| OMB APPROVAL |

OMB Number: 3235-0570

Expires: Nov. 30, 2005

Estimated average burden hours per response: 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIESInvestment Company Act file number 811-08415Evergreen Fixed Income Trust

_____________________________________________________________

(Exact name of registrant as specified in charter)

200 Berkeley Street

Boston, Massachusetts 02116

_____________________________________________________________

(Address of principal executive offices) (Zip code)

Michael H. Koonce, Esq.

200 Berkeley Street

Boston, Massachusetts 02116

____________________________________________________________

(Name and address of agent for service)Registrant's telephone number, including area code: (617) 210-3200

Date of fiscal year end: Registrant is making an annual filing for 5 of its series, Evergreen Diversified Bond Fund, Evergreen High Yield Bond Fund, Evergreen Institutional Mortgage Portfolio, Evergreen Strategic Income Fund and Evergreen U.S. Government Fund, for the year ended April 30, 2004. These 5 series have a 4/30 fiscal year end.

Date of reporting period: April 30, 2004Item 1 - Reports to Stockholders.Evergreen Diversified Bond Fund

Evergreen Diversified Bond Fund

This annual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more

complete information, including fees and expenses, and should be read carefully before investing or sending money.A description of the Fund's proxy voting policies and procedures is available without charge, upon request, by calling 1.800.343.2898, by visiting our website

at EvergreenInvestments.com or by visiting the SEC's website at http://www.sec.gov.| Mutual Funds: |

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment

Management Company, LLC. Copyright 2004.Evergreen mutual funds are distributed by Evergreen Investment Services, Inc.

200 Berkeley Street, Boston, MA 02116LETTER TO SHAREHOLDERS

June 2004

Dennis H. Ferro

President and Chief

Executive Officer | |

|

Dear Shareholder,

We are pleased to provide the annual report for the Evergreen Diversified Bond Fund, which covers the twelve-month period ended April 30, 2004.

Investors in the fixed income markets experienced alternating periods of risk and reward over the past twelve months. Geopolitical uncertainties, improving economic growth, changes in tax legislation, and an accommodative stance from the Federal Reserve managed to both excite and confuse bond market participants at varying points, and in varying sectors, since the beginning of the investment period in May 2003.

The period began with the financial markets focused on the war in Iraq. The associated uncertainty led to higher demand for bonds, particularly within the Treasury market, as investors sought solace in a flight to quality. This performance in government bonds carried over to many municipal and corporate issues, too, and the increased demand for bonds quickly became a sort of self-fulfilling prophecy, as total return potential climbed with higher prices and declining yields. This increasingly popular strategy, though, soon helped set the stage for a summer of volatility unmatched in recent history.

At the conclusion of its monetary policy meeting in May, the Federal Reserve had commented on the "possibility of an unwelcome, substantial fall in inflation." Many bond investors, convinced the Fed was taking rates to zero, drove yields down to 45-year lows in the U.S. Treasury market. Common market wisdom determined that since the Fed's primary concern was deflation, rates were likely headed lower. Yet when central bankers reduced their target for the federal funds rate by a less than expected 25 basis points in late June, many fixed income investors became alarmed. These

1

LETTER TO SHAREHOLDERS continued

worries were compounded by optimistic GDP (Gross Domestic Product) forecasts from Fed Chairman Alan Greenspan during congressional banking committee hearings in July. As a result of these events, the yield on the 10-year Treasury surged from a low of 3.1% in June to 4.6% in late July. Thus, the "deflation trade" in bonds had changed from a significant overbought condition to an oversold one in a matter of just six weeks.

The bond market began to stabilize as investors became more comfortable with the likelihood that monetary policy makers would keep rates low for the foreseeable future. This was a welcome respite for owners of Treasuries and municipal securities. In addition to the excitement in Treasuries, investors in municipal bonds also experienced heightened concerns related to the changes in the tax laws, which were initially perceived as a potential threat to their market. After careful consideration, though, many investors became convinced that capital preservation would remain a primary, if not dominant, theme for the future demand of these securities. A second concern involved the poor financial condition of many states and local governments. Yet just as these concerns were reaching a crescendo, economic growth picked up significantly and tax receipts climbed, improving the financial conditions of many of these entities.

As economic growth strengthened, investors in corporate bonds benefited from the combination of stronger balance sheets, improving credit quality, declining default rates, and the outlook for growth in GDP and corporate profits. In addition, the many steps taken to improve corporate credibility rallied many investors to the credit markets, where many risk appropriate investors successfully searched for improved returns in the high yield market.

Throughout the investment period, the Federal Reserve attempted to improve the clarity of its intentions for the financial markets. At the conclusion of its monetary policy meetings, the Fed's statements ranged from maintaining policy accommodation for a "considerable period" to one of being "measured" in its approach to remove this monetary stimulus. In addition,

2

LETTER TO SHAREHOLDERS continued

central bankers tried to be even more clear in a variety of speeches and public testimonies, as the Fed continued to display an unusually strong effort in clarifying its upcoming changes in monetary policy. Most recently, though, these attempts at clarity caused volatility throughout the fixed income markets, as investors feared a repeat of the experiences in 1994. Given the current level of interest rates, inflation, the dollar, and global economic growth, we believe these concerns are overblown. However, the price of oil remains a wild card, as sustained high oil prices will eventually embed a higher level of manufacturing and service cost in the economy.

We encourage investors to maintain their diversified, long-term strategies within their fixed income portfolios.

Please visit our website, EvergreenInvestments.com, for more information about our funds and other investment products available to you. From the website, you may also access a new feature that presents a detailed Q&A interview with the portfolio manager(s) for your fund. You can easily reach these interviews by following the link, EvergreenInvestments.com/Annual updates, from our website. Thank you for your continued support of Evergreen Investments.

Sincerely, Dennis H. Ferro

Dennis H. Ferro

President and Chief Executive Officer

Evergreen Investment Company, Inc.

3

FUND AT A GLANCE

as of April 30, 2004MANAGEMENT TEAM

David K. Fowley, CFA

Customized Fixed Income Team

Lead Manager

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar's style box is based on a portfolio date as of 3/31/2004.

The fixed income style box placement is based on a fund's average effective maturity or duration and the average credit rating of the bond portfolio.PERFORMANCE AND RETURNS

Portfolio inception date: 9/11/1935

| Class A | Class B | Class C | Class I |

| Class inception date | 1/20/1998 | 9/11/1935 | 4/7/1998 | 2/11/1998 |

|

| Nasdaq symbol | EKDLX | EKDMX | EKDCX | EKDYX |

|

| Average annual return* |

|

| 1 year with sales charge | -3.02% | -3.74% | 0.13% | N/A |

|

| 1 year w/o sales charge | 1.82% | 1.10% | 1.10% | 2.12% |

|

| 5 year | 4.21% | 4.13% | 4.46% | 5.50% |

|

| 10 year | 5.52% | 5.54% | 5.54% | 6.13% |

|

| * Adjusted for maximum applicable sales charge, unless noted. |

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors' shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Class A, B, C or I shares, please go to EvergreenInvestments.com/fundperformance. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Historical performance shown for Classes A, C and I prior to their inception is based on the performance of Class B, the original class offered. The historical returns for Classes A and I have not been adjusted to reflect the effect of each class' 12b-1 fee. These fees are 0.30% for Class A and 1.00% for Classes B and C. Class I does not pay a 12b-1 fee. If these fees had been reflected, returns for Classes A and I would have been higher.

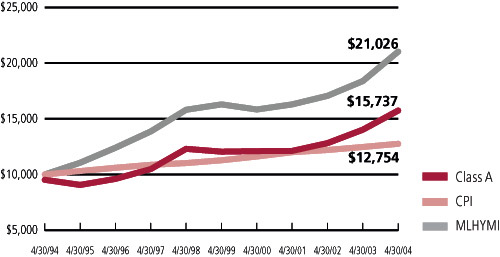

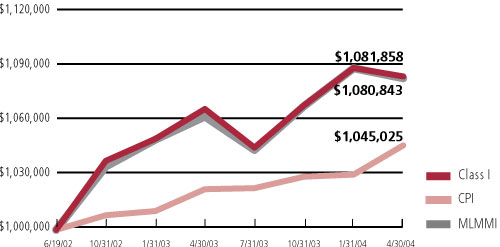

The advisor is waiving a portion of its advisory fee. Had the fee not been waived, returns would have been lower. Returns reflect expense limits previously in effect for Class A, without which returns for Class A would have been lower.LONG-TERM GROWTH

