UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-8399

PIMCO Variable Insurance Trust

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer

PIMCO Funds

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (949) 720-4761

Date of fiscal year end: December 31

Date of reporting period: January 1, 2003–June 30, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

P I M C O PIMCO VARIABLE INSURANCE TRUST SHORT-TERM PORTFOLIO ADMINISTRATIVE CLASS

SEMI-ANNUAL REPORT June 30, 2003 |

Contents

| | | Fund Summary

| | Schedule of Investments

|

Short-Term Portfolio (Administrative Class) | | 2 | | 7 |

Chairman’s Letter

Dear PIMCO Variable Insurance Trust Shareholder:

Financial assets gained during the first half of 2003 amid a revival of risk appetites as anxiety about the war in Iraq faded. Assets that generally benefit from economic growth, such as stocks, corporate bonds and emerging market debt, fared the best year-to-date as investors returned to these sectors in anticipation of a recovery in the second half of 2003. Reflationary forces that investors expected to fuel a rebound included federal tax cuts and a weak dollar, as well as low borrowing rates that eased the burden of high personal and corporate indebtedness. Low mortgage rates kept refinancings booming in the second quarter and put more money in consumers’ pockets.

U.S. Treasuries lagged their riskier counterparts but still enjoyed a modest rally. Yields fell to levels not seen in 45 years early in the second quarter before bouncing off their lows in June as hopes for recovery increased. The yield on the benchmark 10-year Treasury closed the six-month period 0.30% lower to 3.51%, after nearing 3% earlier in the period. Buyers were encouraged that inflation would remain tame amid low capacity utilization and weak employment growth. Asian central banks bought U.S. Treasuries to limit the rise in their currencies versus the dollar in an effort to protect their export industries. In June, the Federal Reserve cut the federal funds rate by 0.25% to 1%, its 13th easing since 2001, in an effort to boost the economy and ward off deflation. Although the cut was less than expected, the Fed suggested that rates would stay low until deflation risks abated.

On the following pages you will find specific details as to the Portfolio’s total return investment performance and a discussion of those factors that affected performance.

We appreciate the trust you have placed in us, and we will continue to focus our efforts to meet your investment needs.

