UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08879

MFS VARIABLE INSURANCE TRUST III

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

ANNUAL REPORT

December 31, 2014

MFS® BLENDED RESEARCH® SMALL CAP EQUITY PORTFOLIO

MFS® Variable Insurance Trust III

VSC-ANN

MFS® BLENDED RESEARCH® SMALL CAP EQUITY PORTFOLIO

CONTENTS

The report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED Ÿ MAY LOSE VALUE Ÿ NO BANK OR CREDIT UNION GUARANTEE Ÿ NOT A DEPOSIT Ÿ NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

MFS Blended Research Small Cap Equity Portfolio

LETTER FROM THE CHAIRMAN

Dear Contract Owners:

As 2015 begins, sharply lower oil prices are reshaping the global economy, adding to deflationary pressures in the eurozone and exacerbating challenges faced by oil exporters such as Russia. The U.S. economy stands on firmer ground, having expanded steadily over the past year. The U.S. labor market has regained momentum, consumer confidence is buoyant and gasoline prices have tumbled, boosting prospects for a stronger economic rebound in 2015.

Other regions are struggling. The eurozone economy is barely expanding, and the European Central Bank (ECB) has introduced large-scale asset purchases.

Despite Japan’s efforts to strengthen its economy, its sales tax increase last spring tipped the country into a recession, leading to additional monetary stimulus from the Bank of Japan. China’s economy is slowing as it transitions to a more sustainable basis, and its growth rate will likely continue to decline.

As always, active risk management is integral to how we at MFS® manage your investments. We use a collaborative process, sharing insights across asset classes, regions and economic sectors. Our global investment team uses a diversified, multidisciplined, long-term approach.

Applying proven principles, such as asset allocation and diversification, can best serve investors over the long term. We are confident that this approach can help you as you work with your financial advisors to reach your goals in the years ahead.

Respectfully,

Robert J. Manning

Chairman

MFS Investment Management

February 13, 2015

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

MFS Blended Research Small Cap Equity Portfolio

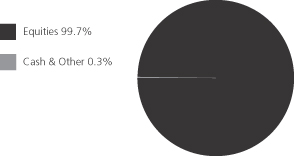

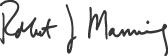

PORTFOLIO COMPOSITION

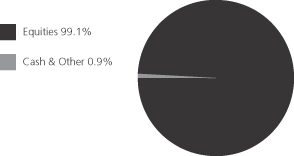

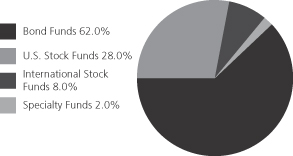

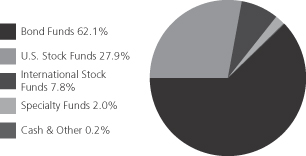

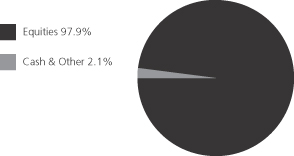

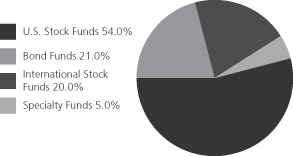

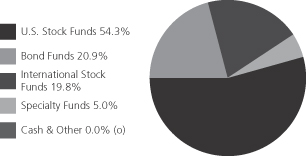

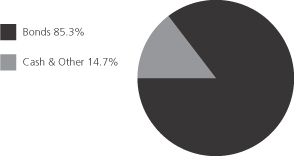

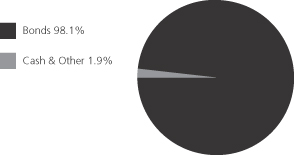

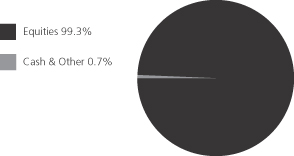

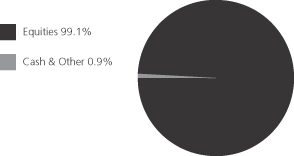

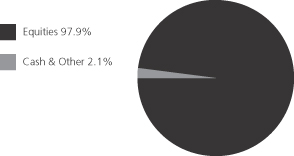

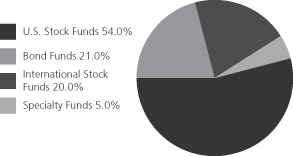

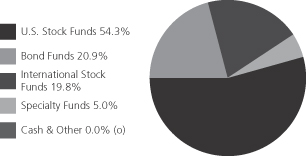

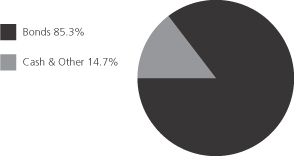

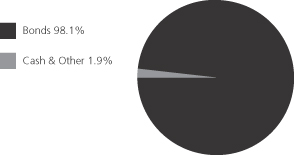

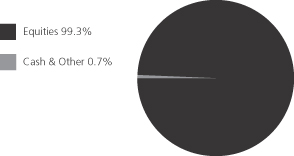

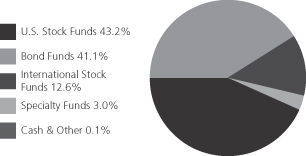

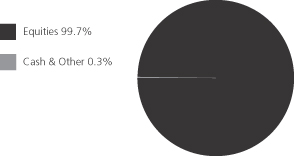

Portfolio structure

| | | | |

| Top ten holdings | | | | |

| SS&C Technologies Holdings, Inc. | | | 1.7% | |

| OraSure Technologies, Inc. | | | 1.7% | |

| Office Depot, Inc. | | | 1.5% | |

| PrivateBancorp, Inc. | | | 1.5% | |

| Burlington Stores, Inc. | | | 1.5% | |

| MiMedx Group, Inc. | | | 1.4% | |

| PTC, Inc. | | | 1.4% | |

| Carriage Services, Inc. | | | 1.4% | |

| Medical Properties Trust, Inc., REIT | | | 1.4% | |

| Aspen Technology, Inc. | | | 1.3% | |

| | | | |

| Equity sectors | | | | |

| Financial Services | | | 20.6% | |

| Technology | | | 18.6% | |

| Health Care | | | 13.8% | |

| Industrial Goods & Services | | | 7.3% | |

| Special Products & Services | | | 7.3% | |

| Retailing | | | 5.7% | |

| Basic Materials | | | 5.5% | |

| Energy | | | 4.5% | |

| Utilities & Communications | | | 4.4% | |

| Leisure | | | 3.3% | |

| Autos & Housing | | | 3.3% | |

| Consumer Staples | | | 2.4% | |

| Transportation | | | 2.4% | |

Cash & Other can include cash, other assets less liabilities, offsets to derivative positions, and short-term securities.

Percentages are based on net assets as of 12/31/14.

The portfolio is actively managed and current holdings may be different.

2

MFS Blended Research Small Cap Equity Portfolio

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended December 31, 2014, Initial Class shares of the MFS Blended Research Small Cap Equity Portfolio (“fund”) provided a total return of 7.29%, while Service Class shares of the fund provided a total return of 7.04%. These compare with a return of 4.89% over the same period for the fund’s benchmark, the Russell 2000 Index.

Market Environment

Early in the period, US equities suffered what proved to be a temporary setback due to concerns over emerging markets as well as what was perceived at the time to be a pause in US economic growth, partially caused by extreme weather events and a weak December 2013 labor market report. Markets soon recovered as the economic pause concluded and investors appeared to have become increasingly comfortable that newly-installed US Federal Reserve (“Fed”) Chair Janet Yellen would not make any substantial changes to the trajectory of Fed monetary policy.

A generally risk-friendly, carry trade environment persisted from February 2014 until mid-year. While geopolitical tensions flared in the Middle East and Russia/Ukraine, any market setbacks were short-lived as improving economic growth in the US, coupled with prospects for easier monetary policy in regions with slowing growth, such as Japan, Europe and China, supported risk assets. For example, the European Central Bank (“ECB”) cut policy interest rates into negative territory and, by the end of the period, expectations were for additional rate cuts and the announcement for non-conventional easing measures. Similarly, the Bank of Japan surprised markets late in the period with fresh stimulus measures given lackluster growth trends. The related decline in developed market government bond yields and credit spreads were also supportive for equity markets. At the end of the period, the US equity market was trading close to all-time highs and US Treasury yields were close to their lows for the period. However, credit markets did not fare as well in the second half of 2014, particularly US high yield and emerging market debt. The higher weightings of oil and gas credits in these asset classes resulted in widening spreads and increased volatility as oil prices began to decline in an accelerated fashion in the fourth quarter.

