UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number File No. 811-08961

TIAA-CREF LIFE FUNDS

(Exact Name of Registrant as specified in charter)

730 Third Avenue, New York, New York 10017-3206

(Address of Principal Executive Offices) (Zip code)

Terry H. Lin, Esq.

c/o TIAA-CREF

730 Third Avenue

New York, New York 10017-3206

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-490-9000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2015

Item 1. Reports to Stockholders.

Understanding your TIAA-CREF Life Funds report

This annual report contains information about the eleven TIAA-CREF Life Funds and describes the funds’ results for the twelve months ended December 31, 2015. The report contains three main sections:

| | • | The fund performance section compares each fund’s investment returns with those of its benchmark index. |

| | • | The summary portfolios of investments list the industries and types of securities in which each fund had investments as of December 31, 2015. |

| | • | The financial statements provide detailed information about the operations and financial condition of each fund. |

The views and opinions expressed in this report are through the end of the period, as stated on the cover of this report. They are subject to change at any time based on a variety of factors. As such, they are not guarantees of future performance or investment results and should not be taken as investment advice. The risks of investing in the TIAA-CREF Life Funds vary from fund to fund; to see the risks of investing in an individual fund, please refer to that fund’s latest prospectus.

As always, you should carefully consider the investment objectives, risks, charges and expenses of any fund before investing. For a prospectus that contains this and other important information, please visit our website at tiaa-cref.org, or call 800 223-1200. We urge you to read the prospectus carefully before investing.

2 2015 Annual Report ¡ TIAA-CREF Life Funds

Information on the TIAA-CREF Life Funds

Portfolio holdings

Securities and Exchange Commission (SEC) rules allow investment companies to list the top holdings of each fund in their annual and semiannual reports, instead of providing complete portfolio listings. The TIAA-CREF Life Funds also file complete portfolio listings with the SEC, and they are available to the public.

You can obtain a complete list of the TIAA-CREF Life Funds’ portfolio holdings (Schedules of Investments) as of the most recently completed fiscal quarter in the following ways:

| | • | By visiting our website at tiaa-cref.org; or |

| | • | By calling us at 800 842-2252 to request a copy free of charge. |

You can also obtain a complete list of the TIAA-CREF Life Funds’ portfolio holdings as of the most recently completed fiscal quarter, and for prior quarter-ends, from our SEC Form N-CSR and Form N-Q filings. Form N-CSR filings are as of December 31 or June 30; Form N-Q filings are as of March 31 or September 30. Copies of these forms are available:

| | • | Through the Electronic Data Gathering and Retrieval System (EDGAR) on the SEC’s website at www.sec.gov; or |

| | • | From the SEC’s Office of Investor Education and Advocacy. |

(Call 202 551-8090 for more information.)

Proxy voting

TIAA-CREF Life Funds’ ownership of stock gives it the right to vote on proxy issues of companies in which it invests. A description of our proxy voting policies and procedures can be found on our website at tiaa-cref.org or on the SEC’s website at www.sec.gov. You can also call us at 800 223-1200 to request a free copy. A report of how the funds voted during the most recently completed twelve-month period ended June 30 can be found on our website or on Form N-PX at www.sec.gov.

Contacting TIAA-CREF

There are three easy ways to contact us: by email, using the Contact Us link at the top of our home page; by mail at TIAA-CREF, 730 Third Avenue, New York, NY 10017–3206; or by phone at 800 223-1200.

Fund management

TIAA-CREF Life Funds are managed by the portfolio management teams of Teachers Advisors, Inc. The members of these teams are responsible for the day-to-day investment management of the funds.

TIAA-CREF Life Funds ¡ 2015 Annual Report 3

About the funds’ benchmarks

Equity Indexes

Broad market indexes

The Russell 3000® Index measures the performance of the stocks of the 3,000 largest publicly traded U.S. companies, based on market capitalization. The index measures the performance of about 98% of the total market capitalization of the publicly traded U.S. equity market.

The MSCI EAFE Index measures the performance of the leading stocks in 21 developed market countries outside North America—in Europe, Australasia and the Far East.

Large-cap indexes

The S&P 500® Index is a market-capitalization-weighted index of the stocks of 500 leading companies in leading industries of the U.S. economy.

The Russell 1000® Growth Index is a subset of the Russell 1000 Index, which measures the performance of the stocks of the 1,000 largest companies in the Russell 3000 Index, based on market capitalization. The Russell 1000 Growth Index measures the performance of those stocks of the Russell 1000 Index with higher relative forecasted growth rates and price/book ratios.

The Russell 1000 Value Index is a subset of the Russell 1000 Index, which measures the performance of the stocks of the 1,000 largest companies in the Russell 3000 Index, based on market capitalization. The Russell 1000 Value Index measures the performance of those stocks of the Russell 1000 Index with lower relative forecasted growth rates and price/book ratios.

Small-cap index

The Russell 2000® Index measures the performance of the stocks of the 2,000 smallest companies in the Russell 3000 Index, based on market capitalization.

Specialty equity index

The FTSE NAREIT All Equity REITs Index measures the performance of certain publicly traded real estate investment trusts in the United States that own, manage and lease investment-grade commercial real estate.

4 2015 Annual Report ¡ TIAA-CREF Life Funds

About the funds’ benchmarks

Fixed-income Index

The Barclays U.S. Aggregate Bond Index measures the performance of the domestic investment-grade fixed-rate bond market, including government and corporate securities, agency mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities.

Composite Index

The Balanced Fund Composite Index is a composite of three unmanaged benchmark indexes, each of which represents one of the three market sectors in which the underlying funds invest: domestic equity (Russell 3000 Index), international equity (MSCI EAFE Index), and fixed income (Barclays U.S. Aggregate Bond Index). The fund’s composite benchmark combines those public indexes in proportions that reflect the fund’s target market sector allocations.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

Russell 1000, Russell 2000 and Russell 3000 are trademarks and service marks of Russell Investments. TIAA-CREF products are not promoted or sponsored by, or affiliated with, Russell Investments. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. This report is not approved, reviewed or produced by MSCI. S&P 500 is a registered trademark and service mark of the McGraw-Hill Companies, Inc. FTSE is a trademark of London Stock Exchange plc and The Financial Times Limited.

TIAA-CREF Life Funds ¡ 2015 Annual Report 5

Important information about expenses

All shareholders of the TIAA-CREF Life Funds incur ongoing costs, including management fees and other fund expenses.

The TIAA-CREF Life Funds are the underlying investment vehicles for certain variable life insurance and variable annuity contracts issued by TIAA-CREF Life Insurance Company. These contracts have additional administrative expense fees and mortality and expense risk charges. Because of these additional deductions, the costs to investors will be higher than the figures shown in the expense examples. Information about these additional charges can be found in the product prospectuses.

The expense examples that appear on the performance pages are intended to help you understand your ongoing costs only (in U.S. dollars) and do not reflect transactional costs incurred by the fund for buying and selling securities. The examples are designed to help you compare these ongoing costs with the ongoing costs of investing in other mutual funds. Shareholders of the TIAA-CREF Life Funds do not incur a sales charge on purchases, on reinvested dividends or other distributions.

The examples are based on an investment of $1,000 invested at the beginning of the six-month period and held for the entire period (July 1, 2015–December 31, 2015).

Actual expenses

The first line in each table uses the fund’s actual expenses and its actual rate of return. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the six-month period.

Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses paid during period” to estimate the expenses you paid during the six-month period. Some funds have a contractual fee reimbursement. Had these not been in effect, fund expenses would have been higher.

Hypothetical example for comparison purposes

The second line shows hypothetical account values and expenses based on the fund’s actual expense ratio for the six-month period and an assumed 5% per year rate of return before expenses. This was not the fund’s actual return.

