Evergreen Investment Company, Inc.

A copy of the restated shareholder report is available on EvergreenInvestments.com. If you have questions regarding this restatement, please contact your financial advisor or an Evergreen Client Service representative at 800-343-2898.

FUND AT A GLANCE

as of October 31, 2008

MANAGEMENT TEAM

Investment Advisor:

Evergreen Investment Management Company, LLC

Sub-Advisors:

Evergreen International Advisors; Tattersall Advisory Group, Inc.

Portfolio Managers:

Robert A. Calhoun, CFA; Michael Lee; Anthony Norris; Alex Perrin; Peter Wilson; Parham M. Behrooz, CFA; Andrew Cestone; Todd C. Kuimjian, CFA

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 9/30/2008.

The Fixed Income style box placement is based on a fund’s average effective maturity or duration and the average credit rating of the bond portfolio.

PERFORMANCE AND RETURNS

Portfolio inception date: 11/30/1972

| | Class A | | Class B | | Class C | | Class I |

Class inception date | | 5/20/2005 | | 5/20/2005 | | 5/20/2005 | | 11/30/1972 |

|

|

|

|

|

|

|

|

|

Nasdaq symbol | | EKDLX | | EKDMX | | EKDCX | | EKDYX |

|

|

|

|

|

|

|

|

|

6-month return with sales charge | | -22.71% | | -23.05% | | -19.95% | | N/A |

|

|

|

|

|

|

|

|

|

6-month return w/o sales charge | | -18.84% | | -19.10% | | -19.16% | | -18.73% |

|

|

|

|

|

|

|

|

|

Average annual return* | | | | | | | | |

|

|

|

|

|

|

|

|

|

1-year with sales charge | | -25.97% | | -26.54% | | -23.60% | | N/A |

|

|

|

|

|

|

|

|

|

1-year w/o sales charge | | -22.26% | | -22.86% | | -22.86% | | -22.06% |

|

|

|

|

|

|

|

|

|

5-year | | -2.15% | | -2.00% | | -1.70% | | -1.01% |

|

|

|

|

|

|

|

|

|

10-year | | 2.16% | | 2.39% | | 2.39% | | 2.75% |

|

|

|

|

|

|

|

|

|

Maximum sales charge | | 4.75% | | 5.00% | | 1.00% | | N/A |

| | Front-end | | CDSC | | CDSC | | |

|

|

|

|

|

|

|

|

|

* | Adjusted for maximum applicable sales charge, unless noted. |

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end for Classes A, B, C or I, please go to EvergreenInvestments.com/fundperformance. The performance of each class may vary based on differences in loads, fees and expenses paid by the shareholders investing in each class. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Historical performance shown for Class I prior to 5/23/2005 is based on the performance of the fund’s predecessor closed-end fund, Vestaur Securities Fund. Historical performance shown for Classes A, B and C prior to their inception is based on the performance of Class I. The historical returns for Classes A, B and C have not been adjusted to reflect the effect of each class’ 12b-1 fee. These fees are 0.25% for Class A and 1.00% for Classes B and C. Class I does not, and Vestaur Securities Fund did not, pay a 12b-1 fee. If these fees had been reflected, returns for Classes A, B and C would have been lower.

The advisor is waiving its advisory fee and reimbursing the fund for a portion of other expenses. Had the fee not been waived and expenses not reimbursed, returns would have been lower. Returns reflect expense limits previously in effect for Class A, without which returns for Class A would have been lower.

Class I shares are only offered, subject to the minimum initial purchase requirements, in the following manner: (1) to investment advisory clients of EIMC (or its advisory affiliates), (2) to employer- or state-sponsored benefit plans, including but not limited to, retirement plans, defined benefit plans, deferred compensation plans, or savings plans, (3) to fee-based mutual fund wrap accounts, (4) through arrangements entered into on behalf of the Evergreen funds with certain financial services firms, (5) to certain institutional investors, and (6) to persons who owned Class Y shares in registered name in an Evergreen fund on or before December 31, 1994 or who owned shares of any SouthTrust fund in registered name as of March 18, 2005 or who owned shares of Vestaur Securities Fund as of May 20, 2005.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

4

FUND AT A GLANCE continued

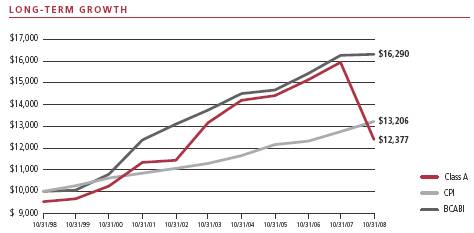

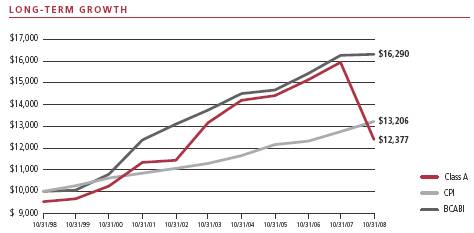

Comparison of a $10,000 investment in the Evergreen Core Plus Bond Fund Class A shares versus a similar investment in the Barclays Capital Aggregate Bond Index (BCABI) and the Consumer Price Index (CPI).

The BCABI is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

The fund’s investment objective may be changed without a vote of the fund’s shareholders.

Foreign investments may contain more risk due to the inherent risks associated with changing political climates, foreign market instability and foreign currency fluctuations. Risks of international investing are magnified in emerging or developing markets.

Asset-backed and mortgage-backed securities are generally subject to higher prepayment risks than other types of debt securities, which can limit the potential for gain in a declining interest rate environment and increase the potential for loss in a rising interest rate environment. Mortgage-backed securities may also be structured so that they are particularly sensitive to interest rates. A high rate of defaults on the mortgages held by a mortgage pool may limit the pool’s ability to make payments to the fund if the fund holds securities that are subordinate to other interest in the same mortgage pool; the risk of such defaults is generally higher in mortgage pools that include subprime mortgages.

Derivatives involve additional risks including interest rate risk, credit risk, the risk of improper valuation and the risk of non-correlation to the relevant instruments they are designed to hedge or to closely track.

High yield, lower-rated bonds may contain more risk due to the increased possibility of default.

The return of principal is not guaranteed due to fluctuation in the fund’s NAV caused by changes in the price of individual bonds held by the fund and the buying and selling of bonds by the fund. Bond funds have the same inflation, interest rate and credit risks as individual bonds. Generally, the value of bond funds rises when prevailing interest rates fall, and falls when interest rates rise.

U.S. government guarantees apply only to certain securities held in the fund’s portfolio and not to the fund’s shares.

All data is as of October 31, 2008, and subject to change.

5

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2008 to October 31, 2008.

The example illustrates your fund’s costs in two ways:

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes |

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Beginning

Account Value

5/1/2008 | Ending

Account Value

10/31/2008 | Expenses Paid

During Period* |

|

|

|

|

Actual | | | | | | |

Class A | $1,000.00 | | $ | 799.13 | | $4.17 |

Class B | $1,000.00 | | $ | 795.98 | | $7.56 |

Class C | $1,000.00 | | $ | 795.98 | | $7.56 |

Class I | $1,000.00 | | $ | 800.18 | | $3.04 |

Hypothetical | | | | | | |

(5% return before expenses) | | | | | | |

Class A | $1,000.00 | | $ | 1,020.57 | | $4.69 |

Class B | $1,000.00 | | $ | 1,016.79 | | $8.49 |

Class C | $1,000.00 | | $ | 1,016.79 | | $8.49 |

Class I | $1,000.00 | | $ | 1,021.83 | | $3.41 |

|

|

|

|

|

|

|

* | For each class of the fund, expenses are equal to the annualized expense ratio of each class (0.92% for Class A, 1.67% for Class B, 1.67% for Class C and 0.67% for Class I), multiplied by the average account value over the period, multiplied by 184 / 365 days. |

6

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

CLASS A | | Six Months Ended

October 31, 2008

(unaudited) | | Year Ended April 30, | | Year Ended

November 30,

20052, 3 | |

|

2008 | | 2007 | | 20061 |

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | | $ | 14.83 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.37 | | | 0.74 | | | 0.81 | | | 0.33 | | | 0.41 | 4 |

Net realized and unrealized gains or losses on investments | | | (2.85 | ) | | (1.07 | ) | | 0.23 | | | (0.27 | ) | | (0.28 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (2.48 | ) | | (0.33 | ) | | 1.04 | | | 0.06 | | | 0.13 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | (0.36 | ) | | (0.51 | ) | | (0.83 | ) | | (0.34 | ) | | (0.43 | ) |

Tax basis return of capital | | | 0 | | | (0.21 | ) | | (0.01 | ) | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | (0.36 | ) | | (0.72 | ) | | (0.84 | ) | | (0.34 | ) | | (0.43 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 10.56 | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return5 | | | (18.84 | )% | | (2.38 | )% | | 7.49 | % | | 0.43 | % | | 0.89 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 122,950 | | $ | 167,732 | | $ | 199,442 | | $ | 213,268 | | $ | 226,450 | |

Ratios to average net assets | | | | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 0.92 | %6 | | 0.92 | % | | 0.94 | % | | 0.96 | %6 | | 0.97 | %6 |

Expenses excluding waivers/reimbursements and expense reductions | | | 1.18 | %6 | | 1.15 | % | | 1.16 | % | | 1.19 | %6 | | 1.15 | %6 |

Net investment income (loss) | | | 5.84 | %6 | | 5.23 | % | | 5.65 | % | | 5.43 | %6 | | 5.28 | %6 |

Portfolio turnover rate | | | 96 | %7 | | 374 | %7 | | 70 | % | | 30 | % | | 55 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | For the five months ended April 30, 2006. The Fund changed its fiscal year end from November 30 to April 30, effective April 30, 2006. |

2 | For the period from May 20, 2005 (commencement of class operations), to November 30, 2005. |

3 | Effective at the close of business on May 20, 2005, the Fund acquired the net assets of Vestaur Securities Fund. Vestaur Securities Fund became the accounting and performance survivor in this transaction. Class A shares of Vestaur Securities Fund did not exist prior to the transaction. As a result, accounting and performance information for Class A shares commenced on May 20, 2005. |

