UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-08879

MFS VARIABLE INSURANCE TRUST III

(Exact name of registrant as specified in charter)

111 Huntington Avenue, Boston, Massachusetts 02199

(Address of principal executive offices) (Zip code)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, Massachusetts 02199

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617)954-5000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2018

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Annual Report

December 31, 2018

MFS® Blended Research® Small Cap Equity Portfolio

MFS® Variable Insurance Trust III

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, the insurance company that offers your contract may determine that it will no longer send you paper copies of the fund’s annual and semiannual shareholder reports unless you specifically request paper copies from the insurance company or from your financial intermediary. Instead, the shareholder reports will be made available on a Web site (insurancefunds.mfs.com or other Web site of which you will be notified), and the insurance company will notify you by mail each time a report is posted and provide you with a Web site link to access the report. Instructions for requesting paper copies will be provided by your insurance company or financial intermediary.

If you already elected to receive shareholder reports by email, you will not be affected by this change and you need not take any action. If your insurance company or financial intermediary offers electronic delivery, you may elect to receive shareholder reports and other communications from the insurance company or financial intermediary by email by following the instructions provided by the insurance company or financial intermediary.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge from the insurance company or financial intermediary. You can inform the insurance company or financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting your insurance company or financial intermediary. Your election to receive reports in paper will apply to all funds held in your account with your insurance company or financial intermediary.

VSC-ANN

MFS® Blended Research® Small Cap Equity Portfolio

CONTENTS

The report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

NOT FDIC INSURED• MAY LOSE VALUE• NO BANK OR CREDIT UNION GUARANTEE• NOT A DEPOSIT• NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF

MFS Blended Research Small Cap Equity Portfolio

LETTER FROM THE EXECUTIVE CHAIRMAN

Dear Contract Owners:

Higher interest rates, international trade friction, and geopolitical uncertainty surrounding issues such as Brexit have contributed to an uptick in market volatility in recent quarters — a departure from thelow-volatility environment that prevailed for much of the past several years. Against this more challenging backdrop, equity markets in the United States outperformed most international markets on a relative basis in 2018, though broad market returns were modestly negative on an absolute basis. Global economic growth has become less synchronized over the past few quarters, with Europe, China, and some emerging markets having shown signs of significantly slowing growth. While U.S. growth has remained above average, the pace of that growth slowed in the second half of 2018.

Slowing global growth and tighter financial conditions have clouded the outlook for U.S. monetary policy, with the chairman of the U.S. Federal Reserve acknowledging that policy rates are close to levels that the Fed deems neutral for the U.S. economy. This suggests that the predictable pattern of quarterly rate increases is behind us. At the same time, markets must contend with a shift from years of quantitative easing toward a cycle of quantitative tightening now that the European Central Bank has halted asset purchases. U.S. tax reforms adopted in late 2017 have been welcomed by equity markets while emerging market economies have recently had to contend with tighter financial conditions as a result of firmer U.S. interest rates and a stronger dollar. With the Republicans losing control of the U.S. House of Representatives, further meaningful U.S. fiscal stimulus appears less likely over the remainder of this presidential term. A partial U.S. government shutdown, beginning in late 2018, also added to political uncertainty. Globally, inflation remains largely subdued thanks in part to falling oil prices, but tight labor markets and moderate global demand have investors on the lookout for its potential reappearance. Increased U.S. protectionism is also a growing concern, as investors fear trade disputes could dampen business sentiment, leading to even slower global growth. While there has been progress on this front — a NAFTA replacement has been agreed upon between the U.S., Mexico, and Canada; the free trade pact with Korea has been updated; and a negotiating framework with the European Union has been agreed upon — tensions over trade with China remain quite high, though the two sides have recently returned to the negotiating table.

As a global investment manager with nearly a century of expertise, MFS® firmly believes active risk management offers downside mitigation and may help improve investment outcomes. We built our active investment platform with this belief in mind. Ourlong-term perspective influences nearly every aspect of our business, ensuring our investment decisions align with the investing time horizons of our clients.

Respectfully,

Robert J. Manning

Executive Chairman

MFS Investment Management

February 15, 2019

The opinions expressed in this letter are subject to change and may not be relied upon for investment advice. No forecasts can be guaranteed.

1

MFS Blended Research Small Cap Equity Portfolio

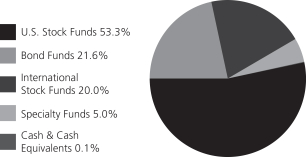

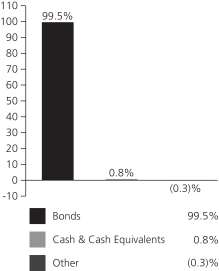

PORTFOLIO COMPOSITION

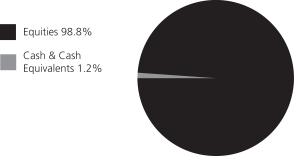

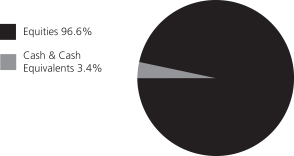

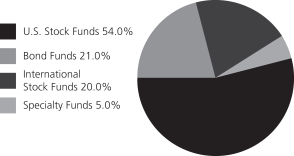

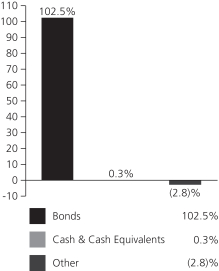

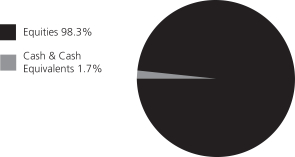

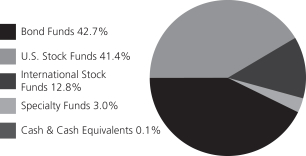

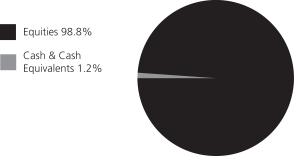

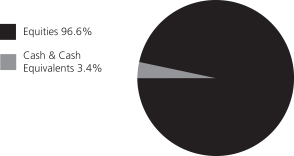

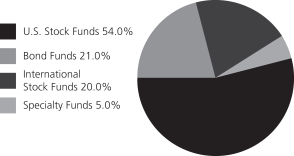

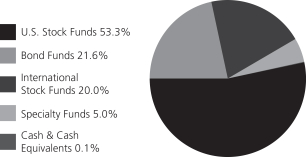

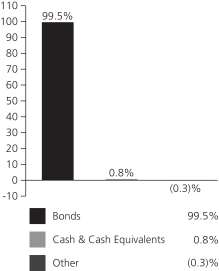

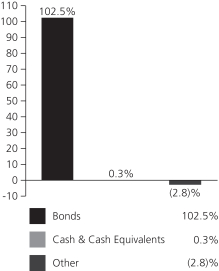

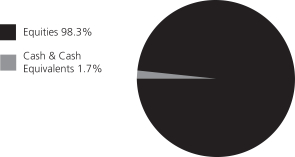

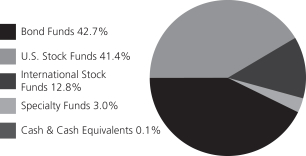

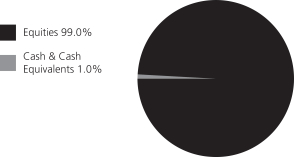

Portfolio structure

| | | | |

| Top ten holdings | | | | |

| Store Capital Corp., REIT | | | 1.6% | |

| Paylocity Holding Corp. | | | 1.4% | |

| Tech Data Corp. | | | 1.4% | |

| Medical Properties Trust, Inc., REIT | | | 1.4% | |

| LogMeIn, Inc. | | | 1.4% | |

| Stoneridge, Inc. | | | 1.4% | |

| TriMas Corp. | | | 1.4% | |

| Cathay General Bancorp, Inc. | | | 1.4% | |

| Five9, Inc. | | | 1.3% | |

| Rapid7, Inc. | | | 1.3% | |

| | | | |

| Equity sectors (k) | | | | |

| Financial Services | | | 26.2% | |

| Technology | | | 16.5% | |

| Health Care | | | 15.0% | |

| Industrial Goods & Services | | | 11.2% | |

| Utilities & Communications | | | 5.7% | |

| Basic Materials | | | 5.5% | |

| Leisure | | | 3.9% | |

| Energy | | | 3.8% | |

| Autos & Housing | | | 3.3% | |

| Retailing | | | 2.5% | |

| Special Products & Services | | | 2.4% | |

| Consumer Staples | | | 2.0% | |

| Transportation | | | 0.8% | |

| (k) | The sectors set forth above and the associated portfolio composition are based on MFS’ own custom sector classification methodology. |

Cash & Cash Equivalents includes any cash, investments in money market funds, short-term securities, and other assets less liabilities. Please see the Statement of Assets and Liabilities for additional information related to the fund’s cash position and other assets and liabilities.

Percentages are based on net assets as of December 31, 2018.

The portfolio is actively managed and current holdings may be different.

2

MFS Blended Research Small Cap Equity Portfolio

MANAGEMENT REVIEW

Summary of Results

For the twelve months ended December 31, 2018, Initial Class shares of the MFS Blended Research Small Cap Equity Portfolio (“fund”) provided a total return of –5.11%, while Service Class shares of the fund provided a total return of –5.35%. These compare with a return of –11.01% over the same period for the fund’s benchmark, the Russell 2000® Index.

