UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Hartford Series Fund, Inc.

(Exact name of registrant as specified in charter)

690 Lee Road, Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

Copy to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Registrant's telephone number, including area code:

Date of reporting period:

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a)

Annual Shareholder Report

December 31, 2024

Hartford Balanced HLS Fund

Class IA/HADAX

This annual shareholder report contains important information about the Hartford Balanced HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IA | $67 | 0.63% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Most fixed income sectors generated positive total returns during the trailing twelve-months ended December 31, 2024, as coupon income and spread tightening helped offset the impact of rising United States Treasury yields. Most spread sectors produced positive excess returns over duration-equivalent government bonds as spreads narrowed, supported by more accommodative central bank policies. Fund performance described below is relative to the Fund’s blended benchmark, 60% S&P 500 Index/ 35% Bloomberg US Government/Credit Bond Index/ 5% ICE BofA US 3-Month Treasury Bill Index (the "Blended Benchmark"), for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Equity security selection within the Financials, Energy, and Healthcare sectors contributed positively to relative performance.

Within the equity portion of the Fund, the Fund’s overweight to the Financials sector and underweight allocation to the Materials sector also contributed to relative performance.

Top equity contributors over the period were overweight positions in Targa Resources (Energy), Broadcom (Information Technology) and Corning (Information Technology).

In the fixed income portion of the Fund, security selection within Investment-Grade Corporate Credit was the primary contributor to relative performance, particularly within the Industrials, Utilities, and Financials sectors. An overweight to Financial Institutions also contributed to relative returns. Within Non-Corporate Credit, security selection within Taxable Municipal Bonds contributed to relative performance over the period.

Overweight allocation to and security selection within Asset-Backed Securities (ABS) had a positive impact on relative performance. Duration and yield curve positioning had a positive impact on relative performance over the period.

Top Detractors to Performance

Within the equity portion of the Fund, security selection was the primary relative detractor during the period, driven by weak selection within the Information Technology, Consumer Discretionary, and Industrials sectors.

Sector allocation, a result of our bottom-up stock selection process, was also a relative detractor in the equity portion of the Fund during the period due to the Fund’s overweight allocation to the Healthcare sector and underweight allocation to the Information Technology sector.

The largest equity detractors over the period were not owning S&P 500 Index constituents NVIDIA (Information Technology) and Meta Platforms (Communication Services), as well as an overweight position in Elevance Health (Healthcare).

In the fixed income portion of the Fund, an underweight to the Industrials sector detracted from performance over the period.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

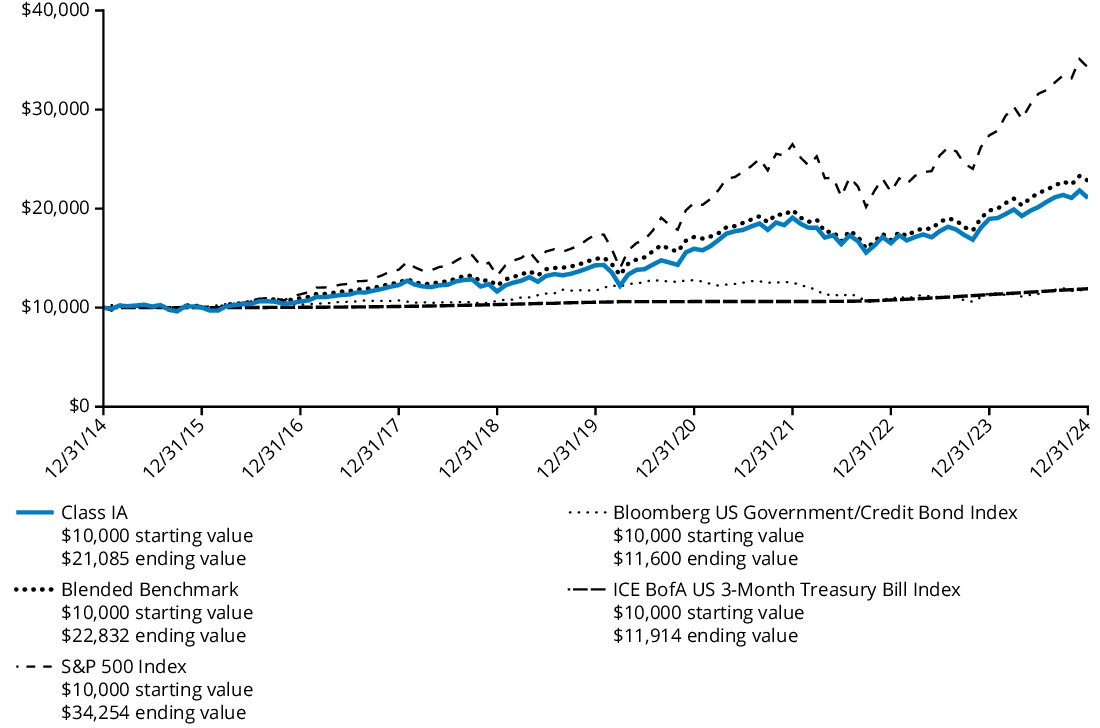

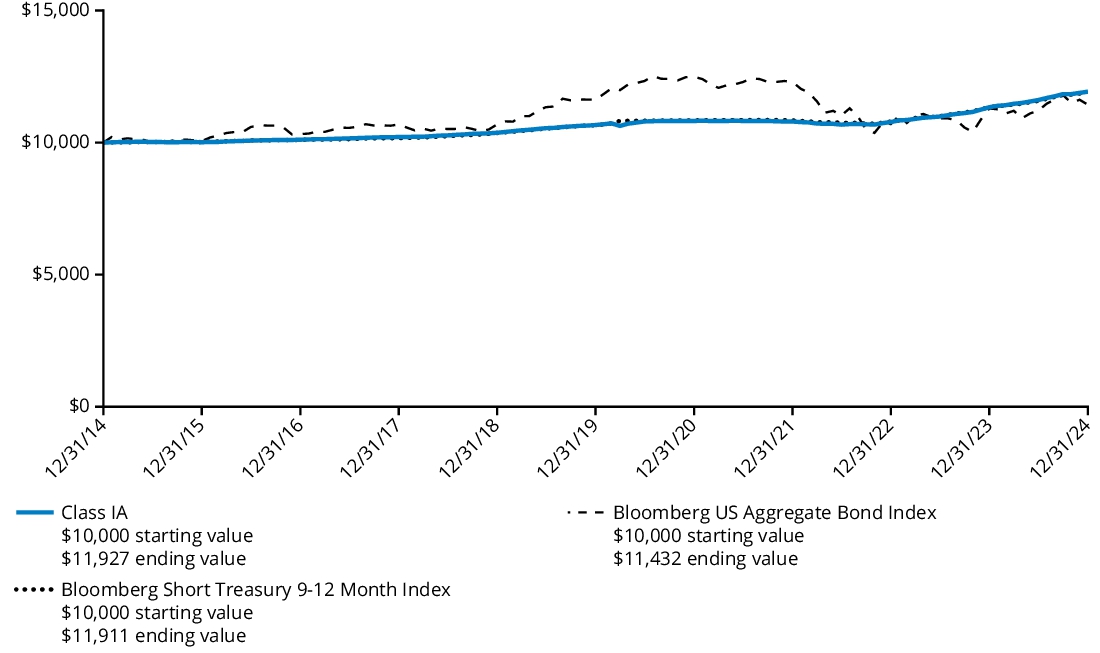

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IA shares and the comparative indices. Performance information for the Fund in the graph and table reflects fee waivers, if any. Absent any applicable waivers, performance would have been lower. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IA | 11.21% | 8.09% | 7.75% |

| Blended Benchmark | 15.25% | 8.88% | 8.61% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

| Bloomberg US Government/Credit Bond Index | 1.18% | (0.21)% | 1.50% |

| ICE BofA US 3-Month Treasury Bill Index | 5.25% | 2.46% | 1.77% |

The Blended Benchmark serves as the Fund’s performance index because the Fund’s investment manager, Hartford Funds Management Company, LLC ("HFMC"), believes it is more representative of the Fund’s investment strategy. The Blended Benchmark is calculated by HFMC. The S&P 500 Index, one of the indices included in the Fund’s blended benchmark, serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $1,648,620,113 |

| Total number of portfolio holdings (excluding derivatives, if any) | 494 |

| Total investment management fees paid | $10,193,370 |

| Portfolio turnover rate (excludes to be announced (TBA) roll transactions) | 50% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

Composition by Security Type

| Common Stocks | 64.6 | % |

| U.S. Government Securities | 20.9 | % |

| Corporate Bonds | 10.4 | % |

| Asset & Commercial Mortgage-Backed Securities | 1.0 | % |

| Municipal Bonds | 0.5 | % |

| U.S. Government Agencies^ | 0.5 | % |

| Foreign Government Obligations | 0.2 | % |

| Short-Term Investments | 0.4 | % |

| Other Assets & Liabilities | 1.5 | % |

| Total | 100.0 | % |

^ | All, or a portion of the securities categorized as U.S. Government Agencies, were agency mortgage-backed securities. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Balanced HLS Fund

Class IB/HAIBX

This annual shareholder report contains important information about the Hartford Balanced HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IB | $93 | 0.88% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Most fixed income sectors generated positive total returns during the trailing twelve-months ended December 31, 2024, as coupon income and spread tightening helped offset the impact of rising United States Treasury yields. Most spread sectors produced positive excess returns over duration-equivalent government bonds as spreads narrowed, supported by more accommodative central bank policies. Fund performance described below is relative to the Fund’s blended benchmark, 60% S&P 500 Index/ 35% Bloomberg US Government/Credit Bond Index/ 5% ICE BofA US 3-Month Treasury Bill Index (the "Blended Benchmark"), for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Equity security selection within the Financials, Energy, and Healthcare sectors contributed positively to relative performance.

Within the equity portion of the Fund, the Fund’s overweight to the Financials sector and underweight allocation to the Materials sector also contributed to relative performance.

Top equity contributors over the period were overweight positions in Targa Resources (Energy), Broadcom (Information Technology) and Corning (Information Technology).

In the fixed income portion of the Fund, security selection within Investment-Grade Corporate Credit was the primary contributor to relative performance, particularly within the Industrials, Utilities, and Financials sectors. An overweight to Financial Institutions also contributed to relative returns. Within Non-Corporate Credit, security selection within Taxable Municipal Bonds contributed to relative performance over the period.

Overweight allocation to and security selection within Asset-Backed Securities (ABS) had a positive impact on relative performance. Duration and yield curve positioning had a positive impact on relative performance over the period.

Top Detractors to Performance

Within the equity portion of the Fund, security selection was the primary relative detractor during the period, driven by weak selection within the Information Technology, Consumer Discretionary, and Industrials sectors.

Sector allocation, a result of our bottom-up stock selection process, was also a relative detractor in the equity portion of the Fund during the period due to the Fund’s overweight allocation to the Healthcare sector and underweight allocation to the Information Technology sector.

The largest equity detractors over the period were not owning S&P 500 Index constituents NVIDIA (Information Technology) and Meta Platforms (Communication Services), as well as an overweight position in Elevance Health (Healthcare).

