciences industry, such as Gilead Sciences, Inc. (+69%), Biogen Idec Inc. (+38%), and Pacira Pharmaceuticals, Inc. (+46%) were major contributors to performance. All three companies offer what we believe are innovative products with large markets, and currently appear to have compelling new product pipelines. Health Care was one of the strongest performing sectors of the S&P 500 Index during the reporting period and the Fund benefitted from having an overweight allocation to the sector.

Canadian Pacific Railway Ltd. (+68%) was the Fund’s leading holding within the Industrials sector. Despite a challenging period of harsh winter weather, the railroad continued to improve its operations and cut costs.

Stock selection in the Consumer Discretionary sector was mixed. Media holding The Walt Disney Company (+40%) and hospitality company Starwood Hotels & Resorts Worldwide, Inc. (+32%) generated strong returns. Several other holdings in the sector struggled, however. Coffee company Starbucks Corporation (-2%) experienced stock price pressure as global coffee prices rose. Athletic apparel retailer lululemon athletica, inc. (-17% prior to being sold), like many other retailers, was hurt by exceptionally harsh winter weather in a number of its core markets. Further, the company faced several challenges including supply chain issues and a change in CEO. While lululemon has a strong brand and compelling opportunities to expand into new markets, we felt it prudent to exit the position and monitor the company for evidence of its success in managing its supply chain more effectively and its new CEO’s ability to execute. The Fund sold its position in discount retailer The TJX Companies, Inc. (-8% prior to being sold) as we became concerned about the competitive retail environment. From a sector allocation standpoint, the Fund’s performance was hampered by maintaining a significant overweight allocation to the Consumer Discretionary sector, as it was a weak-performing sector of the benchmark index.

The Fund’s Information Technology holdings also posted mixed performance results. Social media company Facebook, Inc. – Cl. A soared +57% and Internet services company Google, Inc. – Cl. A rose +35%. Both companies have gained market share as advertising dollars migrate from traditional media to online. The Fund purchased Alibaba Group Holding Ltd. Spon. ADR on its September 19, 2014 initial public offering and subsequently added modestly to the position. As of September 30, Alibaba had posted a return of +30%. Alibaba is China’s largest ecommerce company. We see Alibaba as an ecosystem that aims to remove friction from the flow of commerce globally. Alibaba’s business is multi-faceted, with elements related to Internet services, online advertising, electronic commerce, payment processing, and logistics.

While several Fund holdings within the Information Technology sector posted strong gains, others generated weak performance results. Cloud-based customer relationship manager services company salesforce.com, inc. declined -6% prior to being sold from the Fund. ASML Holding N.V., a leading Dutch semiconductor equipment provider of advanced lithography systems used in chip manufacturing, posted a return of just +0.7%. ASML’s stock price weakened after announcing a delay in introducing its new extreme ultraviolet technology tools used in chip manufacturing. The Fund re-established a position in Apple, Inc. (+3%) late in the reporting period. While Apple posted a modest, positive return, its performance did not keep pace with the overall return of the benchmark index.

The Fund’s Financials holdings posted a collective return of +10% during the period. While positive, the return lagged the +19% gain of the S&P 500 Index Financials sector. Fund positions in Citigroup, Inc. (+0.8%) and American International Group, Inc. (+0.6%) posted returns that were essentially flat prior to the sale of both securities from the Fund.

During the reporting period, the Fund reduced its exposure to the Financials, Industrials, and Consumer Discretionary sectors while increasing its allocations to the Information Technology, Energy, and Health Care sectors.

GROWTH FUND

Although the Marsico Growth Fund generated a strong positive return, it underperformed the S&P 500 Index for the one-year fiscal period ended September 30, 2014.

Stock selection and an overweight allocation to the Consumer Discretionary sector detracted from performance results. Athletic apparel retailer lululemon athletica, inc. (-36% prior to being sold) was the largest individual detractor from performance during the period. As compared to the Focus Fund, the Growth Fund held its position in lululemon longer, and the Growth Fund’s performance was negatively impacted as the company’s stock price posted further declines before being sold. Discount retailer The TJX Companies, Inc. (-7% prior to being sold) and media holding CBS Corporation – Cl. B (-2%) also posted weak returns. From a sector allocation standpoint, the Growth Fund’s performance was hampered by maintaining a significant overweight allocation to the Consumer Discretionary sector, as it was a weak-performing sector of the benchmark index.

Similar to the Focus Fund, the Growth Fund’s stock selection in the Information Technology sector posted mixed results. Social networking position LinkedIn Corporation – Cl. A (-40%) declined sharply after the company lowered its growth forecast. The Fund maintained an investment in the company as we believe LinkedIn is an innovative social media platform poised to grow user engagement and better monetize its content going forward. Apple, Inc. (+3%) and semiconductor company ASML Holding N.V. (+7%) posted modest positive returns that trailed the performance of the benchmark index. A portion of the negative stock selection effect was offset by strong performance of other Fund technology holdings, including Facebook, Inc. – Cl. A (+57%) and Google, Inc. – Cl. A (+35%). Like the Focus Fund, the Growth Fund purchased Alibaba Group Holding Ltd. Spon. ADR at the company’s IPO and subsequently added slightly to the position. Alibaba’s return to the Fund was +30% as of period end.

Also like the Focus Fund, the Growth Fund’s stock selection in the Financials sector was weak. Citigroup, Inc. (-0.2%) and American International Group, Inc. (-0.3%) posted modest negative returns prior to being sold from the Fund.

FOCUS FUND & GROWTH FUND

The Growth Fund’s Materials holdings posted a collective return of +16% during the period. While positive, the return lagged the +20% gain of the S&P 500 Index Materials sector. Agricultural materials holding Monsanto Company (+9%) produced a positive return, but was the primary detractor within the sector.

There were several areas of strength for the Fund during the period. The Fund’s Health Care positions, particularly Gilead Sciences, Inc. (+70%) and Biogen Idec Inc. (+38%) aided performance. Gilead’s newly launched hepatitis C therapy, Sovaldi, experienced strong sales during the period. Biogen’s stock price rose on strong performance of its new Multiple Sclerosis treatment, Tecfidera.

Within the Industrials sector, the Fund’s railroad operator positions in Canadian Pacific Railway Ltd. (+69%) and Union Pacific Corporation (+42%) were material contributors to performance.

The Fund’s stock selection and positioning in the Consumer Staples sector further aided performance. The Fund benefitted from having few investments in Consumer Staples, as it was a weaker-performing sector of the benchmark index. The Fund further benefitted from stock selection within that sector. Keurig Green Mountain, Inc. soared +71% during the period. The company’s stock price rose sharply on the company’s announcement of a partnership with Coca-Cola.