Sincerely,

Brent R. Harris

Chairman

July 31, 2003

1

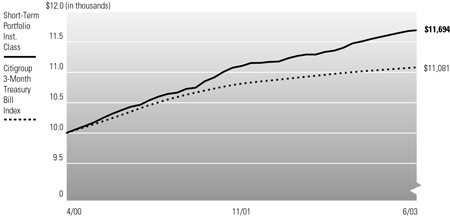

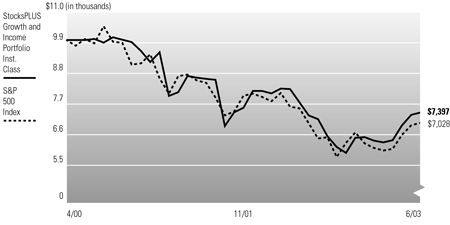

Short-Term Portfolio

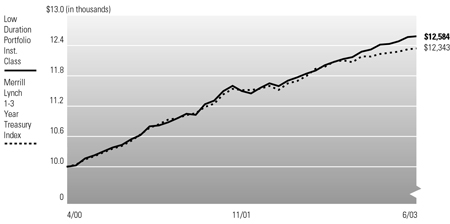

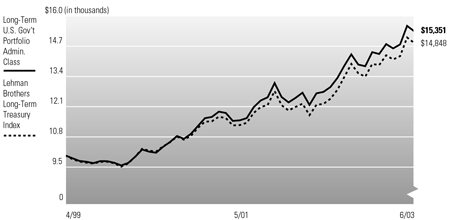

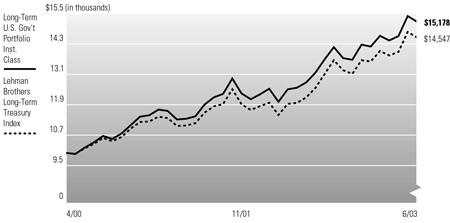

TOTAL RETURN INVESTMENT PERFORMANCE For the period ended June 30, 2003

| | | 1 Year | | | Since Inception* | |

Short-Term Portfolio Administrative Class | | 3.40 | % | | 5.00 | % |

Citigroup 3-Month Treasury Bill Index | | 1.41 | % | | — | |

| * | | Annualized (All Portfolio returns are net of fees and expenses) |

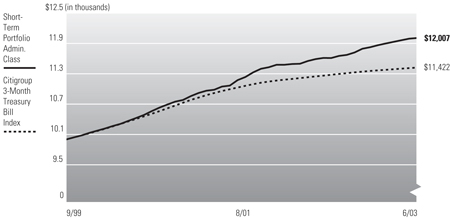

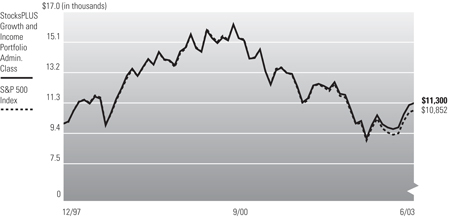

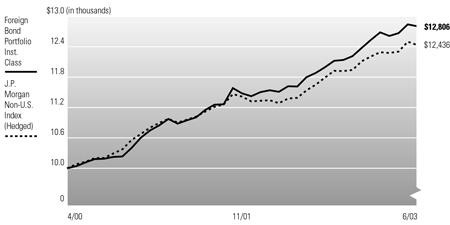

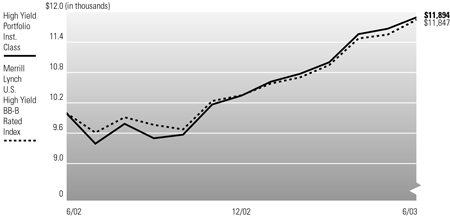

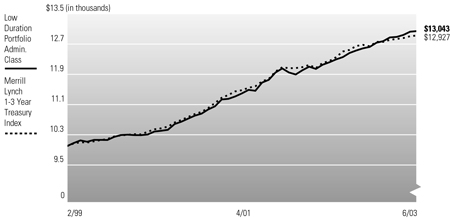

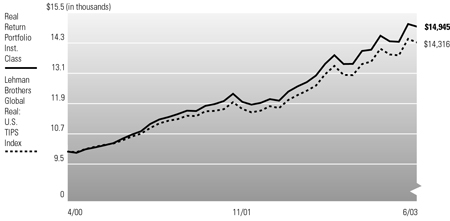

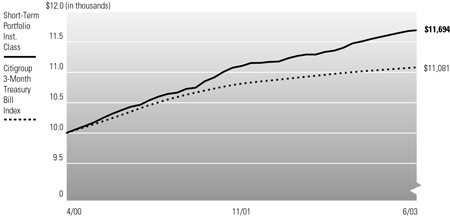

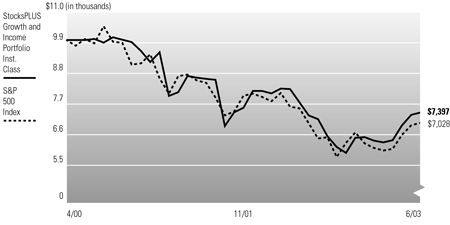

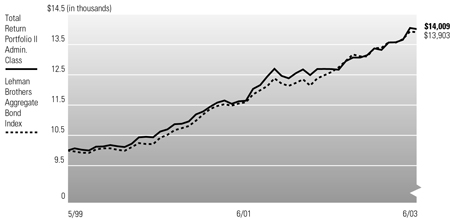

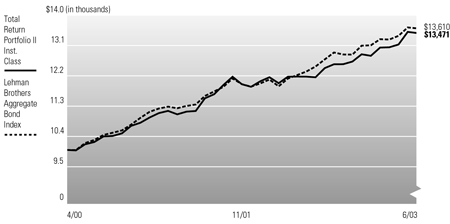

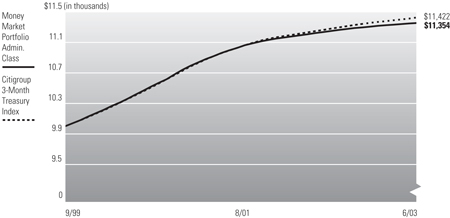

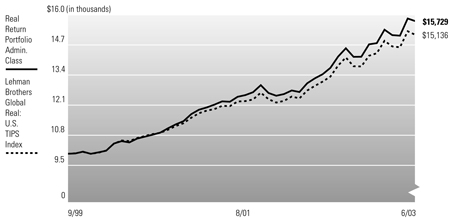

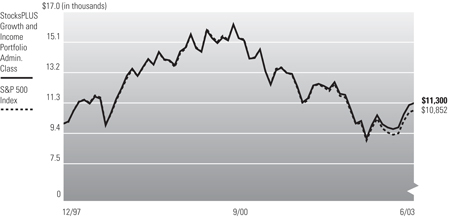

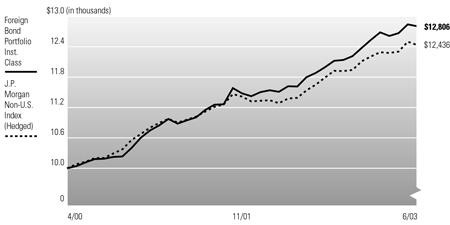

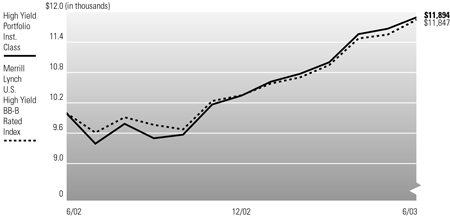

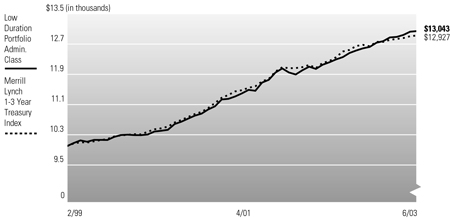

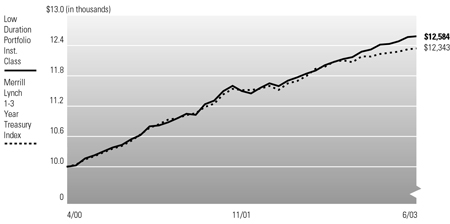

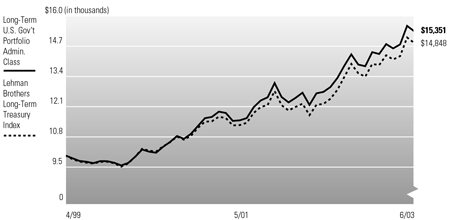

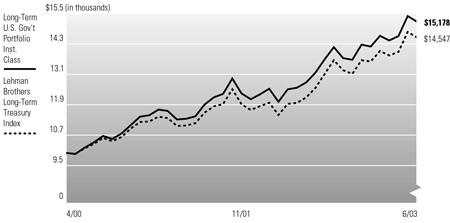

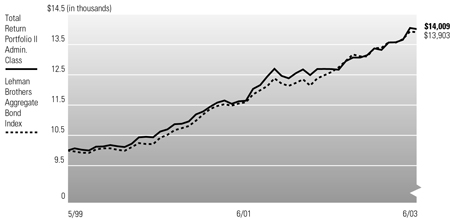

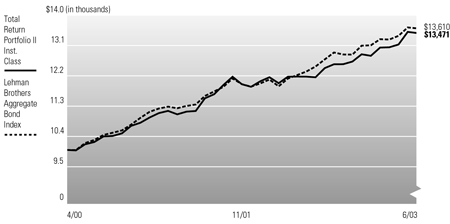

CUMULATIVE RETURNS THROUGH JUNE 30, 2003

$ 10,000 invested at inception

Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that Portfolio shares, when redeemed, may be worth more or less than their original cost. The line graph above assumes the investment of $10,000 on 10/01/1999, the first full month following the Portfolio’s Administrative Class inception on 9/30/1999, compared to the Citigroup 3-Month Treasury Bill Index, an unmanaged market index. It is not possible to invest directly in the Index. Prior to 4/7/03 the Citigroup 3-Month Treasury Bill Index was known as the Saloman Smith Barney 3-Month Treasury Bill Index. Whereas money market funds attempt to maintain a stable share price, the Short-Term Portfolio’s share price will fluctuate in response to market conditions. The Portfolio may invest in foreign securities which involve potentially higher risks including foreign currency fluctuations and political or economic uncertainty. These risks may be enhanced when investing in emerging market securities.

PORTFOLIO INSIGHTS

| • | | The Short-Term Portfolio seeks to achieve its investment objective by investing under normal circumstances at least 65% of its total assets in a diversified portfolio of Fixed Income Instruments of varying maturities. |

| • | | The total return performance of the Portfolio was 1.54% for the six-month period ended June 30, 2003, outperforming the 0.59% return of the Citigroup 3-Month Treasury Bill Index. |

| • | | A duration longer than the effective benchmark was modestly positive for performance as rates fell. |

| • | | Mortgages enhanced the Portfolio’s yield and credit quality. |

| • | | Corporate holdings provided high relative yields and positive price performance as credit risk premiums fell. |

| • | | An allocation to real return bonds was neutral as real yields fell roughly in line with those on nominal bonds. |

| • | | Emerging market bonds helped returns. This asset class continued to gain amid strong demand from investors drawn to relatively high yields and improving credit quality. |

| • | | Asset-backed bonds helped returns, providing attractive relative yields. |

| • | | Short maturity Eurozone exposure was a slight positive as these maturities fell more than U.S. rates amid expectations of more easing by the European Central Bank. |

| • | | Option strategies added incremental income and contributed positively to overall performance. |

2

Financial Highlights

Short-Term Portfolio (Administrative Class)

| Selected Per Share Data for the Year or Period Ended: | | 06/30/2003 +

| | | 12/31/2002

| | | 12/31/2001

| | | 12/31/2000

| | | 09/30/1999- 12/31/1999

| |

Net asset value beginning of period | | $ | 10.08 | | | $ | 10.08 | | | $ | 10.01 | | | $ | 10.00 | | | $ | 10.00 | |

Net investment income (a) | | | 0.09 | | | | 0.28 | | | | 0.48 | | | | 0.53 | | | | 0.13 | |

Net realized/unrealized gain on investments (a) | | | 0.06 | | | | 0.02 | | | | 0.15 | | | | 0.09 | | | | 0.00 | |

Total income from investment operations | | | 0.15 | | | | 0.30 | | | | 0.63 | | | | 0.62 | | | | 0.13 | |

Dividends from net investment income | | | (0.10 | ) | | | (0.29 | ) | | | (0.52 | ) | | | (0.61 | ) | | | (0.13 | ) |

Distributions from net realized capital gains | | | 0.00 | | | | (0.01 | ) | | | (0.04 | ) | | | 0.00 | | | | 0.00 | |

Total distributions | | | (0.10 | ) | | | (0.30 | ) | | | (0.56 | ) | | | (0.61 | ) | | | (0.13 | ) |

Net asset value end of period | | $ | 10.13 | | | $ | 10.08 | | | $ | 10.08 | | | $ | 10.01 | | | $ | 10.00 | |

Total return | | | 1.54 | % | | | 3.02 | % | | | 6.45 | % | | | 6.42 | % | | | 1.32 | % |

Net assets end of period (000s) | | $ | 6,027 | | | $ | 4,340 | | | $ | 1,683 | | | $ | 37 | | | $ | 3,040 | |

Ratio of expenses to average net assets | | | 0.60 | %* | | | 0.60 | %(e) | | | 0.61 | %(c)(d) | | | 0.60 | % | | | 0.60 | %(b)* |

Ratio of net investment income to average net assets | | | 1.80 | %* | | | 2.81 | % | | | 4.74 | % | | | 5.27 | % | | | 5.17 | %* |

Portfolio turnover rate | | | 68 | % | | | 60 | % | | | 94 | % | | | 281 | % | | | N/A | |

| (a) | | Per share amounts based on average number of shares outstanding during the period. |

| (b) | | If the investment manager had not reimbursed expenses, the ratio of operating expenses to average net assets would have been 1.42% for the period ended December 31, 1999. |

| (c) | | Ratio of expenses to average net assets excluding interest expense is 0.60%. |

| (d) | | If the investment manager had not reimbursed expenses, the ratio of operating expenses to average net assets would have been 0.62% for the year ended December 31, 2001. |

| (e) | | If the investment manager had not reimbursed expenses, the ratio of operating expenses to average net assets would have been 0.61% for the year ended December 31, 2002. |

See accompanying notes

3

Statement of Assets and Liabilities

Short-Term Portfolio

June 30, 2003 (Unaudited)

Amounts in thousands, except per share amounts

Assets: | | | | |

Investments, at value | | $ | 16,185 | |

Cash | | | 1 | |

Foreign currency, at value | | | 12 | |

Receivable for Portfolio shares sold | | | 1 | |

Interest receivable | | | 71 | |

Variation margin receivable | | | 2 | |

Unrealized appreciation on swap agreements | | | 13 | |

| | |

|

|

|

| | | | 16,285 | |

| | |

|

|

|

Liabilities: | | | | |

Payable for investments purchased | | $ | 110 | |

Written options outstanding | | | 11 | |

Payable for Portfolio shares redeemed | | | 11 | |

Accrued investment advisory fee | | | 3 | |

Accrued administration fee | | | 3 | |

Accrued servicing fee | | | 1 | |

| | |

|

|

|

| | | | 139 | |

| | |

|

|

|

Net Assets | | $ | 16,146 | |

| | |

|

|

|

Net Assets Consist of: | | | | |

Paid in capital | | $ | 16,047 | |

Undistributed (overdistributed) net investment income | | | (9 | ) |

Accumulated undistributed net realized gain | | | 39 | |

Net unrealized appreciation | | | 69 | |

| | |

|

|

|

| | | $ | 16,146 | |

| | |

|

|

|

Net Assets: | | | | |

Institutional Class | | $ | 10,119 | |

Administrative Class | | | 6,027 | |

Shares Issued and Outstanding: | | | | |

Institutional Class | | | 999 | |

Administrative Class | | | 595 | |

Net Asset Value and Redemption Price Per Share (Net Assets Per Share Outstanding) | | | | |

Institutional Class | | $ | 10.13 | |

Administrative Class | | | 10.13 | |

Cost of Investments Owned | | $ | 16,162 | |

Cost of Foreign Currency Held | | $ | 12 | |

See accompanying notes

4

Statement of Operations

Short-Term Portfolio

For the six months ended June 30, 2003 (Unaudited)

Amounts in thousands

Investment Income: | | | | |

Interest | | $ | 136 | |

Miscellaneous income | | | 7 | |

| | |

|

|

|

Total Income | | | 143 | |

| | |

|

|

|

Expenses: | | | | |

Investment advisory fees | | | 15 | |

Administration fees | | | 12 | |

Distribution and/or servicing fees - Administrative Class | | | 4 | |

| | |

|

|

|

Total Expenses | | | 31 | |

| | |

|

|

|

Net Investment Income | | | 112 | |

| | |

|

|

|

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized gain on investments | | | 6 | |

Net realized gain on futures contracts, written options, and swaps | | | 62 | |

Net realized (loss) on foreign currency transactions | | | (2 | ) |

Net change in unrealized appreciation on investments | | | 1 | |

Net change in unrealized appreciation on futures contracts, written options, and swaps | | | 5 | |

Net change in unrealized appreciation on translation of assets and liabilities denominated in foreign currencies | | | 1 | |

Net Gain | | | 73 | |

| | |

|

|

|

Net Increase in Assets Resulting from Operations | | $ | 185 | |

| | |

|

|

|

See accompanying notes

5

Statements of Changes in Net Assets

Short-Term Portfolio

Amounts in thousands

| Increase (Decrease) in Net Assets from: | | Six Months Ended June 30, 2003

| | | Year Ended December 31, 2002

| |

| | | (Unaudited) | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 112 | | | $ | 227 | |

