UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08397

THE MARSICO INVESTMENT FUND

(Exact name of registrant as specified in charter)

1200 17th Street, Suite 1600

Denver, CO 80202

(Address of principal executive offices)(Zip code)

Christopher J. Marsico

The Marsico Investment Fund

1200 17th Street, Suite 1600

Denver, CO 80202

(Name and address of agent for service)

Copies to:

Anthony H. Zacharski

Dechert LLP

90 State House Square

Hartford, CT 06103

Registrant's telephone number, including area code: (303)454-5600

Date of fiscal year end: September 30

Date of reporting period: September 30, 2016

Item 1 – Reports to Stockholders.

DEAR SHAREHOLDER:

Enclosed is your annual report for The Marsico Investment Fund, encompassing the one-year fiscal period from October 1, 2015 to September 30, 2016.

The purpose of this report is to provide a review of the Marsico Funds’ one-year investment results by discussing what we believe were the main areas that impacted performance – including the macroeconomic environment, sector and industry positioning, and individual stock selection – as compared to the Funds’ performance benchmark indexes. For updated information regarding the market environment and the Funds’ overall investment postures and performance, please refer to the Funds’ most recent monthly fact sheets and quarterly investment updates, which are available in the Investor Resources section of the Funds’ website at marsicofunds.com.(1)

(1) | The references to the Marsico Funds website (marsicofunds.com) included throughout this annual report do not incorporate the website’s contents into this report. |

| | KEY FUND STATISTICS | 2 | |

| | MARKET ENVIRONMENT | 5 | |

| | | | |

| | MARSICO FOCUS FUND |

| | Investment Review | 6 | |

| | Fund Overview | 9 | |

| | Schedule of Investments | 10 | |

| | | | |

| | MARSICO GROWTH FUND |

| | Investment Review | 11 | |

| | Fund Overview | 14 | |

| | Schedule of Investments | 15 | |

| | | | |

| | MARSICO 21st CENTURY FUND |

| | Investment Review | 17 | |

| | Fund Overview | 19 | |

| | Schedule of Investments | 20 | |

| | | | |

| | MARSICO INTERNATIONAL OPPORTUNITIES FUND |

| | Investment Review | 22 | |

| | Fund Overview | 24 | |

| | Schedule of Investments | 25 | |

| | | | |

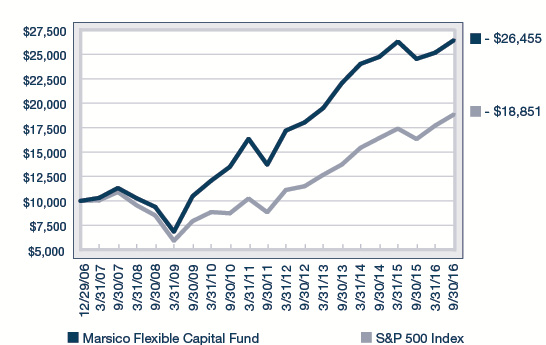

| | MARSICO FLEXIBLE CAPITAL FUND |

| | Investment Review | 27 | |

| | Fund Overview | 29 | |

| | Schedule of Investments | 30 | |

| | | | |

| | MARSICO GLOBAL FUND |

| | Investment Review | 32 | |

| | Fund Overview | 35 | |

| | Schedule of Investments | 36 | |

| | | | |

| | FINANCIAL STATEMENTS | 38 | |

| | NOTES TO FINANCIAL STATEMENTS | 48 | |

| | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 56 | |

| | EXPENSE EXAMPLE | 57 | |

| | OTHER INFORMATION | 58 | |

| | TRUSTEE AND OFFICER INFORMATION | 59 | |

1

KEY FUND STATISTICS (UNAUDITED) |

Marsico Focus Fund | Marsico Growth Fund | Marsico 21st Century

Fund |

| | MFOCX | | | MGRIX | | | MXXIX | |

For additional disclosures, please see page 9. | For additional disclosures, please see page 14. | For additional disclosures, please see page 19. |

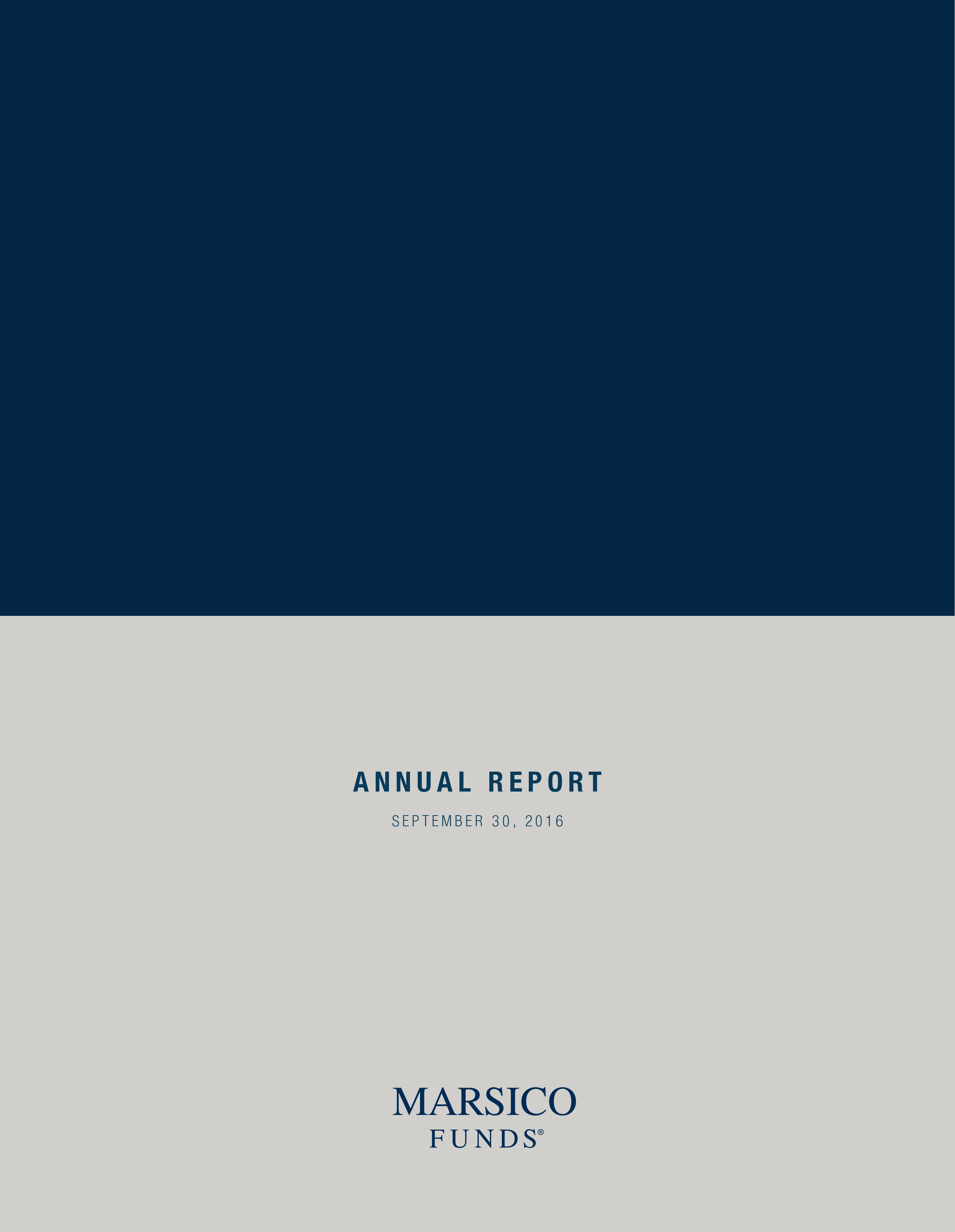

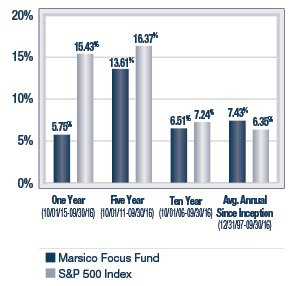

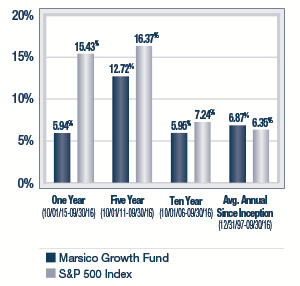

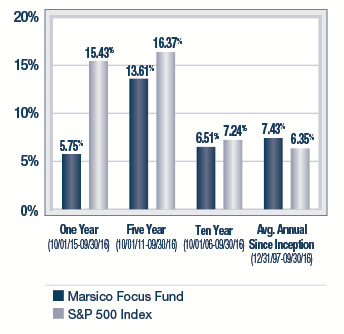

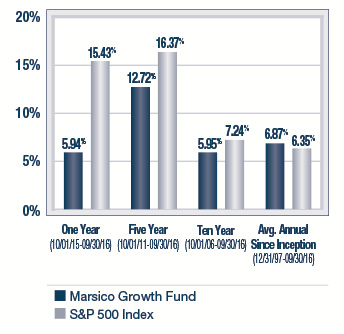

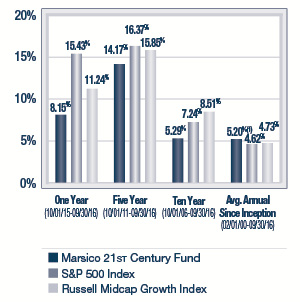

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

|

|

|

TOTAL ANNUAL OPERATING EXPENSES* 1.19% | TOTAL ANNUAL OPERATING EXPENSES* 1.27% | TOTAL ANNUAL OPERATING EXPENSES* 1.33% |

