QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Under Rule 14a-12 |

DOV PHARMACEUTICAL, INC. |

(Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

1) |

|

Title of each class of securities to which transaction applies:

|

| | | 2) | | Aggregate number of securities to which transaction applies:

|

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | 4) | | Proposed maximum aggregate value of transaction:

|

| | | 5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials:

|

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

|

|

(1) |

|

Amount previously paid: ___________________________________________________ |

|

|

(2) |

|

Form, Schedule or Registration Statement No.: _____________________________ |

|

|

(3) |

|

Filing Party: _____________________________________________________________ |

|

|

(4) |

|

Date Filed: _______________________________________________________________ |

DOV PHARMACEUTICAL, INC.

433 Hackensack Avenue

Hackensack, New Jersey 07601

May 5, 2003

Dear Shareholder:

I am pleased to invite you to the DOV Pharmaceutical, Inc. 2003 annual meeting of shareholders. The meeting will be at 10:00 a.m. on Friday, May 30, 2003, at the headquarters of DOV Pharmaceutical, Inc., 433 Hackensack Ave., Hackensack, New Jersey.

The proposals before the meeting are to elect a director to our board of directors, approve an amendment to our 2000 Stock Option and Grant Plan to increase the total number of shares of common stock authorized under the plan to 2,192,090 from 1,692,090, to ratify the selection of PricewaterhouseCoopers LLP as independent auditors for our fiscal year ending December 31, 2003, and transact any other business that properly comes before the meeting. You will have the opportunity at the meeting to ask questions of senior management and our auditors. In addition to the enclosed proxy statement, you will find other detailed information about us and our operations, including our audited financial statements, in the enclosed 2002 Annual Report to Shareholders.

We hope you can join us on May 30, 2003. Whether or not you can attend, please read the enclosed materials, and when you have done so, please mark your votes on the enclosed proxy card, sign and date the proxy card and return it in the enclosed envelope. Your vote is important, so please return your proxy card promptly. You remain free to change your vote with a revised proxy card or revoke your proxy by personal attendance at the meeting.

DOV PHARMACEUTICAL, INC.

433 Hackensack Avenue

Hackensack, New Jersey 07601

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held Friday, May 30, 2003

Dear Shareholder:

On Friday, May 30, 2003, starting at 10 a.m., DOV Pharmaceutical, Inc. will hold its 2003 annual meeting of shareholders at its headquarters, 433 Hackensack Ave., Hackensack, New Jersey. Only shareholders owning stock at the close of business on April 21, 2003, the record date, can vote at this meeting or any adjournments that may take place. At the meeting, we will ask you to vote in favor of the following proposals:

No. 1—elect a director to hold office for the term as described in the enclosed proxy statement;

No. 2—approve an amendment to the company's 2000 stock option and grant plan to increase by 500,000 the total number of shares of common stock authorized for issuance under the plan to 2,192,090 from 1,692,090; and

No. 3—ratify the selection of PricewaterhouseCoopers LLP as independent auditors of the company for its fiscal year ending December 31, 2003.

We may also transact any other business that properly comes before at the meeting.

Your board of directors recommends that you vote in favor of the three proposals as more fully outlined in the proxy statement.

At the meeting, we will also report on the 2002 business results of the company and other matters of interest to shareholders.

To ensure your representation at the annual meeting, you are urged to complete, sign, date and return the enclosed proxy card as soon as possible in the enclosed postage prepaid envelope. Your stock will be voted in accordance with the instructions you give on your proxy card. You may, of course, attend the meeting and vote in person as you wish even if you have previously returned your proxy card. You remain free to change your proxy vote by submission of a revised proxy.

The approximate date of mailing for the proxy statement and accompanying proxy card is May 5, 2003.

May 5, 2003

Please note that attendance at the annual meeting will be limited to shareholders as of the company as of the record date, or their authorized representatives, and guests of the company.

DOV PHARMACEUTICAL, INC.

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The board of directors of DOV Pharmaceutical, Inc. is sending you this proxy statement to solicit your proxy for use at our 2003 annual meeting of shareholders. The annual meeting will be held on Friday, May 30, 2003, at the headquarters of DOV Pharmaceutical, 433 Hackensack Ave., Hackensack, New Jersey, starting at 10:00 a.m. We intend to give or mail to shareholders definitive copies of the proxy statement and accompanying proxy card on or about May 5, 2003.

Record Date and Outstanding Shares

Only those shareholders owning common stock of DOV Pharmaceutical at the close of business on April 21, 2003, the record date for the annual meeting, are eligible to vote. At that date, there were approximately 14,523,135 issued and outstanding shares of common stock.

Quorum

A quorum for the annual meeting is a majority of the outstanding shares of common stock entitled to vote at the meeting present in person or by proxy.

Revocability of Proxies

If you give your proxy card to us, you have the power to revoke it at any time before it is exercised. Your proxy card may be revoked by:

- •

- notifying the secretary of DOV Pharmaceutical in writing before the annual meeting;

- •

- delivering to the Secretary of DOV Pharmaceutical before the annual meeting a signed proxy card with a later date; or

- •

- attending the annual meeting and voting in person.

Voting

You are entitled to one vote for each share of common stock you hold.

If your shares are represented by proxy, they will be voted in accordance with your directions. If your proxy is signed and returned without any direction given, your shares will be voted in accordance with our recommendations. We are not aware, as of the date of this proxy statement, of any matter to be voted on at the annual meeting other than those stated in this proxy statement. If any other matter is properly brought before the annual meeting, the enclosed proxy card gives discretionary authority to the persons named in it to vote the shares.

A majority of shares entitled to vote, present at the meeting in person or by proxy, is required for a quorum. A majority of the votes properly cast for and against each of Proposal Nos. 1, 2 and 3 will determine whether it is adopted. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting, but will be disregarded in determining the "votes cast" for purposes of each of Proposal Nos. 1, 2 and 3. As a result, abstentions and broker non-votes will not affect the outcome of those proposals. A "broker non-vote" is a proxy from a broker or other nominee indicating that such person has not received instructions from the beneficial owner or other person entitled to vote the shares covered by the proxy on a particular matter where the broker or other nominee does not have discretionary voting power.

1

Attendance at the Annual Meeting

If you own shares of record, you may attend the annual meeting and vote in person, regardless of whether you have previously voted on a proxy card. If you own shares through a bank or brokerage account, you may attend the annual meeting, but you must bring account statements or letters from the bank or brokerage firm showing that you owned DOV Pharmaceutical common stock as of April 21, 2003. Additionally, if you own shares through a bank or brokerage account, to vote your shares in person at the meeting, you must obtain a "legal proxy" from the bank or brokerage firm that holds your shares. You should contact your account representative to learn how to obtain a "legal proxy."

Solicitation of Proxies

Proxies may be solicited by certain of our directors, officers and regular employees, without payment of any additional compensation to them. Proxies may be solicited by personal interview, mail, electronic mail or telephone. Any costs relating to such solicitation of proxies will be borne by us. In addition, we may reimburse banks, brokerage firms and other persons representing beneficial owners of shares of common stock for their expense in forwarding solicitation materials to beneficial owners.

Publication of Voting Results

We will announce preliminary voting results at the meeting. We will publish the final results in our quarterly report on Form 10-Q for the second quarter of 2003.

PROPOSAL NO. 1: ELECTION OF DIRECTOR

In accordance with our by-laws, the board of directors has fixed the number of directors at six. The board is divided into three classes, with one class of directors elected to a three-year term at each annual meeting of shareholders. At the 2003 annual meeting, one director will be elected to hold office until the 2006 annual meeting of shareholders, or until his respective successor is elected and qualified.

The board of directors is currently comprised of five members. The class I director, whose term expires at the 2003 annual meeting, is Mr. Daniel S. Van Riper. The class II directors, whose terms expire at our 2004 annual meeting, are Dr. Bernard Beer and Dr. Zola Horovitz. The class III directors, whose terms expire at our 2005 annual meeting, are Dr. Arnold S. Lippa and Mr. Patrick Ashe. There currently is a vacancy representing the position previously held by Mr. Mark Lampert, a class I director, who resigned effective November 1, 2002.

