UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-09025

New Covenant Funds

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

Corporation Trust Center

1209 Orange Street

Wilmington, Delaware 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-835-4531

Date of fiscal year end: June 30, 2016

Date of reporting period: June 30, 2016

| Item 1. | Reports to Stockholders. |

| | |

| | June 30, 2016 ANNUAL REPORT |

| |

| | New Covenant Funds |

| |

| | ➤ New Covenant Growth Fund |

| | ➤ New Covenant Income Fund |

| | ➤ New Covenant Balanced Growth Fund |

| | ➤ New Covenant Balanced Income Fund |

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the ‘‘Commission’’) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-877-835-4531; and (ii) on the Commission’s website at http://www.sec.gov.

NEW COVENANT FUNDS — JUNE 30, 2016 (Unaudited)

To Our Shareholders:

The Funds’ fiscal year — July 1, 2015 through June 30, 2016 — was notable for several key themes: energy-sector volatility spread to other areas of the market amid continued oil-price weakness, followed by a partial recovery; major central-bank policies diverged, with the Federal Reserve (Fed) commencing rate increases while the European Central Bank (ECB), Bank of Japan (BOJ) and People’s Bank of China (PBOC) deepened their commitments to monetary accommodation; and, as a result of the diverging policies, major developed-market sovereign-bond yields continued to fall, with some edging into negative-rate territory. A vote (Brexit) by U.K. citizens in favor of leaving the European Union (EU) took place with roughly a week left in the reporting period, briefly upending global financial markets and presenting major questions about how the relationship will be dissolved.

Geopolitical events

Severe unrest continued in certain areas of the Middle East, driven by the sometimes-opposing and sometimes-overlapping interests of Islamic State, the Syrian regime, Syrian nationalists, Kurdish forces and the Iraqi military. Regional superpowers Iran, Saudi Arabia and Turkey also applied varying degrees of indirect influence. Broader involvement escalated, with Russia’s airpower commitment in early fall and a redoubled coalition of Western powers targeting Islamic State after a series of attacks by religious extremists across the globe. A U.S.-Russia-brokered ceasefire between the Syrian regime and nationalist rebels (excluding Islamic State and other terrorist groups) came into effect during late February, maintaining a questionable hold through the end of the reporting period. Iraqi forces, supported by U.S. air and ground resources, began to make notable progress in reversing Islamic State gains as the end of the reporting period approached; at the same time, incidences of terrorism appeared to increase in Africa, Asia, Europe, the Middle East and North America. While the conflict that originated in Syria and Iraq appears to have influenced destabilizing events elsewhere around the globe, and taken a terrible human toll, it has not had a significant impact on global markets or the economy at this point.

It will be interesting, however, to see the ultimate effects of the ensuing Syrian migrant crisis on the European Union (EU). Immigration served as one of the key points of contention leading up to Great Britain’s EU referendum, which resulted in a vote to leave the EU just before the end of the reporting period. U.K. Prime Minister David Cameron tendered his resignation as a result, and a litany of questions entered the public dialogue on topics ranging from when the government would commence the formal withdrawal process, to how negotiations would fare regarding trade agreements, and the likelihood that immigration goals espoused by the Leave campaign would come to pass.

Immigration-driven ballot-box uncertainty has also taken center stage in the U.S. presidential election, where the leading primary candidates of the two major political parties were essentially positioned to clinch their nominations at the end of the reporting period.

Despite the considerable aforementioned instability in the Middle East, the price of oil remained mostly insulated from regional developments. Oil-price weakness, which persisted for the first two-thirds of the reporting period, remained primarily attributable to oversupply: members of the Organization of Petroleum Exporting Countries failed to agree on production cuts; U.S. Congress approved the restoration of oil exports in mid-December; and Iran’s multilateral agreement on the scope of its nuclear program paved the way for its post-sanction return as a major low-cost oil supplier. The International Energy Agency, however, projected a return to supply-demand balance in 2017.

Energy-export-dependent Venezuela succumbed to the economically depressive effects of low oil prices during the fiscal year. Food shortages and a breakdown of the rule of law appeared to worsen as the reporting period concluded, despite a partial rebound in the price of oil. Brazil’s prospects also paled during the reporting period, as a corruption investigation centering on its lead state-run oil company enveloped a cross-section of political leaders — culminating in the impeachment of President Dilma Rousseff.

Economic performance

U.S. economic growth in the second quarter of 2015 bordered on impressive, due in large part to strong consumer activity. The pace of growth essentially halved during the third quarter amid slow sales and lackluster export activity. Fourth-quarter growth decelerated further, as industrial production and manufacturing came under pressure from the effects of U.S. dollar strength. Growth during the first quarter of 2016 slowed more still; although business activity improved toward the end of the quarter and early in the second quarter. Retail sales and consumer spending surged in April 2016, foreshadowing a potential rebound in second-quarter economic growth. At the end of the reporting

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 1 |

NEW COVENANT FUNDS — JUNE 30, 2016 (Unaudited) (Continued)

period, the Federal Reserve Bank of Atlanta projected second-quarter economic growth would roughly double the first quarter’s pace; while welcomed, it falls far short of the growth rate achieved during the second quarter of 2015. The labor market improved consistently for most of the fiscal year, with the unemployment rate declining from 5.3% in July 2015 to 4.9% in June 2016. Average hourly earnings and real personal incomes gained with relative steadiness, bouncing around a rough mean of about 0.2% per month over the reporting period. The Fed raised its target interest rate in mid-December for the first time since 2006, leaving behind a near-zero rate that had been in place since late 2008.

Europe maintained steady, if modest, economic expansion during the second, third and fourth quarters of 2015, with an uptick in the growth rate during the first quarter of 2016. The ECB’s expansion of its asset-purchase program and introduction of a negative deposit rate in early 2015 (prior to the start of the Funds’ fiscal year) was followed during the reporting period by a deeper foray into negative-rate territory and additional asset-purchase commitments. The eurozone contended with negotiations at the beginning of the reporting period regarding the restructuring of Greek public-debt obligations, which pitted Greece’s ruling Syriza Party against other euro-member states, the ECB and the International Monetary Fund. A new round of discussions on Greek debt relief occurred toward the end of the reporting period, but with less conflict among parties. As the end of the fiscal year approached, U.K. economic data increasingly depicted moderating conditions or outright slowdown amid uncertainty caused by the looming Brexit vote.

In the Asia-Pacific region, Japan’s economy swung between advances and declines during the fiscal year, beginning with a small contraction in gross domestic product (GDP) during the second quarter of 2015. Modest growth during the third quarter was followed by a fourth-quarter contraction, and then a return to expansion during the first quarter of 2016. The yen remained in a relatively narrow range compared to the U.S. dollar during most of the reporting period, then strengthened substantially starting at the end of 2015. A renewed surge in yen value relative to other major currencies was one of the more notable post-Brexit outcomes, despite expansions during the period to the BOJ’s asset-purchase program and the adoption of a negative benchmark interest rate. China, meanwhile, experienced steadily declining growth, albeit from levels considerably higher than most other economies. The PBOC loosened its monetary-policy stance, reducing benchmark interest rates and bank-reserve requirements at multiple points during the reporting period. The government’s decision to peg its currency (the renminbi) to a basket of currencies instead of just the U.S. dollar, along with the decline of the renminbi against the U.S. dollar during the third quarter of 2015, had significant global repercussions — especially given the implications for a potential rebalancing of global trade and uncertainty about potential future actions.

Market developments

Risk assets were treading water at the start of the fiscal year after spending June 2015 (immediately prior to the start of the reporting period) in a downtrend that originated with deep losses on China’s mainland stock exchanges. More severe declines in late summer, when China moderately devalued its currency, were followed by a partial recovery through October. As 2015 came to a close, the questionable health of U.S. energy companies (which was caused by a persistent, multi-year oil-price decline) raised concerns among high-yield bond investors. This resulted in a selloff that likely discouraged investor risk appetite, keeping a lid on performance at year end and into the new year.

The beginning of 2016 was marked by a global flight to quality, benefitting safe-haven assets at the expense of risk assets. A trend reversal took place in mid-February, with risk assets rallying into April, followed by mixed performance until late June. The price of oil, and commodities in general, also advanced sharply from mid-February into June. Brexit caused a major spike in global stock-market volatility, yields were driven downward to record levels on perceived safe-haven investments like developed-market government bonds, and the currencies at the center of the developments — sterling and the euro — weakened substantially relative to the U.S. dollar and Japanese yen. Most of the stock-market losses, however, were recovered within a week’s time as the reporting period drew to a close.

The U.S. dollar ended the fiscal year less than 1% higher against a trade-weighted basket of major currencies, having been as much as 6.5% higher in late January, and 2.5% lower in early May.

First-quarter 2016 earnings declined for companies in the S&P 500 Index; although a majority fared better than analysts’ late-quarter average estimates. The consumer discretionary sector fared best, reporting earnings growth approaching 20% year over year; the energy sector lagged, reporting an aggregate year-over-year loss of about 7%. Analysts forecast another decline in earnings for second-quarter 2016, and estimates of the shortfall continued to deepen through the end of the fiscal year.

| | |

| 2 | | New Covenant Funds / Annual Report / June 30, 2016 |

For the full reporting period, the MSCI All-Country World Index, a proxy for global equities, fell 3.73% in U.S. dollar terms. The MSCI All-Country World ex U.S. Index fell by 10.24%, considerably sharper than the decline of its U.S.-inclusive counterpart. Emerging-market equity returns were more negative in U.S. dollar terms, with the MSCI Emerging Markets Index falling by 12.05%.