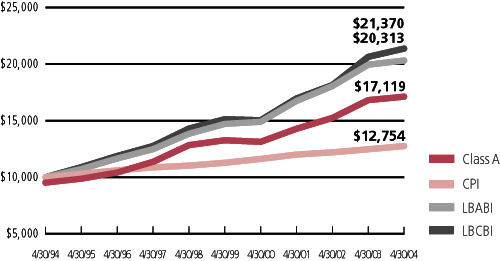

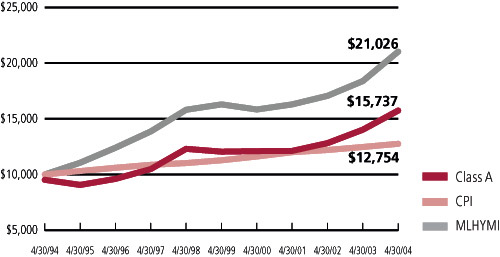

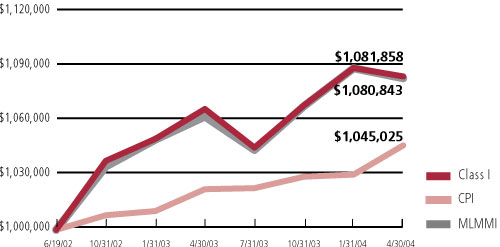

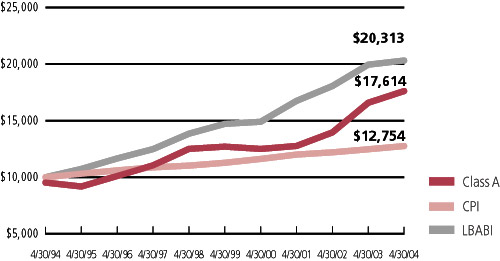

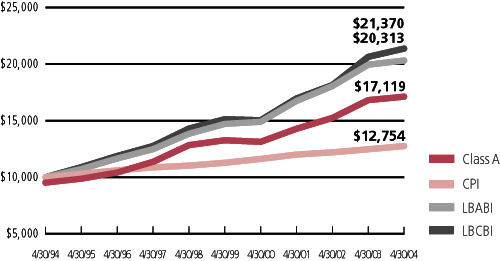

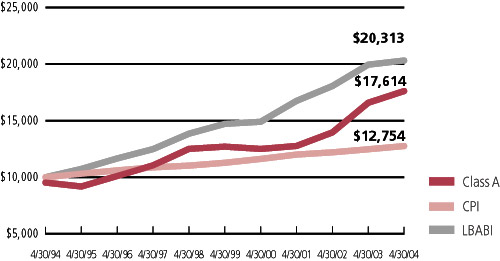

Comparison of a $10,000 investment in Evergreen Diversified Bond Fund Class A shares, versus a similar investment in the Lehman Brothers Aggregate Bond Index (LBABI), Lehman Brothers Corporate Bond Index (LBCBI) and the Consumer Price Index (CPI).

Comparison of a $10,000 investment in Evergreen Diversified Bond Fund Class A shares, versus a similar investment in the Lehman Brothers Aggregate Bond Index (LBABI), Lehman Brothers Corporate Bond Index (LBCBI) and the Consumer Price Index (CPI).

The LBABI and LBCBI are unmanaged market indexes and do not include transaction costs associated with buying and selling securities, any mutual fund expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

4

PORTFOLIO MANAGER COMMENTARY

The fund's Class A shares returned 1.82% for the twelve-month period ended April 30, 2004, excluding any applicable sales charges. During the same period, the fund's benchmarks, Lehman Brothers Corporate Bond Index (LBCBI), returned 3.53%, and the Lehman Brothers Aggregate Bond Index, (LBABI), returned 1.82%.

The single largest determinant of bond market performance over the course of the fund's fiscal year was interest rate movement. With the exception of the very short end of the Treasury curve (3 and 6 month Treasury bills), rates rose significantly during the period. This upward shift in rates caused U.S. Treasuries to provide significantly less total return than other fixed income asset classes. Another bond market determinant was the strong performance of corporate bonds in both investment grade and high yield bonds. The increase in financial strength in corporate America, led by improving earnings and reduction of financial debt caused corporate credit to turn in a strong year from a performance perspective.

Given where interest rates were at the beginning of the fiscal period and the slow but steady economic improvement witnessed at the beginning of 2003, the fund was positioned short from a duration and maturity perspective. This stance was appropriate as it attempted to minimize the negative effect of rising interest rates on bond principal values. The only detractor of this positioning was the fact that longer maturity bonds offered significantly more yield than shorter ones. Some amount of the fund's yield was sacrificed in order to increase capital preservation.

Improvement in corporate credit quality was fairly transparent over the course of the fiscal period as companies paid down debt with proceeds from asset sales and benefited from the generally low level of interest rates. As such, the fund was positioned heavily in the lower quality segment of the corporate bond market. In an improving economy, we believed lower quality companies stood to benefit the most. The fund out-performed the LBABI, mostly as a result of lack of exposure to U.S. Treasuries and agencies (the worst performing components of the index) and by its overweight position in corporate bonds of all qualities. When compared to the LBCBI, the fund slightly under-performed due to the specific maturity structure of the portfolio.Class I shares are only offered to investment advisory clients of an investment advisor of an Evergreen fund (or its advisory affiliates), through special arrangements entered into on behalf of Evergreen funds with certain financial services firms, certain institutional investors and persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994. Class I shares are only available to institutional shareholders with a minimum $1 million investment

The fund's investment objective is nonfundamental and may be changed without the vote of the fund's shareholders.

Funds that invest in high yield, lower-rated bonds may contain more risk due to the increased possibility of default.

Foreign investments may contain more risk due to the inherent risks associated with changing political climates, foreign market instability and foreign currency fluctuations.

The return of principal is not guaranteed due to fluctuation in the NAV of the fund caused by changes in the price of the individual bonds held by the fund and the buying and selling of bonds by the fund. Bond funds have the same inflation, interest rate, and credit risks that are associated with the individual bonds held by the fund.

All data is as of April 30, 2004, and subject to change.

5

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period) | Year Ended April 30,

|

CLASS A

| 20041

| 2003

| 20022

| 20011

| 20001

|

Net asset value, beginning of period

| $15.25

| $14.63

| $14.53

| $14.28

| $15.48

|

| Income from investment operations |

| Net investment income | 0.70 | 0.82 | 0.83 | 0.97 | 0.97 |

Net realized and unrealized gains or losses

on securities, foreign currency related

transactions and futures contracts | -0.42

| 0.64

| 0.13

| 0.25

| -1.14

|

Total from investment operations

| 0.28

| 1.46

| 0.96

| 1.22

| -0.17

|

| Distributions to shareholders from |

Net investment income

| -0.76

| -0.84

| -0.86

| -0.97

| -1.03

|

Net asset value, end of period

| $14.77

| $15.25

| $14.63

| $14.53

| $14.28

|

Total return3

| 1.82%

| 10.31%

| 6.72%

| 8.81%

| -1.06%

|

| Ratios and supplemental data |

| Net assets, end of period (thousands) | $275,755 | $322,963 | $300,670 | $314,274 | $344,296 |

| Ratios to average net assets |

| Expenses4 | 1.12% | 1.09% | 1.13% | 1.15% | 1.19% |

| Net investment income | 4.58% | 5.51% | 5.68% | 6.73% | 6.65% |

| Portfolio turnover rate | 157% | 109% | 116% | 176% | 175% |

|

1 Net investment income per share is based on average shares outstanding during the period.2 As required, effective May 1, 2001, the Fund adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies , and began amortizing premium on its fixed-income securities. The effects of this change for the year ended April 30, 2002 was a decrease in net investment income per share of $0.02; an increase in net realized gains or losses per share of $0.02; and a decrease to the ratio of net investment income to average net assets of 0.16%. The above per share information, ratios and supplemental data for the periods prior to May 1, 2001 have not been restated to reflect this change in presentation.3 Excluding applicable sales charges4 The ratio of expenses to average net assets excludes expense reductions but includes fee waivers and/or expense reimbursements.

See Notes to Financial Statements |

6

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period) | Year Ended April 30,

|

CLASS B

| 20041

| 20031

| 20021,2

| 20011

| 20001

|

Net asset value, beginning of period

| $15.25

| $14.63

| $14.53

| $14.28

| $15.48

|

| Income from investment operations |

| Net investment income | 0.59 | 0.70 | 0.72 | 0.86 | 0.84 |

Net realized and unrealized gains or losses

on securities, foreign currency related

transactions and futures contracts | -0.42

| 0.65

| 0.13

| 0.25

| -1.12

|

Total from investment operations

| 0.17

| 1.35

| 0.85

| 1.11

| -0.28

|

| Distributions to shareholders from |

Net investment income

| -0.65

| -0.73

| -0.75

| -0.86

| -0.92

|

Net asset value, end of period

| $14.77

| $15.25

| $14.63

| $14.53

| $14.28

|

Total return3

| 1.10%

| 9.50%

| 5.93%

| 8.00%

| -1.80%

|

| Ratios and supplemental data |

| Net assets, end of period (thousands) | $25,825 | $27,252 | $19,283 | $23,392 | $21,694 |

| Ratios to average net assets |

| Expenses4 | 1.82% | 1.84% | 1.88% | 1.90% | 1.94% |

| Net investment income | 3.87% | 4.75% | 4.92% | 5.97% | 5.86% |

| Portfolio turnover rate | 157% | 109% | 116% | 176% | 175% |

|

1 Net investment income per share is based on average shares outstanding during the period.2 As required, effective May 1, 2001 the Fund adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies , and began amortizing premium on its fixed-income securities. The effects of this change for the year ended April 30, 2002 was a decrease in net investment income per share of $0.03; an increase in net realized gains or losses per share of $0.03; and a decrease to the ratio of net investment income to average net assets of 0.16%. The above per share information, ratios and supplemental data for the periods prior to May 1, 2001 have not been restated to reflect this change in presentation.3 Excluding applicable sales charges4 The ratio of expenses to average net assets excludes expense reductions but includes fee waivers and/or expense reimbursements.

