UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-8399

PIMCO Variable Insurance Trust

(Exact name of registrant as specified in charter)

840 Newport Center Drive, Newport Beach, CA 92660

(Address of principal executive offices)

John P. Hardaway

Treasurer

PIMCO Funds

840 Newport Center Drive

Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

Brendan Fox

Dechert LLP

1775 I Street, N.W.

Washington, D.C. 20006

Registrant’s telephone number, including area code: (949) 720-4761

Date of fiscal year end: December 31

Date of reporting period: January 1, 2004 – June 30, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

PIMCO VARIABLE INSURANCE TRUST

HIGH YIELD PORTFOLIO

ADMINISTRATIVE CLASS

SEMI-ANNUAL REPORT

June 30, 2004

|

| This material is authorized for use only when preceded or accompanied by the current PIMCO Variable Insurance Trust prospectus. Investors should consider the investment objectives, risks, charges and expenses of Portfolio carefully before investing. This and other information is contained in the Portfolio’s prospectus. Please read the prospectus carefully before you invest or send money. |

Chairman’s Letter

Dear PIMCO Variable Insurance Trust Shareholder:

Bond prices were more volatile during the six-month period ended June 30, 2004. Interest rates rose sharply during the second quarter 2004, causing bonds to give back modest gains from earlier in the year. The Lehman Brothers Aggregate Bond Index, a widely used index for the high-grade bond market, was nearly flat during the first six months of 2004, returning 0.15% after losing 2.44% during the second quarter. The yield on the benchmark ten-year Treasury closed June 30, 2004 at 4.58%, up 0.75% from April 1, 2004, but up only 0.34% from where it began the six-month period on January 1, 2004.

Continued growth in employment convinced the markets that the Federal Reserve would soon begin a long anticipated tightening cycle. On June 30, 2004, the Fed met market expectations by increasing the federal funds rate 0.25%, which was the first rate increase since June 25, 2003. The central bank had held this rate at 1% for more than a year, which generated negative real short-term rates. And on August 10, 2004, the Fed increased the federal funds rate another 0.25% to 1.50%.

Investors that had profited handsomely from borrowing at low short-term rates and investing in higher-yielding longer maturity bonds surrendered some of those profits towards the latter part of the six-month period. Concern that borrowing rates would rise led investors to liquidate long positions and unwind these trades, which caused bond prices to decrease. However, substantial leverage remained among banks, hedge funds, and other investors, making bond markets somewhat vulnerable to additional Fed rate increases. There were also signs of rising inflation, which fueled anxiety that central banks might continue to raise interest rates.

On the following pages you will find a more complete review of the Portfolio in light of financial market activities as well as specific details about the total return investment performance for the six-month period.

We appreciate the trust you have placed in us, and we will continue to focus our efforts to meet your investment needs.

Sincerely,

Brent R. Harris

Chairman

August 11, 2004

| | | | |

| June 30, 2004 | | Semi-Annual Report | | 1 |

Important Information About the Portfolio

We believe that bond funds have an important role to play in a well diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates will negatively impact the performance of most bond funds, and fixed income securities held by a fund are likely to decrease in value. The price volatility of fixed income securities can also increase during periods of rising interest rates resulting in increased losses to a fund. Bond funds and individual bonds with a longer duration (a measure of the expected life of a security) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. The longer-term performance of most bond funds has benefited from capital gains in part resulting from an extended period of declining interest rates. In the event interest rates increase, these capital gains should not be expected to recur.

The Portfolio may be subject to various risks in addition to those described above. Some of these risks may include, but are not limited to, the following: real rate risk, derivative risk, small company risk, foreign security risk, high yield security risk and specific sector investment risks. The Portfolio may use derivative instruments for hedging purposes or as part of an investment strategy. Use of these instruments may involve certain costs and risks such as liquidity risk, interest rate risk, market risk, credit risk, management risk and the risk that a fund could not close out a position when it would be most advantageous to do so. A Portfolio investing in derivatives could lose more than the principal amount invested in these instruments. Investing in non-U.S. securities may entail risk due to non-U.S. economic and political developments; this risk may be enhanced when investing in emerging markets. High-yield bonds typically have a lower credit rating than other bonds. Lower rated bonds generally involve a greater risk to principal than higher rated bonds. Smaller companies may be more volatile than larger companies and may entail more risk. Concentrating investments in individual sectors may add additional risk and volatility compared to a diversified portfolio.

On the performance summary page in this semi-annual report, the Total Return Investment Performance table measures performance assuming that all dividend and capital gain distributions were reinvested. Returns do not reflect the deduction of taxes that a shareholder would pay (i) on Portfolio distributions or (ii) the redemption of Portfolio shares.

An investment in a Portfolio is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in the Funds.

The following disclosure provides important information regarding the Portfolio’s Expense Example, which appears on the Portfolio’s individual page in this semi-annual report. Please refer to this information when reviewing the Expense Example for the Portfolio.

Example

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs, including redemption and exchange fees; and (2) ongoing costs, including advisory and administrative fees; distribution and/or service (12b-1) fees (Administrative Class only); and other Portfolio expenses. The Example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which is from 1/1/04 to 6/30/04.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000 = 8.60), then multiply the result by the number in the appropriate column for your share class, in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other portfolios. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other portfolios.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information under the heading “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different portfolios. In addition, if these transactional costs were included, your costs would have been higher.

PIMCO Variable Insurance Trust is distributed by PA Distributors LLC, 2187 Atlantic Street, Stamford, CT 06902.

| | | | |

| 2 | | Semi-Annual Report | | June 30, 2004 |

High Yield Portfolio

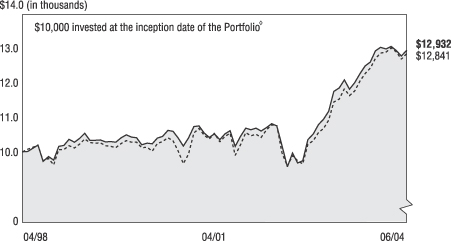

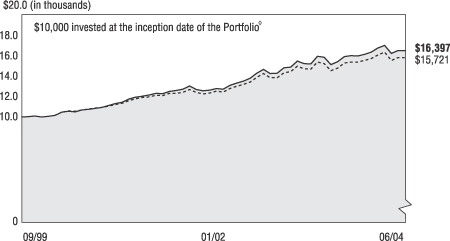

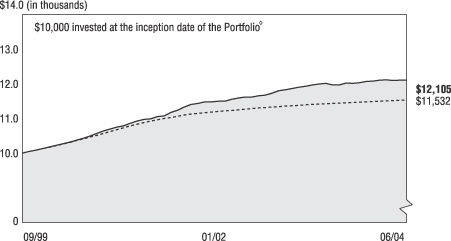

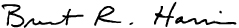

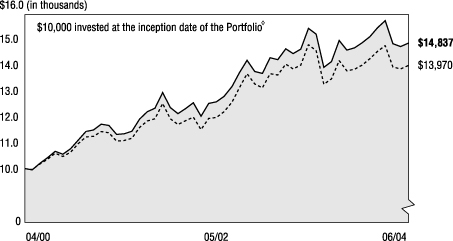

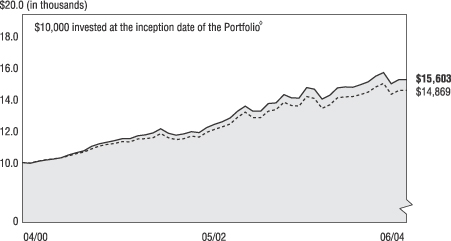

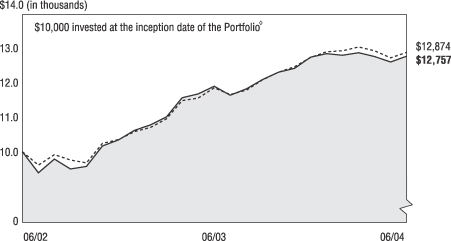

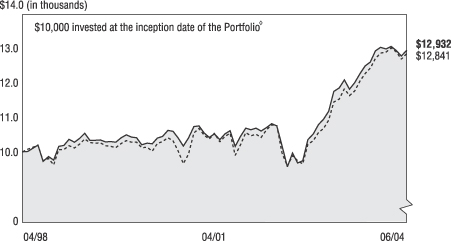

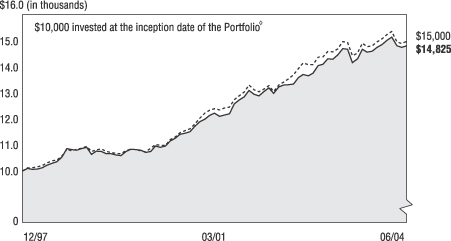

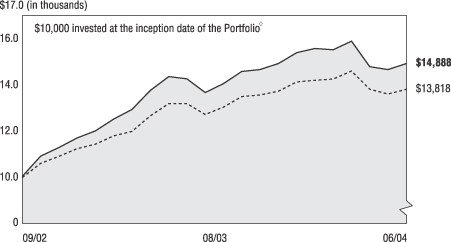

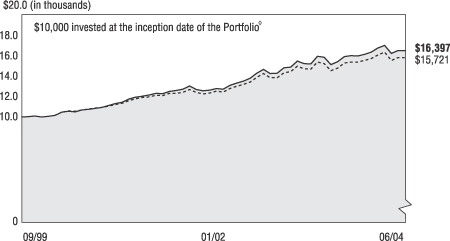

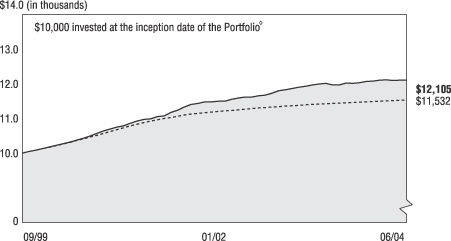

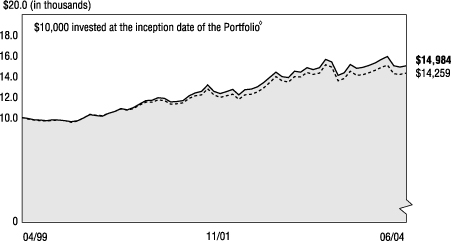

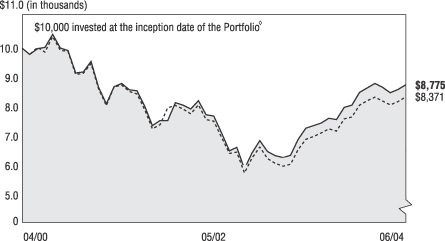

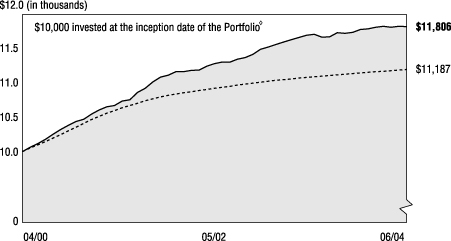

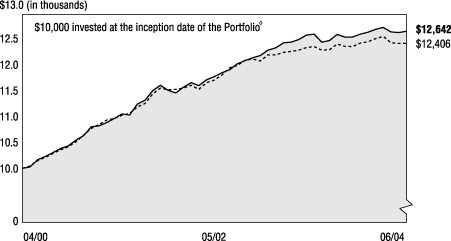

CUMULATIVE RETURNS THROUGH JUNE 30, 2004

[CHART]

