marked-to-market daily based on quotations from an independent pricing service or market makers and any change in value is recorded as an unrealized gain or loss. Periodic payments made or received are recorded as realized gains or losses. In addition, payments received or made as a result of a credit event or termination of the contract are recognized as realized gains or losses. As guarantor, the Fund is subject to investment exposure on the notional amount of the swap and has assumed the risk of default of the underlying security or index. As counterparty, the Fund could be exposed to risks if the guarantor defaults on its obligation to perform, or if there are unfavorable changes in the fluctuation of interest rates or in the price of the underlying security or index.

Security transactions are recorded on trade date. Realized gains and losses are computed using the specific cost of the security sold. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums. Dividend income is recorded on the ex-dividend date.

Distributions to shareholders from net investment income are accrued daily and paid monthly. Distributions from net realized gains, if any, are recorded on the ex-dividend date. Such distributions are determined in conformity with income tax regulations, which may differ from generally accepted accounting principles.

Income, common expenses and realized and unrealized gains and losses are allocated to the classes based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the class level based on the appropriate net assets of each class and the specific expense rates applicable to each class.

Evergreen Investment Management Company, LLC (“EIMC”), an indirect, wholly-owned subsidiary of Wachovia Corporation (“Wachovia”), is the investment advisor to the Fund and is paid a fee at an annual rate of 2% of the Fund’s gross investment income plus an amount determined by applying percentage rates to the average daily net assets of

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

the Fund, starting at 0.31% and declining to 0.16% as average daily net assets increase. For the six months ended October 31, 2008, the advisory fee was equivalent to 0.51% of the Fund’s average daily net assets (on an annualized basis).

Tattersall Advisory Group, Inc., an indirect, wholly-owned subsidiary of Wachovia, is an investment sub-advisor to the Fund and is paid by EIMC for its services to the Fund.

On October 3, 2008, Wells Fargo & Company (“Wells Fargo”) and Wachovia announced that Wells Fargo agreed to acquire Wachovia in a whole company transaction that will include all of Wachovia’s banking and other businesses. In connection with this transaction, Wachovia issued preferred shares to Wells Fargo representing approximately a 40% voting interest in Wachovia. Due to its ownership of preferred shares, Wells Fargo may be deemed to control EIMC. If Wells Fargo is deemed to control EIMC, then the existing advisory agreement between the Fund and EIMC and the sub-advisory agreement between EIMC and the Fund’s sub-advisor would have terminated automatically in connection with the issuance of preferred shares. To address this possibility, on October 20, 2008 the Board of Trustees approved an interim advisory agreement with EIMC and an interim sub-advisory agreement with the sub-advisor with the same terms and conditions as the existing agreement, which became effective upon the issuance of the preferred shares. EIMC’s receipt of the advisory fees under the interim advisory agreement is subject to the approval by shareholders of the Fund of a new advisory agreement with EIMC.

From time to time, EIMC may voluntarily or contractually waive its fee and/or reimburse expenses in order to limit operating expenses. During the six months ended October 31, 2008, EIMC contractually waived its advisory fee in the amount of $196,206.

The Fund may invest in money market funds which are advised by EIMC. Income earned on these investments is included in income from affiliate on the Statement of Operations.

EIMC also serves as the administrator to the Fund and is paid an annual rate determined by applying percentage rates to the aggregate average daily net assets of the Evergreen funds (excluding money market funds) starting at 0.10% and declining to 0.05% as the aggregate average daily net assets of the Evergreen funds (excluding money market funds) increase. For the six months ended October 31, 2008, the administrative services fee was equivalent to 0.10% of the Fund’s average daily net assets (on an annualized basis).

Evergreen Service Company, LLC (“ESC”), an indirect, wholly-owned subsidiary of Wachovia, is the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based on the type of account held by the shareholders in the Fund. For the six months ended October 31, 2008, the transfer agent fees were equivalent to an annual rate of 0.21% of the Fund’s average daily net assets.

The Fund has placed a portion of its portfolio transactions with brokerage firms that are affiliates of Wachovia. During the six months ended October 31, 2008, the Fund paid brokerage commissions of $735 to Wachovia Securities, LLC.

35

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

4. DISTRIBUTION PLANS

EIS serves as distributor of the Fund’s shares. The Fund has adopted Distribution Plans, as allowed by Rule 12b-1 of the 1940 Act, for each class of shares, except Class I. Under the Distribution Plans, the Fund is permitted to pay distribution fees at an annual rate of up to 0.75% of the average daily net assets for Class A shares and up to 1.00% of the average daily net assets for each of Class B and Class C shares. However, currently the distribution fees for Class A shares are limited to 0.25% of the average daily net assets of the class.

For the six months ended October 31, 2008, EIS received $6,730 from the sale of Class A shares and $16,870, $120,539 and $2,488 in contingent deferred sales charges from redemptions of Class A, Class B and Class C shares, respectively.

5. ACQUISITION

Effective at the close of business on September 19, 2008, the Fund acquired the net assets of Evergreen Select High Yield Bond Fund in a tax-free exchange for Class A and Class I shares of the Fund. Shares were issued to Class A and Class I shareholders of Evergreen Select High Yield Bond Fund at an exchange ratio of 2.80 and 2.80 for Class A and Class I shares, respectively, of the Fund. The acquired net assets consisted primarily of portfolio securities with unrealized depreciation of $10,172,035. The aggregate net assets of the Fund and Evergreen Select High Yield Bond Fund immediately prior to the acquisition were $440,185,205 and $94,017,018, respectively. The aggregate net assets of the Fund immediately after the acquisition were $534,202,223.

6. INVESTMENT TRANSACTIONS

Cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were $291,726,484 and $337,294,395, respectively, for the six months ended October 31, 2008.

On May 1, 2008, the Fund implemented Statement of Financial Accounting Standards No. 157, Fair Value Measurements (“FAS 157”). FAS 157 establishes a single authoritative definition of fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. FAS 157 establishes a fair value hierarchy based upon the various inputs used in determining the value of the Fund’s investments. These inputs are summarized into three broad levels as follows:

Level 1 – quoted prices in active markets for identical securities Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

36

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

As of October 31, 2008, the inputs used in valuing the Fund’s assets, which are carried at fair value, were as follows:

Valuation Inputs | | Investments in

Securities | | Other Financial

Instruments* |

|

|

|

|

|

|

|

Level 1 – Quoted Prices | | $ | 51,465,902 | | | $ | 0 | |

Level 2 – Other Significant Observable Inputs | | | 352,248,549 | | | | (8,908 | ) |

Level 3 – Significant Unobservable Inputs | | | 0 | | | | 0 | |

|

|

|

|

|

|

|

Total | | $ | 403,714,451 | | | $ | (8,908 | ) |

|

|

|

|

|

|

|

|

|

| * | Other financial instruments include swap contracts. |

As of October 31, 2008, the Fund had unfunded loan commitments of $9,933,929.

During the six months ended October 31, 2008, the Fund loaned securities to certain brokers and earned $68,486 in affiliated income relating to securities lending activity which is included in income from affiliate on the Statement of Operations. At October 31, 2008, the value of securities on loan and the total value of collateral received for securities loaned amounted to $1,419,527 and $1,463,350, respectively.