4 | Net investment income (loss) per share is based on average shares outstanding during the period. |

5 | Excluding applicable sales charges |

7 | Portfolio turnover rate includes mortgage dollar roll activity. |

See Notes to Financial Statements

7

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

CLASS B | | Six Months Ended

October 31, 2008

(unaudited) | | Year Ended April 30, | | Year Ended

November 30,

20052, 3 | |

|

2008 | | 2007 | | 20061 |

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | | $ | 14.83 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.33 | | | 0.64 | | | 0.70 | | | 0.28 | | | 0.36 | 4 |

Net realized and unrealized gains or losses on investments | | | (2.86 | ) | | (1.07 | ) | | 0.23 | | | (0.26 | ) | | (0.28 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (2.53 | ) | | (0.43 | ) | | 0.93 | | | 0.02 | | | 0.08 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | (0.31 | ) | | (0.41 | ) | | (0.72 | ) | | (0.30 | ) | | (0.38 | ) |

Tax basis return of capital | | | 0 | | | (0.21 | ) | | (0.01 | ) | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | (0.31 | ) | | (0.62 | ) | | (0.73 | ) | | (0.30 | ) | | (0.38 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 10.56 | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return5 | | | (19.10 | )% | | (3.18 | )% | | 6.71 | % | | 0.14 | % | | 0.52 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 8,743 | | $ | 13,618 | | $ | 16,102 | | $ | 18,277 | | $ | 20,439 | |

Ratios to average net assets | | | | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 1.67 | %6 | | 1.67 | % | | 1.67 | % | | 1.67 | %6 | | 1.67 | %6 |

Expenses excluding waivers/reimbursements and expense reductions | | | 1.93 | %6 | | 1.85 | % | | 1.85 | % | | 1.89 | %6 | | 1.85 | %6 |

Net investment income (loss) | | | 5.09 | %6 | | 4.49 | % | | 4.91 | % | | 4.72 | %6 | | 4.58 | %6 |

Portfolio turnover rate | | | 96 | %7 | | 374 | %7 | | 70 | % | | 30 | % | | 55 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | For the five months ended April 30, 2006. The Fund changed its fiscal year end from November 30 to April 30, effective April 30, 2006. |

2 | For the period from May 20, 2005 (commencement of class operations), to November 30, 2005. |

3 | Effective at the close of business on May 20, 2005, the Fund acquired the net assets of Vestaur Securities Fund. Vestaur Securities Fund became the accounting and performance survivor in this transaction. Class B shares of Vestaur Securities Fund did not exist prior to the transaction. As a result, accounting and performance information for Class B shares commenced on May 20, 2005. |

4 | Net investment income (loss) per share is based on average shares outstanding during the period. |

5 | Excluding applicable sales charges |

7 | Portfolio turnover rate includes mortgage dollar roll activity. |

See Notes to Financial Statements

8

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

CLASS C | | Six Months Ended

October 31, 2008

(unaudited) | | Year Ended April 30, | | Year Ended

November 30,

20052, 3 | |

|

2008 | | 2007 | | 20061 |

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | | $ | 14.83 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.33 | | | 0.63 | | | 0.70 | | | 0.28 | | | 0.36 | 4 |

Net realized and unrealized gains or losses on investments | | | (2.86 | ) | | (1.06 | ) | | 0.23 | | | (0.26 | ) | | (0.28 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (2.53 | ) | | (0.43 | ) | | 0.93 | | | 0.02 | | | 0.08 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | |

Net investment income | | | (0.31 | ) | | (0.41 | ) | | (0.72 | ) | | (0.30 | ) | | (0.38 | ) |

Tax basis return of capital | | | 0 | | | (0.21 | ) | | (0.01 | ) | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | (0.31 | ) | | (0.62 | ) | | (0.73 | ) | | (0.30 | ) | | (0.38 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 10.56 | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return5 | | | (19.16 | )% | | (3.11 | )% | | 6.71 | % | | 0.14 | % | | 0.52 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 15,125 | | $ | 21,699 | | $ | 24,157 | | $ | 25,972 | | $ | 27,764 | |

Ratios to average net assets | | | | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 1.67 | %6 | | 1.67 | % | | 1.67 | % | | 1.67 | %6 | | 1.67 | %6 |

Expenses excluding waivers/reimbursements and expense reductions | | | 1.93 | %6 | | 1.85 | % | | 1.85 | % | | 1.89 | %6 | | 1.85 | %6 |

Net investment income (loss) | | | 5.09 | %6 | | 4.48 | % | | 4.91 | % | | 4.72 | %6 | | 4.58 | %6 |

Portfolio turnover rate | | | 96 | %7 | | 374 | %7 | | 70 | % | | 30 | % | | 55 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | For the five months ended April 30, 2006. The Fund changed its fiscal year end from November 30 to April 30, effective April 30, 2006. |

2 | For the period from May 20, 2005 (commencement of class operations), to November 30, 2005. |

3 | Effective at the close of business on May 20, 2005, the Fund acquired the net assets of Vestaur Securities Fund. Vestaur Securities Fund became the accounting and performance survivor in this transaction. Class C shares of Vestaur Securities Fund did not exist prior to the transaction. As a result, accounting and performance information for Class C shares commenced on May 20, 2005. |

4 | Net investment income (loss) per share is based on average shares outstanding during the period. |

5 | Excluding applicable sales charges |

7 | Portfolio turnover rate includes mortgage dollar roll activity. |

See Notes to Financial Statements

9

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | Six Months Ended

October 31, 2008

(unaudited) | | Year Ended April 30, | | Year Ended November 30, | |

| | |

| |

| |

CLASS I | | | 2008 | | 2007 | | 20061 | | 20052 | | 20042 | | 20032 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | | $ | 15.14 | | $ | 15.14 | | $ | 14.27 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.38 | | | 0.76 | | | 0.83 | | | 0.34 | | | 0.79 | 3 | | 0.93 | | | 0.95 | |

Net realized and unrealized gains or losses on investments | | | (2.84 | ) | | (1.05 | ) | | 0.25 | | | (0.26 | ) | | (0.41 | ) | | 0.02 | | | 0.91 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (2.46 | ) | | (0.29 | ) | | 1.08 | | | 0.08 | | | 0.38 | | | 0.95 | | | 1.86 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.38 | ) | | (0.55 | ) | | (0.87 | ) | | (0.36 | ) | | (0.86 | ) | | (0.95 | ) | | (0.99 | ) |

Tax basis return of capital | | | 0 | | | (0.21 | ) | | (0.01 | ) | | 0 | | | (0.13 | )4 | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | (0.38 | ) | | (0.76 | ) | | (0.88 | ) | | (0.36 | ) | | (0.99 | ) | | (0.95 | ) | | (0.99 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 10.56 | | $ | 13.40 | | $ | 14.45 | | $ | 14.25 | | $ | 14.53 | | $ | 15.14 | | $ | 15.14 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return | | | (18.73 | )% | | (2.13 | )% | | 7.78 | % | | 0.55 | % | | 2.82 | % | | 6.47 | % | | 13.43 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 35,228 | | $ | 47,668 | | $ | 56,478 | | $ | 61,711 | | $ | 65,893 | | $ | 97,235 | | $ | 97,277 | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 0.67 | %5 | | 0.67 | % | | 0.67 | % | | 0.67 | %5 | | 0.79 | % | | 0.94 | % | | 0.91 | % |

Expenses excluding waivers/reimbursements and expense reductions | | | 0.93 | %5 | | 0.85 | % | | 0.85 | % | | 0.89 | %5 | | 0.88 | % | | 0.97 | % | | 0.94 | % |

Net investment income (loss) | | | 6.09 | %5 | | 5.48 | % | | 5.91 | % | | 5.72 | %5 | | 5.50 | % | | 6.10 | % | | 6.43 | % |

Portfolio turnover rate | | | 96 | %6 | | 374 | %6 | | 70 | % | | 30 | % | | 55 | % | | 23 | % | | 45 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | For the five months ended April 30, 2006. The Fund changed its fiscal year end from November 30 to April 30, effective April 30, 2006. |

2 | Effective at the close of business on May 20, 2005, the Fund acquired the net assets of Vestaur Securities Fund. Vestaur Securities Fund became the accounting and performance survivor in this transaction. The financial highlights for the periods prior to May 23, 2005 are those of Vestaur Securities Fund. The per share information has been restated to give effect to this transaction. Total return performance reflects the total return of Vestaur Securities Fund based on its net asset value. |

3 | Net investment income (loss) per share is based on average shares outstanding during the period. |

4 | Return of capital relates to former Vestaur Securities Fund shareholders and is based on average shares outstanding from December 1, 2004 through May 20, 2005. |