From a sector allocation standpoint, during the fiscal period, the Fund increased its exposure to the Energy, Information Technology, Health Care, and Consumer Staples sectors while reducing its exposure to Financials, Industrials, Consumer Discretionary, and Materials.

Fiscal Period-End Investment Posture

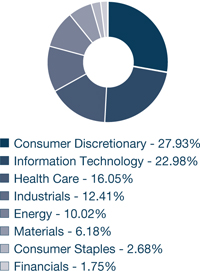

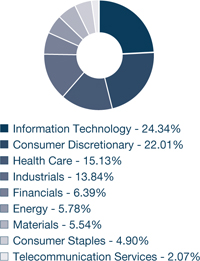

As of September 30, 2014, the Focus Fund’s and the Growth Fund’s largest sector allocations included Consumer Discretionary, Information Technology, Health Care, Industrials, Energy, and Materials. The Funds had no exposure to the Utilities or Telecommunication Services sectors.

Sincerely,

THOMAS F. MARSICO

CORALIE T. WITTER, CFA

PORTFOLIO MANAGERS

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Please see the Prospectus for more information. |

| (2) | Regarding GICS data cited throughout this report, the Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by Marsico Capital Management, LLC (the “Adviser”). Neither MSCI, S&P, nor the Adviser or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, the Adviser, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

September 30, 2014 (Unaudited)

The Focus Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Fund will normally hold a core position of between 20 and 35 common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* 1.36% | NET ASSETS $933,054,313 | NET ASSET VALUE PER SHARE $22.41 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

|  |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | |

| GILEAD SCIENCES, INC. | 8.50% |

| FACEBOOK, INC. - CL. A | 6.15% |

| BIOGEN IDEC INC. | 5.42% |

| CANADIAN PACIFIC RAILWAY LTD. | 5.25% |

| ALIBABA GROUP HOLDING LTD. SPON. ADR | 4.15% |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2014 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| (1) | This chart assumes an initial investment of $10,000 made on September 30, 2004. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO FOCUS FUND

SCHEDULE OF INVESTMENTS

September 30, 2014

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| General Dynamics Corporation | | | 187,024 | | | $ | 23,768,880 | | | | 2.55 | % |

| | | | | | | | | | | | | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Tesla Motors, Inc.* | | | 90,693 | | | | 22,009,377 | | | | 2.36 | |

| | | | | | | | | | | | | |

| Biotechnology | | | | | | | | | | | | |

| Biogen Idec Inc.* | | | 152,797 | | | | 50,546,775 | | | | 5.42 | |

| Celgene Corporation* | | | 206,849 | | | | 19,605,148 | | | | 2.10 | |

| Gilead Sciences, Inc.* | | | 745,008 | | | | 79,306,102 | | | | 8.50 | |

| | | | | | | | 149,458,025 | | | | 16.02 | |

| Cable & Satellite | | | | | | | | | | | | |

| Comcast Corporation - Cl. A | | | 662,186 | | | | 35,612,363 | | | | 3.82 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 177,601 | | | | 33,225,595 | | | | 3.56 | |

| | | | | | | | | | | | | |

| Consumer Finance | | | | | | | | | | | | |

| American Express Company | | | 195,575 | | | | 17,120,636 | | | | 1.83 | |

| | | | | | | | | | | | | |

| Data Processing & Outsourced Services | | | | | |

| Visa, Inc. - Cl. A | | | 175,854 | | | | 37,521,968 | | | | 4.02 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | |

| Monsanto Company | | | 316,420 | | | | 35,600,414 | | | | 3.81 | |

| | | | | | | | | | | | | |

| Footwear | | | | | | | | | | | | |

| NIKE, Inc. - Cl. B | | | 228,106 | | | | 20,347,055 | | | | 2.18 | |

| | | | | | | | | | | | | |

| Health Care Facilities | | | | | | | | | | | | |

| HCA Holdings, Inc.* | | | 408,888 | | | | 28,834,782 | | | | 3.09 | |

| | | | | | | | | | | | | |

| Hotels, Resorts & Cruise Lines | | | | | | | | | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 433,830 | | | | 36,098,994 | | | | 3.87 | |

| | | | | | | | | | | | | |

| Internet Software & Services | | | | | | | | | |

| Alibaba Group Holding Ltd. Spon. ADR* | | | 435,180 | | | | 38,665,743 | | | | 4.15 | |

| Facebook, Inc. - Cl. A* | | | 726,283 | | | | 57,405,408 | | | | 6.15 | |

| Google, Inc. - Cl. A* | | | 48,200 | | | | 28,361,362 | | | | 3.04 | |

| LinkedIn Corporation - Cl. A* | | | 21,129 | | | | 4,390,395 | | | | 0.47 | |

| | | | | | | | 128,822,908 | | | | 13.81 | |

| Investment Banking & Brokerage | | | | | | | | | |

| The Charles Schwab Corporation | | | 679,523 | | | | 19,971,181 | | | | 2.14 | |

| | | | | | | | | | | | | |

| Movies & Entertainment | | | | | | | | | | | | |

| The Walt Disney Company | | | 429,830 | | | | 38,267,765 | | | | 4.10 | |

| | | | | | | | | | | | | |

| Oil & Gas Equipment & Services | | | | | | | | | |

| Halliburton Company | | | 254,510 | | | | 16,418,440 | | | | 1.76 | |

| Schlumberger Ltd. | | | 297,815 | | | | 30,284,808 | | | | 3.24 | |

| | | | | | | | 46,703,248 | | | | 5.00 | |

COMMON STOCKS (continued) | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | |

| Continental Resources, Inc.* | | | 320,150 | | | $ | 21,283,572 | | | | 2.28 | % |

| | | | | | | | | | | | | |

| Packaged Foods & Meats | | | | | | | | | | | | |

| Keurig Green Mountain, Inc. | | | 90,138 | | | | 11,729,658 | | | | 1.26 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Pacira Pharmaceuticals, Inc.* | | | 200,969 | | | | 19,477,916 | | | | 2.09 | |

| | | | | | | | | | | | | |

| Railroads | | | | | | | | | | | | |

| Canadian Pacific Railway Ltd. | | | 235,973 | | | | 48,957,318 | | | | 5.25 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Starbucks Corporation | | | 356,287 | | | | 26,885,417 | | | | 2.88 | |

| | | | | | | | | | | | | |

| Semiconductor Equipment | | | | | | | | | | | | |

| ASML Holding N.V. | | | 206,645 | | | | 20,420,659 | | | | 2.19 | |

| | | | | | | | | | | | | |

| Specialty Chemicals | | | | | | | | | | | | |

| The Sherwin-Williams Company | | | 152,043 | | | | 33,295,897 | | | | 3.57 | |

| | | | | | | | | | | | | |

| Technology Hardware, Storage & Peripherals | | | | | |

| Apple, Inc. | | | 346,776 | | | | 34,937,682 | | | | 3.74 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $602,803,342) | | | | | | | 890,351,310 | | | | 95.42 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | |

| State Street Institutional U.S. Government Money Market Fund, 0.000% | | | 44,200,875 | | | | 44,200,875 | | | | 4.74 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | |

| (Cost $44,200,875) | | | | | | | 44,200,875 | | | | 4.74 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $647,004,217) | | | | | | | 934,552,185 | | | | 100.16 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (1,497,872 | ) | | | (0.16 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 933,054,313 | | | | 100.00 | % |

See notes to financial statements.

