UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-09025

New Covenant Funds

(Exact name of registrant as specified in charter)

________

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Timothy D. Barto, Esq.

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-610-676-1000

Date of fiscal year end: June 30, 2024

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto. |

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about New Covenant Growth Fund (the "Fund") for the period from July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 877-835-4531.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| New Covenant Growth Fund | $80 | 0.72% |

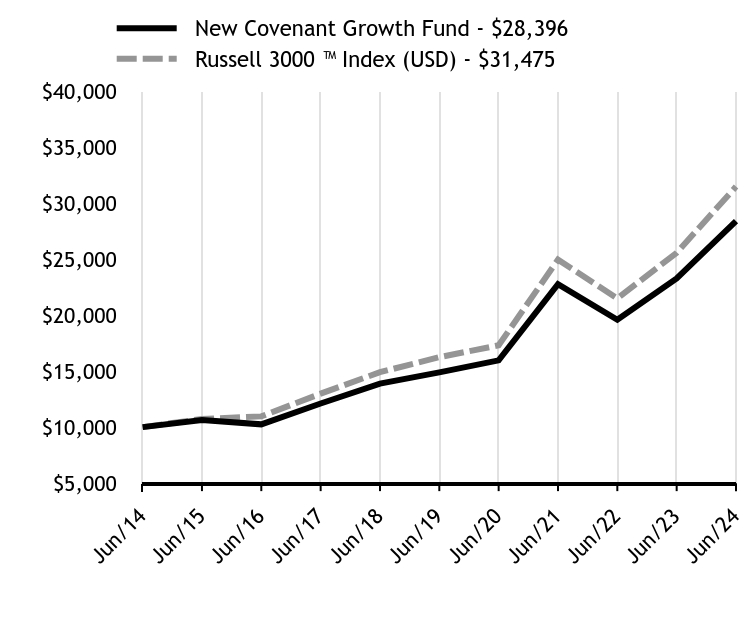

How did the fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| New Covenant Growth Fund - $28396 | Russell 3000 ™ Index (USD) - $31475 |

|---|

| Jun/14 | $10000 | $10000 |

| Jun/15 | $10641 | $10729 |

| Jun/16 | $10249 | $10959 |

| Jun/17 | $12106 | $12987 |

| Jun/18 | $13890 | $14907 |

| Jun/19 | $14892 | $16246 |

| Jun/20 | $15961 | $17306 |

| Jun/21 | $22758 | $24950 |

| Jun/22 | $19590 | $21490 |

| Jun/23 | $23279 | $25563 |

| Jun/24 | $28396 | $31475 |

How did the Fund perform in the last year?

The Fund recorded a positive return for the 12-month reporting period, but underperformed its benchmark, the Russell 3000 Index—which tracks the performance of the 3,000 largest U.S. companies representing approximately 96% of the investable U.S. equity market.

U.S. stocks rose significantly during the reporting period as a result of strong corporate earnings as investors became less concerned about inflation. Growth stocks outperformed relative to value stocks, and shares of larger-capitalization companies outperformed relative to smaller-capitalization stocks. Lower-beta stocks generally lagged relative to higher-beta stocks.

Positions in the information technology and communication services sectors were the most notable positive contributors to Fund performance as they included several of the mega-cap growth stocks that led the market over the reporting period. Conversely, the utilities and consumer staples sectors were the primary detractors from Fund performance as those low-beta sectors underperformed the overall market during the period.

Total Return Based on $10,000 Investment

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| New Covenant Growth Fund | 21.98% | 13.78% | 11.00% |

| Russell 3000 ™ Index (USD) | 23.13% | 14.14% | 12.15% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $549,620 | 1,506 | $1,206 | 3% |

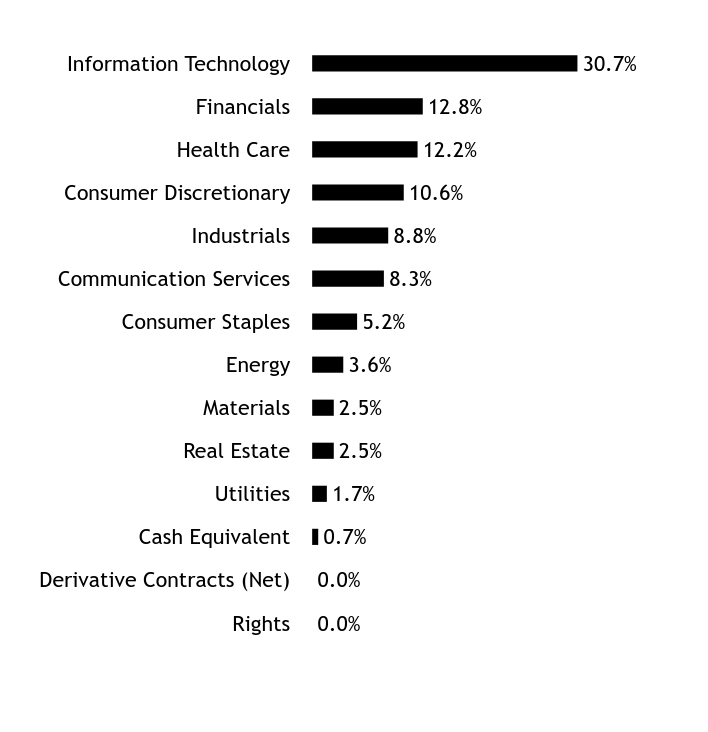

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Rights | 0.0% |

| Derivative Contracts (Net) | 0.0% |

| Cash Equivalent | 0.7% |

| Utilities | 1.7% |

| Real Estate | 2.5% |

| Materials | 2.5% |

| Energy | 3.6% |

| Consumer Staples | 5.2% |

| Communication Services | 8.3% |

| Industrials | 8.8% |

| Consumer Discretionary | 10.6% |

| Health Care | 12.2% |

| Financials | 12.8% |

| Information Technology | 30.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net Assets |

|---|

| Microsoft Corp | | | 6.5% |

| NVIDIA Corp | | | 5.8% |

| Apple Inc | | | 5.8% |

| Amazon.com Inc | | | 3.3% |

| Meta Platforms Inc, Class A | | | 2.0% |

| Alphabet Inc, Class A | | | 2.0% |

| Eli Lilly & Co | | | 1.7% |

| Alphabet Inc, Class C | | | 1.6% |

| Broadcom Inc | | | 1.5% |

| Berkshire Hathaway Inc, Class B | | | 1.3% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting, visit or call:

New Covenant Growth Fund: NCGFX

Annual Shareholder Report - June 30, 2024

NCGFX-AR-24

Annual Shareholder Report - June 30, 2024

This annual shareholder report contains important information about New Covenant Income Fund (the "Fund") for the period from July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 877-835-4531.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| New Covenant Income Fund | $78 | 0.77% |

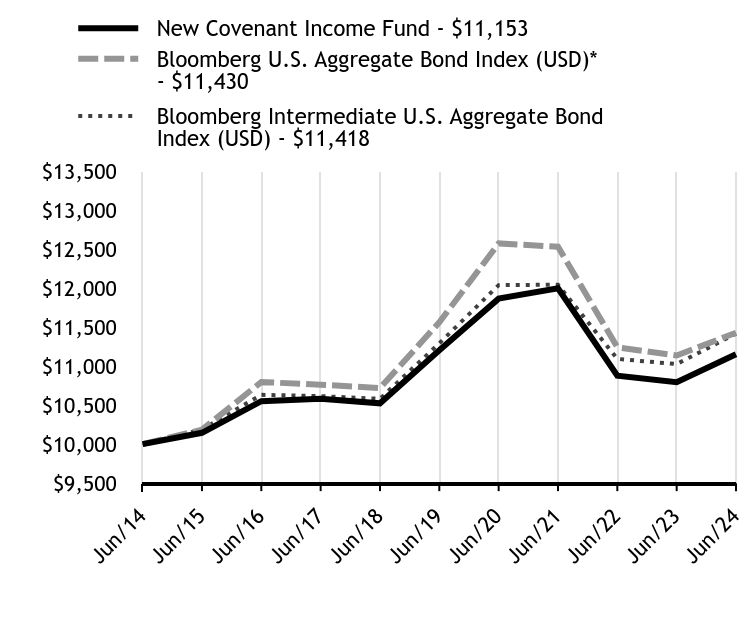

How did the fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| New Covenant Income Fund - $11153 | Bloomberg U.S. Aggregate Bond Index (USD)* - $11430 | Bloomberg Intermediate U.S. Aggregate Bond Index (USD) - $11418 |

|---|

| Jun/14 | $10000 | $10000 | $10000 |

| Jun/15 | $10146 | $10186 | $10189 |

| Jun/16 | $10552 | $10797 | $10633 |

| Jun/17 | $10581 | $10763 | $10616 |

| Jun/18 | $10524 | $10720 | $10582 |

| Jun/19 | $11205 | $11564 | $11294 |

| Jun/20 | $11867 | $12575 | $12040 |

| Jun/21 | $12000 | $12533 | $12046 |

| Jun/22 | $10879 | $11243 | $11094 |

| Jun/23 | $10794 | $11137 | $11027 |

| Jun/24 | $11153 | $11430 | $11418 |

How did the Fund perform in the last year?

The Fund underperformed its benchmark, the Bloomberg Intermediate U.S. Aggregate Bond Index—which tracks the performance of fixed-rate, publicly issued, non-investment-grade bonds—for the 12-month period ending June 30, 2024.

The Fund’s slightly longer duration posture detracted from performance as yields rose during the first half of 2024. All spread sectors outperformed the overall U.S. bond market, as represented by the Bloomberg U.S. Aggregate Bond Index, and Fund performance benefited from overweight positions in agency mortgage-backed securities (MBS) and the financial sector. Security selection in agency MBS enhanced performance for the reporting period.

Among the Fund’s sub-advisers, Western Asset Management Company benefited from an overweight to corporate bonds, which outperformed over the period, while an overweight to 30-year U.S. Treasury bonds detracted from performance as yields moved higher. Income Research & Management’s performance was bolstered by overweight allocations and security selection within both the asset-backed securities (ABS) and commercial mortgage-backed securities (CMBS) sectors.

Strong labor markets and increasing wages resulted in a resilient consumer enabling ABS to outperform the overall market for the reporting period. Credit spreads narrowed as the U.S. economy continued to expand, while the anticipated recession never materialized. Consequently, the Fund’s overweight to MBS contributed positively to performance. The Fed continued to taper asset purchases for most of the reporting period, and agency MBS spreads widened, enabling the Fund’s managers to add high-quality liquid assets with a yield advantage to U.S. Treasurys.

The Fund’s use of derivatives had no material impact on performance during the reporting period.

.

Total Return Based on $10,000 Investment

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| New Covenant Income Fund | 3.33% | | 1.10% |

| Bloomberg U.S. Aggregate Bond Index (USD)* | 2.63% | | 1.35% |

| Bloomberg Intermediate U.S. Aggregate Bond Index (USD) | 3.55% | 0.22% | 1.33% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

Footnote Reference*As of June 2024, pursuant to the new regulatory requirements, this index has been added to represent the broad-based securities market index.

