UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-08399

PIMCO Variable Insurance Trust

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer

PIMCO Funds

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan C. Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (866) 746-2606

Date of fiscal year end: December 31

Date of reporting period: January 1, 2007 to June 30, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

| | • | | PIMCO Variable Insurance Trust All Asset Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust All Asset Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust All Asset Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust All Asset Portfolio Class M |

| | • | | PIMCO Variable Insurance Trust CommodityRealReturn Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust CommodityRealReturn Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Emerging Markets Bond Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Emerging Markets Bond Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Foreign Bond Portfolio (U.S. Dollar-Hedged) Administrative Class |

| | • | | PIMCO Variable Insurance Trust Foreign Bond Portfolio (U.S. Dollar-Hedged) Institutional Class |

| | • | | PIMCO Variable Insurance Trust Global Bond Portfolio (Unhedged) Administrative Class |

| | • | | PIMCO Variable Insurance Trust Global Bond Portfolio (Unhedged) Institutional Class |

| | • | | PIMCO Variable Insurance Trust Global Bond Portfolio (Unhedged) Advisor Class |

| | • | | PIMCO Variable Insurance Trust High Yield Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust High Yield Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust High Yield Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Long-Term U.S. Government Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Long-Term U.S. Government Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Low Duration Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Low Duration Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Low Duration Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Money Market Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Money Market Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Real Return Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Real Return Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Real Return Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust RealEstateRealReturn Strategy Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Short-Term Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Short-Term Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Small Cap StocksPLUS® TR Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Small Cap StocksPLUS® TR Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust StocksPLUS® Growth and Income Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust StocksPLUS® Growth and Income Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust StocksPLUS® Total Return Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio Administrative Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio Institutional Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio Advisor Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio II Administrative Class |

| | • | | PIMCO Variable Insurance Trust Total Return Portfolio II Institutional Class |

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO Variable Insurance Trust (the “Trust”) prospectus. Investors should consider the investment objectives, risks, charges and expenses of this Trust carefully before investing. Ask your financial professional to explain all charges that may apply. This and other information is contained in the Trust’s prospectus. The variable product prospectus may be obtained by contacting your Investment Consultant. Please read the Trust and variable product prospectus carefully before you invest or send money.

Chairman’s Letter

Dear PIMCO Variable Insurance Trust Shareholder:

It is our pleasure to present to you the semiannual report for the PIMCO Variable Insurance Trust, covering the six-month period ended June 30, 2007. The PIMCO Variable Insurance Trust’s net assets were $8.68 billion at June 30, 2007, as compared to $7.76 billion at December 31, 2006.

Highlights of the financial markets during the reporting period include:

| | n | | Economic data during the first quarter of 2007 pointed to slower growth, which heightened market expectations for a decrease in the Federal Funds Rate. By the second quarter, economic data, such as employment statistics, provided little indication of economic weakness, causing expectations of a decrease in the Federal Funds Rate to unwind and U.S. interest rates to move higher. Interest rates in Europe and the U.K. also rose over the period as central banks raised their key lending rates due to inflation concerns. The benchmark ten-year U.S. Treasury yielded 5.03% as of June 30, 2007, or 0.32% higher than at the beginning of the year. |

| | n | | Most bonds generally returned much of their gains from earlier in the year as worldwide growth and capital flows drove interest rates higher in the second quarter. Increased risk aversion in global financial markets, due in part to subprime mortgage worries in the U.S., also contributed to the rise in interest rates. The Lehman Brothers Aggregate Bond Index, which includes Treasury, investment-grade corporate and mortgage-backed securities, returned 0.98% for the six-month period. |

| | n | | Locally issued emerging market (“EM”) bonds posted positive returns for the reporting period. Yields on these bonds declined and the local currencies in which they are denominated generally gained, amid increasing investor awareness, strong economic growth and surging capital inflows. External EM bonds (debt instruments issued by emerging markets countries and typically denominated in U.S. dollars) lagged behind local EM bonds (debt instruments issued by emerging markets countries and denominated in the currency of the issuer), as external EM bonds tend to trade more in-line with U.S. Treasuries. |

| | n | | Treasury Inflation-Protected Securities (“TIPS”) outpaced nominal bonds (non-inflation linked bonds) for the first part of the year and all but the longest maturity TIPS outperformed in the second quarter as high gasoline prices drove higher inflation accruals. Commodities, as represented by the Dow Jones-AIG Commodity Total Return Index, returned 4.46% for the period. Equities, as measured by the S&P 500 Index and the Russell 2000 Index, returned 6.96% and 6.45%, respectively, for the period. |

On the following pages, please find specific details as to the Portfolio’s total return investment performance and a discussion of those factors that affected performance.

Thank you for the trust you have placed in us. We will continue to work diligently to serve your investment needs.

Sincerely,

Brent R. Harris

Chairman, PIMCO Variable Insurance Trust

July 31, 2007

| | | | | | |

| | Semiannual Report | | June 30, 2007 | | 1 |

Important Information About the Portfolio

PIMCO Variable Insurance Trust (the “Trust”) is an open-end management investment company currently consisting of twenty separate investment portfolios, including the All Asset Portfolio (the “Portfolio”). The Portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies (“Variable Contracts”). Individuals may not purchase shares of the Portfolio directly. Shares of the Portfolio also may be sold to qualified pension and retirement plans outside of the separate account context.

The Portfolio is a “fund of funds,” which is a term used to describe mutual funds that pursue their investment objective by investing in other mutual funds instead of investing directly in stocks or bonds of other issuers. Under normal circumstances, the Portfolio invests substantially all of its assets in Institutional Class shares of PIMCO Funds, an affiliated open-end investment company, except the All Asset and All Asset All Authority Funds (“Underlying Funds”).

Among the principal risks of investing in the Portfolio are allocation risk, Underlying Fund risk and issuer non-diversification risk. The Portfolio also is indirectly subject to the risks of the Underlying Funds, which may include, but are not limited to, the following: interest rate risk, credit risk, high yield risk, market risk, issuer risk, variable dividends risk, liquidity risk, derivatives risk, commodity risk, equity risk, mortgage risk, non-U.S. investment risk, real estate risk, emerging markets risk, currency risk, issuer non-diversification risk, leveraging risk, small company risk, management risk, California state-specific risk, New York state-specific risk, tax risk, and subsidiary risk. A complete description of these risks is contained in the Portfolio’s prospectus. An Underlying Fund may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that the Underlying Fund could not close out a position when it would be most advantageous to do so. An Underlying Fund investing in derivatives could lose more than the principal amount invested in these instruments. An Underlying Fund’s investment in non-U.S. securities may entail risk due to non-U.S. economic and political developments; this risk may be increased when investing in emerging markets.

The cost of investing in the Portfolio will generally be higher than the cost of investing in a mutual fund that invests directly in individual stocks and bonds. By investing in the Portfolio, an investor will indirectly bear fees and expenses charged by the Underlying Funds in addition to the Portfolio’s direct fees and expenses.

On the performance summary page in this Semiannual Report, the Total Return Investment Performance table measures performance assuming that all dividend and capital gain distributions were reinvested.

An investment in the Portfolio is not a deposit of a bank and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Portfolio.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Trust as the policies and procedures that PIMCO will use when voting proxies on behalf of the Portfolio. A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of the Portfolio, and information about how the Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Trust at 1-866-746-2606 and on the Portfolio’s website at www.pimco.com.

The Portfolio files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. A copy of the Trust’s Form N-Q is also available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330, and is available without charge, upon request, by calling the Trust at 1-866-746-2606 and on the Portfolio’s website at www.pimco.com.

PIMCO Variable Insurance Trust is distributed by Allianz Global Investors Distributors LLC, 1345 Avenue of the Americas, New York, NY 10105.

| | | | |

| 2 | | PIMCO Variable Insurance Trust | | |

The following disclosure provides important information regarding the Portfolio’s Expense Example (“Example” or “Expense Example”), which appears in this Semiannual Report. Please refer to this information when reviewing the Expense Example for the Portfolio.

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including advisory and administrative fees; distribution and/or service (12b-1) fees (Administrative Class, Advisor Class and Class M only); and other Portfolio expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Expense Example does not reflect any fees or other expenses imposed by the Variable Contracts. If it did, the expenses reflected in the Expense Example would be higher. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which is from January 1, 2007 to June 30, 2007.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the row titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transactional costs were included, your costs would have been higher.