See Notes to Financial Statements |

7

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period) | Year Ended April 30,

|

CLASS C

| 20041

| 20031

| 20022

| 20011

| 20001

|

Net asset value, beginning of period

| $15.25

| $14.63

| $14.53

| $14.28

| $15.48

|

| Income from investment operations |

| Net investment income | 0.59 | 0.70 | 0.74 | 0.81 | 0.88 |

Net realized and unrealized gains or losses

on securities, foreign currency related

transactions and futures contracts | -0.42

| 0.65

| 0.11

| 0.30

| -1.16

|

Total from investment operations

| 0.17

| 1.35

| 0.85

| 1.11

| -0.28

|

| Distributions to shareholders from |

Net investment income

| -0.65

| -0.73

| -0.75

| -0.86

| -0.92

|

Net asset value, end of period

| $14.77

| $15.25

| $14.63

| $14.53

| $14.28

|

Total return3

| 1.10%

| 9.50%

| 5.93%

| 8.00%

| -1.80%

|

| Ratios and supplemental data |

| Net assets, end of period (thousands) | $38,490 | $47,506 | $4,008 | $3,077 | $603 |

| Ratios to average net assets |

| Expenses4 | 1.83% | 1.84% | 1.88% | 1.90% | 1.93% |

| Net investment income | 3.88% | 4.78% | 4.91% | 5.82% | 5.92% |

| Portfolio turnover rate | 157% | 109% | 116% | 176% | 175% |

|

1 Net investment income per share is based on average shares outstanding during the period.2 As required, effective May 1, 2001, the Fund adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies , and began amortizing premium on its fixed-income securities. The effects of this change for the year ended April 30, 2002 was a decrease in net investment income per share of $0.02; an increase in net realized gains or losses per share of $0.02; and a decrease to the ratio of net investment income to average net assets of 0.16%. The above per share information, ratios and supplemental data for the periods prior to May 1, 2001 have not been restated to reflect this change in presentation.3 Excluding applicable sales charges4 The ratio of expenses to average net assets excludes expense reductions but includes fee waivers and/or expense reimbursements.

See Notes to Financial Statements |

8

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period) | Year Ended April 30,

|

CLASS I1

| 20042

| 20032

| 20022,3

| 20012

| 20002

|

Net asset value, beginning of period

| $15.25

| $14.63

| $14.53

| $14.28

| $15.48

|

| Income from investment operations |

| Net investment income | 0.74 | 0.85 | 0.87 | 1.01 | 0.90 |

Net realized and unrealized gains or losses

on securities, foreign currency related

transactions and futures contracts | -0.42

| 0.65

| 0.12

| 0.25

| -1.04

|

Total from investment operations

| 0.32

| 1.50

| 0.99

| 1.26

| -0.14

|

| Distributions to shareholders from |

Net investment income

| -0.80

| -0.88

| -0.89

| -1.01

| -1.06

|

Net asset value, end of period

| $14.77

| $15.25

| $14.63

| $14.53

| $14.28

|

Total return

| 2.12%

| 10.59%

| 6.99%

| 9.08%

| -0.81%

|

| Ratios and supplemental data |

| Net assets, end of period (thousands) | $2,311 | $3,235 | $299 | $980 | $885 |

| Ratios to average net assets |

| Expenses4 | 0.82% | 0.87% | 0.88% | 0.90% | 0.95% |

| Net investment income | 4.87% | 5.76% | 5.91% | 6.97% | 6.89% |

| Portfolio turnover rate | 157% | 109% | 116% | 176% | 175% |

|

1 Effective at the close of business on May 11, 2001, Class Y shares were renamed as Institutional shares (Class I).2 Net investment income per share is based on average shares outstanding during the period.3 As required, effective May 1, 2001, the Fund adopted the provisions of the AICPA Audit and Accounting Guide, Audits of Investment Companies , and began amortizing premium on its fixed-income securities. The effects of this change for the year ended April 30, 2002 was a decrease in net investment income per share of $0.02; an increase in net realized gains or losses per share of $0.02; and a decrease to the ratio of net investment income to average net assets of 0.16%. The above per share information, ratios and supplemental data for the periods prior to May 1, 2001 have not been restated to reflect this change in presentation.4 The ratio of expenses to average net assets excludes expense reductions but includes fee waivers and/or expense reimbursements.

See Notes to Financial Statements |

9

SCHEDULE OF INVESTMENTS

April 30, 2004 | Principal

Amount | Value |

|

| ASSET-BACKED SECURITIES 1.7% |

Credit Suisse First Boston Mtge. Securities Corp., Ser. 1996-2, Class A-6,

7.18%, 02/25/2018 | $ 612,470 | $ 612,230 |

| Oakwood Mtge. Investors, Inc., Ser. 1996-C, Class A5, 7.35%, 04/15/2027 | 2,184,906 | 2,277,700 |

| Railcar Leasing LLC, Ser. 1, Class A-2, 7.125%, 01/15/2013 144A | 2,500,000 | 2,760,312 |

| Total Asset-Backed Securities (cost $5,631,687) | | 5,650,242 |

| COLLATERALIZED MORTGAGE OBLIGATIONS 5.0% |

| Banc America, Inc., Ser. 2001-7, 1.91%, 01/27/2006 144A (h) | 3,500,000 | 3,283,437 |

| Criimi Mae Finl. Corp., Ser. 1, Class A, 7.00%, 01/01/2033 | 1,643,315 | 1,644,600 |

Financial Asset Securitization, Inc., Ser. 1997-NAM2, Class B-2,

7.88%, 07/25/2027 | 1,226,182 | 1,229,934 |

| GE Capital Mtge. Svcs., Inc., Ser. 1999-H, Class A-7, 6.27%, 04/25/2029 | 1,345,643 | 1,388,058 |

Greenwich Capital Acceptance, Inc., Ser. 2001-ZC1A, Class A,

6.36%, 06/14/2006 144A (h) | 2,897,708 | 3,018,057 |

| Midland Realty Acceptance Corp., Ser. 1996-C1, Class E, 8.26%, 08/25/2028 | 2,784,000 | 3,173,751 |

| Morgan Stanley Capital I, Inc., Ser. 1997-ALIC, Class B, 6.71%, 01/15/2006 | 734,885 | 751,318 |

Residential Funding Mtge. Securities I, Inc., Ser. 1999-S2, Class M-1,

6.50%, 01/25/2029 | 2,586,601 | 2,581,611 |

| Total Collateralized Mortgage Obligations (cost $16,788,762) | | 17,070,766 |

| CORPORATE BONDS 72.8% |

| CONSUMER DISCRETIONARY 13.2% |

| Auto Components 0.1% |

| Dana Corp., 9.00%, 08/15/2011 | 200,000 | 237,000 |

| HLI Operating, Inc., 10.50%, 06/15/2010 | 130,000 | 147,550 |

| 384,550 |

| Automobiles 2.6% |

| DaimlerChrysler Holdings Corp., 7.30%, 01/15/2012 | 4,000,000 | 4,430,396 |

| General Motors Corp., 8.375%, 07/15/2033 | 4,000,000 | 4,338,468 |

| 8,768,864 |

| Distributors 0.1% |

| Roundy's, Inc., Ser. B, 8.875%, 06/15/2012 | 200,000 | 218,000 |

| Hotels, Restaurants & Leisure 0.2% |

| Chumash Casino & Resort Enterprise, 9.00%, 07/15/2010 144A | 175,000 | 195,125 |

| El Pollo Loco, Inc., 9.25%, 12/15/2009 144A | 40,000 | 41,000 |

| Friendly Ice Cream Corp., 8.375%, 06/15/2012 144A | 40,000 | 41,100 |

| John Q Hammons Hotels LP, Ser. B, 8.875%, 05/15/2012 | 175,000 | 193,375 |

| Mandalay Resort Group, 6.375%, 12/15/2011 | 200,000 | 206,000 |

| 676,600 |

| Household Durables 0.2% |

| Meritage Corp., 9.75%, 06/01/2011 | 175,000 | 195,781 |

| Standard Pacific Corp., 7.75%, 03/15/2013 | 175,000 | 182,438 |

| WCI Communities, Inc., 9.125%, 05/01/2012 | 400,000 | 438,000 |

| 816,219 |

See Notes to Financial Statements |

10

SCHEDULE OF INVESTMENTS continued

April 30, 2004 | Principal

Amount | Value |

|

| CORPORATE BONDS continued |

| CONSUMER DISCRETIONARY continued |

| Media 9.6% |

| Clear Channel Communications, 5.75%, 01/15/2013 (p) | $ 5,000,000 | $ 5,121,100 |