Contributors to Performance

Strong stock selection in the health care sector contributed to performance relative to the Russell 2000 Index. Within this sector, overweight positions in medical device manufacturers, Mimedx Group, Orasure Technologies, Nxstage Medical, Volcano and Dexcom (h), and in program and services provider for under-insured individuals Centene, boosted relative returns. Shares of Mimedx Group surged towards the end of the period on the back of strong results driven primarily by better-than-expected revenue growth. The share price of Orasure Technologies rose during the period as a result of higher sales of its infectious disease testing products.

Stock selection within the energy sector also aided relative results, led by an overweight position in independent exploration and production company Athlon Energy (h). Shares of Athlon Energy appreciated following the acquisition by Canadian natural gas company Encana.

Strong stock selection also provided a boost to relative performance in the telecommunication services sector. However, there were no individual stocks within this sector that were among the fund’s top relative contributors.

Elsewhere, overweight positions in poultry products manufacturer Pilgrim’s Pride, urban fashion apparel retailer Burlington Stores and semiconductor image sensor device developer Omnivision Technologies (h) boosted relative returns. Shares of Pilgrim’s Pride benefited from a favorable operating environment, driven primarily by strong chicken demand, limited supply growth, high prices of competitive protein products and falling feed costs.

Detractors from Performance

Weak stock selection within the information technology sector detracted from relative performance. Within this sector, overweight positions in data and information management software provider CommVault Systems, online business ratings and reviews provider Yelp and software solutions provider Fleetmatics Group held back relative returns. Shares of CommVault Systems plummeted as the company reported poor earnings results and increased expenses during the second half of the year. The company witnessed the slowest growth rate in their software business in the past thirteen quarters.

Elsewhere, other top relative detractors for the period included the fund’s overweight positions in education services company ITT Educational Services (h), oil & gas services provider Basic Energy Services, skin health company PhotoMedex (h), technology workflow management solutions provider Performant Financial, premium audio and consumer accessory manufacturer VOXX International and independent oil & gas company Clayton Williams Energy. Shares of ITT Educational Services declined during the period reflecting weaker trends in new student enrollment and potential regulatory issues brought forward by the Security and Exchange Commission (SEC). In addition, the Department of Education introduced sanctions against ITT Educational Services as the company did not submit

3

MFS Blended Research Small Cap Equity Portfolio

Management Review – continued

2013 audited financials within the deadline date which further pressured the stock. The share price of Basic Energy Services weakened in the second half of the year as a result of reduced spending by oil companies that scaled back their activities due to less attractive oil prices. Not holding strong-performing biotechnology company Intermune also hurt relative performance.

Respectfully,

Matthew Krummell

Portfolio Manager

| (h) | Security was not held in the portfolio at period end. |

The views expressed in this report are those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