September 30, 2014 (Unaudited)

The Growth Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Growth Fund will normally hold a core position of between 35 and 50 common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* 1.37% | NET ASSETS $562,653,045 | NET ASSET VALUE PER SHARE $23.63 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

|  |

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | |

| GILEAD SCIENCES, INC. | 6.63% |

| FACEBOOK, INC. - CL. A | 5.15% |

| CANADIAN PACIFIC RAILWAY LTD. | 4.75% |

| UNION PACIFIC CORPORATION | 4.06% |

| STARWOOD HOTELS & RESORTS WORLDWIDE, INC. | 3.88% |

GROWTH FUND OVERVIEW

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2014 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| (1) | This chart assumes an initial investment of $10,000 made on September 30, 2004. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO GROWTH FUND

SCHEDULE OF INVESTMENTS

September 30, 2014

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| General Dynamics Corporation | | | 118,615 | | | $ | 15,074,780 | | | | 2.68 | % |

| | | | | | | | | | | | | |

| Airlines | | | | | | | | | | | | |

| Delta Air Lines, Inc. | | | 71,722 | | | | 2,592,750 | | | | 0.46 | |

| | | | | | | | | | | | | |

| Auto Parts & Equipment | | | | | | | | | | | | |

| Delphi Automotive PLC | | | 84,483 | | | | 5,182,187 | | | | 0.92 | |

| | | | | | | | | | | | | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Tesla Motors, Inc.* | | | 56,067 | | | | 13,606,340 | | | | 2.42 | |

| | | | | | | | | | | | | |

| Biotechnology | | | | | | | | | | | | |

| Biogen Idec Inc.* | | | 54,734 | | | | 18,106,555 | | | | 3.22 | |

| Celgene Corporation* | | | 122,322 | | | | 11,593,679 | | | | 2.06 | |

| Gilead Sciences, Inc.* | | | 350,638 | | | | 37,325,415 | | | | 6.63 | |

| | | | | | | | 67,025,649 | | | | 11.91 | |

| Broadcasting | | | | | | | | | | | | |

| CBS Corporation - Cl. B | | | 330,625 | | | | 17,688,437 | | | | 3.14 | |

| | | | | | | | | | | | | |

| Cable & Satellite | | | | | | | | | | | | |

| Comcast Corporation - Cl. A | | | 314,486 | | | | 16,913,057 | | | | 3.01 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 99,152 | | | | 18,549,356 | | | | 3.30 | |

| | | | | | | | | | | | | |

| Data Processing & Outsourced Services | | | | | |

| FleetCor Technologies, Inc.* | | | 40,251 | | | | 5,720,472 | | | | 1.02 | |

| Visa, Inc. - Cl. A | | | 85,166 | | | | 18,171,869 | | | | 3.23 | |

| | | | | | | | 23,892,341 | | | | 4.25 | |

| Drug Retail | | | | | | | | | | | | |

| CVS Caremark Corporation | | | 110,540 | | | | 8,797,879 | | | | 1.56 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | |

| Monsanto Company | | | 150,021 | | | | 16,878,863 | | | | 3.00 | |

| | | | | | | | | | | | | |

| Footwear | | | | | | | | | | | | |

| NIKE, Inc. - Cl. B | | | 140,894 | | | | 12,567,745 | | | | 2.23 | |

| | | | | | | | | | | | | |

| Health Care Facilities | | | | | | | | | | | | |

| HCA Holdings, Inc.* | | | 211,290 | | | | 14,900,171 | | | | 2.65 | |

| | | | | | | | | | | | | |

| Hotels, Resorts & Cruise Lines | | | | | | | | | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 262,096 | | | | 21,809,008 | | | | 3.88 | |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| The Priceline Group, Inc.* | | | 10,939 | | | | 12,673,707 | | | | 2.25 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | | | | | |

| Internet Software & Services | | | | | | | | | |

| Alibaba Group Holding Ltd. Spon. ADR* | | | 187,701 | | | $ | 16,677,234 | | | | 2.96 | % |

| Facebook, Inc. - Cl. A* | | | 366,201 | | | | 28,944,527 | | | | 5.15 | |

| Google, Inc. - Cl. A* | | | 25,941 | | | | 15,263,944 | | | | 2.71 | |

| Google, Inc. - Cl. C* | | | 9,213 | | | | 5,319,217 | | | | 0.95 | |

| LinkedIn Corporation - Cl. A* | | | 13,052 | | | | 2,712,075 | | | | 0.48 | |

| | | | | | | | 68,916,997 | | | | 12.25 | |

| Investment Banking & Brokerage | | | | | | | | | |

| The Charles Schwab Corporation | | | 322,208 | | | | 9,469,693 | | | | 1.68 | |

| | | | | | | | | | | | | |

| Movies & Entertainment | | | | | | | | | | | | |

| The Walt Disney Company | | | 217,708 | | | | 19,382,543 | | | | 3.44 | |

| | | | | | | | | | | | | |

| Oil & Gas Equipment & Services | | | | | | | | | |

| Halliburton Company | | | 195,051 | | | | 12,582,740 | | | | 2.24 | |

| Schlumberger Ltd. | | | 206,580 | | | | 21,007,120 | | | | 3.73 | |

| | | | | | | | 33,589,860 | | | | 5.97 | |

| Oil & Gas Exploration & Production | | | | | | | | | |

| Antero Resources Corporation* | | | 161,286 | | | | 8,852,989 | | | | 1.57 | |

| Continental Resources, Inc.* | | | 109,806 | | | | 7,299,903 | | | | 1.30 | |

| EOG Resources, Inc. | | | 24,670 | | | | 2,442,823 | | | | 0.43 | |

| Pioneer Natural Resources Company | | | 10,693 | | | | 2,106,200 | | | | 0.38 | |

| | | | | | | | 20,701,915 | | | | 3.68 | |

| Packaged Foods & Meats | | | | | | | | | | | | |

| Keurig Green Mountain, Inc. | | | 43,759 | | | | 5,694,359 | | | | 1.01 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Pacira Pharmaceuticals, Inc.* | | | 51,526 | | | | 4,993,900 | | | | 0.89 | |

