UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08879

SUN CAPITAL ADVISERS TRUST

(Exact name of registrant as specified in charter)

One Sun Life Executive Park, Wellesley Hills, Massachusetts 02481

(Address of principal executive offices) (Zip code)

James M.A. Anderson

Sun Capital Advisers Trust

One Sun Life Executive Park

Wellesley Hills, Massachusetts 02481

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 432-1102 x 3330

Date of fiscal year end: December 31

Date of reporting period: December 31, 2008

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended:

SUN CAPITAL ADVISERS TRUST®

Annual Report December 31, 2008

Sun Capital Investment Grade Bond Fund®

Sun Capital Money Market Fund®

Sun Capital Global Real Estate Fund®

SCSM Davis Venture Value Fund

SCSM Oppenheimer Main Street Small Cap Fund

SCSM Oppenheimer Large Cap Core Fund

SCSM WMC Large Cap Growth Fund

SCSM WMC Blue Chip Mid Cap Fund

SCSM Lord Abbett Growth & Income Fund

SCSM Goldman Sachs Mid Cap Value Fund

SCSM Goldman Sachs Short Duration Fund

SCSM Dreman Small Cap Value Fund

SCSM PIMCO High Yield Fund

SCSM PIMCO Total Return Fund

SCSM AIM Small Cap Growth Fund

SCSM AllianceBernstein International Value Fund

SCSM BlackRock Inflation Protected Bond Fund

SCSM Ibbotson Moderate Fund

SCSM Ibbotson Balanced Fund

SCSM Ibbotson Growth Fund

| | |

| | Sun Capital Advisers Trust is a mutual fund registered with the Securities and Exchange Commission under the Investment Company Act of 1940. Its investment adviser is Sun Capital Advisers LLC®, a member of the Sun Life Financial group of companies. |

TABLE OF CONTENTS

Please Note:

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

The views and opinions expressed in each Fund’s “Management’s Discussion and Analysis” are those of the portfolio manager(s) of the Fund. The views and opinions expressed, and the portfolio holdings described, are as of December 31, 2008, and are subject to change at any time without notice due to market or other conditions. These should not be construed as investment advice or as a recommendation to buy or sell any security. Any forecasts or other forward looking views may not come to pass. Past performance is no guarantee of future results. Performance may have changed materially since December 31, 2008.

Industry classifications included within each Fund’s Portfolio of Investments are unaudited.

MANAGEMENT’S DISCUSSION & ANALYSIS

INVESTMENT GRADE BOND FUND

The Fund’s performance for the year ended December 31, 2008 was a direct reflection of the Fund’s overweight to the spread sectors of the Barclays Capital U.S. Aggregate Bond Index (the “Index”), which continued to reach historically wide levels, and subsequent underweight to U.S. Treasuries. In 2008 U.S. Treasuries recorded their best returns since 1995. The Barclays Capital U.S. Treasury Index generated a return of almost 14% for 2008. Negative excess (vs. duration neutral U.S. Treasuries), and in some cases absolute returns for 2008, were historical by any measure. Negative excess returns were multiples of those previously experienced in most sectors. September, October and November were among the worst months ever for the Index as well as most of its sectors. All sectors reached their historically wide levels in late 2008, despite significant governmental policy response. In late December, historically wide spreads and attractive yields began to stimulate investors whose risk appetite was slowly returning. The deleveraging phenomena, which affected all asset classes over the last 18 months has slowed, thus removing the technical overhang of sellers far outnumbering buyers.

With historically wide spreads, the Fund continues to focus on taking advantage of market dislocations, as opportunities exist across all spread sectors. According to Credit Suisse, current spread levels for investment grade corporate securities imply a default rate of approximately 9%. Moody’s 5-year cumulative investment grade corporate default rate from the depression era of 1931-1935 was 3.88%. Commercial mortgage-backed securities that benefit from significant credit enhancement are extremely attractive with yields north of 10%. During the last real estate collapse in the early 1990s, commercial loans experienced about a 10% default rate while these AAA rated securities benefit from 15-50% of credit enhancement. We will continue to search to enhance the portfolio while also remaining cognizant of the overall level of risk. Given the existing market dislocation, prudent portfolio construction is key. We continue to seek value from an irrational marketplace.

The Fund’s allocation to the spread sectors of the Index declined modestly during the 4th quarter of 2008. Cash was allowed to increase to almost 10% during the 4th quarter in anticipation of attractive opportunities in the marketplace. At December 31, 2008, approximately, 6% of the Fund’s holdings retained a credit rating below investment grade.

1

INVESTMENT GRADE BOND FUND

| | |

TOP TEN BOND ISSUERS At December 31, 2008 | | PORTFOLIO COMPOSITION At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Federal National Mortgage Association | | 25.3 | % |

Federal Home Loan Mortgage Corp. | | 9.4 | |

U.S. Treasury | | 3.5 | |

Rogers Communications, Inc. | | 2.6 | |

Government National Mortgage Association | | 1.7 | |

GMAC Commercial Mortgage Securities, Inc. | | 1.4 | |

Residential Accredited Loans, Inc. | | 1.4 | |

Allegheny Energy Supply Co. LLC | | 1.3 | |

Wachovia Corp. | | 1.2 | |

Bear Stearns Commercial Mortgage Securities | | 1.2 | |

| | | |

| | | % of Net Assets | |

U.S. Treasury and U.S. Government Agency Obligations | | 39.9 | % |

Corporate Debt Obligations | | 36.8 | |

Short Term Investments | | 11.3 | |

Commercial Mortgage Backed Securities | | 7.0 | |

Residential Mortgage Backed Securities | | 3.3 | |

Asset Backed Securities | | 0.4 | |

Other assets less liabilities | | 1.3 | |

| | | |

TOTAL | | 100.0 | % |

| | | |

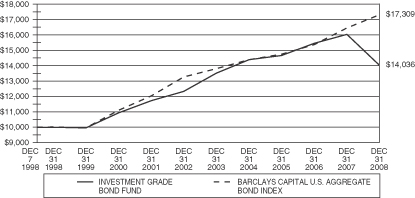

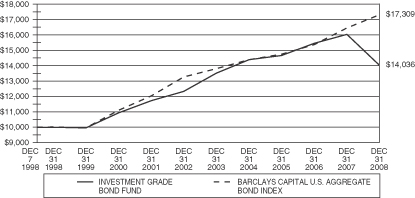

Comparison of Change in Value of a $10,000 Investment in the Investment Grade Bond Fund – Initial Class and the Barclays Capital U.S. Aggregate Bond Index

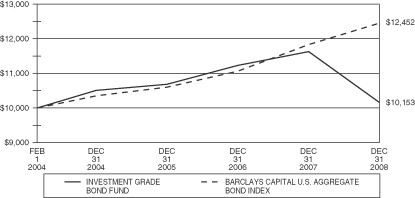

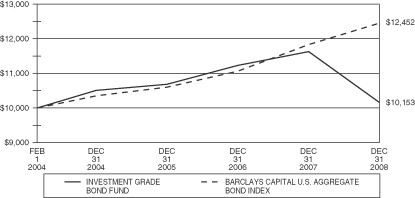

Comparison of Change in Value of a $10,000 Investment in the Investment Grade Bond Fund – Service Class and the Barclays Capital U.S. Aggregate Bond Index

2

INVESTMENT GRADE BOND FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Life of

Fund*** | |

Investment Grade Bond Fund | | (12.47 | )% | | (1.45 | )% | | 0.76 | % | | 3.44 | % | | 3.42 | % |

Barclays Capital U.S. Aggregate Bond Index* | | 5.24 | % | | 5.51 | % | | 4.65 | % | | 5.63 | % | | 5.60 | % |

Service Class Shares | | | | | | | | | | | | | | | |

Investment Grade Bond Fund | | (12.67 | )% | | (1.68 | )% | | N/A | | | N/A | | | 0.31 | % |

Barclays Capital U.S. Aggregate Bond Index* | | 5.24 | % | | 5.51 | % | | N/A | | | N/A | | | 4.56 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The Barclays Capital U.S. Aggregate Bond Index (formerly Lehman Brothers U.S. Aggregate Bond Index) is composed of U.S. securities in the Treasury, Government-Related, Corporate, and Securitized sectors. The Barclays Capital U.S. Aggregate Bond Index has been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and/or reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Investment Grade Bond Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2008. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2008.

3

MANAGEMENT’S DISCUSSION & ANALYSIS

MONEY MARKET FUND

The Federal Reserve’s monetary policy committee (FOMC) began 2008 deliberating the impact of the deterioration in financial markets, weak labor markets, as well as the ongoing correction in the housing market. As a result, the FOMC voted in an emergency meeting to reduce their benchmark lending rate by 75 basis points on January 22nd from 4.25% to 3.50%. Fed Chairman Bernanke, along with other officials, were proactive in efforts to alleviate the credit crunch by utilizing a host of liquidity programs, including expanding the Term Auction Facility (TAF) auctions, lengthening the maturity of open market repurchase agreements, and making changes to acceptable collateral for those loans to include mortgage-linked bonds. The central bank arranged for an emergency loan to Bear Stearns Co. to prevent the institution from filing for bankruptcy and disrupting the capital markets. At each of the next three regular meetings, the FOMC lowered the lending rate. By the end of April, the rate had been reduced to 2%.

The FOMC kept rates unchanged through the end of the third quarter, content that growth and inflation risks were essentially balanced. In September, market conditions took a serious turn for the worse, as confidence and liquidity appeared to vanish. Federal National Mortgage Association and Federal Home Loan Mortgage Corporation were suddenly forced into conservatorship. Lehman Brothers abruptly filed for Chapter 11 bankruptcy and in the same weekend, Merrill Lynch was acquired by the Bank of America. Shortly thereafter, American International Group (AIG) received emergency loans from the U.S. government in return for equity interest to avert bankruptcy. The safety of money market mutual funds suddenly came into question. In response, the Federal Reserve, the Bank of Canada, the Bank of England, the ECB and the Bank of Japan poured billions into the banking system on a daily basis through a variety of liquidity and lending programs. In October, the Commercial Paper Funding Facility (CPFF) was launched to provide a liquidity backstop for U.S. issuers of commercial paper. In addition the Federal Reserve of New York was tapped to finance the purchase of unsecured and asset-backed commercial paper and agency discount notes from eligible issues through its primary dealers. The Treasury also established a temporary guaranty program for the U.S. money market mutual fund industry to stem the tide of redemptions and repair the confidence lost. In October, Congress authorized and President Bush signed the Troubled Assets Relief Program (TARP) which would provide up to $700 billion to the U.S. Treasury to purchase troubled assets. Later, bank holding companies were given the ability to issue bonds and commercial paper, unconditionally guaranteed by the U.S. government though the Term Lending Guarantee Program (TLGP).