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $345,299 | 1,349 | $933 | 83% |

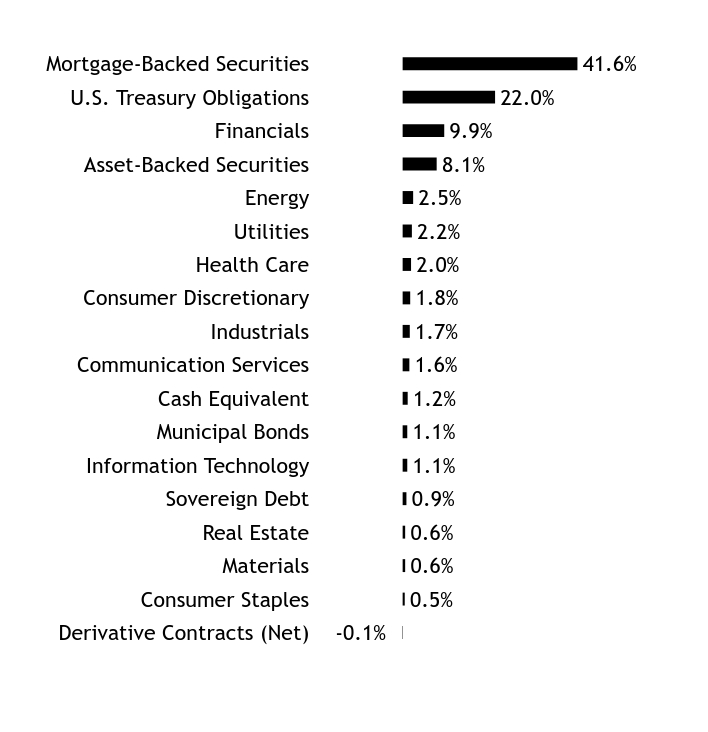

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Derivative Contracts (Net) | |

| Consumer Staples | 0.5% |

| Materials | 0.6% |

| Real Estate | 0.6% |

| Sovereign Debt | 0.9% |

| Information Technology | 1.1% |

| Municipal Bonds | 1.1% |

| Cash Equivalent | 1.2% |

| Communication Services | 1.6% |

| Industrials | 1.7% |

| Consumer Discretionary | 1.8% |

| Health Care | 2.0% |

| Utilities | 2.2% |

| Energy | 2.5% |

| Asset-Backed Securities | 8.1% |

| Financials | 9.9% |

| U.S. Treasury Obligations | 22.0% |

| Mortgage-Backed Securities | 41.6% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | Coupon Rate | Maturity Date | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| U.S. Treasury Notes | 4.000% | 01/31/29 | 3.4% |

| U.S. Treasury Notes | 0.750% | 05/31/26 | 2.0% |

| U.S. Treasury Notes | 4.000% | 02/15/34 | 1.7% |

| U.S. Treasury Notes | 4.375% | 08/31/28 | 1.4% |

| U.S. Treasury Notes | 3.500% | 01/31/28 | 1.3% |

| U.S. Treasury Notes | 4.375% | 11/30/28 | 0.9% |

| U.S. Treasury Notes | 3.625% | 05/31/28 | 0.9% |

| U.S. Treasury Bills | 5.332% | 08/20/24 | 0.8% |

| U.S. Treasury Notes | 4.000% | 01/31/31 | 0.7% |

| U.S. Treasury Notes | 4.625% | 04/30/29 | 0.7% |

| Footnote | Description |

Footnote(A) | Excludes short-term investments used for cash management purposes. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting, visit or call:

New Covenant Income Fund: NCICX

Annual Shareholder Report - June 30, 2024

NCICX-AR-24

Annual Shareholder Report - June 30, 2024

New Covenant Balanced Growth Fund

This annual shareholder report contains important information about New Covenant Balanced Growth Fund (the "Fund") for the period from July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 877-835-4531.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| New Covenant Balanced Growth Fund | $14 | 0.13% |

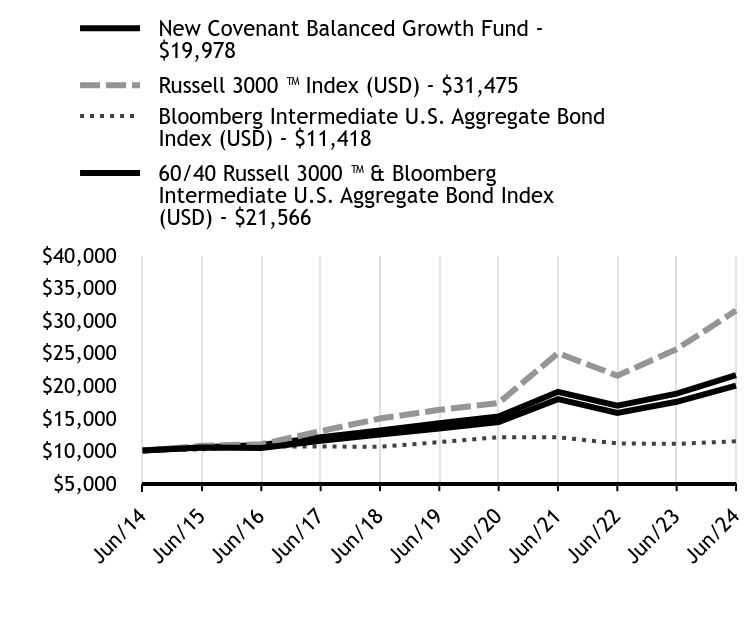

How did the fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| New Covenant Balanced Growth Fund - $19978 | Russell 3000 ™ Index (USD) - $31475 | Bloomberg Intermediate U.S. Aggregate Bond Index (USD) - $11418 | 60/40 Russell 3000 ™ & Bloomberg Intermediate U.S. Aggregate Bond Index (USD) - $21566 |

|---|

| Jun/14 | $10000 | $10000 | $10000 | $10000 |

| Jun/15 | $10454 | $10729 | $10189 | $10520 |

| Jun/16 | $10402 | $10959 | $10633 | $10866 |

| Jun/17 | $11504 | $12987 | $10616 | $12034 |

| Jun/18 | $12475 | $14907 | $10582 | $13068 |

| Jun/19 | $13363 | $16246 | $11294 | $14188 |

| Jun/20 | $14375 | $17306 | $12040 | $15212 |

| Jun/21 | $17897 | $24950 | $12046 | $19015 |

| Jun/22 | $15776 | $21490 | $11094 | $16874 |

| Jun/23 | $17484 | $25563 | $11027 | $18742 |

| Jun/24 | $19978 | $31475 | $11418 | $21566 |

How did the Fund perform in the last year?

The Fund underperformed the New Covenant Balanced Growth Benchmark (a 60%/40% blend of the Russell 3000 Index and the Bloomberg Intermediate U.S. Aggregate Bond Index) for the 12-month period ending June 30, 2024.

U.S. stocks rose significantly during the reporting period as a result of strong corporate earnings as investors became less concerned about inflation. Growth stocks outperformed relative to value stocks, and shares of larger-capitalization companies outperformed relative to smaller-capitalization stocks. Lower-beta stocks generally lagged relative to higher-beta stocks.

Positions in the information technology and communication services sectors were the most notable positive contributors to the performance of the Fund’s equity portfolio as they included several of the mega-cap growth stocks that led the market over the reporting period. Conversely, the utilities and consumer staples sectors were the primary detractors from Fund performance as those low-beta sectors underperformed the overall market during the period.

The slightly longer duration posture of the Fund’s fixed income portfolio detracted from performance as yields rose during the first half of 2024. All spread sectors outperformed the overall U.S. bond market, as represented by the Bloomberg U.S. Aggregate Bond Index, and Fund performance benefited from overweight positions in agency mortgage backed securities (MBS) and the financial sector, with a concentration in money center banks. Selection in agency MBS added to performance as the Fund’s managers preferred specified pools over to be announced (TBA) securities (contracts for the purchase or sale of an MBS to be delivered at an agreed-upon future date).

Total Return Based on $10,000 Investment

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| New Covenant Balanced Growth Fund | 14.26% | 8.37% | 7.16% |

| Russell 3000 ™ Index (USD) | 23.13% | 14.14% | 12.15% |

| Bloomberg Intermediate U.S. Aggregate Bond Index (USD) | 3.55% | 0.22% | 1.33% |

| 60/40 Russell 3000 ™ & Bloomberg Intermediate U.S. Aggregate Bond Index (USD) | 15.07% | 8.74% | 7.99% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $354,322 | 3 | $- | 6% |

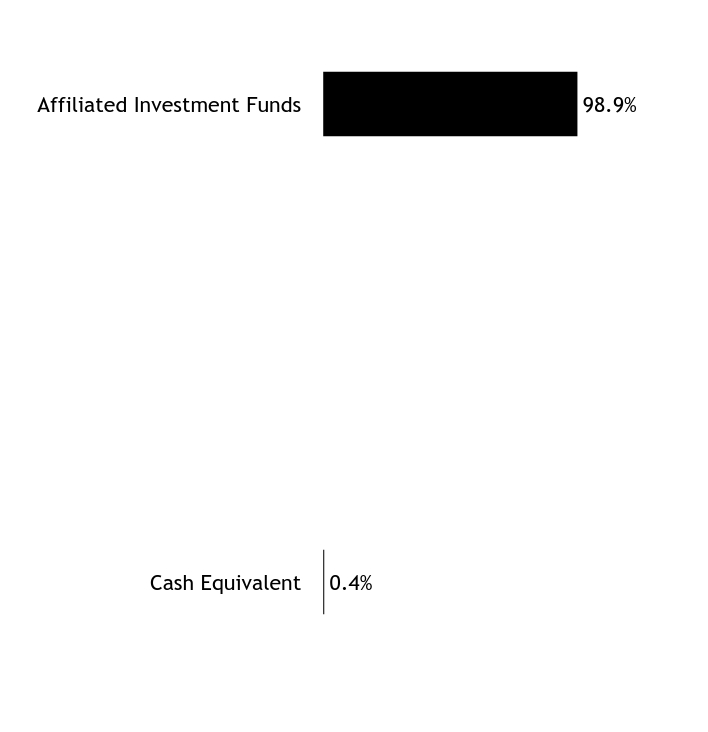

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Cash Equivalent | 0.4% |

| Affiliated Investment Funds | 98.9% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| New Covenant Growth Fund | | | 61.3% |

| New Covenant Income Fund | | | 37.6% |

| Footnote | Description |

Footnote(A) | Excludes short-term investments used for cash management purposes. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting, visit or call:

New Covenant Balanced Growth Fund: NCBGX

Annual Shareholder Report - June 30, 2024

NCBGX-AR-24

Annual Shareholder Report - June 30, 2024

New Covenant Balanced Income Fund

This annual shareholder report contains important information about New Covenant Balanced Income Fund (the "Fund") for the period from July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 877-835-4531.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| New Covenant Balanced Income Fund | $17 | 0.16% |

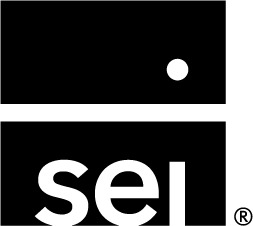

How did the fund perform during the last 10 years?

