Exhibit 99.1

CONNECTING YOUR BUSINESS TO MORE BUSINESSSM

Investor Presentation September 2005

Safe Harbor Statement . . .

Statements made during today’s presentation may include certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations and are subject to risks and uncertainties. These risks include the risks summarized in the Company’s filings with the SEC, including the section entitled “Risk Factors” in its Annual Report on Form 10-K.

Time Warner Telecom Inc. is under no obligation, and expressly disclaims any obligation, to update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

Comments and discussions related to financial performance and trends are based on the information from our second quarter 2005 earnings call and press release. Please see our Q2 2005 earnings release at www.twtelecom.com.

2

Time Warner Telecom . . . Connecting Your Business to More Business

Company Overview

3

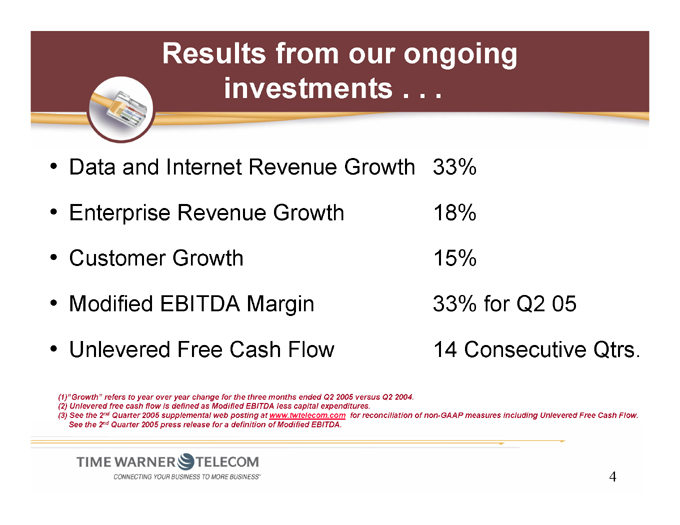

Results from our ongoing investments . . .

Data and Internet Revenue Growth 33%

Enterprise Revenue Growth 18%

Customer Growth 15%

Modified EBITDA Margin 33% for Q2 05

Unlevered Free Cash Flow 14 Consecutive Qtrs.

(1) ”Growth” refers to year over year change for the three months ended Q2 2005 versus Q2 2004. (2) Unlevered free cash flow is defined as Modified EBITDA less capital expenditures.

(3) See the 2nd Quarter 2005 supplemental web posting at www.twtelecom.com for reconciliation of non-GAAP measures including Unlevered Free Cash Flow.

See the 2nd Quarter 2005 press release for a definition of Modified EBITDA.

4

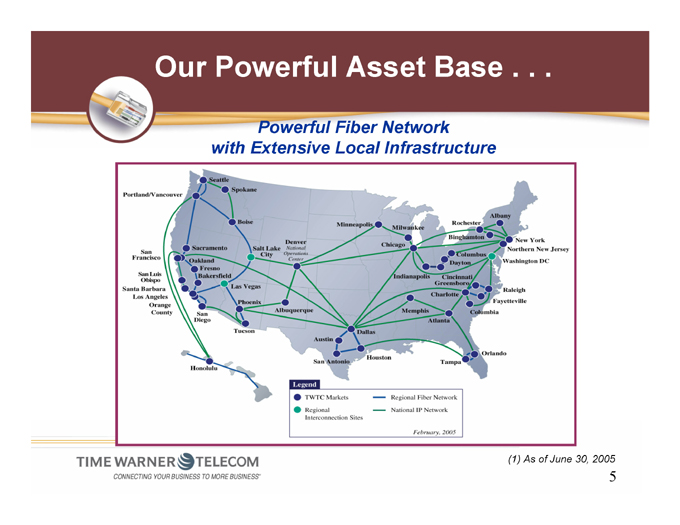

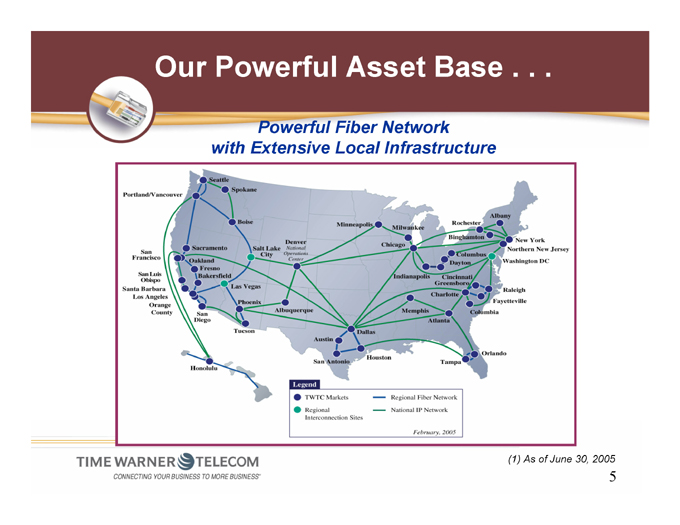

Our Powerful Asset Base . . .