In addition to the programs mentioned above, the FOMC continued to lower rates in the fourth quarter. By year end, the Fed Funds target interest rate was at a record low and is now quoted in a range of 0.00% to 0.25%. The Discount Rate ended the year at 0.50%. The liquidity programs, along with the safety of U.S. Treasury bills provided tremendous demand for safe, short term investments. The persistent flight to quality has brought interest rates on U.S. Treasury bills near and even below zero. Rates on agency discount paper, industrial and TLGP commercial paper also declined sharply given their safety and liquidity.

Three-month Treasury bills started the year at the high of 3.33%. However, as the Fed started to lower interest rates in January, for a total of ten reductions by year end, U.S. Treasury bills plummeted to a low of (0.02%) early in December before ending the year at 0.08%.

Economic data continues to indicate weak consumer, housing, and manufacturing data as well as falling commodity prices. With the Fed Funds target interest rate now in a range of 0.00% to 0.25%, the Fed has ensured the market it will use whatever tools necessary to maintain stability in the financial markets and promote economic development. Our strategy remains to invest in a high quality, liquid portfolio.

4

MONEY MARKET FUND

| | |

TOP TEN ISSUERS At December 31, 2008 | | PORTFOLIO COMPOSITION At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Federal Home Loan Mortgage | | 20.4 | % |

Federal National Mortgage Association | | 19.1 | |

U.S. Treasury | | 3.9 | |

Government of Canada | | 3.4 | |

Coca Cola Co. | | 3.0 | |

AT&T, Inc. | | 2.9 | |

Hewlett Packard Co. | | 2.9 | |

The Procter & Gamble Co. | | 2.9 | |

Pfizer, Inc. | | 2.9 | |

Wal-Mart Stores, Inc. | | 2.9 | |

| | | |

| | | % of Net Assets | |

Commercial Paper | | 43.8 | % |

U.S. Treasury and U.S. Government Agency Obligations | | 43.4 | |

Mutual Funds | | 4.7 | |

Foreign Government Obligations | | 4.0 | |

U.S. Government Guaranteed Commercial Paper | | 3.9 | |

Other assets less liabilities | | 0.2 | |

| | | |

TOTAL | | 100.0 | % |

| | | |

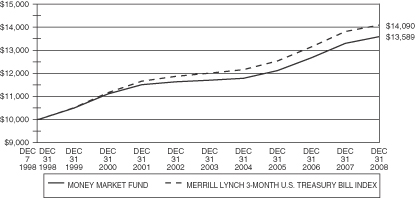

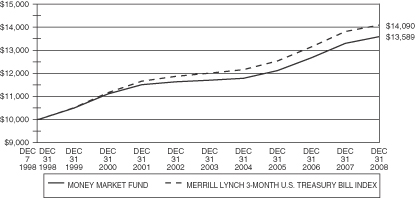

Comparison of Change in Value of a $10,000 Investment in the Money Market Fund –Initial Class and the Merrill Lynch 3-Month U.S. Treasury Bill Index

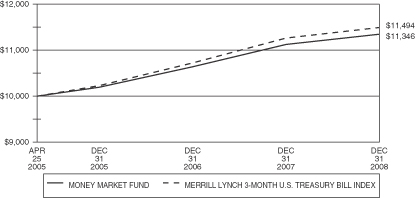

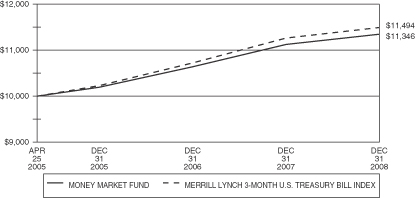

Comparison of Change in Value of a $10,000 Investment in the Money Market Fund –Service Class and the Merrill Lynch 3-Month U.S. Treasury Bill Index

5

MONEY MARKET FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Life of

Fund*** | |

Money Market Fund | | 2.25 | % | | 3.90 | % | | 3.03 | % | | 3.08 | % | | 3.09 | % |

Merrill Lynch 3-month U.S. Treasury Bill Index* | | 2.06 | % | | 3.96 | % | | 3.25 | % | | 3.45 | % | | 3.46 | % |

Service Class Shares | | | | | | | | | | | | | | | |

Money Market Fund | | 2.00 | % | | 3.64 | % | | N/A | | | N/A | | | 3.49 | % |

Merrill Lynch 3-month U.S. Treasury Bill Index* | | 2.06 | % | | 3.96 | % | | N/A | | | N/A | | | 3.85 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The Merrill Lynch 3-month U.S. Treasury Bill Index is a one-security index which at the beginning of every month selects for inclusion the U.S. Treasury Bill maturing closest to, but not beyond 91 days from that date. That issue is then held for one month, sold and rolled into the new U.S. Treasury Bill. The Merrill Lynch 3-month U.S. Treasury Bill Index has been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and/or reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Money Market Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2008. Service Class Shares for the period from April 25, 2005 (commencement of operations) to December 31, 2008.

6

MANAGEMENT’S DISCUSSION & ANALYSIS

GLOBAL REAL ESTATE FUND

Effective May 1, 2008, Global Real Estate Fund amended its investment strategy to a global real estate mandate, with the Fund now benchmarked to the FTSE/EPRA NAREIT Global Real Estate Index rather than the MSCI US REIT Index. In the first four months of 2008, the Fund outperformed its then benchmark, the MSCI US REIT Index. For the period May 1, 2008 to December 31, 2008, the Fund underperformed its benchmark, the FTSE/EPRA NAREIT Global Real Estate Index, due to a combination of poor stock selection, sector allocation and country allocation.

Despite the strategic rationale for global mandate, the tactical timing of the switch was not ideal, as the transition occurred in the midst of a worsening global recession. Global diversification was not a benefit in 2008, and the only business model, and/or property type that did well was one that featured virtually no debt. The last eight months of 2008, the period in which the Fund was fully global, saw the MSCI U.S. REIT Index tumble -42.73%, and the FTSE EPRA/NAREIT Global Real Estate Index fall - -47.86%, and the Fund underperformed on a relative basis.

We have always believed that diversification takes on a special meaning in managing a U.S. real estate portfolio because the different property types and business models typically behave very differently at different stages of the economic cycle. With a global portfolio, the opportunities to diversify are even greater. Furthermore, we believe real estate as an asset class will remain less correlated globally than bonds and stocks due to the local economic drivers that have a large influence on the users and owners of real estate.

The 3rd and 4th quarters of 2008 were extremely volatile in both the global and U.S. real estate equity markets, with the global markets fairing slightly worse than the U.S. market. For the year, global real estate equities also underperformed U.S. real estate equities. Globally, the performance trends by property type were the same for the last 6 months and for all of 2008, mostly because the terrible performance in the 4th quarter overwhelmed the performance in the other three quarters. Due to their above industry average leverage levels and economic cyclicality, the industrial, regional mall, and hotel property types were the worst performers. The best performing property types were the self-storage, health care, and apartment sectors.

No review of 2008 would be complete without at least recognizing the on-going global recession. As one of the more leveraged asset classes, anything real estate-related has, and will continue to suffer until more realistic values are reached. The damage has not spared any property type.

7

GLOBAL REAL ESTATE FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2008 | | INDUSTRY WEIGHTINGS At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Unibail-Rodamco | | 4.7 | % |

Simon Property Group, Inc. | | 4.4 | |

Vornado Realty Trust | | 4.3 | |

Alexandria Real Estate Equities, Inc. | | 4.2 | |

Ventas, Inc. | | 4.2 | |

Mitsubishi Estate Co. Ltd. | | 4.0 | |

Kimco Realty Corp. | | 4.0 | |

Capitaland Ltd. | | 3.9 | |

The Link REIT | | 3.8 | |

Plum Creek Timber Co., Inc. | | 3.8 | |

| | | |

| | | % of Net Assets | |

Diversified | | 23.9 | % |

Shopping Centers | | 18.9 | |

Regional Malls | | 13.1 | |

Office | | 9.1 | |

Health Care Equipment & Services | | 7.8 | |

Short Term Investments | | 7.5 | |

Timber & Forest Products | | 6.8 | |

Warehouse & Industrial | | 6.6 | |

Apartments | | 4.9 | |

Storage | | 0.6 | |

Other assets less liabilities | | 0.8 | |

| | | |

TOTAL | | 100.0 | % |

| | | |

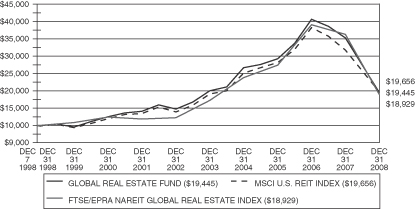

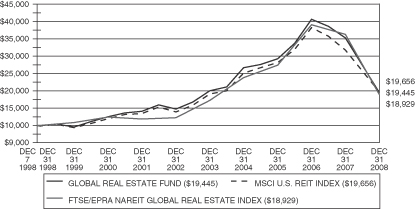

Comparison of Change in Value of a $10,000 Investment in the Global Real Estate Fund – Initial Class, MSCI U.S. REIT Index and the FTSE/EPRA NAREIT Global Real Estate Index

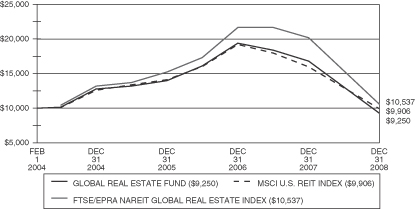

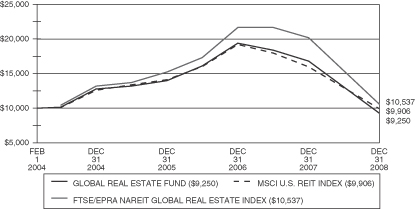

Comparison of Change in Value of a $10,000 Investment in the Global Real Estate Fund – Service Class, MSCI U.S. REIT Index and the FTSE/EPRA NAREIT Global Real Estate Index

8

GLOBAL REAL ESTATE FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Life of

Fund*** | |

Global Real Estate Fund | | (44.73 | )% | | (12.62 | )% | | (0.49 | )% | | 6.95 | % | | 6.83 | % |

MSCI U.S. REIT Index* | | (37.97 | )% | | (11.15 | )% | | 0.67 | % | | 7.19 | % | | 6.94 | % |

FTSE/EPRA NAREIT Global Real Estate Index* | | (47.72 | )% | | (11.53 | )% | | 1.96 | % | | 6.63 | % | | 6.54 | % |

Service Class Shares | | | | | | | | | | | | | | | |

Global Real Estate Fund | | (44.89 | )% | | (12.84 | )% | | N/A | | | N/A | | | (1.57 | )% |

MSCI U.S. REIT Index* | | (37.97 | )% | | (11.15 | )% | | N/A | | | N/A | | | (0.19 | )% |

FTSE/EPRA NAREIT Global Real Estate Index* | | (47.72 | )% | | (11.53 | )% | | N/A | | | N/A | | | 1.07 | % |

*The performance data of the indices has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The indices are unmanaged and have no fees. The MSCI U.S. REIT Index is a total-return index composed of the most actively traded real estate investment trusts and is designed to be a measure of real estate equity performance. The FTSE EPRA/NAREIT Global Real Estate Index is a total-return comprising eight index families covering the world’s largest investment markets in various currencies, and is designed to track the performance of listed real estate companies and REITs worldwide. The MSCI U.S. REIT Index and the FTSE EPRA/NAREIT Global Real Estate Index have been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and/or reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Global Real Estate Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized. Effective May 1, 2008, Global Real Estate Fund amended its investment strategy to a global real estate mandate, with the Fund now benchmarked to the FTSE/EPRA NAREIT Global Real Estate Index rather than the MSCI U.S. REIT Index.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2008. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2008.