At October 31, 2008, the Fund had the following credit default swap contracts outstanding:

Expiration | | Counterparty | | Reference Debt

Obligation/

Index | | Notional

Amount | | Fixed

Payments

Received

by the Fund | | Frequency of

Payments

Received | | Unrealized

Gain (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6/20/2013 | | Bank of America | | LCDX.NA.10,

06/13/2018 | | $ | 220,000 | | 3.25 | % | | Quarterly | | $ | 12,837 | |

12/20/2013 | | Deutsche Bank | | Expedia, Inc., 7.46%,

08/01/2018 | | | 1,070,000 | | 3.50 | % | | Quarterly | | | 51,063 | |

12/20/2013 | | UBS | | Motorola, Inc., 6.50%,

09/01/2025 | | | 670,000 | | 2.58 | % | | Quarterly | | | 26,669 | |

12/20/2013 | | CitiBank | | GE Capital, 6.00%,

06/15/2012 | | | 225,000 | | 4.90 | % | | Quarterly | | | (17,004 | ) |

12/20/2013 | | CitiBank | | GE Capital, 6.00%,

06/15/2012 | | | 655,000 | | 6.65 | % | | Quarterly | | | 32,244 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

Expiration | | Counterparty | | Reference Debt

Obligation/

Index | | Notional

Amount | | Fixed

Payments

Made by

the Fund | | Frequency of

Payments

Made | | Unrealized

Gain (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9/20/2013 | | Deutsche Bank | | GE, 4.25%, 05/15/2011 | | $ | 430,000 | | 4.00 | % | | Quarterly | | $ | (20,335 | ) |

12/20/2013 | | Goldman Sachs | | Humana, Inc., 6.30%,

12/22/2008 | | | 1,060,000 | | 3.75 | % | | Quarterly | | | (41,962 | ) |

12/20/2013 | | Goldman Sachs | | Sun Microsystem, Inc.,

0.75%, 02/01/2014 | | | 1,135,000 | | 1.55 | % | | Quarterly | | | (5,659 | ) |

12/20/2013 | | JPMorgan | | Expedia, Inc., 7.46%,

08/01/2018 | | | 625,000 | | 5.35 | % | | Quarterly | | | (17,296 | ) |

12/20/2013 | | UBS | | Motorola, Inc., 6.50%,

09/01/2025 | | | 250,000 | | 3.07 | % | | Quarterly | | | 4,947 | |

12/20/2013 | | Goldman Sachs | | GE Capital, 6.00%,

06/15/2012 | | | 545,000 | | 4.50 | % | | Quarterly | | | (15,975 | ) |

12/20/2013 | | UBS | | Motorola, Inc., 6.50%,

09/01/2025 | | | 780,000 | | 2.55 | % | | Quarterly | | | 32,051 | |

12/20/2013 | | UBS | | Pulte, Inc., 5.25%,

01/15/2014 | | | 735,000 | | 2.43 | % | | Quarterly | | | 37,732 | |

12/20/2013 | | UBS | | Pulte, Inc., 5.25%,

01/15/2014 | | | 1,280,000 | | 2.45 | % | | Quarterly | | | 84,898 | |

12/13/2049 | | CitiBank | | Markit CMBX North

America AJ.3 Index | | | 505,000 | | 1.47 | % | | Monthly | | | (59,488 | ) |

12/13/2049 | | Deutsche Bank | | Markit CMBX North

America AJ.3 Index | | | 270,000 | | 1.47 | % | | Monthly | | | (40,534 | ) |

12/13/2049 | | Goldman Sachs | | Markit CMBX North

America AJ.3 Index | | | 620,000 | | 1.47 | % | | Monthly | | | (73,096 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On October 31, 2008, the aggregate cost of securities for federal income tax purposes was $552,393,975. The gross unrealized appreciation and depreciation on securities based on tax cost was $0 and $148,679,524, respectively, with a net unrealized depreciation of $148,679,524.

As of April 30, 2008, the Fund had $118,191,291 in capital loss carryovers for federal income tax purposes expiring as follows:

Expiration |

|

2009 | | 2010 | | 2011 | | 2014 | | 2015 |

|

|

|

|

|

|

|

|

|

|

$38,451,200 | | $57,513,490 | | $15,936,101 | | $1,353,885 | | $4,936,615 |

|

|

|

|

|

|

|

|

|

|

These losses are subject to certain limitations prescribed by the Internal Revenue Code.

For income tax purposes, capital and currency losses incurred after October 31 within the Fund’s fiscal year are deemed to arise on the first business day of the following fiscal year. As of April 30, 2008, the Fund incurred and elected to defer post-October capital and currency losses of $9,272,466 and $192, respectively.

7. INTERFUND LENDING

Pursuant to an Exemptive Order issued by the SEC, the Fund may participate in an inter-fund lending program with certain funds in the Evergreen fund family. This program

38

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

allows the Fund to borrow from, or lend money to, other participating funds. During the six months ended October 31, 2008, the Fund did not participate in the interfund lending program.

8. EXPENSE REDUCTIONS

Through expense offset arrangements with ESC and the Fund’s custodian, a portion of fund expenses has been reduced.

9. DEFERRED TRUSTEES’ FEES

Each Trustee of the Fund may defer any or all compensation related to performance of his or her duties as a Trustee. The Trustees’ deferred balances are allocated to deferral accounts, which are included in the accrued expenses for the Fund. The investment performance of the deferral accounts is based on the investment performance of certain Evergreen funds. Any gains earned or losses incurred in the deferral accounts are reported in the Fund’s Trustees’ fees and expenses. At the election of the Trustees, the deferral account will be paid either in one lump sum or in quarterly installments for up to ten years.

10. FINANCING AGREEMENT

The Fund and certain other Evergreen funds share in a $100 million unsecured revolving credit commitment for temporary and emergency purposes, including the funding of redemptions, as permitted by each participating fund’s borrowing restrictions. Borrowings under this facility bear interest at 0.50% per annum above the Federal Funds rate. All of the participating funds are charged an annual commitment fee of 0.09% on the unused balance, which is allocated pro rata. Prior to June 27, 2008, the annual commitment fee was 0.08%.

During the six months ended October 31, 2008, the Fund had average borrowings outstanding of $15,600 (on an annualized basis) at an average rate of 1.93% and paid interest of $301.

11. REGULATORY MATTERS AND LEGAL PROCEEDINGS

The Evergreen funds, EIMC and certain of EIMC’s affiliates are involved in various legal actions, including private litigation and class action lawsuits. In addition, certain Evergreen funds, EIMC and certain of EIMC’s affiliates are currently, and may in the future be, subject to regulatory inquiries and investigations.

The SEC and the Secretary of the Commonwealth, Securities Division, of the Commonwealth of Massachusetts are conducting separate investigations of EIMC and EIS concerning alleged issues surrounding the drop in net asset value of the Evergreen Ultra Short Opportunities Fund (the “Ultra Short Fund”) in May and June 2008. In addition, three purported class actions have been filed in the U.S. District Court for the District of Massachusetts relating to the same events; defendants include various

39

NOTES TO FINANCIAL STATEMENTS (unaudited) continued

Evergreen entities and Evergreen Fixed Income Trust and its Trustees. The cases generally allege that investors in the Ultra Short Fund suffered losses as a result of (i) misleading statements in Ultra Short Fund’s prospectus, (ii) the failure to accurately price securities in the Ultra Short Fund at different points in time and (iii) the failure of the Ultra Short Fund’s risk disclosures and description of its investment strategy to inform investors adequately of the actual risks of the fund.

EIMC does not expect that any of the legal actions, inquiries or investigations currently pending or threatened will have a material adverse impact on the financial position or operations of any of the Evergreen funds to which these financial statements relate. Any publicity surrounding or resulting from any legal actions or regulatory inquiries involving EIMC or its affiliates or any of the Evergreen Funds could result in reduced sales or increased redemptions of Evergreen fund shares, which could increase Evergreen fund transaction costs or operating expenses or have other adverse consequences on the Evergreen funds.

12. NEW ACCOUNTING PRONOUNCEMENTS

In March 2008, FASB issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities (“FAS 161”), an amendment of FASB Statement No. 133. FAS 161 requires enhanced disclosures about (a) how and why a fund uses derivative instruments, (b) how derivative instruments and hedging activities are accounted for, and (c) how derivative instruments and related hedging activities affect a fund’s financial position, financial performance, and cash flows. Management of the Fund does not believe the adoption of FAS 161 will materially impact the financial statement amounts, but will require additional disclosures. This will include qualitative and quantitative disclosures on derivative positions existing at period end and the effect of using derivatives during the reporting period. FAS 161 is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008.

