UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-08399

PIMCO Variable Insurance Trust

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer

PIMCO Funds

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (866) 746-2606

Date of fiscal year end: December 31

Date of reporting period: January 1, 2006 - June 30, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

| | • | | PIMCO Variable Insurance Trust All Asset Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust All Asset Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust All Asset Portfolio Class M |

| | • | | PIMCO Variable Insurance Trust CommodityRealReturn Strategy Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust CommodifyRealReturn Strategy Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Emerging Markets Bond Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Emerging Markets Bond Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Foreign Bond Portfolio (U.S. Dollar-Hedged) Administrative Class |

| | • | | PIMCO Variable Insurance Trust Global Bond Portfolio (Unhedged) Administrative Class |

| | • | | PIMCO Variable Insurance Trust High Yield Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust High Yield Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Long-Term U.S. Government Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Long-Term U.S. Government Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Low Duration Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Low Duration Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Money Market Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Money Market Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Real Return Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Real Return Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Real Return Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust RealEstateRealReturn Strategy Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Short-Term Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Short-Term Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust StocksPLUS® Growth and Income Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust StocksPLUS® Growth and Income Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust StocksPLUS® Total Return Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio II Administrative Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio II Institutional Class |

| | • | | PIMCO Variable Insurance Trust Combined Portfolios |

| | • | | All Asset Portfolio Institutional Class |

| | • | | Foreign Bond Portfolio (U.S. Dollar-Hedged) Institutional Class |

| | • | | Global Bond Portfolio (Unhedged) Institutional Class |

| | • | | High Yield Portfolio Advisor Class |

| | • | | Low Duration Portfolio Advisor Class |

Share Class Administrative

Semiannual Report June 30, 2006

PIMCO Variable Insurance Trust

All Asset Portfolio

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO Variable Insurance Trust (the “Trust”) prospectus. Investors should consider the investment objectives, risks, charges and expenses of this Trust carefully before investing. Ask your financial professional to explain all charges that may apply. This and other information is contained in the Trust’s prospectus. The variable product prospectus may be obtained by contacting your Investment Consultant. Please read the Trust and variable product prospectus carefully before you invest or send money.

Chairman’s Letter

Dear PIMCO Variable Insurance Trust Shareholder:

It is our pleasure to present to you the semiannual report for the PIMCO Variable Insurance Trust covering the six-month period ended June 30, 2006.

Highlights of the global bond markets during the six-month period included:

| | n | | Most fixed-income sectors lost ground during the first half of 2006, as concern about accelerating inflation and central bank tightening pushed interest rates higher worldwide. The benchmark Lehman Brothers Aggregate Bond Index (which includes Treasury, Investment-Grade Corporate, and Residential Mortgage-Backed Securities) returned -0.72% for the first six months of the year. On June 30, the benchmark ten-year Treasury yielded 5.14%, 0.75% higher than at the start of the year. The U.S. yield curve remained flat as shorter-maturity yields rose by a comparable amount. |

| | n | | The Federal Reserve tightened four times during the reporting period, bringing the Federal Funds Rate to 5.25%. The increase near the end of the period was the Federal Reserve’s 17th consecutive rate hike since the start of its tightening cycle in 2004. The Federal Reserve was not alone, as central banks in Europe, India, and China tightened credit in unison for the first time since 2000. The Bank of Japan, whose zero-interest-rate policy has flooded global markets with liquidity, looked set to reverse this policy in the coming months. |

In these pages please find a more complete Portfolio review as it relates to financial-market activities, as well as details about total-return investment performance for the six-month reporting period. Thank you for the trust you have placed in us. We will continue to work diligently to meet your investment needs.

Sincerely,

Brent R. Harris

Chairman, PIMCO Variable Insurance Trust

July 31, 2006

| | | | | | |

| | | Semiannual Report | | June 30, 2006 | | 1 |

Important Information About the Portfolio

PIMCO Variable Insurance Trust (the “Trust”) is an open-end management investment company currently consisting of nineteen separate investment portfolios, including the All Asset Portfolio (the “Portfolio”). The Portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies (“Variable Contracts”). Individuals may not purchase shares of the Portfolio directly. Shares of the Portfolio also may be sold to qualified pension and retirement plans outside of the separate account context.

The Portfolio is a “fund of funds,” which is a term used to describe mutual funds that pursue their investment objective by investing in other mutual funds instead of investing directly in stocks or bonds of other issuers. Under normal circumstances, the Portfolio invests substantially all of its assets in Institutional Class shares of PIMCO Funds, an affiliated open-end investment company, except the All Asset and All Asset All Authority Funds (“Underlying Funds”).

Among the principal risks of investing in the Portfolio are allocation risk, Underlying Fund risk and issuer non-diversification risk. The Portfolio also is indirectly subject to the risks of the Underlying Funds, which may include, but are not limited to, the following: interest rate risk, credit risk, high yield risk, market risk, issuer risk, variable dividends risk, liquidity risk, derivatives risk, commodity risk, equity risk, mortgage risk, non-U.S. investment risk, real estate risk, emerging markets risk, currency risk, issuer non-diversification risk, leveraging risk, small company risk, management risk, California state specific risk, New York state specific risk, tax risk and index risk. A complete description of these risks is contained in the Portfolio’s prospectus. An Underlying Fund may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that the Underlying Fund could not close out a position when it would be most advantageous to do so. An Underlying Fund investing in derivatives could lose more than the principal amount invested in these instruments. Investing in non-U.S. securities may entail risk due to non-U.S. economic and political developments; this risk may be increased when investing in emerging markets.

The cost of investing in the Portfolio will generally be higher than the cost of investing in a mutual fund that invests directly in individual stocks and bonds. By investing in the Portfolio, an investor will indirectly bear fees and expenses charged by the Underlying Funds in addition to the Portfolio’s direct fees and expenses.

On the performance summary page in this Semiannual Report, the Total Return Investment Performance table measures performance assuming that all dividend and capital gain distributions were reinvested.

An investment in the Portfolio is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Portfolio.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Portfolio. Copies of the written Proxy Policy and the factors that PIMCO may consider in determining how to vote proxies for the Portfolio, and information about how the Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at 1-866-746-2606 and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

The Portfolio files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Trust’s Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PIMCO Variable Insurance Trust is distributed by Allianz Global Investors Distributors LLC, 2187 Atlantic Street, Stamford, CT 06902.

| | | | |

| 2 | | PIMCO Variable Insurance Trust | | |

The following disclosure provides important information regarding the Portfolio’s Expense Example (“Example” or “Expense Example”), which appears in this Semiannual Report. Please refer to this information when reviewing the Expense Example for the Portfolio.

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including advisory and administrative fees; distribution and/or service (12b-1) fees (Administrative Class, Advisor Class and Class M only); and other Portfolio expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Expense Example does not reflect any fees or other expenses imposed by the Variable Contracts. If it did, the expenses reflected in the Expense Examples would be higher. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which is from January 1, 2006 to June 30, 2006.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the appropriate column for your share class, in the row titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transactional costs were included, your costs would have been higher.

The expense ratio may vary period to period because of various factors, such as an increase in expenses not covered by the advisory and administrative fees (such as expenses of the trustees and their counsel or litigation expense).

Portfolio Benchmarks

Lehman Brothers U.S. TIPS: 1-10 Year is an unmanaged index market comprised of U.S. Treasury Inflation Linked securities having a maturity of at least 1 year and less than 10 years. It is not possible to invest directly in such an unmanaged index.

The CPI + 500 Basis Points benchmark is created by adding 5% to the annual percentage change in the Consumer Price Index (“CPI”). This index reflects non-seasonally adjusted returns. The CPI is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the US Department of Labor Statistics. There can be no guarantee that the CPI or other indexes will reflect the exact level of inflation at any given time.