Powerful Fiber Network with Extensive Local Infrastructure

(1) As of June 30, 2005

5

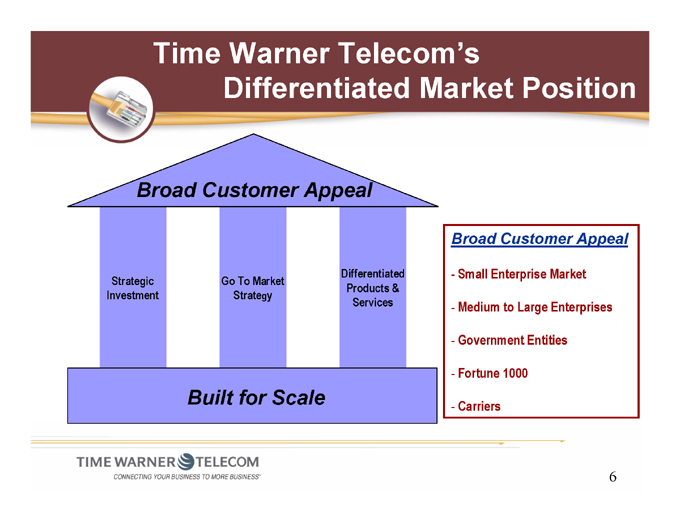

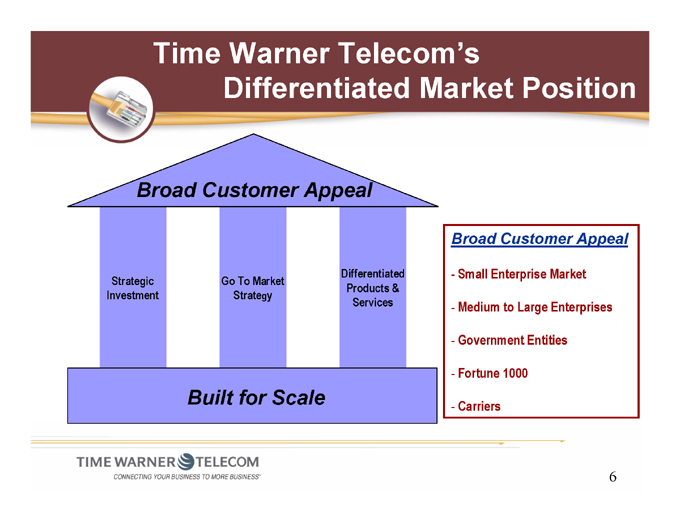

Time Warner Telecom’s

Differentiated Market Position

Broad Customer Appeal

Strategic Investment

Go To Market Strategy

Differentiated Products & Services

Built for Scale

Broad Customer Appeal

Small Enterprise Market

Medium to Large Enterprises

Government Entities

Fortune 1000

Carriers

6

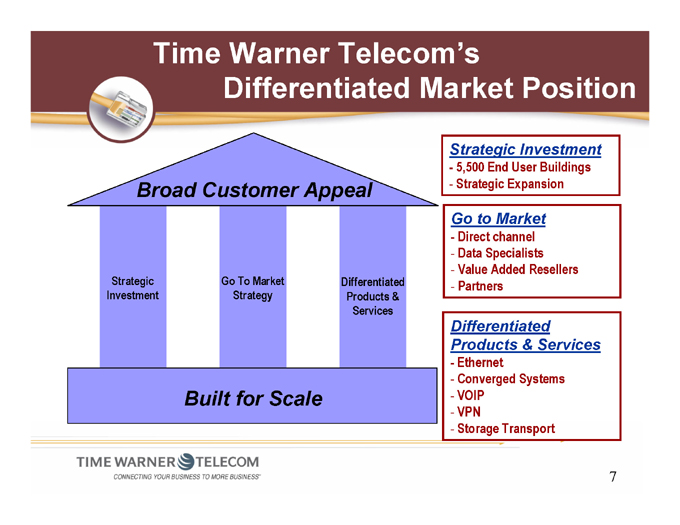

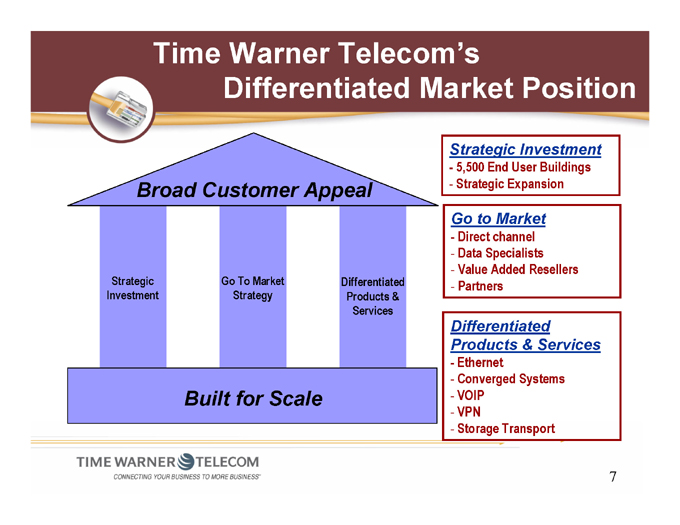

Time Warner Telecom’s

Differentiated Market Position

Broad Customer Appeal

Strategic Investment

Go To Market Strategy

Differentiated Products & Services

Built for Scale

Strategic Investment

5,500 End User Buildings

Strategic Expansion

Go to Market

Direct channel

Data Specialists

Value Added Resellers

Partners

Differentiated Products & Services

Ethernet

Converged Systems

VOIP

VPN

Storage Transport

7

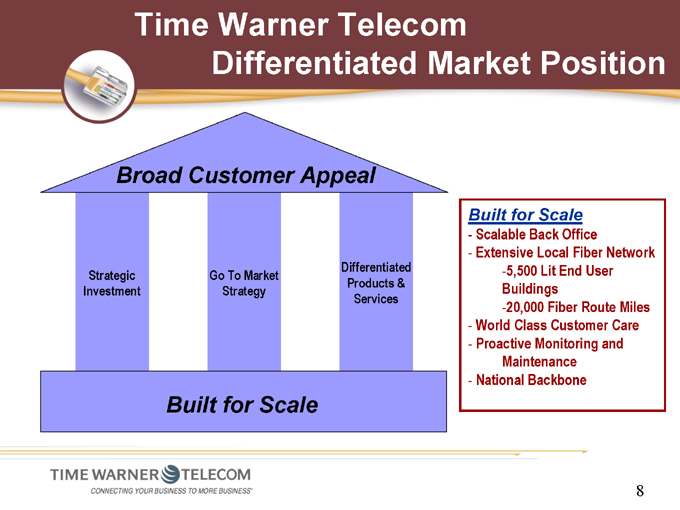

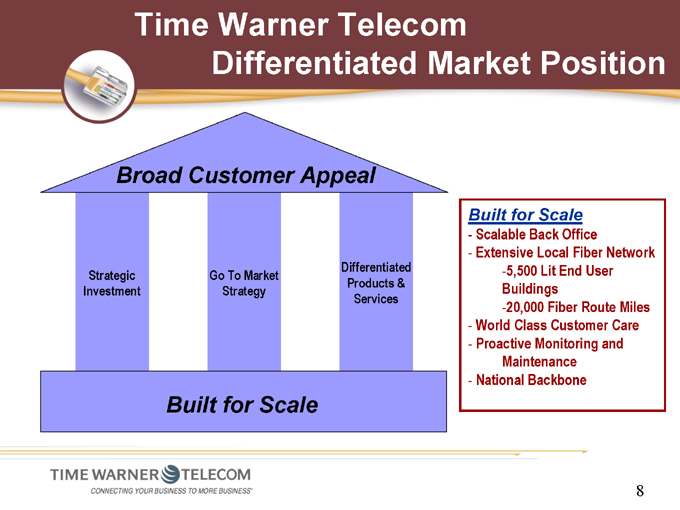

Time Warner Telecom

Differentiated Market Position

Broad Customer Appeal

Strategic Investment

Go To Market Strategy

Differentiated Products & Services

Built for Scale

Built for Scale

Scalable Back Office

Extensive Local Fiber Network -5,500 Lit End User Buildings -20,000 Fiber Route Miles

