EXHIBIT 2.3

Fl No. 24.462 BRESI

Serapis No. 2007-0223

TIM CELULAR PROJECT

(Loan from Own Resources)

Guarantee and Indemnity Agreement

between

European Investment Bank

and

TIM Participações S.A.

Luxembourg, 3rd June 2008

EUROPEAN INVESTMENT BANK

N° Fi: 24.462/BR

TIM CELULAR PROJECT

GUARANTEE AND INDEMNITY AGREEMENT

between

EUROPEAN INVESTMENT BANK

and

TIM PARTICIPAÇÕES S.A

Luxembourg, 3rd June 2008

MADE BETWEEN:

European Investment Bank established at 100, boulevard Konrad Adenauer, Luxembourg, Grand Duchy of Luxembourg, represented by Mr. Francisco de Paula Coelho, Director and Mrs. Regan Otte, Associate Director,

hereinafter referred to as: the "Bank"

of the first part, and

TIM Participações S.A., a company registered under Brazilian law, whose registered office is at Av. Das Américas, 3434 Bloco 1 — 7 ° Andar, Barra da Tijuca, Rio de Janeiro, State of Rio de Janeiro, Brazil represented by, Mr. Francesco Tanzi, Business Manager,

hereinafter referred to as: the "Guarantor"

of the second part.

WHEREAS:

By an agreement (the "Finance Contract") dated 3rd June 2008 and made between the Bank and TIM Celular S.A., a joint stock company incorporated in the Federative Republic of Brazil, having its principal office at Av. Giovanni Gronchi 7143, Vila Andrade Sao Paulo, State of Sao Paulo, Brazil (the "Borrower"), the Bank has agreed to establish in favour of the Borrower a credit in an amount of EUR 166 000 000 (one hundred and sixty six million euros).

As at the date of this Guarantee and Indemnity Agreement (the "Guarantee"), the Guarantor owns 100% (one hundred percent) of the voting shares in the Borrower, and 100% (one hundred percent) of its total share capital.

The obligations of the Bank under the Finance Contract are conditional upon the prior execution and delivery by the Guarantor of a guarantee of performance by the Borrower of its financial obligations under the Finance Contract and the delivery of a favourable legal opinion thereon.

By resolutions dated 26th May 2008, the Board of Directors of the Guarantor has authorised the granting of the Guarantee and Mr Francesco Tanzi been authorised to execute this Guarantee (evidence of such authorisation is attached as Annex I). The Brazilian legal adviser to the Bank will issue a favourable legal opinion regarding the enforceability of this Guarantee against the Guarantor in form and substance acceptable to the Bank.

NOW THEREFORE it is hereby agreed as follows:

ARTICLE 1

Finance Contract

The Guarantor acknowledges notice of the provisions of the Finance Contract, a copy of which has been delivered to it. Terms defined in the Finance Contract shall have the same meaning when used herein.

ARTICLE 2

Guarantee

2.01 Payment

In consideration of the Credit established by THE BANK under THE FINANCE CONTRACT, and subject to Articles 4 to 7 inclusive, THE GUARANTOR hereby guarantees the payment of all Guaranteed Sums (as defined below). THE GUARANTOR undertakes that, if THE BORROWER should fail to pay any Guaranteed Sum to THE BANK, whether upon the normal due date, upon demand for early repayment or otherwise, THE GUARANTOR shall upon receipt of a written demand from THE BANK pay the Guaranteed Sum so demanded to THE BANK within 5 Business Days in the currency specified in THE FINANCE CONTRACT and to the account or accounts specified in the demand, provided that the maximum liability of THE GUARANTOR shall not at any time exceed 115% of the principal and interest amount of the Loan outstanding from time to time under THE FINANCE CONTRACT, less all principal instalments of the Loan in respect of which THE GUARANTOR has been released and continues to be released from liability at or prior to that time under either or both Articles 5or6.

For the purposes of this Guarantee, a "Guaranteed Sum" means any sum of principal, interest, commission, liquidated damages, charge or expense or any other sum which is expressed to be payable from time to time by the Borrower to the Bank under or pursuant to the Finance Contract and any other sum due from time to time by the Borrower in connection with any advance or credit extended under the Finance Contract.

The Guarantor further agrees and undertakes to pay interest to the Bank at the rate and on the terms specified in the Finance Contract for payment of overdue sums on any sum demanded under this Guarantee from the date of receipt of the Bank's demand until the date of receipt of such sum by the Bank.

2.02 Nature of Guarantor's Liability

The obligations of the Guarantor hereunder are those of a primary obligor and not merely those of a surety. They shall not be impaired or discharged by reason of:

| (a) | illegality, invalidity or unenforceability in or of the terms of the Finance Contract; |

| (b) | disability, incapacity or change in status or constitution of the Borrower, the Bank or any other party; |

| (c) | liquidation or insolvency of the Borrower; |

| (d) | time or other indulgence granted by the Bank or any arrangement entered into or composition accepted by the Bank, varying the rights of the Bank under the Finance Contract; |

| (e) | forbearance or delay on the part of the Bank in asserting any of its rights against the Borrower under the Finance Contract; |

| (f) | any other security or guarantee which the Bank now has or may hereafter acquire with respect to the Borrower's obligations under the Finance Contract; or |

| (g) | any circumstance, other than actual payment of a Guaranteed Sum, which might otherwise discharge or diminish the obligations of the Guarantor. |

2.03 Indemnity

As a continuing obligation additional to and separate from those set out in Articles 2.01 and 2.02, and without prejudice to the validity or enforceability of those obligations, the Guarantor unconditionally and irrevocably undertakes that if any Guaranteed Sum should not be recoverable by the Bank from the Guarantor under Article 2.01 for whatsoever reason, and whether or not the reason was known to the Bank, the Guarantor shall, upon first written demand by the Bank, and as if it were a sole and independent obligor, compensate the Bank by way of a full indemnity for all loss resulting from the failure of the Borrower to make payment of any Guaranteed Sum in the amount and currency provided for by or pursuant to the Finance Contract, whether upon the normal due date, upon demand for early repayment or otherwise, as the case may be.

2.04 Continuing Security

This Guarantee is a continuing security and shall endure until all Guaranteed Sums have been fully and unconditionally paid or discharged and, in any case, until the date six months after the Maturity Date as defined in the Finance Contract. No payment or discharge which may be avoided under any enactment relating to insolvency, no payment or discharge made or given which is subsequently avoided and no release, cancellation or discharge of this Guarantee given or made on the faith of any such payment shall constitute discharge of the Guarantor under this Guarantee or prejudice or affect the Bank's right to recover from the Guarantor to the full extent of this Guarantee.

2.05 Application of Payments

Any money duly received by the Bank pursuant to this Guarantee may be placed by the Bank to the credit of a suspense account with a view to preserving the right of the Bank to prove for the whole of the claims against the Borrower or may be applied by the Bank in or towards satisfaction of such of the Guaranteed Sums as the Bank in its absolute discretion may from time to time determine.

2.06 Covenants of Guarantor

The Guarantor agrees that until all the Guaranteed Sums have been fully paid or discharged:

| (a) | it shall not seek to enforce any obligation owed to the Guarantor by the Borrower which arises by virtue of the discharge by the Guarantor of its obligations hereunder; |

| (b) | except as required by mandatory provision of law, it shall pay to the Bank all dividends or payment of interest on equity in liquidation or otherwise received by it from or for the account of the Borrower in respect of any obligation referred to in indent (a) above; the Bank shall apply such sums to reduce the outstanding Guaranteed Sums in such sequence as it may decide; |

| (c) | it shall not exercise any right of subrogation to the rights of the Bank under the Finance Contract or any security granted in connection therewith; and |

| (d) | it shall not exercise (and hereby waives) any rights of contribution which it may have against any other guarantor of the Guaranteed Sums. |

2.07 Acknowledgement

The Guarantor acknowledges: (i) that it has entered into this Guarantee on the basis of its own assessment of the Borrower and of any security provided, and (ii) that it has not been induced to enter into this Guarantee by any representation made by the Bank. The Bank shall not be obliged to report to the Guarantor on the financial position of the Borrower or of any other guarantor or on any security provided or on any other matter. The Bank shall have no liability for granting or disbursing the Loan, for cancelling or not cancelling the Credit or for demanding or not demanding prepayment under the Finance Contract.

ARTICLE 3

Enforcement of Guarantee

3.01 Certificate Conclusive

A certificate of the Bank as to any default by the Borrower in the payment of any Guaranteed Sum shall, in the absence of manifest error, be conclusive against the Guarantor.