Net realized gain (loss) | | | 66 | | | | (25 | ) |

Net change in unrealized appreciation | | | 7 | | | | 50 | |

| | |

|

|

| |

|

|

|

Net increase resulting from operations | | | 185 | | | | 252 | |

| | |

|

|

| |

|

|

|

Distributions to Shareholders: | | | | | | | | |

From net investment income | | | | | | | | |

Institutional Class | | | (69 | ) | | | (136 | ) |

Administrative Class | | | (58 | ) | | | (91 | ) |

From net realized capital gains | | | | | | | | |

Institutional Class | | | 0 | | | | (7 | ) |

Administrative Class | | | 0 | | | | (6 | ) |

| | |

|

|

| |

|

|

|

Total Distributions | | | (127 | ) | | | (240 | ) |

| | |

|

|

| |

|

|

|

Portfolio Share Transactions: | | | | | | | | |

Receipts for shares sold | | | | | | | | |

Institutional Class | | | 6,317 | | | | 945 | |

Administrative Class | | | 2,511 | | | | 3,406 | |

Issued as reinvestment of distributions | | | | | | | | |

Institutional Class | | | 69 | | | | 142 | |

Administrative Class | | | 58 | | | | 97 | |

Cost of shares redeemed | | | | | | | | |

Institutional Class | | | (1,188 | ) | | | (290 | ) |

Administrative Class | | | (912 | ) | | | (855 | ) |

| | |

|

|

| |

|

|

|

Net increase resulting from Portfolio share transactions | | | 6,855 | | | | 3,445 | |

| | |

|

|

| |

|

|

|

Total Increase in Net Assets | | | 6,913 | | | | 3,457 | |

| | |

|

|

| |

|

|

|

Net Assets: | | | | | | | | |

Beginning of period | | | 9,233 | | | | 5,776 | |

End of period* | | $ | 16,146 | | | $ | 9,233 | |

*Including undistributed (overdistributed) net investment income of: | | $ | (9 | ) | | $ | 6 | |

See accompanying notes

6

Schedule of Investments

Short-Term Portfolio

June 30, 2003 (Unaudited)

| | | Principal Amount (000s)

| | Value (000s)

