UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08879

SUN CAPITAL ADVISERS TRUST

(Exact name of registrant as specified in charter)

One Sun Life Executive Park, Wellesley Hills, Massachusetts 02481

(Address of principal executive offices) (Zip code)

John T. Donnelly

Sun Capital Advisers Trust

One Sun Life Executive Park

Wellesley Hills, Massachusetts 02481

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 432-1102 x 3330

Date of fiscal year end: December 31

Date of reporting period: December 31, 2009

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended:

SUN CAPITAL ADVISERS TRUST®

Annual Report December 31, 2009

Sun Capital Investment Grade Bond Fund®

Sun Capital Money Market Fund®

Sun Capital Global Real Estate Fund

SCSM Davis Venture Value Fund

SCSM Oppenheimer Main Street Small Cap Fund

SCSM Oppenheimer Large Cap Core Fund

SCSM WMC Large Cap Growth Fund

SCSM WMC Blue Chip Mid Cap Fund

SCSM Lord Abbett Growth & Income Fund

SCSM Goldman Sachs Mid Cap Value Fund

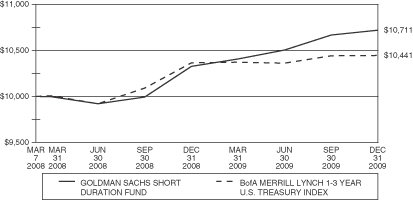

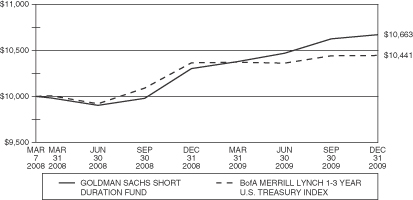

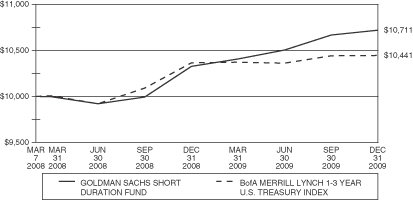

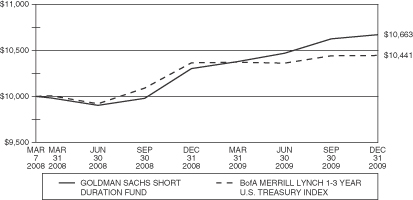

SCSM Goldman Sachs Short Duration Fund

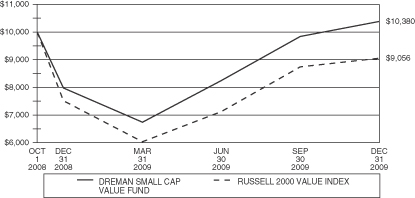

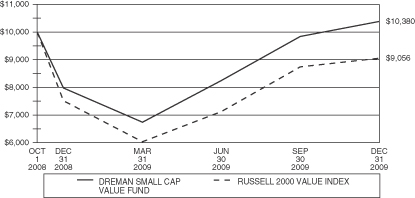

SCSM Dreman Small Cap Value Fund

SCSM PIMCO High Yield Fund

SCSM PIMCO Total Return Fund

SCSM AIM Small Cap Growth Fund

SCSM AllianceBernstein International Value Fund

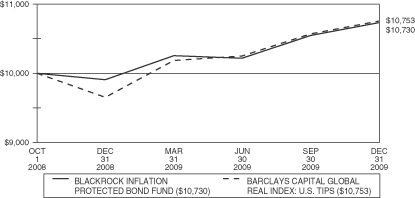

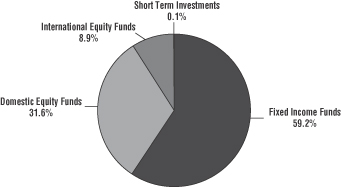

SCSM BlackRock Inflation Protected Bond Fund

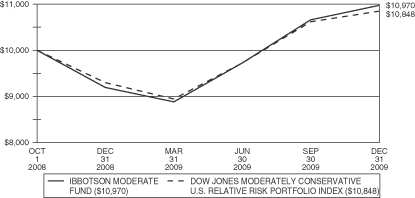

SCSM Ibbotson Moderate Fund

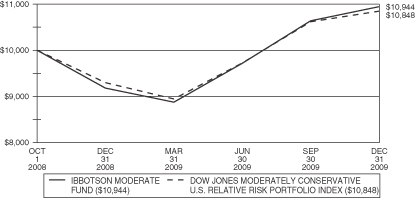

SCSM Ibbotson Balanced Fund

SCSM Ibbotson Growth Fund

| | |

| | Sun Capital Advisers Trust is registered under the Investment Company Act of 1940 as an open-end management investment company. Its investment adviser is Sun Capital Advisers LLC®, a member of the Sun Life Financial group of companies. |

TABLE OF CONTENTS

Important Information about this Report:

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus. Investors should consider the investment objectives, risks, charges and expenses of a Fund before investing. This and other information is contained in a Fund’s prospectus. Please read the prospectus carefully before you invest.

The views and opinions expressed in each Fund’s “Management’s Discussion and Analysis” are those of the portfolio manager(s) of the Fund. The views and opinions expressed, and the portfolio holdings described, are as of December 31, 2009, and are subject to change at any time without notice due to market or other conditions. These should not be construed as investment advice or as a recommendation to buy or sell any security. Any forecasts or other forward looking views may not come to pass. Past performance is no guarantee of future results. Performance may have changed materially since December 31, 2009.

An investment in a Fund is not a bank deposit and is not insured by the Federal Deposit Insurance Corporation. It is possible to lose money on an investment in any of the Funds.

Country codes included within each Fund’s Portfolio of Investments are unaudited.

INVESTMENT GRADE BOND FUND

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Investment Grade Bond Fund (the “Fund”) outperformed its benchmark, the Barclays Capital U.S. Aggregate Bond Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the fixed income markets as a whole during the year ended December 31, 2009?

Following a pattern that began in earnest during the second quarter of 2009, risky assets were very much in demand during the fourth quarter of 2009 and generated strong one-year returns. In retrospect, during the fourth quarter of 2008, the Federal Reserve was, among other things, slashing interest rates to zero while the U.S. Government was injecting capital directly into financial institutions as part of the $700 billion TARP program, as the Credit Crisis of 2008 continued in an unrelenting manner. Most of the Federal Reserve’s special liquidity facilities that were enacted to support the financial markets in late 2008, will expire in early 2010 given the improvement in market stability and investor confidence. After a significant down year in 2008, all fixed income spread sectors generated strong returns in 2009. The high yield and investment grade corporate sectors produced strong positive returns in 2009, up 58.2% and 18.5%, respectively. Beleaguered structured sectors, Commercial Mortgage Backed Securities (CMBS) and Asset Backed Securities (ABS), returned 28.5% and 24.7%, respectively. Corporate securities with CCC credit ratings, considered highly speculative, returned 90.6% in 2009. While U.S. Treasuries benefited during 2008 as investors sought their safety, the trend for 2009 has been about capturing valuations. In general, the lower the credit quality of securities, the higher the return they generated for 2009. As market participants began to gain confidence that the credit crisis was abating, and spreads were deemed to offer adequate compensation for market risks, beginning during the first quarter of 2009, demand for spread product began to increase. While traditional fixed income participants were present, equity players were also enticed by the historically attractive return potential (equity-like) while being able to improve their position in the capital structure.

What key factors were most responsible for the Fund’s performance during the year ended December 31, 2009?

The primary driver of performance for 2009 was the Fund’s overweight position in the spread sectors of the Index, particularly the Credit sector. The Credit portion of the Fund returned 40.4% for 2009 while the Index allocation returned 18.7%. The Fund’s 9.8% allocation to the U.S. Treasury sector generated a return of 6.4% as a result of an allocation to U.S. Treasury Inflation Protected Securities (TIPS) while the 24% Index allocation returned a negative 3.6%. The Fund’s weighting to CMBS produced a return of 37.0% while the Index return was 28.5%. The Fund’s duration position had a modest positive affect on Fund performance while yield curve positioning detracted slightly.

What changes did you make to the Fund’s sector allocations during the year ended December 31, 2009 and how did these affect performance during the reporting period?

In general, sector allocations positively affected the relative performance of the Fund during 2009 given the overweight allocations to Credit, MBS and CMBS, while the Fund’s allocation to short term investments negatively affected performance. The allocation to the MBS and CMBS sectors, while still greater than the Index, declined, while the allocation to the U.S. Treasury sector increased for the year ended December 31, 2009. The allocation to the Credit sector remained relatively unchanged during the reporting period.

1

INVESTMENT GRADE BOND FUND (Continued)

Did the Fund experience major changes to its top ten issuers during the year ended December 31, 2009?

Top ten issuers were altered during the year to maximize total return. Allocations to Federal National Mortgage Association and Federal Home Loan Mortgage Corp. were reduced in favor of U.S. Treasuries while holdings of corporate and non-agency Mortgage-Backed Securities were purchased or sold to generate enhanced returns.

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

The Fund remained overweight the Credit sector of the Index while being underweight U.S. Treasuries, Agencies and to a lesser extent, MBS and CMBS.

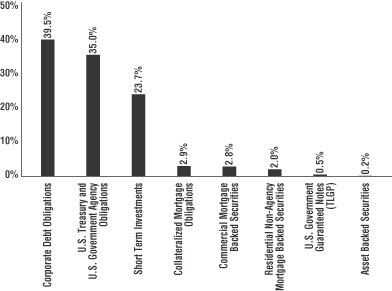

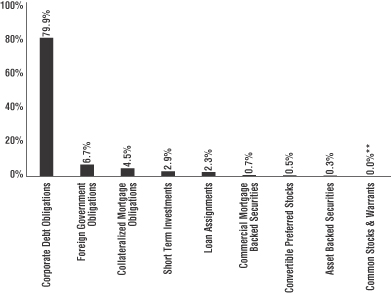

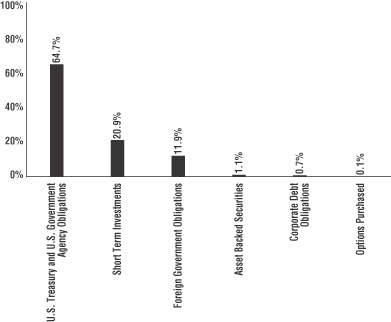

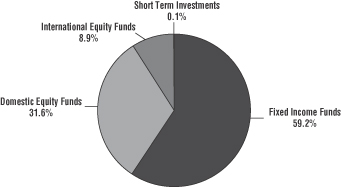

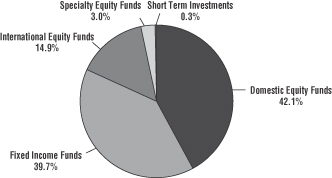

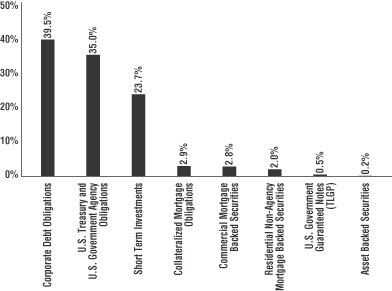

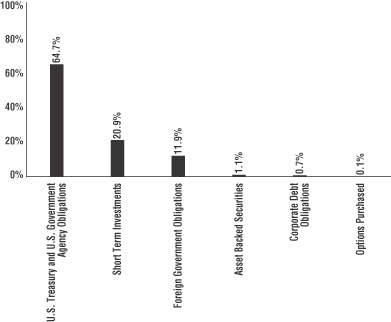

PORTFOLIO COMPOSITION AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The percentages shown for each investment category reflect the value of investments in that category as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN ISSUERS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Category |

