Filed Pursuant to Rule 424(b)(3)

Registration No. 333-159645

PROSPECTUS

AMBIENT CORPORATION

38,533,831 shares of Common Stock

This Prospectus relates to the resale by the selling stockholders of up to 38,533,831 shares of our common stock, par value $0.001 (the "Common Stock") issuable upon exercise of currently exercisable warrants.

We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

The selling stockholders may sell the shares from time to time at the prevailing market price or in negotiated transactions. Each of the selling stockholders may be deemed to be an "underwriter," as such term is defined in the Securities Act of 1933, as amended (the "Act").

Our Common Stock is quoted on the OTC Bulletin Board under the trading symbol "ABTG". The last reported sales price per share of our Common Stock as quoted by the OTC Bulletin Board on April 29, 2010 was $0.082.

AS YOU REVIEW THIS PROSPECTUS, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DESCRIBED IN THE SECTION OF THIS PROSPECTUS TITLED "RISK FACTORS" BEGINNING ON PAGE 4.

NEITHER THE SECURITIES EXCHANGE AND COMMISSION (THE "SEC") NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED ON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is May 4, 2010

PRINCIPAL EXECUTIVE OFFICE:

Ambient Corporation

7 Wells Avenue

Newton, Massachusetts 02459

(617) 332-0004

TABLE OF CONTENT

| PROSPECTUS SUMMARY | | 1 | |

| RISK FACTORS | | 4 | |

| USE OF PROCEEDS | | 8 | |

| AGREEMENTS WITH THE SELLING STOCKHOLDERS | | 8 | |

| DIVIDEND POLICY | | 9 | |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | | | 10 | |

| MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | | | 10 | |

| DESCRIPTION OF BUSINESS | | | 16 | |

| DESCRIPTION OF PROPERTY | | | 22 | |

| LEGAL PROCEEDINGS | | | 22 | |

| MANAGEMENT | | | 22 | |

| EXECUTIVE COMPENSATION | | | 23 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | 25 | |

| BENEFICIAL OWNERSHIP OF MANAGEMENT, DIRECTORS AND CERTAIN BENEFICIAL HOLDERS | | | 26 | |

| SELLING STOCKHOLDERS | | | 28 | |

| PLAN OF DISTRIBUTION | | | 29 | |

| DESCRIPTION OF CAPITAL STOCK | | | 30 | |

| DISCLOSURE OF SEC POSITION ON I NDEMNIFICATION FOR SECURITIES ACT LIABILITIES | | | 30 | |

| LEGAL MATTERS | | | 31 | |

| EXPERTS | | | 31 | |

| WHERE YOU CAN FIND MORE INFORMATION | | | 31 | |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | | F-1 | |

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this Prospectus. The selling stockholders are offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of Common Stock.

PROSPECTUS SUMMARY

THIS IS ONLY A SUMMARY AND DOES NOT CONTAIN ALL OF THE INFORMATION THAT MAY BE IMPORTANT TO YOU. YOU SHOULD READ THE ENTIRE PROSPECTUS, ESPECIALLY THE SECTION TITLED "RISK FACTORS" AND OUR FINANCIAL STATEMENTS AND THE RELATED NOTES INCLUDED IN THIS PROSPECTUS, BEFORE DECIDING TO INVEST IN SHARES OF OUR COMMON STOCK.

AMBIENT CORPORATION

Ambient Corporation (referred to herein as “we,” “our,” “us,” “Ambient,” or the “Company”), incorporated under the laws of the State of Delaware in June 1996, is a pioneering integrator of smart grid communications platforms, creating high-speed Internet Protocols (IP)-based data communications networks to support all aspects of a smart grid. The Ambient smart grid platform, known as Ambient Smart Grid®, facilitates a two-way, real-time communications network to serve the “last mile” backhaul. This common-core infrastructure is necessary for utilities to implement smart grid applications such as Advanced Metering Infrastructures (AMI), real-time pricing, and Demand Side Management (DSM) while enabling distribution monitoring and automation, as well as direct load control. When combined, these applications can offer economic, operational and environmental benefits for utilities, and their customers.

The Ambient’s Smart Grid® platform, which includes communication nodes, a management system and a suite of applications, has been designed to be an open, standards-based system intended to support a variety of applications and services simultaneously. Ambient has designed, developed, and delivered three generations of our Smart Grid® communications nodes. With each successive generation, Ambient has continued to support and integrate additional applications. During the summer of 2009, Ambient began the design and development of its fourth generation communication node. Testing of prototypes is expected to begin during the second quarter of 2010.

Throughout the past four years, Ambient has been a supplier to Duke Energy’s smart grid initiatives. In 2008, Ambient received purchase orders from Duke Energy for its X2000 and X-3000 communications nodes, license for the Ambient Element Management System (AmbientNMS®), and engineering support in building out an intelligent smart grid platform. In September 2009, Ambient and the utility entered into a long-term agreement to supply Ambient’s latest X-series smart grid nodes, the X-3100 for deployment throughout the utility’s electric power distribution grid. Under the terms of the agreement, we have, to date, received purchase orders for product to be delivered through third quarter of 2010, amounting to approximately $10.0 million.

Our goal remains to be the leading designer, developer and systems integrator of a turnkey Ambient Smart Grid® platform, incorporating a wide array of communications technology and protocols enabling smart grid applications such as third-party advanced metering solutions and our internally developed energy sensing capabilities. Ambient views the smart grid communications platform to be a key factor for utilities to efficiently integrate increasing portfolios of energy services and applications.

Ambient intends to actively seek new opportunities for commercial deployments and to bring new and existing networks to full commercialization. Throughout 2010, Ambient’s principal target customers will continue to be electric utilities deploying smart grid technologies, primarily in North America. Ambient intends to continue to collaborate with other technology companies and utility customers to drive the development of new utility and consumer applications and to promote the need for the Ambient Smart Grid® platform.

To date, we have funded operations primarily through the sale of our securities. In connection with the continued development, marketing, and deployment of our products, technology, and services, we anticipate that we will continue to augment our revenue generation capabilities with such raises in the future and anticipate that we will continue to incur losses during 2010. We recognized revenues of 2,193,338 and $12,622,353 for the years ended December 31, 2009 and 2008 respectively, representing sales of equipment, software and services to Duke Energy. We incurred net losses of 14,246,284 and $11,294,199 for the years ended December 31, 2009 and 2008, respectively. From inception through the third quarter of 2008, the Company was in the development stage and had insignificant recurring revenues. In the fourth quarter of 2008, management determined that the Company was no longer in the development stage as the Company’s products were being deployed in more significant smart grid deployments and the prospects for generating significant revenues from generally available products were increasing.

CORPORATE INFORMATION

Our principal offices are located 7 Wells Avenue, Newton, Massachusetts 02459, and our telephone number is (617) 332-0004. We maintain a website at www.ambientcorp.com. Information contained on our website is not part of this Prospectus.

RISK FACTORS

Investing in shares of our Common Stock involves significant risk. You should consider the information under the caption "RISK FACTORS" beginning on page 4of this Prospectus in deciding whether to purchase the Common Stock offered under this Prospectus.