In the fixed income portion of the Fund, an underweight to the Industrials sector detracted from performance over the period.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

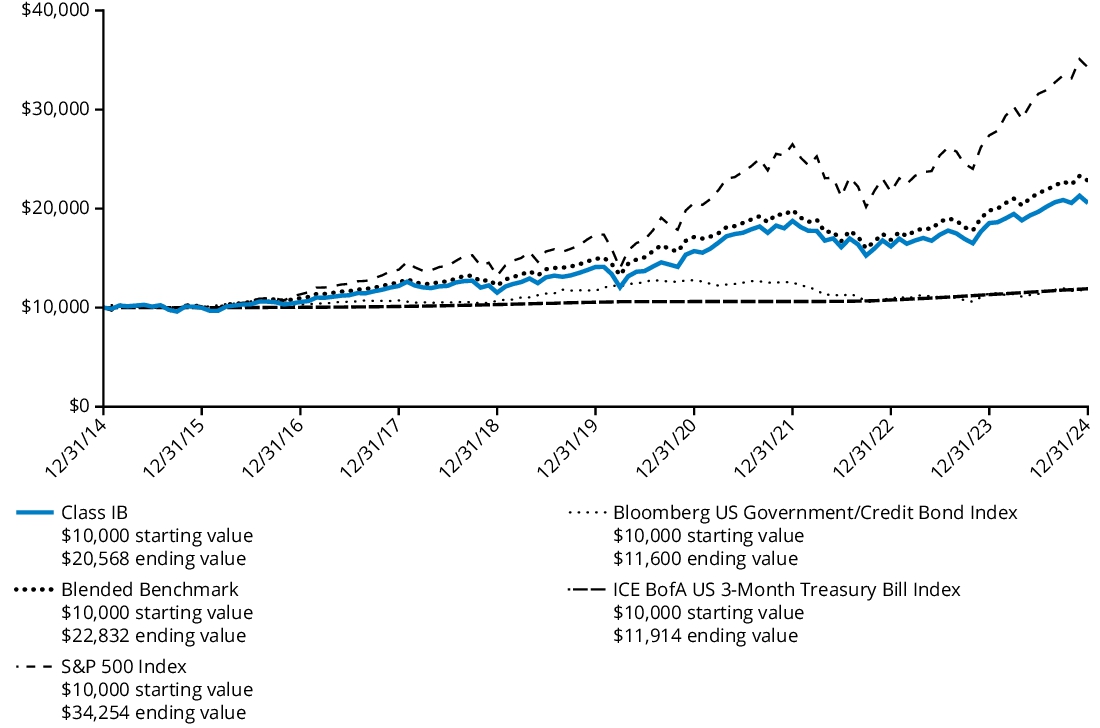

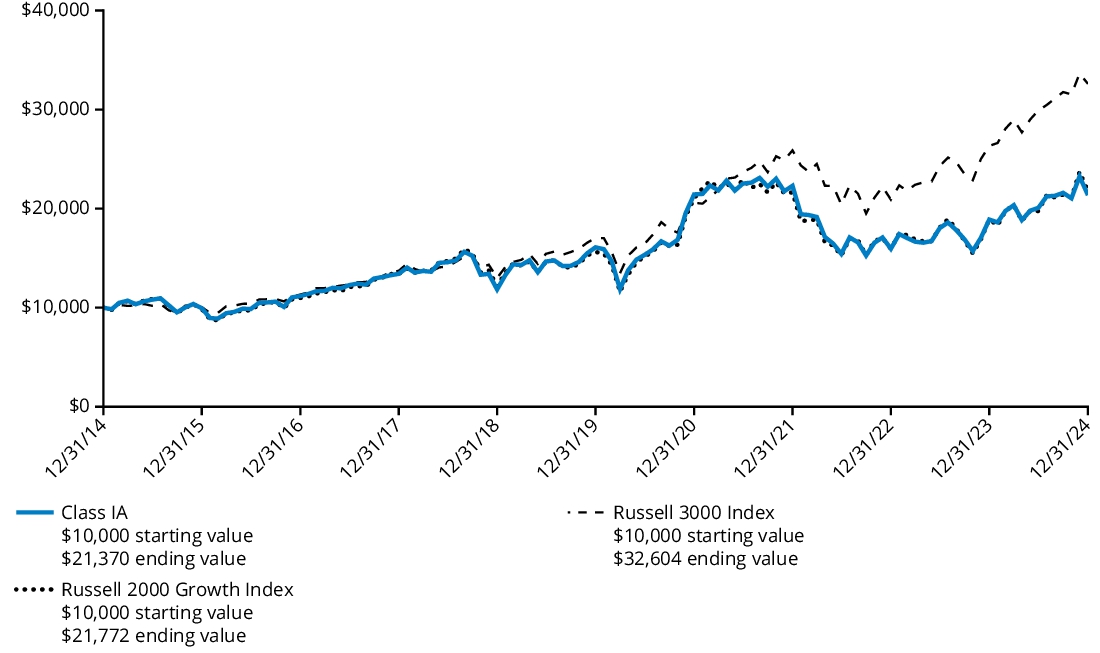

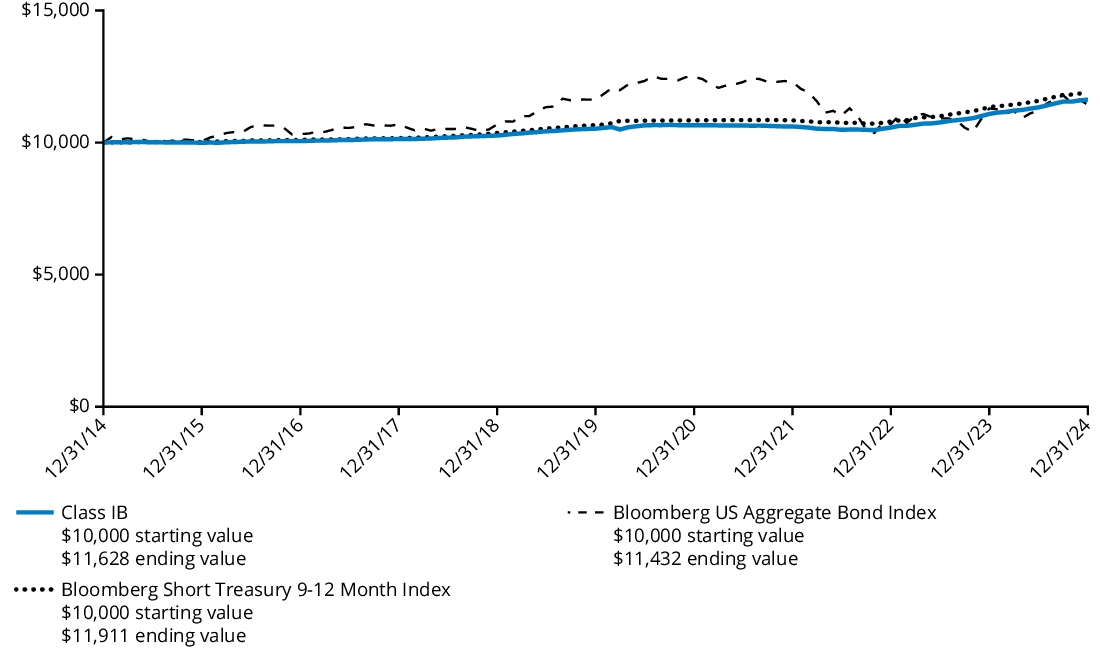

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IB shares and the comparative indices. Performance information for the Fund in the graph and table reflects fee waivers, if any. Absent any applicable waivers, performance would have been lower. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IB | 10.94% | 7.83% | 7.48% |

| Blended Benchmark | 15.25% | 8.88% | 8.61% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

| Bloomberg US Government/Credit Bond Index | 1.18% | (0.21)% | 1.50% |

| ICE BofA US 3-Month Treasury Bill Index | 5.25% | 2.46% | 1.77% |

The Blended Benchmark serves as the Fund’s performance index because the Fund’s investment manager, Hartford Funds Management Company, LLC ("HFMC"), believes it is more representative of the Fund’s investment strategy. The Blended Benchmark is calculated by HFMC. The S&P 500 Index, one of the indices included in the Fund’s blended benchmark, serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $1,648,620,113 |

| Total number of portfolio holdings (excluding derivatives, if any) | 494 |

| Total investment management fees paid | $10,193,370 |

| Portfolio turnover rate (excludes to be announced (TBA) roll transactions) | 50% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

Composition by Security Type

| Common Stocks | 64.6 | % |

| U.S. Government Securities | 20.9 | % |

| Corporate Bonds | 10.4 | % |

| Asset & Commercial Mortgage-Backed Securities | 1.0 | % |

| Municipal Bonds | 0.5 | % |

| U.S. Government Agencies^ | 0.5 | % |

| Foreign Government Obligations | 0.2 | % |

| Short-Term Investments | 0.4 | % |

| Other Assets & Liabilities | 1.5 | % |

| Total | 100.0 | % |

^ | All, or a portion of the securities categorized as U.S. Government Agencies, were agency mortgage-backed securities. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Capital Appreciation HLS Fund

Class IA/HIACX

This annual shareholder report contains important information about the Hartford Capital Appreciation HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IA | $74 | 0.67% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the Russell 3000 Index, rose over the twelve-month period ending December 31, 2024. Financial markets adjusted to expectations of fewer interest rate cuts by the U.S. Federal Reserve (Fed) amid persistent inflation, sustained economic growth and a resilient labor market supporting consumer spending. Despite strong first-quarter results, the labor market cooled with reduced hiring and fewer job openings. Concerns about slowing economic activity and a cooling labor market led the (Fed) to implement a 50 basis point interest rate cut in September. Stocks rallied in November following Donald Trump’s presidential election victory, which shifted political power to the Republican Party and paved the way for major policy initiatives, including tax and spending cuts, deregulation, and nationalist trade policies. Fund performance described below is relative to the Russell 3000 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

The Fund’s underweight allocations to the Healthcare and Consumer Discretionary sectors and overweight allocation to the Communication Services sector contributed to relative results.

Security selection within the Information Technology and Communication Services sectors contributed to relative performance.

Top individual contributors over the period were an overweight position in Apple (Information Technology), not holding Intel (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection was the primary detractor to relative performance during the period, driven by selection within the Consumer Staples, Consumer Discretionary, and Financials sectors.

An underweight allocation to the Information Technology sector and overweight exposures to the Materials and Real Estate sectors detracted from relative performance.

From a factor style perspective, the Fund’s underweight exposure to stocks with higher momentum detracted from relative performance.