The expense ratio may vary period to period because of various factors, such as an increase in expenses not covered by the advisory and administrative fees (such as expenses of the trustees and their counsel, litigation expense and interest expense).

| | | | | | |

| | Semiannual Report | | June 30, 2007 | | 3 |

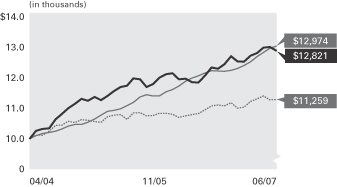

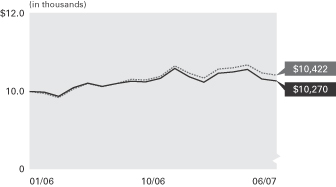

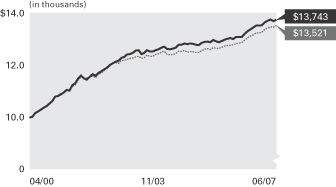

PIMCO All Asset Portfolio

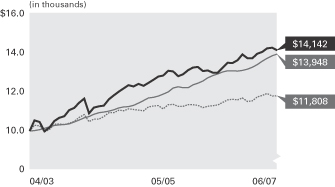

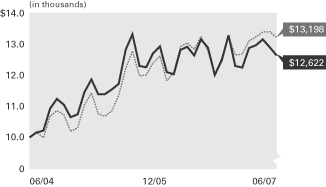

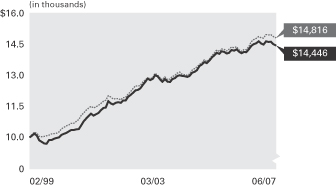

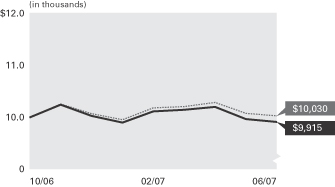

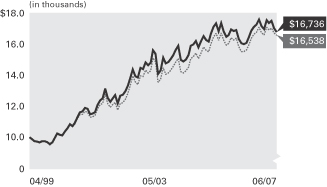

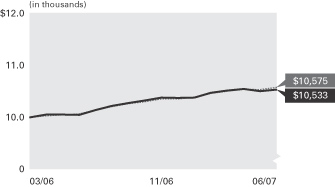

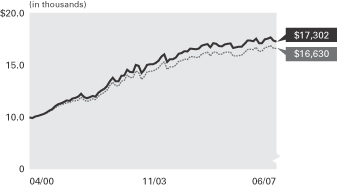

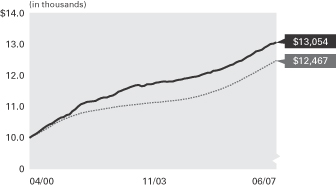

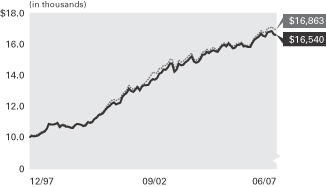

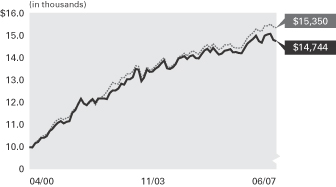

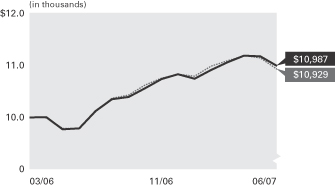

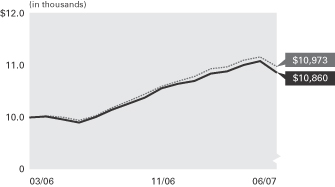

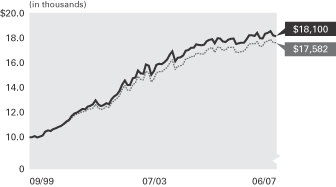

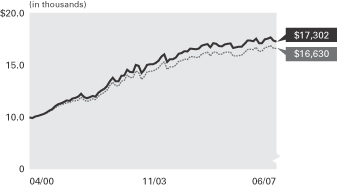

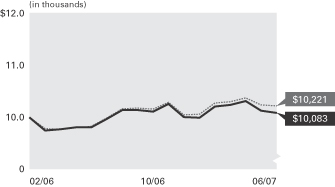

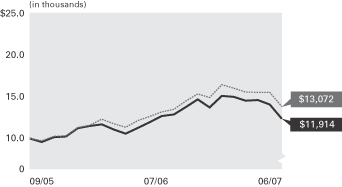

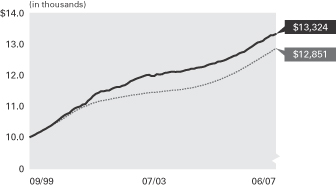

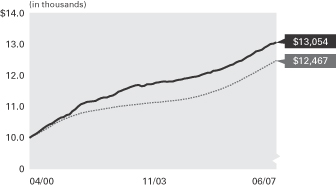

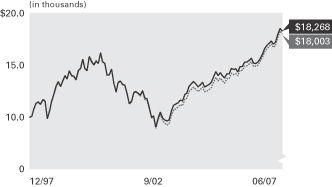

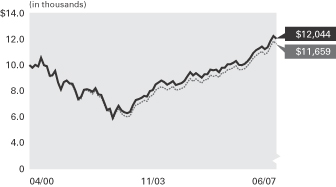

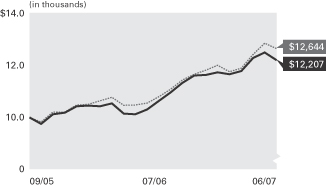

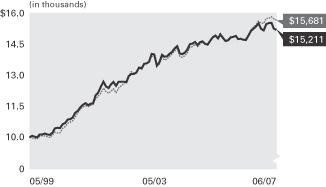

Cumulative Returns Through June 30, 2007

$10,000 invested at the beginning of the first full month following the inception date of the Portfolio’s Administrative Class.

PIMCO Funds Allocation‡

| | |

Floating Income Fund | | 19.7% |

Real Return Asset Fund | | 14.9% |

Developing Local Markets Fund | | 12.4% |

Emerging Local Bond Fund | | 11.2% |

CommodityRealReturn Strategy Fund® | | 9.0% |

Real Return Fund | | 6.8% |

Long-Term U.S. Government Fund | | 5.7% |

Other | | 20.3% |

| | ‡ | % of Total Investments as of 06/30/2007 |

| | | | | | | | |

| Average Annual Total Return for the period ended June 30, 2007 | | |

| | | | | 6 Months* | | 1 Year | | Portfolio

Inception

(04/30/03) |

| | PIMCO All Asset Portfolio Administrative Class | | 2.98% | | 8.92% | | 8.67% |

| | Lehman Brothers U.S. TIPS: 1-10 Year Index± | | 2.49% | | 4.19% | | 4.07% |

| | CPI + 500 Basis Points±± | | 5.84% | | 7.93% | | 8.31% |

All Portfolio returns are net of fees and expenses.

* Cumulative return.

Performance quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value will fluctuate so the Portfolio shares, when redeemed, may be worth more or less than their original cost. The Portfolio’s performance does not reflect the deduction of additional charges and expenses imposed in connection with investing in Variable Contracts, which will reduce returns. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available by calling (800) 927-4648.

± Lehman Brothers U.S. TIPS: 1-10 Year Index is an unmanaged index comprised of U.S. Treasury Inflation-Protected Securities having a maturity of at least 1 year and less than 10 years. It is not possible to invest directly in the index. The index does not reflect deductions for fees and expenses.

±± CPI + 500 Basis Points benchmark is created by adding 5% to the annual percentage change in the Consumer Price Index (“CPI”). This index reflects non-seasonally adjusted returns. The CPI is an unmanaged index representing the rate of inflation of the U.S. consumer prices as determined by the U.S. Department of Labor, Bureau of Labor Statistics. There can be no guarantee that the CPI or other indices will reflect the exact level of inflation at any given time. It is not possible to invest directly in the index. The index does not reflect deductions for fees and expenses.

| | | | | | |

| Expense Example | | Actual Performance | | Hypothetical Performance |

| | | | | (5% return before expenses) |

Beginning Account Value (01/01/07) | | $ | 1,000.00 | | $ | 1,000.00 |

Ending Account Value (06/30/07) | | $ | 1,029.76 | | $ | 1,021.94 |

Expenses Paid During Period† | | $ | 2.89 | | $ | 2.88 |

† Expenses are equal to the Portfolio’s Administrative Class annualized expense ratio of 0.575%, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The expense ratio excludes the expenses of the Underlying Funds, which based upon the allocation of the Portfolio’s assets among the Underlying Funds are indirectly borne by the shareholders of the Portfolio. The Underlying Fund Expenses are currently capped at 0.64%. Overall fees and expenses of investing in the Portfolio will be higher because the example does not reflect Variable Contract fees and expenses.

Please refer to page 3 herein for an explanation of the information presented in the above Expense Example.