| | | | | | | | | | | | | |

| Railroads | | | | | | | | | | | | |

| Canadian Pacific Railway Ltd. | | | 128,813 | | | | 26,724,833 | | | | 4.75 | |

| Union Pacific Corporation | | | 210,724 | | | | 22,846,696 | | | | 4.06 | |

| | | | | | | | 49,571,529 | | | | 8.81 | |

| Restaurants | | | | | | | | | | | | |

| Starbucks Corporation | | | 171,234 | | | | 12,921,318 | | | | 2.30 | |

| | | | | | | | | | | | | |

| Semiconductor Equipment | | | | | | | | | | | | |

| ASML Holding N.V. | | | 119,045 | | | | 11,764,027 | | | | 2.09 | |

| | | | | | | | | | | | | |

| Specialty Chemicals | | | | | | | | | | | | |

| The Sherwin-Williams Company | | | 75,901 | | | | 16,621,560 | | | | 2.95 | |

| | | | | | | | | | | | | |

| Technology Hardware, Storage & Peripherals | | | | | |

| Apple, Inc. | | | 197,765 | | | | 19,924,824 | | | | 3.54 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $371,088,208) | | | | | | | 541,704,795 | | | | 96.27 | |

See notes to financial statements.

| | | | Number of Shares | | | | Value | | | | Percent of Net Assets | |

| SHORT-TERM INVESTMENTS | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund, 0.000% | | | 20,568,469 | | | $ | 20,568,469 | | | | 3.66 | % |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | |

| (Cost $20,568,469) | | | | | | | 20,568,469 | | | | 3.66 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $391,656,677) | | | | | | | 562,273,264 | | | | 99.93 | |

| | | | | | | | | | | | | |

| Cash and Other Assets, Less Liabilities | | | | | | | 379,781 | | | | 0.07 | |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 562,653,045 | | | | 100.00 | % |

See notes to financial statements.

INVESTMENT REVIEW BY BRANDON GEISLER (UNAUDITED)

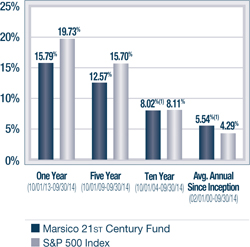

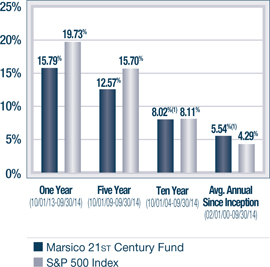

The Marsico 21st Century Fund posted a return of +15.79% for the one-year fiscal period ended September 30, 2014. While the Fund registered a solid gain, it underperformed the S&P 500 Index, which we consider to be the Fund’s primary benchmark index and which had a total return of +19.73% over the same time period. The Russell 3000 Index, a proxy for the performance of all publicly-traded US equity securities including smaller capitalization companies (which may be a useful comparison in light of the Fund’s ability to invest across the entire market capitalization spectrum), had a total return of +17.76% for the fiscal period. Please see the Fund Overview immediately following this commentary for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2014.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

Stock selection in a few sectors and variations from certain benchmark sector weightings detracted from the Fund’s performance for the one-year fiscal period ended September 30, 2014.

Consumer Discretionary was a relatively weak-performing sector of the benchmark S&P 500 Index with a return of +12%, and Fund performance was hampered by having more than 22% of the Fund’s net assets, on average, invested in the sector. The Fund’s holdings within the sector gained +0.9% and significantly underperformed the benchmark index sector return. Lululemon athletica, inc., an athletic apparel company, for example, faced several challenges during the period, including a change in its CEO. The stock declined -34% prior to being sold from the Fund. Retailing companies generally struggled during the period as extremely harsh winter weather led to fewer shoppers visiting stores. Fund positions LKQ Corporation, an auto parts retailer (-21%), Ulta Salon, Cosmetics & Fragrance, Inc. (-26% prior to being sold) and Lumber Liquidators Holdings, Inc. (-46% prior to being sold) each were material detractors from Fund performance.

Stock selection in the Industrials sector detracted from performance. DigitalGlobe, Inc., a provider of commercial earth imagery services, posted a return of ‑29% prior to being sold. Information services company Verisk Analytics, Inc. – Cl. A (-4% prior to being sold) also had a negative impact on performance results. Railroad operator Genessee & Wyoming, Inc. – Cl. A rose +2%; while positive, the company’s stock price return did not keep pace with the overall benchmark index return.

Several of the Fund’s Financials and Materials holdings struggled. Real estate company Realogy Holdings Corp. (-41% prior to being sold) and First Republic Bank (-0.8%) were weak-performing Financials positions. Within the Materials sector, agricultural products provider Monsanto Company posted a return of +9% which, though positive, significantly trailed the +20% return of the S&P 500 Index Materials sector return.

Stock selection in the Information Technology sector yielded mixed results. Social networking company holding LinkedIn Corporation – Cl. A (-13%) and semiconductor equipment companies ARM Holdings PLC (-1% prior to being sold) and ASML Holding N.V. (+3%) each detracted from performance as compared to the S&P 500 Index. Meanwhile, several of the Fund’s Internet services holdings performed well. Social media company Facebook, Inc. – Cl. A (+58%), European payment processor Wirecard A.G. (+35% prior to being sold), and Internet search and advertising company Google, Inc. – Cl. A (+35%) were among the Fund’s best performing positions. The Fund purchased shares of China’s biggest online commerce company, Alibaba Group Holding Ltd. Spon. ADR, at its IPO and later added to the position. The company’s return to the Fund was +31% as of September 30, 2014.

Stock selection within the Health Care sector was beneficial to performance. Biotechnology companies Gilead Sciences, Inc. (+71%), Biogen Idec Inc. (+38%) and Incyte Corporation Ltd. (+36% prior to being sold) each registered significant stock price gains.

The Fund’s Consumer Staples holdings also performed well. Beverage companies Keurig Green Mountain, Inc. (+74%) and Constellation Brands, Inc. – Cl. A (+52%) were among the Fund’s strongest-performing holdings.

Other individual holdings that performed well included media company The Walt Disney Company (+39%) and casino operator Wynn Resorts Ltd. (+24%).

During the reporting period, the Fund increased its investments in the Information Technology, Telecommunication Services, Energy, and Health Care sectors and trimmed its exposure to the Consumer Discretionary, Industrials, and Materials sectors.

Fiscal Period-End Investment Posture

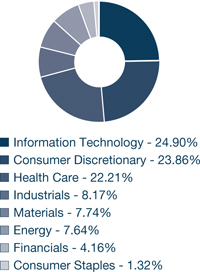

As of September 30, 2014, the Fund’s primary economic sector allocations included Information Technology, Consumer Discretionary, Health Care, and Industrials. The Fund had no investments in the Utilities sector.