In September 2008, FASB issued FASB Staff Position No. FAS 133-1 and FIN 45-4, Disclosures about Credit Derivatives and Certain Guarantees: An Amendment of FASB Statement No. 133 and FASB Interpretation No. 45; and Clarification of the Effective Date of FASB Statement No. 161. This FASB Staff Position (1) amends FASB Statement No. 133 to require disclosures by sellers of credit derivatives, including credit derivatives embedded in a hybrid instrument (2) amends FASB Interpretation No. 45 to require additional disclosure about the current status of the payment/performance risk of a guarantee and (3) clarifies the effective date of FAS 161. Management of the Fund does not believe the adoption of this FASB Staff Position will materially impact the financial statement amounts, but will require additional disclosures. This FASB Staff Position is effective for reporting periods (annual or interim) ending after November 15, 2008.

40

ADDITIONAL INFORMATION (unaudited)

INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE FUND’S INVESTMENT ADVISORY AGREEMENT

Each year, the Fund’s Board of Trustees determines whether to approve the continuation of the Fund’s investment advisory agreements. In September 2008, the Trustees, including a majority of the Trustees who are not “interested persons” (as that term is defined in the 1940 Act) of the Fund, Tattersall Advisory Group, Inc. (the “Sub-Advisor”), or EIMC (the “independent Trustees”), approved the continuation of the Fund’s investment advisory agreements. (References below to the “Fund” are to Evergreen High Income Fund; references to the “funds” are to the Evergreen funds generally.)

At the same time, the Trustees considered the continuation of the investment advisory agreements for all of the funds. The description below refers in many cases to the Trustees’ process for considering, and conclusions regarding, all of the funds’ agreements. In all of its deliberations, the Board of Trustees and the independent Trustees were advised by independent counsel to the independent Trustees and counsel to the funds.

The review process. In connection with its review of the funds’ investment advisory agreements, the Board of Trustees requests and evaluates, and EIMC and any sub-advisors furnish, such information as the Trustees consider to be reasonably necessary in the circumstances. The Trustees began their 2008 review process at the time of the last advisory contract-renewal process in September 2007. In the course of their 2007 review, the Trustees identified a number of funds that had experienced either short-term or longer-term performance issues. During the 2008 review process, the Trustees monitored each of these funds in particular for changes in performance and for the results of any changes in a fund’s investment process or investment team. In addition, during the course of the year, the Trustees regularly reviewed information regarding the investment performance of all of the funds, paying particular attention to funds whose performance since September 2007 indicated short-term or longer-term performance issues.

In spring 2008, a committee of the Board of Trustees (the “Committee”), working with EIMC management, determined generally the types of information the Board would review as part of its 2008 review process and set a timeline detailing the information required and the dates for its delivery to the Trustees. The Board engaged the independent data provider Keil Fiduciary Strategies LLC (“Keil”) to provide fund-specific and industry-wide data containing information of a nature and in a format generally prescribed by the Committee, and the Committee worked with Keil and EIMC to develop appropriate groups of peer funds for each fund. The Committee also identified a number of expense, performance, and other issues and requested specific information as to those issues.

The Trustees reviewed, with the assistance of an independent industry consultant retained by the independent Trustees, the information that EIMC, the Sub-Advisor, and Keil provided. The Trustees formed small groups to review individual funds in greater detail.

41

ADDITIONAL INFORMATION (unaudited) continued

In addition, the Trustees considered information regarding, among other things, brokerage practices of the funds, the use of derivatives by the funds, strategic planning for the funds, analyst and research support available to the portfolio management teams, and information regarding the various fall-out benefits received directly and indirectly by EIMC and its affiliates from the funds. The Trustees requested and received additional information following that review.

The Committee met several times by telephone during the 2008 review process to consider the information provided by EIMC. The Committee then met with representatives of EIMC. In addition, over the period of this review, the independent Trustees discussed the continuation of the funds’ advisory agreements with representatives of EIMC and in multiple private sessions with independent legal counsel at which no personnel of EIMC were present. At a meeting of the full Board of Trustees in September, the Committee reported the results of its discussions with EIMC, and the full Board met with representatives of EIMC and engaged in further review of the materials provided to it, and approved the continuation of each of the advisory and sub-advisory agreements.

In considering the continuation of the agreements, the Trustees did not identify any particular information or consideration that was all-important or controlling, and each Trustee attributed different weights to various factors. The Trustees evaluated information provided to them both in terms of the funds generally and with respect to each fund, including the Fund, specifically as they considered appropriate. Although the Trustees considered the continuation of the agreements as part of the larger process of considering the continuation of the advisory contracts for all of the funds, their determination to continue the advisory agreements for each of the funds was ultimately made on a fund-by-fund basis.

This summary describes a number of the most important, but not necessarily all, of the factors considered by the Board and the independent Trustees.

Information reviewed. The Board of Trustees and committees of the Board of Trustees meet periodically during the course of the year. At those meetings, EIMC presents a wide variety of information regarding the services it performs, the investment performance of the funds, and other aspects of the business and operations of the funds. At those meetings, and in the process of considering the continuation of the agreements, the Trustees considered information regarding, for example, the funds’ investment results; the portfolio management teams for the funds and the experience of the members of those teams, and any recent changes in the membership of the teams; portfolio trading practices; compliance by the funds, EIMC, and the Sub-Advisor with applicable laws and regulations and with the funds’ and EIMC’s compliance policies and procedures; risk evaluation and oversight procedures at EIMC; services provided by affiliates of EIMC to the funds and shareholders of the funds; and other information relating to the nature, extent, and quality of services provided by EIMC and the Sub-Advisor. The Trustees considered a

42

ADDITIONAL INFORMATION (unaudited) continued

number of changes in portfolio management personnel at EIMC and its advisory affiliates in the year since September 2007. The Trustees also considered changes in personnel at the funds and EIMC, including the appointment of a new Chief Compliance Officer for the funds in June of 2007 and a new Chief Investment Officer at EIMC in August of 2008.

The Trustees considered the rates at which the funds pay investment advisory fees, and the efforts generally by EIMC and its affiliates as sponsors of the funds. The data provided by Keil showed the management fees paid by each fund in comparison to the management fees of other peer mutual funds, in addition to data regarding the investment performance of the funds in comparison to other peer mutual funds. The Trustees were assisted by an independent industry consultant in reviewing the information presented to them.

The Trustees noted that, in certain cases, EIMC and/or its affiliates provide advisory services to other clients that are comparable to the advisory services they provide to certain funds. The Trustees considered the information EIMC provided regarding the rates at which those other clients pay advisory fees to EIMC or its affiliates for such services. Fees charged to those other clients were generally lower than those charged to the respective funds. In respect of these other accounts, EIMC noted that the compliance, reporting, and other legal burdens of providing investment advice to mutual funds generally exceed those required to provide advisory services to non-mutual fund clients such as retirement or pension plans. The Trustees also considered the investment performance of those other accounts managed by EIMC and its affiliates, where applicable, and concluded that the performance of those accounts did not suggest any substantial difference in the quality of the service provided by EIMC and its affiliates to those accounts.

The Trustees considered the transfer agency fees paid by the funds to an affiliate of EIMC. They reviewed information presented to them showing that the transfer agency fees charged to the funds were generally consistent with industry norms.