Federal National Mortgage Association | | 16.4 | % | | U.S. Government Agency |

U.S. Treasury | | 9.2 | | | U.S. Treasury |

Federal Home Loan Mortgage Corp. | | 9.0 | | | U.S. Government Agency |

Philip Morris International, Inc. | | 3.3 | | | Short Term – Commercial Paper |

HSBC Finance Corp. | | 3.0 | | | Short Term – Commercial Paper |

KFW International Finance, Inc. | | 3.0 | | | Short Term – Commercial Paper |

JPMorgan Chase & Co. | | 2.1 | | | Corporate Debt – Financials |

Coca-Cola Co. | | 1.8 | | | Short Term – Commercial Paper |

Barclays Bank PLC | | 1.5 | | | Corporate Debt – Financials |

Morgan Stanley | | 1.4 | | | Corporate Debt – Financials |

2

INVESTMENT GRADE BOND FUND (Continued)

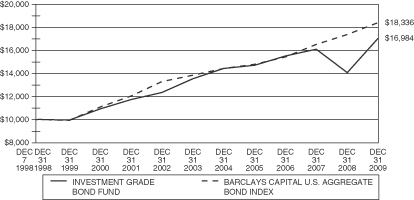

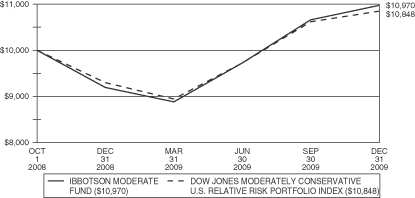

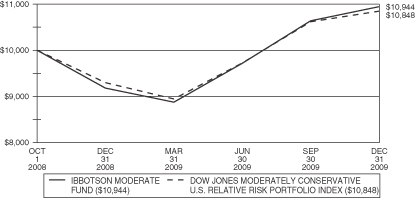

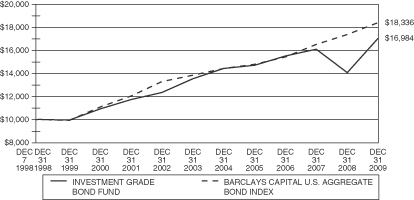

Comparison of Change in Value of a $10,000 Investment in the Investment Grade Bond Fund – Initial Class and the Barclays Capital U.S. Aggregate Bond Index

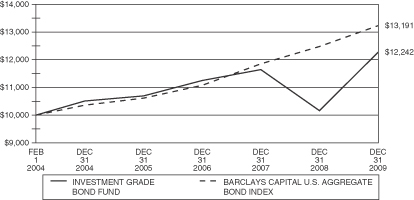

Comparison of Change in Value of a $10,000 Investment in the Investment Grade Bond Fund – Service Class and the Barclays Capital U.S. Aggregate Bond Index

3

INVESTMENT GRADE BOND FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Life of

Fund*** | |

Investment Grade Bond Fund | | 21.00 | % | | 3.19 | % | | 3.38 | % | | 5.49 | % | | 4.90 | % |

Barclays Capital U.S. Aggregate Bond Index* | | 5.93 | % | | 6.04 | % | | 4.97 | % | | 6.33 | % | | 5.63 | % |

Service Class Shares | | | | | | | | | | | | | | | |

Investment Grade Bond Fund | | 20.58 | % | | 2.91 | % | | 3.11 | % | | — | | | 3.48 | % |

Barclays Capital U.S. Aggregate Bond Index* | | 5.93 | % | | 6.04 | % | | 4.97 | % | | — | | | 4.79 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Barclays Capital U.S. Aggregate Bond Index is composed of U.S. securities in the Treasury, Government-Related, Corporate, and Securitized sectors.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Investment Grade Bond Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2009. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2009.

4

MONEY MARKET FUND

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Money Market Fund (the “Fund”) performed approximately in line with its benchmark, the BofA Merrill Lynch U.S. 3-Month Treasury Bill Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the money markets as a whole during the year ended December 31, 2009?

Several signs of economic rebound appeared throughout the year. The pace of job loss has slowed, the housing sector showed some signs of improvement, and household spending expanded moderately. This data would typically lead to higher short term rates. However, the zero interest rate policy of the Federal Reserve and the market’s persistent demand for quality completely overwhelmed the economic data, leaving short term rates at historically low levels. The Federal Open Market Committee (FOMC) elected to keep rates unchanged during 2009 at the 0.00% to 0.25% range that was implemented in December of 2008. Three-month Treasury bills traded in a very tight range, starting the year at 0.08% and closing the year at 0.06%.

Commercial paper issuance remained subdued, as many companies continued to reduce their reliance on short term funding in favor of longer term issuance. Since the peak of August 8, 2007, commercial paper issuance is down 47%. For the year ended December 31, 2009, issuance was down 28%. The Temporary Liquidity Guarantee Program (TLGP), used by financial institutions to accomplish a large portion of their funding earlier in the year, expired at the beginning of the fourth quarter, leaving investors with fewer choices and increasing demand on an already thin supply of short-term investment options.

What key factors were responsible for the Fund’s performance during the year ended December 31, 2009?

The Federal Reserve’s zero interest rate policy and the market’s insatiable demand for quality were the most influential factors on the performance of the Fund. Market conditions have forced the Fund’s gross portfolio yield below the Fund’s operating expense caps causing the adviser to further subsidize the Fund to maintain a minimum yield of 0.00%.

How did you manage the Fund’s weighted average maturity during the year ended December 31, 2009?

On December 31, 2009, the Fund had an average maturity of 51 days, slightly longer than the average taxable money market fund maturity of 47 days as reported in the Money Fund Report, published by iMoneyNet Inc. The Fund’s average maturity ranged from 35-56 days during the year. Though the money market yield curve has been stubbornly flat, the Fund has extended the average days to maturity when appropriate longer term opportunities were present.

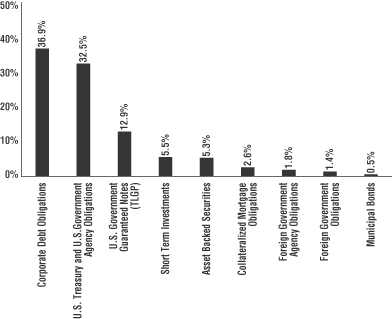

How was the Fund invested during the year ended December 31, 2009?

The Fund is invested in a diversified portfolio of top tier, short term investments. Fund holdings in Federal Home Loan Mortgage (FHLMC), Federal National Mortgage Association (FNMA) and U.S. Treasury Bills were lower in 2009 than 2008, in favor of TLGP investments issued by Goldman Sachs Group, Inc. and GE Capital Corp. The TLGP securities offered slightly more yield than the FNMA and FHLMC offerings and carried a full U.S. Government guarantee. Yields were compressed on all money market instruments, and this minor change in asset mix had minimal impact on performance.

5

MONEY MARKET FUND (Continued)

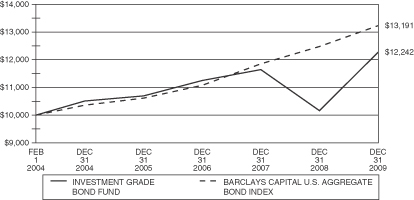

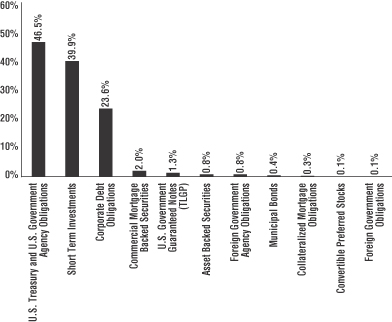

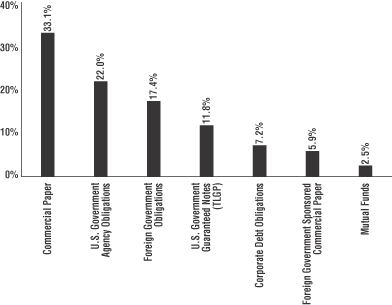

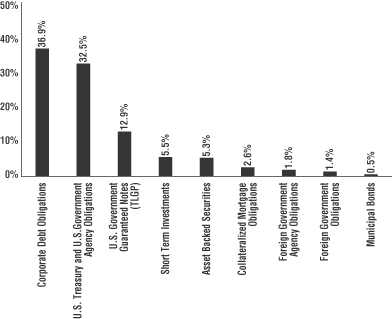

PORTFOLIO COMPOSITION AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The percentages shown for each investment category reflect the value of investments in that category as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN ISSUERS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Category |

Federal National Mortgage Association | | 12.5 | % | | U.S. Government Agency |

Federal Home Loan Mortgage Corp. | | 9.5 | | | U.S. Government Agency |

Goldman Sachs Group, Inc. | | 8.6 | | | Commercial Paper & TLGP |

Province of British Columbia | | 3.9 | | | Foreign Government |

GE Capital Corp. | | 3.4 | | | Commercial Paper & TLGP |

Philip Morris International, Inc. | | 3.4 | | | Commercial Paper |

Procter & Gamble International Funding SCA | | 3.4 | | | Corporate Debt & Commercial Paper |

Province of Quebec | | 3.4 | | | Foreign Government |

KFW International Finance, Inc. | | 3.4 | | | Commercial Paper |

Province of Ontario | | 3.4 | | | Foreign Government |

6

MONEY MARKET FUND (Continued)

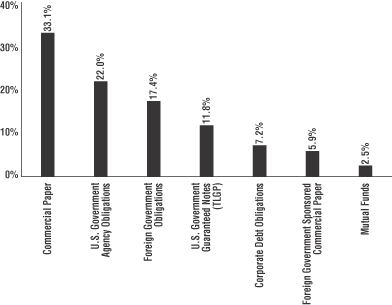

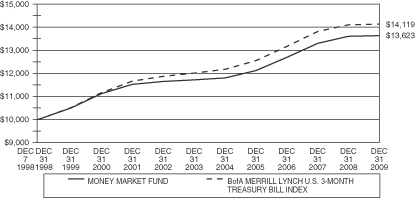

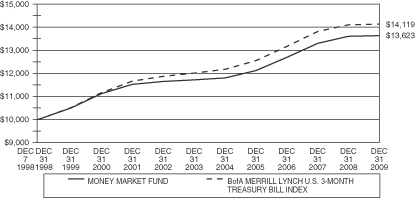

Comparison of Change in Value of a $10,000 Investment in the Money Market Fund – Initial Class and the BofA Merrill Lynch U.S. 3-Month Treasury Bill Index