| | | | | | |

| | | Semiannual Report | | June 30, 2006 | | 3 |

| | | | |

| | |

| PIMCO All Asset Portfolio | | | | |

| | | | |

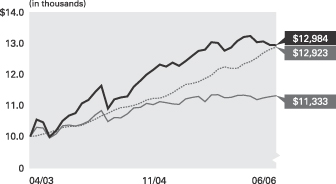

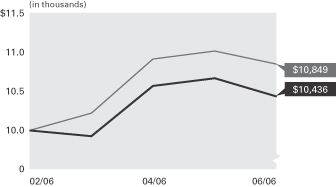

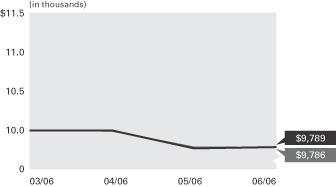

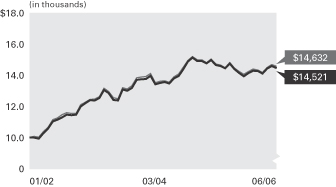

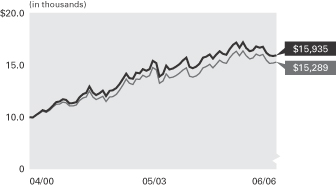

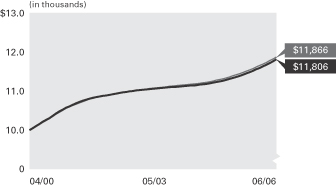

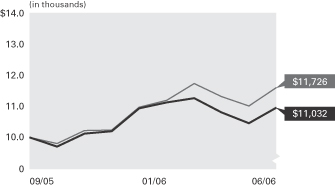

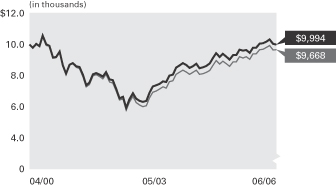

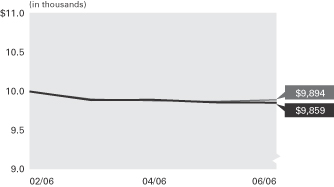

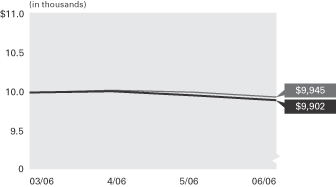

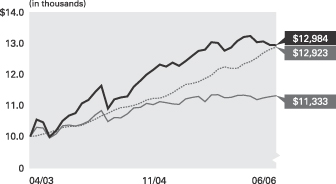

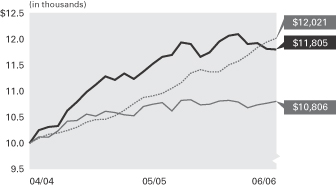

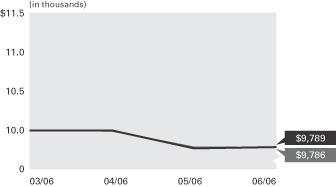

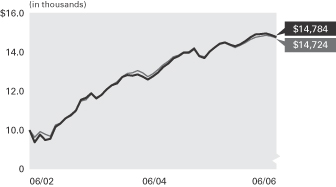

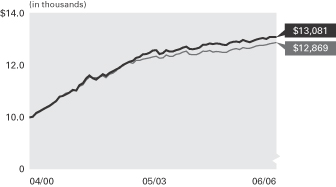

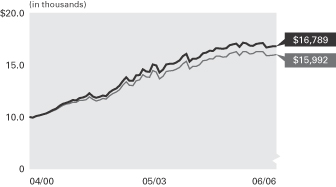

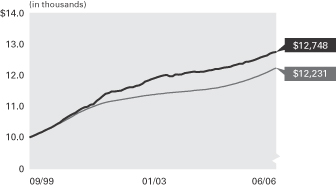

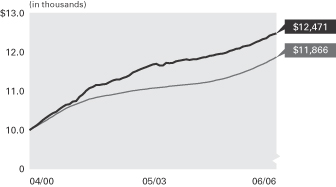

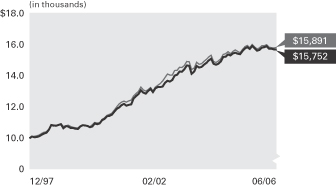

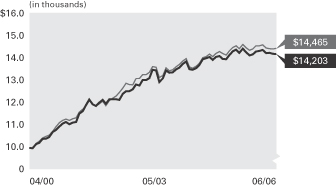

Cumulative Returns Through June 30, 2006

All Asset

Portfolio Lehman Brothers Consumer Price

Administrative U.S. TIPS: 1-10 Index + 500

Class Year Index Basis points

-------------- --------------- --------------

04/30/2003 $10,000 $10,000 $10,000

05/31/2003 10,550 10,296 10,025

06/30/2003 10,464 10,275 10,078

07/31/2003 9,991 9,949 10,131

08/31/2003 10,182 10,081 10,212

09/30/2003 10,511 10,351 10,288

10/31/2003 10,682 10,368 10,319

11/30/2003 10,763 10,337 10,334

12/31/2003 11,079 10,397 10,366

01/31/2004 11,192 10,496 10,460

02/29/2004 11,449 10,701 10,560

03/31/2004 11,661 10,845 10,672

04/30/2004 10,909 10,488 10,751

05/31/2004 11,208 10,618 10,859

06/30/2004 11,276 10,610 10,938

07/31/2004 11,307 10,742 10,966

08/31/2004 11,626 10,936 11,018

09/30/2004 11,818 10,946 11,087

10/31/2004 12,025 11,079 11,192

11/30/2004 12,181 11,040 11,244

12/31/2004 12,352 11,135 11,250

01/31/2005 12,288 11,106 11,320

02/28/2005 12,415 11,066 11,433

03/31/2005 12,312 11,046 11,570

04/30/2005 12,462 11,229 11,696

05/31/2005 12,633 11,278 11,733

06/30/2005 12,794 11,306 11,788

07/31/2005 12,837 11,141 11,891

08/31/2005 13,085 11,356 12,002

09/30/2005 13,055 11,367 12,198

10/31/2005 12,805 11,266 12,274

11/30/2005 12,903 11,277 12,226

12/31/2005 13,121 11,344 12,228

01/31/2006 13,254 11,352 12,372

02/28/2006 13,288 11,320 12,448

03/31/2006 13,080 11,205 12,569

04/30/2006 13,102 11,262 12,728

05/31/2006 12,990 11,299 12,845

06/30/2006 12,984 11,333 12,923

$10,000 invested at the beginning of the first full month following the inception date of the Portfolio’s Administrative Class.

PIMCO Funds Allocation‡

| | |

Real Return Asset | | 28.4% |

Real Return | | 18.1% |

Developing Local Markets | | 8.5% |

Floating Income | | 8.3% |

Long-Term U.S. Government | | 7.4% |

International StocksPLUS® TR Strategy | | 6.0% |

Emerging Markets Bond | | 5.6% |

Other | | 17.7% |

| | ‡ | % of Total Investments as of June 30, 2006 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2006 |

| | | | | | | 6 Months* | | 1 Year | | Since

Inception

(04/30/03) |

| | |

| | PIMCO All Asset Portfolio Administrative Class | | -1.05% | | 1.48% | | 8.59% |

| | |

| | Lehman Brothers U.S. TIPS 1-10 Year Index | | -0.09% | | 0.24% | | 4.03% |

| | | ------ | | Consumer Price Index + 500 Basis points | | 5.69% | | 9.64% | | 8.43% |

All Portfolio returns are net of fees and expenses.

* Cumulative return.

Past performance is no guarantee of future results. The performance quoted represents past performance. Investment return and principal value will fluctuate so the Portfolio shares, when redeemed, may be worth more or less than their original cost. The Portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in Variable Contracts, which will reduce returns. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available by calling (800) 927-4648.

| | | | | | | | | | |

| Expense Example | | | | Actual Performance | | | | Hypothetical Performance |

| | | | | | | | | (5% return before expenses) |

Beginning Account Value (01/01/06) | | | | $ | 1,000.00 | | | | $ | 1,000.00 |

Ending Account Value (06/30/06) | | | | $ | 989.50 | | | | $ | 1,021.82 |

Expenses Paid During Period† | | | | $ | 2.96 | | | | $ | 3.01 |

† Expenses are equal to the Portfolio’s Administrative Class annualized expense ratio of 0.60%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The expense ratio excludes the expenses of the Underlying Funds, which based upon the allocation of the Portfolio’s assets among the Underlying Funds are indirectly borne by the shareholders of the Portfolio. The Underlying Fund Expenses for the Portfolio are estimated at 0.63%. Overall fees and expenses of investing in the Portfolio will be higher because the example does not reflect Variable Contract fees and expenses.