Merrill Lynch

High Yield U.S. High Yield

Portfolio Admin. Class BB-B Rated Index

---------------------- ----------------

04/30/1998 $10,000 $10,000

05/31/1998 $10,004 $10,069

06/30/1998 $10,101 $10,126

07/31/1998 $10,195 $10,189

08/31/1998 $9,722 $9,739

09/30/1998 $9,858 $9,806

10/31/1998 $9,760 $9,617

11/30/1998 $10,152 $10,066

12/31/1998 $10,180 $10,062

01/31/1999 $10,357 $10,173

02/28/1999 $10,279 $10,106

03/31/1999 $10,383 $10,219

04/30/1999 $10,539 $10,370

05/31/1999 $10,335 $10,263

06/30/1999 $10,331 $10,244

07/31/1999 $10,338 $10,260

08/31/1999 $10,288 $10,175

09/30/1999 $10,292 $10,159

10/31/1999 $10,277 $10,121

11/30/1999 $10,403 $10,243

12/31/1999 $10,486 $10,321

01/31/2000 $10,419 $10,272

02/29/2000 $10,401 $10,276

03/31/2000 $10,205 $10,117

04/30/2000 $10,253 $10,127

05/31/2000 $10,226 $10,020

06/30/2000 $10,393 $10,240

07/31/2000 $10,443 $10,290

08/31/2000 $10,619 $10,409

09/30/2000 $10,589 $10,317

10/31/2000 $10,397 $10,014

11/30/2000 $10,162 $9,661

12/31/2000 $10,396 $9,922

01/31/2001 $10,726 $10,542

02/28/2001 $10,742 $10,672

03/31/2001 $10,540 $10,478

04/30/2001 $10,417 $10,372

05/31/2001 $10,516 $10,530

06/30/2001 $10,354 $10,286

07/31/2001 $10,514 $10,439

08/31/2001 $10,607 $10,530

09/30/2001 $10,155 $9,894

10/31/2001 $10,450 $10,216

11/30/2001 $10,678 $10,551

12/31/2001 $10,640 $10,457

01/31/2002 $10,682 $10,509

02/28/2002 $10,603 $10,412

03/31/2002 $10,701 $10,636

04/30/2002 $10,814 $10,776

05/31/2002 $10,751 $10,755

06/30/2002 $10,185 $9,974

07/31/2002 $9,566 $9,586

08/31/2002 $9,966 $9,889

09/30/2002 $9,673 $9,738

10/31/2002 $9,744 $9,649

11/30/2002 $10,351 $10,210

12/31/2002 $10,513 $10,322

01/31/2003 $10,788 $10,553

02/28/2003 $10,945 $10,675

03/31/2003 $11,176 $10,917

04/30/2003 $11,740 $11,444

05/31/2003 $11,846 $11,520

06/30/2003 $12,076 $11,816

07/31/2003 $11,811 $11,620

08/31/2003 $11,994 $11,754

09/30/2003 $12,263 $12,045

10/31/2003 $12,478 $12,265

11/30/2003 $12,589 $12,422

12/31/2003 $12,916 $12,690

01/31/2004 $13,016 $12,854

02/29/2004 $12,970 $12,882

03/31/2004 $13,046 $12,996

04/30/2004 $12,928 $12,887

05/31/2004 $12,767 $12,680

06/30/2004 $12,932 $12,841

SECTOR BREAKDOWN‡

| | | |

Industrials | | 56.6 | % |

Utilities | | 12.7 | % |

Banking & Finance | | 10.8 | % |

Short-Term Instruments | | 6.5 | % |

Sovereign Issues | | 5.8 | % |

Other | | 7.6 | % |

‡ % of Total Investments as of June 30, 2004

à$10,000 invested at the beginning of the first full month following the inception of the Administrative Class.

TOTAL RETURN INVESTMENT PERFORMANCE For the period ended June 30, 2004

| | | | | | | | | | | | | | | | |

| | | | | | | 6 Months | | | 1 Year | | | 5 Years* | | | Since Inception* | |

| | |

| | High Yield Portfolio Administrative Class (Inception 04/30/98) | | 0.13 | % | | 7.09 | % | | 4.59 | % | | 4.27 | % |

| | | - - - - - - - | | Merrill Lynch U.S. High Yield BB-B Rated Index | | 1.18 | % | | 8.67 | % | | 4.62 | % | | — | |

| | | | | * Annualized. All Portfolio returns are net of fees and expenses. | | | | | | | | | | | | |

Past performance is no guarantee of future results. The performance quoted represents past performance. Investment return and principal value will fluctuate so the Portfolio shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end is available by calling (800) 927-4648.

Please refer to page 2 herein for an explanation of the information presented in the following Expense Example.

| | | | | | | | | | |

| EXPENSE EXAMPLE | | | | Actual Performance | | | | Hypothetical Performance

(5% return before expenses) |

Beginning Account Value (01/01/04) | | | | $ | 1,000.00 | | | | $ | 1,000.00 |

Ending Account Value (06/30/04) | | | | $ | 1,001.30 | | | | $ | 1,025.00 |

Expenses Paid During Period† | | | | $ | 3.73 | | | | $ | 3.78 |

†Expenses are equal to the Portfolio’s Administrative Class annualized expense ratio of 0.75%, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period).

PORTFOLIO INSIGHTS

| • | The High Yield Portfolio seeks to achieve its investment objective by investing under normal circumstances at least 80% of its assets in a diversified portfolio of high yield securities rated below investment grade but rated at least Caa (subject to a maximum of 5% of total assets in securities rated Caa) by Moody’s or S&P, or, if unrated, determined by PIMCO to be of comparable quality. |

| • | The Portfolio’s Administrative Class shares returned 0.13% for the six-month period ended June 30, 2004, compared to 1.18% for the Merrill Lynch U.S. High Yield BB-B Rated Index. |

| • | During the semi-annual period, chemical issues outperformed the high yield market by more than 3%, thus the Portfolio’s underweight to the sector hurt performance. |

| • | An overweight to telecom, with an emphasis on large-cap issues, was a detriment to relative performance as this sector was one of the worst performers during the period. |

| • | Although an overweight to the cable/pay TV sector was a slight detractor to performance, security selection was a strong positive and more than offset the negative impact. |

| • | As the airline sector fell lower, due in part to high fuel prices and the threat of terrorism, an emphasis on higher quality secured issues boosted returns. |

| • | Modest exposure to emerging market sovereign debt detracted from performance, as this asset class declined approximately 2.25% over the 6-month period. |

| | | | |

| June 30, 2004 | | Semi-Annual Report | | 3 |

Financial Highlights

High Yield Portfolio (Administrative Class)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selected Per Share Data for the

Year or Period Ended: | | | | 06/30/2004+ | | | | | 12/31/2003 | | | | | 12/31/2002 | | | | | 12/31/2001 | | | | | 12/31/2000 | | | | | 12/31/1999 | |

| | | | | | | | | | | | |

Net asset value beginning of period | | | | $ | 8.19 | | | | | $ | 7.17 | | | | | $ | 7.88 | | | | | $ | 8.33 | | | | | $ | 9.18 | | | | | $ | 9.67 | |

Net investment income (a) | | | | | 0.26 | (c) | | | | | 0.55 | (c) | | | | | 0.59 | (c) | | | | | 0.64 | | | | | | 0.77 | | | | | | 0.77 | |

Net realized/unrealized gain (loss) on investments (a) | | | | | (0.25 | )(c) | | | | | 1.04 | (c) | | | | | (0.70 | )(c) | | | | | (0.45 | ) | | | | | (0.85 | ) | | | | | (0.49 | ) |

Total income (loss) from investment operations | | | | | 0.01 | | | | | | 1.59 | | | | | | (0.11 | ) | | | | | 0.19 | | | | | | (0.08 | ) | | | | | 0.28 | |

Dividends from net investment income | | | | | (0.27 | ) | | | | | (0.57 | ) | | | | | (0.60 | ) | | | | | (0.64 | ) | | | | | (0.77 | ) | | | | | (0.77 | ) |

Distributions from net realized capital gains | | | | | 0.00 | | | | | | 0.00 | | | | | | 0.00 | | | | | | 0.00 | | | | | | 0.00 | | | | | | 0.00 | |

Total distributions | | | | | (0.27 | ) | | | | | (0.57 | ) | | | | | (0.60 | ) | | | | | (0.64 | ) | | | | | (0.77 | ) | | | | | (0.77 | ) |

Net asset value end of period | | | | $ | 7.93 | | | | | $ | 8.19 | | | | | $ | 7.17 | | | | | $ | 7.88 | | | | | $ | 8.33 | | | | | $ | 9.18 | |

Total return | | | | | 0.13 | % | | | | | 22.85 | % | | | | | (1.19 | )% | | | | | 2.35 | % | | | | | (0.86 | )% | | | | | 3.01 | % |

Net assets end of period (000s) | | | | $ | 338,692 | | | | | $ | 955,599 | | | | | $ | 481,473 | | | | | $ | 264,718 | | | | | $ | 169,557 | | | | | $ | 151,020 | |

Ratio of net expenses to average net assets | | | | | 0.75 | %* | | | | | 0.75 | % | | | | | 0.75 | %(b) | | | | | 0.75 | %(b) | | | | | 0.75 | % | | | | | 0.75 | %(b) |

Ratio of net investment income to average net assets | | | | | 6.55 | %*(c) | | | | | 7.14 | %(c) | | | | | 8.14 | %(c) | | | | | 7.88 | % | | | | | 8.81 | % | | | | | 8.25 | % |

