SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by Registrant x

Filed by a Party other than Registranto

Check the appropriate box:

| | o | Preliminary Proxy Statement |

| | | Confidential, for Use of the Commission Only |

(as permitted by Rule 14a-6(e)(2))

| | x | Definitive Proxy Statement |

| | | Definitive Additional Materials |

| | o | Soliciting Material Under Rule 14a-12 |

DOV PHARMACEUTICAL, INC.

(Name of Registrant as Specified in Its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant) |

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: ____________________________________________________________________________________________________ |

| (2) | Form, Schedule or Registration Statement No.: _________________________________________________________________________ |

| (3) | Filing Party: ______________________________________________________________________________________________________________ |

| (4) | Date Filed: _______________________________________________________________________________________________________________ |

DOV PHARMACEUTICAL, INC.

433 Hackensack Avenue

Hackensack, NJ 07601

April 22, 2005

Dear Shareholder:

I am pleased to invite you to the DOV Pharmaceutical, Inc. 2005 annual meeting of shareholders. The meeting will start at 10:00 a.m. on Monday, May 23, 2005, at company headquarters, 433 Hackensack Ave., Hackensack, New Jersey.

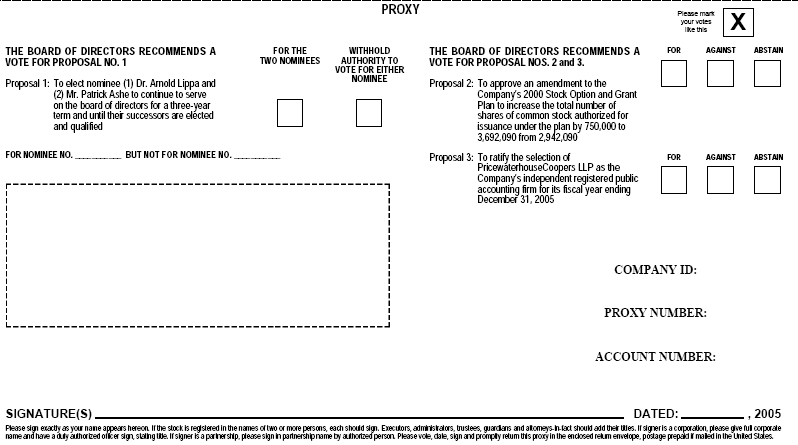

The proposals before the meeting are to elect two directors to our board of directors, approve an amendment to our 2000 stock option and grant plan to increase the shares of common stock authorized under the plan to 3,692,090 from 2,942,090, ratify the selection of PricewaterhouseCoopers LLP as independent registered public accounting firm for the company for its fiscal year ending December 31, 2005, and transact any other business that properly comes before the meeting. The two directors to be elected currently serve as directors along with four other members whose terms expire in 2006 and 2007. We will offer a management presentation and an informal question and answer session following the conclusion of our annual meeting of shareholders. In addition to the enclosed proxy statement, you will find other detailed information about the company and our operations, including our audited financial statements, in the enclosed 2004 annual report to shareholders.

We hope you can join us on May 23, 2005. Whether or not you plan to attend, please read the enclosed materials, and when you have done so, please mark your votes on the enclosed proxy card, sign and date the proxy card and return it in the enclosed envelope. Your vote is important, including for quorum purposes, so please return your proxy card promptly. You of course remain free to change your vote with a revised proxy card prior to the meeting or revoke your proxy by personal attendance at the meeting.

Sincerely,

Arnold S. Lippa, Ph.D.

Chairman and Chief Executive Officer

DOV PHARMACEUTICAL, INC.

433 Hackensack Avenue

Hackensack, New Jersey 07601

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be Held Monday, May 23, 2005

On Monday, May 23, 2005, starting at 10 a.m., DOV Pharmaceutical, Inc., or the company or DOV, will hold its 2005 annual meeting of shareholders at its headquarters, 433 Hackensack Ave., Hackensack, New Jersey 07601 (together will all adjournments and postponements thereof, referred to as the annual meeting or meetings), for the following purposes:

1. To elect two directors of DOV, each to serve for a term of three years or until their respective successors are duly elected and qualified, as more fully described in the enclosed proxy statement;

2. To approve an amendment to the company’s 2000 stock option and grant plan to increase by 750,000 the total number of shares of common stock authorized for issuance under the plan to 3,692,090 from 2,942,090;

3. To ratify the selection of PricewaterhouseCoopers LLP as the company’s independent registered public accounting firm for the fiscal year ending December 31, 2005; and

4. To consider and act upon such other business and matters or proposals as may properly come before the meeting.

The board of directors of DOV has fixed the close of business on April 22, 2005, as the record date for determining the shareholders having the right to receive notice of and to vote at the annual meeting. Only shareholders of record at the close of business on such date are entitled to notice of and to vote at the meeting. A list of shareholders entitled to vote will be available during ordinary business hours at DOV’s headquarters at 433 Hackensack Ave., Hackensack, New Jersey, for 10 days prior to the meeting, for examination by any shareholder for purposes germane to the meeting. Your board of directors recommends that you vote in favor of the three proposals as more fully outlined in the proxy statement.

TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE IN THE ENCLOSED POSTAGE PREPAID ENVELOPE. YOUR STOCK WILL BE VOTED IN ACCORDANCE WITH THE INSTRUCTIONS YOU GIVE ON YOUR PROXY CARD. YOU MAY, OF COURSE, ATTEND THE MEETING AND VOTE IN PERSON AS YOU WISH EVEN IF YOU HAVE PREVIOUSLY RETURNED YOUR PROXY CARD. YOU REMAIN FREE TO CHANGE YOUR PROXY VOTE BY SUBMISSION OF A REVISED PROXY.

The approximate date of mailing for the proxy statement and accompanying proxy card will be on your shortly following April 22, 2005, the record date for the meeting.

By Order of the Board of Directors,

Arnold S. Lippa, Ph.D.

Chairman and Chief Executive Officer

DOV PHARMACEUTICAL, INC.

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The board of directors of DOV Pharmaceutical, Inc., or the company or DOV, is sending you this proxy statement to solicit your proxy for use at our 2005 annual meeting of shareholders. The annual meeting will be held on Monday, May 23, 2005, at our headquarters, 433 Hackensack Ave., Hackensack, New Jersey, starting at 10:00 a.m. We intend to give or mail to shareholders definitive copies of the proxy statement and accompanying proxy card shortly following April 22, 2005.

Record Date and Outstanding Shares

Only those shareholders owning common stock of DOV at the close of business on April 22, 2005, the record date for the annual meeting, will receive notice and are eligible to vote. At that date, there were 22,759,901 issued and outstanding shares of common stock. Each outstanding share of common stock entitles the holder to cast one vote for each matter to be voted upon.

Quorum

A quorum for the annual meeting is a majority of the outstanding shares of common stock entitled to vote at the meeting present in person or by proxy. Votes cast in person or by proxy will be tabulated by the inspector of elections appointed for the meeting. The inspector of elections will also determine whether a quorum is present. The inspector of elections will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the shareholders for a vote. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter, those shares will be considered as present but not entitled to vote with respect to that matter.

Revocation of Proxies

If you give your proxy card to the company, you have the power to revoke it at any time before it is exercised. Your proxy card may be revoked by:

- notifying the secretary of DOV in writing before the annual meeting;

- delivering to the secretary of DOV before the annual meeting a signed proxy card with a date later then the one you wish to revoke; or

- attending the annual meeting and voting in person.

Any shareholder of record as of the record date attending the annual meeting may vote in person, whether or not a proxy has been previously given, but the presence (without further action) of a shareholder at the annual meeting will not constitute revocation of a previously given proxy.

Voting

You are entitled to one vote for each share of common stock you hold.

If your shares are represented by proxy, they will be voted in accordance with your directions. If your proxy is signed and returned without any direction given, your shares will be voted in accordance with the board of directors’ recommendations in favor of the three proposals. We are not aware, as of the date of this proxy statement, of any matter to be voted on at the annual meeting other than those stated in this proxy statement. If any other matter is properly brought before the annual meeting, the enclosed proxy card gives discretionary authority to the persons named in it to vote the shares.