The board has proposed that nominee Mr. Daniel S. Van Riper be re-elected at the annual meeting. Unless otherwise instructed, persons named in the accompanying proxy will vote for this nominee. Although we anticipate that Mr. Van Riper will be available to serve as director, should he ask that his nomination be withdrawn, or otherwise be unable to serve, the proxyholders will have discretionary authority to vote for a substitute nominee.

The board of directors recommends a vote "FOR" approval of Proposal No. 1.

The names of the nominee and of the directors whose terms continue after the annual meeting, their ages as of May 30, 2003, and certain other information about them are set forth below:

Continuing Directors

| | Age

| | Company Position/Offices

| | Director Since

| | Term Expires

|

|---|

| Daniel S. Van Riper(1)(2) | | 62 | | Director | | March 2002 | | |

| Arnold S. Lippa, Ph.D.(3) | | 56 | | Chairman and Chief Executive Officer | | April 1995 | | 2005 |

| Patrick Ashe(1) | | 40 | | Director | | January 1999 | | 2005 |

| Bernard Beer, Ph.D. | | 70 | | Co-Chairman, President and Director | | April 1995 | | 2004 |

| Zola Horowitz, Ph.D(1)(2)(3) | | 68 | | Director | | April 1995 | | 2004 |

There are no family relationships among any of the directors or executive officers of the Company.

- (1)

- Member of audit committee

- (2)

- Member of compensation committee

- (3)

- Member of search committee

2

Nominee for the Board of Directors for Three-Year Term

Daniel S. Van Riper became a member of our board of directors in March 2002. He is also a member of the board of directors and chairman of the audit committee of New Brunswick Scientific Co., Inc. Mr. Van Riper is currently employed as special advisor to Sealed Air Corporation, where he served as senior vice president and chief financial officer from July 1998 to January 2002. Previously, Mr. Van Riper was a partner of KPMG LLP, where he worked from June 1962 to June 1998. Mr. Van Riper was graduated with high honors and a B.S. in accounting and a M.B.A. in economics and finance from Rutgers University. He is a certified public accountant, and a member of the American Institute of Certified Public Accountants and Beta Gamma Sigma, national honorary business fraternity.

Continuing Non-Management Director Profiles

Patrick Ashe has been a member of our board of directors since January 1999. He currently serves as senior vice president, business development at Athpharma, Ltd. From May 1994 to November 2001, Mr. Ashe served as vice president, commercial development at Elan Pharmaceutical Technologies, a division of Elan Corporation, plc. Additionally, from January 1999 to November 2001, Mr. Ashe also served as co-manager of Nascime Limited, a company formed in connection with our joint venture with Elan. Mr. Ashe was graduated from University College Dublin with a B.Sc. in pharmacology in 1985 and completed his M.B.A. at Dublin City University's Business School in 1994.

Zola Horovitz, Ph.D. has been a member of our board of directors since our formation in April 1995. Dr. Horovitz currently is a consultant to the pharmaceutical and biotechnology industries and serves as a director of Diacrin, Inc., BioCryst Pharmaceuticals, Inc., Avigen, Inc., Genaera Pharmaceuticals, Inc. and Paligent, Inc. Before joining us, Dr. Horovitz served 35 years in various managerial and research positions at Bristol-Myers Squibb and its affiliates. At Bristol-Myers Squibb, Dr. Horovitz served as vice president, business development and planning from 1991-1994, vice president, licensing in 1990, and vice president, research, planning and scientific liaison from 1985-1989. Dr. Horovitz received a B.S. in pharmacy and his M.S. and Ph.D. in pharmacology from the University of Pittsburgh in 1955, 1958 and 1960 respectively.

Information on Committees of the Board of Directors and Meetings

During the last fiscal year, the board of directors met or acted by unanimous written consent twelve times. All incumbent directors attended at least 75% of board meetings and the meetings of the committees on which they served.

The board of directors has a compensation committee, an audit committee and a search committee.

Compensation Committee. The compensation committee reviews and approves the compensation of our executive officers and directors, carries out duties under our incentive compensation plans and other plans approved by us as may be assigned to the committee by the board of directors and makes recommendations to the board of directors regarding these matters. The current members of the compensation committee are Zola Horovitz (chairman) and Daniel Van Riper. The compensation committee met or acted by unanimous written consent six times during the last fiscal year.

Audit Committee. The audit committee determines the selection and retention of our independent auditors, reviews the scope and results of audits, submits appropriate recommendations to the board of directors regarding audits, reviews our internal controls and is responsible for reviewing filings with the Securities and Exchange Commission and releases containing our financial statements. The current members of the audit committee are Patrick Ashe, Zola Horovitz and Daniel Van Riper (chairman). The audit committee met three times during the last fiscal year.

Search Committee. This committee has the responsibility of identifying and recommending a director to fill the existing board vacancy. It may also make recommendations regarding an increase in

3

board size. Its members are Zola Horovitz (chairman) and Arnold Lippa. It met twice during the last fiscal year.

Compensation of Directors

Our outside directors each receive $4,000 for each quarterly board meeting in which they participate. In 2002, Mr. Van Riper received a nonqualified stock option to purchase 24,300 shares of our common stock at an exercise price of $6.17 per share. These options will become exercisable in equal (25%), annual installments after the completion of each full year of service following such grant. Our compensation committee members receive $500 for each meeting in which they participate. Our audit committee members receive $1,000 for each meeting in which they participate and the chairman of the audit committee receives an additional $1,000 for each meeting in which he participates, up to a maximum of $4,000 annually. We have agreed to reimburse our directors for their reasonable expenses incurred in attending meetings of the board of directors and its committees.

PROPOSAL NO. 2: AMENDMENT OF 2000 STOCK OPTION AND GRANT PLAN

You are being asked to approve an amendment of the 2000 stock option and grant plan to increase the number of shares authorized for grant by 500,000 shares. The plan is applicable for grants to officers, employees, advisers, consultants and directors of the company and its majority-owned subsidiaries. A total of 2,192,090 shares of common stock would be authorized for issuance under the plan, of which 1,366,239 were subject to outstanding options at December 31, 2002, leaving 825,851 shares available for grant. This includes the proposed increase of 500,000 shares. During 2002, we granted the following under the plan:

- —

- employees options to purchase a total of 475,000 shares at exercise prices ranging from $4.25 to $4.40 per share to two current executive officers;

- —

- options to purchase a total of 152,040 shares at exercise prices ranging from $3.95 to $10.19 per share to other employees;

- —

- options to purchase 24,300 shares at an exercise price of $6.17 to Mr. Van Riper, a current director who is not an executive officer; and

- —

- options to purchase 8,100 shares at an exercise price of $10.19 per share to a consultant.

For information regarding stock option grants to our CEO and our four other most highly compensated executives for the year ended December 31, 2002, see "Executive Compensation—Summary Compensation Table."

The board of directors believes that this share increase is necessary in order to assure that we will have a sufficient reserve of shares of common stock available in the future to grant options to attract and retain the services of individuals considered to be essential to our long-term success. This amendment to the plan will reserve for issuance an additional 500,000 shares of common stock and make no further change. If the stockholders fail to approve this proposal, the 2000 stock option and grant plan will continue with the present authorization for issuance.

No grants have been made with respect to the additional shares of our common stock to be reserved for issuance under the 2000 stock option and grant plan. The number of shares of our common stock that may be granted to executive officers, non-executive directors and non-executive employees is not determinable at this time, as such grants are subject to the discretion of the plan administrator, our compensation committee.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to approve the increase amendment.

