File Pursuant to Rule 424(b)(3)

Registration No. 333-159645PROSPECTUS

AMBIENT CORPORATION

37,368,831shares of Common Stock

This Prospectus relates to the resale by the selling stockholders of up to 37,368,831 shares of our common stock, par value $0.001 (the "Common Stock") issuable upon exercise of currently exercisable warrants.

We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

The selling stockholders may sell the shares from time to time at the prevailing market price or in negotiated transactions. Each of the selling stockholders may be deemed to be an "underwriter," as such term is defined in the Securities Act of 1933, as amended (the "Act").

Our Common Stock is quoted on the OTC Bulletin Board under the trading symbol "ABTG". The last reported sales price per share of our Common Stock as quoted by the OTC Bulletin Board on April 21, 2011 was $0.072.

AS YOU REVIEW THIS PROSPECTUS, YOU SHOULD CAREFULLY CONSIDER THE MATTERS DESCRIBED IN THE SECTION OF THIS PROSPECTUS TITLED "RISK FACTORS" BEGINNING ON PAGE 3.

NEITHER THE SECURITIES EXCHANGE AND COMMISSION (THE "SEC") NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED ON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is April 27, 2011

PRINCIPAL EXECUTIVE OFFICE:

Ambient Corporation

7 Wells Avenue

Newton, Massachusetts 02459

(617) 332-0004

TABLE OF CONTENT

| PROSPECTUS SUMMARY | | | 1 | |

| RISK FACTORS | | | 3 | |

| USE OF PROCEEDS | | | 7 | |

| AGREEMENTS WITH THE SELLING STOCKHOLDERS | | | 7 | |

| DIVIDEND POLICY | | | 8 | |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | | | 9 | |

| MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | | | 9 | |

| DESCRIPTION OF BUSINESS | | | 10 | |

| DESCRIPTION OF PROPERTY | | | 24 | |

| LEGAL PROCEEDINGS | | | 24 | |

| MANAGEMENT | | | 24 | |

| EXECUTIVE COMPENSATION | | | 26 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | 28 | |

| BENEFICIAL OWNERSHIP OF MANAGEMENT, DIRECTORS AND CERTAIN BENEFICIAL HOLDERS | | | 29 | |

| SELLING STOCKHOLDERS | | | 31 | |

| PLAN OF DISTRIBUTION | | | 31 | |

| DESCRIPTION OF CAPITAL STOCK | | | 33 | |

| DISCLOSURE OF SEC POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | | | 33 | |

| LEGAL MATTERS | | | 33 | |

| EXPERTS | | | 34 | |

| WHERE YOU CAN FIND MORE INFORMATION | | | 34 | |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | | F-1 | |

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this Prospectus. The selling stockholders are offering to sell, and seeking offers to buy, shares of our Common Stock only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or of any sale of Common Stock.

THIS IS ONLY A SUMMARY AND DOES NOT CONTAIN ALL OF THE INFORMATION THAT MAY BE IMPORTANT TO YOU. YOU SHOULD READ THE ENTIRE PROSPECTUS, ESPECIALLY THE SECTION TITLED "RISK FACTORS" AND OUR FINANCIAL STATEMENTS AND THE RELATED NOTES INCLUDED IN THIS PROSPECTUS, BEFORE DECIDING TO INVEST IN SHARES OF OUR COMMON STOCK.

AMBIENT CORPORATION

Ambient Corporation (“Ambient” the “Company” “we or “us”) is a pioneering integrator of smart grid communications platforms, creating high-speed Internet Protocols (IP) based data communications networks for the medium and low-voltage distribution grid. The Ambient smart grid platform, known as Ambient Smart Grid®, facilitates a two-way, real-time communications network designed to modernize the power grid infrastructure, making it more receptive to wide-scale adoption of renewable energy sources and supportive of new energy efficiency technologies and programs. The Ambient Smart Grid® platform facilitates a utility’s ability to implement smart grid applications such as Advanced Metering Infrastructures (AMI), Demand Side Management (DSM), Distribution Monitoring and Automation, direct load control and more. When combined, these applications offer economic, operational and environmental benefits for utilities, and ultimately the utility customers.

Ambient has been focused, since 2000, on the collaborative development of communication solutions that meet the needs of utilities to ultimately deploy what is now referred to as the smart grid. From inception, Ambient’s platform, which includes Nodes, management systems, current transformers and a suite of applications, has been designed to function as an open standards-based system intended to support a variety of applications and services simultaneously. Over the years, Ambient has developed and delivered three generations of smart grid communications Nodes that with thousands of our units deployed in the field are already beginning to transform today’s century-old power delivery system into an advanced energy network that provides timely energy usage information and remote grid monitoring, automation and control. With each successive generation, Ambient has continued to support and integrate additional applications, while driving lower the manufacturing costs and price to our customers making our products even more attractive. In December of 2010, Ambient delivered to our marquee customer units of our fourth generation communications Node which are being beta tested in the field.

Throughout the past five years, Ambient has been a key supplier to Duke Energy’s grid efficiency programs, and the leading supplier of the smart grid communications Nodes for their smart grid deployments. During 2008, Ambient received purchase orders from Duke Energy to purchase its X2000 and X-3000 communications Nodes and to license our AmbientNMS®, to enable the building out of an intelligent grid/intelligent-metering platform, which generated approximately $14.8 million in revenues throughout 2008 and 2009.

In September 2009, we entered into a long-term agreement, running through 2015 to supply Ambient’s X-3100 Node and to license our management software – AmbientNMS® for deployment throughout the utility’s electric power distribution grid. Since the execution of the agreement, we have generated, through December 31, 2010, approximately $21.1 million in revenues from the sale of our product.

With Ambient Smart Grid®, our goal remains to be a leading designer, developer and systems integrator of smart grid communications platforms, incorporating a wide array of communications protocols and smart grid applications such as advanced metering solutions to complement our communications platform and our internally developed energy sensing capabilities. We view a flexible smart grid communications platform to be a key factor for utilities to efficiently integrate the increasing portfolios of smart grid technologies and applications into and on the electrical grid.

Ambient continues to seek new opportunities for commercial deployments and to bring new and existing networks to full commercialization. Throughout 2011, Ambient’s principal target customers will continue to be electric utilities that seek to both increase efficiencies in the delivery of energy and enable consumers to better understand and manage their energy consumption. Ambient seeks to continue to extend existing relationships, and develop new relationships to collaborate on efforts to drive the development of new functionality for both utility and consumer applications that further enhance the value of the Ambient Smart Grid® platform.

In February 2011, our majority stockholder approved a reverse split of our common stock, in the range of 1-for 30 to 1-for 100, which our Board of Directors may implement in its discretion (if at all) before December 31, 2011, without any further stockholder approval. Our Board approved and recommended the reverse stock split primarily in order to increase Ambient’s prospects of successfully listing its common stock on the NASDAQ Capital Market. In connection therewith and in an effort to strengthen our balance sheet position in any such listing effort, as discussed below in further detail in December 2010 our majority stockholder applied the $5 million then remaining in the escrow account for our benefit to the purchase of Ambient’s securities.

Since inception, we have funded operations primarily through the sale of our securities and most recently from the revenue generated from purchase orders received from our marquee customer. To date, we have funded operations primarily through the sale of our securities. In connection with the continued development, marketing, and deployment of our products, technology, and services, we anticipate that we will continue to augment our revenue generation capabilities with such raises in the future. We recognized revenues of $20,358,040 and $2,193,338 for the years ended December 31, 2010 and 2009, respectively, representing sales of equipment, software and services to Duke Energy. We incurred net losses of $3,186,229 and $14,246,284 for the years ended December 31, 2010 and 2009, respectively.

CORPORATE INFORMATION

Our principal offices are located 7 Wells Avenue, Newton, Massachusetts 02459, and our telephone number is (617) 332-0004. We maintain a website at www.ambientcorp.com. Information contained on our website is not part of this Prospectus.