U.S. equity returns were modestly positive; the S&P 500 Index returned 3.99% during the fiscal year. U.S. large caps (represented by the Russell 1000 Index) continued to outpace small caps (represented by the Russell 2000 Index), returning 2.93% and -6.73%, respectively. The persistence of U.S. large-cap outperformance relative to other equities has been remarkable — both within the U.S. and internationally — with returns topping not just small caps, but also emerging markets, Europe, Japan and the global stock market when annualized over one, three, five and ten years through the end of the reporting period. The extended stretch of U.S. large-cap outperformance has coincided with a challenging environment for active U.S. large-cap strategies; conversely, active managers have fared much better in benchmark-relative terms within international and emerging-market equity strategies.

Defensive and less-cyclically sensitive equity sectors (which typically exhibit lower volatility in challenging market environments compared to cyclically sensitive sectors) fared relatively well. Utilities, consumer staples and telecommunications were the top-performing sectors in the U.S. and globally, while energy, materials and financials suffered the steepest declines.

Global fixed income, as measured by the Barclays Global Aggregate Bond Index, advanced 8.87% in U.S. dollar terms during the fiscal year. Interest rates generally declined during the reporting period, as major central banks outside of the U.S. guided benchmark rates downward (into negative territory in some cases) and expanded their asset-purchase programs.

U.S. Treasurys generally performed well as the yield curve flattened (bond yields move inversely to prices) and rates fell across most maturities, with only the yields on Treasurys with maturities shorter than two years increasing during the full reporting period.

U.S. investment-grade corporate debt performed well, and the high-yield market was modestly positive. The BofA Merrill Lynch US High Yield Constrained Index increased by 1.74% during the full fiscal year, although a sharp advance beginning in mid-February eliminated a double-digit decline by the end of the reporting period. Mortgage- and asset-backed securities also delivered positive returns during the reporting period.

Emerging-market debt delivered mixed gains. The J.P. Morgan GBI Emerging Markets Global Diversified Index, which tracks local-currency-denominated emerging-market bonds, increased by 2.24% in U.S. dollar terms during the reporting period, bolstered by an impressive late-period rally as U.S. dollar strength waned. The J.P. Morgan EMBI Global Diversified Index, which tracks emerging-market debt denominated in external currencies (such as the U.S. dollar), advanced by 9.79%.

A combination of subdued inflation and dollar strength began to ease in the latter part of the reporting period, reducing headwinds to the performance of inflation-sensitive assets such as Treasury inflation-protected securities and commodities. The latter declined by 15% over the Funds’ fiscal year, according to the TR/CC CRB Commodities Total Return Index, but dropped by almost 32% as recently as mid-February before staging a steep partial recovery.

Our view

The U.K.’s vote to leave the EU is a major political and economic event that will likely weigh on international financial markets, not just for weeks and months, but perhaps for years. The leap into the unknown will likely depress economic growth as business spending freezes until some clarity re-emerges on the country’s trading relationships. Sterling’s plunge immediately following the Leave vote, however, should provide a much-needed offset to the mostly negative impact of all the uncertainty, as U.K. exporters find themselves in a more competitive position.

Britain’s growth prospects were decent prior to Brexit; by contrast, continental Europe was already struggling to improve. Of the many economic imbalances that exist in the world, among the greatest is the huge trade surplus run by the eurozone. In the aftermath of the Leave vote, nationalist parties in various countries are lobbying for their own referendums on continued membership in the EU, which adds to the uncertainty facing investors. The ability of the

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 3 |

NEW COVENANT FUNDS — JUNE 30, 2016 (Unaudited) (Concluded)

equity market to bounce back from the immediate shock is heartening, but it is hard to draw firm conclusions on how disruptive Brexit will be on future EU and eurozone economic activity. The fragility of the recovery going into this crisis is a matter of deep concern.

The U.S. has remained resilient despite numerous shocks over the past seven years, and we expect this resilience will once again be on display following the U.K. vote. May’s employment figure was the weakest since 2010, but other labor-market data are not quite as downbeat. Job openings remain in a solid uptrend, rising well beyond the previous cycle’s peak in mid-2007. The first hints of wage pressure have appeared, with a moderate acceleration in wages and total labor compensation apparent on a year-over-year basis. As corporate margins get squeezed by the pick-up in labor costs, the pressure to raise prices will likely intensify.

This puts the Fed in something of a quandary, since the Brexit shock has seemingly upended any possibility of a near-term rise in the funds rate. Market-implied expectations for the next policy-rate move have been pushed out to late 2017; in fact, futures traders have priced in the mild possibility of a rate cut in the near term. Yet, we admit to a growing uneasiness that the central bank may be a falling behind the inflation curve.

We understand that the still-soggy global economy and the shock delivered by the U.K. vote argue for a very cautious process of interest-rate normalization. But if the upward trend in labor costs is sustained, a more aggressive response by the U.S. central bank eventually will be justified.

In the months immediately ahead, investors’ attention will be focused on the U.S. presidential election. Investors need to be prepared for a bit of volatility in the coming months, since the uncertainty level has been ratcheted upward, and will likely remain elevated between now and the election. For now, we lean toward the optimistic side, mainly because U.S. economic and financial fundamentals appear relatively healthy.

One of the more surprising market responses to the Brexit vote is the sharp appreciation of the Japanese yen. This is the last thing that the country needs, since an ultra-strong currency exacerbates downward pressure on inflation. Corporate earnings have begun to roll over in response to the currency’s appreciation. As Japanese yields sink further into negative territory across the curve, we wonder what measures the BOJ will introduce next, since the most recent interest rate moves have failed to weaken the currency or boost the economy.

Investor fears earlier this year of an imminent Chinese debt and currency meltdown have receded. China’s economy mostly appears to be treading water, much like the rest of the world. The government continues to encourage growth fuelled by additional debt, prop up state-owned enterprises and allow its currency to fall. Economic and financial reforms are proceeding, but at an erratic pace. Chinese equities have not shown much spark, however, despite the risk-on environment for emerging-market assets that began in late January.

Globally, the points of general consistency in our investment outlook and positioning are that stability and momentum appear expensive within equities, and that fixed-income managers favor credit at the expense of interest-rate duration.

On behalf of SEI Investments, I want to thank you for your continued confidence. We are working every day to maintain that confidence, and we look forward to serving your investment needs in the future.

Sincerely,

William T. Lawrence, CFA

Managing Director, Portfolio Management Team

| | |

| 4 | | New Covenant Funds / Annual Report / June 30, 2016 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Growth Fund

I. Objective

The New Covenant Growth Fund’s (the “Fund”) investment objective is long-term capital appreciation. Dividend income, if any, will be incidental.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisers with different investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the following sub-advisers as of June 30, 2016: BlackRock Investment Management, LLC, Brandywine Global Investment Management Company LLC, Coho Partners, Ltd., Parametric Portfolio Associates LLC, and Waddell & Reed Investment Management Company. Coho Partners, Ltd. was added in July of 2015.

III. Return vs. Benchmark

For the one-year period ending June 30, 2016, the Fund returned -3.68% and the Russell 1000 Index returned 2.93%.

IV. Fund Attribution

Market expectations of an improving domestic economy and the Federal Reserve’s (Fed) managed transition from an easing mindset derailed in August as concerns about oil prices, energy stocks, high-yield bonds and emerging markets came to the forefront for investors. This led to a short-lived market correction, during which losses were more pronounced within energy and cyclical sectors, smaller-cap companies and non-U.S. names.

Most of the losses were recovered by early November, as data — including an impressive U.S. jobs report — indicated the domestic economy was improving. This gave way to a modest Fed funds rate hike in December and, as the shareholder letter addressed, set a backdrop of monetary policy differences between the U.S. and other major developed nations that remained on an easing track. This divergence led to strong appreciation of the U.S. dollar versus other currencies, which further exacerbated weakness among non-U.S. investments from a U.S. investor perspective.

High-yield bond market spreads widened again in late November due to concerns about energy companies and emerging markets. As noted in the shareholder letter, investor preference turned back to safety-based assets in both fixed income and equities during December and January. By early February, riskier out-of-favor investments regained momentum and clawed back most of their recent losses on the hopes that the worst had past.

Fund performance struggled due to a combination of forward-looking allocations and traditional stock selection, especially from our value-oriented specialist manager. Sector allocation detracted primarily due to an underweight to the utilities sector during an environment in which safety and stability were favored. All Fund managers were underweight utilities not only for the time period, but also strategically in terms of their respective philosophies. Losses were greater from a stylistic perspective, where forward mean-reverting value strategies (buying inexpensive companies as measured by price-to-earnings or price-to-cash flow ratios, for example) were strongly disfavored. This trend was highly correlated to the declines in oil and energy prices, and continued through the end of the period in response to Brexit and other global growth worries. By contrast, pure safety measures (such as exposure to dividend yield and lower trailing stock volatility) had one of their strongest performances on record.