The essential features of the Company's various stock option and grant plans are summarized below:

4

1998 Stock Option Plan

Our 1998 stock option plan, adopted by our board of directors and approved by our stockholders in September 1998, provided for the issuance of 2,025,000 shares of our common stock. As of March 1, 2003, options to purchase 1,130,760 shares of our common stock were outstanding under the 1998 plan. Generally, options granted under the 1998 plan vest 50% six months from the date of grant and 50% eighteen months from the date of grant. All options generally terminate on the tenth anniversary of the date of grant. In the event of a change in control, all options will become immediately exercisable. The compensation committee administers the 1998 plan. We will not make any additional grants under the plan.

Stock Option Grant to Phil Skolnick

In connection with the commencement of Dr. Skolnick's employment with us in January 2001, we granted him stock options to acquire 405,000 shares of our common stock at (as adjusted for our subsequent 1.62-for-1 stock split) an exercise price of $2.78 per share (as so adjusted). Dr. Skolnick's options vest as follows: 50% on July 19, 2002 and ratably thereafter over the next six quarters. Although Dr. Skolnick's 405,000 options were not granted under our 1998 stock option plan or our 2000 stock option and grant plan, the options were charged against the total number of options available for future grants under our 2000 plan.

2000 Stock Option and Grant Plan

Our board of directors adopted, and our stockholders approved, our 2000 stock option and grant plan in November 2000. The 2000 plan provides for the issuance of up to 1,692,090 shares of common stock plus that number of shares of common stock underlying any future termination, cancellation or reacquisition of options granted under the 1998 stock option plan. Additionally, if any of the 405,000 options granted to Dr. Skolnick are terminated, canceled or otherwise reacquired by us, that number of reacquired shares will also become available for issuance under the 2000 plan. As of March 6, 2003, options to purchase 1,465,620 shares of common stock had been granted and 226,470 shares of common stock were available for future grants under the 2000 plan. Our compensation committee administers the 2000 Plan.

Under the 2000 stock option and grant plan, our compensation committee may:

- •

- grant incentive stock options;

- •

- grant non-qualified stock options;

- •

- grant stock appreciation rights;

- •

- issue or sell common stock with or without vesting or other restrictions; and

- •

- grant common stock upon the attainment of specified performance goals.

These grants and issuances may be made to our officers, employees, directors, consultants, advisors and other key persons.

The compensation committee has the right, in its discretion, to select the individuals eligible to receive awards, determine the terms of the awards granted, accelerate the vesting schedule of any award and generally administer and interpret the 2000 plan.

The exercise price of options granted under the 2000 plan is determined by our compensation committee. Under present law, incentive stock options and options intended to qualify as performance-based compensation under section 162(m) of the Internal Revenue Code of 1986 may not be granted at an exercise price less than the fair market value of our common stock on the date of grant, or less than 110% of the fair market value in the case of incentive stock options granted to optionees holding more than 10% of our voting power.

Non-qualified stock options may be granted under the 2000 plan at prices that are less than the fair market value of the underlying shares on the date granted. Options are typically subject to vesting

5

schedules, terminate 10 years from the date of grant and may be exercised for specified periods after the termination of the optionee's employment or other service relationship with us. Upon the exercise of options, the option exercise price must be paid in full either in cash or by certified or bank check or other instrument acceptable to the committee or, in the sole discretion of the committee, by net equity cashless exercise or delivery of shares of common stock that have been owned by the optionee free of restrictions for at least six months.

Restricted stock awards may be granted to eligible service providers at the compensation committee's discretion. The compensation committee determines the terms of restricted stock awards and a restricted stock agreement may give us the option, or impose an obligation, to repurchase some of or all the shares of restricted stock held by a grantee upon the termination of the grantee's employment or other service relationship with us. Restricted stock awards vest at a rate determined by the compensation committee and may be granted without restrictions.

Stock appreciation rights may be granted to eligible service providers at the compensation committee's discretion. Stock appreciation rights entitle the optionee to elect to receive an amount of cash or shares of stock or a combination thereof having a value equal to the excess of the value of the stock on the date of exercise over the exercise price of the award. The terms of the stock appreciation rights will be determined by the compensation committee. Stock appreciation rights will generally terminate upon the termination of an optionee's employment or other service relationship with us.

The 2000 plan and all awards granted under the plan will terminate upon a merger, reorganization or consolidation, the sale of all or substantially all our assets or all our outstanding capital stock or a liquidation or other similar transaction, unless we and the other parties to such transactions agree otherwise. All participants under the 2000 plan will be permitted to exercise before any such termination all awards held by them that are then exercisable or will become exercisable upon the closing of the transaction. Under employment agreements with executive officers vesting may be accelerated in connection with a change of control.

PROPOSAL NO. 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The audit committee has appointed, with board approval, PricewaterhouseCoopers LLP as our independent auditors for fiscal year 2003. PricewaterhouseCoopers LLP has served as our independent auditors since November 2001 and provided us with audit services in respect of the years 1999, 2000, 2001 and 2002. In the event that ratification of this selection of auditors is not approved the annual meeting, the audit committee will re-address its selection of auditors.

A representative of PricewaterhouseCoopers LLP will to be present at the annual meeting. The representative will have an opportunity to make a statement and will be available to respond to questions from shareholders.

6

EQUITY COMPENSATION PLAN INFORMATION

We maintain two equity compensation plans, the 2000 stock option and grant plan and the 1998 stock option plan, each of which is described above. The following table sets forth information regarding securities authorized for issuance under our equity compensation plans as of December 31, 2002, excluding the proposed increase set forth above:

| | Equity Compensation Plan Information

|

|---|

Plan category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities referenced in

column (a))

|

|---|

| | | (a) | | | (b) | | (c) |

| Equity compensation plans approved by security holders | | 2,545,599 | | $ | 3.68 | | 277,251 |

Equity compensation plans not approved by security holders(1) |

|

405,000 |

(1) |

$ |

2.78 |

|

0 |

Total |

|

2,950,599 |

|

$ |

3.56 |

|

277,251 |

- (1)

- Represents options granted to Dr. Skolnick as described above under "Proposal No. 2: Amendment of 2000 Stock Option and Grant Plan." Dr. Skolnick's options were charged to the 2000 plan, which was approved by security holders.

REPORT BY THE AUDIT COMMITTEE(1)

The audit committee is a committee of the board of directors. Its primary function is to assist the board in fulfilling its oversight responsibilities by reviewing the financial information to be provided to shareholders and others, the systems of internal controls that management and the board have established and our audit process. The members of the audit committee are independent as that term is defined in Rule 4200(a)(14) of the National Association of Securities Dealers Marketplace Rules.

- (1)

- This Report is not "soliciting material," is not deemed "filed" with the SEC and is not intended to be incorporated by reference in any filing of the company under the Securities Act or the Exchange Act, whether made before or after the date hereof and notwithstanding of any general incorporation language in such filing.

Our outside auditors are ultimately accountable to the audit committee as the representative of the shareholders. The audit committee has the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the outside auditors and reviews whether the non-audit services provided by them are compatible with being independent for purposes of our financial audit. It is the responsibility of management to prepare the financial statements and the responsibility of the outside auditors to obtain reasonable assurance whether the company's financial statements are free from material misstatement and present fairly, in all material respects, our financial position as of our balance sheet data and our result of operations and cash flows for the fiscal period in accordance with accounting principles generally accepted in the United States of America.

The board of directors and audit committee have adopted an audit committee charter. A copy of the charter is attached as Appendix A. The audit committee held three meetings during calendar 2002, including pre-issuance reviews of quarterly financial statements and press releases. The committee has reviewed and discussed the audited financial statements for fiscal year 2002 with our management and our auditors. In addition, the committee has discussed with our auditors the matters required to be discussed by Statement on Auditing Standards No. 61. The audit committee also has received the written disclosures and the letter from the auditors required by the Independence Standards Board

7

Standard No. 1 and has discussed their independence with the auditors. Based on these discussions and reviews, the audit committee recommended to the board of directors that the audited financial statements be included in our annual report on Form 10-K for the year ended December 31, 2002, filed with the Securities and Exchange Commission.