The Trustees also considered that EIMC serves as administrator to the funds and receives a fee for its services as administrator. In their comparison of the advisory fee paid by the funds with those paid by other mutual funds, the Trustees considered administrative fees paid by the funds and those other mutual funds. The Board considered that EIS, an affiliate of EIMC, serves as distributor to the funds generally and receives fees from the funds for those services. They considered other so-called “fall-out” benefits to EIMC and its affiliates due to their other relationships with the funds, including, for example, soft-dollar services received by EIMC attributable to transactions entered into by EIMC for the benefit of the funds and brokerage commissions received by Wachovia Securities, LLC, an affiliate of EIMC, from transactions effected by it for the funds. The Trustees also noted that the funds pay sub-transfer agency fees to various financial institutions that hold fund shares in omnibus accounts, and that Wachovia Securities, LLC and its affiliates receive such payments from the funds in respect of client accounts they hold in omnibus arrange-

43

ADDITIONAL INFORMATION (unaudited) continued

ments, and that an affiliate of EIMC receives fees for administering the sub-transfer agency payment program. In reviewing the services provided by an affiliate of EIMC, the Trustees noted that an affiliate of EIMC had won recognition from Dalbar customer service each year since 1998, and also won recognition from National Quality Review for customer service and for accuracy in processing transactions in 2008. They also considered that Wachovia Securities, LLC and its affiliates receive distribution-related fees and shareholder servicing payments (including amounts derived from payments under the funds’ Rule 12b-1 plans) in respect of shares sold or held through it. The Trustees also noted that an affiliate of EIMC receives compensation for serving as a securities lending agent for a number of the funds.

In the period leading up to the Trustees’ approval of continuation of the investment advisory agreements, the Trustees were mindful of the financial condition of Wachovia Corporation (“Wachovia”), EIMC’s parent company. They considered the possibility that a significant adverse change in Wachovia’s financial condition could impair the ability of EIMC or its affiliates to perform services for the funds at the same level as in the past. The Trustees concluded that any change in Wachovia’s financial condition had not to date had any such effect, but determined to monitor EIMC’s and its affiliates’ performance, and financial conditions generally, going forward in order to identify any such impairment that may develop and to take appropriate action.

Nature and quality of the services provided. The Trustees considered that EIMC and its affiliates generally provide a comprehensive investment management service to the funds. They noted that EIMC and the Sub-Advisor formulate and implement an investment program for the Fund. They noted that EIMC makes its personnel available to serve as officers of the funds, and concluded that the reporting and management functions provided by EIMC with respect to the funds were generally satisfactory. The Trustees considered the investment philosophy of the Fund’s portfolio management team, and considered the in-house research capabilities of EIMC and its affiliates, as well as other resources available to EIMC, including research services available to it from third parties. The Board considered the managerial and financial resources available to EIMC and its affiliates, and the commitment that the Wachovia organization has made to the funds generally. On the basis of these factors, they determined that the nature and scope of the services provided by EIMC and the Sub-Advisor were consistent with their respective duties under the investment advisory agreements and appropriate and consistent with the investment programs and best interests of the funds.

The Trustees noted the resources EIMC and its affiliates have committed to the regulatory, compliance, accounting, tax and oversight of tax reporting, and shareholder servicing functions, and the number and quality of staff committed to those functions, which they concluded were appropriate and generally in line with EIMC’s responsibilities to the Fund and to the funds generally. The Board and the disinterested Trustees concluded, within

44

ADDITIONAL INFORMATION (unaudited) continued

the context of their overall conclusions regarding the funds’ advisory agreements, that they were generally satisfied with the nature, extent, and quality of the services provided by the Sub-Advisor and EIMC, including services provided by EIMC under its administrative services agreements with the funds.

Investment performance. The Trustees considered the investment performance of each fund, both by comparison to other comparable mutual funds and to broad market indices. Although the Trustees considered the performance of all share classes, the Trustees noted that, for the one- and ten-year periods ended December 31, 2007, the Fund’s Class B shares (the Fund’s oldest share class) had underperformed the Fund’s benchmark index, the Merrill Lynch High-Yield Master Index, and had outperformed a majority of the mutual funds against which the Trustees compared the Fund’s performance. The Trustees also noted that, for the three- and five-year periods ended December 31, 2007, the Fund’s Class B shares had underperformed the Fund’s benchmark index and performed in the fifth quintile of the mutual funds against which the Trustees compared the Fund’s performance. The Trustees noted that changes to the Fund’s portfolio management team had recently been implemented and that the new team’s performance record with the Fund may be too short to draw definitive conclusions; however, the Trustees noted that the Fund’s relative performance had improved since the change in the team.

The Trustees discussed each fund’s performance with representatives of EIMC. In each instance where a fund experienced a substantial period of underperformance relative to its benchmark index and/or the non-Evergreen fund peers against which the Trustees compared the fund’s performance, the Trustees considered EIMC’s explanation of the reasons for the relative underperformance and the steps being taken to address the relative underperformance. The Trustees also noted that EIMC had appointed a new Chief Investment Officer in August of 2008 who had not yet had sufficient time to evaluate and direct remedial efforts with respect to funds that have experienced a substantial period of relative underperformance. The Trustees emphasized that the continuation of the investment advisory agreement for a fund should not be taken as any indication that the Trustees did not believe investment performance for any specific fund might not be improved, and they noted that they would continue to monitor closely the investment performance of the funds going forward.

Advisory and administrative fees. The Trustees recognized that EIMC does not seek to provide the lowest cost investment advisory service, but to provide a high quality, full-service investment management product at a reasonable price. They also noted that EIMC has in many cases sought to set its investment advisory fees at levels consistent with industry norms. The Trustees noted that, in certain cases, a fund’s management fees were higher than many or most other mutual funds in the same Keil peer group. However, in each case, the Trustees determined on the basis of the information presented that the level of management fees was not excessive. The Trustees noted that the Fund’s management

45

ADDITIONAL INFORMATION (unaudited) continued

fee was lower than the management fees paid by a majority of the mutual funds against which the Trustees compared the Fund’s management fee, and that the level of profitability realized by EIMC in respect of the fee did not appear excessive.

Economies of scale. The Trustees noted the possibility that economies of scale would be achieved by EIMC in managing the funds as the funds grow. The Trustees noted that the Fund had implemented breakpoints in its advisory fee structure. The Trustees noted that they would continue to review the appropriate levels of breakpoints in the future, but concluded that the breakpoints as implemented appeared to be a reasonable step toward the realization of economies of scale by the Fund.

Profitability. The Trustees considered information provided to them regarding the profitability to the EIMC organization of the investment advisory, administration, and transfer agency (with respect to the open-end funds only) fees paid to EIMC and its affiliates by each of the funds. They considered that the information provided to them was necessarily estimated, and that the profitability information provided to them, especially on a fund-by-fund basis, did not necessarily provide a definitive tool for evaluating the appropriateness of each fund’s advisory fee. They noted that the levels of profitability of the funds to EIMC varied widely, depending on among other things the size and type of fund. They considered the profitability of the funds in light of such factors as, for example, the information they had received regarding the relation of the fees paid by the funds to those paid by other mutual funds, the investment performance of the funds, and the amount of revenues involved. In light of these factors, the Trustees concluded that the profitability of any of the funds, individually or in the aggregate, should not prevent the Trustees from approving the continuation of the agreements.

Matters Relating to Approval of Interim Investment Advisory and Sub-Advisory Agreements. Following the Trustees’ approval of the continuation of the funds’ investment advisory agreements, Wells Fargo & Company (“Wells Fargo”) announced that it had agreed to acquire Wachovia in a whole company transaction that will include all of Wachovia’s banking and other businesses, including EIMC. As a result of this transaction, the funds’ investment advisory and sub-advisory agreements were expected to terminate. Accordingly, on October 20, 2008 the Board of Trustees approved interim investment advisory and sub-advisory agreements for the funds. In approving these interim advisory arrangements, the Trustees noted EIMC’s representation that the scope and quality of the services provided to the funds during the term of the interim contracts would be at least equivalent to the scope and quality of the services provided under the previous advisory agreements and that the terms of the interim agreements are substantially similar to the funds’ previous advisory agreements except that the interim agreements will be in effect for a period of no more than 150 days and certain advisory fees will be placed in escrow until new advisory agreements are approved.