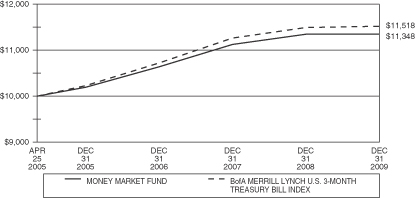

Comparison of Change in Value of a $10,000 Investment in the Money Market Fund – Service Class and the BofA Merrill Lynch U.S. 3-Month Treasury Bill Index

7

MONEY MARKET FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Life of

Fund*** | |

Money Market Fund | | 0.25 | % | | 2.44 | % | | 2.93 | % | | 2.64 | % | | 2.83 | % |

BofA Merrill Lynch U.S. 3-Month Treasury Bill Index* | | 0.21 | % | | 2.40 | % | | 3.02 | % | | 2.99 | % | | 3.16 | % |

Service Class Shares | | | | | | | | | | | | | | | |

Money Market Fund | | 0.02 | % | | 2.19 | % | | — | | | — | | | 2.73 | % |

BofA Merrill Lynch U.S. 3-Month Treasury Bill Index* | | 0.21 | % | | 2.40 | % | | — | | | — | | | 3.06 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The BofA Merrill Lynch U.S. 3-Month Treasury Bill Index is a single security index which at the beginning of every month selects for inclusion the U.S. Treasury Bill maturing closest to, but not beyond, three months from that date. That issue is then held for one month, sold and rolled into the newly selected U.S. Treasury Bill.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. Although the Fund seeks to maintain a stable net asset value of $1 per share there can be no assurance that it will do so. The value of an investment in the Money Market Fund and the return on the investment may fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2009. Service Class Shares for the period from April 25, 2005 (commencement of operations) to December 31, 2009.

8

GLOBAL REAL ESTATE FUND

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Global Real Estate Fund (the “Fund”) underperformed its benchmark, the FTSE/EPRA NAREIT Developed Real Estate Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the global real estate equity markets as a whole during the year ended December 31, 2009?

Real estate companies were most impacted by the turmoil in the debt capital markets in 2009. Many real estate companies, which were suffering from the effects of worsening fundamentals and high leverage, were forced to issue equity to calm equity owners, lenders, and other stakeholders. The equity markets, which were one of the only capital markets accessible during the height of the capital markets crisis, responded positively to the re-equitization, despite resulting in heavy shareholder dilution. As 2009 progressed, the debt capital markets stabilized, though borrowers are likely to be paying higher rates and be subject to stricter underwriting standards in the future.

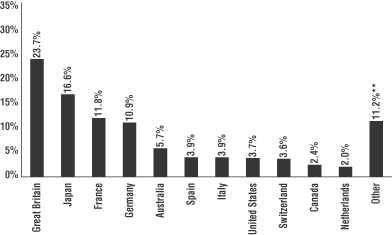

How did the Fund’s country allocations affect relative performance during the year ended December 31, 2009?

The allocation to the U.S. contributed to the underperformance in the 1st quarter of 2009. For the remainder of 2009, the Fund’s country weightings were mostly in-line with the benchmark, so the relative impact on performance from country allocations was minimized. However, in terms of absolute performance, Japan was the worst performer in 2009 due to the poor performance of the Japanese economy. Hong Kong’s return was the best in 2009. It outperformed on the strength of the Chinese economy.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2009?

Capitaland Ltd., Simon Property Group, Inc., Atrium European Real Estate Ltd., The Link REIT, and Klepierre were the top five contributors to the Fund’s returns in 2009.

Which stocks detracted from the Fund’s results during the year ended December 31, 2009?

Mitsubishi Estate Co. Ltd., Brixton, Nippon Building Fund, Inc., British Land Co. PLC, and Sun Hung Kai Properties, Ltd. were the top five detractors to the Fund’s returns in 2009. The Fund no longer holds Brixton.

Did the Fund experience major changes to its top ten holdings during the year ended December 31, 2009?

The top ten holdings at the end of 2009 included nine non-U.S. based companies, compared to only four in 2008. In May 2009 the Fund composition changed dramatically to more closely align the Fund’s country weights to the country weights of the Index. As a result, at the end of 2009 the Fund had a U.S. weight of only 39.0% compared to the U.S. weighting at the end of 2008 of 57.3%.

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

The Fund finished 2009 closely aligned to the country weights in the Index, with a few exceptions. The Fund was overweight in the U.S., Australia, the U.K., France, and Brazil. The Fund was underweight in Singapore, China, and Hong Kong.

9

GLOBAL REAL ESTATE FUND (Continued)

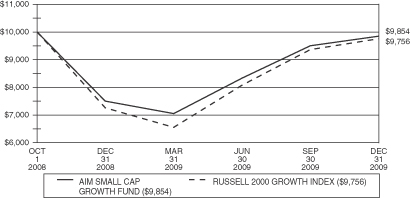

COUNTRY ALLOCATIONS AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The percentages shown for each country reflect the value of investments in that country as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

| ** | Includes 4 countries with an allocation of less than 2% individually. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Industry |

Westfield Group | | 5.6 | % | | Retail |

Simon Property Group, Inc. | | 5.1 | | | Retail |

Unibail-Rodamco | | 4.4 | | | Retail |

Sun Hung Kai Properties, Ltd. | | 4.2 | | | Diversified Real Estate Activities |

Mitsubishi Estate Co. Ltd. | | 4.2 | | | Diversified Real Estate Activities |

The Link REIT | | 3.9 | | | Retail |

Capitaland Ltd. | | 3.6 | | | Diversified Real Estate Activities |

Segro PLC | | 3.4 | | | Industrial |

Atrium European Real Estate Ltd. | | 3.3 | | | Real Estate Operating Companies |

Mitsui Fudosan Co., Ltd. | | 3.2 | | | Diversified Real Estate Activities |

10

GLOBAL REAL ESTATE FUND (Continued)

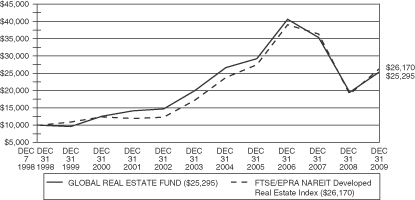

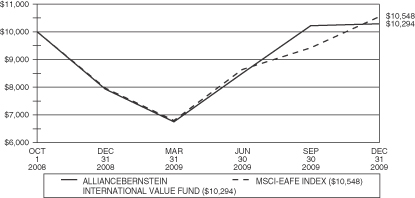

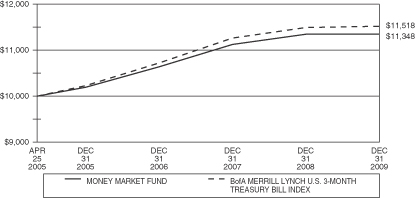

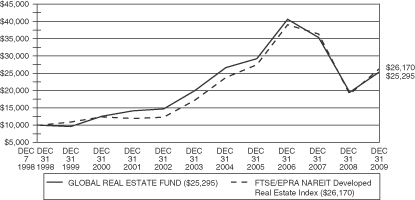

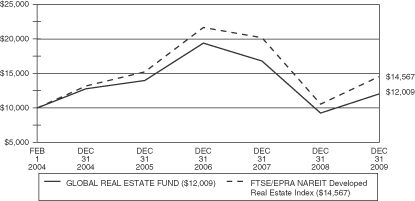

Comparison of Change in Value of a $10,000 Investment in the Global Real Estate Fund – Initial Class and the FTSE/EPRA NAREIT Developed Real Estate Index

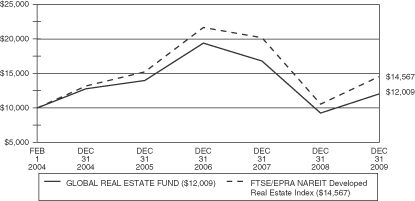

Comparison of Change in Value of a $10,000 Investment in the Global Real Estate Fund – Service Class and the FTSE/EPRA NAREIT Developed Real Estate Index

11

GLOBAL REAL ESTATE FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Life of

Fund*** | |

Global Real Estate Fund | | 30.09 | % | | (14.52 | )% | | (0.98 | )% | | 10.25 | % | | 8.75 | % |

FTSE EPRA/NAREIT Developed Real Estate Index* | | 38.26 | % | | (12.39 | )% | | 2.00 | % | | 9.21 | % | | 9.07 | % |

Service Class Shares | | | | | | | | | | | | | | | |

Global Real Estate Fund | | 29.83 | % | | (14.73 | )% | | (1.23 | )% | | — | | | 3.14 | % |

FTSE EPRA/NAREIT Developed Real Estate Index* | | 38.26 | % | | (12.39 | )% | | 2.00 | % | | — | | | 6.56 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The FTSE EPRA/NAREIT Developed Real Estate Index (formerly FTSE EPRA/NAREIT Global Real Estate Index) is a total-return index comprising eight index families covering the world’s largest investment markets in various currencies, and is designed to track the performance of listed real estate companies and REITs worldwide.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Global Real Estate Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from December 7, 1998 (commencement of operations) to December 31, 2009. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2009.

12

DAVIS VENTURE VALUE FUND

(subadvised by Davis Selected Advisers, L.P.)

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Davis Venture Value Fund (the “Fund”) outperformed its benchmark, the S&P 500® Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2009?

During 2009 the financial markets evidenced some improvement as the market benefited from credit extended through the Federal Reserve’s liquidity programs. Real Gross Domestic Product reversed a year and a half downward trend and turned up during the last part of 2009 while unemployment remained high. For the year ended December 2009, the consumer price index for all urban consumers rose 2.7%, compared to 0.1% for 2008.

Were there any significant sector over/under weights that materially impacted Fund performance relative to the benchmark during the year ended December 31, 2009?

The sectors within the Index that turned in the strongest performance over the year were Information Technology, Materials, and Consumer Discretionary. The sectors that turned in the weakest performance (although the performance was still positive) were Utilities, Telecommunication Services, and Energy. The lowest returning sector of the Index, Telecommunication Services, returned 9% for the year ended December 31, 2009.

The Fund, as compared to the Index, was underweight in both the Information Technology (9% versus 18% for the Index) and Telecommunication Services (less than 1% versus 3% for the Index) sectors. Being underweight in the strongly performing Information Technology sector was the largest detractor from Fund performance relative to the Index. Being underweight in the weakly performing Telecommunication Services sector was a contributor to the Fund’s performance relative to the Index.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2009?

American Express Co. and GAM Holding, Ltd, two financial companies, were among the largest contributors to the Fund’s performance. The Fund also benefited from the stock selection of a number of Energy securities. Where the Index’s Energy companies only gained 14%, the Fund’s Energy companies gained 37%. Occidental Petroleum Corp., EOG Resources, Inc., and Canadian Natural Resources, Ltd. were among the Fund’s strongest contributors to performance. Other securities contributing strongly to performance were three information technology companies, Google, Inc., Microsoft Corp., and Texas Instruments, Inc.