Market Environment

During the reporting period, the US Federal Reserve raised interest rates by 100 basis points, bringing the total number of rate hikes to nine since the central bank began to normalize monetary policy in late 2015. Economic growth rates in the US, Eurozone and Japan remained above trend, despite a slowing in global growth, particularly toward the end of the period. Inflation remained contained, particularly outside the US. Late in the period, the European Central Bank halted its asset purchase program but issued forward guidance that it does not expect to raise interest rates at least until after the summer of 2019. The Bank of England (once) and the Bank of Canada (three times) each raised rates during the period. The European political backdrop became a bit more volatile, late in the period, spurred by concerns over cohesion in the eurozone after the election of an anti-establishment, Eurosceptic coalition government in Italy and widespread protests over stagnant wage growth in France.

Bond yields rose in the US during most of the period, but remained low by historical standards and slipped from their highs, late in the period, as market volatility increased. Yields in many developed markets fell. Outside of emerging markets, where spreads and currencies came under pressure, credit spreads remained quite tight until the end of the period, when thinner liquidity, lower oil prices and concerns over high degrees of corporate leverage emerged. Growing concern over increasing global trade friction appeared to have weighed on business sentiment during the period’s second half, especially outside the US. Tighter financial conditions from rising US rates and a strong dollar, combined with trade uncertainty, helped expose structural weaknesses in several emerging markets in the second half of the period.

Volatility increased, at the end of the period, amid signs of slowing global economic growth and increasing trade tensions, which prompted a market setback shortly after US markets set record highs in September. It was the second such equity market decline during the reporting period. The correction came despite a third consecutive quarter of strong growth in US earnings per share. Strong earnings growth, combined with the market decline, brought US equity valuations down from elevated levels, earlier in the period, to multiples more in line with long-term averages. While the US economy held up better than most, global economic growth became less synchronized during the period, with Europe and China showing signs of a slowdown and some emerging markets coming under stress.

Contributors to Performance

Security selection and, to a lesser extent, an overweight position in thetechnology sector contributed to performance relative to the Russell 2000® Index. Within this sector, the fund’s overweight positions in security risk intelligence solutions provider Rapid7,cloud-based software solutions providers Five9 and Paylocity and digital intelligence software manufacturer New Relic (h) aided relative returns. Shares of Rapid7 appreciated, outpacing the benchmark, as the company’s transition to a subscription-based platform continued to accelerate and strong results from its vulnerability management and application security divisions led to solid earnings results throughout the year.

Stock selection in both thehealth care andenergy sectors further strengthened relative results. Within thehealth care sector, overweight positions in medical device and component manufacturer Integer and medical technology company CONMED benefited relative performance. Shares of CONMED rose as better-than-expected growth helped drive solid earnings results and appeared to have lifted investor sentiment. Although security selection in theenergy sector supported relative returns, there were no individual stocks within this sector that were among the fund’s top relative contributors during the reporting period.

Elsewhere, the fund’s holdings of power generation company NRG Energy (b) and real estate investment trusts Medical Properties Trust (b) and Store Capital (b), as well as an overweight position in biofuel and renewable chemicals producer Renewable Energy Group, helped relative performance

Detractors from Performance

Security selection in theretailing,consumer staples andindustrials goods & services sectors weighed on relative performance during the reporting period. Within theretailing sector, holding shares of arts and crafts specialty retailer Michaels Companies (b)(h) hurt relative returns as high freight costs, lower-than-expected gross margins and weak same-store sales weighed on its earnings results and appeared to have soured investor sentiment. Although stock selection in theconsumer staples sector held back relative returns, there were no individual stocks within this sector that were among the fund’s top relative detractors during the reporting period. Within theindustrial goods & services sector, an overweight position in industrial components manufacturer SPX Flow and holding shares of electrical products manufacturer Wesco International (b) dampened relative performance. The stock price of SPX Flow, depreciated, notably late in the period, as unfavorable pricing trends, weak order growth and company-specific execution issues negatively impacted corporate earnings.

3

MFS Blended Research Small Cap Equity Portfolio

Management Review – continued

Stocks in other sectors that further hindered relative results included the fund’s holdings of industrial and specialty chemicals distributor Univar (b), banking services provider Bank OZK (b), high-performance laser manufacturer IPG Photonics (b) and omni-channel technology solutions provider NCR (b). The timing of the fund’s ownership in shares of hospital operator Tenet Healthcare, and overweight positions in equipment rental supplier Herc Holdings and specialty pharmaceuticals company Mallinckrodt (United Kingdom) also weakened relative returns.

Respectfully,

Portfolio Manager(s)

Jim Fallon, Matt Krummell, Jonathan Sage, and Jed Stocks

| (b) | Security is not a benchmark constituent. |

| (h) | Security was not held in the portfolio at period end. |

The views expressed in this report are those of the portfolio manager(s) only through the end of the period of the report as stated on the cover and do not necessarily reflect the views of MFS or any other person in the MFS organization. These views are subject to change at any time based on market or other conditions, and MFS disclaims any responsibility to update such views. These views may not be relied upon as investment advice or an indication of trading intent on behalf of any MFS portfolio. References to specific securities are not recommendations of such securities, and may not be representative of any MFS portfolio’s current or future investments.

4

MFS Blended Research Small Cap Equity Portfolio

PERFORMANCE SUMMARY THROUGH 12/31/18

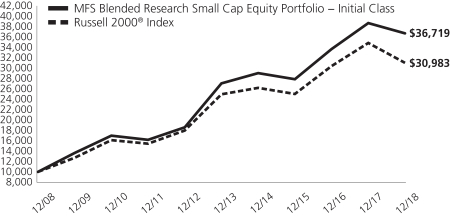

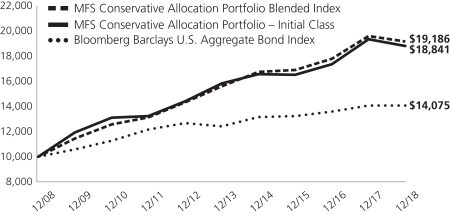

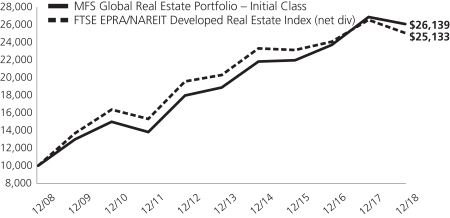

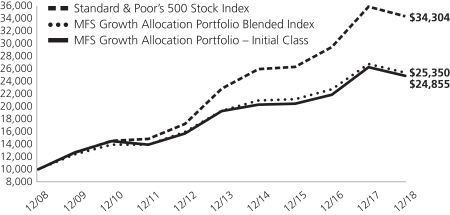

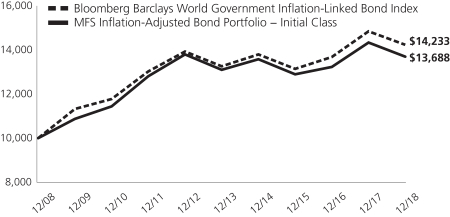

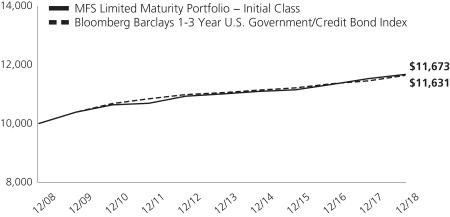

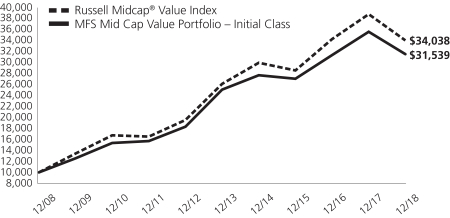

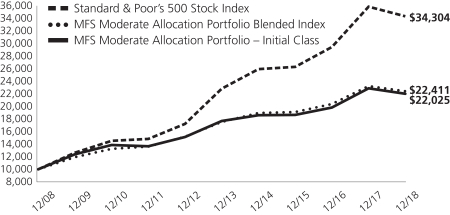

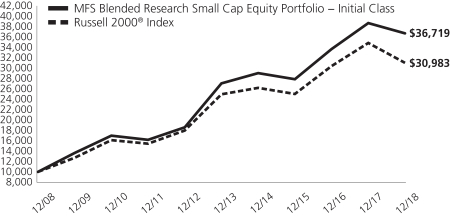

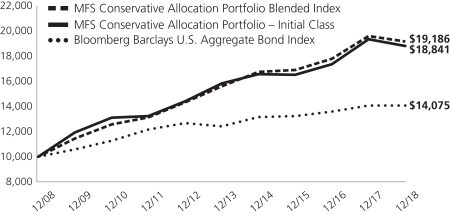

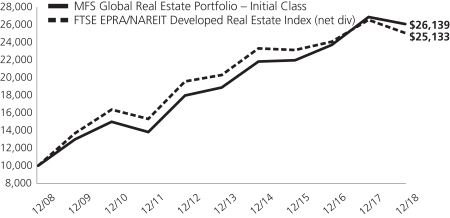

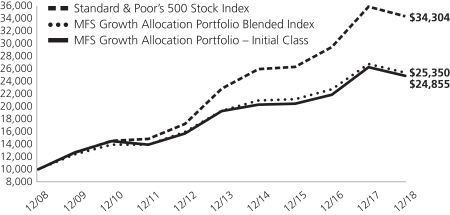

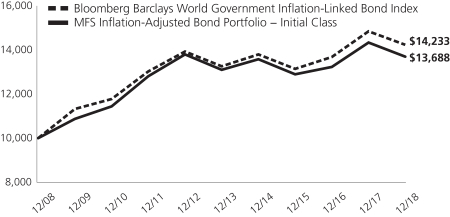

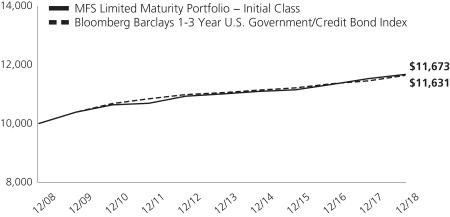

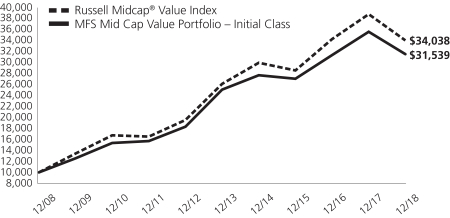

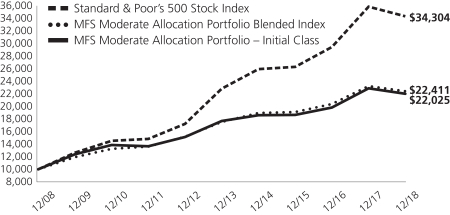

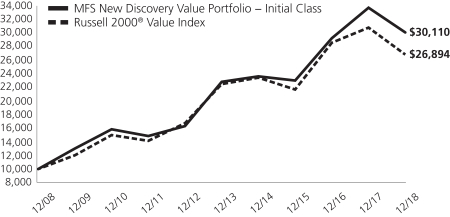

The following chart illustrates the historical performance of the fund in comparison to its benchmark(s). Benchmarks are unmanaged and may not be invested in directly. Benchmark returns do not reflect any fees or expenses. The performance of other share classes will be greater than or less than that of the class depicted below. (See Notes to Performance Summary.)

Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value fluctuate so your units, when sold, may be worth more or less than the original cost; current performance may be lower or higher than quoted. The performance shown does not reflect the deduction of taxes, if any, that a contract holder would pay on fund distributions or the redemption of contract units. The returns for the fund shown also do not reflect the deduction of expenses associated with variable products, such as mortality and expense risk charges, separate account charges, and sales charges imposed by the insurance company separate accounts. Such expenses would reduce the overall returns shown.

Growth of a Hypothetical $10,000 Investment

Total Returns through 12/31/18

Average annual total returns

| | | | | | | | | | | | |

| | | Share Class | | Class Inception Date | | 1-yr | | 5-yr | | 10-yr | | |

| | | Initial Class | | 7/17/00 | | (5.11)% | | 6.29% | | 13.89% | | |

| | | Service Class | | 5/01/06 | | (5.35)% | | 6.02% | | 13.60% | | |

| | | | |

| Comparative benchmark(s) | | | | | | | | |

| | | Russell 2000® Index (f) | | (11.01)% | | 4.41% | | 11.97% | | |

| (f) | Source: FactSet Research Systems Inc. |

Benchmark Definition(s)

Russell 2000® Index – constructed to provide a comprehensive barometer for securities in the small-cap segment of the U.S. equity universe. The index includes 2,000 of the smallest U.S. companies based on total market capitalization, representing approximately 10% of the investable U.S. equity market. The Russell 2000® Index is a trademark/service mark of the Frank Russell Company. Russell® is a trademark of the Frank Russell Company.

It is not possible to invest directly in an index.

Notes to Performance Summary

Average annual total return represents the average annual change in value for each share class for the periods presented.

Performance results reflect any applicable expense subsidies and waivers in effect during the periods shown. Without such subsidies and waivers the fund’s performance results would be less favorable. Please see the prospectus and financial statements for complete details. All results are historical and assume the reinvestment of any dividends and capital gains distributions.

Performance prior to close of business December 7, 2012, reflects time periods when another adviser or subadviser was responsible for selecting investments for the fund under a different investment objective and different investment strategies.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the financial highlights.

From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower.

5

MFS Blended Research Small Cap Equity Portfolio

EXPENSE TABLE

Fund Expenses Borne by the Contract Holders during the Period,

July 1, 2018 through December 31, 2018

As a contract holder of the fund, you incur ongoing costs, including management fees; distribution and/or service(12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2018 through December 31, 2018.

Actual Expenses

The first line for each share class in the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line for each share class in the following table provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight the fund’s ongoing costs only and do not take into account the fees and expenses imposed under the variable contracts through which your investment in the fund is made. Therefore, the second line for each share class in the table is useful in comparing ongoing costs associated with an investment in vehicles (such as the fund) which fund benefits under variable annuity and variable life insurance contracts and to qualified pension and retirement plans only, and will not help you determine the relative total costs of investing in the fund through variable annuity and variable life insurance contracts. If the fees and expenses imposed under the variable contracts were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| Share Class | | | | Annualized

Expense Ratio | | | Beginning

Account Value

7/01/18 | | | Ending Account Value

12/31/18 | | | Expenses Paid

During Period (p)

7/01/18-12/31/18 | |

| Initial Class | | Actual | | | 0.54% | | | | $1,000.00 | | | | $873.69 | | | | $2.55 | |

| | Hypothetical (h) | | | 0.54% | | | | $1,000.00 | | | | $1,022.48 | | | | $2.75 | |

| Service Class | | Actual | | | 0.79% | | | | $1,000.00 | | | | $872.64 | | | | $3.73 | |

| | Hypothetical (h) | | | 0.79% | | | | $1,000.00 | | | | $1,021.22 | | | | $4.02 | |

| (h) | 5% class return per year before expenses. |

| (p) | “Expenses Paid During Period” are equal to each class’s annualized expense ratio, as shown above, multiplied by the average account value over the period, multiplied by 184/365 (to reflect theone-half year period). |

6

MFS Blended Research Small Cap Equity Portfolio

PORTFOLIO OF INVESTMENTS – 12/31/18

The Portfolio of Investments is a complete list of all securities owned by your fund. It is categorized by broad-based asset classes.

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| COMMON STOCKS – 98.8% | | | | | | | | |

| Aerospace – 1.4% | | | | | |

| American Outdoor Brands Corp. (a) | | | 42,088 | | | $ | 541,252 | |

| CACI International, Inc., “A” (a) | | | 4,581 | | | | 659,801 | |

| | | | | | | | |

| | | | | | $ | 1,201,053 | |

| | | | | | | | |

| Apparel Manufacturers – 0.6% | | | | | |

| Skechers USA, Inc., “A” (a) | | | 21,587 | | | $ | 494,126 | |

| | | | | | | | |

| Automotive – 1.4% | | | | | |

| Stoneridge, Inc. (a) | | | 47,873 | | | $ | 1,180,070 | |

| | | | | | | | |

| Biotechnology – 4.5% | | | | | |

| Acorda Therapeutics, Inc. (a) | | | 32,742 | | | $ | 510,120 | |

| AMAG Pharmaceuticals, Inc. (a) | | | 35,975 | | | | 546,460 | |

| Bio-Techne Corp. | | | 7,862 | | | | 1,137,789 | |

| Bruker BioSciences Corp. | | | 6,221 | | | | 185,199 | |

| Genomic Health, Inc. (a) | | | 3,087 | | | | 198,834 | |

| Macrogenics, Inc. (a) | | | 33,716 | | | | 428,193 | |

| Pieris Pharmaceuticals, Inc. (a) | | | 24,814 | | | | 66,005 | |

| Vanda Pharmaceuticals, Inc. (a) | | | 20,627 | | | | 538,984 | |

| Varex Imaging Corp. (a) | | | 9,463 | | | | 224,084 | |

| | | | | | | | |

| | | | | | $ | 3,835,668 | |

| | | | | | | | |

| Broadcasting – 0.1% | | | | | |

| MDC Partners, Inc. (a) | | | 21,815 | | | $ | 56,937 | |

| | | | | | | | |

| Brokerage & Asset Managers – 0.1% | | | | | |

| LPL Financial Holdings, Inc. | | | 1,533 | | | $ | 93,636 | |

| | | | | | | | |

| Business Services – 2.5% | | | | | |

| Forrester Research, Inc. | | | 23,590 | | | $ | 1,054,473 | |

| Grand Canyon Education, Inc. (a) | | | 10,845 | | | | 1,042,638 | |

| | | | | | | | |

| | | | | | $ | 2,097,111 | |

| | | | | | | | |

| Chemicals – 1.1% | | | | | |

| Ingevity Corp. (a) | | | 11,019 | | | $ | 922,180 | |

| | | | | | | | |

| Computer Software – 3.6% | | | | | |

| Cornerstone OnDemand, Inc. (a) | | | 19,982 | | | $ | 1,007,692 | |

| Eventbrite, Inc. (a)(l) | | | 6,748 | | | | 187,662 | |

| Paylocity Holding Corp. (a) | | | 20,045 | | | | 1,206,910 | |

| RingCentral, Inc. (a) | | | 3,860 | | | | 318,218 | |

| SecureWorks Corp. (a) | | | 20,244 | | | | 341,921 | |

| | | | | | | | |

| | | | | | $ | 3,062,403 | |

| | | | | | | | |

| Computer Software – Systems – 9.1% | | | | | |

| EPAM Systems, Inc. (a) | | | 9,311 | | | $ | 1,080,169 | |

| Five9, Inc. (a) | | | 26,341 | | | | 1,151,628 | |

| ForeScout Tech, Inc. (a) | | | 8,920 | | | | 231,831 | |

| Insight Enterprises, Inc. (a) | | | 4,177 | | | | 170,213 | |

| NCR Corp. (a) | | | 41,017 | | | | 946,672 | |

| Presidio, Inc. | | | 67,119 | | | | 875,903 | |

| Rapid7, Inc. (a) | | | 36,718 | | | | 1,144,133 | |

| Tech Data Corp. (a) | | | 14,636 | | | | 1,197,371 | |

| Verint Systems, Inc. (a) | | | 12,173 | | | | 515,040 | |

| Wageworks, Inc. (a) | | | 17,536 | | | | 476,278 | |

| | | | | | | | |

| | | | | | $ | 7,789,238 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| COMMON STOCKS – continued | | | | | | | | |

