BlackRock & Merrill Lynch Investment Managers

Merger Update

BlackRock Overview

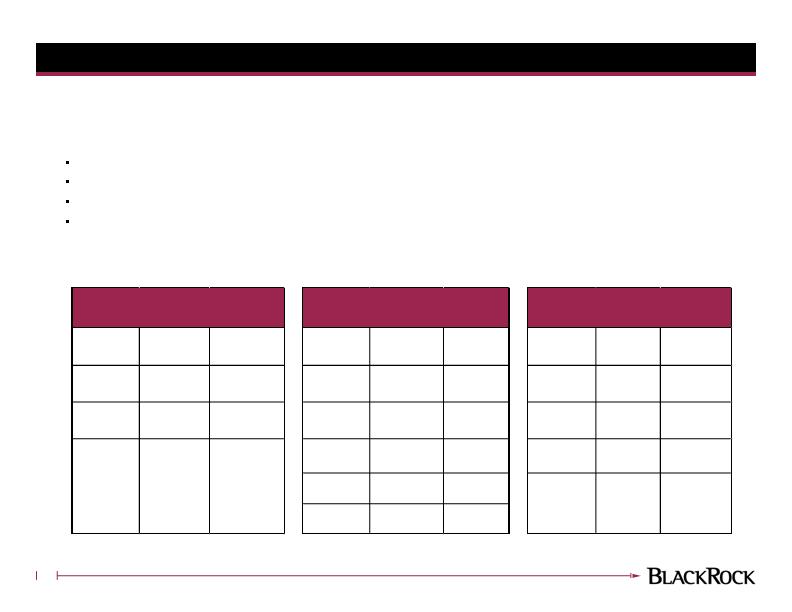

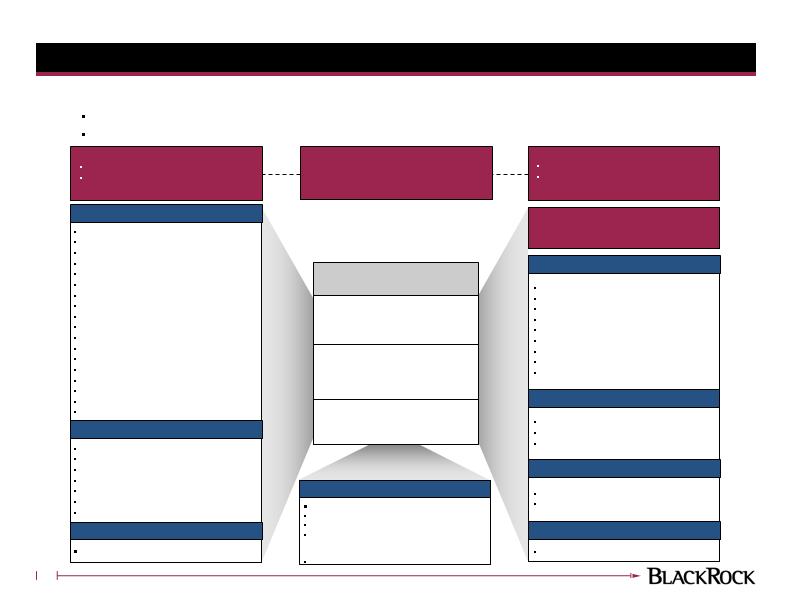

Combined Assets of US$1 Trillion

Fixed Income

Equity / Balanced

Real Estate

Alternatives

$433 Billion

$354 Billion

$27 Billion

$13 Billion

Liquidity

$212 Billion

Combined as of March 31, 2006

Risk Management

Investment Accounting

$3.5 Trillion

$50 Billion

Announced merger of BlackRock and Merrill Lynch Investment

Managers (MLIM) on February 15, 2006

Independent firm in ownership and governance

Public company (NYSE: BLK) with over 4,000 employees

Headquartered in NYC

Laurence Fink continues as Chairman and CEO

All founding partners remain affiliated with BlackRock

No majority owners

Merrill Lynch 49%, PNC 34%, employees and public 17%

Majority of Board of Directors is independent

Achieve scale in multiple products and markets

Combine complementary US retail platforms with mutual funds, managed accounts,

and enhanced client service

Institutional client base to benefit from additional US dollar and non-dollar products

Non-US business to span institutional and retail clients in over 50 countries

Spectrum of products across asset classes to broaden with global and non-US products,

non-US real estate, and alternative investment strategies

Operating in 18 countries and more than 35 cities

Investment centers in Boston, Edinburgh, Eindhoven, Florham Park, London,

Melbourne, Newport Beach, New York City, Philadelphia, Princeton, San Francisco,

Sydney, Tokyo, and Wilmington

Client service presence in local markets

Expected closing date on September 30, 2006

1

BlackRock and MLIM Combined

Diversified product mix

Scale across asset classes

Products tailored to client needs

Selected mergers proposed to rationalize fund families

Competitive performance

82%* of BlackRock composites outperformed their

benchmark as of December 31, 2005

77% of MLIM composites outperformed their benchmark

as of December 31, 2005

84 funds of the combined offerings as of May 31, 2006

have Morningstar ratings of 4 or 5 stars**

Global asset management company

Over one-third of employees based outside the U.S.

