UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: 811-02554 |

Name of Registrant: | Vanguard Money Market Reserves |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Anne E. Robinson, Esquire

P.O. Box 876

Valley Forge, PA 19482 |

| |

| |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: August 31 | |

Date of reporting period: September 1, 2016 – August 31, 2017 |

Item 1: Reports to Shareholders | |

Annual Report | August 31, 2017

Vanguard Money Market Funds

Vanguard Prime Money Market Fund

Vanguard Federal Money Market Fund

Vanguard Treasury Money Market Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| Chairman’s Perspective. | 3 |

| Advisor’s Report. | 7 |

| Prime Money Market Fund. | 10 |

| Federal Money Market Fund. | 29 |

| Treasury Money Market Fund. | 43 |

| About Your Fund’s Expenses. | 55 |

| Trustees Approve Advisory Arrangements. | 57 |

| Glossary. | 59 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Nautical images have been part of Vanguard’s rich heritage since its start in 1975. For an incoming ship, a lighthouse offers a beacon and safe path to shore. You can similarly depend on Vanguard to put you first––and light the way––as you strive to meet your financial goals. Our client focus and low costs, stemming from our unique ownership structure, assure that your interests are paramount.

Your Fund’s Performance at a Glance

• For the 12 months ended August 31, 2017, Investor Shares of Vanguard Prime Money Market Fund returned 0.83%, while Admiral Shares, with their lower expense ratio, returned 0.89%. Vanguard Federal Money Market Fund returned 0.57% and Vanguard Treasury Money Market Fund returned 0.54%. The results for all three funds exceeded the average returns of their peer groups.

• During the 12 months, the Federal Reserve raised the federal funds rate three times, pushing its target range to 1%–1.25%. It also signaled it would begin trimming its $4.5 trillion balance sheet.

• The period also coincided with the final implementation of new money market regulations. Under the rules, all three funds covered by this report seek to maintain a stable net asset value of $1 per share.

• Toward the end of the period, the funds made portfolio moves that helped insulate them from a spike in rates that occurred in the wake of a debt-ceiling debate.

| | |

| Total Returns: Fiscal Year Ended August 31, 2017 | | |

| | 7-Day SEC | Total |

| | Yield | Returns |

| Vanguard Prime Money Market Fund | | |

| Investor Shares | 1.10% | 0.83% |

| Admiral™ Shares | 1.16 | 0.89 |

| Money Market Funds Average | | 0.43 |

Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. In April 2017, the Institutional Money Market Funds Average was replaced with the Money Market Funds Average.

| | |

| Vanguard Federal Money Market Fund | 0.97% | 0.57% |

| Government Money Market Funds Average | | 0.19 |

| Government Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| |

| Vanguard Treasury Money Market Fund | 0.93% | 0.54% |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average | | 0.19 |

iMoneyNet Money Fund Report’s 100% Treasury Funds Average: Derived from data provided by iMoneyNet, Inc.

The 7-day SEC yield of a money market fund more closely reflects the current earnings of the fund than its total return.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

1

| |

| Total Returns: Ten Years Ended August 31, 2017 | |

| | Average |

| | Annual Return |

| Prime Money Market Fund Investor Shares | 0.62% |

| Money Market Funds Average | 0.41 |

| Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Federal Money Market Fund | 0.54% |

| Government Money Market Funds Average | 0.33 |

| Government Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Treasury Money Market Fund | 0.45% |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average | 0.24 |

| iMoneyNet Money Fund Report’s 100% Treasury Funds Average: Derived from data provided by iMoneyNet, Inc. | |

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the funds. (Current performance may be lower or higher than

the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.)

| | |

| Expense Ratios | | |

| Your Fund Compared With Its Peer Group | | |

| | | Peer Group |

| | Fund | Average |

| Prime Money Market Fund | | |

| Investor Shares | 0.16% | 0.32% |

| Admiral Shares | 0.10 | 0.32 |

| Federal Money Market Fund | 0.11 | 0.26 |

| Treasury Money Market Fund | 0.09 | 0.16 |

The fund expense ratios shown are from the prospectus dated December 23, 2016, and represent estimated costs for the current fiscal

year. For the fiscal year ended August 31, 2017, the funds’ expense ratios were: for the Prime Money Market Fund, 0.16% for Investor

Shares and 0.10% for Admiral Shares; for the Federal Money Market Fund, 0.11%; and for the Treasury Money Market Fund, 0.09%.

Peer groups: For the Prime Money Market Fund Investor Shares and Admiral Shares, Money Market Funds; for the Federal Money Market

Fund, Government Money Market Funds; and for the Treasury Money Market Fund, iMoneyNet Money Fund Report’s 100% Treasury

Funds.

2

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

Since mid-August we’ve been reaching out to you about the proposals put forth by the Vanguard funds that, if approved, will enable us to manage the funds more efficiently and effectively. As the November deadline for voting approaches, I’d like to offer some perspective on a few of the proposals that I believe are important to the way Vanguard operates and manages your investments. I hope you consider this information and promptly cast your ballot.

Your biggest advocate

The main driver for this proxy solicitation is to ask all our fund shareholders to elect a full slate of trustees who oversee each U.S.-based Vanguard mutual fund. These trustees serve an important role, making sure your funds are managed in your best interests. This includes monitoring fund performance, approving advisory agreements, and ensuring that we’re keeping your investment costs as low as possible. Simply put, they are your biggest advocate.

Each trustee brings a variety of skills and professional experiences that contribute to the board’s strength and diversity.

Of the 12 nominees, nine currently serve on the board, and three are new. If elected, the new board would include ten independent members, meaning they have no affiliation with Vanguard or the funds apart from any investments they may choose to make as private individuals.

3

These are the proposed new trustees:

• Sarah Bloom Raskin is a former member of the Federal Reserve Board of Governors and former deputy secretary of the U.S. Treasury Department. She is an expert in cybersecurity—a critically important issue at Vanguard, as we place a premium on protecting clients’ assets and sensitive data.

• Deanna Mulligan is chief executive officer of The Guardian Life Insurance Company of America. It’s rare to find a CEO such as Deanna who leads a company with a mutual ownership structure similar to Vanguard’s.

• Tim Buckley is president and a director of Vanguard and will succeed me in January as CEO. (I’ll remain chairman for a period to be determined by the board.) I interviewed Tim when he applied for his first job here in 1991 and again when he was graduating from Harvard Business School. I was thrilled he picked Vanguard as a place to build his career, and I’ve been delighted to see him take on several leadership positions, including as head of our Retail Investor Group, chief information officer, and chief investment officer. I can think of no one better prepared to succeed me.

| | | |

| Market Barometer | | | |

| | | Average Annual Total Returns |

| | | Periods Ended August 31, 2017 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 16.16% | 9.21% | 14.37% |

| Russell 2000 Index (Small-caps) | 14.91 | 7.67 | 13.15 |

| Russell 3000 Index (Broad U.S. market) | 16.06 | 9.08 | 14.27 |

| FTSE All-World ex US Index (International) | 18.74 | 2.80 | 7.76 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 0.49% | 2.64% | 2.19% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 0.88 | 3.40 | 3.23 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.58 | 0.25 | 0.16 |

| |

| CPI | | | |

| Consumer Price Index | 1.94% | 1.06% | 1.28% |

4

Vanguard believes that diversity of thought, background, and experience, as well as diversity of personal characteristics, meaningfully contributes to the board’s ability to effectively serve shareholders. If Sarah and Deanna are elected, women will account for 40% of the board’s independent trustees.

I should note that even as Vanguard is nominating three new board members, we’re saying goodbye to trustee Rajiv Gupta. Rajiv was a legendary CEO of Rohm and Haas Co., and Vanguard and our clients have benefited greatly from his expertise. I wish him a happy retirement.

Summarizing the proposals

Among the trustees’ leading responsibilities is overseeing the funds’ internal and external investment advisory agreements. The trustees, in consultation with our Global Investment Committee and our Portfolio Review Department, choose the investment advisors that manage client assets. Over decades, we have built a strong track record of picking advisors whose portfolio management strategies have served clients well.

Two proposals in the proxy focus on this oversight responsibility. Shareholders of 48 Vanguard funds have already voted to allow the board to make external advisor changes without obtaining prior shareholder approval. The new proposals would extend that policy across our entire U.S.-based fund lineup and expand it to include internal advisory agreements with Vanguard subsidiaries. Eliminating the need for shareholder approval removes a step that is costly and time-consuming if done frequently or on an individual fund basis. Although there are no current plans to employ the policy on any Vanguard-managed funds, standardizing it enables the trustees to retain an advisory firm to diversify a fund’s management team or ensure management continuity should a contingency arise.