Portfolio Insights

| » | | The PIMCO All Asset Portfolio seeks to achieve its investment objective by investing under normal circumstances substantially all of its assets in Institutional Class shares of the PIMCO Funds, an affiliated open-end investment company, except the PIMCO All Asset and PIMCO All Asset All Authority Funds. |

| » | | Significant exposure to short-term strategies, particularly through the PIMCO Floating Income Fund, contributed to performance as the PIMCO Floating Income Fund returned 2.62% net of fees during the period. |

| » | | Although any exposure to Real Estate Investment Trusts (“REITs”) would detract from performance, as the Dow Jones Wilshire REIT Index returned -5.97% during the period, negligible exposure was a positive asset allocation decision. |

| » | | Exposure to equity strategies benefited performance due to strong returns domestically and internationally. However, reduced equity exposure in the Portfolio was not a positive asset allocation decision. |

| » | | Large exposure to developing local market bonds contributed to performance as the asset class benefited from continued capital inflows and strong economic fundamentals. |

| » | | Large exposure to Treasury Inflation-Protected Securities (“TIPS”) detracted from performance as real yields rose. |

| » | | Minimal exposure to convertibles detracted from returns as the asset class had positive performance. |

| | | | |

| 4 | | PIMCO Variable Insurance Trust | | |

Financial Highlights All Asset Portfolio

| | | | | | | | | | | | | | | | | | | | |

| Selected per Share Data for the Year or Period Ended: | | 06/30/2007+ | | | 12/31/2006 | | | 12/31/2005 | | | 12/31/2004 | | | 04/30/2003-12/31/2003 | |

| | | | | |

Administrative Class | | | | | | | | | | | | | | | | | | | | |

Net asset value beginning of year or period | | $ | 11.67 | | | $ | 11.81 | | | $ | 11.62 | | | $ | 10.77 | | | $ | 10.00 | |

Net investment income (a) | | | 0.26 | | | | 0.63 | | | | 0.83 | | | | 1.50 | | | | 0.53 | |

Net realized/unrealized gain (loss) on investments (a) | | | 0.09 | | | | (0.10 | ) | | | (0.11 | ) | | | (0.27 | ) | | | 0.54 | |

Total income from investment operations | | | 0.35 | | | | 0.53 | | | | 0.72 | | | | 1.23 | | | | 1.07 | |

Dividends from net investment income | | | (0.29 | ) | | | (0.64 | ) | | | (0.49 | ) | | | (0.37 | ) | | | (0.30 | ) |

Distributions from net realized capital gains | | | 0.00 | | | | (0.03 | ) | | | (0.04 | ) | | | (0.01 | ) | | | 0.00 | |

Total distributions | | | (0.29 | ) | | | (0.67 | ) | | | (0.53 | ) | | | (0.38 | ) | | | (0.30 | ) |

Net asset value end of year or period | | $ | 11.73 | | | $ | 11.67 | | | $ | 11.81 | | | $ | 11.62 | | | $ | 10.77 | |

Total return | | | 2.98 | % | | | 4.66 | % | | | 6.23 | % | | | 11.49 | % | | | 10.79 | % |

Net assets end of year or period (000s) | | $ | 258,604 | | | $ | 251,076 | | | $ | 251,482 | | | $ | 102,183 | | | $ | 1,017 | |

Ratio of expenses to average net assets | | | 0.575 | %*(c)(f) | | | 0.585 | %(c)(e) | | | 0.59 | %(c)(d) | | | 0.57 | %(c)(d) | | | 0.60 | %*(b)(c) |

Ratio of expenses to average net assets excluding interest expense | | | 0.575 | %*(c)(f) | | | 0.585 | %(c)(e) | | | 0.59 | %(c)(d) | | | 0.57 | %(c)(d) | | | 0.60 | %*(b)(c) |

Ratio of net investment income to average net assets | | | 4.43 | %* | | | 5.39 | % | | | 6.98 | % | | | 13.02 | % | | | 7.56 | %* |

Portfolio turnover rate | | | 48 | % | | | 66 | % | | | 75 | % | | | 93 | % | | | 136 | % |

+ Unaudited

* Annualized

(a) Per share amounts based on average number of shares outstanding during the period.

(b) If the investment manager had not reimbursed expenses, the ratio of expenses to average net assets would have been 10.92%.

(c) Ratio of expenses to average net assets excluding underlying Funds’ expenses in which the Portfolio invests.

(d) If the investment manager had not reimbursed expenses, the ratio of expenses to average net assets would have been 0.60%.

(e) Effective October 1, 2006, the advisory fee was reduced to 0.175%.

(f) If the investment manager had not reimbursed expenses, the ratio of expenses to average net assets would have been 0.585%.

| | | | | | |

| See Accompanying Notes | | Semiannual Report | | June 30, 2007 | | 5 |

Statement of Assets and Liabilities All Asset Portfolio

| | | | |

| (Amounts in thousands, except per share amounts) | | June 30, 2007

(Unaudited) | |

| |

Assets: | | | | |

Investments in affiliates, at value | | $ | 1,125,710 | |

Repurchase agreements, at value | | | 4,111 | |

Cash | | | 1 | |

Receivable for investments in affiliates sold | | | 9,423 | |

Receivable for Portfolio shares sold | | | 2,631 | |

Interest and dividends receivable | | | 2 | |

Interest and dividends receivable from affiliates | | | 5,016 | |

Manager reimbursement receivable | | | 31 | |

| | | | 1,146,925 | |

| |

Liabilities: | | | | |

Payable for investments in affiliates purchased | | $ | 16,789 | |

Payable for Portfolio shares redeemed | | | 69 | |

Accrued investment advisory fee | | | 163 | |

Accrued administration fee | | | 233 | |

Accrued distribution fee | | | 168 | |

Accrued servicing fee | | | 30 | |

| | | | 17,452 | |

| |

Net Assets | | $ | 1,129,473 | |

| |

Net Assets Consist of: | | | | |

Paid in capital | | $ | 1,125,794 | |

Undistributed net investment income | | | 4,112 | |

Accumulated undistributed net realized (loss) | | | (7,260 | ) |

Net unrealized appreciation | | | 6,827 | |

| | | $ | 1,129,473 | |

| |

Net Assets: | | | | |

Institutional Class | | $ | 291 | |

Administrative Class | | | 258,604 | |

Advisor Class | | | 822,338 | |

Class M | | | 48,240 | |

| |

Shares Issued and Outstanding: | | | | |

Institutional Class | | | 25 | |

Administrative Class | | | 22,035 | |

Advisor Class | | | 69,990 | |

Class M | | | 4,106 | |

| |

Net Asset Value and Redemption Price Per Share (Net Asset Per Share Outstanding) | | | | |

Institutional Class | | $ | 11.74 | |

Administrative Class | | | 11.73 | |

Advisor Class | | | 11.74 | |

Class M | | | 11.74 | |

| |

Cost of Investments in Affiliates Owned | | $ | 1,118,883 | |

Cost of Repurchase Agreements Owned | | $ | 4,111 | |

| | | | |

| 6 | | PIMCO Variable Insurance Trust | | See Accompanying Notes |

Statement of Operations All Asset Portfolio

| | | | |

| (Amounts in thousands) | | Six Months Ended June 30, 2007 (Unaudited) | |

| |

| Investment Income: | | | | |

Interest | | $ | 99 | |

Dividends from affiliate investments | | | 24,338 | |

Total Income | | | 24,437 | |

| |

Expenses: | | | | |

Investment advisory fees | | | 831 | |

Administration fees | | | 1,187 | |

Servicing fees – Administrative Class | | | 187 | |

Distribution and/or servicing fees – Advisor Class | | | 813 | |

Distribution and/or servicing fees – Class M | | | 111 | |

Total Expenses | | | 3,129 | |

Reimbursement by Manager | | | (45 | ) |

Net Expenses | | | 3,084 | |

| |

Net Investment Income | | | 21,353 | |

| |

Net Realized and Unrealized Gain (Loss): | | | | |

Net realized (loss) on affiliate investments | | | (1,069 | ) |

Net change in unrealized appreciation on affiliate investments | | | 5,843 | |

Net Gain | | | 4,774 | |

| |

Net Increase in Net Assets Resulting from Operations | | $ | 26,127 | |

| | | | | | |

| See Accompanying Notes | | Semiannual Report | | June 30, 2007 | | 7 |

Statements of Changes in Net Assets All Asset Portfolio

| | | | | | | | |

| (Amounts in thousands) | | Six Months Ended June 30, 2007 (Unaudited) | | | Year Ended December 31, 2006 | |

| | |

| Increase in Net Assets from: | | | | | | | | |

| | |

Operations: | | | | | | | | |

Net investment income | | $ | 21,353 | | | $ | 32,372 | |

Net realized (loss) on affiliate investments | | | (1,069 | ) | | | (7,977 | ) |

Net capital gain distributions received from Underlying Funds | | | 0 | | | | 2,277 | |