RISK FACTORS

Investing in shares of our Common Stock involves significant risk. You should consider the information under the caption "RISK FACTORS" beginning on page 7 of this Prospectus in deciding whether to purchase the Common Stock offered under this Prospectus.

THE OFFERING

| Securities offered by the selling stockholders | | 37,368,831 shares of Common Stock. (1) |

| Shares outstanding before the Offering | | 1,649,301,354 (2) |

| Use of Proceeds | | We will not receive any proceeds from the sale of the Common Stock by the selling stockholders |

| (1) | Refers to shares issuable upon exercise of warrants issued to Kuhns Brothers (“Kuhns”), an investment firm and a registered broker dealer, or its designees, in connection with certain financings that we consummated between July 2007 and November 2008 and is comprised of the following: to (i) 750,000 shares of Common Stock issuable upon exercise of warrants issued in January 2007 in connection with the retainer of Kuhns as investment advisor to us and (ii) 36,618,831 shares of Common Stock issuable upon exercise of warrants issued as compensation for placement agent services rendered in connection with the above referenced financings. For a description of the agreement between us and the holders of the Warrants and the Other Warrants, see "DESCRIPTION OF THE AGREEMENTS WITH SELLING STOCKHOLDERS". |

| | |

| (2) | As of April 21, 2011. Does not include (i) up to an aggregate of 107,146,500 shares of Common Stock issuable upon exercise of options granted under our 2000 Equity Incentive Stock Option Plan and our 2002 Non-Employee Director Stock Option Plan, (ii) any of the shares described in footnote (1) above and (iii) 122,225,000 shares of Common Stock issuable upon exercise of other outstanding options and warrants. |

RISK FACTORS

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE RISKS AND UNCERTAINTIES DESCRIBED BELOW BEFORE YOU PURCHASE ANY OF OUR COMMON STOCK. IF ANY OF THESE RISKS OR UNCERTAINTIES ACTUALLY OCCURS, OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATIONS COULD BE MATERIALLY ADVERSELY AFFECTED, AND YOU COULD LOSE ALL OR PART OF YOUR INVESTMENT.

RISKS CONCERNING OUR BUSINESS

WE CURRENTLY DEPEND ON ONE KEY CUSTOMER FOR ALL OUR REVENUE, AND THE LOSS OF, OR A SIGNIFICANT SHORTFALL IN ORDERS FROM, THIS KEY CUSTOMER COULD SIGNIFICANTLY REDUCE OUR REVENUE.

For the years ended December 31, 2010 and 2009, 100% of our revenue was from Duke Energy. Our inability to generate additional anticipated revenue from our key customer, or a significant shortfall in sales will likely significantly reduce our revenue and adversely affect our business. Our operating results in the foreseeable future continue to depend on our ability to further our deployments with our existing customer.

Our immediate business opportunities continue to be largely dependent on the success of our deployments, and the future decisions of Duke Energy relating to smart grid system architecture, and the Ambient fourth generation Node. We are focusing much of our time, attention and resources on the rollout of the equipment and software delivered to Duke Energy. The success of our endeavors with respect to the deployment is subject to several risks. We depend on third parties to deliver and support reliable components to manufacture and assemble our end products, as well as our engineering team to continue to advance our software products.

If we are unable to effectively manage, maintain and grow our relationship with Duke Energy, our business could be materially and adversely affected in its ability to continue operations as currently conducted.

Additionally, management is unable at this time to assess the effects, if any, that the proposed merger between Duke and Progress Energy, which merger was announced in January 2011 and is subject to shareholder and regulatory approval, will have on the continuation and/or expansion of our deployment by the new combined company following the merger, No assurance can be provided that the post merger entity will continue with or expand the current deployments at Duke Energy.

WE UTILIZE ONE SUPPLIER TO MANUFACTURE OUR NODES

In both 2010 and 2009, we utilized one contract manufacturer to produce our Nodes. Should our relationship with the manufacturer deteriorate or terminate or should this supplier lose some or all of its access to the products or components that comprise all or part of the Nodes that we purchase from it performance would be adversely affected. Under such circumstances, we would be required to seek alternative sources of supply for these products, and there can be no assurance that we would be able to obtain such products from alternative sources on the same terms. A failure to obtain such products on as favorable terms would have an adverse effect on our revenue and/or gross margin.

SLOWER ECONOMIC GROWTH RATES IN THE US MAY MATERIALLY ADVERSELY IMPACT OUR OPERATING RESULTS.

The US and other economies are recovering from a global financial crisis and recession which began in 2008. Growth has resumed, but has been modest and at an unsteady rate. There are likely to be significant long-term effects resulting from the financial crisis and recession, including a future global economic growth rate that is slower than what was experienced in the years leading up to the crisis, and more volatility may occur before a sustainable, yet lower, growth rate is achieved.

In addition, the OECD has encouraged countries with large federal budget deficits, such as the US, to initiate deficit reduction measures. Such measures, if they are undertaken too rapidly, could further undermine economic recovery and slow growth by reducing demand.

A lower future economic growth rate could result in reductions in sales of our products and services, slower adoption of new technologies and increase price competition. Any of these events would likely harm our business, results of operations and financial condition or cash flows from operations and our profitability.

IF WE ARE UNABLE TO OBTAIN ADDITIONAL FUNDS WHEN NEEDED, WE MAY NOT BE ABLE TO EXPAND EXISTING COMMERCIAL DEPLOYMENTS.

Management believes that our currently available cash resources, as well as anticipated revenue from firm purchase orders will allow us to meet our operating requirements through fiscal 2011. However, it is conceivable that we may raise additional funds to expand existing commercial deployments, support strategic acquisitions and/ orjoint venture opportunities, and/or to satisfy any additional significant purchase order that it may receive. If and or when additional capital is required there are no assurances that we will be successful in obtaining additional required capital on reasonable terms and conditions.

OTHERS MAY CHALLENGE OUR INTELLECTUAL PROPERTY RIGHTS WHICH MAY NEGATIVELY IMPACT OUR COMPETITIVE POSITION

Although we rely on a combination of patents, copyrights, trade secrets, nondisclosure and other contractual provisions and technical measures to protect our intellectual property rights, it is possible that our rights relating to Ambient’s Smart Grid® solution may be challenged and invalidated or circumvented. Further, effective intellectual property protection may be unavailable or limited. Despite efforts to protect our proprietary rights, unauthorized parties may attempt to copy, reverse engineer, or otherwise use aspects of processes and devices that we may regard as proprietary. Policing unauthorized use of proprietary information is difficult, and there can be no assurance that the steps we have taken will prevent misappropriation of our technologies. In the event that our intellectual property protection is insufficient to protect our intellectual property rights, we could face increased competition in the market for technologies, which could have a material adverse effect on our business, financial condition and results of operations.

OTHER COMPANIES MAY DEVELOP AND SELL COMPETING PRODUCTS WHICH MAY REDUCE THE SALES OF OUR PRODUCTS OR RENDER OUR PRODUCTS OBSOLETE.

The smart grid communications marketplace is rapidly evolving and therefore has rapidly changing technological, regulatory and consumer requirements. We will need to continue to maintain and improve our competitive position to keep pace with the evolving needs of our customers, and continue to develop and introduce new products, features and services in a timely and efficient manner.

Some of our potential competitors have longer operating histories, greater name recognition and substantially greater financial, technical, sales, marketing and other resources than our Company. These potential competitors may, among other things, undertake more extensive marketing campaigns, adopt more aggressive pricing policies, obtain more favorable pricing from suppliers and manufacturers and exert more influence on the sales channel than we do. As a result, we may not be able to compete successfully with these potential competitors, and these potential competitors may develop or market technologies and products that are more widely accepted than those we are developing or that would render our products obsolete or noncompetitive.