World Class Customer Care

Proactive Monitoring and Maintenance

National Backbone

8

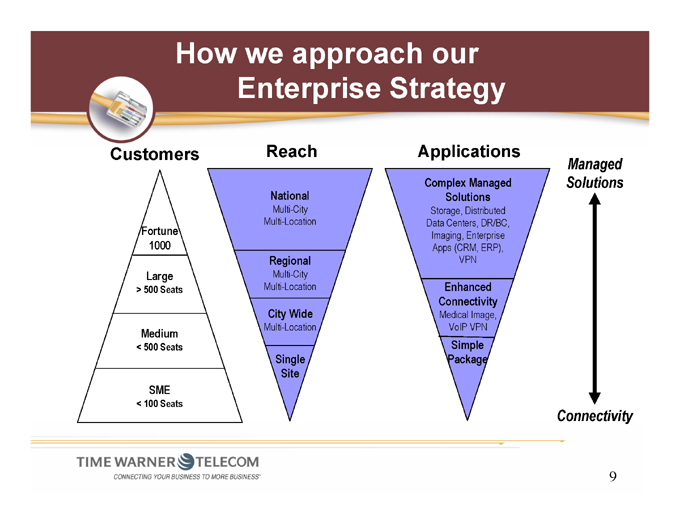

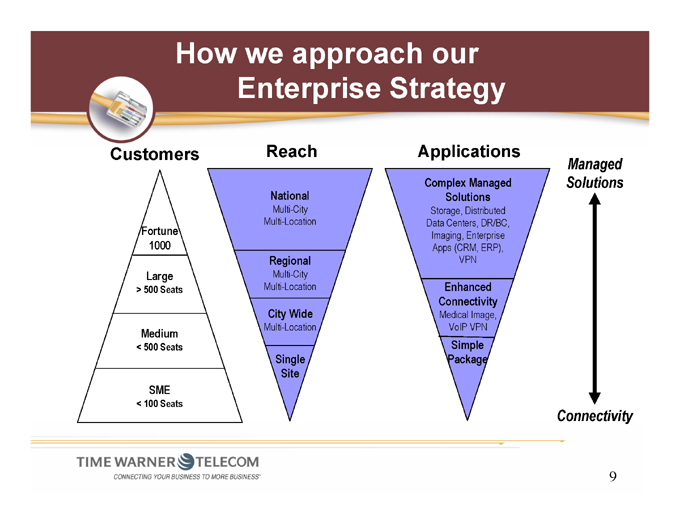

How we approach our Enterprise Strategy

Customers

Fortune 1000

Large

> 500 Seats

Medium

< 500 Seats

SME

< 100 Seats

Reach

National

Multi-City Multi-Location

Regional

Multi-City Multi-Location

City Wide

Multi-Location

Single Site

Applications

Complex Managed Solutions

Storage, Distributed Data Centers, DR/BC, Imaging, Enterprise Apps (CRM, ERP), VPN

Enhanced Connectivity

Medical Image, VoIP VPN

Simple Package

Managed Solutions

Connectivity

9

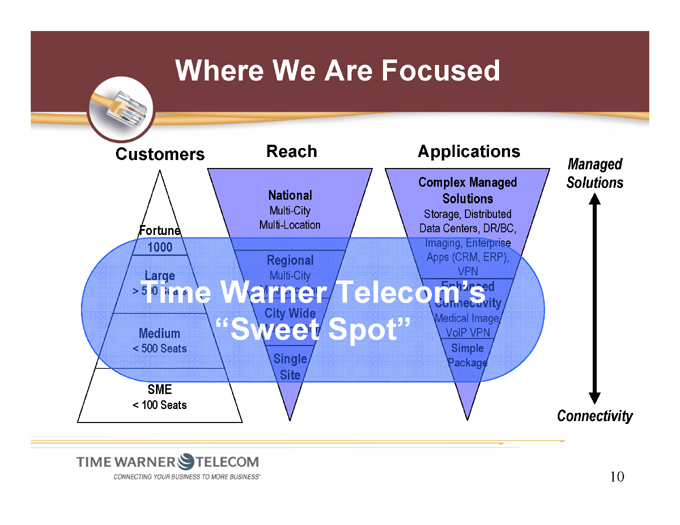

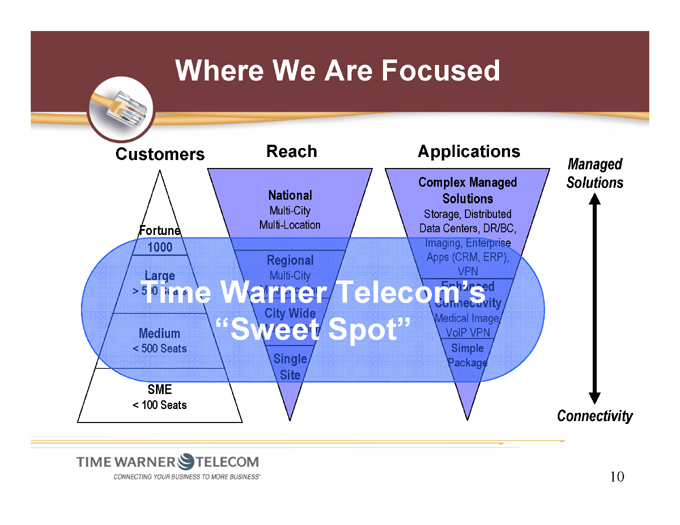

Where We Are Focused

Customers

Fortune 1000 Large

>Time500 Seats

Medium

< 500 Seats

SME

< 100 Seats

Reach

National

Multi-City Multi-Location

Regional

Multi-City Multi-Location

City Wide

Multi-Location

Single Site

Time Warner Telecom’s “Sweet Spot”

Applications

Complex Managed Solutions

Storage, Distributed Data Centers, DR/BC, Imaging, Enterprise Apps (CRM, ERP), VPN

Enhanced Connectivity

Medical Image, VoIP VPN

Simple Package

Managed Solutions

Connectivity

10

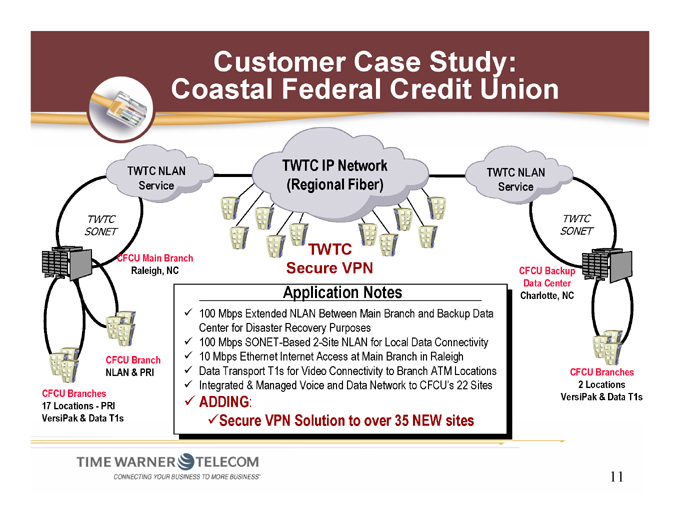

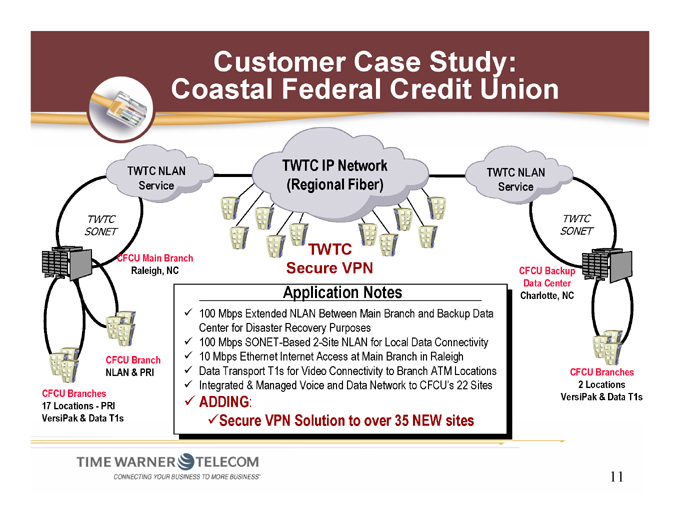

Customer Case Study: Coastal Federal Credit Union

CFCU Branches 17 Locations—PRI VersiPak & Data T1s

CFCU Branch NLAN & PRI

CFCU Main Branch Raleigh, NC

TWTC SONET

TWTC NLAN

Service

TWTC IP Network (Regional Fiber)

TWTC Secure VPN

TWTC NLAN

Service

TWTC SONET

CFCU Backup Data Center Charlotte, NC

CFCU Branches 2 Locations VersiPak & Data T1s

Application Notes

100 Mbps Extended NLAN Between Main Branch and Backup Data Center for Disaster Recovery Purposes

100 Mbps SONET-Based 2-Site NLAN for Local Data Connectivity

10 Mbps Ethernet Internet Access at Main Branch in Raleigh

Data Transport T1s for Video Connectivity to Branch ATM Locations

Integrated & Managed Voice and Data Network to CFCU’s 22 Sites

ADDING:

Secure VPN Solution to over 35 NEW sites

11

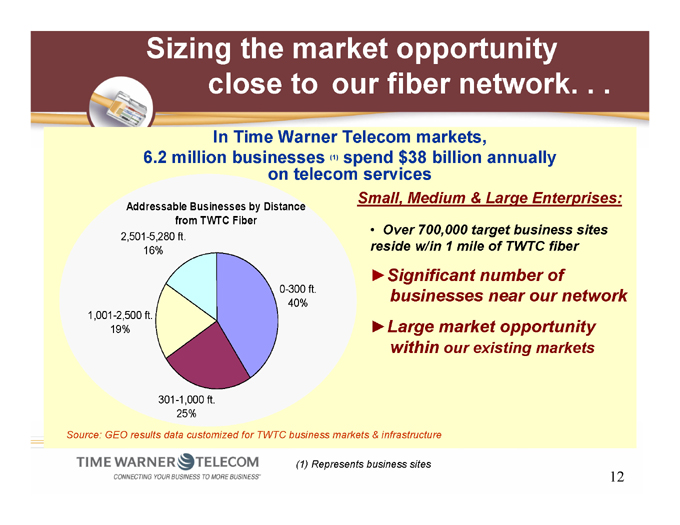

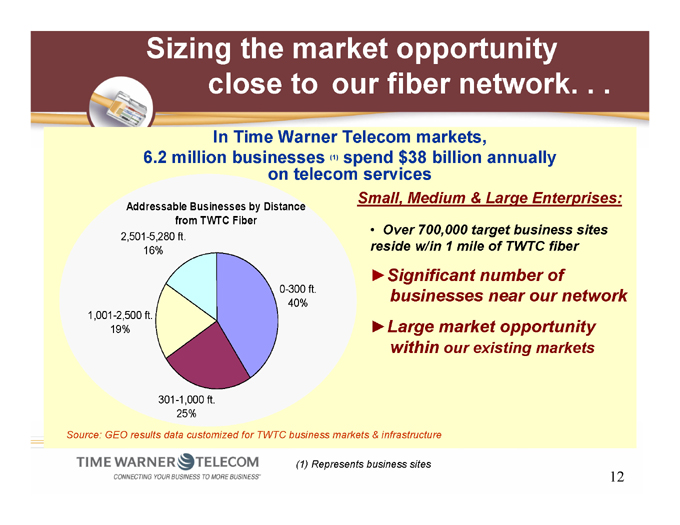

Sizing the market opportunity close to our fiber network. . .

In Time Warner Telecom markets,

6.2 million businesses (1) spend $38 billion annually on telecom services

Addressable Businesses by Distance from TWTC Fiber

2,501-5,280 ft.

16%

1,001-2,500 ft.

19%

301-1,000 ft.

25%

0-300 ft.

40%

Small, Medium & Large Enterprises:

Over 700,000 target business sites reside w/in 1 mile of TWTC fiber

Significant number of businesses near our network

Large market opportunity within our existing markets

Source: GEO results data customized for TWTC business markets & infrastructure

(1) Represents business sites

12

TWTC’s Ongoing Focus . . .

Unique Asset Base Access to Customer never more critical

Industry-Leading Portfolio Making businesses run more efficiently

Leveraging Infrastructure Focused on capital efficiency and cash flow

Innovative solutions Enabling technology for customer networks

13

Time Warner Telecom . . . Connecting Your Business to More Business

Product and Services

14

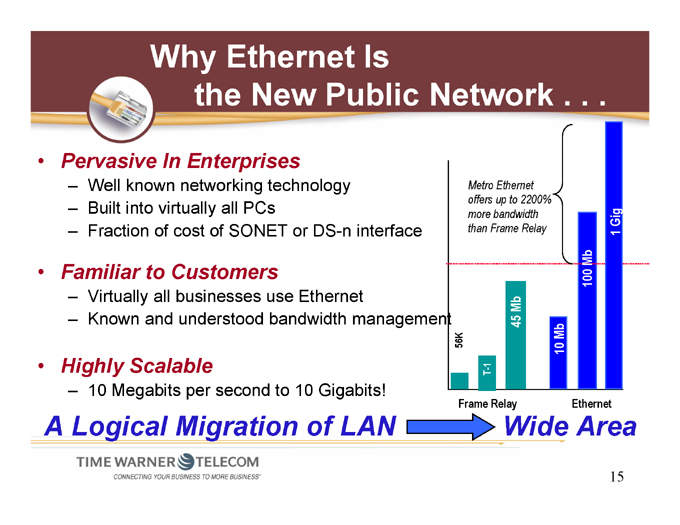

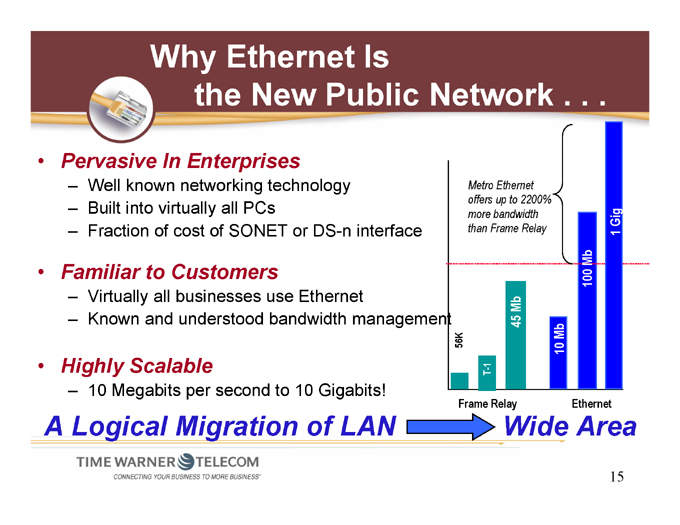

Why Ethernet Is the New Public Network . . .

