UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number811-09025

New Covenant Funds

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Timothy D. Barto, Esp.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-610-676-1000

Date of fiscal year end: June 30, 2019

Date of reporting period: June 30, 2019

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on FormN-PORT. The Trust’s FormN-PORT reports are available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent12-month period ended June 30, is available (i) without charge, upon request, by calling1-877-835-4531; and (ii) on the Commission’s website at http://www.sec.gov.

NEW COVENANT FUNDS — JUNE 30, 2019 (Unaudited)

To Our Shareholders:

After an extended period of historical calm and steady gains, volatility returned to financial markets during the fiscal year ending June 30, 2019, with a selloff toward the end of 2018 that sent most global indexes into or near bear market territory before an early-2019 rebound that saw the S&P 500 Index deliver its bestfirst-quarter performance in 20 years. Trade war fears, ongoing Brexit discussions and the U.S. yield curve all weighed on investor expectations.

The pace of interest-rate increases by the Federal Reserve (Fed) mostly followed the market’s projections. Long-term rates fell by a greater magnitude than short-term rates after the Federal Reserve raised rates twice during the reporting period; the yield curve flattened to a post-recession low and even inverted at multiple maturities.

The European Central Bank ended its bond-buying program at the end of 2018 but made assurances that it would reinvest maturing securities for some time to help keep rates low. Christine Lagarde (who resigned as president of the International Monetary Fund after the reporting period) was named to succeed Mario Draghi as European Central Bank (ECB) President at the end of October 2019. Lagarde is expected to maintain her predecessor’s dovish policies.

The Japanese yen, typically viewed as a safe-haven asset inrisk-off environments, finished the period higher against the U.S. dollar while the Bank of Japan (BOJ) held monetary policy stable. Driven by trade-related tensions, the Chinese yuan slid to a10-year low against the U.S. dollar in the first half of the fiscal period. While China’s currency strengthened earlier this year as trade negotiations appeared to be reaching a favorable conclusion, its value weakened again following a breakdown in talks at the beginning of May.

Oil prices rose during the first half of the reporting period to a four-year high, supported by geopolitical tensions and news that Saudi Arabia and Russia would extend an agreement to curb output. However, growing concerns over falling demand and increasing global supply, along with a broad selloff in risk assets, helped drive a correction during the last three months of 2018 that sent the commodity down as much as 40% from its earlier highs. Support at the start of the new year saw anear-50% recovery from its lows, and oil closed the fiscal year down about 20%.

Geopolitical Events

U.S. elections in November 2018 produced a partial shift in power away from Republicans and toward Democrats in Congress and statehouses across the country. The new balance of authority in Congress could substantially limit the ability of President Donald Trump and Republicans to pass meaningful legislation; it also enhances the investigatory powers available to Democrats, thereby adding to political risk for the Trump administration.

The partial shutdown of the U.S. government in December lasted over a month due to an impasse between Congress and President Trump’s administration about whether to fund a multi-billion dollar wall on the U.S.-Mexico border championed by the president. The Trump administration also received a measure of resolution in March, when the special counsel investigating the 2016 election “did not establish that members of the Trump campaign conspired or coordinated with the Russian government” to sway the election. The special counsel reportedly could not conclude that the president committed criminal obstruction of justice, although neither did it exonerate him. Congressional Democrats intend to review the special counsel’s report to make a separate determination in conjunction with information gathered through Congressional investigations.

NAFTA’s successor came into focus during the year—first when the U.S. and Mexico came to an agreement in August, and then when the U.S. and Canada finally ironed out their differences in September. Now called the United States-Mexico-Canada Agreement, the revised deal is expected to strengthen its predecessor’s provisions and improve labor standards. The U.S. is projected to offer Canada and Mexico relief from automobile-related trade barriers as a result of the new agreement, although aluminum and steel tariffs will remain.

Trade negotiations between the U.S. and China deteriorated in early May. The U.S. announced an escalation of existing tariffs on $200 billion of Chinese imports from 10% to 25% and proposed expanding the scope of the 25% tariffs to an additional $300 billion of imports—prompting smaller retaliatory tariffs from China. However, the U.S. stalled the proposed tariffs in late June to entice Chinese President Xi Jinping to meet with President Donald Trump on the sidelines of a Group of 20 summit (an international forum for governments and central bank governors from 19 countries and the EU); the meeting produced a temporary truce as both sides agreed to return to the negotiating table.

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 1 | |

NEW COVENANT FUNDS — JUNE 30, 2019 (Unaudited) (Continued)

U.K. Prime Minister Theresa May announced on May 24 her intention to resign following a poor showing for Conservatives in European Parliamentary elections. May’s inability to establish sufficient support for her Brexit deal or a viable alternative had become an impasse, and her recent overtures for a second referendum alienated a large subset of her party’s leadership. More than a dozen candidates announced plans to run for Prime Minister and leader of the Conservative Party following May’s announcement; Boris Johnson was eventually named as May’s successor just after the end of the fiscal year. Johnson campaigned on an explicit willingness to depart the EU without a deal upon the October 31 deadline but has made conflicting comments on the likelihood of this outcome.

Elections for European Parliament exposed support for centrist parties shifting toward more polarizing alternatives on the left and right. Concerns about the impact of climate change bolstered the Green Party alliance, especially in Germany, where it outpaced the Social Democratic Party (which serves as the junior partner in Chancellor Angela Merkel’s coalition government). Eurosceptic nationalist parties also fared well, particularly in France and Italy, where they earned a plurality of votes.

Economic Performance

The U.S. economy grew 3.4% at the start of the fiscal period, a drop from 4.2% in the previous quarter, pointing to a slight decrease in consumer spending and a broader decline in exports. Economic growth slowed to 2.2% in the fourth quarter of 2018, primarily due to a softer environment for business investment that was only modestly affected by the partial government shutdown. Still, GDP for the 2018 calendar year finished at 2.9%, equaling growth in 2015 as the best in 10 years. The government shutdown that continued through most of January likely detracted in 2019; however, growth rebounded to 3.1% in the first quarter, driven by increases in inventories and trade.

The labor market remained robust throughout the fiscal year: the unemployment rate fell, finishing the period near a49-year low at 3.7%; the labor-force participation rate ended at 62.9%, unchanged from a year ago. Average hourly earnings gained 3.1% over the year, although a modest increase in price pressures weighed on real personal income growth as the period progressed. The historically strong labor market and improving wage growth helped boost the debt profile of the U.S. consumer. The Fed raised its target interest rate two times during the period but took a dovish turn toward the end of the fiscal year, with new economic projections that showed zero interest-rate increases in 2019. The central bank also unveiled a plan to start slowing the reduction of its balance sheet in May—before halting reduction altogether in September and converting its allocation of mortgage-related assets to Treasurys.

The ECB held its benchmark interest rate unchanged at a historic low through the fiscal year, while the Bank of England raised its official bank rate for only the second time since the global financial crisis, by 0.25%. Committee guidance noted a bias toward higher rates in the future, depending on the Brexit outcome. Broad economic growth in the eurozone slowed to its weakest pace in four years at the end of the fourth quarter of 2018, as tightening auto emission standards in Germany and a stagnating Italian economy hampered expansion; growth rebounded in the first quarter but likely did not weaken the case for continued accommodative policy by the ECB for some time. The U.K. economy grew 1.8%year-on-year through the first quarter of 2019, up from asix-year low of 1.4% in the fourth quarter of 2018.

Japanese GDP grew 0.6%year-on-year at the end of the first quarter of 2019; the BOJ maintained monetary stimulus in an attempt to counter slowing growth and weak productivity gains. Meanwhile, GDP in China expanded by just 6.2%year-on-year in the second quarter of 2019, its weakest pace in 28 years, as a lack of consumer confidence due to the U.S. trade war continued to put pressure on economic growth.

Market Developments

For the fiscal year ending June 30, 2019, growth stocks generally outperformed value stocks. The U.S. equity market experienced a significant decline midway through the fiscal year as concerns about rising interest rates, trade issues, and softening global economic growth weighed on investor sentiment. The highly-cyclical energy sector experienced a significant selloff, while the health care and utilities sectors, in particular, outperformed and helped mitigate some damage in the falling market. However, January marked the best start for equities in thirty years; the recovery rally continued until a slight retreat in May, but touched a record high in June before the end of the fiscal year.

| | |

| 2 | | New Covenant Funds / Annual Report / June 30, 2019 |

The Russell 1000 Growth Index finished up 11.56% during the fiscal year, while the Russell 1000 Value Index lagged, gaining 8.46% over the same period.Small-cap stocks (Russell 2000 Index) failed to keep up with large caps (Russell 1000 Index) during the fiscal year. Large caps finished up 10.02%, easily outpacing small caps, which lost 3.31%.

Brexit concerns continued to overshadow the outlook for business in the U.K.; the FTSE UK SeriesAll-Share Index shed 3.05% in U.S. dollar terms but managed to gain 0.57% in sterling. The MSCI ACWI Index, a proxy for global equities in both developed and emerging markets, rose 5.74% in U.S. dollar terms; U.S. markets did better, as the S&P 500 Index returned 10.42%. Despite continued accommodative monetary policy from the ECB, European equities lagged, as fears over trade wars and policy uncertainty grew. The MSCI Europe Index finished up 1.88% in U.S. dollar terms and 4.25% higher in euros; the euro finished down 2.82% versus the U.S. dollar for the period.

Emerging markets failed to keep pace over the full reporting period. The MSCI Emerging Markets Index finished the fiscal year 1.21% ahead in U.S. dollar terms, after a generous rally over the final six months. Asian markets ended the period lower as trade-related concerns drove regional market weakness.

