Filed Pursuant to Rule 424(b)(3)

Registration No. 333-159645

SUPPLEMENT NO. 1 DATED AUGUST 16, 2011

TO PROSPECTUS DATED APRIL 27, 2011

AMBIENT CORPORATION

Copies of the following current reports, registration statement and quarterly report of Ambient Corporation are attached:

Current Report on Form 8-K filed July 1, 2011

Current Report on Form 8-K filed July 20, 2011

Registration Statement on Form 8-A filed July 29, 2011

Current Report on Form 8-K filed August 2, 2011

Current Report on Form 8-K filed August 3, 2011

Current Report on Form 8-K filed August 8, 2011

Quarterly report on Form 10-Q for the quarter ended June 30, 2011, as filed August 10, 2011

Current Report on Form 8-K filed August 16, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 27, 2011

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | | 0-23723 | | 98-0166007 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

7 WELLS AVENUE, SUITE 11, NEWTON, MASSACHUSETTS, 02459

(Address of principal executive offices, including Zip Code)

617- 332-0004

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 5 – CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(a) Effective June 27, 2011, Mark Fidler joined Ambient Corporation (“Ambient” or the Company”) as its Principal Financial Officer and Vice President. Prior to joining Ambient, Mr. Fidler, 40, spent ten years at Evergreen Solar Inc. in positions of increasing responsibility, first as Corporate Controller and most recently as Vice President of Finance & Treasurer. Prior to his tenure at Evergreen Solar, Mr. Fidler held various senior finance roles at The Boston Consulting Group and Hampshire Chemical, a division of Dow Chemical, and he began his career as an accountant at Coopers & Lybrand. Mr. Fidler received a B.S. degree in Accounting from Syracuse University and an M.B.A. from Northeastern University’s Graduate School of Business Administration. Mr. Fidler is also a certified public accountant.

Mr. Fidler will receive an annual salary of $250,000, and he received a signing bonus of $12,500. The Company also granted to Mr. Fidler a stock option to purchase 2,000,000 shares of Ambient common stock under the Company’s 2000 Equity Incentive Plan at an exercise price of $0.075 per share, which options will vest in equal quarterly installments over a three-year period beginning on the first anniversary of the effective date of his employment. Upon satisfactory job performance as determined by Ambient’s Chief Executive Officer, Mr. Fidler will become the Chief Financial Officer on the earlier of September 27, 2011 and the anticipated listing of the Company’s common stock on the NASDAQ Stock Market, at which time, the Company would enter into an employment agreement with Mr. Fidler, pay him an additional $12,500 bonus and grant him an additional stock option to purchase 3,000,000 shares of Ambient common stock subject to approval by the Company’s Compensation Committee. If, prior to Mr. Fidler’s promotion to Chief Financial Officer, the Company terminates Mr. Fidler without cause or he terminates his employment in connection with a change of control, he will receive a severance payment of six months of his base salary, and the Company will pay his COBRA premiums for six months.

(b) Effective June 29, 2011, the Board of Directors of the Company elected Francesca E. Scarito to the Board as a Director. Ms. Scarito was also appointed to the Audit Committee of the Board. Ms. Scarito is President of RS Finance & Consulting, LLC, a boutique investment bank located in Boston, Massachusetts. Ms. Scarito has been an investment banker for over 20 years and has extensive experience in private capital, equity capital markets and mergers and acquisitions. Ms. Scarito earned a B.A. from Dartmouth College and an M.B.A. from Harvard Business School. There are no arrangements or understandings between Ms. Scarito and any other person pursuant to which she was elected to the Board, and there are no relationships between Ms. Scarito and the Company that would require disclosure under Item 404(a) of Regulation S-K of the Securities Exchange Act of 1934, as amended. Ambient compensates independent directors at an annual rate of $15,000. Ms. Scarito will receive a pro rata portion of such compensation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | AMBIENT CORPORATION | |

| | | | |

| Dated: July 1, 2011 | By: | /s/ John J. Joyce | |

| | | John J. Joyce | |

| | | Chief Executive Officer | |

| | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 18, 2011

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | | 0-23723 | | 98-0166007 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | |

7 WELLS AVENUE, SUITE 11, NEWTON, MASSACHUSETTS 02459

(Address of principal executive offices, including Zip Code)

617- 332-0004

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 2 – FINANCIAL INFORMATION

Item 2.02 Results of Operations and Financial Condition.

See the disclosure under Item 8.01.

SECTION 8 – OTHER EVENTS

Item 8.01 Other Events.

Ambient Corporation (the “Company”) has attached hereto as Exhibit 99.1 a press release containing a preliminary announcement of its revenues for the second quarter of 2011. At this time, the Company is finalizing its financial results for the second quarter of 2011 and will report those results on or before August 15, 2011. The results described in the attached press release are estimated and preliminary and are subject to revision based upon the Company’s completion of its ordinary quarterly closing procedures.

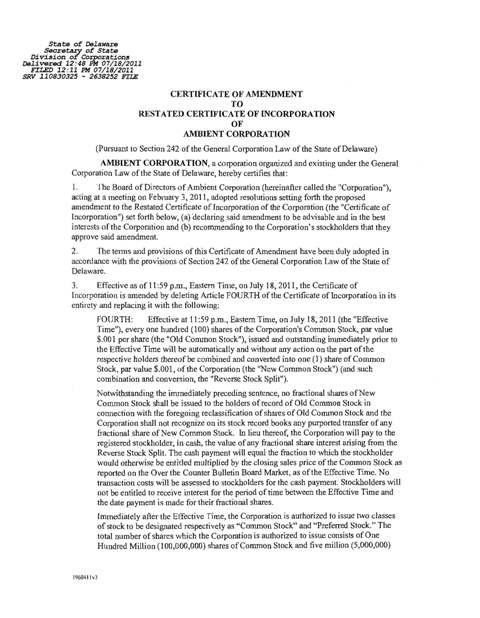

In addition to announcing preliminary second quarter revenues, the Company announced that the previously approved reverse stock split was effected on July 18, 2011, at 11:59 p.m. Eastern Time on a 1-for-100 basis. The reverse split, which the Company’s Board of Directors and stockholders approved earlier this year, is expected to improve the Company’s prospects of successfully listing its common stock on the Nasdaq Capital Market. In connection with the reverse stock split, the Company reduced its authorized shares of stock such that the total number of shares which the Company is authorized to issue consists of 100,000,000 shares of common stock, par value of $0.001 per share, and 5,000,000 shares of preferred stock, par value of $0.001 per share. More information on the reverse stock split is available in the Company's information statement filed with the Securities and Exchange Commission on February 28, 2011.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

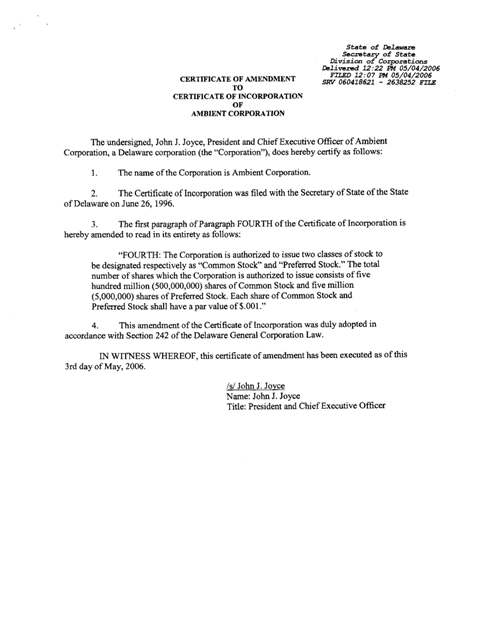

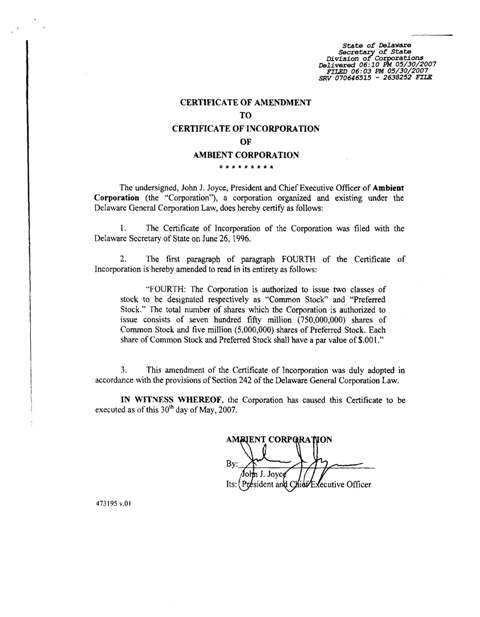

| Exhibit 3.1 | | Certificate of Amendment to Restated Certificate of Incorporation of Ambient Corporation filed and effective July 18, 2011 |

