UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-09025

New Covenant Funds

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-835-4531

Date of fiscal year end: June 30, 2014

Date of reporting period: June 30, 2014

| Item 1. | Reports to Stockholders. |

June 30, 2014

ANNUAL REPORT

New Covenant Funds

† New Covenant Growth Fund

† New Covenant Income Fund

† New Covenant Balanced Growth Fund

† New Covenant Balanced Income Fund

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the ‘‘Commission’’) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-877-835-4531; and (ii) on the Commission’s website at http://www.sec.gov.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

NEW COVENANT FUNDS — JUNE 30, 2014

New Covenant Growth Fund

I. Objective:

The New Covenant Growth Fund (the ‘‘Fund’’) seeks to provide long-term capital appreciation.

II. Multi-Manager Approach Statement:

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corporation (‘‘SIMC’’). The Fund utilized the following sub-advisers as of June 30, 2014: Sustainable Growth Advisers, LP (‘‘SGA’’); Parametric Portfolio Associates; Brandywine Global Investment Management, LLC; and Waddell & Reed Investment Management Comapany. Tocqueville Asset Management, LP; WestEnd Advisors, LLC and Baillie Gifford Overseas Limited were terminated from the Fund during the period.

III. Market Commentary:

Growth stocks outperformed value stocks for the period, and large companies outperformed small. This performance occurred during an environment in which the Federal Reserve actually started tapering its multi-year stimulus program in late 2013. Belief in an improving economy led to expanding equity multiples and continued outperformance of U.S. stocks over their non-U.S. counterparts. Interest rates within the U.S. started rising in June, which led to defensive, interest rate-sensitive stocks strongly lagging more pro-cyclical areas. The first two quarters of 2014 have been largely characterized by falling real interest rates (interest rates minus the rate of inflation, which tend to be correlated to economic growth) and a surprising decline in the U.S. economy during the first three months of the year. Both of these dynamics helped defensive areas of the market. This notwithstanding, belief in a favorable outlook for the U.S. economy has persisted, which has also helped fuel the returns of deeper cyclical sectors. The best performing sectors over the full 12-month period were industrials, health care, energy and materials, while traditional defensives such as consumer staples and telecommunications were among the worst performers.

IV. Return vs. Benchmark:

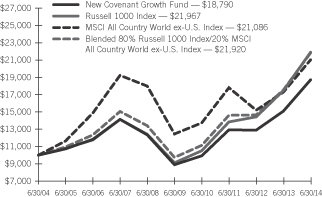

For the year ended June 30, 2014, the Fund returned 24.18%, while the Russell 1000 Index returned 25.35%.

V. Fund Attribution:

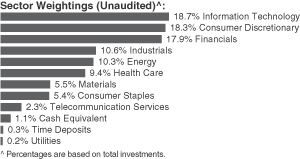

The Fund underperformed slightly during the period. Performance was mainly driven by allocation effects. Underweights to the more

defensive telecommunications and utilities sectors added value, as did an overweight to materials. An overweight to consumer discretionary was the largest allocation-related detractor. Stock selection was best within materials and industrials, and most challenged in consumer discretionary and staples. Brandywine added the most value for the period, while SGA was the largest detractor.

New Covenant Growth Fund

AVERAGE ANNUAL TOTAL RETURN1,2

| | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | | Annualized

3-Year

Return | | | Annualized

5-Year

Return | | | Annualized

10-Year

Return | | | Annualized

Inception

to Date | |

New Covenant Growth Fund | | | 24.18% | | | | 13.24% | | | | 16.15% | | | | 6.51% | | | | 5.98% | |

| Russell 1000 Index | | | 25.35% | | | | 16.63% | | | | 19.25% | | | | 8.19% | | | | 9.74% | |

| MSCI All Country World ex-U.S. Index | | | 21.75% | | | | 5.73% | | | | 11.11% | | | | 7.75% | | | | 5.41% | |

| Blended 80% Russell 1000 Index/20% MSCI All Country World ex-U.S. Index | | | 24.65% | | | | 14.42% | | | | 17.63% | | | | 8.16% | | | | 8.97% | |

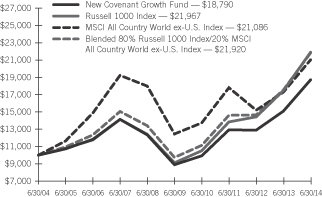

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Growth Fund, versus the Russell 1000 Index, MSCI All Country World ex-U.S. Index and Blended 80% Russell 1000 Index/20% MSCI All Country World ex-U.S. Index.

| | 1 | | For the years ended June 30, 2014. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| | 2 | | This table compares the Fund’s average annual total returns to those of a broad-based index and the Fund’s 80/20 Blended Benchmark, which consists of the Russell 1000 Index and the MSCI All Country World ex-U.S. Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 1 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

NEW COVENANT FUNDS — JUNE 30, 2014

New Covenant Income Fund

I. Objective:

The investment objective of the New Covenant Income Fund (the ‘‘Fund’’) is a high level of current income with preservation of capital.

II. Multi-Manager Approach Statement:

The Fund uses a multi-manager approach, relying on a number of sub-advisers with differing investment approaches to manage portions of the Fund’s portfolio under the general supervision of SEI Investments Management Corporation(‘‘SIMC’’). The Fund utilized the following sub-advisers as of June 30, 2014: Western Asset Management Company, Western Asset Management Company Limited and J.P. Morgan Investment Management Inc.

III. Market Commentary:

Early in the reporting period (mid-2013), global geopolitical concerns, along with comments from the Federal Reserve (Fed) about tapering its accommodative policies, led to increased market uncertainty and volatility. The Fed surprised the market in September 2013 by choosing not to taper its asset purchases, stating that financial conditions were not strong enough to justify tapering. Several months later, in mid-December, the Fed announced it would begin reducing its $85 billion monthly bond purchases by $10 billion per month, while restating its commitment to keeping interest rates low. Since that time, the Fed has continued to taper its bond-buying program, citing sufficient strength in the economy. With this as a backdrop, Treasury yields rose dramatically across the curve in the first half of the period, before recovering in the second half of the period amid slower economic growth and instability in the Middle East and Ukraine. For the year, five-year Treasury yields rose the most (23 basis points), while thirty-year bond yields actually fell by roughly 14 basis points. The five-year Treasury Inflation-Protected Securities (TIPS) breakeven inflation rate, which is the difference in yield between nominal Treasurys and TIPS of similar maturities, widened by almost 30 basis points to 2.1%. As a result, TIPS outperformed their nominal Treasury counterparts.

For the 12 months ending June 30, 2014, the non-Treasury sectors of the U.S. fixed-income market rallied, as investors seemed to view the Federal Reserve’s policy decisions as a sign of improving economic conditions. Despite record corporate issuance, corporate bond

spreads (the difference between corporate bond and Treasury yields) tightened to post-crisis lows, due to low broker-dealer inventories, improving corporate earnings and strong investor demand. Spreads on bank debt also tightened, thanks in part to regulations implemented by the FDIC that were a bit more accommodating than expected, allowing banks to continue improving their capital ratios and asset quality, a trend that should be positive for bondholders. Event risk remained elevated among industrial issuers in our view, as share buybacks and dividend payments (equity-friendly actions financed with debt) continued, and merger-and-acquisition activity picked up. Within non-corporate sub-sectors, sovereigns, foreign agencies and taxable municipals recovered from the selling that took place in mid-2013. Among securitized sectors, commercial mortgage-backed securities (CMBS) benefited from improving fundamentals, as property values increased, and defaults and delinquencies declined. Spreads tightened within agency MBS, as that asset class benefited from continued Fed purchases. Non-agency MBS continued to be supported by attractive risk-adjusted yields relative to other sectors, favorable supply and demand, and improving fundamentals.

IV. Return vs. Benchmark:

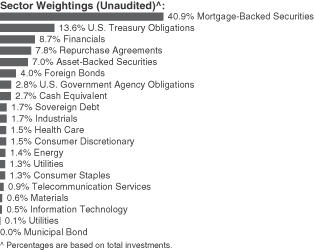

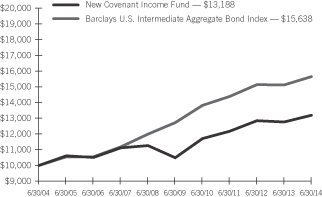

The Fund returned 3.31% for the year ended June 30, 2014, compared to 3.48% for the benchmark, the Barclays U.S. Intermediate Aggregate Bond Index.

V. Fund Attribution:

The Fund’s short duration (J.P. Morgan) and yield-curve flattening (Western) positions added to performance, as intermediate interest rates rose and the yield curve flattened. The Fund’s allocation to non-agency MBS (J.P. Morgan, Western) was a big contributor, as the sector continued to be supported by improving housing fundamentals, strong market conditions and still-attractive valuations. The Fund’s overweight exposure to agency MBS (J.P. Morgan, Western) added to performance, as yield spreads narrowed in the sector thanks to continued Fed purchases and lower overall interest-rate volatility. The Fund’s overweight to financials, particularly bank bonds, also added to relative return, as regulatory reform served to improve banks’ financial health.

| | |

| 2 | | New Covenant Funds / Annual Report / June 30, 2014 |

New Covenant Income Fund

AVERAGE ANNUAL TOTAL RETURN1

| | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | | Annualized

3-Year

Return | | | Annualized

5-Year

Return | | | Annualized

10-Year

Return | | | Annualized

Inception

to Date | |

| New Covenant Income Fund | | | 3.31% | | | | 2.71% | | | | 4.71% | | | | 2.81% | | | | 2.78% | |

| Barclays U.S. Intermediate Aggregate Bond Index | | | 3.48% | | | | 2.86% | | | | 4.23% | | | | 4.57% | | | | 6.51% | |

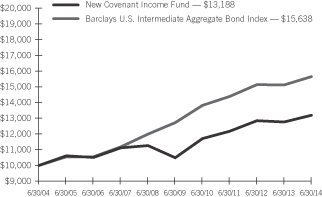

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Income Fund, versus the Barclays U.S. Intermediate Aggregate Bond Index

| | 1 | | For the years ended June 30, 2014. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 3 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

NEW COVENANT FUNDS — JUNE 30, 2014

New Covenant Balanced Growth Fund

I. Objective:

The New Covenant Balanced Growth Fund (the ‘‘Fund’’) seeks to produce capital appreciation with less risk than would be present in a portfolio of only common stocks.