This hypothetical example cannot be used to estimate the actual expenses you paid for the period but rather allows you to compare the ongoing costs of investing in the fund with that of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

6 2015 Annual Report ¡ TIAA-CREF Life Funds

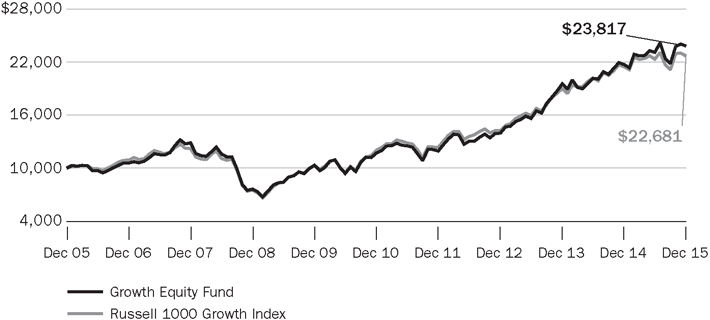

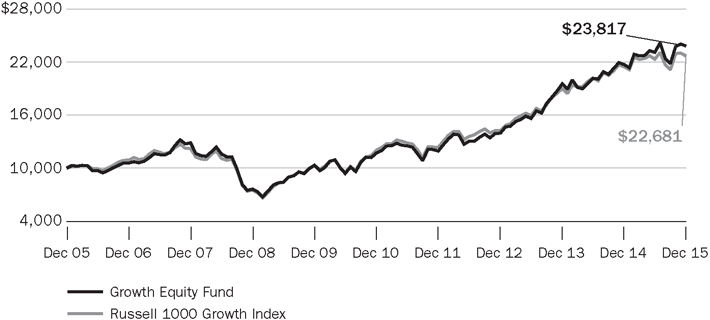

Growth Equity Fund

Performance for the twelve months ended December 31, 2015

The Growth Equity Fund returned 9.67% for the year, compared with the 5.67% return of its benchmark, the Russell 1000® Growth Index.

Following a weak first quarter, gross domestic product (GDP), which measures the value of all goods and services produced in the United States, rose at an annualized rate of 3.9% and 2.0% in the second and third quarters, respectively. Average hourly wages increased, inflation rose slightly and the national unemployment rate dropped to 5.0%. The Federal Reserve raised the federal funds target rate by 0.25%, while central banks overseas eased rates.

Stock prices were volatile, particularly in the third quarter, largely in reaction to slowing growth in China, interest rate uncertainties and plunging oil prices. For the twelve months, the Russell 3000® Index, a broad measure of the U.S. stock market, returned 0.48%. Large-cap stocks topped mid-cap equities, which outperformed small-cap stocks. Growth stocks ended the year up, but their value counterparts ended down. (Returns are based on Russell indexes.)

For the ten years ended December 31, 2015, the Russell 1000 Growth Index produced an average annual gain of 8.53%, beating the 7.35% average return of the Russell 3000 Index over the same period.

Stock choices boost relative performance

Six of the ten industry sectors within the fund’s benchmark generated gains for the twelve months. Consumer discretionary (up 11.6%), information technology (up 9.2%) and health care (up 6.8%) were among the benchmark’s best performing sectors. These three largest sectors comprised nearly two-thirds of the index’s total market capitalization on December 31, 2015. The energy sector had the most significant decline (down 38.2%).

The fund outperformed its benchmark, aided by overweight positions in Amazon.com and Starbucks. Amazon’s stock rose on strong sales growth and the profitability of Amazon Web Services, its fast-growing cloud-computing business. Starbucks benefited from increased customer traffic and revenue and the announcement of a share buyback program.

Slightly offsetting these strong performers were out-of-benchmark holdings in Yahoo! and Valeant Pharmaceuticals, which detracted from relative returns. Naysayers pressured online content provider Yahoo!’s stock. Although Valeant had a solid year financially, the stock suffered when a probe was launched questioning the company’s drug pricing practices.

TIAA-CREF Life Funds ¡ 2015 Annual Report 7

Growth Equity Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Growth Equity Fund | | | 4/3/2000 | | | | 9.67% | | | | 15.26 | % | | | 9.07% | |

|

| |

| | | | |

Russell 1000® Growth Index | | | — | | | | 5.67 | | | | 13.53 | | | | 8.53 | |

|

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

8 2015 Annual Report ¡ TIAA-CREF Life Funds

Growth Equity Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Growth Equity Fund | | Beginning account value

(7/1/15) | | | Ending account value

(12/31/15) | | | Expenses paid during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $1,031.05 | | | | $2.66 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,022.58 | | | | 2.65 | |

|

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.52%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Information technology | | | 38.4 | |

| |

Consumer discretionary | | | 23.9 | |

| |

Health care | | | 17.0 | |

| |

Industrials | | | 7.1 | |

| |

Consumer staples | | | 4.4 | |

| |

Financials | | | 4.1 | |

| |

Materials | | | 3.2 | |

| |

Telecommunication services | | | 1.1 | |

| |

Energy | | | 0.7 | |

| |

Short-term investments, other assets & liabilities, net | | | 0.1 | |

|

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments

as of 12/31/2015 | |

| |

| |

More than $50 billion | | | 55.5 | |

| |

More than $15 billion–$50 billion | | | 36.8 | |

| |

More than $2 billion–$15 billion | | | 7.7 | |

|

| |

| |

Total | | | 100.0 | |

TIAA-CREF Life Funds ¡ 2015 Annual Report 9

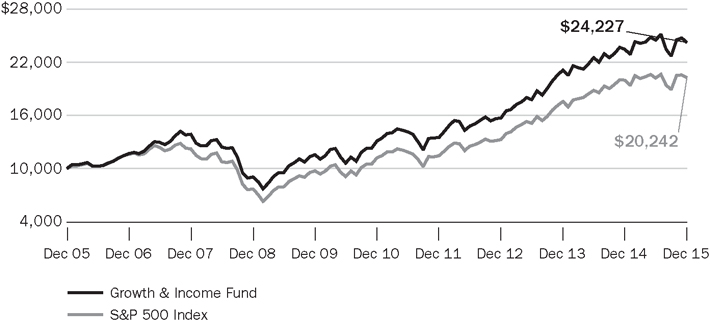

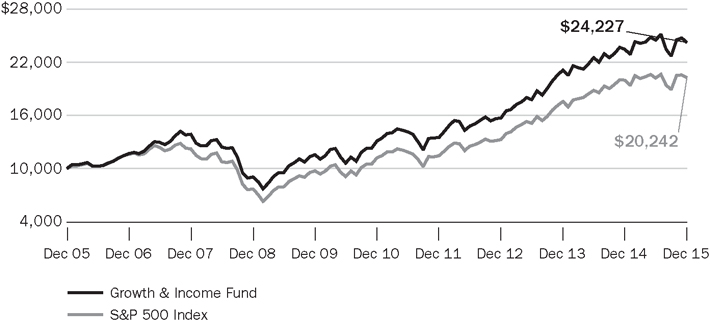

Growth & Income Fund

Performance for the twelve months ended December 31, 2015

The Growth & Income Fund returned 3.34% for the year, compared with the 1.38% return of its benchmark, the S&P 500® Index.

Following a weak first quarter, gross domestic product (GDP), which measures the value of all goods and services produced in the United States, rose at an annualized rate of 3.9% and 2.0% in the second and third quarters, respectively. Average hourly wages increased, inflation rose slightly and the national unemployment rate dropped to 5.0%. The Federal Reserve raised the federal funds target rate by 0.25%, while central banks overseas eased rates.

Stock prices were volatile, particularly in the third quarter, largely in reaction to slowing growth in China, interest rate uncertainties and plunging oil prices.