The aggregate fees and expenses billed for professional services rendered by our auditors PricewaterhouseCoopers LLP with respect to fiscal year 2002 were as follows:

(1) |

|

Audit Fees |

|

$ |

136,500 |

(2) |

|

Financial Information Systems Design and Implementation Fees |

|

$ |

— |

(3) |

|

All Other Non-Audit Related Fees |

|

$ |

273,723 |

Audit fees include fees for quarterly reviews, the 2002 audit fee for DOV Bermuda, a joint venture with Elan Corporation plc in which we hold an 80.1% equity interest, and the 2002 audit fee for Nacime Ltd., a wholly owned subsidiary of the print venture. Non-audit related fees include fees of $262,723 for our initial public offering, which was completed in April 2002, $5,000 for tax return preparation services and $6,000 for review of the S-8 filing for our shareholder rights plan.

The audit committee has determined that the provision of the services provided by PricewaterhouseCoopers LLP is compatible with maintaining auditor independence.

Audit Committee

Daniel S. Van Riper (chairman)

Patrick Ashe

Zola Horovitz

8

STOCK PERFORMANCE GRAPH

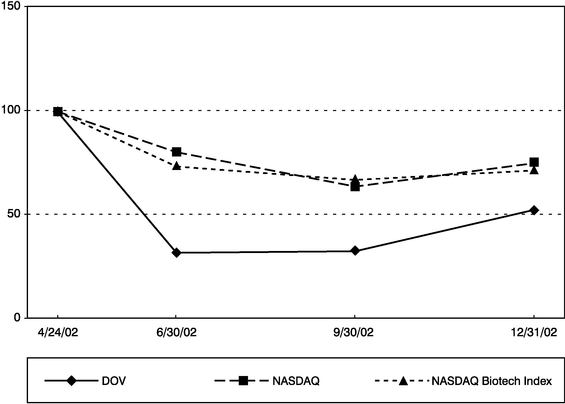

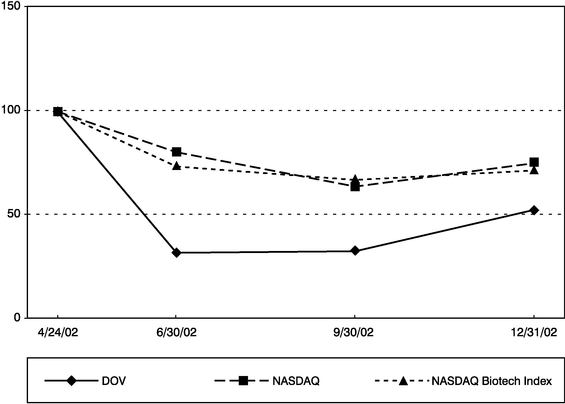

The following graph compares the cumulative total stockholder return data for our common stock since April 24, 2002 (the date on which our common stock was first registered under section 12 of the Securities Exchange Act of 1934) to the cumulative return over such period of (i) the Nasdaq Stock Market (U.S.) Index, and (ii) the Nasdaq Biotechnology Index. The graph assumes that $100 was invested on April 24, 2002, the date on which we priced the initial public offering of our common stock, and at the same time in each of the comparative indices. The graph further assumes that such amount was initially invested in our common stock at a per share price of $13.00, the price which the stock was first sold to the underwriters on the date of our initial public offering, and reinvestment of any dividends. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

COMPARISON OF CUMULATIVE TOTAL RETURN

FROM APRIL 24, 2002 TO DECEMBER 31, 2002

| | 04/24/02

| | 06/30/02

| | 09/30/02

| | 12/31/02

|

|---|

| DOV Pharmaceutical, Inc. | | 100.0 | | 31.5 | | 32.3 | | 52.3 |

| NASDAQ Stock Market (U.S.) | | 100.0 | | 80.3 | | 63.7 | | 74.9 |

| NASDAQ Biotechnology Index | | 100.0 | | 73.3 | | 66.8 | | 71.4 |

9

CERTAIN TRANSACTIONS

Employment Agreements

Arnold S. Lippa, Ph.D. We have entered into an employment agreement with Dr. Lippa, which provides for his employment as CEO until December 10, 2004. Dr. Lippa's base compensation was $296,154 for 2002, and during each subsequent year his base compensation will increase by at least 10% annually. The agreement provides for benefits, the reimbursement of expenses and the payment of incentive compensation, which will be determined by our board of directors in its sole discretion. Additionally, if we should merge or consolidate with or into an unrelated entity, sell all or substantially all our assets, or enter into a transaction or series of transactions with the result that 51% or more of our capital stock is transferred to one or more unrelated third parties, Dr. Lippa is entitled to receive a bonus equal to 2% of the gross proceeds of such sale (as defined in the agreement). We are obligated to continue to pay Dr. Lippa his base and incentive compensation and to continue his benefits for a period of nine months if he is terminated upon becoming disabled or for a period of 90 days upon his death. If Dr. Lippa terminates his employment with us for good reason, or within six months of a change of control, or if we terminate Dr. Lippa without cause, he is entitled to receive his base and incentive compensation and the continuation of all benefits for two years from the date of termination, and all stock options granted to him will immediately vest. The agreement also requires Dr. Lippa to refrain from competing with us and from soliciting our clients and customers for the duration of his employment and for a period following employment equal to the length of time we make severance payments to him.

Bernard Beer, Ph.D. We have entered into an employment agreement with Dr. Beer, which provides for his employment as President until December 10, 2004. Dr. Beer's base compensation was $296,154 for 2002, and during each subsequent year his base compensation will increase by at least 10% annually. The agreement provides for benefits, the reimbursement of expenses and the payment of incentive compensation, which will be determined by our board of directors in its sole discretion. Additionally, if we should merge or consolidate with or into an unrelated entity, sell all or substantially all of our assets, or enter into a transaction or series of transactions with the result that 51% or more of our capital stock is transferred to one or more unrelated third parties, Dr. Beer is entitled to receive a bonus equal to 2% of the gross proceeds of such sale (as defined in the agreement). We are obligated to continue to pay Dr. Beer his base and incentive compensation and to continue his benefits for a period of nine months if he is terminated upon becoming disabled or for a period of 90 days upon his death. If Dr. Beer terminates his employment with us for good reason, or within six months of a change of control, or if we terminate Dr. Beer without cause, he is entitled to receive his base and incentive compensation and the continuation of all benefits for two years from the date of termination, and all stock options granted to him shall immediately vest. The agreement also requires Dr. Beer to refrain from competing with us and from soliciting our clients and customers for the duration of his employment and for a period following employment equal to the length of time we make severance payments to him.

Phil Skolnick, Ph.D., D.Sc.(hon) In connection with his employment by us in January 2001, we entered into an employment agreement with Dr. Skolnick, which provides for his employment as Vice-President, Research and Chief Scientific Officer until January 19, 2004. Under the agreement, we will pay Dr. Skolnick base compensation of at least $250,000 per year. The agreement provides for benefits, the reimbursement of expenses and the payment of incentive compensation, which will be determined by our board of directors in its sole discretion. Additionally, upon the commencement of Dr. Skolnick's employment, we granted him options to purchase 405,000 shares of our common stock (adjusted for subsequent 1.62-for-1 stock split) at an exercise price of $2.78 (as so adjusted). The options vest 50% on July 19, 2002 and will continue to vest ratably thereafter over the next six quarters. We are obligated to continue to pay Dr. Skolnick his base and incentive compensation and to continue his benefits for a period of nine months if he is terminated upon becoming disabled or for a

10

period of 90 days upon his death. If Dr. Skolnick terminates his employment with us for good reason, or within six months of a change of control, or if we terminate Dr. Skolnick without cause, he is entitled to receive his base compensation for three years from the date of termination and all stock options granted to him will immediately vest. The agreement also requires Dr. Skolnick to refrain from competing with us and from soliciting our customers and clients for the duration of his employment and for a period following employment equal to the length of time we make severance payments to him.