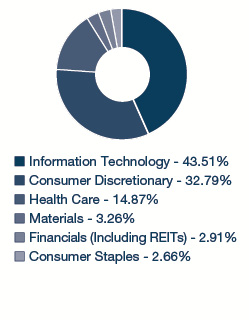

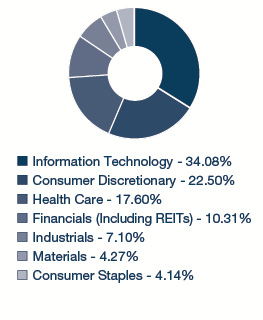

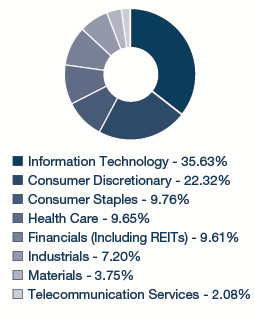

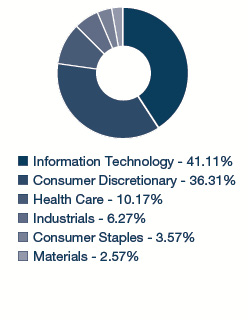

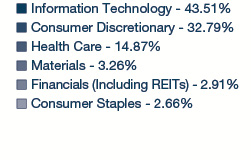

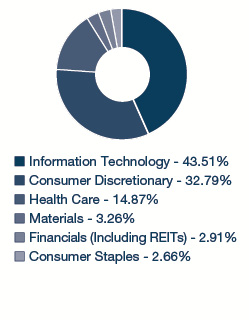

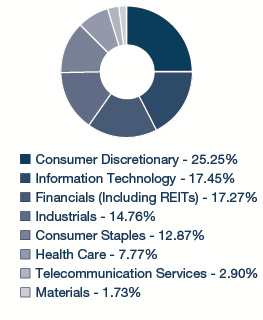

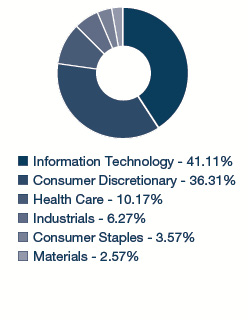

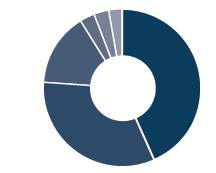

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

|

|

|

TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

| ALIBABA GROUP HOLDING LTD. SPON. ADR | 8.29% | FACEBOOK, INC. - CL. A | 5.25% | CONSTELLATION BRANDS, INC. - CL. A | 4.22% |

| FACEBOOK, INC. - CL. A | 8.07% | AMAZON.COM, INC. | 5.05% | DOMINO’S PIZZA, INC. | 4.00% |

| AMAZON.COM, INC. | 6.33% | ALIBABA GROUP HOLDING LTD. SPON. ADR | 4.51% | FACEBOOK, INC. - CL. A | 4.00% |

| VISA, INC. - CL. A | 6.32% | VISA, INC. - CL. A | 4.20% | AMAZON.COM, INC. | 3.93% |

| ELECTRONIC ARTS, INC. | 6.03% | THE HOME DEPOT, INC. | 3.67% | MASTERCARD, INC. - CL. A | 3.75% |

For additional disclosures about the Marsico Funds, please see page 4. The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

2

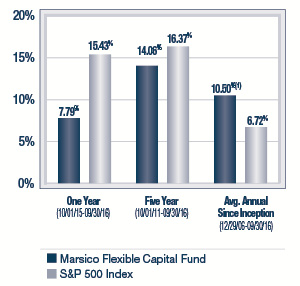

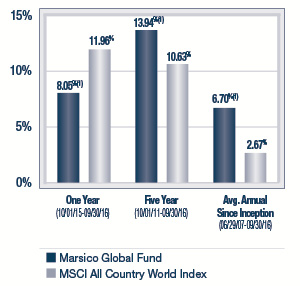

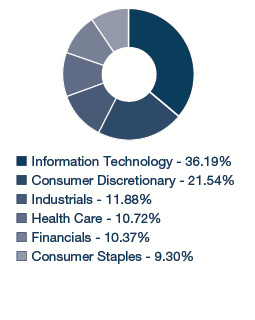

KEY FUND STATISTICS (UNAUDITED) |

Marsico International

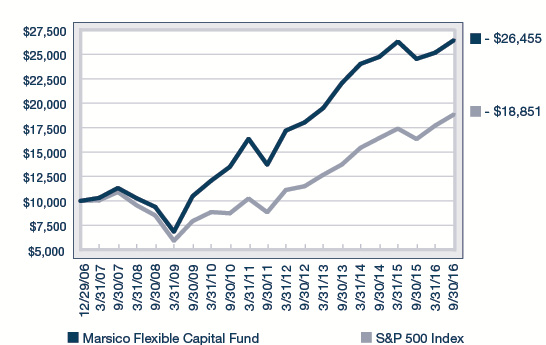

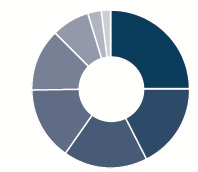

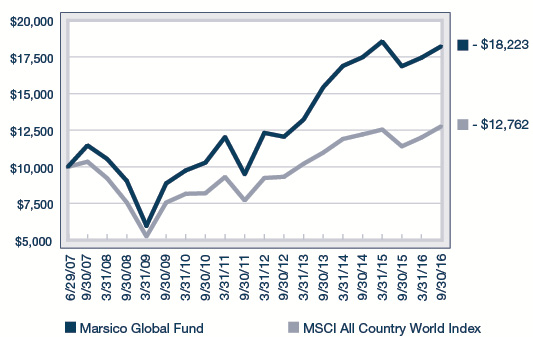

Opportunities Fund | Marsico Flexible Capital

Fund | Marsico Global Fund |

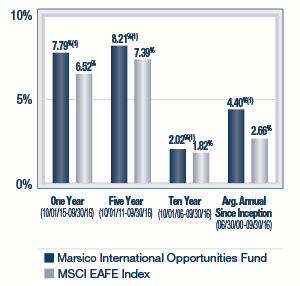

| | MIOFX | | | MFCFX | | | MGLBX | |

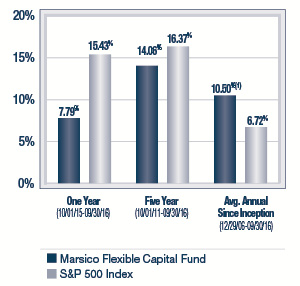

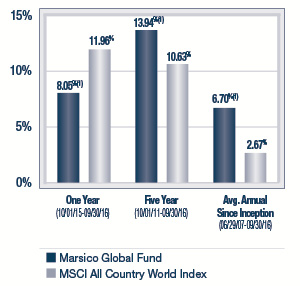

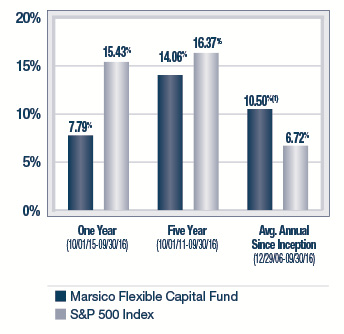

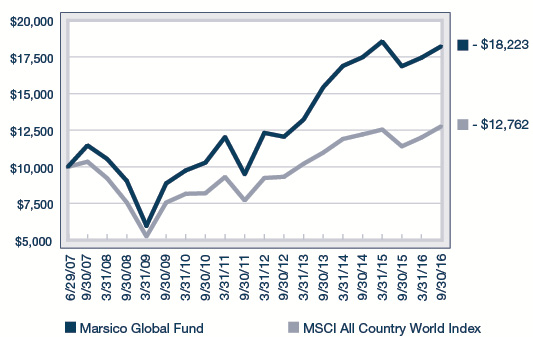

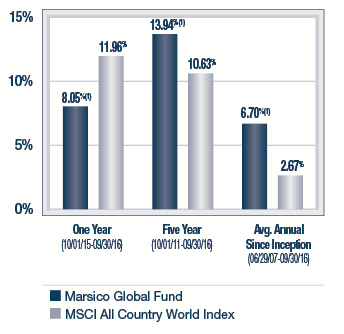

For additional disclosures, please see page 24. | For additional disclosures, please see page 29. | For additional disclosures, please see page 35. |

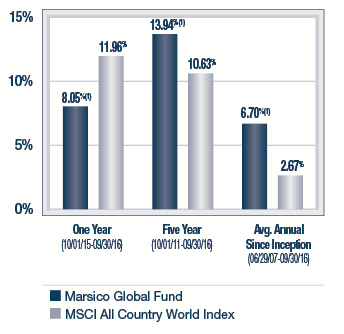

PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) | PERFORMANCE COMPARISON(1) |

|

|

|

TOTAL ANNUAL OPERATING EXPENSES* 1.58% NET EXPENSES*† 1.60% | TOTAL ANNUAL OPERATING EXPENSES* 1.27% | TOTAL ANNUAL OPERATING EXPENSES* 1.49% NET EXPENSES*† 1.60% |

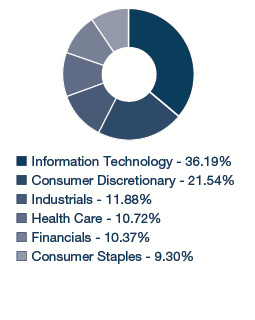

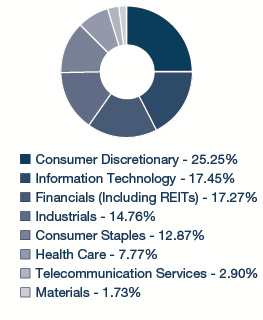

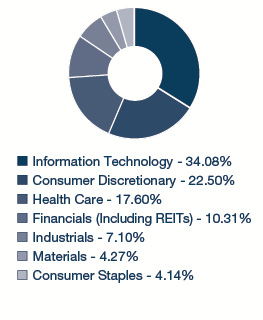

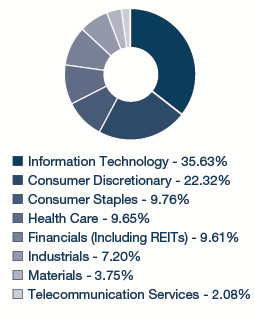

SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) | SECTOR ALLOCATION(2) |

|

|

|

TOP FIVE HOLDINGS | TOP FIVE HOLDINGS | TOP FIVE HOLDINGS |

| TENCENT HOLDINGS LTD. | 5.41% | CONSTELLATION BRANDS, INC. - CL. A | 6.36% | TENCENT HOLDINGS LTD. | 6.40% |

| ASML HOLDING N.V. | 5.12% | CROWN CASTLE INTERNATIONAL CORP. | 4.82% | ALIBABA GROUP HOLDING LTD. SPON. ADR | 5.77% |

| ELEMENT FINANCIAL CORPORATION | 4.42% | VISA, INC. - CL. A | 4.58% | FACEBOOK, INC. - CL. A | 5.25% |

| FACEBOOK, INC. - CL. A | 4.08% | THE HOME DEPOT, INC. | 4.48% | AMAZON.COM, INC. | 4.47% |

| WIRECARD A.G. | 4.06% | NIELSEN HOLDINGS PLC | 4.25% | DOMINO’S PIZZA ENTERPRISES LTD. | 3.74% |

Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com.