II. Investments in Underlying New Covenant Funds:

The Fund’s assets are managed under the direction of SEI Investments Management Corporation (‘‘SIMC’’), which manages the Fund’s assets in a way that it believes will achieve the Fund’s investment objective. In order to achieve its investment objective, SIMC allocates the Fund’s assets primarily in shares of the New Covenant Growth Fund (the ‘‘Growth Fund’’) and the New Covenant Income Fund (the ‘‘Income Fund), with a majority of its assets generally invested in shares of the Growth Fund. Between 45% and 75% of the Fund’s net assets (with a ‘‘neutral’’ position of approximately 60% of the Fund’s net assets) are invested in shares of the Growth Fund, with the balance of its assets invested in shares of the Income Fund. The Growth and Income Funds, in turn, invest directly in securities in accordance with their own varying investment objectives and policies.

III. Market Commentary:

In equity markets, growth stocks outperformed value stocks for the period, and large companies outperformed small. This performance occurred during an environment in which the Federal Reserve actually started tapering its multi-year stimulus program in late 2013. Belief in an improving economy led to expanding equity multiples and continued outperformance of U.S. stocks over their non-U.S. counterparts. Interest rates within the U.S. started rising in June, which led to defensive, interest rate-sensitive stocks strongly lagging more pro-cyclical areas. The first two quarters of 2014 have been largely characterized by falling real interest rates (interest rates minus the rate of inflation, which tend to be correlated to economic growth) and a surprising decline in the U.S. economy during the first three months of the year. Both of these dynamics helped defensive areas of the market. This notwithstanding, belief in a favorable outlook for the U.S. economy has persisted, which has also helped fuel the returns of deeper cyclical sectors. The best performing sectors over the full 12-month period were industrials, health care, energy and materials, while traditional defensives such as consumer staples and telecommunications were among the worst performers.

Within fixed-income markets, non-Treasurys generally outperformed duration-neutral Treasurys, thanks to global central banks’ accommodative policies. In 2012, the European Central Bank launched two rounds of long-term refinancing operations, which helped alleviate short-term funding pressure in the eurozone. In the U.S., the Federal Reserve (Fed) started a third quantitative-easing program (QE3) to purchase $85 billion of agency mortgage-backed and long-term Treasury securities every month. In addition, economic and corporate fundamentals continued to improve, while inflation in the U.S. remained benign. The housing market experienced a strong recovery, with the S&P/Case-Shiller home-price index up double digits from a year ago. The non-agency mortgage-backed securities (MBS) market saw strong price appreciation over the year, helped by improving credit fundamentals and attractive valuations. Corporations, especially financial companies, have much stronger balance sheets and solid earnings after a few years of de-leveraging. Primary issuance was robust and has been met with strong demand from investors. However, the market turned a corner at the beginning of May 2013, as fear of the Fed tapering QE3 caused interest rates to surge and triggered a broad market selloff. The 10-year Treasury yield rose by 82 basis points and the 30-year Treasury yield increased by 62 basis points from the beginning of May to the end of June. Credit spreads widened across sectors, and fixed-income funds witnessed the largest cash outflow since the beginning of the year. Liquidity suffered, and dealer balance sheets were constrained by new financial regulations. Agency MBS were hit especially hard, as the sharp rise in Treasury yields resulted in significant extension risk and the QE3 uncertainty caused selling from real-estate investment trusts and overseas investors.

IV. Return vs. Benchmark

The Fund returned 15.30% for the year ended June 30, 2014, compared to 16.26% for the benchmark, a 60%/40% blend, respectively, of the Russell 1000 Index and Barclays U.S. Intermediate Aggregate Bond Index.

V. Fund Attribution:

The Fund underperformed its blended benchmark over the one year ending June 30. The Growth Fund drove outperformance in the first quarter of the Fund’s fiscal year, but dragged on performance in the subsequent three quarters. The Income Fund contributed positively

| | |

| 4 | | New Covenant Funds / Annual Report / June 30, 2014 |

during the last three quarters of the Fund’s fiscal year, but the impact was overcome by expenses, a small drag from cash holdings, and the Fund’s larger strategic weight in the Growth Fund. Both of the underlying Funds underperformed their benchmarks after fees over the full year. The Growth Fund returned 24.18%, while its benchmark, the Russell 1000 Index, returned 25.35%. The Income Fund returned 3.31%, while its benchmark, the Barclays Intermediate Aggregate Bond Index, returned 3.48%. Within the Growth Fund, performance was mainly driven by allocation effects. Underweights to the more defensive telecommunications and utilities sectors added value, as did an overweight to materials. An overweight to consumer discretionary was the largest allocation-related detractor. Stock selection was best within materials and industrials, and most challenged in consumer discretionary and staples. Within the Income Fund, the Fund’s short-duration and yield-curve flattening positions added to performance, as intermediate interest rates rose and the yield curve flattened. The Fund’s allocation to non-agency MBS was a big contributor, as the sector continued to be supported by improving housing fundamentals, strong market conditions and still-attractive valuations. The Fund’s overweight exposure to agency MBS added to performance, as yield spreads narrowed in the sector thanks to continued Fed purchases and lower overall interest-rate volatility. The Fund’s overweight to financials, particularly bank bonds, also added to relative return, as regulatory reform served to improve banks’ financial health.

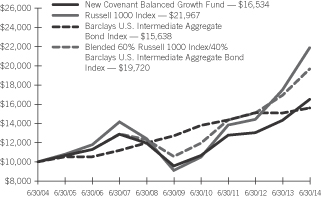

New Covenant Balanced Growth Fund

AVERAGE ANNUAL TOTAL RETURN1,2

| | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | | Annualized

3-Year

Return | | | Annualized

5-Year

Return | | | Annualized

10-Year

Return | | | Annualized

Inception to Date | |

| New Covenant Balanced Growth Fund | | | 15.30% | | | | 8.91% | | | | 11.55% | | | | 5.16% | | | | 5.12% | |

| Russell 1000 Index | | | 25.35% | | | | 16.63% | | | | 19.25% | | | | 8.19% | | | | 10.34% | |

| Barclays U.S. Intermediate Aggregate Bond Index | | | 3.48% | | | | 2.86% | | | | 4.23% | | | | 4.57% | | | | 6.53% | |

| Blended 60% Russell 1000 Index/40% Barclays U.S. Intermediate Aggregate Bond Index | | | 16.26% | | | | 11.14% | | | | 13.28% | | | | 7.03% | | | | 9.09% | |

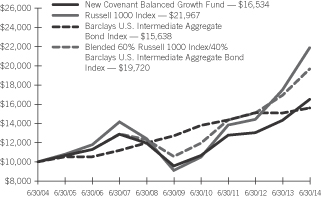

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Balanced Growth Fund, versus the Russell 1000 Index, Barclays U.S. Intermediate Aggregate Bond Index and Blended 60% Russell 1000 Index/40% Barclays U.S. Intermediate Aggregate Bond Index.

| | 1 | | For the years ended June 30, 2014. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| | 2 | | This table compares the Fund’s average annual total returns to those of a broad-based index and the Fund’s 60/40 Blended Benchmark, which consists of the Russell 1000 Index and the Barclays U.S. Intermediate Aggregate Bond Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 5 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

NEW COVENANT FUNDS — JUNE 30, 2014

New Covenant Balanced Income Fund

I. Objective:

The New Covenant Balanced Income Fund (the ‘‘Fund’’) seeks to produce current income and long-term growth of capital.

II. Investment in Underlying New Covenant Funds:

The Fund’s assets are managed under the direction of SEI Investments Management Corporation (‘‘SIMC’’), which manages the Fund’s assets in a way that it believes will achieve the Fund’s investment objective. In order to achieve its investment objective, SIMC allocates the Fund’s assets primarily in shares of the New Covenant Growth Fund (the ‘‘Growth Fund’’) and the New Covenant Income Fund (the ‘‘Income Fund), with a majority of its assets generally invested in shares of the Income Fund. Between 50% and 75% of the Fund’s net assets (with a neutral position of approximately 65%) are invested in shares of the Income Fund, with the balance of its nets assets invested in shares of the Growth Fund. The Growth and Income Funds, in turn, invest directly in securities in accordance with their own varying investment objectives and policies.

III. Market Commentary:

Within fixed-income markets, non-Treasurys generally outperformed duration-neutral Treasurys, thanks to global central banks’ accommodative policies. In 2012, the European Central Bank launched two rounds of long-term refinancing operations, which helped alleviate short-term funding pressure in the eurozone. In the U.S., the Federal Reserve (Fed) started a third quantitative-easing program (QE3) to purchase $85 billion of agency mortgage-backed and long-term Treasury securities every month. In addition, economic and corporate fundamentals continued to improve, while inflation in the U.S. remained benign. The housing market experienced a strong recovery, with the S&P/Case-Shiller home-price index up double digits from a year ago. The non-agency mortgage-backed securities (MBS) market saw strong price appreciation over the year, helped by improving credit fundamentals and attractive valuations. Corporations, especially financial companies, have much stronger balance sheets and solid earnings after a few years of de-leveraging. Primary issuance was robust and has been met with strong demand from investors. However, the market turned a corner at the beginning of May 2013, as fear of the Fed tapering QE3 caused interest rates to surge and

triggered a broad market selloff. The 10-year Treasury yield rose by 82 basis points and the 30-year Treasury yield increased by 62 basis points from the beginning of May to the end of June. Credit spreads widened across sectors, and fixed-income funds witnessed the largest cash outflow since the beginning of the year. Liquidity suffered, and dealer balance sheets were constrained by new financial regulations. Agency MBS were hit especially hard, as the sharp rise in Treasury yields resulted in significant extension risk and the QE3 uncertainty caused selling from real-estate investment trusts and overseas investors. In equity markets, growth stocks outperformed value stocks for the period, and large companies outperformed small. This performance occurred during an environment in which the Federal Reserve actually started tapering its multi-year stimulus program in late 2013. Belief in an improving economy led to expanding equity multiples and continued outperformance of U.S. stocks over their non-U.S. counterparts. Interest rates within the U.S. started rising in June, which led to defensive, interest rate-sensitive stocks strongly lagging more pro-cyclical areas. The first two quarters of 2014 have been largely characterized by falling real interest rates (interest rates minus the rate of inflation, which tend to be correlated to economic growth) and a surprising decline in the U.S. economy during the first three months of the year. Both of these dynamics helped defensive areas of the market. This notwithstanding, belief in a favorable outlook for the U.S. economy has persisted, which has also helped fuel the returns of deeper cyclical sectors. The best performing sectors over the full 12-month period were industrials, health care, energy and materials, while traditional defensives such as consumer staples and telecommunications were among the worst performers.

IV. Return vs. Benchmark:

The Fund returned 10.01% for the year ended June 30, 2014, compared to 10.81% for the secondary benchmark, a 65%/35% blend, respectively, of the Barclays U.S. Intermediate Aggregate Bond Index and Russell 1000 Index.