6 | Portfolio turnover rate includes mortgage dollar roll activity. |

See Notes to Financial Statements

10

SCHEDULE OF INVESTMENTS

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

AGENCY COMMERCIAL MORTGAGE-BACKED SECURITIES 1.8% | | | | | | | |

FIXED-RATE 1.8% | | | | | | | |

FHLMC, Ser. M009, Class A, 5.40%, 10/15/2021 ## (cost $3,112,998) | | $ | 3,109,888 | | $ | 3,212,763 | |

| | | | |

|

| |

AGENCY MORTGAGE-BACKED COLLATERALIZED MORTGAGE OBLIGATIONS 4.3% | | | | | | | |

FIXED-RATE 4.3% | | | | | | | |

FHLMC: | | | | | | | |

Ser. 2594, Class QE, 5.00%, 08/15/2031 | | | 2,395,000 | | | 2,328,003 | |

Ser. 2647, Class PC, 5.00%, 11/15/2031 | | | 2,500,000 | | | 2,426,008 | |

FNMA: | | | | | | | |

Ser. 2002-T12, Class A3, 7.50%, 05/25/2042 | | | 16,443 | | | 17,375 | |

Ser. 2003-129, Class PW, 4.50%, 07/25/2033 | | | 2,800,000 | | | 2,802,648 | |

Ser. 2003-W4, Class 4A, 7.50%, 10/25/2042 | | | 168,706 | | | 174,854 | |

| | | | |

|

| |

Total Agency Mortgage-Backed Collateralized Mortgage Obligations (cost $7,572,671) | | | | | | 7,748,888 | |

| | | | |

|

| |

AGENCY MORTGAGE-BACKED PASS THROUGH SECURITIES 20.9% | | | | | | | |

FIXED-RATE 20.9% | | | | | | | |

FHLMC: | | | | | | | |

5.00%, 09/15/2028 | | | 210,000 | | | 208,502 | |

6.50%, 09/25/2043 | | | 100,264 | | | 105,138 | |

7.50%, 09/01/2013-08/25/2042 | | | 140,884 | | | 146,840 | |

9.00%, 12/01/2016 | | | 107,494 | | | 116,051 | |

9.50%, 12/01/2022 | | | 16,140 | | | 17,824 | |

FHLMC 30 year: | | | | | | | |

5.00%, TBA # | | | 11,475,000 | | | 10,860,009 | |

5.50%, TBA # | | | 5,430,000 | | | 5,296,797 | |

FNMA: | | | | | | | |

5.69%, 11/01/2011 | | | 5,052,449 | | | 5,201,951 | |

6.27%, 02/01/2011 ## | | | 3,306,397 | | | 3,401,240 | |

6.45%, 09/01/2016 | | | 1,726,933 | | | 1,761,972 | |

7.87%, 07/01/2026 | | | 2,972,506 | | | 3,274,132 | |

9.00%, 02/01/2025-09/01/2030 | | | 160,609 | | | 175,617 | |

10.00%, 09/01/2010-04/01/2021 | | | 77,241 | | | 87,857 | |

FNMA 15 year: | | | | | | | |

4.50%, TBA # | | | 3,705,000 | | | 3,526,697 | |

5.00%, TBA # | | | 620,000 | | | 606,147 | |

5.50%, TBA # | | | 2,940,000 | | | 2,931,271 | |

GNMA: | | | | | | | |

8.00%, 03/15/2022-08/15/2024 | | | 56,979 | | | 61,061 | |

8.25%, 05/15/2020 | | | 53,287 | | | 57,147 | |

8.50%, 09/15/2024-01/15/2027 | | | 27,275 | | | 29,318 | |

9.00%, 12/15/2019 | | | 56,877 | | | 61,968 | |

9.50%, 09/15/2019 | | | 9,970 | | | 11,015 | |

10.00%, 01/15/2019-03/15/2020 | | | 28,552 | | | 33,043 | |

| | | | |

|

| |

Total Agency Mortgage-Backed Pass Through Securities (cost $38,428,670) | | | | | | 37,971,597 | |

| | | | |

|

| |

See Notes to Financial Statements

11

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

AGENCY REPERFORMING MORTGAGE-BACKED COLLATERALIZED MORTGAGE OBLIGATIONS 0.8% | | | | | | | |

| | | | | | | |

FIXED-RATE 0.8% | | | | | | | |

FNMA: | | | | | | | |

Ser. 2003-W02, Class 2A9, 5.90%, 07/25/2042 | | $ | 149,800 | | $ | 148,801 | |

Ser. 2003-W12, Class 1A8, 4.55%, 06/25/2043 | | | 1,353,473 | | | 1,250,445 | |

| | | | |

|

| |

Total Agency Reperforming Mortgage-Backed Collateralized Mortgage Obligations

(cost $1,427,947) | | | | | | 1,399,246 | |

| | | | |

|

| |

ASSET-BACKED SECURITIES 2.0% | | | | | | | |

Acacia CDO, Ltd.: | | | | | | | |

Ser. 05A, Class E, FRN, 5.60%, 11/08/2039 144A o | | | 3,000,000 | | | 225,000 | |

Ser. 10A, Class C, FRN, 4.12%, 09/07/2046 144A | | | 1,021,393 | | | 17,180 | |

C-Bass, Ltd., Ser. 13A, Class D, FRN, 5.17%, 03/17/2040 144A | | | 1,735,000 | | | 61,246 | |

Deutsche Alt-A Securities, Inc., Mtge. Loan Trust, Ser. 2006-AB2, Class A3, 6.27%, 06/25/2036 | | | 1,500,000 | | | 761,110 | |

Deutsche Alt-A Securities, NIM, Ser. 2007-0A1, Class N1, 6.50%, 02/25/2047 144A o | | | 138,736 | | | 2,775 | |

GSAA Home Equity Trust, Ser. 2007-5, Class 1AV1, FRN, 3.36%, 03/25/2047 | | | 48,466 | | | 40,943 | |

MASTR Asset Backed Securities Trust, Ser. 2005-AB1, Class A4, 5.65%, 10/25/2032 | | | 2,500,000 | | | 1,390,235 | |

Nautilus RMBS CDO, Ltd., Ser. 2005-1A, Class A3, FRN, 5.83%, 07/07/2040 144A o | | | 2,560,890 | | | 385,414 | |

Nomura Asset Acceptance Corp., Ser. 2006-AP1, Class A2, 5.52%, 01/25/2036 | | | 1,078,000 | | | 820,311 | |

| | | | |

|

| |

Total Asset-Backed Securities (cost $9,014,951) | | | | | | 3,704,214 | |

| | | | |

|

| |

COMMERCIAL MORTGAGE-BACKED SECURITIES 14.5% | | | | | | | |

FIXED-RATE 12.3% | | | | | | | |

American Home Mtge. Investment Trust: | | | | | | | |

Ser. 2005-2, Class LV-A, 5.66%, 08/25/2035 | | | 726,492 | | | 464,153 | |

Ser. 2005-2, Class 5A4C, 5.41%, 09/25/2035 | | | 1,000,000 | | | 454,700 | |

Banc of America Comml. Mtge., Inc.: | | | | | | | |

Ser. 2000-2, Class F, 7.92%, 09/15/2032 | | | 3,000,000 | | | 2,849,082 | |

Ser. 2003-7, Class B6, 4.75%, 09/25/2018 | | | 218,067 | | | 103,632 | |

Ser. 2007-04, Class A4, 5.74%, 02/10/2051 | | | 50,000 | | | 37,686 | |

Citigroup Comml. Mtge. Trust, Ser. 2007-C6, Class C, 5.70%, 07/10/2017 | | | 855,000 | | | 395,340 | |

Commercial Mtge. Pass-Through Cert., Ser. 2007-C9, Class B, 5.82%, 12/10/2049 | | | 910,000 | | | 436,531 | |

Crown Castle Towers, LLC, Ser. 2006-1A, Class C, 5.47%, 11/15/2036 144A | | | 1,920,000 | | | 1,428,538 | |

GE Capital Comml. Mtge. Corp., Ser. 2007-C1, Class C, 5.70%, 12/10/2049 | | | 2,500,000 | | | 1,172,479 | |

Goldman Sachs Mtge. Securities Corp., Ser. 2007-GG10, Class A2, 5.78%, 08/10/2045 | | | 3,665,000 | | | 3,203,530 | |

Greenwich Capital Comml. Funding Corp.: | | | | | | | |

Ser. 2004-GG1, Class A7, 5.32%, 06/10/2036 | | | 4,000,000 | | | 3,445,758 | |

Ser. 2007-GG11, Class AM, 5.87%, 08/10/2017 | | | 80,000 | | | 48,721 | |

GS Mtge. Securities Corp., Ser. 2007-GG10, Class AM, 5.80%, 08/10/2045 | | | 2,700,000 | | | 1,666,762 | |

See Notes to Financial Statements

12

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

COMMERCIAL MORTGAGE-BACKED SECURITIES continued | | | | | | | |

FIXED-RATE continued | | | | | | | |

JPMorgan Chase & Co. Comml. Mtge. Securities Corp.: | | | | | | | |

Ser. 2004-CB9, Class A1, 3.48%, 06/12/2041 | | $ | 2,384,935 | | $ | 2,337,962 | |

Ser. 2006-LDP8, Class B, 5.52%, 05/15/2045 | | | 1,000,000 | | | 536,287 | |

Ser. 2007-LD12, Class A2, 5.83%, 02/15/2051 | | | 3,045,000 | | | 2,721,373 | |

Morgan Stanley Capital I, Inc., Ser. 2001-TOP5, Class G, 6.00%, 10/15/2035 144A | | | 1,042,000 | | | 692,993 | |

Prima Capital Securitization, Ltd., Ser. 2006, Class D, 5.88%, 12/28/2048 | | | 1,085,000 | | | 451,393 | |

| | | | |

|

| |

| | | | | | 22,446,920 | |

| | | | |

|

| |

FLOATING-RATE 2.2% | | | | | | | |

Capmark, Ltd., Ser. 2006-7A, Class B, 4.93%, 08/20/2036 144A | | | 500,000 | | | 230,015 | |

Citigroup Comml. Mtge. Trust, Ser. 2006-C4, Class AJ, 5.72%, 03/15/2049 | | | 450,000 | | | 278,874 | |

Credit Suisse Mtge. Capital Cert., Ser. 2006-C1, Class AM, 5.55%, 02/15/2039 | | | 2,835,000 | | | 1,856,235 | |

JPMorgan Chase & Co. Comml. Mtge. Securities Corp., Ser. 2007-CB19, Class A4, 5.75%, 02/12/2049 | | | 2,105,000 | | | 1,585,471 | |