Pervasive In Enterprises

Well known networking technology

Built into virtually all PCs

Fraction of cost of SONET or DS-n interface

Familiar to Customers

Virtually all businesses use Ethernet

Known and understood bandwidth management

Highly Scalable

10 Megabits per second to 10 Gigabits!

Metro Ethernet offers up to 2200% more bandwidth than Frame Relay

56K

T-1

45 Mb

10 Mb

100 Mb

1 Gig

Frame Relay Ethernet

A Logical Migration of LAN Wide Area

15

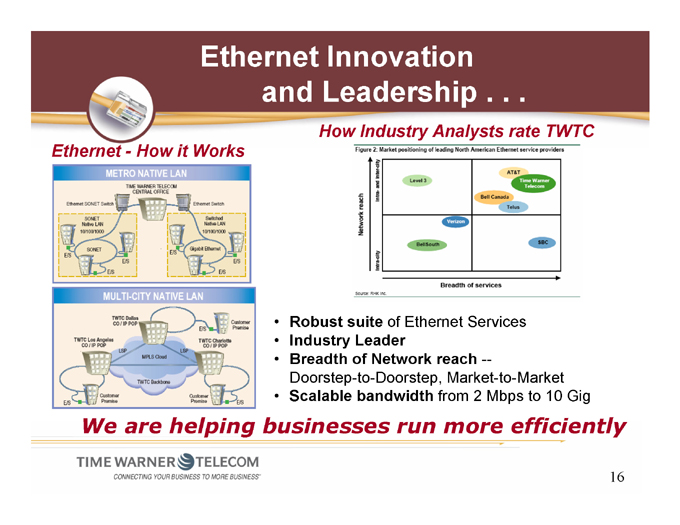

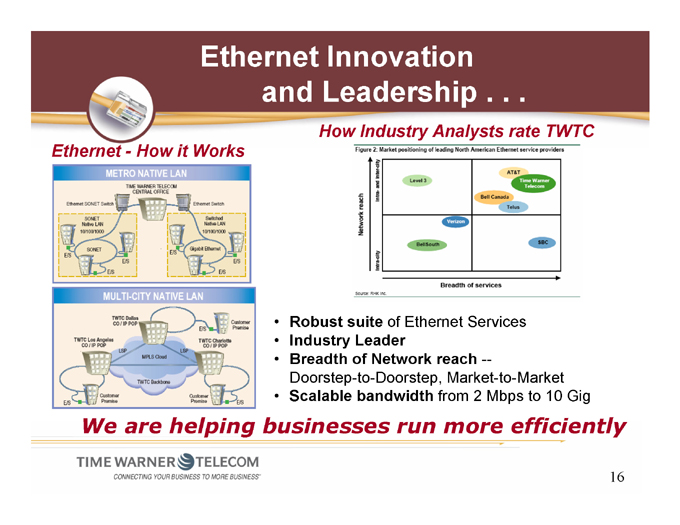

Ethernet Innovation and Leadership . . .

How Industry Analysts rate TWTC

Ethernet—How it Works

Robust suite of Ethernet Services

Industry Leader

Breadth of Network reach —

Doorstep-to-Doorstep, Market-to-Market Scalable bandwidth from 2 Mbps to 10 Gig

We are helping businesses run more efficiently

16

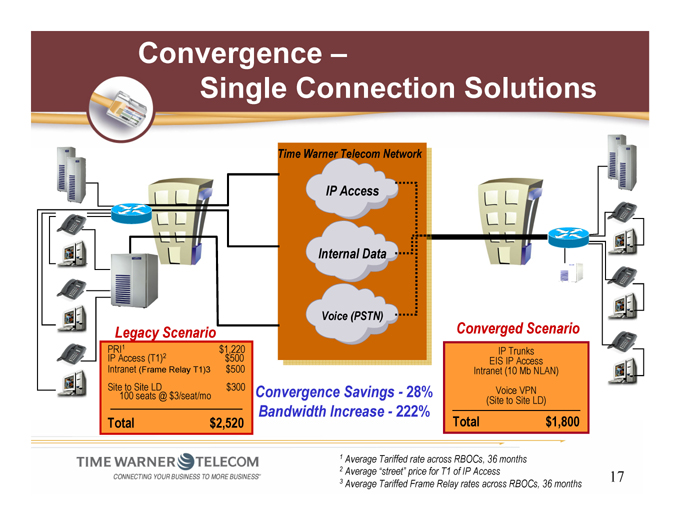

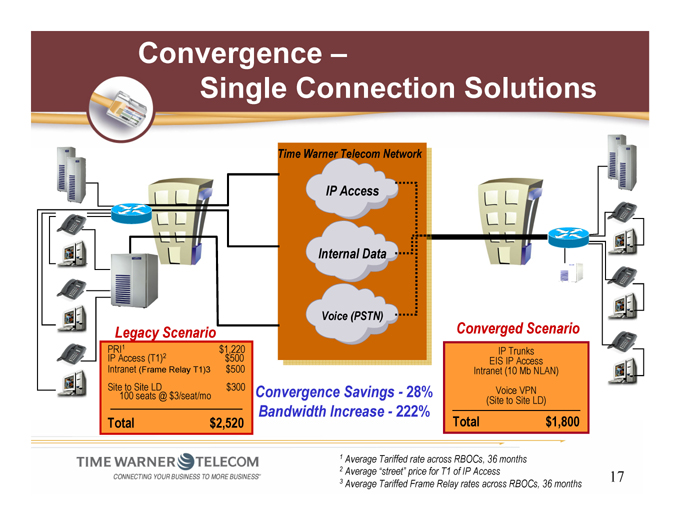

Convergence –

Single Connection Solutions

Time Warner Telecom Network

IP Access

Internal Data

Voice (PSTN)

Legacy Scenario

PRI1 $1,220

IP Access (T1)2 $500

Intranet (Frame Relay T1)3 $500

Site to Site LD $300

100 seats @ $3/seat/mo

Total $ 2,520

Convergence Savings—28% Bandwidth Increase—222%

Converged Scenario

IP Trunks

EIS IP Access

Intranet (10 Mb NLAN)

Voice VPN

(Site to Site LD)

Total $1,800

1 Average Tariffed rate across RBOCs, 36 months

2 Average “street” price for T1 of IP Access

3 Average Tariffed Frame Relay rates across RBOCs, 36 months

17

Time Warner Telecom . . . Connecting Your Business to More Business

Financial Overview

18

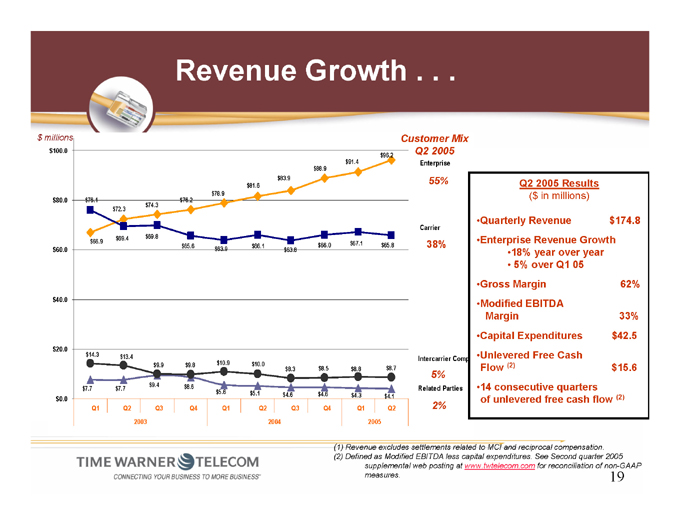

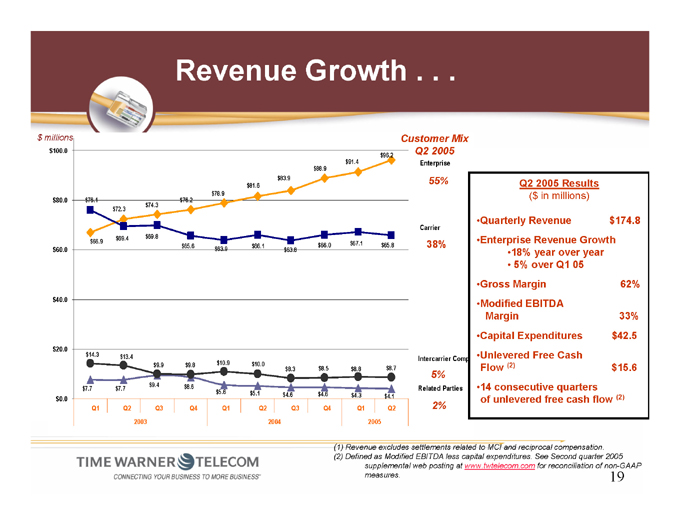

Revenue Growth . . .. $millions

$100.0 $80.0 $60.0 $40.0 $20.0 $0.0 $96.2 $91.4 $88.9 $83.9 $81.6 $78.9 $76.1 $76.2 $74.3 $72.3 $69.4 $69.8 $66.9 $67.1 $65.6 $66.1 $66.0 $65.8 $63.9 $63.8