These crosswinds within the market created an environment that was difficult for Brandywine, our value specialist. The angst about future growth prospects as well as declining sell-side earnings also presented headwinds for Waddell and Blackrock, which trade more on growth prospects. Coho, our defensive specialist that was hired during the period, benefitted from systematic tailwinds, but not by enough to compensate for the underperformance of other managers. Selection outside of these value-oriented headwinds was also negative, particularly within the pharmaceuticals portion of healthcare, and also within diversified financials and the automobile industry.

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN 1,2 | |

| | | | | | Annualized | | | Annualized | | | Annualized | | | Annualized | |

| | | One Year | | | 3 Year | | | 5 Year | | | 10 Year | | | Inception | |

| | | Return | | | Return | | | Return | | | Return | | | to Date | |

New Covenant Growth Fund | | | -3.68% | | | | 8.37% | | | | 8.28% | | | | 4.99% | | | | 5.62% | |

Russell 1000 Index | | | 2.93% | | | | 11.48% | | | | 11.88% | | | | 7.51% | | | | 9.38% | |

MSCI All Country World ex-U.S. Index | | | -10.24% | | | | 1.16% | | | | 0.10% | | | | 1.87% | | | | 4.36% | |

Blended 80% Russell 1000 Index/20% MSCI All Country World ex-U.S. Index | | | 0.19% | | | | 9.38% | | | | 9.48% | | | | 6.42% | | | | 8.47% | |

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 5 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Growth Fund (Concluded)

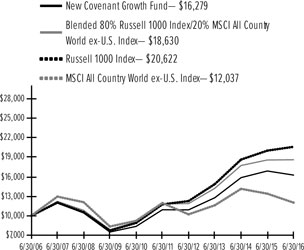

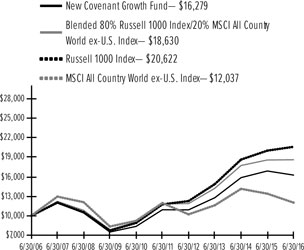

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Growth Fund, versus the Russell 1000 Index, MSCI All Country World ex-U.S. Index and Blended 80% Russell 1000 Index/20% MSCI All Country World ex-U.S. Index.

| 1 | For the years ended June 30, 2016. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| 2 | This table compares the Fund’s average annual total returns to those of a broad-based index and the Fund’s 80/20 Blended Benchmark, which consists of the Russell 1000 Index and the MSCI All Country World ex-U.S. Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | |

| 6 | | New Covenant Funds / Annual Report / June 30, 2016 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Income Fund

I. Objective

The New Covenant Income Fund’s (the “Fund”) investment objective is a high level of current income with preservation of capital.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number of sub-advisers with different investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the following sub-advisers as of June 30, 2016: Income Research & Management, Western Asset Management Company and Western Asset Management Company Limited. Income Research & Management was added and J.P. Morgan Investment Management Inc. was removed in January of 2016.

III. Return vs. Benchmark

For the one-year period ending June 30, 2016, the Fund returned 4.00% and the Barclays U.S. Intermediate Aggregate Bond Index returned 4.36%.

IV. Fund Attribution

U.S. Treasury yields were volatile during the fiscal year, with short-term yields rising and long-term yields declining as noted in the shareholder letter, resulting in generally positive returns for bonds. Returns were positive for non-Treasurys, including asset-backed, commercial-mortgage securities and agency-mortgage bonds, which all outperformed comparable duration-neutral U.S. Treasurys. While corporate bonds as a whole underperformed comparable Treasurys, the utilities and financials sub-sectors outperformed, while industrial bonds underperformed given the decline in commodity prices.

The Fund provided a positive return as interest rates generally declined over the period. The Fund’s underweight to U.S. Treasurys detracted, as that sector outperformed investment-grade credit as credit spreads widened in the period, although overweights to the financials and utilities sub-sectors added to relative performance. An overweight to mortgage-backed securities (MBS), specifically non-agency MBS, contributed to relative performance, while selection within agency MBS detracted. Overweights to asset-backed securities (ABS) and commercial MBS, as well as selection within the latter with an emphasis on senior securities, also benefitted relative performance over the fiscal year. Additionally, yield-curve positioning

contributed to relative performance with an overweight to 30-year bonds and an underweight to two-year bonds. Western Asset Management’s duration and yield curve posture detracted, while positions in non-agency MBS and ABS contributed. JP Morgan (which was removed from the Fund in January) underperformed due to MBS security selection. Income Research & Management (which was added to the Fund in January) benefited from an overweight to and selection within commercial MBS.

The Fund used Treasury futures, eurodollar futures and to-be-announced (TBA) forward contracts to effectively manage duration, yield-curve and market exposures. (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS — Fannie Mae, Freddie Mac and Ginnie Mae.) None of these had a meaningful impact on the Fund’s performance.

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN 1 | |

| | | One Year

Return | | | Annualized 3 Year Return | | | Annualized 5 Year Return | | | Annualized 10 Year Return | | | Annualized Inception to Date | |

| New Covenant Income Fund | | | 4.00% | �� | | | 2.92% | | | | 2.71% | | | | 2.85% | | | | 2.78% | |

| Barclays U.S. Intermediate Aggregate Bond Index | | | 4.36% | | | | 3.24% | | | | 2.96% | | | | 4.66% | | | | 6.26% | |

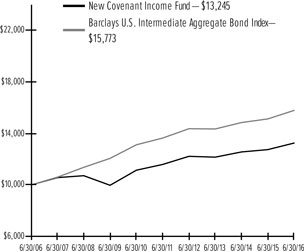

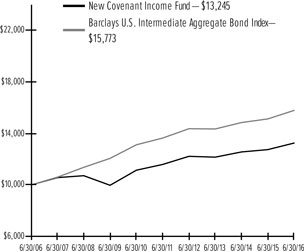

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Income Fund, versus the Barclays U.S. Intermediate Aggregate Bond Index.

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 7 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Income Fund (Concluded)

| 1 | For the years ended June 30, 2016. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| | |

| 8 | | New Covenant Funds / Annual Report / June 30, 2016 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Balanced Growth Fund

I. Objective

The New Covenant Balanced Growth Fund’s (the “Fund”) investment objective is to produce capital appreciation with less risk than would be present in a portfolio of only common stocks.

II. Investment Approach

The Fund’s assets are managed under the direction of SEI Investments Management Corporation (“SIMC”), which manages the Fund’s assets, in a way that it believes will achieve the Fund’s investment objective. In order to achieve its investment objective, SIMC allocates the Fund’s assets primarily in shares of the New Covenant Growth Fund (the “Growth Fund”) and the New Covenant Income Fund (the “Income Fund”), with a majority of its assets generally invested in shares of the Growth Fund. Between 45% and 75% of the Fund’s net assets (with a neutral position of approximately 60% of the Fund’s net assets) are invested in shares of the Growth Fund, with the balance of its assets invested in shares of the Income Fund. The Growth and Income Funds, in turn, invest directly in securities in accordance with their own varying investment objectives and policies.

III. Return vs. Benchmark

For the one-year period ending June 30, 2016, the Fund returned -0.50% and the Russell 1000 Index returned 2.93%.

IV. Fund Attribution

Both equities and fixed income provided positive returns over the period. For equities, market expectations of an improving domestic economy and the Federal Reserve’s (Fed) managed transition from an easing mindset derailed in August as concerns about oil prices, energy stocks, high-yield bonds and emerging markets came to the forefront for investors. This led to a short-lived market correction, during which losses were more pronounced within energy and cyclical sectors, smaller-cap companies and non-U.S. names.

Most of the losses were recovered by early November, as data — including an impressive U.S. jobs report — indicated the domestic economy was improving. This gave way to a modest Fed funds rate hike in December and, as the shareholder letter addressed, set a backdrop of monetary policy differences between the U.S. and other major developed nations that remained on an easing track. This divergence led to strong appreciation of the U.S. dollar versus other currencies, which further

exacerbated weakness among non-U.S. investments from a U.S. investor perspective.

High-yield bond market spreads widened again in late November due to concerns about energy companies and emerging markets. As noted in the shareholder letter, investor preference turned back to safety-based assets in both fixed income and equities during December and January. By early February, riskier out-of-favor investments regained momentum and clawed back most of their recent losses on the hopes that the worst had past.

U.S. Treasury yields were volatile during the fiscal year, with short-term yields rising and long-term yields declining as noted in the shareholder letter, resulting in generally positive returns for bonds. Returns were positive for non-Treasurys, including asset-backed, commercial-mortgage securities and agency-mortgage bonds, which all outperformed comparable duration-neutral U.S. Treasurys. While corporate bonds as a whole underperformed comparable Treasurys, the utilities and financials sub-sectors outperformed, while industrial bonds underperformed given the decline in commodity prices.

In the Growth Fund, performance struggled due to a combination of forward-looking allocations and traditional stock selection. Sector allocation detracted primarily due to an underweight to the utilities sector during an environment in which safety and stability were favored. All Growth Fund managers were underweight utilities not only for the time period, but also strategically in terms of their respective philosophies. Losses were greater from a stylistic perspective, where forward mean-reverting value strategies (buying inexpensive companies as measured by price-to-earnings or price-to-cash flow ratios, for example) were strongly disfavored. This trend was highly correlated to the declines in oil and energy prices, and continued through the end of the period in response to Brexit and other global growth worries. By contrast, pure safety measures (such as exposure to dividend yield and lower trailing stock volatility) had one of their strongest performances on record. Selection outside of these value-orientated headwinds was also negative, particularly within the pharmaceuticals portion of healthcare, and also within diversified financials and the automobile industry.