3

KEY FUND STATISTICS (UNAUDITED) |

ADDITIONAL DISCLOSURES ABOUT THE MARSICO FUNDS

* | The Total Annual Operating Expenses and Net Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 29, 2016. The information may differ from the expense ratios disclosed in this report. |

† | Marsico Capital Management, LLC (the “Adviser”) has entered into a written expense limitation and fee waiver agreement under which it has agreed to limit the total expenses of each of the International Opportunities Fund and the Global Fund (excluding interest, taxes, acquired fund fees and expenses, litigation, brokerage and extraordinary expenses) to an annual rate of 1.60% of each Fund’s average net assets until January 31, 2017. This expense limitation and fee waiver agreement may be terminated by the Adviser at any time after January 31, 2017, upon 15 days prior notice to the Fund and its administrator. The Adviser may recoup from a Fund fees previously waived or expenses previously reimbursed by the Adviser with respect to that Fund pursuant to this agreement (or a previous expenses limitation agreement) if: (1) such recoupment by the Adviser does not cause the Fund, at the time of recoupment, to exceed the lesser of (a) the expense limitation in effect at the time the relevant amount was waived and/or reimbursed, or (b) the expense limitation in effect at the time of the proposed recoupment, and (2) the recoupment is made within three fiscal years after the end of the fiscal year in which the amount was waived or reimbursed. |

(1) | The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

| The performance included in the chart does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| All indices are unmanaged and investors cannot invest directly in an index. |

| Periodically, certain fees and expenses have been waived or reimbursed by the Adviser for the 21st Century Fund, the International Opportunities Fund, the Flexible Capital Fund and the Global Fund. In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses from the 21st Century Fund, the International Opportunities Fund, and the Global Fund, resulting in a lower performance return. |

(2) | Sector weightings represent the percentage of the respective Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. For the year ended September 30, 2016, the Financials sector includes real estate investment trusts. The Fund’s portfolio composition is subject to change at any time. |

4

MARKET ENVIRONMENT: OCTOBER 2015 – SEPTEMBER 2016 (UNAUDITED)

After a sharp decline in early 2016, global equity markets generally recorded positive performances for the one-year fiscal period ended September 30, 2016, with a few notable exceptions. Gains were healthy in the US, the UK, Germany, and in many emerging markets. Modest losses were recorded in other European markets, with larger losses in Japan. Chinese shares, although highly volatile, ended the period nearly flat.

Similarly, most commodity prices moved sideways during the one-year fiscal period, trading in relatively tight trading ranges at prices well below those of a few years ago. For example, oil prices were up only $3 per barrel over the prior one-year period ended September 30, 2015, with West Texas Intermediate crude ending the September 30, 2016 period trading at approximately $48 per barrel, or roughly half the price in place for much of 2014.

Regarding the decline in early 2016, after mounting decent rallies through year-end 2015, most of the world’s equity markets swooned during the first two months of 2016, in part as a reaction to the mid-December decision by the US Federal Reserve Board to begin raising interest rates. By early spring, Fed officials signaled newfound restraint, and ratcheted down their predictions of how fast rates would rise. Share prices globally rebounded, in part because of the Fed’s about-face, as well as easing by other central banks and signs of life in some emerging markets. As of period-end, there have been no Fed moves to tighten since late 2015. The general failure of wages and inflation to rebound, the slow pace for real GDP growth, and the surprising return of previously unemployed laborers to the US workforce all appear to have slowed Fed plans to tighten.

During the remainder of the one-year fiscal period ended September 30, 2016, three distinct storylines emerged. US and emerging economy shares continued to climb, as intermittent growth emerged and it appeared less likely that the Fed would raise short-term interest rates. In Japan, shares were saddled with an unwanted surge in the yen after the Bank of Japan expanded its stimulus program, and the Nikkei Index ended the period down sharply. Finally, in late June, the British surprised the world by voting to leave the European Union. This ushered in a violent sell-off for the British pound. The plunge for the pound compounded worries for Continental Europe regarding the impact of a “Brexit.”

With the exception of the pound and the yen, currency markets experienced relatively low volatility during the period. The dollar was little changed versus the euro, and declined versus a broad basket of currencies during the one-year period.

Throughout the developed world, inflation remained largely subdued. With global growth tepid and inflation quiescent, sovereign bond yields fell meaningfully. Domestically, the US 10-year Treasury bond yield fell to 1.37% in the summer of 2016 before rising to 1.60% at period end. In the rest of the developed world the declines were even more dramatic. Incredibly, 5-year sovereign yields ended the period in negative territory in Japan, Switzerland, the Netherlands, Sweden, Germany and France.

The performance of global markets during the period is depicted below. US markets posted strong gains for the one-year period. Large capitalization US equities mirrored small capitalization stocks, as companies of all sizes mostly rose in unison. Emerging market equities outperformed as their currencies strengthened slightly relative to the US dollar, easing import costs for those countries. Developed international markets posted the weakest returns, dragged down by factors such as the Japanese market’s reaction to Bank of Japan stimulus.

Index Name(1) | Universe of

Equities Represented | One-Year

Total Return (as of September 30, 2016) |

US | | |

S&P 500 | US large-capitalization equities | +15.43% |

Russell 3000 | US publicly-traded equities of all sizes | +14.96% |

Russell 2000 | US small-capitalization equities | +15.47% |

Russell Mid-Cap Growth | US medium-capitalization

equities | +11.24% |

Index Name(1) | Universe of

Equities Represented | One-Year

Total Return (as of September 30, 2016) |

INTERNATIONAL | |

MSCI EAFE (US$) | Equities in developed international equity markets, including Japan, Western Europe, and Australasia | +6.52% |

MSCI Emerging Markets (US$) | Equities in developing international equity markets, including China, India, Eastern Europe, and Latin America | +16.78% |

MSCI ACWI (US$) | Equities in the global developed and emerging markets | +11.96% |

THE MARSICO INVESTMENT TEAM

(1) | All indices are unmanaged and investors cannot invest directly in an index. |

5

INVESTMENT REVIEW BY TOM MARSICO AND CORALIE WITTER (UNAUDITED)

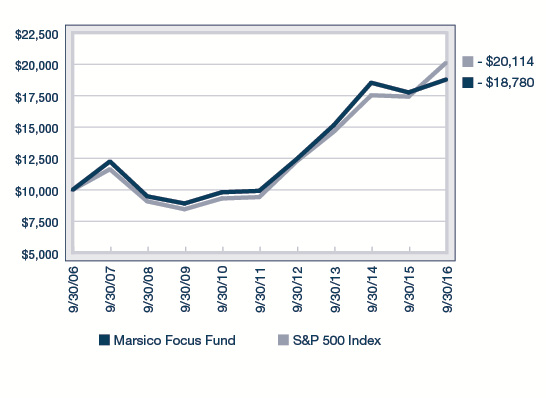

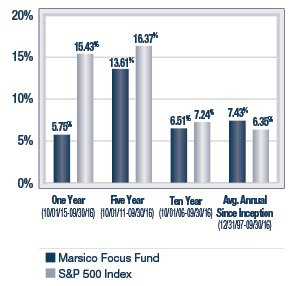

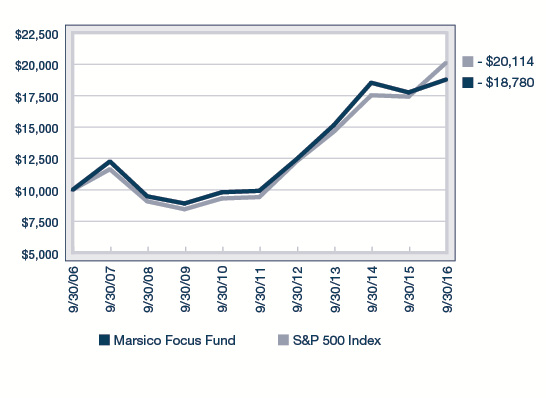

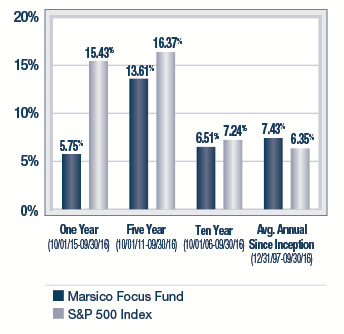

The Marsico Focus Fund posted a total return of +5.75% for the one-year fiscal period ended September 30, 2016. While the Fund posted a positive return, the Fund’s relative performance lagged its benchmark index, the S&P 500 Index, which had a total return of +15.43% over the same time period. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2016.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. (1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Focus Fund is non-diversified and may hold fewer securities than a diversified fund because it is permitted to invest a greater percentage of its assets in a smaller number of securities. Holding fewer securities increases the risk that the value of the Fund could go down because of the poor performance of a single investment or may be more volatile than its benchmark. The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

The Fund is not managed to track the benchmark index, and may hold a substantially overweight or underweight position in a sector, industry, or security compared to its weight in the benchmark. For informational purposes, the discussion below may compare the benchmark weight or performance of a sector or industry to the investment approach of the Fund.

The Focus Fund’s performance shortfall during the one-year ended September 30, 2016, as compared to the S&P 500 Index, was primarily attributable to certain Fund holdings in the Health Care, Consumer Discretionary, and Consumer Staples sectors, as defined in the Global Industry Classification Standard (“GICS”)(2).

Stock prices of many Health Care companies were under pressure during the reporting period. Hospital operators slumped during late 2015 on worries that an increasing number of uninsured patients will be unable to pay their bills as fewer states expand Medicaid and more patients drop insurance because of unaffordable premiums. The Fund’s position in health care facility operator HCA Holdings, Inc. slid -16% prior to being sold during the period.

Certain of the Fund’s holdings within the Pharmaceutical, Biotechnology & Life Sciences industry posted negative returns. A specific holding, Pacira Pharmaceuticals, Inc., a manufacturer of a non-opioid post-surgical pain anesthetic, Exparel, declined by -18% prior to being sold from the Fund. Pacira’s stock price was pressured by uncertainty surrounding its application for FDA approval for expanded use of Exparel to provide post-surgical pain relief. Although Pacira received a label expansion for Exparel in late 2015, the company has struggled to reaccelerate sales. Regeneron Pharmaceuticals, Inc. and Novartis AG declined -20% and -19%, respectively, during the period prior to being sold from the Fund. We chose to sell Regeneron because the US government is stepping up efforts to control Medicare Part B costs, an area where Regeneron has more exposure than many of its peers. We sold Novartis after a disappointing launch of the company’s new heart failure drug and operational challenges in its eye care division. Genome sequencing company Illumina, Inc. (-21% during the period prior to being sold) preannounced lower-than-expected revenues and cut its guidance due in part to disappointing sales in Europe and Asia.

6

Several of the Fund’s Consumer Discretionary holdings struggled during the period, including Chipotle Mexican Grill, Inc. and NIKE, Inc. – Cl. B. Restaurant operator Chipotle (-42%) posted a negative return during the period after it was discovered that foodborne illnesses, including norovirus and E. coli outbreaks, were linked to Chipotle restaurants in several states. The Fund maintained a position in the company as the company is taking important measures to improve the safety of its food supply chain, and a resolution of food safety issues should lead to improvement in the number of customer visits and contribute to strong same store sales growth. Additionally, the company launched a loyalty rewards program during the period, which should incentivize customers to return to the stores. Athletic apparel company NIKE, meanwhile, posted a return of -13% during the period. Although the company’s growth rates slowed slightly as competitors Adidas and Under Armour, Inc. took market share, we still like the long-term growth potential of NIKE, which we believe remains the clear leader in the space. Consumer Discretionary was a weaker-performing sector of the S&P 500 Index, and the Fund’s performance was held back by having an overweight allocation to the sector as compared to the benchmark index.