The largest individual detractors over the period were overweight positions in American Tower (Real Estate) and Nike (Consumer Discretionary), as well as an underweight position in NVIDIA (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

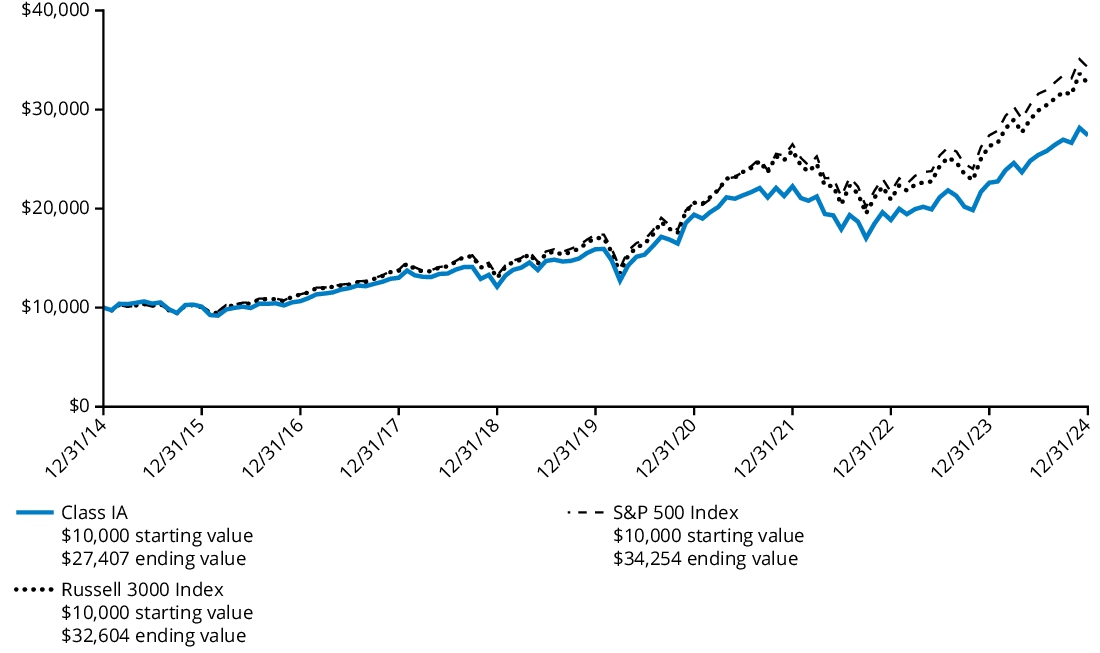

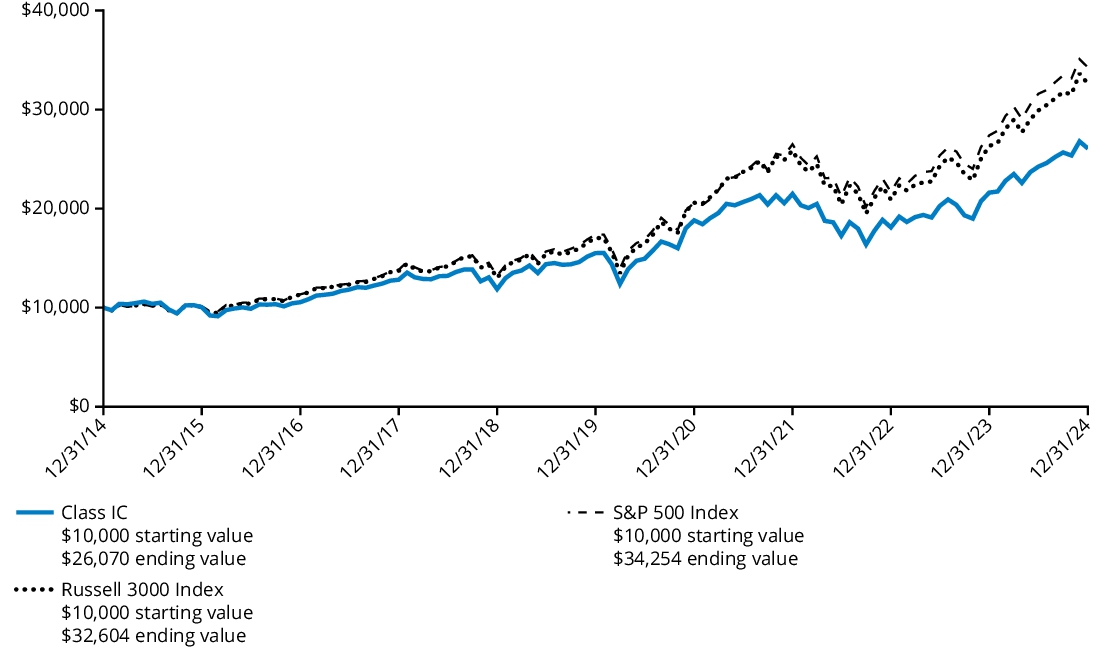

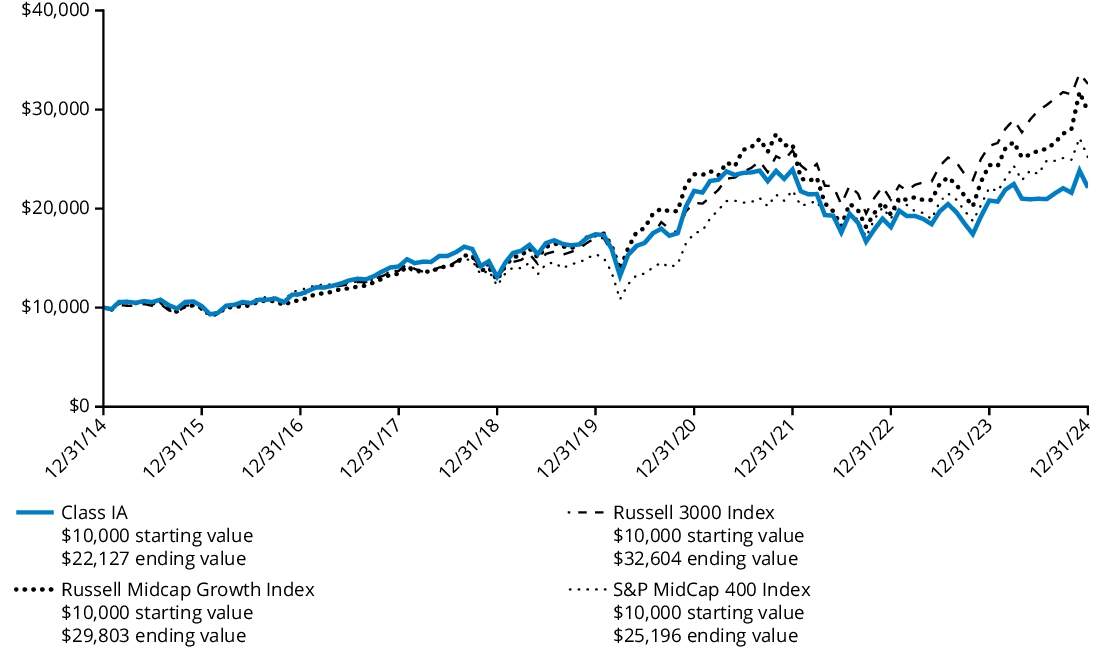

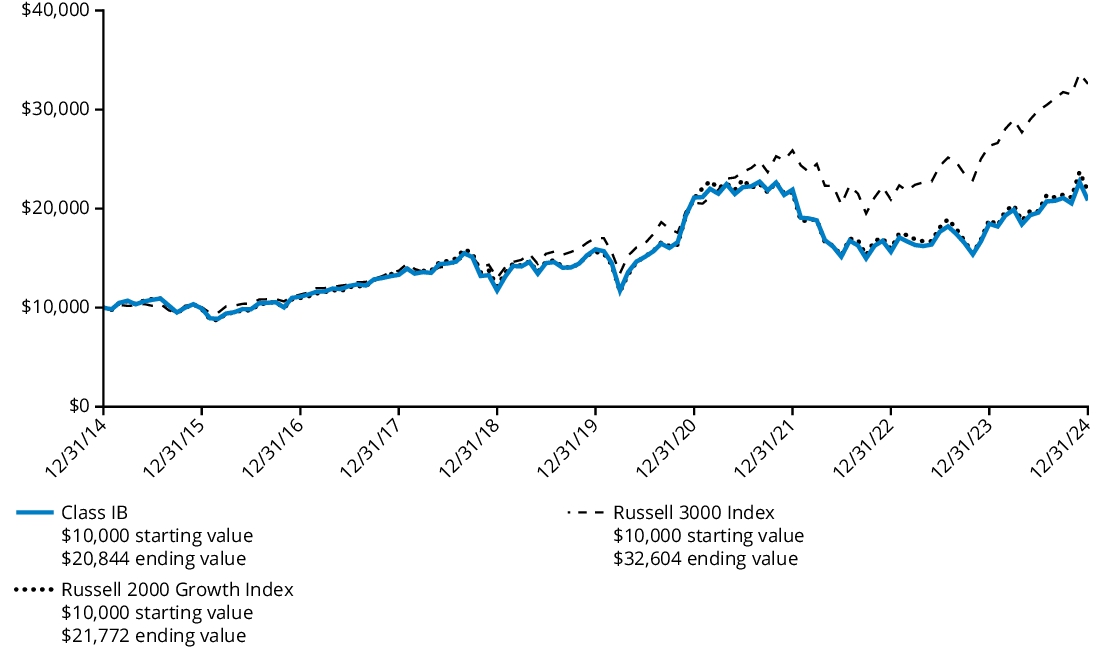

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IA shares and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IA | 21.19% | 11.50% | 10.61% |

| Russell 3000 Index | 23.81% | 13.86% | 12.55% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $3,759,915,745 |

| Total number of portfolio holdings (excluding derivatives, if any) | 157 |

| Total investment management fees paid | $24,128,372 |

| Portfolio turnover rate | 72% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 29.4 | % |

| Financials | 12.4 | % |

| Consumer Discretionary | 11.3 | % |

| Communication Services | 10.7 | % |

| Health Care | 9.7 | % |

| Industrials | 8.0 | % |

| Consumer Staples | 5.8 | % |

| Materials | 3.4 | % |

| Energy | 3.3 | % |

| Real Estate | 2.3 | % |

| Utilities | 1.6 | % |

| Short-Term Investments | 0.4 | % |

| Other Assets & Liabilities | 1.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Capital Appreciation HLS Fund

Class IB/HIBCX

This annual shareholder report contains important information about the Hartford Capital Appreciation HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IB | $102 | 0.92% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the Russell 3000 Index, rose over the twelve-month period ending December 31, 2024. Financial markets adjusted to expectations of fewer interest rate cuts by the U.S. Federal Reserve (Fed) amid persistent inflation, sustained economic growth and a resilient labor market supporting consumer spending. Despite strong first-quarter results, the labor market cooled with reduced hiring and fewer job openings. Concerns about slowing economic activity and a cooling labor market led the (Fed) to implement a 50 basis point interest rate cut in September. Stocks rallied in November following Donald Trump’s presidential election victory, which shifted political power to the Republican Party and paved the way for major policy initiatives, including tax and spending cuts, deregulation, and nationalist trade policies. Fund performance described below is relative to the Russell 3000 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

The Fund’s underweight allocations to the Healthcare and Consumer Discretionary sectors and overweight allocation to the Communication Services sector contributed to relative results.

Security selection within the Information Technology and Communication Services sectors contributed to relative performance.

Top individual contributors over the period were an overweight position in Apple (Information Technology), not holding Intel (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection was the primary detractor to relative performance during the period, driven by selection within the Consumer Staples, Consumer Discretionary, and Financials sectors.

An underweight allocation to the Information Technology sector and overweight exposures to the Materials and Real Estate sectors detracted from relative performance.

From a factor style perspective, the Fund’s underweight exposure to stocks with higher momentum detracted from relative performance.