3.02 Guarantor's Obligations Unconditional

The Guarantor undertakes to pay all sums due hereunder in full, free of set-off or counterclaim. This Guarantee may be enforced by the Bank upon provision of a statement of the reason for the demand. The Bank shall not be obliged to take any action against the Borrower, to have recourse to any other guarantee or enforce any other security as a condition precedent to the enforcement by the Bank of this Guarantee.

3.03 Guarantor's Option

The Guarantor may, at any date which is a Payment Date and with a prior notice of thirty (30) days, pay to the Bank all (but not less than all) outstanding Guaranteed Sums, in settlement of its obligations hereunder and of the Borrower's obligations under the Finance Contract. If the Guarantor makes such payment, the Bank shall, upon the request and at the expense of that Guarantor, assign to the Guarantor the Bank's rights under the Finance Contract and under any security therefore.

ARTICLE 4

Information and other Undertakings

4.01 Information concerning the Guarantor

The Guarantor shall deliver to the Bank each year, within fifteen (15) days of delivery to its shareholders, a copy of its annual report and audited financial statements together with all other such information as the Bank may reasonably require as to the Guarantor's financial situation and shall inform the Bank without delay of any material change in its By-laws, , so long as the Guarantor is not prevented by law from disclosing such change to any third party.

4.02 Material Changes concerning the Guarantor

So long as the Loan is outstanding, the Guarantor shall immediately inform the Bank of:

| (a) | any material alteration to its documents of incorporation and of any substantial modification of any legislation which would adversely affect in any material respect its activities; |

| (b) | its knowledge, that a single natural or legal person or a group of such persons acting in concert, has acquired (or will acquire shortly) such number of its voting shares, and/or of those of any other legal person, as is necessary to control it by the direct and/or indirect exercise of voting rights, such information to be communicated as soon as practicable; |

| (c) | any intention on its part to grant any security over any of its assets in favour of a third party; |

| (d) | any intention on its part to make any disposal of any material component of its assets, which would adversely affect its ability to perform its obligations hereunder; |

| (e) | any fact which obliges it, and any demand made to it, to prepay or discharge ahead of maturity, by reason of default, any loan, Financial Indebtedness or obligation arising out of any financial transaction, exceeding 1.5% of the Guarantor's net tangible worth. |

4.03 Performance in Jeopardy

Generally, the Guarantor shall inform the Bank forthwith of any fact or event which could reasonably be expected to jeopardise the performance or to prevent the substantial fulfilment of any obligation of the Guarantor under this Guarantee.

For the purposes of this Contract TIMP's net tangible worth means on a consolidated basis the sum of total assets less total liabilities less intangible assets

ARTICLE 5

Amendment to the Finance Contract

In addition to any variations provided for in the Finance Contract, the Bank may agree to any amendment or variation thereto, if:

| (a) | the amendment or variation does not increase the amounts payable by the Guarantor under this Guarantee or change the conditions under which such amounts are payable; or |

| (b) | the amendment or variation consists in the extension of time for payment of a Guaranteed Sum of up to three (3) months; or |

| (c) | the Guarantor has given its prior written consent to the amendment or variation, provided that such consent may not unreasonably be refused or delayed. |

ARTICLE 6

Waiver of Rights

This GUARANTEE is provided with the express waiver of the benefits contained in articles 366, 827, 829, 835, 836, 837, 838 and 839 of the Brazilian Civil Code and in article 595 of the Brazilian Civil Procedure Code.

ARTICLE 7

Other Guarantees

This Guarantee is independent of any guarantees now or hereafter given to the Bank by other guarantors or by the European Community (the "EC"). The Guarantor hereby waives any right to contribution or indemnity from the EC. If payment is made to the Bank by the EC on account of any Guaranteed Sum, the EC shall be subrogated to the rights of the Bank under this Guarantee and the EC may recover from the Guarantor any amount outstanding under this Guarantee.

ARTICLE 8

Taxes, Charges and Expenses

The Guarantor shall bear its own costs of execution and implementation of this Guarantee and, without prejudice to the terms of Article 2, shall indemnify the Bank against all:

| (a) | taxes and fiscal charges, legal costs and other expenses duly documented incurred by the Bank in the execution or implementation of this Guarantee; and |

| (b) | losses, charges and expenses duly documented to which the Bank may be subject or which it may properly incur under or in connection with the recovery from any person of sums expressed due under or pursuant to the Finance Contract. |

Furthermore, the Guarantor shall make payments hereunder without withholding or deduction on account of tax or fiscal charges.

ARTICLE 9

Law and Jurisdiction

9.01 Law

This Guarantee shall be governed by, and construed in all respects in accordance with, English law.

9.02 Jurisdiction

The parties hereto submit to the jurisdiction of the High Court of Justice in England (the "Court") and all disputes concerning this Guarantee shall be submitted to the Court. A decision of the Court given pursuant to this Article 9.02 shall be conclusive and binding on the parties without restriction or reservation.

9.03 Agent for Service

The Guarantor appoints TI United Kingdom Limited, whose address is 100, New Bridge Street, EC4V 6JA London, United Kingdom to be its Agent for the purpose of accepting service on their behalf on any writ, notice, order, judgement or other legal process.

9.04 Waiver of immunity

To the fullest extent permitted by law, the Guarantor hereby irrevocably agrees that no immunity (to the extent that it may at any time exist) from any proceedings, from attachment (whether in aid of execution, before judgement or otherwise) of its assets or from execution of judgement shall be claimed by it or on its behalf or with respect to its assets, any such immunity being irrevocably waived.

The Guarantor hereby irrevocably agrees that it and its assets are, and shall be, subject to such proceedings, attachment or execution in respect of its obligations under this Guarantee, and consents to such proceedings, attachment or execution.

9.05 Invalidity

If any provision hereof is invalid, such invalidity shall not prejudice any other provision hereof.

9.06 Assignment

The Guarantor shall not assign all or any part of the benefit of its rights or obligations under this Guarantee without the prior consent of the Bank.

9.07 Evidence of Sums due

In any legal action arising out of this Guarantee the certificate of the Bank as to any amount due to the Bank under this Guarantee shall be prima facie evidence of such amount, in the absence of manifest error.

9.08 Third Party Rights

Save for the purposes of Article 2.06 (d) which may be enforced by any other guarantor of the Guaranteed Sums, a person who is not a party to this Guarantee has no rights under the Contract (Rights of Third Parties) Act 1999 to enforce any term of this Guarantee.

ARTICLE 10

Final Clauses

10.01 Notices

Notices and other communications given hereunder by one party to this Guarantee to the other shall be sent to its address set out below, or to such other address as it shall have previously notified to the former in writing as its new address for such purpose:

- for the Bank: - for the Guarantor: | 100, boulevard Konrad Adenauer L-2950 Luxembourg Grand Duchy of Luxembourg Av. Das Américas, 3434 Bloco 01 – 7 °Andar Barra da Tijuca Rio de Janeiro State of Rio de Janeiro, Brazil |

10.02 Form of Notice

Notices and other communications, for which fixed periods are laid down in this Guarantee or which themselves fix periods binding on the addressee, shall be served by hand delivery, registered letter, internationally recognised courier services, telex or any other means of transmission which affords evidence of receipt by the addressee. The date of registration or, as the case may be, the stated date of receipt of transmission shall be conclusive for the determination of a period.

10.03 Recitals, Schedules and Annexes

The Recitals form part of this Guarantee.

The following Annex is attached hereto:

Annex I Authority of Signatories

IN WITNESS WHEREOF the parties hereto have caused this Guarantee to be executed in four (4) originals in the English language, having caused each page to be initialled by Mrs. R. Otte, on behalf of the Bank and Mr. F. Tanzi, on behalf of the Guarantor.

| Signed for and on behalf of | Signed for and on behalf of |

| EUROPEAN INVESTMENT BANK | TIM PARTICIPAÇÕES S.A |

| | |

| (signature) | (signature) |

F. de Paula Coelho R. Otte | TIM PARTICIPAÇÕES S.A. |

this 3rd day of June 2008, at Luxembourg

The undersigned Paul FRIEDERS, notary residing in Luxembourg, hereby certifies that this document was signed in his presence by Mr. F. de Paula Coelho and Mrs. R. Otte for and on behalf of EUROPEAN INVESTMENT BANK and by Mr. Tanzi on behalf of TIM PARTICIPAÇÕES S.A

Luxembourg, 3rd June 2008.

| Witness | Witness |

| | |

| | |

| (signature) | (signature) |

A. Barragán | F. Petralia |

ANNEX I

TIM PARTICIPAÇÕES S.A.