| Exhibit 99.1 | | Press Release Issued on July 20, 2011 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | AMBIENT CORPORATION | |

| | | | |

| Dated: July 20, 2011 | By: | /s/ John J. Joyce | |

| | | John J. Joyce | |

| | | Chief Executive Officer | |

| | | | |

EXHIBIT INDEX

| Exhibit | | Description |

| 3.1 | | Certificate of Amendment to Restated Certificate of Incorporation of Ambient Corporation filed and effective July 18, 2011 |

| 99.1 | | Press release issued by Ambient Corporation dated as of July 20, 2011 |

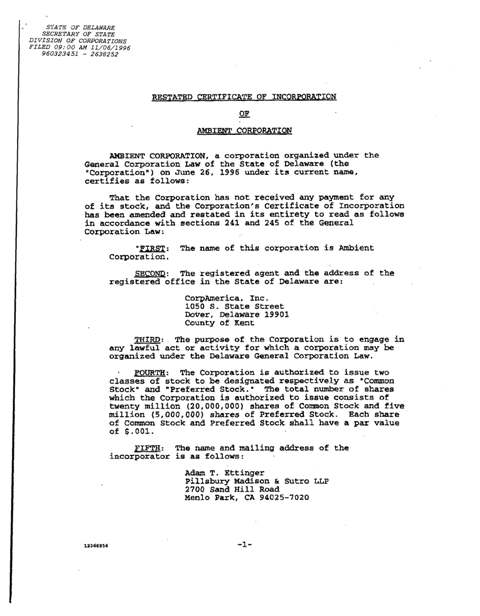

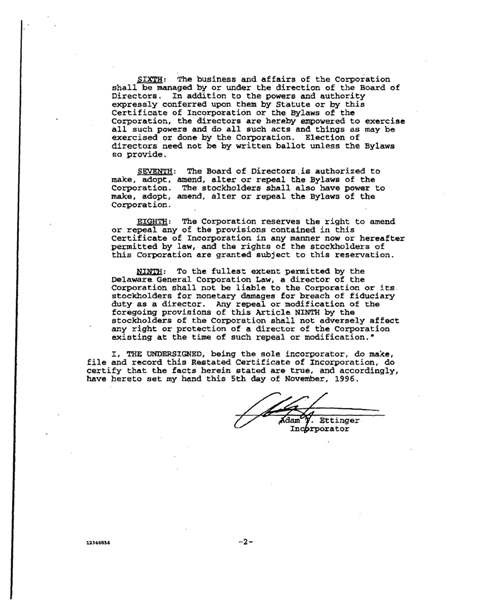

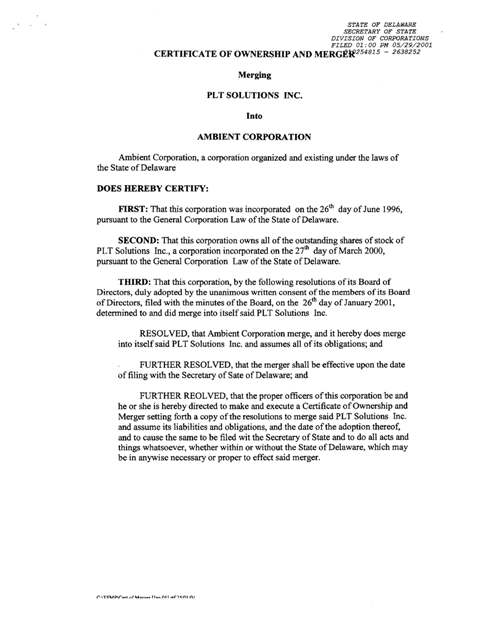

Exhibit 3.1

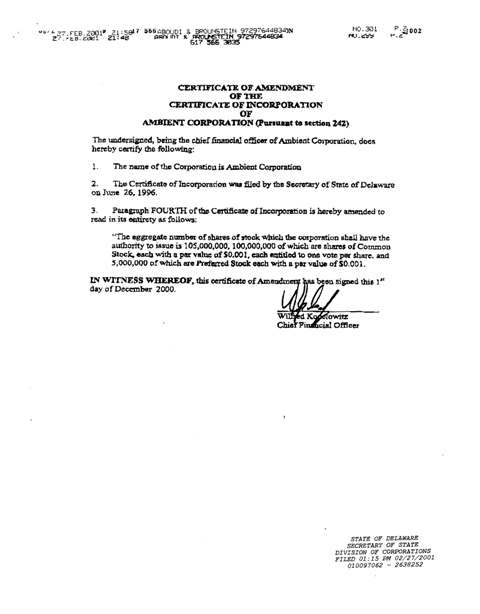

CERTIFICATE OF AMENDMENT

TO

RESTATED CERTIFICATE OF INCORPORATION

OF

AMBIENT CORPORATION

(Pursuant to Section 242 of the General Corporation Law of the State of Delaware)

AMBIENT CORPORATION, a corporation organized and existing under the General Corporation Law of the State of Delaware, hereby certifies that:

1. The Board of Directors of Ambient Corporation (hereinafter called the "Corporation"), acting at a meeting on February 3, 2011, adopted resolutions setting forth the proposed amendment to the Restated Certificate of Incorporation of the Corporation (the "Certificate of Incorporation") set forth below, (a) declaring said amendment to be advisable and in the best interests of the Corporation and (b) recommending to the Corporation’s stockholders that they approve said amendment.

2. The terms and provisions of this Certificate of Amendment have been duly adopted in accordance with the provisions of Section 242 of the General Corporation Law of the State of Delaware.

3. Effective as of 11:59 p.m., Eastern Time, on July 18, 2011, the Certificate of Incorporation is amended by deleting Article FOURTH of the Certificate of Incorporation in its entirety and replacing it with the following:

| | FOURTH: Effective at 11:59 p.m., Eastern Time, on July 18, 2011 (the "Effective Time"), every one hundred (100) shares of the Corporation's Common Stock, par value $.001 per share (the "Old Common Stock"), issued and outstanding immediately prior to the Effective Time will be automatically and without any action on the part of the respective holders thereof be combined and converted into one (1) share of Common Stock, par value $.001, of the Corporation (the "New Common Stock") (and such combination and conversion, the "Reverse Stock Split"). |

| | Notwithstanding the immediately preceding sentence, no fractional shares of New Common Stock shall be issued to the holders of record of Old Common Stock in connection with the foregoing reclassification of shares of Old Common Stock and the Corporation shall not recognize on its stock record books any purported transfer of any fractional share of New Common Stock. In lieu thereof, the Corporation will pay to the registered stockholder, in cash, the value of any fractional share interest arising from the Reverse Stock Split. The cash payment will equal the fraction to which the stockholder would otherwise be entitled multiplied by the closing sales price of the Common Stock as reported on the Over the Counter Bulletin Board Market, as of the Effective Time. No transaction costs will be assessed to stockholders for the cash payment. Stockholders will not be entitled to receive interest for the period of time between the Effective Time and the date payment is made for their fractional shares. |

| | Immediately after the Effective Time, the Corporation is authorized to issue two classes of stock to be designated respectively as “Common Stock” and “Preferred Stock.” The total number of shares which the Corporation is authorized to issue consists of One Hundred Million (100,000,000) shares of Common Stock and five million (5,000,000) shares of Preferred Stock. Each share of Common Stock and Preferred Stock shall have a par value of $0.001. |