Please refer to page 3 herein for a description of the Portfolio’s benchmark and an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO All Asset Portfolio seeks to achieve its investment objective by investing under normal circumstances substantially all of its assets in Institutional Class Shares of the Underlying Funds (i.e., any of the PIMCO Funds, except the All Asset and All Asset All Authority Funds). |

| » | | Significant exposure to the Treasury Inflation-Protected Securities (“TIPS”) asset class detracted significantly from tactical asset allocation alpha due to the asset class, particularly longer dated TIPS, posting negative returns. |

| » | | Less than optimal exposure to commodities detracted from performance, as the Dow Jones AIG Commodity Index returned 3.58% over the period. |

| » | | Less than optimal exposure to Real Estate Investment Trusts (“REITs”) detracted from performance, as the Dow Jones Wilshire REIT Index gained 14.40% for the period. |

| » | | Significant exposure to lower duration instruments was positive for performance, as lower duration assets tend to outperform assets with longer duration in a rising interest rate environment. Exposure to the Floating Rate Income Fund provided positive returns. |

| » | | Significant exposure to the Developing Local Markets Fund and emerging market currencies added to performance with the fund returning 4.34%. |

| » | | Exposure to the High Yield Fund was positive due to coupon selection providing solid returns for the period. |

| | | | |

| 4 | | PIMCO Variable Insurance Trust | | |

| | |

| |

| Financial Highlights All Asset Portfolio | | |

| | | | | | | | | | | | | | | | |

| Selected Per Share Data for the Year or Period Ended: | | 06/30/2006+ | | | 12/31/2005 | | | 12/31/2004 | | | 04/30/2003-12/31/2003 | |

| | | | |

Administrative Class | | | | | | | | | | | | | | | | |

| Net asset value beginning of period | | $ | 11.81 | | | $ | 11.62 | | | $ | 10.77 | | | $ | 10.00 | |

| Net investment income (a) | | | 0.23 | | | | 0.83 | | | | 1.50 | | | | 0.53 | |

| Net realized/unrealized gain (loss) on investments (a) | | | (0.35 | ) | | | (0.11 | ) | | | (0.27 | ) | | | 0.54 | |

| Total income (loss) from investment operations | | | (0.12 | ) | | | 0.72 | | | | 1.23 | | | | 1.07 | |

| Dividends from net investment income | | | (0.24 | ) | | | (0.49 | ) | | | (0.37 | ) | | | (0.30 | ) |

| Distributions from net realized capital gains | | | 0.00 | | | | (0.04 | ) | | | (0.01 | ) | | | 0.00 | |

| Total distributions | | | (0.24 | ) | | | (0.53 | ) | | | (0.38 | ) | | | (0.30 | ) |

| Net asset value end of period | | $ | 11.45 | | | $ | 11.81 | | | $ | 11.62 | | | $ | 10.77 | |

| Total return | | | (1.05 | )% | | | 6.23 | % | | | 11.49 | % | | | 10.79 | % |

| Net assets end of period (000s) | | $ | 233,824 | | | $ | 251,482 | | | $ | 102,183 | | | $ | 1,017 | |

| Ratio of expenses to average net assets | | | 0.60 | %* | | | 0.59 | %(c)(d) | | | 0.57 | %(c)(d) | | | 0.60 | %*(b)(c) |

| Ratio of net investment income to average net assets | | | 3.89 | %* | | | 6.98 | % | | | 13.02 | % | | | 7.56 | %* |

| Portfolio turnover rate | | | 33 | % | | | 75 | % | | | 93 | % | | | 136 | % |

+ Unaudited

* Annualized

(a) Per share amounts based on average number of shares outstanding during the period.

(b) If the investment manager had not reimbursed expenses, the ratio of expenses to average net assets would have been 10.92%.

(c) Ratio of expenses to average net assets excluding underlying Funds’ expenses in which the Portfolio invests.

(d) If the investment manager had not reimbursed expenses, the ratio of expenses to average net assets would have been 0.60%.

| | | | | | |

| See Accompanying Notes | | Semiannual Report | | June 30, 2006 | | 5 |

| | |

| |

| Statement of Assets and Liabilities All Asset Portfolio | | |

| | | | |

| (Amounts in thousands, except per share amounts) | | June 30, 2006

(Unaudited) | |

| |

Assets: | | | | |

Investments in Affiliates, at value | | $ | 364,075 | |

Cash | | | 1 | |

Receivable for Portfolio shares sold | | | 2,020 | |

Interest and dividends receivable from Affiliates | | | 1,899 | |

| | | | 367,995 | |

| |

Liabilities: | | | | |

Payable for investments in Affiliates purchased | | $ | 3,433 | |

Payable for Portfolio shares redeemed | | | 228 | |

Accrued investment advisory fee | | | 62 | |

Accrued administration fee | | | 77 | |

Accrued servicing fee | | | 62 | |

Recoupment payable to Manager | | | 5 | |

| | | | 3,867 | |

| |

Net Assets | | $ | 364,128 | |

| |

Net Assets Consist of: | | | | |

Paid in capital | | $ | 368,395 | |

Undistributed net investment income | | | 6,814 | |

Accumulated undistributed net realized (loss) | | | (1,686 | ) |

Net unrealized (depreciation) | | | (9,395 | ) |

| | | $ | 364,128 | |

| |

Net Assets: | | | | |

Institutional Class | | $ | 10 | |

Administrative Class | | | 233,824 | |

Advisor Class | | | 65,231 | |

Class M | | | 65,063 | |

| |

Shares Issued and Outstanding: | | | | |

Institutional Class | | | 1 | |

Administrative Class | | | 20,415 | |

Advisor Class | | | 5,693 | |

Class M | | | 5,684 | |

| |

Net Asset Value and Redemption Price Per Share (Net Assets Per Share Outstanding) | | | | |

Institutional Class | | $ | 11.45 | |

Administrative Class | | | 11.45 | |

Advisor Class | | | 11.45 | |

Class M | | | 11.44 | |

| |

Cost of Investments in Affiliates Owned | | $ | 373,469 | |

| | | | |

| 6 | | PIMCO Variable Insurance Trust | | See Accompanying Notes |

| | |

| |

| Statement of Operations All Asset Portfolio | | |

| | | | |

| (Amounts in Thousands) | | Six Months Ended

June 30, 2006

(Unaudited) | |

| |

Investment Income: | | | | |

Interest | | $ | 14 | |

Dividends from Affiliate investments | | | 7,717 | |

Total Income | | | 7,731 | |

| |

Expenses: | | | | |

Investment advisory fees | | | 337 | |

Administration fees | | | 422 | |

Servicing fees – Administrative Class | | | 190 | |

Distribution and/or servicing fees – Advisor Class | | | 21 | |

Distribution and/or servicing fees – Class M | | | 152 | |

Interest expense | | | 1 | |

Miscellaneous expense | | | 10 | |

Total Expenses | | | 1,133 | |

| |

Net Investment Income | | | 6,598 | |

| |

Net Realized and Unrealized (Loss): | | | | |

Net realized (loss) on Affiliate investments | | | (3,155 | ) |

Net change in unrealized (depreciation) on Affiliate investments | | | (7,231 | ) |

Net (Loss) | | | (10,386 | ) |

| |

Net (Decrease) in Net Assets Resulting from Operations | | $ | (3,788 | ) |

| | | | | | |

| See Accompanying Notes | | Semiannual Report | | June 30, 2006 | | 7 |

| | |

| |

| Statements of Changes in Net Assets All Asset Portfolio | | |

| | | | | | | | |

| (Amounts In Thousands) | | Six Months Ended

June 30, 2006

(Unaudited) | | | Year Ended

December 31, 2005 | |

| | |

Increase (Decrease) in Net Assets from: | | | | | | | | |

| | |

Operations: | | | | | | | | |

Net investment income | | $ | 6,598 | | | $ | 16,918 | |

Net realized gain (loss) on Affiliate investments | | | (3,155 | ) | | | 1,306 | |

Net capital (loss) distributions received from Underlying Funds | | | 0 | | | | 712 | |

Net change in unrealized (depreciation) on Affiliate investments | | | (7,231 | ) | | | (3,656 | ) |

Net increase (decrease) resulting from operations | | | (3,788 | ) | | | 15,280 | |

| | |

Distributions to Shareholders: | | | | | | | | |

| From net investment income | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | (5,038 | ) | | | (9,080 | ) |

Advisor Class | | | (632 | ) | | | (160 | ) |

Class M | | | (1,232 | ) | | | (2,166 | ) |

| From net realized capital gains | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | 0 | | | | (735 | ) |

Advisor Class | | | 0 | | | | (22 | ) |

Class M | | | 0 | | | | (198 | ) |

| | |

Total Distributions | | | (6,902 | ) | | | (12,361 | ) |

| | |

Portfolio Share Transactions: | | | | | | | | |

| Receipts for shares sold | | | | | | | | |

Institutional Class | | | 10 | | | | 0 | |

Administrative Class | | | 33,411 | | | | 166,191 | |

Advisor Class | | | 58,213 | | | | 7,545 | |

Class M | | | 11,550 | | | | 54,317 | |

| Issued as reinvestment of distributions | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | 5,038 | | | | 9,815 | |

Advisor Class | | | 632 | | | | 182 | |

Class M | | | 1,232 | | | | 2,364 | |

| Cost of shares redeemed | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | (48,154 | ) | | | (29,204 | ) |