Total Return Based on $10,000 Investment

| New Covenant Balanced Income Fund - $15699 | Russell 3000 ™ Index (USD) - $31475 | Bloomberg Intermediate U.S. Aggregate Bond Index (USD) - $11418 | 35/65 Russell 3000 ™ & Bloomberg Intermediate U.S. Aggregate Bond Index (USD) - $16713 |

|---|

| Jun/14 | $10000 | $10000 | $10000 | $10000 |

| Jun/15 | $10322 | $10729 | $10189 | $10385 |

| Jun/16 | $10468 | $10959 | $10633 | $10782 |

| Jun/17 | $11107 | $12987 | $10616 | $11440 |

| Jun/18 | $11614 | $14907 | $10582 | $11992 |

| Jun/19 | $12400 | $16246 | $11294 | $12948 |

| Jun/20 | $13285 | $17306 | $12040 | $13880 |

| Jun/21 | $15177 | $24950 | $12046 | $15834 |

| Jun/22 | $13547 | $21490 | $11094 | $14286 |

| Jun/23 | $14338 | $25563 | $11027 | $15168 |

| Jun/24 | $15699 | $31475 | $11418 | $16713 |

How did the Fund perform in the last year?

The Fund underperformed the New Covenant Balanced Income Benchmark (a 35%/65% blend of the Russell 3000 Index and the Bloomberg Intermediate U.S. Aggregate Bond Index) for the 12-month period ending June 30, 2024.

The reporting period began with the Federal Reserve (Fed) hiking its benchmark interest rate for the eleventh time since March 2022, before pausing for the remainder of the period. Consequently, yields moved higher across the U.S. Treasury curve, with long-term yields rising at a greater pace than short-term yields. The slightly longer duration posture of the Fund’s fixed income portfolio detracted from performance as yields rose during the first half of 2024. All spread sectors outperformed the overall U.S. bond market, as represented by the Bloomberg U.S. Aggregate Bond Index, and Fund performance benefited from overweight positions in agency mortgage backed securities (MBS) and the financial sector, with a concentration in money center banks. Selection in agency MBS added to performance as the Fund’s managers preferred specified pools over to be announced (TBA) securities (contracts for the purchase or sale of an MBS to be delivered at an agreed-upon future date).

U.S. stocks rose significantly during the reporting period as a result of strong corporate earnings as investors became less concerned about inflation. Growth stocks outperformed relative to value stocks, and shares of larger-capitalization companies outperformed relative to smaller-capitalization stocks. Lower-beta stocks generally lagged relative to higher-beta stocks. The equity portfolio’s positions in the information technology and communication services sectors contributed positively to Fund performance as they included several of the mega-cap growth stocks that led the market over the reporting period. Conversely, the utilities and consumer staples sectors were the primary detractors from Fund performance as those low-beta sectors underperformed the overall market during the period.

Total Return Based on $10,000 Investment

| Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

| New Covenant Balanced Income Fund | 9.49% | 4.83% | 4.61% |

| Russell 3000 ™ Index (USD) | 23.13% | 14.14% | 12.15% |

| Bloomberg Intermediate U.S. Aggregate Bond Index (USD) | 3.55% | 0.22% | 1.33% |

| 35/65 Russell 3000 ™ & Bloomberg Intermediate U.S. Aggregate Bond Index (USD) | 10.18% | 5.24% | 5.27% |

The line graph represents historical performance of a hypothetical investment of $10,000 in the Fund during the last 10 years. Returns shown are total returns, which assume the reinvestment of dividends and capital gains. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund Shares. Past performance is not indicative of future performance.

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $75,461 | 3 | $- | 3% |

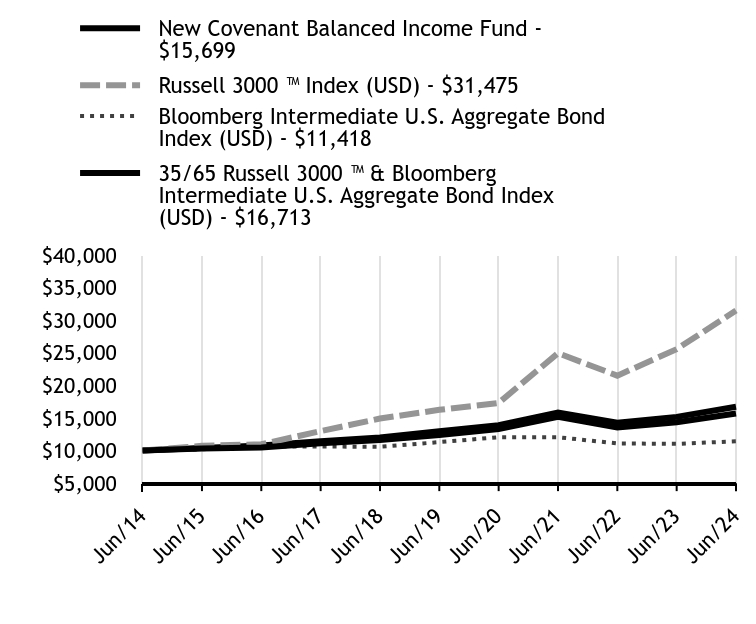

What did the Fund invest in?

Asset WeightingsFootnote Reference*

| Value | Value |

|---|

| Cash Equivalent | 0.4% |

| Affiliated Investment Funds | 98.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

| Holding Name | | | Percentage of Total Net AssetsFootnote Reference(A) |

|---|

| New Covenant Income Fund | | | 62.7% |

| New Covenant Growth Fund | | | 36.1% |

| Footnote | Description |

Footnote(A) | Excludes short-term investments used for cash management purposes. |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, holdings, and proxy voting, visit or call:

New Covenant Balanced Income Fund: NCBIX

Annual Shareholder Report - June 30, 2024

NCBIX-AR-24

Item 2. Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant’s Board of Trustees has determined that the Registrant has one audit committee financial expert serving on the audit committee.

(a) (2) The audit committee financial expert is Susan C. Cote. Ms. Cote is independent as defined in Form N-CSR Item 3 (a) (2).

Item 4. Principal Accountant Fees and Services.

Fees billed by KPMG LLP (“KPMG”) related to the Registrant.

KPMG billed the Registrant aggregate fees for services rendered to the Registrant for the fiscal years 2024 and 2023 as follows:

| | | Fiscal Year 2024 | Fiscal Year 2023 |

| | | All fees and services to the Registrant that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval | All fees and services to the Registrant that were pre-approved | All fees and services to service affiliates that were pre-approved | All other fees and services to service affiliates that did not require pre-approval |

| (a) | Audit Fees(1) | $77,330 | N/A | $0 | $77,330 | N/A | $0 |

| (b) | Audit-Related Fees | $0 | $0 | $0 | $0 | $0 | $0 |

| (c) | Tax Fees | $0 | $0 | $0 | $0 | $0 | $0 |

| (d) | All Other Fees(2) | $0 | $309,370 | $0 | $0 | $301,000 | $0 |

Notes:

| (1) | Audit fees include amounts related to the audit of the Registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. |

| (2) | See Item 4(g) for a description of the services comprising the fees disclosed in this category. |

(e)(1) The Registrant’s Audit Committee has adopted and the Board of Trustees has ratified an Audit and Non-Audit Services Pre-Approval Policy (the “Policy”), which sets forth the procedures and the conditions pursuant to which services proposed to be performed by the independent auditor of the Registrant may be pre-approved. In any instance where services require pre-approval, the Audit Committee will consider whether such services are consistent with SEC’s rules on auditor independence and whether the provision of such services would compromise the auditor’s independence.

The Policy provides that all requests or applications for proposed services to be provided by the independent auditor must be submitted to the Registrant’s Chief Financial Officer (“CFO”) and must include a detailed description of the services proposed to be rendered. The CFO will determine whether such services: (1) require specific pre-approval; (2) are included within the list of services that have received the general pre-approval of the Audit Committee pursuant to the Policy; or (3) have been previously pre-approved in connection with the independent auditor’s annual engagement letter for the applicable year or otherwise.

Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by the CFO. The Audit Committee has delegated specific pre-approval authority to either the Audit Committee Chair or financial experts, provided that the estimated fee for any such proposed pre-approved service does not exceed $100,000 and any pre-approval decisions are reported to the Audit Committee at its next regularly scheduled meeting.

Services that have received the general pre-approval of the Audit Committee are identified and described in the Policy. In addition, the Policy sets forth a maximum fee per engagement with respect to each identified service that has received general pre-approval. The Audit Committee will annually review and pre-approve the services that may be provided by the independent auditor during the following twelve months without obtaining specific pre-approval from the Audit Committee.

The Audit Committee will be informed by the CFO on a quarterly basis of all services rendered by the independent auditor.

All services to be provided by the independent auditor shall be provided pursuant to a signed written engagement letter with the Registrant, the investment advisor or applicable control affiliate (except that matters as to which an engagement letter would be impractical because of timing issues or because the matter is small may not be the subject of an engagement letter) that sets forth both the services to be provided by the independent auditor and the total fees (or the manner of their determination) to be paid to the independent auditor for those services.

In addition, the Audit Committee has determined to take additional measures on an annual basis to meet its responsibility to oversee the work of the independent auditor and to assure the auditor’s independence from the Registrant, such as reviewing a formal written statement from the independent auditor delineating all relationships between the independent auditor and the Registrant, and discussing with the independent auditor its methods and procedures for ensuring independence.

(e)(2) Percentage of fees billed applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | Fiscal Year 2024 | Fiscal Year 2023 |

Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

All Other Fees | 0% | 0% |

(f) Not Applicable.

(g) The aggregate non-audit fees and services billed by KPMG for the fiscal years 2024 and 2023 were $309,370 and $301,000, respectively. Non-audit fees consist of SSAE No. 16 review of fund accounting and administration operations and an attestation report in accordance with Rule 17Ad-13.

(h) During the past fiscal year, Registrant’s principal accountant provided certain non-audit services to Registrant’s investment adviser or to entities controlling, controlled by, or under common control with Registrant’s investment adviser that provide ongoing services to Registrant that were not subject to pre-approval pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X. The Audit Committee of Registrant’s Board of Trustees reviewed and considered these non-audit services provided by Registrant’s principal accountant to Registrant’s affiliates, including whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence.

(i) Not Applicable.

(j) Not Applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) The Schedules of Investments and Consolidated Schedules of Investments are included as part of the Financial Statements and Financial Highlights filed under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial statements and financial highlights filed herein.

| NEW COVENANT FUNDS® |  |

June 30, 2024

ANNUAL FINANCIALS AND OTHER INFORMATION

New Covenant Funds

❯ | New Covenant Growth Fund |

❯ | New Covenant Income Fund |

❯ | New Covenant Balanced Growth Fund |

❯ | New Covenant Balanced Income Fund |

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Funds or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online and you will be notified by mail each time a report is posted on the Funds’ website and provided with a link to access the report online.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-877-835-4531. Your election to receive reports in paper will apply to all funds held with the SEI Funds or your financial intermediary.

TABLE OF CONTENTS

| Financial Statements (Form N-CSR Item 7) | |

| Schedules of Investments | 1 |

| Statements of Assets and Liabilities | 37 |

| Statements of Operations | 38 |

| Statements of Changes in Net Assets | 39 |

| Financial Highlights | 41 |

| Notes to Financial Statements | 45 |

| Report of Independent Registered Public Accounting Firm | 60 |

| Notice to Shareholders | 61 |

| Board of Trustees Considerations in Approving the Advisory and Sub-Advisory Agreements (Form N-CSR Item 11) | 62 |

The Trust files its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Trust’s Form N-PORT reports are available on the Trust’s website at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports.

A description of the policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-877-835-4531; and (ii) on the Trust’s website at https://www.seic.com/mutual-fund-documentation/proxy-voting.