4

MFS Blended Research Small Cap Equity Portfolio

PERFORMANCE SUMMARY THROUGH 12/31/14

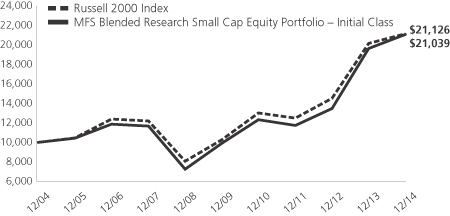

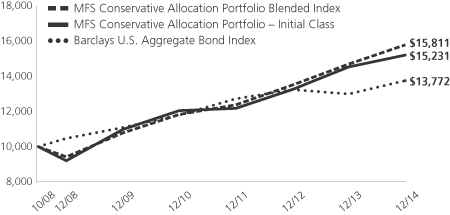

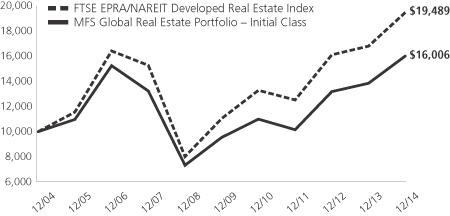

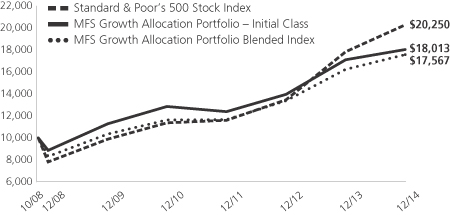

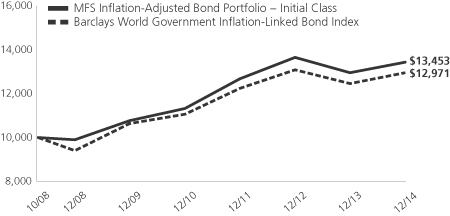

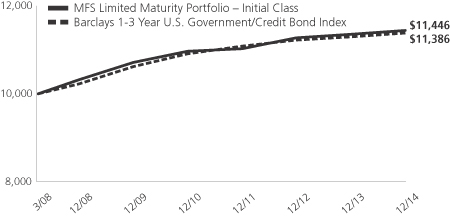

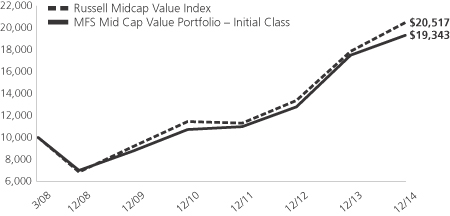

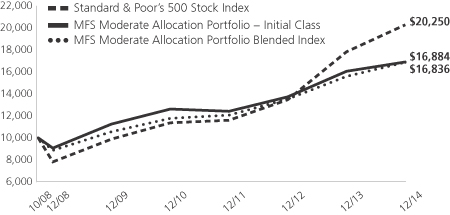

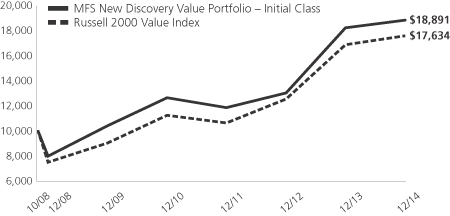

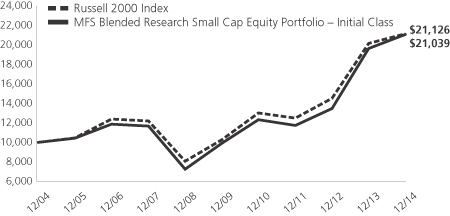

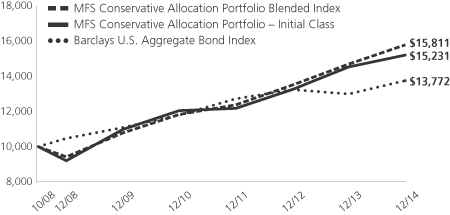

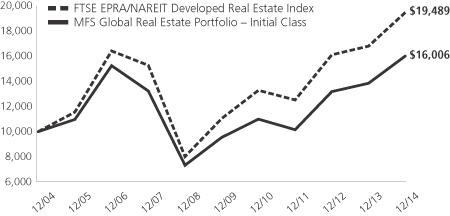

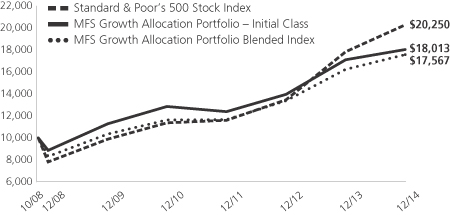

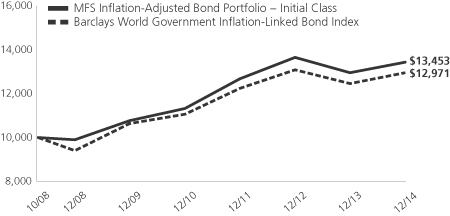

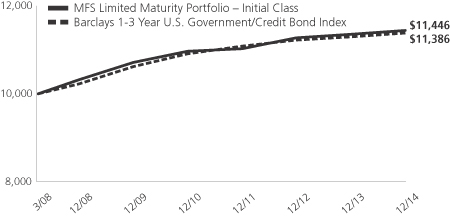

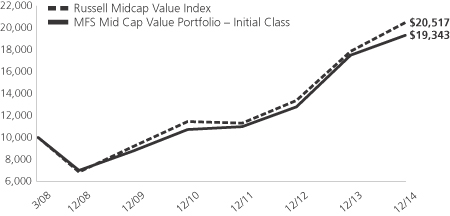

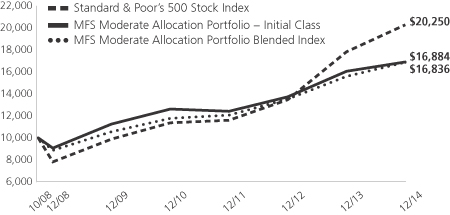

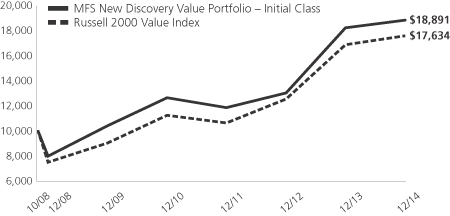

The following chart illustrates the historical performance of the fund in comparison to its benchmark(s). Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect any fees or expenses. The performance of other share classes will be greater than or less than that of the class depicted below. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your units, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a contract holder would pay on fund distributions or the redemption of contract units. The returns for the fund shown also do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges imposed by the insurance company separate accounts. Such expenses would reduce the overall returns shown.

Growth of a Hypothetical $10,000 Investment

Total Returns through 12/31/14

Average annual total returns

| | | | | | | | | | | | | | |

| | | Share Class | | Class inception date | | 1-yr | | 5-yr | | 10-yr | | Life (t) | | |

| | | Initial Class | | 7/17/00 | | 7.29% | | 16.26% | | 7.72% | | N/A | | |

| | | Service Class | | 5/01/06 | | 7.04% | | 15.95% | | N/A | | 6.59% | | |

| | | | | |

| Comparative benchmark | | | | | | | | | | |

| | | Russell 2000 Index (f) | | 4.89% | | 15.55% | | 7.77% | | N/A | | |

| (f) | Source: FactSet Research Systems Inc. |

| (t) | For the period from the class inception date through the stated period end (for those share classes with less than 10 years of performance history). No comparative benchmark performance information is provided for “life” periods. (See Notes to Performance Summary.) |

Benchmark Definition

Russell 2000 Index – constructed to provide a comprehensive barometer for securities in the small-cap segment of the U.S. equity universe. The index includes 2,000 of the smallest U.S. companies based on total market capitalization, representing approximately 10% of the investable U.S. equity market.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented. Life returns are presented where the share class has less than 10 years of performance history and represent the average annual total return from the class inception date to the stated period end date. As the fund’s share classes may have different inception dates, the life returns may represent different time periods and may not be comparable. As a result, no comparative benchmark performance information is provided for life periods.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details. All results are historical and assume the reinvestment of any dividends and capital gains distributions.

5

MFS Blended Research Small Cap Equity Portfolio

Performance Summary – continued

Performance prior to close of business December 7, 2012, reflects time periods when another adviser or subadviser was responsible for selecting investments for the fund under a different investment objective and different investment strategies.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

6

MFS Blended Research Small Cap Equity Portfolio

EXPENSE TABLE

Fund Expenses Borne by the Contract Holders During the Period,

July 1, 2014 through December 31, 2014

As a contract holder of the fund, you incur ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2014 through December 31, 2014.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight the fund’s ongoing costs only and do not take into account the fees and expenses imposed under the variable contracts through which your investment in the fund is made. Therefore, the second line for each share class in the table is useful in comparing ongoing costs associated with an investment in vehicles (such as the fund) which fund benefits under variable annuity and variable life insurance contracts and to qualified pension and retirement plans only, and will not help you determine the relative total costs of investing in the fund through variable annuity and variable life insurance contracts. If the fees and expenses imposed under the variable contracts were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| Share Class | | | | Annualized

Expense Ratio | | | Beginning

Account Value

7/01/14 | | | Ending

Account Value

12/31/14 | | | Expenses Paid

During Period (p)

7/01/14-12/31/14 | |

| Initial Class | | Actual | | | 0.47% | | | | $1,000.00 | | | | $1,012.39 | | | | $2.38 | |

| | Hypothetical (h) | | | 0.47% | | | | $1,000.00 | | | | $1,022.84 | | | | $2.40 | |

| Service Class | | Actual | | | 0.72% | | | | $1,000.00 | | | | $1,010.73 | | | | $3.65 | |

| | Hypothetical (h) | | | 0.72% | | | | $1,000.00 | | | | $1,021.58 | | | | $3.67 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

7

MFS Blended Research Small Cap Equity Portfolio

PORTFOLIO OF INVESTMENTS – 12/31/14

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| COMMON STOCKS – 99.1% | | | | | |

| Aerospace – 1.6% | | | | | |

| AAR Corp. | | | 19,278 | | | $ | 535,542 | |

| Ducommun, Inc. (a) | | | 27,443 | | | | 693,759 | |

| Engility Holdings, Inc. (a) | | | 23,111 | | | | 989,151 | |

| | | | | | | | |

| | | $ | 2,218,452 | |

| | | | | | | | |

| Airlines – 0.6% | | | | | |

| Republic Airways Holdings, Inc. (a) | | | 54,942 | | | $ | 801,604 | |

| | | | | | | | |

| Automotive – 0.4% | | | | | |

| Meritor, Inc. (a) | | | 32,003 | | | $ | 484,845 | |

| | | | | | | | |

| Biotechnology – 3.6% | | | | | |

| Affymetrix, Inc. (a) | | | 112,826 | | | $ | 1,113,593 | |

| Emergent BioSolutions, Inc. (a) | | | 3,766 | | | | 102,548 | |

| Epizyme, Inc. (a) | | | 20,103 | | | | 379,344 | |

| Foundation Medicine, Inc. (a)(l) | | | 62,254 | | | | 1,383,284 | |

| MiMedx Group, Inc. (a) | | | 169,778 | | | | 1,957,540 | |

| | | | | | | | |

| | | $ | 4,936,309 | |

| | | | | | | | |

| Brokerage & Asset Managers – 0.1% | | | | | |

| Investment Technology Group, Inc. (a) | | | 4,089 | | | $ | 85,133 | |

| | | | | | | | |

| Business Services – 4.9% | | | | | |

| Forrester Research, Inc. | | | 44,299 | | | $ | 1,743,609 | |

| Jones Lang LaSalle, Inc. | | | 7,118 | | | | 1,067,202 | |

| Performant Financial Corp. (a) | | | 158,243 | | | | 1,052,316 | |

| RE/MAX Holdings, Inc., “A” | | | 30,638 | | | | 1,049,352 | |

| Resources Connection, Inc. | | | 108,585 | | | | 1,786,223 | |

| | | | | | | | |

| | | $ | 6,698,702 | |

| | | | | | | | |

| Computer Software – 4.6% | | | | | |

| Aspen Technology, Inc. (a) | | | 52,173 | | | $ | 1,827,098 | |

| CommVault Systems, Inc. (a) | | | 34,947 | | | | 1,806,410 | |

| PTC, Inc. (a) | | | 52,600 | | | | 1,927,790 | |

| SolarWinds, Inc. (a) | | | 12,675 | | | | 631,595 | |

| | | | | | | | |

| | | $ | 6,192,893 | |

| | | | | | | | |

| Computer Software – Systems – 5.8% | | | | | |

| Cvent, Inc. (a) | | | 21,312 | | | $ | 593,326 | |

| Fleetmatics Group PLC (a) | | | 47,825 | | | | 1,697,309 | |

| Ingram Micro, Inc., “A” (a) | | | 53,232 | | | | 1,471,332 | |

| Insight Enterprises, Inc. (a) | | | 31,591 | | | | 817,891 | |

| NCR Corp. (a) | | | 2,842 | | | | 82,816 | |

| Premiere Global Services, Inc. (a) | | | 58,191 | | | | 617,988 | |

| SS&C Technologies Holdings, Inc. | | | 39,088 | | | | 2,286,257 | |

| Vantiv, Inc., “A” (a) | | | 9,577 | | | | 324,852 | |

| | | | | | | | |

| | | $ | 7,891,771 | |

| | | | | | | | |

| Construction – 2.9% | | | | | |

| Eagle Materials, Inc. | | | 12,510 | | | $ | 951,135 | |

| Lennox International, Inc. | | | 17,207 | | | | 1,635,869 | |

| Patrick Industries, Inc. (a) | | | 16,517 | | | | 726,418 | |

| Pool Corp. | | | 10,122 | | | | 642,140 | |

| | | | | | | | |

| | | $ | 3,955,562 | |

| | | | | | | | |

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| COMMON STOCKS – continued | | | | | |