Advisor Class | | | (431 | ) | | | (208 | ) |

Class M | | | (12,991 | ) | | | (8,152 | ) |

Net increase resulting from Portfolio share transactions | | | 48,510 | | | | 202,850 | |

| | |

Total Increase in Net Assets | | | 37,820 | | | | 205,769 | |

| | |

Net Assets: | | | | | | | | |

Beginning of period | | | 326,308 | | | | 120,539 | |

End of period* | | $ | 364,128 | | | $ | 326,308 | |

| | |

*Including undistributed net investment income of: | | $ | 6,814 | | | $ | 7,118 | |

| | | | |

| 8 | | PIMCO Variable Insurance Trust | | See Accompanying Notes |

| | |

| |

| Schedule of Investments All Asset Portfolio (a) | | June 30, 2006 (Unaudited) |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | | VALUE |

| | | | | SHARES | | | | (000S) |

| |

| PIMCO FUNDS (b) 99.5% |

CommodityRealReturn Strategy Fund® | | | | 639,133 | | $ | | 9,395 |

Convertible Fund | | | | 99,294 | | | | 1,240 |

Developing Local Markets Fund | | | | 2,967,035 | | | | 30,946 |

Diversified Income Fund | | | | 95,839 | | | | 1,031 |

Emerging Markets Bond Fund | | | | 1,908,223 | | | | 20,552 |

Floating Income Fund | | | | 2,936,807 | | | | 30,396 |

Foreign Bond Fund (Unhedged) | | | | 81,715 | | | | 833 |

Fundamental IndexPLUS® Fund | | | | 162,512 | | | | 1,666 |

Fundamental IndexPLUS® TR Fund | | | | 780,708 | | | | 7,823 |

GNMA Fund | | | | 249,029 | | | | 2,670 |

High Yield Fund | | | | 1,318,660 | | | | 12,554 |

International StocksPLUS® TR Strategy Fund | | | | 1,888,909 | | | | 22,025 |

Long-Term U.S. Government Fund | | | | 2,636,612 | | | | 26,893 |

Low Duration Fund | | | | 304,426 | | | | 2,993 |

Real Return Asset Fund | | | | 9,461,298 | | | | 103,412 |

Real Return Fund | | | | 6,131,194 | | | | 65,726 |

RealEstateRealReturn Strategy Fund | | | | 202,957 | | | | 1,756 |

Short-Term Fund | | | | 994 | | | | 10 |

StocksPLUS® Fund | | | | 7,084 | | | | 72 |

StocksPLUS® Total Return Fund | | | | 148,481 | | | | 1,679 |

Total Return Fund | | | | 1,477,051 | | | | 15,036 |

Total Return Mortgage Fund | | | | 346,837 | | | | 3,586 |

| | | | | | | | |

|

Total PIMCO Funds (Cost $371,688) | | | | 362,294 |

| | | | | | | | |

|

| | | | | | | | |

| SHORT-TERM INSTRUMENTS 0.5% |

| |

| REPURCHASE AGREEMENT 0.5% |

| State Street Bank | | | | | | | | |

4.900% due 07/03/2006 | | $ | | 1,781 | | $ | | 1,781 |

| | | | | | | | |

|

(Dated 06/30/2006. Collateralized by Federal Home Loan Bank 4.875% due 02/15/2007 valued at $1,819. Repurchase proceeds are $1,782.) |

| |

Total Short-Term Instruments

(Cost $1,781) | | 1,781 |

| | | | | | | | |

|

| |

Total Investments 100.0%

(Cost $373,469) | | $ | | 364,075 |

| |

| Other Assets and Liabilities (Net) 0.0% | | 53 |

| | | | | | | | |

|

| Net Assets 100.0% | | $ | | 364,128 |

| | | | | | | | |

|

| | | | | | | | |

Notes to Schedule of Investments: |

(a) The All Asset Portfolio is investing in shares of affiliated Funds. |

| | | | | | | | | |

(b) Institutional Class of each PIMCO Funds. |

| | | | | | |

| See Accompanying Notes | | Semiannual Report | | June 30, 2006 | | 9 |

Notes to Financial Statements

1. ORGANIZATION

The All Asset Portfolio (the “Portfolio”) is a series of the PIMCO Variable Insurance Trust (the “Trust”). The Trust is registered under the Investment Company Act of 1940 (the “Act”), as amended, as an open-end investment management company organized as a Delaware business trust on October 3, 1997. The Portfolio offers four classes of shares: Institutional, Administrative, Advisor, and Class M. Information presented in these financial statements pertains to the Administrative Class of the Portfolio. Certain detailed financial information for the Institutional Class, Advisor Class and Class M are provided separately and are available upon request. The Trust is designed to be used as an investment vehicle by Separate Accounts of insurance companies that fund variable annuity contracts and variable life insurance policies and by qualified pension and retirement plans.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Portfolio in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Security Valuation Investments in Funds within the PIMCO Funds are valued at their net asset value as reported by the Underlying Funds.

Securities Transactions and Investment Income. Securities transactions are recorded as of the trade date. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Portfolio is informed of the ex-dividend date. Interest income, adjusted for the accretion of discounts and amortization of premiums, is recorded on the accrual basis. Paydown gains and losses on mortgage-related or asset-backed securities are recorded as components of interest income in the Statement of Operations.

Dividends and Distributions to Shareholders. Dividends from net investment income, if any, are declared and distributed to shareholders quarterly. Net realized capital gains earned by the Portfolio, if any, will be distributed no less frequently than once each year. Most shareholders choose to reinvest their dividends and capital gain distribution in additional shares of the Portfolio.

Income dividends and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. Differences between tax regulations and GAAP may change the fiscal year when income and capital items are recognized for tax and GAAP purposes. Examples of events that give rise to timing differences include wash sales, straddles, net operating losses and capital loss carryforwards. Further, the character of investment income and capital gains may be different for certain transactions under the two methods of accounting. Examples of characterization differences include the treatment of mortgage paydowns, swaps, foreign currency transactions and contingent debt instruments. As a result, income dividends and capital gain distributions declared during a fiscal period may differ significantly from the net investment income and realized capital gain reported in the Portfolio’s annual financial statements presented under GAAP.

Distributions classified as a tax basis return of capital, if any, are reflected in the accompanying Statements of Changes in Net Assets and have been reclassified to paid in capital. In addition, other amounts have been reclassified between undistributed net investment income, accumulated undistributed net realized gains or losses and/or paid in capital to more appropriately conform financial accounting to tax characterizations of dividend distributions.

Multiclass Operations. Each class offered by the Portfolio has equal rights as to assets and voting privileges (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Income and non-class specific expenses of the Portfolio are allocated daily to each class of shares based on the relative value of settled shares. Realized and unrealized capital gains and losses of the Portfolio are allocated daily to each class of shares based on the relative net assets of each class. Class specific expenses, where applicable, currently include administrative, distribution and servicing fees.

Federal Income Taxes. The All Asset Portfolio (“the Portfolio”) intends to qualify as a regulated investment company and distribute all of its taxable income and net realized gains, if applicable, to shareholders. Accordingly, no provision for Federal income taxes has been made.

To the extent the All Asset Portfolio invest in the CommodityRealReturn Strategy Portfolio® (the “CRRS Portfolio”), an Underlying Fund, this Portfolio may be subject to the risks associated with commodity-linked derivative instruments.

One of the requirements for favorable tax treatment as a regulated investment company under the Code is that the CRRS Portfolio derive at least 90 percent of its gross income from certain qualifying sources of income. On December 16, 2005, the IRS issued Revenue Ruling 2006-01 which held that income from commodity index-linked swaps was not qualifying income. At the time Revenue Ruling 2006-01 was issued, the CRRS Portfolio invested primarily in commodity index-linked swaps to gain exposure to the commodity markets. Revenue Ruling 2006-01 provided an effective date of June 30, 2006, after which time the CRRS Portfolio’s ability to utilize commodity index-linked swaps as part of its investment strategy will be limited to a maximum of 10 percent of its gross income.

On June 2, 2006, the IRS issued Revenue Ruling 2006-31 which extends the effective date for Revenue Ruling 2006-01 from June 30, 2006 until September 30, 2006. Revenue Ruling 2006-31 also clarifies the holding of Revenue Ruling 2006-01 by providing that income from alternative instruments (such as certain commodity index-linked notes) that create commodity exposure may be considered qualifying income under the Code. In addition, the IRS has also issued private letter rulings to at least two other funds in which the IRS specifically concluded that income from certain commodity index-linked notes is qualifying income. The CRRS Portfolio has also obtained an opinion of counsel with respect to the treatment of income from commodity index-linked notes as qualifying income under the Code. Such an opinion is not binding upon the IRS.

Based on Revenue Ruling 2006-31, IRS guidance and advice of counsel, the CRRS Portfolio will seek to gain exposure to the commodity markets primarily through investments in commodity indexlinked notes. The use of commodity index-linked notes involves specific risks. The CRRS Portfolio will continue to seek ways to make use of other commodity-linked derivative instruments, including swap agreements, commodity options, futures and options on futures, and alternative structures within the Portfolio to gain exposure to commodity markets. Please refer to the prospectus for the Separate Account and Variable Contract for information regarding federal income tax treatment of distributions to the Separate Account.