I also encourage shareholders of several specific Vanguard index funds to read the proxy proposals that affect those funds. One proposal would change the investment objective of Vanguard REIT Index Fund and Vanguard Variable Insurance Fund REIT Index Portfolio to include real estate-related securities, aligning the funds with updated industry-sector classification methodology. Another proposal seeks to change the diversification status of the REIT Index Fund to enable it to better track its benchmark. Finally, we seek your approval of the Funds’ Service Agreement for Vanguard Institutional Index Fund and Vanguard Institutional Total Stock Market Index Fund. If approved, this arrangement would then be standardized across Vanguard’s entire publicly available U.S. mutual fund lineup. It should also reduce costs and minimum initial investment requirements in select share classes.

5

At the ballot box

We hope you’ll make it a priority to cast your ballot. We want to avoid the added time and cost of soliciting sufficient votes should we not obtain a quorum by the shareholder meeting on November 15, when voting concludes. Ultimately, we believe the proposals I’ve discussed are in your best interest as Vanguard fund shareholders, and the trustees recommend that you vote in favor of them. For more information, visit vanguard.com and enter the search term “proxy.”

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

September 14, 2017

6

Advisor’s Report

For the 12 months ended August 31, 2017, Investor Shares of Vanguard Prime Money Market Fund returned 0.83%, while Admiral Shares, with their lower expense ratio, returned 0.89%. Vanguard Federal Money Market Fund returned 0.57% and Vanguard Treasury Money Market Fund 0.54%. The results for all three funds exceeded the average returns of their peer groups.

The investment environment

The period began with a wave of optimism, as investor attention turned from disappointing economic results in early 2016 to stronger-than-expected third-quarter GDP. That enthusiasm gained momentum in the wake of the U.S. presidential election as investors anticipated benefits from the new administration’s policy initiatives focused on tax reform, infrastructure spending, and greater deregulation. That fueled a shift to riskier assets, propelling many bellwether stock indexes to record highs in early 2017.

The Federal Reserve also acknowledged the economy’s strength. In December, it raised the federal funds target rate by a quarter percentage point—only the second increase in a decade. Although 2017 got off to a slow start, it picked up in the spring as consumers opened their wallets and the unemployment rate continued to grind lower. Those developments most likely played a large part in the Fed’s further raising of rates in March and June, which pushed its target range to 1%–1.25%. Those moves, along with the establishment of a framework for trimming its $4.5 trillion balance sheet, took the Fed closer to normalizing monetary policy after its emergency intervention in the wake of the Great Recession.

Inflation measures, on the other hand, disappointed. Annualized core inflation, which had been running at or above 2%, softened a little. In response, the Fed scaled back its 2017 inflation forecast but still expected inflation to move closer to its 2% target over the medium term. Further tightening in the labor market should help, although wage gains have been modest. Continued weakness in the dollar also could eventually feed through to higher prices.

Abroad, many major central banks including the Bank of Japan, the Bank of England, and the European Central Bank remained in accommodative policy mode as they struggled to balance growth and inflation concerns. Even with a weaker U.S. dollar, comparatively low yields across many developed markets kept U.S. bonds attractive to international investors.

The period concluded on an uncertain note, with investors fretting about a possible U.S. government shutdown over a debt-ceiling debate. Because the Fed’s rate moves were telegraphed in advance, the market responded with a measured increase in short-term rates. But the unexpected rhetoric around the debt-ceiling debate led to a sell-off in short-term bonds, causing their yields to spike as your fund’s fiscal year came to a close.

7

The yield of the 3-month U.S. Treasury note increased 66 basis points over the period, to 0.99%. The 2-year yield jumped 52 bps to 1.33%. On the longer end of the curve, the 10-year yield rose 54 bps to 2.12% and the 30-year yield rose 50 bps to 2.73%.

Management of the funds

The start of the fiscal year coincided with final implementation of new money market regulations. In the run-up to the final compliance deadline in October 2016, more than $1 trillion in assets industrywide moved to government money market funds from prime money market funds; that led spreads to widen between short-term government securities and bank certificates of deposit.

In the weeks before the compliance deadline, we took steps to prepare for the volatility, including maintaining the funds’ liquidity in excess of U.S. Securities and Exchange Commission targets and shortening the weighted average maturity. These measures allowed us to provide maximum safety and liquidity. The volatility associated with final implementation has since dissipated.

Throughout the period, we added to the Prime Money Market Fund’s exposure to floating-rate securities. These debt instruments reset, typically every month, at prevailing interest rates. They performed well as the Fed raised rates, generating a large portion of the fund’s returns. We continued to purchase high-quality bonds, such as short-term corporate and bank debt. Some of those bonds were from non-U.S. companies, enhancing the fund’s diversification.

We followed a similar strategy with the Federal Money Market Fund, increasing its exposure to floating-rate agency securities, and with the Treasury Money Market Fund, adding to its floating-rate Treasury securities; these moves allowed us to generate incremental yield while maintaining the funds’ short maturity profiles. We also continued to add to the Federal Money Market Fund’s Treasury exposure.

Across all three funds, as the debt-ceiling debate heated up, we sold Treasuries that were vulnerable to related market volatility. We reallocated those proceeds to other Treasury securities. We are closely monitoring any debt-ceiling developments that may occur later this year that could affect the markets.

A look ahead

Absent any external shocks, the U.S. economy is set to continue on its trajectory of modest but steady growth, with real GDP expanding by about 2% in 2017. The pace could pick up a little next year depending on the timing and size of any fiscal stimulus the government may enact.

We agree with the Fed’s assessment that the recent disinflation is transitory and that we will see consumer prices gradually rise through 2019. The Fed is likely to remain patient and cautious,

8

however, in carrying out monetary tightening. Some Fed officials have indicated they would favor waiting for inflation to reach or even modestly exceed 2% for some time before moving to raise rates more quickly. That could mean we won’t see another rate hike until the second half of 2018, especially if the Fed begins reducing its balance sheet later this year.

David R. Glocke, Principal

Vanguard Fixed Income Group

September 18, 2017

9

Prime Money Market Fund

Fund Profile

As of August 31, 2017

| | |

| Financial Attributes | | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VMMXX | VMRXX |

| Expense Ratio1 | 0.16% | 0.10% |

| 7-Day SEC Yield | 1.10% | 1.16% |

| Average Weighted | | |

| Maturity | 44 days | 44 days |

| |

| Sector Diversification (% of portfolio) | |

| Certificates of Deposit | | 7.3% |

| U.S. Commercial Paper | | 2.2 |

| Other | | 0.1 |

| Repurchase Agreements | | 4.3 |

| U.S. Government Obligations | 1.6 |

| U.S. Treasury Bills | | 26.2 |

| Yankee/Foreign | | 58.3 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government.

1 The expense ratios shown are from the prospectus dated December 23, 2016, and represent estimated costs for the current fiscal year. For the fiscal year ended August 31, 2017, the expense ratios were 0.16% for Investor Shares and 0.10% for Admiral Shares.

10

Prime Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. The fund is only available to retail investors (natural persons). You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1 per share, it cannot guarantee it will do so. The fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

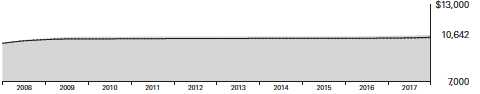

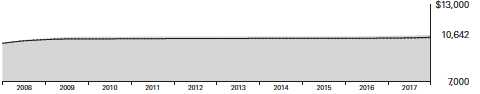

Cumulative Performance: August 31, 2007, Through August 31, 2017

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended August 31, 2017 | |

| |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| |

| Prime Money Market Fund Investor | | | | |

| Shares | 0.83% | 0.24% | 0.62% | $10,642 |

| |

| • • • • • • • • Money Market Funds Average | 0.43 | 0.09 | 0.41 | 10,417 |

| Citigroup Three-Month U.S. Treasury | | | | |

| Bill Index | 0.58 | 0.16 | 0.44 | 10,444 |

| Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | | |

See Financial Highlights for dividend information.

