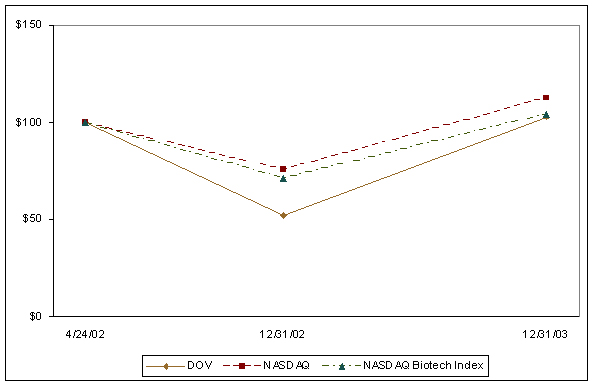

The following graph compares the yearly percentage change in the cumulative total stockholder return data for our common stock based on the market price of DOV’s common stock, since April 24, 2002 (the date on which our common stock was first registered under section 12 of the Securities Exchange Act of 1934) to the cumulative return over such period of companies included within the (i) NASDAQ Stock Market (U.S.) Index, and (ii) NASDAQ Biotechnology Index.

The graph assumes that $100 was invested on April 24, 2002, the date on which our stock was first sold to the underwriters on the date of our initial public offering at a per share price of $13.00.

CERTAIN TRANSACTIONS

In January 1999, we established a joint venture with Elan to develop controlled release formulations of bicifadine and ocinaplon. Elan provided us with debt and equity financing to fund our investment in the joint venture and our share of the operations of the joint venture. Elan purchased, for an aggregate of $3.0 million, 525,025 shares of our common stock, 354,643 shares of series B preferred stock, and warrants to purchase 121,500 shares of our common stock at an exercise price of $3.41 per share. We issued Elan a convertible promissory note for $8.01 million and Elan provided us a $7.0 million convertible line of credit promissory note, which expired in March 2002. In March 2003, we and Elan agreed to amend the convertible promissory note to eliminate the exchange feature pursuant to which Elan could have exchanged the note for an approximate 30% position in the joint venture, thereby making our equity positions equal. In connection with this amendment, we granted EIS warrants to purchase 75,000 shares of our common stock at an exercise price of $10.00 per share, which expire on January 21, 2006. On October 21, 2003, we entered into an agreement with Elan to acquire 100% ownership of Nascime Limited, the joint venture’s operating company, established to develop controlled release formulations of bicifadine and ocinaplon and to terminate the joint venture. In connection with the acquisition, we paid $5.0 million to a subsidiary of Elan in respect of its by then diluted 17% equity stake in the joint venture. Elan granted to the operating company a non-exclusive, royalty-free, perpetual, worldwide license to make and sell the two product candidates in controlled release formulations using the Elan intellectual property licensed to the joint venture, including that developed during the venture. In connection with the license grant, Elan will be entitled to receive up to an aggregate of $3.0 million when the products are licensed or come to market. In the ordinary course of its business and prior to the termination of the joint venture, DOV Bermuda incurred expenses for formulation development work provided by Elan. These expenses amounted to approximately $509,000 in 1999, $1.6 million in 2000, $1.8 million in 2001, $1.2 million in 2002 and $854,000 in 2003. In March 2004, Elan converted its series B preferred stock into common stock and thereby relinquished its right to nominate a board member in January 2005.

On July 2, 2003, we concluded a private placement of 1,428,571 shares of our common stock and three-year warrants to purchase an aggregate of 392,857 shares of our common stock at an exercise price of $16.00 per share to a group of funds managed by OrbiMed Advisors, LLC, for gross proceeds of $15,000,000. The investors also received the right to nominate a director to our board of directors. Jonathan Silverstein, a director of OrbiMed Advisors, LLC, joined our board effective December 19, 2003.

Mr. Gary Beer, son of Dr. Bernard Beer, is employed by us as director of data management. During 2003, he was paid $146,000 in salary, $8,000 in bonuses and was awarded options to purchase 5,000 shares of our common stock. Effective January 23, 2004, Mr. Beer was promoted to vice president and his annual salary was increased to $175,000.

On March 15, 2004, our co-founder and president, Dr. Bernard Beer, retired. In connection with his retirement, we have entered into a severance agreement with him that provides for the termination of his employment agreement, a year’s salary of $365,750, and payment of an amount equal to $11,000 for his health insurance premiums over the next 12 months. Dr. Beer remains as co-chairman of our board of directors and Dr. Lippa, our chief executive officer, has assumed his title of president.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file reports of ownership with the SEC and Nasdaq. Directors, executive officers and greater than ten-percent beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on a review of filings with the SEC, we believe that other than the exceptions detailed below, all our directors and executive officers have complied with the reporting requirements of Section 16(a) of the Securities Exchange Act of 1934, during fiscal 2003.

27

| | | Reporting Requirement | | |

| | |

| | |

| Name | | Form | | Required Filing Date | | Actual Filed Date |

| |

| |

| |

|

| Zola Horovitz | | Form 4 | | September 5, 2003 | | September 19, 2003 |

| | | Amended Form 4 | | September 5, 2003 | | September 22, 2003 |

| | | Form 5 | | September 15, 2003 | | March 4, 2004 |

| Patrick Ashe | | Form 5 | | September 15, 2003 | | March 4, 2004 |

| Daniel S. Van Riper | | Form 5 | | September 15, 2003 | | March 4, 2004 |

| Jonathan Silverstein | | Form 3 | | December 29, 2003 | | February 19, 2004 |

We undertake to prepare Section 16 filings for the convenience of our officers and directors. The late Form 4 and amended Form 4 filings resulted from late and inaccurate broker information on a sale by Dr. Horovitz and the late Form 5’s related to option grants to the named directors that should originally have been filed on Form 4. The late Form 3 related to Mr. Silverstein joining our board.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 29, 2004, certain information regarding the beneficial ownership of our common stock by:

- each person known by us to beneficially own 5% or more of a class of our common stock;

- each of our directors;

- each of our executive officers for whom compensation information is given in the summary compensation table in this proxy statement; and

- all our directors and executive officers of as a group.

The number of shares beneficially owned by each stockholder is determined under rules issued by the SEC (Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended) and includes voting or investment power with respect to securities. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and includes any shares to which an individual or entity has the right to acquire beneficial ownership within 60 days of March 29, 2004, through the exercise of any warrant, stock option or other right. The inclusion in this calculation of such shares, however, does not constitute an admission that the named stockholder is a direct or indirect beneficial owner of such shares. Each of the stockholders listed has sole voting and investment power with respect to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