The Income Fund provided a positive return as interest rates generally declined over the period. The Income Fund’s underweight to U.S. Treasurys detracted, as that sector outperformed investment-grade credit as credit spreads widened in the period, although overweights

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 9 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Balanced Growth Fund (Concluded)

to the financials and utilities sub-sectors added to relative performance. An overweight to mortgage-backed securities (MBS), specifically non-agency MBS, contributed to relative performance, while selection within agency MBS detracted. Overweights to asset-backed securities (ABS) and commercial MBS, as well as selection within the latter with an emphasis on senior securities, also benefitted relative performance over the fiscal year. Additionally, yield-curve positioning contributed to relative performance with an overweight to 30-year bonds and an underweight to two-year bonds.

The Income Fund used Treasury futures, eurodollar futures and to-be-announced (TBA) forward contracts to effectively manage duration, yield-curve and market exposures. (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS — Fannie Mae, Freddie Mac and Ginnie Mae.) None of these had a meaningful impact on the Fund’s performance.

| | | | | | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURN 1,2 | |

| |

| |

| One

Year

Return |

| |

| Annualized

3 Year

Return |

| |

| Annualized

5 Year

Return |

| |

| Annualized

10 Year

Return |

| |

| Annualized

Inception

to Date |

|

| |

| New Covenant Balanced Growth Fund | | | -0.50% | | | | 6.25% | | | | 6.09% | | | | 4.29% | | | | 4.88% | |

| |

| Russell 1000 Index | | | 2.93% | | | | 11.48% | | | | 11.88% | | | | 7.51% | | | | 9.94% | |

| |

| Barclays U.S. Intermediate Aggregate Bond Index | | | 4.36% | | | | 3.24% | | | | 2.96% | | | | 4.66% | | | | 6.27% | |

| |

| Blended 60% Russell 1000 Index/40% Barclays U.S. Intermediate Aggregate Bond Index | | | 3.76% | | | | 8.28% | | | | 8.43% | | | | 6.68% | | | | 8.74% | |

| |

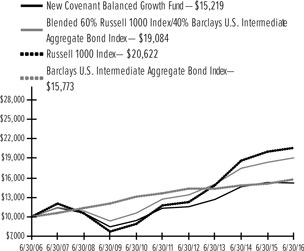

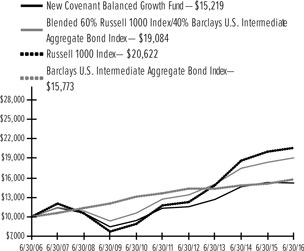

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Balanced Growth Fund, versus the Russell 1000 Index, Barclays U.S. Intermediate Aggregate Bond Index and Blended 60% Russell 1000 Index/40% Barclays U.S. Intermediate Aggregate Bond Index.

| 1 | For the years ended June 30, 2016. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| 2 | This table compares the Fund’s average annual total returns to those of a broad based index and the Fund’s 60/40 Blended Benchmark, which consists of the Russell 1000 Index and the Barclays U.S. Intermediate Aggregate Bond Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | |

| 10 | | New Covenant Funds / Annual Report / June 30, 2016 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Balanced Income Fund

I. Objective

The New Covenant Balanced Income Fund’s (the “Fund”) investment objective is to produce current income and long-term growth of capital.

II. Investment Approach

The Fund’s assets are managed under the direction of SEI Investments Management Corporation (“SIMC”), which manages the Fund’s assets, in a way that it believes will achieve the Fund’s investment objective. In order to achieve its investment objective, SIMC allocates the Fund’s assets primarily in shares of the New Covenant Growth Fund (the “Growth Fund”) and the New Covenant Income Fund (the “Income Fund”), with a majority of its assets generally invested in shares of the Income Fund. Between fifty percent and seventy-five percent of the Fund’s net assets (with a neutral position of approximately 65%) are invested in shares of the Income Fund, with the balance of its net assets invested in shares of the Growth Fund. The Growth and Income Funds, in turn, invest directly in securities in accordance with their own varying investment objectives and policies.

III. Return vs. Benchmark

For the one-year period ending June 30, 2016, the Fund returned 1.41% and the Russell 1000 Index returned 2.93%.

IV. Fund Attribution

Both equities and fixed income provided positive returns over the period. U.S. Treasury yields were volatile during the fiscal year, with short-term yields rising and long-term yields declining as noted in the shareholder letter, resulting in generally positive returns for bonds. Returns were positive for non-Treasurys, including asset-backed, commercial-mortgage securities and agency-mortgage bonds, which all outperformed comparable duration-neutral U.S. Treasurys. While corporate bonds as a whole underperformed comparable Treasurys, the utilities and financials sub-sectors outperformed, while industrial bonds underperformed given the decline in commodity prices.

For equities, market expectations of an improving domestic economy and the Federal Reserve’s (Fed) managed transition from an easing mindset derailed in August as concerns about oil prices, energy stocks, high-yield bonds and emerging markets came to the forefront for investors. This led to a short-lived market correction, during which losses were more pronounced within

energy and cyclical sectors, smaller-cap companies and non-U.S. names.

Most of the losses were recovered by early November, as data — including an impressive U.S. jobs report — indicated the domestic economy was improving. This gave way to a modest Fed funds rate hike in December and, as the shareholder letter addressed, set a backdrop of monetary policy differences between the U.S. and other major developed nations that remained on an easing track. This divergence led to strong appreciation of the U.S. dollar versus other currencies, which further exacerbated weakness among non-U.S. investments from a U.S. investor perspective.

High-yield bond market spreads widened again in late November due to concerns about energy companies and emerging markets. As noted in the shareholder letter, investor preference turned back to safety-based assets in both fixed income and equities during December and January. By early February, riskier out-of-favor investments regained momentum and clawed back most of their recent losses on the hopes that the worst had past.

The Income Fund provided a positive return as interest rates generally declined over the period. The Income Fund’s underweight to U.S. Treasurys detracted, as that sector outperformed investment-grade credit as credit spreads widened in the period, although overweights to the financials and utilities sub-sectors added to relative performance. An overweight to mortgage-backed securities (MBS), specifically non-agency MBS, contributed to relative performance, while selection within agency MBS detracted. Overweights to asset-backed securities (ABS) and commercial MBS, as well as selection within the latter with an emphasis on senior securities, also benefitted relative performance over the fiscal year. Additionally, yield-curve positioning contributed to relative performance with an overweight to 30-year bonds and an underweight to two-year bonds.

In the Growth Fund, performance struggled due to a combination of forward-looking allocations and traditional stock selection. Sector allocation detracted primarily due to an underweight to the utilities sector during an environment in which safety and stability were favored. All Growth Fund managers were underweight utilities not only for the time period, but also strategically in terms of their respective philosophies. Losses were greater from a stylistic perspective, where forward mean-reverting value strategies (buying inexpensive companies as measured by price-to-earnings or price-to-cash flow ratios, for example) were strongly disfavored.

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 11 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

JUNE 30, 2016 (Unaudited)

New Covenant Balanced Income Fund (Concluded)

This trend was highly correlated to the declines in oil and energy prices, and continued through the end of the period in response to Brexit and other global growth worries. By contrast, pure safety measures (such as exposure to dividend yield and lower trailing stock volatility) had one of their strongest performances on record. Selection outside of these value-orientated headwinds was also negative, particularly within the pharmaceuticals portion of healthcare, and also within diversified financials and the automobile industry.

The Income Fund used Treasury futures, eurodollar futures and to-be-announced (TBA) forward contracts to effectively manage duration, yield-curve and market exposures. (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS — Fannie Mae, Freddie Mac and Ginnie Mae.) None of these had a meaningful impact on the Fund’s performance.

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN 1,2 | |

| | | One

Year

Return | | | Annualized

3 Year

Return | | | Annualized

5 Year

Return | | | Annualized

10 Year

Return | | | Annualized

Inception

to Date | |

| New Covenant Balanced Income Fund | | | 1.41% | | | | 4.81% | | | | 4.64% | | | | 3.66% | | | | 3.88% | |

| Russell 1000 Index | | | 2.93% | | | | 11.48% | | | | 11.88% | | | | 7.51% | | | | 9.38% | |

| Barclays U.S. Intermediate Aggregate Bond Index | | | 4.36% | | | | 3.24% | | | | 2.96% | | | | 4.66% | | | | 6.07% | |

| Blended 35% Russell 1000 Index/65% Barclays U.S. Intermediate Aggregate Bond Index | | | 4.10% | | | | 6.21% | | | | 6.20% | | | | 5.95% | | | | 7.48% | |

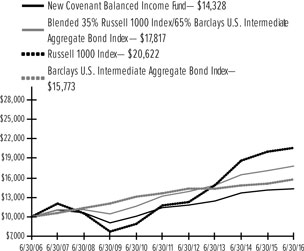

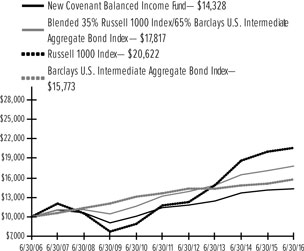

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Balanced Income Fund, versus the Russell 1000 Index, Barclays U.S. Intermediate Aggregate Bond Index and Blended 35% Russell 1000 Index/65% Barclays U.S. Intermediate Aggregate Bond Index.

| 1 | For the years ended June 30, 2016. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| 2 | This table compares the Fund’s average annual total returns to those of a broad-based index and the Fund’s 35/65 Blended Benchmark, which consists of the Russell 1000 Index and the Barclays U.S. Intermediate Aggregate Bond Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | |

| 12 | | New Covenant Funds / Annual Report / June 30, 2016 |

SCHEDULE OF INVESTMENTS

June 30, 2016

New Covenant Growth Fund

| | | | |

| Sector Weightings (Unaudited)†: | | | | |

|

|

†Percentages are based on total investments.