Net change in unrealized appreciation on affiliate investments | | | 5,843 | | | | 3,148 | |

Net increase resulting from operations | | | 26,127 | | | | 29,820 | |

| | |

Distributions to Shareholders: | | | | | | | | |

From net investment income | | | | | | | | |

Institutional Class | | | (7 | ) | | | (2 | ) |

Administrative Class | | | (6,179 | ) | | | (13,550 | ) |

Advisor Class | | | (17,050 | ) | | | (15,816 | ) |

Class M | | | (1,079 | ) | | | (3,041 | ) |

From net realized capital gains | | | | | | | | |

Institutional Class | | | 0 | | | | 0 | |

Administrative Class | | | 0 | | | | (622 | ) |

Advisor Class | | | 0 | | | | (1,205 | ) |

Class M | | | 0 | | | | (139 | ) |

| | |

Total Distributions | | | (24,315 | ) | | | (34,375 | ) |

| | |

Portfolio Share Transactions: | | | | | | | | |

Receipts for shares sold | | | | | | | | |

Institutional Class | | | 294 | | | | 73 | |

Administrative Class | | | 25,388 | | | | 60,956 | |

Advisor Class | | | 304,743 | | | | 485,456 | |

Class M | | | 5,550 | | | | 15,354 | |

Issued as reinvestment of distributions | | | | | | | | |

Institutional Class | | | 7 | | | | 3 | |

Administrative Class | | | 6,179 | | | | 14,172 | |

Advisor Class | | | 17,050 | | | | 17,022 | |

Class M | | | 1,079 | | | | 3,180 | |

Cost of shares redeemed | | | | | | | | |

Institutional Class | | | (83 | ) | | | 0 | |

Administrative Class | | | (25,052 | ) | | | (72,158 | ) |

Advisor Class | | | (1,505 | ) | | | (7,990 | ) |

Class M | | | (13,565 | ) | | | (30,245 | ) |

Net increase resulting from Portfolio share transactions | | | 320,085 | | | | 485,823 | |

| | |

Total Increase in Net Assets | | | 321,897 | | | | 481,268 | |

| | |

Net Assets: | | | | | | | | |

Beginning of period | | | 807,576 | | | | 326,308 | |

End of period* | | $ | 1,129,473 | | | $ | 807,576 | |

| | |

*Including undistributed net investment income of: | | $ | 4,112 | | | $ | 7,074 | |

| | | | |

| 8 | | PIMCO Variable Insurance Trust | | See Accompanying Notes |

| | |

| |

| Schedule of Investments All Asset Portfolio (a) | | June 30, 2007 (Unaudited) |

| | | | | | | | |

| | | | | SHARES | | | | VALUE (000S) |

| PIMCO FUNDS (b) 99.7% | | |

CommodityRealReturn Strategy Fund® | | | | 7,268,477 | | $ | | 102,122 |

Convertible Fund | | | | 589,376 | | | | 8,434 |

Developing Local Markets Fund | | | | 12,645,454 | | | | 139,732 |

Diversified Income Fund | | | | 4,446,275 | | | | 48,242 |

Emerging Local Bond Fund | | | | 12,272,617 | | | | 126,285 |

Emerging Markets Bond Fund | | | | 1,580,326 | | | | 17,241 |

Floating Income Fund | | | | 21,146,569 | | | | 222,251 |

Foreign Bond Fund (Unhedged) | | | | 87,682 | | | | 862 |

Fundamental IndexPLUS™ Fund | | | | 2,578,927 | | | | 29,709 |

Fundamental IndexPLUS™ TR Fund | | | | 3,313,300 | | | | 35,817 |

GNMA Fund | | | | 261,736 | | | | 2,856 |

High Yield Fund | | | | 669,256 | | | | 6,539 |

Income Fund | | | | 368,140 | | | | 3,619 |

International StocksPLUS® TR Strategy Fund (Unhedged) | | | | 379,112 | | | | 3,969 |

| | | | | | | | |

| | | | | SHARES | | | | VALUE (000S) |

International StocksPLUS® TR Strategy Fund (U.S.Dollar-Hedged) | | | | 2,537,938 | | $ | | 31,927 |

Long-Term U.S. Government Fund | | | | 6,413,670 | | | | 65,163 |

Low Duration Fund | | | | 130,601 | | | | 1,280 |

Real Return Asset Fund | | | | 15,807,400 | | | | 168,665 |

Real Return Fund | | | | 7,279,172 | | | | 76,577 |

RealEstateRealReturn Strategy Fund | | | | 291,240 | | | | 1,899 |

Short-Term Fund | | | | 364,763 | | | | 3,619 |

Small Cap StocksPLUS® TR Strategy Fund | | | | 173,830 | | | | 1,877 |

StocksPLUS® Fund | | | | 158,184 | | | | 1,830 |

StocksPLUS® Total Return Fund | | | | 561,247 | | | | 6,836 |

Total Return Fund | | | | 360,250 | | | | 3,660 |

Total Return Mortgage Fund | | | | 1,397,281 | | | | 14,699 |

| | | | | | | | |

Total PIMCO Funds (Cost $1,118,883) | | | | 1,125,710 |

| | | | | | | | |

| | | | | | | | | |

| | | | | PRINCIPAL AMOUNT

(000S) | | | | VALUE (000S) | |

| SHORT-TERM INSTRUMENTS 0.3% | |

| |

| REPURCHASE AGREEMENTS 0.3% | |

| State Street Bank and Trust Co. | | | | | |

4.900% due 07/02/2007 | | $ | | 4,111 | | $ | | 4,111 | |

| | | | | | | | | |

(Dated 06/29/2007. Collateralized by Fannie Mae 3.250% due 08/15/2008 valued at $4,197. Repurchase proceeds are $4,113.) | |

Total Short-Term Instruments

(Cost $4,111) | | 4,111 | |

| | | | | | | | | |

| |

| |

Total Investments 100.0%

(Cost $1,122,994) | | $ | | 1,129,821 | |

| |

| Other Assets and Liabilities (Net) (0.0%) | | | | (348 | ) |

| | | | | | | | | |

| Net Assets 100.0% | | | | | | $ | | 1,129,473 | |

| | | | | | | | | |

Notes to Schedule of Investments

(a) The All Asset Portfolio is investing in shares of affiliated Funds.

(b) Institutional Class Shares of each PIMCO Fund.

| | | | | | |

| See Accompanying Notes | | Semiannual Report | | June 30, 2007 | | 9 |

Notes to Financial Statements

1. ORGANIZATION

The All Asset Portfolio (the “Portfolio”) is a series of the PIMCO Variable Insurance Trust (the “Trust”). The Trust is registered under the Investment Company Act of 1940 (the “Act”), as amended, as an open-end management investment company organized as a Delaware business trust on October 3, 1997. The Portfolio offers four classes of shares: Institutional, Administrative, Advisor, and Class M. Information presented on these financial statements pertains to the Administrative Class of the Portfolio. Certain detailed financial information for the Institutional Class, Advisor Class and Class M is provided separately and is available upon request. The Trust is designed to be used as an investment vehicle by Separate Accounts of insurance companies that fund variable annuity contracts and variable life insurance policies and by qualified pension and retirement plans.

The Portfolio may invest a portion of its assets in certain affiliated underlying investment funds (the “Underlying Funds” or “Acquired Funds”). The Portfolio’s combined investments in the Fundamental IndexPLUS™, Fundamental IndexPLUS™ TR, International StocksPLUS® TR Strategy (U.S. Dollar-Hedged), International StocksPLUS® TR Strategy (Unhedged), Small Cap StocksPLUS® TR, StocksPLUS® and StocksPLUS® Total Return Funds normally will not exceed 50% of its total assets. In addition, the Portfolio’s combined investments in the CommodityRealReturn Strategy, Real Return, Real Return Asset and RealEstateRealReturn Strategy Funds normally will not exceed 75% of its total assets. The Portfolio’s investment in a particular Underlying Fund normally will not exceed 50% of its total assets.

The Portfolio’s assets are not allocated according to a predetermined blend of shares of the Underlying Funds. Instead, when making allocation decisions among the Underlying Funds, the Portfolio’s asset allocation sub-adviser considers various quantitative and qualitative data relating to the U.S. and foreign economies and securities markets. These data include projected growth trends in the U.S. and foreign economies, forecasts for interest rates and the relationship between short- and long-term interest rates (yield curve), current and projected trends in inflation, relative valuation levels in the equity and fixed income markets and various industrial sectors, information relating to business cycles, borrowing needs and the cost of capital, political trends data relating to trade balances and labor information. The Portfolio’s asset allocation sub-adviser has the flexibility to reallocate the Portfolio’s assets among any or all of the Underlying Funds based on its ongoing analyses of the equity, fixed income and commodity markets, although these shifts are not expected to be large or frequent in nature. The Portfolio is non-diversified, which means that it may concentrate its assets in a smaller number of Underlying Funds than a diversified fund.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Portfolio in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures on the financial statements. Actual results could differ from those estimates.