In the Consumer Staples sector, shares of grocer The Kroger Company, the nation’s largest supermarket chain by sales, slumped -19% as the company cut its full-year sales and earnings forecast due to declining food prices. An excess supply of food products, together with reduced global demand, have placed the US on track to post the largest decline in food prices in more than 50 years. Given the outlook, we elected to sell the position during the period.

We sold one of the Fund’s few holdings in the Financials sector, The Charles Schwab Corporation (-14% during the portion of the reporting period it was held), following the outcome of the “Brexit” vote, as we believe a persistent headwind of lower interest rates for a longer period will prove challenging for the stock.

From a sector allocation perspective, the Fund’s performance was impaired by having no exposure to the Telecommunication Services and Utilities sectors – two of the stronger-performing sectors of the S&P 500 Index during the period. In the continued uncertain macroeconomic environment, dividend paying stocks perceived by the market to offer safety, such as Utilities and Telecommunications, were rewarded. We believed valuations for many companies in both sectors were high, and we found more compelling investment opportunities in other sectors. In addition, Fund performance lagged as a result of having little exposure to the strong-performing Energy sector.

The picture was brighter in other areas. The Fund’s holdings in the Information Technology sector performed strongly, led by holdings in the Software & Services industry. For some time, the Fund has maintained investments in companies making innovative use of technology to create better retail and advertising business models. Alibaba Group Holding Ltd. Spon. ADR, China’s leading ecommerce company, staged a stock price gain of +79% during the period. Alibaba’s stock rose after sales on China’s “Singles Day,” a holiday popular among young unmarried adults in China, were stronger than expected. Positions in social media company Facebook, Inc. – Cl. A and internet services company Alphabet, Inc. – Cl. A also were among the Fund’s best performing holdings, and posted gains of +43% and +26%, respectively, during the reporting period. Facebook’s results continued to exceed market expectations, led by strong advertising revenue and monthly active user growth rates, a result of the company’s embracing a shift towards mobile phone usage. Early in the period, Google reorganized its business under a new holding company called Alphabet. The restructuring separated the companies’ reporting of proven moneymaking Internet business units from innovative “moonshot” businesses such as self-driving cars, smart home technology, and life sciences. The reorganization was welcomed by many investors, and Alphabet’s shares were buoyed by strong revenue growth, particularly from continued strength in mobile search.

Video game software company Electronic Arts, Inc.’s stock price rose +26% during the period. We believe the firm’s profitability should continue to improve as new video game consoles make it more convenient for players to download video games online, rather than purchasing physical copies of game software.

In the Consumer Discretionary sector, shares of online retailer Amazon.com, Inc. soared +62% during the period, thanks to a major contribution from its fast-growing and profitable cloud computing business Amazon Web Services. By expanding into cloud computing and other areas such as digital media, the company is complementing its core retail business. Amazon posted its fifth-straight profitable quarter.

The Fund’s sole holding in the Materials sector, The Sherwin-Williams Company (+26%), was another individual holding having a significant, positive impact on Fund performance. Sherwin-Williams has benefitted from lower raw materials costs and continued strength in the housing market.

7

From a sector allocation perspective, the Fund was aided relative to its benchmark index by having an overweight allocation to the strong-performing Information Technology sector, while being underweight the weak-performing Financials sector.

During the reporting period, the Fund sold its positions in the Industrials and Energy sectors and reduced its exposure to the Health Care, Financials, and Materials sectors. The Fund increased its allocations to the Consumer Discretionary and Information Technology sectors.

Fiscal Period-End Investment Posture

As of September 30, 2016, the Fund’s largest sector allocations included Information Technology, Consumer Discretionary, and Health Care. As of that date, the Fund had no exposure to the Energy, Industrials, Utilities, or Telecommunication Services sectors.

Sincerely,

THOMAS F. MARSICO

CORALIE T. WITTER, CFA

PORTFOLIO MANAGERS

(1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Please see the Prospectus for more information. |

(2) | Regarding GICS data cited throughout this report, the Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s (“S&P”) and is licensed for use by Marsico Capital Management, LLC (the “Adviser”). Neither MSCI, S&P, nor the Adviser or any third party involved in compiling GICS makes any express or implied warranties or representations with respect to such standard or classification (or the results from use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any such standard or classification. MSCI, S&P, the Adviser, and any of their affiliates or third parties involved in compiling GICS shall not have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. |

8

September 30, 2016 (Unaudited)

The Focus Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Fund will normally hold a core position of between 20 and 35 common stocks.

TOTAL ANNUAL OPERATING EXPENSES* 1.19% | NET ASSETS $613,870,293 | NET ASSET VALUE PER SHARE $15.96 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

|

|

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | | | |

| | Alibaba Group Holding Ltd. Spon. ADR | 8.29% | |

| | Facebook, Inc. - Cl. A | 8.07% | |

| | Amazon.com, Inc. | 6.33% | |

| | Visa, Inc. - Cl. A | 6.32% | |

| | Electronic Arts, Inc. | 6.03% | |

| | | | |

* | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 29, 2016 and may differ from the expense ratio disclosed in this report. |

| The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

| The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| All indices are unmanaged and investors cannot invest directly in an index. |

(1) | This chart assumes an initial investment of $10,000 made on September 30, 2006. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

(2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. For the year ended September 30, 2016, the Financials sector includes real estate investment trusts. The Fund’s portfolio composition is subject to change at any time. |

9

MARSICO FOCUS FUND

SCHEDULE OF INVESTMENTS

September 30, 2016

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS | | | | | | | | | |

Application Software | | | | | | | | | |

salesforce.com, inc.* | | | 517,874 | | | $ | 36,939,952 | | | | 6.02 | % |

| | | | | | | | | | | | | |

Biotechnology | | | | | | | | | | | | |

Celgene Corporation* | | | 131,784 | | | | 13,775,382 | | | | 2.24 | |

| | | | | | | | | | | | | |

Data Processing & Outsourced Services | |

Visa, Inc. - Cl. A | | | 469,025 | | | | 38,788,367 | | | | 6.32 | |

| | | | | | | | | | | | | |

Footwear | | | | | | | | | | | | |

NIKE, Inc. - Cl. B | | | 464,523 | | | | 24,457,136 | | | | 3.99 | |

| | | | | | | | | | | | | |

General Merchandise Stores | |

Dollar Tree, Inc.* | | | 254,311 | | | | 20,072,767 | | | | 3.27 | |

| | | | | | | | | | | | | |

Home Entertainment Software | |

Activision Blizzard, Inc. | | | 235,799 | | | | 10,445,896 | | | | 1.70 | |

Electronic Arts, Inc.* | | | 433,488 | | | | 37,019,875 | | | | 6.03 | |

| | | | | | | | 47,465,771 | | | | 7.73 | |

Home Improvement Retail | |

The Home Depot, Inc. | | | 170,255 | | | | 21,908,413 | | | | 3.57 | |

| | | | | | | | | | | | | |

Internet & Direct Marketing Retail | |

Amazon.com, Inc.* | | | 46,447 | | | | 38,890,538 | | | | 6.33 | |

The Priceline Group, Inc.* | | | 18,339 | | | | 26,985,655 | | | | 4.40 | |

| | | | | | | | 65,876,193 | | | | 10.73 | |

Internet Software & Services | |

Alibaba Group Holding Ltd. Spon. ADR* | | | 481,247 | | | | 50,911,120 | | | | 8.29 | |

Alphabet, Inc. - Cl. A* | | | 27,745 | | | | 22,308,645 | | | | 3.64 | |

Facebook, Inc. - Cl. A* | | | 386,279 | | | | 49,548,007 | | | | 8.07 | |

| | | | | | | | 122,767,772 | | | | 20.00 | |

IT Consulting & Other Services | |

Accenture PLC - Cl. A | | | 131,527 | | | | 16,068,654 | | | | 2.62 | |

| | | | | | | | | | | | | |

Managed Health Care | | | | | | | | | | | | |

UnitedHealth Group, Inc. | | | 243,514 | | | | 34,091,960 | | | | 5.55 | |

| | | | | | | | | | | | | |

Packaged Foods & Meats | | | | | | | | | | | | |

The Kraft Heinz Company | | | 178,986 | | | | 16,021,037 | | | | 2.61 | |

| | | | | | | | | | | | | |

Pharmaceuticals | | | | | | | | | | | | |

Allergan PLC* | | | 88,030 | | | | 20,274,189 | | | | 3.30 | |

Zoetis, Inc. | | | 412,034 | | | | 21,429,889 | | | | 3.49 | |

| | | | | | | | 41,704,078 | | | | 6.79 | |

Restaurants | | | | | | | | | | | | |

Chipotle Mexican Grill, Inc.* | | | 75,844 | | | | 32,119,934 | | | | 5.23 | |

Domino's Pizza Enterprises Ltd. | | | 143,876 | | | | 7,743,320 | | | | 1.26 | |

Starbucks Corporation | | | 467,604 | | | | 25,316,081 | | | | 4.13 | |

| | | | | | | | 65,179,335 | | | | 10.62 | |

COMMON STOCKS (continued) | |

Specialized REITs | | | | | | | | | | | | |

Crown Castle International Corp. | | | 185,730 | | | $ | 17,497,623 | | | | 2.85 | % |

| | | | | | | | | | | | | |

Specialty Chemicals | | | | | | | | | | | | |

The Sherwin-Williams Company | | | 71,075 | | | | 19,663,609 | | | | 3.20 | |

| | | | | | | | | | | | | |

TOTAL COMMON STOCKS | |

(Cost $456,101,765) | | | | | | | 602,278,049 | | | | 98.11 | |

| | | | | | | | | | | | | |

SHORT-TERM INVESTMENTS | |

State Street Institutional U.S. Government Money Market Fund, 0.000% | | | 20,180,224 | | | | 20,180,224 | | | | 3.29 | |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | |

(Cost $20,180,224) | | | | | | | 20,180,224 | | | | 3.29 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS | |

(Cost $476,281,989) | | | | | | | 622,458,273 | | | | 101.40 | |

| | | | | | | | | | | | | |

Liabilities, Less Cash and Other Assets | | | | | | | (8,587,980 | ) | | | (1.40 | ) |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | $ | 613,870,293 | | | | 100.00 | % |

| See notes to financial statements. |

10

INVESTMENT REVIEW BY TOM MARSICO AND CORALIE WITTER (UNAUDITED)