9

MANAGEMENT’S DISCUSSION & ANALYSIS

DAVIS VENTURE VALUE FUND (subadvised by Davis Selected Advisers, L.P.)

The sectors within the S&P 500 Index that turned in the weakest performance over the year were financials, materials, and information technology. The sectors that turned in the strongest (but still negative) performance over the year were consumer staples and health care.

The Fund’s financial companies out-performed the corresponding sector within the Index (down 49% versus down 55% for the Index), but were still the largest detractors from performance. A higher relative average weighting in this sector (30% versus 16% for the Index) detracted from both absolute and relative performance. American International Group, American Express, Merrill Lynch, Berkshire Hathaway, Loews, Wachovia, and JPMorgan Chase were among the top detractors from performance. Wells Fargo and Hartford Financial Services were among the top contributors to the Fund’s performance.

The second largest detractor from performance were energy companies. The Fund’s energy companies performed roughly in-line with the corresponding sector within the Index (both down 35%) but had a higher relative average weighting in this sector (17% versus 14% for the Index). ConocoPhillips was among the top detractors from performance.

The Fund’s relative performance was helped by having a higher relative average weighting in consumer staple companies (15% versus 11% for the Index). Unfortunately, the Fund’s consumer staple companies under-performed the corresponding sector within the Index (down 25% vs down 16% for the Index). Wal-Mart Stores was among the most important contributors to performance while Costco was among the most important detractors. The Fund no longer owns Wal-Mart Stores.

The Fund’s relative performance was harmed by having a lower relative average weighting in health care companies (4% versus 13% for the Index). The Fund’s healthcare companies under-performed the corresponding sector within the Index (down 29% vs down 23% for the Index). Schering Plough, was among the most important contributors to performance.

H&R Block, a consumer discretionary company, was the single most important contributor to performance over the year.

The Fund held approximately 9% of assets in foreign companies (including American Depositary Receipts) at December 31, 2008. As a whole these companies under-performed the domestic companies held by the Fund.

10

DAVIS VENTURE VALUE FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2008 | | INDUSTRY WEIGHTINGS (Continued) At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Costco Wholesale Corp. | | 5.1 | % |

Wells Fargo & Co. | | 4.5 | |

JPMorgan Chase & Co. | | 4.3 | |

ConocoPhillips | | 4.3 | |

Occidental Petroleum Corp. | | 4.1 | |

Berkshire Hathaway, Inc., Class A | | 4.0 | |

Devon Energy Corp. | | 3.3 | |

Philip Morris International, Inc. | | 3.3 | |

EOG Resources, Inc. | | 2.9 | |

Comcast Corp., Class A Special | | 2.4 | |

INDUSTRY WEIGHTINGS

At December 31, 2008

| | | |

| | | % of Net Assets | |

Oil & Gas-Exploration & Production | | 16.4 | % |

Short Term Investments | | 13.5 | |

Insurance | | 10.1 | |

Food & Staples Retailing | | 7.2 | |

Diversified Financial Services | | 5.2 | |

Media | | 4.9 | |

Commercial Banks | | 4.7 | |

Tobacco | | 3.3 | |

Capital Markets | | 3.2 | |

Commercial Services & Supplies | | 2.6 | |

Health Care Providers & Services | | 2.6 | |

Consumer Finance | | 2.5 | |

Beverages | | 2.2 | |

Software | | 2.0 | |

Pharmaceuticals | | 1.8 | |

Household Products | | 1.7 | |

Diversified Consumer Services | | 1.6 | |

Specialty Retail | | 1.5 | |

Containers & Packaging | | 1.4 | |

Computers & Peripherals | | 1.4 | |

Semiconductors & Semiconductor Equipment | | 1.3 | |

Construction Materials | | 1.3 | |

Electronic Equipment & Instruments | | 1.2 | |

Industrial Conglomerates | | 0.9 | |

Internet Software & Services | | 0.9 | |

| | | |

| | | % of Net Assets | |

Real Estate Management & Development | | 0.7 | % |

Automobiles | | 0.7 | |

Communications Equipment | | 0.6 | |

Energy Equipment & Services | | 0.5 | |

Internet & Catalog Retail | | 0.5 | |

Air Freight & Logistics | | 0.5 | |

Marine | | 0.5 | |

Chemicals | | 0.5 | |

Transportation | | 0.5 | |

Metals & Mining | | 0.4 | |

Paper & Forest Products | | 0.4 | |

Machinery | | 0.3 | |

Personal Products | | 0.3 | |

Food Products | | 0.2 | |

Independent Power Producers & Energy Traders | | 0.2 | |

Wireless Telecommunication Services | | 0.2 | |

Electrical Equipment | | 0.1 | |

Household Durables | | 0.1 | |

Multi-Line Retail | | 0.1 | |

Liabilities in excess of other assets | | (2.7 | ) |

| | | |

TOTAL | | 100.0 | % |

| | | |

11

DAVIS VENTURE VALUE FUND

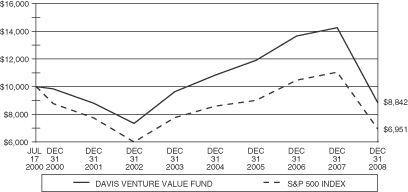

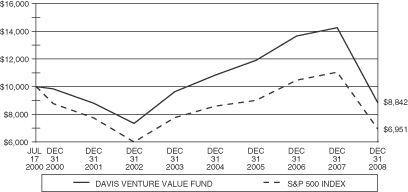

Comparison of Change in Value of a $10,000 Investment in the Davis Venture Value Fund – Initial Class and the S&P 500 Index

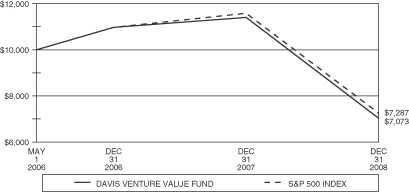

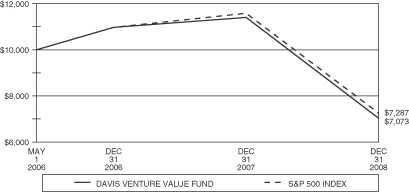

Comparison of Change in Value of a $10,000 Investment in the Davis Venture Value Fund – Service Class and the S&P 500 Index

12

DAVIS VENTURE VALUE FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Davis Venture Value Fund | | (37.81 | )% | | (9.39 | )% | | (1.70 | )% | | (1.44 | )% |

S&P 500 Index* | | (37.00 | )% | | (8.34 | )% | | (2.19 | )% | | (4.21 | )% |

Service Class Shares | | | | | | | | | | | | |

Davis Venture Value Fund | | (37.93 | )% | | N/A | | | N/A | | | (12.16 | )% |

S&P 500 Index* | | (37.00 | )% | | N/A | | | N/A | | | (11.19 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The S&P’s 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market. The S&P 500 Index has been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and/or reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Davis Venture Value Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2008. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2008.

13

MANAGEMENT’S DISCUSSION & ANALYSIS

OPPENHEIMER MAIN STREET SMALL CAP FUND (subadvised by OppenheimerFunds, Inc.)

Like most other asset classes, U.S. stocks declined sharply when a credit crunch that began in 2007 developed into a full-blown global financial crisis over the summer of 2008. Turmoil spread from the sub-prime mortgage sector of the U.S. bond market to other financial markets, including stocks, as investors became increasingly risk-averse. Declining asset prices compelled major financial institutions to write down or write off a significant portion of their investments’ value, contributing to massive losses that led to the insolvency of several major commercial banks, investment banks, mortgage agencies and insurers.

Meanwhile, a U.S. economic slowdown that began in late 2007 was exacerbated by the financial crisis, leading to a surge in job losses and additional pressure on slumping home prices. Cash-strapped consumers and anxious businesses curtailed spending, adding fuel to the downturn. The U.S. recession quickly spread to overseas markets, reducing previously robust demand for energy and building materials. Consequently, commodity prices that had reached record highs over the first half of the year plummeted over the second half.

Investors worried about these developments engaged in a “flight to quality,” selling riskier assets, such as small-cap stocks, in favor of U.S. Treasury securities. Selling pressure appeared to be indiscriminate as investors rushed for the exits, punishing stocks of fundamentally sound companies along with less healthy ones. Although the financial institutions at the epicenter of the crisis were mainly very large companies, the flight to quality was also damaging for smaller businesses, which historically have been more volatile than their larger counterparts. The bear market was especially severe for traditionally economically-sensitive sectors, such as the consumer discretionary and information technology sectors, while sectors whose fortunes rise and fall with commodity prices, such as energy and basic materials producers, also were hard hit. Conversely, the historically defensive consumer staples and utilities sectors held up relatively well.

As always, we invested the Fund’s assets in accordance with the signals generated by our multi-factor quantitative models, including a newly developed model designed to consider unusually volatile market conditions. Our process worked relatively well over the first half of 2008, when the Fund generally produced higher returns than the Russell 2000 Index. Our market capitalization model indicated that companies toward the larger end of the small-cap range, including a number of mid-cap companies, were likely to fare better than micro-cap and other smaller stocks. In addition, our stock selection model found a number of opportunities in the materials sector, leading to an overweight position that benefited relative performance as commodity prices soared to record highs. Conversely, we identified relatively few highly ranked stocks in the financial sector, which was hurt by the credit crisis, and the health care sector, where managed care companies struggled with rising costs. On the other hand, an underweight position in the energy sector, a relatively small component of the index, detracted from relative performance over the first half of the year.

The positions that benefited the Fund’s results during the first half of the year were detractors over the second half of the year, when extreme volatility roiled equity markets. Midcap stocks, many of which had been removed from the Russell 2000 Index when it rebalanced at mid-year, fell sharply in the wake of the banking crisis, adversely affecting the Fund to a greater extent than the index. Although we reduced the Fund’s exposure to mid-cap stocks over the second half of 2008, it was not enough to offset the capitalization range’s poor performance. In addition, the Fund’s overweight positions in the materials, consumer discretionary and information technology sectors fared poorly in the deepening recession that dominated the final six months of 2008.