Guarantees and Indemnifications. Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust (including the Trust’s investment manager) is indemnified against certain liabilities that may arise out of performance of their duties to the Portfolio. Additionally, in the normal course of business, the Portfolio enters into contracts that contain a variety of

| | | | |

| 10 | | PIMCO Variable Insurance Trust | | |

| | |

| |

| | | June 30, 2006 (Unaudited) |

indemnification clauses. The Portfolio’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Portfolio that have not yet occurred. However, the Portfolio has not had prior claims or losses pursuant to these contracts, and believes the risk of loss to be remote.

Underlying Funds. The Portfolio may invest in any or all of the Underlying Funds, but will not normally invest in every Underlying Fund at any particular time. The Underlying Funds are the Institutional Class shares of the PIMCO Funds, an affiliated open-end investment company, except All Asset and All Asset All Authority Funds. Though it is anticipated that the All Asset Portfolio will not currently invest in the European StocksPLUS® Total Return Strategy, Far East (ex-Japan) StocksPLUS® Total Return Strategy, Japanese StocksPLUS® TR Strategy, StocksPLUS® Municipal-Backed and StocksPLUS® TR Short Strategy Funds, the Portfolio may invest in these Funds in the future, without shareholder approval, at the discretion of the Portfolio’s asset allocation sub-adviser.

New Accounting Policies. In July 2006, the Financial Accounting Standards Board issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109” (the “Interpretation”). The Interpretation is effective for fiscal years beginning after December 15, 2006. Management is currently evaluating the application of the Interpretation to the Portfolio and will provide additional information in relation to the Interpretation in the Portfolio’s annual financial statements for the year ending December 31, 2006.

3. FEES, EXPENSES, AND RELATED PARTY TRANSACTIONS

Investment Advisory Fee. PIMCO is a majority-owned subsidiary of Allianz Global Investors of America L.P. (“AGI”), and serves as investment adviser (the “Adviser”) to the Trust, pursuant to an investment advisory contract. The Adviser receives a monthly fee at an annual rate based on average daily net assets of the Portfolio. The Advisory Fee is charged at an annual rate of 0.20%.

Administration Fee. PIMCO serves as administrator (the “Administrator”), and provides administrative services to the Trust for which it receives a monthly administrative fee based on average daily net assets of the Portfolio. As the Administrator, PIMCO bears the costs of various third-party services, including audit, custodial, portfolio accounting, legal, transfer agency and printing costs. The Administration Fee is charged at the annual rate of 0.25%.

Distribution and Servicing Fees. Allianz Global Investors Distributors LLC (“AGID”) is an indirect wholly-owned subsidiary of AGI and serves as the distributor of the Trust’s shares. The Trust is permitted to reimburse AGID on a quarterly basis, out of the Administrative Class assets of the Portfolio in the amount of 0.15% on an annual basis of the average daily net assets of that class, for payments made to financial intermediaries that provide services in connection with the distribution of shares or administration of plans or programs that use Portfolio shares as their funding medium. The effective rate paid to AGID was 0.15% during the current fiscal year.

Expenses. The Trust is responsible for the following expenses: (i) salaries and other compensation of any of the Trust’s executive officers and employees who are not officers, directors, stockholders or employees of PIMCO or its subsidiaries or affiliates; (ii) taxes and governmental fees; (iii) brokerage fees and commissions and other portfolio transaction expenses; (iv) the costs of borrowing money, including interest expenses and bank overdraft charges; (v) fees and expenses of the Trustees who are not “interested persons” of PIMCO or the Trust, and any counsel retained exclusively for their benefit; (vi) extraordinary expenses, including costs of litigation and indemnification expenses; (vii) organization expenses and (viii) any expenses allocated or allocable to a specific class of shares, which include service fees payable with respect to the Administrative Class shares and may include certain other expenses as permitted by the Trust’s Multiple Class Plan adopted pursuant to Rule 18f-3 under the Act and subject to review and approval by the Trustees. The ratio of expenses to average net assets per share class, as disclosed in the Financial Highlights, may differ from the annual portfolio operating expenses per share class as disclosed in the Prospectus for the reasons set forth above.

PIMCO has agreed to waive a portion of its administrative fees to the extent that the payment of the Portfolio’s pro rata share of organization expenses and Trustee fees cause the actual expense ratio to rise above the rates disclosed in the then-current prospectus plus 0.49 basis points as set forth below (calculated as a percentage of the Portfolio’s average daily net assets attributable to each class):

| | | |

| Administrative Class | | 0.60 | % |

PIMCO may be reimbursed for these waived amounts in future periods, not to exceed thirty-six months. Expenses that have been waived and may still be reimbursed by the Administrator, to the extent the Portfolio’s annualized total portfolio operating expenses plus the amount so reimbursed does not exceed the operating expense limitation, are as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | | | | Year of Waiver |

| | | | | | 12/31/2003 | | | | | 12/31/2004 | | | | | 12/31/2005 | | | | | 06/30/2006 |

Amount Available for Reimbursement | | | | $ | 12 | | | | $ | 0 | | | | $ | 0 | | | | $ | 0 |

For the current period ended June 30, 2006, each unaffiliated Trustee received an annual retainer of $15,000, plus $2,000 for each Board of Trustees quarterly meeting attended, $500 for each Board of Trustees committee meeting attended and $500 for each special board meeting attended, plus reimbursement of related expenses. In addition, each Committee Chair received an additional annual retainer of $500 and each Audit Committee Chair received an additional annual retainer of $1,500. These expenses are allocated on a pro-rata basis to each Portfolio of the Trust according to its respective net assets. The Trust pays no compensation directly to any Trustee or any other officer who is affiliated with the Administrator, all of whom receive remuneration for their services to the Trust from the Administrator or its affiliates.

4. PURCHASES AND SALES OF SECURITIES

The length of time the Portfolio has held a particular security is not generally a consideration in investment decisions. A change in the securities held by the Portfolio is known as “portfolio turnover”. The Portfolio may engage in frequent and active trading of portfolio securities to achieve its investment objective, particularly during periods of volatile market movements. High portfolio turnover (e.g., over 100%) involves correspondingly greater expenses to the Portfolio, including brokerage commissions or dealer mark-ups and other transaction costs on the sale of securities and reinvestments in other securities. Such sales may also result in realization of taxable capital gains, including short-term capital gains (which are generally taxed at ordinary income tax rates). The trading costs and tax effects associated with portfolio turnover may adversely affect the Portfolio’s performance.

Purchases and sales of securities (excluding short-term investments) for the period ended June 30, 2006 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | |

| | U.S Government/Agency | | | | | All Other |

| | Purchases | | | | | Sales | | | | | Purchases | | | | | Sales |

| $ | 0 | | | | $ | 0 | | | | $ | 159,640 | | | | $ | 113,374 |

| | | | | | |

| | | Semiannual Report | | June 30, 2006 | | 11 |

Notes to Financial Statements (Cont.)

5. SHARES OF BENEFICIAL INTEREST

The Portfolio may issue an unlimited number of shares of beneficial interest with a $0.001 par value. Changes in shares of beneficial interest were as follows (shares and amounts in thousands):

| | | | | | | | | | | | | | | | | | |

| | | | | Six Months Ended

06/30/2006 | | | | | Year Ended

12/31/2005 | |

| | | | | Shares | | | Amount | | | | | Shares | | | Amount | |

| | | | | | |

Receipts for shares sold | | | | | | | | | | | | | | | | | | |

Institutional Class | | | | 1 | | | $ | 10 | | | | | 0 | | | $ | 0 | |

Administrative Class | | | | 2,843 | | | | 33,411 | | | | | 14,121 | | | | 166,191 | |

Advisor Class | | | | 5,043 | | | | 58,213 | | | | | 632 | | | | 7,545 | |

Class M | | | | 982 | | | | 11,550 | | | | | 4,617 | | | | 54,317 | |

Issued as reinvestment of distributions | | | | | | | | | | | | | | | | | | |

Institutional Class | | | | 0 | | | | 0 | | | | | 0 | | | | 0 | |

Administrative Class | | | | 437 | | | | 5,038 | | | | | 828 | | | | 9,815 | |

Advisor Class | | | | 56 | | | | 632 | | | | | 15 | | | | 182 | |

Class M | | | | 107 | | | | 1,232 | | | | | 200 | | | | 2,364 | |

Cost of shares redeemed | | | | | | | | | | | | | | | | | | |

Institutional Class | | | | 0 | | | | 0 | | | | | 0 | | | | 0 | |

Administrative Class | | | | (4,149 | ) | | | (48,154 | ) | | | | (2,453 | ) | | | (29,204 | ) |

Advisor Class | | | | (37 | ) | | | (431 | ) | | | | (17 | ) | | | (208 | ) |

Class M | | | | (1,114 | ) | | | (12,991 | ) | | | | (689 | ) | | | (8,152 | ) |

Net increase resulting from Portfolio share transactions | | | | 4,169 | | | $ | 48,510 | | | | | 17,254 | | | $ | 202,850 | |

The following schedule shows the number of shareholders each owning 5% or more of the Portfolio and the total percentage of the Portfolio held by such shareholders:

| | | | | | | |

| | | | | Number of

Shareholders | | % of Portfolio

Held | |

Institutional Class | | | | 1 | | 100 | |

Administrative Class | | | | 2 | | 89 | * |

Advisor Class | | | | 2 | | 93 | |

Class M | | | | 3 | | 97 | |

* Allianz Life Insurance Co. of North America, an indirect wholly owned subsidiary of AGI and a related party to the Portfolio, owned 25% or more of the outstanding shares of beneficial interest of the Portfolio and therefore may be presumed to “control” the Portfolio, as that term is defined in the 1940 Act.