| Consumer Products – 0.1% | | | | | |

| USANA Health Sciences, Inc. (a) | | | 759 | | | $ | 77,866 | |

| | | | | | | | |

| Consumer Services – 2.3% | | | | | |

| Carriage Services, Inc. | | | 91,493 | | | $ | 1,916,778 | |

| Grand Canyon Education, Inc. (a) | | | 26,638 | | | | 1,242,929 | |

| | | | | | | | |

| | | | | | $ | 3,159,707 | |

| | | | | | | | |

| Containers – 0.3% | | | | | |

| Graphic Packaging Holding Co. (a) | | | 26,515 | | | $ | 361,134 | |

| | | | | | | | |

| Electrical Equipment – 0.2% | | | | | |

| WESCO International, Inc. (a) | | | 4,359 | | | $ | 332,199 | |

| | | | | | | | |

| Electronics – 3.5% | | | | | |

| Amkor Technology, Inc. (a) | | | 23,830 | | | $ | 169,193 | |

| Jabil Circuit, Inc. | | | 46,500 | | | | 1,015,095 | |

| MaxLinear, Inc., “A” (a) | | | 96,033 | | | | 711,605 | |

| Photronics, Inc. (a) | | | 24,083 | | | | 200,130 | |

| Sanmina Corp. (a) | | | 40,445 | | | | 951,671 | |

| Silicon Laboratories, Inc. (a) | | | 29,130 | | | | 1,387,171 | |

| Vishay Intertechnology, Inc. | | | 18,316 | | | | 259,171 | |

| | | | | | | | |

| | | | | | $ | 4,694,036 | |

| | | | | | | | |

| Energy – Independent – 2.8% | | | | | |

| Alon USA Energy, Inc. | | | 45,916 | | | $ | 581,756 | |

| Clayton Williams Energy, Inc. (a) | | | 13,522 | | | | 862,704 | |

| Delek U.S. Holdings, Inc. | | | 27,210 | | | | 742,289 | |

| PBF Energy, Inc., “A” | | | 26,242 | | | | 699,087 | |

| Western Refining Co. LP | | | 22,506 | | | | 850,277 | |

| | | | | | | | |

| | | | | | $ | 3,736,113 | |

| | | | | | | | |

| Entertainment – 0.1% | | | | | |

| Cinemark Holdings, Inc. | | | 3,795 | | | $ | 135,026 | |

| | | | | | | | |

| Food & Beverages – 2.4% | | | | | |

| Diamond Foods, Inc. (a) | | | 890 | | | $ | 25,125 | |

| Pilgrim’s Pride Corp. (a) | | | 31,913 | | | | 1,046,427 | |

| Pinnacle Foods, Inc. | | | 38,583 | | | | 1,361,980 | |

| Sanderson Farms, Inc. | | | 9,000 | | | | 756,225 | |

| | | | | | | | |

| | | | | | $ | 3,189,757 | |

| | | | | | | | |

| Food & Drug Stores – 0.7% | | | | | |

| SUPERVALU, Inc. (a) | | | 92,174 | | | $ | 894,088 | |

| | | | | | | | |

| Forest & Paper Products – 0.1% | | | | | |

| Domtar Corp. | | | 2,933 | | | $ | 117,965 | |

| | | | | | | | |

| Gaming & Lodging – 1.1% | | | | | |

| Global Cash Access Holdings, Inc. (a) | | | 98,477 | | | $ | 704,111 | |

| Isle of Capri Casinos, Inc. (a) | | | 93,500 | | | | 782,595 | |

| | | | | | | | |

| | | | | | $ | 1,486,706 | |

| | | | | | | | |

| Health Maintenance Organizations – 1.0% | | | | | |

| Centene Corp. (a) | | | 9,908 | | | $ | 1,028,946 | |

| Health Net, Inc. (a) | | | 3,155 | | | | 168,887 | |

| Molina Healthcare, Inc. (a) | | | 3,244 | | | | 173,651 | |

| | | | | | | | |

| | | | | | $ | 1,371,484 | |

| | | | | | | | |

8

MFS Blended Research Small Cap Equity Portfolio

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| COMMON STOCKS – continued | | | | | |

| Insurance – 5.1% | | | | | |

| Assurant, Inc. | | | 19,480 | | | $ | 1,333,016 | |

| Hanover Insurance Group, Inc. | | | 1,698 | | | | 121,101 | |

| HCI Group, Inc. | | | 20,828 | | | | 900,603 | |

| Maiden Holdings Ltd. | | | 6,904 | | | | 88,302 | |

| Safety Insurance Group, Inc. | | | 13,391 | | | | 857,158 | |

| Symetra Financial Corp. | | | 78,261 | | | | 1,803,916 | |

| Third Point Reinsurance Ltd. (a) | | | 43,020 | | | | 623,360 | |

| Validus Holdings Ltd. | | | 27,886 | | | | 1,158,942 | |

| | | | | | | | |

| | | $ | 6,886,398 | |

| | | | | | | | |

| Internet – 3.6% | | | | | |

| AVG Technologies N.V. (a) | | | 21,889 | | | $ | 432,089 | |

| Dice Holdings, Inc. (a) | | | 10,227 | | | | 102,372 | |

| Shutterfly, Inc. (a) | | | 35,180 | | | | 1,466,830 | |

| Shutterstock, Inc. (a) | | | 24,295 | | | | 1,678,785 | |

| Yelp, Inc. (a) | | | 23,036 | | | | 1,260,760 | |

| | | | | | | | |

| | | $ | 4,940,836 | |

| | | | | | | | |

| Leisure & Toys – 0.6% | | | | | |

| Brunswick Corp. | | | 2,045 | | | $ | 104,827 | |

| Malibu Boats, Inc., “A” (a) | | | 34,667 | | | | 668,033 | |

| | | | | | | | |

| | | $ | 772,860 | |

| | | | | | | | |

| Machinery & Tools – 5.4% | | | | | |

| Allison Transmission Holdings, Inc. | | | 38,069 | | | $ | 1,290,539 | |

| Columbus McKinnon Corp. | | | 60,693 | | | | 1,701,832 | |

| Herman Miller, Inc. | | | 43,671 | | | | 1,285,238 | |

| IPG Photonics Corp. (a) | | | 22,360 | | | | 1,675,211 | |

| Kadant, Inc. | | | 3,510 | | | | 149,842 | |

| Park-Ohio Holdings Corp. | | | 14,212 | | | | 895,782 | |

| SPX Corp. | | | 3,826 | | | | 328,730 | |

| | | | | | | | |

| | | $ | 7,327,174 | |

| | | | | | | | |

| Medical & Health Technology & Services – 0.6% | |

| Kindred Healthcare, Inc. | | | 45,732 | | | $ | 831,408 | |

| | | | | | | | |

| Medical Equipment – 7.6% | | | | | |

| Analogic Corp. | | | 4,662 | | | $ | 394,452 | |

| AngioDynamics, Inc. (a) | | | 34,687 | | | | 659,400 | |

| AtriCure, Inc. (a) | | | 80,064 | | | | 1,598,077 | |

| GenMark Diagnostics, Inc. (a) | | | 33,826 | | | | 460,372 | |

| Heartware International, Inc. (a) | | | 4,174 | | | | 306,497 | |

| Masimo Corp. (a) | | | 12,998 | | | | 342,367 | |

| NxStage Medical, Inc. (a) | | | 87,755 | | | | 1,573,447 | |

| OraSure Technologies, Inc. (a) | | | 222,473 | | | | 2,255,876 | |

| Orthofix International N.V. (a) | | | 24,170 | | | | 726,550 | |

| STERIS Corp. | | | 5,296 | | | | 343,446 | |

| Symmetry Surgical, Inc. (a) | | | 10,360 | | | | 80,704 | |

| Volcano Corp. (a) | | | 84,613 | | | | 1,512,880 | |

| | | | | | | | |

| | | $ | 10,254,068 | |

| | | | | | | | |

| Metals & Mining – 2.1% | | | | | |

| AK Steel Holding Corp. (a) | | | 89,368 | | | $ | 530,846 | |

| Century Aluminum Co. (a) | | | 29,044 | | | | 708,674 | |

| Olympic Steel, Inc. | | | 22,698 | | | | 403,570 | |

| U.S. Silica Holdings, Inc. | | | 27,128 | | | | 696,918 | |

| United States Steel Corp. | | | 20,768 | | | | 555,336 | |

| | | | | | | | |

| | | $ | 2,895,344 | |

| | | | | | | | |

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| COMMON STOCKS – continued | | | | | |