A majority of shares entitled to vote, present at the meeting in person or by proxy, is required for a quorum. With regard to Proposal No. 1, those individuals receiving the two highest number of votes at the meeting will be elected, even if their votes do not constitute a majority of the votes properly cast. A majority of the votes properly cast for and against each of Proposal Nos. 2 and 3 will determine whether it is adopted.

Attendance at the Annual Meeting

If you own shares of record as of the close of business on the record date, you (or your designated proxy) may attend the annual meeting and vote in person, regardless of whether you have previously voted on a proxy card. Each shareholder or proxy may be asked to present a government-issued form of picture identification, such as a driver’s license or passport.

If you own shares through a bank or brokerage account, you may attend the annual meeting, but you must bring account statements or letters from the bank or brokerage firm showing that you owned DOV common stock as of April 22, 2005. Additionally, if you own shares through a bank or brokerage account, in order to vote your shares in person at the meeting you must obtain a "legal proxy" from the bank or brokerage firm that holds your shares. You should contact your account representative to learn how to obtain a "legal proxy."

Solicitation of Proxies

Proxies may be solicited by certain of our directors, officers and regular employees, without payment of any additional compensation to them. Proxies may be solicited by personal interview, mail, electronic mail or telephone. Any costs relating to such solicitation of proxies will be borne by us. In addition, we may reimburse banks, brokerage firms and other persons representing beneficial owners of shares of common stock for their expense in forwarding solicitation materials to our beneficial owners.

Publication of Voting Results

We will announce preliminary voting results at the annual meeting. We will publish the final results in our quarterly report on Form 10-Q for the second quarter of 2005 due to be filed by August 9, 2005.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

In accordance with our by-laws, the board of directors has fixed the number of directors at six. The board is divided into three classes, with two directors in class I, two directors in class II and two directors in class III. Directors serve for three-year terms with one class of directors being elected by our shareholders at each annual meeting of shareholders. At the 2005 annual meeting, each of two class III directors will be elected to hold office until the 2008 annual meeting of shareholders, or until his or her successor is elected and qualified. Three class II directors were presented for election and elected at the 2004 annual meeting.

The class III directors, whose terms expire at the 2005 annual meeting, are Dr. Arnold S. Lippa and Mr. Patrick Ashe. The class I directors, whose terms expire at the 2006 annual meeting, are Mr. Daniel S. Van Riper and Mr. Jonathan Silverstein. The class II directors, whose terms expire at the 2007 annual meeting, are Dr. Zola Horovitz and Ms. Theresa Bischoff. Until his resignation on March 15, 2005, Dr. Bernard Beer had served as a class II director and there had been seven members of the board. The board, in accordance with our certificate of incorporation and by-laws, is exclusively empowered to increase the number of directors and fill vacancies. The board may consider adding one or more additional directors to its membership after the annual meeting of shareholders.

The board of directors, based upon the unanimous recommendation of our independent directors and the search and nominating committee, has proposed that nominees Dr. Arnold S. Lippa and Mr. Patrick Ashe be elected at the annual meeting. Unless otherwise instructed, persons named in the accompanying proxy will vote for these nominees. The nominees have agreed and consented to stand for election and to serve, if elected, as directors. Although we anticipate that each nominee will be available to serve as director, should either ask that his or her nomination be withdrawn, or otherwise be unable to serve, the proxy holders will have discretionary authority, but shall not be required, to vote for a substitute nominee approved by the board.

Vote Required for Approval

A quorum being present, the affirmative vote of a plurality of the votes cast is necessary to elect each of the nominees as a director of the company. Votes may be cast “for the two nominees,” “withhold authority to vote for the nominees” or withheld with respect to a specific nominee. Votes cast “for the two nominees” will count as “yes votes”; votes cast “withhold authority to vote for the nominees” will not be voted with respect to any nominee, although they will be counted when determining whether there is a quorum; and votes withheld with respect to a specific nominee will not be voted with respect to the nominee indicated, although they will likewise be counted in determining a quorum.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR THE TWO NOMINEES" FOR ELECTION AS CLASS III DIRECTORS. UNLESS INDICATED AS “WITHHOLD AUTHORITY TO VOTE FOR THE NOMINEES” OR WITHHELD WITH RESPECT TO A SPECIFIC NOMINEE, ALL PROXIES THAT AUTHORIZE THE PROXY HOLDER TO VOTE FOR THE ELECTION OF DIRECTORS WILL BE VOTED “FOR THE TWO NOMINEES” OR THE SPECIFIC NOMINEE INDICATED.

Information Regarding the Nominees, Other Directors and Executive Officers

The names of the nominees and of the directors whose terms continue after the annual meeting, their ages as of the record date and certain other information about them are set forth below:

Names of Nominees | Age | Company Position/Offices | Director Since |

Arnold S. Lippa, Ph.D. | 58 | Chairman, Chief Executive Officer and President | April 1995 |

| Patrick Ashe (2) | 42 | Director | January 1999 |

Continuing Directors | Age | Company Position/Offices | Director Since | Term Expires |

Daniel S. Van Riper (1)(2) | 64 | Director | March 2002 | 2006 |

Jonathan Silverstein (3) | 38 | Director | December 2003 | 2006 |

Zola Horovitz, Ph.D. (1)(2) | 70 | Director | April 1995 | 2007 |

Theresa A. Bischoff (1)(3) | 51 | Director | December 2003 | 2007 |

There are no family relationships among any of the directors or executive officers of the company.

| (1) | Member of audit committee |

| (2) | Member of compensation committee |

| (3) | Member of search and nominating committee |

Nominees for Class III Directors and Profiles

Arnold S. Lippa, Ph.D. is a co-founder and has served as our chief executive officer since our inception in April 1995. Dr. Lippa also serves as our president and chairman of our board of directors. Dr. Lippa also serves as chairman of Nascime Limited, the operating company initially formed in connection with the Elan joint venture that is now wholly owned by us. Prior to founding DOV in 1995, Dr. Lippa founded Fusion Associates, Ltd., an investment and management company specializing in the creation and management of biomedical companies. Dr. Lippa served as Fusion's managing director from 1991 to 1995. From 1989 through 1990, Dr. Lippa served as Vega Biotechnologies, Inc.'s chairman and chief executive officer. In 1984, Dr. Lippa co-founded Praxis Pharmaceuticals, Inc. and served as president and chief operating officer until 1988. Prior to 1985, he served as director of molecular neurobiology and held other positions at American Cyanamid. In addition, Dr. Lippa has consulted for various pharmaceutical and biotechnology companies and has been a graduate faculty professor at the New York University School of Medicine and the City University of New York. He received his B.A. from Rutgers University in 1969 and his Ph.D. in psychobiology from the University of Pittsburgh in 1973.

Patrick Ashe has been a member of our board of directors since January 1999. He currently serves as senior vice president, business development and as a director of AGI Therapeutics, Ltd. From May 1994 to November 2001, Mr. Ashe served as vice president, commercial development at Elan Pharmaceutical Technologies, a division of Elan Corporation, plc. Additionally, from January 1999 to November 2001, Mr. Ashe served as co-manager, and currently serves as a director, of Nascime Limited. Mr. Ashe was graduated from University College Dublin with a B.Sc. in pharmacology in 1985 and completed his M.B.A. at Dublin City University's Business School in 1994.

Continuing Non-Management Director Profiles

Theresa A. Bischoff became a member of our board of directors effective in December 2003. Ms. Bischoff is also a trustee of Mutual of America Capital Asset Management. Ms. Bischoff currently serves as the chief executive officer of the American Red Cross in Greater New York. She has also served as chair of the Association of American Medical Colleges, the policy setting and advocacy organization for the 125 medical schools and 400 major teaching hospitals in the United States. From 1984 to 2003, Ms. Bischoff served as president and also held various other positions at the NYU Medical Center. Prior to joining NYU Medical Center, she worked in corporate finance at Squibb Corporation and Great Northern Nekoosa. Ms. Bischoff received a B.S. in accounting from the University of Connecticut in 1975 and an M.B.A. from the New York University in 1991. Ms. Bischoff is also a certified public accountant.