Portfolio turnover rate | | | | | 49 | % | | | | | 97 | % | | | | | 102 | % | | | | | 129 | % | | | | | 59 | % | | | | | 13 | % |

| (a) | Per share amounts based on average number of shares outstanding during the period. |

| (b) | If the investment manager had not reimbursed expenses, the ratio of expenses to average net assets would have been 0.76%. |

| (c) | Indicates a period in which, as a result of a change in generally accepted accounting principles, the portfolio has reclassified periodic payments made or received under certain derivative instruments, which were previously included within miscellaneous income, to a component of realized gain (loss) in the Statement of Operations. The effect of this reclassification was to (reduce) the net investment income ratio for the period ending June 30, 2004 by (0.05)% and the net investment income per share by $0.00. For consistency, similar reclassifications have been made to prior year amounts, resulting in (reductions) to the net investment income ratio of (0.07)% and (0.13)% and to the net investment income per share of $(0.01) and $(0.01) in the fiscal years ending December 31, 2003 and 2002, respectively. This change had no impact on the reported net asset value per share for any period. |

| | | | | | |

| 4 | | Semi-Annual Report | | June 30, 2004 | | See accompanying notes |

Statement of Assets and Liabilities

High Yield Portfolio

June 30, 2004 (Unaudited)

| | | | | | |

| Amounts in thousands, except per share amounts | | | | | |

| | |

Assets: | | | | | | |

| | |

Investments, at value | | | | $ | 330,645 | |

Cash | | | | | 14 | |

Foreign currency, at value | | | | | 2,543 | |

Receivable for investments sold | | | | | 2,465 | |

Unrealized appreciation on forward foreign currency contracts | | | | | 101 | |

Receivable for Portfolio shares sold | | | | | 173 | |

Interest and dividends receivable | | | | | 6,596 | |

Variation margin receivable | | | | | 100 | |

Unrealized appreciation on swap agreements | | | | | 21 | |

| | | | | | 342,658 | |

| | |

Liabilities: | | | | | | |

| | |

Payable for investments purchased | | | | $ | 2,859 | |

Unrealized depreciation on forward foreign currency contracts | | | | | 9 | |

Written options outstanding | | | | | 398 | |

Payable for Portfolio shares redeemed | | | | | 12 | |

Dividends payable | | | | | 4 | |

Accrued investment advisory fee | | | | | 67 | |

Accrued administration fee | | | | | 94 | |

Accrued servicing fee | | | | | 32 | |

Recoupment payable to Manager | | | | | 2 | |

Unrealized depreciation on swap agreements | | | | | 171 | |

| | | | | | 3,648 | |

| | |

Net Assets | | | | $ | 339,010 | |

| | |

Net Assets Consist of: | | | | | | |

| | |

Paid in capital | | | | $ | 330,728 | |

(Overdistributed) net investment income | | | | | (2,710 | ) |

Accumulated undistributed net realized gain | | | | | 11,543 | |

Net unrealized (depreciation) | | | | | (551 | ) |

| | | | | $ | 339,010 | |

| | |

Net Assets: | | | | | | |

| | |

Institutional Class | | | | $ | 319 | |

Administrative Class | | | | | 338,692 | |

| | |

Shares Issued and Outstanding: | | | | | | |

| | |

Institutional Class | | | | | 40 | |

Administrative Class | | | | | 42,722 | |

| | |

Net Asset Value and Redemption Price Per Share

(Net Assets Per Share Outstanding) | | | | | | |

| | |

Institutional Class | | | | $ | 7.93 | |

Administrative Class | | | | | 7.93 | |

| | |

Cost of Investments Owned | | | | $ | 332,203 | |

Cost of Foreign Currency Held | | | | $ | 2,530 | |

| | | | | | |

| See accompanying notes | | June 30, 2004 | | Semi-Annual Report | | 5 |

Statement of Operations

High Yield Portfolio

| | | | | | |

| Amounts in thousands | | | | | |

| | | | | Six Months Ended

June 30, 2004

(Unaudited) | |

Investment Income: | | | | | | |

| | |

Interest | | | | $ | 26,945 | |

Dividends | | | | | 384 | |

Miscellaneous income | | | | | 105 | |

Total Income | | | | | 27,434 | |

| | |

Expenses: | | | | | | |

| | |

Investment advisory fees | | | | | 937 | |

Administration fees | | | | | 1,312 | |

Distribution and/or servicing fees - Administrative Class | | | | | 562 | |

Trustees’ fees | | | | | 8 | |

Interest expense | | | | | 5 | |

Miscellaneous expense | | | | | 2 | |

Total Expenses | | | | | 2,826 | |

| | |

Net Investment Income | | | | | 24,608 | |

| | |

Net Realized and Unrealized Gain (Loss): | | | | | | |

| | |

Net realized gain on investments | | | | | 32,492 | |

Net realized gain on futures contracts, options, and swaps | | | | | 2,120 | |

Net realized gain on foreign currency transactions | | | | | 754 | |

Net change in unrealized (depreciation) on investments | | | | | (60,044 | ) |

Net change in unrealized (depreciation) on futures contracts,

options, and swaps | | | | | (331 | ) |

Net change in unrealized appreciation on translation of

assets and liabilities denominated in foreign currencies | | | | | 738 | |

Net (Loss) | | | | | (24,271 | ) |

| | |

Net Increase in Assets Resulting from Operations | | | | $ | 337 | |

| | | | | | |

| 6 | | Semi-Annual Report | | June 30, 2004 | | See accompanying notes |

Statements of Changes in Net Assets

High Yield Portfolio

| | | | | | | | | | | | |

| Amounts in thousands | | | | | | | | | | |

| | | | | Six Months Ended

June 30, 2004

(Unaudited) | | | | | Year Ended

December 31, 2003 | |

Increase (Decrease) in Net Assets from: | | | | | | | | | | | | |

| | | | |

Operations: | | | | | | | | | | | | |

| | | | |

Net investment income | | | | $ | 24,608 | | | | | $ | 51,650 | |

Net realized gain | | | | | 35,366 | | | | | | 15,242 | |

Net change in unrealized appreciation (depreciation) | | | | | (59,637 | ) | | | | | 74,319 | |

Net increase resulting from operations | | | | | 337 | | | | | | 141,211 | |

| | | | |

Distributions to Shareholders: | | | | | | | | | | | | |

| | | | |

From net investment income | | | | | | | | | | | | |

Institutional Class | | | | | (3 | ) | | | | | (1 | ) |

Administrative Class | | | | | (24,831 | ) | | | | | (52,189 | ) |

Total Distributions | | | | | (24,834 | ) | | | | | (52,190 | ) |

| | | | |

Portfolio Share Transactions: | | | | | | | | | | | | |

| | | | |

Receipts for shares sold | | | | | | | | | | | | |

Institutional Class | | | | | 298 | | | | | | 0 | |

Administrative Class | | | | | 155,987 | | | | | | 820,631 | |

| | | | |

Issued as reinvestment of distributions | | | | | | | | | | | | |

Institutional Class | | | | | 3 | | | | | | 1 | |

Administrative Class | | | | | 21,323 | | | | | | 52,190 | |

| | | | |

Cost of shares redeemed | | | | | | | | | | | | |

Institutional Class | | | | | (1 | ) | | | | | 0 | |

Administrative Class | | | | | (769,715 | ) | | | | | (487,714 | ) |

Net increase (decrease) resulting from Portfolio share transactions | | | | | (592,105 | ) | | | | | 385,108 | |

| | | | |

Total Increase (Decrease) in Net Assets | | | | | (616,602 | ) | | | | | 474,129 | |

| | | | |

Net Assets: | | | | | | | | | | | | |

| | | | |

Beginning of period | | | | | 955,612 | | | | | | 481,483 | |

End of period* | | | | $ | 339,010 | | | | | $ | 955,612 | |

| | | | |

*Including (overdistributed) net investment income of: | | | | $ | (2,710 | ) | | | | $ | (2,484 | ) |

| | | | | | |

| See accompanying notes | | June 30, 2004 | | Semi-Annual Report | | 7 |

Schedule of Investments

High Yield Portfolio

June 30, 2004 (Unaudited)