For the twelve months, the Russell 3000® Index, a broad measure of the U.S. stock market, returned 0.48%. Large-cap stocks, like those contained in the S&P 500, outperformed mid-cap and small-cap issues.

For the ten years ended December 31, 2015, the S&P 500 Index had an average annual return of 7.31%, a gain nearly matching the 7.35% average annual return of the Russell 3000 Index over the same period.

Large-cap stocks perform well, fund does even better

Five of the ten industry sectors within the benchmark ended the twelve months with gains. Consumer discretionary had a double-digit return. Health care, consumer staples, information technology and telecommunication services had single-digit gains. This group of sectors made up more than half of the benchmark’s total market capitalization on December 31, 2015.

The energy and materials sectors registered the biggest declines due to falling commodity prices.

Many holdings helped the fund outperform its benchmark for the twelve months, especially an overweight position in Netflix and an underweight in energy company Kinder Morgan. Netflix benefited from strong subscriber growth. Lower oil prices hurt Kinder Morgan.

Not all stock choices worked as expected. An overweight position in Anadarko Petroleum and an out-of-benchmark weight in GoPro detracted from relative results. Bad news stalked energy giant Anadarko, including declining revenue and being ordered to pay a fine resulting from the 2010 oil spill in the Gulf of Mexico. GoPro struggled as more competitors entered the action-camera space and results disappointed investors.

10 2015 Annual Report ¡ TIAA-CREF Life Funds

Growth & Income Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Growth & Income Fund | | | 4/3/2000 | | | | 3.34% | | | | 13.08 | % | | | 9.25% | |

|

| |

| | | | |

S&P 500 Index | | | — | | | | 1.38 | | | | 12.57 | | | | 7.31 | |

|

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

TIAA-CREF Life Funds ¡ 2015 Annual Report 11

Growth & Income Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Growth & Income Fund | | Beginning account value

(7/1/15) | | | Ending account value

(12/31/15) | | | Expenses paid during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $ 989.10 | | | | $2.61 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,022.58 | | | | 2.65 | |

|

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.52%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Information technology | | | 24.2 | |

| |

Consumer discretionary | | | 18.5 | |

| |

Health care | | | 15.6 | |

| |

Financials | | | 11.2 | |

| |

Consumer staples | | | 9.6 | |

| |

Industrials | | | 9.5 | |

| |

Energy | | | 4.7 | |

| |

Materials | | | 2.5 | |

| |

Telecommunication services | | | 2.4 | |

| |

Utilities | | | 1.7 | |

| |

Short-term investments, other assets & liabilities, net | | | 0.1 | |

|

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments

as of 12/31/2015 | |

| |

| |

More than $50 billion | | | 55.1 | |

| |

More than $15 billion–$50 billion | | | 22.7 | |

| |

More than $2 billion–$15 billion | | | 20.4 | |

| |

$2 billion or less | | | 1.8 | |

|

| |

| |

Total | | | 100.0 | |

12 2015 Annual Report ¡ TIAA-CREF Life Funds

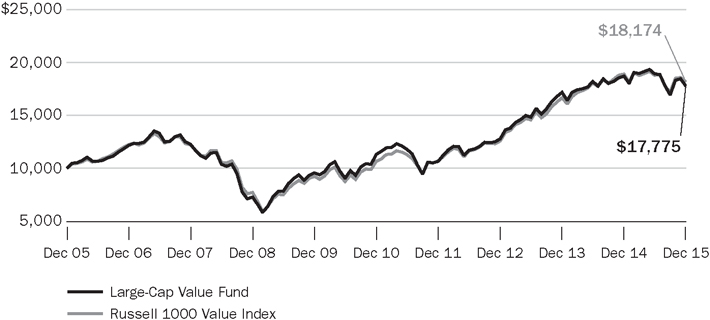

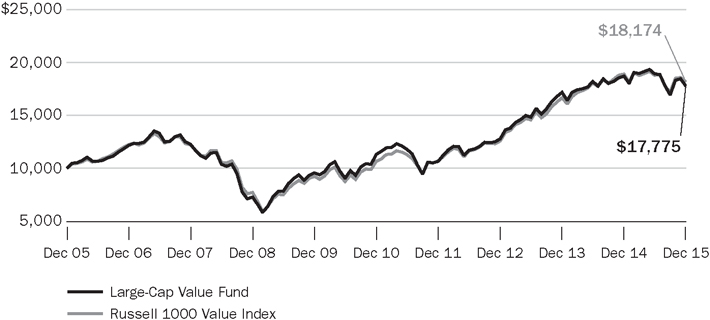

Large-Cap Value Fund

Performance for the twelve months ended December 31, 2015

The Large-Cap Value Fund returned –5.00% for the year, compared with the –3.83% return of its benchmark, the Russell 1000® Value Index.

The U.S. economy expanded in 2015. Following a weak first quarter, gross domestic product (GDP), which measures the value of all goods and services produced in the United States, rose at an annualized rate of 3.9% and 2.0% in the second and third quarters, respectively. Average hourly wages increased, inflation rose slightly and the national unemployment rate dropped to 5.0%.

Stock prices were volatile, largely in reaction to slowing growth in China, interest rate uncertainties and plunging oil prices. For the twelve months, the Russell 3000® Index, a broad measure of the U.S. stock market, rose 0.48%, marking the seventh straight year of positive performance. Large-cap stocks topped mid-caps, which outperformed small-cap stocks. Growth stocks ended the year up, but their value counterparts declined.

For the ten years ended December 31, 2015, the Russell 1000 Value Index registered an average annual gain of 6.16%, less than the 8.53% average annual return of the Russell 1000 Growth Index over the same period. (Returns by investment style and capitalization size are based on the Russell indexes.)

Stock choices limit returns

All but three of the industry sectors comprising the fund’s benchmark posted losses for the twelve-month period. Energy was the worst performer (down 23.5%). Materials (down 11.5%), consumer discretionary (down 5.9%) and utilities (down 5.4%) also suffered sizable losses. Together, these four sectors made up more than one-quarter of the benchmark’s total market capitalization. The index’s second-largest sector, health care, was the best performer (up 7.8%).

In 2015, the fund trailed its benchmark. An overweight position in SPX detracted most, as a decline in revenue negatively impacted the HVAC solutions company. Next in line were an out-of-benchmark position in Groupon and an overweight in Yahoo! as both suffered losses.

Conversely, an out-of-benchmark position in Kraft Heinz contributed most to relative performance as the completion of its merger boosted net sales. Sizable underweights in energy company Kinder Morgan and technology giant Intel were next in line as both stocks declined.