28

| Name and Address of Beneficial Owner | Amount and Nature of

Beneficial Ownership | | Percentage of

Class(1) |

|

| |

|

| Elan Corporation, plc(2) | | | | | |

| Lincoln House | | | | | |

| Lincoln Place | | | | | |

| Dublin 2, Ireland | 3,647,200 | | | 17.26 | % |

| Elan Pharmaceutical Investments II, Ltd.(3) | | | | | |

| Flatts, Smiths Parish | | | | | |

| Bermuda, FL04 | 1,090,992 | | | 5.87 | |

| OrbiMed Advisors, LLC(4) | | | | | |

| 767 Third Avenue | | | | | |

| 30thFloor | | | | | |

| New York, NY 10017 | 2,251,428 | | | 12.59 | |

| Deutsche Bank AG(6) | | | | | |

| Taunusanlage 12 | | | | | |

| D-60325 | | | | | |

| Frankfurt am Main Federal Republic of Germany | 1,640,100 | | | 9.38 | |

| CIBC World Markets Corp.(5) | | | | | |

| 425 Lexington Avenue | | | | | |

| New York, NY 10017 | 1,011,670 | | | 5.79 | |

| Federated Investors, Inc.(6) | | | | | |

| 140 East 45thStreet | | | | | |

| New York, NY 10017 | 991,345 | | | 5.67 | |

| Arnold S. Lippa(7) | 1,509,800 | | | 8.53 | |

| Bernard Beer(8) | 1,423,730 | | | 8.14 | |

| Phil Skolnick(9) | 333,000 | | | 1.87 | |

| Barbara G. Duncan(10) | 294,119 | | | 1.65 | |

| Zola Horovitz(11) | 223,335 | | | 1.26 | |

| Robert Horton(12) | 164,233 | | | * | |

| Patrick Ashe(13) | 77,135 | | | * | |

| Daniel S. Van Riper(14) | 12,150 | | | * | |

| Warren Stern(15) | — | | | — | |

| Theresa A. Bischoff(16) | — | | | — | |

| Jonathan Silverstein(17) | — | | | — | |

| All directors and executive officers as a group (11 persons)(18) | 6,288,930 | | | 33.54 | |

| | | | | |

| *Less than one percent. | | | | | |

| |

(1)

| As of March 29, 2004, the number of outstanding shares of our common stock and common stock equivalents was 17,484,232. Effective March 31, 2004, the holder of the series B preferred stock converted all 354,643 shares of series B preferred stock, acquired in 1999, into 574,521 shares of our common stock in accordance with the transaction documents.

|

(2)

| Elan Corporation, plc is the parent corporation of, and wholly owns, either directly or indirectly, Elan International Services, Ltd. and Elan Pharmaceutical Investments, Ltd., and has or shares, either directly or indirectly, voting and investment power with respect to shares of our common stock held of record by each of the foregoing entities. Includes warrants to purchase 196,500 shares of common stock that are currently exercisable, 574,521 shares of common stock issuable upon the conversion of our series B preferred stock and approximately 2,876,179 shares of common stock issuable upon the conversion of the Elan convertible promissory note. Effective March 31, 2004, Elan converted all 354,643 shares of series B preferred stock into 574,521 shares of our common stock in accordance with the transaction documents.

|

(3)

| Represents approximately 1,090,992 shares of common stock issuable upon conversion of the Elan convertible line of credit promissory note.

|

29

(4)

| OrbiMed Advisors, LLC and OrbiMed Capital, LLC, together with Samuel D. Islay, who owns a controlling interest in each of the foregoing entities, has or shares, either directly or indirectly, voting and investment power with respect to the shares of our common stock held of record by UBS Juniper Crossover Fund, L.L.C., Caduceus Private Investments, LP and OrbiMed Associates LLC. Includes 1,858,571 shares of common stock and warrants to purchase 392,857 shares of common stock that are currently exercisable. The information reported herein is based solely upon public filings made with the SEC by or on behalf of the beneficial holders so listed.

|

(5)

| CIBC World Markets Corp. is an indirect wholly-owned subsidiary of Canadian Imperial Bank of Commerce, who may be deemed to be the beneficial owner of these shares. The information reported herein is based solely upon public filings made with the SEC by or on behalf of the beneficial holder so listed or on information provided directly to us by such holder.

|

(6)

| The information reported herein is based solely upon public filings made with the SEC by or on behalf of the beneficial holder so listed.

|

(7)

| Includes 1,229,200 shares of common stock and options to purchase 210,600 shares of common stock that are currently exercisable. Excludes options to purchase 25,000 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(8)

| Includes 1,423,730 shares of common stock.

|

(9)

| Includes options to purchase 333,000 shares of common stock that are currently exercisable. Excludes options to purchase 100,000 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(10)

| Includes options to purchase 294,119 shares of common stock that are currently exercisable. Excludes options to purchase 55,381 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(11)

| Includes 50,200 shares of common stock and options to purchase 173,135 shares of common stock that are currently exercisable. Excludes options to purchase 20,065 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(12)

| Includes options to purchase 164,233 shares of common stock that are currently exercisable. Excludes options to purchase 129,168 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(13)

| Includes options to purchase 77,135 shares of common stock that are currently exercisable. Excludes options to purchase 20,065 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(14)

| Includes options to purchase 12,150 shares of common stock that are currently exercisable. Excludes options to purchase 27,150 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(15)

| Excludes options to purchase 285,000 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(16)

| Excludes options to purchase 24,300 shares of common stock that are not exercisable within 60 days of March 29, 2004.

|

(17)

| Mr. Silverstein is a managing director of OrbiMed Advisors, LLC, that, together with certain funds managed by OrbiMed, owns the securities referenced in footnote 4 above. Mr. Silverstein’s beneficial ownership does not include beneficial ownership of the securities that are presented for OrbiMed Advisors, LLC in this principal stockholder table.

|

| (18) | Includes options to purchase 1,264,372 shares of common stock that are exercisable within 60 days of March 29, 2004. |

30

SHAREHOLDER PROPOSALS FOR 2005 ANNUAL MEETING

Under the SEC proxy rules, shareholder proposals that meet certain conditions may be included in the proxy statement and form of proxy for a particular annual meeting. Shareholders that intend to present a proposal at our 2005 annual meeting of shareholders pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended, must give us notice of the proposal no later than January 1, 2005, to be considered for inclusion in the proxy statement and form of proxy relating to that meeting. In addition, our by-laws provide that if the date set for the annual 2005 meeting is more than 30 days before the anniversary of the 2004 annual meeting or more than 60 days after the anniversary, notice, in order to be timely, a shareholder notice shall be delivered to the secretary at our principal executive offices, and must be given no earlier than the close of business on the 120thday prior to the 2005 annual meeting and not later than the close of business on the later of the 90th day prior to the annual meeting and the 10th day following the day on which the first public announcement of the meeting date is made. Shareholders that intend to present a proposal at the 2005 annual meeting that will not be included in the proxy statement and form of proxy must give notice of the proposal to us not earlier than January 23, 2005, and not later than February 23, 2005. Pursuant to Rule 14a-4(c)(1) promulgated under the Exchange Act, the proxies designated by us for the 2005 annual meeting will have discretionary authority to vote with respect to any such proposal that is determined to be untimely. The SEC has published rules relating to shareholder proposals including procedural requirements for their inclusion or exclusion from the proxy statement. In addition, our bylaws provide that any matter to be presented at an annual meeting must be proper business to be transacted at the meeting and must have been properly brought pursuant to the bylaws. Timely receipt by us of any such proposal from a shareholder will not guarantee its inclusion in the proxy materials or its presentation at the 2005 annual meeting because there are other inclusion requirements and exclusion guidelines in the SEC’s proxy rules that must also be satisfied. Any such shareholder proposals, or written requests for a copy of our bylaws, should be mailed to DOVPharmaceutical, Inc., 433 Hackensack Avenue, Hackensack, NJ 07601, Attention: Secretary.

31

OTHERMATTERS

As of the date of this proxy statement, the board of directors does not intend to present, and has not been informed that any other person intends to present, any matters for action at the 2004 annual meeting other than the matters set forth in this proxy statement. If other matters properly come before the annual meeting, the holders of the proxies will act in accordance with their best judgment.

Copies of our 2003 annual report to shareholders are being mailed to shareholders together with this proxy statement, form of proxy and notice of annual meeting of shareholders. Additional copies may be obtained from the general counsel of DOV Pharmaceutical, 433 Hackensack Ave., Hackensack, New Jersey 07601. In addition a copy of the annual report on Form 10-K will be provided free of charge to any shareholder who requests such report in writing.

| | By Order of the Board of Directors, |

| | |

| | Arnold S. Lippa, Ph.D.