46

This page left intentionally blank

47

TRUSTEES AND OFFICERS

TRUSTEES1

Charles A. Austin III

Trustee

DOB: 10/23/1934

Term of office since: 1991

Other directorships: None | | Investment Counselor, Anchor Capital Advisors, LLC. (investment advice); Director, The Andover Companies (insurance); Trustee, Arthritis Foundation of New England; Former Director, The Francis Ouimet Society (scholarship program); Former Director, Executive Vice President and Treasurer, State Street Research & Management Company (investment advice) |

|

|

|

K. Dun Gifford

Trustee

DOB: 10/23/1938

Term of office since: 1974

Other directorships: None | | Chairman and President, Oldways Preservation and Exchange Trust (education); Trustee, Chairman of the Finance Committee, Member of the Executive Committee, and Former Treasurer, Cambridge College |

|

|

|

Dr. Leroy Keith, Jr.

Trustee

DOB: 2/14/1939

Term of office since: 1983

Other directorships: Trustee,

Phoenix Fund Complex

(consisting of 53 portfolios as of 12/31/2007) | | Managing Director, Almanac Capital Management (commodities firm); Trustee, Phoenix Fund Complex; Director, Diversapack Co. (packaging company); Former Partner, Stonington Partners, Inc. (private equity fund); Former Director, Obagi Medical Products Co.; Former Director, Lincoln Educational Services |

|

|

|

Carol A. Kosel1

Trustee

DOB: 12/25/1963

Term of office since: 2008

Other directorships: None | | Former Consultant to the Evergreen Boards of Trustees; Former Vice President and Senior Vice President, Evergreen Investments, Inc.; Former Treasurer, Evergreen Funds; Former Treasurer, Vestaur Securities Fund |

|

|

|

Gerald M. McDonnell

Trustee

DOB: 7/14/1939

Term of office since: 1988

Other directorships: None | | Former Manager of Commercial Operations, CMC Steel (steel producer) |

|

|

|

Patricia B. Norris

Trustee

DOB: 4/9/1948

Term of office since: 2006

Other directorships: None | | President and Director of Buckleys of Kezar Lake, Inc. (real estate company); Former President and Director of Phillips Pond Homes Association (home community); Former Partner, PricewaterhouseCoopers, LLP (independent registered public accounting firm) |

|

|

|

William Walt Pettit2

Trustee

DOB: 8/26/1955

Term of office since: 1988

Other directorships: None | | Partner and Vice President, Kellam & Pettit, P.A. (law firm); Director, Superior Packaging Corp. (packaging company); Member, Superior Land, LLC (real estate holding company), Member, K&P Development, LLC (real estate development); Former Director, National Kidney Foundation of North Carolina, Inc. (non-profit organization) |

|

|

|

David M. Richardson

Trustee

DOB: 9/19/1941

Term of office since: 1982

Other directorships: None | | President, Richardson, Runden LLC (executive recruitment advisory services); Director, J&M Cumming Paper Co. (paper merchandising); Trustee, NDI Technologies, LLP (communications); Former Consultant, AESC (The Association of Executive Search Consultants) |

|

|

|

Dr. Russell A. Salton III

Trustee

DOB: 6/2/1947

Term of office since: 1984

Other directorships: None | | President/CEO, AccessOne MedCard, Inc. |

|

|

|

48

TRUSTEES AND OFFICERS continued

Michael S. Scofield

Trustee

DOB: 2/20/1943

Term of office since: 1984

Other directorships: None | | Retired Attorney, Law Offices of Michael S. Scofield; Former Director and Chairman, Branded Media Corporation (multi-media branding company) |

|

|

|

Richard J. Shima

Trustee

DOB: 8/11/1939

Term of office since: 1993

Other directorships: None | | Independent Consultant; Director, Hartford Hospital; Trustee, Greater Hartford YMCA; Former Director, Trust Company of CT; Former Director, Old State House Association; Former Trustee, Saint Joseph College (CT) |

|

|

|

Richard K. Wagoner, CFA3

Trustee

DOB: 12/12/1937

Term of office since: 1999

Other directorships: None | | Member and Former President, North Carolina Securities Traders Association; Member, Financial Analysts Society |

|

|

|

OFFICERS

Dennis H. Ferro4

President

DOB: 6/20/1945

Term of office since: 2003 | | Principal occupations: President and Chief Executive Officer, Evergreen Investment Company, Inc. and Executive Vice President, Wachovia Bank, N.A.; former Chief Investment Officer, Evergreen Investment Company, Inc. |

|

|

|

Kasey Phillips5

Treasurer

DOB: 12/12/1970

Term of office since: 2005 | | Principal occupations: Senior Vice President, Evergreen Investment Management Company, LLC; Former Vice President, Evergreen Investment Services, Inc.; Former Assistant Vice President, Evergreen Investment Services, Inc. |

|

|

|

Michael H. Koonce5

Secretary

DOB: 4/20/1960

Term of office since: 2000 | | Principal occupations: Senior Vice President and General Counsel, Evergreen Investment Services, Inc.; Secretary, Senior Vice President and General Counsel, Evergreen Investment Management Company, LLC and Evergreen Service Company, LLC; Senior Vice President and Assistant General Counsel, Wachovia Corporation |

|

|

|

Robert Guerin5

Chief Compliance Officer

DOB: 9/20/1965

Term of office since: 2007 | | Principal occupations: Chief Compliance Officer, Evergreen Funds and Senior Vice President of Evergreen Investments Co., Inc.; Former Managing Director and Senior Compliance Officer, Babson Capital Management LLC; Former Principal and Director, Compliance and Risk Management, State Street Global Advisors; Former Vice President and Manager, Sales Practice Compliance, Deutsche Asset Management |

|

|

|

1 | Each Trustee, except Mses. Kosel and Norris, serves until a successor is duly elected or qualified or until his or her death, resignation, retirement or removal from office. As new Trustees, Ms. Kosel’s and Ms. Norris’ initial terms end December 31, 2010 and June 30, 2009, respectively, at which times they may be re-elected by Trustees to serve until a successor is duly elected or qualified or until her death, resignation, retirement or removal from office by the Trustees. Each Trustee, except Ms. Kosel, oversaw 94 Evergreen funds as of December 31, 2007. Ms. Kosel became a Trustee on January 1, 2008. Correspondence for each Trustee may be sent to Evergreen Board of Trustees, P.O. Box 20083, Charlotte, NC 28202. |

2 | It is possible that Mr. Pettit may be viewed as an “interested person” of the Fund, as defined in the 1940 Act, because of his law firm’s representation of affiliates of Wells Fargo & Company (“Wells Fargo”). Wells Fargo and Wachovia Corporation announced on October 3, 2008 that Wells Fargo agreed to acquire Wachovia Corporation in a whole company transaction that will include the Fund’s investment advisor, EIMC. The Trustees are treating Mr. Pettit as an interested trustee for the time being. |

3 | Mr. Wagoner is an “interested person” of the Fund because of his ownership of shares in Wachovia Corporation, the parent to the Fund’s investment advisor. |

4 | The address of the Officer is 401 S. Tryon Street, 20th Floor, Charlotte, NC 28288. |

5 | The address of the Officer is 200 Berkeley Street, Boston, MA 02116. |

Additional information about the Fund’s Board of Trustees and Officers can be found in the Statement of Additional Information (SAI) and is available upon request without charge by calling 800.343.2898.

49

564355 rv6 12/2008

Evergreen Institutional Mortgage Portfolio

| | table of contents |

1 | | LETTER TO SHAREHOLDERS |

4 | | FUND AT A GLANCE |

6 | | ABOUT YOUR FUND’S EXPENSES |

7 | | FINANCIAL HIGHLIGHTS |

8 | | SCHEDULE OF INVESTMENTS |

9 | | STATEMENT OF ASSETS AND LIABILITIES |

10 | | STATEMENT OF OPERATIONS |

11 | | STATEMENTS OF CHANGES IN NET ASSETS |

12 | | NOTES TO FINANCIAL STATEMENTS |

20 | | ADDITIONAL INFORMATION |

28 | | TRUSTEES AND OFFICERS |

This semiannual report must be preceded or accompanied by a prospectus of the Evergreen fund contained herein. The prospectus contains more complete information, including fees and expenses, and should be read carefully before investing or sending money.