| Natural Gas – Distribution – 0.1% | | | | | |

| Atmos Energy Corp. | | | 2,740 | | | $ | 152,728 | |

| | | | | | | | |

| Network & Telecom – 1.1% | | | | | |

| Emulex Corp. (a) | | | 128,691 | | | $ | 729,678 | |

| Voxx International Corp. (a) | | | 83,773 | | | | 733,851 | |

| | | | | | | | |

| | | $ | 1,463,529 | |

| | | | | | | | |

| Oil Services – 1.7% | | | | | |

| Basic Energy Services, Inc. (a) | | | 139,763 | | | $ | 979,739 | |

| Furmanite Corp. (a) | | | 28,500 | | | | 222,870 | |

| Oil States International, Inc. (a) | | | 5,782 | | | | 282,740 | |

| Superior Energy Services, Inc. | | | 18,102 | | | | 364,755 | |

| Willbros Group, Inc. (a) | | | 82,310 | | | | 516,084 | |

| | | | | | | | |

| | | $ | 2,366,188 | |

| | | | | | | | |

| Other Banks & Diversified Financials – 8.0% | | | | | |

| BancorpSouth, Inc. | | | 73,178 | | | $ | 1,647,237 | |

| Berkshire Hills Bancorp, Inc. | | | 13,406 | | | | 357,404 | |

| East West Bancorp, Inc. | | | 10,761 | | | | 416,558 | |

| First Interstate BancSystem, Inc. | | | 58,239 | | | | 1,620,209 | |

| Metro Bancorp, Inc. (a) | | | 16,507 | | | | 427,861 | |

| Nationstar Mortgage Holdings, Inc. (a) | | | 18,379 | | | | 518,104 | |

| Nelnet, Inc., “A” | | | 17,748 | | | | 822,265 | |

| Ocwen Financial Corp. (a) | | | 5,667 | | | | 85,572 | |

| PacWest Bancorp | | | 20,011 | | | | 909,700 | |

| Popular, Inc. (a) | | | 22,348 | | | | 760,949 | |

| PrivateBancorp, Inc. | | | 62,170 | | | | 2,076,478 | |

| Western Alliance Bancorp. (a) | | | 15,065 | | | | 418,807 | |

| World Acceptance Corp. (a) | | | 9,947 | | | | 790,289 | |

| | | | | | | | |

| | | $ | 10,851,433 | |

| | | | | | | | |

| Pharmaceuticals – 0.9% | | | | | |

| Alere, Inc. (a) | | | 6,016 | | | $ | 228,608 | |

| Impax Laboratories, Inc. (a) | | | 8,847 | | | | 280,273 | |

| Receptos, Inc. (a) | | | 6,331 | | | | 775,611 | |

| | | | | | | | |

| | | $ | 1,284,492 | |

| | | | | | | | |

| Printing & Publishing – 1.1% | | | | | |

| Quad/Graphics, Inc. | | | 34,886 | | | $ | 800,983 | |

| R.R. Donnelley & Sons Co. | | | 41,333 | | | | 694,601 | |

| | | | | | | | |

| | | $ | 1,495,584 | |

| | | | | | | | |

| Railroad & Shipping – 0.2% | | | | | |

| Safe Bulkers, Inc. | | | 85,860 | | | $ | 335,713 | |

| | | | | | | | |

| Real Estate – 7.5% | | | | | |

| Ashford Hospitality Prime, REIT | | | 10,827 | | | $ | 185,791 | |

| Ashford Hospitality Trust, REIT | | | 67,885 | | | | 711,435 | |

| Corporate Office Properties Trust, REIT | | | 11,800 | | | | 334,766 | |

| Gramercy Property Trust, Inc., REIT | | | 76,757 | | | | 529,623 | |

| Hilltop Holdings, Inc. (a) | | | 31,484 | | | | 628,106 | |

| Home Properties, Inc., REIT | | | 15,318 | | | | 1,004,861 | |

| Hospitality Properties Trust | | | 6,801 | | | | 210,831 | |

| Medical Properties Trust, Inc., REIT | | | 136,440 | | | | 1,880,143 | |

| Mid-America Apartment Communities, Inc., REIT | | | 14,521 | | | | 1,084,428 | |

| Potlatch Corp., REIT | | | 24,431 | | | | 1,022,926 | |

9

MFS Blended Research Small Cap Equity Portfolio

Portfolio of Investments – continued

| | | | | | | | |

| Issuer | | Shares/Par | | | Value ($) | |

| | | | | | | | |

| COMMON STOCKS – continued | | | | | |

| Real Estate – continued | | | | | |

| Resource Capital Corp., REIT | | | 27,629 | | | $ | 139,250 | |

| RLJ Lodging Trust, REIT | | | 32,350 | | | | 1,084,696 | |

| Ryman Hospitality Properties, Inc., REIT | | | 6,555 | | | | 345,711 | |

| Tanger Factory Outlet Centers, Inc., REIT | | | 26,180 | | | | 967,613 | |

| | | | | | | | |

| | | $ | 10,130,180 | |

| | | | | | | | |

| Restaurants – 0.5% | | | | | |

| Chuy’s Holdings, Inc. (a) | | | 7,622 | | | $ | 149,925 | |

| Jack in the Box, Inc. | | | 2,950 | | | | 235,882 | |

| Red Robin Gourmet Burgers, Inc. (a) | | | 2,623 | | | | 201,905 | |

| Ruby Tuesday, Inc. (a) | | | 8,038 | | | | 54,980 | |

| | | | | | | | |

| | | $ | 642,692 | |

| | | | | | | | |

| Specialty Chemicals – 3.1% | | | | | |

| A. Schulman, Inc. | | | 14,805 | | | $ | 600,047 | |

| Andersons, Inc. | | | 17,931 | | | | 952,853 | |

| Green Plains, Inc. | | | 28,070 | | | | 695,575 | |

| Pacific Ethanol, Inc. (a) | | | 46,993 | | | | 485,438 | |

| REX American Resources Corp. (a) | | | 10,983 | | | | 680,617 | |

| Trinseo S.A. (a) | | | 41,304 | | | | 720,755 | |

| | | | | | | | |

| | | $ | 4,135,285 | |

| | | | | | | | |

| Specialty Stores – 5.1% | | | | | |

| Barnes & Noble, Inc. (a) | | | 10,502 | | | $ | 243,856 | |

| Build-A-Bear Workshop, Inc. (a) | | | 26,076 | | | | 524,128 | |

| Burlington Stores, Inc. (a) | | | 42,055 | | | | 1,987,519 | |

| Children’s Place, Inc. | | | 22,279 | | | | 1,269,903 | |

| Express, Inc. (a) | | | 49,858 | | | | 732,414 | |

| Office Depot, Inc. (a) | | | 244,911 | | | | 2,100,112 | |

| | | | | | | | |

| | | $ | 6,857,932 | |

| | | | | | | | |

| Telecommunications – Wireless – 0.5% | | | | | |

| Intelsat S.A. (a) | | | 40,036 | | | $ | 695,025 | |

| | | | | | | | |

| Telephone Services – 1.5% | | | | | |

| Inteliquent, Inc. | | | 62,745 | | | $ | 1,231,684 | |

| Shenandoah Telecommunications Co. | | | 25,099 | | | | 784,344 | |

| West Corp. | | | 2,045 | | | | 67,485 | |

| | | | | | | | |

| | | $ | 2,083,513 | |

| | | | | | | | |

| Trucking – 1.5% | | | | | |

| Celadon Group, Inc. | | | 29,774 | | | $ | 675,572 | |

| Swift Transportation Co. (a) | | | 49,758 | | | | 1,424,572 | |

| | | | | | | | |

| | | $ | 2,100,144 | |

| | | | | | | | |

| Utilities – Electric Power – 1.7% | | | | | |

| Great Plains Energy, Inc. | | | 9,495 | | | $ | 269,753 | |

| NRG Yield, Inc. | | | 3,193 | | | | 150,518 | |

| PNM Resources, Inc. | | | 39,005 | | | | 1,155,718 | |

| Portland General Electric Co. | | | 19,270 | | | | 728,984 | |

| | | | | | | | |

| | | $ | 2,304,973 | |

| | | | | | | | |

| Utilities – Water – 0.5% | | | | | |

| American States Water Co. | | | 19,232 | | | $ | 724,277 | |

| | | | | | | | |

Total Common Stocks

(Identified Cost, $108,167,898) | | | | | | $ | 134,353,128 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| Issuer | | Strike