Chairman and Chief Executive Officer |

Hackensack, New Jersey

April 26, 2004

32

Appendix A

DOV PHARMACEUTICAL, INC.

AUDIT COMMITTEE CHARTER

I. General Statement of Purpose

The primary function of the audit committee is to assist the board of directors in fulfilling its oversight responsibilities by reviewing the qualifications and performance of the company’s independent accountants and the financial reports and other financial information provided by the company to governmental bodies or the public, and to review and monitor the company’s system of internal controls and the company’s auditing, accounting and financial reporting processes. In carrying out its primary function the audit committee shall also provide an open avenue of communication among the independent auditors, financial and senior management and the board of directors. The audit committee shall fulfill these responsibilities by carrying out the activities enumerated in section V of this charter.

II. Composition

The audit committee shall consist of at least three members of the board, each of whom must be independent according to both NASD rules and the Sarbanes-Oxley Act of 2002, and moreover not own or control 20% or more of the company’s voting securities, or such lesser amount as may be established by the SEC.

As an exception to the above independence criteria, a director who is not an employee or family member and meets all the above qualifications except those of the NASD can be an audit committee member. For this to occur, the board, under exceptional and limited circumstances, must determine that the director’s membership is required in the best interests of the company and its stockholders. The company must then disclose, in the next following annual proxy statement, its reasons for that determination. A member appointed and whose appointment continues under this exception may not serve on the audit committee for more than two years and may not chair the committee.

Each member of the audit committee must be able to understand financial statements. Moreover, at least one member of the audit committee must be a "financial expert" under SEC rules. Those rules require among other things that, in addition to understanding financial statements, the financial expert have an understanding of generally accepted accounting principles and their application as well as experience with internal controls for financial reporting.

Members of the audit committee shall be appointed annually by the board and may be replaced or removed by the board with or without cause. Resignation or removal of a director, for whatever reason, shall if a member mean automatic resignation or removal from the audit committee. Any vacancy on the audit committee may be filled only by the board. The board shall designate one member of the audit committee to be the chair.

III. Compensation

A member may not, other than in his or her capacity as a member of the audit committee, the board or any other board committee, receive any compensation from the company. A member may receive additional director fees to compensate for the significant time and effort required to serve on the audit committee.

1

IV. Meetings

The audit committee shall meet not less frequently than quarterly to review each quarterly earnings release and quarterly report, and at least on one further occasion to review internal controls, audit progress and the annual report. Apart from these required meetings, the committee may have additional meetings as often as it determines. A majority of the members of the audit committee shall constitute a quorum for purposes of holding a meeting and the committee may act by a vote of a majority of the members present at the meeting. In lieu of a meeting, where warranted in special circumstances the audit committee may act by unanimous written consent.

V. Responsibilities and Authority

Matters Relating to Selection, Performance and Independence of Auditors

- Sole authority to appoint (subject to stockholder ratification), terminate and determine funding for auditors

- Instruct auditors to report directly to audit committee

- Exercise oversight of auditors’ work including resolution of disagreements between management and auditors

- Pre-approval of all audit, audit-related, tax and other services not prohibited by SEC or Public Company Accounting Oversight Board

- Pre-approval of audit-related and non-audit services may be delegated to one or more members of audit committee

- Review and approve scope and staffing of auditors’ overall audit plan

- Require auditors to provide audit committee with written disclosures and letter required by

Independence Standards Board Standard No. 1, and to submit to audit committee on a periodic basis a formal written statement delineating all relationships between auditors and company

- Discuss with auditors any disclosed relationships or services that may impact objectivity and independence, and take appropriate action to satisfy audit committee of auditors’ independence

- Determine whether services of auditors reported in annual report or proxy statement are compatible with maintaining auditors’ independence

Audited Financial Statements

- Review overall audit plan with auditors and management responsible for preparing company’s financial statements

- Review and discuss with management and auditors as appropriate:

- Company’s annual audited financial statements including all critical accounting policies and practices used or to be used by company and any significant financial reporting issues that have arisen in connection with preparation of audited financial statements, prior to filing company’s annual report

2

- Any analysis prepared by management or auditors setting forth significant financial reporting issues and judgments made in connection with preparation of financial statements including analyses of effect of alternative GAAP methods on financial statements

- Ramifications of use of such alternative disclosures and treatments on financial statements and treatment preferred by auditors, and consider other material written communications between auditors and management including any management letter or schedule of unadjusted differences

- Adequacy of company’s internal controls and procedures for financial reporting and risk management policies

- Major changes in and other issues regarding accounting and auditing principles and procedures including any significant changes in company’s selection or application of accounting principles and

- Effect on financial statements of regulatory and accounting initiatives as well as off-balance sheet transactions and structures

- Review and discuss outside presence of management any audit problems or difficulties and management’s response thereto including any difficulties encountered by auditors in the course of their work, including any restrictions on scope of their activities or access to information, responsibilities, budget and staffing of company’s internal audit function if any or financial reporting function and any significant accounting issues raised with management

- Review and discuss matters brought to attention of audit committee by auditors pursuant to Statement on Auditing Standards No. 61 and No. 90(SAS 61and SAS 90) including any

- Restriction on scope of auditors’ activities or access to requested information

- Accounting adjustments proposed by auditors but not made by management

- Communication between auditors and its national office regarding significant auditing or accounting issues presented by management

- Management or internal control letter issued, or proposed to be issued, by auditors and

- Significant disagreement between company and auditors

- Review and discuss with auditors their report pursuant to Securities Exchange Act on their non-audit services if any

- Discuss with CEO, CFO and general counsel significant deficiencies and material weaknesses brought to audit committee’s attention in design or operation of internal controls and procedures for financial reporting that could adversely affect company’s ability to record, process, summarize and report financial information or reveal any fraud involving management or other employees who have a significant role in company’s internal controls and procedures for financial reporting

3

- Based on its review and discussions with management including review of matters required to be discussed by SAS 61 and SAS 90, recommend to board whether company’s audited financial statements should be included in 10-K

- Prepare audit committee report required by Item 306 of Regulation S-K to be included in company’s annual proxy statement

Unaudited Quarterly Financial Statements

Discuss with management and review any financial information including press releases and Form 10-Q submitted to a governmental body or the public including any certification, report, opinion or review by the independent auditors.

Procedures for Addressing Complaints and Concerns

- Establish and require company to publish or file procedures for receipt, retention and treatment of complaints received by company regarding accounting, internal accounting controls or auditing matters and confidential, anonymous submission to audit committee by employees of concerns regarding questionable accounting or auditing matters or disclosure controls

Regular Reports to Board

- Regularly report to and review with board any issues that arise with respect to quality or integrity of company’s financial statements, compliance with legal or regulatory requirements, performance and independence of auditors, performance of internal audit function if any and any other matters that audit committee considers appropriate or is requested by board to review

Review of Charter

- Review at least annually and more often as appropriate adequacy of charter and recommend amendments if any to board

Engagement of Advisors

- Engage and determine compensation for independent counsel to audit committee and such other advisors necessary or appropriate to carry out its responsibilities and powers

Legal and Regulatory Compliance

- Discuss with management legal and regulatory requirements applicable to company and its subsidiaries and company’s compliance, and make recommendations to board regarding compliance

- Discuss with CEO, CFO and general counsel legal matters (including pending or threatened litigation) that may have a material effect on company’s financial statements or its legal and regulatory compliance policies and procedures

General

- Form and delegate authority to subcommittees consisting of one or more of its members to carry out its responsibilities and exercise its powers

4

- Require that any officer or employee of company, company’s outside legal counsel, auditors or any other professional retained by company attend a meeting of audit committee or meet with any member of or advisor to committee

* * *

Notwithstanding the responsibilities and powers of the audit committee set forth in this charter, it is not intended to carry responsibility for planning or conducting audits of the company’s financial statements or determining whether the company’s financial statements are complete, accurate and prepared in accordance with GAAP. Such responsibilities are the duty of management and, to the extent of their audit responsibilities, the auditors. In addition, it is not the duty of the audit committee to conduct investigations or to assure compliance with laws and regulations. The audit committee shall be entitled to rely upon advice and information it receives if it believes to be reliable or has reason to draft in its discussions and communications with management, auditors and such experts, advisors and professionals it may consult.

