UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08879

SUN CAPITAL ADVISERS TRUST

(Exact name of registrant as specified in charter)

| | |

One Sun Life Executive Park, Wellesley Hills, Massachusetts 02481 |

| (Address of principal executive offices) (Zip code) |

James M.A. Anderson

Sun Capital Advisers Trust

One Sun Life Executive Park

Wellesley Hills, Massachusetts 02481

(Name and address of agent for service)

Registrant’s telephone number, including area code: (781) 237-6030

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended:

SUN CAPITAL ADVISERS TRUST®

Annual Report December 31, 2006

Sun Capital® All Cap Fund

Sun Capital Investment Grade Bond Fund®

Sun Capital Money Market Fund®

Sun Capital Real Estate Fund®

SCSM Davis Venture Value Fund

SCSM Oppenheimer Main Street Small Cap Fund

SCSM FI Large Cap Growth Fund

SCSM Blue Chip Mid Cap Fund

| | |

| | Sun Capital Advisers Trust is a mutual fund registered with the Securities and Exchange Commission under the Investment Company Act of 1940. Its investment adviser is Sun Capital Advisers LLC®, a member of the Sun Life Financial group of companies. |

MANAGEMENT’S DISCUSSION & ANALYSIS

ALL CAP FUND

Throughout 2006, the Fund continued to be weighted towards economically sensitive stocks, a strategy we have kept in place since 2003. We have maintained a bias towards large capitalization stocks, ending the quarter with a roughly 76% weighting in large caps, 14% in mid caps, and 10% in small caps. During the fourth quarter the large cap weighting decreased approximately 700 basis points while the mid cap and small cap weightings increased by 600 basis points and 100 basis points, respectively. The weighting changes between large, mid, and small cap holdings was due to better valuation opportunities found in the mid cap and small cap sectors.

During the fourth quarter, we continued to manage the portfolio to take advantage of opportunities in various sectors. Weightings increased in Industrials and Technology, and decreased in Consumer Staples, Healthcare, and Telecommunications. The Fund ended the year with an overweight in Technology, Industrials, Materials, and Health Care and an underweight in Consumer Discretion, Consumer Staples, Energy, Financials, Telecommunications and Utilities.

Overall, the All Cap Fund has maintained a diversified portfolio roughly aligned with S&P 500 Index sector weightings. Specifically, valuation metrics as of December 31 show the portfolio trading at 1.63 times sales vs. 2.00 times for the S&P 500 index, a price to book of 1.8 vs. 2.8, and a price to cash flow of 12.3 vs. 11.3, respectively. The portfolio’s dividend yield was 1.7% versus 1.7% for the S&P 500 Index, and debt to capitalization ratio was 35% vs. 32% for the S&P 500 Index.

1

ALL CAP FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2006 | | INDUSTRY WEIGHTINGS At December 31, 2006 |

| | | |

| | | % of Net Assets | |

General Electric Co. | | 4.2 | % |

MRV Communications, Inc. | | 3.7 | |

Ciena Corp. | | 3.2 | |

Verizon Communications, Inc. | | 3.0 | |

Exxon Mobil Corp. | | 2.9 | |

Redback Networks, Inc. | | 2.7 | |

Finisar Corp. | | 2.6 | |

Omnicare, Inc. | | 2.4 | |

Citigroup, Inc. | | 2.3 | |

JPMorgan Chase & Co. | | 2.1 | |

| | | |

| | | % of Net Assets | |

Communications Equipment | | 13.5 | % |

Oil, Gas & Consumable Fuels | | 7.3 | |

Diversified Financial Services | | 6.4 | |

Pharmaceuticals | | 6.1 | |

Industrial Conglomerates | | 5.8 | |

Software | | 4.2 | |

Health Care Provider & Services | | 4.1 | |

Media | | 4.1 | |

Insurance | | 3.8 | |

Aerospace & Defense | | 3.7 | |

Computer & Peripherals | | 3.7 | |

Commercial Banks | | 3.2 | |

Diversified Telecommunication Services | | 3.0 | |

Beverages | | 2.7 | |

Capital Markets | | 2.6 | |

Leisure Equipment & Products | | 2.2 | |

Electric Utilities | | 1.7 | |

Hotels Restaurants & Leisure | | 1.5 | |

Consumer Finance | | 1.3 | |

Food & Staples Retailing | | 1.3 | |

Tobacco | | 1.2 | |

Short Term Investments | | 1.1 | |

Chemicals | | 1.0 | |

Health Care Equipment & Supplies | | 1.0 | |

Health Care Technology | | 1.0 | |

Household Products | | 1.0 | |

Biotechnology | | 0.9 | |

Electrical Equipment | | 0.9 | |

Internet Software & Services | | 0.9 | |

Metals & Mining | | 0.9 | |

Multiline Retail | | 0.9 | |

REITS | | 0.9 | |

Semiconductors & Semiconductor Equipment | | 0.9 | |

Specialty Retail | | 0.9 | |

Thrift & Mortgage Finance | | 0.9 | |

Air Freight & Logistics | | 0.8 | |

Multi-Utilities | | 0.8 | |

Paper & Forest Products | | 0.8 | |

Machinery | | 0.5 | |

Personal Products | | 0.4 | |

Other assets less liabilities | | 0.1 | |

| | | |

| | 100.0 | % |

| | | |

2

ALL CAP FUND

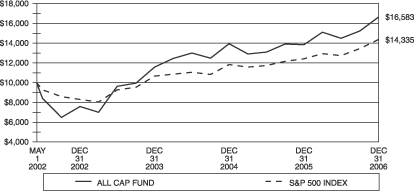

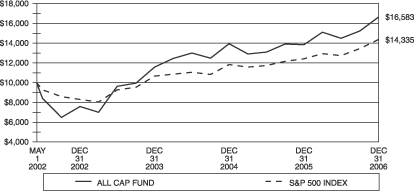

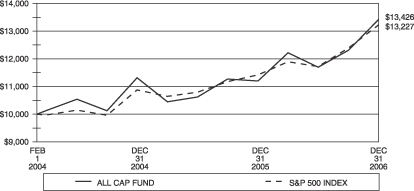

Comparison of Change in Value of a $10,000 Investment in the All Cap Fund – Initial Class and the S&P 500 Index

Comparison of Change in Value of a $10,000 Investment in the All Cap Fund – Service Class and the S&P 500 Index

3

ALL CAP FUND

Total Returns for Periods Ended December 31, 2006**

| | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | Life of

Fund*** | |

All Cap Fund | | 20.07 | % | | 12.80 | % | | N/A | | 11.44 | % |

S&P 500 Index* | | 15.79 | % | | 10.45 | % | | N/A | | 8.02 | % |

Service Class Shares | | | | | | | | | | | |

All Cap Fund | | 19.78 | % | | N/A | | | N/A | | 10.64 | % |

S&P 500 Index* | | 15.79 | % | | N/A | | | N/A | | 10.06 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The Standard & Poor’s 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and certain other expenses during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the All Cap Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from May 1, 2002 (commencement of operations) to December 31, 2006. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2006.

4

MANAGEMENT’S DISCUSSION & ANALYSIS

INVESTMENT GRADE BOND FUND

Performance for 2006 was positively impacted by an overweight to the credit sector, particularly below investment grade and BBB rated securities as market participants embraced higher yielding instruments. The Fund’s duration, which was generally short that of the Index, positively affected results.

Mortgage-backed securities (MBS) comprised 33.9% of the portfolio at December 31, 2006, while 41.3% of fund assets were allocated to the credit sector. The portfolio retained 8.4% commercial mortgages-backed securities (CMBS), 6.2% US Treasuries, almost 4.4% US Agencies and 1.3% asset-backed securities (ABS).

After 17 straight 25 basis point (bp) increases which raised the overnight lending rate from 1%, the Federal Reserve left the overnight lending rate unchanged at the last four meetings of the Federal Open Market Committee (FOMC) in 2006. During 2006, the Fed Funds rate increased from 4.50%, to its current 5.25%. During 2006, the 10-year US Treasury increased by 34bp to 4.70%, while the 2-year jumped by 48bp to 4.81%. A Treasury curve inversion persisted at year-end 2006 as the Federal Funds rate was 55bp higher than the 10-year US Treasury.

With 3rd quarter GDP being reported as 2%, the economy has slowed from its Q1 2006 and Q2 2006 growth rates of 5.6% and 2.6%, respectively. The slowdown in the housing sector, and to a lesser extent manufacturing, especially autos, were the primary drivers behind the anemic Q3 2006 growth figure. Despite the housing slowdown, to date, other sectors of the economy have not been as affected as once feared, specifically the consumer. With the employment picture remaining solid and energy prices having receded from their highs, data related to consumer spending has remained acceptable, dispelling the notion that declining home prices would remove a feeling of wealth and subsequently the penchant to spend. In addition, recent consumer confidence readings have also surprised on the upside, perhaps as a result of the recent strong performance of the equity markets.

While inflation levels remain elevated according to the Fed, expectations are for a “moderation over time”. The housing market is, according to a Fed release, undergoing a “substantial cooling”. However, spillover affects from housing have not been felt in other areas of the economy as the consumer remains vibrant according to recent measures. The manufacturing sector has also slowed from a relatively vibrant pace but appears to be on solid footing. In addition, manufacturing is continuing to become less relevant to the services-led economy on the United States. The Fed believes that the economy is “likely to expand at a moderate pace”.