Price | | | First

Exercise | | | Shares/Par | | | Value ($) | |

| | | | | | | | | | | | | | | | |

| WARRANTS – 0.0% | | | | | |

| OTHER BANKS & DIVERSIFIED FINANCIALS – 0.0% | |

| Imperial Holdings, Inc. (1 share for 1 warrant) (a) | | $ | 10.75 | | | | 11/06/14 | | | | 318 | | | $ | 277 | |

| | | | | | | | | | | | | | | | |

| |

| MONEY MARKET FUNDS – 0.3% | | | | | |

| MFS Institutional Money Market Portfolio, 0.09%, at Cost and Net Asset Value (v) | | | | 408,030 | | | $ | 408,030 | |

| | | | | | | | | | | | | | | | |

|

| COLLATERAL FOR SECURITIES LOANED – 0.7% | |

| Navigator Securities Lending Prime Portfolio, 0.16%, at Cost and Net Asset Value (j) | | | | 920,398 | | | $ | 920,398 | |

| | | | | | | | | | | | | | | | |

Total Investments

(Identified Cost, $109,496,326) | | | | | | | $ | 135,681,833 | |

| | | | | | | | | | | | | | | | |

OTHER ASSETS, LESS

LIABILITIES – (0.1)% | | | | | | | | (137,769 | ) |

| | | | | | | | | | | | | | | | |

| NET ASSETS – 100.0% | | | | | | | $ | 135,544,064 | |

| | | | | | | | | | | | | | | | |

| (a) | | Non-income producing security. |

| (j) | | The rate quoted is the annualized seven-day yield of the fund at period end. |

| (l) | | A portion of this security is on loan. |

| (v) | | Underlying affiliated fund that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualized seven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

See Notes to Financial Statements

10

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | STATEMENT OF ASSETS AND LIABILITIES

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | | | | | |

At 12/31/14 | | | | | | | | |

Assets | | | | | | | | |

Investments – | | | | | | | | |

Non-affiliated issuers, at value (identified cost, $109,088,296) | | | $135,273,803 | | | | | |

Underlying affiliated funds, at cost and value | | | 408,030 | | | | | |

Total investments, at value, including $879,623 of securities on loan (identified cost, $109,496,326) | | | $135,681,833 | | | | | |

Receivables for | | | | | | | | |

Investments sold | | | 656,412 | | | | | |

Fund shares sold | | | 208,882 | | | | | |

Interest and dividends | | | 105,727 | | | | | |

Other assets | | | 1,501 | | | | | |

Total assets | | | | | | | $136,654,355 | |

Liabilities | | | | | | | | |

Payable for fund shares reacquired | | | $123,228 | | | | | |

Collateral for securities loaned, at value | | | 920,398 | | | | | |

Payable to affiliates | | | | | | | | |

Investment adviser | | | 2,325 | | | | | |

Shareholder servicing costs | | | 23 | | | | | |

Distribution and/or service fees | | | 1,442 | | | | | |

Payable for independent Trustees’ compensation | | | 82 | | | | | |

Accrued expenses and other liabilities | | | 62,793 | | | | | |

Total liabilities | | | | | | | $1,110,291 | |

Net assets | | | | | | | $135,544,064 | |

Net assets consist of | | | | | | | | |

Paid-in capital | | | $87,604,225 | | | | | |

Unrealized appreciation (depreciation) on investments | | | 26,185,507 | | | | | |

Accumulated net realized gain (loss) on investments | | | 21,270,997 | | | | | |

Undistributed net investment income | | | 483,335 | | | | | |

Net assets | | | | | | | $135,544,064 | |

Shares of beneficial interest outstanding | | | | | | | 8,569,685 | |

| | | | | | | | | | | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

Initial Class | | | $31,323,013 | | | | 1,952,683 | | | | $16.04 | |

Service Class | | | 104,221,051 | | | | 6,617,002 | | | | 15.75 | |

See Notes to Financial Statements

11

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | STATEMENT OF OPERATIONS

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | | | | | |

Year ended 12/31/14 | | | | | | | | |

Net investment income | | | | | | | | |

Income | | | | | | | | |

Dividends | | | $1,469,194 | | | | | |

Interest | | | 31,371 | | | | | |

Dividends from underlying affiliated funds | | | 848 | | | | | |

Foreign taxes withheld | | | (2,786 | ) | | | | |

Total investment income | | | | | | | $1,498,627 | |

Expenses | | | | | | | | |

Management fee | | | $569,620 | | | | | |

Distribution and/or service fees | | | 274,717 | | | | | |

Shareholder servicing costs | | | 5,020 | | | | | |

Administrative services fee | | | 29,762 | | | | | |

Independent Trustees’ compensation | | | 4,594 | | | | | |

Custodian fee | | | 44,340 | | | | | |

Shareholder communications | | | 323 | | | | | |

Audit and tax fees | | | 55,061 | | | | | |

Legal fees | | | 1,214 | | | | | |

Miscellaneous | | | 10,385 | | | | | |

Total expenses | | | | | | | $995,036 | |

Fees paid indirectly | | | (3 | ) | | | | |

Reduction of expenses by investment adviser | | | (6,738 | ) | | | | |

Net expenses | | | | | | | $988,295 | |

Net investment income | | | | | | | $510,332 | |

Realized and unrealized gain (loss) on investments | | | | | | | | |

Realized gain (loss) on investments (identified cost basis) | | | | | | | $21,857,044 | |

Change in unrealized appreciation (depreciation) on investments | | | | | | | $(12,934,875 | ) |

Net realized and unrealized gain (loss) on investments | | | | | | | $8,922,169 | |

Change in net assets from operations | | | | | | | $9,432,501 | |

See Notes to Financial Statements

12

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

For years ended 12/31 | | | 2014 | | | | 2013 | |

Change in net assets | | | | | | | | |

From operations | | | | | | | | |

Net investment income | | | $510,332 | | | | $721,762 | |

Net realized gain (loss) on investments | | | 21,857,044 | | | | 24,794,254 | |

Net unrealized gain (loss) on investments | | | (12,934,875 | ) | | | 31,002,423 | |

Change in net assets from operations | | | $9,432,501 | | | | $56,518,439 | |

Distributions declared to shareholders | | | | | | | | |

From net investment income | | | $(1,069,864 | ) | | | $(2,211,067 | ) |

From net realized gain on investments | | | (24,659,608 | ) | | | (9,643,715 | ) |

Total distributions declared to shareholders | | | $(25,729,472 | ) | | | $(11,854,782 | ) |

Change in net assets from fund share transactions | | | $(2,595,267 | ) | | | $(34,208,250 | ) |

Total change in net assets | | | $(18,892,238 | ) | | | $10,455,407 | |

Net assets | | | | | | | | |

At beginning of period | | | 154,436,302 | | | | 143,980,895 | |

At end of period (including undistributed net investment income of $483,335 and

$1,069,860, respectively) | | | $135,544,064 | | | | $154,436,302 | |

See Notes to Financial Statements

13

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate by which an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | |

| Initial Class | | Years ended 12/31 | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

Net asset value, beginning of period | | | $18.24 | | | | $13.57 | | | | $12.42 | | | | $13.12 | | | | $10.58 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.10 | | | | $0.11 | | | | $0.16 | | | | $0.11 | | | | $0.06 | |

Net realized and unrealized gain (loss) on investments

and foreign currency | | | 1.16 | | | | 5.91 | | | | 1.68 | | | | (0.75 | ) | | | 2.52 | |

Total from investment operations | | | $1.26 | | | | $6.02 | | | | $1.84 | | | | $(0.64 | ) | | | $2.58 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.18 | ) | | | $(0.28 | ) | | | $(0.08 | ) | | | $(0.06 | ) | | | $(0.04 | ) |