Customer Mix Q2 2005

Enterprise

55%

Carrier

38% $14.3 $13.4 $9.9 $9.8 $10.9 $10.0 $8.3 $8.5 $8.8 $8.7 $9.4 $8.6 $7.7 $7.7 $5.6 $5.1 $4.6 $4.6 $4.3 $4.1

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2003 2004 2005

Intercarrier Comp

5%

Related Parties

2%

Q2 2005 Results

($ in millions)

Quarterly Revenue $174.8

Enterprise Revenue Growth

18% year over year

5% over Q1 05

Gross Margin 62%

Modified EBITDA

Margin 33%

Capital Expenditures $42.5

Unlevered Free Cash Flow (2) $15.6

14 consecutive quarters of unlevered free cash flow(2)

(1) Revenue excludes settlements related to MCI and reciprocal compensation. (2) Defined as Modified EBITDA less capital expenditures. See Second quarter 2005 supplemental web posting at www.twtelecom.com for reconciliation of non-GAAP measures. 19

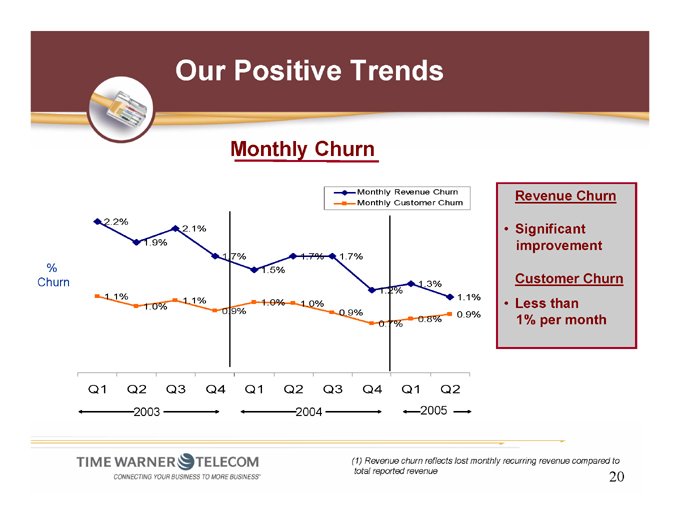

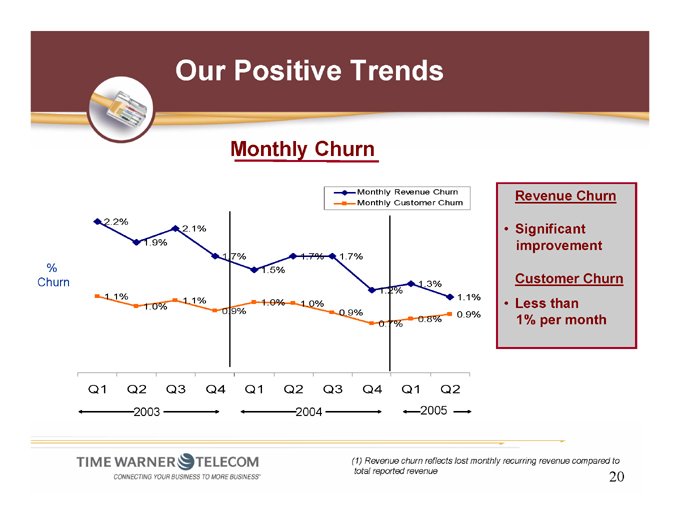

Our Positive Trends

Monthly Churn

% Churn

2.2%

2.1% 1.9%

1.7% 1.7% 1.7% 1.5%

1.3% 1.2% 1.1% 1.1% 1.1% 1.0% 1.0% 1.0%

Monthly Revenue Churn Monthly Customer Churn

0.9% 0.9% 0.9% 0.8% 0.7%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2003 2004 2005

Revenue Churn

Significant improvement

Customer Churn

Less than 1% per month

(1) Revenue churn reflects lost monthly recurring revenue compared to total reported revenue 20

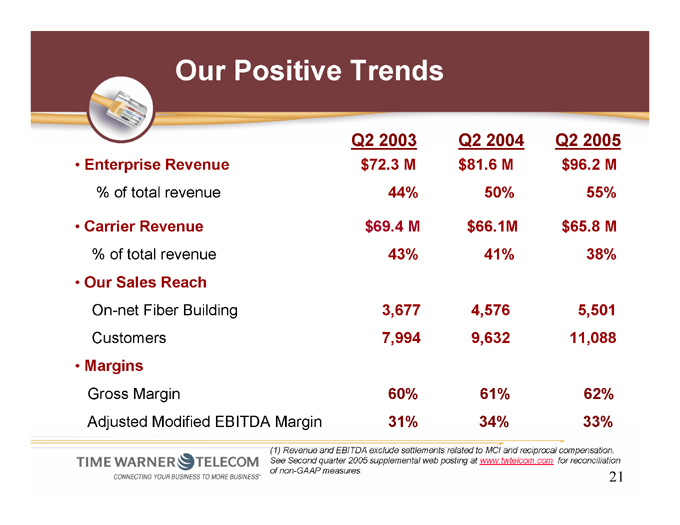

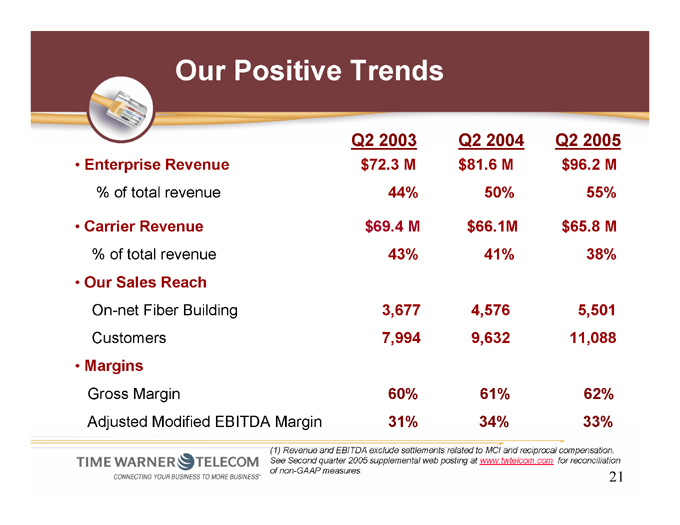

Our Positive Trends

Q2 2003 Q2 2004 Q2 2005

Enterprise Revenue $72.3 M $81.6 M $96.2 M

% of total revenue 44% 50% 55%

Carrier Revenue $69.4 M $66.1M $65.8 M

% of total revenue 43% 41% 38%

Our Sales Reach

On-net Fiber Building 3,677 4,576 5,501

Customers 7,994 9,632 11,088

Margins

Gross Margin 60% 61% 62%

Adjusted Modified EBITDA Margin 31% 34% 33%

(1) Revenue and EBITDA exclude settlements related to MCI and reciprocal compensation. See Second quarter 2005 supplemental web posting at www.twtelcom.com for reconciliation of non-GAAP measures. 21