Sincerely,

BRANDON A. GEISLER

PORTFOLIO MANAGER

21st CENTURY FUND

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. For the period prior to March 31, 2004, the performance returns for the 21st Century Fund reflect a fee waiver in effect; in the absence of such a waiver, the returns would have been reduced. For the period from April 2004 through January 2005, performance returns for the 21st Century Fund would have been higher but for the reimbursement of fees waived previously. Please see the Prospectus for more information. |

21ST CENTURY FUND OVERVIEW |

September 30, 2014 (Unaudited)

The 21st Century Fund invests primarily in common stocks that are selected for their long-term growth potential. The Fund may invest in companies of any size, and will normally hold a core position of between 35 and 60 common stocks.

| TOTAL ANNUAL OPERATING EXPENSES* 1.46% | NET ASSETS $316,293,021 | NET ASSET VALUE PER SHARE $20.90 |

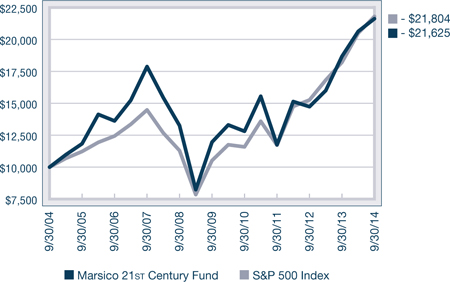

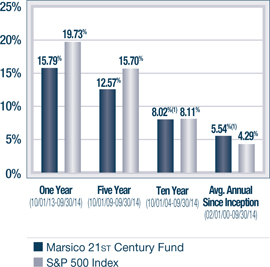

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

|  |

SECTOR ALLOCATION(3) | TOP FIVE HOLDINGS |

| | |

| FACEBOOK, INC. - CL. A | 5.21% |

| GILEAD SCIENCES, INC. | 4.89% |

| BIOGEN IDEC INC. | 3.59% |

| SCHLUMBERGER LTD. | 3.58% |

| THE WALT DISNEY COMPANY | 3.29% |

| * | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2014 and may differ from the expense ratio disclosed in this report. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| (1) | The performance returns for the 21st Century Fund (for the period prior to March 31, 2004) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. For the period from April 2004 through January 2005, performance returns for the 21st Century Fund would be higher but for the reimbursement of fees waived previously. |

| (2) | This chart assumes an initial investment of $10,000 made on September 30, 2004. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (3) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS

September 30, 2014

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| BE Aerospace, Inc.* | | | 67,398 | | | $ | 5,657,388 | | | | 1.79 | % |

| General Dynamics Corporation | | | 66,486 | | | | 8,449,706 | | | | 2.67 | |

| | | | | | | | 14,107,094 | | | | 4.46 | |

| Airlines | | | | | | | | | | | | |

| Delta Air Lines, Inc. | | | 89,417 | | | | 3,232,424 | | | | 1.02 | |

| | | | | | | | | | | | | |

| Apparel, Accessories & Luxury Goods | | | | | |

| Under Armour, Inc. - Cl. A* | | | 23,199 | | | | 1,603,051 | | | | 0.51 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| Mobileye N.V.* | | | 29,029 | | | | 1,555,664 | | | | 0.49 | |

| salesforce.com, inc.* | | | 110,821 | | | | 6,375,532 | | | | 2.02 | |

| Workday, Inc. - Cl. A* | | | 29,864 | | | | 2,463,780 | | | | 0.78 | |

| | | | | | | | 10,394,976 | | | | 3.29 | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Tesla Motors, Inc.* | | | 13,168 | | | | 3,195,610 | | | | 1.01 | |

| | | | | | | | | | | | | |

| Biotechnology | | | | | | | | | | | | |

| Alexion Pharmaceuticals, Inc.* | | | 27,032 | | | | 4,482,446 | | | | 1.42 | |

| Alkermes PLC* | | | 79,249 | | | | 3,397,405 | | | | 1.07 | |

| Biogen Idec Inc.* | | | 34,343 | | | | 11,361,008 | | | | 3.59 | |

| Gilead Sciences, Inc.* | | | 145,298 | | | | 15,466,972 | | | | 4.89 | |

| | | | | | | | 34,707,831 | | | | 10.97 | |

| Cable & Satellite | | | | | | | | | | | | |

| Comcast Corporation - Cl. A | | | 94,639 | | | | 5,089,685 | | | | 1.61 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| Wynn Resorts Ltd. | | | 47,023 | | | | 8,797,063 | | | | 2.78 | |

| | | | | | | | | | | | | |

| Data Processing & Outsourced Services | | | | | |

| FleetCor Technologies, Inc.* | | | 52,084 | | | | 7,402,178 | | | | 2.34 | |

| MasterCard, Inc. - Cl. A | | | 92,893 | | | | 6,866,651 | | | | 2.17 | |

| | | | | | | | 14,268,829 | | | | 4.51 | |

| Distillers & Vintners | | | | | | | | | | | | |

| Constellation Brands, Inc. - Cl. A* | | | 107,637 | | | | 9,381,641 | | | | 2.97 | |

| | | | | | | | | | | | | |

| Distributors | | | | | | | | | | | | |

| LKQ Corporation* | | | 181,055 | | | | 4,814,252 | | | | 1.52 | |

| | | | | | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | | |

| Monsanto Company | | | 70,415 | | | | 7,922,392 | | | | 2.50 | |

| | | | | | | | | | | | | |

| Footwear | | | | | | | | | | | | |

| Deckers Outdoor Corporation* | | | 28,621 | | | | 2,781,389 | | | | 0.88 | |

| | | | | | | | | | | | | |

| Health Care Services | | | | | | | | | | | | |

| Envision Healthcare Holdings, Inc.* | | | 186,603 | | | | 6,471,392 | | | | 2.05 | |

| | | | | | | | | | | | | |

| Hotels, Resorts & Cruise Lines | | | | | | | | | |

| Hilton Worldwide Holdings, Inc.* | | | 259,795 | | | | 6,398,751 | | | | 2.02 | |

| | | | | | | | | | | | | |

COMMON STOCKS (continued) | | | | | |

| Human Resource & Employment Services | | | | | |

| Robert Half International, Inc. | | | 97,423 | | | $ | 4,773,727 | | | | 1.51 | % |

| | | | | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| TripAdvisor, Inc.* | | | 70,923 | | | | 6,483,781 | | | | 2.05 | |

| | | | | | | | | | | | | |

| Internet Software & Services | | | | | | | | | |

| Alibaba Group Holding Ltd. Spon. ADR* | | | 91,525 | | | | 8,131,996 | | | | 2.57 | |