Zola Horovitz, Ph.D. has been a member of our board of directors since our inception in April 1995. Dr. Horovitz currently is a consultant to the pharmaceutical and biotechnology industries and serves as a director of Genvec, Inc., BioCryst Pharmaceuticals, Inc., Palatin Technologies, Inc., Avigen, Inc., Genaera Pharmaceuticals, Inc., Immunicon Corp. and Nitromed, Inc. Before joining us, Dr. Horovitz served 35 years in various managerial and research positions at Bristol-Myers Squibb and its affiliates. At Bristol-Myers Squibb, Dr. Horovitz served as vice president, business development andplanning from 1991-1994, vice president, licensing in 1990, and vice president, research, planning and scientific liaison from 1985-1989. Dr. Horovitz received a B.S. in pharmacy and his M.S. and Ph.D. in pharmacology from the University of Pittsburgh in 1955, 1958 and 1960 respectively.

Jonathan Silverstein became a member of our board of directors in December 2003.Mr. Silverstein is a general partner of OrbiMed Advisors LLC., a health care fund manager based in New York.Mr. Silverstein is also a director ofGiven Imaging, Ltd., Emphasys Medical, Avanir Pharmaceuticals and Predix Pharmaceuticals. Mr. Silverstein is a former director of LifeCell Corporation, Orthovita and Auxilium Pharmaceuticals. From 1996 to 1998, he was the director of life sciences at Sumitomo Bank Limited. From 1994 to 1996, he was an associate at Hambro Resource Development. Mr. Silverstein has a B.A. in economics from Denison University and a J.D. and M.B.A. from the University of San Diego.

Daniel S. Van Riper became a member of our board of directors in March 2002. Mr. Van Riper is also a director of Hubbell Incorporated, where he serves on both the audit and finance committees, a director of New Brunswick Scientific Co., Inc. where he serves on the compensation and governance committee, and a director of 3D Systems Corporation. Mr. Van Riper currently serves as special advisor to Sealed Air Corporation, where he previously served as senior vice president and chief financial officer from July 1998 to January 2002. He is a former director of Millennium Chemicals Inc., where he served on the audit committee and chaired the compensation committee. Previously, Mr. Van Riper was a partner of KPMG LLP, where he worked from June 1962 to June 1998. Mr. Van Riper was graduated with high honors and a B.S. in accounting and completed his M.B.A. in economics and finance from Rutgers University. He is a certified public accountant and is a member of the American Institute of Certified Public Accountants and Beta Gamma Sigma, national honorary business fraternity.

Executive Officers who are not Directors

Barbara G. Duncanjoined us in August 2001 and serves as our senior vice president, finance and chief financial officer and treasurer. Prior to joining us, Ms. Duncan served as a vice president of Lehman Brothers Inc. in its corporate finance division from August 1998 to August 2001, where she provided financial advisory services primarily to companies in the life sciences and general industrial industries. From September 1994 to August 1998, Ms. Duncan was an associate and director at SBC Warburg Dillon Read, Inc. in its corporate finance group, where she focused primarily on structuring mergers, divestitures and financings for companies in the life sciences and general industrial industries. She also worked for PepsiCo, Inc. from 1989 to 1992 in its international audit division, and was a certified public accountant in the audit division of Deloitte & Touche from 1986 to 1989. Ms. Duncan received her B.S. from Louisiana State University in 1985 and her M.B.A. from the Wharton School, University of Pennsylvania, in 1994.

Robert Horton joined us in August 2002 and serves as senior vice president and general counsel and as secretary. Prior to joining us, Mr. Horton served with Goodwin Procter LLP from 2001 to 2003 and with Friedman Siegelbaum LP from 1996 to 2001, in their New York law offices. Prior thereto, Mr. Horton served with Balber Pickard et. al. (formerly, Stults Balber Horton and Slotnick) in New York City. He has served in the JAG Corps and in New Jersey and New York City government. He has practiced corporate and securities law for over 25 years and represented us since shortly after our formation. He was graduated Beta Gamma Sigma from the University of Virginia in 1961 and Order of the Coif from the University of Chicago, where he received his law degree, in 1964. He is a member of the California and New York bars.

Phil Skolnick, Ph.D., D.Sc. (hon)joined us in January 2001 and serves as our senior vice president, research and chief scientific officer. Prior to joining us, Dr. Skolnick served as a Lilly research fellow (Neuroscience) at Eli Lilly & Company from January 1997 to January 2001 where he spearheaded several innovative programs in drug discovery. From 1986 to August 1997, he served as senior investigator and chief, laboratory of neuroscience, at the National Institutes of Health. Dr. Skolnick served as a research professor of psychiatry at the Uniformed Services University of the Health Sciences from 1989 to 1998. He is currently an adjunct professor of anesthesiology at The Johns Hopkins University, an adjunct professor of pharmacology and toxicology at Indiana University School of Medicine and research professor of psychiatry at New York University School of Medicine. Dr. Skolnick is an editor of Current Protocols in Neuroscience and also serves on the editorial advisory boards of the European Journal of Pharmacology, Cellular and Molecular Neurobiology, the Journal of Molecular Neuroscience and Pharmacology, Biochemistry & Behavior. He received a B.S. (summa cum laude) from Long Island University in 1968 and his Ph.D. from The George Washington University in 1972. Dr. Skolnick was awarded the D.Sc.honoris causa from Long Island University in 1993 and the University of Wisconsin-Milwaukee in 1995.

Warren Stern, Ph.D. joined us as a consultant in September 2003 and started full-time in December 2003 as senior vice president, drug development. Dr. Stern also serves as a director of Nascime Limited. Previously he was senior vice president of scientific and medical Services at PAREXEL International Corporation, a major contract research organization, or CRO, where he had worked for the past five and one-half years. Dr. Stern has also held senior level positions in clinical research at Cato Research Ltd., a CRO, Forest Laboratories, Inc. and earlier, Burroughs Wellcome Co. Previously, Dr. Stern was president and CEO of Pharmatec Inc., a CNS-oriented drug delivery company. He has also founded two drug delivery companies, Research Triangle Pharmaceuticals and Nobex, Inc. Dr. Stern has over 25 years' experience in drug development in CNS and other fields. He directed the successful NDA submissions of bupropion (Wellbutrin) and citalopram (Celexa). He has performed preclinical studies and clinical trials in psychopharmacology and published some 90 papers describing the results of his research in animal pharmacology and CNS-oriented clinical trials. Dr. Stern is the inventor on six patents, including patents related to CNS products, and two drug delivery systems. He received his Ph.D. in psychopharmacology from Indiana University in 1969 and completed postdoctoral fellowships at Boston State Hospital and at the Worcester Foundation for Experimental Biology.

The Board of Directors and its Committees

Board of Directors

DOV currently has a six-member board of directors, divided into three classes currently consisting of two directors in each of the three classes. Directors serve for three-year staggered terms with one class of directors being elected by our shareholders at each annual meeting of shareholders. At the 2005 annual meeting, each of the two class III directors will be elected to hold office until the 2008 annual meeting of shareholders, or until his successor is elected and qualified. Three class II directors were voted on at the 2004 meeting of shareholders including Dr. Beer, who recently resigned.

Our board of directors met eight times in 2004 including twice by unanimous written consent in lieu of a meeting. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors and (ii) the total number of meetings of all committees of the board of directors on which the director served. DOV encourages its directors to attend the annual meeting of shareholders. Last year, all its directors attended the annual meeting.