V. Fund Attribution:

The Fund underperformed its blended benchmark over the one year ending June 30. The Growth Fund drove outperformance in the first quarter of the Fund’s fiscal year, but dragged on performance in the subsequent three quarters. The Income Fund contributed positively during the last three quarters of the Fund’s fiscal year, but the impact

| | |

| 6 | | New Covenant Funds / Annual Report / June 30, 2014 |

was overcome by expenses, a small drag from cash holdings, and the Fund’s allocation to the Growth Fund. Both of the underlying Funds underperformed their benchmarks after fees over the full year. The Income Fund returned 3.31%, while its benchmark, the Barclays Intermediate Aggregate Bond Index, returned 3.48%. The Growth Fund returned 24.18%, while its benchmark, the Russell 1000 Index, returned 25.35%. Within the Income Fund, the Fund’s short-duration and yield-curve flattening positions added to performance, as intermediate interest rates rose and the yield curve flattened. The Fund’s allocation to non-agency MBS was a big contributor, as the sector continued to be supported by improving housing fundamentals, strong market conditions and still-attractive valuations. The Fund’s overweight exposure to agency MBS added to performance, as yield spreads narrowed in the sector thanks to continued Fed purchases and lower overall interest-rate volatility. The Fund’s overweight to financials, particularly bank bonds, also added to relative return, as regulatory reform served to improve banks’ financial health. Within the Growth Fund, performance was mainly driven by allocation effects. Underweights to the more defensive telecommunications and utilities sectors added value, as did an overweight to materials. An overweight to consumer discretionary was the largest allocation-related detractor. Stock selection was best within materials and industrials, and most challenged in consumer discretionary and staples.

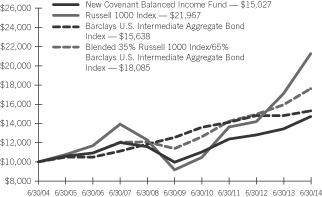

New Covenant Balanced Income Fund

AVERAGE ANNUAL TOTAL RETURN1,2

| | | | | | | | | | | | | | | | | | | | |

| | | One Year

Return | | | Annualized

3-Year

Return | | | Annualized

5-Year

Return | | | Annualized

10-Year

Return | | | Annualized

Inception

to Date | |

| New Covenant Balanced Income Fund | | | 10.01% | | | | 6.22% | | | | 8.57% | | | | 4.16% | | | | 4.01% | |

| Russell 1000 Index | | | 25.35% | | | | 16.63% | | | | 19.25% | | | | 8.19% | | | | 9.74% | |

Barclays U.S. Intermediate Aggregate Bond Index | | | 3.48% | | | | 2.86% | | | | 4.23% | | | | 4.57% | | | | 6.31% | |

Blended 35% Russell 1000 Index/65% Barclays U.S. Intermediate Aggregate Bond Index | | | 10.81% | | | | 7.69% | | | | 9.52% | | | | 6.10% | | | | 7.77% | |

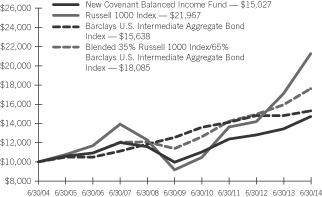

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Balanced Income Fund, versus the Russell 1000 Index, Barclays U.S. Intermediate Aggregate Bond Index and Blended 35% Russell 1000 Index/65% Barclays U.S. Intermediate Aggregate Bond Index.

| | 1 | | For the years ended June 30, 2014. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| | 2 | | This table compares the Fund’s average annual total returns to those of a broad-based index and the Fund’s 35/65 Blended Benchmark, which consists of the Russell 1000 Index and the Barclays U.S. Intermediate Aggregate Bond Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 7 | |

SCHEDULE OF INVESTMENTS

New Covenant Growth Fund

June 30, 2014

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

|

COMMON STOCK — 98.5% | |

|

Canada — 2.2% | |

Canadian Natural Resources | | | 75,785 | | | $ | 3,479 | |

Canadian Pacific Railway | | | 31,863 | | | | 5,771 | |

Catamaran* | | | 1,804 | | | | 80 | |

Thomson Reuters | | | 3,958 | | | | 144 | |

| | | | | | | | |

| | | | | | | 9,474 | |

| | | | | | | | |

|

France — 1.0% | |

Sanofi ADR | | | 75,249 | | | | 4,001 | |

| | | | | | | | |

|

Germany — 0.6% | |

SAP ADR | | | 35,391 | | | | 2,725 | |

| | | | | | | | |

|

Hong Kong — 1.1% | |

China Mobile ADR | | | 95,990 | | | | 4,666 | |

| | | | | | | | |

|

Ireland — 3.1% | |

Accenture, Cl A | | | 1,420 | | | | 115 | |

Covidien | | | 521 | | | | 47 | |

Eaton | | | 2,465 | | | | 190 | |

Mallinckrodt* | | | 65 | | | | 6 | |

Pentair | | | 45,704 | | | | 3,296 | |

Perrigo | | | 14,484 | | | | 2,111 | |

Seagate Technology | | | 51,356 | | | | 2,918 | |

Shire ADR | | | 18,969 | | | | 4,467 | |

| | | | | | | | |

| | | | | | | 13,150 | |

| | | | | | | | |

|

Israel — 0.4% | |

Check Point Software Technologies* | | | 27,937 | | | | 1,873 | |

| | | | | | | | |

|

Japan — 1.6% | |

Toyota Motor ADR | | | 56,407 | | | | 6,750 | |

| | | | | | | | |

|

Netherlands — 0.0% | |

Chicago Bridge & Iron | | | 509 | | | | 35 | |

QIAGEN* | | | 1,417 | | | | 34 | |

| | | | | | | | |

| | | | | | | 69 | |

| | | | | | | | |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

|

Norway — 0.1% | |

Seadrill | | | 4,420 | | | $ | 177 | |

| | | | | | | | |

|

Sweden — 0.0% | |

Allied World Assurance Holdings | | | 102 | | | | 4 | |

| | | | | | | | |

|

Switzerland — 0.4% | |

Novartis ADR | | | 19,513 | | | | 1,766 | |

| | | | | | | | |

|

United Kingdom — 2.2% | |

Aon | | | 39,702 | | | | 3,577 | |

BP ADR | | | 107,146 | | | | 5,652 | |

| | | | | | | | |

| | | | | | | 9,229 | |

| | | | | | | | |

|

United States — 85.8% | |

Consumer Discretionary — 16.5% | |

Amazon.com* | | | 13,588 | | | | 4,413 | |

Cablevision Systems, Cl A | | | 5,421 | | | | 96 | |

CBS, Cl B | | | 60,041 | | | | 3,731 | |

Charter Communications, Cl A* | | | 9,078 | | | | 1,438 | |

Chipotle Mexican Grill, Cl A* | | | 2,793 | | | | 1,655 | |

Comcast, Cl A | | | 54,341 | | | | 2,917 | |

Delphi Automotive | | | 26,453 | | | | 1,819 | |

Dillard’s, Cl A | | | 18,819 | | | | 2,194 | |

DIRECTV* | | | 23,551 | | | | 2,002 | |

Ford Motor | | | 102,320 | | | | 1,764 | |

Gannett | | | 313 | | | | 10 | |

General Motors | | | 163,148 | | | | 5,922 | |

Gentex | | | 172 | | | | 5 | |

Genuine Parts | | | 256 | | | | 23 | |

Harley-Davidson | | | 48,795 | | | | 3,409 | |

Harman International Industries | | | 72 | | | | 8 | |

Hilton Worldwide Holdings* | | | 3,198 | | | | 75 | |

Home Depot | | | 27,451 | | | | 2,223 | |

Hyatt Hotels, Cl A* | | | 47 | | | | 3 | |

Jarden* | | | 2,799 | | | | 166 | |

Johnson Controls | | | 606 | | | | 30 | |

L Brands | | | 248 | | | | 15 | |

Lennar, Cl A | | | 1,057 | | | | 44 | |

Liberty Interactive, Cl A* | | | 1,140 | | | | 34 | |

Liberty Media* | | | 249 | | | | 34 | |

Lowe’s | | | 101,631 | | | | 4,877 | |

Macy’s | | | 19 | | | | 1 | |

Marriott International, Cl A | | | 4,311 | | | | 276 | |

Mattel | | | 2,653 | | | | 103 | |

McDonald’s | | | 2,429 | | | | 245 | |

McGraw Hill Financial | | | 2,414 | | | | 200 | |

Michael Kors Holdings* | | | 492 | | | | 43 | |

Mohawk Industries* | | | 490 | | | | 68 | |

News* | | | 1,689 | | | | 30 | |

NIKE, Cl B | | | 3,851 | | | | 299 | |

Panera Bread, Cl A* | | | 60 | | | | 9 | |

Polaris Industries | | | 76 | | | | 10 | |

priceline.com* | | | 60 | | | | 72 | |

| | |

| 8 | | New Covenant Funds / Annual Report / June 30, 2014 |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

PulteGroup | | | 443 | | | $ | 9 | |

Ross Stores | | | 363 | | | | 24 | |

Signet Jewelers | | | 454 | | | | 50 | |

Starbucks | | | 44,305 | | | | 3,428 | |

Starwood Hotels & Resorts Worldwide | | | 44,166 | | | | 3,569 | |

Target | | | 35,770 | | | | 2,073 | |

Tesla Motors* | | | 534 | | | | 128 | |

Time Warner | | | 1,084 | | | | 76 | |

Time Warner Cable | | | 16,549 | | | | 2,438 | |

TJX | | | 2,696 | | | | 143 | |

Tribune* | | | 25,799 | | | | 2,193 | |

TripAdvisor* | | | 6,000 | | | | 652 | |

Tupperware Brands | | | 2,785 | | | | 233 | |

Twenty-First Century Fox | | | 100,004 | | | | 3,423 | |

Twenty-First Century Fox, Cl A | | | 5,700 | | | | 200 | |

Walt Disney | | | 58,906 | | | | 5,050 | |

Wyndham Worldwide | | | 3,292 | | | | 249 | |

Yum! Brands | | | 78,854 | | | | 6,403 | |

| | | | | | | | |

| | | | | | | 70,604 | |

| | | | | | | | |

Consumer Staples — 5.5% | | | | | | | | |

Archer-Daniels-Midland | | | 3,910 | | | | 172 | |

Avon Products | | | 13,860 | | | | 202 | |

Bunge | | | 1,900 | | | | 144 | |

Campbell Soup | | | 2,864 | | | | 131 | |

Church & Dwight | | | 3,466 | | | | 242 | |

Clorox | | | 2,741 | | | | 251 | |

Coca-Cola | | | 7,544 | | | | 320 | |

Coca-Cola Enterprises | | | 3,360 | | | | 161 | |

Colgate-Palmolive | | | 71,546 | | | | 4,878 | |

ConAgra Foods | | | 4,128 | | | | 122 | |

Costco Wholesale | | | 17,518 | | | | 2,017 | |

Coty, Cl A | | | 14,701 | | | | 252 | |

Dr. Pepper Snapple Group | | | 2,621 | | | | 153 | |

Energizer Holdings | | | 1,500 | | | | 183 | |

Estee Lauder, Cl A | | | 3,658 | | | | 272 | |

Flowers Foods | | | 5,820 | | | | 123 | |

General Mills | | | 3,656 | | | | 192 | |

Hershey | | | 1,759 | | | | 171 | |

Hillshire Brands | | | 4,379 | | | | 273 | |

Hormel Foods | | | 3,334 | | | | 165 | |

Ingredion | | | 2,197 | | | | 165 | |

JM Smucker | | | 1,311 | | | | 140 | |

Kellogg | | | 2,537 | | | | 167 | |

Keurig Green Mountain | | | 1,309 | | | | 163 | |

Kimberly-Clark | | | 1,854 | | | | 206 | |

Kraft Foods Group | | | 3,280 | | | | 197 | |

Kroger | | | 5,511 | | | | 272 | |

McCormick | | | 1,682 | | | | 120 | |

Mead Johnson Nutrition, Cl A | | | 25,522 | | | | 2,378 | |

Mondelez International, Cl A | | | 5,803 | | | | 218 | |

Monster Beverage* | | | 2,325 | | | | 165 | |

Nu Skin Enterprises, Cl A | | | 2,709 | | | | 200 | |

PepsiCo | | | 4,205 | | | | 376 | |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