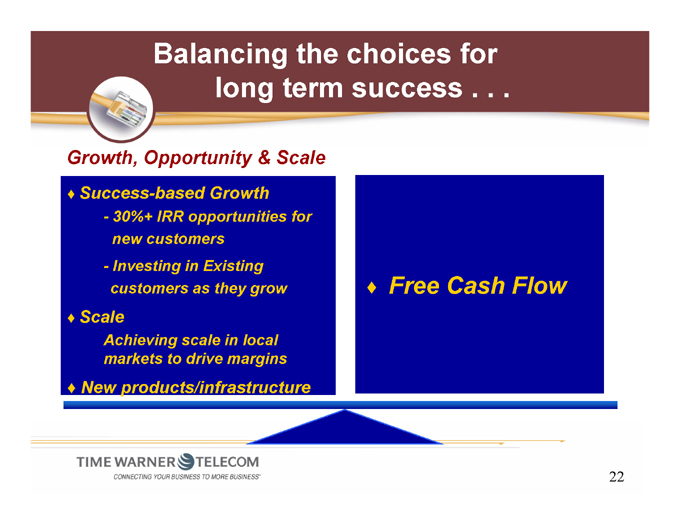

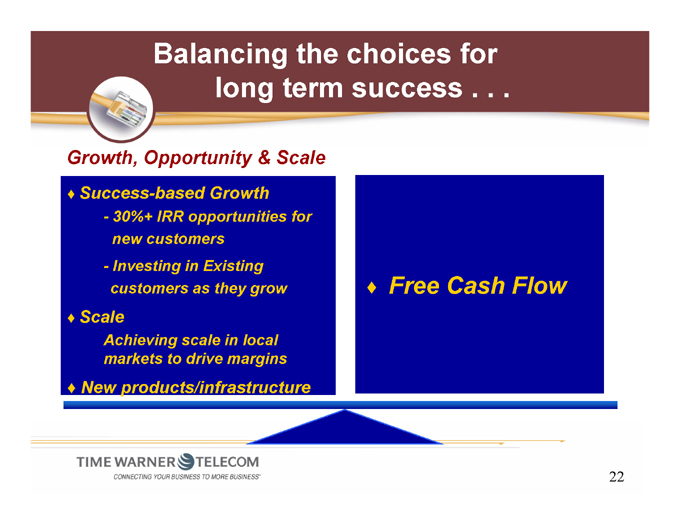

Balancing the choices for long term success . . .

Growth, Opportunity & Scale

Success-based Growth

- 30%+ IRR opportunities for new customers

- Investing in Existing customers as they grow

Scale

Achieving scale in local markets to drive margins

New products/infrastructure

Free Cash Flow

22

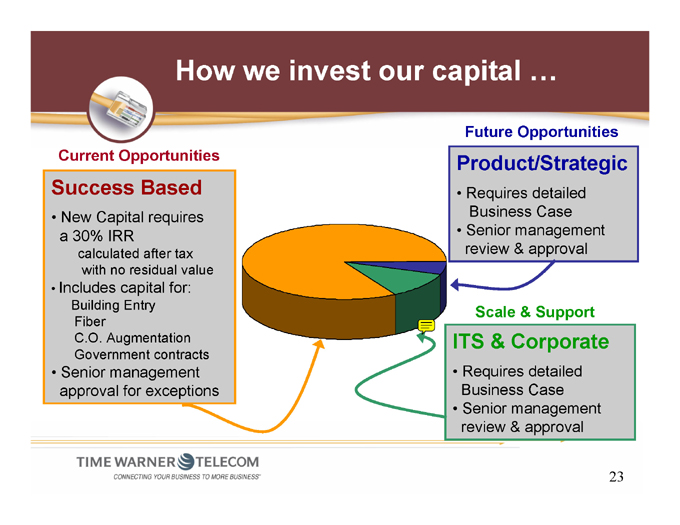

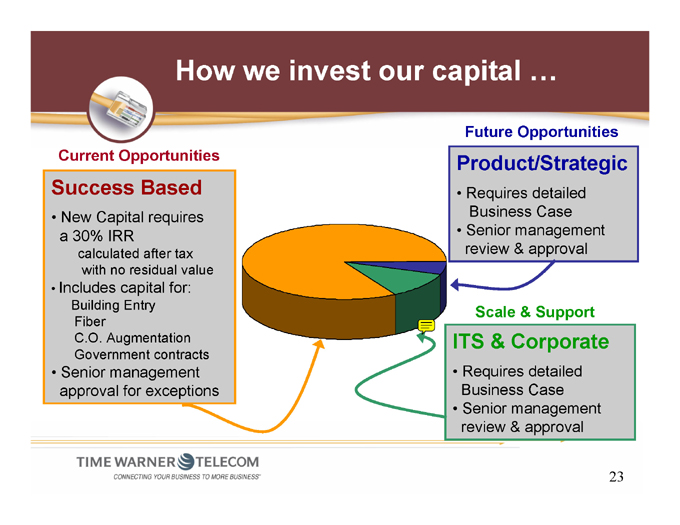

How we invest our capital …

Current Opportunities

Success Based

New Capital requires a 30% IRR calculated after tax with no residual value

Includes capital for:

Building Entry Fiber C.O. Augmentation Government contracts

Senior management approval for exceptions

Future Opportunities

Product/Strategic

Requires detailed Business Case

Senior management review & approval

Scale & Support

ITS & Corporate

Requires detailed Business Case

Senior management review & approval

23

Where we have invested . . .

$ in millions Full Yr 2004 6 Mo. Ended June 30, 2005

Short-Medium Term Success Based $121 $68

(Building entry, fiber, CO augmentation; and

government related contracts)