Led by the dovish tone of global central banks and better-than-expected earnings toward the end of the reporting period, global high-yield bonds outperformed global government bonds. A continuing theme for U.S.fixed-income markets was the flattening yield curve, as short-term yields fell less than long-term yields. In early December, the spread between2-year and10-year Treasury bonds compressed to 11 basis points, its narrowest point in more than 12 years. At the same time, the spread between2-year and5-year Treasurys inverted, as did the spread between3-year and5-year Treasurys. Notably, the3-month and10-year rates inverted at the end of the reporting period, a signal of impending recession to some market watchers. The Federal Open Market Committee increased the federal-funds rate inmid-December—the second hike of the reporting period and ninth during this tightening cycle—while softening its projections for future rate increases. The rate hikes failed to sustain an impact on higher short-term yields, while subdued inflation and long-term economic growth expectations pressured the long end of the curve. Yields for10-year government bonds declined and ended the period 85 basis points lower at 2.00%, while2-year yields rose to almost 3% during the first half of the fiscal year but finished the period down 77 basis points at 1.75%.

Inflation-sensitive assets, such as commodities and Treasury inflation-protected securities, were mixed. The Bloomberg Commodity Total Return Index (which represents the broad commodity market) slid 6.75%, primarily due to oil market headwinds, while the Bloomberg Barclays1-10 Year US TIPS Index (USD) moved 4.67% higher.

Global fixed income, as measured by the Bloomberg Barclays Global Aggregate Index, climbed 5.85% in U.S. dollar terms during the reporting period, while the high-yield market did slightly better, with the ICE BofAML US High Yield Constrained Index up 7.58%.

U.S. investment-grade corporate debt performed well, as the Bloomberg Barclays US Corporate Investment Grade Index returned 10.72%. U.S. asset-backed and mortgage-backed securities also managed gains during the fiscal year.

Emerging-market debt delivered strong performance. The JP Morgan GBI Emerging Markets Global Diversified Index, which tracks local-currency-denominated emerging-market bonds, climbed 8.99% higher in U.S. dollar terms, with almost all of its gains coming over the last six months. The JP Morgan EMBI Global Diversified Index, which tracks emerging-market debt denominated in external currencies (such as the U.S. dollar), gained 12.45%, also with most of its gains coming during the second half of the fiscal year.

Our view

The U.S. economic expansion turns 10 years old in July. The bull market in the S&P 500 Index marked its tenth anniversary back in March, and it appears to be celebrating these achievements by poking intonew-high territory. But there is anxiety that the bull market in equities is on its last legs, the victim of a slowing global economy, the lagged impact of last year’s interest-rate increases and, most importantly, a trade war between the U.S. and China.

To be sure, the U.S. economy is hardly firing on all cylinders. There’s a good chance that capital spending will continue to ease in the months ahead, but we’re not forecasting a significant downturn. Corporate cash generation continues to run slightly ahead of capital expenditures. The main point to remember: It’s not unusual for capital expenditures to run well in excess of cash flow, especially toward the end of the economicup-cycle. That’s not happening yet.

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 3 | |

NEW COVENANT FUNDS — JUNE 30, 2019 (Unaudited) (Concluded)

We need to see a severe deterioration in financial and leading economic indicators before climbing onto the recession train. Even after the past two years of multiple Fed rate increases, there are still few signs of abuild-up in financial stress.

The big question, of course, is how the evolving tariff war with China affects U.S. economic growth and global trade in the months ahead. Tensions with China and worries about global growth have so far put only a modest dent in the confidence of U.S. businesses. But it certainly looks as if the U.S.-China trade relationship is frosty at best, even though another tariff truce has been declared in order to pursue additional discussions.

We believe the U.S. economy should be able to weather this storm. Anall-out tariff war between the two largest economies in the world will undoubtedly be disruptive to supply chains and will likely lead to higher prices for a broad range of consumer goods. Still, it is helpful to keep the problem in perspective. Even if a 25% tariff is eventually imposed on all Chinese imports into the U.S., total duties will equal roughly 0.5% of U.S. GDP.

It is not our intention to minimize the importance of the shift in U.S. trade policy toward protectionism. The speed and ease with which supply chains can be relocated to other countries will be a critical factor, either exacerbating or tempering the tariff impact on consumers and companies in both the U.S. and China. An escalation of the trade wars by the U.S. against other countries would prove far more dangerous for the near-term growth prospects in the U.S. than if trade is disrupted only with China.

We have been thinking that the U.S. would avoid waging multiple tariff wars as it concentrated its firepower on China. Our persistent optimism might not hold. Tariffs on German and Japanese autos are still a possibility later this year.

In all, we think the U.S. economy will show resilience in the face of what is admittedly a stiff headwind. Household income growth continues to advance at a good pace. The decline in interest rates that began late last year will also certainly help consumers.

The market-implied rate forecasts a federal-funds rate of 1.7% atyear-end, consistent with three 25 basis point cuts. Although the forecasts of the Federal Open Market Committee members are more cautious, they are moving in the direction of the markets. The recent decline in bond yields to levels last seen in 2016 ranks as one of the biggest surprises of the year. We find it hard to justify these moves. In our view, recession is not likely in the absence of a severe policy mistake, such as fighting a tariff war on multiple fronts.

In emerging economies, when one considers all the headwinds they face—a significant slowdown in Chinese economic growth, theon-going trade tensions between the U.S. and China, weak commodity pricing and a still-resilient U.S. dollar—it’s surprising that emerging stock markets have appreciated at all this year. But as long as a tariff truce remains in place with the U.S., SEI expects China’s economy to improve in the months ahead. Scores of measures, both monetary and fiscal, have been put in place over the past year.

Europe currently faces a variety of distinctive challenges, both economic and political, that makes it hard even for a contrarian investor to get enthusiastic about the near term. Economically, the downward trajectory is similar to that of the2011-to-2012 period, when the region was in the midst of the periphery debt crisis. However, this time, Germany’s industrial economy is fully participating in the slowdown.

It’s not just the region’s massive exposure to manufacturing and international trade that makes German industrialists glum. There is also a worrisome vacuum of political leadership. Chancellor Angela Merkel is on her way out, and given the country’s central importance in the eurozone and EU, a politically distracted Germany is a concerning issue.

And then, there’s the looming cloud of Brexit. Although it has been delayed until October 31, there is little sign that the breathing space will be put to good use. Boris Johnson was named Prime Minister just after the end of the fiscal year. It’s hard to see how that improves the chances of an orderly exit.

Although economic growth is sluggish, the U.K. economy is not exactly cratering as the deadline approaches. In fact, the unemployment rate has fallen to a multi-decade low. The eurozone also is recording steady labor-market improvement, although the jobless rate itself remains far higher owing to structural factors.

| | |

| 4 | | New Covenant Funds / Annual Report / June 30, 2019 |

That said, we can’t help but think Brexit will prove to be a highly disruptive event for the U.K. and the EU if it indeed occurs. Roughly half of the U.K.’s trade in goods, both imports and exports, is with the EU.

We think there is still life in the economic expansion, both in the U.S. and globally. If we’re right, that means corporate profits should continue to expand and push global stock markets to higher levels in the months ahead. This may seem like a bold statement at a time when the world looks increasingly unpredictable, and the economic data point to slowing growth. But we do not yet see the economic imbalances or nosebleed equity-market valuations that typically bring on recessions and an associated contraction in earnings and stock prices. It is also clear that central banks have investors’ backs, as monetary policymakers promise to, or already are, cutting interest rates and providing additional liquidity to their banking systems in both developed and emerging countries.

Sincerely,

William T. Lawrence, CFA

Head and Chief Investment Officer of Traditional Asset Management

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 5 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

June 30, 2019 (Unaudited)

New Covenant Growth Fund

I. Objective

The New Covenant Growth Fund’s (the “Fund”) investment objective is long-term capital appreciation. A modest amount of dividend income may be provided by the Fund’s equity securities.

II. Investment Approach

During the fiscal year, the Fund’s management approach changed from an active to mostly passive implementation, while still maintaining the Fund’s social screen and environmental, social, and governance (ESG) tilt as key components for the entire reporting period. For the period from July 1, 2018 through May 13, 2019, the Fund utilized a multi-manager approach, relying on a multiplesub-advisers with different investment approaches to more actively manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). From May 14, 2019 through the end of the reporting period on June 30, 2019, the Fund’s sole remainingsub-adviser managed the Fund as a generally passive implementation along with the social screen and ESG tilt, also under the supervision of SIMC. The sole remainingsub-adviser as of June 30, 2019, was Parametric Portfolio Associates LLC (Parametric). During the reporting period, BlackRock Investment Management, LLC (BlackRock), Brandywine Global Investment Management Company LLC (Brandywine), and Coho Partners, Ltd. (Coho), were removed from the Fund, while Fred Alger Management, Inc. (Alger), was added but later also terminated.

III. Return vs. Benchmark

For theone-year period ending June 30, 2019, the Fund returned 7.21%. The Fund’s primary benchmark—the Russell 1000® Index—returned 10.02%.

IV. Fund Attribution

The fiscal year produced positive returns for equity investors as the global economy expanded gradually and U.S. long-term interest rates declined. Heightened concerns about a potential trade war, along with possible signs of a slowdown in global economic growth, weighed on investors’ minds.

Interest-rate-sensitive bond proxies, such as utilities, consumer staples and real-estate investment trusts, outperformed. These sectors represented a significant portion of thelow-volatility stock universe and, as a result,low-volatility stocks outperformed. Economically-sensitive sectors, such as energy, materials and financials, underperformed. These stocks comprised

a meaningful portion of the value stock universe, and value indexes lagged relative to growth, as noted in the shareholder letter; the information technology and health care sectors outperformed, and this helped propel growth indexes higher. Small- andmid-cap stocks lagged relative to the largest-capitalization stocks.

In this environment, the Fund underperformed relative to its benchmark as a result of its underweight to the largest-capitalization names, as well as underweights to real-estate investment trusts and utilities. The Fund’s value tilt—and associated overweight to the energy sector and underweight to information technology—also detracted.

During their time in the Fund, Coho and Brandywine underperformed as a result of their value orientation; an overweight to the energy sector and underweight to information technology detracted for both. Alger and BlackRock contributed to performance due to their growth mandates.