Fourteen investment centers in US, UK, Europe, Japan,

and Australia

Marketing and client service offices in 35 cities plus

regional wholesalers

Extensive fund offerings registered in domiciles around

the world

Local resources for operations, administration, and

compliance

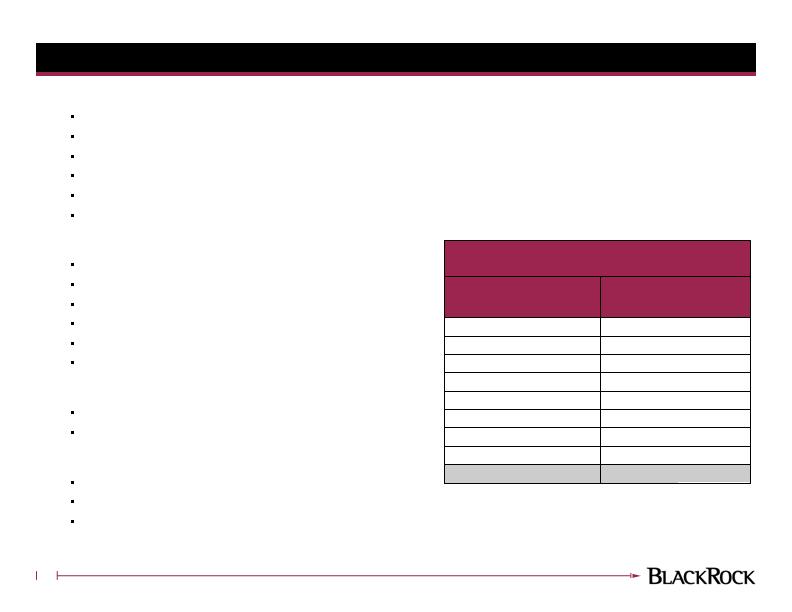

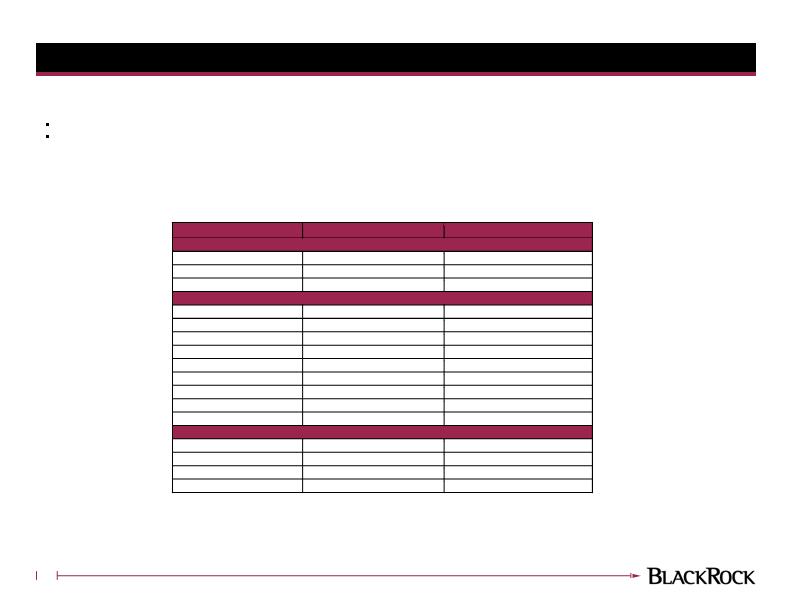

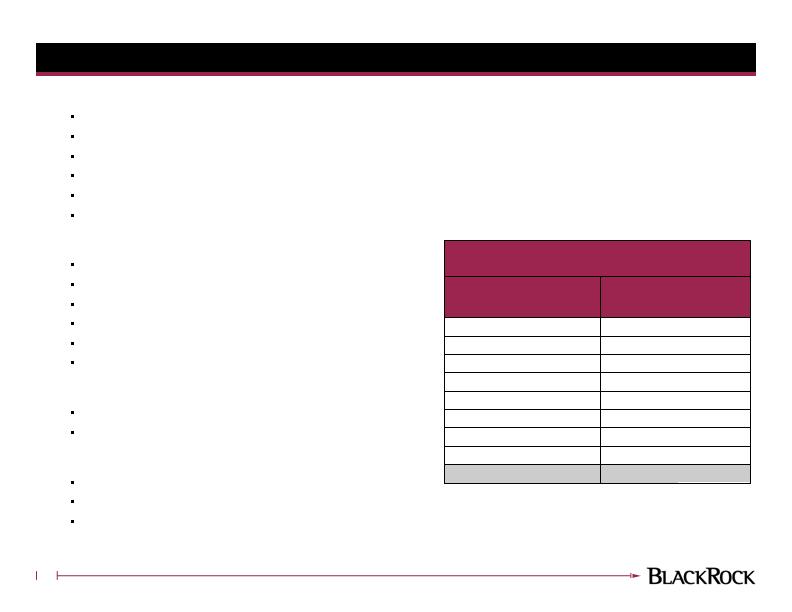

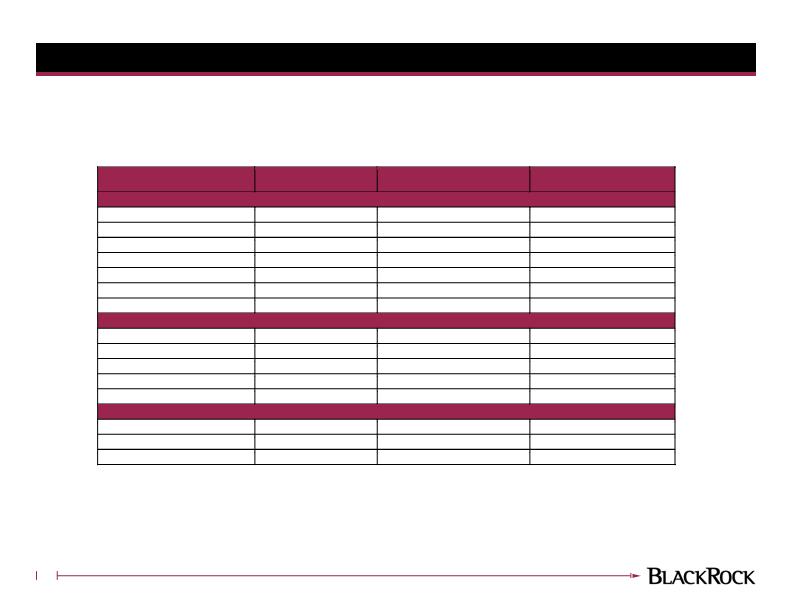

433

127

306

Fixed Income

212

126

86

Liquidity

27

10

17

Alternatives

TOTAL

Real Estate

Equity1

13

3

10

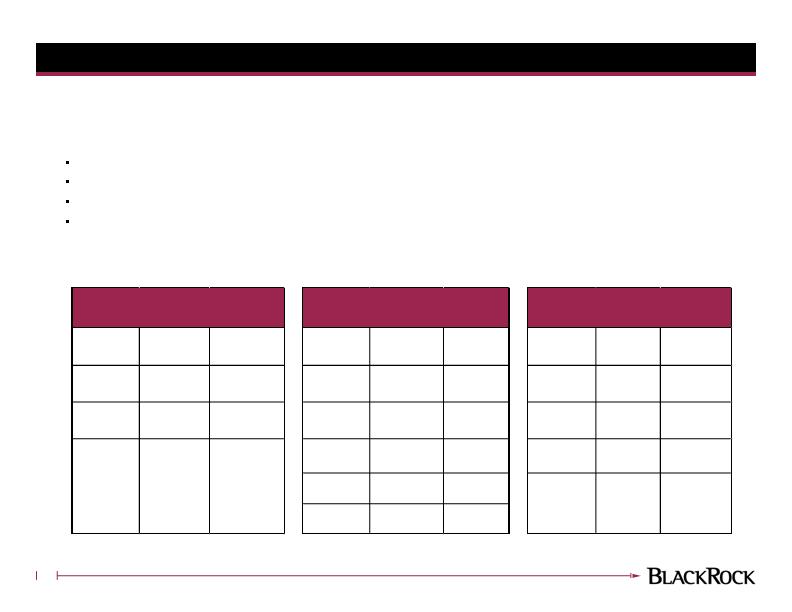

AUM by Asset Class

US$ Billions

354

310

44

$1,039

$576

$463

Combined

MLIM

BlackRock

1 Includes Balanced assets

AUM by Client Geography

*Based on annualized 3-year gross of fee returns for products with at least a 3-year track record

**Ratings are based on historical risk-adjusted performance and the overall rating is derived from a weighted average of the funds' 3-, 5-, and 10-year

Morningstar Rating Metrics includes closed/open-end funds

Combined assets as of March 31, 2006

2

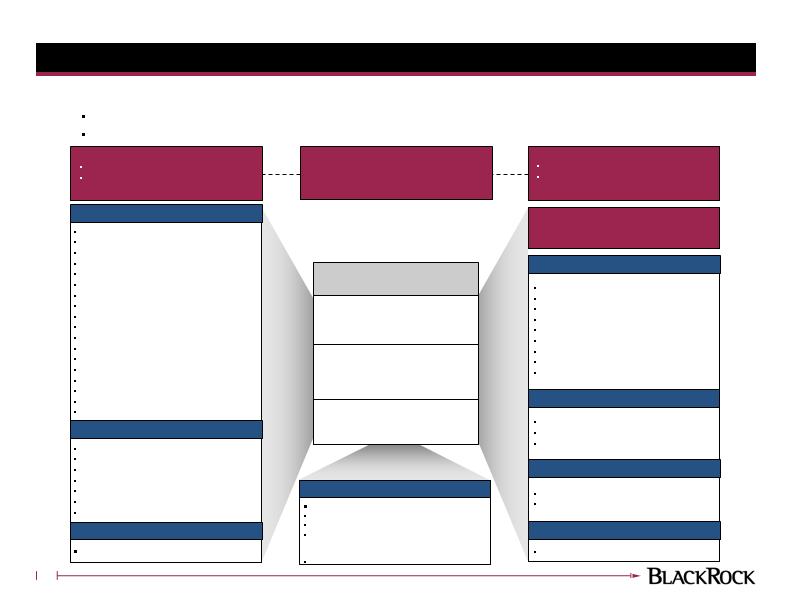

Similar business philosophy in equities

Culture of investment excellence

Distinct portfolio teams accountable for investment results in specific products

Structure of regional investment centers with integrated research supplemented by shared global investment perspectives

Process that enhances returns through careful risk and performance analysis

Pay for performance compensation model that aligns portfolio managers with clients