11

Prime Money Market Fund

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended August 31, 2017 | |

| |

| | | | | Final Value |

| | One | Five | Ten | of a $5,000,000 |

| | Year | Years | Years | Investment |

| Prime Money Market Fund Admiral Shares | 0.89% | 0.29% | 0.71% | $5,368,605 |

| Money Market Funds Average | 0.43 | 0.09 | 0.41 | 5,208,500 |

| Citigroup Three-Month U.S. Treasury Bill | | | | |

| Index | 0.58 | 0.16 | 0.44 | 5,222,100 |

Fiscal-Year Total Returns (%): August 31, 2007, Through August 31, 2017

| | |

| | | Money |

| | | Market |

| | | Funds |

| | Investor Shares | Average |

| Fiscal Year | Total Returns | Total Returns |

| 2008 | 3.60% | 3.02% |

| 2009 | 1.31 | 0.62 |

| 2010 | 0.08 | 0.02 |

| 2011 | 0.06 | 0.00 |

| 2012 | 0.04 | 0.00 |

| 2013 | 0.02 | 0.00 |

| 2014 | 0.02 | 0.00 |

| 2015 | 0.02 | 0.00 |

| 2016 | 0.32 | 0.04 |

| 2017 | 0.83 | 0.43 |

7-day SEC yield (8/31/2017): 1.10%

Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Average Annual Total Returns: Periods Ended June 30, 2017

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 6/4/1975 | 0.72% | 0.20% | 0.69% |

| Admiral Shares | 10/3/1989 | 0.78 | 0.26 | 0.78 |

12

Prime Money Market Fund

Financial Statements

Statement of Net Assets

As of August 31, 2017

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | | |

| | | | | | Face | Market |

| | | | | Maturity | Amount | Value • |

| | | | Yield1 | Date | ($000) | ($000) |

| U.S. Government and Agency Obligations (27.7%) | | | |

| | United States Treasury Bill | | 0.949% | 10/19/17 | 599,981 | 599,225 |

| | United States Treasury Bill | 0.960%–0.965% | 10/26/17 | 1,500,000 | 1,497,806 |

| | United States Treasury Bill | 0.000%–0.980% | 11/2/17 | 2,490,000 | 2,485,827 |

| | United States Treasury Bill | 1.020%–1.043% | 11/9/17 | 4,000,000 | 3,992,122 |

| | United States Treasury Bill | | 1.025% | 11/16/17 | 1,591,090 | 1,587,664 |

| | United States Treasury Bill | | 1.056% | 11/24/17 | 2,500,000 | 2,493,875 |

| | United States Treasury Bill | | 1.066% | 11/30/17 | 2,000,000 | 1,994,700 |

| | United States Treasury Bill | 1.103%–1.106% | 12/7/17 | 700,000 | 697,928 |

| | United States Treasury Bill | | 1.116% | 12/28/17 | 1,000,000 | 996,362 |

| | United States Treasury Bill | | 1.136% | 1/4/18 | 2,000,000 | 1,992,153 |

| | United States Treasury Bill | | 1.131% | 1/11/18 | 1,500,000 | 1,493,812 |

| | United States Treasury Bill | | 1.111% | 1/18/18 | 1,500,000 | 1,493,600 |

| | United States Treasury Bill | | 1.121% | 2/15/18 | 2,000,000 | 1,989,655 |

| | United States Treasury Bill | | 1.121% | 3/1/18 | 2,000,000 | 1,988,788 |

| 2 | United States Treasury Floating Rate Note | 1.193% | 10/31/18 | 1,500,000 | 1,500,017 |

| Total U.S. Government and Agency Obligations (Cost $26,803,534) | | 26,803,534 |

| Commercial Paper (34.4%) | | | | | |

| Bank Holding Company (0.3%) | | | | | |

| 3 | ABN Amro Funding USA LLC | | 1.235% | 9/15/17 | 119,500 | 119,443 |

| 3 | ABN Amro Funding USA LLC | | 1.225% | 9/21/17 | 173,250 | 173,132 |

| | | | | | | 292,575 |

| Finance—Auto (1.0%) | | | | | |

| | American Honda Finance Corp. | | 1.294% | 10/5/17 | 16,550 | 16,530 |

| | American Honda Finance Corp. | | 1.294% | 10/16/17 | 212,300 | 211,958 |

| 3 | BMW US Capital LLC | | 1.203% | 9/11/17 | 59,500 | 59,480 |

| 3 | BMW US Capital LLC | | 1.194% | 9/14/17 | 86,250 | 86,213 |

| 3 | BMW US Capital LLC | | 1.204% | 9/25/17 | 158,750 | 158,623 |

| 4 | Toyota Motor Credit Corp. | | 1.649% | 9/14/17 | 155,000 | 155,000 |

| 4 | Toyota Motor Credit Corp. | | 1.647% | 9/15/17 | 131,000 | 131,000 |

| 4 | Toyota Motor Credit Corp. | | 1.629% | 10/6/17 | 69,500 | 69,500 |

| 4 | Toyota Motor Credit Corp. | | 1.629% | 10/10/17 | 52,250 | 52,250 |

| | | | | | | 940,554 |

13

Prime Money Market Fund

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value • |

| | | Yield1 | Date | ($000) | ($000) |

| Finance—Other (0.3%) | | | | |

| | GE Capital Treasury Services US LLC | 1.147% | 9/13/17 | 100,000 | 99,962 |

| 4 | GE Capital Treasury Services US LLC | 1.304% | 1/24/18 | 63,500 | 63,500 |

| 4 | GE Capital Treasury Services US LLC | 1.312% | 3/2/18 | 99,000 | 99,000 |

| | | | | | 262,462 |

| Foreign Banks (28.0%) | | | | |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.381% | 9/7/17 | 337,250 | 337,250 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.369% | 9/12/17 | 113,750 | 113,748 |

| 3 | Australia & New Zealand Banking Group Ltd. | 1.197% | 10/12/17 | 150,000 | 149,797 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.335% | 1/22/18 | 240,000 | 239,999 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.335% | 1/22/18 | 117,000 | 117,000 |

| 3 | Australia & New Zealand Banking Group Ltd. | 1.395% | 3/1/18 | 99,000 | 98,311 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.351% | 3/21/18 | 156,000 | 156,000 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.344% | 3/22/18 | 121,500 | 121,483 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.381% | 6/21/18 | 156,000 | 156,000 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.384% | 7/26/18 | 63,000 | 62,994 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.392% | 8/2/18 | 107,000 | 107,000 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.389% | 8/7/18 | 240,000 | 240,000 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.389% | 8/8/18 | 89,000 | 88,996 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.389% | 8/9/18 | 118,000 | 118,000 |

| 3,4 | Australia & New Zealand Banking Group Ltd. | 1.397% | 8/14/18 | 161,500 | 161,485 |

| 3 | Bank of Nova Scotia | 1.207% | 10/5/17 | 194,000 | 193,780 |

| 3 | Bank of Nova Scotia | 1.228% | 10/10/17 | 257,750 | 257,409 |

| 3,4 | Bank of Nova Scotia | 1.426% | 10/23/17 | 163,000 | 163,000 |

| 3,4 | Bank of Nova Scotia | 1.401% | 11/10/17 | 258,000 | 258,000 |

| 3,4 | Bank of Nova Scotia | 1.321% | 11/20/17 | 151,500 | 151,500 |

| 3,4 | Bank of Nova Scotia | 1.321% | 12/7/17 | 195,000 | 195,000 |

| 3,4 | Bank of Nova Scotia | 1.345% | 12/22/17 | 156,000 | 156,000 |

| 3,4 | Bank of Nova Scotia | 1.342% | 1/2/18 | 185,000 | 185,000 |

| 3 | Bank Nederlandse Gemeenten NV | 1.180% | 9/1/17 | 418,500 | 418,500 |

| 3 | Bank Nederlandse Gemeenten NV | 1.190% | 9/5/17 | 193,500 | 193,474 |

| | BNP Paribas SA (New York Branch) | 1.140% | 9/5/17 | 644,000 | 643,918 |

| 3 | Canadian Imperial Bank of Commerce | 1.228% | 9/28/17 | 485,500 | 485,056 |

| 3,4 | Canadian Imperial Bank of Commerce | 1.364% | 2/26/18 | 378,000 | 378,000 |