WE HAVE A HISTORY OF LOSSES AND WE MAY EXPERIENCE LOSSES IN THE FUTURE

We are a company engaged in the design, development and marketing of our smart grid communication technology and solutions. We have incurred losses of $3,186,229 and $14,246,284 for the years ended December 31, 2010 and 2009, respectively.

Our ability to generate and sustain significant additional revenues or achieve profitability will depend upon the factors discussed elsewhere in this "Risk Factors" section. There are no assurances that we will sustain profitability, or that operating losses will not resume in the future.

RISKS CONCERNING OUR CAPITAL STRUCTURE

VICIS CAPITAL MASTER FUND OWNS A MAJORITY OF AMBIENT’S ISSUED AND OUTSTANDING COMMON STOCK AND WILL THUS BE ABLE TO CONTROL THE OUTCOME OF ALL ISSUES SUBMITTED TO OUR STOCKHOLDERS.

Vicis holds, as of April 21, 2011, approximately 84.2% of our issued and outstanding common stock. As a result, Vicis is able to control the outcome of all issues submitted to our stockholders, including the election of all of our directors and the approval of any other action requiring the approval of our stockholders, including any amendments to our certificate of incorporation, a sale of all or substantially all of our assets or a merger or a private transaction. A principal of Vicis also is a member of our board of directors.

THE EFFECTS OF A POTENTIAL REVERSE STOCK SPLIT OF OUR COMMON STOCK ARE UNKNOWN.

In February 2011, our majority stockholder approved a reverse split of Ambient’s stock, in the range of 1-for 30 to 1-for 100, which the Board of Directors may implement in its discretion (if at all) before December 31, 2011, without any further stockholder approval.

The Board approved and recommended the reverse stock split primarily in order to increase Ambient’s prospects of successfully listing its common stock on the Nasdaq Capital Market. If the Board determines to effect a reverse stock split, we cannot assure you that it will be successful in achieving a listing on The Nasdaq Capital Market (or any other exchange). Stockholders should also note that if our Board elects to implement a reverse stock split, there is no assurance that prices for shares of the Common Stock after the reverse split will increase proportionally to the exchange ratio of the reverse stock split (or at all). We cannot guarantee to stockholders that the price of our shares will reach or sustain any price level in the future, and it is possible the proposed reverse stock split will have no lasting impact on our share price.

FUTURE SALES OF COMMON STOCK OR OTHER DILUTIVE EVENTS MAY ADVERSELY AFFECT PREVAILING MARKET PRICES FOR OUR COMMON STOCK.

As of April 21, 2011, we were authorized to issue up to 2,000,000,000 shares of common stock, of which 1,649,301,354 shares were outstanding as of such date. As of April 21, 2011, an additional 290,956,931 shares of common stock were reserved for the exercise of outstanding options and warrants to purchase common stock and the reservations of shares in the various stock option plans. Many of the above options and warrants contain provisions that require the issuance of increased numbers of shares of common stock in the event of stock splits, redemptions, mergers and other transactions. The occurrence of any such event or the exercise of any of these options or warrants would dilute the interest in our company represented by each share of common stock and may adversely affect the prevailing market price of our common stock.

Additionally, our board of directors has the authority, without further action or vote of our stockholders, to issue authorized shares of our common stock that are not reserved for issuance. In addition, in order to raise the amount of capital that we may need at the current market price of our common stock, we may need to issue a significant number of shares of common stock or securities that are convertible into or exercisable for a significant number of shares of our common stock.

Any of these issuances will dilute the percentage ownership interests of our current stockholders, which will have the effect of reducing their influence on matters on which our stockholders vote, and might dilute the book value and market value of our common stock. Our stockholders may incur additional dilution upon the exercise of currently outstanding or subsequently granted options or warrants to purchase shares of our common stock.

OUR STOCK PRICE MAY BE VOLATILE.

The market price of our common stock will likely fluctuate significantly in response to the following factors, some of which are beyond our control:

| | ● | Announcements by us of commencement of, changes to, or cancellation of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| | ● | Changes in financial estimates of our revenues and operating results by securities analysts or investors; |

| | ● | Variations in our quarterly operating results due to a number of factors, including but not limited to those identified in this "RISK FACTORS" section; |

| | ● | Additions or departures of key personnel; |

| | ● | Future sales of our common stock; |

| | ● | Stock market price and volume fluctuations attributable to inconsistent trading volume levels of our stock; |

| | ● | Commencement of or involvement in litigation; and/or |

| | ● | Announcements by us, or by our competitors of technological innovations or new products. |

In addition, the equity markets have experienced volatility that has particularly affected the market prices of equity securities issued by high technology companies and that often has been unrelated or disproportionate to the operating results of those companies. These broad market fluctuations may adversely affect the market price of our common stock.

PENNY STOCK REGULATIONS ARE APPLICABLE TO INVESTMENT IN SHARES OF OUR COMMON STOCK.

Broker-dealer practices in connection with transactions in "penny stocks" are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges, provided that current prices and volume information with respect to transactions in such securities are provided by the exchange or system). Penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. In addition, penny stock rules generally require that prior to a transaction in a penny stock, the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to penny stock rules. Many brokers will not deal with penny stocks, restricting the market for our shares of common stock.

BECAUSE WE DO NOT INTEND TO PAY ANY CASH DIVIDENDS ON OUR SHARES OF COMMON STOCK, OUR STOCKHOLDERS WILL NOT BE ABLE TO RECEIVE A RETURN ON THEIR SHARES UNLESS THEY SELL THEM.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains some "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995 and information relating to us that are based on the beliefs of our management, as well as assumptions made by and the information currently available to our management. When used in this Prospectus, the words "estimate," "project," "believe," "anticipate," "intend," "expect" and similar expressions are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated in these forward-looking statements, including those risks discussed in this Prospectus.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Prospectus. Except for special circumstances in which a duty to update arises when prior disclosure becomes materially misleading in light of subsequent circumstances, we do not intend to update any of these forward-looking statements to reflect events or circumstances after the date of this Prospectus or to reflect the occurrence of unanticipated events.

USE OF PROCEEDS

The selling stockholders will receive the net proceeds from sales of the shares of Common Stock included in this Prospectus. We will not receive any proceeds from the sale of Common Stock by the selling stockholders. We would, however, receive proceeds from the exercise of the Retainer Warrants and Placement Agent Warrants to purchase up to 37,368,831 shares of Common Stock that are held by the selling stockholders, to the extent such warrants are exercised for cash. If the warrants are exercised on a cashless basis, we will not receive proceeds from those exercises.

The selling stockholders are not obligated to exercise these warrants, and there can be no assurance that they will do so. If all of these warrants were exercised for cash, we would receive proceeds of approximately $1.32 million. Any proceeds we receive from the exercise of these options and warrants will be used for working capital and general corporate purposes.

AGREEMENTS WITH THE SELLING STOCKHOLDERS

Between July 31, 2007 and January 15, 2008, we raised gross proceeds of $12,500,000 from the private placement of our three year 8% Secured Convertible Promissory Note to Vicis Master Master Fund. On April 23, 2008, we raised from Vicis $3,000,000 from the issuance of warrants, exercisable through April 2013, to purchase up to 135,000,000 shares of our Common Stock at a per share exercise price of $0.001. Finally, on November 21, 2008, we and Vicis entered into an agreement, pursuant to which Vicis invested in us an additional $8 million, in consideration of which we reduced the conversion price on the above referenced notes.

In January 2007, we and Kuhns Brothers (“Kuhns”), an investment firm and a registered broker dealer, entered into a placement agency agreement pursuant to which Kuhns provided to us investment banking services. In connection with the entry into the placement agency agreement, we issued to Kuhns warrants to purchase up 750,000 shares of our Common Stock (the “Retainer Warrants”). Thereafter, in connection with the above referenced transactions, we paid to Kuhns, an investment firm and a registered broker dealer which served as placement agent for the above transactions, a cash fee of $615,000 and we issued, between July 31, 2007 and November 21, 2008 warrants to purchase up to 45,016,665 shares of our Common Stock (the “Placement Warrants”; together with the Retainer Warrants, the “Placement Agent Warrants”). Of the Placement Warrants issued, warrants for 7,619,047 shares were issued in lieu of the payment of a cash fee of $300,000. The registration statements of which this prospectus forms a part was filed in order to register for resale the shares of Common Stock underlying the Placement Agent Warrants held by Kuhns or its designees, except for warrants for 1,383,334 shares.