From net realized gain on investments | | | (3.28 | ) | | | (1.07 | ) | | | (0.61 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(3.46 | ) | | | $(1.35 | ) | | | $(0.69 | ) | | | $(0.06 | ) | | | $(0.04 | ) |

Net asset value, end of period (x) | | | $16.04 | | | | $18.24 | | | | $13.57 | | | | $12.42 | | | | $13.12 | |

Total return (%) (k)(r)(s)(x) | | | 7.29 | | | | 45.71 | | | | 14.74 | | | | (4.87 | ) | | | 24.46 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.51 | | | | 0.51 | | | | 0.58 | | | | 0.70 | | | | 0.99 | |

Expenses after expense reductions (f) | | | 0.50 | | | | 0.51 | | | | N/A | | | | 0.61 | | | | 0.95 | |

Net investment income | | | 0.56 | | | | 0.68 | | | | 1.22 | | | | 0.83 | | | | 0.57 | |

Portfolio turnover | | | 67 | | | | 69 | | | | 82 | | | | 37 | | | | 131 | |

Net assets at end of period (000 omitted) | | | $31,323 | | | | $33,401 | | | | $29,429 | | | | $71,405 | | | | $45,720 | |

See Notes to Financial Statements

14

MFS Blended Research Small Cap Equity Portfolio

Financial Highlights – continued

| | | | | | | | | | | | | | | | | | | | |

| Service Class | | Years ended 12/31 | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

Net asset value, beginning of period | | | $17.96 | | | | $13.38 | | | | $12.26 | | | | $12.95 | | | | $10.45 | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income (d) | | | $0.05 | | | | $0.07 | | | | $0.15 | | | | $0.06 | | | | $0.04 | |

Net realized and unrealized gain (loss) on investments

and foreign currency | | | 1.15 | | | | 5.82 | | | | 1.63 | | | | (0.72 | ) | | | 2.47 | |

Total from investment operations | | | $1.20 | | | | $5.89 | | | | $1.78 | | | | $(0.66 | ) | | | $2.51 | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.13 | ) | | | $(0.24 | ) | | | $(0.05 | ) | | | $(0.03 | ) | | | $(0.01 | ) |

From net realized gain on investments | | | (3.28 | ) | | | (1.07 | ) | | | (0.61 | ) | | | — | | | | — | |

Total distributions declared to shareholders | | | $(3.41 | ) | | | $(1.31 | ) | | | $(0.66 | ) | | | $(0.03 | ) | | | $(0.01 | ) |

Net asset value, end of period (x) | | | $15.75 | | | | $17.96 | | | | $13.38 | | | | $12.26 | | | | $12.95 | |

Total return (%) (k)(r)(s)(x) | | | 7.04 | | | | 45.33 | | | | 14.39 | | | | (5.09 | ) | | | 24.07 | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.76 | | | | 0.76 | | | | 0.83 | | | | 0.94 | | | | 1.23 | |

Expenses after expense reductions (f) | | | 0.75 | | | | 0.76 | | | | N/A | | | | 0.85 | | | | 1.20 | |

Net investment income | | | 0.30 | | | | 0.42 | | | | 1.11 | | | | 0.50 | | | | 0.34 | |

Portfolio turnover | | | 67 | | | | 69 | | | | 82 | | | | 37 | | | | 131 | |

Net assets at end of period (000 omitted) | | | $104,221 | | | | $121,036 | | | | $114,552 | | | | $117,293 | | | | $134,958 | |

Information prior to the close of business on December 7, 2012, reflects time periods when another adviser or subadviser was responsible for selecting investments for the fund under a different investment objective and different investment strategies.

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (k) | The total return does not reflect expenses that apply to separate accounts. Inclusion of these charges would reduce the total return figures for all periods shown. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (x) | The net asset values per share and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

15

MFS Blended Research Small Cap Equity Portfolio

NOTES TO FINANCIAL STATEMENTS

| (1) | | Business and Organization |

MFS Blended Research Small Cap Equity Portfolio (the fund) is a diversified series of MFS Variable Insurance Trust III (the trust). The trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company. The shareholders of each series of the trust are separate accounts of insurance companies, which offer variable annuity and/or life insurance products, and qualified retirement and pension plans.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

| (2) | | Significant Accounting Policies |

General – The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund will generally focus on securities of small size companies which may be more volatile than those of larger companies.

In June 2014, FASB issued Accounting Standards Update 2014-11, Transfers and Servicing (Topic 860) – Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures (“ASU 2014-11”). ASU 2014-11 changes the accounting for repurchase-to-maturity transactions (i.e., repurchase agreements that settle at the same time as the maturity of the transferred financial asset) and enhances the required disclosures for repurchase agreements and other similar transactions. Although still evaluating the potential impacts of ASU 2014-11 to the fund, management expects that the impact of the fund’s adoption will be limited to additional financial statement disclosures which would first be effective for interim reporting periods beginning after March 15, 2015.

Balance Sheet Offsetting – The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’s in-scope financial instruments and transactions.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price as provided by a third-party pricing service on the market or exchange on which they are primarily traded. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation as provided by a third-party pricing service on the market or exchange on which such securities are primarily traded. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value. Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. Values obtained from third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the

16

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of December 31, 2014 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| Investments at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Equity Securities: | | | | | | | | | | | | | | | | |

United States | | | $132,890,301 | | | | $— | | | | $277 | | | | $132,890,578 | |

Luxembourg | | | 695,025 | | | | — | | | | — | | | | 695,025 | |

Netherlands | | | 432,089 | | | | — | | | | — | | | | 432,089 | |

Greece | | | 335,713 | | | | — | | | | — | | | | 335,713 | |

| Mutual Funds | | | 1,328,428 | | | | — | | | | — | | | | 1,328,428 | |

| Total Investments | | | $135,681,556 | | | | $— | | | | $277 | | | | $135,681,833 | |

For further information regarding security characteristics, see the Portfolio of Investments.

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. The fund’s policy is to recognize transfers between the levels as of the end of the period. The table presents the activity of level 3 securities held at the beginning and the end of the period.

| | | | |

| | | Equity Securities | |

| Balance as of 12/31/13 | | | $— | |

Acquisition via Corporate Action (Warrant Issuance) | | | 277 | |

| Balance as of 12/31/14 | | | $277 | |

The net change in unrealized appreciation (depreciation) from investments held as level 3 at December 31, 2014 is $0. At December 31, 2014, the fund held one level 3 security.

Security Loans – Under its Securities Lending Agency Agreement with the fund, State Street Bank and Trust Company (“State Street”), as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. On loans collateralized by cash, the cash collateral is invested in a money market fund. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. State Street provides the fund with indemnification against Borrower default. In the event of Borrower default, State Street will for the benefit of the fund either purchase securities identical to those loaned or, when such purchase is commercially impracticable, pay the fund the market value of the loaned securities. In return, State Street assumes the fund’s rights to the related collateral. If the collateral value is less than the cost to purchase identical securities, State Street is responsible for the shortfall, but only to the extent that such shortfall is not due to a decline in collateral value resulting from collateral reinvestment for which the fund bears the risk of loss. At period end, the fund had investment securities on loan with a fair value of $879,623 and a related liability of $920,398 for cash collateral received on securities loaned, both of which are presented gross in the Statement of Assets and Liabilities. The collateral received on securities loaned exceeded the value of securities on loan at period end. The liability for cash collateral for securities loaned is carried at fair value, which is categorized as level 2 within the fair value hierarchy. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is included in “Interest” income in the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the

17

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends received in cash are recorded on the ex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date. Dividend and interest payments received in additional securities are recorded on the ex-dividend or ex-interest date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Fees Paid Indirectly – The fund’s custody fee may be reduced according to an arrangement that measures the value of cash deposited with the custodian by the fund. This amount, for the year ended December 31, 2014, is shown as a reduction of total expenses in the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests. Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

Distributions to shareholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to wash sale loss deferrals.