As of year-end, our models have indicated that smaller-cap stocks generally are better positioned in the current market environment, which was reflected in a modestly underweighted position in mid-cap stocks and mildly overweight exposure to small and micro-cap stocks relative to the benchmark. In addition, the Fund ended the reporting period with an emphasis on the information technology, industrials and energy sector, where a number

14

MANAGEMENT’S DISCUSSION & ANALYSIS (Continued)

of companies appear to have been punished too severely during the downturn and may be poised to rebound strongly in an eventual recovery. Likewise, we are also keeping an eye on the materials sector in 2009 and as of period end maintained an overweight position relative to the benchmark. Conversely, we ended the reporting period underweight the benchmark in financials.

15

OPPENHEIMER MAIN STREET SMALL CAP FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2008 | | INDUSTRY WEIGHTINGS (Continued) At December 31, 2008 |

| | | |

| | | % of Net Assets | |

EMCOR Group, Inc. | | 0.4 | % |

QLogic Corp. | | 0.4 | |

AMERIGROUP Corp. | | 0.3 | |

First Horizon National Corp. | | 0.3 | |

Tractor Supply Co. | | 0.3 | |

Gardner Denver, Inc. | | 0.3 | |

GrafTech International Ltd. | | 0.3 | |

Acuity Brands, Inc. | | 0.3 | |

Perini Corp. | | 0.3 | |

Deluxe Corp. | | 0.3 | |

INDUSTRY WEIGHTINGS

At December 31, 2008

| | | |

| | | % of Net Assets | |

Semiconductors & Semiconductor Equipment | | 5.7 | % |

Commercial Services & Supplies | | 5.4 | |

Machinery | | 5.3 | |

Specialty Retail | | 5.2 | |

Insurance | | 5.0 | |

Commercial Banks | | 4.3 | |

Oil & Gas-Exploration & Production | | 3.6 | |

Health Care Providers & Services | | 3.2 | |

Software | | 3.2 | |

Communications Equipment | | 3.1 | |

Electronic Equipment & Instruments | | 3.1 | |

Energy Equipment & Services | | 2.9 | |

Chemicals | | 2.8 | |

Real Estate Investment Trusts | | 2.7 | |

Hotels, Restaurants & Leisure | | 2.5 | |

IT Services | | 2.3 | |

Metals & Mining | | 2.1 | |

Internet Software & Services | | 2.1 | |

Electrical Equipment | | 2.0 | |

Computers & Peripherals | | 1.9 | |

Textiles, Apparel & Luxury Goods | | 1.7 | |

Household Durables | | 1.7 | |

Health Care Equipment & Supplies | | 1.5 | |

Construction & Engineering | | 1.4 | |

Diversified Telecommunication Services | | 1.4 | |

Aerospace & Defense | | 1.4 | |

Biotechnology | | 1.4 | |

| | | |

| | | % of Net Assets | |

Capital Markets | | 1.3 | % |

Trading Companies & Distributors | | 1.2 | |

Building Products | | 1.2 | |

Media | | 1.1 | |

Auto Components | | 1.1 | |

Thrift & Mortgage Finance | | 1.1 | |

Internet & Catalog Retail | | 1.0 | |

Airlines | | 0.9 | |

Consumer Finance | | 0.8 | |

Short Term Investments | | 0.8 | |

Personal Products | | 0.8 | |

Road & Rail | | 0.8 | |

Leisure Equipment & Products | | 0.8 | |

Pharmaceuticals | | 0.8 | |

Diversified Consumer Services | | 0.7 | |

Life Sciences Tools & Services | | 0.6 | |

Wireless Telecommunication Services | | 0.6 | |

Paper & Forest Products | | 0.6 | |

Multi-Line Retail | | 0.5 | |

Food Products | | 0.5 | |

Food & Staples Retailing | | 0.5 | |

Diversified Financial Services | | 0.5 | |

Containers & Packaging | | 0.5 | |

Marine | | 0.4 | |

Air Freight & Logistics | | 0.3 | |

Industrial Conglomerates | | 0.3 | |

Multi-Utilities | | 0.2 | |

Gas Utilities | | 0.2 | |

Office Electronics | | 0.2 | |

Automobiles | | 0.2 | |

Tobacco | | 0.2 | |

Health Care Technology | | 0.1 | |

Household Products | | 0.1 | |

Real Estate Management & Development | | 0.1 | |

Water Utilities | | 0.1 | |

Independent Power Producers & Energy Traders | | 0.0 | * |

Beverages | | 0.0 | * |

Distributors | | 0.0 | * |

Other assets less liabilities | | 0.0 | * |

| | | |

TOTAL | | 100.0 | % |

| | | |

| * | Amount is less than 0.05%. |

16

OPPENHEIMER MAIN STREET SMALL CAP FUND

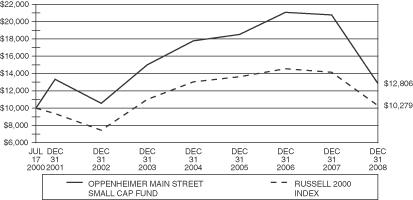

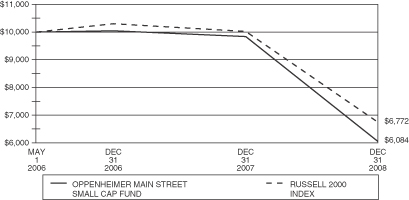

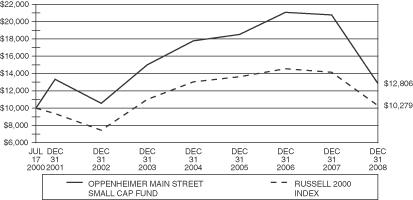

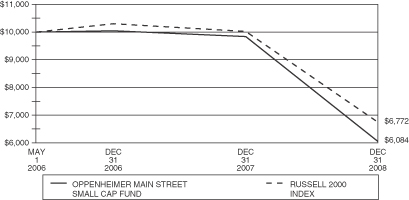

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Main Street Small Cap Fund – Initial Class and the Russell 2000 Index

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Main Street Small Cap Fund – Service Class and the Russell 2000 Index

17

OPPENHEIMER MAIN STREET SMALL CAP FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Oppenheimer Main Street Small Cap Fund | | (37.99 | )% | | (11.45 | )% | | (3.02 | )% | | 2.97 | % |

Russell 2000 Index* | | (33.79 | )% | | (8.28 | )% | | (0.93 | )% | | 0.33 | % |

Service Class Shares | | | | | | | | | | | | |

Oppenheimer Main Street Small Cap Fund | | (38.14 | )% | | N/A | | | N/A | | | (16.98 | )% |

Russell 2000 Index* | | (33.79 | )% | | N/A | | | N/A | | | (13.60 | )% |

*The performance data for the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The Russell 2000 Index includes the 2000 companies with the smallest market capitalizations from the Russell 3000 Index. The Russell 2000 Index has been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and/or reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Oppenheimer Main Street Small Cap Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2008. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2008.

18

MANAGEMENT’S DISCUSSION & ANALYSIS

OPPENHEIMER LARGE CAP CORE FUND (subadvised by OppenheimerFunds, Inc.)

Effective May 1, 2008 Oppenheimer Funds, Inc. replaced Sun Capital Advisers LLC as subadviser to the Sun Capital All Cap Fund. Also effective May 1, 2008 the name of the Fund was changed to SC Oppenheimer Large Cap Core Fund. OFI Institutional Asset Management, Inc., an affiliate of OppenheimerFunds, Inc., serves as sub-subadviser to SC Oppenheimer Large Cap Core Fund.

The pervasive lack of credit in 2008 fueled a massive scaling back among U.S. corporations, increasing unemployment, and decreasing consumer spending. And while third quarter GDP was only slightly negative, economists anticipate the fourth quarter will be among the worst on record. Equity markets have been sent reeling, turning in the weakest calendar year performance in the post World-War II era. In response, the Federal Reserve cut interest rates to their lowest level in history; Congress approved a roughly $170 billion stimulus plan early in 2008 and a $700 billion TARP in the opening days of the fourth quarter. Deals were brokered to save the likes of Bear Stearns, Fannie Mae, and Freddie Mac and Congress is arranging for billions of dollars in loans for a struggling automotive industry.

The fourth quarter brought unprecedented volatility to the markets. Once unheard of, daily price movements of ±5% were not uncommon and moves of ±3% were commonplace, particularly early in the quarter. Though volatility eased in the closing weeks of the fourth quarter the average daily price movement of the S&P 500 was ±3.3%.

While we would hesitate to call November 20 the ultimately low in the bear market ravaging equities over the preceding 14 months, the subsequent rally has been significant. From the intra-quarter low through December 31, the S&P 500 gained 20.5%. In an absolute sense, this rally surpasses the technical definition of a bull market; however, its brevity precludes this designation, as we typically look for a sustained rally over at least three months.

Financials added the most value versus the S&P 500 since inception. Earlier in 2008, in response to ongoing uncertainty surrounding the integrity of data coming out of the sector, our quantitative team took steps to either limit the allowable position size in our client portfolios or to avoid specific stocks altogether – a strategy that worked well. The portfolio did not hold Fannie Mae, Freddie Mac, Goldman Sachs, Merrill Lynch, Lehman Brothers, or Wachovia; further, we elected to remove AIG from the portfolio well ahead of its collapsing share price.

Stock selectivity in Consumer Staples proved costly to the portfolio. Proctor & Gamble was the most costly holding in the sector; added to the portfolio in November, the stock is underweight in comparison to the benchmark making it costly in relative terms. The decision to avoid Anheuser-Busch also proved costly as the stock had strong gains.

We see parallels between today’s housing and credit turmoil and the technology bubble of the late ‘90s. Markets have seen prices rise on little or no substance; valuation tools are not working in line with their historical norms, and quantitative techniques have been out of favor. A decade ago, the tech bubble burst and stocks fell into a long and costly bear market. After some initial choppiness, markets experienced indiscriminate selling as fear of a protracted bear market grew. Following the tumult, valuation and risk measures swung back into favor and our process led to market outperformance for the next several years. The position we are now in is strikingly similar: we are seeing choppiness (with unprecedented volatility) and indiscriminate selling, which has altered the complacency and extreme risk-seeking behavior of earlier this year, moving the markets back towards a historically normal risk-averse stance.