TIAA-CREF Life Funds ¡ 2015 Annual Report 13

Large-Cap Value Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Large-Cap Value Fund | | | 10/28/2002 | | | | –5.00% | | | | 9.46 | % | | | 5.92% | |

|

| |

| | | | |

Russell 1000® Value Index | | | — | | | | –3.83 | | | | 11.27 | | | | 6.16 | |

|

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

14 2015 Annual Report ¡ TIAA-CREF Life Funds

Large-Cap Value Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Large-Cap Value Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $ 939.55 | | | | $2.54 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,022.58 | | | | 2.65 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.52%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Financials | | | 27.6 | |

| |

Information technology | | | 13.9 | |

| |

Health care | | | 11.8 | |

| |

Energy | | | 10.8 | |

| |

Consumer discretionary | | | 10.1 | |

| |

Industrials | | | 8.6 | |

| |

Consumer staples | | | 5.6 | |

| |

Materials | | | 4.3 | |

| |

Utilities | | | 3.6 | |

| |

Telecommunication services | | | 2.9 | |

| |

Short-term investments, other assets & liabilities, net | | | 0.8 | |

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments

as of 12/31/2015 | |

| |

| |

More than $50 billion | | | 38.3 | |

| |

More than $15 billion–$50 billion | | | 21.5 | |

| |

More than $2 billion–$15 billion | | | 34.1 | |

| |

$2 billion or less | | | 6.1 | |

| |

| |

Total | | | 100.0 | |

TIAA-CREF Life Funds ¡ 2015 Annual Report 15

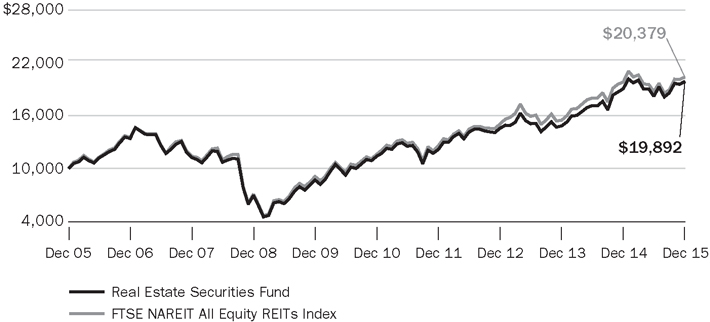

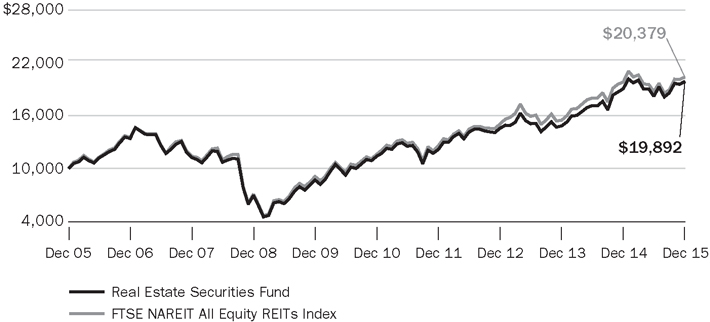

Real Estate Securities Fund

Performance for the twelve months ended December 31, 2015

The Real Estate Securities Fund returned 4.37% for the year, compared with the 2.83% return of its benchmark, the FTSE NAREIT All Equity REITs Index.

For the year, the FTSE index topped the 0.48% return of the broad U.S. stock market, as measured by the Russell 3000® Index. The fund’s benchmark also outperformed the 0.55% return of the U.S. investment-grade fixed-rate bond market, as measured by the Barclays U.S. Aggregate Bond Index.

The fund’s benchmark rose in three of the four quarters of 2015. It fell in the second quarter when renewed concerns about rising U.S. interest rates jolted the REIT market, given its sensitivity to bond yields. Yet the benchmark improved during the third and fourth quarters when corporate profits rose, and the Federal Reserve approved a quarter-point hike in its federal funds target rate.

For the ten years ended December 31, 2015, the benchmark generated an average annual return of 7.38%, narrowly surpassing the 7.35% average annual return of the Russell 3000 and outpacing the 4.51% average annual gain of the Barclays index.

All but four of the benchmark’s 14 property sectors and subsectors posted positive returns for the period. The top performers were self-storage (up 40.7%), manufactured homes (up 25.7%), apartments (up 16.5%) and free standing (up 5.9%). Self-storage REITs continued to perform well against a backdrop of strong demand and limited supply. The benchmark’s detractors included lodging (down 24.4%), health care (down 7.3%) and timber (down 7.0%). Lodging fell in part due to competition from room rentals in private residences, fueled by the rising popularity of Airbnb.

Stock choices boost the fund’s relative results

The fund beat its benchmark largely due to favorable stock choices. The biggest contributions to relative performance came from the fund’s overweight position in specialized REITs CubeSmart and Extra Space Storage, both of which posted double-digit gains for the year. An underweight in forest products company Weyerhaeuser also aided relative returns.

These positive contributions were partly offset by a nonbenchmark position in NorthStar Asset Management Group, an overweight in NorthStar Realty Finance and an underweight in wireless provider Crown Castle International.

During the twelve months, the fund also held stocks of several companies that are not REITs but engage in activities related to real estate.

16 2015 Annual Report ¡ TIAA-CREF Life Funds

Real Estate Securities Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Real Estate Securities Fund | | | 10/28/2002 | | | | 4.37% | | | | 11.80% | | | | 7.12% | |

| |

| | | | |

FTSE NAREIT All Equity REITs Index | | | — | | | | 2.83 | | | | 11.91 | | | | 7.38 | |

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

TIAA-CREF Life Funds ¡ 2015 Annual Report 17

Real Estate Securities Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Real Estate Securities Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $1,093.52 | | | | $3.01 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,022.33 | | | | 2.91 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.57%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Specialized REITs | | | 26.7 | |

| |

Retail REITs | | | 21.3 | |

| |

Residential REITs | | | 20.7 | |

| |

Office REITs | | | 11.0 | |

| |

Industrial REITs | | | 9.6 | |

| |

Diversified REITs | | | 3.2 | |

| |

Real estate services | | | 1.6 | |

| |

Hotels, resorts & cruise lines | | | 0.9 | |

| |

Mortgage REITs | | | 0.8 | |

| |

Real estate operating companies | | | 0.8 | |

| |

Asset management & custody banks | | | 0.8 | |

| |

Diversified capital markets | | | 0.3 | |

| |

Health care facilities | | | 0.3 | |

| |

Short-term investments, other assets & liabilities, net | | | 2.0 | |

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments

as of 12/31/2015 | |

| |

| |

More than $50 billion | | | 9.8 | |

| |

More than $15 billion–$50 billion | | | 47.4 | |

| |

More than $2 billion–$15 billion | | | 35.1 | |

| |

$2 billion or less | | | 7.7 | |

| |

| |

Total | | | 100.0 | |

18 2015 Annual Report ¡ TIAA-CREF Life Funds

Small-Cap Equity Fund

Performance for the twelve months ended December 31, 2015

The Small-Cap Equity Fund returned –0.15% for the year, compared with the –4.41% return of its benchmark, the Russell 2000® Index.

Following a weak first quarter, gross domestic product (GDP), which measures the value of all goods and services produced in the United States, rose at an annualized rate of 3.9% and 2.0% in the second and third quarters, respectively. Average hourly wages increased, inflation rose slightly and the national unemployment rate dropped to 5.0%. The Federal Reserve raised the federal funds target rate by 0.25%, while central banks overseas eased rates.

Stock prices were volatile, particularly in the third quarter, largely in reaction to slowing growth in China, interest rate uncertainties and plunging oil prices. For the twelve months, the Russell 3000® Index, a broad measure of the U.S. stock market, returned 0.48%. Small-cap stocks underperformed mid- and large-cap stocks. Growth stocks ended the year up, but their value counterparts ended down. (Returns are based on Russell indexes.)

For the ten years ended December 31, 2015, the Russell 2000 Index registered an average annual gain of 6.80%, and underperformed the 7.35% average return of the Russell 3000 Index over the same period.

Fund outperforms as small-cap stocks struggle

Eight of the ten industry sectors within the fund’s benchmark recorded negative returns for the twelve months. The only positive sectors were health care (up 8.1%) and information technology (up 3.0%). These two sectors plus financials (down 0.3%) comprised over half of the benchmark’s total market capitalization on December 31, 2015. The energy and materials sectors posted the biggest losses, hurt by falling commodity prices.

The fund outperformed its benchmark, helped by overweight positions in Cambrex and American Woodmark. Drug manufacturer Cambrex benefited by partnering with pharmaceutical firms to help them bring new drugs to market. New residential construction contributed to strong sales for cabinet manufacturer American Woodmark.