Director Independence

In accordance with the requirements of the Nasdaq Marketplace Rules, our board of directors has determined that Messrs. Van Riper, Silverstein and Ashe, Dr. Horovitz and Ms. Bischoff, representing a majority of the board of directors, are “independent” in accordance with the applicable Nasdaq Marketplace Rules (more specifically, Rule 4200). In order to make this determination, the board of directors has determined that each of such director’s relationship if any with DOV is not expressly excluded from the definition of “independent director” under these Rules, and was limited to serving as a director and a board committee member (and not as an officer or employee of DOV), and none of such directors otherwise had a material relationship with DOV that in the opinion of the board of directors would impair his or her independence or interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The independent directors of DOV meet without management in a regular executive session at least annually and will have such meetings whenever they consider it useful or appropriate.

Audit Committee

The audit committee consists of three members:Dr. Horovitz, Ms. Bischoff and Mr. Van Riper (chairman). The audit committee determines the selection, retention and compensation of our independent registered public accounting firm, reviews the scope and results of audits, submits appropriate recommendations to the board of directors regarding audits, reviews our internal controls and is responsible for reviewing filings with theSEC and releases containing our financial statements, among other matters. No member of the audit committee has participated in the preparation of the company’s financial statements during the last three years. The audit committee met six times during 2004.

Our board of directors has determined that each member of the audit committeehas the appropriate level of financial sophistication and is “independent” under bothSection 10A of the Securities Act of 1934, as amended, or Exchange Act and under the Nasdaq Marketplace Rules. Our board of directors has also determined that Mr. Van Riper and Ms. Bischoff, members of the audit committee and board of directors, are each an audit committee financial expert as such term is defined in Item 401(h) of SEC Regulation S-K. For these members’ relevant experience, see their biographies listed herein.

Our board of directors has adopted an audit committee charter, a copy of which is filed with this proxy statement as Appendix A. The board of directors reviews and reassesses the adequacy of the audit committee charter annually. As part of this annual review, the audit committee charter was amended on March 14, 2005.

Compensation Committee

Our board of directors has established a compensation committee consisting of Dr. Horovitz (chairman) and Messrs. Ashe and Van Riper. The compensation committee reviews and approves the compensation of our executive officers and directors, carries out duties under our incentive compensation plans and other plans approved by us as may be assigned to the committee by the board of directors and makes recommendations to the board of directors regarding these matters. The committee also reviews and approves the compensation including stock option grants of all new employees whose compensation start at or is increased above $150,000 per annum plus the aggregate allowance for raises, bonuses and options to be awarded annually to all non-executive employees. The compensation committee met or acted by unanimous written consent five times during2004.

Our board has determined that each member of the compensation committee is “independent” under the Nasdaq Marketplace Rules.

Search and Nominating Committee

The search and nominating committee has the responsibility of identifying, recommending and nominating a director to fill any existing board vacancies. It may also make recommendations regarding an increase in board size. Its members are Jonathan Silverstein (chairman) and Theresa Bischoff. The search and nominating committee met once during 2004. While the nominating committee has operated pursuant to resolution as permitted by Nasdaq rules, the board has directed that a formal charter be adopted in the first half of 2005. Until such charter is adopted, the committee will consider nominees recommended by shareholders pursuant to procedures to be set forth in our proxy statement.

The search and nominating committee will considera range of criteria when evaluating a candidate for directorship. At a minimum, candidates for director must have the highest personal and professional integrity and demonstrate exceptional ability and judgment. The committee will also consider whether the candidate has direct experience in the biopharmaceutical or related industry or businesses with similar fundamentals, and whether the candidate will assist DOV in achieving a mix of directors that represents a diversity of backgrounds and experience. In addition, the committee, when considering a candidate, will ensure that a majority of the members of the board of directors remain “independent” in accordance with Nasdaq Marketplace Rules. A shareholder may recommend candidates for director by complying with the procedures set forth in this proxy statement under “Shareholder Director Recommendations”, directly following.

Our board of directors has determined that both members of the search and nominating committee, Mr. Silverstein and Ms. Bischoff, are “independent” under Nasdaq Marketplace Rules.

Shareholder Director Recommendations

Shareholders wishing to make director recommendations must write to the search and nominating committee, c/o Secretary of DOV Pharmaceutical, Inc., 433 Hackensack Avenue, Hackensack, New Jersey 07601. All shareholder recommendations for director candidates must be submitted to us not less than 120 calendar days prior to the anniversary of the date on which our proxy statement was released to stockholders in connection with the previous year’s annual meeting, in the case of the 2005 annual meeting by December 27, 2004. The submission must include the name and address of the shareholder; a representation that the shareholder is a record holder of our shares, or evidence of security ownership in accordance with Rule 14a-8(b)(2) of the Exchange Act; the amount and type of ownership of our shares held by the shareholder; the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment of the proposed director for our preceding five full fiscal years; a description of the qualifications and background of the proposed director that addresses the minimum qualifications and other criteria as proscribed by the search and nominating committee from time to time; the amount and type of ownership of our shares held by the proposed director; a description of all arrangements or understandings between the proposed director and shareholder making the recommendation; the consent of the proposed director to be named in the proxy statement and to serve as a director if elected; and any other information regarding the proposed director that is required to be included in a proxy statement filed pursuant to the rules of the SEC. The search and nominating committee will evaluate all candidates for director in the same manner, without regard to the source of the initial recommendation of the candidate.In the event the nominating process becomes the responsibility of the independent directors, the foregoing material will be provided to, and considered by, the independent directors.

Other Committees

Our board ofdirectorsmay from time to time, by a vote of a majority of directors, establish additional committees to facilitate the management of DOV or to discharge specific duties delegated to such committees by the full board of directors. Specifically, the board formed a subcommittee in connection with the company’s license of two of its drug candidates to an affiliate of Merck & Co. in August 2004 and the company’s issuance in December 2004 and January 2005 of its 2.50% convertible subordinated debentures due in January 2025 in December 2004.

Code of Business Conduct and Ethics

All directors and all officers and employees of DOV must act ethically at all times and in accordance with the policies comprising DOV’s code of business conduct and ethics, a copy of whichcan be obtained on our website atwww.dovpharm.com.

Board of Director Communications

Our board of directors provides a process for shareholders to communicate with the board of directors. Anyone may communicate with members of the board of directors, including the search and nominating committee, the non-employee directors, the independent directors and the audit committee. Such communications may be confidential and may be submitted in writing to DOV Pharmaceutical, Inc., 433 Hackensack Avenue, Hackensack, New Jersey 07601, Attn: Secretary. Complaints submitted under the audit committee complaint procedures should be directed to either the general counsel or chairman of the audit committee, and under the code of business conduct and ethics should be directed to the general counsel. All such concerns communicated to directors or officers will be forwarded to the appropriate director or officers for his or her review, and reviewed and addressed in the same way that other concerns will be addressed by the company. We report to the directors on the status of all outstanding concerns addressed to the search and nominating committee, to the non-employee directors, to the independent directors or to the audit committee on a quarterly basis. The chairman of the search and nominating committee, the non-employee directors, the independent directors or the audit committee may direct special treatment, including the retention of outside advisors or counsel, for any concern addressed to them.

Additional Information

The charter for the audit committee, audit committee complaint procedures and code of business conduct and ethics as well as additional corporate information about DOV are available on DOV’s website atwww.dovpharm.com. DOV will provide, without charge upon the written request of any shareholder, a copy of any suchdocument. Any such requests shall be addressed to DOV Pharmaceutical, Inc., 433 Hackensack Avenue, Hackensack, New Jersey 07601, Attn: Investor Relations.

PROPOSAL NO. 2: AMENDMENT OF 2000 STOCK OPTION AND GRANT PLAN

Proposal

On April 7, 2005, the board of directors, subject to shareholder approval, voted to increase the base number of shares reserved for issuance under DOV’s 2000 stock option and grant plan, or the 2000 plan, by 750,000 shares of common stock, and amend the 2000 plan accordingly to include those shares in the number of shares eligible for issuance as incentive options and other awards under the 2000 plan. The amendment to the 2000 plan would increase the number of shares reserved for issuance under the 2000 plan to 3,692,090 shares of common stock from 2,942,090 shares of common stock.