The Retainer warrants first became exercisable on January 31, 2008 and are exercisable through January 30, 2012 at a per share exercise price of $0.075. The Placement Warrants are exercisable at a share price of $0.035. Of the Placement Warrants, warrants for 16,600,000 shares are exercisable through July 30, 2012, warrants for 11,666,666 are exercisable through November 1, 2012, warrants for 14,999,999 are exercisable through January 14, 2013, and warrants for 1,000,000 shares are exercisable through April 23, 2013. As of April 23, 2010, Placement Warrants exercisable through July 30, 2012, were exercised for an aggregate of 5,814,500 shares of the Company's Common Stock. The exercise price for the Placement Agent Warrants is subject to adjustment if there are certain capital adjustments or similar transactions, such as a stock split or merger. Placement Agent Warrants for fifty percent of the shares contain provisions providing the holders thereof with the right to exercise the Warrants on a "cashless" basis after the first anniversary of issuance if the Registration Statement is not in effect at the time of exercise. If the holder elects the cashless exercise option, it will receive a lesser number of shares and we will not receive any cash proceeds from that exercise. The lesser number of shares which the holder will receive is determined by a formula that takes into account the closing bid price of our Common Stock on the trading day immediately before the Warrant exercise. That closing price is multiplied by the full number of shares for which the Warrant is then being exercised. That result is reduced by the total exercise price the holder would have paid for those shares if it had not elected a cashless exercise. The number of shares actually issued under the cashless exercise option is equal to the balance amount divided by the closing price referred to above. We are filing the Registration Statement so that we can receive cash proceeds upon any exercise of the Placement Warrants.

The Placement Agent Warrants provide that the beneficial owner can exercise such warrant in accordance with their respective terms by giving notice to us. However, the holder may not exercise its Warrant to the extent that such exercise would result in such owner and its affiliates beneficially owning more than 4.99% of our stock then outstanding (after taking into account the shares of our Common Stock issuable upon such conversion or warrant exercise). If the holder then disposes of some or all of its holdings, it can again convert its debentures or exercise its warrant.

DIVIDEND POLICY

We have paid no dividends on our Common Stock and do not expect to pay cash dividends in the foreseeable future. It is the present policy of our board of directors to retain all earnings to provide funds for the growth of the Company. The declaration and payment of dividends in the future will be determined by our board of directors based upon our earnings, financial condition, capital requirements and such other factors as our board of directors may deem relevant. We are not under any contractual restriction as to present or future ability to pay dividends.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

The following table shows the quarterly high and low bid prices for our Common Stock over the last two completed fiscal years as quoted on the OTC Bulletin Board. The prices represent quotations by dealers without adjustments for retail mark-ups, mark-downs or commission and may not represent actual transactions. The closing price of our Common Stock on April 21, 2011, was $0.072 per share.

| | | Low | | | High | |

| Year Ended December 31, 2010 | | | | | | |

| First Quarter | | $ | 0.102 | | | $ | 0.165 | |

| Second Quarter | | $ | 0.062 | | | $ | 0.101 | |

| Third Quarter | | | 0.063 | | | | 0.097 | |

| Fourth Quarter | | | 0.088 | | | | 0.139 | |

| | | | | | | | | |

| Year Ended December 31, 2009 | | | | | | | | |

| First Quarter | | $ | 0.02 | | | $ | 0.101 | |

| Second Quarter | | $ | 0.091 | | | $ | 0.198 | |

| Third Quarter | | $ | 0.14 | | | $ | 0.183 | |

| Fourth Quarter | | $ | 0.13 | | | $ | 0.25 | |

As of April 21, 2011, there were 138 holders of record of our Common Stock. A significant number of shares of our Common Stock are held in either nominee name or street name brokerage accounts, and consequently, we are unable to determine the number of beneficial owners of our stock.

MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

THE FOLLOWING DISCUSSION SHOULD BE READ IN CONJUNCTION WITH OUR FINANCIAL STATEMENTS AND THE NOTES RELATED TO THOSE STATEMENTS. SOME OF OUR DISCUSSION IS FORWARD-LOOKING AND INVOLVES RISKS AND UNCERTAINTIES. FOR INFORMATION REGARDING RISK FACTORS THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, REFER TO THE “RISK FACTORS” SECTION OF THIS ANNUAL REPORT.

OVERVIEW

Ambient Corporation is a pioneering integrator of smart grid communications platforms, creating high-speed Internet Protocols (IP) based data communications networks for the medium and low-voltage distribution grid. The Ambient smart grid platform, known as Ambient Smart Grid®, facilitates a two-way, real-time communications network designed to modernize the power grid infrastructure, making it more receptive to wide-scale adoption of renewable energy sources and supportive of new energy efficiency technologies and programs. The Ambient Smart Grid® platform facilitates a utility’s ability to implement smart grid applications such as Advanced Metering Infrastructures (AMI), Demand Side Management (DSM), Distribution Monitoring and Automation, direct load control and more. When combined, these applications offer economic, operational and environmental benefits for utilities, and ultimately the utility customers.

Ambient has been focused, since 2000, on the collaborative development of communication solutions that meet the needs of utilities to ultimately deploy what is now referred to as the smart grid. From inception, Ambient’s platform, which includes Nodes, management systems, current transformers and a suite of applications, has been designed to function as an open standards-based system intended to support a variety of applications and services simultaneously. Over the years, Ambient has developed and delivered three generations of smart grid communications Nodes that with thousands of our units deployed in the field are already beginning to transform today’s century-old power delivery system into an advanced energy network that provides timely energy usage information and remote grid monitoring, automation and control. With each successive generation, Ambient has continued to support and integrate additional applications, while driving lower the manufacturing costs and price to our customers making our products even more attractive. In December of 2010, Ambient delivered to our marquee customer units of our fourth generation communications Node which are being beta tested in the field.

Throughout the past five years, Ambient has been a key supplier to Duke Energy’s grid efficiency programs, and the leading supplier of the smart grid communications Nodes for their smart grid deployments. During 2008, Ambient received purchase orders from Duke Energy to purchase its X2000 and X-3000 communications Nodes and to license our AmbientNMS®, to enable the building out of an intelligent grid/intelligent-metering platform, which generated approximately $14.8 million in revenues throughout 2008 and 2009.

In September 2009, we entered into a long-term agreement, running through 2015 to supply Ambient’s X-3100 Node and to license our management software – AmbientNMS® for deployment throughout the utility’s electric power distribution grid. Since the execution of the agreement, we have generated, through December 31, 2010, approximately $21.1 million in revenues from the sale of our product.

With Ambient Smart Grid®, our goal remains to be a leading designer, developer and systems integrator of smart grid communications platforms, incorporating a wide array of communications protocols and smart grid applications such as advanced metering solutions to complement our communications platform and our internally developed energy sensing capabilities. We view a flexible smart grid communications platform to be a key factor for utilities to efficiently integrate the increasing portfolios of smart grid technologies and applications into and on the electrical grid.

Ambient continues to seek new opportunities for commercial deployments and to bring new and existing networks to full commercialization. Throughout 2011, Ambient’s principal target customers will continue to be electric utilities that seek to both increase efficiencies in the delivery of energy and enable consumers to better understand and manage their energy consumption. Ambient seeks to continue to extend existing relationships, and develop new relationships to collaborate on efforts to drive the development of new functionality for both utility and consumer applications that further enhance the value of the Ambient Smart Grid® platform.