Spread sectors continue to offer upside opportunity when compared to US Treasuries. The credit sector benefits from very strong supply/demand technicals, including heavy foreign buying. At the end of 1995, insurance companies held approximately 34% of the outstanding corporate securities while foreign buyers owned about 16%. Currently, insurance companies own about 25%, while foreign entities report owning 28%. Notwithstanding a weaker US Dollar, it is not expected that foreign buyers curtail their buying of US corporate credit. While shareholding enhancing activities remain a concern, especially LBOs, many new corporate bonds contain provisions that allow the bondholder the right to sell or “put” the bond back to the issuer at par or higher should an LBO occur. Away from LBOs, company credit fundamentals appear very solid after years of repair. Some minor deterioration is to be expected. Defaults, which may move up from historically low levels should continue to remain well below long term norms. MBS and CMBS securities retain attractive risk adjusted valuations and will continue to be a focus. Portfolio duration, given our interest rate outlook, will remain matched to slightly long the benchmark duration.

5

INVESTMENT GRADE BOND FUND

| | |

TOP TEN BOND ISSUERS At December 31, 2006 | | PORTFOLIO COMPOSITION At December 31, 2006 |

| | | |

| | | % of Net Assets | |

Federal National Mortgage Association | | 25.6 | % |

Federal Home Loan Mortgage | | 11.2 | |

U.S. Treasury Notes | | 6.4 | |

Government National Mortgage Association | | 2.2 | |

Commercial Net Lease Realty | | 2.1 | |

Ford Motor Credit Co. | | 1.8 | |

GMAC Commercial Mortgage Securities, Inc. | | 1.8 | |

Allegheny Energy Supply Co. LLC | | 1.5 | |

Capital One Capital III | | 1.5 | |

Peco Energy Transition Trust | | 1.4 | |

| | | |

| | | % of Net Assets | |

U.S. Government Agency Obligations | | 45.7 | % |

Corporate Debt Obligations | | 42.5 | |

Commercial Mortgage Backed Securities | | 8.7 | |

Short Term Investments | | 4.5 | |

Asset Backed Securities | | 1.4 | |

Liabilities in excess of other assets | | (2.8 | ) |

| | | |

| | 100.0 | % |

| | | |

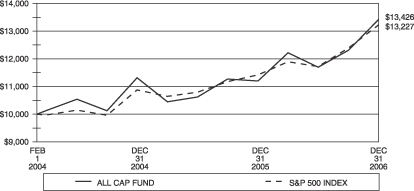

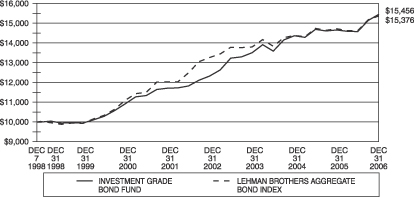

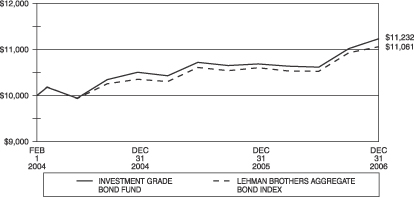

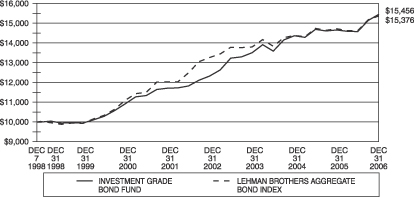

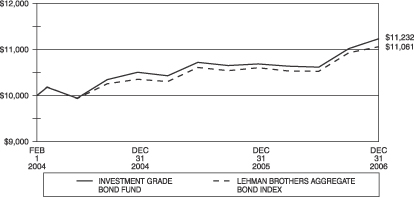

Comparison of Change in Value of a $10,000 Investment in the Investment Grade Bond Fund – Initial Class and the Lehman Brothers Aggregate Bond Index

Comparison of Change in Value of a $10,000 Investment in the Investment Grade Bond Fund – Service Class and the Lehman Brothers Aggregate Bond Index

6

INVESTMENT GRADE BOND FUND

Total Returns for Periods Ended December 31, 2006**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of Fund*** | |

Investment Grade Bond Fund | | 5.39 | % | | 4.57 | % | | 5.70 | % | | 5.54 | % |

Lehman Brothers Aggregate Bond Index* | | 4.33 | % | | 3.70 | % | | 5.06 | % | | 5.47 | % |

Service Class Shares | | | | | | | | | | | | |

Investment Grade Bond Fund | | 5.13 | % | | N/A | | | N/A | | | 4.07 | % |

Lehman Brothers Aggregate Bond Index* | | 4.33 | % | | N/A | | | N/A | | | 3.52 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The Lehman Brothers Aggregate Bond Index is composed of securities from the Lehman Brothers Government/Credit Index, the Mortgage-Backed Securities Index and the Asset-Backed Securities Index.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Investment Grade Bond Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2006. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2006.

7

MANAGEMENT’S DISCUSSION & ANALYSIS

MONEY MARKET FUND

At December 31, 2006, the Fund had net assets of $121.4 million, compared to $110.9 million a year earlier. The Fund had a seven-day yield of 4.75% and an average maturity of 40 days. The portfolio was primarily invested in highly rated commercial paper.

The Federal Open Market Committee (FOMC) of the Federal Reserve Board started the year with the Federal Funds rate at 4.25%. The Fed increased rates at its first four meetings by 25 basis points at each meeting before pausing in June at 5.25%, where it ended the year.

The minutes of the FOMC December 12th meeting were released on January 3rd of 2007. The minutes indicated that the Governors believe the biggest risk to the economy continues to be the current elevated level of inflation. However, the lower energy costs, effects of prior interest rate increases and a cooling housing market will continue to impede further inflationary pressures. Policy change will be dependent on the strength of economic growth versus inflation in the upcoming months.

Three-month Treasury bills started the year at the low of 4.08%. Rates began to increase with the four consecutive rate hikes and Treasury bills reached their high on July 25, 2006 at 5.13% and ended the year at 5.01%. The spread on 90-day commercial paper over Treasury bills fluctuated between 16 and 57 basis points during the year.

With the FOMC most likely on hold for at least the first quarter of 2007, it is our current strategy to maintain an average maturity that reflects a neutral Fed. We will continue to invest in a diversified portfolio of high quality instruments.

| | |

TOP TEN ISSUERS At December 31, 2006 | | PORTFOLIO COMPOSITION At December 31, 2006 |

| | | |

| | | % of Net Assets | |

FCAR Owner Trust | | 4.2 | % |

Canada (Govt of) | | 4.1 | |

Merrill Lynch & Co., Inc. | | 4.1 | |

Societe Generale North America | | 4.1 | |

International Business Machines Corp. (IBM) | | 4.1 | |

Province of British Columbia | | 4.1 | |

AT&T, Inc. | | 4.0 | |

Barclays U.S. Funding | | 4.0 | |

Harley Davidson | | 4.0 | |

Morgan Stanley Dean Witter | | 4.0 | |

| | | |

| | | % of Net Assets | |

Commercial Paper | | 97.6 | % |

Mutual Funds | | 2.3 | |

Other assets less liabilities | | 0.1 | |

| | | |

| | 100.0 | % |

| | | |

8

MONEY MARKET FUND

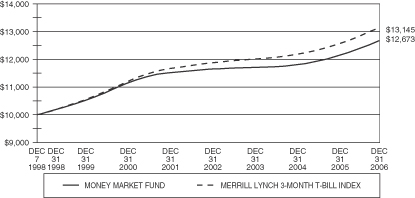

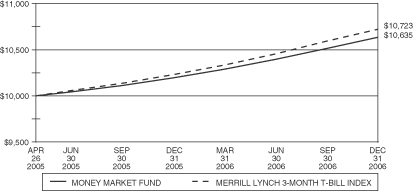

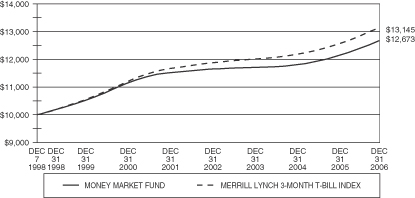

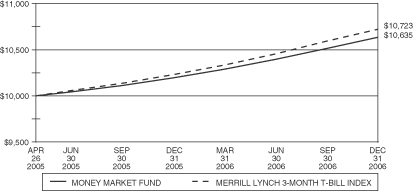

Comparison of Change in Value of a $10,000 Investment in the Money Market Fund –Initial Class and the Merrill Lynch 3-Month U.S. Treasury Bill Index

Comparison of Change in Value of a $10,000 Investment in the Money Market Fund –Service Class and the Merrill Lynch 3-Month U.S. Treasury Bill Index

9

MONEY MARKET FUND

Total Returns for Periods Ended December 31, 2006**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Money Market Fund | | 4.59 | % | | 2.68 | % | | 1.94 | % | | 2.98 | % |

Merrill Lynch 3-month U.S. Treasury Bill Index* | | 4.82 | % | | 3.06 | % | | 2.42 | % | | 3.44 | % |

Service Class Shares | | | | | | | | | | | | |

Money Market Fund | | 4.33 | % | | N/A | | | N/A | | | 3.71 | % |

Merrill Lynch 3-month U.S. Treasury Bill Index* | | 4.82 | % | | N/A | | | N/A | | | 4.23 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The Merrill Lynch three-month U.S. Treasury Bill Index is a one-security index which at the beginning of every month selects for inclusion the U.S. Treasury Bill maturing closest to, but not beyond 91 days from that date. That issue is then held for one month, sold and rolled into the new U.S. Treasury Bill.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Money Market Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2006. Service Class Shares for the period from April 25, 2005 (commencement of operations) to December 31, 2006.