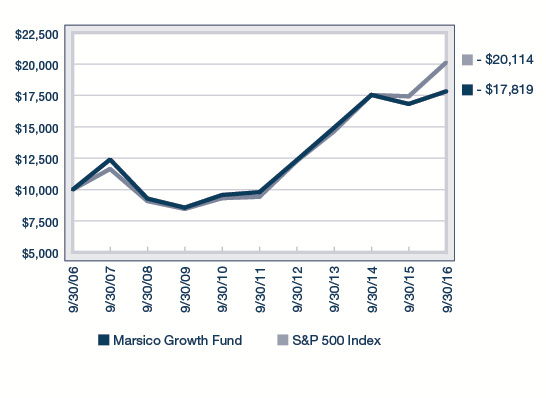

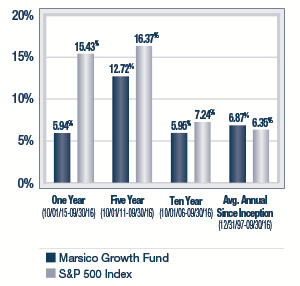

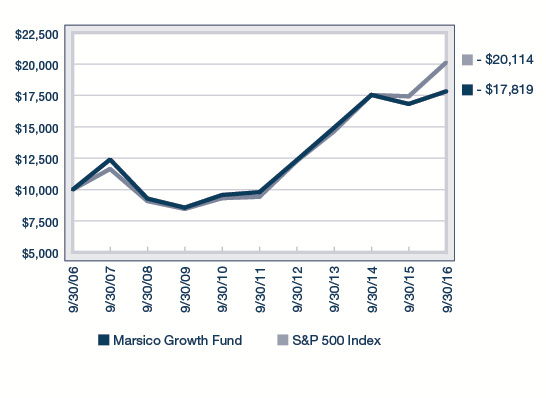

The Marsico Growth Fund posted a total return of +5.94% for the one-year fiscal period ended September 30, 2016. The Fund underperformed the S&P 500 Index, the Fund’s benchmark index, which had a total return of +15.43% over the same time period. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2016.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. (1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

The Fund is not managed to track the benchmark index, and may hold a substantially overweight or underweight position in a sector, industry, or security compared to its weight in the benchmark. For informational purposes, the discussion below may compare the benchmark weight or performance of a sector or industry to the investment approach of the Fund.

Much of the Growth Fund’s underperformance during the one-year ended September 30, 2016, as compared to the S&P 500 Index, was attributable to certain holdings in the Consumer Discretionary, Health Care and Consumer Staples sectors.

Several of the Growth Fund’s Consumer Discretionary holdings struggled during the period, including Chipotle Mexican Grill, Inc. and NIKE, Inc. – Cl. B. Restaurant operator Chipotle (-44% prior to being sold) posted a negative return during the period after it was discovered that foodborne illnesses, including norovirus and E. coli outbreaks, were linked to Chipotle restaurants in several states. Athletic apparel company NIKE, meanwhile, posted a return of -14% during the period, trailing the return of the Fund’s benchmark index. Although the company’s growth rates slowed slightly as competitors Adidas and Under Armour, Inc. took market share, we still like the long-term growth potential of NIKE, which we believe remains the clear leader in the space.

Also within the Consumer Discretionary sector, Tesla Motors, Inc. (-40% prior to being sold) was a holding that detracted from Fund performance. Tesla’s stock price was subject to heightened volatility due to lofty production targets and the timing of new vehicle deliveries. In general, Consumer Discretionary was a weaker-performing sector of the S&P 500 Index and the Fund’s performance was held back by having an overweight allocation to the sector as compared to the benchmark index.

Stock prices of many Health Care companies were under pressure during the reporting period. Hospital operators slumped during late 2015 on worries that an increasing number of uninsured patients will be unable to pay their bills as fewer states expand Medicaid and more patients drop insurance because of unaffordable premiums. The Fund’s position in health care facility operator HCA Holdings, Inc. slid -16% prior to being sold during the period.

Several of the Fund’s Health Care holdings within the Pharmaceuticals, Biotechnology & Life Sciences industry posted negative returns. Illumina, Inc. and Regeneron Pharmaceuticals, Inc. declined -21% and -20%, respectively, during the period prior to being sold from the Fund. Genome sequencing company Illumina preannounced lower-than-expected revenues and cut its guidance due in part to disappointing sales in Europe and Asia. We chose to sell Regeneron because the US government is stepping up efforts to control Medicare Part B costs, an area where Regeneron has more exposure than many of its peers.

11

In the Consumer Staples sector, shares of grocer The Kroger Company, the nation’s largest supermarket chain by sales, slumped -23% as the company cut its full-year sales and earnings forecast due to declining food prices. An excess supply of food products, together with reduced global demand, have placed the US on track to post the largest decline in food prices in more than 50 years. Given the outlook, we elected to sell the position during the period.

We sold one of the Fund’s few holdings in the Financials sector, The Charles Schwab Corporation (-14% during the portion of the reporting period it was held), following the outcome of the “Brexit” vote, as we believe a persistent headwind of lower interest rates for a longer period will prove challenging for the stock.

From a sector allocation perspective, the Fund’s performance also was impaired by having no exposure to the Telecommunication Services and Utilities sectors – the two strongest-performing sectors of the S&P 500 Index. In the uncertain macroeconomic environment, dividend paying stocks perceived by the market to offer safety, such as Utilities and Telecommunications, were rewarded. We believed valuations for many companies in both sectors were high, and we found more compelling investment opportunities in other sectors.

The Fund’s Information Technology holdings posted mixed results. Two of the Fund’s holdings within the sector posted weaker returns. Cybersecurity provider Palo Alto Networks, Inc. slipped -27% prior to being sold on market concerns about slower spending by corporate enterprise customers. salesforce.com, inc., although posting a slightly positive return, lagged the benchmark index. This likely was due to market chatter about potential acquisitions in which the proposed strategic fit appeared questionable. The Fund continues to hold a position in the stock.

On the brighter side, several of the Fund’s Software & Services holdings posted strong returns. The Growth Fund maintained investments in companies making innovative use of technology to create better retail and advertising business models. Alibaba Group Holding Ltd. Spon. ADR, China’s leading ecommerce company, staged a stock price gain of +79% during the period. Alibaba’s stock rose after sales on China’s “Singles Day,” a holiday popular among young unmarried adults in China, were stronger than expected. A position in social media company Facebook, Inc. – Cl. A was among the Fund’s best performing holdings, and posted a gain of +43% during the reporting period. Facebook’s results continued to exceed market expectations, led by strong advertising revenue and monthly active user growth rates, a result of the company’s embracing a shift towards mobile phone usage. Early in the period, Alphabet, Inc. Cl. - A. (+26%), formerly Google, Inc., reorganized its business under a new holding company called Alphabet. The restructuring separated the companies’ reporting of proven moneymaking Internet business units from innovative “moonshot” businesses such as self-driving cars, smart home technology, and life sciences. The reorganization was welcomed by many investors, and Alphabet’s shares were buoyed by strong revenue growth, particularly from continued strength in mobile search.

Video game software company Electronic Arts, Inc.’s stock price rose +27% during the period. We believe the firm’s profitability should continue to improve as new video game consoles make it more convenient for players to download video games online, rather than purchasing physical copies of game software.

In the Consumer Discretionary sector, shares of online retailer Amazon.com, Inc. soared +63% during the period, thanks to a major contribution from its fast-growing and profitable cloud computing business Amazon Web Services. By expanding into cloud computing and other areas such as digital media, the company is complementing its core retail business. Amazon posted its fifth-straight profitable quarter.

One of the Fund’s few holdings in the Materials sector, The Sherwin-Williams Company (+26%), was another individual holding having a material, positive impact on Fund performance. Sherwin-Williams has benefitted from lower raw materials costs and continued strength in the housing market.

From a sector allocation perspective, the Fund benefitted relative to its benchmark index by having an overweight allocation to the strong-performing Information Technology sector, while being underweight the weak-performing Financials sector.

During the reporting period, the Fund sold its sole position in the Energy sector and reduced its exposure to the Health Care and Consumer Discretionary sectors. The Fund increased its allocations to the Financials, Industrials, and Information Technology sectors.

12

Fiscal Period-End Investment Posture

As of September 30, 2016, the Fund’s largest sector allocations included Information Technology, Consumer Discretionary, and Health Care. As of that date, the Fund had no exposure to the Energy, Utilities, or Telecommunication Services sectors.

Sincerely,

THOMAS F. MARSICO

CORALIE T. WITTER, CFA

PORTFOLIO MANAGERS

(1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Please see the Prospectus for more information. |

13

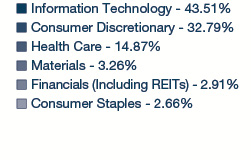

September 30, 2016 (Unaudited)

The Growth Fund invests primarily in the common stocks of large companies that are selected for their long-term growth potential. The Growth Fund will normally hold a core position of between 35 and 50 common stocks.

TOTAL ANNUAL OPERATING EXPENSES* 1.27% | NET ASSETS $288,212,959 | NET ASSET VALUE PER SHARE $15.54 |

GROWTH OF $10,000(1) | PERFORMANCE COMPARISON |

|

|

SECTOR ALLOCATION(2) | TOP FIVE HOLDINGS |

| | | | |

| | Facebook, Inc. - Cl. A | 5.25% | |

| | Amazon.com, Inc. | 5.05% | |

| | Alibaba Group Holding Ltd. Spon. ADR | 4.51% | |

| | Visa, Inc. - Cl. A | 4.20% | |

| | The Home Depot, Inc. | 3.67% | |

| | | | |

* | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 29, 2016 and may differ from the expense ratio disclosed in this report. |

| The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

| The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| All indices are unmanaged and investors cannot invest directly in an index. |

(1) | This chart assumes an initial investment of $10,000 made on September 30, 2006. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

(2) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. For the year ended September 30, 2016, the Financials sector includes real estate investment trusts. The Fund’s portfolio composition is subject to change at any time. |