|

CORPORATE BONDS & NOTES 20.2% | | | | | | |

Banking & Finance 7.0% | | | | | | |

Bear Stearns Cos., Inc. | | | | | | |

1.676% due 09/21/2004 (a) | | $ | 100 | | $ | 100 |

CIT Group, Inc. | | | | | | |

5.500% due 02/15/2004 | | | 130 | | | 133 |

Deutsche Telekom International Finance BV | | | | | | |

8.250% due 06/15/2005 | | | 80 | | | 89 |

Ford Motor Credit Co. | | | | | | |

2.040% due 03/08/2004 (a) | | | 100 | | | 100 |

General Motors Acceptance Corp. | | | | | | |

1.390% due 08/18/2003 (a) | | | 104 | | | 104 |

1.990% due 05/17/2004 (a) | | | 100 | | | 99 |

4.500% due 07/15/2006 | | | 30 | | | 30 |

Household International Netherlands BV | | | | | | |

6.200% due 12/01/2003 | | | 105 | | | 107 |

Merrill Lynch & Co., Inc. | | | | | | |

1.578% due 05/21/2004 (a) | | | 105 | | | 105 |

Popular North America, Inc. | | | | | | |

6.625% due 01/15/2004 | | | 60 | | | 62 |

U.S. Bank National Association | | | | | | |

1.360% due 11/14/2003 (a) | | | 90 | | | 90 |

Unibank A/S | | | | | | |

1.680% due 05/28/2007 (a) | | | 50 | | | 50 |

Verizon Wireless Capital LLC | | | | | | |

1.658% due 12/17/2003 (a) | | | 60 | | | 60 |

| | | | | |

|

|

| | | | | | | 1,129 |

| | | | | |

|

|

Industrials 7.0% | | | | | | |

Clear Channel Communications, Inc. | | | | | | |

7.250% due 09/15/2003 | | | 50 | | | 51 |

DaimlerChrysler North America Holding Corp. | | | | | | |

1.810% due 08/01/2003 (a) | | | 200 | | | 200 |

HCA, Inc. | | | | | | |

6.730% due 07/15/2045 | | | 50 | | | 50 |

Kellogg Co. | | | | | | |

6.625% due 01/29/2004 | | | 60 | | | 62 |

Kraft Foods, Inc. | | | | | | |

2.080% due 02/27/2004 (a) | | | 100 | | | 99 |

Newell Co. | | | | | | |

5.700% due 09/22/2003 | | | 50 | | | 50 |

Norfolk Southern Corp. | | | | | | |

7.875% due 02/15/2004 | | | 100 | | | 104 |

Park Place Entertainment Corp. | | | | | | |

7.950% due 08/01/2003 | | | 90 | | | 90 |

Raytheon Co. | | | | | | |

5.700% due 11/01/2003 | | | 50 | | | 50 |

Safeway, Inc. | | | | | | |

6.050% due 11/15/2003 | | | 80 | | | 81 |

TCI Communications, Inc. | | | | | | |

8.650% due 09/15/2004 | | | 40 | | | 43 |

Time Warner, Inc. | | | | | | |

7.975% due 08/15/2004 | | | 100 | | | 106 |

Weyerhaeuser Co. | | | | | | |

2.243% due 09/15/2003 (a) | | | 150 | | | 150 |

| | | | | |

|

|

| | | | | | | 1,136 |

| | | | | |

|

|

Utilities 6.2% | | | | | | |

ALLETE, Inc. | | | | | | |

2.179% due 10/20/2003 (a) | | | 100 | | | 100 |

Appalachian Power Co. | | | | | | |

1.990% due 08/20/2003 (a) | | | 90 | | | 90 |

AT&T Corp. | | | | | | |

6.375% due 03/15/2004 | | | 110 | | | 113 |

Baltimore Gas & Electric Co. | | | | | | |

6.125% due 07/01/2003 | | | 60 | | | 60 |

British Telecom PLC | | | | | | |

2.413% due 12/15/2003 (a) | | | 100 | | | 100 |

Commonwealth Edison Co. | | | | | | |

1.915% due 09/30/2003 (a) | | | 100 | | | 100 |

DTE Energy Co. | | | | | | |

6.000% due 06/01/2004 | | | 25 | | | 26 |

Entergy Gulf States Inc | | | | | | |

3.600% due 06/01/2008 | | | 100 | | | 100 |

Florida Power Corp. | | | | | | |

6.000% due 07/01/2003 | | | 50 | | | 50 |

Niagara Mohawk Power Co. | | | | | | |

7.375% due 07/01/2003 | | | 76 | | | 76 |

Ohio Edison Co | | | | | | |

4.000% due 05/01/2008 | | | 30 | | | 31 |

Sprint Capital Corp. | | | | | | |

5.700% due 11/15/2003 | | | 150 | | | 151 |

| | | | | |

|

|

| | | | | | | 997 |

| | | | | |

|

|

Total Corporate Bonds & Notes

(Cost $3,243) | | | | | | 3,262 |

| | | | | |

|

|

U.S. GOVERNMENT AGENCIES 2.4% | | | | | | |

Federal Home Loan Bank | | | | | | |

6.270% due 08/26/2004 | | | 175 | | | 184 |

3.250% due 09/26/2005 | | | 200 | | | 201 |

| | | | | |

|

|

Total U.S. Government Agencies

(Cost $385) | | | | | | 385 |

| | | | | |

|

|

U.S. TREASURY OBLIGATIONS 3.6% | | | | | | |

Treasury Inflation Protected Securities (c) | | | | | | |

3.375% due 01/15/2007 | | | 35 | | | 38 |

3.625% due 01/15/2008 | | | 478 | | | 536 |

| | | | | |

|

|

Total U.S. Treasury Obligations

(Cost $580) | | | | | | 574 |

| | | | | |

|

|

MORTGAGE-BACKED SECURITIES 14.4% | | | | | | |

Collateralized Mortgage Obligations 6.8% | | | | | | |

Bank of America Mortgage Securities, Inc. | | | | | | |

6.357% due 07/25/2032 (a) | | | 64 | | | 66 |

5.768% due 10/20/2032 (a) | | | 49 | | | 51 |

Bear Stearns Adjustable Rate Mortgage Trust | | | | | | |

6.158% due 01/25/2032 (a) | | | 15 | | | 15 |

Countrywide Home Loans, Inc. | | | | | | |

4.855% due 09/19/2032 (a) | | | 41 | | | 42 |

CS First Boston Mortgage Securities Corp. | | | | | | |

1.931% due 03/25/2032 (a) | | | 230 | | | 226 |

5.726% due 05/25/2032 (a) | | | 39 | | | 40 |

1.375% due 07/25/2032 (a) | | | 68 | | | 68 |

First Republic Mortgage Loan Trust | | | | | | |

1.480% due 08/15/2032 (a) | | | 96 | | | 95 |

Freddie Mac | | | | | | |

5.500% due 08/15/2004 | | | 21 | | | 21 |

5.625% due 07/15/2028 | | | 55 | | | 56 |

5.750% due 06/15/2029 | | | 39 | | | 40 |

5.750% due 05/15/2031 | | | 50 | | | 50 |

Sequoia Mortgage Trust | | | | | | |

1.668% due 04/20/2033 (a)(g) | | | 60 | | | 60 |

Structured Asset Mortgage Investments, Inc. | | | | | | |

1.422% due 09/19/2032 (a) | | | 94 | | | 94 |

Wachovia Bank Commercial Mortgage Trust | | | | | | |

1.225% due 06/15/2013 (a) | | | 40 | | | 40 |

Washington Mutual Mortgage Securities Corp. | | | | | | |

5.780% due 02/25/2031 | | | 88 | | | 89 |

5.207% due 10/25/2032 (a) | | | 40 | | | 41 |

| | | | | |

|

|

| | | | | | | 1,094 |

| | | | | |

|

|

Fannie Mae 4.9% | | | | | | |

5.500% due 11/01/2016-09/01/2017 (b) | | | 650 | | | 676 |

6.000% due 06/01/2017 | | | 117 | | | 122 |

| | | | | |

|

|

| | | | | | | 798 |

| | | | | |

|

|

Freddie Mac 1.2% | | | | | | |

6.500% due 08/01/2032 | | | 51 | | | 54 |

9.500% due 12/01/2019 | | | 121 | | | 135 |

| | | | | |

|

|

| | | | | | | 189 |

| | | | | |

|

|

Government National Mortgage Association 1.5% | | | | | | |

4.000% due 02/20/2032 (a) | | | 195 | | | 202 |

6.000% due 03/15/2032 | | | 36 | | | 38 |

| | | | | |

|

|

| | | | | | | 240 |

| | | | | |

|

|

Total Mortgage-Backed Securities

(Cost $2,317) | | | | | | 2,321 |

| | | | | |

|

|

ASSET-BACKED SECURITIES 3.2% | | | | | | |

Bear Stearns Asset-Backed Securities, Inc. | | | | | | |

1.365% due 10/25/2032 (a) | | | 28 | | | 28 |

CDC Mortgage Capital Trust | | | | | | |

1.375% due 01/25/2032 (a) | | | 80 | | | 80 |

Contimortgage Home Equity Loan Trust | | | | | | |

1.360% due 04/15/2029 (a) | | | 100 | | | 100 |

CS First Boston Mortgage Securities Corp. | | | | | | |

1.475% due 08/25/2032 (a) | | | 27 | | | 27 |

Financial Asset Securities Corp. AAA Trust | | | | | | |

1.310% due 09/25/2033 (a) | | | 38 | | | 38 |

First Franklin Mortgage Loan Trust | | | | | | |

Asset-Backed Certificates | | | | | | |

1.385% due 09/25/2032 (a) | | | 75 | | | 76 |

Irwin Home Equity Loan Trust | | | | | | |

1.305% due 07/25/2032 (a) | | | 60 | | | 60 |

Morgan Stanley Dean Witter Capital I | | | | | | |

1.405% due 07/25/2030 (a) | | | 25 | | | 25 |

Renaissance Home Equity Loan Trust | | | | | | |

1.475% due 08/25/2033 (a) | | | 20 | | | 20 |

Saxon Asset Securities Trust | | | | | | |

1.435% due 12/25/2032 (a) | | | 26 | | | 26 |

Terwin Mortgage Trust | | | | | | |

1.000% due 06/25/2033 (a) | | | 30 | | | 30 |

| | | | | |

|

|

Total Asset-Backed Securities

(Cost $509) | | | | | | 510 |

| | | | | |

|

|

SOVEREIGN ISSUES 1.6% | | | | | | |

Province of Alberta | | | | | | |

4.875% due 10/29/2003 | | | 100 | | | 101 |

Republic of Brazil | | | | | | |

2.125% due 04/15/2006 (a) | | | 106 | | | 99 |

10.000% due 01/16/2007 | | | 30 | | | 31 |

2.187% due 04/15/2009 (a) | | | 35 | | | 30 |

| | | | | |

|

|

Total Sovereign Issues

(Cost $256) | | | | | | 261 |

| | | | | |

|

|

SHORT-TERM INSTRUMENTS 54.9% | | | | | | |

Commercial Paper 53.8% | | | | | | |

Barclays U.S. Funding Corp. | | | | | | |

0.930% due 08/25/2003 | | | 200 | | | 200 |

CBA Finance, Inc. | | | | | | |

1.220% due 08/01/2003 | | | 400 | | | 400 |

Danske Corp. | | | | | | |

1.190% due 08/21/2003 | | | 300 | | | 299 |

0.915% due 09/19/2003 | | | 100 | | | 100 |

Fannie Mae | | | | | | |

1.200% due 07/16/2003 | | | 500 | | | 500 |

1.135% due 08/13/2003 | | | 200 | | | 200 |

1.150% due 08/13/2003 | | | 1,000 | | | 999 |

1.165% due 08/13/2003 | | | 500 | | | 499 |

Federal Home Loan Bank | | | | | | |

1.175% due 07/02/2003 | | | 1,300 | | | 1,300 |

1.135% due 11/05/2003 | | | 200 | | | 199 |

Freddie Mac | | | | | | |

1.195% due 07/17/2003 | | | 600 | | | 600 |

1.110% due 08/21/2003 | | | 1,800 | | | 1,797 |

HBOS Treasury Services PLC | | | | | | |

1.195% due 08/20/2003 | | | 300 | | | 299 |

Royal Bank of Scotland PLC | | | | | | |

1.215% due 07/08/2003 | | | 500 | | | 500 |

Shell Finance PLC | | | | | | |

1.190% due 08/14/2003 | | | 400 | | | 399 |

UBS Finance, Inc. | | | | | | |

1.210% due 07/08/2003 | | | 400 | | | 400 |

| | | | | |

|

|

| | | | | | | 8,691 |

| | | | | |

|

|

Repurchase Agreement 0.6% | | | | | | |

State Street Bank | | | | | | |

0.800% due 07/01/2003 | | | 91 | | | 91 |

| | | | | |

|

|

(Dated 06/30/2003. Collateralized by Federal Home Loan Bank 3.375% due 05/14/2004 valued at $97. Repurchase proceeds are $91.) | | | | | | |

See accompanying notes

7

| | | Principal Amount (000s)

| | Value (000s)

| |

U.S. Treasury Bills 0.5% | | | | | | | |

1.079% due 08/07/2003-08/14/2003 (b)(d) | | $ | 90 | | $ | 90 | |

| | | | | |

|

|

|

Total Short-Term Instruments

(Cost $8,872) | | | | | | 8,872 | |

| | | | | |

|

|

|

Total Investments 100.3%

(Cost $16,162) | | | | | $ | 16,185 | |

Written Options (e) (0.1%)

(Premiums $26) | | | | | | (11 | ) |

Other Assets and Liabilities (Net) (0.2%) | | | | | | (28 | ) |

| | | | | |

|

|

|

Net Assets 100.0% | | | | | $ | 16,146 | |

| | | | | |

|

|

|

Notes to Schedule of Investments

(amounts in thousands, except number of contracts):

| (a) | | Variable rate security. The rate listed is as of June 30, 2003. |

| (b) | | Securities are grouped by coupon or range of coupons and represent a range of maturities. |

| (c) | | Principal amount of security is adjusted for inflation. |

| (d) | | Securities with an aggregate market value of $90 have been segregated with the custodian to cover margin requirements for the following open futures contracts at June 30, 2003: |

Type

| | # of Contracts

| | Unrealized Appreciation/ (Depreciation)

| |

Euribor Written Put Options Strike @ 97.250 (03/2004) - Short | | 14 | | $ | 10 | |

Euribor Written Put Options Strike @ 97.500 (03/2004) - Short | | 7 | | | 5 | |

Euribor Purchase Put Options Strike @ 95.125 (03/2004) - Long | | 21 | | | 0 | |

Euribor Written Put Options Strike @ 97.000 (12/2004) - Short | | 14 | | | 4 | |

Euribor Purchase Put Options Strike @ 93.750 (12/2004) - Long | | 14 | | | 0 | |

Euribor Written Put Options Strike @ 97.500 (12/2004) - Short | | 3 | | | (2 | ) |

Euribor Purchase Put Options Strike @ 95.000 (12/2004) - Long | | 4 | | | 0 | |

Euribor March Futures (03/2005) - Long | | 1 | | | 0 | |

Euribor June Futures (06/2005) - Long | | 1 | | | (1 | ) |

Euribor September Futures (09/2005) - Long | | 1 | | | (1 | ) |

Eurodollar March Futures (03/2006) - Long | | 1 | | | 0 | |

Eurodollar June Futures (06/2005) - Long | | 1 | | | 1 | |

Eurodollar September Futures (09/2005) - Long | | 1 | | | 1 | |

Eurodollar December Futures (12/2005) - Long | | 1 | | | 0 | |

| | | | |

|

|

|

| | | | | $ | 17 | |

| | | | |

|

|

|

| (e) | | Premiums received on written options: |

Type

| | Notional Amount

| | Premium

| | Value

|

Put - OTC 7 Year Interest Rate Swap | | | | | | | | | |

Strike @ 7.000%** Exp. 01/07/2005 | | $ | 140,000 | | $ | 3 | | $ | 1 |

Call - OTC 7 Year Interest Rate Swap | | | | | | | | | |

Strike @ 5.000%* Exp. 01/07/2005 | | | 140,000 | | | 3 | | | 10 |

| | | | | |

|

| |

|

|

| | | | | | $ | 6 | | $ | 11 |

| | | | | |

|

| |

|

|

| | | |

Type

| | # of Contracts

| | Premium

| | Value

|

Put - CME Eurodollar March Futures | | | | | | | | | |

Strike @ 97.250 Exp. 03/15/2004 | | | 4 | | $ | 3 | | $ | 0 |

Put - CME Eurodollar June Futures | | | | | | | | | |

Strike @ 97.000 Exp. 06/14/2004 | | | 8 | | | 9 | | | 0 |

Put - CME Eurodollar June Futures | | | | | | | | | |

Strike @ 97.250 Exp. 06/14/2004 | | | 6 | | | 8 | | | 0 |

| | | | | |

|

| |

|

|

| | | | | | $ | 20 | | $ | 0 |

| | | | | |

|

| |

|

|

| * | | The Portfolio will receive a floating rate based on 3-month LIBOR. |

| ** | | The Portfolio will pay a floating rate based on 3-month LIBOR. |

| (f) | | Swap agreements outstanding at June 30, 2003: |

Type

| | Notional Amount

| | Unrealized Appreciation

|

Receive a fixed rate equal to 0.360% and the Portfolio will pay to the counterparty at par in the event of default of General Electric Capital Corp. 5.875% due 02/15/2012. Counterparty: ABN AMRO Bank, N.V. | | | | | | |

Exp. 07/11/2003 | | $ | 50 | | $ | 0 |

Receive a fixed rate equal to 0.410% and the Portfolio will pay to the counterparty at par in the event of default of General Electric Capital Corp. 5.875% due 02/15/2012. Counterparty: Goldman Sachs & Co. | | | | | | |

Exp. 06/07/2004 | | | 100 | | | 0 |

Receive a fixed rate equal to 0.730% and the Portfolio will pay to the counterparty at par in the event of default of the United Mexican States 11.500% due 05/15/2026. Counterparty: Bear, Stearns & Co., Inc. | | | | | | |