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

| | |

COMMON STOCK — 92.1% | | | | | | | | |

Canada — 1.5% | | | | | | | | |

Canadian Natural Resources | | | 80,545 | | | $ | 2,483 | |

Canadian Pacific Railway | | | 10,082 | | | | 1,298 | |

Magna International | | | 58,954 | | | | 2,068 | |

| | | | | | | 5,849 | |

| | |

China — 0.7% | | | | | | | | |

Tencent Holdings ADR | | | 123,615 | | | | 2,839 | |

| | |

Hong Kong — 0.5% | | | | | | | | |

China Mobile ADR | | | 33,332 | | | | 1,930 | |

| | |

Ireland — 1.4% | | | | | | | | |

Accenture, Cl A | | | 2,147 | | | | 243 | |

Ingersoll-Rand | | | 3,390 | | | | 216 | |

Jazz Pharmaceuticals * | | | 1,291 | | | | 182 | |

Mallinckrodt * | | | 11,336 | | | | 689 | |

Medtronic | | | 17,662 | | | | 1,533 | |

Shire ADR | | | 14,058 | | | | 2,588 | |

| | | | | | | 5,451 | |

| | |

Israel — 0.6% | | | | | | | | |

Teva Pharmaceutical Industries ADR | | | 47,023 | | | | 2,362 | |

| | |

Japan — 0.5% | | | | | | | | |

Toyota Motor ADR | | | 18,984 | | | | 1,898 | |

| | |

Netherlands — 0.2% | | | | | | | | |

Chicago Bridge & Iron | | | 23,052 | | | | 798 | |

| | |

Puerto Rico — 0.1% | | | | | | | | |

Popular | | | 23,691 | | | | 694 | |

| | |

United Kingdom — 1.7% | | | | | | | | |

BP ADR | | | 131,639 | | | | 4,675 | |

Liberty Global, Cl A * | | | 67,623 | | | | 1,965 | |

| | | | | | | 6,640 | |

| | |

United States — 84.9% | | | | | | | | |

| | |

Consumer Discretionary — 13.2% | | | | | | | | |

Amazon.com * | | | 13,360 | | | | 9,561 | |

Best Buy | | | 6,116 | | | | 187 | |

Cable One | | | 417 | | | | 213 | |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

Charter Communications, Cl A * | | | 916 | | | $ | 209 | |

Chipotle Mexican Grill, Cl A * | | | 6,468 | | | | 2,605 | |

Comcast, Cl A | | | 32,437 | | | | 2,115 | |

Dillard’s, Cl A | | | 12,657 | | | | 767 | |

Dollar General | | | 34,792 | | | | 3,270 | |

Domino’s Pizza | | | 5,741 | | | | 754 | |

Ford Motor | | | 17,445 | | | | 219 | |

General Motors | | | 91,915 | | | | 2,601 | |

Goodyear Tire & Rubber | | | 48,221 | | | | 1,237 | |

Hasbro | | | 3,540 | | | | 297 | |

Hilton Worldwide Holdings | | | 9,039 | | | | 204 | |

Home Depot | | | 29,525 | | | | 3,770 | |

John Wiley & Sons, Cl A | | | 4,244 | | | | 221 | |

Johnson Controls | | | 9,270 | | | | 410 | |

Kohl’s | | | 35,518 | | | | 1,347 | |

L Brands | | | 1,988 | | | | 133 | |

Liberty Global LiLAC * | | | 8,437 | | | | 272 | |

Liberty Ventures, Ser A * | | | 14,720 | | | | 546 | |

Lowe’s | | | 17,966 | | | | 1,422 | |

Macy’s | | | 41,112 | | | | 1,382 | |

Madison Square Garden * | | | 1,136 | | | | 196 | |

Michael Kors Holdings * | | | 42,430 | | | | 2,099 | |

Netflix * | | | 25,655 | | | | 2,347 | |

Newell Brands | | | 10,273 | | | | 499 | |

NIKE, Cl B | | | 43,661 | | | | 2,410 | |

Omnicom Group | | | 40,282 | | | | 3,283 | |

priceline.com * | | | 1,507 | | | | 1,881 | |

Scripps Networks Interactive, Cl A | | | 11,302 | | | | 704 | |

ServiceMaster Global Holdings * | | | 4,767 | | | | 190 | |

Staples | | | 20,697 | | | | 178 | |

Starbucks | | | 21,282 | | | | 1,216 | |

Target | | | 5,064 | | | | 354 | |

Tesla Motors * | | | 1,290 | | | | 274 | |

Thomson Reuters | | | 12,073 | | | | 488 | |

TripAdvisor * | | | 16,799 | | | | 1,080 | |

Tupperware Brands | | | 7,571 | | | | 426 | |

Twenty-First Century Fox, Cl A | | | 18,283 | | | | 495 | |

Under Armour, Cl C * | | | 5,368 | | | | 195 | |

Visteon | | | 3,720 | | | | 245 | |

Walt Disney | | | 1,816 | | | | 178 | |

Williams-Sonoma | | | 3,319 | | | | 173 | |

| | |

| | | | | | | 52,653 | |

| | |

Consumer Staples — 8.7% | | | | | | | | |

Campbell Soup | | | 19,200 | | | | 1,277 | |

Clorox | | | 11,827 | | | | 1,637 | |

Coca-Cola | | | 43,634 | | | | 1,978 | |

Colgate-Palmolive | | | 5,492 | | | | 402 | |

Costco Wholesale | | | 20,790 | | | | 3,265 | |

CVS Caremark | | | 33,266 | | | | 3,185 | |

Dr. Pepper Snapple Group | | | 18,651 | | | | 1,802 | |

General Mills | | | 15,944 | | | | 1,137 | |

Hershey | | | 4,367 | | | | 496 | |

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 13 |

SCHEDULE OF INVESTMENTS

June 30, 2016

New Covenant Growth Fund (Continued)

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

JM Smucker | | | 17,312 | | | $ | 2,639 | |

Kellogg | | | 13,042 | | | | 1,065 | |

Kimberly-Clark | | | 8,984 | | | | 1,235 | |

Kraft Heinz | | | 33,784 | | | | 2,989 | |

Kroger | | | 42,369 | | | | 1,559 | |

Mead Johnson Nutrition, Cl A | | | 13,346 | | | | 1,211 | |

Monster Beverage * | | | 3,589 | | | | 577 | |

PepsiCo | | | 18,163 | | | | 1,924 | |

Procter & Gamble | | | 39,359 | | | | 3,333 | |

Rite Aid * | | | 25,211 | | | | 189 | |

Spectrum Brands Holdings | | | 1,514 | | | | 181 | |

Sysco | | | 7,853 | | | | 398 | |

US Foods Holding * | | | 36,187 | | | | 877 | |

Walgreens Boots Alliance | | | 10,512 | | | | 875 | |

| | |

| | | | | | | 34,231 | |

| | |

Energy — 6.9% | | | | | | | | |

Anadarko Petroleum | | | 23,440 | | | | 1,248 | |

Apache | | | 26,622 | | | | 1,482 | |

Baker Hughes | | | 11,697 | | | | 528 | |

Cabot Oil & Gas | | | 55,134 | | | | 1,419 | |

Chevron | | | 9,547 | | | | 1,001 | |

Cimarex Energy | | | 17,084 | | | | 2,038 | |

Concho Resources * | | | 9,021 | | | | 1,076 | |

Devon Energy | | | 79,215 | | | | 2,872 | |

Diamondback Energy * | | | 6,408 | | | | 584 | |

EOG Resources | | | 31,284 | | | | 2,610 | |

EQT | | | 2,732 | | | | 212 | |

Exxon Mobil | | | 2,218 | | | | 208 | |

Gulfport Energy * | | | 7,288 | | | | 228 | |

Halliburton | | | 64,606 | | | | 2,926 | |

Helmerich & Payne | | | 15,340 | | | | 1,030 | |

Hess | | | 4,700 | | | | 282 | |

Newfield Exploration * | | | 4,642 | | | | 205 | |

Occidental Petroleum | | | 42,871 | | | | 3,239 | |

PrairieSky Royalty | | | 1,765 | | | | 33 | |

Royal Dutch Shell ADR, Cl A | | | 62,587 | | | | 3,456 | |

Schlumberger | | | 5,289 | | | | 418 | |

| | |

| | | | | | | 27,095 | |

| | |

Financials — 12.2% | | | | | | | | |

Aflac | | | 35,263 | | | | 2,545 | |

American International Group | | | 23,177 | | | | 1,226 | |

American Tower, Cl A ‡ | | | 27,576 | | | | 3,133 | |

Arthur J Gallagher | | | 5,408 | | | | 257 | |

AvalonBay Communities ‡ | | | 2,286 | | | | 412 | |

Bank of America | | | 335,151 | | | | 4,447 | |

Berkshire Hathaway, Cl B * | | | 30,200 | | | | 4,373 | |

Blackstone Group (A) | | | 67,613 | | | | 1,659 | |

Chimera Investment ‡ | | | 27,516 | | | | 432 | |

Citigroup | | | 105,092 | | | | 4,455 | |

Corporate Office Properties Trust ‡ | | | 21,890 | | | | 647 | |

Crown Castle International ‡ | | | 25,457 | | | | 2,582 | |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