Paul Schiffrin. We entered into an employment agreement with Mr. Schiffrin, which provided for his employment as Vice-President, Corporate Services. Mr. Schiffrin terminated and went on long term disability in January 2003. Under the agreement, we agreed to pay Mr. Schiffrin base compensation of at least $180,000 per year. The agreement provided for benefits, the reimbursement of expenses and the payment of incentive compensation, to be determined by our board of directors in its sole discretion. Mr. Schiffrin qualified for long term disability through our insurance carrier upon his departure.

Barbara Duncan. In connection with her employment by us in August 2001, we entered into an employment agreement with Ms. Duncan, which provides for her employment as Vice-President, Finance and Chief Financial Officer until August 20, 2004. Under the agreement, we will pay Ms. Duncan base compensation of at least $225,000 per year. The agreement provides for benefits, the reimbursement of expenses and the payment of incentive compensation, which will be determined by our board of directors in its sole discretion. Additionally, upon the commencement of Ms. Duncan's employment, we granted her options to purchase 364,500 shares of our common stock (adjusted for subsequent 1.62-for-1 stock split) at an exercise price of $4.01 (as so adjusted). The options vested 50% on February 20, 2003 and will continue to vest ratably thereafter over the next six quarters. We are obligated to continue to pay Ms. Duncan her base and incentive compensation and to continue her benefits for a period of nine months if she is terminated upon becoming disabled or for a period of 90 days upon her death. If Ms. Duncan terminates her employment with us for good reason, or within six months of a change of control, or if we terminate Ms. Duncan without cause, she is entitled to receive her base compensation for three years from the date of her agreement and all stock options granted to her will immediately vest. The agreement also requires Ms. Duncan to refrain from competing with us and from soliciting our customers and clients for the duration of her employment and for a period following employment equal to the length of time we make severance payments to her.

Robert Horton. In connection with his employment by us in August 2002, we entered into an employment agreement with Mr. Horton, which provides for his employment as Vice-President and General Counsel until August 16, 2005. Under the agreement, we will pay Mr. Horton base compensation of at least $250,000 per year. The agreement provides for benefits, the reimbursement of expenses and the payment of incentive compensation, which will be determined by our board of directors in its sole discretion. Additionally, upon the commencement of Mr. Horton's employment, we granted him options to purchase 250,000 shares of our common stock at an exercise price of $4.40. The options vest 50% on March 12, 2004 and will continue to vest ratably thereafter over the next six quarters. We are obligated to continue to pay Mr. Horton his base and incentive compensation and to continue his benefits for a period of nine months if he is terminated upon becoming disabled or for a period of 90 days upon his death. If Mr. Horton terminates his employment with us for good reason, or within six months of a change of control, or if we terminate Mr. Horton without cause, he is entitled to receive his base compensation for three years from the date of his agreement and all stock options granted to him will immediately vest. The agreement also requires Mr. Horton to refrain from competing with us and from soliciting our customers and clients for the duration of his employment and for a period following employment equal to the length of time we make severance payments to him.

11

Laurence Meyerson, Ph.D. In connection with his employment by us in September 2002, we entered into an employment agreement with Dr. Meyerson, which provides for his employment as Senior Vice-President, Drug Development until September 16, 2005. Under the agreement, we will pay Dr. Meyerson base compensation of at least $250,000 per year. The agreement provides for benefits, the reimbursement of expenses and the payment of incentive compensation, which will be determined by our board of directors in its sole discretion. Additionally, upon the commencement of Dr. Meyerson's employment, we granted him options to purchase 225,000 shares of our common stock at an exercise price of $4.25. The options vest 50% on April 16, 2004 and will continue to vest ratably thereafter over the next six quarters. We are obligated to continue to pay Dr. Meyerson his base and incentive compensation and to continue his benefits for a period of nine months if he is terminated upon becoming disabled or for a period of 90 days upon his death. If Dr. Meyerson terminates his employment with us for good reason, or within six months of a change of control, or if we terminate Dr. Meyerson without cause, he is entitled to receive his base compensation for three years from the date of his agreement and all stock options granted to him will immediately vest. The agreement also requires Dr. Meyerson to refrain from competing with us and from soliciting our customers and clients for the duration of his employment and for a period following employment equal to the length of time we make severance payments to him.

Related Party Transactions

From January 1, 2002 until August 1, 2002, Ms. Morgen Lippa, daughter of Arnold Lippa, was employed by us as Comptroller and a project manager. During 2002, she was paid $52,654 in salary, $10,000 in bonuses and was awarded options to purchase 8,100 shares of our common stock. Ms. Lippa resigned effective August 1, 2002. As part of a severance agreement with Ms. Lippa, she was paid $46,681 in a lump sum severance payment, we accelerated the vesting on 10,000 options and we extended the exercise date of all her options an additional nine months from what is provided under the 1998 stock option and the 2000 stock option and grant plans. As a result, we recorded a charge of $11,858 for the acceleration and extended exercise date of the options.

Mr. Gary Beer, son of Bernard Beer, is employed by us as Director of Data Management. During 2002, he was paid $77,211 in salary, $10,000 in bonuses and was awarded options to purchase 8,100 shares of our common stock. Effective December 1, 2002, Mr. Beer's annual salary was increased to $145,000 annually because of substantially expanded responsibilities.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the officers, directors and persons who own more than 10% of a registered class of our equity securities of to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater-than-10% beneficial owners are required by SEC regulations to furnish us with copies of all section 16(a) forms they file.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of March 6, 2003, certain information regarding the beneficial ownership of our common stock by:

- •

- each person known by us to beneficially own 5% or more of a class of our common stock;

- •

- each of our directors;

- •

- each of our executive officers for whom compensation information is given in the Summary Compensation Table in this proxy statement; and

- •

- all our directors and executive officers of as a group.

12

The number of shares beneficially owned by each stockholder is determined under rules issued by the SEC (Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended) and includes voting or investment power with respect to securities. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and includes any shares to which an individual or entity has the right to acquire beneficial ownership within 60 days of March 6, 2003, through the exercise of any warrant, stock option or other right. The inclusion in this calculation of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. Unless otherwise indicated, the address of all listed stockholders is c/o DOV Pharmaceutical, Inc., 433 Hackensack Avenue, Hackensack, NJ 07601. Each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

Name of Beneficial Owner

| | Number of Shares

Beneficially Owned

| | Percentage of

Class(1)

| |

|---|

Elan Corporation, plc(2)

Lincoln House

Lincoln Place

Dublin 2, Ireland | | 3,893,989 | | 21.80 | % |

Elan Pharmaceutical Investments II, Ltd.(3)

Flatts, Smiths Parish

Bermuda, FL04 | | 983,338 | | 6.35 | |

BVF Inc.(4)

1 Sansome Street

39th Floor

San Francisco, CA 94104 | | 2,049,300 | | 14.14 | |

CIBC World Markets Corp.

425 Lexington Avenue

New York, NY 10017 | | 1,874,005 | | 12.93 | |

Merlin BioMed Private Equity Fund, L.P.

230 Park Ave, Suite 928

New York, NY 10169 | | 810,000 | | 5.59 | |

Reservoir Capital Group, L.L.C.(5)

650 Madison Ave.

New York, NY 10022 | | 810,000 | | 5.59 | |

Oppenheimer Discovery Fund

6803 South Tuscan Way

Englewood, CO 80112 | | 486,000 | | 3.35 | |

| Arnold Lippa(6) | | 1,790,100 | | 12.18 | |

| Bernard Beer(6) | | 1,790,100 | | 12.18 | |

| Phil Skolnick(7) | | 303,750 | | 2.05 | |

| Stephen Petti(8) | | 261,400 | | 1.78 | |

| Barbara Duncan(9) | | 182,250 | | 1.24 | |

| Paul Schiffrin(10) | | 109,520 | | * | |

| Zola Horovitz(11) | | 263,756 | | 1.80 | |

| Patrick Ashe(12) | | 86,569 | | * | |

| Daniel S. Van Riper(13) | | 6,075 | | * | |

| All directors and executive officers as a group (7 persons)(14) | | 4,532,120 | | 28.40 | |

- *

- Less than one percent.