THE OFFERING

| Securities offered by the selling stockholders | | 38,533,831 shares of Common Stock. (1) |

| Shares outstanding before the Offering | | (2) 1,587,790,354 |

| Use of Proceeds | | We will not receive any proceeds from the sale of the Common Stock by the selling stockholders |

———————

(1) | Refers to shares issuable upon exercise of warrants issued to Kuhns Brothers (“Kuhns”), an investment firm and a registered broker dealer, or its designees, in connection with certain financings that we consummated between July 2007 and November 2008 and is comprised of the following: to (i) 750,000 shares of Common Stock issuable upon exercise of warrants issued in January 2007 in connection with the retainer of Kuhns as investment advisor to us and (ii) 37,783,831 shares of Common Stock issuable upon exercise of warrants issued as compensation for placement agent services rendered in connection with the above referenced financings. For a description of the agreement between us and the holders of the Warrants and the Other Warrants, see "DESCRIPTION OF THE AGREEMENTS WITH SELLING STOCKHOLDERS" . |

| | |

(2) | As of April 29, 2010. Does not include (i) up to an aggregate of 52,512,000 shares of Common Stock issuable upon exercise of options granted under our 2000 Equity Incentive Stock Option Plan and our 2002 Non-Employee Director Stock Option Plan, (ii) any of the shares described in footnote (1) above and (iii) 61,060,000 shares of Common Stock issuable upon exercise of other outstanding options and warrants. |

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE RISKS AND UNCERTAINTIES DESCRIBED BELOW BEFORE YOU PURCHASE ANY OF OUR COMMON STOCK. IF ANY OF THESE RISKS OR UNCERTAINTIES ACTUALLY OCCURS, OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATIONS COULD BE MATERIALLY ADVERSELY AFFECTED, AND YOU COULD LOSE ALL OR PART OF YOUR INVESTMENT.

RISKS CONCERNING OUR BUSINESS

RISKS CONCERNING OUR BUSINESS

OUR RELATIONSHIP WITH DUKE ENERGY IS MATERIAL TO OUR SUCCESS, AND THE TERMINATION OF SUCH RELATIONSHIP FOR ANY REASON WILL ADVERSELY AFFECT OUR OPERATIONS AND PROSPECTS.

Our immediate business opportunities continue to be largely dependent on the success of our deployments, and the future decisions of Duke Energy relating to smart grid system architecture, and the Ambient fourth generation Node. We are focusing much of our time, attention and resources on the rollout of the equipment and software delivered to Duke Energy. The success of our endeavors with respect to the deployment is subject to several risks. These risks include our dependence on third parties to deliver and support reliable components to manufacture and assemble our end products, and our dependence on our engineering team to continue to advance our software products.

If we are unable to effectively manage and maintain our relationship with Duke Energy, our business could be materially and adversely affected in its ability to continue, and our operations could be jeopardized.

We will need to secure additional firm purchase orders from Duke Energy or enter into additional contracts with other utilities to be able to continue our operations in the future, and there is no assurance that other utilities will adopt our smart grid technology or contract with us to provide our services to them. Further, no assurance can be provided that Duke Energy will purchase or deploy our new generation nodes that are currently under development.

WE CURRENTLY DEPEND ON ONE KEY CUSTOMER FOR All OUR REVENUE, AND THE LOSS OF, OR A SIGNIFICANT SHORTFALL IN ORDERS FROM, THIS KEY CUSTOMER COULD SIGNIFICANTLY REDUCE OUR REVENUE.

For the years ended December 31, 2009 and 2008, 100% of our revenue was from Duke Energy. Our inability to generate additional anticipated revenue from our key customer, or a significant shortfall in sales will likely significantly reduce our revenue and adversely affect our business. Our operating results in the foreseeable future continue to depend on our ability to further our deployments with our existing customer, and our ability to affect deployments with our existing utility.

THE PACE AND PROGRESS OF FEDERAL INITIATIVES IN THE SMART GRID AREA, MAY AFFECT PURCHASING DECISION BY UTILITIES AND THEREBY ADVERSELY AFFECT OUR BUSINESS OPERATIONS.

The promise of funding from the federal government, provided by the American Reinvestment and Recovery Act, minimized much of the risk associated with adoption of new technology and encouraged utilities considering smart grid deployments to actively develop deployment plans. While the intent of the American Reinvestment and Recovery Act was to boost the fledgling industry, in 2009, the lack of available federal funds unexpectedly resulted in a slowing of anticipated deployments while the Department of Energy transformed the ARRA mandates into workable programs. Accordingly, any further significant delay in utilities reaching agreement with the terms of the grant awards may affect utilities' decision process as it relates to the timing of deployment of smart grid technologies. All of these factors could materially adv ersely affect our business and prospects.

WE HAVE CONTRACTED WITH ONE SUPPLIER TO MANUFACTURE OUR NODES

In both 2009 and 2008, we used one contract manufacturer to produce our nodes. Should our relationship with the manufacturer deteriorate or terminate or should this supplier lose some or all of its access to the products or components that comprise all or part of the nodes that we purchase from it our performance could be adversely affected. Under such circumstances, we would be required to seek alternative sources of supply for these products, and there can be no assurance that we would be able to obtain such products from alternative sources on the same terms. A failure to obtain such products on as favorable terms could have an adverse effect on our revenue and/or gross margin.

FUTURE ECONOMIC CONDITIONS IN THE U.S. AND GLOBAL MARKETS MAY HAVE A MATERIAL ADVERSE IMPACT ON OUR BUSINESS AND FINANCIAL CONDITION THAT WE CURRENTLY CANNOT PREDICT.

The U.S. and other global world economies are slowly recovering from a recession that began in 2008 and extended into 2009. Although economic growth has resumed, it remains modest and the timing of an economic recovery is uncertain. There are likely to be significant long-term effects resulting from the recession and credit market crisis, including a future global economic growth rate that is slower than what was experienced in recent years. Unemployment rates remain high and businesses and consumer confidence levels have not yet fully recovered to pre-recession levels. In addition, more volatility may occur before a sustainable, yet lower, growth rate is achieved. This could result in reductions in sales of our products and services, slower adoption of new technologies and increase price competition. Any of these events would likely harm our business, results of operations and financial conditions.

IF WE ARE UNABLE TO OBTAIN ADDITIONAL FUNDS WHEN NEEDED, WE MAY NOT BE ABLE TO EXPAND EXISTING COMMERCIAL DEPLOYMENTS.

Management believes that we will be able to meet our operating requirements for the balance of 2010. This is based on the value of our currently available cash resources, the committed equity based financing arrangement discussed in Note 9 to our financial statements, and anticipated revenues. However, we may need to raise funds in order to expand existing commercial deployments and otherwise grow our operations to meet the demands associated with any additional significant purchase orders. There are no assurances that we will be successful in obtaining additional required capital if or when needed.

OTHERS MAY CHALLENGE OUR INTELLECTUAL PROPERTY RIGHTS WHICH MAY NEGATIVELY IMPACT OUR COMPETITIVE POSITION

Our portfolio includes twenty-three patents issued or allowed by the USPTO primarily relating to coupling technology, and we have several pending patent applications in the United States and in other jurisdictions. We have filed with the United States Patent and Trademark Office ("USPTO"), and with the appropriate agencies in foreign countries and other jurisdictions, patent applications with respect to various aspects and applications of our smart grid technology including the Energy Sensing portion of Ambient Smart Grid®.

Although we rely on a combination of patents, copyrights, trade secrets, nondisclosure and other contractual provisions and technical measures to protect our intellectual property rights, it is possible that our rights relating to Ambient’s Smart Grid™ solution may be challenged and invalidated or circumvented. Further, effective intellectual property protection may be unavailable or limited. Despite efforts to protect our proprietary rights, unauthorized parties may attempt to copy, reverse engineer, or otherwise use aspects of processes and devices that we may regard as proprietary. Policing unauthorized use of proprietary information is difficult, and there can be no assurance that the steps we have taken will prevent misappropriation of our technologies. In the event that our intellectual property protection is insufficie nt to protect our intellectual property rights, we could face increased competition in the market for technologies, which could have a material adverse effect on our business, financial condition and results of operations.

OTHER COMPANIES MAY DEVELOP AND SELL COMPETING PRODUCTS THAT MAY REDUCE THE SALES OF OUR PRODUCTS OR RENDER OUR PRODUCTS OBSOLETE.