| CoStar Group, Inc.* | | | 14,127 | | | | 2,197,313 | | | | 0.69 | |

| Facebook, Inc. - Cl. A* | | | 208,277 | | | | 16,462,214 | | | | 5.21 | |

| Google, Inc. - Cl. A* | | | 10,229 | | | | 6,018,846 | | | | 1.90 | |

| Google, Inc. - Cl. C* | | | 2,844 | | | | 1,642,012 | | | | 0.52 | |

| LinkedIn Corporation - Cl. A* | | | 42,021 | | | | 8,731,544 | | | | 2.76 | |

| | | | | | | | 43,183,925 | | | | 13.65 | |

| Investment Banking & Brokerage | | | | | | | | | |

| Morgan Stanley | | | 213,388 | | | | 7,376,823 | | | | 2.33 | |

| The Charles Schwab Corporation | | | 182,131 | | | | 5,352,830 | | | | 1.69 | |

| | | | | | | | 12,729,653 | | | | 4.02 | |

| Movies & Entertainment | | | | | | | | | | | | |

| The Walt Disney Company | | | 116,741 | | | | 10,393,451 | | | | 3.29 | |

| Time Warner, Inc. | | | 105,344 | | | | 7,922,922 | | | | 2.50 | |

| | | | | | | | 18,316,373 | | | | 5.79 | |

| Oil & Gas Equipment & Services | | | | | | | | | |

| Schlumberger Ltd. | | | 111,232 | | | | 11,311,182 | | | | 3.58 | |

| | | | | | | | | | | | | |

| Oil & Gas Exploration & Production | | | | | | | | | |

| Antero Resources Corporation* | | | 116,000 | | | | 6,367,240 | | | | 2.01 | |

| | | | | | | | | | | | | |

| Packaged Foods & Meats | | | | | | | | | | | | |

| Keurig Green Mountain, Inc. | | | 43,015 | | | | 5,597,542 | | | | 1.77 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Salix Pharmaceuticals Ltd.* | | | 32,596 | | | | 5,092,799 | | | | 1.61 | |

| | | | | | | | | | | | | |

| Railroads | | | | | | | | | | | | |

| Genesee & Wyoming, Inc. - Cl. A* | | | 95,219 | | | | 9,075,323 | | | | 2.87 | |

| | | | | | | | | | | | | |

| Regional Banks | | | | | | | | | | | | |

| City National Corporation | | | 44,806 | | | | 3,390,470 | | | | 1.07 | |

| First Republic Bank | | | 69,133 | | | | 3,413,788 | | | | 1.08 | |

| | | | | | | | 6,804,258 | | | | 2.15 | |

| Research & Consulting Services | | | | | | | | | |

| IHS, Inc. - Cl. A* | | | 50,800 | | | | 6,359,652 | | | | 2.01 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Domino's Pizza, Inc. | | | 68,596 | | | | 5,279,148 | | | | 1.67 | |

| Dunkin' Brands Group, Inc. | | | 66,740 | | | | 2,991,287 | | | | 0.95 | |

| | | | | | | | 8,270,435 | | | | 2.62 | |

| Semiconductor Equipment | | | | | | | | | | | | |

| ASML Holding N.V. | | | 82,489 | | | | 8,151,563 | | | | 2.58 | |

See notes to financial statements.

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS (continued)

September 30, 2014

| | | | Number of Shares | | | | Value | | | | Percent of Net Assets | |

COMMON STOCKS (continued) | | | | | | | | | |

| Specialty Chemicals | | | | | | | | | | | | |

| The Sherwin-Williams Company | | | 41,260 | | | $ | 9,035,527 | | | | 2.86 | % |

| | | | | | | | | | | | | |

| Trading Companies & Distributors | | | | | | | | | |

| Fastenal Company | | | 106,326 | | | | 4,774,037 | | | | 1.51 | |

| | | | | | | | | | | | | |

| Wireless Telecommunication Services | | | | | |

| SBA Communications Corporation - Cl. A* | | | 57,113 | | | | 6,333,832 | | | | 2.00 | |

| | | | | | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $221,174,130) | | | | | | | 305,827,229 | | | | 96.69 | |

| | | | | | | | | | | | | |

| SHORT-TERM INVESTMENTS | | | | | | | | | |

| State Street Institutional Treasury Money Market Fund, 0.000% | | | 15,097,485 | | | | 15,097,485 | | | | 4.77 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | |

| (Cost $15,097,485) | | | | | | | 15,097,485 | | | | 4.77 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS | | | | | | | | | | | | |

| (Cost $236,271,615) | | | | | | | 320,924,714 | | | | 101.46 | |

| | | | | | | | | | | | | |

| Liabilities, Less Cash and Other Assets | | | | | | | (4,631,693 | ) | | | (1.46 | ) |

| | | | | | | | | | | | | |

| NET ASSETS | | | | | | $ | 316,293,021 | | | | 100.00 | % |

SCHEDULE OF INVESTMENTS

See notes to financial statements.

INTERNATIONAL OPPORTUNITIES FUND |

INVESTMENT REVIEW BY MUNISH MALHOTRA (UNAUDITED)

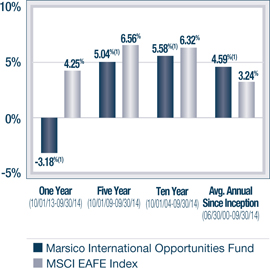

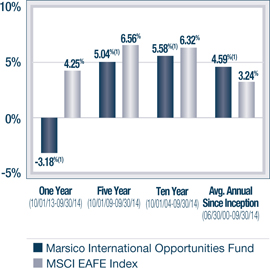

The Marsico International Opportunities Fund posted a total return of (US$) -3.18% for the one-year fiscal period ended September 30, 2014. The Fund underperformed the MSCI EAFE Index, which we consider to be the Fund’s benchmark index and which had a total return of (US$) +4.25%. Please see the Fund Overview immediately following this commentary for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2014.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.(1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our views on all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, differences in securities regulations and accounting standards, possible changes in taxation, limited public information, and other factors. In addition, the Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

Stock selection and an overweight allocation to the Consumer Discretionary sector, a weak-performing sector of the benchmark MSCI EAFE Index, detracted from Fund performance. Athletic apparel companies lululemon athletica, inc. and Adidas A.G. declined -36% and -24%, respectively, prior to the sale of both securities from the Fund. Several other Consumer Discretionary positions posted significant stock price declines, including casino operator Sands China Ltd.

(-23% prior to being sold) and Japanese online retailer Start Today Company Ltd. (-22%).

Within the Consumer Staples sector, French alcoholic beverage company Remy Cointreau S.A. (-26%) and Jeronimo Martins SGPS, S.A., a leading food distributor in Poland and Portugal (-25%), were primary detractors. Both positions were sold during the period.