| Cox Communications, Inc., 7.125%, 10/01/2012 | 5,000,000 | 5,545,970 |

| CSC Holdings, Inc., 7.625%, 04/01/2011 | 200,000 | 209,000 |

| Dex Media West LLC, 8.50%, 08/15/2010 144A (p) | 285,000 | 310,650 |

| Emmis Communications Corp., Ser. B, 8.125%, 03/15/2009 | 175,000 | 183,531 |

| Emmis Operating Co., 6.875%, 05/15/2012 144A # | 90,000 | 90,225 |

| InterActiveCorp., 7.00%, 01/15/2013 (p) | 5,000,000 | 5,449,160 |

| Liberty Media Corp., 5.70%, 05/15/2013 (p) | 4,500,000 | 4,507,452 |

| LIN TV Corp., 6.50%, 05/15/2013 (p) | 200,000 | 198,000 |

| Mediacom LLC: |

| 7.875%, 02/15/2011 (p) | 110,000 | 106,700 |

| 9.50%, 01/15/2013 (p) | 135,000 | 135,000 |

| Medianews Group, Inc., 6.875%, 10/01/2013 | 175,000 | 174,125 |

| News America Holdings, Inc., 8.00%, 10/17/2016 | 5,000,000 | 5,966,420 |

| R.H. Donnelley Fin. Corp., 10.875%, 12/15/2012 | 175,000 | 209,125 |

| Time Warner, Inc.: |

| 6.95%, 01/15/2028 | 2,000,000 | 2,054,604 |

| 7.625%, 04/15/2031 | 2,500,000 | 2,744,185 |

| 33,005,247 |

| Specialty Retail 0.4% |

| Cole National Group, Inc., 8.875%, 05/15/2012 | 155,000 | 168,175 |

| CSK Auto, Inc., 7.00%, 01/15/2014 144A | 175,000 | 173,250 |

| Group 1 Automotive, Inc., 8.25%, 08/15/2013 | 200,000 | 219,500 |

| Michaels Stores, Inc., 9.25%, 07/01/2009 | 200,000 | 220,750 |

| Steinway Musical Instruments, Inc., 8.75%, 04/15/2011 (p) | 175,000 | 190,750 |

| United Auto Group, Inc., 9.625%, 03/15/2012 | 175,000 | 196,438 |

| Warnaco Group, Inc., 8.875%, 06/15/2013 | 175,000 | 189,000 |

| 1,357,863 |

| CONSUMER STAPLES 3.4% |

| Food & Staples Retailing 3.4% |

| Albertsons, Inc., 7.50%, 02/15/2011 (p) | 5,000,000 | 5,686,605 |

| Crown Cork & Seal Co., Inc., 7.375%, 12/15/2026 (p) | 175,000 | 158,375 |

| Delhaize America, Inc., 8.125%, 04/15/2011 | 5,000,000 | 5,601,445 |

| Rite Aid Corp., 8.125%, 05/01/2010 | 175,000 | 189,875 |

| 11,636,300 |

| Food Products 0.0% |

| Dole Food Co., Inc., 7.25%, 06/15/2010 | 175,000 | 177,188 |

| ENERGY 5.0% |

| Energy Equipment & Services 0.2% |

| Dresser, Inc., 9.375%, 04/15/2011 | 175,000 | 189,875 |

| NRG Energy, Inc., 8.00%, 12/15/2013 144A | 75,000 | 75,938 |

| Parker Drilling Co., Ser. B, 10.125%, 11/15/2009 | 175,000 | 188,563 |

See Notes to Financial Statements |

11

SCHEDULE OF INVESTMENTS continued

April 30, 2004 | Principal

Amount | Value |

|

| CORPORATE BONDS continued |

| ENERGY continued |

| Energy Equipment & Services continued |

| SESI LLC, 8.875%, 05/15/2011 | $ 175,000 | $ 190,312 |

| 644,688 |

| Oil & Gas 4.8% |

| Amerada Hess Corp., 6.65%, 08/15/2011 (p) | 5,000,000 | 5,337,395 |

| Chesapeake Energy Corp., 6.875%, 01/15/2016 | 175,000 | 178,500 |

| El Paso Energy Partners LP, 8.50%, 06/01/2011 | 175,000 | 194,250 |

| Evergreen Resources, Inc., 5.875%, 03/15/2012 144A | 15,000 | 14,925 |

| Exco Resources, Inc., 7.25%, 01/15/2011 144A | 30,000 | 30,450 |

| Ferrellgas Escrow LLC, 6.75%, 05/01/2014 144A | 160,000 | 160,800 |

| Forest Oil Corp., 7.75%, 05/01/2014 | 175,000 | 188,125 |

| Gulfterra Energy Partners LP, Ser. B, 6.25%, 06/01/2010 | 175,000 | 182,000 |

| Pemex Project Funding Master Trust, 8.625%, 02/01/2022 | 4,000,000 | 4,300,000 |

| Premcor Refining Group, Inc., 6.75%, 05/01/2014 | 175,000 | 175,000 |

| Stone Energy Corp., 8.25%, 12/15/2011 | 210,000 | 227,850 |

| Tesoro Petroleum Corp., Ser. B, 9.00%, 07/01/2008 (p) | 175,000 | 182,437 |

| Valero Energy Corp., 4.75%, 06/15/2013 | 5,000,000 | 4,788,205 |

| Westport Resources Corp., 8.25%, 11/01/2011 | 400,000 | 451,000 |

| 16,410,937 |

| FINANCIALS 29.8% |

| Capital Markets 7.7% |

| Bear Stearns, Inc., 5.70%, 11/15/2014 | 7,000,000 | 7,137,438 |

| Credit Suisse First Boston, 5.125%, 01/15/2014 | 6,000,000 | 5,882,934 |

| Goldman Sachs Group, Inc., 5.15%, 01/15/2014 | 7,000,000 | 6,825,105 |

| Morgan Stanley Co., Inc., 4.75%, 04/01/2014 | 7,000,000 | 6,552,665 |

| 26,398,142 |

| Commercial Banks 2.4% |

| Banco Bradesco SA, 8.75%, 10/24/2013 144A | 3,000,000 | 2,977,500 |

| FBOP Corp., 10.00%, 01/15/2009 144A | 1,000,000 | 1,110,000 |

| First Empire Capital Trust I, 8.23%, 02/01/2027 | 3,600,000 | 4,031,600 |

| 8,119,100 |

| Consumer Finance 11.4% |

| CIT Group, Inc., 5.00%, 02/13/2014 (p) | 5,000,000 | 4,784,950 |

| Ford Motor Credit Co., 6.50%, 01/25/2007 | 5,000,000 | 5,305,535 |

| General Electric Capital Corp., 5.45%, 01/15/2013 | 8,000,000 | 8,205,080 |

| HSBC Capital Funding LP, 4.61%, 12/29/2049 144A | 6,000,000 | 5,545,452 |

| Ohio National Financial Services, Inc., 6.35%, 04/01/2013 144A | 5,000,000 | 5,184,965 |

| SLM Corp., 5.00%, 10/01/2013 (p) | 4,000,000 | 3,921,196 |

| Sprint Capital Corp., 8.75%, 03/15/2032 | 5,000,000 | 5,989,980 |

| 38,937,158 |

| Diversified Financial Services 0.1% |

| Arch Western Finance LLC, 6.75%, 07/01/2013 144A | 200,000 | 207,000 |

| Couche Tard LP, 7.50%, 12/15/2013 | 40,000 | 42,200 |

See Notes to Financial Statements |

12

SCHEDULE OF INVESTMENTS continued

April 30, 2004 | Principal

Amount | Value |

|

| CORPORATE BONDS continued |

| FINANCIALS continued |

| Diversified Financial Services continued |

| Pemex Finance, Ltd., 10.61%, 08/15/2017 144A | $ 190,000 | $ 247,172 |

| 496,372 |

| Insurance 5.6% |

| Aon Capital Trust A, 8.21%, 01/01/2027 | 4,000,000 | 4,417,976 |

| Crum & Forster Holding Corp., 10.375%, 06/15/2013 | 175,000 | 194,250 |

| Fund American Companies, Inc., 5.875%, 05/15/2013 | 5,000,000 | 5,037,615 |

| Markel Corp., Ser. A, 6.80%, 02/15/2013 | 5,000,000 | 5,242,860 |

| RLI Corp., 5.95%, 01/15/2014 | 4,500,000 | 4,428,117 |

| 19,320,818 |

| Real Estate 2.6% |

| Crescent Real Estate Equities, 9.25%, 04/15/2009 REIT (p) | 185,000 | 205,350 |

| FelCor Suites LP, 7.625%, 10/01/2007 REIT | 175,000 | 180,250 |

| Health Care Property, Inc., 6.00%, 03/01/2015 REIT | 4,000,000 | 4,102,580 |

| Host Marriott Corp., 7.125%, 11/01/2013 REIT | 175,000 | 178,500 |

| LNR Property Corp., 7.625%, 07/15/2013 | 175,000 | 181,125 |

| Omega Healthcare Investors, Inc., 7.00%, 04/01/2014 144A REIT | 35,000 | 35,875 |

| Pan Pacific Retail Properties, Inc., 7.95%, 04/15/2011 REIT | 3,250,000 | 3,744,383 |