The Fund held approximately 14% of its assets in foreign companies (including American Depositary Receipts) at December 31, 2009. As a whole these companies out-performed the domestic companies held by the Fund.

Which stocks detracted from the Fund’s results during the year ended December 31, 2009?

ConocoPhillips, an energy company, and Philip Morris International, Inc., a consumer staples company, were the largest detractors from performance. Two financial companies, Bank of America and Citigroup, along with Iron Mountain, Inc., an industrial company, and Vulcan Materials Co., a material company, were also among the largest detractors from performance. The Fund no longer holds Bank of America or Citigroup.

13

DAVIS VENTURE VALUE FUND (Continued)

Did the Fund experience major changes to its top ten holdings during the year ended December 31, 2009?

As of December 31, 2009, only three companies had dropped out of the Fund’s top 10 holdings from the end of 2008. This is consistent with our low-turnover strategy. The Fund continues to own all three companies that dropped out of the top ten, Comcast Corp., Philip Morris International, Inc., and ConocoPhillips, but in reduced amounts. The three new holdings in the top 10 were American Express Co. and Loews Corp., both of which were in the top 20 at the end of 2008, and Merck & Co., Inc., which is a new addition to the Fund.

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

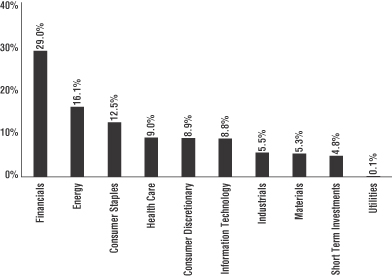

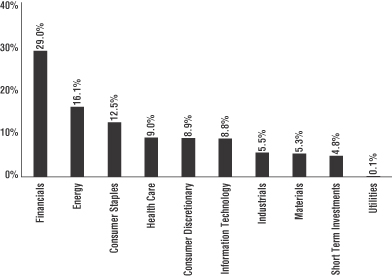

The Fund’s portfolio is positioned using a bottom up stock selection process rather than a top down sector biased process. As a result, all weighting differentials relative to the Index reflect stock selection rather than sector bets. As of the year end the Fund continued to hold a larger percentage of securities in energy and financial companies when compared to the Index (16% versus 12% and 29% versus 14%, respectively). The Fund also remains underweight as compared to the Index in Industrial and Information Technology companies (6% versus 10% and 9% versus 20%, respectively).

SECTOR ALLOCATIONS AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The above graph categorizes investments using Global Industry Classification Standards (“GICS”). The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

14

DAVIS VENTURE VALUE FUND (Continued)

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Industry |

Occidental Petroleum Corp. | | 4.5 | % | | Oil, Gas & Consumable Fuels |

Berkshire Hathaway, Inc., Class A | | 4.5 | | | Insurance |

Costco Wholesale Corp. | | 4.3 | | | Food & Staples Retailing |

Wells Fargo & Co. | | 4.3 | | | Commercial Banks |

American Express Co. | | 4.0 | | | Consumer Finance |

EOG Resources, Inc. | | 3.5 | | | Oil, Gas & Consumable Fuels |

Devon Energy Corp. | | 3.3 | | | Oil, Gas & Consumable Fuels |

Loews Corp. | | 2.6 | | | Insurance |

JP Morgan Chase & Co. | | 2.5 | | | Diversified Financial Services |

Merck & Co., Inc. | | 2.4 | | | Pharmaceuticals |

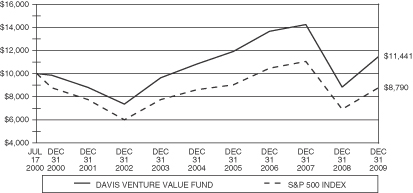

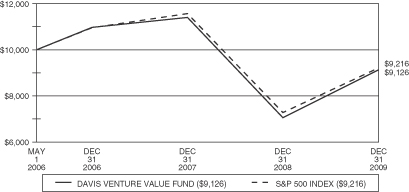

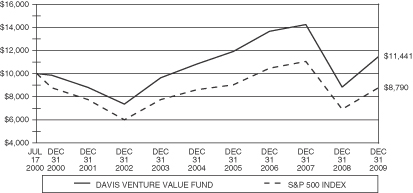

Comparison of Change in Value of a $10,000 Investment in the Davis Venture Value Fund – Initial Class and the S&P 500 Index

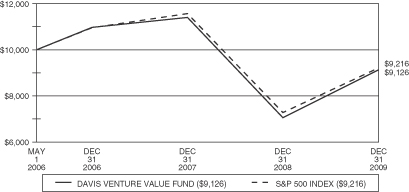

Comparison of Change in Value of a $10,000 Investment in the Davis Venture Value Fund – Service Class and the S&P 500 Index

15

DAVIS VENTURE VALUE FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Davis Venture Value Fund | | 29.39 | % | | (5.69 | )% | | 1.10 | % | | 1.43 | % |

S&P 500 Index* | | 26.46 | % | | (5.61 | )% | | 0.42 | % | | (1.35 | )% |

Service Class Shares | | | | | | | | | | | | |

Davis Venture Value Fund | | 29.02 | % | | (5.94 | )% | | — | | | (2.46 | )% |

S&P 500 Index* | | 26.46 | % | | (5.61 | )% | | — | | | (2.20 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The S&P 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Davis Venture Value Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2009. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2009.

16

OPPENHEIMER MAIN STREET SMALL CAP FUND

(subadvised by OppenheimerFunds, Inc.)

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Oppenheimer Main Street Small Cap Fund (the “Fund”) outperformed its benchmark, the Russell 2000 Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2009?

Pronounced signs of economic weakness persisted through the first half of 2009. After declining in the fourth quarter of 2008, Gross Domestic Product (“GDP”) continued to decline in the first and second quarters of 2009, falling by 6.4% and 0.7%, respectively. In February and March, the U.S. economy lost more than 600,000 jobs in each month and consumer confidence dropped sharply. In early March, the U.S. stock market hit a multi-year low.

Investor sentiment soon began to improve as evidence appeared that global credit markets were thawing in response to massive remedial efforts by U.S. Government and monetary authorities. The U.S. Government enacted the $787 billion American Recovery and Reinvestment Act of 2009, which was designed to retain and create jobs, provide budget relief to states and localities, maintain social programs and offer tax relief to businesses and individuals.

As it became clearer that these remedial measures had helped to avert a collapse of the U.S. banking system and with historically low valuations, equities began an impressive rally that began in March 2009 and continued through the end of the year. While volatility persisted, most global equity markets ended the reporting period with substantial gains.

For the first time since the second quarter of 2008, the rate of GDP was once again positive in the third quarter of 2009, increasing at a modest rate. Some of the lagging indicators, such as unemployment figures, continued to be troubling and hovered at around 10% in the U.S. The housing market continued to slump through the end of the year and consumer confidence remained shaky.

Were there any significant sector over/under weights that materially impacted Fund performance relative to the benchmark during the year ended December 31, 2009?

The Fund outperformed the Index in nine out of ten sectors during the reporting period, led by gains in Consumer Discretionary, Information Technology, Financials and Industrials, in that order. In Consumer Discretionary, both a relative overweight position and stock selection helped Fund performance, as Consumer Discretionary vied with the Materials sector as the top performing sector, in terms of total return. In Information Technology, both a relative overweight position and stock selection helped Fund performance here as well, as Information Technology finished as the third top performing sector in terms of total return. An underweight to Financials, the worst performing sector of the Index, and better relative stock selection both helped Fund performance during the reporting period. Financials was the only sector in the Index to post negative returns for the period. Within Industrials, strong relative stock selection led outperformance.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2009?

Among the top contributors in the Consumer Discretionary sector were TRW Automative Holdings Corp. and Philips-Van Heusen Corp.

17

OPPENHEIMER MAIN STREET SMALL CAP FUND (Continued)

In Information Technology, Skyworks Solutions, Inc. was the top contributor to performance and the second largest contributor to overall Fund performance. Skyworks Solutions is a manufacturer of semiconductor chips for communications technologies. Other top contributors included Western Digital Corp. (which the Fund sold by period end), STEC, Inc., Brocade Communications Systems, Inc. (which the Fund sold) and Blue Coat Systems, Inc.

In Industrials, Gardner Denver, Inc., a manufacturer based in Quincy, Illinois of various compressors, pumps and blowers as well as fluid transfer equipment for the petroleum, chemical and food industries, was the top performer and the third largest contributor to overall Fund performance. BE Aerospace, Inc. also outperformed within the sector and was the fifth largest driver of performance for the Fund.

Which stocks detracted from the Fund’s results during the year ended December 31, 2009?

The securities which detracted most from Fund performance included a few financial stocks, including Pacific Capital Bancorp, East West Bancorp, Inc., Susquehanna Bancshares, Inc., all of which the Fund sold by period end. Insurance stock Conseco, Inc. also detracted but remained in the Fund at period end. Within Industrials, logistics company Pacer International, Inc. detracted from performance as did airline company U.S. Airways Group, Inc. NCI Building Systems also detracted.

Did the Fund experience major changes during the year ended December 31, 2009?

Effective May 19, 2009, Matthew P. Ziehl and Raman Vardharaj assumed co-management of the Fund, bringing their time-tested investment approach, which combines fundamental security analysis with robust quantitative tools. Accordingly, during the year, the number of securities in the portfolio was reduced significantly. The Fund’s investment process will continue to be driven by in-depth fundamental research, supported by quantitative screening and implemented by an experienced team of portfolio managers and sector managers. The resulting portfolio will be comprised of stocks that they believe are attractively priced relative to a company’s underlying prospects. The investment process has four elements which combine fundamental and quantitative research: idea generation, fundamental research, quantitative process and portfolio construction.

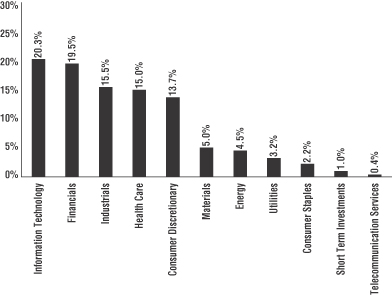

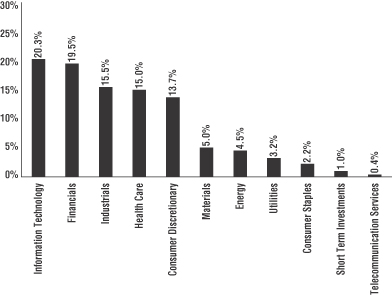

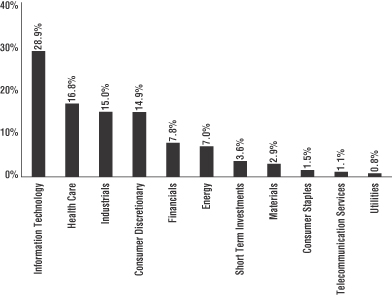

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

The Fund was overweight Information Technology, Health Care and Materials, and underweight all other sectors.