Publicly Held Company

CNPJ/MF 02.558.115/0001-21

NIRE 33.300.276.963

MINUTES OF MEETING OF THE BOARD OF DIRECTORS

HELD ON MAY 05, 2008

DATE, TIME AND PLACE: May 05, 2008, at 15:30h, in the City and State of Rio de Janeiro.

ATTENDANCE: The Meeting of the Board of Directors of TIM Participações S.A. (“Company”) on the date, time and place mentioned above, with the attendance of all of its acting members, Messrs. Mario Cesar Pereira de Araujo and Francesco Saverio Locati. According to the authorization provided in §2 of Article 29 of the Bylaws of the Company, Messrs. Giorgio della Seta Ferrari Corbelli Greco, Stefano Ciurli, Isaac Selim Sutton, Maílson Ferreira da Nóbrega and Josino de Almeida Fonseca participated in the meeting by audio-conference. Mrs. Lara Ribeiro Piau Marques, Legal Director of the Company, Mr. Gianandrea Castelli Rivolta, Financial and Investors Relations Director of the Company, Mr. Miguel Roberto Gherrize, Chairman of the Company’s Audit Committee and Mrs. Kátia Nozela, manager of the Company’s balance sheet area were also present.

PRESIDING OFFICERS: Mr. Giorgio della Seta Ferrari Corbelli Greco, who invited me, Alessandra Catanante, to act as Secretary, assumed as Chairman.

AGENDA: (1) examine, discuss and approve the report of Quarterly Information (“ITR”) of the Company raised on March 30, 2008; (2) become aware of the execution of 02 (two) contractual instruments, in the following terms: (i) Contracting Party: TIM Celular S.A.; Contractor: Banco ABN AMRO Real S.A.; Purpose: loan for working capital; Value: R$ 150,000,000.00 (one hundred and fifty million reais) and (ii) Contracting Party: TIM Celular S.A.; Contractor: Banco ABN AMRO Real S.A.; Purpose: loan for working capital; Value: R$ 50,000,000.00 (fifty million reais) (iii) become aware of the rectification of typing error in the Proposal of the Administration for Destination of the Income of the fiscal year ended on December 31, 2007; (4) deliberate on the distribution, among the directors of the board, of the remuneration funds, approved in the Annual Shareholders’ Meeting/Special Shareholders’ Meeting held on April 11, 2008, to the Board of Directors and (5) reelection of the members of the Management.

RESOLUTIONS: After analysis and discussion of the matters set forth in the Agenda, as well as of the related material, the Directors resolved, by unanimous vote, and without any restriction, in the following terms: (1) approve the report of the ITR’s of the Company raised on March 30, 2008, and audited by the Auditor Directors; (2) became aware, approved and ratified the execution of 02 (two) contractual instruments, in the following terms: (i) Contracting Party: TIM Celular S.A.; Contractor: Banco ABN AMRO Real S.A.; Purpose: loan for working capital; Value: R$ 150,000,000.00 (one hundred and fifty million reais); and (ii) Contracting Party: TIM Celular S.A.; Contractor: Banco ABN AMRO Real S.A.; Purpose: loan for working capital; Value: R$ 50,000,000.00 (fifty million reais); (3) approve the rectification of the reference to dividends to distribute, substituting the expression “Lot for one thousand shares” by “Per share”, set forth in the Proposal of the Administration for Destination of the Income of the Fiscal Year ended on December 31, 2007 attached to the Minutes of the Meeting of the Board of Directors held on March 04, 2008, in view of the typing error verified; (4) approve the distribution, among the directors of the Board, of the remuneration funds approved in the Annual/Special Shareholders’ Meeting, held on April 11, 2008, to the Board of Directors, according to the instrument filed at the Company headquarters, whereas Messrs. Giorgio della Seta Ferrari Corbelli Greco, Stefano Ciurli, Mario Cesar Pereira de Araujo and Francesco Saverio Locati, waived expressly their remuneration funds; and (5) approve the reelection of the composition of the Company’s Management, comprised by: (i) Mario Cesar Pereira de Araujo – CEO, Brazilian, married, engineer, holder of ID Card No. 02.158.026-1, issued by IFP/RJ and CPF/MF No. 235.485.337-87; (ii) Francesco Saverio Locati – General Director, Italian, married, physicist, holder of Italian passport No. 708463-X and CPF/MF No. 060.287.447-60; (iii) Gianandrea Castelli Rivolta – Financial and Investors Relations Director, Italian, divorced, administrator, holder of Italian passport No. C-113621, valid thru 02/10/2014, and CPF/MF No. 060.522.167-78; (iv) Cláudio Roberto de Argollo Bastos – Supplies Director, Brazilian, married, engineer, holder of ID Card No. 07101376-7 and CPF/MF No. 805.708.607-68; (v) Orlando Lopes Junior, Human Resources Director, Brazilian, married, lawyer, ID OAB/SP No. 59.567 and CPF/MF No. 858.808.338-87; (vi) Lara Cristina Ribeiro Piau Marques – Legal Director, Brazilian, married, lawyer, ID OAB/DF No. 11.539 and CPF/MF No. 554.012.011-68, all with commercial address at Avenida das Américas No. 3434, Block 1, 7th floor, Barra da Tijuca, City and State of Rio de Janeiro, CEP: 22640-102, all with term of 02 (two) years, as provided in §1 of Article 20 of the Bylaws of the Company, until the first Meeting of the Board of Directors, to be held after the Annual Shareholders’ Meeting of 2010.

ADJOURNMENT: Having nothing further to deal, the works were closed and the meeting suspended for the time necessary to draw up these minutes, which, once the session was reopened, were read, found correct, approved and signed by all the Directors present. Directors: Messrs. Giorgio della Seta Ferrari Corbelli Greco, Mario Cesar Pereira de Araujo, Stefano Ciurli, Franscesco Saverio Locati, Maílson Ferreira de Nóbrega, Josino de Almeida Fonseca, Isaac Selim Dutton.

I attest that this is a true copy of the original drawn up in the appropriate book.

Rio de Janeiro/RJ, May 05, 2008.

[signature]

ALESSANDRA CATANANTE

Secretary of the Board

(stamp) Board of Trade of the State of Rio de Janeiro

00001798273

(stamp) Authentication of Document

(Attachment to the Annual/Special Shareholders Meeting held on 04.11.2008)

BYLAWS

TIM PARTICIPAÇÕES S.A.

CHAPTER I

CHARACTERISTICS OF THE COMPANY

Article 1 – TIM PARTICIPAÇÕES S.A. is a company by shares, publicly held, which is governed by these Bylaws and by the applicable legislation:

Article 2 – The Company’s purpose is:

I – exercise the control of companies that exploit telecommunications services, including mobile telephony services and others, in the areas of their concessions and/or authorizations;

II – promote, through subsidiaries or associated companies, the expansion and implementation of mobile telephony services, in the respective concession and/or authorization areas;

III – promote, perform or orient the funding, from internal and external sources, of funds to be applied by the Company or by its subsidiaries;

IV – promote and encourage activities of studies and research aimed at the development of the mobile telephony sector;

V – perform, through subsidiaries or associated companies, specialized technical services related to the area of mobile telephony;

VI – promote, stimulate and coordinate, through controlled companies, or associated companies, the education and training of the personnel necessary to the mobile telephony sector;

VII – perform or promote imports of goods and services for their controlled and associated companies;

VIII – perform other related or correlated activities to its corporate purpose; and

IX – participate in the capital of other companies.

Article 3 – The Company has headquarters and venue in the City and State of Rio de Janeiro, at Avenida das Américas No. 3434, Block 1, 7th floor – Part, and may, by decision of the Board of Directors, create and extinguish branches and offices anywhere in the country and abroad.

Article 4 – The duration of the Company is indefinite.

CHAPTER II

CAPITAL STOCK

Article 5 – The capital stock, subscribed and paid-in, is R$ 7,613,610,143.12 (seven billion, six hundred and thirteen million, six hundred and ten thousand, one hundred and forty-three reais and twelve centavos), represented by 2,343,826,537 (two billion, three hundred and forty-three, eight hundred and twenty-six thousand, five hundred and thirty-seven) shares, 798,350,977 (seven hundred and ninety-eight million, three hundred and fifty thousand, nine hundred and seven) being common shares and 1,545,475,560 (one billion, five hundred and forty-five million, four hundred and seventy-five thousand, five hundred and sixty) preferred shares, all nominative and without par value.