10

MANAGEMENT’S DISCUSSION & ANALYSIS

REAL ESTATE FUND

The best performing stocks in the portfolio during the last twelve months were SL Green Reality Corp., Medical Properties Trust, Inc., Equity Office Properties Trust, AvalonBay Communities, Inc., and Vornado Realty Trust. The worst performing stocks during the last twelve months were Pennsylvania Real Estate Investment, New York Community Bancorp, Inc., Alexandria Real Estate Equities, Inc., CapitalSource, Inc. and Eastgroup Properties, Inc.

For the last twelve months, the MSCI US REIT Index was up 35.92%, outperforming the Dow Jones Industrial Average, the S&P 500 Index, and the NASDAQ Composite Index which were up 19.03%, 15.79%, and 10.38%, respectively.

Real estate fundamentals are very good at the moment, and there is no indication that fundamentals will take a turn for the worse. Therefore, with earnings at or near their peak for many of the REIT property types, it seems odd that valuation multiples are also at peak levels. In other words, after outperforming every major market index each year for the past seven years, and with fundamentals as good as they have ever been, investors are expecting the good times continue. If that were not the case, valuation multiples would be below average, indicating that earnings were decelerating, or even going down.

The nature of real estate ownership dictates that fundamentals rarely break down overnight due to the presence of leases. Therefore, dedicated real estate investors have the luxury (or burden) of being able to monitor trends like job growth, interest rates, and development starts, that often can signal a reversal of fortunes. For the time being all indications are that nothing is changing, other than some scattered reports of new developments appearing on the drawing board. The large amount of acquisitions and go-private transactions in the REIT universe in 2006 eliminated a number of viable investment alternatives in the lodging, apartment, retail, and office sectors, but also created opportunities for some not widely held U.S. REITs and international REITs to expand their equity market capitalizations. If the strong performance in fourth quarter of 2006 was any indication, health care REITs could be one of the property types that is gaining investor acceptance. The Fund is currently meaningfully underweight residential, and has built a large weighting in health care REITs, which are within the specialty property type of the benchmark.

The average dividend yield for the MSCI U.S. REIT Index was 3.6% at the end of the 4th quarter 2006. The Fund finished the quarter with an average dividend yield of 3.9%. The average equity market capitalization for the Fund was $8.34 billion, compared to $3.65 billion for the MSCI U.S.REIT Index.

| | |

TOP TEN REIT HOLDINGS At December 31, 2006 | | SECTOR WEIGHTINGS At December 31, 2006 |

| | | |

| | | % of Net Assets | |

Simon Property Group, Inc. | | 4.6 | % |

Ventas, Inc. | | 4.6 | |

SL Green Reality Corp. | | 4.4 | |

Macerich Co. | | 4.2 | |

Medical Properties Trust, Inc. | | 4.0 | |

Equity Office Properties Trust | | 4.0 | |

Archstone-Smith Trust | | 4.0 | |

BRE Properties, Inc. | | 3.8 | |

Highwoods Properties, Inc. | | 3.5 | |

Alexandria Real Estate Equities, Inc. | | 3.5 | |

| | | |

| | | % of Net Assets | |

Office | | 15.5 | % |

Regional Malls | | 14.0 | |

Apartments | | 13.2 | |

Health Care Equipment & Services | | 10.6 | |

Diversified | | 10.2 | |

Shopping Centers | | 9.3 | |

Hotel & Restaurants | | 6.8 | |

Warehouse & Industrial | | 5.8 | |

Banks | | 3.2 | |

Financial Services | | 3.0 | |

Storage | | 2.8 | |

Short-Term Investments | | 2.7 | |

Mortgage | | 2.7 | |

Other assets less liabilities | | 0.2 | |

| | | |

| | 100.0 | % |

| | | |

11

REAL ESTATE FUND

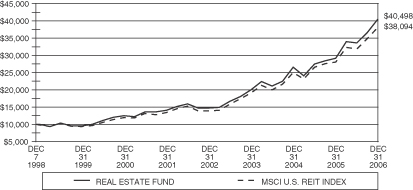

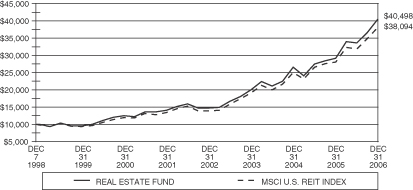

Comparison of Change in Value of a $10,000 Investment in the Real Estate Fund – Initial Class and the MSCI U. S. REIT Index

Comparison of Change in Value of a $10,000 Investment in the Real Estate Fund –Service Class and the MSCI U. S. REIT Index

12

REAL ESTATE FUND

Total Returns for Periods Ended December 31, 2006**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Real Estate Fund | | 38.96 | % | | 26.66 | % | | 23.51 | % | | 18.93 | % |

MSCI US REIT Index* | | 35.92 | % | | 26.08 | % | | 23.22 | % | | 18.01 | % |

Service Class Shares | | | | | | | | | | | | |

Real Estate Fund | | 38.64 | % | | N/A | | | N/A | | | 25.45 | % |

MSCI US REIT Index* | | 35.92 | % | | N/A | | | N/A | | | 25.06 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees. The MSCI U.S. REIT Index is a total-return index composed of the most actively traded real estate investment trusts and is designed to be a measure of real estate equity performance.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Real Estate Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2006. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2006.

13

MANAGEMENT’S DISCUSSION & ANALYSIS

DAVIS VENTURE VALUE FUND (subadvised by Davis Advisors)

During the twelve-month period ended December 31, 2006, the stock market, as measured by the Standard & Poor’s 500 Index, increased by 15.79%. U.S. economic activity, as measured by the gross domestic product (“GDP”), increased by 1.8% in the last calendar quarter of 2005 and between 2.2% and 5.6% over each of the first three calendar quarters of 2006. Interest rates, as measured by the 10-year Treasury bond, began 2006 a little above 4.4%, peaked in June at about 5.1%, and ended the year just below 4.6%.

Consumer discretionary companies were the most important contributors to the Fund’s performance over the twelve-month period. The Fund benefited from careful stock selection in this sector as the Fund’s consumer discretionary companies out-performed consumer discretionary companies included in the Index. Comcast and Harley-Davidson were among the top contributors to performance. Apollo Group (purchased in March 2006) and H&R Block were among the top detractors from performance.

Diversified financial and consumer staple companies also made important contributions to performance. Two diversified financial companies, JPMorgan Chase and American Express, and one consumer staples company, Altria, were among the top contributors to performance. One consumer staples company, Hershey Foods, was among the top detractors from performance.

The Fund’s largest investment was in insurance companies. While insurance companies made a positive contribution to performance, they under-performed the Index. Berkshire Hathaway and Loews were among the top contributors to performance. Progressive and Transatlantic Holdings were among the top detractors from performance.

The Fund’s investments in telecommunication service and energy companies also contributed to the Fund under-performing the Index over the twelve-month period. Telecommunication service companies were the strongest performing sector of the Index, but the telecommunication service companies owned by the Fund did not perform as well. While energy companies made positive contributions to the Fund’s performance, they also under-performed the Index. One energy company, ConocoPhillips, was among the top contributors to performance. One telecommunications company, Sprint Nextel (purchased in March 2006), and one energy company, EOG Resources, were among the top detractors from performance.

The Fund had approximately 6% of its assets invested in foreign companies at December 31, 2006. As a group, the foreign companies owned by the Fund out-performed the S&P 500 Index over the twelve-month period. Consistent with our low-turnover strategy, only two companies dropped out of the Fund’s top 13 holdings, Progressive and Golden West Financial. Progressive remains among the Fund’s top 20 holdings at year-end and Golden West Financial was acquired by Wachovia. Two new additions to the Fund’s top 13 holdings at year-end were Wachovia (which the Fund received when Wachovia acquired Golden West Financial) and Citigroup (which had already been a top 20 holding).