| Thornburg Mortgage, Inc., 8.00%, 05/15/2013 REIT | 175,000 | 180,688 |

| 8,808,751 |

| HEALTH CARE 1.8% |

| Health Care Equipment & Supplies 0.0% |

| NeighborCare, Inc., 6.875%, 11/15/2013 144A | 45,000 | 46,125 |

| Health Care Providers & Services 1.7% |

| Extendicare Health Services, Inc., 9.50%, 07/01/2010 (p) | 175,000 | 195,125 |

| Manor Care, Inc., 6.25%, 05/01/2013 | 5,000,000 | 5,168,750 |

| Omnicare, Inc., Ser. B, 8.125%, 03/15/2011 | 175,000 | 193,375 |

| Stewart Enterprises, Inc., 10.75%, 07/01/2008 | 200,000 | 227,000 |

| Triad Hospitals, Inc., 7.00%, 11/15/2013 | 200,000 | 194,500 |

| 5,978,750 |

| Pharmaceuticals 0.1% |

| Alpharma, Inc., 8.625%, 05/01/2011 144A | 200,000 | 211,000 |

| INDUSTRIALS 6.5% |

| Airlines 1.0% |

| Southwest Airlines Co., 8.70%, 07/01/2011 | 2,720,106 | 3,267,051 |

| Commercial Services & Supplies 0.5% |

| Allied Waste North America, Inc., 6.50%, 11/15/2010 144A | 200,000 | 201,000 |

| Coinmach Corp., 9.00%, 02/01/2010 | 200,000 | 213,000 |

| Geo Group, Inc., 8.25%, 07/15/2013 | 200,000 | 209,000 |

| Hines Nurseries, Inc., 10.25%, 10/01/2011 | 190,000 | 209,000 |

| Iron Mountain, Inc., 6.625%, 01/01/2016 | 175,000 | 163,625 |

| Mail Well I Corp., 7.875%, 12/01/2013 144A (p) | 200,000 | 190,000 |

| Manitowoc Co., Inc., 7.125%, 11/01/2013 | 200,000 | 210,000 |

See Notes to Financial Statements |

13

SCHEDULE OF INVESTMENTS continued

April 30, 2004 | Principal

Amount | Value |

|

| CORPORATE BONDS continued |

| INDUSTRIALS continued |

| Commercial Services & Supplies continued |

| NationsRent, Inc., 9.50%, 10/15/2010 144A | $ 175,000 | $ 188,562 |

| Service Corporation International, 6.75%, 04/01/2016 144A | 55,000 | 54,863 |

| United Rentals North America, Inc., 6.50%, 02/15/2012 144A | 200,000 | 194,000 |

| 1,833,050 |

| Construction & Engineering 1.6% |

| Centex Corp., Ser. E, FRN, 3.12%, 11/22/2004 | 500,000 | 504,533 |

| Pulte Homes, Inc., 5.25%, 01/15/2014 | 5,000,000 | 4,784,755 |

| 5,289,288 |

| Machinery 0.3% |

| AGCO Corp., 8.50%, 03/15/2006 (p) | 175,000 | 176,312 |

| CNH Global N.V., 9.25%, 08/01/2011 144A | 400,000 | 448,000 |

| Cummins, Inc., 9.50%, 12/01/2010 | 50,000 | 58,250 |

| Terex Corp., 7.375%, 01/15/2014 144A | 190,000 | 199,025 |

| Wolverine Tube, Inc., 7.375%, 08/01/2008 144A | 200,000 | 198,000 |

| 1,079,587 |

| Road & Rail 3.1% |

| Bombardier, Inc., 6.30%, 05/01/2014 144A (p) | 5,000,000 | 4,939,655 |

| Goodrich Corp., 7.625%, 12/15/2012 | 5,000,000 | 5,711,395 |

| 10,651,050 |

| INFORMATION TECHNOLOGY 0.1% |

| IT Services 0.1% |

| Stratus Technologies, Inc., 10.375%, 12/01/2008 144A | 200,000 | 200,000 |

| MATERIALS 2.2% |

| Chemicals 0.4% |

| Airgas, Inc., 9.125%, 10/01/2011 | 175,000 | 198,625 |

| Equistar Chemicals LP, 10.625%, 05/01/2011 | 200,000 | 225,000 |

| FMC Corp., 10.25%, 11/01/2009 | 175,000 | 207,375 |

| Huntsman Advanced Materials LLC, 11.625%, 10/15/2010 | 175,000 | 193,375 |

| Lyondell Chemical Co., 9.50%, 12/15/2008 | 175,000 | 183,750 |

| Nalco Co., 7.75%, 11/15/2011 144A | 165,000 | 174,487 |

| Noveon, Inc., Ser. B, 11.00%, 02/28/2011 | 175,000 | 204,750 |

| Scotts Co., 6.625%, 11/15/2013 144A | 200,000 | 207,000 |

| 1,594,362 |

| Containers & Packaging 0.2% |

| Graphic Packaging International, Inc., 8.50%, 08/15/2011 | 175,000 | 194,250 |

| Owens-Brockway Glass Container, Inc., 8.875%, 02/15/2009 | 175,000 | 190,969 |

| Stone Container Corp., 9.75%, 02/01/2011 | 200,000 | 223,000 |

| 608,219 |

| Metals & Mining 0.1% |

| Massey Energy Co., 6.625%, 11/15/2010 | 95,000 | 95,950 |

| Peabody Energy Corp., 5.875%, 04/15/2016 | 65,000 | 60,775 |

See Notes to Financial Statements |

14

SCHEDULE OF INVESTMENTS continued

April 30, 2004 | Principal

Amount | Value |

|

| CORPORATE BONDS continued |

| MATERIALS continued |

| Metals & Mining continued |

| U.S. Steel Corp., 10.75%, 08/01/2008 | $ 114,000 | $ 133,950 |

| 290,675 |

| Paper & Forest Products 1.5% |

| Georgia Pacific Corp., 8.125%, 05/15/2011 (p) | 200,000 | 226,500 |

| Weyerhaeuser Co., 8.50%, 01/15/2025 | 4,000,000 | 4,793,036 |

| 5,019,536 |

| TELECOMMUNICATION SERVICES 4.8% |

| Diversified Telecommunication Services 3.4% |

| Bellsouth Telecommunications, 6.125%, 09/23/2008 | 2,950,000 | 3,186,147 |

| Insight Midwest LP, 10.50%, 11/01/2010 | 175,000 | 191,625 |

| TCI Communications, Inc., 8.75%, 08/01/2015 | 3,000,000 | 3,676,683 |

| Verizon New York, Inc., Ser. A, 6.875%, 04/01/2012 | 4,000,000 | 4,381,780 |

| 11,436,235 |

| Wireless Telecommunications Services 1.4% |

| Intelsat, Ltd., 6.50%, 11/01/2013 (p) | 5,000,000 | 4,593,295 |

| Nextel Communications, Inc.: |

| 5.95%, 03/15/2014 (p) | 200,000 | 189,000 |

| 6.875%, 10/31/2013 | 79,000 | 80,185 |

| Rural Cellular Corp., 8.25%, 03/15/2012 144A | 15,000 | 15,563 |

| 4,878,043 |

| UTILITIES 6.0% |

| Aerospace & Defense 1.5% |

| Raytheon Co., 5.375%, 04/01/2013 | 5,000,000 | 5,021,500 |

| Electric Utilities 1.5% |

| FirstEnergy Corp., Ser. B, 6.45%, 11/15/2011 | 5,000,000 | 5,271,845 |

| Gas Utilities 0.1% |

| Western Gas Resources, Inc., 10.00%, 06/15/2009 | 400,000 | 422,000 |

| Multi-Utilities & Unregulated Power 2.9% |

| Constellation Energy Group, Inc., 4.55%, 06/15/2015 | 4,000,000 | 3,607,816 |

| Duke Energy Corp., 8.25%, 10/15/2004 | 3,000,000 | 3,077,421 |

| Niagara Mohawk Power Corp., 7.75%, 05/15/2006 | 2,000,000 | 2,190,126 |

| Pacific Gas & Electric Co., 4.80%, 03/01/2014 | 1,000,000 | 958,624 |

| Reliant Resources, Inc., 9.25%, 07/15/2010 | 175,000 | 188,125 |

| 10,022,112 |

| Total Corporate Bonds (cost $252,643,741) | | 249,297,225 |

| FOREIGN BONDS-GOVERNMENT (PRINCIPAL AMOUNT |

| DENOMINATED IN CURRENCY INDICATED) 1.0% |

| Hungary, 8.50%, 10/12/2004, HUF (cost $3,577,566) | 750,000,000 | 3,541,892 |

See Notes to Financial Statements |

15

SCHEDULE OF INVESTMENTS continued

April 30, 2004 | Principal

Amount | Value |

|

| MORTGAGE-BACKED SECURITIES 0.8% |

| FHLMC: |

| 6.00%, 01/01/2032 | $ 21,188 | $ 21,693 |

| 7.50%, 09/01/2013-05/01/2015 ## | 176,537 | 188,450 |

| FNMA: |

| 5.125%, 01/02/2014 (p) | 2,500,000 | 2,464,027 |

| 7.00%, 07/01/2029 | 11,146 | 11,796 |

| Total Mortgage-Backed Securities (cost $2,696,665) | | 2,685,966 |

| YANKEE OBLIGATIONS-CORPORATE 12.9% |

| CONSUMER STAPLES 1.2% |

| Beverages 1.2% |

| Cia Brasileira De Bebida, 8.75%, 09/15/2013 144A | 4,000,000 | 4,250,000 |

| ENERGY 1.5% |

| Oil & Gas 1.5% |

| Transocean, Inc., 7.375%, 04/15/2018 | 4,582,000 | 5,278,134 |

| FINANCIALS 2.8% |

| Insurance 2.8% |

| Axa SA, 8.60%, 12/15/2030 | 4,000,000 | 4,986,228 |

| Montpelier Re Holdings, Ltd, 6.125%, 08/15/2013 | 4,500,000 | 4,559,832 |

| 9,546,060 |

| INDUSTRIALS 3.0% |

| Industrial Conglomerates 3.0% |

| Hutchison Whampoa International, Ltd., 6.50%, 02/13/2013 144A | 5,000,000 | 5,044,880 |

| Tyco International Group SA, 6.00%, 11/15/2013 144A | 5,000,000 | 5,077,785 |

| 10,122,665 |

| MATERIALS 0.6% |

| Paper & Forest Products 0.6% |

| Millar Western Forest Products, 7.75%, 11/15/2013 144A | 20,000 | 21,100 |

| Nexfor, Inc., 7.25%, 07/01/2012 | 2,000,000 | 2,196,194 |

| 2,217,294 |

| TELECOMMUNICATION SERVICES 1.5% |

| Diversified Telecommunication Services 1.4% |

| Telecom Italia Capital, 5.25%, 11/15/2013 144A | 5,000,000 | 4,938,760 |

| Wireless Telecommunications Services 0.1% |

| Rogers Wireless, Inc., 6.375%, 03/01/2014 144A | 175,000 | 165,375 |

| UTILITIES 2.3% |

| Electric Utilities 1.5% |

| Transalta Corp, 5.75%, 12/15/2013 | 5,000,000 | 4,946,655 |

| Oil & Gas 0.8% |

| Petrobras International Finance Co., 8.375%, 12/10/2018 | 3,000,000 | 2,835,000 |

| Total Yankee Obligations-Corporate (cost $45,112,331) | | 44,299,943 |

| YANKEE OBLIGATIONS-GOVERNMENT 1.7% |

| United Mexican States, 5.875%, 01/15/2014 (p) (cost $5,868,037) | 6,000,000 | 5,823,000 |