19

OPPENHEIMER LARGE CAP CORE FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2008 | | INDUSTRY WEIGHTINGS (Continued) At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Wal-Mart Stores, Inc. | | 4.0 | % |

Exxon Mobil Corp. | | 3.8 | |

International Business Machines Corp. | | 2.9 | |

Hewlett-Packard Co. | | 2.8 | |

Johnson & Johnson | | 2.5 | |

Amgen, Inc. | | 2.2 | |

Microsoft Corp. | | 2.1 | |

Northrop Grumman Corp. | | 2.1 | |

Pfizer, Inc. | | 2.0 | |

Verizon Communications, Inc. | | 2.0 | |

INDUSTRY WEIGHTINGS

At December 31, 2008

| | | |

| | | % of Net Assets | |

Oil & Gas-Exploration & Production | | 13.1 | % |

Pharmaceuticals | | 7.8 | |

Computers & Peripherals | | 6.9 | |

Aerospace & Defense | | 6.1 | |

Short Term Investments | | 5.6 | |

Food Products | | 5.6 | |

Health Care Providers & Services | | 5.5 | |

Food & Staples Retailing | | 4.9 | |

Software | | 4.0 | |

Road & Rail | | 3.4 | |

Insurance | | 2.9 | |

Diversified Telecommunication Services | | 2.8 | |

Specialty Retail | | 2.6 | |

Capital Markets | | 2.6 | |

Real Estate Investment Trusts | | 2.4 | |

Biotechnology | | 2.2 | |

Tobacco | | 2.2 | |

Energy Equipment & Services | | 2.2 | |

Diversified Financial Services | | 2.1 | |

Household Products | | 2.0 | |

Electric Utilities | | 1.9 | |

Media | | 1.4 | |

Multi-Utilities | | 1.4 | |

Chemicals | | 1.4 | |

Communications Equipment | | 1.1 | |

| | | |

| | | % of Net Assets | |

Health Care Equipment & Supplies | | 1.1 | % |

Construction & Engineering | | 1.1 | |

Machinery | | 1.1 | |

Beverages | | 0.9 | |

Commercial Services & Supplies | | 0.7 | |

Commercial Banks | | 0.6 | |

Office Electronics | | 0.6 | |

Semiconductors & Semiconductor Equipment | | 0.5 | |

IT Services | | 0.5 | |

Thrift & Mortgage Finance | | 0.4 | |

Metals & Mining | | 0.4 | |

Air Freight & Logistics | | 0.3 | |

Leisure Equipment & Products | | 0.3 | |

Wireless Telecommunication Services | | 0.2 | |

Textiles, Apparel & Luxury Goods | | 0.2 | |

Industrial Conglomerates | | 0.1 | |

Liabilities in excess of other assets | | (3.1 | ) |

| | | |

TOTAL | | 100.0 | % |

| | | |

20

OPPENHEIMER LARGE CAP CORE FUND

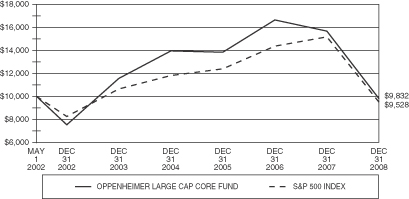

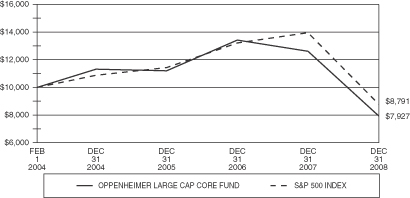

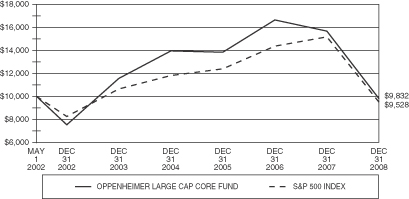

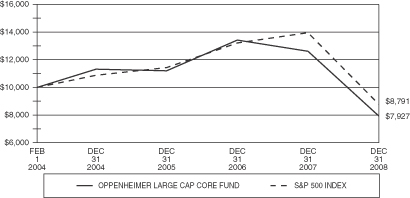

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Large Cap Core Fund – Initial Class and the S&P 500 Index

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Large Cap Core Fund – Service Class and the S&P 500 Index

21

OPPENHEIMER LARGE CAP CORE FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Oppenheimer Large Cap Core Fund | | (37.06 | )% | | (10.71 | )% | | (3.18 | )% | | (0.25 | )% |

S&P 500 Index* | | (37.00 | )% | | (8.34 | )% | | (2.19 | )% | | (0.72 | )% |

Service Class Shares | | | | | | | | | | | | |

Oppenheimer Large Cap Core Fund | | (37.15 | )% | | (10.91 | )% | | N/A | | | (4.62 | )% |

S&P 500 Index* | | (37.00 | )% | | (8.34 | )% | | N/A | | | (2.59 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The S&P 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market. The S&P 500 Index has been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Oppenheimer Large Cap Core Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized. Effective May 1, 2008 Oppenheimer Funds, Inc. replaced Sun Capital Advisers LLC as subadviser to the Sun Capital All Cap Fund. Also effective May 1, 2008 the name of the Fund was changed to SC Oppenheimer Large Cap Core Fund. OFI Institutional Asset Management, Inc., an affiliate of OppenheimerFunds, Inc., serves as sub-subadviser to SC Oppenheimer Large Cap Core Fund.

***Initial Class Shares for the period from May 1, 2002 (commencement of operations) to December 31, 2008. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2008.

22

MANAGEMENT’S DISCUSSION & ANALYSIS

WMC LARGE CAP GROWTH FUND (subadvised by Wellington Management Co., LLP)

Effective August 1, 2008, Wellington Management Company, LLP replaced Pyramis Global Advisors, LLC as subadviser to FI Large Cap Growth Fund. Also effective August 1, 2008, the name of the Fund changed to WMC Large Cap Growth Fund.

The one-year period ended December 31, 2008 was an extraordinarily challenging year in financial markets as nearly every asset class recorded significant price declines. After a positive start to the year, global equity markets stumbled as a widespread contraction in credit led to major changes in the financial landscape. These included the near collapse of large investment bank Bear Stearns, government takeovers of Fannie Mae and Freddie Mac, the collapse of Lehman Brothers, the fall of insurance firm AIG, and the seizure of banking firm Washington Mutual. The global economy also weakened, sending energy and commodities prices lower. Equity investors sought to shed risk in response to increasing concerns about the financial system and a US recession, punishing stock prices broadly.

Small cap, mid cap, and large cap stocks declined in unison during the period, as measured by the Russell 2000, S&P MidCap 400, and S&P 500 indices, respectively. Value and Growth stocks performed similarly during the period, as measured by the Russell 1000 Value and Russell 1000 Growth indices. There were no safe havens as all ten sectors within the Russell 1000 Growth Index posted negative double digit returns. Energy, Materials, and Telecommunication Services were the biggest laggards. Consumer Staples, Health Care, and Consumer Discretionary declined the least.

For the period from early August to year-end, overall Fund performance was hurt by weaker stock selection within the Materials, Financials, and Health Care sectors. This was partially offset by the positive impact to relative performance from stock selection within the Information Technology, Consumer Discretionary, and Energy sectors. The Fund’s underweight position to the relatively outperforming Consumer Staples sector negatively impacted relative performance. An underweight position to Materials and an overweight position to Information Technology also detracted from relative performance.

Among the largest detractors from relative performance during the period were Smith International, Potash, and Mosaic. Not owning integrated oil and gas company Exxon Mobil detracted from relative performance, as the market viewed its shares as a safe haven within the Energy sector. Shares of oil and gas exploration and production supplier Smith International declined because of lower revenues due to lower natural gas and oil prices. Shares of Canadian-based fertilizer and feed products company Potash and major fertilizer producer Mosaic fell as falling grain prices led to weakness in fertilizer demand. Information technology companies Cisco Systems, Microsoft, and IBM also detracted from the Fund’s absolute returns.

Top contributors to relative performance included AutoZone, Apollo Group, and Eli Lilly. Not owning oilfield service company Schlumberger also contributed to relative performance. Specialty auto parts retailer AutoZone’s shares rose over the period due to better than expected earnings and expectations that replacement part sales will increase as car owners try to extend the life of existing vehicles. Shares of for-profit education company Apollo Group rose as the company experienced very strong sales growth and high incremental margins in the most recent quarter. Shares of pharmaceutical company Eli Lilly performed well due to the possibility of sustainable growth with several new drugs. Department store giant Wal-Mart was also among other top absolute contributors.

Sector exposure is predominantly a fall-out of stock selection. At the end of 2008 our largest overweights relative to the Russell 1000 Growth Index were to the Information Technology and Health Care sectors, while the largest underweights were to Consumer Staples and Utilities.

23

WMC LARGE CAP GROWTH FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2008 | | INDUSTRY WEIGHTINGS At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Cisco Systems, Inc. | | 4.4 | % |

Microsoft Corp. | | 4.3 | |

Oracle Corp. | | 4.0 | |

Occidental Petroleum Corp. | | 3.1 | |

Philip Morris International, Inc. | | 3.0 | |

International Business Machines Corp. | | 3.0 | |

Abbott Laboratories | | 2.7 | |

Wal-Mart Stores, Inc. | | 2.7 | |

Eli Lilly & Co. | | 2.4 | |

Altera Corp. | | 2.2 | |

| | | |

| | | % of Net Assets | |

Software | | 11.6 | % |

Pharmaceuticals | | 10.1 | |

Oil, Gas & Consumable Fuels | | 7.3 | |

Communications Equipment | | 6.4 | |

Short Term Investments | | 5.3 | |

Specialty Retail | | 5.2 | |

Semiconductors & Semiconductor Equipment | | 5.0 | |

Computers & Peripherals | | 5.0 | |

Machinery | | 4.9 | |

Biotechnology | | 3.6 | |

Aerospace & Defense | | 3.1 | |

Tobacco | | 3.0 | |

Household Products | | 3.0 | |

Food Products | | 2.9 | |

Food & Staples Retailing | | 2.7 | |

Health Care Equipment & Supplies | | 2.5 | |

Electrical Equipment | | 2.4 | |

Chemicals | | 2.2 | |

IT Services | | 2.0 | |

Construction & Engineering | | 1.8 | |

Energy Equipment & Services | | 1.5 | |

Capital Markets | | 1.4 | |

Diversified Consumer Services | | 1.3 | |

Commercial Banks | | 1.1 | |

Textiles, Apparel & Luxury Goods | | 0.9 | |

Diversified Financial Services | | 0.8 | |

Insurance | | 0.8 | |

Commercial Services & Supplies | | 0.7 | |

Household Durables | | 0.6 | |

Road & Rail | | 0.6 | |

Life Sciences Tools & Services | | 0.5 | |

Diversified Telecommunication Services | | 0.4 | |

Personal Products | | 0.4 | |

Media | | 0.4 | |

Auto Components | | 0.3 | |

Hotels, Restaurants & Leisure | | 0.1 | |

Liabilities in excess of other assets | | (1.8 | ) |

| | | |

TOTAL | | 100.0 | % |

| | | |

24

WMC LARGE CAP GROWTH FUND

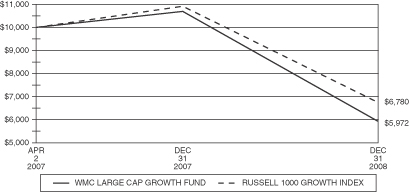

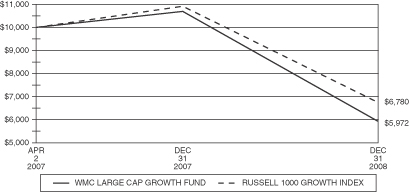

Comparison of Change in Value of a $10,000 Investment in the WMC Large Cap Growth Fund – Initial Class and the Russell 1000 Growth Index