SCHEDULE OF INVESTMENTS

June 30, 2024

New Covenant Growth Fund

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† — 98.9% |

| | | | | | | | | |

Communication Services — 8.3% | | | | |

Alphabet Inc, Cl A | | | 58,874 | | | $ | 10,724 | |

Alphabet Inc, Cl C | | | 48,238 | | | | 8,848 | |

AT&T Inc | | | 46,385 | | | | 886 | |

Atlanta Braves Holdings Inc, Cl A * | | | 1,732 | | | | 72 | |

Atlanta Braves Holdings Inc, Cl C * | | | 1,938 | | | | 76 | |

Bandwidth Inc, Cl A * | | | 74 | | | | 1 | |

Cable One Inc | | | 79 | | | | 28 | |

Cardlytics Inc * | | | 761 | | | | 6 | |

Cars.com Inc * | | | 4,178 | | | | 82 | |

Charter Communications Inc, Cl A * | | | 277 | | | | 83 | |

Cinemark Holdings Inc * | | | 4,289 | | | | 93 | |

Cogent Communications Holdings Inc | | | 148 | | | | 8 | |

Comcast Corp, Cl A | | | 43,273 | | | | 1,695 | |

EchoStar Corp, Cl A * | | | 1,124 | | | | 20 | |

Electronic Arts Inc | | | 6,385 | | | | 890 | |

EverQuote Inc, Cl A * | | | 1,468 | | | | 31 | |

EW Scripps Co/The, Cl A * | | | 3,299 | | | | 10 | |

Fox Corp, Cl A | | | 1,372 | | | | 47 | |

Fox Corp, Cl B | | | 1,428 | | | | 46 | |

IAC Inc * | | | 376 | | | | 18 | |

IMAX Corp * | | | 2,244 | | | | 38 | |

Interpublic Group of Cos Inc/The | | | 8,487 | | | | 247 | |

Iridium Communications Inc | | | 366 | | | | 10 | |

John Wiley & Sons Inc, Cl A | | | 236 | | | | 10 | |

Liberty Broadband Corp, Cl A * | | | 81 | | | | 4 | |

Liberty Broadband Corp, Cl C * | | | 343 | | | | 19 | |

Liberty Media Corp-Liberty Live, Cl C * | | | 59 | | | | 2 | |

Liberty Media Corp-Liberty SiriusXM * | | | 234 | | | | 5 | |

Madison Square Garden Entertainment Corp, Cl A * | | | 697 | | | | 24 | |

Madison Square Garden Sports Corp * | | | 39 | | | | 7 | |

Magnite Inc * | | | 2,551 | | | | 34 | |

Match Group Inc * | | | 1,841 | | | | 56 | |

MediaAlpha Inc, Cl A * | | | 8,359 | | | | 110 | |

Meta Platforms Inc, Cl A | | | 21,660 | | | | 10,921 | |

Netflix Inc * | | | 3,698 | | | | 2,496 | |

New York Times Co/The, Cl A | | | 439 | | | | 22 | |

News Corp, Cl A | | | 829 | | | | 23 | |

Nexstar Media Group Inc, Cl A | | | 94 | | | | 16 | |

Omnicom Group Inc | | | 8,191 | | | | 735 | |

Paramount Global, Cl B | | | 7,304 | | | | 76 | |

Pinterest Inc, Cl A * | | | 3,339 | | | | 147 | |

ROBLOX Corp, Cl A * | | | 3,654 | | | | 136 | |

Shutterstock Inc | | | 205 | | | | 8 | |

Sirius XM Holdings Inc | | | 7,153 | | | | 20 | |

Sphere Entertainment Co * | | | 697 | | | | 24 | |

Spotify Technology SA * | | | 1,265 | | | | 397 | |

Take-Two Interactive Software Inc * | | | 897 | | | | 139 | |

TechTarget Inc * | | | 1,986 | | | | 62 | |

TEGNA Inc | | | 3,052 | | | | 43 | |

TKO Group Holdings Inc, Cl A | | | 780 | | | | 84 | |

T-Mobile US Inc | | | 2,215 | | | | 390 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Trade Desk Inc/The, Cl A * | | | 8,290 | | | $ | 810 | |

TripAdvisor Inc * | | | 1,712 | | | | 31 | |

Verizon Communications Inc | | | 57,853 | | | | 2,386 | |

Vimeo Inc * | | | 610 | | | | 2 | |

Walt Disney Co/The | | | 21,958 | | | | 2,180 | |

Warner Bros Discovery Inc * | | | 4,164 | | | | 31 | |

Yelp Inc, Cl A * | | | 1,355 | | | | 50 | |

Ziff Davis Inc * | | | 2,547 | | | | 140 | |

ZoomInfo Technologies Inc, Cl A * | | | 2,021 | | | | 26 | |

| | | | | | | | | |

| | | | | | | | 45,625 | |

Consumer Discretionary — 10.6% | | | | |

1-800-Flowers.com Inc, Cl A * | | | 3,668 | | | | 35 | |

Abercrombie & Fitch Co, Cl A * | | | 788 | | | | 140 | |

Academy Sports & Outdoors Inc | | | 2,047 | | | | 109 | |

Acushnet Holdings Corp | | | 987 | | | | 63 | |

Adient PLC * | | | 732 | | | | 18 | |

ADT Inc | | | 4,942 | | | | 38 | |

Adtalem Global Education Inc * | | | 5,431 | | | | 370 | |

Advance Auto Parts Inc | | | 317 | | | | 20 | |

Airbnb Inc, Cl A * | | | 2,716 | | | | 412 | |

Amazon.com Inc * | | | 93,527 | | | | 18,074 | |

American Eagle Outfitters Inc | | | 3,416 | | | | 68 | |

Aptiv PLC * | | | 3,490 | | | | 246 | |

Aramark | | | 260 | | | | 9 | |

Asbury Automotive Group Inc * | | | 70 | | | | 16 | |

AutoNation Inc * | | | 649 | | | | 103 | |

AutoZone Inc * | | | 235 | | | | 697 | |

Bath & Body Works Inc | | | 638 | | | | 25 | |

Best Buy Co Inc | | | 1,309 | | | | 110 | |

Bloomin' Brands Inc | | | 2,259 | | | | 43 | |

Booking Holdings Inc | | | 563 | | | | 2,230 | |

Boot Barn Holdings Inc * | | | 199 | | | | 26 | |

BorgWarner Inc | | | 321 | | | | 10 | |

Bright Horizons Family Solutions Inc * | | | 76 | | | | 8 | |

Brinker International Inc * | | | 1,180 | | | | 85 | |

Brunswick Corp/DE | | | 839 | | | | 61 | |

Buckle Inc/The | | | 1,885 | | | | 70 | |

Burlington Stores Inc * | | | 482 | | | | 116 | |

Capri Holdings Ltd * | | | 1,319 | | | | 44 | |

CarMax Inc * | | | 1,086 | | | | 80 | |

Carnival Corp * | | | 15,800 | | | | 296 | |

Carter's Inc | | | 471 | | | | 29 | |

Carvana Co, Cl A * | | | 879 | | | | 113 | |

Cavco Industries Inc * | | | 60 | | | | 21 | |

Cheesecake Factory Inc/The | | | 1,236 | | | | 49 | |

Chegg Inc * | | | 176 | | | | 1 | |

Chipotle Mexican Grill Inc, Cl A * | | | 11,600 | | | | 727 | |

Choice Hotels International Inc | | | 113 | | | | 13 | |

Columbia Sportswear Co | | | 891 | | | | 70 | |

Coursera Inc * | | | 15,856 | | | | 113 | |

Cracker Barrel Old Country Store Inc | | | 323 | | | | 14 | |

Crocs Inc * | | | 1,116 | | | | 163 | |

Dana Inc | | | 2,660 | | | | 32 | |

SCHEDULE OF INVESTMENTS

June 30, 2024

New Covenant Growth Fund (Continued)

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Darden Restaurants Inc | | | 705 | | | $ | 107 | |

Dave & Buster's Entertainment Inc * | | | 1,283 | | | | 51 | |

Deckers Outdoor Corp * | | | 1,186 | | | | 1,148 | |

Denny's Corp * | | | 2,500 | | | | 18 | |

Designer Brands Inc, Cl A | | | 3,316 | | | | 23 | |

Dick's Sporting Goods Inc | | | 700 | | | | 150 | |

Dillard's Inc, Cl A | | | 45 | | | | 20 | |

Domino's Pizza Inc | | | 33 | | | | 17 | |

DoorDash Inc, Cl A * | | | 523 | | | | 57 | |

Dorman Products Inc * | | | 128 | | | | 12 | |

DR Horton Inc | | | 890 | | | | 125 | |

eBay Inc | | | 19,465 | | | | 1,046 | |

Etsy Inc * | | | 1,162 | | | | 68 | |

Expedia Group Inc * | | | 389 | | | | 49 | |

Five Below Inc * | | | 410 | | | | 45 | |

Floor & Decor Holdings Inc, Cl A * | | | 232 | | | | 23 | |

Foot Locker Inc | | | 1,308 | | | | 33 | |

Ford Motor Co | | | 16,002 | | | | 201 | |

Fox Factory Holding Corp * | | | 749 | | | | 36 | |

Frontdoor Inc * | | | 251 | | | | 8 | |

GameStop Corp, Cl A * | | | 2,040 | | | | 50 | |

Gap Inc/The | | | 4,661 | | | | 111 | |

Garmin Ltd | | | 418 | | | | 68 | |

General Motors Co | | | 2,770 | | | | 129 | |

Gentex Corp | | | 440 | | | | 15 | |

Gentherm Inc * | | | 184 | | | | 9 | |

Genuine Parts Co | | | 67 | | | | 9 | |

Goodyear Tire & Rubber Co/The * | | | 989 | | | | 11 | |

Graham Holdings Co, Cl B | | | 78 | | | | 55 | |

Grand Canyon Education Inc * | | | 121 | | | | 17 | |

Group 1 Automotive Inc | | | 86 | | | | 26 | |

GrowGeneration Corp * | | | 2,599 | | | | 6 | |

H&R Block Inc | | | 2,109 | | | | 114 | |

Hanesbrands Inc * | | | 13,319 | | | | 66 | |

Hasbro Inc | | | 2,632 | | | | 154 | |

Helen of Troy Ltd * | | | 57 | | | | 5 | |

Hilton Grand Vacations Inc * | | | 3,016 | | | | 122 | |

Hilton Worldwide Holdings Inc | | | 8,404 | | | | 1,834 | |

Home Depot Inc/The | | | 11,555 | | | | 3,978 | |

Hyatt Hotels Corp, Cl A | | | 135 | | | | 20 | |

Installed Building Products Inc | | | 125 | | | | 26 | |

iRobot Corp * | | | 1,013 | | | | 9 | |

Jack in the Box Inc | | | 658 | | | | 33 | |

Johnson Outdoors Inc, Cl A | | | 659 | | | | 23 | |

KB Home | | | 4,733 | | | | 332 | |

Kohl's Corp | | | 1,859 | | | | 43 | |

Kontoor Brands Inc | | | 1,282 | | | | 85 | |

La-Z-Boy Inc, Cl Z | | | 1,597 | | | | 59 | |

LCI Industries | | | 483 | | | | 50 | |

Lear Corp | | | 5,902 | | | | 674 | |

Leggett & Platt Inc | | | 222 | | | | 3 | |

Lennar Corp, Cl B | | | 122 | | | | 17 | |

LGI Homes Inc * | | | 127 | | | | 11 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