Procter & Gamble | | | 5,469 | | | $ | 430 | |

Safeway | | | 4,969 | | | | 171 | |

Sprouts Farmers Market* | | | 5,804 | | | | 190 | |

Sysco | | | 4,724 | | | | 177 | |

Tyson Foods, Cl A | | | 5,401 | | | | 203 | |

Walgreen | | | 2,793 | | | | 207 | |

Wal-Mart Stores | | | 38,676 | | | | 2,903 | |

WhiteWave Foods, Cl A* | | | 4,030 | | | | 130 | |

Whole Foods Market | | | 88,986 | | | | 3,438 | |

| | | | | | | | |

| | | | | | | 23,040 | |

| | | | | | | | |

Energy — 8.1% | | | | | | | | |

Anadarko Petroleum | | | 2,042 | | | | 223 | |

Apache | | | 36,363 | | | | 3,659 | |

Cabot Oil & Gas | | | 44,380 | | | | 1,515 | |

Cameron International* | | | 235 | | | | 16 | |

Chevron | | | 27,086 | | | | 3,536 | |

ConocoPhillips | | | 1,362 | | | | 117 | |

EOG Resources | | | 2,434 | | | | 284 | |

Exxon Mobil | | | 5,701 | | | | 574 | |

Halliburton | | | 53,030 | | | | 3,766 | |

Hess | | | 25,219 | | | | 2,494 | |

Kinder Morgan | | | 853 | | | | 31 | |

Kosmos Energy* | | | 15,744 | | | | 177 | |

MarkWest Energy Partners | | | 26,009 | | | | 1,862 | |

Noble Energy | | | 51,584 | | | | 3,996 | |

Occidental Petroleum | | | 26,726 | | | | 2,743 | |

Phillips 66 | | | 47,234 | | | | 3,799 | |

Schlumberger | | | 47,826 | | | | 5,641 | |

Spectra Energy | | | 845 | | | | 36 | |

Ultra Petroleum* | | | 1,421 | | | | 42 | |

Williams | | | 764 | | | | 44 | |

| | | | | | | | |

| | | | | | | 34,555 | |

| | | | | | | | |

Financials — 17.1% | | | | | | | | |

ACE | | | 13,346 | | | | 1,384 | |

American Express | | | 51,316 | | | | 4,868 | |

American International Group | | | 81,153 | | | | 4,429 | |

American Tower, Cl A‡ | | | 2,665 | | | | 240 | |

Ameriprise Financial | | | 295 | | | | 35 | |

Arch Capital Group* | | | 558 | | | | 32 | |

Axis Capital Holdings | | | 3,078 | | | | 136 | |

Bank of America | | | 552,413 | | | | 8,491 | |

Bank of New York Mellon | | | 1,615 | | | | 60 | |

BB&T | | | 906 | | | | 36 | |

Berkshire Hathaway, Cl B* | | | 40,615 | | | | 5,140 | |

BlackRock, Cl A | | | 504 | | | | 161 | |

Blackstone Group LP | | | 72,764 | | | | 2,433 | |

Boston Properties‡ | | | 97 | | | | 11 | |

Capital One Financial | | | 2,466 | | | | 204 | |

Charles Schwab | | | 7,975 | | | | 215 | |

Chubb | | | 1,345 | | | | 124 | |

Citigroup | | | 205,174 | | | | 9,664 | |

Crown Castle International‡ | | | 2,550 | | | | 189 | |

Discover Financial Services | | | 435 | | | | 27 | |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 9 | |

SCHEDULE OF INVESTMENTS

New Covenant Growth Fund (Continued)

June 30, 2014

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

Equity Residential‡ | | | 2,092 | | | $ | 132 | |

Erie Indemnity, Cl A | | | 25 | | | | 2 | |

Everest Re Group | | | 226 | | | | 36 | |

Fidelity National Financial, Cl A | | | 247 | | | | 8 | |

Forest City Enterprises, Cl A* | | | 179 | | | | 4 | |

General Growth Properties‡ | | | 246 | | | | 6 | |

Goldman Sachs Group | | | 673 | | | | 113 | |

Hartford Financial Services Group | | | 50,395 | | | | 1,805 | |

Hatteras Financial‡ | | | 95,538 | | | | 1,892 | |

HCP‡ | | | 2,081 | | | | 86 | |

JPMorgan Chase | | | 128,581 | | | | 7,409 | |

KKR LP | | | 76,400 | | | | 1,859 | |

Leucadia National | | | 4,980 | | | | 130 | |

Lincoln National | | | 44,253 | | | | 2,276 | |

Loews | | | 544 | | | | 24 | |

Marsh & McLennan | | | 713 | | | | 37 | |

MetLife | | | 117,755 | | | | 6,543 | |

Morgan Stanley | | | 5,222 | | | | 169 | |

Navient | �� | | 686 | | | | 12 | |

Northern Trust | | | 204 | | | | 13 | |

PartnerRe | | | 316 | | | | 35 | |

Plum Creek Timber‡ | | | 149 | | | | 7 | |

PNC Financial Services Group | | | 684 | | | | 61 | |

ProLogis‡ | | | 596 | | | | 24 | |

Prudential Financial | | | 632 | | | | 56 | |

Santander Consumer USA Holdings | | | 30,000 | | | | 583 | |

Simon Property Group‡ | | | 1,047 | | | | 174 | |

SLM | | | 686 | | | | 6 | |

State Street | | | 48,284 | | | | 3,248 | |

SunTrust Banks | | | 39,686 | | | | 1,590 | |

Two Harbors Investment‡ | | | 156,665 | | | | 1,642 | |

US Bancorp | | | 2,716 | | | | 117 | |

Vornado Realty Trust‡ | | | 1,113 | | | | 119 | |

Washington Prime Group‡* | | | 524 | | | | 10 | |

Wells Fargo | | | 83,424 | | | | 4,385 | |

White Mountains Insurance Group | | | 41 | | | | 25 | |

| | | | | | | | |

| | | | | | | 72,517 | |

| | | | | | | | |

Health Care — 6.4% | | | | | | | | |

Abbott Laboratories | | | 1,908 | | | | 78 | |

AbbVie | | | 1,789 | | | | 101 | |

Alexion Pharmaceuticals* | | | 14,678 | | | | 2,294 | |

Amgen | | | 25,770 | | | | 3,050 | |

Baxter International | | | 881 | | | | 64 | |

Biogen Idec* | | | 8,187 | | | | 2,582 | |

Bristol-Myers Squibb | | | 58,196 | | | | 2,823 | |

Celgene* | | | 1,040 | | | | 89 | |

Cerner* | | | 65,352 | | | | 3,371 | |

DENTSPLY International | | | 183 | | | | 8 | |

Eli Lilly | | | 1,831 | | | | 114 | |

Express Scripts Holding* | | | 2,785 | | | | 193 | |

Gilead Sciences* | | | 1,908 | | | | 158 | |

HCA Holdings* | | | 3,556 | | | | 201 | |

Intuitive Surgical* | | | 44 | | | | 18 | |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

Johnson & Johnson | | | 2,724 | | | $ | 285 | |

Medtronic | | | 561 | | | | 36 | |

Merck | | | 58,395 | | | | 3,378 | |

Mettler-Toledo International* | | | 42 | | | | 11 | |

Mylan* | | | 480 | | | | 25 | |

Pfizer | | | 117,685 | | | | 3,493 | |

Regeneron Pharmaceuticals* | | | 7,328 | | | | 2,070 | |

Thermo Fisher Scientific | | | 1,016 | | | | 120 | |

UnitedHealth Group | | | 1,054 | | | | 86 | |

WellPoint | | | 24,878 | | | | 2,677 | |

| | | | | | | | |

| | | | | | | 27,325 | |

| | | | | | | | |

Industrials — 8.5% | | | | | | | | |

ADT | | | 195 | | | | 7 | |

American Airlines Group* | | | 35,205 | | | | 1,512 | |

AMETEK | | | 314 | | | | 16 | |

Armstrong World Industries* | | | 462 | | | | 27 | |

Avis Budget Group* | | | 2,511 | | | | 150 | |

Caterpillar | | | 16,790 | | | | 1,825 | |

Cintas | | | 551 | | | | 35 | |

CSX | | | 1,434 | | | | 44 | |

Cummins | | | 18,498 | | | | 2,854 | |

Danaher | | | 2,292 | | | | 181 | |

Deere | | | 1,846 | | | | 167 | |

Delta Air Lines | | | 67,641 | | | | 2,619 | |

Dover | | | 243 | | | | 22 | |

Emerson Electric | | | 744 | | | | 49 | |

Fastenal | | | 73,605 | | | | 3,643 | |

FedEx | | | 224 | | | | 34 | |

Flowserve | | | 32,281 | | | | 2,400 | |

Generac Holdings* | | | 23,998 | | | | 1,170 | |

General Electric | | | 157,892 | | | | 4,149 | |

HD Supply Holdings* | | | 3,669 | | | | 104 | |

Hertz Global Holdings* | | | 53,043 | | | | 1,487 | |

Honeywell International | | | 2,483 | | | | 231 | |

IHS, Cl A* | | | 64 | | | | 8 | |

Joy Global | | | 34,317 | | | | 2,113 | |

Kansas City Southern | | | 20,771 | | | | 2,233 | |

Masco | | | 4,598 | | | | 102 | |

Nielsen Holdings | | | 42,672 | | | | 2,066 | |

Norfolk Southern | | | 429 | | | | 44 | |

PACCAR | | | 497 | | | | 31 | |

Pall | | | 38,725 | | | | 3,307 | |

Parker Hannifin | | | 11,104 | | | | 1,396 | |

Precision Castparts | | | 759 | | | | 192 | |

Republic Services, Cl A | | | 692 | | | | 26 | |

Stanley Black & Decker | | | 1,500 | | | | 132 | |

Towers Watson, Cl A | | | 74 | | | | 8 | |

TransDigm Group | | | 918 | | | | 153 | |

Triumph Group | | | 119 | | | | 8 | |

Union Pacific | | | 2,242 | | | | 224 | |

United Continental Holdings* | | | 579 | | | | 24 | |

United Parcel Service, Cl B | | | 2,448 | | | | 251 | |

United Technologies | | | 2,323 | | | | 268 | |

| | |

| 10 | | New Covenant Funds / Annual Report / June 30, 2014 |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