The Fund’s performance was also adversely affected by stock selection in the Information Technology and Financials sectors. Several of the Fund’s Internet services investments posted negative returns. European data center provider Telecity Group PLC (-25% prior to being sold) and Latin American ecommerce company MercadoLibre, Inc. (-29% prior to being sold) each had a material, negative effect on performance. Semiconductor equipment company ARM Holdings PLC (-6%) was another detractor within the sector. Primary detractors in the Financials sector were Brazilian real estate company BR Malls Participacoes S.A. (-28% prior to being sold) and Italian asset management company Azimut Holding S.p.A. (-26%).

Certain individual Fund holdings had a material, positive effect on performance. Railroad operator Canadian Pacific Railway Ltd. gained +69% as the company continued to improve its operations and cut costs. Biotechnology company Gilead Sciences, Inc. rose +41%, aided by strong sales of Sovaldi, its new treatment for hepatitis C. Indian multinational automotive company Tata Motors Ltd. ADR (+67%) and global Internet services and media provider Naspers Ltd. – Cl. N (+38% prior to being sold) were other leading Fund holdings that produced strong returns. Chinese Internet services companies Baidu, Inc. Spon. ADR (+39%) and Alibaba Group Holding Ltd. Spon. ADR (+32%) were positive contributors to performance. The Fund purchased Alibaba at the company’s IPO and later added to the position.

INTERNATIONAL OPPORTUNITIES FUND |

INTERNATIONAL OPPORTUNITIES FUND

Although active currency management is not a central facet of the Fund’s investment process, fluctuations in major world currencies can at times affect the Fund’s performance. During the period, the net effect of currency moves was positive for the Fund. The Fund did well as compared to the benchmark index by having greater exposure to securities denominated in the US dollar, which strengthened versus most major world currencies. Additionally, the Fund’s results were positively affected by having very little exposure to the Japanese yen, which weakened during the period.

From a sector allocation perspective, the Fund benefitted as compared to its benchmark index by having overweight allocations to the strong-performing Information Technology and Health Care sectors, while being underweight the weak-performing Materials sector.

During the period, the Fund increased its allocations to the Health Care, Information Technology, and Industrials sectors. The Fund reduced its allocations to the Consumer Discretionary, Consumer Staples, Financials, and Materials sectors.

The International Opportunities Fund experienced elevated portfolio turnover during the period, which primarily related to the Fund’s changing its portfolio composition to reinvest in other positions that we believe may have more upside potential and to take advantage of new opportunities. Portfolio turnover increases transaction-related expenses and could reduce Fund returns.

As noted earlier in this report, effective August 22, 2014, Munish Malhotra, CFA, previously co-manager of the Marsico International Opportunities Fund, assumed sole portfolio manager responsibility for the Fund. Effective the same date, former co-manager James G. Gendelman no longer served as co-manager of the Fund.

Fiscal Period-End Investment Posture

As of September 30, 2014, the Fund’s primary economic sector allocations included Information Technology, Consumer Discretionary, Health Care, and Industrials. The Fund had no exposure to the Consumer Staples, Utilities, Telecommunication Services, and Materials sectors at period-end.

In terms of country allocations, the Fund’s most significant weightings at period-end, excluding short-term investments, were China/Hong Kong, the United Kingdom, the United States, Germany, and the Netherlands. The Fund’s United States holdings primarily comprised multi-national companies. Country-level weightings generally should be considered a residual of the Fund’s stock selection process rather than a major, proactive facet of its investment strategy.

Sincerely,

MUNISH MALHOTRA, CFA

PORTFOLIO MANAGER

| (1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. For the period prior to September 30, 2004 and from October 2011 through December 2013, the performance returns for the International Opportunities Fund reflect a fee waiver in effect; in the absence of such a waiver, the returns would have been reduced. For the period from October 2004 through December 2005 and from January 2014 through September 2014, performance returns for the International Opportunities Fund would have been higher but for the reimbursement of fees waived previously. Please see the Prospectus for more information. |

INTERNATIONAL OPPORTUNITIES FUND OVERVIEW |

September 30, 2014 (Unaudited)

The International Opportunities Fund invests primarily in common stocks of foreign companies that are selected for their long-term growth potential. The Fund may invest in an unlimited number of companies of any size throughout the world. It normally invests in the securities of issuers that are economically tied to one or more foreign countries, and expects to be invested in various issuers or securities that together have ties to at least four different foreign countries. Some issuers or securities in the Fund’s portfolio may be based in or economically tied to the United States or to emerging markets.

TOTAL ANNUAL OPERATING EXPENSES * NET EXPENSES*† | 1.74% 1.60% | NET ASSETS $175,983,641 | NET ASSET VALUE PER SHARE $14.72 |

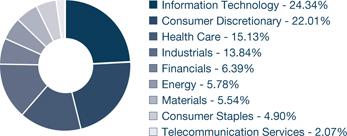

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

|  |

SECTOR ALLOCATION(3) | TOP FIVE HOLDINGS |

| | |

| LIBERTY GLOBAL PLC - SERIES C | 4.62% |

| CANADIAN PACIFIC RAILWAY LTD. | 4.49% |

| ASML HOLDING N.V. | 4.32% |

| ROCHE HOLDING AG | 4.00% |

| GILEAD SCIENCES, INC. | 3.56% |

INTERNATIONAL OPPORTUNITIES FUND OVERVIEW

| * | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 31, 2014 and may differ from the expense ratios disclosed in this report. |

| † | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of the International Opportunities Fund (excluding interest, taxes, acquired fund fees and expenses, litigation, brokerage and extraordinary expenses) to an annual rate of 1.60% of the Fund’s average net assets until January 31, 2015. This expense limitation and fee waiver agreement may be terminated by the Adviser at any time after January 31, 2015, upon 15 days prior notice to the Fund and its administrator. The Adviser may recoup from the Fund fees previously waived or expenses previously reimbursed by the Adviser with respect to the Fund pursuant to this agreement (or a previous expense limitation agreement) if such reimbursement does not cause the Fund to exceed the expense limitation currently in effect and the reimbursement is made within three years after the year in which the Adviser waived the fee or reimbursed the expense. |

The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit www.marsicofunds.com.

The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares.

All indices are unmanaged and investors cannot invest directly in an index.

| (1) | The performance returns for the International Opportunities Fund (for the period prior to September 30, 2004 and from October 2011 through December 2013) reflect a fee waiver in effect; in the absence of such a waiver, the returns would be reduced. For the period from October 2004 through December 2005 and from January 2014 through September 2014, performance returns for the International Opportunities Fund would be higher but for the reimbursement of fees waived previously. |

| (2) | This chart assumes an initial investment of $10,000 made on September 30, 2004. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

| (3) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. The Fund’s portfolio composition is subject to change at any time. |

The MSCI EAFE Index tracks the stocks of about 1,000 companies in Europe, Australasia, and the Far East (EAFE).