You are being asked to approve an amendment of the 2000 plan to increase the number of shares authorized for grant by 750,000 shares. Based solely on the closing price of the common stock as reported on the Nasdaq National Market on December 31, 2004, the maximum aggregate market value of the additional common stock that could potentially be issued under the 2000 plan as so increased is $27,228,479. Officers, employees, advisers, consultants and directors of the company and its majority-owned subsidiaries are eligible to receive awards under the 2000 plan. Approximately 65 individuals are eligible to receive awards under the 2000 plan. As of December 31, 2004, 758,503 shares of common stock remain available for future grants under the 2000 plan.

Decision to Amend the 2000 Plan

The board of directors believes that this share increase is necessary in order to assure a sufficient reserve of shares of common stock available to grant options to attract and retain the services of individuals considered to be essential to our long-term success. This amendment to the 2000 plan will reserve for issuance an additional 750,000 shares of common stock and make no further change. If the stockholders fail to approve this proposal, the 2000 plan will continue with the present authorization for issuance. None of the additional 750,000 shares has been granted or otherwise allocated to any specific persons, and at the time the amendment was approved by our board of directors, there were no plans to grant or allocate such options to any specific person. The number of shares that may be allocated to our chief executive officer, other executive officers, employees and directors out of the additional 750,000 shares is not determinable at this time since, as noted above, the 2000 plan has shares available for future grants and awards under the 2000 plan are discretionary.

A summary of the 2000 plan is presented below under “Summary of Plans - 2000 Stock Option and Grant Plan.” A copy of theproposed third amendment thereto is attached as Appendix B to this proxy statement. A copy of the 2000 plan is posted on our website,www.dovpharm.com.

Vote Required for Approval

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to approve the amendment to increase the number of shares under the 2000 plan.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE AMENDMENT TO THE 2000 PLAN.

DOV’s Option Grants to Date

As of December 31, 2004,we had outstanding options to purchase 2,646,176 shares of our common stock at a weighted average price of $7.72 under our stock option plans and options convertible into 758,503 shares of common stock are available for future grants under the 2000 plan. Options to purchase an aggregate of 1,092,611 shares of common stock have been exercised under our stock option plans, as of December 31, 2004.

During 2004, we granted the following awards under the 2000 plan:

| - | options to purchase a total of 100,000 shares, upon renewal of his three-year employment agreement, at an exercise price of $13.58 per share, to Dr. Phil Skolnick, a current executive officer; |

| - | options to purchase 25,000 shares as a 2004 bonus at an exercise price of $13.66 to each of Dr. Arnold Lippa, Ms. Barbara Duncan and Mr. Robert Horton, each a current executive officer; |

| - | options to purchase 100,000 shares upon renewal of her three-year employment agreement, at an exercise price of $12.79, to Ms. Barbara Duncan, a current executive officer; |

| - | options to purchase a total of 290,750 shares at exercise prices ranging from $12.70 to $17.38 per share to other employees; and |

| - | options to purchase 15,000 shares, as part of ongoing annual outside director compensation, at an exercise price of $15.04, to each of Dr. Zola Horovitz, Mr. Patrick Ashe and Mr. Daniel Van Riper, each a current director who is not an executive officer. |

All grants were made with exercise prices equal to fair market value on the date of grant.

Option Grants to Directors

Each of our outside directors will receive 15,000 options on the annual meeting date for a full year of service.In 2004, Dr. Horovitz and Messrs. Ashe and Van Riper each received 15,000 options at an exercise price of $15.04.These options will become exercisable in equal (25%), annual installments after the completion of each full year of service following such grant.

Equity Compensation Plan Information

The following table provides information with respect to compensation plans under which equity compensation is authorized at December 31, 2004.

| | Securities to be Issued Upon Exercise of Outstanding Options | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issue |

| Equity Compensation Plans Approved by Shareholders | 2,646,176 | 7.72 | 758,503 |

| Equity Compensation Plan Not Approved by Shareholders | — | — | — |

| Total | 2,646,176 | 7.72 | 758,503 |

Summary of Plans

The essential features of the company’s various stock option and grant plans are summarized below.

1998 Stock Option Plan

Our 1998 stock option plan, or 1998 plan, adopted by our board of directors and approved by our stockholders in September 1998, provided for the issuance of 2,025,000 sharesof our common stock. As of December 31, 2004, options to purchase 471,100 shares of our common stock were outstanding under the 1998 plan. Options to purchase an aggregate of 671,810 shares of common stock have been exercised under the 1998 plan. Generally, options granted under the 1998 plan vest 50% six months from the date of grant and 50% eighteen months from the date of grant. All options generally terminate on the tenth anniversary of the date of grant. In the event of a change in control, all options will become immediately exercisable. The compensation committee administers the 1998 plan. We will not make any additional grants under the 1998 plan. Shares of common stock underlying awards granted under the 1998 plan that are forfeited, canceled, reacquired by the company, satisfied without the issuance of common stock or otherwise terminated (other than by exercise) will be available for future grants under the 2000 plan.

Stock Option Grant to Phil Skolnick

In connection with the commencement of Dr. Skolnick's employment with us in January 2001, we granted him stock options to acquire 405,000 shares of our common stock at an exercise price of $2.78 per share (such shares and price as adjusted for our subsequent 1.62-for-1 stock split). Although Dr. Skolnick's 405,000 options were not granted under the 1998 plan or the 2000 plan, the options were charged against the total number of options available for future grants under the 2000 plan. As of December 31, 2004, all Dr. Skolnick’s 325,000 options remaining from his original grant were vested. During 2004, Dr. Skolnick exercised 40,000 options. Shares of common stock underlying Dr. Skolnick’s options that are terminated (other than by exercise) will be available for future grants under the 2000 plan.

2000 Stock Option and Grant Plan

Our board of directors adopted, and our stockholders approved, our 2000 plan in November 2000. In May 2003 and 2004, our stockholders approved amendments to the 2000 plan to increase the number of shares authorized for grant by 500,000 and 750,000 shares, respectively. The 2000 plan now provides for the issuance of up to 2,942,090 shares of common stock plus that number of shares of common stock underlying any future termination, cancellation or reacquisition of options granted under the 2000 plan or 1998 plan. Additionally, if any of the 405,000 options granted to Dr. Skolnick are terminated, canceled or otherwise reacquired by us, that number of terminated or reacquired shares will also become available for issuance under the 2000 plan. As ofDecember 31, 2004, options to purchase 1,850,076 shares of common stock were outstanding and 758,503 shares of common stock were available for future grants under the 2000 plan. Options to purchase an aggregate of 340,801 shares of common stock have been exercised under our 2000 plan. Our compensation committee administers the 2000 plan.

Under the 2000plan, our compensation committee may among other things:

| · | grant incentive stock options; |

| · | grant non-qualified stock options; |

| · | grant stock appreciation rights; |

| · | issue or sell common stock with or without vesting or other restrictions; and |

| · | grant common stock upon the attainment of specified performance goals. |

These grants and issuancesmay be made to our officers, employees, directors, consultants, advisors and other key persons. A description of each type of award that may be granted under the 2000 plan is included below.

Our compensation committee has the right, in its discretion, to select the individuals eligible to receive awards, determine the terms and conditions of theawards granted, determine the number of shares of common stock covered by an award, determine and modify the terms and conditions of awards, impose limitations on awards, accelerate the vesting schedule of any award and generally administer and interpret the 2000 plan. The decisions and interpretations of the committee are binding on all persons including the company and plan grantees. The committee may delegate to the chief executive officer of the company the authority to grant awards at fair market value to certain individuals who are not executive officers or directors of the company.

Options. The exercise price of options granted under the 2000 plan is determined by our compensation committee and generally is not less than 100% of the fair market value of our common stock on the date of grant. Under present law, incentive stock options and options intended to qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986 may not be granted at an exercise price less than the fair market value of our common stock on the date of grant, or less than 110% of the fair market value in the case of incentive stock options granted to optionees holding more than 10% of our voting power. Generally, vesting under the 2000 plan occurs either 25% after the first year and the balance ratably annually over the next three years or 50% after the first 18 months and the balance ratably quarterly thereafter.