The fund will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q will be available on the SEC’s Web site at http://www.sec.gov. In addition, the fund’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330.

A description of the fund’s proxy voting policies and procedures, as well as information regarding how the fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available by visiting our Web site at EvergreenInvestments.com or by visiting the SEC’s Web site at http://www.sec.gov. The fund’s proxy voting policies and procedures are also available without charge, upon request, by calling 800.343.2898.

Mutual Funds:

| NOT FDIC INSURED | MAY LOSE VALUE | NOT BANK GUARANTEED |

Evergreen InvestmentsSM is a service mark of Evergreen Investment Management Company, LLC. Copyright 2008, Evergreen Investment Management Company, LLC.

Evergreen Investment Management Company, LLC is a subsidiary of Wachovia Corporation and is an affiliate of Wachovia Corporation’s other Broker Dealer subsidiaries.

Evergreen mutual funds are distributed by Evergreen Investment Services, Inc. 200 Berkeley Street, Boston, MA 02116

LETTER TO SHAREHOLDERS

December 2008

Dennis H. Ferro

President and Chief Executive Officer

Dear Shareholder:

We are pleased to provide the Semiannual Report for Evergreen Institutional Mortgage Portfolio for the six-month period ended October 31, 2008 (the “period”).

World capital markets experienced unprecedented volatility in the final weeks of the period. Further evidence of deteriorating conditions in the global economy combined with uncertainty about government policy responses to cause stock and corporate bond valuations to plummet in both domestic and foreign markets. During October 2008, the final month of the period, the U.S. equity market experienced its worst one-month loss in more than 20 years, with the S&P 500® Index dropping by almost 17%. High yield corporate bonds performed almost as poorly. In contrast, U.S. Treasuries gathered strength, as safety-conscious investors appeared willing to accept yields that sometimes fell below 1%. The flight to quality extended to capital markets beyond the United States. Foreign sovereign government securities in industrialized nations held up relatively well, but international stock indexes declined by as much as 20% during October 2008 and the values of emerging market debt and foreign high yield corporate bonds also sank. Signs of global recession, meanwhile, continued to pressure commodities, while the prices of gold and the U.S. dollar strengthened.

Economic news grew steadily worse during the period, prompting major governments and central banks to search for new ways to intervene to re-stimulate growth. After months of deceleration, the U.S. economy finally contracted in the third quarter of 2008. Real Gross Domestic Product (“GDP”) fell by 0.5%, with consumer spending recording its greatest drop in three decades. News was hardly better overseas. The European Union’s economic analysis bureau reported that the economy of the 15-nation Eurozone slipped into recession during the third quarter of 2008, with GDP falling by 0.2%. Outside of major developed economies, signs of economic slowing appeared in even the fastest-growing economies. In China, the central government announced a major fiscal program to stimulate growth while the central bank cut interest rates by one-half of a percentage point. Even after the period ended, evidence of further economic deterioration only continued. U.S. retail sales plummeted and durable goods orders sank, while new unemployment claims reached a 16-year high in mid-November 2008. Faced with widening evidence of economic deterioration, the central banks in the U.S. and other major industrialized nations injected added liquidity into the markets. In the U.S., the overnight bank lending rate stood at just 1.00% after the Federal Reserve Board (the “Fed”) slashed the fed funds rate to 1.00%. In November 2008, the federal government provided U.S.-based Citigroup with a second massive

1

LETTER TO SHAREHOLDERS continued

capital infusion and moved to guarantee the financial services giant against most losses on up to $300 billion in troubled investments. Later, the Fed and the Treasury Department moved to inject more cash into the credit system by announcing plans to buy up to $800 billion in securities backed by mortgages or consumer loans. At the same time, concerns grew about the faltering domestic automotive industry. Against this backdrop, President-elect Barack Obama announced his new economic team and began outlining additional plans to revive the U.S. economy.

During a volatile and challenging period in the capital markets, the investment managers of Evergreen’s intermediate and long-term bond funds paid careful attention to risk management in a rapidly changing market environment. The teams supervising Evergreen U.S. Government Fund, Evergreen Core Bond Fund and Evergreen Institutional Mortgage Portfolio focused on interest-rate movements, Fed policy and general economic trends in managing their portfolios. Meanwhile, the managers of Evergreen High Income Fund positioned the portfolio relatively conservatively during a period of growing risk aversion.

As we look back over the extraordinary series of events during the period, we believe it is vitally important for all investors to keep perspective and remain focused on their long-term strategies. Most importantly, we continue to urge investors to pursue fully-diversified strategies in order to participate in future market gains and limit the risks of potential losses. If they haven’t already done so, we encourage individual investors to work with their financial advisors to develop a diversified, long-term strategy and, most importantly, to adhere to it. Investors should keep in mind that the economy and the financial markets have had long and successful histories of adaptability, recovery, innovation and growth. Proper asset allocation decisions can have significant impacts on the returns of long-term portfolios.

2

LETTER TO SHAREHOLDERS continued

Please visit us at EvergreenInvestments.com for more information about our funds and other investment products available to you. Thank you for your continued support of Evergreen Investments.

Sincerely,

Dennis H. Ferro

President and Chief Executive Officer

Evergreen Investment Company, Inc.

3

FUND AT A GLANCE

as of October 31, 2008

MANAGEMENT TEAM

Investment Advisor:

Evergreen Investment Management Company, LLC

Sub-Advisor:

Tattersall Advisory Group, Inc.

Portfolio Managers:

Robert A. Calhoun, CFA; Christoper Y. Kauffman, CFA^; Todd C. Kuimjian, CFA

^Effective September 2, 2008, Mr. Kauffman became a portfolio manager of the fund.

CURRENT INVESTMENT STYLE

Source: Morningstar, Inc.

Morningstar’s style box is based on a portfolio date as of 9/30/2008.

The Fixed Income style box placement is based on a fund’s average effective maturity or duration and the average credit rating of the bond portfolio.

PERFORMANCE AND RETURNS

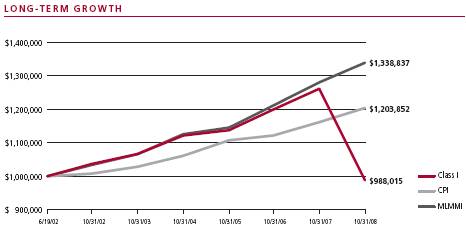

Portfolio inception date: 6/19/2002

Class inception date | Class I

6/19/2002 |

|

|

Nasdaq symbol | EMSFX |

|

|

6-month return | -20.11% |

|

|

Average annual return | |

|

|

1-year | -21.66% |

|

|

5-year | -1.52% |

|

|

Since portfolio inception | -0.19% |

|

|

Past performance is no guarantee of future results. The performance quoted represents past performance and current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. To obtain performance information current to the most recent month-end, please go to EvergreenInvestments.com/fundperformance. Performance includes the reinvestment of income dividends and capital gain distributions. Performance shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The advisor is reimbursing the fund for a portion of other expenses. Had expenses not been reimbursed, returns would have been lower.

Class I shares are only offered to investment advisory clients of an investment advisor of an Evergreen fund (or its advisory affiliates) and through special arrangements entered into on behalf of Evergreen funds with certain financial services firms.

Class I shares are only available to institutional shareholders with a minimum of $1 million investment, which may be waived in certain situations.