In general, the MLIM and BlackRock equity teams remain unchanged

Broad and deep resources for managing equities

Bob Doll, Global CIO for Equities

Quintin Price, CIO for EMEA Pacific Equities

46 Equity Portfolio Management Teams

Global Equity Trading team

Risk and Quantitative Analysis Group

BlackRock Solutions Technology Platform

Investment decision-making

Decentralized team decision-making

Centralized dialogue resulting in knowledge sharing

Differentiated and diverse product line tailored to investor's needs

Equity and balanced products

Institutional and retail products

Global and local market products

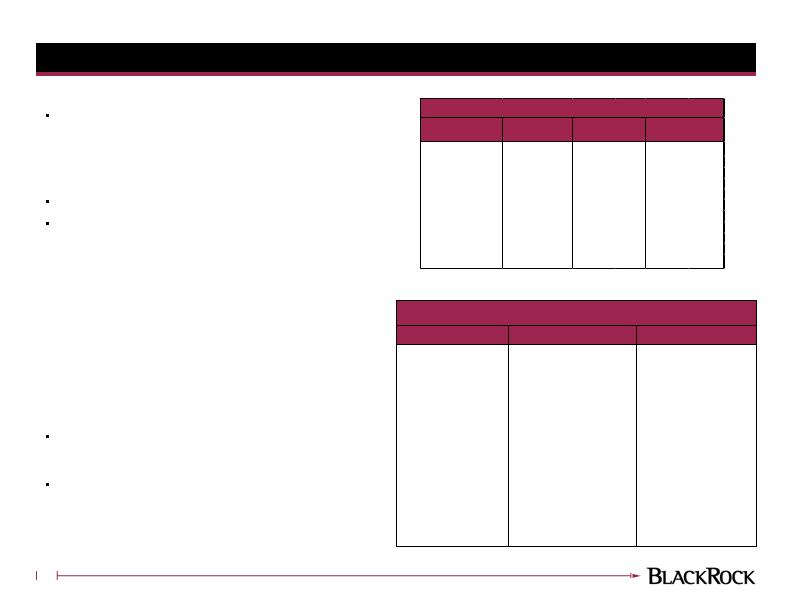

Combining BlackRock and MLIM Equity Capabilities

Equity Investment Centers

As of March 31, 2006

$3.4

Philadelphia

$165.2

Princeton

$17.2

Boston

$2.9

Australia

$313.5

TOTAL

$91.4

London

$10.1

Edinburgh

$11.1

Tokyo

$12.2

New York

Combined Equity AUM

Excluding Balanced Assets

(US$ billions)

Office Location

3

BlackRock Equity Platform

BlackRock Equity Investment Philosophy

Integrated research and fund management teams, where performance is the primary focus

Shared investment ideas, common view of risk management and portfolio attribution

Risk and Quantitative Analysis Group

Leaders: Golub, Fishwick, Patti, Damm

Locations: NY, Princeton, Philadelphia,

London, Edinburgh, Tokyo, Melbourne

Bob Doll, Global CIO, Equities

Global Equity Trading

Leaders: Mahoney, Gitlin, Walker-Duncalf

Locations: Princeton, NY, Philadelphia,

Boston, London, Edinburgh, Tokyo,

Singapore, Melbourne

BlackRock Solutions

Technology Platform

Aladdin®

Straight-through processing

Galileo™

Shared Research Database

Green Package®

Risk Management Tools

Princeton Teams

Boston Teams

Philadelphia Team

Global Opportunities: Callan, Carey, Rosenbaum

London Teams

Edinburgh Teams

Tokyo Teams

Melbourne Teams

Quintin Price, CIO

EMEA Pacific Equities

Japan Large Cap: Desmidt

Japan Small Cap: Tateda

Australian Equities: Himpoo

Quantitative Teams

New York: Byrket, Herrmann

Tokyo: Hosaka

Melbourne: Liow

Princeton: Bertani, Clark, Jelilian, Roisenberg,

Russo

Portable Alpha: Green, Struthers

Large Cap Series: Doll

Basic/Focus Value: Rendino, Martorelli

US Active Large Cap Value: Gaskin

Balanced Capital: Schansinger

Equity Dividend: Shearer

Fundamental Growth: Burke

Global Allocation: Stattman, Chamby

Global Value: Bell, Kassem, Berman

Global Small Cap: Coyle, Balaraman

Value Opportunities: Baum

Latin America: Landers

Pacific: Moyer

Healthcare: Schreiber, Hodgson

Natural Resources: Shearer

Utilities: Anderson

Global Technology: Vignola, Zidar

Financials: Kassem

Private Investors: Willoughby

UK Equity: Macpherson

UK Specialist: Chappell

European Style Diversified: Macmillan

European Specialist: Lee

Emerging Europe: Bourrier , Monovski

Natural Resources: Birch

Large Cap Global: Turnill

Asia Pacific: Moakes

Strategic Investment Group: Cameron-Watt

EAFE: Anderson, Low

European Large Cap GARP: Morillo

Pacific Basin: Barry

Small to Mid Value: Archambo, Forcione

Small to Mid Growth: Wagner, Leary

Small Cap Core: O’Connor

Fundamental Large Growth: Lindsey, Dowd

Energy: Rice, Walsh

Health Sciences: Xie

Asset Allocation: Zhang

Edinburgh Teams

4

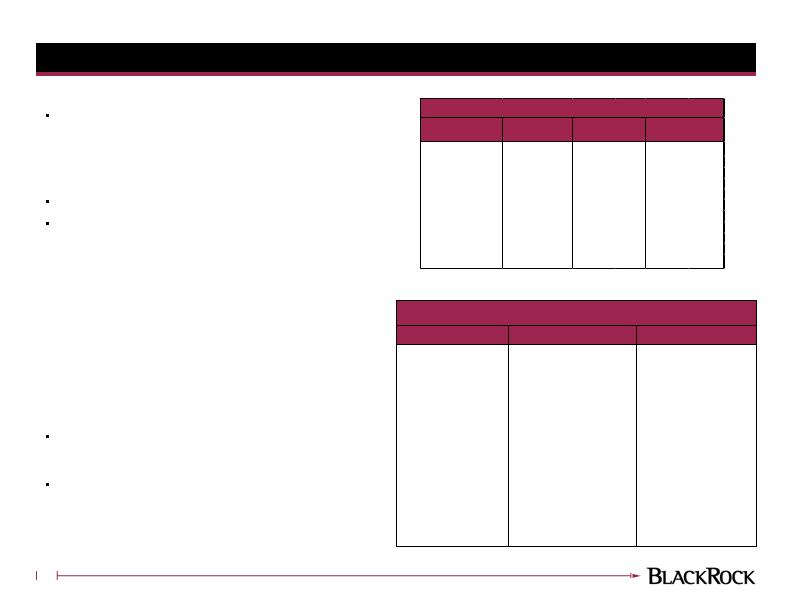

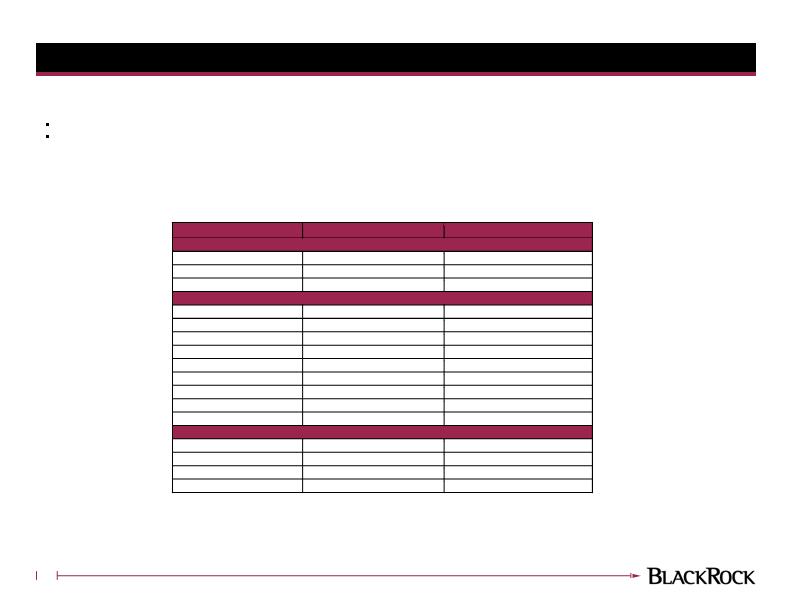

Combining BlackRock and MLIM Fixed Income and Liquidity Teams

“One BlackRock” approach will incorporate MLIM’s strengths

Keith Anderson, Global CIO for Fixed Income, and Scott Amero continue to lead the

fixed income effort

Expect to combine teams in several disciplines

Jeff Gary and Mark Williams will continue to lead the High Yield and Bank Loan

team

Kevin Booth will join the team as a portfolio manager

Additional analysts will augment our existing efforts in bank loans and distressed debt