6. AFFILIATED TRANSACTIONS

The Underlying Funds are considered to be affiliated with the Portfolio. The table below shows the transactions in and earnings from investments in these affiliated Funds for the period ended June 30, 2006 (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Underlying Funds | | Market Value

12/31/2005 | | Purchases

at Cost | | Proceeds

from Sales | | Unrealized

Appreciation

(Depreciation) | | | Market Value

6/30/2006 | | Dividend

Income | | Net Capital and

Realized

Gain (Loss) | |

CommodityRealReturn Strategy Fund® | | $ | 11,984 | | $ | 3,509 | | $ | 6,126 | | $ | 130 | | | $ | 9,395 | | $ | 46 | | $ | (270 | ) |

Convertible Fund | | | 1,193 | | | 16 | | | 0 | | | 66 | | | | 1,240 | | | 16 | | | 0 | |

Developing Local Markets Fund | | | 23,695 | | | 11,797 | | | 5,002 | | | 582 | | | | 30,946 | | | 529 | | | 96 | |

Diversified Income Fund | | | 0 | | | 1,051 | | | 0 | | | (19 | ) | | | 1,031 | | | 11 | | | 0 | |

Emerging Markets Bond Fund | | | 26,326 | | | 9,172 | | | 13,874 | | | 321 | | | | 20,552 | | | 756 | | | (215 | ) |

Floating Income Fund | | | 23,662 | | | 14,886 | | | 8,178 | | | 272 | | | | 30,396 | | | 678 | | | 65 | |

Foreign Bond Fund (Unhedged) | | | 7,223 | | | 1,078 | | | 7,621 | | | 25 | | | | 833 | | | 80 | | | (356 | ) |

Fundamental IndexPLUS® Fund | | | 1,258 | | | 1,753 | | | 1,411 | | | 28 | | | | 1,666 | | | 18 | | | 24 | |

Fundamental IndexPLUS® TR Fund | | | 10,704 | | | 972 | | | 3,795 | | | (28 | ) | | | 7,823 | | | 164 | | | (158 | ) |

GNMA Fund | | | 3,197 | | | 539 | | | 988 | | | (63 | ) | | | 2,670 | | | 70 | | | (9 | ) |

High Yield Fund | | | 20,384 | | | 705 | | | 8,205 | | | (76 | ) | | | 12,554 | | | 705 | | | (85 | ) |

International StocksPLUS® TR Strategy Fund | | | 10,584 | | | 12,012 | | | 75 | | | (675 | ) | | | 22,025 | | | 379 | | | (9 | ) |

Long-Term U.S. Government Fund | | | 39,326 | | | 3,546 | | | 13,541 | | | (2,088 | ) | | | 26,893 | | | 717 | | | (831 | ) |

Low Duration Fund | | | 4,844 | | | 12,249 | | | 13,954 | | | (2 | ) | | | 2,993 | | | 158 | | | (146 | ) |

Real Return Asset Fund | | | 49,421 | | | 59,336 | | | 997 | | | (4,724 | ) | | | 103,412 | | | 1,423 | | | (38 | ) |

Real Return Fund | | | 43,544 | | | 24,385 | | | 591 | | | (2,425 | ) | | | 65,726 | | | 995 | | | (45 | ) |

RealEstateRealReturn Strategy Fund | | | 10,989 | | | 230 | | | 9,873 | | | 36 | | | | 1,756 | | | 230 | | | (537 | ) |

Short-Term Fund | | | 0 | | | 76 | | | 66 | | | 0 | | | | 10 | | | 0 | | | 0 | |

StocksPLUS® Fund | | | 70 | | | 1 | | | 0 | | | 3 | | | | 72 | | | 1 | | | 0 | |

StocksPLUS® Total Return Fund | | | 1,687 | | | 21 | | | 0 | | | (59 | ) | | | 1,679 | | | 21 | | | 0 | |

Total Return Fund | | | 26,281 | | | 2,128 | | | 12,615 | | | (576 | ) | | | 15,036 | | | 542 | | | (463 | ) |

Total Return Mortgage Fund | | | 10,041 | | | 178 | | | 6,462 | | | (123 | ) | | | 3,586 | | | 178 | | | (178 | ) |

Totals | | $ | 326,413 | | $ | 159,640 | | $ | 113,374 | | $ | (9,395 | ) | | $ | 362,294 | | $ | 7,717 | | $ | (3,155 | ) |

| | | | |

| 12 | | PIMCO Variable Insurance Trust | | |

| | |

| |

| | | June 30, 2006 (Unaudited) |

7. FEDERAL INCOME TAX MATTERS

As of June 30, 2006, the aggregate cost of investments was the same for federal income tax and financial statement purposes. The net unrealized appreciation (depreciation) of investment securities for federal income tax purposes is as follows (amounts in thousands):

| | | | |

Aggregate

Gross

Unrealized

Appreciation | | Aggregate

Gross

Unrealized

(Depreciation) | | Net

Unrealized

(Depreciation) |

$ 1,463 | | $ (10,857) | | $ (9,394) |

8. REGULATORY AND LITIGATION MATTERS

On June 1, 2004, the Attorney General of the State of New Jersey announced that it had dismissed PIMCO from a complaint filed by the New Jersey Attorney General on February 17, 2004, and that it had entered into a settlement agreement (the “New Jersey Settlement”) with Allianz Global Investors of America L.P. (“AGI”) (formerly known as Allianz Dresdner Asset Management of America L.P.), PEA Capital LLC (an entity affiliated with PIMCO through common ownership) (“PEA”) and Allianz Global Investors Distributors LLC (“AGID”), in connection with the same matter. In the New Jersey Settlement, AGI, PEA and AGID neither admitted nor denied the allegations or conclusions of law, but did agree to pay New Jersey a civil fine of $15 million and $3 million for investigative costs and further potential enforcement initiatives against unrelated parties. They also undertook to implement certain governance changes. The complaint relating to the New Jersey Settlement alleged, among other things, that AGI, PEA and AGID had failed to disclose that they improperly allowed certain hedge funds to engage in “market timing” in certain funds. The complaint sought injunctive relief, civil monetary penalties, restitution and disgorgement of profits.

Since February 2004, PIMCO, AGI, PEA, AGID, and certain of their affiliates, including the PIMCO Funds, the Allianz Funds (formerly known as PIMCO Funds: Multi-Manager Series), and the Trustees and employees of the PIMCO Funds, have been named as defendants in fifteen lawsuits filed in various jurisdictions. Eleven of those lawsuits concern “market timing,” and they have been transferred to and consolidated for pre-trial proceedings in a multi-district litigation proceeding in the U.S. District Court for the District of Maryland; the other four lawsuits concern “revenue sharing” and have been consolidated into a single action in the U.S. District Court for the District of Connecticut. The lawsuits have been commenced as putative class actions on behalf of investors who purchased, held or redeemed shares of the various series of the PIMCO Funds and the Allianz Funds during specified periods, or as derivative actions on behalf of the PIMCO Funds and Allianz Funds.

The market timing actions in the District of Maryland generally allege that certain hedge funds were allowed to engage in “market timing” in certain of the Allianz Funds and the PIMCO Funds and this alleged activity was not disclosed. Pursuant to tolling agreements entered into with the derivative and class action plaintiffs, PIMCO, the Trustees, and certain employees of PIMCO who were previously named as defendants have all been dropped as defendants in the market timing actions; the plaintiffs continue to assert claims on behalf of the shareholders of the PIMCO Funds or on behalf of the PIMCO Funds themselves against other defendants. By order dated November 3, 2005, the U.S. District Court for the District of Maryland granted the PIMCO Funds’ motion to dismiss claims asserted against it in a consolidated amended complaint where the PIMCO Funds were named, in the complaint, as a nominal defendant. The revenue sharing action in the District of Connecticut generally alleges that fund assets were inappropriately used to pay brokers to promote the Allianz Funds and PIMCO Funds, including directing fund brokerage transactions to such brokers, and that such alleged arrangements were not fully disclosed to shareholders. On August 11, 2005 the U.S. District Court for the District of Connecticut conducted a hearing on defendants’ motion to dismiss the consolidated amended complaint in the revenue sharing action but has not yet ruled on the motion to dismiss. The market timing and revenue sharing lawsuits seek, among other things, unspecified compensatory damages plus interest and, in some cases, punitive damages, the rescission of investment advisory contracts, the return of fees paid under those contracts and restitution.