MASTR Reperforming Loan Trust, Ser. 2006-2, Class B3, 5.88%, 05/25/2036 144A | | | 421,503 | | | 45,248 | |

| | | | |

|

| |

| | | | | | 3,995,843 | |

| | | | |

|

| |

Total Commercial Mortgage-Backed Securities (cost $36,056,867) | | | | | | 26,442,763 | |

| | | | |

|

| |

CORPORATE BONDS 26.6% | | | | | | | |

CONSUMER DISCRETIONARY 2.7% | | | | | | | |

Auto Components 0.1% | | | | | | | |

Cooper Standard Automotive, Inc., 7.00%, 12/15/2012 | | | 10,000 | | | 6,350 | |

Cooper Tire & Rubber Co., 7.625%, 03/15/2027 | | | 110,000 | | | 55,550 | |

Goodyear Tire & Rubber Co., 9.00%, 07/01/2015 | | | 60,000 | | | 48,000 | |

| | | | |

|

| |

| | | | | | 109,900 | |

| | | | |

|

| |

Automobiles 0.0% | | | | | | | |

Ford Motor Co., 7.875%, 06/15/2010 | | | 25,000 | | | 16,802 | |

General Motors Corp., 6.75%, 12/01/2014 | | | 15,000 | | | 7,583 | |

| | | | |

|

| |

| | | | | | 24,385 | |

| | | | |

|

| |

Diversified Consumer Services 0.0% | | | | | | | |

Carriage Services, Inc., 7.875%, 01/15/2015 | | | 35,000 | | | 29,400 | |

Sotheby’s, 7.75%, 06/15/2015 144A | | | 20,000 | | | 13,029 | |

| | | | |

|

| |

| | | | | | 42,429 | |

| | | | |

|

| |

Hotels, Restaurants & Leisure 0.2% | | | | | | | |

Boyd Gaming Corp., 7.75%, 12/15/2012 | | | 5,000 | | | 4,125 | |

Caesars Entertainment, Inc.: | | | | | | | |

7.875%, 03/15/2010 | | | 70,000 | | | 39,900 | |

8.125%, 05/15/2011 | | | 20,000 | | | 7,200 | |

Inn of the Mountain Gods Resort & Casino, 12.00%, 11/15/2010 | | | 35,000 | | | 15,575 | |

Isle of Capri Casinos, Inc., 7.00%, 03/01/2014 | | | 110,000 | | | 53,900 | |

MGM MIRAGE, 8.50%, 09/15/2010 | | | 15,000 | | | 10,463 | |

See Notes to Financial Statements

13

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

CONSUMER DISCRETIONARY continued | | | | | | | |

Hotels, Restaurants & Leisure continued | | | | | | | |

Pokagon Gaming Authority, 10.375%, 06/15/2014 144A | | $ | 59,000 | | $ | 53,985 | |

Seneca Gaming Corp., 7.25%, 05/01/2012 | | | 50,000 | | | 33,750 | |

Shingle Springs Tribal Gaming Authority, 9.375%, 06/15/2015 144A | | | 80,000 | | | 39,600 | |

Universal City Development Partners, Ltd., 11.75%, 04/01/2010 | | | 50,000 | | | 40,125 | |

| | | | |

|

| |

| | | | | | 298,623 | |

| | | | |

|

| |

Household Durables 0.2% | | | | | | | |

Centex Corp., 5.80%, 09/15/2009 | | | 65,000 | | | 58,175 | |

D.R. Horton, Inc.: | | | | | | | |

4.875%, 01/15/2010 | | | 25,000 | | | 21,563 | |

8.00%, 02/01/2009 | | | 50,000 | | | 48,500 | |

9.75%, 09/15/2010 | | | 65,000 | | | 61,262 | |

Hovnanian Enterprises, Inc.: | | | | | | | |

6.00%, 01/15/2010 | | | 20,000 | | | 15,900 | |

6.50%, 01/15/2014 | | | 15,000 | | | 4,575 | |

11.50%, 05/01/2013 144A | | | 5,000 | | | 4,075 | |

Lennar Corp.: | | | | | | | |

5.125%, 10/01/2010 | | | 90,000 | | | 68,850 | |

7.625%, 03/01/2009 | | | 25,000 | | | 23,000 | |

Libbey, Inc., FRN, 9.93%, 06/01/2011 | | | 80,000 | | | 52,000 | |

Meritage Homes Corp., 7.00%, 05/01/2014 | | | 45,000 | | | 27,675 | |

Pulte Homes, Inc.: | | | | | | | |

7.875%, 08/01/2011 | | | 5,000 | | | 4,263 | |

8.125%, 03/01/2011 | | | 15,000 | | | 13,125 | |

| | | | |

|

| |

| | | | | | 402,963 | |

| | | | |

|

| |

Internet & Catalog Retail 0.0% | | | | | | | |

Ticketmaster Entertainment, Inc., 10.75%, 08/01/2016 144A | | | 20,000 | | | 16,900 | |

| | | | |

|

| |

Media 0.7% | | | | | | | |

Charter Communications, Inc.: | | | | | | | |

8.00%, 04/30/2012 144A | | | 20,000 | | | 15,500 | |

10.875%, 09/15/2014 144A | | | 195,000 | | | 159,412 | |

CSC Holdings, Inc., 7.625%, 04/01/2011 | | | 55,000 | | | 50,875 | |

Idearc, Inc., 8.00%, 11/15/2016 | | | 155,000 | | | 22,281 | |

Lamar Media Corp.: | | | | | | | |

6.625%, 08/15/2015 | | | 5,000 | | | 3,700 | |

7.25%, 01/01/2013 | | | 10,000 | | | 7,900 | |

Mediacom, LLC, 7.875%, 02/15/2011 | | | 25,000 | | | 21,375 | |

R.H. Donnelley Corp., 11.75%, 05/15/2015 144A | | | 85,000 | | | 33,575 | |

Sinclair Broadcast Group, Inc., 8.00%, 03/15/2012 | | | 40,000 | | | 33,100 | |

Time Warner, Inc., 7.625%, 04/15/2031 | | | 1,100,000 | | | 881,625 | |

| | | | |

|

| |

| | | | | | 1,229,343 | |

| | | | |

|

| |

See Notes to Financial Statements

14

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

CONSUMER DISCRETIONARY continued | | | | | | | |

Multiline Retail 0.8% | | | | | | | |

Kohl’s Corp., 6.875%, 12/15/2037 | | $ | 575,000 | | $ | 391,899 | |

Macy’s, Inc.: | | | | | | | |

6.375%, 03/15/2037 | | | 700,000 | | | 357,307 | |

7.45%, 09/15/2011 | | | 500,000 | | | 409,537 | |

7.875%, 07/15/2015 | | | 20,000 | | | 15,071 | |

Neiman Marcus Group, Inc., 9.00%, 10/15/2015 | | | 35,000 | | | 24,150 | |

Target Corp., 6.50%, 10/15/2037 | | | 450,000 | | | 324,750 | |

| | | | |

|

| |

| | | | | | 1,522,714 | |

| | | | |

|

| |

Specialty Retail 0.6% | | | | | | | |

American Achievement Corp., 8.25%, 04/01/2012 144A | | | 125,000 | | | 125,312 | |

Best Buy Co., Inc., 6.75%, 07/15/2013 144A | | | 15,000 | | | 14,138 | |

Home Depot, Inc., 5.875%, 12/16/2036 | | | 1,530,000 | | | 917,425 | |

Payless ShoeSource, Inc., 8.25%, 08/01/2013 | | | 25,000 | | | 18,875 | |

| | | | |

|

| |

| | | | | | 1,075,750 | |

| | | | |

|

| |

Textiles, Apparel & Luxury Goods 0.1% | | | | | | | |

Oxford Industries, Inc., 8.875%, 06/01/2011 | | | 225,000 | | | 185,625 | |

| | | | |

|

| |

CONSUMER STAPLES 0.1% | | | | | | | |

Food & Staples Retailing 0.0% | | | | | | | |

Rite Aid Corp., 10.375%, 07/15/2016 | | | 5,000 | | | 3,500 | |

| | | | |

|

| |

Food Products 0.1% | | | | | | | |

Del Monte Foods Co.: | | | | | | | |

6.75%, 02/15/2015 | | | 15,000 | | | 12,450 | |

8.625%, 12/15/2012 | | | 70,000 | | | 63,700 | |

Pilgrim’s Pride Corp., 7.625%, 05/01/2015 | | | 45,000 | | | 15,525 | |

Tyson Foods, Inc., 7.35%, 04/01/2016 | | | 30,000 | | | 22,371 | |

| | | | |

|

| |

| | | | | | 114,046 | |

| | | | |

|

| |

Personal Products 0.0% | | | | | | | |

Central Garden & Pet Co., 9.125%, 02/01/2013 | | | 10,000 | | | 6,150 | |

| | | | |

|

| |

ENERGY 2.4% | | | | | | | |

Energy Equipment & Services 0.2% | | | | | | | |

Bristow Group, Inc., 7.50%, 09/15/2017 | | | 50,000 | | | 37,750 | |

GulfMark Offshore, Inc., 7.75%, 07/15/2014 | | | 55,000 | | | 40,975 | |

Hornbeck Offshore Services, Inc., Ser. B, 6.125%, 12/01/2014 | | | 140,000 | | | 103,600 | |

Parker Drilling Co., 9.625%, 10/01/2013 | | | 83,000 | | | 69,720 | |

PHI, Inc., 7.125%, 04/15/2013 | | | 125,000 | | | 92,500 | |

| | | | |

|

| |

| | | | | | 344,545 | |

| | | | |

|

| |

See Notes to Financial Statements

15

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

ENERGY continued | | | | | | | |

Oil, Gas & Consumable Fuels 2.2% | | | | | | | |

Chesapeake Energy Corp., 6.875%, 01/15/2016 | | $ | 220,000 | | $ | 177,650 | |

El Paso Corp.: | | | | | | | |

7.25%, 06/01/2018 | | | 20,000 | | | 15,100 | |

7.42%, 02/15/2037 | | | 60,000 | | | 39,362 | |

EnCana Corp., 6.625%, 08/15/2037 | | | 1,225,000 | | | 867,851 | |

Encore Acquisition Co.: | | | | | | | |

6.00%, 07/15/2015 | | | 65,000 | | | 42,900 | |

6.25%, 04/15/2014 | | | 30,000 | | | 21,300 | |

Exco Resources, Inc., 7.25%, 01/15/2011 | | | 105,000 | | | 85,575 | |

Ferrellgas Partners, LP, 6.75%, 05/01/2014 144A | | | 70,000 | | | 50,050 | |

Forest Oil Corp.: | | | | | | | |

7.25%, 06/15/2019 144A | | | 35,000 | | | 23,975 | |

7.25%, 06/15/2019 | | | 30,000 | | | 20,550 | |

Frontier Oil Corp., 6.625%, 10/01/2011 | | | 35,000 | | | 31,150 | |

Kinder Morgan Energy Partners, LP, 7.40%, 03/15/2031 | | | 1,125,000 | | | 857,665 | |