The tax character of distributions declared to shareholders for the last two fiscal years is as follows:

| | | | | | | | |

| | | 12/31/14 | | | 12/31/13 | |

| Ordinary income (including any short-term capital gains) | | | $21,338,383 | | | | $2,211,067 | |

| Long-term capital gains | | | 4,391,089 | | | | 9,643,715 | |

| Total distributions | | | $25,729,472 | | | | $11,854,782 | |

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | | |

| As of 12/31/14 | | | | |

| Cost of investments | | | $109,723,523 | |

| Gross appreciation | | | 30,486,000 | |

| Gross depreciation | | | (4,527,690 | ) |

| Net unrealized appreciation (depreciation) | | | $25,958,310 | |

| Undistributed ordinary income | | | 5,178,099 | |

| Undistributed long-term capital gain | | | 16,793,798 | |

| Other temporary differences | | | 9,632 | |

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and/or service fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share

18

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

dividend rates are generally due to differences in separate class expenses. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| | | | | | | | | | | | | | | | |

| | | From net investment

income | | | From net realized gain on

investments | |

| | | Year ended

12/31/14 | | | Year ended

12/31/13 | | | Year ended

12/31/14 | | | Year ended

12/31/13 | |

| Initial Class | | | $310,319 | | | | $516,885 | | | | $5,595,876 | | | | $1,991,337 | |

| Service Class | | | 759,545 | | | | 1,694,182 | | | | 19,063,732 | | | | 7,652,378 | |

| Total | | | $1,069,864 | | | | $2,211,067 | | | | $24,659,608 | | | | $9,643,715 | |

| (3) | | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at an annual rate of 0.40% of the fund’s average daily net assets.

MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund’s Board of Trustees. For the year ended December 31, 2014, this management fee reduction amounted to $6,487, which is included in the reduction of total expenses in the Statement of Operations. The management fee incurred for the year ended December 31, 2014 was equivalent to an annual effective rate of 0.40% of the fund’s average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses such that total annual operating expenses do not exceed 0.60% of average daily net assets for the Initial Class shares and 0.85% of average daily net assets for the Service Class shares. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until April 30, 2016. For the year ended December 31, 2014 the fund’s actual operating expenses did not exceed the limit and therefore, the investment adviser did not pay any portion of the fund’s expenses related to this agreement.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, is the distributor of shares of the fund. The Trustees have adopted a distribution plan for the Service Class shares pursuant to Rule 12b-1 under the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD distribution and/or service fees equal to 0.25% per annum of its average daily net assets attributable to Service Class shares as partial consideration for services performed and expenses incurred by MFD and financial intermediaries (including participating insurance companies that invest in the fund to fund variable annuity and variable life insurance contracts, sponsors of qualified retirement and pension plans that invest in the fund, and affiliates of these participating insurance companies and plan sponsors) in connection with the sale and distribution of the Service Class shares. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent. For the year ended December 31, 2014, the fee was $4,923, which equated to 0.0035% annually of the fund’s average daily net assets. MFSC also receives payment from the fund for out-of-pocket expenses paid by MFSC on behalf of the fund. For the year ended December 31, 2014, these costs amounted to $97.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund partially reimburses MFS the costs incurred to provide these services. The fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the year ended December 31, 2014 was equivalent to an annual effective rate of 0.0209% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Other – Effective November 1, 2014, this fund and certain other funds managed by MFS (the funds) have entered into a service agreement (the ISO Agreement) which provides for payment of fees solely by the funds to Tarantino LLC in return for the provision of services of an Independent Senior Officer (ISO) for the funds. Frank L. Tarantino serves as the ISO and is an officer of the funds and the sole member of Tarantino LLC. The funds can terminate the ISO Agreement with Tarantino LLC at any time under the terms of the ISO Agreement. Prior to November 1, 2014, the funds had entered into services agreements (the Compliance Officer Agreements) which provided for payment of fees by the funds to Tarantino LLC and Griffin Compliance LLC in return for the provision of services of an Independent Chief Compliance Officer (ICCO) and Assistant ICCO, respectively, for the funds. Prior to

19

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

November 1, 2014, Frank L. Tarantino served as the ICCO. Effective October 31, 2014, Mr. Tarantino resigned as ICCO and the Compliance Officer Agreement between the funds and Tarantino LLC was terminated. Prior to June 1, 2014, Robyn L. Griffin served as the Assistant ICCO and was an officer of the funds. Ms. Griffin is the sole member of Griffin Compliance LLC. Effective May 31, 2014, Ms. Griffin resigned as Assistant ICCO and the Compliance Officer Agreement between the funds and Griffin Compliance LLC was terminated. For the year ended December 31, 2014, the aggregate fees paid by the fund under these agreements were $674 and are included in “Miscellaneous” expense in the Statement of Operations. MFS had agreed to reimburse the fund for a portion of the payments made by the fund for the services under the Compliance Officer Agreements in the amount of $251, which is included in the reduction of total expenses in the Statement of Operations. Additionally, MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ICCO, Assistant ICCO, and ISO.

The fund invests in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks current income consistent with preservation of capital and liquidity. Income earned on this investment is included in “Dividends from underlying affiliated funds” in the Statement of Operations. This money market fund does not pay a management fee to MFS.

For the year ended December 31, 2014, purchases and sales of investments, other than short-term obligations, aggregated $95,560,555 and $122,949,846, respectively.

| (5) | | Shares of Beneficial Interest |

The fund’s Declaration of Trust permits the Trustees to issue an unlimited number of full and fractional shares of beneficial interest. Transactions in fund shares were as follows:

| | | | | | | | | | | | | | | | |

| | | Year ended 12/31/14 | | | Year ended 12/31/13 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Shares sold | | | | | | | | | | | | | | | | |

Initial Class | | | 164,926 | | | | $2,870,988 | | | | 64,982 | | | | $1,048,081 | |

Service Class | | | 278,229 | | | | 4,786,443 | | | | 217,153 | | | | 3,629,669 | |

| | | 443,155 | | | | $7,657,431 | | | | 282,135 | | | | $4,677,750 | |

| Shares issued to shareholders in reinvestment of distributions | | | | | | | | | | | | | | | | |

Initial Class | | | 375,473 | | | | $5,906,195 | | | | 156,764 | | | | $2,508,222 | |

Service Class | | | 1,282,230 | | | | 19,823,277 | | | | 592,680 | | | | 9,346,560 | |

| | | 1,657,703 | | | | $25,729,472 | | | | 749,444 | | | | $11,854,782 | |

| Shares reacquired | | | | | | | | | | | | | | | | |

Initial Class | | | (418,741 | ) | | | $(7,258,583 | ) | | | (559,516 | ) | | | $(9,070,000 | ) |

Service Class | | | (1,681,322 | ) | | | (28,723,587 | ) | | | (2,634,233 | ) | | | (41,670,782 | ) |

| | | (2,100,063 | ) | | | $(35,982,170 | ) | | | (3,193,749 | ) | | | $(50,740,782 | ) |

| Net change | | | | | | | | | | | | | | | | |

Initial Class | | | 121,658 | | | | $1,518,600 | | | | (337,770 | ) | | | $(5,513,697 | ) |

Service Class | | | (120,863 | ) | | | (4,113,867 | ) | | | (1,824,400 | ) | | | (28,694,553 | ) |

| | | 795 | | | | $(2,595,267 | ) | | | (2,162,170 | ) | | | $(34,208,250 | ) |

The fund and certain other funds managed by MFS participate in a $1.1 billion unsecured committed line of credit, subject to a $1 billion sublimit, provided by a syndication of banks under a credit agreement. Borrowings may be made for temporary financing needs. Interest is charged to each fund, based on its borrowings, generally at a rate equal to the higher of the Federal Reserve funds rate or one month LIBOR plus an agreed upon spread. A commitment fee, based on the average daily, unused portion of the committed line of credit, is allocated among the participating funds at the end of each calendar quarter. In addition, the fund and other funds managed by MFS have established unsecured uncommitted borrowing arrangements with certain banks for temporary financing needs. Interest is charged to each fund, based on its borrowings, at a rate equal to the Federal Reserve funds rate plus an agreed upon spread. For the year ended December 31, 2014, the fund’s commitment fee and interest expense were $530 and $0, respectively, and are included in “Miscellaneous” expense in the Statement of Operations.

20

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

| (7) | | Transactions in Underlying Affiliated Funds – Affiliated Issuers |

An affiliated issuer may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. For the purposes of this report, the fund assumes the following to be an affiliated issuer:

| | | | | | | | | | | | | | | | |

| Underlying Affiliated Fund | | Beginning Shares/Par Amount | | | Acquisitions Shares/Par Amount | | | Dispositions Shares/Par Amount | | | Ending Shares/Par Amount | |