Under Section 9(a) of the Investment Company Act of 1940, as amended (“1940 Act”), if the New Jersey Settlement or any of the lawsuits described above were to result in a court injunction against AGI, PEA, AGID and/or their affiliates, PIMCO could, in the absence of exemptive relief granted by the SEC, be barred from serving as an investment adviser, and AGID could be barred from serving as principal underwriter, to any registered investment company, including the Portfolios of the Trust. In connection with an inquiry from the SEC concerning the status of the New Jersey Settlement under Section 9(a), PEA, AGID, AGI and certain of their affiliates (including PIMCO) (together, the “Applicants”) have sought exemptive relief from the SEC under Section 9(c) of the 1940 Act. The SEC has granted the Applicants a temporary exemption from the provisions of Section 9(a) with respect to the New Jersey Settlement until the earlier of (i) September 13, 2006 and (ii) the date on which the SEC takes final action on their application for a permanent order. There is no assurance that the SEC will issue a permanent order.

Two nearly identical class action civil complaints have been filed in August 2005, in the Northern District of Illinois Eastern Division alleging that the plaintiffs each purchased and sold a 10-year Treasury note futures contract and suffered damages from an alleged shortage when PIMCO held both physical and futures positions in 10-year Treasury notes for its client accounts. The two actions have been consolidated into one action, and the two separate complaints have been replaced by a consolidated complaint. PIMCO is a named defendant, and the PIMCO Funds have been added as a defendant, to the consolidated action. PIMCO strongly believes the complaint (and any consolidated complaint filed hereafter) is without merit and intends to vigorously defend itself.

Certain Portfolios of the Trust were recently served in an adversary proceeding brought by the Official Committee of Asbestos Claimants of G-I Holdings, Inc. in G-I Holdings, Inc.’s bankruptcy in the District of New Jersey. PIMCO was previously named in this lawsuit and remains a defendant. The plaintiff seeks to recover for the bankruptcy estate assets that were transferred by the predecessor entity of G-I Holdings, Inc. to a wholly-owned subsidiary in 1994. The subsidiary has since issued notes, of which certain Portfolios of the Trust are alleged to be holders. The complaint alleges that in 2000, more than two hundred noteholders —including certain Portfolios of the Trust—were granted a second priority lien on the assets of the subsidiary in exchange for their consent to a refinancing transaction and the granting of a first priority lien to the lending banks. The plaintiff is seeking invalidation of the lien in favor of the noteholders and/or the value of the lien.

It is possible that these matters and/or other developments resulting from these matters could result in increased fund redemptions or other adverse consequences to the Portfolios. However, PIMCO and AGID believe that these matters are not likely to have a material adverse effect on the Portfolios or on PIMCO’s or AGID’s ability to perform their respective investment advisory or distribution services relating to the Portfolios.

| | | | | | |

| | | Semiannual Report | | June 30, 2006 | | 13 |

Investment Adviser and Administrator

Pacific Investment Management Company LLC

840 Newport Center Drive

Newport Beach, California 92660

Distributor

Allianz Global Investors Distributors LLC

2187 Atlantic Street

Stamford, Connecticut 06902

Custodian

State Street Bank & Trust Company

801 Pennsylvania

Kansas City, Missouri 64105

Transfer Agent

Boston Financial Data Services–Midwest

330 W. 9th Street

Kansas City, Missouri 64105

Legal Counsel

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

1055 Broadway

Kansas City, Missouri 64105

P I M C O

Share Class Advisor

Semiannual Report June 30, 2006

PIMCO Variable Insurance Trust

All Asset Portfolio

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO Variable Insurance Trust (the “Trust”) prospectus. Investors should consider the investment objectives, risks, charges and expenses of this Trust carefully before investing. Ask your financial professional to explain all charges that may apply. This and other information is contained in the Trust’s prospectus. The variable product prospectus may be obtained by contacting your Investment Consultant. Please read the Trust and variable product prospectus carefully before you invest or send money.

Chairman’s Letter

Dear PIMCO Variable Insurance Trust Shareholder:

It is our pleasure to present to you the semiannual report for the PIMCO Variable Insurance Trust covering the six-month period ended June 30, 2006.

Highlights of the global bond markets during the six-month period included:

| | n | | Most fixed-income sectors lost ground during the first half of 2006, as concern about accelerating inflation and central bank tightening pushed interest rates higher worldwide. The benchmark Lehman Brothers Aggregate Bond Index (which includes Treasury, Investment-Grade Corporate, and Residential Mortgage-Backed Securities) returned -0.72% for the first six months of the year. On June 30, the benchmark ten-year Treasury yielded 5.14%, 0.75% higher than at the start of the year. The U.S. yield curve remained flat as shorter-maturity yields rose by a comparable amount. |

| | n | | The Federal Reserve tightened four times during the reporting period, bringing the Federal Funds Rate to 5.25%. The increase near the end of the period was the Federal Reserve’s 17th consecutive rate hike since the start of its tightening cycle in 2004. The Federal Reserve was not alone, as central banks in Europe, India, and China tightened credit in unison for the first time since 2000. The Bank of Japan, whose zero-interest-rate policy has flooded global markets with liquidity, looked set to reverse this policy in the coming months. |

In these pages please find a more complete Portfolio review as it relates to financial-market activities, as well as details about total-return investment performance for the six-month reporting period. Thank you for the trust you have placed in us. We will continue to work diligently to meet your investment needs.

Sincerely,

Brent R. Harris

Chairman, PIMCO Variable Insurance Trust

July 31, 2006

| | | | | | |

| | | Semiannual Report | | June 30, 2006 | | 1 |

Important Information About the Portfolio

PIMCO Variable Insurance Trust (the “Trust”) is an open-end management investment company currently consisting of nineteen separate investment portfolios, including the All Asset Portfolio (the “Portfolio”). The Portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies (“Variable Contracts”). Individuals may not purchase shares of the Portfolio directly. Shares of the Portfolio also may be sold to qualified pension and retirement plans outside of the separate account context.

The Portfolio is a “fund of funds,” which is a term used to describe mutual funds that pursue their investment objective by investing in other mutual funds instead of investing directly in stocks or bonds of other issuers. Under normal circumstances, the Portfolio invests substantially all of its assets in Institutional Class shares of PIMCO Funds, an affiliated open-end investment company, except the All Asset and All Asset All Authority Funds (“Underlying Funds”).

Among the principal risks of investing in the Portfolio are allocation risk, Underlying Fund risk and issuer non-diversification risk. The Portfolio also is indirectly subject to the risks of the Underlying Funds, which may include, but are not limited to, the following: interest rate risk, credit risk, high yield risk, market risk, issuer risk, variable dividends risk, liquidity risk, derivatives risk, commodity risk, equity risk, mortgage risk, non-U.S. investment risk, real estate risk, emerging markets risk, currency risk, issuer non-diversification risk, leveraging risk, small company risk, management risk, California state specific risk, New York state specific risk, tax risk and index risk. A complete description of these risks is contained in the Portfolio’s prospectus. An Underlying Fund may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that the Underlying Fund could not close out a position when it would be most advantageous to do so. An Underlying Fund investing in derivatives could lose more than the principal amount invested in these instruments. Investing in non-U.S. securities may entail risk due to non-U.S. economic and political developments; this risk may be increased when investing in emerging markets.

The cost of investing in the Portfolio will generally be higher than the cost of investing in a mutual fund that invests directly in individual stocks and bonds. By investing in the Portfolio, an investor will indirectly bear fees and expenses charged by the Underlying Funds in addition to the Portfolio’s direct fees and expenses.

On the performance summary page in this Semiannual Report, the Total Return Investment Performance table measures performance assuming that all dividend and capital gain distributions were reinvested.

An investment in the Portfolio is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Portfolio.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Portfolio. Copies of the written Proxy Policy and the factors that PIMCO may consider in determining how to vote proxies for the Portfolio, and information about how the Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at 1-866-746-2606 and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

The Portfolio files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Trust’s Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

PIMCO Variable Insurance Trust is distributed by Allianz Global Investors Distributors LLC, 2187 Atlantic Street, Stamford, CT 06902.

| | | | |

| 2 | | PIMCO Variable Insurance Trust | | |

The following disclosure provides important information regarding the Portfolio’s Expense Example (“Example” or “Expense Example”), which appears in this Semiannual Report. Please refer to this information when reviewing the Expense Example for the Portfolio.