14

DAVIS VENTURE VALUE FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2006 | | INDUSTRY WEIGHTINGS At December 31, 2006 |

| | | |

| | | % of Net Assets | |

ConocoPhillips | | 4.6 | % |

American Express Co | | 4.6 | |

American International Group, Inc. | | 4.5 | |

Altria Group, Inc | | 4.5 | |

Tyco International, Ltd. | | 4.3 | |

JPMorgan Chase & Co | | 4.2 | |

Costco Wholesale Corp. | | 3.6 | |

Comcast Corp. Class A Special | | 3.5 | |

Berkshire Hathaway, Inc. Class A | | 3.4 | |

HSBC Holdings PLC | | 2.7 | |

| | | |

| | | % of Net Assets | |

Insurance | | 14.4 | % |

Oil, Gas & Consumable Fuels | | 11.3 | |

Commercial Banks | | 8.2 | |

Diversified Financial Services | | 7.8 | |

Media | | 7.2 | |

Food & Staples Retailing | | 5.5 | |

Consumer Finance | | 4.6 | |

Tobacco | | 4.5 | |

Industrial Conglomerates | | 4.3 | |

Health Care Providers & Services | | 3.7 | |

Capital Markets | | 2.5 | |

Containers & Packaging | | 2.2 | |

Software | | 2.2 | |

Beverages | | 2.0 | |

Automobiles | | 1.9 | |

Wireless Telecommunication Services | | 1.6 | |

Construction Materials | | 1.5 | |

Commercial Services & Supplies | | 1.3 | |

Computers & Peripherals | | 1.3 | |

Diversified Consumer Services | | 1.3 | |

IT Services | | 1.3 | |

Internet & Catalog Retail | | 1.3 | |

Specialty Retail | | 1.3 | |

Household Products | | 1.1 | |

Short Term Investments | | 1.1 | |

Transportation Infrastructure | | 1.0 | |

Energy Equipment & Services | | 0.8 | |

Food Products | | 0.6 | |

Air Freight & Logistics | | 0.5 | |

Marine | | 0.4 | |

Metals & Mining | | 0.4 | |

Personal Products | | 0.4 | |

Communications Equipment | | 0.2 | |

Household Durables | | 0.2 | |

Multiline Retail | | 0.2 | |

Liabilities in excess of other assets | | (0.1 | ) |

| | | |

| | 100.0 | % |

| | | |

15

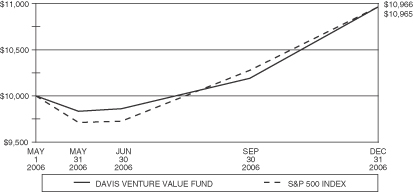

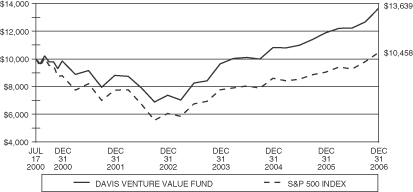

DAVIS VENTURE VALUE FUND

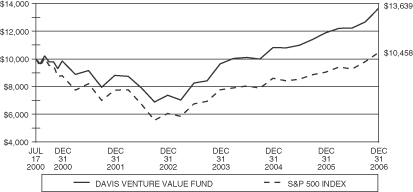

Comparison of Change in Value of a $10,000 Investment in the Davis Venture Value Fund – Initial Class and the S&P 500 Index

Comparison of Change in Value of a $10,000 Investment in the Davis Venture Value Fund – Service Class and the S&P 500 Index

16

DAVIS VENTURE VALUE FUND

Total Returns for Periods Ended December 31, 2006**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Davis Venture Value Fund | | 14.77 | % | | 12.30 | % | | 9.13 | % | | 4.92 | % |

S&P 500 Index* | | 15.79 | % | | 10.45 | % | | 6.19 | % | | 0.69 | % |

Service Class Shares | | | | | | | | | | | | |

Davis Venture Value Fund | | N/A | | | N/A | | | N/A | | | 9.66 | % |

S&P 500 Index* | | N/A | | | N/A | | | N/A | | | 9.65 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The Standard & Poor’s 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and certain other expenses during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Davis Venture Value Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2006. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2006.

17

MANAGEMENT’S DISCUSSION & ANALYSIS

OPPENHEIMER MAIN STREET SMALL CAP FUND (subadvised by OppenheimerFunds, Inc.)

OppenheimerFunds began subadvising the Fund on January 9, 2006, since which time through December 31, 2006 the Fund produced lower returns than its benchmark, the Russell 2000 Index. We attribute the Fund’s performance primarily to its underweighted position in real estate investment trusts, which fared relatively well during the reporting period, and its comparatively heavy exposure to mid-cap stocks, which generally lagged other capitalization ranges in 2006.

Although our investment approach relies on the results of our multi-factor quantitative models, and not our subjective view of economic events, it is worth noting that economic conditions changed significantly during 2006. While the first half of the year was characterized by rising interest rates and robust economic growth, the July through December period saw stable short-term interest rates and the onset of an economic slowdown. In fact, after more than two years of steady increases that drove the overnight federal funds rate from 1% to 5.25% by the end of June 2006, the Federal Reserve Board refrained from further rate hikes during the remainder of the reporting period. The pause in the Fed’s tightening campaign apparently was a response to cooling housing markets, less robust employment gains and other signs that the U.S. economy is moving to a slower, more mature phase of its cycle. Yet, the rate of inflation has remained above the Fed’s stated “comfort zone,” despite a sharp decline in energy prices in the final four months of the year.

With their economic and inflation outlooks more uncertain, investors began to turn away from smaller, economically sensitive companies and toward larger, well-established businesses with track records of consistent earnings under a variety of economic conditions. From 2000 through 2005, micro-, small- and mid-cap stocks produced substantially higher returns, on average, than larger capitalization ranges as investors remained comfortable with the risks that smaller companies typically entail. In contrast, the largest U.S. companies, which comprise the “mega-cap” category, underperformed other capitalization ranges. This situation began to change in 2006, as mega-cap stocks pulled ahead of mid- and large-cap stocks, but continued to trail small- and micro-cap stocks for the year overall.

Within the small-cap market, value-oriented stocks produced returns that were significantly higher than those of growth-oriented shares. This was largely due to high mergers & acquisitions (M&A) and leverage buyout (LBO) activity, which caused a rise in prices for inexpensively valued companies across the board. Additionally, the cyclical nature of value companies benefited from the strong global economy.

The momentum factors considered by our quantitative stock selection models became less predictive of performance as market conditions evolved, and stocks that had done well over the first half of the year fared relatively poorly over the second half. For example, a number of industrial and energy companies had strong momentum characteristics after gaining value over the first half of 2006, but many of those companies lagged the averages during the second half as the U.S. economy slowed and commodity prices fell. Conversely, real estate investment trusts that had relatively weak momentum characteristics rallied strongly during the final six months of 2006. Our stock selection models also proved to be relatively ineffective in the consumer staples, technology and health care sectors. In addition, the Fund’s relative performance was hindered by its relatively heavy exposure to mid-cap stocks during a year in which mid-cap stocks produced below-average results.

These disappointments were offset to a significant degree by better performance in other areas, where valuation factors contributed to high rankings for a number of individual companies. For example, both valuation and momentum factors supported high rankings for stocks in the basic materials sector, leading to an overweighted position in one of the small-cap market’s better performing areas. Finally, seasonal factors considered by our “turn of the year” model helped the Fund participate more fully in a year-end rally among lower-quality stocks.

As of the end of the reporting period, our models prefer larger stocks within the small-cap market and as a result we have reduced the Fund’s exposure to micro-cap stocks. Our stock selection models have assigned relatively high rankings to companies in the basic materials and technology sectors, and generally lower rankings to stocks in the more fully valued utilities, heath care, energy and consumer staples areas.

18

OPPENHEIMER MAIN STREET SMALL CAP FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2006 | | INDUSTRY WEIGHTINGS (Continued) At December 31, 2006 |