The largest individual detractors over the period were overweight positions in American Tower (Real Estate) and Nike (Consumer Discretionary), as well as an underweight position in NVIDIA (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

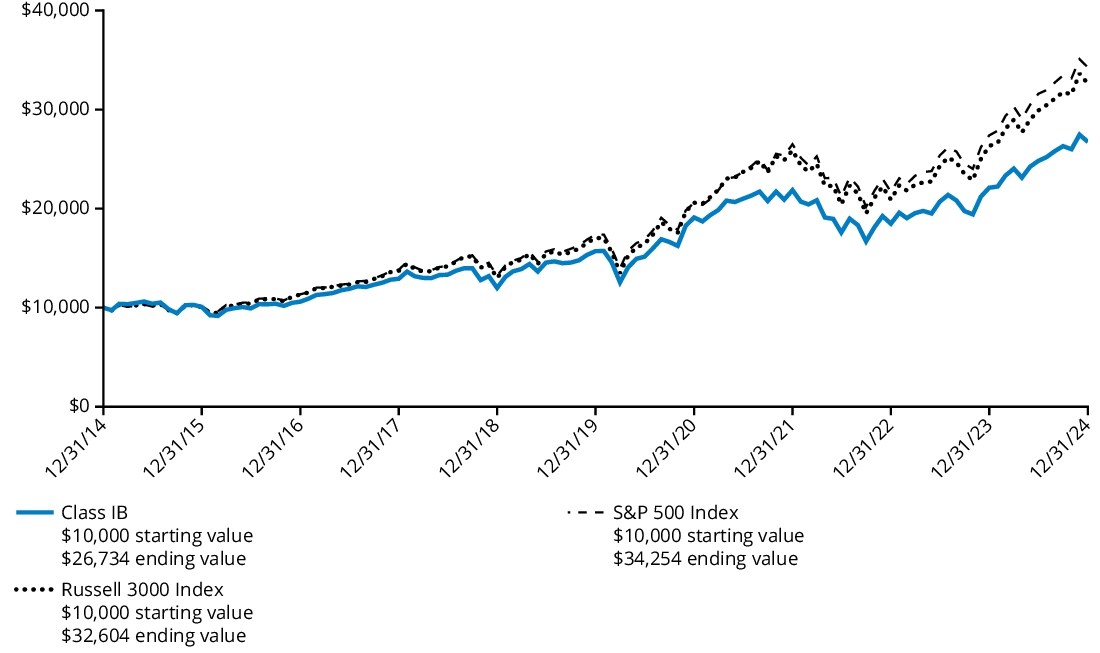

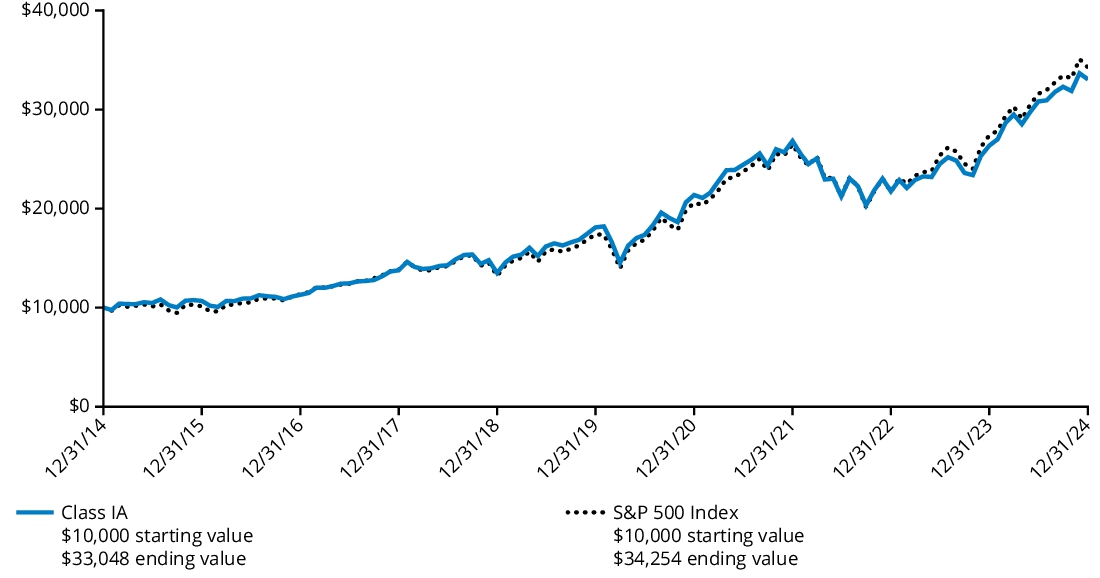

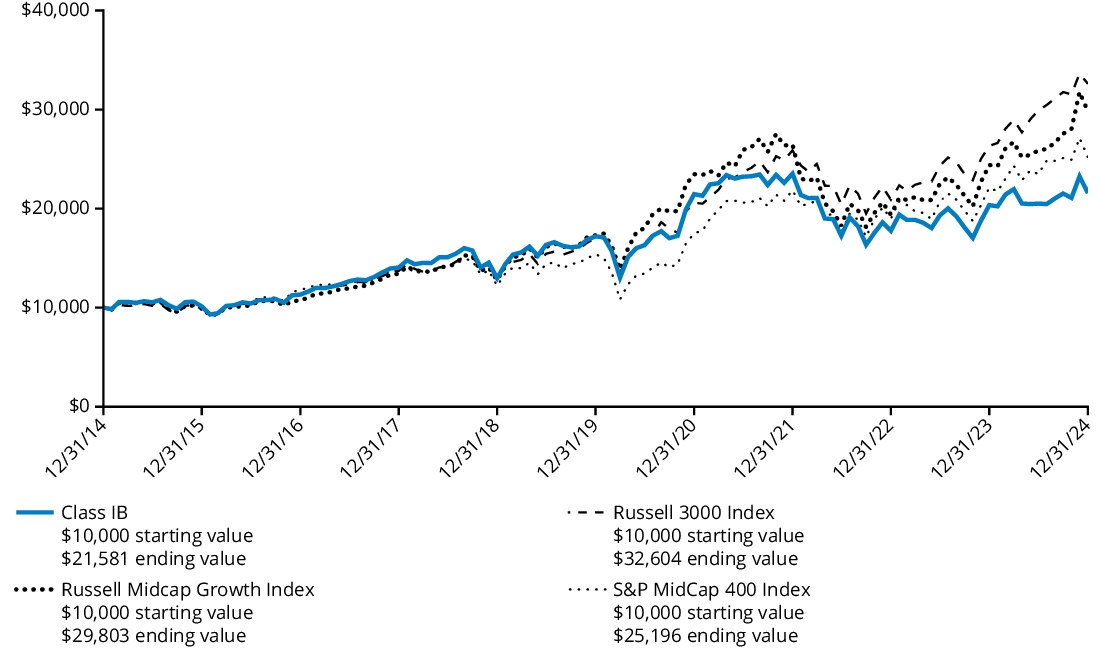

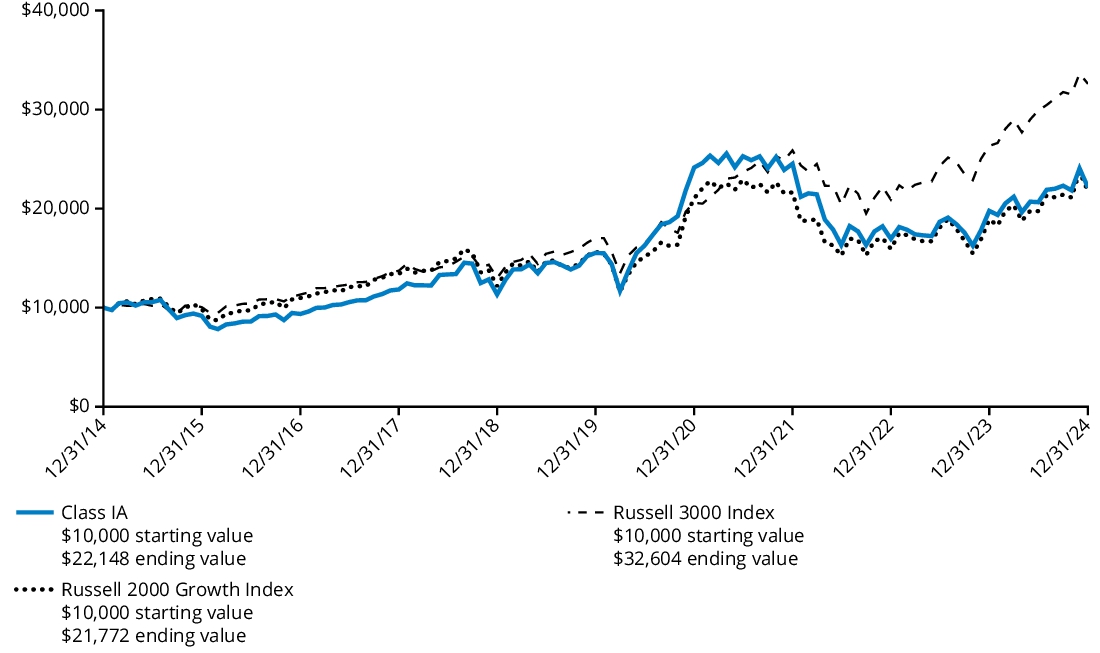

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IB shares and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IB | 20.90% | 11.22% | 10.33% |

| Russell 3000 Index | 23.81% | 13.86% | 12.55% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $3,759,915,745 |

| Total number of portfolio holdings (excluding derivatives, if any) | 157 |

| Total investment management fees paid | $24,128,372 |

| Portfolio turnover rate | 72% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 29.4 | % |

| Financials | 12.4 | % |

| Consumer Discretionary | 11.3 | % |

| Communication Services | 10.7 | % |

| Health Care | 9.7 | % |

| Industrials | 8.0 | % |

| Consumer Staples | 5.8 | % |

| Materials | 3.4 | % |

| Energy | 3.3 | % |

| Real Estate | 2.3 | % |

| Utilities | 1.6 | % |

| Short-Term Investments | 0.4 | % |

| Other Assets & Liabilities | 1.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Capital Appreciation HLS Fund

Class IC/HCPCX

This annual shareholder report contains important information about the Hartford Capital Appreciation HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IC | $129 | 1.17% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the Russell 3000 Index, rose over the twelve-month period ending December 31, 2024. Financial markets adjusted to expectations of fewer interest rate cuts by the U.S. Federal Reserve (Fed) amid persistent inflation, sustained economic growth and a resilient labor market supporting consumer spending. Despite strong first-quarter results, the labor market cooled with reduced hiring and fewer job openings. Concerns about slowing economic activity and a cooling labor market led the (Fed) to implement a 50 basis point interest rate cut in September. Stocks rallied in November following Donald Trump’s presidential election victory, which shifted political power to the Republican Party and paved the way for major policy initiatives, including tax and spending cuts, deregulation, and nationalist trade policies. Fund performance described below is relative to the Russell 3000 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

The Fund’s underweight allocations to the Healthcare and Consumer Discretionary sectors and overweight allocation to the Communication Services sector contributed to relative results.

Security selection within the Information Technology and Communication Services sectors contributed to relative performance.

Top individual contributors over the period were an overweight position in Apple (Information Technology), not holding Intel (Information Technology), and an out-of-benchmark position in ARM Holdings (Information Technology).

Top Detractors to Performance

Security selection was the primary detractor to relative performance during the period, driven by selection within the Consumer Staples, Consumer Discretionary, and Financials sectors.

An underweight allocation to the Information Technology sector and overweight exposures to the Materials and Real Estate sectors detracted from relative performance.

From a factor style perspective, the Fund’s underweight exposure to stocks with higher momentum detracted from relative performance.