URS | | | 102 | | | $ | 5 | |

Waste Management | | | 3,917 | | | | 175 | |

Xylem | | | 232 | | | | 9 | |

| | | | | | | | |

| | | | | | | 35,501 | |

| | | | | | | | |

Information Technology — 16.9% | | | | | | | | |

Activision Blizzard | | | 97,181 | | | | 2,167 | |

Adobe Systems* | | | 61,559 | | | | 4,454 | |

Alliance Data Systems* | | | 5,252 | | | | 1,477 | |

ANSYS* | | | 120 | | | | 9 | |

Apple | | | 33,632 | | | | 3,126 | |

Applied Materials | | | 348,189 | | | | 7,852 | |

Autodesk* | | | 35,253 | | | | 1,988 | |

Automatic Data Processing | | | 53,725 | | | | 4,259 | |

CA | | | 799 | | | | 23 | |

Cisco Systems | | | 225,827 | | | | 5,612 | |

Citrix Systems* | | | 245 | | | | 15 | |

Cognizant Technology Solutions, Cl A* | | | 496 | | | | 24 | |

Corning | | | 2,041 | | | | 45 | |

eBay* | | | 63,875 | | | | 3,198 | |

Equinix* | | | 18,962 | | | | 3,984 | |

F5 Networks* | | | 1,214 | | | | 135 | |

Facebook, Cl A* | | | 2,084 | | | | 140 | |

Freescale Semiconductor* | | | 6,600 | | | | 155 | |

Gartner* | | | 127 | | | | 9 | |

Genpact* | | | 1,342 | | | | 23 | |

Google, Cl A* | | | 282 | | | | 165 | |

Google, Cl C* | | | 9,335 | | | | 5,370 | |

Hewlett-Packard | | | 5,681 | | | | 191 | |

Intel | | | 11,456 | | | | 354 | |

International Business Machines | | | 1,647 | | | | 299 | |

Intuit | | | 314 | | | | 25 | |

Juniper Networks* | | | 693 | | | | 17 | |

Knowles* | | | 121 | | | | 4 | |

LinkedIn, Cl A* | | | 16,256 | | | | 2,787 | |

Marvell Technology Group | | | 1,401 | | | | 20 | |

Mastercard, Cl A | | | 45,186 | | | | 3,320 | |

MICROS Systems* | | | 105 | | | | 7 | |

Microsoft | | | 72,103 | | | | 3,007 | |

NetApp | | | 456 | | | | 17 | |

Oracle | | | 9,616 | | | | 390 | |

Paychex | | | 615 | | | | 26 | |

QUALCOMM | | | 48,603 | | | | 3,849 | |

Red Hat* | | | 213 | | | | 12 | |

Salesforce.com* | | | 53,030 | | | | 3,080 | |

SanDisk | | | 310 | | | | 32 | |

Solera Holdings | | | 92 | | | | 6 | |

Symantec | | | 982 | | | | 23 | |

Teradata* | | | 2,906 | | | | 117 | |

Texas Instruments | | | 58,638 | | | | 2,802 | |

Total System Services | | | 458 | | | | 14 | |

Visa, Cl A | | | 23,915 | | | | 5,039 | |

Western Digital | | | 23,740 | | | | 2,191 | |

| | | | | | | | |

| | | | | | | 71,859 | |

| | | | | | | | |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

Materials — 5.6% | | | | | | | | |

Air Products & Chemicals | | | 274 | | | $ | 35 | |

Ball | | | 3,167 | | | | 198 | |

Crown Holdings* | | | 2,386 | | | | 119 | |

Dow Chemical | | | 128,372 | | | | 6,606 | |

E.I. du Pont de Nemours | | | 2,731 | | | | 179 | |

Ecolab | | | 33,559 | | | | 3,736 | |

Freeport-McMoRan Copper & Gold | | | 4,726 | | | | 172 | |

International Paper | | | 1,686 | | | | 85 | |

Louisiana-Pacific* | | | 99,718 | | | | 1,498 | |

LyondellBasell Industries, Cl A | | | 20,797 | | | | 2,031 | |

MeadWestvaco | | | 694 | | | | 31 | |

Monsanto | | | 31,309 | | | | 3,906 | |

Packaging Corp of America | | | 50 | | | | 4 | |

PPG Industries | | | 9,418 | | | | 1,979 | |

Reliance Steel & Aluminum | | | 35,696 | | | | 2,631 | |

Sherwin-Williams | | | 97 | | | | 20 | |

Sonoco Products | | | 320 | | | | 14 | |

Southern Copper | | | 4,104 | | | | 125 | |

Vulcan Materials | | | 947 | | | | 60 | |

| | | | | | | | |

| | | | | | | 23,429 | |

| | | | | | | | |

Telecommunication Services — 1.0% | | | | | | | | |

AT&T | | | 8,443 | | | | 298 | |

CenturyLink | | | 554 | | | | 20 | |

Verizon Communications | | | 90,787 | | | | 4,442 | |

Windstream Holdings | | | 1,862 | | | | 19 | |

| | | | | | | | |

| | | | | | | 4,779 | |

| | | | | | | | |

Utilities — 0.2% | | | | | | | | |

Dominion Resources | | | 2,840 | | | | 203 | |

Duke Energy | | | 2,553 | | | | 189 | |

Entergy | | | 232 | | | | 19 | |

Exelon | | | 3,536 | | | | 129 | |

FirstEnergy | | | 225 | | | | 8 | |

NextEra Energy | | | 541 | | | | 56 | |

Northeast Utilities | | | 406 | | | | 19 | |

PG&E | | | 1,643 | | | | 79 | |

Southern | | | 3,498 | | | | 159 | |

Xcel Energy | | | 243 | | | | 8 | |

| | | | | | | | |

| | | | | | | 869 | |

| | | | | | | | |

| | | | | | | 364,478 | |

| | | | | | | | |

Total Common Stock

(Cost $340,509) ($ Thousands) | | | | | | | 418,362 | |

| | | | | | | | |

| | |

CASH EQUIVALENT — 1.1% | | | | | | | | |

SEI Daily Income Trust, Prime

Obligation Fund, Cl A 0.010%†** | | | 4,580,336 | | | | 4,580 | |

| | | | | | | | |

Total Cash Equivalent

(Cost $4,580) ($ Thousands) | | | | | | | 4,580 | |

| | | | | | | | |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 11 | |

SCHEDULE OF INVESTMENTS

New Covenant Growth Fund (Concluded)

June 30, 2014

| | | | | | | | | | | | |

| Description | | | | | Face Amount

(Thousands)(1) | | | Market Value

($ Thousands) | |

| | | |

TIME DEPOSITS — 0.3% | | | | | | | | | | | | |

Brown Brothers Harriman | | | | | | | | | | | | |

0.030%, 07/01/2014 | | | | | | | 1,376 | | | $ | 1,376 | |

0.005%, 07/01/2014 | | | JPY | | | | 132 | | | | 1 | |

| | | | | | | | | | | | |

Total Time Deposits

(Cost $1,377) ($ Thousands) | | | | | | | | | | | 1,377 | |

| | | | | | | | | | | | |

Total Investments — 99.9%

(Cost $346,466) ($ Thousands) | | | $ | 424,319 | |

| | | | | | | | | | | | |

Percentages are based on a Net Assets of $424,852 ($ Thousands).

| * | | Non-income producing security. |

| ** | | The rate reported is the 7-day effective yield as of June 30, 2014. |

| † | | Investment in Affiliated Security (see Note 3). |

| ‡ | | Real Estate Investment Trust |

| (1) | | In U.S. Dollars unless otherwise indicated. |

ADR — American Depositary Receipt

Cl — Class

JPY — Japanese Yen

LP — Limited Partnership

As of June 30, 2014, all of the Fund’s investments were considered Level 1, i in accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended June 30, 2014, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the year ended June 30, 2014, there were no transfers between Level 2 and Level 3 assets and liabilites.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| | |

| 12 | | New Covenant Funds / Annual Report / June 30, 2014 |

SCHEDULE OF INVESTMENTS

New Covenant Income Fund

June 30, 2014

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

|

MORTGAGE-BACKED SECURITIES — 43.6% | |

|

Agency Mortgage-Backed Obligations — 35.0% | |

FHLMC | | | | | | | | |

6.500%, 09/01/2039 | | $ | 151 | | | $ | 170 | |

5.500%, 12/01/2036 | | | 188 | | | | 210 | |

5.500%, 08/01/2038 | | | 148 | | | | 165 | |

5.500%, 11/01/2038 | | | 139 | | | | 155 | |

5.500%, 12/01/2038 | | | 702 | | | | 787 | |

5.000%, 12/01/2020 | | | 363 | | | | 392 | |

5.000%, 05/01/2022 | | | 159 | | | | 172 | |

5.000%, 04/01/2024 | | | 148 | | | | 162 | |

5.000%, 08/01/2038 | | | 45 | | | | 50 | |

5.000%, 03/01/2039 | | | 39 | | | | 43 | |

5.000%, 02/01/2040 | | | 592 | | | | 657 | |

4.006%, 07/01/2040 (A) | | | 363 | | | | 387 | |

4.000%, 09/01/2040 | | | 157 | | | | 166 | |

4.000%, 04/01/2043 | | | 192 | | | | 203 | |

4.000%, 06/01/2043 | | | 98 | | | | 104 | |

4.000%, 06/01/2043 | | | 98 | | | | 104 | |

4.000%, 07/01/2043 | | | 94 | | | | 101 | |

4.000%, 07/01/2043 | | | 94 | | | | 100 | |

4.000%, 08/01/2043 | | | 96 | | | | 101 | |

3.500%, 07/15/2041 | | | 1,400 | | | | 1,439 | |

3.500%, 11/01/2042 | | | 378 | | | | 386 | |

3.500%, 01/01/2043 | | | 193 | | | | 197 | |

3.500%, 02/01/2043 | | | 96 | | | | 98 | |

3.500%, 04/01/2043 | | | 97 | | | | 99 | |

3.500%, 05/01/2043 | | | 980 | | | | 1,001 | |

3.500%, 05/01/2043 | | | 372 | | | | 383 | |

3.500%, 06/01/2043 | | | 951 | | | | 971 | |

3.500%, 07/01/2043 | | | 982 | | | | 1,002 | |

3.000%, 08/01/2042 | | | 1,400 | | | | 1,378 | |

2.500%, 07/15/2027 | | | 1,000 | | | | 1,015 | |

FHLMC, Ser 2012-4099, Cl ST, IO | | | | | | | | |

5.848%, 08/15/2042 (A) | | | 266 | | | | 62 | |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