| | | | |

| | | Principal | | |

| | | Amount | | Value |

| | | (000s) | | (000s) |

| | | | | | |

CORPORATE BONDS & NOTES 78.2% |

Banking & Finance 10.6% | | | | | | |

AES Ironwood LLC | | | | | | |

8.857% due 11/30/2025 | | $ | 1,645 | | $ | 1,752 |

BCP Caylux Holdings Luxembourg S.A. | | | |

9.625% due 06/15/2014 | | | 1,425 | | | 1,484 |

Bluewater Finance Ltd. | | | | | | |

10.250% due 02/15/2012 | | | 1,675 | | | 1,775 |

Bombardier Capital, Inc. | | | | | | |

7.090% due 03/30/2007 (i) | | | 1,000 | | | 1,008 |

Cedar Brakes II LLC | | | | | | |

9.875% due 09/01/2013 | | | 572 | | | 573 |

Choctaw Resort Development Enterprise |

9.250% due 04/01/2009 | | | 1,050 | | | 1,134 |

Dow Jones TRAC-X N.A. High Yield Index |

7.375% due 03/25/2009 | | | 3,520 | | | 3,445 |

8.000% due 03/25/2009 | | | 3,500 | | | 3,402 |

Eircom Funding | | | | | | |

8.250% due 08/15/2013 | | | 800 | | | 836 |

FINOVA Group, Inc. | | | | | | |

7.500% due 11/15/2009 | | | 1,380 | | | 762 |

Ford Motor Credit Co. | | | | | | |

7.000% due 10/01/2013 | | | 1,650 | | | 1,668 |

Forest City Enterprises, Inc. | | | | | | |

7.625% due 06/01/2015 | | | 425 | | | 429 |

General Motors Acceptance Corp. |

7.000% due 02/01/2012 | | | 400 | | | 412 |

6.875% due 08/28/2012 | | | 825 | | | 841 |

8.000% due 11/01/2031 | | | 425 | | | 437 |

JET Equipment Trust | | | | | | |

10.000% due 06/15/2012 (b) | | | 800 | | | 540 |

7.630% due 08/15/2012 (b) | | | 403 | | | 259 |

JSG Funding PLC | | | | | | |

9.625% due 10/01/2012 | | | 1,840 | | | 2,024 |

Mizuho Preferred Capital Co. | | | | | | |

9.870% due 06/30/2008 (c) | | | 1,575 | | | 1,783 |

8.790% due 12/29/2049 (c) | | | 700 | | | 770 |

Qwest Capital Funding, Inc. | | | | | | |

7.250% due 02/15/2011 | | | 2,600 | | | 2,236 |

7.750% due 02/15/2031 | | | 140 | | | 111 |

Riggs Capital Trust | | | | | | |

8.625% due 12/31/2026 | | | 150 | | | 151 |

8.875% due 03/15/2027 | | | 550 | | | 554 |

Rotech Healthcare, Inc. | | | | | | |

9.500% due 04/01/2012 | | | 2,000 | | | 2,145 |

Targeted Return Index Securities Trust |

4.149% due 08/01/2015 (b) | | | 3,225 | | | 3,352 |

UGS Corp. | | | | | | |

10.000% due 06/01/2012 | | | 375 | | | 401 |

Universal City Development Partners |

11.750% due 04/01/2010 | | | 550 | | | 639 |

Ventas Capital Corp. | | | | | | |

8.750% due 05/01/2009 | | | 825 | | | 895 |

| | | | | |

|

|

| | | | | | | 35,818 |

| | | | | |

|

|

Industrials 55.2% | | | | | | |

Abitibi-Consolidated, Inc. | | | | | | |

6.950% due 12/15/2006 | | | 700 | | | 721 |

6.950% due 04/01/2008 | | | 250 | | | 254 |

5.250% due 06/20/2008 | | | 375 | | | 358 |

8.550% due 08/01/2010 | | | 350 | | | 371 |

6.000% due 06/20/2013 | | | 400 | | | 356 |

8.850% due 08/01/2030 | | | 1,053 | | | 1,031 |

Ahold Finance USA, Inc. |

8.250% due 07/15/2010 | | | 150 | | | 159 |

Alderwoods Group, Inc. | | | | | | |

12.250% due 01/02/2009 | | | 1,000 | | | 1,110 |

Allied Waste North America, Inc. |

8.875% due 04/01/2008 | | | 600 | | | 660 |

8.500% due 12/01/2008 | | | 350 | | | 385 |

10.000% due 08/01/2009 | | | 1 | | | 1 |

6.375% due 04/15/2011 | | | 700 | | | 689 |

9.250% due 09/01/2012 | | | 2,500 | | | 2,812 |

7.875% due 04/15/2013 | | | 300 | | | 315 |

7.375% due 04/15/2014 | | | 400 | | | 391 |

| | | | | | |

|

American Media Operations, Inc. |

10.250% due 05/01/2009 | | $ | 1,900 | | $ | 1,981 |

American Tower Escrow Corp. | | | | | | |

0.000% due 08/01/2008 | | | 3,150 | | | 2,315 |

AmeriGas Partners LP | | | | | | |

10.000% due 04/15/2006 | | | 120 | | | 130 |

8.830% due 04/19/2010 | | | 488 | | | 523 |

8.875% due 05/20/2011 | | | 200 | | | 214 |

Arco Chemical Co. | | | | | | |

10.250% due 11/01/2010 | | | 50 | | | 51 |

ArvinMeritor, Inc. | | | | | | |

6.625% due 06/15/2007 | | | 250 | | | 257 |

8.750% due 03/01/2012 | | | 1,050 | | | 1,144 |

Aviall, Inc. | | | | | | |

7.625% due 07/01/2011 | | | 650 | | | 679 |

Boise Cascade Corp. | | | | | | |

7.000% due 11/01/2013 | | | 500 | | | 514 |

Boyd Gaming Corp. | | | | | | |

7.750% due 12/15/2012 | | | 900 | | | 913 |

Cablevision Systems Corp. | | | | | | |

8.000% due 04/15/2012 | | | 1,000 | | | 990 |

Canwest Media, Inc. | | | | | | |

10.625% due 05/15/2011 | | | 1,645 | | | 1,853 |

CCO Holdings LLC | | | | | | |

8.750% due 11/15/2013 | | | 3,000 | | | 2,887 |

Chesapeake Energy Corp. | | | | | | |

8.375% due 11/01/2008 | | | 650 | | | 705 |

7.500% due 06/15/2014 | | | 1,000 | | | 1,035 |

Circus & Eldorado Joint Venture Silver Legacy Capital Corp. | | | | | | |

10.125% due 03/01/2012 | | | 575 | | | 581 |

Colorado Interstate Gas Co. | | | | | | |

6.850% due 06/15/2037 | | | 200 | | | 206 |

Commonwealth Brands, Inc. | | | | | | |

9.750% due 04/15/2008 | | | 650 | | | 699 |

10.625% due 09/01/2008 | | | 850 | | | 914 |

Continental Airlines, Inc. | | | | | | |

7.461% due 04/01/2015 | | | 81 | | | 76 |

7.373% due 12/15/2015 | | | 342 | | | 273 |

6.545% due 02/02/2019 | | | 169 | | | 158 |

Crown Castle International Corp. |

9.375% due 08/01/2011 | | | 380 | | | 420 |

10.750% due 08/01/2011 | | | 1,000 | | | 1,125 |

Crown European Holdings S.A. | | | | | | |

9.500% due 03/01/2011 | | | 2,025 | | | 2,217 |

10.875% due 03/01/2013 | | | 450 | | | 515 |

CSC Holdings, Inc. | | | | | | |

8.125% due 07/15/2009 | | | 250 | | | 261 |

8.125% due 08/15/2009 | | | 2,305 | | | 2,409 |

7.625% due 04/01/2011 | | | 1,000 | | | 1,007 |

6.750% due 04/15/2012 | | | 1,250 | | | 1,206 |

Delhaize America, Inc. | | | | | | |

8.125% due 04/15/2011 | | | 1,725 | | | 1,892 |

Dex Media West LLC | | | | | | |

8.500% due 08/15/2010 | | | 1,150 | | | 1,259 |

9.875% due 08/15/2013 | | | 1,650 | | | 1,819 |

Dimon, Inc. | | | | | | |

7.750% due 06/01/2013 | | | 150 | | | 140 |

DirecTV Holdings LLC | | | | | | |

8.375% due 03/15/2013 | | | 1,375 | | | 1,528 |

Dobson Communications Corp. | | | | | | |

8.875% due 10/01/2013 | | | 650 | | | 497 |

Dresser, Inc. |

9.375% due 04/15/2011 | | | 1,650 | | | 1,774 |

Dunlop Standard Aerospace Holdings PLC | | | |

11.875% due 05/15/2009 | | | 1,048 | | | 1,119 |

Dura Operating Corp. | | | | | | |

8.625% due 04/15/2012 | | | 1,875 | | | 1,922 |

Dynegy Danskammer & Roseton LLC | | | |

7.270% due 11/08/2010 | | | 1,100 | | | 1,050 |

7.670% due 11/08/2016 | | | 1,400 | | | 1,218 |

Dynegy Holdings, Inc. | | | | | | |

9.875% due 07/15/2010 | | | 600 | | | 648 |

10.125% due 07/15/2013 | | | 1,150 | | | 1,251 |

| | | | | | |

| | |

EchoStar DBS Corp. | | | | | | |

10.375% due 10/01/2007 | | $ | 550 | | $ | 591 |

El Paso CGP Co. | | | | | | |