14

MARSICO GROWTH FUND

SCHEDULE OF INVESTMENTS

September 30, 2016

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS | | | | | | | | | |

Aerospace & Defense | | | | | | | | | |

Lockheed Martin Corporation | | | 30,332 | | | $ | 7,271,187 | | | | 2.52 | % |

Raytheon Company | | | 20,937 | | | | 2,850,154 | | | | 0.99 | |

| | | | | | | | 10,121,341 | | | | 3.51 | |

Application Software | | | | | | | | | | | | |

Adobe Systems, Inc.* | | | 72,717 | | | | 7,892,703 | | | | 2.74 | |

salesforce.com, inc.* | | | 111,249 | | | | 7,935,391 | | | | 2.75 | |

| | | | | | | | 15,828,094 | | | | 5.49 | |

Automotive Retail | | | | | | | | | | | | |

O'Reilly Automotive, Inc.* | | | 19,232 | | | | 5,387,076 | | | | 1.87 | |

| | | | | | | | | | | | | |

Biotechnology | | | | | | | | | | | | |

Amgen, Inc. | | | 51,709 | | | | 8,625,578 | | | | 2.99 | |

Celgene Corporation* | | | 45,615 | | | | 4,768,136 | | | | 1.66 | |

| | | | | | | | 13,393,714 | | | | 4.65 | |

Construction Materials | | | | | | | | | | | | |

Vulcan Materials Company | | | 25,384 | | | | 2,886,922 | | | | 1.00 | |

| | | | | | | | | | | | | |

Data Processing & Outsourced Services | |

FleetCor Technologies, Inc.* | | | 43,674 | | | | 7,587,484 | | | | 2.63 | |

Visa, Inc. - Cl. A | | | 146,116 | | | | 12,083,793 | | | | 4.20 | |

| | | | | | | | 19,671,277 | | | | 6.83 | |

Footwear | | | | | | | | | | | | |

NIKE, Inc. - Cl. B | | | 163,396 | | | | 8,602,799 | | | | 2.99 | |

| | | | | | | | | | | | | |

General Merchandise Stores | |

Dollar Tree, Inc.* | | | 81,278 | | | | 6,415,273 | | | | 2.23 | |

| | | | | | | | | | | | | |

Health Care Equipment | |

Edwards Lifesciences Corporation* | | | 24,419 | | | | 2,943,955 | | | | 1.02 | |

| | | | | | | | | | | | | |

Health Care Services | |

Laboratory Corporation of America Holdings* | | | 46,035 | | | | 6,328,892 | | | | 2.20 | |

| | | | | | | | | | | | | |

Home Entertainment Software | |

Electronic Arts, Inc.* | | | 108,664 | | | | 9,279,906 | | | | 3.22 | |

| | | | | | | | | | | | | |

Home Improvement Retail | |

The Home Depot, Inc. | | | 82,282 | | | | 10,588,048 | | | | 3.67 | |

| | | | | | | | | | | | | |

Hotel & Resort REITs | |

MGM Growth Properties LLC - Cl. A | | | 151,872 | | | | 3,959,303 | | | | 1.37 | |

| | | | | | | | | | | | | |

Housewares & Specialties | |

Newell Brands, Inc. | | | 56,249 | | | | 2,962,072 | | | | 1.03 | |

| | | | | | | | | | | | | |

Internet & Direct Marketing Retail | |

Amazon.com, Inc.* | | | 17,369 | | | | 14,543,237 | | | | 5.05 | |

The Priceline Group, Inc.* | | | 4,175 | | | | 6,143,471 | | | | 2.13 | |

| | | | | | | | 20,686,708 | | | | 7.18 | |

COMMON STOCKS (Continued) | | | | | |

Internet Software & Services | |

Alibaba Group Holding Ltd. Spon. ADR* | | | 122,935 | | | $ | 13,005,294 | | | | 4.51 | % |

Alphabet, Inc. - Cl. A* | | | 11,223 | | | | 9,023,965 | | | | 3.13 | |

Facebook, Inc. - Cl. A* | | | 117,910 | | | | 15,124,316 | | | | 5.25 | |

| | | | | | | | 37,153,575 | | | | 12.89 | |

| | | | | | | | | | | | | |

IT Consulting & Other Services | |

Accenture PLC - Cl. A | | | 77,215 | | | | 9,433,357 | | | | 3.27 | |

| | | | | | | | | | | | | |

Managed Health Care | | | | | | | | | | | | |

UnitedHealth Group, Inc. | | | 73,622 | | | | 10,307,080 | | | | 3.58 | |

| | | | | | | | | | | | | |

Multi-Sector Holdings | | | | | | | | | | | | |

Berkshire Hathaway, Inc. - Cl. B* | | | 65,900 | | | | 9,520,573 | | | | 3.30 | |

| | | | | | | | | | | | | |

Packaged Foods & Meats | | | | | | | | | | | | |

The Kraft Heinz Company | | | 81,879 | | | | 7,328,989 | | | | 2.55 | |

TreeHouse Foods, Inc.* | | | 43,062 | | | | 3,754,576 | | | | 1.30 | |

| | | | | | | | 11,083,565 | | | | 3.85 | |

Pharmaceuticals | | | | | | | | | | | | |

Allergan PLC* | | | 22,091 | | | | 5,087,778 | | | | 1.76 | |

Zoetis, Inc. | | | 175,422 | | | | 9,123,698 | | | | 3.17 | |

| | | | | | | | 14,211,476 | | | | 4.93 | |

Regional Banks | | | | | | | | | | | | |

First Republic Bank | | | 57,608 | | | | 4,442,153 | | | | 1.54 | |

| | | | | | | | | | | | | |

Research & Consulting Services | |

Nielsen Holdings PLC | | | 166,398 | | | | 8,913,941 | | | | 3.09 | |

| | | | | | | | | | | | | |

Restaurants | | | | | | | | | | | | |

Starbucks Corporation | | | 105,053 | | | | 5,687,569 | | | | 1.97 | |

| | | | | | | | | | | | | |

Specialized Finance | | | | | | | | | | | | |

IntercontinentalExchange, Inc. | | | 10,280 | | | | 2,769,021 | | | | 0.96 | |

| | | | | | | | | | | | | |

Specialized REITs | | | | | | | | | | | | |

Crown Castle International Corp. | | | 73,716 | | | | 6,944,784 | | | | 2.41 | |

| | | | | | | | | | | | | |

Specialty Chemicals | | | | | | | | | | | | |

The Sherwin-Williams Company | | | 30,964 | | | | 8,566,500 | | | | 2.97 | |

| | | | | | | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | | | | | |

(Cost $206,907,235) | | | | | | | 268,088,974 | | | | 93.02 | |

| See notes to financial statements. |

15

MARSICO GROWTH FUND

SCHEDULE OF INVESTMENTS (continued)

September 30, 2016

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

SHORT-TERM INVESTMENTS | |

State Street Institutional Treasury Money Market Fund, 0.000% | | | 24,529,643 | | | $ | 24,529,643 | | | | 8.51 | % |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | |

(Cost $24,529,643) | | | | | | | 24,529,643 | | | | 8.51 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | | | | | |

(Cost $231,436,878) | | | | | | | 292,618,617 | | | | 101.53 | |

| | | | | | | | | | | | | |

Liabilities, Less Cash and Other Assets | | | | | | | (4,405,658 | ) | | | (1.53 | ) |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | $ | 288,212,959 | | | | 100.00 | % |

| See notes to financial statements. |

16

INVESTMENT REVIEW BY BRANDON GEISLER (UNAUDITED)

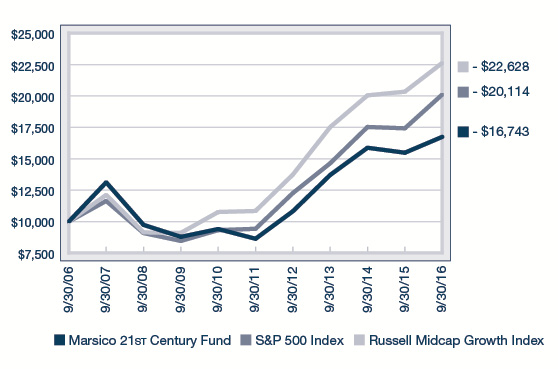

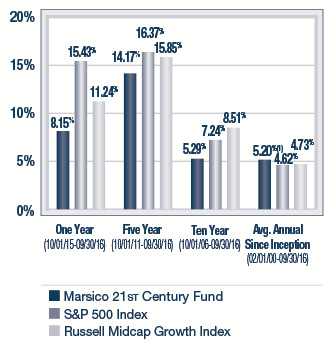

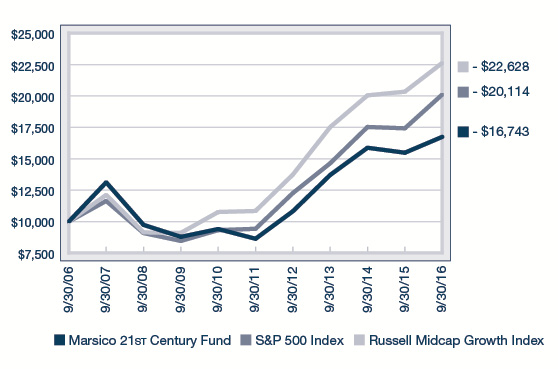

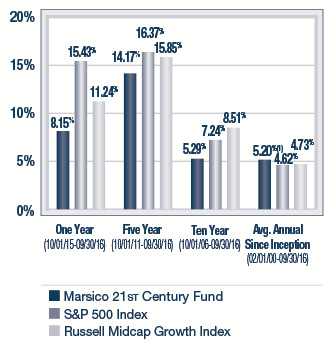

The Marsico 21st Century Fund posted a total return of +8.15% for the one-year fiscal period ended September 30, 2016. The Fund underperformed the S&P 500 Index, the Fund’s primary benchmark index, which had a total return of +15.43% over the same time period. The Russell Midcap Growth Index, a proxy for the performance of medium-capitalization US equity securities (which may be a useful comparison in light of the Fund’s current medium-capitalization positioning), had a total return of +11.24%. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2016.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. (1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

The Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

The Fund is not managed to track the benchmark index, and may hold a substantially overweight or underweight position in a sector, industry, or security compared to its weight in the benchmark. For informational purposes, the discussion below may compare the benchmark weight or performance of a sector or industry to the investment approach of the Fund.

The 21st Century Fund’s underperformance as compared to the S&P 500 Index for the one-year period ended September 30, 2016 was primarily attributable to certain holdings in the Health Care, Information Technology, and Industrials sectors.

Health Care services provider Acadia Healthcare Company, Inc. posted a return of -25% during the period. Though the company has relatively little Medicare exposure, Acadia’s stock price slumped in tandem with many of its industry peers on worries about government reimbursement for health facilities and services.

Several of the Fund’s holdings in the Pharmaceuticals, Biotechnology & Life Sciences industry group also posted negative returns. Alkermes PLC, an Ireland-based specialty pharmaceutical company, slid -30% during the period. Regeneron Pharmaceuticals, Inc. and Alexion Pharmaceuticals, Inc. declined -24% and -21%, respectively. We sold the Fund’s holding in Regeneron because the US government is stepping up efforts to control Medicare Part B costs, an area where Regeneron has more exposure than many of its peers. The Fund added modestly to its position in shares of Alexion, a developer of treatments for rare diseases, at what we consider to be attractive stock prices. Among the products in Alexion’s pipeline is Soliris, a breakthrough drug for treatment of a rare, life-threatening blood disorder.

A few of the Fund’s Information Technology holdings posted negative returns and had an adverse effect on Fund performance. NXP Semiconductors N.V. (-22% prior to being sold) posted a negative return on concerns about weaker demand for semiconductors and rising inventory levels. salesforce.com, inc., although posting a slightly positive return, lagged the benchmark index. This likely was due to market chatter about potential acquisitions in which the proposed strategic fit appeared questionable. The Fund continues to maintain a position in the stock.