FHLMC, Ser 2014-326, Cl F2 | | | | | | | | |

0.702%, 03/15/2044 (A) | | $ | 592 | | | $ | 597 | |

FHLMC, Ser 2014-4310, Cl SA, IO

| | | | | | | | |

5.798%, 02/15/2044 (A) | | | 99 | | | | 23 | |

FHLMC, Ser 2014-4335, Cl SW, IO

| | | | | | | | |

5.848%, 05/15/2044 (A) | | | 100 | | | | 23 | |

FHLMC, Ser CS-4579, IO

| | | | | | | | |

1.916%, 07/29/2044 | | | 1,000 | | | | 75 | |

FHLMC CMO, Ser 2005-2990, Cl UZ

| | | | | | | | |

5.750%, 06/15/2035 | | | 891 | | | | 957 | |

FHLMC CMO, Ser 2007-3349, Cl AS, IO

| | | | | | | | |

6.348%, 07/15/2037 (A) | | | 1,182 | | | | 186 | |

FHLMC CMO, Ser 2009-3558, Cl G

| | | | | | | | |

4.000%, 08/15/2024 | | | 270 | | | | 292 | |

FHLMC CMO, Ser 2011-3947, Cl SG, IO

| | | | | | | | |

5.798%, 10/15/2041 (A) | | | 806 | | | | 160 | |

FHLMC CMO, Ser 2012-274, Cl F1

| | | | | | | | |

0.652%, 08/15/2042 (A) | | | 455 | | | | 455 | |

FHLMC CMO, Ser 2012-279, Cl F6

| | | | | | | | |

0.602%, 09/15/2042 (A) | | | 446 | | | | 445 | |

FHLMC CMO, Ser 2012-4013, Cl AI, IO

| | | | | | | | |

4.000%, 02/15/2039 | | | 576 | | | | 106 | |

FHLMC CMO, Ser 2012-4057, Cl UI, IO

| | | | | | | | |

3.000%, 05/15/2027 | | | 474 | | | | 52 | |

FHLMC CMO, Ser 2012-4085, Cl IO, IO

| | | | | | | | |

3.000%, 06/15/2027 | | | 1,073 | | | | 134 | |

FHLMC CMO, Ser 2012-4092, Cl AI, IO

| | | | | | | | |

3.000%, 09/15/2031 | | | 1,331 | | | | 184 | |

FHLMC CMO, Ser 2012-4097, Cl ST, IO

| | | | | | | | |

5.898%, 08/15/2042 (A) | | | 88 | | | | 20 | |

FHLMC CMO, Ser 2012-4136, Cl SQ, IO

| | | | | | | | |

5.998%, 11/15/2042 (A) | | | 90 | | | | 20 | |

FHLMC CMO, Ser 2013-4203, Cl PS, IO

| | | | | | | | |

6.098%, 09/15/2042 (A) | | | 457 | | | | 85 | |

FHLMC CMO, Ser 2013-4219, Cl JA

| | | | | | | | |

3.500%, 08/15/2039 | | | 943 | | | | 980 | |

FHLMC CMO, Ser 2013-4231, Cl FB

| | | | | | | | |

0.602%, 07/15/2038 (A) | | | 576 | | | | 576 | |

FHLMC CMO, Ser K038

| | | | | | | | |

3.389%, 03/25/2024 | | | 114 | | | | 119 | |

FHLMC Multifamily Structured Pass Through Certificates, Ser K715, Cl X1, IO | | | | | | | | |

1.316%, 01/25/2021 (A) | | | 3,268 | | | | 209 | |

FHLMC Multifamily Structured Pass-Through Certificates CMO,

Ser K021, Cl X1, IO

| | | | | | | | |

1.643%, 06/25/2022 (A) | | | 555 | | | | 53 | |

FHLMC Multifamily Structured Pass-Through Certificates CMO,

Ser K024, Cl X1, IO | | | | | | | | |

1.022%, 09/25/2022 (A) | | | 278 | | | | 16 | |

FNMA | | | | | | | | |

7.000%, 11/01/2037 | | | 11 | | | | 13 | |

7.000%, 11/01/2037 | | | 3 | | | | 3 | |

7.000%, 12/01/2037 | | | 8 | | | | 9 | |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 13 | |

SCHEDULE OF INVESTMENTS

New Covenant Income Fund (Continued)

June 30, 2014

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

7.000%, 02/01/2038 | | $ | 11 | | | $ | 12 | |

7.000%, 09/01/2038 | | | 4 | | | | 4 | |

7.000%, 11/01/2038 | | | 9 | | | | 10 | |

7.000%, 11/01/2038 | | | 7 | | | | 8 | |

7.000%, 11/01/2038 | | | 49 | | | | 53 | |

7.000%, 11/01/2038 | | | 15 | | | | 17 | |

6.500%, 08/01/2017 | | | 106 | | | | 112 | |

6.500%, 01/01/2038 | | | 265 | | | | 291 | |

6.500%, 05/01/2040 | | | 702 | | | | 792 | |

6.000%, 07/01/2037 | | | 129 | | | | 145 | |

6.000%, 09/01/2037 | | | 176 | | | | 199 | |

6.000%, 11/01/2038 | | | 271 | | | | 305 | |

5.936%, 10/01/2017 | | | 585 | | | | 655 | |

5.500%, 09/01/2034 | | | 745 | | | | 838 | |

5.500%, 02/01/2035 | | | 443 | | | | 498 | |

5.478%, 06/01/2017 | | | 2,088 | | | | 2,285 | |

5.000%, 01/01/2021 | | | 304 | | | | 324 | |

5.000%, 11/01/2025 | | | 199 | | | | 221 | |

5.000%, 06/01/2035 | | | 227 | | | | 252 | |

5.000%, 02/01/2036 | | | 385 | | | | 429 | |

5.000%, 03/01/2040 | | | 286 | | | | 318 | |

5.000%, 06/01/2040 | | | 504 | | | | 560 | |

5.000%, 06/01/2040 | | | 59 | | | | 65 | |

5.000%, 06/01/2040 | | | 661 | | | | 735 | |

4.603%, 04/01/2020 | | | 1,347 | | | | 1,505 | |

4.530%, 12/01/2019 | | | 942 | | | | 1,056 | |

4.501%, 01/01/2020 | | | 746 | | | | 827 | |

4.500%, 07/01/2037 | | | 400 | | | | 433 | |

4.500%, 09/01/2043 | | | 196 | | | | 213 | |

4.500%, 10/01/2043 | | | 196 | | | | 213 | |

4.500%, 11/01/2043 | | | 98 | | | | 107 | |

4.500%, 12/01/2043 | | | 99 | | | | 108 | |

4.500%, 01/01/2044 | | | 98 | | | | 107 | |

4.377%, 11/01/2019 | | | 512 | | | | 564 | |

4.000%, 06/01/2025 | | | 411 | | | | 440 | |

4.000%, 07/13/2039 | | | 2,700 | | | | 2,865 | |

4.000%, 08/13/2039 | | | 4,500 | | | | 4,761 | |

4.000%, 09/01/2041 | | | 670 | | | | 712 | |

4.000%, 04/01/2042 | | | 4,984 | | | | 5,301 | |

4.000%, 07/01/2042 | | | 905 | | | | 956 | |

4.000%, 05/01/2043 | | | 187 | | | | 200 | |

4.000%, 06/01/2043 | | | 96 | | | | 102 | |

4.000%, 06/01/2043 | | | 184 | | | | 196 | |

4.000%, 06/01/2043 | | | 98 | | | | 104 | |

4.000%, 06/01/2043 | | | 94 | | | | 101 | |

4.000%, 06/01/2043 | | | 92 | | | | 98 | |

4.000%, 07/01/2043 | | | 92 | | | | 98 | |

4.000%, 07/01/2043 | | | 194 | | | | 207 | |

4.000%, 07/01/2043 | | | 189 | | | | 201 | |

4.000%, 08/01/2043 | | | 98 | | | | 104 | |

3.700%, 12/01/2020 | | | 339 | | | | 365 | |

3.694%, 01/01/2021 | | | 1,602 | | | | 1,719 | |

3.500%, 07/25/2026 | | | 1,400 | | | | 1,484 | |

3.500%, 12/01/2032 | | | 1,197 | | | | 1,246 | |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