4. Holders of at least a majority of the outstanding shares of Common Stock, acting by written consent on February 15, 2011, duly approved the amendment to the Certificate of Incorporation contained herein.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by the undersigned this 15 day of July, 2011.

| | AMBIENT CORPORATION | |

| | | | |

| | By: | /s/ John J. Joyce | |

| | | John J. Joyce | |

| | | President and Chief Executive Officer | |

| | | | |

Ambient Corporation Announces Preliminary Second Quarter Revenue

Company Achieves Record Revenue of Approximately $16.0 million

Newton, Mass., July 20, 2011 – Ambient Corporation (OTCBB: ABTG), a leading provider of integrated networking and communications solutions that allow utilities to enable smart grid applications and enhanced communication platforms, announced today preliminary revenue for the second quarter ended June 30, 2011 of approximately $16.0 million, representing a 250% increase over the comparable quarter in 2010 and a 33% increase over the first quarter of 2011.

John J. Joyce, President and CEO of Ambient Corporation, commented, “We are excited to see the first large-scale deployment of Ambient Smart Grid communications technologies and equipment continue to expand and perform as designed to the mutual benefit of Ambient and Duke Energy. We have now delivered approximately 60,000 communications nodes through the second quarter as part of the Ohio Smart Grid implementation.”

Continued Mr. Joyce, “As of June 30, 2011, we have over $60 million of orders in backlog that we expect to be fulfilled through the remainder of 2011 and into fiscal 2012. Based upon our strong performance year-to-date and our expected delivery schedule for the remainder of 2011, we expect total revenue to be approximately $50 to $55 million for fiscal year 2011, up from $20.4 million for 2010.”

In addition to announcing preliminary second quarter record revenue, the Company announced that the previously approved reverse stock split was effected on July 18, 2011, at 11:59 p.m. Eastern Time on a 1-for-100 basis. The reverse split, which the Company’s Board of Directors and stockholders approved earlier this year, is expected to improve the Company’s prospects of successfully listing its common stock on the Nasdaq Capital Market. Due to the reverse stock split, Ambient’s common stock will trade under a new CUSIP number, 02318N 201, and will temporarily trade under the symbol "ABTGD" for 20 trading days beginning July 20, 2011, after which time the symbol will revert to "ABTG." More information on the reverse stock split is available in the Company's information statement filed with the Securities and Exchange Commission on February 28, 2011.

All data are preliminary and subject to revision based upon the Company’s completion of its ordinary closing procedures. These preliminary results should not be viewed as a substitute for full interim financial statements prepared in accordance with Generally Accepted Accounting Principles.

For more information about the Ambient Smart Grid® communications platform, visit www.ambientcorp.com.

About Ambient Corporation

Ambient designs, develops and markets Ambient Smart Grid® communications technologies and equipment. Using open standards-based technologies along with in-depth industry experience, Ambient provides utilities with solutions for creating smart grid communication platforms and technologies. Headquartered in Newton, MA, Ambient is a publicly traded company (OTCBB: ABTG). More information on Ambient is available at www.ambientcorp.com.

This press release contains statements that may be deemed to be “forward-looking statements” under federal securities laws. These forward-looking statements involve substantial uncertainties and risks and include the Company’s assessment of its performance to date in 2011, its expectations regarding its delivery schedule for the remainder of 2011 and into 2012, its expectation regarding total revenue for 2011, and its assessment of its prospects for listing its common stock on The Nasdaq Capital Market. These forward-looking statements are based upon our current expectations, estimates and projections about our business and our industry and reflect our beliefs

and assumptions based upon information available to us at the date of this release. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Our actual results, performance or achievements could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including but not limited to, the potential listing of Ambient common stock on The Nasdaq Capital Market, the dependence on one key customer, the Company’s ability to raise additional capital when needed, the sufficiency of working capital, the competitive market generally and in the smart grid industry specifically, the success of the Company’s collaborative arrangements, changes in economic conditions generally and the smart grid industry specifically, changes in technology, legislative or regulatory changes , and other risks and uncertainties discussed under the heading "RISK FACTORS" in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010, and in the Company’s other filings with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update any forward-looking statement for any reason.

Ambient, Ambient Smart Grid, Communications for a Smarter Grid and AmbientNMS are registered trademarks of Ambient Corporation with the U.S. Patent and Trademark Office.

Media Contact

Anna E. Croop

acroop@ambientcorp.com

(617) 614-6739

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) or 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

Delaware (State of incorporation or organization) | | 98-0166007 (I.R.S. Employer Identification No.) |

7 WELLS AVENUE

NEWTON, MASSACHUSETTS 02459

(Address of Principal Executive Offices)

Securities to be registered pursuant to Section 12(b) of the Act:

Title of each class to be so registered | | Name of each exchange on which each class is to be registered |

| Common Stock, par value $0.001 | | The NASDAQ Stock Market LLC |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), check the following box. þ

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box. ¨

Securities Act registration statement file number to which this form relates: _______________

(If applicable)

Securities to be registered pursuant to Section 12(g) of the Act:

None

ITEM 1. Description of Registrant's Securities to be Registered.

Authorized Shares. The registrant’s authorized capital stock includes 100,000,000 shares of common stock, $0.001 par value per share.

Voting. Except as otherwise required by Delaware law, holders of the registrant’s common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders. There is no cumulative voting in the election of directors.

Dividend Rights. Dividends or other distributions in cash, securities or other property of the registrant as may be declared from time to time by the board of directors out of assets and funds legally available for dividend payments.

Liquidation and Preemptive Rights. In the event of the registrant’s liquidation, dissolution or winding-up, holders of common stock are entitled to share equally on a per share basis in all assets remaining after payment or provision of payment of the registrant’s debts. Holders of our common stock have no conversion, exchange, preemption or other subscription rights. There are no redemption or sinking fund provisions applicable to the common stock.

ITEM 2. Exhibits

Pursuant to the Instructions as to Exhibits for Form 8-A, no exhibits are required to be filed because no other securities of the registrant are registered on The NASDAQ Stock Market LLC, and the securities registered hereby are not being registered pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended.

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Act of 1934, the registrant has duly caused this registration statement to be signed by the undersigned, duly authorized.

Date: July 29, 2011 | AMBIENT CORPORATION | |

| | By: | /s/ John J. Joyce | |

| | | Name: John J. Joyce | |

| | | Title: Chief Executive Officer | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): July 28, 2011

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | | 0-23723 | | 98-0166007 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

7 WELLS AVENUE, SUITE 11, NEWTON, MASSACHUSETTS 02459

(Address of principal executive offices, including Zip Code)

617- 332-0004

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 5 – CORPORATE GOVERNANCE AND MANAGEMENT

ITEM 5.05. AMENDMENTS TO THE REGISTRANT'S CODE OF ETHICS, OR WAIVER OF A PROVISION OF THE CODE OF ETHICS.