The smart grid communications marketplace is rapidly evolving and therefore has rapidly changing technological, regulatory and consumer requirements. We will need to continue to maintain and improve our competitive position to keep pace with the evolving needs of our customers, and continue to develop and introduce new products, features and services in a timely and efficient manner.

Our competitors include both small companies and some of the largest companies in the electronics industry, operating either alone or together with trade associations and partners. There can be no assurance that other companies will not develop products that compete with our products in the future.

Some of our potential competitors have longer operating histories, greater name recognition, and substantially greater financial, technical, sales, marketing and other resources than our Company. These potential competitors may, among other things, undertake more extensive marketing campaigns, adopt more aggressive pricing policies, obtain more favorable pricing from suppliers and manufacturers and exert more influence on the sales channel than we do. As a result, we may not be able to compete successfully with these potential competitors, and these potential competitors may develop or market technologies and products that are more widely accepted than those we are developing or that would render our products obsolete or noncompetitive.

WE HAVE A HISTORY OF LOSSES, AND WE EXPECT THESE LOSSES TO CONTINUE INTO 2010.

We are a company engaged in the design, development and marketing of our smart grid communication technology and solutions. We incurred net losses of $14,246,284 and $11,294,199 for the years ended December 31, 2009 and 2008, respectively.

We expect to continue to incur net losses as we further develop, test, and market Ambient Smart Grid® technology. Our ability to generate and sustain significant additional revenues or achieve profitability will depend upon the factors discussed elsewhere in this "Risk Factors" section. There are no assurances that we will achieve or sustain profitability, or that our operating losses will not increase in the future. If we do achieve profitability, we cannot be certain that we can sustain or increase profitability on a quarterly or annual basis in the future.

IF WE ARE UNABLE TO SATISFY THE REQUIREMENTS OF SECTION 404 OF THE SARBANES-OXLEY ACT, OR OUR INTERNAL CONTROL OVER FINANCIAL REPORTING IS NOT EFFECTIVE, THE RELIABILITY OF OUR FINANCIAL STATEMENTS MAY BE QUESTIONED AND OUR SHARE PRICE MAY SUFFER.

Section 404 of the Sarbanes-Oxley Act requires any company subject to the reporting requirements of the U.S. securities laws to do a comprehensive evaluation of its internal control over financial reporting. Our independent auditors will be required to issue an opinion on the effectiveness of our internal control over financial reporting for our annual report on Form 10-K for our fiscal year ending December 31, 2010. The rules governing the standards that must be met for management to assess our internal controls over financial reporting are complex and require significant documentation, testing and possible remediation to meet the detailed standards under the rules. It is possible that we could discover certain deficiencies in the design and/or operation of our inte rnal controls that could adversely affect our ability to record, process, summarize and report financial data. We have invested and will continue to invest significant resources in this process. We are uncertain as to what impact a conclusion that deficiencies exist in our internal control over financial reporting would have on the trading price of our common stock.

RISKS CONCERNING OUR CAPITAL STRUCTURE

VICIS CAPITAL MASTER FUND OWNS A MAJORITY OF AMBIENT’S ISSUED AND OUTSTANDING COMMON STOCK AND WILL THUS BE ABLE TO CONTROL THE OUTCOME OF ALL ISSUES SUBMITTED TO OUR STOCKHOLDERS.

Vicis holds, as of April 29, 2010, approximately 83.62% of our issued and outstanding common stock. As a result, Vicis is able to control the outcome of all issues submitted to our stockholders, including the election of all of our directors, the appointment of new management and the approval of any other action requiring the approval of our stockholders, including any amendments to our certificate of incorporation, a sale of all or substantially all of our assets or a merger or a going private transaction. A principal of Vicis also is a member of our board of directors.

FUTURE SALES OF COMMON STOCK OR OTHER DILUTIVE EVENTS MAY ADVERSELY AFFECT PREVAILING MARKET PRICES FOR OUR COMMON STOCK.

As of April 29, 2010, we were authorized to issue up to 2,000,000,000 shares of common stock, of which 1,587,790,354 shares were outstanding. As of April 29, 2010, an additional 232,017,931 shares of common stock were reserved for the exercise of outstanding options and warrants to purchase common stock and the reservations of shares in the various stock option plans. Many of the above options and warrants contain provisions that require the issuance of increased numbers of shares of common stock in the event of stock splits, redemptions, mergers and other transactions. The occurrence of any such event or the exercise of any of these options or warrants would dilute the interest in our company represented by each share of common stock and may adversely affect the prevailing market price of our common stock.

Additionally, our board of directors has the authority, without further action or vote of our stockholders, to issue authorized shares of our common stock that are not reserved for issuance. In addition, in order to raise the amount of capital that we need at the current market price of our common stock, we may need to issue a significant number of shares of common stock (or securities that are convertible into or exercisable for a significant number of shares of our common stock).

Any of these issuances will dilute the percentage ownership interests of our current stockholders, which will have the effect of reducing their influence on matters on which our stockholders vote, and might dilute the book value and market value of our common stock. Our stockholders may incur additional dilution upon the exercise of currently outstanding or subsequently granted options or warrants to purchase shares of our common stock.

OUR STOCK PRICE MAY BE VOLATILE.

The market price of our common stock will likely fluctuate significantly in response to the following factors, some of which are beyond our control:

| ● | Announcements by us of commencement of, changes to, or cancellation of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| ● | Changes in financial estimates of our revenues and operating results by securities analysts or investors; |

| ● | Variations in our quarterly operating results due to a number of factors, including but not limited to those identified in this "RISK FACTORS" section; |

| ● | Additions or departures of key personnel; |

| ● | Future sales of our common stock; |

| ● | Stock market price and volume fluctuations attributable to inconsistent trading volume levels of our stock; |

| ● | Commencement of or involvement in litigation; and/or |

| ● | Announcements by us, or by our competitors of technological innovations or new products. |

In addition, the equity markets have experienced volatility that has particularly affected the market prices of equity securities issued by high technology companies. This volatility often has been unrelated or disproportionate to the operating results of those companies. These broad market fluctuations may adversely affect the market price of our common stock.

PENNY STOCK REGULATIONS ARE APPLICABLE TO INVESTMENT IN SHARES OF OUR COMMON STOCK.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges, provided that current prices and volume information with respect to transactions in such securities are provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salespe rson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to penny stock rules. Many brokers will not deal with penny stocks, restricting the market for our shares of common stock.

BECAUSE WE DO NOT INTEND TO PAY ANY CASH DIVIDENDS ON OUR SHARES OF COMMON STOCK, OUR STOCKHOLDERS WILL NOT BE ABLE TO RECEIVE A RETURN ON THEIR SHARES UNLESS THEY SELL THEM.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains some "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and information relating to us that are based on the beliefs of our management, as well as assumptions made by and the information currently available to our management. When used in this Prospectus, the words "estimate," "project," "believe," "anticipate," "intend," "expect" and similar expressions are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated in these forward-looking statements, including those risks discussed in this Prospectus.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Prospectus. Except for special circumstances in which a duty to update arises when prior disclosure becomes materially misleading in light of subsequent circumstances, we do not intend to update any of these forward-looking statements to reflect events or circumstances after the date of this Prospectus or to reflect the occurrence of unanticipated events.

USE OF PROCEEDS

The selling stockholders will receive the net proceeds from sales of the shares of Common Stock included in this Prospectus. We will not receive any proceeds from the sale of Common Stock by the selling stockholders. We would, however, receive proceeds from the exercise of the Retainer Warrants and Placement Agent Warrants to purchase up to 38,533,831 shares of Common Stock that are held by the selling stockholders, to the extent such warrants are exercised for cash. If the warrants are exercised on a cashless basis, we will not receive proceeds from those exercises.