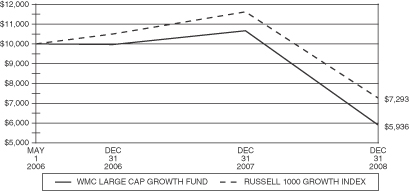

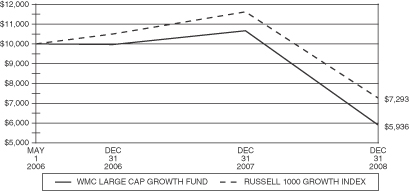

Comparison of Change in Value of a $10,000 Investment in the WMC Large Cap Growth Fund – Service Class and the Russell 1000 Growth Index

25

WMC LARGE CAP GROWTH FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | |

Initial Class Shares | | One Year | | | Life of

Fund*** | |

WMC Large Cap Growth Fund | | (44.12 | )% | | (25.53 | )% |

Russell 1000 Growth Index* | | (38.44 | )% | | (19.94 | )% |

Service Class Shares | | | | | | |

WMC Large Cap Growth Fund | | (44.30 | )% | | (17.75 | )% |

Russell 1000 Growth Index* | | (38.44 | )% | | (11.16 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The Russell 1000 Growth Index is an unmanaged index that measures the performance of those Russell 1000 Index securities with higher price-to-book ratios and higher forecasted growth values, representative of U.S. securities exhibiting growth characteristics. The Russell 1000 Growth Index includes the largest 1000 securities in the Russell 3000 Index, based on market cap. The Russell 3000 Index consists of the 3000 largest and most liquid stocks based and traded in the U.S. The Russell 1000 Growth Index has been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and/or reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the WMC Large Cap Growth Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized. Effective August 1, 2008, Wellington Management Company, LLP replaced Pyramis Global Advisors, LLC as subadviser to FI Large Cap Growth Fund. Also effective August 1, 2008, the name of the Fund changed to WMC Large Cap Growth Fund.

***Initial Class Shares for the period from April 2, 2007 (commencement of operations) to December 31, 2008. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2008.

26

MANAGEMENT’S DISCUSSION & ANALYSIS

WMC BLUE CHIP MID CAP FUND (subadvised by Wellington Management Co., LLP)

The one-year period ended December 31, 2008 was an extraordinarily challenging year in financial markets as nearly every asset class recorded significant price declines. After a positive start to the year, global equity markets stumbled as a widespread contraction in credit led to major changes in the financial landscape. These included the near collapse of large investment bank Bear Stearns, government takeovers of Fannie Mae and Freddie Mac, the collapse of Lehman Brothers, the fall of insurance firm AIG, and the seizure of banking firm Washington Mutual. The global economy also weakened, sending energy and commodities prices lower. Equity investors sought to shed risk in response to increasing concerns about the financial system and a US recession, punishing stock prices broadly.

Small cap, mid cap, and large cap stocks declined in unison during the period, as measured by the Russell 2000, S&P MidCap 400, and S&P 500 indices, respectively. There were no safe havens as all ten sectors within the S&P MidCap 400 Index posted negative returns. Energy, Telecommunication Services, and Materials were the biggest laggards. Utilities and Consumer Staples declined the least.

Security selection in Consumer Discretionary, Materials, and Health Care contributed to positive relative performance for the Fund, and more than offset weaker stock selection in the Financials, Information Technology, and Energy sectors. Sector positioning, driven by security selection, also contributed positively to benchmark-relative returns during the period, primarily due to underweight positions in Energy and Consumer Discretionary. The Fund benefited from a modest cash position, which helped relative performance in a downward-trending market.

Top contributors to returns on a relative basis included Barr Pharmaceuticals, ITT Educational Services, and Allied Waste. Shares of specialty pharmaceutical company Barr Pharmaceuticals rose after the company received a stock and cash takeover offer from generic drug firm Teva Pharmaceutical. Shares of ITT Educational Services, a technology-oriented postsecondary degree programs provider, benefited from strong industry fundamentals as the softer economy aided enrollment growth and increases in federal loan limits enhanced pricing power. Waste management company Allied Waste was acquired by Republic Services in early December. Other top contributors to absolute performance included drug developer Millennium Pharmaceuticals, who was purchased by Takeda Pharmaceutical, and specialty automotive aftermarket parts and accessories retailer O’Reilly Automotive.

Top detractors from relative performance included Electronic Arts, CGG Veritas, and Chicago Bridge & Iron. Video game software company Electronic Arts saw its shares drift lower on disappointing bottom-line results due to high development costs and acquisition charges. Shares of CGG Veritas, a geophysical equipment and services provider, fell on concerns that demand for its seismic services would decline as energy companies cut back their exploration and production expenditures. Shares of global engineering and construction company Chicago Bridge & Iron declined due to project cost overruns and poor bidding on projects. US hospital operator Community Health Systems and oil and gas exploration and production company Forest Oil were also among the top detractors from absolute performance.

Sector exposure is predominantly a fall-out of stock selection. At the end of 2008 our largest overweights relative to the S&P MidCap 400 Index were to the Information Technology and Health Care sectors, while the largest underweights were to Financials and Materials.

27

WMC BLUE CHIP MID CAP FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2008 | | INDUSTRY WEIGHTINGS (Continued) At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Republic Services, Inc. | | 2.7 | % |

The Western Union Co. | | 2.2 | |

Beckman Coulter, Inc. | | 1.9 | |

Equifax, Inc. | | 1.9 | |

Northeast Utilities | | 1.8 | |

UGI Corp. | | 1.8 | |

O’Reilly Automotive, Inc. | | 1.8 | |

DPL, Inc. | | 1.8 | |

Dreamworks Animation Skg, Inc., Class A | | 1.7 | |

Clorox Co. | | 1.7 | |

INDUSTRY WEIGHTINGS

At December 31, 2008

| | | |

| | | % of Net Assets | |

Insurance | | 8.6 | % |

Specialty Retail | | 8.1 | |

Health Care Providers & Services | | 5.5 | |

Short Term Investments | | 5.4 | |

Software | | 4.9 | |

Computers & Peripherals | | 4.3 | |

Professional Services | | 4.3 | |

Health Care Equipment & Supplies | | 3.9 | |

Diversified Consumer Services | | 3.7 | |

Electric Utilities | | 3.6 | |

IT Services | | 3.6 | |

Oil & Gas-Exploration & Production | | 3.1 | |

Biotechnology | | 2.9 | |

Commercial Services & Supplies | | 2.7 | |

Semiconductors & Semiconductor Equipment | | 2.6 | |

Machinery | | 2.3 | |

Media | | 2.3 | |

Containers & Packaging | | 2.2 | |

Road & Rail | | 2.2 | |

Aerospace & Defense | | 2.1 | |

Life Sciences Tools & Services | | 2.0 | |

Gas Utilities | | 1.8 | |

Food & Staples Retailing | | 1.7 | |

Household Products | | 1.7 | |

Building Products | | 1.4 | |

| | | |

| | | % of Net Assets | |

Capital Markets | | 1.4 | % |

Commercial Banks | | 1.2 | |

Wireless Telecommunication Services | | 1.1 | |

Electrical Equipment | | 1.0 | |

Electronic Equipment & Instruments | | 1.0 | |

Household Durables | | 0.9 | |

Pharmaceuticals | | 0.9 | |

Chemicals | | 0.8 | |

Energy Equipment & Services | | 0.8 | |

Hotels, Restaurants & Leisure | | 0.8 | |

Metals & Mining | | 0.8 | |

Internet Software & Services | | 0.7 | |

Leisure Equipment & Products | | 0.7 | |

Real Estate Investment Trusts | | 0.6 | |

Health Care Technology | | 0.4 | |

Airlines | | 0.3 | |

Auto Components | | 0.2 | |

Consumer Finance | | 0.2 | |

Food Products | | 0.0 | * |

Liabilities in excess of other assets | | (0.7 | ) |

| | | |

TOTAL | | 100.0 | % |

| | | |

| * | Amount is less than 0.05%. |

28

WMC BLUE CHIP MID CAP FUND

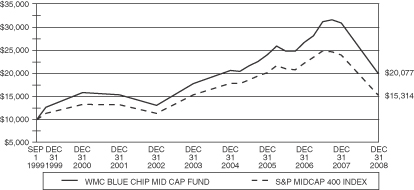

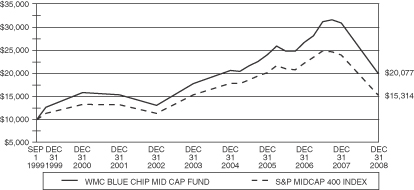

Comparison of Change in Value of a $10,000 Investment in the WMC Blue Chip Mid Cap Fund – Initial Class and the S&P MidCap 400 Index

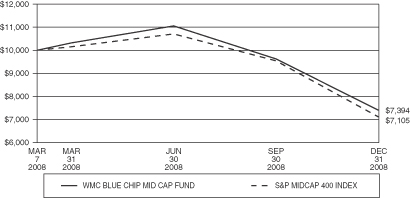

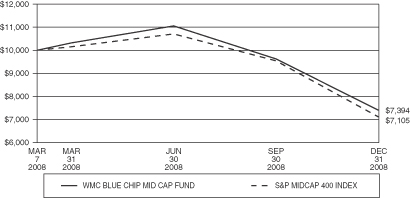

Comparison of Change in Value of a $10,000 Investment in the WMC Blue Chip Mid Cap Fund – Service Class and the S&P MidCap 400 Index

29

WMC BLUE CHIP MID CAP FUND

Total Returns for Periods Ended December 31, 2008**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Blue Chip Mid Cap Fund | | (35.14 | )% | | (5.91 | )% | | 2.44 | % | | 7.75 | % |

S&P MidCap 400 Index* | | (36.23 | )% | | (8.74 | )% | | (0.08 | )% | | 4.67 | % |

Service Class Shares | | | | | | | | | | | | |

Blue Chip Mid Cap Fund | | NA | | | NA | | | NA | | | (26.06 | )% |

S&P MidCap 400 Index* | | NA | | | NA | | | NA | | | (28.95 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and has no fees or costs. The S&P MidCap 400 Index is a capitalization-weighted index that measures the mid-range sector of the U.S. stock market. The S&P MidCap 400 Index has been taken from published sources.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. Performance numbers are net of all operating expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. In addition, the investment adviser reduced its management fee and/or reimbursed certain other expenses during these periods. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the WMC Blue Chip Mid Cap Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost. Returns greater than one year are annualized.

***Initial Class Shares for the period from September 1, 1999 (commencement of operations) to December 31, 2008. Service Class Shares for the period from March 7, 2008 (commencement of operations) to December 31, 2008.

30

MANAGEMENT’S DISCUSSION & ANALYSIS

LORD ABBETT GROWTH & INCOME FUND (subadvised by Lord, Abbett & Co. LLC)

Stock selection within the financial services sector was the largest contributor to relative performance during the period since inception until December 31, 2008. A key contributor was Wells Fargo & Company, a bank holding company with a sizable residential mortgage business. The company was one of the few financial firms that showed a positive return during a tumultuous year for the financial industry, far outperforming its peers. In the past three quarters it reported better than expected earnings and it raised its dividend. The Fund’s overweight position in the overall financial sector reduced somewhat the benefit of good stock selection.