(Adopted by the board of directors March 21, 2003, and amended March 11, 2004)

5

APPENDIXB

DOVPHARMACEUTICAL,INC.

Audit Committee Complaint Procedures

These procedures have been adopted by the audit committee of the board of directors and govern the receipt and treatment of complaints or concerns on accounting, internal accounting controls and auditing matters as well as compliance under statutory anti-fraud laws or SEC rules and regulations pertaining to fraud against shareholders. They apply to both the company and its subsidiaries. The word “complaint” used in these audit committee complaint procedures should be read as “complaints or concerns.” A reporting person is not required to believe he or she has a complaint in the formal or legal sense of the word in order to make a report under these procedures. Concerns are sufficient if they relate to and identify improper accounting, internal accounting controls or auditing matters or compliance with such laws or regulations.

A.Procedures for Complaints

Complaints should be submitted to either the compliance officer, who is required to pass them promptly to the chairman of the audit committee, or directly to the audit committee chairman. The general counsel will serve as compliance officer. The complaint may be made orally or in writing and may be either confidential or anonymous, or both. It should identify the practices in question and give as much detail as possible. If the reporting party wishes for any reason to report differently or to a different person with suitable authority, he or she is free to do so. In this case the officer to whom the report is made will notify the compliance officer.

B.Procedures for Addressing Complaints

Once received, the chairman of the audit committee will promptly make an initial evaluation of the complaint. The chairman may delegate this authority to another member of the committee. In the initial evaluation, the chairman or his or her designee will determine whether the complaint (a) requires immediate investigation, (b) can be held for discussion at the next meeting of the audit committee or whether a special meeting should be called or (c) does not relate to accounting, internal accounting controls or auditing matters and should be reviewed by the compliance officer including against the company’s code of business conduct and ethics.

If the chairman retains jurisdiction the complaint will be discussed at the next meeting of the audit committee. At that meeting, the committee will determine how the complaint will be investigated or if the investigation has commenced, how to proceed. The audit committee has the following options on the investigation

- choose to investigate the complaint on its own;

- designate a person within the company to investigate the complaint and report to the committee. No such designee can be either the source of the complaint or involved or likely involved in the alleged wrongdoing. Even if the complaint is not made anonymously, the committee will determine whether it is appropriate to identify the complaining party to the investigator;

- retain an outside financial expert (other than the company’s independent auditor) as investigator; or

- retain outside counsel as an investigator, including as appropriate to work with an outside financial expert.

- These options are not mutually exclusive.

- The investigator will be permitted access to the company, its employees, its documents and its computer systems for purposes of conducting the investigation. At the conclusion of its investigation, the investigator will report to the audit committee on the complaint and, if requested, make recommendations for corrective or preventive measures.

The audit committee will report to the board of directors not later than its next regularly-scheduled meeting with respect to each completed investigation and any recommended corrective and preventative measures. If the complaint involves any director (whether in his or her role as a director, employee or officer of the company or otherwise), the audit committee will make its report in an executive session of the board with such director recused.

C.Procedures for Retaining Records Regarding Complaints

The audit committee will ensure that all complaints received by the committee, together with all documents relating to the committee’s or its investigator’s inquiry and treatment of each complaint, are retained in a secure location for the longer of ten years and, if a complaint becomes the subject of a criminal investigation or civil litigation, until such investigation or litigation is finally resolved.

D.Protection for Whistleblowers

The company absolutely forbids any retaliation against any employee who, acting in good faith, makes a complaint even if the complaint turns out to be mistaken. Any person who participates in such retaliation will be identified by the committee to the company and subject to disciplinary action including termination.

E.Disciplinary Action

These procedures do not affect the right of the company to take such disciplinary action under the company’s code of business conduct and ethics or other applicable policies of the company warranted by the investigation.

F.Periodic Review of Procedures

The audit committee will review these procedures and consider changes on an annual or more frequent basis as appropriate.

Adopted December 18, 2003

Appendix C

DOVPHARMACEUTICAL,INC.

2000 Stock Option and Grant Plan

As Amended and Restated as of March 28, 2002

SECTION 1.GENERAL PURPOSE OF THE PLAN; DEFINITIONS

The name of the plan is the DOV Pharmaceutical, Inc. 2000 Stock Option and Grant Plan, as amended and restated as of March 28, 2002 (the “Plan”). The purpose of the Plan is to encourage and enable the officers, employees, directors, consultants and other key persons of DOV Pharmaceutical, Inc., a Delaware corporation (the “Company”), and its Subsidiaries, upon whose judgment, initiative and efforts the Company depends for the successful conduct of its business to acquire a proprietary interest in the Company. It is anticipated that providing such persons with a direct stake in the Company’s welfare will assure a closer identification of their interests with those of the Company, thereby stimulating their efforts on the Company’s behalf and strengthening their desire to remain with the Company.

The following terms shall be defined as set forth below:

“Act” means the Securities Act of 1933, as amended, and the rules and regulations thereunder.

“Award” or “Awards,” except where referring to a particular category of grant under the Plan, shall include Incentive Stock Options, Non-Qualified Stock Options, Stock Appreciation Rights, Restricted Stock Awards, Unrestricted Stock Awards, or any combination of the foregoing.

“Board” means the Board of Directors of the Company or its successor entity.

“Code” means the Internal Revenue Code of 1986, as amended, and any successor Code, and related rules, regulations and interpretations.

“Committee” has the meaning specified in Section 2.

“Covered Employee” means an employee who is a “Covered Employee” within the meaning of Section 162(m) of the Code.

“Effective Date” means the date on which the Plan is approved by stockholders as set forth at the end of this Plan.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder.

“Fair Market Value” of the Stock on any given date means the fair market value of the Stock determined in good faith by the Committee; provided that (i) if the Stock trades on a

national securities exchange, the Fair Market Value on any given date is the closing sale price on such date; (ii) if the Stock does not trade on any national securities exchange but is admitted to trading on the National Association of Securities Dealers, Inc. Automated Quotation System (“NASDAQ”), the Fair Market Value on any given date is the closing sale price as reported by NASDAQ on such date or, if no such closing sale price information is available, the average of the highest bid and lowest asked prices for the Stock reported on such date. For any date that is not a trading day, the Fair Market Value of the Stock for such date will be determined by using the closing sale price or the average of the highest bid and lowest asked prices, as appropriate, for the immediately preceding trading day. The Committee can substitute a particular time of day or other measure of closing sale price if appropriate because of changes in exchange or market procedures. Notwithstanding the foregoing, if the date for which Fair Market Value is determined is the first day when trading prices for the Stock are reported on NASDAQ or trading on a national securities exchange, the Fair Market Value shall be the “Price to the Public” (or equivalent) set forth on the cover page for the final prospectus relating to the Company’s Initial Public Offering.

“Incentive Stock Option” means any Stock Option designated and qualified as an “incentive stock option” as defined in Section 422 of the Code.