On July 28, 2011, the Board of Directors of Ambient Corporation (the "Company") approved the replacement of the Company's existing "Code of Ethics for Senior Executive Officers and Senior Financial Officers” with a new Code of Business Conduct and Ethics (the “Code of Conduct”), which applies to all of the Company’s directors, officers and employees, including its principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The Company adopted the new Code of Conduct in connection with the listing of its common stock on the NASDAQ Capital Market. The new Code of Conduct, among other things, enhances the description of the policies and regulations pertaining to conflicts of interest, insider trading, confidentiality, honest and ethical conduct and fair dealing, protection and proper use of corporate assets, gifts and gratuities, accuracy of books and records and public reports, concerns regarding accounting and auditing matters, and dealing with independent auditors. The Code of Conduct also describes the procedures for waivers of the Code of Conduct and for reporting suspected violations of the Code. The foregoing summary is subject to and qualified in its entirety by reference to the full text of the Code of Conduct, a copy of which is attached as Exhibit 14.1 to this Current Report on Form 8-K and which is incorporated by reference into this Item 5.05.

The Code of Conduct is available in the Investor Relations section of the Company's website at http://www.ambientcorp.com.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

| Exhibit 14.1 | | Code of Business Conduct and Ethics |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | AMBIENT CORPORATION | |

| | | | |

| Dated: August 2, 2011 | By: | /s/ John J. Joyce | |

| | | John J. Joyce | |

| | | Chief Executive Officer | |

EXHIBIT INDEX

| Exhibit 14.1 | | Code of Business Conduct and Ethics |

4

Exhibit 14.1

Ambient Corporation

Code of Business Conduct and Ethics

This Code of Business Conduct and Ethics (the “Code”) sets forth legal and ethical standards of conduct for directors, officers and employees of Ambient Corporation (the “Company”). This Code applies to the Company and any subsidiaries and other business entities controlled by it. The Board of Directors has adopted and issued this Code to deter wrongdoing and to promote:

● honest and ethical conduct by everyone associated with the Company, including the ethical handling of actual or apparent conflicts of interest;

● full, fair, accurate, timely, and understandable disclosure in reports and documents that the Company submits to the United States Securities and Exchange Commission (“SEC”) and in the Company’s other public communications;

● compliance with applicable governmental laws, rules, and regulations;

● the prompt internal reporting of any violations of this Code to the appropriate person at the Company; and

● accountability for adherence to the Code.

The Board of Directors has designated the Chief Financial Officer as the “Compliance Officer” with respect to the Code. The Board of Directors, upon recommendation of the Nominating and Corporate Governance Committee, may change the Compliance Officer from time to time and will inform all directors, officers and employees of any change in the Compliance Officer by providing the identity and contact information of the Compliance Officer through an email distribution, physical posting or update of the Company’s employee handbook. If you have any questions regarding this Code or its application to you in any situation, you should contact your supervisor or the Compliance Officer.

Compliance with Laws, Rules and Regulations

The Company requires that all employees, officers and directors comply with all laws, rules and regulations applicable to the Company wherever it does business. You are expected to use good judgment and common sense in seeking to comply with all applicable laws, rules and regulations and to ask for advice when you are uncertain about them.

If you become aware of the violation of any law, rule or regulation by the Company, whether by its officers, employees, directors, or any third party doing business on behalf of the Company, it is your responsibility to promptly report the matter to your supervisor or to the Company’s Compliance Officer. While it is the Company’s desire to address matters internally, nothing in this Code should discourage you from reporting any illegal activity, including any violation of the securities laws, antitrust laws, environmental laws or any other federal, state or foreign law, rule or regulation, to the appropriate regulatory authority. Employees, officers and directors shall not discharge, demote, suspend, threaten, harass or in any other manner discriminate or retaliate against an employee because he or she reports any such violation, unless it is determined that the report was made with knowledge that it was false. This Code should not be construed to prohibit you from testifying, participating or otherwise assisting in any state or federal administrative, judicial or legislative proceeding or investigation.

Conflicts of Interest

Employees, officers and directors must act in the best interests of the Company. You must refrain from engaging in any activity or having a personal interest that presents a “conflict of interest.” A conflict of interest occurs when your personal interest interferes, or appears to interfere, with the interests of the Company. A conflict of interest can arise whenever you, as an officer, director or employee, take action or have an interest that prevents you from performing your Company duties and responsibilities honestly, objectively and effectively.

For example:

| ● | No employee, officer or director shall perform services as a consultant, employee, officer, director, advisor or in any other capacity for, or have a financial interest in, a direct competitor of the Company, other than services performed at the request of the Company and other than a financial interest representing less than one percent (1%) of the outstanding shares of a publicly held company; and |

| ● | No employee, officer or director shall use his or her position with the Company to influence a transaction with a supplier or customer in which such person has any personal interest, other than a financial interest representing less than one percent (1%) of the outstanding shares of a publicly held company. |

It is your responsibility to disclose any transaction or relationship that reasonably could be expected to give rise to a conflict of interest to the Company’s Compliance Officer or, if you are an executive officer or director, to the Board of Directors, who shall be responsible for determining whether such transaction or relationship constitutes a conflict of interest.

Insider Trading

Employees, officers and directors who have material non-public information about the Company or other companies, including our suppliers and customers, as a result of their relationship with the Company are prohibited by law and Company policy from trading in securities of the Company or such other companies, as well as from communicating such information to others who might trade on the basis of that information. To help ensure that you do not engage in prohibited insider trading and avoid even the appearance of an improper transaction, the Company has adopted a Policy Statement Regarding Insider Trading, which is available in the Company’s employee handbook.

If you are uncertain about the constraints on your purchase or sale of any Company securities or the securities of any other company that you are familiar with by virtue of your relationship with the Company, you should consult with the Company’s Chief Executive Officer before making any such purchase or sale.

Confidentiality

Employees, officers and directors must maintain the confidentiality of confidential information entrusted to them by the Company or other companies, including our suppliers and customers, except when disclosure is authorized by a supervisor or legally mandated. Unauthorized disclosure of any confidential information is prohibited. Additionally, employees should take appropriate precautions to ensure that confidential or sensitive business information, whether it is proprietary to the Company or another company, is not communicated within the Company except to employees who have a need to know such information to perform their responsibilities for the Company.

Third parties may ask you for information concerning the Company. Subject to the exceptions noted in the preceding paragraph, employees, officers and directors (other than the Company’s authorized spokespersons) must not discuss internal Company matters with, or disseminate internal Company information to, anyone outside the Company, except as required in the performance of their Company duties and, if appropriate, after a confidentiality agreement is in place. This prohibition applies particularly to inquiries concerning the Company from the media, market professionals (such as securities analysts, institutional investors, investment advisers, brokers and dealers) and security holders. All responses to inquiries on behalf of the Company must be made only by the Company’s authorized spokespersons. If you receive any inquiries of this nature, you must decline to comment and refer the inquirer to your supervisor or one of the Company’s authorized spokespersons. The Company’s policies with respect to public disclosure of internal matters are described more fully in the Company’s Insider Trading Policy and employee handbook.

You also must abide by any lawful obligations that you have to your former employers. These obligations may include restrictions on the use and disclosure of confidential information, restrictions on the solicitation of former colleagues to work at the Company and non-competition obligations.

Honest and Ethical Conduct and Fair Dealing

Employees, officers and directors should endeavor to deal honestly, ethically and fairly with the Company’s suppliers, customers, competitors and employees. Statements regarding the Company’s products and services must not be untrue, misleading, deceptive or fraudulent. You must not take unfair advantage of anyone through manipulation, concealment, abuse of privileged information, misrepresentation of material facts or any other unfair-dealing practice.

Protection and Proper Use of Corporate Assets

Employees, officers and directors should seek to protect the Company’s assets. Theft, carelessness and waste have a direct impact on the Company’s financial performance. Employees, officers and directors must use the Company’s assets and services solely for legitimate business purposes of the Company and not for any personal benefit or the personal benefit of anyone else.

Employees, officers and directors must advance the Company’s legitimate interests when the opportunity to do so arises. You must not take for yourself personal opportunities that are discovered through your position with the Company or the use of property or information of the Company.