| Construction – 1.9% | | | | | |

| Armstrong World Industries, Inc. | | | 17,943 | | | $ | 1,044,462 | |

| Eagle Materials, Inc. | | | 6,454 | | | | 393,888 | |

| Foundation Building Materials, Inc. (a) | | | 15,107 | | | | 125,539 | |

| GMS, Inc. (a) | | | 4,578 | | | | 68,029 | |

| | | | | | | | |

| | | | | | $ | 1,631,918 | |

| | | | | | | | |

| Consumer Products – 0.6% | | | | | |

| e.l.f. Beauty, Inc. (a) | | | 15,060 | | | $ | 130,420 | |

| Herbalife Ltd. (a) | | | 5,797 | | | | 341,733 | |

| | | | | | | | |

| | | | | | $ | 472,153 | |

| | | | | | | | |

| Electrical Equipment – 2.7% | | | | | |

| Atkore International Group, Inc. (a) | | | 3,307 | | | $ | 65,611 | |

| TriMas Corp. (a) | | | 42,698 | | | | 1,165,228 | |

| WESCO International, Inc. (a) | | | 22,987 | | | | 1,103,376 | |

| | | | | | | | |

| | | | | | $ | 2,334,215 | |

| | | | | | | | |

| Electronics – 2.3% | | | | | |

| Amkor Technology, Inc. (a) | | | 38,259 | | | $ | 250,979 | |

| IPG Photonics Corp. (a) | | | 4,495 | | | | 509,239 | |

| Jabil Circuit, Inc. | | | 22,377 | | | | 554,726 | |

| OSI Systems, Inc. (a) | | | 4,114 | | | | 301,556 | |

| Sanmina Corp. (a) | | | 15,282 | | | | 367,685 | |

| | | | | | | | |

| | | | | | $ | 1,984,185 | |

| | | | | | | | |

| Energy – Independent – 1.9% | | | | | |

| Bonanza Creek Energy, Inc. (a) | | | 14,521 | | | $ | 300,149 | |

| Delek U.S. Holdings, Inc. | | | 11,582 | | | | 376,531 | |

| PBF Energy, Inc., “A” | | | 11,349 | | | | 370,772 | |

| W&T Offshore, Inc. (a) | | | 29,888 | | | | 123,139 | |

| Warrior Met Coal, Inc. | | | 20,196 | | | | 486,925 | |

| | | | | | | | |

| | | | | | $ | 1,657,516 | |

| | | | | | | | |

| Engineering – Construction – 1.9% | | | | | |

| KBR, Inc. | | | 74,901 | | | $ | 1,136,997 | |

| Quanta Services, Inc. | | | 15,331 | | | | 461,463 | |

| | | | | | | | |

| | | | | | $ | 1,598,460 | |

| | | | | | | | |

| Entertainment – 0.9% | | | | | |

| AMC Entertainment Holdings, Inc., “A” | | | 14,724 | | | $ | 180,811 | |

| Six Flags Entertainment Corp. | | | 10,913 | | | | 607,090 | |

| | | | | | | | |

| | | | | | $ | 787,901 | |

| | | | | | | | |

| Food & Beverages – 1.5% | | | | | |

| Dean Foods Co. | | | 23,901 | | | $ | 91,063 | |

| Hostess Brands, Inc. (a) | | | 21,385 | | | | 233,952 | |

| Pilgrim’s Pride Corp. (a) | | | 30,364 | | | | 470,945 | |

| SpartanNash Co. | | | 27,122 | | | | 465,956 | |

| | | | | | | | |

| | | | | | $ | 1,261,916 | |

| | | | | | | | |

| Forest & Paper Products – 2.3% | | | | | |

| Boise Cascade Corp. | | | 12,743 | | | $ | 303,920 | |

| Trex Co., Inc. (a) | | | 15,320 | | | | 909,395 | |

| Verso Corp., “A” (a) | | | 34,664 | | | | 776,474 | |

| | | | | | | | |

| | | | | | $ | 1,989,789 | |

| | | | | | | | |

7

MFS Blended Research Small Cap Equity Portfolio

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| COMMON STOCKS – continued | |

| Health Maintenance Organizations – 1.0% | | | | | |

| Molina Healthcare, Inc. (a) | | | 7,220 | | | $ | 839,108 | |

| | | | | | | | |

| Insurance – 3.9% | | | | | |

| American Equity Investment Life Holding Co. | | | 30,313 | | | $ | 846,945 | |

| Essent Group Ltd. (a) | | | 17,311 | | | | 591,690 | |

| MGIC Investment Corp. (a) | | | 59,703 | | | | 624,494 | |

| Radian Group, Inc. | | | 37,386 | | | | 611,635 | |

| Universal Insurance Holdings, Inc. | | | 17,786 | | | | 674,445 | |

| | | | | | | | |

| | | | | | $ | 3,349,209 | |

| | | | | | | | |

| Internet – 1.5% | | | | | |

| Blucora, Inc. (a) | | | 2,822 | | | $ | 75,178 | |

| LogMeIn, Inc. | | | 14,538 | | | | 1,185,865 | |

| | | | | | | | |

| | | | | | $ | 1,261,043 | |

| | | | | | | | |

| Leisure & Toys – 1.0% | | | | | |

| Brunswick Corp. | | | 14,474 | | | $ | 672,317 | |

| Funko, Inc., “A” (a) | | | 12,090 | | | | 158,984 | |

| | | | | | | | |

| | | | | | $ | 831,301 | |

| | | | | | | | |

| Machinery & Tools – 4.9% | | | | | |

| ACCO Brands Corp. | | | 26,682 | | | $ | 180,904 | |

| AGCO Corp. | | | 4,070 | | | | 226,577 | |

| Allison Transmission Holdings, Inc. | | | 7,451 | | | | 327,173 | |

| Herman Miller, Inc. | | | 4,903 | | | | 148,316 | |

| ITT, Inc. | | | 1,876 | | | | 90,555 | |

| Knoll, Inc. | | | 18,073 | | | | 297,843 | |

| Park-Ohio Holdings Corp. | | | 14,070 | | | | 431,808 | |

| Regal Beloit Corp. | | | 13,727 | | | | 961,576 | |

| SPX FLOW, Inc. (a) | | | 29,238 | | | | 889,420 | |

| Steelcase, Inc., “A” | | | 10,668 | | | | 158,206 | |

| Titan Machinery, Inc. (a) | | | 34,012 | | | | 447,258 | |

| | | | | | | | |

| | | | | | $ | 4,159,636 | |

| | | | | | | | |

| Medical & Health Technology & Services – 0.9% | | | | | |

| Premier, Inc., “A” (a) | | | 7,041 | | | $ | 262,981 | |

| Tenet Healthcare Corp. (a) | | | 31,743 | | | | 544,075 | |

| | | | | | | | |

| | | | | | $ | 807,056 | |

| | | | | | | | |

| Medical Equipment – 4.9% | | | | | |

| AngioDynamics, Inc. (a) | | | 27,400 | | | $ | 551,562 | |

| Avanos Medical, Inc. (a) | | | 16,756 | | | | 750,501 | |

| CONMED Corp. | | | 12,123 | | | | 778,297 | |

| CUTERA, Inc. (a) | | | 2,539 | | | | 43,214 | |

| Integer Holdings Corp. (a) | | | 11,071 | | | | 844,275 | |

| IntriCon Corp. (a) | | | 15,301 | | | | 403,640 | |

| Lantheus Holdings, Inc. (a) | | | 25,338 | | | | 396,540 | |

| LivaNova PLC (a) | | | 3,005 | | | | 274,867 | |

| NuVasive, Inc. (a) | | | 3,770 | | | | 186,841 | |

| | | | | | | | |

| | | | | | $ | 4,229,737 | |

| | | | | | | | |

| Metals & Mining – 0.4% | | | | | |

| Olympic Steel, Inc. | | | 11,418 | | | $ | 162,935 | |

| Ryerson Holding Corp. (a) | | | 19,087 | | | | 121,012 | |

| Schnitzer Steel Industries, Inc., “A” | | | 2,459 | | | | 52,991 | |

| | | | | | | | |

| | | | | | $ | 336,938 | |

| | | | | | | | |

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| COMMON STOCKS – continued | |