Exp. 06/20/2005 | | | 80 | | | 0 |

Receive a fixed rate equal to 0.750% and the Portfolio will pay to the counterparty at par in the event of default of the United Mexican States 8.375% due 01/14/2011. Counterparty: Merrill Lynch & Co., Inc. | | | | | | |

Exp. 12/16/2003 | | | 90 | | | 0 |

Receive a fixed rate equal to 1.450% and the Portfolio will pay to the counterparty at par in the event of default of Republic of Bulgaria 2.813% due 07/28/2011. Counterparty: Goldman Sachs & Co. | | | | | | |

Exp. 04/15/2004 | | | 30 | | | 0 |

Receive a fixed rate equal to 16.500% and the Portfolio will pay to the counterparty at par in the event of default of Federative Republic of Brazil 2.563% due 04/15/2006. Counterparty: Merrill Lynch & Co., Inc. | | | | | | |

Exp. 01/16/2005 | | | 75 | | | 13 |

| | | | | |

|

|

| | | | | | $ | 13 |

| | | | | |

|

|

| (g) | | Indicates a fair valued security which has not been valued utilizing an independent quote and which is valued pursuant to guidelines established by the Trustees. The aggregate value of fair valued securities is $60, which is 0.37% of net assets. |

See accompanying notes

8

Notes to Financial Statements

June 30, 2003 (Unaudited)

1. Organization

The Short-Term Portfolio (the “Portfolio”) is a series of the PIMCO Variable Insurance Trust (the “Trust”). The Trust is registered under the Investment Company Act of 1940 (the “Act”), as amended, as an open-end investment company organized as a Delaware business trust on October 3, 1997. The Trust may offer up to two classes of shares: Institutional and Administrative. Each share class has identical voting rights (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Information presented in these financial statements pertains to the Administrative Class of the Trust. Certain detailed financial information for the Institutional Class is provided separately and is available upon request. The Trust is designed to be used as an investment vehicle by Separate Accounts of insurance companies that fund variable annuity contracts and variable life insurance policies and by qualified pension and retirement plans. The Portfolio commenced operations on September 30, 1999.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Security Valuation. Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Market value is determined at the close of regular trading (normally, 4:00 p.m., Eastern Time) on the New York Stock Exchange on each day the New York Stock Exchange is open, or if no sales are reported, as is the case for most securities traded over-the-counter, the mean between representative bid and asked quotations obtained from a quotation reporting system or from established market makers. Fixed income securities, including those to be purchased under firm commitment agreements, are normally valued on the basis of quotes obtained from brokers and dealers or pricing services. Short-term investments, which mature in 60 days or less are valued at amortized cost, which approximates market value. Certain fixed income securities for which daily market quotations are not readily available may be valued, pursuant to guidelines established by the Board of Trustees, with reference to fixed income securities whose prices are more readily obtainable. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. The prices used by the Portfolio may differ from the value that would be realized if the securities were sold and the differences could be material to the financial statements.

Securities Transactions and Investment Income. Securities transactions are recorded as of the trade date. Securities purchased or sold on a when-issued or delayed delivery basis may be settled a month or more after the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, are recorded as soon as the Portfolio is informed of the ex-dividend date. Interest income, adjusted for the accretion of discounts and amortization of premiums, is recorded on the accrual basis. Paydowns gains and losses on mortgage- and asset-backed securities are recorded as adjustments to interest income in the Statement of Operations.

Dividends and Distributions to Shareholders. Dividends from net investment income, if any, are declared on each day the Trust is open for business and are distributed to shareholders monthly. All dividends are reinvested in additional shares of the Portfolio. Net realized capital gains earned by the Portfolio, if any, will be distributed no less frequently than once each year.

Income dividends and capital gain distributions are determined in accordance with income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments for such items as wash sales, foreign currency transactions, net operating losses and capital loss carryforwards.

Distributions classified as a tax basis return of capital, if any, are reflected in the accompanying Statements of Changes in Net Assets and have been reclassified to paid in capital. In addition, other amounts have been reclassified between undistributed net investment income, accumulated undistributed net realized gains or losses and/or paid in capital to more appropriately conform financial accounting to tax characterizations of dividend distributions.

Foreign Currency. The accounting records of the Portfolio are maintained in U.S. dollars. The market values of foreign securities, currency holding and other assets and liabilities are translated into U.S. dollars based on the current exchange rates each business day. Fluctuations in the value of these assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains or losses. Realized gains or losses and unrealized appreciation (depreciation) on investment securities and income and expenses are translated on the respective dates of such transactions. The effect of changes in foreign currency exchange rates on investments in securities are not

9

segregated in the Statement of Operations from the effects of changes in market prices of those securities, but are included with the net realized and unrealized gain or loss on investment securities.

Multiclass Operations. Each class offered by the Trust has equal rights as to assets. Income, non-class specific expenses, and realized and unrealized capital gains and losses are allocated to each class of shares based on the relative net assets of each class.

Federal Income Taxes. The Portfolio intends to qualify as a regulated investment company and distribute all of its taxable income and net realized gains, if applicable, to shareholders. Accordingly, no provision for Federal income taxes has been made.

Futures Contracts. The Portfolio is authorized to enter into futures contracts. The Portfolio may use futures contracts to manage its exposure to the securities markets or to movements in interest rates and currency values. The primary risks associated with the use of futures contracts are imperfect correlation between the change in market value of the securities held by the Portfolio and the prices of futures contracts, the possibility of an illiquid market, and the inability of the counterparty to meet the terms of the contract. Futures contracts are valued based upon their quoted daily settlement prices. Upon entering into a futures contract, the Portfolio may be required to deposit with its custodian, in a segregated account in the name of the futures broker, an amount of cash or U.S. Government and Agency Obligations in accordance with the initial margin requirements of the broker or exchange. Futures contracts are marked to market daily and an appropriate payable or receivable for the change in value (“variation margin”) is recorded by the Portfolio. Gains or losses are recognized but not considered realized until the contracts expire or are closed. Futures contracts involve, to varying degrees, risk of loss in excess of the variation margin disclosed in the Statement of Assets and Liabilities.

Options Contracts. The Portfolio may write call and put options on futures, securities or currencies it owns or in which it may invest. Writing put options tends to increase the Portfolio’s exposure to the underlying instrument. Writing call options tends to decrease the Portfolio’s exposure to the underlying instrument. When the Portfolio writes a call or put option, an amount equal to the premium received is recorded as a liability and subsequently marked to market to reflect the current value of the option written. Payment received or made, if any, from writing options with premiums to be determined on a future date are reflected as such on the Statement of Assets and Liabilities. Premiums received from writing options which expire are treated as realized gains. Premiums received from writing options which are exercised or closed are added to the proceeds or offset against amounts paid on the underlying future, security or currency transaction to determine the realized gain or loss. The Portfolio as a writer of an option has no control over whether the underlying future, security or currency may be sold (call) or purchased (put) and as a result bears the market risk of an unfavorable change in the price of the future, security or currency underlying the written option. There is the risk the Portfolio may not be able to enter into a closing transaction because of an illiquid market.

The Portfolio may also purchase put and call options. Purchasing call options tends to increase the Portfolio’s exposure to the underlying instrument. Purchasing put options tends to decrease the Portfolio’s exposure to the underlying instrument. The Portfolio pays a premium which is included in the Portfolio’s Statement of Assets and Liabilities as an investment and subsequently marked to market to reflect the current value of the option. Premiums paid for purchasing options which expire are treated as realized losses. The risk associated with purchasing put and call options is limited to the premium paid. Premiums paid for purchasing options which are exercised or closed are added to the amounts paid or offset against the proceeds on the underlying future, security or currency transaction to determine the realized gain or loss.

Swap Agreements. The Portfolio may invest in swap agreements. A swap is an agreement to exchange the return generated by one instrument for the return generated by another instrument. The Portfolio may enter into interest rate, total return, forward swap spread lock and credit default swap agreements to manage its exposure to interest rates and credit risk. Interest rate swap agreements involve the exchange by the Portfolio with another party of their respective commitments to pay or receive interest, e.g., an exchange of floating rate payments for fixed rate payments with respect to a notional amount of principal. Total return swap agreements involve commitments to pay interest in exchange for a market-linked return, both based on notional amounts. To the extent the total return of the security or index underlying the transaction exceeds or falls short of the offsetting interest rate obligation, the Portfolio will receive a payment from or make a payment to the counterparty. Forward spread lock swap agreements involve commitments to pay or receive a settlement amount calculated as the difference between the swap spread and a fixed spread, multiplied by the notional amount times the duration of the swap. The swap spread is the difference between the benchmark swap rate (market rate) and the specific Treasury rate. In a credit default swap, one party makes a stream of payments to another party in exchange for the right to receive a specified return in the event of a default by a third party, typically corporate issues or sovereign issues of an emerging country, on its obligation. The Portfolio may use credit default swaps to provide a measure of protection against defaults of

10

sovereign issuers (i.e., to reduce risk where the Portfolio owns or has exposure to the sovereign issuer) or to take an active long or short position with respect to the likelihood of a particular issuer’s default. Swaps are marked to market daily based upon quotations from market makers and vendors and the change in value, if any, is recorded as unrealized gain or loss in the Statement of Operations. Payments received or made at the beginning of the measurement period are reflected as such on the Statement of Assets and Liabilities. A liquidation payment received or made at the termination of the swap is recorded as realized gain or loss in the Statement of Operations. Net periodic payments are included as part of miscellaneous income on the Statement of Operations. Entering into these agreements involves, to varying degrees, elements of credit, market and documentation risk in excess of the amounts recognized on the Statement of Assets and Liabilities. Such risks involve the possibility that there will be no liquid market for these agreements, that the counterparty to the agreements may default on its obligation to perform or disagree as to the meaning of contractual terms in the agreements, and that there may be unfavorable changes in interest rates.