Gifts and Gratuities

The use of Company funds or assets for gifts, gratuities or other favors to employees or government officials is prohibited, except to the extent such gifts are in compliance with applicable law, insignificant in amount and not given in consideration or expectation of any action by the recipient.

Employees, officers and directors must not accept, or permit any member of his or her immediate family to accept, any gifts, gratuities or other favors from any customer, supplier or other person doing or seeking to do business with the Company, other than items of insignificant value. Any gifts that are not of insignificant value should be returned immediately and reported to your supervisor. If immediate return is not practical, they should be given to the Company for charitable disposition or such other disposition as the Company, in its sole discretion, believes appropriate.

Common sense and moderation should prevail in business entertainment engaged in on behalf of the Company. Employees, officers and directors should provide, or accept, business entertainment to or from anyone doing business with the Company only if the entertainment is infrequent, modest and intended to serve legitimate business goals.

Bribes and kickbacks are criminal acts, strictly prohibited by law. You must not offer, give, solicit or receive any form of bribe or kickback anywhere in the world.

Accuracy of Books and Records and Public Reports

Employees, officers and directors must honestly and accurately report all business transactions. You are responsible for the accuracy of your records and reports. Accurate information is essential to the Company’s ability to meet legal and regulatory obligations.

All Company books, records and accounts shall be maintained in accordance with all applicable regulations and standards and accurately reflect the true nature of the transactions they record. The financial statements of the Company shall conform to generally accepted accounting rules and the Company’s accounting policies. No undisclosed or unrecorded account or fund shall be established for any purpose. No false or misleading entries shall be made in the Company’s books or records for any reason, and no disbursement of corporate funds or other corporate property shall be made without adequate supporting documentation.

It is the policy of the Company to provide full, fair, accurate, timely and understandable disclosure in reports and documents filed with, or submitted to, the SEC and in other public communications.

Concerns Regarding Accounting or Auditing Matters

Employees with concerns regarding questionable accounting or auditing matters or complaints regarding accounting, internal accounting controls or auditing matters may confidentially, and anonymously if they wish, submit such concerns or complaints in writing to the Company’s Compliance Officer at Ambient Corporation, Attn: Compliance Officer, 7 Wells Avenue, Newton, MA 02459 or may use the telephone number 1-617-614-6900. See “Reporting and Compliance Procedures” below. All such concerns and complaints will be forwarded to the Audit Committee of the Board of Directors, unless they are determined to be without merit by the Company’s Compliance Officer. In any event, a record of all complaints and concerns received will be provided to the Audit Committee each fiscal quarter. Any such concerns or complaints may also be communicated, confidentially and, if you desire, anonymously, directly to the Chair of the Audit Committee of the Board of Directors.

The Audit Committee will evaluate the merits of any concerns or complaints received by it and authorize such follow-up actions, if any, as it deems necessary or appropriate to address the substance of the concern or complaint.

The Company will not discipline, discriminate against or retaliate against any employee who reports a complaint or concern, unless it is determined that the report was made with knowledge that it was false.

Dealings with Independent Auditors

No employee, officer or director shall, directly or indirectly, make or cause to be made a materially false or misleading statement to an accountant in connection with (or omit to state, or cause another person to omit to state, any material fact necessary in order to make statements made, in light of the circumstances under which such statements were made, not misleading to, an accountant in connection with) any audit, review or examination of the Company’s financial statements or the preparation or filing of any document or report with the SEC. No employee, officer or director shall, directly or indirectly, take any action to coerce, manipulate, mislead or fraudulently influence any independent public or certified public accountant engaged in the performance of an audit or review of the Company’s financial statements.

Waivers of this Code of Business Conduct and Ethics

While some of the policies contained in this Code must be strictly adhered to and no exceptions can be allowed, in other cases exceptions may be appropriate. Any employee or officer who believes that a waiver of any of these policies is appropriate in his or her case should first contact his or her immediate supervisor. If the supervisor agrees that a waiver is appropriate, the approval of the Company’s Compliance Officer must be obtained. The Company’s Compliance Officer shall be responsible for maintaining a record of all requests by employees or officers for waivers of any of these policies and the disposition of such requests.

Any executive officer or director who seeks a waiver of any of these policies should contact the Company’s Compliance Officer. Any waiver of this Code for executive officers or directors or any change to this Code that applies to executive officers or directors may be made only by the Board of Directors of the Company and will be disclosed as required by law or stock exchange regulation.

Reporting and Compliance Procedures

Every employee, officer and director has the responsibility to ask questions, seek guidance, report suspected violations and express concerns regarding compliance with this Code. Any employee, officer or director who knows or believes that any other employee or representative of the Company has engaged or is engaging in Company-related conduct that violates applicable law or this Code should report such information to his or her supervisor or to the Company’s Compliance Officer, as described below. You may report such conduct openly or anonymously without fear of retaliation. The Company will not discipline, discriminate against or retaliate against any employee who reports such conduct, unless it is determined that the report was made with knowledge that it was false, or who cooperates in any investigation or inquiry regarding such conduct. Any supervisor who receives a report of a violation of this Code must immediately inform the Company’s Compliance Officer.

You may report violations of this Code, on a confidential or anonymous basis, by contacting the Company’s Compliance Officer by mail at: Ambient Corporation, Attn: Compliance Officer, 7 Wells Avenue, Newton, MA 02459, by fax at 617-332-7260. In addition, the Company has established a telephone number 1-617-614-6900 where you can leave a recorded message about any violation or suspected violation of this Code. While we prefer that you identify yourself when reporting violations so that we may follow up with you, as necessary, for additional information, you may leave messages anonymously if you wish.

If the Company’s Compliance Officer receives information regarding an alleged violation of this Code, he or she shall, as appropriate, (a) evaluate such information, (b) if the alleged violation involves an executive officer or a director, inform the Chief Executive Officer and Board of Directors of the alleged violation, (c) determine whether it is necessary to conduct an informal inquiry or a formal investigation and, if so, initiate such inquiry or investigation and (d) report the results of any such inquiry or investigation, together with a recommendation as to disposition of the matter, to the Company’s Chief Executive Officer for action, or if the alleged violation involves an executive officer or a director, report the results of any such inquiry or investigation to the Board of Directors or a committee thereof. Employees, officers and directors are expected to cooperate fully with any inquiry or investigation by the Company regarding an alleged violation of this Code. Failure to cooperate with any such inquiry or investigation may result in disciplinary action, up to and including discharge.

The Company shall determine whether violations of this Code have occurred and, if so, shall determine the disciplinary measures to be taken against any employee who has violated this Code. In the event that the alleged violation involves an executive officer or a director, the Board of Directors shall determine whether a violation of this Code has occurred and, if so, shall determine the disciplinary measures to be taken against such executive officer or director.

Failure to comply with the standards outlined in this Code will result in disciplinary action including, but not limited to, reprimands, warnings, probation or suspension without pay, demotions, reductions in salary, discharge and restitution. Certain violations of this Code may require the Company to refer the matter to the appropriate governmental or regulatory authorities for investigation or prosecution. Moreover, any supervisor who directs or approves of any conduct in violation of this Code, or who has knowledge of such conduct and does not immediately report it, also will be subject to disciplinary action, up to and including discharge.

Dissemination and Amendment

This Code shall be distributed to each new employee, officer and director of the Company upon commencement of his or her employment or other relationship with the Company and shall also be distributed annually to each employee, officer and director of the Company, and each employee, officer and director shall certify that he or she has received, read and understood the Code and has complied with its terms.

The Company reserves the right to amend, alter or terminate this Code at any time for any reason. The most current version of this Code can be found in the Company’s employee handbook. This Code supersedes the Company’s Code of Ethics for Senior Executive Officers and Senior Financial Officers.

This document is not an employment contract between the Company and any of its employees, officers or directors.