The largest individual detractors over the period were overweight positions in American Tower (Real Estate) and Nike (Consumer Discretionary), as well as an underweight position in NVIDIA (Information Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

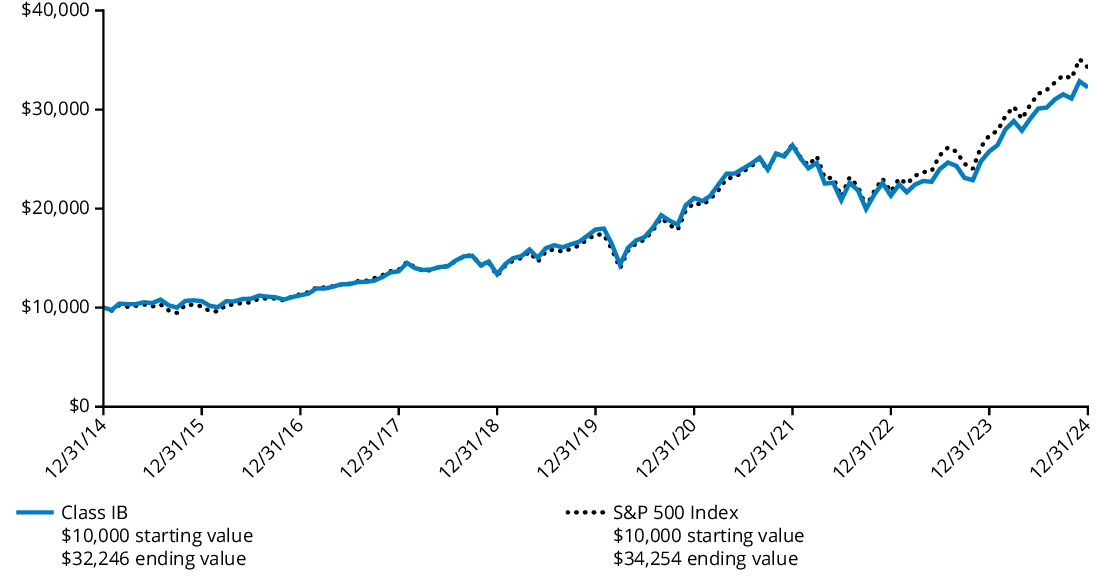

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IC shares and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IC | 20.60% | 10.95% | 10.06% |

| Russell 3000 Index | 23.81% | 13.86% | 12.55% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $3,759,915,745 |

| Total number of portfolio holdings (excluding derivatives, if any) | 157 |

| Total investment management fees paid | $24,128,372 |

| Portfolio turnover rate | 72% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 29.4 | % |

| Financials | 12.4 | % |

| Consumer Discretionary | 11.3 | % |

| Communication Services | 10.7 | % |

| Health Care | 9.7 | % |

| Industrials | 8.0 | % |

| Consumer Staples | 5.8 | % |

| Materials | 3.4 | % |

| Energy | 3.3 | % |

| Real Estate | 2.3 | % |

| Utilities | 1.6 | % |

| Short-Term Investments | 0.4 | % |

| Other Assets & Liabilities | 1.7 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Disciplined Equity HLS Fund

Class IA/HIAGX

This annual shareholder report contains important information about the Hartford Disciplined Equity HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IA | $66 | 0.59% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Moderating inflationary pressures and a cooling labor market led the U.S. Federal Reserve (Fed) to begin easing monetary policy in September, delivering its first rate cut in four years. Subsequently, in the fourth quarter, the Fed cut interest rates twice before signaling a slower pace of cuts in 2025 amid concerns of reaccelerating inflation. In November, Donald Trump won the presidential election, paving the way for major policy initiatives, including a protectionist trade agenda. Fund performance described below is relative to the S&P 500 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Information Technology, Healthcare, and Communication Services sectors.

Top individual contributors over the period were overweight positions in Broadcom (Information Technology) and GE Vernova (Industrials) and not owning benchmark constituent Intel (Information Technology).

Underweight allocations to the Energy, Materials, and Consumer Staples sectors were additive to relative results.

Top Detractors to Performance

Sector allocation, a result of the team’s bottom-up stock selection process, was a detractor to relative performance during the period due to the Fund’s overweight allocation to the Healthcare sector and underweights to the Information Technology and Financials sectors.

Weak security selection within the Consumer Staples, Consumer Discretionary, and Energy sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Estee Lauder (Consumer Staples) and CDW (Information Technology), and an underweight position in Tesla (Consumer Discretionary).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IA shares and the comparative index. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IA | 25.37% | 12.79% | 12.70% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $2,982,324,711 |

| Total number of portfolio holdings (excluding derivatives, if any) | 72 |

| Total investment management fees paid | $16,647,833 |

| Portfolio turnover rate | 27% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 31.8 | % |

| Consumer Discretionary | 12.0 | % |

| Financials | 12.0 | % |

| Health Care | 12.0 | % |

| Communication Services | 9.7 | % |

| Industrials | 8.4 | % |

| Consumer Staples | 4.5 | % |

| Utilities | 3.2 | % |

| Energy | 2.9 | % |

| Materials | 1.7 | % |

| Real Estate | 1.7 | % |

| Short-Term Investments | 0.0 | %† |

| Other Assets & Liabilities | 0.1 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

† | Percentage rounds to zero. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Disciplined Equity HLS Fund

Class IB/HBGIX

This annual shareholder report contains important information about the Hartford Disciplined Equity HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IB | $95 | 0.84% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Moderating inflationary pressures and a cooling labor market led the U.S. Federal Reserve (Fed) to begin easing monetary policy in September, delivering its first rate cut in four years. Subsequently, in the fourth quarter, the Fed cut interest rates twice before signaling a slower pace of cuts in 2025 amid concerns of reaccelerating inflation. In November, Donald Trump won the presidential election, paving the way for major policy initiatives, including a protectionist trade agenda. Fund performance described below is relative to the S&P 500 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Information Technology, Healthcare, and Communication Services sectors.

Top individual contributors over the period were overweight positions in Broadcom (Information Technology) and GE Vernova (Industrials) and not owning benchmark constituent Intel (Information Technology).

Underweight allocations to the Energy, Materials, and Consumer Staples sectors were additive to relative results.

Top Detractors to Performance

Sector allocation, a result of the team’s bottom-up stock selection process, was a detractor to relative performance during the period due to the Fund’s overweight allocation to the Healthcare sector and underweights to the Information Technology and Financials sectors.

Weak security selection within the Consumer Staples, Consumer Discretionary, and Energy sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Estee Lauder (Consumer Staples) and CDW (Information Technology), and an underweight position in Tesla (Consumer Discretionary).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

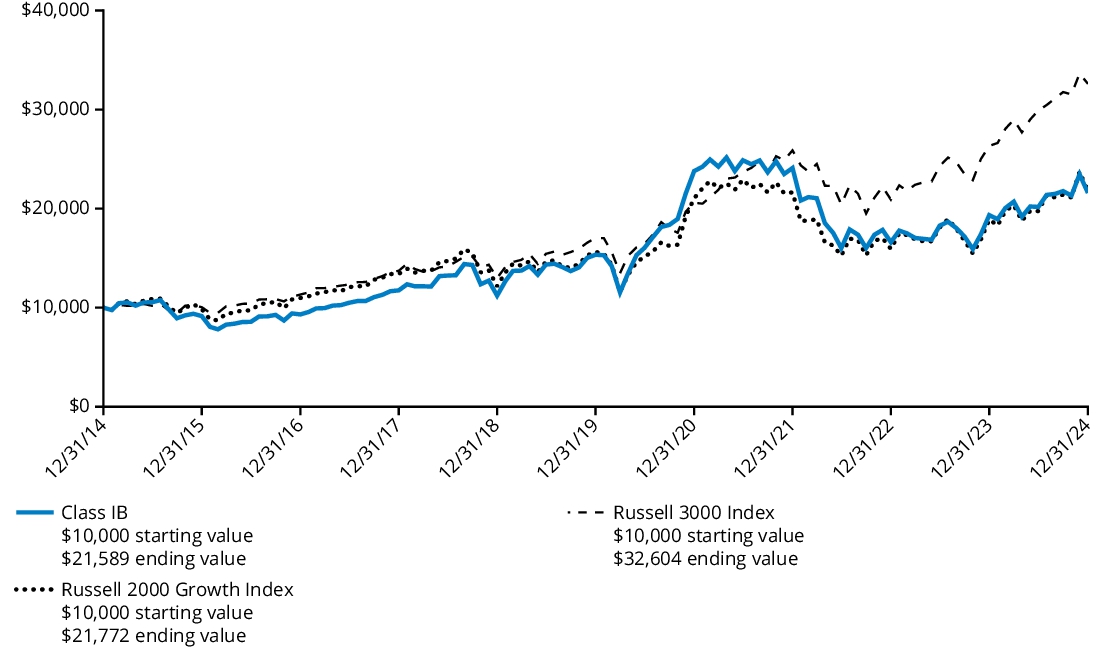

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IB shares and the comparative index. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IB | 25.10% | 12.51% | 12.42% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $2,982,324,711 |

| Total number of portfolio holdings (excluding derivatives, if any) | 72 |

| Total investment management fees paid | $16,647,833 |

| Portfolio turnover rate | 27% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 31.8 | % |

| Consumer Discretionary | 12.0 | % |

| Financials | 12.0 | % |

| Health Care | 12.0 | % |

| Communication Services | 9.7 | % |

| Industrials | 8.4 | % |

| Consumer Staples | 4.5 | % |

| Utilities | 3.2 | % |

| Energy | 2.9 | % |

| Materials | 1.7 | % |

| Real Estate | 1.7 | % |

| Short-Term Investments | 0.0 | %† |

| Other Assets & Liabilities | 0.1 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

† | Percentage rounds to zero. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Disciplined Equity HLS Fund

Class IC/HLSCX

This annual shareholder report contains important information about the Hartford Disciplined Equity HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IC | $122 | 1.09% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Moderating inflationary pressures and a cooling labor market led the U.S. Federal Reserve (Fed) to begin easing monetary policy in September, delivering its first rate cut in four years. Subsequently, in the fourth quarter, the Fed cut interest rates twice before signaling a slower pace of cuts in 2025 amid concerns of reaccelerating inflation. In November, Donald Trump won the presidential election, paving the way for major policy initiatives, including a protectionist trade agenda. Fund performance described below is relative to the S&P 500 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Security selection was the primary contributor to relative performance during the period, driven by strong selection within the Information Technology, Healthcare, and Communication Services sectors.

Top individual contributors over the period were overweight positions in Broadcom (Information Technology) and GE Vernova (Industrials) and not owning benchmark constituent Intel (Information Technology).

Underweight allocations to the Energy, Materials, and Consumer Staples sectors were additive to relative results.

Top Detractors to Performance

Sector allocation, a result of the team’s bottom-up stock selection process, was a detractor to relative performance during the period due to the Fund’s overweight allocation to the Healthcare sector and underweights to the Information Technology and Financials sectors.

Weak security selection within the Consumer Staples, Consumer Discretionary, and Energy sectors detracted from relative results.

The largest individual detractors over the period were overweight positions in Estee Lauder (Consumer Staples) and CDW (Information Technology), and an underweight position in Tesla (Consumer Discretionary).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

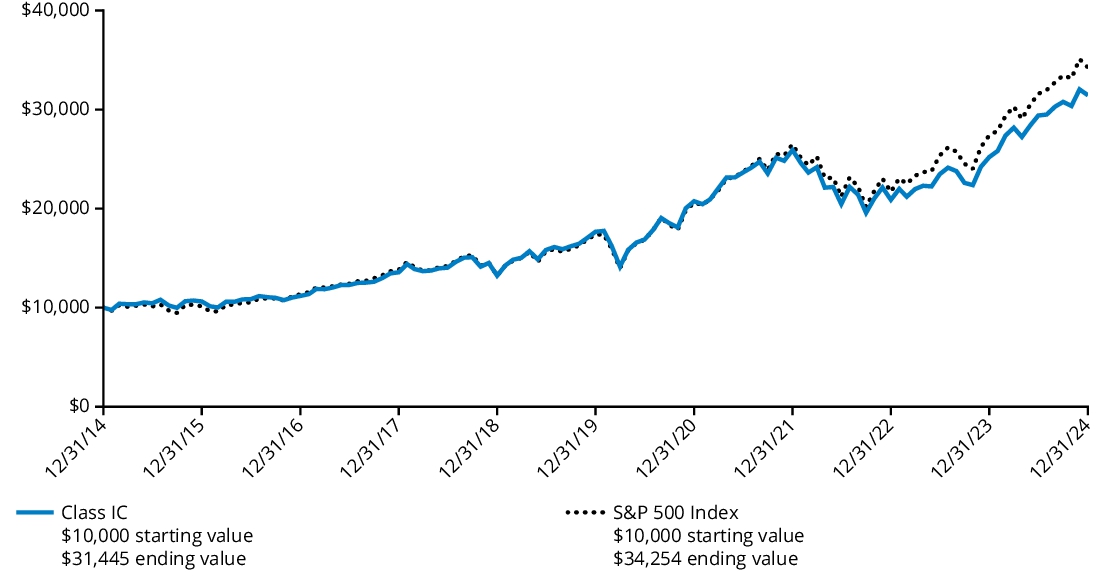

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IC shares and the comparative index. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IC | 24.76% | 12.23% | 12.14% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