Delayed Delivery Transactions. The Portfolio may purchase or sell securities on a when-issued or delayed delivery basis. These transactions involve a commitment by the Portfolio to purchase or sell securities for a predetermined price or yield, with payment and delivery taking place beyond the customary settlement period. When delayed delivery purchases are outstanding, the Portfolio will set aside and maintain until the settlement date in a segregated account, liquid assets in an amount sufficient to meet the purchase price. When purchasing a security on a delayed delivery basis, the Portfolio assumes the rights and risks of ownership of the security, including the risk of price and yield fluctuations, and takes such fluctuations into account when determining its net asset value. The Portfolio may dispose of or renegotiate a delayed delivery transaction after it is entered into, and may sell when-issued securities before they are delivered, which may result in a capital gain or loss. When the Portfolio has sold a security on a delayed delivery basis, the Portfolio does not participate in future gains and losses with respect to the security.

Inflation-Indexed Bonds. Inflation-indexed bonds are fixed income securities whose principal value is periodically adjusted to the rate of inflation. The interest rate on these bonds is generally fixed at issuance at a rate lower than typical bonds. Over the life of an inflation-indexed bond, however, interest will be paid based on a principal value, which is adjusted for inflation. Any increase in the principal amount of an inflation-indexed bond will be included as interest income in the Statement of Operations, even though investors do not receive their principal until maturity.

Repurchase Agreements. The Portfolio may engage in repurchase transactions. Under the terms of a typical repurchase agreement, the Portfolio takes possession of an underlying debt obligation subject to an obligation of the seller to repurchase, and the Portfolio to resell, the obligation at an agreed-upon price and time. The market value of the collateral must be equal at all times to the total amount of the repurchase obligations, including interest. Generally, in the event of counterparty default, the Portfolio has the right to use the collateral to offset losses incurred.

3. Fees, Expenses, and Related Party Transactions

Investment Advisory Fee. Pacific Investment Management Company LLC (PIMCO) is a majority owned subsidiary partnership of Allianz Dresdner Asset Management of America L.P. (formerly PIMCO Advisors L.P.) and serves as investment adviser (the “Adviser”) to the Trust, pursuant to an investment advisory contract. The Adviser receives a monthly fee at an annual rate based on average daily net assets of the Portfolio. The Advisory Fee is charged at an annual rate of 0.25%.

Administration Fee. PIMCO serves as administrator (the “Administrator”) and provides administrative services to the Trust for which it receives a monthly administrative fee based on average daily net assets of the Portfolio. The Administration Fee is charged at the annual rate of 0.20%.

Servicing Fee. PIMCO Advisors Distributors LLC (“PAD”), is an indirect wholly-owned subsidiary of Allianz Dresdner Asset Management of America L.P. and serves as the distributor of the Trust’s shares. The Trust is permitted to reimburse PAD on a quarterly basis, out of the Administrative Class assets of the Portfolio in the amount of 0.15% on an annual basis of the average daily net assets of that class, for payments made to financial intermediaries that provide services in connection with the distribution of shares or administration of plans or programs that use Portfolio shares as their funding medium. The effective rate paid to PAD during the current fiscal year is 0.15%.

Expenses. The Portfolio is responsible for the following expenses: (i) salaries and other compensation of any of the Trust’s executive officers and employees who are not officers, directors, stockholders or employees of PIMCO or its subsidiaries or affiliates; (ii) taxes and governmental fees; (iii) brokerage fees and commissions and other portfolio transaction expenses; (iv) the cost of borrowing money, including interest expense; (v) fees and expenses of the Trustees who are not “interested persons” of PIMCO or the Trust, and any counsel retained exclusively for their benefit; (vi) extraordinary expenses, including costs of litigation and indemnification expenses; (vii) organization expenses and (viii) any expenses allocated or allocable to a specific class of shares, which include service fees payable with respect to

11

the Administrative Class shares and may include certain other expenses as permitted by the Trust’s Multiple Class Plan adopted pursuant to Rule 18f-3 under the Act and subject to review and approval by the Trustees. The ratio of expenses to average net assets per share class, as disclosed in the Financial Highlights, may differ from the annual Portfolio operating expenses per share class as disclosed in the Prospectus for the reasons set forth above. PIMCO has agreed to waive a portion of its administrative fees to the extent that the payment of the Portfolio’s pro rata share of Trustees’ fees causes the actual expense ratio to rise above the rates disclosed in the current prospectus plus 0.49 basis points as set forth below (calculated as a percentage of the Portfolio’s average daily net assets attributable to each class):

| | | Institutional

Class

| | | Administrative

Class

| |

Short-Term Portfolio | | 0.45 | % | | 0.60 | % |

PIMCO may be reimbursed for these waived amounts in future periods. The Trust pays no compensation directly to any Trustee or any other officer who is affiliated with the Administrator, all of whom receive renumeration for their services to the Trust from the Administrator or its affiliates.

Each unaffiliated Trustee receives an annual retainer of $4,000, plus $1,500 for each Board of Trustees meeting attended in person and $250 for each meeting attended telephonically, plus reimbursement of related expenses. In addition, each committee chair receives an additional annual retainer of $500. These expenses are allocated on a pro-rata basis to each Portfolio of the Trust according to its respective net assets.

4. Purchases and Sales of Securities

Purchases and sales of securities (excluding short-term investments) for the period ended June 30, 2003 were as follows (amounts in thousands):

| | | U.S Government/

Agency

| | All Other

|

| | | Purchases

| | Sales

| | Purchases

| | Sales

|

Short-Term Portfolio | | $ | 2,716 | | $ | 1,641 | | $ | 2,903 | | $ | 2,898 |

5. Transactions in Written Call and Put Options

Transactions in written call and put options were as follows (amounts in thousands):

| | | Short-Term Portfolio

| |

| | | Premium

| |

Balance at 12/31/2002 | | $ | 37 | |

Sales | | | 30 | |

Closing Buys | | | (41 | ) |

Expirations | | | 0 | |

Exercised | | | 0 | |

| | |

|

|

|

Balance at 06/30/2003 | | $ | 26 | |

| | |

|

|

|

12

6. Federal Income Tax Matters

At June 30, 2003, the aggregate cost of investments was the same for federal income tax and financial statement purposes. The net unrealized appreciation (depreciation) of investments securities for federal income tax purposes is as follows (amounts in thousands):

| | | Aggregate

Gross Unrealized Appreciation

| | Aggregate

Gross Unrealized (Depreciation)

| | | Net

Unrealized Appreciation

|

Short-Term Portfolio | | $ | 41 | | $ | (18 | ) | | $ | 23 |

7. Shares of Beneficial Interest

The Trust may issue an unlimited number of shares of beneficial interest with a $.0001 par value. Changes in shares of beneficial interest were as follows (shares and amounts in thousands):

| | | Short-Term Portfolio

| |

| | | Six Months Ended 06/30/2003

| | | Year Ended 12/31/2002

| |

| | | Shares

| | | Amount

| | | Shares

| | | Amount

| |

Receipts for shares sold | | | | | | | | | | | | | | |

Institutional Class | | 624 | | | $ | 6,317 | | | 95 | | | $ | 945 | |

Administrative Class | | 248 | | | | 2,511 | | | 339 | | | | 3,406 | |

Issued as reinvestment of distributions | | | | | | | | | | | | | | |

Institutional Class | | 7 | | | | 69 | | | 14 | | | | 142 | |

Administrative Class | | 6 | | | | 58 | | | 10 | | | | 97 | |

Cost of shares redeemed | | | | | | | | | | | | | | |

Institutional Class | | (118 | ) | | | (1,188 | ) | | (29 | ) | | | (290 | ) |

Administrative Class | | (90 | ) | | | (912 | ) | | (85 | ) | | | (855 | ) |

| | |

|

| |

|

|

| |

|

| |

|

|

|

Net increase resulting from Portfolio share transactions | | 677 | | | $ | 6,855 | | | 344 | | | $ | 3,445 | |

| | |

|

| |

|

|

| |

|

| |

|

|

|

The following schedule shows the number of shareholders each owning 5% or more of the Portfolio and the total percentage of the Portfolio held by such shareholders:

| | | Number

| | % of Portfolio

Held

|

Short-Term Portfolio | | | | |

Institutional Class | | 3 | | 99 |

Administrative Class | | 4 | | 92 |

13

Trustees and Officers

Brent R. Harris, Chairman and Trustee

R. Wesley Burns, President and Trustee

E. Philip Cannon, Trustee

Vern O. Curtis, Trustee

J. Michael Hagan, Trustee

William J. Popejoy, Trustee

Garlin G. Flynn, Secretary

John P. Hardaway, Treasurer

Investment Adviser and Administrator

Pacific Investment Management Company LLC

840 Newport Center Drive

Newport Beach, California 92660

Transfer Agent

National Financial Data Services

330 W. 9th Street, 4th Floor

Kansas City, Missouri 64105

Custodian

State Street Bank & Trust Company

801 Pennsylvania

Kansas City, Missouri 64105

Counsel

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Independent Accountants

PricewaterhouseCoopers LLP

1055 Broadway

Kansas City, Missouri 64105

PIMCO VARIABLE INSURANCE TRUST

This report is submitted for the general information of the shareholders of the PIMCO Variable Insurance Trust. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective prospectus for the PIMCO Variable Insurance Trust, which contains information covering its investment policies as well as other pertinent information.

All Funds distributed by PIMCO ADVISORS DISTRIBUTORS LLC, member NASD

840 NEWPORT CENTER DRIVE

NEWPORT BEACH, CA 92660

800.927.4648

WWW.PIMCOADVISORS.COM

WWW.PIMCO.COM

P I M C O PIMCO VARIABLE INSURANCE TRUST MONEY MARKET PORTFOLIO ADMINISTRATIVE CLASS |

SEMI-ANNUAL REPORT June 30, 2003 |

| | | Fund

Summary

| | Schedule of

Investments

|

Money Market Portfolio (Administrative Class) | | 2 | | 7 |

Chairman’s Letter

Dear PIMCO Variable Insurance Trust Shareholder:

Financial assets gained during the first half of 2003 amid a revival of risk appetites as anxiety about the war in Iraq faded. Assets that generally benefit from economic growth, such as stocks, corporate bonds and emerging market debt, fared the best year-to-date as investors returned to these sectors in anticipation of a recovery in the second half of 2003. Reflationary forces that investors expected to fuel a rebound included federal tax cuts and a weak dollar, as well as low borrowing rates that eased the burden of high personal and corporate indebtedness. Low mortgage rates kept refinancings booming in the second quarter and put more money in consumers’ pockets.