Certification

I, ______________________________ do hereby certify that:

(Print Name Above)

1. I have received and carefully read the Code of Business Conduct and Ethics of Ambient Corporation.

2. I understand the Code of Business Conduct and Ethics.

3. I have complied and will continue to comply with the terms of the Code of Business Conduct and Ethics.

Date: __________________________ __________________________________

(Signature)

EACH EMPLOYEE, OFFICER AND DIRECTOR IS REQUIRED TO SIGN, DATE AND RETURN THIS CERTIFICATION TO THE COMPANY’S CHIEF FINANCIAL OFFICER WITHIN FIVE DAYS OF ISSUANCE. FAILURE TO DO SO MAY RESULT IN DISCIPLINARY ACTION.

7

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 3, 2011

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | | 0-23723 | | 98-0166007 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

7 WELLS AVENUE, SUITE 11, NEWTON, MASSACHUSETTS 02459

(Address of principal executive offices, including Zip Code)

617- 332-0004

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 3 – SECURITIES AND TRADING MARKETS

ITEM 3.01 NOTICE OF DELISTING OR FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING.

On August, 2, 2011, Ambient Corporation (the “Company”) announced that its common stock has been approved for listing on the NASDAQ Capital Market. The Company expects its common stock to commence trading on the NASDAQ Capital Market on Wednesday, August 3, 2011 under the ticker symbol “AMBT.” Prior to the listing change to NASDAQ, the Company's common stock traded on the OTC Bulletin Board under the ticker symbol "ABTGD."

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

Exhibit 99.1 – Press Release Issued on August 2, 2011

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | AMBIENT CORPORATION | |

| | | | |

| Dated: August 3, 2011 | By: | /s/ John J. Joyce | |

| | | Name: John J. Joyce | |

| | | Title: Chief Executive Officer | |

| | | | |

EXHIBIT INDEX

| 99.1 | Press release issued by Ambient Corporation dated as of August 2, 2011 |

4

| | Media Contact Anna E. Croop acroop@ambientcorp.com (617) 614-6739 |

Ambient Corporation Announces Listing on NASDAQ

Newton, Mass., August 2, 2011 – Ambient Corporation (OTCBB: ABTGD), a leading provider of smart grid applications and enhanced communication platforms, announced today that its common stock has been approved for listing on the NASDAQ Capital Market.

The Company expects its common stock to commence trading on the NASDAQ Capital Market on Wednesday, August 3, 2011, under the ticker symbol “AMBT”. Prior to the listing change to NASDAQ, the company's common stock will continue to trade on the OTC Bulletin Board under the current ticker symbol "ABTGD.OB".

About Ambient Corporation

Ambient designs, develops and markets Ambient Smart Grid® communications technologies and equipment. Using open standards-based technologies along with in-depth industry experience, Ambient provides utilities with solutions for creating smart grid communication platforms and technologies. Headquartered in Newton, MA, Ambient is a publicly traded company (OTCBB: ABTGD). More information on Ambient is available at www.ambientcorp.com.

This press release contains statements that may be deemed to be “forward-looking statements” under federal securities laws. These forward-looking statements are based upon our current expectations, estimates and projections about our business and our industry and reflect our beliefs and assumptions based upon information available to us at the date of this release. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Our actual results, performance or achievements could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including but not limited to, the dependence on one key customer, the Company’s ability to raise additional capital when needed, the sufficiency of working capital, the competitive market generally and in the smart grid industry specifically, the success of the Company’s collaborative arrangements, changes in economic conditions generally and the smart grid industry specifically, changes in technology, legislative or regulatory changes , and other risks and uncertainties discussed under the heading "RISK FACTORS" in Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2010, and in the Company’s other filings with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update any forward-looking statement for any reason.

Ambient, Ambient Smart Grid, Communications for a Smarter Grid and AmbientNMS are registered trademarks of Ambient Corporation with the U.S. Patent and Trademark Office.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 4, 2011

AMBIENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | | 011-35259 | | 98-0166007 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

7 WELLS AVENUE, SUITE 11, NEWTON, MASSACHUSETTS, 02459

(Address of principal executive offices, including Zip Code)

617- 332-0004

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

SECTION 5 – CORPORATE GOVERNANCE AND MANAGEMENT

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

(a) On August 8, 2011, Ambient Corporation (“Ambient” or the Company”) announced that it had named Mark L. Fidler as Ambient’s Chief Financial Officer. Effective June 27, 2011, Mr. Fidler joined Ambient as its Principal Financial Officer and Vice President. In accordance with Mr. Fidler’s employment offer letter, in connection with the successful listing of the Company’s common stock on the NASDAQ Capital Market, the Company promoted Mr. Fidler to the position of Chief Financial Officer.

Effective August 4, 2011, the Company and Mr. Fidler entered into an Employment Agreement. Pursuant to the Employment Agreement, Mr. Fidler will receive an annual salary of $250,000. Additionally, the Company is obligated to pay Mr. Fidler, within 10 days of the execution of the Employment Agreement, an additional bonus of $12,500, less all required deductions. The Company also granted to Mr. Fidler a stock option to purchase 30,000 shares of Ambient common stock under the Company’s 2000 Equity Incentive Plan at an exercise price of $10.40 per share, which options will vest in equal quarterly installments over a three-year period with the first quarterly installment vesting on October 31, 2011. The agreement also contains certain provisions for early termination, which may result in a severance payment equal to one year of base salary then in effect.

Prior to joining the Company, Mr. Fidler spent the last ten years at Evergreen Solar Inc. in positions of increasing responsibility, first as Corporate Controller from 2001 to 2006 and most recently as Vice President of Finance & Treasurer. Prior to his tenure at Evergreen Solar, Mr. Fidler held various senior finance roles at The Boston Consulting Group from 1998 to 2001 and Hampshire Chemical, a division of Dow Chemical, from 1996 to 1998. From 1992 to 1995, Mr. Fidler was with the audit practice of Coopers & Lybrand. Mr. Fidler received a B.S. degree in Accounting from Syracuse University and an M.B.A. from Northeastern University's Graduate School of Business Administration and is a certified public accountant.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| | Exhibit 10.1 – Employment Agreement dated as of August 4, 2011 between Mark Fidlerand Ambient Corporation |

| | Exhibit 99.1 – Press Release Issued on August 8, 2011 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | AMBIENT CORPORATION | |

| | | | |

| Dated: August 8, 2011 | By: | /s/ John J. Joyce | |

| | | Name: John J. Joyce | |

| | | Title: Chief Executive Officer | |

| | | | |

EXHIBIT INDEX

| Exhibit | | Description |

| | | |

| 10.1 | | Employment Agreement dated as of August 4, 2011 between Mark Fidler and Ambient Corporation |

| | | |

| 99.1 | | Press release issued by Ambient Corporation dated as of August 8, 2011 |

4

EXHIBIT 10.1

EMPLOYMENT AGREEMENT

EMPLOYMENT AGREEMENT ("Agreement") entered into as of August 4, 2011, between MARK FIDLER ("Employee") and AMBIENT CORPORATION, a Delaware corporation (collectively, the "Company").

WHEREAS, the Company desires to employ the Employee, and the Employee wishes to be employed, as the Company’s Chief Financial Officer on the terms and conditions set forth herein;

NOW, THEREFORE, in consideration of the foregoing and the mutual agreements set forth herein, and other valuable consideration, the parties hereto, intending to be legally bound, hereby agree as follows:

1. EMPLOYMENT

The Company agrees to employ Employee, and Employee hereby agrees to such employment, subject to the terms and conditions set forth in this Agreement.

2. POSITIONS AND DUTIES

(a) Employee shall continue to occupy the position and perform the duties of Chief Financial Officer on a full-time basis. In his capacity as Chief Financial Officer, Employee shall report directly to, and be responsible to John J. Joyce, the Chief Executive Officer of the Company, or such other Company officer as shall be designated by the Chief Executive Officer. Employee shall perform duties and responsibilities as are consistent with the position described above which relate to the business of Company, or of any affiliates or subsidiaries of the Company, or any business ventures in which Company, its affiliates or subsidiaries may participate and as are assigned to him from time to time by the Chief Executive Officer.