(a) Security Valuation Investments in funds within the PIMCO Funds are valued at their net asset value as reported by the Underlying Funds.

(b) Securities Transactions and Investment Income Securities transactions are recorded as of the trade date for financial reporting purposes. Securities purchased or sold on a when-issued or delayed-delivery basis may be settled a month or more after the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the

ex-dividend date. Interest income, adjusted for the accretion of discounts and amortization of premiums, is recorded on the accrual basis.

(c) Dividends and Distributions to Shareholders Dividends from net investment income, if any, are declared and distributed to shareholders quarterly. Net realized capital gains earned by the Portfolio, if any, will be distributed no less frequently than once each year.

Income dividends and capital gain distributions are determined in accordance with income tax regulations which may differ from GAAP. Differences between tax regulations and GAAP may change the fiscal year when income and capital items are recognized for tax and GAAP purposes. Examples of events that give rise to timing differences include wash sales, straddles, net operating losses and capital loss carryforwards. Further, the character of investment income and capital gains may be different for certain transactions under the two methods of accounting. Examples of characterization differences include the treatment of mortgage paydowns, swaps, foreign currency transactions and contingent debt instruments. As a result, income dividends and capital gain distributions declared during a fiscal period may differ significantly from the net investment income and realized capital gain reported on the Portfolio’s annual financial statements presented under GAAP.

Distributions classified as a tax basis return of capital, if any, are reflected on the accompanying Statements of Changes in Net Assets and have been reclassified to paid in capital. In addition, other amounts have been reclassified between undistributed net investment income, accumulated undistributed net realized gains or losses and/or paid in capital to more appropriately conform financial accounting to tax characterizations of dividend distributions.

(d) Multiclass Operations Each class offered by the Portfolio has equal rights as to assets and voting privileges (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Income and non-class specific expenses of the Portfolio are allocated daily to each class of shares based on the relative value of settled shares. Realized and unrealized capital gains and losses of the Portfolio are allocated daily to each class of shares based on the relative net assets of each class. Class specific expenses, where applicable, currently include administrative, distribution and servicing fees.

(e) Repurchase Agreements The Portfolio may engage in repurchase transactions. Under the terms of a typical repurchase agreement, the Portfolio takes possession of an underlying debt obligation (collateral) subject to an obligation of the seller to repurchase, and the Portfolio to resell, the obligation at an agreed-upon price and time. The underlying securities for all repurchase agreements are held in safekeeping at the Portfolio’s custodian or designated subcustodians under tri-party repurchase agreements. The market value of the collateral must be equal to or exceed the total amount of the repurchase obligations, including interest. Securities purchased under repurchase agreements are reflected as an asset on the Statement of Assets and Liabilities. Generally, in the event of counterparty default, the Portfolio has the right to use the collateral to offset losses incurred. If the counterparty should default, the Portfolio will seek to sell the securities which it holds as collateral. This could involve procedural costs or delays in addition to a loss on the securities if their value should fall below their repurchase price.

(f) New Accounting Policies In July 2006, the Financial Accounting Standards Board (“FASB”) issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes—an Interpretation of FASB Statement No. 109” (the “Interpretation”). The Interpretation became effective for the Portfolio on June 29, 2007. Management has evaluated the application of the Interpretation in relation to the Portfolio and has concluded that no single filing position or combination of

| | | | |

| 10 | | PIMCO Variable Insurance Trust | | |

| | |

| |

| | | June 30, 2007 (Unaudited) |

filing positions identified as uncertain tax positions required the accrual of a tax liability in the accounting records of the Portfolio for the period ending June 30, 2007. Management will monitor all existing filing positions and future filing positions in light of the Interpretation and evaluate the need for any future tax accruals and financial statement disclosures as warranted.

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (the “Statement”). The Statement is effective for fiscal years beginning after November 15, 2007 and will require expanded disclosure about fair value measurements, separately for each major category of assets and liabilities, that enables shareholders to assess the inputs used to develop those measurements, and for recurring fair value measurements using significant unobservable inputs the effect of the measurements on changes in net assets for the reporting period. Management is currently evaluating the application of the Statement to the Portfolio and will provide additional information in relation to the Statement on the Portfolio’s annual financial statements for the period ending December 31, 2007.

3. FEES AND EXPENSES

(a) Investment Advisory Fee Pacific Investment Management Company LLC (“PIMCO”) is a majority-owned subsidiary of Allianz Global Investors of America L.P. (“AGI”), and serves as investment adviser (the “Adviser”) to the Trust, pursuant to an investment advisory contract. The Adviser receives a monthly fee from the Portfolio, at an annual rate based on average daily net assets. The Advisory Fee for all classes is charged at an annual rate of 0.175%.

Research Affiliates, LLC (“Research Affiliates”) serves as the asset allocation sub-adviser and selects the Underlying Funds in which the Portfolio invests. PIMCO pays a fee to Research Affiliates at an annual rate of 0.175% based on average daily net assets of the Portfolio.

(b) Administration Fee PIMCO serves as administrator (the “Administrator”), and provides administrative services to the Trust for which it receives a monthly administrative fee based on each share class’s average daily net assets. As the Administrator, PIMCO bears the costs of various third-party services, including audit, custodial, portfolio accounting, legal, transfer agency and printing costs. The Administration Fee for all classes is charged at the annual rate of 0.25%.

(c) Distribution and Servicing Fees Allianz Global Investors Distributors LLC (“AGID”) is an indirect wholly-owned subsidiary of AGI and serves as the distributor (the “Distributor”) of the Trust’s shares. The Trust is permitted to reimburse AGID on a quarterly basis, out of the Administrative Class assets of the Portfolio in the amount of 0.15% on an annual basis of the average daily net assets of that class, for payments made to financial intermediaries that provide services in connection with the distribution of shares or administration of plans or programs that use Portfolio shares as their funding medium. The effective rate paid to AGID was 0.15% during the current fiscal year.

The Trust has adopted separate Distribution Plans for the Advisor Class and Class M shares of the Portfolio. The Distribution Plans have been adopted pursuant to Rule 12b-1 under the Act. The Distribution Plans permit payments for expenses in connection with the distribution and marketing of Advisor Class and Class M shares and/or the provision of shareholder services to Advisor Class and Class M shareholders which permits the Portfolio to make total payments at an annual rate of 0.25% of its average daily net assets attributable to its Advisor Class and Class M shares. The Trust has also adopted Administrative Services Plans (“Service Plans”) for the Class M shares of the Portfolio. The Service Plans allows the

Portfolio to use its Class M assets to compensate or reimburse financial intermediaries that provide services relating to Class M shares which permits the Portfolio to make total payments at an annual rate of 0.20% of its average daily net assets attributable to its Class M shares.

(d) Portfolio Expenses The Trust is responsible for the following expenses: (i) salaries and other compensation of any of the Trust’s executive officers and employees who are not officers, directors, stockholders or employees of PIMCO or its subsidiaries or affiliates; (ii) taxes and governmental fees; (iii) brokerage fees and commissions and other portfolio transaction expenses; (iv) the costs of borrowing money, including interest expenses and bank overdraft charges; (v) fees and expenses of the Trustees who are not “interested persons” of PIMCO or the Trust, and any counsel retained exclusively for their benefit; (vi) extraordinary expenses, including costs of litigation and indemnification expenses; (vii) organization expenses and (viii) any expenses allocated or allocable to a specific class of shares, which include service fees payable with respect to the Administrative Class Shares, and may include certain other expenses as permitted by the Trust’s Multiple Class Plan adopted pursuant to Rule 18f-3 under the Act and subject to review and approval by the Trustees. The ratio of expenses to average net assets per share class, as disclosed in the Financial Highlights, may differ from the annual portfolio operating expenses per share class as disclosed in the Prospectus for the reasons set forth above.

Effective April 1, 2007, each Trustee, other than those affiliated with PIMCO or its affiliates, receives an annual retainer of $15,000, plus $2,375 for each Board of Trustees meeting attended in person, $500 for each committee meeting attended and $750 for each Board of Trustees meeting attended telephonically, plus reimbursement of related expenses. In addition, the audit committee chair receives an additional annual retainer of $2,000 and each other committee chair receives an additional annual retainer of $500. These expenses are allocated on a pro-rata basis to the various portfolios of the Trust according to their respective net assets. The Trust pays no compensation directly to any Trustee or any other officer who is affiliated with the Administrator, all of whom receive remuneration for their services to the Trust from the Administrator or its affiliates. Prior to April 1, 2007, each Trustee, other than those affiliated with PIMCO or its affiliates, received an annual retainer of $15,000 plus $2,000 for each Board of Trustees meeting attended ($500 for each special meeting attended), plus reimbursement of related expenses. The Audit Committee Chairman received an annual retainer of $1,500 and the Governance Committee Chairman received an annual retainer of $500. In addition, each member of a committee received $500 for each committee meeting attended.