Class IC shares commenced operations on September 18, 2020. Class IC shares performance prior to that date reflects the Fund's Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $2,982,324,711 |

| Total number of portfolio holdings (excluding derivatives, if any) | 72 |

| Total investment management fees paid | $16,647,833 |

| Portfolio turnover rate | 27% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 31.8 | % |

| Consumer Discretionary | 12.0 | % |

| Financials | 12.0 | % |

| Health Care | 12.0 | % |

| Communication Services | 9.7 | % |

| Industrials | 8.4 | % |

| Consumer Staples | 4.5 | % |

| Utilities | 3.2 | % |

| Energy | 2.9 | % |

| Materials | 1.7 | % |

| Real Estate | 1.7 | % |

| Short-Term Investments | 0.0 | %† |

| Other Assets & Liabilities | 0.1 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

† | Percentage rounds to zero. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Dividend and Growth HLS Fund

Class IA/HIADX

This annual shareholder report contains important information about the Hartford Dividend and Growth HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IA | $70 | 0.66% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Moderating inflationary pressures and a cooling labor market led the U.S. Federal Reserve (Fed) to begin easing monetary policy in September, delivering its first rate cut in four years. Subsequently, in the fourth quarter, the Fed cut interest rates twice before signaling a slower pace of cuts in 2025 amid concerns of reaccelerating inflation. In November, Donald Trump won the presidential election, paving the way for major policy initiatives, including a protectionist trade agenda. Fund performance described below is relative to the S&P 500 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Security selection within the Financials, Utilities, and Industrials sectors contributed positively to relative performance.

The Fund’s overweight allocation to the Financials sector contributed to relative performance.

Top individual contributors over the period were overweight allocations to Wells Fargo (Financials), Micron Technology (Information Technology) and Constellation Energy (Utilities).

Top Detractors to Performance

Security selection was the primary detractor from relative performance during the period, driven by weak selection within the Information Technology, Materials, and Communication Services sectors.

The largest individual detractors over the period were not owning NVIDIA (Information Technology), an underweight allocation to Broadcom (Information Technology), and an overweight allocation to Celanese (Materials)

Sector allocation, a result of our bottom-up stock selection process, was also a detractor from relative performance during the period due to the Fund’s underweight allocation to the Information Technology sector and overweight allocation to the Energy sector.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

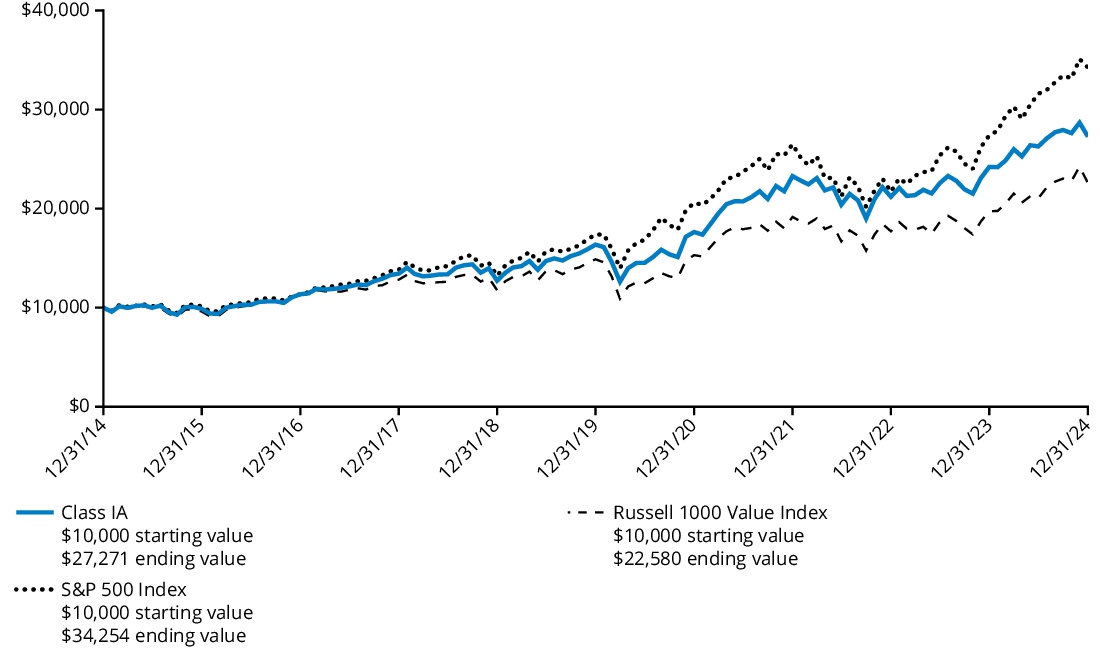

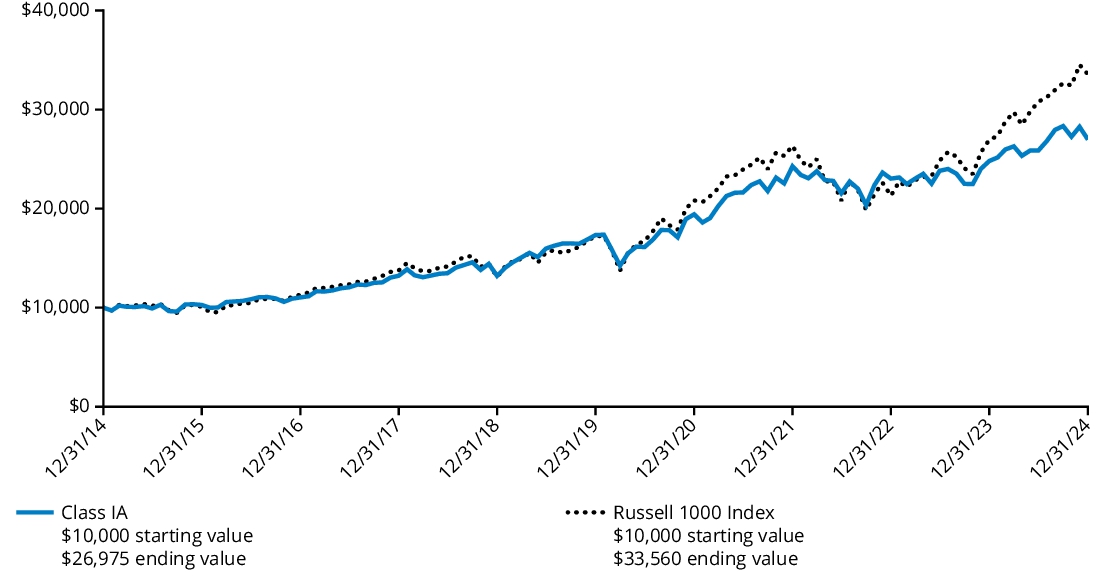

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IA shares and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IA | 12.67% | 10.75% | 10.55% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

| Russell 1000 Value Index | 14.37% | 8.68% | 8.49% |

The S&P 500 Index serves as the Fund’s performance and regulatory index and provides a broad measure of market performance. The Russell 1000 Value Index serves as the Fund’s secondary performance index.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $3,288,765,231 |

| Total number of portfolio holdings (excluding derivatives, if any) | 75 |

| Total investment management fees paid | $21,909,493 |

| Portfolio turnover rate | 31% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 19.1 | % |

| Financials | 18.0 | % |

| Health Care | 14.0 | % |

| Industrials | 11.1 | % |

| Communication Services | 7.0 | % |

| Consumer Staples | 6.7 | % |

| Energy | 6.1 | % |

| Utilities | 5.8 | % |

| Consumer Discretionary | 5.1 | % |

| Materials | 2.8 | % |

| Real Estate | 2.7 | % |

| Short-Term Investments | 0.5 | % |

| Other Assets & Liabilities | 1.1 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Dividend and Growth HLS Fund

Class IB/HDGBX

This annual shareholder report contains important information about the Hartford Dividend and Growth HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IB | $97 | 0.91% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Moderating inflationary pressures and a cooling labor market led the U.S. Federal Reserve (Fed) to begin easing monetary policy in September, delivering its first rate cut in four years. Subsequently, in the fourth quarter, the Fed cut interest rates twice before signaling a slower pace of cuts in 2025 amid concerns of reaccelerating inflation. In November, Donald Trump won the presidential election, paving the way for major policy initiatives, including a protectionist trade agenda. Fund performance described below is relative to the S&P 500 Index for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Security selection within the Financials, Utilities, and Industrials sectors contributed positively to relative performance.

The Fund’s overweight allocation to the Financials sector contributed to relative performance.

Top individual contributors over the period were overweight allocations to Wells Fargo (Financials), Micron Technology (Information Technology) and Constellation Energy (Utilities).

Top Detractors to Performance

Security selection was the primary detractor from relative performance during the period, driven by weak selection within the Information Technology, Materials, and Communication Services sectors.

The largest individual detractors over the period were not owning NVIDIA (Information Technology), an underweight allocation to Broadcom (Information Technology), and an overweight allocation to Celanese (Materials)

Sector allocation, a result of our bottom-up stock selection process, was also a detractor from relative performance during the period due to the Fund’s underweight allocation to the Information Technology sector and overweight allocation to the Energy sector.