John Loffredo and Bob DiMella of MLIM will lead the tax-exempt team

Team members will be located in Princeton and New York

BlackRock Solutions’ Aladdin platform being installed at MLIM to facilitate global

information sharing

BlackRock/MLIM combination accelerates global bond expansion

Large, experienced MLIM team in London facilitates our European expansion

Significant local presences in Sydney and Tokyo enhance our capabilities

MLIM’s non-US cash management complements BlackRock’s product line

Differentiated and diverse product line

Products provide range of risk/reward characteristics

Global and local market products

Institutional and retail products

Dedicated “on-balance sheet” capabilities for Financial Institutions and Corporate

Cash

Strong Liability-Driven Investing products for Europe and the U.S.

Assets as of March 31, 2006

$433 Billion Combined Fixed Income AUM

$212 Billion Combined Liquidity AUM

1 Excludes balanced mandates

1

5

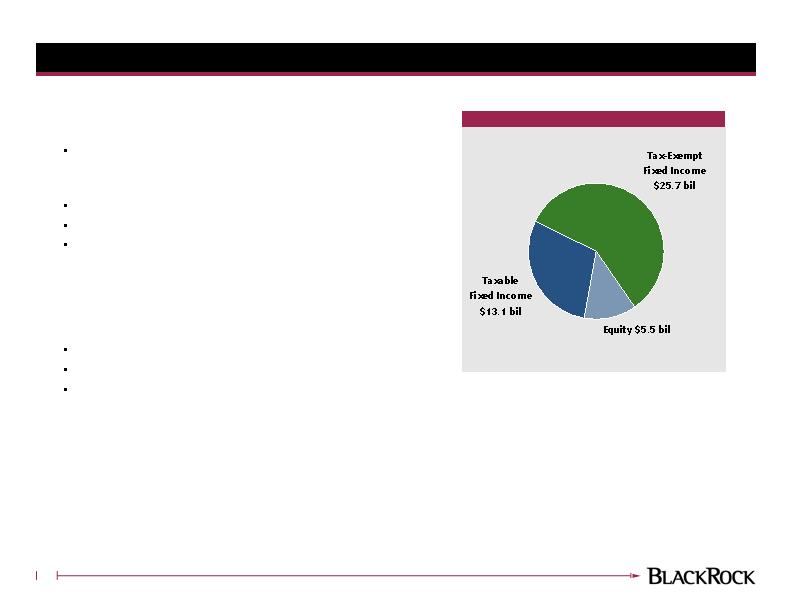

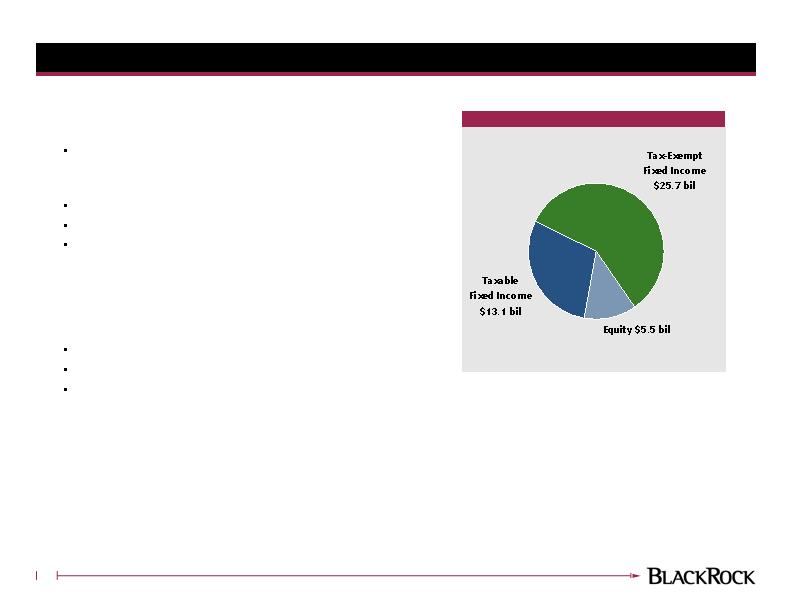

Combined U.S. Private Client Group

Private Client Industry Leader

4th largest broker-sold open-end fund family

2nd largest closed-end fund sponsor

3rd largest SMA provider

Over 10 million private client investors

Resulting business has significant scale and breadth of product

Combined business is responsible for $268 billion

Strong, broad product line

Strength in equity, fixed income and cash management

Investment management provided through multiple wrappers

Anticipate ongoing reinvestment and product development

Competitive performance

84 funds of the combined offerings as of May 31, 2006 have Morningstar

ratings of 4 or 5 stars**

Extensive resources focused on serving individual investors

Over 400 professionals focused on product, sales, servicing, and

marketing

Dalbar award winning call center and shareholder statements

Data as of 3/31/06, except where noted

**Ratings are based on historical risk-adjusted performance and the overall rating is derived from a weighted average of the funds'

3-, 5-, and 10-year Morningstar Rating Metrics – includes open and closed-end funds

Products Managed

$268 bil Combined AUM

As of 3/31/06

6

A World-Class Mutual Fund Family with Scale |

Fixed income product breadth - $20 bil in AUM |

|

| • | Top performing municipal funds |

| | |

| • | Multiple core taxable funds |

| | |

| • | Strong performing sector funds, including High Yield and GNMA |

| SHORT | INTERMEDIATE/

LONG | GOVERNMENT |

Fixed Income | Enhanced Income

Short Term Bond

Low Duration

Sr. Income

Sr. Income II | Intermediate Bond

Intermediate Bond II

Total Return

Bond Fund

Total Return II

Managed Income

Aggregate Bond Index | Intermediate Govt

GNMA

GNMA Accumulation

Government Income |

| TIPS | HIGH YIELD | GLOBAL |

Other | Inflation Protected | High Yield

High Income | International Bond

World Income |

| SHORT | NATIONAL | STATE SPECIFIC |

Municipals | Short Term Muni | Muni Int Term

Insured Muni

National Muni

AMT-Free Muni | California Muni

Delaware Muni

Florida Muni

Kentucky Muni

New Jersey Muni

New York Muni

Ohio Muni

PA Muni |

Equity product breadth – $70.6 bil in AUM |

|

| • | Top performing large cap equity funds |

| | |

| • | Selected global funds & strong sector fund line-up, including Energy |

Domestic Equity | VALUE | CORE | GROWTH |

Large | Large Cap Value

Basic Value

Focus Value

Equity Dividend Fund | Large Cap Core

S&P 500 Fund

Investment Trust

Index Equity

Exchange | Large Cap Growth

Fundamental Growth

Focus 20

Legacy |

Mid | Mid-Cap Value

Mid Cap Value Opps | US Opportunities | Mid-Cap Growth |

SMID | Aurora | | SMID Growth |

Small | Value Opportunities

Small Cap Value1 | Small Cap Index

Small Cap Core | Small Cap Growth

Small Cap Growth II |

Global &

International | VALUE | CORE | GROWTH |

Large | Global Value

International Value | International

International Index

Global Dynamic Equity | Global Growth

Global Opps |

Small | Developing Capital Mkts

| | Global Small Cap

Intl. Opps |

| SPECIALTY |

Other | Global Technology

Global Science & Tech.