| Natural Gas – Distribution – 0.5% | | | | | |

| MDU Resources Group, Inc. | | | 16,371 | | | $ | 390,285 | |

| South Jersey Industries, Inc. | | | 1,422 | | | | 39,531 | |

| | | | | | | | |

| | | | | | $ | 429,816 | |

| | | | | | | | |

| Oil Services – 1.8% | | | | | |

| Liberty Oilfield Services, Inc. (l) | | | 34,611 | | | $ | 448,212 | |

| MRC Global, Inc. (a) | | | 21,965 | | | | 268,632 | |

| ProPetro Holding Corp. (a) | | | 70,250 | | | | 865,480 | |

| | | | | | | | |

| | | | | | $ | 1,582,324 | |

| | | | | | | | |

| Other Banks & Diversified Financials – 12.6% | | | | | |

| Assured Guaranty Ltd. | | | 11,263 | | | $ | 431,148 | |

| BancFirst Corp. | | | 5,517 | | | | 275,298 | |

| Bank of N.T. Butterfield & Son Ltd. | | | 14,237 | | | | 446,330 | |

| Bank OZK | | | 35,470 | | | | 809,780 | |

| CAI International, Inc. (a) | | | 19,643 | | | | 456,307 | |

| Cathay General Bancorp, Inc. | | | 34,626 | | | | 1,161,010 | |

| East West Bancorp, Inc. | | | 15,514 | | | | 675,325 | |

| Enova International, Inc. (a) | | | 23,806 | | | | 463,265 | |

| First Hawaiian, Inc. | | | 47,457 | | | | 1,068,257 | |

| First Interstate BancSystem, Inc. | | | 25,844 | | | | 944,857 | |

| Hanmi Financial Corp. | | | 8,290 | | | | 163,313 | |

| Herc Holdings, Inc. (a) | | | 16,863 | | | | 438,269 | |

| Legacytextas Financial Group, Inc. | | | 6,580 | | | | 211,152 | |

| OFG Bancorp | | | 7,233 | | | | 119,055 | |

| On Deck Capital, Inc. (a) | | | 8,650 | | | | 51,035 | |

| Popular, Inc. | | | 11,973 | | | | 565,365 | |

| Prosperity Bancshares, Inc. | | | 4,904 | | | | 305,519 | |

| Regional Management Corp. (a) | | | 22,668 | | | | 545,165 | |

| Triton International Ltd. of Bermuda | | | 18,486 | | | | 574,360 | |

| Wintrust Financial Corp. | | | 16,493 | | | | 1,096,620 | |

| | | | | | | | |

| | | | | | $ | 10,801,430 | |

| | | | | | | | |

| Pharmaceuticals – 3.6% | | | | | |

| Assertio Therapeutics, Inc. (a) | | | 93,456 | | | $ | 337,376 | |

| Catalent, Inc. (a) | | | 5,768 | | | | 179,846 | |

| Endo International PLC (a) | | | 52,927 | | | | 386,367 | |

| Horizon Pharma PLC (a) | | | 41,961 | | | | 819,918 | |

| Mallinckrodt PLC (a) | | | 25,512 | | | | 403,090 | |

| Phibro Animal Health Corp., “A” | | | 14,779 | | | | 475,293 | |

| United Therapeutics Corp. (a) | | | 4,605 | | | | 501,484 | |

| | | | | | | | |

| | | | | | $ | 3,103,374 | |

| | | | | | | | |

| Pollution Control – 0.3% | | | | | |

| Advanced Disposal Services, Inc. (a) | | | 11,705 | | | $ | 280,218 | |

| | | | | | | | |

| Printing & Publishing – 0.1% | | | | | |

| Gannett Co., Inc. | | | 6,320 | | | $ | 53,910 | |

| | | | | | | | |

| Real Estate – 9.5% | | | | | |

| Ashford Hospitality Trust, REIT | | | 76,046 | | | $ | 304,184 | |

| Brixmor Property Group Inc., REIT | | | 54,449 | | | | 799,856 | |

| CoreCivic, Inc., REIT | | | 26,524 | | | | 472,923 | |

| EPR Properties, REIT | | | 16,063 | | | | 1,028,514 | |

| GEO Group, Inc., REIT | | | 26,996 | | | | 531,821 | |

| Life Storage, Inc., REIT | | | 11,155 | | | | 1,037,303 | |

| Medical Properties Trust, Inc., REIT | | | 74,222 | | | | 1,193,490 | |

8

MFS Blended Research Small Cap Equity Portfolio

Portfolio of Investments – continued

| | | | | | | | |

| | |

| Issuer | | Shares/Par | | | Value ($) | |

| COMMON STOCKS – continued | | | | | |

| Real Estate – continued | | | | | |

| Preferred Apartment Communities, Inc., “A”, REIT | | | 23,278 | | | $ | 327,289 | |

| RE/MAX Holdings, Inc., “A” | | | 20,219 | | | | 621,734 | |

| Store Capital Corp., REIT | | | 47,719 | | | | 1,350,925 | |

| Uniti Group, Inc., REIT | | | 24,336 | | | | 378,911 | |

| Xenia Hotels & Resorts Inc., REIT | | | 6,434 | | | | 110,665 | |

| | | | | | | | |

| | | | | | $ | 8,157,615 | |

| | | | | | | | |

| Restaurants – 1.9% | | | | | |

| BJ’s Restaurants, Inc. | | | 4,177 | | | $ | 211,231 | |

| Bloomin Brands, Inc. | | | 28,995 | | | | 518,721 | |

| Brinker International, Inc. | | | 12,047 | | | | 529,827 | |

| Carrols Restaurant Group, Inc. (a) | | | 38,831 | | | | 382,097 | |

| | | | | | | | |

| | | | | | $ | 1,641,876 | |

| | | | | | | | |

| Specialty Chemicals – 1.7% | | | | | |

| PolyOne Corp. | | | 4,731 | | | $ | 135,307 | |

| Renewable Energy Group, Inc. (a) | | | 23,299 | | | | 598,784 | |

| Univar, Inc. (a) | | | 38,671 | | | | 686,023 | |

| | | | | | | | |

| | | | | | $ | 1,420,114 | |

| | | | | | | | |

| Specialty Stores – 1.9% | | | | | |

| Express, Inc. (a) | | | 33,846 | | | $ | 172,953 | |

| Party City Holdco, Inc. (a) | | | 16,143 | | | | 161,107 | |

| Signet Jewelers Ltd. | | | 4,641 | | | | 147,445 | |

| Urban Outfitters, Inc. (a) | | | 28,271 | | | | 938,597 | |

| Zumiez, Inc. (a) | | | 11,540 | | | | 221,222 | |

| | | | | | | | |

| | | | | | $ | 1,641,324 | |

| | | | | | | | |

| Telecommunications – Wireless – 1.3% | | | | | |

| Intelsat S.A. (a) | | | 26,840 | | | $ | 574,108 | |

| Telephone and Data Systems, Inc. | | | 17,074 | | | | 555,588 | |

| | | | | | | | |

| | | | | | $ | 1,129,696 | |

| | | | | | | | |

| Telephone Services – 0.9% | | | | | |

| ATN International, Inc. | | | 587 | | | $ | 41,988 | |

| Shenandoah Telecommunications Co. | | | 15,823 | | | | 700,168 | |

| | | | | | | | |

| | | | | | $ | 742,156 | |

| | | | | | | | |

| Trucking – 0.8% | | | | | |

| ArcBest Corp. | | | 10,126 | | | $ | 346,917 | |

| Forward Air Corp. | | | 6,330 | | | | 347,200 | |

| | | | | | | | |

| | | | | | $ | 694,117 | |

| | | | | | | | |

| Utilities – Electric Power – 3.0% | | | | | |

| Clearway Energy, Inc. | | | 39,906 | | | $ | 675,209 | |

| NRG Energy, Inc. | | | 20,846 | | | | 825,502 | |

| Portland General Electric Co. | | | 21,113 | | | | 968,031 | |

| Spark Energy, Inc., “A” (l) | | | 18,554 | | | | 137,856 | |

| | | | | | | | |

| | | | | | $ | 2,606,598 | |

| | | | | | | | |

Total Common Stocks

(Identified Cost, $84,181,354) | | | | | | $ | 84,549,071 | |

| | | | | | | | |

| | | | | | | | | | | | | | |

| | | | |

| Issuer | | Strike

Price | | | First

Exercise | | | Shares/Par | | Value ($) | |

| WARRANTS – 0.0% | | | | |

| Other Banks & Diversified Financials – 0.0% | | | | |

| Emergent Capital, Inc. (1 share for 1 warrant) (a)(u) (Identified Cost, $0) | | $ | 10.75 | | | | 11/06/14 | | | 318 | | $ | 0 | |

| | | | | | | | | | | | | | |

| |

| INVESTMENT COMPANIES (h) – 1.2% | | | | |

| Money Market Funds – 1.2% | | | | |

| MFS Institutional Money Market Portfolio, 2.4% (v) (Identified Cost, $1,018,574) | | | 1,018,676 | | $ | 1,018,574 | |

| | | | | | | | | | | | | | |

|

| COLLATERAL FOR SECURITIES LOANED – 0.2% | |

| State Street Navigator Securities Lending Government Money Market Portfolio, 2.29% (j) (Identified Cost, $216,533) | | | 216,533 | | $ | 216,533 | |

| | | | | | | | | | | | | | |

| OTHER ASSETS, LESS LIABILITIES – (0.2)% | | | | | | | | | | (200,095 | ) |

| | | | | | | | | | | | | | |

| NET ASSETS – 100.0% | | | | | | | | | $ | 85,584,083 | |

| | | | | | | | | | | | | | |

| (a) | | Non-income producing security. |

| (h) | | An affiliated issuer, which may be considered one in which the fund owns 5% or more of the outstanding voting securities, or a company which is under common control. At period end, the aggregate values of the fund’s investments in affiliated issuers and in unaffiliated issuers were $1,018,574 and $84,765,604, respectively. |

| (j) | | The rate quoted is the annualizedseven-day yield of the fund at period end. |

| (l) | | A portion of this security is on loan. See Note 2 for additional information. |

| (u) | | The security was valued using significant unobservable inputs and is considered level 3 under the fair value hierarchy. For further information about the fund’s level 3 holdings, please see Note 2 in the Notes to Financial Statements. |

| (v) | | Affiliated issuer that is available only to investment companies managed by MFS. The rate quoted for the MFS Institutional Money Market Portfolio is the annualizedseven-day yield of the fund at period end. |

The following abbreviations are used in this report and are defined:

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

See Notes to Financial Statements

9

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | STATEMENT OF ASSETS AND LIABILITIES

This statement represents your fund’s balance sheet, which details the assets and liabilities comprising the total value of the fund.

| | | | |

At 12/31/18 | | | | |

| |

Assets | | | | |

Investments in unaffiliated issuers, at value, including $301,781 of securities on loan (identified cost, $84,397,887) | | | $84,765,604 | |

Investments in affiliated issuers, at value (identified cost, $1,018,574) | | | 1,018,574 | |