LKQ Corp | | | 317 | | | $ | 13 | |

Lowe's Cos Inc | | | 8,938 | | | | 1,970 | |

Lucid Group Inc * | | | 33,236 | | | | 87 | |

Lululemon Athletica Inc * | | | 245 | | | | 73 | |

M/I Homes Inc * | | | 198 | | | | 24 | |

Macy's Inc | | | 4,042 | | | | 78 | |

Malibu Boats Inc, Cl A * | | | 202 | | | | 7 | |

Marriott International Inc/MD, Cl A | | | 3,599 | | | | 870 | |

Marriott Vacations Worldwide Corp | | | 394 | | | | 34 | |

Mattel Inc * | | | 711 | | | | 12 | |

McDonald's Corp | | | 9,415 | | | | 2,399 | |

Meritage Homes Corp | | | 794 | | | | 128 | |

Mohawk Industries Inc * | | | 127 | | | | 14 | |

Monro Inc | | | 626 | | | | 15 | |

Murphy USA Inc | | | 263 | | | | 123 | |

National Vision Holdings Inc * | | | 447 | | | | 6 | |

Newell Brands Inc | | | 605 | | | | 4 | |

NIKE Inc, Cl B | | | 6,941 | | | | 523 | |

Nordstrom Inc | | | 3,866 | | | | 82 | |

Norwegian Cruise Line Holdings Ltd * | | | 5,839 | | | | 110 | |

NVR Inc * | | | 13 | | | | 99 | |

ODP Corp/The * | | | 283 | | | | 11 | |

Ollie's Bargain Outlet Holdings Inc * | | | 212 | | | | 21 | |

O'Reilly Automotive Inc * | | | 196 | | | | 207 | |

Oxford Industries Inc | | | 665 | | | | 67 | |

Papa John's International Inc | | | 151 | | | | 7 | |

Peloton Interactive Inc, Cl A * | | | 2,845 | | | | 10 | |

Penske Automotive Group Inc | | | 957 | | | | 143 | |

Phinia Inc | | | 64 | | | | 2 | |

Planet Fitness Inc, Cl A * | | | 173 | | | | 13 | |

Polaris Inc | | | 966 | | | | 76 | |

PulteGroup Inc | | | 871 | | | | 96 | |

PVH Corp | | | 108 | | | | 11 | |

Ralph Lauren Corp, Cl A | | | 690 | | | | 121 | |

Revolve Group Inc, Cl A * | | | 2,223 | | | | 35 | |

RH * | | | 45 | | | | 11 | |

Rivian Automotive Inc, Cl A * | | | 1,274 | | | | 17 | |

Ross Stores Inc | | | 857 | | | | 125 | |

Royal Caribbean Cruises Ltd * | | | 7,156 | | | | 1,141 | |

Sabre Corp * | | | 506 | | | | 1 | |

Sally Beauty Holdings Inc * | | | 2,794 | | | | 30 | |

Service Corp International/US | | | 250 | | | | 18 | |

Shake Shack Inc, Cl A * | | | 157 | | | | 14 | |

Signet Jewelers Ltd | | | 2,402 | | | | 215 | |

Six Flags Entertainment Corp | | | 248 | | | | 8 | |

Sleep Number Corp * | | | 1,033 | | | | 10 | |

Standard Motor Products Inc | | | 943 | | | | 26 | |

Starbucks Corp | | | 15,798 | | | | 1,230 | |

Steven Madden Ltd | | | 1,178 | | | | 50 | |

Stitch Fix Inc, Cl A * | | | 1,021 | | | | 4 | |

Strategic Education Inc | | | 331 | | | | 37 | |

Stride Inc * | | | 348 | | | | 24 | |

Tapestry Inc | | | 2,803 | | | | 120 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Taylor Morrison Home Corp, Cl A * | | | 12,743 | | | $ | 706 | |

Tempur Sealy International Inc | | | 2,272 | | | | 108 | |

Tesla Inc * | | | 26,233 | | | | 5,191 | |

Texas Roadhouse Inc, Cl A | | | 889 | | | | 153 | |

Thor Industries Inc | | | 106 | | | | 10 | |

TJX Cos Inc/The | | | 13,629 | | | | 1,501 | |

Toll Brothers Inc | | | 269 | | | | 31 | |

TopBuild Corp * | | | 315 | | | | 121 | |

Topgolf Callaway Brands Corp * | | | 2,383 | | | | 36 | |

Tractor Supply Co | | | 2,377 | | | | 642 | |

Travel + Leisure Co | | | 307 | | | | 14 | |

Tri Pointe Homes Inc * | | | 3,236 | | | | 121 | |

Udemy Inc * | | | 3,378 | | | | 29 | |

Ulta Beauty Inc * | | | 279 | | | | 108 | |

Under Armour Inc, Cl C * | | | 556 | | | | 4 | |

United Parks & Resorts Inc * | | | 251 | | | | 14 | |

Upbound Group Inc, Cl A | | | 1,764 | | | | 54 | |

Urban Outfitters Inc * | | | 417 | | | | 17 | |

Vail Resorts Inc | | | 46 | | | | 8 | |

Valvoline Inc * | | | 11,216 | | | | 484 | |

VF Corp | | | 4,023 | | | | 54 | |

Victoria's Secret & Co * | | | 212 | | | | 4 | |

Visteon Corp * | | | 85 | | | | 9 | |

Wayfair Inc, Cl A * | | | 320 | | | | 17 | |

Wendy's Co/The | | | 11,419 | | | | 194 | |

Whirlpool Corp | | | 638 | | | | 65 | |

Williams-Sonoma Inc | | | 160 | | | | 45 | |

Wingstop Inc | | | 363 | | | | 153 | |

Winnebago Industries Inc | | | 191 | | | | 10 | |

Wolverine World Wide Inc | | | 1,511 | | | | 20 | |

Worthington Enterprises Inc | | | 223 | | | | 11 | |

Wyndham Hotels & Resorts Inc | | | 189 | | | | 14 | |

Yum! Brands Inc | | | 8,356 | | | | 1,107 | |

| | | | | | | | | |

| | | | | | | | 57,995 | |

Consumer Staples — 5.2% | | | | |

Andersons Inc/The | | | 338 | | | | 17 | |

Archer-Daniels-Midland Co | | | 5,103 | | | | 308 | |

B&G Foods Inc | | | 862 | | | | 7 | |

BellRing Brands Inc * | | | 136 | | | | 8 | |

Beyond Meat Inc * | | | 166 | | | | 1 | |

Bunge Global SA | | | 929 | | | | 99 | |

Calavo Growers Inc | | | 571 | | | | 13 | |

Campbell Soup Co | | | 10,354 | | | | 468 | |

Casey's General Stores Inc | | | 65 | | | | 25 | |

Chefs' Warehouse Inc/The * | | | 1,366 | | | | 53 | |

Church & Dwight Co Inc | | | 1,025 | | | | 106 | |

Clorox Co/The | | | 2,716 | | | | 371 | |

Coca-Cola Co/The | | | 48,833 | | | | 3,108 | |

Colgate-Palmolive Co | | | 3,197 | | | | 310 | |

Conagra Brands Inc | | | 3,435 | | | | 98 | |

Costco Wholesale Corp | | | 3,989 | | | | 3,391 | |

Coty Inc, Cl A * | | | 1,026 | | | | 10 | |

Darling Ingredients Inc * | | | 716 | | | | 26 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Dollar General Corp | | | 752 | | | $ | 99 | |

Dollar Tree Inc * | | | 1,320 | | | | 141 | |

Edgewell Personal Care Co | | | 310 | | | | 12 | |

elf Beauty Inc * | | | 1,902 | | | | 401 | |

Energizer Holdings Inc | | | 231 | | | | 7 | |

Estee Lauder Cos Inc/The, Cl A | | | 2,390 | | | | 254 | |

Flowers Foods Inc | | | 555 | | | | 12 | |

Fresh Del Monte Produce Inc | | | 1,442 | | | | 31 | |

General Mills Inc | | | 13,887 | | | | 878 | |

Hain Celestial Group Inc/The * | | | 461 | | | | 3 | |

Herbalife Ltd * | | | 1,088 | | | | 11 | |

Hershey Co/The | | | 2,295 | | | | 422 | |

HF Foods Group Inc * | | | 2,213 | | | | 7 | |

Hormel Foods Corp | | | 4,797 | | | | 146 | |

Ingredion Inc | | | 1,110 | | | | 127 | |

J M Smucker Co/The | | | 6,494 | | | | 708 | |

Kellanova | | | 6,713 | | | | 387 | |

Keurig Dr Pepper Inc | | | 32,477 | | | | 1,085 | |

Kimberly-Clark Corp | | | 6,484 | | | | 896 | |

Kraft Heinz Co/The | | | 3,923 | | | | 126 | |

Kroger Co/The | | | 15,936 | | | | 796 | |

Lamb Weston Holdings Inc | | | 594 | | | | 50 | |

McCormick & Co Inc/MD | | | 5,832 | | | | 414 | |

Medifast Inc | | | 71 | | | | 2 | |

Mondelez International Inc, Cl A | | | 17,402 | | | | 1,139 | |

Monster Beverage Corp * | | | 889 | | | | 44 | |

National Beverage Corp | | | 344 | | | | 18 | |

PepsiCo Inc | | | 21,178 | | | | 3,493 | |

PriceSmart Inc | | | 179 | | | | 15 | |

Procter & Gamble Co/The | | | 21,348 | | | | 3,521 | |

SpartanNash Co | | | 1,252 | | | | 23 | |

Sprouts Farmers Market Inc * | | | 623 | | | | 52 | |

Sysco Corp | | | 11,594 | | | | 828 | |

Target Corp | | | 6,577 | | | | 974 | |

TreeHouse Foods Inc * | | | 237 | | | | 9 | |

Tyson Foods Inc, Cl A | | | 1,410 | | | | 81 | |

US Foods Holding Corp * | | | 2,211 | | | | 117 | |

Vita Coco Co Inc/The * | | | 1,354 | | | | 38 | |

Walgreens Boots Alliance Inc | | | 27,118 | | | | 328 | |

Walmart Inc | | | 37,247 | | | | 2,522 | |

WK Kellogg Co | | | 1,678 | | | | 28 | |

| | | | | | | | | |

| | | | | | | | 28,664 | |

Energy — 3.6% | | | | |

Antero Midstream Corp | | | 26,635 | | | | 393 | |

Antero Resources Corp * | | | 6,426 | | | | 210 | |

APA Corp | | | 2,988 | | | | 88 | |

Ardmore Shipping Corp | | | 5,335 | | | | 120 | |

Baker Hughes Co, Cl A | | | 9,516 | | | | 335 | |

Borr Drilling Ltd | | | 11,900 | | | | 77 | |

Cactus Inc, Cl A | | | 298 | | | | 16 | |

ChampionX Corp | | | 383 | | | | 13 | |

Cheniere Energy Inc | | | 6,249 | | | | 1,092 | |

Chesapeake Energy Corp | | | 1,093 | | | | 90 | |

SCHEDULE OF INVESTMENTS

June 30, 2024

New Covenant Growth Fund (Continued)

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Civitas Resources Inc | | | 179 | | | $ | 12 | |