7.500% due 08/15/2006 | | | 1,200 | | | 1,191 |

6.500% due 06/01/2008 | | | 250 | | | 226 |

7.625% due 09/01/2008 | | | 750 | | | 697 |

7.750% due 06/15/2010 | | | 250 | | | 227 |

9.625% due 05/15/2012 | | | 200 | | | 191 |

7.750% due 10/15/2035 | | | 400 | | | 316 |

El Paso Corp. | | | | | | |

7.000% due 05/15/2011 | | | 100 | | | 88 |

7.875% due 06/15/2012 | | | 2,155 | | | 1,945 |

7.375% due 12/15/2012 | | | 300 | | | 262 |

7.800% due 08/01/2031 | | | 700 | | | 565 |

El Paso Production Holding Co. | | | | | | |

7.750% due 06/01/2013 | | | 1,650 | | | 1,522 |

Encore Acquisition Co. | | | | | | |

6.250% due 04/15/2014 | | | 550 | | | 520 |

Equistar Chemicals LP | | | | | | |

10.125% due 09/01/2008 | | | 430 | | | 473 |

8.750% due 02/15/2009 | | | 1,435 | | | 1,503 |

10.625% due 05/01/2011 | | | 400 | | | 446 |

Evergreen Resources, Inc. | | | | | | |

5.875% due 03/15/2012 | | | 700 | | | 710 |

EXCO Resources, Inc. | | | | | | |

7.250% due 01/15/2011 | | | 500 | | | 510 |

Extendicare Health Services | | | | | | |

9.500% due 07/01/2010 | | | 800 | | | 892 |

Ferrellgas Partners LP | | | | | | |

6.990% due 08/01/2005 (i) | | | 1,000 | | | 1,013 |

8.870% due 08/01/2009 (i)(l) | | | 1,200 | | | 1,273 |

6.750% due 05/01/2014 | | | 400 | | | 388 |

Fimep S.A. | | | | | | |

10.500% due 02/15/2013 | | | 385 | | | 441 |

Fisher Scientific International | | | | | | |

8.000% due 09/01/2013 | | | 650 | | | 699 |

Fresenius Medical Care | | | | | | |

7.875% due 06/15/2011 | | | 2,250 | | | 2,396 |

General Motors Corp. | | | | | | |

8.250% due 07/15/2023 | | | 450 | | | 472 |

Georgia-Pacific Corp. | | | | | | |

8.125% due 06/15/2023 | | | 600 | | | 619 |

8.000% due 01/15/2024 | | | 2,750 | | | 2,764 |

8.875% due 05/15/2031 | | | 650 | | | 697 |

Grief Brothers Corp. | | | | | | |

8.875% due 08/01/2012 | | | 400 | | | 432 |

GulfTerra Energy Partners LP | | | | | | |

8.500% due 06/01/2010 | | | 649 | | | 709 |

Hanover Compressor Co. | | | | | | |

9.000% due 06/01/2014 | | | 500 | | | 521 |

Hanover Equipment Trust | | | | | | |

8.500% due 09/01/2008 | | | 2,300 | | | 2,444 |

HCA, Inc. | | | | | | |

7.875% due 02/01/2011 | | | 950 | | | 1,043 |

6.250% due 02/15/2013 | | | 1,350 | | | 1,344 |

6.750% due 07/15/2013 | | | 625 | | | 641 |

HealthSouth Corp. | | | | | | |

8.500% due 02/01/2008 (b) | | | 110 | | | 109 |

8.375% due 10/01/2011 (b) | | | 1,000 | | | 972 |

Hilton Hotels Corp. | | | | | | |

7.625% due 12/01/2012 | | | 1,500 | | | 1,620 |

HMH Properties, Inc. | | | | | | |

7.875% due 08/01/2008 | | | 550 | | | 566 |

Hollinger International Publishing |

9.000% due 12/15/2010 | | | 2,550 | | | 2,958 |

Hollinger Participation Trust | | | | | | |

12.125% due 11/15/2010 (d) | | | 389 | | | 398 |

Horizon Lines LLC | | | | | | |

9.000% due 11/01/2012 | | | 275 | | | 277 |

Host Marriott LP | | | | | | |

9.500% due 01/15/2007 | | | 250 | | | 274 |

9.250% due 10/01/2007 | | | 1,200 | | | 1,329 |

7.125% due 11/01/2013 | | | 185 | | | 182 |

Ingles Markets, Inc. | | | | | | |

8.875% due 12/01/2011 | | | 1,000 | | | 1,032 |

| | | | | | |

| 8 | | Semi-Annual Report | | June 30, 2004 | | See accompanying notes |

| | | | |

| | | Principal | | |

| | | Amount | | Value |

| | | (000s) | | (000s) |

| | | | | | |

| | |

Insight Midwest LP | | | | | | |

9.750% due 10/01/2009 | | $ | 445 | | $ | 472 |

9.750% due 10/01/2009 | | | 900 | | | 954 |

10.500% due 11/01/2010 | | | 765 | | | 838 |

10.500% due 11/01/2010 | | | 150 | | | 164 |

Invensys PLC | | | | | | |

9.875% due 03/15/2011 | | | 650 | | | 650 |

ISP Chemco, Inc. | | | | | | |

10.250% due 07/01/2011 | | | 1,465 | | | 1,637 |

Johnsondiversey, Inc. | | | | | | |

9.625% due 05/15/2012 | | | 390 | | | 427 |

K&F Industries, Inc. | | | | | | |

9.625% due 12/15/2010 | | | 350 | | | 385 |

K2, Inc. | | | | | | |

7.375% due 07/01/2014 | | | 150 | | | 153 |

Legrand S.A. | | | | | | |

8.500% due 02/15/2025 | | | 550 | | | 569 |

Mail Well I Corp. | | | | | | |

9.625% due 03/15/2012 | | | 1,000 | | | 1,080 |

Mandalay Resort Group | | | | | | |

6.500% due 07/31/2009 | | | 750 | | | 766 |

9.375% due 02/15/2010 | | | 1,900 | | | 2,080 |

7.625% due 07/15/2013 | | | 200 | | | 200 |

MCI, Inc. | | | | | | |

5.908% due 05/01/2007 | | | 300 | | | 292 |

6.688% due 05/01/2009 | | | 1,590 | | | 1,475 |

7.735% due 05/01/2014 | | | 257 | | | 231 |

Mediacom Broadband LLC | | | | | | |

11.000% due 07/15/2013 | | | 1,515 | | | 1,621 |

Merisant Co. | | | | | | |

9.500% due 07/15/2013 | | | 700 | | | 749 |

Meritor Automotive, Inc. | | | | | | |

6.800% due 02/15/2009 | | | 250 | | | 256 |

MGM Mirage, Inc. | | | | | | |

6.000% due 10/01/2009 | | | 350 | | | 345 |

8.375% due 02/01/2011 | | | 2,050 | | | 2,153 |

Midwest Generation LLC | | | | | | |

8.300% due 07/02/2009 | | | 300 | | | 306 |

8.560% due 01/02/2016 | | | 3,575 | | | 3,593 |

8.750% due 05/01/2034 | | | 1,250 | | | 1,269 |

Nalco Co. | | | | | | |

7.750% due 11/15/2011 | | | 2,750 | | | 2,894 |

Newpark Resources, Inc. | | | | | | |

8.625% due 12/15/2007 | | | 890 | | | 908 |

Norampac, Inc. | | | | | | |

6.750% due 06/01/2013 | | | 650 | | | 640 |

Owens-Brockway Glass Container, Inc. | | | |

8.875% due 02/15/2009 | | | 400 | | | 434 |

7.750% due 05/15/2011 | | | 150 | | | 157 |

8.750% due 11/15/2012 | | | 1,550 | | | 1,690 |

8.250% due 05/15/2013 | | | 850 | | | 882 |

PacifiCare Health Systems, Inc. | | | | | | |

10.750% due 06/01/2009 | | | 417 | | | 477 |

PanAmSat Corp. | | | | | | |

8.500% due 02/01/2012 | | | 625 | | | 713 |

Park Place Entertainment Corp. | | | | | | |

9.375% due 02/15/2007 | | | 1,475 | | | 1,606 |

7.875% due 03/15/2010 | | | 600 | | | 636 |

7.000% due 04/15/2013 | | | 1,400 | | | 1,418 |

Peabody Energy Corp. | | | | | | |

6.875% due 03/15/2013 | | | 1,800 | | | 1,832 |

Plains Exploration & Production Co | | | |

7.125% due 06/15/2014 | | | 1,625 | | | 1,662 |

Premcor Refining Group, Inc. | | | | | | |

6.750% due 02/01/2011 | | | 1,000 | | | 1,033 |

6.750% due 05/01/2014 | | | 300 | | | 299 |

Pride International, Inc. | | | | | | |

9.375% due 05/01/2007 | | | 1,330 | | | 1,360 |

Primedia, Inc. | | | | | | |

7.625% due 04/01/2008 | | | 350 | | | 348 |

6.565% due 05/15/2010 | | | 150 | | | 153 |

8.000% due 05/15/2013 | | | 1,250 | | | 1,181 |

Quebecor Media, Inc. | | | | | | |

11.125% due 07/15/2011 | | | 1,400 | | | 1,605 |

Qwest Communications International, Inc. | | | |

7.250% due 02/15/2011 | | | 2,400 | | | 2,250 |

7.500% due 02/15/2014 | | | 1,800 | | | 1,634 |

| | | | | | |

| | |

Qwest Corp. | | | | | | |