3.500%, 05/01/2033 | | $ | 480 | | | $ | 500 | |

3.500%, 08/01/2033 | | | 94 | | | | 98 | |

3.500%, 10/01/2033 | | | 95 | | | | 100 | |

3.500%, 11/01/2033 | | | 96 | | | | 100 | |

3.500%, 12/01/2033 | | | 97 | | | | 101 | |

3.500%, 07/01/2041 | | | 100 | | | | 103 | |

3.500%, 10/01/2042 | | | 93 | | | | 95 | |

3.500%, 12/01/2042 | | | 93 | | | | 96 | |

3.500%, 12/01/2042 | | | 181 | | | | 186 | |

3.500%, 12/01/2042 | | | 188 | | | | 194 | |

3.500%, 03/01/2043 | | | 1,135 | | | | 1,167 | |

3.500%, 04/01/2043 | | | 665 | | | | 684 | |

3.500%, 06/01/2043 | | | 968 | | | | 990 | |

3.450%, 11/01/2023 | | | 700 | | | | 733 | |

3.030%, 12/01/2021 | | | 718 | | | | 743 | |

2.740%, 06/01/2023 | | | 600 | | | | 601 | |

2.500%, 07/01/2027 | | | 200 | | | | 203 | |

2.500%, 10/01/2042 | | | 1,010 | | | | 959 | |

2.480%, 06/01/2019 | | | 993 | | | | 1,015 | |

2.400%, 12/01/2022 | | | 250 | | | | 245 | |

2.393%, 12/01/2035 (A) | | | 110 | | | | 118 | |

2.325%, 03/01/2036 (A) | | | 76 | | | | 80 | |

2.260%, 12/01/2022 | | | 1,000 | | | | 971 | |

1.940%, 07/01/2019 | | | 400 | | | | 401 | |

1.859%, 05/01/2043 (A) | | | 2,058 | | | | 2,100 | |

0.641%, 11/01/2023 (A) | | | 600 | | | | 600 | |

0.621%, 12/01/2023 (A) | | | 500 | | | | 504 | |

0.601%, 01/01/2024 (A) | | | 1,000 | | | | 1,008 | |

0.511%, 01/01/2023 (A) | | | 486 | | | | 490 | |

0.501%, 01/01/2023 (A) | | | 485 | | | | 485 | |

0.491%, 01/01/2023 (A) | | | 400 | | | | 403 | |

0.491%, 01/01/2023 (A) | | | 500 | | | | 500 | |

FNMA, Ser 2010-100, Cl SD, IO | | | | | | | | |

6.428%, 09/25/2040 (A) | | | 1,196 | | | | 233 | |

FNMA, Ser M5, Cl SA, IO | | | | | | | | |

4.936%, 01/25/2017 (A) | | | 4,458 | | | | 210 | |

FNMA, Ser M6, Cl FA | | | | | | | | |

0.442%, 12/25/2017 (A) | | | 169 | | | | 169 | |

FNMA CMO, Ser 1992-1, Cl F | | | | | | | | |

0.952%, 01/25/2022 (A) | | | 193 | | | | 195 | |

FNMA CMO, Ser 2003-W2, Cl 2A9 | | | | | | | | |

5.900%, 07/25/2042 | | | 885 | | | | 998 | |

FNMA CMO, Ser 2004-90, Cl LH | | | | | | | | |

5.000%, 04/25/2034 | | | 953 | | | | 995 | |

FNMA CMO, Ser 2005-22, Cl DA | | | | | | | | |

5.500%, 12/25/2034 | | | 691 | | | | 748 | |

FNMA CMO, Ser 2009-86, Cl CA | | | | | | | | |

4.500%, 09/25/2024 | | | 13 | | | | 14 | |

FNMA CMO, Ser 2011-44, Cl EB | | | | | | | | |

3.000%, 05/25/2026 | | | 500 | | | | 497 | |

FNMA CMO, Ser 2012-108, Cl F | | | | | | | | |

0.652%, 10/25/2042 (A) | | | 451 | | | | 450 | |

FNMA CMO, Ser 2012-128, Cl SL, IO | | | | | | | | |

5.998%, 11/25/2042 (A) | | | 92 | | | | 21 | |

| | |

| 14 | | New Covenant Funds / Annual Report / June 30, 2014 |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

FNMA CMO, Ser 2012-128, Cl SQ, IO | | | | | | | | |

5.998%, 11/25/2042 (A) | | $ | 91 | | | $ | 21 | |

FNMA CMO, Ser 2012-134, Cl SK, IO | | | | | | | | |

5.998%, 12/25/2042 (A) | | | 90 | | | | 18 | |

FNMA CMO, Ser 2012-74, Cl AI, IO | | | | | | | | |

3.000%, 07/25/2027 | | | 1,675 | | | | 187 | |

FNMA CMO, Ser 2012-93, Cl SG, IO | | | | | | | | |

5.948%, 09/25/2042 (A) | | | 351 | | | | 76 | |

FNMA CMO, Ser 2012-93, Cl UI, IO | | | | | | | | |

3.000%, 09/25/2027 | | | 1,312 | | | | 167 | |

FNMA CMO, Ser 2012-M11, Cl FA | | | | | | | | |

0.674%, 08/25/2019 (A) | | | 226 | | | | 227 | |

FNMA CMO, Ser 2013-M7, Cl A2 | | | | | | | | |

2.280%, 12/27/2022 | | | 219 | | | | 212 | |

FNMA TBA | | | | | | | | |

5.000%, 07/15/2038 | | | 2,000 | | | | 2,221 | |

3.000%, 07/01/2026 | | | 2,300 | | | | 2,389 | |

GNMA | | | | | | | | |

5.500%, 02/20/2037 | | | 217 | | | | 242 | |

5.500%, 07/20/2038 | | | 120 | | | | 134 | |

5.500%, 01/15/2039 | | | 263 | | | | 294 | |

5.000%, 12/20/2038 | | | 100 | | | | 108 | |

5.000%, 03/15/2039 | | | 297 | | | | 327 | |

5.000%, 03/20/2039 | | | 191 | | | | 205 | |

5.000%, 07/20/2040 | | | 2,476 | | | | 2,751 | |

4.863%, 06/20/2061 | | | 1,578 | | | | 1,717 | |

4.826%, 06/20/2061 | | | 1,382 | | | | 1,544 | |

4.697%, 09/20/2061 | | | 1,371 | | | | 1,497 | |

4.650%, 12/20/2060 | | | 1,376 | | | | 1,490 | |

4.626%, 07/20/2061 | | | 1,489 | | | | 1,621 | |

4.500%, 07/20/2038 | | | 81 | | | | 88 | |

4.500%, 05/20/2040 | | | 1,420 | | | | 1,555 | |

4.500%, 01/20/2041 | | | 787 | | | | 863 | |

4.500%, 07/20/2041 | | | 307 | | | | 336 | |

4.295%, 07/20/2061 | | | 1,301 | | | | 1,410 | |

3.500%, 07/15/2041 | | | 1,200 | | | | 1,250 | |

3.500%, 07/01/2042 | | | 1,100 | | | | 1,144 | |

2.500%, 02/20/2027 | | | 2,210 | | | | 2,274 | |

GNMA, Ser 85, Cl IA, IO | | | | | | | | |

0.834%, 03/16/2047 (A) | | | 3,970 | | | | 246 | |

GNMA CMO, Ser 2009-108, Cl WG | | | | | | | | |

4.000%, 09/20/2038 | | | 625 | | | | 663 | |

GNMA CMO, Ser 2009-31, Cl MA | | | | | | | | |

4.500%, 08/20/2033 | | | 57 | | | | 59 | |

GNMA CMO, Ser 2009-86, Cl A | | | | | | | | |

3.536%, 09/16/2035 | | | 198 | | | | 200 | |

GNMA CMO, Ser 2011-147, Cl A | | | | | | | | |

2.174%, 07/16/2038 | | | 1,352 | | | | 1,363 | |

GNMA CMO, Ser 2012-22, Cl AB | | | | | | | | |

1.661%, 03/16/2033 | | | 1,069 | | | | 1,070 | |

GNMA CMO, Ser 2012-66, Cl CI, IO | | | | | | | | |

3.500%, 02/20/2038 | | | 247 | | | | 36 | |

GNMA CMO, Ser 2012-77, Cl KI, IO | | | | | | | | |

7.500%, 04/20/2031 | | | 205 | | | | 36 | |

GNMA CMO, Ser 2012-H18, Cl NA | | | | | | | | |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

0.672%, 08/20/2062 (A) | | $ | 349 | | | $ | 348 | |

GNMA CMO, Ser 2013-H21, Cl FB | | | | | | | | |

0.852%, 09/20/2063 (A) | | | 740 | | | | 744 | |

GNMA TBA | | | | | | | | |

4.000%, 07/01/2039 | | | 1,500 | | | | 1,605 | |

NCUA Guaranteed Notes Trust,

Ser 2010-C1, Cl A2 | | | | | | | | |

2.900%, 10/29/2020 | | | 350 | | | | 363 | |

NCUA Guaranteed Notes Trust,

Ser 2010-C1, Cl APT | | | | | | | | |

2.650%, 10/29/2020 | | | 328 | | | | 337 | |

| | | | | | | | |

| | | | | | | 108,114 | |

| | | | | | | | |

|

Non-Agency Mortgage-Backed Obligations — 8.6% | |

A10 Term Asset Financing, Ser 2013-2, Cl A | | | | | | | | |

2.620%, 11/15/2027 (B) | | | 250 | | | | 250 | |

American Home Mortgage Investment Trust, Ser 2004-4, Cl 1A1 | | | | | | | | |

0.492%, 02/25/2045 (A) | | | 343 | | | | 328 | |

American Home Mortgage Investment Trust, Ser 2005-1, Cl 7A1 | | | | | | | | |

2.322%, 06/25/2045 (A) | | | 307 | | | | 311 | |

Banc of America Commercial Mortgage Trust, Ser 2, Cl AJ | | | | | | | | |

5.954%, 05/10/2045 (A) | | | 190 | | | | 203 | |

Banc of America Commercial Mortgage Trust, Ser 2006-5, Cl AM | | | | | | | | |

5.448%, 09/10/2047 | | | 240 | | | | 258 | |

Banc of America Funding,

Ser 2012- R6, Cl 1A1 | | | | | | | | |

3.000%, 10/26/2039 (B)(C) | | | 151 | | | | 150 | |

Banc of America Mortgage Trust,

Ser 2004-3, Cl 1A26 | | | | | | | | |

5.500%, 04/25/2034 | | | 60 | | | | 61 | |

Banc of America Mortgage Trust,

Ser 2004-9, Cl 3A1 | | | | | | | | |

6.500%, 09/25/2032 | | | 119 | | | | 125 | |

BCAP Trust, Ser 2012-RR10, Cl 3A1 | | | | | | | | |

0.340%, 05/26/2036 (A)(B) | | | 311 | | | | 294 | |

Bear Stearns ALT-A Trust, Ser 2004- 6,

Cl 1A | | | | | | | | |

0.792%, 07/25/2034 (A) | | | 229 | | | | 219 | |

Bear Stearns ALT-A Trust, Ser 2004- 7,

Cl 2A1 | | | | | | | | |

2.493%, 08/25/2034 (A) | | | 258 | | | | 261 | |

Bear Stearns Commercial Mortgage Securities Trust,

Ser 2005-PWR9, Cl A4A | | | | | | | | |

4.871%, 09/11/2042 | | | 279 | | | | 289 | |

Bear Stearns Commercial Mortgage Securities Trust, Ser 2007-PW18, Cl AM | | | | | | | | |

6.084%, 06/11/2050 (A) | | | 110 | | | | 124 | |

CAM Mortgage Trust, Ser 2014-1, Cl A | | | | | | | | |

3.352%, 12/15/2053 (B) | | | 51 | | | | 51 | |

| | | | |

| New Covenant Funds / Annual Report / June 30, 2014 | | | 15 | |

SCHEDULE OF INVESTMENTS

New Covenant Income Fund (Continued)

June 30, 2014

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

CD Mortgage Trust, Ser 2007-CD5,

Cl AMA | | | | | | | | |

6.321%, 11/15/2044 (A) | | $ | 150 | | | $ | 167 | |

Citigroup Mortgage Loan Trust,

Ser 2012-A, Cl A | | | | | | | | |

2.500%, 06/25/2051 (B)(C) | | | 97 | | | | 94 | |

COBALT CMBS Commercial Mortgage Trust, Ser 2007-C2, Cl AMFX | | | | | | | | |

5.526%, 04/15/2047 (A) | | | 70 | | | | 77 | |

Commercial Mortgage Pass-Through Certificates, Ser 2005-C6, Cl A5A | | | | | | | | |