4

FUND AT A GLANCE continued

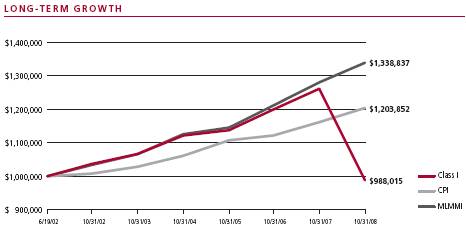

Comparison of a $1,000,000 investment in the Evergreen Institutional Mortgage Portfolio Class I shares versus a similar investment in the Merrill Lynch Mortgage Master Index† (MLMMI) and the Consumer Price Index (CPI).

The MLMMI is an unmanaged market index and does not include transaction costs associated with buying and selling securities, any mutual fund fees or expenses or any taxes. The CPI is a commonly used measure of inflation and does not represent an investment return. It is not possible to invest directly in an index.

The fund’s investment objective may be changed without a vote of the fund’s shareholders.

Asset-backed and mortgage-backed securities are generally subject to higher prepayment risks than other types of debt securities, which can limit the potential for gain in a declining interest rate environment and increase the potential for loss in a rising interest rate environment. Mortgage-backed securities may also be structured so that they are particularly sensitive to interest rates. A high rate of defaults on the mortgages held by a mortgage pool may limit the pool’s ability to make payments to the fund if the fund holds securities that are subordinate to other interest in the same mortgage pool; the risk of such defaults is generally higher in mortgage pools that include subprime mortgages.

Derivatives involve additional risks including interest rate risk, credit risk, the risk of improper valuation and the risk of non-correlation to the relevant instruments they are designed to hedge or to closely track.

The return of principal is not guaranteed due to fluctuation in the fund’s NAV caused by changes in the price of individual bonds held by the fund and the buying and selling of bonds by the fund. Bond funds have the same inflation, interest rate and credit risks as individual bonds. Generally, the value of bond funds rises when prevailing interest rates fall, and falls when interest rates rise.

U.S. government guarantees apply only to certain securities held in the fund’s portfolio and not to the fund’s shares.

† Copyright 2008. Merrill Lynch, Pierce, Fenner & Smith Incorporated. All rights reserved.

All data is as of October 31, 2008, and subject to change.

5

ABOUT YOUR FUND’S EXPENSES

The Example below is intended to describe the fees and expenses borne by shareholders and the impact of those costs on your investment.

Example

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2008 to October 31, 2008.

The example illustrates your fund’s costs in two ways:

• Actual expenses

The section in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the appropriate column for your share class, in the column entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

• Hypothetical example for comparison purposes

The section in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the section in the table under the heading “Hypothetical (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account Value

5/1/2008 | | Ending

Account Value

10/31/2008 | | Expenses Paid

During Period* |

|

|

|

|

|

|

|

Actual | | | | | | |

Class I | | $1,000.00 | | $ 798.89 | | $0.91 |

Hypothetical | | | | | | |

(5% return before expenses) | | | | | | |

Class I | | $1,000.00 | | $1,024.20 | | $1.02 |

|

|

|

|

|

|

|

* | Expenses are equal to the Fund’s annualized expense ratio (0.20% for Class I), multiplied by the average account value over the period, multiplied by 184 / 365 days. |

6

FINANCIAL HIGHLIGHTS

(For a share outstanding throughout each period)

| | Six Months Ended

October 31, 2008 (unaudited) | | Year Ended April 30, | |

| | |

| |

CLASS I | | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, beginning of period | | $ | 9.30 | | $ | 9.78 | | $ | 9.57 | | $ | 9.89 | | $ | 9.89 | | $ | 10.18 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income from investment operations | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | 0.23 | 1 | | 0.49 | | | 0.48 | | | 0.43 | | | 0.35 | | | 0.35 | |

Net realized and unrealized gains or losses on investments | | | (2.07 | ) | | (0.47 | ) | | 0.22 | | | (0.29 | ) | | 0.10 | | | (0.18 | ) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total from investment operations | | | (1.84 | ) | | 0.02 | | | 0.70 | | | 0.14 | | | 0.45 | | | 0.17 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Distributions to shareholders from | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.23 | ) | | (0.30 | ) | | (0.49 | ) | | (0.46 | ) | | (0.45 | ) | | (0.45 | ) |

Net realized gains | | | 0 | | | 0 | | | 0 | | | 0 | | | 0 | | | (0.01 | ) |

Tax basis return of capital | | | 0 | | | (0.20 | ) | | 0 | | | 0 | | | 0 | | | 0 | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total distributions to shareholders | | | (0.23 | ) | | (0.50 | ) | | (0.49 | ) | | (0.46 | ) | | (0.45 | ) | | (0.46 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net asset value, end of period | | $ | 7.23 | | $ | 9.30 | | $ | 9.78 | | $ | 9.57 | | $ | 9.89 | | $ | 9.89 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total return | | | (20.11 | )% | | 0.14 | % | | 7.51 | % | | 1.45 | % | | 4.66 | % | | 1.63 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ratios and supplemental data | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (thousands) | | $ | 18,996 | | $ | 51,981 | | $ | 62,263 | | $ | 58,552 | | $ | 45,997 | | $ | 48,032 | |

Ratios to average net assets | | | | | | | | | | | | | | | | | | | |

Expenses including waivers/reimbursements but excluding expense reductions | | | 0.20 | %2 | | 0.20 | % | | 0.20 | % | | 0.20 | % | | 0.20 | % | | 0.20 | % |

Expenses excluding waivers/reimbursements and expense reductions | | | 0.36 | %2 | | 0.23 | % | | 0.23 | % | | 0.21 | % | | 0.24 | % | | 0.28 | % |

Net investment income (loss) | | | 5.12 | %2 | | 5.09 | % | | 4.97 | % | | 4.37 | % | | 3.44 | % | | 3.33 | % |

Portfolio turnover rate | | | 194 | %3 | | 400 | %3 | | 131 | % | | 121 | % | | 177 | % | | 327 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 | Net investment income (loss) per share is based on average shares outstanding during the period. |

3 | Portfolio turnover rate includes mortgage dollar roll activity. |

See Notes to Financial Statements

7

SCHEDULE OF INVESTMENTS

October 31, 2008 (unaudited)

| | Principal

Amount | | Value | |

|

|

|

|

|

|

AGENCY MORTGAGE-BACKED PASS THROUGH SECURITIES 84.7% | | | | | | | |

FIXED-RATE 84.7% | | | | | | | |

FHLMC 30 year: | | | | | | | |

5.00%, TBA # | | $ | 4,775,000 | | $ | 4,519,089 | |

5.50%, TBA # | | | 2,215,000 | | | 2,160,664 | |

FNMA: | | | | | | | |

4.50%, 04/01/2019 | | | 290,729 | | | 278,392 | |

5.78%, 11/01/2011 | | | 763,774 | | | 778,592 | |

FNMA 15 year: | | | | | | | |

4.50%, TBA # | | | 7,235,000 | | | 6,886,816 | |

5.00%, TBA # | | | 500,000 | | | 488,828 | |

5.50%, TBA # | | | 980,000 | | | 977,090 | |

| | | | |

|

| |

Total Agency Mortgage-Backed Pass Through Securities (cost $16,489,195) | | | | | | 16,089,471 | |

| | | | |

|

| |

|

|

|

|

|

|

| | Shares | | Value | |

|

|

|

|

|

|

SHORT-TERM INVESTMENTS 98.9% | | | | | | | |

MUTUAL FUND SHARES 98.9% | | | | | | | |

Evergreen Institutional Money Market Fund, Class I, 3.21% q ø ## (cost $18,780,723) | | | 18,780,723 | | | 18,780,723 | |

| | | | |

|

| |

Total Investments (cost $35,269,918) 183.6% | | | | | | 34,870,194 | |

Other Assets and Liabilities (83.6%) | | | | | | (15,873,882 | ) |

| | | | |

|

| |

Net Assets 100.0% | | | | | $ | 18,996,312 | |

| | | | |

|

| |

# | When-issued or delayed delivery security |

q | Rate shown is the 7-day annualized yield at period end. |

ø | Evergreen Investment Management Company, LLC is the investment advisor to both the Fund and the money market fund. |