Also contributing to relative performance was stock selection within the materials & processing sector. Agricultural processor Archer-Daniels-Midland Company rose sharply due to fourth quarter earnings results that far surpassed analysts’ expectations. Fears of a margin squeeze evaporated as corn prices fell dramatically in the second half of the year.

Within the auto & transportation sector, shares of Delta Air Lines rose significantly during the fourth quarter. Investors liked the solid growth in the airline’s Revenue per Available Seat Mile accompanied by a strategic reduction in capacity and declining fuel costs. Also, during the fourth quarter the airline completed its merger with Northwest Airlines which should result in operational synergies and geographical diversification.

The Fund’s sizeable underweights within the utilities and the integrated oils sectors were the largest detractors from relative performance. Electric utilities performed well in a poor market, and international oil holdings held up even in the face of dramatically lower crude oil prices in the second half of the year.

With the U.S. economy softening and credit fears deepening throughout 2008, just about every asset class, except Treasuries, suffered. The average ‘BAA’ U.S. corporate bond fell approximately 15 percent, oil plummeted nearly 60 percent, and the S&P 500® Index declined roughly 40 percent. But as weak as the economic fundamentals remained by year-end, it became increasingly apparent that financial markets had discounted altogether too much pessimism. The ensuing reassessment, helped, no doubt, by the relief measures undertaken by the Federal Reserve Board (the Fed) and the Treasury, has begun to improve financial conditions, as is evidenced by the uptrend that developed in equity markets.

Despite the marked sell-off suffered by equities during 2008, the year began with only modest losses – the S&P 500 was down just 11.4 percent (on a total return basis) in the eight months ended August, 2008. However, the bankruptcy of U.S. investment bank Lehman Brothers in September sent the credit markets into a tailspin and intensified the selling of equities. In the credit markets, the spread between the three-month London Interbank Offering Rate (LIBOR) and three-month overnight indexed swap rates (OIS) measured 78 basis points (bps) in early September but Lehman’s failure on September 15 helped send the LIBOR/OIS spread to a record high of 364 bps by the end of September. From the end of August 2008 to the market’s low on November 20, 2008, the S&P 500 sharply dropped 41.0 percent (on a total return basis).

Fortunately, the actions taken by the Fed and the Treasury, including a reduction in the fed funds rate to a record low of 0.25 percent and the establishment of several special funding facilities, helped restore some semblance of confidence to the financial system, as stocks, bond prices, and most credit spreads began to recover towards the end of 2008. The S&P 500 Index, for instance, finished the year approximately 19 percent above its November lows, and the LIBOR-OIS spread narrowed to 126 bps.

For the period, the losses in the equity market were broad as every major equity investment style plummeted during 2008. At the margin, smaller capitalization companies outperformed their larger peers; small caps finished the year down about 33.1 percent, versus a loss of roughly 36.1 percent for large caps (on a total return basis). Small and mid cap value outperformed their “growthier” peers, while large cap growth eked out slightly better performance than the large cap value style of investing. As for sector performance, consumer staples, health care,

31

MANAGEMENT’S DISCUSSION & ANALYSIS (Continued)

and utilities (three sectors largely considered defensive) outperformed the others, on a relative basis, with losses of 16.1 percent, 23.4 percent, and 30.2 percent, respectively (on a total return basis). It was the financial sector that paced the sell-off in equities with a total return meltdown of 56.6 percent.

The financial services sector remains the largest overweight within the Fund, after having moved above a market weight in late June. Throughout the fourth quarter, we cautiously and opportunistically added to existing positions in high-quality diversified financial firms, an investment management company and a mortgage Real Estate Investment Trust. We increased the consumer discretionary sector from a meaningful to a significant overweight by adding to positions within the retail industry. We believe this will position the portfolio well as the economy begins to bottom and consumer spending starts to increase at some point in 2009.

The utilities sector remains the Fund’s largest underweight sector. We believe investors have crowded into this expensive, “safe haven” area because of the poor stock market environment and will be unpleasantly surprised by the lack of upside when the overall market turns more positive. The integrated oils sector also remains a significant underweight. This sector held up well during the quarter, even though crude oil and other energy prices declined sharply. We have difficulty finding attractively valued companies here, as we believe most are over-earning their long term potential by a substantial margin because of the “mini bubble” in energy prices over the past year.

We considerably reduced exposure to the technology sector such that it moved from being a large overweight to a moderate overweight, and to the consumer staples sector, such that it moved from being overweight to being underweight. Most of the stocks we sold in these areas have held up better than the overall market and we are finding better risk-reward opportunities elsewhere in the market.

32

LORD ABBETT GROWTH & INCOME FUND

| | |

TOP TEN EQUITY HOLDINGS At December 31, 2008 | | INDUSTRY WEIGHTINGS At December 31, 2008 |