18

OPPENHEIMER MAIN STREET SMALL CAP FUND (Continued)

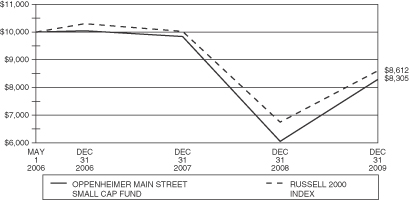

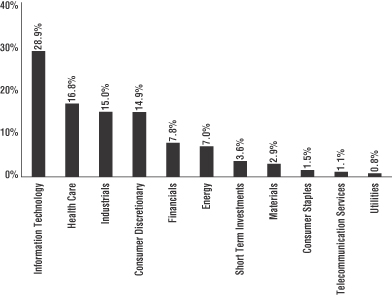

SECTOR ALLOCATIONS AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Industry |

Blue Coat Systems, Inc. | | 1.2 | % | | Communications Equipment |

Health Management Associates, Inc., Class A | | 1.0 | | | Health Care Providers & Services |

BE Aerospace, Inc. | | 0.8 | | | Aerospace & Defense |

Tractor Supply Co. | | 0.8 | | | Specialty Retail |

Gardner Denver, Inc. | | 0.8 | | | Machinery |

Mid-America Apartment Communities, Inc. | | 0.8 | | | Real Estate Investment Trusts |

Hanover Insurance Group, Inc. | | 0.8 | | | Insurance |

Capella Education Co. | | 0.7 | | | Diversified Consumer Services |

Stifel Financial Corp. | | 0.7 | | | Capital Markets |

Old Dominion Freight Line | | 0.7 | | | Road & Rail |

19

OPPENHEIMER MAIN STREET SMALL CAP FUND (Continued)

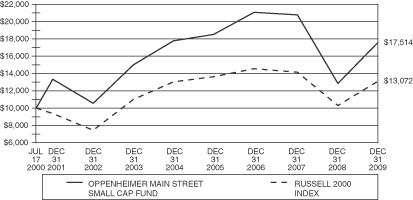

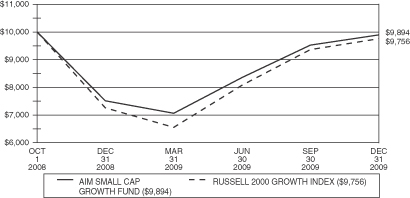

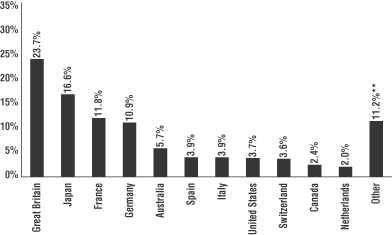

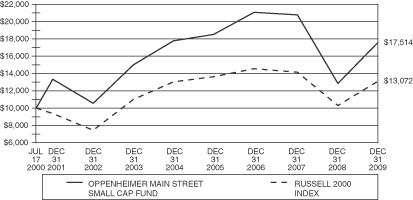

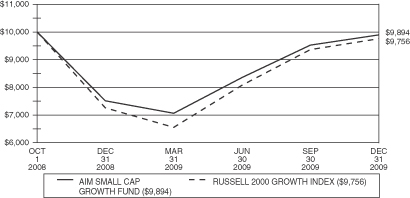

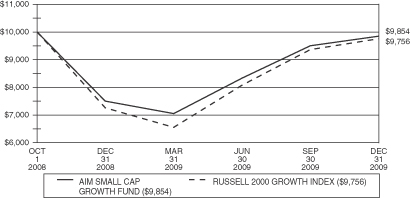

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Main Street Small Cap Fund – Initial Class and the Russell 2000 Index

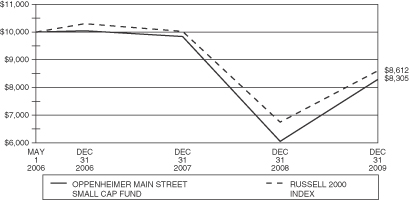

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Main Street Small Cap Fund – Service Class and the Russell 2000 Index

20

OPPENHEIMER MAIN STREET SMALL CAP FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Oppenheimer Main Street Small Cap Fund | | 36.77 | % | | (5.80 | )% | | (0.19 | )% | | 6.10 | % |

Russell 2000 Index* | | 27.17 | % | | (6.07 | )% | | 0.51 | % | | 2.87 | % |

Service Class Shares | | | | | | | | | | | | |

Oppenheimer Main Street Small Cap Fund | | 36.50 | % | | (6.15 | )% | | — | | | (4.93 | )% |

Russell 2000 Index* | | 27.17 | % | | (6.07 | )% | | — | | | (3.99 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Russell 2000 Index is comprised of the 2,000 companies with the smallest market capitalizations from the Russell 3000 Index.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Oppenheimer Main Street Small Cap Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from July 17, 2000 (commencement of operations) to December 31, 2009. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2009.

21

OPPENHEIMER LARGE CAP CORE FUND

(subadvised by OppenheimerFunds, Inc.)

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Oppenheimer Large Cap Core Fund (the “Fund”) underperformed its benchmark, the S&P 500 Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2009?

A year ago, the economic picture was, at best, grim. Already ensnared in a brutal bear market, a pervasive lack of credit forced a massive scaling back among U.S. corporations, increasing unemployment and decreasing consumer spending; fourth-quarter 2008’s GDP figure was among the worst on record.

March 9, 2009 represented the low point of the most recent bear market. The ensuing rally has been nothing short of spectacular – the price-only S&P® gained 65.6% from the market bottom through the year’s end. Much of the rally was driven by stocks that had been battered early in the year. As is typical at the beginning of a cyclical recovery, the market rally demonstrated a “worst to first” move: higher-risk, lower-quality assets – those that are typically ranked poorly by our investment process – outperforming higher-quality assets.

Were there any significant sector over/under weights that materially impacted Fund performance relative to the benchmark during the year ended December 31, 2009?

Quantitative models identifying high-quality, low-risk securities form the heart of our investment process. While a sound investment strategy, and one we continue to believe in, this approach underperformed in a year dominated by a contrary philosophy, (i.e., the higher the risk or lower the quality of the underlying firm, the better the stock performed). While the third quarter marked the emergence of a return to quality, it did not take hold to the extent that we had hoped, and we are still experiencing a disconnect between improving fundamentals and stock performance.

While Energy and Health Care were among the Fund’s top performing sectors for the full year, largely due to strong stock selection, their positive impact was not enough to compensate for the negative drag of stock selection in the Information Technology and Consumer Discretionary sectors. To a lesser extent, Materials and Telecommunication Services contributed positively to performance, where sector allocation was the driving benefit, while Utilities and Financials detracted from returns. An overweight to Financials, a sector that underperformed the broader market, proved costly.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2009?

The Dow Chemical Co., a materials manufacturer of chemicals, plastics and other specialized products, was the top contributor to Fund performance for the year, followed by financials holding company Wells Fargo & Co. and industrials conglomerate General Electric Co. Given our strong selection in Energy, it is unsurprising that three of the top ten performing stocks were Energy positions, as Exxon Mobil Corp., Chesapeake Energy Corp., and the Williams Cos., Inc. all made notable contribution to relative returns.

Which stocks detracted from the Fund’s results during the year ended December 31, 2009?

An underweight to a technology holding Google, Inc. was the leading detractor for the year, as our models underweighted this strong performing stock. An overweight to the Wal-Mart Stores, Inc., a stock whose price had a difficult year, was a close second. A number of financial holdings also negatively impacted relative performance, including the Goldman Sachs Group, Inc., Bank of America Corp., and JP Morgan Chase & Co.

22

OPPENHEIMER LARGE CAP CORE FUND (Continued)

Did the Fund experience major changes to its top ten holdings during the year ended December 31, 2009?

As compared with year-end 2008, concentration in top ten names decreased as of December 31, 2009. Four 2008 top ten names remained in the top ten at year end 2009, including Wal-Mart Stores, Inc., Hewlett-Packard Co., Exxon Mobil Corp., and International Business Machines Corp. Of the six 2008 names that fell out of the top ten this year, four are still held (Johnson & Johnson, Microsoft Corp., Northrop Grumman Corp. and Verizon Communications, Inc.), and two were sold completely (Amgen and Pfizer).

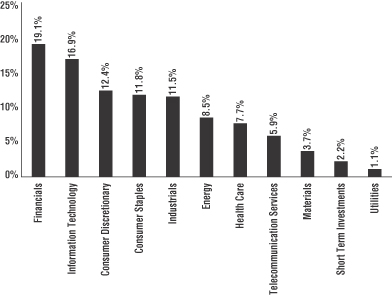

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

Although stock selection remains the primary source of risk and return for our strategy, earlier this year we incorporated a sector-tilt strategy as a potential source of alpha. At December 31, 2009, the largest overweight position relative to the Fund’s benchmark was in Financials, followed by Consumer Discretionary, Telecommunication Services and Industrials. The largest underweight position relative to the benchmark was Health Care, followed by Energy, Information Technology and Utilities. In each case, sector weights were within our target limit of 5% deviation from the benchmark.

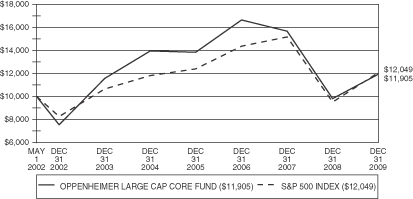

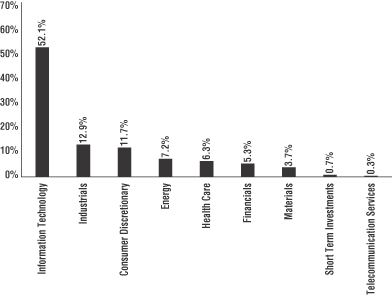

SECTOR ALLOCATIONS AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

23

OPPENHEIMER LARGE CAP CORE FUND (Continued)

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Industry |

AT&T, Inc. | | 3.8 | % | | Diversified Telecommunication Services |

Wal-Mart Stores, Inc. | | 3.1 | | | Food & Staples Retailing |

Hewlett-Packard Co. | | 2.7 | | | Computers & Peripherals |

Apple, Inc. | | 2.6 | | | Computers & Peripherals |

Exxon Mobil Corp. | | 2.4 | | | Oil, Gas & Consumable Fuels |

American Express Co. | | 2.3 | | | Consumer Finance |

JP Morgan Chase & Co. | | 2.2 | | | Diversified Financial Services |

McDonald’s Corp. | | 2.1 | | | Hotels, Restaurants & Leisure |

International Business Machines Corp. | | 2.1 | | | Computers & Peripherals |

The Goldman Sachs Group, Inc. | | 2.0 | | | Capital Markets |

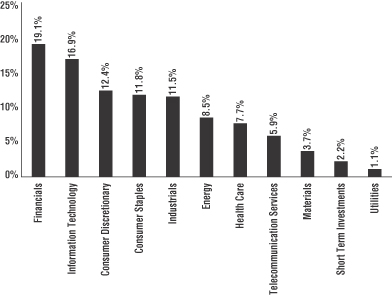

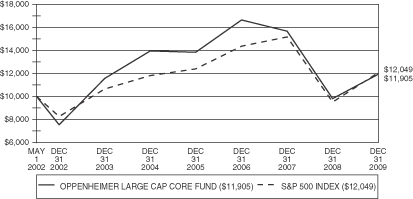

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Large Cap Core Fund – Initial Class and the S&P 500 Index

Comparison of Change in Value of a $10,000 Investment in the Oppenheimer Large Cap Core Fund – Service Class and the S&P 500 Index

24

OPPENHEIMER LARGE CAP CORE FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Life of

Fund*** | |

Oppenheimer Large Cap Core Fund | | 21.09 | % | | (10.46 | )% | | (3.07 | )% | | 2.30 | % |

S&P 500 Index* | | 26.46 | % | | (5.61 | )% | | 0.42 | % | | 2.46 | % |

Service Class Shares | | | | | | | | | | | | |

Oppenheimer Large Cap Core Fund | | 20.85 | % | | (10.64 | )% | | (3.28 | )% | | (0.72 | )% |

S&P 500 Index* | | 26.46 | % | | (5.61 | )% | | 0.42 | % | | 1.81 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The S&P 500 Index is a market-value weighted index of 500 blue chip stocks and is considered to be a benchmark of the overall stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Oppenheimer Large Cap Core Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from May 1, 2002 (commencement of operations) to December 31, 2009. Service Class Shares for the period from February 1, 2004 (commencement of operations) to December 31, 2009.