Article 6 - The Company is authorized to increase its capital stock, by deliberation of the Board of Directors, regardless of statutory reform, up to the limit of 2,500,000,000 (two billion and five hundred million) shares, common or preferred.

Sole §- Within the limit of the authorized capital contemplated in the heading of this Article, the Company may grant a purchase option of shares to its administrators, employees and to natural persons, who provide services to the Company or to companies under the same control, according to the plan approved by the General Meeting;

Article 7 – The capital stock is represented by common and preferred shares, without par value, there not being the obligation, in capital increases, to preserve the proportion among them, in compliance with the legal and statutory provisions.

Article 8 – By resolution of the General Meeting, the preemptive right for issue of shares, debentures convertible into shares and subscription bonuses may be excluded, whose placement is made by:

I – public subscription or sale in the stock exchange;

II – swap of shares, in public acquisition offering, pursuant to the terms of Articles 257 to 263 of Law 6.404/76 of Law 6.404/76;

I III– enjoyment of tax incentives, pursuant to the terms of the special law.

Article 9 – The right to a vote corresponds to each common share in the resolutions of the General Meeting.

Article 10 – The preferred shares do not entitle to vote, except in the event of the single § of Article 13 of these Bylaws, they being assured the following preferences or advantages:

I – priority in the reimbursement of capital, without premium;

II – payment of the minimum , non-cumulative dividends, of 6% (six percent) per annum, on the value resulting from the division of the capital subscribed by the total number of shares of the Company.

§1. It is assured to the holders of the preferred shares, year by year, the right to receive a dividend per share, corresponding to 3% (three percent) of the value of the shareholders’ equity of the share, according to the last approved balance sheet, whenever the dividend established according to this criteria is superior to the dividend calculated according to the criteria established in item II of this Article.

§2. The preferred shares will acquire the voting right if the Company, for a period of 03 (three) consecutive years, fails to pay the minimum dividends to which they are entitled in the terms of the heading of this Article, which right they shall preserve, if such dividends are not cumulative, or until the cumulative dividends in arrears are paid, all according to §1 of Article III of Law No. 6.404/76.

Article 11 - The shares of the Company will be book shares, being held in a deposit account, in a financial institution, in the name of its holders, without issue of certificates. The depositary institution may collect from the shareholders the cost of the service of transfer of its shares, pursuant to the terms of Article 35, §3 of Law 6.404/76.

CHAPTER III

GENERAL MEETING

Article 12 – The General Meeting is the superior body of the Company, with powers to deliberate on all the business relating to the corporate purpose and to take steps that it deems convenient to the defense and development of the Company.

Article 13 – It is privately incumbent upon the Shareholders’ Meeting:

I . to reform the Bylaws;

II. authorize the issue of debentures and debentures convertible into stock or sell them, if in treasury, as well as authorize the sale of debentures convertible into shares held by issued by subsidiaries, being able to delegate to the Board of Directors, the resolution at the time and conditions of maturity, amortization or redemption, at the time and payment conditions of interest, participation in profits and reimbursement premium, if any, and the manner of subscription or placement, as well as of the type of the debentures;

III – resolve on the evaluation of the assets that the shareholder competes for the formation of the capital stock;

IV – deliberate on the transformation, merger, incorporation and split of the Company, its dissolution and liquidation, elect and remove liquidators and judge their accounts;

V – authorize the provision of guarantees by the Company to obligations of third parties, not including subsidiaries;

VI – suspend the exercise of the rights of the shareholder who fails to comply with the obligations imposed by law or by Bylaws;

VII – elect or remove, at any time, the members of the Board of Directors and the members of the Audit Committee;

VIII – set the aggregate or individual remuneration of the members of the Board of Directors, the Management and the Audit Committee;

IX – take, annually, the accounts of the administrators and deliberate on the financial statements presented by them;

X – resolve on the extension of the civil liability plan to be filed by the Company against the administrators, for the losses caused to its shareholders, in accordance with the provisions in Article 159 of Law 6.404/76;

XI – authorize the disposal, as a whole or in part, of the shares of the company under its control;

XII – resolve on the increase of capital stock by subscription of new shares, in the event of the Sole § of Article 6, when the limit of the authorized capital is exhausted;

XIII – resolve on the issue of any other instruments or securities, in Brazil or abroad, especially on the issue of shares and subscription bonuses, in compliance with the legal and statutory provisions;

XIV- authorize the swap of shares or other securities issued by subsidiaries;

XV – approve previously the execution of any contracts with term superior to 12 (twelve) months by the Company or its subsidiaries, on the one hand, and the controlling shareholder or the subsidiaries, subject to the common control or parent companies of the latter, or what constitutes parties related to the Company, of another party, except when the contracts comply with uniform clauses.

Sole § - Without prejudice to the provisions in §1 of Article 115 of Law 6.404/76, the holders of preferred shares will be entitled to vote in the shareholders’ meeting mentioned in item XV of this Article, as well as in those referring to the alteration or revocation of the following statutory provisions:

I – item XV of Article 13;

II – Sole § of Article 14; and

III – Article 49.

Article 14 – The Shareholders’ Meeting shall be called by the Board of Directors, it being incumbent upon its chairman to substantiate the respective act, which may be called as contemplated in the Sole § of Article 123 of Law 6.404/76.

Sole § - In the events of Article 136 of Law 6.404/76, the first call of the Shareholders’ Meeting shall be made with 30 (thirty) days notice, at least, and with minimum notice of 08 (eight) days, on second call.

Article 15 - The Shareholders’ Meeting shall be convened by the CEO of the Company or by an attorney-in-fact appointed by him, with specific powers, who will carry out the election of the presiding officers, comprised of a Chairman and one secretary, chosen among those present.

Sole § - For purposes of evidencing the condition of shareholder, it shall be observed the provisions of Article 126 of Law 6.404/76, whereas the holders of the book or custody shares shall deposit, to 02 (two) business days prior to the shareholders’ meeting, at the headquarters of the Company, in addition to the ID document and the respective instrument of power of attorney, when necessary, the evidence/statement issued by the depositary financial institution, the latter issued, at least 05 (five) business days prior to the shareholders’ meeting.

Article 16 – Minutes shall be drawn up of the General Meeting, signed by all the members of the board and by the shareholders present, who represent, at least, the majority necessary for the deliberations taken.

§1- The minutes shall be drawn up in summary form of the fact, including dissidences and protests;.

§2 – Except for resolution to the contrary at a Meeting, the minutes will be published with omission of the signatures of the shareholders.

Article 17 – Annually, in the four first months subsequent to the end of the fiscal year, the General Meeting shall meet, annually, to:

I – take the accounts of the administrators: examine, discuss and vote on the financial statements;

II – resolve on the destination of the net profits of the fiscal year and the distribution of dividends;

III – elect the members of the Audit Committee, and, when applicable, the members of the Board of Directors.

Article 18 – The General Meeting will meet, specially, whenever the interests of the Company require.

Article 19 - The shareholders shall exercise their voting right in the interest of the Company.

CHAPTER IV

ADMINISTRATION OF THE COMPANY

SECTION I

GENERAL RULES

Article 20 – The administration of the Company is exercised by the Board of Directors and by the Management.

§1 – The Board of Directors, the collegiate decision body, exercise the superior administration of the Company.

§2 - The Management is the representative and executive body of administration of the Company, each of its members acting according to the respective competence, in compliance with the limitations established in Articles 13, 25 and 32 of these Bylaws.

§3 - The attributions and powers conferred by law to each of the bodies of the administration may not be granted to another body.

§4 – The members of the Board of Directors and of the Management are waived from providing bail as guarantee for their management.

Article 21 – The administrators are invested by terms drawn up in the Book of Minutes of the Meetings of the Board of Directors or of the Management, according to the case.

Article 22 – Upon investiture, the administrators of the Company shall sign, in addition to the term of investiture through which they will adhere to the terms of the Company’s Code of Ethics, and of the policy manual of disclosure and use of the information and negotiations of securities of the Company.

Article 23 – In addition to the cases of death, waiver, removal and others contemplated in the law, vacancy of office will occur when the administrator fails to sign the term of investiture in the period of 30 (thirty) days of election of fail to exercise the function for more than 30 (thirty) consecutive days or 90 (ninety) intercalated days during the term of office, all without cause, at the discretion of the Board of Directors.

Sole § - The waiver from the office of administrator occurs by communication in writing to the body which the waiving party integrates, from this moment, before the Company and third parties, it becomes effective, after filing of the waiver document in the trade register and its publication.

Article 24 – The mandate of the administrators is of 02 (two) years, reelection being permitted.