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN1 | |

| | | One Year

Return | | | Annualized

3 Year

Return | | | Annualized

5 Year

Return | | | Annualized

10 Year

Return | | | Annualized

Inception

to Date | |

| New Covenant Growth Fund | | | 7.21% | | | | 13.26% | | | | 8.29% | | | | 12.15% | | | | 6.37% | |

| Russell 1000® Index | | | 10.02% | | | | 14.15% | | | | 10.45% | | | | 14.77% | | | | 9.86% | |

| | |

| 6 | | New Covenant Funds / Annual Report / June 30, 2019 |

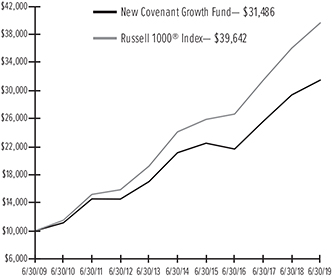

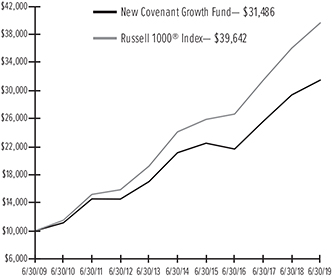

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Growth Fund, versus the Russell 1000® Index.

| 1 | For the periods ended June 30, 2019. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 7 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

June 30, 2019 (Unaudited)

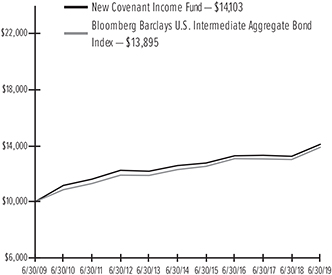

New Covenant Income Fund

I. Objective

The New Covenant Income Fund’s (the Fund) investment objective is a high level of current income with preservation of capital.

II. Investment Approach

The Fund uses a multi-manager approach, relying on a number ofsub-advisors with different investment approaches to manage portions of the Fund’s portfolio, under the general supervision of SEI Investments Management Corporation (SIMC). The Fund utilized the followingsub-advisors as of June 30, 2019: Income Research & Management, Western Asset Management Company and Western Asset Management Company Limited. There were nosub-advisor changes during the fiscal period.

III. Return vs. Benchmark

For theone-year period ending June 30, 2019, the Fund returned 6.46%. The Fund’s primary benchmark—the Bloomberg Barclays Intermediate US Aggregate Bond Index—returned 6.73%.

IV. Fund Attribution

As noted in the shareholder letter, the Federal Reserve (Fed) increased the federal-funds rate two times in 25 basis point increments in the first half of the fiscal year but made a dovish pivot during early 2019 in response to concerns of downside risk and the impact of global trade developments on the U.S. economy.30-year Treasury yields declined by a lesser magnitude than2-year yields over the period, with2-year yields down 77 basis points and30-year yields 46 basis points lower;3-month Treasury bill yields were 19 basis points higher during the 12 months after the Fed hiked rates in September and December of 2018, causing an inversion between3-month bills and10-year bonds. Within this environment, spread sectors generally managed to outperform, with the exception of agency mortgage-backed securities (MBS). Expanding GDP, low unemployment and gradually improving wages supported the housing sector and enablednon-agency mortgages, commercial mortgage-backed securities (CMBS) and MBS to outperform.

With the sharp decline in overall yields during the reporting period, the Fund’s absolute returns were strong. An overweight to non-Treasury sectors enhanced performance, while a small overweight to agency MBS detracted. Overweights to the securitized sectors, and strong security selection innon-agency mortgages and CMBS, added to relative performance. An overweight

to ABS was positive from a sector perspective, but selection within student loan securitizations subtracted. The Fund’s yield-curve posture, which included an overweight to the30-year segment, aided as yields declined.

Western Asset Management outperformed primarily due to its corporate overweight, holdings innon-agency MBS and overweight to the30-year part of the curve as yields declined. Income Research & Management also outperformed due to security selection in corporates, particularly within the industrial sector, and an underweight to agency MBS.

The Fund used Treasury futures, eurodollar futures andto-be-announced (TBA) forward contracts to effectively manage duration, yield-curve and market exposures. (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and Ginnie Mae.) None of these had a meaningful impact on the Fund’s performance.

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN1 | |

| | | One Year

Return | | | Annualized

3 Year

Return | | | Annualized

5 Year

Return | | | Annualized

10 Year

Return | | | Annualized

Inception

to Date | |

| New Covenant Income Fund | | | 6.46% | | | | 2.02% | | | | 2.30% | | | | 3.50% | | | | 2.70% | |

| Bloomberg Barclays U.S. Intermediate Aggregate Bond Index | | | 6.73% | | | | 2.03% | | | | 2.46% | | | | 3.34% | | | | 5.83% | |

| | |

| 8 | | New Covenant Funds / Annual Report / June 30, 2019 |

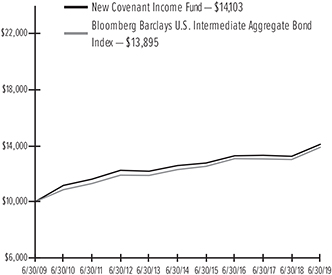

Comparison of Change in the Value of a $10,000 Investment in the New Covenant Income Fund, versus the Bloomberg Barclays U.S. Intermediate Aggregate Bond Index.

| 1 | For the periods ended June 30, 2019. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 9 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

June 30, 2019 (Unaudited)

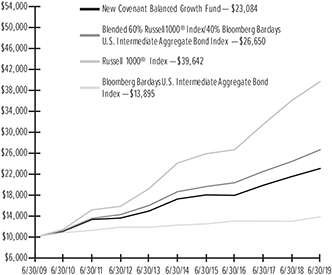

New Covenant Balanced Growth Fund

I. Objective

The Balanced Growth Fund’s (the “Fund”) investment objective is to produce capital appreciation with less risk than would be present in a portfolio of only common stocks.

II. Investment Approach

The Fund’s assets are managed under the direction of SEI Investments Management Corporation (“SIMC”), which manages the Fund’s assets in a way that it believes will achieve the Fund’s investment objective. In order to achieve its investment objective, SIMC allocates the Fund’s assets primarily in shares of the New Covenant Growth Fund (the “Growth Fund”) and the New Covenant Income Fund (the “Income Fund”), with a majority of its assets generally invested in shares of the Growth Fund. Between 45% and 75% of the Fund’s net assets (with a neutral position of approximately 60% of the Fund’s net assets) are invested in shares of the Growth Fund, with the balance of its assets invested in shares of the Income Fund. The Growth and Income Funds, in turn, invest directly in securities in accordance with their own varying investment objectives and policies.

III. Return vs. Benchmark

For theone-year period ending June 30, 2019, the Fund returned 7.12%. The Fund’s primary benchmark—the Russell 1000® Index—returned 10.02%.

IV. Fund Attribution

Equity andfixed-income markets both provided positive returns over the fiscal period. The fiscal year produced positive returns for equity investors as the global economy expanded gradually and U.S. long-term interest rates declined. Heightened concerns about a potential trade war, along with possible signs of a slowdown in global economic growth, weighed on investors’ minds.

Interest-rate-sensitive bond proxies, such as utilities, consumer staples and real-estate investment trusts, outperformed. These sectors represented a significant portion of thelow-volatility stock universe and, as a result,low-volatility stocks outperformed. Economically-sensitive sectors, such as energy, materials and financials, underperformed. These stocks comprised a meaningful portion of the value stock universe, and value indexes lagged relative to growth, as noted in the shareholder letter; the information technology and health care sectors outperformed, and this helped propel

growth indexes higher. Small- andmid-cap stocks lagged relative to the largest-capitalization stocks.

As mentioned in the shareholder letter, the Federal Reserve (Fed) increased the federal-funds rate two times in 25 basis point increments in the first half of the fiscal year, but made a dovish pivot during early 2019, in response to concerns of downside risk and the impact of global trade developments on the U.S. economy.30-year Treasury yields declined by a lesser magnitude than2-year yields over the period, with2-year yields down 77 basis points and30-year yields 46 basis points lower;3-month Treasury bill yields were 19 basis points higher during the 12 months after the Fed hiked rates in September and December of 2018, causing an inversion between3-month bills and10-year bonds. Within this environment, spread sectors generally managed to outperform, with the exception of agency mortgage-backed securities (MBS). Expanding GDP, low unemployment and gradually improving wages supported the housing sector and enablednon-agency mortgages, commercial mortgage-backed securities (CMBS) and MBS to outperform.

In the Growth Fund, underperformance was driven by an underweight to the largest-capitalization names, as well as underweights to real-estate investment trusts and utilities. The Fund’s value tilt—and associated overweight to the energy sector and underweight to information technology—also detracted.

With the sharp decline in overall yields during the reporting period, the Fund’s absolute returns were strong. An overweight tonon-Treasury sectors enhanced performance, while a small overweight to agency MBS detracted. Overweights to the securitized sectors and strong security selection innon-agency mortgages and CMBS added to performance. An overweight to ABS was positive from a sector perspective, but selection within student loan securitizations subtracted. The Fund’s yield-curve posture, which included an overweight to the30-year segment, aided as yields declined.