Since inception, we have funded operations primarily through the sale of our securities and most recently from the revenue generated from purchase orders received from our marquee customer. In connection with the continued development, upgrade, and marketing of our products, technology, and services, Ambient will continue to emphasize the ongoing research and development efforts necessary to complete development of our fourth generation Node, incorporate additional applications into our platform, and to continue to enhance the capabilities and functionality of our AmbientNMS® system used by customers to scale and manage the network created by the deployment of our Nodes.

In February 2011, our majority stockholder approved a reverse split of our common stock, in the range of 1-for 30 to 1-for 100, which our Board of Directors may implement in its discretion (if at all) before December 31, 2011, without any further stockholder approval. Our Board approved and recommended the reverse stock split primarily in order to increase Ambient’s prospects of successfully listing its common stock on the NASDAQ Capital Market. In connection therewith and in an effort to strengthen our balance sheet position in any such listing effort, as discussed below in further detail in December 2010 our majority stockholder applied the $5 million then remaining in the escrow account for our benefit to the purchase of Ambient’s securities.

Prospects and Outlook

Our business success in the immediate future will depend largely on our marquee customer expanding their existing deployments, as well as the deployment decisions of other utilities. Today, Ambient is reliant on one significant marquee customer that shares the Ambient vision for an open standards-based common communications infrastructure. We anticipate that we will continue to collaborate with this customer and continue to support their smart grid deployments.

Notwithstanding the above, Ambient recognizes that our customer could alter their vision regarding the common communications infrastructure, determine that a competing company offers a more desirable product, or slow its deployments indefinitely, significantly affecting the prospects and outlook of the Company.

Additionally, management is unable at this time to assess the effects, if any, that the proposed merger between Duke and Progress Energy, which merger was announced in January 2011 and is subject to shareholder and regulatory approval, will have on the continuation and/or expansion of our deployment by the new combined company following the merger, No assurance can be provided that the post merger entity will continue with or expand the current deployments at Duke Energy.

As we have demonstrated success over the course of 2010, we believe that additional utilities will ultimately begin to accept and endorse the concept of one common communications infrastructure to support many utility and consumer applications, strengthening Ambient’s position. However, no assurance can be given that this development will in fact ultimately occur and even if it does that the Ambient Smart Grid® will be their choice technology.

RESULTS OF OPERATIONS

COMPARISON OF THE YEAR ENDED DECEMBER 31, 2010 (the “2010 Period”) AND THE YEAR ENDED DECEMBER 31, 2009 (the “2009 Period”)

REVENUES. Revenues for the 2010 Period were $20,358,040, compared to $2,193,338, for the 2009 Period. Revenues for each of the 2010 and 2009 Periods were attributable to the sales of products, and maintenance to our customer. Revenues for the 2010 and 2009 Periods related to the sales of products totaled $20,282,596 and $2,127,977, respectively. Revenues from the sale of software and services for the 2010 Period and the 2009 Period totaled $75,444 and $65,361, respectively. The increase in revenue during the 2010 Period compared to the 2009 Period reflects an increase in the number of communication nodes delivered as well as increased license fees recorded from the licensing of our AmbientNMS®.

COST OF GOODS SOLD. Cost of goods sold for the 2010 Period was $12,023,332 compared to $1,836,546 for the 2009 Period. Cost of goods sold included all costs related to manufacturing of our products and consisted primarily of direct material costs. Cost of goods sold also included expenses related to the write down of inventory to the lower of cost or market. For the 2010 and 2009 Periods, cost of goods sold included an inventory write-off of $0 and $151,689 and respectively for excess, obsolete inventory. The increase in cost of goods sold during the 2010 period reflected the increase in production to fill orders placed by our customer as discussed above in REVENUES.

GROSS PROFIT. Gross profits for the 2010 Period was $8,334,708 compared to $356,792 for the 2009 Period. The gross profit on product sales amounted to $11,177,367 during the 2010 Period compared to $291,431 during the 2009 Period. The overall gross margins for the 2010 Period increased to 41% compared to 16% during the 2009 Period. The increase in the gross margin percentage in the 2010 Period compared to the 2009 Period is a reflection of the maturing of our product set, an enhanced ability to plan production and scale based on increased lead-time and transparency in the forecasting and purchasing process of our customer, and a stable and productive relationship with our contract manufacturer.

RESEARCH AND DEVELOPMENT EXPENSES. Research and development expenses consisted of expenses incurred primarily in designing, developing and field testing our smart grid solutions. These expenses consisted primarily of salaries and related expenses for personnel, contract design and testing services, supplies used and consulting and license fees paid to third parties. Research and development expenses were approximately $6.1 million for the 2010 Period compared to $4.6 million for the 2009 Period. The increase in research and development during the 2010 Period was due primarily to the increase in personnel and consultants for the continued development of our fourth generation communications Node, and the enhancement of our AmbientNMS® system. We believe that our continued development efforts are critical to our strategic objectives of enhancing our technology while reducing cost and therefore we expect that our research and development expenses will increase over the next twelve months as we continue to focus our efforts on developing more robust solutions and additional value-added functionality for the Ambient Smart Grid® communications platforms.

OPERATING, GENERAL AND ADMINISTRATIVE EXPENSES. Operating, general and administrative expenses primarily consisted of salaries and other related costs for personnel in executive and other administrative functions. Other significant costs included professional fees for legal, accounting and other services. General and administrative expenses for the 2010 Period were approximately $4.8 million compared to $4.1 million for the 2009 Period. The increase in operating, general and administrative expenses during the 2010 period as compared to the 2009 period was due to the increase in efforts to market and commercialize the Ambient Smart Grid® communications platforms. As we continue to increase our efforts to market and commercialize the Ambient Smart Grid® communication platforms, over the next twelve months, we expect our operating, general and administrative expenses to increase during that time.

STOCK BASED COMPENSATION. A portion of our operating expenses was attributable to non-cash charges associated with the compensation of consultants and employees through the issuance of stock options and stock grants. Stock-based compensation is non-cash and will therefore have no impact on our cash flows or liquidity. For the 2010 Period, we incurred non-cash stock based compensation expense of $725,343 compared to $967,301 for the 2009 Period.

INTEREST AND FINANCE EXPENSES. For the 2010 Period, we incurred interest of $31,814 compared to $617,060 for the 2009 Period, respectively. The interest related primarily to our 8% Secured Convertible Promissory Notes, which were issued in July and November of 2007 and January 2008. Additionally, for the 2010 Period and 2009 Period, we incurred non-cash interest of $183,609 and $4,375,767, respectively. This interest related to the amortization of the beneficial conversion features and deferred financing costs incurred in connection with the placement of our convertible promissory notes. These costs are amortized to the date of maturity of the debt unless converted earlier. In January 2010, Vicis converted the remaining $10 million outstanding on the notes. Following the conversion of the notes, we no longer had any long-term debt. In addition, on June 30, 2009, we agreed to modify the terms of the expiring Class A warrants. Under the new terms, the warrants were exercisable through August 31, 2009 and the exercise prices were reduced from $0.20 to $0.15 per share. The resulting charge due to the modification was $1,147,167 and was reflected as additional interest expense.

LIQUIDITY AND CAPITAL RESOURCES

While we have, since inception, funded operations primarily through the sale of our securities, most recently the revenues generated from purchase orders received from our marquee customer have been applied to meet our operating requirement. In addition, the $5 million proceeds from the investment in December 2010 by our majority stockholder formerly on deposit in the escrow account established for our benefit strengthened our cash position. Management believes that cash on hand plus anticipated revenue from purchase orders received from our marquee customer will allow us to meet our operating requirements for fiscal year 2011. However, we may need to raise additional funds to expand existing commercial deployments, support strategic acquisitions and/ or joint venture opportunities, and/or to satisfy any additional significant purchase order that it may receive. At the present time, the Company does not have any commitments for additional funding.