The selling stockholders are not obligated to exercise these warrants, and there can be no assurance that they will do so. If all of these warrants were exercised for cash, we would receive proceeds of approximately $1.35 million. Any proceeds we receive from the exercise of these options and warrants will be used for working capital and general corporate purposes.

AGREEMENTS WITH THE SELLING STOCKHOLDERS

Between July 31, 2007 and January 15, 2008, we raised gross proceeds of $12,500,000 from the private placement of our three year 8% Secured Convertible Promissory Note to Vicis Master Fund Ltd. On April 23, 2008, we raised from Vicis $3,000,000 from the issuance of warrants, exercisable through April 2013, to purchase up to 135,000,000 shares of our Common Stock at a per share exercise price of $0.001. Finally, on November 21, 2008, we and Vicis entered into an agreement, pursuant to which Vicis invested in us an additional $8 million, in consideration of which we reduced the conversion price on the above referenced notes.

In January 2007, we and Kuhns Brothers (“Kuhns”), an investment firm and a registered broker dealer, entered into a placement agency agreement pursuant to which Kuhns provided to us investment banking services. In connection with the entry into the placement agency agreement, we issued to Kuhns warrants to purchase up 750,000 shares of our Common Stock (the “Retainer Warrants”). Thereafter, in connection with the above referenced transactions, we paid to Kuhns, an investment firm and a registered broker dealer which served as placement agent for the above transactions, a cash fee of $615,000 and we issued, between July 31, 2007 and November 21, 2008 warrants to purchase up to 45,016,665 shares of our Common Stock (the “Placement Warrants”; together with the Retainer Warran ts, the “Placement Agent Warrants”). Of the Placement Warrants issued, warrants for 7,619,047 shares were issued in lieu of the payment of a cash fee of $300,000. The registration statements of which this prospectus forms a part was filed in order to register for resale the shares of Common Stock underlying the Placement Agent Warrants held by Kuhns or its designees, except for warrants for 1,383,334 shares.

The Retainer warrants first became exercisable on January 31, 2008 and are exercisable through January 30, 2012 at a per share exercise price of $0.075. The Placement Warrants are exercisable at a share price of $0.035. Of the Placement Warrants, warrants for 16,600,000 shares are exercisable through July 30, 2012, warrants for 11,666,666 are exercisable through November 1, 2012, warrants for 14,999,999 are exercisable through January 14, 2013, and warrants for 1,000,000 shares are exercisable through April 23, 2013. As of April 23, 2010, Placement Warrants exercisable through July 30, 2012, were exercised for an aggregate of 5,814,500 shares of the Company's Common Stock. The exercise price for the Placement Agent Warrants is subject to adjustment if there are certain capital adjustments or simila r transactions, such as a stock split or merger. Placement Agent Warrants for fifty percent of the shares contain provisions providing the holders thereof with the right to exercise the Warrants on a "cashless" basis after the first anniversary of issuance if the Registration Statement is not in effect at the time of exercise. If the holder elects the cashless exercise option, it will receive a lesser number of shares and we will not receive any cash proceeds from that exercise. The lesser number of shares which the holder will receive is determined by a formula that takes into account the closing bid price of our Common Stock on the trading day immediately before the Warrant exercise. That closing price is multiplied by the full number of shares for which the Warrant is then being exercised. That result is reduced by the total exercise price the holder would have paid for those shares if it had not elected a cashless exercise. The number of shares actually issued under the cashless exercise option is equal to the balance amount divided by the closing price referred to above. We are filing the Registration Statement so that we can receive cash proceeds upon any exercise of the Placement Warrants.

The Placement Agent Warrants provide that the beneficial owner can exercise such warrant in accordance with their respective terms by giving notice to us. However, the holder may not exercise its Warrant to the extent that such exercise would result in such owner and its affiliates beneficially owning more than 4.99% of our stock then outstanding (after taking into account the shares of our Common Stock issuable upon such conversion or warrant exercise). If the holder then disposes of some or all of its holdings, it can again convert its debentures or exercise its warrant.

DIVIDEND POLICY

We have paid no dividends on our Common Stock and do not expect to pay cash dividends in the foreseeable future. It is the present policy of our board of directors to retain all earnings to provide funds for the growth of the Company. The declaration and payment of dividends in the future will be determined by our board of directors based upon our earnings, financial condition, capital requirements and such other factors as our board of directors may deem relevant. We are not under any contractual restriction as to present or future ability to pay dividends. MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our Common Stock is quoted on the OTC Bulletin Board under the symbol "ABTG". Although trading in our Common Stock has occurred on a relatively consistent basis, the volume of shares traded has been sporadic.

| | | Low | | | High | |

Year Ending December 31, 2010 | | | | | | |

| First Quarter | | $ | 0.102 | | | $ | 0.165 | |

| | | | | | | | | |

| Year Ended December 31, 2009 | | | | | | | | |

| First Quarter | | $ | 0.02 | | | $ | 0.101 | |

| Second Quarter | | $ | 0.091 | | | $ | 0.198 | |

| Third Quarter | | $ | 0.14 | | | $ | 0.183 | |

| Fourth Quarter | | $ | 0.13 | | | $ | 0.25 | |

| | | | | | | | | |

| Year Ended December 31, 2008 | | | | | | | | |

| First Quarter | | $ | 0.03 | | | $ | 0.045 | |

| Second Quarter | | $ | 0.03 | | | $ | 0.06 | |

| Third Quarter | | $ | 0.027 | | | $ | 0.036 | |

| Fourth Quarter | | $ | 0.011 | | | $ | 0.03 | |

| | | | | | | | | |

As of April 29, 2010, there were 152 holders of record of our Common Stock. A significant number of shares of our Common Stock are held in either nominee name or street name brokerage accounts and, consequently, we are unable to determine the number of beneficial owners of our stock.

MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

THE FOLLOWING DISCUSSION SHOULD BE READ IN CONJUNCTION WITH OUR FINANCIAL STATEMENTS AND THE NOTES RELATED TO THOSE STATEMENTS. SOME OF OUR DISCUSSION IS FORWARD-LOOKING AND INVOLVES RISKS AND UNCERTAINTIES. FOR INFORMATION REGARDING RISK FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, REFER TO THE “RISK FACTORS” SECTION OF THIS ANNUAL REPORT.

OVERVIEW

Ambient is a pioneering integrator of smart grid communications platforms, creating high-speed Internet Protocols (IP)-based data communications networks over existing medium and low-voltage distribution grids, thereby enabling smart grid applications. The Ambient smart grid platform, known as Ambient Smart Grid®, facilitates a two-way, real-time communications network to serve the “last mile” backhaul necessary for utilities to implement smart grid applications such as Advanced Metering Infrastructures (AMI), real-time pricing, Demand Side Management (DSM), Distribution Monitoring and Automation, direct load control and more. When combined, these applications can offer economic, operational and environmental benefits for utilities, and ultimately the utility’s customers.

Ambient has been focused, since 2000, on the collaborative development of communication solutions that meets the needs of smart grid platforms. From inception, Ambient’s platform, which includes, Nodes, Management Systems and a suite of applications, has been architected to be an open, standards based system intended to support a variety of applications and services simultaneously. Over the years, Ambient has developed and shipped three generations of communications nodes. With each successive generation, Ambient has continued to support and integrate more applications while driving the price lower. Ambient began working on its fourth generation of the communications node during the summer of 2009, and anticipates prototypes being available for testing during the second quarter of 2010.

Throughout the past four years, Ambient has been a supplier to Duke Energy’s smart grid initiatives. In 2008, Ambient received purchase orders from Duke Energy to purchase its X2000 and X-3000 communications nodes, license its AmbientNMS®, and acquire engineering support in building out an intelligent grid/intelligent-metering platform, which generated approximately $12.6 million in revenues. In 2009, Ambient generated approximately $2.2 million in revenues from the sale of the X-3000 and X-3100 communication nodes, software licenses and support. In September 2009, we entered into a long-term agreement to supply Ambient’s X-3100 for deployment throughout the utility’s electric power distribution grid. Under the terms of the agreement, we have, to date, received purchase orders for product to be delivered through third quarter of 2010, amounting to approximately $10.0 million.