(b) Employee shall devote 100% of his working time, attention and energies to the business of the Company and shall assume and perform such further reasonable and lawful responsibilities and duties as may be assigned or directed by the Board.

(c) Employee agrees that he will at all times devote his reasonable best efforts, skill and ability to promote the Company's interests and work with the Chief Executive Officer and the other executives of the Company.

(d) Employee acknowledges and agrees that he is required to observe all the lawful rules and policies of the Company generally applicable to senior executives to the extent they are not inconsistent with the terms of this Agreement.

3. COMPENSATION AND BENEFITS

For the full and faithful performance of the services to be rendered by Employee, in consideration of Employee's obligations under this Agreement, provided Employee is not in material breach of this Agreement and that Employee is employed by the Company as of each relevant payment date, and it being understood and agreed by Employee and the Company that Employee would not be entitled to the full compensation package and benefits without his absolute commitment to comply with his undertakings set forth in this Agreement, the Company shall pay to Employee and Employee shall be entitled to receive:

(a) Base Salary. Company will pay to Employee during the term of his employment under this Agreement, a base salary at the annual rate of Two Hundred Fifty Thousand Dollars ($250,000) per annum less required deductions for state and federal withholding tax, social security and other employee taxes (said amounts hereinafter referred to as the "Base Salary"). Any Base Salary payable hereunder shall be paid in regular intervals in accordance with the Company's payroll practices, but no less frequently than once each month. Subject to review at January 1st of each year, commencing on January 1, 2012, Employee's Base Salary may, at the discretion of the Chief Executive Officer, be increased for the succeeding calendar year.

(b) Incentive Compensation.

(i) In addition to his Base Salary, Employee shall be eligible for an annual incentive cash compensation as determined by the Compensation Committee of the Board of Directors (“Compensation Committee”). In addition, pursuant to the offer letter between the Company and Employee dated June 5, 2011 (“Offer Letter”), within 10 days of execution by Employee of this Agreement, the Company will pay you a $12,500 bonus, less all required deductions.

(ii) Company Plans. Employee shall be eligible to participate, on terms no less favorable than those afforded to other executives of the Company, in any incentive compensation plan that may hereafter be adopted by the Company for its executives and management employees from time to time. Such participation shall be subject to the terms of the applicable plans, generally applicable policies of the Company, applicable law and the discretion of the Board of Directors. Nothing contained in this Agreement shall be construed to create any obligation on the part of the Company to establish any such plan or to maintain the effectiveness of any such plan which may be in effect from time to time.

(c) Stock Option Grants. The Employer has previously granted non-qualified stock options to Employee under the Company's 2000 Equity Incentive Plan (the "Plan"). Pursuant to the Offer Letter, August 4, 2011, the Company will grant you a non-qualified stock option pursuant to the Plan to purchase 30,000 shares of Ambient common stock (“Stock”) at the Fair Market Value of the Stock as of August 4, 2011 (it being acknowledged that such number of shares reflects the one for one hundred reverse stock split of the Stock that was effected on July 18, 2011). All such stock options are subject to the terms of the written stock option agreement(s) issued by the Company.

(d) Benefits. Employee shall be entitled to participate in any employee benefit plans, medical insurance plans, life insurance plans, disability insurance plans, retirement plans, 401(k) and other benefit plans which are available to any other executives of the Company. Such participation shall be subject to the terms of the applicable plan documents, generally applicable policies of the Company, and applicable law.

(e) Expense Reimbursement. The Company shall promptly pay the reasonable, business-related expenses incurred by Employee in the performance of his duties hereunder, including, without limitation, those incurred in connection with business related travel, telecommunications and entertainment, or, if such expenses are paid directly by Employee, shall promptly reimburse the Employee for such payment, provided that Employee has properly accounted therefor in accordance with Company policy.

(f) Vacation. Employee shall be entitled to four (4) weeks paid vacation in accordance with the Company's vacation policies for its executives, as in effect from time to time, but in no event less than four (4) weeks per year. The timing and duration of any vacation shall be taken at such time so as not to interfere with Employee's responsibilities and commitment to the company as determined by the Chief Executive Officer. Employee shall also be entitled to all paid holidays given by the Company to its employees.

4. TERMINATION.

Employee's services shall terminate upon the first to occur of the following events:

(a) Upon Employee's date of death or the date Employee is given written notice that he has been determined to be disabled by the Company. For purposes of this Agreement, Employee shall be deemed to be disabled if Employee, as a result of illness or incapacity, shall be unable to perform substantially his required duties for a period of sixty (60) consecutive days or an aggregate of ninety (90) days in any twelve (12) month period ("Incapacity"). Termination of Employee's employment by the Company due to Incapacity shall be communicated to Employee by written notice to Employee and shall be effective on the tenth (10) day after receipt of such notice by Employee, unless Employee returns to full-time performance of his required duties before such tenth (10th) day;

(b) On the date Employee is terminated by the Company for "Cause." For purposes of this Agreement, Cause shall be defined as: (i) Employee's conviction of, or plea of nolo contendre, to any felony or to a crime involving moral depravity or fraud; (ii) Employee's commission of an act of dishonesty or fraud or breach of fiduciary duty or act that has a adverse effect on the name or public image of the Company (iii) Employee's commission of an act of willful misconduct or gross negligence, as determined by the Board, provided the Employee shall have the opportunity to state his case before the Board prior to the Board taking such decision to so terminate the Employee; (iv) the failure of Employee to substantially perform his duties under this Agreement; (v) the material breach of any of Employee's material obligations under this Agreement; (vi) the failure of Employee to follow a lawful directive of the Chief Executive Officer or the Board Of Directors or (vii) excessive absenteeism, chronic alcoholism or any other form of addiction that prevents Employee from performing the essential functions of his position with or without a reasonable accommodation; provided, however, that the Company may terminate Employee's employment for Cause, as to (iv) or (v) above, only after failure by Employee to correct or cure, or to commence or to continue to pursue the correction or curing of, such conduct or omission within ten (10) days after receipt by Employee of written notice by the Company of each specific claim of any such misconduct or failure. Notwithstanding the foregoing, the Company may place Employee on paid administrative leave immediately after discovery of any such conduct or omission, and prior to termination of employment.

(c) On the date Employee terminates his employment with the Company for Good Reason (as defined below). For the purposes of this Agreement, "Good Reason" shall mean, without Employee's express written consent, the occurrence of one or both of the following conditions, provided that Employee shall have given notice to the Company within 30 days of the initial onset of the condition (the “Notice Period”) and the Company shall not have remedied such condition within 30 days thereafter: (i) a material diminution of Employee’s authority, duties or responsibilities, (ii) a material breach by the Company of any of its obligations under this Agreement, including the Company’s failure to obtain a satisfactory agreement from any successor to the Company to assume and agree to perform this Agreement pursuant to Section 14 hereof.

(d) On the date Employee terminates his employment without Good Reason, provided that Employee shall give the Company thirty (30) days written notice prior to such date of his intention to terminate his employment ("Notice Period"); or

(e) On the date the Company terminates Employee's employment for any reason, other than a reason set forth in Section 4(a) (Incapacity) or 4(b) (Cause), provided that the Company shall give Employee thirty (30) days written notice prior to such date of its intention to terminate Employee's employment ("Notice Period"). During such Notice Period, Employee will continue to perform his duties and responsibilities, and to be compensated therefore, unless the Company advises Employee otherwise.