“Initial Public Offering” means the consummation of the first fully underwritten, firm commitment public offering pursuant to an effective registration statement under the Exchange Act covering the offer and sale by the Company of its equity securities, as a result of or following which the Stock is publicly held.

“Non-Qualified Stock Option” means any Stock Option that is not an Incentive Stock Option.

“Option” or“Stock Option” means any option to purchase shares of Stock granted pursuant to Section 5.

“Performance Cycle” means one or more periods of time, which may be of varying and overlapping durations, as the Committee may select, over which the attainment of one or more performance criteria will be measured for the purpose of determining a grantee’s right to and the payment of a Restricted Stock Award.

“Restricted Stock Award” means Awards granted pursuant to Section 6.

“Stock” means the Common Stock, par value $0.0001 per share, of the Company, subject to adjustments pursuant to Section 3.

“Stock Appreciation Right” means any Award granted pursuant to Section 8.

“Subsidiary” means any corporation or other entity (other than the Company) in which the Company has a controlling interest, either directly or indirectly.

“Unrestricted Stock Award” means any Award granted pursuant to Section 7.

| SECTION 2. | ADMINISTRATION OF PLAN; COMMITTEE AUTHORITY TO SELECTGRANTEES AND DETERMINE AWARDS |

(a)Administration of Plan. The Plan shall be administered by the Board or, at the discretion of the Board, by a committee of the Board (“the Committee”), comprised of not less than two Directors. All references herein to the Committee shall be deemed to refer to the Board or, as the case may be, to the Committee.

(b)Powers of Committee. The Committee shall have the authority to grant Awards consistent with the terms of the Plan including the authority:

(i) to select the individuals to whom Awards may from time to time be granted;

(ii) to determine the time or times of grant, and the extent, if any, of Incentive Stock Options, Non-Qualified Stock Options, Stock Appreciation Rights, Restricted Stock Awards, Unrestricted Stock Awards, or any combination of the foregoing, granted to any one or more grantees;

(iii) to determine the number of shares of Stock to be covered by any Award;

(iv) to determine and modify from time to time the terms and conditions, including restrictions, not inconsistent with the terms of the Plan, of any Award, which terms and conditions may differ among individual Awards and grantees, and to approve the form of written instruments evidencing the Awards;

(v)to accelerate at any time the exercisability or vesting of all or any portion of any Award;

(vi)to impose any limitations on Awards granted under the Plan, including limitations on transfers, repurchase provisions and the like and to exercise repurchase rights or obligations;

(vii)subject to the provisions of Section 5(b)(ii), to extend at any time the period in which Stock Options may be exercised;

(viii)to determine at any time whether, to what extent, and under what circumstances distribution or the receipt of Stock and other amounts payable with respect to an Award shall be deferred either automatically or at the election of the grantee and whether and to what extent the Company shall pay or credit amounts constituting interest (at rates determined by the Committee) or dividends or deemed dividends on such deferrals; and

(ix)at any time to adopt, alter and repeal such rules, guidelines and practices for administration of the Plan and for its own acts and proceedings as it shall deem advisable; to interpret the terms and provisions of the Plan and any Award (including related written instruments); to make all determinations it deems advisable for the administration of the Plan; to decide all disputes arising in connection with the Plan; and to otherwise supervise the administration of the Plan.

All decisions and interpretations of the Committee shall be binding on all persons, including the Company and Plan grantees.

(c)Delegation of Authority to Grant Awards. The Committee, in its discretion, may delegate to the Chief Executive Officer of the Company all or part of the Committee’s authority and duties with respect to the granting of Awards at Fair Market Value, to individuals who are not subject to the reporting and other provisions of Section 16 of the Exchange Act or “covered employees” within the meaning of Section 162(m) of the Code. Any such delegation by the Committee shall include a limitation as to the amount of Awards that may be granted during the period of the delegation and shall contain guidelines as to the determination of the exercise price of any Stock Option or Stock Appreciation Right, the conversion ratio or price of other Awards and the vesting criteria. The Committee may revoke or amend the terms of a delegation at any time but such action shall not invalidate any prior actions of the Committee’s delegate or delegates that were consistent with the terms of the Plan.

(d)Indemnification. Neither the Board nor the Committee, nor any member of either or any delegatee thereof, shall be liable for any act, omission, interpretation, construction or determination made in good faith in connection with the Plan, and the members of the Board and the Committee (and any delegatee thereof) shall be entitled in all cases to indemnification and reimbursement by the Company in respect of any claim, loss, damage or expense (including, without limitation, reasonable attorneys’ fees) arising or resulting therefrom to the fullest extent permitted by law and/or under any directors’ and officers’ liability insurance coverage that may be in effect from time to time.

SECTION 3. STOCK ISSUABLE UNDER THE PLAN; MERGERS; SUBSTITUTION

(a)Stock Issuable. The maximum number of shares of Stock reserved and available for issuance under the Plan shall equal the sum of the following, subject to adjustment as provided in Section 3(b): (i) 3,227,850 including (ii) the number of shares of Common Stock underlying any awards under the Company’s 1998 Stock Option and Grant Plan that are forfeited, canceled, reacquired by the Company, satisfied without the issuance of Common Stock or otherwise terminated other than by exercise (collectively, “terminated”) plus (iii) the number, if any, of shares of Common Stock underlying that certain stock option agreement between the Company and Phil Skolnick, dated as of January 19, 2001, that are terminated. For purposes of this limitation, the shares of Stock underlying any Awards forfeited, canceled, reacquired by the Company, satisfied without the issuance of Stock or otherwise terminated (other than by exercise) shall be added back to the shares of Stock available for issuance under the Plan. Subject to such overall limitation, shares of Stock may be issued up to such maximum number pursuant to any type or types of Award; provided, however, that Stock Options and Stock Appreciation Rights with respect to no more than 500,000 shares of Stock may be granted to any one individual grantee during any one calendar year period. The shares available for issuance under the Plan may be authorized but unissued shares of Stock or shares of Stock reacquired by the Company and held in its treasury.

(b)Changes in Stock. Subject to Section 3(c) hereof, if, as a result of any reorganization, recapitalization, reclassification, stock dividend, stock split, reverse stock split or other similar change in the Company’s capital stock, the outstanding shares of Stock are increased or decreased or are exchanged for a different number or kind of shares or other securities of the Company, or additional shares or new or different shares or other securities of the Company or other non-cash assets are distributed with respect to such shares of Stock or other securities, or, if, as a result of any merger, consolidation or sale of all or substantially all the assets of the Company, the outstanding shares of Stock are converted into or exchanged for different number or kind of securities of the Company or any successor entity (or a parent or

subsidiary thereof), the Committee shall make an appropriate or proportionate adjustment in (i) the maximum number of shares reserved for issuance under the Plan, (ii) the number of Stock Options that can be granted to any one individual grantee, (iii) the number and kind of shares or other securities subject to any outstanding Awards under the Plan, (iv) the repurchase price per share subject to each outstanding Restricted Stock Award, and (v) the exercise price and exchange price for each share subject to any outstanding Stock Options or Stock Appreciation Rights under the Plan, without changing the aggregate exercise price in respect of such Stock Options or Stock Appreciation Rights. The adjustment made by the Committee shall be final, finding and conclusive. No fractional shares of Stock shall be issued under the Plan resulting from any such adjustment, but the Committee in its discretion may make a cash payment in lieu of fractional shares.