Options typically terminate ten years from the date of grant and may beexercised for specified periods after the termination of the optionee's employment or other service relationship with us. Upon the exercise of options, the option exercise price must be paid in full either in cash or by certified or bank check or other instrument acceptable to the committee or through delivery of DOV common stock purchased on the open market or beneficially owned for six months or, if approved by the board, by promissory note.

Restricted Stock. Restricted stock awards may be granted to eligible participants at the compensation committee's discretion. The compensation committee determines the terms of restricted stock awards and a restricted stock agreement may give us the option, or impose an obligation, to repurchase some of or all the shares of restricted stock held by a grantee upon the termination of the grantee's employment or other service relationship with us. Restricted stock awards will vest at a rate determined by the compensation committee.

��

Unrestricted Stock. The committee may grant shares of common stock under the 2000 plan that are free from any restrictions. Unrestricted stock may be issued to participants in recognition of past services or other valid consideration, and may be issued in lieu of cash compensation to be paid to such individuals.

Stock Appreciation Rights. Stock appreciation rights may be granted to eligible participants at the compensation committee's discretion. Stock appreciation rights entitle the recipient to elect to receive an amount of cash or shares of stock or a combination thereof having a value equal to the excess of the value of thestock on the date of exercise over the exercise price of the award. The exercise price per share of stock appreciation rights may generally not be less than 100% of the fair market value of the shares of common stock on the date of grant. The terms of the stock appreciation rights will be determined by the compensation committee. Stock appreciation rights will generally terminate upon the termination of an optionee's employment or other service relationship with us.

Performance-Based Awards. To ensure that certain awards of restricted stock granted under the 2000 plan to the top five named executive officers of the company qualify as “performance based compensation” under Section 162(m) of the Code, the 2000 plan provides that the committee may require that the vesting of such awards be conditioned on the satisfaction of performance criteria that may include any of or all the following: (i) the company’s return on equity, assets, capital or investment; (ii) pre tax or after tax profit levels of the company or any subsidiary, division, operating unit or business segment thereof, or any combination of the foregoing; (iii) cash flow, funds from operations or similar measures; (iv) total shareholder return; (v) changes in the market price of our common stock; (vi) sales or market share; or (vii) earnings per share. The committee will select the particular performance criteria within 90 days following the commencement of a performance cycle. To satisfy the requirements of Section 162(m) of the Code, stock options and stock appreciation rights with respect to no more than 500,000 shares of common stock (subject to adjustment for stock splits and similar events) may be granted to any one individual during any one calendar-year period. In addition, the maximum award that is intended to qualify as “performance based compensation” under Section 162(m) of the Code will not exceed 500,000 shares of common stock (subject to adjustment for stock splits and similar events) for any performance cycle.

The 2000 plan and all awards granted under the plan will terminate upon a merger, reorganization or consolidation, the sale of all or substantially all our assets or all our outstanding capital stock or a liquidation or other similar transaction, unless we and the otherparties to such transactions agree otherwise. All participants under the 2000 plan will be permitted to exercise, before any such termination, all awards held by them that are then exercisable or will become exercisable upon the closing of the transaction. Under employment agreements with executive officers and certain employees as well as certain options granted to directors, vesting may be accelerated in connection with a change of control.

Tax Information

The following is a summary of the principal federal income tax consequences of transactions under the 2000 plan. It does not describe all federal tax consequences under the 2000 plan; nor does it describe state or local tax consequences.

Incentive Options. No taxable income is generally realized by the optionee upon the grant or exercise of an incentive option. If shares of common stock issued to an optionee pursuant to the exercise of an incentive option are sold or transferred after two years from the date of grant and after one year from the date of exercise, then (i) upon sale of such shares, any amount realized in excess of the option price (the amount paid for the shares) will be taxed to the optionee as a long-term capital gain, and any loss sustained will be a long-term capital loss, and (ii) there will be no deduction for the company for federal income tax purposes. The exercise of an incentive option will give rise to an item of tax preference that may result in alternative minimum tax liability for the optionee. An optionee will not have any additional FICA (Social Security) taxes upon exercise of an incentive option.

��

If shares of common stock acquired upon the exercise of an incentive option are disposed of prior to the expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”), generally (i) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares of common stock at exercise (or, if less, the amount realized on a sale of such shares of common stock) over the option price thereof, and (ii) the company will be entitled to deduct such amount. Special rules will apply where all or a portion of the exercise price of the incentive option is paid by tendering shares of common stock.

If an incentive option is exercised at a time when it no longer qualifies for the tax treatment described above, the option is treated as a non-qualified option. Generally, an incentive option will not be eligible for the tax treatment described above if it is exercised more than three months following termination of employment (or one year in the case of termination of employment by reason of disability). In the case of termination of employment by reason of death, the three-month rule does not apply.

Non-Qualified Options. With respect to non-qualified options under the 2000 plan, no income is realized by the optionee at the time the option is granted. Generally (i) upon exercise, ordinary income is realized by the optionee in an amount equal to the difference between the option price and the fair market value of the shares of common stock on the date of exercise, and the company receives a tax deduction for the same amount, and (ii) at disposition, appreciation or depreciation after the date of exercise is treated as either short-term or long-term capital gain or loss depending on how long the shares of common stock have been held. Special rules will apply where all or a portion of the exercise price of the non-qualified option is paid by tendering shares of common stock. Upon exercise, the optionee will also be subject to FICA taxes on the excess of the fair market value over the exercise price of the option.

Parachute Payments. The vesting of any portion of an option or other award that is accelerated due to the occurrence of a change in control may cause a portion of the payments with respect to such accelerated awards to be treated as “parachute payments” as defined in the Code. Any such parachute payments may be non-deductible to the company, in whole or in part, and may subject the recipient to a non-deductible 20% federal excise tax on all or a portion of such payment (in addition to other taxes ordinarily payable).

Limitation on the company’s Deductions. As a result of Section 162(m) of the Code, the company’s deduction for certain awards under the 2000 plan may be limited to the extent that the chief executive officer or other executive officer whose compensation is required to be reported in the summary compensation table receives compensation in excess of $1 million a year (other than performance-based compensation that otherwise meets the requirements of Section 162(m) of the Code).

PROPOSAL NO. 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee has selected PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2005. PricewaterhouseCoopers LLP has served as our independent auditors since November 2001 and provided us with audit services in respect of the years 1999, 2000, 2001, 2002, 2003 and 2004. Our shareholder views on auditors are advisory only because the audit committee is required under the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC to have responsibility for the appointment of our independent registered public accounting firm. Nonetheless, this proposal is put before the shareholders in order to seek their views on this important corporate matter. If the shareholders do not ratify the appointment, the audit committee will take the matter under advisement.

A representative of PricewaterhouseCoopers LLP will be present at the annual meeting. The representative will have an opportunity to make a statement and will be available to respond to questions from shareholders.

Recommendation

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTEFOR RATIFICATION OF THE SELECTION OFPRICEWATERHOUSECOOPERS LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY’S FISCAL YEAR ENDED DECEMBER 31, 2005. UNLESS INDICATED AS “AGAINST” OR “ABSTAIN”, ALL PROXIES THAT AUTHORIZE THE PROXY HOLDER TO VOTE WITH RESPECT TO THE RATIFICATION OF APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP WILL BE VOTEDFOR THE RATIFICATION.

Fees of Independent Registered Public Accounting Firm

The aggregate fees and expenses billed for professional services rendered by our independent registered public accounting firm, PricewaterhouseCoopers LLP, with respect to fiscal years ended 2003 and 2004, were as follows:

| | | Years Ended December 31, | |

| | | 2003 | | 2004 | |

| (1) Audit (1) | | $ | 238,180 | | $ | 420,100 | |

| (2) Audit Related (2) | | | — | | | 15,000 | |

| (3) Tax (3) | | | 34,000 | | | 118,000 | |

| (4) All Other | | | — | | | — | |

Total | | | 272,180 | | | 553,100 | |

(1) Audit fees include fees for the audit of our 2003 financial statements and the integrated audit of our 2004 financial statements, management’s assessment of the effectiveness of internal control over financial reporting at December 31, 2004 (Sarbanes-Oxley 404 compliance) and the effectiveness of internal control of financial reporting at December 31, 2004. Audit fees also include quarterly reviews, the 2003 and 2004 audit fee for Nascime Ltd., our wholly-owned subsidiary, fees for review of the S-8 filing for our shareholder rights plan, fees for review of S-1 filings and fees for review of our convertible debt offering. Audit fees related to the Sarbanes-Oxley 404 compliance in 2004 totaled $125,000.