(e) Acquired Fund Fees and Expenses The Underlying Fund Expenses for the Portfolio are based upon an allocation of the Portfolio’s assets among the Underlying Funds and upon the total annual operating expenses of the Institutional Class shares of these Underlying Funds. Underlying Fund Expenses will vary with changes in the expenses of the Underlying Funds, as well as allocation of the Portfolio’s assets.

PIMCO has contractually agreed, for the Portfolio’s current fiscal year, to reduce its advisory fee to the extent that the Acquired Fund Fees and Expenses attributable to advisory and administrative fees exceed 0.64% of the total assets invested in Underlying Funds. The waiver is reflected in the Statement of Operations as a component of Reimbursement by Manager. For the period ended June 30, 2007, the amount was $45,332. PIMCO may recoup these waivers in future periods, not exceeding three years, provided total expenses, including such recoupment, do not exceed the annual expense limit. As of June 30, 2007, the recoverable amount to the Administrator was $81,026.

| | | | | | |

| | Semiannual Report | | June 30, 2007 | | 11 |

Notes to Financial Statements (Cont.)

4. RELATED PARTY TRANSACTIONS

The Advisor, Administrator, and Distributor are related parties as defined by FAS 57, Related Party Disclosures. Fees payable to these parties are disclosed in Note 3.

The All Asset Portfolio invests substantially all of its assets in Institutional Class shares of PIMCO Funds, an affiliated open-end investment company. The Underlying Funds are considered to be affiliated with the Portfolio. The table below shows the transactions in and earnings from investments in these affiliated Funds for the period ended June 30, 2007 (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Underlying Funds | | Market Value 12/31/2006 | | Purchases at Cost | | Proceeds from Sales | | Unrealized Appreciation (Depreciation) | | | Market Value 6/30/2007 | | Dividend Income | | Net Capital and Realized Gain

(Loss) | |

Convertible Fund | | $ | 1,351 | | $ | 6,967 | | $ | 0 | | $ | 258 | | | $ | 8,434 | | $ | 15 | | $ | 0 | |

Developing Local Markets Fund | | | 92,781 | | | 59,318 | | | 15,272 | | | 5,598 | | | | 139,732 | | | 2,343 | | | (50 | ) |

Diversified Income Fund | | | 10,826 | | | 51,300 | | | 12,520 | | | (1,267 | ) | | | 48,242 | | | 1,006 | | | (200 | ) |

Emerging Local Bond Fund | | | 0 | | | 123,827 | | | 138 | | | 2,601 | | | | 126,285 | | | 1,737 | | | (5 | ) |

Emerging Markets Bond Fund | | | 32,346 | | | 842 | | | 15,795 | | | 563 | | | | 17,241 | | | 842 | | | 148 | |

Floating Income Fund | | | 223,808 | | | 187,752 | | | 188,313 | | | 1,339 | | | | 222,251 | | | 8,175 | | | 94 | |

Foreign Bond Fund (Unhedged) | | | 877 | | | 15 | | | 0 | | | (7 | ) | | | 862 | | | 15 | | | 0 | |

Fundamental IndexPLUS™ Fund | | | 21,485 | | | 10,115 | | | 3,471 | | | 902 | | | | 29,709 | | | 101 | | | 138 | |

Fundamental IndexPLUS™ TR Fund | | | 29,493 | | | 4,605 | | | 0 | | | 795 | | | | 35,817 | | | 103 | | | 0 | |

GNMA Fund | | | 2,815 | | | 72 | | | 0 | | | (17 | ) | | | 2,856 | | | 72 | | | 0 | |

High Yield Fund | | | 25,812 | | | 996 | | | 20,125 | | | 157 | | | | 6,539 | | | 867 | | | 187 | |

Income Fund | | | 0 | | | 3,703 | | | 0 | | | (84 | ) | | | 3,619 | | | 37 | | | 0 | |

International StocksPLUS® TR Strategy Fund (Unhedged) | | | 1,138 | | | 2,662 | | | 0 | | | 150 | | | | 3,969 | | | 48 | | | 0 | |

International StocksPLUS® TR Strategy Fund

(U.S. Dollar-Hedged) | | | 29,781 | | | 336 | | | 0 | | | 1,763 | | | | 31,927 | | | 336 | | | 0 | |

Long-Term U.S. Government Fund | | | 10,595 | | | 96,296 | | | 41,674 | | | (566 | ) | | | 65,163 | | | 564 | | | 541 | |

Low Duration Fund | | | 20,641 | | | 18,385 | | | 37,450 | | | 1 | | | | 1,280 | | | 407 | | | (250 | ) |

Real Return Asset Fund | | | 99,339 | | | 136,338 | | | 64,587 | | | (2,898 | ) | | | 168,665 | | | 2,807 | | | 948 | |

Real Return Fund | | | 51,460 | | | 42,705 | | | 17,008 | | | (1,167 | ) | | | 76,577 | | | 1,488 | | | (147 | ) |

RealEstateRealReturn Strategy Fund | | | 2,066 | | | 85 | | | 0 | | | (480 | ) | | | 1,899 | | | 85 | | | 0 | |

Short-Term Fund | | | 3,622 | | | 809 | | | 797 | | | (14 | ) | | | 3,619 | | | 87 | | | (1 | ) |

Small Cap StocksPLUS® TR Fund | | | 0 | | | 1,881 | | | 0 | | | (3 | ) | | | 1,877 | | | 4 | | | 0 | |

StocksPLUS® Fund | | | 1,719 | | | 42 | | | 0 | | | 117 | | | | 1,830 | | | 42 | | | 0 | |

StocksPLUS® Total Return Fund | | | 6,570 | | | 37 | | | 0 | | | 7 | | | | 6,836 | | | 37 | | | 0 | |

Total Return Fund | | | 18,875 | | | 449 | | | 15,206 | | | (123 | ) | | | 3,660 | | | 450 | | | (374 | ) |

Total Return Mortgage Fund | | | 3,782 | | | 11,065 | | | 0 | | | (166 | ) | | | 14,699 | | | 299 | | | 0 | |

CommodityRealReturn Strategy Fund® | | | 115,847 | | | 11,589 | | | 25,927 | | | (632 | ) | | | 102,122 | | | 2,371 | | | (2,098 | ) |

Totals | | $ | 807,029 | | $ | 772,191 | | $ | 458,283 | | $ | 6,827 | | | $ | 1,125,710 | | $ | 24,338 | | $ | (1,069 | ) |

5. GUARANTEES AND INDEMNIFICATIONS

Under the Trust’s organizational documents, each Trustee, officer, employee or other agent of the Trust (including the Trust’s investment manager) is indemnified, to the extent permitted by the Act, against certain liabilities that may arise out of performance of their duties to the Portfolio. Additionally, in the normal course of business, the Portfolio enters into contracts that contain a variety of indemnification clauses. The Portfolio’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Portfolio that have not yet occurred. However, the Portfolio has not had prior claims or losses pursuant to these contracts and believes the risk of loss to be remote.

6. PURCHASES AND SALES OF SECURITIES

The length of time the Portfolio has held a particular security is not generally a consideration in investment decisions. A change in the securities held by the

Portfolio is known as “portfolio turnover”. The Portfolio may engage in frequent

and active trading of portfolio securities to achieve its investment objective, particularly during periods of volatile market movements. High portfolio turnover (e.g., over 100%) involves correspondingly greater expenses to the Portfolio, including brokerage commissions or dealer mark-ups and other transaction costs on the sale of securities and reinvestments in other securities. Such sales may also result in realization of taxable capital gains, including short-term capital gains (which are generally taxed at ordinary income tax rates). The trading costs and tax effects associated with portfolio turnover may adversely affect the Portfolio’s performance.