The Committee may also adjust the number of shares subject to outstanding Awards and the exercise price and the terms of outstanding Awards to take into consideration material changes in accounting practices or principles, extraordinary dividends, acquisitions or dispositions of stock or property or any other event if it is determined by the Committee that such adjustment is appropriate to avoid distortion in the operation of the Plan provided that no such adjustment shall be made in the case of an Incentive Stock Option, without the consent of the grantee, if it would constitute a modification, extension or renewal of the Option within the meaning of Section 424(h) of the Code.

(c)Mergers and Other Sale Events. In the case of and subject to the consummation of (i) the dissolution or liquidation of the Company, (ii) the sale of all or substantially all the assets of the Company on a consolidated basis to an unrelated person or entity, (iii) a merger, reorganization or consolidation in which the outstanding shares of Stock are converted into or exchanged for a different kind of securities of the successor entity and the holders of the Company’s outstanding voting power immediately prior to such transaction do not own a majority of the outstanding voting power of the successor entity immediately upon completion of such transaction, (iv) the sale of all or a majority of the outstanding capital stock of the Company to an unrelated person or entity or (v) any other transaction in which the owners of the Company’s outstanding voting power prior to such transaction do not own at least a majority of the outstanding voting power of the successor entity immediately upon completion of the transaction (in each case, regardless of the form thereof, a “Sale Event”), the Plan and all outstanding Options issued hereunder shall terminate upon the effective time of any such Sale Event, unless provision is made in connection with such transaction in the sole discretion of the parties thereto for the assumption or continuation of Options theretofore granted (after taking into account any acceleration hereunder) by the successor entity, or the substitution of such Options with new Options of the successor entity or a parent or subsidiary thereof, with such adjustment as to the number and kind of shares and the per share exercise prices as such parties shall agree (after taking into account any acceleration if any, hereunder). In the event of such termination, each grantee shall be permitted, within a specified period of time prior to the consummation of the Sale Event as determined by the Committee, to exercise all outstanding Options held by such grantee then exercisable or that will become exercisable as of the effective time of the Sale Event provided that the exercise of Options not exercisable prior to the Sale Event shall be subject to the consummation of the Sale Event. (The treatment of Restricted Stock Award in connection with any such transaction shall be as specified in the relevant Award agreement.) (d)Substitute Awards. The Committee may grant Awards under the Plan in substitution for stock and stock based awards held by employees, directors or other key persons of another corporation in connection with a merger or consolidation of the employing corporation with the Company or a Subsidiary or the acquisition by the Company or a Subsidiary of property or stock of the employing corporation. The Committee may direct that the substitute awards be granted on such terms and conditions as the Committee considers appropriate in the circumstances. Any substitute Awards granted under the Plan shall not count against the share limitation set forth in Section 3(a).

SECTION 4. ELIGIBILITY

Grantees in the Plan shall be such full or part-time officers, directors, employees, consultants and other key persons (including prospective employees) of the Company and its Subsidiaries responsible for, or who contribute to, the management of, or to the growth or profitability of the Company and its Subsidiaries as are selected from time to time by the Committee in its sole discretion.

SECTION 5. STOCK OPTIONS

(a) Each Stock Option grant under the Plan shall be made pursuant to a Stock Option agreement in such form as the Committee may from time to time approve. Option agreements need not be identical. Stock Options granted under the Plan may be either Incentive Stock Options or Non-Qualified Stock Options. Incentive Stock Options may be granted only to employees of the Company or any Subsidiary that is a “subsidiary corporation” within the meaning of Section 424(f) of the Code. To the extent that any Option does not qualify as an Incentive Stock Option, it shall be deemed a Non-Qualified Stock Option. No Incentive Stock Option shall be granted under the Plan after March 28, 2012.

(b)Terms of Stock Options. Stock Options granted under the Plan shall be subject to the following terms and conditions and shall contain such additional terms and conditions, not inconsistent with the terms of the Plan, as the Committee shall deem desirable. If the Committee so determines, Stock Options may be granted in lieu of cash compensation at the grantee’s election, subject to such terms and conditions as the Committee may establish, as well as in addition to other compensation.

(i)Exercise Price. The exercise price per share for the Stock covered by a Stock Option shall be determined by the Committee at the time of grant but shall not be less than 100 percent of the Fair Market Value on the date of grant in the case of Incentive Stock Options. If an employee owns or is deemed to own (by reason of the attribution rules of Section 424(d) of the Code) more than 10 percent of the combined voting power of all classes of stock of the Company or any parent or subsidiary corporation and an Incentive Stock Option is granted to such employee, the option price of such Incentive Stock Option shall be not less than 110 percent of the Fair Market Value on the grant date.

(ii)Option Term. The term of each Stock Option shall be fixed by the Committee, but no Stock Option shall be exercisable more than ten years after the date the Stock Option is granted. If an employee owns or is deemed to own (by reason of the attribution rules of Section 424(d) of the Code) more than ten percent of the combined voting power of all classes of stock of the Company or any parent or subsidiary corporation and an Incentive Stock Option is granted to such employee, the term of such Stock Option shall be no more than five years from the date of grant.

(iii)Exercisability; Rights of a Stockholder. Stock Options shall become exercisable at such time or times, whether or not in installments, as shall be determined by the Committee at or after the grant date. The Committee may at any time accelerate the exercisability of all or any portion of any Stock Option. An optionee shall have the rights of a stockholder only as to shares acquired upon the exercise of a Stock Option and not as to unexercised Stock Options.

(iv)Method of Exercise. Stock Options may be exercised in whole or in part, by giving written notice of exercise to the Company, specifying the number of shares to be purchased. Payment of the purchase price may be made by one or more of the following methods to the extent provided in the Stock Option agreement:

(A) In cash;

(B) By the optionee delivering to the Company a promissory note if the Board has expressly authorized the loan of funds to the optionee for the purpose of enabling or assisting the optionee to effect the exercise of his Stock Option; provided that at least so much of the exercise price as represents the par value of the Stock shall be paid other than with a promissory note if otherwise required by state law;

(C) Through the delivery (or attestation to the ownership) of shares of Stock that have been purchased by the optionee on the open market or have been beneficially owned by the optionee for at least six months and are not then subject to restrictions under any Company plan, such surrendered shares to be valued at Fair Market Value on the exercise date; or

(D) By the optionee delivering to the Company a properly executed exercise notice together with irrevocable instructions to a broker to promptly deliver to the Company cash or a check payable and acceptable to the Company to pay the purchase price provided that the optionee and the broker shall comply with such procedures and enter into such agreements of indemnity and other agreements as the Committee shall prescribe as a condition of such payment procedure.

Payment instruments shall be received subject to collection. No certificates for shares of Stock so purchased shall be issued to optionee until the Company has completed all steps required by law to be taken in connection with the issuance and sale of the shares, including, without limitation, obtaining from optionee payment or provision for all withholding taxes due as a result of the exercise of the Option. The delivery of certificates representing the shares of Stock to be purchased pursuant to the exercise of a Stock Option shall be contingent upon receipt from or on behalf of the optionee of the full purchase price for such shares and the fulfillment of any other requirements contained in the Stock Option agreement or applicable provisions of laws. In the event an optionee chooses to pay the purchase price by previously-owned shares of Stock through the attestation method, the number of shares of Stock transferred to the optionee upon the exercise of the Stock Option shall be net of the number of shares attested to.

(c)Annual Limit on Incentive Stock Options. To the extent the aggregate Fair Market Value (determined as of the time of grant) of the shares of Stock with respect to which Incentive Stock Options granted under this Plan and any other plan of the Company or its parent and subsidiary corporations become exercisable for the first time by an optionee during any calendar year exceed $100,000, such excess shall constitute a Non-Qualified Stock Option.