| | | |

| | | % of Net Assets | |

Payless Shoesource, Inc. | | 0.4 | % |

Greif, Inc. | | 0.4 | |

Cleveland-Cliffs, Inc. | | 0.4 | |

AK Steel Holding Corp. | | 0.4 | |

AMERIGROUP Corp. | | 0.4 | |

Oregon Steel Mills, Inc. | | 0.4 | |

Hercules, Inc. | | 0.4 | |

WR Grace & Co. | | 0.4 | |

Chaparral Steel Co. | | 0.4 | |

Interdigital Communications Corp. | | 0.4 | |

INDUSTRY WEIGHTINGS

At December 31, 2006

| | | |

| | | % of Net Assets | |

Specialty Retail | | 5.8 | % |

Commercial Services & Supplies | | 5.1 | |

Semiconductors & Semiconductor Equipment | | 4.9 | |

Software | | 4.8 | |

Chemicals | | 4.0 | |

Insurance | | 3.9 | |

Machinery | | 3.7 | |

REITS | | 3.6 | |

Electronic Equipment & Instruments | | 3.5 | |

Health Care Provider & Services | | 3.1 | |

Metals & Mining | | 3.1 | |

Communications Equipment | | 3.0 | |

Internet Software & Services | | 3.0 | |

IT Services | | 2.9 | |

Oil, Gas & Consumable Fuels | | 2.8 | |

Energy Equipment & Services | | 2.3 | |

Hotels Restaurants & Leisure | | 2.3 | |

Textiles, Apparel & Luxury Goods | | 1.9 | |

Computers & Peripherals | | 1.8 | |

Electrical Equipment | | 1.8 | |

Thrift & Mortgage Finance | | 1.8 | |

Diversified Consumer Services | | 1.7 | |

Health Care Equipment & Supplies | | 1.7 | |

Pharmaceuticals | | 1.6 | |

Household Durables | | 1.5 | |

| | | |

| | | % of Net Assets | |

Auto Components | | 1.4 | % |

Media | | 1.4 | |

Consumer Finance | | 1.2 | |

Diversified Telecommunication Services | | 1.2 | |

Aerospace & Defense | | 1.1 | |

Life Sciences Tools & Services | | 1.1 | |

Capital Markets | | 1.0 | |

Commercial Banks | | 0.9 | |

Construction & Engineering | | 0.9 | |

Containers & Packaging | | 0.9 | |

Air Freight & Logistics | | 0.8 | |

Airlines | | 0.8 | |

Food & Staples Retailing | | 0.8 | |

Multiline Retail | | 0.8 | |

Trading Companies & Distributors | | 0.8 | |

Food Products | | 0.7 | |

Leisure Equipment & Products | | 0.7 | |

Personal Products | | 0.7 | |

Road & Rail | | 0.7 | |

Construction Materials | | 0.6 | |

Internet & Catalog Retail | | 0.6 | |

Building Products | | 0.5 | |

Electric Utilities | | 0.5 | |

Gas Utilities | | 0.5 | |

Multi-Utilities | | 0.5 | |

Health Care Technology | | 0.3 | |

Marine | | 0.3 | |

Paper & Forest Products | | 0.3 | |

Wireless Telecommunication Services | | 0.3 | |

Beverages | | 0.2 | |

Biotechnology | | 0.2 | |

Diversified Financial Services | | 0.2 | |

Tobacco | | 0.2 | |

Automobiles | | 0.1 | |

Distributors | | 0.1 | |

Household Products | | 0.1 | |

Independent Power Producers & Energy Traders | | 0.1 | |

Industrial Conglomerates | | 0.1 | |

Real Estate Management & Development | | 0.1 | |

Other asset less liabilities | | 0.7 | |

| | | |

| | 100.0 | % |

| | | |

19

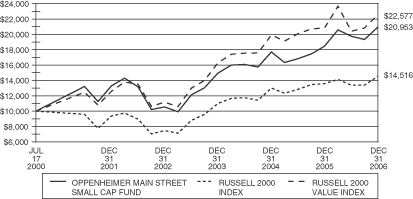

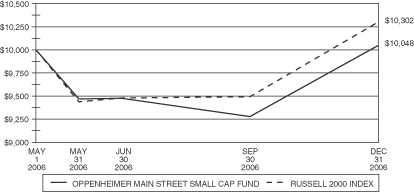

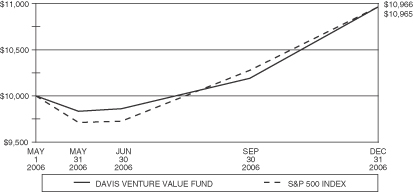

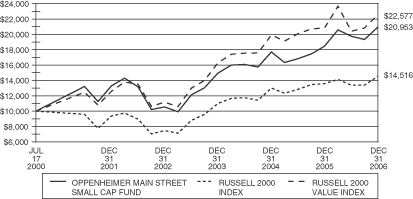

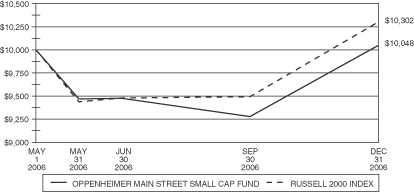

OPPENHEIMER MAIN STREET SMALL CAP FUND

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Main Street Small Cap Fund – Initial Class, Russell 2000 Index and the Russell 2000 Value Index

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Main Street Small Cap Fund – Service Class and the Russell 2000 Index

20

OPPENHEIMER MAIN STREET SMALL CAP FUND

Total Returns for Periods Ended December 31, 2006**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Oppenheimer Main Street Small Cap Fund | | 13.60 | % | | 11.96 | % | | 9.55 | % | | 12.13 | % |

Russell 2000 Index* | | 18.37 | % | | 13.56 | % | | 11.39 | % | | 5.93 | % |

Russell 2000 Value Index* | | 23.48 | % | | 16.48 | % | | 15.37 | % | | 13.43 | % |

Service Class Shares | | | | | | | | | | | | |

Oppenheimer Main Street Small Cap Fund | | N/A | | | N/A | | | N/A | | | 0.48 | % |

Russell 2000 Index* | | N/A | | | N/A | | | N/A | | | 3.02 | % |

*Effective with the change in subadviser to OppenheimerFunds, Inc. on January 9, 2006, the benchmark index was changed from the Russell 2000 Value Index to the Russell 2000 Index. The performance data of each index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The Russell 2000 Value Index is an unmanaged, marketweighted total return index that measures the performance of companies within the Russell 2000 Index having lower price-to-book ratios and lower forecasted growth values. The Russell 2000 Index includes the 2000 companies with the smallest market capitalizations from the Russell 3000 Index.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Oppenheimer Main Street Small Cap Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2006. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2006.

21

MANAGEMENT’S DISCUSSION & ANALYSIS

FI LARGE CAP GROWTH FUND (subadvised by Pyramis Global Advisors, LLC)

The Materials, Industrials, and Telecommunication Services sectors finished as the Fund’s largest contributors. Outperformance within Materials was due in large part to holdings within the Metals & Mining industry. Share prices of Allegheny Technologies, a specialty metals producer, appreciated from record stainless steel profits driven by the company’s purchase of cheap nickel. The Industrial sector’s positive return was largely attributed to the Machinery industry, where holdings of Manitowoc, a manufacturer of cranes and construction related equipment, accounted for much of the outperformance. Manitowoc shares appreciated after the company announced positive earnings results stemming from continued demand within non-residential construction markets.

The Consumer Discretionary and Information Technology sectors proved to be the two largest detractors from performance. The former’s underperformance was due to stock selection within the Specialty Retail and Household Durable industries. Share prices of two Specialty Retail holdings, Circuit City and Ann Taylor declined over the period as investors worried that a projected U.S. economic slowdown would slow consumer spending. A number of semiconductor holdings in the Information Technology sector dragged down returns as their performance did not meet expectations.

The Portfolio is positioned to gain from active stock selection through a combination of quantitative and fundamental research platforms that seek companies with faster, more consistent growth prospects at attractive valuations. We continue to favor the Machinery industry, with positions in heavy machinery manufacturers. We believe these businesses will benefit from a continued global boom in non-residential construction and steady demand for mining-related equipment. Additionally, we are overweight the Biotechnology industry, focusing on companies with strong franchises and solid product pipelines. Within the Information Technology sector, we are bullish on the Computer & Peripherals industry, maintaining our positions in Hard Disk Drive producers and Personal Computer manufacturers. We believe these businesses will benefit from market share gains and better than expected PC and flash data storage demand. Finally of note, we are overweight the Metals & Mining industry, focusing on specialty metals producers that should grow earnings from demand within the Aerospace industry and increased production capacity.

22

FI LARGE CAP GROWTH FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2006 | | INDUSTRY WEIGHTINGS At December 31, 2006 |

| | | |

| | | % of Net Assets | |

Google, Inc. | | 3.6 | % |

Allegheny Technologies, Inc. | | 3.1 | |

Manitowoc, Inc. | | 3.0 | |

Joy Global, Inc. | | 2.9 | |

Hewlett-Packard Co. | | 2.9 | |

Terex Corp. | | 2.8 | |

Merrill Lynch & Co., Inc. | | 2.7 | |

Cisco Systems, Inc. | | 2.7 | |

Cymer, Inc. | | 2.7 | |

Western Digital Corp. | | 2.7 | |

| | | |

| | | % of Net Assets | |

Machinery | | 10.4 | % |

Computers & Peripherals | | 10.3 | |

Biotechnology | | 8.5 | |

Semiconductors & Semiconductor Equipment | | 7.3 | |

Short Term Investments | | 6.3 | |

Capital Markets | | 5.7 | |

Health Care Providers & Services | | 4.6 | |

Communications Equipment | | 4.3 | |

Specialty Retail | | 4.3 | |

Metals & Mining | | 3.9 | |

Oil, Gas & Consumable Fuels | | 3.8 | |

Internet Software & Services | | 3.6 | |

Food & Staples Retailing | | 3.1 | |

Multiline Retail | | 2.9 | |

Pharmaceuticals | | 2.9 | |

Household Durables | | 2.5 | |

Tobacco | | 2.5 | |

Insurance | | 2.1 | |

Beverages | | 2.0 | |

Road & Rail | | 1.7 | |

Software | | 1.6 | |

Life Sciences Tools & Services | | 1.5 | |

Automobiles | | 1.3 | |

Distributors | | 1.0 | |

Food Products | | 0.9 | |

Hotels Restaurants & Leisure | | 0.9 | |

Diversified Telecommunication Services | | 0.8 | |

Electrical Equipment | | 0.8 | |

Independent Power Producers & Energy Traders | | 0.8 | |

Health Care Equipment & Supplies | | 0.7 | |

Industrial Conglomerates | | 0.5 | |

Textiles, Apparel & Luxury Goods | | 0.5 | |

Thrift & Mortgage Finance | | 0.4 | |

Commercial Banks | | 0.3 | |

Liabilities in excess of other assets | | (4.7 | ) |

| | | |

| | 100.0 | % |

| | | |

23

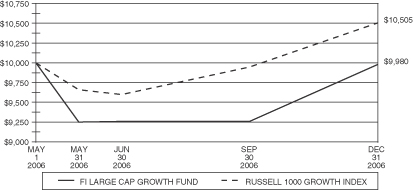

FI LARGE CAP GROWTH FUND

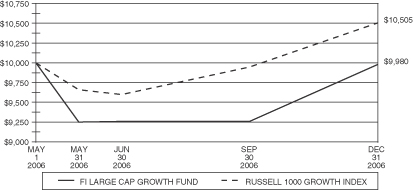

Comparison of Change in Value of a $10,000 Investment in the FI Large Cap Growth Fund – Service Class and the Russell 1000 Growth Index

Total Returns for Period Ended December 31, 2006**

| | | | | | | | | |

Service Class Shares | | One Year | | Three Years | | Five Years | | Life of

Fund*** | |

FI Large Cap Growth Fund | | N/A | | N/A | | N/A | | (0.20 | )% |

Russell 1000 Growth Index* | | N/A | | N/A | | N/A | | 5.05 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The Russell 1000 Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index securities with higher price-to-book ratios and higher forecasted growth values, representative of U.S. securities exhibiting growth characteristics. The Russell 1000 Index includes the largest 1000 securities in the Russell 3000 Index, based on market cap. The Russell 3000 Index consists of the 3000 largest and most liquid stocks based and traded in the U.S.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and certain other expenses during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the FI Large Cap Growth Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2006.