5. RIGHTS UPON TERMINATION.

(a) Upon termination of Employee's employment by either party for any reason, all rights Employee has to payment under this Agreement shall cease as of the effective date of the termination, and except as expressly provided herein or as may be provided under any employee benefit plan or as required by law, Employee shall not be entitled to any additional compensation, commission, bonus, perquisites, or benefits with the exception of this Section 5 which shall survive termination of this agreement as outlined herein.

(b) Upon termination of Employee's employment (i) by the Company for Cause, (ii) by the Company for reason of Employee's death or Incapacity or (iii) by Employee without Good Reason, the Company shall pay to Employee or Employee's estate or representatives, as the case may be, his Base Salary and any benefits and outstanding reimbursable expenses accrued and payable to him through the last day of his actual employment by the Company.

(c) If Employee's employment is terminated by Employee pursuant to Section 4(c) or by the Company pursuant to Section 4(e) hereof, Employee shall receive his Base Salary for twelve (12) months following the date of termination and shall continue to be eligible for the Company’s medical and dental benefits (on the same terms applicable to active employees) for twelve (12) months following termination. In addition, subject to the provisions of this Agreement and the Company’s expense reimbursement policy, the Company shall reimburse Employee for all reimbursable expenses incurred prior to termination; such reimbursement shall be made in a lump sum upon or as soon as practicable following termination, provided appropriate documentation has been submitted by Employee in accordance with Company policy, and in no event later than March 15 of the year following the year in which termination occurs. Payment of Base Salary under this Section 5(c) shall commence on a date to be determined by the Company but no later than 90 days following termination of employment.

In order to be eligible for the severance benefits as set forth in this Section 5(c), Employee must (i) execute and deliver to the Company a general release, in a form satisfactory to the Company, within 90 days following the date of termination and (ii) be and remain in full compliance with his obligations under this Agreement and under the NDA (as defined below). In the event Employee breaches any obligation under this Agreement or the NDA any and all payments or benefits provided for in this Section 5(c) shall cease immediately.

(d) Notwithstanding the foregoing, in the event that this Agreement shall have been terminated by Employee pursuant to Section 4(d) or by the Company pursuant to Section 4(e) hereof, upon the request of the Company the Employee shall vacate his position and the Company's premises (if applicable) on a termination date specified by the Company which is earlier than the end of the Notice Period specified in Section 4(d) or 4(e) and Employee shall be paid, in one lump sum on such termination date, the Base Salary that would have been payable to him from such termination date through the end of the Notice Period, less required deductions for state and federal withholding tax, social security and other employee taxes.

(e) This agreement automatically shall terminate upon the death of Employee, except that Employee's estate shall be entitled to receive any amount accrued under Section 5(b) and any other amount to which Employee was entitled of the time of his death. Upon the Employee’s death, all stock options, warrants and stock appreciation rights granted by the employer to employee under any plan or otherwise prior to the date of Employee’s death, shall become vested, accelerate and become immediately exercisable by the Employee’s Estate for a period of six (6) months from the date of Employee’s death. In the event the Employee owned or was entitled to receive any unregistered securities of Employer, then Employer must use its reasonable best efforts to effect the registration of all such securities as soon as practical, and the estate of the Employee shall then have six (6) months after the effective date of the registration statement to exercise said options for the previously unregistered securities.

6. CONFIDENTIALITY AND NON-COMPETITION AGREEMENT

Employee has previously executed the Employee Confidentiality and Non-Competition Agreement annexed hereto as Exhibit A ("NDA"), which shall be incorporated by reference into this Agreement and made a part hereof. All references herein to this Agreement shall be construed to include Exhibit A. Employee understands that continued compliance with the NDA is a condition to Employee 's continued employment with the Company and that failure to comply with the terms and conditions of these provisions may result in termination "for cause" under this Agreement and in other damages to the Company.

7. COOPERATION FOLLOWING TERMINATION

Employee agrees that, following notice of termination of his employment until the date of his termination, he shall in good faith cooperate with the Company in all matters relating to the completion of his pending work on behalf of the Company and the orderly transition of such work to such other employees as the Company may designate. Employee further agrees that during and following the termination of his employment he shall in good faith cooperate with the Company as to any and all claims, controversies, disputes or complaints over which he has any knowledge or that may relate to his employment relationship with the Company; provided, however, that (a) Employee will be reimbursed by the Company for any out of pocket expenses incurred pursuant to his duties under this Section 7 and reasonably compensated for his time, and (b) Employee's obligation to cooperate under this Section 7 shall in no way preclude Employee from seeking to enforce his rights under this Agreement. Such cooperation includes, but is not limited to, providing the Company with all information known to him related to such claims, controversies, disputes or complaints and appearing and giving testimony in any forum.

8. GOVERNING LAW

Except as otherwise explicitly noted, this Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts (without giving effect to the conflict of law rules of Massachusetts).

9. INTEGRATION

This Agreement and the previously executed NDA attached hereto as Exhibit A constitutes the entire understanding between the parties hereto relating to the subject matter hereof, superseding all negotiations, prior discussions, preliminary agreements and agreements (other than the NDA) related to the subject matter hereof made prior to the date hereof.

10. MODIFICATIONS AND AMENDMENTS

This Agreement may be modified or amended only by an instrument in writing executed by the parties hereto and approved in writing by the Board of Directors. Such modification or amendment will not become effective until such approval has been given.

11. SEVERABILITY

If any of the terms or conditions of this Agreement shall be declared void or unenforceable by any court or administrative body of competent jurisdiction, such term or condition shall be deemed severable from the remainder of this Agreement, and the other terms and conditions of this Agreement shall continue to be valid and enforceable.

12. NOTICE

For the purpose of this Agreement, notices and all other communications provided for in this Agreement shall be in writing and shall be deemed to have been duly given as of the date if delivered in person or by telecopy, on the next business day, if sent by a nationally recognized overnight courier service, and on the second business day if mailed by registered mail, return receipt requested, postage prepaid, in each case addressed as follows:

If to the Employee:

Mark Fidler

c/o Ambient Corporation

7 Wells Avenue, Suite 11

Newton, MA 02459

If to the Company:

Ambient Corporation

7 Wells Avenue, Suite 11

Newton, MA 02459

or to such other address as any party may have furnished to the other in writing in accordance herewith, except that notices of changes of address shall be effective upon receipt.

13. WAIVER

The observation or performance of any condition or obligation imposed upon Employee hereunder may be waived only upon the written consent of the Board of Directors. Such waiver shall be limited to the terms thereof and shall not constitute a waiver of any other condition or obligation of the Employee under this Agreement.

14. ASSIGNMENT

The rights and obligations of the Company in this Agreement shall inure to its benefit and be binding upon its successors-in-interest (whether by merger, consolidation, reorganization, sale of stock or assets or otherwise), and the Company may assign this Agreement to any affiliate. This Agreement, being for the personal services of Employee, shall not be assignable by Employee.

15. HEADINGS

The headings have been inserted for convenience only and are not to be considered when construing the provisions of this Agreement.

16. COUNTERPARTS

This Agreement may be executed in one or more counterparts, each of which counterparts, when taken together, shall constitute but one and the same agreement.

17. COMPLIANCE WITH INTERNAL REVENUE CODE SECTION 409A

No amounts payable under this Agreement are intended to constitute deferred compensation within the meaning of Section 409A of the Internal Revenue Code and applicable regulatory guidance issued thereunder (“Section 409A”). Amounts payable as severance under Section 5 of this Agreement are intended to be excepted from 409A and shall be interpreted accordingly. If and to the extent any amount provided under this Agreement becomes subject to the requirements of Section 409A, such amount shall be paid or otherwise provided in a manner that complies in form and in operation with the requirements of Section 409A. If, at the time his employment terminates, the Employee is a “specified employee” as defined in Section 409A, no payments that constitute “deferred compensation” as defined in Section 409A shall be made prior to six months from his separation from service. Nothing in this Agreement shall be construed as an entitlement to or guarantee of any particular tax treatment to the Employee.

[signature page follows]