Clean Energy Fuels Corp * | | | 4,579 | | | | 12 | |

CNX Resources Corp * | | | 1,745 | | | | 42 | |

ConocoPhillips | | | 21,820 | | | | 2,496 | |

CONSOL Energy Inc | | | 213 | | | | 22 | |

Coterra Energy Inc | | | 19,841 | | | | 529 | |

Delek US Holdings Inc | | | 2,494 | | | | 62 | |

Devon Energy Corp | | | 10,747 | | | | 509 | |

DHT Holdings Inc | | | 1,338 | | | | 15 | |

Diamondback Energy Inc | | | 1,863 | | | | 373 | |

Dorian LPG Ltd | | | 2,360 | | | | 99 | |

Dril-Quip Inc * | | | 1,072 | | | | 20 | |

DT Midstream Inc | | | 405 | | | | 29 | |

Encore Energy Corp * | | | 31,435 | | | | 124 | |

Energy Fuels Inc/Canada * | | | 11,707 | | | | 71 | |

EOG Resources Inc | | | 12,533 | | | | 1,578 | |

EQT Corp | | | 7,282 | | | | 269 | |

Equitrans Midstream Corp | | | 2,185 | | | | 28 | |

Expro Group Holdings NV * | | | 1,529 | | | | 35 | |

FLEX LNG Ltd | | | 2,301 | | | | 62 | |

Golar LNG Ltd | | | 3,888 | | | | 122 | |

Green Plains Inc * | | | 2,069 | | | | 33 | |

Halliburton Co | | | 5,199 | | | | 176 | |

Helix Energy Solutions Group Inc * | | | 10,917 | | | | 130 | |

Helmerich & Payne Inc | | | 4,134 | | | | 149 | |

Hess Corp | | | 6,554 | | | | 967 | |

HF Sinclair Corp | | | 1,944 | | | | 104 | |

International Seaways Inc | | | 329 | | | | 19 | |

Kinder Morgan Inc | | | 84,043 | | | | 1,670 | |

Kinetik Holdings Inc, Cl A | | | 2,668 | | | | 111 | |

Kosmos Energy Ltd * | | | 44,503 | | | | 247 | |

Magnolia Oil & Gas Corp, Cl A | | | 1,806 | | | | 46 | |

Marathon Oil Corp | | | 4,448 | | | | 128 | |

Murphy Oil Corp | | | 449 | | | | 18 | |

Nabors Industries Ltd * | | | 367 | | | | 26 | |

New Fortress Energy Inc, Cl A | | | 2,307 | | | | 51 | |

NextDecade Corp * | | | 10,122 | | | | 80 | |

Noble Corp PLC | | | 1,325 | | | | 59 | |

Nordic American Tankers Ltd | | | 3,610 | | | | 14 | |

NOV Inc | | | 482 | | | | 9 | |

Occidental Petroleum Corp | | | 1,677 | | | | 106 | |

ONEOK Inc | | | 10,887 | | | | 888 | |

Overseas Shipholding Group Inc, Cl A | | | 15,434 | | | | 131 | |

Ovintiv Inc | | | 2,011 | | | | 94 | |

Patterson-UTI Energy Inc | | | 4,952 | | | | 51 | |

PBF Energy Inc, Cl A | | | 316 | | | | 15 | |

Peabody Energy Corp | | | 612 | | | | 14 | |

Range Resources Corp | | | 2,839 | | | | 95 | |

RPC Inc | | | 1,226 | | | | 8 | |

Schlumberger NV | | | 35,254 | | | | 1,663 | |

Scorpio Tankers Inc | | | 270 | | | | 22 | |

SM Energy Co | | | 840 | | | | 36 | |

Southwestern Energy Co * | | | 14,284 | | | | 96 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Talos Energy Inc * | | | 10,408 | | | $ | 126 | |

Targa Resources Corp | | | 1,165 | | | | 150 | |

Teekay Corp * | | | 15,129 | | | | 136 | |

Teekay Tankers Ltd, Cl A | | | 1,755 | | | | 121 | |

Texas Pacific Land Corp | | | 945 | | | | 694 | |

Transocean Ltd * | | | 20,466 | | | | 109 | |

Uranium Energy Corp * | | | 15,244 | | | | 92 | |

Valaris Ltd * | | | 739 | | | | 55 | |

Vital Energy Inc * | | | 2,462 | | | | 110 | |

Vitesse Energy Inc | | | 272 | | | | 6 | |

Weatherford International PLC * | | | 1,190 | | | | 146 | |

Williams Cos Inc/The | | | 43,224 | | | | 1,837 | |

World Kinect Corp | | | 4,395 | | | | 113 | |

| | | | | | | | | |

| | | | | | | | 19,894 | |

Financials — 12.8% | | | | |

Affiliated Managers Group Inc | | | 910 | | | | 142 | |

Affirm Holdings Inc, Cl A * | | | 2,309 | | | | 70 | |

Aflac Inc | | | 4,907 | | | | 438 | |

AGNC Investment Corp ‡ | | | 2,838 | | | | 27 | |

Allstate Corp/The | | | 3,458 | | | | 552 | |

Ally Financial Inc | | | 1,575 | | | | 62 | |

Amalgamated Financial Corp | | | 2,110 | | | | 58 | |

American Express Co | | | 9,360 | | | | 2,167 | |

American Financial Group Inc/OH | | | 89 | | | | 11 | |

American International Group Inc | | | 1,586 | | | | 118 | |

Ameriprise Financial Inc | | | 1,250 | | | | 534 | |

AMERISAFE Inc | | | 743 | | | | 33 | |

Annaly Capital Management Inc ‡ | | | 655 | | | | 12 | |

Aon PLC, Cl A | | | 3,101 | | | | 910 | |

Apollo Commercial Real Estate Finance Inc ‡ | | | 2,686 | | | | 26 | |

Apollo Global Management Inc | | | 1,165 | | | | 138 | |

Arch Capital Group Ltd * | | | 1,254 | | | | 127 | |

Ares Management Corp, Cl A | | | 632 | | | | 84 | |

Arthur J Gallagher & Co | | | 416 | | | | 108 | |

Artisan Partners Asset Management Inc, Cl A | | | 1,589 | | | | 66 | |

Associated Banc-Corp | | | 4,274 | | | | 90 | |

Assurant Inc | | | 87 | | | | 14 | |

Assured Guaranty Ltd | | | 994 | | | | 77 | |

Atlantic Union Bankshares Corp | | | 1,302 | | | | 43 | |

Axis Capital Holdings Ltd | | | 825 | | | | 58 | |

Axos Financial Inc * | | | 310 | | | | 18 | |

Banc of California Inc | | | 843 | | | | 11 | |

Bank of America Corp | | | 56,445 | | | | 2,245 | |

Bank of Hawaii Corp | | | 1,051 | | | | 60 | |

Bank of Marin Bancorp | | | 1,079 | | | | 17 | |

Bank of New York Mellon Corp/The | | | 12,656 | | | | 758 | |

Bank of NT Butterfield & Son Ltd/The | | | 1,324 | | | | 46 | |

Bank OZK | | | 366 | | | | 15 | |

BankUnited Inc | | | 346 | | | | 10 | |

Banner Corp | | | 851 | | | | 42 | |

Berkshire Hathaway Inc, Cl B * | | | 17,635 | | | | 7,174 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Berkshire Hills Bancorp Inc | | | 1,501 | | | $ | 34 | |

BlackRock Inc, Cl A | | | 1,878 | | | | 1,479 | |

Blackstone Inc | | | 6,935 | | | | 859 | |

Block Inc, Cl A * | | | 1,553 | | | | 100 | |

BOK Financial Corp | | | 568 | | | | 52 | |

Bread Financial Holdings Inc | | | 1,335 | | | | 59 | |

Brighthouse Financial Inc * | | | 268 | | | | 12 | |

Brown & Brown Inc | | | 290 | | | | 26 | |

Cadence Bank | | | 1,525 | | | | 43 | |

Capital One Financial Corp | | | 3,914 | | | | 542 | |

Capitol Federal Financial Inc | | | 3,529 | | | | 19 | |

Carlyle Group Inc/The | | | 923 | | | | 37 | |

Cass Information Systems Inc | | | 865 | | | | 35 | |

Cathay General Bancorp | | | 1,291 | | | | 49 | |

Cboe Global Markets Inc | | | 99 | | | | 17 | |

Central Pacific Financial Corp | | | 1,651 | | | | 35 | |

Charles Schwab Corp/The | | | 16,432 | | | | 1,211 | |

Chimera Investment Corp ‡ | | | 800 | | | | 10 | |

Chubb Ltd | | | 6,169 | | | | 1,574 | |

Cincinnati Financial Corp | | | 891 | | | | 105 | |

Citigroup Inc | | | 11,801 | | | | 749 | |

Citizens Financial Group Inc | | | 3,587 | | | | 129 | |

City Holding Co | | | 607 | | | | 64 | |

CME Group Inc, Cl A | | | 3,763 | | | | 740 | |

CNA Financial Corp | | | 253 | | | | 12 | |

Cohen & Steers Inc | | | 764 | | | | 55 | |

Columbia Banking System Inc | | | 1,640 | | | | 33 | |

Comerica Inc | | | 1,232 | | | | 63 | |

Commerce Bancshares Inc/MO | | | 1,808 | | | | 101 | |

Community Financial System Inc | | | 710 | | | | 34 | |

ConnectOne Bancorp Inc | | | 1,891 | | | | 36 | |

Corpay Inc * | | | 277 | | | | 74 | |

Credit Acceptance Corp * | | | 177 | | | | 91 | |

Cullen/Frost Bankers Inc | | | 121 | | | | 12 | |

Dime Community Bancshares Inc | | | 1,467 | | | | 30 | |

Discover Financial Services | | | 9,192 | | | | 1,202 | |

Eagle Bancorp Inc | | | 1,035 | | | | 20 | |

East West Bancorp Inc | | | 1,710 | | | | 125 | |

Ellington Financial Inc ‡ | | | 2,748 | | | | 33 | |

Enterprise Financial Services Corp | | | 1,063 | | | | 43 | |

Equitable Holdings Inc | | | 432 | | | | 18 | |

Essent Group Ltd | | | 970 | | | | 54 | |

Euronet Worldwide Inc * | | | 74 | | | | 8 | |

Evercore Inc, Cl A | | | 659 | | | | 137 | |

Everest Group Ltd | | | 179 | | | | 68 | |

EVERTEC Inc | | | 1,569 | | | | 52 | |

F&G Annuities & Life Inc | | | 2,571 | | | | 98 | |

FactSet Research Systems Inc | | | 306 | | | | 125 | |

FB Financial Corp | | | 1,250 | | | | 49 | |

Federal Agricultural Mortgage Corp, Cl C | | | 119 | | | | 22 | |

Fidelity National Financial Inc | | | 1,063 | | | | 53 | |

Fidelity National Information Services Inc | | | 7,874 | | | | 593 | |

Fifth Third Bancorp | | | 4,599 | | | | 168 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