| 3,4 | Commonwealth Bank of Australia | 1.916% | 9/25/17 | 134,250 | 134,250 |

| 3,4 | Commonwealth Bank of Australia | 1.748% | 1/12/18 | 75,000 | 75,000 |

| 3,4 | Commonwealth Bank of Australia | 1.702% | 1/25/18 | 248,000 | 248,000 |

| 3,4 | Commonwealth Bank of Australia | 1.702% | 1/29/18 | 182,000 | 182,000 |

| 3,4 | Commonwealth Bank of Australia | 1.594% | 2/26/18 | 63,000 | 63,000 |

| 3,4 | Commonwealth Bank of Australia | 1.572% | 3/1/18 | 100,000 | 100,000 |

| 3,4 | Commonwealth Bank of Australia | 1.572% | 3/2/18 | 350,000 | 349,990 |

| 3,4 | Commonwealth Bank of Australia | 1.429% | 5/11/18 | 100,000 | 100,000 |

| 3,4 | Commonwealth Bank of Australia | 1.428% | 5/17/18 | 148,000 | 148,000 |

| 3,4 | Commonwealth Bank of Australia | 1.428% | 5/18/18 | 99,000 | 99,000 |

| 3,4 | Commonwealth Bank of Australia | 1.391% | 6/4/18 | 99,000 | 98,996 |

| 3,4 | Commonwealth Bank of Australia | 1.387% | 6/15/18 | 99,000 | 99,000 |

| 3,4 | Commonwealth Bank of Australia | 1.399% | 7/13/18 | 300,000 | 300,000 |

| 3,4 | Commonwealth Bank of Australia | 1.399% | 8/2/18 | 132,000 | 131,988 |

| 3,4 | Commonwealth Bank of Australia | 1.399% | 8/3/18 | 110,000 | 110,000 |

| 3,4 | Commonwealth Bank of Australia | 1.409% | 8/9/18 | 268,000 | 268,000 |

| | Credit Agricole Corporate and Investment | | | | |

| | Bank (New York) | 1.080% | 9/1/17 | 1,935,000 | 1,935,000 |

| 3 | Danske Corp. | 1.194% | 9/5/17 | 50,500 | 50,493 |

| 3 | Danske Corp. | 1.194% | 9/6/17 | 205,500 | 205,466 |

14

Prime Money Market Fund

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value • |

| | | Yield1 | Date | ($000) | ($000) |

| 3 | Danske Corp. | 1.194% | 9/7/17 | 56,970 | 56,959 |

| 3 | Danske Corp. | 1.244% | 9/8/17 | 230,000 | 229,945 |

| 3 | Danske Corp. | 1.244% | 9/14/17 | 439,000 | 438,803 |

| 3 | Danske Corp. | 1.244% | 9/15/17 | 260,000 | 259,875 |

| 3 | Danske Corp. | 1.325% | 11/10/17 | 78,950 | 78,747 |

| 3 | Danske Corp. | 1.314% | 11/28/17 | 45,000 | 44,856 |

| 3 | Danske Corp. | 1.314% | 11/29/17 | 290,000 | 289,061 |

| 3 | DNB Bank ASA | 1.165% | 9/15/17 | 250,000 | 249,887 |

| 3 | DNB Bank ASA | 1.165% | 9/18/17 | 250,000 | 249,863 |

| 3,4 | DNB Bank ASA | 1.318% | 11/16/17 | 475,000 | 475,000 |

| 3 | DNB Bank ASA | 1.314% | 12/11/17 | 495,000 | 493,188 |

| 3 | DNB Bank ASA | 1.314% | 12/13/17 | 500,000 | 498,133 |

| 3,4 | HSBC Bank plc | 1.481% | 12/20/17 | 305,500 | 305,500 |

| 3,4 | HSBC Bank plc | 1.561% | 3/19/18 | 160,750 | 160,750 |

| 3,4 | HSBC Bank plc | 1.466% | 4/24/18 | 110,000 | 110,000 |

| 3,4 | HSBC Bank plc | 1.464% | 4/25/18 | 63,000 | 63,000 |

| | ING US Funding LLC | 1.225% | 9/21/17 | 495,000 | 494,665 |

| | ING US Funding LLC | 1.225% | 9/22/17 | 500,000 | 499,644 |

| 3,4 | National Australia Bank Ltd. | 1.679% | 9/8/17 | 600,000 | 600,000 |

| 3,4 | National Australia Bank Ltd. | 1.474% | 11/28/17 | 484,000 | 484,000 |

| 3,4 | National Australia Bank Ltd. | 1.402% | 1/3/18 | 283,000 | 283,000 |

| 3,4 | National Australia Bank Ltd. | 1.331% | 1/19/18 | 360,000 | 360,000 |

| 3,4 | National Australia Bank Ltd. | 1.339% | 2/12/18 | 100,000 | 100,000 |

| 3,4 | National Australia Bank Ltd. | 1.386% | 5/30/18 | 186,000 | 186,000 |

| 3,4 | National Australia Bank Ltd. | 1.389% | 5/31/18 | 160,000 | 160,000 |

| | Natixis (New York Branch) | 1.180% | 9/5/17 | 1,000,000 | 999,869 |

| 3 | Nederlandse Waterschapsbank NV | 1.190% | 9/6/17 | 512,000 | 511,915 |

| 3 | Nordea Bank AB | 1.192% | 9/13/17 | 500,000 | 499,803 |

| 3 | Nordea Bank AB | 1.182% | 9/20/17 | 500,000 | 499,690 |

| 3 | Nordea Bank AB | 1.182% | 10/4/17 | 550,000 | 549,408 |

| 3 | Nordea Bank AB | 1.279% | 12/4/17 | 47,350 | 47,193 |

| 3 | Nordea Bank AB | 1.323% | 12/22/17 | 400,000 | 398,360 |

| 3 | Nordea Bank AB | 1.395% | 3/1/18 | 190,000 | 188,677 |

| 3 | Svenska Handelsbanken AB | 1.270% | 11/28/17 | 445,750 | 444,377 |

| 3 | Svenska Handelsbanken AB | 1.270% | 11/29/17 | 385,250 | 384,050 |

| | Swedbank AB | 1.180% | 9/11/17 | 200,000 | 199,935 |

| | Swedbank AB | 1.180% | 9/12/17 | 180,000 | 179,935 |

| | Swedbank AB | 1.180% | 9/13/17 | 163,000 | 162,936 |

| | Swedbank AB | 1.180% | 9/14/17 | 163,000 | 162,931 |

| | Swedbank AB | 1.180% | 9/15/17 | 163,000 | 162,926 |

| | Swedbank AB | 1.306% | 11/6/17 | 200,000 | 199,523 |

| | Swedbank AB | 1.306% | 11/7/17 | 200,000 | 199,516 |

| | Swedbank AB | 1.331% | 11/27/17 | 200,000 | 199,360 |

| | Swedbank AB | 1.331% | 11/28/17 | 120,000 | 119,611 |

| | Swedbank AB | 1.331% | 11/29/17 | 50,200 | 50,036 |

| | Swedbank AB | 1.321% | 12/27/17 | 159,000 | 158,321 |

| | Swedbank AB | 1.400% | 3/1/18 | 126,750 | 125,864 |

| 3,4 | Westpac Banking Corp. | 1.914% | 9/28/17 | 150,000 | 150,000 |

| 3,5 | Westpac Banking Corp. | 1.703% | 9/29/17 | 100,000 | 100,000 |

| 3,5 | Westpac Banking Corp. | 1.702% | 10/6/17 | 200,000 | 200,000 |

| 3,4 | Westpac Banking Corp. | 1.881% | 10/6/17 | 198,000 | 198,000 |

| 3,4 | Westpac Banking Corp. | 1.749% | 12/14/17 | 355,000 | 355,000 |

| 3,4 | Westpac Banking Corp. | 1.749% | 1/8/18 | 200,000 | 200,000 |

| 3,4 | Westpac Banking Corp. | 1.682% | 2/2/18 | 600,000 | 600,000 |

15

Prime Money Market Fund

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value • |

| | | Yield1 | Date | ($000) | ($000) |

| 3,4 | Westpac Banking Corp. | 1.572% | 3/1/18 | 198,000 | 198,000 |

| 3,4 | Westpac Banking Corp. | 1.414% | 5/25/18 | 312,000 | 312,000 |

| 3,4 | Westpac Banking Corp. | 1.389% | 6/14/18 | 186,000 | 186,000 |

| 3,4 | Westpac Banking Corp. | 1.387% | 6/15/18 | 400,000 | 400,000 |

| | | | | | 27,158,995 |

| Foreign Governments (1.8%) | | | | |

| 3 | CDP Financial Inc. | 1.359% | 9/27/17 | 29,000 | 28,972 |

| 3 | CDP Financial Inc. | 1.369% | 10/2/17 | 57,000 | 56,933 |

| 3 | CDP Financial Inc. | 1.349% | 10/5/17 | 22,500 | 22,472 |

| 6 | CPPIB Capital Inc. | 1.215% | 10/12/17 | 297,000 | 296,591 |

| 6 | CPPIB Capital Inc. | 1.215% | 10/13/17 | 297,000 | 296,581 |

| | Export Development Canada | 1.100% | 9/6/17 | 3,230 | 3,230 |

| | Export Development Canada | 1.306% | 1/3/18 | 146,500 | 145,844 |

| | Export Development Canada | 1.306% | 1/8/18 | 64,000 | 63,702 |

| | Export Development Canada | 1.306% | 1/9/18 | 127,500 | 126,901 |

| | Export Development Canada | 1.306% | 1/10/18 | 63,750 | 63,448 |

| | Export Development Canada | 1.306% | 1/11/18 | 63,750 | 63,446 |

| 3 | Ontario Teachers’ Finance Trust | 1.308% | 9/6/17 | 14,830 | 14,827 |

| 3 | Ontario Teachers’ Finance Trust | 1.308% | 9/15/17 | 15,000 | 14,992 |

| 3 | Ontario Teachers’ Finance Trust | 1.259% | 9/18/17 | 49,500 | 49,471 |

| 3 | Ontario Teachers’ Finance Trust | 1.308% | 9/21/17 | 20,000 | 19,986 |

| 3,4 | Ontario Teachers’ Finance Trust | 1.449% | 10/13/17 | 100,250 | 100,250 |