7.200% due 11/01/2004 | | $ | 470 | | $ | 476 |

8.875% due 03/15/2012 | | | 1,650 | | | 1,790 |

Rayovac Corp. | | | | | | |

8.500% due 10/01/2013 | | | 850 | | | 897 |

Rogers Cablesystems, Inc. | | | | | | |

10.000% due 03/15/2005 | | | 235 | | | 245 |

Roundy’s, Inc. | | | | | | |

8.875% due 06/15/2012 | | | 1,900 | | | 2,024 |

Safety-Kleen Corp. | | | | | | |

9.250% due 06/01/2008 (b) | | | 1,450 | | | 4 |

9.250% due 05/15/2009 (b) | | | 250 | | | 13 |

Saks, Inc. | | | | | | |

8.250% due 11/15/2008 | | | 1 | | | 1 |

Sinclair Broadcast Group, Inc. | | | | | | |

8.750% due 12/15/2011 | | | 800 | | | 860 |

Six Flags, Inc. | | | | | | |

9.750% due 04/15/2013 | | | 1,600 | | | 1,616 |

Sonat, Inc. | | | | | | |

7.625% due 07/15/2011 | | | 2,650 | | | 2,378 |

SPX Corp. | | | | | | |

6.250% due 06/15/2011 | | | 650 | | | 635 |

7.500% due 01/01/2013 | | | 1,875 | | | 1,931 |

Starwood Hotels & Resorts Worldwide, Inc. | | | |

7.375% due 05/01/2007 | | | 550 | | | 582 |

7.875% due 05/01/2012 | | | 900 | | | 968 |

Station Casinos, Inc. | | | | | | |

6.000% due 04/01/2012 | | | 825 | | | 802 |

6.500% due 02/01/2014 | | | 225 | | | 218 |

Stone Container Corp. | | | | | | |

11.500% due 08/15/2006 | | | 450 | | | 454 |

9.750% due 02/01/2011 | | | 525 | | | 580 |

8.375% due 07/01/2012 | | | 650 | | | 683 |

Suburban Propane Partners LP | | | | | | |

6.875% due 12/15/2013 | | | 500 | | | 486 |

Tenet Healthcare Corp. | | | | | | |

6.375% due 12/01/2011 | | | 975 | | | 858 |

7.375% due 02/01/2013 | | | 2,975 | | | 2,707 |

9.875% due 07/01/2014 | | | 450 | | | 460 |

Tenneco Automotive, Inc. | | | | | | |

10.250% due 07/15/2013 | | | 525 | | | 596 |

10.250% due 07/15/2013 | | | 1,075 | | | 1,220 |

Time Warner Telecom, Inc. | | | | | | |

9.750% due 07/15/2008 | | | 950 | | | 893 |

10.125% due 02/01/2011 | | | 500 | | | 458 |

Toys “R” Us, Inc. | | | | | | |

7.625% due 08/01/2011 | | | 750 | | | 757 |

7.875% due 04/15/2013 | | | 550 | | | 555 |

Triad Hospitals, Inc. | | | | | | |

7.000% due 05/15/2012 | | | 500 | | | 506 |

7.000% due 11/15/2013 | | | 550 | | | 525 |

Trinity Industries, Inc. | | | | | | |

6.500% due 03/15/2014 | | | 900 | | | 828 |

TRW Automotive, Inc. | | | | | | |

9.375% due 02/15/2013 | | | 1,220 | | | 1,382 |

Tyco International Group S.A. | | | | | | |

6.750% due 02/15/2011 | | | 668 | | | 727 |

U.S. Airways, Inc. | | | | | | |

9.625% due 09/01/2003 (b) | | | 1,016 | | | 295 |

9.330% due 01/01/2006 (b) | | | 84 | | | 22 |

United Airlines, Inc. | | | | | | |

6.201% due 09/01/2008 | | | 225 | | | 185 |

7.730% due 07/01/2010 | | | 800 | | | 654 |

7.186% due 04/01/2011 (b) | | | 196 | | | 163 |

6.602% due 09/01/2013 | | | 500 | | | 417 |

Valero Energy Corp. | | | | | | |

7.800% due 06/14/2010 | | | 400 | | | 387 |

Vintage Petroleum, Inc. | | | | | | |

7.875% due 05/15/2011 | | | 1,125 | | | 1,159 |

8.250% due 05/01/2012 | | | 790 | | | 841 |

Westlake Chemical Corp. | | | | | | |

8.750% due 07/15/2011 | | | 400 | | | 436 |

Williams Cos., Inc. | | | | | | |

8.625% due 06/01/2010 | | | 2,450 | | | 2,707 |

8.125% due 03/15/2012 | | | 450 | | | 483 |

7.625% due 07/15/2019 | | | 3,200 | | | 3,096 |

7.875% due 09/01/2021 | | | 700 | | | 677 |

8.750% due 03/15/2032 | | | 1,000 | | | 1,005 |

| | | | | | |

| | |

Young Broadcasting, Inc. | | | | | | |

8.500% due 12/15/2008 | | $ | 574 | | $ | 607 |

8.500% due 12/15/2008 | | | 350 | | | 370 |

10.000% due 03/01/2011 | | | 580 | | | 593 |

| | | | | |

|

|

| | | | | | | 187,165 |

| | | | | |

|

|

Utilities 12.4% | | | | | | |

ACC Escrow Corp. | | | | | | |

10.000% due 08/01/2011 | | | 1,600 | | | 1,388 |

AES Corp. | | | | | | |

9.375% due 09/15/2010 | | | 300 | | | 321 |

8.875% due 02/15/2011 | | | 825 | | | 860 |

8.750% due 05/15/2013 | | | 2,850 | | | 3,067 |

8.540% due 11/30/2019 | | | 335 | | | 347 |

Calpine Corp. | | | | | | |

8.500% due 07/15/2010 | | | 1,175 | | | 978 |

Centerpoint Energy, Inc. | | | | | | |

7.250% due 09/01/2010 | | | 1,200 | | | 1,278 |

Cincinnati Bell, Inc. | | | | | | |

7.250% due 07/15/2013 | | | 1,475 | | | 1,387 |

8.375% due 01/15/2014 | | | 900 | | | 806 |

CMS Energy Corp. | | | | | | |

7.000% due 01/15/2005 | | | 1,950 | | | 1,970 |

8.900% due 07/15/2008 | | | 100 | | | 105 |

7.500% due 01/15/2009 | | | 2,200 | | | 2,200 |

7.750% due 08/01/2010 | | | 1,200 | | | 1,200 |

DPL, Inc. | | | | | | |

6.875% due 09/01/2011 | | | 1,100 | | | 1,114 |

Edison International, Inc. | | | | | | |

6.875% due 09/15/2004 | | | 1,000 | | | 1,009 |

El Paso Energy Partners | | | | | | |

8.500% due 06/01/2011 | | | 321 | | | 349 |

IPALCO Enterprises, Inc. | | | | | | |

8.375% due 11/14/2008 | | | 1,050 | | | 1,145 |

8.625% due 11/14/2011 | | | 490 | | | 534 |

MSW Energy Holdings LLC | | | | | | |

7.375% due 09/01/2010 | | | 650 | | | 650 |

Nextel Communications, Inc. | | | | | | |

9.500% due 02/01/2011 | | | 1 | | | 1 |

6.875% due 10/31/2013 | | | 2,300 | | | 2,291 |

7.375% due 08/01/2015 | | | 1,875 | | | 1,903 |

Northwestern Bell Telephone | | | | | | |

7.750% due 05/01/2030 | | | 713 | | | 631 |

Northwestern Corp. | | | | | | |

7.250% due 03/03/2008 | | | 650 | | | 621 |

NRG Energy, Inc. | | | | | | |

8.000% due 12/15/2013 | | | 2,150 | | | 2,182 |

PSEG Energy Holdings, Inc. | | | | | | |

7.750% due 04/16/2007 | | | 700 | | | 737 |

8.625% due 02/15/2008 | | | 350 | | | 378 |

10.000% due 10/01/2009 | | | 690 | | | 783 |

8.500% due 06/15/2011 | | | 2,050 | | | 2,204 |

Qwest Capital Funding, Inc. | | | | | | |

7.900% due 08/15/2010 | | | 700 | | | 623 |

Reliant Resources, Inc. | | | | | | |

9.250% due 07/15/2010 | | | 1,975 | | | 2,118 |

9.500% due 07/15/2013 | | | 350 | | | 379 |

Rogers Wireless Communications, Inc. |

6.375% due 03/01/2014 | | | 350 | | | 324 |

Rural Cellular Corp. | | | | | | |

8.250% due 03/15/2012 | | | 950 | | | 976 |

SESI LLC | | | | | | |

8.875% due 05/15/2011 | | | 615 | | | 666 |

South Point Energy Corp. | | | | | | |

8.400% due 05/30/2012 | | | 1,659 | | | 1,444 |

TECO Energy, Inc. | | | | | | |

7.500% due 06/15/2010 | | | 1,950 | | | 1,979 |

Time Warner Telecom Holdings, Inc. | | | |

9.250% due 02/15/2014 | | | 500 | | | 483 |

Triton PCS, Inc. | | | | | | |

8.500% due 06/01/2013 | | | 575 | | | 546 |

| | | | | |

|

|

| | | | | | | 41,977 |

| | | | | |

|

|

Total Corporate Bonds & Notes (Cost $266,069) | | | 264,960 |

| |

|

|

| | | | | | |

| See accompanying notes | | June 30, 2004 | | Semi-Annual Report | | 9 |

Schedule of Investments (Cont.)

High Yield Portfolio

June 30, 2004 (Unaudited)