(2) In 2004, audit related fees are attributable to the review of the agreement with a subsidiary of Merck & Co.

(3) In 2003, tax fees include fees for tax advice in relation to our acquisition of 100% of the equity of Nascime and for tax return preparation services. In 2004, tax fees include fees for tax advice in relation to Nascime, an analysis of the Section 382 limitations on the utilization of NOL’s and tax return preparation services.

Policy on Audit Committee Approval of Audit and Non-Audit Services

The audit committee's policy is to pre-approve all audit and non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services, including tax research and consultations, international tax consulting, tax assistance and compliance in international locations, assistance with transfer pricing, expatriate tax services, consultations and assistance with other taxes including state and local taxes, sales and use taxes, customs and duties, review of intercompany agreements and assistance with international manufacturing tax issues. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget.The independent registered public accounting firm and management are required to periodically report to the full audit committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. All the audit, audit-related, tax and other services provided by PricewaterhouseCoopers LLP in fiscal year 2004 and related fees were approved in accordance with the audit committee's policy.

The audit committee charter, adopted in March 2003 and amended in March 2004 and March 2005, is attached to this proxy statement as Appendix A.

The audit committee has determined that the provision of the non-audit services provided by PricewaterhouseCoopers LLP is compatible with its maintaining auditor independence.

Peer Review

As required by the Nasdaq Marketplace Rules, the company will be audited by an independent registered public accounting firm that (i) has received an external quality control review by an independent public accountant (“peer review”) that determines whether the auditor’s system of quality control is in place and operating effectively and whether established policies and procedures and applicable auditing standards are being followed or (ii) is enrolled in a peer review program and within 18 months receives a peer review that meets acceptable guidelines.

REPORT BY THE AUDIT COMMITTEE

The audit committee is a committee of the board of directors. Its primary function is to assist the board in fulfilling its oversight responsibilities by reviewing the financial information to be provided to shareholders and others, the systems of internal controls that management and the board have established and our audit process. The members of the audit committee are independent as that term is defined in Rule 4200(a)(14) of the Nasdaq Marketplace Rules and two of its three members are “audit committee financial experts” under SEC rules.

Our outside independent registered public accounting firm, PricewaterhouseCoopers LLP, is accountable to the audit committee as the representative of the shareholders. The audit committee has the authority and responsibility to select, evaluate and, where appropriate, replace the outside independent registered public accounting firm and reviews whether the non-audit services provided by it are compatible with its being independent for purposes of our financial audit. It is the responsibility of management to prepare the financial statements and the responsibility of the outside independent registered public accounting firm to determine whether our financial statements are free from material misstatement and present fairly, in all material respects, our financial position as of our balance sheet date and our result of operations and cash flows for the fiscal period in accordance with generally accepted accounting principles.

The board of directors and audit committee have adopted an audit committee charter. A copy of the charter is attached as Appendix A. The audit committee held six meetings during 2004, including pre-issuance reviews of quarterly financial statements and press releases. The committee has reviewed and discussed the audited financial statements for fiscal year 2004 with our management and our independent registered public accounting firm. In addition, the committee has discussed with our independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards Nos. 61 and 90, as amended. The audit committee also has received the written disclosures and the letter from the independent registered public accounting firm required by the Independence Standards Board Standard No. 1 and has discussed its independence with the independent registered public accounting firm. Based on these discussions and reviews, the audit committee recommended to the board of directors that the audited financial statements be included in our annual report on Form 10-K for the year ended December 31, 2004, filed with the SEC on March 15, 2005.

The audit committee regularly reviews and determines whether specific projects or expenditures with our independent registered public accounting firm, PricewaterhouseCoopers LLP, potentially affects its independence. The audit committee's policy is to pre-approve all audit and permissible non-audit services provided by PricewaterhouseCoopers LLP. Pre-approval is generally provided by the audit committee for up to one year, is detailed as to the particular service or category of services to be rendered and is generally subject to a specific budget. The audit committee may also pre-approve additional services or specific engagements on a case-by-case basis. Management is required to provide quarterly updates to the audit committee regarding the extent of any services provided in accordance with this pre-approval, as well as the cumulative fees for all non-audit services incurred to date.

Audit Committee

Daniel S. Van Riper (chairman)

Theresa Bischoff

Zola Horovitz

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Director Compensation

Our outside directors each receive $4,000 for each quarterly board meeting and outside directors receive 15,000 options for a full year of service on the annual meeting date. In 2004, Dr. Horovitz, Mr. Ashe and Mr. Van Riper each received 15,000 options at an exercise price of $15.04 per share. These options will become exercisable in equal (25%), annual installments after the completion of each full year of service following such grant. Our compensation committee members receive $1,000 for each meeting in which they participate with a limit of one such payment per quarter and the chairman of the compensation committee receives additional compensation of $500 per quarter. Our audit committee members receive $1,000 for each meeting in which they participate and the chairman of the audit committee receives additional compensation of $3,000 per quarter. We have agreed to reimburse our directors for their reasonable expenses incurred in attending meetings of the board of directors and its committees.

Executive Compensation

The following table sets forth certain compensation information for the years indicated as to our CEO and the four additional most highly compensated executive officers (the named executives) based on salary and bonus for the fiscal years ended December 31, 2002, 2003 and 2004. In addition, we have included information for our former president who retired effective March 15, 2004.

| | | | | | | | | | | | | Long-Term Compensation Awards | | | | |

| | | | | Securities | | | | |

| | | Annual Compensation | | Underlying | | | All Other | |

Name and Principal Position | | | Year | | | Salary | | | Bonus(1) | | | Options(1) | | | Compensation | |

| Arnold S. Lippa, Ph.D.(2) | | | 2004 | | $ | 363,212 | | $ | 125,000 | | | 25,000 | | $ | 33,895 | |

| Chairman, Chief Executive | | | 2003 | | | 325,769 | | | 50,000 | | | — | | | 30,408 | |

| Officer and President | | | 2002 | | | 296,154 | | | 110,000 | | | — | | | 30,218 | |

| | | | | | | | | | | | | | | | | |

| Phil Skolnick, Ph.D., D.Sc. (hon)(3) | | | 2004 | | | 299,038 | | | 50,000 | | | 100,000 | | | 13,290 | |

| Senior Vice President, Research | | | 2003 | | | 273,558 | | | 30,000 | | | — | | | 8,100 | |

| and Chief Scientific Officer | | | 2002 | | | 250,000 | | | 40,000 | | | — | | | 8,100 | |

| | | | | | | | | | | | | | | | | |

| Barbara Duncan (4) | | | 2004 | | | 298,077 | | | 50,000 | | | 125,000 | | | 12,300 | |

| Senior Vice President, Finance, | | | 2003 | | | 258,942 | | | 30,000 | | | — | | | 8,100 | |

Chief Financial Officerand Treasurer | | | 2002 | | | 235,288 | | | 75,000 | | | — | | | 8,100 | |

| | | | | | | | | | | | | | | | | |

| Robert Horton (5) | | | 2004 | | | 307,211 | | | 50,000 | | | 25,000 | | | 15,048 | |

| Senior Vice President, General | | | 2003 | | | 250,000 | | | — | | | — | | | 9,525 | |

| Counsel and Secretary | | | 2002 | | | 87,500 | | | — | | | 250,000 | | | 2,700 | |

| | | | | | | | | | | | | | | | | |

| Warren Stern (6) | | | 2004 | | | 300,000 | | | — | | | — | | | 13,815 | |

| Senior Vice President, Drug | | | 2003 | | | 24,077 | | | — | | | 285,000 | | | 46,000 | |

| Development | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Bernard Beer, Ph.D.(7) | | | 2004 | | | 441,988 | | | 75,000 | | | 25,000 | | | 79,225 | |

| | | | 2003 | | | 325,769 | | | 50,000 | | | — | | | 30,704 | |

| | | | 2002 | | | 296,154 | | | 110,000 | | | — | | | 27,229 | |

(1) Does not reflect bonuses paid and options granted in 2005 to the five named executive officers aggregating $400,000 and 120,000 options.