24

MANAGEMENT’S DISCUSSION & ANALYSIS

BLUE CHIP MID CAP FUND (subadvised by Wellington Management Co., LLP)

Equity markets got off to a slow start early in the year as investor concerns about excessive monetary tightening by the Federal Reserve Bank took center stage. Falling energy prices and the long awaited pause in the Fed’s rate hikes provided some relief during the second half of the year. US equities continued to rally through the end of the year on record merger and acquisition activity and a surprisingly resilient consumer in the face of a slowing economy. Employment held up well, while housing continued to weaken.

During the twelve-month period ended December 31, 2006, investor preferences shifted to small (+18.4) and large cap shares (+15.8) versus mid cap stocks (+10.4) when measured by the Russell 2000 Indexes, S&P 500 Index and S&P MidCap 400 Index respectively. Value (+22.2) comfortably outperformed growth (+9.1) for the year. In a reversal from last year within the S&P MidCap 400 Index, Telecommunication Services was the best-performing sector, while Health Care was the only sector to post a negative return.

The Fund’s outperformance was driven primarily by positive security selection in seven out of the ten broad-based sectors, but was partially offset by negative sector allocation decisions. The Fund benefited from strong stock selection within the Consumer Discretionary and Industrials sectors. Negative stock selection was, for the most part, confined to the Information Technology sector. The Fund’s overweight allocation to the top-performing Telecommunications sector also positively contributed to performance. However, our underweight position to the strong performing Utilities sector detracted from performance.

The best-performing stock for the year on an absolute and relative basis was American Tower. Shares of the communications tower operator rose as the company benefited from a high, predictable growth rate, operating leverage, and strong free cash flow. The Telecommunications industry continues to experience growth as cell phone companies increase spending to support both new subscribers and the move to new technology. A number of the top contributors to performance also came from the Industrials sector, including employment services company Manpower, aerospace and defense company Rockwell Collins, and machinery manufacturer PACCAR. Shares of aviation and electronics supplier Rockwell Collins advanced after the company announced strong results and increased its earnings forecast. The company also continued to benefit from Boeing’s new 787 product cycle. Among other contributors was IT services provider Cognizant Technology Solutions.

Two of the top three detractors, on a relative and absolute basis, were Consumer Discretionary names, Sirius Satellite and D R Horton. Shares of Sirius suffered from a deceleration in demand, particularly in retail sales, and an up-tick in churn. We eliminated the stock due to concerns about the long-term sustainability of customer growth at current monthly pricing levels. Homebuilder DR Horton declined as the market reacted to increasing evidence of slower new home demand within the US, and we exited our position. We also eliminated our position in blue chip electronics manufacturing company Jabil Circuit, which was among other top detractors and declined on options backdating concerns and disappointing guidance.

The largest increase in relative weight during the year was in Industrials, with exposure to staffing and employment companies such as Manpower and Monster Worldwide. Within this sector we also like select engineering & construction stocks. We reduced our overweight to Consumer Discretionary by eliminating consumer services stock Harrah’s Entertainment after a takeover offer and reduced our Media exposure. We recently added to Energy holdings via a new purchase of Murphy Oil. These exploration & production purchases provide greater leverage to energy prices following a period of price weakness.

At year-end our largest overweights relative to the S&P MidCap 400 Index were to the Industrials and Health Care sectors, while the largest underweights were to Financials and Utilities.

25

BLUE CHIP MID CAP FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2006 | | INDUSTRY WEIGHTINGS At December 31, 2006 |

| | | |

| | | % of Net Assets | |

SUPERVALU, Inc. | | 2.0 | % |

Equifax, Inc. | | 1.9 | |

Manpower, Inc | | 1.8 | |

GlobalSantaFe Corp. | | 1.7 | |

American Standard Cos., Inc. | | 1.7 | |

Cameco Corp | | 1.7 | |

Network Appliance, Inc. | | 1.7 | |

Abercrombie & Fitch Co. Class A | | 1.6 | |

Republic Services, Inc. | | 1.5 | |

Altera Corp. | | 1.5 | |

| | | |

| | | % of Net Assets | |

Commercial Services & Supplies | | 8.9 | % |

Special Retail | | 6.2 | |

Oil, Gas & Consumable Fuels | | 5.5 | |

Semiconductors & Semiconductor Equipment | | 5.5 | |

Capital Markets | | 5.0 | |

Insurance | | 4.2 | |

IT Services | | 4.0 | |

Health Care Providers & Services | | 3.8 | |

Software | | 3.8 | |

Pharmaceuticals | | 3.7 | |

Energy Equipment & Services | | 3.1 | |

Aerospace & Defense | | 2.9 | |

Health Care Equipment & Supplies | | 2.9 | |

Construction & Engineering | | 2.7 | |

Biotechnology | | 2.6 | |

Media | | 2.5 | |

Metals & Mining | | 2.1 | |

Food & Staples Retailing | | 2.0 | |

Short Term Investment | | 2.0 | |

Building Products | | 1.7 | |

Computers & Peripherals | | 1.7 | |

Electric Utilities | | 1.5 | |

Machinery | | 1.5 | |

Auto Components | | 1.4 | |

Road & Rail | | 1.4 | |

Wireless Telecommunication Services | | 1.4 | |

Electrical Equipment | | 1.3 | |

Household Products | | 1.3 | |

Independent Power Producers & Energy Traders | | 1.3 | |

REITS | | 1.3 | |

Air Freight & Logistics | | 1.1 | |

Household Durables | | 1.0 | |

Life Sciences Tools & Services | | 1.0 | |

Hotels Restaurants & Leisure | | 0.9 | |

Thrigt & Mortgage Finance | | 0.9 | |

Commercial Banks | | 0.8 | |

Diversified Financial Services | | 0.8 | |

Diversified Commercial Services | | 0.7 | |

Food Products | | 0.7 | |

Multi-Utilities | | 0.6 | |

Multiline Retail | | 0.6 | |

Textiles, Apparel & Luxury Goods | | 0.6 | |

Consumer Finance | | 0.5 | |

Personal Products | | 0.4 | |

Trading Companies & Distributors | | 0.3 | |

Liabilities in excess of other assets | | (0.1 | ) |

| | | |

| | 100.0 | % |

| | | |

26

BLUE CHIP MID CAP FUND

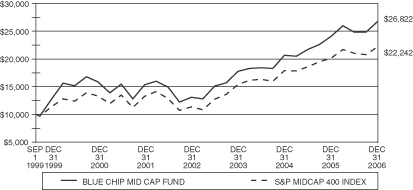

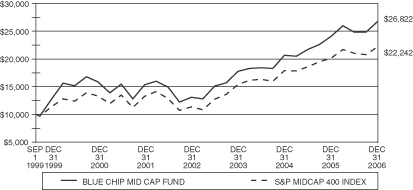

Comparison of Change in Value of a $10,000 Investment in the Blue Chip Mid Cap Fund – Initial Class and the S&P MidCap 400 Index

Total Returns for Periods Ended December 31, 2006**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Blue Chip Mid Cap Fund | | 11.30 | % | | 14.66 | % | | 11.79 | % | | 14.40 | % |

S&P MidCap 400 Index* | | 10.32 | % | | 13.10 | % | | 10.90 | % | | 11.52 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The Standard & Poor’s MidCap 400 Index is a capitalization-weighted index that measures the mid-range sector of the U.S. stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee during this period. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Blue Chip Mid Cap Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from September 1, 1999 (commencement of operations) to December 31, 2006.

27

EXPENSE INFORMATION

December 31, 2006 (Unaudited)

Information About Your Fund’s Expenses

All mutual funds incur ongoing operating expenses, including management fees and administrative services, among others. The following tables are intended to increase your understanding of the ongoing costs of investing in each Fund. The following examples are based on the investment of $1,000 at the beginning of the period and held for the entire period, July 1, 2006 to December 31, 2006. Expense information does not include any insurance charges imposed in connection with your variable insurance contract.

Actual Expenses: The first section of each table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading “Expenses Paid During the Period”.

Hypothetical (5% annual return before expenses): The second section of each table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. However, you may use this information to compare the ongoing costs of investing in the Funds with the hypothetical examples that appear in the shareholder reports of other mutual funds.