Cullen | | | 9,288 | | | $ | 592 | |

Forest City Realty Trust, Cl A ‡ | | | 10,256 | | | | 229 | |

Goldman Sachs Group | | | 6,238 | | | | 927 | |

JPMorgan Chase | | | 83,577 | | | | 5,193 | |

KKR (A) | | | 189,329 | | | | 2,336 | |

Marsh & McLennan | | | 39,761 | | | | 2,722 | |

MetLife | | | 32,110 | | | | 1,279 | |

Morgan Stanley | | | 18,121 | | | | 471 | |

Morningstar | | | 2,226 | | | | 182 | |

Northern Trust | | | 18,122 | | | | 1,201 | |

ProLogis ‡ | | | 16,644 | | | | 816 | |

Prudential Financial | | | 3,399 | | | | 242 | |

Regency Centers ‡ | | | 6,727 | | | | 563 | |

Santander Consumer USA Holdings * | | | 108,741 | | | | 1,123 | |

State Street | | | 45,310 | | | | 2,443 | |

Synchrony Financial * | | | 28,395 | | | | 718 | |

Validus Holdings | | | 4,808 | | | | 234 | |

Wells Fargo | | | 17,038 | | | | 806 | |

Weyerhaeuser ‡ | | | 15,108 | | | | 450 | |

| | |

| | | | | | | 48,695 | |

| | |

Health Care — 13.1% | | | | | | | | |

Abbott Laboratories | | | 26,354 | | | | 1,036 | |

AbbVie | | | 29,915 | | | | 1,852 | |

Acadia Healthcare * | | | 3,163 | | | | 175 | |

Alexion Pharmaceuticals * | �� | | 8,455 | | | | 987 | |

Allergan * | | | 12,995 | | | | 3,003 | |

AmerisourceBergen, Cl A | | | 22,183 | | | | 1,760 | |

Amgen | | | 19,034 | | | | 2,896 | |

Baxter International | | | 61,982 | | | | 2,803 | |

Becton Dickinson and | | | 29,117 | | | | 4,938 | |

Biogen Idec * | | | 2,700 | | | | 653 | |

Boston Scientific * | | | 57,338 | | | | 1,340 | |

Bristol-Myers Squibb | | | 36,636 | | | | 2,695 | |

Celgene * | | | 20,592 | | | | 2,031 | |

Cigna | | | 4,415 | | | | 565 | |

Edwards Lifesciences * | | | 3,081 | | | | 307 | |

Eli Lilly | | | 2,709 | | | | 213 | |

Gilead Sciences | | | 39,557 | | | | 3,300 | |

HCA Holdings * | | | 18,054 | | | | 1,390 | |

Horizon Pharma * | | | 66,714 | | | | 1,099 | |

Illumina * | | | 13,931 | | | | 1,956 | |

Intuitive Surgical * | | | 320 | | | | 212 | |

Johnson & Johnson | | | 29,946 | | | | 3,632 | |

Medivation * | | | 3,950 | | | | 238 | |

Merck | | | 14,063 | | | | 810 | |

Mylan * | | | 14,258 | | | | 617 | |

Pfizer | | | 36,793 | | | | 1,295 | |

Regeneron Pharmaceuticals * | | | 4,140 | | | | 1,446 | |

ResMed | | | 2,930 | | | | 185 | |

UnitedHealth Group | | | 50,911 | | | | 7,189 | |

Varian Medical Systems * | | | 2,214 | | | | 182 | |

Vertex Pharmaceuticals * | | | 10,023 | | | | 862 | |

| | |

| 14 | | New Covenant Funds / Annual Report / June 30, 2016 |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