Newfield Exploration Co.: | | | | | | | |

6.625%, 04/15/2016 | | | 55,000 | | | 40,975 | |

7.125%, 05/15/2018 | | | 30,000 | | | 21,337 | |

Peabody Energy Corp.: | | | | | | | |

5.875%, 04/15/2016 | | | 155,000 | | | 120,125 | |

7.875%, 11/01/2026 | | | 25,000 | | | 19,688 | |

Petrohawk Energy Corp., 7.875%, 06/01/2015 144A | | | 130,000 | | | 88,725 | |

Plains Exploration & Production Co.: | | | | | | | |

7.625%, 06/01/2018 | | | 40,000 | | | 26,400 | |

7.75%, 06/15/2015 | | | 40,000 | | | 29,400 | |

Quicksilver Resources, Inc., 8.25%, 08/01/2015 | | | 35,000 | | | 24,500 | |

Sabine Pass LNG, LP, 7.25%, 11/30/2013 | | | 190,000 | | | 135,850 | |

SandRidge Energy, Inc., 8.00%, 06/01/2018 144A | | | 15,000 | | | 10,050 | |

Southwestern Energy Co., 7.50%, 02/01/2018 144A | | | 20,000 | | | 16,500 | |

Sunoco, Inc., 9.00%, 11/01/2024 | | | 500,000 | | | 453,697 | |

Tesoro Corp., 6.50%, 06/01/2017 | | | 145,000 | | | 97,875 | |

Williams Cos.: | | | | | | | |

7.125%, 09/01/2011 | | | 135,000 | | | 121,575 | |

8.125%, 03/15/2012 | | | 10,000 | | | 9,150 | |

XTO Energy, Inc., 6.75%, 08/01/2037 | | | 700,000 | | | 520,108 | |

| | | | |

|

| |

| | | | | | 3,969,083 | |

| | | | |

|

| |

FINANCIALS 15.6% | | | | | | | |

Capital Markets 5.1% | | | | | | | |

American Capital Strategies, Ltd., Ser. A, 5.92%, 09/01/2009 + o | | | 3,500,000 | | | 3,340,155 | |

E*TRADE Financial Corp.: | | | | | | | |

12.50%, 11/30/2017 144A | | | 50,000 | | | 44,250 | |

12.50%, 11/30/2017 | | | 5,000 | | | 4,525 | |

See Notes to Financial Statements

16

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

FINANCIALS continued | | | | | | | |

Capital Markets continued | | | | | | | |

Goldman Sachs Group, Inc.: | | | | | | | |

5.125%, 01/15/2015 | | $ | 5,000 | | $ | 4,155 | |

5.30%, 02/14/2012 | | | 1,200,000 | | | 1,090,820 | |

6.15%, 04/01/2018 | | | 104,000 | | | 86,298 | |

6.75%, 10/01/2037 | | | 1,000,000 | | | 652,839 | |

Lehman Brothers Holdings, Inc., 6.875%, 05/02/2018 • | | | 15,000 | | | 2,025 | |