Expense Information

| | | | | | | | | |

All Cap Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Initial Class | | $ | 1,000.00 | | $ | 1,148.10 | | $ | 4.87 |

Service Class | | $ | 1,000.00 | | $ | 1,147.37 | | $ | 6.22 |

|

Hypothetical (5% annual return before expenses) |

Initial Class | | $ | 1,000.00 | | $ | 1,020.67 | | $ | 4.58 |

Service Class | | $ | 1,000.00 | | $ | 1,019.41 | | $ | 5.85 |

| | | | | | | | | |

|

Money Market Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Initial Class | | $ | 1,000.00 | | $ | 1,024.35 | | $ | 2.55 |

Service Class | | $ | 1,000.00 | | $ | 1,023.07 | | $ | 3.82 |

|

Hypothetical (5% annual return before expenses) |

Initial Class | | $ | 1,000.00 | | $ | 1,022.68 | | $ | 2.55 |

Service Class | | $ | 1,000.00 | | $ | 1,021.42 | | $ | 3.82 |

| | | | | | | | | |

Investment Grade Bond Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Initial Class | | $ | 1,000.00 | | $ | 1,059.59 | | $ | 3.89 |

Service Class | | $ | 1,000.00 | | $ | 1,058.03 | | $ | 5.19 |

|

Hypothetical (5% annual return before expenses) |

Initial Class | | $ | 1,000.00 | | $ | 1,021.42 | | $ | 3.82 |

Service Class | | $ | 1,000.00 | | $ | 1,020.16 | | $ | 5.09 |

| | | | | | | | | |

|

Real Estate Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Initial Class | | $ | 1,000.00 | | $ | 1,205.59 | | $ | 6.12 |

Service Class | | $ | 1,000.00 | | $ | 1,203.78 | | $ | 7.50 |

|

Hypothetical (5% annual return before expenses) |

Initial Class | | $ | 1,000.00 | | $ | 1,019.66 | | $ | 5.60 |

Service Class | | $ | 1,000.00 | | $ | 1,018.40 | | $ | 6.87 |

28

EXPENSE INFORMATION (Continued)

December 31, 2006 (Unaudited)

| | | | | | | | | |

Davis Venture Value Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Initial Class | | $ | 1,000.00 | | $ | 1,113.94 | | $ | 4.80 |

Service Class | | $ | 1,000.00 | | $ | 1,112.25 | | $ | 6.12 |

|

Hypothetical (5% annual return before expenses) |

Initial Class | | $ | 1,000.00 | | $ | 1,020.67 | | $ | 4.58 |

Service Class | | $ | 1,000.00 | | $ | 1,019.41 | | $ | 5.85 |

|

FI Large Cap Growth Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Service Class | | $ | 1,000.00 | | $ | 1,077.75 | | $ | 5.55 |

|

Hypothetical (5% annual return before expenses) |

Service Class | | $ | 1,000.00 | | $ | 1,019.86 | | $ | 5.40 |

| | | | | | | | | |

Oppenheimer Main Street Small Cap Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Initial Class | | $ | 1,000.00 | | $ | 1,062.04 | | $ | 5.20 |

Service Class | | $ | 1,000.00 | | $ | 1,060.67 | | $ | 6.49 |

|

Hypothetical (5% annual return before expenses) |

Initial Class | | $ | 1,000.00 | | $ | 1,020.16 | | $ | 5.09 |

Service Class | | $ | 1,000.00 | | $ | 1,018.90 | | $ | 6.36 |

|

Blue Chip Mid Cap Fund |

Actual | | Beginning

Account

Value

7/1/2006 | | Ending

Account

Value

12/31/2006 | | Expenses

Paid During

the Period* |

Initial Class | | $ | 1,000.00 | | $ | 1,079.94 | | $ | 5.24 |

|

Hypothetical (5% annual return before expenses) |

Initial Class | | $ | 1,000.00 | | $ | 1,020.16 | | $ | 5.09 |

| * | For each class of the Fund, expenses are equal to the six-month annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period divided by the number of days in the year. The six-month annualized expense ratio was 0.90%, 1.15%, 0.75%, 1.00%, 0.50%, 0.75%, 1.10%, 1.35%, 0.90%, 1.15%, 1.00%, 1.25%, 1.06% and 1.00% for the All Cap Fund –Initial Class, All Cap Fund – Service Class, Investment Grade Bond Fund – Initial Class, Investment Grade Bond Fund – Service Class, Money Market Fund – Initial Class, Money Market Fund – Service Class, Real Estate Fund – Initial Class, Real Estate Fund – Service Class, Davis Venture Value Fund – Initial Class, Davis Venture Value Fund – Service Class, Oppenheimer Main Street Small Cap Fund – Initial Class, Oppenheimer Main Street Small Cap Fund – Service Class, FI Large Cap Growth Fund – Service Class and Blue Chip Mid Cap Fund – Initial Class, respectively. |

29

ALL CAP FUND

| | |

PORTFOLIO OF INVESTMENTS December 31, 2006 | | Sun Capital Advisers Trust |

| | | | | |

| | | Shares | | Value |

| | | | | |

COMMON STOCKS – 98.8% | | | | | |

AEROSPACE & DEFENSE – 3.7% | | | |

Honeywell International, Inc. | | 2,178 | | $ | 98,533 |

Raytheon Co. | | 2,139 | | | 112,939 |

The Boeing Co. | | 1,311 | | | 116,469 |

United Technologies Corp. | | 1,603 | | | 100,220 |

| | | | | |

| | | | | 428,161 |

| | | | | |

AIR FREIGHT & LOGISTICS – 0.8% | | | |

United Parcel Services, Inc.

Class B | | 1,257 | | | 94,250 |

| | | | | |

BEVERAGES – 2.7% | | | |

Anheuser-Busch Cos., Inc. | | 2,233 | | | 109,863 |

Coca-Cola Co | | 2,072 | | | 99,974 |

PepsiCo, Inc. | | 1,572 | | | 98,329 |

| | | | | |

| | | | | 308,166 |

| | | | | |

BIOTECHNOLOGY – 0.9% | | | |

Biogen Idec, Inc.* | | 2,000 | | | 98,380 |

| | | | | |

CAPITAL MARKETS – 2.6% | | | |

Merrill Lynch & Co., Inc. | | 1,474 | | | 137,229 |

The Goldman Sachs Group, Inc. | | 797 | | | 158,882 |

| | | | | |

| | | | | 296,111 |

| | | | | |

CHEMICALS – 1.0% | | | |

E.I. du Pont de Nemours & Co. | | 2,293 | | | 111,692 |

| | | | | |

COMMERCIAL BANKS – 3.2% | | | |

Wachovia Corp. | | 2,570 | | | 146,362 |

Wells Fargo & Co. | | 6,272 | | | 223,032 |

| | | | | |

| | | | | 369,394 |

| | | | | |

COMMUNICATIONS EQUIPMENT – 13.5% |

Ciena Corp.* | | 13,074 | | | 362,280 |

Cisco Systems, Inc.* | | 5,417 | | | 148,047 |

Finisar Corp.* | | 93,600 | | | 302,328 |

MRV Communications, Inc.* | | 120,598 | | | 426,917 |

Redback Networks, Inc.* | | 12,387 | | | 308,932 |

| | | | | |

| | | | | 1,548,504 |

| | | | | |

COMPUTERS & PERIPHERALS – 3.7% | | | |

Apple Computer, Inc.* | | 1,661 | | | 140,919 |

Hewlett-Packard Co. | | 3,603 | | | 148,408 |

International Business Machines Corp. | | 1,362 | | | 132,318 |

| | | | | |

| | | | | 421,645 |

| | | | | |

CONSUMER FINANCE – 1.3% | | | |

American Express Co. | | 2,528 | | | 153,374 |

| | | | | |

| | | | | |

| | | Shares | | Value |

| | | | | |

DIVERSIFIED FINANCIAL SERVICES – 6.4% |

Bank of America Corp. | | 4,358 | | $ | 232,674 |

Citigroup, Inc. | | 4,671 | | | 260,175 |

JPMorgan Chase & Co. | | 4,975 | | | 240,292 |

| | | | | |

| | | | | 733,141 |

| | | | | |

DIVERSIFIED TELECOMMUNICATION SERVICES – 3.0% | | | |

Verizon Communications, Inc. | | 9,291 | | | 345,997 |

| | | | | |

ELECTRIC UTILITIES – 1.7% | | | |

Duke Energy Corp. | | 3,066 | | | 101,822 |

Exelon Corp. | | 1,555 | | | 96,239 |

| | | | | |

| | | | | 198,061 |

| | | | | |

ELECTRICAL EQUIPMENT – 0.9% | | | |

Emerson Electric Co. | | 2,192 | | | 96,645 |

| | | | | |

FOOD & STAPLES RETAILING – 1.3% | | | |

CVS Corp. | | 1,877 | | | 58,018 |

Wal-Mart Stores, Inc. | | 1,977 | | | 91,298 |

| | | | | |

| | | | | 149,316 |

| | | | | |

HEALTH CARE EQUIPMENT & SUPPLIES – 1.0% |

Baxter International, Inc. | | 2,435 | | | 112,960 |

| | | | | |

HEALTH CARE PROVIDERS & SERVICES – 4.1% |

Omnicare, Inc. | | 6,977 | | | 269,522 |

Tenet Healthcare Corp.* | | 14,696 | | | 102,431 |

WellPoint, Inc.* | | 1,258 | | | 98,992 |

| | | | | |

| | | | | 470,945 |

| | | | | |

HEALTH CARE TECHNOLOGY – 1.0% | | | |

Merge Technologies, Inc.* | | 17,077 | | | 112,025 |

| | | | | |

HOTELS RESTAURANTS & LEISURE – 1.5% |

Cosi, Inc.* | | 34,418 | | | 175,188 |

| | | | | |

HOUSEHOLD PRODUCTS – 1.0% | | | |

Kimberly-Clark Corp. | | 1,587 | | | 107,837 |

| | | | | |

INDUSTRIAL CONGLOMERATES – 5.8% | | | |

General Electric Co. | | 12,947 | | | 481,758 |

Tyco International, Ltd. | | 3,629 | | | 110,321 |

Walter Industries, Inc. | | 2,472 | | | 66,868 |

| | | | | |

| | | | | 658,947 |

| | | | | |

INSURANCE – 3.8% | | | |

Metlife, Inc. | | 1,778 | | | 104,920 |

Prudential Financial, Inc. | | 2,480 | | | 212,933 |

The Allstate Corp. | | 1,700 | | | 110,687 |

| | | | | |

| | | | | 428,540 |

| | | | | |

See Notes to Financial Statements.