Other choices did not work out as expected. The fund did not hold Synageva BioPharma, a developer of drugs to treat rare diseases. Synageva was acquired during the period at a significant premium. An overweight position in LivePerson detracted as the cloud-based customer service specialist announced results that disappointed investors. Finally, the fund had a small exposure to derivative instruments, which detracted from its relative performance.

TIAA-CREF Life Funds ¡ 2015 Annual Report 19

Small-Cap Equity Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Small-Cap Equity Fund | | | 10/28/2002 | | | | –0.15% | | | | 10.26% | | | | 7.15% | |

| |

| | | | |

Russell 2000® Index | | | — | | | | –4.41 | | | | 9.19 | | | | 6.80 | |

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

20 2015 Annual Report ¡ TIAA-CREF Life Funds

Small-Cap Equity Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Small-Cap Equity Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $ 945.04 | | | | $2.60 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,022.53 | | | | 2.70 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.53%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Financials | | | 23.5 | |

| |

Information technology | | | 19.5 | |

| |

Health care | | | 16.8 | |

| |

Industrials | | | 12.5 | |

| |

Consumer discretionary | | | 12.0 | |

| |

Materials | | | 4.7 | |

| |

Consumer staples | | | 3.7 | |

| |

Energy | | | 3.2 | |

| |

Utilities | | | 2.8 | |

| |

Telecommunication services | | | 1.5 | |

| |

Short-term investments, other assets & liabilities, net | | | –0.2 | |

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments

as of 12/31/2015 | |

| |

| |

More than $2 billion–$15 billion | | | 49.1 | |

| |

$2 billion or less | | | 50.9 | |

| |

| |

Total | | | 100.0 | |

TIAA-CREF Life Funds ¡ 2015 Annual Report 21

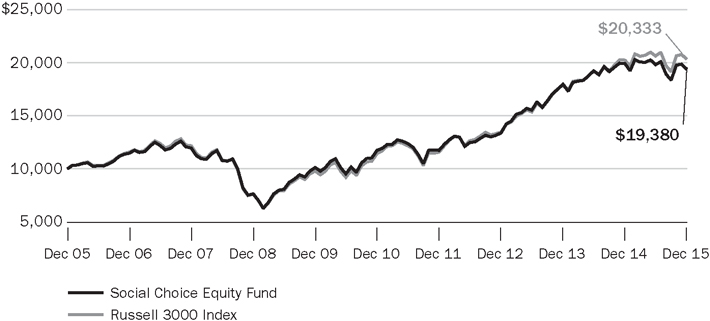

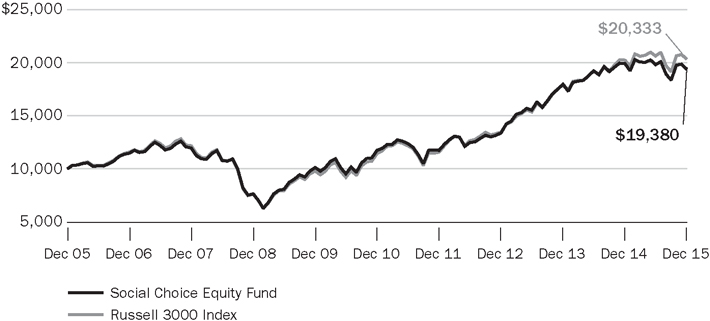

Social Choice Equity Fund

Performance for the twelve months ended December 31, 2015

The Social Choice Equity Fund returned –2.70% for the year, compared with the 0.48% return of its benchmark, the Russell 3000® Index. The fund screens for investments by using certain environmental, social and governance (ESG) criteria, while the benchmark does not.

Because of its ESG criteria, the fund did not invest in a number of stocks and bonds that were included in the Russell index. Avoiding these companies produced mixed results, but the net effect partly caused the fund to trail its benchmark.

The largest detractors relative to the Russell 3000 Index were the exclusions of stocks Amazon.com, Microsoft, General Electric and Facebook. Shares of Amazon.com rose sharply, driven by the strong earnings growth of its cloud business. The growth of cloud computing also boosted demand for Microsoft shares, which rose significantly.

These negative effects were partly offset by the exclusions of stocks Exxon Mobil, Wal-Mart, Chevron and Micron Technology. Many energy stocks such as Exxon Mobil and Chevron fell as oil prices plunged.

Stock positions hamper fund’s performance

To compensate for the fund’s exclusion of some stocks, its managers use quantitative (mathematical) modeling and other techniques in an attempt to match the overall investment characteristics of the portfolio with those of its benchmark.

The fund also underperformed due in part to stock selections that did not perform as well as anticipated. They included overweight positions in Yahoo!, HP and National Oilwell Varco, respectively. Yahoo! dropped in reaction to concerns about its future earnings potential and uncertainties regarding its turnaround strategy. On November 2, 2015, Hewlett-Packard split into two companies—HP Inc. and Hewlett Packard Enterprise—in an effort to separate the technology business from the personal computer and printer market.

The losses were partly offset by the fund’s successful stock selections, led by overweight positions in shares of Google-parent Alphabet, Starbucks, and property and casualty insurer Chubb Corp, respectively. Alphabet’s and Starbucks’ earnings and revenues exceeded expectations. Shares of Chubb rallied after Switzerland’s ACE Limited agreed to purchase Chubb for $28.3 billion in cash and stock. At period-end, the merger remained subject to obtaining certain regulatory approvals. An overweight position in Aetna also aided relative returns.

22 2015 Annual Report ¡ TIAA-CREF Life Funds

Social Choice Equity Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Social Choice Equity Fund | | | 4/3/2000 | | | | –2.70% | | | | 10.54% | | | | 6.84% | |

| |

| | | | |

Russell 3000® Index | | | — | | | | 0.48 | | | | 12.18 | | | | 7.35 | |

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

TIAA-CREF Life Funds ¡ 2015 Annual Report 23

Social Choice Equity Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Social Choice Equity Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $ 978.36 | | | | $1.10 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,024.10 | | | | 1.12 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.22%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Financials | | | 20.8 | |

| |

Information technology | | | 18.3 | |

| |

Health care | | | 14.8 | |

| |

Consumer discretionary | | | 12.6 | |

| |

Industrials | | | 9.7 | |

| |

Consumer staples | | | 7.9 | |

| |

Energy | | | 6.2 | |

| |

Materials | | | 4.0 | |

| |

Utilities | | | 3.2 | |

| |

Telecommunication services | | | 1.9 | |

| |

Short-term investments, other assets & liabilities, net | | | 0.6 | |

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments

as of 12/31/2015 | |

| |

| |

More than $50 billion | | | 40.0 | |

| |

More than $15 billion–$50 billion | | | 39.5 | |

| |

More than $2 billion–$15 billion | | | 17.4 | |

| |

$2 billion or less | | | 3.1 | |

| |

| |

Total | | | 100.0 | |

24 2015 Annual Report ¡ TIAA-CREF Life Funds

Stock Index Fund

Performance for the twelve months ended December 31, 2015

The Stock Index Fund returned 0.43% for the year, compared with the 0.48% return of its benchmark, the Russell 3000® Index.

For the twelve-month period, the fund’s return lagged that of its benchmark index, primarily because of the effect of expenses. The fund’s return includes a deduction for expenses, while the benchmark’s does not. The fund had a risk profile similar to that of its benchmark.

Following a weak first quarter, gross domestic product (GDP), which measures the value of all goods and services produced in the United States, rose at an annualized rate of 3.9% and 2.0% in the second and third quarters, respectively. Average hourly wages increased and national unemployment dropped to 5.0%. The Federal Reserve raised the federal funds target rate by 0.25%, while central banks overseas eased rates.