The Income Fund used Treasury futures, eurodollar futures andto-be-announced (TBA) forward contracts to effectively manage duration, yield-curve and market exposures. (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and Ginnie Mae.) None of these had a meaningful impact on the Fund’s performance.

| | |

| 10 | | New Covenant Funds / Annual Report / June 30, 2019 |

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN1,2 | |

| | | One Year

Return | | | Annualized

3 Year

Return | | | Annualized

5 Year

Return | | | Annualized

10 Year

Return | | | Annualized

Inception

to Date | |

| New Covenant Balanced Growth Fund | | | 7.12% | | | | 8.71% | | | | 5.97% | | | | 8.73% | | | | 5.26% | |

| Russell 1000® Index | | | 10.02% | | | | 14.15% | | | | 10.45% | | | | 14.77% | | | | 10.35% | |

| Bloomberg Barclays U.S. Intermediate Aggregate Bond Index | | | 6.73% | | | | 2.03% | | | | 2.46% | | | | 3.34% | | | | 5.84% | |

| Blended 60% Russell 1000® Index/40% Bloomberg Barclays U.S. Intermediate Aggregate Bond Index | | | 9.17% | | | | 9.36% | | | | 7.39% | | | | 10.30% | | | | 8.80% | |

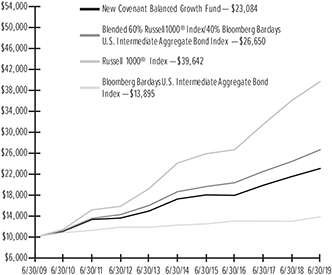

Comparison of Change in the Value of a $10,000

Investment in the New Covenant Balanced Growth Fund, versus the Russell 1000® Index, Bloomberg Barclays U.S. Intermediate Aggregate Bond Index and Blended 60% Russell 1000 Index/40% Bloomberg Barclays U.S. Intermediate Aggregate Bond Index.

| 1 | For the periods ended June 30, 2019. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| 2 | This table compares the Fund’s average annual total returns to those of a broad based index and the Fund’s 60/40 Blended Benchmark, which consists of the Russell 1000® Index and the Bloomberg Barclays U.S. Intermediate Aggregate Bond Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 11 | |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FUND PERFORMANCE

June 30, 2019 (Unaudited)

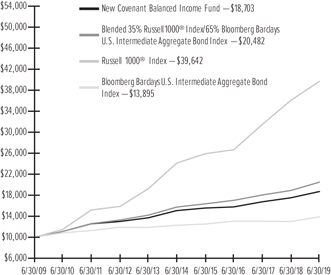

New Covenant Balanced Income Fund

I. Objective

The Balanced Income Fund’s (the “Fund”) investment objective is to produce current income and long-term growth of capital.

II. Investment Approach

The Fund’s assets are managed under the direction of SEI Investments Management Corporation (“SIMC”), which manages the Fund’s assets in a way that it believes will achieve the Fund’s investment objective. In order to achieve its investment objective, SIMC allocates the Fund’s assets primarily in shares of the New Covenant Growth Fund (the “Growth Fund”) and the New Covenant Income Fund (the “Income Fund”), with a majority of its assets generally invested in shares of the Income Fund. Between fifty percent and seventy-five percent of the Fund’s net assets (with a neutral position of approximately 65%) are invested in shares of the Income Fund, with the balance of its net assets invested in shares of the Growth Fund. The Growth and Income Funds, in turn, invest directly in securities in accordance with their own varying investment objectives and policies.

III. Return vs. Benchmark

For theone-year period ending June 30, 2019, the Fund returned 6.76%. The Fund’s primary benchmark—the Russell 1000® Index—returned 10.02%.

IV. Fund Attribution

Equity andfixed-income markets both provided positive returns over the fiscal period. As noted in the shareholder letter, the Federal Reserve (Fed) increased the federal-funds rate two times in 25 basis point increments in the first half of the fiscal year, but made a dovish pivot during early 2019 in response to concerns of downside risk and the impact of global trade developments on the U.S. economy.30-year Treasury yields declined by a lesser magnitude than2-year yields over the period, with2-year yields down 77 basis points and30-year yields 46 basis points lower;3-month Treasury bill yields were 19 basis points higher during the 12 months after the Fed hiked rates in September and December of 2018, causing an inversion between3-month bills and10-year bonds. Within this environment, spread sectors generally managed to outperform, with the exception of agency mortgage-backed securities (MBS). Expanding GDP, low unemployment and gradually improving wages supported the housing sector and enablednon-agency mortgages, commercial mortgage-backed securities (CMBS) and MBS to outperform.

The fiscal year produced positive returns for equity investors as the global economy expanded gradually and U.S. long-term interest rates declined. Heightened concerns about a potential trade war, along with possible signs of a slowdown in global economic growth, weighed on investors’ minds.

Interest-rate-sensitive bond proxies, such as utilities, consumer staples and real-estate investment trusts, outperformed. These sectors represented a significant portion of thelow-volatility stock universe and, as a result,low-volatility stocks outperformed. Economically-sensitive sectors, such as energy, materials and financials, underperformed. These stocks comprised a meaningful portion of the value stock universe, and value indexes lagged relative to growth, as mentioned in the shareholder letter; the information technology and health care sectors outperformed, and this helped propel growth indexes higher. Small- andmid-cap stocks lagged relative to the largest-capitalization stocks.

With the sharp decline in overall yields during the reporting period, the Fund’s absolute returns were strong. An overweight tonon-Treasury sectors enhanced performance, while a small overweight to agency MBS detracted. Overweights to the securitized sectors and strong security selection innon-agency mortgages and CMBS added to performance. An overweight to ABS was positive from a sector perspective, but selection within student loan securitizations subtracted. The Fund’s yield-curve posture, which included an overweight to the30-year segment, aided as yields declined.

In the Growth Fund, underperformance was driven by an underweight to the largest-capitalization names, as well as underweights to real-estate investment trusts and utilities. The Fund’s value tilt—and associated overweight to the energy sector and underweight to information technology—also detracted.

The Income Fund used Treasury futures, eurodollar futures andto-be-announced (TBA) forward contracts to effectively manage duration, yield-curve and market exposures. (TBA contracts confer the obligation to buy or sell future debt obligations of the three U.S. government-sponsored agencies that issue or guarantee MBS—Fannie Mae, Freddie Mac and Ginnie Mae.) None of these had a meaningful impact on the Fund’s performance.

| | |

| 12 | | New Covenant Funds / Annual Report / June 30, 2019 |

| | | | | | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL TOTAL RETURN1,2 | |

| | | One Year

Return | | | Annualized

3 Year

Return | | | Annualized

5 Year

Return | | | Annualized

10 Year

Return | | | Annualized

Inception

to Date | |

| New Covenant Balanced Income Fund | | | 6.76% | | | | 5.81% | | | | 4.40% | | | | 6.46% | | | | 4.08% | |

| Russell 1000® Index | | | 10.02% | | | | 14.15% | | | | 10.45% | | | | 14.77% | | | | 9.86% | |

| Bloomberg Barclays U.S. Intermediate Aggregate Bond Index | | | 6.73% | | | | 2.03% | | | | 2.46% | | | | 3.34% | | | | 5.66% | |

| Blended 35% Russell 1000® Index/65% Bloomberg Barclays U.S. Intermediate Aggregate Bond Index | | | 8.32% | | | | 6.33% | | | | 5.38% | | | | 7.43% | | | | 7.37% | |

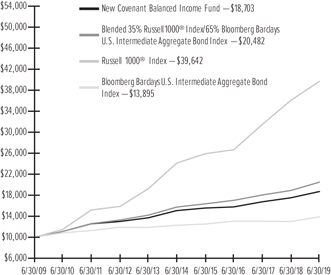

Comparison of Change in the Value of a $10,000

Investment in the New Covenant Balanced Income Fund, versus the Russell 1000® Index, Bloomberg Barclays U.S. Intermediate Aggregate Bond Index and Blended 35% Russell 1000® Index/65% Bloomberg Barclays U.S. Intermediate Aggregate Bond Index.

| 1 | For the periods ended June 30, 2019. Past performance is not an indication of future performance. Fund Shares were offered beginning 7/1/99. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns for certain periods reflect fee waivers and/or reimbursements in effect for that year; absent fee waivers and reimbursements, performance would have been lower. |

| 2 | This table compares the Fund’s average annual total returns to those of a broad-based index and the Fund’s 35/65 Blended Benchmark, which consists of the Russell 1000® Index and the Bloomberg Barclays U.S. Intermediate Aggregate Bond Index. The Fund’s Blended Benchmark is designed to provide a useful comparison to the Fund’s overall performance and more accurately reflects the Fund’s investment strategy than the broad-based index. |

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 13 | |

SCHEDULE OF INVESTMENTS

June 30, 2019

New Covenant Growth Fund

|

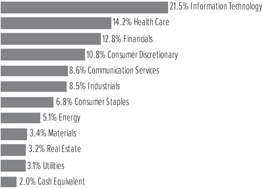

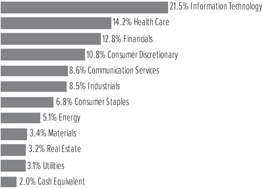

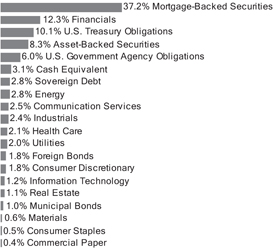

Sector Weightings (Unaudited)†: |

†Percentages are based on total investments.