Our goal remains to be the leading designer, developer and systems integrator of a turnkey Ambient Smart Grid® communications platform, incorporating a wide array of communications protocols and smart grid applications such as advanced metering solutions to complement our internally developed energy sensing capabilities. We view the smart grid communications platform to be a key factor for utilities to efficiently integrate increasing portfolios of renewable energy generation into the electrical grid.

Ambient intends to actively seek new opportunities for commercial deployments and to bring new and existing networks to full commercialization. Throughout 2010, Ambient’s principal target customers will continue to be electric utilities, primarily in North America that will be deploying the smart grid technologies. Ambient intends to collaborate with other technology companies and utility customers to drive the development of new utility and consumer applications that create the need for its Ambient Smart Grid® platform.

To date, we have funded operations primarily through the sale of our securities. In connection with the continued development and upgrade, marketing, and deployment of our products, technology, and services, we anticipate that we will continue to augment our revenue generation capabilities with such capital raises in the future, and anticipate that we will continue to incur losses during 2010.

Prospects and Outlook

Our business success in the immediate future will largely depend on the expansion by our key customer of their existing deployments, as well as the deployment decisions of other utilities. Today, Ambient is reliant on one significant marquee customer that shares the Ambient vision for an open standard-based common communication infrastructure. We anticipate that we will continue to collaborate with this customer and continue to support their smart grid deployments. In September 2009, Ambient and this customer entered into a long-term agreement to supply Ambient’s latest X-series smart grid nodes, the X-3100 for deployment throughout the utility’s electric power distribution grid. Under the terms of the agreement, we have, to date, received purchase orders for product to be delivered through third quarter o f 2010, amounting to approximately $10.0 million. Notwithstanding the above, Ambient recognizes that our customer could alter its vision regarding the common communication infrastructure, determine that a competing company offers a more desirable product, or slow its deployments indefinitely, significantly affecting the prospects and outlook of the Company.

As we demonstrate success over the coming months, we believe that additional utilities will begin to accept and endorse the concept of one common communication infrastructure to support many utility and consumer applications strengthening Ambient’s position. However, no assurance can be given that this development will in fact ultimately occur and even if it does that Ambient will be their choice technology.

Additionally, the time lag from the issuance of the federal mandate to assist the deployment of the smart grid to the development of workable programs to support such mandates is likely to have affected, and will continue to affect, the decision process of utilities as to the deployment and expansion of smart grid projects. In turn, these developments are likely to affect the cash flow that we are able to generate from purchase orders for Ambient Smart Grid® technologies.

As further clarity is achieved on both the federal and state levels relating to funding, standards, and the ability to receive regulatory approval from individual state regulators for smart grid deployments, we believe that the prospects for additional smart grid deployments should increase though no assurance can of course be provided that this will in fact occur. RESULTS OF OPERATIONS

COMPARISON OF THE YEAR ENDED DECEMBER 31, 2009 (the “2009 Period”) AND THE YEAR ENDED DECEMBER 31, 2008 (the “2008 Period”)

REVENUES. Revenues for the 2009 Period were $2,193,338, compared to $12,622,353, for the 2008 Period. Revenues for the 2009 Period were attributable to the sales of equipment, software and services to Duke Energy. Revenues for the 2008 period were attributable to the sales of equipment and software to Duke Energy. Revenues for the 2009 and 2008 Periods related to the sales of equipment totaled $2,127,977 and $12,136,283, respectively. Revenues from the sale of software and services for the 2009 Period and the 2008 Period totaled $65,361 and $486,070, respectively. During the fourth quarter of 2009 and first quarter of 2010, we received new purchase orders for approximately $10 million for our third generation X-node product base. These purchase orders resulted in recorded hardware revenues of approximately $1.3 million for the year ended December 31, 2009. We intend to fulfill the remainder of the purchase orders by third quarter of 2010.

The decline in firm purchase orders received from our customer accounted for the decline in revenues during the 2009 Period as compared to the 2008 Period. Numerous factors contributed to the decline, including the uncertainty of the amount and timing of any federal grant funding by our major customer and uncertainty and delay of state regulatory approvals related to smart grid deployments. We are positioned to fulfill the purchase orders received to date.

COST OF GOODS SOLD. Cost of goods sold for the 2009 Period was $1,836,546 compared to $9,942,009 for the 2008 Period. Cost of goods sold included all costs related to manufacturing and selling products and services and consisted primarily of direct material costs. Cost of goods sold also included expenses related to the write down of inventory to the lower of cost or market. For the 2009 and 2008 Periods, cost of goods sold included an inventory write-off of $151,689 and $481,860 respectively for excess, obsolete, and surplus inventory resulting from the transition from second to third generation technology. The decrease in cost of goods sold during the 2009 Period was due to the decrease in sales as discussed above in REVENUES.

GROSS PROFIT. Gross profits for the 2009 Period was $356,792 compared to $2,680,344 for the 2008 Period. The gross profit on hardware sales amounted to $291,431 during the 2009 Period compared to $2,194,274 in the 2008 Period. Our overall gross margins also decreased from 21% in 2008 compared to 16% in 2009. The decrease in gross margin percentage in the 2009 Period as compared to the 2008 Period was primarily due to changes to our products, associated cost of our older generation Nodes, and inventory markdown having a greater impact in the 2009 Period than in the 2008 Period.

RESEARCH AND DEVELOPMENT EXPENSES. Research and development expenses consisted of expenses incurred primarily in designing, developing and field testing our smart grid solutions. These expenses consisted primarily of salaries and related expenses for personnel, contract design and testing services, supplies used and consulting and license fees paid to third parties. Research and development expenses were approximately $4.6 million for the 2009 Period compared to $4.2 million for 2008 Period. The increase in research and development during the 2009 Period was due primarily to the increase in personnel and consultants for the development of our X-3100 Node, as we ready it for commercialization. We expect that our research and development expenses will increase over the next twelve months as we continue to focus our eff orts on developing more robust solutions and additional value-added functionality for the Ambient Smart Grid® communication platforms.

OPERATING, GENERAL AND ADMINISTRATIVE EXPENSES. Operating, general and administrative expenses consisted primarily of salaries and other related costs for personnel in executive and other functions. Other significant costs included insurance and professional fees for legal, accounting and other services. General and administrative expenses for the 2009 Period were approximately $4.1 million compared to $3.4 million for the 2008 Period. The increase in operating, general and administrative expenses was due to the increase in efforts to market and commercialize the Ambient Smart Grid ® communication platforms. As we continue to increase our efforts to market and commercialize the Ambient Smart Grid ® com munication platforms, over the next twelve months, we expect our operating, general and administrative expenses to increase during that time.

STOCK BASED COMPENSATION. A portion of our operating expenses was attributable to non-cash charges associated with the compensation of consultants and employees through the issuance of stock options and stock grants. Stock-based compensation is non-cash and will therefore have no impact on our cash flows or liquidity. For the 2009 Period, we incurred non-cash stock based compensation expense of $967,301 compared to $329,320 for the 2008 Period.