Stocks were volatile, particularly in the third quarter, in reaction to slowing growth in China, interest rate uncertainties and plunging oil prices. For the twelve months, large-cap stocks topped mid-cap equities, which outperformed small-cap stocks. Growth stocks ended the year up, but their value counterparts ended down. (Returns are based on Russell indexes.)

Five of ten sectors post positive returns

For the period, half of the ten industry sectors in the fund’s benchmark ended in positive territory. The largest sector, information technology, contributed most with a return of 5.4%. Health care (up 7.2%) and consumer discretionary (up 6.0%) also contributed significantly. Together, these sectors constituted nearly half of the benchmark’s total market capitalization. Energy performed worst (down 23.2%), followed by materials (down 10.2%) and utilities (down 5.2%). Lower oil prices particularly hurt energy stocks.

Seven of the ten largest stocks in the index by market capitalization at year-end beat the benchmark, and three finished lower for the period. Among the ten, Amazon.com performed best—more than doubling in price—fueled by strong earnings growth of its cloud business. The growth of cloud computing also boosted Microsoft shares. Exxon Mobil ended down, and Apple ended lower amid weakening demand for smartphones.

TIAA-CREF Life Funds ¡ 2015 Annual Report 25

Stock Index Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Stock Index Fund | | | 1/4/1999 | | | | 0.43% | | | | 12.10% | | | | 7.34% | |

| |

| | | | |

Russell 3000® Index | | | — | | | | 0.48 | | | | 12.18 | | | | 7.35 | |

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

26 2015 Annual Report ¡ TIAA-CREF Life Funds

Stock Index Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Stock Index Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $ 985.23 | | | | $0.45 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,024.75 | | | | 0.46 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.09%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Information technology | | | 19.7 | |

| |

Financials | | | 18.5 | |

| |

Health care | | | 14.7 | |

| |

Consumer discretionary | | | 13.4 | |

| |

Industrials | | | 10.6 | |

| |

Consumer staples | | | 8.8 | |

| |

Energy | | | 5.9 | |

| |

Materials | | | 3.1 | |

| |

Utilities | | | 3.1 | |

| |

Telecommunication services | | | 2.2 | |

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments

as of 12/31/2015 | |

| |

| |

More than $50 billion | | | 50.1 | |

| |

More than $15 billion–$50 billion | | | 23.2 | |

| |

More than $2 billion–$15 billion | | | 21.8 | |

| |

$2 billion or less | | | 4.9 | |

| |

| |

Total | | | 100.0 | |

TIAA-CREF Life Funds ¡ 2015 Annual Report 27

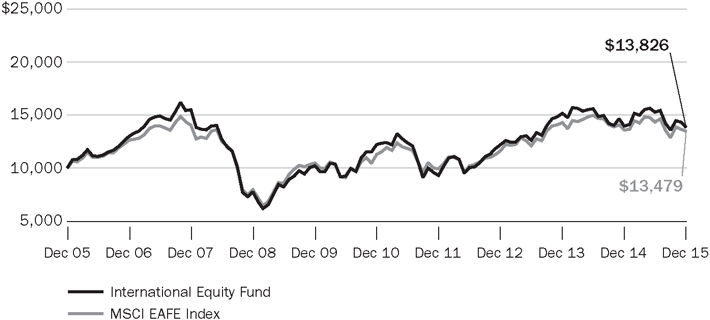

International Equity Fund

Performance for the twelve months ended December 31, 2015

The International Equity Fund returned –0.98% for the year, compared with the –0.81% return of its benchmark, the MSCI EAFE Index.

Foreign stocks fell in 2015 amid concerns about Greece’s debt problems and slowing growth in China. U.S. dollar strength was also a headwind as the EAFE index, which measures stock performance in 21 developed market nations outside North America, actually advanced 5.33%, in terms of local currency. In comparison, U.S. stocks, as measured by the Russell 3000® Index, rose 0.48%, marking the seventh straight year of positive performance.

Market performance varied significantly across countries. United Kingdom stocks fell in both local and U.S. dollar terms as reduced demand for energy and commodity-related exports hurt the region. U.S. dollar strength was a headwind for index shares in the eurozone, which declined when converted to U.S. dollar returns. Japan achieved nearly double-digit gains in both local and U.S. currency.

Stock choices trim results

In 2015, the fund modestly trailed its benchmark. The largest detractor was an overweight position in Tesco. Ongoing issues related to its expansion initiatives have hurt the supermarket giant. Next in line were losses from overweight positions in global engineering company Weir Group and industrial gas and engineering firm Linde.

Conversely, an overweight position in Adidas contributed most to relative performance. The sportswear company benefited from strong product sales. Sizable overweights in French automaker Renault and entertainment company Sky were next in line as both stocks produced double-digit returns.

The fund’s returns may sometimes diverge from the returns of its benchmark more than would be expected. This divergence may be the result of the fund’s fair value pricing adjustments or of the timing of foreign currency valuations. Many foreign exchanges close for trading before the fund’s net asset value (NAV) is calculated (generally 4 p.m. ET). In the intervening hours, the values of foreign securities can change, and these changes are not reflected immediately in the returns of the fund’s benchmark. These changes are, however, taken into account to value the fund’s portfolio holdings at the time the fund’s NAV is calculated; these are known as fair value pricing adjustments.

28 2015 Annual Report ¡ TIAA-CREF Life Funds

International Equity Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

International Equity Fund | | | 4/3/2000 | | | | –0.98% | | | | 2.50 | % | | | 3.29% | |

| |

MSCI EAFE Index | | | — | | | | –0.81 | | | | 3.60 | | | | 3.03 | |

|

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

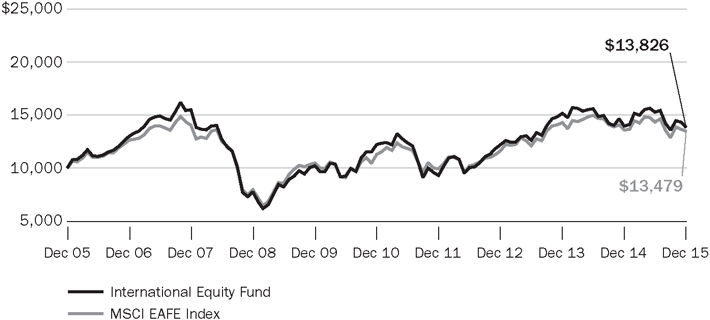

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

TIAA-CREF Life Funds ¡ 2015 Annual Report 29

International Equity Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

International Equity Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | $ | 1,000.00 | | | | $ 905.13 | | | | $2.88 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,022.18 | | | | 3.06 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.60%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