Cash | | | 9,527 | |

Receivables for | | | | |

Fund shares sold | | | 24,375 | |

Interest and dividends | | | 121,278 | |

Other assets | | | 988 | |

Total assets | | | $85,940,346 | |

| |

Liabilities | | | | |

Payables for | | | | |

Fund shares reacquired | | | $82,135 | |

Collateral for securities loaned, at value (c) | | | 216,533 | |

Payable to affiliates | | | | |

Investment adviser | | | 3,847 | |

Shareholder servicing costs | | | 68 | |

Distribution and/or service fees | | | 1,506 | |

Payable for independent Trustees’ compensation | | | 5 | |

Accrued expenses and other liabilities | | | 52,169 | |

Total liabilities | | | $356,263 | |

Net assets | | | $85,584,083 | |

| |

Net assets consist of | | | | |

Paid-in capital | | | $69,877,315 | |

Total distributable earnings (loss) | | | 15,706,768 | |

Net assets | | | $85,584,083 | |

Shares of beneficial interest outstanding | | | 7,759,409 | |

| | | | | | | | | | | | |

| | | |

| | | Net assets | | | Shares

outstanding | | | Net asset value

per share | |

Initial Class | | | $29,935,942 | | | | 2,661,812 | | | | $11.25 | |

Service Class | | | 55,648,141 | | | | 5,097,597 | | | | 10.92 | |

| (c) | Non-cash collateral is not included. |

See Notes to Financial Statements

10

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | STATEMENT OF OPERATIONS

This statement describes how much your fund earned in investment income and accrued in expenses. It also describes any gains and/or losses generated by fund operations.

| | | | |

Year ended 12/31/18 | | | | |

| |

Net investment income (loss) | | | | |

Income | | | | |

Dividends | | | $1,172,554 | |

Income on securities loaned | | | 26,304 | |

Other | | | 18,101 | |

Dividends from affiliated issuers | | | 18,056 | |

Foreign taxes withheld | | | (1,338 | ) |

Total investment income | | | $1,233,677 | |

Expenses | | | | |

Management fee | | | $407,533 | |

Distribution and/or service fees | | | 165,405 | |

Shareholder servicing costs | | | 8,798 | |

Administrative services fee | | | 24,865 | |

Independent Trustees’ compensation | | | 3,540 | |

Custodian fee | | | 5,640 | |

Shareholder communications | | | 23,096 | |

Audit and tax fees | | | 53,663 | |

Legal fees | | | 931 | |

Miscellaneous | | | 18,165 | |

Total expenses | | | $711,636 | |

Reduction of expenses by investment adviser | | | (9,699 | ) |

Net expenses | | | $701,937 | |

Net investment income (loss) | | | $531,740 | |

| |

Realized and unrealized gain (loss) | | | | |

Realized gain (loss) (identified cost basis) | | | | |

Unaffiliated issuers | | | $15,298,968 | |

Affiliated issuers | | | 511 | |

Net realized gain (loss) | | | $15,299,479 | |

Change in unrealized appreciation or depreciation | | | | |

Unaffiliated issuers | | | $(18,798,977 | ) |

Net realized and unrealized gain (loss) | | | $(3,499,498 | ) |

Change in net assets from operations | | | $(2,967,758 | ) |

See Notes to Financial Statements

11

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | STATEMENTS OF CHANGES IN NET ASSETS

These statements describe the increases and/or decreases in net assets resulting from operations, any distributions, and any shareholder transactions.

| | | | | | | | |

| | | Year ended | |

| | | 12/31/18 | | | 12/31/17 | |

Change in net assets | | | | | | | | |

| | |

From operations | | | | | | | | |

Net investment income (loss) | | | $531,740 | | | | $680,254 | |

Net realized gain (loss) | | | 15,299,479 | | | | 12,101,069 | |

Net unrealized gain (loss) | | | (18,798,977 | ) | | | 2,075,039 | |

Change in net assets from operations | | | $(2,967,758 | ) | | | $14,856,362 | |

Total distributions to shareholders (a) | | | $(12,885,061 | ) | | | $(12,174,151 | ) |

Change in net assets from fund share transactions | | | $(6,124,153 | ) | | | $1,710,788 | |

Total change in net assets | | | $(21,976,972 | ) | | | $4,392,999 | |

| | |

Net assets | | | | | | | | |

At beginning of period | | | 107,561,055 | | | | 103,168,056 | |

At end of period (b) | | | $85,584,083 | | | | $107,561,055 | |

| (a) | Distributions from net investment income and from net realized gain are no longer required to be separately disclosed. See Note 2. For the year ended December 31, 2017, distributions from net investment income and from net realized gain were $764,011 and $11,410,140, respectively. |

| (b) | Parenthetical disclosure of undistributed net investment income is no longer required. See Note 2. For the year ended December 31, 2017, end of period net assets included undistributed net investment income of $680,118. |

See Notes to Financial Statements

12

MFS Blended Research Small Cap Equity Portfolio

FINANCIAL STATEMENTS | FINANCIAL HIGHLIGHTS

The financial highlights table is intended to help you understand the fund’s financial performance for the past 5 years. Certain information reflects financial results for a single fund share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in the fund share class (assuming reinvestment of all distributions) held for the entire period.

| | | | | | | | | | | | | | | | | | | | |

| Initial Class | | Year ended | |

| | | | | |

| | | 12/31/18 | | | 12/31/17 | | | 12/31/16 | | | 12/31/15 | | | 12/31/14 | |

| | | | | |

Net asset value, beginning of period | | | $13.47 | | | | $13.23 | | | | $12.29 | | | | $16.04 | | | | $18.24 | |

| | | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.09 | | | | $0.11 | | | | $0.11 | (c) | | | $0.15 | | | | $0.10 | |

Net realized and unrealized gain (loss) | | | (0.40 | ) | | | 1.70 | | | | 2.35 | | | | (0.94 | ) | | | 1.16 | |

Total from investment operations | | | $(0.31 | ) | | | $1.81 | | | | $2.46 | | | | $(0.79 | ) | | | $1.26 | |

| | | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.13 | ) | | | $(0.12 | ) | | | $(0.16 | ) | | | $(0.10 | ) | | | $(0.18 | ) |

From net realized gain | | | (1.78 | ) | | | (1.45 | ) | | | (1.36 | ) | | | (2.86 | ) | | | (3.28 | ) |

Total distributions declared to shareholders | | | $(1.91 | ) | | | $(1.57 | ) | | | $(1.52 | ) | | | $(2.96 | ) | | | $(3.46 | ) |

Net asset value, end of period (x) | | | $11.25 | | | | $13.47 | | | | $13.23 | | | | $12.29 | | | | $16.04 | |

Total return (%) (k)(r)(s)(x) | | | (5.11 | ) | | | 14.97 | | | | 20.90 | (c) | | | (4.15 | ) | | | 7.29 | |

| | | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.54 | | | | 0.53 | | | | 0.42 | (c) | | | 0.54 | | | | 0.51 | |

Expenses after expense reductions (f) | | | 0.53 | | | | 0.52 | | | | 0.41 | (c) | | | 0.53 | | | | 0.50 | |

Net investment income (loss) | | | 0.69 | | | | 0.82 | | | | 0.92 | (c) | | | 1.03 | | | | 0.56 | |

Portfolio turnover | | | 72 | | | | 81 | | | | 72 | | | | 78 | | | | 67 | |

Net assets at end of period (000 omitted) | | | $29,936 | | | | $36,195 | | | | $28,715 | | �� | | $27,795 | | | | $31,323 | |

| |

| Service Class | | Year ended | |

| | | | | |

| | | 12/31/18 | | | 12/31/17 | | | 12/31/16 | | | 12/31/15 | | | 12/31/14 | |

| | | | | |

Net asset value, beginning of period | | | $13.12 | | | | $12.92 | | | | $12.03 | | | | $15.75 | | | | $17.96 | |

| | | | | |

| Income (loss) from investment operations | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (d) | | | $0.06 | | | | $0.07 | | | | $0.08 | (c) | | | $0.12 | | | | $0.05 | |

Net realized and unrealized gain (loss) | | | (0.39 | ) | | | 1.67 | | | | 2.29 | | | | (0.93 | ) | | | 1.15 | |

Total from investment operations | | | $(0.33 | ) | | | $1.74 | | | | $2.37 | | | | $(0.81 | ) | | | $1.20 | |

| | | | | |

| Less distributions declared to shareholders | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | $(0.09 | ) | | | $(0.09 | ) | | | $(0.12 | ) | | | $(0.05 | ) | | | $(0.13 | ) |

From net realized gain | | | (1.78 | ) | | | (1.45 | ) | | | (1.36 | ) | | | (2.86 | ) | | | (3.28 | ) |

Total distributions declared to shareholders | | | $(1.87 | ) | | | $(1.54 | ) | | | $(1.48 | ) | | | $(2.91 | ) | | | $(3.41 | ) |

Net asset value, end of period (x) | | | $10.92 | | | | $13.12 | | | | $12.92 | | | | $12.03 | | | | $15.75 | |

Total return (%) (k)(r)(s)(x) | | | (5.35 | ) | | | 14.70 | | | | 20.58 | (c) | | | (4.38 | ) | | | 7.04 | |

| | | | | |

Ratios (%) (to average net assets)

and Supplemental data: | | | | | | | | | | | | | | | | | | | | |

Expenses before expense reductions (f) | | | 0.79 | | | | 0.78 | | | | 0.67 | (c) | | | 0.79 | | | | 0.76 | |

Expenses after expense reductions (f) | | | 0.78 | | | | 0.77 | | | | 0.66 | (c) | | | 0.78 | | | | 0.75 | |