INTEREST AND FINANCE EXPENSES. For the 2009 Period and 2008 Period, interest expense totaled $4,992,827 and $3,155,815, respectively. Interest totaling $617,060 for the 2009 period and $673,527 for the 2008 Period related primarily to our 8% Secured Convertible Promissory Notes, which were issued in July and November of 2007 and January 2008, and our 8% Convertible Debentures, which were issued in May 2006 and were retired in their entirety as of January 2, 2008. Additionally, for the 2009 Period and 2008 Period, we incurred non-cash interest of $3,228,600 and $2,482,288, respectively. This interest related to the amortization of the beneficial conversion features and deferred financing costs incurred in connection with the placement of our convertible debentures and notes. These costs are amortized to the d ate of maturity of the debt unless converted earlier. In addition, on June 30, 2009, we agreed to modify the terms of the expiring Class A warrants. Under the new terms the warrants were exercisable through August 31, 2009 and the exercise prices were reduced from $0.20 to $0.15 per share. The resulting charge due to the modification was $1,147,167 and was reflected as additional interest expense.

LOSS ON EXTINGUISHMENT OF DEBT. We accounted for the modification in November 2008 of the convertible promissory notes that we issued to Vicis between July 2007 and January 2008 as an extinguishment of debt. We deemed the terms of the amendment to be substantially different and treated the notes as extinguished and exchanged for new notes. As such, it was necessary to reflect the convertible promissory notes at fair market value and record a loss on extinguishment of debt of approximately $2.8 million. See Note 8 of the financial statements for a more detailed discussion.

LIQUIDITY AND CAPITAL RESOURCES

Management believes that cash on hand, the $6.0 million remaining from our equity based financing arrangement plus anticipated short term revenue, will allow us to meet our operating requirements for fiscal year 2010. However, we may need to raise funds in order to allow for shortfalls in anticipated revenue, or to expand existing commercial deployments and/or to satisfy any additional significant purchase order that we may receive. At the present time, we have no assurances of additional revenue beyond the firm purchase orders we have received from our largest customer, nor do we have commitments for additional funding beyond the committed equity based financing arrangement described below.

Cash balances totaled $987,010 at December 31, 2009 and $8,011,764 at December 31, 2008. As of April 29, 2010, we have approximately $1,564,882 cash on hand.

From inception through December 31, 2009, we have funded our operations primarily through the issuance of our securities. Our recent financings are discussed below.

Net cash used in operating activities during the year ended December 31, 2009 was approximately $7.7 million and was used primarily to pay ongoing research and development and operating, general and administrative expenses.

Net cash used in investing activities during the year ended December 31, 2009 was approximately $268,969 and was for the redemption of marketable securities of $125,000, and net of purchases and proceeds from sale of property and equipment of $393,969.

Net cash provided by financing activities during the year ended December 31, 2009 was approximately $964,492, and represented the exercise of warrants and the payments on capitalized lease obligations.

Our recent financing transactions are discussed below.

In July 2007, November 2007 and January 2008, we entered into Securities Purchase Agreements with an institutional investor, Vicis Capital Master Fund ("Vicis"), and raised gross proceeds of $12.5 million. The notes (the “Vicis Notes”) issued under the Securities Purchase Agreements had a term of three years and were payable between July 2010 and January 2011. The outstanding principal amounts of the notes were convertible at the option of Vicis into shares of Common Stock at an original conversion price of $0.035 per share, subject to certain adjustments. As discussed below, in November 2008, the conversion rate was reduced to the current rate of $0.015 per shares, subject to certain adjustments. On August 10, 2009, Vicis converted $2.5 million of the Vicis Notes into 166,666 ,667 shares of our common stock. On January 21, 2010, Vicis converted the remaining $10 million balance into 666,666,667 shares of our common stock. Following the conversion of the Debentures, we no longer have any long-term debt.

On April 23, 2008, we raised $3,000,000 from Vicis from the issuance of warrants, exercisable through April 2013, to purchase up to 135,000,000 shares of our Common Stock at a per share exercise price of $0.001. On November 21, 2008, we and Vicis entered into a Debenture Amendment Agreement (the “Debenture Amendment Agreement”), pursuant to which Vicis invested in the Company an additional $8,000,000. In consideration of Vicis’ investment, we reduced the conversion price on the Vicis Notes from $0.035 per share to $0.015 per share. The parties also agreed under the Debenture Amendment Agreement that, in the event that on the trading day immediately preceding June 1, 2009, the closing per share price of our common stock was less than $0.10, then the per share conversion price with respect to any amoun t then outstanding under the Notes would automatically be further adjusted to $0.01. The price of the Common Stock was greater than $0.10 on the trading day immediately preceding June 1, 2009, and therefore no adjustment was made.

On June 30, 2009, the Company extended the terms of the expiring Class A warrants (See note 9 of the consolidated financial statements). For the period from July 1, 2009 to August 31, 2009, we received net proceeds of $848,250 for the exercise of 6,283,333 Class A warrants.

Finally, on November 13, 2009, we and Vicis entered into an agreement pursuant to which Vicis furnished to us access to a $3,000,000 equity based credit line. Pursuant to the arrangement, Vicis established an escrow account into which it deposited $3,000,000. From time to time as our cash resources fall below $1,500,000, we are entitled to receive $500,000 from the account in consideration of which we initially agreed to issue to Vicis 3,333,333 shares of our common stock as well as warrants for a corresponding number of shares. On January 15, 2010, we and Vicis entered into an amendment to the arrangement described above pursuant to which Vicis deposited an additional $5 million into the Escrow Account such that the total amount in the escrow account, prior to any drawdown by us, will be $8,000,000. In consideration of Vicis’ increase of the Escrow Account and its agreement to convert the Vicis Notes, we agreed that upon each drawdown from the escrow account, which is required to be in the amount of $500,000, we will issue to Vicis 5,000,000 shares of Common Stock and warrants for a corresponding number of shares of Common Stock. Between January 19 and April 12, 2010, we effected four draw-downs in the amount of the $2,000,000. Ambient may draw down on the escrow account as needed until the entire $8,000,000 is exhausted. The arrangement terminates on June 30, 2011, unless the parties elect to extend it by mutual agreement. The Warrants are exercisable through the second anniversary of issuance at a per share exercise price of $0.25.

Between January 19 and April 12, 2010, we effected four draw-downs in the amount of the $2,000,000. Ambient may draw down on the escrow account as needed until the entire $8,000,000 is exhausted. The arrangement terminates on June 30, 2011, unless the parties elect to extend it by mutual agreement .

CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to revenue recognition, bad debts, investments, intangible assets and income taxes. Our estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates.

We have identified the accounting policies below as critical to our business operations and the understanding of our results of operations.

REVENUE RECOGNITION. Hardware sales consist of smart grid nodes ("Nodes") and system software embedded in the nodes. System software embedded in Ambient’s Nodes is used solely in connection with the operation of the product. Upon the sale and shipment of its product, Ambient is not required to update the embedded software for newer versions that are subsequently developed. In addition, the Company does not offer or provide any free post-contract customer support. There is an original warranty period, which may run for a period of up to twelve months from sale of product, in which the Company will provide fixes for the Nodes when and if appropriate. As such, we recognize revenue from the sales of the Nodes when shipped. Amounts billed to custome rs before the Nodes are shipped are classified as deferred revenue.

The Company’s other proprietary software consists of the Ambient NMS®, an element management product that may be sold on a stand-alone basis. A purchaser of Ambient’s Nodes is not required to purchase this product, as our Nodes could be managed with independently developed management software. The sale of the Ambient NMS® does not include post-contract customer support, unless the customer enters into a maintenance agreement with the Company. As such, Ambient recognizes revenue from the sale of this software product when shipped. Amounts billed to customers before software is shipped are classified as deferred revenue.

The Company offers maintenance service, on a fee basis that entitles the purchasers of its Nodes and NMS® software to benefits including telephone support, as well as updates and upgrades to our products. Such revenue, when received, will be amortized over the appropriate period based on the terms of individual agreements and contracts.