Sole § - The mandates of the administrators are reputed extended until investiture of their elected successors.

SECTION II

BOARD OF DIRECTORS

Article 25 – In addition to the attributions contemplated by law, the following is incumbent upon the Board of Directors:

I – approve and follow up on the annual budget of the Company, as well as the companies controlled by it, in addition to the targets and business strategy plan contemplated for the effective period of the budget.

II – resolve on the capital increase of the Company up to the limit of capital authorized, according to Article 6 of these Bylaws;

III – authorize the issue of (illegible) commercial for public subscription (“commercial papers”);

(authentication stamp of document)

IV – resolve, when delegated by the General Meeting, on the conditions of issue of debentures, according to the provisions in §1 of Article 59 of Law 6.404/76;

V – authorize the acquisition of the shares issued by the Company, for purposes of cancellation or permanence in treasury and subsequent disposal;

VI – resolve on the approval of the “depositary receipts” program issued by the Company;

VII – approve the participation or disposal of participation of the Company in the capital of other companies, except for the event contemplated in item XI of Article 13 of these Bylaws;

VIII – authorize the waiver of shares subscription rights, debentures convertible into shares or subscription bonus issued by the subsidiaries;

IX – authorize the creation of a subsidiary;

X – authorize the Company, as well as its subsidiaries and associated companies, to execute, alter or terminate the shareholders agreements.

XI – approve previously the execution of any continued service agreement, with effectiveness equal to or lower than 12 (twelve) months and amount equal or superior to R$ 5,000,000.00 (five million reais) per annum, between the Company or its subsidiaries, on the one hand, and the controlling shareholder or controlled companies, associated companies, subject to common contract or parent companies of the latter, or in which in any other way constitute parties related to the Company or its subsidiaries, on the other hand;

XII – submit to the approval of the General Meeting the performance of any business or transaction, which is included among those mentioned in item XV of Article 13 of these Bylaws;

XIII – authorize the rendering of in collateral securities or personal securities by the Company in favor of a subsidiary;

XIV – authorize the disposal or encumbrance of any securities of the Company, or of the companies controlled by it, whose book value is superior to R$ 250,000.00 (two hundred and fifty thousand reais).

XV – authorize the disposal or encumbrance of any assets that integrate the permanent assets of the Company or companies controlled by it, whose book value is superior to R$ 5,000,000.00 (five million reais);

XVI – authorize the acquisition by the Company, or by the companies controlled by it, of assets for the permanent assets whose individual value is superior to 2% (two percent) of the shareholders’ equity of the Company, verified in the last annual balance sheet approved by the General Meeting;

XVII – approve the contracting by the Company, or by companies controlled by it, of loans, financing or other transactions which imply in debt by the Company or the subsidiaries, whose individual value is superior to 2% (two percent) of the Company’s shareholders’ equity, calculated in the last annual balance sheet approved by the Shareholders’ Meeting;

XVIII – having in view the corporate responsibilities of the Company and its subsidiaries, authorize the practice of gratuitous acts to the benefit of the employees or the community, whenever the value involved is superior to R$ 250,000.00 (two hundred and fifty thousand reais); whereas the provision of bail to employees in the case of transfers and/or interstate and/or intermunicipal reorganization does not configure a matter that depends on previous approval by the Board of Directors.

XIX – approve the policy of complementary pension funds of the Company and of the companies controlled by it;

XX – elect and remove, at any time, the Company’s Directors, including the Chairman, setting their attributions and the specific authority limits, in compliance with the provisions of these Bylaws, as well as approve the attribution of new functions to the Directors and any alteration in the composition and in the attributions of the members of the Management;

XXI – apportion the aggregate amount, established by the Shareholders’ Meeting, among the Directors and Officers of the Company, when applicable;

XXII – approve the proposal of the Management with respect to the regimen of the Company with the respective organizational structure, including competence and specific attributions of the Company Officers;

XXIII – establish guidelines for the exercise of the voting right by the representatives of the Company at the General Meetings of their subsidiaries or associated companies, regarding the matters approved by this Board of Directors;

XXIV – appoint the Company’s representatives in the administration of the company in which it participates;

XXV – choose and remove the Company’s independent auditors, the recommendations of the Audit Committee being heard;

XXVI – perform other activities delegated to them by the General Meeting;

XXVII – resolve the casus omissis in these Bylaws and perform other attributions that the Law or these Bylaws do not confer to another body of the Company.

Article 26 – The Board of Directors is comprised of 03 (three) to 07 (seven) effective members and an equal number of deputies.

Article 27 – The members of the Board of Directors and the respective deputies are elected by the General Meeting who chooses them, among them, the Chairman of the Board.

§1- The Director must have a blameless reputation, he who, falls under the following, may not be elected, except for waiver by the General Meeting: I – holds office in companies that may be considered competitors of the Company or II – has or represents an interest in conflict with the Company. The voting right may not be exercised if the impediment factors indicated in §1 are configured, in supervention.

§2. It is prohibited, in the form of Article 115, § 1 of Law 6.404/76, the voting right, in the election of the members of the Board of Directors, in circumstances which configure conflict of interest with the Company.

§3- The Director may not have access to information or participate in the meeting of the Board of Directors related to matters on which it has or represents an interest in conflict with the Company.

Article 28 – The members of the Board of Directors will be substituted in their absences, impediment or vacancy, by the respective deputy.

Sole § - In the case of vacancy from the office of effective Director, and, in the absence of its deputy, to comply with the time remaining in the mandate, the other Directors shall appoint a deputy who will serve to the first General Meeting.

Article 29 – The Board of Directors meets ordinarily once per quarter and especially with minimum notice of 07 (seven) days, except in the events of manifest urgency, at the sole discretion of the Chairman of the Board of Directors, and the communication shall contain the agenda.

§1 – Calls are made by letter, fax or e-mail delivered with 7 days in advance, unless in cases of urgency, at the sole discretion of the Chairman of the Board of Directors. The communication shall comprise the agenda.

§2 – The members of the Board of Directors may participate in the meeting by audio or video-audioconference, all without any loss to the validity of the decisions taken. Votes by letter, fax or e-mail will also be admitted, provided that received by the Chairman of the Board or his deputy to the time of the respective meeting.

§3 – The Chairman of the Board of Directors may invite to participate in the meetings of the body any member of the Management, other executives of the Company, as well as third parties, who may contribute with opinions or recommendations related to the matters to be deliberated by the Board of Directors. The individuals invited to participate in the meetings of the Board of Directors shall not be entitled to vote.

Article 30 – The Board of Directors deliberates by majority of votes, the majority of its members present, it being incumbent upon the Chairman of the Board, in the case of a tie, the casting vote.

Sole § - In any event, minutes shall be drawn up of the meetings of the Board of Directors, which will be signed by those present.

SECTION III

MANAGEMENT

Article 31 – The Management shall be comprised by at least 02 (two) and a maximum of 06 (six) members, shareholders or not, who will have the following designations: I – CEO; II – Financial Directors; III – General Director; IV – Supplies Director; V – Human Resources Director; VI – Legal Director. All the Directors will be elected by the Board of Directors removable by it at any time.

§1 – The Financial Director shall accumulate the function of Investors Relations Director.

§2 – In the event of a vacancy in the office of Director, it will be incumbent upon the Board of Directors to elect the new Director or designate the deputy, who will complete the mandate of the deputy.

§3 – In the event of absences or temporary impediments of any Director, the deputy will be appointed by the CEO, or, in its impossibility, by a decision of the majority of the Management.