Merrill Lynch & Co., Inc.: | | | | | | | |

6.05%, 08/15/2012 | | | 1,325,000 | | | 1,207,075 | |

7.75%, 05/14/2038 | | | 575,000 | | | 473,957 | |

Morgan Stanley: | | | | | | | |

5.625%, 01/09/2012 | | | 1,425,000 | | | 1,241,025 | |

5.95%, 12/28/2017 | | | 1,125,000 | | | 902,620 | |

6.625%, 04/01/2018 | | | 100,000 | | | 83,335 | |

FRN, 5.23%, 10/15/2015 | | | 15,000 | | | 9,897 | |

| | | | | |

| |

| | | | | | 9,142,976 | |

| | | | | |

| |

Commercial Banks 3.9% | | | | | | | |

BankAmerica Capital II, 8.00%, 12/15/2026 | | | 1,000,000 | | | 773,902 | |

FBOP Corp., 10.00%, 01/15/2009 144A | | | 4,000,000 | | | 4,027,040 | |

National City Corp., 5.80%, 06/07/2017 | | | 1,700,000 | | | 1,289,868 | |

SunTrust Banks, Inc., 6.00%, 09/11/2017 | | | 1,300,000 | | | 1,079,356 | |

| | | | | |

| |

| | | | | | 7,170,166 | |

| | | | | |

| |

Consumer Finance 2.2% | | | | | | | |

American Express Credit Co., 7.30%, 08/20/2013 | | | 55,000 | | | 48,594 | |

American Water Capital Corp., 6.09%, 10/15/2017 | | | 850,000 | | | 658,081 | |

Daimler Financial Services AG, 4.875%, 06/15/2010 | | | 100,000 | | | 85,975 | |

Ford Motor Credit Co., LLC: | | | | | | | |

5.70%, 01/15/2010 | | | 345,000 | | | 256,157 | |

5.80%, 01/12/2009 | | | 80,000 | | | 74,177 | |

9.75%, 09/15/2010 | | | 75,000 | | | 51,022 | |

General Electric Capital Corp.: | | | | | | | |

5.625%, 05/01/2018 | | | 40,000 | | | 32,987 | |

5.875%, 01/14/2038 | | | 85,000 | | | 60,806 | |

6.15%, 08/07/2037 | | | 20,000 | | | 14,747 | |

General Motors Acceptance Corp., LLC: | | | | | | | |

5.85%, 01/14/2009 | | | 50,000 | | | 46,463 | |

6.875%, 09/15/2011 | | | 250,000 | | | 146,495 | |

6.875%, 08/28/2012 | | | 200,000 | | | 109,539 | |

7.75%, 01/19/2010 | | | 85,000 | | | 63,681 | |

8.00%, 11/01/2031 | | | 190,000 | | | 86,270 | |

FRN, 4.05%, 05/15/2009 | | | 190,000 | | | 165,589 | |

See Notes to Financial Statements

17

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

FINANCIALS continued | | | | | | | |

Consumer Finance continued | | | | | | | |

International Lease Finance Corp.: | | | | | | | |

4.375%, 11/01/2009 | | $ | 10,000 | | $ | 8,411 | |

4.75%, 07/01/2009 | | | 10,000 | | | 8,825 | |

4.75%, 01/13/2012 | | | 10,000 | | | 6,563 | |

4.875%, 09/01/2010 | | | 40,000 | | | 28,021 | |

5.125%, 11/01/2010 | | | 15,000 | | | 10,329 | |

5.75%, 06/15/2011 | | | 17,000 | | | 11,655 | |

6.375%, 03/15/2009 | | | 13,000 | | | 11,848 | |

MBNA Corp., Ser. A, 8.28%, 12/01/2026 | | | 1,750,000 | | | 1,373,377 | |

Sprint Capital Corp., 6.875%, 11/15/2028 | | | 1,180,000 | | | 691,689 | |

| | | | | |

| |

| | | | | | 4,051,301 | |

| | | | | |

| |

Diversified Financial Services 0.8% | | | | | | | |

Citigroup, Inc.: | | | | | | | |

5.50%, 08/27/2012 | | | 650,000 | | | 602,010 | |

6.50%, 08/19/2013 | | | 50,000 | | | 47,446 | |

JPMorgan Chase & Co., 6.40%, 05/15/2038 | | | 750,000 | | | 645,812 | |

Leucadia National Corp.: | | | | | | | |

7.125%, 03/15/2017 | | | 15,000 | | | 12,900 | |

8.125%, 09/15/2015 | | | 190,000 | | | 169,100 | |

| | | | | |

| |

| | | | | | 1,477,268 | |

| | | | | |

| |

Insurance 0.5% | | | | | | | |

Prudential Financial, Inc., 6.10%, 06/15/2017 | | | 1,200,000 | | | 964,348 | |

| | | | | |

| |

Real Estate Investment Trusts (REITs) 3.0% | | | | | | | |

BRE Properties, Inc., 5.50%, 03/15/2017 | | | 1,200,000 | | | 796,801 | |

Camden Property Trust, 5.00%, 06/15/2015 | | | 3,500,000 | | | 2,466,867 | |

Colonial Realty, Ltd., 6.25%, 06/15/2014 | | | 1,370,000 | | | 1,220,597 | |

ERP Operating, LP, 5.75%, 06/15/2017 | | | 1,000,000 | | | 682,494 | |

Host Marriott Corp.: | | | | | | | |

7.125%, 11/01/2013 | | | 110,000 | | | 86,900 | |

Ser. Q, 6.75%, 06/01/2016 | | | 120,000 | | | 87,600 | |

Omega Healthcare Investors, Inc.: | | | | | | | |

7.00%, 04/01/2014 | | | 65,000 | | | 54,275 | |

7.00%, 01/15/2016 | | | 105,000 | | | 83,738 | |

Ventas, Inc., 7.125%, 06/01/2015 | | | 45,000 | | | 39,150 | |

| | | | | |

| |

| | | | | | 5,518,422 | |

| | | | | |

| |

Thrifts & Mortgage Finance 0.1% | | | | | | | |

Residential Capital, LLC: | | | | | | | |

8.50%, 05/15/2010 144A | | | 30,000 | | | 14,700 | |

9.625%, 05/15/2015 144A | | | 92,000 | | | 23,460 | |

See Notes to Financial Statements

18

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

FINANCIALS continued | | | | | | | |

Thrifts & Mortgage Finance continued | | | | | | | |

Residential Capital, LLC: | | | | | | | |

Step Bond: | | | | | | | |

8.125%, 11/21/2008 †† | | $ | 25,000 | | $ | 23,250 | |

8.375%, 06/30/2010 †† | | | 195,000 | | | 42,900 | |

| | | | | |

| |

| | | | | | 104,310 | |

| | | | | |

| |

HEALTH CARE 1.8% | | | | | | | |

Biotechnology 0.7% | | | | | | | |

Amgen, Inc., 6.375%, 06/01/2037 | | | 1,500,000 | | | 1,215,582 | |

| | | | | |

| |

Health Care Providers & Services 1.1% | | | | | | | |

HCA, Inc., 9.25%, 11/15/2016 | | | 295,000 | | | 251,487 | |

Humana, Inc., 7.20%, 06/15/2018 | | | 65,000 | | | 52,015 | |

Omnicare, Inc., 6.125%, 06/01/2013 | | | 165,000 | | | 136,125 | |

UnitedHealth Group, Inc., 5.375%, 03/15/2016 | | | 1,000,000 | | | 754,557 | |

WellPoint, Inc., 6.375%, 06/15/2037 | | | 1,300,000 | | | 932,584 | |

| | | | | |

| |

| | | | | | 2,126,768 | |

| | | | | |

| |

INDUSTRIALS 0.8% | | | | | | | |

Aerospace & Defense 0.4% | | | | | | | |

Alliant Techsystems, Inc., 6.75%, 04/01/2016 | | | 45,000 | | | 37,350 | |

DRS Technologies, Inc.: | | | | | | | |

6.625%, 02/01/2016 | | | 65,000 | | | 64,675 | |

7.625%, 02/01/2018 | | | 10,000 | | | 9,950 | |

L-3 Communications Holdings, Inc.: | | | | | | | |

5.875%, 01/15/2015 | | | 560,000 | | | 462,000 | |

6.375%, 10/15/2015 | | | 185,000 | | | 154,475 | |

| | | | | |

| |

| | | | | | 728,450 | |

| | | | | |

| |

Building Products 0.0% | | | | | | | |

Ply Gem Industries, Inc., 11.75%, 06/15/2013 144A | | | 20,000 | | | 13,300 | |

| | | | | |

| |

Commercial Services & Supplies 0.2% | | | | | | | |

Browning-Ferris Industries, Inc.: | | | | | | | |

7.40%, 09/15/2035 | | | 105,000 | | | 79,275 | |

9.25%, 05/01/2021 | | | 95,000 | | | 89,775 | |

Corrections Corporation of America, 6.75%, 01/31/2014 | | | 5,000 | | | 4,350 | |

Geo Group, Inc., 8.25%, 07/15/2013 | | | 5,000 | | | 4,400 | |

Mobile Mini, Inc., 6.875%, 05/01/2015 | | | 70,000 | | | 50,750 | |

Toll Corp.: | | | | | | | |

8.25%, 02/01/2011 | | | 125,000 | | | 108,750 | |

8.25%, 12/01/2011 | | | 5,000 | | | 4,275 | |

| | | | | |

| |

| | | | | | 341,575 | |

| | | | | |

| |

Machinery 0.1% | | | | | | | |

Commercial Vehicle Group, Inc., 8.00%, 07/01/2013 | | | 260,000 | | | 167,700 | |

| | | | | |

| |

See Notes to Financial Statements

19

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

INDUSTRIALS continued | | | | | | | |

Road & Rail 0.1% | | | | | | | |

CSX Corp., 8.375%, 10/15/2014 | | $ | 45,000 | | $ | 45,221 | |

Kansas City Southern, 7.50%, 06/15/2009 | | | 50,000 | | | 48,250 | |

| | | | |

|

| |

| | | | | | 93,471 | |

| | | | |

|

| |

Trading Companies & Distributors 0.0% | | | | | | | |

United Rentals, Inc., 6.50%, 02/15/2012 | | | 50,000 | | | 35,250 | |

| | | | |

|

| |

INFORMATION TECHNOLOGY 0.3% | | | | | | | |

Communications Equipment 0.0% | | | | | | | |

EchoStar Corp.: | | | | | | | |

6.625%, 10/01/2014 | | | 25,000 | | | 20,125 | |

7.125%, 02/01/2016 | | | 10,000 | | | 8,075 | |

7.75%, 05/31/2015 | | | 25,000 | | | 20,437 | |

| | | | |

|

| |

| | | | | | 48,637 | |

| | | | |

|

| |

Electronic Equipment & Instruments 0.2% | | | | | | | |

Da-Lite Screen Co., Inc., 9.50%, 05/15/2011 | | | 50,000 | | | 44,750 | |

Jabil Circuit, Inc., 8.25%, 03/15/2018 | | | 270,000 | | | 206,550 | |

Sanmina-SCI Corp., 8.125%, 03/01/2016 | | | 5,000 | | | 3,175 | |

| | | | |

|

| |

| | | | | | 254,475 | |

| | | | |

|

| |

IT Services 0.1% | | | | | | | |

First Data, 9.875%, 09/24/2015 | | | 5,000 | | | 3,225 | |

Lender Processing Services, Inc., 8.125%, 07/01/2016 | | | 40,000 | | | 34,400 | |

SunGard Data Systems, Inc., 4.875%, 01/15/2014 | | | 135,000 | | | 104,625 | |

Unisys Corp., 6.875%, 03/15/2010 | | | 55,000 | | | 42,694 | |

| | | | |

|

| |

| | | | | | 184,944 | |

| | | | |

|

| |

Semiconductors & Semiconductor Equipment 0.0% | | | | | | | |

Spansion, Inc., FRN, 5.94%, 06/01/2013 144A | | | 120,000 | | | 26,400 | |

| | | | |

|

| |

MATERIALS 0.6% | | | | | | | |

Chemicals 0.2% | | | | | | | |

ARCO Chemical Co.: | | | | | | | |

9.80%, 02/01/2020 | | | 120,000 | | | 57,000 | |

10.25%, 11/01/2010 | | | 10,000 | | | 9,350 | |

Huntsman, LLC: | | | | | | | |

7.375%, 01/01/2015 | | | 15,000 | | | 13,125 | |

11.625%, 10/15/2010 | | | 85,000 | | | 84,362 | |

Koppers Holdings, Inc.: | | | | | | | |

9.875%, 10/15/2013 | | | 10,000 | | | 9,050 | |

Sr. Disc. Note, Step Bond, 0.00%, 11/15/2014 † | | | 95,000 | | | 76,475 | |

Millenium America, Inc., 7.625%, 11/15/2026 | | | 95,000 | | | 19,475 | |

Momentive Performance Materials, Inc.: | | | | | | | |

9.75%, 12/01/2014 | | | 5,000 | | | 2,825 | |

10.125%, 12/01/2014 | | | 120,000 | | | 58,200 | |

See Notes to Financial Statements

20

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

MATERIALS continued | | | | | | | |

Chemicals continued | | | | | | | |

Mosaic Co.: | | | | | | | |

7.30%, 01/15/2028 | | $ | 60,000 | | $ | 42,857 | |

7.625%, 12/01/2016 144A | | | 80,000 | | | 69,962 | |

Tronox Worldwide, LLC, 9.50%, 12/01/2012 | | | 95,000 | | | 21,375 | |

| | | | |

|

| |

| | | | | | 464,056 | |

| | | | |

|

| |

Construction Materials 0.1% | | | | | | | |

CPG International, Inc.: | | | | | | | |

10.50%, 07/01/2013 | | | 160,000 | | | 104,000 | |

FRN, 9.90%, 07/01/2012 | | | 35,000 | | | 22,575 | |

CRH America, Inc., 8.125%, 07/15/2018 | | | 25,000 | | | 20,575 | |

Texas Industries, Inc., 7.25%, 07/15/2013 144A | | | 25,000 | | | 19,750 | |

| | | | |

|

| |

| | | | | | 166,900 | |

| | | | |

|

| |

Containers & Packaging 0.1% | | | | | | | |

Berry Plastics Holdings Corp., 8.875%, 09/15/2014 | | | 23,000 | | | 12,075 | |

Exopack Holding Corp., 11.25%, 02/01/2014 | | | 135,000 | | | 104,625 | |

Graphic Packaging International, Inc., 8.50%, 08/15/2011 | | | 95,000 | | | 79,800 | |

Smurfit-Stone Container Corp., 8.375%, 07/01/2012 | | | 30,000 | | | 15,450 | |

| | | | |

|

| |

| | | | | | 211,950 | |

| | | | |

|

| |

Metals & Mining 0.1% | | | | | | | |

Freeport-McMoRan Copper & Gold, Inc.: | | | | | | | |

8.25%, 04/01/2015 | | | 25,000 | | | 20,023 | |

8.375%, 04/01/2017 | | | 140,000 | | | 110,052 | |

| | | | |

|

| |

| | | | | | 130,075 | |

| | | | |

|

| |

Paper & Forest Products 0.1% | | | | | | | |

Georgia Pacific Corp.: | | | | | | | |

8.125%, 05/15/2011 | | | 30,000 | | | 25,500 | |

8.875%, 05/15/2031 | | | 5,000 | | | 3,250 | |

International Paper Co., 7.95%, 06/15/2018 | | | 115,000 | | | 93,284 | |

Verso Paper Holdings, LLC, 9.125%, 08/01/2014 | | | 125,000 | | | 66,875 | |

| | | | |

|

| |

| | | | | | 188,909 | |

| | | | |

|

| |

TELECOMMUNICATION SERVICES 1.5% | | | | | | | |

Diversified Telecommunication Services 0.5% | | | | | | | |

Citizens Communications Co., 7.875%, 01/15/2027 | | | 50,000 | | | 25,250 | |

FairPoint Communications, Inc., 13.125%, 04/01/2018 144A | | | 15,000 | | | 10,650 | |