Cash balances totaled $6,986,881 at December 31, 2010 and $987,010 at December 31, 2009. As of February 21, 2011, we have approximately $7,494,525 cash on hand.

Net cash used in operating activities during the year ended December 31, 2010 was approximately $1.7 million and was used primarily to pay ongoing research and development and operating, general and administrative expenses.

Net cash used in investing activities during the year ended December 31, 2010 was approximately $410,805 and was for additions to property and equipment.

Net cash provided by financing activities during the year ended December 31, 2010 was approximately $8,118,934, and represented the issuance of common stock, exercise of warrants and options and the payments on capitalized lease obligations.

CRITICAL ACCOUNTING POLICIES AND USE OF ESTIMATES

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with generally accepted accounting principles in the United States. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates, including those related to revenue recognition, bad debts, investments, intangible assets and income taxes. Our estimates are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results may differ from these estimates.

We have identified the accounting policies below as critical to our business operations and the understanding of our results of operations.

REVENUE RECOGNITION. Hardware sales consist of smart grid Nodes as well as system software embedded in the Nodes. System software embedded in Ambient’s Nodes is used solely in connection with the operation of the product. Upon the sale and shipment of its product, Ambient is not required to update the embedded software for newer versions that are subsequently developed. In addition, the Company does not offer or provide any free post-contract customer support. There is an original warranty period, which may run for a period of up to twelve months from sale of product, in which the Company will provide fixes for the Nodes when and if appropriate. As such, we recognize revenue from the sales of the Nodes when Product is received by the customer.

The Company’s other proprietary software consists of the AmbientNMS® an element management product that may be sold on a stand-alone basis. A purchaser of Ambient’s Nodes is not required to purchase this product, as our Nodes could be managed with independently developed management software. The sale and or license of the AmbientNMS® does not include post-contract customer support, unless the customer enters into a maintenance agreement with the Company. As such, Ambient recognizes revenue from the sale of this software product when shipped. Amounts billed to customers before software is shipped are classified as deferred revenue.

The Company offers maintenance service, on a fee basis that entitles the purchasers of its Nodes and NMS® software to benefits including telephone support, as well as updates and upgrades to our products. Such revenue, when received, will be amortized over the appropriate period based on the terms of individual agreements and contracts.

INVENTORY VALUATION. Inventory is valued at the lower of cost or market determined on the first-in, first-out (FIFO) basis. Market, with respect to direct materials, is replacement cost and is net realizable value for work-in-process and finished goods. The value of the inventory is adjusted for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated market value based upon assumptions about future demand and market conditions.

SOFTWARE DEVELOPMENT COSTS. Costs incurred in the research and development of new software products and enhancements to existing software products have historically been expensed as incurred. After technological feasibility is established, additional development costs are capitalized. No software development costs have been capitalized as of December 31, 2010 and 2009.

STOCK-BASED COMPENSATION. The Company accounts for stock-based compensation in accordance with accounting guidance now codified as Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 718, “Compensation – Stock Compensation.” Under the fair value recognition provision of ASC 718 stock-based compensation cost is estimated at the grant date based on the fair value of the award. The Company estimates the fair value of stock options granted using the Black-Scholes option pricing model.

DEFERRED INCOME TAXES. Deferred income taxes are recognized for the tax consequences of "temporary differences" by applying enacted statutory rates applicable to future years to differences between the financial statement carrying amounts and the tax basis of existing assets and liabilities. At December 31, 2010, our deferred income tax assets consisted primarily of net operating loss carry forwards and stock based compensation charges which have been fully offset with a valuation allowance due to the uncertainty that a tax benefit will be realized from the assets in the future.

WARRANTIES. The Company accounts for its warranties under the FASB ASC 450 “Contingencies.” The Company generally warrants that its products are free from defects in material and workmanship for a period of one year from the date of initial acceptance by our customers. The warranty does not cover any losses or damage that occurs as a result of improper installation, misuse or neglect or repair or modification by anyone other than the Company or its authorized repair agent. The Company's policy is to accrue anticipated warranty costs based upon historical percentages of items returned for repair within one year of the initial sale. The Company’s repair rate of products under warranty has been minimal, and a historical percentage has not been established. The Company has not provided for any reserves for such warranty liability.

The Company’s software license agreements generally include certain provisions for indemnifying customers against liabilities if the Company's software products infringe upon a third party's intellectual property rights. The Company has not provided for any reserves for such warranty liabilities.

The Company’s software license agreements also generally include a warranty that the Company's software products will substantially operate as described in the applicable program documentation. The Company also warrants that services the Company performs will be provided in a manner consistent with industry standards. To date, the Company has not incurred any material costs associated with these product and service performance warranties, and as such the Company has not provided for any reserves for any such warranty liabilities in its operating results.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

The Financial Accounting Standards Board (FASB) ratified Accounting Statement Update 2009-13 (ASU), “Revenue Recognition-Milestone Method (Topic 605): Multiple-Deliverable Revenue Arrangements,” which eliminates the residual method of allocation, and instead requires companies to use the relative selling price method when allocating revenue in a multiple deliverable arrangement. When applying the relative selling price method, the selling price for each deliverable shall be determined using vendor specific objective evidence of selling price, if it exists, and otherwise using third-party evidence of selling price. If neither vendor specific objective evidence nor third-party evidence of selling price exists for a deliverable, companies shall use their best estimate of the selling price for that deliverable when applying the relative selling price method. ASU 2009-13 shall be effective in fiscal years beginning on or after June 15, 2010, with earlier application permitted. Companies may elect to adopt this guidance prospectively for all revenue arrangements entered into or materially modified after the date of adoption, or retrospectively for all periods presented. The Company will adopt this standard effective January 1, 2011. The Company does not expect the provisions of ASU 2010-13 to have a material effect on the financial position, results of operations or cash flows of the Company.

In April 2010, the FASB issued ASU 2010-17 (ASU 2010-17), “Revenue Recognition-Milestone Method (Topic 605): Milestone Method of Revenue Recognition.” The amendments in this Update are effective on a prospective basis for milestones achieved in fiscal years, and interim periods within those years, beginning on or after June 15, 2010. Early adoption is permitted. If a vendor elects early adoption and the period of adoption is not the beginning of the entity’s fiscal year, the entity should apply the amendments retrospectively from the beginning of the year of adoption. The Company will adopt this standard effective January 1, 2011. The Company does not expect the provisions of ASU 2010-17 to have a material effect on the financial position, results of operations or cash flows of the Company.

Management does not believe that any other recently issued, but not yet effective, accounting standard if currently adopted would have a material effect on the accompanying financial statements.

OFF-BALANCE SHEET ARRANGEMENTS

None.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

| | | Payments Due By Period | |

| Contractual Obligations | | Total | | | Less Than 1 Year | | | 1 – 3 Years | | | 3 – 5 Years | | | More Than 5 years | |

| Short -Term Debt Obligations | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| Capital Lease Obligations | | | 10,842 | | | | 10,842 | | | | 0 | | | | 0 | | | | 0 | |

| Operating Lease Obligations | | | 793,724 | | | | 389,885 | | | | 403,839 | | | | 0 | | | | 0 | |

| Purchase Obligations | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Other Long-Term Liabilities Reflected on the Registrant’s Balance Sheet under GAAP | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| Total | | $ | 804,566 | | | $ | 400,727 | | | $ | 403,839 | | | $ | 0 | | | $ | 0 | |

DESCRIPTION OF BUSINESS

OVERVIEW

We are a pioneering integrator of smart grid communications platforms, creating high-speed Internet Protocols (IP) based data communications networks for the medium and low-voltage distribution grid. The Ambient smart grid platform, known as Ambient Smart Grid®, facilitates a two-way, real-time communications network designed to modernize the power grid infrastructure, making it more receptive to wide-scale adoption of renewable energy sources and supportive of new energy efficiency technologies and programs. The Ambient Smart Grid® platform facilitates a utility’s ability to implement smart grid applications such as Advanced Metering Infrastructures (AMI), Demand Side Management (DSM), Distribution Monitoring and Automation, direct load control and more. When combined, these applications offer economic, operational and environmental benefits for utilities, and ultimately the utility customers.