| 3 | Ontario Teachers’ Finance Trust | 1.361% | 10/27/17 | 65,500 | 65,362 |

| 3 | Ontario Teachers’ Finance Trust | 1.361% | 11/13/17 | 39,000 | 38,893 |

| 3 | Ontario Teachers’ Finance Trust | 1.361% | 11/16/17 | 16,250 | 16,204 |

| 3 | Ontario Teachers’ Finance Trust | 1.341% | 11/27/17 | 24,800 | 24,720 |

| 6 | PSP Capital Inc. | 1.187%–1.207% | 10/10/17 | 80,750 | 80,646 |

| 6 | PSP Capital Inc. | 1.207% | 10/12/17 | 29,000 | 28,960 |

| 4,6 | PSP Capital Inc. | 1.328% | 10/18/17 | 84,500 | 84,500 |

| | | | | | 1,706,931 |

| Foreign Industrial (1.7%) | | | | |

| 3 | Nestle Capital Corp. | 1.225% | 10/13/17 | 124,000 | 123,824 |

| 3 | Nestle Capital Corp. | 1.225% | 10/16/17 | 93,000 | 92,858 |

| 3 | Nestle Capital Corp. | 1.225% | 10/17/17 | 93,000 | 92,855 |

| 3 | Nestle Capital Corp. | 1.225% | 10/18/17 | 198,000 | 197,685 |

| | Nestle Finance International Ltd. | 1.143% | 9/8/17 | 61,750 | 61,736 |

| | Nestle Finance International Ltd. | 1.143% | 9/11/17 | 49,500 | 49,484 |

| | Nestle Finance International Ltd. | 1.225% | 10/13/17 | 124,000 | 123,824 |

| | Nestle Finance International Ltd. | 1.225% | 10/16/17 | 161,250 | 161,004 |

| 3 | Total Credit Canada Inc. | 1.204% | 9/14/17 | 307,750 | 307,617 |

| 3 | Total Credit Canada Inc. | 1.204% | 9/15/17 | 109,000 | 108,949 |

| 3 | Total Credit Canada Inc. | 1.204% | 9/18/17 | 270,000 | 269,847 |

| | Toyota Capital Canada Ltd. | 1.306% | 12/12/17 | 49,500 | 49,318 |

| | Toyota Capital Canada Ltd. | 1.376% | 12/18/17 | 16,000 | 15,934 |

| | Toyota Capital Canada Ltd. | 1.377% | 12/19/17 | 32,000 | 31,867 |

| | | | | | 1,686,802 |

| Industrial (1.3%) | | | | |

| 3 | Apple Inc. | 1.204% | 10/16/17 | 150,000 | 149,775 |

| 3 | Apple Inc. | 1.204% | 10/17/17 | 238,000 | 237,635 |

| 3 | Cisco Systems Inc. | 1.203% | 9/13/17 | 245,108 | 245,010 |

| 3 | Henkel of America Inc. | 1.314% | 9/6/17 | 24,750 | 24,745 |

| 3 | Henkel of America Inc. | 1.234% | 9/18/17 | 93,650 | 93,596 |

| 3 | Microsoft Corp. | 1.204% | 10/2/17 | 297,000 | 296,693 |

16

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value • |

| | Yield1 | Date | ($000) | ($000) |

| 3 The Coca-Cola Co. | 1.244% | 12/4/17 | 173,000 | 172,440 |

| 3 The Coca-Cola Co. | 1.244% | 12/5/17 | 49,750 | 49,587 |

| | | | | 1,269,481 |

| Total Commercial Paper (Cost $33,317,800) | | | | 33,317,800 |

| Certificates of Deposit (32.3%) | | | | |

| Domestic Banks (6.0%) | | | | |

| Citibank NA | 1.180% | 9/7/17 | 224,000 | 224,000 |

| Citibank NA | 1.180% | 9/8/17 | 224,000 | 224,000 |

| Citibank NA | 1.180% | 9/11/17 | 191,000 | 191,000 |

| Citibank NA | 1.210% | 9/20/17 | 74,000 | 74,000 |

| Citibank NA | 1.210% | 9/21/17 | 148,500 | 148,500 |

| Citibank NA | 1.240% | 10/2/17 | 145,000 | 145,000 |

| Citibank NA | 1.270% | 11/6/17 | 302,500 | 302,500 |

| Citibank NA | 1.290% | 11/10/17 | 49,000 | 49,000 |

| 4 HSBC Bank USA NA | 1.612% | 9/1/17 | 407,000 | 407,000 |

| HSBC Bank USA NA | 1.415% | 9/19/17 | 31,500 | 31,503 |

| 4 HSBC Bank USA NA | 1.452% | 10/2/17 | 200,000 | 200,000 |

| 4 HSBC Bank USA NA | 1.592% | 3/2/18 | 67,250 | 67,250 |

| 4 HSBC Bank USA NA | 1.591% | 3/6/18 | 101,250 | 101,250 |

| 4 HSBC Bank USA NA | 1.542% | 4/3/18 | 130,000 | 130,000 |

| 4 HSBC Bank USA NA | 1.511% | 4/19/18 | 63,000 | 63,000 |

| 4 HSBC Bank USA NA | 1.472% | 5/3/18 | 273,500 | 273,500 |

| 4 HSBC Bank USA NA | 1.421% | 6/5/18 | 150,000 | 150,000 |

| 4 HSBC Bank USA NA | 1.428% | 8/16/18 | 48,300 | 48,300 |

| 4 HSBC Bank USA NA | 1.436% | 8/21/18 | 99,000 | 99,000 |

| 4 Wells Fargo Bank NA | 1.391% | 9/6/17 | 270,000 | 270,000 |

| Wells Fargo Bank NA | 1.200% | 9/18/17 | 205,000 | 205,000 |

| 4 Wells Fargo Bank NA | 1.359% | 10/13/17 | 472,000 | 472,000 |

| 4 Wells Fargo Bank NA | 1.329% | 11/9/17 | 500,000 | 500,000 |

| 4 Wells Fargo Bank NA | 1.332% | 12/1/17 | 209,000 | 209,000 |

| 4 Wells Fargo Bank NA | 1.338% | 1/16/18 | 600,000 | 600,000 |

| 4 Wells Fargo Bank NA | 1.338% | 1/17/18 | 600,000 | 600,000 |

| | | | | 5,784,803 |

| Eurodollar Certificates of Deposit (0.9%) | | | | |

| 4 National Australia Bank Ltd. | 1.621% | 11/6/17 | 890,000 | 890,000 |

| |

| Yankee Certificates of Deposit (25.4%) | | | | |

| 4 Bank of Montreal (Chicago Branch) | 1.422% | 9/1/17 | 378,000 | 378,000 |

| 4 Bank of Montreal (Chicago Branch) | 1.401% | 9/6/17 | 169,000 | 169,000 |

| 4 Bank of Montreal (Chicago Branch) | 1.421% | 9/20/17 | 140,000 | 140,000 |

| 4 Bank of Montreal (Chicago Branch) | 1.362% | 11/3/17 | 250,000 | 250,000 |

| 4 Bank of Montreal (Chicago Branch) | 1.338% | 11/17/17 | 192,000 | 192,000 |

| 4 Bank of Montreal (Chicago Branch) | 1.341% | 12/6/17 | 153,250 | 153,250 |

| 4 Bank of Montreal (Chicago Branch) | 1.341% | 12/7/17 | 231,250 | 231,250 |

| 4 Bank of Montreal (Chicago Branch) | 1.344% | 12/27/17 | 325,000 | 325,000 |

| Bank of Montreal (Chicago Branch) | 1.352% | 1/29/18 | 322,000 | 322,000 |

| 4 Bank of Montreal (Chicago Branch) | 1.359% | 2/9/18 | 245,000 | 244,994 |

| 4 Bank of Montreal (Chicago Branch) | 1.364% | 2/26/18 | 392,000 | 391,990 |

| 4 Bank of Montreal (Chicago Branch) | 1.369% | 3/2/18 | 168,000 | 168,000 |

| Bank of Nova Scotia (Houston Branch) | 1.560% | 11/6/17 | 28,000 | 28,014 |

| 4 Bank of Nova Scotia (Houston Branch) | 1.319% | 12/11/17 | 185,000 | 185,000 |

| 4 Bank of Nova Scotia (Houston Branch) | 1.365% | 2/22/18 | 633,000 | 633,000 |