\\

MARSICO INTERNATIONAL OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

September 30, 2014

| | | Number of Shares | | | Value | | | Percent of Net Assets | |

| COMMON STOCKS | | | | | | | | | |

| Aerospace & Defense | | | | | | | | | |

| Safran S.A. | | | 94,347 | | | $ | 6,122,699 | | | | 3.48 | % |

| | | | | | | | | | | | | |

| Airlines | | | | | | | | | | | | |

| Copa Holdings S.A. - Cl. A | | | 13,343 | | | | 1,431,570 | | | | 0.81 | |

| | | | | | | | | | | | | |

| Apparel Retail | | | | | | | | | | | | |

| Zalando S.E.* | | | 33,257 | | | | 903,113 | | | | 0.51 | |

| | | | | | | | | | | | | |

| Application Software | | | | | | | | | | | | |

| Mobileye N.V.* | | | 15,332 | | | | 821,642 | | | | 0.47 | |

| | | | | | | | | | | | | |

| Asset Management & Custody Banks | | | | | |

| Azimut Holding S.p.A. | | | 117,932 | | | | 2,983,550 | | | | 1.70 | |

| Hargreaves Lansdown PLC | | | 148,438 | | | | 2,274,051 | | | | 1.29 | |

| | | | | | | | 5,257,601 | | | | 2.99 | |

| Automobile Manufacturers | | | | | | | | | | | | |

| Bayerische Motoren Werke AG | | | 38,004 | | | | 4,081,043 | | | | 2.32 | |

| Tata Motors Ltd. ADR | | | 65,875 | | | | 2,879,396 | | | | 1.64 | |

| | | | | | | | 6,960,439 | | | | 3.96 | |

| Biotechnology | | | | | | | | | | | | |

| Alkermes PLC* | | | 54,194 | | | | 2,323,297 | | | | 1.32 | |

| Gilead Sciences, Inc.* | | | 58,898 | | | | 6,269,692 | | | | 3.56 | |

| | | | | | | | 8,592,989 | | | | 4.88 | |

| Cable & Satellite | | | | | | | | | | | | |

| Liberty Global PLC - Series C* | | | 198,158 | | | | 8,127,450 | | | | 4.62 | |

| | | | | | | | | | | | | |

| Casinos & Gaming | | | | | | | | | | | | |

| MGM China Holdings Ltd. | | | 1,328,400 | | | | 3,806,500 | | | | 2.16 | |

| | | | | | | | | | | | | |

| Data Processing & Outsourced Services | | | | | |

| Cielo S.A. | | | 153,600 | | | | 2,510,061 | | | | 1.43 | |

| MasterCard, Inc. - Cl. A | | | 82,285 | | | | 6,082,507 | | | | 3.46 | |

| QIWI PLC Spon. ADR | | | 44,627 | | | | 1,409,767 | | | | 0.80 | |

| Wirecard A.G. | | | 86,493 | | | | 3,195,963 | | | | 1.81 | |

| | | | | | | | 13,198,298 | | | | 7.50 | |

| Electronic Equipment & Instruments | | | | | | | | | |

| Keyence Corporation | | | 10,700 | | | | 4,650,244 | | | | 2.64 | |

| | | | | | | | | | | | | |

| General Merchandise Stores | | | | | | | | | |

| Dollarama, Inc. | | | 36,926 | | | | 3,132,256 | | | | 1.78 | |

| | | | | | | | | | | | | |

| Industrial Machinery | | | | | | | | | | | | |

| FANUC Corporation | | | 14,700 | | | | 2,655,181 | | | | 1.51 | |

| The Weir Group PLC | | | 72,753 | | | | 2,950,947 | | | | 1.68 | |

| | | | | | | | 5,606,128 | | | | 3.19 | |

COMMON STOCKS (continued) | | | | | | | | | |

| Internet Retail | | | | | | | | | | | | |

| Ctrip.com International, Ltd. ADR* | | | 49,806 | | | $ | 2,826,989 | | | | 1.61 | % |

| Start Today Company Ltd. | | | 73,400 | | | | 1,597,500 | | | | 0.91 | |

| The Priceline Group, Inc.* | | | 3,892 | | | | 4,509,193 | | | | 2.56 | |

| Vipshop Holdings Ltd. Spon. ADR* | | | 7,645 | | | | 1,444,981 | | | | 0.82 | |

| | | | | | | | 10,378,663 | | | | 5.90 | |

| Internet Software & Services | | | | | | | | | |

| Alibaba Group Holding Ltd. Spon. ADR* | | | 68,233 | | | | 6,062,502 | | | | 3.44 | |

| Baidu, Inc. Spon. ADR* | | | 21,580 | | | | 4,709,403 | | | | 2.68 | |

| Tencent Holdings Ltd. | | | 279,600 | | | | 4,151,771 | | | | 2.36 | |

| | | | | | | | 14,923,676 | | | | 8.48 | |

| Oil & Gas Equipment & Services | | | | | | | | | |

| Schlumberger Ltd. | | | 43,930 | | | | 4,467,242 | | | | 2.54 | |

| | | | | | | | | | | | | |

| Pharmaceuticals | | | | | | | | | | | | |

| Novartis AG | | | 50,653 | | | | 4,783,040 | | | | 2.72 | |

| Ono Pharmaceutical Company Ltd. | | | 26,500 | | | | 2,353,408 | | | | 1.34 | |

| Perrigo Company | | | 21,253 | | | | 3,191,988 | | | | 1.81 | |

| Roche Holding AG | | | 23,733 | | | | 7,037,616 | | | | 4.00 | |

| UCB S.A. | | | 52,861 | | | | 4,799,148 | | | | 2.73 | |

| | | | | | | | 22,165,200 | | | | 12.60 | |

| Railroads | | | | | | | | | | | | |

| Canadian Pacific Railway Ltd. | | | 38,103 | | | | 7,907,746 | | | | 4.49 | |

| | | | | | | | | | | | | |

| Restaurants | | | | | | | | | | | | |

| Domino's Pizza Group PLC | | | 520,498 | | | | 4,792,815 | | | | 2.72 | |

| | | | | | | | | | | | | |

| Semiconductor Equipment | | | | | | | | | | | | |

| ASML Holding N.V. | | | 76,420 | | | | 7,607,889 | | | | 4.32 | |

| | | | | | | | | | | | | |

| Semiconductors | | | | | | | | | | | | |

| ARM Holdings PLC | | | 305,996 | | | | 4,494,353 | | | | 2.55 | |

| Infineon Technologies AG | | | 413,126 | | | | 4,275,099 | | | | 2.43 | |

| | | | | | | | 8,769,452 | | | | 4.98 | |

| TOTAL COMMON STOCKS | | | | | | | | | | | | |

| (Cost $137,582,635) | | | | | | | 149,623,612 | | | | 85.02 | |