Healthcare

Health Sciences Opps | Natural Resources

All-Cap Global Resources

Global Resources1

Real Investment | Global Financial Svcs.

Utilities and Telecom

Basic Value Prin. Prtd. 1

Core Prin. Protected 1

Fndmntl Gr. Prin. Prtd. 1 |

BLENDED |

Global Allocation | Balanced Capital | Asset Allocation |

REGIONAL |

EuroFund | Latin America | Pacific |

| 1 Fund closed to new investors | | |

| | | |

| Bold denotes 4 and 5 star funds | | |

/7/ |

| > |

|

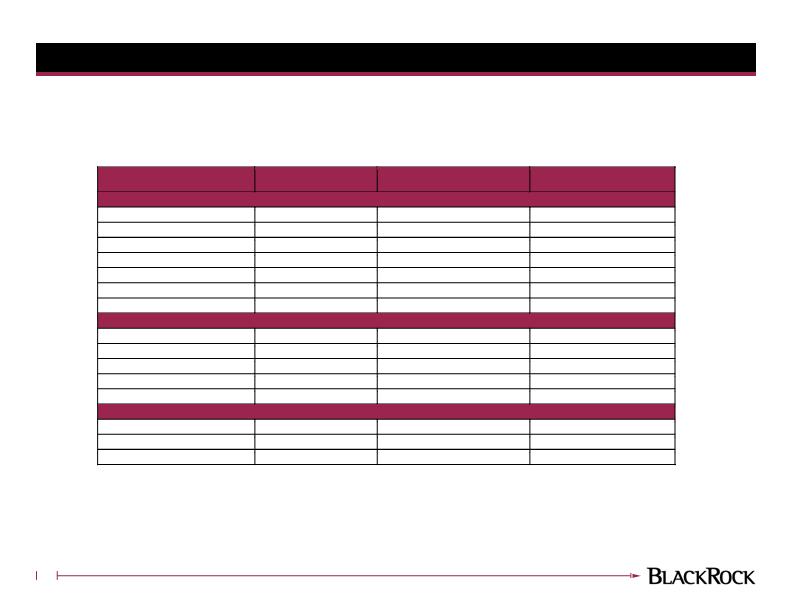

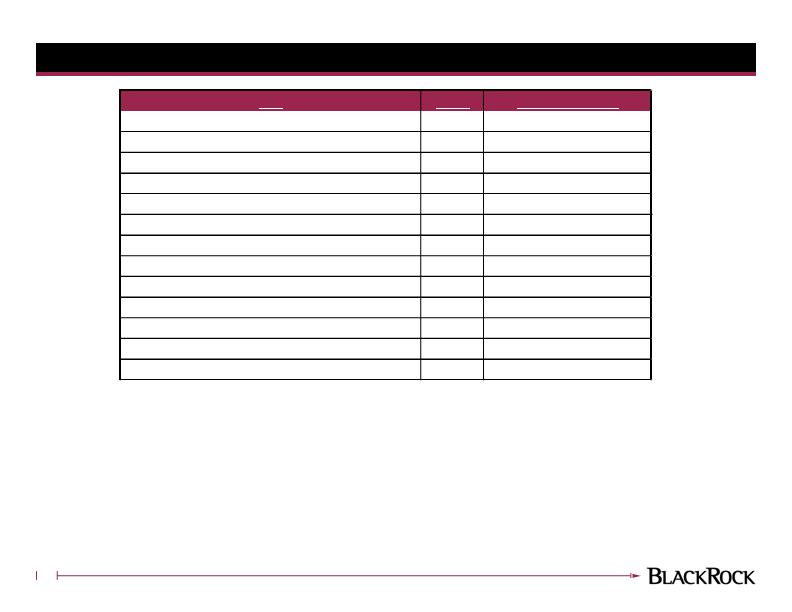

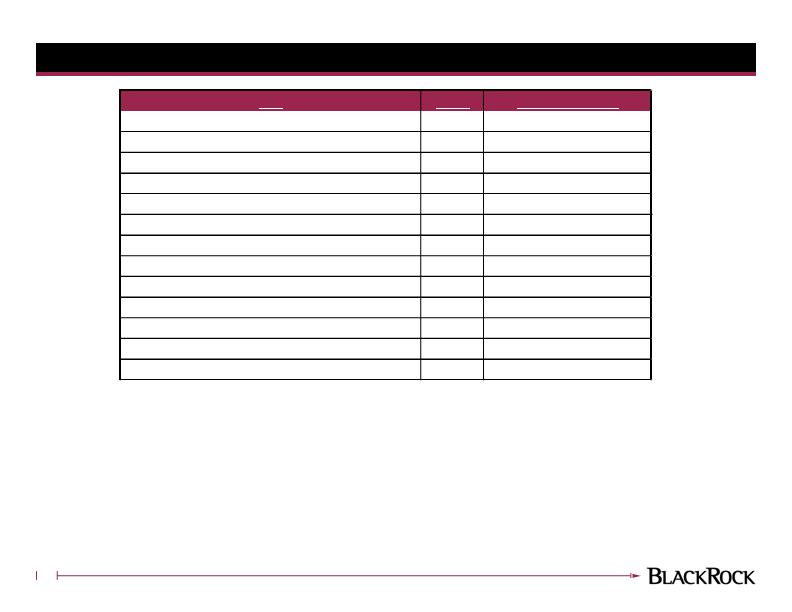

Consolidating BlackRock and MLIM Fund Families

Currently, BlackRock has 43 funds and MLIM has 59 funds (excluding money market funds)

As we considered different fund mergers, we did so with several goals:

Provide shareholders with strongest products

Reduce number of funds that overlap

Generally, shareholders would maintain or improve expense ratios

Considered a variety of administrative impacts

We are proposing the following fund mergers:

8

1 Surviving fund track record

Portfolio Name

Merge into

1

PM Team

Portfolio Name

Merge into

1

PM Team

Portfolio Name

Merge into

1

PM Team

ML U.S. High Yield

BR High Yield

Gary/Amero

BR UltraShort

Municipal

ML Short Term

Municipal

Hayes

ML Intermediate

Term

ML Core Bond

Anderson/Amero/

Marra/Phillips

ML Inflation

Protected

BR Inflation

Protected

Spodek/

Weinstein

BR New Jersey

Tax-Free

ML New Jersey

Municipal

Jaeckel

ML Strategy All

Equity

ML Large Cap

Core

Doll

ML Short Term U.S.

Government

BR Low Duration

Anderson/

Amero/Kopstein

BR Pennsylvania

Tax-Free

ML Pennsylvania

Municipal

Bock

ML Disciplined

Equity

ML Large Cap

Core

Doll

BR Dividend

Achievers

TM

ML Equity Dividend

Shearer

ML Strategy

Growth & Income

ML Global

Allocation

Stattman/

Chamby

BR Large Cap

Growth

ML Large Cap

Growth

Doll

BR Large Cap

Value

ML Large Cap Value

Doll

MLIM To BlackRock

BlackRock to MLIM

MLIM to MLIM

ML Strategy Long-

Term Growth

ML Global

Allocation

Stattman/

Chamby

ML U.S.