VWR * | | | 7,046 | | | $ | 204 | |

| | |

| | | | | | | 51,871 | |

Industrials — 8.4% | | | | | | | | |

3M | | | 21,029 | | | | 3,683 | |

Acuity Brands | | | 2,979 | | | | 739 | |

AECOM Technology * | | | 18,799 | | | | 597 | |

AerCap Holdings * | | | 44,389 | | | | 1,491 | |

Allegion | | | 2,910 | | | | 202 | |

American Airlines Group | | | 60,013 | | | | 1,699 | |

BE Aerospace | | | 13,074 | | | | 604 | |

Caterpillar | | | 5,994 | | | | 454 | |

Covanta Holding | | | 32,357 | | | | 532 | |

Deere | | | 3,383 | | | | 274 | |

Delta Air Lines | | | 69,296 | | | | 2,524 | |

Eaton | | | 22,899 | | | | 1,368 | |

General Electric | | | 19,163 | | | | 603 | |

Hexcel | | | 4,105 | | | | 171 | |

Illinois Tool Works | | | 32,012 | | | | 3,334 | |

Kansas City Southern | | | 12,614 | | | | 1,136 | |

ManpowerGroup | | | 8,258 | | | | 531 | |

Norfolk Southern | | | 23,254 | | | | 1,980 | |

Orbital ATK | | | 4,890 | | | | 416 | |

Owens Corning | | | 4,196 | | | | 216 | |

Southwest Airlines | | | 4,455 | | | | 175 | |

Stanley Black & Decker | | | 1,841 | | | | 205 | |

Terex | | | 51,698 | | | | 1,050 | |

TransDigm Group * | �� | | 5,740 | | | | 1,514 | |

Union Pacific | | | 18,424 | | | | 1,607 | |

United Parcel Service, Cl B | | | 6,206 | | | | 669 | |

United Technologies | | | 1,811 | | | | 186 | |

Waste Management | | | 3,397 | | | | 225 | |

WW Grainger | | | 18,783 | | | | 4,268 | |

Xylem | | | 5,835 | | | | 261 | |

| | |

| | | | | | | 32,714 | |

| | |

Information Technology — 17.6% | | | | | | | | |

Activision Blizzard | | | 52,300 | | | | 2,073 | |

Adobe Systems * | | | 29,116 | | | | 2,789 | |

Alliance Data Systems * | | | 904 | | | | 177 | |

Alphabet, Cl A * | | | 14,167 | | | | 9,967 | |

Alphabet, Cl C * | | | 1,671 | | | | 1,157 | |

Analog Devices | | | 4,506 | | | | 255 | |

Apple | | | 20,038 | | | | 1,916 | |

Applied Materials | | | 196,729 | | | | 4,716 | |

Automatic Data Processing | | | 23,809 | | | | 2,187 | |

Black Knight Financial Services, Cl A * | | | 6,144 | | | | 231 | |

CA | | | 12,146 | | | | 399 | |

Cisco Systems | | | 81,984 | | | | 2,352 | |

Cognizant Technology Solutions, Cl A * | | | 5,218 | | | | 299 | |

eBay * | | | 7,634 | | | | 179 | |

EMC | | | 30,157 | | | | 819 | |

Facebook, Cl A * | | | 70,191 | | | | 8,021 | |

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

FleetCor Technologies * | | | 9,375 | | | $ | 1,342 | |

Global Payments | | | 13,035 | | | | 930 | |

Ingram Micro, Cl A | | | 6,261 | | | | 218 | |

Intel | | | 33,132 | | | | 1,087 | |

International Business Machines | | | 4,066 | | | | 617 | |

Juniper Networks | | | 7,785 | | | | 175 | |

Lam Research | | | 12,708 | | | | 1,068 | |

Lexmark International, Cl A | | | 5,543 | | | | 209 | |

Mastercard, Cl A | | | 19,576 | | | | 1,724 | |

Microchip Technology | | | 49,356 | | | | 2,505 | |

Micron Technology * | | | 188,783 | | | | 2,598 | |

Microsoft | | | 133,298 | | | | 6,821 | |

Motorola Solutions | | | 4,687 | | | | 309 | |

NVIDIA | | | 4,150 | | | | 195 | |

NXP Semiconductors * | | | 21,635 | | | | 1,695 | |

Oracle | | | 11,032 | | | | 452 | |

Salesforce.com * | | | 34,716 | | | | 2,757 | |

Symantec | | | 15,350 | | | | 315 | |

Texas Instruments | | | 7,575 | | | | 475 | |

Visa, Cl A | | | 88,286 | | | | 6,548 | |

| | |

| | | | | | | 69,577 | |

| | |

Materials — 3.1% | | | | | | | | |

Air Products & Chemicals | | | 13,366 | | | | 1,899 | |

Alcoa | | | 18,948 | | | | 176 | |

Ball | | | 9,099 | | | | 658 | |

Dow Chemical | | | 18,722 | | | | 931 | |

Eastman Chemical | | | 14,450 | | | | 981 | |

Ecolab | | | 10,832 | | | | 1,285 | |

Louisiana-Pacific * | | | 34,939 | | | | 606 | |

Newmont Mining | | | 5,259 | | | | 206 | |

Praxair | | | 11,097 | | | | 1,247 | |

Reliance Steel & Aluminum | | | 8,576 | | | | 660 | |

Sherwin-Williams | | | 11,326 | | | | 3,326 | |

Sonoco Products | | | 5,855 | | | | 291 | |

| | |

| | | | | | | 12,266 | |

| | |

Telecommunication Services — 0.9% | | | | | | | | |

AT&T | | | 5,187 | | | | 224 | |

Level 3 Communications * | | | 20,480 | | | | 1,055 | |

Liberty SiriusXM Group, Cl C * | | | 5,993 | | | | 185 | |

SBA Communications, Cl A * | | | 5,603 | | | | 605 | |

Verizon Communications | | | 20,491 | | | | 1,144 | |

| | |

| | | | | | | 3,213 | |

| | |

Utilities — 0.8% | | | | | | | | |

American Water Works | | | 10,442 | | | | 882 | |

Calpine * | | | 12,748 | | | | 188 | |

CMS Energy | | | 23,592 | | | | 1,082 | |

Eversource Energy | | | 4,495 | | | | 269 | |

Exelon | | | 5,418 | | | | 197 | |

Sempra Energy | | | 1,856 | | | | 212 | |

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 15 |

SCHEDULE OF INVESTMENTS

June 30, 2016

New Covenant Growth Fund (Concluded)

| | | | | | | | |

| Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK (continued) | | | | | | | | |

Xcel Energy | | | 4,714 | | | $ | 211 | |

| | |

| | | | | | | 3,041 | |

| | | | | | | 335,356 | |

Total Common Stock | | | | | | | | |

(Cost $317,830) ($ Thousands) | | | | | | | 363,817 | |

| | | Face Amount

($ Thousands) | | | | |

U.S. TREASURY OBLIGATION — 0.1% | | | | | | | | |

U.S. Treasury Bill | | | | | | | | |

0.225%, 08/18/2016 (B) | | $ | 175 | | | | 175 | |

| | |

Total U.S. Treasury Obligation | | | | | | | | |

(Cost $175) ($ Thousands) | | | | | | | 175 | |

| | | Shares | | | | | |

CASH EQUIVALENT — 4.7% | | | | | | | | |

SEI Daily Income Trust, Government Fund, Cl A 0.150% **† | | | 18,617,587 | | | | 18,618 | |

| | |

Total Cash Equivalent | | | | | | | | |

(Cost $18,618) ($ Thousands) | | | | | | | 18,618 | |

| | |

Total Investments — 96.9% | | | | | | | | |

(Cost $336,623) ($ Thousands) | | | | | | $ | 382,610 | |

| | | | | | | | |

A list of the open futures contracts held by the Fund at June 30, 2016 are as follows:

| | | | | | | | | | | | |

| Type of Contract | | Number of

Contracts

Long | | | Expiration

Date | | | Unrealized

Appreciation

($ Thousands) | |

| S&P Mid Cap 400 Index E-MINI | | | 2 | | | | Sep-2016 | | | | $ 6 | |

S&P 500 Index E-MINI | | | 29 | | | | Sep-2016 | | | | 44 | |

| | | | | | | | | | | $50 | |

| | | | | | | | | | | | |

For the year ended June 30, 2016, the total amount of all open futures contracts, as presented in the table above, are representative of the volume of activity for the derivative type during the year.

The futures contracts are considered to have interest rate risk associated with them.

Percentages are based on a Net Assets of $394,943 ($ Thousands).

| ‡ | Real Estate Investment Trust. |

| * | Non-income producing security. |

| ** | Rate shown is the 7-day effective yield as of June 30, 2016. |

| † | Investment in Affiliated Security (see Note 3). |

| (A) | Security is a Master Limited Partnership. At June 30, 2016, such securities amounted to $3,995 ($ Thousands), or 1.01% of Net Assets (See Note 2). |

| (B) | The rate reported is the effective yield at time of purchase. |

ADR — American Depositary Receipt

Cl — Class

S&P — Standard & Poor’s

The following is a list of the levels of inputs used as of June 30, 2016 in valuing the Fund’s investments and other financial instruments carried at value ($ Thousands):

| | | | | | | | | | | | | | | | |

Investments in Securities | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

Common Stock | | $ | 363,817 | | | $ | – | | | $ | – | | | $ | 363,817 | |

U.S. Treasury Obligation | | | – | | | | 175 | | | | – | | | | 175 | |

Cash Equivalent | | | 18,618 | | | | – | | | | – | | | | 18,618 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 382,435 | | | $ | 175 | | | $ | – | | | $ | 382,610 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

Futures Contracts * | | | | | | | | | | | | | | | | |

Unrealized Appreciation | | $ | 50 | | | $ | — | | | $ | — | | | $ | 50 | |

| | | | | | | | | | | | | | | | |

Total Other Financial Instruments | | $ | 50 | | | $ | — | | | $ | — | | | $ | 50 | |

| | | | | | | | | | | | | | | | |

* Futures contracts are valued at the unrealized appreciation on the instrument.

For the year ended June 30, 2016, there were no transfers between Level 1 and Level 2 assets and liabilities.

For the year ended June 30, 2016, there were no transfers between Level 2 and Level 3 assets and liabilities.

Amounts designated as “—” are either $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

| | |

| 16 | | New Covenant Funds / Annual Report / June 30, 2016 |

SCHEDULE OF INVESTMENTS

June 30, 2016

New Covenant Income Fund

Sector Weightings (Unaudited)†:

†Percentages based on total investments.

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

MORTGAGE-BACKED SECURITIES — 34.0% | |

Agency Mortgage-Backed Obligations — 24.8% | |

FHLMC | | | | | | | | |

6.500%, 09/01/2039 | | $ | 79 | | | $ | 92 | |

5.500%, 12/01/2035 to 12/01/2038 | | | 2,304 | | | | 2,655 | |

5.000%, 12/01/2020 to 02/01/2040 | | | 722 | | | | 784 | |

4.500%, 05/01/2042 | | | 2,109 | | | | 2,303 | |

4.000%, 04/01/2043 to 08/01/2043 | | | 586 | | | | 639 | |

3.953%, 07/01/2040 (A) | | | 176 | | | | 184 | |

3.500%, 11/01/2042 to 12/01/2045 | | | 4,991 | | | | 5,298 | |

FHLMC CMO, Ser 2005-2990, Cl UZ | | | | | | | | |

5.750%, 06/15/2035 | | | 644 | | | | 747 | |

FHLMC CMO, Ser 2009-3558, Cl G | | | | | | | | |

4.000%, 08/15/2024 | | | 270 | | | | 300 | |

FHLMC CMO, Ser 2012-4013, Cl AI, IO | | | | | | | | |

4.000%, 02/15/2039 | | | 394 | | | | 31 | |

FHLMC CMO, Ser 2012-4057, Cl UI, IO | | | | | | | | |

3.000%, 05/15/2027 | | | 326 | | | | 31 | |

FHLMC CMO, Ser 2012-4085, Cl IO, IO | | | | | | | | |

3.000%, 06/15/2027 | | | 750 | | | | 72 | |

FHLMC CMO, Ser 2012-4092, Cl AI, IO | | | | | | | | |

3.000%, 09/15/2031 | | | 968 | | | | 83 | |

FHLMC CMO, Ser 2013-4203, Cl PS, IO | | | | | | | | |

5.808%, 09/15/2042 (A) | | | 334 | | | | 64 | |

FHLMC CMO, Ser 2013-4219, Cl JA | | | | | | | | |

3.500%, 08/15/2039 | | | 755 | | | | 800 | |

FHLMC CMO, Ser 2013-4231, Cl FB | | | | | | | | |

0.892%, 07/15/2038 (A) | | | 425 | | | | 428 | |

FHLMC Multifamily Structured Pass-Through Certificates, Ser K715, Cl X1, IO | | | | | | | | |

1.153%, 01/25/2021 (A) | | | 3,150 | | | | 137 | |

FHLMC Structured Agency Credit Risk Debt Notes, Ser 2014-HQ1, Cl M2 | | | | | | | | |

2.953%, 08/25/2024 (A) | | | 250 | | | | 253 | |

FHLMC TBA | | | | | | | | |

3.500%, 08/25/2041 | | | 700 | | | | 737 | |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