- (1)

- The number of outstanding shares of our common stock is based on the number of shares and common stock equivalents outstanding as of March 6, 2003. Our calculation uses 14,490,635 shares of common

13

stock, including the shares of common stock issuable upon conversion and exercise of the securities listed in the following footnote.

- (2)

- Elan Corporation, plc is the parent corporation of, and wholly owns, either directly or indirectly, Elan Pharmaceutical Investments, Ltd., and has or shares, either directly or indirectly, voting and investment power with respect to shares of our common stock held of record by Elan Pharmaceutical Investments, Ltd. Includes 525,025 shares of common stock, warrants to purchase 196,500 shares of common stock that are currently exercisable, 574,521 shares of common stock issuable upon the conversion of our series B preferred stock and approximately 2,672,943 shares of common stock issuable upon the conversion of the Elan exchangeable convertible promissory note.

- (3)

- Includes approximately 983,338 shares of common stock issuable upon the conversion of the Elan convertible line of credit.

- (4)

- BVF Inc. is the general partner of BVF Partners L.P., which is either the general partner of or the investment advisor of Biotechnology Value Fund, L.P., Biotechnology Fund II, L.P. and Investment 10 LLC, and exercises sole voting and investment power over shares held of record by Biotechnology Value Fund, L.P., Biotechnology Fund II, L.P. and Investment 10 LLC.

- (5)

- Reservoir Capital Group, L.L.C. is the general partner of Reservoir Capital Partners, L.P., Reservoir Capital Master Fund, L.P. and Reservoir Capital Associates, L.P., and exercises sole voting and investment power over shares held of record by Reservoir Capital Partners, L.P., Reservoir Capital Master Fund, L.P. and Reservoir Capital Associates, L.P.

- (6)

- Includes 1,579,500 shares of common stock and options to purchase 210,600 shares of common stock that are currently exercisable.

- (7)

- Includes options to purchase 303,750 shares of common stock that are currently exercisable. Excludes options to purchase 101,250 shares of common stock that are not exercisable within 60 days of March 6, 2003.

- (8)

- Includes options to purchase 193,900 shares of common stock that are currently exercisable.

- (9)

- Includes options to purchase 182,250 shares of common stock that are currently exercisable. Excludes options to purchase 182,250 shares of common stock that are not exercisable within 60 days of March 6, 2003.

- (10)

- Includes options to purchase 109,520 shares of common stock that are currently exercisable. Excludes options to purchase 30,756 shares of common stock that are not exercisable within 60 days of March 6, 2003.

- (11)

- Includes 97,200 shares of common stock and options to purchase 166,856 shares of common stock that are currently exercisable. Excludes options to purchase 11,644 shares of common stock that are not exercisable within 60 days of March 6, 2003.

- (12)

- Includes options to purchase 86,556 shares of common stock that are currently exercisable. Excludes options to purchase 11,644 shares of common stock that are not exercisable within 60 days of March 6, 2003.

- (13)

- Includes options to purchase 6,075 shares of common stock that are currently exercisable. Excludes options to purchase 18,225 shares of common stock that are not exercisable within 60 days of March 6, 2003.

- (14)

- Includes options to purchase 1,274,907 shares of common stock that are currently exercisable.

14

EXECUTIVE OFFICERS

The following persons are executive officers of DOV Pharmaceutical and will serve in the capacities noted until May 30, 2003, or until the election and qualification of their successors. Each officer named below is expected to be re-elected at the meeting of the board of directors to be held on May 30, 2003.

Name

| | Age

| | Positions and Offices with DOV Pharmaceutical

| | Officer

Since

|

|---|

Arnold S. Lippa, Ph.D. |

|

56 |

|

Chairman of the Board of Directors, Chief Executive Officer, Secretary and Director |

|

1995 |

Bernard Beer, Ph.D. |

|

70 |

|

Co-Chairman of the Board of Directors, President and Director |

|

1995 |

Phil Skolnick, Ph.D., D.Sc. (hon) |

|

56 |

|

Senior Vice President, Research and Chief Scientific Officer |

|

2001 |

Barbara G. Duncan |

|

38 |

|

Vice President, Finance, Chief Financial Officer and Treasurer |

|

2001 |

Robert Horton |

|

63 |

|

Vice President, and General Counsel |

|

2002 |

Laurence Meyerson, Ph.D. |

|

55 |

|

Senior Vice President, Drug Development |

|

2002 |

Arnold S. Lippa, Ph.D. is a co-founder and has served as CEO since our formation in April 1995. Dr. Lippa also serves as our Secretary and is a director and chairman of our board of directors. Dr. Lippa also serves as director and chairman of Nascime Limited, a company formed in connection with the Elan joint venture. Prior to founding DOV in 1995, Dr. Lippa founded Fusion Associates, Ltd., an investment and management company specializing in the creation and management of biomedical companies. Dr. Lippa served as Fusion's managing director from 1991 to 1995. From 1989 through 1990, Dr. Lippa served as Vega Biotechnologies, Inc.'s chairman and chief executive officer. In 1984, Dr. Lippa co-founded Praxis Pharmaceuticals, Inc. and served as president and chief operating officer until 1988. In addition, Dr. Lippa has consulted for various pharmaceutical and biotechnology companies and has been a graduate faculty professor at the New York University School of Medicine and the City University of New York. He received his B.A. from Rutgers University in 1969 and his Ph.D. in psychobiology from the University of Pittsburgh in 1973.

Bernard Beer, Ph.D. is a co-founder and has served as President, director and co-chairman of our board of directors since our formation in April 1995. From 1977 to 1995, Dr. Beer was employed by American Cyanamid, now Wyeth-Ayerst, and served as its global director of central nervous system biological and clinical research. Dr. Beer has extensive experience in pharmaceutical research starting at Squibb Corporation from 1966 to 1976 where he was section head, neuropsychopharmacology. He is currently an adjunct professor of psychiatry at the New York University School of Medicine and a special Professor in pharmacology at Boston University Medical School. Dr. Beer received his B.A. from Brooklyn College in 1956 and his M.S. and Ph.D. from The George Washington University in 1961 and 1966.

Phil Skolnick, Ph.D., D.Sc. (hon) joined us in January 2001 and serves as Senior Vice President, Research and Chief Scientific Officer. Prior to joining us, Dr. Skolnick served as a Lilly research fellow (Neuroscience) at Eli Lilly & Company from January 1997 to January 2001 where he spearheaded several innovative programs in drug discovery. From 1986 to August 1997, he served as senior investigator and chief, laboratory of neuroscience, at the National Institutes of Health. Dr. Skolnick served as a research professor of psychiatry at the Uniformed Services University of the Health Sciences from 1989 to 1998. He is currently an adjunct professor of anesthesiology at The Johns Hopkins University, an adjunct professor of pharmacology and toxicology at Indiana University School

15

of Medicine and research professor of psychiatry at New York University School of Medicine. Dr. Skolnick is an editor of Current Protocols in Neuroscience and also serves on the editorial advisory boards of the European Journal of Pharmacology, the Journal of Molecular Neuroscience and Pharmacology, Biochemistry & Behavior. He received a B.S. (summa cum laude) from Long Island University in 1968 and his Ph.D. from The George Washington University in 1972. Dr. Skolnick was awarded the D.Sc.honoris causa from Long Island University in 1993 and the University of Wisconsin-Milwaukee in 1995.