The Fund’s cash position was slightly elevated at times, particularly during the early portions of the reporting period. Much of the period was characterized by volatility in the markets. The Fund’s cash levels were reduced during the period as we sought to pick entry points in which to redeploy cash into securities at what we believed to be attractive prices. Nevertheless, in a generally rising equity market, the Fund’s cash positions were a drag on performance when measured over the full one-year period.

17

Within the Consumer Discretionary sector, Tesla Motors, Inc. (-18%) was a holding that detracted from Fund performance. Tesla’s stock price was subject to heightened volatility due to lofty production targets and the timing of new vehicle deliveries. Another of the Fund’s Consumer Discretionary holdings, cruise line operator Norwegian Cruise Line Holdings Ltd., posted a return of -34% during the period, and was an additional detractor from performance.

On the brighter side, Fund holdings in the Consumer Discretionary sector performed well. Clothing retailer Burlington Stores, Inc. soared +59%. Pizza delivery company Domino’s Pizza, Inc. gained +42% as the company reported strong same store sales growth. Central to our investment thesis is Domino’s use of technology to enable customers to place their orders more efficiently, and other technology enhancements designed to prepare and deliver pizzas more quickly. Online retailer Amazon.com, Inc. soared +63% during the period, thanks to a major contribution from its fast-growing and profitable cloud computing business Amazon Web Services. By expanding into cloud computing and other areas such as digital media, the company is complementing its core retail business. Amazon posted its fifth-straight profitable quarter.

A position in social media company Facebook, Inc. – Cl. A was among the Fund’s best performing holdings and posted a gain of +43% during the reporting period. Facebook’s results continued to exceed market expectations, led by strong advertising revenue and monthly active user growth rates, a result of the company’s embracing a shift towards mobile phone usage.

A select Financials holding, First Republic Bank, rose +24% during the period on the back of strong loan growth and continued expansion of its geographical reach and product lineup. As big banks struggle, we believe that First Republic, which focuses on affluent clients in Silicon Valley, may continue to grow.

In the Health Care sector, Intuitive Surgical, Inc. gained +58% during the period as it launched a next-generation surgical robot which allowed the company to enter the general surgery market, leading to revenue and earnings-per-share acceleration.

The Fund benefitted from having a significant portion of its assets invested in the strong-performing Information Technology sector. The Fund also did well by having underweight exposure to the Financials sector, the weakest-performing sector of the benchmark index.

The Fund invests across the market capitalization spectrum in companies of any size. Over the reporting period, the Fund has increased exposure to medium-capitalization companies, as we believe these companies have compelling growth opportunities that may not be recognized by the larger market. However, the Fund continues to hold stocks in what we considered to be high quality large-sized companies that we believe continue to offer strong long-term growth potential.

During the reporting period, the Fund significantly reduced its exposure to the Health Care sector. The Fund increased investment in the Information Technology, Consumer Staples, and Financials sectors.

Fiscal Period-End Investment Posture

As of September 30, 2016, the Fund’s primary economic sector allocations included Information Technology, Consumer Discretionary, Consumer Staples, Health Care, and Financials. The Fund had no investments in the Energy or Utilities sectors.

Sincerely,

BRANDON A. GEISLER

PORTFOLIO MANAGER

(1) | Total returns are based on net change in net asset value assuming reinvestment of distributions. Periodically, certain fees and expenses have been waived or reimbursed by the Adviser for the 21st Century Fund. In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses from the 21st Century Fund, resulting in a lower performance return. Please see the Prospectus for more information. |

18

21st CENTURY FUND OVERVIEW |

September 30, 2016 (Unaudited)

The 21st Century Fund invests primarily in common stocks that are selected for their long-term growth potential. The Fund may invest in companies of any size. The portions of Fund assets invested in large-capitalization, medium-capitalization, or small-capitalization companies will vary based on market conditions, depending on the portfolio manager’s judgment as to how to achieve the Fund’s investment objective. Under current market conditions the portfolio manager expects to invest substantially in medium-capitalization companies. The Fund will normally hold a core position of between 35 and 60 common stocks.

TOTAL ANNUAL OPERATING EXPENSES* 1.33% | NET ASSETS $234,779,718 | NET ASSET VALUE PER SHARE $22.04 |

GROWTH OF $10,000(1)(2) | PERFORMANCE COMPARISON |

|

|

SECTOR ALLOCATION(3) | TOP FIVE HOLDINGS |

| | | | |

| | Constellation Brands, Inc. - Cl. A | 4.22% | |

| | Domino’s Pizza, Inc. | 4.00% | |

| | Facebook, Inc. - Cl. A | 4.00% | |

| | Amazon.com, Inc. | 3.93% | |

| | MasterCard, Inc. - Cl. A | 3.75% | |

| | | | |

* | The Total Annual Operating Expenses are reflective of the information disclosed in the Funds’ Prospectus dated January 29, 2016 and may differ from the expense ratio disclosed in this report. |

| The performance data quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. |

| The performance included in the chart and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. |

| All indices are unmanaged and investors cannot invest directly in an index. |

(1) | Periodically, certain fees and expenses have been waived or reimbursed by the Adviser for the 21st Century Fund. In the absence of such a waiver or reimbursement, the performance returns reflected would have been reduced. In accordance with the expense limitation and fee waiver agreement, the Adviser may recoup fees and expenses previously waived or reimbursed under certain parameters. Periodically, the Adviser has recouped such fees or expenses from the 21st Century Fund, resulting in a lower performance return. |

(2) | This chart assumes an initial investment of $10,000 made on September 30, 2006. Total returns are based on net change in NAV, assuming reinvestment of distributions. |

(3) | Sector weightings represent the percentage of the Fund’s investments (excluding cash equivalents) in certain general sectors. These sectors may include more than one industry. For the year ended September 30, 2016, the Financials sector includes real estate investment trusts. The Fund’s portfolio composition is subject to change at any time. |

| Effective July 15, 2016, the Russell Midcap Growth Index was added as a supplemental benchmark index. The Russell Midcap Growth Index is an index composed of mid-capitalization US equities that exhibit growth characteristics. |

19

MARSICO 21st CENTURY FUND

SCHEDULE OF INVESTMENTS

September 30, 2016

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS | | | | | | | | | |

Aerospace & Defense | | | | | | | | | |

BE Aerospace, Inc. | | | 91,649 | | | $ | 4,734,587 | | | | 2.02 | % |

| | | | | | | | | | | | | |

Apparel Retail | |

Burlington Stores, Inc.* | | | 102,129 | | | | 8,274,492 | | | | 3.52 | |

| | | | | | | | | | | | | |

Application Software | | | | | | | | | | | | |

Adobe Systems, Inc.* | | | 46,275 | | | | 5,022,689 | | | | 2.14 | |

Atlassian Corporation PLC - Cl. A* | | | 29,829 | | | | 893,975 | | | | 0.38 | |

Blackbaud, Inc. | | | 60,856 | | | | 4,037,187 | | | | 1.72 | |

Mobileye N.V.* | | | 64,247 | | | | 2,734,995 | | | | 1.17 | |

salesforce.com, inc.* | | | 118,554 | | | | 8,456,457 | | | | 3.60 | |

The Descartes Systems Group, Inc.* | | | 107,200 | | | | 2,306,685 | | | | 0.98 | |

| | | | | | | | 23,451,988 | | | | 9.99 | |

Automobile Manufacturers | |

Tesla Motors, Inc.* | | | 10,041 | | | | 2,048,665 | | | | 0.87 | |

| | | | | | | | | | | | | |

Automotive Retail | | | | | | | | | | | | |

O'Reilly Automotive, Inc.* | | | 21,576 | | | | 6,043,653 | | | | 2.57 | |

| | | | | | | | | | | | | |

Biotechnology | | | | | | | | | | | | |

Alexion Pharmaceuticals, Inc.* | | | 20,877 | | | | 2,558,267 | | | | 1.09 | |

Alkermes PLC* | | | 37,126 | | | | 1,746,036 | | | | 0.74 | |

| | | | | | | | 4,304,303 | | | | 1.83 | |

Communications Equipment | |

Palo Alto Networks, Inc.* | | | 29,960 | | | | 4,773,527 | | | | 2.03 | |

| | | | | | | | | | | | | |

Construction Materials | | | | | | | | | | | | |

Vulcan Materials Company | | | 40,483 | | | | 4,604,132 | | | | 1.96 | |

| | | | | | | | | | | | | |

Data Processing & Outsourced Services | |

Broadridge Financial Solutions, Inc. | | | 55,281 | | | | 3,747,499 | | | | 1.60 | |

FleetCor Technologies, Inc.* | | | 35,943 | | | | 6,244,377 | | | | 2.66 | |

MasterCard, Inc. - Cl. A | | | 86,574 | | | | 8,810,636 | | | | 3.75 | |

Paysafe Group PLC* | | | 557,718 | | | | 3,224,794 | | | | 1.37 | |

Vantiv, Inc. - Cl. A* | | | 55,837 | | | | 3,141,948 | | | | 1.34 | |

| | | | | | | | 25,169,254 | | | | 10.72 | |

Distillers & Vintners | | | | | | | | | | | | |

Constellation Brands, Inc. - Cl. A | | | 59,452 | | | | 9,898,163 | | | | 4.22 | |

| | | | | | | | | | | | | |

Distributors | |

LKQ Corporation* | | | 56,336 | | | | 1,997,675 | | | | 0.85 | |

| | | | | | | | | | | | | |

Diversified Support Services | |

Healthcare Services Group, Inc. | | | 135,549 | | | | 5,365,029 | | | | 2.28 | |

| | | | | | | | | | | | | |

Environmental & Facilities Services | |

Stericycle, Inc.* | | | 13,938 | | | | 1,116,991 | | | | 0.47 | |

| | | | | | | | | | | | | |

Food Retail | |

Whole Foods Market, Inc. | | | 17,871 | | | | 506,643 | | | | 0.22 | |

| | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

COMMON STOCKS (Continued) | | | | | |

Health Care Equipment | |

Dexcom, Inc.* | | | 39,256 | | | $ | 3,441,181 | | | | 1.47 | % |

Intuitive Surgical, Inc.* | | | 10,079 | | | | 7,305,562 | | | | 3.11 | |

Teleflex, Inc. | | | 21,130 | | | | 3,550,896 | | | | 1.51 | |

| | | | | | | | 14,297,639 | | | | 6.09 | |

Health Care Facilities | | | | | | | | | | | | |

Acadia Healthcare Company, Inc.* | | | 78,555 | | | | 3,892,400 | | | | 1.66 | |

| | | | | | | | | | | | | |

Home Entertainment Software | |

Activision Blizzard, Inc. | | | 58,832 | | | | 2,606,258 | | | | 1.11 | |

Electronic Arts, Inc.* | | | 79,725 | | | | 6,808,515 | | | | 2.90 | |

| | | | | | | | 9,414,773 | | | | 4.01 | |

Hotels, Resorts & Cruise Lines | |

Norwegian Cruise Line Holdings Ltd.* | | | 119,748 | | | | 4,514,500 | | | | 1.92 | |

| | | | | | | | | | | | | |

Integrated Telecommunication Services | |

SBA Communications Corporation - Cl. A* | | | 43,307 | | | | 4,857,313 | | | | 2.07 | |

| | | | | | | | | | | | | |

Internet & Direct Marketing Retail | |

Amazon.com, Inc.* | | | 11,009 | | | | 9,217,946 | | | | 3.93 | |

Ctrip.com International, Ltd. ADR* | | | 111,376 | | | | 5,186,780 | | | | 2.21 | |