New Jersey Bell Telephone Co., 7.85%, 11/15/2029 | | | 750,000 | | | 639,279 | |

Qwest Corp.: | | | | | | | |

6.50%, 06/01/2017 | | | 50,000 | | | 36,000 | |

7.50%, 06/15/2023 | | | 35,000 | | | 22,750 | |

7.875%, 09/01/2011 | | | 130,000 | | | 113,425 | |

8.875%, 03/15/2012 | | | 65,000 | | | 57,200 | |

| | | | |

|

| |

| | | | | | 904,554 | |

| | | | |

|

| |

See Notes to Financial Statements

21

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

CORPORATE BONDS continued | | | | | | | |

TELECOMMUNICATION SERVICES continued | | | | | | | |

Wireless Telecommunication Services 1.0% | | | | | | | |

AT&T Wireless, 8.125%, 05/01/2012 | | $ | 1,600,000 | | $ | 1,587,232 | |

Centennial Communications Corp., 8.125%, 02/01/2014 | | | 100,000 | | | 86,000 | |

Cricket Communications, Inc., 9.375%, 11/01/2014 | | | 65,000 | | | 53,138 | |

Sprint Nextel Corp.: | | | | | | | |

6.90%, 05/01/2019 | | | 25,000 | | | 17,654 | |

Ser. D, 7.375%, 08/01/2015 | | | 130,000 | | | 71,537 | |

Ser. E, 6.875%, 10/31/2013 | | | 60,000 | | | 34,650 | |

| | | | |

|

| |

| | | | | | 1,850,211 | |

| | | | |

|

| |

UTILITIES 0.8% | | | | | | | |

Electric Utilities 0.8% | | | | | | | |

Allegheny Energy Supply Co., 8.25%, 04/15/2012 144A | | | 165,000 | | | 151,800 | |

Aquila, Inc., Step Bond, 11.875%, 07/01/2012 †† | | | 348,000 | | | 341,286 | |

CMS Energy Corp., 8.50%, 04/15/2011 | | | 15,000 | | | 14,389 | |

Edison Mission Energy, 7.00%, 05/15/2017 | | | 5,000 | | | 3,981 | |

Energy Future Holdings Corp.: | | | | | | | |

10.875%, 11/01/2017 144A | | | 105,000 | | | 81,375 | |

11.25%, 11/01/2017 144A | | | 60,000 | | | 37,800 | |

Mirant Mid-Atlantic, LLC, Ser. C, 10.06%, 12/30/2028 | | | 43,843 | | | 39,021 | |

Mirant North America, LLC, 7.375%, 12/31/2013 | | | 215,000 | | | 188,931 | |

NRG Energy, Inc., 7.375%, 02/01/2016 | | | 150,000 | | | 129,750 | |

Orion Power Holdings, Inc., 12.00%, 05/01/2010 | | | 205,000 | | | 198,850 | |

Public Service Company of New Mexico, 7.95%, 04/01/2015 | | | 20,000 | | | 16,343 | |

Reliant Energy, Inc.: | | | | | | | |

6.75%, 12/15/2014 | | | 210,000 | | | 184,013 | |

7.625%, 06/15/2014 | | | 20,000 | | | 15,500 | |

7.875%, 06/15/2017 | | | 5,000 | | | 3,850 | |

| | | | |

|

| |

| | | | | | 1,406,889 | |

| | | | |

|

| |

Independent Power Producers & Energy Traders 0.0% | | | | | | | |

AES Corp.: | | | | | | | |

8.00%, 10/15/2017 | | | 5,000 | | | 3,875 | |

8.00%, 06/01/2020 144A | | | 30,000 | | | 22,200 | |

| | | | |

|

| |

| | | | | | 26,075 | |

| | | | |

|

| |

Multi-Utilities 0.0% | | | | | | | |

PNM Resources, Inc., 9.25%, 05/15/2015 | | | 15,000 | | | 12,525 | |

| | | | |

|

| |

Total Corporate Bonds (cost $60,039,015) | | | | | | 48,373,443 | |

| | | | |

|

| |

FOREIGN BONDS – CORPORATE (PRINCIPAL AMOUNT DENOMINATED IN CURRENCY INDICATED) 2.4% | | | | | | | |

CONSUMER DISCRETIONARY 0.1% | | | | | | | |

Media 0.1% | | | | | | | |

Central European Media Enterprise, Ltd., 8.25%, 05/15/2012 EUR | | | 170,000 | | | 153,591 | |

| | | | |

|

| |

See Notes to Financial Statements

22

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

FOREIGN BONDS – CORPORATE (PRINCIPAL AMOUNT DENOMINATED IN CURRENCY INDICATED) continued | | | | | | | |

CONSUMER STAPLES 0.2% | | | | | | | |

Beverages 0.0% | | | | | | | |

Canandaigua Brands, Inc., 8.50%, 11/15/2009 GBP | | | 50,000 | | $ | 79,133 | |

| | | | |

|

| |

Food & Staples Retailing 0.2% | | | | | | | |

Carrefour SA, 3.625%, 05/06/2013 EUR | | | 250,000 | | | 290,549 | |

| | | | |

|

| |

FINANCIALS 1.6% | | | | | | | |

Capital Markets 0.1% | | | | | | | |

Ahold Finance USA, Inc., 6.50%, 03/14/2017 GBP | | | 65,000 | | | 94,737 | |

| | | | |

|

| |

Commercial Banks 0.6% | | | | | | | |

KfW Bankengruppe, 15.50%, 01/25/2010 TRY | | | 240,000 | | | 145,539 | |

Kreditanstalt fur Wiederaufbau: | | | | | | | |

5.25%, 01/12/2012 GBP | | | 65,000 | | | 106,935 | |

6.375%, 02/17/2015 NZD | | | 585,000 | | | 343,503 | |

Landwirtschaftliche Rentenbank: | | | | | | | |

4.375%, 11/27/2017 EUR | | | 150,000 | | | 188,143 | |

5.75%, 01/21/2015 AUD | | | 610,000 | | | 404,268 | |

| | | | |

|

| |

| | | | | | 1,188,388 | |

| | | | |

|

| |

Consumer Finance 0.5% | | | | | | | |

ABB International Finance, Ltd., 6.50%, 11/30/2011 EUR | | | 250,000 | | | 322,868 | |

BMW Finance Corp., 4.25%, 01/22/2014 EUR | | | 300,000 | | | 314,379 | |

Toyota Motor Credit Corp., 5.125%, 01/17/2012 GBP | | | 205,000 | | | 328,424 | |

Virgin Media Finance plc, 9.75%, 04/15/2014 GBP | | | 50,000 | | | 46,430 | |

| | | | |

|

| |

| | | | | | 1,012,101 | |

| | | | |

|

| |

Diversified Financial Services 0.3% | | | | | | | |

Dubai Holding Commercial Operations Group, LLC, 6.00%, 02/01/2017 GBP | | | 100,000 | | | 103,930 | |

European Investment Bank: | | | | | | | |

3.625%, 10/15/2013 EUR | | | 70,000 | | | 87,324 | |

6.00%, 07/15/2009 NZD | | | 450,000 | | | 261,835 | |

General Electric Capital Corp., 3.375%, 02/08/2012 EUR | | | 120,000 | | | 134,488 | |

| | | | |

|

| |

| | | | | | 587,577 | |

| | | | |

|

| |

Thrifts & Mortgage Finance 0.1% | | | | | | | |

Totalkredit, FRN, 5.68%, 01/01/2015 DKK | | | 596,874 | | | 99,801 | |

| | | | |

|

| |

INDUSTRIALS 0.1% | | | | | | | |

Aerospace & Defense 0.1% | | | | | | | |

Bombardier, Inc., 7.25%, 11/15/2016 EUR | | | 70,000 | | | 56,340 | |

| | | | |

|

| |

Machinery 0.0% | | | | | | | |

Savcio Holdings, Ltd., 8.00%, 02/15/2013 EUR | | | 50,000 | | | 49,230 | |

| | | | |

|

| |

MATERIALS 0.1% | | | | | | | |

Containers & Packaging 0.1% | | | | | | | |

Owens-Illinois European Group BV, 6.875%, 03/31/2017 EUR | | | 70,000 | | | 69,924 | |

| | | | |

|

| |

See Notes to Financial Statements

23

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

FOREIGN BONDS – CORPORATE (PRINCIPAL AMOUNT DENOMINATED IN CURRENCY INDICATED) continued | | | | | | | |

MATERIALS continued | | | | | | | |

Metals & Mining 0.0% | | | | | | | |

New World Resources NV, 7.375%, 05/15/2015 EUR | | | 60,000 | | $ | 44,283 | |

| | | | |

|

| |

TELECOMMUNICATION SERVICES 0.2% | | | | | | | |

Diversified Telecommunication Services 0.2% | | | | | | | |

France Telecom, 7.50%, 03/14/2011 GBP | | | 270,000 | | | 454,634 | |

| | | | |

|

| |

UTILITIES 0.1% | | | | | | | |

Multi-Utilities 0.1% | | | | | | | |

Veolia Environnement SA, 4.00%, 02/12/2016 EUR | | | 200,000 | | | 205,111 | |

| | | | |

|

| |

Total Foreign Bonds – Corporate (Principal Amount Denominated in Currency Indicated) (cost $5,561,654) | | | 4,385,399 | |