Barbara G. Duncan joined us in August 2001 and serves as Vice President, Finance and Chief Financial Officer and Treasurer. Prior to joining us, Ms. Duncan served as a vice president of Lehman Brothers Inc. in its corporate finance division from August 1998 to August 2001, where she provided financial advisory services primarily to companies in the life sciences and general industrial industries. From September 1994 to August 1998, Ms. Duncan was an associate and director at SBC Warburg Dillon Read, Inc. in its corporate finance group, where she focused primarily on structuring mergers, divestitures and financings for companies in the life sciences and general industrial industries. She worked for PepsiCo, Inc. from 1989 to 1992 in its international audit division, and was a certified public accountant in the audit division of Deloitte & Touche from 1986 to 1989. Ms. Duncan received her B.S. from Louisiana State University in 1985 and her M.B.A. from the Wharton School, University of Pennsylvania, in 1994.

Paul M. Schiffrin, B.Sc. joined us in February 1999 and served as Vice President, Corporate Services until his departure on short term disability in July 2002. He terminated and went on long term disability in January 2003. Prior to joining us, Mr. Schiffrin was president of Pharmadev Inc., a site management company serving a number of major pharmaceutical companies from January 1997 to January 1999. From 1982 through 1995, Mr. Schiffrin held several management positions with American Cyanamid, now Wyeth-Ayerst, including manager of clinical systems development/forms design, and manager of office automation in support of clinical drug development. Mr. Schiffrin received his B.Sc. from City University of New York, Hunter College Institute of Health Sciences in 1973.

Robert Horton joined us in August 2002 and serves as Vice President and General Counsel. Prior to joining us, Mr. Horton served with Goodwin Proctor LLP from 2001 - 2003 and with Friedman Siegelbaum LP from 1996 - 2001, in their New York law offices. Prior thereto Mr. Horton served with Balber Pickard et al (formerly Stults Balber Horton and Slotnick) in New York City. He has served in the JAGC Corps and in New Jersey and New York City government, practiced corporate and securities law for over 25 years and represented DOV Pharmaceutical since shortly after its formation. He was graduated with honors from the University of Virginia in 1961 and from the University of Chicago, where he received his law degree, in 1964. He is a member of the California and New York bars.

Laurence R. Meyerson, Ph.D. joined us in September 2002 and serves as Senior Vice President, Drug Development. Prior to joining us, Dr. Meyerson served as vice president of Elan Enterprises at Elan Corporation from January 2001 to September 2002 where he managed the clinical and regulatory product development of several joint ventured drugs. From October 1996 to January 2001, he served as director of regulatory affairs at Fujisawa Healthcare, Inc. where he directed the regulatory activities of several drug candidates in central nervous system, oncology and inflammation. Dr. Meyerson was part of the original senior management founding team for Shaman Pharmaceuticals, a company involved in research and development of novel natural products, where he served as vice president of biological sciences. Dr. Meyerson holds the appointment of Research Associate Professor in Psychiatry at New York University School of Medicine and is an active member of DIA, American Society Phamacology & Experimental Therapeutics, RAPS and the Society for Neuroscience. He received his B.S. from University of New Mexico in biology and chemistry in 1970 and his Ph.D. in biochemistry from the University of Health Sciences/Chicago Medical School in 1974.

16

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain compensation information for the years indicated as to our CEO and the four additional most highly compensated executive officers plus Stephen Petti, a former officer of the Company, based on salary and bonus for the fiscal years ended December 31, 2001, and 2002.

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

|

|---|

| | Annual Compensation

| |

|

|---|

Name and Principal Position

| | Securities

Underlying

Options

| | All Other

Compensation

|

|---|

| | Year

| | Salary

| | Bonus(1)

|

|---|

Arnold S. Lippa, Ph.D.(2)

Chariman and Chief

Executive Officer | | 2002

2001 | | $

| 296,154

260,577 | | $

| 110,000

150,000 | | —

— | | $

| 30,218

23,308 |

Bernard Beer, Ph.D.(3)

Co-Chairman and President | | 2002

2001 | | | 296,154

260,577 | | | 110,000

150,000 | | —

— | | | 27,229

30,423 |

Phil Skolnick, Ph.D., D.Sc. (hon)(4)

Senior Vice President, Research and

Chief Scientific Officer | | 2002

2001 | | | 250,000

230,769 | | | 40,000

— | |

405,000 | | | 8,100

9,847 |

Barbara Duncan(5)

Vice President, Finance, Chief

Financial Officer and Treasurer | | 2002

2001 | | | 235,288

82,212 | | | 75,000

— | | —

364,500 | | | 8,100

2,571 |

Paul Schiffrin(6)

Vice President, Corporate Services | | 2002

2001 | | | 174,493

140,288 | | | 10,000

10,000 | | 21,200

8,100 | | | —

— |

Stephen Petti(7)

Vice President, Drug Development | | 2002

2001 | | | 147,115

221,154 | | | 15,000

16,250 | | 24,300

153,900 | | | 161,474

4,500 |

- (1)

- Does not reflect expected bonuses not yet paid to five named executive officers aggregating approximately $165,000 to be reviewed by compensation committee.

- (2)

- $100,000 of bonus granted for work on April 2002 initial public offering. All other compensation represents $16,800 and $18,405 in 2002 and 2001 for automobile allowance and $13,418 and $4,903 in 2002 and 2001, for insurance premiums.

- (3)

- $100,000 of bonus granted for work on April 2002 initial public offering. All other compensation represents $16,800 and $16,518 in 2002 and 2001 for automobile allowance and $10,429 and $13,905 in 2002 and 2001, for insurance premiums.

- (4)

- Bonus granted for work in April 2002 intial public offering. All other compensation represents automobile allowance.

- (5)

- Bonus granted for work in April 2002 intial public offering. All other compensation represents automobile allowance. Ms. Duncan joined us effective August 20, 2001.

- (6)

- Mr. Schiffrin is currently on medical leave of absence. He has been on long-term disability with the Company's carrier since January 2003.

17

- (7)

- Mr. Petti resigned effective August 1, 2002. All other compensation represents $128,474 in 2002 for a lump sum severance payment upon his resignation, $30,000 for consulting services provided after his resignation and $3,000 and $4,500 in 2002 and 2001 for automobile allowance.

Option Grants in Last Fiscal Year and Option Values at Fiscal Year End

The following table provides information regarding stock options granted for the fiscal year ended December 31, 2002, to the CEO and other officers for whom compensation information is given in the Summary Compensation Table in this proxy Statement. In 2002 we did not grant any stock appreciation rights. All options were granted under the 2000 stock option and grant plan.

| | Individual Grants(1)

| |

| |

| |

|

|---|

| | Potential Realizable Value

at Assumed Annual

Rate of Stock Price

Appreciation for Option Term(1)

|

|---|

| |

| | Percentage of

Total Options

Granted to

Employees in

Fiscal Year

| |

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options Granted

| |

| | Market

Price on

Date of

Grant ($)

| |

|

|---|

Name

| | Exercise

Price Per

Share ($)

| | Expiration

Date

|

|---|

| | 0%

| | 5%

| | 10%

|

|---|

| Paul Schiffrin | | 21,200(3 | ) | 3.08 | | 7.30 | | 7.30 | | 5/07/12 | | $ | 0 | | $ | 72,770 | | $ | 196,989 |

| Stephen Petti(2) | | 24,300(3 | ) | 3.50 | | 7.30 | | 7.30 | | 8/01/03 | | $ | 0 | | $ | 0 | | $ | 0 |

- (1)

- The percentage of total options set forth below is based on options to purchase an aggregate of 687,240 shares of common stock granted to employees in 2002. Potential realizable values are based on our closing price per share as of December 31, 2002, net of exercise price, but before taxes associated with exercise. Amounts represent hypothetical gains that could be achieved for the options if exercised at the end of the option term. The assumed 0%, 5% and 10% rates of stock appreciation are provided in accordance with SEC rules and do not represent our estimate or projection of the future common stock price. Actual gains if any on stock option exercise will be dependent on the future performance of our common stock as well as the optionee's continued employment through the vesting period. The amounts reflected in these columns may not be achieved.

- (2)

- Mr. Petti resigned August 1, 2002.