Purchases and sales of securities (excluding short-term investments) for the period ended June 30, 2007, were as follows (amounts in thousands):

| | | | | | | | | | | | |

| U.S. Government/Agency | | | | All Other |

| Purchases | | Sales | | | | Purchases | | Sales |

| $ | 0 | | $ | 0 | | | | $ | 772,191 | | $ | 458,283 |

| | | | |

| 12 | | PIMCO Variable Insurance Trust | | |

| | |

| |

| | | June 30, 2007 (Unaudited) |

7. SHARES OF BENEFICIAL INTEREST

The Portfolio may issue an unlimited number of shares of beneficial interest with a $0.001 par value. Changes in shares of beneficial interest were as follows (shares and amounts in thousands):

| | | | | | | | | | | | | | | | |

| | | | | Six Months Ended 06/30/2007 | | | Year Ended 12/31/2006 | |

| | | | | Shares | | | Amount | | | Shares | | | Amount | |

| | | | | |

Receipts for shares sold | | | | | | | | | | | | | | | | |

Institutional Class | | | | 25 | | | $ | 294 | | | 6 | | | $ | 73 | |

Administrative Class | | | | 2,142 | | | | 25,388 | | | 5,177 | | | | 60,956 | |

Advisor Class | | | | 25,760 | | | | 304,743 | | | 41,500 | | | | 485,456 | |

Class M | | | | 468 | | | | 5,550 | | | 1,306 | | | | 15,354 | |

Issued as reinvestment of distributions | | | | | | | | | | | | | | | | |

Institutional Class | | | | 1 | | | | 7 | | | 0 | | | | 3 | |

Administrative Class | | | | 525 | | | | 6,179 | | | 1,218 | | | | 14,172 | |

Advisor Class | | | | 1,449 | | | | 17,050 | | | 1,455 | | | | 17,022 | |

Class M | | | | 92 | | | | 1,079 | | | 273 | | | | 3,180 | |

Cost of shares redeemed | | | | | | | | | | | | | | | | |

Institutional Class | | | | (7 | ) | | | (83 | ) | | 0 | | | | 0 | |

Administrative Class | | | | (2,130 | ) | | | (25,052 | ) | | (6,181 | ) | | | (72,158 | ) |

Advisor Class | | | | (129 | ) | | | (1,505 | ) | | (676 | ) | | | (7,990 | ) |

Class M | | | | (595 | ) | | | (13,565 | ) | | (2,587 | ) | | | (30,245 | ) |

Net increase resulting from Portfolio share transactions | | | | 27,601 | | | $ | 320,085 | | | 41,491 | | | $ | 485,823 | |

The following schedule shows the number of shareholders each owning 5% or more of the Portfolio and the total percentage of the Portfolio held by such shareholders:

| | | | | | |

| | | | | Number of Shareholders | | % of Portfolio Held |

Institutional Class | | | | 1 | | 95 |

Administrative Class | | | | 3 | | 91 |

Advisor Class | | | | 2 | | 97 |

Class M | | | | 3 | | 94 |

8. REGULATORY AND LITIGATION MATTERS

Since February 2004, PIMCO, Allianz Global Investors of America L.P. (PIMCO’s parent company), AGID, and certain of their affiliates, including the PIMCO Funds (another series of funds managed by PIMCO), the Allianz Funds (formerly known as PIMCO Funds: Multi-Manager Series (another series of funds managed by affiliates of PIMCO)), certain Trustees of the Trust (in their capacity as Trustees of the PIMCO Funds or the Allianz Funds) and certain employees of PIMCO, have been named as defendants in fifteen lawsuits filed in various jurisdictions. Eleven of those lawsuits concern “market timing,” and they have been transferred to and consolidated for pre-trial proceedings in a multi-district litigation proceeding in the U.S. District Court for the District of Maryland; the other four lawsuits concern “revenue sharing” and have been consolidated into a single action in the U.S. District Court for the District of Connecticut. The lawsuits have been commenced as putative class actions on behalf of investors who purchased, held or redeemed shares of the various series of the PIMCO Funds and the Allianz Funds during specified periods, or as derivative actions on behalf of the PIMCO Funds and the Allianz Funds.

The market timing actions in the District of Maryland generally allege that certain hedge funds were allowed to engage in “market timing” in certain funds of the PIMCO Funds and the Allianz Funds and this alleged activity was not disclosed.

Pursuant to tolling agreements entered into with the derivative and class action

plaintiffs, PIMCO, certain PIMCO Funds Trustees, and certain employees of PIMCO who were previously named as defendants have all been dropped as defendants in the market timing actions; the plaintiffs continue to assert claims on behalf of the shareholders of the PIMCO Funds or on behalf of the PIMCO Funds itself against other defendants. By order dated November 3, 2005, the U.S. District Court for the District of Maryland granted the PIMCO Funds’ motion to dismiss claims asserted against it in a consolidated amended complaint where the PIMCO Funds were named, in the complaint, as a nominal defendant. The revenue sharing action in the District of Connecticut generally alleges that fund assets were inappropriately used to pay brokers to promote funds of the PIMCO Funds and the Allianz Funds, including directing fund brokerage transactions to such brokers, and that such alleged arrangements were not fully disclosed to shareholders. On August 11, 2005, the U.S. District Court for the District of Connecticut conducted a hearing on defendants’ motion to dismiss the consolidated amended complaint in the revenue sharing action but has not yet ruled on the motion to dismiss. The market timing and revenue sharing lawsuits seek, among other things, unspecified compensatory damages plus interest and, in some cases, punitive damages, the rescission of investment advisory contracts, the return of fees paid under those contracts and restitution.

Two nearly identical class action civil complaints have been filed in August 2005, in the Northern District of Illinois Eastern Division, alleging that the plaintiffs each purchased and sold a 10-year Treasury note futures contract and suffered damages from an alleged shortage when PIMCO held both physical and futures positions in 10-year Treasury notes for its client accounts. The two actions have been consolidated into one action, and the two separate complaints have been replaced by a consolidated complaint. PIMCO is a named defendant, and PIMCO Funds has been added as a defendant, to the consolidated action. PIMCO strongly believes the complaint is without merit and intends to vigorously defend itself.

In April 2006, certain portfolios of the Trust and certain other funds managed by PIMCO were served in an adversary proceeding brought by the Official Committee of Asbestos Claimants of G-I Holdings, Inc. in G-I Holdings, Inc.’s bankruptcy in the District of New Jersey. In July 2004, PIMCO was named in this lawsuit and remains a defendant. The plaintiff seeks to recover for the bankruptcy estate assets that were transferred by the predecessor entity of G-I Holdings, Inc. to a wholly-owned subsidiary in 1994. The subsidiary has since issued notes, of which certain portfolios of the Trust and certain other funds managed by PIMCO are alleged to be holders. The complaint alleges that in 2000, more than two hundred noteholders—including certain portfolios of the Trust and certain other funds managed by PIMCO—were granted a second priority lien on the assets of the subsidiary in exchange for their consent to a refinancing transaction and the granting of a first priority lien to the lending banks. The plaintiff is seeking invalidation of the lien in favor of the noteholders and/or the value of the lien. On June 21, 2006, the District of New Jersey overturned the Bankruptcy Court’s decision granting permission to file the adversary proceeding and remanded the matter to the Bankruptcy Court for further proceedings. Following a motion to reconsider, the District Court upheld its remand on August 7, 2006, and instructed the Bankruptcy Court to conduct a “cost-benefit” analysis of the Committee’s claims, including the claims against the noteholders. The Bankruptcy Court held a status conference on October 25, 2006 and set a briefing schedule relating to this cost-benefit analysis.

The foregoing speaks only as of the date of this report. It is possible that these matters and/or other developments resulting from these matters could result in increased portfolio redemptions or other adverse consequences to the Portfolio. However, PIMCO and AGID believe that these matters are not likely to have a material adverse effect on the Portfolio or on PIMCO’s or AGID’s ability to perform their respective investment advisory or distribution services relating to the Portfolio.

| | | | | | |

| | Semiannual Report | | June 30, 2007 | | 13 |

Notes to Financial Statements (Cont.)

9. FEDERAL INCOME TAX MATTERS

The Portfolio intends to qualify as a regulated investment company under sub-chapter M of the Internal Revenue Code (the “Code”) and distribute all of its taxable income and net realized gains, if applicable, to shareholders. Accordingly, no provision for Federal income taxes has been made.

To the extent the Portfolio invests in the CommodityRealReturn Strategy Fund® (the “CRRS Fund”), an Underlying Fund, this Portfolio may be subject to additional tax risk.

One of the requirements for favorable tax treatment as a regulated investment company under the Code is that the Fund derive at least 90% of its gross income from certain qualifying sources of income. The IRS has issued a revenue ruling which holds that income derived from commodity index-linked swaps is not qualifying income under Subchapter M of the Code. Subsequently, the IRS issued a private letter ruling to the CRRS Fund in which the IRS specifically concluded that income from certain commodity index-linked notes is qualifying income. In addition, the IRS issued another private letter ruling to the CRRS Fund in which the IRS specifically concluded that income derived from the CRRS Fund’s investment in

the Subsidiary, which invests primarily in commodity index-linked swaps, will also constitute qualifying income to the CRRS Fund. Based on such rulings, the CRRS Fund will continue to seek to gain exposure to the commodity markets primarily through investments in commodity-linked notes and through investments in its subsidiary.