| | | | | | | | |

| | | |

| Description | | Shares | | | Market Value ($ Thousands) | |

COMMON STOCK — 97.5% | | | | | | | | |

Canada — 0.0% | | | | | | | | |

Lululemon Athletica lnc * | | | 771 | | | $ | 139 | |

| | | | | | | | |

| | |

Ireland — 1.1% | | | | | | | | |

Accenture PLC, CI A | | | 11,297 | | | | 2,087 | |

Ingersoll-Rand PLC | | | 7,234 | | | | 916 | |

Jazz Pharmaceuticals PLC * | | | 616 | | | | 88 | |

Medtronic PLC | | | 19,976 | | | | 1,946 | |

Perrigo Co PLC | | | 1,650 | | | | 79 | |

| | | | | | | | |

| | | | | | | 5,116 | |

| | | | | | | | |

| | |

Puerto Rico — 0.0% | | | | | | | | |

Popular Inc | | | 1,507 | | | | 82 | |

| | | | | | | | |

| | |

Switzerland — 0.1% | | | | | | | | |

Garmin Ltd | | | 2,934 | | | | 234 | |

| | | | | | | | |

| | |

United Kingdom — 0.1% | | | | | | | | |

Aon PLC | | | 2,921 | | | | 564 | |

| | | | | | | | |

| | |

United States — 96.2% | | | | | | | | |

| | |

Communication Services — 8.6% | | | | | | | | |

Activision Blizzard Inc | | | 8,449 | | | | 399 | |

Alphabet Inc, CI A * | | | 4,600 | | | | 4,981 | |

Alphabet Inc, CI C * | | | 4,691 | | | | 5,071 | |

AT&T Inc | | | 133,201 | | | | 4,464 | |

CenturyLink Inc | | | 7,881 | | | | 93 | |

Charter Communications Inc, CI A* | | | 2,147 | | | | 848 | |

Cinemark Holdings Inc | | | 2,104 | | | | 76 | |

Comcast Corp, CI A | | | 66,971 | | | | 2,832 | |

Electronic Arts lnc * | | | 2,980 | | | | 302 | |

Facebook Inc, CI A* | | | 41,503 | | | | 8,010 | |

Fox Corp, CI A | | | 1,372 | | | | 50 | |

Fox Corp, CI B | | | 5,833 | | | | 213 | |

Interpublic Group of Cos Inc/The | | | 8,487 | | | | 192 | |

John Wiley & Sons Inc, CI A | | | 3,657 | | | | 168 | |

Liberty Media Corp-Liberty Formula One, CI A * | | | 4,776 | | | | 171 | |

| | | | | | | | |

| | | |

| Description | | Shares | | | Market Value ($ Thousands) | |

COMMON STOCK (continued) | | | | | | | | |

Liberty Media Corp-Liberty Formula One, CI C * | | | 5,721 | | | $ | 214 | |

Live Nation Entertainment lnc * | | | 1,313 | | | | 87 | |

News Corp | | | 7,134 | | | | 100 | |

Omnicom Group Inc | | | 18,116 | | | | 1,485 | |

Spotify Technology SA * | | | 607 | | | | 89 | |

Sprint Corp * | | | 31,627 | | | | 208 | |

Take-Two Interactive Software Inc * | | | 830 | | | | 94 | |

T-Mobile US lnc * | | | 3,026 | | | | 224 | |

Twitter Inc * | | | 6,144 | | | | 214 | |

Verizon Communications Inc | | | 62,462 | | | | 3,568 | |

Viacom Inc, CI A | | | 2,473 | | | | 84 | |

Viacom Inc, CI B | | | 7,351 | | | | 220 | |

Walt Disney Co/The | | | 26,709 | | | | 3,730 | |

Zayo Group Holdings lnc * | | | 2,614 | | | | 86 | |

Zillow Group Inc, CI C * | | | 2,383 | | | | 111 | |

Zynga Inc, CI A * | | | 14,448 | | | | 89 | |

| | | | | | | | |

| | | | | | | 38,473 | |

| | | | | | | | |

Consumer Discretionary — 10.6% | | | | | | | | |

Amazon.com lnc * | | | 6,511 | | | | 12,329 | |

Aptiv PLC | | | 3,490 | | | | 282 | |

Aramark | | | 6,162 | | | | 222 | |

AutoZone lnc * | | | 235 | | | | 258 | |

Best Buy Co Inc | | | 3,307 | | | | 231 | |

Booking Holdings lnc * | | | 624 | | | | 1,170 | |

BorgWarner Inc | | | 4,528 | | | | 190 | |

Bright Horizons Family Solutions Inc * | | | 649 | | | | 98 | |

Burlington Stores Inc * | | | 1,183 | | | | 201 | |

Cable One Inc | | | 79 | | | | 92 | |

CarMax Inc * | | | 1,086 | | | | 94 | |

Carnival Corp | | | 11,633 | | | | 542 | |

Carvana Co, CI A * | | | 1,405 | | | | 88 | |

CBS Corp, CI B | | | 1,742 | | | | 87 | |

Chipotle Mexican Grill Inc, CI A * | | | 122 | | | | 89 | |

Choice Hotels International Inc | | | 1,031 | | | | 90 | |

Columbia Sportswear Co | | | 891 | | | | 89 | |

Darden Restaurants Inc | | | 705 | | | | 86 | |

Discovery Inc, CI A * | | | 3,016 | | | | 93 | |

Discovery Inc, CI C * | | | 3,206 | | | | 91 | |

Dollar General Corp | | | 2,859 | | | | 387 | |

Dollar Tree lnc * | | | 2,154 | | | | 231 | |

Domino’s Pizza Inc | | | 309 | | | | 86 | |

DR Horton Inc | | | 1,973 | | | | 85 | |

Dunkin’ Brands Group Inc | | | 2,803 | | | | 223 | |

eBay Inc | | | 24,197 | | | | 956 | |

Expedia Group Inc | | | 723 | | | | 96 | |

Floor & Decor Holdings Inc, CI A * | | | 2,075 | | | | 87 | |

Ford Motor Co | | | 41,791 | | | | 427 | |

frontdoor lnc * | | | 2,205 | | | | 96 | |

Gap Inc/The | | | 14,224 | | | | 256 | |

General Motors Co | | | 51,542 | | | | 1,986 | |

Gentex Corp | | | 3,795 | | | | 94 | |

| | |

| 14 | | New Covenant Funds / Annual Report / June 30, 2019 |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

Genuine Parts Co | | | 871 | | | $ | 90 | |

Goodyear Tire & Rubber Co/The | | | 5,710 | | | | 87 | |

Grand Canyon Education lnc * | | | 729 | | | | 85 | |

GrubHub lnc * | | | 1,289 | | | | 101 | |

H&R Block Inc | | | 3,157 | | | | 93 | |

Hanesbrands Inc | | | 13,319 | | | | 229 | |

Harley-Davidson Inc | | | 2,391 | | | | 86 | |

Hasbro Inc | | | 2,632 | | | | 278 | |

Hilton Grand Vacations lnc * | | | 3,016 | | | | 96 | |

Hilton Worldwide Holdings Inc | | | 4,365 | | | | 427 | |

Home Depot Inc/The | | | 16,979 | | | | 3,531 | |

Hyatt Hotels Corp, CI A | | | 2,635 | | | | 201 | |

Kohl’s Corp | | | 1,859 | | | | 88 | |

L Brands Inc | | | 5,950 | | | | 155 | |

Lear Corp | | | 1,457 | | | | 203 | |

Leggett & Platt Inc | | | 2,232 | | | | 86 | |

Lennar Corp, CI A | | | 1,654 | | | | 80 | |

LKQ Corp * | | | 3,141 | | | | 84 | |

Lowe’s Cos Inc | | | 23,723 | | | | 2,394 | |

Macy’s Inc | | | 4,042 | | | | 87 | |

Madison Square Garden Co/The * | | | 284 | | | | 79 | |

Marriott International lnc/MD, CI A | | | 3,599 | | | | 505 | |

Mattel lnc * | | | 18,661 | | | | 209 | |

McDonald’s Corp | | | 11,361 | | | | 2,359 | |

Mohawk Industries Inc * | | | 634 | | | | 93 | |

Netflix Inc * | | | 6,211 | | | | 2,281 | |

Newell Brands Inc | | | 5,602 | | | | 86 | |

News Corp | | | 7,212 | | | | 97 | |

NIKE Inc, CI B | | | 17,157 | | | | 1,440 | |

Nordstrom Inc | | | 3,866 | | | | 123 | |

Norwegian Cruise Line Holdings Ltd * | | | 1,482 | | | | 79 | |

O’Reilly Automotive lnc * | | | 677 | | | | 250 | |

Polaris Industries Inc | | | 966 | | | | 88 | |

Pool Corp | | | 466 | | | | 89 | |

PulteGroup Inc | | | 26,308 | | | | 832 | |

PVH Corp | | | 1,776 | | | | 168 | |

Qurate Retail lnc * | | | 9,266 | | | | 115 | |

Ralph Lauren Corp, CI A | | | 690 | | | | 79 | |

Roku Inc, CI A * | | | 933 | | | | 85 | |

Ross Stores Inc | | | 13,755 | | | | 1,363 | |

Royal Caribbean Cruises Ltd | | | 8,804 | | | | 1,067 | |

Service Corp International/US | | | 2,015 | | | | 94 | |

Six Flags Entertainment Corp | | | 1,563 | | | | 78 | |

Starbucks Corp | | | 16,902 | | | | 1,417 | |

Tapestry Inc | | | 2,803 | | | | 89 | |

Target Corp | | | 6,577 | | | | 570 | |

Tesla lnc * | | | 1,323 | | | | 296 | |

Tiffany & Co | | | 2,287 | | | | 214 | |

TJX Cos Inc/The | | | 15,858 | | | | 838 | |

Toll Brothers Inc | | | 2,246 | | | | 82 | |

Tractor Supply Co | | | 2,377 | | | | 259 | |

Tribune Media Co, CI A | | | 1,847 | | | | 85 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