NetFlix, Inc.* | | | 24,814 | | | | 2,445,420 | | | | 1.04 | |

| | | | | | | | 16,850,146 | | | | 7.18 | |

Internet Software & Services | |

CoStar Group, Inc.* | | | 35,500 | | | | 7,686,815 | | | | 3.27 | |

Facebook, Inc. - Cl. A* | | | 73,262 | | | | 9,397,317 | | | | 4.00 | |

Scout24 A.G.* | | | 61,007 | | | | 2,055,965 | | | | 0.88 | |

| | | | | | | | 19,140,097 | | | | 8.15 | |

Investment Banking & Brokerage | |

The Charles Schwab Corporation | | | 174,000 | | | | 5,493,180 | | | | 2.34 | |

| | | | | | | | | | | | | |

IT Consulting & Other Services | |

Gartner, Inc.* | | | 12,966 | | | | 1,146,843 | | | | 0.49 | |

| | | | | | | | | | | | | |

Packaged Foods & Meats | | | | | | | | | | | | |

Blue Buffalo Pet Products, Inc.* | | | 70,623 | | | | 1,678,002 | | | | 0.72 | |

TreeHouse Foods, Inc.* | | | 75,430 | | | | 6,576,742 | | | | 2.80 | |

| | | | | | | | 8,254,744 | | | | 3.52 | |

Railroads | | | | | | | | | | | | |

Genesee & Wyoming, Inc. - Cl. A* | | | 22,906 | | | | 1,579,369 | | | | 0.67 | |

| | | | | | | | | | | | | |

Regional Banks | | | | | | | | | | | | |

First Republic Bank | | | 107,613 | | | | 8,298,038 | | | | 3.53 | |

Signature Bank* | | | 10,000 | | | | 1,184,500 | | | | 0.51 | |

| | | | | | | | 9,482,538 | | | | 4.04 | |

Research & Consulting Services | |

Verisk Analytics, Inc. - Cl. A* | | | 49,049 | | | | 3,986,703 | | | | 1.70 | |

| | | | | | | | | | | | | |

Restaurants | | | | | | | | | | | | |

Domino's Pizza, Inc. | | | 61,900 | | | | 9,399,515 | | | | 4.00 | |

| | | | | | | | | | | | | |

Soft Drinks | | | | | | | | | | | | |

Monster Beverage Corporation* | | | 27,965 | | | | 4,105,542 | | | | 1.75 | |

| See notes to financial statements. |

20

| | | Number

of

Shares | | | Value | | | Percent

of Net

Assets | |

COMMON STOCKS (Continued) | | | | |

Specialized Finance | | | | | | | | | |

Element Financial Corporation | | | 221,106 | | | $ | 2,767,301 | | | | 1.18 | % |

| | | | | | | | | | | | | |

Specialized REITs | | | | | | | | | | | | |

Crown Castle International Corp. | | | 49,545 | | | | 4,667,634 | | | | 1.99 | |

| | | | | | | | | | | | | |

Specialty Chemicals | | | | | | | | | | | | |

The Sherwin-Williams Company | | | 15,007 | | | | 4,151,837 | | | | 1.77 | |

| | | | | | | | | | | | | |

Specialty Stores | | | | | | | | | | | | |

Ulta Salon Cosmetics & Fragrance, Inc.* | | | 12,311 | | | | 2,929,772 | | | | 1.25 | |

| | | | | | | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | | | | | |

(Cost $174,256,344) | | | | | | | 233,220,948 | | | | 99.33 | |

| | | | | | | | | | | | | |

SHORT-TERM INVESTMENTS | |

State Street Institutional Treasury Money Market Fund, 0.000% | | | 2,884,890 | | | | 2,884,890 | | | | 1.23 | |

| | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS | |

(Cost $2,884,890) | | | | | | | 2,884,890 | | | | 1.23 | |

| | | | | | | | | | | | | |

TOTAL INVESTMENTS | | | | | | | | | | | | |

(Cost $177,141,234) | | | | | | | 236,105,838 | | | | 100.56 | |

| | | | | | | | | | | | | |

Liabilities, Less Cash and Other Assets | | | | | | | (1,326,120 | ) | | | (0.56 | ) |

| | | | | | | | | | | | | |

NET ASSETS | | | | | | $ | 234,779,718 | | | | 100.00 | % |

| See notes to financial statements. |

21

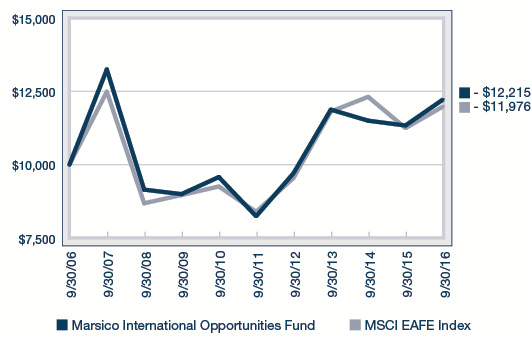

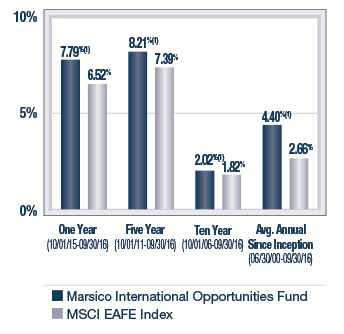

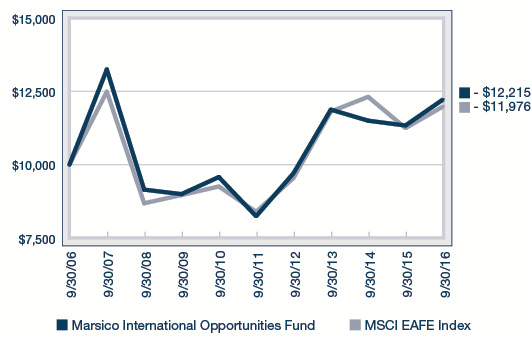

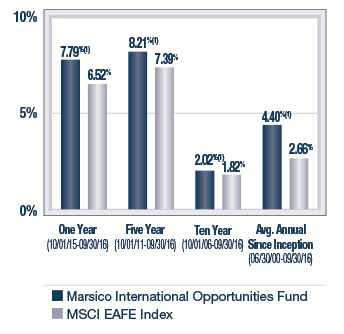

INTERNATIONAL OPPORTUNITIES FUND |

INVESTMENT REVIEW BY MUNISH MALHOTRA (UNAUDITED)

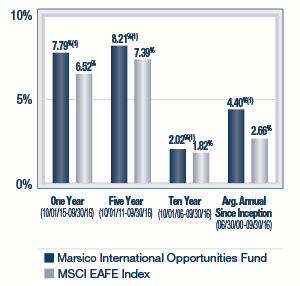

The Marsico International Opportunities Fund posted a total return of (US$) +7.79% for the one-year fiscal period ended September 30, 2016. The Fund outperformed the MSCI EAFE Index, the Fund’s benchmark index, which had a total return of (US$) +6.52% over the same time period. Please see the Fund’s Overview for more detailed information about the Fund’s longer-term performance for various time periods ended September 30, 2016.

The performance data for the Fund quoted here represent past performance, and past performance is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. To obtain performance information current to the most recent month-end, please call 888-860-8686 or visit marsicofunds.com. (1)

This review highlights Fund performance over a one-year fiscal period. Shareholders should keep in mind that the Fund is intended for long-term investors who hold their shares for substantially longer periods of time. You should also keep in mind that our current views and beliefs regarding all investments discussed in this report are subject to change at any time. References to specific securities, industries, and sectors discussed in this report are not recommendations to buy or sell such securities or related investments, and the Fund may not necessarily hold these securities or investments today. Please see the accompanying Schedule of Investments for the percentage of the Fund’s portfolio represented by the securities mentioned in this report as of the end of the reporting period.

Foreign investments present additional risks due to currency fluctuations, economic and political factors, lower liquidity, differences in securities regulations and accounting standards, possible changes in taxation, limited public information, and other factors. In addition, the Fund is subject to broad risks associated with investing in equity securities markets generally, including the risks that the securities and markets in which it invests may experience volatility and instability, that domestic and global economies and markets may undergo periods of cyclical change and decline, that investors may at times avoid investments in equity securities, and that investments may not perform as anticipated. Please see the Prospectus for more information.

The Fund is not managed to track the benchmark index, and may hold a substantially overweight or underweight position in a sector, industry, or security compared to its weight in the benchmark. For informational purposes, the discussion below may compare the benchmark weight or performance of a sector or industry to the investment approach of the Fund.

The International Opportunities Fund’s outperformance during the one-year period ended September 30, 2016, as compared to the MSCI EAFE Index, was primarily attributable to certain outperforming stocks we selected in the Consumer Discretionary sector.

Several of the Fund’s positions in the Retailing and Consumer Services industries were significant, positive contributors to performance. Chinese online travel reservations company Ctrip.com International, Ltd. ADR soared +47%. Ctrip’s business has benefitted from a growing middle class in China that is increasing tourist travel. Canadian discount retailer Dollarama, Inc. gained +49% as the company reported strong same-store sales growth, benefiting from value conscious spending by consumers. Pizza delivery is a growing franchise business in Australia, where Domino’s Pizza Enterprises Ltd. (+92%) operates. Central to our investment thesis is Domino’s use of technology to enable customers to place their orders more efficiently, and other innovative enhancements designed to prepare and deliver pizzas more quickly. Japanese ecommerce fashion retailer Start Today Company Ltd. rose +54%. The company has made improvements to its smartphone app and is rolling out new discount promotions to help drive sales.

Media holding REA Group Ltd. gained +42%. REA’s Australian online real estate advertising service has seen improving revenue as its user base continues to grow.

The stocks we selected in the Information Technology sector exhibited strong performance, led by holdings in the Software & Services industry. Chinese Internet services company Tencent Holdings Ltd. gained +64% as the company generated strong revenue growth from its mobile gaming business. The company also is beginning to generate successful returns from its payments and cloud computing products. Social media company Facebook, Inc. – Cl. A gained +40%. Facebook’s results continued to exceed market expectations, led by strong advertising revenue and monthly active user growth rates, a result of the company’s embracing a shift towards mobile phone usage. The Fund’s overweight allocation to the Information Technology sector further benefitted performance, as Information Technology was among the stronger-performing sectors of the MSCI EAFE Index.