INVENTORY VALUATION. Inventory is valued at the lower of cost or market determined on the first-in, first-out (FIFO) basis. Market, with respect to direct materials, is replacement cost and is net realizable value for work-in-process and finished goods. The value of the inventory is adjusted for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated market value based upon assumptions about future demand and market conditions.

SOFTWARE DEVELOPMENT COSTS. Costs incurred in the research and development of new software products and enhancements to existing software products have historically been expensed as incurred. After technological feasibility is established, additional development costs are capitalized. No software development costs have been capitalized as of December 31, 2009 and 2008.

STOCK-BASED COMPENSATION. The Company accounts for stock-based compensation in accordance with accounting guidance now codified as Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 718, “Compensation – Stock Compensation.” Under the fair value recognition provision of ASC 718 stock-based compensation cost is estimated at the grant date based on the fair value of the award. The Company estimates the fair value of stock options granted using the Black-Scholes option pricing model.

DEFERRED INCOME TAXES. Deferred income taxes are recognized for the tax consequences of "temporary differences" by applying enacted statutory rates applicable to future years to differences between the financial statement carrying amounts and the tax basis of existing assets and liabilities. At December 31, 2009, our deferred income tax assets consisted primarily of net operating loss carry forwards and stock based compensation charges which have been fully offset with a valuation allowance due to the uncertainty that a tax benefit will be realized from the assets in the future.

WARRANTIES. The Company accounts for its warranties under the FASB ASC 450 “Contingencies.”. The Company generally warrants that its products are free from defects in material and workmanship for a period of one year from the date of initial acceptance by our customers. The warranty does not cover any losses or damage that occurs as a result of improper installation, misuse or neglect or repair or modification by anyone other than the Company or its authorized repair agent. The Company's policy is to accrue anticipated warranty costs based upon historical percentages of items returned for repair within one year of the initial sale. The Company’s repair rate of products under warranty has been minimal, and a historical percentage has not been established. The Company has not provided for any reserves for such warranty liability.

The Company’s software license agreements generally include certain provisions for indemnifying customers against liabilities if the Company's software products infringe upon a third party's intellectual property rights. The Company has not provided for any reserves for such warranty liabilities.

The Company’s software license agreements also generally include a warranty that the Company's software products will substantially operate as described in the applicable program documentation. The Company also warrants that services the Company performs will be provided in a manner consistent with industry standards. To date, the Company has not incurred any material costs associated with these product and service performance warranties, and as such the Company has not provided for any reserves for any such warranty liabilities in its operating results.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Effective July 1, 2009, the Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification ("ASC") became the single official source of authoritative, nongovernmental generally accepted accounting principles (“GAAP”) in the United States. The historical GAAP hierarchy was eliminated and the ASC became the only level of authoritative GAAP, other than guidance issued by the Securities and Exchange Commission. Our accounting policies were not affected by the conversion to ASC. However, references to specific accounting standards in the footnotes to our consolidated financial statements have been changed to refer to the appropriate section of ASC.

In October 2009, the FASB issued new standards for revenue recognition with multiple deliverables. These new standards impact the determination of when the individual deliverables included in a multiple-element arrangement may be treated as separate units of accounting. Additionally, these new standards modify the manner in which the transaction consideration is allocated across the separately identified deliverables by no longer permitting the residual method of allocating arrangement consideration. These new standards are effective for us beginning in the first quarter of fiscal year 2011; however, early adoption is permitted. Ambient does not expect these new standards to significantly impact its consolidated financial statements.

In October 2009, the FASB issued new standards for the accounting for certain revenue arrangements that include software elements. These new standards amend the scope of pre-existing software revenue guidance by removing from the guidance non-software components of tangible products and certain software components of tangible products. These new standards are required to be adopted in the first quarter of 2011; however, early adoption is permitted. We do not expect these new standards to significantly impact our consolidated financial statements.

In January 2010, the FASB issued amended standards that require additional fair value disclosures. These amended standards require disclosures about inputs and valuation techniques used to measure fair value as well as disclosures about significant transfers, beginning in the first quarter of 2010. Additionally, these amended standards require presentation of disaggregated activity within the reconciliation for fair value measurements using significant unobservable inputs (Level 3), beginning in the first quarter of 2011. We do not expect these new standards to significantly impact our consolidated financial statements.

Management does not believe that any other recently issued, but not yet effective, accounting standard if currently adopted would have a material effect on the accompanying financial statements.

OFF-BALANCE SHEET ARRANGEMENTS

None.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

| | | Payments Due By Period | |

| Contractual Obligations | | Total | | | Less Than 1 Year | | | 1 – 3 Years | | | 3 – 5 Years | | | More Than 5 years | |

| Short -Term Debt Obligations | | $ | 10,000,000 | | | $ | 10,000,000 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| Capital Lease Obligations | | | 25,298 | | | | 14,456 | | | | 10,842 | | | | 0 | | | | 0 | |

| Operating Lease Obligations | | | 996,910 | | | | 203,186, | | | | 793,724 | | | | 0 | | | | 0 | |

| Purchase Obligations | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Other Long-Term Liabilities Reflected on the Registrant’s Balance Sheet under GAAP | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Total | | $ | 11,022,208 | | | $ | 10,217,642 | | | $ | 804,566 | | | $ | 0 | | | $ | 0 | |

DESCRIPTION OF BUSINESS

OVERVIEW

Ambient Corporation (referred to herein as “we,” “our,” “us,” “Ambient,” or the “Company”), incorporated under the laws of the State of Delaware in June 1996, is a pioneering integrator of a smart grid communications platform, creating a high-speed Internet Protocols (IP)-based data communications infrastructure to support all aspects of a smart grid. The Ambient smart grid platform, known as Ambient Smart Grid®, facilitates a two-way, real-time communications network to serve the “last mile” backhaul. This common-core infrastructure is necessary for utilities to implement smart grid applications such as Advanced Metering Infrastructures (AMI), real-time pricing, and Demand Side Management (DSM) while enabling distribution monitoring and automatio n, as well as direct load control. When combined, these applications can offer economic, operational and environmental benefits for utilities, and their customers.

The Ambient’s Smart Grid® platform, which includes communication nodes, a management system and a suite of applications, has been designed to be an open, standards-based system intended to support a variety of applications and services simultaneously. Ambient has designed, developed, and delivered three generations of our Smart Grid® communications nodes. With each successive generation, Ambient has continued to support and integrate additional applications. During the summer of 2009, Ambient began the design and development of its fourth generation communication node. Testing of prototypes is expected to begin during the second quarter of 2010.

Throughout the past four years, Ambient has been a supplier to Duke Energy’s smart grid initiatives. In 2008, Ambient received purchase orders from Duke Energy for its X2000 and X-3000 communications nodes, license for the Ambient Element Management System (AmbientNMS®), and engineering support in building out an intelligent smart grid platform. In September 2009, Ambient and the utility entered into a long-term agreement to supply Ambient’s latest X-series smart grid nodes, the X-3100 for deployment throughout the utility’s electric power distribution grid. Under the terms of the agreement, we have, to date, received purchase orders for product to be delivered through third quarter of 2010, amounting to approximately $10.0 million.

Our goal remains to be the leading designer, developer and systems integrator of a turnkey Ambient Smart Grid® platform, incorporating a wide array of communications technology and protocols enabling smart grid applications such as third-party advanced metering solutions and our internally developed energy sensing capabilities. Ambient views the smart grid communications platform to be a key factor for utilities to efficiently integrate increasing portfolios of energy services and applications.

Ambient intends to actively seek new opportunities for commercial deployments and to bring new and existing networks to full commercialization. Throughout 2010, Ambient’s principal target customers will continue to be electric utilities deploying smart grid technologies, primarily in North America. Ambient intends to continue to collaborate with other technology companies and utility customers to drive the development of new utility and consumer applications and to promote the need for the Ambient Smart Grid® platform.