Ulta Beauty lnc * | | | 279 | | | $ | 97 | |

Under Armour Inc, CI A * | | | 3,938 | | | | 100 | |

Under Armour Inc, CI C * | | | 4,463 | | | | 99 | |

Urban Outfitters lnc * | | | 3,059 | | | | 70 | |

Vail Resorts Inc | | | 381 | | | | 85 | |

VF Corp | | | 4,023 | | | | 352 | |

Wayfair Inc, CI A* | | | 590 | | | | 86 | |

Wendy’s Co/The | | | 11,419 | | | | 224 | |

Whirlpool Corp | | | 638 | | | | 91 | |

Williams-Sonoma Inc | | | 3,319 | | | | 216 | |

Wyndham Destinations Inc | | | 4,669 | | | | 205 | |

Wyndham Hotels & Resorts Inc | | | 3,409 | | | | 190 | |

Yum China Holdings Inc | | | 1,913 | | | | 88 | |

Yum! Brands Inc | | | 3,237 | | | | 358 | |

| | | | | | | | |

| | | | | | | 47,683 | |

| | | | | | | | |

| | |

Consumer Staples — 6.8% | | | | | | | | |

Archer-Daniels-Midland Co | | | 4,997 | | | | 204 | |

Beyond Meat Inc * | | | 535 | | | | 86 | |

Bunge Ltd | | | 1,596 | | | | 89 | |

Campbell Soup Co | | | 10,354 | | | | 415 | |

Church & Dwight Co Inc | | | 3,000 | | | | 219 | |

Clorox Co/The | | | 3,366 | | | | 516 | |

Coca-Cola Co/The | | | 77,274 | | | | 3,935 | |

Colgate-Palmolive Co | | | 14,526 | | | | 1,041 | |

Conagra Brands Inc | | | 30,656 | | | | 813 | |

Costco Wholesale Corp | | | 6,316 | | | | 1,669 | |

Coty Inc, CI A | | | 7,317 | | | | 98 | |

Energizer Holdings Inc | | | 1,973 | | | | 76 | |

Estee Lauder Cos Inc/The, CI A | | | 2,390 | | | | 438 | |

Flowers Foods Inc | | | 9,872 | | | | 230 | |

General Mills Inc | | | 13,887 | | | | 729 | |

Hain Celestial Group Inc/The * | | | 3,752 | | | | 82 | |

Hershey Co/The | | | 2,295 | | | | 308 | |

Hormel Foods Corp | | | 4,797 | | | | 194 | |

Ingredion Inc | | | 4,380 | | | | 361 | |

JM Smucker Co/The | | | 10,889 | | | | 1,254 | |

Kellogg Co | | | 6,713 | | | | 360 | |

Keurig Dr Pepper Inc | | | 38,334 | | | | 1,108 | |

Kimberly-Clark Corp | | | 6,484 | | | | 864 | |

Kraft Heinz Co/The | | | 4,224 | | | | 131 | |

Kroger Co/The | | | 57,546 | | | | 1,249 | |

McCormick & Co Inc/MD | | | 2,916 | | | | 452 | |

Mondelez International Inc, CI A | | | 18,714 | | | | 1,009 | |

Monster Beverage Corp * | | | 2,979 | | | | 190 | |

PepsiCo Inc | | | 31,732 | | | | 4,161 | |

Pilgrim’s Pride Corp * | | | 3,030 | | | | 77 | |

Post Holdings lnc * | | | 793 | | | | 82 | |

Procter & Gamble Co/The | | | 37,857 | | | | 4,151 | |

Spectrum Brands Holdings Inc | | | 1,320 | | | | 71 | |

Sprouts Farmers Market lnc * | | | 9,458 | | | | 179 | |

Sysco Corp | | | 8,925 | | | | 631 | |

TreeHouse Foods lnc * | | | 1,471 | | | | 80 | |

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 15 | |

SCHEDULE OF INVESTMENTS

June 30, 2019

New Covenant Growth Fund (Continued)

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

Tyson Foods Inc, CI A | | | 1,963 | | | $ | 158 | |

US Foods Holding Corp * | | | 2,211 | | | | 79 | |

Walgreens Boots Alliance Inc | | | 8,946 | | | | 489 | |

Walmart Inc | | | 20,825 | | | | 2,301 | |

| | | | | | | | |

| | | | | | | 30,579 | |

| | | | | | | | |

| | |

Energy — 5.1% | | | | | | | | |

Anadarko Petroleum Corp | | | 5,131 | | | | 362 | |

Apache Corp | | | 4,822 | | | | 140 | |

Apergy Corp * | | | 5,586 | | | | 187 | |

Baker Hughes a GE Co, CI A | | | 7,765 | | | | 191 | |

Cabot Oil & Gas Corp | | | 3,306 | | | | 76 | |

Cheniere Energy Inc * | | | 1,265 | | | | 87 | |

Chesapeake Energy Corp * | | | 32,883 | | | | 64 | |

Chevron Corp | | | 39,996 | | | | 4,977 | |

Concho Resources Inc | | | 1,204 | | | | 124 | |

ConocoPhillips | | | 28,755 | | | | 1,754 | |

Continental Resources Inc/OK | | | 2,048 | | | | 86 | |

Devon Energy Corp | | | 8,276 | | | | 236 | |

Diamondback Energy Inc | | | 796 | | | | 87 | |

EOG Resources Inc | | | 6,996 | | | | 652 | |

EQT Corp | | | 2,732 | | | | 43 | |

Equitrans Midstream Corp | | | 2,185 | | | | 43 | |

Exxon Mobil Corp | | | 65,031 | | | | 4,983 | |

Halliburton Co | | | 23,046 | | | | 524 | |

Helmerich & Payne Inc | | | 1,494 | | | | 76 | |

Hess Corp | | | 7,788 | | | | 495 | |

HollyFrontier Corp | | | 3,119 | | | | 144 | |

Kinder Morgan Inc/DE | | | 21,442 | | | | 448 | |

Kosmos Energy Ltd | | | 31,233 | | | | 196 | |

Marathon Oil Corp | | | 10,930 | | | | 155 | |

Marathon Petroleum Corp | | | 7,000 | | | | 391 | |

Murphy Oil Corp | | | 3,117 | | | | 77 | |

National Oilwell Varco Inc | | | 3,446 | | | | 77 | |

Noble Energy Inc | | | 6,179 | | | | 138 | |

Occidental Petroleum Corp | | | 33,170 | | | | 1,668 | |

ONEOK Inc | | | 3,505 | | | | 241 | |

PBF Energy Inc, CI A | | | 2,828 | | | | 89 | |

Phillips 66 | | | 4,879 | | | | 456 | |

Pioneer Natural Resources Co | | | 1,910 | | | | 294 | |

Range Resources Corp | | | 22,746 | | | | 159 | |

Schlumberger Ltd | | | 51,478 | | | | 2,046 | |

Targa Resources Corp | | | 5,515 | | | | 217 | |

Valero Energy Corp | | | 4,219 | | | | 361 | |

Williams Cos Inc/The | | | 13,098 | | | | 367 | |

| | | | | | | | |

| | | | | | | 22,711 | |

| | | | | | | | |

| | |

Financials — 12.6% | | | | | | | | |

Affiliated Managers Group Inc | | | 910 | | | | 84 | |

Aflac Inc | | | 8,664 | | | | 475 | |

Alleghany Corp * | | | 128 | | | | 87 | |

Allstate Corp/The | | | 3,458 | | | | 352 | |

American Express Co | | | 9,360 | | | | 1,155 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

American International Group Inc | | | 10,083 | | | $ | 537 | |

Ameriprise Financial Inc | | | 1,604 | | | | 233 | |

Annaly Capital Management Inc ‡ | | | 8,922 | | | | 81 | |

Arch Capital Group Ltd * | | | 2,404 | | | | 89 | |

Arthur J Gallagher & Co | | | 1,029 | | | | 90 | |

Assurant Inc | | | 883 | | | | 94 | |

AXA Equitable Holdings Inc | | | 37,558 | | | | 785 | |

Bank of America Corp | | | 166,804 | | | | 4,837 | |

Bank of Hawaii Corp | | | 1,051 | | | | 87 | |

Bank of New York Mellon Corp/The | | | 12,656 | | | | 559 | |

Bank OZK | | | 2,609 | | | | 78 | |

BankUnited Inc | | | 2,418 | | | | 82 | |

BB&T Corp | | | 8,015 | | | | 394 | |

Berkshire Hathaway Inc, CI B * | | | 30,259 | | | | 6,451 | |

BlackRock Inc, CI A | | | 1,478 | | | | 694 | |

Brighthouse Financial lnc * | | | 2,182 | | | | 80 | |

Brown & Brown Inc | | | 2,667 | | | | 89 | |

Capital One Financial Corp | | | 5,083 | | | | 461 | |

Cboe Global Markets Inc | | | 830 | | | | 86 | |

Charles Schwab Corp/The | | | 14,548 | | | | 585 | |

Chubb Ltd | | | 5,856 | | | | 863 | |

Cincinnati Financial Corp | | | 891 | | | | 92 | |

Citigroup Inc | | | 55,008 | | | | 3,852 | |

Citizens Financial Group Inc | | | 2,381 | | | | 84 | |

CME Group Inc, CI A | | | 4,747 | | | | 921 | |

CNA Financial Corp | | | 1,871 | | | | 88 | |

Comerica Inc | | | 2,799 | | | | 203 | |

Commerce Bancshares Inc/MO | | | 1,418 | | | | 85 | |

Credit Acceptance Corp * | | | 177 | | | | 86 | |

Cullen/Frost Bankers Inc | | | 850 | | | | 80 | |

Discover Financial Services | | | 3,009 | | | | 233 | |

E*TRADE Financial Corp | | | 1,729 | | | | 77 | |

East West Bancorp Inc | | | 1,710 | | | | 80 | |

Erie Indemnity Co, CI A | | | 433 | | | | 110 | |

FactSet Research Systems Inc | | | 306 | | | | 88 | |

Fifth Third Bancorp | | | 4,599 | | | | 128 | |

First Hawaiian Inc | | | 3,126 | | | | 81 | |

First Republic Bank/CA | | | 831 | | | | 81 | |

Franklin Resources Inc | | | 6,856 | | | | 239 | |

Goldman Sachs Group Inc/The | | | 5,574 | | | | 1,140 | |

Hanover Insurance Group Inc/The | | | 694 | | | | 89 | |

Hartford Financial Services Group Inc/The | | | 4,042 | | | | 225 | |

Huntington Bancshares Inc/OH | | | 6,282 | | | | 87 | |

Intercontinental Exchange Inc | | | 6,350 | | | | 546 | |

Invesco Ltd | | | 50,690 | | | | 1,037 | |

JPMorgan Chase & Co | | | 59,458 | | | | 6,647 | |

KeyCorp | | | 12,904 | | | | 229 | |

Lazard Ltd, CI A (A) | | | 2,316 | | | | 80 | |

Lincoln National Corp | | | 3,621 | | | | 234 | |

Loews Corp | | | 1,670 | | | | 91 | |

LPL Financial Holdings Inc | | | 1,036 | | | | 84 | |

M&T Bank Corp | | | 929 | | | | 158 | |

| | |

| 16 | | New Covenant Funds / Annual Report / June 30, 2019 |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