25

WMC LARGE CAP GROWTH FUND

(subadvised by Wellington Management Co., LLP)

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

WMC Large Cap Growth Fund (the “Fund”) performed approximately in line with its benchmark, the Russell 1000 Growth Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2009?

After a tumultuous start, U.S. equities finished 2009 near their highs for the year. Throughout the year, extraordinary government and central bank measures helped to stabilize global economies and markets, and as the year progressed, low interest rates, better-than-expected corporate earnings, and improving economic data provided a favorable backdrop for equities.

Small cap, mid cap, and large cap stocks rose in unison during the period, as measured by the Russell 2000, S&P Midcap 400, and S&P 500 indices, respectively. Growth stocks outperformed value stocks during the period, as measured by the Russell 1000 Growth and Russell 1000 Value indices. All ten sectors within the Russell 1000 Growth Index posted positive double digit returns. Information Technology, Materials, and Consumer Discretionary rose the most, and Utilities, Consumer Staples, and Health Care rose the least.

Were there any significant sector over/under weights that materially impacted Fund performance relative to the benchmark during the year ended December 31, 2009?

Sector positioning, driven by bottom-up security selection, contributed positively to benchmark-relative returns during the period. The Fund’s overweight position to the strong performing Information Technology sector and underweight positions in the Consumer Staples and Health Care sectors aided returns. An overweight position to Energy detracted from relative performance. Fund performance was aided by strong security selection within the Financials and Consumer Discretionary sectors. This was partially offset by poor stock selection within the Information Technology, Health Care, and Materials sectors.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2009?

Top contributors to relative performance included NetApp Inc., Joy Global, Inc., and Coach, Inc. Also, not owning diversified energy company Exxon Mobil and consumer products giant Procter & Gamble contributed positively to Fund performance relative to the Index. Shares of network storage equipment manufacturer NetApp Inc. rose as the company gained market share during the period due to its low cost hardware combined with unified storage software. Shares of mining equipment manufacturer Joy Global, Inc. moved higher along with commodity prices as the company gained market share in the underground coal mining market. Shares of New York-based accessories maker Coach, Inc. rose as the company completed an acquisition in China early in the year and weathered the U.S. recession through new pricing strategies and promotional activities. Telecommunications equipment supplier Cisco Systems, Inc. and global technology giant Microsoft Corp. were also among the top absolute contributors.

Which stocks detracted from the Fund’s results during the year ended December 31, 2009?

Among the largest detractors from relative performance during the period were Eli Lilly & Co., Apple, Inc., and Raytheon Co. Shares of major U.S. pharmaceutical company Eli Lilly & Co. came under pressure on concerns about the impact of future patent expirations on the company’s long-term growth, as well as near-term pressures

26

WMC LARGE CAP GROWTH FUND (Continued)

due to a slower ramp-up of anti-clotting agent, Effient. Our underweight position in consumer electronics company Apple, Inc. hurt relative returns during part of the year. Apple, Inc. shares rose due to strong sales of iPhones and MacBooks and expectations for the launch of its new tablet device. Shares of Massachusetts-based defense contractor Raytheon Co. underperformed as investors feared that President Obama’s budget proposal would negatively impact defense spending and would include sharp cuts to defense contractors. Health Care company Abbott Laboratories also detracted from the Fund’s absolute returns.

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

Our largest overweights relative to the Russell 1000 Growth Index were to the Information Technology, Energy, and Industrials, while the largest underweights were to Consumer Staples and Health Care.

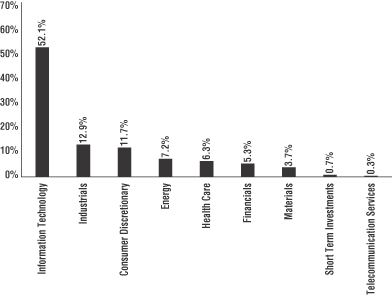

SECTOR ALLOCATIONS AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

27

WMC LARGE CAP GROWTH FUND (Continued)

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Industry |

Cisco Systems, Inc. | | 5.1 | % | | Communications Equipment |

Microsoft Corp. | | 4.8 | | | Software |

Apple, Inc. | | 3.9 | | | Computers & Peripherals |

Google, Inc., Class A | | 3.4 | | | Internet Software & Services |

International Business Machines Corp. | | 3.3 | | | Computers & Peripherals |

Oracle Corp. | | 2.6 | | | Software |

NetApp, Inc. | | 2.3 | | | Computers & Peripherals |

Caterpillar, Inc. | | 2.3 | | | Machinery |

QLogic Corp. | | 2.1 | | | Computers & Peripherals |

EMC Corp. | | 1.8 | | | Computers & Peripherals |

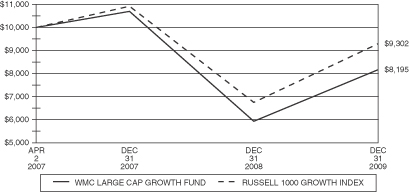

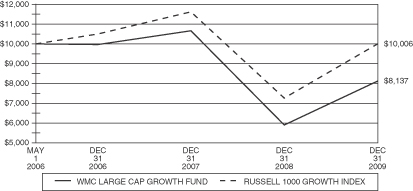

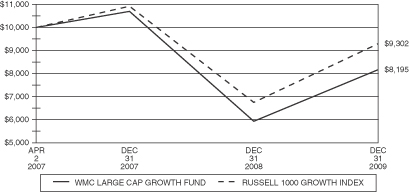

Comparison of Change in Value of a $10,000 Investment in the WMC Large Cap Growth Fund – Initial Class and the Russell 1000 Growth Index

Comparison of Change in Value of a $10,000 Investment in the WMC Large Cap Growth Fund – Service Class and the Russell 1000 Growth Index

28

WMC LARGE CAP GROWTH FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Life of

Fund*** | |

WMC Large Cap Growth Fund | | 37.23 | % | | — | | | (6.98 | )% |

Russell 1000 Growth Index* | | 37.21 | % | | — | | | (2.60 | )% |

Service Class Shares | | | | | | | | | |

WMC Large Cap Growth Fund | | 37.08 | % | | (6.58 | )% | | (5.46 | )% |

Russell 1000 Growth Index* | | 37.21 | % | | (1.89 | )% | | 0.02 | % |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Russell 1000 Growth Index measures the performance of those Russell 1000 Index securities with higher price-to-book ratios and higher forecasted growth values, representative of U.S. securities exhibiting growth characteristics. The Russell 1000 Growth Index includes the largest 1,000 securities in the Russell 3000 Index, based on market cap. The Russell 3000 Index consists of the 3,000 largest and most liquid stocks based and traded in the U.S.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the WMC Large Cap Growth Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from April 2, 2007 (commencement of operations) to December 31, 2009. Service Class Shares for the period from May 1, 2006 (commencement of operations) to December 31, 2009.

29

WMC BLUE CHIP MID CAP FUND

(subadvised by Wellington Management Co., LLP)

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Blue Chip Mid Cap Fund (the “Fund”) underperformed its benchmark, the S&P Midcap 400 Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2009?

After a tumultuous start, U.S. equities finished 2009 near their highs for the year. Throughout the year, extraordinary government and central bank measures helped to stabilize global economies and markets, and as the year progressed, low interest rates, better-than-expected corporate earnings, and improving economic data provided a favorable backdrop for equities.

Small cap, mid cap, and large cap stocks rose in unison during the period, as measured by the Russell 2000, S&P Midcap 400, and S&P 500 indices, respectively. All ten sectors within the S&P Midcap 400 Index rose during the year led by Energy, Information Technology, and Consumer Discretionary. Financials and Telecommunication Services increased the least.

Were there any significant sector over/under weights that materially impacted Fund performance relative to the benchmark during the year ended December 31, 2009?

Sector positioning, driven by security selection, contributed positively to benchmark-relative returns during the period, primarily due to an underweight to Financials and overweight positions in Information Technology and Health Care. An underweight to the strong performing Materials sector detracted from relative returns. Security selection in Consumer Discretionary, Energy, and Materials detracted most from relative performance for the Fund, and more than offset stronger stock selection in the Information Technology and Financials sectors.

Which stocks contributed most to the Fund’s returns during the year ended December 31, 2009?

Top contributors to returns on a relative basis included NetApp, Inc., Life Technologies Corp., and Red Hat, Inc. Shares of data storage equipment maker NetApp, Inc. rose as the company’s earnings exceeded expectations and management raised guidance citing manufacturing cost improvements and signs of improving business sentiment. Life Technologies Corp., created through the merger of Invitrogen and Applied Biosystems, is a provider of tools and cultures used in genetic research and drug development. The company’s shares benefited during the period from strong synergies after the merger and the impact of government agency stimulus funds. Open-source enterprise software and services company Red Hat, Inc. benefited from growing revenue and higher margins as Information Technology organizations moved ahead with purchases of the firm’s high value software solutions.

Which stocks detracted from the Fund’s results during the year ended December 31, 2009?

Top detractors from relative performance included Huntington Bancshares, Inc., W.R. Berkley Corp., and Apollo Group Inc. Ohio-based diversified banking and financials services company Huntington Bancshares, Inc. reported a larger-than-expected earnings loss due to an increase in provision for credit loss expense. W.R. Berkley Corp. shares underperformed as the insurance sector came under pressure on concerns about the pricing cycle. Shares of for-profit educational services provider Apollo Group Inc. fell after the firm announced that the SEC had launched an informal investigation into its revenue recognition practices. Health and supplemental benefit plans provider Humana, Inc. and waste management company Republic Services, Inc. were also among the top detractors from absolute performance.