Net investment income (loss) | | | 0.43 | | | | 0.55 | | | | 0.66 | (c) | | | 0.79 | | | | 0.30 | |

Portfolio turnover | | | 72 | | | | 81 | | | | 72 | | | | 78 | | | | 67 | |

Net assets at end of period (000 omitted) | | | $55,648 | | | | $71,366 | | | | $74,453 | | | | $82,794 | | | | $104,221 | |

See Notes to Financial Statements

13

MFS Blended Research Small Cap Equity Portfolio

Financial Highlights – continued

| (c) | Amount reflects aone-time reimbursement of expenses by the custodian (or former custodian) without which net investment income and performance would be lower and expenses would be higher. |

| (d) | Per share data is based on average shares outstanding. |

| (f) | Ratios do not reflect reductions from fees paid indirectly, if applicable. |

| (k) | The total return does not reflect expenses that apply to separate accounts. Inclusion of these charges would reduce the total return figures for all periods shown. |

| (r) | Certain expenses have been reduced without which performance would have been lower. |

| (s) | From time to time the fund may receive proceeds from litigation settlements, without which performance would be lower. |

| (x) | The net asset values and total returns have been calculated on net assets which include adjustments made in accordance with U.S. generally accepted accounting principles required at period end for financial reporting purposes. |

See Notes to Financial Statements

14

MFS Blended Research Small Cap Equity Portfolio

NOTES TO FINANCIAL STATEMENTS

| (1) | | Business and Organization |

MFS Blended Research Small Cap Equity Portfolio (the fund) is a diversified series of MFS Variable Insurance Trust III (the trust). The trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended, as anopen-end management investment company. The shareholders of each series of the trust are separate accounts of insurance companies, which offer variable annuity and/or life insurance products, and qualified retirement and pension plans.

The fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

| (2) | | Significant Accounting Policies |

General– The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. In the preparation of these financial statements, management has evaluated subsequent events occurring after the date of the fund’s Statement of Assets and Liabilities through the date that the financial statements were issued. The fund will generally focus on securities of small size companies which may be more volatile than those of larger companies.

In August 2018, the FASB issued Accounting Standards Update2018-13, Fair Value Measurement (Topic 820) – Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement (“ASU2018-13”) which introduces new fair value disclosure requirements as well as eliminates and modifies certain existing fair value disclosure requirements. ASU2018-13 would be effective for fiscal years beginning after December 15, 2019, and interim periods within those fiscal years; however, management has elected to early adopt ASU2018-13 effective with the current reporting period. The impact of the fund’s adoption was limited to changes in the fund’s financial statement disclosures regarding fair value, primarily those disclosures related to transfers between levels of the fair value hierarchy.

In August 2018, the Securities and Exchange Commission (SEC) released its Final Rule on Disclosure Update and Simplification (the “Final Rule”) which is intended to simplify an issuer’s disclosure compliance efforts by removing redundant or outdated disclosure requirements without significantly altering the mix of information provided to investors. Effective with the current reporting period, the fund adopted the Final Rule with the impacts being that the fund is no longer required to present the components of distributable earnings on the Statement of Assets and Liabilities or the sources of distributions to shareholders and the amount of undistributed net investment income on the Statements of Changes in Net Assets. The fund will generally focus on securities of small size companies which may be more volatile than those of larger companies.

Balance Sheet Offsetting – The fund’s accounting policy with respect to balance sheet offsetting is that, absent an event of default by the counterparty or a termination of the agreement, the International Swaps and Derivatives Association (ISDA) Master Agreement, or similar agreement, does not result in an offset of reported amounts of financial assets and financial liabilities in the Statement of Assets and Liabilities across transactions between the fund and the applicable counterparty. The fund’s right to setoff may be restricted or prohibited by the bankruptcy or insolvency laws of the particular jurisdiction to which a specific master netting agreement counterparty is subject. Balance sheet offsetting disclosures, to the extent applicable to the fund, have been included in the fund’s Significant Accounting Policies note under the captions for each of the fund’sin-scope financial instruments and transactions.

Investment Valuations – Equity securities, including restricted equity securities, are generally valued at the last sale or official closing price on their primary market or exchange as provided by a third-party pricing service. Equity securities, for which there were no sales reported that day, are generally valued at the last quoted daily bid quotation on their primary market or exchange as provided by a third-party pricing service. Short-term instruments with a maturity at issuance of 60 days or less may be valued at amortized cost, which approximates market value.Open-end investment companies are generally valued at net asset value per share. Securities and other assets generally valued on the basis of information from a third-party pricing service may also be valued at a broker/dealer bid quotation. In determining values, third-party pricing services can utilize both transaction data and market information such as yield, quality, coupon rate, maturity, type of issue, trading characteristics, and other market data. The values of foreign securities and other assets and liabilities expressed in foreign currencies are converted to U.S. dollars using the mean of bid and asked prices for rates provided by a third-party pricing service.

The Board of Trustees has delegated primary responsibility for determining or causing to be determined the value of the fund’s investments (including any fair valuation) to the adviser pursuant to valuation policies and procedures approved by the Board. If the adviser determines that reliable market quotations are not readily available, investments are valued at fair value as determined in good faith by the adviser in accordance with such procedures under the oversight of the Board of Trustees. Under the fund’s valuation policies and procedures, market quotations are not considered to be readily available for most types of debt instruments

15

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

and floating rate loans and many types of derivatives. These investments are generally valued at fair value based on information from third-party pricing services. In addition, investments may be valued at fair value if the adviser determines that an investment’s value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded (such as foreign exchange or market) and prior to the determination of the fund’s net asset value, or after the halting of trading of a specific security where trading does not resume prior to the close of the exchange or market on which the security is principally traded. Events that occur on a frequent basis after foreign markets close (such as developments in foreign markets and significant movements in the U.S. markets) and prior to the determination of the fund’s net asset value may be deemed to have a material effect on the value of securities traded in foreign markets. Accordingly, the fund’s foreign equity securities may often be valued at fair value. The adviser generally relies on third-party pricing services or other information (such as the correlation with price movements of similar securities in the same or other markets; the type, cost and investment characteristics of the security; the business and financial condition of the issuer; and trading and other market data) to assist in determining whether to fair value and at what value to fair value an investment. The value of an investment for purposes of calculating the fund’s net asset value can differ depending on the source and method used to determine value. When fair valuation is used, the value of an investment used to determine the fund’s net asset value may differ from quoted or published prices for the same investment. There can be no assurance that the fund could obtain the fair value assigned to an investment if it were to sell the investment at the same time at which the fund determines its net asset value per share.

Various inputs are used in determining the value of the fund’s assets or liabilities. These inputs are categorized into three broad levels. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The fund’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. Level 1 includes unadjusted quoted prices in active markets for identical assets or liabilities. Level 2 includes other significant observable market-based inputs (including quoted prices for similar securities, interest rates, prepayment speed, and credit risk). Level 3 includes unobservable inputs, which may include the adviser’s own assumptions in determining the fair value of investments. The following is a summary of the levels used as of December 31, 2018 in valuing the fund’s assets or liabilities:

| | | | | | | | | | | | | | | | |

| Financial Instruments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Equity Securities: | | | | | | | | | | | | | | | | |

United States | | | $84,102,741 | | | | $— | | | | $0 | | | | $84,102,741 | |

Bermuda | | | 446,330 | | | | — | | | | — | | | | 446,330 | |

| Mutual Funds | | | 1,235,107 | | | | — | | | | — | | | | 1,235,107 | |

| Total | | | $85,784,178 | | | | $— | | | | $0 | | | | $85,784,178 | |

For further information regarding security characteristics, see the Portfolio of Investments.

The following is a reconciliation of level 3 assets for which significant unobservable inputs were used to determine fair value. The table presents the activity of level 3 securities held at the beginning and the end of the period.

| | | | |

| |

| | | Equity

Securities | |

| Balance as of 12/31/17 | | | $3 | |

Change in unrealized appreciation or depreciation | | | (3 | ) |

| Balance as of 12/31/18 | | | $0 | |

The net change in unrealized appreciation or depreciation from investments held as level 3 at December 31, 2018 is $(3). At December 31, 2018, the fund held one level 3 security.

Security Loans – Under its Securities Lending Agency Agreement with the fund, State Street Bank and Trust Company, as lending agent, loans the securities of the fund to certain qualified institutions (the “Borrowers”) approved by the fund. Security loans can be terminated at the discretion of either the lending agent or the fund and the related securities must be returned within the earlier of the standard trade settlement period for such securities or within three business days. The loans are collateralized by cash and/or U.S. Treasury and federal agency obligations in an amount typically at least equal to the market value of the securities loaned. On loans collateralized by cash, the cash collateral is invested in a money market fund. The market value of the loaned securities is determined at the close of business of the fund and any additional required collateral is delivered to the fund on the next business day. The lending agent provides the fund with indemnification against Borrower default. In the event of Borrower default, the lending agent will, for the benefit of the fund, either purchase securities identical to those loaned or, when such purchase is commercially impracticable, pay the fund the market value of the loaned securities. In return, the lending agent assumes the fund’s rights to the related collateral. If the collateral value is less than the cost to purchase identical securities, the lending agent is responsible for the shortfall, but only to the extent that such shortfall is not due to a decline in collateral value resulting from collateral reinvestment for which the fund bears the risk of loss. At period end, the fund had investment securities on loan, all of which were classified as equity

16

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

securities in the fund’s Portfolio of Investments, with a fair value of $301,781. The fair value of the fund’s investment securities on loan and a related liability of $216,533 for cash collateral received on securities loaned are both presented gross in the Statement of Assets and Liabilities. Additionally, these loans were collateralized by U.S. Treasury Obligations of $91,270 held by the lending agent. The collateral on securities loaned exceeded the value of securities on loan at period end. The liability for cash collateral for securities loaned is carried at fair value, which is categorized as level 2 within the fair value hierarchy. A portion of the income generated upon investment of the collateral is remitted to the Borrowers, and the remainder is allocated between the fund and the lending agent. On loans collateralized by U.S. Treasury and/or federal agency obligations, a fee is received from the Borrower, and is allocated between the fund and the lending agent. Income from securities lending is separately reported in the Statement of Operations. The dividend and interest income earned on the securities loaned is accounted for in the same manner as other dividend and interest income.