Government

BR Government

Income

Phillips/

Pellicciaro

Enhancements to Fund Family

Proposed mergers are shareholder friendly

Generally, shareholders invested at same or lower fees in each

product

Conformed redemption fees for combined fund family

Fee is 2% for redemptions or exchanges made in 30 days

Fee assessed on small, SMID, International, global and certain

fixed income and sector funds

Closing B shares to new investors in all fixed income

funds (still available for exchanges)

Aligned A share sales loads and breakpoints to be more

competitive with the industry

R shares will be added to selected BlackRock funds:

Fixed Income: High Yield, Government Income, Core Bond Total

Return (Total Return II), and Core PLUS Total Return (Total

Return)

Equity: Small/Mid-Cap Growth, Aurora, and Mid-Cap Growth

9

*Expenses as of 2/28/06

1 2% redemption fee is assessed on redemptions or exchanges made within 30 days

Sector/Fixed Income

Global/International

Small/SMID

All Cap Global Rscs

Global Resources

Global Science & Tech

Global Technology

Health Sciences

High Income

High Yield

International Bond

Real Investment

World Income

Developing Captl Mkts

EuroFund

Global Value

Global Allocation

Global Dynamic Equity

Global Financial Services

Global Growth

Global Opportunities

Global Small Cap

International

International Index

Intl Opportunities

International Value

Latin America

Pacific

Aurora

Small Cap Core

Small Cap Growth

Small Cap Growth II

Small Cap Index

Small Cap Value

SMID Growth

U.S. Opportunities

Value Opportunities

Redemption Fees1 For Combined Fund Family

Acquired Fund

Surviving Fund

Institutional

Class A

Institutional

Class A

ML U.S. High Yield

High Yield

0.87%

1.12%

0.62%

0.96%

ML Inflation Protected

Inflation Protected

0.98%

1.23%

0.38%

0.66%

ML Short-Term U.S. Govt

Low Duration

0.69%

0.94%

0.45%

0.81%

ML US Government

Govt Income

0.83%

1.08%

0.70%

0.95%

BR UltraShort Muni

Short Term Muni

0.38%

0.80%

0.35%

0.60%

BR NJ Tax-Free

NJ Muni

0.60%

0.90%

0.60%

0.85%

BR PA Tax-Free

PA Muni

0.60%

0.90%

0.60%

0.85%

BR Lg Cap Value

Lg Cap Value

0.77%

1.24%

0.95%

1.20%

BR Lg Cap Growth

Lg Cap Growth

0.82%

1.29%

1.02%

1.27%

BR Dividend Achievers

TM

Equity Dividend Fund

0.90%

1.30%

0.82%

1.07%

Pre-Merger of

Acquired Fund

Post-Merger of

Acquired Fund

Merged Funds' Net Expenses*

Summary of Fund Mergers

10

PORTFOLIO IMPACTED

MERGED INTO

RESULTING

FUND NAME

PORTFOLIO MANAGEMENT TEAM

Equity Funds

ML Strategy All Equity

ML Large Cap Core

BR Large Cap Core

Doll

ML Strategy Growth & Income

ML Global Allocation

BR Global Allocation

Stattman/Chamby

ML Strategy

Long

-

Term Growth

ML Global Allocation

BR Global Allocation

Stattman/Chamby

ML Disciplined Equity

ML Large Cap Core

BR Large Cap Core

Doll

BR Dividend Achievers

TM

ML Equity Dividend

BR Equity Dividend

Shearer

BR Large Cap Growth

ML Large Cap Growth

BR La

rge Cap Growth

Doll

BR Large Cap Value

ML Large Cap Value

BR Large Cap Value

Doll

Taxable Fixed Income Funds

Ml Inflation Protected

BR Inflation Protected

BR Inflation Protected

Spodek/Weinstein

ML Intermediate Term

ML Core Bond Fund

BR Bond Fund

Ander

son/Amero/Marra/Phillips

ML Short Term U.S. Government

BR Low Duration

BR Low Duration

Anderson/Amero/Kopstein

ML U.S. Government

BR Government Income

BR Government Income

Phillips/Pellicciaro

ML U.S. High Yield

BR High Yield

BR High Yield

Gary/Amero

M

unicipal Funds

BR New Jersey

Tax

-

Free

ML New Jersey Municipal

BR New Jersey Municipal

Jaeckel

BR Pennsylvania

Tax

-

Free

ML Pennsylvania Municipal

BR Pennsylvania Municipal

Bock

BR UltraShort Municipal

ML Short Term Municipal

BR Short Term

M

unicipal

Hayes

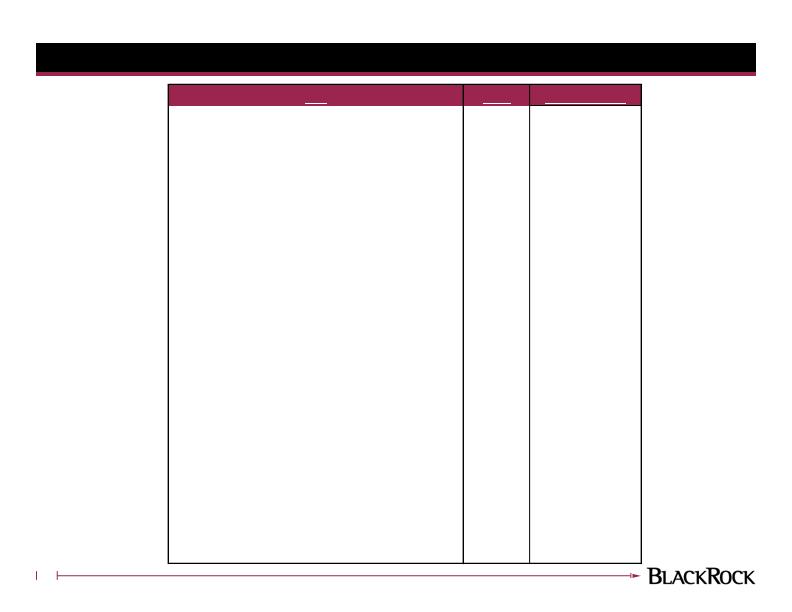

Additional Name, Portfolio Manager and/or Investment Changes

As a result of the announced combination of BLK and MLIM, we evaluated the names of funds

All MLIM funds will be rebranded as BlackRock

We are recommending a number of name changes to assist in competitive positioning

Certain funds’ portfolio management teams will change or have additional members named

Selected municipal funds will expand their guidelines to have greater latitude to purchase AMT bonds and/or below

investment grade municipal bonds

11

1 Portfolio guidelines will be expanded to allow greater latitude to purchase AMT bonds (shareholder vote required) and bonds rated below investment grade.

2 It is anticipated that following the closing of the MLIM and BlackRock transaction, Matthew Marra and Andrew J. Phillips will join Keith Anderson and Scott Amero in the day-to-

day management of the Portfolios.

3 Portfolio guidelines will be expanded to include bonds rated below investment grade.

PORTFOLIO IMPACTED

NAME CHANGE

PORTFOLIO MANAGEMENT TEAM

Equity Funds

ML Global Equity Opportunities

BR Global Dynamic Equity

No Change

ML Small Cap Growth

BR Small Cap Growth II

Wagner/Leary/Thut

BR Health Sciences

BR Health Sciences Opportunities

No

Change

Taxable Fixed Income Funds

ML High Income

BR

High Income

Gary/Amero

ML Real Investment

BR

Real Investment

Spodek/Weinstein

ML Low Duration

BR Short Term Bond

Anderson/Amero/Kopstein

ML World Income

BR

World Income

Gordon/Hussain/Gary

ML Core

Bond Fund

BR Bond Fund

Anderson/Amero/Marra/Phillips

BR Intermediate Bond

BR Intermediate Bond II

No Change

2

BR Intermediate PLUS Bond

BR Intermediate Bond

No Change

2

BR Core Bond Total Return

BR Total Return II

No Change

2

BR Core PLUS Total Return

BR

Total Return

No Change

2

Municipal Funds

BR Delaware Tax

-

Free

1

BR Delaware Municipal

O’Connor

BR Kentucky Tax

-

Free

1

BR Kentucky Municipal

O’Connor

BR Ohio Tax

-

Free

1

BR Ohio Municipal

O’Connor

BR Tax

-

Free Income

3

BR AMT

–

Free Municipal

O’Connor

Proxy & Mutual Fund Changes Timeline

What will BlackRock Funds’ shareholders receive?