## | All or a portion of this security has been segregated for when-issued or delayed delivery securities. |

Summary of Abbreviations

FHLMC | Federal Home Loan Mortgage Corp. |

FNMA | Federal National Mortgage Association |

TBA | To Be Announced |

The following table shows the percent of total investments by credit quality based on Moody’s and Standard & Poor’s ratings as of October 31, 2008*:

The following table shows the percent of total investments based on effective maturity as of October 31, 2008*:

Less than 1 year | 15.0% |

1 to 3 year(s) | 4.2% |

3 to 5 years | 1.5% |

5 to 10 years | 79.3% |

|

|

| 100.0% |

|

|

* | Calculations exclude equity securities, collateral from securities on loan and segregated cash and cash equivalents, as applicable. |

See Notes to Financial Statements

8

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2008 (unaudited)

Assets | | | | |

Investments in securities, at value (cost $16,489,195) | | $ | 16,089,471 | |

Investments in affiliated money market fund, at value (cost $18,780,723) | | | 18,780,723 | |

|

|

|

|

|

Total investments | | | 34,870,194 | |

Receivable for securities sold | | | 364,890 | |

Interest receivable | | | 59,723 | |

Receivable from investment advisor | | | 1,001 | |

Prepaid expenses and other assets | | | 6,424 | |

|

|

|

|

|

Total assets | | | 35,302,232 | |

|

|

|

|

|

Liabilities | | | | |

Dividends payable | | | 79,463 | |

Payable for securities purchased | | | 16,212,204 | |

Due to related parties | | | 266 | |

Accrued expenses and other liabilities | | | 13,987 | |

|

|

|

|

|

Total liabilities | | | 16,305,920 | |

|

|

|

|

|

Net assets | | $ | 18,996,312 | |

|

|

|

|

|

Net assets represented by | | | | |

Paid-in capital | | $ | 29,352,097 | |

Overdistributed net investment income | | | (339,871 | ) |

Accumulated net realized losses on investments | | | (9,615,879 | ) |

Net unrealized losses on investments | | | (400,035 | ) |

|

|

|

|

|

Total net assets | | $ | 18,996,312 | |

|

|

|

|

|

Shares outstanding (unlimited number of shares authorized) | | | | |

Class I | | | 2,628,228 | |

|

|

|

|

|

Net asset value per share | | | | |

Class I | | $ | 7.23 | |

|

|

|

|

|

See Notes to Financial Statements

9

STATEMENT OF OPERATIONS

Six Months Ended October 31, 2008 (unaudited)

Investment income | | | | |

Interest | | $ | 899,202 | |

Income from affiliate | | | 95,257 | |

Securities lending | | | 2,966 | |

|

|

|

|

|

Total investment income | | | 997,425 | |

|

|

|

|

|

Expenses | | | | |

Administrative services fee | | | 18,764 | |

Transfer agent fees | | | 441 | |

Trustees’ fees and expenses | | | 1,674 | |

Printing and postage expenses | | | 12,862 | |

Custodian and accounting fees | | | 13,190 | |

Registration and filing fees | | | 7,223 | |

Professional fees | | | 13,446 | |

Other | | | 855 | |

|

|

|

|

|

Total expenses | | | 68,455 | |

Less: Expense reductions | | | (206 | ) |

Expense reimbursements | | | (30,720 | ) |

|

|

|

|

|

Net expenses | | | 37,529 | |

|

|

|

|

|

Net investment income | | | 959,896 | |

|

|

|

|

|

Net realized and unrealized gains or losses on investments | | | | |

Net realized losses on: | | | | |

Securities | | | (7,651,001 | ) |

Credit default swap transactions | | | (308,101 | ) |

Total return swap transactions | | | (394,891 | ) |

|

|

|

|

|

Net realized losses on investments | | | (8,353,993 | ) |

Net change in unrealized gains or losses on investments | | | 1,216,378 | |

|

|

|

|

|

Net realized and unrealized gains or losses on investments | | | (7,137,615 | ) |

|

|

|

|

|

Net decrease in net assets resulting from operations | | $ | (6,177,719 | ) |

|

|

|

|

|

See Notes to Financial Statements

10

STATEMENTS OF CHANGES IN NET ASSETS

| | Six Months Ended

October 31, 2008

(unaudited) | | Year Ended

April 30, 2008 | |

|

|

|

|

|

|

Operations | | | | | | | | | | | |

Net investment income | | | | $ | 959,896 | | | | $ | 2,810,004 | |

Net realized losses on investments | | | | | (8,353,993 | ) | | | | (1,325,391 | ) |

Net change in unrealized gains or losses on investments | | | | | 1,216,378 | | | | | (1,409,634 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in net assets resulting from operations | | | | | (6,177,719 | ) | | | | 74,979 | |

|

|

|

|

|

|

|

|

|

|

|

|

Distributions to shareholders from | | | | | | | | | | | |

Net investment income | | | | | | | | | | | |

Class I | | | | | (961,196 | ) | | | | (1,755,285 | ) |

Tax basis return of capital | | | | | | | | | | | |

Class I | | | | | 0 | | | | | (1,113,554 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

Total distributions to shareholders | | | | | (961,196 | ) | | | | (2,868,839 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

| | Shares | | | | | Shares | | | | |

|

|

|

|

|

|

|

|

|

|

|

|

Capital share transactions | | | | | | | | | | | |

Proceeds from shares sold | | 188,414 | | | 1,674,747 | | 1,393,615 | | | 13,363,533 | |

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value of shares issued in reinvestment of distributions | | 21,820 | | | 184,179 | | 73,555 | | | 707,024 | |

|

|

|

|

|

|

|

|

|

|

|

|

Payment for shares redeemed | | (3,174,099 | ) | | (27,704,992 | ) | (2,239,001 | ) | | (21,558,141 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

Net decrease in net assets resulting from capital share transactions | | | | | (25,846,066 | ) | | | | (7,487,584 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

Total decrease in net assets | | | | | (32,984,981 | ) | | | | (10,281,444 | ) |

Net assets | | | | | | | | | | | |

Beginning of period | | | | | 51,981,293 | | | | | 62,262,737 | |

|

|

|

|

|

|

|

|

|

|

|

|

End of period | | | | $ | 18,996,312 | | | | $ | 51,981,293 | |

|

|

|

|

|

|

|

|

|

|

|

|

Overdistributed net investment income | | | | $ | (339,871 | ) | | | $ | (338,571 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements

11

NOTES TO FINANCIAL STATEMENTS (unaudited)

1. ORGANIZATION

Evergreen Institutional Mortgage Portfolio (the “Fund”) is a diversified series of Evergreen Fixed Income Trust (the “Trust”), a Delaware statutory trust organized on September 18, 1997. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”).

The Fund offers Class I shares. Class I shares are sold without a front-end sales charge or contingent deferred sales charge.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with generally accepted accounting principles in the United States of America, which require management to make estimates and assumptions that affect amounts reported herein. Actual results could differ from these estimates.

a. Valuation of investments

Portfolio debt securities acquired with more than 60 days to maturity are fair valued using matrix pricing methods determined by an independent pricing service which takes into consideration such factors as similar security prices, yields, maturities, liquidity and ratings. Securities for which valuations are not readily available from an independent pricing service may be valued by brokers which use prices provided by market makers or estimates of market value obtained from yield data relating to investments or securities with similar characteristics.

Short-term securities with remaining maturities of 60 days or less at the time of purchase are valued at amortized cost, which approximates market value.

Investments in open-end mutual funds are valued at net asset value. Securities for which market quotations are not readily available or not reflective of current market value are valued at fair value as determined by the investment advisor in good faith, according to procedures approved by the Board of Trustees.

b. Repurchase agreements