17

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value • |

| | Yield1 | Date | ($000) | ($000) |

| Bank of Tokyo-Mitsubishi UFJ Ltd. | | | | |

| (New York Branch) | 1.250% | 9/11/17 | 925,000 | 925,000 |

| Bank of Tokyo-Mitsubishi UFJ Ltd. | | | | |

| (New York Branch) | 1.250% | 9/25/17 | 265,000 | 265,000 |

| Bank of Tokyo-Mitsubishi UFJ Ltd. | | | | |

| (New York Branch) | 1.280% | 10/2/17 | 715,000 | 715,000 |

| 4 Canadian Imperial Bank of Commerce | | | | |

| (New York Branch) | 1.361% | 2/20/18 | 945,000 | 945,000 |

| Canadian Imperial Bank of Commerce | | | | |

| (New York Branch) | 1.200% | 10/5/17 | 253,000 | 253,000 |

| Canadian Imperial Bank of Commerce | | | | |

| (New York Branch) | 1.270% | 10/20/17 | 193,000 | 193,000 |

| 4 Canadian Imperial Bank of Commerce | | | | |

| (New York Branch) | 1.338% | 12/18/17 | 150,000 | 150,000 |

| Credit Industriel et Commercial | | | | |

| (New York Branch) | 1.170% | 9/5/17 | 1,278,000 | 1,278,000 |

| Credit Industriel et Commercial | | | | |

| (New York Branch) | 1.160% | 9/6/17 | 528,000 | 528,000 |

| Credit Industriel et Commercial | | | | |

| (New York Branch) | 1.170% | 9/6/17 | 129,000 | 129,000 |

| Credit Suisse AG (New York Branch) | 1.430% | 11/3/17 | 100,000 | 100,020 |

| Credit Suisse AG (New York Branch) | 1.320% | 12/1/17 | 300,000 | 300,000 |

| 4 DNB Bank ASA (New York Branch) | 1.344% | 2/28/18 | 450,000 | 450,000 |

| KBC Bank NV (New York Branch) | 1.180% | 9/5/17 | 500,000 | 500,000 |

| Lloyds Bank plc (New York Branch) | 1.220% | 9/25/17 | 345,000 | 345,000 |

| Lloyds Bank plc (New York Branch) | 1.220% | 9/26/17 | 62,750 | 62,750 |

| Natixis (New York Branch) | 1.180% | 9/5/17 | 935,000 | 935,000 |

| Nordea Bank AB (New York Branch) | 1.315% | 12/14/17 | 518,000 | 518,000 |

| 4 Royal Bank of Canada (New York Branch) | 1.411% | 9/20/17 | 701,630 | 701,630 |

| 4 Royal Bank of Canada (New York Branch) | 1.321% | 12/19/17 | 371,000 | 371,000 |

| 4 Royal Bank of Canada (New York Branch) | 1.491% | 12/20/17 | 225,000 | 225,000 |

| 4 Royal Bank of Canada (New York Branch) | 1.324% | 12/28/17 | 118,000 | 118,000 |

| 4 Royal Bank of Canada (New York Branch) | 1.358% | 2/20/18 | 245,000 | 245,000 |

| 4 Royal Bank of Canada (New York Branch) | 1.581% | 3/7/18 | 100,875 | 100,875 |

| 4 Royal Bank of Canada (New York Branch) | 1.358% | 3/16/18 | 979,000 | 979,000 |

| 4 Royal Bank of Canada (New York Branch) | 1.551% | 3/20/18 | 128,400 | 128,400 |

| Skandinaviska Enskilda Banken AB | | | | |

| (New York Branch) | 1.160% | 9/6/17 | 500,000 | 500,000 |

| 4 Skandinaviska Enskilda Banken AB | | | | |

| (New York Branch) | 1.371% | 11/20/17 | 129,750 | 129,750 |

| 4 Skandinaviska Enskilda Banken AB | | | | |

| (New York Branch) | 1.325% | 12/22/17 | 148,500 | 148,498 |

| 4 Skandinaviska Enskilda Banken AB | | | | |

| (New York Branch) | 1.325% | 12/22/17 | 148,500 | 148,498 |

| 4 Skandinaviska Enskilda Banken AB | | | | |

| (New York Branch) | 1.335% | 12/22/17 | 673,000 | 673,000 |

| 4 Skandinaviska Enskilda Banken AB | | | | |

| (New York Branch) | 1.314% | 12/28/17 | 63,000 | 62,999 |

| 4 Skandinaviska Enskilda Banken AB | | | | |

| (New York Branch) | 1.324% | 12/28/17 | 152,000 | 152,000 |

| 4 Sumitomo Mitsui Banking Corp. | | | | |

| (New York Branch) | 1.327% | 10/16/17 | 423,000 | 423,000 |

| 4 Sumitomo Mitsui Banking Corp. | | | | |

| (New York Branch) | 1.327% | 10/17/17 | 462,000 | 462,000 |

18

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value • |

| | Yield1 | Date | ($000) | ($000) |

| 4 Sumitomo Mitsui Banking Corp. | | | | |

| (New York Branch) | 1.352% | 11/1/17 | 250,000 | 250,000 |

| 4 Sumitomo Mitsui Banking Corp. | | | | |

| (New York Branch) | 1.352% | 12/1/17 | 315,750 | 315,750 |

| 4 Sumitomo Mitsui Banking Corp. | | | | |

| (New York Branch) | 1.349% | 12/11/17 | 482,000 | 482,000 |

| 4 Svenska HandelsBanken AB | | | | |

| (New York Branch) | 1.349% | 12/8/17 | 189,000 | 189,000 |

| 4 Svenska HandelsBanken AB | | | | |

| (New York Branch) | 1.354% | 1/29/18 | 941,000 | 941,000 |

| 4 Svenska HandelsBanken AB | | | | |

| (New York Branch) | 1.361% | 2/20/18 | 785,000 | 785,000 |

| 4 Svenska HandelsBanken AB | | | | |

| (New York Branch) | 1.386% | 4/30/18 | 135,000 | 135,000 |

| Swedbank AB (New York Branch) | 1.310% | 12/28/17 | 440,000 | 440,000 |

| 4 Toronto Dominion Bank (New York Branch) | 1.692% | 9/5/17 | 500,000 | 500,000 |

| 4 Toronto Dominion Bank (New York Branch) | 1.672% | 11/1/17 | 807,000 | 807,000 |

| Toronto Dominion Bank (New York Branch) | 1.400% | 12/8/17 | 405,000 | 405,000 |

| 4 Toronto Dominion Bank (New York Branch) | 1.407% | 6/15/18 | 490,000 | 490,000 |

| 4 Toronto Dominion Bank (New York Branch) | 1.431% | 8/10/18 | 694,000 | 694,000 |