See Notes to Financial Statements |

16

SCHEDULE OF INVESTMENTS continued

April 30, 2004 | Shares | Value |

|

| MUTUAL FUND SHARES 2.1% |

| PIMCO High Income Fund (cost $7,729,358) | 513,000 | $ 7,043,490 |

| PREFERRED STOCKS 0.1% |

| FINANCIALS 0.1% |

| Diversified Financial Services 0.1% |

| Fleet Capital Trust (cost $500,000) | 20,000 | 511,600 |

| SHORT-TERM INVESTMENTS 13.2% |

|

| Principal

Amount | Value |

|

| U.S. TREASURY OBLIGATIONS 0.6% |

| U.S. Treasury Bills, 1.08%, 08/12/2004 (f) † | $ 2,200,000 | 2,194,089 |

|

| Shares | Value |

|

| MUTUAL FUND SHARES 12.6% |

| Evergreen Institutional Money Market Fund (o) | 1,320,601 | 1,320,601 |

| Navigator Prime Portfolio (pp) | 41,618,310 | 41,618,310 |

| 42,938,911 |

| Total Short-Term Investments (cost $45,133,000) | | 45,133,000 |

| Total Investments (cost $385,681,147) 111.3% | | 381,057,124 |

| Other Assets and Liabilities (11.3%) | | (38,675,710) |

| Net Assets 100.0% | | $ 342,381,414 |

| 144A | Security that may be sold to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended. This security has been determined to be liquid under guidelines established by the Board of Trustees. |

| (o) | Evergreen Investment Management Company, LLC is the investment advisor to both the Fund and the money market fund. |

| (h) | No market quotation available. Valued at fair value as determined in good faith under procedures established by the Board of Trustees. |

| (p) | All or a portion of this security is on loan. |

| (pp) | Represents investment of cash collateral received from securities on loan. |

| (f) | All or a portion of the principal amount of this security was pledged to cover initial margin requirements for open futures contracts. |

| † | Rate shown represents the yield to maturity at date of purchase. |

| # | When-issued or delayed delivery security. |

| ## | All or a portion of this security has been segregated for when-issued or delayed delivery securities. |

|

| Summary of Abbreviations: |

| FNMA | Federal National Mortgage Association |

| FHLMC | Federal Home Loan Mortgage Corp. |

| FRN | Floating Rate Note |

| HUF | Hungarian Forint |

| REIT | Real Estate Investment Trust |

See Notes to Financial Statements |

17

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2004

|

| Assets |

| Investments in securities, at value (cost $385,681,147) including |

| $40,853,555 of securities loaned | $ 381,057,124 |

| Foreign currency, at value (cost $115) | 107 |

| Receivable for Fund shares sold | 81,956 |

| Interest and dividends receivable | 5,486,715 |

| Receivable for securities lending income | 4,491 |

| Prepaid expenses and other assets | 184,344 |

|

| Total assets | 386,814,737 |

|

| Liabilities |

| Dividends payable | 599,490 |

| Payable for securities purchased | 1,210,044 |

| Payable for Fund shares redeemed | 624,834 |

| Payable for securities on loan | 41,618,310 |

| Payable for daily variation margin on open futures contracts | 269,063 |

| Advisory fee payable | 9,943 |

| Distribution Plan expenses payable | 12,003 |

| Due to other related parties | 8,715 |

| Accrued expenses and other liabilities | 80,921 |

|

| Total liabilities | 44,433,323 |

|

| Net assets | $ 342,381,414 |

|

| Net assets represented by |

| Paid-in capital | $ 390,870,118 |

| Overdistributed net investment income | (483,222) |

Accumulated net realized losses on securities, foreign currency

related transactions and futures contracts | (44,275,458) |

Net unrealized gains or losses on securities, foreign currency

related transactions and futures contracts | (3,730,024) |

|

| Total net assets | $ 342,381,414 |

|

| Net assets consists of |

| Class A | $ 275,755,139 |

| Class B | 25,824,831 |

| Class C | 38,490,469 |

| Class I | 2,310,975 |

|

| Total net assets | $ 342,381,414 |

|

| Shares outstanding |

| Class A | 18,670,830 |

| Class B | 1,748,528 |

| Class C | 2,606,117 |

| Class I | 156,473 |

|

| Net asset value per share |

| Class A | $ 14.77 |

| Class A -- Offering price (based on sales charge of 4.75%) | $ 15.51 |

| Class B | $ 14.77 |

| Class C | $ 14.77 |

| Class I | $ 14.77 |

|

See Notes to Financial Statements |

18

STATEMENT OF OPERATIONS

Year Ended April 30, 2004

|

| Investment income |

| Interest | $ 21,326,539 |

| Dividends | 281,754 |

|

| Total investment income | 21,608,293 |

|

| Expenses |

| Advisory fee | 1,742,710 |

| Distribution Plan expenses |

| Class A | 912,599 |

| Class B | 276,742 |

| Class C | 442,215 |

| Administrative services fee | 378,933 |

| Transfer agent fees | 756,747 |

| Trustees' fees and expenses | 5,357 |

| Printing and postage expenses | 45,717 |

| Custodian and accounting fees | 108,700 |

| Registration and filing fees | 38,082 |

| Professional fees | 24,108 |

| Other | 37,129 |

|

| Total expenses | 4,769,039 |

| Less: Expense reductions | (3,705) |

| Fee waivers and expense reimbursements | (13,847) |

|

| Net expenses | 4,751,487 |

|

| Net investment income | 16,856,806 |

|

Net realized and unrealized gains or losses on securities,

foreign currency related transactions and futures contracts |

| Net realized gains or losses on: |

| Securities | 7,988,872 |

| Foreign currency related transactions | 33,627 |

| Futures contracts | (2,436,155) |

|

Net realized gains on securities, foreign currency related transactions

and futures contracts | 5,586,344 |

Net change in unrealized gains or losses on securities, foreign currency

related transactions and futures contracts | (15,614,330) |

|

Net realized and unrealized gains or losses on securities, foreign currency

related transactions and futures contracts | (10,027,986) |

|

| Net increase in net assets resulting from operations | $ 6,828,820 |

|

See Notes to Financial Statements |

19

STATEMENTS OF CHANGES IN NET ASSETS

| Year Ended April 30,

|

| 2004 | 2003 |

|

| Operations |

| Net investment income | | $ 16,856,806 | | $ 20,996,142 |

Net realized gains on securities, foreign

currency related transactions

and futures contracts | | 5,586,344 | | 9,731,009 |

Net change in unrealized gains or losses

on securities, foreign currency related

transactions and futures contracts | | (15,614,330) | | 7,310,653 |

|

Net increase in net assets resulting

from operations | | 6,828,820 | | 38,037,804 |

|

| Distributions to shareholders from |

| Net investment income |

| Class A | | (15,198,914) | | (18,272,267) |

| Class B | | (1,186,466) | | (1,184,413) |

| Class C | | (1,898,544) | | (2,206,336) |

| Class I | | (162,471) | | (67,251) |

|

| Total distributions to shareholders | | (18,446,395) | | (21,730,267) |

|

| | Shares | | Shares |

| Capital share transactions |

| Proceeds from shares sold |

| Class A | 362,207 | 5,511,500 | 1,481,355 | 21,845,129 |

| Class B | 451,342 | 6,871,941 | 677,706 | 10,000,437 |

| Class C | 307,989 | 4,687,644 | 426,470 | 6,296,087 |

| Class I | 69,019 | 1,049,350 | 352,088 | 5,201,827 |

|

| | | 18,120,435 | | 43,343,480 |

|

Net asset value of shares issued in

reinvestment of distributions |

| Class A | 611,529 | 9,254,418 | 741,379 | 10,963,641 |

| Class B | 44,009 | 665,861 | 45,204 | 669,071 |

| Class C | 81,748 | 1,237,149 | 96,774 | 1,431,987 |

| Class I | 1,518 | 22,947 | 774 | 11,455 |

|

| | | 11,180,375 | | 13,076,154 |

|

Automatic conversion of Class B shares

to Class A shares |

| Class A | 27,179 | 413,022 | 32,698 | 486,881 |

| Class B | (27,179) | (413,022) | (32,698) | (486,881) |

|

| | | 0 | | 0 |

|

| Payment for shares redeemed |

| Class A | (3,504,087) | (53,099,113) | (4,208,009) | (61,957,227) |

| Class B | (506,299) | (7,674,174) | (386,863) | (5,697,146) |

| Class C | (898,190) | (13,598,071) | (1,007,555) | (14,873,551) |

| Class I | (126,148) | (1,885,559) | (165,145) | (2,418,714) |

|

| | | (76,256,917) | | (84,946,638) |

|

Net asset value of shares issued

in acquisition |

| Class A | 0 | 0 | 2,579,947 | 37,764,120 |

| Class B | 0 | 0 | 165,564 | 2,423,469 |

| Class C | 0 | 0 | 3,325,020 | 48,669,466 |

| Class I | 0 | 0 | 3,931 | 57,540 |

|

| | | 0 | | 88,914,595 |

|

Net increase (decrease) in net assets

resulting from capital share transactions | | (46,956,107) | | 60,387,591 |

|

| Total increase (decrease) in net assets | | (58,573,682) | | 76,695,128 |

| Net assets |

| Beginning of period | | 400,955,096 | | 324,259,968 |

|

| End of period | | $ 342,381,414 | | $ 400,955,096 |

|

| Overdistributed net investment income | | $ (483,222) | | $ (558,241) |

|

See Notes to Financial Statements |

20

NOTES TO FINANCIAL STATEMENTS

1. ORGANIZATION

Evergreen Diversified Bond Fund (the "Fund") is a diversified series of Evergreen Fixed Income Trust (the "Trust"), a Delaware statutory trust organized on September 18, 1997. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act").