To date, we have funded operations primarily through the sale of our securities. In connection with the continued development, marketing, and deployment of our products, technology, and services, we anticipate that we will continue to augment our revenue generation capabilities with such raises in the future and anticipate that we will continue to incur losses during 2010.

INDUSTRY BACKGROUND

The existing electrical power distribution system is under increasing pressure to catch up to the digital economy which it serves. Dedicated sensors and communications infrastructures are necessary components needed to monitor and manage the distribution grid, allowing system-wide efficiency and security. For several decades, utilities have used their distribution networks to carry low-speed data for simple monitoring and control functions. Ambient has built upon this model by combining multiple high-speed Internet Protocol (IP)-based communications technologies to help utilities migrate to the next generation digital distribution grid and to solve some of the challenges that electric utilities and their customers have experienced.

Recently, the industry has attracted much media attention. The term "smart grid" was popularized in 2007, and today grid modernization has become more commonly understood by the public, media, investors, and utility regulators on the state and federal level. Ambient is ahead of this trend. We began developing the Ambient Smart Grid® in 2000. Likewise, our customers historically have been forward-looking utilities on the cutting edge of grid modernization.

Recent political developments have had a significant impact on the prospects of the smart grid industry. In 2007, the Federal Energy Independence and Security Act underscored the need for smart grid and provided a mechanism for federal funds to help promote smart grid deployments and developments. In 2008 and 2009, the prospects of the deployment of smart grid technologies were significantly advanced through the passage of both the Troubled Asset Relief Program and the American Reinvestment and Recovery Act (ARRA), which passed early in 2009.

The ultimate allocation of funding from the federal government provided by the ARRA (Stimulus Funding) eliminated much of the risk associated with early adoption of technology. The promise of funding encouraged utilities considering smart grid deployments to actively develop business and deployment plans. Although the intent of the ARRA was to boost the fledgling industry, in 2009, the lack of available federal funds unexpectedly resulted in a slowing of anticipated deployments while the Department of Energy transformed the ARRA mandates into workable programs able to implement those mandates.

The ARRA, which passed in February 2009, set federal precedent for state regulators to support smart grid deployments. However, because each state has an independent utility regulatory commission charged with regulating its state utilities, much of 2009 was spent working with state regulators to establish rules associated with smart grid deployments in individual states. The regulatory uncertainty related to smart grid deployment and lack of national uniformity has directly affected our business.

AMBIENT SOLUTION

THE AMBIENT SMART GRID® COMMUNICATIONS NETWORK

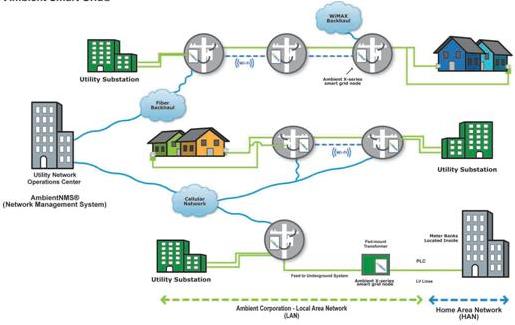

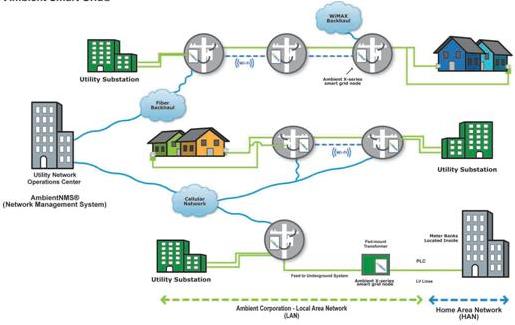

Ambient’s vision for the smart grid calls for solutions based on open, standards-based technologies. The primary benefits derived from this vision are that (i) a common underlying communications platform is utilized to support all of the smart grid applications and services and (ii) the remote processing and storage of data combine to deliver the lowest cost points on an overall system basis while achieving a high level of integration of communications services and applications. The use of open, standards-based technologies is widely accepted as the basis for the success of the Internet and credited with enabling all of the applications that have evolved on the Internet. Many, if not most, of these applications were not envisioned in the early days of d evelopment. Ambient believes that the evolution of the smart grid is analogous to that of the Internet . It is because of this vision that from its beginning in its efforts to build communications platform for the utilities, Ambient has always advocated and designed an open communications platform for our smart grid solution. This is depicted in the Ambient System Architecture diagram shown in Figure 1 .

Figure 1: Ambient Smart Grid ® System Architecture

Ambient's solution addresses a key problem with the usual approaches to smart grid communications. Typically, utilities use multiple application-specific communications systems, requiring separate resources for each application. The Ambient Smart Grid® allows utilities to allocate costs across many applications or purposes, thus minimizing the overall costs of the communications infrastructure. Once again, the Internet is an excellent reference and analogy for this concept. The growing trend of providing multiple communications services (television, telephone, and Internet access) over a single medium into the premises demonstrates the concept, both technically and economically, of supporting multiple services and applications over a common network infrastructure. This holistic approach will enable a variety of distributi on system monitoring and management capabilities that have not thus far been feasible or not even envisioned today.

AMBIENT SMART GRID® COMMUNICATIONS PLATFORM FUNCTIONALITY AND BENEFITS

Open Architecture: For a smart grid to keep pace with advancing technologies, changing expectations, and evolving needs, , utilities need an open and flexible platform based architecture comprised of open and flexible building blocks such as the Ambient Smart Grid Node® (“Node”) and AmbientNMS®. Ambient’s architecture for the Node, allows utilities to mix and match smart grid application technologies today, and provides a platform that can evolve with the technology. An open and flexible communications architecture and node improves the chances for success throughout the distribution system since no one technology is likely to meet the requirements for all environments or locations. Having several node component options to overcome i mpediments, such as topographical, economical, or impediments inherent in the physical infrastructure itself, will be required to successfully address as many of the system requirements as possible.

WAN Technologies: There are a variety of Ethernet technologies, both wired and wireless, that could be used for backhaul or WAN purposes. 3G cellular wireless networks for WAN services are the most practical for a large (if not the most significant) portion of the smart grid infrastructure because it leverages the cellular carrier’s commitment and investment into their wireless network. Although utilities have a long history of using cellular networks for some applications, the scale required for the smart grid is unprecedented. The availability of multiple carriers and technologies is beneficial. The 3G networks of today certainly provide sufficient bandwidth to address the requirements of the smart grid. Ambient believes that other wireless technologies, especially WiMAX may, in the future, be viable for WAN segments of the smart grid.

LAN Technologies: Ambient supports a variety of LAN technologies. As demonstrated with its products to date, Ambient has been able to support a variety of smart grid applications and services with these technologies. Ethernet and serial ports are the basic and most commonly found technologies utilized for communications interfaces. This is why Ambient’s typical node configuration has included both Ethernet and serial (RS-232) ports.

Though not quite as prevalent as Ethernet and serial ports, IEEE 802.11 (Wi-Fi) is fast becoming a leading choice for connectivity between devices physically separated by some distance. The increasing market share has helped to drive down the costs of the technology. In the smart grid architecture, Wi-Fi can be a convenient and useful technology to provide connectivity from the Node to other distribution system devices, such as sensors and switches, where wired connectivity between the Node and these devices could be impractical or cost prohibitive. Ambient offers Wi-Fi connectivity as an optional node component.

Power Line Carrier (PLC) technologies have been in existence for a very long time, and more importantly, they are known and proven technologies in the distribution system. A significant advantage to these technologies when incorporated in a smart grid platform is that they inherently provide information about the distribution system infrastructure. From our earlier Broadband over Power Lines (BPL) pilots, Ambient has extensive experience in the use of such technologies utilizing the distribution system. To date, Ambient has worked with and integrated multiple PLC technologies into its Node.