Please refer to the prospectus for the Separate Account and Variable Contract for information regarding federal income tax treatment of distributions to the Separate Account.

As of June 30, 2007, the aggregate cost of investments was the same for federal income tax and financial statement purposes. The net unrealized appreciation (depreciation) of investment securities for federal income tax purposes is as follows (amount in thousands):

| | | | |

Aggregate Gross Unrealized Appreciation | | Aggregate Gross Unrealized (Depreciation) | | Net Unrealized Appreciation |

$ 14,251 | | $ (7,424) | | $ 6,827 |

| | | | |

| 14 | | PIMCO Variable Insurance Trust | | |

| | |

| |

Privacy Policy* | | (Unaudited) |

The Funds consider customer privacy to be a fundamental aspect of their relationships with shareholders and are committed to maintaining the confidentiality, integrity and security of their current, prospective and former shareholders’ personal information. To ensure their shareholders’ privacy, the Funds have developed policies that are designed to protect this confidentiality, while allowing shareholder needs to be served.

Obtaining Personal Information

In the course of providing shareholders with products and services, the Funds and certain service providers to the Funds, such as the Funds’ investment advisers (“Advisers”), may obtain non-public personal information about shareholders, which may come from sources such as account applications and other forms, from other written, electronic or verbal correspondence, from shareholder transactions, from a shareholder’s brokerage or financial advisory firm, financial adviser or consultant, and/or from information captured on the Funds’ internet web sites.

Respecting Your Privacy

As a matter of policy, the Funds do not disclose any personal or account information provided by shareholders or gathered by the Funds to non-affiliated third parties, except as required or permitted by law or as necessary for such third parties to perform their agreements with respect to the Funds. As is common in the industry, non-affiliated companies may from time to time be used to provide certain services, such as preparing and mailing prospectuses, reports, account statements and other information, conducting research on shareholder satisfaction and gathering shareholder proxies. A Fund’s Distributor may also retain non-affiliated companies to market the Fund’s shares or products which use the Fund’s shares and enter into joint marketing agreements with other companies. These companies may have access to a shareholder’s personal and account information, but are permitted to use this information solely to provide the specific service or as otherwise permitted by law. In most cases, the shareholders will be clients of a third party, but the Funds may also provide a shareholder’s personal and account information to the shareholder’s respective brokerage or financial advisory firm.

Sharing Information with Third Parties

The Funds reserve the right to disclose or report personal information to non-affiliated third parties, in limited circumstances, where the Funds believe in good faith that disclosure is required under law to cooperate with regulators or law enforcement authorities, to protect their rights or property or upon reasonable request by any Fund in which a shareholder has chosen to invest. In addition, the Funds may disclose information about a shareholder’s accounts to a non-affiliated third party with the consent of the shareholder.

Sharing Information with Affiliates

The Funds may share shareholder information with their affiliates in connection with servicing their shareholders’ accounts or to provide shareholders with information about products and services that the Funds or their Advisers, principal underwriters or their affiliates (“Service Affiliates”) believe may be of interest to such shareholders. The information that the Funds share may include, for example, a shareholder’s participation in one of the Funds or in other investment programs sponsored by a Service Affiliate, a shareholder’s ownership of certain types of accounts (such as IRAs), or other data about a shareholder’s accounts. The Funds’ Service Affiliates, in turn, are not permitted to share shareholder information with non-affiliated entities, except as required or permitted by law.

Procedures to Safeguard Private Information

The Funds take seriously the obligation to safeguard shareholder non-public personal information. In addition to this policy, the Funds have also implemented procedures that are designed to restrict access to a shareholder’s non-public personal information only to internal personnel who need to know that information in order to provide products or services to such shareholders. In order to guard a shareholder’s non-public personal information, physical, electronic and procedural safeguards are in place.

* This Privacy Policy applies to the following entities: PIMCO Funds, PIMCO Variable Insurance Trust, PCM Fund, Inc. and PIMCO Strategic Global Government Fund, Inc. (collectively, the “Funds”).

| | | | | | |

| | Semiannual Report | | June 30, 2007 | | 15 |

Investment Adviser and Administrator

Pacific Investment Management Company LLC

840 Newport Center Drive

Newport Beach, California 92660

Investment Sub-Adviser

Research Affiliates, LLC

800 E. Colorado Boulevard

Pasadena, California 91101

Distributor

Allianz Global Investors Distributors LLC

1345 Avenue of the Americas

New York, New York 10105

Custodian

State Street Bank & Trust Company

801 Pennsylvania

Kansas City, Missouri 64105

Transfer Agent

Boston Financial Data Services–Midwest

330 W. 9th Street

Kansas City, Missouri 64105

Legal Counsel

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

1055 Broadway

Kansas City, Missouri 64105

P I M C O

Table of Contents

This material is authorized for use only when preceded or accompanied by the current PIMCO Variable Insurance Trust (the “Trust”) prospectus. Investors should consider the investment objectives, risks, charges and expenses of this Trust carefully before investing. Ask your financial professional to explain all charges that may apply. This and other information is contained in the Trust’s prospectus. The variable product prospectus may be obtained by contacting your Investment Consultant. Please read the Trust and variable product prospectus carefully before you invest or send money.

Chairman’s Letter

Dear PIMCO Variable Insurance Trust Shareholder:

It is our pleasure to present to you the semiannual report for the PIMCO Variable Insurance Trust, covering the six-month period ended June 30, 2007. The PIMCO Variable Insurance Trust’s net assets were $8.68 billion at June 30, 2007, as compared to $7.76 billion at December 31, 2006.

Highlights of the financial markets during the reporting period include:

| | n | | Economic data during the first quarter of 2007 pointed to slower growth, which heightened market expectations for a decrease in the Federal Funds Rate. By the second quarter, economic data, such as employment statistics, provided little indication of economic weakness, causing expectations of a decrease in the Federal Funds Rate to unwind and U.S. interest rates to move higher. Interest rates in Europe and the U.K. also rose over the period as central banks raised their key lending rates due to inflation concerns. The benchmark ten-year U.S. Treasury yielded 5.03% as of June 30, 2007, or 0.32% higher than at the beginning of the year. |

| | n | | Most bonds generally returned much of their gains from earlier in the year as worldwide growth and capital flows drove interest rates higher in the second quarter. Increased risk aversion in global financial markets, due in part to subprime mortgage worries in the U.S., also contributed to the rise in interest rates. The Lehman Brothers Aggregate Bond Index, which includes Treasury, investment-grade corporate and mortgage-backed securities, returned 0.98% for the six-month period. |

| | n | | Locally issued emerging market (“EM”) bonds posted positive returns for the reporting period. Yields on these bonds declined and the local currencies in which they are denominated generally gained, amid increasing investor awareness, strong economic growth and surging capital inflows. External EM bonds (debt instruments issued by emerging markets countries and typically denominated in U.S. dollars) lagged behind local EM bonds (debt instruments issued by emerging markets countries and denominated in the currency of the issuer), as external EM bonds tend to trade more in-line with U.S. Treasuries. |

| | n | | Treasury Inflation-Protected Securities (“TIPS”) outpaced nominal bonds (non-inflation linked bonds) for the first part of the year and all but the longest maturity TIPS outperformed in the second quarter as high gasoline prices drove higher inflation accruals. Commodities, as represented by the Dow Jones-AIG Commodity Total Return Index, returned 4.46% for the period. Equities, as measured by the S&P 500 Index and the Russell 2000 Index, returned 6.96% and 6.45%, respectively, for the period. |

On the following pages, please find specific details as to the Portfolio’s total return investment performance and a discussion of those factors that affected performance.

Thank you for the trust you have placed in us. We will continue to work diligently to serve your investment needs.

Sincerely,

Brent R. Harris

Chairman, PIMCO Variable Insurance Trust

July 31, 2007

| | | | | | |

| | Semiannual Report | | June 30, 2007 | | 1 |

Important Information About the Portfolio

PIMCO Variable Insurance Trust (the “Trust”) is an open-end management investment company currently consisting of twenty separate investment portfolios, including the All Asset Portfolio (the “Portfolio”). The Portfolio is only available as a funding vehicle under variable life insurance policies or variable annuity contracts issued by insurance companies (“Variable Contracts”). Individuals may not purchase shares of the Portfolio directly. Shares of the Portfolio also may be sold to qualified pension and retirement plans outside of the separate account context.

The Portfolio is a “fund of funds,” which is a term used to describe mutual funds that pursue their investment objective by investing in other mutual funds instead of investing directly in stocks or bonds of other issuers. Under normal circumstances, the Portfolio invests substantially all of its assets in Institutional Class shares of PIMCO Funds, an affiliated open-end investment company, except the All Asset and All Asset All Authority Funds (“Underlying Funds”).