First American Financial Corp | | | 814 | | | $ | 44 | |

First BanCorp/Puerto Rico | | | 821 | | | | 15 | |

First Busey Corp | | | 1,790 | | | | 43 | |

First Citizens BancShares Inc/NC, Cl A | | | 75 | | | | 126 | |

First Commonwealth Financial Corp | | | 3,365 | | | | 46 | |

First Financial Bancorp | | | 1,921 | | | | 43 | |

First Financial Bankshares Inc | | | 1,378 | | | | 41 | |

First Hawaiian Inc | | | 3,126 | | | | 65 | |

First Horizon Corp | | | 22,027 | | | | 347 | |

First Interstate BancSystem Inc, Cl A | | | 1,171 | | | | 33 | |

First Merchants Corp | | | 1,182 | | | | 39 | |

FirstCash Holdings Inc | | | 612 | | | | 64 | |

Fiserv Inc * | | | 2,378 | | | | 354 | |

FNB Corp/PA | | | 3,907 | | | | 53 | |

Franklin Resources Inc | | | 6,856 | | | | 153 | |

Genworth Financial Inc, Cl A * | | | 10,439 | | | | 63 | |

German American Bancorp Inc | | | 1,414 | | | | 50 | |

Global Payments Inc | | | 842 | | | | 81 | |

Globe Life Inc | | | 108 | | | | 9 | |

Goldman Sachs Group Inc/The | | | 3,960 | | | | 1,791 | |

Goosehead Insurance Inc, Cl A * | | | 215 | | | | 12 | |

Hancock Whitney Corp | | | 1,142 | | | | 55 | |

Hannon Armstrong Sustainable Infrastructure Capital Inc | | | 7,020 | | | | 208 | |

Hanover Insurance Group Inc/The | | | 124 | | | | 16 | |

HarborOne Bancorp Inc | | | 861 | | | | 10 | |

Hartford Financial Services Group Inc/The | | | 1,006 | | | | 101 | |

Heartland Financial USA Inc | | | 1,003 | | | | 45 | |

Heritage Financial Corp/WA | | | 1,744 | | | | 31 | |

Home BancShares Inc/AR | | | 2,523 | | | | 60 | |

HomeStreet Inc | | | 309 | | | | 4 | |

Hope Bancorp Inc | | | 3,233 | | | | 35 | |

Horace Mann Educators Corp | | | 1,125 | | | | 37 | |

Houlihan Lokey Inc, Cl A | | | 192 | | | | 26 | |

Huntington Bancshares Inc/OH | | | 9,540 | | | | 126 | |

Independent Bank Corp | | | 580 | | | | 29 | |

Independent Bank Group Inc | | | 846 | | | | 39 | |

Intercontinental Exchange Inc | | | 1,921 | | | | 263 | |

Invesco Ltd | | | 18,276 | | | | 273 | |

Invesco Mortgage Capital Inc ‡ | | | 323 | | | | 3 | |

Jack Henry & Associates Inc | | | 636 | | | | 106 | |

Jackson Financial Inc, Cl A | | | 1,486 | | | | 110 | |

Janus Henderson Group PLC | | | 1,207 | | | | 41 | |

Jefferies Financial Group Inc | | | 2,313 | | | | 115 | |

JPMorgan Chase & Co | | | 26,967 | | | | 5,454 | |

KeyCorp | | | 12,904 | | | | 183 | |

Kinsale Capital Group Inc | | | 73 | | | | 28 | |

KKR & Co Inc | | | 3,222 | | | | 339 | |

Lazard Inc, Cl A | | | 2,316 | | | | 88 | |

Lemonade Inc * | | | 1,665 | | | | 27 | |

LendingTree Inc * | | | 175 | | | | 7 | |

Lincoln National Corp | | | 3,621 | | | | 113 | |

Loews Corp | | | 222 | | | | 17 | |

SCHEDULE OF INVESTMENTS

June 30, 2024

New Covenant Growth Fund (Continued)

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

LPL Financial Holdings Inc | | | 1,036 | | | $ | 289 | |

M&T Bank Corp | | | 765 | | | | 116 | |

MarketAxess Holdings Inc | | | 144 | | | | 29 | |

Marsh & McLennan Cos Inc | | | 2,823 | | | | 595 | |

Mastercard Inc, Cl A | | | 9,928 | | | | 4,380 | |

Mercury General Corp | | | 233 | | | | 12 | |

MetLife Inc | | | 6,576 | | | | 462 | |

MFA Financial Inc ‡ | | | 1,584 | | | | 17 | |

MGIC Investment Corp | | | 3,455 | | | | 74 | |

Moelis & Co, Cl A | | | 461 | | | | 26 | |

Moody's Corp | | | 4,549 | | | | 1,915 | |

Morgan Stanley | | | 12,464 | | | | 1,211 | |

Morningstar Inc | | | 67 | | | | 20 | |

Mr Cooper Group Inc * | | | 335 | | | | 27 | |

MSCI Inc, Cl A | | | 635 | | | | 306 | |

Nasdaq Inc | | | 7,134 | | | | 430 | |

NBT Bancorp Inc | | | 1,213 | | | | 47 | |

NCR Atleos Corp * | | | 167 | | | | 5 | |

Nelnet Inc, Cl A | | | 145 | | | | 15 | |

New York Community Bancorp Inc | | | 951 | | | | 3 | |

New York Mortgage Trust Inc ‡ | | | 1,944 | | | | 11 | |

NMI Holdings Inc, Cl A * | | | 1,470 | | | | 50 | |

Northern Trust Corp | | | 7,549 | | | | 634 | |

Northfield Bancorp Inc | | | 2,868 | | | | 27 | |

OFG Bancorp | | | 2,119 | | | | 79 | |

Old National Bancorp/IN | | | 5,093 | | | | 88 | |

OneMain Holdings Inc, Cl A | | | 258 | | | | 13 | |

Orchid Island Capital Inc, Cl A ‡ | | | 3,472 | | | | 29 | |

Pacific Premier Bancorp Inc | | | 3,188 | | | | 73 | |

Palomar Holdings Inc, Cl A * | | | 145 | | | | 12 | |

Pathward Financial Inc | | | 266 | | | | 15 | |

PayPal Holdings Inc * | | | 16,718 | | | | 970 | |

PennyMac Mortgage Investment Trust ‡ | | | 24,099 | | | | 331 | |

Pinnacle Financial Partners Inc | | | 1,489 | | | | 119 | |

PNC Financial Services Group Inc/The | | | 1,439 | | | | 224 | |

Popular Inc | | | 1,507 | | | | 133 | |

PRA Group Inc * | | | 1,320 | | | | 26 | |

Primerica Inc | | | 323 | | | | 76 | |

Principal Financial Group Inc | | | 662 | | | | 52 | |

ProAssurance Corp * | | | 1,351 | | | | 17 | |

PROG Holdings Inc | | | 832 | | | | 29 | |

Progressive Corp/The | | | 7,459 | | | | 1,549 | |

Prosperity Bancshares Inc | | | 1,192 | | | | 73 | |

Provident Financial Services Inc | | | 4,392 | | | | 63 | |

Prudential Financial Inc | | | 974 | | | | 114 | |

Radian Group Inc | | | 1,924 | | | | 60 | |

Raymond James Financial Inc | | | 1,949 | | | | 241 | |

Redwood Trust Inc ‡ | | | 2,992 | | | | 19 | |

Regions Financial Corp | | | 62,324 | | | | 1,249 | |

Reinsurance Group of America Inc, Cl A | | | 578 | | | | 119 | |

RenaissanceRe Holdings Ltd | | | 69 | | | | 15 | |

Renasant Corp | | | 1,366 | | | | 42 | |

Repay Holdings Corp, Cl A * | | | 7,436 | | | | 79 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Rithm Capital Corp ‡ | | | 1,403 | | | $ | 15 | |

RLI Corp | | | 545 | | | | 77 | |

S&P Global Inc | | | 5,805 | | | | 2,589 | |

Sandy Spring Bancorp Inc | | | 1,350 | | | | 33 | |

Seacoast Banking Corp of Florida | | | 1,616 | | | | 38 | |

ServisFirst Bancshares Inc | | | 187 | | | | 12 | |

SLM Corp | | | 8,316 | | | | 173 | |

SouthState Corp | | | 216 | | | | 17 | |

Starwood Property Trust Inc ‡ | | | 2,000 | | | | 38 | |

State Street Corp | | | 9,970 | | | | 738 | |

Stifel Financial Corp | | | 245 | | | | 21 | |

Synchrony Financial | | | 4,720 | | | | 223 | |

Synovus Financial Corp | | | 1,267 | | | | 51 | |

T Rowe Price Group Inc | | | 2,711 | | | | 313 | |

Texas Capital Bancshares Inc * | | | 822 | | | | 50 | |

TFS Financial Corp | | | 573 | | | | 7 | |

TPG RE Finance Trust Inc ‡ | | | 2,439 | | | | 21 | |

Travelers Cos Inc/The | | | 4,033 | | | | 820 | |

TriCo Bancshares | | | 1,219 | | | | 48 | |

Triumph Financial Inc * | | | 822 | | | | 67 | |

Truist Financial Corp | | | 14,236 | | | | 553 | |

Trustmark Corp | | | 1,410 | | | | 42 | |

Two Harbors Investment Corp ‡ | | | 1,597 | | | | 21 | |

UMB Financial Corp | | | 715 | | | | 60 | |

Univest Financial Corp | | | 1,820 | | | | 42 | |

Unum Group | | | 1,638 | | | | 84 | |

Upstart Holdings Inc * | | | 1,290 | | | | 30 | |

US Bancorp | | | 2,749 | | | | 109 | |

Valley National Bancorp | | | 4,269 | | | | 30 | |

Veritex Holdings Inc | | | 348 | | | | 7 | |

Virtu Financial Inc, Cl A | | | 3,026 | | | | 68 | |

Visa Inc, Cl A | | | 21,036 | | | | 5,521 | |

W R Berkley Corp | | | 247 | | | | 19 | |

Walker & Dunlop Inc | | | 749 | | | | 74 | |

Washington Trust Bancorp Inc | | | 924 | | | | 25 | |

Webster Financial Corp | | | 2,008 | | | | 88 | |

Wells Fargo & Co | | | 26,817 | | | | 1,593 | |

Westamerica BanCorp | | | 731 | | | | 35 | |

Western Alliance Bancorp | | | 1,801 | | | | 113 | |

Western Union Co/The | | | 425 | | | | 5 | |

WEX Inc * | | | 55 | | | | 10 | |

Willis Towers Watson PLC | | | 907 | | | | 238 | |

Wintrust Financial Corp | | | 708 | | | | 70 | |

XP Inc, Cl A | | | 3,989 | | | | 70 | |

Zions Bancorp NA | | | 1,771 | | | | 77 | |

| | | | | | | | | |

| | | | | | | | 70,156 | |

Health Care — 12.2% | | | | |

Abbott Laboratories | | | 25,893 | | | | 2,691 | |

AbbVie Inc | | | 21,359 | | | | 3,663 | |

Acadia Healthcare Co Inc * | | | 220 | | | | 15 | |

Accolade Inc * | | | 956 | | | | 3 | |

AdaptHealth Corp, Cl A * | | | 2,632 | | | | 26 | |

Adaptive Biotechnologies Corp * | | | 1,704 | | | | 6 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Addus HomeCare Corp * | | | 495 | | | $ | 57 | |