| | | | |

| | | Principal | | |

| | | Amount | | Value |

| | | (000s) | | (000s) |

| | | | | | |

MUNICIPAL BONDS & NOTES 0.2% |

New Jersey Tobacco Settlement Funding Corp. Revenue Bonds, Series 2003 |

6.375% due 06/01/2032 | | $ | 650 | | $ | 583 |

| | | | | |

|

|

Total Municipal Bonds & Notes (Cost $623) | | | | | | 583 |

| | | | |

|

|

| | | | | | | |

MORTGAGE-BACKED SECURITIES 0.2% |

Continental Airlines, Inc. | | | | | | |

6.920% due 04/02/2013 (i)(l) | | | 840 | | | 829 |

| | | | | |

|

|

Total Mortgage-Backed Securities (Cost $752) | | | | | | 829 |

| | | | |

|

|

| | | | | | | |

ASSET-BACKED SECURITIES 3.9% |

| | |

Allegheny Energy, Inc. | | | | | | |

5.350% due 06/08/2011 (c) | | | 36 | | | 37 |

5.430% due 06/08/2011 (c) | | | 180 | | | 183 |

5.640% due 06/08/2011 (c) | | | 1,584 | | | 1,615 |

Aquila, Inc. | | | | | | |

8.000% due 04/15/2006 (c) | | | 465 | | | 480 |

Brenntag | | | | | | |

3.880% due 02/28/2012 (c) | | | 1,250 | | | 1,268 |

Centennial Communications | | | | | | |

3.875% due 01/20/2011 (c) | | | 38 | | | 38 |

3.910% due 01/20/2011 (c) | | | 754 | | | 759 |

3.910% due 01/20/2011 (c) | | | 71 | | | 71 |

4.050% due 01/20/2011 (c) | | | 35 | | | 36 |

DirecTV Holdings LLC | | | | | | |

3.350% due 03/06/2010 (c) | | | 330 | | | 335 |

3.950% due 04/06/2010 (c) | | | 322 | | | 327 |

Inmarsat Ventures PLC | | | | | | |

4.111% due 10/10/2010 (c) | | | 600 | | | 607 |

4.611% due 10/10/2011 (c) | | | 600 | | | 607 |

Invensys PLC | | | | | | |

4.611% due 08/05/2009 (c) | | | 87 | | | 89 |

4.611% due 09/30/2009 (c) | | | 313 | | | 317 |

5.861% due 12/30/2009 (c) | | | 900 | | | 925 |

Midwest Generation LLC | | | | | | |

4.380% due 04/27/2011 (c) | | | 1,000 | | | 1,013 |

4.570% due 04/27/2011 (c) | | | 1,000 | | | 1,013 |

NRG Energy, Inc. | | | | | | |

5.500% due 05/08/2010 (c) | | | 378 | | | 390 |

5.070% due 12/23/2010 (c) | | | 213 | | | 220 |

Qwest Corp. | | | | | | |

6.500% due 06/30/2007 (c) | | | 1,850 | | | 1,925 |

Tucson Electric Power Co. | | | | | | |

5.000% due 03/30/2009 (c) | | | 1,000 | | | 1,011 |

| | | | | |

|

|

Total Asset-Backed Securities (Cost $13,090) | | | 13,266 |

| |

|

|

| | | | | | | |

SOVEREIGN ISSUES 5.7% |

| | |

Republic of Brazil | | | | | | |

2.062% due 04/15/2006 (c) | | | 1,056 | | | 1,042 |

11.000% due 01/11/2012 | | | 800 | | | 809 |

8.000% due 04/15/2014 (c) | | | 3,987 | | | 3,662 |

8.250% due 01/20/2034 | | | 1,100 | | | 835 |

10.250% due 06/17/2013 | | | 200 | | | 194 |

11.000% due 08/17/2040 | | | 2,750 | | | 2,595 |

Republic of Guatemala | | | | | | |

9.250% due 08/01/2013 | | | 225 | | | 245 |

Republic of Panama | | | | | | |

9.625% due 02/08/2011 | | | 850 | | | 946 |

9.375% due 07/23/2012 | | | 375 | | | 412 |

8.875% due 09/30/2027 | | | 1,050 | | | 1,024 |

| | | | | | |

| | |

Republic of Peru | | | | | | |

9.125% due 01/15/2008 | | $ | 600 | | $ | 654 |

9.125% due 02/21/2012 | | | 1,550 | | | 1,596 |

9.875% due 02/06/2015 | | | 350 | | | 367 |

4.500% due 03/07/2017 (c) | | | 600 | | | 487 |

5.000% due 03/07/2017 (c) | | | 228 | | | 199 |

Republic of Ukraine | | | | | | |

11.000% due 03/15/2007 | | | 342 | | | 369 |

6.875% due 03/04/2011 | | | 500 | | | 472 |

7.650% due 06/11/2013 | | | 300 | | | 286 |

Russian Federation | | | | | | |

5.000% due 03/31/2030 (c) | | | 3,435 | | | 3,145 |

| | | | | |

|

|

Total Sovereign Issues (Cost $20,262) | | | | | | 19,339 |

| | | | |

|

|

| | | | | | | |

FOREIGN CURRENCY-DENOMINATED

ISSUES (j)(k) 1.2% |

| | |

El Paso Corp. | | | | | | |

5.750% due 03/14/2006 | | EC | 700 | | | 818 |

Johnsondiversey, Inc. | | | | | | |

9.625% due 05/15/2012 | | | 350 | | | 462 |

JSG Funding PLC | | | | | | |

10.125% due 10/01/2012 | | | 650 | | | 862 |

Kronos International, Inc. | | | | | | |

8.875% due 06/30/2009 | | | 300 | | | 390 |

Lighthouse International Co. S.A. | | | |

8.000% due 04/30/2014 | | | 1,420 | | | 1,676 |

| | | | | |

|

|

Total Foreign Currency-Denominated Issues (Cost $3,708) | | | 4,208 |

| |

|

|

| | | | | | | |

CONVERTIBLE BONDS & NOTES 0.9% |

Banking & Finance 0.5% | | | | | | |

Fiat Finance Luxembourg S.A. | | | | | | |

3.250% due 01/09/2007 | | $ | 1,600 | | | 1,612 |

| | | | | |

|

|

Industrials 0.2% | | | | | | |

Dimon, Inc. | | | | | | |

6.250% due 03/31/2007 | | | 850 | | | 769 |

| | | | | |

|

|

Utilities 0.2% | | | | | | |

Rogers Communication, Inc. | | | | | | |

2.000% due 11/26/2005 | | | 665 | | | 631 |

| | | | | |

|

|

Total Convertible Bonds & Notes (Cost $2,880) | | | 3,012 |

| |

|

|

| | | | | | | |

COMMON STOCKS 0.3% |

| | | Shares | | |

Communications 0.2% | | | | | | |

MCI, Inc. | | | 38,968 | | | 562 |

| | | | | |

|

|

Industrials 0.1% | | | | | | |

Dobson Communications Corp. | | | 85,601 | | | 279 |

| | | | | |

|

|

Total Common Stocks (Cost $1,253) | | | | | | 841 |

| | | | |

|

|

| | | | | | | |

CONVERTIBLE PREFERRED STOCK 0.0% |

| | |

Dobson Communications Corp. | | | | | | |

6.000% due 08/19/2016 | | | 650 | | | 71 |

| | | | | |

|

|

Total Convertible Preferred Stock (Cost $109) | | | 71 |

| |

|

|

| | | | | | | |

PREFERRED SECURITY 0.3% |

| | |

Riggs Capital Trust II | | | | | | |

8.875% due 03/15/2027 | | | 950,000 | | | 957 |

| | | | | |

|

|

Total Preferred Security (Cost $900) | | | 957 |

| |

|

|

| | | | | | |

PREFERRED STOCK 0.3% |

| | |

Fresenius Medical Care | | | | | | |

7.875% due 02/01/2008 | | | 1,050 | | $ | 1,110 |

| | | | | |

|

|

Total Preferred Stock (Cost $1,082) | | | 1,110 |

| |

|

|

| | | | | | | |

PURCHASED PUT OPTIONS 0.0% |

| | | # of Contracts | | |

Eurodollar September Futures (CME) | | | |

Strike @ 96.500

Exp. 09/13/2004 | | | 400 | | | 2 |

| | | | | |

|

|

Total Purchased Put Options (Cost $4) | | | 2 |

| |

|

|

| | | | | | | |

SHORT-TERM INSTRUMENTS 6.3% |

| | | Principal Amount (000s) | | |

Commercial Paper 5.0% | | | | | | |

Barclays U.S. Funding Corp. | | | | | | |

1.280% due 09/27/2004 | | $ | 1,600 | | | 1,594 |

CDC Commercial Corp. | | | | | | |

1.260% due 09/22/2004 | | | 4,000 | | | 3,986 |

Freddie Mac | | | | | | |

1.200% due 08/09/2004 | | | 900 | | | 899 |

1.410% due 09/14/2004 | | | 200 | | | 200 |

1.560% due 10/20/2004 | | | 3,400 | | | 3,383 |

General Electric Capital Corp. | | | | | | |

1.460% due 09/14/2004 | | | 1,600 | | | 1,595 |

1.480% due 09/15/2004 | | | 900 | | | 897 |

HBOS Treasury Services PLC | | | | | | |

1.290% due 09/24/2004 | | | 600 | | | 598 |

TotalFinaElf Capital S.A. | | | | | | |

1.420% due 07/01/2004 | | | 3,000 | | | 3,000 |

UBS Finance, Inc. | | | | | | |

1.245% due 07/21/2004 | | | 900 | | | 900 |

| | | | | |

|

|

| | | | | | | 17,052 |

| | | | | |

|

|

| | |

Repurchase Agreement 0.9% | | | | | | |

State Street Bank | | | | | | |

0.800% due 07/01/2004 | | | 3,019 | | | 3,019 |

| | | | | |

|

|

(Dated 06/30/2004. Collateralized by Freddie Mac

5.500% due 07/15/2006 valued at $3,080.

Repurchase proceeds are $3,019.) |

U.S. Treasury Bills 0.4% | | | | | | |

1.205% due 09/02/2004-09/16/2004 (a)(e)(f) | | | 1,400 | | | 1,396 |

| | | | | |

|

|

Total Short-Term Instruments (Cost $21,471) | | | 21,467 |

| |

|

|

| | | | | | |

| | |

Total Investments 97.5% | | | | $ | 330,645 | |

(Cost $332,203) | | | | | | |

| | |

Written Options (h) (0.1%) | | | | | (398 | ) |

(Premiums $2,085) | | | | | | |

| |

Other Assets and Liabilities (Net) 2.6% | | | 8,763 | |

| | |

|

|

|

| |

Net Assets 100.0% | | $ | 339,010 | |

| | | | |

|

|

|

| | | | | | |

| 10 | | Semi-Annual Report | | June 30, 2004 | | See accompanying notes |

Notes to Schedule of Investments

(amounts in thousands, except number of contracts):

(a) Securities are grouped by coupon or range of coupons and represent a range of maturities.

(b) Security is in default.

(c) Variable rate security.

(d) Payment in-kind bond security.

(e) Securities with an aggregate market value of $649 have been segregated with the custodian to cover margin requirements for the following open futures contracts at June 30, 2004:

| | | | | | | | |

| Type | | Expiration

Month | | # of

Contracts | | Unrealized (Depreciation) | |

Eurodollar March Long Futures | | 03/2005 | | 20 | | $ | (44 | ) |

Eurodollar March Long Futures | | 03/2006 | | 34 | | | (106 | ) |

Eurodollar June Long Futures | | 06/2005 | | 34 | | | (109 | ) |

Eurodollar September Long Futures | | 09/2005 | | 34 | | | (109 | ) |

Eurodollar December Long Futures | | 12/2005 | | 34 | | | (109 | ) |

Euribor June Long Futures | | 06/2005 | | 118 | | | (47 | ) |

Euribor Purchased Put Options Strike @ 89.000 | | 03/2005 | | 310 | | | (4 | ) |

Euribor September Long Futures | | 09/2005 | | 71 | | | (112 | ) |

| | | | | | |

|

|

|

| | | | | | | | $ (640 | ) |

| | | | | | |

|

|

|

(f) Securities with an aggregate market value of $748 have been pledged as collateral for swap and swaption contracts at June 30, 2004.

(g) Swap agreements outstanding at June 30, 2004:

| | | | | | | |

| Type | | Notional

Amount | | Appreciation/

(Depreciation) | |

|

Receive a fixed rate equal to 1.350% and the

Portfolio will pay to the counterparty at par

in the event of default of Republic of Peru 9.125% due 02/21/2012. | |

Counterparty: UBS Warburg LLC | | | | |

Exp. 09/20/2004 | | $ | 5,000 | | $ | 7 | |

|

Receive a fixed rate equal to 1.400% and the

Portfolio will pay to the counterparty at par

in the event of default of Tyco International Group S.A. 2.750% due 01/15/2018. | |

Counterparty: Morgan Stanley Dean Witter & Co. | |

Exp. 09/20/2004 | | | 4,000 | | | 12 | |

|

Receive a fixed rate equal to 2.600% and the

Portfolio will pay to the counterparty at par

in the event of default of Bombardier, Inc.

6.750% due 05/01/2012. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 09/20/2004 | | | 1,286 | | | (11 | ) |

| | | | | | | |

|

Receive a fixed rate equal to 2.600% and the

Portfolio will pay to the counterparty at par in the

event of default of Clear Channel Communications, Inc.

7.650% due 09/15/2010. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 09/20/2004 | | $ | 1,286 | | $ | (11 | ) |

|

Receive a fixed rate equal to 2.600% and the

Portfolio will pay to the counterparty at par in the

event of default of Comcast Cable Communications, Inc.

6.750% due 01/30/2011. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 09/20/2004 | | | 1,286 | | | (11 | ) |

|

Receive a fixed rate equal to 2.600% and the Portfolio will pay to the counterparty at par in the

event of default of Cox Communications, Inc.

7.750% due 11/01/2010. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 09/20/2004 | | | 1,286 | | | (11 | ) |

|

Receive a fixed rate equal to 2.600% and the

Portfolio will pay to the counterparty at par

in the event of default of Harrah’s Operating Co.

8.000% due 02/01/2011. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 09/20/2004 | | | 1,286 | | | (11 | ) |

|

Receive a fixed rate equal to 2.600% and the

Portfolio will pay to the counterparty at par

in the event of default of Sprint Capital Corp.

6.875% due 11/15/2028. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 09/20/2004 | | | 1,286 | | | (11 | ) |

|

Receive a fixed rate equal to 2.600% and the

Portfolio will pay to the counterparty at par in the event of default of Time Warner, Inc.

6.875% due 05/01/2012. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 09/20/2004 | | | 1,286 | | | (11 | ) |

|

Receive a fixed rate equal to 1.000% and the

Portfolio will pay to the counterparty at par

in the event of default of Russian Federation

5.000% due 03/31/2030. | |

Counterparty: Morgan Stanley Dean Witter & Co. | |

Exp. 09/30/2004 | | | 5,000 | | | 2 | |

|

Receive a fixed rate equal to 0.720% and the

Portfolio will pay to the counterparty at par

in the event of default of Russian Federation,

5.000% until 03/31/2007 and 7.500% thereafter,

due 03/31/2030. | |

Counterparty: Goldman Sachs & Co. | |

Exp. 10/21/2004 | | | 4,000 | | | (2 | ) |

|

Receive a fixed rate equal to 4.100% and the

Portfolio will pay to the counterparty at par

in the event of default of Dow Jones TRAC-X NA High Yield Series. | |

Counterparty: J.P. Morgan Chase & Co. | |

Exp. 03/20/2009 | | | 5,000 | | | (92 | ) |

| | | | | |

|

|

|

| | | | | | $ | (150 | ) |

| | | | | |

|

|

|

| | | | | | |

| See accompanying notes | | June 30, 2004 | | Semi-Annual Report | | 11 |

Schedule of Investments (Cont.)