U.S. Treasuries lagged their riskier counterparts but still enjoyed a modest rally. Yields fell to levels not seen in 45 years early in the second quarter before bouncing off their lows in June as hopes for recovery increased. The yield on the benchmark 10-year Treasury closed the six-month period 0.30% lower to 3.51%, after nearing 3% earlier in the period. Buyers were encouraged that inflation would remain tame amid low capacity utilization and weak employment growth. Asian central banks bought U.S. Treasuries to limit the rise in their currencies versus the dollar in an effort to protect their export industries. In June, the Federal Reserve cut the federal funds rate by 0.25% to 1%, its 13th easing since 2001, in an effort to boost the economy and ward off deflation. Although the cut was less than expected, the Fed suggested that rates would stay low until deflation risks abated.

On the following pages you will find specific details as to the Portfolio’s total return investment performance and a discussion of those factors that affected performance.

We appreciate the trust you have placed in us, and we will continue to focus our efforts to meet your investment needs.

Sincerely, |

|

|

|

Brent R. Harris Chairman |

|

July 31, 2003 |

1

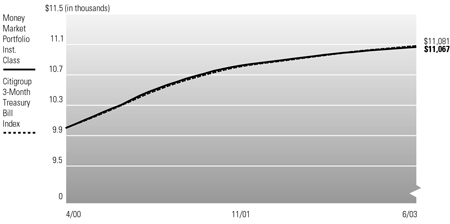

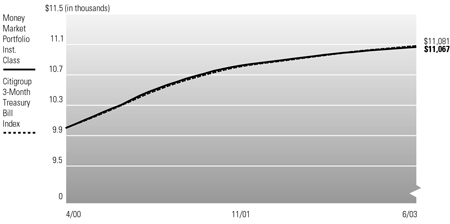

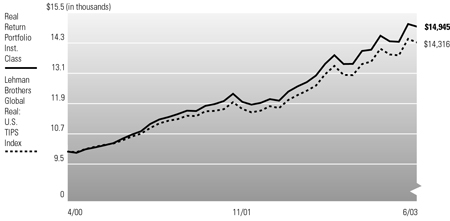

Money Market Portfolio

TOTAL RETURN INVESTMENT PERFORMANCE For the period ended June 30, 2003

| | | 1 Year | | | Since Inception* | |

Money Market Portfolio Administrative Class | | 1.06 | % | | 3.44 | % |

Citigroup 3-Month Treasury Bill Index | | 1.41 | % | | — | |

| * | | Annualized (All Portfolio returns are net of fees and expenses) |

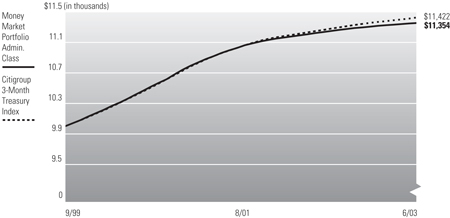

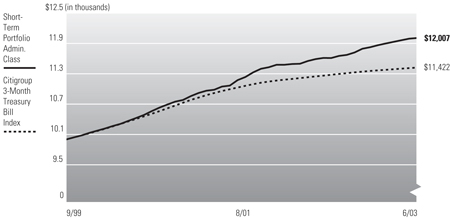

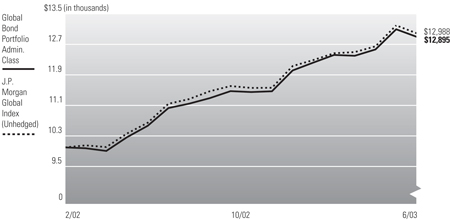

CUMULATIVE RETURNS THROUGH JUNE 30, 2003

$10,000 invested at inception

Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that Portfolio shares, when redeemed, may be worth more or less than their original cost. The line graph above assumes the investment of $10,000 on 10/01/1999, the first full month following the Portfolio’s Administrative Class inception on 9/30/1999, compared to the Citigroup 3-Month Treasury Bill Index, an unmanaged market index. It is not possible to invest directly in the Index. Prior to 4/7/03 the Citigroup 3-Month Treasury Bill Index was known as the Salomon Smith Barney 3-Month Treasury Bill Index. An investment in the Money Market Portfolio is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other U.S. Government Agency. Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio. If there is a material difference between the quoted total return and the quoted current yield, the yield quotation more closely reflects the current earnings of the Money Market Portfolio than the total return quotation.

PORTFOLIO INSIGHTS

| • | | The Money Market Portfolio seeks to achieve its investment objective by investing at least 95% of its total assets in a diversified portfolio of money market securities that are in the highest rating category for short-term obligations. |

| • | | The total return performance of the Portfolio was 0.42% for the six-month period ended June 30, 2003, versus a return of 0.59% for its benchmark, the Citigroup 3-Month Treasury Bill Index. |

| • | | Already low interest rates plunged to levels not seen in 45 years as investors had anticipated that inflation would remain tame. |

| • | | The Portfolio’s average duration was maintained at about one-month, providing for ample liquidity and limiting the price effects from increasing yields. |

| • | | The 3-month Treasury sector outperformed short maturity securities from other sectors. |

| • | | U.S.-issued high quality (A1/P1) commercial paper was emphasized due to attractive yields, limited interest rate sensitivity, and low credit exposure. |

| • | | The Investment Adviser used high quality U.S. agency and shorter-term, fixed and floating rate U.S. corporates to boost portfolio income, while limiting credit risk. |

| • | | Seven-day and thirty-day SEC yields were 0.83% and 0.91%, respectively, at the end of the period. These yields were competitive with yields on similar duration portfolios. |

2

Financial Highlights

Money Market Portfolio (Administrative Class)

| Selected Per Share Data for the Year or Period Ended: | | 06/30/2003 +

| | | 12/31/2002

| | | 12/31/2001

| | | 12/31/2000

| | | 09/30/1999-12/31/1999

| |

Net asset value beginning of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

Net investment income (a) | | | 0.01 | | | | 0.01 | | | | 0.04 | | | | 0.06 | | | | 0.01 | |

Total income from investment operations | | | 0.01 | | | | 0.01 | | | | 0.04 | | | | 0.06 | | | | 0.01 | |

Dividends from net investment income | | | (0.01 | ) | | | (0.01 | ) | | | (0.04 | ) | | | (0.06 | ) | | | (0.01 | ) |

Total distributions | | | (0.01 | ) | | | (0.01 | ) | | | (0.04 | ) | | | (0.06 | ) | | | (0.01 | ) |

Net asset value end of period | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | | | $ | 1.00 | |

Total return | | | 0.42 | % | | | 1.41 | % | | | 3.83 | % | | | 6.01 | % | | | 1.30 | % |

Net assets end of period (000s) | | $ | 27,879 | | | $ | 25,850 | | | $ | 12,860 | | | $ | 4,334 | | | $ | 3,605 | |

Ratio of expenses to average net assets | | | 0.50 | %* | | | 0.50 | % | | | 0.50 | %(c) | | | 0.50 | % | | | 0.50 | %(b)* |

Ratio of net investment income to average net assets | | | 0.83 | %* | | | 1.41 | % | | | 3.37 | % | | | 5.88 | % | | | 5.14 | %* |

Portfolio turnover rate | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| (a) | | Per share amounts based on average number of shares outstanding during the period. |

| (b) | | If the investment manager had not reimbursed expenses, the ratio of operating expenses to average net assets would have been 1.27% for the period ended December 31, 1999. |

| (c) | | If the investment manager had not reimbursed expenses, the ratio of operating expenses to average net assets would have been 0.51% for the year ended December 31, 2001. |

See accompanying notes

3

Statement of Assets and Liabilities

Money Market Portfolio

June 30, 2003 (Unaudited)

Amounts in thousands, except per share amounts

Assets: | | | | |

Investments, at value | | $ | 26,779 | |

Cash | | | 1 | |

Receivable for investments sold | | | 1,029 | |

Receivable for Portfolio shares sold | | | 21 | |

Interest receivable | | | 74 | |

| | |

|

|

|

| | | | 27,904 | |

| | |

|

|

|

Liabilities: | | | | |

Dividends payable | | | 1 | |

Accrued investment advisory fee | | | 4 | |

Accrued administration fee | | | 5 | |

Accrued servicing fee | | | 3 | |

| | |

|

|

|

| | | | 13 | |

| | |

|

|

|

Net Assets | | $ | 27,891 | |

| | |

|

|

|

Net Assets Consist of: | | | | |

Paid in capital | | $ | 27,891 | |

Undistributed net investment income | | | 6 | |

Accumulated undistributed net realized (loss) | | | (6 | ) |

| | |

|

|

|

| | | $ | 27,891 | |

| | |

|

|

|

Net Assets: | | | | |

Institutional Class | | $ | 12 | |

Administrative Class | | | 27,879 | |

Shares Issued and Outstanding: | | | | |

Institutional Class | | | 12 | |

Administrative Class | | | 27,879 | |

Net Asset Value and Redemption Price Per Share (Net Assets Per Share Outstanding) | | | | |

Institutional Class | | $ | 1.00 | |

Administrative Class | | | 1.00 | |

Cost of Investments Owned | | $ | 26,779 | |

See accompanying notes

4

Statement of Operations

Money Market Portfolio

For the six months ended June 30, 2003 (Unaudited)

Amounts in thousands

Investment Income: | | | |

Interest | | $ | 182 |

| | |

|

|

Total Income | | | 182 |

| | |

|

|

Expenses: | | | |

Investment advisory fees | | | 20 |

Administration fees | | | 27 |

Distribution and/or servicing fees - Administrative Class | | | 20 |

| | |

|

|

Total Expenses | | | 67 |

| | |

|

|

Net Investment Income | | | 115 |

| | |

|

|

Net Realized Gain: | | | |

Net realized gain on investments | | | 3 |

Net Gain | | | 3 |

| | |

|

|

Net Increase in Assets Resulting from Operations | | $ | 118 |

| | |

|

|

See accompanying notes

5

Statements of Changes in Net Assets

Money Market Portfolio

Amounts in thousands

| Increase (Decrease) in Net Assets from: | | Six Months Ended

June 30, 2003

| | | Year Ended

December 31, 2002

| |

| | | (Unaudited) | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 115 | | | $ | 291 | |