Sector | | % of net assets

as of 12/31/2015 | |

| |

| |

Consumer discretionary | | | 40.1 | |

| |

Industrials | | | 15.3 | |

| |

Financials | | | 15.2 | |

| |

Health care | | | 10.3 | |

| |

Consumer staples | | | 9.0 | |

| |

Materials | | | 5.8 | |

| |

Information technology | | | 3.7 | |

| |

Short-term investments,other assets & liabilities, net | | | 0.6 | |

| |

| |

Total | | | 100.0 | |

Holdings by company size

| | | | |

| |

Market capitalization | | % of equity investments as of 12/31/2015 | |

| |

| |

More than $50 billion | | | 4.0 | |

| |

More than $15 billion–$50 billion | | | 60.3 | |

| |

More than $2 billion–$15 billion | | | 33.6 | |

| |

$2 billion or less | | | 2.1 | |

| |

| |

Total | | | 100.0 | |

Holdings by country

| | | | |

| |

| | | % of portfolio investments as of 12/31/2015 | |

| |

| |

France | | | 24.2 | |

| |

Germany | | | 18.6 | |

| |

United Kingdom | | | 17.6 | |

| |

Japan | | | 14.0 | |

| |

India | | | 7.9 | |

| |

Netherlands | | | 5.1 | |

| |

Switzerland | | | 4.8 | |

| |

Sweden | | | 1.9 | |

| |

7 other nations | | | 5.0 | |

| |

Short-term investments | | | 0.9 | |

| |

| |

Total | | | 100.0 | |

30 2015 Annual Report ¡ TIAA-CREF Life Funds

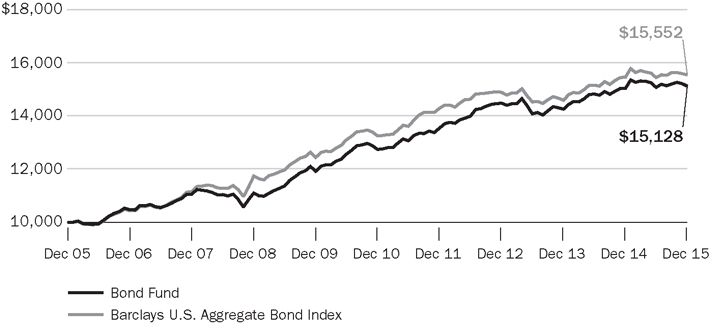

Bond Fund

Performance for the twelve months ended December 31, 2015

The Bond Fund returned 0.57% for the year, compared with the 0.55% return of its benchmark, the Barclays U.S. Aggregate Bond Index.

The U.S. economy expanded in 2015. Following a weak first quarter, gross domestic product (GDP), which measures the value of all goods and services produced in the United States, rose at an annualized rate of 3.9% and 2.0% in the second and third quarters, respectively. Average hourly wages increased, inflation rose slightly and the national unemployment rate dropped to 5.0%.

On December 16, 2015, the Federal Reserve approved a quarter-point hike in its federal funds target rate. The new target went from 0.00%–0.25% to 0.25%–0.50% and marks the first increase since June 29, 2006. The yield on the 10-year U.S. Treasury bond rose from 2.12% on January 2, 2015 to 2.27% on December 31, 2015.

Strong security selection and a significant overweight aid returns

Throughout much of 2015, extreme swings in the financial markets and concerns over the pace of growth overseas kept investors unsettled. Strong investor demand for more stable assets bolstered the performance of U.S. Treasuries and other higher-quality/high-rated sectors. Mortgage-backed securities (MBS), commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS) also benefited from low default rates and relatively attractive returns.

U.S. Treasury securities, the benchmark’s largest sector at more than 36% of total market capitalization, rose nearly 0.9% for the period. MBS, the benchmark’s second-largest weighting at nearly 28%, gained 1.5% for the twelve months. Corporate bonds, which constituted almost 24% of the benchmark’s total capitalization, returned –0.7%.

The fund outperformed its benchmark primarily due to strong security selection and a sizable overweight position in CMBS, which topped CMBS holdings in the benchmark by a wide margin. Select corporate bonds were the next largest contributor helped by beneficial security selection and favorable yield curve positioning as well as higher coupons.

In contrast, the fund was held back partly by spread weakness in high-yield and emerging markets where spreads widened on concerns U.S. rate increases would harm the sector. A small allocation to cash further diminished the fund’s relative performance.

TIAA-CREF Life Funds ¡ 2015 Annual Report 31

Bond Fund

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

Bond Fund | | | 7/8/2003 | | | | 0.57% | | | | 3.49 | % | | | 4.23% | |

| |

Barclays U.S. Aggregate Bond Index | | | — | | | | 0.55 | | | | 3.25 | | | | 4.51 | |

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

You cannot invest directly in any index. Index returns do not include a deduction for fees or expenses.

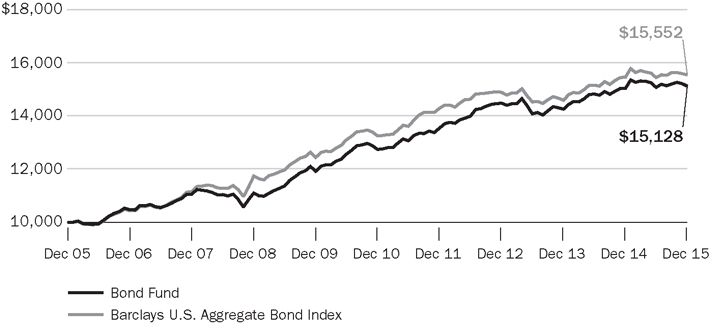

$10,000 over 10 years

For the purpose of comparison, the graph also shows the change in the value of the fund’s benchmark during the same period.

32 2015 Annual Report ¡ TIAA-CREF Life Funds

Bond Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Bond Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $1,002.93 | | | | $1.77 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,023.44 | | | | 1.79 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.35%. The expense charges of the fund may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

|

% of net assets as of 12/31/2015 | |

| |

| |

Corporate bonds | | | 34.3 | |

| |

Mortgage-backed securities† | | | 19.6 | |

| |

Foreign government & corporate bonds denominated in U.S. dollars | | | 16.9 | |

| |

Commercial mortgage-backed securities | | | 14.5 | |

| |

Asset-backed securities | | | 5.5 | |

| |

U.S. Treasury securities | | | 4.1 | |

| |

Bank loan obligations | | | 1.5 | |

| |

Municipal bonds | | | 0.5 | |

| |

U.S. agency securities | | | 0.3 | |

| |

Short-term investments,other assets & liabilities, net | | | 2.8 | |

| |

| |

Total | | | 100.0 | |

| † | Includes mortgage pass-through securities and collateralized mortgage obligations |

Holdings by maturity

| | | | |

| |

% of fixed-income investments (excluding

short-term investments) as of 12/31/2015 | |

| |

| |

Less than 1 year | | | 6.1 | |

| |

1–3 years | | | 16.2 | |

| |

3–5 years | | | 17.3 | |

| |

5–10 years | | | 48.2 | |

| |

Over 10 years | | | 12.2 | |

| |

| |

Total | | | 100.0 | |

Holdings by credit quality‡

| | | | |

| |

% of fixed-income investments (excluding short-term investments) as of 12/31/2015 | |

| |

| |

Aaa/AAA | | | 26.1 | |

| |

Aa/AA | | | 4.0 | |

| |

A/A | | | 15.7 | |

| |

Baa/BBB | | | 35.1 | |

| |

Ba/BB | | | 5.3 | |

| |

B/B | | | 7.6 | |

| |

Below B/B | | | 3.4 | |

| |

Non-rated | | | 2.8 | |

| |

| |

Total | | | 100.0 | |

| ‡ | Credit quality ratings are based on the Barclays methodology, which uses the median rating of those compiled by the Moody’s, Standard & Poor’s and Fitch ratings agencies. If ratings are available from only two of these agencies, the lower rating is used. When only one rating is available, that one is used. These ratings are subject to change without notice. |

TIAA-CREF Life Funds ¡ 2015 Annual Report 33

Money Market Fund

Performance for the twelve months ended December 31, 2015

The Money Market Fund returned 0.00% for the year, compared with the 0.02% return of the iMoneyNet Money Fund Averages™—All Taxable, a simple average of over 1,000 taxable money market funds. The iMoneyNet average is not an index, and its return reflects the deduction of expenses charged by the funds included in the average.

The Federal Reserve’s target for short-term interest rates went from 0.00%–0.25% to 0.25%–0.50% on December 16, 2015, fulfilling speculation of a rate hike that permeated financial markets for much of 2015. The increase in the federal funds target rate was the first to occur in nine years and represents a process of “rate normalization” by the Fed.