MORTGAGE-BACKED SECURITIES (continued) | |

2.500%, 08/15/2027 | | $ | 1,000 | | | $ | 1,032 | |

FHLMC, Ser 2011-3947, Cl SG, IO | | | | | | | | |

5.508%, 10/15/2041 (A) | | | 548 | | | | 91 | |

FHLMC, Ser 2012-4073, Cl MF | | | | | | | | |

0.892%, 08/15/2039 (A) | | | 245 | | | | 246 | |

FHLMC, Ser 2012-4099, Cl ST, IO | | | | | | | | |

5.558%, 08/15/2042 (A) | | | 204 | | | | 38 | |

FHLMC, Ser 2013-4194, Cl BI, IO | | | | | | | | |

3.500%, 04/15/2043 | | | 543 | | | | 68 | |

FHLMC, Ser 2014-326, Cl F2 | | | | | | | | |

0.992%, 03/15/2044 (A) | | | 495 | | | | 496 | |

FHLMC, Ser 2014-4310, Cl SA, IO | | | | | | | | |

5.508%, 02/15/2044 (A) | | | 84 | | | | 16 | |

FHLMC, Ser 2014-4335, Cl SW, IO | | | | | | | | |

5.558%, 05/15/2044 (A) | | | 171 | | | | 33 | |

FHLMC, Ser 2014-4415, Cl IO, IO | | | | | | | | |

1.858%, 04/15/2041 (A) | | | 152 | | | | 11 | |

FNMA | | | | | | | | |

7.000%, 11/01/2037 to 11/01/2038 | | | 58 | | | | 66 | |

6.500%, 08/01/2017 to 05/01/2040 | | | 518 | | | | 592 | |

6.000%, 07/01/2037 to 11/01/2038 | | | 319 | | | | 364 | |

5.500%, 02/01/2035 | | | 262 | | | | 298 | |

5.000%, 01/01/2021 to 06/01/2040 | | | 2,184 | | | | 2,425 | |

4.500%, 01/01/2041 to 01/01/2045 | | | 2,175 | | | | 2,414 | |

4.000%, 06/01/2025 to 01/01/2045 | | | 11,666 | | | | 12,602 | |

3.500%, 12/01/2032 to 01/01/2046 | | | 8,967 | | | | 9,503 | |

2.763%, 03/01/2036 (A) | | | 48 | | | | 50 | |

2.517%, 01/01/2036 (A) | | | 71 | | | | 74 | |

2.500%, 10/01/2042 | | | 833 | | | | 843 | |

1.845%, 05/01/2043 (A) | | | 1,565 | | | | 1,611 | |

FNMA CMO, Ser 1992-1, Cl F | | | | | | | | |

1.246%, 01/25/2022 (A) | | | 67 | | | | 68 | |

FNMA CMO, Ser 2003-W2, Cl 2A9 | | | | | | | | |

5.900%, 07/25/2042 | | | 708 | | | | 821 | |

FNMA CMO, Ser 2004-90, Cl LH | | | | | | | | |

5.000%, 04/25/2034 | | | 397 | | | | 413 | |

FNMA CMO, Ser 2005-22, Cl DA | | | | | | | | |

5.500%, 12/25/2034 | | | 374 | | | | 405 | |

FNMA CMO, Ser 2011-44, Cl EB | | | | | | | | |

3.000%, 05/25/2026 | | | 500 | | | | 532 | |

FNMA CMO, Ser 2012-108, Cl F | | | | | | | | |

0.946%, 10/25/2042 (A) | | | 355 | | | | 355 | |

FNMA CMO, Ser 2012-128, Cl SQ, IO | | | | | | | | |

5.704%, 11/25/2042 (A) | | | 72 | | | | 16 | |

FNMA CMO, Ser 2012-128, Cl SL, IO | | | | | | | | |

5.704%, 11/25/2042 (A) | | | 146 | | | | 35 | |

FNMA CMO, Ser 2012-74, Cl AI, IO | | | | | | | | |

3.000%, 07/25/2027 | | | 1,189 | | | | 117 | |

FNMA CMO, Ser 2012-93, Cl UI, IO | | | | | | | | |

3.000%, 09/25/2027 | | | 916 | | | | 86 | |

FNMA CMO, Ser 2012-93, Cl SG, IO | | | | | | | | |

5.647%, 09/25/2042 (A) | | | 252 | | | | 47 | |

| | |

| New Covenant Funds / Annual Report / June 30, 2016 | | 17 |

SCHEDULE OF INVESTMENTS

June 30, 2016

New Covenant Income Fund (Continued)

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

MORTGAGE-BACKED SECURITIES (continued) | |

FNMA TBA | | | | | | | | |

4.000%, 07/13/2039 | | $ | 2,700 | | | $ | 2,895 | |

3.500%, 08/01/2040 to 08/01/2040 | | | 1,100 | | | | 1,165 | |

3.000%, 08/25/2026 | | | 200 | | | | 209 | |

2.500%, 08/25/2027 | | | 200 | | | | 207 | |

FNMA TBA | | | | | | | | |

5.000%, 07/15/2038 | | | 1,500 | | | | 1,667 | |

FNMA, Ser 2005-29, Cl ZA | | | | | | | | |

5.500%, 04/25/2035 | | | 232 | | | | 263 | |

FNMA, Ser 2014-47, Cl AI, IO | | | | | | | | |

1.890%, 08/25/2044 (A) | | | 710 | | | | 48 | |

FNMA, Ser 2015-55, Cl IO, IO | | | | | | | | |

1.686%, 08/25/2055 (A) | | | 85 | | | | 5 | |

FNMA, Ser 2015-56, Cl AS, IO | | | | | | | | |

5.697%, 08/25/2045 (A) | | | 93 | | | | 25 | |

FNMA, Ser M3, Cl X2, IO | | | | | | | | |

0.385%, 10/25/2024 (A) | | | 4,908 | | | | 133 | |

FNMA, Ser M5, Cl SA, IO | | | | | | | | |

1.579%, 01/25/2017 (A) | | | 310 | | | | – | |

FNMA, Ser M7, Cl AB2 | | | | | | | | |

2.502%, 12/25/2024 | | | 100 | | | | 103 | |

FREMF Mortgage Trust, Ser K44, Cl C | | | | | | | | |

3.811%, 01/25/2048 (A)(B) | | | 130 | | | | 109 | |

FREMF Mortgage Trust, Ser K503, Cl C | | | | | | | | |

3.009%, 10/25/2047 (A)(B) | | | 140 | | | | 136 | |

GNMA | | | | | | | | |

5.500%, 02/20/2037 to 01/15/2039 | | | 348 | | | | 389 | |

5.000%, 12/20/2038 to 07/20/2040 | | | 1,710 | | | | 1,895 | |

4.500%, 07/20/2038 to 07/20/2041 | | | 1,552 | | | | 1,689 | |

4.000%, 03/20/2046 | | | 2,135 | | | | 2,289 | |

3.500%, 08/20/2045 to 09/20/2045 | | | 1,652 | | | | 1,755 | |

2.500%, 02/20/2027 | | | 1,479 | | | | 1,540 | |

GNMA CMO, Ser 2009-108, Cl WG | | | | | | | | |

4.000%, 09/20/2038 | | | 282 | | | | 294 | |

GNMA CMO, Ser 2012-66, Cl CI, IO | | | | | | | | |

3.500%, 02/20/2038 | | | 171 | | | | 12 | |

GNMA CMO, Ser 2012-77, Cl KI, IO | | | | | | | | |

7.500%, 04/20/2031 | | | 23 | | | | 4 | |

GNMA CMO, Ser 2012-H18, Cl NA | | | | | | | | |

0.956%, 08/20/2062 (A) | | | 281 | | | | 279 | |

GNMA CMO, Ser 2013-H21, Cl FB | | | | | | | | |

1.137%, 09/20/2063 (A) | | | 665 | | | | 667 | |

GNMA TBA | | | | | | | | |

3.500%, 07/15/2041 to 07/01/2042 | | | (300 | ) | | | (319 | ) |

3.000%, 08/15/2042 | | | 700 | | | | 731 | |

GNMA, Ser 101, Cl VM | | | | | | | | |

2.532%, 02/16/2039 (A) | | | 177 | | | | 186 | |

GNMA, Ser 186, Cl IO, IO | | | | | | | | |

0.840%, 08/16/2054 (A) | | | 1,879 | | | | 117 | |

GNMA, Ser 2012-34, Cl SA, IO | | | | | | | | |

5.602%, 03/20/2042 (A) | | | 61 | | | | 13 | |

| | | | | | | | |

| Description | | Face Amount

($ Thousands) | | | Market Value

($ Thousands) | |

MORTGAGE-BACKED SECURITIES (continued) | |

GNMA, Ser 2012-44, Cl A | | | | | | | | |

2.170%, 04/16/2041 | | $ | 120 | | | $ | 121 | |

GNMA, Ser 2012-H30, Cl GA | | | | | | | | |

0.786%, 12/20/2062 (A) | | | 1,162 | | | | 1,149 | |

GNMA, Ser 2013-H01, Cl TA | | | | | | | | |

0.936%, 01/20/2063 (A) | | | 359 | | | | 359 | |

GNMA, Ser 2013-H08, Cl BF | | | | | | | | |

0.837%, 03/20/2063 (A) | | | 1,094 | | | | 1,082 | |

GNMA, Ser 2014-105, IO | | | | | | | | |

1.100%, 06/16/2054 | | | 1,787 | | | | 126 | |

GNMA, Ser 2015-167, Cl OI, IO | | | | | | | | |

4.000%, 04/16/2045 | | | 187 | | | | 36 | |

GNMA, Ser 2015-H20, Cl FA | | | | | | | | |

0.663%, 08/20/2065 (A) | | | 377 | | | | 373 | |

GNMA, Ser 7, Cl IO, IO | | | | | | | | |

0.957%, 01/16/2057 (A) | | | 1,462 | | | | 108 | |

GNMA, Ser 85, Cl IA, IO | | | | | | | | |

0.754%, 03/16/2047 (A) | | | 3,619 | | | | 176 | |

GNMA, Ser 95, Cl IO, IO | | | | | | | | |

0.711%, 04/16/2047 (A) | | | 2,198 | | | | 110 | |