30

ALL CAP FUND

| | |

PORTFOLIO OF INVESTMENTS (Continued) December 31, 2006 | | Sun Capital Advisers Trust |

| | | | | |

| | | Shares | | Value |

| | | | | |

INTERNET SOFTWARE & SERVICES – 0.9% |

Google, Inc.* | | 229 | | $ | 105,450 |

| | | | | |

LEISURE EQUIPMENT & PRODUCTS – 2.2% |

Eastman Kodak Co. | | 3,227 | | | 83,257 |

Nautilus, Inc. | | 11,715 | | | 164,010 |

| | | | | |

| | | | | 247,267 |

| | | | | |

MACHINERY – 0.5% | | | |

Mueller Water Products Inc* | | 4,084 | | | 60,852 |

| | | | | |

MEDIA – 4.1% | | | |

Comcast Corp. Class A* | | 3,193 | | | 135,160 |

Idearc, Inc.* | | 464 | | | 13,293 |

The Walt Disney Co. | | 2,637 | | | 90,370 |

Time Warner, Inc. | | 6,119 | | | 133,272 |

Viacom, Inc.* | | 2,421 | | | 99,334 |

| | | | | |

| | | | | 471,429 |

| | | | | |

METALS & MINING – 0.9% | | | |

Newmont Mining Corp. | | 2,357 | | | 106,418 |

| | | | | |

MULTI-UTILITIES – 0.8% | | | |

Dominion Resources, Inc. | | 1,139 | | | 95,494 |

| | | | | |

MULTILINE RETAIL – 0.9% | | | |

Federated Department Stores, Inc. | | 2,565 | | | 97,803 |

| | | | | |

OIL, GAS & CONSUMABLE FUELS – 7.3% |

ChevronTexaco Corp. | | 2,671 | | | 196,399 |

ConocoPhillips | | 1,249 | | | 89,865 |

Exxon Mobil Corp. | | 4,265 | | | 326,827 |

Massey Energy Co. | | 9,488 | | | 220,406 |

| | | | | |

| | | | | 833,497 |

| | | | | |

PAPER & FOREST PRODUCTS – 0.8% |

International Paper Co. | | 2,695 | | | 91,899 |

| | | | | |

PERSONAL PRODUCTS – 0.4% | | | |

Alberto Culver Co.* | | 1,981 | | | 42,492 |

| | | | | |

PHARMACEUTICALS – 6.1% | | | |

Abbott Laboratories | | 2,076 | | | 101,122 |

Eli Lilly & Co. | | 1,748 | | | 91,071 |

Johnson & Johnson | | 2,576 | | | 170,067 |

Merck & Co., Inc. | | 2,663 | | | 116,107 |

Schering-Plough Corp. | | 4,990 | | | 117,963 |

Wyeth | | 2,042 | | | 103,979 |

| | | | | |

| | | | | 700,309 |

| | | | | |

| * | Non-income producing security |

| | | | | |

| | | Shares | | Value |

| | | | | |

REITS – 0.9% | | | | | |

CapitalSource, Inc. | | 3,702 | | $ | 101,102 |

| | | | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT – 0.9% |

Intel Corp. | | 4,949 | | | 100,217 |

| | | | | |

SOFTWARE – 4.2% | | | | | |

Microsoft Corp. | | 7,601 | | | 226,966 |

Oracle Corp.* | | 7,507 | | | 128,670 |

Symantec Corp.* | | 5,959 | | | 124,245 |

| | | | | |

| | | | | 479,881 |

| | | | | |

SPECIALTY RETAIL – 0.9% | | | |

Lowe’s Cos., Inc. | | 2,904 | | | 90,459 |

Sally Beauty Holdings, Inc.* | | 1,981 | | | 15,452 |

| | | | | |

| | | | | 105,911 |

| | | | | |

THRIFT & MORTGAGE FINANCE – 0.9% |

Freddie Mac | | 1,577 | | | 107,078 |

| | | | | |

TOBACCO – 1.2% | | | | | |

Altria Group, Inc. | | 1,611 | | | 138,256 |

| | | | | |

Total Common Stocks (cost $9,850,996) | | | | | 11,304,634 |

| | | | | |

SHORT TERM INVESTMENT – 1.1% | | | |

MUTUAL FUNDS – 1.1% | | | | | |

Federated Prime Obligation Fund (amortized cost $133,001) | | 133,001 | | | 133,001 |

| | | | | |

TOTAL INVESTMENTS – 99.9% (cost $9,983,997) | | | | | 11,437,635 |

Other assets less liabilities – 0.1% | | | | | 7,145 |

| | | | | |

NET ASSETS – 100.0% | | | | $ | 11,444,780 |

| | | | | |

See Notes to Financial Statements.

31

INVESTMENT GRADE BOND FUND

| | |

PORTFOLIO OF INVESTMENTS December 31, 2006 | | Sun Capital Advisers Trust |

| | | | | | |

| | | Principal

Amount

(000) | | Value |

| | | | | | |

ASSET BACKED SECURITIES – 1.4% | | | |

Airplanes Pass Through Trust Series D (1)

10.88%, 3/15/19 | | $ | 494 | | $ | 0 |

Peco Energy Transition Trust 6.13%, 3/1/09 | | | 750 | | | 756,302 |

| | | | | | |

Total Asset Backed Securities

(cost $1,094,905) | | | | | | 756,302 |

| | | | | | |

CORPORATE DEBT OBLIGATIONS – 42.5% |

AEROSPACE & DEFENSE – 0.9% | | | |

Embraer Overseas, Ltd. (2)

6.38%, 1/24/17 | | | 500 | | | 500,000 |

| | | | | | |

AUTOMOTIVE – 1.8% | | | | | | |

Ford Motor Credit Co.

8.00%, 12/15/16 | | | 1,000 | | | 988,150 |

| | | | | | |

BANKS – 2.8% | | | | | | |

Financial Security Assurance Holdings, Ltd. (2)

6.40%, 12/15/66 | | | 300 | | | 301,382 |

HBOS PLC (2)

5.92%, 9/29/49 | | | 500 | | | 490,477 |

Washington Mutual Preferred Funding Trust (2)

6.53%, 3/29/49 | | | 750 | | | 741,375 |

| | | | | | |

| | | | | | 1,533,234 |

| | | | | | |

BROADCASTING/MEDIA – 1.1% | | | |

Time Warner Entertainment Co. 10.15%, 5/1/12 | | | 500 | | | 592,071 |

| | | | | | |

BROKERAGE – 2.7% | | | | | | |

Jefferies Group, Inc.

6.25%, 1/15/36 | | | 500 | | | 485,025 |

Lehman Brothers Holdings, Inc. 5.75%, 5/17/13 | | | 500 | | | 507,890 |

Morgan Stanley

4.75%, 4/1/14 | | | 500 | | | 478,064 |

| | | | | | |

| | | | | | 1,470,979 |

| | | | | | |

BUILDING MATERIALS – 3.0% | | | |

C10 Capital Spv., Ltd (2)

6.72%, 12/1/49 | | | 650 | | | 648,405 |

CRH America, Inc.

6.00%, 9/30/16 | | | 500 | | | 504,698 |

Owens Corning, Inc. (2)

6.50%, 12/1/16 | | | 500 | | | 507,919 |

| | | | | | |

| | | | | | 1,661,022 |

| | | | | | |

| | | | | | |

| | | Principal

Amount

(000) | | Value |

| | | | | | |

CONSUMER SERVICES – 0.6% | | | |

Realogy Corp. (2)

6.50%, 10/15/16 | | $ | 300 | | $ | 307,158 |

| | | | | | |

DISTRIBUTORS – 0.7% | | | | | | |

Southern Union Co.

7.20%, 11/1/66 | | | 380 | | | 374,589 |

| | | | | | |

ELECTRIC UTILITIES – 1.9% | | | |

Allegheny Energy Supply Co. LLC (2)

8.25%, 4/15/12 | | | 750 | | | 823,125 |

PSEG Energy Holdings, Inc. 8.50%, 6/15/11 | | | 200 | | | 215,000 |

| | | | | | |

| | | | | | 1,038,125 |

| | | | | | |

FINANCIAL SERVICES – 4.7% | | | |

Allied Capital Corp.

6.00%, 4/1/12 | | | 500 | | | 492,812 |

Capital One Capital III

7.69%, 8/15/36 | | | 700 | | | 792,791 |

General Motors Acceptance Corp.

7.00%, 2/1/12 | | | 300 | | | 309,504 |

iStar Financial, Inc. (2)

5.95%, 10/15/13 | | | 500 | | | 502,518 |

Noble Group, Ltd. (2)

6.63%, 3/17/15 | | | 500 | | | 454,181 |

| | | | | | |

| | | | | | 2,551,806 |

| | | | | | |

GAMING – 1.7% | | | | | | |

Buffalo Thunder Development Authority (2)

9.38%, 12/15/14 | | | 100 | | | 101,500 |