Agilent Technologies Inc | | | 765 | | | | 99 | |

Agios Pharmaceuticals Inc * | | | 1,062 | | | | 46 | |

Akero Therapeutics Inc * | | | 913 | | | | 21 | |

Alector Inc * | | | 2,628 | | | | 12 | |

Align Technology Inc * | | | 311 | | | | 75 | |

Alkermes PLC * | | | 2,433 | | | | 59 | |

Allogene Therapeutics Inc * | | | 1,838 | | | | 4 | |

Alnylam Pharmaceuticals Inc * | | | 562 | | | | 137 | |

Amedisys Inc * | | | 56 | | | | 5 | |

Amgen Inc | | | 7,026 | | | | 2,195 | |

Amicus Therapeutics Inc * | | | 5,193 | | | | 51 | |

AMN Healthcare Services Inc * | | | 832 | | | | 43 | |

AnaptysBio Inc * | | | 1,908 | | | | 48 | |

Anika Therapeutics Inc * | | | 920 | | | | 23 | |

Apellis Pharmaceuticals Inc * | | | 1,789 | | | | 69 | |

Arcturus Therapeutics Holdings Inc * | | | 483 | | | | 12 | |

Arrowhead Pharmaceuticals Inc * | | | 251 | | | | 7 | |

Arvinas Inc * | | | 1,298 | | | | 35 | |

Astrana Health Inc * | | | 344 | | | | 14 | |

AtriCure Inc * | | | 1,029 | | | | 23 | |

Atrion Corp | | | 71 | | | | 32 | |

Avanos Medical Inc * | | | 301 | | | | 6 | |

Avantor Inc * | | | 1,656 | | | | 35 | |

Avidity Biosciences Inc * | | | 2,388 | | | | 98 | |

Axonics Inc * | | | 351 | | | | 24 | |

Azenta Inc * | | | 207 | | | | 11 | |

Baxter International Inc | | | 12,373 | | | | 414 | |

Becton Dickinson & Co | | | 769 | | | | 180 | |

BioCryst Pharmaceuticals Inc * | | | 1,030 | | | | 6 | |

Biogen Inc * | | | 1,991 | | | | 462 | |

Biohaven Ltd * | | | 45 | | | | 2 | |

BioLife Solutions Inc * | | | 2,163 | | | | 46 | |

BioMarin Pharmaceutical Inc * | | | 1,042 | | | | 86 | |

Bio-Rad Laboratories Inc, Cl A * | | | 32 | | | | 9 | |

Bio-Techne Corp | | | 212 | | | | 15 | |

Boston Scientific Corp * | | | 16,399 | | | | 1,263 | |

Bridgebio Pharma Inc * | | | 241 | | | | 6 | |

Bristol-Myers Squibb Co | | | 12,713 | | | | 528 | |

Brookdale Senior Living Inc * | | | 7,397 | | | | 50 | |

Cardinal Health Inc | | | 1,413 | | | | 139 | |

CareDx Inc * | | | 6,310 | | | | 98 | |

Cassava Sciences Inc * | | | 614 | | | | 8 | |

Castle Biosciences Inc * | | | 730 | | | | 16 | |

Catalent Inc * | | | 949 | | | | 53 | |

Catalyst Pharmaceuticals Inc * | | | 6,810 | | | | 105 | |

Cencora Inc, Cl A | | | 589 | | | | 133 | |

Centene Corp * | | | 4,805 | | | | 319 | |

Charles River Laboratories International Inc * | | | 77 | | | | 16 | |

Cigna Group/The | | | 6,030 | | | | 1,993 | |

Collegium Pharmaceutical Inc * | | | 2,915 | | | | 94 | |

Cooper Cos Inc/The | | | 944 | | | | 82 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Corcept Therapeutics Inc * | | | 3,878 | | | $ | 126 | |

CorVel Corp * | | | 125 | | | | 32 | |

Crinetics Pharmaceuticals Inc * | | | 2,310 | | | | 103 | |

CryoPort Inc * | | | 871 | | | | 6 | |

CVS Health Corp | | | 3,727 | | | | 220 | |

Cytokinetics Inc * | | | 1,159 | | | | 63 | |

Danaher Corp | | | 7,586 | | | | 1,895 | |

DaVita Inc * | | | 160 | | | | 22 | |

Denali Therapeutics Inc * | | | 2,631 | | | | 61 | |

DENTSPLY SIRONA Inc | | | 3,113 | | | | 78 | |

Dexcom Inc * | | | 3,388 | | | | 384 | |

Editas Medicine Inc, Cl A * | | | 1,596 | | | | 7 | |

Edwards Lifesciences Corp * | | | 8,484 | | | | 784 | |

Elanco Animal Health Inc * | | | 398 | | | | 6 | |

Elevance Health Inc | | | 4,663 | | | | 2,527 | |

Eli Lilly & Co | | | 10,234 | | | | 9,266 | |

Embecta Corp | | | 887 | | | | 11 | |

Enanta Pharmaceuticals Inc * | | | 785 | | | | 10 | |

Encompass Health Corp | | | 164 | | | | 14 | |

Enhabit Inc * | | | 82 | | | | 1 | |

Enovis Corp * | | | 485 | | | | 22 | |

Envista Holdings Corp * | | | 317 | | | | 5 | |

Exact Sciences Corp * | | | 930 | | | | 39 | |

Exelixis Inc * | | | 4,344 | | | | 98 | |

Fate Therapeutics Inc * | | | 3,277 | | | | 11 | |

Fortrea Holdings Inc * | | | 515 | | | | 12 | |

Fulgent Genetics Inc * | | | 853 | | | | 17 | |

GE HealthCare Technologies Inc | | | 153 | | | | 12 | |

Gilead Sciences Inc | | | 14,228 | | | | 976 | |

Glaukos Corp * | | | 167 | | | | 20 | |

Globus Medical Inc, Cl A * | | | 179 | | | | 12 | |

GRAIL Inc * | | | 352 | | | | 5 | |

Haemonetics Corp * | | | 195 | | | | 16 | |

Halozyme Therapeutics Inc * | | | 2,641 | | | | 138 | |

HCA Healthcare Inc | | | 1,358 | | | | 436 | |

Health Catalyst Inc * | | | 1,594 | | | | 10 | |

HealthEquity Inc * | | | 673 | | | | 58 | |

Henry Schein Inc * | | | 2,612 | | | | 167 | |

Hologic Inc * | | | 927 | | | | 69 | |

Humana Inc | | | 242 | | | | 90 | |

Ideaya Biosciences Inc * | | | 4,068 | | | | 143 | |

IDEXX Laboratories Inc * | | | 707 | | | | 344 | |

IGM Biosciences Inc * | | | 1,084 | | | | 7 | |

Illumina Inc * | | | 2,114 | | | | 221 | |

Inari Medical Inc * | | | 419 | | | | 20 | |

Incyte Corp * | | | 1,063 | | | | 64 | |

Innoviva Inc * | | | 3,557 | | | | 58 | |

Inogen Inc * | | | 706 | | | | 6 | |

Insmed Inc * | | | 2,129 | | | | 143 | |

Insulet Corp * | | | 65 | | | | 13 | |

Integer Holdings Corp * | | | 625 | | | | 72 | |

Integra LifeSciences Holdings Corp * | | | 188 | | | | 5 | |

Intellia Therapeutics Inc * | | | 1,231 | | | | 28 | |

SCHEDULE OF INVESTMENTS

June 30, 2024

New Covenant Growth Fund (Continued)

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Intuitive Surgical Inc * | | | 4,209 | | | $ | 1,872 | |

Ionis Pharmaceuticals Inc * | | | 782 | | | | 37 | |

Iovance Biotherapeutics Inc * | | | 1,433 | | | | 11 | |

IQVIA Holdings Inc * | | | 491 | | | | 104 | |

iRhythm Technologies Inc * | | | 210 | | | | 23 | |

Ironwood Pharmaceuticals Inc, Cl A * | | | 3,844 | | | | 25 | |

iTeos Therapeutics Inc * | | | 5,921 | | | | 88 | |

Jazz Pharmaceuticals PLC * | | | 616 | | | | 66 | |

Johnson & Johnson | | | 32,711 | | | | 4,781 | |

Kiniksa Pharmaceuticals International PLC, Cl A * | | | 801 | | | | 15 | |

Kodiak Sciences Inc * | | | 1,218 | | | | 3 | |

Krystal Biotech Inc * | | | 823 | | | | 151 | |

Kura Oncology Inc * | | | 3,438 | | | | 71 | |

Labcorp Holdings Inc | | | 515 | | | | 105 | |

Lantheus Holdings Inc * | | | 2,408 | | | | 193 | |

Ligand Pharmaceuticals Inc * | | | 462 | | | | 39 | |

LivaNova PLC * | | | 657 | | | | 36 | |

MacroGenics Inc * | | | 1,782 | | | | 8 | |

Madrigal Pharmaceuticals Inc * | | | 531 | | | | 149 | |

McKesson Corp | | | 527 | | | | 308 | |

Medtronic PLC | | | 19,976 | | | | 1,572 | |

MeiraGTx Holdings plc * | | | 4,240 | | | | 18 | |

Merck & Co Inc | | | 35,830 | | | | 4,436 | |

Mettler-Toledo International Inc * | | | 404 | | | | 565 | |

Moderna Inc * | | | 4,368 | | | | 519 | |

Myriad Genetics Inc * | | | 1,860 | | | | 45 | |

National Research Corp | | | 779 | | | | 18 | |

Neogen Corp * | | | 300 | | | | 5 | |

Neurocrine Biosciences Inc * | | | 717 | | | | 99 | |

Nevro Corp * | | | 83 | | | | 1 | |

Novavax Inc * | | | 816 | | | | 10 | |

Novocure Ltd * | | | 905 | | | | 15 | |

OmniAb Inc, Cl W * | | | 2,263 | | | | 8 | |

Omnicell Inc * | | | 466 | | | | 13 | |

Option Care Health Inc * | | | 648 | | | | 18 | |

OraSure Technologies Inc * | | | 6,042 | | | | 26 | |

Organon & Co | | | 649 | | | | 13 | |

Pediatrix Medical Group Inc * | | | 417 | | | | 3 | |

Pennant Group Inc/The * | | | 1,609 | | | | 37 | |

Penumbra Inc * | | | 72 | | | | 13 | |

Perrigo Co PLC | | | 211 | | | | 5 | |

Pfizer Inc | | | 69,593 | | | | 1,947 | |

Phreesia Inc * | | | 361 | | | | 8 | |

Premier Inc, Cl A | | | 2,266 | | | | 42 | |

Protagonist Therapeutics Inc * | | | 1,083 | | | | 38 | |

Prothena Corp PLC * | | | 5,314 | | | | 110 | |

PTC Therapeutics Inc * | | | 1,021 | | | | 31 | |

QIAGEN NV | | | 2,267 | | | | 93 | |

Quest Diagnostics Inc | | | 865 | | | | 118 | |

Recursion Pharmaceuticals Inc, Cl A * | | | 11,559 | | | | 87 | |

Regeneron Pharmaceuticals Inc * | | | 1,105 | | | | 1,161 | |

REGENXBIO Inc * | | | 456 | | | | 5 | |

| | | | | | | |

Description | | Shares | | | Market Value

($ Thousands) | |

COMMON STOCK†† (continued) |

Relay Therapeutics Inc * | | | 11,508 | | | $ | 75 | |

Repligen Corp * | | | 553 | | | | 70 | |

ResMed Inc | | | 1,013 | | | | 194 | |

Revance Therapeutics Inc * | | | 3,056 | | | | 8 | |

Revvity Inc | | | 120 | | | | 13 | |

Rocket Pharmaceuticals Inc * | | | 932 | | | | 20 | |

Sage Therapeutics Inc * | | | 516 | | | | 6 | |

Sarepta Therapeutics Inc * | | | 87 | | | | 14 | |

Simulations Plus Inc | | | 1,477 | | | | 72 | |

Solventum Corp * | | | 1,703 | | | | 90 | |

STAAR Surgical Co * | | | 2,233 | | | | 106 | |

STERIS PLC | | | 501 | | | | 110 | |

Stryker Corp | | | 2,212 | | | | 753 | |