| UBS AG (Stamford Branch) | 1.200% | 9/6/17 | 200,000 | 200,000 |

| | | | | 24,605,668 |

| Total Certificates of Deposit (Cost $31,280,471) | | | | 31,280,471 |

| Other Notes (1.3%) | | | | |

| Bank of America NA | 1.300% | 10/2/17 | 275,000 | 275,000 |

| 4 Bank of America NA | 1.411% | 10/4/17 | 162,000 | 162,000 |

| 4 Bank of America NA | 1.409% | 10/11/17 | 156,500 | 156,500 |

| 4 Bank of America NA | 1.349% | 11/14/17 | 124,000 | 124,000 |

| 4 Bank of America NA | 1.351% | 12/4/17 | 153,000 | 153,000 |

| 4 Bank of America NA | 1.342% | 1/2/18 | 157,000 | 157,000 |

| 4 Bank of America NA | 1.339% | 1/8/18 | 247,500 | 247,500 |

| Total Other Notes (Cost $1,275,000) | | | | 1,275,000 |

| Repurchase Agreements (4.3%) | | | | |

| Federal Reserve Bank of New York | | | | |

| (Dated 8/31/17, Repurchase Value | | | | |

| $4,214,117,000, collateralized by | | | | |

| U.S. Treasury Note/Bond 1.625%–2.750%, | | | | |

| 8/15/22–11/15/42, with a value of | | | | |

| $4,214,117,000) | 1.000% | 9/1/17 | 4,214,000 | 4,214,000 |

| Total Repurchase Agreements (Cost $4,214,000) | | | | 4,214,000 |

| Taxable Municipal Bonds (0.1%) | | | | |

| 7 Greene County GA Development Authority | | | | |

| Revenue VRDO | 1.180% | 9/7/17 | 6,250 | 6,250 |

| 6 Los Angeles CA Department of Water | | | | |

| & Power Revenue TOB VRDO | 1.170% | 9/7/17 | 9,900 | 9,900 |

| 6 Massachusetts Transportation Fund Revenue | | | | |

| TOB VRDO | 1.170% | 9/7/17 | 9,900 | 9,900 |

| 6 Seattle WA Municipal Light & Power Revenue | | | | |

| TOB VRDO | 1.170% | 9/7/17 | 9,900 | 9,900 |

| University of Texas System Revenue | 1.100% | 9/7/17 | 62,000 | 62,000 |

19

Prime Money Market Fund

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value • |

| | Yield1 | Date | ($000) | ($000) |

| University of Texas System Revenue | | | | |

| Financing System Revenue VRDO | 1.100% | 9/7/17 | 34,500 | 34,500 |

| Total Taxable Municipal Bonds (Cost $132,450) | | | 132,450 |

| Total Investments (100.1%) (Cost $97,023,255) | | | 97,023,255 |

| |

| | | | | Amount |

| | | | | ($000) |

| Other Assets and Liabilities (-0.1%) | | | | |

| Other Assets | | | | |

| Investment in Vanguard | | | | 6,121 |

| Receivables for Accrued Income | | | | 52,014 |

| Receivables for Capital Shares Issued | | | | 152,687 |

| Other Assets | | | | 91,297 |

| Total Other Assets | | | | 302,119 |

| Liabilities | | | | |

| Payables for Investment Securities Purchased | | | | (300,000) |

| Payables for Capital Shares Redeemed | | | | (129,656) |

| Payables for Distributions | | | | (4,957) |

| Payables to Vanguard | | | | (7,280) |

| Total Liabilities | | | | (441,893) |

| Net Assets (100%) | | | | 96,883,481 |

| |

| |

| At August 31, 2017, net assets consisted of: | | | | |

| | | | | Amount |

| | | | | ($000) |

| Paid-in Capital | | | | 96,875,505 |

| Undistributed Net Investment Income | | | | 45 |

| Accumulated Net Realized Gains | | | | 7,931 |

| Net Assets | | | | 96,883,481 |

| |

| |

| Investor Shares—Net Assets | | | | |

| Applicable to 84,870,047,409 outstanding $.001 par value shares of | | |

| beneficial interest (unlimited authorization) | | | | 84,886,286 |

| Net Asset Value Per Share—Investor Shares | | | | $1.00 |

20

Prime Money Market Fund

| |

| | Amount |

| | ($000) |

| Admiral Shares—Net Assets | |

| Applicable to 11,994,893,859 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 11,997,195 |

| Net Asset Value Per Share—Admiral Shares | $1.00 |

• See Note A in Notes to Financial Statements.

1 Represents annualized yield at date of purchase for discount securities, and coupon for coupon-bearing securities.

2 Adjustable-rate security based upon 3-month U.S. Treasury Bill Auction High Money Market Yield plus spread.

3 Security exempt from registration under Section 4(2) of the Securities Act of 1933. Such securities may be sold in transactions exempt

from registration only to dealers in that program or other “accredited investors.” At August 31, 2017, the aggregate value of these

securities was $24,178,094,000, representing 25.0% of net assets.

4 Adjustable-rate security based upon 1-month USD LIBOR plus spread.

5 Adjustable-rate security based upon 3-month USD LIBOR plus spread.

6 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt

from registration, normally to qualified institutional buyers. At August 31, 2017, the aggregate value of these securities was

$816,978,000, representing 0.8% of net assets.

7 Scheduled principal and interest payments are guaranteed by bank letter of credit.

TOB—Tender Option Bond.

VRDO—Variable Rate Demand Obligation.

See accompanying Notes, which are an integral part of the Financial Statements.

21

Prime Money Market Fund

Statement of Operations

| |

| | Year Ended |

| | August 31,2017 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 987,891 |

| Total Income | 987,891 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 3,200 |

| Management and Administrative—Investor Shares | 114,064 |

| Management and Administrative—Admiral Shares | 11,069 |

| Marketing and Distribution—Investor Shares | 19,502 |

| Marketing and Distribution—Admiral Shares | 613 |

| Custodian Fees | 1,170 |

| Auditing Fees | 33 |

| Shareholders’ Reports and Proxy—Investor Shares | 3,923 |

| Shareholders’ Reports and Proxy—Admiral Shares | 63 |

| Trustees’ Fees and Expenses | 113 |

| Total Expenses | 153,750 |

| Net Investment Income | 834,141 |

| Realized Net Gain (Loss) on Investment Securities Sold | 1,961 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 836,102 |

See accompanying Notes, which are an integral part of the Financial Statements.

22

Prime Money Market Fund

Statement of Changes in Net Assets

| | |

| | Year Ended August 31, |

| | 2017 | 2016 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 834,141 | 444,857 |

| Realized Net Gain (Loss) | 1,961 | 2,974 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 836,102 | 447,831 |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (726,141) | (344,430) |

| Admiral Shares1 | (107,955) | (100,426) |

| Realized Capital Gain | | |

| Investor Shares | — | — |

| Admiral Shares1 | — | — |

| Total Distributions | (834,096) | (444,856) |

| Capital Share Transactions (at $1.00 per share) | | |

| Investor Shares | (15,325,634) | (5,612,729) |

| Admiral Shares1 | (4,432,381) | (12,558,967) |

| Net Increase (Decrease) from Capital Share Transactions | (19,758,015) | (18,171,696) |

| Total Increase (Decrease) | (19,756,009) | (18,168,721) |

| Net Assets | | |

| Beginning of Period | 116,639,490 | 134,808,211 |

| End of Period2 | 96,883,481 | 116,639,490 |

1 Institutional Shares were renamed Admiral Shares in December 2015.

2 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $45,000 and $0.

See accompanying Notes, which are an integral part of the Financial Statements.

23

Prime Money Market Fund

Financial Highlights

Investor Shares

| | | | | |

| For a Share Outstanding | | | Year Ended August 31, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | |

| Net Investment Income | . 0081 | .0032 | .0002 | .0001 | .0002 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | — | — | — | — | — |

| Total from Investment Operations | .008 | .0032 | .0002 | .0001 | .0002 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.008) | (.0032) | (.0002) | (.0001) | (.0002) |

| Distributions from Realized Capital Gains | — | — | — | (.0000)2 | — |

| Total Distributions | (.008) | (.0032) | (.0002) | (.0001) | (.0002) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return3 | 0.83% | 0.32% | 0.02% | 0.02% | 0.02% |

| | | | | |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $84,886 | $100,210 | $105,820 | $101,910 | $102,160 |

| Ratio of Total Expenses to Average Net Assets | 0.16% | 0.16%4 | 0.15% 4 | 0.14% 4 | 0.16% 4 |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 0.82% | 0.32% | 0.02% | 0.01% | 0.02% |

1 Calculated based on average shares outstanding.

2 Distribution was less than $.0001 per share.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information

about any applicable account service fees.

4 The ratio of total expenses to average net assets before an expense reduction was 0.16% for 2016, 0.16% for 2015, 0.16% for 2014, and

0.17% for 2013. For the year ended August 31, 2017, there was no expense reduction. See Note B in the Notes to Financial Statements.

See accompanying Notes, which are an integral part of the Financial Statements.

24

Prime Money Market Fund

Financial Highlights

Admiral Shares

| | | | | |

| For a Share Outstanding | | | Year Ended August 31, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | |

| Net Investment Income | . 0091 | .004 | .001 | .001 | .001 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | — | — | — | — | — |

| Total from Investment Operations | .009 | .004 | .001 | .001 | .001 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (. 009) | (. 004) | (. 001) | (. 001) | (. 001) |

| Distributions from Realized Capital Gains | — | — | — | (.000)2 | — |

| Total Distributions | (. 009) | (. 004) | (. 001) | (. 001) | (. 001) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return3 | 0.89% | 0.38% | 0.07% | 0.06% | 0.07% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $11,997 | $16,429 | $28,988 | $28,699 | $27,015 |

| Ratio of Total Expenses to Average Net Assets | 0.10% | 0.10% | 0.10% | 0.10% | 0.10% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 0.88% | 0.38% | 0.07% | 0.05% | 0.07% |

Institutional Shares were renamed Admiral Shares in December 2015. Prior periods’ Financial Highlights are for the Institutional class.

1 Calculated based on average shares outstanding.

2 Distribution was less than $.0001 per share.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information

about any applicable account service fees.

See accompanying Notes, which are an integral part of the Financial Statements.