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including advisory and administrative fees; distribution and/or service (12b-1) fees (Administrative Class, Advisor Class and Class M only); and other Portfolio expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Expense Example does not reflect any fees or other expenses imposed by the Variable Contracts. If it did, the expenses reflected in the Expense Examples would be higher. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which is from January 1, 2006 to June 30, 2006.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.60), then multiply the result by the number in the appropriate column for your share class, in the row titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transactional costs were included, your costs would have been higher.

The expense ratio may vary period to period because of various factors, such as an increase in expenses not covered by the advisory and administrative fees (such as expenses of the trustees and their counsel or litigation expense).

Portfolio Benchmarks

Lehman Brothers U.S. TIPS: 1-10 Year is an unmanaged index market comprised of U.S. Treasury Inflation Linked securities having a maturity of at least 1 year and less than 10 years. It is not possible to invest directly in such an unmanaged index.

The CPI + 500 Basis Points benchmark is created by adding 5% to the annual percentage change in the Consumer Price Index (“CPI”). This index reflects non-seasonally adjusted returns. The CPI is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the US Department of Labor Statistics. There can be no guarantee that the CPI or other indexes will reflect the exact level of inflation at any given time.

| | | | | | |

| | | Semiannual Report | | June 30, 2006 | | 3 |

|

|

| PIMCO All Asset Portfolio |

|

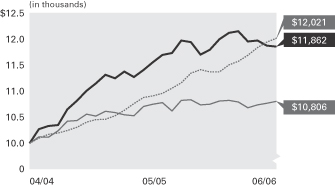

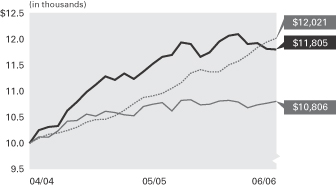

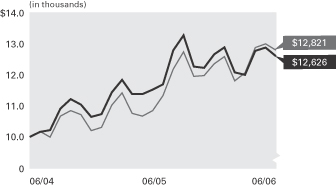

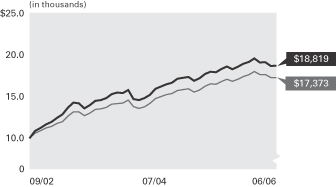

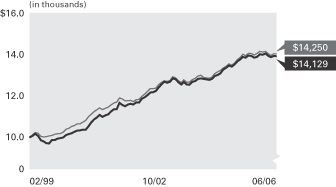

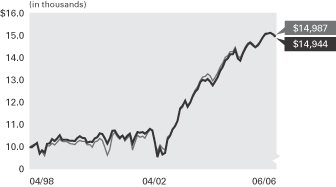

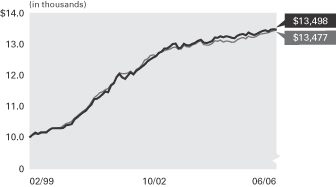

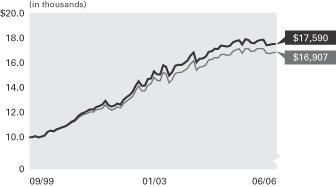

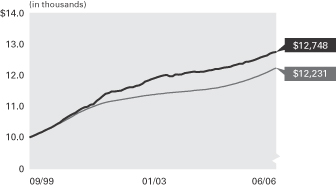

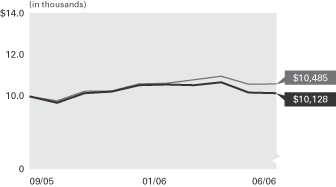

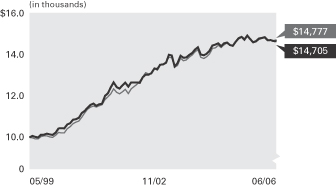

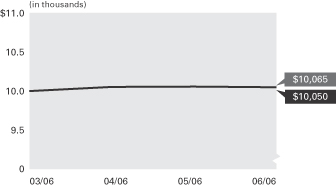

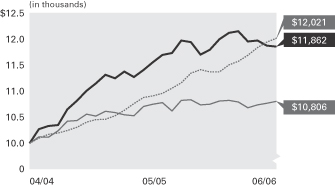

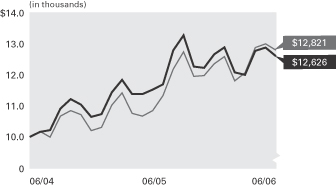

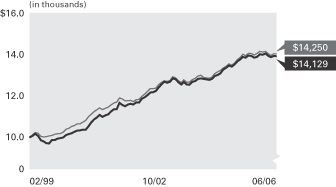

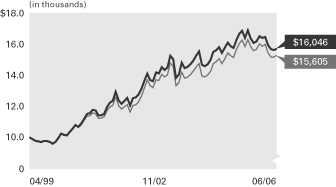

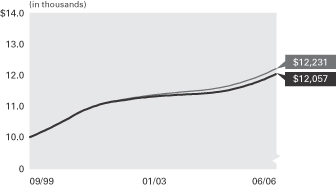

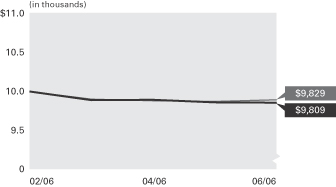

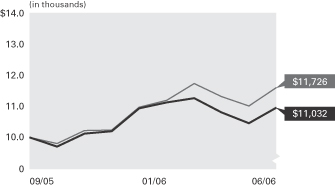

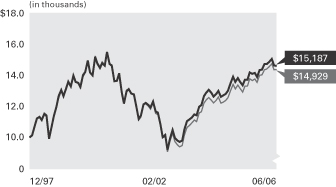

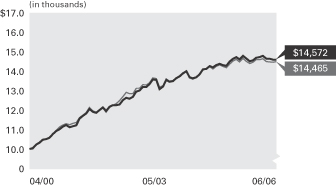

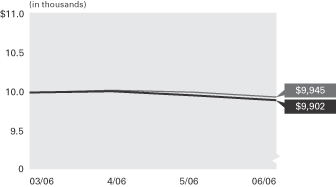

Cumulative Returns Through June 30, 2006

Consumer Price

All Asset Portfolio Index + 500 Lehman Brothers U.S.

Advisor Class Basis points TIPS 1-10 Year Index

------------------- -------------- --------------------

04/30/2004 $10,000 $10,000 $10,000

05/31/2004 10,274 10,100 10,124

06/30/2004 10,332 10,174 10,116

07/31/2004 10,351 10,201 10,242

08/31/2004 10,653 10,249 10,427

09/30/2004 10,821 10,313 10,437

10/31/2004 11,010 10,410 10,564

11/30/2004 11,152 10,459 10,527

12/31/2004 11,318 10,464 10,617

01/31/2005 11,250 10,530 10,590

02/28/2005 11,377 10,634 10,552

03/31/2005 11,275 10,762 10,532

04/30/2005 11,412 10,679 10,707

05/31/2005 11,558 10,913 10,753

06/30/2005 11,697 10,964 10,780

07/31/2005 11,738 11,061 10,623

08/31/2005 11,975 11,163 10,828

09/30/2005 11,945 11,346 10,838

10/31/2005 11,707 11,416 10,742

11/30/2005 11,796 11,372 10,752

12/31/2005 12,001 11,374 10,816

01/31/2006 12,123 11,508 10,825

02/28/2006 12,153 11,579 10,793

03/31/2006 11,958 11,691 10,684

04/30/2006 11,978 11,839 10,738

05/31/2006 11,876 11,948 10,774

06/30/2006 11,862 12,021 10,806

$10,000 invested at the beginning of the first full month following the inception date of the Portfolio’s Advisor Class.

PIMCO Funds Allocation‡

| | |

Real Return Asset | | 28.4% |

Real Return | | 18.1% |

Developing Local Markets | | 8.5% |

Floating Income | | 8.3% |

Long-Term U.S. Government | | 7.4% |

International StocksPLUS® TR Strategy | | 6.0% |

Emerging Markets Bond | | 5.6% |

Other | | 17.7% |

| | ‡ | % of Total Investments as of June 30, 2006 |

| | | | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2006 |

| | | | | | | 6 Months* | | 1 Year | | Since

Inception

(04/30/04) |

| | |

| | PIMCO All Asset Portfolio Advisor Class | | -1.16% | | 1.39% | | 8.20% |

| | |

| | Lehman Brothers U.S. TIPS 1-10 Year Index | | -0.09% | | 0.24% | | 3.65% |

| | | - - - - | | Consumer Price Index + 500 Basis points | | 5.69% | | 9.64% | | 8.87% |

* Cumulative return. All Portfolio returns are net of fees and expenses.