30

WMC BLUE CHIP MID CAP FUND (Continued)

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

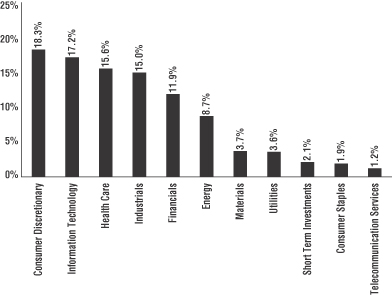

Sector exposure is predominantly a fall-out of stock selection. Our largest overweights relative to the Index were to the Consumer Discretionary and Health Care sectors, while the largest underweights were to Financials and Utilities.

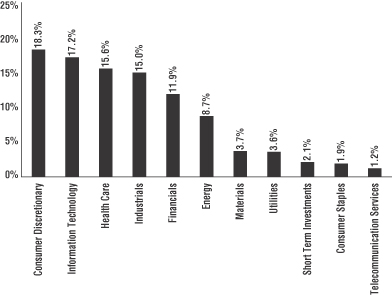

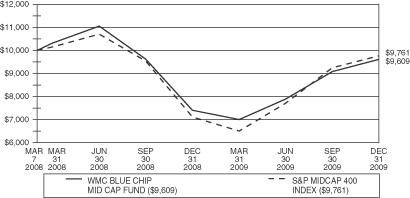

SECTOR ALLOCATIONS AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Industry |

Dreamworks Animation Skg, Inc., Class A | | 2.0 | % | | Media |

Beckman Coulter, Inc. | | 1.9 | | | Health Care Equipment & Supplies |

Lam Research Corp. | | 1.7 | | | Semiconductors & Semiconductor Equipment |

PACCAR, Inc. | | 1.6 | | | Machinery |

Massey Energy Co. | | 1.6 | | | Oil, Gas & Consumable Fuels |

Unum Group | | 1.6 | | | Insurance |

Watson Pharmaceuticals, Inc. | | 1.5 | | | Pharmaceuticals |

The Western Union Co. | | 1.5 | | | IT Services |

Rockwell Collins, Inc. | | 1.5 | | | Aerospace & Defense |

Southwest Airlines Co. | | 1.5 | | | Airlines |

31

WMC BLUE CHIP MID CAP FUND (Continued)

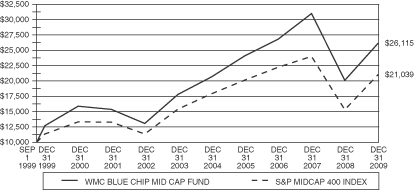

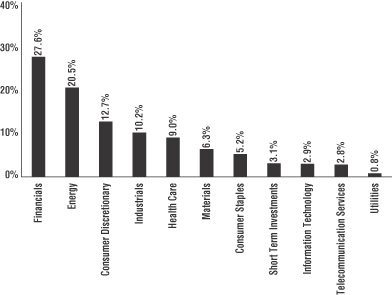

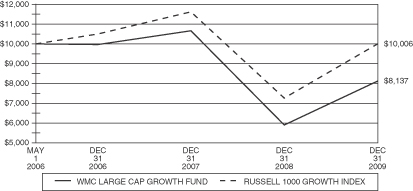

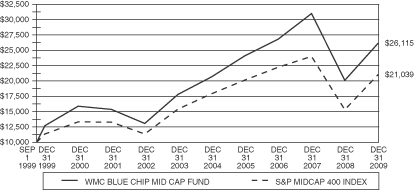

Comparison of Change in Value of a $10,000 Investment in the WMC Blue Chip Mid Cap Fund – Initial Class and the S&P Midcap 400 Index

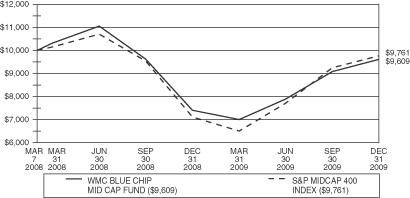

Comparison of Change in Value of a $10,000 Investment in the WMC Blue Chip Mid Cap Fund – Service Class and the S&P Midcap 400 Index

32

WMC BLUE CHIP MID CAP FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | | | | | | | | | | |

Initial Class Shares | | One Year | | | Three Years | | | Five Years | | | Ten Years | | | Life of

Fund*** | |

WMC Blue Chip Mid Cap Fund | | 30.07 | % | | (0.89 | )% | | 4.79 | % | | 7.47 | % | | 9.73 | % |

S&P Midcap 400 Index* | | 37.38 | % | | (1.83 | )% | | 3.27 | % | | 6.36 | % | | 7.46 | % |

Service Class Shares | | | | | | | | | | | | | | | |

WMC Blue Chip Mid Cap Fund | | 29.96 | % | | — | | | — | | | — | | | (2.16 | )% |

S&P Midcap 400 Index* | | 37.38 | % | | — | | | — | | | — | | | (1.33 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The S&P Midcap 400 Index is a capitalization-weighted index that measures the mid-range sector of the U.S. stock market.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the WMC Blue Chip Mid Cap Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***Initial Class Shares for the period from September 1, 1999 (commencement of operations) to December 31, 2009. Service Class Shares for the period from March 7, 2008 (commencement of operations) to December 31, 2009.

33

LORD ABBETT GROWTH & INCOME FUND

(subadvised by Lord, Abbett & Co. LLC)

MANAGEMENT’S DISCUSSION & ANALYSIS

How did the Fund perform during the year ended December 31, 2009?

Lord Abbett Growth & Income Fund (the “Fund”) underperformed its benchmark, the Russell 1000 Value Index (the “Index”), for the year ended December 31, 2009.

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2009?

After a difficult start to the year, the equity markets (as represented by the S&P 500 Index) recovered during the balance of the period, ending the year up 26.46%. This improvement enabled some investors to recover a portion of their previous losses.

Overall, all equity asset classes and investing styles trended higher throughout the period. Mid cap stocks (as defined by the Russell MidCap Index) generally outperformed large cap stocks (as measured by the Russell 1000 Index) and small cap stocks (as measured by the Russell 2000 Index). Growth stocks (as represented by the Russell 3000 Growth Index) generally outperformed value stocks (as represented by the Russell 3000 Value Index) for the year.

On the international side, foreign equity markets (as measured by the MSCI EAFE Index with Gross Dividends) outperformed domestic equity markets (as represented by the S&P 500 Index) for the 12-month period.

Were there any significant sector over/under weights that materially impacted Fund performance relative to the benchmark during the year ended December 31, 2009?

An overweight within the underperforming Financials sector was the largest detractor from relative performance for the year. Financial stocks suffered relatively in the first quarter of the year but strengthened in the last three quarters.

A beneficial overweight and favorable stock selection within the robust Consumer Discretionary sector contributed relatively for the year. Also, strong stock selection and an overweight position within the diversified retail area of the sector aided relative performance for the year.

Among individual holdings, which stocks contributed most to the Fund’s returns during the year ended December 31, 2009?

Hertz Global Holdings, Inc. was one of the Fund’s strongest performers for the period, as shares of the car and equipment rental provider rose after investors began detecting early signs of a bottoming process in the overall economy. Hertz also benefited from reducing its fleet, which resulted in lower-than-expected expenses. Strong stock selection also was evident within the Energy sector. Oilfield services company Schlumberger, Ltd. rebounded sharply from its price swoon in fourth quarter 2008, as reported earnings for the first two quarters of 2009 exceeded consensus expectations. Also within the Energy sector, the Fund benefited from an underweight of Exxon Mobil Corp., which underperformed both the sector and the Index. J. Crew Group, Inc. and HSN, Inc. were notable contributors within the Consumer Discretionary sector.

Which stocks detracted from the Fund’s results during the year ended December 31, 2009?

Unfavorable stock selection within the producer durables sector also detracted from relative performance. Shares of General Electric Co. declined in sympathy with the financial services sector during the tumultuous first quarter. The company reported quarterly earnings that were below consensus expectations, it reduced its quarterly dividend and it suffered from a credit rating downgrade. We eliminated the position during this time.

The Fund’s underweight position in Bank of America Corp. for the last three quarters of the year detracted from relative performance as the stock more than doubled during that recovery period.

34

LORD ABBETT GROWTH & INCOME FUND (Continued)

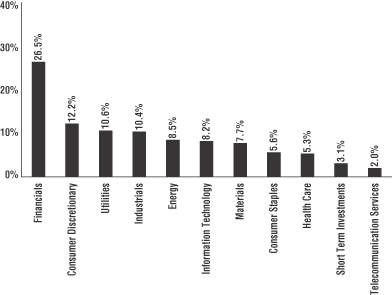

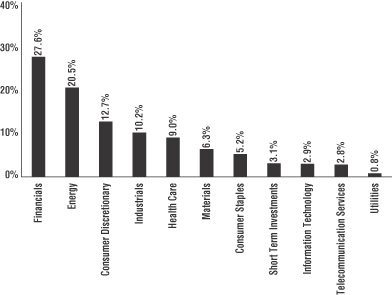

How was the Fund positioned relative to its benchmark index at the end of December 31, 2009?

The Fund continues to be positioned for a cyclical recovery in the economy. Consumer Discretionary was the Fund’s largest overweight sector relative to the Index, with a continuing concentration primarily in the diversified retail area. The Fund sold select Diversified Retail and Specialty Retail holdings throughout the period, however, so the overweight is somewhat reduced from a year ago. Financials is now the second largest overweight sector. Over the past year, however, the sector represented the Fund’s largest decline in active weight versus the benchmark index. As in the previous two quarters, the Fund continued to reduce exposure here during the fourth quarter. Specifically, the Fund trimmed or eliminated positions within the asset management & custodian, financial data & systems, and multi-line insurance industries.

The Utilities sector remains the Fund’s largest underweight sector, as we believe individual stock valuations are relatively expensive and better opportunities exist elsewhere in the market. The Producer Durables sector is now moderately underweight, and we made relatively few changes during the most recent quarter.

The largest increase in active weight over the course of the year occurred within the Energy sector. The Fund increased exposure to existing holdings as well as initiated new positions within the integrated oils industry. The Fund also added to an existing position in a coal company. As a result, the Energy sector moved from a significant underweight to a moderate overweight during the period.