25

Prime Money Market Fund

Notes to Financial Statements

Vanguard Prime Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in short-term debt instruments of companies primarily operating in specific industries, particularly financial services; the issuers’ abilities to meet their obligations may be affected by economic developments in such industries. The fund offers two classes of shares, Investor Shares and Admiral Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. Admiral Shares are designed for investors who meet certain administrative, service, and account-size criteria. Effective December 2015, Institutional Shares were renamed Admiral Shares.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Securities are valued at amortized cost, which approximates market value.

2. Repurchase Agreements: The fund enters into repurchase agreements with institutional counterparties. Securities pledged as collateral to the fund under repurchase agreements are held by a custodian bank until the agreements mature, and in the absence of a default, such collateral cannot be repledged, resold, or rehypothecated. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. The fund further mitigates its counterparty risk by entering into repurchase agreements only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master repurchase agreements with its counterparties. The master repurchase agreements provide that, in the event of a counter-party’s default (including bankruptcy), the fund may terminate any repurchase agreements with that counterparty, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund. Such action may be subject to legal proceedings, which may delay or limit the disposition of collateral.

3. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (August 31, 2014–2017), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

4. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

5. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

26

Prime Money Market Fund

The fund had no borrowings outstanding at August 31, 2017, or at any time during the period then ended.

6. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and the proxy. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At August 31, 2017, the fund had contributed to Vanguard capital in the amount of $6,121,000, representing 0.01% of the fund’s net assets and 2.45% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

Vanguard and the board of trustees have agreed to temporarily limit certain net operating expenses in excess of the fund’s daily yield in order to maintain a zero or positive yield for the fund. Vanguard and the board of trustees may terminate the temporary expense limitation at any time. The fund is not obligated to repay this amount to Vanguard. For the year ended August 31, 2017, the fund did not receive an expense reduction from Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are

noted on the Statement of Net Assets.

27

Prime Money Market Fund

At August 31, 2017, 100% of the market value of the fund’s investments was determined using amortized cost, in accordance with rules under the Investment Company Act of 1940. Amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, securities valued at amortized cost are considered to be valued using Level 2 inputs.

| | | | |

| D. Capital share transactions for each class of shares were: | | | |

| | | | Year Ended August 31, |

| | | 2017 | | 2016 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 64,128,512 | 64,127,620 | 101,526,451 | 101,527,243 |

| Issued in Lieu of Cash Distributions | 680,319 | 680,319 | 335,584 | 335,584 |

| Redeemed | (80,134,465) | (80,134,468) | (107,474,764) | (107,474,762) |

| Net Increase (Decrease)—Investor Shares | (15,325,634) | (15,326,529) | (5,612,729) | (5,611,935) |

| Admiral Shares1 | | | | |

| Issued | 8,144,434 | 8,145,324 | 17,763,247 | 17,762,458 |

| Issued in Lieu of Cash Distributions | 102,733 | 102,733 | 96,589 | 96,589 |

| Redeemed | (12,679,548) | (12,679,548) | (30,418,803) | (30,418,803) |

| Net Increase (Decrease) —Admiral Shares | (4,432,381) | (4,431,491) | (12,558,967) | (12,559,756) |

| 1 Institutional Shares were renamed Admiral Shares in December 2015. | | | |

E. Management has determined that no material events or transactions occurred subsequent to August 31, 2017, that would require recognition or disclosure in these financial statements.

28

Federal Money Market Fund

Fund Profile

As of August 31, 2017

| |

| Financial Attributes | |

| Ticker Symbol | VMFXX |

| Expense Ratio1 | 0.11% |

| 7-Day SEC Yield | 0.97% |

| Average Weighted | |

| Maturity | 58 days |

| |

| Sector Diversification (% of portfolio) | |

| U.S. Treasury Bills | 42.5% |

| U.S. Government Obligations | 32.5 |

| Repurchase Agreements | 25.0 |

The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are

generally not backed by the full faith and credit of the U.S. government.

1 The expense ratio shown is from the prospectus dated December 23, 2016, and represents estimated costs for the current fiscal year. For the fiscal year ended August 31, 2017, the expense ratio was 0.11%.

29

Federal Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. The fund is only available to retail investors (natural persons). You could lose money by investing in the fund. Although the fund seeks to preserve the value of your investment at $1 per share, it cannot guarantee it will do so. The fund may impose a fee upon sale of your shares or may temporarily suspend your ability to sell shares if the fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The fund’s sponsor has no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

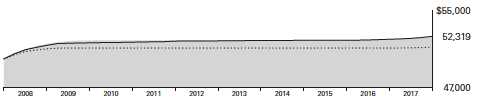

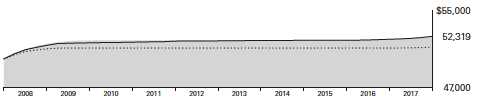

Cumulative Performance: August 31, 2007, Through August 31, 2017

Initial Investment of $10,000

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended August 31, 2017 | |

| |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| |

| Federal Money Market Fund | 0.57% | 0.17% | 0.54% | $10,551 |

| Government Money Market Funds | | | | |

| • • • • • • • • | | | | |

| Average | 0.19 | 0.04 | 0.33 | 10,335 |

| Citigroup Three-Month U.S. Treasury | | | | |

| Bill Index | 0.58 | 0.16 | 0.44 | 10,444 |

| Government Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

See Financial Highlights for dividend information.

30

Federal Money Market Fund

Fiscal-Year Total Returns (%): August 31, 2007, Through August 31, 2017

| | |

| | | Gov't Money |

| | | Market Funds Average |

| Fiscal Year | Total Returns | Total Returns |

| 2008 | 3.46% | 2.71% |

| 2009 | 1.06 | 0.43 |

| 2010 | 0.04 | 0.00 |

| 2011 | 0.02 | 0.00 |

| 2012 | 0.01 | 0.00 |

| 2013 | 0.01 | 0.00 |

| 2014 | 0.02 | 0.00 |

| 2015 | 0.01 | 0.00 |

| 2016 | 0.23 | 0.00 |

| 2017 | 0.57 | 0.19 |

7-day SEC yield (8/31/2017): 0.97%

Government Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Average Annual Total Returns: Periods Ended June 30, 2017

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Federal Money Market Fund | 7/13/1981 | 0.46% | 0.14% | 0.61% |

31

Federal Money Market Fund

Financial Statements

Statement of Net Assets

As of August 31, 2017

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | | |

| | | | | Face | Market |

| | | | Maturity | Amount | Value • |

| | | Yield1 | Date | ($000) | ($000) |

| U.S. Government and Agency Obligations (73.8%) | | | |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.000% | 9/6/17 | 155 | 155 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.043% | 9/8/17 | 137,095 | 137,067 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.028%–1.043% | 9/13/17 | 626,305 | 626,089 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 0.983% | 9/14/17 | 350,000 | 349,876 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 0.983% | 9/15/17 | 200,000 | 199,924 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 0.983% | 9/18/17 | 100,000 | 99,954 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.029%–1.03% | 9/20/17 | 1,463,200 | 1,462,407 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 0.983% | 9/21/17 | 250,000 | 249,864 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.074% | 10/4/17 | 1,400,000 | 1,398,627 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.027%–1.031% | 10/11/17 | 1,851,379 | 1,849,264 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.084% | 10/12/17 | 250,000 | 249,692 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.027%–1.029% | 10/13/17 | 704,400 | 703,556 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.022% | 10/18/17 | 1,287,650 | 1,285,935 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.022% | 10/20/17 | 1,357,000 | 1,355,116 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.053% | 11/15/17 | 197,000 | 196,569 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.049% | 11/17/17 | 300,000 | 299,329 |

| 2 | Federal Home Loan Bank Discount | | | | |

| | Notes | 1.063% | 11/27/17 | 70,000 | 69,821 |

32

Federal Money Market Fund

| | | | | | |

| | | | | | Face | Market |

| | | | | Maturity | Amount | Value • |

| | | | Yield1 | Date | ($000) | ($000) |

| 2 | Federal Home Loan Bank Discount Notes | 1.079% | 12/15/17 | 50,000 | 49,843 |

| 2,3 | Federal Home Loan Banks | | 0.991% | 10/6/17 | 250,000 | 249,990 |

| 2,3 | Federal Home Loan Banks | | 1.241% | 10/19/17 | 250,000 | 250,000 |

| 2,4 | Federal Home Loan Banks | | 1.179% | 11/28/17 | 500,000 | 500,000 |

| 2,4 | Federal Home Loan Banks | | 1.181% | 11/28/17 | 250,000 | 250,000 |

| 2,4 | Federal Home Loan Banks | | 1.181% | 11/28/17 | 250,000 | 250,000 |

| 2,3 | Federal Home Loan Banks | | 1.101% | 2/1/18 | 495,000 | 495,026 |

| 2,4 | Federal Home Loan Banks | | 1.282% | 3/2/18 | 250,000 | 250,001 |