Ambient has been focused, since 2000, on the collaborative development of communication solutions that meet the needs of utilities to ultimately deploy what is now referred to as the smart grid. From inception, Ambient’s platform, which includes nodes, management systems, current transformers and a suite of applications, has been designed to function as an open standards-based system intended to support a variety of applications and services simultaneously. Over the years, Ambient has developed and delivered three generations of smart grid communications nodes that with thousands of our units deployed in the field are already beginning to transform today’s century-old power delivery system into an advanced energy network that provides timely energy usage information and remote grid monitoring, automation and control. With each successive generation, Ambient has continued to support and integrate additional applications, while driving lower the manufacturing costs and price to our customers making our products even more attractive. In December 2010, Ambient delivered to our marquee customer, units of our fourth generation communications node which are being beta tested in the field.

Throughout the past five years, Ambient has been a key supplier to Duke Energy’s grid efficiency programs, and the leading supplier of the smart grid communications nodes for their smart grid deployments. During 2008, Ambient received purchase orders from Duke Energy to purchase its X2000 and X-3000 communications nodes and to license our AmbientNMS®, to enable the building out of an intelligent grid/intelligent-metering platform, which generated approximately $14.8 million in revenues throughout 2008 and 2009.

In September 2009, we entered into a long-term agreement, running through 2015 to supply Ambient’s X-3100 Node and to license our management software – AmbientNMS® for deployment throughout the utility’s electric power distribution grid. Since the execution of the agreement, we have generated, through December 31, 2010, approximately $21.1 million in revenues from the sale of our product.

With Ambient Smart Grid®, our goal remains to be a leading designer, developer and systems integrator of smart grid communications platforms, incorporating a wide array of communications protocols and smart grid applications such as advanced metering solutions to complement our communications platform and our internally developed energy sensing capabilities. We view a flexible smart grid communications platform to be a key factor for utilities to efficiently integrate the increasing portfolios of smart grid technologies and applications into and on the electrical grid.

Ambient continues to seek new opportunities for commercial deployments and to bring new and existing networks to full commercialization. Throughout 2011, Ambient’s principal target customers will continue to be electric utilities that seek to both increase efficiencies in the delivery of energy and enable consumers to better understand and manage their energy consumption. Ambient seeks to continue to extend existing relationships and develop new relationships to collaborate on efforts to drive the development of new functionality for both utility and consumer applications that further enhance the value of the Ambient Smart Grid® platform.

Ambient is a Delaware Corporation incorporated on June 26, 1996. Since inception, we have funded operations primarily through the sale of our securities and most recently from the revenue generated from purchase orders received from our marquee customer. In connection with the continued development, upgrade, and marketing of our products, technology, and services, Ambient will continue to emphasize the ongoing development efforts necessary to complete development of our fourth generation node, incorporate additional applications into our platform, and to continue to enhance the capabilities and functionality of our AmbientNMS® system.

In February 2011, our majority stockholder approved a reverse split of our common stock, in the range of 1-for 30 to 1-for 100, which our Board of Directors may implement in its discretion (if at all) before December 31, 2011, without any further stockholder approval. Our Board approved and recommended the reverse stock split primarily in order to increase Ambient’s prospects of successfully listing its common stock on the NASDAQ Capital Market.

INDUSTRY BACKGROUND

The existing electrical power distribution system continues to be under increasing pressure to catch up to the digital economy. Through the incorporation and deployment of advanced communication technology throughout the grid system, the singular approach of building new environmentally unfriendly centrally located power plants to meet energy and capacity requirements will no longer be the sole solution to utilities. The smarter grid will help increase the use of renewable capacity, embrace the emergence of electric vehicles and distributed generation, and equip customers with the tools and technology needed to help navigate through an environment increasingly concerned with such issues as climate change, rising costs, increasing regulation, and energy independence. Increasing the efficiency in the delivery of energy will continue to be an emphasis for utilities and regulators alike. A dedicated communication infrastructure to monitor and manage the distribution grid is a key enabler for accomplishing this efficiency.

In 2007, the Federal Energy Independence and Security Act underscored the need for a smart grid and provided a mechanism for federal funds to help promote smart grid deployments and developments. The prospects of the deployment of smart grid technologies were significantly advanced through the passage of both the Troubled Asset Relief Program, which reduced the period of depreciation of smart grid assets from twenty years to ten years and the later passage of the American Reinvestment and Recovery Act (ARRA) in February 2009, which provided stimulus funding of smart grid projects. In March 2010, the smart grid received a further federal boost with the release of the National Broadband Plan that highlighted the role smart grid communications can have in improving the grid’s reliability, security and efficiency.

The ultimate allocation of funding from the federal government provided by the ARRA (Stimulus Funding) was intended to eliminate a portion of the risk associated with early adoption of technology. The promise of funding encouraged utilities considering smart grid deployments to actively develop business and deployment plans and to negotiate terms with the U.S. Department of Energy ("DOE") to receive the ARRA funds. For many utilities, this process required significant effort over many months, and thus resulted in the lack of available federal funds throughout 2009 and into 2010. Many of the ultimate grant recipients executed agreements with the DOE and thus smart grid deployments began in earnest in the later part of 2010.

AMBIENT SOLUTION

THE AMBIENT SMART GRID® COMMUNICATIONS NETWORK

Ambient’s vision for the smart grid calls for solutions based on interoperable and open, standards-based technologies. This vision is made a reality through the Ambient Smart Grid® Node and network management system - AmbientNMS® and an open application environment. A common underlying communications platform (Ambient Smart Grid®) is utilized to support all the smart grid applications and services in parallel to achieve the lowest cost point on an overall system basis while achieving a high level of integration of communications services and applications. The use of open, standards-based technologies is widely accepted as the basis for the success of the Internet and credited with enabling all of the applications that have evolved on the Internet. Ambient’s communication platform relies on distributed Ambient Smart Grid® Nodes incorporating remote processing and flash memory that allow for a robust application-hosting environment enabling the platform to evolve like the Internet. Additionally, remote processing and storage of data combined with the ability to access this locally, without the use of the backhaul connection, allow the utility and end users to limit network charges.

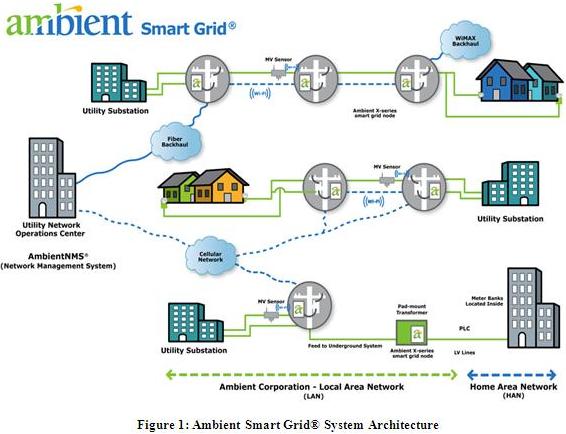

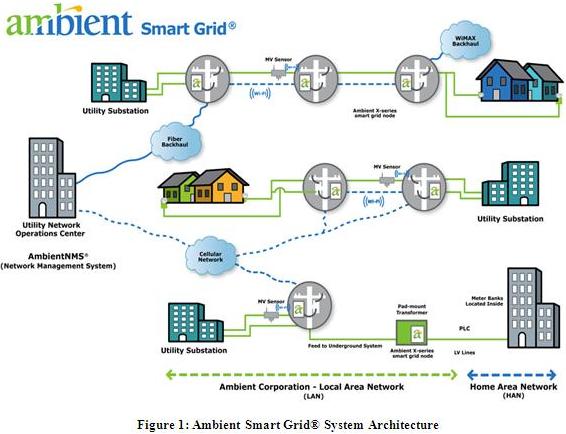

Ambient’s distributed platform system architecture are depicted below in Figure 1.