Net realized gain | | | 3 | | | | 0 | |

| | |

|

|

| |

|

|

|

Net increase resulting from operations | | | 118 | | | | 291 | |

| | |

|

|

| |

|

|

|

Distributions to Shareholders: | | | | | | | | |

From net investment income | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | (118 | ) | | | (291 | ) |

| | |

|

|

| |

|

|

|

Total Distributions | | | (118 | ) | | | (291 | ) |

| | |

|

|

| |

|

|

|

Portfolio Share Transactions: | | | | | | | | |

Receipts for shares sold | | | | | | | | |

Institutional Class | | | 1 | | | | 0 | |

Administrative Class | | | 8,976 | | | | 38,288 | |

Issued as reinvestment of distributions | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | 118 | | | | 291 | |

Cost of shares redeemed | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | (7,065 | ) | | | (25,589 | ) |

| | |

|

|

| |

|

|

|

Net increase resulting from Portfolio share transactions | | | 2,030 | | | | 12,990 | |

| | |

|

|

| |

|

|

|

Total Increase in Net Assets | | | 2,030 | | | | 12,990 | |

| | |

|

|

| |

|

|

|

Net Assets: | | | | | | | | |

Beginning of period | | | 25,861 | | | | 12,871 | |

End of period* | | $ | 27,891 | | | $ | 25,861 | |

*Including undistributed net investment income of: | | $ | 6 | | | $ | 9 | |

See accompanying notes

6

Schedule of Investments

Money Market Portfolio

June 30, 2003 (Unaudited)

| | | Principal

Amount

(000s)

| | Value

(000s)

|

SHORT-TERM INSTRUMENTS 96.0% | | | | | | |

Commercial Paper 84.7% | | | | | | |

ABN AMRO Mortgage Corp. | | | | | | |

1.040% due 07/16/2003 | | $ | 400 | | $ | 400 |

Australia and New Zealand Banking Group Ltd. | | | | | | |

1.330% due 03/05/2004 | | | 300 | | | 300 |

Bell Atlantic New Jersey, Inc. | | | | | | |

5.875% due 02/01/2004 | | | 350 | | | 359 |

Bristol-Myers Squibb Co. | | | | | | |

0.920% due 10/28/2003 | | | 400 | | | 399 |

CBA Finance, Inc. | | | | | | |

1.230% due 07/23/2003 | | | 900 | | | 899 |

Danske Corp. | | | | | | |

1.280% due 07/10/2003 | | | 200 | | | 200 |

Dupont De Nemours & Co. | | | | | | |

8.125% due 03/15/2004 | | | 330 | | | 345 |

Fannie Mae | | | | | | |

1.050% due 07/31/2003 | | | 1,600 | | | 1,599 |

1.170% due 08/27/2003 | | | 200 | | | 200 |

1.175% due 08/27/2003 | | | 300 | | | 299 |

0.990% due 10/22/2003 | | | 3,700 | | | 3,688 |

5.625% due 05/14/2004 | | | 400 | | | 415 |

Federal Home Loan Bank | | | | | | |

1.010% due 07/01/2003 | | | 5,100 | | | 5,100 |

5.195% due 01/29/2004 | | | 165 | | | 169 |

4.750% due 06/28/2004 | | | 400 | | | 415 |

Freddie Mac | | | | | | |

3.750% due 04/15/2004 | | | 900 | | | 918 |

General Electric Capital Corp. | | | | | | |

1.220% due 07/09/2003 | | | 200 | | | 200 |

1.140% due 07/10/2003 | | | 600 | | | 600 |

6.267% due 07/23/2003 | | | 300 | | | 301 |

HBOS Treasury Services PLC | | | | | | |

1.250% due 07/16/2003 | | | 500 | | | 500 |

0.970% due 08/27/2003 | | | 100 | | | 100 |

1.401% due 01/16/2004 | | | 500 | | | 500 |

Lloyds Bank PLC | | | | | | |

1.250% due 07/10/2003 | | | 100 | | | 100 |

National Westminster Bank PLC | | | | | | |

9.375% due 11/15/2003 | | | 500 | | | 515 |

Nestle Capital Corp. | | | | | | |

1.195% due 08/01/2003 | | | 500 | | | 499 |

Oesterreichische Kontrollbank AG | | | | | | |

4.625% due 11/03/2003 | | | 100 | | | 101 |

Procter & Gamble Co. | | | | | | |

5.250% due 09/15/2003 | | | 300 | | | 302 |

Province of Alberta | | | | | | |

4.875% due 10/29/2003 | | | 250 | | | 253 |

Queensland Treasury Corp. | | | | | | |

1.170% due 07/11/2003 | | | 800 | | | 800 |

Rabobank Nederland NV | | | | | | |

1.230% due 07/07/2003 | | | 600 | | | 600 |

Royal Bank of Scotland PLC | | | | | | |

1.255% due 07/02/2003 | | | 100 | | | 100 |

1.225% due 07/09/2003 | | | 600 | | | 600 |

Svenska Handelsbank, Inc. | | | | | | |

1.250% due 07/01/2003 | | | 300 | | | 300 |

Toyota Motor Credit Corp. | | | | | | |

5.625% due 11/13/2003 | | | 175 | | | 178 |

Wells Fargo Financial, Inc. | | | | | | |

7.250% due 07/14/2003 | | | 460 | | | 461 |

5.375% due 09/30/2003 | | | 300 | | | 303 |

Westpac Trust Securities NZ Ltd. | | | | | | |

1.250% due 07/10/2003 | | | 200 | | | 200 |

1.200% due 08/27/2003 | | | 400 | | | 399 |

| | | | | |

|

|

| | | | | | | 23,617 |

| | | | | |

|

|

Repurchase Agreement 11.3% | | | | | | |

State Street Bank | | | | | | |

0.800% due 07/01/2003 | | $ | 3,162 | | $ | 3,162 |

(Dated 06/30/2003. Collateralized by Fannie Mae 3.125% due 10/01/2003 valued at $3,227. Repurchase proceeds are $3,162.) | | | | | | |

| | | | | |

|

|

Total Short-Term Instruments

(Cost $26,779) | | | | | | 26,779 |

| | | | | |

|

|

Total Investments 96.0%

(Cost $26,779) | | | | | $ | 26,779 |

Other Assets and Liabilities (Net) 4.0% | | | | | | 1,112 |

| | | | | |

|

|

Net Assets 100.0% | | | | | $ | 27,891 |

| | | | | |

|

|

See accompanying notes

7

Notes to Financial Statements

June 30, 2003 (Unaudited)

1. Organization

The Money Market Portfolio (the “Portfolio”) is a series of the PIMCO Variable Insurance Trust (the “Trust”). The Trust is registered under the Investment Company Act of 1940 (the “Act”), as amended, as an open-end investment company organized as a Delaware business trust on October 3, 1997. The Trust may offer up to two classes of shares: Institutional and Administrative. Each share class has identical voting rights (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Information presented in these financial statements pertains to the Administrative Class of the Trust. Certain detailed financial information for the Institutional Class is provided separately and is available upon request. The Trust is designed to be used as an investment vehicle by Separate Accounts of insurance companies that fund variable annuity contracts and variable life insurance policies and by qualified pension and retirement plans. The Portfolio commenced operations on September 30, 1999.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Security Valuation. Portfolio securities held by the Portfolio are valued at amortized cost, which approximates current market value. When valuations are not readily available, securities are valued at fair value as determined in accordance with procedures adopted by the Board of Trustees.

Securities Transactions and Investment Income. Securities transactions are recorded as of the trade date. Securities purchased or sold on a when-issued or delayed delivery basis may be settled a month or more after the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date. Interest income, adjusted for the accretion of discounts and amortization of premiums, is recorded on the accrual basis. Paydowns gains and losses on mortgage- and asset-backed securities are recorded as adjustments to interest income in the Statement of Operations.

Dividends and Distributions to Shareholders. Dividends from net investment income, if any, are declared on each day the Trust is open for business and are distributed to shareholders monthly. All dividends are reinvested in additional shares of the Portfolio. Net realized capital gains earned by the Portfolio, if any, will be distributed no less frequently than once each year.

Income dividends and capital gain distributions are determined in accordance with income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments for such items as wash sales, foreign currency transactions, net operating losses and capital loss carryforwards.

Distributions classified as a tax basis return of capital, if any, are reflected in the accompanying Statements of Changes in Net Assets and have been reclassified to paid in capital. In addition, other amounts have been reclassified between undistributed net investment income, accumulated undistributed net realized gains or losses and/or paid in capital to more appropriately conform financial accounting to tax characterizations of dividend distributions.

Multiclass Operations. Each class offered by the Trust has equal rights as to assets. Income, non-class specific expenses, and realized and unrealized capital gains and losses are allocated to each class of shares based on the relative net assets of each class.

Federal Income Taxes. The Portfolio intends to qualify as a regulated investment company and distribute all of its taxable income and net realized gains, if applicable, to shareholders. Accordingly, no provision for Federal income taxes has been made.

Repurchase Agreements. The Portfolio may engage in repurchase transactions. Under the terms of a typical repurchase agreement, the Portfolio takes possession of an underlying debt obligation subject to an obligation of the seller to repurchase, and the Portfolio to resell, the obligation at an agreed-upon price and time. The market value of the collateral must be equal at all times to the total amount of the repurchase obligations, including interest. Generally, in the event of counterparty default, the Portfolio has the right to use the collateral to offset losses incurred.

3. Fees, Expenses, and Related Party Transactions

Investment Advisory Fee. Pacific Investment Management Company LLC (PIMCO) is a majority owned subsidiary partnership of Allianz Dresdner Asset Management of America L.P. (formerly PIMCO Advisors L.P.) and serves as investment adviser (the “Adviser”) to the Trust, pursuant to an investment advisory contract. The Adviser receives a monthly fee at an annual rate based on average daily net assets of the Portfolio. The Advisory Fee is charged at an annual rate of 0.15%.

Administration Fee. PIMCO serves as administrator (the “Administrator”) and provides administrative services to the Trust for which it receives a monthly administrative fee based on average daily net assets of the Portfolio. The Administration Fee is charged at the annual rate of 0.20%.

8