High Yield Portfolio

June 30, 2004 (Unaudited)

(h) Premiums received on written options:

| | | | | | | | | | | | | | | | | | | |

| Name of Issuer | | Exercise

Price | | | Expiration

Date | | # of

Contracts | | Premium | | | Value | |

Call - CBOT U.S. Treasury Note September Futures | | $ | 115.000 | | | 08/27/2004 | | | 76 | | $ | 36 | | | $ | 2 | |

| | | | | | |

Name of Issuer | | Counterparty | | Exercise

Rate | | | Expiration

Date | | Notional

Amount | | Premium | | | Value | |

Put - OTC 7-Year Interest Rate Swap | | Greenwich Capital Markets, Inc. | | | 5.250 | %* | | 07/19/2004 | | $ | 21,400 | | $ | 128 | | | $ | 3 | |

Call - OTC 7-Year Interest Rate Swap | | J.P. Morgan Chase & Co. | | | 4.500 | %** | | 08/02/2004 | | | 5,600 | | | 19 | | | | 12 | |

Call - OTC 10-Year Interest Rate Swap | | Bear Stearns & Co., Inc. | | | 4.000 | %** | | 10/07/2004 | | | 27,000 | | | 416 | | | | 1 | |

Put - OTC 10-Year Interest Rate Swap | | Bear Stearns & Co., Inc. | | | 6.500 | %* | | 10/07/2004 | | | 27,000 | | | 797 | | | | 9 | |

Call - OTC 7-Year Interest Rate Swap | | Wachovia Bank N.A. | | | 5.500 | %** | | 01/07/2005 | | | 5,900 | | | 285 | | | | 210 | |

Call - OTC 7-Year Interest Rate Swap | | Goldman Sachs & Co. | | | 5.000 | %** | | 01/07/2005 | | | 9,100 | | | 215 | | | | 157 | |

Put - OTC 7-Year Interest Rate Swap | | Goldman Sachs & Co. | | | 7.000 | %* | | 01/07/2005 | | | 9,100 | | | 190 | | | | 4 | |

| | | | | | | | | | | | | | $ | 2,050 | | | $ | 396 | |

| * The Portfolio will pay a floating rate based on 3-month LIBOR. | |

| **The Portfolio will receive a floating rate based on 3-month LIBOR. | |

| (i) Restricted security or securities as of June 30, 2004: | |

| Issuer Description | | | | | | | Acquisition

Date | | Cost as of June 30, 2004 | | Market

Value as of

June 30, 2004 | | | Market Value

as Percentage

of Net Assets | |

Bombardier Capital, Inc. | | | | | | | | 08/11/2003 | | $ | 1,008 | | $ | 1,008 | | | | 0.30 | % |

Continental Airlines, Inc. | | | | | | | | 07/01/2003 | | | 752 | | | 829 | | | | 0.24 | |

Ferrellgas Partners LP | | | | | | | | 06/30/2003 | | | 990 | | | 1,013 | | | | 0.30 | |

Ferrellgas Partners LP | | | | | | | | 06/30/2003 | | | 1,334 | | | 1,273 | | | | 0.38 | |

| | | | | | | | | | | $ | 4,084 | | $ | 4,123 | | | | 1.22 | % |

| | | |

(j) Forward foreign currency contracts outstanding at June 30, 2004: | | | | | | | | | | | |

| | | | | | |

| Type | | Currency | | Principal

Amount

Covered by

Contract | | | Settlement

Month | | Unrealized

Appreciation | | Unrealized

(Depreciation) | | | Net

Unrealized

Appreciation | |

Buy | | EC | | | 1,152 | | | 07/2004 | | $ | 6 | | $ | (5 | ) | | $ | 1 | |

Sell | | | | | 6,621 | | | 07/2004 | | | 86 | | | (4 | ) | | | 82 | |

Buy | | JY | | | 167,529 | | | 07/2004 | | | 9 | | | 0 | | | | 9 | |

| | | | | | | | | | | $ | 101 | | $ | (9 | ) | | $ | 92 | |

(k) Principal amount denoted in indicated currency:

EC - Euro

JY - Japanese Yen

(l) Indicates a fair-valued security which has not been valued utilizing an independent quote but has been valued in good faith pursuant to guidelines established by the Board of Trustees. The aggregate value of fair-valued securities is $2,102, which represents 0.62% of net assets.

| | | | | | |

| 12 | | Semi-Annual Report | | June 30, 2004 | | See accompanying notes |

Notes to Financial Statements

June 30, 2004 (Unaudited)

1. Organization

The High Yield Portfolio (the “Portfolio”) is a series of the PIMCO Variable Insurance Trust (the “Trust”). The Trust is registered under the Investment Company Act of 1940 (the “Act”), as amended, as an open-end investment company organized as a Delaware business trust on October 3, 1997. The Portfolio offers two classes of shares: Institutional and Administrative. Each share class has identical voting rights (except that shareholders of a class have exclusive voting rights regarding any matter relating solely to that class of shares). Information presented in these financial statements pertains to the Administrative Class of the Portfolio. Certain detailed financial information for the Institutional Class is provided separately and is available upon request. The Trust is designed to be used as an investment vehicle by Separate Accounts of insurance companies that fund variable annuity contracts and variable life insurance policies and by qualified pension and retirement plans. The Portfolio commenced operations on April 30, 1998.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the Trust in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Security Valuation. Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Portfolio securities and other financial instruments for which market quotes are not readily available are valued at fair value, as determined in good faith and pursuant to guidelines established by the Board of Trustees, including certain fixed income securities which may be valued with reference to securities whose prices are more readily obtainable. Market value is determined at the close of regular trading (normally, 4:00 p.m., Eastern Time) on the New York Stock Exchange on each day the New York Stock Exchange is open, or if no sales are reported, as is the case for most securities traded over-the-counter, the mean between representative bid and asked quotations obtained from a quotation reporting system or from established market makers. The prices of certain portfolio securities or other financial instruments may be determined at a time prior to the close of regular trading on the New York Stock Exchange. Fair valuation may be used if significant events occur after the close of the relevant markets and prior to the close of regular trading on the New York Stock Exchange that materially affect the values of such securities or financial instruments. Fixed income securities are normally valued on the basis of quotes obtained from brokers and dealers or pricing services. Certain fixed income securities purchased on a delayed delivery basis are marked to market daily until settlement at the forward settlement value. Short-term investments, which mature in 60 days or less are valued at amortized cost, which approximates market value. Exchange traded options, futures and options on futures are valued at the settlement price determined by the relevant exchange. Prices may be obtained from independent pricing services which use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. The prices used by the Portfolio may differ from the value that would be realized if the securities were sold and the differences could be material to the financial statements.

Securities Transactions and Investment Income. Securities transactions are recorded as of the trade date. Securities purchased or sold on a when-issued or delayed delivery basis may be settled a month or more after the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, are recorded as soon as the Portfolio is informed of the ex-dividend date. Interest income, adjusted for the accretion of discounts and amortization of premiums, is recorded on the accrual basis. Paydowns gains and losses on mortgage- and asset-backed securities are recorded as adjustments to interest income in the Statement of Operations.

Dividends and Distributions to Shareholders. Dividends from net investment income, if any, are declared on each day the Trust is open for business and are distributed to shareholders monthly. All dividends are reinvested in additional shares of the Portfolio. Net realized capital gains earned by the Portfolio, if any, will be distributed no less frequently than once each year.

Income dividends and capital gain distributions are determined in accordance with income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments for such items as wash sales, foreign currency transactions, net operating losses, notional principal contracts, certain asset-backed securities, certain futures and forward contracts, tax straddles, and capital loss carryforwards.

Distributions classified as a tax basis return of capital, if any, are reflected in the accompanying Statements of Changes in Net Assets and have been reclassified to paid in capital. In addition, other amounts have been reclassified between undistributed net investment income, accumulated undistributed net realized gains or losses and/or paid in capital to more appropriately conform financial accounting to tax characterizations of dividend distributions.

Multiclass Operations. Each class offered by the Trust has equal rights as to assets. Income, non-class specific expenses, and realized and unrealized capital gains and losses are allocated to each class of shares based on the relative net assets of each class.

Federal Income Taxes. The Portfolio intends to qualify as a regulated investment company and distribute all of its taxable

| | | | |

| June 30, 2004 | | Semi-Annual Report | | 13 |

Notes to Financial Statements (Cont.)

June 30, 2004 (Unaudited)

income and net realized gains, if applicable, to shareholders. Accordingly, no provision for Federal income taxes has been made.

Foreign Currency. The accounting records of the Portfolio are maintained in U.S. dollars. The market values of foreign securities, currency holdings and other assets and liabilities are translated into U.S. dollars based on the current exchange rates each business day. Fluctuations in the value of these assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains or losses. Realized gains or losses and unrealized appreciation or depreciation on investment securities and income and expenses are translated on the respective dates of such transactions. The effect of changes in foreign currency exchange rates on investments in securities are not segregated in the Statement of Operations from the effects of changes in market prices of those securities, but are included with the net realized and unrealized gain or loss on investment securities.

Forward Currency Transactions. The Portfolio may enter into forward currency contracts and forward cross-currency contracts in connection with settling planned purchases or sales of securities, to hedge the currency exposure associated with some or all of the Portfolio’s securities or as a part of an investment strategy. A forward currency contract is an agreement between two parties to buy and sell a currency at a set price on a future date. The market value of a forward currency contract fluctuates with changes in forward currency exchange rates. Forward currency contracts are marked to market daily and the change in value is recorded by the Portfolio as an unrealized gain or loss. Realized gains or losses equal to the difference between the value of the contract at the time it was opened and the value at the time it was closed are recorded upon delivery or receipt of the currency or, if a forward currency contract is offset by entering into another forward currency contract with the same broker, upon settlement of the net gain or loss. These contracts may involve market risk in excess of the unrealized gain or loss reflected in the Portfolio’s Statement of Assets and Liabilities. In addition, the Portfolio could be exposed to risk if the counterparties are unable to meet the terms of the contracts or if the value of the currency changes unfavorably to the U.S. dollar.

Futures Contracts. The Portfolio is authorized to enter into futures contracts. The Portfolio may use futures contracts to manage its exposure to the securities markets or to movements in interest rates and currency values. The primary risks associated with the use of futures contracts are the imperfect correlation between the change in market value of the securities held by the Portfolio and the prices of futures contracts, the possibility of an illiquid market, and the inability of the counterparty to meet the terms of the contract. Futures contracts are valued based upon their quoted daily settlement prices. Upon entering into a futures contract, the Portfolio may be required to deposit with its custodian, in a segregated account in the name of the futures broker, an amount of cash or U.S. Government and Agency Obligations in accordance with the initial margin requirements of the broker or exchange. Futures contracts are marked to market daily and an appropriate payable or receivable for the change in value (“variation margin”) is recorded by the Portfolio. Gains or losses are recognized but not considered realized until the contracts expire or are closed. Futures contracts involve, to varying degrees, risk of loss in excess of the variation margin disclosed in the Statement of Assets and Liabilities.