Money Market Fund is restructuring to comply with new SEC regulations

On August 11, 2015, the TIAA-CREF Life Funds board approved a restructuring of the Money Market Fund as a “government” money market instrument. This action was taken to comply with new SEC regulations requiring all money market funds to restructure as retail, institutional or government. As a government fund, the Money Market Fund will invest 99.5% or more of its total assets in cash, U.S. government securities and/or repurchase agreements (“repos”) collateralized fully in cash or U.S. government securities. The restructuring will be effective by October 2016.

Many other U.S. money market funds are also expected to restructure as government funds. As a result, the supply of commercial paper declined in 2015, while the supply of short-term Treasuries increased by year-end. LIBOR yields also rose at the end of 2015, as a result of the Fed rate hike in December. Three-month LIBOR increased from 0.26% in January 2015 to 0.61% by December 31.

In pursuit of additional yield, the fund held longer-dated, floating-rate government agency paper in order to capture slightly higher yields. In 2015, our commercial paper exposure was diversified across industries and issuers, nearly all of which are U.S.-domiciled. The fund had limited exposure in Europe and made select investments in top-tier Pacific Rim banks. As of December 29, 2015, the fund’s weighted average maturity was 44 days, versus 35 days for the average iMoneyNet fund.

34 2015 Annual Report ¡ TIAA-CREF Life Funds

Money Market Fund

Net annualized yield for the 7 days ended December 29, 2015*

| | | | | | | | |

| |

| | |

| | | Current yield | | | Effective yield | |

| |

| | |

Money Market Fund† | | | 0.12 | % | | | 0.12% | |

| |

| | |

iMoneyNet Money Fund Averages—All Taxable‡ | | | 0.06 | | | | 0.06 | |

| |

The current yield more closely reflects current earnings than does the total return.

| * | Typically, iMoneyNet reports its 7-day yields as of Tuesday of each week. |

Performance as of December 31, 2015

| | | | | | | | | | | | | | | | |

| |

| | | |

| | | | | | Total

return | | | Average annual

total return | |

| | | Inception date | | | 1 year | | | 5 years | | | 10 years | |

| |

| | | | |

Money Market Fund† | | | 7/8/2003 | | | | 0.00% | | | | 0.01% | | | | 1.38% | |

| |

| | | | |

iMoneyNet Money Fund Averages—All Taxable‡ | | | — | | | | 0.02 | | | | 0.02 | | | | 1.14 | |

| |

The returns in this report show past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your shares. For current performance information, including performance to the most recent month-end, please visit tiaa-cref.org. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower.

Total returns for the shares of the fund do not include the effect of expenses attributable to the variable annuity or variable life insurance product; if they did, returns for the shares of the fund would have been lower.

Investments in the TIAA-CREF Life Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund. For a detailed discussion of risk, please see the prospectus.

| † | Beginning May 29, 2013, part or all of the investment management fees of the TIAA-CREF Life Money Market Fund are being voluntarily waived. Without this waiver, the total returns would have been lower. This voluntary fee waiver may be discontinued at any time without notice. |

| ‡ | The iMoneyNet Money Fund Averages–All Taxable category is a simple average of over 1,000 taxable money market funds. You cannot invest in it directly. |

TIAA-CREF Life Funds ¡ 2015 Annual Report 35

Money Market Fund

Expense example

Six months ended December 31, 2015

| | | | | | | | | | | | |

| |

Money Market Fund | | Beginning

account value

(7/1/15) | | | Ending

account value

(12/31/15) | | | Expenses paid

during period*

(7/1/15–12/31/15) | |

| |

| | | |

Actual return | | | $1,000.00 | | | | $1,000.03 | | | | $0.86 | |

| | | |

5% annual hypothetical return | | | 1,000.00 | | | | 1,024.35 | | | | 0.87 | |

| |

| * | “Expenses paid during period” is based on the fund’s actual expense ratio for the most recent fiscal half-year, multiplied by the average account value over the six-month period, multiplied by 184/365. There were 184 days in the six months ended December 31, 2015. The fund’s annualized six-month expense ratio for that period was 0.17%. The expense charges of the fund reflect a voluntary waiver and may at times reflect a reimbursement. Please see the prospectus for an explanation, including the date on which this reimbursement is scheduled to end. Without such waiver and reimbursement, the expenses of the fund would be higher and its performance lower. |

For more information about this expense example, please see page 6.

Portfolio composition

| | | | |

| |

% of net assets as of 12/31/2015 | |

| |

| |

U.S. government agency securities | | | 38.1 | |

| |

Commercial paper | | | 26.3 | |

| |

U.S. Treasury securities | | | 19.3 | |

| |

Floating-rate securities, government | | | 12.7 | |

| |

Certificates of deposit | | | 3.2 | |

| |

Other assets & liabilities, net | | | 0.4 | |

| |

| |

Total | | | 100.0 | |

36 2015 Annual Report ¡ TIAA-CREF Life Funds

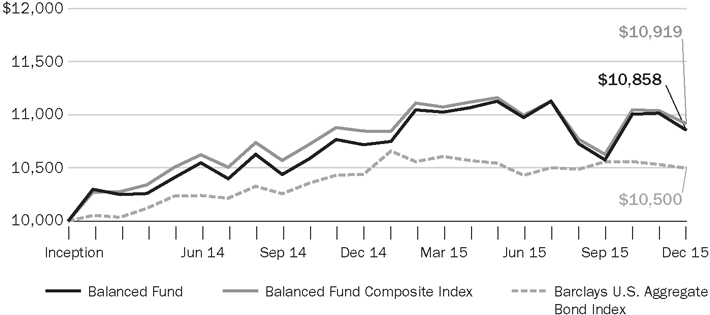

Balanced Fund

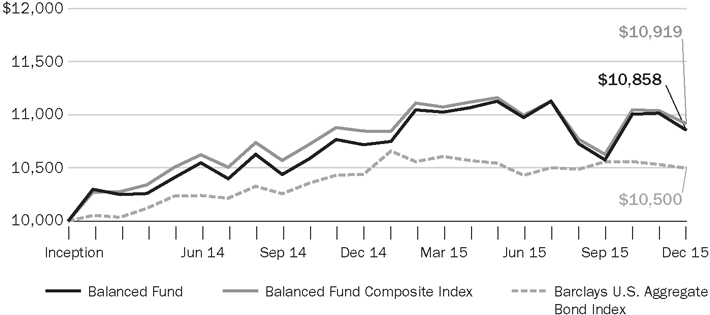

Performance for the twelve months ended December 31, 2015

The Balanced Fund returned 1.28% for the year, compared with the 0.64% return of its benchmark, the Balanced Fund Composite Index.

The U.S. economy expanded in 2015. Following a weak first quarter, gross domestic product (GDP), which measures the value of all goods and services produced in the United States, rose at an annualized rate of 3.9% and 2.0% in the second and third quarters, respectively. Average hourly wages increased, inflation rose slightly and the national unemployment rate dropped to 5.0%.

U.S. stocks gained 0.48% in 2015, as measured by the Russell 3000® Index, marking seven straight years of positive performance. Foreign equities fell, in U.S. dollar terms, amid concerns about Greece’s debt problems and slowing growth in China. U.S. dollar strength was also a headwind as the MSCI EAFE Index, which measures stock performance in 21 developed market nations outside North America, actually advanced 5.33%, in terms of local currency.

On December 16, 2015, the Federal Reserve approved a quarter-point hike in its federal funds target rate, which marked the first increase since June 29, 2006. The broad investment-grade fixed-rate bond market, as measured by the Barclays U.S. Aggregate Bond Index, gained 0.55% for the period. The yield on the 10-year U.S. Treasury bond rose from 2.12% on January 2, 2015 to 2.27% on December 31, 2015.

Strong selection in U.S. stock holdings propels the fund past its benchmark