The Fund offers Class A, Class B, Class C and Institutional ("Class I") shares. Class A shares are sold with a front-end sales charge. Class B shares are sold without a front-end sales charge but are subject to a contingent deferred sales charge that is payable upon redemption and decreases depending on how long the shares have been held. Effective February 2, 2004, Class C shares are no longer sold with a front-end sales charge but are still subject to a contingent deferred sales charge that is payable upon redemption within one year after the month of purchase. Class I shares are sold without a front-end sales charge or contingent deferred sales charge. Each class of shares, except Class I shares, pays an ongoing distribution fee.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America, which require management to make estimates and assumptions that affect amounts reported herein. Actual results could differ from these estimates.

a. Valuation of investments

Portfolio debt securities acquired with more than 60 days to maturity are valued at prices obtained from an independent pricing service which takes into consideration such factors as similar security prices, yields, maturities, liquidity and ratings. Securities for which valuations are not available from an independent pricing service may be valued by brokers which use prices provided by market makers or estimates of market value obtained from yield data relating to investments or securities with similar characteristics.

Listed equity securities are usually valued at the last sales price or official closing price on the national securities exchange where the securities are principally traded.

Short-term securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates market value.

Investments in other mutual funds are valued at net asset value. Securities for which market quotations are not available or not reflective of current market value are valued at fair value as determined in good faith, according to procedures approved by the Board of Trustees.

b. Foreign currency translation

All assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not separately account for that portion of the results of operations

21

NOTES TO FINANCIAL STATEMENTS continued

resulting from changes in foreign exchange rates on investments and the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on securities.

c. Futures contracts

In order to gain exposure to or protect against changes in security values, the Fund may buy and sell futures contracts. The primary risks associated with the use of futures contracts are the imperfect correlation between changes in market values of securities held by the Fund and the prices of futures contracts, and the possibility of an illiquid market.

Futures contracts are valued based upon their quoted daily settlement prices. The aggregate principal amounts of the contracts are not recorded in the financial statements. Fluctuations in the value of the contracts are recorded in the Statement of Assets and Liabilities as an asset or liability and in the Statement of Operations as unrealized gains or losses until the contracts are closed, at which point they are recorded as net realized gains or losses on futures contracts.

d. Securities lending

The Fund may lend its securities to certain qualified brokers in order to earn additional income. The Fund receives compensation in the form of fees or interest earned on the investment of any cash collateral received. The Fund also continues to receive interest and dividends on the securities loaned. The Fund receives collateral in the form of cash or securities with a market value at least equal to the market value of the securities on loan, including accrued interest. In the event of default or bankruptcy by the borrower, the Fund could experience delays and costs in recovering the loaned securities or in gaining access to the collateral. The Fund has the right under the lending agreement to recover the securities from the borrower on demand.

e. Security transactions and investment income

Security transactions are recorded on trade date. Realized gains and losses are computed using the specific cost of the security sold. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Dividend income is recorded on the ex-dividend date or in the case of some foreign securities, on the date when the Fund is made aware of the dividend.

f. Federal taxes

The Fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income, including any net capital gains (which have already been offset by available capital loss carryovers). Accordingly, no provision for federal taxes is required.

g. Distributions

Distributions to shareholders from net investment income are accrued daily and paid monthly. Distributions from net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

22

NOTES TO FINANCIAL STATEMENTS continued

Reclassifications have been made to the Fund's components of net assets to reflect income and gains available for distribution (or available capital loss carryovers, as applicable) under income tax regulations. The primary permanent differences causing such reclassifications are due to expiration of capital loss carryovers and premium amortization.

h. Class allocations

Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

3. ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Evergreen Investment Management Company, LLC ("EIMC"), an indirect, wholly-owned subsidiary of Wachovia Corporation ("Wachovia"), is the investment advisor to the Fund and is paid a fee at an annual rate of 2% of the Fund's gross investment income plus an amount determined by applying percentage rates to the average daily net assets of the Fund, starting at 0.31% and declining to 0.16% as average daily net assets increase. Prior to April 1, 2004, the Fund paid a fee at an annual rate of 2% of the Fund's gross investment income plus an amount determined by applying percentage rates to the average daily net assets of the Fund, which started at 0.41% and declined to 0.16% as the Fund's average daily net assets increased.

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. For any fee waivers and/or reimbursements made after January 1, 2003, EIMC may recoup certain amounts waived and/or reimbursed up to a period of three years following the end of the fiscal year in which the fee waivers and/or reimbursements were made. During the year ended April 30, 2004, EIMC waived its fee in the amount of $10,985 and reimbursed expenses relating to Class A shares in the amount of $2,862. Total amounts subject to recoupment as of April 30, 2004 were $19,540.

Evergreen Investment Services, Inc. ("EIS"), an indirect, wholly-owned subsidiary of Wachovia, is the administrator to the Fund. As administrator, EIS provides the Fund with facilities, equipment and personnel and is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds), starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds) increase.

Evergreen Service Company, LLC ("ESC"), an indirect, wholly-owned subsidiary of Wachovia, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund. For the year ended April 30, 2004, the transfer agent fees were equivalent to an annual rate of 0.20% of the Fund's average daily net assets.

23

NOTES TO FINANCIAL STATEMENTS continued

4. DISTRIBUTION PLANS

Evergreen Distributor, Inc., a wholly-owned subsidiary of BISYS Fund Services, Inc., serves as principal underwriter to the Fund.

The Fund has adopted Distribution Plans, as allowed by Rule 12b-1 of the 1940 Act, for each class of shares, except Class I. Under the Distribution Plans, distribution fees are paid at an annual rate of 0.30% of the average daily net assets for Class A shares and 1.00% of the average daily net assets for each of Class B and Class C shares.

5. ACQUISITION

Effective at the close of business on June 7, 2002, the Fund acquired the net assets of Evergreen Quality Income Fund in a tax-free exchange for Class A, Class B, Class C and Class I shares of the Fund. Shares were issued to Class A, Class B, Class C and Class I shares of Evergreen Quality Income Fund at an exchange ratio of 0.87, 0.87, 0.87 and 0.90 for Class A, Class B, Class C and Class I shares, respectively, of the Fund. The acquired net assets consisted primarily of portfolio securities with unrealized appreciation of $599,698. The aggregate net assets of the Fund and Evergreen Quality Income Fund immediately prior to the acquisition were $321,141,608 and $88,914,595, respectively. The aggregate net assets of the Fund immediately after the acquisition were $410,056,203.

6. SECURITIES TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows for the year ended April 30, 2004: | Cost of Purchases | Proceeds from Sales |

|

| U.S. | Non-U.S. | U.S. | Non-U.S. |

| Government | Government | Government | Government |

|

| $ 34,982,779 | $ 539,120,938 | $ 33,117,477 | $ 566,275,347 |

|

At April 30, 2004, the Fund had open short futures contracts outstanding as follows: | | | Initial Contract | Value at | Unrealized |

| Expiration | Contracts | Amount | April 30, 2004 | Gain |

|

| | 820 U.S. Treasury |

| June 30, 2004 | Bond Futures | $ 91,503,908 | $ 90,610,000 | $ 893,908 |

|

The Fund loaned securities during the year ended April 30, 2004 to certain brokers. At April 30, 2004, the value of securities on loan and the value of collateral amounted to $40,853,555 and $41,618,310, respectively. During the year ended April 30, 2004, the Fund earned $42,223 in income from securities lending which is included in interest income on the Statement of Operations.

On April 30, 2004, the aggregate cost of securities for federal income tax purposes was $386,428,133. The gross unrealized appreciation and depreciation on securities based on tax cost was $4,360,878 and $9,731,887, respectively, with a net unrealized depreciation of $5,371,009.

24

NOTES TO FINANCIAL STATEMENTS continued

As of April 30, 2004, the Fund had $42,634,473 in capital loss carryovers for federal income tax purposes expiring as follows: | Expiration |

|

| 2007 | 2008 | 2009 | 2010 |

|

| $ 7,055,922 | $ 19,652,642 | $ 11,338,929 | $ 4,586,980 |

|

7. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an interfund lending program with certain funds in the Evergreen fund family. This program allows the Fund to borrow from, or lend money to, other participating funds. During the year ended April 30, 2004, the Fund did not participate in the interfund lending program.