Indemnifications – Under the fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the fund. Additionally, in the normal course of business, the fund enters into agreements with service providers that may contain indemnification clauses. The fund’s maximum exposure under these agreements is unknown as this would involve future claims that may be made against the fund that have not yet occurred.

Investment Transactions and Income – Investment transactions are recorded on the trade date. Interest income is recorded on the accrual basis. Dividends received in cash are recorded on theex-dividend date. Certain dividends from foreign securities will be recorded when the fund is informed of the dividend if such information is obtained subsequent to theex-dividend date. Dividend payments received in additional securities are recorded on theex-dividend date in an amount equal to the value of the security on such date.

The fund may receive proceeds from litigation settlements. Any proceeds received from litigation involving portfolio holdings are reflected in the Statement of Operations in realized gain/loss if the security has been disposed of by the fund or in unrealized gain/loss if the security is still held by the fund. Any other proceeds from litigation not related to portfolio holdings are reflected as other income in the Statement of Operations.

Tax Matters and Distributions – The fund intends to qualify as a regulated investment company, as defined under Subchapter M of the Internal Revenue Code, and to distribute all of its taxable income, including realized capital gains. As a result, no provision for federal income tax is required. The fund’s federal tax returns, when filed, will remain subject to examination by the Internal Revenue Service for a three year period. Management has analyzed the fund’s tax positions taken on federal and state tax returns for all open tax years and does not believe that there are any uncertain tax positions that require recognition of a tax liability. Foreign taxes, if any, have been accrued by the fund in the accompanying financial statements in accordance with the applicable foreign tax law. Foreign income taxes may be withheld by certain countries in which the fund invests. Additionally, capital gains realized by the fund on securities issued in or by certain foreign countries may be subject to capital gains tax imposed by those countries.

Distributions to shareholders are recorded on theex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. Certain capital accounts in the financial statements are periodically adjusted for permanent differences in order to reflect their tax character. These adjustments have no impact on net assets or net asset value per share. Temporary differences which arise from recognizing certain items of income, expense, gain or loss in different periods for financial statement and tax purposes will reverse at some time in the future. Distributions in excess of net investment income or net realized gains are temporary overdistributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes.

Book/tax differences primarily relate to wash sale loss deferrals.

The tax character of distributions declared to shareholders for the last two fiscal years is as follows:

| | | | | | | | |

| | | Year ended

12/31/18 | | | Year ended

12/31/17 | |

| Ordinary income (including any short-term capital gains) | | | $2,614,042 | | | | $2,113,078 | |

| Long-term capital gains | | | 10,271,019 | | | | 10,061,073 | |

| Total distributions | | | $12,885,061 | | | | $12,174,151 | |

17

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

The federal tax cost and the tax basis components of distributable earnings were as follows:

| | | | |

| As of 12/31/18 | | | | |

| |

| Cost of investments | | | $86,079,186 | |

| Gross appreciation | | | 10,547,921 | |

| Gross depreciation | | | (10,842,929 | ) |

| Net unrealized appreciation (depreciation) | | | $(295,008 | ) |

| |

| Undistributed ordinary income | | | 4,405,639 | |

| Undistributed long-term capital gain | | | 11,591,790 | |

| Other temporary differences | | | 4,347 | |

Multiple Classes of Shares of Beneficial Interest – The fund offers multiple classes of shares, which differ in their respective distribution and/or service fees. The fund’s income, realized and unrealized gain (loss), and common expenses are allocated to shareholders based on the daily net assets of each class. Dividends are declared separately for each class. Differences in per share dividend rates are generally due to differences in separate class expenses. The fund’s distributions declared to shareholders as reported in the Statements of Changes in Net Assets are presented by class as follows:

| | | | | | | | | | | | | | | | |

| | | From net investment

income | | | From net realized

gain | |

| | | | |

| | | Year ended

12/31/18 | | | Year ended

12/31/17 | | | Year ended

12/31/18 | | | Year ended

12/31/17 | |

| Initial Class | | | $298,909 | | | | $312,130 | | | | $4,211,769 | | | | $3,720,235 | |

| Service Class | | | 382,104 | | | | 451,881 | | | | 7,992,279 | | | | 7,689,905 | |

| Total | | | $681,013 | | | | $764,011 | | | | $12,204,048 | | | | $11,410,140 | |

| (3) | | Transactions with Affiliates |

Investment Adviser – The fund has an investment advisory agreement with MFS to provide overall investment management and related administrative services and facilities to the fund. The management fee is computed daily and paid monthly at an annual rate of 0.40% of the fund’s average daily net assets.

MFS has agreed in writing to reduce its management fee by a specified amount if certain MFS mutual fund assets exceed thresholds agreed to by MFS and the fund’s Board of Trustees. For the year ended December 31, 2018, this management fee reduction amounted to $9,699, which is included in the reduction of total expenses in the Statement of Operations. The management fee incurred for the year ended December 31, 2018 was equivalent to an annual effective rate of 0.39% of the fund’s average daily net assets.

The investment adviser has agreed in writing to pay a portion of the fund’s total annual operating expenses, excluding interest, taxes, extraordinary expenses, brokerage and transaction costs, and investment-related expenses, such that total annual operating expenses do not exceed 0.60% of average daily net assets for the Initial Class shares and 0.85% of average daily net assets for the Service Class shares. This written agreement will continue until modified by the fund’s Board of Trustees, but such agreement will continue at least until April 30, 2020. For the year ended December 31, 2018, the fund’s actual operating expenses did not exceed the limit and therefore, the investment adviser did not pay any portion of the fund’s expenses related to this agreement.

Distributor – MFS Fund Distributors, Inc. (MFD), a wholly-owned subsidiary of MFS, is the distributor of shares of the fund. The Trustees have adopted a distribution plan for the Service Class shares pursuant to Rule12b-1 under the Investment Company Act of 1940.

The fund’s distribution plan provides that the fund will pay MFD distribution and/or service fees equal to 0.25% per annum of its average daily net assets attributable to Service Class shares as partial consideration for services performed and expenses incurred by MFD and financial intermediaries (including participating insurance companies that invest in the fund to fund variable annuity and variable life insurance contracts, sponsors of qualified retirement and pension plans that invest in the fund, and affiliates of these participating insurance companies and plan sponsors) in connection with the sale and distribution of the Service Class shares. MFD may subsequently pay all, or a portion, of the distribution and/or service fees to financial intermediaries.

Shareholder Servicing Agent – MFS Service Center, Inc. (MFSC), a wholly-owned subsidiary of MFS, receives a fee from the fund for its services as shareholder servicing agent. For the year ended December 31, 2018, the fee was $8,305, which equated to 0.0082% annually of the fund’s average daily net assets. MFSC also receives payment from the fund forout-of-pocket expenses paid by MFSC on behalf of the fund. For the year ended December 31, 2018, these costs amounted to $493.

Administrator – MFS provides certain financial, legal, shareholder communications, compliance, and other administrative services to the fund. Under an administrative services agreement, the fund reimburses MFS the costs incurred to provide these services. The

18

MFS Blended Research Small Cap Equity Portfolio

Notes to Financial Statements – continued

fund is charged an annual fixed amount of $17,500 plus a fee based on average daily net assets. The administrative services fee incurred for the year ended December 31, 2018 was equivalent to an annual effective rate of 0.0244% of the fund’s average daily net assets.

Trustees’ and Officers’ Compensation – The fund pays compensation to independent Trustees in the form of a retainer, attendance fees, and additional compensation to Board and Committee chairpersons. The fund does not pay compensation directly to Trustees or officers of the fund who are also officers of the investment adviser, all of whom receive remuneration for their services to the fund from MFS. Certain officers and Trustees of the fund are officers or directors of MFS, MFD, and MFSC.

Other – This fund and certain other funds managed by MFS (the funds) have entered into a service agreement (the ISO Agreement) which provides for payment of fees solely by the funds to Tarantino LLC in return for the provision of services of an Independent Senior Officer (ISO) for the funds. Frank L. Tarantino serves as the ISO and is an officer of the funds and the sole member of Tarantino LLC. The funds can terminate the ISO Agreement with Tarantino LLC at any time under the terms of the ISO Agreement. For the year ended December 31, 2018, the fee paid by the fund under this agreement was $173 and is included in “Miscellaneous” expense in the Statement of Operations. MFS has agreed to bear all expenses associated with office space, other administrative support, and supplies provided to the ISO.

The fund invests in the MFS Institutional Money Market Portfolio which is managed by MFS and seeks current income consistent with preservation of capital and liquidity. This money market fund does not pay a management fee to MFS.

Effective on or about January 3, 2018, the adviser has voluntarily undertaken to reimburse the fund from its own resources on a quarterly basis for the cost of investment research embedded in the cost of the fund’s securities trades. This agreement may be rescinded at any time. For the period on or about January 3, 2018 to December 31, 2018, this reimbursement amounted to $18,071, which is included in “Other” income in the Statement of Operations.

For the year ended December 31, 2018, purchases and sales of investments, other than short-term obligations, aggregated $71,869,579 and $89,932,669, respectively.

| (5) | | Shares of Beneficial Interest |