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

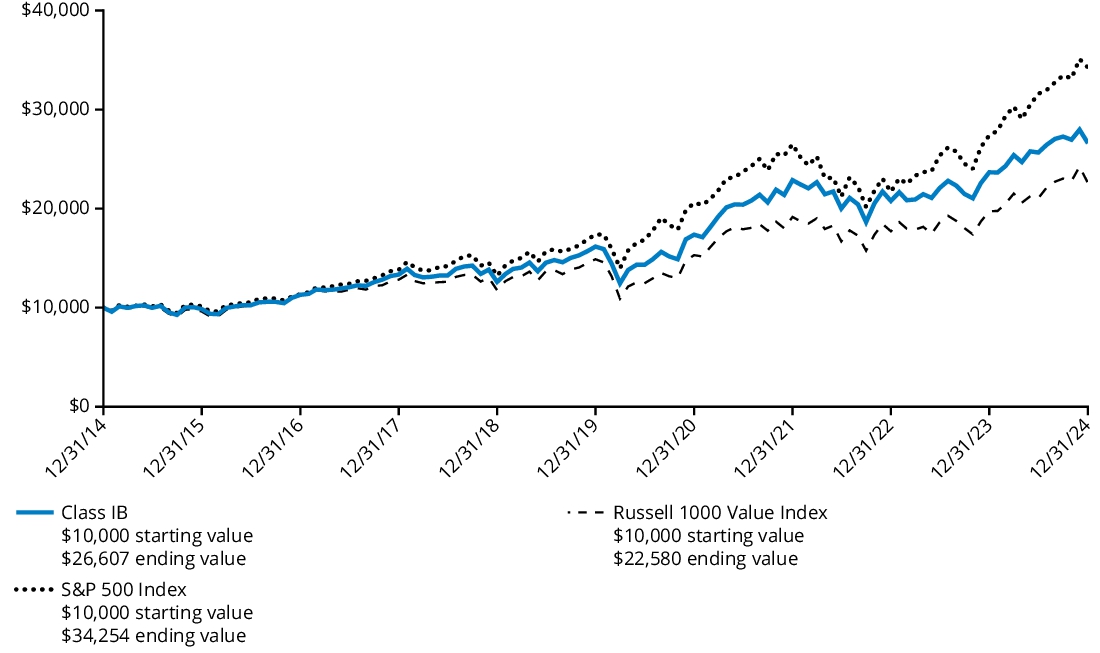

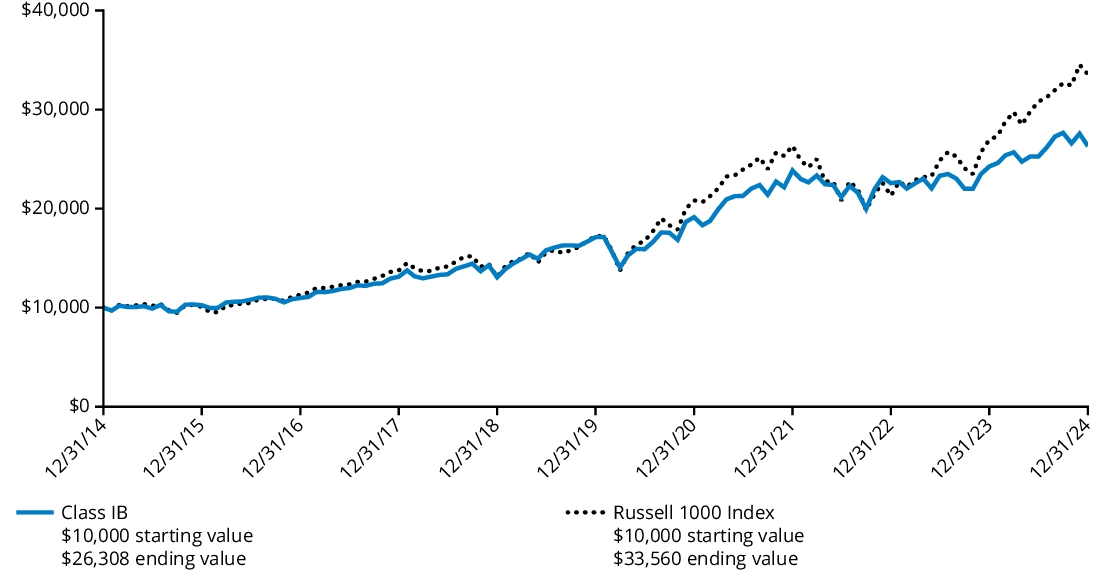

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IB shares and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Periods Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IB | 12.42% | 10.48% | 10.28% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

| Russell 1000 Value Index | 14.37% | 8.68% | 8.49% |

The S&P 500 Index serves as the Fund’s performance and regulatory index and provides a broad measure of market performance. The Russell 1000 Value Index serves as the Fund’s secondary performance index.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $3,288,765,231 |

| Total number of portfolio holdings (excluding derivatives, if any) | 75 |

| Total investment management fees paid | $21,909,493 |

| Portfolio turnover rate | 31% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

| Information Technology | 19.1 | % |

| Financials | 18.0 | % |

| Health Care | 14.0 | % |

| Industrials | 11.1 | % |

| Communication Services | 7.0 | % |

| Consumer Staples | 6.7 | % |

| Energy | 6.1 | % |

| Utilities | 5.8 | % |

| Consumer Discretionary | 5.1 | % |

| Materials | 2.8 | % |

| Real Estate | 2.7 | % |

| Short-Term Investments | 0.5 | % |

| Other Assets & Liabilities | 1.1 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Healthcare HLS Fund

Class IA/HIAHX

This annual shareholder report contains important information about the Hartford Healthcare HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IA | $93 | 0.93% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Moderating inflationary pressures and a cooling labor market led the U.S. Federal Reserve (Fed) to begin easing monetary policy in September, delivering its first rate cut in four years. Subsequently, in the fourth quarter, the Fed cut interest rates twice before signaling a slower pace of cuts in 2025 amid concerns of reaccelerating inflation. In November, Donald Trump won the presidential election, paving the way for major policy initiatives. Fund performance described below is relative to the Fund’s performance index, the S&P Composite 1500 Health Care Index, for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Security selection within the large-cap Biopharma and small-cap Biopharma subsectors contributed positively to relative performance.

Top individual contributors over the period were not owning benchmark constituent CVS Health (Healthcare Services), an overweight to Boston Scientific (Medical Technology) and the Fund’s out-of-benchmark position in Argenx (large-cap Biopharma).

Top Detractors to Performance

Security selection was the primary detractor to relative performance during the period, driven by weak selection within the Healthcare Services and mid-cap Biopharma subsectors.

Sector allocation, a result of the team’s bottom-up stock selection process, was a modest detractor to relative performance during the period, largely due to the Fund’s underweight allocation to the Medical Technology sector.

The largest individual detractors over the period were an overweight position in Acadia Healthcare (Healthcare Services), the Fund’s out-of-benchmark position in agilon health (Healthcare Services), and an overweight in Dexcom (Medical Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

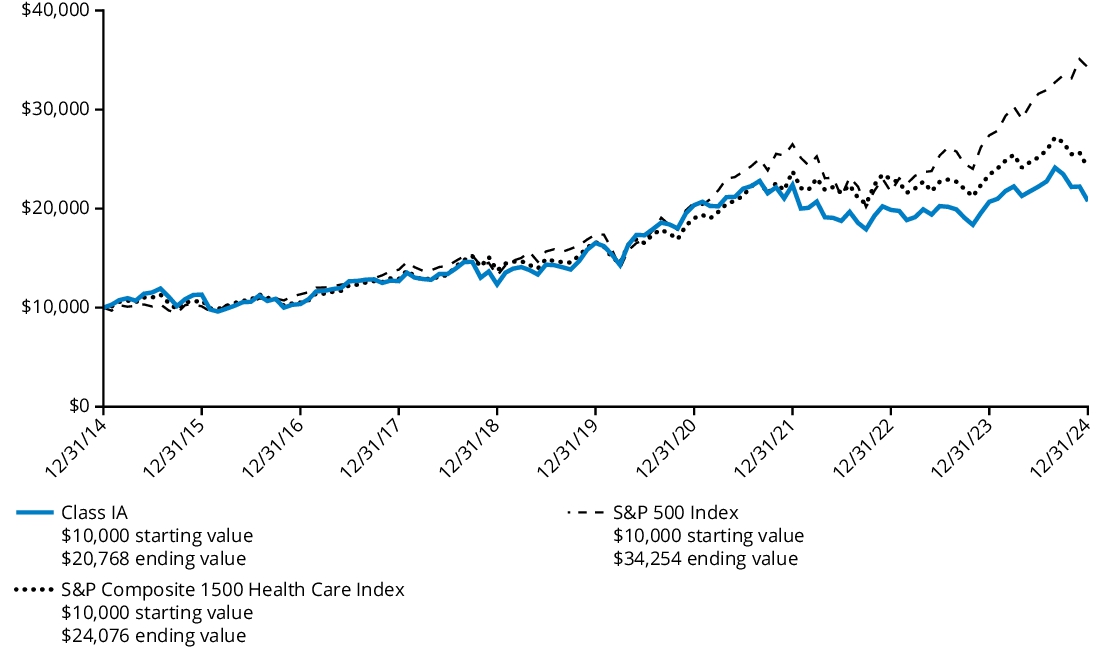

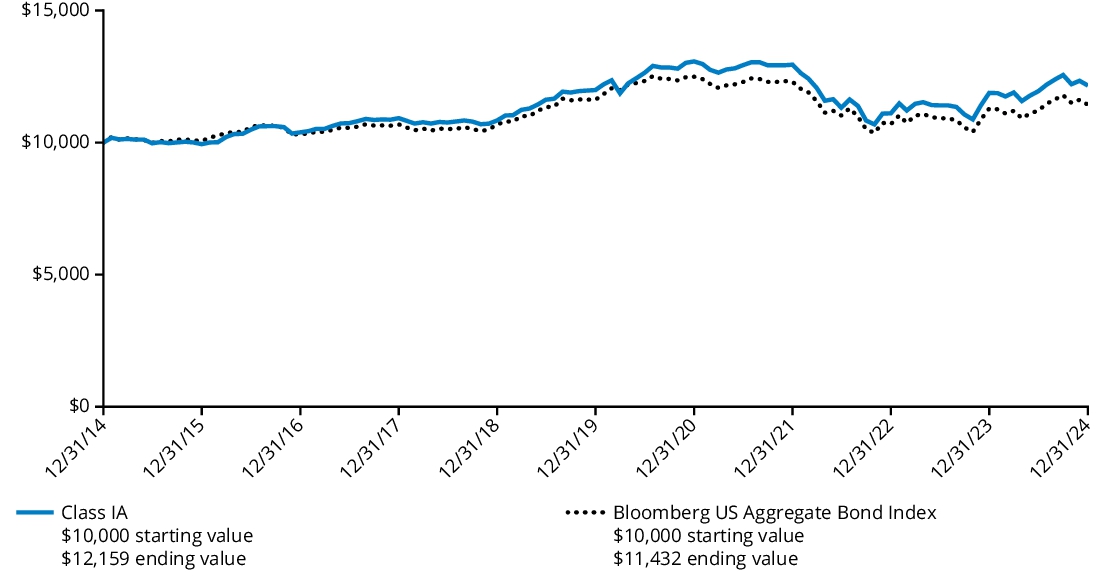

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IA shares and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Period Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IA | 0.39% | 4.67% | 7.58% |

| S&P Composite 1500 Health Care Index | 2.81% | 7.70% | 9.18% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

The S&P Composite 1500 Health Care Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The S&P 500 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $117,615,958 |

| Total number of portfolio holdings (excluding derivatives, if any) | 99 |

| Total investment management fees paid | $1,168,859 |

| Portfolio turnover rate | 42% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

Composition by subsector *

| Pharmaceuticals | 27.0 | % |

| Health Care Providers & Services | 23.8 | % |

| Biotechnology | 22.0 | % |

| Health Care Equipment & Services & Supplies | 16.0 | % |

| Life Sciences Tools & Services | 10.3 | % |

| Health Care Technology | 0.3 | % |

| Other Assets & Liabilities | 0.6 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

Annual Shareholder Report

December 31, 2024

Hartford Healthcare HLS Fund

Class IB/HBGHX

This annual shareholder report contains important information about the Hartford Healthcare HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IB | $118 | 1.18% |

| * | This does not reflect any transactional costs, such as sales charges (loads) or fees which may be applied at the variable life insurance, variable annuity, or qualified retirement plan product level. |

How did the Fund perform last year and what impacted its performance?

Management's Discussion of Fund Performance

United States (U.S.) equities, as measured by the S&P 500 Index, rose over the trailing twelve-month period ending December 31, 2024, with the S&P 500 Index reaching new highs, driven by the performance of a select group of artificial intelligence (AI) related, mega-cap technology companies. Moderating inflationary pressures and a cooling labor market led the U.S. Federal Reserve (Fed) to begin easing monetary policy in September, delivering its first rate cut in four years. Subsequently, in the fourth quarter, the Fed cut interest rates twice before signaling a slower pace of cuts in 2025 amid concerns of reaccelerating inflation. In November, Donald Trump won the presidential election, paving the way for major policy initiatives. Fund performance described below is relative to the Fund’s performance index, the S&P Composite 1500 Health Care Index, for the trailing twelve-month period ended December 31, 2024.

Top Contributors to Performance

Security selection within the large-cap Biopharma and small-cap Biopharma subsectors contributed positively to relative performance.

Top individual contributors over the period were not owning benchmark constituent CVS Health (Healthcare Services), an overweight to Boston Scientific (Medical Technology) and the Fund’s out-of-benchmark position in Argenx (large-cap Biopharma).