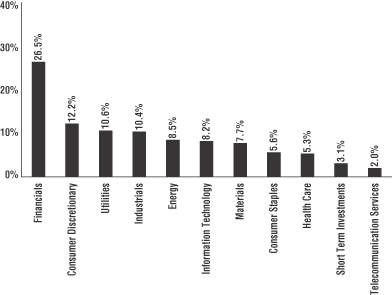

SECTOR ALLOCATIONS AT DECEMBER 31, 2009*

Percentage of Net Assets

| * | The above graph categorizes investments using GICS. The percentages shown for each sector reflect the value of investments in that sector as a percentage of net assets. Figures in the above graph may not total to 100% due to the exclusion of the Fund’s other assets and liabilities. |

35

LORD ABBETT GROWTH & INCOME FUND (Continued)

TOP TEN EQUITY HOLDINGS AT DECEMBER 31, 2009

| | | | | |

| | | % of Net Assets | | | Industry |

Wells Fargo & Co. | | 4.4 | % | | Commercial Banks |

JP Morgan Chase & Co. | | 4.2 | | | Diversified Financial Services |

Exxon Mobil Corp. | | 3.9 | | | Oil, Gas & Consumable Fuels |

Delta Air Lines, Inc. | | 3.1 | | | Airlines |

Schlumberger, Ltd. | | 2.7 | | | Energy Equipment & Services |

Chevron Corp. | | 2.7 | | | Oil, Gas & Consumable Fuels |

The Goldman Sachs Group, Inc. | | 2.5 | | | Capital Markets |

Hertz Global Holdings, Inc. | | 2.2 | | | Road & Rail |

Kroger Co. | | 2.2 | | | Food & Staples Retailing |

Bank of New York Mellon Corp. | | 2.1 | | | Capital Markets |

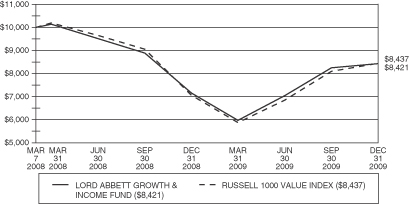

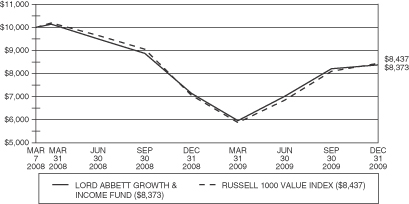

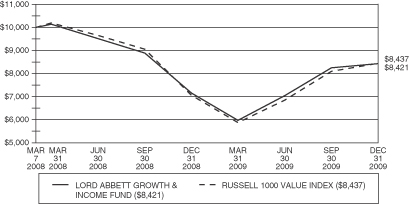

Comparison of Change in Value of a $10,000 Investment in the Lord Abbett Growth & Income Fund – Initial Class and the Russell 1000 Value Index

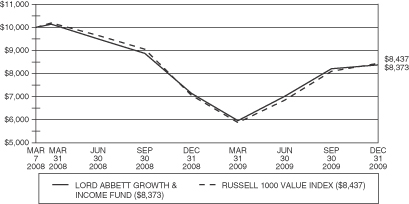

Comparison of Change in Value of a $10,000 Investment in the Lord Abbett Growth & Income Fund – Service Class and the Russell 1000 Value Index

36

LORD ABBETT GROWTH & INCOME FUND (Continued)

Average Annual Total Returns for Periods Ended December 31, 2009**

| | | | | | |

| | | One Year | | | Life of

Fund*** | |

Lord Abbett Growth & Income Fund-Initial Class Shares | | 17.85 | % | | (9.00 | )% |

Lord Abbett Growth & Income Fund-Service Class Shares | | 17.41 | % | | (9.28 | )% |

Russell 1000 Value Index* | | 19.69 | % | | (8.92 | )% |

*The performance data of the index has been prepared from sources and data that the investment adviser believes to be reliable, but no representation is made as to their accuracy. The index is unmanaged and cannot be invested in directly. The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization. The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratio and lower forecasted growth values.

**Performance data is historical and includes changes in share price and reinvestment of income dividends and capital gains distributions. Past performance does not indicate future results. All Fund returns are net of fees and expenses, but do not include any insurance charges imposed in connection with your variable insurance contract. If this performance information included the effect of the insurance charges and the fees and expenses assumed by the investment adviser, performance numbers would be lower. The value of an investment in the Lord Abbett Growth & Income Fund and the return on the investment will fluctuate and redemption proceeds may be higher or lower than an investor’s original cost.

***For the period from March 7, 2008 (commencement of operations) to December 31, 2009.

37

GOLDMAN SACHS MID CAP VALUE FUND

(subadvised by Goldman Sachs Asset Management, L.P.)

MANAGEMENT’S DISCUSSION & ANALYSIS

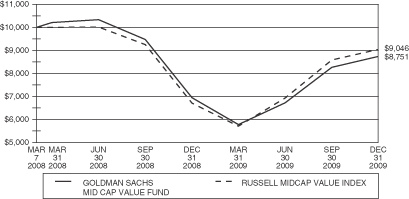

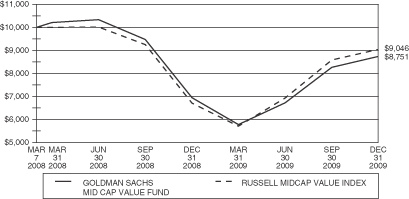

How did the Fund perform during the year ended December 31, 2009?

Goldman Sachs Mid Cap Value Fund (the “Fund”) underperformed its benchmark, the Russell Midcap Value Index (the “Index”), for the year ended December 31, 2009.

Returns to the investment themes were negative overall. Momentum was the worst performing theme, followed at a distance by Management, Sentiment, Quality and Profitability. Conversely, Valuation contributed positively to excess returns. Valuation and Profitability summarize results from the balance sheet and income statement, whereas Quality and Management measure the operating, investing, and financing activities from a company’s statement of cash flows. Momentum measures information about a wide variety of investment-relevant events that are sufficiently complex, in many cases, that it takes time for the market to fully appreciate their implications for security values. The sixth theme, Sentiment, is based on the detailed research of stock analysts, research that includes the evaluation of financial statements, discussions with management, and the study of industry trends. Sentiment allows us to incorporate a wide range of qualitative information on companies and their industries into our quantitative evaluation of stocks.

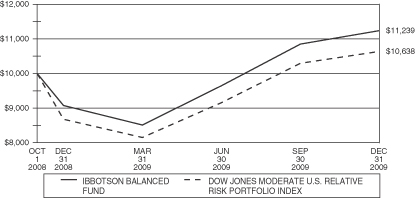

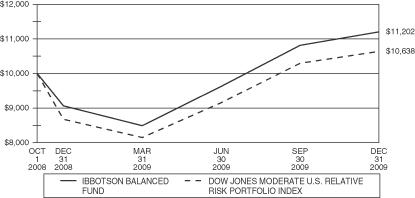

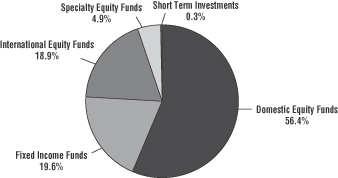

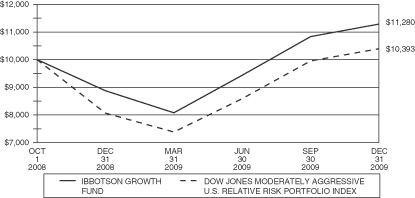

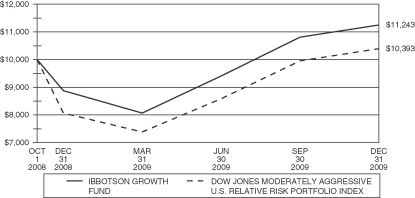

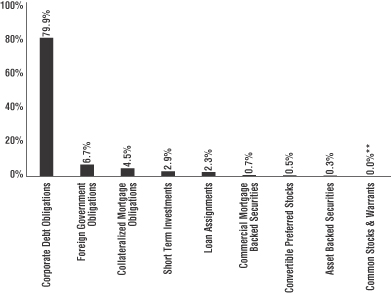

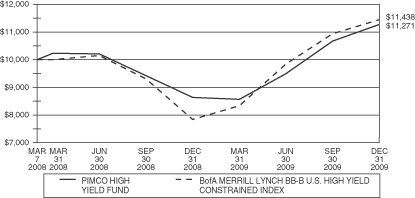

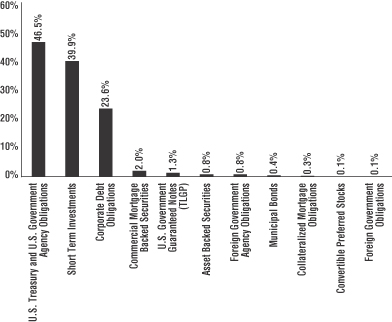

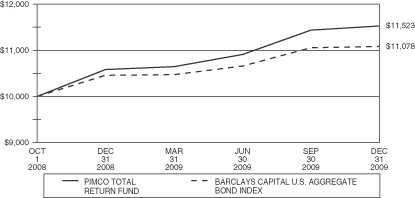

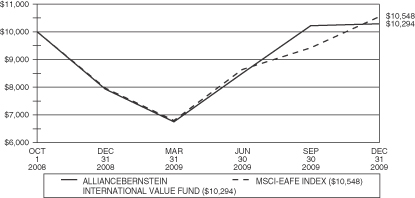

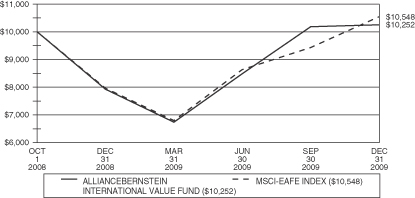

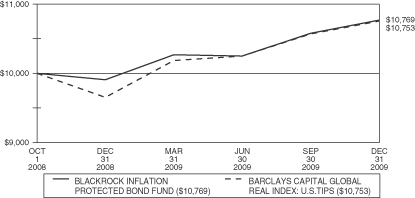

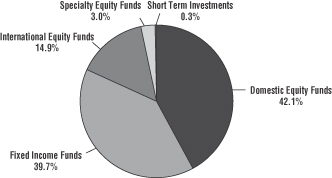

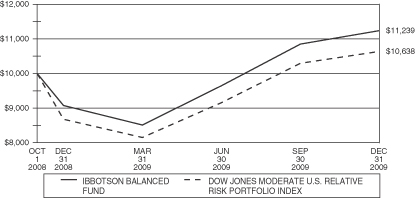

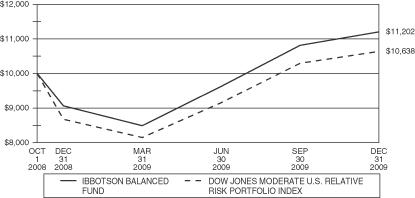

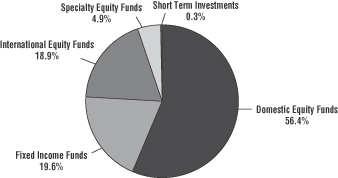

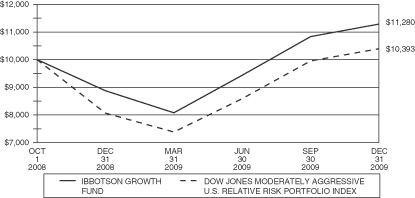

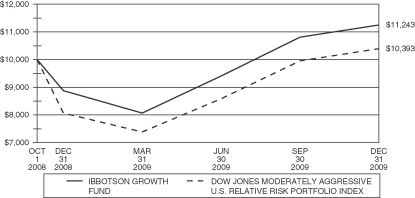

What economic and market factors most influenced the equity markets as a whole during the year ended December 31, 2009?