Article 32 – Pursuant to the terms of Article 143, §2 of Law 6.404/76, it is incumbent upon the General Meeting, to:

I – approve the proposals, plans and projects to be submitted to the Board of Directors and/or to the General Meeting;

II – approve prior to the execution of any contracts by the Company or its subsidiaries, on the one hand, and the controlling shareholder or the subsidiaries, associated companies, subject to common control or parent companies of the latter, or which in any other way constitute parties related to the Company or its subsidiaries, on the other hand, in compliance with the provisions in Articles 13 and 25 of these Bylaws;

III – authorize the participation of the Company or of companies controlled by it in any “joint venture”, association, consortium, or any other similar structure;

IV – authorize the disposal or encumbrance of any securities of the Company, or of companies controlled by it, in compliance with the provisions in item XIV of Article 25 of these Bylaws;

V – authorize the disposal or operation of any goods that integrate the permanent assets of the Company, or of companies controlled by it, whose book value is superior to R$ 1,000,000.00 (one million reais), in compliance with the provision in item XV of Article 25 of these Bylaws;

VI – approve the execution by the Company or by the companies controlled by it, of active or passive contracts of supply or lease of goods or services, whose annual value is superior to R$ 15,000,000.00 (fifteen million reais);

VII – approve the contracting by the Company, or by companies controlled by it, of loans, financing, or other transactions that imply debt by the Company or subsidiaries, whose individual value is superior to R$ 30,000,000.00 (thirteen million reais), in compliance with the provisions in item XVII of Article 25 of these Bylaws;

VIII – authorize the transaction or agreement in administrative or legal proceedings, actions or litigation, related to the Company or the companies controlled by it, whenever the value involved is superior to (illegible ciphers) (five million reais);

(authentication stamp)

IX – having in view the corporate responsibilities of the Company and its subsidiaries, authorize the practice of gratuitous acts to the benefit of the employees or the community, in compliance with the provisions in item XVIII of Article 25 of these Bylaws;

X – approve the execution of collective agreements by the Company or companies controlled by it;

XI – set the internal policy of authorizations of the Company and of the companies controlled by it;

XII – authorize the appointment of attorneys-in-fact for the practice of the acts listed in this Article 32.

Article 33 – The Management shall meet whenever the CEO is called or by 02 (two) members of the Management.

§1 – The calls are made by letter, fax or e-mail, delivered with the minimum advance of 02 (two) days, except in the events of manifest urgency, at the sole discretion of the CEO, such communication shall contain the agenda.

§2 – The members of the Management may participate in the meetings by audio or videoconference, all without any loss to the validity of the decisions taken. Votes by letter, fax or e-mail shall also be admitted, provided that received by the CEO or his deputy to the time of the meeting.

§3 – The meetings of the Management shall be taken by the vote of the majority of the acting Directors, it being incumbent upon the CEO the casting vote, in the event of a tie.

§4 – In any event, of the meetings of the Management, their minutes will be drawn upon, which will be signed by those present.

Article 34 – The CEO, acting in isolation, will have full powers to perform all and any acts and sign all and any documents in the name of the Company, in compliance with the limitations established in Articles 13, 25 and 32 of these Bylaws and in the law.

§1 – It will be incumbent upon the Chairman of the Board of Directors the limit of authority of each of the other Directors, setting the value within which the same will be authorized to perform acts and sign documents in the name of the Company, in compliance with the limitations established in Articles 13, 25 and 32 of these Bylaws and in the law.

§2 - Without prejudice to the provisions in the heading and in §1 of this Article, any one of the Directors of the Company may act individually in questions whose value does not exceed the amount of R$ 100,000.00 (one hundred thousand reais), as well as the representation of the Company before third parties, including federal, state and municipal public bodies.

Article 35 – In compliance with the limitations established in Articles 13, 25, 32 and 34 of these Bylaws and of the Law, the Company will be represented and will be considered validly bound for act or signature: I – of any Director, acting in isolation, or II – of 02 (two) attorneys-in-fact, acting jointly. The Company may also be represented by a single attorney-in-fact, acting individually, provided that the respective instrument of power of attorney has been signed by 02 (two) Directors of the Company, one of them being necessarily the CEO.

Sole § - The instruments of power of attorney granted by the Company will be signed by a Director, in compliance with the respective limits of authority of said Director. The powers of attorney shall specify the powers granted, and, with the exception of the powers of attorney granted for legal purposes, will have the maximum period of 01 (one) year. The subgranting of “ad negotia” powers of attorney is prohibited.

Article 36 - The Management will administer the Company complying strictly with the provisions in these Bylaws and in the applicable legislation, it being prohibited to their members, jointly or individually, perform acts foreign to the corporate purposes of the Company.

CHAPTER V

AUDIT COMMITTEE

Article 37 - The Audit Committee is the inspection body of the acts of the administrative acts of the Company and information to shareholders, and it shall function permanently.

Sole § - In addition to the ordinary attributions, the “Conselho Fiscal” also performs the function of its equivalent US Audit Committee.

Article 38 – The Audit Committee will be comprised of 03 (three) to 05 (five) effective members and an equal number of deputies, shareholders or not, elected by the General Meeting.

§1 – The members of the “Conselho Fiscal” or Audit Committee shall be independent, and it shall, for such, comply with the following requirements: I - not be or have been, in the past 03 (three) years, employed or the administrator of the Company or of a subsidiaries or company under common control; II – not receive any remuneration, directly or indirectly, from the Company or company controlled or under common control, except the remuneration as member of the Audit Committee. Individuals not qualified as independent, according to the provisions of this §1, may not be elected to the Company’s Audit Committee.

§2 – The mandate of the members of the Audit Committee ends on the first subsequent Shareholders’ Meeting to the

respective election, reelection being permitted, the members of the committee holding office until the investiture of their successors.

§3 – The members of the Audit Committee, in their first meeting, shall elect their Chairman, who shall comply with the resolutions of the body.

§4 – The Audit Committee may request to the Company the appointment of qualified personnel to act as secretary and provide technical support.

§5 – Upon investiture (illegible) the Audit Committee shall sign, in addition to the term of investiture, a declaration through (illegible) terms of the internal regulations of the body, of the Company’s ethics code, of the policy manual of disclosure and use of information and negotiations of the Company, as well as of a declaration that they are not impeded, according to the provisions in the Audit Committee’s Internal Regulations.

Article 39 – In addition to the attributions contemplated in the law, the Audit Committee, it is capacity as the Company’s Audit Committee, shall:

I – recommend to the Board of Auditors the contracting or termination of the contract with independent auditors of the Company;

II – previously recommend the services to be provided by the independent auditors, whether said services are audit services or not, as well as the respective fees to be paid by the Company, all pursuant to the terms of the respective procedure approved by the Audit Committee:

III – analyze the annual labor plan of the Company’s independent auditors, discuss the result of its activities, works and reviews made, as well as assess its performance and independence;

IV – issue opinions and supervise the activities of the independent auditors of the Company, including, but not limited to, to the extent permitted by law, assistances in the solution of eventual divergence among the administration and the independent auditors regarding the presentation of the financial statement and information;

V – analyze the work plan of the internal auditors, discuss the result of its activities, works and reviews conducted;

VI – analyze the effectiveness of the internal control and risk management systems of the Company, to, among others, monitor compliance with the provisions related to the presentation of the financial statements and information;

VII – exercise the attributions contemplated in the internal regulations of the Audit Committee related to the receipt, processing and treatment of the anonymous accusations in connection with any accounting matters, internal accounting or audit controls (“denouncement channel”).

Article 40 – The Audit Committee shall meet, ordinarily, once per quarter and, especially, whenever necessary.

§1 – The meetings will be called by the Chairman of the Audit Committee, by 02 (two) members of the Audit Committee or by the CEO of the Company, being convened with the presence of the majority of its members;

§2 – The Audit Committee manifests by majority of votes, the majority of its members being present, the dissident Audit Committee being authorized to consign its dissident vote in meeting minutes and inform it to the bodies of the administration and to the General Meeting.

Article 41 – The members of the Audit Committee will be substituted, in their absences or impediments, by the respective deputy.

Article 42 – In addition to the cases of death, waiver, removal and others contemplated in the law, the office’s vacancy shall occur when the member of the Audit Committee fails to attend, without cause, 02 (two) consecutive meetings or 03 (three) intercalary meetings, in the fiscal year.

§1 – If the vacancy in the office of the member of the Audit Committee occurs, the substitution will occur according to the provisions in Article 41 of these Bylaws.

§2 – The office of the member of the Audit Committee becoming vacant and in the absence of the respective deputy to

fulfill the remaining time of the term, the General Meeting shall be called to elect a deputy.

Article 43 – The remuneration of the members of the Audit Committee will be established by the Annual Shareholders’ Meeting which elects them, and may not be inferior, for each acting member, to one tenth of that which, on average, is attributed to each member of the Management, not computing the profit sharing.

Sole § - The acting deputy will be entitled to remuneration of its effective counterpart, in the period in which the substitution occurs, counting month by month, in which case the incumbent member shall not receive his monthly remuneration.

Article 44 – By proposal of the Audit Committee, the Company’s General Meeting shall separate, annually, a reasonable amount to pay for the expenses of the Audit Committee, which will be incurred according to the budget approved by the majority of its members.

§1 – The Company’s administration will take the steps necessary for the Company to bear with all the costs and expenses, as approved by the Audit Committee, in compliance with the limit established by the General Meeting of the Company.

§2 – The Audit Committee, by resolution of the majority of its members, may engage external consultants, including independent auditors and lawyers, to assist it in complying with its attributions, in compliance with the annual budget limit established by the General Meeting, according to the heading of this Article.