| | | | |

|

| |

FOREIGN BONDS – GOVERNMENT (PRINCIPAL AMOUNT DENOMINATED IN CURRENCY INDICATED) 5.4% | | | | | | | |

Australia: | | | | | | | |

6.00%, 05/01/2012 AUD | | | 400,000 | | | 270,136 | |

6.00%, 10/14/2015 AUD | | | 670,000 | | | 454,664 | |

6.00%, 02/15/2017 AUD | | | 300,000 | | | 212,140 | |

Brazil: | | | | | | | |

7.375%, 02/03/2015 EUR | | | 60,000 | | | 67,761 | |

10.25%, 01/10/2028 BRL | | | 350,000 | | | 113,531 | |

Canada, 4.25%, 02/27/2013 EUR | | | 100,000 | | | 127,518 | |

Colombia, 11.50%, 05/31/2011 EUR | | | 50,000 | | | 64,929 | |

France: | | | | | | | |

2.25%, 07/25/2020 EUR | | | 456,561 | | | 534,131 | |

3.75%, 04/25/2017 EUR | | | 400,000 | | | 492,428 | |

4.25%, 04/25/2019 EUR | | | 755,000 | | | 946,963 | |

Germany, 4.25%, 07/04/2018 EUR | | | 670,000 | | | 875,591 | |

Hungary, 6.75%, 04/12/2010 HUF | | | 20,500,000 | | | 93,786 | |

Korea, 5.25%, 03/10/2027 KRW | | | 465,000,000 | | | 349,308 | |

Malaysia: | | | | | | | |

3.83%, 09/28/2011 MYR | | | 1,450,000 | | | 406,973 | |

3.87%, 04/13/2010 MYR | | | 650,000 | | | 183,180 | |

Mexico: | | | | | | | |

4.25%, 06/16/2015 EUR | | | 100,000 | | | 101,590 | |

5.50%, 02/17/2020 EUR | | | 320,000 | | | 315,580 | |

8.00%, 12/07/2023 MXN | | | 5,200,000 | | | 380,656 | |

10.00%, 12/05/2024 MXN | | | 2,015,000 | | | 174,310 | |

Morocco, 5.375%, 06/27/2017 EUR | | | 65,000 | | | 65,643 | |

Netherlands, 4.00%, 07/15/2016 EUR | | | 850,000 | | | 1,063,420 | |

Norway, 5.00%, 05/15/2015 NOK | | | 3,900,000 | | | 613,173 | |

Philippines, 6.25%, 03/15/2016 EUR | | | 200,000 | | | 212,507 | |

Singapore, 4.375%, 01/15/2009 SGD | | | 595,000 | | | 403,925 | |

South Africa, 5.25%, 05/16/2013 EUR | | | 100,000 | | | 97,466 | |

See Notes to Financial Statements

24

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

| |

FOREIGN BONDS – GOVERNMENT (PRINCIPAL AMOUNT DENOMINATED IN CURRENCY INDICATED) continued | | | | | | | |

Sweden, 3.75%, 08/12/2017 SEK | | | 2,850,000 | | $ | 377,181 | |

Turkey, 4.75%, 07/06/2012 EUR | | | 290,000 | | | 308,681 | |

Ukraine, 4.95%, 10/13/2015 EUR | | | 50,000 | | | 25,450 | |

United Kingdom, 5.00%, 03/07/2012 GBP | | | 280,000 | | | 471,788 | |

| | | | |

|

| |

Total Foreign Bonds – Government (Principal Amount Denominated in Currency Indicated) (cost $11,680,819) | | | | | | 9,804,409 | |

| | | | |

|

| |

WHOLE LOAN MORTGAGE-BACKED COLLATERALIZED MORTGAGE OBLIGATIONS 1.2% | | | | | | | |

FIXED-RATE 1.2% | | | | | | | |

Banc of America Mtge. Securities, Inc., Ser. 2005-D, Class 2A6, 4.79%, 05/25/2035 | | $ | 3,255,000 | | | 2,170,547 | |

Harborview NIM Corp., Ser. 2006-14, Class N2, 8.35%, 03/19/2038 144A o | | | 469,183 | | | 79,522 | |

| | | | |

|

| |

Total Whole Loan Mortgage-Backed Collateralized Mortgage Obligations (cost $3,634,428) | | | | | | 2,250,069 | |

| | | | |

|

| |

WHOLE LOAN MORTGAGE-BACKED PASS THROUGH SECURITIES 13.5% | | | | | | | |

FIXED-RATE 6.3% | | | | | | | |

Countrywide Alternative Loan Trust, Inc., Ser. 2005-50CB, Class 1A1, 5.50%, 11/25/2035 | | | 1,630,624 | | | 1,082,454 | |

CSMC Mtge. Backed Trust, Ser. 2007-4R, Class 1A1, 5.69%, 10/26/2036 144A | | | 405,000 | | | 306,747 | |

First Horizon Mtge. Pass Through Trust, Ser. 2007-AR2, Class 2A1, 5.88%, 07/25/2037 | | | 2,666,751 | | | 1,735,016 | |

GSAA Home Equity Trust, Ser. 2007-10, Class A1A, 6.00%, 11/25/2037 | | | 1,259,162 | | | 818,259 | |

GSR Mtge. Loan Trust, Ser. 2006-8F, Class 4A3, 6.50%, 09/25/2036 | | | 580,000 | | | 494,561 | |

Morgan Stanley Capital I, Inc., Ser. 2007-13, Class 5A1, 5.50%, 10/25/2037 | | | 3,413,753 | | | 2,179,952 | |

PHH Alternative Mtge. Trust, Ser. 2007-01, Class 21A, 6.00%, 02/25/2037 | | | 747,749 | | | 517,712 | |

Residential Accredited Loans, Inc., Ser. 2007-QS10, Class A1, 6.50%, 09/25/2037 | | | 855,537 | | | 511,885 | |

Washington Mutual, Inc., Ser. 2005-AR3, Class A1, 4.64%, 03/25/2035 | | | 2,896,449 | | | 2,145,857 | |

Wells Fargo Mtge. Backed Securities Trust, Ser. 2006-AR10, Class 5A1, 5.59%, 07/25/2036 | | | 2,326,066 | | | 1,727,134 | |

| | | | |

|

| |

| | | | | | 11,519,577 | |

| | | | |

|

| |

FLOATING-RATE 7.2% | | | | | | | |

American Home Mtge. Assets: | | | | | | | |

Ser. 2006-2, Class 1A1, 3.625%, 09/25/2046 | | | 135,806 | | | 71,750 | |

Ser. 2007-1, Class A1, 3.37%, 02/25/2047 | | | 25,593 | | | 12,023 | |

Citigroup Mtge. Loan Trust, Inc., Ser. 2005-7, Class 2A3A, 5.16%, 09/25/2035 | | | 2,948,739 | | | 2,236,866 | |

Lehman XS Trust, Ser. 2006-18N, Class A5A, 3.43%, 12/25/2036 | | | 145,000 | | | 76,624 | |

MASTR Adjustable Rate Mtge. Trust, Ser. 2006-OA2, Class 4A1B, 4.06%, 12/25/2046 | | | 54,629 | | | 24,414 | |

MASTR Reperforming Loan Trust, Ser. 2006-2, Class 1A1, 5.89%, 05/25/2046 144A | | | 2,369,477 | | | 2,017,002 | |

Merrill Lynch Countrywide Comml. Mtge. Trust, Ser. 2007-8,Class A3, 5.96%, 07/12/2017 | | | 3,530,000 | | | 2,703,819 | |

See Notes to Financial Statements

25

SCHEDULE OF INVESTMENTS continued

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

|

|

| |

WHOLE LOAN MORTGAGE-BACKED PASS THROUGH SECURITIES continued | | | | | | | |

FLOATING-RATE continued | | | | | | | |

Residential Funding Mtge. Securities, Ser. 2007-SA3, Class 2A1, 5.77%, 07/27/2037 | | $ | 3,323,542 | | $ | 2,118,726 | |

Washington Mutual, Inc. Mtge. Pass-Through Cert.: | | | | | | | |

Ser. 2006-AR02, Class A1A, 3.61%, 04/25/2046 | | | 403,893 | | | 214,041 | |

Ser. 2006-AR09, Class 2A, 3.51%, 11/25/2046 | | | 50,246 | | | 23,217 | |

Ser. 2006-AR17, Class 1A1B, 3.48%, 12/25/2046 | | | 2,356,743 | | | 922,558 | |

Ser. 2007-HY7, Class 3A2, 5.90%, 07/25/2037 | | | 2,746,804 | | | 1,870,231 | |

Ser. 2007-OA5, Class 1A1B, 3.42%, 06/25/2047 | | | 2,118,559 | | | 807,920 | |

| | | | |

|

| |

| | | | | | 13,099,191 | |

| | | | |

|

| |

Total Whole Loan Mortgage-Backed Pass Through Securities (cost $36,044,305) | | | | | | 24,618,768 | |

| | | | |

|

| |

WHOLE LOAN SUBORDINATE COLLATERALIZED MORTGAGE OBLIGATIONS 0.3% | | | | | | | |

FIXED-RATE 0.1% | | | | | | | |

Financial Asset Securitization, Inc., Ser. 1997-NAM2, Class B-2, 7.88%, 07/25/2027 | | | 217,752 | | | 217,113 | |

| | | | |

|

| |

FLOATING-RATE 0.2% | | | | | | | |

Harborview Mtge. Loan Trust: | | | | | | | |

Ser. 2004-7, Class B4, 5.43%, 11/19/2034 | | | 2,350,369 | | | 300,717 | |

Ser. 2005-8, Class 2B3, 5.02%, 09/19/2035 o | | | 1,057,969 | | | 107,035 | |

| | | | |

|

| |

| | | | | | 407,752 | |

| | | | |

|

| |

Total Whole Loan Subordinate Collateralized Mortgage Obligations (cost $3,096,429) | | | | | | 624,865 | |

| | | | |

|

| |

U.S. TREASURY OBLIGATIONS 2.0% | | | | | | | |

U.S. Treasury Bond, 6.00%, 02/15/2026 | | | 1,495,000 | | | 1,704,651 | |

U.S. Treasury Note, 4.00%, 08/15/2018 | | | 1,975,000 | | | 1,978,241 | |

| | | | |

|

| |

Total U.S. Treasury Obligations (cost $3,768,762) | | | | | | 3,682,892 | |

| | | | |

|

| |

YANKEE OBLIGATIONS – CORPORATE 3.0% | | | | | | | |

CONSUMER DISCRETIONARY 0.0% | | | | | | | |

Media 0.0% | | | | | | | |

Videotron, Ltd., 9.125%, 04/15/2018 144A | | | 5,000 | | | 4,463 | |

| | | | |

|

| |

CONSUMER STAPLES 0.1% | | | | | | | |

Beverages 0.1% | | | | | | | |

Companhia Brasileira de Bebidas, 8.75%, 09/15/2013 | | | 115,000 | | | 108,675 | |

| | | | |

|

| |

Food Products 0.0% | | | | | | | |

Sadia Overseas, Ltd., 6.875%, 05/24/2017 144A | | | 100,000 | | | 61,000 | |

| | | | |

|