Rather than the typical disconnected and application specific communications systems that have been the norm in the utility environment, Ambient provides a common communications platform that allows costs to be allocated across many applications or purposes thus enhancing the value and minimizing the overall costs of the communications infrastructure and total smart grid build out. The Internet is an excellent reference and analogy for the common infrastructure concept. The growing trend of providing multiple communications services (television, telephone, and Internet access) over a single medium into the premises demonstrates the concept, both technically and economically, of supporting multiple services and applications over a common network infrastructure. This holistic approach will enable a variety of distribution system monitoring and management capabilities that have not thus far not been feasible or not even envisioned today.

AMBIENT SMART GRID® COMMUNICATIONS PLATFORM FUNCTIONALITY AND BENEFITS

Complete Turnkey Delivery: Ambient designs and builds the core network hardware and management software incorporating smart grid communication technologies. Our familiarity with multiple communications protocols, architecture, hardware, and software requirements, coupled with experienced field engineers, provides us with the tools necessary for a successful rollout.

Open Architecture: For a smart grid to evolve with the advancement in technologies, and expectations of what the smart grid will enable, utilities need an open and flexible platform architecture comprised of open and flexible building blocks such as the Ambient Smart Grid® Node (“Node”) and AmbientNMS®. Ambient’s architecture for the communications Node, offers the openness and flexibility that allows utilities to mix and match smart grid application technologies today, and a platform that can evolve with the technology. As no single communication technology is likely to meet all smart grid requirements for all environments or locations, the use of an open and flexible communications architecture and Node is more likely to ensure higher levels of interoperability, longevity and overall success. Having several available Node components and options overcomes fundamental impediments, such as topographical, economical, or other inherent impediments in the physical infrastructure itself, and will be required to successfully address as large a portion of the system requirements as possible.

Wide Area Network (WAN) Technologies: There are a variety of Ethernet technologies, both wired and wireless, that can be used by Ambient’s Node for backhaul or WAN purposes. The use of 3G/4G cellular wireless networks for WAN services for a large, if not the most significant, portions of the smart grid infrastructure is most practical as it leverages the cellular carrier's commitment and investment into their wireless network. Although utilities have a long history of using cellular networks for some applications, the scale required for the smart grid is unprecedented. The availability of multiple carriers and technologies is beneficial. The 3G networks of today and the planned 4G networks being rolled-out certainly provide sufficient bandwidth to address the requirements of the smart grid.

Local Area Network (LAN) Technologies: Ambient’s Node also supports a variety of LAN technologies. As demonstrated with its products to date, Ambient has been able to support a variety of smart grid applications and services with these technologies. Ethernet and serial ports are the basic and most commonly found technologies used for communications interfaces. This is why Ambient’s typical Node configuration has included both Ethernet and serial (RS-232) ports.

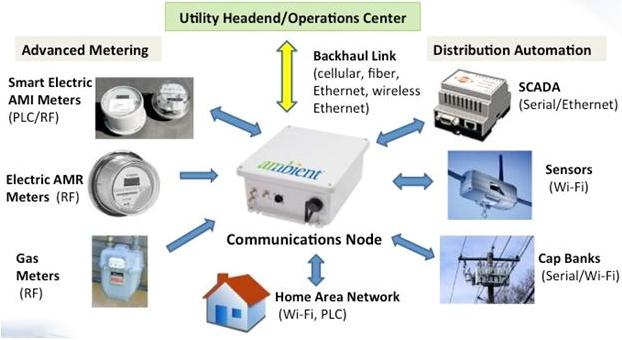

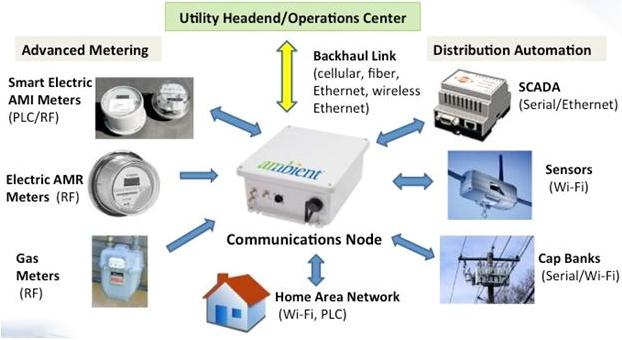

The Ambient Node supports multiple communication technologies simultaneously allowing a utility to leverage a single communications infrastructure to support many smart grid applications that rely on different communication methods i.e. 3G cellular, Wi-Fi, 900MHz radio frequency, power line carrier etc., all operating in parallel in a single communications Node. Each customizable Node combines to create the overarching communication platform that protects a utility against stranding IT and smart grid related assets. A graphical description of how an individual Node can function as part of a collected platform is below.

The Node utilizes standard-based protocols as well as proprietary technologies for communications. This allows the Ambient Smart Grid® platform to connect with any IP device as well as legacy systems and vendor technologies reliant on proprietary protocols. Ambient’s architecture provides utilities an open IP-based architecture that pushes proprietary technologies out to the fringes of the network, which enhances the flexibility and longevity of the overall architecture. Flexibility with communication technologies and protocols means in different segments of the utility’s distribution network a single communications platform and foundational architecture can be leveraged yet customized to meet locational needs and economies that vary between urban and rural environments.

Flexible and Expandable Network Architecture: The Ambient Smart Grid® communications platform permits sequential expansions corresponding to actual demand. When the platform is first deployed, separate network elements can be “bridged” at specific points. As the network load increases, switches and/or routers can maximize the bandwidth available to a particular network segment. At higher subscriber densities, additional backhaul connectivity points may be added. By allowing utilities to build networks that provide just the capacity that is needed, as it is needed, we help our customers minimize initial installation costs, shorten the time between investment and realization of revenues, and reduce operations and maintenance expense.

Ability to Integrate Many Applications: Utility operators are not limited to Advanced Meter Reading (AMR), smart metering, or other applications at the end of the distribution grid: Grid operators can monitor and communicate with Nodes or any piece of IP-based equipment integrated at any point along the medium and low voltage distribution network, which can range from distributed generation resources, power quality control devices, and a range of Demand Side Management and Demand Response applications. When couplers are integrated into an Ambient Smart Grid® communications network, information on the current of the distribution grid can be obtained in real-time enabling better energy management, predictive maintenance and less system down-time which can combine to reduce the need for additional generation facilities.

Outage Detection and Restoration Confirmation: Rather than dedicated outage detection systems that employ either customer premise or service side equipment, the Node is powered from the low voltage line itself and can be equipped with an optional battery that can help a utility specifically identify line outages and allow for continued Node operation in the event of such a power outage. Access to the Nodes in an outage scenario allows timely recognition of outage locations and provides invaluable input to the restoration process. Additional information provided by our energy sensing capabilities may also provide useful and preventative information to utilities.

Support External Applications: A high-speed Ambient Smart Grid® enhances traditional low bandwidth, one-way applications such as meter reading. In addition to the elimination of the labor required to visit every customer location each month, or the inaccuracies introduced by customer self-reporting, the constant real-time load data can enhance a utility's ability to balance its supply portfolio, improve its load profiling, and increase its knowledge of customer usage patterns. Meters that remotely turn service on or off can be deployed, eliminating the labor involved in this non-repair, non-revenue task. Additionally, real-time communications enabled by Ambient’s high-speed backhaul network allow utilities the flexibility to introduce time-of-use pricing models.

Application Development Environment: To support our collaborative efforts, Ambient has developed specifications for developing and supporting third-party applications to run on the Ambient’s platform. The specifications provide for third-party applications to run in a structured, controlled, and predictable environment. This framework has been used to support third party application to provide connectivity to, and management of, their distribution line sensors. This configuration is deployed for testing in the field today.

AMBIENT STRATEGY