(2) All other compensation represents $16,723, $16,668, and $16,800 in 2004, 2003 and 2002 for automobile allowance, $8,018, $13,740, and $13,418 in 2004, 2003 and 2002 for life insurance premiums and $9,154 for advances repaid in 2005.

(3) All other compensation represents $12,000, $8,100 and $8,100 in 2004, 2003 and 2002 for automobile allowance and $1,290 in 2004 for life insurance premiums. Includes, for 2004, 100,000 options granted upon renewal of three-year employment agreement.

(4) All other compensation represents $12,000, $8,100 and $8,100 in 2004, 2003 and 2002 for automobile allowance, and $300 in 2004 for life insurance premiums. Includes, for 2004, 100,000 options granted upon renewal of three-year employment agreement.

(5) All other compensation represents $12,000, $8,100 and $2,700 in 2004, 2003 and 2002 for automobile allowance, $3,048 in 2004 for life insurance premiums and $1,425 in 2003 for moving expenses. Mr. Horton joined us effective August 16, 2002.

(6) All other compensation represents $12,000 and $1,000 in 2004 and 2003 for automobile allowance, $45,000 in 2003 for consulting expenses and $1,815 in 2004 for life insurance premiums. Dr. Stern joined us effective December 2, 2003.

(7) Dr. Beer retired as president of the company effective March 15, 2004 and resigned from our board of directors effective March 15, 2005. In connection with his retirement, Dr. Beer received a year’s salary of $365,750. All other compensation represents $4,200, $16,800 and $16,800 in 2004, 2003 and 2002 for automobile allowance, $7,756, $13,904, and $10,429 in 2004, 2003, and 2002 for life insurance premiums, and $56,269 and $11,000 in 2004 for unused vacation and medical insurance for one year paid at time of retirement.

Option Grants in Last Fiscal Year and Option Values at Fiscal Year End

The following table sets forth information with respect to the named executives concerning the grant of stock options during 2004. All the options were granted at the fair market value on the date of grant as determined by the compensation committee.

| | | Individual Grants | | | |

Name | | | Options Granted in 2004 | | | % of Total Options Granted in 2004 | | | Exercise or Base Price ($/Sh) | | | Expiration Date | | | Grant Date Present Value | |

| Arnold S. Lippa, Ph.D. | | | 25,000 | | | 4.1 | % | $ | 13.66 | | | 1/26/2014 | | $ | 277,527 | |

Phil Skolnick, Ph.D. D.Sc. (hon) (1) | | | 100,000 | | | 16.4 | | | 13.58 | | | 1/09/2014 | | | 1,107,865 | |

| Barbara Duncan (2) | | | 125,000 | | | 20.5 | | | 12.96 | | | 8/3/2014 | | | 1,282,902 | |

| Robert Horton | | | 25,000 | | | 4.1 | | | 13.66 | | | 1/26/2014 | | | 277,527 | |

| Warren Stern | | | — | | | — | | | — | | | — | | | — | |

| (1) | 100,000 options were granted on January 9, 2004, upon renewal of three-year employment agreement at an exercise price of $13.58. |

| (2) | 25,000 options were granted on January 26, 2004 at an exercise price of $13.66 and 100,000 options were granted on August 3, 2004 upon renewal of three-year employment agreement at an exercise price of $12.79. |

Aggregate Option Exercises in Last Fiscal Year and Year-End Option Values

The following table sets forth certain information as of December 31, 2004, regarding options held by the named executives.

| | | Shares | | | | Number of Securities Underlying Unexercised Options at Fiscal Year-End(1) | | Value ($) of Unexercised in-the-Money Options at Fiscal Year-End(2) | |

Name | | | Acquired on Exercise | | | Value ($) Realized | | | Number Exercisable | | | Number Unexercisable | | | Value ($) Exercisable | | | Value ($) Unexercisable | |

| Arnold S. Lippa, Ph.D. | | | — | | | — | | | 210,600 | | | 25,000 | | $ | 3,239,028 | | $ | 109,750 | |

| Phil Skolnick, Ph.D. D. Sc. (hon) | | | 40,000 | | | 548,112 | | | 325,000 | | | 100,000 | | | 4,962,750 | | | 447,000 | |

| Barbara Duncan | | | — | | | — | | | 324,500 | | | 125,000 | | | 4,555,980 | | | 635,750 | |

| Robert Horton(3) | | | 90,500 | | | 1,048,042 | | | 137,498 | | | 87,502 | | | 1,876,848 | | | 962,902 | |

| Warren Stern | | | — | | | — | | | — | | | 285,000 | | | — | | | 766,650 | |

(1) Includes both in-the money and out-of-the-money options.

(2) Fair value of DOV’s common stock at December 31, 2004 ($18.05 based on the closing sales price reported on Nasdaq) less the exercise price.

(3) Includes 40,500 options (adjusted for subsequent 1.62-for-1 stock split) at an exercise price of $2.78 (as so adjusted) granted in May 2000 before employment.

Employment Agreements with Named Executive Officers

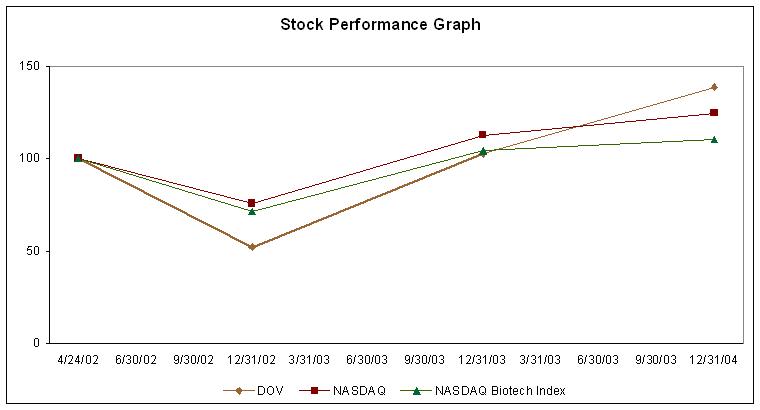

Arnold S. Lippa, Ph.D.We have entered into an employment agreement with Dr. Lippa (as extended effective December 2004), which provides for his employment as CEO. Dr. Lippa's base compensation was $366,025 for 2004, and his base compensation was increased by 10% in December 2004. The agreement provides for benefits, the reimbursement of expenses and the payment of incentive compensation, which will be determined by our board of directors in its sole discretion. Additionally, his employment agreement provides that if we should merge or consolidate with or into an unrelated entity, sell all or substantially all our assets, or enter into a transaction or series of transactions with the result that 51% or more of our capital stock is transferred to one or more unrelated third parties, Dr. Lippa is entitled to receive a bonus equal to 2% of the gross proceeds of such sale (as defined in the agreement). We are obligated to continue to pay Dr. Lippa his base and incentive compensation and to continue his benefits for a period of nine months if he is terminated upon becoming disabled or for a period of 90 days upon his death. If Dr. Lippa terminates his employment with us for good reason, or within six months of a change of control, or if we terminate Dr. Lippa without cause, he is entitled to receive his base and incentive compensation and the continuation of all benefits for two years from the date of termination, and all stock options granted to him will immediately vest. The agreement also requires Dr. Lippa to refrain from competing with us and from soliciting our clients and customers for the duration of his employment and for a period following employment equal to the length of time we make severance payments to him.