CHAPTER VI

FISCAL YEAR AND FINANCIAL STATEMENTS

Article 45 – The fiscal year will have the duration of one year, beginning on January 1st (first) of each year and ending on the last day of December.

Article 46 – Together with the financial statements, the bodies of the Company’s administration shall present to the Annual Shareholders’ Meeting, a proposal on the participation of the employees in the profits and destination of the net profit of the fiscal year.

§1 – The net profits will have the following destination:

I – 5% (five percent) to the legal reserve, up to 20% (twenty percent) of the capital stock paid-in;

II – 25% (twenty-five) percent (illegible) of the net profit adjusted according to items II and III of Article 202 of Law 6.404/76 (illegible) as minimum compulsory dividend to all the shareholders, in compliance with the provisions in the following article, this value being increased up to the amount necessary for the payment of the priority dividend of the preferred shares.

§2 – The balance of the net profits not allocated to the payment of the minimum compulsory dividend or to the priority dividend of the preferred shares will be destined to a supplementary reserve for expansion of the corporate business, which may not exceed 80% (eighty percent) of the capital stock. This limit being reached, the General Meeting shall deliberate on the balance, carrying out its distribution to the shareholders or to increase in the capital stock.

Article 47 – The value corresponding to the minimum compulsory dividend will be destined prioritarily to payment of the priority dividend of the preferred shares, up to the limit of the preference; next, the holders of common shares will be paid, up to the limit of the preferred shares; the balance, if any, will be apportioned by all the shares, in equal conditions.

§1- The bodies of the administration may pay or credit interest on net current assets pursuant to the terms of §7 of Article 9 of Law 9.249/95 and relevant legislation and regulation, which may be imputed to the compulsory dividends contemplated in Article 202 of Law 6.404/76, even when included in the minimum dividend of preferred shares.

§2 – The dividends not claimed within 03 (three) years shall revert to the benefit of the Company.

CHAPTER VII

LIQUIDATION OF THE COMPANY

Article 48 - The Company will enter into liquidation in the cases contemplated in the law, or by resolution of the General Meeting, which will establish the form of liquidation, elect the liquidator and convene the Audit Committee, for the liquidation period, electing the members and setting their respective remunerations.

CHAPTER VIII

GENERAL AND TRANSITORY PROVISIONS

Article 49 – The approval by the Company, through its representatives, of merger, split, incorporation or dissolution transactions of its subsidiaries shall be preceded by an economic-financial analysis by independent company, of international renown, confirming that equitable treatment is being given to all the interested companies, whose shareholders shall have full access to the report of each analysis.

Article 50 – These Bylaws shall be interpreted in good faith. The shareholders and the Company shall act, in their relations, preserving the strictest subjective and objective good faith.

TIM PARTICIPAÇÕES S.A.

Publicly Held Company

CNPJ/MF 02.558.115/0001-21

NIRE 33.300.276.963

MINUTES OF MEETING OF THE BOARD OF DIRECTORS

HELD ON APRIL 11, 2008

DATE, TIME AND PLACE: April 11, 2008, at 11:00h, at the headquarters of TIM Participações S.A. (“Company”), located at Avenida das Américas No. 3434, Block 1, Barra da Tijuca, Rio de Janeiro – RJ.

ATTENDANCE: Shareholders representing more than 74.63% (seventy-four point sixty-three percent) of the voting capital, as verified by the signatures posted in the Shareholders Attendance Book. Moreover, Mr. Gianandrea Castelli Rivolta, Financial and Investors Relations Director of the Company, Mr. Miguel Roberto Gherrize, member of the Audit Committee and also representative of the independent auditors of the Company were present.

PRESIDING OFFICERS: Chairman – Robson Goulart Barreto, Secretary – Alessandra Catanante.

CALL NOTICE: (1) Call Notice published in the Official Gazette of the State of Rio de Janeiro, in Jornal do Brasil and in Gazeta Mercantil, on March 25, 26 and 27, 2008; (2) The announcement contemplated in Article 133 of Law No. 6.404/76 was published in the Official Gazette of the State of Rio de Janeiro, in Gazeta Mercantil, on March 25, 26 and 27, 2008; (3) The administration report, the financial statements and the opinion of the independent auditors relative to the fiscal year ended on December 31, 2007 were published in the Official Gazette of the State of Rio de Janeiro, in Gazeta Mercantil and in Jornal do Brasil, on March 14, 2008.

AGENDA: (1) resolve on the administration report and the financial statements of the Company, in connection with the fiscal year ended on December 31, 2007; (2) resolve on the proposal by the administration in connection with the destination of the income of fiscal year 2007 and the distribution of dividends of the Company; (3) resolve on the proposal by the administration for increase in the capital stock of the Company; (4) elect the effective and deputy members of the Audit Committee and decide on the proposal for their remuneration; (5) resolve on the proposal of remuneration of the administrators of the Company in connection with the fiscal year 2008; and (6) decide on the alteration of the newspapers for legal publications of the Company.

READING OF DOCUMENTS, RECEIPT OF VOTES AND DRAWING UP OF MINUTES: (1) The reading of the documents related to the matter to be decided in this General Meeting, once its content is fully known by the shareholders; (2) The vote declarations, protests, and dissidences that may be presented will be numbered, received and authenticated by the Board and will be filed at the Company’s headquarters, pursuant to the terms of Article 130, §1 of Law 6.404/76; (3) The drawing up of these minutes was authorized, according to the (illegible) publication with omission of the signatures of all the shareholders, pursuant to the terms of Article 130, §§ 1 and 2 of Law 6.404/76, respectively; (4) minutes of the Annual and Special Shareholders’ Meeting will be drawn up in a single instrument, pursuant to the terms of Article 131, Sole §, of Law No. 6.404/76;

RESOLUTIONS: After analysis and discussion of the matter set forth in the Agenda, the shareholders decided, to: (1) approve, unanimously, the administration report and the financial statements of the Company, drawn up on December 31, 2007, which were the purpose of revision by the independent auditors of the Company, Directa Auditores, it being consigned the abstaining of the shareholders legally impeded in relation to the approval of the financial statements; (2) approve, by absolute majority o votes, the proposal of the administration of the destination of the income of fiscal year 2007 and of the distribution of the net profits of the fiscal year, less the legal reserve, and the remaining balance resulting from the reversal of the reserve for expansion, both paid exclusively to the preferred shares as priority dividend, as determined by Article 47 of the Company’s Bylaws. Thus, each preferred share will give the right to receive R$ 0.1377 (one thousand and seventy-seven tenths of thousandths of reais), to be paid in the period of up to 75 (seventy-five) days. It was emphasized that the common shares fail to give right to minimum dividends by virtue of the Company’s result in the past fiscal year having been insufficient to pay the priority dividends of the preferred shares; (3) approve, by majority of votes, the proposal of the administration for capital increase of the Company, in the amount of R$63,084,868.02 (sixty-three million, eighty-four thousand, eight hundred and sixty-eight reais and two cents) with issue of 3,359,308 (three million, three hundred and fifty-nine thousand, three hundred and eight) common shares and 6,503,066 (six million, five hundred and three thousand, sixty-six) preferred shares, at the price of issue of R$ 7.59 (seven reais and fifty-nine cents) and R$ 5.78 (five reais and seventy-eight cents) per common and preferred share, respectively, by capitalization of the remaining portion of the Special Premium Reserve, corresponding to the tax benefit earned by the Company’s Subsidiaries during the fiscal year 2007, which benefit resulting from the amortization of the premium incorporated by the Subsidiaries in the fiscal year 200. Pursuant to the terms of CVM Instruction No. 319/99 and the Split and Incorporation Protocols contemplated in this issue, the portion of the Special Premium Reserve corresponding to the tax benefit shall be