Markel Corp * | | | 81 | | | $ | 88 | |

MarketAxess Holdings Inc | | | 305 | | | | 98 | |

Marsh & McLennan Cos Inc | | | 20,171 | | | | 2,012 | |

Mercury General Corp | | | 1,523 | | | | 95 | |

MetLife Inc | | | 8,552 | | | | 425 | |

Moody’s Corp | | | 1,782 | | | | 348 | |

Morgan Stanley | | | 35,755 | | | | 1,566 | |

Morningstar Inc | | | 1,607 | | | | 232 | |

MSCl lnc, CI A | | | 1,669 | | | | 399 | |

Nasdaq Inc | | | 2,378 | | | | 229 | |

New York Community Bancorp Inc | | | 7,595 | | | | 76 | |

Northern Trust Corp | | | 8,350 | | | | 751 | |

OneMain Holdings Inc, CI A | | | 2,529 | | | | 86 | |

People’s United Financial Inc | | | 5,001 | | | | 84 | |

Pinnacle Financial Partners Inc | | | 1,489 | | | | 86 | |

PNC Financial Services Group Inc/The | | | 5,690 | | | | 781 | |

Principal Financial Group Inc | | | 7,045 | | | | 408 | |

Progressive Corp/The | | | 6,981 | | | | 558 | |

Prosperity Bancshares Inc | | | 1,192 | | | | 79 | |

Prudential Financial Inc | | | 16,015 | | | | 1,618 | |

Raymond James Financial Inc | | | 980 | | | | 83 | |

Regions Financial Corp | | | 5,703 | | | | 85 | |

Reinsurance Group of America Inc, CI A | | | 578 | | | | 90 | |

S&P Global Inc | | | 8,103 | | | | 1,846 | |

Santander Consumer USA Holdings Inc | | | 4,038 | | | | 97 | |

Signature Bank/New York NY | | | 676 | | | | 82 | |

SLM Corp | | | 8,316 | | | | 81 | |

State Street Corp | | | 23,884 | | | | 1,339 | |

SunTrust Banks Inc | | | 4,136 | | | | 260 | |

SVB Financial Group * | | | 346 | | | | 78 | |

Synchrony Financial | | | 6,500 | | | | 225 | |

T Rowe Price Group Inc | | | 2,711 | | | | 297 | |

TD Ameritrade Holding Corp | | | 1,608 | | | | 80 | |

TFS Financial Corp | | | 4,940 | | | | 89 | |

Torchmark Corp | | | 972 | | | | 87 | |

Travelers Cos Inc/The | | | 2,743 | | | | 410 | |

Two Harbors Investment Corp | | | 6,390 | | | | 81 | |

US Bancorp | | | 20,106 | | | | 1,054 | |

Voya Financial Inc | | | 4,001 | | | | 221 | |

Wells Fargo & Co | | | 61,564 | | | | 2,913 | |

Western Alliance Bancorp * | | | 1,801 | | | | 80 | |

Willis Towers Watson PLC | | | 1,386 | | | | 266 | |

WR Berkley Corp | | | 1,397 | | | | 92 | |

Zions Bancorp NA | | | 1,771 | | | | 81 | |

| | | | | | | | |

| | |

| | | | | | | 56,699 | |

| | | | | | | | |

| | |

Health Care — 13.6% | | | | | | | | |

Abbott Laboratories | | | 42,548 | | | | 3,578 | |

AbbVie Inc | | | 21,492 | | | | 1,563 | |

ABIOMED Inc * | | | 332 | | | | 87 | |

Agilent Technologies Inc | | | 7,874 | | | | 588 | |

Alexion Pharmaceuticals lnc * | | | 2,032 | | | | 266 | |

Align Technology Inc * | | | 602 | | | | 165 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

Allergan PLC | | | 4,194 | | | $ | 702 | |

Alnylam Pharmaceuticals lnc * | | | 1,202 | | | | 87 | |

AmerisourceBergen Corp, CI A | | | 1,108 | | | | 94 | |

Amgen Inc | | | 16,833 | | | | 3,102 | |

Anthem Inc | | | 3,366 | | | | 950 | |

Baxter International Inc | | | 12,373 | | | | 1,013 | |

Becton Dickinson and Co | | | 4,437 | | | | 1,118 | |

Biogen lnc * | | | 3,113 | | | | 728 | |

BioMarin Pharmaceutical lnc * | | | 1,042 | | | | 89 | |

Bio-Rad Laboratories Inc, CI A * | | | 813 | | | | 254 | |

Bio-Techne Corp | | | 426 | | | | 89 | |

Bluebird Bio lnc * | | | 645 | | | | 82 | |

Boston Scientific Corp * | | | 40,840 | | | | 1,755 | |

Bristol-Myers Squibb Co | | | 29,745 | | | | 1,349 | |

Bruker Corp | | | 1,999 | | | | 100 | |

Cantel Medical Corp | | | 1,233 | | | | 100 | |

Cardinal Health Inc | | | 4,140 | | | | 195 | |

Celgene Corp * | | | 8,987 | | | | 831 | |

Centene Corp * | | | 3,110 | | | | 163 | |

Cerner Corp | | | 2,541 | | | | 186 | |

Charles River Laboratories International lnc * | | | 629 | | | | 89 | |

Cigna Corp | | | 5,007 | | | | 789 | |

Cooper Cos Inc/The | | | 295 | | | | 100 | |

Covetrus lnc * | | | 1,045 | | | | 25 | |

CVS Health Corp | | | 41,565 | | | | 2,265 | |

Danaher Corp | | | 10,230 | | | | 1,462 | |

DaVita lnc * | | | 1,647 | | | | 93 | |

DENTSPLY SIRONA Inc | | | 3,113 | | | | 182 | |

DexCom lnc * | | | 723 | | | | 108 | |

Edwards Lifesciences Corp * | | | 2,828 | | | | 523 | |

Elanco Animal Health lnc * | | | 6,958 | | | | 235 | |

Eli Lilly & Co | | | 12,283 | | | | 1,361 | |

Encompass Health Corp | | | 1,377 | | | | 87 | |

Exact Sciences Corp * | | | 930 | | | | 110 | |

Exelixis Inc * | | | 4,344 | | | | 93 | |

Gilead Sciences Inc | | | 18,126 | | | | 1,224 | |

HCA Healthcare Inc | | | 2,683 | | | | 363 | |

Henry Schein lnc * | | | 2,612 | | | | 183 | |

Hill-Rom Holdings Inc | | | 2,029 | | | | 212 | |

Hologic lnc * | | | 1,882 | | | | 90 | |

Humana Inc | | | 2,054 | | | | 545 | |

ICU Medical lnc * | | | 374 | | | | 94 | |

IDEXX Laboratories lnc * | | | 690 | | | | 190 | |

IlIumina lnc * | | | 3,352 | | | | 1,234 | |

Incyte Corp * | | | 1,063 | | | | 90 | |

Insulet Corp * | | | 831 | | | | 99 | |

Integra LifeSciences Holdings Corp * | | | 1,632 | | | | 91 | |

Intuitive Surgical Inc * | | | 1,480 | | | | 776 | |

IQVIA Holdings Inc * | | | 1,493 | | | | 240 | |

Johnson & Johnson | | | 51,318 | | | | 7,147 | |

Laboratory Corp of America Holdings * | | | 515 | | | | 89 | |

McKesson Corp | | | 1,711 | | | | 230 | |

| | | | |

New Covenant Funds / Annual Report / June 30, 2019 | | | 17 | |

SCHEDULE OF INVESTMENTS

June 30, 2019

New Covenant Growth Fund (Continued)

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

MEDNAX Inc * | | | 2,907 | | | $ | 73 | |

Merck & Co Inc | | | 56,489 | | | | 4,737 | |

Mettler-Toledo International Inc * | | | 562 | | | | 472 | |

Moderna Inc * | | | 8,718 | | | | 128 | |

Mylan NV * | | | 3,872 | | | | 74 | |

Neurocrine Biosciences lnc * | | | 1,089 | | | | 92 | |

Penumbra lnc * | | | 654 | | | | 105 | |

PerkinElmer Inc | | | 928 | | | | 90 | |

Pfizer Inc | | | 86,529 | | | | 3,748 | |

PRA Health Sciences lnc * | | | 931 | | | | 92 | |

Premier Inc, CI A * | | | 2,266 | | | | 89 | |

QIAGEN NV * | | | 2,338 | | | | 95 | |

Quest Diagnostics Inc | | | 865 | | | | 88 | |

Regeneron Pharmaceuticals lnc * | | | 1,105 | | | | 346 | |

ResMed Inc | | | 2,930 | | | | 358 | |

Sage Therapeutics Inc * | | | 516 | | | | 94 | |

Sarepta Therapeutics lnc * | | | 703 | | | | 107 | |

STERIS PLC | | | 1,661 | | | | 247 | |

Stryker Corp | | | 4,567 | | | | 939 | |

Teleflex Inc | | | 742 | | | | 246 | |

Thermo Fisher Scientific Inc | | | 5,791 | | | | 1,701 | |

UnitedHealth Group Inc | | | 20,119 | | | | 4,909 | |

Universal Health Services Inc, CI B | | | 698 | | | | 91 | |

Varian Medical Systems Inc * | | | 1,773 | | | | 241 | |

Veeva Systems Inc, CI A * | | | 904 | | | | 147 | |

Vertex Pharmaceuticals lnc * | | | 3,090 | | | | 567 | |

Waters Corp * | | | 395 | | | | 85 | |

WellCare Health Plans lnc * | | | 313 | | | | 89 | |

West Pharmaceutical Services Inc | | | 1,875 | | | | 235 | |

Zimmer Biomet Holdings Inc | | | 4,581 | | | | 539 | |

Zoetis Inc, CI A | | | 6,097 | | | | 692 | |

| | | | | | | | |

| | |

| | | | | | | 61,169 | |

| | | | | | | | |

| | |

Industrials — 8.3% | | | | | | | | |

3M Co | | | 13,677 | | | | 2,371 | |

Acuity Brands Inc | | | 598 | | | | 82 | |

AECOM * | | | 6,633 | | | | 251 | |

AGCO Corp | | | 1,171 | | | | 91 | |

Alaska Air Group Inc | | | 3,175 | | | | 203 | |

Allegion PLC | | | 855 | | | | 94 | |

Allison Transmission Holdings Inc | | | 1,870 | | | | 87 | |

American Airlines Group Inc | | | 26,880 | | | | 876 | |

AMETEK Inc | | | 1,712 | | | | 156 | |

AO Smith Corp | | | 1,708 | | | | 80 | |

Arconic Inc | | | 7,379 | | | | 191 | |

Armstrong World Industries Inc | | | 979 | | | | 95 | |

BWX Technologies Inc | | | 6,269 | | | | 327 | |

CH Robinson Worldwide Inc | | | 1,051 | | | | 89 | |

Cintas Corp | | | 4,567 | | | | 1,084 | |

Clean Harbors Inc * | | | 1,228 | | | | 87 | |

Copart lnc * | | | 1,284 | | | | 96 | |

CoStar Group Inc * | | | 266 | | | | 147 | |

Crane Co | | | 999 | | | | 83 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) | |