5.116%, 06/10/2044 (A) | | | 347 | | | | 359 | |

Commercial Mortgage Pass-Through Certificates, Ser 2012-CR3, Cl A3 | | | | | | | | |

2.822%, 11/15/2045 | | | 10 | | | | 10 | |

Commercial Mortgage Pass-Through Certificates, Ser 2012-MVP, Cl A | | | | | | | | |

2.091%, 11/17/2026 (A)(B) | | | 91 | | | | 92 | |

Commercial Mortgage Pass-Through Certificates, Ser 2013-WWP, Cl A2 | | | | | | | | |

3.424%, 03/10/2031 (B) | | | 100 | | | | 102 | |

Commercial Mortgage Pass-Through Certificates, Ser LC15, Cl XA, IO | | | | | | | | |

1.601%, 04/10/2047 (A) | | | 2,035 | | | | 180 | |

Commercial Mortgage Trust,

Ser 2013-CR11, Cl AM | | | | | | | | |

4.715%, 10/10/2046 (A) | | | 111 | | | | 122 | |

Commercial Mortgage Trust, Ser CR12, Cl A4 | | | | | | | | |

4.046%, 10/10/2046 | | | 50 | | | | 53 | |

Commercial Mortgage Trust, Ser CR12,

Cl AM | | | | | | | | |

4.300%, 10/10/2046 | | | 50 | | | | 53 | |

Commercial Mortgage Trust, Ser CR12, Cl B | | | | | | | | |

4.762%, 10/10/2046 (A) | | | 20 | | | | 21 | |

Commercial Mortgage Trust, Ser CR12, Cl C | | | | | | | | |

5.255%, 10/10/2046 (A) | | | 10 | | | | 11 | |

Commercial Mortgage Trust, Ser TWC, Cl A | | | | | | | | |

1.002%, 02/13/2032 (A)(B) | | | 100 | | | | 100 | |

Countrywide Alternative Loan Trust,

Ser 2003-20CB, Cl 1A1 | | | | | | | | |

5.500%, 10/25/2033 | | | 472 | | | | 506 | |

Credit Suisse First Boston Mortgage Securities, Ser 2005-C5, Cl A4 | | | | | | | | |

5.100%, 08/15/2038 (A) | | | 392 | | | | 404 | |

CSMC, Ser 2010-11R, Cl A6 | | | | | | | | |

1.150%, 06/28/2047 (A)(B) | | | 373 | | | | 357 | |

CSMC Trust, Ser 2014-SURF, Cl B | | | | | | | | |

1.460%, 02/15/2029 (A)(B) | | | 200 | | | | 200 | |

CSMC Trust, Ser 2014-SURF, Cl C | | | | | | | | |

1.960%, 02/15/2029 (A)(B) | | | 120 | | | | 120 | |

DBRR Trust, Ser 2013-EZ2, Cl A | | | | | | | | |

0.853%, 02/25/2045 (A)(B) | | | 134 | | | | 133 | |

DBRR Trust, Ser 2013-EZ3, Cl A | | | | | | | | |

1.636%, 12/18/2049 (A)(B) | | | 161 | | | | 162 | |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

Deutsche Mortgage Securities Mortgage Loan Trust, Ser 2006-PR1, Cl 3AF1 | | | | | | | | |

0.432%, 04/15/2036 (A)(B) | | $ | 715 | | | $ | 673 | |

Educational Funding of the South, Ser 2011-1, Cl A2 | | | | | | | | |

0.879%, 04/25/2035 (A) | | | 1,160 | | | | 1,163 | |

Extended Stay America Trust,

Ser 2013-ESH7, Cl A27 | | | | | | | | |

2.958%, 12/05/2031 (B) | | | 110 | | | | 112 | |

FDIC Trust, Ser 2013-N1, Cl A | | | | | | | | |

4.500%, 10/25/2018 (B) | | | 68 | | | | 69 | |

GMAC Commercial Mortgage Securities Trust, Ser 2004-C2, Cl A4 | | | | | | | | |

5.301%, 08/10/2038 (A) | | | 104 | | | | 104 | |

GMAC Commercial Mortgage Securities Trust, Ser 2006-C1, Cl AM | | | | | | | | |

5.290%, 11/10/2045 (A) | | | 300 | | | | 315 | |

GS Mortgage Securities Trust,

Ser 2013-GC16, Cl AS | | | | | | | | |

4.649%, 11/10/2046 | | | 110 | | | | 120 | |

GS Mortgage Securities Trust,

Ser 2013-GC16, Cl B | | | | | | | | |

5.161%, 11/10/2046 (A) | | | 90 | | | | 99 | |

Homestar Mortgage Acceptance,

Ser 2004-6, Cl M2 | | | | | | | | |

0.822%, 01/25/2035 (A) | | | 689 | | | | 666 | |

Homestar Mortgage Acceptance,

Ser 2004-6, Cl M3 | | | | | | | | |

1.252%, 01/25/2035 (A) | | | 1,270 | | | | 1,214 | |

Impac CMB Trust, Ser 2004-6, Cl 1A2 | | | | | | | | |

0.932%, 10/25/2034 (A) | | | 114 | | | | 106 | |

Impac CMB Trust, Ser 2007-A, Cl M1 | | | | | | | | |

0.552%, 05/25/2037 (A) | | | 818 | | | | 773 | |

Impac Secured Assets Trust, Ser 2007-2, Cl 2A | | | | | | | | |

0.402%, 04/25/2037 (A) | | | 208 | | | | 193 | |

JPMBB Commercial Mortgage Securities Trust, Ser 2013-C15, Cl AS | | | | | | | | |

4.420%, 11/15/2045 | | | 120 | | | | 129 | |

JPMBB Commercial Mortgage Securities Trust, Ser 2013-C15, Cl B | | | | | | | | |

4.927%, 11/15/2045 | | | 210 | | | | 229 | |

JPMBB Commercial Mortgage Securities Trust, Ser 2013-C15, Cl C | | | | | | | | |

5.251%, 11/15/2045 (A) | | | 50 | | | | 54 | |

JPMBB Commercial Mortgage Securities Trust, Ser C17, Cl B | | | | | | | | |

5.050%, 01/15/2047 (A) | | | 30 | | | | 33 | |

JPMorgan Chase Commercial Mortgage Securities Trust, Ser 2011-C5, Cl A3 | | | | | | | | |

4.171%, 08/15/2046 | | | 10 | | | | 11 | |

JPMorgan Mortgage Trust, Ser 2005-A1, Cl 5A2 | | | | | | | | |

2.643%, 02/25/2035 (A) | | | 141 | | | | 142 | |

| | |

| 16 | | New Covenant Funds / Annual Report / June 30, 2014 |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

LB Commercial Mortgage Trust,

Ser 2007-C3, Cl AM | | | | | | | | |

6.090%, 07/15/2044 (A) | | $ | 340 | | | $ | 380 | |

LB-UBS Commercial Mortgage Trust,

Ser 2006-C6, Cl A4 | | | | | | | | |

5.372%, 09/15/2039 | | | 103 | | | | 111 | |

LB-UBS Commercial Mortgage Trust,

Ser 2007-C7, Cl AM | | | | | | | | |

6.370%, 09/15/2045 (A) | | | 280 | | | | 319 | |

Lehman Brothers Small Balance Commercial, Ser 2A, Cl 1A | | | | | | | | |

0.402%, 09/25/2030 (A)(B) | | | 288 | | | | 270 | |

MASTR Alternative Loans Trust,

Ser 2004-2, Cl 4A1 | | | | | | | | |

5.000%, 02/25/2019 | | | 114 | | | | 117 | |

MASTR Asset Securitization Trust,

Ser 2003-11, Cl 8A1 | | | | | | | | |

5.500%, 12/25/2033 | | | 291 | | | | 309 | |

MASTR Asset Securitization Trust,

Ser 2003-7, Cl 1A1 | | | | | | | | |

5.500%, 09/25/2033 | | | 104 | | | | 108 | |

MASTR Seasoned Securities Trust,

Ser 2004-2, Cl A2 | | | | | | | | |

6.500%, 08/25/2032 | | | 140 | | | | 158 | |

ML-CFC Commercial Mortgage Trust,

Ser 2007-8, Cl A3 | | | | | | | | |

6.079%, 08/12/2049 (A) | | | 200 | | | | 222 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Ser 2012-C6, Cl AS | | | | | | | | |

3.476%, 11/15/2045 | | | 40 | | | | 41 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Ser 2013-C10, Cl A4 | | | | | | | | |

4.218%, 07/15/2046 (A) | | | 120 | | | | 129 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Ser 2013-C7, Cl A4 | | | | | | | | |

2.918%, 02/15/2046 | | | 40 | | | | 39 | |

Morgan Stanley Bank of America Merrill Lynch Trust, Ser 2013-C7, Cl AS | | | | | | | | |

3.214%, 02/15/2046 | | | 61 | | | | 60 | |

Morgan Stanley Capital I, Ser 2007-IQ14, Cl A4 | | | | | | | | |

5.692%, 04/15/2049 (A) | | | 35 | | | | 39 | |

Morgan Stanley Re-Remic Trust,

Ser 2012-IO, Cl AXA | | | | | | | | |

1.000%, 03/27/2051 (B) | | | 90 | | | | 90 | |

Morgan Stanley Re-Remic Trust,

Ser 2012-XA, Cl A | | | | | | | | |

2.000%, 07/27/2049 (B) | | | 213 | | | | 214 | |

MortgageIT Trust, Ser 2005-3, Cl A1 | | | | | | | | |

0.452%, 08/25/2035 (A) | | | 652 | | | | 619 | |

Nomura Asset Acceptance Alternative Loan Trust,

Ser 2007-1, Cl 1A3 | | | | | | | | |

5.957%, 03/25/2047 | | | 151 | | | | 153 | |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

Nomura Asset Acceptance Alternative Loan Trust, Ser 2007-1, Cl 1A4 | | | | | | | | |

6.138%, 03/25/2047 | | $ | 128 | | | $ | 130 | |

Normandy Mortgage Loan Trust,

Ser 2013-NPL3, Cl A | | | | | | | | |

4.949%, 09/16/2043 (B) | | | 482 | | | | 481 | |

NorthStar Mortgage Trust, Ser 2012-1, Cl A | | | | | | | | |

1.350%, 08/25/2029 (A)(B) | | | 91 | | | | 91 | |

NorthStar Mortgage Trust, Ser 2013-1A, Cl A | | | | | | | | |

2.002%, 08/25/2029 (A)(B) | | | 250 | | | | 250 | |

OnDeck Asset Securitization Trust,

Ser 2014-1A, Cl A | | | | | | | | |

3.150%, 05/17/2018 (B) | | | 117 | | | | 117 | |

Ores, Ser 2013-LV2, Cl A | | | | | | | | |

3.081%, 09/25/2025 (B) | | | 100 | | | | 100 | |