- (3)

- Options vest 25% in annual installments after the completion of each full year of employment following the grant. None of Mr. Petti's options granted during 2002 were outstanding as of December 31, 2002, as these were not accelerated and thus not vested.

18

Option Exercises in Last Fiscal Year and Year-End Option Values

The following table sets forth certain information as of December 31, 2002, regarding options held by the CEO and other officers for whom compensation information is given in the Summary Compensation Table in this proxy statement.

| |

| |

| | Number of Securities Underlying

Unexercised Options at Fiscal Year-End(1)

| | Value ($) of Unexercised in-the-Money

Options at Fiscal

Year-End(2)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

| | Number

Exercisable

| | Number

Unexercisable

| | Value ($)

Exercisable

| | Value ($)

Unexercisable

|

|---|

| Arnold S. Lippa, Ph.D. | | — | | — | | 210,600 | | — | | 870,080 | | — |

| Bernard Beer, Ph.D. | | — | | — | | 210,600 | | — | | 870,080 | | — |

| Phil Skolnick, Ph.D. D. Sc. (hon) | | — | | — | | 236,250 | | 168,750 | | 950,250 | | 678,750 |

| Barbara Duncan. | | — | | — | | — | | 364,500 | | — | | 1,016,100 |

| Paul Schiffrin | | — | | — | | 108,844 | | 25,756 | | 476,919 | | 12,701 |

| Stephen Petti(3) | | — | | — | | 261,400 | | — | | 1,005,193 | | — |

- (1)

- Includes both in-the money and out-of-the-money options.

- (2)

- Fair value of DOV's common stock at December 31, 2002 ($6.80 based on the closing sales price reported on Nasdaq) less the exercise price.

- (3)

- Mr. Petti resigned on August 1, 2002. As part of his severance we agreed to accelerate 40,000 of his options that had an exercise price of $4.01 per share and extended the exercise date of the options for an additional nine months from the term allowed under the 1998 stock option and the 2000 stock sption and grant plans.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves as a member of the compensation committee or board of directors of any entity that has an executive officer serving as a member of our compensation committee or board of directors.

REPORT ON EXECUTIVE COMPENSATION(1)

The following is a report of the compensation committee of the board of directors describing the compensation policies applicable to our executive officers during the fiscal year ending December 31, 2002. The compensation committee is responsible for establishing and monitoring our general compensation policies and compensation plans, as well as the specific compensation levels for executive officers. It also makes recommendations to the board of directors concerning option grants under our 2000 stock option and grant plan. Executive officers who are also directors have not participated in deliberations or decisions involving their own compensation.

(1) This report is not "soliciting material," is not deemed "filed" with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and notwithstanding any general incorporation language in such filing.

General Compensation Policy

Under the supervision of the board of directors, our compensation policy is designed to attract and retain qualified key executives critical to our growth and long-term success. It is the objective of the

19

board to have a portion of each executive's compensation contingent upon our corporate performance as well as upon the individual's personal performance. Accordingly, each executive officer's compensation package is comprised of three elements: (i) base salary, which reflects individual background, performance and expertise, progress and collaboration objectives and, to lesser extent, his or her success in achieving designated individual goals, (ii) variable bonus awards payable in cash and tied to the achievement of certain performance goals that the board of directors establishes from time to time for the Company and (iii) long-term stock-based incentive awards designed to strengthen the mutuality of interests between executive officers and stockholders.

The summary below describes in more detail the factors that the compensation committee considers in establishing each of the three primary components of the compensation package provided to the executive officers.

Base Salary

The level of base salary is established primarily on the basis of the individual's qualifications and relevant experience, the strategic goals for which he or she has responsibility, the compensation levels at similar companies and the salary necessary to attract and retain qualified management. Base salary is adjusted each year to take into account the individual's performance and to maintain a competitive salary structure. Company performance does not play a significant role in the determination of base salary.

Cash-Based Incentive Compensation

Cash bonuses are awarded on a discretionary basis to executive officers on the basis of their success in or contribution to achieving specific company-wide goals, such as product development milestones.

Long-Term Incentive Compensation

We have utilized our stock option plans to provide executives and other key employees with incentives to maximize long-term stockholder values. Awards under the 2000 stock option and grant plan by the compensation committee take the form of stock options designed to give the recipient a significant equity stake and thereby closely align his or her interests with those of our stockholders. Factors considered in making such awards include the individual's position, his or her performance and responsibilities and internal comparability considerations.

Each option grant allows the executive officer to acquire shares of our common stock at a fixed price per share (typically the fair market value on the date of grant) over a specified period of time (up to 10 years). The options typically vest in periodic installments over a four-year period, contingent upon the executive officer's continued employment with us. Accordingly, the option will provide a return to the executive officer to a significant degree only if he or she remains in our service, and then only if the market price of our common stock appreciates over the option term.

Compensation of the Chief Executive Officer and President

Dr. Lippa's and Dr. Beer's base salary during fiscal 2002 as CEO and President, respectively, was $296,154 each. Each of their paid bonuses for the fiscal year was $110,000(1).

(1) Drs. Lippa and Beer are among five named executive officers each of whom expects to receive a portion of approximately $165,000 in aggregate bonuses under review by the compensation committee. See fn. 1 to Summary Compensation Table under "Executive Compensation."

The factors discussed were applied in establishing the amount of Dr. Lippa's and Dr. Beer's salary and bonus. Significant factors in establishing Dr. Lippa's and Dr. Beer's compensation were their contributions toward completion of our initial public offering and advancement of our clinical programs and operating and financial goals.

The Compensation Committee

Zola Horovitz (chairman)

Daniel S. Van Riper

20

SHAREHOLDER PROPOSALS FOR 2004 ANNUAL MEETING

Under the SEC's proxy rules, shareholder proposals that meet certain conditions may be included in the proxy statement and form of proxy for a particular annual meeting. Shareholders that intend to present a proposal at our 2004 annual meeting of shareholders must give us notice of the proposal no later than December 31, 2003, to be considered for inclusion in the proxy statement and form of proxy relating to that meeting. In the event, however, that the 2004 annual meeting is scheduled to be held more than 30 days before the anniversary of the 2003 annual meeting or more than 60 days after the anniversary, notice must be given not earlier than the close of business on the 120th day prior to the 2004 annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which the first public announcement of the meeting date is made. Shareholders that intend to present a proposal at the 2004 annual meeting that will not be included in the proxy statement and form of proxy must give notice of the proposal to us not earlier than March 1, 2004, and not later than April 1, 2004. Pursuant to Rule 14a-4(c)(1) promulgated under the Exchange Act, the proxies designated by us for the 2004 annual meeting will have discretionary authority to vote with respect to any such proposal that is determined to be untimely. The SEC has published rules relating to shareholder proposals including procedural requirements for their inclusion or exclusion from the proxy statement. In addition, our bylaws provide that any matter to be presented at an annual meeting must be proper business to be transacted at the meeting and must have been properly brought pursuant to the bylaws. Timely receipt by us of any a proposal from a shareholder will not guarantee its inclusion in the proxy materials or its presentation at the 2004 annual meeting because there are other inclusion requirements in the SEC's proxy rules that must also be satisfied.

OTHER MATTERS

As of the date of this proxy statement, the board of directors does not intend to present, and has not been informed that any other person intends to present, any matters for action at the 2003 annual meeting other than the matters set forth in this proxy statement. If other matters properly come before the annual meeting, it is intended that the holders of the proxies will act in accordance with their best judgment.

Copies of the Company's 2002 annual report to shareholders are being mailed to shareholders together with this proxy statement, form of proxy and notice of annual meeting of shareholders. Additional copies may be obtained from the General Counsel of DOV Pharmaceutical, 433 Hackensack Ave., Hackensack, New Jersey 07601.

Hackensack, New Jersey

May 5, 2003

21

APPENDIX A

DOV PHARMACEUTICAL, INC.

AUDIT COMMITTEE CHARTER

I. General Statement of Purpose

The purpose of the audit committee is to