| | |

COMMON STOCK (continued) | | | | | | | | |

CSX Corp | | | 9,694 | | | $ | 750 | |

Cummins Inc | | | 3,179 | | | | 545 | |

Curtiss-Wright Corp | | | 1,789 | | | | 227 | |

Deere & Co | | | 4,735 | | | | 785 | |

Delta Air Lines Inc | | | 28,033 | | | | 1,591 | |

Donaldson Co Inc | | | 1,646 | | | | 84 | |

Dover Corp | | | 2,207 | | | | 221 | |

Eaton Corp PLC | | | 13,217 | | | | 1,101 | |

Emerson Electric Co | | | 6,592 | | | | 440 | |

Equifax Inc | | | 719 | | | | 97 | |

Expeditors International of Washington Inc | | | 1,163 | | | | 88 | |

Fastenal Co | | | 6,120 | | | | 199 | |

FedEx Corp | | | 3,607 | | | | 592 | |

Flowserve Corp | | | 1,726 | | | | 91 | |

Fluor Corp | | | 4,373 | | | | 147 | |

Fortune Brands Home & Security Inc | | | 1,585 | | | | 91 | |

Gardner Denver Holdings lnc * | | | 2,502 | | | | 87 | |

Gates Industrial Corp PLC * | | | 6,472 | | | | 74 | |

General Electric Co | | | 121,638 | | | | 1,277 | |

Graco Inc | | | 1,670 | | | | 84 | |

GrafTech International Ltd | | | 7,088 | | | | 82 | |

HD Supply Holdings Inc * | | | 1,986 | | | | 80 | |

HEICO Corp | | | 4,884 | | | | 654 | |

HEICO Corp, CI A | | | 1,813 | | | | 187 | |

Hexcel Corp | | | 4,105 | | | | 332 | |

Honeywell International Inc | | | 10,659 | | | | 1,861 | |

Hubbell, Inc CI B | | | 682 | | | | 89 | |

IDEX Corp | | | 555 | | | | 95 | |

IHS Markit Ltd * | | | 3,910 | | | | 249 | |

Illinois Tool Works Inc | | | 12,876 | | | | 1,942 | |

ITT Inc | | | 1,404 | | | | 92 | |

Jacobs Engineering Group Inc | | | 1,091 | | | | 92 | |

JetBlue Airways Corp * | | | 4,688 | | | | 87 | |

Johnson Controls International plc | | | 19,263 | | | | 796 | |

Kansas City Southern | | | 1,741 | | | | 212 | |

Kirby Corp * | | | 1,032 | | | | 81 | |

Landstar System Inc | | | 2,284 | | | | 247 | |

Lennox International Inc | | | 310 | | | | 85 | |

Lincoln Electric Holdings Inc | | | 1,027 | | | | 84 | |

Lyft Inc, CI A * | | | 1,333 | | | | 88 | |

Macquarie Infrastructure Corp | | | 2,041 | | | | 83 | |

ManpowerGroup Inc | | | 3,586 | | | | 347 | |

Masco Corp | | | 6,315 | | | | 248 | |

Middleby Corp/The * | | | 632 | | | | 86 | |

MSC Industrial Direct Co Inc, CI A | | | 1,115 | | | | 83 | |

Nielsen Holdings PLC | | | 10,117 | | | | 229 | |

Nordson Corp | | | 600 | | | | 85 | |

Norfolk Southern Corp | | | 3,218 | | | | 641 | |

nVent Electric PLC | | | 3,298 | | | | 82 | |

Oshkosh Corp | | | 2,762 | | | | 231 | |

Owens Corning | | | 4,958 | | | | 289 | |

PACCAR Inc | | | 3,029 | | | | 217 | |

| | |

| 18 | | New Covenant Funds / Annual Report / June 30, 2019 |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

Parker-Hannifin Corp | | | 1,231 | | | $ | 209 | |

Pentair PLC | | | 4,928 | | | | 183 | |

Quanta Services Inc | | | 2,291 | | | | 88 | |

Regal Beloit Corp | | | 1,068 | | | | 87 | |

Republic Services Inc, CI A | | | 2,647 | | | | 229 | |

Resideo Technologies lnc * | | | 448 | | | | 10 | |

Rockwell Automation Inc | | | 1,620 | | | | 265 | |

Rollins Inc | | | 2,355 | | | | 85 | |

Roper Technologies Inc | | | 1,151 | | | | 421 | |

Ryder System Inc | | | 1,425 | | | | 83 | |

Schneider National Inc, CI B | | | 4,347 | | | | 79 | |

Sensate Technologies Holding PLC * | | | 4,273 | | | | 209 | |

Southwest Airlines Co | | | 4,524 | | | | 230 | |

Spirit AeroSystems Holdings Inc, CI A | | | 8,213 | | | | 668 | |

Stanley Black & Decker Inc | | | 1,349 | | | | 195 | |

Stericycle lnc * | | | 1,710 | | | | 82 | |

Teledyne Technologies Inc * | | | 878 | | | | 240 | |

Timken Co/The | | | 1,715 | | | | 88 | |

Toro Co/The | | | 1,175 | | | | 79 | |

TransDigm Group lnc * | | | 1,732 | | | | 838 | |

TransUnion | | | 3,412 | | | | 251 | |

Trinity Industries Inc | | | 3,977 | | | | 82 | |

Union Pacific Corp | | | 12,488 | | | | 2,112 | |

United Airlines Holdings Inc * | | | 2,850 | | | | 249 | |

United Parcel Service Inc, CI B | | | 9,414 | | | | 972 | |

United Rentals lnc * | | | 1,692 | | | | 224 | |

Univar lnc * | | | 10,632 | | | | 234 | |

Valmont Industries Inc | | | 689 | | | | 87 | |

Verisk Analytics Inc, CI A | | | 1,729 | | | | 253 | |

WABCO Holdings Inc * | | | 649 | | | | 86 | |

Wabtec Corp | | | 465 | | | | 33 | |

Waste Management Inc | | | 6,467 | | | | 746 | |

Watsco Inc | | | 537 | | | | 88 | |

WESCO International lnc * | | | 3,527 | | | | 179 | |

Woodward Inc | | | 769 | | | | 87 | |

WW Grainger Inc | | | 5,055 | | | | 1,356 | |

XPO Logistics lnc * | | | 1,396 | | | | 81 | |

Xylem Inc/NY | | | 8,168 | | | | 683 | |

| | | | | | | | |

| | |

| | | | | | | 37,288 | |

| | | | | | | | |

| | |

Information Technology — 20.9% | | | | | | | | |

2U lnc * | | | 2,061 | | | | 78 | |

Adobe lnc * | | | 12,031 | | | | 3,545 | |

Advanced Micro Devices lnc * | | | 9,113 | | | | 277 | |

Akamai Technologies lnc * | | | 3,119 | | | | 250 | |

Alliance Data Systems Corp | | | 1,335 | | | | 187 | |

Alteryx Inc, CIA * | | | 810 | | | | 88 | |

Amdocs Ltd | | | 3,632 | | | | 226 | |

Amphenol Corp, CI A | | | 2,838 | | | | 272 | |

Analog Devices Inc | | | 4,564 | | | | 515 | |

Anaplan Inc * | | | 1,752 | | | | 88 | |

AHSYS Inc * | | | 448 | | | | 92 | |

Apple Inc | | | 74,954 | | | | 14,835 | |

| | | | | | | | |

| | | |

| Description | | Shares | | Market Value

($ Thousands) |

| | |

COMMON STOCK (continued) | | | | | | | | |

Applied Materials Inc | | | 10,761 | | | $ | 483 | |

Arista Networks lnc * | | | 768 | | | | 199 | |

Arrow Electronics lnc * | | | 2,550 | | | | 182 | |

Atlassian Corp PLC, CI A* | | | 665 | | | | 87 | |

Autodesk lnc * | | | 3,559 | | | | 580 | |

Automatic Data Processing Inc | | | 14,168 | | | | 2,342 | |

Avnet Inc | | | 1,892 | | | | 86 | |

Black Knight lnc * | | | 1,569 | | | | 94 | |

Booz Allen Hamilton Holding Corp, CI A | | | 1,402 | | | | 93 | |

Broadcom Inc | | | 6,023 | | | | 1,734 | |

Broadridge Financial Solutions Inc | | | 720 | | | | 92 | |

Cadence Design Systems lnc * | | | 1,372 | | | | 97 | |

CDK Global Inc | | | 1,636 | | | | 81 | |

CDW Corp/DE | | | 806 | | | | 89 | |

Cisco Systems Inc | | | 68,588 | | | | 3,754 | |

Citrix Systems Inc | | | 1,980 | | | | 194 | |