| | | |

| | | % of Net Assets | |

Wells Fargo & Co. | | 4.8 | % |

Bank of New York Mellon Corp. | | 4.8 | |

JPMorgan Chase & Co. | | 4.6 | |

Delta Air Lines, Inc. | | 3.5 | |

Merrill Lynch & Co., Inc. | | 3.5 | |

General Electric Co. | | 3.1 | |

Archer-Daniels-Midland Co. | | 2.7 | |

Exxon Mobil Corp. | | 2.6 | |

The Goldman Sachs Group, Inc. | | 2.5 | |

The Home Depot, Inc. | | 2.5 | |

| | | |

| | | % of Net Assets | |

Capital Markets | | 15.5 | % |

Commercial Banks | | 9.9 | |

Short Term Investments | | 8.7 | |

Multi-Line Retail | | 7.4 | |

Oil & Gas-Exploration & Production | | 5.1 | |

Diversified Financial Services | | 4.6 | |

Pharmaceuticals | | 4.4 | |

Specialty Retail | | 4.3 | |

Airlines | | 3.5 | |

Food & Staples Retailing | | 3.1 | |

Industrial Conglomerates | | 3.1 | |

Insurance | | 2.8 | |

Health Care Equipment & Supplies | | 2.8 | |

Software | | 2.7 | |

Energy Equipment & Services | | 2.3 | |

Beverages | | 2.3 | |

Biotechnology | | 2.1 | |

Food Products | | 1.9 | |

Consumer Finance | | 1.6 | |

Internet & Catalog Retail | | 1.6 | |

Machinery | | 1.5 | |

Diversified Telecommunication Services | | 1.5 | |

Real Estate Investment Trusts | | 1.4 | |

Road & Rail | | 1.2 | |

Hotels, Restaurants & Leisure | | 1.1 | |

Media | | 1.0 | |

Commercial Services & Supplies | | 0.9 | |

Computers & Peripherals | | 0.8 | |

IT Services | | 0.7 | |

Chemicals | | 0.6 | |

Metals & Mining | | 0.6 | |

Building Products | | 0.4 | |

Semiconductors & Semiconductor Equipment | | 0.3 | |

Health Care Providers & Services | | 0.2 | |

Air Freight & Logistics | | 0.1 | |

Household Products | | 0.1 | |

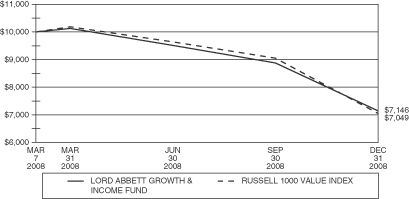

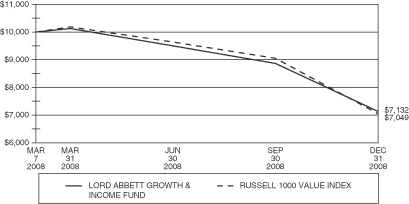

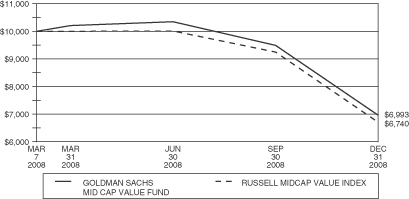

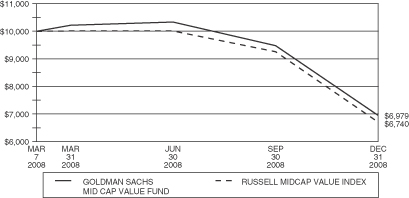

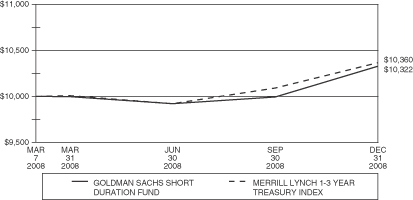

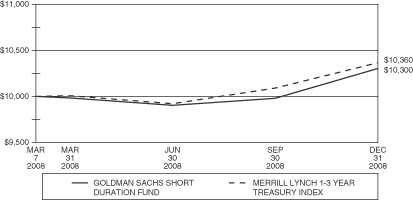

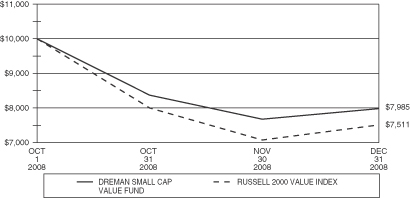

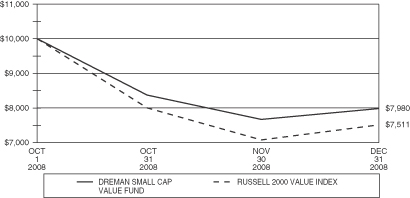

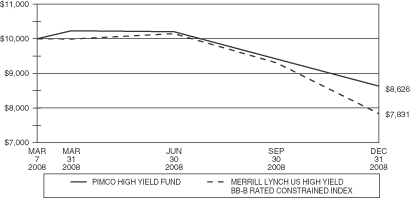

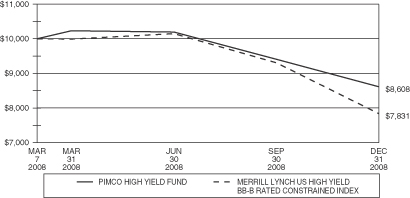

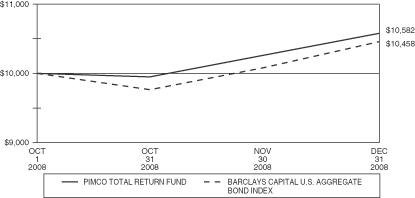

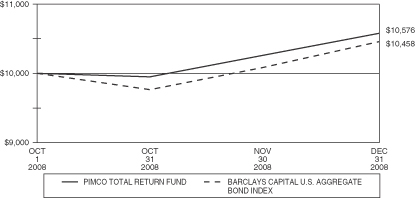

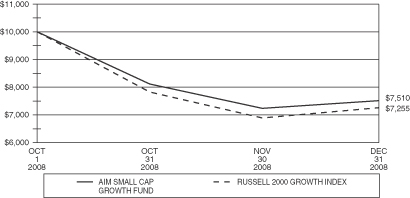

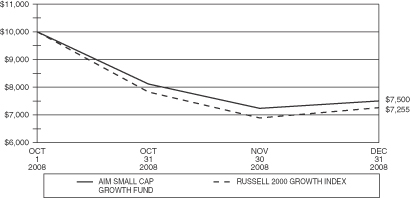

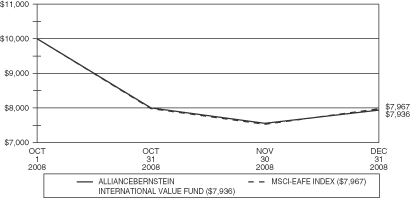

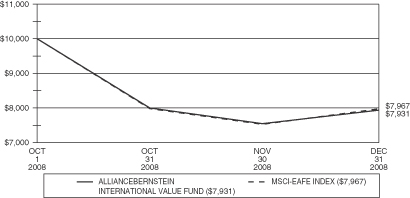

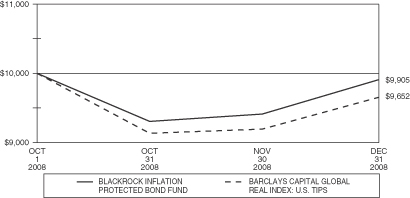

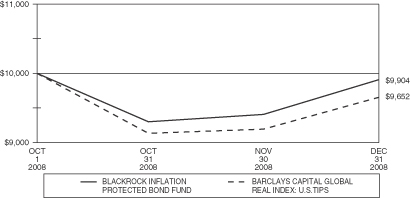

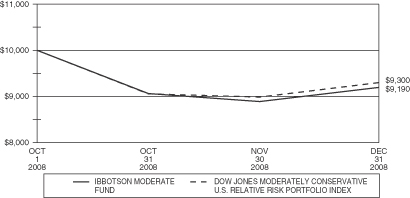

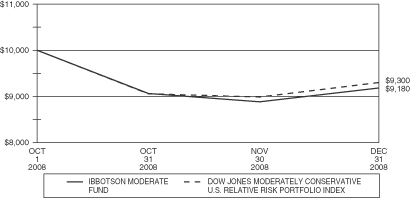

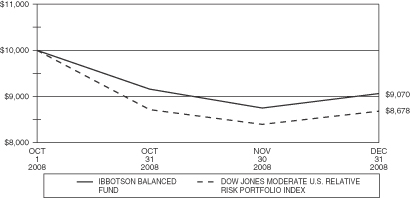

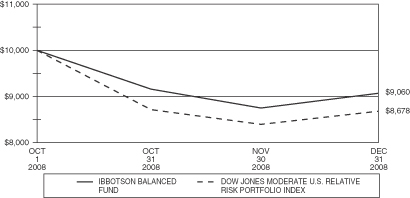

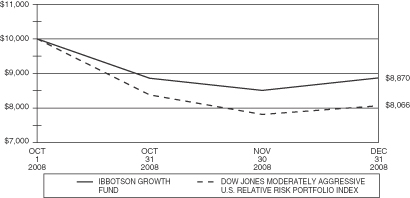

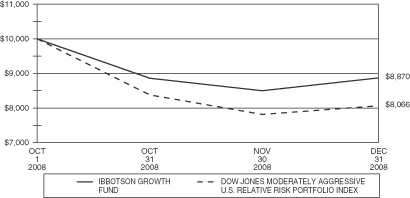

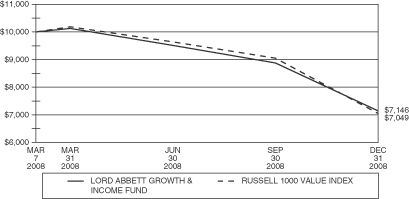

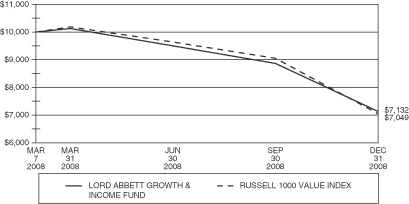

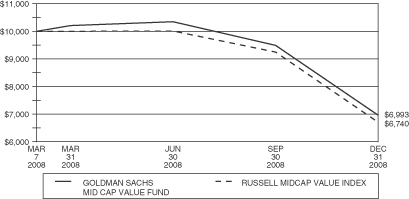

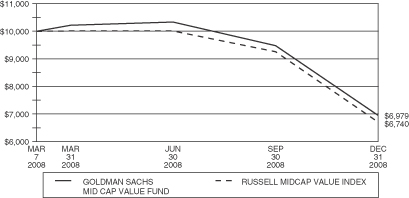

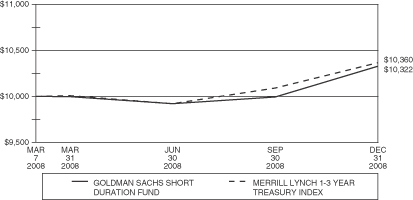

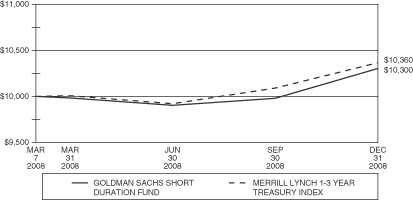

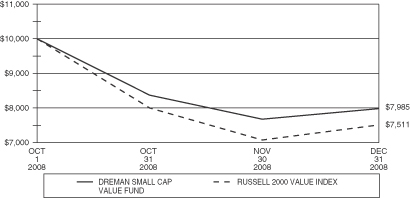

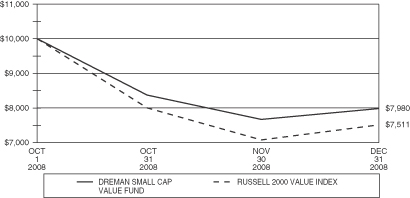

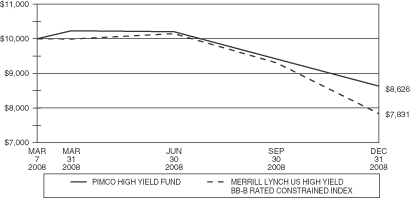

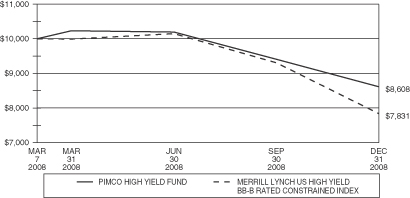

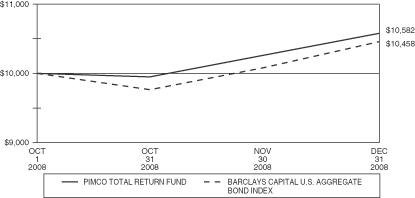

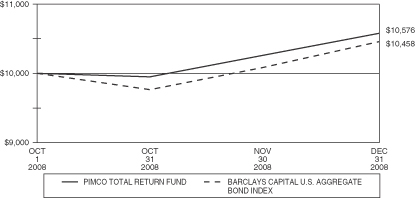

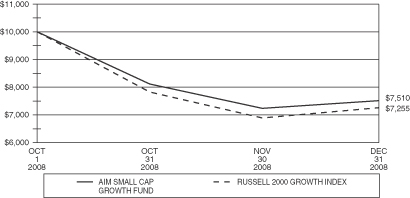

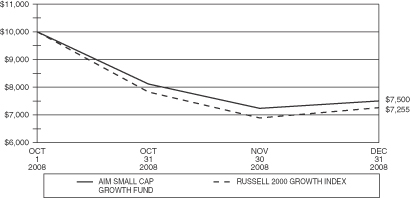

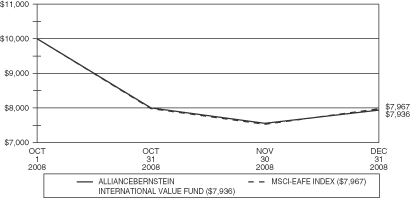

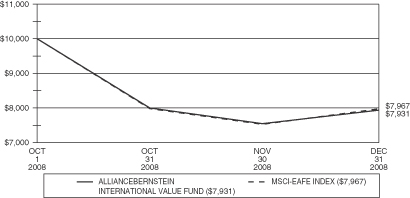

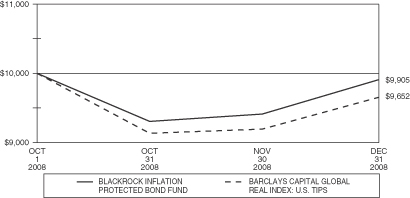

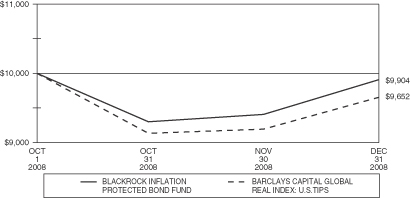

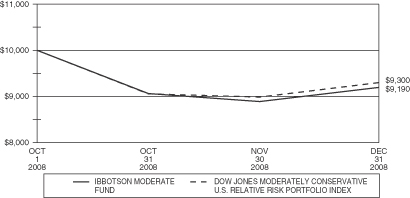

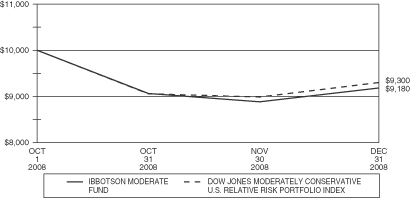

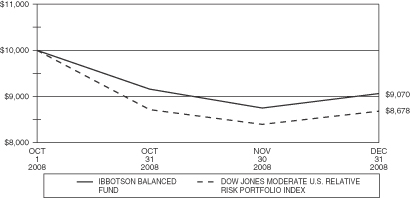

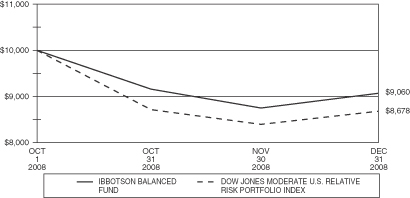

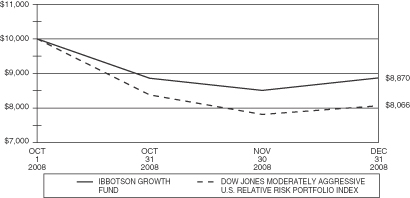

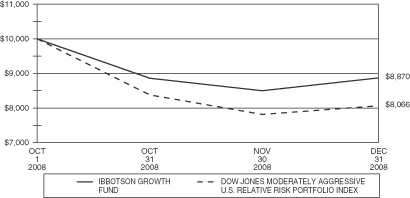

Liabilities in excess of other assets | | (2.1 | ) |