8. DISTRIBUTIONS TO SHAREHOLDERS

As of April 30, 2004, the components of distributable earnings on a tax basis were as follows: | Overdistributed | Unrealized | Capital Loss |

| Ordinary Income | Depreciation | Carryover |

|

| $ 483,222 | $ 5,371,009 | $ 42,634,473 |

|

The differences between the components of distributable earnings on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to wash sales, premium amortization adjustments and marked to market income on futures contracts.

The tax character of distributions paid was as follows: | | Year Ended April 30,

|

| | 2004 | 2003 |

|

| Ordinary Income | $ 18,446,395 | $ 21,730,267 |

|

9. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund's custodian, a portion of fund expenses has been reduced.

10. DEFERRED TRUSTEES' FEES

Each Trustee of the Fund may defer any or all compensation related to performance of their duties as Trustees. The Trustees' deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts are based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported in the Fund's Trustees' fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

25

NOTES TO FINANCIAL STATEMENTS continued

11. FINANCING AGREEMENT

The Fund and certain other Evergreen funds share in a $150 million unsecured revolving credit commitment for temporary and emergency purposes, including the funding of redemptions, as permitted by each Fund's borrowing restrictions. Borrowings under this facility bear interest at 0.50% per annum above the Federal Funds rate. All of the participating funds are charged an annual commitment fee of 0.09% of the unused balance, which is allocated pro rata. During the year ended April 30, 2004, the Fund had no borrowings under this agreement.

12. SUBSEQUENT EVENT

Effective May 1, 2004, EIS replaced Evergreen Distributor, Inc. as the distributor of the Fund's shares.

26

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Board of Trustees and Shareholders

Evergreen Fixed Income Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of the Evergreen Diversified Bond Fund, a series of Evergreen Fixed Income Trust, as of April 30, 2004, and the related statement of operations for the year then ended, statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2004 by correspondence with the custodian. As to securities purchased but not yet received, we performed other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Evergreen Diversified Bond Fund, as of April 30, 2004, the results of its operations, changes in its net assets and financial highlights for each of the years described above in conformity with accounting principles generally accepted in the United States of America.

Boston, Massachusetts

June 4, 2004

27

ADDITIONAL INFORMATION (unaudited)

FEDERAL TAX DISTRIBUTIONS

For corporate shareholders, 1.50% of ordinary income dividends paid during the fiscal year ended April 30, 2004 qualified for the dividends received deduction.

With respect to dividends paid from investment company taxable income during the fiscal year ended April 30, 2004, the Fund designates 1.47% of ordinary income and short-term capital gain distributions as Qualified Dividend Income in accordance with the Internal Revenue Code. Complete 2004 year-end tax information will be reported to you on your 2004 Form 1099-DIV, which shall be provided to you in early 2005.

28

This page left intentionally blank

29

This page left intentionally blank

30

This page left intentionally blank

31

TRUSTEES AND OFFICERS

| TRUSTEES1 | |

Charles A. Austin III

Trustee

DOB: 10/23/1934

Term of office since: 1991

Other directorships: None | Principal occupations: Investment Counselor, Anchor Capital Advisors, Inc. (investment advice); Director, The Andover Companies (insurance); Trustee, Arthritis Foundation of New England; Director, The Francis Ouimet Society; Former Director, Health Development Corp. (fitness-wellness centers); Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust; Former Investment Counselor, Appleton Partners, Inc. (investment advice); Former Director, Executive Vice President and Treasurer, State Street Research & Management Company (investment advice) |

|

Shirley L. Fulton

Trustee

DOB: 1/10/1952

Term of office since: 2004

Other directorships: None | Principal occupations: Partner, Helms, Henderson & Fulton, P.A. (law firm); Retired Senior Resident Superior Court Judge, 26th Judicial District, Charlotte, NC |

|

K. Dun Gifford

Trustee

DOB: 10/23/1938

Term of office since: 1974

Other directorships: None | Principal occupations: Chairman and President, Oldways Preservation and Exchange Trust (education); Trustee, Treasurer and Chairman of the Finance Committee, Cambridge College; Former Chairman of the Board, Director, and Executive Vice President, The London Harness Company (leather goods purveyor); Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

Dr. Leroy Keith, Jr.

Trustee

DOB: 2/14/1939

Term of office since: 1983

Other directorships: Trustee, Phoenix Series Fund, Phoenix Multi-Portfolio Fund, and The Phoenix Big Edge Series Fund | Principal occupations: Partner, Stonington Partners, Inc. (private investment firm); Trustee of Phoenix Series Fund, Phoenix Multi-Portfolio Fund, and The Phoenix Big Edge Series Fund; Former Chairman of the Board and Chief Executive Officer, Carson Products Company (manufacturing); Director, Obagi Medical Products Co.; Director, Lincoln Educational Services; Director, Diversapack Co.; Former President, Morehouse College; Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

Gerald M. McDonnell

Trustee

DOB: 7/14/1939

Term of office since: 1988

Other directorships: None | Principal occupations: Manager of Commercial Operations, SMI STEEL Co. - South Carolina (steel producer); Former Sales and Marketing Management, Nucor Steel Company; Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

William Walt Pettit

Trustee

DOB: 8/26/1955

Term of office since: 1984

Other directorships: None | Principal occupations: Partner and Vice President, Kellam & Pettit, P.A. (law firm); Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

David M. Richardson

Trustee

DOB: 9/19/1941

Term of office since: 1982

Other directorships: None | Principal occupations: President, Richardson, Runden & Company (executive recruitment business development/consulting company); Consultant, Kennedy Information, Inc. (executive recruitment information and research company); Consultant, AESC (The Association of Retained Executive Search Consultants); Trustee, NDI Technologies, LLP (communications); Director, J&M Cumming Paper Co. (paper merchandising); Former Vice Chairman, DHR International, Inc. (executive recruitment); Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

Dr. Russell A. Salton III

Trustee

DOB: 6/2/1947

Term of office since: 1984

Other directorships: None | Principal occupations: President/CEO, AccessOne MedCard; Former Medical Director, Healthcare Resource Associates, Inc.; Former Medical Director, U.S. Health Care/Aetna Health Services; Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

32

TRUSTEES AND OFFICERS continued

Michael S. Scofield

Trustee

DOB: 2/20/1943

Term of office since: 1984

Other directorships: None | Principal occupations: Attorney, Law Offices of Michael S. Scofield; Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

Richard J. Shima

Trustee

DOB: 8/11/1939

Term of office since: 1993

Other directorships: None | Principal occupations: Independent Consultant; Director, Trust Company of CT; Trustee, Saint Joseph College (CT); Director, Hartford Hospital; Trustee, Greater Hartford YMCA; Former Director, Enhance Financial Services, Inc.; Former Director, Old State House Association; Former Director of CTG Resources, Inc. (natural gas); Former Director, Mentor Income Fund, Inc.; Former Trustee, Mentor Funds and Cash Resource Trust |

|

Richard K. Wagoner, CFA2

Trustee

DOB: 12/12/1937

Term of office since: 1999

Other directorships: None | Principal occupations: Member and Former President, North Carolina Securities Traders Association; Member, Financial Analysts Society; Former Consultant to the Boards of Trustees of the Evergreen funds; Former Trustee, Mentor Funds and Cash Resource Trust |

|

| OFFICERS |

|

Dennis H. Ferro3

President

DOB: 6/20/1945

Term of office since: 2003 | Principal occupations: President, Chief Executive Officer and Chief Investment Officer, Evergreen Investment Company, Inc. and Executive Vice President, Wachovia Bank, N.A. |

|

Carol Kosel4

Treasurer

DOB: 12/25/1963

Term of office since: 1999 | Principal occupations: Senior Vice President, Evergreen Investment Services, Inc. |

|

Michael H. Koonce4

Secretary

DOB: 4/20/1960

Term of office since: 2000 | Principal occupations: Senior Vice President and General Counsel, Evergreen Investment Services, Inc.; Senior Vice President and Assistant General Counsel, Wachovia Corporation |

|

1 Each Trustee serves until a successor is duly elected or qualified or until his death, resignation, retirement or removal from office. Each Trustee oversees 94 Evergreen funds. Correspondence for each Trustee may be sent to Evergreen Board of Trustees, P.O. Box 20083, Charlotte, North Carolina 28202.

2 Mr. Wagoner is an "interested person" of the Fund because of his ownership of shares in Wachovia Corporation, the parent to the Fund's investment advisor.

3 The address of the Officer is 401 S. Tryon Street, 20th Floor, Charlotte, NC 28288.

4 The address of the Officer is 200 Berkeley Street, Boston, MA 02116.

Additional information about the Fund's Board of Trustees and Officers can be found in the Statement of Additional Information (SAI) and is available upon request without charge by calling 800.343.2898. |

33

INVESTMENTS THAT STAND THE TEST OF TIME

At Evergreen Investments, we remain steadfastly dedicated to four core principles that lead to success in today's financial world.- Leadership -- With over $248 billion in assets under management as of March 31, 2004 and a history of innovation spanning more than 70 years, we offer the strength that comes with experience.

Excellence -- We have been consistently recognized for risk-adjusted historical performance through disciplined, rigorous management focused on achieving sustainable success.

Experience -- Our investment managers are seasoned professionals who share their diverse points of view and have the perspective that comes with weathering good markets and bad.