Top Detractors to Performance

Security selection was the primary detractor to relative performance during the period, driven by weak selection within the Healthcare Services and mid-cap Biopharma subsectors.

Sector allocation, a result of the team’s bottom-up stock selection process, was a modest detractor to relative performance during the period, largely due to the Fund’s underweight allocation to the Medical Technology sector.

The largest individual detractors over the period were an overweight position in Acadia Healthcare (Healthcare Services), the Fund’s out-of-benchmark position in agilon health (Healthcare Services), and an overweight in Dexcom (Medical Technology).

The views expressed in this section reflect the opinions of the Fund's sub-adviser, Wellington Management Company LLP, as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

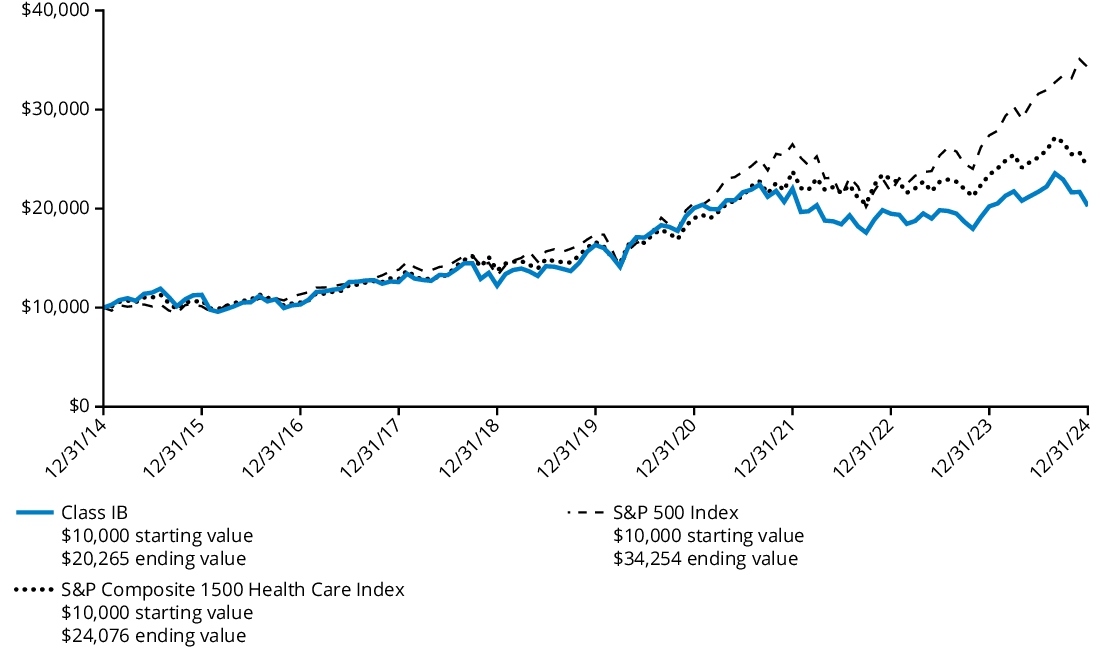

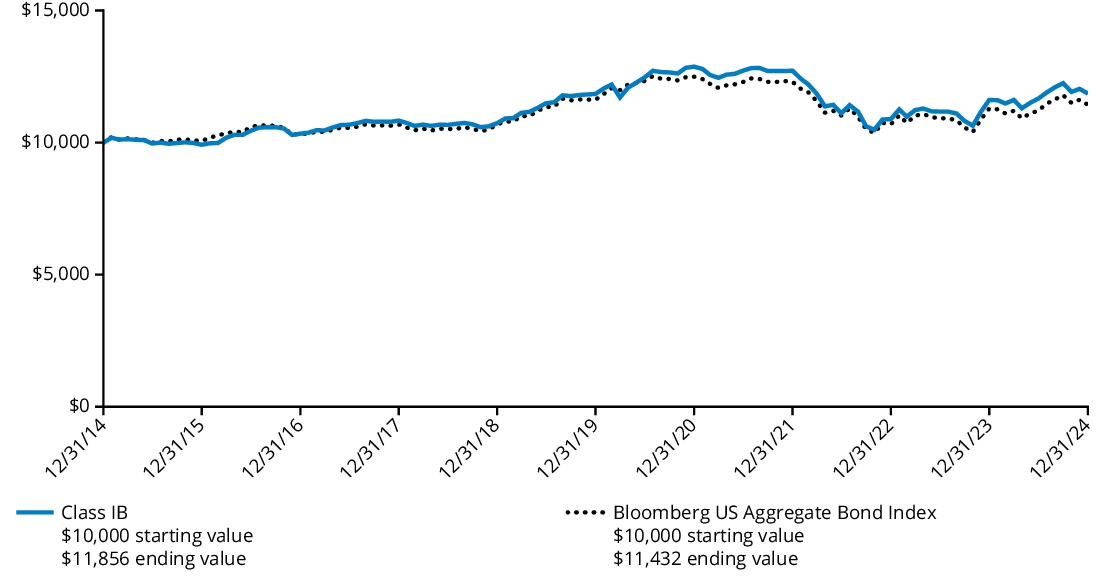

Comparison of Change in Value of $ 10,000 Investment

The graph below represents the hypothetical growth of a $10,000 investment in Class IB shares and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

Average Annual Total Returns

For the Period Ended December 31, 2024 | 1 Year | 5 Years | 10 Years |

| Class IB | 0.19% | 4.41% | 7.32% |

| S&P Composite 1500 Health Care Index | 2.81% | 7.70% | 9.18% |

| S&P 500 Index | 25.02% | 14.53% | 13.10% |

The S&P Composite 1500 Health Care Index serves as the Fund’s performance index because the Fund’s investment manager believes it is more representative of the Fund’s investment strategy. The S&P 500 Index serves as the Fund’s regulatory index and provides a broad measure of market performance.

The Fund’s past performance is not a good predictor of the Fund’s future performance. The Fund's performance in the graph and table do not reflect the deductions of taxes, sales charges or other fees which may be applied at the variable contract level or by a qualified pension or retirement plan. Any such additional sales charges or other fees or expenses would lower the contract’s or plan’s performance. Visit hartfordfunds.com for the most recent performance information.

Key Fund Statistics as of December 31, 2024

| Fund's net assets | $117,615,958 |

| Total number of portfolio holdings (excluding derivatives, if any) | 99 |

| Total investment management fees paid | $1,168,859 |

| Portfolio turnover rate | 42% |

Graphical Representation of Holdings as of December 31, 2024

The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund.

Composition by subsector *

| Pharmaceuticals | 27.0 | % |

| Health Care Providers & Services | 23.8 | % |

| Biotechnology | 22.0 | % |

| Health Care Equipment & Services & Supplies | 16.0 | % |

| Life Sciences Tools & Services | 10.3 | % |

| Health Care Technology | 0.3 | % |

| Other Assets & Liabilities | 0.6 | % |

| Total | 100.0 | % |

* | For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

Availability of Additional Information

For additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, please visit the Fund’s website at the website address included at the beginning of this report.

The Fund is distributed by Hartford Funds Distributors, LLC (HFD).

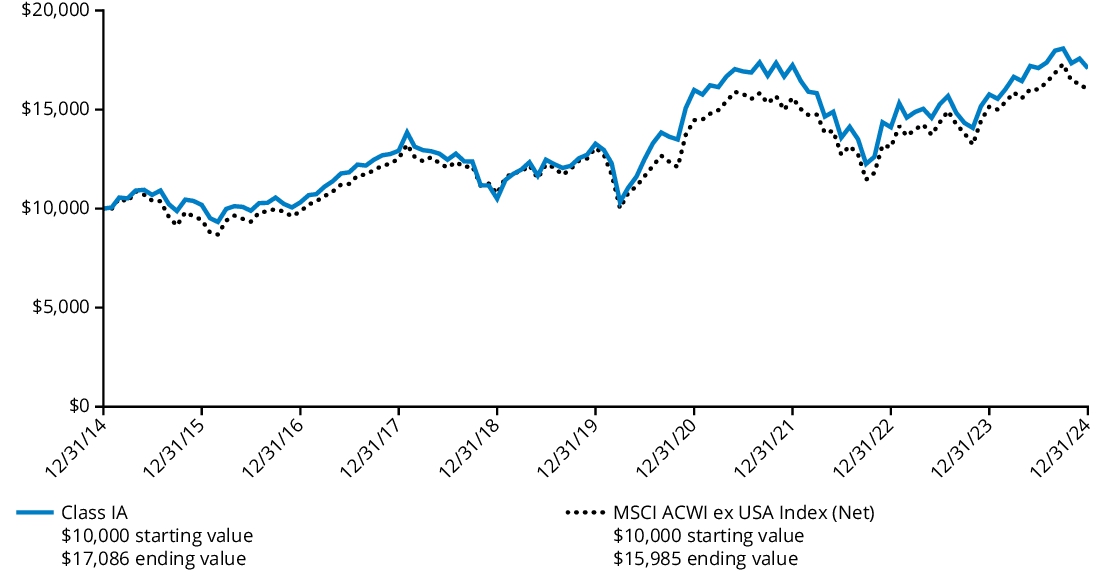

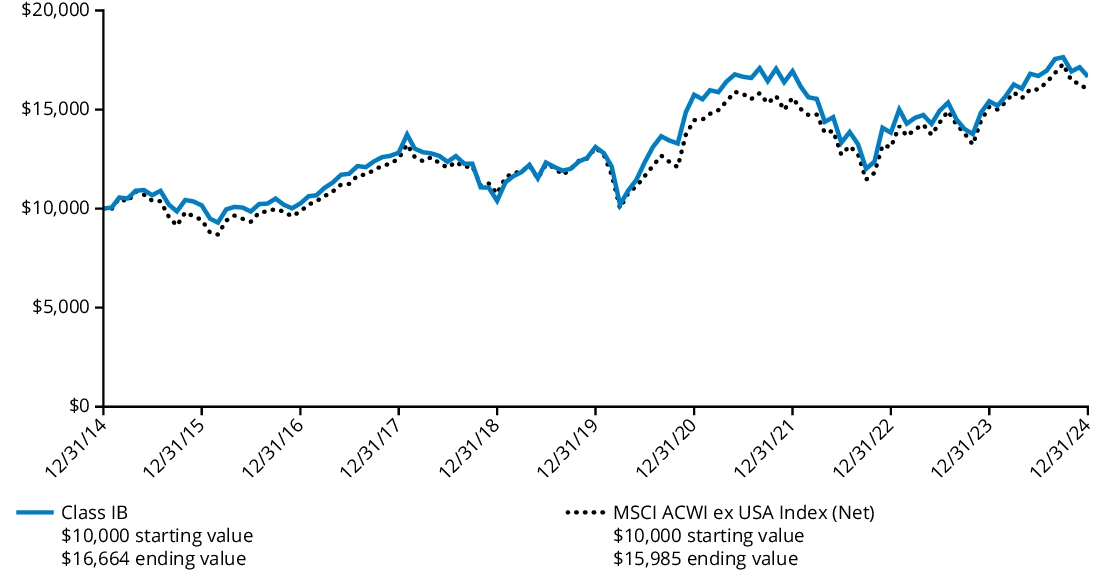

Annual Shareholder Report

December 31, 2024

Hartford International Opportunities HLS Fund

Class IA/HIAOX

This annual shareholder report contains important information about the Hartford International Opportunities HLS Fund (the "Fund") for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at hartfordfunds.com/reports-hls. You can also request this information by contacting us by calling 1‑888‑843‑7824.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment* | Costs paid as a percentage

of a $10,000 investment* |

| Class IA | $79 | 0.76% |