(d)Non-transferability of Options. No Stock Option shall be transferable by the optionee otherwise than by will or by the laws of descent and distribution and all Stock Options shall be exercisable, during the optionee’s lifetime, only by the optionee, or by the optionee’s legal representative or guardian in the event of the optionee’s incapacity provided that the Committee may provide in the Option agreement that the optionee may transfer, without consideration for the transfer, Non-Qualified Stock Options to members of the optionee’s immediate family, to trusts for the benefit of such family members, or to partnerships in which such family members are the only partners, provided further that the transferee agrees in writing with the Company to be bound by all the terms and conditions of this Plan and the applicable Option.

SECTION 6. RESTRICTED STOCK AWARDS

(a)Nature of Restricted Stock Awards. The Committee may grant or sell, at such purchase price as determined by the Committee, shares of Stock subject to such restrictions and conditions as the Committee may determine at the time of grant (“Restricted Stock”), which purchase price shall be payable in cash or other form of consideration acceptable to the Committee. Conditions may be based on continuing employment (or other service relationship) or achievement of pre-established performance goals and objectives. The terms and conditions of each such agreement shall be determined by the Committee, and such terms and conditions may differ among individual Awards and grantees.

(b)Rights as a Stockholder. Upon execution of a written instrument setting forth the Restricted Stock Award and payment of any applicable purchase price, a grantee shall have the rights of a stockholder with respect to the voting of the Restricted Stock, subject to such conditions contained in the written instrument evidencing the Restricted Stock Award. Unless the Committee shall otherwise determine, certificates evidencing the Restricted Stock shall remain in the possession of the Company until such Restricted Stock is vested as provided in subsection (d) of this Section, and the grantee shall be required, as a condition of the grant, to deliver to the Company a stock power endorsed in blank.

(c)Restrictions. Restricted Stock may not be sold, assigned, transferred, pledged or otherwise encumbered or disposed of except as provided herein or in the Restricted Stock Award agreement. The Restricted Stock Award agreement may give the Company the option, or impose upon it the obligation, to repurchase some of or all of the shares of Stock subject to the Award at such purchase price set forth therein if the grantee’s employment (or other service relationship) with the Company or a Subsidiary terminates or changes in manner set forth therein.

(d)Vesting of Restricted Stock. The Committee at the time of grant shall specify the date or dates and/or the attainment of pre-established performance goals, objectives and other conditions on which Restricted Stock shall become vested, subject to such further rights of the Company or its assigns as may be specified in the Restricted Stock Award agreement.

(e)Waiver, Deferral and Reinvestment of Dividends. The Restricted Stock Award agreement may require or permit the immediate payment, waiver, deferral or investment of dividends paid on the Restricted Stock.

SECTION 7.UNRESTRICTED STOCK AWARDS

(a)Grant or Sale of Unrestricted Stock. The Committee may grant (or sell at par value or such higher purchase price determined by the Committee) an Unrestricted Stock Award to any grantee, pursuant to which such grantee may receive shares of Stock free of any vesting restrictions (“Unrestricted Stock”) under the Plan. Unrestricted Stock Awards may be granted in respect of past services or other valid consideration.

(b)Elections to Receive Unrestricted Stock In Lieu of Compensation. Upon the request of a grantee and with the consent of the Committee, each such grantee may, pursuant to an advance written election delivered to the Company no later than the date specified by the Committee, receive a portion of the cash compensation otherwise due to such grantee in the form of shares of Unrestricted Stock either currently or on a deferred basis.

(c) Restrictions on Transfers. The right to receive shares of Unrestricted Stock on a deferred basis may not be sold, assigned, transferred, pledged or otherwise encumbered, other than by will or the laws of descent and distribution.

SECTION 8. STOCK APPRECIATION RIGHTS

(a)Nature of Stock Appreciation Rights. A Stock Appreciation Right is an Award entitling the recipient to elect to receive an amount in cash or shares of Stock or a combination thereof having a value equal to up to the excess of the Fair Market Value of the Stock on the date of exercise over the exercise price of the Stock Appreciation Right. A Stock Appreciation Right may be included by the Committee at the time of, or subsequent to, the grant of a Stock Option as set forth in Subsection (b) hereof.

(b)Grant and Exercise of Stock Appreciation Rights. Stock Appreciation Rights may be granted by the Committee in tandem with, or independently of, any Stock Option granted pursuant to Section 5 of the Plan. In the case of a Stock Appreciation Right granted in tandem with a Non-Qualified Stock Option, such Stock Appreciation Right may be granted either at or after the time of the grant of such Option. In the case of a Stock Appreciation Right granted in tandem with an Incentive Stock Option, such Stock Appreciation Right may be granted only at the time of the grant of the Option.

A Stock Appreciation Right or applicable portion thereof granted in tandem with a Stock Option shall terminate and no longer be exercisable upon the termination or exercise of the related Option.

(c)Terms and Conditions of Stock Appreciation Rights. Stock Appreciation Rights shall be subject to such terms and conditions as shall be determined from time to time by the Committee including the following: (i) Stock Appreciation Rights granted in tandem with Options shall be exercisable at such time or times and to the extent that the related Stock Options shall be exercisable; (ii) upon exercise of a Stock Appreciation Right, the applicable portion of any related Option shall be surrendered; and (iii) all Stock Appreciation Rights shall be exercisable during the grantee’s lifetime only by the grantee or the grantee’s legal representative.

(d)Termination. Except as may otherwise be provided by the Committee either in the Award agreement or in writing after the Award agreement is issued, a grantee’s rights in all Stock Appreciation Rights shall automatically terminate upon the grantee’s termination of employment (or other service relationship) with the Company and its Subsidiaries for any reason.

SECTION 9. PERFORMANCE-BASED AWARDS TO COVERED EMPLOYEES

Notwithstanding anything to the contrary contained herein, if any Restricted Stock Award granted to a Covered Employee is intended to qualify as “Performance-based Compensation” under Section 162(m) of the Code and the regulations promulgated thereunder (a “Performance-based Award”), such Award shall comply with the provisions set forth below:

(a)Performance Criteria. The performance criteria used in performance goals governing Performance-based Awards granted to Covered Employees may include any or all of the following: (i) the Company’s return on equity, assets, capital or investment, (ii) pre-tax or after-tax profit levels of the Company or any Subsidiary, a division, an operating unit or a business segment of the Company, or any combination of the foregoing; (iii) cash flow, funds from operations or similar measure; (iv) total shareholder return; (v) changes in the market price of the Stock; (vi) sales or market share; or (vii) earnings per share.

(b)Grant of Performance-based Awards. With respect to each Performance-based Award granted to a Covered Employee, the Committee shall select, within the first 90 days of a Performance Cycle (or, if shorter, within the maximum period allowed under Section 162(m) of the Code) the performance criteria for such grant, and the achievement targets with respect to each performance criterion (including a threshold level of performance below which no amount will become payable with respect to such Award). Each Performance-based Award will specify the amount payable, or the formula for determining the amount payable, upon achievement of the various applicable performance targets. The performance criteria established by the Committee may be (but need not be) different for each Performance Cycle and different goals may be applicable to Performance-based Awards to different Covered Employees.

(c)Payment of Performance-based Awards. Following the completion of a Performance Cycle, the Committee shall meet to review and certify in writing whether, and to what extent, the performance criteria for the Performance Cycle have been achieved and, if so, to also calculate and certify in writing the amount of the Performance-based Awards earned for the Performance Cycle. The Committee shall then determine the actual size of each Covered Employee’s Performance-based Award, and, in doing so, may reduce or eliminate the amount of the Performance-based Award for a Covered Employee if, in its sole judgment, such reduction or elimination is appropriate.