capitalized in the Subsidiaries, where R$37,904,239.62 (thirty-seven million, nine hundred and four thousand, two hundred and thirty-nine reais and seventy-two cents) in connection with TIM Celular S.A. and R$ 25,180,628.40 (twenty-five million, one hundred and eighty thousand, six hundred and twenty-eight reais and forty cents) in connection with TIM Nordeste S.A. As a result of the capital increase mentioned previously, the capital stock passes from R$7,550,525,275.10 (seven billion, five hundred and fifty million, five hundred and twenty-five thousand, two hundred and seventy-five reais and ten cents) to R$7,613,610,143.12 (seven billion, six hundred and thirteen million, six hundred and ten thousand, one hundred and forty-three reais and twelve cents) whereas its homologation is immediate in view of the commitments previously assumed by the shareholders of TIM Brasil Serviços e Participações S.A., the other minority shareholders being able to exercise their preemptive rights in the legal period, in the proportion of the shares held by them, as determined by CVM Instruction No. 319/99, the values eventually calculated reverting to said controlling clause. Thus, Article 5 of the Bylaws come into effect with the following wording: “Article 5 – The capital stock, subscribed and paid in is of R$7,613,610,143.12 (seven billion, six hundred and thirteen million, six hundred and ten thousand, one hundred and forty-three reais and twelve cents), represented by 2,343,826,537 (two billion, one thousand, one hundred and forty-three reais and twelve cents),, 798,350,977 (seven hundred and ninety-eight million, three hundred and fifty thousand, nine hundred and seventy-seven) being common shares and 1,545,475,560 (one billion, five hundred and forty-five million, four hundred and seventy-five thousand, five hundred and sixty) preferred shares, all nominative and without par value; (4) it was decided by the majority of the shareholders present to increase the composition of the Company’s Audit Committee to 5 (five) effective members and other 5 (five) deputy members and to elect, first, as effective member and deputy of the Company’s Audit Committee, in separate ballot, in the form of §4, section “a” of Article 161 of Law No.6.404/76, by shareholders representing approximately 2.77% (two point seventy-seven percent) of the preferred shareholders present at this Meeting, with abstaining of the controlling shareholder in the vote, as effective member, Mr. José Sampaio de Lacerda Junior, Brazilian, married, economist, holder of ID Card No. 198809, issued by SSP/DF, individual taxpayer register CPF No. 067.890.051/53, domiciled at SQN 213 – Block D – apt. 503, Asa Norte, Brasilia, and as deputy Mr. Robson Balilla, Brazilian, married, banker, and economist, holder of ID Card No. 5136909, individual taxpayer register under CPF No. 873.184.238/00, issued by SSP/SP, domiciled at Av. Alfredo Bechelli No. 74, Rudge Ramos, São Bernardo do Campo, São Paulo; further elected were, by majority vote of the shareholders holders of common shares present at this Meeting, as effective member: (i) Mr. Miguel Roberto Gherrize, Brazilian, married, accountant, CPF/MF No. 107140308-72, holder of ID Card RG No. 2563050, domiciled at Rua Joaquim José Esteves No. 60, apt. 192c, Bairro Santo Amaro, in the City and State of São Paulo, and as deputy Mr. João Carlos Hopp, Brazilian, married, college professor, CPF No. 201275708-10, holder of ID Card No. 1395761-2, issued by SSP/SP, residing at the city and State of São Paulo, at Alameda Casa Branca, No 456/ 7th floor,; (ii) Oswaldo Orsolia, Brazilian, married, economist CPF No 034.987.868-49, holder of ID Card No 29118529, issued by SSP/SP, domiciled at Avenida Lopes de Azevedo, No 154, casa 1, Bairro Jardim Everest, São Paulo/SP, CEP:05603-000, and as deputy Mr. Roosevelt Fernandes Leadebal, Brazilian, married, economist, CPF No. 016.083.804-59, holder of ID Card No. 74.045, issued by SSP/RN, residing at SQSW 305, Block G, apt. 407, Brasilia, DF; (iii) Messrs. Alberto Emmanuel Whitaker, Brazilian, married, administrator and lawyer, CRA 2724 and OAB/SP 37643, CPF No. 002.337.738-00, holder of ID Card 2025093, issued by SSP/SP, residing and domiciled at Alameda Itu No. 823, apt. 31, Bairro Cerqueira Cesar, São Paulo/SP, CEP 01421-000, and as deputy Mr. João Verner Juenemann, Brazilian, married, CPF No. 000.952.490-87, holder of ID Card No. 3010401283, residing at Rua André Poente, No. 238, Bairro Independência, Porto Alegre/RS. CEP: 90035-150, still elected as effective member Mr. Alfredo Ferreira Marques Filho, Brazilian, married, auditor, CRC 1SP154954/O-3, CPF No. 01329-000, and as deputy Mr. Francisco de Paula dos Reis Junior, Brazilian, married, auditor, CPF No. 007.190.878-13, holder of ID Card No. 9448100-3, issued by SSP-SP, residing at Rua dos Ingleses, 609, São Paulo, SP, CEP: 01329-000, accepting the indication and recommendation made by the representative of the administrator Credit Suisse Hedging-Griffo Corretora de Valores S.A., which now represents several minority shareholders holder of common shares present at this Meeting. The shareholders who indicated the members of the Audit Committee presently elected declared that, as a condition for investiture of these effective and deputy elected members, the shall obtain, within 30 (thirty) days, or even prior to the date of the next meeting of the Audit Committee, whichever occurs first, from these members the confirmation that they have the necessary qualifications and comply with the requirements established in Law 6.404/76 and in the Bylaws of the Company to hold the office of member of the Conselho Fiscal/Audit Committee of the Company. These presently elected members shall have a term of office until the Annual Shareholders’ Meeting of the Company to be held in (illegible) invested in the offices upon compliance with the conditions applicable and execution of the respective terms of investiture, as and in the period established in Law 6.404/76 and in the Company’s Bylaws. It was also approved, by majority of the votes cast, the aggregate remuneration of the members of the Audit Committee for the fiscal year 2008, in the amount of R$ 612,000.00 (six hundred and twelve thousand reais), which corresponds to R$11,500.00 (eleven thousand and five hundred reais) per member; (5) approve, unanimously, the remuneration of the administrators in connection with the fiscal year 2008, in the following terms: (a) Remuneration of the Board of Directors: aggregate annual remuneration of the Directors in the amount of R$ 459,000.00 (four hundred and fifty-nine thousand reais), to be attributed to the Directors, individually, according to the criteria deliberated in the next meeting of the Board of Directors; (b) Remuneration of the Management: aggregate annual remuneration in the amount of up to R$ 10,600,000.00 (ten million and six hundred thousand reais). With respect to the variable remuneration (bonus/profit sharing, to be determined according to the variable remuneration policy of the Company). It is registered that the proposal approved herein was appreciated by the Board of Directors of the Company, at a meeting held on March 04, 2008; and (6) ratify, unanimously, the decision of the administration, to the effect that the

legal publications of the Company start to be made in “Jornal do Comércio” and in “Valor Econômico”, in addition to the official body published in the State of Rio de Janeiro, pursuant to the terms of Article 289, §3 of Law 6.404/76.

ADJOURNMENT: Having nothing further to deal, the Chairman of the Board suspended the works for the time necessary to draw up these minutes. The session reopened, the minutes were read and approved by those present, signed by the President and Secretary of the Board and by the shareholders identified below.

[signature] [signature]

ROBSON GOULART BARRETO ALESSANDRA CATANANTE

Chairman of the Board Secretary of the Board

[signature]

TIM BRASIL SERVIÇOS E PARTICIPAÇÕES S.A.

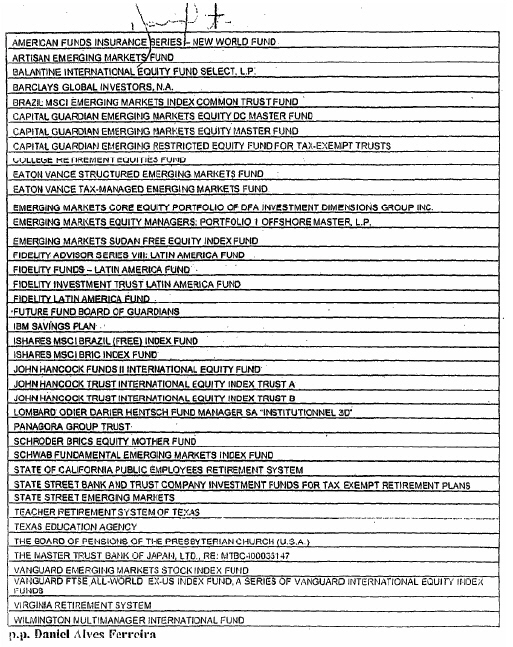

pp. Kenneth Gerald Clark Junior

[signature]

CAIXA DE PREVIDÊNCIA DOS FUNCIIONÁRIOS DO

BANCO DO BRASIL – PREVI

pp. Sabrina de Lima Martins

[signature]

FUNDAÇÃO DOS ECONOMIÁRIOS FEDERAIS – FUNCEF

pp. Sabrina de Lima Martins

[stamp of authentication as of may 28th 2008, signed by Jobson Eleuterio Belo, Authorized Clerl]

[seal]

[stamp]