All BlackRock Funds’ shareholders will receive a proxy to:

Approve a new investment advisory agreement

Approve a new sub-advisory agreement, if applicable

Approve a change in the fundamental policy of the New Jersey Tax-Free Income, Delaware Tax-Free Income, Ohio Tax-Free

Income, Pennsylvania Tax-Free Income and Kentucky Tax-Free Income Portfolios

Additionally, all shareholders in the BlackRock: Large Cap Value Equity, Large Cap Growth Equity, Dividend Achievers TM,

New Jersey Tax-Free Income, Pennsylvania Tax-Free Income and Ultra Short Municipal Portfolios will receive a

prospectus/proxy statement (N-14) for the reorganizations of these funds

Shareholders will receive a proxy card with instructions how to vote their shares

Shareholders may vote by mail, phone or internet, or in person

BlackRock has hired a proxy solicitor to assist in obtaining shareholder votes

Timing of Communication & Changes

Fund mergers to be completed over the weekend

October 13

Implementation of name, cusip, and shareholder feature

changes (sales loads, redemption fees, etc.)

October 2

Shareholder meetings for approval of: new advisory and

sub-advisory agreements, fundamental investment

policies, and fund mergers

Late July through Late August

Distribute back office communication

Week of July 3

Commence distribution of proxies to shareholders

Week of June 19

Action

Date

12

Combined Closed-End Fund Complex

Combined closed-end fund complex with over $44 billion in

assets

2nd largest closed-end fund sponsor

Resulting business has significant scale and breadth of product

13 equity funds

24 taxable fixed income funds

67 municipal funds

Committed to continuing leadership and innovation

Continued focus on supporting the funds in the secondary

market

Dedicated team of closed-end fund professionals

Focused on building relationships with closed-end fund research analysts

Maintain strong relationships with financial advisors, institutions, and

broker-dealer home offices

Data as of 3/31/06

Products Managed

$44 Billion Combined AUM

As of 3/31/06

13

Closed-End Fund Line-Up*

* Names reflect BlackRock branding post transaction, 1 Shareholders are being asked to approve a merger into the open-end EuroFund

14

BlackRock Apex Municipal Fund, Inc.

APX

BlackRock Florida Municipal Income Trust

BBF

BlackRock Muni New York Intermediate Duration Fund, Inc.

MJI

BlackRock Investment Quality Municipal Trust

BKN

BlackRock Florida Municipal Bond Trust

BIE

BlackRock New York Investment Quality Municipal Trust

RNY

BlackRock Muni Intermediate Duration Fund, Inc.

MUI

BlackRock Florida Investment Quality Municipal Trust

RFA

BlackRock New York Municipal Bond Trust

BQH

BlackRock MuniAssets Fund, Inc.

MUA

BlackRock MuniYield Florida Fund, Inc.

MYF

BlackRock New York Municipal Income Trust

BNY

BlackRock Municipal Bond Trust

BBK

BlackRock New York Municipal Income Trust II

BFY

BlackRock Municipal Income Trust

BFK

BlackRock Florida Insured Municipal Income Trust

BAF

BlackRock Municipal Income Trust II

BLE

BlackRock MuniHoldings Florida Insured Fund, Inc.

MFL

BlackRock MuniHoldings New York Insured Fund, Inc.

MUJ

BlackRock MuniEnhanced Fund, Inc.

MEN

BlackRock MuniYield Florida Insured Fund, Inc.

MFT

BlackRock MuniYield New York Insured Fund, Inc.

MYJ

BlackRock MuniHoldings Fund II, Inc.

MUH

BlackRock New York Insured Municipal Income Trust

BSE

BlackRock MuniHoldings Fund, Inc.

MHD

BlackRock Florida Municipal 2020 Term Trust

BFO

BlackRock MuniVest Fund II, Inc.

MVT

BlackRock Florida Insured Municipal 2008 Term Trust

BRF

BlackRock New York Insured Municipal 2008 Term Trust

BLN

BlackRock MuniVest Fund, Inc.

MVF

BlackRock New York Municipal 2018 Term Trust

BLH

BlackRock MuniYield Fund, Inc.

MYD

BlackRock California Municipal Income Trust II

BCL

BlackRock MuniYield Quality Fund II, Inc.

MQT

BlackRock California Municipal Income Trust

BFZ

BlackRock MuniYield New Jersey Fund, Inc.

MYN

BlackRock MuniYield Quality Fund, Inc.

MQY

BlackRock California Municipal Bond Trust

BZA

BlackRock New Jersey Investment Quality Municipal Trust

RNJ

BlackRock Strategic Municipal Trust

BSD

BlackRock California Investment Quality Municipal Trust

RAA

BlackRock New Jersey Municipal Bond Trust

BLJ

BlackRock Long-Term Municipal Advantage Trust

BTA

BlackRock MuniHoldings California Insured Fund, Inc.

MUC

BlackRock New Jersey Municipal Income Trust

BNJ

BlackRock MuniYield California Fund, Inc.

MYC

BlackRock MuniHoldings Insured Fund II, Inc.

MUE

BlackRock MuniHoldings New Jersey Insured Fund, Inc.

MHN

BlackRock MuniHoldings Insured Fund, Inc.

MUS

BlackRock California Insured Municipal Income Trust

BCK

BlackRock MuniYield New Jersey Insured Fund, Inc.

MNE

BlackRock Insured Municipal Income Trust

BYM

BlackRock MuniYield California Insured Fund, Inc.

MCA

BlackRock MuniYield Insured Fund, Inc.

MYI

BlackRock Maryland Municipal Bond Trust

BZM

BlackRock California Municipal 2018 Term Trust

BJZ

BlackRock MuniYield Arizona Fund, Inc.

MZA

BlackRock Insured Municipal Term Trust

BMT

BlackRock California insured Municipal 2008 Term Trust

BFC

BlackRock MuniYield Michigan Insured Fund II, Inc.

MYM

BlackRock Insured Municipal 2008 Term Trust

BRM

BlackRock MuniYield Michigan Insured Fund, Inc.

MIY

BlackRock Municipal 2018 Term Trust

BPK

BlackRock Pennsylvania Strategic Municipal Trust

BPS

BlackRock Municipal 2020 Term Trust

BKK

BlackRock Massachussetts Health and Education

MHE

BlackRock Municipal Target Term Trust

BMN

BlackRock Virginia Municipal Bond Trust

BHV

BlackRock Core Bond Trust

BHK

BlackRock Senior High Income Fund, Inc.

ARK

BlackRock Global Resources Trust

BGR

BlackRock Income Opportunity Trust Inc.

BNA

BlackRock Floating Rate Income Strategies Fund, Inc.

FRA

BlackRock World Investment Trust

BWC

BlackRock Diversified Income Strategies Fund, Inc.

DVF

BlackRock Floating Rate Income Strategies Fund II, Inc.

FRB

BlackRock S&P Quality Ranking Global Equity

Managed Trust

BQY

BlackRock Enhanced Government Fund, Inc.

EGF

BlackRock High Yield Trust

BHY

BlackRock Global Equity Opportunities Trust

BOE

BlackRock Capital and Income Strategies Fund, Inc.

CII

BlackRock Corporate High Yield Fund, Inc.

COY

BlackRock Dividend Achievers

TM

Trust

BDV

BlackRock Limited Duration Income Trust

BLW

BlackRock Corporate High Yield Fund III, Inc.

CYE

BlackRock Enhanced Dividend Achievers

TM

Trust

BDJ

BlackRock Investment Grade 2009 Term Trust

BCT

BlackRock Corporate High Yield Fund V, Inc.

HYV

BlackRock Strategic Dividend Achievers

TM

Trust

BSD

BlackRock Income Trust

BKT

BlackRock Corporate High Yield Fund VI, Inc.

HYT

BlackRock Enhanced Equity Yield Fund, Inc.

EEF

BlackRock Debt Strategies Fund, Inc.