(d)Maximum Award Payable. The maximum Performance-based Award payable to any one Covered Employee under the Plan for a Performance Cycle is 500,000 Shares (subject to adjustment as provided in Section 3(b) hereof).

SECTION 10. TAX WITHHOLDING

(a)Payment by Grantee. Each grantee shall, no later than the date as of which the value of an Award or of any Stock or other amounts received thereunder first becomes subject to inclusion in the gross income of the grantee for Federal income tax purposes, pay to the Company, or make arrangements satisfactory to the Committee regarding payment of, any federal, state, or local taxes of any kind required by law to be withheld with respect to such income. The Company and its Subsidiaries shall, to the extent permitted by law, have the right to deduct any such taxes from any payment of any kind otherwise due to the grantee. TheCompany’s obligation to deliver stock certificates to any grantee is subject to and conditioned on tax obligations being satisfied by the grantee.

(b)Payment in Stock. Subject to approval by the Committee, a grantee may elect to have the minimum required tax withholding obligation satisfied, in whole or in part, by (i) authorizing the Company to withhold from shares of Stock to be issued pursuant to any Award a number of shares with an aggregate Fair Market Value (as of the date the withholding is effected) that would satisfy the withholding amount due, or (ii) transferring to the Company shares of Stock owned by the grantee with an aggregate Fair Market Value (as of the date the withholding is effected) that would satisfy the minimum withholding amount due.

SECTION 11. TRANSFER, LEAVE OF ABSENCE, ETC.

For purposes of the Plan, the following events shall not be deemed a termination of employment:

(a) a transfer to the employment of the Company from a Subsidiary or from the Company to a Subsidiary, or from one Subsidiary to another; or

(b) an approved leave of absence for military service or sickness, or for any other purpose approved by the Company, if the employee’s right to re-employment is guaranteed either by a statute or by contract or under the policy pursuant to which the leave of absence was granted or if the Committee otherwise so provides in writing.

SECTION 12.AMENDMENTS AND TERMINATION

The Board may, at any time, amend or discontinue the Plan and the Committee may, at any time, amend or cancel any outstanding Award (or provide substitute Awards at the same or reduced exercise or purchase price or with no exercise or purchase price in a manner not inconsistent with the terms of the Plan), but such price, if any, must satisfy the requirements which would apply to the substitute or amended Award if it were then initially granted under this Plan for the purpose of satisfying changes in law or for any other lawful purpose, but no such action shall adversely affect rights under any outstanding Award without the holder’s consent. If and to the extent determined by the Committee to be required by the Code to ensure that Incentive Stock Options granted under the Plan are qualified under Section 422 of the Code or to ensure that compensation earned under Awards qualifies as performance-based compensation under Section 162(m) of the Code, if and to the extent intended to so qualify, Plan amendments shall be subject to approval by the Company’s stockholders who are eligible to vote at a meeting of stockholders. Nothing in this Section 12 shall limit the Board’s or Committee’s authority to take any action permitted pursuant to Section 3(c).

SECTION 13.STATUS OF PLAN

With respect to the portion of any Award that has not been exercised and any payments in cash, Stock or other consideration not received by a grantee, a grantee shall have no rights greater than those of a general creditor of the Company unless the Committee shall otherwise expressly determine in connection with any Award or Awards. In its sole discretion, the Committee may authorize the creation of trusts or other arrangements to meet the Company’s obligations to deliver Stock or make payments with respect to Awards hereunder, provided that the existence of such trusts or other arrangements is consistent with the foregoing sentence.

SECTION 14.GENERAL PROVISIONS

(a)No Distribution; Compliance with Legal Requirements. The Committee may require each person acquiring Stock pursuant to an Award to represent to and agree with the Company in writing that such person is acquiring the shares without a view to distribution thereof. No shares of Stock shall be issued pursuant to an Award until all applicable securities law and other legal and stock exchange or similar requirements have been satisfied. The Committee may require the placing of such stop-orders and restrictive legends on certificates for Stock and Awards as it deems appropriate.

(b)Delivery of Stock Certificates. Stock certificates to grantees under this Plan shall be deemed delivered for all purposes when the Company or a stock transfer agent of the Company shall have mailed such certificates in the United States mail, addressed to the grantee, at the grantee’s last known address on file with the Company.

(c)Other Compensation Arrangements; No Employment Rights. Nothing contained in this Plan shall prevent the Board from adopting other or additional compensation arrangements, including trusts, and such arrangements may be either generally applicable or applicable only in specific cases. The adoption of this Plan and the grant of Awards do not confer upon any employee any right to continued employment with the Company or any Subsidiary.

(d)Trading Policy Restrictions. Option exercises and other Awards under the Plan shall be subject to such Company’s insider-trading-policy-related restrictions, terms and conditions as may be established by the Committee, or in accordance with policies set by the Committee, from time to time.

(e)Loans to Award Recipients. The Company shall have the authority to make loans to recipients of Awards hereunder (including to facilitate the purchase of shares) and shall further have the authority to issue shares for promissory notes hereunder.

(f)Designation of Beneficiary. Each grantee to whom an Award has been made under the Plan may designate a beneficiary or beneficiaries to exercise any Award or receive any payment under any Award payable on or after the grantee’s death. Any such designation shall be on a form provided for that purpose by the Administrator and shall not be effective until received by the Administrator. If no beneficiary has been designated by a deceased grantee, or if the designated beneficiaries have predeceased the grantee, the beneficiary shall be the grantee’s estate.

SECTION 15.EFFECTIVE DATE OF PLAN

This Plan shall become effective upon approval by the holders of a majority of the votes cast at a meeting of stockholders at which a quorum is present or by written consent in accordance with applicable law. Subject to such approval by the stockholders and to the requirement that no Stock may be issued hereunder prior to such approval, Stock Options and other Awards may be granted hereunder on and after adoption of this Plan by the Board.

SECTION 16.GOVERNING LAW

This Plan and all Awards and actions taken thereunder shall be governed by Delaware law, applied without regard to conflict of law principles.

Second Amendment

To

DOV Pharmaceutical, Inc.

2000 Stock Option and Grant Plan

As Amended and Restated as of March 28, 2002

The DOV Pharmaceutical, Inc. 2000 Stock Option and Grant Plan, as amended and restated as of March 28, 2002 (the “2000 Plan”) is hereby amended as follows:

1. The first sentence of Section 3(a) of the 2000 Plan is hereby amended in its entirety as follows:

The maximum number of shares of Stock reserved and available for issuance under the Plan shall equal the sum of the following, subject to adjustment as provided in Section 3(b): (i) 2,942,850 plus (ii) the number of shares of Common Stock underlying any awards under the Company’s 1998 Stock Option and Grant Plan that are forfeited, canceled, reacquired by the Company, satisfied without the issuance of Common Stock or otherwise terminated other than by exercise (collectively, “terminated”) plus (iii) the number, if any, of shares of Common Stock underlying that certain stock option agreement between the Company and Phil Skolnick, dated as of January 19, 2001, that are terminated.

2. Except as otherwise expressly modified herein, the 2000 Plan is, and shall continue to be, in full force and effect and is hereby ratified and confirmed in all respects.

3. The effective date of this Second Amendment to the 2000 Plan shall be the date of approval by the shareholders.

APPROVED AND ADOPTED BY THE BOARD OF DIRECTORS OF

DOV PHARMACEUTICAL, INC.:

| By: | /s/ Arnold S. Lippa | |

| |

| |

| | Name: Arnold S. Lippa

Title: Chairman of the Board of Directors | |

Date: April 19, 2004.