Longer-term Strategic

VoIP product investment & 35 5

Strategic market expansions

IT/Corporate investment/Other 16 9

Total $172 $82

— Revised Guidance for 2005 Cap Ex of $160 to $170 Million —

24

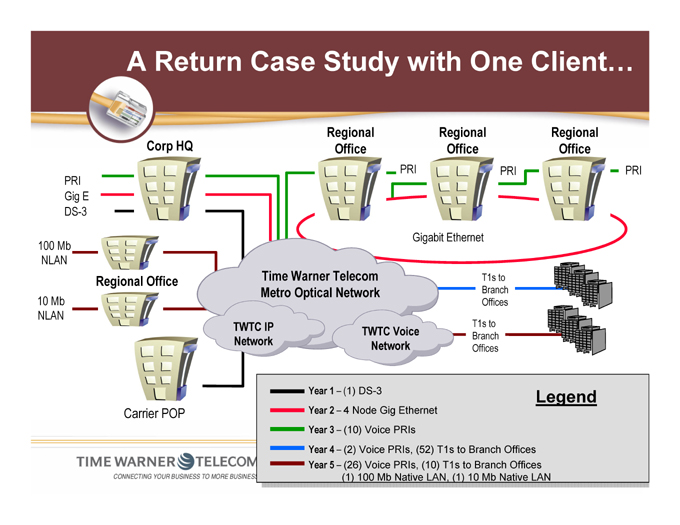

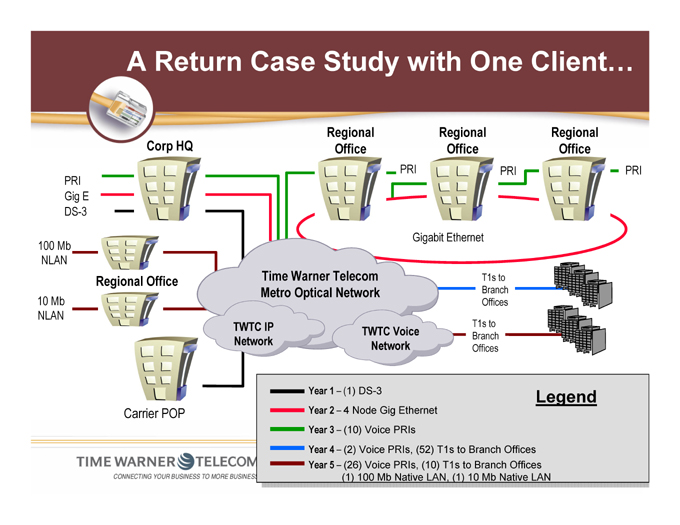

A Return Case Study with One Client…

10 Mb NLAN

100 Mb NLAN

PRI Gig E DS-3

Corp HQ

Regional Office

PRI

Regional Office

PRI

Regional Office

PRI

Regional Office

Carrier POP

Time Warner Telecom Metro Optical Network

TWTC IP Network

TWTC Voice Network

Gigabit Ethernet

T1s to Branch Offices

T1s to Branch Offices

Legend

Year 1 – (1) DS-3

Year 2 – 4 Node Gig Ethernet

Year 3 – (10) Voice PRIs

Year 4 – (2) Voice PRIs, (52) T1s to Branch Offices

Year 5 – (26) Voice PRIs, (10) T1s to Branch Offices

(1) 100 Mb Native LAN, (1) 10 Mb Native LAN

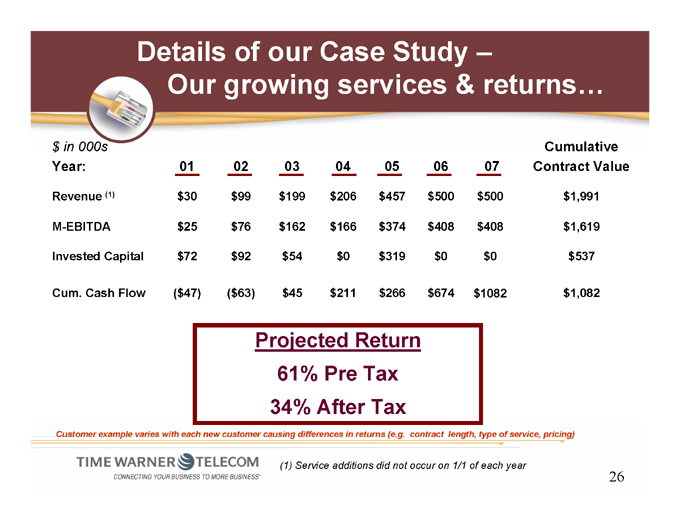

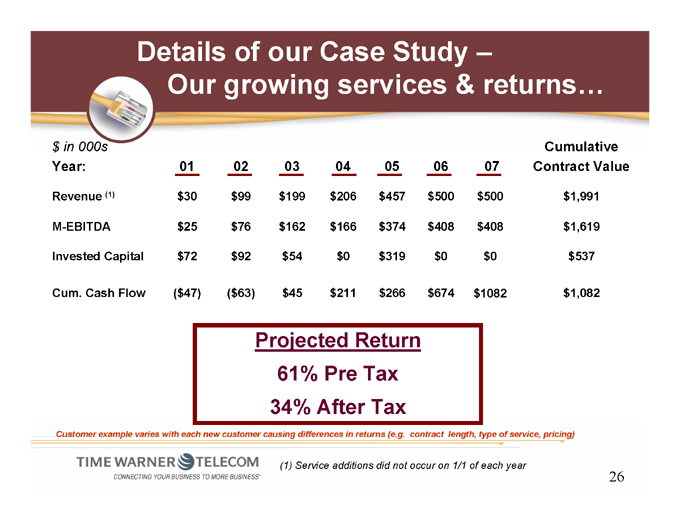

Details of our Case Study –

Our growing services & returns…

$ in 000s Year: 01 02 03 04 05 06 07 Cumulative Contract Value

Revenue (1) $30 $99 $199 $206 $457 $500 $500 $1,991

M-EBITDA $25 $76 $162 $166 $374 $408 $408 $1,619

Invested Capital $72 $92 $54 $0 $319 $0 $0 $537

Cum. Cash Flow ($47) ($63) $45 $211 $266 $674 $1082 $1,082

Projected Return 61% Pre Tax 34% After Tax

Customer example varies with each new customer causing differences in returns (e.g. contract length, type of service, pricing)

(1) Service additions did not occur on 1/1 of each year

26

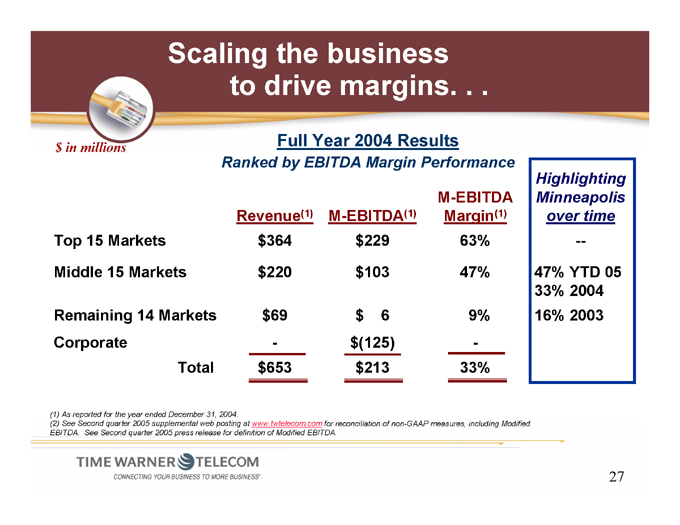

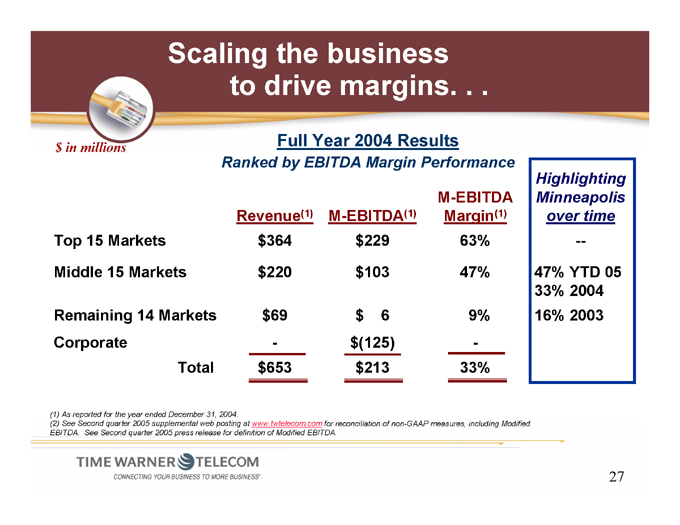

Scaling the business to drive margins. . .

$ in millions Full Year 2004 Results

Ranked by EBITDA Margin Performance

M-EBITDA Revenue(1) M-EBITDA(1) Margin(1) Top 15 Markets $364 $229 63%

Middle 15 Markets $220 $103 47%

Remaining 14 Markets $69 $ 6 9% Corporate - $(125) -Total $653 $213 33%

Highlighting Minneapolis over time

—

47% YTD 05 33% 2004 16% 2003

(1) As reported for the year ended December 31, 2004.

(2) See Second quarter 2005 supplemental web posting at www.twtelecom.com for reconciliation of non-GAAP measures, including Modified EBITDA. See Second quarter 2005 press release for definition of Modified EBITDA.

27

Financial Summary .. . .

Enterprise revenue now 55% of total revenue Enterprise revenue grew 18% year over year Carrier revenue relatively stable year over year

Strong & consistent margins –M-EBITDA margin 33%

Strong liquidity

(1) For the quarter ended June 30, 2005 with year over year growth compared to June 30, 2004

28

Questions & Answers