DSU

BlackRock High Income Shares

HIS

BlackRock Enhanced Equity Yield & Premium Fund, Inc.

ECV

BlackRock Preferred Opportunity Trust

BPP

BlackRock Strategic Bond Trust

BHD

BlackRock S&P 500 Protected Equity Fund, Inc.

PEFX

BlackRock Preferred Income Strategies Fund, Inc.

PSY

BlackRock Global Floating Rate Income Tust

BGT

BlackRock Europe Fund, Inc.

1

EF

BlackRock Preferred & Corporate Income

Strategies Fund, Inc.

PSW

BlackRock Health Sciences Trust

BME

New Jersey Insured Municipal Funds

Other State Municipal Funds

National Municipal Funds

National Insured Municipal Funds

New York Municipal Funds

New York Insured Municipal Funds

New York Municipal Term Trusts

New Jersey Municipal Funds

Florida Municipal Funds

Florida Insured Municipal Funds

Florida Municipal Term Trusts

California Municipal Funds

Taxable Fixed Income Funds

California Insured Municipal Funds

Equity Funds

Taxable Fixed Income Funds

California Municipal Term Trusts

National Municipal Term Trust Funds

Current MLIM Closed-End Funds with Portfolio Manager Changes

15

1 MLIM manager

Fund

Ticker

Portfolio Managers

Debt Strategies Fund, Inc.

DSU

Booth

1

/Williams

Floating Rate Income Strategies Fund, Inc.

FRA

Booth

1

/Williams

Floating Rate Income Strategies Fund II, Inc.

FRB

Booth

1

/Williams

Senior High Income Portfolio, Inc.

ARK

Booth

1

/Williams

Diversified Income Strategies Portfolio, Inc.

DVF

Booth

1

/Williams

Corporate High Yield Fund III, Inc.

CYE

Gary/Amero

Corporate High Yield Fund V, Inc.

HYV

Gary/Amero

Corporate High Yield Fund VI, Inc.

HYT

Gary/Amero

Corporate High Yield Fund, Inc.

COY

Gary/Amero

Capital and Income Strategies Fund, Inc.

CII

Burger

1

/Amero/Chen

Preferred Income Strategies Fund, Inc.

PSY

Burger

1

/Amero/Chen

Preferred and Corporate Income Strategies Fund, Inc.

PSW

Burger

1

/Amero/Chen

Enhanced Government Fund, Inc.

EGF

Phillips/Pellicciaro/Spodek

Current BlackRock Closed-End Funds with Portfolio Manager Changes

16

Fund

Ticker

Portfolio Managers

BlackRock Long-Term Municipal Advantage Trust

BTA

O'Connor

BlackRock Municipal Income Trust II

BLE

O'Connor

BlackRock Municipal Bond Trust

BBK

O'Connor

BlackRock Municipal Income Trust

BFK

O'Connor

BlackRock Strategic Municipal Trust

BSD

O'Connor

BlackRock Investment Quality Municipal Trust Inc.

BKN

O'Connor

BlackRock Insured Municipal Income Trust

BYM

DiMella

BlackRock Municipal 2020 Term Trust

BKK

O'Connor

BlackRock Municipal 2018 Term Trust

BPK

O'Connor

BlackRock Insured Municipal 2008 Term Trust Inc.

BRM

DiMella

BlackRock Insured Municipal Term Trust Inc. (2010)

BMT

DiMella

BlackRock Municipal Target Term Trust Inc. (2006)

BMN

DiMella

BlackRock California Insured Municipal Income Trust

BCK

O'Connor

BlackRock California Municipal Income Trust II

BCL

O'Connor

BlackRock California Municipal Bond Trust

BZA

O'Connor

BlackRock California Municipal Income Trust

BFZ

O'Connor

BlackRock California Investment Quality Municipal Trust Inc.

RAA

O'Connor

BlackRock Florida Insured Municipal Income Trust

BAF

Sneeden

BlackRock Florida Municipal Bond Trust

BIE

Sneeden

BlackRock Florida Municipal Income Trust

BBF

Sneeden

BlackRock Florida Investment Quality Municipal Trust

RFA

Sneeden

BlackRock Maryland Municipal Bond Trust

BZM

O'Connor

BlackRock New Jersey Municipal Bond Trust

BLJ

Jaeckel

BlackRock New Jersey Municipal Income Trust

BNJ

Jaeckel

BlackRock New Jersey Investment Quality Municipal Trust

RNJ

Jaeckel

BlackRock New York Insured Municipal Income Trust

BSE

O'Connor/Browse

BlackRock New York Municipal Income Trust II

BFY

O'Connor/Browse

BlackRock New York Municipal Bond Trust

BQH

O'Connor/Browse

BlackRock New York Municipal Income Trust

BNY

O'Connor/Browse

BlackRock New York Investment Quality Municipal Trust Inc.

RNY

O'Connor/Browse

BlackRock Pennsylvania Strategic Municipal Trust

BPS

Bock

BlackRock Virginia Municipal Bond Trust

BHV

O'Connor

BlackRock California Municipal 2018 Term Trust

BJZ

O'Connor

BlackRock California Insured Municipal 2008 Term Trust Inc.

BFC

O'Connor

BlackRock Florida Municipal 2020 Term Trust

BFO

Sneeden

BlackRock Florida Insured Municipal 2008 Term Trust

BRF

Sneeden

BlackRock New York Municipal 2018 Term Trust

BLH

O'Connor

BlackRock New York Insured Municipal 2008 Term Trust Inc.

BLN

O'Connor

Disclosure

FORWARD LOOKING STATEMENTS

This communication, and other statements that BlackRock may make, including statements about the benefits of the transaction with Merrill

Lynch, may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act, with respect to BlackRock’s

future financial or business performance, strategies or expectations. Forward-looking statements are typically identified by words or phrases

such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” ���current,” “intention,” “estimate,”

“position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may” or similar expressions.

BlackRock cautions that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date they are made, and BlackRock assumes no duty to and does not undertake to update

forward-looking statements. Actual results could differ materially from those anticipated in forward-looking statements and future results could

differ materially from historical performance. In addition to factors previously disclosed in BlackRock's Securities and Exchange Commission

(SEC) reports and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ

materially from forward-looking statements or historical performance: (1) the ability of BlackRock to complete the transaction with Merrill

Lynch; (2) BlackRock's ability to successfully integrate the MLIM business with its existing business; (3) the ability of BlackRock to effectively

manage the former MLIM assets along with its historical assets under management; (4) the relative and absolute investment performance of

BlackRock's investment products, including its separately-managed accounts and the former MLIM business; and (5) BlackRock's success in

maintaining distribution of its products.

BlackRock's Annual Reports on Form 10-K and BlackRock's subsequent reports filed with the SEC, accessible on the SEC's website at

http://www.sec.gov and on BlackRock’s website at http://www.blackrock.com, discuss these factors in more detail and identify additional

factors that can affect forward-looking statements. The information contained on our website is not a part of this press release.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed transactions, a registration statement of New BlackRock, Inc. (Registration No. 333-134916), which includes a

preliminary proxy statement of BlackRock, and other materials have been filed with the SEC and are publicly available. The proxy

statement/prospectus will be mailed to the stockholders of BlackRock. STOCKHOLDERS OF BLACKROCK ARE ADVISED TO READ THE DEFINITIVE

PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Such proxy

statement/prospectus (when available) and other relevant documents may also be obtained, free of charge, on the Securities and Exchange

Commission's website (http://www.sec.gov) or by contacting our Secretary, BlackRock, Inc., 40 East 52nd Street, New York, New York 10022.

PARTICIPANTS IN THE SOLICITATION

BlackRock and certain persons may be deemed to be participants in the solicitation of proxies relating to the proposed transactions. The

participants in such solicitation may include BlackRock's executive officers and directors. Further information regarding persons who may be

deemed participants is available in the proxy statement/prospectus filed with the Securities and Exchange Commission in connection with the

transactions.

17